SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

| Filed by a Party other than the Registrant | o |

Check the appropriate box:

| o | Preliminary Proxy Statement |

| | |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| | |

| o | Definitive Additional Materials |

| o | Soliciting Material Pursuant to Rule 14a-12 |

Jacksonville Bancorp, Inc.

(Name of Registrant as Specified in its Charter)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| | |

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | 1) | Title of each class of securities to which transaction applies: |

| | | |

| | 2) | Aggregate number of securities to which transaction applies: |

| | 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

| | 4) | Proposed maximum aggregate value of transaction: |

| | 5) | Total fee paid: |

| | |

| o | Fee paid previously with preliminary materials. |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | |

| | 1) | Amount Previously Paid: |

| | 2) | Form Schedule or Registration Statement No.: |

| | | |

| | 3) | Filing Party: |

March 31, 2009

Dear Shareholder:

You are cordially invited to attend the Annual Meeting of Shareholders of Jacksonville Bancorp, Inc., which will be held on Tuesday, April 28, 2009, beginning at 11:00 a.m., Eastern Time. The meeting will be held at The River Club, 1 Independent Drive, Suite 3500, Jacksonville, Florida 32202. The purpose of the meeting is to consider and vote upon the proposal explained in the notice and the Proxy Statement.

A formal notice describing the business to come before the meeting, a Proxy Statement and a proxy card are enclosed. We have also enclosed our Annual Report on Form 10-K for the year ended December 31, 2008 for your review which contains detailed information concerning our 2008 financial performance and activities.

You may think your vote is not important, but it is vital. The meeting of shareholders will be unable to conduct any business if less than a majority of the shares eligible to vote is represented. Whether or not you plan to attend the Annual Meeting in person, please vote your shares immediately by telephone, by Internet or by completing, signing and dating the enclosed proxy card and returning it in the enclosed postage-paid envelope as promptly as possible. If you later decide to attend the Annual Meeting and vote in person, or if you wish to revoke your proxy for any reason before the vote at the Annual Meeting, you may do so and your proxy will have no further effect.

Thank you for taking the time to vote.

Sincerely,

Donald E. Roller

Chairman of the Board

Jacksonville Bancorp, Inc.

100 North Laura Street, Suite 1000

Jacksonville, Florida 32202

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To the Holders of Common Stock:

Notice is hereby given that the Annual Meeting of Shareholders of Jacksonville Bancorp, Inc. will be held on Tuesday, April 28, 2009, at 11:00 a.m., Eastern Time, at The River Club, 1 Independent Drive, Suite 3500, Jacksonville, Florida 32202 to consider and act upon the following matters:

| | 1. | To elect two of our directors for a three-year term; and |

| | 2. | To transact any other business that may properly come before the Annual Meeting or any adjournment(s) thereof. |

Only shareholders of record of our common stock at the close of business on February 27, 2009 are entitled to receive notice of, and to vote on, the business that may come before the Annual Meeting.

Whether or not you plan to attend the meeting, please vote immediately by telephone, by Internet or by completing, signing and dating the enclosed proxy card and returning it as promptly as possible in the enclosed postage-paid envelope to ensure your representation at the Annual Meeting. You may revoke the proxy at any time before it is exercised by following the instructions set forth in Voting of Proxies on the first page of the accompanying Proxy Statement. Please note that if you choose to vote in person at the Annual Meeting and you hold your shares through a securities broker in street name, you must obtain a proxy from your broker and bring that proxy to the meeting.

BY ORDER OF THE BOARD OF DIRECTORS

Price W. Schwenck

Corporate Secretary

March 31, 2009

*********************************************************************************

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS

FOR THE SHAREHOLDER MEETING TO BE HELD ON APRIL 28, 2009

Our Proxy Statement and Annual Report on Form 10-K are available at www.proxyvote.com

or on the Company’s website at www.jaxbank.com under Investor Relations/SEC Filings.

Jacksonville Bancorp, Inc.

100 North Laura Street, Suite 1000

Jacksonville, Florida 32202

PROXY STATEMENT

Annual Meeting of Shareholders

This Proxy Statement and the accompanying notice and proxy card are being furnished to you as a holder of Jacksonville Bancorp, Inc. common stock, $.01 par value, in connection with the solicitation of proxies by our Board of Directors (the “Board”) for use at the 2009 Annual Meeting of Shareholders (the “Annual Meeting”). The Annual Meeting will be held on Tuesday, April 28, 2009, beginning at 11:00 a.m., Eastern Time, at The River Club, 1 Independent Drive, Suite 3500, Jacksonville, Florida 32202. This Proxy Statement and the accompanying notice and proxy card are first being mailed to holders of our common stock on or about March 31, 2009.

Unless the context requires otherwise, references in this statement to “we,” “us” or “our” refer to Jacksonville Bancorp, Inc., its wholly owned subsidiary, The Jacksonville Bank, and the Bank’s wholly owned subsidiary, Fountain Financial, Inc., on a consolidated basis. References to the “Company” denote Jacksonville Bancorp, Inc. The Jacksonville Bank is referred to as the “Bank.”

VOTING OF PROXIES

Shares represented by proxies properly signed and returned, unless subsequently revoked, will be voted at the Annual Meeting in accordance with the instructions marked on the proxy. If a proxy is signed and returned without indicating any voting instructions, the shares represented by the proxy will be voted FOR approval of the proposals stated in this Proxy Statement and in the discretion of the holders of the proxies on other matters that may properly come before the Annual Meeting.

If you have executed and delivered a proxy, you may revoke such proxy at any time before it is voted by attending the Annual Meeting and voting in person or by giving written notice of revocation of the proxy or by submitting a signed proxy bearing a later date. Such notice of revocation or later proxy should be sent to our transfer agent, Computershare Investor Services, LLC, at the address indicated on the enclosed proxy. In order for the notice of revocation or later proxy to revoke the prior proxy, our transfer agent must receive such notice or later proxy before the vote of shareholders at the Annual Meeting. Unless you vote at the meeting or take other action, your attendance at the Annual Meeting will not revoke your proxy. If you are a beneficial owner but do not hold the shares in your name, you may vote your shares in person at the Annual Meeting only if you provide a legal proxy obtained from your broker, trustee or nominee at the Annual Meeting.

VOTING PROCEDURES

Our bylaws provide that a majority of the outstanding shares of common stock entitled to vote constitutes a quorum at a meeting of shareholders. Under the Florida Business Corporation Act (the “Act”) and our articles of incorporation, directors are elected by a plurality of the votes cast in the election at a meeting at which a quorum is present. Other matters are approved if affirmative votes cast by the holders of the shares represented at a meeting at which a quorum is present exceed votes opposing the action, unless the Act or our articles of incorporation require a greater number of affirmative votes or voting by classes. Abstentions and broker non-votes will be considered present for purposes of constituting a quorum but will have no effect under Florida law with respect to the votes on the proposals.

VOTING SECURITIES

Our Board has fixed the close of business on February 27, 2009 as the record date for determining the holders of our common stock entitled to receive notice of, and to vote at, the Annual Meeting. At the close of business on February 27, 2009, there were issued and outstanding 1,748,799 shares of our common stock entitled to vote at the Annual Meeting held by approximately 155 registered holders. You are entitled to one vote upon each matter properly submitted at the Annual Meeting for each share of common stock held on the record date.

PURPOSE

We anticipate that our shareholders will act upon the following business at the meeting:

PROPOSAL 1: ELECTION OF DIRECTORS

The directors nominated for election at the Annual Meeting are James M. Healey and John C. Kowkabany in Class 3. Those directors elected as Class 3 directors at this Annual Meeting will have a term of office of three years, expiring at the Annual Meeting of Shareholders in 2012. The term of office of the Class 1 directors expires at the Annual Meeting of Shareholders in 2010 and the term of office of the Class 2 directors expires at the Annual Meeting of Shareholders in 2011.

If elected, the nominees will constitute two of the ten members of our Board. To be elected, each nominee must receive a plurality of the votes cast, which shall be counted as described in the section of this Proxy Statement captioned “Voting Procedures.” Unless you mark the accompanying proxy otherwise, the proxy will be voted FOR the election of Messrs. Healey and Kowkabany. If any nominee should become unable to serve, which is not now anticipated, the persons voting the accompanying proxy may vote for a substitute in their discretion.

OUR BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE ELECTION OF EACH OF THE DIRECTOR NOMINEES.

Our articles of incorporation provide that our directors are divided into three classes. The following provides certain information with respect to each of our directors, including the nominees for director in Class 3. Except as otherwise indicated, each person has been or was engaged in his present or last principal occupation, in the same or a similar position, for more than five years. Directors Healey, Kowkabany, Mills, Rose, Schultz, Spencer and Winfield became directors during our organizational period. Messrs. Pomar and Schwenck were appointed to the Board in March 1999; and Mr. Roller was appointed to the Board in August 1999. All directors serve on the Boards of both the Company and the Bank and the term of office for all directors is three years. The Nominating and Corporate Governance Committee is evaluating whether to fill the current vacancies on the Board of Directors.

CLASS 3 DIRECTORS—Term expires at the 2012 Annual Meeting of Shareholders

| | Positions Held and Principal Occupations During the Past Five Years |

| James M. Healey | 51 | Director and Partner of Mint Magazine, Inc. Before his association with Mint Magazine in 1985, Mr. Healey worked with Carnation Food Products, Inc. and International Harvester. Mr. Healey attended Purdue University where he received a Bachelor of Arts degree from Purdue’s Business School with special studies in Marketing and Personnel. Mr. Healey has been a resident and active member of the Jacksonville community since 1984. |

| John C. Kowkabany | 66 | Jacksonville-based real estate investor and consultant. Mr. Kowkabany has significant private and public sector experience. A resident of the city of Neptune Beach, he has been active in local government, serving as the city’s Mayor from 1989 to 1997, and Councilman from 1985 to 1989. The Honorable John C. Kowkabany’s public sector experience has provided him with experience and knowledge regarding the local business and civic communities. For many years, Mr. Kowkabany has served with various civic and charitable organizations as an officer or director. Mr. Kowkabany graduated with a Bachelor of Arts degree from Jacksonville University. |

CLASS 1 DIRECTORS—Term expires at the 2010 Annual Meeting of Shareholders

| | Positions Held and Principal Occupations During the Past Five Years |

| John W. Rose | 59 | A financial services executive, advisor and investor for over 30 years. Mr. Rose is a Principal of CapGen Financial Advisors, a New York City-based private equity fund established in 2007, which specializes in bank and thrift investments. Prior to that, and since 1991, he was President of McAllen Capital Partners, a financial advisory firm. Mr. Rose earned his undergraduate degree from Case Western Reserve University and his M.B.A. from Columbia University. |

| John R. Schultz | 45 | Vice President of Schultz Investments, Inc., an investment management company primarily involved in real estate investments. A fourth generation native of Jacksonville, Florida, Mr. Schultz attended The Bolles School (Jacksonville, Florida) and the University of Florida. Mr. Schultz is a director of numerous companies and community organizations, including Metro YMCA, Daniel Properties, Inc. (Chairman), Trust for Public Land North Florida Advisory Council and The Schultz Foundation, Inc. |

Price W. Schwenck | 66 | Chairman of the Board of Directors for the Bank and former Chief Executive Officer of the Company until April 26, 2000. From May 2000 to February 2003, Mr. Schwenck was President and Chief Executive Officer of P.C.B. Bancorp, Inc., n/k/a Colonial BancGroup Inc., a multi-bank holding company located in Clearwater, Florida. Mr. Schwenck served as Regional President for First Union National Bank in Ft. Lauderdale, Florida, from 1988 to 1994 and in Jacksonville, Florida, from 1994 until he retired in 1999. Mr. Schwenck is currently a director of Freedom Bank of America in St. Petersburg, Florida. Mr. Schwenck received his Bachelors degree and M.B.A. from the University of South Florida and his M.S. from the University of Miami. |

| Gary L. Winfield, M.D. | 52 | A medical director since November 2005 and a consultant since June 2000 at Memorial Hospital. From 1991 through 2007, Dr. Winfield had an active family practice in Jacksonville Beach, Florida, operating as Sandcastle Family Practice, P.A. Dr. Winfield has served as Vice President of Medical Affairs for Anthem Health Plans of Florida, a provider of health insurance. Dr. Winfield received his undergraduate degree from the University of Oklahoma and is a graduate of the College of Medicine at the University of Oklahoma. |

CLASS 2 DIRECTORS—Term expires at the 2011 Annual Meeting of Shareholders

| | Positions Held and Principal Occupations During the Past Five Years |

| R. C. Mills | 71 | Retired and former President of Heritage Propane Partners, L.P., a national distributor of propane gas. Mr. Mills is a graduate of the University of Sarasota and resides in the Jacksonville area. Mr. Mills has an extensive business background and is experienced in business mergers and acquisitions, corporate finance and personnel management, having served in several executive management positions with a vertically integrated oil and gas company for over 25 years. |

| Gilbert J. Pomar, III | 49 | President and Chief Executive Officer for both the Company and the Bank, Mr. Pomar joined the Company in March 1999, having been previously employed by First Union National Bank in Jacksonville since 1991. During his tenure with First Union, Mr. Pomar was Senior Portfolio Manager and Senior Vice President/Commercial Banking Manager. Mr. Pomar has more than 25 years of banking experience, including holding various positions with Southeast Bank, First National Bank of Chicago, Barnett Bank and Florida Coast Bank. Mr. Pomar is active in various community efforts, including directorships with the American Cancer Society, University of North Florida, College of Business, and the Florida Bankers Association. Mr. Pomar is a graduate of the University of Florida, where he earned his Bachelor of Science degree in Finance. |

| Donald E. Roller | 71 | Chairman of our Board of Directors. Mr. Roller served as President and Chief Executive Officer of U.S. Gypsum Company from 1993 through 1996. He was also previously the Executive Vice President of USG Corporation. Mr. Roller has had extensive experience in directorship positions; he serves as President and a director of Glenmoor at St. Johns, a not for profit CCRC, located in St. Augustine, Florida, and has served as acting Chief Executive Officer and Chairman of the Audit Committee for Payless Cashways, Inc. |

| Charles F. Spencer | 66 | President of INOC LLC, a real estate management development company, and Cottage Street Land Trust, Inc., a real estate holding company, in Jacksonville, Florida. Mr. Spencer is a member of the International Longshoremen’s Association’s AFL-CIO Executive Council where he serves as an International Vice President representing members from Maine to Texas. In addition, Mr. Spencer is Executive Vice President of the South Atlantic and Gulf Coast District of I.L.A. and Vice President of the Florida AFL-CIO. He serves on the Board of Trustees of Edward Waters College, the board of the Jacksonville Airport Authority, and Board of Governors of the Jacksonville Chamber of Commerce. Mr. Spencer is the former Chairman of the Board of the Jacksonville Sports Authority and former board member of the I.M. Sulzbacher Center for the Homeless, United Way of Northeast Florida, and the foundation board of Florida Community College at Jacksonville. |

BOARD OF DIRECTORS, GOVERNANCE AND COMMITTEES

Corporate Governance. The Board of Directors is committed to good business practices, transparency in financial reporting, the highest level of corporate governance and the highest ethical, moral and legal standards in the conduct of its business and operations. We believe that these standards form the basis for our reputation of integrity in the marketplace and are essential to our efficiency and continued overall success.

Communications with the Board of Directors. The Board has established a process for shareholders to communicate with members of the Board. If you would like to contact the Board, you can do so by forwarding your concern, question or complaint to the Company’s Corporate Secretary, Price W. Schwenck, at 100 North Laura Street, Jacksonville, Florida 32202, who will relay the information to the Board at or prior to the Board’s next meeting.

Independence. The Board of Directors has determined that nine of its ten members are independent as defined under the NASDAQ Marketplace Rules: Messrs. Healey, Kowkabany, Mills, Roller, Rose, Schultz, Schwenck, Spencer and Winfield. Mr. Pomar is the only director that is considered to be an “inside” director because of his employment as President and Chief Executive Officer of the Company and the Bank. Each of Messrs. D. Michael Carter, Melvin Gottlieb and Bennett A. Tavar served on the Board during 2008 prior to his resignation and was independent as defined under the NASDAQ Marketplace Rules. The independent directors of the Company hold executive sessions from time to time without the Chief Executive Officer or any other member of management present. In 2008, the independent directors held two executive sessions after Board meetings; executive sessions were also held throughout the year at the conclusion of two Audit Committee meetings.

Meetings. During fiscal year 2008, the Board held ten meetings, and all directors attended at least 80% or more of the aggregate number of meetings of the Board and committees on which they served, except for Mr. Gottlieb, who attended 70% of the Board and committee meetings on which he served. Board members are encouraged, but not required, to attend the Annual Meeting, and 10 of the 11 board members at that time attended the Annual Meeting of Shareholders in 2008.

Committees. Our Board of Directors maintains an Audit Committee, an Organization and Compensation Committee, and a Nominating and Corporate Governance Committee, which are described below. Our Board elects the members of these committees at the Board’s Annual Meeting, and membership may change throughout the year based on varying circumstances at the discretion of the Board. Under our bylaws, the Board of Directors is authorized to fill any vacancy on a committee.

Audit Committee. The Audit Committee is responsible for the matters set forth in its written charter, which was adopted by the Board of Directors and was attached to the Company’s 2007 Proxy Statement. The primary function of the Audit Committee is to assist the Board of Directors in fulfilling its oversight responsibilities by reviewing the Company’s financial reports, systems of internal controls regarding finance, accounting, legal compliance and ethics, and evaluating the independence of the Company’s independent accountants. The Audit Committee held 11 meetings in 2008. The current members of the Audit Committee are James M. Healey, John C. Kowkabany, John W. Rose (Chairman), Price W. Schwenck and Gary L. Winfield, M.D. All members of the Audit Committee are independent as defined by rules promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and the NASDAQ Marketplace Rules.

Audit Committee Pre-Approval Policies and Procedures. In accordance with the Sarbanes-Oxley Act of 2002, the Audit Committee is required to pre-approve all auditing services and permissible nonaudit services, including related fees and terms, to be performed for the Company by its independent auditor subject to the de minimus exceptions for nonaudit services described under the Exchange Act, which are approved by the Audit Committee prior to the completion of the audit. In 2008, the Audit Committee pre-approved all services performed for the Company by its independent auditor.

Audit Committee Financial Expert. The Board of Directors has determined that John W. Rose is an audit committee financial expert. Mr. Rose is independent as defined by the NASDAQ Marketplace Rules and the rules promulgated under the Exchange Act.

Organization and Compensation Committee. The Organization and Compensation Committee, the charter of which was attached to the Company’s 2007 Proxy Statement, is responsible for oversight of compensation matters, employment issues and personnel policies. The Organization and Compensation Committee makes recommendations to the Board of Directors regarding compensation for the Chief Executive Officer, as well as other Executive Officers and certain other officers/managers, including salary, bonuses, option grants, other forms of long-term compensation and employee benefits. Additionally, the Organization and Compensation Committee reviews general levels of compensation and is responsible for evaluation of salaries and other compensation in light of industry trends and the practices of similarly situated, publicly traded bank holding companies. The Organization and Compensation Committee may retain one or more compensation consultants or other advisors to assist it with these duties and shall have available to it such support personnel, including management staff, outside auditors, attorneys and consultants as it deems necessary to discharge its responsibilities. The Organization and Compensation Committee held two meetings in 2008. The current members of the Organization and Compensation Committee are R.C. Mills, Donald E. Roller, John W. Rose, Price W. Schwenck (Chairman) and Charles F. Spencer, all of whom are independent as defined under the NASDAQ Marketplace Rules.

In 2008, the Consulting Division of Silverton Bank, N.A. (formerly The Bankers Bank) assisted the Organization and Compensation Committee in conducting an assessment of general market compensation practices and the compensation levels of the Company’s Executive Officers. The results are referred to in this assessment as the “Markets” or the “Market Data.” The Market Data was used to help establish and monitor total direct compensation levels recommended for the Company’s Executive Officers for 2008 and 2009.

The Market Data consisted of a customized compensation peer group and market compensation surveys (the “Peer Group”). The Peer Group consists of companies against which the Organization and Compensation Committee believes the Company competes for talent. The financial institutions comprising the Peer Group consisted of 27 Securities and Exchange Commission (the “SEC”)-reporting bank holding companies with total assets between $242 million to $917 million (median assets of $450 million), using third-quarter 2008 financial data reported to the SEC and taking into consideration the Company’s projected size over the next 12-month period. Based upon the study, the Organization and Compensation Committee determined that base salary targets and earned amounts were, on average, 96% of the 50th percentile of the Peer Group.

Consideration of the following year’s total compensation starts during the fourth quarter of each year. During the fourth quarter meetings, matters such as changes in the Market Data, plan philosophy and design, expected performance and historical performance are discussed. Final determinations of salaries and annual incentive targets are made at the Organization and Compensation Committee’s meeting in connection with the Board’s regular meeting in January. At that meeting, the Organization and Compensation Committee is able to review prior year performance and the status of prior awards of long-term incentive compensation. The Organization and Compensation Committee has found that considering these matters in this manner allows it to not only factor in the prior year’s financial results and the current year’s operating plan, but also to better assess the prior year’s compensation. Occasionally, grants of long-term incentive compensation or changes in compensation are made at other meetings of the Organization and Compensation Committee.

The Company’s Chief Executive Officer is involved in making compensation recommendations for other Executive Officers, which are considered by the Organization and Compensation Committee. Additionally, it reviews general levels of compensation and is responsible for evaluation of salaries and other compensation in light of industry trends and the practices of similarly situated, publicly traded bank holding companies.

Organization and Compensation Committee Interlocks and Insider Participation. During 2008, none of the members of the Organization and Compensation Committee were current or former officers or employees of the Company or its subsidiaries nor had any other material relationship requiring disclosure pursuant to Item 404 or 407(e)(4) of Regulation S-K, except Mr. Schwenck, who served as the Company’s Chief Executive Officer until April 26, 2000, and served otherwise as an Executive Officer of the Company through December 31, 2005.

Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee is responsible for formulating policies governing the Board of Directors and its committees as set out in its charter, a copy of which was attached to the Company’s 2007 Proxy Statement. The responsibilities include recommending new Board members, establishing criteria for membership on the Board, designating chairs and members of Board committees, setting dates for Board meetings, monitoring compliance with our bylaws and regulations governing public companies and making recommendations regarding director compensation. The Nominating and Corporate Governance Committee held two meetings in 2008. The current members of the Nominating and Corporate Governance Committee are John C. Kowkabany, R.C. Mills (Chairman), Donald E. Roller and Charles F. Spencer, all of whom are independent as defined under the NASDAQ Marketplace Rules. Melvin Gottlieb was also a member of the Nominating and Corporate Governance Committee until his resignation from the Board effective January 27, 2009 and was independent as defined under the NASDAQ Marketplace Rules. In accordance with its charter, the Nominating and Corporate Governance Committee elected James M. Healey to replace Mr. Gottlieb as a Committee member effective February 24, 2009. Mr. Healey is also independent as defined under the NASDAQ Marketplace Rules. In the event of selecting a new Board member, the Nominating and Corporate Governance Committee will develop a pool of potential director candidates for consideration based on the candidate’s business and professional experience, involvement in the community and understanding of the business and operations of the Company. It will also consider candidates for Board seats who are recommended by our shareholders, but a formal policy has not been adopted with respect to consideration of such candidates because shareholder recommendations may be informally submitted and considered by the Nominating and Corporate Governance Committee under its charter. Written suggestions for nominees should be sent to the Corporate Secretary, Price W. Schwenck, Jacksonville Bancorp, Inc., 100 North Laura Street, Jacksonville, Florida 32202. Any such recommendation must include the name and address of the candidate; a brief biographical description, including the candidate’s occupation for at least five years; a statement of the qualifications of the candidate; and the candidate’s signed consent to be named in the Proxy Statement and to serve as director, if elected. Directors should possess qualities such as understanding the business and operations of the Bank and corporate governance principles.

EXECUTIVE OFFICERS OF THE COMPANY

Our Executive Officers, in addition to Mr. Pomar, who serves as a director, are listed below. Except as otherwise indicated, each person has been or was engaged in his or her present or last principal occupation, in the same or a similar position, for more than five years. Each officer holds office for the term set forth in the officer’s written employment agreement, if any, or until the officer’s successor has been elected and qualified.

| | Positions Held and Principal Occupations During the Past Five Years |

| Scott M. Hall | 44 | Executive Vice President and Chief Lending Officer of the Company and Bank since February 2008 and previously Executive Vice President and Senior Loan Officer of the Bank since 2000. Mr. Hall has over 20 years of experience in the financial services industry. Before joining the Bank in 1999 as Senior Vice President, he was employed with First Union National Bank in Jacksonville for eight years as Vice President/Commercial Banking Relationship Manager. His community activities include serving on the Board of The National Association of Industrial and Office Properties (NAIOP) and as a committee member of the Gator Bowl Association. Mr. Hall is a graduate of the University of North Florida, where he received his Bachelor of Business Administration degree in Finance. |

| Valerie A. Kendall | 56 | Executive Vice President and Chief Financial Officer of the Company and Bank. Ms. Kendall’s banking career spans more than 20 years. Prior to joining the Bank in 2004, she served from 2000 as Executive Vice President and Chief Financial Officer of P.C.B. Bancorp, Inc., n/k/a Colonial BancGroup Inc., a $650 million multi-bank holding company based in Clearwater, Florida. She also held senior finance positions with AmSouth Bank, Barnett Bank (Bank of America) and SunTrust. Ms. Kendall received her Bachelor of Science degree in Accounting from Florida Southern College and is a Certified Public Accountant. |

EXECUTIVE COMPENSATION

COMPENSATION DISCUSSION AND ANALYSIS

Business Environment

Jacksonville Bancorp, Inc. (the “Company”) was established on October 24, 1997 and its subsidiary, The Jacksonville Bank, was established on May 28, 1999 to provide a variety of community banking services to businesses and individuals through its five offices in Jacksonville (Duval County), Florida. We offer a variety of competitive commercial and retail banking services with an emphasis on specialized services for small business owners along with the professional and personal relationships of our officers, directors and employees.

Our Mission – To have a positive and meaningful impact on our employees, our customers, our shareholders and our community.

Our Values – Compassion, Ambition, Responsibility, Positive Attitude and Ethics.

In spite of the economic downturn in 2008, the Company achieved budgeted asset growth; however, net profit and asset quality were substantially below expectation.

In keeping with the Company’s compensation philosophy as discussed below, the named Executive Officers received total compensation for 2008 accordingly.

Role of the Organization and Compensation Committee. The Organization and Compensation Committee is responsible for oversight of compensation matters, employment issues and personnel policies. The Organization and Compensation Committee makes recommendations to the Board of Directors regarding compensation for the Chief Executive Officer, as well as other Executive Officers and certain other officers/managers, including salary, bonuses, option grants, other forms of long-term compensation and employee benefits. Additionally, the Organization and Compensation Committee reviews general levels of compensation and is responsible for evaluation of salaries and other compensation in light of industry trends and the practices of similarly situated, publicly traded bank holding companies. In 2008, the Consulting Division of Silverton Bank, N.A. (formerly The Bankers Bank) assisted the Organization and Compensation Committee in conducting an assessment of general market compensation practices and the compensation levels of the Company’s Executive Officers. The results are referred to in this assessment as the “Markets” or the “Market Data.” The Market Data was used to help establish and monitor total direct compensation levels recommended for the Company’s Executive Officers for 2008 and 2009.

The Market Data consisted of customized compensation peer group and market compensation surveys (the “Peer Group”). The Peer Group consists of companies against which the Organization and Compensation Committee believes the Company competes for talent. The financial institutions comprising the Peer Group consisted of 27 Securities and Exchange Commission (the “SEC”)-reporting bank holding companies with total assets between $242 million to $917 million (median assets of $450 million), using third-quarter 2008 financial data reported to the SEC and taking into consideration the Company’s projected size over the next 12-month period. Based upon the study, the Organization and Compensation Committee determined that base salary targets and earned amounts were, on average, 96% of the 50th percentile of the Peer Group.

The Company’s Chief Executive Officer is involved in making compensation recommendations for other Executive Officers, which are considered by the Organization and Compensation Committee. Additionally, the Organization and Compensation Committee reviews general levels of compensation and is responsible for evaluation of salaries and other compensation in light of industry trends and the practices of similarly situated, publicly traded bank holding companies.

Philosophy, Objectives and Determinations

Philosophy. All compensation matters will be aligned with the Company’s core values, strategic plan, annual financial objectives and the long-term interest of shareholders. The Organization and Compensation Committee is responsible for the oversight of all compensation matters and for making recommendations to the Board of Directors regarding, among other things, compensation of Executive Officers, overall annual salary increases and bonuses, the Company’s 401(k) match, and changes in employee health and benefit plans.

The Company believes that it is in the shareholders’ best interest to compensate its Executive Officers in accordance with the performance of the Company. This is accomplished by using a higher than average variable component of annual compensation. Accordingly, the Company attempts to maintain Executive Officer salaries at approximately the 50th percentile of similarly situated publicly traded bank holding companies and to award annual bonuses based on the Company’s performance compared to the performance of the peer group of bank holding companies. For example, if the Company’s performance is in the upper quartile of peer companies, then total cash compensation (salary and bonus) for the year should be in the upper quartile.

Objectives. Overall, the Organization and Compensation Committee reviews financial and other corporate performance measures to help ensure that compensation to the executives reflects the success of the Company as well as the value provided to our shareholders. Following are the specific objectives of the Company’s compensation programs:

| | · | Shareholder value creation – Provide equity-based awards to stimulate a shareholder value-oriented culture. |

| | · | Motivation – Provide short-term and long-term awards that are contingent upon achieving Company targets. |

| | · | Attraction – Provide a compensation package to attract highly qualified individuals who can enhance shareholder value. |

| | · | Retention – Provide a competitive compensation package to retain key executives who deliver significant value to the Company. |

Determinations. The Organization and Compensation Committee takes into consideration the following factors in determining the level of compensation for each Executive Officer:

| | · | Operating performance – The Company was successful in meeting both short-term and long-term strategic objectives. |

| | · | Individual responsibilities – The individual executive’s contribution to achieving both short-term and long-term objectives. |

| | · | Peer industry studies – The executive’s pay should be consistent with that of the Company’s peers. |

Compensation Elements

The Company maintains three main components of compensation:

| | · | Salary. This annual fixed component of pay takes into account the Executive Officer’s role, experience, prior performance and the salary required to attract a comparable replacement. The fairness of the salary is determined by reviewing the salaries of similarly situated publicly traded bank holding companies and industry trends. This fixed pay also takes into account the individual’s role and responsibilities, experience, expertise and individual performance. This supports the retention objective and, in the case of new hires, the attraction objective. The Organization and Compensation Committee met in January 2008 to approve the salaries for the upcoming year for the Executive Officers. In view of the Company’s performance in 2008, compared to both internal expectations and peer bank holding companies, the Organization and Compensation Committee determined to hold constant the salaries of Mr. Hall, Ms. Kendall and Mr. Pomar for the year 2009. |

| | · | Annual Bonus Award. This annual variable component of pay is designed to reward achievement of annual performance goals. The amount of the award is determined after reviewing performance compared to Company goals and after reviewing the annual bonuses granted in similarly situated bank holding companies. These awards are intended to foster the motivation objective by focusing on the achievement of annual financial targets. Individual performance may also be taken into consideration. For 2008, the Organization and Compensation Committee believes that, while the individual performance of its three Executive Officers was satisfactory, the overall performance of the Company did not warrant paying bonuses for 2008. |

| | · | Long-Term Awards. Equity-based awards, including but not limited to stock options and restricted stock, are granted to align the Executive Officer’s long-term compensation with the long-term interests of shareholders. The amount, type, vesting period, and frequency of these awards are determined after reviewing the Executive Officer’s prior performance and awards and after reviewing the long term awards and performance of similarly situated bank holding companies. These awards are intended to drive the following objectives: |

| | o | Motivation – Restricted stock is earned based on the achievement of long-term financial performance. |

| | o | Retention – Restricted stock and stock options vest based on the passage of time and continued employment. |

| | o | Shareholder value creation – Restricted stock and stock options gain value based on increases in the Company’s share price. |

During 2008, neither Mr. Pomar nor the other Executive Officers were granted stock options or restricted stock. Between 1999 and 2004, Mr. Pomar, Mr. Hall and Ms. Kendall were granted stock options in the amounts of 55,000, 25,000 and 15,000, respectively, based on attraction and retention objectives. During 2009, the Organization and Compensation Committee intends to develop a plan which will provide performance-based equity grants to Mr. Pomar and the other Executive Officers.

Employment Agreements. The Bank has employment agreements with Messrs. Pomar and Hall. Both employment agreements provide for annual base salaries plus annual increases and participation in bonus plans, stock option plans, stock ownership plans, profit sharing plans and 401(k) plans made available to the Company’s employees and executives. Additionally, the Company pays medical and dental insurance plan premiums for Messrs. Pomar and Hall.

In 2009, the Bank also intends to enter into an employment agreement with Ms. Kendall similar to its agreement with Mr. Hall. Additionally, the Bank will amend the existing agreements with Mr. Pomar and Mr. Hall to comply with Section 409A of the Internal Revenue Code. These modifications will have no material financial impact on the Company.

Compensation Allocation

The Company uses the elements described above to achieve the annual financial and operational objectives and long-term strategic objectives. The allocation of compensation to Executive Officers will be based on his or her total compensation tied to relevant performance goals. The Organization and Compensation Committee, at its discretion, may change the allocation methodology to better align the elements with desired outcomes.

Other Benefits and Perquisites

The Company’s Executive Officers receive other benefits also available to other employees. For example, we provide Executive Officers and other employees with health and disability insurance and paid time off. The Company currently provides the Executive Officers with automobiles, country club and dining club memberships and reimbursement of “business development expenses.” Additionally, the Company pays medical and dental insurance plan premiums for Messrs. Pomar and Hall. The Executive Officers are responsible for reimbursing the Company for any “social expenses” incurred, except to the extent that they are specifically, directly, and exclusively made in connection with business development or the conduct of business.

Conclusion

Pay opportunities for specific Executive Officers may vary based on a number of factors such as scope of duties, tenure and knowledge of the institution. Actual total compensation in a given year may vary based on the attainment of short-term and long-term financial goals and the enhancement of shareholder value. In some cases, the amount and structure of compensation may be the result of negotiations with executives which reflect an increasingly competitive market for quality and proven managerial talent.

The level and mix of compensation that is ultimately decided upon is considered to be within the context of both the objective data (targeted performance) as well as the subjective factors outlined in the above discussion and analysis.

SUMMARY COMPENSATION TABLE

The following table sets forth for the fiscal years ended December 31, 2008 and December 31, 2007 the cash compensation paid or accrued for services in all capacities to our Chief Executive Officer, Chief Financial Officer and Chief Lending Officer.

| Name and Principal Position | Year | Salary (1) | Bonus (2) | All Other Compensation | Total Compensation (3) |

| Gilbert J. Pomar, III, President and | 2008 | $204,167 | - | $33,484 (4) | $237,651 |

| Chief Executive Officer | 2007 | 172,917 | $115,000 | 31,880 (5) | 319,797 |

| | | | | | |

| Scott M. Hall, Executive Vice | 2008 | $156,673 | - | $28,813 (6) | $185,486 |

| President and Chief Lending Officer | 2007 | 138,750 | $ 80,000 | 27,439 (7) | 246,189 |

| | | | | | |

| Valerie A. Kendall, Executive Vice | 2008 | $144,173 | - | $21,888 (8) | $166,061 |

| President and Chief Financial Officer | 2007 | 138,750 | $ 48,000 | 18,652 (9) | 205,402 |

| | | | | | |

| (1) | Effective March 1, 2007, Mr. Pomar’s salary changed from $165,000 to $175,000, and Mr. Hall’s and Ms. Kendall’s salaries changed from $134,000 to $140,000. Effective March 1, 2008, Mr. Pomar’s salary changed from $175,000 to $210,000; Mr. Hall’s salary changed from $140,000 to $160,000; and Ms. Kendall’s salary changed from $140,000 to $145,000. |

| (2) | The amounts shown for fiscal 2007 were earned for 2007 performance and were paid in January 2008. No performance bonuses for 2008 were granted. |

| (3) | Columns relating to Stock Awards, Option Awards, Non-Equity Incentive Plan Compensation and Change in Pension Value and Nonqualified Deferred Compensation Earnings have been deleted because no compensation required to be reported in such columns was awarded to, earned by or paid to the named executives during 2007 or 2008. |

| (4) | Represents Company matches for 401(k) deferrals of $12,256, $9,750 for use of Company owned automobile, $6,124 in club dues and $5,354 in insurance premiums in 2008. |

| (5) | Represents Company matches for 401(k) deferrals of $10,396, $9,750 for use of Company owned automobile, $6,375 in club dues and $5,359 in insurance premiums in 2007. |

| (6) | Represents Company matches for 401(k) deferrals of $9,406, $9,250 for use of Company owned automobile, $4,803 in club dues and $5,354 in insurance premiums in 2008. |

| (7) | Represents Company matches for 401(k) deferrals of $8,346, $9,250 for use of Company owned automobile, $4,484 in club dues and $5,359 in insurance premiums in 2007. |

| (8) | Represents Company matches for 401(k) deferrals of $11,536, $9,250 for use of Company owned automobile and $1,102 in club dues in 2008. |

| (9) | Represents Company matches for 401(k) deferrals of $8,346, $9,250 for use of Company owned automobile and $1,056 in club dues in 2007. |

During 2007, each Executive Officer earned at or above their targeted bonus, based on the Company’s 2007 financial performance. The targeted performance measure for 2007 was primarily EPS growth; additionally, the Organization and Compensation Committee considers superior individual performance as a subjective measure when determining the overall award. For 2008, the Organization and Compensation Committee believes that, while the individual performance of its three Executive Officers was satisfactory, the overall performance of the Company did not warrant paying bonuses for 2008. During 2007 and 2008, none of the named Executive Officers were granted stock options or restricted stock. Between 1999 and 2004, Mr. Pomar, Mr. Hall and Ms. Kendall were granted stock options in the amounts of 55,000, 25,000 and 15,000, respectively, based on attraction and retention objectives. During 2009, the Organization and Compensation Committee intends to develop a plan which will provide for the availability of performance-based equity grants to Mr. Pomar and the other Executive Officers. For more information regarding employment arrangements, see the section captioned “Employment Agreements.”

GRANTS OF PLAN-BASED AWARDS

There were no grants of plan-based awards to Executive Officers in the last fiscal year.

OUTSTANDING EQUITY AWARDS AT YEAR END

The following table details all outstanding equity grants for the Executive Officers as of December 31, 2008:

Option Awards

| Name | Grant Date | Number of Securities Underlying Unexercised Options (#) Exercisable | Number of Securities Underlying Unexercised Options (#) Unexercisable | Option Exercise Price ($) | Option Expiration Date |

Gilbert J. Pomar, III (1) | 11/09/1999 | 30,000 | - | $10.00 | 11/09/2009 |

| | 03/05/2003 | 15,000 | - | 12.55 | 03/05/2013 |

| | 04/07/2004 | 8,000 | 2,000 | 23.25 | 04/07/2014 |

Scott M. Hall (1) | 11/09/1999 | 12,500 | - | 10.00 | 11/09/2009 |

| | 03/05/2003 | 5,000 | - | 12.55 | 03/05/2013 |

| | 04/07/2004 | 6,000 | 1,500 | 23.25 | 04/07/2014 |

Valerie A. Kendall (1) | 04/07/2004 | 12,000 | 3,000 | 23.25 | 04/07/2014 |

| | | | | | |

| | | | | | |

(1) Options become exercisable in equal annual increments of 20% over a five-year period.

EQUITY COMPENSATION PLANS INFORMATION

The following table sets forth the securities authorized for issuance under the equity incentive plans as of December 31, 2008:

| Plan Category | Number of securities to be issued upon exercise of outstanding options, warrants and rights | Weighted average exercise price of outstanding options, warrants and rights | Number of securities remaining available for future issuance |

| Equity compensation plans approved by security holders | 158,942 | $14.62 | 68,233 |

| Equity compensation plans not approved by security holders | -- | -- | -- |

| Total | 158,942 | $14.62 | 68,233 |

OPTION EXERCISES AND STOCK VESTING

There were no option exercises by Executive Officers in the last fiscal year, and no Executive Officers have been granted restricted stock.

RETIREMENT AND PENSION BENEFITS

The Company does not offer a retirement plan for Executive Officers or other employees, but does offer participation in the Jacksonville Bancorp, Inc. 401(k) Plan (the “Plan”) to all employees, including Executive Officers. The Plan is a qualified retirement plan that was adopted to provide employees with the opportunity to save for retirement on a tax-advantage basis. Employees may elect to contribute a portion of their compensation to the Plan after six months of full-time employment, and the Company may make a discretionary matching contribution to the Plan on their behalf equal to a uniform percentage of their salary deferrals. The Company will determine the amount of the discretionary percentage each year. The participants under the Plan may elect to reduce their compensation by a specific percentage or dollar amount and have that amount contributed to the Plan as either a Pre-Tax 401(k) deferral or a Roth 401(k) deferral. The vesting schedule for profit sharing contributions covers a five-year period as follows:

1 Year of Service 0%

2 Years of Service 25%

3 Years of Service 50%

4 Years of Service 75%

5 Years of Service 100%

EMPLOYMENT AGREEMENTS

The following information relates to employment agreements between the Bank and each of Mr. Pomar and Mr. Hall. Other than as described below, there are no potential payments to a named Executive Officer upon termination or a change in control.

Gilbert J. Pomar, III. Under our employment agreement with Gilbert J. Pomar, III (the “Pomar Agreement”), he became the Bank’s President in March 1999 at a salary of $120,000 and was promoted to Chief Executive Officer on April 26, 2000. Mr. Pomar’s salary was increased from $175,000 to $210,000 effective March 15, 2008, based on the evaluation of performance factors by the Organization and Compensation Committee. The Pomar Agreement provides for an annual base salary plus annual increases and participation in bonus plans, stock option plans, stock ownership plans, profit sharing plans and 401(k) plans made available to our employees and executives. No performance bonus was awarded under the Pomar Agreement for 2008, and there was no salary increase for 2009.

Additionally, we pay Mr. Pomar’s medical and dental insurance plan premiums. The Pomar Agreement has a rolling one-year term, ending no later than Mr. Pomar’s 65th birthday and contains a six-month noncompetition provision against employment with any person seeking to organize a financial institution in Duval County or Clay County.

If we terminate Mr. Pomar’s employment for a reason other than for “just cause” (as defined in the Pomar Agreement), death or disability, or if Mr. Pomar terminates his employment for “good reason” (as defined), then we must pay Mr. Pomar an amount equal to his annual base salary and any bonus to which he would have been entitled under the Pomar Agreement. If Mr. Pomar’s employment is terminated as a result of a “change in control” (as defined) or a change in control occurs within 12 months of his involuntary termination or termination for good reason, then Mr. Pomar is entitled to a severance payment equal to 2.99 times his current annual base salary plus any incentive compensation to which he was entitled under the Pomar Agreement. These payments will be made in substantially equal semi-monthly installments until paid in full. In addition, upon a change in control, all unvested options will vest on the day before the effective date of the change in control. Furthermore, under certain banking regulatory requirements, or unless Mr. Pomar is terminated for just cause, or Mr. Pomar terminates his employment for other than good reason, we are also required to maintain in full force and effect all employee benefit plans in which Mr. Pomar was participating before termination for the remainder of the Pomar Agreement, or 12 months, whichever is shorter. The Pomar Agreement also contains provisions required under certain banking regulations that suspend or terminate the Pomar Agreement upon certain banking regulatory findings or actions.

Scott M. Hall. Under our employment agreement with Scott M. Hall (the “Hall Agreement”), he became the Bank’s Senior Loan Officer on January 1, 2003 at an annual salary of $112,000. Mr. Hall’s salary was increased from $140,000 to $160,000 effective March 15, 2008. The Hall Agreement provides for an annual base salary plus incentive compensation and participation in bonus plans, stock option plans, stock ownership plans, profit sharing plans and 401(k) plans made available to our employees and executives. No performance bonus was awarded under the Hall Agreement for 2008, and there was no salary increase for 2009. Additionally, we pay Mr. Hall’s medical and dental insurance plan premiums. The Hall Agreement has a rolling one-year term, ending no later than Mr. Hall’s 65th birthday, and contains a 12-month noncompetition provision against employment with any person seeking to organize a financial institution in Duval County or Clay County; however, such provision is limited to a three-month period if Mr. Hall is terminated due to a “change in control” (as defined in the Hall Agreement).

If we terminate Mr. Hall’s employment for a reason other than for “just cause” (as defined) or Mr. Hall terminates his employment for “good reason” (as defined), then we must pay an amount equal to his annual base salary and any incentive compensation or bonus to which he would have been entitled under the Hall Agreement. If Mr. Hall’s employment is terminated as a result of a change in control or said change occurs within 12 months of his involuntary termination or termination for good reason, then Mr. Hall is entitled to a severance payment equal to 300% of the highest annual salary and bonus he was paid or entitled to in the two years preceding termination. These payments will be made in substantially equal semi-monthly installments until paid in full. In addition, upon a termination for a change in control, we are also required to maintain in full force and effect all employee benefit plans in which Mr. Hall was participating before termination for the remainder of the Hall Agreement, or 12 months, whichever is shorter.

DIRECTOR COMPENSATION

In aggregate, the directors who are not employees of the Company received a total of $111,624 in 2008 for their services to the Company. Non-employee directors currently participate in the Company’s Directors Stock Purchase Plan under which a director may designate all, or any part, of his compensation for investment in the Company’s common stock. All non-employee directors elected to designate all of their compensation for such investment, each receiving 600 shares of Company stock, except for Mr. Schwenck, who elected to receive his director fees in cash. The following table summarizes director compensation in 2008:

| Fees Earned or Paid in Cash ($) | | |

D. Michael Carter (1) | -0- | -0- | -0- |

Melvin Gottlieb (2) | -0- | 10,506 | 10,506 |

| James M. Healey | -0- | 10,506 | 10,506 |

| John C. Kowkabany | -0- | 10,506 | 10,506 |

| R. C. Mills | -0- | 10,506 | 10,506 |

| Donald E. Roller | -0- | 10,506 | 10,506 |

| John W. Rose | -0- | 10,471 | 10,471 |

| John R. Schultz | -0- | 10,506 | 10,506 |

| Price W. Schwenck | 10,506 | -0- | 10,506 |

| Charles F. Spencer | -0- | 10,506 | 10,506 |

Bennett A. Tavar (3) | -0- | 6,599 | 6,599 |

| Gary L. Winfield | -0- | 10,506 | 10,506 |

| (1) | Mr. Carter resigned from the Board effective June 30, 2008. Mr. Carter received no compensation in 2008 because he had been on an indeterminate leave of absence since 2007 and was not entitled to compensation as a director since that time. |

| (2) | Mr. Gottlieb resigned from the Board effective January 27, 2009. |

| (3) | Mr. Tavar resigned from the Board effective March 18, 2008 and received compensation for his services as director through such date. |

Director fees consist of an annual retainer, paid quarterly for the preceding quarter, payable in either cash or the Company’s common stock based on each director’s election. Fees paid in stock are purchased at market during the quarter in which they are applicable and paid on the 15th of the month following the end of the quarter. Fees paid in cash are calculated at the same value as the stock payments.

ORGANIZATION AND COMPENSATION COMMITTEE REPORT

The duties and responsibilities of the Organization and Compensation Committee of the Board of Directors are set forth in a written charter adopted by the Board, a copy of which was attached to the Company’s 2007 Proxy Statement. The Organization and Compensation Committee reviews and reassesses this charter annually and recommends any changes to the Board for approval.

As part of the exercise of its duties, the Organization and Compensation Committee has reviewed and discussed the “Compensation Discussion and Analysis” contained in this Proxy Statement with management. Based upon that review and those discussions, it recommended to the Board of Directors that the “Compensation Discussion and Analysis” be included in the Company’s Annual Report on Form 10-K and in this Proxy Statement.

The foregoing report is submitted by the Organization and Compensation Committee: R.C. Mills, Donald E. Roller, John W. Rose, Price W. Schwenck (Chairman) and Charles F. Spencer.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

The Company has granted loans to and accepted deposits from its Executive Officers, directors and their affiliates in the ordinary course of business on substantially the same terms, including interest rates and collateral, as those prevailing at the time for comparable transactions with other customers and which did not involve more than the normal risk of collectibility or present other unfavorable features.

Insiders’ transactions with the Bank will be promptly and fully disclosed to the Board. Fees and payments to insiders will be appropriate based on the type, level, quality and value of goods or services the Bank is receiving. Fees and other payments will directly relate to, and be based solely upon, the fair value of goods or services received, compensation for goods or services that meet legitimate needs of the Bank, and be made only to service providers who have the necessary expertise to provide the services.

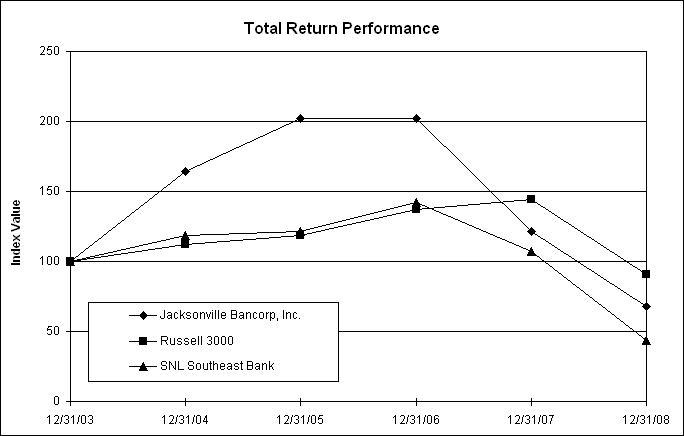

SHAREHOLDER RETURN PERFORMANCE A five-year comparison of shareholder return performance of the Company with the Russell 3000 Index and the SNL Southeast Bank Index is shown on the graph below. This graph assumes that $100 was invested on December 31, 2002 and all dividends were reinvested in the Company and other indices. The Russell 3000 index is a broad equity market index which measures the performance of the largest 3,000 U.S. companies representing approximately 98% of the U.S. equity market. The SNL Southeast Bank Index is a published industry index which represents publicly-traded banks and bank holding companies located in the southeastern United States. |

| |

| | | | Period Ending | |

| | Index | 12/31/03 | 12/31/04 | 12/31/05 | 12/31/06 | 12/31/07 | 12/31/08 |

| | Jacksonville Bancorp, Inc. | 100.00 | 164.35 | 202.13 | 201.83 | 121.34 | 67.68 |

| | Russell 3000 | 100.00 | 111.95 | 118.80 | 137.47 | 144.54 | 90.61 |

| | SNL Southeast Bank | 100.00 | 118.59 | 121.39 | 142.34 | 107.23 | 43.41 |

AUDIT COMMITTEE REPORT

As set forth in its charter, the Audit Committee assists the Board by reviewing financial reports we provide to governmental bodies or the public, monitoring the adequacy of our internal controls regarding finance and accounting, reviewing our auditing, accounting, and financial reporting processes generally, and verifying the independence of our independent auditors. All auditors employed or engaged by us report directly to the Audit Committee. To fulfill its responsibilities, the Audit Committee recommends the selection of auditors, reviews an annual risk assessment to ensure sufficient audit coverage and reviews all reports of auditors and examiners, as well as management’s responses to such reports, to ensure the effectiveness of internal controls and the implementation of remedial action. The Audit Committee also recommends to the Board whether to include the audited financial statements in the annual report to shareholders.

In discharging its oversight responsibility as to the audit process, the Audit Committee obtained from the independent auditors a formal written statement describing their relationships with us that might bear on their independence, consistent with Independence Standards Board Standard No. 1, Independence Discussions with Audit Committees; discussed any relationships that may impact their objectivity and independence with the auditors; considered whether the provision of nonaudit services was compatible with maintaining the auditors’ independence; and satisfied itself as to their independence. The Audit Committee also discussed with management and the independent auditors the quality and adequacy of our internal controls, and the accounting function’s organization, responsibilities, budget and staffing. The Audit Committee further reviewed with the independent auditors their audit plans, audit scope and identification of audit risks.

The Audit Committee discussed with the independent auditors all communications required by generally accepted auditing standards, including those described in Statement on Auditing Standards No. 61, as amended, Communication with Audit Committees, and with and without management present, discussed and reviewed the results of the independent auditors’ examination of the financial statements.

The Audit Committee reviewed and discussed our audited financial statements as of and for the year ended December 31, 2008 with management and the independent auditors. Management has the responsibility for preparation of our financial statements, and the independent auditors have the responsibility for examination of those statements. Based on this review and the discussions with management and the independent auditors, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in our Annual Report on Form 10-K for the year ended December 31, 2008 for filing with the SEC. All of the following members of the Audit Committee are independent directors as defined under the NASDAQ Marketplace Rules: James M. Healey, John C. Kowkabany, John W. Rose (Chairman), Price W. Schwenck and Gary L. Winfield, M.D.

The foregoing is submitted by the Audit Committee: James M. Healey, John C. Kowkabany, John W. Rose (Chairman), Price W. Schwenck and Gary L. Winfield, M.D.

SECURITY OWNERSHIP OF DIRECTORS AND OFFICERS AND CERTAIN BENEFICIAL OWNERS

The following table indicates the common stock beneficially owned as of February 27, 2009 by our Executive Officers and directors, by each person known by us to own beneficially more than 5% of the common stock of the Company, and all our Executive Officers and directors as a group. Unless otherwise noted, all shares are held directly by the director or Executive Officer and such person has the sole voting and investment power. All amounts are determined as of February 27, 2009 when there were 1,748,799 shares outstanding.

Director or Executive Officer (1) | Amount and Nature of Beneficial Ownership (2) | Percent of Shares of Common Stock Outstanding |

Scott M. Hall (3) | 23,800 | 1.34% |

James M. Healey (4) | 10,013 | 0.57% |

Valerie A. Kendall (5) | 13,000 | 0.74% |

| John C. Kowkabany | 40,843 | 2.34% |

R. C. Mills (6) | 110,693 | 6.33% |

Gilbert J. Pomar, III (7) | 58,000 | 3.22% |

Donald E. Roller (4) | 51,993 | 2.97% |

John W. Rose (8) | 102,593 | 5.85% |

John R. Schultz (9) | 59,830 | 3.41% |

Price W. Schwenck (10) | 33,691 | 1.92% |

Charles F. Spencer (4) | 23,543 | 1.34% |

Gary L. Winfield (4) | 33,843 | 1.93% |

All Executive Officers and directors as a group (12 persons) (11) | 561,842 | 30.05% |

| (1) | The address of each Executive Officer and director is Jacksonville Bancorp, Inc., 100 North Laura Street, Suite 1000, Jacksonville, Florida 32202. |

| (2) | Under the rules of the SEC, the determinations of “beneficial ownership” of our common stock are based upon Rule 13d-3 under the Exchange Act. Under this Rule, shares will be deemed to be “beneficially owned” where a person has, either solely or with others, the power to vote or to direct the voting of shares and/or the power to dispose, or to direct the disposition of shares, or where a person has the right to acquire any such power within 60 days after the date such beneficial ownership is determined. Shares of our common stock that a beneficial owner has the right to acquire within 60 days under the exercise of the options or warrants are deemed to be outstanding for the purpose of computing the percentage ownership of such owner but are not deemed outstanding for the purpose of computing the percentage ownership of any other person. |

| (3) | Includes options to purchase 23,500 shares exercisable within 60 days of February 27, 2009. |

| (4) | Includes options to purchase 4,643 shares exercisable within 60 days of February 27, 2009. |

| (5) | Includes options to purchase 12,000 shares exercisable within 60 days of February 27, 2009. |

| (6) | Includes 15,500 shares solely held by Mr. Mills’ spouse. |

| (7) | Includes options to purchase 53,000 shares exercisable within 60 days of February 27, 2009. |

| (8) | Includes options to purchase 4,643 shares exercisable within 60 days of February 27, 2009. Also includes (a) 80,100 shares as to which Mr. Rose shares beneficial ownership with his spouse, (b) 8,050 shares solely held by Mr. Rose’s spouse and (c) 4,900 shares held by each of Mr. Rose’s two daughters as to which he has sole voting power. |

| (9) | Includes options to purchase 4,643 shares exercisable within 60 days of February 27, 2009. Also includes (a) 5,000 shares held by the Schultz Family Foundation as to which Mr. Schultz exercises voting control and (b) 162 shares held in Mr. Schultz’s IRA account. |

| (10) | Includes options to purchase 4,641 shares exercisable within 60 days of February 27, 2009. |

| (11) | Includes options to purchase 120,999 shares for all directors and Executive Officers as a group exercisable within 60 days of February 27, 2009. |

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

The Exchange Act requires our Executive Officers and directors and any persons owning more than 10% of a class of our stock to file certain reports on ownership and changes in ownership with the SEC. We believe that during fiscal year 2008 our Executive Officers and directors filed on a timely basis all reports required by Section 16(a) of the Exchange Act relating to transactions involving our equity securities beneficially owned by them, except for (i) one late Form 4 filing for John W. Rose reporting one transaction, and (ii) one late Form 4 filing for John R. Schultz reporting four transactions. In making this statement, we have relied upon examination of the copies of Forms 3, 4 and 5 provided to us and the written representation of our directors, officers and 10% shareholders.

PRINCIPAL ACCOUNTANT FEES AND SERVICES

The firm of Crowe Horwath LLP (“Crowe”) served as our independent accountants for the fiscal year ending December 31, 2008 and will continue to serve for the current year and until such time as we select a replacement auditor. Representatives of Crowe will be present at the Annual Meeting, will have an opportunity to make a statement, if they desire to do so, and will be available to respond to appropriate questions.

AUDIT FEES

| | 2008 | 2007 |

Audit Fees (1) | $130,000 | $ 65,700 |

Audit Related Fees (2) | $ 7,272 | $ 5,000 |

Tax Fees (3) | $ 21,131 | $ 20,425 |

All Other Fees (4) | $ 19,527 | $ 3,714 |

| Total | $177,930 | $ 94,839 |

| (1) | Audit fees consisted of audit work performed in the preparation and review of the Company’s financial statements and for quarterly and annual review of Forms 10-Q and Form 10-K. |

| (2) | Audit related fees consisted of fees for assurance and related services performed that are reasonably related to the performance of the audit or review of the Company’s financial statements. This includes consulting on financial accounting/reporting standards. |

| (3) | Tax fees consisted principally of assistance related to tax compliance reporting. |

| (4) | Fees for products and services other than those already reported such as fees relating to Sarbanes-Oxley compliance, merger and acquisition activity and preparation of private placement memorandum. |

Shareholders who wish to include a proposal in our Proxy Statement and form of proxy relating to the 2010 Annual Meeting of Shareholders should deliver a written copy of their proposal to our principal executive offices no later than November 27, 2009. Proposals must comply with the SEC proxy rules relating to shareholder proposals in order to be included in our proxy materials. Except for shareholder proposals to be included in our Proxy Statement and form of proxy, the deadline for nominations for director and other proposals made by a shareholder is February 10, 2010. We may solicit proxies in connection with next year’s Annual Meeting of Shareholders that confer discretionary authority to vote on any shareholder proposals of which we do not receive notice by February 10, 2010. Proposals should be directed to Price W. Schwenck, Corporate Secretary, Jacksonville Bancorp, Inc., 100 North Laura Street, Jacksonville, Florida 32202.

DELIVERY TO SHAREHOLDERS SHARING ADDRESS

We are providing to our shareholders a copy of our Annual Report on Form 10-K for the fiscal year ended December 31, 2008 simultaneously with delivery of this Proxy Statement. You may obtain additional copies of the Annual Report on Form 10-K filed with the SEC by writing to Glenna Riesterer, Assistant Corporate Secretary, Jacksonville Bancorp, Inc., 100 North Laura Street, Jacksonville, Florida 32202.

We are delivering only one Proxy Statement and Annual Report on Form 10-K to multiple shareholders sharing an address unless we have received contrary instructions from one or more of the shareholders. We will promptly deliver upon written or oral request a separate copy of this Proxy Statement or the Annual Report on Form 10-K to a shareholder at a shared address to which a single copy was sent. If you are a shareholder residing at a shared address and would like to request an additional copy of the Proxy Statement or Annual Report on Form 10-K now or with respect to future mailings, or to request to receive only one copy of the Proxy Statement or Annual Report on Form 10-K if you are currently receiving multiple copies, please send your request to Glenna Riesterer at the address noted above or call us at 904-421-3040.

OTHER MATTERS

As of the date of this Proxy Statement, our Board of Directors does not anticipate that other matters will be brought before the Annual Meeting. If, however, other matters are properly brought before the Annual Meeting, the persons appointed as proxies will have the discretion to vote or act thereon according to their best judgment.

COST OF SOLICITATION

We will bear the cost of solicitation of proxies, including expenses in connection with the preparation and mailing of this Proxy Statement. We will solicit primarily through the mail, and our officers, directors and employees may solicit by personal interview, telephone, facsimile or e-mail proxies. These people will not receive additional compensation for such solicitations, but we may reimburse them for their reasonable out-of-pocket expenses.

Holders of common stock are requested to vote immediately by telephone, by Internet or by completing, signing and dating the accompanying proxy card and promptly returning it in the enclosed addressed, postage-paid envelope.

Price W. Schwenck

Corporate Secretary