UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act File Number 811-09025

New Covenant Funds

SEI Investments

One Freedom Valley Drive

Oaks, PA 19456

Timothy D. Barto, Esq.

SEI Investments

One Freedom Valley Drive

Oaks, PA 19456

Registrant’s telephone number, including area code: 610-676-1000

Date of fiscal year end: June 30, 2021

Date of reporting period: December 31, 2020

| Item 1. | Reports to Stockholders. |

|

December 31, 2020

SEMI-ANNUAL REPORT

New Covenant Funds

New Covenant Growth Fund

New Covenant Growth Fund

New Covenant Income Fund

New Covenant Income Fund

New Covenant Balanced Growth Fund

New Covenant Balanced Growth Fund

New Covenant Balanced Income Fund

New Covenant Balanced Income Fund

Paper copies of the Funds’ shareholder reports are no longer sent by mail, unless you specifically request them from the Funds or from your financial intermediary, such as a broker-dealer or bank. Shareholder reports are available online and you will be notified by mail each time a report is posted on the Funds’ website and provided with a link to access the report online.

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to inform it that you wish to continue receiving paper copies of your shareholder reports. If you invest directly with the Funds, you can inform the Funds that you wish to continue receiving paper copies of your shareholder reports by calling 1-877-835-4531. Your election to receive reports in paper will apply to all funds held with the SEI Funds or your financial intermediary.

| 1 | ||||

| ||||

| 38 | ||||

| ||||

| 39 | ||||

| ||||

| 40 | ||||

| ||||

| 42 | ||||

| ||||

| 46 | ||||

| ||||

| 58 | ||||

| ||||

Board of Trustees Considerations in Approving the Advisory and Sub-Advisory Agreements | 59 | |||

| ||||

The Trust files its complete schedule of portfolio holdings with the Securities and Exchange Commission for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The Trust’s Form N-PORT reports are available on the Commission’s website at http://www.sec.gov.

A description of the policies and procedures that the Trust uses to determine how to vote proxies relating to portfolio securities, as well as information relating to how a Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, is available (i) without charge, upon request, by calling 1-877-835-4531; and (ii) on the Commission’s website at http://www.sec.gov.

SCHEDULE OF INVESTMENTS (Unaudited)

December 31, 2020

New Covenant Growth Fund

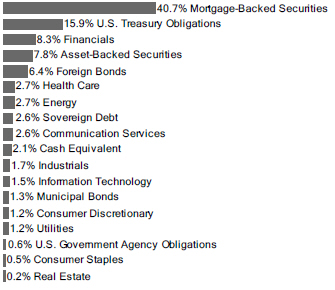

Sector Weightings†:

†Percentages are based on total investments.

| Description | Shares | Market Value ($ Thousands) | ||||||

COMMON STOCK — 96.3% |

| |||||||

United States — 96.3% |

| |||||||

Communication Services — 8.5% | ||||||||

Activision Blizzard Inc | 8,807 | $ | 818 | |||||

Alphabet Inc, Cl A * | 4,202 | 7,365 | ||||||

Alphabet Inc, Cl C * | 4,147 | 7,265 | ||||||

AT&T Inc | 124,429 | 3,579 | ||||||

Bandwidth Inc, Cl A * | 74 | 11 | ||||||

Cardlytics Inc * | 143 | 20 | ||||||

Cars.com Inc * | 4,178 | 47 | ||||||

CenturyLink Inc | 872 | 8 | ||||||

Charter Communications Inc, Cl A * | 1,676 | 1,109 | ||||||

Cinemark Holdings Inc | 2,104 | 37 | ||||||

Cogent Communications Holdings Inc | 148 | 9 | ||||||

Comcast Corp, Cl A | 57,606 | 3,019 | ||||||

Electronic Arts Inc | 2,676 | 384 | ||||||

Emerald Holding Inc | 4,781 | 26 | ||||||

Eventbrite Inc, Cl A * | 2,537 | 46 | ||||||

EverQuote Inc, Cl A * | 1,468 | 55 | ||||||

EW Scripps Co/The, Cl A | 3,299 | 50 | ||||||

Facebook Inc, Cl A * | 32,037 | 8,751 | ||||||

Fox Corp, Cl A | 1,372 | 40 | ||||||

IAC/InterActiveCorp * | 376 | 71 | ||||||

IMAX Corp * | 2,244 | 40 | ||||||

Interpublic Group of Cos Inc/The | 8,487 | 200 | ||||||

Iridium Communications Inc * | 366 | 14 | ||||||

John Wiley & Sons Inc, Cl A | 236 | 11 | ||||||

Liberty Broadband Corp, Cl A * | 81 | 13 | ||||||

Liberty Broadband Corp, Cl C * | 843 | 133 | ||||||

Liberty Media Corp-Liberty Formula One, Cl C * | 1,355 | 58 | ||||||

Live Nation Entertainment Inc * | 181 | 13 | ||||||

Madison Square Garden Entertainment Corp * | 39 | 4 | ||||||

Match Group Inc * | 1,537 | 232 | ||||||

Meredith Corp | 1,401 | 27 | ||||||

MSG Networks Inc * | 2,988 | 44 | ||||||

New York Times Co/The, Cl A | 439 | 23 | ||||||

Nexstar Media Group Inc, Cl A | 455 | 50 | ||||||

| Description | Shares | Market Value ($ Thousands) | ||||||

COMMON STOCK (continued) |

| |||||||

Omnicom Group Inc | 10,137 | $ | 632 | |||||

Pinterest, Cl A * | 2,610 | 172 | ||||||

Scholastic Corp | 1,266 | 32 | ||||||

Shenandoah Telecommunications Co | 222 | 10 | ||||||

Sirius XM Holdings Inc | 7,153 | 46 | ||||||

Spotify Technology SA * | 1,265 | 398 | ||||||

Take-Two Interactive Software Inc * | 830 | 172 | ||||||

TechTarget Inc * | 1,986 | 117 | ||||||

TEGNA Inc | 3,052 | 43 | ||||||

T-Mobile US Inc * | 5,590 | 754 | ||||||

Twitter Inc * | 7,369 | 399 | ||||||

Verizon Communications Inc | 57,853 | 3,399 | ||||||

ViacomCBS Inc, Cl B | 1,000 | 37 | ||||||

Walt Disney Co/The | 23,176 | 4,199 | ||||||

World Wrestling Entertainment Inc, Cl A | 780 | 37 | ||||||

Zillow Group Inc, Cl C * | 1,112 | 144 | ||||||

Zynga Inc, Cl A * | 14,448 | 143 | ||||||

|

44,306 |

| ||||||

Consumer Discretionary — 12.7% | ||||||||

1-800-Flowers.com Inc, Cl A * | 3,668 | 95 | ||||||

Aaron’s Co Inc * | 416 | 8 | ||||||

Abercrombie & Fitch Co, Cl A | 2,970 | 60 | ||||||

Adtalem Global Education Inc * | 1,460 | 50 | ||||||

Advance Auto Parts Inc | 317 | 50 | ||||||

Amazon.com Inc * | 5,729 | 18,659 | ||||||

American Eagle Outfitters Inc | 3,416 | 69 | ||||||

American Public Education Inc * | 1,831 | 56 | ||||||

Aramark | 260 | 10 | ||||||

Asbury Automotive Group Inc * | 425 | 62 | ||||||

At Home Group Inc * | 6,757 | 104 | ||||||

AutoNation Inc * | 970 | 68 | ||||||

AutoZone Inc * | 235 | 279 | ||||||

Bed Bath & Beyond Inc | 2,963 | 53 | ||||||

Best Buy Co Inc | 14,318 | 1,429 | ||||||

Big Lots Inc | 1,758 | 75 | ||||||

Bloomin’ Brands Inc | 2,259 | 44 | ||||||

Booking Holdings Inc * | 563 | 1,254 | ||||||

Boot Barn Holdings Inc * | 1,181 | 51 | ||||||

BorgWarner Inc | 2,278 | 88 | ||||||

Bright Horizons Family Solutions Inc * | 76 | 13 | ||||||

Brinker International Inc | 1,180 | 67 | ||||||

Brunswick Corp/DE | 839 | 64 | ||||||

Buckle Inc/The | 1,885 | 55 | ||||||

Burlington Stores Inc * | 482 | 126 | ||||||

Cable One Inc | 79 | 176 | ||||||

Callaway Golf Co | 2,383 | 57 | ||||||

Capri Holdings Ltd * | 1,319 | 55 | ||||||

CarMax Inc * | 1,086 | 103 | ||||||

Carnival Corp | 15,800 | 342 | ||||||

Carter’s Inc | 471 | 44 | ||||||

Carvana Co, Cl A * | 309 | 74 | ||||||

Cavco Industries Inc * | 255 | 45 | ||||||

| New Covenant Funds / Semi-Annual Report / December 31, 2020 | 1 |

SCHEDULE OF INVESTMENTS (Unaudited)

December 31, 2020

New Covenant Growth Fund (Continued)

| Description | Shares | Market Value ($ Thousands) | ||||||

COMMON STOCK (continued) |

| |||||||

Cheesecake Factory Inc/The | 1,236 | $ | 46 | |||||

Chegg Inc * | 176 | 16 | ||||||

Children’s Place Inc/The | 812 | 41 | ||||||

Chipotle Mexican Grill Inc, Cl A * | 232 | 322 | ||||||

Choice Hotels International Inc | 113 | 12 | ||||||

Columbia Sportswear Co | 891 | 78 | ||||||

Cooper Tire & Rubber Co | 1,668 | 68 | ||||||

Cracker Barrel Old Country Store Inc | 323 | 43 | ||||||

Dana Inc | 2,660 | 52 | ||||||

Darden Restaurants Inc | 705 | 84 | ||||||

Dave & Buster’s Entertainment Inc | 1,283 | 38 | ||||||

Deckers Outdoor Corp * | 306 | 88 | ||||||

Denny’s Corp * | 2,500 | 37 | ||||||

Designer Brands Inc, Cl A | 3,316 | 25 | ||||||

Dick’s Sporting Goods Inc | 1,054 | 59 | ||||||

Dillard’s Inc, Cl A | 726 | 46 | ||||||

Discovery Inc, Cl C * | 354 | 9 | ||||||

Dollar General Corp | 2,608 | 548 | ||||||

Dollar Tree Inc * | 1,320 | 143 | ||||||

Domino’s Pizza Inc | 309 | 118 | ||||||

Dorman Products Inc * | 128 | 11 | ||||||

DR Horton Inc | 1,973 | 136 | ||||||

eBay Inc | 24,197 | 1,216 | ||||||

Etsy Inc * | 1,162 | 207 | ||||||

Expedia Group Inc | 103 | 14 | ||||||

Five Below Inc * | 410 | 72 | ||||||

Floor & Decor Holdings Inc, Cl A * | 232 | 21 | ||||||

Foot Locker Inc | 1,308 | 53 | ||||||

Ford Motor Co | 28,288 | 249 | ||||||

Fox Factory Holding Corp * | 749 | 79 | ||||||

frontdoor Inc * | 251 | 13 | ||||||

Gap Inc/The | 11,382 | 230 | ||||||

General Motors Co | 11,957 | 498 | ||||||

Gentex Corp | 440 | 15 | ||||||

Gentherm Inc * | 1,113 | 73 | ||||||

Genuine Parts Co | 109 | 11 | ||||||

Goodyear Tire & Rubber Co/The | 690 | 7 | ||||||

Graham Holdings Co, Cl B | 78 | 42 | ||||||

Grand Canyon Education Inc * | 121 | 11 | ||||||

Group 1 Automotive Inc | 479 | 63 | ||||||

Grubhub Inc * | 1,289 | 96 | ||||||

Guess? Inc | 2,341 | 53 | ||||||

H&R Block Inc | 3,157 | 50 | ||||||

Hanesbrands Inc | 13,319 | 194 | ||||||

Harley-Davidson Inc | 306 | 11 | ||||||

Hasbro Inc | 2,632 | 246 | ||||||

Helen of Troy Ltd * | 57 | 13 | ||||||

Hilton Grand Vacations Inc * | 3,016 | 95 | ||||||

Hilton Worldwide Holdings Inc | 4,365 | 486 | ||||||

Home Depot Inc/The | 14,251 | 3,785 | ||||||

Hyatt Hotels Corp, Cl A | 135 | 10 | ||||||

Installed Building Products Inc * | 694 | 71 | ||||||

| Description | Shares | Market Value ($ Thousands) | ||||||

COMMON STOCK (continued) |

| |||||||

iRobot Corp * | 1,013 | $ | 81 | |||||

Jack in the Box Inc | 658 | 61 | ||||||

Johnson Outdoors Inc, Cl A | 659 | 74 | ||||||

KB Home | 4,733 | 159 | ||||||

Kohl’s Corp | 1,859 | 76 | ||||||

Kontoor Brands Inc | 1,282 | 52 | ||||||

L Brands Inc | 638 | 24 | ||||||

La-Z-Boy Inc, Cl Z | 1,597 | 64 | ||||||

LCI Industries | 483 | 63 | ||||||

Lear Corp | 6,486 | 1,031 | ||||||

Leggett & Platt Inc | 222 | 10 | ||||||

Lennar Corp, Cl A | 651 | 50 | ||||||

Lennar Corp, Cl B | 728 | 45 | ||||||

LGI Homes Inc * | 127 | 13 | ||||||

Liberty Media Corp-Liberty SiriusXM, Cl C * | 234 | 10 | ||||||

LKQ Corp * | 317 | 11 | ||||||

Lowe’s Cos Inc | 15,716 | 2,523 | ||||||

M/I Homes Inc * | 1,195 | 53 | ||||||

Macy’s Inc | 4,042 | 45 | ||||||

Madison Square Garden Sports Corp * | 39 | 7 | ||||||

Magnite Inc * | 1,140 | 35 | ||||||

Malibu Boats Inc, Cl A * | 202 | 13 | ||||||

Marriott International Inc/MD, Cl A | 3,599 | 475 | ||||||

Marriott Vacations Worldwide Corp | 394 | 54 | ||||||

Mattel Inc * | 14,805 | 258 | ||||||

McDonald’s Corp | 11,361 | 2,438 | ||||||

Meritage Homes Corp * | 794 | 66 | ||||||

Michaels Cos Inc/The * | 7,530 | 98 | ||||||

Mohawk Industries Inc * | 127 | 18 | ||||||

Monro Inc | 626 | 33 | ||||||

Murphy USA Inc | 422 | 55 | ||||||

National Vision Holdings Inc * | 447 | 20 | ||||||

Netflix Inc * | 5,354 | 2,895 | ||||||

Newell Brands Inc | 605 | 13 | ||||||

News Corp, Cl A | 829 | 15 | ||||||

NIKE Inc, Cl B | 17,693 | 2,503 | ||||||

Nordstrom Inc | 3,866 | 121 | ||||||

Norwegian Cruise Line Holdings Ltd * | 14,956 | 380 | ||||||

NVR Inc * | 13 | 53 | ||||||

Office Depot Inc | 1,901 | 56 | ||||||

Ollie’s Bargain Outlet Holdings Inc * | 746 | 61 | ||||||

OneSpaWorld Holdings Ltd | 3,063 | 31 | ||||||

O’Reilly Automotive Inc * | 677 | 306 | ||||||

Oxford Industries Inc | 665 | 44 | ||||||

Papa John’s International Inc | 806 | 68 | ||||||

Peloton Interactive Inc, Cl A * | 3,058 | 464 | ||||||

Penske Automotive Group Inc | 957 | 57 | ||||||

PetMed Express Inc | 366 | 12 | ||||||

Planet Fitness Inc, Cl A * | 3,228 | 251 | ||||||

Polaris Inc | 966 | 92 | ||||||

PulteGroup Inc | 5,125 | 221 | ||||||

PVH Corp | 108 | 10 | ||||||

| 2 | New Covenant Funds / Semi-Annual Report / December 31, 2020 |

| Description | Shares | Market Value ($ Thousands) | ||||||

COMMON STOCK (continued) | ||||||||

Qurate Retail Inc | 1,412 | $ | 15 | |||||

Ralph Lauren Corp, Cl A | 690 | 72 | ||||||

RealReal Inc/The * | 2,868 | 56 | ||||||

Rent-A-Center Inc/TX, Cl A | 1,764 | 68 | ||||||

RH * | 224 | 100 | ||||||

Roku Inc, Cl A * | 1,227 | 407 | ||||||

Ross Stores Inc | 3,209 | 394 | ||||||

Royal Caribbean Cruises Ltd | 8,804 | 658 | ||||||

Sally Beauty Holdings Inc * | 2,794 | 36 | ||||||

SeaWorld Entertainment Inc * | 1,594 | 50 | ||||||

Service Corp International/US | 250 | 12 | ||||||

Shake Shack Inc, Cl A * | 157 | 13 | ||||||

Shutterstock Inc | 205 | 15 | ||||||

Signet Jewelers Ltd | 2,402 | 65 | ||||||

Six Flags Entertainment Corp | 248 | 8 | ||||||

Sleep Number Corp * | 1,033 | 85 | ||||||

Stamps.com Inc * | 630 | 124 | ||||||

Standard Motor Products Inc | 943 | 38 | ||||||

Starbucks Corp | 16,902 | 1,808 | ||||||

Steven Madden Ltd | 1,178 | 42 | ||||||

Stitch Fix Inc, Cl A * | 1,950 | 114 | ||||||

Strategic Education Inc | 331 | 32 | ||||||

Stride Inc * | 348 | 7 | ||||||

Tapestry Inc | 2,803 | 87 | ||||||

Target Corp | 6,577 | 1,161 | ||||||

Taylor Morrison Home Corp, Cl A * | 12,743 | 327 | ||||||

Tempur Sealy International Inc * | 2,272 | 61 | ||||||

Tenneco Inc, Cl A * | 3,599 | 38 | ||||||

Terminix Global Holdings Inc * | 303 | 15 | ||||||

Tesla Inc * | 9,924 | 7,003 | ||||||

Texas Roadhouse Inc, Cl A | 889 | 69 | ||||||

Thor Industries Inc | 106 | 10 | ||||||

Tiffany & Co | 101 | 13 | ||||||

TJX Cos Inc/The | 14,736 | 1,006 | ||||||

Toll Brothers Inc | 2,246 | 98 | ||||||

TopBuild Corp * | 476 | 88 | ||||||

Tractor Supply Co | 2,377 | 334 | ||||||

TRI Pointe Group Inc * | 3,236 | 56 | ||||||

TripAdvisor Inc * | 1,712 | 49 | ||||||

Ulta Beauty Inc * | 279 | 80 | ||||||

Under Armour Inc, Cl C * | 556 | 8 | ||||||

Urban Outfitters Inc * | 417 | 11 | ||||||

Vail Resorts Inc | 46 | 13 | ||||||

VF Corp | 4,023 | 344 | ||||||

Visteon Corp * | 551 | 69 | ||||||

Wayfair Inc, Cl A * | 506 | 114 | ||||||

Wendy’s Co/The | 11,419 | 250 | ||||||

Whirlpool Corp | 638 | 115 | ||||||

Williams-Sonoma Inc | 160 | 16 | ||||||

Wingstop Inc | 582 | 77 | ||||||

Winnebago Industries Inc | 191 | 11 | ||||||

Wolverine World Wide Inc | 1,511 | 47 | ||||||

| Description | Shares | Market Value ($ Thousands) | ||||||

COMMON STOCK (continued) | ||||||||

Workhorse Group Inc * | 1,652 | $ | 33 | |||||

WW International Inc * | 1,262 | 31 | ||||||

Wyndham Destinations Inc | 4,669 | 209 | ||||||

Wyndham Hotels & Resorts Inc | 189 | 11 | ||||||

Yum China Holdings Inc | 1,913 | 109 | ||||||

Yum! Brands Inc | 8,356 | 907 | ||||||

Zumiez Inc * | 1,593 | 59 | ||||||

|

66,605 |

| ||||||

Consumer Staples — 5.6% | ||||||||

Andersons Inc/The | 1,960 | 48 | ||||||

Archer-Daniels-Midland Co | 4,581 | 231 | ||||||

B&G Foods Inc | 862 | 24 | ||||||

Beyond Meat Inc * | 535 | 67 | ||||||

BJ’s Wholesale Club Holdings Inc * | 2,099 | 78 | ||||||

Bunge Ltd | 1,596 | 105 | ||||||

Calavo Growers Inc | 571 | 40 | ||||||

Campbell Soup Co | 10,354 | 500 | ||||||

Casey’s General Stores Inc | 319 | 57 | ||||||

Celsius Holdings * | 3,536 | 178 | ||||||

Chefs’ Warehouse Inc/The * | 1,366 | 35 | ||||||

Church & Dwight Co Inc | 1,025 | 89 | ||||||

Clorox Co/The | 2,716 | 548 | ||||||

Coca-Cola Co/The | 48,059 | 2,636 | ||||||

Colgate-Palmolive Co | 14,526 | 1,242 | ||||||

Conagra Brands Inc | 14,479 | 525 | ||||||

Costco Wholesale Corp | 5,520 | 2,080 | ||||||

Coty Inc, Cl A | 1,026 | 7 | ||||||

Edgewell Personal Care Co | 1,589 | 55 | ||||||

Energizer Holdings Inc | 231 | 10 | ||||||

Estee Lauder Cos Inc/The, Cl A | 2,390 | 636 | ||||||

Flowers Foods Inc | 9,872 | 223 | ||||||

Fresh Del Monte Produce Inc | 1,442 | 35 | ||||||

General Mills Inc | 13,887 | 816 | ||||||

Grocery Outlet Holding Corp * | 263 | 10 | ||||||

Hain Celestial Group Inc/The * | 461 | 18 | ||||||

Hershey Co/The | 2,295 | 350 | ||||||

HF Foods Group Inc * | 2,213 | 17 | ||||||

Hormel Foods Corp | 4,797 | 224 | ||||||

Ingredion Inc | 1,110 | 87 | ||||||

J M Smucker Co/The | 6,494 | 751 | ||||||

Kellogg Co | 6,713 | 418 | ||||||

Keurig Dr Pepper Inc | 16,196 | 518 | ||||||

Kimberly-Clark Corp | 6,484 | 874 | ||||||

Kraft Heinz Co/The | 2,811 | 97 | ||||||

Kroger Co/The | 23,786 | 755 | ||||||

Lamb Weston Holdings Inc | 594 | 47 | ||||||

Lancaster Colony Corp | 319 | 59 | ||||||

McCormick & Co Inc/MD | 5,832 | 558 | ||||||

Medifast Inc | 71 | 14 | ||||||

Mondelez International Inc, Cl A | 17,402 | 1,017 | ||||||

Monster Beverage Corp * | 2,682 | 248 | ||||||

National Beverage Corp | 172 | 15 | ||||||

| New Covenant Funds / Semi-Annual Report / December 31, 2020 | 3 |

SCHEDULE OF INVESTMENTS (Unaudited)

December 31, 2020

New Covenant Growth Fund (Continued)

| Description | Shares | Market Value ($ Thousands) | ||||||

COMMON STOCK (continued) |

| |||||||

PepsiCo Inc | 28,432 | $ | 4,216 | |||||

Performance Food Group Co * | 1,023 | 49 | ||||||

Pilgrim’s Pride Corp * | 355 | 7 | ||||||

Post Holdings Inc * | 108 | 11 | ||||||

PriceSmart Inc | 690 | 63 | ||||||

Procter & Gamble Co/The | 31,672 | 4,407 | ||||||

Sanderson Farms Inc | 297 | 39 | ||||||

SpartanNash Co | 1,252 | 22 | ||||||

Spectrum Brands Holdings Inc | 183 | 14 | ||||||

Sprouts Farmers Market Inc * | 4,114 | 83 | ||||||

Sysco Corp | 18,307 | 1,359 | ||||||

TreeHouse Foods Inc * | 237 | 10 | ||||||

Tyson Foods Inc, Cl A | 1,004 | 65 | ||||||

US Foods Holding Corp * | 2,211 | 74 | ||||||

Walgreens Boots Alliance Inc | 8,946 | 357 | ||||||

Walmart Inc | 17,426 | 2,512 | ||||||

| 29,630 | ||||||||

Energy — 2.0% |

| |||||||

Antero Midstream Corp | 7,912 | 61 | ||||||

Apache Corp | 7,933 | 113 | ||||||

Baker Hughes Co, Cl A | 4,496 | 94 | ||||||

Cabot Oil & Gas Corp | 3,306 | 54 | ||||||

Cactus Inc, Cl A | 1,525 | 40 | ||||||

ChampionX Corp * | 383 | 6 | ||||||

Cheniere Energy Inc * | 1,265 | 76 | ||||||

Chevron Corp | 23,561 | 1,990 | ||||||

Cimarex Energy Co | 995 | 37 | ||||||

CNX Resources Corp * | 6,091 | 66 | ||||||

Concho Resources Inc | 142 | 8 | ||||||

ConocoPhillips | 28,755 | 1,150 | ||||||

Continental Resources Inc/OK | 337 | 5 | ||||||

Devon Energy Corp | 8,276 | 131 | ||||||

Diamond S Shipping Inc * | 3,276 | 22 | ||||||

Diamondback Energy Inc | 133 | 6 | ||||||

Dril-Quip Inc * | 1,072 | 32 | ||||||

EOG Resources Inc | 4,528 | 226 | ||||||

EQT Corp | 2,732 | 35 | ||||||

Equitrans Midstream Corp | 2,185 | 17 | ||||||

Exxon Mobil Corp | 52,096 | 2,147 | ||||||

Frank’s International NV * | 9,174 | 25 | ||||||

Golar LNG Ltd | 3,888 | 37 | ||||||

Halliburton Co | 4,450 | 84 | ||||||

Helmerich & Payne Inc | 1,494 | 35 | ||||||

Hess Corp | 4,195 | 221 | ||||||

HollyFrontier Corp | 3,119 | 81 | ||||||

International Seaways Inc | 1,773 | 29 | ||||||

Kinder Morgan Inc | 21,442 | 293 | ||||||

Magnolia Oil & Gas Corp * | 3,984 | 28 | ||||||

Marathon Oil Corp | 5,472 | 37 | ||||||

Marathon Petroleum Corp | 7,000 | 289 | ||||||

Murphy Oil Corp | 449 | 5 | ||||||

Nabors Industries Ltd | 367 | 21 | ||||||

| Description | Shares | Market Value ($ Thousands) | ||||||

COMMON STOCK (continued) |

| |||||||

National Oilwell Varco Inc | 482 | $ | 7 | |||||

Occidental Petroleum Corp | 8,202 | 142 | ||||||

Oceaneering International Inc * | 3,376 | 27 | ||||||

ONEOK Inc | 3,505 | 134 | ||||||

Parsley Energy Inc, Cl A | 2,802 | 40 | ||||||

Patterson-UTI Energy Inc | 4,952 | 26 | ||||||

PBF Energy Inc, Cl A | 363 | 3 | ||||||

Phillips 66 | 5,367 | 375 | ||||||

Pioneer Natural Resources Co | 1,910 | 217 | ||||||

Range Resources Corp | 2,413 | 16 | ||||||

RPC Inc * | 10,482 | 33 | ||||||

Schlumberger NV Ltd | 41,175 | 899 | ||||||

Southwestern Energy Co * | 21,739 | 65 | ||||||

Targa Resources Corp | 11,252 | 297 | ||||||

Valero Energy Corp | 4,715 | 267 | ||||||

Williams Cos Inc/The | 11,002 | 221 | ||||||

WPX Energy Inc * | 3,940 | 32 | ||||||

|

10,302 |

| ||||||

Financials — 10.8% |

| |||||||

Aaron’s Holdings Inc * | 832 | 45 | ||||||

Affiliated Managers Group Inc | 910 | 93 | ||||||

Aflac Inc | 4,771 | 212 | ||||||

AGNC Investment Corp ‡ | 2,838 | 44 | ||||||

Alleghany Corp | 15 | 9 | ||||||

Allegiance Bancshares Inc | 1,318 | 45 | ||||||

Allstate Corp/The | 3,458 | 380 | ||||||

Ally Financial Inc | 1,575 | 56 | ||||||

American Express Co | 9,360 | 1,132 | ||||||

American Financial Group Inc/OH | 449 | 39 | ||||||

American Homes 4 Rent, Cl A ‡ | 1,974 | 59 | ||||||

American International Group Inc | 6,002 | 227 | ||||||

American National Group Inc | 421 | 40 | ||||||

Ameriprise Financial Inc | 1,250 | 243 | ||||||

Ameris Bancorp | 1,129 | 43 | ||||||

AMERISAFE Inc | 743 | 43 | ||||||

Annaly Capital Management Inc ‡ | 8,922 | 75 | ||||||

Apollo Commercial Real Estate Finance Inc ‡ | 2,686 | 30 | ||||||

Arch Capital Group Ltd * | 2,404 | 87 | ||||||

Argo Group International Holdings Ltd | 750 | 33 | ||||||

ARMOUR Residential REIT Inc ‡ | 2,854 | 31 | ||||||

Arthur J Gallagher & Co | 743 | 92 | ||||||

Artisan Partners Asset Management Inc, Cl A | 1,589 | 80 | ||||||

Assetmark Financial Holdings Inc * | 1,796 | 43 | ||||||

Associated Banc-Corp | 4,274 | 73 | ||||||

Assurant Inc | 87 | 12 | ||||||

Assured Guaranty Ltd | 994 | 31 | ||||||

Athene Holding Ltd, Cl A * | 1,071 | 46 | ||||||

Atlantic Union Bankshares Corp | 1,302 | 43 | ||||||

Axis Capital Holdings Ltd | 825 | 42 | ||||||

Axos Financial Inc * | 1,657 | 62 | ||||||

Banc of California Inc | 2,959 | 44 | ||||||

BancorpSouth Bank | 1,525 | 42 | ||||||

| 4 | New Covenant Funds / Semi-Annual Report / December 31, 2020 |

| Description | Shares | Market Value ($ Thousands) | ||||||

COMMON STOCK (continued) | ||||||||

Bank of America Corp | 97,734 | $ | 2,962 | |||||

Bank of Hawaii Corp | 1,051 | 81 | ||||||

Bank of Marin Bancorp | 1,079 | 37 | ||||||

Bank of New York Mellon Corp/The | 12,656 | 537 | ||||||

Bank of NT Butterfield & Son Ltd/The | 1,324 | 41 | ||||||

Bank OZK | 366 | 11 | ||||||

BankUnited Inc | 2,418 | 84 | ||||||

Banner Corp | 851 | 40 | ||||||

Berkshire Hathaway Inc, Cl B * | 25,070 | 5,813 | ||||||

Berkshire Hills Bancorp Inc | 1,501 | 26 | ||||||

BGC Partners Inc, Cl A | 8,389 | 34 | ||||||

BlackRock Inc, Cl A | 1,878 | 1,355 | ||||||

Blackstone Mortgage Trust Inc, Cl A ‡ | 1,347 | 37 | ||||||

BOK Financial Corp | 568 | 39 | ||||||

Boston Private Financial Holdings Inc | 4,112 | 35 | ||||||

Boston Properties Inc ‡ | 1,468 | 139 | ||||||

Bridge Bancorp Inc | 1,467 | 35 | ||||||

Brighthouse Financial Inc * | 268 | 10 | ||||||

Brown & Brown Inc | 290 | 14 | ||||||

Bryn Mawr Bank Corp | 1,221 | 37 | ||||||

Camden National Corp | 1,097 | 39 | ||||||

Capital One Financial Corp | 3,651 | 361 | ||||||

Capitol Federal Financial Inc | 3,529 | 44 | ||||||

Capstead Mortgage Corp ‡ | 6,235 | 36 | ||||||

Cathay General Bancorp | 1,291 | 42 | ||||||

Cboe Global Markets Inc | 99 | 9 | ||||||

Central Pacific Financial Corp | 1,651 | 31 | ||||||

Charles Schwab Corp/The | 14,498 | 769 | ||||||

Chimera Investment Corp ‡ | 2,402 | 25 | ||||||

Chubb Ltd | 6,169 | 950 | ||||||

Cincinnati Financial Corp | 891 | 78 | ||||||

CIT Group Inc | 1,060 | 38 | ||||||

Citigroup Inc | 25,211 | 1,555 | ||||||

Citizens Financial Group Inc | 2,381 | 85 | ||||||

City Holding Co | 607 | 42 | ||||||

CME Group Inc, Cl A | 4,726 | 860 | ||||||

CNA Financial Corp | 253 | 10 | ||||||

Cohen & Steers Inc | 764 | 57 | ||||||

Colony Credit Real Estate Inc ‡ | 3,608 | 27 | ||||||

Columbia Banking System Inc | 1,223 | 44 | ||||||

Comerica Inc | 1,232 | 69 | ||||||

Commerce Bancshares Inc/MO | 1,562 | 103 | ||||||

Community Bank System Inc | 710 | 44 | ||||||

ConnectOne Bancorp Inc | 1,891 | 37 | ||||||

Credit Acceptance Corp * | 177 | 61 | ||||||

Cullen/Frost Bankers Inc | 850 | 74 | ||||||

CVB Financial Corp | 2,268 | 44 | ||||||

Discover Financial Services | 19,417 | 1,758 | ||||||

Eagle Bancorp Inc | 1,035 | 43 | ||||||

East West Bancorp Inc | 1,710 | 87 | ||||||

eHealth Inc * | 512 | 36 | ||||||

Ellington Financial Inc ‡ | 2,748 | 41 | ||||||

| Description | Shares | Market Value ($ Thousands) | ||||||

COMMON STOCK (continued) | ||||||||

Enterprise Financial Services Corp | 1,063 | $ | 37 | |||||

Equitable Holdings Inc | 432 | 11 | ||||||

Erie Indemnity Co, Cl A | 433 | 106 | ||||||

Essent Group Ltd | 970 | 42 | ||||||

Evercore Inc, Cl A | 659 | 72 | ||||||

Everest Re Group Ltd | 179 | 42 | ||||||

FactSet Research Systems Inc | 306 | 102 | ||||||

FB Financial Corp | 1,250 | 43 | ||||||

Federal Agricultural Mortgage Corp, Cl C | 597 | 44 | ||||||

Federated Hermes Inc, Cl B | 1,492 | 43 | ||||||

Fidelity National Financial Inc | 1,063 | 42 | ||||||

Fifth Third Bancorp | 4,599 | 127 | ||||||

First American Financial Corp | 814 | 42 | ||||||

First BanCorp/Puerto Rico | 4,571 | 42 | ||||||

First Busey Corp | 1,790 | 39 | ||||||

First Citizens BancShares Inc/NC, Cl A | 94 | 54 | ||||||

First Commonwealth Financial Corp | 3,365 | 37 | ||||||

First Financial Bancorp | 1,921 | 34 | ||||||

First Financial Bankshares Inc | 1,378 | 50 | ||||||

First Hawaiian Inc | 3,126 | 74 | ||||||

First Horizon National Corp | 6,041 | 77 | ||||||

First Merchants Corp | 1,182 | 44 | ||||||

First Midwest Bancorp Inc/IL | 2,129 | 34 | ||||||

First Republic Bank/CA | 831 | 122 | ||||||

FirstCash Inc | 612 | 43 | ||||||

FNB Corp/PA | 3,907 | 37 | ||||||

Franklin Resources Inc | 6,856 | 171 | ||||||

Fulton Financial Corp | 2,789 | 35 | ||||||

Genworth Financial Inc, Cl A * | 10,439 | 39 | ||||||

German American Bancorp Inc | 1,414 | 47 | ||||||

Globe Life Inc | 108 | 10 | ||||||

Goldman Sachs Group Inc/The | 3,960 | 1,044 | ||||||

Goosehead Insurance Inc, Cl A | 215 | 27 | ||||||

Great Western Bancorp Inc | 1,390 | 29 | ||||||

Hancock Whitney Corp | 1,142 | 39 | ||||||

Hannon Armstrong Sustainable Infrastructure Capital Inc | 21,598 | 1,370 | ||||||

Hanover Insurance Group Inc/The | 124 | 15 | ||||||

HarborOne Bancorp Inc | 4,621 | 50 | ||||||

Hartford Financial Services Group Inc/The | 4,042 | 198 | ||||||

Heartland Financial USA Inc | 1,003 | 40 | ||||||

Heritage Financial Corp/WA | 1,744 | 41 | ||||||

Home BancShares Inc/AR | 2,523 | 49 | ||||||

HomeStreet Inc | 1,465 | 49 | ||||||

Hope Bancorp Inc | 3,233 | 35 | ||||||

Horace Mann Educators Corp | 1,125 | 47 | ||||||

Host Hotels & Resorts Inc ‡ | 17,568 | 257 | ||||||

Houlihan Lokey Inc, Cl A | 192 | 13 | ||||||

Huntington Bancshares Inc/OH | 6,282 | 79 | ||||||

Independent Bank Corp | 580 | 42 | ||||||

Independent Bank Group Inc | 846 | 53 | ||||||

Intercontinental Exchange Inc | 6,879 | 793 | ||||||

| New Covenant Funds / Semi-Annual Report / December 31, 2020 | 5 |

SCHEDULE OF INVESTMENTS (Unaudited)

December 31, 2020

New Covenant Growth Fund (Continued)

| Description | Shares | Market Value ($ Thousands) | ||||||

COMMON STOCK (continued) | ||||||||

International Bancshares Corp | 1,137 | $ | 43 | |||||

Invesco Ltd | 18,276 | 319 | ||||||

Invesco Mortgage Capital Inc ‡ | 3,234 | 11 | ||||||

Investors Bancorp Inc | 4,061 | 43 | ||||||

James River Group Holdings Ltd | 1,180 | 58 | ||||||

Jefferies Financial Group Inc | 2,313 | 57 | ||||||

JPMorgan Chase & Co | 43,320 | 5,505 | ||||||

KeyCorp | 12,904 | 212 | ||||||

Kinsale Capital Group Inc | 73 | 15 | ||||||

KKR & Co Inc | 1,439 | 58 | ||||||

KKR Real Estate Finance Trust Inc ‡ | 2,440 | 44 | ||||||

Lakeland Bancorp Inc | 2,890 | 37 | ||||||

Lazard Ltd, Cl A (A) | 2,316 | 98 | ||||||

LendingTree Inc * | 175 | 48 | ||||||

Lincoln National Corp | 3,621 | 182 | ||||||

Loews Corp | 222 | 10 | ||||||

LPL Financial Holdings Inc | 1,036 | 108 | ||||||

M&T Bank Corp | 929 | 118 | ||||||

Markel Corp * | 48 | 50 | ||||||

MarketAxess Holdings Inc | 144 | 82 | ||||||

Marsh & McLennan Cos Inc | 16,703 | 1,954 | ||||||

Mercury General Corp | 233 | 12 | ||||||

Meta Financial Group Inc | 1,407 | 51 | ||||||

MetLife Inc | 5,812 | 273 | ||||||

MFA Financial Inc ‡ | 6,337 | 25 | ||||||

MGIC Investment Corp | 3,455 | 43 | ||||||

Moelis & Co, Cl A | 1,564 | 73 | ||||||

Moody’s Corp | 1,782 | 517 | ||||||

Morgan Stanley | 37,558 | 2,574 | ||||||

Morningstar Inc | 67 | 16 | ||||||

Mr Cooper Group Inc * | 3,903 | 121 | ||||||

MSCI Inc, Cl A | 559 | 250 | ||||||

Nasdaq Inc | 2,378 | 316 | ||||||

Navient Corp | 3,513 | 34 | ||||||

NBT Bancorp Inc | 1,213 | 39 | ||||||

Nelnet Inc, Cl A | 793 | 56 | ||||||

New Residential Investment Corp ‡ | 14,139 | 141 | ||||||

New York Community Bancorp Inc | 951 | 10 | ||||||

New York Mortgage Trust Inc ‡ | 7,776 | 29 | ||||||

NMI Holdings Inc, Cl A * | 1,470 | 33 | ||||||

Northern Trust Corp | 7,549 | 703 | ||||||

Northfield Bancorp Inc | 2,868 | 35 | ||||||

OFG Bancorp | 2,119 | 39 | ||||||

Old National Bancorp/IN | 2,680 | 44 | ||||||

Old Republic International Corp | 2,203 | 43 | ||||||

OneMain Holdings Inc, Cl A | 258 | 12 | ||||||

Pacific Premier Bancorp Inc | 3,188 | 100 | ||||||

PacWest Bancorp | 1,283 | 33 | ||||||

Palomar Holdings Inc, Cl A * | 145 | 13 | ||||||

PennyMac Mortgage Investment Trust ‡ | 2,215 | 39 | ||||||

People’s United Financial Inc | 5,001 | 65 | ||||||

Pinnacle Financial Partners Inc | 1,489 | 96 | ||||||

| Description | Shares | Market Value ($ Thousands) | ||||||

COMMON STOCK (continued) | ||||||||

PNC Financial Services Group Inc/The | 5,690 | $ | 848 | |||||

PRA Group Inc * | 1,320 | 52 | ||||||

Preferred Bank/Los Angeles CA | 845 | 43 | ||||||

Principal Financial Group Inc | 662 | 33 | ||||||

ProAssurance Corp | 1,351 | 24 | ||||||

Progressive Corp/The | 6,981 | 690 | ||||||

ProSight Global Inc * | 2,999 | 38 | ||||||

Prosperity Bancshares Inc | 1,192 | 83 | ||||||

Provident Financial Services Inc | 1,988 | 36 | ||||||

Prudential Financial Inc | 16,015 | 1,250 | ||||||

Radian Group Inc | 1,924 | 39 | ||||||

Raymond James Financial Inc | 980 | 94 | ||||||

Redwood Trust Inc ‡ | 2,992 | 26 | ||||||

Regions Financial Corp | 72,286 | 1,165 | ||||||

Reinsurance Group of America Inc, Cl A | 578 | 67 | ||||||

Renasant Corp | 1,366 | 46 | ||||||

RLI Corp | 545 | 57 | ||||||

S&P Global Inc | 7,167 | 2,356 | ||||||

S&T Bancorp Inc | 1,247 | 31 | ||||||

Sandy Spring Bancorp Inc | 1,350 | 43 | ||||||

Santander Consumer USA Holdings Inc | 476 | 10 | ||||||

Seacoast Banking Corp of Florida * | 1,616 | 48 | ||||||

Selective Insurance Group Inc | 739 | 50 | ||||||

ServisFirst Bancshares Inc | 1,306 | 53 | ||||||

Signature Bank/New York NY | 676 | 91 | ||||||

Simmons First National Corp, Cl A | 1,836 | 40 | ||||||

SLM Corp | 8,316 | 103 | ||||||

South State Corp | 216 | 16 | ||||||

Starwood Property Trust Inc ‡ | 2,000 | 39 | ||||||

State Street Corp | 9,970 | 726 | ||||||

Sterling Bancorp/DE | 2,321 | 42 | ||||||

Stifel Financial Corp | 1,210 | 61 | ||||||

SVB Financial Group * | 346 | 134 | ||||||

Synchrony Financial | 4,720 | 164 | ||||||

Synovus Financial Corp | 1,267 | 41 | ||||||

T Rowe Price Group Inc | 2,711 | 410 | ||||||

TCF Financial Corp | 1,085 | 40 | ||||||

Texas Capital Bancshares Inc * | 822 | 49 | ||||||

TFS Financial Corp | 573 | 10 | ||||||

TPG RE Finance Trust Inc ‡ | 2,439 | 26 | ||||||

Travelers Cos Inc/The | 2,743 | 385 | ||||||

TriCo Bancshares | 1,219 | 43 | ||||||

TriState Capital Holdings Inc * | 1,917 | 33 | ||||||

Triumph Bancorp Inc * | 1,296 | 63 | ||||||

Truist Financial Corp | 13,273 | 636 | ||||||

Trustmark Corp | 1,410 | 39 | ||||||

Two Harbors Investment Corp ‡ | 6,390 | 41 | ||||||

UMB Financial Corp | 715 | 49 | ||||||

Umpqua Holdings Corp | 2,753 | 42 | ||||||

Univest Financial Corp | 1,820 | 37 | ||||||

Unum Group | 1,638 | 38 | ||||||

US Bancorp | 13,598 | 634 | ||||||

| 6 | New Covenant Funds / Semi-Annual Report / December 31, 2020 |

| Description | Shares | Market Value ($ Thousands) | ||||||

COMMON STOCK (continued) | ||||||||

Valley National Bancorp | 4,269 | $ | 42 | |||||

Veritex Holdings Inc | 1,729 | 44 | ||||||

Virtu Financial Inc, Cl A | 3,026 | 76 | ||||||

Voya Financial Inc | 4,001 | 235 | ||||||

W R Berkley Corp | 165 | 11 | ||||||

Waddell & Reed Financial Inc, Cl A | 2,974 | 76 | ||||||

Walker & Dunlop Inc | 749 | 69 | ||||||

Washington Trust Bancorp Inc | 924 | 41 | ||||||

Webster Financial Corp | 934 | 39 | ||||||

Wells Fargo & Co | 42,500 | 1,283 | ||||||

Westamerica BanCorp | 731 | 40 | ||||||

Western Alliance Bancorp | 1,801 | 108 | ||||||

Wintrust Financial Corp | 708 | 43 | ||||||

Zions Bancorp NA | 1,771 | 77 | ||||||

| 56,739 | ||||||||

Health Care — 13.5% | ||||||||

Abbott Laboratories | 33,726 | 3,693 | ||||||

AbbVie Inc | 25,124 | 2,692 | ||||||

ABIOMED Inc * | 332 | 108 | ||||||

Acadia Healthcare Co Inc * | 1,517 | 76 | ||||||

Acceleron Pharma Inc * | 123 | 16 | ||||||

Adaptive Biotechnologies Corp * | 1,704 | 101 | ||||||

Adverum Biotechnologies Inc * | 4,537 | 49 | ||||||

Aerie Pharmaceuticals Inc * | 2,282 | 31 | ||||||

Agilent Technologies Inc | 7,874 | 933 | ||||||

Agios Pharmaceuticals Inc * | 1,062 | 46 | ||||||

Akebia Therapeutics Inc * | 1,063 | 3 | ||||||

Alector Inc * | 2,628 | 40 | ||||||

Alexion Pharmaceuticals Inc * | 1,593 | 249 | ||||||

Align Technology Inc * | 602 | 322 | ||||||

Allakos Inc * | 378 | 53 | ||||||

Allogene Therapeutics Inc * | 1,838 | 46 | ||||||

Alnylam Pharmaceuticals Inc * | 1,202 | 156 | ||||||

Amedisys Inc * | 56 | 16 | ||||||

AmerisourceBergen Corp, Cl A | 266 | 26 | ||||||

Amgen Inc | 11,116 | 2,556 | ||||||

Amicus Therapeutics Inc * | 5,193 | 120 | ||||||

AMN Healthcare Services Inc * | 832 | 57 | ||||||

Anika Therapeutics Inc * | 920 | 42 | ||||||

Anthem Inc | 2,728 | 876 | ||||||

Apellis Pharmaceuticals Inc * | 1,618 | 93 | ||||||

Apollo Medical Holdings Inc * | 2,730 | 50 | ||||||

Arcturus Therapeutics Holdings * | 483 | 21 | ||||||

Arcus Biosciences Inc * | 2,371 | 62 | ||||||

Arena Pharmaceuticals Inc * | 1,077 | 83 | ||||||

Arrowhead Pharmaceuticals Inc * | 251 | 19 | ||||||

Assembly Biosciences Inc * | 2,159 | 13 | ||||||

Atara Biotherapeutics Inc * | 3,254 | 64 | ||||||

Atrion Corp | 71 | 46 | ||||||

Avanos Medical Inc * | 301 | 14 | ||||||

Avantor Inc * | 494 | 14 | ||||||

Axonics Modulation Technologies Inc * | 351 | 17 | ||||||

| Description | Shares | Market Value ($ Thousands) | ||||||

COMMON STOCK (continued) | ||||||||

Axsome Therapeutics Inc * | 618 | $ | 50 | |||||

Baxter International Inc | 12,373 | 993 | ||||||

Becton Dickinson and Co | 4,437 | 1,110 | ||||||

BioCryst Pharmaceuticals Inc * | 14,016 | 104 | ||||||

BioDelivery Sciences International Inc * | 7,746 | 32 | ||||||

Biogen Inc * | 3,113 | 762 | ||||||

Biohaven Pharmaceutical Holding Co Ltd * | 941 | 81 | ||||||

BioMarin Pharmaceutical Inc * | 1,042 | 91 | ||||||

Bio-Rad Laboratories Inc, Cl A * | 32 | 19 | ||||||

Bio-Techne Corp | 53 | 17 | ||||||

BioTelemetry Inc * | 1,100 | 79 | ||||||

Bluebird Bio Inc * | 645 | 28 | ||||||

Boston Scientific Corp * | 16,399 | 589 | ||||||

Bridgebio Pharma Inc * | 1,432 | 102 | ||||||

Bristol-Myers Squibb Co | 38,732 | 2,403 | ||||||

Brookdale Senior Living Inc * | 7,397 | 33 | ||||||

Bruker Corp | 233 | 13 | ||||||

Cantel Medical Corp | 163 | 13 | ||||||

Cara Therapeutics Inc * | 2,942 | 44 | ||||||

Cardinal Health Inc | 2,213 | 118 | ||||||

Catalent Inc * | 949 | 99 | ||||||

Catalyst Pharmaceuticals Inc * | 11,416 | 38 | ||||||

Centene Corp * | 4,805 | 288 | ||||||

Cerner Corp | 16,243 | 1,275 | ||||||

Change Healthcare Inc * | 3,522 | 66 | ||||||

Charles River Laboratories International Inc * | 77 | 19 | ||||||

Chemed Corp | 114 | 61 | ||||||

ChemoCentryx Inc * | 2,278 | 141 | ||||||

Cigna Corp | 4,819 | 1,003 | ||||||

Constellation Pharmaceuticals Inc * | 1,060 | 30 | ||||||

Cooper Cos Inc/The | 236 | 86 | ||||||

Corcept Therapeutics Inc * | 3,878 | 101 | ||||||

CorVel Corp * | 606 | 64 | ||||||

Covetrus Inc * | 1,045 | 30 | ||||||

Crinetics Pharmaceuticals Inc * | 2,310 | 33 | ||||||

Cue Biopharma Inc * | 2,087 | 26 | ||||||

CVS Health Corp | 28,143 | 1,922 | ||||||

Cytokinetics Inc * | 7,134 | 148 | ||||||

Danaher Corp | 7,616 | 1,692 | ||||||

DaVita Inc * | 160 | 19 | ||||||

Deciphera Pharmaceuticals Inc * | 716 | 41 | ||||||

Denali Therapeutics Inc * | 2,631 | 220 | ||||||

DENTSPLY SIRONA Inc | 3,113 | 163 | ||||||

DexCom Inc * | 847 | 313 | ||||||

Dicerna Pharmaceuticals Inc * | 1,898 | 42 | ||||||

Dynavax Technologies Corp * | 8,733 | 39 | ||||||

Eagle Pharmaceuticals Inc/DE * | 828 | 39 | ||||||

Editas Medicine Inc * | 1,596 | 112 | ||||||

Edwards Lifesciences Corp * | 8,484 | 774 | ||||||

Eidos Therapeutics Inc * | 786 | 103 | ||||||

Elanco Animal Health Inc * | 398 | 12 | ||||||

Eli Lilly and Co | 11,942 | 2,016 | ||||||

| New Covenant Funds / Semi-Annual Report / December 31, 2020 | 7 |

SCHEDULE OF INVESTMENTS (Unaudited)

December 31, 2020

New Covenant Growth Fund (Continued)

| Description | Shares | Market Value ($ Thousands) | ||||||

COMMON STOCK (continued) | ||||||||

Emergent BioSolutions Inc * | 950 | $ | 85 | |||||

Enanta Pharmaceuticals Inc * | 785 | 33 | ||||||

Encompass Health Corp | 164 | 14 | ||||||

Envista Holdings Corp * | 1,731 | 58 | ||||||

Epizyme Inc * | 2,749 | 30 | ||||||

Esperion Therapeutics Inc * | 962 | 25 | ||||||

Evofem Biosciences Inc * | 1,811 | 4 | ||||||

Exact Sciences Corp * | 930 | 123 | ||||||

Exelixis Inc * | 4,344 | 87 | ||||||

Fate Therapeutics Inc * | 3,277 | 298 | ||||||

FibroGen Inc * | 1,053 | 39 | ||||||

Flexion Therapeutics Inc * | 2,711 | 31 | ||||||

G1 Therapeutics Inc * | 1,715 | 31 | ||||||

Gilead Sciences Inc | 18,126 | 1,056 | ||||||

Glaukos Corp * | 167 | 13 | ||||||

Global Blood Therapeutics Inc * | 643 | 28 | ||||||

Globus Medical Inc, Cl A * | 851 | 55 | ||||||

Gossamer Bio Inc * | 3,279 | 32 | ||||||

Halozyme Therapeutics Inc * | 2,641 | 113 | ||||||

Hanger Inc * | 1,891 | 42 | ||||||

Harpoon Therapeutics Inc * | 2,825 | 47 | ||||||

HCA Healthcare Inc | 2,314 | 381 | ||||||

Health Catalyst Inc * | 1,594 | 69 | ||||||

HealthEquity Inc * | 673 | 47 | ||||||

Henry Schein Inc * | 2,612 | 175 | ||||||

Heron Therapeutics Inc * | 1,977 | 42 | ||||||

Heska Corp * | 532 | 77 | ||||||

Hill-Rom Holdings Inc | 825 | 81 | ||||||

HMS Holdings Corp * | 1,707 | 63 | ||||||

Hologic Inc * | 927 | 67 | ||||||

Humana Inc | 1,256 | 515 | ||||||

ICU Medical Inc * | 62 | 13 | ||||||

IDEXX Laboratories Inc * | 707 | 353 | ||||||

Illumina Inc * | 3,200 | 1,184 | ||||||

Incyte Corp * | 1,063 | 92 | ||||||

Innoviva Inc * | 3,557 | 44 | ||||||

Inogen Inc * | 706 | 31 | ||||||

Inovalon Holdings Inc, Cl A * | 464 | 8 | ||||||

Inovio Pharmaceuticals Inc * | 2,095 | 18 | ||||||

Insmed Inc * | 2,129 | 71 | ||||||

Inspire Medical Systems Inc * | 110 | 21 | ||||||

Insulet Corp * | 65 | 17 | ||||||

Integer Holdings Corp * | 625 | 51 | ||||||

Integra LifeSciences Holdings Corp * | 188 | 12 | ||||||

Intercept Pharmaceuticals Inc * | 417 | 10 | ||||||

Intra-Cellular Therapies Inc * | 3,894 | 124 | ||||||

Intuitive Surgical Inc * | 1,403 | 1,148 | ||||||

Invitae Corp * | 330 | 14 | ||||||

Ionis Pharmaceuticals Inc * | 782 | 44 | ||||||

Iovance Biotherapeutics Inc * | 1,782 | 83 | ||||||

IQVIA Holdings Inc * | 1,378 | 247 | ||||||

iRhythm Technologies * | 210 | 50 | ||||||

| Description | Shares | Market Value ($ Thousands) | ||||||

COMMON STOCK (continued) | ||||||||

Ironwood Pharmaceuticals Inc, Cl A * | 3,844 | $ | 44 | |||||

Johnson & Johnson | 34,658 | 5,454 | ||||||

Kadmon Holdings * | 12,254 | 51 | ||||||

Kala Pharmaceuticals Inc * | 7,142 | 48 | ||||||

Karuna Therapeutics Inc * | 717 | 73 | ||||||

Karyopharm Therapeutics Inc * | 2,929 | 45 | ||||||

Kiniksa Pharmaceuticals Ltd, Cl A * | 4,016 | 71 | ||||||

Kodiak Sciences Inc * | 702 | 103 | ||||||

Krystal Biotech Inc * | 823 | 49 | ||||||

Kura Oncology Inc * | 3,438 | 112 | ||||||

Laboratory Corp of America Holdings * | 515 | 105 | ||||||

Lantheus Holdings Inc * | 2,408 | 32 | ||||||

LHC Group Inc * | 57 | 12 | ||||||

Ligand Pharmaceuticals Inc * | 462 | 46 | ||||||

Luminex Corp | 2,284 | 53 | ||||||

MacroGenics Inc * | 1,782 | 41 | ||||||

Madrigal Pharmaceuticals Inc * | 531 | 59 | ||||||

McKesson Corp | 992 | 173 | ||||||

MEDNAX Inc * | 417 | 10 | ||||||

Merck & Co Inc | 39,446 | 3,227 | ||||||

Meridian Bioscience Inc * | 5,130 | 96 | ||||||

Mettler-Toledo International Inc * | 1,494 | 1,703 | ||||||

Mirati Therapeutics Inc * | 429 | 94 | ||||||

Moderna Inc * | 4,368 | 456 | ||||||

Myriad Genetics Inc * | 1,860 | 37 | ||||||

Natera Inc * | 229 | 23 | ||||||

National Research Corp | 779 | 33 | ||||||

Natus Medical Inc * | 1,614 | 32 | ||||||

Nektar Therapeutics, Cl A * | 2,328 | 40 | ||||||

Neogen Corp * | 721 | 57 | ||||||

Neurocrine Biosciences Inc * | 1,089 | 104 | ||||||

Nevro Corp * | 83 | 14 | ||||||

NextCure Inc * | 952 | 10 | ||||||

NextGen Healthcare Inc * | 3,392 | 62 | ||||||

Novavax Inc * | 570 | 64 | ||||||

Ontrak * | 751 | 46 | ||||||

Option Care Health Inc * | 648 | 10 | ||||||

OraSure Technologies Inc * | 6,042 | 64 | ||||||

Pennant Group Inc/The * | 1,609 | 93 | ||||||

Penumbra Inc * | 72 | 13 | ||||||

PerkinElmer Inc | 120 | 17 | ||||||

Pfizer Inc | 86,529 | 3,185 | ||||||

Phreesia Inc * | 361 | 20 | ||||||

PRA Health Sciences Inc * | 108 | 14 | ||||||

Premier Inc, Cl A | 2,266 | 79 | ||||||

PTC Therapeutics Inc * | 1,021 | 62 | ||||||

Puma Biotechnology Inc * | 5,574 | 57 | ||||||

QIAGEN NV * | 2,338 | 124 | ||||||

Quest Diagnostics Inc | 865 | 103 | ||||||

Radius Health Inc * | 2,352 | 42 | ||||||

Regeneron Pharmaceuticals Inc * | 1,105 | 534 | ||||||

Repligen Corp * | 553 | 106 | ||||||

| 8 | New Covenant Funds / Semi-Annual Report / December 31, 2020 |

| Description | Shares | Market Value ($ Thousands) | ||||||

COMMON STOCK (continued) | ||||||||

ResMed Inc | 2,930 | $ | 623 | |||||

Revance Therapeutics Inc * | 3,056 | 87 | ||||||

Rhythm Pharmaceuticals Inc * | 2,112 | 63 | ||||||

Rubius Therapeutics Inc * | 3,679 | 28 | ||||||

Sage Therapeutics Inc * | 516 | 45 | ||||||

Sangamo Therapeutics Inc * | 1,002 | 16 | ||||||

Sarepta Therapeutics Inc * | 87 | 15 | ||||||

Scholar Rock Holding Corp * | 2,520 | 122 | ||||||

Seagen Inc * | 750 | 131 | ||||||

Shockwave Medical Inc * | 1,114 | 116 | ||||||

Simulations Plus Inc | 1,477 | 106 | ||||||

Sorrento Therapeutics Inc * | 12,406 | 85 | ||||||

STAAR Surgical Co * | 193 | 15 | ||||||

Stryker Corp | 3,828 | 938 | ||||||

Supernus Pharmaceuticals Inc * | 2,174 | 55 | ||||||

Surmodics Inc * | 1,169 | 51 | ||||||

Syros Pharmaceuticals Inc * | 1,610 | 17 | ||||||

Tactile Systems Technology Inc * | 728 | 33 | ||||||

Tandem Diabetes Care Inc * | 144 | 14 | ||||||

Teladoc Health Inc * | 1,178 | 236 | ||||||

Teleflex Inc | 742 | 305 | ||||||

TG Therapeutics Inc * | 4,916 | 256 | ||||||

Theravance Biopharma Inc * | 2,200 | 39 | ||||||

Thermo Fisher Scientific Inc | 5,343 | 2,489 | ||||||

Translate Bio Inc * | 2,224 | 41 | ||||||

Travere Therapeutics * | 3,434 | 94 | ||||||

Turning Point Therapeutics Inc * | 828 | 101 | ||||||

Twist Bioscience Corp * | 153 | 22 | ||||||

Ultragenyx Pharmaceutical Inc * | 1,143 | 158 | ||||||

United Therapeutics Corp * | 559 | 85 | ||||||

UnitedHealth Group Inc | 14,586 | 5,115 | ||||||

Universal Health Services Inc, Cl B | 80 | 11 | ||||||

UroGen Pharma Ltd * | 1,543 | 28 | ||||||

US Physical Therapy Inc | 428 | 51 | ||||||

Varex Imaging Corp * | 1,631 | 27 | ||||||

Varian Medical Systems Inc * | 1,773 | 310 | ||||||

VBI Vaccines Inc * | 14,663 | 40 | ||||||

Veeva Systems Inc, Cl A * | 1,157 | 315 | ||||||

Vertex Pharmaceuticals Inc * | 3,305 | 781 | ||||||

Viatris Inc, Cl W * | 11,343 | 213 | ||||||

Viking Therapeutics Inc * | 6,150 | 35 | ||||||

Waters Corp * | 395 | 98 | ||||||

West Pharmaceutical Services Inc | 1,875 | 531 | ||||||

Zimmer Biomet Holdings Inc | 3,501 | 539 | ||||||

Zoetis Inc, Cl A | 6,022 | 997 | ||||||

Zogenix Inc * | 947 | 19 | ||||||

| 70,593 | ||||||||

Industrials — 8.1% | ||||||||

3M Co | 10,841 | 1,895 | ||||||

A O Smith Corp | 1,708 | 94 | ||||||

AAON Inc | 192 | 13 | ||||||

AAR Corp | 1,101 | 40 | ||||||

| Description | Shares | Market Value ($ Thousands) | ||||||

COMMON STOCK (continued) | ||||||||

ABM Industries Inc | 1,349 | $ | 51 | |||||

ACCO Brands Corp | 5,214 | 44 | ||||||

Acuity Brands Inc | 84 | 10 | ||||||

ADT Inc | 6,039 | 47 | ||||||

AECOM * | 6,633 | 330 | ||||||

AGCO Corp | 149 | 15 | ||||||

Air Lease Corp, Cl A | 1,053 | 47 | ||||||

Alamo Group Inc | 424 | 59 | ||||||

Alaska Air Group Inc | 10,133 | 527 | ||||||

Allison Transmission Holdings Inc | 1,870 | 81 | ||||||

Altra Industrial Motion Corp | 260 | 14 | ||||||

AMERCO | 136 | 62 | ||||||

American Airlines Group Inc | 405 | 6 | ||||||

American Woodmark Corp * | 461 | 43 | ||||||

AMETEK Inc | 1,369 | 166 | ||||||

Apogee Enterprises Inc | 1,229 | 39 | ||||||

Applied Industrial Technologies Inc | 745 | 58 | ||||||

ArcBest Corp | 336 | 14 | ||||||

Arcosa Inc | 1,128 | 62 | ||||||

Argan Inc | 1,315 | 58 | ||||||

Armstrong World Industries Inc | 979 | 73 | ||||||

ASGN Inc * | 723 | 60 | ||||||

Astec Industries Inc | 204 | 12 | ||||||

Avis Budget Group Inc * | 2,276 | 85 | ||||||

Axon Enterprise Inc * | 1,934 | 237 | ||||||

AZZ Inc | 1,071 | 51 | ||||||

Barnes Group Inc | 807 | 41 | ||||||

Bloom Energy Corp, Cl A * | 2,773 | 79 | ||||||

Brady Corp, Cl A | 873 | 46 | ||||||

Brink’s Co/The | 540 | 39 | ||||||

Carlisle Cos Inc | 311 | 49 | ||||||

Carrier Global Corp | 6,184 | 233 | ||||||

CBIZ Inc * | 1,805 | 48 | ||||||

CH Robinson Worldwide Inc | 148 | 14 | ||||||

Chart Industries Inc * | 142 | 17 | ||||||

Cintas Corp | 1,907 | 674 | ||||||

CIRCOR International Inc * | 1,110 | 43 | ||||||

Clean Harbors Inc * | 137 | 10 | ||||||

Colfax Corp * | 1,455 | 56 | ||||||

Comfort Systems USA Inc | 988 | 52 | ||||||

Construction Partners Inc, Cl A * | 2,838 | 83 | ||||||

Copa Holdings SA, Cl A | 469 | 36 | ||||||

Copart Inc * | 1,284 | 163 | ||||||

CoStar Group Inc * | 326 | 301 | ||||||

Covanta Holding Corp | 3,388 | 44 | ||||||

Crane Co | 135 | 10 | ||||||

CSW Industrials Inc | 116 | 13 | ||||||

CSX Corp | 9,694 | 880 | ||||||

Cummins Inc | 3,179 | 722 | ||||||

Curtiss-Wright Corp | 1,789 | 208 | ||||||

Deere & Co | 4,735 | 1,274 | ||||||

Delta Air Lines Inc | 38,313 | 1,541 | ||||||

| New Covenant Funds / Semi-Annual Report / December 31, 2020 | 9 |

SCHEDULE OF INVESTMENTS (Unaudited)

December 31, 2020

New Covenant Growth Fund (Continued)

| Description | Shares | Market Value ($ Thousands) | ||||||

COMMON STOCK (continued) | ||||||||

Deluxe Corp | 981 | $ | 29 | |||||

Donaldson Co Inc | 202 | 11 | ||||||

Dover Corp | 103 | 13 | ||||||

Dycom Industries Inc * | 1,064 | 80 | ||||||

EMCOR Group Inc | 565 | 52 | ||||||

Emerson Electric Co | 6,592 | 530 | ||||||

EnerSys | 664 | 55 | ||||||

EnPro Industries Inc | 738 | 56 | ||||||

Equifax Inc | 535 | 103 | ||||||

ESCO Technologies Inc | 568 | 59 | ||||||

Expeditors International of Washington Inc | 1,163 | 111 | ||||||

Exponent Inc | 727 | 65 | ||||||

Fastenal Co | 5,056 | 247 | ||||||

Federal Signal Corp | 1,560 | 52 | ||||||

FedEx Corp | 3,239 | 841 | ||||||

Flowserve Corp | 239 | 9 | ||||||

Fluor Corp | 4,373 | 70 | ||||||

Forrester Research Inc * | 1,169 | 49 | ||||||

Fortune Brands Home & Security Inc | 174 | 15 | ||||||

Forward Air Corp | 727 | 56 | ||||||

Franklin Electric Co Inc | 897 | 62 | ||||||

FTI Consulting Inc * | 443 | 50 | ||||||

Generac Holdings Inc * | 89 | 20 | ||||||

General Electric Co | 96,317 | 1,040 | ||||||

Gibraltar Industries Inc * | 164 | 12 | ||||||

Graco Inc | 223 | 16 | ||||||

GrafTech International Ltd | 954 | 10 | ||||||

Granite Construction Inc | 1,780 | 48 | ||||||

Great Lakes Dredge & Dock Corp * | 4,289 | 56 | ||||||

Greenbrier Cos Inc/The | 1,583 | 58 | ||||||

Hawaiian Holdings Inc | 1,619 | 29 | ||||||

Healthcare Services Group Inc | 2,050 | 58 | ||||||

HEICO Corp | 4,884 | 647 | ||||||

HEICO Corp, Cl A | 4,700 | 550 | ||||||

Helios Technologies Inc | 1,091 | 58 | ||||||

Herc Holdings Inc * | 1,012 | 67 | ||||||

Herman Miller Inc | 1,053 | 36 | ||||||

Hexcel Corp | 4,105 | 199 | ||||||

Hillenbrand Inc | 1,501 | 60 | ||||||

HNI Corp | 1,268 | 44 | ||||||

Honeywell International Inc | 10,659 | 2,267 | ||||||

Howmet Aerospace Inc | 7,379 | 211 | ||||||

Hubbell Inc, Cl B | 78 | 12 | ||||||

IAA Inc * | 253 | 16 | ||||||

ICF International Inc | 545 | 41 | ||||||

IDEX Corp | 68 | 14 | ||||||

IHS Markit Ltd | 3,273 | 294 | ||||||

Illinois Tool Works Inc | 10,512 | 2,143 | ||||||

Ingersoll Rand Inc * | 355 | 16 | ||||||

Insperity Inc | 592 | 48 | ||||||

Interface Inc, Cl A | 2,949 | 31 | ||||||

ITT Inc | 1,404 | 108 | ||||||

| Description | Shares | Market Value ($ Thousands) | ||||||

COMMON STOCK (continued) | ||||||||

Jacobs Engineering Group Inc | 1,091 | $ | 119 | |||||

JB Hunt Transport Services Inc | 437 | 60 | ||||||

JetBlue Airways Corp * | 4,688 | 68 | ||||||

John Bean Technologies Corp | 439 | 50 | ||||||

Kadant Inc | 475 | 67 | ||||||

Kaman Corp | 743 | 42 | ||||||

Kansas City Southern | 1,741 | 355 | ||||||

KAR Auction Services Inc | 2,303 | 43 | ||||||

Kelly Services Inc, Cl A | 2,214 | 46 | ||||||

Kennametal Inc | 1,343 | 49 | ||||||

Kforce Inc | 1,239 | 52 | ||||||

Kirby Corp * | 1,032 | 53 | ||||||

Knight-Swift Transportation Holdings Inc, Cl A | 1,357 | 57 | ||||||

Knoll Inc | 1,853 | 27 | ||||||

Korn Ferry | 1,193 | 52 | ||||||

Landstar System Inc | 432 | 58 | ||||||

Lennox International Inc | 44 | 12 | ||||||

Lincoln Electric Holdings Inc | 1,027 | 119 | ||||||

Lindsay Corp | 523 | 67 | ||||||

Lyft Inc, Cl A * | 240 | 12 | ||||||

Macquarie Infrastructure Corp | 266 | 10 | ||||||

ManpowerGroup Inc | 3,586 | 323 | ||||||

Marten Transport Ltd | 3,469 | 60 | ||||||

Masco Corp | 6,315 | 347 | ||||||

Matson Inc | 1,273 | 73 | ||||||

Maxar Technologies Inc | 6,794 | 262 | ||||||

McGrath RentCorp | 666 | 45 | ||||||

Mercury Systems Inc * | 2,386 | 210 | ||||||

Meritor Inc * | 2,088 | 58 | ||||||

Middleby Corp/The * | 103 | 13 | ||||||

MRC Global Inc * | 3,597 | 24 | ||||||

MSA Safety Inc | 392 | 59 | ||||||

MSC Industrial Direct Co Inc, Cl A | 1,115 | 94 | ||||||

Nordson Corp | 600 | 121 | ||||||

Norfolk Southern Corp | 2,430 | 577 | ||||||

NOW Inc * | 4,359 | 31 | ||||||

NV5 Global Inc * | 202 | 16 | ||||||

Old Dominion Freight Line Inc | 400 | 78 | ||||||

Omega Flex Inc | 70 | 10 | ||||||

Oshkosh Corp | 2,762 | 238 | ||||||

Otis Worldwide Corp | 1,821 | 123 | ||||||

Owens Corning | 4,958 | 376 | ||||||

PACCAR Inc | 2,133 | 184 | ||||||

PAE * | 5,932 | 54 | ||||||

Parker-Hannifin Corp | 1,231 | 335 | ||||||

Parsons Corp * | 1,198 | 44 | ||||||

Pitney Bowes Inc | 11,792 | 73 | ||||||

Plug Power Inc * | 1,263 | 43 | ||||||

Proto Labs Inc * | 91 | 14 | ||||||

Quanta Services Inc | 2,291 | 165 | ||||||

Raven Industries Inc | 1,437 | 48 | ||||||

| 10 | New Covenant Funds / Semi-Annual Report / December 31, 2020 |

| Description | Shares | Market Value ($ Thousands) | ||||||

COMMON STOCK (continued) | ||||||||

RBC Bearings Inc * | 320 | $ | 57 | |||||

Regal Beloit Corp | 1,068 | 131 | ||||||

Republic Services Inc, Cl A | 842 | 81 | ||||||

Resideo Technologies Inc * | 448 | 10 | ||||||

Robert Half International Inc | 806 | 50 | ||||||

Rockwell Automation Inc | 1,620 | 406 | ||||||

Rollins Inc | 3,532 | 138 | ||||||

Roper Technologies Inc | 861 | 371 | ||||||

Ryder System Inc | 1,425 | 88 | ||||||

Saia Inc * | 96 | 17 | ||||||

Schneider National Inc, Cl B | 521 | 11 | ||||||

Shyft Group Inc/The | 2,836 | 80 | ||||||

Simpson Manufacturing Co Inc | 643 | 60 | ||||||

Snap-on Inc | 318 | 54 | ||||||

Southwest Airlines Co | 3,131 | 146 | ||||||

SP Plus Corp * | 1,169 | 34 | ||||||

Spirit AeroSystems Holdings Inc, Cl A | 9,098 | 356 | ||||||

Spirit Airlines Inc * | 1,221 | 30 | ||||||

SPX Corp * | 999 | 54 | ||||||

SPX FLOW Inc * | 1,044 | 61 | ||||||

Stanley Black & Decker Inc | 1,349 | 241 | ||||||

Steelcase Inc, Cl A | 2,620 | 36 | ||||||

Stericycle Inc * | 179 | 12 | ||||||

Sunrun Inc * | 405 | 28 | ||||||

Teledyne Technologies Inc * | 878 | 344 | ||||||

Tennant Co | 639 | 45 | ||||||

Terex Corp | 1,651 | 58 | ||||||

Tetra Tech Inc | 564 | 65 | ||||||

Timken Co/The | 204 | 16 | ||||||

Toro Co/The | 1,175 | 111 | ||||||

TPI Composites Inc * | 472 | 25 | ||||||

TransDigm Group Inc * | 1,732 | 1,072 | ||||||

TransUnion | 135 | 13 | ||||||

Trex Co Inc * | 1,134 | 95 | ||||||

TriMas Corp * | 1,583 | 50 | ||||||

Trinity Industries Inc | 511 | 13 | ||||||

Triumph Group Inc | 1,853 | 23 | ||||||

TrueBlue Inc * | 2,106 | 39 | ||||||

Uber Technologies Inc * | 14,661 | 748 | ||||||

UFP Industries Inc | 196 | 11 | ||||||

UniFirst Corp/MA | 235 | 50 | ||||||

Union Pacific Corp | 12,488 | 2,600 | ||||||

United Airlines Holdings Inc * | 2,850 | 123 | ||||||

United Parcel Service Inc, Cl B | 8,932 | 1,504 | ||||||

United Rentals Inc * | 1,692 | 392 | ||||||

Univar Solutions Inc * | 476 | 9 | ||||||

US Ecology Inc | 900 | 33 | ||||||

Valmont Industries Inc | 76 | 13 | ||||||

Verisk Analytics Inc, Cl A | 1,729 | 359 | ||||||

Virgin Galactic Holdings Inc * | 4,426 | 105 | ||||||

Wabash National Corp | 3,217 | 55 | ||||||

Waste Management Inc | 6,467 | 763 | ||||||

| Description | Shares | Market Value ($ Thousands) | ||||||

COMMON STOCK (continued) | ||||||||

Watsco Inc | 537 | $ | 122 | |||||

Watts Water Technologies Inc, Cl A | 507 | 62 | ||||||

Welbilt Inc * | 3,137 | 41 | ||||||

WESCO International Inc * | 3,661 | 287 | ||||||

Westinghouse Air Brake Technologies Corp | 465 | 34 | ||||||

WillScot Mobile Mini Holdings Corp, Cl A * | 590 | 14 | ||||||

Woodward Inc | 139 | 17 | ||||||

WW Grainger Inc | 3,913 | 1,598 | ||||||

XPO Logistics Inc * | 1,396 | 166 | ||||||

Xylem Inc/NY | 15,912 | 1,620 | ||||||

| 42,556 | ||||||||

Information Technology — 26.7% | ||||||||

2U Inc * | 871 | 35 | ||||||

8x8 Inc * | 2,725 | 94 | ||||||

ACI Worldwide Inc * | 1,373 | 53 | ||||||

Adobe Inc * | 9,281 | 4,642 | ||||||

ADTRAN Inc | 979 | 14 | ||||||

Advanced Energy Industries Inc * | 725 | 70 | ||||||

Advanced Micro Devices Inc * | 14,318 | 1,313 | ||||||

Agilysys Inc * | 323 | 12 | ||||||

Akamai Technologies Inc * | 7,949 | 835 | ||||||

Akoustis Technologies Inc * | 6,091 | 74 | ||||||

Alarm.com Holdings Inc * | 1,192 | 123 | ||||||

Alliance Data Systems Corp | 1,335 | 99 | ||||||

Altair Engineering Inc, Cl A * | 269 | 16 | ||||||

Alteryx Inc, Cl A * | 70 | 8 | ||||||

Ambarella Inc * | 160 | 15 | ||||||

Amdocs Ltd | 3,632 | 258 | ||||||

Amkor Technology Inc | 3,864 | 58 | ||||||

Amphenol Corp, Cl A | 2,340 | 306 | ||||||

Analog Devices Inc | 4,564 | 674 | ||||||

Anaplan Inc * | 217 | 16 | ||||||

ANSYS Inc * | 683 | 248 | ||||||

Appian Corp, Cl A * | 1,246 | 202 | ||||||

Apple Inc | 218,768 | 29,028 | ||||||

Applied Materials Inc | 10,761 | 929 | ||||||

Arista Networks Inc * | 768 | 223 | ||||||

Arrow Electronics Inc * | 2,550 | 248 | ||||||

Aspen Technology Inc * | 413 | 54 | ||||||

Autodesk Inc * | 3,559 | 1,087 | ||||||

Automatic Data Processing Inc | 12,646 | 2,228 | ||||||

Avaya Holdings Corp * | 4,140 | 79 | ||||||

Avnet Inc | 1,892 | 66 | ||||||

Axcelis Technologies Inc * | 2,104 | 61 | ||||||

Badger Meter Inc | 775 | 73 | ||||||

Belden Inc | 900 | 38 | ||||||

Benchmark Electronics Inc | 1,447 | 39 | ||||||

Bill.com Holdings Inc * | 995 | 136 | ||||||

Black Knight Inc * | 1,569 | 139 | ||||||

Blackbaud Inc | 629 | 36 | ||||||

Blackline Inc * | 185 | 25 | ||||||

Booz Allen Hamilton Holding Corp, Cl A | 677 | 59 | ||||||

| New Covenant Funds / Semi-Annual Report / December 31, 2020 | 11 |

SCHEDULE OF INVESTMENTS (Unaudited)

December 31, 2020

New Covenant Growth Fund (Continued)

| Description | Shares | Market Value ($ Thousands) | ||||||

COMMON STOCK (continued) | ||||||||

Bottomline Technologies DE Inc * | 943 | $ | 50 | |||||

Box Inc, Cl A * | 539 | 10 | ||||||

Broadcom Inc | 5,340 | 2,338 | ||||||

Broadridge Financial Solutions Inc | 720 | 110 | ||||||

Brooks Automation Inc | 207 | 14 | ||||||

Cadence Design Systems Inc * | 2,046 | 279 | ||||||

Cass Information Systems Inc | 865 | 34 | ||||||

CDK Global Inc | 1,636 | 85 | ||||||

CDW Corp/DE | 806 | 106 | ||||||

Cerence Inc * | 493 | 50 | ||||||

Ceridian HCM Holding Inc * | 792 | 84 | ||||||

Ciena Corp * | 1,223 | 65 | ||||||

Cirrus Logic Inc * | 640 | 53 | ||||||

Cisco Systems Inc | 68,588 | 3,069 | ||||||

Citrix Systems Inc | 1,980 | 258 | ||||||

Cloudera Inc * | 4,481 | 62 | ||||||

Cloudflare, Cl A * | 1,190 | 90 | ||||||

CMC Materials | 373 | 56 | ||||||

Cognex Corp | 203 | 16 | ||||||

Cognizant Technology Solutions Corp, Cl A | 8,315 | 681 | ||||||

Coherent Inc * | 626 | 94 | ||||||

Cohu Inc | 2,351 | 90 | ||||||

CommScope Holding Co Inc * | 7,086 | 95 | ||||||

CommVault Systems Inc * | 1,095 | 61 | ||||||

Concentrix * | 387 | 38 | ||||||

CoreLogic Inc/United States | 271 | 21 | ||||||

Cornerstone OnDemand Inc * | 862 | 38 | ||||||

Corning Inc | 6,104 | 220 | ||||||

Coupa Software Inc * | 970 | 329 | ||||||

Cree Inc * | 248 | 26 | ||||||

Crowdstrike Holdings Inc, Cl A * | 1,523 | 323 | ||||||

CSG Systems International Inc | 965 | 43 | ||||||

CTS Corp | 1,735 | 60 | ||||||

Datadog Inc, Cl A * | 460 | 45 | ||||||

Dell Technologies Inc, Cl C * | 4,108 | 301 | ||||||

Diebold Nixdorf Inc * | 4,695 | 50 | ||||||

Digital Turbine Inc * | 6,346 | 359 | ||||||

DocuSign Inc, Cl A * | 1,618 | 360 | ||||||

Dolby Laboratories Inc, Cl A | 731 | 71 | ||||||

Domo Inc, Cl B * | 297 | 19 | ||||||

Dropbox Inc, Cl A * | 2,914 | 65 | ||||||

DXC Technology Co | 5,395 | 139 | ||||||

Dynatrace Inc * | 465 | 20 | ||||||

Ebix Inc | 1,517 | 58 | ||||||

EchoStar Corp, Cl A * | 1,124 | 24 | ||||||

Elastic NV * | 183 | 27 | ||||||

Enphase Energy Inc * | 792 | 139 | ||||||

Entegris Inc | 980 | 94 | ||||||

Envestnet Inc * | 717 | 59 | ||||||

EPAM Systems Inc * | 1,434 | 514 | ||||||

Euronet Worldwide Inc * | 74 | 11 | ||||||

Everbridge Inc * | 1,814 | 270 | ||||||

| Description | Shares | Market Value ($ Thousands) | ||||||

COMMON STOCK (continued) | ||||||||

EVERTEC Inc | 1,569 | $ | 62 | |||||

ExlService Holdings Inc * | 711 | 60 | ||||||

Extreme Networks Inc * | 6,878 | 47 | ||||||

F5 Networks Inc * | 578 | 102 | ||||||

Fair Isaac Corp * | 299 | 153 | ||||||

Fastly Inc, Cl A * | 905 | 79 | ||||||

Fidelity National Information Services Inc | 7,874 | 1,114 | ||||||

FireEye Inc * | 5,502 | 127 | ||||||

First Solar Inc * | 3,538 | 350 | ||||||

Fiserv Inc * | 6,758 | 769 | ||||||

Five9 Inc * | 93 | 16 | ||||||

FleetCor Technologies Inc * | 277 | 76 | ||||||

FLIR Systems Inc | 1,671 | 73 | ||||||

FormFactor Inc * | 353 | 15 | ||||||

Fortinet Inc * | 269 | 40 | ||||||

Genpact Ltd | 6,870 | 284 | ||||||

Global Payments Inc | 2,965 | 639 | ||||||

Globant SA * | 271 | 59 | ||||||

GoDaddy Inc, Cl A * | 1,102 | 91 | ||||||

Guidewire Software Inc * | 109 | 14 | ||||||

Hackett Group Inc/The | 3,129 | 45 | ||||||

HubSpot Inc * | 322 | 128 | ||||||

Ichor Holdings Ltd * | 1,480 | 45 | ||||||

II-VI Inc * | 224 | 17 | ||||||

Infinera Corp * | 6,579 | 69 | ||||||

Inphi Corp * | 86 | 14 | ||||||

Inseego Corp * | 7,132 | 110 | ||||||

Insight Enterprises Inc * | 754 | 57 | ||||||

Intel Corp | 58,531 | 2,916 | ||||||

Intelligent Systems Corp * | 1,128 | 45 | ||||||

InterDigital Inc | 917 | 56 | ||||||

International Business Machines Corp | 13,123 | 1,652 | ||||||

Intuit Inc | 3,714 | 1,411 | ||||||

IPG Photonics Corp * | 558 | 125 | ||||||

Itron Inc * | 588 | 56 | ||||||

J2 Global Inc * | 540 | 53 | ||||||

Jabil Inc | 6,948 | 295 | ||||||

Jack Henry & Associates Inc | 636 | 103 | ||||||

Juniper Networks Inc | 7,826 | 176 | ||||||

KBR Inc | 1,640 | 51 | ||||||

Keysight Technologies Inc * | 12,701 | 1,678 | ||||||

KLA Corp | 1,904 | 493 | ||||||

Knowles Corp * | 2,314 | 43 | ||||||

Lam Research Corp | 3,493 | 1,650 | ||||||

Lattice Semiconductor Corp * | 369 | 17 | ||||||

Littelfuse Inc | 60 | 15 | ||||||

Lumentum Holdings Inc * | 660 | 63 | ||||||

Manhattan Associates Inc * | 1,278 | 134 | ||||||

Marvell Technology Group Ltd | 4,705 | 224 | ||||||

Mastercard Inc, Cl A | 12,929 | 4,615 | ||||||

Maxim Integrated Products Inc | 3,740 | 332 | ||||||

MAXIMUS Inc | 682 | 50 | ||||||

| 12 | New Covenant Funds / Semi-Annual Report / December 31, 2020 |

| Description | Shares | Market Value ($ Thousands) | ||||||

COMMON STOCK (continued) | ||||||||

Medallia Inc * | 1,562 | $ | 52 | |||||

Microchip Technology Inc | 1,615 | 223 | ||||||

Micron Technology Inc * | 11,609 | 873 | ||||||

Microsoft Corp | 108,220 | 24,070 | ||||||

MicroStrategy Inc, Cl A * | 69 | 27 | ||||||

MKS Instruments Inc | 103 | 15 | ||||||

MongoDB Inc, Cl A * | 574 | 206 | ||||||

Monolithic Power Systems Inc | 64 | 23 | ||||||

National Instruments Corp | 2,353 | 103 | ||||||

NCR Corp * | 334 | 13 | ||||||

NetApp Inc | 2,936 | 194 | ||||||

NetScout Systems Inc * | 2,073 | 57 | ||||||

New Relic Inc * | 749 | 49 | ||||||

NIC Inc | 2,268 | 59 | ||||||

Novanta Inc * | 98 | 12 | ||||||

Nuance Communications Inc * | 2,832 | 125 | ||||||

Nutanix Inc, Cl A * | 359 | 11 | ||||||

NVIDIA Corp | 9,892 | 5,166 | ||||||

Okta Inc, Cl A * | 812 | 206 | ||||||

ON Semiconductor Corp * | 9,649 | 316 | ||||||

Oracle Corp | 34,708 | 2,245 | ||||||

OSI Systems Inc * | 497 | 46 | ||||||

PagerDuty Inc * | 1,821 | 76 | ||||||

Palo Alto Networks Inc * | 675 | 240 | ||||||

Paychex Inc | 2,612 | 243 | ||||||

Paycom Software Inc * | 194 | 88 | ||||||

Paylocity Holding Corp * | 417 | 86 | ||||||

PayPal Holdings Inc * | 18,658 | 4,370 | ||||||

Paysign Inc * | 4,721 | 22 | ||||||

Pegasystems Inc | 150 | 20 | ||||||

Perficient Inc * | 1,142 | 54 | ||||||

Perspecta Inc | 1,895 | 46 | ||||||

Photronics Inc * | 3,197 | 36 | ||||||

Plantronics Inc | 1,930 | 52 | ||||||

Plexus Corp * | 633 | 49 | ||||||

Pluralsight Inc, Cl A * | 2,621 | 55 | ||||||

Power Integrations Inc | 196 | 16 | ||||||

Progress Software Corp | 1,206 | 54 | ||||||

Proofpoint Inc * | 98 | 13 | ||||||

PROS Holdings Inc * | 818 | 41 | ||||||

PTC Inc * | 677 | 81 | ||||||

Pure Storage Inc, Cl A * | 685 | 15 | ||||||

Qorvo Inc * | 100 | 17 | ||||||

QUALCOMM Inc | 17,833 | 2,717 | ||||||

Qualys Inc * | 591 | 72 | ||||||

Rambus Inc * | 3,633 | 63 | ||||||

Rapid7 Inc * | 892 | 80 | ||||||

RealPage Inc * | 211 | 18 | ||||||

RingCentral Inc, Cl A * | 699 | 265 | ||||||

Rogers Corp * | 392 | 61 | ||||||

Sabre Corp | 506 | 6 | ||||||

salesforce.com Inc * | 17,125 | 3,811 | ||||||

| Description | Shares | Market Value ($ Thousands) | ||||||

COMMON STOCK (continued) | ||||||||

Sanmina Corp * | 1,459 | $ | 46 | |||||

ScanSource Inc * | 1,292 | 34 | ||||||

Semtech Corp * | 1,000 | 72 | ||||||

ServiceNow Inc * | 2,243 | 1,235 | ||||||

Silicon Laboratories Inc * | 437 | 56 | ||||||

Skyworks Solutions Inc | 747 | 114 | ||||||

Smartsheet Inc, Cl A * | 266 | 18 | ||||||

SolarEdge Technologies * | 210 | 67 | ||||||

SolarWinds Corp * | 634 | 9 | ||||||

Splunk Inc * | 1,357 | 231 | ||||||

SPS Commerce Inc * | 152 | 16 | ||||||

Square Inc, Cl A * | 4,127 | 898 | ||||||

Switch Inc, Cl A | 779 | 13 | ||||||

Synaptics Inc * | 142 | 14 | ||||||

SYNNEX Corp | 387 | 31 | ||||||

Synopsys Inc * | 1,083 | 281 | ||||||

Teradata Corp * | 4,437 | 100 | ||||||

Teradyne Inc | 4,784 | 574 | ||||||

Texas Instruments Inc | 13,483 | 2,213 | ||||||

Trade Desk Inc/The, Cl A * | 829 | 664 | ||||||

Trimble Inc * | 2,035 | 136 | ||||||

TTEC Holdings Inc | 202 | 15 | ||||||

TTM Technologies Inc * | 3,357 | 46 | ||||||

Tucows Inc, Cl A * | 834 | 62 | ||||||

Twilio Inc, Cl A * | 2,168 | 734 | ||||||

Tyler Technologies Inc * | 393 | 172 | ||||||

Ubiquiti Inc | 48 | 13 | ||||||

Unisys Corp * | 689 | 14 | ||||||

Universal Display Corp | 521 | 120 | ||||||

Upland Software Inc * | 255 | 12 | ||||||

Varonis Systems Inc * | 109 | 18 | ||||||

Verint Systems Inc * | 947 | 64 | ||||||

VeriSign Inc * | 802 | 174 | ||||||

Verra Mobility Corp, Cl A * | 3,479 | 47 | ||||||

ViaSat Inc * | 693 | 23 | ||||||

Viavi Solutions Inc * | 3,355 | 50 | ||||||

Virtusa Corp * | 1,123 | 57 | ||||||

Visa Inc, Cl A | 25,571 | 5,593 | ||||||

VMware Inc, Cl A * | 1,343 | 188 | ||||||

Western Digital Corp | 2,423 | 134 | ||||||

Western Union Co/The | 425 | 9 | ||||||

WEX Inc * | 55 | 11 | ||||||

Workday Inc, Cl A * | 2,079 | 498 | ||||||

Workiva Inc, Cl A * | 1,224 | 112 | ||||||

Xerox Holdings Corp | 7,073 | 164 | ||||||

Xilinx Inc | 2,632 | 373 | ||||||

Xperi Holding Corp | 2,351 | 49 | ||||||

Zebra Technologies Corp, Cl A * | 438 | 168 | ||||||

Zendesk Inc * | 152 | 22 | ||||||

Zoom Video Communications Inc, Cl A * | 2,174 | 733 | ||||||

Zscaler Inc * | 470 | 94 | ||||||

| New Covenant Funds / Semi-Annual Report / December 31, 2020 | 13 |

SCHEDULE OF INVESTMENTS (Unaudited)

December 31, 2020

New Covenant Growth Fund (Continued)

| Description | Shares | Market Value ($ Thousands) | ||||||

COMMON STOCK (continued) | ||||||||

Zuora Inc, Cl A * | 3,498 | $ | 49 | |||||

| 139,692 | ||||||||

Materials — 2.8% | ||||||||

Air Products and Chemicals Inc | 4,688 | 1,281 | ||||||

Albemarle Corp | 167 | 25 | ||||||

Alcoa Corp * | 5,657 | 130 | ||||||

Allegheny Technologies Inc * | 2,362 | 40 | ||||||

AptarGroup Inc | 1,944 | 266 | ||||||

Arconic Corp * | 1,844 | 55 | ||||||

Ashland Global Holdings Inc | 152 | 12 | ||||||

Avery Dennison Corp | 88 | 14 | ||||||

Axalta Coating Systems Ltd * | 7,963 | 227 | ||||||

Balchem Corp | 488 | 56 | ||||||

Ball Corp | 14,154 | 1,319 | ||||||

Berry Global Group Inc * | 4,123 | 232 | ||||||

Cabot Corp | 238 | 11 | ||||||

Carpenter Technology Corp | 1,006 | 29 | ||||||

Celanese Corp, Cl A | 93 | 12 | ||||||

CF Industries Holdings Inc | 1,066 | 41 | ||||||

Chase Corp | 421 | 43 | ||||||

Chemours Co/The | 2,832 | 70 | ||||||

Cleveland-Cliffs Inc | 11,888 | 173 | ||||||

Coeur Mining Inc * | 6,945 | 72 | ||||||

Compass Minerals International Inc | 851 | 52 | ||||||

Corteva Inc | 4,455 | 172 | ||||||

Crown Holdings Inc * | 6,925 | 694 | ||||||

Domtar Corp | 298 | 9 | ||||||

Dow Inc | 5,519 | 306 | ||||||

DuPont de Nemours Inc | 6,954 | 494 | ||||||

Eagle Materials Inc | 126 | 13 | ||||||

Eastman Chemical Co | 9,101 | 913 | ||||||

Ecolab Inc | 2,293 | 496 | ||||||

Element Solutions Inc | 1,023 | 18 | ||||||

FMC Corp | 2,400 | 276 | ||||||

Freeport-McMoRan Inc | 27,003 | 703 | ||||||

Glatfelter | 2,740 | 45 | ||||||

Graphic Packaging Holding Co | 681 | 12 | ||||||

Greif Inc, Cl A | 1,122 | 53 | ||||||

HB Fuller Co | 976 | 51 | ||||||

Huntsman Corp | 475 | 12 | ||||||

Ingevity Corp * | 563 | 43 | ||||||

Innospec Inc | 499 | 45 | ||||||

International Flavors & Fragrances Inc | 2,307 | 251 | ||||||

International Paper Co | 785 | 39 | ||||||

Kraton Corp * | 2,033 | 56 | ||||||

Livent Corp * | 5,807 | 109 | ||||||

Louisiana-Pacific Corp | 1,740 | 65 | ||||||

LyondellBasell Industries NV, Cl A | 2,182 | 200 | ||||||

Martin Marietta Materials Inc | 397 | 113 | ||||||

Minerals Technologies Inc | 880 | 55 | ||||||

Mosaic Co/The | 3,590 | 83 | ||||||

Neenah Inc | 693 | 38 | ||||||

| Description | Shares | Market Value ($ Thousands) | ||||||

COMMON STOCK (continued) | ||||||||

Newmont Corp | 27,433 | $ | 1,643 | |||||

Novagold Resources Inc * | 1,266 | 12 | ||||||

Nucor Corp | 1,510 | 80 | ||||||

Packaging Corp of America | 101 | 14 | ||||||

PPG Industries Inc | 2,274 | 328 | ||||||

Quaker Chemical Corp | 55 | 14 | ||||||

Reliance Steel & Aluminum Co | 412 | 49 | ||||||

Royal Gold Inc | 437 | 46 | ||||||

Scotts Miracle-Gro Co/The | 163 | 32 | ||||||

Sealed Air Corp | 293 | 13 | ||||||

Sensient Technologies Corp | 779 | 57 | ||||||

Sherwin-Williams Co/The | 2,066 | 1,518 | ||||||

Sonoco Products Co | 185 | 11 | ||||||

Southern Copper Corp | 272 | 18 | ||||||

Steel Dynamics Inc | 2,648 | 98 | ||||||

Stepan Co | 510 | 61 | ||||||

Summit Materials Inc, Cl A * | 2,136 | 43 | ||||||

Trinseo SA | 1,345 | 69 | ||||||

United States Lime & Minerals Inc | 581 | 66 | ||||||

United States Steel Corp | 3,709 | 62 | ||||||

Valvoline Inc | 11,216 | 260 | ||||||

Verso Corp | 2,760 | 33 | ||||||

Vulcan Materials Co | 665 | 99 | ||||||

Warrior Met Coal Inc | 2,378 | 51 | ||||||

Westlake Chemical Corp | 718 | 59 | ||||||

Westrock Co | 3,989 | 174 | ||||||

Worthington Industries Inc | 1,149 | 59 | ||||||

| 14,493 | ||||||||

Real Estate — 3.2% | ||||||||

Acadia Realty Trust ‡ | 1,946 | 28 | ||||||

Agree Realty Corp ‡ | 736 | 49 | ||||||

Alexander & Baldwin Inc ‡ | 2,342 | 40 | ||||||

Alexandria Real Estate Equities Inc ‡ | 1,497 | 267 | ||||||

American Campus Communities Inc ‡ | 252 | 11 | ||||||

American Finance Trust Inc ‡ | 3,743 | 28 | ||||||

American Tower Corp, Cl A ‡ | 5,189 | 1,165 | ||||||

Apartment Income REIT ‡ | 1,711 | 66 | ||||||

Apartment Investment and Management, Cl A ‡ | 1,711 | 9 | ||||||

Apple Hospitality REIT Inc ‡ | 718 | 9 | ||||||

AvalonBay Communities Inc ‡ | 3,261 | 523 | ||||||

Brandywine Realty Trust ‡ | 14,492 | 173 | ||||||

Brixmor Property Group Inc ‡ | 4,703 | 78 | ||||||

Camden Property Trust ‡ | 125 | 12 | ||||||

CareTrust REIT Inc ‡ | 2,438 | 54 | ||||||

CBRE Group Inc, Cl A * | 26,520 | 1,663 | ||||||

Colony Capital Inc ‡ | 41,643 | 200 | ||||||

Columbia Property Trust Inc ‡ | 565 | 8 | ||||||

Community Healthcare Trust Inc ‡ | 1,136 | 53 | ||||||

Corporate Office Properties Trust ‡ | 7,752 | 202 | ||||||

Cousins Properties Inc ‡ | 289 | 10 | ||||||

Crown Castle International Corp ‡ | 4,368 | 695 | ||||||

| 14 | New Covenant Funds / Semi-Annual Report / December 31, 2020 |

| Description | Shares | Market Value ($ Thousands) | ||||||

COMMON STOCK (continued) | ||||||||

CubeSmart ‡ | 377 | $ | 13 | |||||

CyrusOne Inc ‡ | 181 | 13 | ||||||

DiamondRock Hospitality Co ‡ | 4,575 | 38 | ||||||

Digital Realty Trust Inc ‡ | 2,674 | 373 | ||||||

Diversified Healthcare Trust ‡ | 6,702 | 28 | ||||||

Douglas Emmett Inc ‡ | 2,338 | 68 | ||||||

Duke Realty Corp ‡ | 2,798 | 112 | ||||||

Empire State Realty Trust Inc, Cl A ‡ | 5,592 | 52 | ||||||

EPR Properties ‡ | 735 | 24 | ||||||

Equinix Inc ‡ | 1,035 | 739 | ||||||

Equity Commonwealth ‡ | 846 | 23 | ||||||

Equity LifeStyle Properties Inc ‡ | 167 | 11 | ||||||

Equity Residential ‡ | 3,485 | 207 | ||||||

Essential Properties Realty Trust Inc ‡ | 2,028 | 43 | ||||||

Essex Property Trust Inc ‡ | 454 | 108 | ||||||

Extra Space Storage Inc ‡ | 811 | 94 | ||||||

Federal Realty Investment Trust ‡ | 664 | 56 | ||||||

First Industrial Realty Trust Inc ‡ | 1,226 | 52 | ||||||

Four Corners Property Trust Inc ‡ | 1,848 | 55 | ||||||

Franklin Street Properties Corp ‡ | 5,897 | 26 | ||||||

Gaming and Leisure Properties Inc ‡ | 283 | 12 | ||||||