UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

[x] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended: April 30, 2011

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934 (FEE REQUIRED)

For the transition period from to

Commission file number 1-11507

JOHN WILEY & SONS, INC.

(Exact name of Registrant as specified in its charter)

| NEW YORK | | 13-5593032 |

| State or other jurisdiction of incorporation or organization | | I.R.S. Employer Identification No. |

| | | |

| | | |

| 111 River Street, Hoboken, NJ | | 07030 |

| Address of principal executive offices | | Zip Code |

| | | |

| | | |

| | (201) 748-6000 | |

| | Registrant’s telephone number including area code | |

| | | |

| | | |

| Securities registered pursuant to Section 12(b) of the Act: Title of each class | | Name of each exchange on which registered |

| Class A Common Stock, par value $1.00 per share | | New York Stock Exchange |

| Class B Common Stock, par value $1.00 per share | | New York Stock Exchange |

| | | |

| | Securities registered pursuant to Section 12(g) of the Act: | |

| | None | |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes |X| No | |

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act.

Yes | | No |X |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes |X| No | |

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes |X| No | |

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. | |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definitions of “large accelerated filer,” ”accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer |X| Accelerated filer | | Non-accelerated filer | | Smaller reporting company | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes | | No |X|

The aggregate market value of the voting stock held by non-affiliates of the registrant, computed by reference to the closing price as of the last business day of the registrant’s most recently completed second fiscal quarter, October 31, 2010, was approximately $2,012.7 million. The registrant has no non-voting common stock.

The number of shares outstanding of the registrant’s Class A and Class B Common Stock as of May 31, 2010 was 51,346,180 and 9,538,411 respectively.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement for use in connection with its annual meeting of stockholders scheduled to be held on September 15, 2011, are incorporated by reference into Part III of this form 10-K.

JOHN WILEY AND SONS, INC. AND SUBSIDIARIES

FORM 10-K

FOR THE FISCAL YEAR ENDED APRIL 30, 2011

INDEX

| PART I | | PAGE |

| ITEM 1. | Business | 4 |

| ITEM 1A. | Risk Factors | 4-9 |

| ITEM 1B. | Unresolved Staff Comments | 9 |

| ITEM 2. | Properties | 10 |

| ITEM 3. | Legal Proceedings | 10 |

| ITEM 4 | [Removed and Reserved] | 10 |

| | | |

| PART II | | |

| ITEM 5. | Market for the Company’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 11 |

| ITEM 6. | Selected Financial Data | 12 |

| ITEM 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 13-46 |

| ITEM 7A. | Quantitative and Qualitative Disclosures About Market Risk | 46-48 |

| ITEM 8. | Financial Statements and Supplemental Data | 49-55 |

| ITEM 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 83 |

| ITEM 9A. | Controls and Procedures | 83 |

| ITEM 9B. | Other Information | 83 |

| | | |

| PART III | | |

| ITEM 10. | Directors, Executive Officers and Corporate Governance | 83-85 |

| ITEM 11. | Executive Compensation | 85 |

| ITEM 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 85 |

| ITEM 13. | Certain Relationships and Related Transactions, and Director Independence | 85 |

| ITEM 14. | Principal Accounting Fees and Services | 85 |

| | | |

| PART IV | | |

| ITEM 15. | Exhibits, Financial Statement Schedules and Reports on Form 8-K | 86 |

| | | |

| SIGNATURES | | |

PART I

The Company, founded in 1807, was incorporated in the state of New York on January 15, 1904. (As used herein the term “Company” means John Wiley & Sons, Inc., and its subsidiaries and affiliated companies, unless the context indicates otherwise.)

The Company is a global publisher of print and electronic products, providing content and digital solutions to customers worldwide. Core businesses produce scientific, technical, medical and scholarly journals, encyclopedias, books, online products and services; professional and consumer books, subscription products, certification and training materials, online applications and websites; and educational materials in all media, including integrated online teaching and learning resources, for undergraduate, graduate and advanced placement students, educators, and lifelong learners worldwide as well as secondary school students in Australia. The Company takes full advantage of its content from all three core businesses in developing and cross-marketing products to its diverse customer base of professionals, consumers, researchers, students, and educators. The use of technology enables the Company to make its content more accessible to its customers around the world. The Company maintains publishing, marketing, and distribution centers in the United States, Canada, Europe, Asia, and Australia.

Further description of the Company’s business is incorporated herein by reference in the Management’s Discussion and Analysis section of this 10-K.

Employees

As of April 30, 2011, the Company employed approximately 5,100 persons on a full-time equivalent basis worldwide.

Financial Information About Industry Segments

The note entitled “Segment Information” of the Notes to Consolidated Financial Statements and the Management’s Discussion and Analysis section of this 10-K, both listed in the attached index, are incorporated herein by reference.

Financial Information About Foreign and Domestic Operations and Export Sales

The note entitled “Segment Information” of the Notes to Consolidated Financial Statements and the Management’s Discussion and Analysis section of this 10-K, both listed in the attached index, are incorporatedherein by reference.

You should carefully consider all of the information set forth in this Form 10-K, including the following risk factors, before deciding to invest in any of the Company’s securities. The risks below are not the only ones the Company faces. Additional risks not currently known to the Company or that the Company presently deems immaterial may also impair its business operations. The Company’s business, financial condition, results of operations or prospects could be materially adversely affected by any of these risks.

Cautionary Statement Under the Private Securities Litigation Reform Act of 1995:

This 10-K and our Annual Report to Shareholders for the year ending April 30, 2011 contain certain forward-looking statements concerning the Company’s operations, performance and financial condition. In addition, the Company provides forward-looking statements in other materials released to the public as well as oral forward-looking information. Statements which contain the words anticipate, expect, believes, estimate, project, forecast, plan, outlook, intend and similar expressions constitute forward-looking statements that involve risk and uncertainties. Reliance should not be placed on forward-looking statements, as actual results may differ materially from those in any forward-looking statements.

Any such forward-looking statements are based upon a number of assumptions and estimates that are inherently subject to uncertainties and contingencies, many of which are beyond the control of the Company, and are subject to change based on many important factors. Such factors include, but are not limited to (i) the level of investment in new technologies and products; (ii) subscriber renewal rates for the Company’s journals; (iii) the financial stability and liquidity of journal subscription agents; (iv) the consolidation of book wholesalers and retail accounts; (v) the market position and financial stability of key retailers; (vi) the impact of the used-book market; (vii) worldwide economic and political conditions; and (viii) the Company’s ability to protect its copyrights and other intellectual property worldwide (ix) other factors detailed from time to time in the Company’s filings with the Securities and Exchange Commission. The Company undertakes no obligation to update or revise any such forward-looking statements to reflect subsequent events or circumstances.

Operating Costs and Expenses

In general, any significant increase in the costs of goods and services provided to the Company may adversely affect the Company’s costs of operation. The Company has a significant investment, and cost, in its employee base around the world. The Company offers competitive salaries and benefits in order to attract and retain the highly skilled workforce needed to sustain and develop new products and services required for growth. Employment and benefit costs are affected by competitive market conditions for qualified individuals, and factors such as healthcare, pension and retirement benefits costs. The Company is a large paper purchaser, and paper prices may fluctuate significantly from time-to-time. To reduce the impact of paper price increases, the Company relies upon multiple suppliers. The Company from time-to-time may hedge the exposure to fluctuations in price by entering into multi-year supply contracts. As of April 30, 2011, there were no outstanding multi-year supply contracts.

Protection of Intellectual Property Rights

Substantially all of the Company’s publications are protected by copyright, held either in the Company’s name, in the name of the author of the work, or in the name of the sponsoring professional society. Such copyrights protect the Company’s exclusive right to publish the work in many countries abroad for specified periods, in most cases the author’s life plus 70 years, but in any event a minimum of 50 years for works published after 1978. The ability of the Company to continue to achieve its expected results depends, in part, upon the Company’s ability to protect its intellectual property rights. The Company’s results may be adversely affected by lack of legal and/or technological protections for its intellectual property in some jurisdictions and markets.

The Scientific, Technical, Medical and Scholarly (“STMS”) publishing industry generates much of its revenue from paid customer subscriptions to print and online journal content. There is debate within the academic and government communities whether such journal content should be made available for free, immediately or following a period of embargo after publication. For instance, certain governments are considering mandating that all publications containing information derived from government-funded research be made available to the public at no cost. These mandates have the potential to put pressure on subscription-based publications and favor business models funded by author fees or government and private subsidies. If such regulations are widely implemented, the Company’s operating results could be adversely affected.

Maintaining the Company’s Reputation

Professionals worldwide rely upon many of the Company’s publications to perform their jobs. It is imperative that the Company consistently demonstrates its ability to maintain the integrity of the information included in its publications. Adverse publicity, whether or not valid, may reduce demand for the Company’s publications.

Trade Concentration and Credit Risk

In the journal publishing business, subscription payments are primarily handled through independent journal subscription agents who, acting as agents for library customers, facilitate payment by consolidating the subscription orders/billings of each subscriber with various publishers. Cash is generally collected in advance from subscribers by the subscription agent and is remitted to the journal publisher, including the Company, generally prior to the commencement of the subscription. Although at fiscal year-end the Company had minimal credit risk exposure to these agents, future calendar-year subscription receipts from these agents are highly dependent on their financial condition and liquidity. Subscription agents account for approximately 23% of total annual consolidated revenue and no one agent accounts for more than 10% of total annual consolidated revenue.

The Company’s business is not dependent upon a single customer; however, the book industry is concentrated in national, regional, and online bookstore chains. Although no one book customer accounts for more than 7% of consolidated revenue, the top 10 book customers account for approximately 18% of total consolidated revenue and approximately 44% of accounts receivable, before reserves at April 30, 2011.

Changes in Regulation and Accounting Standards

The Company maintains publishing, marketing and distribution centers in Asia, Australia, Canada, Europe and the United States. The conduct of our business, including the sourcing of content, distribution, sales, marketing and advertising is subject to various laws and regulations administered by governments around the world. Changes in laws, regulations or government policies, including tax regulations and accounting standards, may adversely affect the Company’s future financial results.

Introduction of New Technologies, Products and Services

The Company must continue to invest in technological and other innovations to adapt and add value to its products and services and remain competitive. There are uncertainties whenever developing new products and services, and it is often possible that such new products and services may not be launched or if launched, may not be profitable or as profitable as existing products and services.

A common trend facing each of the Company’s businesses is the digitization of content and proliferation of distribution channels, either over the internet, or via other electronic means, replacing traditional print formats. The trend to ebooks has also created contraction in the print book retail market which increases the risk of bankruptcy for certain retail customers, potentially leading to the disruption of short-term product supply to the market as well as potential bad debt write-offs. New distribution channels, such as digital formats, the internet, online retailers and growing delivery platforms (e.g. e-readers), present both threats and opportunities to the Company’s traditional consumer publishing models, potentially impacting both sales volumes and pricing.

Information Technology Risks

Information technology is a key part of the Company’s business strategy and operations. As a business strategy, Wiley’s publishing technology enables the Company to provide customers with new and enhanced products and services and is critical to the Company’s success in migrating from print to digital business models. Information technology is also a fundamental component of all our business processes; collecting and reporting business data; and communicating internally and externally with customers, suppliers, employees and others.

Information technology system failures, network disruptions and breaches of data security could significantly disrupt the operations of the Company. Management has designed and implemented policies, processes and controls to mitigate risks of information technology failure and to provide security from unauthorized access to our systems. In addition, the Company has in place disaster recovery plans to maintain business continuity. While the Company has taken steps to address these risks, there can be no assurance that a system failure, disruption or data security breach would not adversely affect the Company’s business and operating results.

Competition for Market Share and Author and Society Relationships

The Company operates in highly competitive markets. Success and continued growth depends greatly on developing new products and the means to deliver them in an environment of rapid technological change. Attracting new authors and professional societies, while retaining our existing business relationships, are also critical to our success.

Introduction of Higher Education Textbook Rental Programs

The Company’s Higher Education business publishes educational materials for two and four-year colleges and universities, for-profit career colleges, advanced placement classes and secondary schools in Australia. Due to a growing demand by students for less expensive textbooks, a growing number of college bookstores and other entities are offering textbook rental programs to students. In many ways, the textbook rental business model is an adaptation of the used book model that has been in place in the higher education market for many years. Due to its recent introduction it is uncertain what impact, if any, such textbook rental programs will have on Wiley’s results.

Interest Rate and Foreign Exchange Risk

Non-U.S. revenues, as well as our substantial non-U.S. net assets, expose the Company’s results to foreign currency exchange rate volatility. Fiscal year 2011 revenue was recognized in the following currencies (as measured in U.S. dollar equivalents): approximately 55% U.S dollar; 28% British pound sterling; 8% Euro and 9% other currencies. In addition, our interest-bearing loans and borrowings are subject to risk from changes in interest rates. These risks and the measures we have taken to help contain them are discussed in the Market Risk section of this 10-K. For additional details, see Note 13 to the Consolidated Financial Statements in this 10-K which is incorporated herein by reference. Notwithstanding our efforts to foresee and mitigate the effects of changes in fiscal circumstances, we cannot predict with certainty changes in currency and interest rates, inflation or other related factors affecting our business.

Changes in Tax Legislation

The Company is subject to tax laws within the jurisdictions in which it does business. Changes in tax legislation could have a material impact on the Company’s financial results. There have been recent proposals to reform U.S. tax laws that would significantly impact how U.S. multinational corporations are taxed on earnings outside of the U.S. A substantial portion of the Company’s income is earned outside the U.S. Although we cannot predict whether or in what form this proposed legislation will pass, if enacted it could have a material adverse impact to the Company’s net income, cash flow and financial position.

Risk of Doing Business in Developing and Emerging Markets

The Company sells its products to customers in the Middle East (including Iran and Syria), Africa (including Sudan), Cuba, and other developing markets where it does not have operating subsidiaries. The Company does not own any assets or liabilities in these markets except for trade receivables. Challenges and uncertainties associated with operating in developing markets has a higher relative risk due to political instability, economic volatility, crime, terrorism, corruption, social and ethnic unrest, and other factors. While sales in these markets are not material to the Company’s business results, adverse developments related to the risks associated with these markets may cause actual results to differ from historical and forecasted future operating results. Disruption in these markets could also trigger a decrease in consumer purchasing power, resulting in a reduced demand for our products. Approximately 8% of STMS journal articles are sourced from authors in China.

Liquidity and Global Economic Conditions

Changes in global financial markets have not had, nor do we anticipate they will have, a significant impact on our liquidity. Due to our significant operating cash flow, financial assets, access to capital markets and available lines of credit and revolving credit agreements, we continue to believe that we have the ability to meet our financing needs for the foreseeable future. As market conditions change, we will continue to monitor our liquidity position. However, there can be no assurance that our liquidity or our results of operations will not be affected by possible future changes in global financial markets and global economic conditions. Similar to other global businesses, we face the potential effects of a global economic recession. Unprecedented market conditions including illiquid credit markets, volatile equity markets, dramatic fluctuations in foreign currency rates and economic recession could affect future results.

Effects of Increases in Pension Costs and Funding Requirements

The Company provides defined benefit pension plans for the majority of its employees worldwide. The funding requirements and costs of these plans are dependent upon various factors, including the actual return on plan assets, discount rates, plan participant population demographics and changes in pension regulations. Changes in these factors affect the Company’s plan funding, cash flow and results of operations. A further discussion on how these factors could impact the Company’s consolidated financial statements is included on page 45 within the Management’s Discussion and Analysis section of this 10-K and incorporated herein by reference.

Effects of Inflation and Cost Increases

The Company, from time to time, experiences cost increases reflecting, in part, general inflationary factors. There is no guarantee that the Company can increase selling prices or reduce costs to fully mitigate the effect of inflation on company costs.

Ability to Successfully Integrate Key Acquisitions

The Company’s growth strategy includes title, imprint and other business acquisitions which complement the Company’s existing businesses; the development of new products and services; designing and implementing new methods of delivering products to our customers, and organic growth of existing brands and titles. Acquisitions may have a substantial impact on the Company’s costs, revenues, cash flows, and financial position. Acquisitions involve risks and uncertainties, including difficulties in integrating acquired operations and in realizing expected opportunities; diversions of management resources and loss of key employees; challenges with respect to operating new businesses; debt incurred in financing such acquisitions; and other unanticipated problems and liabilities.

Attracting and Retaining Key Employees

The Company’s success is highly dependent upon the retention of key employees globally. In addition, we are dependent upon our ability to continue to attract new employees with key skills to support the continued organic growth of the business.

Item 1B. | Unresolved Staff Comments |

None

The Company occupies office, warehouse, and distribution facilities in various parts of the world, as listed below (excluding those locations with less than 10,000 square feet of floor area, none of which is considered material property). All of the buildings and the equipment owned or leased are believed to be in good condition and are generally fully utilized.

Location | Purpose | Owned or Leased | Approx. Sq. Ft. |

| | | | |

| United States: | | | |

| | | | |

| New Jersey | Corporate Headquarters | Leased | 404,000 |

| | Warehouse | Leased | 380,000 |

| | Office & Warehouse | Leased | 185,000 |

| | | | |

| Indiana | Office | Leased | 123,000 |

| | | | |

| Massachusetts | Office | Leased | 43,000 |

| | | | |

| California | Office (Lease expires January 2012) | Leased | 38,000 |

| | Office (Lease commences May 2011) | Leased | 57,000 |

| | | | |

| Iowa | Office & Warehouse | Owned | 27,000 |

| | | | |

| International: | | | |

| | | | |

| Australia | Office & Warehouse | Leased | 93,000 |

| | Offices | Leased | 59,000 |

| | | | |

| Canada | Office & Warehouse | Leased | 87,000 |

| | Office | Leased | 20,000 |

| | | | |

| England | Warehouses | Leased | 382,000 |

| | Offices | Leased | 80,000 |

| | Offices | Owned | 70,000 |

| | | | |

| Germany | Offices | Leased | 49,000 |

| | Office | Owned | 58,000 |

| | | | |

| India | Office & Warehouse | Leased | 16,000 |

| | | | |

| Singapore | Office & Warehouse | Leased | 61,000 |

| | Offices | Leased | 83,000 |

The Company is involved in routine litigation in the ordinary course of its business. In the opinion of management, the ultimate resolution of all pending litigation will not have a material effect upon the financial condition or results of operations of the Company.

| Item 4. | [Removed and Reserved] |

PART II

| Item 5. | Market for the Company’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

The Company’s Class A and Class B shares are listed on the New York Stock Exchange under the symbols JWa and JWb, respectively. Dividends per share and the market price range (Based on daily closing prices) by fiscal quarter for the past two fiscal years were as follows:

| | Class A Common Stock | Class B Common Stock |

| | | Market Price | | Market Price |

| | Dividends | High | Low | Dividends | High | Low |

| 2011 | | | | | | |

| First Quarter | $0.16 | $42.84 | $36.87 | $0.16 | $42.62 | $36.83 |

| Second Quarter | 0.16 | 43.75 | 35.59 | 0.16 | 43.72 | 35.74 |

| Third Quarter | 0.16 | 46.79 | 41.21 | 0.16 | 46.85 | 41.15 |

| Fourth Quarter | 0.16 | 52.64 | 46.71 | 0.16 | 52.81 | 46.55 |

| 2010 | | | | | | |

| First Quarter | $0.14 | $35.04 | $30.84 | $0.14 | $35.00 | $31.00 |

| Second Quarter | 0.14 | 35.90 | 29.77 | 0.14 | 35.76 | 29.50 |

| Third Quarter | 0.14 | 43.17 | 35.35 | 0.14 | 43.30 | 35.17 |

| Fourth Quarter | 0.14 | 43.95 | 39.73 | 0.14 | 43.74 | 39.97 |

The Company’s credit agreement contains certain restrictive covenants related to the payment of dividends and share repurchases. Under the most restrictive covenant, approximately $92 million was available for such restricted payments as of April 30, 2011. Subject to the foregoing, the Board of Directors considers quarterly the payment of cash dividends based upon its review of earnings, the financial position of the Company, and other relevant factors.

As of April 30, 2011, the approximate number of holders of the Company’s Class A and Class B Common Stock were 1,161 and 98 respectively, based on the holders of record.

During the fourth quarter of fiscal year 2011, the Company made the following purchases of Class A Common Stock under its stock repurchase program:

| | Total Number of Shares Purchased | | Average Price Paid Per Share | | Total Number of Shares Purchased as part of a Publicly Announced Program | | Maximum Number of Shares that May be Purchased Under the Program |

| February 2011 | - | | - | | - | | 4,576,825 |

| March 2011 | 174,000 | | $49.73 | | 174,000 | | 4,402,825 |

| April 2011 | 181,600 | | $50.45 | | 181,600 | | 4,221,225 |

| Total | 355,600 | | $50.10 | | 355,600 | | |

| Item 6. | Selected Financial Data |

For the Years Ended April 30, |

| Dollars in millions (except per share data) | 2011 | 2010 | 2009 | 2008 | 2007 |

| Revenue | $1,742.6 | $1,699.1 | $1,611.4 | $1,673.7 | $1,234.6 |

| Operating Income (a, b) | 248.1 | 242.6 | 218.5 | 225.2 | 161.5 |

| Net Income (a,b,c) | 171.9 | 143.5 | 128.3 | 147.5 | 99.6 |

| Working Capital (d) | (228.9) | (188.7) | (157.4) | (243.6) | (199.7) |

| Total Assets | 2,430.1 | 2,308.6 | 2,216.8 | 2,570.3 | 2,547.2 |

| Long-Term Debt | 330.5 | 559.0 | 754.9 | 797.3 | 977.7 |

| Shareholders’ Equity | 977.9 | 722.4 | 513.5 | 689.1 | 529.5 |

| Per Share Data | | | | | |

| Earnings Per Share (a,b,c) | | | | | |

Diluted | $2.80 | $2.41 | $2.15 | $2.49 | $1.71 |

Basic | $2.86 | $2.45 | $2.20 | $2.55 | $1.75 |

| Cash Dividends | | | | | |

| Class A Common | $0.64 | $0.56 | $0.52 | $0.44 | $0.40 |

Class B Common | $0.64 | $0.56 | $0.52 | $0.44 | $0.40 |

| | NOTE: The Company acquired Blackwell Publishing (Holdings) Ltd. (“Blackwell”) on February 2, 2007. |

| (a) | In fiscal year 2011, the Company recorded a $9.3 million bad debt provision ($6.0 million after taxes) or $0.10 per diluted share related to the Company’s customer, Borders Group, Inc. (“Borders”). On February 16, 2011, Borders filed a petition for reorganization relief under Chapter 11 of the U.S. Bankruptcy code. |

| (b) | In fiscal year 2010, the Company recognized intangible asset impairment and restructuring charges principally related to GIT Verlag, a Business-to-Business German-language controlled circulation magazine business acquired in 2002. The fiscal year 2010 charges were $15.1 million ($10.6 million after taxes) and impacted diluted earnings per share by $0.17. |

| (c) | Tax benefits included in fiscal year results are as follows: |

| · | Fiscal year 2011 includes a $4.2 million tax benefit, or $0.07 per diluted share, associated with new tax legislation enacted in the U.K. that reduced the corporate income tax rate from 28% to 27%. The benefit recognized by the Company reflects the adjustments required to record all U.K.-related deferred tax balances at the new income tax rate. |

| · | Fiscal year 2008 includes a $18.7 million tax benefit, or $0.32 per diluted share, associated with new tax legislation enacted in the United Kingdom and Germany that reduced the corporate income tax rates from 30% to 28% and from 39% to 29%, respectively. The benefits recognized by the Company reflect the adjustments required to record all U.K. and Germany-related deferred tax balances at the new corporate income tax rates. |

| · | Fiscal year 2007 includes a $5.5 million tax benefit, or $0.09 per diluted share. This benefit coincides with the resolution and settlements of certain tax matters with authorities in the U.S. and abroad. |

| (d) | Working capital is reduced or negative as a result of including in current liabilities the deferred revenue related to prepaid journal subscriptions for which the cash has been received. The deferred revenue will be recognized into income as the journals are shipped or made available online to the customers over the term of the subscription, generally one year. |

| Item 7. | Management’s Discussion and Analysis of Business, Financial Condition and Results of Operations |

The Company is a global publisher of print and electronic products, providing content and digital solutions to customers worldwide. Core businesses produce scientific, technical, medical and scholarly journals, encyclopedias, books, online products and services; professional and consumer books, subscription products, certification and training materials, online applications and websites; and educational materials in all media, including integrated online teaching and learning resources, for undergraduate and graduate students, educators, and lifelong learners worldwide as well as secondary school students in Australia. The Company takes full advantage of its content from all three core businesses in developing and cross-marketing products to its diverse customer base of professionals, consumers, researchers, students, and educators. The use of technology enables the Company to make its content more accessible to its customers around the world. The Company maintains publishing, marketing, and distribution centers in the United States, Canada, Europe, Asia, and Australia.

Business growth comes from a combination of title, imprint and business acquisitions which complement the Company’s existing businesses; from the development of new products and services; from designing and implementing new methods of delivering products to our customers; and from organic growth of existing brands and titles. The Company’s revenue grew at a compound annual rate of 11% over the past five years, which includes the acquisition of Blackwell Publishing (Holdings) Ltd. (“Blackwell”) in February 2007.

Core Businesses

Scientific, Technical, Medical and Scholarly (STMS):

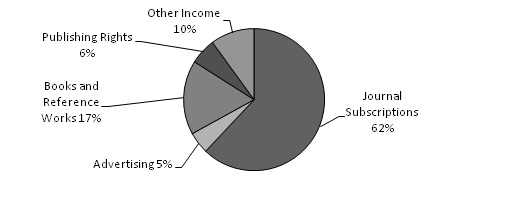

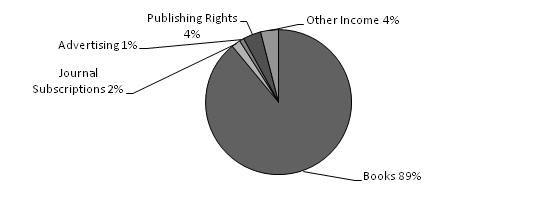

The Company is one of the leading publishers for the scientific, technical, medical and scholarly communities worldwide, including academic, corporate, government, and public libraries; researchers; scientists; clinicians; engineers and technologists; scholarly and professional societies; and students and professors. STMS products include journals, books, major reference works, databases and laboratory manuals. STMS publishing areas include the physical sciences, health sciences, social science and humanities and life sciences. The Company’s STMS products are sold and distributed globally, online and in print through multiple channels, including research libraries and library consortia, independent subscription agents, direct sales to professional society members, bookstores, online booksellers and other customers. Publishing centers include Australia, Germany, Singapore, the United Kingdom and the United States. STMS accounted for approximately 57% of total Company revenue in fiscal year 2011 and generated revenue growth at a compound annual rate of 19% over the past five years, including the February 2007 acquisition of Blackwell, a leading publisher of journals and books for the academic, research and professional markets focused on science, technology, medicine and social sciences and humanities. The graph below presents STMS revenue by product type for fiscal year 2011:

Approximately 54% of journal subscription revenue is derived from publishing rights owned by the Company. Publishing alliances also play a major role in STMS’s success. The Company publishes the journals of prestigious societies, including the American Cancer Society, the British Journal of Surgery Society, the Federation of European Biochemical Societies, The European Molecular Biology Organization, the American Anthropological Association and the German Chemical Society. Approximately 46% of journal subscription revenue is derived from publication rights which are owned by professional societies and published by the Company pursuant to a long-term contract or owned jointly with a professional society. These society alliances bring mutual benefit, with the societies gaining Wiley’s publishing, marketing, sales and distribution expertise, while Wiley benefits from being affiliated with prestigious societies and their members.

STMS is a provider of evidence-based medicine (EBM). The Cochrane Collaboration database, a premier source of high-quality independent evidence to inform healthcare decision-making, provides the foundation for the Company’s growing suite of EBM products designed to improve patient healthcare. EBM facilitates the effective management of patients through clinical expertise informed by best practice evidence that is derived from medical literature.

Wiley Online Library, one of the world’s broadest and deepest multidisciplinary collections of online resources covering life, health and physical sciences, social science and the humanities, was launched successfully in August 2010. Built on the latest technology and designed with extensive input from scholars around the world, Wiley Online Library delivers seamless integrated access to over 4 million articles from 1,500 journals, 10,000 books, and hundreds of reference works, laboratory protocols and databases. Featuring a clean and simple interface, Wiley Online Library provides the user with intuitive navigation, enhanced discoverability, expanded functionality and a range of personalization options. Wiley Online Library provides the Company with new revenue opportunities, including new applications and business models, online advertising, deeper market penetration and individual sales/pay-per-view. In August 2010, Wiley Online Library replaced Wiley InterScience, the Company’s previous online publishing platform for its scientific, technical, medical and scholarly content.

Access to Wiley Online Library is sold through licenses with institutional and corporate libraries, consortia and other academic, government and corporate customers. The Company offers a range of licensing options including customized suites of journal publications for individual customer needs as well as subscriptions for individual journal and online book publications. Licenses are typically sold in durations of one to three years. The Company also provides fee-based access to its content through its Article Select and PayPerView programs which offer non-subscribed journal content, book chapters and major reference work articles.

Wiley Online Library takes advantage of technology to update content frequently and to add new features and resources on an ongoing basis to increase the productivity of scientists, professionals and students. Two examples are EarlyView, through which customers can access individual articles well in advance of print publication, and MobileEditions, which enables users to view tables of content and abstracts on wireless handheld devices and Web-enabled phones.

In February 2011, the Company launched Wiley Open Access, its new publishing program for open-access research articles. Under the Wiley Open Access business model, research articles submitted by authors are published and compiled in certain subject areas into open-access journals. The journal compilation is available free online to the general public on Wiley Online Library. A publication service fee is charged upon acceptance of a research article by the Company. The service fee may be paid by the individual author. To actively support researchers and members who wish to publish in Wiley Open Access journals an academic or research institution, a society or a corporation may fund the fee directly. In return for the service fee, the Company provides its customary publishing, editing, peer review and technology services. All accepted open-access articles are subject to the same rigorous peer-review process applied to the Company’s subscription based journals which are supported by the Company’s network of prestigious journals and societies. In addition to Wiley Open Access, the company provides authors with the opportunity to provide their individual research articles that are published within the Company’s paid subscription journals, free through OnlineOpen. OnlineOpen articles are also available free to the general public via Wiley Online Library.

The Company’s digitization of its entire historical journal content, dating back to the 1800s, is designed to improve the research pathway and ensure content discovery is as seamless and efficient as possible. The backfile collection, which is available online through Wiley Online Library, spans three centuries of scientific research and comprise over 15 million pages – one of the largest archives of its kind issued by a single publisher. As of April 30, 2011, all of the Company’s existing journal content is digitized and made available to customers.

The Company has been focused on reducing costs associated with the STMS business to finance investments in enabling technology and new businesses. The cost savings are principally the result of increased off-shoring of certain functions and activities from high cost locations to Singapore and other countries in Asia. Significant portions of the STMS journals and books content management, customer support and central marketing functions have been off-shored as of the end of fiscal year 2011. In addition to cost savings, the off-shoring of these functions has enabled the Company to focus its resources on value-added activities, such as process and service enhancements.

Professional/Trade:

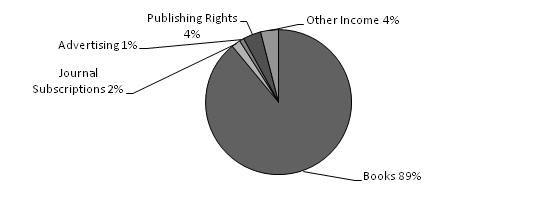

The Company’s Professional/Trade business acquires, develops and publishes books, subscription products and information services in all media, in the subject areas of business, technology, architecture, cooking, psychology, professional education, travel, health, consumer reference and general interest. Products are developed for worldwide distribution through multiple channels, including major chains and online booksellers, independent bookstores, libraries, colleges and universities, warehouse clubs, corporations, direct marketing, and websites. The Company’s Professional/Trade customers are professionals, consumers, and students worldwide. Publishing centers include Australia, Canada, Germany, Singapore, the United Kingdom and the United States. Professional/Trade publishing accounted for approximately 25% of total Company revenue in fiscal year 2011 and generated revenue growth at a compound annual rate of 2% over the past five years. The graph below presents P/T revenue by product type for fiscal year 2011:

Key revenue growth strategies of the Professional/Trade business include adding value to its content, developing its leading brands and franchises, and executing strategic acquisitions. The Company’s leading Professional/Trade brands include the For Dummies series, the Frommer’s and Unofficial Guide travel series, the Bible and Visual technology series, the CliffsNotes study guides and Betty Crocker cookbooks.

Publishing alliances and franchise products are also central to the Company’s strategy. The ability to bring together Wiley’s product development, sales, marketing, distribution and technological capabilities with a partner’s content and brand name recognition has been a driving factor in its success. Professional/Trade alliance partners include General Mills, the Culinary Institute of America, Bloomberg Press, the American Institute of Architects, the Graduate Management Admission Council, the Leader to Leader Institute, Fisher Investments, Meredith Corporation and Weight Watchers, among many others.

Growing revenue from digital products and services represents a core strategy for Professional/Trade, including increased availability of eBooks, advertising from branded websites and online tools and services.

The Company promotes an active and growing Professional/Trade custom publishing program. Custom publications are typically used by organizations for internal promotional or incentive programs. Books that are specifically written for a customer or an existing Professional/Trade publication can be customized, such as having the cover art include custom imprint, messages or slogans. Of special note are customized For Dummies publications, which leverage the power of this well-known brand to meet the specific information needs of a wide range of organizations around the world.

Higher Education:

The Company publishes educational materials in all media, for two and four-year colleges and universities, for-profit career colleges and advanced placement classes worldwide, as well as secondary schools in Australia. Higher Education products focus on print and online solutions in the sciences, engineering, mathematics, business/accounting, geography, computer science, statistics, education, culinary, hospitality, psychology and modern languages.

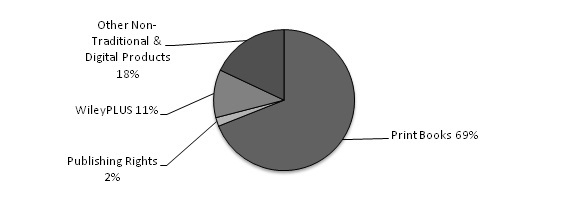

Higher Education customers include teachers, undergraduate, graduate, and advanced placement students, and lifelong learners worldwide as well as secondary school students in Australia. Product is delivered online and in print, principally through college bookstores, online booksellers, and websites. Higher Education accounted for approximately 18% of total Company revenue in fiscal year 2011 and generated revenue growth at a compound annual rate of 7% over the past five years.

Higher Education’s mission is to help teachers teach and students learn throughout the world. Our strategy is to provide value-added quality materials and services through textbooks, supplemental study aids, course and homework management tools and more, in print and electronic formats. The Higher Education website offers online learning materials with links to thousands of companion sub-sites to support and supplement textbooks.

Higher Education delivers high-quality online learning materials that offer more opportunities for customization and accommodate diverse learning styles. A prime example is WileyPLUS, the Company’s online teaching and learning environment. By offering an electronic version of a text along with additional integrated materials, custom content provided by the instructor, and administrative tools, WileyPLUS supports a full range of course-oriented activities, including online planning, presentations, study, homework, and testing.

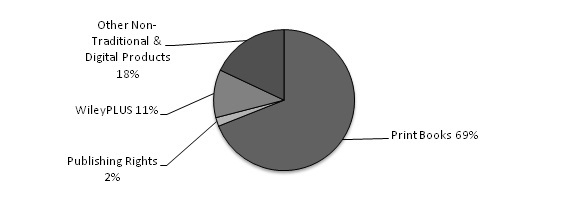

Wiley Higher Education encourages and supports the customization of its content. Wiley Custom Learning Solutions is a full service custom publishing department that offers an array of tools and services designed to put content creation in instructors’ hands. Our suite of custom products empowers users to create high-quality, economical education solutions tailored to meet individual classroom needs. Through the market leading online content customization tool, Wiley Custom Select, instructors can create a solution that contains Wiley content from various sources as well as their own content, delivered in print or as an ebook. The graph below presents global Higher Education revenue by product type for fiscal year 2011:

The Company also provides the services of the Wiley Faculty Network, a peer-to-peer network of faculty/professors supporting the use of online course material tools and discipline-specific software in the classroom. The Company believes this unique, reliable, and accessible service gives the Company a competitive advantage.

Higher Education is also leveraging the internet in its sales and marketing efforts. The internet enhances the Company’s ability to have direct contact with students and faculty at universities worldwide through the use of interactive electronic brochures and e-mail campaigns.

Publishing relationships are key to Higher Education’s strategy. The ability to bring Wiley’s product development, sales, marketing, distribution and technology with a partner’s content and/or brand name has contributed to the Company’s success. Alliance partners include Microsoft and National Geographic.

Publishing Operations

Journal Products:

The Company now publishes approximately 1,600 Scientific, Technical, Medical and Scholarly and Professional/Trade journals up from 1,500 in the prior year. Journal subscription revenue and other related publishing income, such as advertising, backfile sales, the sale of publishing rights, journal reprints and individual article sales accounted for approximately 48% of the Company’s consolidated fiscal year 2011 revenue. The journal portfolio includes titles owned by the Company, in which case they may or may not be sponsored by a professional society; titles owned jointly with a professional society; and titles owned by professional societies and published by the Company pursuant to long-term contract.

Societies that sponsor or own such journals generally receive a royalty and/or other consideration. The Company may procure editorial services from such societies on a pre-negotiated fee basis. The Company also enters into agreements with outside independent editors of journals that state the duties of the editors, and the fees and expenses for their services. Contributors of articles to the Company’s journal portfolio transfer publication rights to the Company or a professional society, as applicable. Journal articles may be based on funded research through government or charitable grants. In certain cases the terms of the grant may require the grantholder to make articles (either the published version or an earlier unedited version) available free of charge to the public, typically after an embargo period. Free access under the Company’s Wiley Open Access and OnlineOpen business models enable the grantholder to comply.

The Company sells journal subscriptions directly through sales representatives; indirectly through independent subscription agents; through promotional campaigns; and through memberships in professional societies for those journals that are sponsored by societies. Journal subscriptions are primarily licensed through contracts for online content delivered through the Company’s web-based platform, Wiley Online Library. Contracts are negotiated by the Company directly with customers or their subscription agents. Licenses range from one to three years in duration and typically cover calendar years.

Printed journals are generally mailed to subscribers directly from independent printers. The Company does not own or manage printing facilities. The print journal content is also available online. Subscription revenue is generally collected in advance, and deferred until the related issue is shipped or made available online at which time the revenue is earned.

Book Products:

Book products and book related publishing revenue, such as advertising revenue and the sale of publishing rights, accounted for approximately 52% of the Company’s consolidated fiscal year 2011 revenue. Materials for book publications are obtained from authors throughout most of the world through the efforts of an editorial staff, outside editorial advisors, and advisory boards. Most materials originate with authors, or as a result of suggestion or solicitations by editors and advisors. The Company enters into agreements with authors that state the terms and conditions under which the materials will be published, the name in which the copyright will be registered, the basis for any royalties, and other matters. Most of the authors are compensated by royalties, which vary with the nature of the product and its anticipated potential profitability. The Company may make advance payments against future royalties to authors of certain publications. Royalty advances are reviewed for recoverability and a reserve for loss is maintained, if appropriate.

The Company continues to add new titles, revise existing titles, and discontinue the sale of others in the normal course of its business, also creating adaptations of original content for specific markets fulfilling customer demand. The Company’s general practice is to revise its textbooks every two to five years, if warranted, and to revise other titles as appropriate. Subscription-based products are updated more frequently on a regular schedule.

Professional and consumer books are sold to bookstores and online booksellers serving the general public; wholesalers who supply such bookstores; warehouse clubs; college bookstores for their non-textbook requirements; individual practitioners; and research institutions, libraries (including public, professional, academic, and other special libraries), industrial organizations, and government agencies. The Company employs sales representatives who call upon independent bookstores, national and regional chain bookstores and wholesalers. Sales of professional and consumer books also result from direct mail campaigns, telemarketing, online access, advertising and reviews in periodicals. Trade sales to bookstores and wholesalers are generally made on a returnable basis with certain restrictions. The Company provides for estimated future returns on sales made during the year principally based on historical return experience and current market trends.

Adopted textbooks, related supplementary material, and online products such as WileyPLUS, are sold primarily to bookstores and online booksellers, serving both for-profit and nonprofit educational institutions. The Company employs sales representatives who call on faculty responsible for selecting books to be used in courses, and on the bookstores that serve such institutions and their students. Textbook sales are generally made on a returnable basis with certain restrictions. The textbook business is seasonal, with the majority of textbook sales occurring during the June through August and November through January periods. There is an active used textbook market, which adversely affects the sale of new textbooks.

Like most other publishers, the Company generally contracts with independent printers and binderies globally for their services. The Company purchases its paper from independent suppliers and printers. The fiscal year 2011 weighted average U.S. paper prices increased approximately 5% from fiscal year 2010. Approximately 57% of the Company’s paper inventory is held in the United States. Management believes that adequate printing and binding facilities, sources of paper and other required materials are available to it, and that it is not dependent upon any single supplier. Printed book products are distributed from both Company-operated warehouses and independent distributors.

The Company develops content in a digital format that can be used for online and print products, resulting in productivity and efficiency savings, as well as enabling the Company to offer customized publishing and print-on-demand products. Book content is increasingly being made available online through Wiley Online Library, WileyPLUS, Custom Select and other platforms, and in eBook formats through direct relationships with eBook vendors and through licenses with alliance partners. The Company also sponsors online communities of interest, both on its own and in partnership with others, to expand the market for its products.

The Company believes that the demand for new electronic technology products will continue to increase. Accordingly, to properly service its customers and to remain competitive, the Company has increased its expenditures related to such new technologies and anticipates it will continue to do so for the foreseeable future.

The Company’s online presence not only enables it to deliver content online, but also to sell more books. The growth of online booksellers benefits the Company because they provide unlimited virtual “shelf space” for the Company’s entire backlist.

Marketing and distribution services are made available to other publishers under agency arrangements. The Company also engages in co-publishing of titles with international publishers and in publication of adaptations of works from other publishers for particular markets. The Company also receives licensing revenue from photocopies, reproductions, translations, and electronic uses of its content.

Advertising Revenue:

The Company generates advertising revenue from print and online journal subscription products; controlled circulation magazines which are issued for free to a specific target audience; its online publishing platform, Wiley Online Library; and the websites of its consumer brands, including Frommers.com, Dummies.com and Cliffsnotes.com. These revenues accounted for approximately 3% of the Company’s consolidated fiscal year 2011 revenue.

Advertisements are sold by company and independent sales representatives to advertising agencies representing the Company’s target customers. Typical customers include worldwide pharmaceutical companies; equipment manufacturers and distributors servicing the pharmaceutical industry; company’s servicing the travel industry and a variety of businesses targeting the Company’s consumer brand customers. The Company’s advertising growth strategy focuses on increasing the volume of advertising on its online publishing platform; leveraging the brand recognition of its consumer titles in all media; the development of new advertising products such as online video promotions or event sponsorship arrangements; and advertising in new and emerging technologies such as the mobile devices market (i.e. smart phone and iPad applications).

Global Operations

The Company’s publications are sold throughout most of the world through operations located in Europe, Canada, Australia, Asia, and the United States. All operations market their indigenous publications, as well as publications produced by other parts of the Company. The Company also markets publications through independent agents as well as independent sales representatives in countries not served by the Company. John Wiley & Sons International Rights, Inc., a wholly owned subsidiary of the Company, sells reprint and translations rights worldwide. The Company publishes or licenses others to publish its products, which are distributed throughout the world in many languages. Approximately 49% of the Company’s consolidated fiscal year 2011 revenue was billed in non-U.S. markets.

The global nature of the Company’s business creates an exposure to foreign currency fluctuations relative to the U.S dollar. Each of the Company’s geographic locations sells products worldwide in multiple currencies. Revenue and deferred revenue, although billed in multiple currencies are accounted for in the local currency of the selling location. Fiscal year 2011 revenue was recognized in the following currencies (on an equivalent U.S. dollar basis): approximately 55% U.S dollar; 28% British pound sterling; 8% Euro and 9% other currencies.

Competition and Economic Drivers within the Publishing Industry

The sectors of the publishing industry in which the Company is engaged are highly competitive. The principal competitive criteria for the publishing industry are considered to be the following: product quality, customer service, suitability of format and subject matter, author reputation, price, timely availability of both new titles and revisions of existing books, digital availability of published products, and timely delivery of products to customers.

The Company is in the top rank of publishers of scientific, technical, medical and scholarly journals worldwide, a leading commercial research chemistry publisher; the leading society journal publisher; one of the leading publishers of university and college textbooks and related materials for the “hardside” disciplines, (i.e. sciences, engineering, and mathematics), and a leading publisher in its targeted professional/trade markets. The Company knows of no reliable industry statistics that would enable it to determine its share of the various international markets in which it operates.

Performance Measurements

The Company measures its performance based upon revenue, operating income, earnings per share and cash flow, excluding unusual or one-time events, and considering worldwide and regional economic and market conditions. The Company evaluates market share statistics for publishing programs in each of its businesses. STMS uses various reports to monitor competitor performance and industry financial metrics. Specifically for STMS journal titles, the ISI Impact Factor, published periodically by the Institute for Scientific Information, is used as a key metric of a journal title’s influence in scientific publishing. For Professional/Trade, the Company evaluates market share statistics periodically published by BOOKSCAN, a statistical clearinghouse for book industry point of sale data in the United States. The statistics include survey data from all major retail outlets, online booksellers, mass merchandisers, small chain and independent retail outlets. For Higher Education, the Company subscribes to Management Practices Inc., which publishes customized comparative sales reports.

Results of Operations

Throughout this report, references to amounts “excluding foreign exchange”, “currency neutral” and “performance basis” exclude both foreign currency translation effects and transactional gains and losses. Foreign currency translation effects are based on the change in average exchange rates for each reporting period multiplied by the current period’s volume of activity in local currency for each non-U.S. location.

Fiscal Year 2011 Summary Results

Revenue and Gross Profit:

Revenue for fiscal year 2011 increased 3% to $1,742.6 million, or 4% excluding the unfavorable impact of foreign exchange. The increase was driven by growth in all three businesses, led by strong growth in Higher Education (“HE”).

Gross profit margin for fiscal year 2011 of 69.1% was 0.5% higher than prior year. The increase was driven by lower journal production costs due to off-shoring (30bps) and increased sales of higher margin digital products (20bps), including a digital backlist book license with a university consortium in Saudi Arabia.

Operating and Administrative Expenses:

Operating and administrative expenses for fiscal year 2011 of $910.8 million were 4% higher than prior year, or 5% excluding the favorable impact of foreign exchange. The increase was primarily driven by higher technology costs ($15 million) reflecting ongoing investments in digital products and infrastructure, such as WileyPLUS, eBooks, customer data/relationship management initiatives, and Wiley Online Library; higher employment costs ($8 million) due to merit increases and retirement benefits; higher journal editorial costs ($7 million); higher warehouse rent and facility costs ($6 million) and travel expenses ($3 million) to support business expansion, partially offset by lower journal distribution costs due to off-shoring and outsourcing ($3 million).

In fiscal year 2011, the Company recorded a $9.3 million bad debt provision ($0.10 per share) within the Professional/Trade reporting segment related to the Company’s customer, Borders Group, Inc. (“Borders”). The provision represents the difference between the Company’s outstanding receivable with Borders and our expectation of potential offsets and recoveries in the future, as well as existing reserves for this customer. Borders was projected to account for 5% of fiscal year 2011 P/T sales. The Company does not anticipate any additional charges or bad debt expense with respect to this customer. On February 16, 2011, Borders filed a petition for reorganization relief under Chapter 11 of the U.S. Bankruptcy code.

In fiscal year 2010, the Company recognized impairment and restructuring charges of $15.1 million ($0.17 per share) within the STMS reporting segment. The prior year charges include an $11.5 million impairment charge for GIT Verlag, a business-to-business German-language controlled circulation magazine business; a $1.6 million restructuring charge for severance-related costs to reduce certain staff levels and the number of magazines published by GIT Verlag; an impairment charge of $0.9 million for three smaller business-to-business controlled circulation advertising magazines; and a $1.1 million restructuring charge for severance costs related to the off-shoring of certain central marketing and content management activities to Singapore and other countries in Asia.

Operating Income:

Operating income for fiscal year 2011 increased 2% to $248.1 million, or 8% on a currency neutral basis. Excluding the impact of the Borders bad debt provision ($9.3 million) and the prior year impairment and restructuring charges ($15.1 million), operating income increased 6% on a currency neutral basis. Higher revenue and higher gross profit margins were partially offset by higher operating and administrative expenses to support business growth.

Interest Expense/Income, Foreign Exchange Losses and Other:

Interest expense for fiscal year 2011 decreased $15.0 million to $17.3 million. Lower interest rates and lower average debt contributed approximately $10.0 million and $5.0 million to the decrease, respectively. Losses on foreign currency transactions for fiscal years 2011 and 2010 were $2.2 million and $10.9 million, respectively. The foreign currency transaction loss in the prior year was principally due to the revaluation of U.S. dollar cash balances held by the Company’s non-U.S. locations into the local currency of those operations. Interest income and other increased $1.6 million from the prior year, reflecting interest earned on higher average cash balances.

Provision for Income Taxes:

The effective tax rate for fiscal year 2011 was 25.6% compared to 28.3% in the prior year. During fiscal year 2011, the Company recorded a $4.2 million ($0.07 per share) non-cash deferred tax benefit associated with new tax legislation enacted in the United Kingdom (“U.K.”) that reduced the U.K. statutory income tax rate from 28% to 27%. The new tax rate was effective as of April 1, 2011. The benefit recognized by the Company reflected the restatement of all applicable U.K. deferred tax balances to the new income tax rate. In fiscal year 2011, the Company also recognized state net operating loss benefits of approximately $1.9 million ($0.03 per share). The Company’s effective tax rate for fiscal year 2011 excluding the tax benefits described above was 28.3%.

As of April 30, 2011, similar tax legislation was proposed in the U.K. to further reduce the statutory income tax rate from 27% to 25%. The Company anticipates that the proposed reduction will be enacted in the first quarter of fiscal year 2012. If enacted, the Company will report an approximate $10 million tax credit ($0.16 per share). The estimated non-cash tax benefit reflects the restatement of all applicable deferred tax balances to the new income tax rate.

Earnings Per Share:

Earnings per diluted share for fiscal years 2011 and 2010 were $2.80 and $2.41, respectively. Excluding the effects of unfavorable foreign exchange transaction and translation losses ($0.07 per share), the current year Borders bad debt provision ($0.10 per share), the prior year impairment and restructuring charges ($0.17 per share) and the current year deferred tax benefit associated with the change in U.K. corporate income tax rates ($0.07 per share), earnings per diluted share increased 12% on higher shares outstanding. The dilutive effect of higher shares outstanding in fiscal year 2011 was approximately $0.08 per share as compared to the prior year.

Fiscal Year 2011 Segment Results

| Scientific, Technical, Medical and Scholarly (STMS): | | |

| | | | | % change |

| Dollars in thousands | 2011 | 2010 | % change | w/o FX (a) |

| | | | | |

| Journal Subscriptions | $621,551 | $621,257 | 0% | 4% |

| Books | 173,231 | 160,658 | 8% | 9% |

| Other Publishing Income | 204,120 | 204,768 | 0% | 1% |

| Total Revenue | $998,902 | $986,683 | 1% | 4% |

| | | | | |

| Gross Profit | 729,931 | 716,470 | 2% | 5% |

| Gross Profit Margin | 73.1% | 72.6% | | |

| | | | | |

| Direct Expenses & Amortization | 305,134 | 311,229 | -2% | 5% |

| | | | | |

| Direct Contribution to Profit | $424,797 | $405,241 | 5% | 5% |

| Direct Contribution Margin | 42.5% | 41.1% | | |

| (a) | Adjusted to exclude fiscal year 2010 impairment and restructuring charges of $15.1 million from direct expenses and direct contribution. |

Revenue:

STMS revenue for fiscal year 2011 increased 1% to $998.9 million, or 4% excluding the unfavorable impact of foreign exchange. On a currency neutral basis, the growth was driven by higher journal subscription and book revenue, while other publishing income increased slightly from prior year.

Journal Subscriptions

Journal subscription revenue for fiscal year 2011 of $621.6 million was flat with the prior year, but increased 4% excluding the unfavorable impact of foreign exchange. On a currency neutral basis, the growth was driven by an increase in journal subscriptions ($18 million), new journal society business ($3 million) and the timing of journal publications ($3 million). As of April 30, 2011, receipts for calendar year 2011 journal subscriptions grew approximately 3% over calendar year 2010 with approximately 95% of expected calendar year 2011 subscription receipts received.

Books

Books revenue for fiscal year 2011 increased 8% to $173.2 million, or 9% excluding the unfavorable impact of foreign exchange. On a currency neutral basis, the growth reflects higher digital ($12 million) and print ($2 million) book sales. The increase in digital book revenue includes a $5 million one-time online book license with a consortium in Saudi Arabia.

Other Publishing Income

Other publishing income for fiscal year 2011 of $204.1 million was flat with the prior year, but grew 1% excluding the unfavorable impact of foreign exchange as an increase in backfile revenue ($4 million) was partially offset by a decline in journal reprint revenue ($3 million).

Gross Profit:

Gross profit margin for fiscal year 2011 of 73.1% was 0.5% higher than the prior year. The improvement was mainly driven by lower journal production costs due to off-shoring and outsourcing.

Direct Expenses and Amortization:

Direct expenses and amortization for fiscal year 2011 decreased 2% to $305.1 million. On a currency neutral basis and excluding the $15.1 million asset impairment and restructuring charges recorded in fiscal year 2010, direct expenses and amortization increased 5%. The increase primarily reflects higher journal editorial costs to support business growth ($9 million) and higher employment costs ($2 million).

Direct Contribution to Profit:

Direct contribution to profit increased 5% to $424.8 million in fiscal year 2011, or 9% excluding the unfavorable impact of foreign exchange. Excluding foreign exchange and the prior year asset impairment and restructuring charges, direct contribution to profit increased 5%. Increased revenue and higher gross profit margins were partially offset by an increase in direct expenses as described above. Direct contribution margin improved 140 basis points to 42.5% in fiscal year 2011, or 40 basis points on a currency neutral basis and excluding the prior year asset impairment and restructuring charges principally due to improved gross profit margins.

Full Year Digital Revenue

| · | Digital revenue was 59% of total STMS revenue |

| · | Digital journal revenue was 81% of total journal revenue, up from 79% a year earlier |

| · | Digital book revenue up 74% and now accounts for 16% of total book sales |

Wiley Online Library

Wiley Online Library, one of the world’s broadest and deepest multidisciplinary collection of online resources covering life, health and physical sciences, social science and the humanities, was launched in August 2010. Built on the new technology and designed with extensive input from scholars around the world, Wiley Online Library provides access to over 4 million articles from 1,500 journals, 10,000 books, and hundreds of reference works, laboratory protocols and databases. Key attributes:

| · | New revenue opportunities, including new applications and business models, online advertising, deeper penetration into markets, enhanced discoverability, and individual sales/pay-per-view |

| · | An easy-to-use interface providing intuitive navigation and fast access to online content |

| · | Research tools to enable the discovery of available resources and help pinpoint information |

| · | Personalization options to keep up-to-date on the latest research with content alerts and RSS feeds and the ability to store key publications and articles for future reference |

| · | Customizable product home pages that allow journal and society communities to highlight key features and share news and information |

| · | Access icons that identify the content available to customers through institutional licenses, society membership and author-funded Online Open publication, as well as freely available content |

Society Partnerships

| · | 37 new society journals were signed with combined annual revenue of approximately $9 million |

| · | 100 renewals/extensions with approximately $56 million in combined annual revenue |

| · | 4 journals were not renewed in fiscal year 2011, totalling approximately $1 million in annual revenue. |

Alliances

| · | An agreement to co-publish a new book series on neuroendocrinology was signed with the International Neuroendocrine Federation |

| · | An agreement signed with GeneBio for us to distribute their SmileMS mass spectrometry software which is used to identify small molecules. |

| · | A publishing agreement was signed for a joint venture with the Society of Chemical Industry (SCI) to launch a new electronic journal entitled Greenhouse Gases: Science and Technology. |

| · | A partnership with the Association of American Geographers to publish a definitive reference work for the discipline to be published online and in 15 print volumes. |

| · | Wiley purchased the remaining 50% of the Journal for the Theory of Social Behaviour, which publishes original theoretical and methodological articles that examine the links between social structures and human agency embedded in behavioral practices. The journal is accessible to readers worldwide in the fields of psychology, sociology and philosophy. |

New Society Journals

| · | Eleven journals on behalf of the British Psychological Society (BPS). The BPS is the second largest psychological society in the world with approximately 50,000 members. |

| · | Acta Obstetricia et Gynecologica, on behalf of the Nordisk Förening för Obstetrik och Gynekologi (NFOG), the Nordic Federation of Societies of Obstetrics and Gynaecology |

| · | Journal of the European Economic Association, on behalf of the European Economic Association (EEA). The EEA is the third highest profile economic society in the world. |

| · | Three journals (Journal of Wildlife Management, Wildlife Monographs and the forthcoming re-launch of the Wildlife Society Bulletin) on behalf of The Wildlife Society |

| · | Journal of Midwifery and Women's Health with the American College of Nurse Midwives |

| · | International Journal of Language and Communication Disorders on behalf of the Royal College of Speech and Language Therapists, providing Wiley with a strong foundation in the field, opening opportunities to add content and relationships |

| · | International Forum of Allergy & Rhinology for the American Rhinologic Society and the American Academy of Otolaryngic Allergy |

| · | Biotechnology and Applied Biochemistry on behalf of the International Union of Biochemistry and Molecular Biology |

| · | European Management Review with the European Academy of Management |

| · | Structural Concrete with the International Federation for Structural Concrete |

| · | The ten journals of the American Counseling Association. The ACA is the world’s leading association for professionals in Counseling. |

| · | International Dental Journal, for the FDI World Dental Federation. |

| · | Journal of Business Logistics, for the Council of Supply Chain Management Professionals (CSCMP). |

| · | International Journal of Paediatric Obesity, for the International Association for the Study of Obesity. |

| · | Journal of Creative Behavior, for the Creative Education Foundation (CEF. Founded in 1954, the CEF is recognized as the world leader in Applied Imagination |

| · | Asia Pacific Journal of Human Resources, for the Australian Human Resources Institute (AHRI). APJHR is the leading journal for HR professionals in Australia. |

Journal Quality and Impact Factors

Wiley announced that two thirds of its journals (68.8% and 1,013 titles) have an Impact Factor according to the revised Thomson ISI® 2009 Journal Citation Reports (JCR) released in September 2010. Impact Factor is a leading evaluator of journal influence and impact, as it reflects the frequency that peer-reviewed journals are cited by researchers. Nearly a quarter of Wiley’s ranked journals are in the top ten of their subject category (238 titles) while two thirds are in the top half of their category. Wiley has 37 number 1 rankings. These titles represent the highest proportion of listed journals receiving the top rank of all the major journals publishers (those publishing 100 or more titles listed in the JCR).

| Professional/Trade (P/T): | | |

| | | | | % change |

| Dollars in thousands | 2011 | 2010 | % change | w/o FX (a) |

| | | | | |

| Books | $387,228 | $379,934 | 2% | 2% |

| Other Publishing Income | 49,860 | 50,054 | 0% | 0% |

| Total Revenue | $437,088 | $429,988 | 2% | 1% |

| | | | | |

| Gross Profit | 269,112 | 263,552 | 2% | 2% |

| Gross Profit Margin | 61.6% | 61.3% | | |

| | | | | |

| Direct Expenses & Amortization | 173,616 | 163,356 | 6% | 1% |

| | | | | |

| Direct Contribution to Profit | $95,496 | $100,196 | -5% | 5% |

| Direct Contribution Margin | 21.8% | 23.3% | | |

| (a) | Adjusted to exclude fiscal year 2011 bad debt provision of $9.3 million related to Borders from direct expenses and direct contribution. |

Revenue: