East West Bancorp, Inc. 3Q Earnings Presentation October 22, 2024 3Q 24

Forward-Looking Statements and Additional Information 2 Forward-Looking Statements This presentation contains forward-looking statements that are intended to be covered by the safe harbor for such statements provided by the Private Securities Litigation Reform Act of 1995. These statements are based on the current beliefs and expectations of the management of East West Bancorp, Inc. (the “Company”) and are subject to significant risks and uncertainties. You should not place undue reliance on these statements. There are various important factors that could cause the Company’s future results to differ materially from historical performance and any forward-looking statements, including the factors described in the Company’s third quarter 2024 earnings release, as well as those factors contained in the Company’s filings with the Securities and Exchange Commission, including the “Risk Factors” section of the Company’s Annual Report on Form 10-K for the year ended December 31, 2023 and in its subsequent Quarterly Reports on Form 10-Q. When considering these forward-looking statements, you should keep in mind these risks and uncertainties, as well as any cautionary statements the Company may make. These statements speak only as of the date they are made and are based only on information then actually known to the Company. The Company does not undertake to update any forward-looking statements except as required by law. Basis of Presentation The preparation of the Company’s consolidated financial statements in conformity with U.S. generally accepted accounting principles (“GAAP”) requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities as of the date of the consolidated financial statements, income and expenses during the reporting periods, and the related disclosures. Although our estimates consider current conditions and how we expect them to change in the future, it is reasonably possible that actual results could be materially different from those estimates. Hence, the current period’s results of operations are not necessarily indicative of results that may be expected for any future interim period or for the year as a whole. Certain prior period information have been reclassified to conform to the current presentation. Non-GAAP Financial Measures Certain financial information in this presentation has not been prepared in accordance with GAAP and is presented on a non-GAAP basis. Investors should refer to the reconciliations included in this presentation and should consider the Company’s non-GAAP measures in addition to, not as a substitute for or superior to, measures prepared in accordance with GAAP. These measures may not be comparable to similarly titled measures used by other companies.

Financial Highlights 3 (1) See reconciliation of GAAP to non-GAAP financial measures in the appendix and in the Company’s earnings press releases ▪ 1.62% Return on Average Assets (ROAA) ▪ 16.2% ROACE (17.4% ROTCE1) YTD ▪ Book value per share of $55.30, up $3.24 Q-o-Q, including AOCI accretion impact ▪ TBVPS1 growth: +7% Q-o-Q, +20% Y-o-Y ▪ YTD declared dividends of $2.20 3Q24 $299 million net income available to common equity, $2.14 diluted earnings per share ▪ Grew average loans +1% Q-o-Q − Growth driven by C&I production, consistent residential mortgage origination ▪ Grew average deposits +3% Q-o-Q − Continued growth from time, money market, interest-bearing checking ▪ NII up 4% Q-o-Q − Increased income from loans and securities, reduced average cost of interest-bearing deposits ▪ Record quarterly fee income of $81mm − Notable strength in lending, wealth management, deposit account fees ▪ Nonperforming assets at 26bps ▪ Stable credit: Criticized loans at 2.08%, classified loans down 2bps to 1.20% ▪ ALLL at 1.31% ▪ Net charge-offs of 22bps Balanced Loan & Deposit Growth Growing NII, Fee Income Strong, Stable Asset Quality Creating Shareholder Value

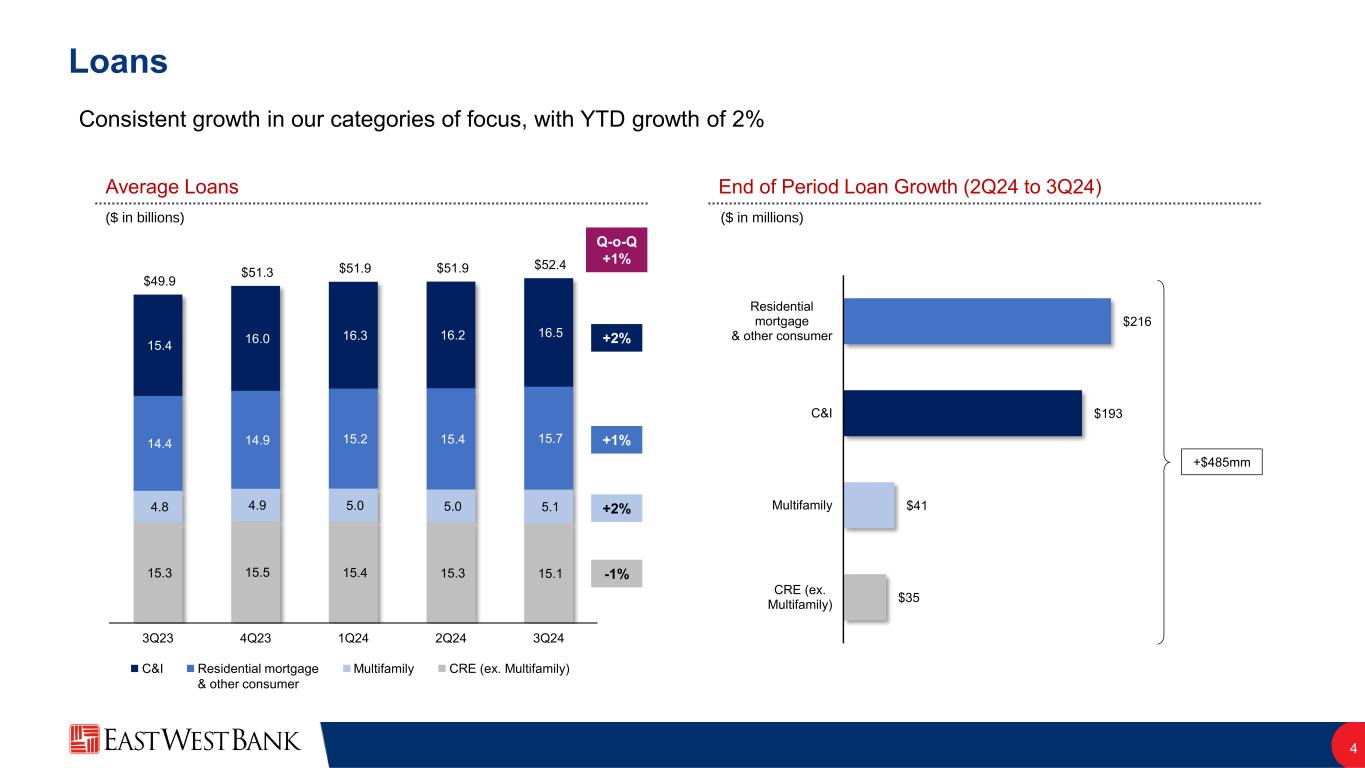

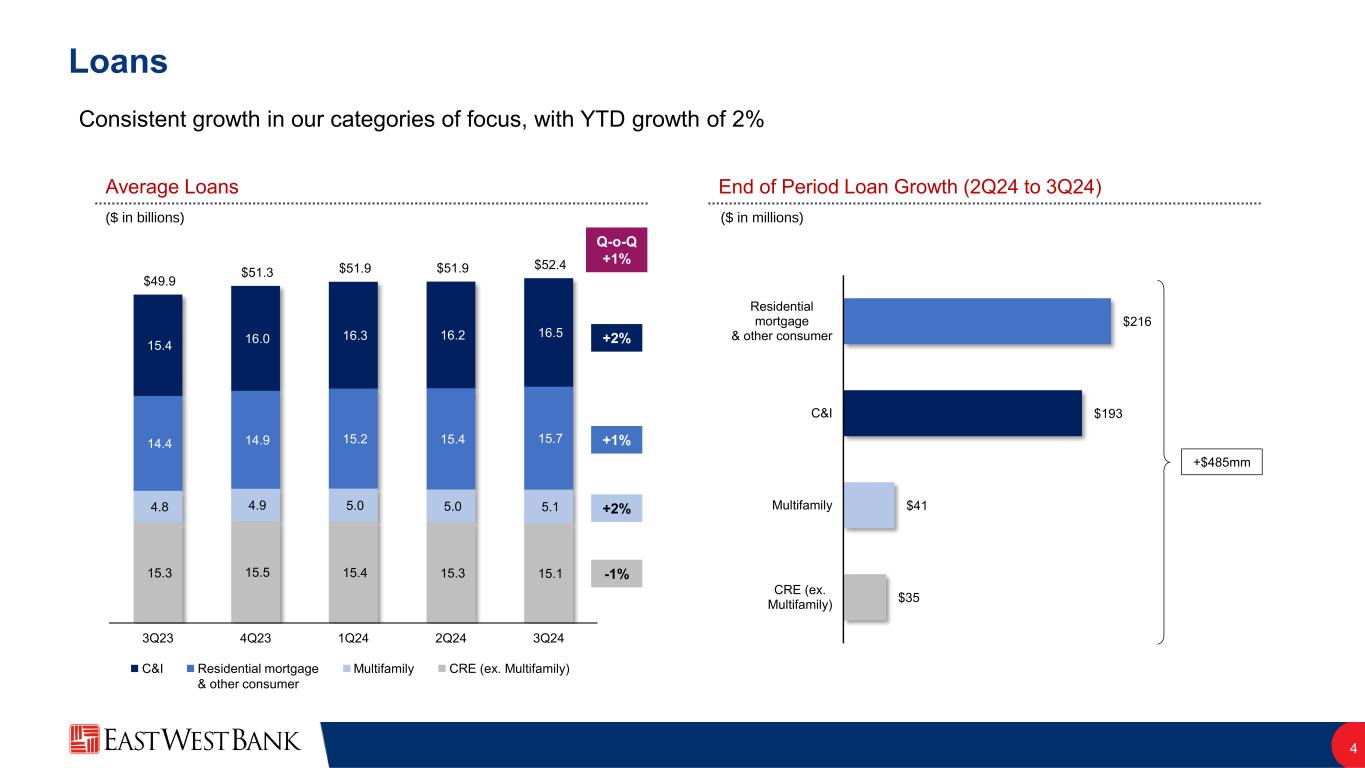

C&I Loans 4 Consistent growth in our categories of focus, with YTD growth of 2% ($ in billions) Average Loans End of Period Loan Growth (2Q24 to 3Q24) ($ in millions) +1% -1% +2% Q-o-Q +1% +2% +$485mm CRE (ex. Multifamily)Residential mortgage & other consumer Multifamily 15.3 15.5 15.4 15.3 15.1 4.8 4.9 5.0 5.0 5.1 14.4 14.9 15.2 15.4 15.7 15.4 16.0 16.3 16.2 16.5 $49.9 $51.3 $51.9 $51.9 $52.4 3Q23 4Q23 1Q24 2Q24 3Q24 $35 $41 $193 $216 CRE (ex. Multifamily) Multifamily C&I Residential mortgage & other consumer

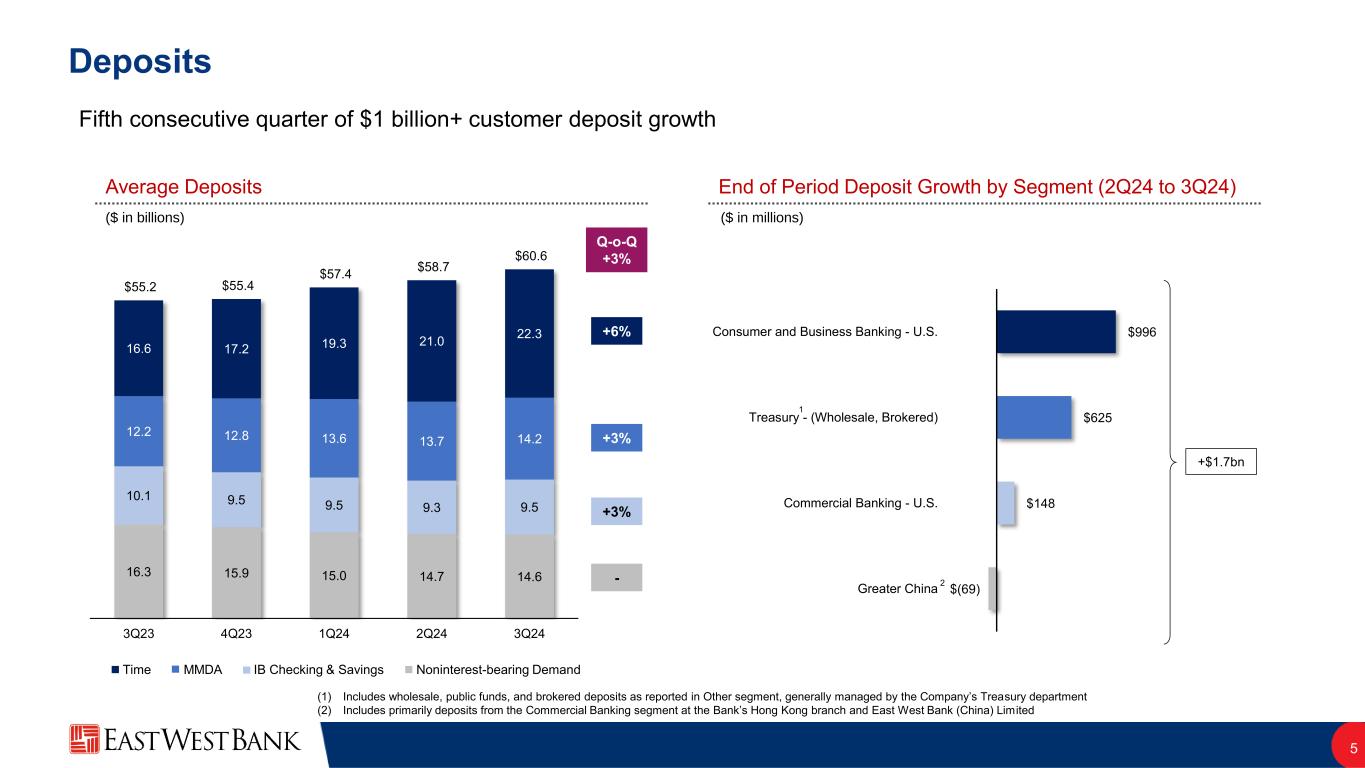

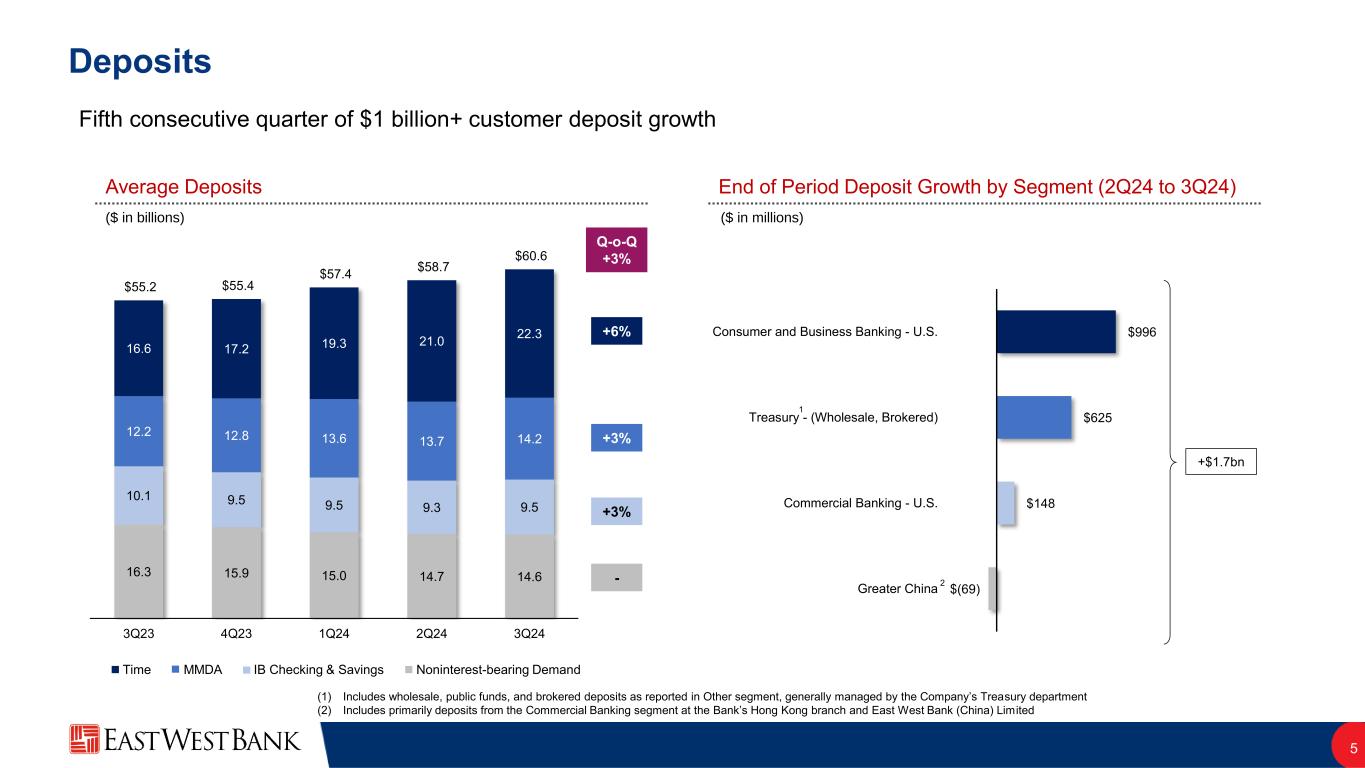

$(69) $148 $625 $996 Greater China Commercial Banking - U.S. Treasury - (Wholesale, Brokered) Consumer and Business Banking - U.S. Deposits 5 Fifth consecutive quarter of $1 billion+ customer deposit growth ($ in billions) Average Deposits End of Period Deposit Growth by Segment (2Q24 to 3Q24) ($ in millions) +3% +3% - Q-o-Q +3% +6% (1) Includes wholesale, public funds, and brokered deposits as reported in Other segment, generally managed by the Company’s Treasury department (2) Includes primarily deposits from the Commercial Banking segment at the Bank’s Hong Kong branch and East West Bank (China) Limited 1 Noninterest-bearing DemandTime IB Checking & SavingsMMDA +$1.7bn 16.3 15.9 15.0 14.7 14.6 10.1 9.5 9.5 9.3 9.5 12.2 12.8 13.6 13.7 14.2 16.6 17.2 19.3 21.0 22.3 $55.2 $55.4 $57.4 $58.7 $60.6 3Q23 4Q23 1Q24 2Q24 3Q24 2

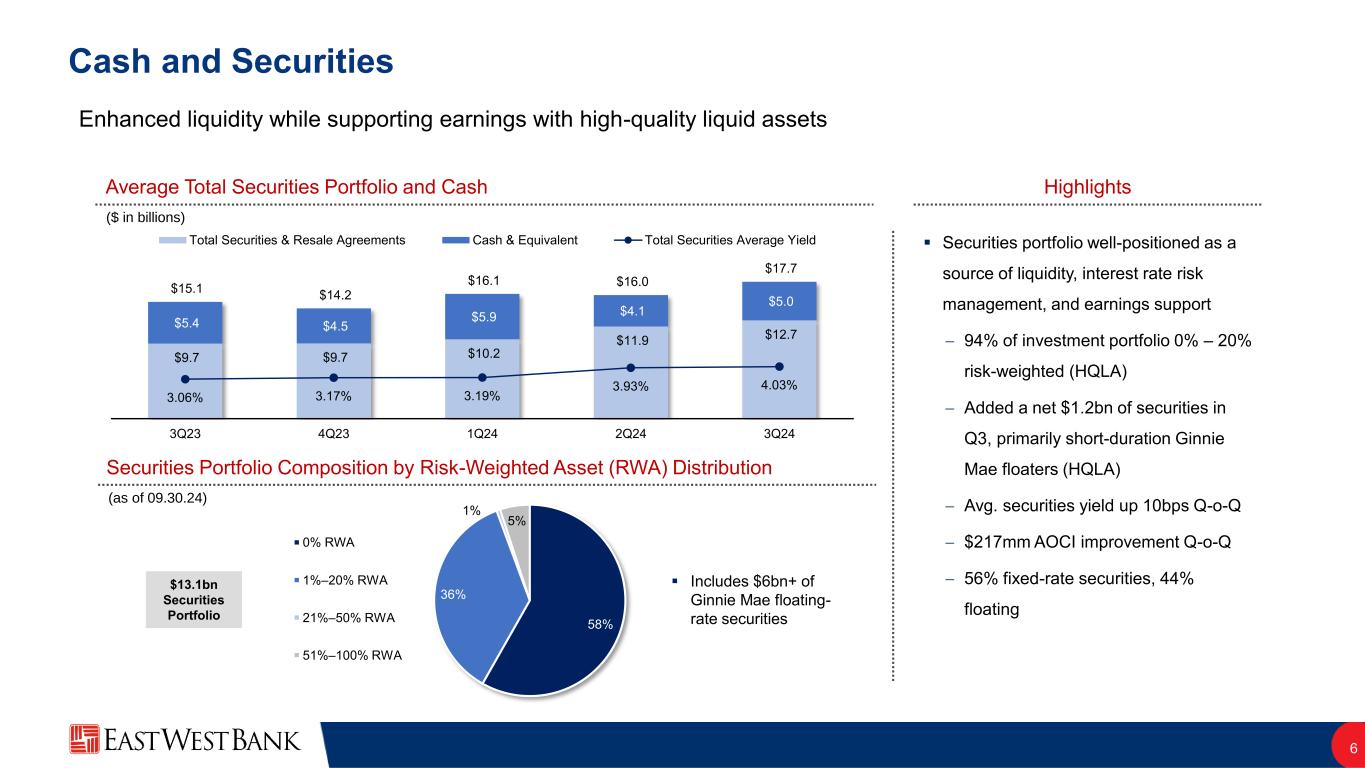

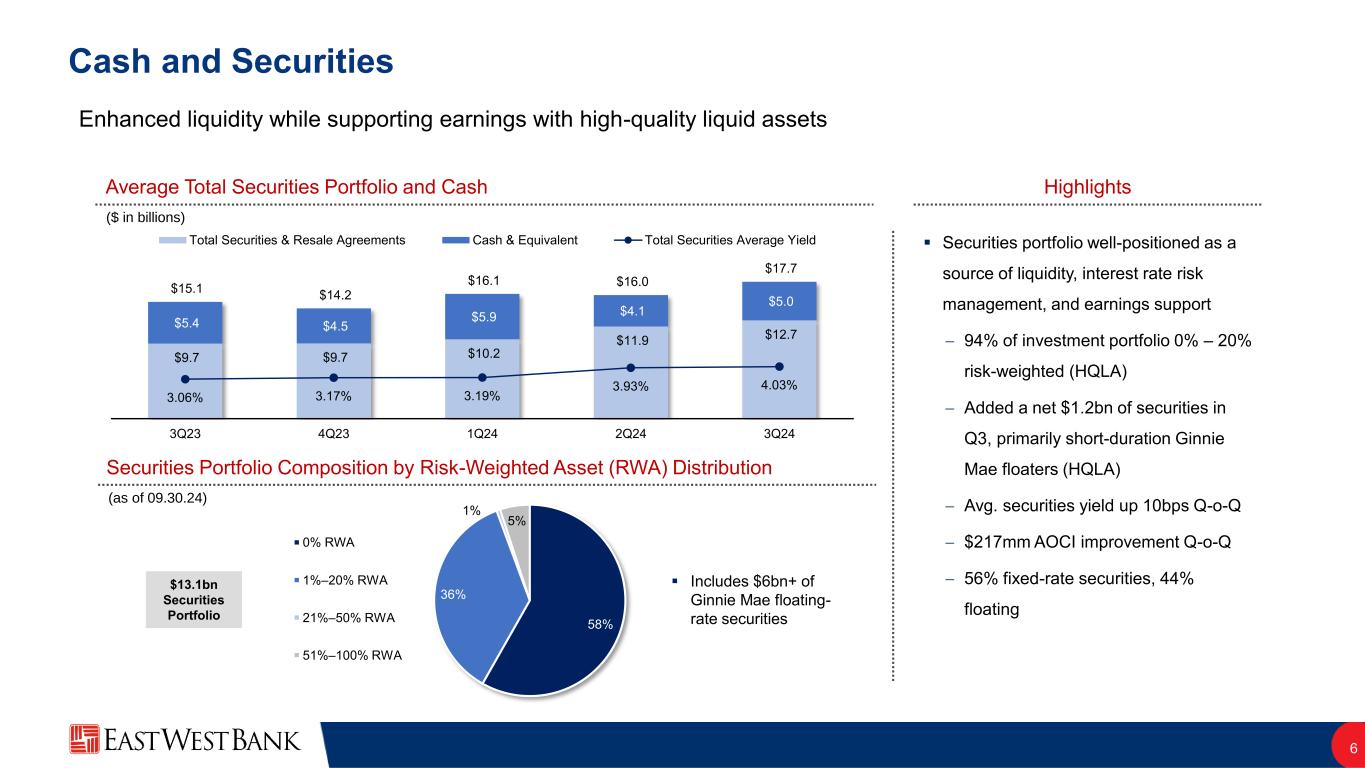

58% 36% 1% 5% 0% RWA 1%‒20% RWA 21%‒50% RWA 51%‒100% RWA ($ in billions) Cash and Securities 6 Enhanced liquidity while supporting earnings with high-quality liquid assets ▪ Securities portfolio well-positioned as a source of liquidity, interest rate risk management, and earnings support − 94% of investment portfolio 0% – 20% risk-weighted (HQLA) − Added a net $1.2bn of securities in Q3, primarily short-duration Ginnie Mae floaters (HQLA) − Avg. securities yield up 10bps Q-o-Q − $217mm AOCI improvement Q-o-Q − 56% fixed-rate securities, 44% floating HighlightsAverage Total Securities Portfolio and Cash Securities Portfolio Composition by Risk-Weighted Asset (RWA) Distribution (as of 09.30.24) $9.7 $9.7 $10.2 $11.9 $12.7 $5.4 $4.5 $5.9 $4.1 $5.0 $15.1 $14.2 $16.1 $16.0 $17.7 3.06% 3.17% 3.19% 3.93% 4.03% 3Q23 4Q23 1Q24 2Q24 3Q24 Total Securities & Resale Agreements Cash & Equivalent Total Securities Average Yield $13.1bn Securities Portfolio ▪ Includes $6bn+ of Ginnie Mae floating- rate securities

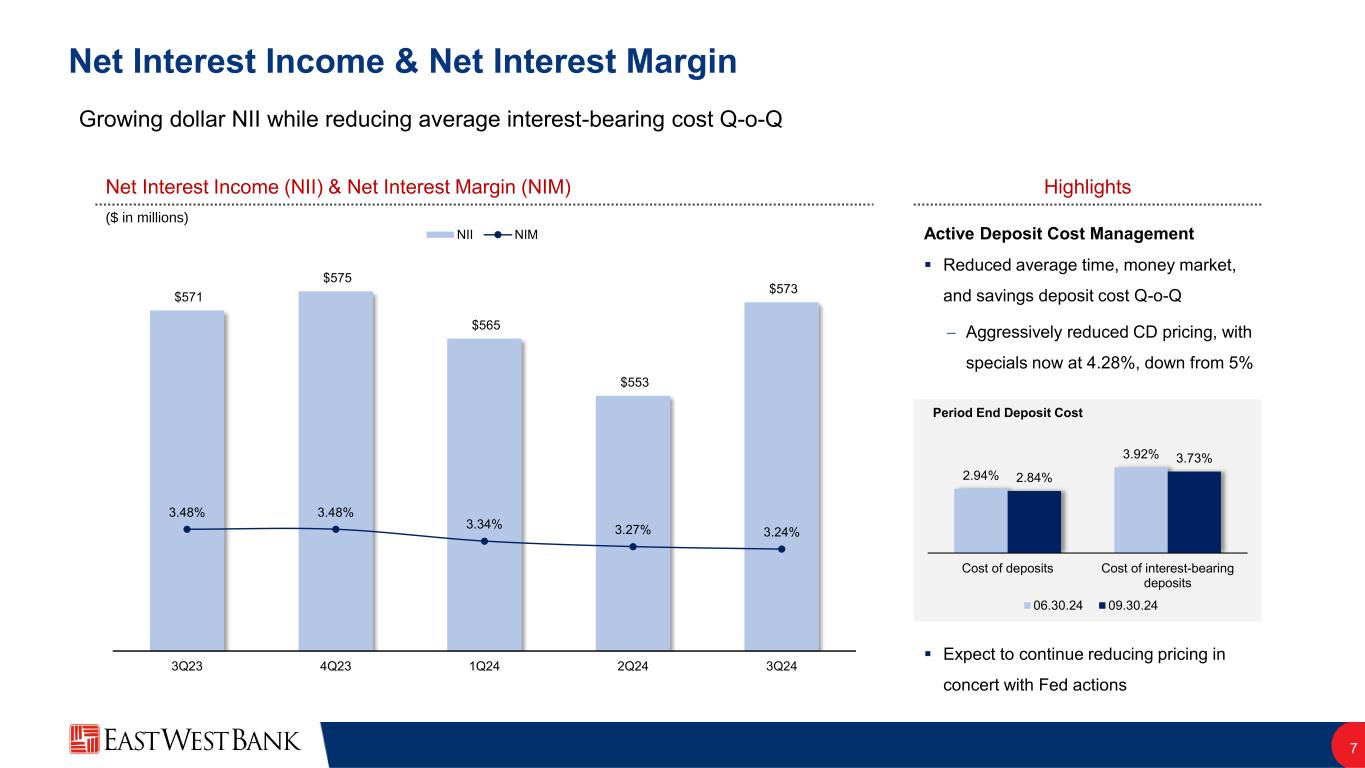

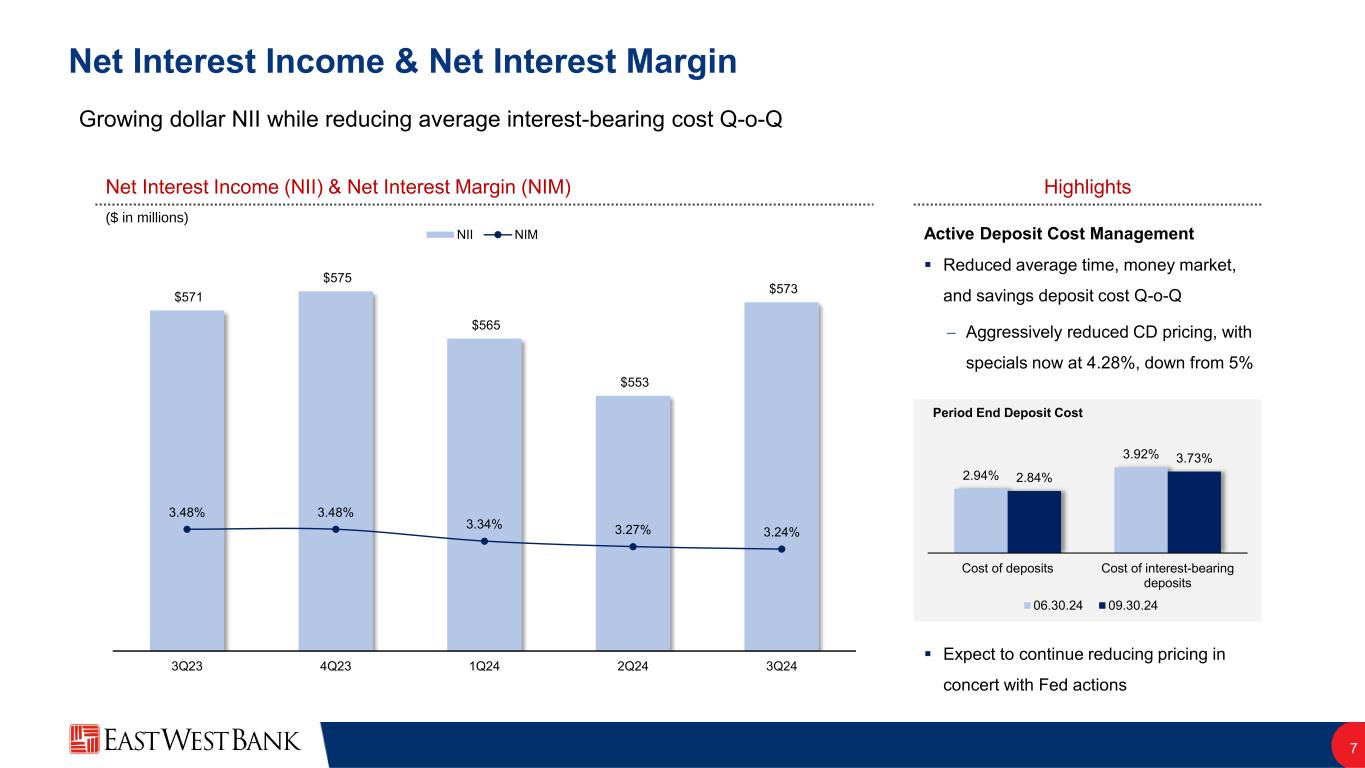

$571 $575 $565 $553 $573 3.48% 3.48% 3.34% 3.27% 3.24% 3Q23 4Q23 1Q24 2Q24 3Q24 NII NIM Net Interest Income & Net Interest Margin 7 Growing dollar NII while reducing average interest-bearing cost Q-o-Q ▪ Reduced average time, money market, and savings deposit cost Q-o-Q − Aggressively reduced CD pricing, with specials now at 4.28%, down from 5% ▪ Expect to continue reducing pricing in concert with Fed actions HighlightsNet Interest Income (NII) & Net Interest Margin (NIM) ($ in millions) Active Deposit Cost Management 2.94% 3.92% 2.84% 3.73% Cost of deposits Cost of interest-bearing deposits 06.30.24 09.30.24 Period End Deposit Cost

Fee Income 8 Record total quarterly fee income, driven by deepening customer relationships and consistent sales execution ▪ Fee income1 of $81mm, up over $4mm, or +6% from $77mm − Lending Fee growth (+$2mm) driven by greater syndication activity − Deposit Account Fee growth (+$1mm) driven by increased transaction activity and balances − Wealth Management Fee growth (+$1mm) reflects higher customer activity Highlights (1) Fee income excludes mark-to-market adjustments related to customer and other derivatives; net gains (losses) on sales of loans; net gains on AFS debt securities; other investment income and other income Wealth Management Fees Customer Derivative Income Fee Income1 ($ in millions) +9% +13% -11% Q-o-Q +6% +5% +5% Deposit Account Fees Lending Fees Foreign Exchange Income vs. Prior Quarter 6 6 3 4 4 6 8 9 10 11 11 13 11 13 13 20 22 23 24 26 24 24 25 26 27 $67 $73 $71 $77 $81 3Q23 4Q23 1Q24 2Q24 3Q24

3.61% 3.14% 1.07% 0.46% 2.85% 3.13% 1.03% 0.46% 2.92% 2.99% 1.45% 0.51% $42 $37 $25 $37 $42 $18 $20 $23 $23 $29 3Q23 4Q23 1Q24 2Q24 3Q24 Provision for credit losses Net charge- offs Asset Quality Metrics 9 Trends remained strong – NCOs normalizing as expected Provision for Credit Losses & Net Charge-offs ($ in millions) Non-Performing Assets Criticized Loans / Loans HFI Criticized Ratio by Loans HFI Portfolio ($ in millions) NCO ratio (ann.) 0.14% 0.15% 0.17% 0.18% 0.22% 1.06% 1.10% 1.25% 1.22% 1.20% 0.95% 0.77% 1.05% 0.83% 0.88% 2.01% 1.87% 2.30% 2.05% 2.08% 09.30.23 12.31.23 03.31.24 06.30.24 09.30.24 Classified loans / Loans HFI Special mention loans / Loans HFI NPA / Total assets 0.15% 0.16% 0.23% 0.27% 0.26% 49 37 49 67 75 39 38 47 52 5211 23 47 42 14 11 17 30 49 5 5 5 5 5 $104 $114 $165 $196 $195 09.30.23 12.31.23 03.31.24 06.30.24 09.30.24 Multifamily OREO and Other CRE (ex. MFR) Resi. mortgage & consumer C&I C&I CRE (ex Multifamily) Multifamily Resi. mortgage & consumer (2024)

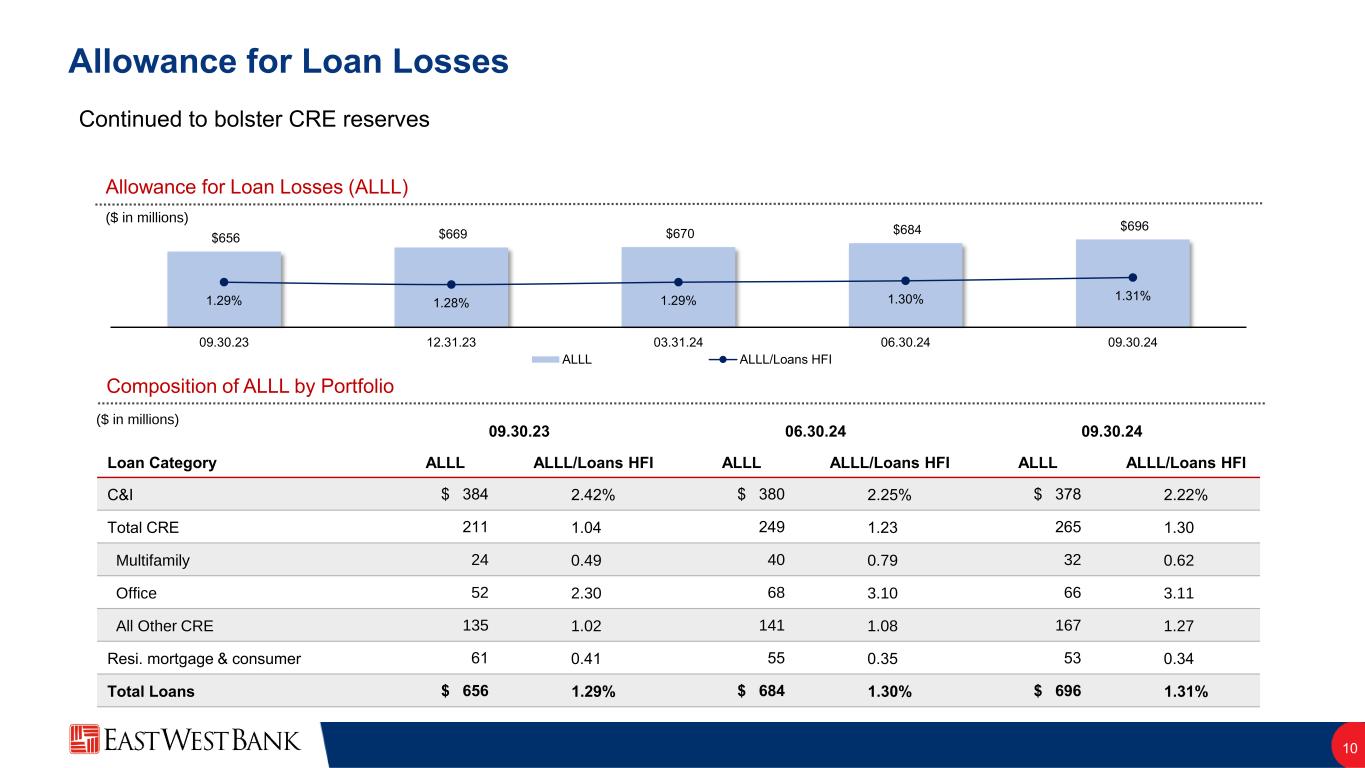

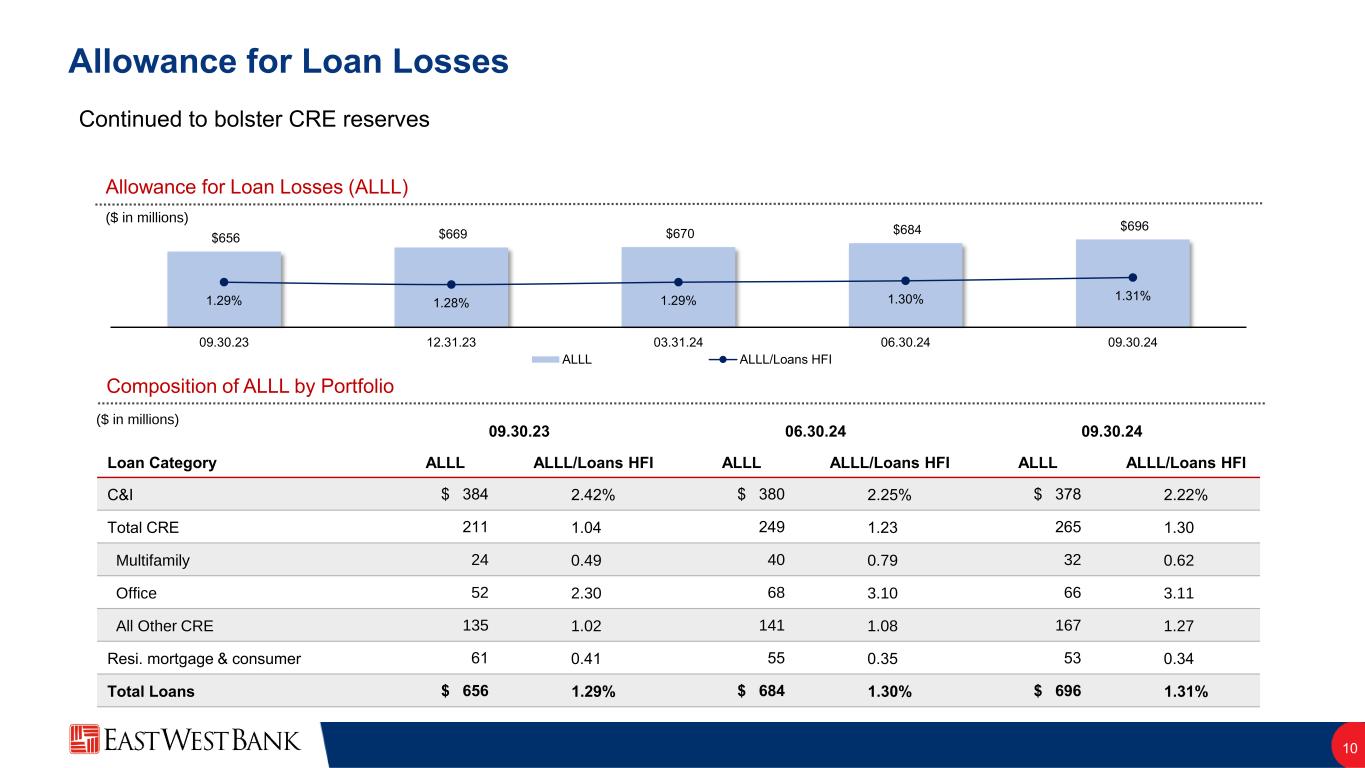

10 Allowance for Loan Losses Continued to bolster CRE reserves Allowance for Loan Losses (ALLL) ($ in millions) 09.30.23 06.30.24 09.30.24 Loan Category ALLL ALLL/Loans HFI ALLL ALLL/Loans HFI ALLL ALLL/Loans HFI C&I $ 384 2.42% $ 380 2.25% $ 378 2.22% Total CRE 211 1.04 249 1.23 265 1.30 Multifamily 24 0.49 40 0.79 32 0.62 Office 52 2.30 68 3.10 66 3.11 All Other CRE 135 1.02 141 1.08 167 1.27 Resi. mortgage & consumer 61 0.41 55 0.35 53 0.34 Total Loans $ 656 1.29% $ 684 1.30% $ 696 1.31% Composition of ALLL by Portfolio ($ in millions) $656 $669 $670 $684 $696 1.29% 1.28% 1.29% 1.30% 1.31% 09.30.23 12.31.23 03.31.24 06.30.24 09.30.24 ALLL ALLL/Loans HFI

9.0% 9.4% 9.3% 9.4% 9.7% Tangible Common Equity Ratio 14.7% 14.8% 14.8% 15.1% 15.4% Total Capital Ratio 10.2% 10.2% 10.1% 10.4% 10.4% Leverage Ratio Highlights 09.30.23 06.30.2403.31.24 11 Capital Healthy capital position, with TCE1 benefiting from Accumulated Other Comprehensive Income (AOCI) earnback ▪ Strong capital − 6bps of capital accretion from net retained earnings, 29bps from AOCI improvement ▪ Declared 4Q24 dividend ‒ Payable on November 15, 2024 to shareholders of record on November 4, 2024 ▪ Capacity for share repurchase ‒ $49 million of East West’s share repurchase authorization remains available; we remain opportunistic Regulatory well capitalized requirement (1) See reconciliation of GAAP to non-GAAP financial measures in the appendix and in the Company’s earnings press releases (2) The Company has elected to use the 2020 CECL transition provision in the calculation of its regulatory capital ratios. The Company’s September 30, 2024 regulatory capital ratios are preliminary Tangible Common Equity Ratio1 Regulatory Capital Ratios2 6.5% 5.0% 10.0% 12.31.23 09.30.242 13.3% 13.3% 13.5% 13.7% 14.1% CET1 Ratio 9.4% 0.29% Q-o-Q impact from AOCI improvement

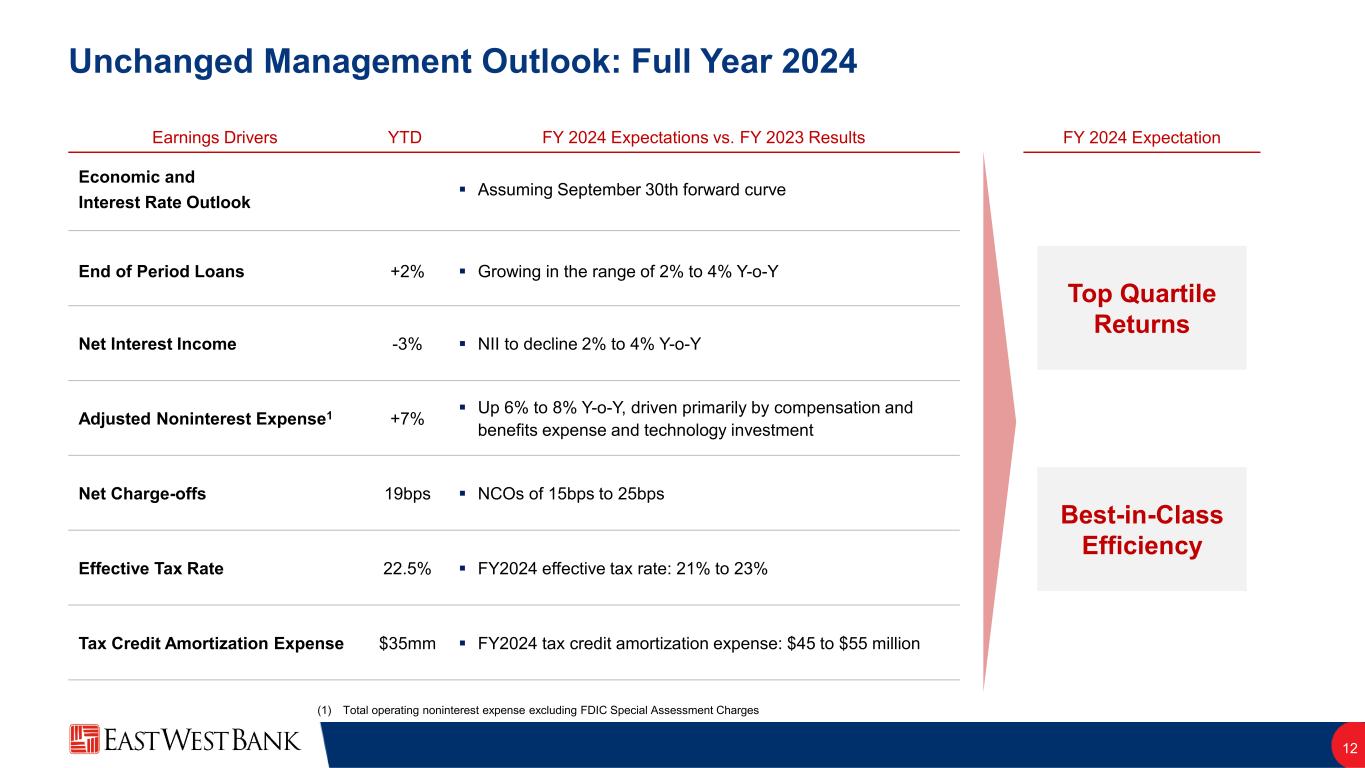

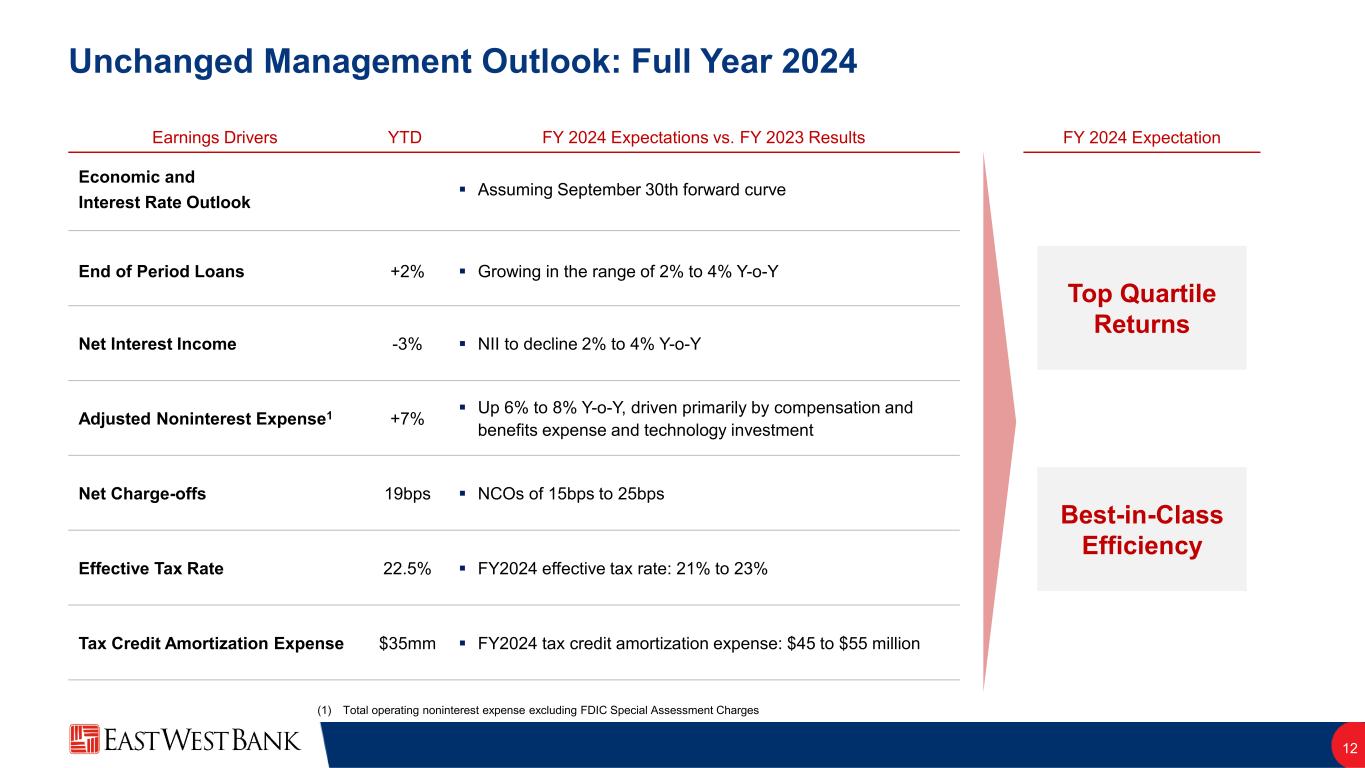

Unchanged Management Outlook: Full Year 2024 12 Earnings Drivers YTD FY 2024 Expectations vs. FY 2023 Results Economic and Interest Rate Outlook ▪ Assuming September 30th forward curve End of Period Loans +2% ▪ Growing in the range of 2% to 4% Y-o-Y Net Interest Income -3% ▪ NII to decline 2% to 4% Y-o-Y Adjusted Noninterest Expense1 +7% ▪ Up 6% to 8% Y-o-Y, driven primarily by compensation and benefits expense and technology investment Net Charge-offs 19bps ▪ NCOs of 15bps to 25bps Effective Tax Rate 22.5% ▪ FY2024 effective tax rate: 21% to 23% Tax Credit Amortization Expense $35mm ▪ FY2024 tax credit amortization expense: $45 to $55 million Best-in-Class Efficiency Top Quartile Returns FY 2024 Expectation (1) Total operating noninterest expense excluding FDIC Special Assessment Charges

Appendix 13

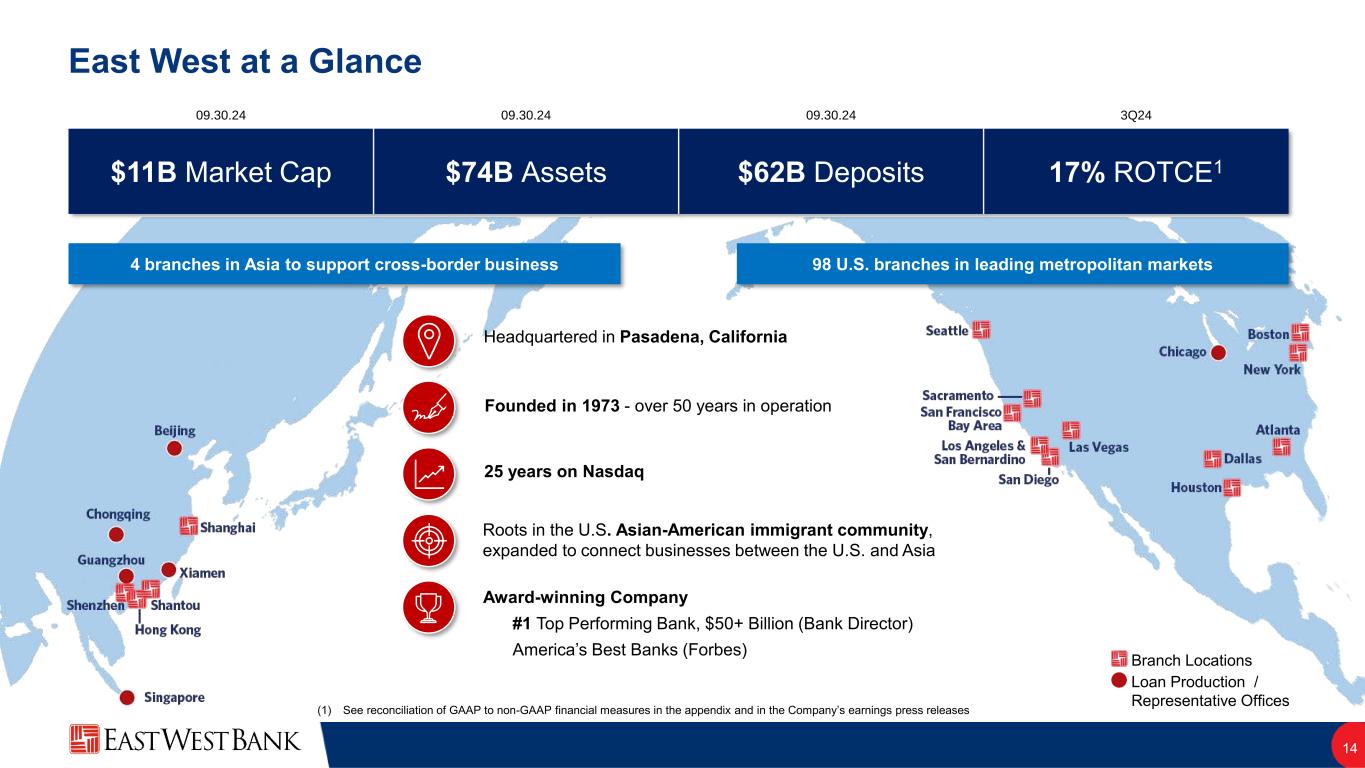

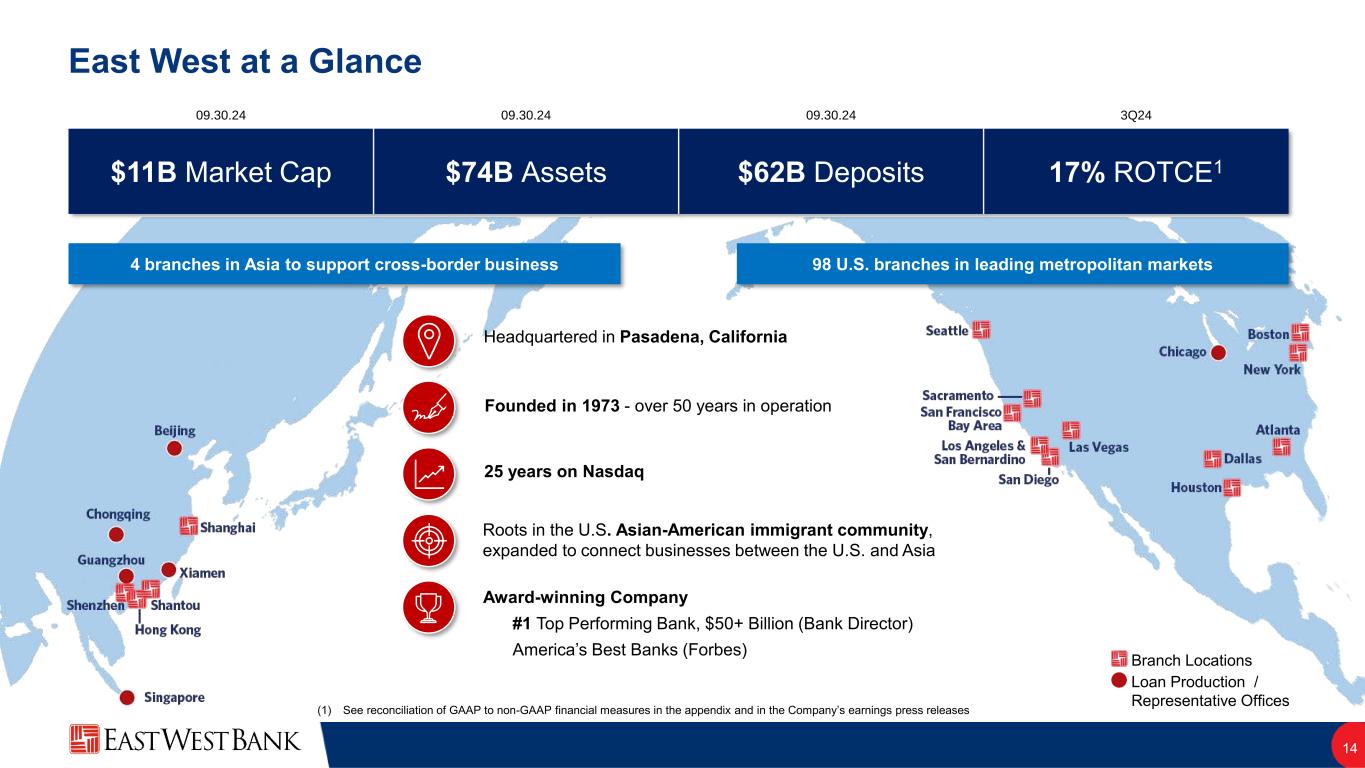

East West at a Glance 14 $11B Market Cap $74B Assets $62B Deposits 17% ROTCE1 09.30.24 09.30.24 09.30.24 3Q24 4 branches in Asia to support cross-border business Branch Locations 98 U.S. branches in leading metropolitan markets (1) See reconciliation of GAAP to non-GAAP financial measures in the appendix and in the Company’s earnings press releases Loan Production / Representative Offices ▪ Headquartered in Pasadena, California ▪ 25 years on Nasdaq ▪ Founded in 1973 - over 50 years in operation Roots in the U.S. Asian-American immigrant community, expanded to connect businesses between the U.S. and Asia Award-winning Company #1 Top Performing Bank, $50+ Billion (Bank Director) America’s Best Banks (Forbes)

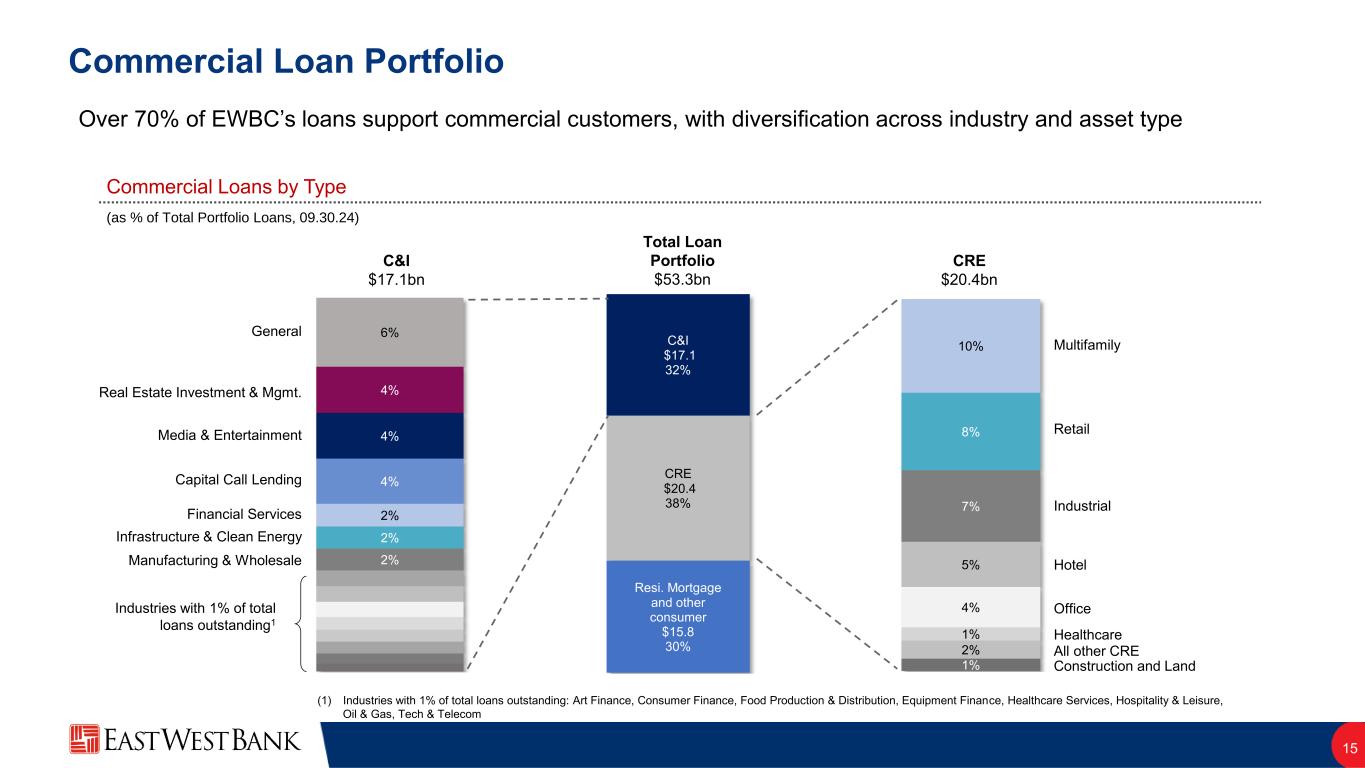

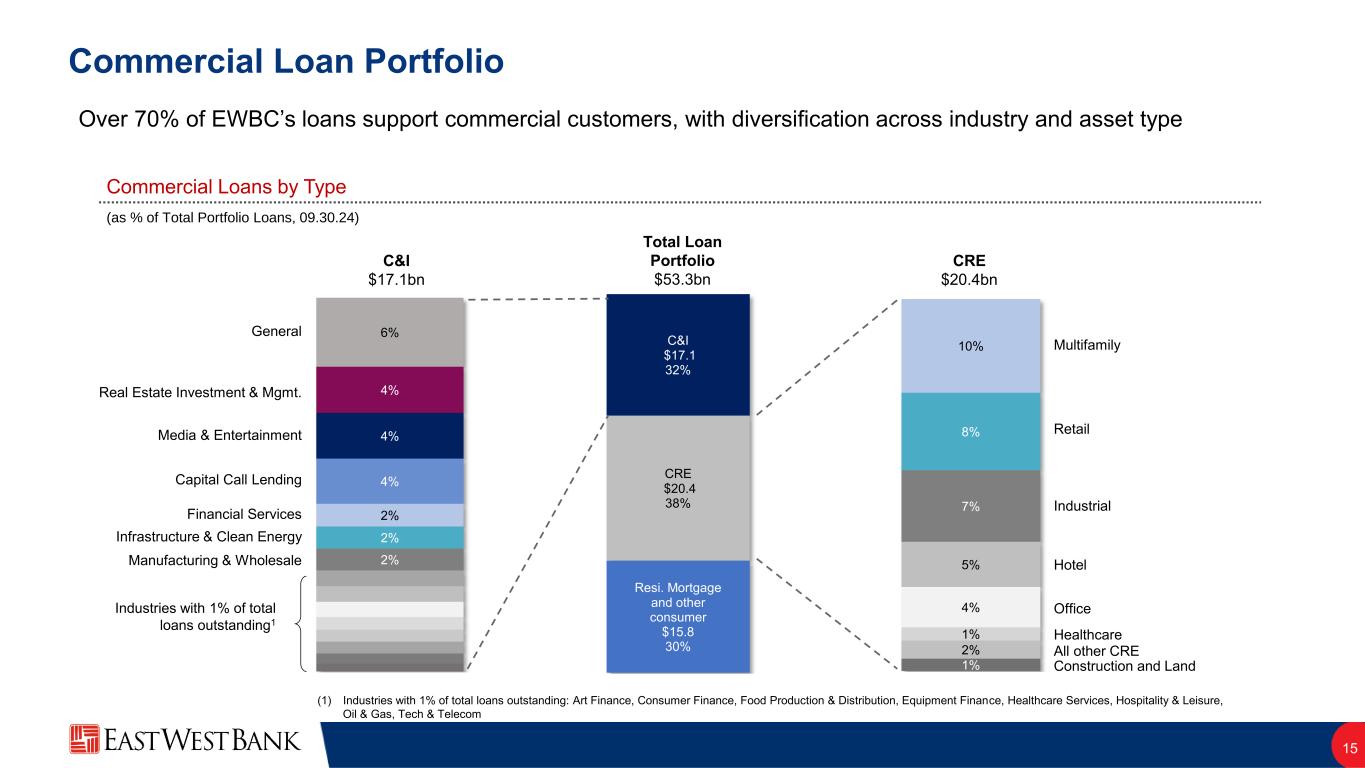

Resi. Mortgage and other consumer $15.8 30% CRE $20.4 38% C&I $17.1 32% 1% 2% 1% 4% 5% 7% 8% 10% 2% 2% 2% 4% 4% 4% 6% Industries with 1% of total loans outstanding1 Commercial Loan Portfolio 15 Over 70% of EWBC’s loans support commercial customers, with diversification across industry and asset type CRE $20.4bn C&I $17.1bn (as % of Total Portfolio Loans, 09.30.24) Commercial Loans by Type Total Loan Portfolio $53.3bn (1) Industries with 1% of total loans outstanding: Art Finance, Consumer Finance, Food Production & Distribution, Equipment Finance, Healthcare Services, Hospitality & Leisure, Oil & Gas, Tech & Telecom Capital Call Lending Media & Entertainment Real Estate Investment & Mgmt. Manufacturing & Wholesale General Industrial Multifamily Retail Hotel Office Healthcare All other CRE Construction and Land Financial Services Infrastructure & Clean Energy

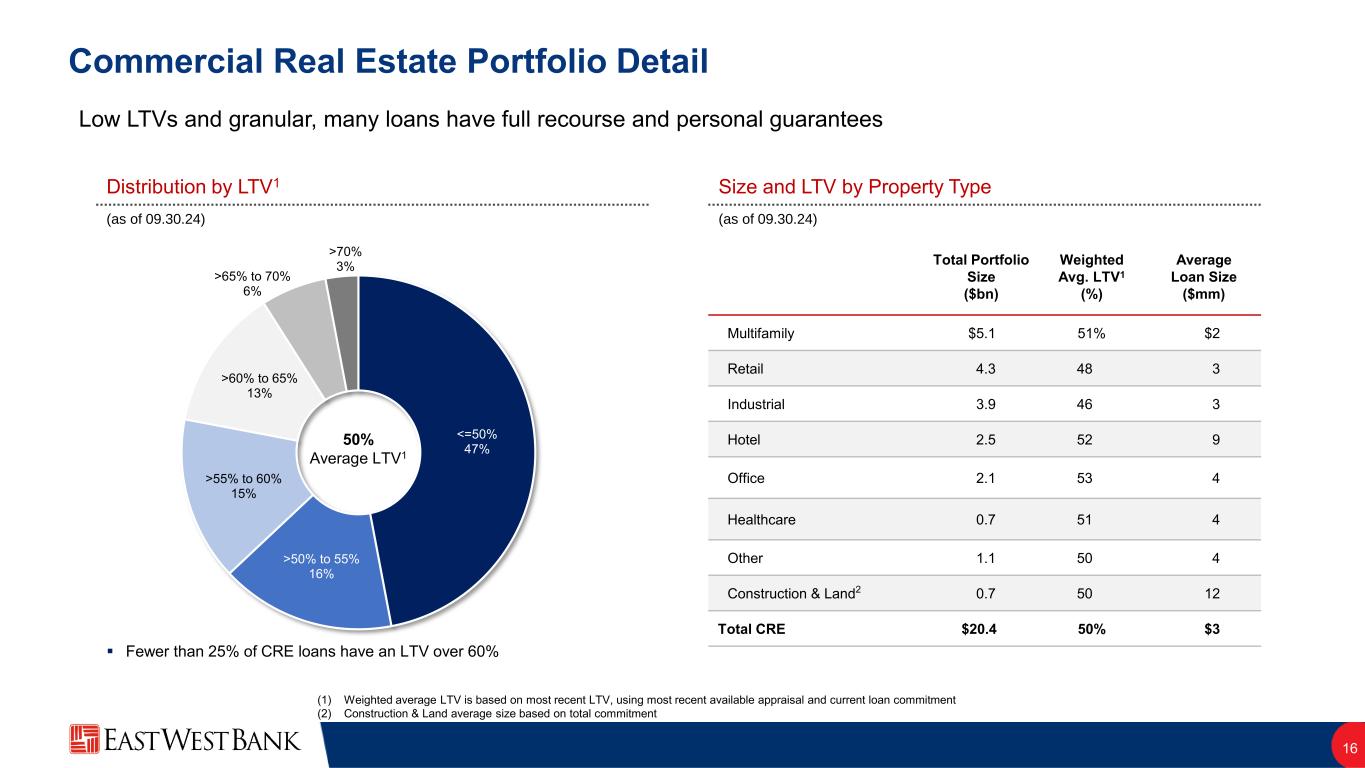

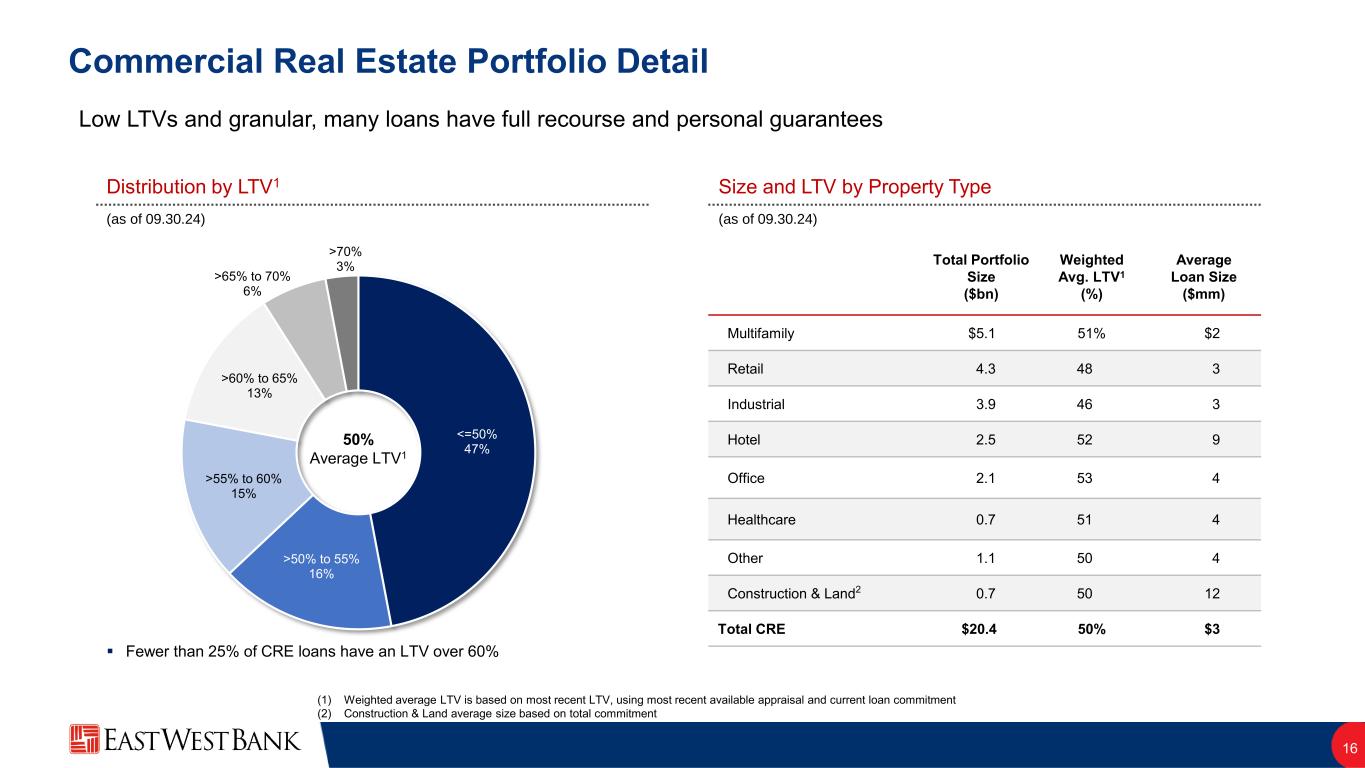

<=50% 47% >50% to 55% 16% >55% to 60% 15% >60% to 65% 13% >65% to 70% 6% >70% 3% Commercial Real Estate Portfolio Detail 16 (1) Weighted average LTV is based on most recent LTV, using most recent available appraisal and current loan commitment (2) Construction & Land average size based on total commitment 50% Average LTV1 Low LTVs and granular, many loans have full recourse and personal guarantees Distribution by LTV1 Size and LTV by Property Type (as of 09.30.24) (as of 09.30.24) ▪ Fewer than 25% of CRE loans have an LTV over 60% Total Portfolio Size ($bn) Weighted Avg. LTV1 (%) Average Loan Size ($mm) Multifamily $5.1 51% $2 Retail 4.3 48 3 Industrial 3.9 46 3 Hotel 2.5 52 9 Office 2.1 53 4 Healthcare 0.7 51 4 Other 1.1 50 4 Construction & Land2 0.7 50 12 Total CRE $20.4 50% $3

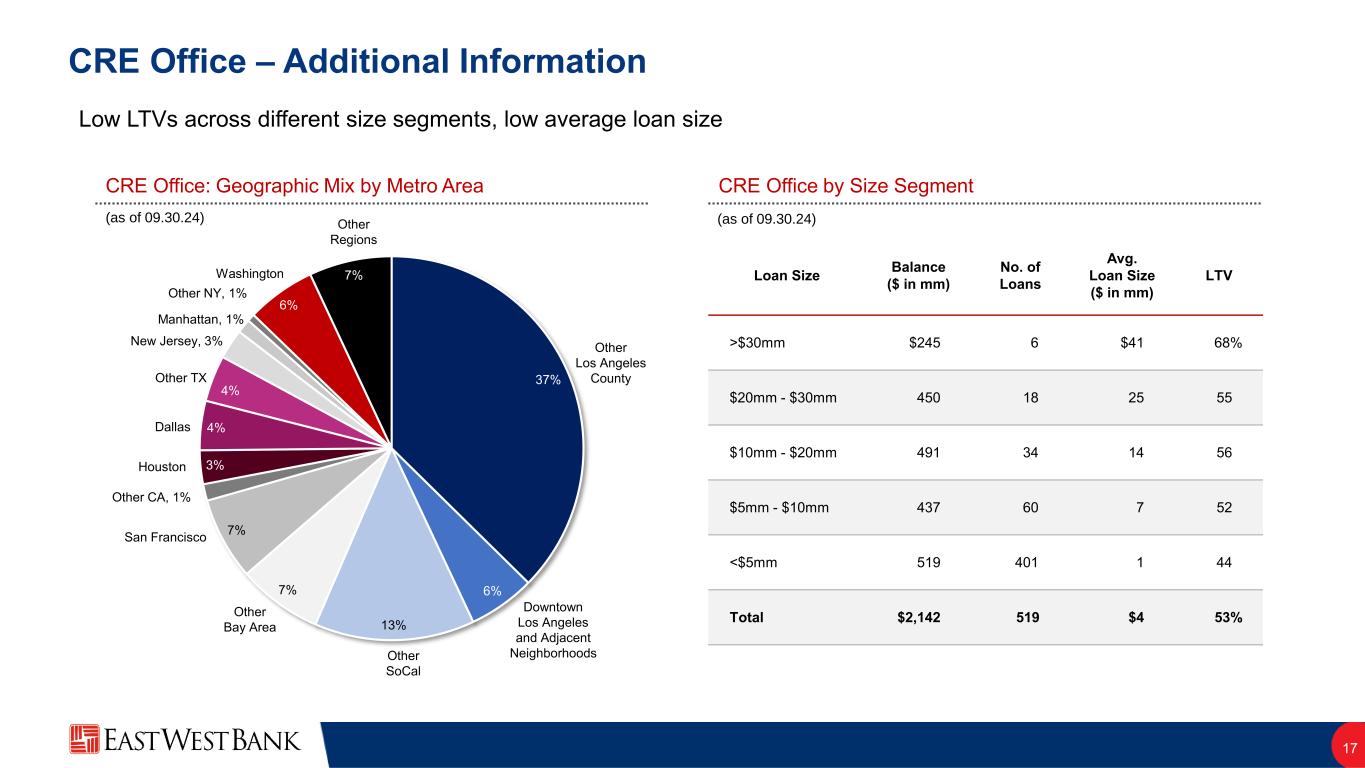

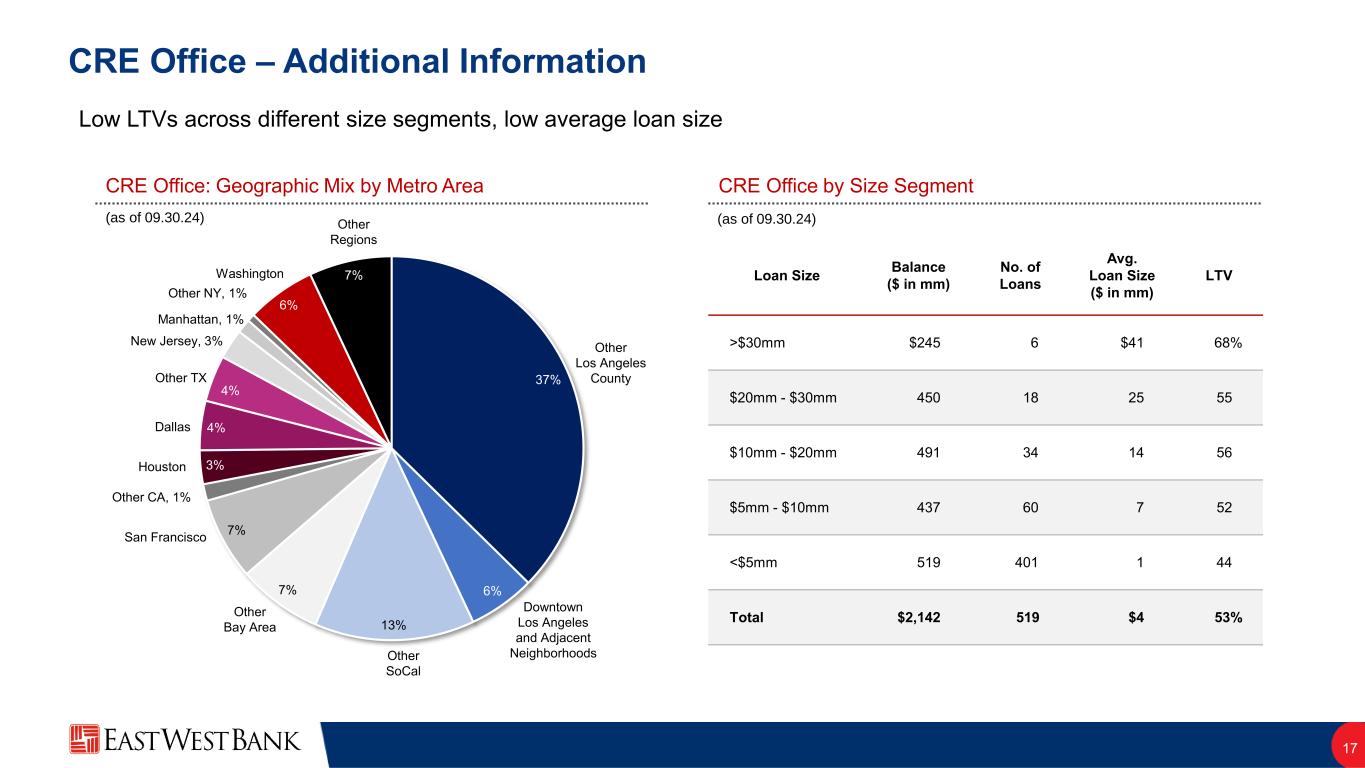

37% 6% 13% 7% 7% 3% 4% 4% 6% 7% CRE Office – Additional Information 17 CRE Office: Geographic Mix by Metro Area CRE Office by Size Segment Other Los Angeles County Other SoCal Other Bay Area San Francisco Other CA, 1% Houston Dallas Manhattan, 1% Other TX Washington Other Regions New Jersey, 3% Other NY, 1% Downtown Los Angeles and Adjacent Neighborhoods (as of 09.30.24) (as of 09.30.24) Low LTVs across different size segments, low average loan size Loan Size Balance ($ in mm) No. of Loans Avg. Loan Size ($ in mm) LTV >$30mm $245 6 $41 68% $20mm - $30mm 450 18 25 55 $10mm - $20mm 491 34 14 56 $5mm - $10mm 437 60 7 52 <$5mm 519 401 1 44 Total $2,142 519 $4 53%

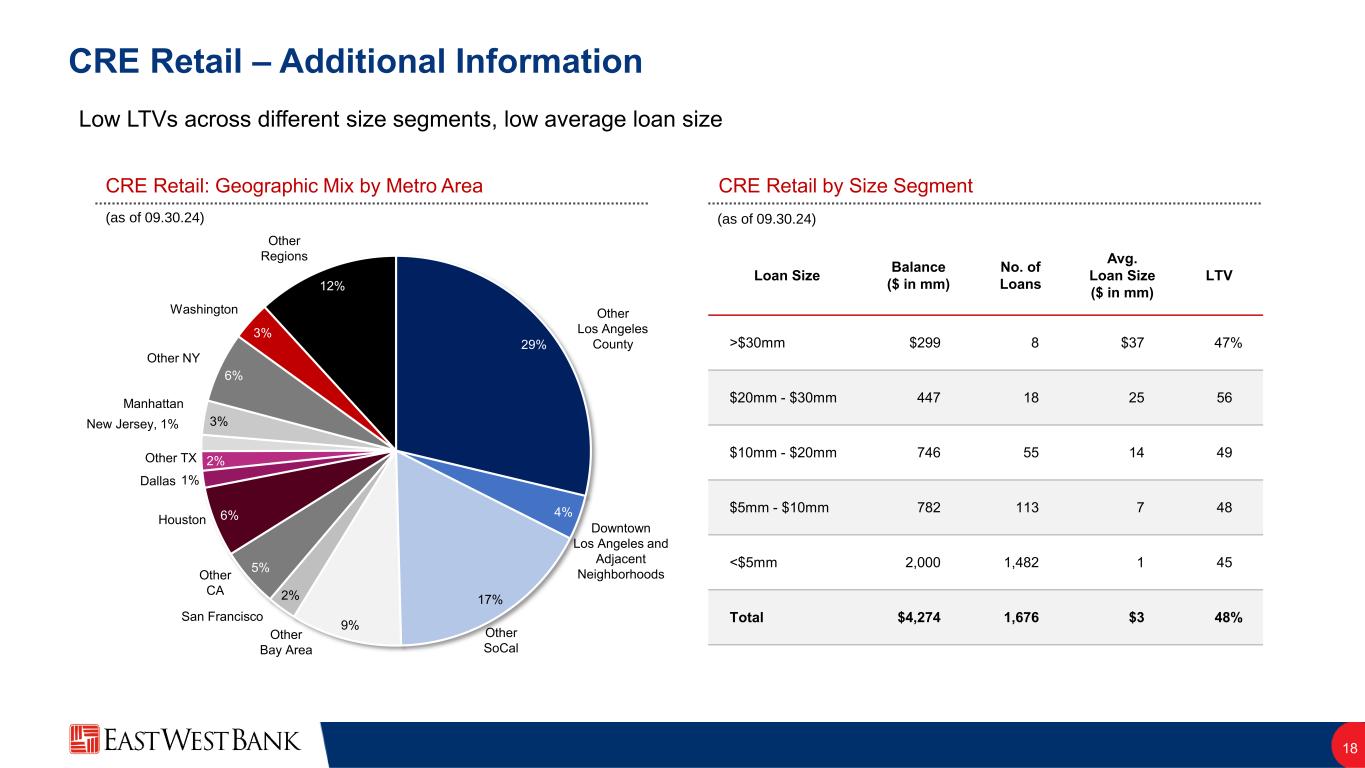

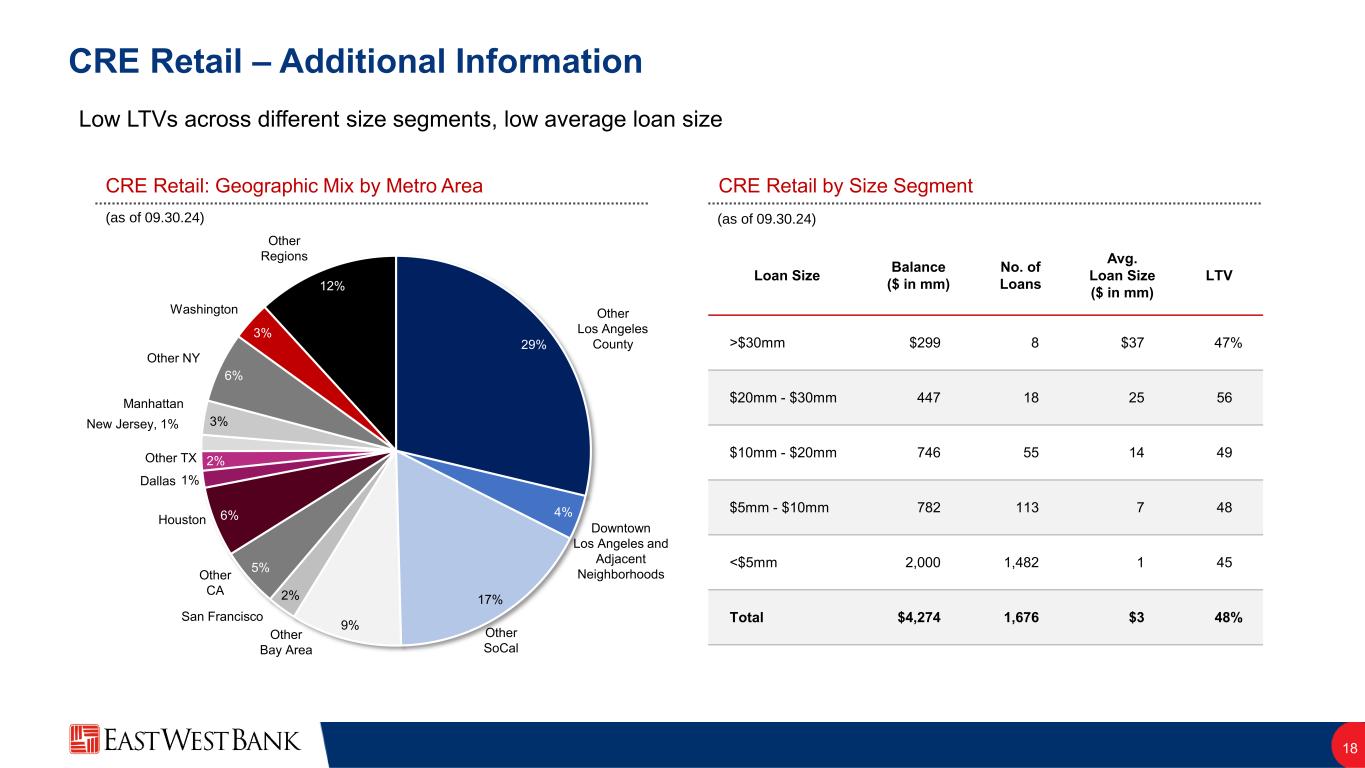

29% 4% 17% 9% 2% 5% 6% 1% 2% 3% 6% 3% 12% CRE Retail – Additional Information 18 Other Los Angeles County Downtown Los Angeles and Adjacent Neighborhoods Other SoCal Other Bay Area San Francisco Other CA Houston Dallas Manhattan Other TX Washington Other Regions Other NY Low LTVs across different size segments, low average loan size CRE Retail: Geographic Mix by Metro Area CRE Retail by Size Segment (as of 09.30.24) (as of 09.30.24) New Jersey, 1% Loan Size Balance ($ in mm) No. of Loans Avg. Loan Size ($ in mm) LTV >$30mm $299 8 $37 47% $20mm - $30mm 447 18 25 56 $10mm - $20mm 746 55 14 49 $5mm - $10mm 782 113 7 48 <$5mm 2,000 1,482 1 45 Total $4,274 1,676 $3 48%

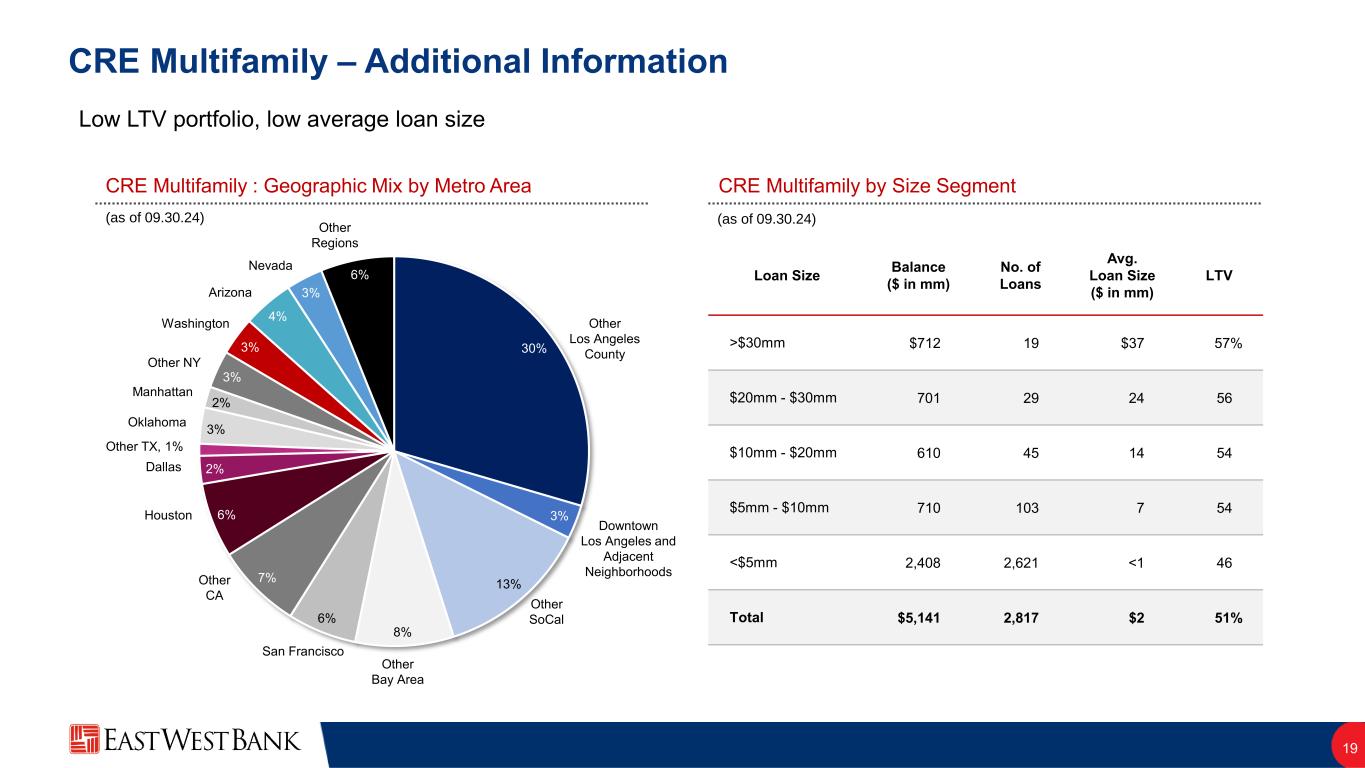

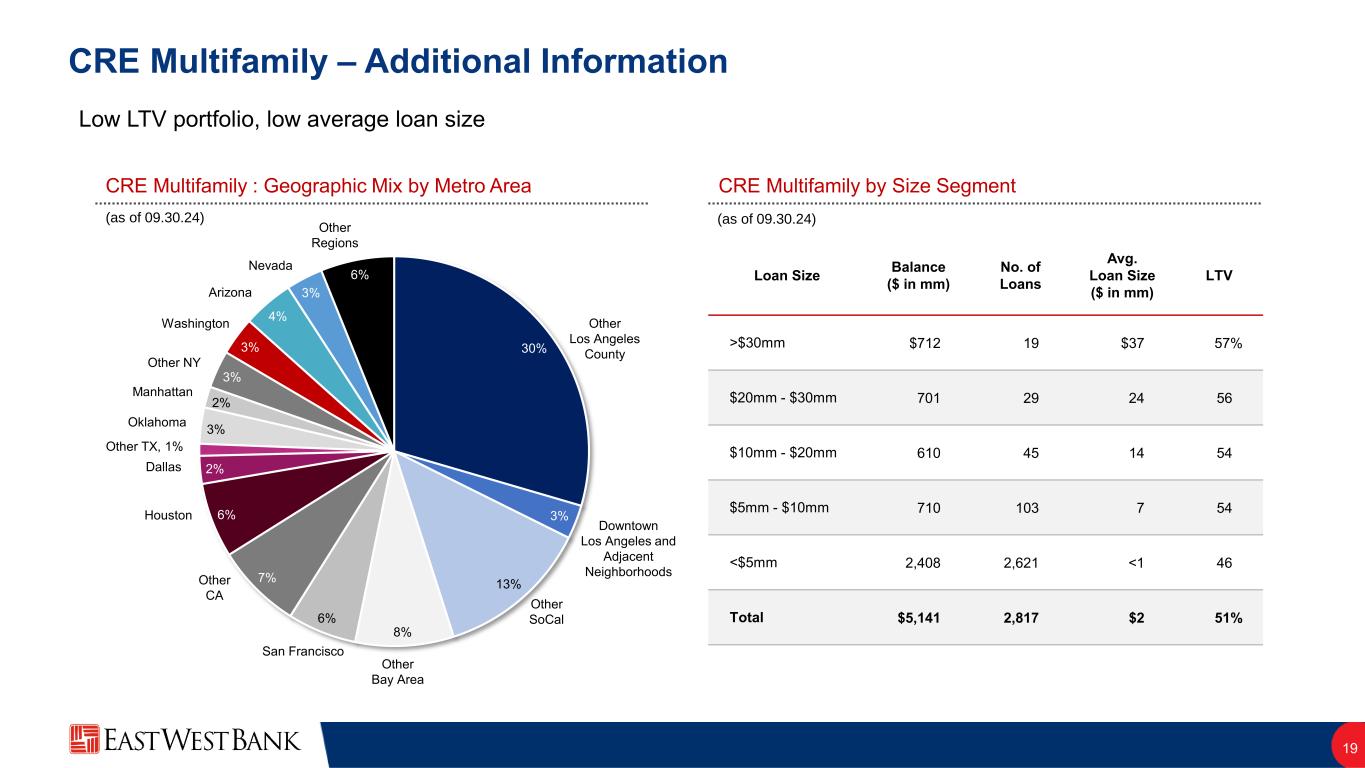

CRE Multifamily – Additional Information 19 Other Los Angeles County Downtown Los Angeles and Adjacent Neighborhoods Other SoCal Other Bay Area San Francisco Other CA Houston Dallas Manhattan Other TX, 1% Washington Other Regions Other NY Low LTV portfolio, low average loan size CRE Multifamily by Size Segment (as of 09.30.24) (as of 09.30.24) Loan Size Balance ($ in mm) No. of Loans Avg. Loan Size ($ in mm) LTV >$30mm $712 19 $37 57% $20mm - $30mm 701 29 24 56 $10mm - $20mm 610 45 14 54 $5mm - $10mm 710 103 7 54 <$5mm 2,408 2,621 <1 46 Total $5,141 2,817 $2 51% CRE Multifamily : Geographic Mix by Metro Area Arizona Nevada Oklahoma 30% 3% 13% 8% 6% 7% 6% 2% 3% 2% 3% 3% 4% 3% 6%

<=50% 48% >50% to 55% 12% >55% to 60% 29% >60% 11% Southern California 40% Northern California 16% New York 26% Washington 7% Texas 2% Other 9% Residential Mortgage Portfolio 20 51% Average LTV1 Low LTVs and average loan size (as of 09.30.24) Resi. Mortgage Distribution by LTV1 (as of 09.30.24) $437,000 Average loan size2 (1) Combined LTV for 1st and 2nd liens; based on commitment (2) Average loan size based on loan outstanding for single-family residential and commitment for HELOC (3) Geographic distribution based on commitment size Portfolio Highlights as of 09.30.24 Outstandings ▪ $15.7bn loans outstanding ▪ +1% Q-o-Q and +8% Y-o-Y Originations ▪ $0.7bn in 3Q24 ▪ Primarily originated through East West Bank branches Single-family Residential ▪ $14.0bn loans outstanding ▪ +2% Q-o-Q and +9% Y-o-Y HELOC ▪ $1.8bn loans outstanding ▪ $3.5bn in undisbursed commitments ▪ 33% utilization, down 1% from 06.30.24 ▪ 77% of commitments in first lien position Resi. Mortgage Distribution by Geography3

21% 21% 29% 24% 5%Fixed rate Hybrid in fixed rate period Variable - LIBOR + SOFR Variable - Prime rate Variable - all other rates Loan Yields 21 Hedge Impact and Outlook Loan Portfolio by Index Rate Average Loan Rate by Portfolio (as of 09.30.24) Total fixed rate and hybrid in fixed period: 42% 56%* variable rate SFR: 45% hybrid in fixed-rate period & 40% fixed rate 3Q23 4Q23 1Q24 2Q24 3Q24 10.15.24 rate sheet price for 30-year fixed: 7.125%*48% had customer-level interest rate derivative contracts 90% variable rate 7.90% 7.99% 8.06% 8.01% 7.93% C&I 6.28% 6.36% 6.39% 6.41% 6.44% CRE 5.36% 5.49% 5.71% 5.80% 5.86% Residential Mortgage ▪ $24mm impact to NII of cash flow hedges (14bps to NIM) ▪ $1bn of active cash flow hedges to roll off in 1Q25, which are negative carry ▪ $1bn forward starting hedges to come on in 2H25, with a blended receive-fixed rate of ~4%

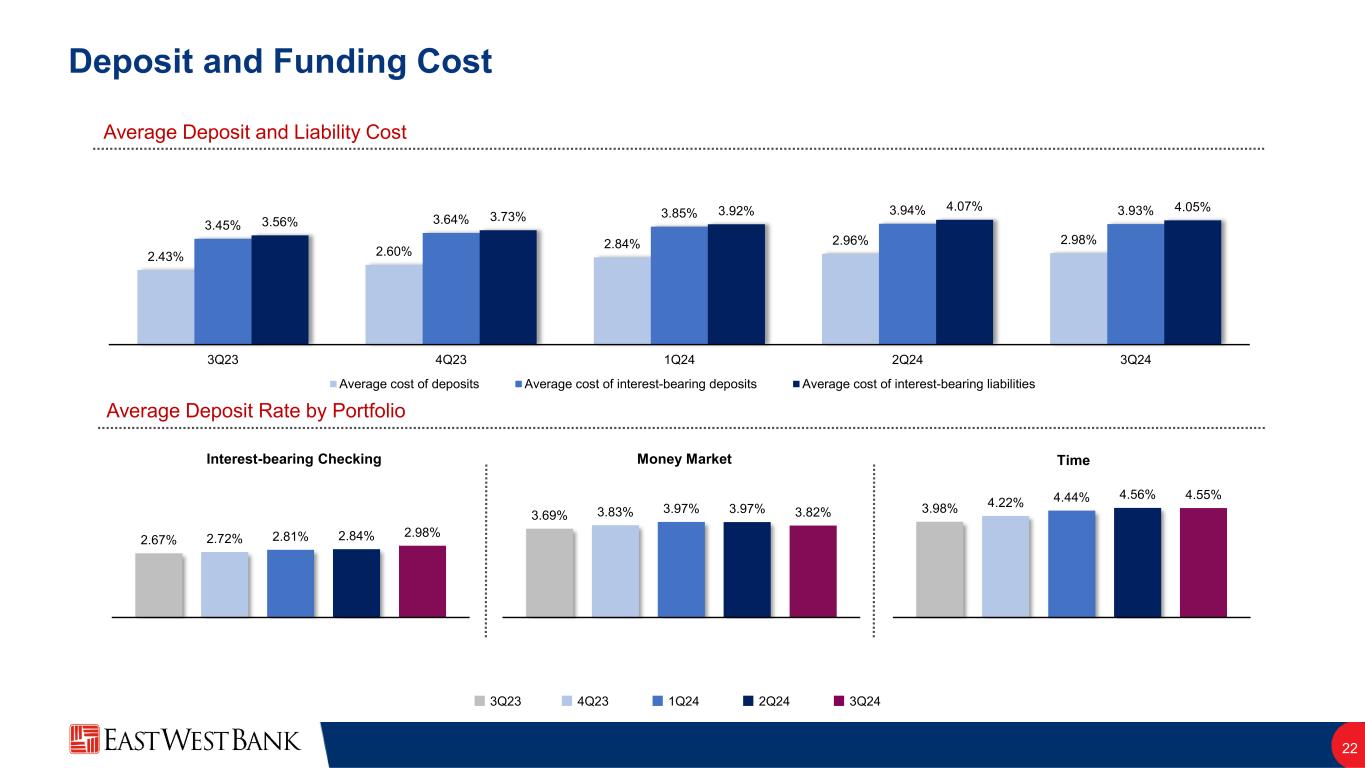

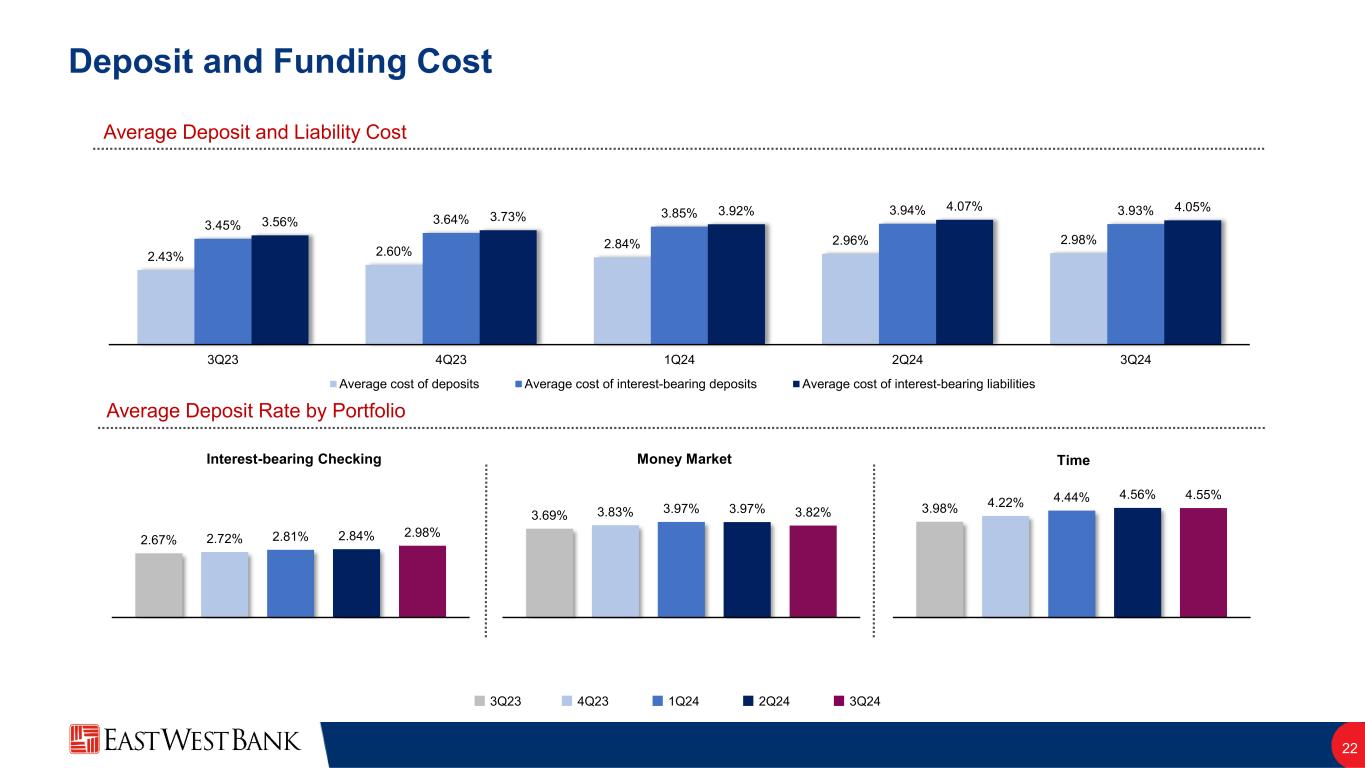

Deposit and Funding Cost 22 Average Deposit and Liability Cost Average Deposit Rate by Portfolio 3Q23 4Q23 1Q24 2Q24 3Q24 2.43% 2.60% 2.84% 2.96% 2.98% 3.45% 3.64% 3.85% 3.94% 3.93% 3.56% 3.73% 3.92% 4.07% 4.05% 3Q23 4Q23 1Q24 2Q24 3Q24 Average cost of deposits Average cost of interest-bearing deposits Average cost of interest-bearing liabilities 2.67% 2.72% 2.81% 2.84% 2.98% Interest-bearing Checking 3.69% 3.83% 3.97% 3.97% 3.82% Money Market 3.98% 4.22% 4.44% 4.56% 4.55% Time

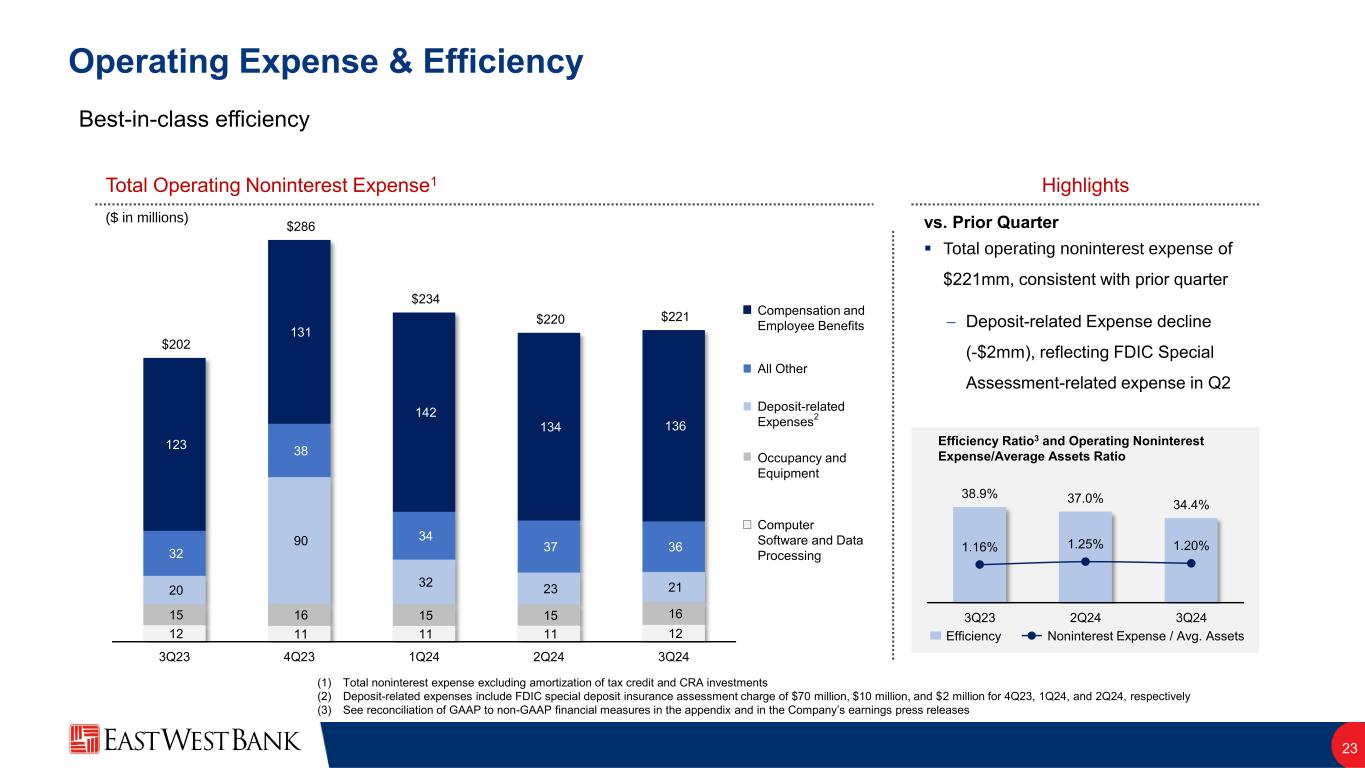

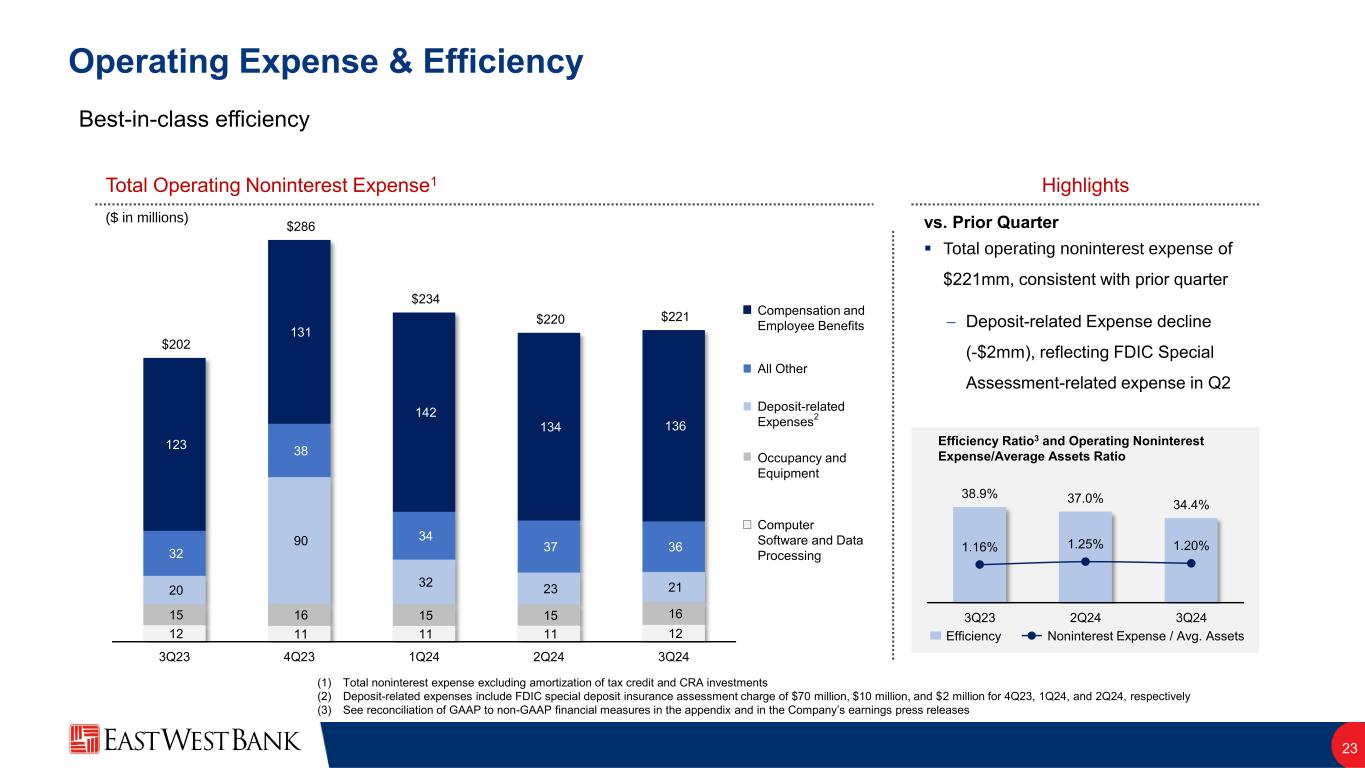

38.9% 37.0% 34.4% 1.16% 1.25% 1.20% 3Q23 2Q24 3Q24 Operating Expense & Efficiency 23 Best-in-class efficiency Total Operating Noninterest Expense1 ($ in millions) ▪ Total operating noninterest expense of $221mm, consistent with prior quarter − Deposit-related Expense decline (-$2mm), reflecting FDIC Special Assessment-related expense in Q2 (1) Total noninterest expense excluding amortization of tax credit and CRA investments (2) Deposit-related expenses include FDIC special deposit insurance assessment charge of $70 million, $10 million, and $2 million for 4Q23, 1Q24, and 2Q24, respectively (3) See reconciliation of GAAP to non-GAAP financial measures in the appendix and in the Company’s earnings press releases Highlights Efficiency Ratio3 and Operating Noninterest Expense/Average Assets Ratio Efficiency Noninterest Expense / Avg. Assets Compensation and Employee Benefits All Other Deposit-related Expenses Occupancy and Equipment Computer Software and Data Processing vs. Prior Quarter 2 12 11 11 11 12 15 16 15 15 16 20 90 32 23 21 32 38 34 37 36 123 131 142 134 136 $202 $286 $234 $220 $221 3Q23 4Q23 1Q24 2Q24 3Q24

Appendix: GAAP to Non-GAAP Reconciliation 24 EAST WEST BANCORP, INC. AND SUBSIDIARIES GAAP TO NON-GAAP RECONCILIATION ($ in thousands) (unaudited) Three Months Ended Nine Months Ended September 30, 2024 June 30, 2024 September 30, 2023 September 30, 2024 September 30, 2023 Net interest income before provision for credit losses (a) $ 572,722 $ 553,229 $ 570,813 $ 1,691,090 $ 1,737,420 Fully taxable equivalent (“FTE”) adjustment (b) 411 751 433 3,491 1,288 FTE net interest income before provision for loan loss (c)=(a)+(b) 573,133 553,980 571,246 1,694,581 1,738,708 Total noninterest income (d) 84,761 84,673 76,752 248,422 215,361 Total revenue (e)=(a)+(d) 657,483 637,902 647,565 1,939,512 1,952,781 Total revenue (FTE) (f)=(c)+(d) $ 657,894 $ 638,653 $ 647,998 $ 1,943,003 $ 1,954,069 Total noninterest expense (g) $ 226,166 $ 236,434 $ 252,014 709,475 $ 732,250 Efficiency ratio (g)/(f) 34.38 % 37.02 % 38.89 % 36.51 % 37.47 % Pre-tax, pre-provision income (f)-(g) $ 431,728 $ 402,219 $ 395,984 $ 1,233,528 $ 1,221,819

Appendix: GAAP to Non-GAAP Reconciliation 25 EAST WEST BANCORP, INC. AND SUBSIDIARIES GAAP TO NON-GAAP RECONCILIATION ($ in thousands) (unaudited) The Company uses certain non-GAAP financial measures to provide supplemental information regarding the Company’s performance. During the third and second quarters of 2024, the Company recorded $11 million and $3 million, respectively, in pre-tax DC solar recoveries (included in Amortization of Tax Credit and CRA Investments on the Condensed Consolidated Statement of Income) related to the Company’s investment in DC Solar. The Company recorded $4 million and $2 million in pre-tax DC solar recoveries in the first and second quarters of 2023. During the second and first quarters of 2024, the Company recorded $2 million and $10 million, respectively, in pre-tax FDIC special assessment charges (included in Deposit insurance premiums and regulatory assessments on the Condensed Consolidated Statement of Income). During the first quarter of 2023, the Company recorded a $10 million pre-tax impairment write-off of an AFS debt security (included in Net gains on AFS debt securities on the Condensed Consolidated Statement of Income) and $4 million in pre-tax repurchase agreements’ extinguishment cost (included in Other operating expenses on the Condensed Consolidated Statement of Income). Adjusted net income represents net income adjusted for the tax-effected above-mentioned adjustments. Adjusted diluted EPS represents diluted EPS adjusted for the above tax-effected adjustments. Management believes that the measures and ratios presented below provide clarity to financial statement users regarding the ongoing performance of the Company and allow comparability to prior periods. (1) Applied statutory tax rate of 29.56% for the three and nine months ended September 30, 2024, and the three months ended June 30, 2024. Applied statutory tax rate of 29.29% for the three and nine months ended September 30, 2023 Three Months Ended Nine Months Ended September 30, 2024 June 30, 2024 September 30, 2023 September 30, 2024 September 30, 2023 Net income $ 299,166 $ 288,230 $ 287,738 $ 872,471 $ 922,208 Add: FDIC special assessment charge — 1,880 — 12,185 — Add: Write-off of AFS debt security — — — — 10,000 Less: DC Solar recovery (11,201) (3,146) — (14,347) (5,571) Add: Repurchase agreements’ extinguishment cost — — — — 3,872 Tax effect of adjustments (1) 3,311 374 — 639 (2,431) Adjusted net income $ 291,276 $ 287,338 $ 287,738 $ 870,948 $ 928,078 Diluted weighted-average number of shares outstanding 139,648 139,801 142,122 139,939 142,044 Diluted EPS $ 2.14 $ 2.06 $ 2.02 $ 6.23 $ 6.49 Add: FDIC special assessment charge — 0.02 — 0.09 — Add: Write-off of AFS debt security — — — — 0.07 Less: DC Solar recovery (0.08) (0.02) — (0.10) (0.04) Add: Repurchase agreements’ extinguishment cost — — — — 0.03 Tax effect of adjustments (1) 0.03 — — — (0.02) Adjusted diluted EPS $ 2.09 $ 2.06 $ 2.02 $ 6.22 $ 6.53

(1) Includes core deposit intangibles and mortgage servicing assets. There were no core deposit intangibles in the 2024 periods presented Appendix: GAAP to Non-GAAP Reconciliation 26 EAST WEST BANCORP, INC. AND SUBSIDIARIES GAAP TO NON-GAAP RECONCILIATION ($ in thousands) (unaudited) The Company uses certain non-GAAP financial measures to provide supplemental information regarding the Company’s performance. Tangible book value, tangible book value per share and TCE ratio are non- GAAP financial measures. Tangible book value and tangible assets represent stockholders’ equity and total assets, respectively, which have been reduced by goodwill and other intangible assets. Given that the use of such measures and ratios is more prevalent in the banking industry, and are used by banking regulators and analysts, the Company has included them below for discussion. September 30, 2024 June 30, 2024 September 30, 2023 Common Stock $ 170 $ 170 $ 169 Additional paid-in capital 2,018,105 2,007,388 1,969,239 Retained earnings 7,095,587 6,873,653 6,294,751 Treasury stock (1,012,019) (1,011,924) (792,076) Accumulated other comprehensive income: AFS debt securities net unrealized losses (456,493) (591,286) (751,357) Cash flow hedges net unrealized gains (losses) 39,143 (44,059) (102,139) Foreign currency translation adjustments (19,954) (18,828) (21,881) Total accumulated other comprehensive loss (437,304) (654,173) (875,377) Stockholders’ equity (a) $ 7,664,539 $ 7,215,114 $ 6,596,706 Less: Goodwill (465,697) (465,697) (465,697) Other intangible assets (1) (5,563) (5,903) (5,649) Tangible book value (b) $ 7,193,279 $ 6,743,514 $ 6,125,360 Number of common shares at period-end (c) 138,609 138,604 141,486 Book value per share (a)/(c) $ 55.30 $ 52.06 $ 46.62 Tangible book value per share (b)/(c) $ 51.90 $ 48.65 $ 43.29 Total assets (d) $ 74,483,720 $ 72,468,272 $ 68,289,458 Less: Goodwill (465,697) (465,697) (465,697) Other intangible assets (1) (5,563) (5,903) (5,649) Tangible assets (e) $ 74,012,460 $ 71,996,672 $ 67,818,112 Total stockholders’ equity to assets ratio (a)/(d) 10.29% 9.96% 9.66% TCE ratio (b)/(e) 9.72% 9.37% 9.03%

Appendix: GAAP to Non-GAAP Reconciliation 27 EAST WEST BANCORP, INC. AND SUBSIDIARIES GAAP TO NON-GAAP RECONCILIATION ($ in thousands) (unaudited) Return on average TCE represents tangible net income divided by average tangible book value. Tangible net income excludes the after-tax impacts of the amortization of core deposit intangibles and mortgage servicing assets. Given that the use of such measures and ratios is more prevalent in the banking industry, and are used by banking regulators and analysts, the Company has included them below for discussion. (1) Applied statutory tax rate of 29.56% for the three and nine months ended September 30, 2024, and the three months ended June 30, 2024. Applied statutory tax rate of 29.29% for the three and nine months ended September 30, 2023 (2) Includes core deposit intangibles and mortgage servicing assets. There were no core deposit intangibles in the 2024 periods presented (3) Annualized Three Months Ended Nine Months Ended September 30, 2024 June 30, 2024 September 30, 2023 September 30, 2024 September 30, 2023 Net income (f) $ 299,166 $ 288,230 $ 287,738 $ 872,471 $ 922,208 Add: Amortization of core deposit intangibles — — 441 — 1,322 Amortization of mortgage servicing assets 348 332 328 988 1,026 Tax effect of amortization adjustments (1) (103) (98) (225) (292) (688) Tangible net income (g) $ 299,411 $ 288,464 $ 288,282 $ 873,167 $ 923,868 Average stockholders’ equity (h) $ 7,443,333 $ 7,087,500 $ 6,604,798 $ 7,175,445 $ 6,411,250 Less: Average goodwill (465,697) (465,697) (465,697) (465,697) (465,697) Average other intangible assets (2) (5,790) (6,110) (6,148) (6,123) (6,916) Average tangible book value (i) $ 6,971,846 $ 6,615,693 $ 6,132,953 $ 6,703,625 $ 5,938,637 Return on average common equity (3) (f)/(h) 15.99% 16.36% 17.28% 16.24% 19.23% Return on average TCE (3) (g)/(i) 17.08% 17.54% 18.65% 17.40% 20.80%