SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. [ ])

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the Appropriate Box:

¨ Preliminary Proxy Statement

¨ Confidential, for Use of the Commission Only (as permitted by Rule

14a-6(e)(2))

x Definitive Proxy Statement

¨ Definitive Additional Materials

¨ Soliciting Material Under Rule 14a-12

JACKSONVILLE BANCORP, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

x No fee required

¨ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1) Title of each class of securities to which transaction applies:

(2) Aggregate number of securities to which transaction applies:

(3) �� Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

(4) Proposed maximum aggregate value of transaction:

(5) Total fee paid:

¨ Fee paid previously with preliminary materials:

¨ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(1) Amount Previously paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Date Filed

March 29, 2010

Dear Shareholder:

You are cordially invited to attend the Annual Meeting of Shareholders of Jacksonville Bancorp, Inc., which will be held on Tuesday, April 27, 2010, beginning at 11:00 a.m., Eastern Time. The meeting will be held at The River Club, 1 Independent Drive, Suite 3500, Jacksonville, Florida 32202. The purpose of the meeting is to consider and vote upon the proposals explained in the notice and the Proxy Statement.

A formal notice describing the business to come before the meeting, a Proxy Statement and a proxy card are enclosed. We have also enclosed for your review the Annual Report on Form 10-K for Jacksonville Bancorp, Inc. for the year ended December 31, 2009, which contains detailed information concerning our 2009 financial performance and activities.

You may think your vote is not important, but it is vital especially given the new shareholder proxy voting rules for this proxy season. As of January 1, 2010, brokers no longer have the discretion to vote in an election of directors their customers’ shares held in companies without receiving voting instructions from those customers. As a result, if you don’t complete the voting instructions, your shares will not be considered when directors are elected. Vote your shares! This is an important right that you have as a shareholder.

Also, the meeting of shareholders will be unable to conduct any business if less than a majority of the shares eligible to vote is represented. Whether or not you plan to attend the Annual Meeting in person, please vote your shares immediately by telephone, by Internet or by mail. If you vote by mail, please sign, date and return the enclosed proxy card in the accompanying postage-paid envelope as promptly as possible. If you later decide to attend the Annual Meeting and vote in person, or if you wish to revoke your proxy for any reason before the vote at the Annual Meeting, you may do so and your proxy will have no further effect.

Thank you for taking the time to vote.

Sincerely,

Donald E. Roller

Chairman of the Board

Jacksonville Bancorp, Inc.

100 North Laura Street, Suite 1000

Jacksonville, Florida 32202

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To the Holders of Common Stock:

Notice is hereby given that the Annual Meeting of Shareholders of Jacksonville Bancorp, Inc. (the “Company”) will be held on Tuesday, April 27, 2010, at 11:00 a.m., Eastern Time, at The River Club, 1 Independent Drive, Suite 3500, Jacksonville, Florida 32202 to consider and act upon the following matters:

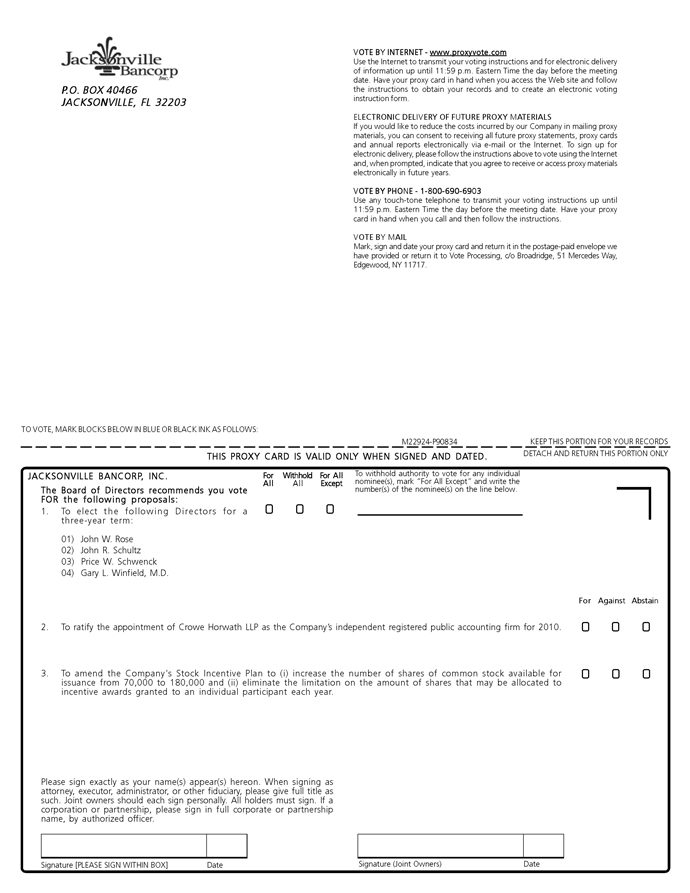

| | 1. | To elect four of the Company’s directors for a three-year term; |

| | 2. | To ratify the appointment of Crowe Horwath LLP as the Company’s independent registered public accounting firm for 2010; |

| | 3. | To amend the Company's Stock Incentive Plan to (i) increase the number of shares of common stock available for issuance from 70,000 to 180,000 and (ii) eliminate the limitation on the amount of shares that may be allocated to incentive awards granted to an individual participant each year; and |

| | 4. | To transact any other business that may properly come before the Annual Meeting or any adjournment(s) thereof. |

Only shareholders of record of Jacksonville Bancorp, Inc. common stock at the close of business on February 26, 2010 are entitled to receive notice of, and to vote on, the business that may come before the Annual Meeting.

To avoid the unnecessary expense of further solicitation, we urge you to immediately indicate your voting instructions by telephone, by Internet or by mail. If you vote by mail, please sign, date and return the enclosed proxy card as promptly as possible in the accompanying postage-paid envelope to ensure your representation at the Annual Meeting. You may revoke the proxy at any time before it is exercised by following the instructions set forth in Voting of Proxies on the first page of the accompanying Proxy Statement. Please note that if you choose to vote in person at the Annual Meeting and you hold your shares through a securities broker in street name, you must obtain a proxy from your broker and bring that proxy to the meeting.

BY ORDER OF THE BOARD OF DIRECTORS

Price W. Schwenck

Corporate Secretary

March 29, 2010

PLEASE VOTE AS SOON AS POSSIBLE.

YOUR VOTE IS VERY IMPORTANT TO US NO MATTER HOW MANY SHARES YOU OWN.

*************************************

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS

FOR THE SHAREHOLDER MEETING TO BE HELD ON APRIL 27, 2010

The Proxy Statement and Annual Report on Form 10-K are available at www.proxyvote.com

or on the Company’s website at www.jaxbank.com.

Jacksonville Bancorp, Inc.

100 North Laura Street, Suite 1000

Jacksonville, Florida 32202

PROXY STATEMENT

Annual Meeting of Shareholders

This Proxy Statement and the accompanying notice and proxy card are being furnished to you as a holder of Jacksonville Bancorp, Inc. common stock, $.01 par value per share, in connection with the solicitation of proxies by the Company’s Board of Directors (the “Board”) for use at the 2010 Annual Meeting of Shareholders (the “Annual Meeting”). The Annual Meeting will be held on Tuesday, April 27, 2010, beginning at 11:00 a.m., Eastern Time, at The River Club, 1 Independent Drive, Suite 3500, Jacksonville, Florida 32202. This Proxy Statement and the accompanying notice and proxy card are first being mailed to holders of the Company’s common stock on or about March 31, 2010.

Unless the context requires otherwise, references in this statement to “we,” “us” or “our” refer to Jacksonville Bancorp, Inc., its wholly owned subsidiary, The Jacksonville Bank, and the Bank’s wholly owned subsidiary, Fountain Financial, Inc., on a consolidated basis. References to the “Company” denote Jacksonville Bancorp, Inc. The Jacksonville Bank is referred to as the “Bank.”

VOTING OF PROXIES

Shares represented by proxies properly signed and returned, unless subsequently revoked, will be voted at the Annual Meeting in accordance with the instructions marked on the proxy. If a proxy is signed and returned without indicating any voting instructions, the shares represented by the proxy will be voted FOR approval of the proposals stated in this Proxy Statement and in the discretion of the holders of the proxies on other matters that may properly come before the Annual Meeting.

If you have executed and delivered a proxy, you may revoke such proxy at any time before it is voted by attending the Annual Meeting and voting in person or by giving written notice of revocation of the proxy or by submitting a signed proxy bearing a later date. Such notice of revocation or later proxy should be sent to the Company’s transfer agent, Computershare Investor Services, LLC, at the address indicated on the enclosed proxy card. In order for the notice of revocation or later proxy to revoke the prior proxy, the Company’s transfer agent must receive such notice or later proxy before the vote of shareholders at the Annual Meeting. Unless you vote at the meeting or take other action, your attendance at the Annual Meeting will not revoke your proxy. If you are a beneficial owner but do not hold the shares in your name, you may vote your shares in person at the Annual Meeting only if you provide a legal proxy obtained from your broker, trustee or nominee at the Annual Meeting.

VOTING PROCEDURES

The Company’s bylaws provide that a majority of the outstanding shares of common stock entitled to vote constitutes a quorum at a meeting of shareholders. Under the Florida Business Corporation Act (the “Act”) and the Company’s articles of incorporation, the Company’s directors are elected by a plurality of the votes cast in the election at a meeting at which a quorum is present. Other matters, including Proposals 2 and 3 described in this Proxy Statement, are approved if affirmative votes cast by the holders of the shares represented at a meeting at which a quorum is present exceed votes opposing the action, unless the Act or the Company’s articles of incorporation require a greater number of affirmative votes or voting by classes. Abstentions and broker non-votes will be considered present for purposes of constituting a quorum but will have no effect under Florida law with respect to the votes on the proposals.

Proposal 2 (Ratification of Appointment of Auditors) is a “discretionary” item. New York Stock Exchange member brokers that do not receive instructions from beneficial owners regarding Proposal 2 may vote your Jacksonville Bancorp, Inc. shares in their discretion. Proposals 1 and 3, however, are “non-discretionary” items; therefore, New York Stock Exchange member brokers that do not receive instructions from beneficial owners do not have the discretion to vote on the proposals, resulting in a broker non-vote.

If you are a beneficial owner and have questions or concerns about your proxy card, you are strongly encouraged to contact your bank, broker or other financial institution through which you hold the Company’s shares.

VOTING SECURITIES

The Company’s Board has fixed the close of business on February 26, 2010 as the record date for determining the holders of its common stock entitled to receive notice of, and to vote at, the Annual Meeting. At the close of business on February 26, 2010, there were issued and outstanding 1,749,526 shares of the Company’s common stock entitled to vote at the Annual Meeting held by approximately 155 registered holders. You are entitled to one vote upon each matter properly submitted at the Annual Meeting for each share of common stock held on the record date.

PURPOSE

The Company anticipates that its shareholders will act upon the following business at the meeting:

PROPOSAL 1: ELECTION OF DIRECTORS

The directors nominated for election at the Annual Meeting are John W. Rose, John R. Schultz, Price W. Schwenck and Gary L. Winfield, M.D. in Class 1. Each nominee is an incumbent director who was recommended by the Nominating and Corporate Governance Committee and nominated by the Board. If elected, the nominees will constitute four of the ten members of the Company’s Board. To be elected, each nominee must receive a plurality of the votes cast, which shall be counted as described in the section of this Proxy Statement captioned “Voting Procedures.”

All directors serve on the board of directors of both the Company and the Bank and the term of office for all directors is three years. The Company’s articles of incorporation provide that the Company’s directors are divided into three classes. The term of office for those directors elected as Class 1 directors at this Annual Meeting expires at the Annual Meeting of Shareholders in 2013. The term of office of the Class 2 directors expires at the Annual Meeting of Shareholders in 2011 and the term of office of the Class 3 directors expires at the Annual Meeting of Shareholders in 2012.

The following provides certain information with respect to each of the Company’s directors, including the nominees for director in Class 1. Except as otherwise indicated, each person has been or was engaged in his present or last principal occupation, in the same or a similar position, for more than five years. The Nominating and Corporate Governance Committee is evaluating whether to fill the current vacancies on the Board of Directors. Proxies cannot be voted for a greater number of persons than the number of nominees named herein.

All of the Company’s directors share an ability to make independent analytical inquiries and possess an overall balance of diversity, including with respect to perspectives, backgrounds, professional experiences, differences in viewpoint, education, skills, age, race and national origin.

CLASS 1 DIRECTORS—Term expires at the 2010 Annual Meeting of Shareholders

| | | | Positions Held and Principal Occupations During the Past Five Years |

| John W. Rose | | 60 | | Director of the Company and the Bank since 1999. A financial services executive, advisor and investor for over 30 years. Mr. Rose is a Principal of CapGen Financial Advisors, a New York City-based private equity fund established in 2007, which specializes in bank and thrift investments. Prior to that, from 1991 to 2007, he was President of McAllen Capital Partners, a financial advisory firm. Mr. Rose earned his undergraduate degree from Case Western Reserve University and his M.B.A. from Columbia University. |

| | | | | |

| | | | | As a result of these professional and other experiences, Mr. Rose possesses particular knowledge in a variety of areas—including accounting and financial acumen; public company board and committee experience (specifically audit, compensation and governance); and mergers and acquisitions—qualities that strengthen the Board’s collective knowledge and capabilities and which may be effective in serving the Company’s long-term best interests. |

| | | | | |

| John R. Schultz | | 46 | | Director of the Company and the Bank since 1999. Vice President of Schultz Investments, Inc., an investment management company primarily involved in real estate investments, since 1992. A fourth generation native of Jacksonville, Florida, Mr. Schultz attended The Bolles School (Jacksonville, Florida) and the University of Florida. Mr. Schultz is a director of numerous companies and community organizations, including Metro YMCA, Daniel Properties, Inc. (Chairman), Trust for Public Land North Florida Advisory Council and The Schultz Foundation, Inc. |

| | | | | |

| | | | | As a result of these professional and other experiences, Mr. Schultz possesses particular knowledge in a variety of areas—including private sector experience; civic and charitable organizations; social responsibility and reputational issues; strategic planning; consumer dynamics and the real estate environment—qualities that strengthen the Board’s collective knowledge and capabilities and which may be effective in serving the Company’s long-term best interests. |

| Name | | Age | | Positions Held and Principal Occupations During the Past Five Years |

Price W. Schwenck | | 67 | | Director of the Company and the Bank since 1999. Chairman of the Board of Directors for the Bank since 1999 and former Chief Executive Officer of the Company from 1999 until April 26, 2000. From May 2000 to February 2003, Mr. Schwenck was President and Chief Executive Officer of P.C.B. Bancorp, Inc., a multi-bank holding company located in Clearwater, Florida. Mr. Schwenck served as Regional President for First Union National Bank in Ft. Lauderdale, Florida, from 1988 to 1994 and in Jacksonville, Florida, from 1994 until he retired in 1999. Mr. Schwenck is currently a director of Freedom Bank of America in St. Petersburg, Florida. Mr. Schwenck received his Bachelors degree and M.B.A. from the University of South Florida and his M.S. from the University of Miami in 1996 after four years of extended study and application in the field of quality management and leadership. |

| | | | | |

| | | | | As a result of these professional and other experiences, Mr. Schwenck possesses particular knowledge in a variety of areas—including corporate structure and board experience; mergers and acquisitions; private and public sector experience; banking and financial services industry experience; strategic planning and management—qualities that strengthen the Board’s collective knowledge and capabilities and which may be effective in serving the Company’s long-term best interests. |

| | | | | |

| Gary L. Winfield, M.D. | | 53 | | Director of the Company and the Bank since 1999. A medical director since November 2005 and a consultant since June 2000 at Memorial Hospital. From 1991 through 2007, Dr. Winfield had an active family practice in Jacksonville Beach, Florida, operating as Sandcastle Family Practice, P.A. Dr. Winfield has served as Vice President of Medical Affairs for Anthem Health Plans of Florida, a provider of health insurance. Dr. Winfield received his undergraduate degree from the University of Oklahoma and is a graduate of the College of Medicine at the University of Oklahoma. |

| | | | | |

| | | | | As a result of these professional and other experiences, Dr. Winfield possesses particular attributes—including a high level of integrity and personal character; business and financial sophistication; business, professional and personal contacts; and an ability to apply sound and independent business judgment—qualities that strengthen the Board’s collective knowledge and capabilities and which may be effective in serving the Company’s long-term best interests. |

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THIS PROPOSAL 1.

CLASS 2 DIRECTORS—Term expires at the 2011 Annual Meeting of Shareholders

| | | | Positions Held and Principal Occupations During the Past Five Years |

| | | | | |

| R. C. Mills | | 72 | | Director of the Company and the Bank since 1999. Retired in April 2008 as President of Heritage Propane Partners, L.P., a national distributor of propane gas. Mr. Mills is a graduate of the University of Sarasota and resides in the Jacksonville area. Mr. Mills has an extensive business background and is experienced in business mergers and acquisitions, corporate finance and personnel management, having served in several executive management positions with a vertically integrated oil and gas company for over 25 years. |

| | | | | |

| | | | | As a result of these professional and other experiences, Mr. Mills possesses particular attributes—including a high level of integrity and personal character; business and corporate financial sophistication in sales and distribution; public company board and committee experience (specifically compensation and governance); and mergers and acquisitions—qualities that strengthen the Board’s collective knowledge and capabilities and which may be effective in serving the Company’s long-term best interests. |

| Name | | Age | | Positions Held and Principal Occupations During the Past Five Years |

| | | | | |

| Gilbert J. Pomar, III | | 50 | | Director of the Company and the Bank since 1999. President and Chief Executive Officer for both the Company and the Bank, Mr. Pomar joined the Company as President in March 1999 and became President and Chief Executive Officer in 2000. He was previously employed by First Union National Bank in Jacksonville since 1991. During his tenure with First Union, Mr. Pomar was Senior Portfolio Manager and Senior Vice President/Commercial Banking Manager. Mr. Pomar has more than 25 years of banking experience, including holding various positions with Southeast Bank, First National Bank of Chicago, Barnett Bank and Florida Coast Bank. Mr. Pomar is active in various community efforts, including directorships at the American Cancer Society, Junior Achievement of North Florida, Downtown Vision, Timuquana Country Club, University of North Florida College of Business, and the Florida Bankers Association. Mr. Pomar is a graduate of the University of Florida, where he earned his Bachelor of Science degree in Finance. |

| | | | | |

| | | | | As a result of these professional and other experiences, Mr. Pomar possesses particular knowledge in a variety of areas—including corporate structure; public company board experience; mergers and acquisitions; strategic planning; accounting and financial acumen; and a high level of integrity and personal character—qualities that strengthen the Board’s collective knowledge and capabilities and which may be effective in serving the Company’s long-term best interests. |

| | | | | |

| Donald E. Roller | | 72 | | Director of the Company and the Bank since 1999. Chairman of the Company’s Board of Directors. Mr. Roller served as President and Chief Executive Officer of U.S. Gypsum Company from 1993 through 1996, when he retired. He was also previously the Executive Vice President of USG Corporation. Mr. Roller has had extensive experience in directorship positions; he serves as Chairman of the Board of Life Care Pastoral Services, Inc. and Glenmoor at St. Johns, both not-for-profit Continuing Care Retirement Communities, located in St. Augustine, Florida, and has served as acting Chief Executive Officer and Chairman of the Audit Committee for Payless Cashways, Inc. |

| | | | | |

| | | | | As a result of these professional and other experiences, Mr. Roller possesses particular knowledge in a variety of areas—including corporate structure; mergers and acquisitions; public company board experience (specifically audit, compensation and governance); and strategic planning—qualities that strengthen the Board’s collective knowledge and capabilities and which may be effective in serving the Company’s long-term best interests. |

| | | | | |

| Charles F. Spencer | | 67 | | Director of the Company and the Bank since 1999. President of INOC LLC, a real estate management development company, since 2001, and Joshua Development LLC, a real estate holding company, since 2006, in Jacksonville, Florida. Mr. Spencer is a member of the International Longshoremen’s Association’s AFL-CIO Executive Council where he has served as an International Vice President representing members from Maine to Texas since 2002. In addition, Mr. Spencer is Executive Vice President of the South Atlantic and Gulf Coast District of I.L.A. and Vice President of the Florida AFL-CIO. He serves on the Board of Trustees of Edward Waters College, the Jacksonville Housing and Community Development Board; and Westside Ministries, Inc. Mr. Spencer is the former Chairman of the Board of the Jacksonville Sports Authority and former board member of the I.M. Sulzbacher Center for the Homeless, United Way of Northeast Florida, and the foundation board of Florida Community College at Jacksonville. |

| | | | | |

| | | | | As a result of these professional and other experiences, Mr. Spencer possesses particular knowledge in a variety of areas—including corporate structure; mergers and acquisitions; private and public sector experience; civic and charitable organizations—qualities that strengthen the Board’s collective knowledge and capabilities and which may be effective in serving the Company’s long-term best interests. |

CLASS 3 DIRECTORS—Term expires at the 2012 Annual Meeting of Shareholders

| | | | Positions Held and Principal Occupations During the Past Five Years |

| | | | | |

| James M. Healey | | 52 | | Director of the Company and the Bank since 1999. Director and Partner of Mint Magazine, Inc. since 1992. Before his association with Mint Magazine in 1985, Mr. Healey worked with Carnation Food Products, Inc. and International Harvester. Mr. Healey attended Purdue University where he received a Bachelor of Arts degree from Purdue’s Business School with special studies in Marketing and Personnel. Mr. Healey has been a resident and active member of the Jacksonville community since 1984. |

| | | | | |

| | | | | As a result of these professional and other experiences, Mr. Healey possesses particular knowledge in a variety of areas—including corporate structure; marketing, manufacturing and the retail environment—qualities that strengthen the Board’s collective knowledge and capabilities and which may be effective in serving the Company’s long-term best interests. |

| | | | | |

| John C. Kowkabany | | 67 | | Director of the Company and the Bank since 1999. Jacksonville-based real estate investor and consultant. Mr. Kowkabany has significant private and public sector experience. A resident of the city of Neptune Beach, he has been active in local government, serving as the city’s Mayor from 1989 to 1997, and Councilman from 1985 to 1989. The Honorable John C. Kowkabany’s public sector experience has provided him with experience and knowledge regarding the local business and civic communities. For many years, Mr. Kowkabany has served with various civic and charitable organizations as an officer or director. Mr. Kowkabany graduated with a Bachelor of Arts degree from Jacksonville University. |

| | | | | |

| | | | | As a result of these professional and other experiences, Mr. Kowkabany possesses particular knowledge in a variety of areas—including real estate; private and public sector experience; civic and charitable organizations; corporate board experience; social responsibility and reputational issues—qualities that strengthen the Board’s collective knowledge and capabilities and which may be effective in serving the Company’s long-term best interests. |

PROPOSAL 2: RATIFICATION OF APPOINTMENT OF AUDITORS

The firm of Crowe Horwath LLP has been the Company’s independent certified public accountants since 2004. Crowe Horwath LLP has been recommended by the Audit Committee and approved by the Board of Directors as the Company’s independent certified public accountants for 2010. Ratification of the Company’s independent certified public accountants is not required by the Company’s bylaws or otherwise, but the Board of Directors has decided to seek such ratification as a matter of good corporate practice. If the selection of Crowe Horwath LLP is not ratified by the shareholders, the Audit Committee will reconsider the matter.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THIS PROPOSAL 2.

PROPOSAL 3: APPROVAL OF AMENDMENT TO STOCK INCENTIVE PLAN

The Board of Directors approved an amendment to the Company’s 2008 Amendment and Restatement of the 2006 Stock Incentive Plan (the “Stock Incentive Plan”) to (i) increase the number of shares of common stock available for issuance from 70,000 to 180,000 and (ii) eliminate the limitation on the amount of shares that may be allocated to incentive awards granted to an individual participant each year, subject to shareholder approval. The purposes of the proposed amendment are to increase the number of shares available for award grants to approximately 10% of the Company’s total outstanding shares, and to provide the Board with more flexibility in determining the amount of awards to grant to particular employees of the Company under the Stock Incentive Plan. The Board believes that the proposed amendment provides better flexibility in the administration of the Stock Incentive Plan.

Description of the Stock Incentive Plan

The following is a description of the material terms of the Stock Incentive Plan, as it is proposed to be amended. This description is intended as a summary only and is qualified in its entirety by reference to the text of the First Amendment to the Stock Incentive Plan which is attached to this Proxy Statement as Appendix A, and the Stock Incentive Plan, as originally approved by the Company’s shareholders, which was filed with the Securities and Exchange Commission (the “SEC”) as Appendix B to this Proxy Statement and which can be accessed at the SEC’s website, www.sec.gov.

Administration. The Stock Incentive Plan will be administered by the compensation committee of the Board, or such other committee comprised of members of the Board that the Board appoints (the “Committee”). If the compensation committee has not been designated as the Committee, members of the Committee must be “non-employee directors” within the meaning of Section 16 of the Securities Exchange Act of 1934, as amended, (the “Exchange Act”) and “independent directors” within the meaning of any applicable stock exchange rule. In addition, to the extent that the Committee intends that an award granted under the Stock Incentive Plan constitute “performance-based compensation” for purposes of Internal Revenue Code (the “Code”) section 162(m) (discussed below), members of the Committee must be “outside directors” within the meaning of Code section 162(m).

Under the Stock Incentive Plan, the Committee has full authority to select the eligible individuals to whom awards will be granted, the types of award to be granted, the number of shares to be subject to an award, the exercise price (in the case of a stock option) and other terms and conditions of awards, to interpret the Stock Incentive Plan, and to prescribe, amend and rescind the rules and regulations relating to the Stock Incentive Plan.

Term, Amendment and Termination. If not terminated sooner by the Board, the Stock Incentive Plan will terminate as of the close of business on the date immediately preceding the tenth anniversary of the Stock Incentive Plan’s effective date, and no awards will be granted after that date. Awards granted and outstanding as of the date the Stock Incentive Plan terminates will not be affected or impaired by such termination.

The Board may amend, alter or discontinue the Stock Incentive Plan at any time. However, no amendment, alteration or discontinuation of the Stock Incentive Plan may impair the rights of an award recipient with respect to awards previously granted without such recipient’s consent (except that no consent is necessary for amendments made to cause the Stock Incentive Plan to qualify for the exemption provided by Rule 16b-3 of the Exchange Act or for awards to qualify for the “qualified performance-based compensation” exception under Code section 162(m), discussed below). In addition, no amendment may be made that would disqualify the Stock Incentive Plan from the exemption provided by Rule 16b-3 of the Exchange Act or to extend the term of the Stock Incentive Plan. Also, to the extent required by the Code or by the rules of NASDAQ, no change may be made to the Stock Incentive Plan that (i) increases the total number of shares of Company stock reserved for issuance pursuant to awards granted under the Stock Incentive Plan (other than changes to reflect changes in the Company's capital structure), (ii) materially modifies the requirements as to eligibility for participation in the plan, (iii) materially increases the benefits accruing to plan, or (iv) expands the types of awards provided for under the Stock Incentive Plan, unless such change is authorized by the Company's shareholders.

The Committee may amend the terms of any outstanding award, either prospectively or retroactively, except that an amendment that would impair the rights of the award holder requires the holder’s consent (except that no consent is necessary for amendments made to cause the Stock Incentive Plan to qualify for the exemption provided by Rule 16b-3 of the Exchange Act or for awards to qualify for the “qualified performance-based compensation” exception under Code section 162(m), discussed below or to comply with Code Section 409A).

No Modification of Stock Options or Stock Appreciation Rights. Except for adjustments for certain corporate events as described below, the Stock Incentive Plan expressly prohibits the Committee from modifying stock options and stock appreciation rights (including repricing stock options or stock appreciation rights once they are granted) without the prior approval of the shareholders of the Company.

Shares Subject to the Stock Incentive Plan. The Stock Incentive Plan currently provides for up to 70,000 shares of the Company’s common stock as available for issuance. Subject to shareholder approval of the First Amendment to the Stock Incentive Plan and the adjustments described below, up to 180,000 shares of the Company’s common stock, will be available for issuance for awards under the Stock Incentive Plan. These shares shall be authorized but unissued shares. Awards may only be granted on shares of the highest-value class of common stock of the Company.

If an award granted under the Stock Incentive Plan expires, terminates, is cancelled, or lapses for any reason without the issuance of shares of common stock, or if any shares of restricted stock awarded under the Stock Incentive Plan are forfeited, the shares covered by such award or such restricted stock will again be available for awards under the Stock Incentive Plan. In addition, if an award recipient tenders previously-acquired shares of the Company’s common stock to satisfy applicable withholding obligations with respect to an award, or if shares of the Company’s common stock are withheld to satisfy applicable withholding obligations, such shares will again be available for further awards under the Stock Incentive Plan. Also, if an award recipient tenders previously-acquired shares of the Company’s common stock in payment of the option price upon exercise of a stock option awarded under the Stock Incentive Plan, or if shares of common stock are withheld in payment of the option price, the number of shares tendered or withheld will again be available for further awards under the Stock Incentive Plan.

The Company’s common stock is traded on the NASDAQ Global Market. The last reported sales price of the Company’s common stock on March 22, 2010 was $9.12.

Individual Limitations. The Stock Incentive Plan currently limits the number of shares that can be allocated to the incentive awards granted to any individual participant each year to 15,000 shares. Subject to shareholder approval of the First Amendment to the Stock Incentive Plan, the 15,000 share limitation described above will be eliminated. Participants, however, may not receive performance grants within one fiscal year that could exceed $500,000 when paid in cash or in shares of common stock.

Subject to the prohibition on modification of stock options and stock appreciation rights after the date of grant as specified above, if there is a change in the common stock of the Company through the declaration of stock dividends, or through recapitalization resulting in stock split-ups, or combinations or exchanges of shares, or otherwise, the Stock Incentive Plan authorizes the Committee to make appropriate adjustments in the number of shares authorized for grants, in the exercise prices of outstanding stock options, in the base prices of stock appreciation rights, and in the limits described above on the number of shares available for grant to individuals per fiscal year.

Eligibility and Types of Awards. The Stock Incentive Plan authorizes the grant of stock options, stock appreciation rights, restricted stock, restricted stock units, and performance grants. Participation in the Stock Incentive Plan is open to employees of the Company and its related companies as selected by the Committee. Directors who are not employees of the Company or of a subsidiary are not eligible to receive grants under the Stock Incentive Plan. As of March 22, 2010, the Bank had approximately 64 employees, including three officers of the Company or any subsidiary that were eligible to receive awards under the Stock Incentive Plan.

Stock Options. Employees of the Company and its related companies may be granted options to acquire the Company’s common stock under the Stock Incentive Plan, either alone or in conjunction with other awards under the Stock Incentive Plan. Under the Stock Incentive Plan, stock options may be either incentive stock options (“ISOs”) or nonqualified stock options. The exercise price of a stock option is determined at the time of grant but may not be and may never become less than the fair market value per share of common stock on date of grant. Additionally, the exercise price of an ISO that is granted to a 10 percent shareholder may not be less than 110% of the fair market value per share of common stock on the date of grant. Stock options are exercisable at the times and upon the conditions that the Committee may determine, as reflected in the applicable stock option agreement. The exercise period of a stock option is determined by the Committee and may not exceed ten years from the date of grant.

The holder of a stock option may exercise the option in whole or in part at such times as specified by the Committee in the grant agreement; provided that an ISO may be exercised no later than the earlier of (i) ten years from the date of grant, (ii) three months following the participant’s retirement or termination from employment for reasons other than for death or disability, or (iii) one year following the date of the Participant’s death or disability.

The exercise price of a stock option must be paid in full at the time of exercise and is payable in cash. However, if (and to the extent) provided by the related grant agreement, the option exercise price may also be paid: (i) by the surrender of common stock already owned by the optionee, (ii) by requesting the Company to withhold, from the number of shares of common stock otherwise issuable upon exercise of the stock option, shares having an aggregate fair market value on the date of exercise equal to the exercise price, or (iii) a combination of the foregoing, as provided by the award agreement. Additionally, if permitted by the Committee and allowable by law, payment of the exercise price may be made through a broker-facilitated cashless exercise.

ISOs are exercisable only by the optionee during his or her lifetime and are not assignable or transferable other than by will or by the application of the laws of inheritance. Nonqualified stock options may be assigned, but only to the extent specifically provided in grant agreement.

For the purpose of complying with Code section 409A, the Stock Incentive Plan prohibits any modification to or extension of a previously granted stock option if such modification or extension would result in the stock option being treated as deferred compensation subject to Code section 409A. A “modification” for this purpose is generally any change to the terms of the stock option (or the Stock Incentive Plan or applicable award agreement) that provides the holder with a direct or indirect decrease in the exercise price of the stock option. An “extension” generally means either (i) the provision of an additional period of time within which to exercise the stock option; (ii) the substitution of the stock option for a future right to compensation; or (iii) the inclusion of a deferral or renewal feature.

The following table sets forth the number of stock options received by the Company’s current executive officers (as a group) and all other Company employees who are not executive officers (as a group).

| Executive Officers | 60,000 stock options |

| | |

| Non-Executive Officer Employee Group | 30,500 stock options |

For more information regarding awards made or contemplated pursuant to the Stock Incentive Plan, please refer to the New Plan Benefits section below.

Stock Appreciation Rights. A stock appreciation right (“SAR”) may be granted (i) to employees in conjunction with all or any part of an option granted under the Stock Incentive Plan (a “Tandem SAR”), or (ii) without relationship to an option (a “Freestanding SAR”). Tandem SARs must be granted at the time such option is granted. A Tandem SAR is only exercisable at the time and to the extent that the related option is exercisable. The base price of a Tandem SAR must be and may never become less than the exercise price of the option to which it relates. Upon the exercise of a Tandem SAR, the holder thereof is entitled to receive, in cash or common stock as provided in the related award agreement, the excess of the fair market value of the share for which the right is exercised (calculated as of the exercise date) over the exercise price per share of the related option. Stock options are no longer exercisable to the extent that a related Tandem SAR has been exercised, and a Tandem SAR is no longer exercisable upon the forfeiture, termination or exercise of the related stock option. A Freestanding SAR entitles the holder to a cash payment equal to the difference between the base price and the fair market value of a share of common stock on the date of exercise. The base price must be equal to and may never become less than the fair market value of a share of common stock on the date of the Freestanding SAR’s grant.

SARs may be sold or assigned, but only to the extent provided in the grant agreement.

For the purpose of complying with Code section 409A, the Stock Incentive Plan prohibits any modification or extension to a previously granted SAR if such modification would result in the SAR being treated as deferred compensation subject to Code section 409A. The terms “modification” and “extension” for this purpose generally have the same meanings as discussed above with respect to stock options.

Restricted Stock. Employees of the Company and its subsidiaries may be granted restricted stock under the Stock Incentive Plan, either alone or in combination with other awards. Restricted stock awards are shares of the Company’s common stock that are subject to forfeiture by the recipient if the conditions to vesting that are set forth in the related restricted stock agreement are not met. Vesting may be based on the continued service of the recipient, one or more performance goals (described below), or such other factors or criteria as the Committee may determine.

Unless otherwise provided in the related restricted stock agreement, the grant of a restricted stock award will entitle the recipient to vote the shares of Company common stock covered by such award and to receive the dividends thereon. Under the Stock Incentive Plan, dividends or other distributions paid in shares of Company stock are subject to the same restrictions as the underlying shares of restricted stock from which they are derived. Dividends or other distributions that are paid in cash are paid at the same time and under the same conditions as such dividends or distributions are paid to shareholders of record of Company stock.

During the period that shares of stock are restricted, the recipient cannot sell, assign, transfer, pledge or otherwise encumber the shares of restricted stock. If a recipient’s employment or service with the Company and its subsidiaries terminates, the recipient will forfeit all rights to the unvested portion of the restricted stock award.

Restricted Stock Units. Employees of the Company and its subsidiaries may be granted restricted stock units under the Stock Incentive Plan, either alone or in combination with other awards. A restricted stock unit is a right to receive a share of common stock of the Company or the fair market value in cash of a share of common stock in the future, under terms and conditions established by the Committee.

The applicable restricted stock units award agreement is required to specify the times or events on which restricted stock units will be paid. These times or events generally include the applicable vesting date, the date of the participant’s termination of employment, or a specified calendar date. Restrictions conditioned on the passage of time shall not expire less than three years from the date of grant. Once specified in the award agreement, payment dates may not be accelerated for a participant for any reason, except as specifically provided for in Code section 409A. At the time specified in the applicable award agreement, restricted stock units will be settled by the delivery to the participant of shares of common stock equal in number to the number of the participant’s restricted stock units that are vested as of the specified date or event (such as termination of employment), or cash equal to the fair market value of such shares. Payment to any specified employee (as defined in the Stock Incentive Plan) upon certain types of a termination of employment, including a specified employee’s retirement, is required to be delayed for six months in order to comply with Code section 409A.

Prior to an actual delivery of shares of common stock in settlement of a restricted stock units grant, a participant acquires no rights of a shareholder. Restricted stock units may not be sold, assigned, transferred or pledged or otherwise encumbered, but a participant may designate one or more beneficiaries to whom shares of common stock covered by a grant of restricted stock units will be transferred in the event of the participant’s death.

The Committee may, in its discretion, provide in a restricted stock units award agreement that a participant will be entitled to receive dividend equivalents with respect to his or her restricted stock units. Dividend equivalents may, in the discretion of the Committee, be paid in cash or credited to the participant as additional restricted stock units, or any combination of cash and additional restricted stock units. The amount that can be paid to a recipient as a dividend equivalent cannot exceed the amount that would be payable as a dividend if the stock unit were actually a share of common stock. If credited to the participant as additional restricted stock units, the additional restricted stock units will vest at the same time as the restricted stock units to which they relate. If credited to the participant as cash, the dividend equivalents must be paid in the same calendar year in which the related dividends are paid to shareholders of the Company, or by the 15th day of the third calendar month following the date on which the related dividends are paid, if later.

Performance grants. Officers and employees of the Company and its subsidiaries may be granted performance grants under the Stock Incentive Plan, either alone or in combination with other Stock Incentive Plan awards.

A performance share is a contingent right to receive a share of common stock of the Company or the fair market value in cash of a share of common stock, in the future, pursuant to the terms of a grant made under the Stock Incentive Plan and the related award agreement. For any grant of performance grants, the Committee will establish (i) one or more performance goals, and (ii) a performance period of not less than one year. The performance goals will be based on one or more performance criteria set forth in the Stock Incentive Plan and described below. At the expiration of the performance period, the Committee will determine and certify the extent to which the performance goals were achieved. The Committee will then determine the number of performance grants to which a recipient of performance grants under the grant is entitled, based upon the number of performance grants originally granted to the recipient and the level of performance achieved. Performance grants will be settled by the delivery of shares of common stock of the Company or cash equal to the fair market value of such shares as soon as practicable after the close of the performance period. Performance grants will be delivered as soon as practicable following the Committee’s determination, but in any event no later than two and one-half months after the end of the year in which the applicable performance period has ended.

Payment to any specified employee (as defined in the Stock Incentive Plan) upon certain types of termination of employment, including a specified employee’s retirement, is required to be delayed for six months in order to comply with Code section 409A

Prior to an actual delivery of shares of common stock in settlement of a performance grants grant, a recipient acquires no rights of a shareholder. Performance grants may not be sold, assigned, transferred or pledged or otherwise encumbered, but a recipient may designate one or more beneficiaries to whom shares of common stock covered by a grant of performance grants will be transferred in the event of the recipient’s death.

Effective Date. The Stock Incentive Plan was approved by the Company’s shareholders and became effective on April 29, 2008. If the First Amendment to the Stock Incentive Plan is approved by the Company’s shareholders, the amendment will become effective as of the date of approval.

Certain Federal Income Tax Considerations

The following is a brief and general summary of the federal income tax consequences of transactions under the Stock Incentive Plan based on federal income tax laws in effect on January 1, 2010. The summary does not purport to be complete, and does not address the tax consequences of a participant’s death or the state, local and foreign tax laws that may also be applicable to awards and transactions involving awards.

Stock Options. Stock options granted under the Stock Incentive Plan may be either “Incentive Stock Options,” as defined in Section 422 of the Code, or Nonstatutory Stock Options.

Incentive Stock Options. Incentive Stock Options granted under the Stock Incentive Plan will be subject to the applicable provisions of the Code, including Code section 422. If shares of common stock are issued to an optionee upon the exercise of an ISO, and if no “disqualifying disposition” of such shares is made by such optionee within one year after the exercise of the ISO or within two years after the date the ISO was granted, then (i) no income will be recognized by the optionee at the time of the grant of the ISO, (ii) no income, for regular tax purposes, will be realized by the optionee at the date of exercise, (iii) upon sale of the shares of the common stock acquired by exercise of the ISO, any amount realized in excess of the option price will be taxed to the optionee, for regular tax purposes, as a capital gain (at varying rates depending upon the optionee’s holding period in the shares and income level) and any loss sustained will be a capital loss, and (iv) no deduction will be allowed to the Company for federal income tax purposes. If a “disqualifying disposition” of such shares is made, the optionee will realize taxable ordinary income in an amount equal to the excess of the fair market value of the shares purchased at the time of exercise over the exercise price (the “bargain purchase element”) and Company will generally be entitled to a federal income tax deduction equal to such amount. The amount of any gain in excess of the bargain purchase element realized upon a “disqualifying disposition” will be taxable as capital gain to the holder (at varying rates depending upon such holder’s holding period in the shares and income level), for which Company will not be entitled to a federal income tax deduction. Upon exercise of an ISO, the optionee may be subject to alternative minimum tax.

Nonqualified Stock Options. With respect to nonqualified stock options, (i) no income is recognized by the optionee at the time the option is granted; (ii) generally, at exercise, ordinary income is recognized by the optionee in an amount equal to the difference between the option exercise price paid for the shares and the fair market value of the shares on the date of exercise, and the Company is entitled to a tax deduction in the same amount; and (iii) at disposition, any gain or loss is treated as capital gain or loss. In the case of an optionee who is also an employee, any income recognized upon exercise of a nonqualified stock option will constitute wages for which withholding will be required.

Stock Appreciation Rights. No income will be recognized by a recipient in connection with the grant of a SAR. When a SAR is exercised, the recipient will generally be required to include as taxable ordinary income in the year of exercise an amount equal to the amount of cash received and the fair market value of any common stock received on the exercise. The Company will be entitled to a tax deduction at the same time and in the same amount. If the optionee receives common stock upon the exercise of a SAR, any gain or loss on the sale of such stock will be treated in the same manner as discussed above under “nonqualified stock options.”

Restricted Stock. A recipient will not realize taxable income at the time of grant of a restricted stock award, assuming that the restrictions constitute a substantial risk of forfeiture for Federal income tax purposes. Upon the vesting of shares of Company common stock subject to an award, the recipient will realize ordinary income in an amount equal to the excess of the fair market value of such shares at such time over the amount paid by the recipient, if any. The Company will be entitled to a deduction equal to the amount of ordinary income realized by the recipient in the taxable year in which the amount is included in the recipient’s income. Dividends paid to the recipient during the restriction period will be taxable as compensation income to the recipient at the time paid and will be deductible at such time by the Company. The recipient of a restricted stock award may, by filing an election with the Internal Revenue Service within 30 days of the date of grant of the restricted stock award, elect to be taxed at the time of grant of the award on the excess of the then fair market value of the shares of Company common stock over the amount paid by the recipient, if any, in which case (1) the Company will be entitled to a deduction equal to the amount of ordinary income realized by the recipient in the taxable year in which the amount is included in the recipient’s income, (2) dividends paid to the recipient during the restriction period will be taxable as dividends to the recipient and not deductible by the Company, and (3) there will be no further tax consequences to either the recipient or the Company when the restrictions lapse.

Restricted Stock Units and Performance Grants. An employee who is awarded one or more restricted stock units and/or performance grants will not recognize income and the Company will not be allowed a deduction at the time the award is made. When an employee receives payment for such awards in cash or shares of common stock, the amount of the cash and the fair market value of the shares of common stock received will be ordinary income to the employee and will be allowed as a deduction for federal income tax purposes to the Company. The Company will be entitled to a deduction equal in amount to the ordinary income realized by the recipient in the year paid.

Section 162(m) Limit. Code section 162(m) generally limits a public company’s federal income tax deduction for compensation paid to any of its executive officers to $1,000,000 per year. However, certain “performance-based compensation” paid to such officers is exempt from the $1,000,000 annual deduction limit.

The Stock Incentive Plan is designed to enable the Company to provide grants of stock options, stock appreciation rights and performance grants under the Stock Incentive Plan to the Company’s executive officers that will satisfy the requirements of the exception of Section 162(m) for performance-based compensation. The Stock Incentive Plan is also designed so that awards of restricted stock and restricted stock units under the Stock Incentive Plan may be made in a manner which satisfies the performance-based compensation exception of Section 162(m). Accordingly, (i) the right to receive a share of common stock or cash in payment of a stock option, stock appreciation right or performance grant, and, (ii) if the Committee intends that a restricted stock or stock unit award satisfy the performance-based compensation exception, the vesting of such stock or restricted stock units, will be contingent upon the achievement of objective performance goals established by the Committee at the time of grant.

Under the Stock Incentive Plan, a performance goal will be based on one or more of the following criteria: total shareholder return, revenue, gross profit, pre-tax earnings, net operating profit after taxes, net income, earnings per share, gross margin, net interest margin, operating cash flow, free cash flow, return on assets, return on invested capital, and return on equity. Performance Criteria may be used to measure the performance of the Company as a whole or any business unit of the Company, and may be measured relative to a peer group or index. The level of achievement of a performance goal will be determined in accordance with generally accepted accounting principles and shall be subject to certification by the Committee. Under the Stock Incentive Plan, the Committee does have the discretion, to the extent such discretion is consistent with the “qualified performance-based exception” of the Code and its regulations, to make equitable adjustments to performance goals in recognition of unusual or non-recurring events affecting the Company or a subsidiary or the financial statements of the Company or any subsidiary, or for changes in the law or accounting principles. Once a performance goal is established, the Committee will have no discretion to increase the amount of compensation that would otherwise be payable to a recipient upon attainment of the performance goal.

Income Tax Withholding. Upon an employee’s realization of income from an award, the Company is generally obligated to withhold against the employee’s Federal and state income and employment tax liability. Payment of the withholding obligation can be made from other amounts due from the Company to the award recipient or with shares of Company common stock owned by the recipient. If the recipient elects to tender shares of Company common stock or to reduce the number of shares the recipient is otherwise entitled to receive to satisfy the withholding obligation, the shares tendered or reduced will be treated as having been sold to the Company.

Special Considerations under Code Section 409A. Code section 409A is effective in general for any compensation deferred under a nonqualified deferred compensation plan on or after January 1, 2005. Compensation deferred under a nonqualified plan prior to that date is also subject to the new requirements if the plan is “materially modified” on or after October 4, 2004. A nonqualified plan is materially modified if any new benefit or right is added to the plan or any existing benefit or right is enhanced.

If at any time during a taxable year a nonqualified deferred compensation plan fails to meet the requirements of Code section 409A, or is not operated in accordance with those requirements, all amounts (including earnings) deferred under the plan for the taxable year and all preceding taxable years, by any participant with respect to whom the failure relates, are includable in such participant’s gross income for the taxable year to the extent not subject to a substantial risk of forfeiture and not previously included in gross income. If a deferred amount is required to be included in income under Code section 409A, the amount also is subject to an additional income tax and enhanced interest. The additional income tax is equal to twenty percent of the amount required to be included in gross income. The interest imposed is equal to the interest at the underpayment rate specified by the Internal Revenue Service, plus one percentage point, imposed on the underpayments that would have occurred had the compensation been includible in income for the taxable year when first deferred, or if later, when not subject to a substantial risk of forfeiture.

In addition, the requirements of Code section 409A are applied as if (a) a separate plan or plans are maintained for each participant, and (b) all compensation deferred with respect to a particular participant under an account balance plan is treated as deferred under a single plan, all compensation deferred under a nonaccount balance plan is treated as deferred under a separate single plan, all compensation deferred under a plan that is neither an account balance plan nor a nonaccount balance plan (for example, equity-based compensation) is treated as deferred under a separate single plan, and all compensation deferred pursuant to an involuntary separation pay arrangement is treated as deferred under a separate single plan. Thus, if a plan failure under Code section 409A relates only to a single participant, then only the compensation deferred by that particular participant will be includable in gross income and subject to the additional income tax and interest; but any amount deferred by the participant under a different plan of a similar basic type will be includable in the participant’s gross income and subject to the additional income tax and interest as well.

In general, stock options and SARs do not provide for a deferral of compensation subject to Code section 409A if (i) the underlying stock is the highest value common stock of the service recipient; (ii) the exercise price is equal to and can never become less than the fair market value of the underlying stock at the time of grant; and (iii) the option or appreciation right is not modified, renewed or extended after the date of grant in a way that would cause the option to provide for a deferral of compensation or additional deferral feature. Restricted stock awards are generally not subject to Code section 409A. The Stock Incentive Plan has been designed with the intent that the arrangements under which participants receive stock options, SAR and restricted stock awards will not be subject to Code section 409A.

An award of restricted stock units or a performance grant may provide for a deferral of compensation subject to Code section 409A if payment under such an award occurs more than 2½ months after the end of the first taxable year (employee’s or employer’s, whichever is later) in which the legally binding right to the award arises and is no longer subject to a substantial risk of forfeiture. In awarding restricted stock or performance grants, the Committee may in its discretion structure such awards to either be exempt from or subject to Code section 409A, as it deems appropriate.

New Plan Benefits

The table below sets forth the number of awards that have been allocated to each person or group listed, under the Stock Incentive Plan, to the extent such amounts are presently determinable.

| Name and Position | | Dollar Value ($) | | | Number of Units | |

| | | | | | | |

Gilbert J. Pomar, III President and Chief Executive Officer | | 81,000 | | | 30,000 stock options | |

| | | | | | | |

Scott M. Hall Executive Vice President and Chief Lending Officer | | 40,500 | | | 15,000 stock options | |

| | | | | | | |

Valerie A. Kendall Executive Vice President and Chief Financial Officer | | 40,500 | | | 15,000 stock options | |

| | | | | | | |

| Executive Group | | 162,000 | | | 60,000 stock options | |

| | | | | | | |

| Non-Executive Director Group | | — | | | — | |

| | | | | | | |

| Non-Executive Officer Employee Group | | 82,350 | | | 30,500 stock options | |

The Company anticipates that awards will be granted during fiscal year 2010 and in subsequent years in which the Stock Incentive Plan remains in effect, if the First Amendment to the Stock Incentive Plan is approved by the Company’s shareholders. Awards for which benefits may be paid under the Stock Incentive Plan are made at the sole discretion of the Committee, subject to the maximum plan and maximum individual limitations described above. In addition, the actual benefits that will be paid pursuant to future awards under the Stock Incentive Plan, as amended, will depend upon a number of factors, including the market value of the Company’s common stock on future dates, and in the case of performance grants and restricted stock with vesting, based on the achievement of one or more performance goals, actual performance of the Company (both absolutely, and in some cases, as measured against the performance of peer companies), and decisions made by performance grant recipients. Since these factors are not known at this time, the future benefits or amounts paid under the Stock Incentive Plan, as amended, and the market value of such awards are not yet determinable.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THIS PROPOSAL 3.

BOARD OF DIRECTORS, GOVERNANCE AND COMMITTEES

Corporate Governance. The Board of Directors is committed to good business practices, transparency in financial reporting, the highest level of corporate governance and the highest ethical, moral and legal standards in the conduct of its business and operations. We believe that these standards form the basis for our reputation of integrity in the marketplace and are essential to our efficiency and continued overall success.

Communications with the Board of Directors. The Board has established a process for shareholders to communicate with members of the Board. If you would like to contact the Board, you can do so by forwarding your concern, question or complaint to the Company’s Corporate Secretary, Price W. Schwenck, at 100 North Laura Street, Jacksonville, Florida 32202, who will relay the information to the Board at or prior to the Board’s next meeting.

Independence. The Board of Directors has determined that nine of its ten members are independent as defined under the NASDAQ Marketplace Rules: Messrs. Healey, Kowkabany, Mills, Roller, Rose, Schultz, Schwenck, Spencer and Winfield. Mr. Pomar is the only director that is considered to be an “inside” director because of his employment as President and Chief Executive Officer of the Company and the Bank. Prior to his resignation on January 27, 2009, Melvin Gottlieb served on the Board and was independent as defined under the NASDAQ Marketplace Rules. The independent directors of the Company hold executive sessions from time to time without the Chief Executive Officer or any other member of management present. In 2009, the independent directors held two executive sessions after Board meetings; executive sessions were also held at the conclusion of two Audit Committee meetings in 2009.

Meetings. During fiscal year 2009, the Board held ten meetings, and all directors attended at least 75% or more of the aggregate number of meetings of the Board and committees on which they served. Board members are encouraged, but not required, to attend the Annual Meeting, and eight of the ten board members attended the Annual Meeting of Shareholders in 2009.

Committees. The Company’s Board of Directors maintains an Audit Committee, an Organization and Compensation Committee, and a Nominating and Corporate Governance Committee, which are described below. The Board elects the members of these committees at the Board’s Annual Meeting, and membership may change throughout the year based on varying circumstances at the discretion of the Board. Under the Company’s bylaws, the Board of Directors is authorized to fill any vacancy on a committee. Mr. Healey was selected to fill the vacancy on the Nominating and Corporate Governance Committee effective February 24, 2009 after Mr. Gottlieb’s resignation from the Board and the Nominating and Corporate Governance Committee in January 2009.

Audit Committee. The Audit Committee is responsible for the matters set forth in its written charter, which was adopted by the Board of Directors, and a copy of which is available on the Company’s Web site at www.jaxbank.com. The primary function of the Audit Committee is to assist the Board of Directors in fulfilling its oversight responsibilities by reviewing the Company’s financial reports, systems of internal controls regarding finance, accounting, legal compliance and ethics, and evaluating the independence of the Company’s independent accountants. The Audit Committee held nine meetings in 2009. The current members of the Audit Committee are James M. Healey, John C. Kowkabany, John W. Rose (Chairman), Price W. Schwenck and Gary L. Winfield, M.D. All members of the Audit Committee are independent as defined by rules promulgated under the Exchange Act and the NASDAQ Marketplace Rules.

Audit Committee Pre-Approval Policies and Procedures. In accordance with the Sarbanes-Oxley Act of 2002, the Audit Committee is required to pre-approve all auditing services and permissible nonaudit services, including related fees and terms, to be performed for the Company by its independent auditor subject to the de minimus exceptions for nonaudit services described under the Exchange Act, which are approved by the Audit Committee prior to the completion of the audit. In 2009, the Audit Committee pre-approved all services performed for the Company by its independent auditor.

Audit Committee Financial Expert. The Board of Directors has determined that John W. Rose is an audit committee financial expert. Mr. Rose is independent as defined by the NASDAQ Marketplace Rules and the rules promulgated under the Exchange Act.

Organization and Compensation Committee. The Organization and Compensation Committee, the charter of which is available on the Company’s Web site at www.jaxbank.com, is responsible for oversight of compensation matters, employment issues and personnel policies. The Organization and Compensation Committee makes recommendations to the Board of Directors regarding compensation for the Chief Executive Officer, as well as other executive officers and certain other officers/managers, including salaries, bonuses, option grants, other forms of long-term compensation and employee benefits. Additionally, the Organization and Compensation Committee reviews general levels of compensation and is responsible for evaluation of salaries and other compensation in light of industry trends and the practices of similarly situated, publicly traded bank holding companies. The Organization and Compensation Committee may retain one or more compensation consultants or other advisors to assist it with these duties and shall have available to it such support personnel, including management staff, outside auditors, attorneys and consultants as it deems necessary to discharge its responsibilities. The Organization and Compensation Committee held four meetings in 2009. The current members of the Organization and Compensation Committee are R.C. Mills, Donald E. Roller, John W. Rose, Price W. Schwenck (Chairman) and Charles F. Spencer, all of whom are independent as defined under the NASDAQ Marketplace Rules.

In 2009, the Organization and Compensation Committee did not engage any independent consultants.

Consideration of the following year’s total compensation starts during the fourth quarter of each year. During the fourth quarter meetings, matters such as changes in the market data, plan philosophy and design, expected performance and historical performance are discussed. Final determinations of salaries and annual incentive targets are made at the Organization and Compensation Committee’s meeting in connection with the Board’s regular meeting in January. At that meeting, the Organization and Compensation Committee is able to review prior year performance and the status of prior awards of long-term incentive compensation. The Organization and Compensation Committee has found that considering these matters in this manner allows it to not only factor in the prior year’s financial results and the current year’s operating plan, but also to better assess the prior year’s compensation. Occasionally, grants of long-term incentive compensation or changes in compensation are made at other meetings of the Organization and Compensation Committee.

The Company’s Chief Executive Officer is involved in making compensation recommendations for other executive officers, which are considered by the Organization and Compensation Committee.

Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee is responsible for formulating policies governing the Board and its committees as set out in its charter, a copy of which is available on the Company’s Web site at www.jaxbank.com. The responsibilities include recommending new director nominees, establishing criteria for membership on the Board, designating chairs and members of Board committees, setting dates for Board meetings, monitoring compliance with the Company’s bylaws and regulations governing public companies and making recommendations regarding director compensation. The Nominating and Corporate Governance Committee held three meetings in 2009. The current members of the Nominating and Corporate Governance Committee are James M. Healey, John C. Kowkabany, R.C. Mills (Chairman), Donald E. Roller and Charles F. Spencer, all of whom are independent as defined under the NASDAQ Marketplace Rules. Melvin Gottlieb was also a member of the Nominating and Corporate Governance Committee until his resignation from the Board effective January 27, 2009 and was independent as defined under the NASDAQ Marketplace Rules. In accordance with its charter, the Nominating and Corporate Governance Committee elected James M. Healey to replace Mr. Gottlieb as a Committee member effective February 24, 2009.

In the event of selecting a new director nominee, the Nominating and Corporate Governance Committee will develop a pool of potential director candidates for consideration based on each candidate’s business and professional experience, involvement in the community and understanding of the business and operations of the Company. While it does not have a formal policy with respect to director diversity, the Nominating and Corporate Governance Committee recognizes that a Board with a diverse set of skills, experiences and perspectives creates a governing body best suited to provide oversight of the Company while representing the interests of the Company’s shareholders, employees and customers. The Nominating and Corporate Governance Committee will also consider candidates for Board seats who are recommended by the Company’s shareholders, but a formal policy has not been adopted with respect to consideration of such candidates because shareholder recommendations may be informally submitted and considered by the Nominating and Corporate Governance Committee under its charter. Written suggestions for nominees should be sent to the Corporate Secretary, Price W. Schwenck, Jacksonville Bancorp, Inc., 100 North Laura Street, Jacksonville, Florida 32202. Any such recommendation must include the name and address of the candidate; a brief biographical description, including the candidate’s occupation for at least five years; a statement of the qualifications of the candidate; and the candidate’s signed consent to be named in the Proxy Statement and to serve as director, if elected. Directors should possess qualities such as understanding the business and operations of the Bank and corporate governance principles.

Board Leadership Structure and Role in Risk Oversight. With respect to the roles of Chairman and Chief Executive Officer, the Board exercises its discretion in combining or separating these positions as it deems appropriate in light of prevailing circumstances. The Board believes it is beneficial to the Company’s shareholders to separate these positions and has designated Donald E. Roller as Chairman of the Board and Gilbert J. Pomar, III, as President and Chief Executive Officer. While the Board believes that the Chief Executive Officer should be a member of the Board, the Board considers it advantageous to independence, perspective, oversight and objectivity to have a separate, independent board member to serve as Chairman. The roles have been separated since the inception of the Company in 1999, and the Company has been well-served by this leadership structure. The Board may reconsider this leadership structure from time to time based on then-current considerations.

The Board has oversight responsibility with respect to the Company’s risk management processes. This includes understanding the Company’s philosophy and strategy towards risk management and mitigation. The Board regularly reviews information regarding the Company’s financial, credit, liquidity, operational, legal, regulatory, compliance, reputational and strategic risks based on reports from management. The Audit Committee is primarily responsible for overseeing the process by which risks are managed. This includes determining that management has established effective risk management practices to identify, assess, and manage the organization’s most significant risk exposures. Management routinely reports to the Audit Committee on risk management processes and the risk identification and evaluation results. In addition, because our operations are conducted primarily through the Bank, we maintain an asset liability committee of the Bank’s board of directors as well as an asset liability committee at the Bank management level (the “ALCO Committees”). Mr. Pomar serves on both ALCO Committees. The ALCO Committees are charged with monitoring our liquidity and funds position and regularly review the rate sensitivity position on a three-month, six-month and one-year time horizon; loans-to-deposits ratios; and average maturities for certain categories of liabilities. The ALCO Committee of the Bank’s board of directors reports to the Bank’s board of directors at least quarterly, and otherwise as needed.

EXECUTIVE OFFICERS OF THE COMPANY

The Company’s executive officers, in addition to Mr. Pomar, who serves as a director, are listed below. Except as otherwise indicated, each person has been or was engaged in his or her present or last principal occupation, in the same or a similar position, for more than five years. Each officer holds office for the term set forth in the officer’s written employment agreement or until the officer’s successor has been elected and qualified.