Back to Contents

Notes to the financial statements

1 General

The financial statements of Swisscom AG, the parent company, comply with the legal provisions of the Swiss Code of Obligations.

2 Contingent liabilities

Total guarantees and pledged securities in favor of third parties at December 31, 2001 and December 31, 2002 amounted to CHF 40 million and CHF 26 million respectively. In addition, total guarantees and pledged securities in favor of third parties on behalf of group companies at December 31, 2002 amounted to CHF 390 million. Swisscom is severally liable with two other shareholders to cover future losses of an associated company.

3 Fire insurance values of property, plant and equipment

The fire insurance values of property, plant and equipment are generally based on replacement or fair values of such assets.

4 Investments

In November 2000, Swisscom AG entered into an agreement with Vodafone plc for the sale of 25% of the equity of the Swisscom Mobile business for CHF 4,500 million. Effective January 1, 2001, Swisscom AG transferred the net assets of its mobile business to Swisscom Mobile AG. On the transaction Swisscom AG realized an increase in the value of its mobile business of CHF 3,949 million.

In 2002, as a result of the development in the capital markets Swisscom AG reviewed the carrying value of its investments and recorded an impairment charge of CHF155 million. Of this, CHF 44 million relates to Swiss International Airlines Ltd. and CHF 111 million to Infonet Services Corp.

In connection with the establishment of a separate legal identity for its fixed network business, Swisscom AG transferred a number of investments (including debitel, Bluewin AG, Telecom FL AG and Conextrade AG) to Swisscom Fixnet AG.

In 2002, the investment in Vesicom Kabelnetz AG was put into liquidation, which resulted in a loss of CHF 32 million.

5 Treasury stock

At the beginning of 2002, Swisscom bought back 7,346,739 (9.99%) of its own registered shares for CHF 4,264 million. The shares acquired as part of the buyback program were cancelled in the third quarter of 2002.

In 2001 and 2002, Swisscom AG acquired 69,804 and 125,442 of its own shares for an average price of CHF 439 and CHF 500 and recorded them under securities available for sale. In 2001, 68,887 shares were issued to employees, members of the Executive Board and the Board of Directors for no consideration. In 2002, 119,372 shares at a price of CHF 240 were sold to employees and 5,896 additional shares were issued to employees and the Executive Board under the Management Incentive and Leverage Executive Asset Plan. The related cost had been recorded under personnel expenses. In 2002, a further 2,000 shares were sold on the market at a price of CHF 474. In 2001 and 2002, Swisscom AG purchased options on the market for its Management Incentive Plan in the amount of CHF 8 million.

At December 31, 2001 and December 31, 2002, Swisscom AG had 3,431 and 1,605 treasury shares outstanding. See Note 33 to the consolidated financial statements.

65 Swisscom Financial statements of Swisscom AG

Back to Contents

Notes to the financial statements

6 Others

Leasing

Assets acquired under leasing agreements which effectively transfer substantially all the risks and rewards incidental to ownership from the lessor to the lessee are classified as finance leases. In 1999 and 2000 Swisscom entered into four cross-border tax leases and recorded financial assets of CHF 1,260 million and financial liabilities of CHF 1,565 million. The financial assets of CHF 1,260 million are not freely available. Swisscom AG transferred the financial assets and financial liabilities to the newly formed subsidiary Swisscom Fixnet AG, effective January 1, 2002.

At December 31, 2002 there were no finance lease obligations not shown on the balance sheet. At December 31, 2001 the finance lease obligations which had not been recorded in the balance sheet amounted to CHF 737 million; these were transferred to Swisscom Immobilien AG as of January 1, 2002.

Significant shareholders

On December 31, 2002 the Swiss Confederation (the “Confederation”) as majority shareholder held 62.7 percent of the shares of Swisscom AG. The Telecommunications Enterprise Act of 1997 (“‘Telekommunikationsunternehmungsgesetz’, TUG”) provides that the Confederation must hold a majority of the capital and voting rights of Swisscom. In addition, Chase Nominees Ltd, London, registered in the share register as shareholder, held at December 31, 2002 7.05 % of the shares.

Change into a holding structure

In 2002, Swisscom AG became a holding company, by transferring its business operations to newly formed subsidiaries. The goal of the new group structure is to provide greater transparency for management and shareholders while giving subsidiary companies clear responsibility for their respective markets.

Consequently, as per January 1, 2002 the companies Swisscom Fixnet AG, Swisscom Enterprise Solutions AG, Swisscom Systems AG and Swisscom Broadcast AG were separated from Swisscom AG. The transfers were made at book value.

Recording of dividends payable by subsidiaries

In contrast to prior years, starting in 2002 dividends of consolidated subsidiaries will be recorded in the year the dividend is proposed. The corresponding dividends have been approved at the subsidiaries’s Shareholder Meeting. This change in methodology resulted in an increase in income from investments of CHF 1,158 million.

Capital reduction

In addition to a dividend of CHF 12 per share, the Board of Directors has proposed a capital reduction of CHF 8 per share. This reduction has to be approved by the shareholders. Should this reduction be approved, Swisscom will pay CHF 530 million to its shareholders in the 3rd quarter of 2003.

66 Swisscom Financial statements of Swisscom AG

Back to Contents

Proposed appropriation of retained earnings

Proposal of the Board of Directors

The Board of Directors proposes to the General Meeting of Shareholders the following appropriation of retained earnings of CHF 4,322 million for the year ended December 31, 2002:

| CHF in millions | | 2002 | |

| |

| |

| Dividend of 133% on registered shares * | | 794 | |

| |

| |

| Balance to be carried forward | | 3 528 | |

| |

| |

| Total retained earnings | | 4 322 | |

| |

| |

| | | | |

| * | excluding treasury stock |

Subject to the approval of this proposal by the General Meeting of Shareholders, the dividend will be paid to shareholders on May 9, 2003:

| Per registered share | | CHF | |

| |

| |

| Dividend, gross | | 12.00 | |

| |

| |

| less 35% withholding tax | | 4.20 | |

| |

| |

| Dividend payment, net | | 7.80 | |

| |

| |

67 Swisscom Proposed appropriation of retained earnings

Back to Contents

Back to Contents

Corporate Governance

1 Group structure

In 2002 Swisscom transferred its operations from Swisscom AG to newly formed subsidiaries. The aim of the new structure is to increase transparency for management and shareholders while allocating clear responsibilities to the subsidiaries for their respective markets. Autonomy also allows them to enter into strategic partnerships as Swisscom Mobile AG did in 2001 with the mobile phone operator Vodafone.

Swisscom AG is the holding company with responsibility for overall management and for strategic and financial management of the Swisscom Group. Strategic and financial management of the independently operating subsidiaries is assured by the fact that the powers and responsibilities are aligned with the Group. Furthermore, the CEO of Swisscom AG chairs the strategic subsidiaries’ Board of Directors, of which the CFO and CSO are also members. The six strategic subsidiaries are Swisscom Fixnet AG, Swisscom Mobile AG, Swisscom Enterprise Solutions AG, Swisscom IT Services AG, Swisscom Systems AG and debitel AG. The role of Chairman of the Board of Directors of the other subsidiaries is exercised by the CEO of a strategic group company or the head of a Group Headquarters Division (GHQ Division). GHQ has the follwing divisions: Group Finance & Controlling, Strategy & Group Steering, Group Communications, Group Information Systems, Group Operations & Related Businesses (formerly Group Management Services) and Group Human Resources. The Group Information Systems Division was integrated in the Strategy & Group Steering Division as of February 1, 2003.

The strategic subsidiaries, excluding Swisscom Systems AG and Swisscom IT Services AG which are included under the segment “Other”, are reported as individual segments in the consolidated financial statements. A diagram of the Group structure is shown in the Annual Report, in the chapter entitled “Organization”. The main subsidiaries are listed in Note 41 to the consolidated financial statements.

70 Swisscom Corporate Governance

Back to Contents

2 Board of Directors

Members of the Board of Directors

The Swisscom Board of Directors consists of nine members, none of whom has an executive role within the Swisscom Group. The Board members have no substantial commercial links with Swisscom AG or the Swisscom Group. There is no reciprocal membership of the Board of Directors of Swisscom AG and any other listed company.

The name, year of birth, duties, initial date of election and remaining term of office of the individual members of the Board are shown below. Further information on nationality, education, career path, any previous work for the Swisscom Group and other activities of the members of the Board of Directors can be obtained in the section “Organization”. Members of the Board of Directors on December 31, 2002:

| Name | Year of

birth | | Position | Initial year

of office | | Expiry of

the term

of office | |

|

|

|

|

|

|

| |

| | | | | | | | |

| Markus Rauh | 1939 | | Chairman | 1998 | | 2003 | |

|

|

|

|

|

|

| |

| André Richoz | 1947 | | Deputy Chairman | 1998 | | 2003 | |

|

|

|

|

|

|

| |

| Franco Ambrosetti | 1941 | | Member | 1998 | | 2003 | |

|

|

|

|

|

|

| |

| Jacqueline Françoise Demierre | 1954 | | Member, employee representative | 1998 | | 2003 | |

|

|

|

|

|

|

| |

| Ernst Hofmann | 1937 | | Member, employee representative | 1998 | | 2003 | |

|

|

|

|

|

|

| |

| Rose Gerrit Huy | 1953 | | Member | 1998 | | 2003 | |

|

|

|

|

|

|

| |

| Peter Küpfer | 1944 | | Member | 1998 | | 2003 | |

|

|

|

|

|

|

| |

| Felix Rosenberg | 1941 | | Member, government representative | 1998 | | 2003 | |

|

|

|

|

|

|

| |

| Helmut Woelki | 1949 | | Member | 1998 | | 2003 | |

|

|

|

|

|

|

| |

| |

Composition, election and term of office

With the exception of the government representative, the Board of Directors of Swisscom AG is elected by the Shareholders' Meeting. In accordance with the Articles of Incorporation, it consists of seven to nine members. The members are elected for two years and may be re-elected. The maximum term of office is eight years. Members who reach the age of seventy retire from the Board on the date of the next Shareholders’ Meeting.

Under the Articles of Incorporation of Swisscom AG, the Federal Government is entitled to appoint two representatives to the Board of Directors of Swisscom AG. Felix Rosenberg is currently the sole government representative on the Board of Directors of Swisscom AG. Under the Swiss Telecommunications Enterprise Act (TUG), the employees must have appropriate representation on the Board of Directors of Swisscom AG. The Articles of Incorporation state that the Board of Directors must include two employee representatives. These are currently Jacqueline Françoise Demierre and Ernst Hofmann.

Internal organization

The TUG makes reference to the Swiss Code of Obligations in respect of the unassignable duties of the Board of Directors of Swisscom AG. The Board of Directors is thus responsible for overall management and for supervision of the Group Executive Board of Swisscom AG. It determines the strategic, organizational, budgeting and accounting guidelines. The Board of Directors has delegated day-to-day business management to the CEO in accordance with the TUG, the Articles of Incorporation and the organizational regulations.

In financial year 2002 the Board of Directors convened seven times, for meetings lasting one to two days. The Board of Directors is called by the Chairman. Should the Chairman be unavailable, the Deputy Chairman will call the meeting. The Chairman sets the agenda for the meetings of the Board of Directors. Any Board member may request the inclusion of further items on the agenda. The members receive documents prior to the meetings to allow them to prepare. The involvement of members of the Group Executive Board, senior employees of Swisscom AG, auditors or other specialists at its meetings guarantees appropriate reporting to the Board. Furthermore, in each meeting of the Board of Directors, the Chairman and the CEO report on the general course of business and on the main busi-

71 Swisscom Corporate Governance

Back to Contents

Corporate Governance

ness transactions and measures taken. At the beginning of each month the CEO also provides the Board of Directors with a functional report on the main events of the previous month. The CEO must submit interim reports with appropriate comments and relevant figures to the Board of Directors after the end of the quarterly reporting period. Any member of the Board may also demand information about other Swisscom AG matters.

The Board of Directors has three standing and two ad hoc committees to carry out a detailed examination of important issues. The committees consist of two to four members. Each member of the Swisscom Board of Directors is at least a member of one standing committee. The Chairman is a member of all standing committees; these are chaired by other Board members. The duties and responsibilities of the standing committees are laid down in regulations. All minutes of the standing committee meetings are distributed to all members of the Board of Directors in order to ensure transparency.

Finance committee: This committee is chaired by Franco Ambrosetti. The other members are Markus Rauh, Rose Gerrit Huy and Helmut Woelki. The committee met five times during financial year 2002 . This committee deals with all financial transactions, such as the establishment or winding up of major subsidiaries, the formation and termination of strategic alliances, medium-term budgeting and major investments and disposals.

Personnel and organization committee: This committee is chaired by Felix Rosenberg. The other members are Markus Rauh, Jacqueline Françoise Demierre and Ernst Hofmann. The committee met eight times during fiscal year 2002. This committee deals with all organizational matters concerning the group structure and matters relating to corporate policy, personnel and salary policy, the collective employment agreement and major restructuring projects.

Audit committee: This committee is chaired by Peter Küpfer. The other members are Markus Rauh and Andrè Richoz. The committee met six times during fiscal year 2002. The audit committee covers all internal and external audit work and thus constitutes the Board of Directors’ central audit body. It is responsible for ensuring that appropriate accounting policies, internal financial controls and compliance measures regarding budget and strategic objectives are in place. It is also responsible for reviewing quarterly financial statements and forecasts, for the appointment of the auditors and may request Swisscom’s Risk Management to perform reviews.

“Compensation Committee” and “Nomination Committee”: These committees are formed on an “ad hoc” basis to determine remuneration of the Group Executive Board and to prepare for the election of new members of the Board of Directors and the Group Executive Board. The “Compensation Committee” met twice and the “Nomination Committee” four times during financial year 2002.

72 Swisscom Corporate Governance

Back to Contents

The Board of Directors’ supervisory and controlling instruments

The Board of Directors receives detailed information each quarter about the course of business, assets, financial situation and profitability of the Group, the segments and the major Group companies. This reporting also includes non-financial key figures for steering purposes. Limited reporting is distributed on a monthly basis. A quarterly forecast of income statement, cash flow statement and balance sheet for the current financial year is produced on a monthly basis. Internal financial reporting is produced in accordance with the same accounting principles and standards as the external financial report.

Swisscom AG also decided to set up a comprehensive risk management system within the scope of corporate governance. This is intended to enhance risk transparency and risk awareness so that opportunities can be exploited consistently and risks controlled. For this purpose, Swisscom AG set up an independent unit at the beginning of 2001 to examine and monitor key risks on behalf of the Chairman of the Board of Directors, the audit committee or the CEO.

In addition to risk management, the internal audit also has an oversight and control function. Its purpose is to identify weaknesses in the internal control system, propose appropriate measures and contribute to improving the effectiveness and efficiency of the supervisory and audit processes. Internal audit is outsourced. This ensures maximum independence. The risk management supervisor is responsible for operational coordination of the internal audit function and ensures that the body performing the internal audit is informed of all major operations, projects, etc.

73 Swisscom Corporate Governance

Back to Contents

Corporate Governance

3 Group Executive Board

Under the Articles of Incorporation, the Group Executive Board consists of one or more members, who may not simultaneously be members of the Board of Directors. Exceptions are admissible for a limited period of time. Accordingly, the Board of Directors has delegated overall executive management of Swisscom AG to the CEO. The CEO is entitled to delegate his powers to subordinates, notably to other members of the Group Executive Board.

The members of the Group Executive Board are appointed by the Board of Directors. The Group Executive Board consists of the CEO of Swisscom AG, the CEOs of the strategic group companies and the heads of the GHQ divisions.

The following list contains the name, year of birth, duties and appointment of the individual members of the Group Executive Board. Further information on the nationality, education, career path, any previous work for the Swisscom Group and other activities of the members of the Group Executive Board can be obtained in the “Organization” section.

Members of the Group Executive Board on December 31, 20021)

| | | | | Appointment to |

| | Year | | | the Group Executive Board |

| Name | of birth | | Position | with effect from |

|

| Jens Alder | 1957 | | CEO of Swisscom AG | January 1998 |

| | | | | (appointed CEO in |

| | | | | December 1999) |

|

| Adrian Bult | 1959 | | CEO of Swisscom Fixnet AG | January 1998 |

|

| Ueli Dietiker | 1953 | | CFO (Chief Financial Officer) | April 2002 |

| | | | and Deputy CEO of Swisscom AG | |

|

| René Fischer | 1965 | | CEO Swisscom Systems AG | August 2002 |

|

| Esther Häberling | 1957 | | Group Human Resources | April 2002 |

| | | | Manager, Swisscom AG | |

|

| Stefan Nünlist | 1961 | | Group Communications | July 2001 |

| | | | Manager, Swisscom AG | |

|

| Hanspeter Quadri | 1953 | | CEO of Swisscom Enterprise | January 2002 |

| | | | Solutions AG | |

|

| Jürg Rötheli | 1963 | | Head of Group Operations & Related | July 2001 |

| | | | Businesses Swisscom AG | |

|

| Mauro Santona2) | 1957 | | CIO (Chief Information Officer) | July 2001 |

| | | | of Swisscom AG | |

|

| Carsten Schloter | 1963 | | CEO of Swisscom Mobile AG | April 2000 |

|

| Michael Shipton | 1956 | | CSO (Chief Strategy Officer) | July 2001 |

| | | | of Swisscom AG | |

|

| Urs Stahlberger | 1946 | | CEO of Swisscom IT Services AG | January 2002 |

|

| Peter Wagner | 1953 | | Chairman of the Executive Board | July 2001 |

| | | | of debitel AG | |

|

1) The following members left the Group Executive Board in financial year 2002: Dave Schnell and Werner Steiner.

2) Left the Group Executive Board on January 31, 2003.

Management contracts

While the Swisscom Group has not entered into any management contracts with third parties on behalf of subsidiaries belonging to the consolidated group, it has concluded such a contract for an affiliated company. See Note 24 to the consolidated financial statements.

74 Swisscom Corporate Governance

Back to Contents

| 4 | Remuneration, participating interests and loans by the Board of Directors and the Group Executive Board |

Content and procedure for stipulation of remuneration and stock based compensation

The members of the Board of Directors are entitled to reimbursement of the expenses incurred in the interests of the company and to remuneration commensurate with their work and responsibility, specified by the Board of Directors itself, in accordance with the Articles of Incorporation. In January 1998, within the scope of its constituent work, it issued a remuneration plan based on a recommendation by the “Personnel and Organization” Committee. This remained in force without amendment for four years. The remuneration was adjusted for the first time on January 1, 2002. The remuneration plan makes provision for a basic fee and allowances for specific duties. Meeting attendance fees are also paid. Expenses are claimed on the basis of expenditure.

The pay for members of the Group Executive Board consists of a basic salary component and a performance-related component (bonus). It depends on the market rate for the position, the respective grade and the employee’s performance and experience. The targets reflect the general requirement to improve the ongoing value of the company per share and the corporate result in terms of productivity compared to the previous year, on a like-for-like basis. Targets such as net revenue, the EBITDA margin, the ratio of net revenue to capital employed and the perception of Swisscom as a customer-friendly company are set each year. The level of the bonus paid depends on the degree to which the targets have been met and the total amount specified by the Board of Directors for the annual bonuses. If the targets are met, the level of the bonus paid corresponds to the target level set. If the targets are exceeded, up to a maximum of twice the bonus may be paid. The bonus regulations issued by the Board of Directors constitute the basis for the individual target setting, the performance appraisal and determination of the bonus. The Board of Directors sets the objectives for the Swisscom Group at the request of the CEO. The CEO agrees on the targets with the members of the Group Executive Board.

A description of the stock based compensation programs of Swisscom AG is given in Note 8 to the consolidated financial statements

Remuneration for serving members

The remuneration of members of the Board of Directors in 2001 and 2002 amounted to CHF 1.4 million and CHF 1.7 million respectively. The remuneration of members of the Group Executive Board for the same years came to CHF 8.0 million and CHF 9.2 million, respectively. In 2002, this includes CHF 420,000 in termination payments, in the form of continued salary payments, and CHF 80,000 arising from further contractual obligations in respect of members of the Group Executive Board who left during 2002. Total remuneration paid to the CEO amounted to CHF 1.6 million in 2001 and CHF 1.4 million in 2002. This includes 192 shares for 2001 and 217 shares for 2002 awarded under the Leverage Executive Asset Plan (LEAP).

Total compensation includes fees, salary, bonuses, special pension fund contributions and additional benefits. 25% of the bonuses to members of the Group Executive Board took the form of stock appreciation rights. In 2001, 25% of the renumeration of the members of the Board of Directors was paid in the form of stock appreciation rights. From 2003 the Board of Directors will receive 25% of its compensation in the form of share options.

Remuneration for former members

There have been no changes in the Board of Directors since January 1, 1998. In 2002 remunerations totaling CHF 100,000 were paid to an executive Board member who left in 2001.

Allocation of shares in the reporting year

During the 2002 financial year 2002 no shares were allocated to members of the Board of Directors, while a total of 562 shares were allocated to the members of the Group Executive Board. Swisscom AG did not allocate any shares to persons, i.e. third parties closely associated with the members of the Board of Directors or the Group Executive Board.

75 Swisscom Corporate Governance

Back to Contents

Corporate Governance

Share ownership

At December 31, 2002, members of the Board of Directors and persons closely associated with them held a total of 4,304 shares, while members of the Group Executive Board and closely associated persons with them held a total of 3,821 shares.

Allocated stock appreciation rights to the members of the Boards of Directors

|

| Year of | Program | Maturity | Blocking | Exchange | Number | Exercise price |

| allocation | | | period | ratio | | in CHF |

|

|

|

|

|

|

|

| 1998 | IPO LEAP A | 20.10.2003 | 05.10.2003 | 1:1 | 6 224 | 315.98 |

|

|

|

|

|

|

|

| 1998 | IPO LEAP B | 20.10.2003 | 05.10.2003 | 1:1 | 3 210 | 399.80 |

|

|

|

|

|

|

|

| 2000 | VR LEAP2000 | 10.10.2005 | 10.10.2003 | 1:1 | 3 210 | 484.70 |

|

|

|

|

|

|

|

| 2001 | VR LEAP2001 | 09.10.2006 | 09.10.2004 | 1:1 | 2 710 | 517.30 |

|

|

|

|

|

|

|

| 2002 | – | – | – | – | – | – |

|

|

|

|

|

|

|

Allocated stock appreciation rights to the members of the Group Executive Board

|

| Year of | Program | Maturity | Blocking | Exchange | Number | Exercise price |

| allocation | | | period | ratio | | in CHF |

|

|

|

|

|

|

|

| 1998 | IPO LEAP A | 20.10.2003 | 05.10.2003 | 1:1 | 4 692 | 315.98 |

|

|

|

|

|

|

|

| 1998 | IPO LEAP B | 20.10.2003 | 05.10.2003 | 1:1 | 1 872 | 399.80 |

|

|

|

|

|

|

|

| 2001 | KL LEAP2000 | 30.05.2006 | 30.05.2004 | 1:1 | 4 260 | 488.50 |

|

|

|

|

|

|

|

| 2002 | GL LEAP2001 | 09.04.2007 | 09.04.2005 | 1:1 | 5 620 1) | 584.70 |

|

|

|

|

|

|

|

1) The tax value of stock appreciation rights in 2002 is CHF 52.10 per right, as calculated using the Black-Scholes method.

Additional fees and remuneration

Neither members of the Board of Directors and persons closely associated with them nor members of the Group Executive Board and persons closely associated with them received fees or any other remuneration in 2002 for additional services performed for the benefit of Swisscom.

Loans to serving members

Swisscom did not grant loans, advances or any credit facilities to members of the Board of Directors, or persons closely associated with them, or to members of the Group Executive Board, or to persons closely associated with them. A short-term guarantee provided in 2002 for a member of the Group Executive Board has not been drawn on and has subsequently been forfeited. There are no receivables of any nature outstanding.

Maximum total remuneration paid to the Board of Directors

Total remuneration paid to the Chairman of the Board of Directors amounted to CHF 480,000 and CHF 517,000 in 2001 and 2002, respectively. No stock or stock appreciation rights were allocated to him in 2002.

76 Swisscom Corporate Governance

Back to Contents

5 Shares and shareholders

Capital structure

The share capital of Swisscom AG amounts to CHF 595,829,349 and is divided into 66,203,261 registered shares with a nominal value of CHF 9 per share. The shares are fully paid-up.

Development of shareholders’ equity of Swisscom AG in its statutary financial statements in accordance with the Swiss Code of Obligations in the years 2000 to 2002:

| | | | | | | | Total | |

| | | | General | | Retained | | shareholders | |

| Amount in CHF millions | Share capital | | reserve | | earnings | | equity | |

|

|

| |

| Balance at January 1, 2000 | 1 839 | | 2 712 | | 2 101 | | 6 652 | |

| |

| Revaluation of investments | – | | – | | 72 | | 72 | |

| |

| Net income | – | | – | | 2 709 | | 2 709 | |

| |

| Dividend | – | | – | | (1 103 | ) | (1 103 | ) |

| |

| Balance at December 31, 2000 | 1 839 | | 2 712 | | 3 779 | | 8 330 | |

| |

| Net income | – | | – | | 1 081 | | 1 081 | |

| |

| Dividend | – | | – | | (809 | ) | (809 | ) |

| |

| Capital reduction | (589 | ) | – | | – | | (589 | ) |

| |

| Balance at December 31, 2001 | 1 250 | | 2 712 | | 4 051 | | 8 013 | |

| |

| Net income | – | | – | | 2 724 | | 2 724 | |

| |

| Dividend | – | | – | | (728 | ) | (728 | ) |

| |

| Capital reduction | (529 | ) | – | | – | | (529 | ) |

| |

| Share buy back | (125 | ) | (2 414 | ) | (1 725) | | (4 264 | ) |

| |

| Balance at December 31, 2002 | 596 | | 298 | | 4 322 | | 5 216 | |

| |

During 2000 certain investments have been sold at a price above their carrying value. The difference of CHF 72 million between the fair value of these investments at the date of incorporation of Swisscom AG and the carrying value of such investments at the date of sale was recorded directly through retained earnings.

A resolution to reduce the capital by repayment of the par value of CHF 8 per share, or a total of CHF 589 million, in addition to the dividend, was adopted at the Shareholders’ Meeting on May 29, 2001.

In March 2002, under a share buy-back scheme, Swisscom purchased 7,346,739 of its own shares, representing 9.99% of those outstanding. One free put option per share was allocated to the shareholders. Ten put options represented an entitlement to sell one share at CHF 580 less 35% withholding tax. Own shares were bought back for a total of CHF 4,264 million. A resolution to reduce the share capital from CHF 1,250 million to CHF 1,125 million, by cancelling the shares acquired under the buy-back, was adopted at the Shareholders’ Meeting on April 30, 2002. The number of shares was thus reduced from 73,550,000 to 66,203,261.

A resolution on capital reduction by repayment of the par value of CHF 8 per share, or a total of CHF 529 million, in addition to the dividend, was adopted at the Shareholders’ Meeting on April 30, 2002. The share capital was thus reduced from CHF 1,125 million to CHF 596 million.

Neither conditional nor approved share capital exists.

77 Swisscom Corporate Governance

Back to Contents

Corporate Governance

Major shareholders and cross-holdings

Under the TUG, the Swiss Federal Government must have a majority holding in the company, in terms of capital and votes. Accordingly, the Swiss Federal Government held 62.7% of the shares in Swisscom AG on December 31, 2002.

On February 5, 2002, the Capital Group Companies, Inc. (CGC), an organized group according to Article 15 Ordinance of the Federal Banking Commission on Stock Exchanges and Securities Trading (SESTO-FBC), and acquirer according to Article 9, Paragraph 2 SESTO-FBC held 3,703,716 registered shares of Swisscom AG, representing 5.04% of the total voting rights in the share capital of Swisscom AG. Refer to the publication of the disclosure in the Swiss Commercial Gazette (SCG) as of Feburary 19, 2002.

No cross holding exists between Swisscom AG and other public limited companies. Swiss-com does however have a cross holding with Publigroup for Swisscom Directories AG and PubliDirect Holding AG.

Legitimization as a shareholder

Every share is entitled to one vote. Voting rights can only be exercised if the shareholder has been entered with voting rights in Swisscom’s share register. The Board of Directors may refuse the approval of an acquirer of shares as a shareholder or beneficial owner with voting rights if the holding of the shareholder or beneficial owner, together with his shares already registered with voting rights, exceeds the 5% limit of all registered shares recorded in the commercial register. The acquirer is entered in the share register as a shareholder or beneficial owner without voting rights for the remaining shares. The restriction of voting rights also applies in the event of purchases of registered shares if subscription, option or conversion rights are exercised. A group clause applies to the calculation of the percentage restriction.

The Board of Directors may recognize an acquirer of shares with more than 5% of all registered shares as a shareholder or beneficial owner with voting rights, in particular in the following exceptional cases:

– in case of acquisition of shares as a result of a merger or combination of businesses;

– in case of acquisition of shares due to a contribution in kind or a share exchange;

– for the foundation of a long-term cooperation or a strategic alliance.

In order to facilitate the trading of the shares on the stock market, the Board of Directors may, by means of regulations or by way of agreements, allow the fiduciary registration of registered shares with voting rights exceeding said percentage restriction by fiduciaries who declare their status as fiduciary (nominees, ADR depositary banks). These parties must be subject to supervision by a banking or a financial market supervisory authority, or otherwise offer assurance of proper business conduct and must act for the account of one or several parties unrelated to each other, and must be able to disclose the names, addresses and the amount of shareholdings of the beneficial owners of the shares. In accordance with this provision, the Board of Directors has issued regulations for the registration of fiduciaries and nominees in Swisscom’s share register. Registration of fiduciaries and nominees as shareholders with voting rights requires a petition and the conclusion of an agreement specifying the registration restrictions and the disclosure obligations of the fiduciary or nominee. Each fiduciary or nominee expressly undertakes not to apply for registration as shareholder with voting rights for more than 0.5% of the registered share capital per individual beneficial owner.

No exceptions for fiduciary entry of registered shares with voting rights above the aforesaid percentage limit were granted in 2002.

In addition to the percentage restriction on voting rights, the Board of Directors may refuse recognition and registration as shareholder or beneficial owner with voting rights, if an acquirer of shares does not expressely state that he has acquired the shares or beneficial interest in the shares in his own name and for his own account. Should the acquirer of the shares refuse to make such a declaration, he will be registered as a shareholder without voting rights.

78 Swisscom Corporate Governance

Back to Contents

The Board of Directors may also delete the entry of a shareholder with voting rights in the share register if the acquirer has obtained said registration by giving false information. The acquirer must be immediately informed of the deletion.

Convening the Shareholders’ Meeting and agenda

The Board of Directors must convene the Shareholders’ Meeting at least 20 days prior to the date of the meeting by an announcement in the Swiss Commercial Gazette (Schwei-zerisches Handelsamtsblatt). The invitation can also take the form of an unregistered or registered letter to all registered shareholders.

Shareholders representing shares with a par value of at least CHF 360,000 may demand that an item be placed on the agenda. This request must be submitted to the Board of Directors at least 45 days prior to the General Meeting, stating the agenda item and the proposal.

Resolutions and elections by the Shareholders’ Meeting

The Shareholders’ Meeting of Swisscom AG adopts its resolutions and holds its elections by absolute majority of valid votes cast. In addition to the specific quora required under the Swiss Code of Obligations, the Articles of Incorporation require a two-thirds majority of voting shares represented and an absolute majority of the par value of the votes represented for the following cases:

– introduction of restrictions on voting rights

– conversion of registered shares to bearer shares and vice versa

– changes to the aforesaid requisite quora.

The specified restrictions on voting rights may only be lifted by resolution of the Share-holders’ Meeting, which requires an absolute majority of the votes cast.

Representation at the Shareholders’ Meeting

A shareholder may be represented at the Shareholders’ Meeting by another shareholder with voting rights who has a written power of attorney. It is also possible to be represented by a representative of a custodian account, the representative of the governing body or the independent representative of voting rights required by Swiss company law and appointed by Swisscom AG.

Voting entitlement at the 2002 Shareholders’ Meeting

The share register was closed from 16.00 hours on April 18, 2002 until after the Share-holders’ Meeting on April 30, 2002. Shareholders who sold their shares prior to the Shareholders’ Meeting were no longer entitled to vote. In the event of a partial sale, the access pass provided had to be exchanged on the date of the Shareholders’ Meeting at the information desk.

79 Swisscom Corporate Governance

Back to Contents

Corporate Governance

6 Change of control and defensive measures

Provision is made in theTUG for the Swiss government to hold the capital and voting majority in Swisscom AG. A takeover bid within the meaning of the Federal Act on Stock Exchanges and Securities Trading (SESTA) would thus not be possible without an amendment to the TUG. There are thus no regulations concerning “opting out” or “opting up” (SESTA Art. 22).

In addition to the benefits in their employment contract, members of the Group Executive Board are entitled to a termination payment equal to their annual salary (including bonus) should a new majority shareholder and/or a new chairman of the Board of Directors of Swisscom AG terminate the employment relationship within 12 months of the takeover. Those members who were elected to the Group Executive Board as CEO of a strategic Group Company are entitled in addition to the benefits in their employment contract to such a termination payment if a new majority shareholder and a new chairman of the respective Group company terminates the employment relationship within 12 months following the takeover.

7 Auditors

The statutary and group auditors are appointed annually by the Shareholders’ Meeting. PricewaterhouseCoopers AG have been the statutory and group auditors of Swisscom AG since January 1, 1998. Peter Wittwer, the senior auditor at PricewaterhouseCoopers AG responsible for the audit work, has held the post since January 1, 1998. The audit fees invoiced by PricewaterhouseCoopers AG in 2002 amounted to CHF 5.7 million. The fees for additional services by PricewaterhouseCoopers AG amounted to CHF 6.3 million, of which CHF 2.0 million relates to services provided by PWC Consulting, which was subsequently transferred to IBM during 2002.

Based on legal restrictions, the audit committee of the Board of Directors has specified that the auditors may not perform any of the following services:

– Bookkeeping or other services related to accounting records or financial statements

– Financial information systems design and implementation

– Appraisal or valuation services, fairness opinions, or contribution-in-kind reports

– Actuarial services

– Internal audit outsourcing services

– Management functions or human resources

– Broker/dealer, investment advisor, banking services

– Legal services and non-audit expert services

On behalf of the Board of Directors, the audit committee is responsible for the supervision of the external auditors an assesses then on an annual basis. The external auditors participate in the meetings of the audit committee of the Board of Directors and report on the performance and results of their activities.

80 Swisscom Corporate Governance

Back to Contents

8 Information policy

Swisscom actively and openly informs the public and the financial markets. Swisscom endeavors to publish comprehensive, consistent, transparent financial information on a quarterly basis.

Swisscom therefore regularly meets investors throughout the year, presents its results at analysts’ meetings and on roadshows, attends specific conferences for financial analysts and investors and informs its shareholders regularly about its business through announcements in the media or shareholders’ letters. The quarterly, half-year and annual reports can be found on Swisscom’s website under Investor Relations (www.swisscom.com/ir) or can be ordered directly from Swisscom. All press releases, presentations and the current Swisscom financial calendar can be found on Swisscom’s website.

81 Swisscom Corporate Governance

Back to Contents

Shareholder information

| | | 2001 | | 2002 | |

|

|

| |

| |

| Key figures per share | | | | | |

|

|

| |

| |

| Average number of shares outstanding | in millions | 73.544 | | 67.648 | |

|

|

| |

| |

| Net income | CHF | 67.50 | | 12.18 | |

|

|

| |

| |

| Gross dividend | CHF | 11.00 | | 12.00 | 1) |

|

|

| |

| |

| Capital reduction | CHF | 8.00 | | 8.00 | 1) |

|

|

| |

| |

| | | | | | |

|

|

| |

| |

| Ratios | | | | | |

|

|

| |

| |

| Return on equity | % | 57.9 | | 6.8 | |

|

|

| |

| |

| EBITDA as % of net revenue | % | 31.1 | | 30.4 | |

|

|

| |

| |

| EBIT before one-off transactions as % of net revenue | % | 15.8 | | 16.6 | |

|

|

| |

| |

| Net revenue | CHF in millions | 14 174 | | 14 526 | |

|

|

| |

| |

| Pay-out ratio 2) | % | 25.3 | | 164.2 | 1) |

|

|

| |

| |

| | | | | | |

| 1) According to the proposal of the Board of Directors to the Shareholders’ Meeting | | | | |

| 2) Represents gross dividend and capital reduction as a percentage of net income per share | | | | | |

| | | | | 2001 | | 2002 | |

| |

|

|

| |

| |

| | Swisscom registered shares 2002 | | | | | |

| |

|

|

| |

| |

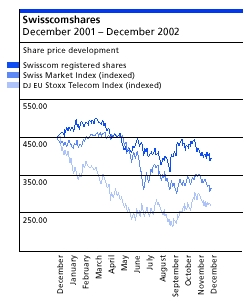

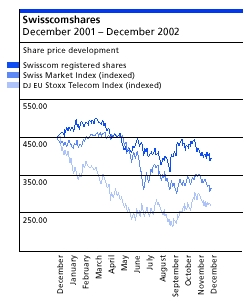

| | Year high 3) | CHF | 492.50 | | 519.00 | |

| |

|

|

| |

| |

| | Price gain (loss) in the year | % | 9.13 | | (12.93 | ) |

| |

|

|

| |

| |

| | Daily average | Shares | 140 686 | | 121 932 | |

| |

|

|

| |

| |

| | Average daily trading volume | CHF in millions | 62.04 | | 55.81 | |

| |

|

|

| |

| |

| | | | | | | |

| |

|

|

| |

| |

| | Swisscom ADR 2002 | | | | | |

| |

|

|

| |

| |

| | Year high 3) | USD | 30.75 | | 31.31 | |

| |

|

|

| |

| |

| | Price gain in the year | % | 8.29 | | 2.74 | |

| |

|

|

| |

| |

| |

|

|

| |

| |

| | Daily average | ADR | 21 887 | | 30 671 | |

| |

|

|

| |

| |

| | Total turnover volume | USD in millions | 145.69 | | 224.00 | |

| |

|

|

| |

| |

| | Average daily trading volume | USD in millions | 0.59 | | 0.89 | |

| | |

|

|

| |

| |

| | | 3) paid prices | | Source: Bloomberg | |

| Stock exchange | Bloomberg | Reuters | Telekurs |

|

| virt-x, London | SCMN VX | SCMZn.VX | SCMN, VTX |

|

| NYSE, New York | SCM | SCMZ.N | SCM, NYS |

|

Return Policy

It is Swisscom’s policy to pay out the free available cash flow annually to shareholders. The available cash flow comprises net income from operating activities less the sum of capital expenditures and acquisitions and repayment of debts. The pay-out takes the form of a dividend of approximately half of net income adjusted by one-time transactions, and is supplemented by either a share buy back or – as last happened for the year 2002 – a reduction in capital. Share buy backs need not take place at the same time as dividend payouts.

82 Swisscom Shareholder information

Back to Contents

Swisscom Group Five year review

| CHFin millions except where indicated | | 1998 | | 1999 | | 2000 | | 2001 | | 2002 | |

|

|

|

|

|

|

|

|

| |

| |

| Net revenue | | 10 388 | | 11 052 | | 14 060 | | 14 174 | | 14 526 | |

|

|

|

|

|

|

|

|

| |

| |

| Operating income before | | | | | | | | | | | |

| exceptional items and | | | | | | | | | | | |

| depreciation (EBITDA) 1) | | 4 513 | | 4 192 | | 4 034 | | 4 409 | | 4 413 | |

|

|

|

|

|

|

|

|

| |

| |

| in % of net revenue | % | 43.4 | | 37.9 | | 28.7 | | 31.1 | | 30.4 | |

|

|

|

|

|

|

|

|

| |

| |

| Operating income before | | | | | | | | | | | |

| exceptional items and | | | | | | | | | | | |

| depreciation (EBITDA) 1) | | 2 892 | | 2 488 | | 1 831 | | 2 235 | | 2 408 | |

|

|

|

|

|

|

|

|

| |

| |

| Exceptional items1) | | – | | – | | – | | 3 275 | | (702 | ) |

|

|

|

|

|

|

|

|

| |

| |

| Operating income | | 2 892 | | 2 488 | | 1 831 | | 5 510 | | 1 706 | |

|

|

|

|

|

|

|

|

| |

| |

| Net income from | | | | | | | | | | | |

| continuing operations | | 2 065 | | 2 208 | | 3 087 | | 4 964 | | 824 | |

|

|

|

|

|

|

|

|

| |

| |

| Net income | | 1 546 | | 2 391 | | 3 156 | | 4 964 | | 824 | |

|

|

|

|

|

|

|

|

| |

| |

| Shareholders' equity | | 5 347 | | 6 685 | | 8 570 | | 12 069 | | 7 299 | |

|

|

|

|

|

|

|

|

| |

| |

| Equity ratio 2) | % | 31.6 | | 32.0 | | 38.9 | | 49.6 | | 43.0 | |

|

|

|

|

|

|

|

|

| |

| |

| Number of full-time equivalent | | | | | | | | | | | |

| employees at end of period 3) 4) | FTE | 21 946 | | 21 777 | | 20604 | | 21 328 | | 20 470 | |

|

|

|

|

|

|

|

|

| |

| |

| Average number of full-time | | | | | | | | | | | |

| equivalent employees 5) | FTE | 22 069 | | 20 393 | | 20 989 | | 20 988 | | 20 910 | |

|

|

|

|

|

|

|

|

| |

| |

| | CHFin | | | | | | | | | | |

| Revenue per employee | thousands | 471 | | 542 | | 670 | | 675 | | 695 | |

|

|

|

|

|

|

|

|

| |

| |

| | CHFin | | | | | | | | | | |

| EBITDAper employee | thousands | 204 | | 206 | | 192 | | 210 | | 211 | |

|

|

|

|

|

|

|

|

| |

| |

| Net cash provided by operating | | | | | | | | | | | |

| activities | | 3 574 | | 3 366 | | 3 821 | | 3 389 | | 3 785 | |

|

|

|

|

|

|

|

|

| |

| |

| Capital expenditure | | 1 305 | | 1 468 | | 1 450 | | 1 234 | | 1 222 | |

|

|

|

|

|

|

|

|

| |

| |

| Net debt (net funds) 6) | | 4 239 | | 5 905 | | 2 891 | | (2 899) | | 642 | |

|

|

|

|

|

|

|

|

| |

| |

| | | | | | | | | | | | |

| Key figures per share | | | | | | | | | | | |

|

|

|

|

|

|

|

|

| |

| |

| Weighted average number of shares | | | | | | | | | | | |

| out standing (at CHF 25 for 1998 | | | | | | | | | | | |

| to 2000, CHF 17 for 2001 and CHF 9 | | | | | | | | | | | |

| for 2002 each, respectively) | in mio. | 67.888 | | 73.550 | | 73.541 | | 73.544 | | 67.648 | |

|

|

|

|

|

|

|

|

| |

| |

| Price per share | | 588.00 | / | 656.00 | / | 754.00 | / | 492.50 | / | 519.00 | / |

| (high/low since October 5, 1998) | CHF | 376.50 | | 445.00 | | 361.00 | | 358.50 | | 360.00 | |

|

|

|

|

|

|

|

|

| |

| |

| Net income from | | | | | | | | | | | |

| continuing operations | CHF | 30.42 | | 30.02 | | 41.97 | | 67.50 | | 12.18 | |

|

|

|

|

|

|

|

|

| |

| |

| Net income | CHF | 22.77 | | 32.51 | | 42.91 | | 67.50 | | 12.18 | |

|

|

|

|

|

|

|

|

| |

| |

| Shareholders' equity | CHF | 72.70 | | 90.89 | | 116.52 | | 164.09 | | 110.25 | |

|

|

|

|

|

|

|

|

| |

| |

| Gross dividend | CHF | 11.00 | | 15.00 | | 11.00 | | 11.00 | | 12.00 | * |

|

|

|

|

|

|

|

|

| |

| |

| Capital reduction | CHF | – | | – | | 8.00 | | 8.00 | | 8.00 | * |

|

|

|

|

|

|

|

|

| |

| |

| Pay-out ratio 7) | % | 52.30 | | 46.13 | | 44.21 | | 25.34 | | 164.20 | * |

|

|

|

|

|

|

|

|

| |

| |

| Market capitalization | | | | | | | | | | | |

| at end of period | | 42 291 | | 47 366 | | 31 001 | | 33 833 | | 26 514 | |

|

|

|

|

|

|

|

|

| |

| |

* In accordance with the proposal of the Board of Directors to the General Meeting of Shareholders.

| 1) | Exceptional items in 2001: Impairment of goodwill CHF 1,130 million, gain of CHF 568 million on sale of real estate and gain of CHF 3,837 million on partial sale of Swisscom Mobile AG.

Exceptional item in 2002: Impairment of goodwill CHF 702 million. |

| 2) | Shareholders' equity as a percentage of total assets. |

| 3) | Includes at December 31, (1998) 0, (1999) 2,523, (2000) 3,145, (2001) 3,544 and (2002) 3,299 employees of debitel. |

| 4) | Excludes 223 and 291 employees of WORK_LINK at December 31, 2001 and 2002, respectively.WORK_LINK was established in 2001. |

| 5) | Excludes 176 and 252 employees of WORK_LINK in 2001 and 2002, respectively. |

| 6) | Definition of net debt (net funds): total debt less cash and cash equivalents, current financial assets and financial assets from cross-border tax lease transactions. |

| 7) | Represents gross dividend and capital reduction as a percentage of net income per share. |

| | |

83 Swisscom Five year review

Back to Contents

Cautionary statement regarding forward-looking statementsThe financial review is published in German and English. The German version is binding.

This communication contains statements that constitute “forward-looking statements”. In this communication, such forward-looking statements include, without limitation, statements relating to our financial condition, results of operations and business and certain of our strategic plans and objectives.

Because these forward-looking statements are subject to risks and uncertainties, actual future results may differ materially from those expressed in or implied by the statements. Many of these risks and uncertainties relate to factors which are beyond Swisscom’s ability to control or estimate precisely, such as future market conditions, currency fluctuations, the behavior of other market participants, the actions of governmental regulators and other risk factors detailed in Swisscom's past and future filings and reports filed with the U.S. Security and Exchange Commission and posted on our websites.

Readers are cautioned not to put undue reliance on forward-looking statements, which speak only of the date of this communication.

Swisscom disclaims any intention or obligation to update and revise any forward-looking statements, whether as a result of new information, future events or otherwise.

| | | Additional copies of the Annual

Report can be ordered from: |

| | | |

| | | Swisscom AG |

| |

T+

F+ | Group Communications

CH-3050 Berne

41 31 342 36 78

41 31 342 27 79 |

| | E | annual.report@swisscom.com

www.swisscom.com |

| | | |

| | | |

| | | Financial Information: |

| | | Swisscom AG |

| | | Investor Relations

CH-3050 Berne |

| | T+

F+ | 41 31 342 25 38

41 31 342 64 11 |

| | E | investor.relations@swisscom.com

www.swisscom.com/ir |

Back to Contents

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Dated: March 26, 2003 | by:

Name:

Title: | /s/ Stephan Wiederkehr

Stephan Wiederkehr

Senior Counsel

Head of Corporate & Financial Law |