On February 16, 2022, Blucora, Inc. (the “Company”) issued a press release containing the Company’s financial results for its fourth quarter and full year ended December 31, 2021. A copy of the press release can be found below, along with the earnings report upon which it is based, a transcript of the earnings call held on February 16, 2022 and the accompanying presentation.

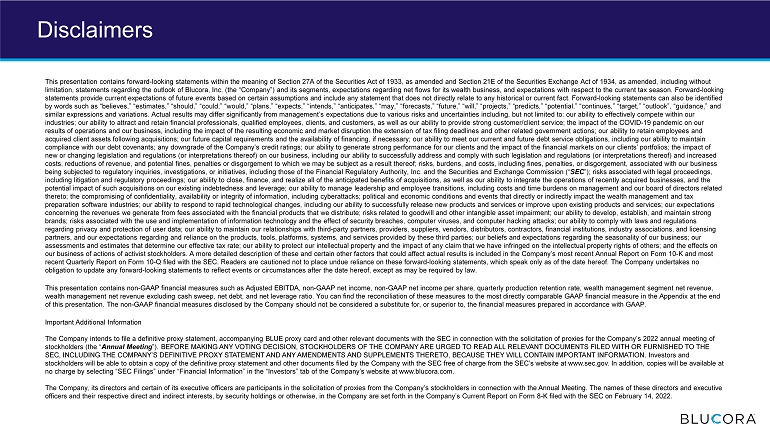

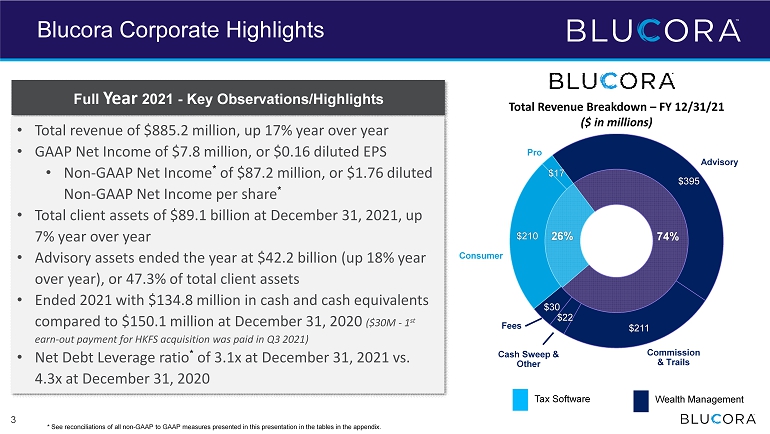

DALLAS, TX — February 16, 2022 — Blucora, Inc. (NASDAQ: BCOR), a leading provider of technology-enabled, tax focused financial solutions, today announced financial results for the fourth quarter and full year ended December 31, 2021.

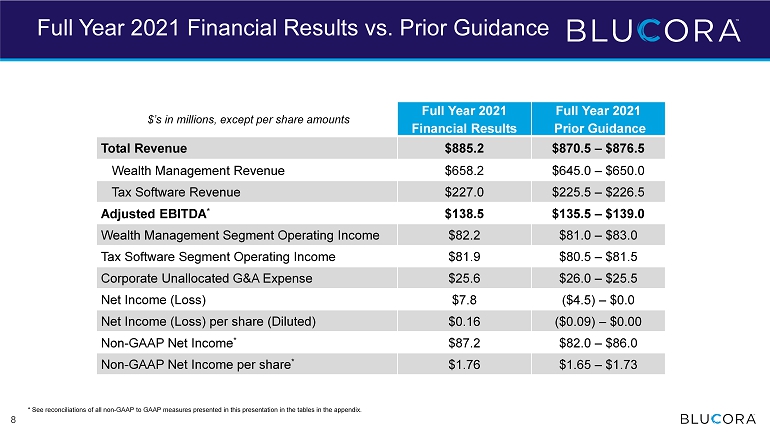

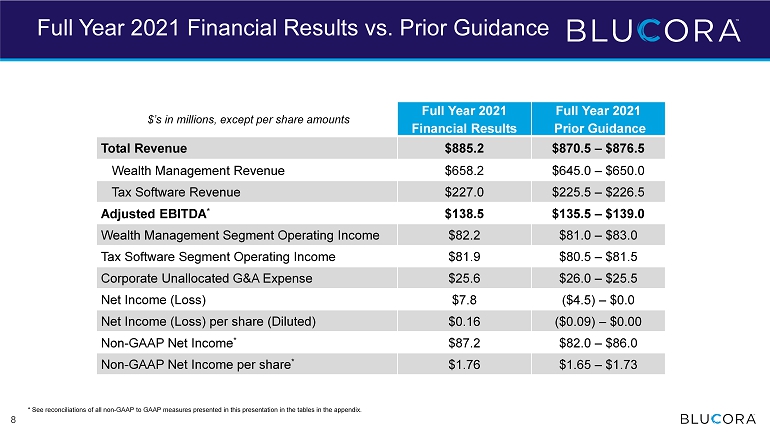

“Blucora made substantial progress in 2021, positioning the business for sustainable and profitable growth. Our team continued to exceed expectations as we achieved or exceeded all elements of our outlook from last quarter and we are on track to achieve our three-year revenue and EBITDA growth goals. My thanks go out to all of our team and our financial professionals for the hard work in achieving these goals,” commented Chris Walters, Blucora’s President and Chief Executive Officer. Mr. Walters continued, “The continued progress that we have seen across the business allows us to confirm our expectations of positive net flows for the wealth business and our outlook for strong continued momentum in tax software in the current tax season.”

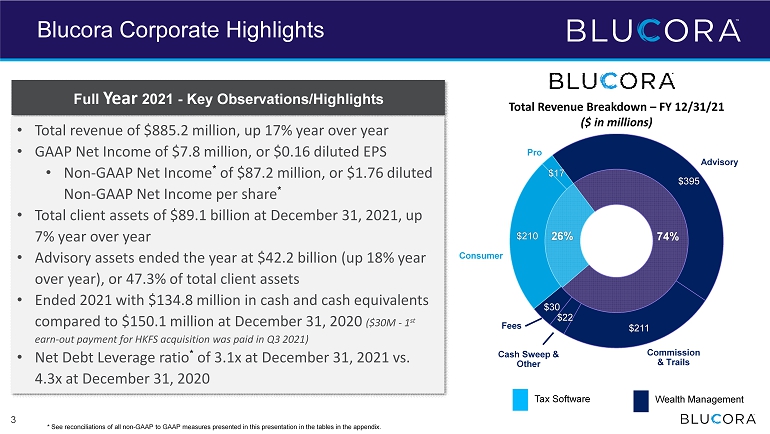

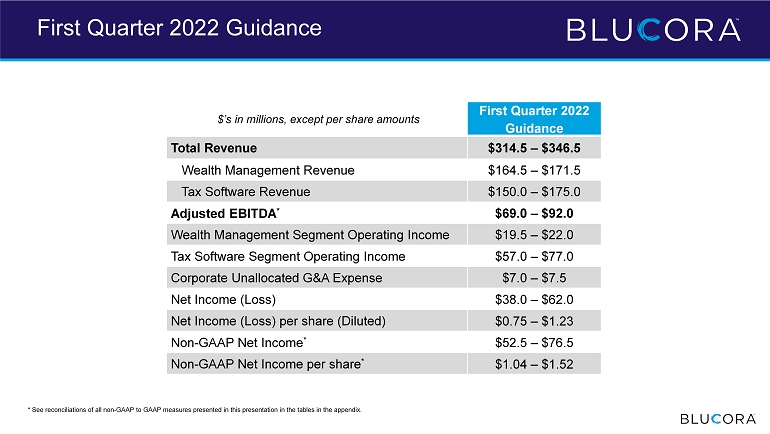

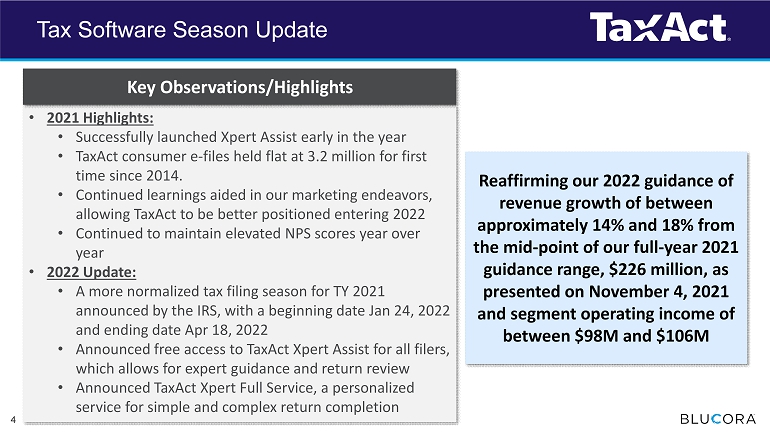

With the tax season now underway and positive early results from the Company’s new marketing efforts and from its new product and service offerings, Blucora is reconfirming its full-year 2022 outlook for the Tax Software segment to provide revenue growth of between 14% and 18% from the mid-point of our full-year 2021 guidance range, $226 million, as presented on November 4, 2021 and segment operating income of between $98 and $106 million.

Conference Call and Webcast

A conference call and live webcast will be held today at 8:30 a.m. Eastern Time during which the Company will further discuss fourth quarter and full year 2021 results, its outlook for 2022 and other business matters. We will also provide supplemental financial information to our results on the Investor Relations section of the Blucora corporate website at www.blucora.com prior to the call. A replay of the call will be available on our website.

About Blucora®

Blucora, Inc. (NASDAQ: BCOR) is a provider of data and technology-driven solutions that empower people to improve their financial wellness. Blucora operates in two segments (i) wealth management, through its Avantax Wealth Management and Avantax Planning Partners brands, with a collective $89 billion in total client assets as of December 31, 2021 and (ii) tax software, through its TaxAct business, a market leader in tax software with over 3 million consumer users and approximately 24,500 professional users in 2021. With integrated tax-focused software and wealth management, Blucora is uniquely positioned to assist our customers in achieving better long-term outcomes via holistic, tax-advantaged solutions. For more information on Blucora, visit www.blucora.com.

Source: Blucora

Blucora Investor Relations

Dee Littrell (972) 870-6463

IR@Blucora.com

This release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. including without limitation, statements regarding the outlook of Blucora, Inc. (the “Company”) and its segments, expectations regarding net flows for its wealth business, and expectations with respect to the current tax season. Forward-looking statements provide current expectations of future events based on certain assumptions and include any statement that does not directly relate to any historical or current fact. Forward-looking statements can also be identified by words such as “believes,” “estimates,” “should,” “could,” “would,” “plans,” “expects,” “intends,” “anticipates,” “may,” “forecasts,” “future,” “will,” “projects,” “predicts,” “potential,” “continues,” “target,” “outlook,” “guidance,” and similar expressions and variations. Actual results may differ significantly from management’s expectations due to various risks and uncertainties including, but not limited to: our ability to effectively compete within our industries; our ability to attract and retain financial professionals, qualified employees, clients, and customers, as well as our ability to provide strong customer/client service; the impact of the COVID-19 pandemic on our results of operations and our business, including the impact of the resulting economic and market disruption, the extension of tax filing deadlines and other related government actions; our ability to retain employees and acquired client assets following acquisitions; our future capital requirements and the availability of financing, if necessary; our ability to meet our current and future debt service obligations, including our ability to maintain compliance with our debt covenants; any downgrade of the Company’s credit ratings; our ability to generate strong performance for our clients and the impact of the financial markets on our clients’ portfolios; the impact of new or changing legislation and regulations (or interpretations thereof) on our business, including our ability to successfully address and comply with such legislation and regulations (or interpretations thereof) and increased costs, reductions of revenue, and potential fines, penalties or disgorgement to which we may be subject as a result thereof; risks, burdens, and costs, including fines, penalties, or disgorgement, associated with our business being subjected to regulatory inquiries, investigations, or initiatives, including those of the Financial Industry Regulatory Authority, Inc. and the Securities and Exchange Commission (“SEC”); risks associated with legal proceedings, including litigation and regulatory proceedings; our ability to close, finance, and realize all of the anticipated benefits of acquisitions, as well as our ability to integrate the operations of recently acquired businesses, and the potential impact of such acquisitions on our existing indebtedness and leverage the compromising of confidentiality, availability or integrity of information, including cyberattacks; our

ability to manage leadership and employee transitions, including costs and time burdens on management and our board of directors related thereto; political and economic conditions and events that directly or indirectly impact the wealth management and tax preparation software industries; our ability to respond to rapid technological changes, including our ability to successfully release new products and services or improve upon existing products and services; our expectations concerning the revenues we generate from fees associated with the financial products that we distribute; risks related to goodwill and other intangible asset impairment; our ability to develop, establish, and maintain strong brands; risks associated with the use and implementation of information technology and the effect of security breaches, computer viruses, and computer hacking attacks; our ability to comply with laws and regulations regarding privacy and protection of user data; our ability to maintain our relationships with third-party partners, providers, suppliers, vendors, distributors, contractors, financial institutions, industry associations, and licensing partners, and our expectations regarding and reliance on the products, tools, platforms, systems, and services provided by these third parties; our beliefs and expectations regarding the seasonality of our business; our assessments and estimates that determine our effective tax rate; our ability to protect our intellectual property and the impact of any claim that we have infringed on the intellectual property rights of others; and the effects on our business of actions of activist stockholders. A more detailed description of these and certain other factors that could affect actual results is included in the Company’s most recent Annual Report on Form 10-K and most recent Quarterly Report on Form 10-Q filed with the SEC. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. The Company undertakes no obligation to update any forward-looking statements to reflect events or circumstances after the date hereof, except as may be required by law.

Important Additional Information

The Company intends to file a definitive proxy statement, accompanying BLUE proxy card and other relevant documents with the SEC in connection with the solicitation of proxies for the Company’s 2022 annual meeting of stockholders (the “Annual Meeting”). BEFORE MAKING ANY VOTING DECISION, STOCKHOLDERS OF THE COMPANY ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH OR FURNISHED TO THE SEC, INCLUDING THE COMPANY’S DEFINITIVE PROXY STATEMENT AND ANY AMENDMENTS AND SUPPLEMENTS THERETO, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Investors and stockholders will be able to obtain a copy of the definitive proxy statement and other documents filed by the Company with the SEC free of charge from the SEC’s website at www.sec.gov. In addition, copies will be available at no charge by selecting “SEC Filings” under “Financial Information” in the “Investors” tab of the Company’s website at www.blucora.com.

The Company, its directors and certain of its executive officers are participants in the solicitation of proxies from the Company’s stockholders in connection with the Annual Meeting. The names of these directors and executive officers and their respective direct and indirect interests, by security holdings or otherwise, in the Company are set forth in the Company’s Current Report on Form 8-K filed with the SEC on February 14, 2022.

Blucora, Inc.

Condensed Consolidated Statements of Operations

(Unaudited) (In thousands, except per share data) | | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended

December 31, | | Year ended

December 31, |

| 2021 | | 2020 | | 2021 | | 2020 |

| Revenue: | | | | | | | |

| Wealth Management | $ | 172,192 | | | $ | 149,384 | | | $ | 658,213 | | | $ | 546,189 | |

| Tax Software | 6,139 | | | 5,773 | | | 226,987 | | | 208,763 | |

| Total revenue | 178,331 | | | 155,157 | | | 885,200 | | | 754,952 | |

| Operating expenses: | | | | | | | |

| Cost of revenue: | | | | | | | |

| Wealth Management | 121,119 | | | 103,630 | | | 464,293 | | | 385,962 | |

| Tax Software | 3,228 | | | 2,569 | | | 15,558 | | | 12,328 | |

| | | | | | | |

| Total cost of revenue | 124,347 | | | 106,199 | | | 479,851 | | | 398,290 | |

| Engineering and technology | 8,471 | | | 5,359 | | | 30,704 | | | 27,258 | |

| Sales and marketing | 32,522 | | | 26,833 | | | 173,331 | | | 177,618 | |

| General and administrative | 27,052 | | | 18,625 | | | 98,671 | | | 82,158 | |

| Acquisition and integration | 4,285 | | | 12,303 | | | 32,798 | | | 31,085 | |

| Depreciation | 2,535 | | | 1,948 | | | 10,906 | | | 7,293 | |

| Amortization of acquired intangible assets | 7,073 | | | 7,578 | | | 28,320 | | | 29,745 | |

| Impairment of goodwill | — | | | — | | | — | | | 270,625 | |

| Total operating expenses | 206,285 | | | 178,845 | | | 854,581 | | | 1,024,072 | |

| Operating income (loss) | (27,954) | | | (23,688) | | | 30,619 | | | (269,120) | |

Interest expense and other, net (1) | (7,878) | | | (7,918) | | | (32,080) | | | (31,304) | |

| Loss before income taxes | (35,832) | | | (31,606) | | | (1,461) | | | (300,424) | |

| Income tax benefit (expense) | 12,138 | | | (19,094) | | | 9,218 | | | (42,331) | |

| Net income (loss) | $ | (23,694) | | | $ | (50,700) | | | $ | 7,757 | | | $ | (342,755) | |

| | | | | | | |

| Net income (loss) per share: | | | | | | | |

| Basic | $ | (0.49) | | | $ | (1.05) | | | $ | 0.16 | | | $ | (7.14) | |

| Diluted | $ | (0.49) | | | $ | (1.05) | | | $ | 0.16 | | | $ | (7.14) | |

| | | | | | | |

| Weighted average shares outstanding: | | | | | | | |

| Basic | 48,834 | | | 48,107 | | | 48,578 | | | 47,978 | |

| Diluted | 48,834 | | | 48,107 | | | 49,526 | | | 47,978 | |

_________________________

(1)Interest expense and other, net consisted of the following (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended

December 31, | | Year ended

December 31, |

| 2021 | | 2020 | | 2021 | | 2020 |

| Interest expense | $ | 7,018 | | | $ | 7,160 | | | $ | 28,807 | | | $ | 24,570 | |

| Amortization of debt issuance costs | 394 | | | 366 | | | 1,522 | | | 1,372 | |

| Accretion of debt discounts | 295 | | | 279 | | | 1,146 | | | 693 | |

| Total interest expense | 7,707 | | | 7,805 | | | 31,475 | | | 26,635 | |

| Interest income | (19) | | | (38) | | | (21) | | | (65) | |

| Gain on sale of a business | — | | | — | | | — | | | (349) | |

| Non-capitalized debt issuance expenses | — | | | — | | | — | | | 3,687 | |

| Other | 190 | | | 151 | | | 626 | | | 1,396 | |

| Interest expense and other, net | $ | 7,878 | | | $ | 7,918 | | | $ | 32,080 | | | $ | 31,304 | |

Blucora, Inc.

Condensed Consolidated Balance Sheets

(Unaudited) (In thousands)

| | | | | | | | | | | |

| December 31, |

| 2021 | | 2020 |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 134,824 | | | $ | 150,125 | |

| Cash segregated under federal or other regulations | — | | | 637 | |

| Accounts receivable, net | 21,906 | | | 12,736 | |

| Commissions and advisory fees receivable | 25,073 | | | 26,132 | |

| | | |

| Prepaid expenses and other current assets | 18,476 | | | 11,038 | |

| Total current assets | 200,279 | | | 200,668 | |

| Long-term assets: | | | |

| Property, equipment, and software, net | 73,638 | | | 58,500 | |

| Right-of-use assets, net | 20,466 | | | 23,455 | |

| Goodwill | 454,821 | | | 454,821 | |

| Acquired intangible assets, net | 302,289 | | | 322,179 | |

| | | |

| Other long-term assets | 20,450 | | | 4,569 | |

| Total long-term assets | 871,664 | | | 863,524 | |

| Total assets | $ | 1,071,943 | | | $ | 1,064,192 | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 8,216 | | | $ | 9,290 | |

| Commissions and advisory fees payable | 17,940 | | | 19,021 | |

| Accrued expenses and other current liabilities | 65,678 | | | 56,419 | |

| Current deferred revenue | 13,180 | | | 12,298 | |

| Current lease liabilities | 4,896 | | | 2,304 | |

| Current portion of long-term debt | 1,812 | | | 1,812 | |

| Total current liabilities | 111,722 | | | 101,144 | |

| Long-term liabilities: | | | |

| Long-term debt, net | 553,134 | | | 552,525 | |

| Deferred tax liabilities, net | 20,124 | | | 30,663 | |

| Long-term deferred revenue | 5,322 | | | 6,247 | |

| Long-term lease liabilities | 33,267 | | | 36,404 | |

| Other long-term liabilities | 6,752 | | | 24,919 | |

| Total long-term liabilities | 618,599 | | | 650,758 | |

| Total liabilities | 730,321 | | | 751,902 | |

| | | |

| | | |

| | | |

| Stockholders’ equity: | | | |

| Common stock, par value $0.0001 per share—900,000 authorized shares; 50,137 shares issued and 48,831 shares outstanding at December 31, 2021; 49,483 shares issued and 48,177 shares outstanding at December 31, 2020 | 5 | | | 5 | |

| Additional paid-in capital | 1,619,805 | | | 1,598,230 | |

| Accumulated deficit | (1,249,789) | | | (1,257,546) | |

| | | |

| Treasury stock, at cost—1,306 shares at December 31, 2021 and December 31, 2020 | (28,399) | | | (28,399) | |

| Total stockholders’ equity | 341,622 | | | 312,290 | |

| Total liabilities and stockholders’ equity | $ | 1,071,943 | | | $ | 1,064,192 | |

Blucora, Inc.

Condensed Consolidated Statements of Cash Flows

(Unaudited) (In thousands) | | | | | | | | | | | |

| Year ended December 31, |

| 2021 | | 2020 |

| Operating activities: | | | |

| Net income (loss) | $ | 7,757 | | | $ | (342,755) | |

| Adjustments to reconcile net income (loss) to net cash from operating activities: | | | |

| Depreciation and amortization of acquired intangible assets | 43,426 | | | 39,907 | |

| Stock-based compensation | 20,754 | | | 10,066 | |

| Impairment of goodwill | — | | | 270,625 | |

| | | |

| Reduction of right-of-use lease assets | 3,046 | | | 8,908 | |

| Deferred income taxes | (10,539) | | | 41,059 | |

| Amortization of debt discount and issuance costs | 2,668 | | | 2,065 | |

| | | |

| Gain on sale of a business | — | | | (349) | |

| Change in the fair value of acquisition-related contingent consideration | 22,400 | | | 8,300 | |

| Accretion of lease liabilities | 1,250 | | | 1,922 | |

| Other non-cash expenses | 2,602 | | | 1,508 | |

| Changes in operating assets and liabilities, net of acquisitions and disposals: | | | |

| | | |

| Accounts receivable, net | (9,152) | | | 10,705 | |

| Commissions and advisory fees receivable | 1,059 | | | (4,956) | |

| | | |

| Prepaid expenses and other current assets | (7,438) | | | 3,847 | |

| Other long-term assets | (17,861) | | | 2,232 | |

| Accounts payable | (1,074) | | | (4,192) | |

| Commissions and advisory fees payable | (857) | | | (884) | |

| Lease liabilities | (1,853) | | | (3,894) | |

| Deferred revenue | (43) | | | (796) | |

| Accrued expenses and other current and long-term liabilities | (19,314) | | | 761 | |

| Net cash provided by operating activities | 36,831 | | | 44,079 | |

| Investing activities: | | | |

| Purchases of property, equipment, and software, net | (30,276) | | | (36,002) | |

| Business acquisitions, net of cash acquired | — | | | (101,910) | |

| | | |

| Asset acquisitions | (8,316) | | | (3,143) | |

| Proceeds from sale of a business, net of cash | — | | | 349 | |

| Net cash used by investing activities | (38,592) | | | (140,706) | |

| Financing activities: | | | |

| Proceeds from credit facilities, net of debt issuance costs and debt discounts | (502) | | | 226,278 | |

| Payments on credit facilities | (1,812) | | | (66,531) | |

| Acquisition-related contingent consideration payments | (14,075) | | | — | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Proceeds from stock option exercises | 579 | | | 97 | |

| Proceeds from issuance of stock through employee stock purchase plan | 3,277 | | | 2,258 | |

| Tax payments from shares withheld for equity awards | (1,644) | | | (1,163) | |

| Net cash provided (used) by financing activities | (14,177) | | | 160,939 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Net increase (decrease) in cash, cash equivalents, and restricted cash | (15,938) | | | 64,312 | |

| Cash, cash equivalents, and restricted cash, beginning of period | 150,762 | | | 86,450 | |

| Cash, cash equivalents, and restricted cash, end of period | $ | 134,824 | | | $ | 150,762 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

Blucora, Inc.

Segment Information

(Unaudited) (In thousands)

Information on reportable segments and a reconciliation to consolidated net income (loss) are presented below (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended

December 31, | | Year ended

December 31, |

| 2021 | | 2020 | | 2021 | | 2020 |

| Revenue: | | | | | | | |

| Wealth Management | $ | 172,192 | | | $ | 149,384 | | | $ | 658,213 | | | $ | 546,189 | |

| Tax Software | 6,139 | | | 5,773 | | | 226,987 | | | 208,763 | |

| Total revenue | 178,331 | | | 155,157 | | | 885,200 | | | 754,952 | |

| Operating income (loss): | | | | | | | |

| Wealth Management | 21,856 | | | 20,368 | | | 82,212 | | | 72,195 | |

| Tax Software | (18,593) | | | (11,025) | | | 81,879 | | | 49,621 | |

| Corporate-level activity | (31,217) | | | (33,031) | | | (133,472) | | | (390,936) | |

| Total operating income (loss) | (27,954) | | | (23,688) | | | 30,619 | | | (269,120) | |

| Interest expense and other, net | (7,878) | | | (7,918) | | | (32,080) | | | (31,304) | |

| Loss before income taxes | (35,832) | | | (31,606) | | | (1,461) | | | (300,424) | |

| Income tax benefit (expense) | 12,138 | | | (19,094) | | | 9,218 | | | (42,331) | |

| Net income (loss) | $ | (23,694) | | | $ | (50,700) | | | $ | 7,757 | | | $ | (342,755) | |

Revenues by major category within each segment are presented below (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended

December 31, | | Year ended

December 31, |

| 2021 | | 2020 | | 2021 | | 2020 |

| Wealth Management: | | | | | | | |

| Advisory revenue | $ | 104,633 | | | $ | 87,079 | | | $ | 395,800 | | | $ | 314,751 | |

| Commission revenue | 53,480 | | | 49,864 | | | 210,677 | | | 185,201 | |

| Asset-based revenue | 5,587 | | | 4,777 | | | 22,101 | | | 23,688 | |

| Transaction and fee revenue | 8,492 | | | 7,664 | | | 29,635 | | | 22,549 | |

| Total Wealth Management revenue | $ | 172,192 | | | $ | 149,384 | | | $ | 658,213 | | | $ | 546,189 | |

| Tax Software: | | | | | | | |

| Consumer revenue | $ | 5,857 | | | $ | 5,502 | | | $ | 209,748 | | | $ | 192,226 | |

| Professional revenue | 282 | | | 271 | | | 17,239 | | | 16,537 | |

| Total Tax Software revenue | $ | 6,139 | | | $ | 5,773 | | | $ | 226,987 | | | $ | 208,763 | |

Corporate-level activity included the following (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended

December 31, | | | | Year ended

December 31, | | |

| 2021 | | 2020 | | | | | | 2021 | | 2020 | | | | |

| Unallocated corporate-level general and administrative expenses | $ | 7,103 | | | $ | 7,118 | | | | | | | $ | 25,555 | | | $ | 26,689 | | | | | |

| Stock-based compensation | 5,255 | | | 2,846 | | | | | | | 20,754 | | | 10,066 | | | | | |

| Acquisition and integration | 4,285 | | | 12,303 | | | | | | | 32,798 | | | 31,085 | | | | | |

| Depreciation | 3,855 | | | 2,710 | | | | | | | 15,106 | | | 10,162 | | | | | |

| Amortization of acquired intangible assets | 7,073 | | | 7,578 | | | | | | | 28,320 | | | 29,745 | | | | | |

| Contested proxy and other legal and consulting costs | 3,646 | | | — | | | | | | | 10,939 | | | — | | | | | |

| Executive transition costs | — | | | 476 | | | | | | | — | | | 10,701 | | | | | |

| Headquarters relocation costs | — | | | — | | | | | | | — | | | 1,863 | | | | | |

| Impairment of goodwill | — | | | — | | | | | | | — | | | 270,625 | | | | | |

| Total corporate-level activity | $ | 31,217 | | | $ | 33,031 | | | | | | | $ | 133,472 | | | $ | 390,936 | | | | | |

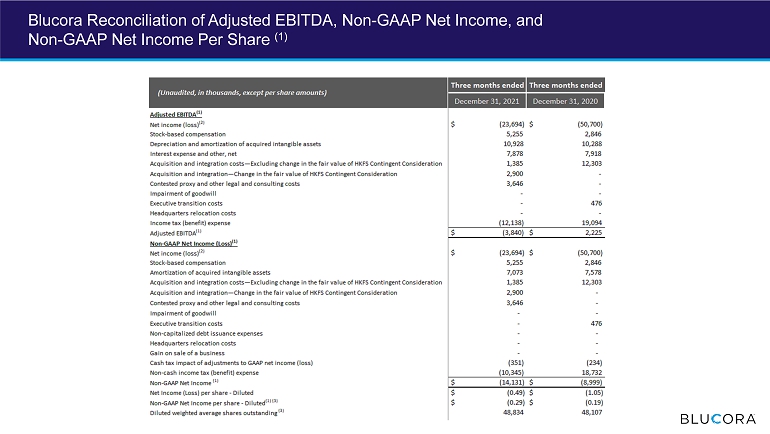

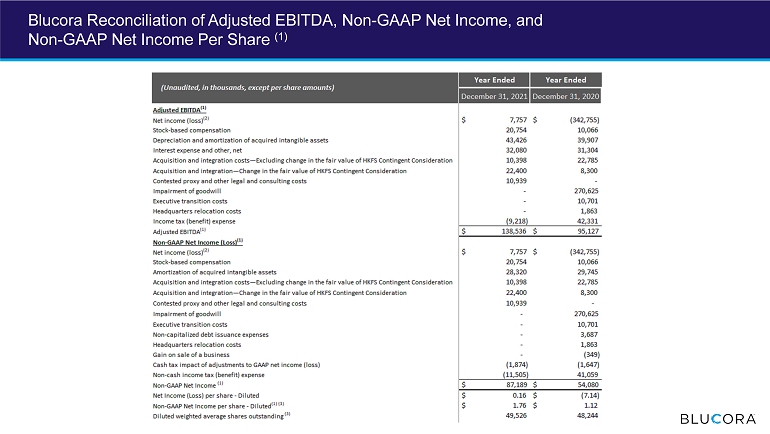

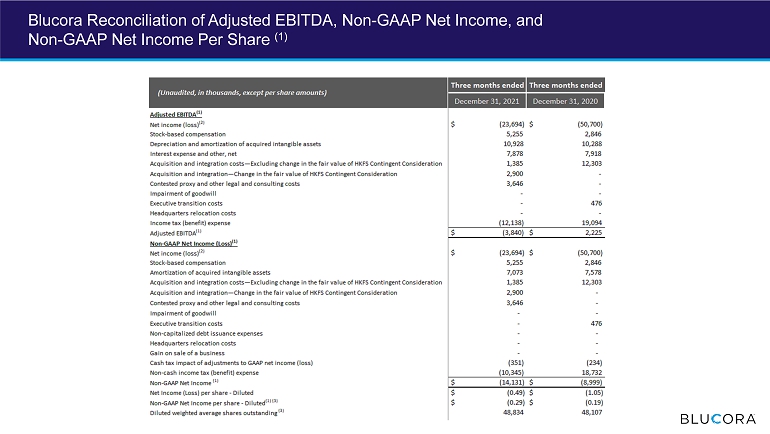

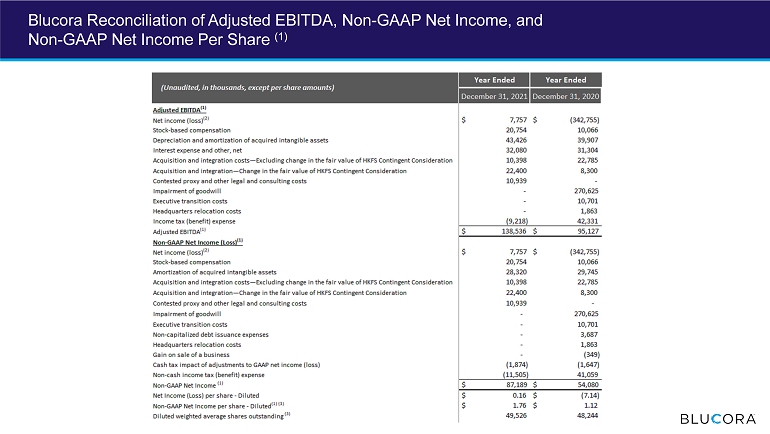

Blucora, Inc.

Reconciliations of Non-GAAP Financial Measures to the Nearest Comparable GAAP Measures (1)

Adjusted EBITDA Reconciliation (1)

(Unaudited, in thousands) | | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended

December 31, | | Year ended

December 31, |

| 2021 | | 2020 | | 2021 | | 2020 |

Net income (loss) (2) | $ | (23,694) | | | $ | (50,700) | | | $ | 7,757 | | | $ | (342,755) | |

| Stock-based compensation | 5,255 | | | 2,846 | | | 20,754 | | | 10,066 | |

| Depreciation and amortization of acquired intangible assets | 10,928 | | | 10,288 | | | 43,426 | | | 39,907 | |

| Interest expense and other, net | 7,878 | | | 7,918 | | | 32,080 | | | 31,304 | |

| Acquisition and integration—Excluding change in the fair value of HKFS Contingent Consideration | 1,385 | | | 3,003 | | | 10,398 | | | 22,785 | |

| Acquisition and integration—Change in the fair value of HKFS Contingent Consideration | 2,900 | | | 9,300 | | | 22,400 | | | 8,300 | |

| Contested proxy and other legal and consulting costs | 3,646 | | | — | | | 10,939 | | | — | |

| Impairment of goodwill | — | | | — | | | — | | | 270,625 | |

| Executive transition costs | — | | | 476 | | | — | | | 10,701 | |

| Headquarters relocation costs | — | | | — | | | — | | | 1,863 | |

| Income tax (benefit) expense | (12,138) | | | 19,094 | | | (9,218) | | | 42,331 | |

Adjusted EBITDA (1) | $ | (3,840) | | | $ | 2,225 | | | $ | 138,536 | | | $ | 95,127 | |

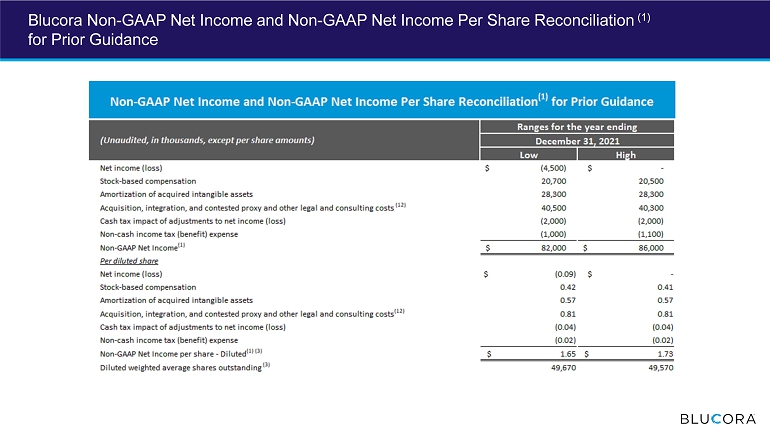

Non-GAAP Net Income (Loss) and Non-GAAP Net Income (Loss) Per Share Reconciliation (1)

(Unaudited, in thousands, except per share amounts) | | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended

December 31, | | Year ended

December 31, |

| 2021 | | 2020 | | 2021 | | 2020 |

Net income (loss) (2) | $ | (23,694) | | | $ | (50,700) | | | $ | 7,757 | | | $ | (342,755) | |

| Stock-based compensation | 5,255 | | | 2,846 | | | 20,754 | | | 10,066 | |

| Amortization of acquired intangible assets | 7,073 | | | 7,578 | | | 28,320 | | | 29,745 | |

| Acquisition and integration—Excluding change in the fair value of HKFS Contingent Consideration | 1,385 | | | 3,003 | | | 10,398 | | | 22,785 | |

| Acquisition and integration—Change in the fair value of HKFS Contingent Consideration | 2,900 | | | 9,300 | | | 22,400 | | | 8,300 | |

| Contested proxy and other legal and consulting costs | 3,646 | | | — | | | 10,939 | | | — | |

| Impairment of goodwill | — | | | — | | | — | | | 270,625 | |

| Executive transition costs | — | | | 476 | | | — | | | 10,701 | |

| Non-capitalized debt issuance expenses | — | | | — | | | — | | | 3,687 | |

| Headquarters relocation costs | — | | | — | | | — | | | 1,863 | |

| Gain on sale of a business | — | | | — | | | — | | | (349) | |

| Cash tax impact of adjustments to GAAP net income (loss) | (351) | | | (234) | | | (1,874) | | | (1,647) | |

| Non-cash income tax (benefit) expense | (10,345) | | | 18,732 | | | (11,505) | | | 41,059 | |

Non-GAAP Net Income (Loss) (1) | $ | (14,131) | | | $ | (8,999) | | | $ | 87,189 | | | $ | 54,080 | |

| Per diluted share: | | | | | | | |

Net income (loss) (2) | $ | (0.49) | | | $ | (1.05) | | | $ | 0.16 | | | $ | (7.10) | |

| Stock-based compensation | 0.11 | | | 0.06 | | | 0.42 | | | 0.21 | |

| Amortization of acquired intangible assets | 0.14 | | | 0.15 | | | 0.57 | | | 0.61 | |

| Acquisition and integration—Excluding change in the fair value of HKFS Contingent Consideration | 0.03 | | | 0.06 | | | 0.21 | | | 0.47 | |

| Acquisition and integration—Change in the fair value of HKFS Contingent Consideration | 0.06 | | | 0.19 | | | 0.45 | | | 0.17 | |

| Contested proxy and other legal and consulting costs | 0.08 | | | — | | | 0.22 | | | — | |

| Impairment of goodwill | — | | | — | | | — | | | 5.61 | |

| Executive transition costs | — | | | 0.01 | | | — | | | 0.22 | |

| Non-capitalized debt issuance expenses | — | | | — | | | — | | | 0.08 | |

| Headquarters relocation costs | — | | | — | | | — | | | 0.04 | |

| Gain on sale of a business | — | | | — | | | — | | | (0.01) | |

| Cash tax impact of adjustments to GAAP net income (loss) | (0.01) | | | — | | | (0.04) | | | (0.03) | |

| Non-cash income tax (benefit) expense | (0.21) | | | 0.39 | | | (0.23) | | | 0.85 | |

Non-GAAP Net Income (Loss) per share - Diluted (1)(3) | $ | (0.29) | | | $ | (0.19) | | | $ | 1.76 | | | $ | 1.12 | |

Diluted weighted average shares outstanding (3) | 48,834 | | | 48,107 | | | 49,526 | | | 48,244 | |

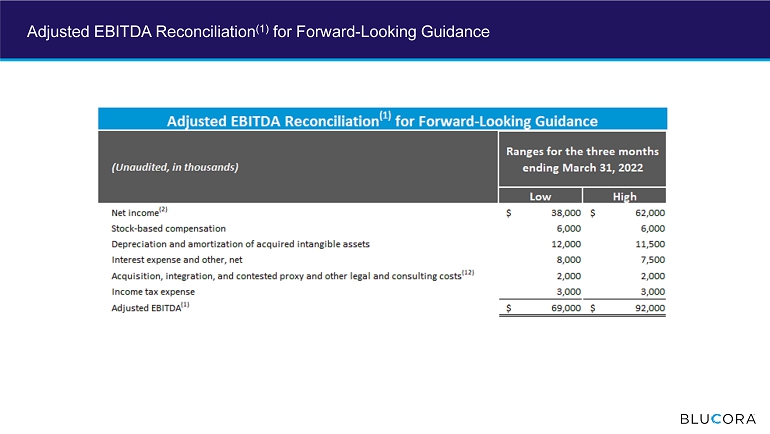

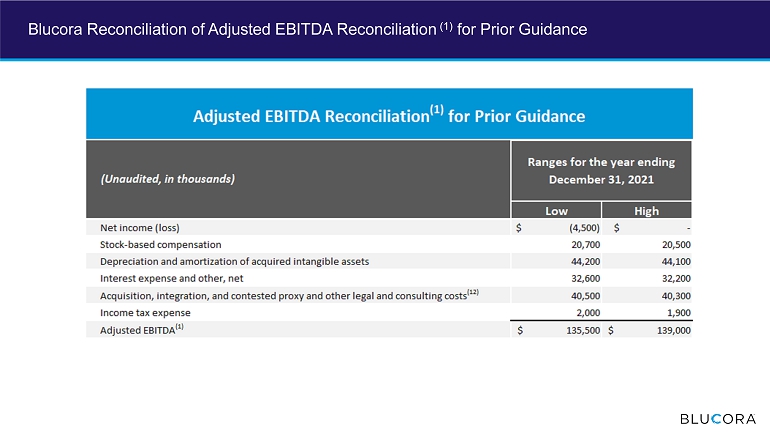

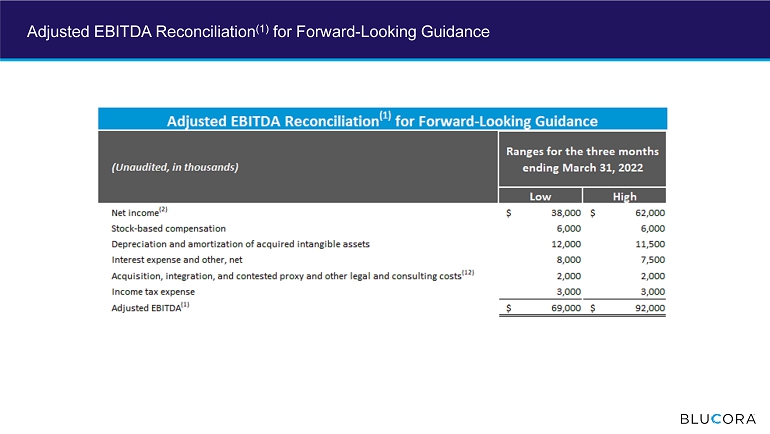

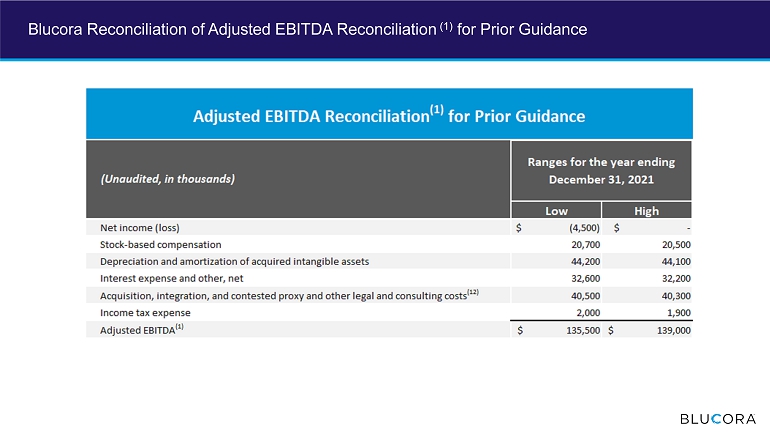

Adjusted EBITDA Reconciliation for Forward-Looking Guidance (1)

(Unaudited, in thousands)

| | | | | | | | | | | | | | | |

| | | Ranges for the quarter ending |

| | | March 31, 2022 |

| | | | | Low | | High |

| Net income | | | | | $ | 38,000 | | | $ | 62,000 | |

| Stock-based compensation | | | | | 6,000 | | | 6,000 | |

| Depreciation and amortization of acquired intangible assets | | | | | 12,000 | | | 11,500 | |

| Interest expense and other, net | | | | | 8,000 | | | 7,500 | |

Acquisition, integration, and contested proxy and other legal and consulting costs (4) | | | | | 2,000 | | | 2,000 | |

| Income tax expense | | | | | 3,000 | | | 3,000 | |

Adjusted EBITDA (1) | | | | | $ | 69,000 | | | $ | 92,000 | |

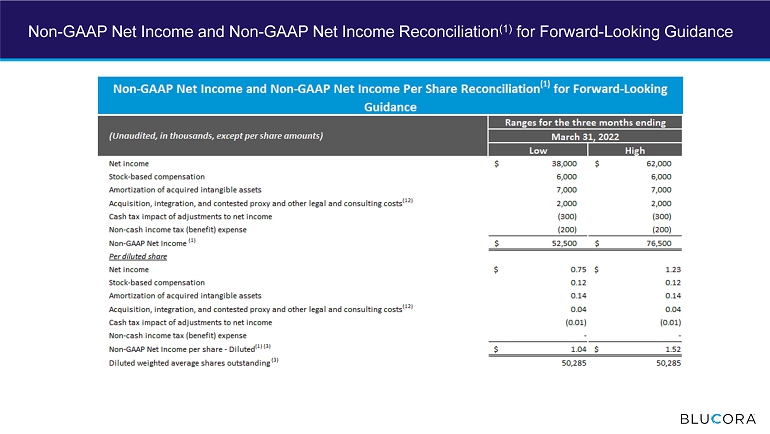

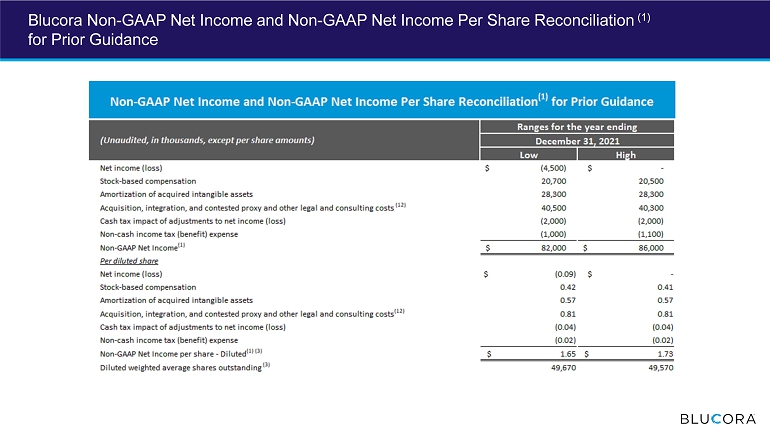

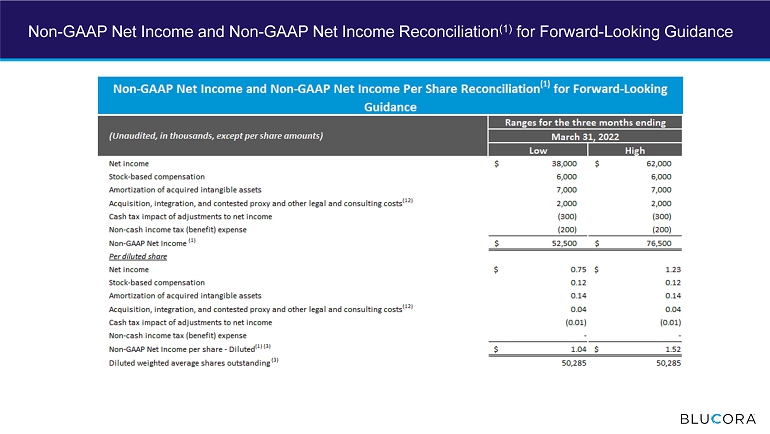

Non-GAAP Net Income and Non-GAAP Net Income Per Share Reconciliation

for Forward-Looking Guidance (1)

(Unaudited, in thousands, except per share amounts)

| | | | | | | | | | | | | | | |

| | | Ranges for the quarter ending |

| | | March 31, 2022 |

| | | | | Low | | High |

| Net income | | | | | $ | 38,000 | | | $ | 62,000 | |

| Stock-based compensation | | | | | 6,000 | | | 6,000 | |

| Amortization of acquired intangible assets | | | | | 7,000 | | | 7,000 | |

Acquisition, integration, and contested proxy and other legal and consulting costs (4) | | | | | 2,000 | | | 2,000 | |

| Cash tax impact of adjustments to net income | | | | | (300) | | | (300) | |

| Non-cash income tax (benefit) expense | | | | | (200) | | | (200) | |

Non-GAAP Net Income (1) | | | | | $ | 52,500 | | | $ | 76,500 | |

| Per diluted share: | | | | | | | |

| Net income | | | | | $ | 0.75 | | | $ | 1.23 | |

| Stock-based compensation | | | | | 0.12 | | | 0.12 | |

| Amortization of acquired intangible assets | | | | | 0.14 | | | 0.14 | |

Acquisition, integration, and contested proxy and other legal and consulting costs (4) | | | | | 0.04 | | | 0.04 | |

| Cash tax impact of adjustments to net income | | | | | (0.01) | | | (0.01) | |

| Non-cash income tax (benefit) expense | | | | | — | | | — | |

Non-GAAP Net Income per share - Diluted (1)(3) | | | | | $ | 1.04 | | | $ | 1.52 | |

Diluted weighted average shares outstanding (3) | | | | | 50,285 | | | 50,285 | |

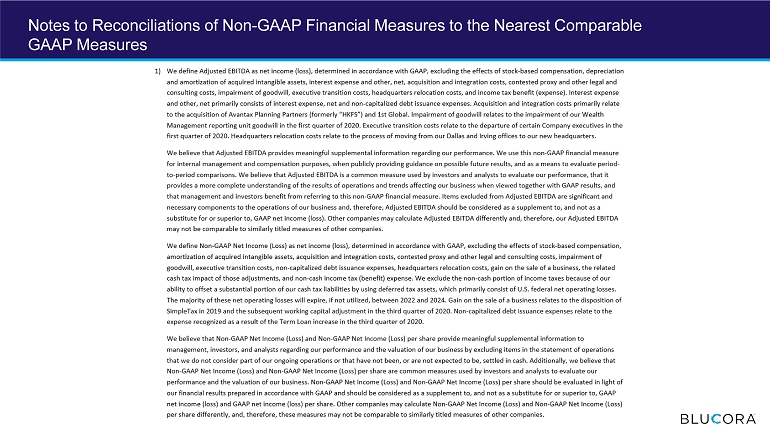

Notes to Reconciliations of Non-GAAP Financial Measures to the Nearest Comparable GAAP Measures

| (1) | We define Adjusted EBITDA as net income (loss), determined in accordance with GAAP, excluding the effects of stock-based compensation, depreciation and amortization of acquired intangible assets, interest expense and other, net, acquisition and integration costs, contested proxy and other legal and consulting costs, impairment of goodwill, executive transition costs, headquarters relocation costs, and income tax benefit (expense). Interest expense and other, net primarily consists of interest expense, net and non-capitalized debt issuance expenses. Acquisition and integration costs primarily relate to the acquisition of Avantax Planning Partners (formerly “HKFS”) and 1st Global. Impairment of goodwill relates to the impairment of our Wealth Management reporting unit goodwill in the first quarter of 2020. Executive transition costs relate to the departure of certain Company executives in the first quarter of 2020. Headquarters relocation costs relate to the process of moving from our Dallas and Irving offices to our new headquarters. |

We believe that Adjusted EBITDA provides meaningful supplemental information regarding our performance. We use this non-GAAP financial measure for internal management and compensation purposes, when publicly providing guidance on possible future results, and as a means to evaluate period-to-period comparisons. We believe that Adjusted EBITDA is a common measure used by investors and analysts to evaluate our performance, that it provides a more complete understanding of the results of operations and trends affecting our business when viewed together with GAAP results, and that management and investors benefit from referring to this non-GAAP financial measure. Items excluded from Adjusted EBITDA are significant and necessary components to the operations of our business and, therefore, Adjusted EBITDA should be considered as a supplement to, and not as a substitute for or superior to, GAAP net income (loss). Other companies may calculate Adjusted EBITDA differently and, therefore, our Adjusted EBITDA may not be comparable to similarly titled measures of other companies.

We define Non-GAAP Net Income (Loss) as net income (loss), determined in accordance with GAAP, excluding the effects of stock-based compensation, amortization of acquired intangible assets, acquisition and integration costs, contested proxy and other legal and consulting costs, impairment of goodwill, executive transition costs, non-capitalized debt issuance expenses, headquarters relocation costs, gain on the sale of a business, the related cash tax impact of those adjustments, and non-cash income tax (benefit) expense. We exclude the non-cash portion of income taxes because of our ability to offset a substantial portion of our cash tax liabilities by using deferred tax assets, which primarily consist of U.S. federal net operating losses. The majority of these net operating losses will expire, if not utilized, between 2022 and 2024. Gain on the sale of a business relates to the disposition of SimpleTax in 2019 and the subsequent working capital adjustment in the third quarter of 2020. Non-capitalized debt issuance expenses relate to the expense recognized as a result of the Term Loan increase in the third quarter of 2020.

We believe that Non-GAAP Net Income (Loss) and Non-GAAP Net Income (Loss) per share provide meaningful supplemental information to management, investors, and analysts regarding our performance and the valuation of our business by excluding items in the statement of operations that we do not consider part of our ongoing operations or that have not been, or are not expected to be, settled in cash. Additionally, we believe that Non-GAAP Net Income (Loss) and Non-GAAP Net Income (Loss) per share are common measures used by investors and analysts to evaluate our performance and the valuation of our business. Non-GAAP Net Income (Loss) and Non-GAAP Net Income (Loss) per share should be evaluated in light of our financial results prepared in accordance with GAAP and should be considered as a supplement to, and not as a substitute for or superior to, GAAP net income (loss) and GAAP net income (loss) per share. Other companies may calculate Non-GAAP Net Income (Loss) and Non-GAAP Net Income (Loss) per share differently, and, therefore, these measures may not be comparable to similarly titled measures of other companies.

| (2) | As presented in the condensed consolidated statements of operations (unaudited). |

| (3) | Any difference in the “per diluted share” amounts between this table and the condensed consolidated statements of operations (unaudited) is due to using different diluted weighted average shares outstanding in the event that there is GAAP net loss but Non-GAAP Net Income and vice versa. |

| (4) | The breakout of components cannot be determined on a forward-looking basis without unreasonable efforts. |

Blucora, Inc.

Supplemental Information

December 31, 2021

Table of Contents

| | | | | |

| Page |

| Financial Information: | |

| |

| |

| |

| |

| |

| |

| Operating Metrics: | |

| |

| |

Blucora Condensed Consolidated Statements of Operations | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (Unaudited, in thousands, except % and per share amounts. Rounding differences may exist) | 2019 | | 2020 | | 2021 |

| FY 12/31 | | 1Q | | 2Q | | 3Q | | 4Q | | FY 12/31 | | 1Q | | 2Q | | 3Q | | 4Q | | FY 12/31 |

| Segment revenue: | | | | | | | | | | | | | | | | | | | | | |

| Wealth Management | $ | 507,979 | | | $ | 144,989 | | | $ | 115,884 | | | $ | 135,932 | | | $ | 149,384 | | | $ | 546,189 | | | $ | 154,491 | | | $ | 162,395 | | | $ | 169,135 | | | $ | 172,192 | | | $ | 658,213 | |

| Tax Software | 209,966 | | | 118,331 | | | 45,238 | | | 39,421 | | | 5,773 | | | 208,763 | | | 123,892 | | | 91,917 | | | 5,039 | | | 6,139 | | | 226,987 | |

| Total segment revenue | 717,945 | | | 263,320 | | | 161,122 | | | 175,353 | | | 155,157 | | | 754,952 | | | 278,383 | | | 254,312 | | | 174,174 | | | 178,331 | | | 885,200 | |

| Operating expenses: | | | | | | | | | | | | | | | | | | | | | |

| Cost of revenue: | | | | | | | | | | | | | | | | | | | | | |

| Wealth Management | 352,081 | | | 102,342 | | | 83,868 | | | 96,122 | | | 103,630 | | | 385,962 | | | 108,623 | | | 113,910 | | | 120,641 | | | 121,119 | | | 464,293 | |

| Tax Software | 10,691 | | | 4,013 | | | 3,054 | | | 2,692 | | | 2,569 | | | 12,328 | | | 5,578 | | | 4,429 | | | 2,323 | | | 3,228 | | | 15,558 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total segment cost of revenue | 362,772 | | | 106,355 | | | 86,922 | | | 98,814 | | | 106,199 | | | 398,290 | | | 114,201 | | | 118,339 | | | 122,964 | | | 124,347 | | | 479,851 | |

| Engineering and technology | 30,931 | | | 8,515 | | | 7,377 | | | 6,007 | | | 5,359 | | | 27,258 | | | 7,128 | | | 7,231 | | | 7,874 | | | 8,471 | | | 30,704 | |

| Sales and marketing | 126,205 | | | 79,710 | | | 40,057 | | | 31,018 | | | 26,833 | | | 177,618 | | | 77,562 | | | 34,848 | | | 28,399 | | | 32,522 | | | 173,331 | |

| General and administrative | 78,529 | | | 24,728 | | | 20,200 | | | 18,605 | | | 18,625 | | | 82,158 | | | 24,685 | | | 23,832 | | | 23,102 | | | 27,052 | | | 98,671 | |

| Acquisition and integration | 25,763 | | | 5,682 | | | 2,824 | | | 10,276 | | | 12,303 | | | 31,085 | | | 8,103 | | | 18,169 | | | 2,241 | | | 4,285 | | | 32,798 | |

| Depreciation | 5,479 | | | 1,796 | | | 1,675 | | | 1,874 | | | 1,948 | | | 7,293 | | | 2,300 | | | 3,204 | | | 2,867 | | | 2,535 | | | 10,906 | |

| Amortization of acquired intangible assets | 37,357 | | | 7,748 | | | 6,673 | | | 7,746 | | | 7,578 | | | 29,745 | | | 7,175 | | | 7,063 | | | 7,009 | | | 7,073 | | | 28,320 | |

Impairment of goodwill and an intangible asset (1) | 50,900 | | | 270,625 | | | — | | | — | | | — | | | 270,625 | | | — | | | — | | | — | | | — | | | — | |

| | | | | | | | | | | | | | | | | | | | | |

| Total operating expenses | 717,936 | | | 505,159 | | | 165,728 | | | 174,340 | | | 178,845 | | | 1,024,072 | | | 241,154 | | | 212,686 | | | 194,456 | | | 206,285 | | | 854,581 | |

| Operating income (loss) | 9 | | | (241,839) | | | (4,606) | | | 1,013 | | | (23,688) | | | (269,120) | | | 37,229 | | | 41,626 | | | (20,282) | | | (27,954) | | | 30,619 | |

| Interest expense and other, net | (16,915) | | | (6,135) | | | (5,288) | | | (11,963) | | | (7,918) | | | (31,304) | | | (7,883) | | | (8,024) | | | (8,295) | | | (7,878) | | | (32,080) | |

| Income (loss) before income taxes | (16,906) | | | (247,974) | | | (9,894) | | | (10,950) | | | (31,606) | | | (300,424) | | | 29,346 | | | 33,602 | | | (28,577) | | | (35,832) | | | (1,461) | |

| Income tax benefit (expense) | 65,054 | | | (67,520) | | | 59,539 | | | (15,256) | | | (19,094) | | | (42,331) | | | (1,700) | | | (1,994) | | | 774 | | | 12,138 | | | 9,218 | |

| | | | | | | | | | | | | | | | | | | | | |

| Net income (loss) | $ | 48,148 | | | $ | (315,494) | | | $ | 49,645 | | | $ | (26,206) | | | $ | (50,700) | | | $ | (342,755) | | | $ | 27,646 | | | $ | 31,608 | | | $ | (27,803) | | | $ | (23,694) | | | $ | 7,757 | |

| | | | | | | | | | | | | | | | | | | | | |

| Net income (loss) per share: | | | | | | | | | | | | | | | | | | | | | |

| Basic | $ | 1.00 | | | $ | (6.60) | | | $ | 1.04 | | | $ | (0.55) | | | $ | (1.05) | | | $ | (7.14) | | | $ | 0.57 | | | $ | 0.65 | | | $ | (0.57) | | | $ | (0.49) | | | $ | 0.16 | |

| Diluted | $ | 0.98 | | | $ | (6.60) | | | $ | 1.03 | | | $ | (0.55) | | | $ | (1.05) | | | $ | (7.14) | | | $ | 0.56 | | | $ | 0.64 | | | $ | (0.57) | | | $ | (0.49) | | | $ | 0.16 | |

| | | | | | | | | | | | | | | | | | | | | |

| Weighted average shares outstanding: | | | | | | | | | | | | | | | | | | | | | |

| Basic | 48,264 | | | 47,827 | | | 47,941 | | | 48,039 | | | 48,107 | | | 47,978 | | | 48,261 | | | 48,508 | | | 48,707 | | | 48,834 | | | 48,578 | |

| Diluted | 49,282 | | | 47,827 | | | 48,092 | | | 48,039 | | | 48,107 | | | 47,978 | | | 49,097 | | | 49,385 | | | 48,707 | | | 48,834 | | | 49,526 | |

____________________________

| (1) | In the first quarter of 2020, we recognized a $270.6 million goodwill impairment related to our Wealth Management reporting unit. In 2019, we recognized a $50.9 million impairment of an intangible asset related to the HD Vest trade name intangible asset. |

Blucora Condensed Consolidated Financial Results (1) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (Unaudited, in thousands, except % and per share amounts. Rounding differences may exist) | 2019 | | 2020 | | 2021 |

| FY 12/31 | | 1Q | | 2Q | | 3Q | | 4Q | | FY 12/31 | | 1Q | | 2Q | | 3Q | | 4Q | | FY 12/31 |

| Segment revenue: | | | | | | | | | | | | | | | | | | | | | |

Wealth Management (1) | $ | 507,979 | | | $ | 144,989 | | | $ | 115,884 | | | $ | 135,932 | | | $ | 149,384 | | | $ | 546,189 | | | $ | 154,491 | | | $ | 162,395 | | | $ | 169,135 | | | $ | 172,192 | | | $ | 658,213 | |

Tax Software (2) | 209,966 | | | 118,331 | | | 45,238 | | | 39,421 | | | 5,773 | | | 208,763 | | | 123,892 | | | 91,917 | | | 5,039 | | | 6,139 | | | 226,987 | |

| Total segment revenue | $ | 717,945 | | | $ | 263,320 | | | $ | 161,122 | | | $ | 175,353 | | | $ | 155,157 | | | $ | 754,952 | | | $ | 278,383 | | | $ | 254,312 | | | $ | 174,174 | | | $ | 178,331 | | | $ | 885,200 | |

Segment operating income: (3) | | | | | | | | | | | | | | | | | | | | | |

Wealth Management (1) | $ | 68,292 | | | $ | 22,598 | | | $ | 11,731 | | | $ | 17,498 | | | $ | 20,368 | | | $ | 72,195 | | | $ | 19,396 | | | $ | 21,396 | | | $ | 19,564 | | | $ | 21,856 | | | $ | 82,212 | |

Tax Software (2) | 96,249 | | | 37,753 | | | 6,659 | | | 16,234 | | | (11,025) | | | 49,621 | | | 50,888 | | | 63,448 | | | (13,864) | | | (18,593) | | | 81,879 | |

| Total segment operating income | $ | 164,541 | | | $ | 60,351 | | | $ | 18,390 | | | $ | 33,732 | | | $ | 9,343 | | | $ | 121,816 | | | $ | 70,284 | | | $ | 84,844 | | | $ | 5,700 | | | $ | 3,263 | | | $ | 164,091 | |

| Segment operating income as a % of segment revenue: | | | | | | | | | | | | | | | | | | | | | |

Wealth Management (1) | 13 | % | | 16 | % | | 10 | % | | 13 | % | | 14 | % | | 13 | % | | 13 | % | | 13 | % | | 12 | % | | 13 | % | | 12 | % |

Tax Software (2) | 46 | % | | 32 | % | | 15 | % | | 41 | % | | (191) | % | | 24 | % | | 41 | % | | 69 | % | | (275) | % | | (303) | % | | 36 | % |

| Total segment operating income as a % of segment revenue | 23 | % | | 23 | % | | 11 | % | | 19 | % | | 6 | % | | 16 | % | | 25 | % | | 33 | % | | 3 | % | | 2 | % | | 19 | % |

Unallocated corporate-level general and administrative expenses (3) | $ | 27,361 | | | $ | 7,016 | | | $ | 5,810 | | | $ | 6,745 | | | $ | 7,118 | | | $ | 26,689 | | | $ | 5,694 | | | $ | 6,259 | | | $ | 6,499 | | | $ | 7,103 | | | $ | 25,555 | |

Adjusted EBITDA (4) | $ | 137,180 | | | $ | 53,335 | | | $ | 12,580 | | | $ | 26,987 | | | $ | 2,225 | | | $ | 95,127 | | | $ | 64,590 | | | $ | 78,585 | | | $ | (799) | | | $ | (3,840) | | | $ | 138,536 | |

Other unallocated corporate-level operating expenses: (3) | | | | | | | | | | | | | | | | | | | | | |

| Stock-based compensation | $ | 16,300 | | | $ | (1,201) | | | $ | 3,904 | | | $ | 4,517 | | | $ | 2,846 | | | $ | 10,066 | | | $ | 5,610 | | | $ | 5,160 | | | $ | 4,729 | | | $ | 5,255 | | | $ | 20,754 | |

| Acquisition and integration—Excluding change in the fair value of acquisition-related contingent consideration | 25,763 | | | 5,682 | | | 2,824 | | | 11,276 | | | 3,003 | | | 22,785 | | | 1,803 | | | 6,669 | | | 541 | | | 1,385 | | | 10,398 | |

| Acquisition and integration—Change in the fair value of acquisition-related contingent consideration | — | | | — | | | — | | | (1,000) | | | 9,300 | | | 8,300 | | | 6,300 | | | 11,500 | | | 1,700 | | | 2,900 | | | 22,400 | |

| Depreciation | 6,851 | | | 2,420 | | | 2,412 | | | 2,620 | | | 2,710 | | | 10,162 | | | 3,243 | | | 4,102 | | | 3,906 | | | 3,855 | | | 15,106 | |

| Amortization of acquired intangible assets | 37,357 | | | 7,748 | | | 6,673 | | | 7,746 | | | 7,578 | | | 29,745 | | | 7,175 | | | 7,063 | | | 7,009 | | | 7,073 | | | 28,320 | |

| Executive transition costs | — | | | 9,184 | | | 636 | | | 405 | | | 476 | | | 10,701 | | | — | | | — | | | — | | | — | | | — | |

| Headquarters relocation costs | — | | | 716 | | | 737 | | | 410 | | | — | | | 1,863 | | | — | | | — | | | — | | | — | | | — | |

| Contested proxy and other legal and consulting costs | — | | | — | | | — | | | — | | | — | | | — | | | 3,230 | | | 2,465 | | | 1,598 | | | 3,646 | | | 10,939 | |

| Impairment of goodwill and an intangible asset | 50,900 | | | 270,625 | | | — | | | — | | | — | | | 270,625 | | | — | | | — | | | — | | | — | | | — | |

| | | | | | | | | | | | | | | | | | | | | |

| Operating income (loss) | $ | 9 | | | $ | (241,839) | | | $ | (4,606) | | | $ | 1,013 | | | $ | (23,688) | | | $ | (269,120) | | | $ | 37,229 | | | $ | 41,626 | | | $ | (20,282) | | | $ | (27,954) | | | $ | 30,619 | |

Unallocated interest expense and other, net: (3) | | | | | | | | | | | | | | | | | | | | | |

| Interest expense | $ | 19,017 | | | $ | 5,316 | | | $ | 4,840 | | | $ | 7,254 | | | $ | 7,160 | | | $ | 24,570 | | | $ | 7,183 | | | $ | 7,302 | | | $ | 7,304 | | | $ | 7,018 | | | $ | 28,807 | |

| Amortization of debt issuance costs | 1,042 | | | 313 | | | 331 | | | 362 | | | 366 | | | 1,372 | | | 363 | | | 377 | | | 388 | | | 394 | | | 1,522 | |

| Accretion of debt discounts | 228 | | | 68 | | | 70 | | | 276 | | | 279 | | | 693 | | | 277 | | | 284 | | | 290 | | | 295 | | | 1,146 | |

| Total interest expense | 20,287 | | | 5,697 | | | 5,241 | | | 7,892 | | | 7,805 | | | 26,635 | | | 7,823 | | | 7,963 | | | 7,982 | | | 7,707 | | | 31,475 | |

| Interest income | (449) | | | (14) | | | (11) | | | (2) | | | (38) | | | (65) | | | (2) | | | — | | | — | | | (19) | | | (21) | |

| Gain on sale of a business | (3,256) | | | — | | | — | | | (349) | | | — | | | (349) | | | — | | | — | | | — | | | — | | | — | |

| Non-capitalized debt issuance expenses | — | | | — | | | — | | | 3,687 | | | — | | | 3,687 | | | — | | | — | | | — | | | — | | | — | |

| Other | 333 | | | 452 | | | 58 | | | 735 | | | 151 | | | 1,396 | | | 62 | | | 61 | | | 313 | | | 190 | | | 626 | |

| Total interest expense and other, net | 16,915 | | | 6,135 | | | 5,288 | | | 11,963 | | | 7,918 | | | 31,304 | | | 7,883 | | | 8,024 | | | 8,295 | | | 7,878 | | | 32,080 | |

| Income (loss) before income taxes | (16,906) | | | (247,974) | | | (9,894) | | | (10,950) | | | (31,606) | | | (300,424) | | | 29,346 | | | 33,602 | | | (28,577) | | | (35,832) | | | (1,461) | |

| Income tax (benefit) expense: | | | | | | | | | | | | | | | | | | | | | |

| Cash | 3,564 | | | 483 | | | 158 | | | 269 | | | 362 | | | 1,272 | | | 1,969 | | | 2,688 | | | (577) | | | (1,793) | | | 2,287 | |

Non-cash (5) | (68,618) | | | 67,037 | | | (59,697) | | | 14,987 | | | 18,732 | | | 41,059 | | | (269) | | | (694) | | | (197) | | | (10,345) | | | (11,505) | |

| Total income tax (benefit) expense | (65,054) | | | 67,520 | | | (59,539) | | | 15,256 | | | 19,094 | | | 42,331 | | | 1,700 | | | 1,994 | | | (774) | | | (12,138) | | | (9,218) | |

| GAAP Net Income (Loss) | $ | 48,148 | | | $ | (315,494) | | | $ | 49,645 | | | $ | (26,206) | | | $ | (50,700) | | | $ | (342,755) | | | $ | 27,646 | | | $ | 31,608 | | | $ | (27,803) | | | $ | (23,694) | | | $ | 7,757 | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| GAAP Net Income (Loss) per share - Diluted | $ | 0.98 | | | $ | (6.60) | | | $ | 1.03 | | | $ | (0.55) | | | $ | (1.05) | | | $ | (7.14) | | | $ | 0.56 | | | $ | 0.64 | | | $ | (0.57) | | | $ | (0.49) | | | $ | 0.16 | |

Non-GAAP Net Income (Loss) (4) | $ | 104,198 | | | $ | 43,561 | | | $ | 4,463 | | | $ | 15,055 | | | $ | (8,999) | | | $ | 54,080 | | | $ | 50,952 | | | $ | 63,122 | | | $ | (12,754) | | | $ | (14,131) | | | $ | 87,189 | |

Non-GAAP Net Income (Loss) per share - Diluted (4) (6) | $ | 2.11 | | | $ | 0.90 | | | $ | 0.09 | | | $ | 0.31 | | | $ | (0.19) | | | $ | 1.12 | | | $ | 1.04 | | | $ | 1.28 | | | $ | (0.26) | | | $ | (0.29) | | | $ | 1.76 | |

| | | | | | | | | | | | | | | | | | | | | |

| Basic weighted average shares outstanding | 48,264 | | | 47,827 | | | 47,941 | | | 48,039 | | | 48,107 | | | 47,978 | | | 48,261 | | | 48,508 | | | 48,707 | | | 48,834 | | | 48,578 | |

Diluted weighted average shares outstanding (6) | 49,282 | | | 47,827 | | | 48,092 | | | 48,039 | | | 48,107 | | | 47,978 | | | 49,097 | | | 49,385 | | | 48,707 | | | 48,834 | | | 49,526 | |

Notes to Condensed Consolidated Financial Results on next page

Notes to Condensed Consolidated Financial Results

| (1) | The operations of 1st Global are included in the Company's operating results as part of the Wealth Management segment beginning May 6, 2019 when 1st Global was acquired. The operations of Avantax Planning Partners (formerly "HKFS") are included in the Company's operating results as part of the Wealth Management segment beginning July 1, 2020 when HKFS was acquired. |

| (2) | As a highly seasonal business, a significant portion of Tax Software revenue is typically generated in the first two quarters of the calendar year. In March 2020 and as a result of the COVID-19 pandemic, the Internal Revenue Service (“IRS”) extended the filing deadline for federal tax returns from April 15, 2020 to July 15, 2020. This filing extension resulted in the shifting of a significant portion of Tax Software segment revenue that is usually earned in the first and second quarters to the third quarter of 2020. As a result of the continued impact of the COVID-19 pandemic, including disruptions associated with the distribution of the second and third rounds of Economic Impact Payments, the IRS delayed the start of the 2021 tax season and extended the filing and payment deadline for tax year 2020 federal tax returns from April 15, 2021 to May 17, 2021. In addition, the IRS extended the federal filing and payment deadline for Texas, Louisiana, and Oklahoma to June 15, 2021. Beyond federal filings, the majority of states also extended their filing and payment deadlines for tax year 2020 state tax returns. This extension resulted in the shifting of a significant portion of Tax Software segment revenue that is usually earned in the first quarter to the second quarter of 2021. |

| (3) | We do not allocate certain operating expenses (including personnel and overhead costs), stock-based compensation, acquisition and integration costs, depreciation, amortization of acquired intangible assets, executive transition costs, headquarters relocation costs, contested proxy and other legal and consulting costs, impairment of goodwill and an intangible asset, interest expense and other, net, or income taxes to the reportable segments. General and administrative costs are included in "Unallocated corporate-level expenses." |

| (4) | See the Reconciliation of Certain Non-GAAP Financial Measures to the Nearest Comparable GAAP Financial Measures on page 5. |

| (5) | Amounts represent the non-cash portion of income taxes. We exclude the non-cash portion of income taxes because of our ability to offset a substantial portion of our cash tax liabilities by using deferred tax assets, which primarily consist of U.S. federal net operating losses. The majority of these federal net operating losses will expire, if not utilized, between 2022 and 2024. |

| (6) | For periods in which non-GAAP net income is generated, non-GAAP net income per share is calculated using diluted weighted average shares outstanding. For periods in which non-GAAP net loss is generated, diluted weighted average shares outstanding is the same as basic weighted average shares outstanding. |

Blucora Reconciliation of Certain Non-GAAP Financial Measures to the Nearest Comparable GAAP Financial Measures (1) (2) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 2019 | | 2020 | | 2021 |

| (Unaudited, in thousands, rounding differences may exist) | FY 12/31 | | 1Q | | 2Q | | 3Q | | 4Q | | FY 12/31 | | 1Q | | 2Q | | 3Q | | 4Q | | FY 12/31 |

Adjusted EBITDA (1) | | | | | | | | | | | | | | | | | | | | | |

Net income (loss) (2) | $ | 48,148 | | | $ | (315,494) | | | $ | 49,645 | | | $ | (26,206) | | | $ | (50,700) | | | $ | (342,755) | | | $ | 27,646 | | | $ | 31,608 | | | $ | (27,803) | | | $ | (23,694) | | | $ | 7,757 | |

| Stock-based compensation | 16,300 | | | (1,201) | | | 3,904 | | | 4,517 | | | 2,846 | | | 10,066 | | | 5,610 | | | 5,160 | | | 4,729 | | | 5,255 | | | 20,754 | |

| Depreciation and amortization of acquired intangible assets | 44,208 | | | 10,168 | | | 9,085 | | | 10,366 | | | 10,288 | | | 39,907 | | | 10,418 | | | 11,165 | | | 10,915 | | | 10,928 | | | 43,426 | |

| Interest expense and other, net | 16,915 | | | 6,135 | | | 5,288 | | | 11,963 | | | 7,918 | | | 31,304 | | | 7,883 | | | 8,024 | | | 8,295 | | | 7,878 | | | 32,080 | |

| Acquisition and integration—Excluding change in the fair value of HKFS Contingent Consideration | 25,763 | | | 5,682 | | | 2,824 | | | 11,276 | | | 3,003 | | | 22,785 | | | 1,803 | | | 6,669 | | | 541 | | | 1,385 | | | 10,398 | |

| Acquisition and integration—Change in the fair value of HKFS Contingent Consideration | — | | | — | | | — | | | (1,000) | | | 9,300 | | | 8,300 | | | 6,300 | | | 11,500 | | | 1,700 | | | 2,900 | | | 22,400 | |

| Executive transition costs | — | | | 9,184 | | | 636 | | | 405 | | | 476 | | | 10,701 | | | — | | | — | | | — | | | — | | | — | |

| Headquarters relocation costs | — | | | 716 | | | 737 | | | 410 | | | — | | | 1,863 | | | — | | | — | | | — | | | — | | | — | |

| Contested proxy and other legal and consulting costs | — | | | — | | | — | | | — | | | — | | | — | | | 3,230 | | | 2,465 | | | 1,598 | | | 3,646 | | | 10,939 | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Income tax (benefit) expense | (65,054) | | | 67,520 | | | (59,539) | | | 15,256 | | | 19,094 | | | 42,331 | | | 1,700 | | | 1,994 | | | (774) | | | (12,138) | | | (9,218) | |

| Impairment of goodwill and an intangible asset | 50,900 | | | 270,625 | | | — | | | — | | | — | | | 270,625 | | | — | | | — | | | — | | | — | | | — | |

Adjusted EBITDA(1) | $ | 137,180 | | | $ | 53,335 | | | $ | 12,580 | | | $ | 26,987 | | | $ | 2,225 | | | $ | 95,127 | | | $ | 64,590 | | | $ | 78,585 | | | $ | (799) | | | $ | (3,840) | | | $ | 138,536 | |

Non-GAAP Net Income (Loss) (1) | | | | | | | | | | | | | | | | | | | | | |

Net income (loss) (2) | $ | 48,148 | | | $ | (315,494) | | | $ | 49,645 | | | $ | (26,206) | | | $ | (50,700) | | | $ | (342,755) | | | $ | 27,646 | | | $ | 31,608 | | | $ | (27,803) | | | $ | (23,694) | | | $ | 7,757 | |

| Stock-based compensation | 16,300 | | | (1,201) | | | 3,904 | | | 4,517 | | | 2,846 | | | 10,066 | | | 5,610 | | | 5,160 | | | 4,729 | | | 5,255 | | | 20,754 | |

| Amortization of acquired intangible assets | 37,357 | | | 7,748 | | | 6,673 | | | 7,746 | | | 7,578 | | | 29,745 | | | 7,175 | | | 7,063 | | | 7,009 | | | 7,073 | | | 28,320 | |

| Acquisition and integration—Excluding change in the fair value of HKFS Contingent Consideration | 25,763 | | | 5,682 | | | 2,824 | | | 11,276 | | | 3,003 | | | 22,785 | | | 1,803 | | | 6,669 | | | 541 | | | 1,385 | | | 10,398 | |

| Acquisition and integration—Change in the fair value of HKFS Contingent Consideration | — | | | — | | | — | | | (1,000) | | | 9,300 | | | 8,300 | | | 6,300 | | | 11,500 | | | 1,700 | | | 2,900 | | | 22,400 | |

| Executive transition costs | — | | | 9,184 | | | 636 | | | 405 | | | 476 | | | 10,701 | | | — | | | — | | | — | | | — | | | — | |

| Headquarters relocation costs | — | | | 716 | | | 737 | | | 410 | | | — | | | 1,863 | | | — | | | — | | | — | | | — | | | — | |

| Contested proxy and other legal and consulting costs | — | | | — | | | — | | | — | | | — | | | — | | | 3,230 | | | 2,465 | | | 1,598 | | | 3,646 | | | 10,939 | |

| Non-capitalized debt issuance expenses | — | | | — | | | — | | | 3,687 | | | — | | | 3,687 | | | — | | | — | | | — | | | — | | | — | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Impairment of goodwill and an intangible asset | 50,900 | | | 270,625 | | | — | | | — | | | — | | | 270,625 | | | — | | | — | | | — | | | — | | | — | |

| Gain on the sale of a business | (3,256) | | | — | | | — | | | (349) | | | — | | | (349) | | | — | | | — | | | — | | | — | | | — | |

| Cash tax impact of adjustments to GAAP net income (loss) | (2,396) | | | (736) | | | (259) | | | (418) | | | (234) | | | (1,647) | | | (543) | | | (649) | | | (331) | | | (351) | | | (1,874) | |

| Non-cash income tax (benefit) expense | (68,618) | | | 67,037 | | | (59,697) | | | 14,987 | | | 18,732 | | | 41,059 | | | (269) | | | (694) | | | (197) | | | (10,345) | | | (11,505) | |

Non-GAAP Net Income (Loss) (1) | $ | 104,198 | | | $ | 43,561 | | | $ | 4,463 | | | $ | 15,055 | | | $ | (8,999) | | | $ | 54,080 | | | $ | 50,952 | | | $ | 63,122 | | | $ | (12,754) | | | $ | (14,131) | | | $ | 87,189 | |

| | | | | | | | | | | | | | | | | | | | | |

Non-GAAP Net Income (Loss) per share - Diluted (1) (3) | $ | 2.11 | | | $ | 0.90 | | | $ | 0.09 | | | $ | 0.31 | | | $ | (0.19) | | | $ | 1.12 | | | $ | 1.04 | | | $ | 1.28 | | | $ | (0.26) | | | $ | (0.29) | | | $ | 1.76 | |

Diluted weighted average shares outstanding (3) | 49,282 | | | 48,253 | | | 48,092 | | | 48,203 | | | 48,107 | | | 48,244 | | | 49,097 | | | 49,385 | | | 48,707 | | | 48,834 | | | 49,526 | |

Notes to Reconciliations of Certain Non-GAAP Financial Measures to the Nearest Comparable GAAP Measures on next page

Notes to Reconciliations of Certain Non-GAAP Financial Measures to the Nearest Comparable GAAP Measures

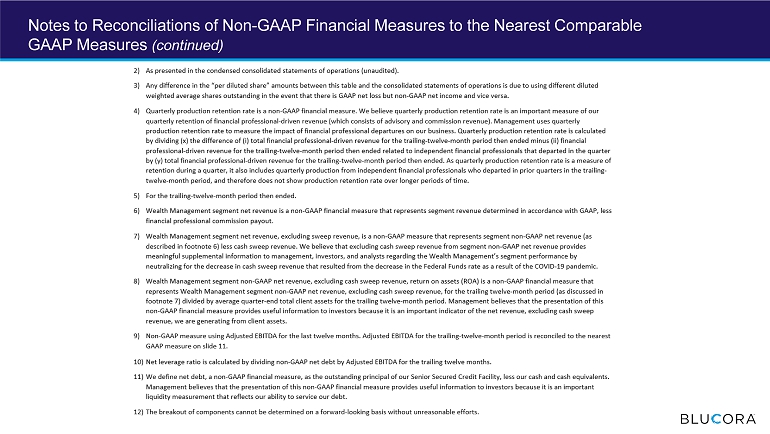

| (1) | We define Adjusted EBITDA as net income (loss), determined in accordance with GAAP, excluding the effects of stock-based compensation, depreciation and amortization of acquired intangible assets, interest expense and other, net, acquisition and integration costs, contested proxy and other legal and consulting costs, impairment of goodwill, executive transition costs, headquarters relocation costs, and income tax benefit (expense). Interest expense and other, net primarily consists of interest expense, net and non-capitalized debt issuance expenses. Acquisition and integration costs primarily relate to the acquisition of Avantax Planning Partners and 1st Global. Impairment of goodwill relates to the impairment of our Wealth Management reporting unit goodwill in the first quarter of 2020. Executive transition costs relate to the departure of certain Company executives in the first quarter of 2020. Headquarters relocation costs relate to the process of moving from our Dallas and Irving offices to our new headquarters. |

We believe that Adjusted EBITDA provides meaningful supplemental information regarding our performance. We use this non-GAAP financial measure for internal management and compensation purposes, when publicly providing guidance on possible future results, and as a means to evaluate period-to-period comparisons. We believe that Adjusted EBITDA is a common measure used by investors and analysts to evaluate our performance, that it provides a more complete understanding of the results of operations and trends affecting our business when viewed together with GAAP results, and that management and investors benefit from referring to this non-GAAP financial measure. Items excluded from Adjusted EBITDA are significant and necessary components to the operations of our business and, therefore, Adjusted EBITDA should be considered as a supplement to, and not as a substitute for or superior to, GAAP net income (loss). Other companies may calculate Adjusted EBITDA differently and, therefore, our Adjusted EBITDA may not be comparable to similarly titled measures of other companies.

We define Non-GAAP Net Income (Loss) as net income (loss), determined in accordance with GAAP, excluding the effects of stock-based compensation, amortization of acquired intangible assets, acquisition and integration costs, contested proxy and other legal and consulting costs, impairment of goodwill, executive transition costs, non-capitalized debt issuance expenses, headquarters relocation costs, gain on the sale of a business, the related cash tax impact of those adjustments, and non-cash income tax (benefit) expense. We exclude the non-cash portion of income taxes because of our ability to offset a substantial portion of our cash tax liabilities by using deferred tax assets, which primarily consist of U.S. federal net operating losses. The majority of these net operating losses will expire, if not utilized, between 2022 and 2024. Gain on the sale of a business relates to the disposition of SimpleTax in 2019 and the subsequent working capital adjustment in the third quarter of 2020. Non-capitalized debt issuance expenses relate to the expense recognized as a result of the Term Loan increase in the third quarter of 2020.

We believe that Non-GAAP Net Income (Loss) and Non-GAAP Net Income (Loss) per share provide meaningful supplemental information to management, investors, and analysts regarding our performance and the valuation of our business by excluding items in the statement of operations that we do not consider part of our ongoing operations or that have not been, or are not expected to be, settled in cash. Additionally, we believe that Non-GAAP Net Income (Loss) and Non-GAAP Net Income (Loss) per share are common measures used by investors and analysts to evaluate our performance and the valuation of our business. Non-GAAP Net Income (Loss) and Non-GAAP Net Income (Loss) per share should be evaluated in light of our financial results prepared in accordance with GAAP and should be considered as a supplement to, and not as a substitute for or superior to, GAAP net income (loss) and GAAP net income (loss) per share. Other companies may calculate Non-GAAP Net Income (Loss) and Non-GAAP Net Income (Loss) per share differently, and, therefore, these measures may not be comparable to similarly titled measures of other companies.

| (2) | See the Condensed Consolidated Financial Results on page 3. |

| (3) | For periods in which non-GAAP net income is generated, Non-GAAP Net Income (Loss) per share is calculated using diluted weighted average shares outstanding. For periods in which Non-GAAP Net Loss is generated, diluted weighted average shares outstanding is the same as basic weighted average shares outstanding. |

Blucora Reconciliation of Trailing Twelve Month ("TTM") Adjusted EBITDA (1) (2)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 2019 | | 2020 | 2021 | | |

| (Unaudited, in thousands, rounding differences may exist) | TTM 4Q | | TTM 1Q | | TTM 2Q | | TTM 3Q | | TTM 4Q | | TTM 1Q | | TTM 2Q | | TTM 3Q | | TTM 4Q | | |

Adjusted EBITDA (1) (2) | | | | | | | | | | | | | | | | | | | |

| Net income (loss) | $ | 48,148 | | | $ | (329,516) | | | $ | (310,907) | | | $ | (274,727) | | | $ | (342,755) | | | $ | 385 | | | $ | (17,652) | | | $ | (19,249) | | | $ | 7,757 | | | |

| Stock-based compensation | 16,300 | | | 12,656 | | | 12,478 | | | 12,356 | | | 10,066 | | | 16,877 | | | 18,133 | | | 18,345 | | | 20,754 | | | |

| Depreciation and amortization of acquired intangible assets | 44,208 | | | 45,022 | | | 43,276 | | | 41,749 | | | 39,907 | | | 40,157 | | | 42,237 | | | 42,786 | | | 43,426 | | | |

| Interest expense and other, net | 16,915 | | | 19,092 | | | 19,262 | | | 28,619 | | | 31,304 | | | 33,052 | | | 35,788 | | | 32,120 | | | 32,080 | | | |

| Acquisition and integration—Excluding change in the fair value of HKFS Contingent Consideration | 25,763 | | | 29,648 | | | 23,289 | | | 27,806 | | | 22,785 | | | 18,906 | | | 22,751 | | | 12,016 | | | 10,398 | | | |

| Acquisition and integration—Change in the fair value of HKFS Contingent Consideration | — | | | — | | | — | | | (1,000) | | | 8,300 | | | 14,600 | | | 26,100 | | | 28,800 | | | 22,400 | | | |

| Executive transition costs | — | | | 9,184 | | | 9,820 | | | 10,225 | | | 10,701 | | | 1,517 | | | 881 | | | 476 | | | — | | | |

| Headquarter relocation costs | — | | | 716 | | | 1,453 | | | 1,863 | | | 1,863 | | | 1,147 | | | 410 | | | — | | | — | | | |

| Contested proxy and other legal and consulting costs | — | | | — | | | — | | | — | | | — | | | 3,230 | | | 5,695 | | | 7,293 | | | 10,939 | | | |

| | | | | | | | | | | | | | | | | | | |

| Impairment of goodwill and an intangible asset | 50,900 | | | 321,525 | | | 321,525 | | | 270,625 | | | 270,625 | | | — | | | — | | | — | | | — | | | |

| Income tax (benefit) expense | (65,054) | | | (1,519) | | | (52,934) | | | (25,347) | | | 42,331 | | | (23,489) | | | 38,044 | | | 22,014 | | | (9,218) | | | |

Adjusted EBITDA(1) | $ | 137,180 | | | $ | 106,808 | | | $ | 67,262 | | | $ | 92,169 | | | $ | 95,127 | | | $ | 106,382 | | | $ | 172,387 | | | $ | 144,601 | | | $ | 138,536 | | | |

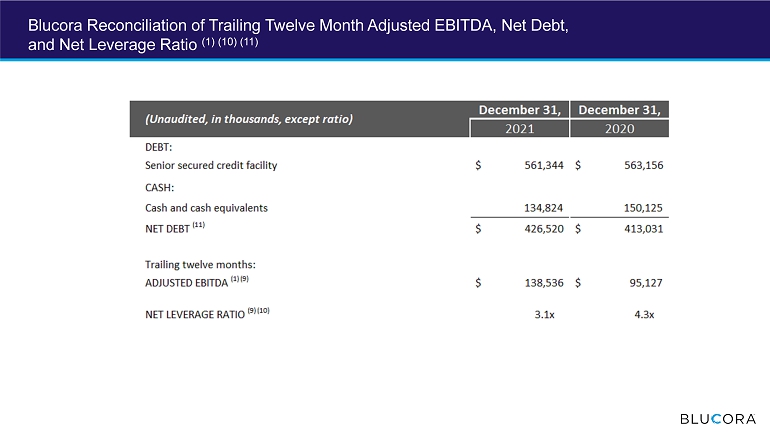

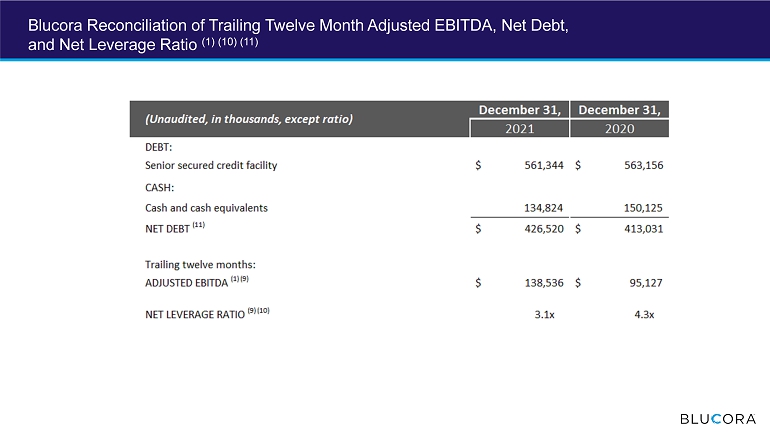

Blucora Net Leverage Ratio (1) (3) (4) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 2019 | | 2020 | | 2021 | | | |

| (Unaudited, in thousands, rounding differences may exist) | 4Q | | 1Q | | 2Q | | 3Q | | 4Q | | 1Q | | 2Q | | 3Q | | 4Q | | | |

| DEBT: | | | | | | | | | | | | | | | | | | | | |

| Senior Secured Credit Facility | $ | 399,687 | | | $ | 444,375 | | | $ | 389,062 | | | $ | 563,609 | | | $ | 563,156 | | | $ | 562,703 | | | $ | 562,250 | | | $ | 561,797 | | | $ | 561,344 | | | | |

| CASH: | | | | | | | | | | | | | | | | | | | | |

| Cash and cash equivalents | 80,820 | | | 168,198 | | | 90,081 | | | 151,166 | | | 150,125 | | | 191,803 | | | 232,409 | | | 184,926 | | | 134,824 | | | | |

NET DEBT (3) | $ | 318,867 | | | $ | 276,177 | | | $ | 298,981 | | | $ | 412,443 | | | $ | 413,031 | | | $ | 370,900 | | | $ | 329,841 | | | $ | 376,871 | | | $ | 426,520 | | | | |

| | | | | | | | | | | | | | | | | | | | |

| Last twelve months: | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

ADJUSTED EBITDA (1) (2) | $ | 137,180 | | | $ | 106,808 | | | $ | 67,262 | | | $ | 92,169 | | | $ | 95,127 | | | $ | 106,382 | | | $ | 172,387 | | | $ | 144,601 | | | $ | 138,536 | | | | |

| | | | | | | | | | | | | | | | | | | | |

NET LEVERAGE RATIO (1) (3) (4) | 2.3 | | x | 2.6 | | x | 4.4 | | x | 4.5 | | x | 4.3 | | x | 3.5 | | x | 1.9 | | x | 2.6 | | x | 3.1 | | x | | |

| | | | | | | | | | | | | | | | | | | | |

____________________________

| (1) | Non-GAAP measure using Adjusted EBITDA for the last twelve months. Adjusted EBITDA for the trailing twelve month period is reconciled to the nearest comparable GAAP measure, net income (loss). |

| (2) | For additional information on Adjusted EBITDA and its use as a non-GAAP measure, see page 6. |

| (3) | We define Net Debt, a non-GAAP financial measure, as the outstanding principal of debt less cash and cash equivalents. Management believes that the presentation of this non-GAAP financial measure provides useful information to investors because it is an important liquidity measurement that reflects our ability to service our debt. |

| (4) | Net leverage ratio is calculated by dividing net debt by Adjusted EBITDA for the trailing twelve months. |

Blucora Reconciliation of Operating Free Cash Flow (1) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 2019 | | 2020 | | 2021 |

| (Unaudited, in thousands, rounding differences may exist) | FY 12/31 | | 1Q | | 2Q | | 3Q | | 4Q | | FY 12/31 | | 1Q | | 2Q | | 3Q | | 4Q | | FY 12/31 |

| Net cash provided by (used in) operating activities | $ | 92,804 | | | $ | 46,864 | | | $ | (12,490) | | | $ | 940 | | | $ | 8,765 | | | $ | 44,079 | | | $ | 53,722 | | | $ | 43,549 | | | $ | (22,880) | | | $ | (37,560) | | | $ | 36,831 | |

| Purchases of property, equipment, and software | (10,501) | | | (7,715) | | | (11,357) | | | (9,639) | | | (7,291) | | | (36,002) | | | (8,598) | | | (4,946) | | | (8,080) | | | (8,652) | | | (30,276) | |

| Operating Free Cash Flow | $ | 82,303 | | | $ | 39,149 | | | $ | (23,847) | | | $ | (8,699) | | | $ | 1,474 | | | $ | 8,077 | | | $ | 45,124 | | | $ | 38,603 | | | $ | (30,960) | | | $ | (46,212) | | | $ | 6,555 | |

____________________________

| (1) | We define Operating Free Cash Flow, which is a non-GAAP measure, as net cash provided by (used in) operating activities less purchases of property, equipment, and software. We believe Operating Free Cash Flow is an important liquidity measure that reflects the cash generated by our businesses, after the purchases of property, equipment, and software, that can then be used for, among other things, strategic acquisitions and investments in the businesses, stock repurchases, and funding ongoing operations. |

Blucora Operating Metrics - Wealth Management | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 2019 | | 2020 | | 2021 | | | | | | |

| (In thousands, rounding differences may exist) | FY 12/31 | | 1Q | | 2Q | | 3Q | | 4Q | | FY 12/31 | | 1Q | | 2Q | | 3Q | | 4Q | | FY 12/31 |

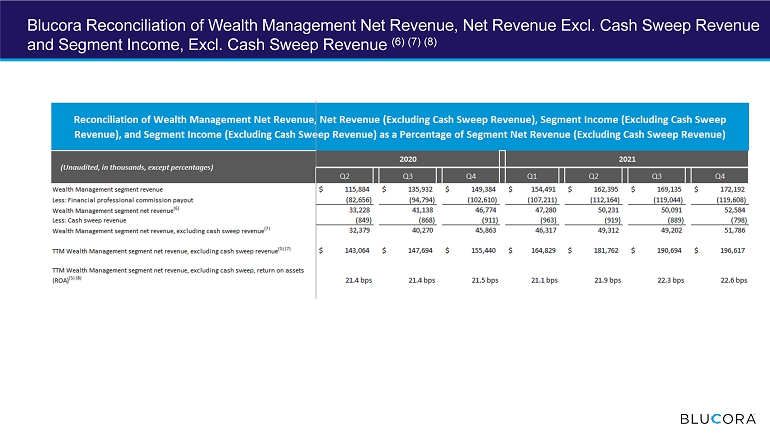

| Segment revenue | $ | 507,979 | | | $ | 144,989 | | | $ | 115,884 | | | $ | 135,932 | | | $ | 149,384 | | | $ | 546,189 | | | $ | 154,491 | | | $ | 162,395 | | | $ | 169,135 | | | $ | 172,192 | | | $ | 658,213 | |

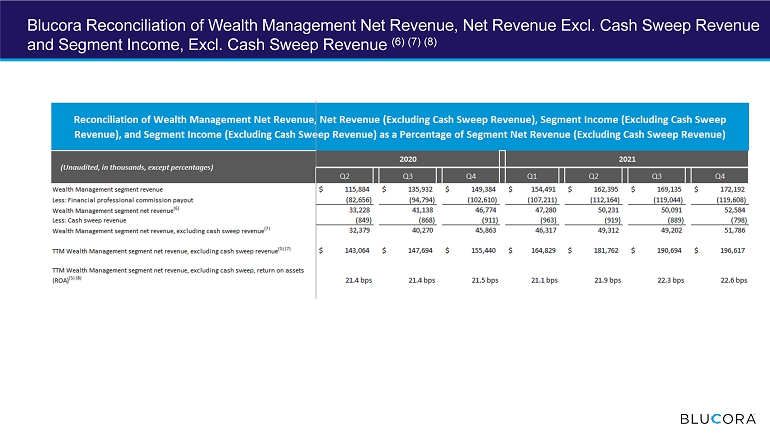

| Less: Financial professional commission payout | (348,003) | | | (100,804) | | | (82,656) | | | (94,794) | | | (102,610) | | | (380,864) | | | (107,211) | | | (112,164) | | | (119,044) | | | (119,609) | | | (458,028) | |

Segment net revenue (1) | $ | 159,976 | | | $ | 44,185 | | | $ | 33,228 | | | $ | 41,138 | | | $ | 46,774 | | | $ | 165,325 | | | $ | 47,280 | | | $ | 50,231 | | | $ | 50,091 | | | $ | 52,583 | | | $ | 200,185 | |

Segment operating income (2) | $ | 68,292 | | | $ | 22,598 | | | $ | 11,731 | | | $ | 17,498 | | | $ | 20,368 | | | $ | 72,195 | | | $ | 19,396 | | | $ | 21,396 | | | $ | 19,564 | | | $ | 21,856 | | | $ | 82,212 | |

| Segment operating income as a % of revenue | 13 | % | | 16 | % | | 10 | % | | 13 | % | | 14 | % | | 13 | % | | 13 | % | | 13 | % | | 12 | % | | 13 | % | | 12 | % |

| Segment operating income as a % of net revenue | 43 | % | | 51 | % | | 35 | % | | 43 | % | | 44 | % | | 44 | % | | 41 | % | | 43 | % | | 39 | % | | 42 | % | | 41 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (In thousands, rounding differences may exist) | 2019 | | 2020 | | 2021 | |

| Sources of Revenue | Primary Drivers | FY 12/31 | | 1Q | | 2Q | | 3Q | | 4Q | | FY 12/31 | | 1Q | | 2Q | | 3Q | | 4Q | | FY 12/31 | |

| Financial professional-driven | Advisory | - Advisory asset levels | $ | 252,367 | | | $ | 78,757 | | | $ | 66,303 | | | $ | 82,612 | | | $ | 87,079 | | | $ | 314,751 | | | $ | 91,119 | | | $ | 96,508 | | | $ | 103,540 | | | $ | 104,633 | | | $ | 395,800 | | |

| Commission | - Transactions

- Asset levels

- Product mix | 191,050 | | | 50,580 | | | 39,836 | | | 44,921 | | | 49,864 | | | 185,201 | | | 52,534 | | | 51,702 | | | 52,961 | | | 53,480 | | | 210,677 | | |

| Other revenue | Asset-based | - Cash balances - Interest rates - Number of accounts - Client asset levels | 48,182 | | | 10,579 | | | 3,981 | | | 4,351 | | | 4,777 | | | 23,688 | | | 5,329 | | | 5,526 | | | 5,659 | | | 5,587 | | | 22,101 | | |

| Transaction and fee | - Account activity - Number of clients - Number of financial professionals - Number of accounts | 16,380 | | | 5,073 | | | 5,764 | | | 4,048 | | | 7,664 | | | 22,549 | | | 5,509 | | | 8,659 | | | 6,975 | | | 8,492 | | | 29,635 | | |

| Total revenue | $ | 507,979 | | | $ | 144,989 | | | $ | 115,884 | | | $ | 135,932 | | | $ | 149,384 | | | $ | 546,189 | | | $ | 154,491 | | | $ | 162,395 | | | $ | 169,135 | | | $ | 172,192 | | | $ | 658,213 | | |

| Total recurring revenue (3) | $ | 422,128 | | | $ | 119,255 | | | $ | 100,004 | | | $ | 117,822 | | | $ | 127,863 | | | $ | 464,944 | | | $ | 130,755 | | | $ | 138,900 | | | $ | 145,311 | | | $ | 144,728 | | | $ | 559,694 | | |

| Recurring revenue rate (3) | 83.1 | % | | 82.3 | % | | 86.3 | % | | 86.7 | % | | 85.6 | % | | 85.1 | % | | 84.6 | % | | 85.5 | % | | 85.9 | % | | 84.1 | % | | 85.0 | % | |

____________________________

| (1) | Non-GAAP financial measure represents segment revenue less financial professional commission payout. |

| (2) | We do not allocate certain operating expenses (including personnel and overhead costs), stock-based compensation, acquisition and integration costs, depreciation, amortization of acquired intangible assets, executive transition costs, headquarters relocation costs, contested proxy and other legal and consulting costs, impairment of goodwill and an intangible asset, interest expense and other, net, or income taxes to the reportable segments. |

| (3) | Recurring revenue consists of advisory fees, trailing commissions, fees from cash sweep programs, and certain transaction and fee revenue. |

Blucora Operating Metrics - Wealth Management (continued) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (In thousands, rounding differences may exist) | 2019 | | 2020 | | 2021 |

| FY 12/31 | | 1Q | | 2Q | | 3Q | | 4Q | | FY 12/31 | | 1Q | | 2Q | | 3Q | | 4Q | | FY 12/31 |

| Total client assets | $ | 70,644,385 | | | $ | 61,014,454 | | | $ | 68,519,998 | | | $ | 76,152,721 | | | $ | 82,961,244 | | | $ | 82,961,244 | | | $ | 84,776,191 | | | $ | 87,814,790 | | | $ | 86,647,743 | | | $ | 89,086,032 | | | $ | 89,086,032 | |

| Brokerage assets | $ | 43,015,221 | | | $ | 37,395,490 | | | $ | 41,964,610 | | | $ | 43,733,735 | | | $ | 47,357,687 | | | $ | 47,357,687 | | | $ | 48,001,320 | | | $ | 48,373,805 | | | $ | 46,850,354 | | | $ | 46,906,981 | | | $ | 46,906,981 | |

| Advisory assets | $ | 27,629,164 | | | $ | 23,618,964 | | | $ | 26,555,388 | | | $ | 32,418,986 | | | $ | 35,603,557 | | | $ | 35,603,557 | | | $ | 36,774,871 | | | $ | 39,440,985 | | | $ | 39,797,389 | | | $ | 42,179,051 | | | $ | 42,179,051 | |

| % of total client assets | 39.1 | % | | 38.7 | % | | 38.8 | % | | 42.6 | % | | 42.9 | % | | 42.9 | % | | 43.4 | % | | 44.9 | % | | 45.9 | % | | 47.3 | % | | 47.3 | % |

Number of financial professionals (in ones) (1) | 3,984 | | | 3,945 | | | 3,862 | | | 3,975 | | | 3,770 | | | 3,770 | | | 3,718 | | | 3,606 | | | 3,529 | | | 3,416 | | | 3,416 | |

Advisory and commission revenue per financial professional (2) | $ | 111.3 | | | $ | 32.8 | | | $ | 27.5 | | | $ | 32.1 | | | $ | 36.3 | | | $ | 132.6 | | | $ | 38.6 | | | $ | 41.1 | | | $ | 44.3 | | | $ | 46.3 | | | $ | 177.5 | |

| | | | | | | | | | | | | | | | | | | | | |

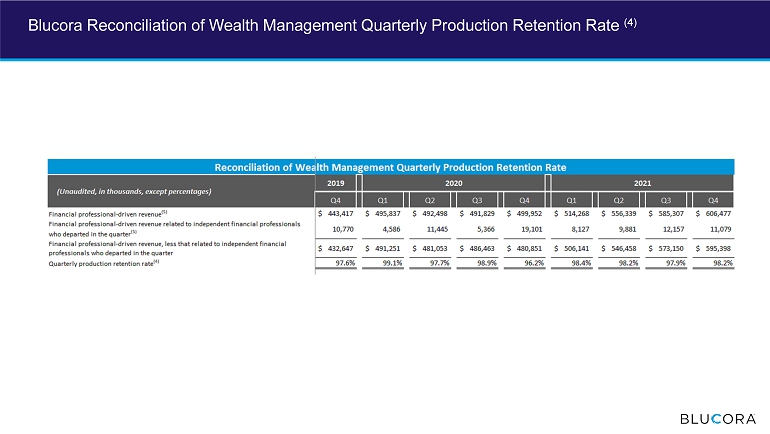

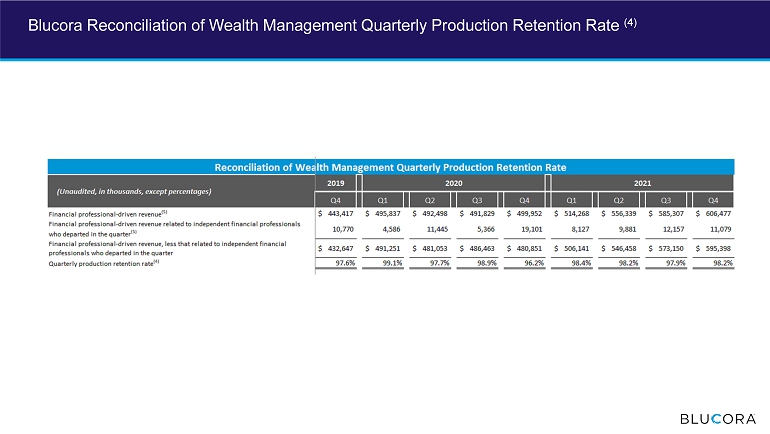

Quarterly production retention rate: (3) | | | | | | | | | | | | | | | | | | | | | |

TTM Financial professional-driven revenue (4) | $ | 443,417 | | | $ | 495,837 | | | $ | 492,498 | | | $ | 491,829 | | | $ | 499,952 | | | $ | 499,952 | | | $ | 514,268 | | | $ | 556,339 | | | $ | 585,307 | | | $ | 606,477 | | | $ | 606,477 | |

TTM Financial professional-driven revenue related to independent financial professionals who departed in the quarter (4) | $ | 10,770 | | | $ | 4,586 | | | $ | 11,445 | | | $ | 5,366 | | | $ | 19,101 | | | $ | 19,101 | | | $ | 8,127 | | | $ | 9,881 | | | $ | 12,157 | | | $ | 11,079 | | | $ | 11,079 | |

TTM Financial professional-driven revenue, less that related to independent financial professionals who departed in the quarter (4) | $ | 432,647 | | | $ | 491,251 | | | $ | 481,053 | | | $ | 486,463 | | | $ | 480,851 | | | $ | 480,851 | | | $ | 506,141 | | | $ | 546,458 | | | $ | 573,150 | | | $ | 595,398 | | | $ | 595,398 | |

Quarterly production retention rate (3) | 97.6 | % | | 99.1 | % | | 97.7 | % | | 98.9 | % | | 96.2 | % | | 96.2 | % | | 98.4 | % | | 98.2 | % | | 97.9 | % | | 98.2 | % | | 98.2 | % |

____________________________

| (1) | The increase in financial professionals in the third quarter of 2020 resulted from the addition of 19 in-house financial professionals (licensed financial planning consultants, which were employees of Avantax Planning Partners) and 131 licensed referring representatives at CPA firms that partner with Avantax Planning Partners. |

| (2) | Advisory and commission revenue per financial professional is based upon a full year of advisory and commission revenue. |