- STL Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

425 Filing

Sterling Bancorp (STL) 425Business combination disclosure

Filed: 6 Apr 04, 12:00am

Filed by Provident Bancorp, Inc.

Pursuant to Rule 425 under the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

of the Securities Exchange Act of 1934

Subject Company: Provident Bancorp, Inc.

Commission File No.: 0-25233

Presentation Materials April 2004

Provident Bancorp Executives

George Strayton—President and Chief Executive Officer

Stephen G. Dormer—Senior Vice President

Paul A. Maisch—Senior Vice President and Chief Financial Officer

2

Forward Looking Statements & Other Information

Statements contained in this presentation that are not historical facts are forward-looking statements as that term is defined in the Private Securities Litigation Reform Act of 1995. Such forward-looking statements are subject to risks and uncertainties which could cause actual results to differ materially from those currently anticipated due to a number of factors.

Words such as “expect”, “feel”, “believe”, “will”, “may”, “anticipate”, “plan”, “estimate”, “intend”, “should”, and similar expressions are intended to identify forward-looking statements. These statements include, but are not limited to, financial projections and estimates and their underlying assumptions; statements regarding plans, objectives and expectations with respect to future operations, products and services; and statements regarding future performance. These statements are subject to certain risks and uncertainties, many of which are difficult to predict and generally beyond the control of Provident Bancorp, Inc. (PBCP) and Warwick Community Bancorp, Inc. (WSBI). The following factors, among others, could cause actual results to differ materially from the anticipated results or other expectations expressed in the forward-looking statements: (1) the businesses of PBCP and WSBI may not be combined successfully, or the combination may take longer to accomplish than expected; (2) the growth opportunities and cost savings from the merger may not be fully realized or may take longer to realize than expected; (3) operating costs and business disruption following the merger, including adverse effects on relationships with employees, may be greater than expected; (4) governmental approvals of the merger may not be obtained, or adverse regulatory conditions may be imposed in connection with governmental approvals of the merger; (5) the stockholders of either PBCP or WSBI may fail to approve the merger; (6) competitive factors which could affect net interest income and non-interest income, general economic conditions which could affect the volume of loan originations, deposit flows and real estate values; (7) the levels of non-interest income and the amount of loan losses as well as other factors discussed in the documents filed by PBCP and WSBI with the Securities and Exchange Commission from time to time. Neither PBCP nor WSBI undertakes any obligation to update these forward-looking statements to reflect events or circumstances that occur after the date on which such statements were made.

This document may be deemed to be solicitation material in respect of the proposed merger of PBCP and WSBI. In connection with the proposed transaction, a registration statement on Form S-4 will be filed with the SEC. STOCKHOLDERS OF

PBCP AND STOCKHOLDERS OF WSBI ARE ENCOURAGED TO READ THE REGISTRATION STATEMENT AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, INCLUDING THE JOINT PROXY

STATEMENT/PROSPECTUS THAT WILL BE PART OF THE REGISTRATION STATEMENT, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED MERGER. The final joint proxy statement/prospectus will be mailed to stockholders of PBCP and stockholders of WSBI. Investors and security holders will be able to obtain the documents free of charge at the SEC’s website, www.sec.gov, from Provident Bancorp, Inc., 400 Rella Boulevard, Montebello, New York 10901, Attention: Investor Relations, or from Warwick Community Bancorp, Inc., 18 Oakland Avenue, Warwick, New York 10990, Attention: Investor Relations.

PBCP, WSBI and their respective directors and executive officers and other members of management and employees may be deemed to participate in the solicitation of proxies in respect of the proposed transactions. Information regarding PBCP’s directors and executive officers is available in PBCP’s Form 10-KA, which was filed with the SEC on January 28, 2004, and information regarding WSBI’s directors and executive officers is available in WSBI’s proxy statement for its 2003 annual meeting of stockholders, which was filed on April 4, 2003. Additional information regarding the interests of such potential participants will be included in the joint proxy statement/prospectus and the other relevant documents filed with the SEC when they become available.

3

Agenda

An overview of Provident Bancorp, Inc.

Financial Highlights

Investment attributes

Warwick Community Bancorp, Inc. Acquisition

4

Provident Bancorp, Inc.

5

Provident Bancorp, Inc.-Snapshot

? Established in 1888

? Federal Savings and Loan Association charter

? Reorganized into an MHC in January 1999 and conducted an IPO that raised $38.6 million and $195.7 million in second step IPO January 2004

?? 1.7 Billion in Assets

? 27 branch offices and 34 ATMs –Rockland, Orange, Ulster and Sullivan Counties, New York

? In April 2002, Provident Municipal Bank was created as a wholly-owned subsidiary

? Provident’s trust department is the only trust operation headquartered in Rockland County

? History of acquisitions: Ellenville National Bank

National Bank of Florida

Republic Bank Branch

Nassau Fed S&L branch

First Federal of Suffern

First Nationwide branch

6

Business Strategy Access – Convenience—Service

? Vision Statement-”Make customers our advocates”

? Full-service, community bank

• Service to consumers

• Service to businesses

? All original branches open six full days per week

? Full service at 8 of Original 18 branches seven days per week

? Ellenville branches to be integrated into Saturday/Sunday banking

? Voice response

? Internet banking

• Consumers

• Business

? Debit cards

7

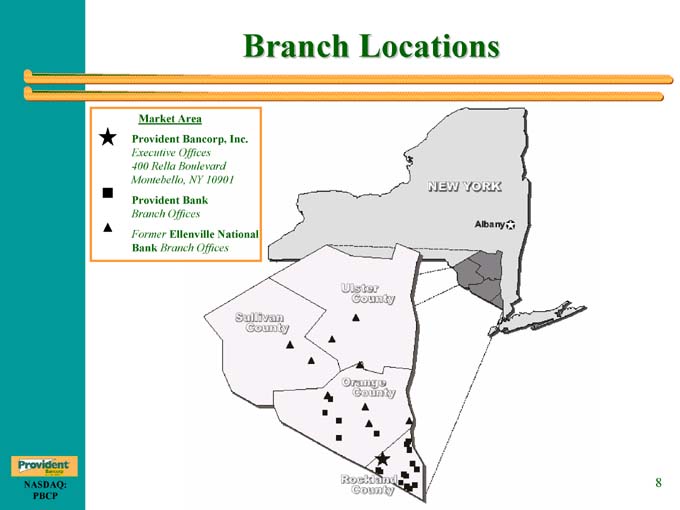

Branch Locations

Market Area

Provident Bancorp, Inc.

Executive Offices 400 Rella Boulevard Montebello, NY 10901

Provident Bank

Branch Offices

Former Ellenville National Bank Branch Offices

8

Robust Market Place

? Rockland and Orange Counties provide an excellent economy to operate within. Both counties experienced meaningful growth in population within the last census period.

Orange – 11% & Rockland – 8%

? Unemployment rate well below the national level. December 2003: Orange – 4.7% & Rockland – 3.9%

Orange County, New York Rockland County, New York

Current % Change Estiated % Change Current % Change Estimated % Change

2003 2000-2003 2008 2003-2008 2003 2000-2003 2008 2003-2008

Total Population: 355,189 4.05 376,500 6.00 292,049 1.85 300,807 3.00

Land Mass ( in s q . mi.) 816 —- —- —- 174 —- —- —-

Pop. Density 435 4.02 461 6.00 1,678 1.95 1,729 3.00

Unemployment 7,600 NM NA NA 5,800 NM NA NA

Total # of Businesses * 8,458 4.73 NA NA 8,844 2.93 NA NA

Housing Costs 243,000 51.97 NA NA 371,750 40.28 NA NA

Total Households: 120,085 4.61 128,395 6.92 94,618 2.10 97,890 3.46

$0-24K (%): 20 -4.23 18 -4.10 15 -4.94 14 -5.15

$25-50K (%): 24 -3.50 27 22.76 18 -5.64 23 34.38

$50K+ (%): 57 12.16 61 15.25 67 6.09 70 8.15

Median HH Income: 57,778 8.90 63,980 10.73 74,426 7.47 82,211 10.46

Per Capita Income: 23,950 10.90 27,147 13.35 30,944 10.19 34,571 11.72

* Current number of businesses is as of 200 1.

9

Critical Mass in Each Market

Rockland County, NY Deposit Market Share Analysis

At June 30, 2003

Deposits Market % of Parent

# of in Market Share Deposits

Rank Ins titution Branches ($000) (%) (%)

1 U.S.B. Holding Co. (NY) 14 1,046,659 17.39 61.00

2 Bank of New York Co. (NY) 23 960,147 15.95 2.57

3 Provident Bancorp Inc. 13 785,129 13.04 65.98

4 HSBC Holdings plc 11 735,442 12.22 1.78

5 J.P. Morgan Chase & Co. ( 6 555,720 9.23 0.28

6 M&T Bank Corp. (NY) 7 455,113 7.56 1.46

7 Citigroup Inc. (NY) 2 366,227 6.08 0.20

8 Washington Mutual Inc. (W 4 349,038 5.80 0.26

9 Charter One Financial (OH 2 219,755 3.65 0.77

10 KeyCorp (OH) 1 181,430 3.01 0.38

11 Wachovia Corp. (NC) 4 145,895 2.42 0.07

12 North Fork Bancorp. (NY) 3 105,027 1.74 0.73

13 Hudson United Bancorp (NJ 3 32,589 0.54 0.52

14 Trust Co. of New Jersey (NJ 3 29,465 0.49 0.86

15 Sound Federal Bancorp Inc. 1 27,303 0.45 4.09

To tals 101 6,020,340 100%

Orange County, NY Deposit Market Share Analysis

At June 30, 2003

Depos its Market % of Parent

# of in Market Share Depos its

Rank Ins titution Branches ($000) (%) (%)

1 Bank of America Corp. (NC) 12 670,157 14.22 0.13

2 Bank of New York Co. (NY) 16 563,502 11.95 1.51

3 Huds on United Bancorp (NJ) 15 483,437 10.26 7.75

4 Warwick Community Bancorp (NY) 7 427,134 9.06 81.56

5 Charter One Financial (OH) 7 424,092 9.00 1.50

6 KeyCorp (OH) 9 385,563 8.18 0.81

7 M&T Bank Corp. (NY) 10 308,995 6.56 0.99

8 Provident Bancorp Inc. 10 251,115 5.33 21.10

9 Orange County Trus t Co. (NY) 5 228,461 4.85 100.00

10 HS BC Holdings plc 5 204,863 4.35 0.49

11 Berks hire Bancorp Inc. (NY) 3 189,359 4.02 33.49

12 Walden S avings Bank (NY) 7 173,988 3.69 93.90

13 Firs t Federal Svgs Middletown (NY) 2 129,471 2.75 100.00

14 Walden Federal Savings & Loan (NY) 3 74,327 1.58 100.00

15 U.S .B. Holding Co. (NY) 1 48,598 1.03 2.83

Totals 123 4,713,618 100%

Market Share data for Orange County is pro forma for E.N.B. Holding Company, Inc. acquis ition

10

Competitive Advantage in Rockland & Orange Counties

• Competition in Rockland: Money Center/Regional Banks and one local competitor

• Competition in Orange: Money Center/Regional Banks, several smaller banks

• Provident Advantages:

- Local decision making

- Local lending presence

- Local product support

- Local branch distribution/extended service hours

- Local community involvement

11

Full Service Community Bank

? We offer a full array of products for consumers, including:

• Internet banking – Penetration Rate of 27%

• Internet bill payment

? We offer a full array of products for businesses, including:

• C&I (commercial and industrial loans)

• Commercial real estate loans

• Credit scoring for small business loans

• Internet cash management and sweep – Currently over 1,200 customers

? We offer Wealth Management

• Asset Management capacity

• Trust services

• Mutual Funds and Annuities

12

What is Provident’s Unique Selling Proposition?

? We have had 7 day a week banking since 1995. Currently 8 branches are open on Sunday

? 18 branches are open a full day on Saturday Since 1987

? Former ENB branches to be integrated into Saturday/Sunday banking

? Our Loan Officers have money center bank experience

? Our size provides us with distinct marketing advantages

• We are large enough that 98% of requests for credit fall within our lending authority

• We are small enough that one lender will oversee a number of different loan activities

13

Why Service?

? Low cost funds—Higher profitability Lower interest rate risk

• Transaction accounts

- First chance for new business

- Fee income opportunities

• Low cost savings products

? Competitive advantage

• Harder for large banks to compete on service

? Quality loan portfolio

14

Financial Highlights

15

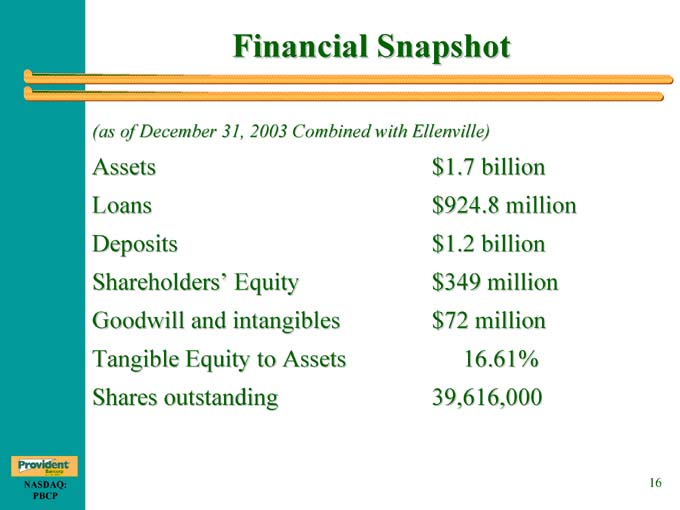

Financial Snapshot

(as of December 31, 2003 Combined with Ellenville)

Assets $1.7 billion

Loans $924.8 million

Deposits $1.2 billion

Shareholders’ Equity $349 million

Goodwill and intangibles $72 million

Tangible Equity to Assets 16.61%

Shares outstanding 39,616,000

16

Asset Growth

( $ in Millions)

$830.3 Million increase

At September 30,

2000 $844.3

2001 $881.3

2002 $1,027.7

2003 $1,174.3

ENB $1,674.6

17

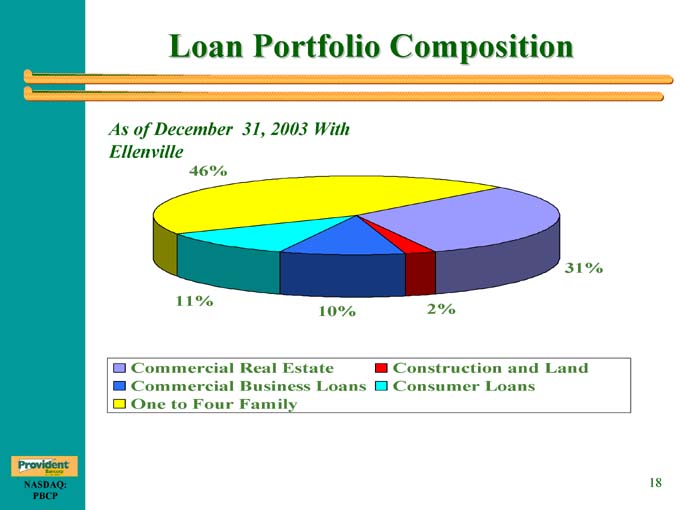

Loan Portfolio Composition

As of December 31, 2003 With Ellenville

46% One to Four Family

11% Consumer Loans

10% Commercial Business Loans

2% Construction and Land

31% Commercial Real Estate

18

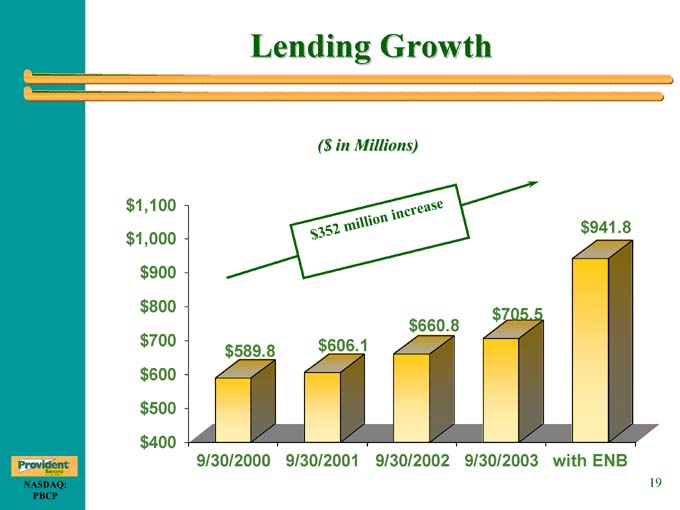

Lending Growth

($in Millions)

$352 million increase

9/30/2000 $589.8

9/30/2001 $606.1

9/30/2002 $660.8

9/30/2003 $705.5

with ENB $941.8

19

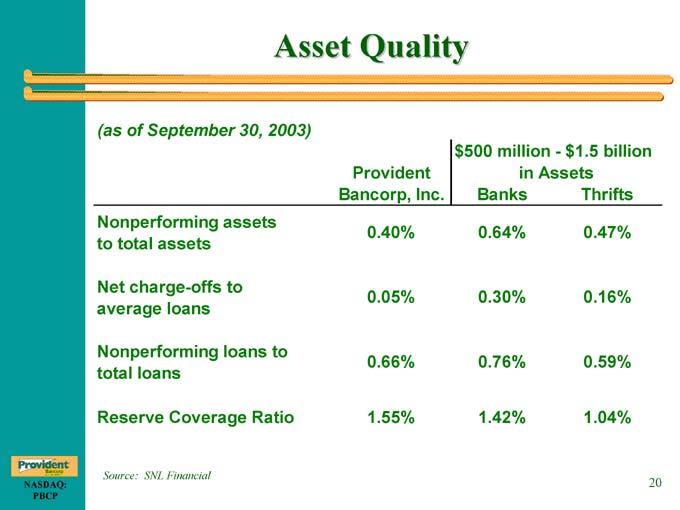

Asset Quality

(as of September 30, 2003)

$500 million—$1.5 billion

Provident in Assets

Bancorp, Inc. Banks Thrifts

Nonperforming assets

to total assets 0.40% 0.64%

Net charge-offs to

average loans 0.05% 0.30%

Nonperforming loans to

total loans 0.66% 0.76%

Reserve Coverage Ratio 1.55% 1.42% 1.04%

Source: SNL Financial

20

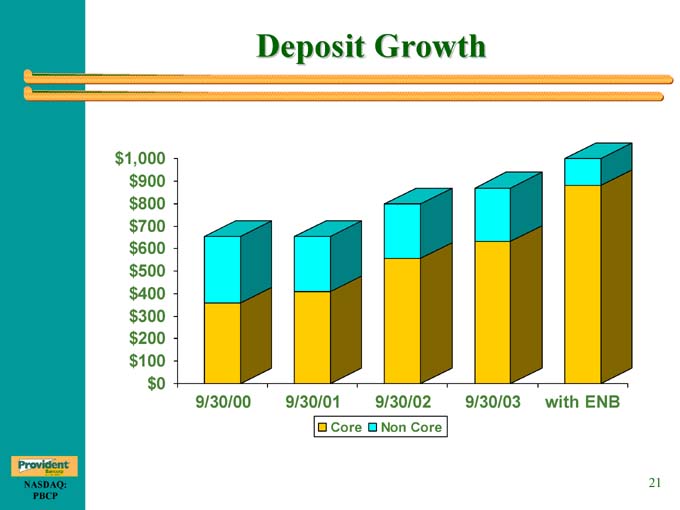

Deposit Growth

9/30/00 9/30/01 9/30/02 9/30/03 with ENB

21

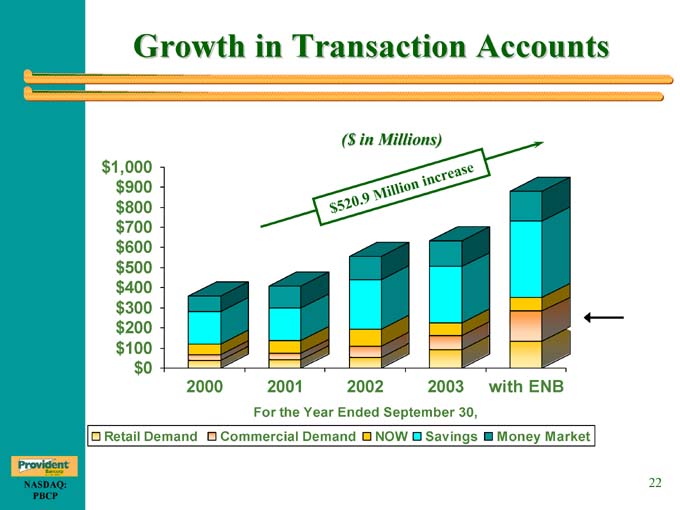

Growth in Transaction Accounts

($ in Millions)

$520.9 Million increase

2000 2001 2002 2003 with ENB

For the Year Ended September 30,

Retail Demand Commercial Demand NOW Savings Money Market

22

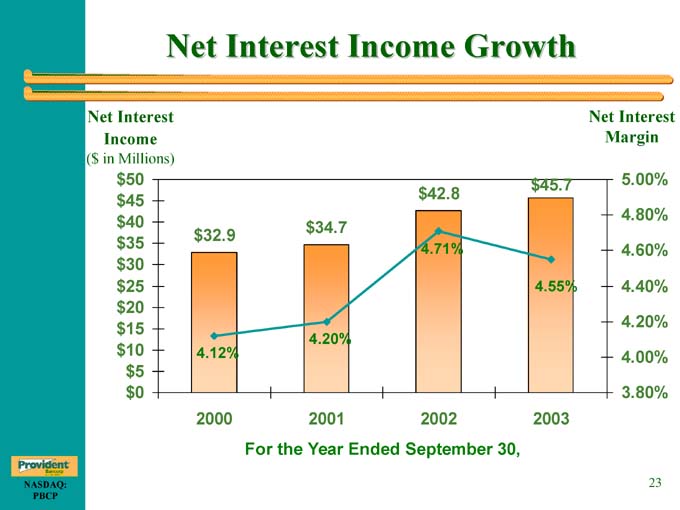

Net Interest Income Growth

For the Year Ended September 30,

Net Interest Net Interest

Income Margin

($ in Millions)

$32.9 4.12% 2000

$34.7 4.20% 2001

$42.8 4.71% 2002

$45.7 4.55% 2003

23

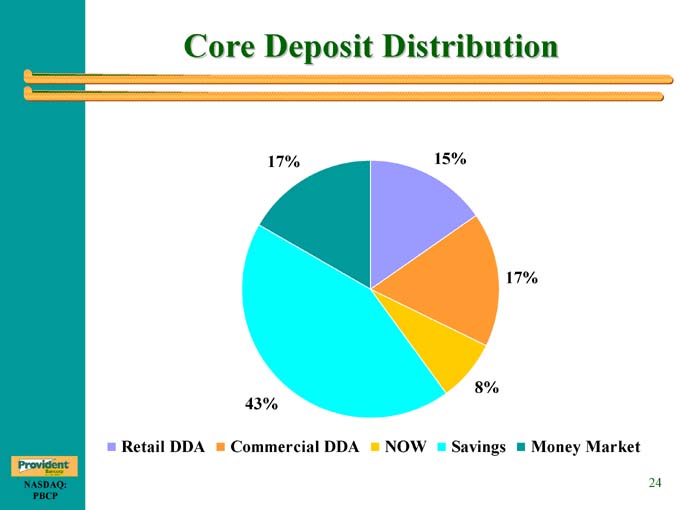

Core Deposit Distribution

17% Money Market

15% Retail DDA

43% Savings

17% Commercial DDA

8% NOW

24

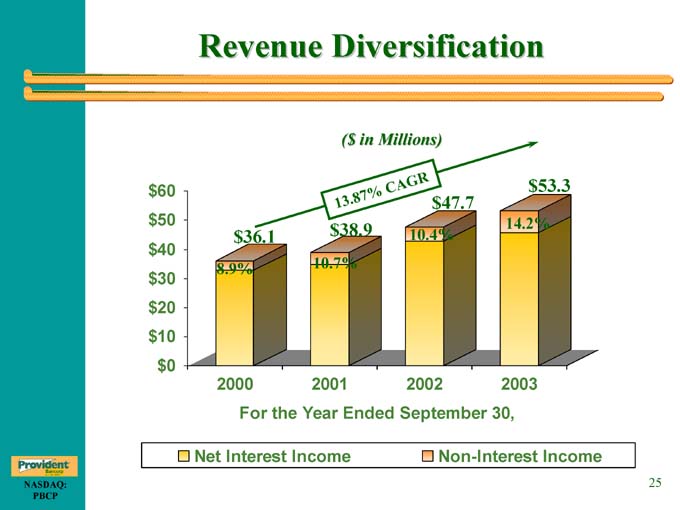

Revenue Diversification

($ in Millions)

13.87% CAGR

For the Year Ended September 30,

$36.1 8.9% 2000

$38.9 10.7% 2001

$47.7 10.4% 2002

$53.3 14.2% 2003

25

Strong Earnings Growth

($ in Millions)

24.20% CAGR

$5.9 2000

$7.5 2001

$9.5 2002

$11.3 2003

For the Year Ended September 30,

26

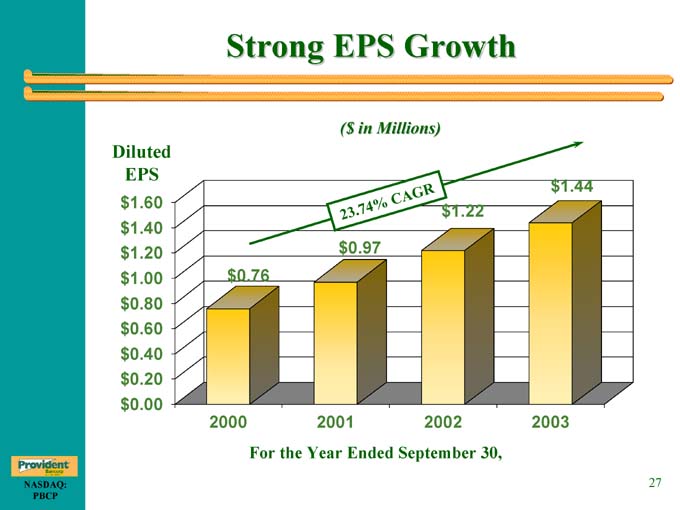

Strong EPS Growth

($ in Millions)

23.74% CAGR

For the Year Ended September 30,

$0.76 2000

$0.97 2001

$1.22 2002

$1.44 2003

27

Investment Attributes

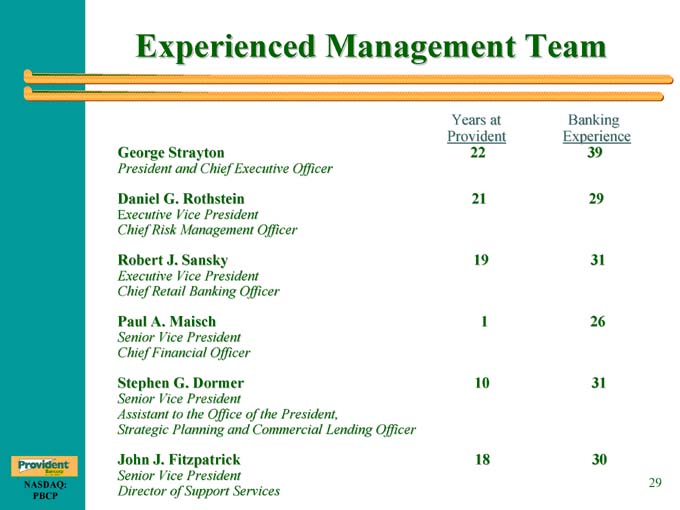

Experienced Management Team

Years at Banking

Provident Experience

George Strayton 22 39

President and Chief Executive Officer

Daniel G. Rothstein 21 29

Executive Vice President

Chief Risk Management Officer

Robert J. Sansky 19 31

Executive Vice President

Chief Retail Banking Officer

Paul A. Maisch 1 26

Senior Vice President

Chief Financial Officer

Stephen G. Dormer 10 31

Senior Vice President

Assistant to the Office of the President,

Strategic Planning and Commercial Lending Officer

John J. Fitzpatrick 18 30

Senior Vice President

Director of Support Services

29

Investment Profile

? Leader in Primary Markets with #1 position in Orange, #3 position in Rockland

? Economicly Vibrant and Growing Market Place

? Profitable, Strategically Positioned Institution

? Strong Management

? Exceptional Asset Quality

? Directors and Officers own more than 3.8 million shares of common stock, or 9.4% of the total outstanding shares

? Current Annual Dividend of $0.14 per share

30

A Record of Creating Shareholder Value

Since our 1999 IPO and the formation of the MHC:

• Price of PBCP common stock is nearly 5 times its IPO price

• Quarterly dividend has increased 400%

• Five year average annual return to shareholders of approximately 63%

31

Warwick Acquisition

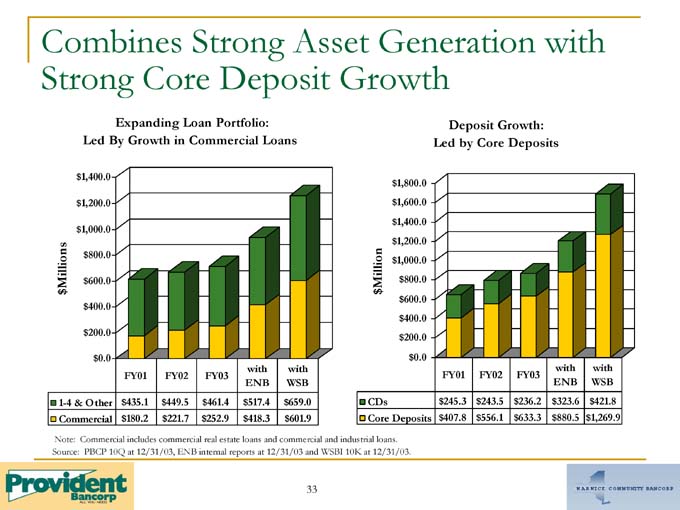

Combines Strong Asset Generation with Strong Core Deposit Growth

Expanding Loan Portfolio: Led By Growth in Commercial Loans $ Millions

with with

FY01 FY02 FY03 ENB WSB

1-4 & Other $ 435.1 $ 449.5 $ 461.4 $ 517.4 $ 659.0

Commercial $ 180.2 $ 221.7 $ 252.9 $ 418.3 $ 601.9

Deposit Growth: Led by Core Deposits $ Million

with with

FY01 FY02 FY03 ENB WSB

CDs $ 245.3 $ 243.5 $ 236.2 $ 323.6 $421.8

Core Deposits $ 407.8 $ 556.1 $ 633.3 $ 880.5 $1,269.9

Note: Commercial includes commercial real estate loans and commercial and industrial loans. Source: PBCP 10Q at 12/31/03, ENB internal reports at 12/31/03 and WSBI 10K at 12/31/03.

33

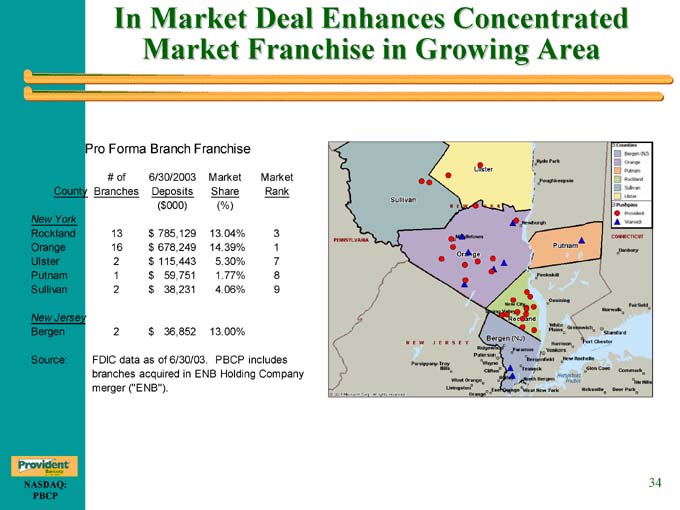

In Market Deal Enhances Concentrated Market Franchise in Growing Area

Pro Forma Branch Franchise

# of 6/30/2003 Market Market

County Branches Deposits Share Rank

($000) (%)

New York

Rockland 13 $ 785,129 13.04% 3

Orange 16 $ 678,249 14.39% 1

Ulster 2 $ 115,443 5.30% 7

Putnam 1 $ 59,751 1.77% 8

Sullivan 2 $ 38,231 4.06% 9

New Jersey

Bergen 2 $ 36,852 13.00%

Source: FDIC data as of 6/30/03. PBCP includes branches acquired in ENB Holding Company merger (“ENB”).

34

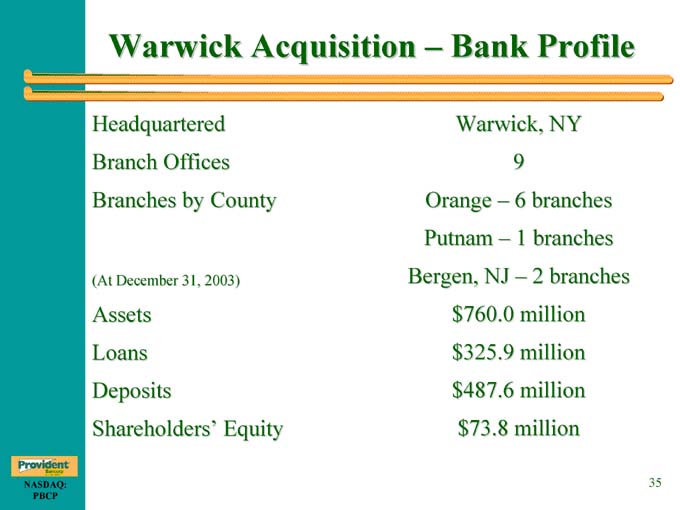

Warwick Acquisition – Bank Profile

Headquartered Warwick, NY

Branch Offices 9

Branches by County Orange – 6 branches

Putnam – 1 branches

(At December 31, 2003) Bergen, NJ – 2 branches

Assets $760.0 million

Loans $325.9 million

Deposits $487.6 million

Shareholders’ Equity $73.8 million

35

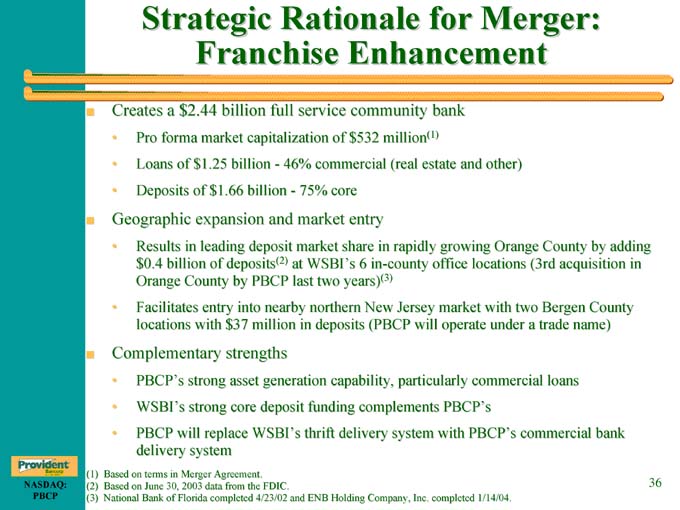

Strategic Rationale for Merger: Franchise Enhancement

? Creates a $2.44 billion full service community bank

• Pro forma market capitalization of $532 million(1)

• Loans of $1.25 billion—46% commercial (real estate and other)

• Deposits of $1.66 billion—75% core

? Geographic expansion and market entry

• Results in leading deposit market share in rapidly growing Orange County by adding $0.4 billion of deposits(2) at WSBI’s 6 in-county office locations (3rd acquisition in Orange County by PBCP last two years)(3)

• Facilitates entry into nearby northern New Jersey market with two Bergen County locations with $37 million in deposits (PBCP will operate under a trade name)

? Complementary strengths

• PBCP’s strong asset generation capability, particularly commercial loans

• WSBI’s strong core deposit funding complements PBCP’s

• PBCP will replace WSBI’s thrift delivery system with PBCP’s commercial bank delivery system

(1) Based on terms in Merger Agreement.

(2) Based on June 30, 2003 data from the FDIC.

(3) National Bank of Florida completed 4/23/02 and ENB Holding Company, Inc. completed 1/14/04.

36

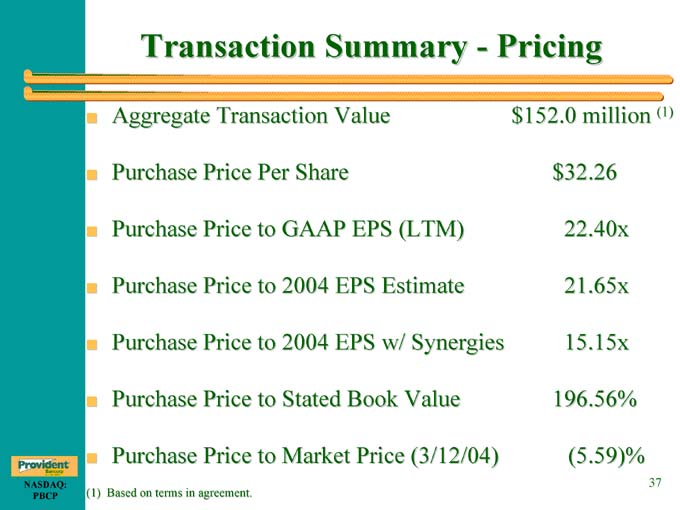

Transaction Summary—Pricing

? Aggregate Transaction Value $152.0 million (1)

? Purchase Price Per Share $32.26

? Purchase Price to GAAP EPS (LTM) 22.40x

? Purchase Price to 2004 EPS Estimate 21.65x

? Purchase Price to 2004 EPS w/ Synergies 15.15x

? Purchase Price to Stated Book Value 196.56%

? Purchase Price to Market Price (3/12/04) (5.59)%

(1) Based on terms in agreement.

37

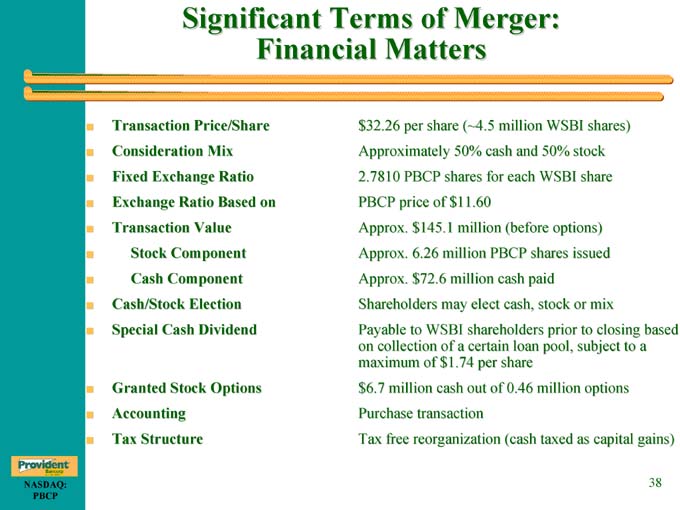

Significant Terms of Merger: Financial Matters

? Transaction Price/Share $32.26 per share (4.5 million WSBI shares)

? Consideration Mix Approximately 50% cash and 50% stock

? Fixed Exchange Ratio 2.7810 PBCP shares for each WSBI share

? Exchange Ratio Based on PBCP price of $11.60

? Transaction Value Approx. $145.1 million (before options)

? Stock Component Approx. 6.26 million PBCP shares issued

? Cash Component Approx. $72.6 million cash paid

? Cash/Stock Election Shareholders may elect cash, stock or mix

? Special Cash Dividend Payable to WSBI shareholders prior to closing based

on collection of a certain loan pool, subject to a

maximum of $1.74 per share

? Granted Stock Options $6.7 million cash out of 0.46 million options

? Accounting Purchase transaction

? Tax Structure Tax free reorganization (cash taxed as capital gains)

38

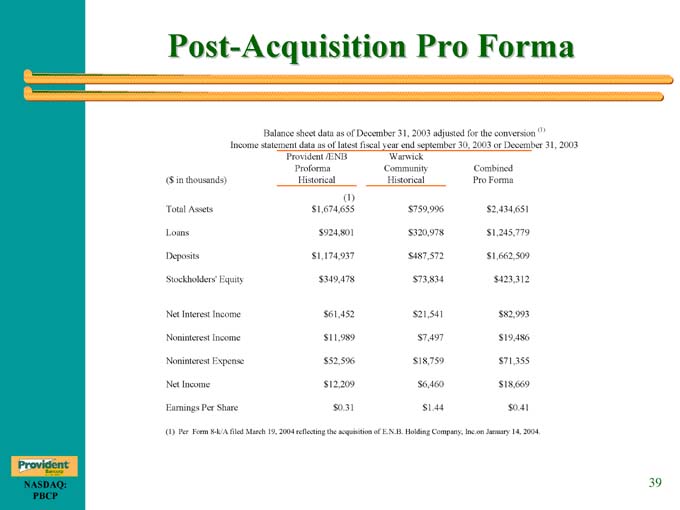

Post-Acquisition Pro Forma

Balance sheet data as of December 31, 2003 adjusted for the conversion (1) Income statement data as of latest fiscal year end september 30, 2003 or December 31, 2003

Provident /ENB Warwick

Proforma Community Combined

($ in thousands) Historical Historical Pro Forma

(1)

Total Assets $1,674,655 $759,996 $2,434,651

Loans $924,801 $320,978 $1,245,779

Deposits $1,174,937 $487,572 $1,662,509

Stockholders’ Equity $349,478 $73,834 $423,312

Net Interest Income $61,452 $21,541 $82,993

Noninterest Income $11,989 $7,497 $19,486

Noninterest Expense $52,596 $18,759 $71,355

Net Income $12,209 $6,460 $18,669

Earnings Per Share $0.31 $1.44 $0.41

(1) Per Form 8-k/A filed March 19, 2004 reflecting the acquisition of E.N.B. Holding Company, Inc.on January 14, 2004.

39

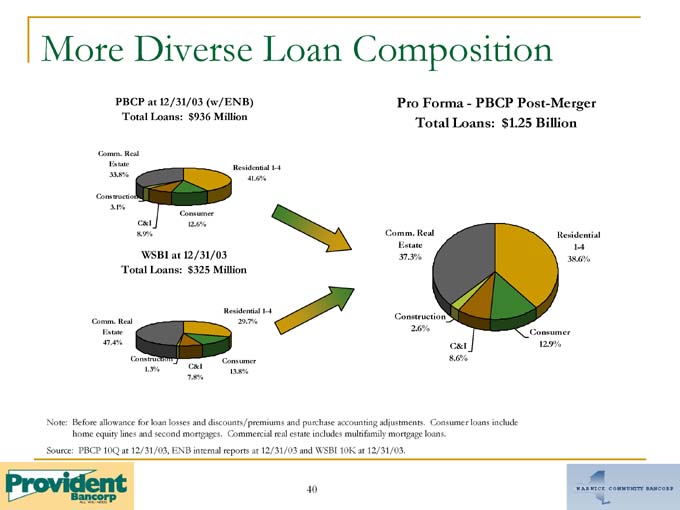

More Diverse Loan Composition

PBCP at 12/31/03 (w/ENB) Total Loans: $936 Million

Comm. Real Estate 33.8%

Construction 3.1%

C&I 8.9%

Consumer 12.6%

Residential 1-4 41.6%

WSBI at 12/31/03 Total Loans: $325 Million

Comm. Real Estate 47.4%

Construction 1.3%

C&I 7.8%

Consumer 13.8%

Residential 1-4 29.7%

Pro Forma—PBCP Post-Merger Total Loans: $1.25 Billion

Comm. Real Estate 37.3%

Construction 2.6%

C&I 8.6%

Consumer 12.9%

Residential 1-4 38.6%

Note: Before allowance for loan losses and discounts/premiums and purchase accounting adjustments. Consumer loans include home equity lines and second mortgages. Commercial real estate includes multifamily mortgage loans.

Source: PBCP 10Q at 12/31/03, ENB internal reports at 12/31/03 and WSBI 10K at 12/31/03.

40

Increased Core Deposit Base

PBCP at 12/31/03 (w/ENB) Total Deposits: $1.2 Billion (72.4% Core)

MMA 12.1%

DDA 21.0%

NOW 7.7%

CDs 27.6%

Savings 31.6%

WSBI at 12/31/03

Total Deposits: $0.5 Billion (79.9% Core)

MMA 14.4%

DDA 14.6%

NOW 10.8%

CDs 20.1%

Savings 40.1%

Pro Forma—PBCP Post-Merger Total Deposits: $1.7 Billion (74.5% Core)

MMA 12.8%

DDA 19.1%

NOW 8.6%

CDs 25.5%

Savings 34.1%

Source: PBCP 10Q at 12/31/03, ENB internal reports at 12/31/03 and WSBI 10K at 12/31/03.

41

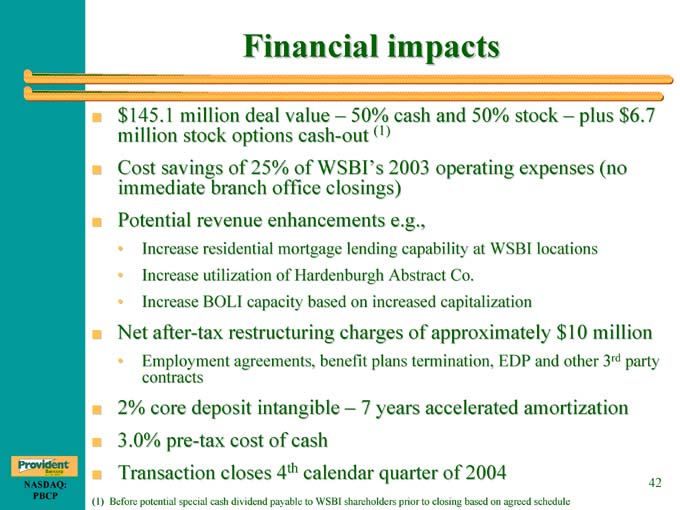

Financial impacts

?? 145.1 million deal value – 50% cash and 50% stock – plus $6.7 million stock options cash-out (1)

? Cost savings of 25% of WSBI’s 2003 operating expenses (no immediate branch office closings)

? Potential revenue enhancements e.g.,

• Increase residential mortgage lending capability at WSBI locations

• Increase utilization of Hardenburgh Abstract Co.

• Increase BOLI capacity based on increased capitalization

? Net after-tax restructuring charges of approximately $10 million

• Employment agreements, benefit plans termination, EDP and other 3rd party contracts

? 2% core deposit intangible – 7 years accelerated amortization

? 3.0% pre-tax cost of cash

? Transaction closes 4th calendar quarter of 2004

(1) Before potential special cash dividend payable to WSBI shar Before potential special cash dividend payable to WSBI shareholders prior to closing based on agreed schedule eholders prior to closing based on agreed schedule

42

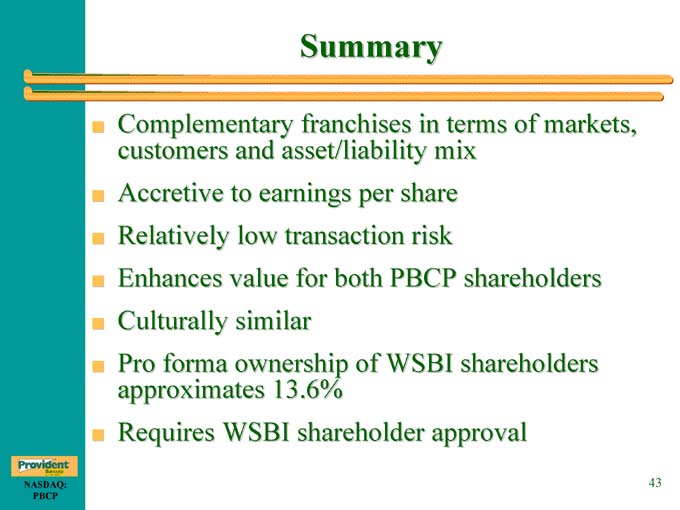

Summary

? Complementary franchises in terms of markets, customers and asset/liability mix

? Accretive to earnings per share

? Relatively low transaction risk

? Enhances value for both PBCP shareholders

? Culturally similar

? Pro forma ownership of WSBI shareholders approximates 13.6%

? Requires WSBI shareholder approval

43

Questions?