QuickLinks -- Click here to rapidly navigate through this document

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý | ||

Filed by a Party other than the Registranto | ||

Check the appropriate box: | ||

| o | Preliminary Proxy Statement | |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ý | Definitive Proxy Statement | |

| o | Definitive Additional Materials | |

| o | Soliciting Material Pursuant to §240.14a-12 | |

PLAYBOY ENTERPRISES, INC. | ||||

(Name of Registrant as Specified In Its Charter) | ||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

| Payment of Filing Fee (Check the appropriate box): | ||||

| ý | No fee required | |||

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

| o | Fee paid previously with preliminary materials. | |||

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

Notice of the 2003 Annual Meeting of Stockholders

May 14, 2003

The Annual Meeting of Stockholders of Playboy Enterprises, Inc. will be held at Spiaggia, located at 980 North Michigan Avenue, Chicago, Illinois 60611, on Wednesday, May 14, 2003, at 9:30 a.m., local time, for the following purposes:

- 1.

- to elect eight directors, each for one-year terms;

- 2.

- to approve an amendment to our Amended and Restated 1995 Stock Incentive Plan to increase the number of shares of Playboy's Class B common stock reserved for issuance under this plan from 3,703,000 shares to 5,503,000 shares and the maximum number of shares which may be granted to any employee in any calendar year from 250,000 shares to 650,000 shares;

- 3.

- to approve an amendment to our 1997 Equity Plan for Non-Employee Directors, as amended, to increase the number of shares of Playboy's Class B common stock reserved for issuance under this plan from 200,000 shares to 400,000 shares;

- 4.

- to vote on the ratification of the appointment of Ernst & Young LLP as our independent auditors for 2003; and

- 5.

- to transact any other business that properly comes before the meeting.

All holders of record of Playboy Class A common stock at the close of business on March 17, 2003 are entitled to notice of and to vote at the meeting. An alphabetical list of those stockholders, their addresses and the number of shares owned by each will be on display for all purposes germane to the meeting at Playboy's Chicago office during normal business hours from May 2, 2003 to May 13, 2003. This list will also be on display at the meeting. Holders of Playboy Class B common stock on the record date are also welcome to attend the meeting but are not entitled to vote.

We hope that you will be present at the meeting. If you cannot attend and you are a holder of Class A common stock, we urge you to vote your shares by dating, signing and mailing the enclosed proxy card in the envelope provided. The envelope requires no postage if it is mailed in the United States.

By Order of the Board of Directors | ||

Howard Shapiro Secretary | ||

April 10, 2003 Chicago, Illinois |

PLAYBOY ENTERPRISES, INC.

680 North Lake Shore Drive

Chicago, Illinois 60611

Proxy Statement

Annual Meeting Time, Location and Admission Procedure

The Annual Meeting of Stockholders of Playboy Enterprises, Inc. will be held on Wednesday, May 14, 2003, at 9:30 a.m., local time, at Spiaggia, located at 980 North Michigan Avenue, Chicago, Illinois 60611.

All stockholders of record on March 17, 2003, the record date for the Annual Meeting, are invited to attend the Annual Meeting. If you attend, you may be asked to present valid picture identification, such as a driver's license or passport. Cameras, recording devices and other electronic devices will not be permitted at the meeting. Please note that if you hold your shares in "street name" (that is, through a broker or other nominee), you will need to bring a copy of a brokerage statement reflecting your stock ownership as of the record date and check in at the registration desk at the meeting.

Securities Entitled to Be Voted at the Meeting

Only shares of our Class A common stock held by stockholders of record on March 17, 2003, the record date for the Annual Meeting, are entitled to vote at the meeting. Each share of Class A common stock is entitled to one vote. On March 17, 2003, 4,864,102 shares of Class A common stock were outstanding. The Class B common stock is not entitled to be voted at the Annual Meeting. Holders of Class B common stock are receiving this proxy statement for information purposes only and will not receive a proxy card.

Information About This Proxy Statement

We sent you these proxy materials because Playboy's Board of Directors is soliciting your proxy to vote your shares of Class A common stock at the Annual Meeting. This proxy statement summarizes the information you need to vote at the Annual Meeting. On April 10, 2003, we began mailing these proxy materials to all of our holders of record of Class A common stock and Class B common stock, as of the close of business on March 17, 2003.

Information About Voting

Holders of Class A common stock can vote in person at the Annual Meeting or by proxy. If you want to vote by proxy, please complete, sign and date the enclosed proxy card and return it promptly in the accompanying envelope, which is postage paid if mailed in the United States. If your shares of Class A common stock are held in the name of a bank, broker or other holder of record, you will receive instructions from that holder of record that you must follow in order for your shares to be voted at the Annual Meeting.

If you plan to attend the meeting and vote in person, we will give you a ballot when you arrive. If your shares of Class A common stock are not registered in your own name, and you plan to attend the Annual Meeting and vote your shares in person, you will need to contact the broker or agent in whose name your shares are registered to obtain a broker's proxy card and bring it with you to the Annual Meeting.

If you vote by proxy, the individuals named on the proxy card (your proxies) will vote your shares in the manner you indicate. You may specify whether your shares should be voted for all, some or none of the

nominees for director and whether your shares should be voted for or against the other proposals. If you sign, date and return the card without indicating your instructions on how to vote your shares, they will be voted as follows:

- •

- FOR the election of the eight nominees for director;

- •

- FOR approval of an amendment to our Amended and Restated 1995 Stock Incentive Plan to increase the number of shares of Playboy's Class B common stock reserved for issuance under this plan from 3,703,000 shares to 5,503,000 shares and the maximum number of shares which may be granted to any employee in any calendar year from 250,000 shares to 650,000 shares;

- •

- FOR approval of an amendment to our 1997 Equity Plan for Non-Employee Directors, as amended, to increase the number of shares of Playboy's Class B common stock reserved for issuance under this plan from 200,000 shares to 400,000 shares; and

- •

- FOR the ratification of the appointment of Ernst & Young LLP as our independent auditors for 2003.

If any other matter is presented at the meeting, the holders of your proxy will vote in accordance with his or her best judgment. At the time this proxy statement went to press, we knew of no other matters to be acted upon at the meeting.

Your vote is important. Whether or not you plan to attend the Annual Meeting, we urge you to vote your shares by completing, signing, dating and mailing the enclosed proxy card in the accompanying envelope. Voting by proxy will not affect your right to attend the meeting and vote your shares in person.

You may revoke or change your proxy at any time before it is exercised by any of the following methods:

- •

- sending a written revocation to Playboy's Secretary, Howard Shapiro;

- •

- signing and delivering a later dated proxy; or

- •

- voting in person at the meeting.

Your most current vote is the one that is counted.

Quorum Requirement

A quorum is necessary to hold a valid Annual Meeting. If stockholders entitled to cast a majority of all the votes entitled to be cast at the meeting are present in person or by proxy, a quorum will exist. Proxies marked "withheld" or "abstain" and broker non-votes are counted as present for establishing a quorum. A broker non-vote occurs when a broker votes on some matters on the proxy card, but not on others because the broker does not have authority to do so.

Information About Votes Necessary for Action to Be Taken

All matters to be considered at the Annual Meeting require an affirmative vote of the majority of all shares of Class A common stock present in person or by proxy. Proxies marked "withheld" or "abstain" will have the same effect as a vote against the proposals or a vote against any other matter. Broker non-votes will have no effect on the four items to be presented at the meeting.

2

PROPOSAL NO. 1

ELECTION OF DIRECTORS

Playboy's directors are elected by the stockholders each year at our Annual Meeting. Our directors are elected to serve one-year terms. Our bylaws allow the Board of Directors to fix the number of directors to be elected at each Annual Meeting at not fewer than five and not more than ten. Our bylaws also allow the Board of Directors to fill any vacancies and newly created directorships resulting from any increase in the authorized number of directors. The directors so chosen shall hold office until the next annual election or until their successors are duly elected and qualified. On September 18, 2002, the Board of Directors voted to increase the number of directors from seven to eight and elected Mr. Jerome H. Kern to fill the directorial vacancy created by the increase in the number of directors, to serve until the Annual Meeting. As a result, the Board of Directors currently consists of eight members. Sir Brian Wolfson, one of our current directors, has informed the Board of Directors that he will not stand for re-election at the Annual Meeting.

The Board of Directors has nominated eight individuals for election at the Annual Meeting. Other than Mr. Russell I. Pillar, each of the director nominees presented in this proxy statement is currently a director. If elected, each director's term will last until the 2004 Annual Meeting or until he or she is succeeded by another qualified director who has been elected.

Your proxy will vote for each of the nominees unless you specifically withhold authority to vote for a particular nominee. If a nominee is unavailable for election, the holders of your proxy may vote for another nominee proposed by the Board of Directors, or the Board of Directors may reduce the number of directors to be elected at the Annual Meeting. Your proxy may not be voted for more than eight nominees.

THE BOARD UNANIMOUSLY RECOMMENDS THAT YOU VOTE FOR ALL OF THE NOMINEES.

The following information is provided with respect to each nominee for election as a director. The ages of the nominees are as of April 8, 2003.

CHRISTIE HEFNER

Director since 1979

Age 50

Ms. Hefner was appointed Chairman of the Board and Chief Executive Officer of Playboy in November 1988. From September 1986 to November 1988, she was Vice Chairman of the Board, President and Chief Operating Officer. From February 1984 to September 1986, she was President and Chief Operating Officer; she had been President since April 1982. From January 1978 to April 1982, she was a Corporate Vice President. She joined Playboy in 1975 as Special Assistant to the Chairman of the Board. In addition, Ms. Hefner is a member of the Board of Directors of MarketWatch.com, Inc., an interactive financial media company; Canyon Ranch, a group of health resorts and club spas; Magazine Publishers of America, the industry association for consumer magazines; the Business Committee for the Arts, an organization helping businesses establish alliances with the arts that meet business objectives; and the Museum of Television and Radio. Ms. Hefner is also on the Advisory Boards of the American Civil Liberties Union and the Creative Coalition and a member of the Chicago Council on Foreign Relations and the National Cable Television Associations Diversity Committee. Ms. Hefner is the daughter of Hugh M. Hefner, Editor-in-Chief.

3

DENNIS S. BOOKSHESTER

Director since 1990

Age 64

Mr. Bookshester has been Chairman of the Board of Cutanix Corporation, a company principally engaged in scientific skin research, since November 1997. Concurrently, Mr. Bookshester was the Chief Executive Officer of Fruit of the Loom, Inc. from June 1999 to May 2002. From December 1990 to May 1991, he served as Chief Executive Officer of Zale Corporation, a company principally involved in the retail sale of jewelry. Mr. Bookshester was Corporate Vice Chairman, Chairman and Chief Executive Officer of the Retail Group of Carson Pirie Scott & Co., positions he held from 1984 to 1989. In addition, Mr. Bookshester is the Chairman of the Illinois Racing Board and a member of the Board of Directors of Elder-Beerman Stores Corp., which operates full-service department stores in the midwest. Mr. Bookshester is on the Visiting Committee of the University of Chicago Graduate School of Business. Mr. Bookshester is Chairman of the audit committee of the Board and is a member of the compensation committee of the Board.

DAVID I. CHEMEROW

Director since 1996

Age 51

Mr. Chemerow is the Chief Operating Officer of ADcom Information Services, Inc., which provides ratings for viewership of TV programs to cable operators. Prior to that, he served as President and Chief Executive Officer of Soldout.com, Inc. from May 2000 through July 2000 and was President and Chief Operating Officer from September 1999 through April 2000. Soldout.com, Inc. was a premium event and entertainment resource, specializing in sold out and hard-to-obtain tickets and personalized entertainment packages for sports, theater, cultural and other events. Mr. Chemerow was President and Chief Operating Officer of GT Interactive Software Corp., a company principally engaged in publishing computer games, from April 1998 to September 1999; he served as Executive Vice President and Chief Operating Officer from May 1997 to April 1998. From April 1996 to May 1997, he was Executive Vice President and Chief Financial Officer of ENTEX Information Services, Inc., a company principally engaged in providing distributed computing management solutions. Beginning in 1990 and prior to joining ENTEX, he was Executive Vice President, Finance and Operations, and Chief Financial Officer of Playboy. Mr. Chemerow is also a member of the Board of Directors of Dunham's Athleisure Corporation, a sporting goods retailer. Mr. Chemerow is a member of the audit committee of the Board.

DONALD G. DRAPKIN

Director since 1997

Age 55

Mr. Drapkin has been a member of the Board of Directors and Vice Chairman of MacAndrews & Forbes Holdings Inc. and various of its affiliates since 1987. Prior to joining MacAndrews & Forbes, Mr. Drapkin was a partner in the law firm of Skadden, Arps, Slate, Meagher & Flom for more than five years. Mr. Drapkin is also a member of the Board of Directors of the following corporations: Anthracite Capital, Inc., BlackRock Asset Investors, The Molson Companies Limited, Panavision, Inc., Revlon Consumer Products Corporation, Revlon, Inc., SIGA Technologies, Inc. and The Warnaco Group, Inc. Mr. Drapkin is a member of the compensation committee of the Board.

4

JEROME H. KERN

Director since 2002

Age 65

Mr. Kern has been the President of Kern Consulting, L.L.C. since 2001. Prior to that, Mr. Kern was Chairman and Chief Executive Officer of On Command Corporation. Prior to his position at On Command, he served as Vice Chairman and a member of the Board of Directors of Tele-Communications, Inc. (TCI). For more than 20 years, Mr. Kern was the principal outside legal counsel to TCI and Liberty Media Corporation (Liberty Media), including from 1992 to 1998, when he served as senior partner of Baker & Botts, L.L.P. Mr. Kern is on the boards of Jones Knowledge, Inc., Liberty Media and the Volunteers of America (Colorado Chapter). He also serves as Chairman of the Institute for Children's Mental Disorders and is Co-Chairman of Board of Trustees for the Colorado Symphony Association. He is a trustee of City Meals-on-Wheels in New York and a trustee of the New York University School of Law Foundation. Mr. Kern is a member of the audit committee of the Board.

RUSSELL I. PILLAR

Director Nominee

Age 37

Mr. Pillar has served as President of the Viacom Digital Media Group and its predecessor entities, all divisions of global media company Viacom Inc., since January 2000. He is Viacom's chief digital strategy and development executive, responsible for leading key initiatives that leverage emerging technologies and the corporation's brand, content, distribution, advertising, and promotional assets. Mr. Pillar also has served as Managing Partner of Critical Mass Ventures LLC, an investment vehicle focused on the intersection of consumer brands, media, and technology, since October 1991. From November 1998 to January 2000, Mr. Pillar served as President, Chief Executive Officer, and a member of the Board of Directors of Richard Branson's Virgin Entertainment Group, Inc., a diversified international entertainment content retailer. From September 1997 to August 1998, Mr. Pillar served as President and Chief Executive Officer of Prodigy Internet, an Internet service provider, and served as a member of Prodigy Inc.'s Board of Directors, including serving as its Vice Chairman, from October 1996 to February 2000. Mr. Pillar is a member of the Board of Directors of MarketWatch.com, Inc. and SportsLine.com, Inc.

SOL ROSENTHAL

Director since 1985

Age 68

Mr. Rosenthal has been Of Counsel to the Los Angeles office of the law firm of Arnold & Porter since July 2000. Prior to that he was Of Counsel to the Los Angeles law firm of Blanc Williams Johnston & Kronstadt, L.L.P. from May 1996 through June 2000. Prior to that, he was a senior partner in the law firm of Buchalter, Nemer, Fields & Younger from 1974 through April 1996. He has served as an arbitrator in entertainment industry disputes since 1977 and as the Writers Guild-Association of Talent Agents Negotiator since 1978. Mr. Rosenthal is a former member of the Board of Governors, Academy of Television Arts & Sciences, on which he served from 1990 to 1992; he is a former President of the Beverly Hills Bar Association and a former President of the Los Angeles Copyright Society. Mr. Rosenthal is Chairman of the compensation committee of the Board.

5

RICHARD S. ROSENZWEIG

Director since 1973

Age 67

Mr. Rosenzweig has been Executive Vice President of Playboy since November 1988. From May 1982 to November 1988, he was Executive Vice President, Office of the Chairman, and from July 1980 to May 1982, he was Executive Vice President, Corporate Affairs. Before that, from January 1977 to June 1980, he had been Executive Vice President, West Coast Operations. His other positions with Playboy have included Executive Vice President, Publications Group, and Associate Publisher,Playboy magazine. He has been with Playboy since 1958.

MEETINGS AND COMMITTEES OF THE BOARD

The Board of Directors held seven meetings during 2002. Each of our directors attended at least 75% of all the meetings of the Board and of the committees on which he or she served during 2002. The Board of Directors has a standing audit committee and a standing compensation committee, which are described below. The Board does not have a standing nominating committee.

Audit Committee

The audit committee of the Board is currently comprised of four independent directors, Messrs. Bookshester (who serves as Chairman), Chemerow and Kern and Sir Brian Wolfson. The functions of the audit committee and its activities during 2002 are described in the section of this proxy statement titled "Report of the Audit Committee."

During 2002, the Board of Directors examined the composition of the audit committee and confirmed that all members of the audit committee are "independent" within the meaning of the New York Stock Exchange's rules governing audit committees.

The audit committee met five times during 2002.

Compensation Committee

The compensation committee of the Board is currently comprised of three directors, Messrs. Rosenthal (who serves as Chairman), Bookshester and Drapkin. The key functions of the compensation committee include reviewing and approving our compensation philosophy concerning corporate officers and certain other key employees, reviewing the competitiveness of our compensation practices and determining salary and termination arrangements for, and all proposed contracts and transactions with, all of our employees whose salaries and bonuses are more than $250,000 but less than $400,000 per year, excluding corporate officers.

Other key responsibilities of the compensation committee include reviewing and making recommendations to the Board concerning our employee benefit programs, determining compensation, salary or termination arrangements for, and all proposed contracts and transactions with, corporate officers and any employee of Playboy (including Mr. Hefner) whose salary and bonus equals or exceeds $400,000 per year, administering our stock incentive plans for key employees and non-employee directors and determining which of our employees are eligible to participate in those plans and administering our employee stock purchase plan.

The compensation committee met five times during 2002.

6

Directors who are Playboy employees receive no compensation for their services as directors. During 2002, non-employee directors received an annual fee of $30,000. This annual fee was earned and is payable in quarterly installments. Half of this annual fee is paid in shares of Class B common stock. In addition, each non-employee director earned a fee of $1,000 for each in-person Board meeting attended, payable in shares of Class B common stock. Mr. Drapkin and Sir Brian Wolfson each attended all five of the in-person Board meetings held in 2002, and therefore each earned total compensation of $35,000 for his services as a director in 2002. Messrs. Bookshester, Chemerow and Rosenthal each attended all five of the in-person Board meetings and three special committee meetings, and therefore each earned total compensation of $38,000 in 2002. Mr. Kern earned total compensation of $17,000 in 2002, comprised of a pro-rated annual fee of $15,000 and $2,000 for his attendance at two in-person Board meetings.

Since October 1992, non-employee directors have also been eligible to participate in Playboy's Deferred Compensation Plan for Non-Employee Directors, which we call the DCP, under which they may elect to defer receipt of part or all of their annual fees and per-meeting payments. All amounts deferred and interest credited are 100% vested immediately and are general unsecured obligations of Playboy.

Each non-employee director is also a participant in the Playboy Enterprises, Inc. 1991 Non-Qualified Stock Option Plan for Non-Employee Directors. We call this stock option plan the 1991 Directors' Stock Option Plan. Under the 1991 Directors' Stock Option Plan, each director is granted a non-qualified stock option to purchase shares of Class B common stock. Each option is exercisable in four equal annual installments, beginning on the first anniversary of the date that options were initially granted, unless accelerated according to the terms of the 1991 Directors' Stock Option Plan. All installments are cumulative and may be exercised in whole or in part. Options granted under the 1991 Directors' Stock Option Plan generally expire ten years after the date of grant, although they may expire earlier. Shares issued upon the exercise of options granted under the 1991 Directors' Stock Option Plan may be either treasury shares or newly-issued shares.

Each non-employee director is also a participant in the 1997 Equity Plan for Non-Employee Directors of Playboy Enterprises, Inc., as amended. We call this equity plan the 1997 Equity Plan. Under the 1997 Equity Plan, we from time to time grant non-employee directors non-qualified stock options to purchase shares of Class B common stock and/or shares of restricted stock. Each option is generally exercisable in four equal annual installments, beginning on the first anniversary of the date that options were initially granted, unless accelerated according to the terms of the 1997 Equity Plan. All installments are cumulative and may be exercised in whole or in part. Options granted under the 1997 Equity Plan generally expire ten years after the date of grant, although they may expire earlier. Shares issued upon the exercise of options granted under the 1997 Equity Plan may be either treasury shares or newly-issued shares.

7

The following information is provided with respect to Playboy's executive officers, except for Ms. Hefner and Mr. Rosenzweig, whose information is provided in the section of this proxy statement titled "PROPOSAL NO. 1—ELECTION OF DIRECTORS." Playboy's officers hold their offices until their successors are chosen and qualified.

JAMES L. ENGLISH

Executive Vice President and President,

Entertainment Group

Age 51

Mr. English joined Playboy in 1994 as President of Playboy Networks Worldwide and was appointed to his present position in November 2000. Before joining Playboy he served as Senior Vice President, Viewer's Choice. He helped launch Pay-Per-View Network, Inc. in 1987. Previously, Mr. English served as a Vice President of MGM/UA, and before that at Home Box Office. He began his career at WJLA-TV, the ABC affiliate in Washington, D.C. He is a member of the Cable Television Administration and Marketing Association, National Cable Television Association and Visual Software Dealers Association.

LINDA G. HAVARD

Executive Vice President, Finance and Operations,

and Chief Financial Officer

Age 48

Ms. Havard was appointed to her present position in May 1997. From August 1982 to May 1997, she held various financial and management positions at Atlantic Richfield Company or ARCO. From October 1996 to May 1997, Ms. Havard served as ARCO's Senior Vice President in the Global Energy Ventures division. She also served as ARCO's Vice President of Corporate Planning from January 1994 to December 1996. Her other positions with ARCO included Vice President, Finance, Planning and Control, ARCO Transportation Co. and President, ARCO Pipe Line Co. Ms. Havard serves as a member of the Board of Directors of Playboy.com, Inc. (Playboy.com). Ms. Havard is also a member of the UCLA Foundation Board of Councillors and a member of the Chicago Club of the Council on Foreign Relations.

HUGH M. HEFNER

Editor-in-Chief

Age 77

Mr. Hefner founded Playboy in 1953. He was appointed to his present position in November 1988. From October 1976 to November 1988, Mr. Hefner served as Chairman of the Board and Chief Executive Officer, and before that he served as Chairman, President and Chief Executive Officer. Mr. Hefner is the father of Christie Hefner, Chairman of the Board and Chief Executive Officer.

MARTHA O. LINDEMAN

Senior Vice President, Corporate Communications

and Investor Relations

Age 52

Ms. Lindeman was appointed to her present position in September 1998. From 1992 to 1998, she served as Vice President, Corporate Communications and Investor Relations. From 1986 to 1992, she served as Manager of Communications at the Tribune Company, a leading information and entertainment company.

8

RANDY A. NICOLAU

President

Playboy Online Group

Age 32

Mr. Nicolau was appointed to his present position in August 2002. From October 2001 to August 2002, Mr. Nicolau served as Senior Vice President of Marketing and E-Commerce for Playboy.com, where he was responsible for the marketing and operation of the corporation's subscription and e-commerce businesses. From June 2000 to April 2001, Mr. Nicolau was Senior Vice President of Direct Marketing and E-Commerce at Small World Media, Inc., which builds and maintains fantasy sports games on the Internet, and was responsible for developing and marketing the corporation's fantasy game and e-commerce businesses. Mr. Nicolau served from January 1997 to April 2000 as the Chief Executive Officer at Bridgepint Marketing, LLC, which marketed collectibles to the male consumer and owned the brand "Sports Traditions," a leader in sports-themed products, and was responsible for the day-to-day operation and overall performance of the corporation. Mr. Nicolau began his career at MBI Inc. (The Danbury Mint) in August 1992, where he created and managed direct response programs within the collectibles industry and facilitated the sales growth of its sports-related product lines.

HOWARD SHAPIRO

Executive Vice President, Law and Administration,

General Counsel and Secretary

Age 55

Mr. Shapiro was appointed to his present position in May 1996. From September 1989 to May 1996, he served as Executive Vice President, Law and Administration, and General Counsel. From May 1985 to September 1989, Mr. Shapiro served as Senior Vice President, Law and Administration, and General Counsel. From July 1984 to May 1985, he served as Senior Vice President and General Counsel. From September 1983 to July 1984, he served as Vice President and General Counsel. From May 1981 to September 1983, he served as Corporate Counsel. From June 1978 to May 1981, he served as Division Counsel. From November 1973 to June 1978, he served as Staff Counsel.

ALEX VAICKUS

Executive Vice President and President,

Global Licensing

Age 43

Mr. Vaickus was appointed to his present position in November 2002. From August 2000 to November 2002, Mr. Vaickus served as Senior Vice President and President of the Licensing Group. Mr. Vaickus previously served as Playboy's Senior Vice President of Strategy, Planning and Operations and was responsible for managing the strategic planning process and all corporate-level business development activities, including the evaluation of acquisitions and new business opportunities. Prior to joining Playboy in 1998, Mr. Vaickus was Vice President of Business Development with ConAgra Refrigerated Prepared Foods and Vice President of Business Planning and Finance for Sara Lee/DE, a division of Sara Lee Corporation. He spent 12 years at Sara Lee, where he held various positions, including Executive Director of U.S. Foods and Director of Business Planning.

9

DAVID F. ZUCKER

President and Chief Operating Officer

Age 40

Mr. Zucker joined Playboy as President and Chief Operating Officer in 2002. From September 2000 to May 2002, Mr. Zucker served as Managing Director of Walker Digital LLC, an integrated business solution invention and development company, where he was responsible for gaming and e-commerce activities, and President and Chief Executive Officer of Skillgames LLC, an online games company, where he was responsible for the overall management of the corporation. From February 1999 to August 2000, he served as President and Chief Executive Officer of DIVA Systems Corporation, a provider of video on demand products and services to cable television operators, and was responsible for the overall management of the corporation. Mr. Zucker was employed by the Walt Disney Company from June 1988 to January 1999. During his tenure with Walt Disney, Mr. Zucker was initially assigned to Fairchild Publication's Travel Agent Magazine, of which he was appointed to serve as Executive Publisher, and later served as Manager of current series for ABC Entertainment before moving on to Walt Disney's ESPN network. At ESPN, Mr. Zucker started as Director of programming for Eurosport based in London, where he was responsible for programming for Eurosport, before becoming Vice President of programming for ESPN's domestic U.S. networks, where he was responsible for programming for ESPN. Rising to Executive Vice President of ESPN, he also served as Managing Director of ESPN International, where he was responsible for overseeing ESPN's international operations, before joining DIVA Systems in 1999.

10

Playboy Stock Ownership by Certain Beneficial Owners

The following table provides information about the only person who we believe, based on a review of filings with the Securities and Exchange Commission, as of February 28, 2003, beneficially owns more than 5% of our outstanding Class A common stock. Our Class A common stock is the only class of our common stock entitled to vote at the Annual Meeting.

| Name and Address | Number of Shares of Class A Common Stock | Percent of Class | ||

|---|---|---|---|---|

| Hugh M. Hefner, Trustee(1) The Hugh M. Hefner 1991 Trust 2706 Media Center Drive, Los Angeles, California 90065 | 3,381,836 | 69.53% |

- (1)

- Mr. Hefner, founder of Playboy and Editor-in-Chief, owns these shares through The Hugh M. Hefner 1991 Trust. Mr. Hefner has sole investment and voting power over these shares. Mr. Hefner has indicated his intent to vote his shares on the matters specified in this proxy statement in accordance with the recommendations made in this proxy statement by the Board of Directors. As a result, these matters will be approved.

Playboy Stock Ownership by Directors and Executive Officers

The following table shows, as of February 28, 2003, the amount of common stock beneficially owned by each of our directors and by each executive officer named in the Summary Compensation table on page 16 of this proxy statement, and by all directors and executive officers as a group. In general, "beneficial ownership" includes those shares over which a director or executive officer has the power to vote, or the power to transfer, and stock options that are currently exercisable or will become exercisable within 60 days of February 28, 2003. Except as otherwise noted, the persons named in the table below have sole voting and investment power with respect to all shares shown as beneficially owned by them.

| Name(1) | Shares of Class A Common Stock | Percent of Class A Common Stock | Shares of Class B Common Stock | Percent of Class B Common Stock | ||||

|---|---|---|---|---|---|---|---|---|

| Dennis S. Bookshester(2) | 3,000 | * | 36,563 | * | ||||

| David I. Chemerow(2) | 800 | * | 55,398 | * | ||||

| Donald G. Drapkin(2) | — | * | 27,500 | * | ||||

| James L. English(2) | — | * | 79,862 | * | ||||

| Linda G. Havard(2) | — | * | 184,709 | * | ||||

| Christie Hefner(2) | 72,274 | 1.49 | 1,126,275 | 5.07 | ||||

| Hugh M. Hefner(3) | 3,381,836 | 69.53 | 6,192,486 | 28.90 | ||||

| Jerome H. Kern | — | * | 5,964 | * | ||||

| Sol Rosenthal(2) | 252 | * | 37,827 | * | ||||

| Richard S. Rosenzweig(2) | 365 | * | 159,114 | * | ||||

| Sir Brian Wolfson(2)(4) | 2,500 | * | 26,649 | * | ||||

| All Directors and Executive Officers as a group (16 persons)(2)(3) | 3,461,042 | 71.15 | 8,287,847 | 36.24 |

- *

- Less than 1% of the total shares outstanding.

11

- (1)

- In each case, beneficial ownership consists of sole voting and investment power, with the exception of Mr. Rosenthal, who owns two shares of Class A common stock and six shares of Class B common stock as custodian for his son. Mr. Rosenthal disclaims beneficial ownership of these shares. As of February 28, 2003, all directors and executive officers as a group shared voting and investment power over two shares of Class A common stock and six shares of Class B common stock.

- (2)

- Includes the following shares of our Class B common stock that are subject to installments of stock option grants made under the Playboy Enterprises, Inc. 1989 Stock Option Plan, as amended, which we call the 1989 Stock Option Plan, the Amended and Restated Playboy Enterprises, Inc. 1995 Stock Incentive Plan, which we call the 1995 Stock Incentive Plan, the 1991 Directors' Stock Option Plan and the 1997 Equity Plan, which were either exercisable on February 28, 2003, or are exercisable within 60 days of February 28, 2003.

| Name | Class B Common Stock | |

|---|---|---|

| Dennis S. Bookshester | 17,500 | |

| David I. Chemerow | 17,500 | |

| Donald G. Drapkin | 22,500 | |

| James L. English | 60,500 | |

| Linda G. Havard | 155,000 | |

| Christie Hefner | 799,386 | |

| Sol Rosenthal | 17,500 | |

| Richard S. Rosenzweig | 100,000 | |

| Sir Brian Wolfson | 17,500 | |

| All Directors and Executive Officers as a group (16 persons) | 1,445,886 |

- (3)

- Excludes shares of Class B common stock that may be issued to Mr. Hefner in connection with the Hefner debt restructuring, which is described in the section of this proxy statement titled "Transactions with Management." Also excludes shares of Class B common stock into which shares of Playboy preferred stock to be issued to Mr. Hefner in connection with the Hefner debt restructuring may be converted.

- (4)

- Sir Brian Wolfson will not stand for re-election to the Board of Directors at the Annual Meeting.

12

Report of the Committee on Executive Compensation

This report by the compensation committee and the Performance Graph on page 19 shall not be deemed to be incorporated by reference by any general statement that incorporates by reference these proxy materials into any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, and they shall not otherwise be deemed filed thereunder.

Playboy's executive compensation programs are administered by the compensation committee of the Board of Directors. Messrs. Rosenthal (who is the Chairman), Bookshester and Drapkin served as members of the compensation committee during 2002. None of these three directors has ever served as an officer of Playboy.

Playboy's executive compensation programs are designed to help Playboy achieve its business objectives by:

- •

- setting levels of compensation designed to attract and retain superior executives in a highly competitive environment;

- •

- providing incentive compensation that varies directly with both Playboy's financial performance and the individual executive's contribution to that performance; and

- •

- linking compensation to elements that affect both short-term and long-term share performance.

Therefore, the compensation committee's primary mission is to structure and administer a range of compensation programs designed to enable Playboy to attract and retain executive talent in a marketplace that is both highly competitive and well-known for its individually tailored compensation packages. To help it fulfill this mission, the compensation committee periodically evaluates the competitiveness of Playboy's executive compensation programs, using information drawn from a variety of sources such as published survey data, information supplied by consultants and its own experience in recruiting and retaining executives. A list of the criteria the compensation committee considers when it establishes compensation programs and the factors it considers when it determines an executive's compensation is supplied in this report.

Base Salary

The compensation committee sets the base salaries and salary ranges for executives based primarily on competitive market data and the executive's level of responsibility. The committee uses outside executive compensation consultants to periodically review these salaries and salary ranges. The committee reviews salary ranges once a year, and adjusts them as necessary, considering a number of factors including Playboy's financial performance. The committee also reviews executives' salaries once a year, and bases any adjustments on each executive's individual performance, while also considering his or her total compensation package and external market data. While some of the companies in the peer group chosen for comparison of stockholder returns in the Performance Graph on page 19 may be included in the surveys and information the compensation committee considers in setting executives' salaries, there is no set peer group against which those salaries are measured. Instead, the committee reviews broad-based industry salary data, which typically exclude financial services and not-for-profit companies, and industry-specific data relative to a particular position when they are available. For 2002, the committee continued its practice of restraining base salaries and salary grade ranges. This is consistent with the committee's current philosophy of focusing less on fixed compensation and more on variable performance-based compensation in the form of short-term and long-term incentives.

13

Short-Term Incentives

Playboy executives are eligible for annual bonuses under Playboy's Executive Incentive Compensation Program. For 2002, participants in this program could earn an annual bonus with a value ranging from 25% to 100% of their base salaries. We calculated the total bonus amount each executive earned based on Playboy's adjusted earnings before interest, taxes, depreciation and amortization, or EBITDA, as well as group and/or individual segment profitability objective goals. For each portion of the bonus, there is a range of bonus amounts paid based on the level of achievement with respect to that portion, with a minimum threshold level of performance required before earning each portion of the bonus. For 2002, the compensation committee determined that Ms. Hefner, Mr. Hefner, Ms. Havard and Mr. Rosenzweig should receive payouts under the Executive Incentive Compensation Program.

Long-Term Incentives

Playboy provides long-term incentive awards through its 1995 Stock Incentive Plan, which the compensation committee administers for Playboy. Subject to the terms of that plan, the compensation committee determines the "key employees" to whom options and other awards may be granted, the number of shares of our Class B common stock covered by each option or other stock award, the time or times at which the options may be exercised, the vesting of awards and other administrative functions. Since the inception of the 1995 Stock Incentive Plan, the compensation committee has granted incentive stock options, non-qualified stock options, restricted stock awards and performance awards. These grants are designed to further the growth, development and financial success of Playboy by providing key employees with strong additional incentives to maximize long-term stockholder value. The committee believes that this objective can be best achieved through assisting key employees to become owners of Playboy stock, which aligns their interests with Playboy's interests. As stockholders, key employees will benefit directly from Playboy's growth, development and financial success. Stock option grants and restricted stock awards also enable Playboy to attract and retain the services of those executives whom we consider essential to Playboy's long-range success by providing these executives with a competitive compensation package and an opportunity to become owners of Playboy stock.

Chairman and Chief Executive Officer Compensation

Ms. Hefner's annual salary for 2002 was $600,000. In determining Ms. Hefner's salary, the compensation committee considered a number of factors, including Playboy's overall financial and operational performance over the last few fiscal years. The compensation committee also reviewed competitive market data and, consistent with its general approach to salaries, attempted to place Ms. Hefner's salary slightly above the median of the data reported in relevant compensation surveys and other information it considered.

The compensation committee calculated Ms. Hefner's bonus payout of $60,000 according to the terms of Playboy's Executive Incentive Compensation Program. Ms. Hefner's maximum bonus opportunity was 100% of her base salary. Her bonus was based on achievement of the group profitability targets described above for 2002, and since Playboy achieved only a portion of these targets, only a portion of the maximum bonus was paid to her.

Deductibility of Compensation

In 1993, changes were made to the federal corporate income tax law that limit Playboy's ability to deduct compensation in excess of $1 million paid annually to Playboy's five most highly compensated executive officers. There are exemptions from this limit, including both compensation that is based on the attainment of performance goals established by the compensation committee and approved by the

14

stockholders and forms of current compensation that were established under a binding contract predating the 1993 changes to the tax code. The committee's policy is to seek to qualify all executive compensation for deductibility to the extent that this policy is consistent with Playboy's overall objectives in attracting, motivating and retaining its executives. The compensation committee believes that grants of stock options and grants of restricted stock made to executive officers under the 1995 Stock Incentive Plan qualify as stockholder-approved performance-based compensation and will therefore be fully deductible when an option is exercised or restricted stock vests. However, grants of restricted stock made under the 1995 Stock Incentive Plan prior to fiscal year 1997 do not qualify as stockholder-approved performance-based compensation and will therefore not be fully deductible to the extent that the value of such grants to any executive, when added to other non-exempt compensation paid to that executive, exceeds the $1 million limit in any tax year. The compensation committee believes that, based upon current compensation levels, all compensation paid in 2002 should be fully deductible.

Submitted by the compensation committee:

Sol Rosenthal, Chairman

Dennis S. Bookshester

Donald G. Drapkin

15

Executive Compensation

The following tables set forth information regarding the compensation earned by Ms. Hefner, who served as Playboy's Chairman of the Board and Chief Executive Officer throughout 2002, and the four next highest compensated executive officers of Playboy for 2002. We refer to these individuals collectively as our Named Executives. The Summary Compensation table details the salary and bonus earned by and the stock options and restricted stock awards granted to each Named Executive during each of the last three fiscal years. The Option Grants in Last Fiscal Year table explains in more detail the terms and hypothetical values of stock options granted during 2002 to the Named Executives. Finally, the Aggregated Option Exercises in Last Fiscal Year and FY-End Option Values table reflects certain information regarding vested and unvested stock options held by the Named Executives as of December 31, 2002, and the value of those options as of that date.

| | | | | Long Term Compensation | | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | | | Class B Common Stock | | |||||||

| | | Annual Compensation | | |||||||||

| Name and Principal Position | | Restricted Stock Awards ($)(1) | Securities Underlying Options (#) | All Other Compensation ($)(2) | ||||||||

| Year | Salary ($) | Bonus ($) | ||||||||||

| Christie Hefner Chairman of the Board and Chief Executive Officer | 2002 2001 2000 | 600,000 600,000 550,000 | 60,000 347,254 96,607 | — — — | 150,000 — — | (3) | 35,688 9,672 9,917 | |||||

James L. English Executive Vice President and President, Entertainment Group | 2002 2001 2000 | 600,000 575,001 508,269 | — 585,870 — | — — — | 20,000 15,000 10,000 | (4) (5) (6) | 9,534 9,672 9,917 | |||||

Hugh M. Hefner Editor-in-Chief | 2002 2001 2000 | 750,000 750,000 750,000 | 30,000 173,627 52,695 | — — — | — — — | 9,534 9,672 9,917 | ||||||

Linda G. Havard Executive Vice President, Finance and Operations and Chief Financial Officer | 2002 2001 2000 | 475,000 475,000 400,015 | 38,000 217,043 49,183 | — — — | 30,000 20,000 30,000 | (4) (5) (7) | 26,755 22,068 19,684 | |||||

Richard S. Rosenzweig Executive Vice President | 2002 2001 2000 | 400,000 363,654 320,000 | 56,000 187,254 39,345 | — — — | — 70,000 15,000 | (8) (6) | 9,534 7,547 7,792 | |||||

- (1)

- As of December 31, 2002, Ms. Hefner held 37,500 shares of restricted Class B common stock, which were valued at $379,875. The restrictions on these stock awards lapse in increments of 50% of the shares at the end of any fiscal year during which specified operating income objectives pertaining to such fiscal year are met. As of December 31, 2002, Mr. English held 9,374 shares of restricted Class B common stock, which were valued at $94,959. The restrictions on these stock awards lapse in increments of 50% of the shares at the end of any fiscal year during which specified operating income objectives pertaining to such fiscal year are met. As of December 31, 2002, Ms. Havard held 20,000 shares of restricted Class B common stock, which were valued at $202,600. The restrictions on these stock awards lapse in increments of 38% and 62% of the shares at the end of any fiscal year during which specified operating income objectives pertaining to such fiscal year are met. As of December 31, 2002, Mr. Rosenzweig held 10,000 shares of restricted Class B common stock, which were valued at $101,300. The restrictions on these stock awards lapse in increments of 50% of the shares at the end of any fiscal year during which specified operating income objectives pertaining to such fiscal year are met.

16

Playboy met the operating income objectives in 2002 and all of the restricted stock outstanding at December 31, 2002 vested in February 2003. Mr. Hefner holds no shares of restricted Class B common stock. Dividends were not paid on restricted Class B common stock.

- (2)

- The amounts disclosed include:

- (a)

- Playboy profit-sharing contributions of $2,534 on behalf of Ms. Hefner, Mr. English, Mr. Hefner, Ms. Havard and Mr. Rosenzweig in 2002 under Playboy's Employees Investment Savings Plan.

- (b)

- Playboy 401(k) matching contributions of $7,000 on behalf of Ms. Hefner, Mr. English, Mr. Hefner, Ms. Havard and Mr. Rosenzweig in 2002 under Playboy's Employees Investment Savings Plan.

- (c)

- Playboy deferred compensation matching contributions of $26,154 on behalf of Ms. Hefner and $17,221 on behalf of Ms. Havard in 2002 under Playboy's DCP.

- (3)

- Represents a non-qualified stock option granted in 2002 under the 1995 Stock Incentive Plan. The option has an exercise price of $15.700 (100% of the fair market value on the business day immediately preceding the date of the grant) and an expiration date of February 12, 2012. One-third of these options became exercisable on February 12, 2003; another one-third of these options will become exercisable on February 12, 2004 and the remaining one-third of these options will become exercisable on February 12, 2005.

- (4)

- Represents a non-qualified stock option granted in 2002 under the 1995 Stock Incentive Plan. The option has an exercise price of $15.850 (100% of the fair market value on the business day immediately preceding the date of the grant) and an expiration date of January 22, 2012. Half of these options became exercisable on January 22, 2003 and the remaining half of these options will become exercisable on January 22, 2004.

- (5)

- Represents a non-qualified stock option granted in 2001 under the 1995 Stock Incentive Plan. The option has an exercise price of $11.375 (100% of the fair market value on the business day immediately preceding the date of the grant) and an expiration date of January 26, 2011. As of January 26, 2003, all of these options were exercisable.

- (6)

- Represents a non-qualified stock option granted in 2000 under the 1995 Stock Incentive Plan. The option has an exercise price of $24.125 (100% of the fair market value on the business day immediately preceding the date of the grant) and an expiration date of January 4, 2010. As of January 4, 2002, all of these options were exercisable.

- (7)

- Represents two non-qualified stock options granted in 2000 under the 1995 Stock Incentive Plan. The first option has an exercise price of $24.125 (100% of the fair market value on the business day immediately preceding the date of the grant) and an expiration date of January 4, 2010. As of January 4, 2002, all of these options were exercisable. The second option has an exercise price of $12.125 (100% of the fair market value on the business day immediately preceding the date of the grant) and an expiration date of June 19, 2010. As of June 19, 2002, all of these options were exercisable.

- (8)

- Represents two non-qualified stock options granted in 2001 under the 1995 Stock Incentive Plan. The first option has an exercise price of $11.375 (100% of the fair market value on the business day immediately preceding the date of the grant) and an expiration date of January 26, 2011. As of January 26, 2003, all of these options were exercisable. The second option has an exercise price of $13.24 (100% of the fair market value on the business day immediately preceding the date of the grant) and an expiration date of February 26, 2011. Two-thirds of these options were exercisable as of February 26, 2003 and the remaining one-third of these options will become exercisable on February 26, 2004.

17

Option Grants in Last Fiscal Year

| | | | | | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term ($)(1) | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | Individual Grants | |||||||||||

| | Number of Securities Underlying Options Granted (#) | Percent of Total Options Granted to Employees in Fiscal Year (%) | | | ||||||||

| Name | Exercise Price ($) | Expiration Date | ||||||||||

| 5% | 10% | |||||||||||

| Christie Hefner | 150,000 | 19.45 | 15.70 | 2/12/12 | 1,483,650 | 3,744,450 | ||||||

| James L. English | 20,000 | 2.59 | 15.85 | 1/22/12 | 199,710 | 504,030 | ||||||

| Hugh M. Hefner | — | — | — | — | — | — | ||||||

| Linda G. Havard | 30,000 | 3.89 | 15.85 | 1/22/12 | 299,565 | 756,045 | ||||||

| Richard S. Rosenzweig | — | — | — | — | — | — | ||||||

- (1)

- The values shown are based on the assumed hypothetical compound annual appreciation rates of 5% and 10% prescribed by Securities and Exchange Commission rules. These hypothetical rates are not intended to forecast either the future appreciation, if any, of the price of Class B common stock or the values, if any, that may actually be realized upon such appreciation, and there can be no assurance that the hypothetical rates will be achieved. The actual value realized upon exercise of an option will be measured by the difference between the price of the Class B common stock and the exercise price on the date the option is exercised.

| | Number of Securities Underlying Unexercised Options at Fiscal Year-End (#)(1) | Value of Unexercised In-the-Money Options at Fiscal Year-End ($)(2) | ||||||

|---|---|---|---|---|---|---|---|---|

| | Exercisable | Unexercisable | Exercisable | Unexercisable | ||||

| Name | Class B common stock | Class B common stock | Class B common stock | Class B common stock | ||||

| Christie Hefner | 629,386 | 270,000 | 23,530 | — | ||||

| James L. English | 43,000 | 27,500 | 10,340 | — | ||||

| Hugh M. Hefner | — | — | — | — | ||||

| Linda G. Havard | 130,000 | 40,000 | — | — | ||||

| Richard S. Rosenzweig | 75,000 | 45,000 | 15,100 | — | ||||

- (1)

- Represents the number of shares of Class B common stock underlying options held by each person set forth below. As of December 31, 2002, there were no options on shares of Class A common stock outstanding.

- (2)

- Calculated based on the closing price of Playboy Class B common stock on December 31, 2002 (the last business day of the fiscal year) of $10.13, less the option exercise price, multiplied by the number of shares. An option is in-the-money if the market value of the common stock subject to the option is greater than the exercise price.

18

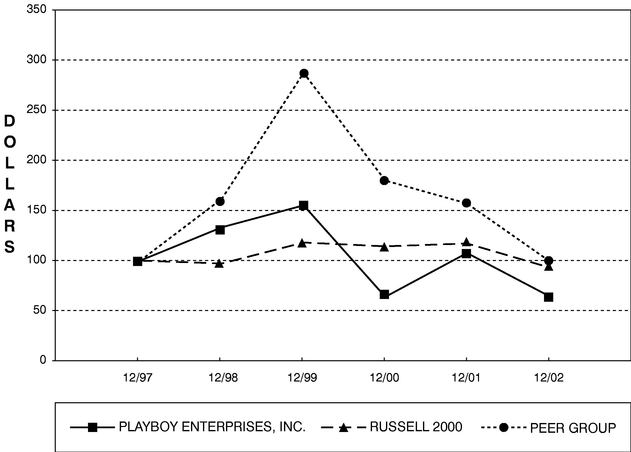

The following graph compares the yearly percentage change in total stockholder return on our Class B common stock with the cumulative total return of the Russell 2000 Stock Index and with our peer group, which is comprised of AOL Time Warner Inc., Meredith Corporation, Metro-Goldwyn-Mayer Inc., Playboy Enterprises, Inc., Primedia, Inc., The Walt Disney Company, World Wrestling Entertainment, Inc. and Viacom Inc.

COMPARISON OF FIVE-YEAR CUMULATIVE TOTAL RETURN*

AMONG PLAYBOY ENTERPRISES, INC., THE RUSSELL 2000 INDEX AND PEER GROUP

- *

- $100 invested on 12/31/96 in stock or index—including reinvestment of dividends. Fiscal year ending December 31.

19

Change In Control Agreements, Employment Agreements and Incentive Compensation Plans

To help us retain our most senior executive officers, the Board of Directors has approved Playboy entering into agreements with certain officers that provide for the payment of specified benefits if their employment terminates after a "change in control" of Playboy. Ms. Hefner, Mr. English, Ms. Havard and Mr. Rosenzweig were beneficiaries of this program in 2002. Each agreement provides that:

- •

- payments become due and benefits are provided if, within 18 months after a change in control, the officer is involuntarily terminated for reasons other than death, disability or "cause," or voluntarily terminates his or her employment for a limited number of permitted reasons described in the agreement;

- •

- a lump-sum cash payment will be made within ten days following termination, equal to three times the sum of the officer's annual base salary in effect immediately prior to the occurrence of the change in control and the average bonus earned by the officer for the three fiscal years prior to the year in which the change in control occurs;

- •

- the amount of the lump-sum cash payment would be grossed-up to compensate the executive for the imposition of any "golden parachute" excise tax imposed thereon;

- •

- the officer will receive a pro-rata bonus payment based on the higher of (a) the target bonus for the year in which termination of employment occurs or (b) the highest bonus paid to the officer during the three-year period preceding the year in which such termination occurs; any restricted stock held by the officer will become fully vested and free from restrictions;

- •

- the officer will be allowed to continue his or her participation in then existing welfare benefit plans, such as medical insurance, for up to three years from the effective date of termination; and

- •

- the agreement will have an initial five-year term, automatically extended on each anniversary of its execution unless Playboy or the officer gives notice that it or the officer does not wish to extend the agreement.

These change-in-control agreements provide that a "change in control" takes place whenever any of the following events occur:

- •

- we liquidate or dissolve;

- •

- we sell, exchange or otherwise dispose ofPlayboy magazine;

- •

- any occurrence by which Mr. Hefner and Ms. Hefner cease, collectively, to hold, directly or indirectly, at least 50% of the stock entitled to vote generally in the election of our directors;

- •

- we merge, consolidate or reorganize, or sell all or substantially all of our assets, unless we initiate the transaction and, as a result of the transaction, persons who held not less than a majority of the combined voting power of our outstanding voting stock immediately prior to the transaction hold not less than a majority of the combined voting power of the securities of the surviving or transferee corporation;

- •

- an equity or other investment in Playboy, the result of which is that Ms. Hefner ceases to serve as our Chief Executive Officer, or relinquishes upon request or is divested of any of the following responsibilities:

- (i)

- functioning as the person primarily responsible for establishing policy and direction for Playboy; or

- (ii)

- being the person to whom the executive reports; or

- •

- the adoption by the Board of Directors of a resolution that a change in control has occurred.

20

Under the agreements, "cause" is defined as conviction of a crime involving dishonesty, fraud or breach of trust, or willful engagement in conduct materially injurious to Playboy.

Effective November 8, 2000, Playboy appointed Mr. English as Executive Vice President and President, Entertainment Group, and entered into an employment contract with Mr. English, under which he will receive annual base salaries of $575,000 in 2000 and 2001, $600,000 in 2002 and $625,000 in 2003. Mr. English is entitled to participate in Board-approved incentive plans at a maximum level of 100% of the base salary he earns. Mr. English is also entitled to participate in the 1995 Stock Incentive Plan. In 2002, he was granted a non-qualified stock option under the 1995 Stock Incentive Plan. The option is exercisable for 20,000 shares of our Class B common stock, at an exercise price equal to 100% of the fair market value on the business day immediately preceding the date of the grant, and vests in equal annual increments over a two-year period from that date. Mr. English's participation in the 1995 Stock Incentive Plan also entitles him to 9,374 shares of our Class B common stock when we achieve specified operating income objectives. Under the agreement, in the event that Mr. English is terminated at any time not "for cause," in the event that Playboy fails to offer to renew his employment contract on comparable terms between four and six months prior to its expiration or in the event that his base salary is reduced or his responsibilities are materially diminished, Mr. English will be entitled to receive severance pay in the form of a lump-sum payment equal to his annual base salary at the time of termination, reduced by the amount of any payment he receives under his change in control agreement described above.

Effective May 16, 1997, Playboy hired Ms. Havard as Executive Vice President, Finance and Operations, and Chief Financial Officer, and entered into an employment contract with Ms. Havard. She received an annual base salary of $475,000 in 2002 and is entitled to participate in Board-approved incentive plans at a maximum level of 80% of the base salary she earns. Ms. Havard is also entitled to participate in the 1995 Stock Incentive Plan. In 2002, she was granted a non-qualified stock option under the 1995 Stock Incentive Plan. The option is exercisable for an aggregate of 30,000 shares of our Class B common stock, at an exercise price equal to 100% of the fair market value on the business day immediately preceding the date of the grant, and each option vests in equal annual increments over a two-year period from that date. Ms. Havard's participation in the 1995 Stock Incentive Plan also entitles her to 20,000 shares of our Class B common stock when we achieve specified operating income objectives. Ms. Havard is entitled to receive severance pay as described above.

Transactions with Management

Playboy owns a 29-room mansion, commonly known as the "Playboy Mansion," located on five and one-half acres in Holmby Hills, California. The Playboy Mansion is used for various corporate activities, including serving as a valuable location for video production, magazine photography, online events, business meetings, enhancing Playboy's image, charitable functions and a wide variety of other promotional and marketing activities. The Playboy Mansion generates substantial publicity and recognition which increase public awareness of Playboy and Playboy's products and services. Facilities at the Playboy Mansion include a tennis court, swimming pool, gymnasium and other recreational facilities as well as extensive film, video, sound and security systems. The Playboy Mansion also includes accommodations for guests and serves as an office and residence for Hugh M. Hefner, our founder and Editor-in-Chief. The Playboy Mansion has a full-time staff which performs maintenance, serves in various capacities at the functions held at the Playboy Mansion and provides guests of Playboy and Mr. Hefner with meals, beverages and other services.

Under a 1979 lease Playboy entered into with Mr. Hefner, the annual rent Mr. Hefner pays to us for his use of the Playboy Mansion is determined by independent experts who appraise the value of Mr. Hefner's basic accommodations and access to the Playboy Mansion's facilities, utilities and attendant services based on comparable hotel accommodations. In addition, Mr. Hefner is required to pay the sum of the per-unit value of non-business meals, beverages and other benefits he and his personal guests receive.

21

These standard food and beverage per-unit values are determined by independent expert appraisals based on fair market values. Valuations for both basic accommodations and standard food and beverage units are reappraised every three years, and between appraisals are annually adjusted based on appropriate consumer price indexes. Mr. Hefner is also responsible for the cost of all improvements in any Hefner residence accommodations, including capital expenditures, that are in excess of normal maintenance for those areas.

Mr. Hefner's usage of Playboy Mansion services and benefits is recorded through a system initially developed by the auditing and consulting firm of PricewaterhouseCoopers LLP and now administered by Playboy, with appropriate modifications approved by the audit and compensation committees of the Board. The lease had an initial two-year term which expired on June 30, 1981, but on its terms continues for ensuing 12-month periods unless either Playboy or Mr. Hefner terminates it. When Playboy changed its fiscal year from a year ending June 30 to a year ending December 31, Mr. Hefner's lease continued for only a six-month period through December 31, 1998 to accommodate this change. On December 31, 1998, the lease renewed automatically and will continue to renew automatically for 12-month periods under the terms as previously described. The rent charged to Mr. Hefner during 2002 included the appraised rent and the appraised per-unit value of other benefits, as described above. Within 120 days after the end of Playboy's fiscal year, the actual charge for all benefits for that year is finally determined. Mr. Hefner pays or receives credit for any difference between the amount finally determined and the amount he paid over the course of the year. The sum of the rent and other benefits payable for 2002 was estimated by us to be $1.1 million, and Mr. Hefner paid that amount during 2002.

Playboy purchased the Playboy Mansion in 1971 for $1.1 million and in the intervening years has made substantial capital improvements at a cost of $13.6 million through 2002 (including $2.5 million to bring the Hefner residence accommodations to a standard similar to the Playboy Mansion's common areas). The Playboy Mansion is included in Playboy's Consolidated Balance Sheet as of December 31, 2002 at a net book value, including all improvements and after accumulated depreciation, of $1.9 million. Playboy incurs all operating expenses of the Playboy Mansion, including depreciation and taxes, which were $3.6 million in 2002, net of rent received from Mr. Hefner.

From time to time, Playboy enters into barter transactions in which Playboy secures air transportation for Mr. Hefner in exchange for advertising pages inPlayboy magazine. Mr. Hefner reimburses Playboy for Playboy's direct costs of providing these ad pages. Playboy receives significant promotional benefit from these transactions.

As previously announced, on March 11, 2003, Playboy completed the private offering of $115 million in aggregate principal amount of senior secured notes by PEI Holdings, Inc., a wholly-owned subsidiary of Playboy, which we call Holdings. As a condition to the sale of these notes, Playboy was required by the purchasers of the notes to restructure the outstanding indebtedness of Playboy.com owed to Mr. Hefner by converting such debt into equity of Playboy, which we call the Hefner debt restructuring.

The Board of Directors appointed a special committee of independent directors to evaluate, negotiate and determine the terms of the Hefner debt restructuring on behalf of Playboy. The special committee approved the Hefner debt restructuring on the terms described below and recommended to the full Board of Directors that it approve the Hefner debt restructuring on those terms, which it did. In connection with their respective approvals of the Hefner debt restructuring, the special committee and the Board of Directors received an opinion from an independent financial advisor of national standing retained by the special committee to the effect that the Hefner debt restructuring was fair to Playboy from a financial point of view.

22

At the time of the Hefner debt restructuring, Playboy.com had an aggregate of approximately $27.235 million of outstanding indebtedness to Mr. Hefner in the form of three promissory notes. Upon closing of the note offering, Playboy.com's debt to Mr. Hefner was restructured as follows:

- •

- a $10 million promissory note payable by Playboy.com to Mr. Hefner was extinguished in exchange for 1,000 shares of Series A preferred stock of Holdings with a stated value of $10,000 per share, which we call the Holdings Series A preferred stock. The Holdings Series A preferred stock is to be subsequently mandatorily exchanged for shares of Playboy's Class B common stock; and

- •

- the two other promissory notes payable by Playboy.com to Mr. Hefner, in a combined principal amount of approximately $17.235 million, were extinguished in exchange for $0.5 million in cash and 1,674 shares of Series B preferred stock of Holdings with a stated value of $10,000 per share, which we call the Holdings Series B preferred stock. The Holdings Series B preferred stock is to be subsequently mandatorily exchanged for shares of a new series of preferred stock of Playboy, which we call the Playboy preferred stock.

In order to issue the Playboy preferred stock, the certificate of incorporation of Playboy must be amended to authorize the issuance. We refer to such amendment as the charter amendment. In accordance with the certificate of incorporation of Playboy, Mr. Hefner, the holder of more than a majority of the outstanding Class A voting common stock, has approved the charter amendment by written consent. Under federal securities laws, Mr. Hefner's consent, and therefore the charter amendment, cannot become effective prior to the 20th calendar day following the mailing to stockholders of Playboy of an information statement that complies with applicable Securities and Exchange Commission rules. The Holdings Series A preferred stock will be mandatorily exchanged for Class B common stock of Playboy and the Holdings Series B preferred stock will be mandatorily exchanged for Playboy preferred stock upon the effectiveness of the charter amendment.

Holdings will be required to redeem the Holdings Series A preferred stock in September 2010, unless exchanged earlier for Class B common stock of Playboy as provided by the terms of the Holdings Series A preferred stock, and the Holdings Series A preferred stock will pay an annual dividend of 8%, payable semi-annually. The dividend will be payable in cash, provided that if the exchange of the Holdings Series A preferred stock for shares of Class B common stock of Playboy has not occurred prior to the 90th day following the original issuance of the Holdings Series A preferred stock, dividends accruing after that date will be paid through the issuance of additional shares of Holdings Series A preferred stock. The number of shares of Class B common stock issued in the exchange would be determined by dividing (a) the sum of the aggregate stated value of the then outstanding shares of Holdings Series A preferred stock and the amount of accrued and unpaid dividends by (b) the weighted average closing price of the Class B common stock during the 90-day period prior to the date of the charter amendment.

Holdings will be required to redeem the Holdings Series B preferred stock in September 2010, unless exchanged earlier for Playboy preferred stock as provided by the terms of the Holdings Series B preferred stock, and such stock will pay an annual cash dividend of 8%, payable semi-annually. Each share of Holdings Series B preferred stock will be exchanged for one share of Playboy preferred stock plus an amount equal to any accrued but unpaid dividends. The Playboy preferred stock to be issued in exchange for the Holdings Series B preferred stock would have the same terms as the Holdings Series B preferred stock, except that it would be convertible at the option of the holder into shares of Class B common stock of Playboy at a price, which we refer to as the conversion price, equal to 125% of the weighted average closing price of Playboy's Class B common stock over the 90-day period prior to the exchange of Holdings Series B preferred stock for Playboy preferred stock. After the date that is three years after the date the Playboy preferred stock is issued, if at any time the weighted average closing price of Playboy's Class B common stock for 15 consecutive trading days equals or exceeds 150% of the conversion price, Playboy would have the option, by delivering a written notice to holders of shares of Playboy preferred stock

23

provided within five business days after the end of such 15 day period, to convert any or all shares of Playboy preferred stock into the number of shares of Class B common stock determined by dividing (a) the sum of the aggregate stated value of such Playboy preferred stock and the amount of accrued and unpaid dividends by (b) the conversion price.

Certain Business Relationships

The law firm of Arnold & Porter provided legal services to Playboy during 2002. Mr. Rosenthal is Of Counsel to the Los Angeles office of Arnold & Porter. During 2002, Playboy paid Arnold & Porter fees for its services in an amount of less than $100,000.

Compensation Committee Interlocks and Insider Participation

The members of the compensation committee during 2002 were Messrs. Rosenthal, Bookshester and Drapkin, none of whom has served at any time as an officer or employee of Playboy or our subsidiaries.

The audit committee of the Board of Directors is currently made up of Messrs. Bookshester (who is the Chairman), Chemerow and Kern and Sir Brian Wolfson. Mr. Kern joined the Board of Directors on September 18, 2002 and was appointed to the audit committee. Sir Wolfson has informed the Board of Directors that he will not stand for re-election and, consequently, will step down from the audit committee upon the election of directors at the Annual Meeting. During 2002, the audit committee amended and restated its audit committee charter. The complete text of our new charter, which reflects the new standards set forth in current Securities and Exchange Commission regulations and the updated New York Stock Exchange listed company rules, is attached to this proxy statement as Exhibit A.

As set forth in more detail in the audit committee charter, the primary responsibilities of Playboy's audit committee fall into three broad categories:

- •

- to serve as an independent and objective party to monitor Playboy's financial reporting process and internal control system;

- •

- to review and appraise the audit efforts of Playboy's independent accountants and internal auditing department; and

- •

- to provide an open avenue of communication among the independent accountants, financial and senior management, the internal auditing department, and the Board of Directors.

The audit committee has implemented procedures to ensure that during the course of each fiscal year it devotes the attention that it deems necessary or appropriate to each of the matters assigned to it under the audit committee's charter. To carry out its responsibilities, the audit committee met five times during 2002.

In overseeing the preparation of Playboy's financial statements, the audit committee met with both management and Playboy's outside auditors to review and discuss all financial statements prior to their issuance and to discuss significant accounting issues. Management advised the audit committee that all financial statements were prepared in accordance with generally accepted accounting principles, and the audit committee discussed the statements with both management and the outside auditors. The audit committee's review included discussion with the outside auditors of matters required to be discussed pursuant to Statement on Auditing Standards No. 61 (Communication with Audit Committees).