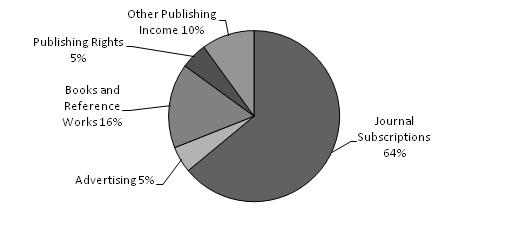

The Company’s Professional/Trade business acquires, develops and publishes books, subscription products and information services in all media, in the subject areas of business, technology, architecture, cooking, psychology, education, travel, health, religion, consumer reference, pets and general interest. Products are developed for worldwide distribution through multiple channels, including major chains and online booksellers, independent bookstores, libraries, colleges and universities, warehouse clubs, corporations, direct marketing, and websites. The Company’s Professional/Trade customers are professionals, consumers, and students worldwide. Publishing centers include Australia, Canada, Germany, Singapore, the United Kingdom and the United States. Professional/Trade publishing accounted for approximately 25% of total Co mpany revenue in fiscal year 2010 and generated revenue growth at a compound annual rate of 3% over the past five years. The graph below presents P/T revenue by product type for fiscal year 2010:

Publishing alliances and franchise products are also central to the Company’s strategy. The ability to bring together Wiley’s product development, sales, marketing, distribution and technological capabilities with a partner’s content and brand name recognition has been a driving factor in its success. Professional/Trade alliance partners include General Mills, the Culinary Institute of America, Bloomberg Press, the American Institute of Architects, the Graduate Management Admission Council, the Leader to Leader Institute, Fisher Investments, Meredith Corporation and Weight Watchers, among many others.

The Company publishes educational materials in all media, for two and four-year colleges and universities, for-profit career colleges, advanced placement classes and secondary schools in Australia. Higher Education products focus on courses in business and accounting, sciences, engineering, computer science, mathematics, statistics, geography, hospitality and the culinary arts, education, psychology and modern languages.

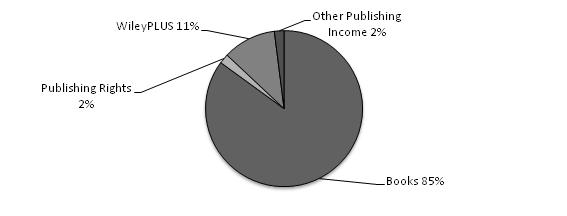

Higher Education customers include undergraduate, graduate, and advanced placement students, educators, and lifelong learners worldwide as well as secondary school students in Australia. Product is delivered online and in print, principally through college bookstores, online booksellers, and websites. Higher Education accounted for approximately 17% of total Company revenue in fiscal year 2010 and generated revenue growth at a compound annual rate of 6% over the past five years.

Higher Education’s mission is to help teachers teach and students learn. Our strategy is to provide value-added quality materials and services through textbooks, supplemental study aids, course and homework management tools and more, in print and electronic formats. The Higher Education website offers online learning materials with links to thousands of companion sub-sites to support and supplement textbooks.

The Company also provides the services of the Wiley Faculty Network, a peer-to-peer network of faculty/professors supporting the use of online course material tools and discipline-specific software in the classroom. The Company believes this unique, reliable, and accessible service gives the Company a competitive advantage.

Higher Education is also leveraging the internet in its sales and marketing efforts. The internet enhances the Company’s ability to have direct contact with students and faculty at universities worldwide through the use of interactive electronic brochures and e-mail campaigns.

Publishing relationships are key to Higher Education’s strategy. The ability to bring Wiley’s product development, sales, marketing, distribution and technology with a partner’s content and/or brand name has contributed to the Company’s success. Alliance partners include Microsoft and National Geographic.

The Company now publishes over 1,600 Scientific, Technical, Medical and Scholarly and Professional/Trade journals. Journal subscription revenue and other related publishing income, such as advertising, backfile sales, the sale of publishing rights, journal reprints and individual article sales accounted for approximately 49% of the Company’s consolidated fiscal year 2010 revenue. The journal portfolio includes titles owned by the Company, in which case they may or may not be sponsored by a professional society; titles owned jointly with a professional society; and titles owned by professional societies and published by the Company pursuant to long-term contract.

Societies that sponsor or own such journals generally receive a royalty and/or other consideration. The Company may procur editorial services from such societies on a pre negotiated fee basis. The Company also enters into agreements with outside independent editors of journals that state the duties of the editors, and the fees and expenses for their services. Contributors of journal articles transfer publication rights to the Company or a professional society, as applicable. Journal articles may be based on funded research through government or charitable grants. In certain cases the terms of the grant may require the grantholder to make articles (either the published version or an earlier unedited version) available free of charge to the public, typically after an embargo period. The Company provides various serv ices for a fee to enable the grantholder to comply.

Printed journals are generally mailed to subscribers directly from independent printers. The Company does not own or manage printing facilities. The print journal content is also available online. Subscription revenue is generally collected in advance, and deferred until the related issue is shipped or made available online at which time the revenue is earned.

Book products and book related publishing revenue, such as advertising revenue and the sale of publishing rights, accounted for approximately 51% of the Company’s consolidated fiscal year 2010 revenue. Materials for book publications are obtained from authors throughout most of the world through the efforts of an editorial staff, outside editorial advisors, and advisory boards. Most materials originate with authors, or as a result of suggestion or solicitations by editors and advisors. The Company enters into agreements with authors that state the terms and conditions under which the materials will be published, the name in which the copyright will be registered, the basis for any royalties, and other matters. Most of the authors are compensated by royalties, which vary with the nature of the product and its anticipate d potential profitability. The Company may make advance payments against future royalties to authors of certain publications. Royalty advances are reviewed for recoverability and a reserve for loss is maintained, if appropriate.

The Company continues to add new titles, revise existing titles, and discontinue the sale of others in the normal course of its business, also creating adaptations of original content for specific markets fulfilling customer demand. The Company’s general practice is to revise its textbooks every three to five years, if warranted, and to revise other titles as appropriate. Subscription-based products are updated more frequently on a regular schedule. Approximately 30% of the Company’s fiscal year 2010 U.S. book-publishing revenue was from titles published or revised in the current fiscal year.

Professional and consumer books are sold to bookstores and online booksellers serving the general public; wholesalers who supply such bookstores; warehouse clubs; college bookstores for their non-textbook requirements; individual practitioners; and research institutions, libraries (including public, professional, academic, and other special libraries), industrial organizations, and government agencies. The Company employs sales representatives who call upon independent bookstores, national and regional chain bookstores and wholesalers. Sales of professional and consumer books also result from direct mail campaigns, telemarketing, online access, advertising and reviews in periodicals. Trade sales to bookstores and wholesalers are generally made on a returnable basis with certain restrictions. The Company provides for estimate d future returns on sales made during the year principally based on historical return experience and current market trends.

Like most other publishers, the Company generally contracts with independent printers and binderies for their services. The Company purchases its paper from independent suppliers and printers. The fiscal year 2010 weighted average U.S. paper prices decreased approximately 8% from fiscal year 2009. Approximately 64% of the Company’s paper inventory is held in the United States. Management believes that adequate printing and binding facilities, sources of paper and other required materials are available to it, and that it is not dependent upon any single supplier. Printed book products are distributed from both Company-operated warehouses and independent distributors.

The Company believes that the demand for new electronic technology products will continue to increase. Accordingly, to properly service its customers and to remain competitive, the Company has increased its expenditures related to such new technologies and anticipates it will continue to do so over the next several years.

The Company’s online presence not only enables it to deliver content online, but also to sell more books. The growth of online booksellers benefits the Company because they provide unlimited virtual “shelf space” for the Company’s entire backlist.

Marketing and distribution services are made available to other publishers under agency arrangements. The Company also engages in co-publishing of titles with international publishers and in publication of adaptations of works from other publishers for particular markets. The Company also receives licensing revenue from photocopies, reproductions, translations, and electronic uses of its content.

The Company’s publications are sold throughout most of the world through operations located in Europe, Canada, Australia, Asia, and the United States. All operations market their indigenous publications, as well as publications produced by other parts of the Company. The Company also markets publications through independent agents as well as independent sales representatives in countries not served by the Company. John Wiley & Sons International Rights, Inc., a wholly owned subsidiary of the Company, sells reprint and translations rights worldwide. The Company publishes or licenses others to publish its products, which are distributed throughout the world in many languages. Approximately 45% of the Company’s consolidated fiscal year 2010 revenue was derived from non-U.S. markets.

The global nature of the Company’s business creates an exposure to foreign currency fluctuations relative to the U.S dollar. Each of the Company’s geographic locations sell products worldwide in multiple currencies. Revenue and deferred revenue, although billed in multiple currencies are accounted for in the local currency of the selling location. Fiscal year 2010 revenue was recognized in the following currencies: approximately 55% U.S dollar; 28% British pound sterling; 8% Euro and 9% other currencies.

The sectors of the publishing industry in which the Company is engaged are highly competitive. The principal competitive criteria for the publishing industry are considered to be the following: product quality, customer service, suitability of format and subject matter, author reputation, price, timely availability of both new titles and revisions of existing books, online availability of published information, and timely delivery of products to customers.

The Company is in the top rank of publishers of scientific, technical, medical and scholarly journals worldwide, a leading commercial research chemistry publisher; the leading society journal publisher; one of the leading publishers of university and college textbooks and related materials for the “hardside” disciplines, (i.e. sciences, engineering, and mathematics), and a leading publisher in its targeted professional/trade markets. The Company knows of no reliable industry statistics that would enable it to determine its share of the various international markets in which it operates.

The Company measures its performance based upon revenue, operating income, earnings per share and cash flow, excluding unusual or one-time events, and considering worldwide and regional economic and market conditions. The Company evaluates market share statistics for publishing programs in each of its businesses. STMS uses various reports to monitor competitor performance and industry financial metrics. Specifically for STMS journal titles, the ISI Impact Factor, published by the Institute for Scientific Information, is used as a key metric of a journal title’s influence in scientific publishing. For Professional/Trade, the Company evaluates market share statistics published by BOOKSCAN, a statistical clearinghouse for book industry point of sale data in the United States. The statistics include s urvey data from all major retail outlets, online booksellers, mass merchandisers, small chain and independent retail outlets. For Higher Education, the Company subscribes to Management Practices Inc., which publishes customized comparative sales reports.

Revenue for fiscal year 2010 increased 5% to $1,699.1 million, or 4% excluding the favorable impact of foreign exchange. Excluding foreign exchange, Higher Education (“HE”) and Professional/Trade (“P/T”) experienced strong growth, while Scientific, Technical, Medical and Scholarly (“STMS”) was flat with the prior year.

Gross profit margin for fiscal year 2010 of 68.6% was 0.6% higher than prior year, or 0.4% excluding the favorable impact of foreign exchange mainly due to increased sales of higher margin digital products.

Operating and administrative expenses for fiscal year 2010 of $872.2 million were 4% higher than the prior year. The increase was mainly due to higher accrued performance-based incentive compensation costs; higher planned HE editorial and production costs to support business growth; increased technology spending; and a $2.0 million bankruptcy recovery in the prior year activity. The increases in cost were partially offset by lower distribution costs; less Blackwell integration activity; and cost savings initiatives.

The Company performed a strategic review of certain non-core businesses within the STMS reporting segment. The review led the Company to consider alternatives for GIT Verlag, a business-to-business German-language controlled circulation magazine business, which was acquired by the Company in 2002. Based on the outlook for the print advertising business in German language publishing, the Company performed an impairment test on the intangible assets related to GIT Verlag. This test resulted in an $11.5 million pre-tax impairment charge in fiscal year 2010. The Company also identified a similar decline in the financial outlook for three smaller business-to-business controlled circulation advertising magazines. An impairment test on the intangible assets associated with those magazines resulted an additional $0.9 million pre-tax impairment charge in fiscal year 2010. After considering a variety of strategic alternatives for GIT Verlag, the Company implemented a restructuring plan in fiscal year 2010 to reduce certain staffing levels and the number of journals published by GIT Verlag. As a result, the Company recorded a pre-tax restructuring charge of approximately $1.6 million within the STMS reporting segment during fiscal year 2010 for GIT Verlag severance-related costs.

The Company recorded severance costs of $1.1 million related to offshoring and outsourcing certain central marketing and content management activities to Singapore and other countries in Asia. These charges are expected to be fully recovered within 18 months from implementation as a result of lower operating expenses. The impairment and restructuring charges described above, totaling $15.1 million, or $0.17 per share, are reflected in the Impairment and Restructuring Charges line item in the Consolidated Statements of Income.

Operating income for fiscal year 2010 increased 11% to $242.6 million, or 7% excluding the favorable impact of foreign exchange and the impairment and restructuring charges. The 7% increase was mainly driven by HE and P/T revenue growth, margin improvement, cost savings initiatives, partially offset by higher performance-based compensation, editorial, production and technology costs to support growth.

Interest expense decreased $16.1 million to $32.3 million. Lower interest rates contributed approximately $12.1 million towards the improvement, while lower average debt outstanding contributed approximately $4.0 million. Losses on foreign currency transactions for fiscal years 2010 and 2009 were $10.9 million and $11.8 million, respectively. The foreign currency transaction losses for fiscal year 2010 were primarily due to the revaluation of U.S. dollar cash balances held by the Company’s non-U.S. locations. The losses incurred in fiscal year 2009 were primarily due to the strengthening of the U.S. dollar in the prior year against U.S. dollar third party loans and intercompany payables maintained in non-U.S. locations during that period. Since these amounts were held in U.S. dollars, the transaction loss di d not represent an economic loss to the Company. Fiscal year 2009 included a favorable $4.6 million ($0.08 per share) insurance settlement reported as Interest Income and Other.

The effective tax rate for fiscal year 2010 was 28.3% compared to 22.0% in the prior year. The effective tax rate for fiscal year 2009 includes the reversal of a previously accrued income tax reserve of approximately $3.2 million ($0.05 per share) due to an income tax settlement with tax authorities in non-U.S. jurisdictions. The Company’s effective tax rate for fiscal year 2009 excluding the reversal was approximately 24.0%. The increase in the effective tax rate excluding the reversal was principally due to lower foreign tax benefits and a non-taxable insurance receipt in the prior year.

Earnings per diluted share for fiscal years 2010 and 2009 was $2.41 and $2.15, respectively, while net income for the same periods was $143.5 million and $128.3 million, respectively. On a currency neutral basis and excluding the impairment and restructuring charges of approximately $0.17 per share from the current year, earnings per diluted share increased 6%. Higher operating income and lower interest expense was partially offset by a prior year insurance receipt ($0.08 per share), a prior year tax reserve reversal ($0.05 per share) and lower foreign tax benefits.

Throughout this report, references to amounts “excluding foreign exchange”, “currency neutral” and “performance basis” exclude both foreign currency translation effects and transactional gains and losses. Foreign currency translation effects are based on the change in average exchange rates for each reporting period multiplied by the current period’s volume of activity in local currency for each non-U.S. location.

As of May 1, 2009, the Company transferred management responsibilities and reporting for certain textbooks from the Professional/Trade segment to the Higher Education segment. All prior periods have been restated for comparability. These changes had no impact on the Company’s consolidated revenue, net income or earnings per share.

Direct contribution to profit for fiscal year 2010 increased 2% to $405.2 million, but was flat excluding the $15.1 million asset impairment and restructuring charges recorded in fiscal year 2010 and the favorable impact of foreign exchange. Lower journal production costs, the completion of Blackwell-related integration activities and other cost savings initiatives were offset by increased costs associated with new business and a $2.0 million bad debt recovery in fiscal year 2009. Direct contribution margin declined 10 basis points to 41.1% and was flat with the prior year excluding the favorable impact of foreign exchange and the asset impairment and restructuring charges.

Due to the fact that the majority of the Company’s journal subscriptions are licensed on a calendar year basis, the Company also monitors and analyzes its journal subscription revenue on that basis. As of April 30, 2010, calendar year 2010 journal subscription billings increased 3% to 4% over prior year on a currency neutral basis, with approximately 95% of expected business closed. There was solid growth in Europe, Middle East, and Africa (“EMEA”), Asia-Pacific and Latin America and modest growth in the U.S. and Canada. Licensed journal business now accounts for 71% of the subscription business as compared to 60% at the same time last year. New licenses included journal subscriptions, backfiles, online books and ArticleSelect sales.

Books and reference revenue for fiscal year 2010 declined 1% to $172.6 million. The decrease is principally due to the transfer of certain books to HE in the current fiscal year which generated revenue of approximately $3.6 million in fiscal year 2009. On a currency neutral basis and excluding the effect of the transfer, books and reference revenue increased 2% over prior year mainly due to increased revenue from licensing rights.

In July 2009, Wiley announced that 338 of its journals received top 10 rankings in their respective categories in the Thomson ISI® 2008 Journal Citation Report (JCR), a leading evaluator of journal influence and impact. Journals are ranked using a metric known as an “Impact Factor,” which reflects the frequency that peer-reviewed journals are cited by researchers. Other highlights include:

Global P/T revenue for fiscal year 2010 increased 7% to $430.0 million, or 6% excluding the favorable impact of foreign exchange. The revenue growth was driven by higher consumer, business and technology sales and new titles acquired through the Meredith and GMAC agreements. The new agreements contributed approximately $14.4 million to current period results. North America exhibited the most growth, followed by EMEA.

Direct contribution to profit for fiscal year 2010 increased 12% to $100.2 million, or 11% excluding the favorable impact of foreign exchange. The improvement reflected higher sales volumes and advertising and marketing cost savings, partially offset by higher performance-based incentive compensation. Direct contribution margin improved 110 basis points to 23.3%, or 90 basis points excluding the favorable impact of foreign exchange.

Global HE revenue for fiscal year 2010 increased 18% to $282.4 million, or 15% excluding the favorable impact of foreign exchange. Double-digit growth was experienced in all regions and in nearly every subject category. The revenue growth includes approximately $3.4 million from books previously reported in STMS and $1.2 million from books previously reported in P/T. Excluding the effect of these transfers and favorable foreign exchange, HE revenue increased 13%.

Direct contribution to profit for fiscal year 2010 increased 29% to $86.2 million, or 25% excluding the favorable impact of foreign exchange. The improvement was driven by the top-line growth and improved margin due to increased sales of digital products, partially offset by higher costs to support business growth and higher performance-based compensation. Direct contribution margin improved 270 basis points to 30.5%, or 230 basis points excluding the favorable impact of foreign exchange.

Revenue for fiscal year 2009 decreased 4% to $1,611.4 million. Excluding the unfavorable impact of foreign exchange revenue increased 3%. Growth in STMS journals, including an acquisition accounting adjustment that reduced fiscal year 2008 STMS revenue by approximately $16.7 million, and growth in Higher Education were partially offset by a decline in P/T revenue due to weak market conditions.

Gross profit margin in fiscal year 2009 of 68.0% was 0.2% lower than the prior year as lower P/T sales volume and higher inventory obsolescence and royalty advance provisions were partially offset by favorable product mix and lower production costs in Higher Education. Operating and administrative expenses for fiscal year 2009 of $839.6 million were 4% lower than the prior year, or increased 1% excluding the favorable impact of foreign exchange. Lower accrued incentive compensation expense and marketing and advertising cost containment programs were more than offset by annual merit increases; higher editorial and distribution costs to support new Higher Education and STMS titles; and higher occupancy, facilities and depreciation costs related to business expansion.

Operating income for fiscal year 2009 decreased 3% to $218.5 million, or improved 11% excluding the unfavorable impact of foreign exchange. The improvement excluding foreign exchange was mainly due to revenue growth, including the acquisition accounting adjustment in fiscal year 2008. Interest expense decreased $18.3 million to $48.4 million. Lower interest rates contributed approximately $10.8 million towards the improvement, while lower average outstanding debt contributed approximately $7.5 million. Interest income and other increased $0.3 million to $6.2 million principally due to a $4.6 million ($0.08 per diluted share) non-recurring insurance receipt received in fiscal year 2009, partially offset by higher interest income in the prior year. Losses on foreign currency transactions for fiscal year 2009 and 2008 were $11. 8 million and $2.9 million, respectively. The increase in foreign currency transaction losses was mainly due to the strengthening of the U.S. dollar against the British pound sterling on intercompany payables and U.S. dollar third party debt outstanding in the U.K.

The effective tax rates for fiscal years 2009 and 2008 were 22.0% and 8.7%, respectively. During fiscal year 2008, the Company recorded an $18.7 million tax benefit associated with new tax legislation enacted in the United Kingdom (UK) and Germany that reduced the corporate income tax rates from approximately 30% to 28% and 39% to 29%, respectively. The benefits recognized by the Company reflect the adjustments required to restate all applicable deferred tax balances at the new income tax rates. The new tax rates were effective in Germany as of May 1, 2007 and in the UK as of April 1, 2008. The effective tax rate for fiscal year 2009 was 22.0% compared to 20.2% for fiscal year 2008, excluding the deferred tax benefits described above. The increase was mainly due to lower foreign tax benefits.

Earnings per diluted share and net income for fiscal year 2009 were $2.15 and $128.3 million, respectively. Reported earnings per diluted share and net income for fiscal year 2008 were $2.49 and $147.5 million, respectively. Adjusted to exclude the non-cash deferred tax benefits described above, earnings per diluted share and net income for fiscal year 2008 were $2.17 and $128.9 million, respectively. See Non-GAAP Financial Measures described below. Excluding the deferred tax benefits and the effect of foreign exchange transaction and translation losses of approximately $0.50 per share, earnings per share increased 22% to $2.15 per share.

Non-GAAP Financial Measures: The Company’s management internally evaluates its operating performance excluding unusual and/or nonrecurring events. The Company believes excluding such events provides a more effective and comparable measure of current and future performance. We also believe that excluding the effects of the following tax benefits provides a more balances view of the underlying dynamics of our business.

Deferred Tax Benefit on Changes in Statutory Tax Rates

The Company recorded an $18.7 million tax benefit ($15.6 million for Blackwell) associated with new tax legislation enacted in the United Kingdom (U.K.) and Germany that reduced the corporate income tax rates from approximately 30% to 28% and 39% to 29%, respectively. The benefits recognized by the Company reflect the adjustments required to restate all applicable deferred tax balances at the new income tax rates. These benefits have been adjusted below due to their infrequent non-recurring nature.

Since adjusted net income and adjusted earnings per share are not measures calculated in accordance with US GAAP, they should not be considered as a substitute for other US GAAP measures, including net income and earnings per share as indicators of operating performance. Accordingly, adjusted net income and adjusted earnings per diluted share are reconciled below to net income and earnings per share on a US GAAP basis, for fiscal years 2009 and 2008.

| Reconciliation of Non-GAAP Financial Disclosure |

| |

| | For the Years Ended April 30, |

| Net Income (in thousands) | 2009 | 2008 |

| | | |

| As Reported | $128,258 | $147,536 |

| | | |

| Deferred Tax Benefit on Changes in Statutory Rates | - | (18,663) |

| | | |

| Adjusted | $128,258 | $128,873 |

| |

| | For the Years Ended April 30, |

| Earnings per Diluted Share | 2009 | 2008 |

| | | |

| As Reported | $2.15 | $2.49 |

| | | |

| Deferred Tax Benefit on Changes in Statutory Rates | - | (0.31) |

| | | |

| Adjusted | $2.15 | $2.17 |

Fiscal Year 2009 Segment Results

| Scientific, Technical, Medical and Scholarly (STMS): | | |

| | | | | % change |

| Dollars in thousands | 2009 | 2008 | % change | w/o FX |

| Revenue | $969,184 | $975,797 | (1%) | 9% |

| Direct Contribution | $399,156 | $384,170 | 4% | 14% |

| Contribution Margin | 41.2% | 39.4% | | |

Global STMS revenue for fiscal year 2009 of $969.2 million declined 1% from prior year mainly due to unfavorable foreign exchange. Excluding the unfavorable impact of foreign exchange revenue increased 9%. Increased revenue from journal subscription renewals, new business, price increases, global rights and STMS books was partially offset by lower sales of backfiles, reprints and custom publishing. Also contributing to the increase in journal subscriptions was a $16.7 million acquisition accounting adjustment related to Blackwell that reduced revenue in fiscal year 2008. This adjustment contributed 2% to revenue growth excluding foreign exchange.

Direct contribution to profit for fiscal year 2009 grew 4% from prior year to $399.2 million, or 14% excluding the unfavorable effect of foreign exchange. Direct contribution margin improved 180 basis points to 41.2%, or 41.1% excluding the unfavorable impact of foreign exchange, mainly due to the prior year acquisition accounting adjustment, a $2.0 million bad debt recovery and cost containment efforts, partially offset by higher performance compensation and other employment costs and editorial costs due to the addition of more society journals. Margins on professional society journals are lower than margins earned on Company owned journals.

STMS Journals

Journal revenue grew 8% excluding unfavorable foreign exchange and the fiscal year 2008 acquisition accounting adjustment related to Blackwell. All regions exhibited journal sales growth, excluding unfavorable foreign exchange. The performance is mainly attributed to renewals, new business, price increases and the acquisition accounting adjustment in fiscal year 2008. Subscription and pay-per-view revenue was up year-over-year, while backfile revenue fell due to the economic climate, particularly in the US.

Society Journal Activity

| · | 87 Renewed/extended contracts |

| · | 9 Contracts not renewed |

Key New Agreements

| · | A new journal launch for 2010 – the Journal of Research Synthesis Methods in association with the Society for Research Synthesis Methodology |

| · | Family and Consumer Science Research on behalf of the American Association of Family and Consumer Sciences |

| · | Design Management Review and Design Management Journal with the Design Management Institute |

| · | The Institute of Development Studies at the University of Sussex, one of Europe’s leading research institutions. The journal, IDS Bulletin, was previously self-published. |

| · | The Economic Society of Australia for Economic Papers. |

| · | Asian Journal of Endoscopic Surgery. |

Key Journal Renewals

| · | Economic Journal and Econometrics Journal (Royal Economic Society) |

| · | Journal of Accounting Research (Institute of Professional Accounting at the University of Chicago Booth School of Business) |

| · | Cancer Science (Japanese Cancer Association) |

| · | ANZ Journal of Surgery (Royal Australasian College of Surgeons) |

| · | International Journal of Urology (Japanese Urological Association) |

| · | Journal of Neuroendocrinology (European Neuroendocrine Association, the British Society for Neuroendocrinology and the International Neuroendocrine Federation) |

| · | Therapeutic Aphaeresis and Dialysis (International Society for Aphaeresis, The Japanese Society for Aphaeresis and The Japanese Society for Dialysis Therapy) |

| · | Journal of Philosophy of Education (Philosophy of Education Society of Great Britain) |

Journal Licenses

Journal licenses, which represent approximately 60% of fiscal year 2009 journal subscription revenue, provide academic, government and corporate customers with online access to multiple journals. During fiscal year 2009, agreements were signed or renewed with universities, library consortia and government agencies in the US, Norway, Japan, China, Brazil, Canada, Greece, Chile, Denmark and India.

STMS Books and References

Book sales and other related income, which account for approximately 17% of fiscal year 2009 STMS revenue, were up 5% excluding unfavorable foreign exchange. The total number of books published increased slightly. Online book sales rose approximately 20% to $10 million. During the fiscal year, Wiley acquired the Arnold statistics book program from Hodder Education. The acquisition, which includes over 50 titles, complements areas of strength in Wiley’s statistics program, while providing growth opportunities.

Wiley InterScience

Wiley achieved an important milestone in the early part of fiscal year 2009 by migrating online journal content, customers and access licenses from Blackwell’s Synergy platform to Wiley InterScience. The migration included approximately 29,000 customers, over two million licenses and nearly two million journal articles.

| Professional/Trade (P/T): | |

| | | | | % change |

| Dollars in thousands | 2009 | 2008 | % change | w/o FX |

| Revenue | $403,113 | $457,286 | (12%) | (9%) |

| Direct Contribution | $89,678 | $130,502 | (31%) | (27%) |

| Contribution Margin | 22.2% | 28.5% | | |

Global P/T revenue for fiscal year 2009 decreased 12% to $403.1 million, or 9% excluding the unfavorable impact of foreign exchange. The decline in revenue was due to a weak retail environment particularly in the U.S., partially offset by modest growth in the European and Canadian markets. Also affecting the comparison to last year was the termination of a publishing agreement in the culinary/hospitality publishing program.

Direct contribution to profit decreased 31% to $89.7 million, or 27% excluding the unfavorable impact of foreign exchange. Direct contribution margin declined 630 basis points to 22.2%, or 560 basis points excluding the unfavorable impact of foreign exchange. The decline reflects lower sales volume, higher inventory obsolescence and royalty advance provisions and a $2.0 million bad debt recovery in the prior year, partially offset by cost containment efforts in advertising, sales and marketing and lower accrued incentive compensation.

Notable Alliances

| · | GMAC/Official Guide to the GMAT: Wiley became the official publisher of the Graduate Management Admission Test® (GMAT®) study guides in October 2008. In March, the 12th edition of the top-selling Official Guide for GMAT Review was released worldwide. It will be followed by The Official Guide for GMAT Verbal Review and The Official Guide for GMAT Quantitative. |

| · | Meredith: In March 2009, as part of its multi-year agreement, Wiley began publishing Better Homes and Garden book titles and other brands such as Family Circle, as well as Food Network TV, Sandra Lee, Rocco DiSpirito and Tyler Florence. |

| · | Kindle (Amazon): Currently, Wiley has over 9,000 P/T books available on the Kindle 2. |

| · | General Mills: Wiley and General Mills signed an agreement to renew their publishing partnership. Under the agreement, Wiley will continue to publish the flagship Betty Crocker “Big Red” cookbook and other cookbooks under the Betty Crocker, Pillsbury and other General Mills brands. |

| · | Vancouver Olympic Organizing Committee: Wiley Canada entered into an agreement with VANOC, becoming the official publication partner of the 2010 Winter Olympic and Paralympics Games in Vancouver/Whistler. In close cooperation with VANOC, Wiley will produce commemorative books, games reports, and custom publications. |

Online Initiatives

| · | For the fiscal year, Frommers.com maintained its top position in website traffic by posting 137 million page views and nearly 29 million visits. The results were lower than last year due to the economy. |

| · | Launched in November 2008, the new Dummies.com generated a total of 29 million page views by fiscal year-end, a 23% increase over prior year. Eleven million unique visitors represented a 21% increase. Users are spending 17% more time on content pages. The site now includes 25 topic areas with 250+ pieces of content in each, 950 fully illustrated step-by-step articles, 6,610 articles, and 265 videos. |

| · | CliffsNotes.com recorded year-on-year increases of 5% in page views and 21% in unique visitors. |

Notable New Titles

Business:

| · | Lee Bolman: Reframing Organizations, Fourth Edition |

| · | Jim Kouzes and Barry Posner: Leadership Challenge, Fourth Edition |

| · | CPA Exam Set, Thirty-fifth edition, Volumes 1 and 2 |

| · | Mary Kay Ash: Mary Kay Way |

| · | Patrick Lencioni: Three Big Questions for A Frantic Family |

Finance:

| · | JK Lasser, Year In Taxes 2009 |

| · | Fischer: Ten Road to Riches |

| · | Peter Schiff: Little Book of Bull Moves in Bear Markets |

| · | Martin Weiss: Depression Survival Guide |

| · | Addison Wiggin: I.O.U.S.A.: One Nation. Under Stress. In Debt |

Psychology:

| · | Lenore Skenazy: Free Range Kids: Giving Our Children the Freedom We had without Going Nuts with Worry |

| · | Michael Gurian: The Purpose of Boys: Helping Our Sons Find Meaning, Significance and Direction in Their Lives |

| · | Gary Groth-Marnat: Handbook of Psychological Assessment, Fifth Edition |

| · | Richard Lerner: Handbook of Adolescent Psychology, Third Edition |

Consumer:

| · | Weight Watchers in 20 Minutes |

| · | Mark Bittman: How to Cook Everything, Second Edition |

| · | Bob Sehlinger: Unofficial Guide to Walt Disney World 2009 |

| · | GMAC: The Official Guide to the GMAT, Twelfth Edition |

| · | Jack Cafferty: Now Or Never: Getting Down To Business of Saving Our American Dream |

| · | Alan Rubin: Diabetes for Dummies |

| · | Paul McFedries: iPhone 3G Portable Genius |

Architecture:

| · | Edward Allen: Fundamentals of Building Construction, Fifth Edition |

| · | Wiley CPE (Continuing Professional Education, a web-based online continuing education system). |

| Higher Education (HE): | | |

| | | | | % change |

| Dollars in thousands | 2009 | 2008 | % change | w/o FX |

| Revenue | $239,093 | $240,651 | (1%) | 3% |

| Direct Contribution | $66,619 | $74,387 | (10%) | (5%) |

| Contribution Margin | 27.9% | 30.9% | | |

Global HE revenue for fiscal year 2009 decreased 1% from the prior year period, but increased 3% excluding the unfavorable impact of foreign exchange. Excluding foreign exchange, revenue growth occurred in every region and in nearly every subject category. Contributing to these results were a strong frontlist; approximately $6.6 million of revenue from recently acquired titles; solid growth from the Microsoft publishing agreement; and the continued success of WileyPLUS.

Direct contribution to profit decreased 10% to $66.6 million, or 5% excluding the unfavorable impact of foreign exchange. Direct contribution margin declined 300 basis points to 27.9%, or 240 basis points excluding the unfavorable impact of foreign exchange. The decline reflects prior year cost containment efforts which significantly curtailed expenditures in fiscal year 2008, higher accrued incentive compensation expense and increased marketing, advertising and content development costs to support the large frontlist.

WileyPLUS

| · | Now accounts for 9% of global HE revenue |

| · | Global full year billings increased 38% |

| · | Digital-only sales grew 70% |

| · | Validation/usage rates increased |

| · | WileyPLUS sales outside the US represent 15% of the total |

Notable Alliances

| · | Microsoft Official Academic Course (MOAC) revenue was up 16% over prior year. |

| · | Wiley is partnering with American Hospitality Training Institute, an online provider of hospitality training for students outside the US interested in working for US hotels and resorts. Twenty-one classes utilizing content from Barrows/Introduction to Management in the Hospitality Industry 9e will begin in June, 2009. |

| · | Wiley and Learning House agreed to create highly integrative online courses based on Wiley textbooks. The courses will be bundled with the book. We received approval for a licensing agreement for two pilot courses in world regional geography and Spanish 1. Learning House is an online education solutions partner helping small colleges and universities offer and manage their online degree programs. |

| · | Wiley expanded its alliance with Amazon to offer select Wiley textbooks for sale through the Kindle DX. Books are set to go live on the Kindle Store in the summer of 2009. |

Acquisitions

| · | In August 2008, Wiley acquired business and modern language textbooks from Cengage Learning and mathematics and statistics textbooks from Key College Publishing. |

| · | These acquisitions contributed approximately $6.6 million of revenue in fiscal year 2009, exceeding expectations. |

Custom Publishing

| · | Wiley Custom Select was successfully launched in the fourth quarter. Wiley Custom Select is a custom textbook system that allows instructors to "build" customized higher education course materials that fit their pedagogical needs, enabling users to easily find the content, personalize the material and format, and submit the order. In fiscal year 2009, custom sales increased approximately 25%. |

Shared Service and Administrative Costs

Shared services and administrative costs for fiscal year 2009 decreased 7% to $337.0 million, or 2% excluding the favorable impact of foreign exchange. The improvement reflects lower accrued incentive compensation expense and lower integration costs, partially offset by planned salary merit increases, higher distribution costs due to increased journal shipping and handling and higher occupancy, facilities and depreciation costs related to business expansion.

Liquidity and Capital Resources

The Company’s cash and cash equivalents balance was $153.5 million at the end of fiscal year 2010, compared with $102.8 million a year earlier. Cash provided by operating activities in fiscal year 2010 increased $77.5 million to $418.8 million due primarily to higher earnings and non-cash charges and provisions, and lower working capital, partially offset by higher pension contributions. Pension contributions in fiscal year 2010 were $48.1 million, of which $31.0 million were discretionary, compared to $21.0 million in the prior year.

The improvement in working capital was principally due to higher accrued incentive compensation, lower inventories due to improved sales and inventory management, and higher unearned deferred revenue, partially offset by higher accounts receivable due to increased book sales, and lower accounts payable due to timing of payments. The improvement in Deferred Revenue reflects journal subscription and WileyPLUS growth and the timing of cash collections on journal subscriptions resulting from the resolution of prior year billing delays of approximately $37 million, which shifted cash collection from fiscal year 2009 to fiscal year 2010.

Cash used for investing activities for fiscal year 2010 was approximately $209.9 million compared to $201.6 million in fiscal year 2009. The Company invested $6.4 million in the acquisition of publishing businesses, assets and rights compared to $24.0 million in the prior year. Cash used for property, equipment and technology and product development increased $25.8 million in fiscal year 2010 versus the prior year with product development spending increasing approximately $23.7 million primarily due to the timing of author advance payments.

Cash used in financing activities was $156.4 million in fiscal year 2010, as compared to $89.1 million in fiscal year 2009. In fiscal 2010, cash was used primarily to pay dividends to shareholders, and repay debt. The Company did not repurchase any shares in fiscal 2010 while during fiscal year 2009, the Company repurchased one million shares at an average price of $34.89. The Company increased its quarterly dividend to shareholders by 7.7% to $0.14 per share in fiscal year 2010 from $0.13 per share in the prior year. Proceeds from stock option exercises increased $21.0 million to $32.6 million in fiscal 2010.

The aggregate notional amount of interest rate swap agreements associated with the Term Loan and Revolving Credit Facility were $300 million as of April 30, 2010. It is management's intention that the notional amount of the interest rate swap be less than the Term Loan and Revolving Credit Facility outstanding during the life of the derivative.

The Company’s operating cash flow is affected by the seasonality and timing of receipts from its STMS journal subscriptions and its Higher Education business. Cash receipts for calendar year STMS subscription journals occur primarily from November through February. Reference is made to the Credit Risk section, which follows, for a description of the impact on the Company as it relates to independent journal agents’ financial position and liquidity. Sales primarily in the U.S. higher education market tend to be concentrated in June through August, and again in November through January. Due to this seasonality, the Company normally requires increased funds for working capital from May through September.

Global capital and credit markets have recently experienced increased volatility. As of April 30, 2010, we had approximately $649.0 million of debt outstanding and approximately $572.0 million of unused borrowing capacity under the Revolving Credit Facility which is described in Note 12. We believe that our operating cash flow, together with our revolving credit facilities and other available debt financing, will be adequate to meet our operating, investing and financing needs in the foreseeable future, although there can be no assurance that continued or increased volatility in the global capital and credit markets will not impair our ability to access these markets on terms commercially acceptable to us or at all.

The Company has adequate cash and cash equivalents available, as well as short-term lines of credit to finance its short-term seasonal working capital requirements. The Company does not have any off-balance-sheet debt.

Working capital at April 30, 2010 was negative $188.7 million. Working capital is negative as a result of including, in current liabilities, unearned deferred revenue related to subscriptions for which cash has been collected in advance. This deferred revenue will be recognized into income as the products are shipped or made available online to the customers over the term of the subscription. Current liabilities as of April 30, 2010 include $275.7 million of such deferred subscription revenue for which cash was collected in advance.

Projected product development and property, equipment and technology capital spending for fiscal year 2011 is forecast to be approximately $145 million and $60 million, respectively, primarily to enhance system functionality and drive future business growth.

Contractual Obligations and Commercial Commitments

A summary of contractual obligations and commercial commitments, excluding interest charges on debt, and unrecognized tax benefits further described in Note 10, as of April 30, 2010 is as follows:

| | | Payments Due by Period | |

| | | Within | 2-3 | 4-5 | After 5 |

| | Total | Year 1 | Years | Years | Years |

| Total Debt | $649.0 | $90.0 | $559.0 | $- | $- |

| | | | | | |

| Non-Cancelable Leases | 238.6 | 34.0 | 59.1 | 54.8 | 90.7 |

| | | | | | |

| Minimum Royalty Obligations | 204.4 | 42.2 | 70.1 | 52.7 | 39.4 |

| | | | | | |

| Other Commitments | 6.8 | 4.6 | 2.1 | 0.1 | - |

| | | | | | |

| Total | $1,098.8 | $170.8 | $690.3 | $107.6 | $130.1 |

Market Risk

The Company is exposed to market risk primarily related to interest rates, foreign exchange, and credit risk. It is the Company’s policy to monitor these exposures and to use derivative financial investments and/or insurance contracts from time to time to reduce fluctuations in earnings and cash flows when it is deemed appropriate to do so. The Company does not use derivative financial instruments for trading or speculative purposes.

Interest Rates:

The Company had $649.0 million of variable rate loans outstanding at April 30, 2010, which approximated fair value. On February 16, 2007, the Company entered into an interest rate swap agreement, designated as a cash flow hedge as defined under the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) 815, “Derivatives and Hedging” (“ASC 815”). The hedge locked-in a portion of the variable interest due on a portion of the Term Loan. Under the terms of the interest rate swap, the Company pays a fixed rate of 5.076% and receives a variable rate of interest based on three month LIBOR (as defined) from the counter party which is reset every three months for a four-year period ending February 8, 2011. The notional amount of the rate swap was initial ly $660 million which will decline through February 8, 2011, based on the expected amortization of the Term Loan. As of April 30, 2010, the notional amount of the rate swap was $200.0 million.

On October 19, 2007, the Company entered into an additional interest rate swap agreement designed by the Company as a cash flow hedge that locked-in a portion of the variable interest due on the Revolving Credit Facility. Under the terms of this interest rate swap, the Company pays a fixed rate of 4.60% and receives a variable rate of interest based on three month LIBOR (as defined) from the counterparty which is reset every three months for a three-year period ending August 8, 2010. The notional amount of the rate swap is $100.0 million.

It is management’s intention that the notional amount of interest rate swaps be less than the Term Loan and the Revolving Credit Facility outstanding during the life of the derivatives. During fiscal year 2010, the Company recognized a loss on its hedge contracts of approximately $20.4 million which is reflected in interest expense. At April 30, 2010, the aggregate fair value of the interest rate swaps was a net loss of $11.5 million which is included in Other Accrued Liabilities in the Consolidated Statements of Financial Position. On an annual basis, a hypothetical one percent change in interest rates for the $349.0 million of unhedged variable rate debt as of April 30, 2010 would affect net income and cash flow by approximately $2.2 million.

Foreign Exchange Rates:

Fluctuations in the currencies of countries where the Company operates outside the U.S. may have a significant impact on financial results. The Company is primarily exposed to movements in British pound sterling, euros, Canadian and Australian dollars, and certain Asian currencies. The Statements of Financial Position of non-U.S. business units are translated into U.S. dollars using period-end exchange rates for assets and liabilities and weighted-average exchange rates for revenues and expenses. Fiscal year 2010 revenue was recognized in the following currencies: approximately 55% U.S dollar; 28% British pound sterling; 8% Euro and 9% other currencies.

Adjustments resulting from translating assets and liabilities are reported as a separate component of Accumulated Other Comprehensive Income (Loss) within Shareholders’ Equity under the caption Foreign Currency Translation Adjustment. The Company also has significant investments in non-U.S. businesses that are exposed to foreign currency risk. During fiscal year 2010, the Company recorded approximately $60.3 million of currency translation gains in other comprehensive income primarily as a result of the weakening of the U.S. dollar relative to the British pound sterling.

Effective November 1, 2008, the Company changed its functional currency reporting basis for the non-Blackwell portion of the Company’s European STMS journal business from U.S. Dollar to local currency. As part of the integration of Blackwell and Wiley fulfillment systems and licensing practices, in the third quarter of fiscal year 2009 the Company began pricing journal revenue based on local currency in Europe. Prior to the integration, journal revenue was principally priced and reported in U.S. Dollars. This change primarily impacted business denominated in Euros and Sterling.

Exchange rate gains or losses related to foreign currency transactions are recognized as transaction gains or losses in the Consolidated Statements of Income as incurred. Under certain circumstances, the Company may enter into derivative financial instruments in the form of foreign currency forward contracts to hedge against specific transactions, including intercompany purchases and loans. The Company does not use derivative financial instruments for trading or speculative purposes.

During fiscal year 2010, the Company entered into forward exchange contracts to manage the Company’s exposure on certain foreign currency denominated assets and liabilities. Foreign currency denominated assets and liabilities are remeasured at spot rates in effect on the balance sheet date, with the effects of changes in spot rates reported in Foreign Exchange Gains (Losses) on the Consolidated Statements of Income. The Company did not designate these forward exchange contracts as hedges under current accounting standards as the benefits of doing so were not material due to the short-term nature of the contracts. Therefore, the forward exchange contracts are marked to market through Foreign Exchange Gains (Losses) on the Consolidated Statements of Income, and carried at their fair value on the Con solidated Statements of Financial Position. Accordingly, fair value changes in the forward exchange contracts substantially mitigated the changes in the value of the remeasured foreign currency denominated assets and liabilities attributable to changes in foreign currency exchange rates. The fair value of open forward exchange contracts were measured on a recurring basis using Level 2 inputs. In fiscal year 2010, the losses recognized on the forward contracts were $2.0 million, and were substantially offset by the foreign exchange gains recognized on the economically hedged foreign currency denominated assets and liabilities. As of April 30, 2010, there were no open contracts outstanding. The Company did not enter into any forward exchange contracts during fiscal year 2009.

Customer Credit Risk:

In the journal publishing business, subscriptions are primarily sourced through journal subscription agents who, acting as agents for library customers, facilitate ordering by consolidating the subscription orders/billings of each subscriber with various publishers. Cash is generally collected in advance from subscribers by the subscription agents and is remitted to the journal publisher, including the Company, generally prior to the commencement of the subscriptions. Although at fiscal year-end the Company had minimal credit risk exposure to these agents, future calendar-year subscription receipts from these agents are highly dependent on their financial condition and liquidity. Subscription agents account for approximately 24% of total consolidated revenue and no one agent accounts for more than 10% of total consolidated revenue.

The Company’s book business is not dependent upon a single customer; however, the industry is concentrated in national, regional, and online bookstore chains. Although no one book customer accounts for more than 8% of total consolidated revenue, the top 10 book customers account for approximately 20% of total consolidated revenue and approximately 45% of accounts receivable at April 30, 2010.

Critical Accounting Policies and Estimates

The preparation of the Company’s financial statements in conformity with accounting principles generally accepted in the U.S. requires management to make estimates and assumptions that affect the reported amount of assets and liabilities, disclosure of contingent assets and liabilities as of the date of the financial statements, and reported amounts of revenue and expenses during the reporting period. Management continually evaluates the basis for its estimates. Actual results could differ from those estimates, which could affect the reported results.

Financial Reporting Release No. 60, released by the Securities and Exchange Commission, requires all companies to discuss critical accounting policies or methods used in the preparation of financial statements. Note 2 of the “Notes to Consolidated Financial Statements” includes a summary of the significant accounting policies and methods used in preparation of our Consolidated Financial Statements. Set forth below is a discussion of the Company’s more critical accounting policies and methods.

Revenue Recognition: The Company recognizes revenue when the following criteria are met: persuasive evidence that an arrangement exists; delivery has occurred or services have been rendered; the price to the customer is fixed or determinable; and collectability is reasonably assured. If all of the above criteria have been met, revenue is principally recognized upon shipment of products or when services have been rendered. Subscription revenue is generally collected in advance. The prepayment is deferred and recognized as earned when the related issue is shipped or made available online over the term of the subscription. When a product is sold with multiple deliverables, the Company accounts for each deliverable within the arrangement as a separate unit of accounting due to the fact that each deliverable is also sold on a stand-alone basis. The total consideration of a multiple-element arrangement is allocated to each unit of accounting using the relative fair value method based on the estimated selling prices of each deliverable within the arrangement. Collectability is evaluated based on the amount involved, the credit history of the customer, and the status of the customer’s account with the Company. Revenue is reported net of any amounts billed to customers for taxes which are remitted to government authorities.

Allowance for Doubtful Accounts: The estimated allowance for doubtful accounts is based on a review of the aging of the accounts receivable balances, historical write-off experience, credit evaluations of customers and current market conditions. A change in the evaluation of a customer’s credit could affect the estimated allowance. The allowance for doubtful accounts is shown as a reduction of accounts receivable in the Consolidated Statements of Financial Position and amounted to $6.9 million and $5.7 million as of April 30, 2010 and 2009, respectively.

Sales Return Reserve: The estimated allowance for sales returns is based on a review of the historical return patterns, as well as current market trends in the businesses in which we operate. Sales return reserves, net of estimated inventory and royalty costs, are reported as a reduction of accounts receivable in the Consolidated Statements of Financial Position and amounted to $55.3 million and $55.2 million as of April 30, 2010 and 2009, respectively. A one percent change in the estimated sales return rate could affect net income by approximately $4.0 million. A change in the pattern or trends in returns could affect the estimated allowance.

Reserve for Inventory Obsolescence: Inventories are carried at the lower of cost or market. A reserve for inventory obsolescence is estimated based on a review of damaged, obsolete, or otherwise unsalable inventory. The review encompasses historical unit sales trends by title; current market conditions, including estimates of customer demand compared to the number of units currently on hand; and publication revision cycles. A change in sales trends could affect the estimated reserve. The inventory obsolescence reserve is reported as a reduction of the inventory balance in the Consolidated Statements of Financial Position and amounted to $39.7 million and $36.3 million as of April 30, 2010 and 2009, respectively.

Allocation of Acquisition Purchase Price to Assets Acquired and Liabilities Assumed: In connection with acquisitions, the Company allocates the cost of the acquisition to the assets acquired and the liabilities assumed based on estimates of the fair value of such items including goodwill and other intangible assets. Such estimates include expected cash flows to be generated by those assets and the expected useful lives based on historical experience, current market trends, and synergies to be achieved from the acquisition and expected tax basis of assets acquired. For significant acquisitions, the Company uses independent appraisers to assist in the determination of such estimates.

Goodwill and Intangible Assets: Goodwill is the excess of the purchase price paid over the fair value of the net assets of the business acquired. Other intangible assets principally consist of branded trademarks, acquired publication rights, customer relationships and non-compete agreements. Goodwill and indefinite-lived intangible assets are not amortized but are reviewed annually for impairment or more frequently if events or circumstances indicate that the asset might be impaired. The fair values of the Company’s reporting units are substantially in excess of their carrying values. Other finite-lived intangible assets continue to be amortized over their useful lives. Acquired publication rights with definitive lives are amortized on a straight-line basis over periods ranging from 5 to 40 years. Non-compete agreements are amortized over the terms of the individual agreement.

Impairment of Long-Lived Assets: Depreciable and amortizable assets are only evaluated for impairment upon a significant change in the operating or macroeconomic environment. In these circumstances, if an evaluation of the current forecasts of undiscounted cash flows indicates impairment, the asset is written down to its estimated fair value based on the discounted future cash flows.

Share-Based Compensation: The Company recognizes share-based compensation expense based on the fair value of the share-based awards on the grant date, reduced by an estimate of future forfeited awards. As such, share-based compensation expense is only recognized for those awards that are expected to ultimately vest. The fair value of share-based awards is recognized in net income on a straight-line basis over the requisite service period. The grant date fair value for stock options is estimated using the Black-Scholes option-pricing model. The determination of the assumptions used in the Black-Scholes model requires the Company to make significant judgments and estimates, which include the expected life of an option, the expected volatility of the Company� 217;s Common Stock over the estimated life of the option, a risk-free interest rate and the expected dividend yield. Judgment is also required in estimating the amount of share-based awards that may be forfeited. Share-based compensation expense associated with performance-based stock awards is determined based upon actual results compared to targets established three years in advance. The cumulative effect on current and prior periods of a change in the estimated number of performance share awards, or estimated forfeiture rate is recognized as an adjustment to earnings in the period of the revision. If actual results differ significantly from estimates, the Company’s share-based compensation expense and results of operations could be impacted.

Retirement Plans: The Company provides defined benefit pension plans for the majority of its employees worldwide. The accounting for benefit plans is highly dependent on assumptions concerning the outcome of future events and circumstances, including compensation increases, long-term return rates on pension plan assets, healthcare cost trends, discount rates and other factors. In determining such assumptions, the Company consults with outside actuaries and other advisors. The discount rates for the U.S. and Canadian pension plans are based on the derivation of a single-equivalent discount rate using a standard spot rate curve and the timing of expected payments as of the balance sheet date. The spot rate curve is based upon a portfolio of Moody’s-rated Aa3 (or hi gher) corporate bonds. The discount rates for other non-U.S. plans are based on similar published indices with durations comparable to that of each plan’s liabilities. The expected long-term rates of return on pension plan assets are estimated using market benchmarks for equities, real estate and bonds applied to each plan’s target asset allocation and are estimated by asset class including an anticipated inflation rate. The expected long-term rates are then compared to the historic investment performance of the plan assets as well as future expectations and estimated through consultation with investment advisors and actuaries. Salary growth and healthcare cost trend assumptions are based on the Company’s historical experience and future outlook. While the Company believes that the assumptions used in these calculations are reasonable, differences in actual experience or changes in assumptions could materially affect the expense and liabilities related to the defined benefit pens ion plans of the Company.

Recently Issued Accounting Standards: In September 2006, the Financial Accounting Standards Board (“FASB”) issued guidance which is included Accounting Standards Codification (“ASC”) 820, “Fair Value Measurements and Disclosures” (“ASC 820”). ASC 820 provides a single authoritative definition of fair value and provides enhanced guidance for measuring the fair value of assets and liabilities and requires additional disclosures related to the extent to which companies measure assets and liabilities at fair value, the information used to measure fair value, and the effect of fair value measurements on earnings. In February 2008, the FASB agreed to a one-year delay of the fair value measurement requirement for certain nonfina ncial assets and liabilities. The Company adopted ASC 820 as of May 1, 2008 for assets and liabilities not subject to the deferral and as of May 1, 2009 for those nonfinancial assets and liabilities subject to the deferral. The adoption did not have a significant impact on the Company’s consolidated financial statements or disclosures.

In December 2007, the FASB issued guidance which is included in ASC 805 “Business Combinations” (“ASC 805”) and is effective for acquisitions made on or after May 1, 2009. ASC 805 expands the scope of acquisition accounting to all transactions under which control of a business is obtained. Principally, ASC 805 requires that contingent consideration be recorded at fair value on the acquisition date and that certain transaction and restructuring costs be expensed. The Company adopted ASC 805 as of May 1, 2009 and is now accounting for all acquisitions made after the effective date under the standard.

In April 2008, the FASB issued guidance which is included in ASC 350 “Intangibles – Goodwill and Other” (“ASC 350”). The guidance in ASC 350 amends the factors that must be considered in developing renewal or extension assumptions used to determine the useful life over which to amortize the cost of a recognized intangible asset under ASC 350. The guidance requires an entity to consider its own experience with the renewal or extension of the terms of a contractual arrangement, consistent with its expected use of the asset. The guidance also requires several incremental disclosures for renewable intangible assets. Application of this standard will not significantly impact the process previously used by the Company to determine the useful life of intangible assets. The Company adopted the guidance as of May 1, 2009 and is applying the guidance to intangible assets acquired after the effective date.

In August 2009, the FASB issued Accounting Standards Update (“ASU”) ASU 2009-05, “Fair Value Measurements and Disclosures (Topic 820): Measuring Liabilities at Fair Value” ("ASU 2009-05"). ASU 2009-05 provides clarification to entities that measure liabilities at fair value under circumstances where a quoted price in an active market is not available. The Company adopted ASU 2009-05 as of November 1, 2009. The adoption did not have a significant impact on the Company’s consolidated financial statements.

In October 2009, the FASB issued ASU 2009-13 “Revenue Recognition (Topic 605): Multiple-Deliverable Revenue Arrangements” (“ASU 2009-13”). ASU 2009-13 addresses the accounting for multiple-deliverable arrangements to enable vendors to account for products and services separately rather than as a combined unit. Specifically, this guidance amends the existing criteria for separating consideration received in multiple-deliverable arrangements, eliminates the residual method of allocation and requires that arrangement consideration be allocated at the inception of the arrangement to all deliverables using the relative selling price method. The guidance also establishes a hierarchy for determining the selling price of a deliverable, which is based on vendor-specific objective evidence; third-par ty evidence; or management estimates. Expanded disclosures related to the Company’s multiple-deliverable revenue arrangements will also be required. The new guidance is effective for revenue arrangements entered into or materially modified on and after May 1, 2011. The Company does not expect the application of this new standard to have a significant impact on its consolidated financial statements.

There have been no other new accounting standards issued that have had, or are expected to have a material impact on the Company’s consolidated financial statements.

“Safe Harbor” Statement Under the

Private Securities Litigation Reform Act of 1995

This report contains certain forward-looking statements concerning the Company’s operations, performance, and financial condition. Reliance should not be placed on forward-looking statements, as actual results may differ materially from those in any forward-looking statements. Any such forward-looking statements are based upon a number of assumptions and estimates that are inherently subject to uncertainties and contingencies, many of which are beyond the control of the Company, and are subject to change based on many important factors. Such factors include, but are not limited to (i) the level of investment in new technologies and products; (ii) subscriber renewal rates for the Company’s journals; (iii) the financial stability and liquidity of journal subscription agents; (iv) the consolidation of book wholesale rs and retail accounts; (v) the market position and financial stability of key online retailers; (vi) the seasonal nature of the Company’s educational business and the impact of the used-book market; (vii) worldwide economic and political conditions; and (viii) the Company’s ability to protect its copyrights and other intellectual property worldwide (ix) other factors detailed from time to time in the Company’s filings with the Securities and Exchange Commission. The Company undertakes no obligation to update or revise any such forward-looking statements to reflect subsequent events or circumstances.

Results By Quarter (Unaudited)

| Dollars in millions, except per share data |

| |

| | | 2010 | | | | 2009 | | |

| | | | | | | | | |

| Revenue | | | | | | | | |

| First Quarter | $ | 388.4 | | | $ | 401.7 | | |

| Second Quarter | | 448.0 | | | | 431.9 | | |

| Third Quarter | | 427.1 | | | | 374.4 | | |

| Fourth Quarter | | 435.6 | | | | 403.4 | | |

| Fiscal Year | $ | 1,699.1 | | | $ | 1,611.4 | | |

| | | | | | | | | |

| Operating Income | | | | | | | | |

| First Quarter | $ | 55.7 | | | $ | 44.3 | | |

| Second Quarter (a) | | 75.3 | | | | 70.2 | | |

| Third Quarter (a) | | 68.3 | | | | 63.3 | | |

| Fourth Quarter (b) | | 43.3 | | | | 40.7 | | |

| Fiscal Year | $ | 242.6 | | | $ | 218.5 | | |

| | | | | | | | | |

| Net Income | | | | | | | | |

| First Quarter | $ | 26.9 | | | $ | 30.2 | | |

| Second Quarter (a) | | 46.3 | | | | 40.1 | | |

| Third Quarter (a) | | 42.4 | | | | 33.4 | | |

| Fourth Quarter (b) | | 27.9 | | | | 24.6 | | |

| Fiscal Year | $ | 143.5 | | | $ | 128.3 | | |

| | | | | | | | | |

| | | 2010 | | 2009 |

| Income Per Share | | Diluted | | Basic | | Diluted | | Basic |

| First Quarter | $ | 0.45 | $ | 0.46 | $ | 0.50 | $ | 0.52 |

| Second Quarter (a) | | 0.78 | | 0.79 | | 0.67 | | 0.68 |

| Third Quarter (a) | | 0.71 | | 0.72 | | 0.57 | | 0.58 |

| Fourth Quarter (b) | | 0.46 | | 0.47 | | 0.42 | | 0.42 |

| Fiscal Year | $ | 2.41 | $ | 2.45 | $ | 2.15 | $ | 2.20 |

| (a) | In the second and third quarters of fiscal year 2010, the Company recognized intangible asset impairment and restructuring charges principally related to GIT Verlag, a Business-to-Business German-language controlled circulation magazine business acquired in 2002. The second quarter charge was $11.5 million ($8.2 million after taxes) or $0.14 per diluted share. The third quarter charge was $2.8 million ($2.0 million after taxes) or $0.03 per diluted share. |

| (b) | In the fourth quarter of fiscal year 2010, the Company recognized restructuring charges principally related to offshoring and outsourcing certain marketing and content management activities to Singapore. The fourth quarter charge was $0.8 million ($0.5 million after taxes) or $0.01 per diluted share. |

Quarterly Share Prices, Dividends, and Related Stockholder Matters and Issuer Purchases of Equity Securities

The Company’s Class A and Class B shares are listed on the New York Stock Exchange under the symbols JWa and JWb, respectively. Dividends per share and the market price range by fiscal quarter for the past two fiscal years were as follows:

| | Class A Common Stock | Class B Common Stock |

| | | Market Price | | Market Price |

| | Dividends | High | Low | Dividends | High | Low |

| 2010 | | | | | | |

| First Quarter | $0.14 | $35.04 | $30.84 | $0.14 | $35.00 | $31.00 |

| Second Quarter | 0.14 | 35.90 | 29.77 | 0.14 | 35.76 | 29.50 |

| Third Quarter | 0.14 | 43.17 | 35.35 | 0.14 | 43.30 | 35.17 |

| Fourth Quarter | 0.14 | 43.95 | 39.73 | 0.14 | 43.74 | 39.97 |

| 2009 | | | | | | |

| First Quarter | $0.13 | $49.76 | $43.39 | $0.13 | $49.52 | $43.53 |

| Second Quarter | 0.13 | 48.88 | 27.75 | 0.13 | 49.11 | 28.02 |

| Third Quarter | 0.13 | 37.60 | 26.21 | 0.13 | 37.58 | 26.05 |

| Fourth Quarter | 0.13 | 36.72 | 27.55 | 0.13 | 36.63 | 27.50 |

As of April 30, 2010, the approximate number of holders of the Company’s Class A and Class B Common Stock were 1,181 and 102 respectively, based on the holders of record.

The Company did not repurchase any common stock during the fourth quarter of fiscal year 2010.

The Company’s credit agreement contains certain restrictive covenants related to the payment of dividends and share repurchases. Under the most restrictive covenant, approximately $106.0 million was available for such restricted payments as of April 30, 2010. Subject to the foregoing, the Board of Directors considers quarterly the payment of cash dividends based upon its review of earnings, the financial position of the Company, and other relevant factors.

Selected Financial Data

For the Years Ended April 30, |

| Dollars in millions (except per share data) | 2010 | 2009 | 2008 | 2007 | 2006 |

| Revenue | $1,699.1 | $1,611.4 | $1,673.7 | $1,234.6 | $1,043.9 |

| Operating Income (a) | 242.6 | 218.5 | 225.2 | 161.5 | 152.9 |

| Net Income (a,b,c) | 143.5 | 128.3 | 147.5 | 99.6 | 110.3 |

| Working Capital (d) | (188.7) | (157.4) | (243.6) | (199.7) | (35.8) |

| Total Assets | 2,316.2 | 2,223.7 | 2,576.2 | 2,553.1 | 1,026.0 |

| Long-Term Debt | 559.0 | 754.9 | 797.3 | 977.7 | 160.5 |

| Shareholders’ Equity | 722.4 | 513.5 | 689.1 | 529.5 | 401.8 |

| Per Share Data | | | | | |

| Income Per Share (a,b,c) | | | | | |

Diluted | $2.41 | $2.15 | $2.49 | $1.71 | $1.85 |

Basic | $2.45 | $2.20 | $2.55 | $1.75 | $1.90 |

| Cash Dividends | | | | | |

| Class A Common | $0.56 | $0.52 | $0.44 | $0.40 | $0.36 |

Class B Common | $0.56 | $0.52 | $0.44 | $0.40 | $0.36 |

| | NOTE: The Company acquired Blackwell Publishing (Holdings) Ltd. (“Blackwell”) on February 2, 2007. |

| (a) | In fiscal year 2010, the Company recognized intangible asset impairment and restructuring charges principally related to GIT Verlag, a Business-to-Business German-language controlled circulation magazine business acquired in 2002. The fiscal year 2010 charges were $15.1 million ($10.6 million after taxes) and impacted diluted earnings per share by $0.17. |

| (b) | Tax benefits included in fiscal year results are as follows: |