QuickLinks -- Click here to rapidly navigate through this document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý | ||

Filed by a Party other than the Registranto | ||

Check the appropriate box: | ||

o | Preliminary Proxy Statement | |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

ý | Definitive Proxy Statement | |

o | Definitive Additional Materials | |

o | Soliciting Material Pursuant to §240.14a-12 | |

PLAYBOY ENTERPRISES, INC. | ||||

(Name of Registrant as Specified In Its Charter) | ||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

| Payment of Filing Fee (Check the appropriate box): | ||||

ý | No fee required. | |||

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | |||

(1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

o | Fee paid previously with preliminary materials. | |||

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

(1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

Notice of the 2004 Annual Meeting of Stockholders

May 13, 2004

The Annual Meeting of Stockholders of Playboy Enterprises, Inc. will be held at Spiaggia, located at 980 North Michigan Avenue, Chicago, Illinois 60611, on Thursday, May 13, 2004, at 9:30 a.m., local time, for the following purposes:

- 1.

- to elect eight directors, each for one-year terms;

- 2.

- to consider and vote on a proposal to amend the amended and restated Certificate of Incorporation of Playboy Enterprises, Inc., as amended, to increase the number of authorized shares of our Class B common stock from 30,000,000 to 75,000,000;

- 3.

- to vote on the ratification of the appointment of Ernst & Young LLP as our independent auditors for 2004; and

- 4.

- to transact any other business that properly comes before the meeting.

All holders of record of Playboy Class A common stock at the close of business on March 16, 2004 are entitled to notice of and to vote on all proposals presented at the meeting. All holders of record of Playboy Class B common stock at the close of business on March 16, 2004 are entitled to notice of and to vote as a separate class on the second proposal only, which is the proposal to amend our charter to increase the number of authorized shares of our Class B common stock. An alphabetical list of those stockholders, their addresses and the number of shares owned by each will be on display for all purposes germane to the meeting at Playboy's Chicago office during normal business hours from May 3, 2004 to May 12, 2004. This list will also be on display at the meeting.

WE HOPE THAT YOU WILL BE PRESENT AT THE MEETING. IF YOU CANNOT ATTEND, WE URGE YOU TO VOTE YOUR SHARES BY DATING, SIGNING AND MAILING THE APPROPRIATE PROXY CARD(S) ENCLOSED IN THE ENVELOPE PROVIDED. The envelope requires no postage if it is mailed in the United States. Proxies marked "withheld" or "abstain" will have the same effect as a vote against the proposals above. If your shares are held in "street name," the broker or bank who holds your shares will have the authority to vote your shares with respect to the proposals without your instructions. If your shares are not held in "street name," not returning your proxy card and not attending the meeting and voting will have the same effect as a vote against the charter amendment and will have no effect on the vote with respect to other proposals.

By Order of the Board of Directors | ||

Howard Shapiro Secretary | ||

April 12, 2004 Chicago, Illinois |

PLAYBOY ENTERPRISES, INC.

680 North Lake Shore Drive

Chicago, Illinois 60611

Proxy Statement

Annual Meeting Time, Location and Admission Procedure

The Annual Meeting of Stockholders of Playboy Enterprises, Inc. will be held on Thursday, May 13, 2004, at 9:30 a.m., local time, at Spiaggia, located at 980 North Michigan Avenue, Chicago, Illinois 60611.

All stockholders of record on March 16, 2004, the record date for the Annual Meeting, are invited to attend the Annual Meeting. If you attend, you may be asked to present valid picture identification, such as a driver's license or passport. Cameras, recording devices and other electronic devices will not be permitted at the meeting. Please note that if you hold your shares in "street name" (that is, through a broker or other nominee), you will need to bring a copy of a brokerage statement reflecting your stock ownership as of the record date and check in at the registration desk at the meeting.

Securities Entitled to Be Voted at the Meeting

Shares of our Class A common stock held by stockholders of record on March 16, 2004, the record date for the Annual Meeting, are entitled to vote on all proposals presented at the meeting. Each share of Class A common stock is entitled to one vote. On March 16, 2004, the record date, 4,864,102 shares of Class A common stock were outstanding. Shares of our Class B common stock held by stockholders of record on March 16, 2004 are entitled to vote as a separate class on the proposal to amend our charter to increase the number of authorized shares of Class B common stock only. Holders of our Class B common stock will not be entitled to vote on any other matter at the Annual Meeting. We refer to this amendment in this proxy statement as the charter amendment. On March 16, 2004, 22,647,305 shares of Class B common stock were outstanding.

Information About This Proxy Statement

We sent you these proxy materials because Playboy's Board of Directors is soliciting your proxy to vote your shares of Class A common stock and Class B common stock at the Annual Meeting. This proxy statement summarizes the information you need to vote at the Annual Meeting. On April 12, 2004, we began mailing these proxy materials to all of our holders of record of Class A common stock and Class B common stock, as of the close of business on March 16, 2004.

Information About Voting

Holders of Class A common stock and Class B common stock can vote in person at the Annual Meeting or by proxy. Included with this proxy statement is a proxy card identified by the "CLASS A COMMON STOCK ONLY" legend on the face of the card, which may be used only for voting shares of our Class A common stock and a proxy card identified by the "CLASS B COMMON STOCK ONLY" legend on the face of the card, which may be used only for voting shares of our Class B common stock. If you own both Class A shares and Class B shares, you must use the proxy card identified as "CLASS A COMMON STOCK ONLY" for your Class A shares and the proxy card identified as "CLASS B COMMON STOCK ONLY" for your Class B shares. If you want to vote by proxy, please complete, sign

1

and date the appropriate proxy card(s) and return it or them promptly in the accompanying envelope, which is postage paid if mailed in the United States. If your shares of Class A common stock or Class B common stock are held in the name of a bank, broker or other holder of record, you will receive instructions from that holder of record that you must follow in order for your shares to be voted at the Annual Meeting.

If you plan to attend the meeting and vote in person, we will give you an appropriate ballot for the class of common stock you own when you arrive. If your shares of Class A common stock or Class B common stock are not registered in your own name, and you plan to attend the Annual Meeting and vote your shares in person, you will need to contact the broker or agent in whose name your shares are registered to obtain a broker's proxy card and bring it with you to the Annual Meeting.

If you vote by proxy, the individuals named on each proxy card (your proxies) will vote the applicable shares of our common stock in the manner you indicate. You may specify whether your shares of Class A common stock should be voted for all, some or none of the nominees for director and whether your shares of Class A or Class B common stock should be voted for or against the other proposals that you are entitled to vote on.

If you sign, date and return the proxy card identified as "CLASS A COMMON STOCK ONLY" without indicating your instructions on how to vote your Class A shares, they will be voted as follows:

- •

- FOR the election of the eight nominees for director;

- •

- FOR the charter amendment to increase the number of authorized shares of our Class B common stock from 30,000,000 to 75,000,000.

- •

- FOR the ratification of the appointment of Ernst & Young LLP as our independent auditors for 2004.

If you sign, date and return the proxy card identified as "CLASS B COMMON STOCK ONLY" without indicating your instructions on how to vote your Class B shares, they will be voted as follows:

- •

- FOR the charter amendment to increase the number of authorized shares of our Class B common stock from 30,000,000 to 75,000,000.

If any other matter is presented at the meeting, the holders of your proxy will vote in accordance with his or her best judgment. At the time this proxy statement went to press, we knew of no other matters to be acted upon at the meeting.

Your vote is important. Whether or not you plan to attend the Annual Meeting, we urge you to vote your shares by completing, signing, dating and mailing the appropriate proxy card(s) enclosed in the accompanying envelope. Voting by proxy will not affect your right to attend the meeting and vote your shares in person.

You may revoke or change a proxy at any time before it is exercised by any of the following methods:

- •

- sending a written revocation to Playboy's Secretary, Howard Shapiro (which will only revoke the proxy for the class of shares specified in the revocation);

- •

- signing and delivering a later dated proxy (which will only revoke the proxy for the same class of shares as in the later dated proxy); or

- •

- voting in person at the meeting.

Your most current vote is the one that is counted. If you have completed a proxy for both Class A and Class B shares, and you want to revoke or change one or both proxies, in order to be effective, your written revocation shall specify the proxy or proxies to which it is applicable, you must sign and deliver a later

2

dated proxy for each class of shares for which you have chosen to revoke your proxy or change your vote, or you must complete a ballot at the Annual Meeting for the class of shares for which you have chosen to revoke your proxy or change your vote.

Quorum Requirement

A quorum is necessary to hold a valid Annual Meeting. A majority of the shares of our Class A common stock, present in person or represented by proxy, shall constitute a quorum at the Annual Meeting. With respect to the separate vote by holders of our Class B common stock on the charter amendment, a majority of the outstanding shares of our Class B common stock, present in person or represented by proxy, shall constitute a quorum. Proxies marked "withheld" or "abstain" are counted as present for establishing a quorum.

Information About Votes Necessary for Action to Be Taken

All matters to be considered at the Annual Meeting, except for the charter amendment, require an affirmative vote of the majority of all shares of Class A common stock present in person or by proxy. The charter amendment requires an affirmative vote of a majority of the outstanding shares of Class A common stock and Class B common stock, each voting as a separate class. Proxies marked "withheld" or "abstain" will have the same effect as a vote against the proposals or a vote against any other matter. If your shares are held in "street name," the broker or bank who holds your shares will have the authority to vote your shares with respect to the proposals without your instructions. If your shares are not held in "street name," not returning your proxy card and not attending the meeting and voting will have the same effect as a vote against the charter amendment and will have no effect on the vote with respect to other proposals.

3

PROPOSAL NO. 1

ELECTION OF DIRECTORS

Playboy's directors are elected by the stockholders each year at our Annual Meeting. Our directors are elected to serve one-year terms. Our bylaws allow the Board of Directors to fix the number of directors to be elected at each Annual Meeting at not fewer than five and not more than ten. The Board of Directors currently consists of eight members. The Board of Directors has nominated eight individuals for election at the Annual Meeting. Each of the director nominees presented in this proxy statement is currently a director. If reelected, each director's term will last until the 2005 Annual Meeting or until he or she is succeeded by another qualified director who has been elected.

Your proxy card identified as "CLASS A COMMON STOCK ONLY" will vote for each of the nominees unless you specifically withhold authority to vote for a particular nominee. If a nominee is unavailable for election, the holders of your proxy may vote for another nominee proposed by the Board of Directors, or the Board of Directors may reduce the number of directors to be elected at the Annual Meeting. Your proxy card identified as "CLASS A COMMON STOCK ONLY" may not be voted for more than eight nominees.

THE BOARD UNANIMOUSLY RECOMMENDS THAT YOU VOTE FOR ALL OF THE NOMINEES.

The following information is provided with respect to each nominee for election as a director. The ages of the nominees are as of April 8, 2004.

CHRISTIE HEFNER

Director since 1979

Age 51

Ms. Hefner was appointed to her present position as Chairman of the Board and Chief Executive Officer of Playboy in November 1988. She joined Playboy in 1975 and worked in a variety of the Company's businesses before being named President in 1982. She is also a board member of the Playboy Foundation, the Company's philanthropic arm. In addition, Ms. Hefner is a member of the Board of Directors of MarketWatch.com, Inc., a publicly traded interactive financial media company; Canyon Ranch, a group of health resorts and club spas; Magazine Publishers of America, the industry association for consumer magazines; the Business Committee for the Arts, an organization helping businesses establish alliances with the arts that meet business objectives; and RUSH University Medical Center. Ms. Hefner is also on the Advisory Boards of the American Civil Liberties Union and the Creative Coalition, and is a founding member of The Chicago Network, an organization of professional women from the Chicago metropolitan area who have reached the highest echelons of business, the arts, government, the professions and academia, and The Committee of 200, an international organization of preeminent women business owners and executives. She is also a member of the Chicago Council on Foreign Relations and the National Cable Television Associations Diversity Committee. Ms. Hefner is the daughter of Hugh M. Hefner, Editor-in-Chief.

DENNIS S. BOOKSHESTER

Director since 1990

Age 65

Mr. Bookshester is the Chief Executive Officer for Turtle Wax Inc., a company specializing in auto appearance chemistry. He has been Chairman of the Board of Cutanix Corporation, a company principally engaged in scientific skin research, since November 1997. Concurrently, Mr. Bookshester was the Chief Executive Officer of Fruit of the Loom, Inc. from June 1999 to May 2002. From December 1990 to May 1991, he served as Chief Executive Officer of Zale Corporation, a company principally involved in the

4

retail sale of jewelry. Mr. Bookshester was Corporate Vice Chairman, Chairman and Chief Executive Officer of the Retail Group of Carson Pirie Scott & Co., positions he held from 1984 to 1989. In addition, Mr. Bookshester is the Chairman of the Illinois Racing Board and a member of the board of directors of Northwestern Hospital Foundation. He is on the Visiting Committee of the University of Chicago Graduate School of Business. Mr. Bookshester is a member of the Audit Committee of the Board.

DAVID I. CHEMEROW

Director since 1996

Age 52

Mr. Chemerow is the Chief Operating Officer for TravelCLICK, Inc., the leading provider of solutions that help hotels and other travel industry suppliers maximize profit from electronic distribution channels. Prior to that, he was the Chief Operating Officer of ADcom Information Services, Inc., which provides ratings for viewership of TV programs to cable operators. He served as President and Chief Executive Officer of Soldout.com, Inc. from May 2000 through July 2000 and was President and Chief Operating Officer from September 1999 through April 2000. Soldout.com, Inc. was a premium event and entertainment resource, specializing in sold out and hard-to-obtain tickets and personalized entertainment packages for sports, theater, cultural and other events. Mr. Chemerow was President and Chief Operating Officer of GT Interactive Software Corp., a company principally engaged in publishing computer games, from April 1998 to September 1999; he served as Executive Vice President and Chief Operating Officer from May 1997 to April 1998. From April 1996 to May 1997, he was Executive Vice President and Chief Financial Officer of ENTEX Information Services, Inc., a company principally engaged in providing distributed computing management solutions. Beginning in 1990 and prior to joining ENTEX, he was Executive Vice President, Finance and Operations, and Chief Financial Officer of Playboy. Mr. Chemerow is also a member of the Board of Directors of Dunham's Athleisure Corporation, a sporting goods retailer. Mr. Chemerow is the Chairman of the Audit Committee of the Board.

DONALD G. DRAPKIN

Director since 1997

Age 56

Mr. Drapkin has been Vice Chairman and a Director of MacAndrews & Forbes Holdings Inc. and various affiliates since 1987. Prior to joining MacAndrews & Forbes, Mr. Drapkin was a partner in the law firm of Skadden, Arps, Slate, Meagher & Flom LLP for more than five years. Mr. Drapkin is also a Director of the following corporations which file reports pursuant to the Securities Exchange Act of 1934: Anthracite Capital, Inc., The Molson Companies Limited, Revlon Consumer Products Corporation, Revlon, Inc. and SIGA Technologies, Inc. Mr. Drapkin is a member of the Compensation Committee of the Board.

JEROME H. KERN

Director since 2002

Age 66

Mr. Kern has been the President of Kern Consulting, LLC since 2001. Prior to that, Mr. Kern was Chairman and Chief Executive Officer of On Command Corporation. Prior to his position at On Command, he served as Vice Chairman and a member of the Board of Directors of Tele-Communications, Inc. (TCI). For more than 20 years, Mr. Kern was the principal outside legal counsel to TCI and Liberty Media Corporation (Liberty Media), including from 1992 to 1998, when he served as senior partner of Baker & Botts, L.L.P. Mr. Kern is on the boards of Volunteers of America (Colorado Chapter) and the New York Philharmonic. He also serves as Chairman of the Institute for Children's Mental Disorders and is Co-Chairman of Board of Trustees for the Colorado Symphony

5

Association. He is a trustee of City Meals-on-Wheels in New York and a trustee of the New York University School of Law Foundation. Mr. Kern is a member of the Audit Committee of the Board.

RUSSELL I. PILLAR

Director since 2003

Age 38

Mr. Pillar has served as Managing Partner of Critical Mass Venture Holdings and its predecessor and related entities, all investment and advisory vehicles focused on maximizing the value of consumer brands, since October 1991. He also is Senior Advisor at Viacom, where he provides insight on media, technology, and communications industry developments and their implications for Viacom's global strategy. From January 2000 until April 2004 he was President of the Viacom Digital Media Group and its predecessor entities, where he served as Viacom's chief digital media strategy and execution executive. From November 1998 to January 2000 he was President, Chief Executive Officer, and a Director of Richard Branson's Virgin Entertainment Group, a diversified international entertainment content retailer. From September 1997 to August 1998 he was President and Chief Executive Officer of Prodigy Internet, an Internet service provider, and was a member of Prodigy Inc.'s board of directors, including having served as its Vice Chairman, from October 1996 (when he helped lead the leveraged buy-out of the company) to February 2000. Mr. Pillar, a Crown Fellow at the Aspen Institute, graduated Phi Beta Kappa, cum laude with an A.B. in East Asian Studies from Brown University.

SOL ROSENTHAL

Director since 1985

Age 69

Mr. Rosenthal has been Of Counsel to the Los Angeles office of the law firm of Arnold & Porter LLP since July 2000. Prior to that he was Of Counsel to the Los Angeles law firm of Blanc Williams Johnston & Kronstadt, L.L.P. from May 1996 through June 2000. Prior to that, he was a senior partner in the law firm of Buchalter, Nemer, Fields & Younger from 1974 through April��1996. He has served as an arbitrator in entertainment industry disputes since 1977 and as the Writers Guild-Association of Talent Agents Negotiator since 1978. Mr. Rosenthal is a former member of the Board of Governors, Academy of Television Arts & Sciences, on which he served from 1990 to 1992; he is a former President of the Beverly Hills Bar Association and a former President of the Los Angeles Copyright Society. Mr. Rosenthal is the Chairman of the Compensation Committee of the Board.

RICHARD S. ROSENZWEIG

Director since 1973

Age 68

Mr. Rosenzweig has been Executive Vice President of Playboy since November 1988. From May 1982 to November 1988, he was Executive Vice President, Office of the Chairman, and from July 1980 to May 1982, he was Executive Vice President, Corporate Affairs. Before that, from January 1977 to June 1980, he had been Executive Vice President, West Coast Operations. His other positions with Playboy have included Executive Vice President, Publications Group, and Associate Publisher,Playboy Magazine. He has been with Playboy since 1958.

MEETINGS AND COMMITTEES OF THE BOARD

The Board of Directors held nine meetings during 2003. Each of our directors attended at least 75% of all the meetings of the Board and of the committees on which he or she served during 2003. The non-management directors also meet periodically in executive sessions without management. The

6

non-management director designated to preside at such executive sessions rotates among such non-management directors. More information on Playboy's policy for communication with directors, including the non-management directors, is described in the section of this proxy statement titled "Stockholder Communications with Directors." The Board of Directors has a standing audit committee and a standing compensation committee, which are described below. The Board does not have a standing nominating committee.

Our Board of Directors is composed of eight individuals. The Board of Directors has affirmatively determined that all directors, other than Ms. Hefner and Mr. Rosenzweig, are "independent directors" under the listing requirements of the New York Stock Exchange. Specifically, these six directors have no material relationship with Playboy, either directly or as a partner, shareholder or officer of an organization that has a relationship with Playboy. In making these determinations, the Board of Directors considered the fact that none of these directors had any relationships with Playboy of the types set forth in the listing requirements of the New York Stock Exchange nor any other relationships that in the Board's judgment would interfere with the director's independence. Ms. Hefner and Mr. Rosenzweig are both executive officers of Playboy, and therefore are not independent directors.

Audit Committee

The audit committee of the Board is currently comprised of three directors, Messrs. Chemerow (who serves as Chairman), Bookshester and Kern. The functions of the audit committee and its activities during 2003 are described in the section of this proxy statement titled "Report of the Audit Committee."

During 2003, the Board of Directors examined the composition of the audit committee and confirmed that all members of the audit committee are "independent" and "financially literate," and that Mr. Chemerow qualifies as an "audit committee financial expert," in each case under the applicable New York Stock Exchange listed company rules and the Securities and Exchange Commission regulations governing audit committees. Mr. Chemerow acquired his financial expert attributes principally through years of experience as chief financial officer or controller of several companies as well as president and chief operating officer of several companies where he actively supervised principal financial officers and actively oversaw the preparation and evaluation of financial statements. Mr. Chemerow's experiences are described in the section of this proxy statement titled "PROPOSAL NO. 1—ELECTION OF DIRECTORS."

The audit committee met five times during 2003.

Compensation Committee

The compensation committee of the Board is currently comprised of three directors, Messrs. Rosenthal (who serves as Chairman), Drapkin and Pillar. Mr. Pillar was appointed to our Board on May 14, 2003 and was appointed to the compensation committee. The key functions of the compensation committee include reviewing and approving our goals and objectives concerning compensation of corporate officers and certain other key employees, evaluating the performance of our Chief Executive Officer in light of these goals and objectives and determining and approving her compensation level based on this evaluation, evaluating the performance of other corporate officers in light of these goals and objectives, reviewing the competitiveness of our compensation practices and determining and approving salary and termination arrangements for, and all proposed contracts and transactions with, all of our employees whose salaries and bonuses are more than $250,000 but less than $400,000 per year, excluding corporate officers.

Other key responsibilities of the compensation committee include reviewing and making recommendations to the Board concerning our employee benefit programs, making recommendations to the Board concerning compensation, salary or termination arrangements for, and all proposed contracts

7

and transactions with, corporate officers, other than our Chief Executive Officer, and any employee of Playboy (including Mr. Hefner) whose salary and bonus equals or exceeds $400,000 per year, administering our stock incentive plans for key employees and non-employee directors and determining which of our employees are eligible to participate in those plans and administering our employee stock purchase plan.

The compensation committee met four times during 2003.

Board Nominations

Playboy is committed to having a Board of Directors comprised of individuals who are accomplished in their fields, have the ability to make meaningful contributions to the Board's oversight of the business and affairs of Playboy and have an impeccable record and reputation for honest and ethical conduct. Our Board of Directors is composed of eight individuals, six of whom the Board of Directors have affirmatively determined to be "independent" directors under the listing requirements of the New York Stock Exchange. Because more than fifty percent of our voting shares are owned by a single individual, the NYSE listing requirements do not require us to have a separate nominating committee composed solely of independent directors to identify and select individuals to serve on our Board. However, we believe the independent composition of our Board of Directors enables us to achieve the purposes of an independent nominating committee by using the full Board. As a consequence, each member of the Board of Directors participates in the consideration of director nominees.

Our Board of Directors will consider director candidates recommended by stockholders. In considering candidates submitted by stockholders, the Board of Directors will take into consideration its needs and the qualifications of the candidate. To have a candidate considered by the Board of Directors, a stockholder must submit the recommendation in writing and must include the following information:

- •

- the name of the stockholder and evidence of the person's ownership of Playboy stock, including the number and class of shares owned and the length of time of ownership; and

- •

- the name of the candidate, the candidate's resume or a listing of his or her qualifications to be a director of Playboy and the person's consent to be named as a director if nominated by the Board of Directors.

The stockholder recommendation and information described above must be sent to the Secretary at Playboy Enterprises, Inc., 680 N. Lake Shore Drive, Chicago, Illinois, 60611 and must be received by the Secretary not less than 120 days prior to the anniversary date of Playboy's most recent annual meeting of stockholders.

In addition to the factors described above, the Board of Directors examines a candidate's specific experiences and skills, time availability in light of other commitments, potential conflicts of interest and independence from management, Playboy and its principal stockholder. The Board of Directors also seeks to have its members represent a diversity of backgrounds and experience.

The Board of Directors identifies potential nominees by asking current directors and executive officers to identify people meeting the criteria described above that are available to serve on the Board. As described above, the Board of Directors will also consider candidates recommended by stockholders.

Once a person has been identified as a potential candidate, the Board of Directors may collect and review publicly available information regarding the person to assess whether the person should be considered further. If the Board of Directors determines that the candidate warrants further consideration, the Chairman or another member of the Board contacts the person. Generally, if the person expresses a willingness to be considered and to serve on the Board, the Board of Directors requests information from the candidate, reviews the person's accomplishments and qualifications, including in light of any other candidates that the Board of Directors might be considering, and conducts one or more interviews with the

8

candidate. In certain instances, the Chairman or another member of the Board may contact one or more references provided by the candidate or may contact other members of the business community or other persons that may have greater first-hand knowledge of the candidate's accomplishments. The Board's evaluation process does not vary based on whether or not a candidate is recommended by a stockholder, although, as stated above, the Board of Directors may take into consideration the number and class of shares held by the recommending stockholder and the length of time that such shares have been held and the needs of the Board at the time.

STOCKHOLDER COMMUNICATIONS WITH DIRECTORS

The Board of Directors has established a process to receive communications from stockholders. Stockholders may contact any member (or all members) of the Board, any Board committee or any chair of any such committee by mail. To communicate with the Board of Directors, any individual directors or any group or committee of directors, correspondence should be addressed to the Board of Directors or any such individual directors or group or committee of directors by either name or title. All such correspondence should be sent "c/o Secretary" at Playboy Enterprises, Inc., 680 N. Lake Shore Drive, Chicago, Illinois, 60611.

All communications received as set forth in the preceding paragraph will be opened by the office of our General Counsel for the sole purpose of determining whether the contents represent a message to our directors. Any contents that are not in the nature of advertising, promotions of a product or service, or patently offensive material will be forwarded promptly to the addressee. In the case of communications to the Board or any group or committee of directors, the General Counsel's office will make sufficient copies of the contents to send to each director who is a member of the group or committee to which the envelope or e-mail is addressed.

In addition, it is Playboy's policy that each of our directors should attend the Annual Meeting absent circumstances which makes attendance impossible. All of our directors other than Mr. Drapkin were in attendance at the 2003 Annual Meeting.

Directors who are Playboy employees receive no compensation for their services as directors. During 2003, non-employee directors earned an annual fee of $36,000. This annual fee was payable in quarterly installments. At least half of this annual fee is payable in shares of Class B common stock. The Chairman of our compensation committee earns an additional fee of $5,000 per year and the Chairman of our audit committee earns an additional fee of $10,000 per year. Each member of our audit committee other than the Chairman of the audit committee earns an additional fee of $5,000 per year. At least half of these additional fees to the Chairman of our compensation committee and the Chairman and members of our audit committee are paid in shares of our Class B common stock. In addition, each non-employee director earned a fee of $1,000 for each in-person Board meeting attended, payable in shares of Class B common stock; and each member of a special committee of the Board earned a fee of $1,000 for each special committee meeting attended, payable in cash. Mr. Pillar attended three of the four in-person Board meetings and all other non-employee directors attended all four of the in-person Board meetings. Messrs. Bookshester, Chemerow, Drapkin, Kern, Pillar and Rosenthal earned total compensation of $56,000, $69,000, $40,000, $45,000, $25,747 and $58,000, respectively, in 2003. Sir Brian Wolfson earned total compensation of $18,253 for his services as a director until May 14, 2003.

Since October 1992, non-employee directors have also been eligible to participate in Playboy's Deferred Compensation Plan for Non-Employee Directors, which we call the DCP, under which they may elect to defer receipt of part or all of their annual fees, committee fees and per-meeting payments. All

9

amounts deferred and earnings credited are 100% vested immediately and are general unsecured obligations of Playboy.

Each non-employee director other than Mr. Pillar is also a participant in the Playboy Enterprises, Inc. 1991 Non-Qualified Stock Option Plan for Non-Employee Directors. We call this stock option plan the 1991 Directors' Stock Option Plan. Under the 1991 Directors' Stock Option Plan, each director is granted a non-qualified stock option to purchase shares of Class B common stock. Each option is exercisable in four equal annual installments, beginning on the first anniversary of the date that options were initially granted, unless accelerated according to the terms of the 1991 Directors' Stock Option Plan. All installments are cumulative and may be exercised in whole or in part. Options granted under the 1991 Directors' Stock Option Plan generally expire ten years after the date of grant, although they may expire earlier. Shares issued upon the exercise of options granted under the 1991 Directors' Stock Option Plan may be either treasury shares or newly-issued shares.

Each non-employee director other than Mr. Kern is also a participant in the Amended and Restated 1997 Equity Plan for Non-Employee Directors of Playboy Enterprises, Inc., as amended. We call this equity plan the 1997 Equity Plan. Under the 1997 Equity Plan, we from time to time grant non-employee directors non-qualified stock options to purchase shares of Class B common stock and/or shares of restricted stock. Each option is generally exercisable in four equal annual installments, beginning on the first anniversary of the date that options were initially granted, unless accelerated according to the terms of the 1997 Equity Plan. All installments are cumulative and may be exercised in whole or in part. Options granted under the 1997 Equity Plan generally expire ten years after the date of grant, although they may expire earlier. Shares issued upon the exercise of options granted under the 1997 Equity Plan may be either treasury shares or newly-issued shares.

10

The following information is provided with respect to Playboy's executive officers, except for Ms. Hefner and Mr. Rosenzweig, whose information is provided in the section of this proxy statement titled "PROPOSAL NO. 1—ELECTION OF DIRECTORS." Playboy's officers hold their offices until their successors are chosen and qualified.

JAMES L. ENGLISH

Executive Vice President and President,

Entertainment Group

Age 52

Mr. English joined Playboy in 1994 as President of Playboy Networks Worldwide and was appointed to his present position in November 2000. Before joining Playboy he served as Senior Vice President, Viewer's Choice. He helped launch Pay-Per-View Network, Inc. in 1987. Previously, Mr. English served as a Vice President of MGM/UA and Showtime, and was a Director at Home Box Office. He began his career at WJLA-TV, the ABC affiliate in Washington, D.C. He is a member of the Cable Television Administration and Marketing Association and National Cable Television Association.

JAMES F. GRIFFITHS

Senior Executive Vice President

Age 50

Mr. Griffiths was appointed to his present and newly created position in January, 2004. He joined Playboy from Metro-Goldwyn-Mayer (MGM) where he spent six years as President, Worldwide Television Distribution. He oversaw the global distribution of movies and television programs and supervised MGM Networks, Inc., the company's cable and satellite channel ventures. Mr. Griffiths joined MGM from Creative Artists Agency where he served as Director of the Entertainment Ventures Group and helped create Tel-TV and the Sundance Channel as well as other business and content opportunities. He began his professional career as a Senior Accountant with Price Waterhouse and was recruited to Home Box Office where he spent eight years. Mr. Griffiths later served as President of Worldwide Pay Television and International Home Video at Twentieth Century Fox before joining Star Television in 1993 as Managing Director in Hong Kong.

LINDA G. HAVARD

Executive Vice President, Finance and Operations,

and Chief Financial Officer

Age 49

Ms. Havard was appointed to her present position in May 1997. From August 1982 to May 1997, she held various financial and management positions at Atlantic Richfield Company or ARCO. From October 1996 to May 1997, Ms. Havard served as ARCO's Senior Vice President in the Global Energy Ventures division. She also served as ARCO's Vice President of Corporate Planning from January 1994 to December 1996. Her other positions with ARCO included Vice President, Finance, Planning and Control, ARCO Transportation Co. and President, ARCO Pipe Line Co. Ms. Havard serves as a member of the Board of Directors of Playboy.com, Inc. (Playboy.com). Ms. Havard is also a member of the UCLA Foundation Board of Councillors, a member of the Chicago Club of the Council on Foreign Relations and a member of Chicago Finance Exchange.

HUGH M. HEFNER

Editor-in-Chief

Age 77

Mr. Hefner founded Playboy in 1953. He assumed his present position in November 1988. From October 1976 to November 1988, Mr. Hefner served as Chairman of the Board and Chief Executive

11

Officer, and before that he served as Chairman, President and Chief Executive Officer. Mr. Hefner is the father of Christie Hefner, Chairman of the Board and Chief Executive Officer.

MARTHA O. LINDEMAN

Senior Vice President, Corporate Communications

and Investor Relations

Age 53

Ms. Lindeman was appointed to her present position in September 1998. From 1992 to 1998, she served as Vice President, Corporate Communications and Investor Relations. From 1986 to 1992, she served as Manager of Communications at the Tribune Company, a leading information and entertainment company.

RANDY A. NICOLAU

Executive Vice President, and

President, Playboy Online Group

Age 33

Mr. Nicolau was appointed to his present position in August 2002 and Executive Vice President of Playboy in February 2004. From October 2001 to August 2002, Mr. Nicolau served as Senior Vice President of Marketing and E-Commerce for Playboy Online Group, where he was responsible for the marketing and operation of the corporation's subscription and e-commerce businesses. From June 2000 to April 2001, Mr. Nicolau was Senior Vice President of Direct Marketing and E-Commerce at Small World Media, Inc., which builds and maintains fantasy sports games on the Internet, and was responsible for developing and marketing the corporation's fantasy game and e-commerce businesses. Mr. Nicolau served from January 1997 to April 2000 as the Chief Executive Officer at Bridgepoint Marketing, LLC, which marketed collectibles to the male consumer and owned the brand "Sports Traditions", a leader in sports-themed products, and was responsible for the day-to-day operation and overall performance of the corporation. Mr. Nicolau began his career at MBI Inc. (The Danbury Mint) in August 1992, where he created and managed direct response programs within the collectibles industry and facilitated the sales growth of its sports-related product lines.

HOWARD SHAPIRO

Executive Vice President, Law and Administration,

General Counsel and Secretary

Age 56

Mr. Shapiro was appointed to his present position in May 1996. From September 1989 to May 1996, he served as Executive Vice President, Law and Administration, and General Counsel. From May 1985 to September 1989, Mr. Shapiro served as Senior Vice President, Law and Administration, and General Counsel. From July 1984 to May 1985, he served as Senior Vice President and General Counsel. From September 1983 to July 1984, he served as Vice President and General Counsel. From May 1981 to September 1983, he served as Corporate Counsel. From June 1978 to May 1981, he served as Division Counsel. From November 1973 to June 1978, he served as Staff Counsel.

ALEX VAICKUS

Executive Vice President and President,

Global Licensing

Age 44

Mr. Vaickus was appointed to his present position in November, 2002. From August 2000 to November 2002, Mr. Vaickus served as Senior Vice President and President of the Licensing Group. Mr. Vaickus previously served as Playboy's Senior Vice President of Strategy, Planning and Operations and was responsible for managing the strategic planning process and all corporate level business development activities, including the evaluation of acquisitions and new business opportunities. Prior to joining Playboy in 1998, Mr. Vaickus was Vice President of Business Development with ConAgra Refrigerated Prepared Foods and Vice President of Business Planning and Finance for Sara Lee/DE, a division of Sara Lee Corporation. He spent 12 years at Sara Lee, where he held various positions, including Executive Director of U.S. Foods and Director of Business Planning.

12

Playboy Stock Ownership by Certain Beneficial Owners

The following table provides information about each person who we believe, based on a review of filings with the Securities and Exchange Commission, as of February 29, 2004, beneficially owns more than 5% of our outstanding Class A common stock.

| Name and Address | Number of Shares of Class A Common Stock | Percent of Class | ||

|---|---|---|---|---|

| Hugh M. Hefner, Trustee(1) The Hugh M. Hefner 1991 Trust 2706 Media Center Drive Los Angeles, California 90065 | 3,381,836 | 69.53% | ||

| John A. Levin & Co.,Inc.(2) BKF Capital Group, Inc. One Rockefeller Plaza New York, New York 10020 | 355,900 | 7.32% |

- (1)

- Mr. Hefner, founder of Playboy and Editor-in-Chief, owns these shares through The Hugh M. Hefner 1991 Trust. Mr. Hefner has sole investment and voting power over these shares. Mr. Hefner has indicated his intent to vote his shares on the matters specified in this proxy statement in accordance with the recommendations made in this proxy statement by the Board of Directors.

- (2)

- Information as to John A. Levin & Co., Inc. and BKF Capital Group, Inc. is based upon a report on Schedule 13G/A filed with the Security and Exchange Commission on February 17, 2004. Such report was filed by John A. Levin & Co., Inc. and BKF Capital Group, Inc. and indicates that each stockholder had sole voting and investment power with respect to 300,100 shares and shared voting and investment power with respect to 55,800 shares.

Playboy Stock Ownership by Directors and Executive Officers

The following table shows, as of February 29, 2004, the amount of common stock beneficially owned by each of our directors and by each executive officer named in the Summary Compensation table on page 18 of this proxy statement, and by all directors and executive officers as a group. In general, "beneficial ownership" includes those shares over which a director or executive officer has the power to vote, or the power to transfer, and stock options that are currently exercisable or will become exercisable

13

within 60 days of February 29, 2004. Except as otherwise noted, the persons named in the table below have sole voting and investment power with respect to all shares shown as beneficially owned by them.

| Name(1) | Shares of Class A Common Stock | Percent of Class A Common Stock | Shares of Class B Common Stock | Percent of Class B Common Stock | ||||

|---|---|---|---|---|---|---|---|---|

| Dennis S. Bookshester(2) | 3,000 | * | 40,313 | * | ||||

| David I. Chemerow(2) | 800 | * | 61,313 | * | ||||

| Donald G. Drapkin(2) | 0 | * | 31,250 | * | ||||

| James L. English(2) | 0 | * | 106,494 | * | ||||

| Linda G. Havard(2) | 0 | * | 210,752 | * | ||||

| Christie Hefner(2) | 72,274 | 1.49 | 1,214,095 | 5.16 | ||||

| Hugh M. Hefner(3)(a) | 3,381,836 | 69.53 | 8,800,643 | 36.48 | ||||

| Jerome H. Kern(2) | 0 | * | 10,427 | * | ||||

| Russell I. Pillar(2) | 5,000 | * | 6,725 | * | ||||

| Sol Rosenthal(2) | 250 | * | 43,534 | * | ||||

| Richard S. Rosenzweig(2) | 365 | * | 191,395 | * | ||||

| All Directors and Executive Officers as a group (16 persons)(2)(3)(a)(b) | 3,463,540 | 71.21 | 11,167,519 | 43.18 |

- *

- Less than 1% of the total shares outstanding.

- (1)

- In each case, beneficial ownership consists of sole voting and investment power, with the exception of Mr. Pillar, who owns 5,000 shares of Class A common stock and 1,725 shares of Class B common stock through Pillar Living Trust and shares voting and investment power of with his wife.

- (2)

- Includes the following shares of our Class B common stock that are subject to installments of stock option grants made under the Second Amended and Restated Playboy Enterprises, Inc. 1995 Stock Incentive Plan, as amended, which we call the 1995 Stock Incentive Plan, the 1991 Directors' Stock Option Plan and the 1997 Equity Plan, which were either exercisable on February 29, 2004, or are exercisable within 60 days of February 29, 2004.

| Name | Class B Common Stock | |

|---|---|---|

| Dennis S. Bookshester | 21,250 | |

| David I. Chemerow | 21,250 | |

| Donald G. Drapkin | 26,250 | |

| James L. English | 81,667 | |

| Linda G. Havard | 186,667 | |

| Christie Hefner | 899,386 | |

| Jerome H. Kern | 2,500 | |

| Sol Rosenthal | 21,250 | |

| Richard S. Rosenzweig | 136,667 | |

| Russell I. Pillar | 5,000 | |

| All Directors and Executive Officers as a group (16 persons) | 1,738,355 |

- (3)

- Includes (a) 1,485,948 shares of Class B common stock that Mr. Hefner will receive upon conversion of the Playboy preferred stock in connection with the announced offering described in the section of this proxy statement titled "Transactions with Management," and (b) 25,000 shares of Class B common stock subject to a restricted stock award granted to Mr. Griffiths in February 2004.

14

Report of the Committee on Executive Compensation

This report by the compensation committee and the Performance Graph on page 21 shall not be deemed to be incorporated by reference by any general statement that incorporates by reference these proxy materials into any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, and they shall not otherwise be deemed to be "soliciting material" or to be "filed" thereunder.

Playboy's executive compensation programs are administered by the compensation committee of the Board of Directors. Messrs. Rosenthal (who is the Chairman), Drapkin and Pillar served as members of the compensation committee during 2003. None of these three directors has ever served as an officer of Playboy.

Playboy's executive compensation programs are designed to help Playboy achieve its business objectives by:

- •

- setting levels of compensation designed to attract and retain superior executives in a highly competitive environment;

- •

- providing incentive compensation that varies directly with both Playboy's financial performance and the individual executive's contribution to that performance; and

- •

- linking compensation to elements that affect both short-term and long-term share performance.

Therefore, the compensation committee's primary mission is to structure and administer a range of compensation programs designed to enable Playboy to attract and retain executive talent in a marketplace that is both highly competitive and well-known for its individually tailored compensation packages. To help it fulfill this mission, the compensation committee periodically evaluates the competitiveness of Playboy's executive compensation programs, using information drawn from a variety of sources such as published survey data, information supplied by consultants and its own experience in recruiting and retaining executives. A list of the criteria the compensation committee considers when it establishes compensation programs and the factors it considers when it determines an executive's compensation is supplied in this report.

Base Salary

The compensation committee sets the base salaries and salary ranges for executives based primarily on competitive market data and the executive's level of responsibility. The committee uses outside executive compensation consultants to periodically review these salaries and salary ranges. The committee reviews salary ranges once a year, and adjusts them as necessary, considering a number of factors including Playboy's financial performance. The committee also reviews executives' salaries once a year, and bases any adjustments on each executive's individual performance, while also considering his or her total compensation package and external market data. While some of the companies in the peer group chosen for comparison of stockholder returns in the Performance Graph on page 21 may be included in the surveys and information the compensation committee considers in setting executives' salaries, there is no set peer group against which those salaries are measured. Instead, the committee reviews broad-based industry salary data, which typically exclude financial services and not-for-profit companies, and industry-specific data relative to a particular position when they are available. For 2003, the committee continued its practice of restraining base salaries and salary grade ranges. This is consistent with the committee's current philosophy of focusing less on fixed compensation and more on variable performance-based compensation in the form of short-term and long-term incentives.

15

Short-Term Incentives

Playboy executives are eligible for annual bonuses under Playboy's Executive Incentive Compensation Program. For 2003, participants in this program could earn an annual bonus with a value ranging from 20% to 100% of their base salaries. We calculated the total bonus amount each executive earned based on Playboy's cash flow as well as group and/or individual segment profitability objective goals. For each portion of the bonus, there is a range of bonus amounts paid based on the level of achievement with respect to that portion, with a minimum threshold level of performance required before earning each portion of the bonus. Additionally, except for Mr. Hefner and Ms. Hefner, a portion of the bonus is based on the achievement of non-financial goals. For 2003, the compensation committee determined that Mr. English, Ms. Havard, Ms. Hefner, Mr. Hefner and Mr. Rosenzweig should receive payouts under the Executive Incentive Compensation Program.

Long-Term Incentives

Playboy provides long-term incentive awards through its 1995 Stock Incentive Plan, which the compensation committee administers for Playboy. Subject to the terms of that plan, the compensation committee determines the "key employees" to whom options and other awards may be granted, the number of shares of our Class B common stock covered by each option or other stock award, the time or times at which the options may be exercised, the vesting of awards and other administrative functions. Since the inception of the 1995 Stock Incentive Plan, the compensation committee has granted incentive stock options, non-qualified stock options, restricted stock awards and performance awards. These grants are designed to further the growth, development and financial success of Playboy by providing key employees with strong additional incentives to maximize long-term stockholder value. The committee believes that this objective can be best achieved through assisting key employees to become owners of Playboy stock, which aligns their interests with Playboy's interests. As stockholders, key employees will benefit directly from Playboy's growth, development and financial success. Stock option grants and restricted stock awards also enable Playboy to attract and retain the services of those executives whom we consider essential to Playboy's long-range success by providing these executives with a competitive compensation package and an opportunity to become owners of Playboy stock.

Chairman and Chief Executive Officer Compensation

Ms. Hefner's annual salary for 2003 was $600,000. In determining Ms. Hefner's salary, the compensation committee considered a number of factors, including Playboy's overall financial and operational performance over the last few fiscal years. The compensation committee also reviewed competitive market data and, consistent with its general approach to salaries, attempted to place Ms. Hefner's salary slightly above the median of the data reported in relevant compensation surveys and other information it considered.

The compensation committee calculated Ms. Hefner's bonus payout of $465,035 according to the terms of Playboy's Executive Incentive Compensation Program. Ms. Hefner's maximum bonus opportunity was 100% of her base salary. Her bonus was based on achievement of the cash flow and the group profitability targets described above for 2003, and since Playboy achieved only a portion of these targets, only a portion of the maximum bonus was paid to her.

Deductibility of Compensation

In 1993, changes were made to the federal corporate income tax law that limit Playboy's ability to deduct compensation in excess of $1 million paid annually to Playboy's five most highly compensated executive officers. There are exemptions from this limit, including compensation that is based on the

16

attainment of performance goals established by the compensation committee and approved by the stockholders. The committee's policy is to seek to qualify all executive compensation for deductibility to the extent that this policy is consistent with Playboy's overall objectives in attracting, motivating and retaining its executives. However, Playboy may make non-conforming grants from time to time. Grants of restricted stock made under the 1995 Stock Incentive Plan prior to fiscal year 1997 do not qualify as stockholder-approved performance-based compensation and will therefore not be fully deductible to the extent that the value of such grants to any executive, when added to other non-exempt compensation paid to that executive, exceeds the $1 million limit in any tax year.

Submitted by the compensation committee:

Sol Rosenthal, Chairman

Donald G. Drapkin

Russell I. Pillar

Dennis S. Bookshester (member of the compensation committee until May 2003)

17

Executive Compensation

The following tables set forth information regarding the compensation earned by Ms. Hefner, who served as Playboy's Chairman of the Board and Chief Executive Officer throughout 2003, and the four highest compensated executive officers of Playboy other than our Chief Executive Officer for 2003. We refer to these individuals as our Named Executives. The Summary Compensation table details the salary and bonus earned by and the stock option grants made to and restricted stock payouts to each Named Executive during each of the last three fiscal years. The Option Grants in Last Fiscal Year table explains in more detail the terms and hypothetical values of stock options granted during 2003 to the Named Executives. Finally, the Aggregated Option Exercises in Last Fiscal Year and FY-End Option Values table reflects certain information regarding vested and unvested stock options held by the Named Executives as of December 31, 2003, and the value of those options as of that date.

| | | | | Long Term Compensation | | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | Annual Compensation | Class B Common Stock | | ||||||||||

| | | | | Awards | Payouts | | ||||||||

| Name and Principal Position | Year | Salary ($) | Bonus ($) | Restricted Stock Awards ($)(1) | Securities Underlying Options (#) | LTIP Payouts ($)(2) | All Other Compensation ($)(3) | |||||||

| Christie Hefner Chairman of the Board and Chief Executive Officer | 2003 2002 2001 | 600,000 600,000 600,000 | 465,035 60,000 347,254 | — — — | 150,000 150,000 — | (8) (4) | 345,000 — — | 26,097 35,688 9,672 | ||||||

James L. English Executive Vice President and President, Entertainment Group | 2003 2002 2001 | 625,000 600,000 575,001 | 527,287 — 585,870 | — — — | 50,000 20,000 15,000 | (8) (5) (6) | 86,241 — — | 9,997 9,534 9,672 | ||||||

Hugh M. Hefner Editor-in-Chief | 2003 2002 2001 | 750,000 750,000 750,000 | 232,518 30,000 173,627 | — — — | — — — | — — — | 9,997 9,534 9,672 | |||||||

Linda G. Havard Executive Vice President, Finance and Operations and Chief Financial Officer | 2003 2002 2001 | 475,000 475,000 475,000 | 317,387 38,000 217,043 | — — — | 50,000 30,000 20,000 | (8) (5) (6) | 184,000 — — | 20,952 26,755 22,068 | ||||||

Richard S. Rosenzweig Executive Vice President | 2003 2002 2001 | 400,000 400,000 363,654 | 212,085 56,000 187,254 | — — — | 50,000 — 70,000 | (8) (7) | 92,000 — — | 9,997 9,534 7,547 | ||||||

- (1)

- As of December 31, 2003, there were no shares of restricted Class B common stock outstanding. Playboy met the operating income objectives in 2002 and all of the restricted stock outstanding at December 31, 2002 vested in February 2003. Mr. Hefner holds no shares of restricted Class B common stock. Dividends were not paid on restricted Class B common stock.

- (2)

- Represents the value of the restricted stock awards previously granted under the 1995 Stock Incentive Plan, which vested in February 2003.

- (3)

- The amounts disclosed for year 2003 include:

- (a)

- Playboy profit-sharing contributions of $2,997 on behalf of Ms. Hefner, Mr. English, Mr. Hefner, Ms. Havard and Mr. Rosenzweig in 2003 under Playboy's Employees Investment Savings Plan.

- (b)

- Playboy 401(k) matching contributions of $7,000 on behalf of Ms. Hefner, Mr. English, Mr. Hefner, Ms. Havard and Mr. Rosenzweig in 2003 under Playboy's Employees Investment Savings Plan.

18

- (c)

- Playboy deferred compensation matching contributions of $16,100 on behalf of Ms. Hefner and $10,955 on behalf of Ms. Havard in 2003 under Playboy's DCP.

- (4)

- Represents non-qualified stock options granted in 2002 under the 1995 Stock Incentive Plan. The options have an exercise price of $15.700 (100% of the fair market value on the business day immediately preceding the date of the grant) and an expiration date of February 12, 2012. One-third of these options became exercisable on February 12, 2003; another one-third of these options became exercisable on February 12, 2004 and the remaining one-third of these options will become exercisable on February 12, 2005.

- (5)

- Represents non-qualified stock options granted in 2002 under the 1995 Stock Incentive Plan. The options have an exercise price of $15.850 (100% of the fair market value on the business day immediately preceding the date of the grant) and an expiration date of January 22, 2012. Half of these options became exercisable on January 22, 2003 and the remaining half of these options will become exercisable on January 22, 2004.

- (6)

- Represents non-qualified stock options granted in 2001 under the 1995 Stock Incentive Plan. The options have an exercise price of $11.375 (100% of the fair market value on the business day immediately preceding the date of the grant) and an expiration date of January 26, 2011. As of January 26, 2003, all of these options were exercisable.

- (7)

- Represents two non-qualified stock option grants made in 2001 under the 1995 Stock Incentive Plan. The options issued in the first grant have an exercise price of $11.375 (100% of the fair market value on the business day immediately preceding the date of the grant) and an expiration date of January 26, 2011. As of January 26, 2003, all of these options were exercisable. The options issued in the second grant have an exercise price of $13.24 (100% of the fair market value on the business day immediately preceding the date of the grant) and an expiration date of February 26, 2011. Two-thirds of these options were exercisable as of February 26, 2003 and the remaining one-third of these options became exercisable on February 26, 2004.

- (8)

- Represents non-qualified stock options granted in 2003 under the 1995 Stock Incentive Plan. The options have an exercise price of $10.00 (100% of the fair market value on the business day immediately preceding the date of the grant) and an expiration date of January 8, 2013. One-third of these options became exercisable on January 8, 2004; another one-third of these options will become exercisable on January 8, 2005 and the remaining one-third of these options will become exercisable on January 8, 2006.

Option Grants in Last Fiscal Year

| | | | | | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term ($)(1) | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | Individual Grants | |||||||||||

| | Number of Securities Underlying Options Granted (#) | Percent of Total Options Granted to Employees in Fiscal Year (%) | | | ||||||||

| Name | Exercise Price ($) | Expiration Date | ||||||||||

| 5% | 10% | |||||||||||

| Christie Hefner | 150,000 | 21.40 | 10.00 | 1/8/13 | 945,000 | 2,385,000 | ||||||

| James L. English | 50,000 | 7.13 | 10.00 | 1/8/13 | 315,000 | 795,000 | ||||||

| Hugh M. Hefner | — | — | — | — | — | — | ||||||

| Linda G. Havard | 50,000 | 7.13 | 10.00 | 1/8/13 | 315,000 | 795,000 | ||||||

| Richard S. Rosenzweig | 50,000 | 7.13 | 10.00 | 1/8/13 | 315,000 | 795,000 | ||||||

- (1)

- The values shown are based on the assumed hypothetical compound annual appreciation rates of 5% and 10% prescribed by Securities and Exchange Commission rules. These hypothetical rates are not intended to forecast either the future appreciation, if any, of the price of Class B common stock or the values, if any, that may actually be realized upon such appreciation, and there can be no assurance

19

that the hypothetical rates will be achieved. The actual value realized upon exercise of an option will be measured by the difference between the price of the Class B common stock and the exercise price on the date the option is exercised.

| | Number of Securities Underlying Unexercised Options at Fiscal Year-End (#)(1) | Value of Unexercised In-the-Money Options at Fiscal Year-End ($)(2) | ||||||

|---|---|---|---|---|---|---|---|---|

| | Exercisable | Unexercisable | Exercisable | Unexercisable | ||||

| Name | Class B common stock | Class B common stock | Class B common stock | Class B common stock | ||||

| Christie Hefner | 799,386 | 250,000 | 330,646 | 970,000 | ||||

| James L. English | 60,500 | 60,000 | 118,380 | 311,100 | ||||

| Hugh M. Hefner | — | — | — | — | ||||

| Linda G. Havard | 155,000 | 65,000 | 330,825 | 312,650 | ||||

| Richard S. Rosenzweig | 100,000 | 70,000 | 300,350 | 366,400 | ||||

- (1)

- Represents the number of shares of Class B common stock underlying options held by each person set forth below. As of December 31, 2003, there were no options on shares of Class A common stock outstanding.

- (2)

- Calculated based on the closing price of Playboy Class B common stock on December 31, 2003 (the last business day of the fiscal year) of $16.16, less the option exercise price, multiplied by the number of shares. An option is in-the-money if the market value of the common stock subject to the option is greater than the exercise price.

20

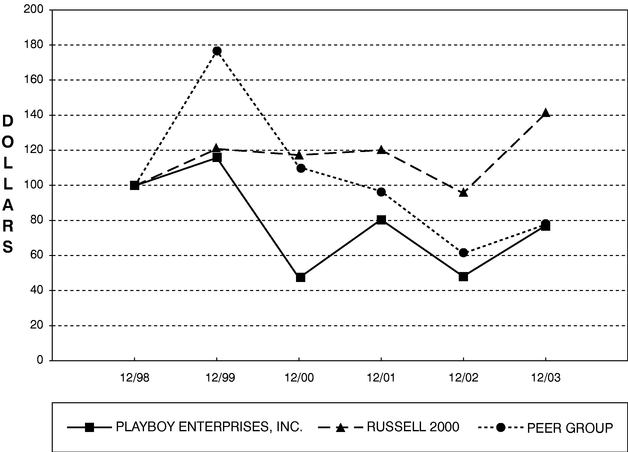

The following graph compares the yearly percentage change in total stockholder return on our Class B common stock with the cumulative total return of the Russell 2000 Stock Index and with our peer group, which is comprised of Time Warner Inc., Meredith Corporation, Metro-Goldwyn-Mayer Inc., Playboy Enterprises, Inc., Primedia, Inc., The Walt Disney Company, World Wrestling Entertainment, Inc. and Viacom Inc.

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN*

AMONG PLAYBOY ENTERPRISES, INC., THE RUSSELL 2000 INDEX AND A PEER GROUP

- *

- $100 invested on 12/31/98 in stock or index—including reinvestment of dividends. Fiscal year ending December 31.

21

Change In Control Agreements, Employment Agreements and Incentive Compensation Plans

To help us retain our most senior executive officers, the Board of Directors has approved Playboy entering into agreements with certain officers that provide for the payment of specified benefits if their employment terminates after a "change in control" of Playboy. Mr. English, Mr. Griffiths, Ms. Havard, Ms. Hefner and Mr. Rosenzweig currently are parties to such agreements. Each agreement provides that:

- •

- payments become due and benefits are provided if, within 18 months after a change in control, the officer is involuntarily terminated for reasons other than death, disability or "cause," or voluntarily terminates his or her employment for a limited number of permitted reasons described in the agreement;

- •

- lump-sum cash payments will be made within ten days following termination in the following amounts:

- (i)

- three times the sum of (A) the officer's annual base salary in effect immediately prior to the occurrence of the change in control and (B) the greater of (x) the average bonus earned by the officer for the three fiscal years prior to the year in which the change in control occurs and (y) the targeted bonus for the offer's position as set forth under Playboy's Executive Incentive Compensation Plan for the applicable year (with the greater of (x) and (y) referred to as the "highest bonus"); and

- (ii)

- the sum of (A) any unpaid incentive compensation which has been allocated or awarded to the officer for a completed fiscal year or other measuring period preceding the termination and is contingent only upon the continued employment of the officer to a subsequent date and (B) a pro-rata portion of the highest bonus for the year in which termination of employment occurs;

- •

- if an agreement becomes operative, the amount of the lump-sum cash payments, as well as any other payments owed to officers by us or our affiliates, would be grossed-up to compensate the executive for the imposition of any "golden parachute" excise tax imposed thereon;

- •

- any restricted stock held by the officer will become fully vested and free from restrictions;

- •

- the officer will be allowed to continue his or her participation in then existing welfare benefit plans, such as medical insurance, for up to three years from the effective date of termination; and

- •

- the agreement will have an initial five-year term, automatically extended on each anniversary of its execution unless Playboy or the officer gives notice that it or the officer does not wish to extend the agreement.

These change-in-control agreements provide that a "change in control" takes place whenever any of the following events occur:

- •

- we liquidate or dissolve;

- •

- we sell, exchange or otherwise dispose ofPlayboy magazine;

- •

- any occurrence by which Mr. Hefner and Ms. Hefner cease, collectively, to hold, directly or indirectly, at least 50% of the stock entitled to vote generally in the election of our directors;

- •

- we merge, consolidate or reorganize, or sell all or substantially all of our assets, unless we initiate the transaction and, as a result of the transaction, persons who held not less than a majority of the combined voting power of our outstanding voting stock immediately prior to the transaction hold not less than a majority of the combined voting power of the securities of the surviving or transferee corporation;

22

- •

- an equity or other investment in Playboy, the result of which is that Ms. Hefner ceases to serve as our Chief Executive Officer, or relinquishes upon request or is divested of any of the following responsibilities:

- (i)

- functioning as the person primarily responsible for establishing policy and direction for Playboy; or

- (ii)

- being the person to whom the executive reports; or

- •

- the adoption by the Board of Directors of a resolution that a change in control has occurred.

Under the agreements, "cause" is defined as conviction of a crime involving dishonesty, fraud or breach of trust, or willful engagement in conduct materially injurious to Playboy.

Effective January 8, 2004, Playboy entered into an employment contract with Mr. Griffiths and hired Mr. Griffiths as Senior Executive Vice President, reporting to our Chief Executive Officer and serving as Playboy's most senior executive in regard to his responsibilities. Under the employment contract, Mr. Griffiths will receive an annual base salary of $650,000 and is eligible to participate in Board-approved incentive plans at a maximum level of 100% of the base salary he earns. If Mr. Griffiths is not terminated for "cause," Playboy will guarantee a payout of a minimum of 25% of such maximum potential under the 2004 incentive compensation plan, payable when fiscal 2004 incentive compensation is paid to Playboy's other senior executives. If Mr. Griffiths is employed on December 31, 2006, he will receive whatever incentive compensation payout he is entitled to for fiscal 2006 at the time such payout is made to other executives of Playboy. In each year from 2004 to 2006, Mr. Griffiths will be granted non-qualified options to purchase 45,000 shares of our Class B common stock and 15,000 restricted stock units, subject to the Playboy's stock option plan and as determined by Playboy's compensation committee, which will be consistent with the terms and conditions of grants and awards made to other executive officers of Playboy. Mr. Griffiths also received a one-time grant of 25,000 shares of our Class B common stock, which restriction will lapse if we achieve specified operating income objective in 2004 and if he has not been terminated prior to January 1, 2005.

Under the employment contract, in the event that Mr. Griffiths is terminated at any time without "cause," in the event that he is asked to report to anyone other than our Chief Executive Officer, Playboy hires a President or Chief Operating Officer, his duties are materially diminished, or his principal place of business is changed to a location more than 50 miles from Glendale, California, Mr. Griffiths will be entitled to receive a severance payment in the sum of twelve months of Mr. Griffiths' then base salary, and if such termination occurs in 2004, an additional payment of $162,500. If Mr. Griffiths' employment is terminated on account of his disability or death, he will be entitled to receive a payment in the sum of six months of his then base salary and a pro rata payout under the incentive compensation plan for him in the year of such termination.

Effective October 8, 2003, Playboy entered into an employment contract with Mr. English extending his employment as Executive Vice President and President, Entertainment Group. Under the employment contract, Mr. English will receive annual base salaries of $650,000 in 2004, $675,000 in 2005 and $700,000 in 2006. Mr. English is entitled to participate in Board-approved incentive plans at a maximum level of 100% of the base salary he earns. Mr. English is also entitled to participate in the 1995 Stock Incentive Plan. Under the agreement, in the event that Mr. English is terminated at any time not "for cause," in the event that Playboy fails to offer to renew his employment contract on comparable terms between four and six months prior to its expiration or in the event that his base salary is reduced, his responsibilities are materially diminished, or he is asked to report to anyone other than our Chief Executive Officer, Chief Operating Officer or President, Mr. English will be entitled to receive severance pay in the form of a lump-sum payment equal to his annual base salary at the time of termination, reduced by the amount of any payment he receives under his change in control agreement described above. Effective January 20, 2004, Playboy changed Mr. English's reporting obligation such that Mr. English now reports to

23

Mr. Griffiths, our Senior Executive Vice President. Playboy and Mr. English have agreed that Mr. English has until July 20, 2004 to notify Playboy of his election to declare that the change in his reporting obligation has resulted in a constructive termination of his employment without cause. If Mr. English makes such an election, he will be entitled to receive a lump sum payment equal to his annual base salary in 2004. In addition, if Mr. English makes such an election and he is not employed on a full time basis after twelve months of his providing such a notice, he will also be entitled to receive immediately at the twelve month anniversary an additional lump sum payment equal to his six months base salary in 2004. If Mr. English does not make such an election by July 20, 2004, he will have waived his right to assert that the change in his reporting obligation has resulted in a constructive termination of his employment without cause and will have waived his right to receive any payment resulting therefrom.

Effective May 16, 1997, Playboy hired Ms. Havard as Executive Vice President, Finance and Operations, and Chief Financial Officer, and entered into an employment contract with Ms. Havard. She received an annual base salary of $475,000 in 2003 and is entitled to participate in Board-approved incentive plans at a maximum level of 80% of the base salary she earns. Ms. Havard is also entitled to participate in the 1995 Stock Incentive Plan. In the event that Ms. Havard is terminated at any time not "for cause," Ms. Havard will be entitled to receive twelve months severance pay based on her salary at that time. In the event of such termination, Ms. Havard will have no duty to mitigate damages and will be free to accept other employment at her discretion.

Transactions with Management