SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant o

Check the Appropriate Box:

o Preliminary Proxy Statement

o Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

x Definitive Proxy Statement

o Definitive Additional Materials

o Soliciting Material Under Rule 14a-12

Jacksonville Bancorp, Inc.

(Name of Registrant as Specified in Its Charter)

----------------------------------------------------------------------------------

Not Applicable

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

x No fee required

o Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1) Title of each class of securities to which transaction applies:

(2) Aggregate number of securities to which transaction applies:

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it

was determined):

(4) Proposed maximum aggregate value of transaction:

(5) Total fee paid:

o Fee paid previously with preliminary materials:

o Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(1) Amount Previously paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Date Filed

March 31, 2006

Dear Shareholder:

You are cordially invited to attend the Annual Meeting of Shareholders of Jacksonville Bancorp, Inc., which will be held on Tuesday, April 25, 2006, beginning at 11:00 a.m., Eastern Time. The meeting will be held at The River Club, 1 Independent Drive, Suite 3500, Jacksonville, Florida 32202. The purpose of the meeting is to consider and vote upon the proposals explained in the notice and the Proxy Statement.

A formal notice describing the business to come before the meeting, a Proxy Statement and a proxy card are enclosed. We have also enclosed our 2005 Annual Report for your review which contains detailed information concerning our 2005 financial performance and activities.

You may think your vote is not important, but it is vital. Whether or not you plan to attend the Annual Meeting in person, please vote your shares immediately either by telephone, by Internet or by completing, signing, and dating the enclosed proxy card, and returning it in the postage-paid envelope provided. If you later decide to attend the Annual Meeting and vote in person, or if you wish to revoke your proxy for any reason before the vote at the Annual Meeting, you may do so and your proxy will have no further effect.

Thank you for taking the time to vote.

Sincerely,

Donald E. Roller

Chairman of the Board

Jacksonville Bancorp, Inc.

100 North Laura Street, Suite 1000

Jacksonville, Florida 32202

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To the Holders of Common Stock:

Notice is hereby given that the Annual Meeting of Shareholders of Jacksonville Bancorp, Inc. will be held on Tuesday, April 25, 2006, at 11:00 a.m., Eastern Time, at The River Club, 1 Independent Drive, Suite 3500, Jacksonville, Florida 32202 to consider and act upon the following matters:

| 1. | To elect five of our directors for a three-year term; |

| 2. | To approve our 2006 Stock Incentive Plan; and |

| 3. | To transact any other business that may properly come before the Annual Meeting or any adjournment(s) thereof. |

Only shareholders of record of our common stock at the close of business on March 13, 2006 are entitled to receive notice of, and to vote on, the business that may come before the Annual Meeting.

Whether or not you plan to attend the Annual Meeting in person, please vote your shares immediately either by telephone, by Internet or by completing, signing, and dating the enclosed proxy card, and returning it in the postage-paid envelope provided. You may revoke your proxy at any time before it is exercised by following the instructions set forth in Voting of Proxies on the first page of the accompanying Proxy Statement.

BY ORDER OF THE BOARD OF DIRECTORS

Price W. Schwenck

Corporate Secretary

March 13, 2006

PLEASE VOTE AS SOON AS POSSIBLE.

YOUR VOTE IS VERY IMPORTANT TO US NO MATTER HOW MANY SHARES YOU OWN.

Jacksonville Bancorp, Inc.

100 North Laura Street, Suite 1000

Jacksonville, Florida 32202

PROXY STATEMENT

Annual Meeting of Shareholders

This Proxy Statement and the accompanying notice and proxy card are being furnished to you as a holder of Jacksonville Bancorp, Inc. common stock, $.01 par value, in connection with the solicitation of proxies by our Board of Directors for use at the Annual Meeting of Shareholders. The Annual Meeting will be held on Tuesday, April 25, 2006, beginning at 11:00 a.m., Eastern Time, at The River Club, 1 Independent Drive, Suite 3500, Jacksonville, Florida 32202. This Proxy Statement and the accompanying notice and proxy card are first being mailed to holders of our common stock on or about March 31, 2006.

Unless the context requires otherwise, references in this statement to “we”, “us”, or “our” refer to Jacksonville Bancorp, Inc., its wholly owned subsidiary, The Jacksonville Bank, and the Bank’s wholly owned subsidiary, Fountain Financial, Inc., on a consolidated basis. References to the “Company” denote Jacksonville Bancorp, Inc., and The Jacksonville Bank is referred to as the “Bank”.

VOTING OF PROXIES

Shares represented by proxies properly signed and returned, unless subsequently revoked, will be voted at the Annual Meeting in accordance with the instructions marked on the proxy. If a proxy is signed and returned without indicating any voting instructions, the shares represented by the proxy will be voted FOR approval of the proposals stated in this Proxy Statement and in the discretion of the holders of the proxies on other matters that may properly come before the Annual Meeting.

If you have executed and delivered a proxy, you may revoke such proxy at any time before it is voted by attending the Annual Meeting and voting in person by giving written notice of revocation of the proxy or by submitting a signed proxy bearing a later date. Such notice of revocation or later proxy should be sent to our transfer agent, SunTrust Bank Stock Transfer Department, at the address indicated on the enclosed proxy. In order for the notice of revocation or later proxy to revoke the prior proxy, our transfer agent must receive such notice or later proxy before the vote of shareholders at the Annual Meeting. Unless you vote at the meeting or take other action, your attendance at the Annual Meeting will not revoke your proxy.

VOTING PROCEDURES

Our bylaws provide that a majority of the outstanding shares entitled to vote constitutes a quorum at a meeting of shareholders. Under the Florida Business Corporation Act (the “Act”) and our articles of incorporation, directors are elected by a plurality of the votes cast in the election at a meeting at which a quorum is present. Other matters are approved if affirmative votes cast by the holders of the shares represented at a meeting at which a quorum is present exceed votes opposing the action, unless the Act or our articles of incorporation require a greater number of affirmative votes or voting by classes. Abstentions and broker non-votes have no effect under Florida law.

VOTING SECURITIES

Our Board of Directors has fixed the close of business on March 13, 2006 as the record date for determining the holders of our common stock entitled to receive notice of, and to vote at, the Annual Meeting. At the close of business on March 13, 2006, there were issued 1,721,652 shares of our common stock, 1,719,852 of which were outstanding, entitled to vote at the Annual Meeting held by approximately 161 registered holders. You are entitled to one vote for each share held upon each matter properly submitted at the Annual Meeting.

PURPOSE

We anticipate that our shareholders will act upon the following business at the meeting:

PROPOSAL 1: ELECTION OF DIRECTORS

The directors nominated for election at the 2006 Annual Meeting are D. Michael Carter, Melvin Gottlieb, James M. Healey, John C. Kowkabany and Bennett A. Tavar in Class 3. Those directors elected as Class 3 directors at this Annual Meeting will have a term of office of three years, expiring at the 2009 Annual Meeting. The term of office of the Class 1 directors expires at the 2007 Annual Meeting and the term of office of the Class 2 directors expires at the 2008 Annual Meeting.

If elected, the nominees will constitute 5 of the 14 members of our Board of Directors. To be elected, each nominee must receive a plurality of the votes cast, which shall be counted as described in Voting Procedures. Unless you mark the accompanying proxy otherwise, the proxy will be voted FOR the election of Messrs. Carter, Gottlieb, Healey, Kowkabany and Tavar. If any nominee should become unable to serve, which is not now anticipated, the persons voting the accompanying proxy may vote for a substitute in their discretion.

OUR BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE ELECTION OF

EACH OF THE DIRECTOR NOMINEES.

Our articles of incorporation provide that our directors are divided into three classes. The following provides certain information with respect to each of our directors, including the nominees for director in Class 3. Except as otherwise indicated, each person has been or was engaged in his present or last principal occupation, in the same or a similar position, for more than five years. Directors Carter, Healey, Kowkabany, Kraft, Mills, Rose, Schultz, Spencer, Tavar, and Winfield became directors during our organizational period. Messrs. Pomar and Schwenck were appointed to the Board in March 1999; Mr. Gottlieb was appointed to the Board in July 1999; and Mr. Roller was appointed to the Board in August 1999. All directors serve on the Boards of both the Company and the Bank and the term of office for all directors is three years.

CLASS 3 DIRECTORS

Name | | Age | | Positions Held and Principal Occupations During the Past Five Years |

D. Michael Carter, C.P.A. | | 53 | | Certified Public Accountant and a graduate of Florida State University. Mr. Carter has lived in Jacksonville, Florida, since 1975 and is Director and President of Carter & Company, CPA’s, P.A., providing services to tax and audit clients, including businesses, business owners and executives, as well as professionals. The practice also provides financial and retirement planning, investment and business counseling services. Mr. Carter is Director and President of Atlantic Capital Associates, Inc. and Florida Capital Associates, Inc., providing private mortgage lending services. Before forming his firm of Carter & Company in 1980, Mr. Carter had been a public accountant with two national accounting firms. Mr. Carter is a member of the American Institute of Certified Public Accountants and the Florida Institute of Certified Public Accountants. He is a member of the Rotary Club of Oceanside in Jacksonville Beach and is a member of the Jacksonville Chamber of Commerce. Mr. Carter has previously served as a Board member for the Ronald McDonald House, Board member of the Rotary Club of Oceanside, President of the Rotary Club of East Arlington (Jacksonville), President of the Mandarin Business Association (Jacksonville), and Board member of Leadership Jacksonville Alumni, Inc. |

Melvin Gottlieb | | 60 | | Chief Executive Officer of Martin Gottlieb & Associates, LLC and Gottlieb Financial Services, LLC. President of Physician Asset Recovery, Inc.; MG Squared, Inc.; GFS Ventures, LLC; and First Coast Investment Properties, LLC. Mr. Gottlieb is active in the community, acting as Vice President for the Jacksonville Jewish Center, River Garden Foundation and Jewish Community Alliance; and as a board member of the Jacksonville Jewish Federation, Fresh Ministries, Memories of Love, Emergency Medicine Learning & Resource Center and Community Asthma Partnership. |

James M. Healey | | 48 | | Director and Partner of Mint Magazine, Inc., Chattanooga Mint, Inc., Tennessee Mint, Inc., Columbia Mint, Inc., and Tampa Mint, Inc. direct mail advertising firms. Before his association with Mint Magazine began in 1985, Mr. Healey worked with Carnation Food Products, Inc., and International Harvester. Mr. Healey attended Purdue University where he received a Bachelor of Arts degree from Purdue's Business School with special studies in Marketing and Personnel. Mr. Healey has been a resident and active member of the Jacksonville community since 1984. |

John C. Kowkabany | | 63 | | Jacksonville-based real estate investor and consultant. Mr. Kowkabany has significant private and public sector experience. A resident of the city of Neptune Beach, he has been active in local government, serving as the City's Mayor from 1989 to 1997, and Councilman from 1985 to 1989. Mr. Kowkabany's public sector experience has provided him with experience and knowledge regarding the local business and civic communities. For many years, Mr. Kowkabany has served with various civic and charitable organizations as an officer or director. Mr. Kowkabany graduated with a Bachelor of Arts degree from Jacksonville University. |

Bennett A. Tavar | | 48 | | President of Logical Business Solutions, Inc., a value added reseller of technology products, located in Jacksonville, Florida. Mr. Tavar has been a resident of Jacksonville since 1982 and is active in a number of local civic organizations. |

CLASS 1 DIRECTORS

Name | | Age | | Positions Held and Principal Occupations During the Past Five Years |

John W. Rose | 56 | | A financial services executive, advisor, and investor for over 30 years. Mr. Rose is President of McAllen Capital Partners, Inc., a financial advisory firm specializing in bank and thrift turnarounds. Through those activities, Mr. Rose has served as Executive Vice President and Chief Financial Officer of Bay View Capital Corp., an NYSE traded bank holding company in California, and Executive Vice President of F.N.B. Corporation, an NYSE traded bank holding company in Pennsylvania. Mr. Rose is currently a director of Bay View Capital Corp.; F.N.B. Corporation; White River Capital, a publicly traded finance company in Indianapolis; and Life Shelters Inc., a finance company in Virginia. Mr. Rose earned his undergraduate degree from Case Western Reserve University and his M.B.A. from Columbia University. |

John R. Schultz | | 42 | | A fourth generation native of Jacksonville, Florida. Mr. Schultz is Vice President of Schultz Investments, Inc., an investment management company primarily involved in the development of shopping centers and office buildings. Mr. Schultz attended The Bolles School (Jacksonville, Florida) and the University of Florida. Mr. Schultz is a director of numerous companies and community organizations, including Southeast-Atlantic Corporation (Canada Dry bottler/distributor), Metro YMCA, Daniel Properties, Inc. and The Schultz Foundation, Inc. |

Price W. Schwenck | | 63 | | Chief Executive Officer of the Company until April 26, 2000, and Chairman of the Board of Directors for the Bank. From May 2000 to February 2003, Mr. Schwenck was President and Chief Executive Officer of P.C.B. Bancorp, Inc., n/k/a Colonial BancGroup, Inc., a multi-bank holding company located in Clearwater, Florida. Mr. Schwenck served as Regional President for First Union National Bank in Ft. Lauderdale, Florida, from 1988 to 1994, and in Jacksonville, Florida, from 1994 until he retired in 1999. Mr. Schwenck received his Bachelors degree and M.B.A. from the University of South Florida and his M.S. from the University of Miami. |

Gary L. Winfield, M.D. | | 49 | | A physician. Dr. Winfield has had an active family practice in Jacksonville Beach, Florida, since 1991, operating as Sandcastle Family Practice, P.A. Dr. Winfield has served as Vice President of Medical Affairs for Anthem Health Plans of Florida, a provider of health insurance. Dr. Winfield received his undergraduate degree from the University of Oklahoma and is a graduate of the College of Medicine at the University of Oklahoma. |

CLASS 2 DIRECTORS

Name | | Age | | Positions Held and Principal Occupations During the Past Five Years |

Rudolph A. Kraft | | 70 | | Consultant to Kraft Motorcar Company, Inc. in Gainesville, Florida, a Mercedes-Benz, Jeep and Buick dealership, since 1990. Mr. Kraft is a Board member of the Jacksonville Marine Institute and Trustee of the Lasell College in Newton, Massachusetts. Mr. Kraft was President and Chief Executive Officer of Kraft Holdings, Inc., a Mercedes-Benz dealership in south Florida from 1977 to 1998. He also served as a director to Barnett Bank of South Florida from 1986 to 1989. Mr. Kraft has served on the boards of a number of civic organizations. |

R. C. Mills | | 69 | | President & COO of Heritage Propane Partners, L.P., a national distributor of propane gas. Mr. Mills is a graduate of the University of Sarasota and resides in the Jacksonville area. Mr. Mills has an extensive business background and is experienced in business mergers and acquisitions, corporate finance, and personnel management having served in several executive management positions with a vertically integrated oil and gas company for over 25 years. |

Gilbert J. Pomar, III | | 45 | | President and Chief Executive Officer for both the Company and the Bank, Mr. Pomar joined the Company in March 1999, having been employed by First Union National Bank in Jacksonville since 1991. During his tenure with First Union, he was Senior Portfolio Manager and Senior Vice President/Commercial Banking Manager. Mr. Pomar has 23 years of banking experience, including Southeast Bank, First National Bank of Chicago, Barnett Bank and Florida Coast Bank. Mr. Pomar is active in various community efforts, including Board positions of the American Cancer Society, University of North Florida, College of Business, and the Florida Bankers Association. He is a graduate of the University of Florida, where he earned his Bachelor of Science degree in Finance. |

Donald E. Roller | | 68 | | Chairman of our Board of Directors. President and Chief Executive Officer of U.S. Gypsum Company from 1993 through 1996. He was also Executive Vice President of USG Corporation. Mr. Roller has had much experience in directorship positions; he serves as a member of the Board and Treasurer of Glenmoor at St. Johns, a not for profit CCRC located in St. Augustine, Florida, and has served as acting Chief Executive Officer and Chairman of the Audit Committee for Payless Cashways, Inc. |

Charles F. Spencer | | 63 | | President of INOC LLC, a real estate management development company, and Cottage Street Land Trust, Inc. in Jacksonville, Florida. In addition, Mr. Spencer is Executive Vice President of the South Atlantic and Gulf Coast District of I.L.A. and Vice President at Large of the Florida AFL-CIO. He serves as a member of the Board of the Jacksonville Airport Authority, the Jacksonville Propeller Club, the I.M. Sulzbacher Center for the Homeless and Edward Waters College. Mr. Spencer is the former Chairman of the Board for the Jacksonville Sports Development Authority, appointed by the Mayor, and a former board member of the United Way of Northeast Florida, the Committee of 100 of the Jacksonville Chamber of Commerce, and the Florida Community College at Jacksonville Foundation. |

PROPOSAL 2: APPROVAL OF 2006 STOCK INCENTIVE PLAN

At its February 28, 2006 meeting, the Board of Directors unanimously adopted the Jacksonville Bancorp, Inc. 2006 Stock Incentive Plan (the “Plan”), under which the maximum of 20,000 shares of the Company’s common stock may be awarded to Company executives and employees, subject to the approval thereof by the shareholders of the Company at the Annual Meeting. A copy of the Plan is attached to this Proxy Statement as Appendix A. The favorable vote of a majority of the shares of common stock represented at the Annual Meeting is required for approval of the Plan.

The purposes of the Plan are to encourage outstanding individuals to accept or continue employment with the Company or its subsidiaries and to furnish maximum incentive to those persons to improve operations and increase profits and to strengthen the mutuality of interest between those persons and the Company’s shareholders by providing them incentives.

OUR BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE APPROVAL OF THE

2006 STOCK INCENTIVE PLAN.

Description of the Jacksonville Bancorp, Inc. 2006 Stock Incentive Plan

The following description of the material terms of the Plan is intended as a summary only and is qualified in its entirety by reference to the text of the attached Plan.

Administration. The Plan will be administered by the Compensation Committee of the Company’s Board of Directors, or such other committee comprised of members of the Board that the Board appoints (the “Committee”). If the Compensation Committee has not been designated as the Committee, members of the Committee must be “non-employee directors” within the meaning of Section 16 of the Securities Exchange Act of 1934, as amended, (the “Exchange Act”) and “independent directors” within the meaning of any applicable stock exchange rule. In addition, to the extent that the Committee intends that an award granted under the Plan constitutes “performance-based compensation” for purposes of Internal Revenue Code (the “Code”) section 162(m) (discussed below), members of the Committee must be “outside directors” within the meaning of Code section 162(m).

Under the Plan, the Committee has full authority to select the eligible individuals to whom awards will be granted, the types of award to be granted, the number of shares to be subject to an award, the exercise price (in the case of a stock option) and other terms and conditions of awards, to interpret the Plan, and to prescribe, amend and rescind the rules and regulations relating to the Plan.

Term, Amendment and Termination. If not terminated sooner by the Board of Directors, the Plan will terminate as of the close of business on the date immediately preceding the tenth anniversary of the Plan’s effective date, and no awards will be granted after that date. Awards granted and outstanding as of the date the Plan terminates will not be affected or impaired by such termination.

The Board of Directors may amend, alter or discontinue the Plan at any time. However, no amendment, alteration or discontinuation of the Plan may impair the rights of an award recipient with respect to awards previously granted without such recipient’s consent (except that no consent is necessary for amendments made to cause the Plan to qualify for the exemption provided by Rule 16b-3 of the Exchange Act or for awards to qualify for the “qualified performance-based compensation” exception under Code section 162(m), discussed below). No amendment may be made that would disqualify the Plan from the exemption provided by Rule 16b-3 of the Exchange Act or to extend the term of the Plan. No amendment can be made to the Plan without the consent of the Company’s shareholders to the extent that such approval is required by law or agreement.

The Committee may amend the terms of any outstanding award, either prospectively or retroactively except that an amendment that would impair the rights of the award holder requires the holder’s consent (except that no consent is necessary for amendments made to cause the Plan to qualify for the exemption provided by Rule 16b-3 of the Exchange Act or for awards to qualify for the “qualified performance-based compensation” exception under Code section 162(m), discussed below or to comply with Code Section 409A).

No Modification of Stock Options or Stock Appreciation Rights. Except for adjustments for certain corporate events as described below, the Plan expressly prohibits the Committee from modifying (including the extension, renewal or repricing of) stock options or stock appreciation rights once they are granted, if such modification would result in the stock options or stock appreciation rights constituting deferred compensation for purposes of Code section 409A.

Shares Subject to the Plan. Subject to adjustments as described below, up to 20,000 shares of the Company’s common stock, par value of $.01 per share, will be available for issuance for awards under the Plan, including with respect to incentive stock options. Shares subject to an award may be authorized and unissued shares, treasury shares, or shares of common stock purchased on the open market. Awards may only be granted on shares of the highest-value class of common stock of the Company, specifically excluding any class of stock that provides a preference as to dividend or liquidation rights. As of March 10, 2006, the closing price of a share of common stock was $32.15.

If an award granted under the Plan expires, terminates, is cancelled, or lapses for any reason without the issuance of shares of common stock, or if any shares of restricted stock awarded under the Plan are forfeited, the shares covered by such award or such restricted stock will again be available for awards under the Plan. In addition, if an award recipient tenders previously-acquired shares of the Company’s common stock to satisfy applicable withholding obligations with respect to an award, or if shares of the Company’s common stock are withheld to satisfy applicable withholding obligations, such shares will again be available for further awards under the Plan. Also, if an award recipient tenders previously-acquired shares of the Company’s common stock in payment of the option price upon exercise of a stock option awarded under the Plan, or if shares of common stock are withheld in payment of the option price, the number of shares tendered or withheld will again be available for further awards under the Plan.

Individual Limitations. Subject to adjustments as described below, no individual may be granted, within one fiscal year of the Company, awards covering more than 10,000 shares of common stock or common stock equivalents (in the case of awards of stock appreciation rights, restricted stock, restricted stock units, and performance grants). Additionally, no individual may be granted within one fiscal year of the Company, grants that exceed $500,000 when paid in cash or in shares of common stock.

Subject to the prohibition on modification of stock options and stock appreciation rights after the date of grant as specified above, if there is a change in the common stock of the Company through the declaration of stock dividends, or through recapitalization resulting in stock split-ups, or combinations or exchanges of shares, or otherwise, the Plan authorizes the Committee to make appropriate adjustments in the number of shares authorized for grants, in the exercise prices of outstanding stock options, in the base prices of stock appreciation rights, and in the limits described above on the number of shares available for grant to individuals per fiscal year.

Eligibility and Types of Awards. The Plan authorizes the grant of stock options, stock appreciation rights, restricted stock, restricted stock units, and performance grants. Participation in the Plan is open to employees of the Company and its subsidiaries as selected by the Committee. Directors who are not employees of the Company or of a subsidiary are not eligible to receive grants under the Plan. As of December 31, 2005, the Bank had approximately 46 employees, including three officers of the Company or any subsidiary, that would have been eligible to receive awards under the Plan.

Stock Options. Employees of the Company and its subsidiaries may be granted options to acquire the Company’s common stock under the Plan, either alone or in conjunction with other awards under the Plan. Under the Plan, stock options may be either incentive stock options (“ISOs”) or nonqualified stock options. The exercise price of a stock option is determined at the time of grant but may not be and may never become less than the fair market value per share of common stock on date of grant. Stock options are exercisable at the times and upon the conditions that the Committee may determine, as reflected in the applicable stock option agreement. The exercise period of a stock option is determined by the Committee and may not exceed ten years from the date of grant.

The holder of a stock option may exercise the option in whole or in part at such times as specified by the Committee in the grant agreement; provided that an ISO may be exercised no later than the earlier of (i) ten years from the date of grant, (ii) three months following the participant’s retirement or termination from employment for reasons other than for death or disability, or (iii) one year following the date of the Participant’s death or disability.

The exercise price of a stock option must be paid in full at the time of exercise and is payable in cash. However, if (and to the extent) provided by the related grant agreement, the option exercise price may also be paid: (i) by the surrender of common stock already owned by the optionee, (ii) by requesting the Company to withhold, from the number of shares of common stock otherwise issuable upon exercise of the stock option, shares having an aggregate fair market value on the date of exercise equal to the exercise price, or (iii) a combination of the foregoing, as provided by the award agreement. Additionally, if permitted by the Committee and allowable by law, payment of the exercise price may be made through a broker-facilitated cashless exercise.

ISOs are exercisable only by the optionee during his or her lifetime and are not assignable or transferable other than by will or by the application of the laws of inheritance. Nonqualified stock options may be assigned, but only to the extent specifically provided in grant agreement.

For the purpose of complying with Code section 409A, the Plan prohibits any modification to a previously granted Stock Option if such modification would result in the Stock Option being treated as deferred compensation subject to Code section 409A. A “modification” for this purpose is generally any change to the terms of the Stock Option (or the Plan or applicable award agreement) that provides the holder with a direct or indirect decrease in the exercise price of the Stock Option, or an additional deferral feature, or an extension or renewal of the Stock Option, regardless of whether the holder in fact benefits from this change. The maximum period in which a Stock Option may be extended for any reason under the Plan is to the 15th day of the third month following, or to the December 31 after the date on which the Stock Option otherwise would have expired, whichever happens to be later.

Stock Appreciation Rights. A stock appreciation right (“SAR”) may be granted (i) to employees in conjunction with all or any part of an option granted under the Plan (a “Tandem SAR”), or (ii) without relationship to an option (a “Freestanding SAR”). Tandem SARs must be granted at the time such option is granted. A Tandem SAR is only exercisable at the time and to the extent that the related option is exercisable. The base price of a Tandem SAR must be and may never become less than the exercise price of the option to which it relates. Upon the exercise of a Tandem SAR, the holder thereof is entitled to receive, in cash or common stock as provided in the related award agreement, the excess of the fair market value of the share for which the right is exercised (calculated as of the exercise date) over the exercise price per share of the related option. Stock options are no longer exercisable to the extent that a related Tandem SAR has been exercised, and a Tandem SAR is no longer exercisable upon the forfeiture, termination or exercise of the related stock option. A Freestanding SAR entitles the holder to a cash payment equal to the difference between the base price and the fair market value of a share of common stock on the date of exercise. The base price must be equal to and may never become less than the fair market value of a share of common stock on the date of the Freestanding SAR’s grant.

SARs may be sold or assigned, but only to the extent provided in the grant agreement.

For the purpose of complying with Code section 409A, the Plan prohibits any modification to a previously granted SAR if such modification would result in the SAR being treated as deferred compensation subject to Code section 409A. A “modification” for this purpose generally has the same meaning as discussed above with respect to Stock Options.

Restricted Stock. Employees of the Company and its subsidiaries may be granted restricted stock under the Plan, either alone or in combination with other awards. Restricted stock are shares of the Company’s common stock that are subject to forfeiture by the recipient if the conditions to vesting that are set forth in the related restricted stock agreement are not met. Vesting may be based on the continued service of the recipient, one or more performance goals (described below), or such other factors or criteria as the Committee may determine.

Unless otherwise provided in the related restricted stock agreement, the grant of a restricted stock award will entitle the recipient to vote the shares of Company common stock covered by such award and to receive the dividends thereon. Under the Plan, a restricted stock agreement may provide that cash dividends paid on restricted stock will be automatically deferred and reinvested in additional restricted stock and dividends payable in stock will be paid in the form of restricted stock. For the purpose of complying with Code section 409A, the Plan provides that cash dividends so reinvested or share dividends so payable shall vest at the same time as the Restricted Stock to which they relate; or, if the applicable award agreement is silent, such dividends shall be paid in the same calendar year in which the same dividends are paid to other shareholders of the Company, or by the 15th day of the third calendar month following the date on which the same dividends are paid to other shareholders of the Company, if later.

During the period that shares of stock are restricted, the recipient cannot sell, assign, transfer, pledge or otherwise encumber the shares of restricted stock. If a recipient’s employment or service with the Company and its subsidiaries terminates, the recipient will forfeit all rights to the unvested portion of the restricted stock award.

Restricted Stock Units. Employees of the Company and its subsidiaries may be granted restricted stock units under the Plan, either alone or in combination with other awards. A restricted stock unit is a right to receive a share of common stock of the Company or the fair market value in cash of a share of common stock in the future, under terms and conditions established by the Committee.

The applicable restricted stock units award agreement is required to specify the times or events on which restricted stock units will be paid. These times or events generally include the applicable vesting date, the date of the participant’s termination of employment, or a specified calendar date. Restrictions conditioned on the passage of time shall not expire less than three years from the date of grant. Once specified in the award agreement, payment dates may not be accelerated for a participant for any reason, except as specifically provided for in Code section 409A. At the time specified in the applicable award agreement, restricted stock units will be settled by the delivery to the participant of shares of common stock equal in number to the number of the participant’s restricted stock units that are vested as of the specified date or event (such as termination of employment), or cash equal to the fair market value of such shares. Payment to any specified employee (as defined in the Plan) upon termination of employment is required to be delayed for six months in order to comply with Code section 409A.

Prior to an actual delivery of shares of common stock in settlement of a restricted stock units grant, a participant acquires no rights of a shareholder. Restricted stock units may not be sold, assigned, transferred or pledged or otherwise encumbered, but a participant may designate one or more beneficiaries to whom shares of common stock covered by a grant of restricted stock units will be transferred in the event of the participant’s death.

The Committee may, in its discretion, provide in a restricted stock units award agreement that a participant will be entitled to receive dividend equivalents with respect to his or her restricted stock units. Dividend equivalents may, in the discretion of the Committee, be paid in cash or credited to the participant as additional restricted stock units, or any combination of cash and additional restricted stock units. The amount that can be paid to a recipient as a dividend equivalent cannot exceed the amount that would be payable as a dividend if the stock unit were actually a share of common stock. If credited to the participant as additional restricted stock units, the additional restricted stock units will vest at the same time as the restricted stock units to which they relate. If credited to the participant as cash, the dividend equivalents must be paid in the same calendar year in which the related dividends are paid to shareholders of the Company, or by the 15th day of the third calendar month following the date on which the related dividends are paid, if later.

Performance grants. Officers and employees of the Company and its subsidiaries may be granted performance grants under the Plan, either alone or in combination with other Plan awards.

A performance grant is a contingent right to receive a share of common stock of the Company or the fair market value in cash of a share of common stock, in the future, pursuant to the terms of a grant made under the Plan and the related award agreement. For any grant of performance grants, the Committee will establish (i) one or more performance goals, and (ii) a performance period of not less than one year. The performance goals will be based on one or more performance criteria set forth in the Plan and described below. At the expiration of the performance period, the Committee will determine and certify the extent to which the performance goals were achieved. The Committee will then determine the number of performance grants to which a recipient of performance grants under the grant is entitled, based upon the number of performance grants originally granted to the recipient and the level of performance achieved. Performance grants will be settled by the delivery of shares of common stock of the Company or cash equal to the fair market value of such shares as soon as practicable after the close of the performance period. Performance grants will be delivered as soon as practicable following the Committee’s determination, but in any event no later than 2½ months after the end of the year in which the applicable performance period has ended.

Payment to any specified employee (as defined in the Plan) upon termination of employment is required to be delayed for six months in order to comply with Code Section 409A

Prior to an actual delivery of shares of common stock in settlement of a performance grants grant, a recipient acquires no rights of a shareholder. Performance grants may not be sold, assigned, transferred or pledged or otherwise encumbered, but a recipient may designate one or more beneficiaries to whom shares of common stock covered by a grant of performance grants will be transferred in the event of the recipient’s death.

Effective Date. If approved by the shareholders, the Plan described above will be effective as of the date of approval.

Certain Federal Income Tax Considerations

The following is a brief and general summary of the federal income tax consequences of transactions under the Plan based on federal income tax laws in effect on January 1, 2006. The summary does not purport to be complete, and does not address the tax consequences of a participant’s death or the state, local and foreign tax laws that may also be applicable to awards and transactions involving awards.

Stock Options. Stock options granted under the Plan may be either “Incentive Stock Options,” as defined in Section 422 of the Code, or Nonstatutory Stock Options.

Incentive Stock Options. Incentive Stock Options granted under the Plan will be subject to the applicable provisions of the Code, including Code section 422. If shares of common stock are issued to an optionee upon the exercise of an ISO, and if no “disqualifying disposition” of such shares is made by such optionee within one year after the exercise of the ISO or within two years after the date the ISO was granted, then (i) no income will be recognized by the optionee at the time of the grant of the ISO, (ii) no income, for regular tax purposes, will be realized by the optionee at the date of exercise, (iii) upon sale of the shares of the common stock acquired by exercise of the ISO, any amount realized in excess of the option price will be taxed to the optionee, for regular tax purposes, as a capital gain (at varying rates depending upon the optionee’s holding period in the shares and income level) and any loss sustained will be a capital loss, and (iv) no deduction will be allowed to the Company for federal income tax purposes. If a “disqualifying disposition” of such shares is made, the optionee will realize taxable ordinary income in an amount equal to the excess of the fair market value of the shares purchased at the time of exercise over the exercise price (the “bargain purchase element”) and Company will generally be entitled to a federal income tax deduction equal to such amount. The amount of any gain in excess of the bargain purchase element realized upon a “disqualifying disposition” will be taxable as capital gain to the holder (at varying rates depending upon such holder’s holding period in the shares and income level), for which Company will not be entitled to a federal income tax deduction. Upon exercise of an ISO, the optionee may be subject to alternative minimum tax.

Nonqualified Stock Options. With respect to nonqualified stock options, (i) no income is recognized by the optionee at the time the option is granted; (ii) generally, at exercise, ordinary income is recognized by the optionee in an amount equal to the difference between the option exercise price paid for the shares and the fair market value of the shares on the date of exercise, and the Company is entitled to a tax deduction in the same amount; and (iii) at disposition, any gain or loss is treated as capital gain or loss. In the case of an optionee who is also an employee, any income recognized upon exercise of a nonqualified stock option will constitute wages for which withholding will be required.

Stock Appreciation Rights. No income will be recognized by a recipient in connection with the grant of a SAR. When a SAR is exercised, the recipient will generally be required to include as taxable ordinary income in the year of exercise an amount equal to the amount of cash received and the fair market value of any common stock received on the exercise. In the case of a recipient who is also an employee, any income recognized upon exercise of a SAR will constitute wages for which withholding will be required. The Company will be entitled to a tax deduction at the same time and in the same amount. If the optionee receives common stock upon the exercise of a SAR, any gain or loss on the sale of such stock will be treated in the same manner as discussed above under “nonqualified stock options.”

Restricted Stock. A recipient will not realize taxable income at the time of grant of a restricted stock award, assuming that the restrictions constitute a substantial risk of forfeiture for Federal income tax purposes. Upon the vesting of shares of Company common stock subject to an award, the recipient will realize ordinary income in an amount equal to the excess of the fair market value of such shares at such time over the amount paid by the recipient, if any. The Company will be entitled to a deduction equal to the amount of ordinary income realized by the recipient in the taxable year in which the amount is included in the recipient’s income. Dividends paid to the recipient during the restriction period will be taxable as compensation income to the recipient at the time paid and will be deductible at such time by the Company. The recipient of a restricted stock award may, by filing an election with the Internal Revenue Service within 30 days of the date of grant of the restricted stock award, elect to be taxed at the time of grant of the award on the excess of the then fair market value of the shares of Company common stock over the amount paid by the recipient, if any, in which case (1) the Company will be entitled to a deduction equal to the amount of ordinary income realized by the recipient in the taxable year in which the amount is included in the recipient’s income, (2) dividends paid to the recipient during the restriction period will be taxable as dividends to the recipient and not deductible by the Company, and (3) there will be no further tax consequences to either the recipient or the Company when the restrictions lapse. In the case of a recipient who is also an employee, any amount included in income will constitute wages for which withholding will be required.

Restricted Stock Units and Performance Grants. An employee who is awarded one or more restricted stock units and/or performance grants will not recognize income and the Company will not be allowed a deduction at the time the award is made. When an employee receives payment for such awards in cash or shares of common stock, the amount of the cash and the fair market value of the shares of common stock received will be ordinary income to the employee and will be allowed as a deduction for federal income tax purposes to the Company. The Company will be entitled to a deduction equal in amount to the ordinary income realized by the recipient in the year paid. In the case of a recipient who is an employee, any amount included in income will constitute wages for which withholding will be required.

Section 162(m) Limit. Code section 162(m) generally limits a public company’s federal income tax deduction for compensation paid to any of its executive officers to $1,000,000 per year. However, certain “performance-based compensation” paid to such officers is exempt from the $1,000,000 annual deduction limit.

The Plan is designed to enable the Company to provide grants of stock options, stock appreciation rights and performance grants under the Plan to the Company’s executive officers that will satisfy the requirements of the exception of Section 162(m) for performance-based compensation. The Plan is also designed so that awards of restricted stock and restricted stock units under the Plan may be made in a manner which satisfies the performance-based compensation exception of Section 162(m). Accordingly, (i) the right to receive a share of common stock or cash in payment of a stock option, stock appreciation right or performance grant, and, (ii) if the Committee intends that a restricted stock or stock unit award satisfy the performance-based compensation exception, the vesting of such stock or restricted stock units, will be contingent upon the achievement of objective performance goals established by the Committee at the time of grant.

Under the Plan, a performance goal will be based on one or more of the following criteria: total shareholder return, revenue, gross profit, pre-tax earnings, net operating profit after taxes, net income, earnings per share, gross margin, net interest margin, operating cash flow, free cash flow, return on assets, return on invested capital, and return on equity. Performance criteria may be used to measure the performance of the Company as a whole or any business unit of the Company, and may be measured relative to a peer group or index. The level of achievement of a performance goal will be determined in accordance with generally accepted accounting principles and shall be subject to certification by the Committee. Under the Plan, the Committee does have the discretion, to the extent such discretion is consistent with the “qualified performance-based exception” of the Code and its regulations, to make equitable adjustments to performance goals in recognition of unusual or non-recurring events affecting the Company or a subsidiary or the financial statements of the Company or any subsidiary, or for changes in the law or accounting principles. Once a performance goal is established, the Committee will have no discretion to increase the amount of compensation that would otherwise be payable to a recipient upon attainment of the performance goal.

Income Tax Withholding. Upon an employee’s realization of income from an award, the Company is generally obligated to withhold against the employee’s Federal and state income and employment tax liability. Payment of the withholding obligation can be made from other amounts due from the Company to the award recipient or with shares of Company common stock owned by the recipient. If the recipient elects to tender shares of Company common stock or to reduce the number of shares the recipient is otherwise entitled to receive to satisfy the withholding obligation, the shares tendered or reduced will be treated as having been sold to the Company.

Capital Gains. Generally, under law in effect as of January 1, 2006, net capital gain (net long-term capital gain minus net short-term capital loss) is taxed at a maximum rate of 15%.

Special Considerations under Code Section 409A. Code section 409A is effective in general for any compensation deferred under a nonqualified deferred compensation plan on or after January 1, 2005. Compensation deferred under a nonqualified plan prior to that date is also subject to the new requirements if the plan is “materially modified” on or after October 4, 2004. A nonqualified plan is materially modified if any new benefit or right is added to the plan or any existing benefit or right is enhanced.

If at any time during a taxable year a nonqualified deferred compensation plan fails to meet the requirements of Code section 409A, or is not operated in accordance with those requirements, all amounts (including earnings) deferred under the plan for the taxable year and all preceding taxable years, by any participant with respect to whom the failure relates, are includible in such participant’s gross income for the taxable year to the extent not subject to a substantial risk of forfeiture and not previously included in gross income. If a deferred amount is required to be included in income under Code section 409A, the amount also is subject to an additional income tax and enhanced interest. The additional income tax is equal to twenty percent of the amount required to be included in gross income. The interest imposed is equal to the interest at the underpayment rate specified by the Internal Revenue Service, plus one percentage point, imposed on the underpayments that would have occurred had the compensation been includible in income for the taxable year when first deferred, or if later, when not subject to a substantial risk of forfeiture.

In addition, the requirements of Code section 409A are applied as if (a) a separate plan or plans are maintained for each participant, and (b) all compensation deferred with respect to a particular participant under an account balance plan is treated as deferred under a single plan, all compensation deferred under a nonaccount balance plan is treated as deferred under a separate single plan, all compensation deferred under a plan that is neither an account balance plan nor a nonaccount balance plan (for example, equity-based compensation) is treated as deferred under a separate single plan, and all compensation deferred pursuant to an involuntary separation pay arrangement is treated as deferred under a separate single plan. Thus, if a plan failure under Code section 409A relates only to a single participant, then only the compensation deferred by that particular participant will be includable in gross income and subject to the additional income tax and interest; but any amount deferred by the participant under a different plan of a similar basic type will be includable in the participant’s gross income and subject to the additional income tax and interest as well.

In general, stock options and SARs do not provide for a deferral of compensation subject to Code section 409A if (i) the underlying stock is the highest value common stock of the service recipient; (ii) the exercise price is equal to and can never become less than the fair market value of the underlying stock at the time of grant; and (iii) the option or appreciation right is not modified, renewed or extended after the date of grant in a way that would cause the option to provide for a deferral of compensation or additional deferral feature. Restricted stock awards and performance grants generally do not provide for a deferral of compensation subject to Code section 409A, unless (i) the award is received more than 2½ months beyond the end of the first taxable year (employee’s or employer’s, whichever is later) in which the legally binding right to such award arises and is no longer subject to a substantial risk of forfeiture and (ii) the award includes at least some shares that are not subject to a substantial risk of forfeiture at the time the award is received. In each case, the Plan has been designed with the intent that the arrangements under which participants receive stock options, SARs, restricted stock and performance grants do not provide for a “deferral of compensation” subject to Code section 409A.

An award of restricted stock units provides for a deferral of compensation subject to Code section 409A if payment of such an award occurs more than 2½ months after the end of the first taxable year (employee’s or employer’s, whichever is later) in which the legally binding right to the award arises and is no longer subject to a substantial risk of forfeiture. Under the Plan, restricted stock units are potentially subject to Code section 409A because payment of restricted stock units may occur on the award recipient’s termination of employment or upon a fixed date which in either case could be more than 2½ months beyond the end of the first taxable year in which the restricted stock units are no longer subject to a substantial risk of forfeiture.

Because participants are not able to submit initial deferral elections with respect to restricted stock units or elections as to the time or form of payment of restricted stock units, the requirements of Code section 409A as they relate to these elections do not apply. Similarly, because restricted stock units are only payable upon certain fixed times or events and because there is a six-month delay for payments upon termination of employment to specified employees, this arrangement satisfies the requirements under Code section 409A regarding permissible distribution events and times. Finally, the Plan includes a provision prohibiting the acceleration of the timing or schedule of payment of restricted stock units to any participant, except in the limited circumstances specifically permitted under Code section 409A. Thus, the Plan has been designed with the intent that the arrangement under which participants receive restricted stock units complies with the requirements of Code section 409A.

New Plan Benefits

No awards have been granted to date under the 2006 Stock Incentive Plan, although it is anticipated that awards will be granted during fiscal year 2006 if the 2006 Stock Incentive Plan is approved by the Company’s shareholders. Awards for which benefits may be paid under the Plan are made at the sole discretion of the Committee, subject to the maximum plan and maximum individual limitations described above. In addition, the actual benefits that will paid under the Plan will depend upon a number of factors, including the market value of the Company’s common stock on future dates, and in the case of performance grants and restricted stock with vesting, based on the achievement of one or more performance goals, actual performance of the Company (both absolutely, and in some cases, as measured against the performance of peer companies), and decisions made by performance grant recipients. Since these factors are not known at this time, the benefits or amounts paid under the Plan, and the market value of such awards are not yet determinable. In addition, because of these unknown variables, it is not possible to determine any other benefits that might be received by recipients under the Plan.

BOARD OF DIRECTORS, GOVERNANCE AND COMMITTEES

Corporate Governance. The Board of Directors is committed to good business practices, transparency in financial reporting, the highest level of corporate governance and the highest ethical, moral and legal standards in the conduct of its business and operations. We believe that these standards form the basis for our reputation of integrity in the marketplace and are essential to our efficiency and continued overall success.

Communications with the Board of Directors. The Board has established a process for shareholders to communicate with members of the Board. If you would like to contact the Board, you can do so by forwarding your concern, question or complaint to the Company’s Corporate Secretary, Price W. Schwenck, at 100 North Laura Street, Jacksonville, Florida 32202.

Independence. The Board of Directors has determined that 13 of its 14 members are independent as defined by the National Association of Securities Dealers listing standards.

Meetings. During fiscal year 2005, the Board held ten meetings, and all directors attended at least 75% of the meetings of the Board and committees on which they served, except for Melvin Gottlieb who returned from a one-year leave of absence in August 2005 and attended 50% of the remaining board meetings in fiscal year 2005. Our Board of Directors maintains an Audit Committee, a Compensation Committee and a Corporate Governance Committee, which are described below. Our Board elects the members of these committees at the Annual Meeting, and membership may change throughout the year based on varying circumstances at the discretion of the Board. Under our bylaws, the Board of Directors is authorized to fill any vacancy on a committee.

Audit Committee. The Audit Committee is responsible for the matters set forth in its written charter, which has been adopted by the Board of Directors, a copy of which is attached to this Proxy Statement. The primary function of the Audit Committee is to assist the Board of Directors in fulfilling its oversight responsibilities by reviewing the Company’s financial reports, systems of internal controls regarding finance, accounting, legal compliance and ethics, and evaluating the independence of the Company’s independent accountants. The Audit Committee held four meetings in fiscal year 2005. The members of the Audit Committee are D. Michael Carter (Chairman), R.C. Mills, John W. Rose and John R. Schultz. All members of the Audit Committee are independent as defined by rule promulgated under the Securities Exchange Act of 1932, as amended (the “Exchange Act”), and the National Association of Securities Dealers listing standards.

Audit Committee Pre-Approval Policies and Procedures. In accordance with the Sarbanes-Oxley Act of 2002, the Audit Committee is required to pre-approve all auditing services and permissible nonaudit services, including related fees and terms, to be performed for the Company by its independent auditor subject to the de minimus exceptions for nonaudit services described under the Exchange Act, which are approved by the Audit Committee prior to the completion of the audit. In fiscal year 2005, the Audit Committee pre-approved all services performed for the Company by the auditor.

Audit Committee Financial Expert. The Board of Directors has determined that D. Michael Carter, C.P.A., is an audit committee financial expert. Mr. Carter is independent as defined by the National Association of Securities Dealers listing standards.

Compensation Committee. The Compensation Committee, the charter of which is attached, is responsible for oversight of compensation matters, employment issues and personnel policies. The Committee makes recommendations to the Board of Directors regarding compensation for the Chief Executive Officer, as well as other executive officers and certain officers/managers, including salary, bonuses, option grants, other forms of long-term compensation, and employee benefits. Additionally, the Committee reviews general levels of compensation and is responsible for evaluation of salaries and other compensation in light of industry trends and the practices of similarly situated, publicly traded bank holding companies. The Compensation Committee held six meetings in fiscal year 2005. The members are John W. Rose (Chairman), R.C. Mills, Donald E. Roller, Charles F. Spencer and Gary L. Winfield, M.D. Price Schwenck serves ex officio to the Compensation Committee.

Compensation Committee Interlocks and Insider Participation. During fiscal year 2005, none of the members of the Compensation Committee were current or former officers or employees of the Company or its subsidiaries, nor had any other material relationship requiring disclosure.

Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee is responsible for formulating policies governing the Board of Directors and its committees as set out in its charter, a copy of which is attached to this Proxy Statement. The responsibilities include recommending new Board members, establishing criteria for membership on the Board, designating chairs and members of Board committees, setting dates for Board meetings, monitoring compliance with our bylaws and regulations governing public companies and making recommendations regarding director compensation. The Nominating and Corporate Governance Committee held four meetings in fiscal year 2005. The members of the Nominating and Corporate Governance Committee are Bennett A. Tavar (Chairman), Melvin Gottlieb, John C. Kowkabany, Rudolph A. Kraft, Donald E. Roller and Charles F. Spencer, all of whom are independent as defined by the National Association of Securities Dealers listing standards. The Nominating and Corporate Governance Committee will consider candidates for Board seats recommended by our shareholders. Written suggestions for nominees should be sent to the Corporate Secretary, Price W. Schwenck, Jacksonville Bancorp, Inc., 100 North Laura Street, Jacksonville, Florida 32202. Any such recommendation must include the name and address of the candidate; a brief biographical description, including the candidate’s occupation for at least five years; a statement of the qualifications of the candidate; and the candidate’s signed consent to be named in the Proxy Statement and to serve as director, if elected.

Director Fees. Directors who are not employees of the Company received $164,949 in 2004 and $204,689 in fiscal year 2005 for their services to the Company. Non-employee directors currently participate in the Company’s Directors Stock Purchase Plan under which a director may designate all, or any part, of his compensation for investment in the Company’s stock. All non-employee directors elected to designate all of their compensation for such investment, each receiving 600 shares of Company stock, except for Mr. Kraft, who received 100% of his director fees in cash.

EXECUTIVE COMPENSATION

COMPENSATION COMMITTEE REPORT

During 2005, the Compensation Committee of the Board of Directors was composed of five members--Messrs. Mills, Roller, Rose, Spencer and Winfield, all of whom constitute independent directors as defined under the rules of the National Association of Securities Dealers. The Board designates the chairman of the Committee and the members of the Committee.

Compensation Policy. The Company’s compensation policy is designed to make changes in total compensation commensurate with changes in the value created for the Company’s shareholders. The Compensation Committee believes that compensation of executive officers and others should be based on the Company’s operating performance, the individual’s responsibilities and peer industry studies, and should be designed to aid the Company in attracting and retaining high-performing executives.

The objectives of the Compensation Committee’s compensation strategy are to establish incentives for certain executives and others to achieve and maintain short-term and long-term strategic and operating performance goals for the Company, and to provide compensation that recognizes individual contributions as well as overall business results. At the Company, executive officer compensation comprises three areas: base salary, short-term annual incentives and long-term stock incentives.

In establishing executive officer salaries and increases, the Compensation Committee, with the Chief Executive Officer’s input, considers individual quarterly performance in the areas of Company profitability, strategic plan progress, growth, asset quality, customer service, morale, completed projects, team work and communication, and the relationship of total compensation to the salary market of similarly situated institutions. The decision to increase base pay is determined by the Compensation Committee using performance results measured quarterly. The Company’s general approach to executive compensation is to provide market competitive base salary, and to reward performance through periodic incentive bonuses consistent with individual contributions to the Company’s financial performance.

Chief Executive Officer Compensation. During the first quarter of each year, the Compensation Committee reviews the compensation paid to the Chief Executive Officer of the Bank. Final approval of Chief Executive Officer compensation is made by the Board of Directors. Changes in base salary and the awarding of cash and stock incentives are based on the Company’s profitability, strategic plan progress, growth and loan quality, morale, completed projects, teamwork and communications. The Compensation Committee also considers the Chief Executive Officer’s abilities in the areas of leadership and community involvement along with the compensation of chief executive officers of comparable-sized financial institutions.

After reviewing the appropriate data, the annual salary for Gilbert J. Pomar, III, President and Chief Executive Officer of the Company and the Bank, was increased by $5,000 to $165,000 for 2006 based on specific accomplishments and the overall financial performance of the Company. Mr. Pomar was awarded a cash bonus award of $85,000.

Summary. In summary, the Compensation Committee believes that the Company’s compensation program is reasonable and competitive with compensation paid by other financial institutions similarly situated. The program is designed to reward strong performance.

Compensation Committee: R.C. Mills, Donald E. Roller, John W. Rose, Charles F. Spencer and Gary L. Winfield

EXECUTIVE OFFICERS OF THE REGISTRANT

Our executive officers, in addition to Mr. Pomar, who serves as a director, are listed below. Except as otherwise indicated, each person has been or was engaged in his present or last principal occupation, in the same or a similar position, for more than five years. Each officer holds office for the term set forth in the officer’s written employment agreement, if any, or until the officer’s successor has been elected and qualified.

Name | | Age | | Positions Held and Principal Occupations During the Past Five Years |

| Scott M. Hall | | 41 | | Executive Vice President and Senior Loan Officer of the Bank. Mr. Hall has over 19 years of experience in the financial services industry. Before joining the Bank, he was employed with First Union National Bank in Jacksonville for eight years as Vice President/Commercial Banking Relationship Manager. His community activities include the Jacksonville Chamber of Commerce and Habitat for Humanity. He serves as a director for the DYE-Clay YMCA. Mr. Hall is a graduate of the University of North Florida, where he received his Bachelor of Business Administration degree in Finance. |

Valerie A. Kendall | | 53 | | Executive Vice President and Chief Financial Officer of the Holding Company and Bank. Ms. Kendall’s banking career spans more than 20 years. Prior to joining the Bank, she served as Executive Vice President and Chief Financial Officer of P.C.B. Bancorp, Inc., n/k/a Colonial BancGroup, Inc., a $650 million multi-bank holding company based in Clearwater, Florida. She also held senior finance positions with AmSouth Bank, Barnett Banks (Bank of America) and SunTrust. Ms. Kendall received her Bachelor of Science degree in Accounting from Florida Southern College and is a Certified Public Accountant. |

SUMMARY COMPENSATION TABLE (1)

The following table sets forth for the fiscal years ended December 31, 2005, 2004 and 2003 the cash compensation paid or accrued, as well as certain other compensation paid or accrued for those years, for services in all capacities to the Chairman of our Bank(2), Chief Executive Officer, Chief Financial Officer and the Senior Loan Officer of our Bank.

| | | Annual Compensation | | |

| Name and Principal Position | Year | Salary ($) | Bonus ($) | Other Annual Compensation ($)(3) | All Other Compensation ($)(4) |

Price W. Schwenck, Chairman of the Bank(2) | 2005 2004 2003 | 100,000 100,000 -0- | -0- 41,372 -0- | -0- -0- -0- | -0- -0- -0- |

| Gilbert J. Pomar, III, President and Chief Executive Officer | 2005 2004 2003 | 160,000 148,000 141,000 | 85,000 67,000 69,000 | -0- -0- -0- | 9,480 13,000 12,000 |

| Scott M. Hall, Executive Vice President and Senior Loan Officer of the Bank | 2005 2004 2003 | 130,000 125,000 110,950 | 60,000 40,000 40,000 | 100 100 250 | 7,750 7,895 8,838 |

Valerie A. Kendall, Executive Vice President and Chief Financial Officer(5) | 2005 2004 2003 | 130,000 125,000 -0- | 40,000 25,000 -0- | -0- -0- -0- | 7,768 -0- -0- |

| (1) | Columns relating to Long-Term Compensation Awards and LTIP Payouts have been deleted because no compensation required to be reported in such columns was awarded to, earned by or paid to the named executives during the periods indicated. Perquisites are not disclosed because the aggregate value does not exceed the lesser of $50,000 or 10% of total annual salary and bonus. |

| (2) | As of January 1, 2006, Price Schwenck is no longer an executive officer of the Registrant or the Bank |

| (3) | The amounts shown in the Other Annual Compensation column consist of commissions. |

| (4) | The amounts shown in the All Other Compensation column consist of matching contributions to the 401(k) plan. |

| (5) | Valerie Kendall commenced her employment with the Registrant/Bank on May 24, 2004. |

AGGREGATE OPTION EXERCISES IN LAST FISCAL YEAR AND FISCAL YEAR END OPTION VALUES

The following table sets forth information regarding stock options exercised in fiscal year 2005 by each of the named executive officers and the value of the unexercised options held by these individuals as of December 31, 2005 based on the market value ($33.96) of the common stock on December 31, 2005 on the Nasdaq SmallCap Market.

| Name | Shares Acquired on Exercise (#) | Value Realized ($) | Number of Securities Underlying Unexercised Options at 12/31/05 | Value of Unexercised in the Money Options at 12/31/05 |

| Exercisable/Unexercisable | Exercisable/Unexercisable |

| Price W. Schwenck | -- | -- | 4,641 / ------- | $111,198 / $-0- |

| Gilbert J. Pomar, III | -- | -- | 38,000 / 17,000 | $868,680 / $278,370 |

| Scott M. Hall | -- | -- | 16,000 / 9,000 | $358,385 / $128,490 |

| Valerie A. Kendall | -- | -- | 3,000 / 12,000 | $ 32,130 / $128,520 |

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

The Company has granted loans to and accepted deposits from its executive officers, directors and their affiliates in the ordinary course of business on substantially the same terms, including interest rates and collateral, as those prevailing at the time for comparable transactions with other customers and which did not involve more than the normal risk of collectibility or present other unfavorable features.

EQUITY COMPENSATION PLAN INFORMATION

The following table sets forth the securities authorized for issuance under the equity incentive plan as of December 31, 2005:

| Plan Category | Number of securities to be issued upon exercise of outstanding options, warrants and rights | Weighted average exercise price of outstanding options, warrants and rights | Number of securities remaining available for future issuance |

| Equity compensation plans approved by security holders | 189,214 | $14.04 | 39,724 |

| Equity compensation plans not approved by security holders | -- | -- | -- |

| Total | 189,214 | $14.04 | 39,724 |

EMPLOYMENT AGREEMENTS

Gilbert J. Pomar, III. Under our employment agreement with Gilbert J. Pomar, III, (the “Pomar Agreement”), he became the Bank's President in March 1999 at a salary of $120,000. He has since been promoted to become our CEO, and his base salary has increased annually. Mr. Pomar's salary was increased from $160,000 to $165,000 effective March 15, 2006, based on the evaluation of performance factors by the Compensation Committee. Further, Mr. Pomar was granted a bonus of $85,000 in January 2006 relative to performance in 2005. The Pomar Agreement provides for an annual base salary plus annual increases and participation in bonus plans, stock option plans, stock ownership plans, profit sharing plans and 401(k) plans made available to our employees and executives. Additionally, we pay Mr. Pomar's medical and dental insurance plan premiums. The Pomar Agreement has a rolling one-year term, ending no later than Mr. Pomar's 65th birthday and contains a six-month noncompetition provision against employment with any person seeking to organize a financial institution in Duval or Clay counties.

If we terminate Mr. Pomar's employment for a reason other than for “just cause” (as defined in the Pomar Agreement), death or disability, or if Mr. Pomar terminates his employment for “good reason” (as defined), then we must pay Mr. Pomar an amount equal to his annual base salary and any bonus to which he would have been entitled under the Pomar Agreement. If Mr. Pomar's employment is terminated as a result of a “change in control” (as defined) or a change in control occurs within 12 months of his involuntary termination or termination for good reason, then Mr. Pomar is entitled to a severance payment equal to 2.99 times his current annual base salary plus any incentive compensation to which he was entitled under the Pomar Agreement. These payments will be made in substantially equal semi-monthly installments until paid in full. In addition, upon a change in control, all unvested options will vest on the day before the effective date of the change in control. Furthermore, unless Mr. Pomar is terminated for just cause, under certain banking regulatory requirements or under a termination of employment by Mr. Pomar for other than good reason, we are also required to maintain in full force and effect all employee benefit plans in which Mr. Pomar was participating before termination for the remainder of the Pomar Agreement, or 12 months, whichever is shorter. The Pomar Agreement also contains provisions required under certain banking regulations that suspend or terminate the Pomar Agreement upon certain banking regulatory findings or actions.

Scott M. Hall. Under our employment agreement with Scott M. Hall (the “Hall Agreement”), he became the Bank's Senior Loan Officer on January 1, 2003 at an annual salary of $112,000. Mr. Hall’s salary was increased from $130,000 to $134,000 effective March 15, 2006. Mr. Hall was granted a bonus of $60,000 in 2006 relative to performance in 2005. The Hall Agreement provides for an annual base salary plus incentive compensation and participation in bonus plans, stock option plans, stock ownership plans, profit sharing plans and 401(k) plans made available to our employees and executives. Additionally, we pay Mr. Hall’s medical and dental insurance plan premiums. The Hall Agreement has a rolling one-year term, ending no later than Mr. Hall’s 65th birthday, and contains a 12-month noncompetition provision against employment with any person seeking to organize a financial institution in Duval or Clay counties; however, such provision is limited to a three-month period if Mr. Hall is terminated due to a change in control.

If we terminate Mr. Hall’s employment for a reason other than for “just cause” (as defined in the Hall Agreement) or Mr. Hall terminates his employment for “good reason” (as defined), then we must pay an amount equal to his annual base salary and any incentive compensation or bonus to which he would have been entitled under the Hall Agreement. If Mr. Hall’s employment is terminated as a result of a “change in control” (as defined) or said change occurs within 12 months of his involuntary termination or termination for good reason, then Mr. Hall is entitled to a severance payment equal to 300% of the highest annual salary and bonus he was paid or entitled to in the two years preceding termination. These payments will be made in substantially equal semi-monthly installments until paid in full. In addition, upon a termination for a change in control, we are also required to maintain in full force and effect all employee benefit plans in which Mr. Hall was participating before termination for the remainder of the Hall Agreement, or 12 months, whichever is shorter.

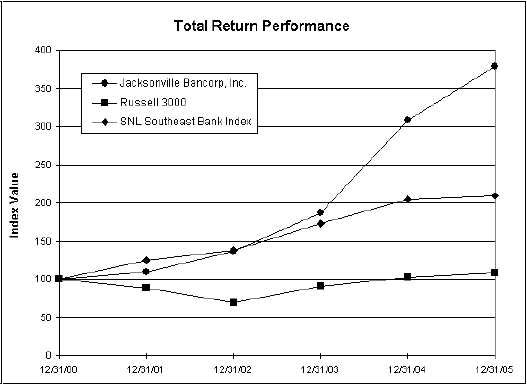

SHAREHOLDER RETURN PERFORMANCE

| | Period Ending |

Index | 12/31/00 | 12/31/01 | 12/31/02 | 12/31/03 | 12/31/04 | 12/31/05 |