Filed by Harrah’s Entertainment, Inc. Pursuant to Rule 425

under the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934

Subject Company: Caesars Entertainment, Inc.

Commission File No.: 001-14573

This filing relates to a proposed acquisition (the “Acquisition”) by Harrah’s Entertainment, Inc. (“Harrah’s”) of Caesars Entertainment, Inc. (“Caesars”) pursuant to the terms of an Agreement and Plan of Merger, dated as of July 14, 2004 (the “Merger Agreement”), by and among Harrah’s, Harrah’s Operating Company, Inc. and Caesars. The Merger Agreement is on file with the Securities and Exchange Commission (the “SEC”) as an exhibit to the Current Report on Form 8-K filed by Harrah’s on July 15, 2004, and is incorporated by reference into this filing.

The following is a series of slides that were presented by Harrah’s at the Deutsche Bank 2004 Hospitality & Gaming Conference in New York, New York on November 4, 2004:

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Searchable text section of graphics shown above

[LOGOS]

Harrah's Entertainment, Inc.

Jonathan S. Halkyard

Vice President and Treasurer

November 4, 2004

Agenda

• Review of HET core strategy: organic growth through loyalty

• CZR acquisition enhances long-term growth profile

• Development pipeline provides complementary growth

• Compelling valuation

• Review of HET core strategy: organic growth through loyalty

• CZR acquisition enhances long-term growth profile

• Development pipeline provides complementary growth

• Compelling valuation

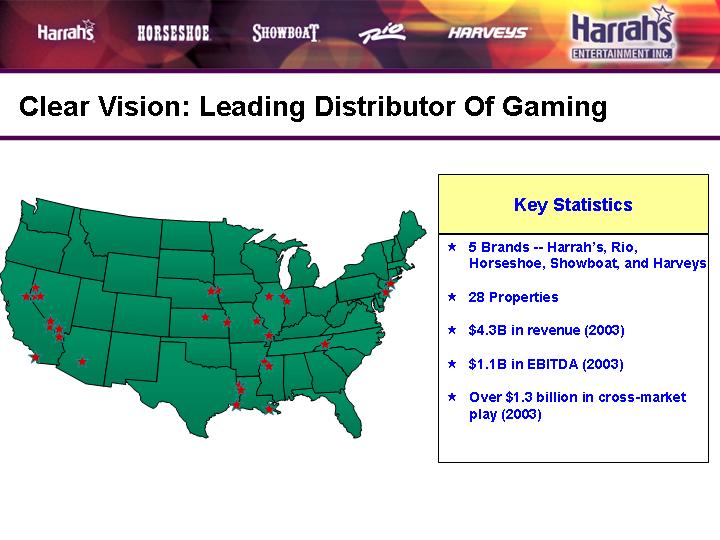

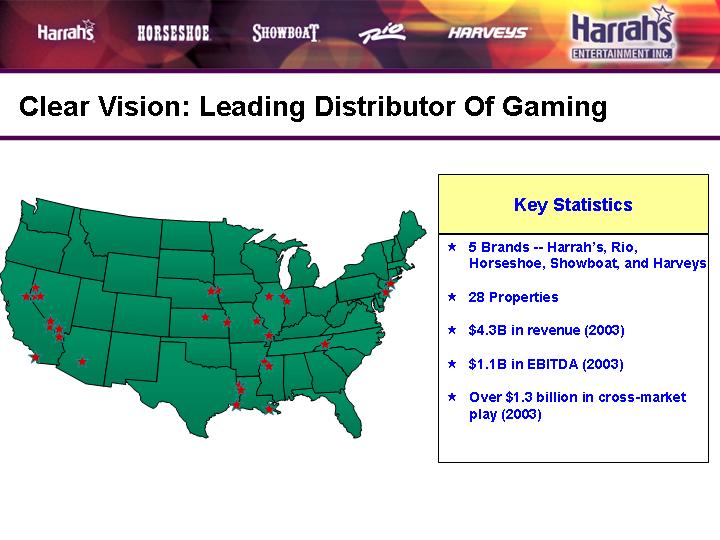

Clear Vision: Leading Distributor Of Gaming

[GRAPHIC]

Key Statistics

• 5 Brands — Harrah’s, Rio, Horseshoe, Showboat, and Harveys

• 28 Properties

• $4.3B in revenue (2003)

• $1.1B in EBITDA (2003)

• Over $1.3 billion in cross-market play (2003)

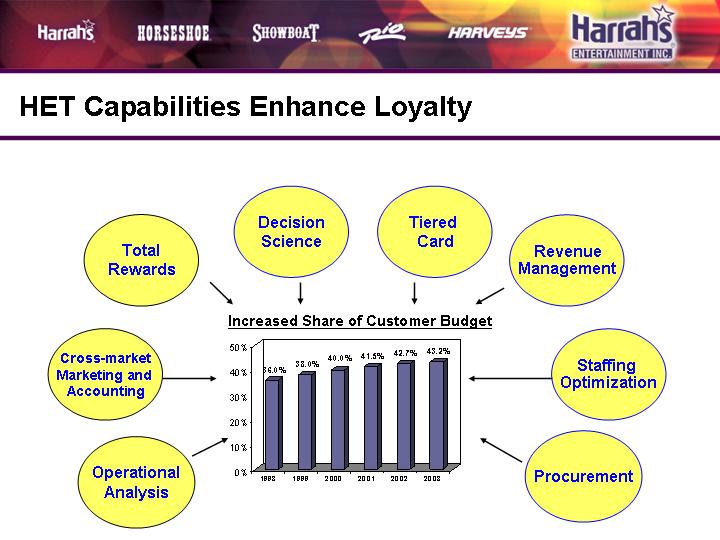

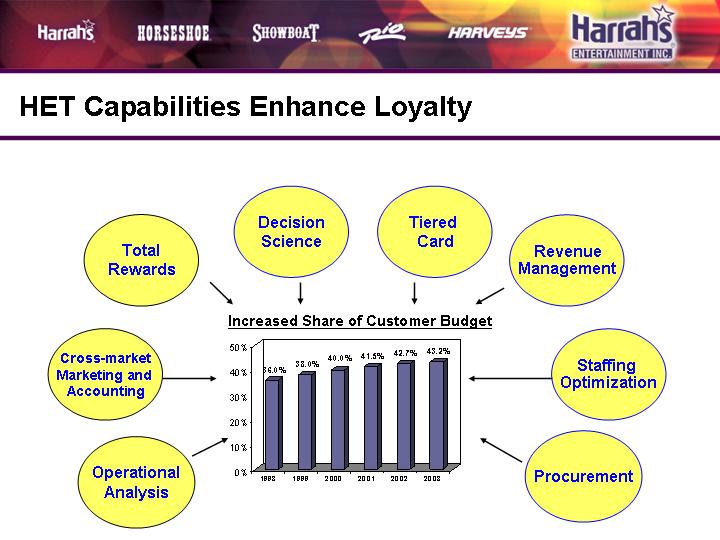

HET Capabilities Enhance Loyalty

Total

Rewards | | Decision

Science | | Tiered

Card | | Revenue

Management |

| | | | | | |

Cross-market

Marketing and

Accounting | | Increased Share of Customer Budget | | Staffing

Optimization |

| | [CHART] | | |

Operational

Analysis | | | | | | Procurement |

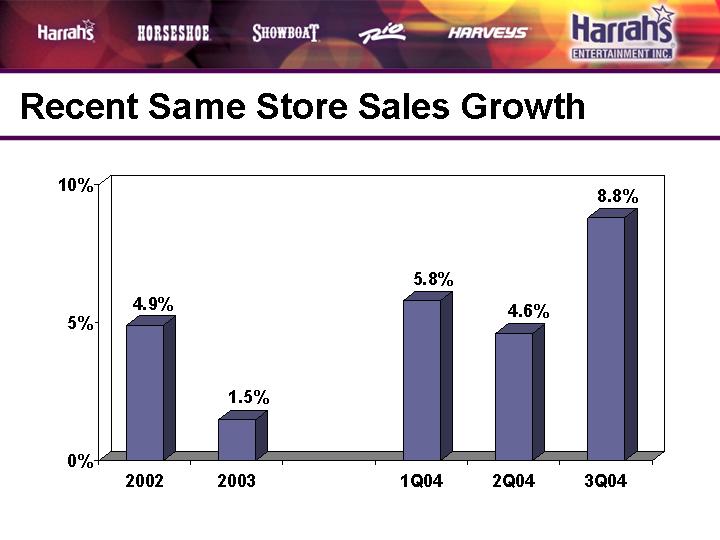

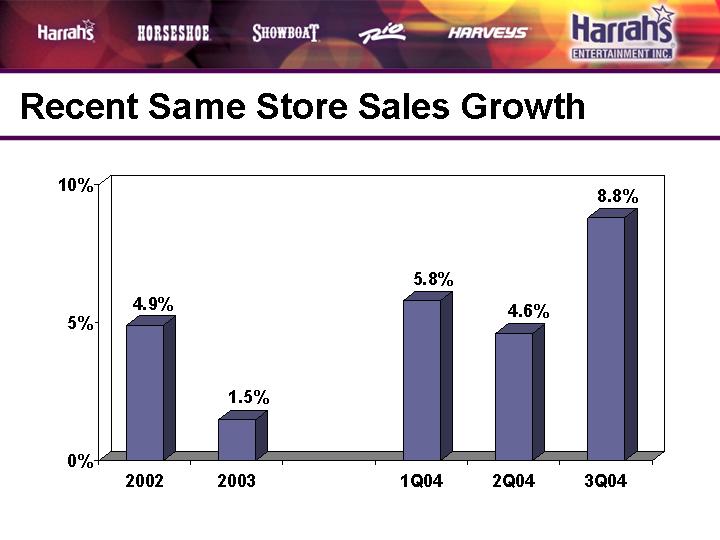

Recent Same Store Sales Growth

[CHART]

• Review of HET core strategy: organic growth through loyalty

• CZR acquisition enhances long-term growth profile

• Development pipeline provides complementary growth

• Compelling valuation

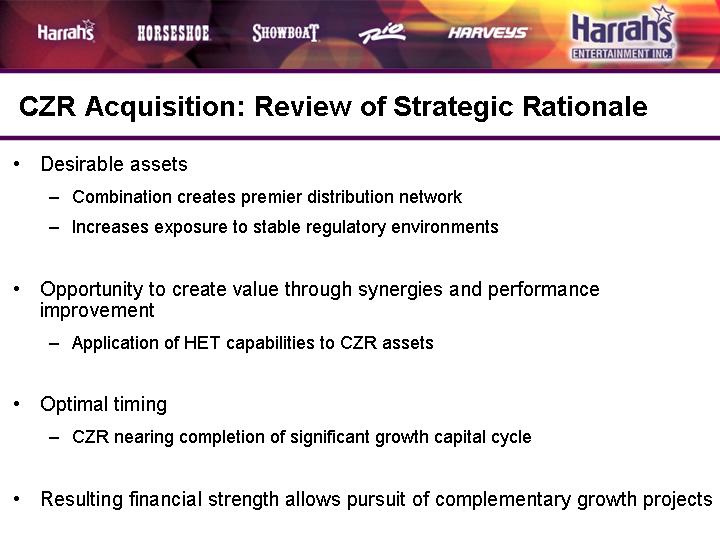

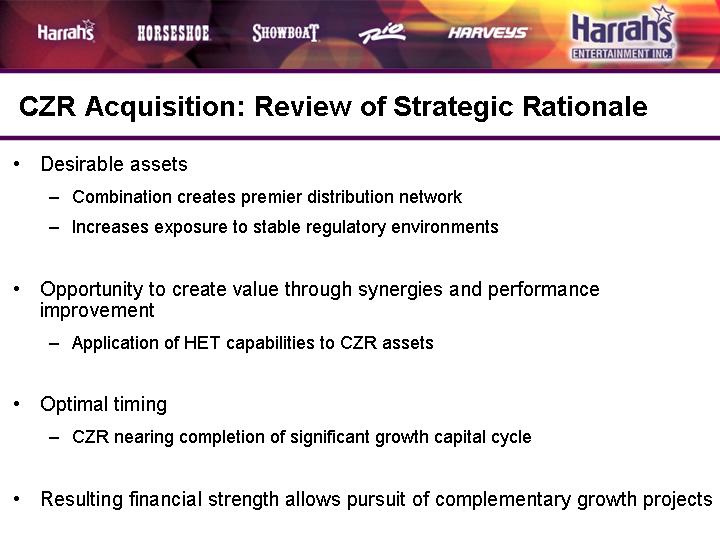

CZR Acquisition: Review of Strategic Rationale

• Desirable assets

• Combination creates premier distribution network

• Increases exposure to stable regulatory environments

• Opportunity to create value through synergies and performance improvement

• Application of HET capabilities to CZR assets

• Optimal timing

• CZR nearing completion of significant growth capital cycle

• Resulting financial strength allows pursuit of complementary growth projects

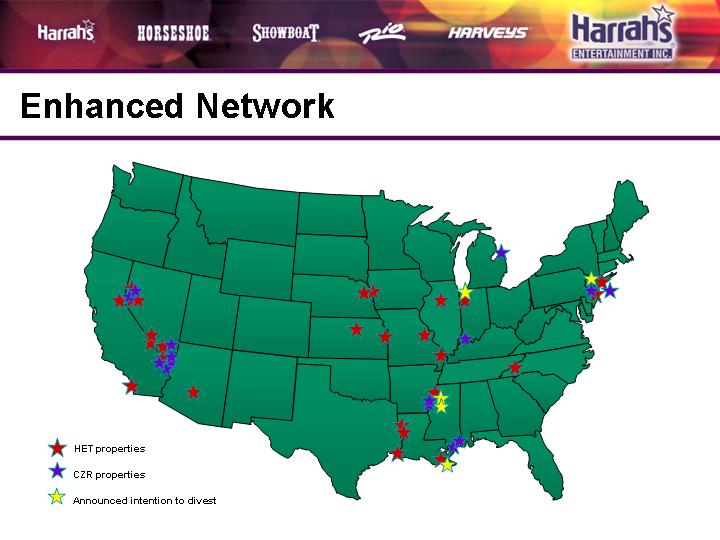

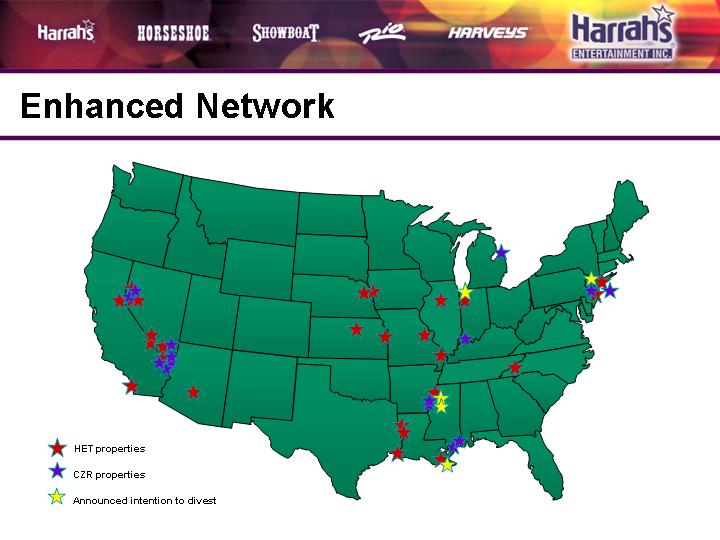

Enhanced Network

[GRAPHIC]

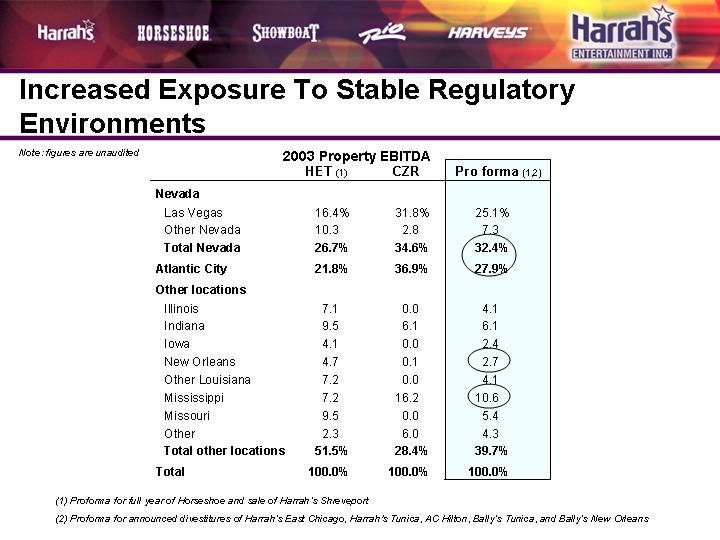

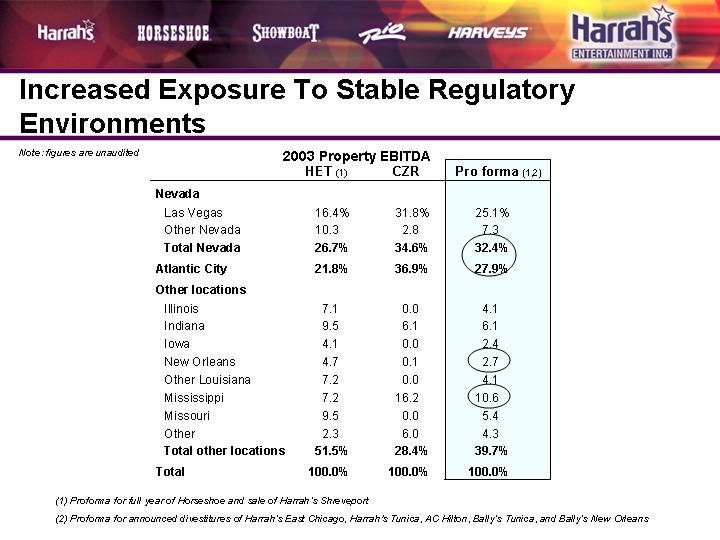

Increased Exposure To Stable Regulatory Environments

Note: figures are unaudited

�� | | 2003 Property EBITDA | | | |

| | HET (1) | | CZR | | Pro forma (1,2) | |

Nevada | | | | | | | |

Las Vegas | | 16.4 | % | 31.8 | % | 25.1 | % |

Other Nevada | | 10.3 | | 2.8 | | 7.3 | |

Total Nevada | | 26.7 | % | 34.6 | % | 32.4 | % |

| | | | | | | |

Atlantic City | | 21.8 | % | 36.9 | % | 27.9 | % |

| | | | | | | |

Other locations | | | | | | | |

Illinois | | 7.1 | | 0.0 | | 4.1 | |

Indiana | | 9.5 | | 6.1 | | 6.1 | |

Iowa | | 4.1 | | 0.0 | | 2.4 | |

New Orleans | | 4.7 | | 0.1 | | 2.7 | |

Other Louisiana | | 7.2 | | 0.0 | | 4.1 | |

Mississippi | | 7.2 | | 16.2 | | 10.6 | |

Missouri | | 9.5 | | 0.0 | | 5.4 | |

Other | | 2.3 | | 6.0 | | 4.3 | |

Total other locations | | 51.5 | % | 28.4 | % | 39.7 | % |

| | | | | | | |

Total | | 100.0 | % | 100.0 | % | 100.0 | % |

(1) Proforma for full year of Horseshoe and sale of Harrah’s Shreveport

(2) Proforma for announced divestitures of Harrah’s East Chicago, Harrah’s Tunica, AC Hilton, Bally’s Tunica, and Bally’s New Orleans

Premier Gaming Brands

Harrah's |

| | | | |

Horseshoe | | | | Caesars |

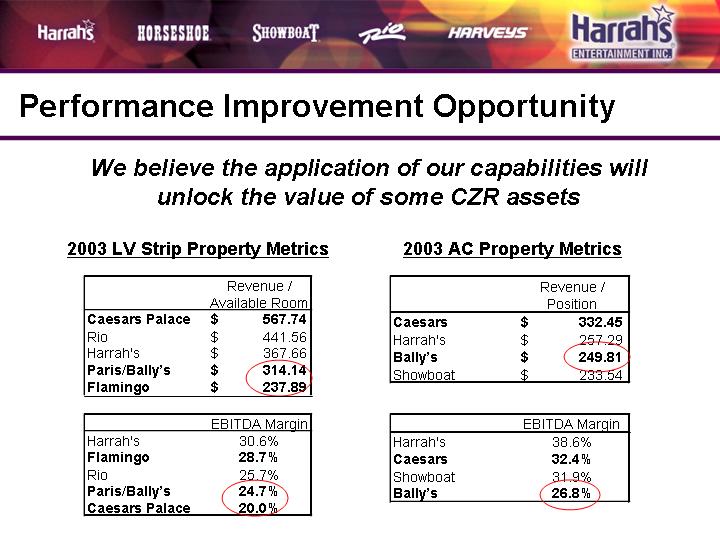

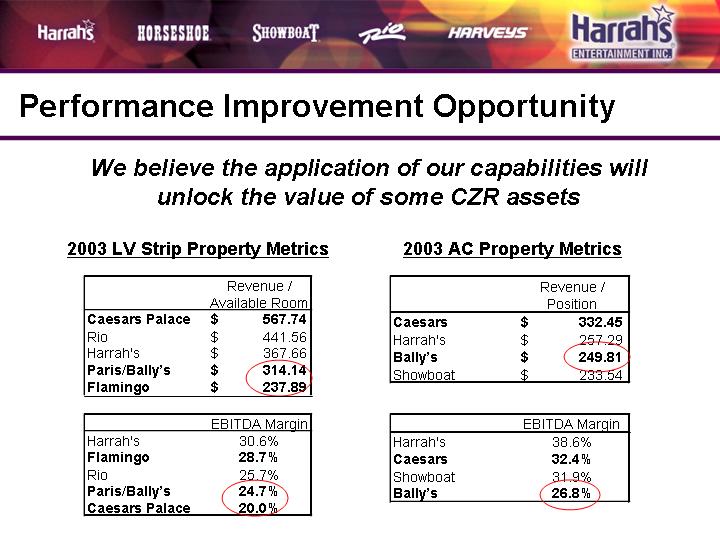

Performance Improvement Opportunity

We believe the application of our capabilities will

unlock the value of some CZR assets

2003 LV Strip Property Metrics

| | Revenue /

Available Room | |

Caesars Palace | | $ | 567.74 | |

Rio | | $ | 441.56 | |

Harrah’s | | $ | 367.66 | |

Paris/Bally’s | | $ | 314.14 | |

Flamingo | | $ | 237.89 | |

| | EBITDA Margin | |

Harrah’s | | 30.6 | % |

Flamingo | | 28.7 | % |

Rio | | 25.7 | % |

Paris/Bally’s | | 24.7 | % |

Caesars Palace | | 20.0 | % |

2003 AC Property Metrics

| | Revenue /

Position | |

Caesars | | $ | 332.45 | |

Harrah’s | | $ | 257.29 | |

Bally’s | | $ | 249.81 | |

Showboat | | $ | 233.54 | |

| | EBITDA Margin | |

Harrah’s | | 38.6 | % |

Caesars | | 32.4 | % |

Showboat | | 31.9 | % |

Bally’s | | 26.8 | % |

CZR Is Near Completion of Significant Growth Capital Cycle

• Caesars Palace

• Roman Plaza opened July 2004

• Forum Shops expansion opened October 2004

• 949-room hotel tower scheduled to open Summer 2005

• Caesars Atlantic City

• New parking garage scheduled to open 2Q05

• The Pier at Caesars scheduled to open in 2005

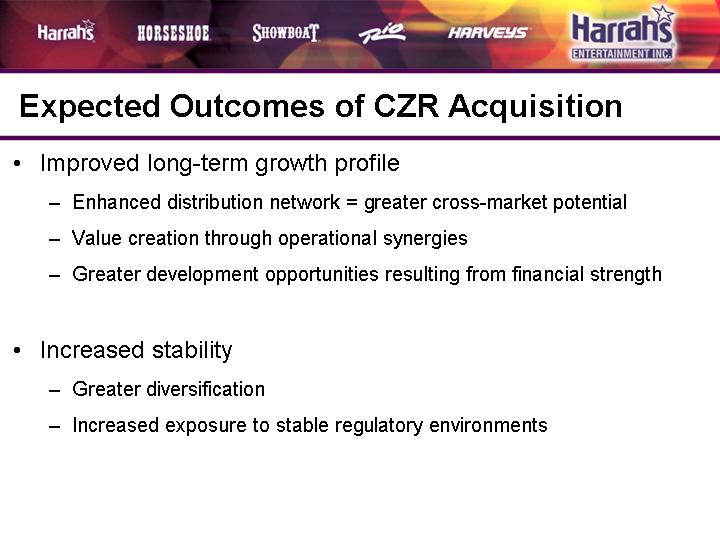

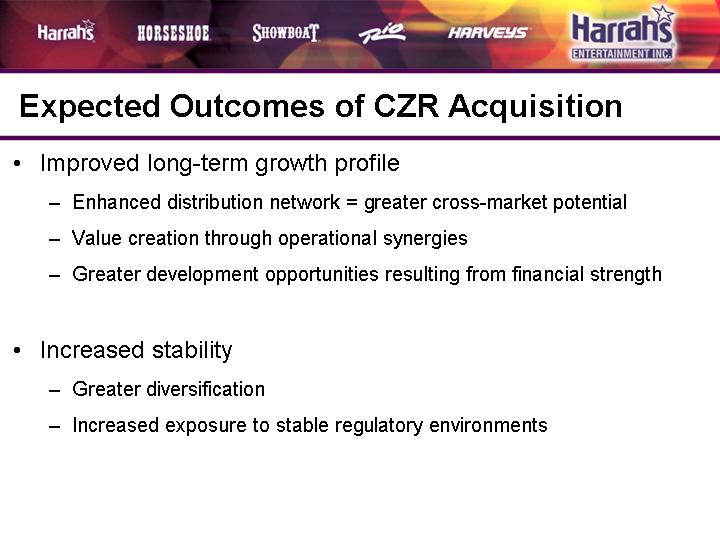

Expected Outcomes of CZR Acquisition

• Improved long-term growth profile

• Enhanced distribution network = greater cross-market potential

• Value creation through operational synergies

• Greater development opportunities resulting from financial strength

• Increased stability

• Greater diversification

• Increased exposure to stable regulatory environments

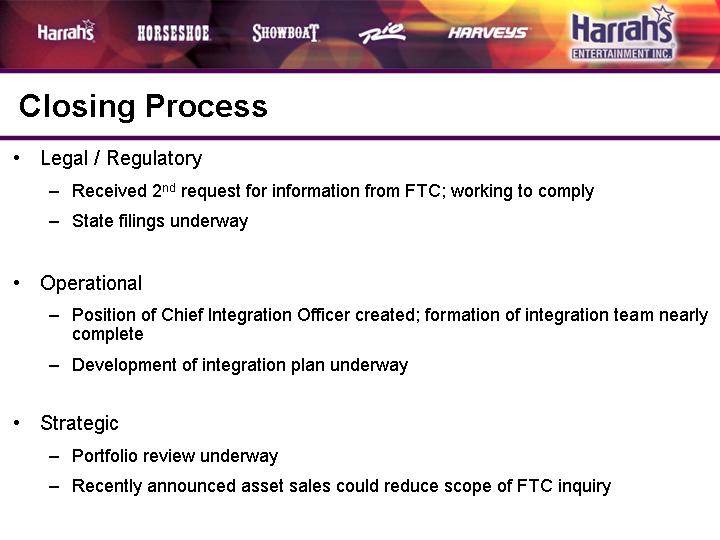

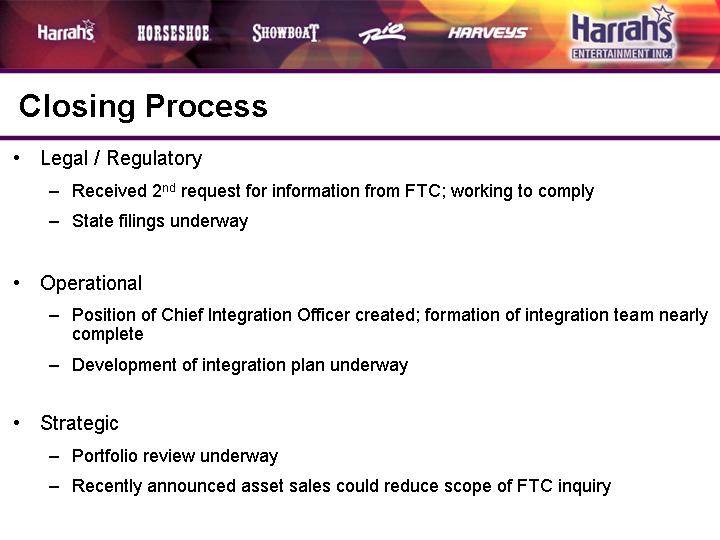

Closing Process

• Legal / Regulatory

• Received 2nd request for information from FTC; working to comply

• State filings underway

• Operational

• Position of Chief Integration Officer created; formation of integration team nearly complete

• Development of integration plan underway

• Strategic

• Portfolio review underway

• Recently announced asset sales could reduce scope of FTC inquiry

• Review of HET core strategy: organic growth through loyalty

• CZR acquisition enhances long-term growth profile

• Development pipeline provides complementary growth

• Compelling valuation

St. Louis

[GRAPHIC]

• $80M expansion |

|

• 210 hotel rooms |

|

• F&B enhancements |

|

• Opened August 2004 |

Kansas City

[GRAPHIC]

• $107M expansion |

|

• 206 hotel rooms |

|

• F&B enhancements |

|

• 2005 opening |

New Orleans

[GRAPHIC]

• $142M expansion |

|

• 450 hotel rooms |

|

• 1H06 opening |

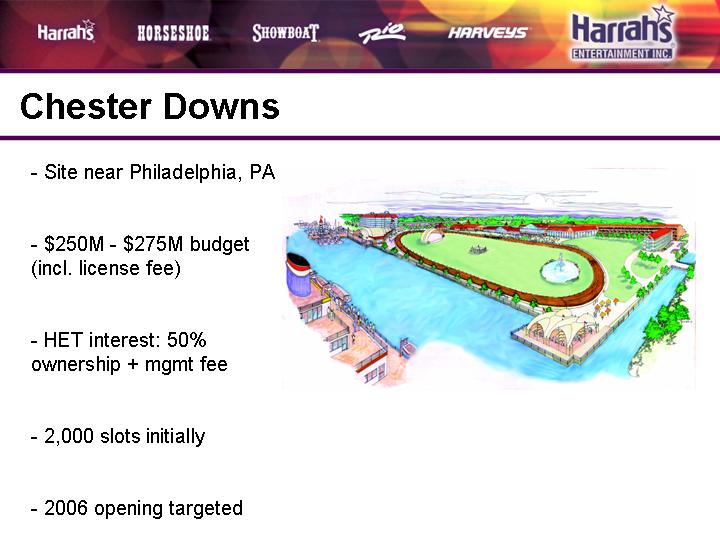

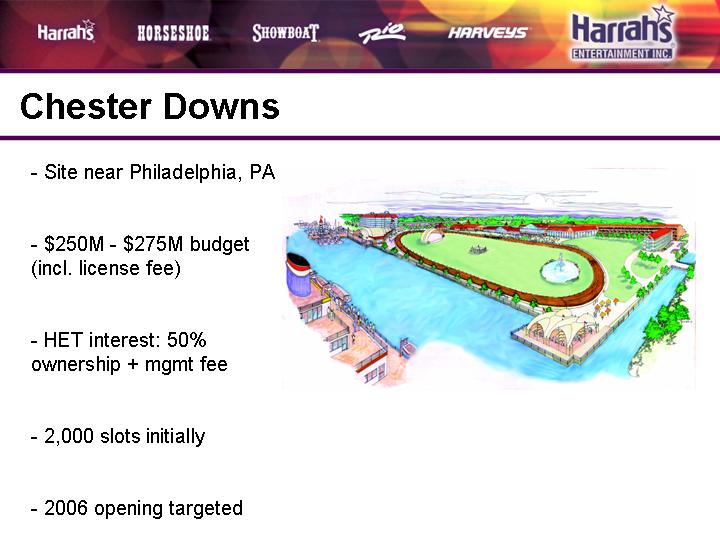

Chester Downs

[GRAPHIC]

• Site near Philadelphia, PA |

|

• $250M - $275M budget (incl. license fee) |

|

• HET interest: 50% ownership + mgmt fee |

|

• 2,000 slots initially |

|

• 2006 opening targeted |

Native American Gaming

• Recently renewed Cherokee and Rincon contracts

• Expansion projects recently completed / underway at 3 of our managed properties

• Continue to pursue new contracts for Class III and Class II operations

• CZR provides additional opportunities

• Development / management agreement for facility in Sullivan County, NY with St. Regis Mohawk Tribe

• Development / management agreement for facility near Fresno, CA with Big Sandy Band of Western Mono Indians

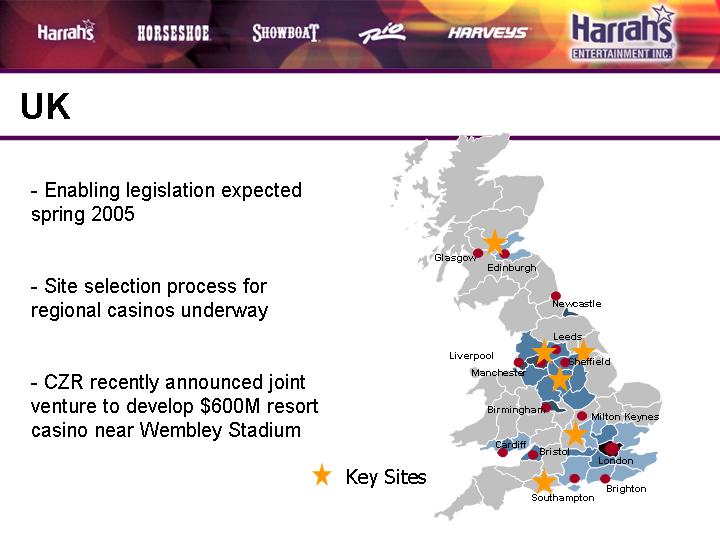

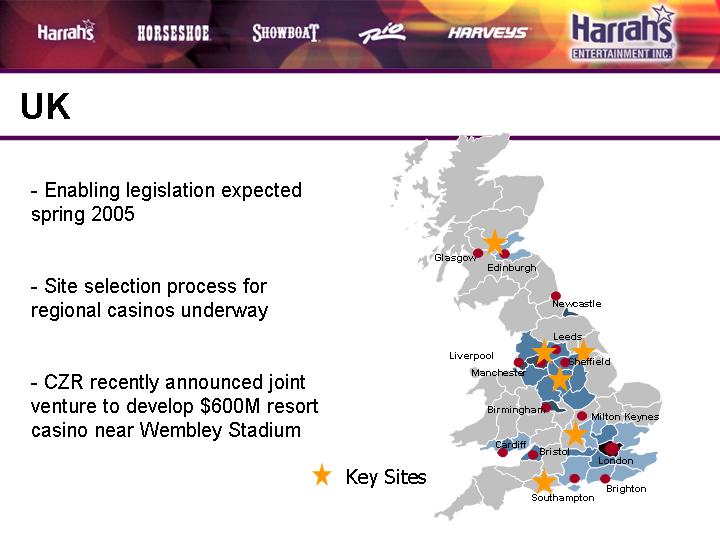

UK

[GRAPHIC]

• Enabling legislation expected spring 2005 |

|

• Site selection process for regional casinos underway |

|

• CZR recently announced joint venture to develop $600M resort casino near Wembley Stadium |

World Series of Poker

[GRAPHIC]

• Participation in 2004 tournament 3x greater than previous record |

|

• WSOP Tournament Circuit begins in January |

|

• Multiple income streams: |

• Licensing/sponsorship |

• Broadcast fees |

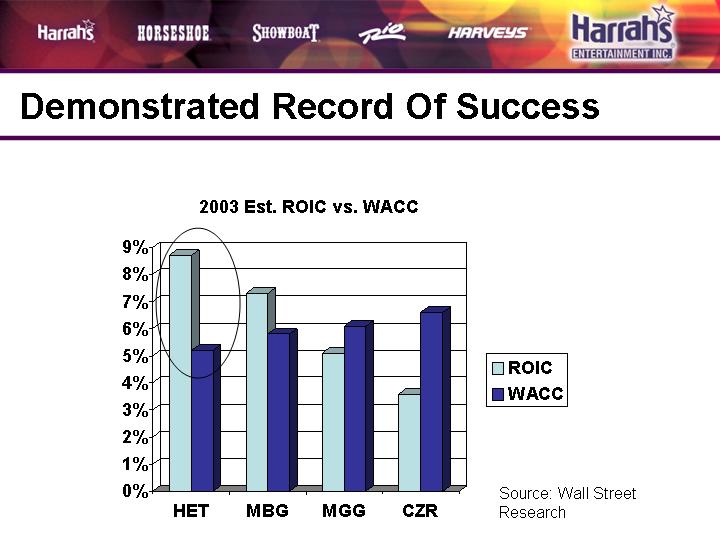

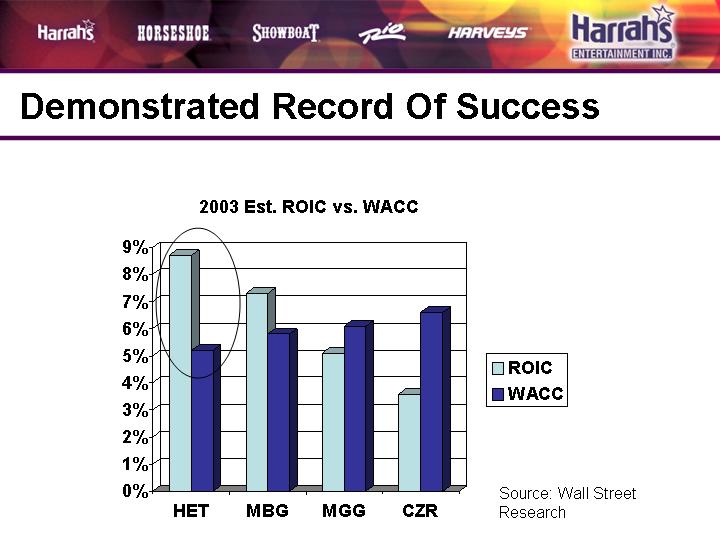

Demonstrated Record Of Success

2003 Est. ROIC vs. WACC

[CHART]

Source: Wall Street Research

• Review of HET core strategy: organic growth through loyalty

• CZR acquisition enhances long-term growth profile

• Development pipeline provides complementary growth

• Compelling valuation

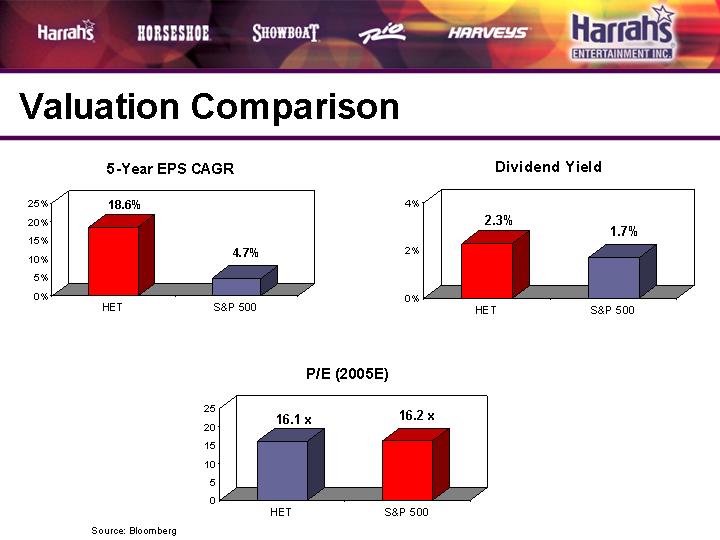

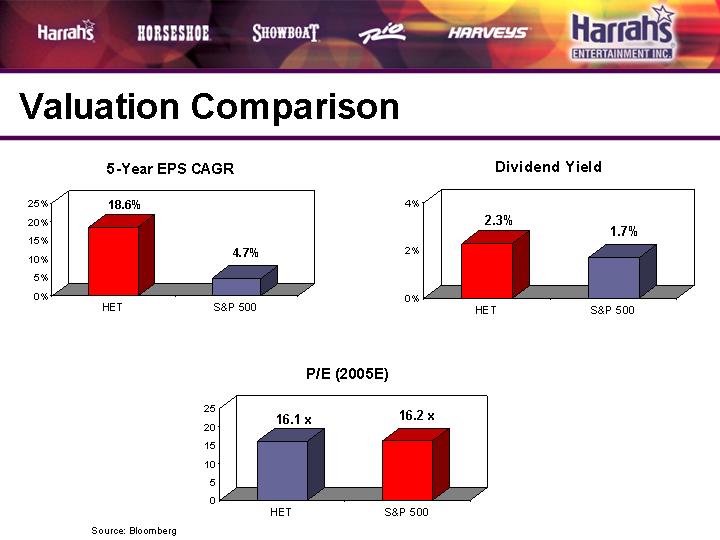

Valuation Comparison

5-Year EPS CAGR | | Dividend Yield |

| | |

[CHART] | | [CHART] |

| | |

P/E (2005E) |

|

[CHART] |

Source: Bloomberg

Summary

• Review of HET core strategy: organic growth through loyalty

• CZR acquisition enhances long-term growth profile

• Development pipeline provides complementary growth

• Compelling valuation

[LOGO]

Additional Information about the Acquisition and Where to Find It

In connection with Harrah’s proposed acquisition of Caesars, on October 20, 2004 Harrah’s filed preliminary materials with the Securities and Exchange Commission, including a registration statement on Form S-4 that contains a preliminary prospectus and a preliminary joint proxy statement. These materials are not yet final and will be amended. INVESTORS AND SECURITY HOLDERS OF HARRAH’S AND CAESARS ARE URGED TO READ THE DEFINITIVE VERSIONS OF THE PROSPECTUS AND JOINT PROXY STATEMENT WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT HARRAH’S, CAESARS AND THE ACQUISITION. The preliminary materials filed on October 20, 2004, the definitive versions of these materials and other relevant materials (when they become available), and any other documents filed by Harrah’s or Caesars with the SEC, may be obtained free of charge at the SEC’s website at www.sec.gov. In addition, investors and security holders may obtain free copies of the documents filed with the SEC by Harrah’s by directing a written request to: Harrah’s Entertainment, Inc., One Harrah’s Court, Las Vegas, Nevada 89119, Attention: Investor Relations or Caesars Entertainment, Inc., 3930 Howard Hughes Parkway, Las Vegas, Nevada 89109, Attention: Investor Relations. Investors and security holders are urged to read the proxy statement, prospectus and the other relevant materials when they become available before making any voting or investment decision with respect to the Acquisition.

Harrah’s, Caesars and their respective executive officers and directors may be deemed to be participants in the solicitation of proxies from the stockholders of Caesars and Harrah’s in connection with the Acquisition. Information about those executive officers and directors of Harrah’s and their ownership of Harrah’s common stock is set forth in the Harrah’s Form 10-K for the year ended December 31, 2003, which was filed with the SEC on March 5, 2004, and the proxy statement for Harrah’s 2004 Annual Meeting of Stockholders, which was filed with the SEC on March 4, 2004. Information about the executive officers and directors of Caesars and their ownership of Caesars common stock is set forth in the proxy statement for Caesars’ 2004 Annual Meeting of Stockholders, which was filed with the SEC on April 16, 2004. Investors and security holders may obtain additional information regarding the direct and indirect interests of Harrah’s, Caesars and their respective executive officers and directors in the Acquisition by reading the proxy statement and prospectus regarding the Acquisition when it becomes available.

This communication shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

Safe Harbor

This document includes “forward-looking statements” intended to qualify for the safe harbor from liability established by the Private Securities Litigation Reform Act of 1995. You can identify these statements by the fact that they do not relate strictly to historical or current facts. These statements contain words such as “may,” “will,” “project,” “might,” “expect,” “believe,” “anticipate,” “intend,” “could,” “would,” “estimate,” “continue” or “pursue,” or the negative or other variations thereof or comparable terminology. In particular, they include statements relating to, among other things, future actions, strategies, future performance, future financial results of Harrah’s and Caesars and Harrah’s anticipated acquisition of Caesars. These forward-looking statements are based on current expectations and projections about future events.

Investors are cautioned that forward-looking statements are not guarantees of future performance or results and involve risks and uncertainties that cannot be predicted or quantified and, consequently, the actual performance or results of Caesars and Harrah’s may differ materially from those expressed or implied by such forward-looking statements. Such risks and uncertainties include, but are not limited to, the following factors as well as other factors described from time to time in our reports filed with the Securities and Exchange Commission (including the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” contained therein): financial community and rating agency perceptions of Harrah’s and Caesars’, the effects of economic, credit and capital market conditions on the economy in general, and on gaming and hotel companies in particular; construction factors, including delays, zoning issues, environmental restrictions, soil and water conditions, weather and other hazards, site access matters and building permit issues; the effects of environmental and structural building conditions relating to our properties; the ability to timely and cost-effectively integrate into Harrah’s operations the companies that it acquires, including with respect to its acquisition of Caesars; access to available and feasible financing, including financing for Harrah’s acquisition of Caesars, on a timely basis; changes in laws (including increased tax rates), regulations or accounting standards, third-party relations and approvals, and decisions of courts, regulators and governmental bodies; litigation outcomes and judicial actions, including gaming legislative action, referenda and taxation; the ability of our customer-tracking, customer loyalty and yield-management programs to continue to increase customer loyalty and same store sales; our ability to recoup costs of capital investments through higher revenues; acts of war or terrorist incidents; abnormal gaming holds; and the effects of competition, including locations of competitors and operating and market competition.