UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant ☒ |

| |

| Filed by a Party other than the Registrant ☐ |

| |

| Check the appropriate box: |

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☒ | Definitive Additional Materials |

| ☐ | Soliciting Material under §240.14a-12 |

| |

| BLUCORA, INC. |

| (Name of Registrant as Specified In Its Charter) |

| |

| |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| |

| Payment of Filing Fee (Check the appropriate box): |

| ☒ | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | | |

| | (2) | Aggregate number of securities to which transaction applies: |

| | | |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

| | (4) | Proposed maximum aggregate value of transaction: |

| | | |

| | (5) | Total fee paid: |

| | | |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | | |

| | (2) | Form, Schedule or Registration Statement No.: |

| | | |

| | (3) | Filing Party: |

| | | |

| | (4) | Date Filed: |

| | | |

| | | | |

On April 12, 2021, Blucora, Inc. (the "Company") posted to its website launched in connection with the Company’s 2021 annual meeting of stockholders summary information regarding certain pay-to-play violations by Ancora Advisors LLC (“Ancora Advisors”), including the Securities and Exchange Commission order censuring Ancora Advisors and ordering Ancora Advisors to pay a $100,000 civil monetary penalty. A copy of the summary information can be found below.

Summary Information

Ancora Advisors’ Pay-to-Play Violation

Due to Multiple Improper Campaign

Contributions by Fred DiSanto

“… Ancora's apparent determination to sidestep confronting

an SEC censure … directly undermines Mr. DiSanto's

credibility as a Blucora director.”

Glass Lewis Research Report April 8, 20211

1 Blucora has neither sought nor obtained consent from any third party for the use of previously published information. Any such statements or information should not be viewed as indicating the support of such third party for the views expressed herein.

Ancora Violated Federal Law and Tried to Minimize It Publicly |

| In December 2018, the SEC censured Ancora Advisors and ordered it to pay a $100,000 fine for violating federal “pay-to-play” rules¹ |

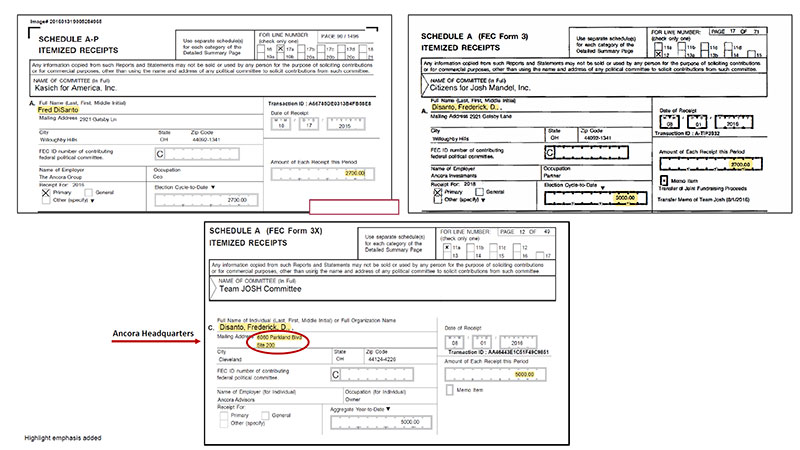

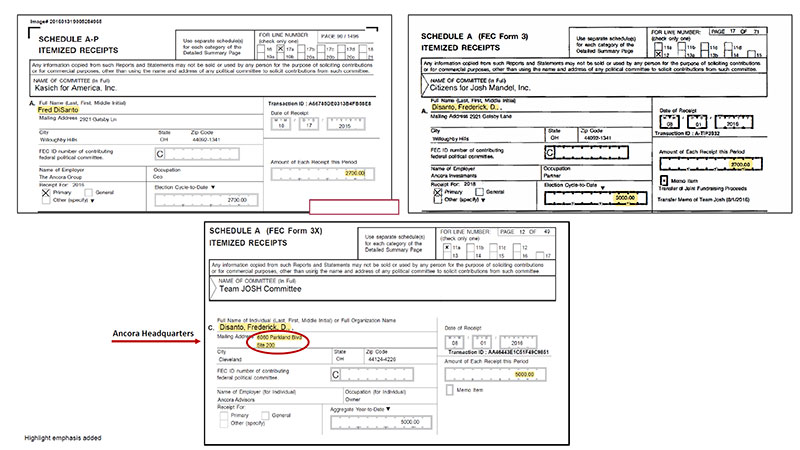

| ▪ | Between January 2013 and June 2017, Mr. DiSanto made over $44,000 of campaign contributions², and another Ancora “covered associate” made a $2,500 campaign contribution, to candidates for elected office in Ohio |

| ▪ | Ancora was then paid to provide advisory services to pension systems over which those officials had influence |

| ▪ | This sort of “pay-to-play” political contributions has been illegal under federal law for years, as is well known in the asset management business |

| ▪ | The SEC censured Ancora and fined it $100,000 |

| ▪ | In its media response, Ancora tried to downplay the violation: Ancora attributed the law breaking to mere “employees” and downplayed the extent of the contributions (noting only that they exceeded the $350 limit, not that they totaled nearly $47,000)³ |

| | | |

| ¹ | SEC order censuring Ancora Advisors December 18, 2018 |

|

| ² | See, e.g., https://docquery.fec.gov/cgi-bin/fecimg/?201601319005284965; https://docquery.fec.gov/cgi-bin/fecimg/?201704199052319941; https://docquery.fec.gov/cgi-bin/fecimg/?201610210200512483, and SEC order censuring Ancora Advisors |

| ³ | Ancora Media Response Statement to SEC Fine |

Cleveland investment firm fined $100,000 for campaign contributions that violated pay-to-play rule

Updated Jan 07, 2019; Posted Jan 03, 2019

By Andrew J. Tobias, cleveland.com

CLEVELAND, Ohio — The Securities and Exchange Commission has fined a Cleveland investment firm $100,000 over recent campaign contributions company executives made to state officials that violated federal “pay-to-play” rules.

In a Dec. 18 administrative order, the SEC identified $46,408 in campaign contributions a company official with Ancora Advisers made between 2013 and 2017 — $24,200 given to Gov. John Kasich, $5,000 given to state Treasurer Josh Mandel and $15,208 given in 2017 to an unnamed candidate for governor.

The complaint does not identify the company official who made the contributions, but state and federal campaign finance records show Fred DiSanto, Ancora’s chairman and CEO, in recent years has given tens of thousands of dollars of contributions to Ohio politicians, including Kasich and U.S. Rep. Jim Renacci, who ran for governor in 2017.

Extracted from Cleveland.com “Cleveland investment firm fined $100,000 for campaign contributions that violated pay-to-play rule”

Highlight emphasis added

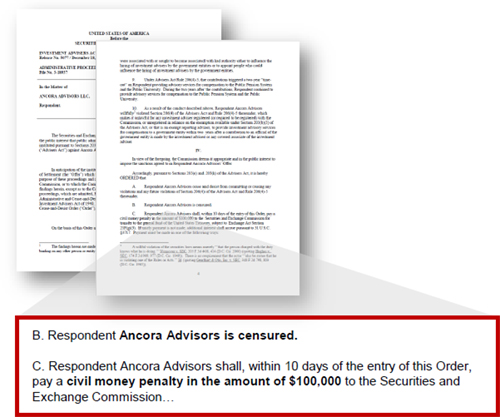

UNITED STATES OF AMERICA

Before the

SECURITIES AND EXCHANGE COMMISSION

INVESTMENT ADVISERS ACT OF 1940

Release No. 5077 / December 18, 2018

ADMINISTRATIVE PROCEEDING

File No. 3-18937

In the Matter of ANCORA ADVISORS LLC, Respondent. | ORDER INSTITUTING ADMINISTRATIVE AND CEASE-AND- DESIST PROCEEDINGS PURSUANT TO SECTIONS 203(e) AND 203(k) OF THE INVESTMENT ADVISERS ACT OF 1940, MAKING FINDINGS, AND IMPOSING REMEDIAL SANCTIONS AND A CEASE-AND-DESIST ORDER |

I.

The Securities and Exchange Commission (“Commission”) deems it appropriate and in the public interest that public administrative and cease-and-desist proceedings be, and hereby are, instituted pursuant to Sections 203(e) and 203(k) of the Investment Advisers Act of 1940 (“ Advisers Act”) against Ancora Advisors LLC (“Ancora Advisors” or “Respondent”).

II.

In anticipation of the institution of these proceedings, Respondent has submitted an Offer of Settlement (the “Offer”) which the Commission has determined to accept. Solely for the purpose of these proceedings and any other proceedings brought by or on behalf of the Commission, or to which the Commission is a party, and without admitting or denying the findings herein, except as to the Commission’s jurisdiction over it and the subject matter of these proceedings, which are admitted, Respondent consents to the entry of this Order Instituting Administrative and Cease-and-Desist Proceedings Pursuant to Sections 203(e) and 203(k) of the Investment Advisers Act of 1940, Making Findings, and Imposing Remedial Sanctions and a Cease-and-Desist Order (“Order”), as set forth below.

III.

On the basis of this Order and Respondent’s Offer, the Commission finds1 that:

1 The findings herein are made pursuant to Respondent’s Offer of Settlement and are not binding on any other person or entity in this or any other proceeding.

Summary

These proceedings involve violations of the Commission’s “pay-to-play” rule for investment advisers by Respondent Ancora Advisors, an investment adviser. Rule 206(4)-5, promulgated under Section 206(4) of the Advisers Act, is a prophylactic rule designed to address pay-to-play abuses involving campaign contributions made by certain investment advisers or their covered associates to government officials who are in a position to influence the selection of investment advisers to manage government client assets, including the assets of public pension funds and other public entities. Among other things, Rule 206(4)-5 prohibits certain investment advisers from providing investment advisory services for compensation to a government client for two years after the adviser or certain of its executives or employees (known as covered associates) makes a campaign contribution to certain elected officials or candidates who can influence the selection of certain investment advisers.

Respondent

1. Ancora Advisors LLC (“Ancora Advisors”) is a limited liability company headquartered in Mayfield Heights, Ohio. Ancora Advisors is registered with the Commission as an investment adviser. In its Form ADV dated March 29, 2018, Ancora Advisors reported regulatory assets under management of approximately $4.6 billion.

Background

2. Between January 2013 and June 2017, two covered associates of Respondent made campaign contributions to candidates for elected office in Ohio, which offices had influence over selecting investment advisers for a public pension system in Ohio and a public university in Ohio. Within two years after these contributions, Respondent provided advisory services for compensation to the public pension system and public university. By providing those advisory services for compensation within two years after the contributions, Respondent violated Section 206(4) of the Advisers Act and Rule 206(4)-5 thereunder.

3. Between October 2010 and the present, Ancora Advisors provided investment advisory services to a public pension system for employees of a public agency within the State of Ohio (the “Public Pension System”). The Public Pension System is a unit or instrumentality of the State of Ohio. Between April 2017 and the present, Ancora Advisors provided investment advisory services to a public university within the State of Ohio (the “Public University”). The Public University is also a unit or instrumentality of the State of Ohio.

4. Between January 2013 and October 2015, a covered associate2 of Respondent made a total of $24,200 in campaign contributions to the Governor of Ohio. On August 1, 2016, the covered associate made a $5,000 campaign contribution to the Treasurer of Ohio. Between April 2017 and June 2017, the covered associate made a total of $15,208 in campaign contributions to a candidate for Governor of Ohio. On June 30, 2017, another covered associate made a $2,500 campaign contribution to a candidate for Governor of Ohio. After the contributions were made, the covered associates requested that the contributions be returned.

2 Covered associates are defined to include: (i) any general partner, managing member or executive officer, or other individual with a similar status or function; (ii) any employee who solicits a government entity for the investment adviser and any person who supervises, directly or indirectly, such employee; and (iii) any political action committee controlled by the investment adviser or by any of its covered associates. See Rule 206(4)-5(f)(2).

5. The offices of Governor and Treasurer of Ohio had the ability to influence the selection of investment advisers for the Public Pension System. Specifically, the Governor and Treasurer of Ohio each appoint at least one member of the board of the Public Pension System, which has influence over selecting investment advisers for the Public Pension System. The office of Governor of Ohio had the ability to influence the selection of investment advisers for the Public University. Specifically, the Governor of Ohio appoints all of the members of the Public University’s Board of Trustees, which has the ability to influence the selection of investment advisers for the Public University.

6. During the two years after the contributions, Respondent continued to provide investment advisory services for compensation to the Public Pension System and the Public University.

7. Advisers Act Rule 206(4)-5(a)(1) prohibits any investment adviser registered with the Commission, investment adviser required to be registered with the Commission, foreign private adviser, or exempt reporting adviser from providing investment advisory services for compensation to a government entity3 within two years after a contribution to an official4 of a government entity made by the investment adviser or any covered associate of the investment adviser. Advisers Act Rule 206(4)-5 does not require a showing of quid pro quo or actual intent to influence an elected official or candidate.

8. As a public pension system or instrumentality of a state government, the Public Pension System and the Public University were government entities as defined in Advisers Act Rule 206(4)-5(f)(5). The contributors were covered associates of Respondent as defined in Advisers Act Rule 206(4)-5(f)(2). The individuals who received the contributions were officials as defined in Advisers Act Rule 206(4)-5(f)(6) of government entities because the offices they were associated with or sought to become associated with had authority either to influence the hiring of investment advisers by the government entities or to appoint people who could influence the hiring of investment advisers by the government entities.

4 “Official” includes any person who, at the time of the relevant contribution, was an incumbent, candidate or successful candidate for elective office of a government entity if the office is directly or indirectly responsible for, or can influence the outcome of, the hiring of an investment adviser by a government entity or has authority to appoint any person who is directly or indirectly responsible for, or can influence the outcome of, the hiring of an investment adviser by a government entity. See Rule 206(4)-5(f)(6).

3 See Rule 206(4)-5(f)(5).

9. Under Advisers Act Rule 206(4)-5, the contributions triggered a two-year “time-out” on Respondent providing advisory services for compensation to the Public Pension System and the Public University. During the two years after the contributions, Respondent continued to provide advisory services for compensation to the Public Pension System and the Public University.

10. As a result of the conduct described above, Respondent Ancora Advisors willfully5 violated Section 206(4) of the Advisers Act and Rule 206(4)-5 thereunder, which makes it unlawful for any investment adviser registered (or required to be registered) with the Commission, or unregistered in reliance on the exemption available under Section 203(b)(3) of the Advisers Act, or that is an exempt reporting adviser, to provide investment advisory services for compensation to a government entity within two years after a contribution to an official of the government entity is made by the investment adviser or any covered associate of the investment adviser.

IV.

In view of the foregoing, the Commission deems it appropriate and in the public interest to impose the sanctions agreed to in Respondent Ancora Advisors’ Offer.

Accordingly, pursuant to Sections 203(e) and 203(k) of the Advisers Act, it is hereby ORDERED that:

A. Respondent Ancora Advisors cease and desist from committing or causing any violations and any future violations of Section 206(4) of the Advisers Act and Rule 206(4)-5 thereunder.

B. Respondent Ancora Advisors is censured.

C. Respondent Ancora Advisors shall, within 10 days of the entry of this Order, pay a civil money penalty in the amount of $100,000 to the Securities and Exchange Commission for transfer to the general fund of the United States Treasury, subject to Exchange Act Section 21F(g)(3). If timely payment is not made, additional interest shall accrue pursuant to 31 U.S.C. §3717. Payment must be made in one of the following ways:

| (1) | Respondent may transmit payment electronically to the Commission, which will provide detailed ACH transfer/Fedwire instructions upon request; |

5 A willful violation of the securities laws means merely “‘that the person charged with the duty knows what he is doing.’” Wonsover v. SEC, 205 F.3d 408, 414 (D.C. Cir. 2000) (quoting Hughes v. SEC, 174 F.2d 969, 977 (D.C. Cir. 1949)). There is no requirement that the actor “‘also be aware that he is violating one of the Rules or Acts.’” Id. (quoting Gearhart & Otis, Inc. v. SEC, 348 F.2d 798, 803 (D.C. Cir. 1965)).

| (2) | Respondent may make direct payment from a bank account via Pay.gov through the SEC website at http://www.sec.gov/about/offices/ofm.htm; or |

| (3) | Respondent may pay by certified check, bank cashier’s check, or United States postal money order, made payable to the Securities and Exchange Commission and hand-delivered or mailed to: |

Enterprise Services Center

Accounts Receivable Branch

HQ Bldg., Room 181, AMZ-341

6500 South MacArthur Boulevard

Oklahoma City, OK 73169

Payments by check or money order must be accompanied by a cover letter identifying Ancora Advisors LLC as the Respondent in these proceedings, and the file number of these proceedings; a copy of the cover letter and check or money order must be sent to LeeAnn Ghazil Gaunt, Chief, Public Finance Abuse Unit, Securities and Exchange Commission, Boston Regional Office, 33 Arch Street, 24th Floor, Boston, MA 02110.

D. Amounts ordered to be paid as civil money penalties pursuant to this Order shall be treated as penalties paid to the government for all purposes, including all tax purposes. To preserve the deterrent effect of the civil penalty, Respondent agrees that in any Related Investor Action, it shall not argue that it is entitled to, nor shall it benefit by, offset or reduction of any award of compensatory damages by the amount of any part of Respondent’s payment of a civil penalty in this action (“Penalty Offset”). If the court in any Related Investor Action grants such a Penalty Offset, Respondent agrees that it shall, within 30 days after entry of a final order granting the Penalty Offset, notify the Commission’s counsel in this action and pay the amount of the Penalty Offset to the Securities and Exchange Commission. Such a payment shall not be deemed an additional civil penalty and shall not be deemed to change the amount of the civil penalty imposed in this proceeding. For purposes of this paragraph, a “Related Investor Action” means a private damages action brought against Respondent by or on behalf of one or more investors based on substantially the same facts as alleged in the Order instituted by the Commission in this proceeding.

By the Commission.

| | Brent J. Fields |

| | Secretary |

| Highlight emphasis added |  |

Media response statement

12/18/18

Statement from Ancora

During a routine inquire, conducted regularly as part of our commitment to regulatory compliance, Ancora recently discovered a violation of Securities and Exchange Commission “SEC” regulations regarding political contributions.

It was discovered that a few employee political contributions, dating back several years, were made which exceed the $350 limit that an employee is allowed to make in certain political contests while also providing investment management services to public clients of the State in which the contest was taking place.

Upon discovery, we began working with the SEC to provide any necessary information to help them assess the nature of the inadvertent error. Employees request, and had returned, contributions which exceeded the $350 limit, however it was outside of the allowable cure period, resulting in our error. We take all compliance reporting responsibilities seriously and assume full responsibility.

We are also in agreement with the regulators that no client was affected by our error and that no employee intended to influence a client with their personal political contributions. Nonetheless, we have subsequently put in place additional training for all employees and have provided them with educational material on the reporting process to guard against any future compliance issues.

Ancora is completely committed to comprehensive compliance with all applicable regulations governing our business and our interactions with our valued clients. We look forward to putting this inadvertent error behind us and continuing to earn and maintain our clients’ trust every day.

Ancora Holdings Inc. is the parent company of three registered investment advisers with the United States Securities and Exchange Commission; Ancora Advisors, LLC, Ancora Family Wealth Advisors, LLC, Ancora Retirement Plan Advisors, Inc. In addition, it owns Inverness Securities, LLC, a FINRA & SIPC member broker dealer.

6060 Parkland Boulevard, Suite 200 / Cleveland, Ohio 44124 / 216-825-4000

…Ancora's meeting materials do not refute Blucora's characterization of Mr. DiSanto's involvement, and they seem to bypass recognition of the censure altogether. We view this taciturn methodology as fairly significant, as it seems to reflect both a disconcerting absence of candor and an apparent disinterest in acknowledging Ancora lacked fundamental compliance architecture capable of timely identifying costly oversight failures within its advisory business, in our view.

That Mr. DiSanto himself appears to have been one of the individuals running afoul of the rule in question invites even greater scrutiny here...

Glass Lewis Research Report April 8, 20211

1 Blucora has neither sought nor obtained consent from any third party for the use of previously published information. Any such statements or information should not be viewed as indicating the support of such third party for the views expressed herein.