Filing under Rule 425 under

the U.S. Securities Act of 1933

Filing by: Sankyo Company, Limited

Subject Company: Daiichi Pharmaceutical Co., Ltd.

and Sankyo Company, Limited

SEC File No. 132-02292

(updated version of previously submitted materials)

Business Integration

of

Daiichi Pharmaceutical Co.,Ltd

and

Sankyo Co., Ltd

25 February, 2005

Background to Integration

Kiyoshi Morita

President & CEO

Daiichi Pharmaceutical Co., Ltd

2

Today’s Announcement

Basic Agreement concluded today to integrate businesses of Daiichi and Sankyo

Holding company to be established on Oct 1*

Complete integration of prescription pharmaceutical operations by April 2007*

*Dates are proposed dates only

3

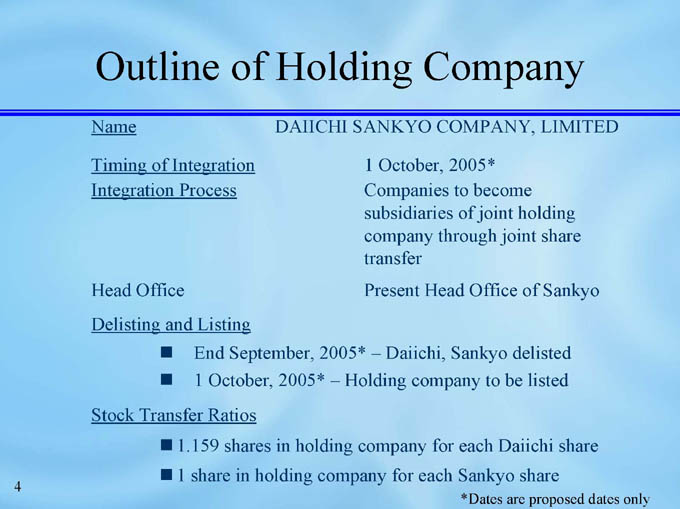

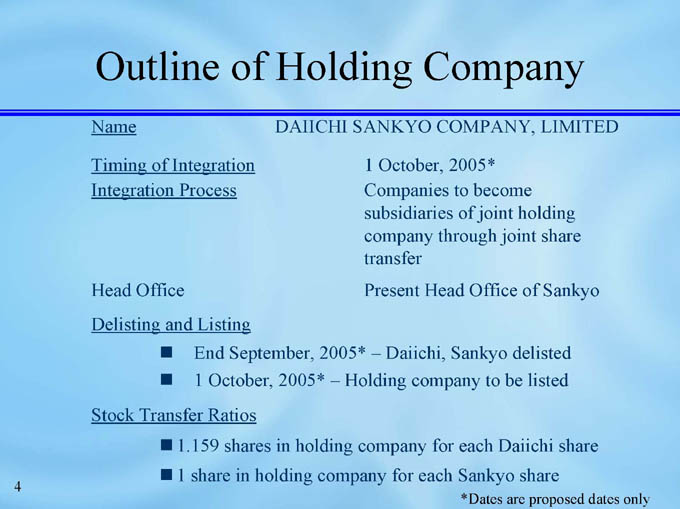

Outline of Holding Company

Name DAIICHI SANKYO COMPANY, LIMITED

Timing of Integration 1 October, 2005*

Integration Process Companies to become subsidiaries of joint holding company through joint share transfer

Head Office Present Head Office of Sankyo

Delisting and Listing

End September, 2005* – Daiichi, Sankyo delisted

1 October, 2005* – Holding company to be listed

Stock Transfer Ratios

1.159 shares in holding company for each Daiichi share

1 share in holding company for each Sankyo share

*Dates are proposed dates only

4

Milestones

March 2005 Establishment of Integration Committee

May 2005 Signing of Definitive Agreement

June 2005 Shareholders’ Meeting

End Sept 2005* Delisting of existing companies

1 October 2005* Holding company established

April 2007 Complete integration of prescription pharmaceutical operations

*Dates are proposed dates only

5

DAIICHI SANKYO

Achievement of true competitiveness as

a Japan based

global pharma-innovator

DAIICHI SANKYO

6

Background

7

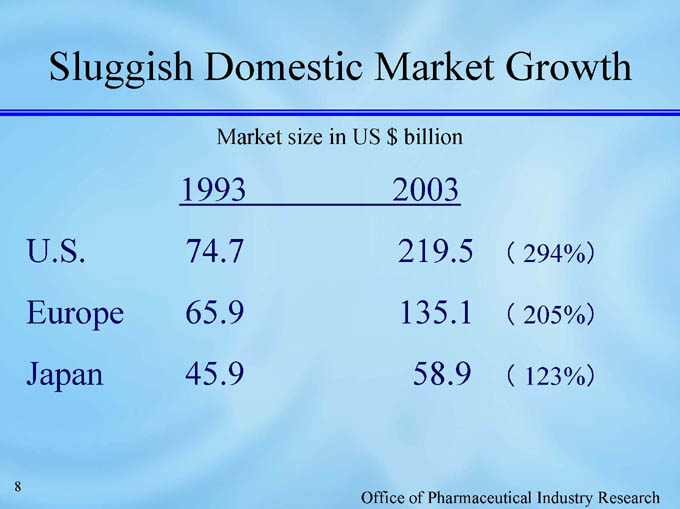

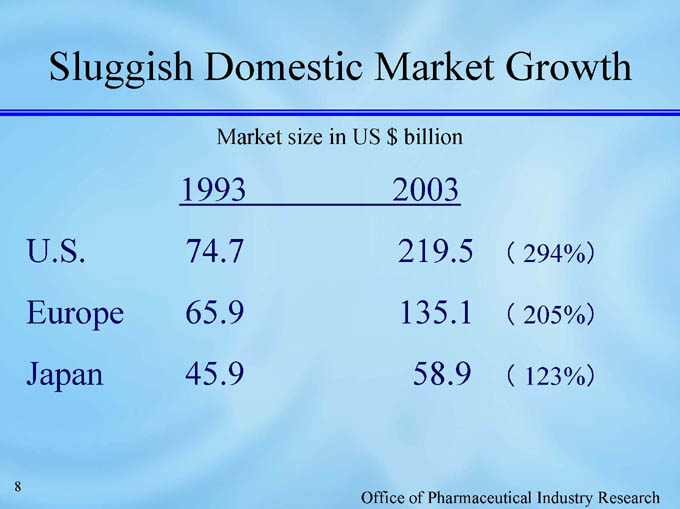

Sluggish Domestic Market Growth

Market size in US $ billion

1993 2003

U.S. 74.7 219.5 ( 294%)

Europe 65.9 135.1 ( 205%)

Japan 45.9 58.9 ( 123%)

Office of Pharmaceutical Industry Research

8

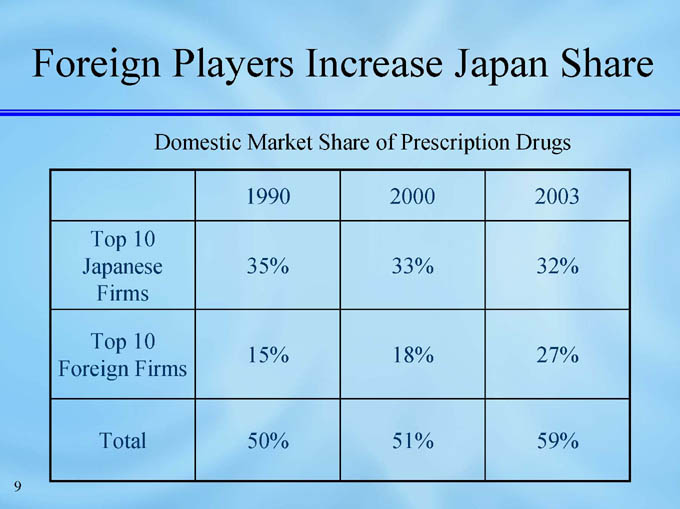

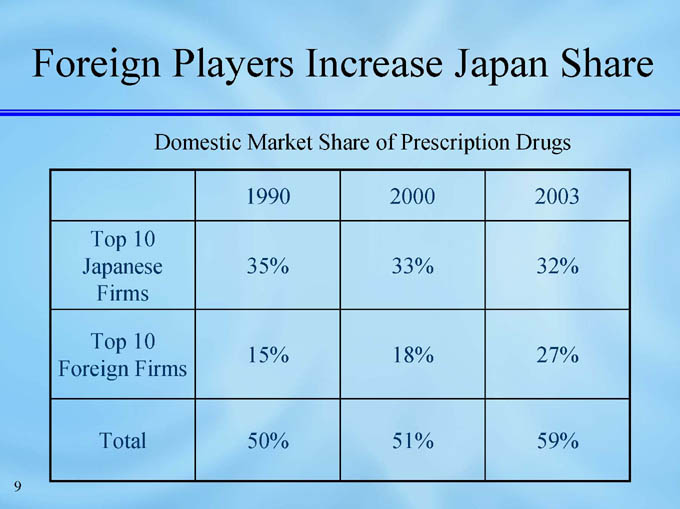

Foreign Players Increase Japan Share

Domestic Market Share of Prescription Drugs

1990

2000

2003

Top 10 Japanese Firms

35%

33%

32%

Top 10 Foreign Firms

15%

18%

27%

Total

50%

51%

59%

9

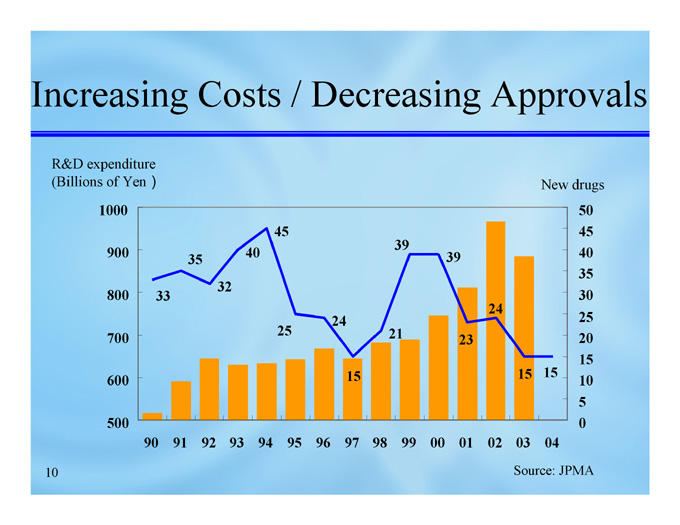

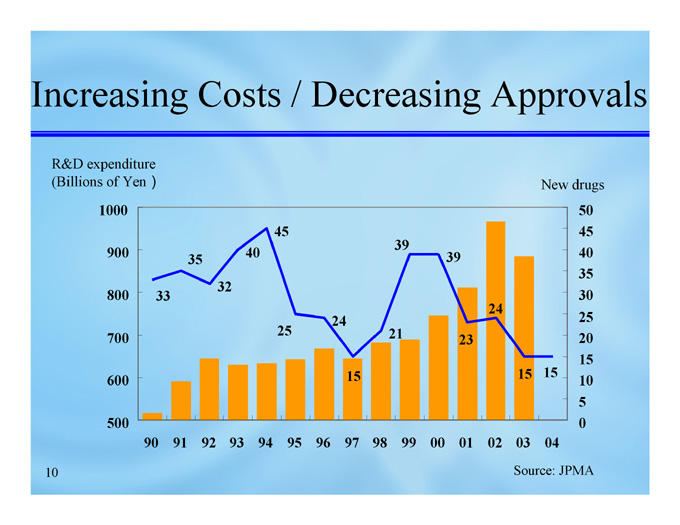

Increasing Costs / Decreasing Approvals

R&D expenditure

(Billions of Yen)

New drugs

1000

50

45

45

39

900

40

39

40

35

35

32

800

33

30

24

24

25

25

20

700

23

21

15

15

15

10

600

15

5

0

500

03

02

01

00

99

98

97

96

95

94

93

92

91

90

04

Source: JPMA

10

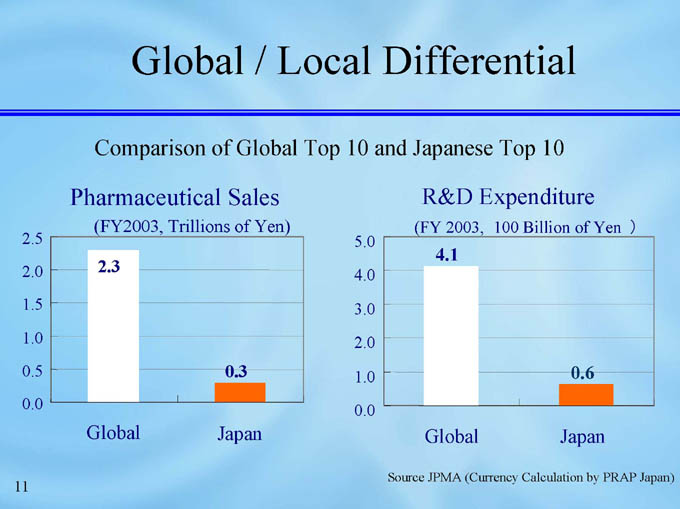

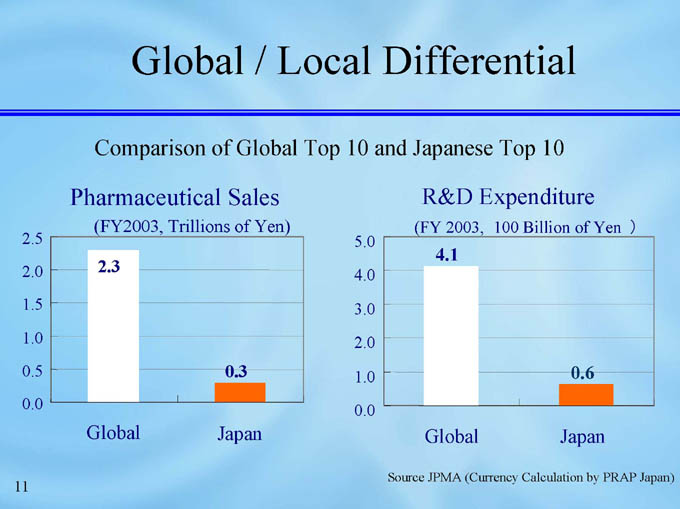

Global / Local Differential

Comparison of Global Top 10 and Japanese Top 10

Pharmaceutical Sales

R&D Expenditure

)

100 Billion of Yen

(FY 2003,

(FY2003, Trillions of Yen)

5.0

2.5

4.1

2.3

4.0

2.0

3.0

1.5

2.0

1.0

0.3

0.6

1.0

0.5

0.0

0.0

Japan

Japan

Global

Global

Source JPMA (Currency Calculation by PRAP Japan)

11

Benefits

12

Benefits of Integration

Integration provides:

Strong R&D franchise categories

Global reach and overwhelming domestic sales strength

Expansion of corporate strategy options arising from increased scale

Increased operational efficiency

Outstanding personnel resources

13

Benefits for Daiichi

Integration provides Daiichi:

Enhanced capabilities of global clinical studies and drug discovery

Further enhancement of domestic sales strength through doubling of MR numbers and increased share with specified distributors

Business infrastructure/opportunities in Europe

14

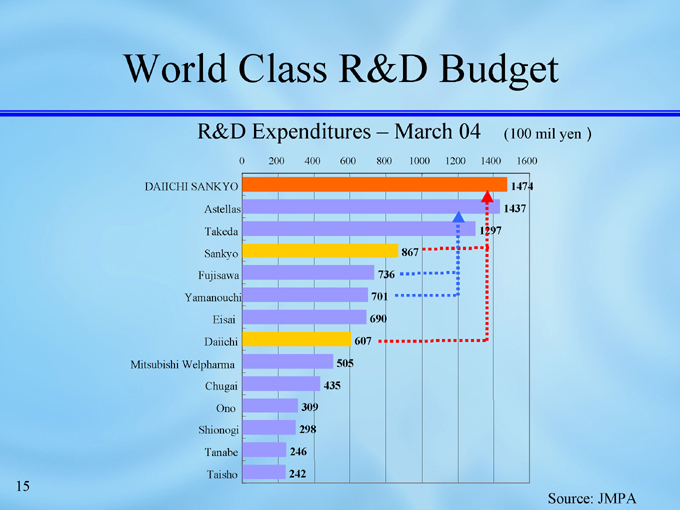

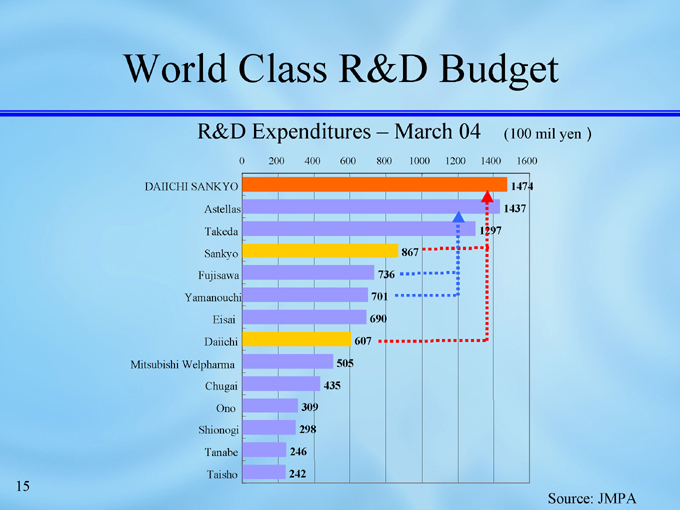

World Class R&D Budget

R&D Expenditures – March 04 (100 mil yen)

1400

1200

1000

800

600

400

200

0

1600

1474

DAIICHI SANKYO

1437

Astellas

1297

Takeda

867

Sankyo

736

Fujisawa

Yamanouchi

701

690

Eisai

607

Daiichi

505

Mitsubishi Welpharma

435

Chugai

309

Ono

298

Shionogi

246

Tanabe

242

Taisho

Source: JMPA

15

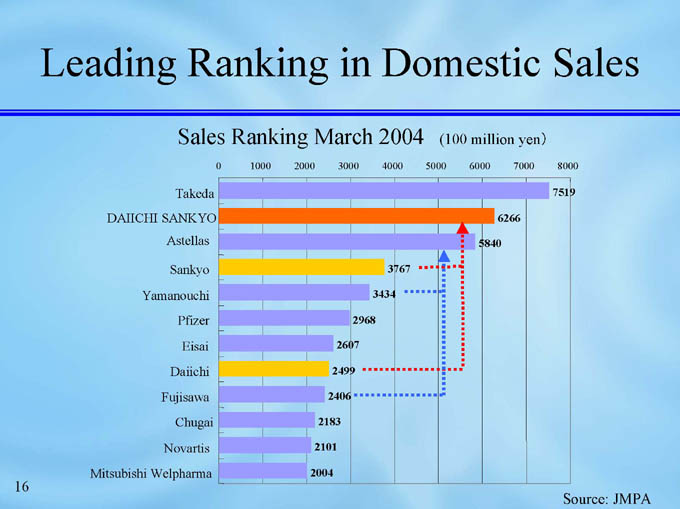

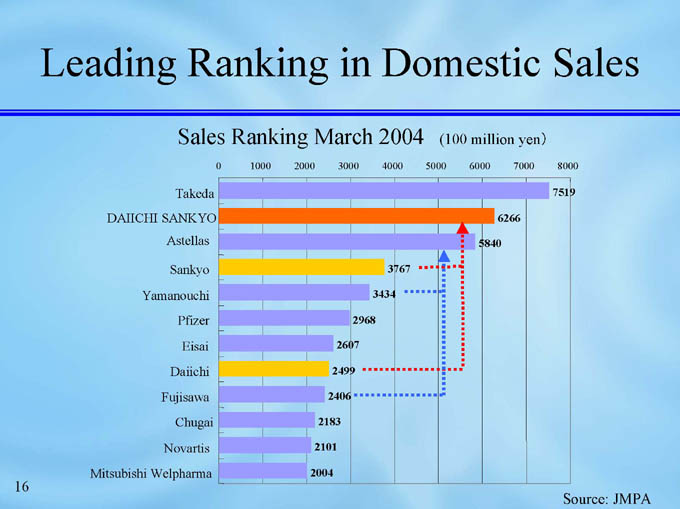

Leading Ranking in Domestic Sales

Sales Ranking March 2004 (100 million yen)

7000

6000

5000

4000

3000

2000

1000

0

8000

Takeda

7519

DAIICHI SANKYO

6266

Astellas

5840

Sankyo

3767

3434

Yamanouchi

Pfizer

2968

Eisai

2607

Daiichi

2499

Fujisawa

2406

Chugai

2183

Novartis

2101

Mitsubishi Welpharma

2004

Source: JMPA

16

A Japan based

global pharma-innovator

DAIICHI SANKYO

Synergies

Takashi Shoda

President & CEO

Sankyo Co., Ltd.

18

Benefits of Integration

Integration provides:

Strong R&D franchise categories

Global reach and overwhelming domestic sales strength

Expansion of corporate strategy options arising from increased scale

Increased operational efficiency

Outstanding personnel resources

19

Benefits for Sankyo

Strengthening of product mix in franchise categories, centering on cardiovascular

Access to Daiichi’s expertise and know-how in cancer category

Seamless pipeline post- CS-747, CS-505

Increase in number of quality MR’s domestically

Increase in corporate strategy options through expansion of overseas operations

Enhancement of corporate strategy in Asia (China, Korea)

20

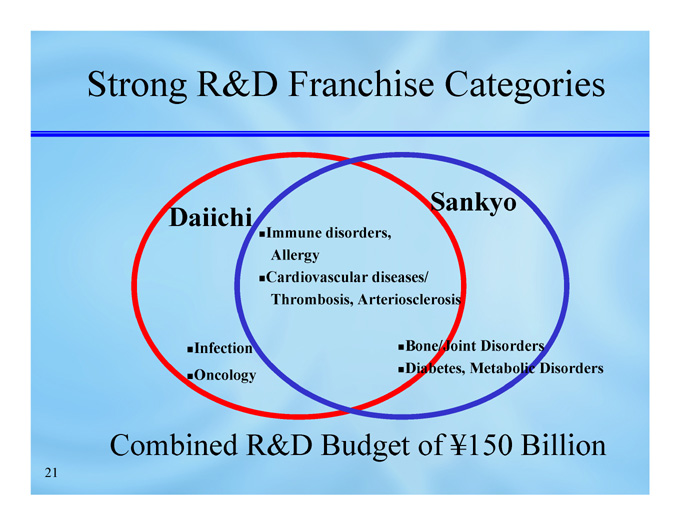

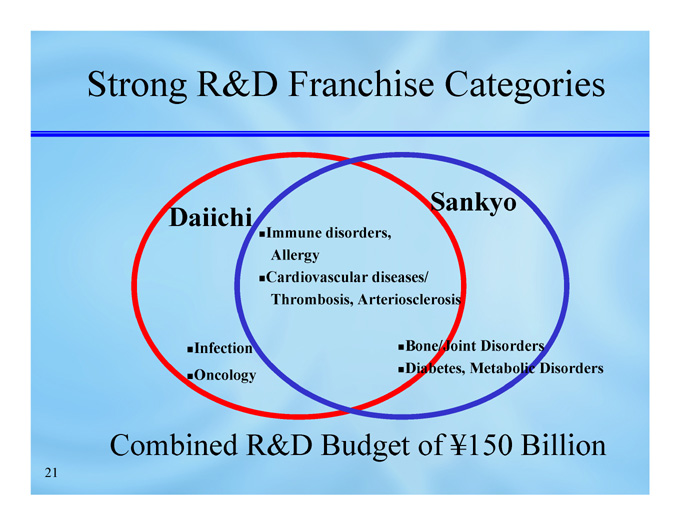

Strong R&D Franchise Categories

Sankyo

Daiichi

Immune disorders, Allergy

Cardiovascular diseases/ Thrombosis, Arteriosclerosis

Infection

Oncology

Bone/Joint Disorders

Diabetes, Metabolic Disorders

Combined R&D Budget of ¥150 Billion

21

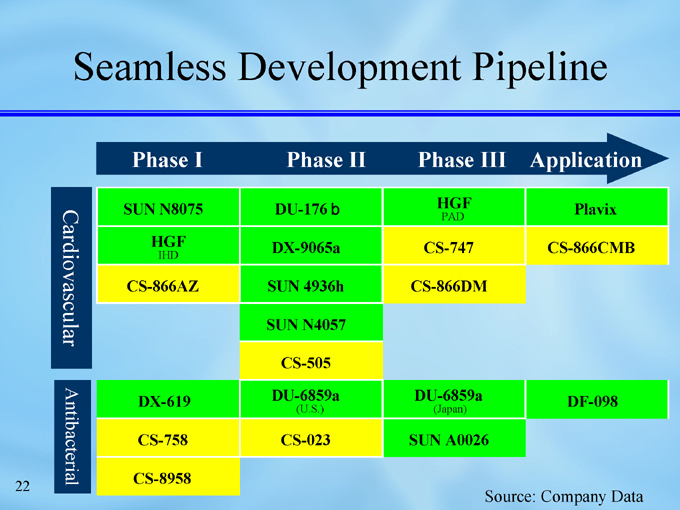

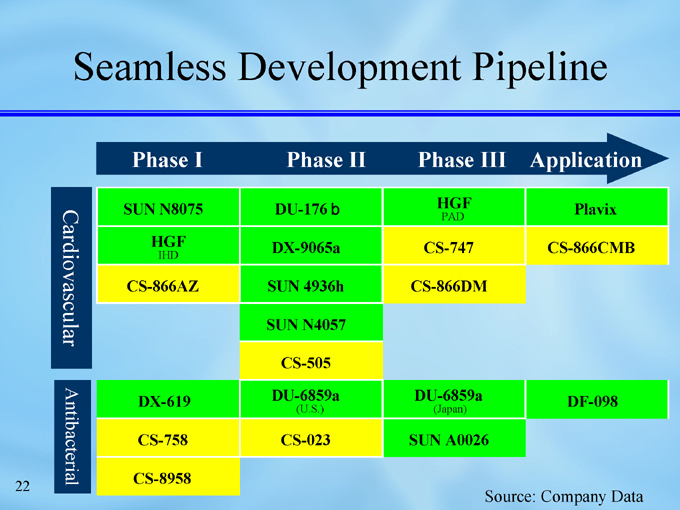

Seamless Development Pipeline

Phase III

Phase II

Phase I

Application

Cardiovascular

HGF

DU-176b

SUN N8075

Plavix

PAD

HGF

CS-747

DX-9065a

CS-866CMB

IHD

SUN 4936h

CS-866AZ

CS-866DM

SUN N4057

CS-505

Antibacterial

DU-6859a

DU-6859a

DX-619

DF-098

(U.S.)

(Japan)

CS-023

CS-758

SUN A0026

CS-8958

Source: Company Data

22

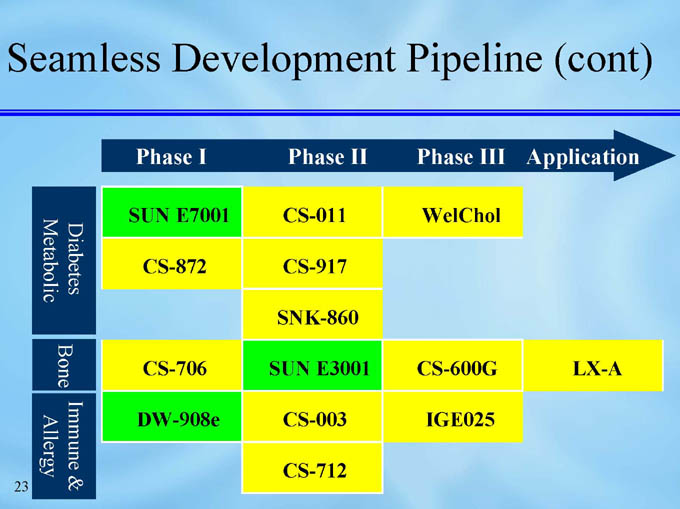

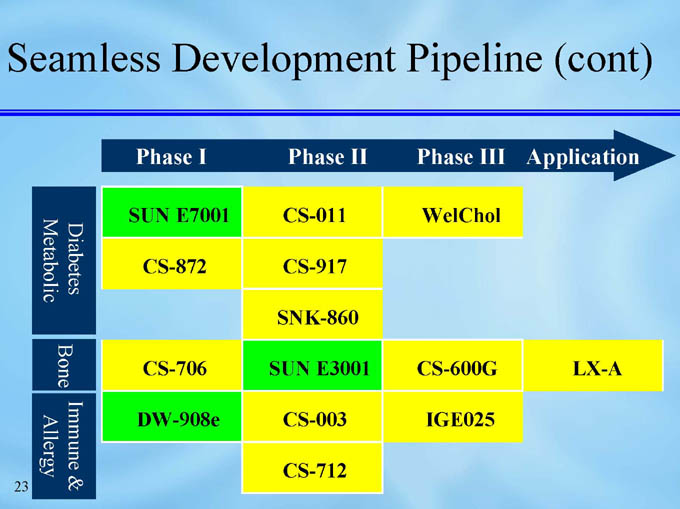

Seamless Development Pipeline (cont)

Phase III

Phase II

Phase I

Application

Diabetes Metabolic

CS-011

SUN E7001

WelChol

CS-872

CS-917

SNK-860

LX-A

CS-600G

SUN E3001

CS-706

Bone

Immune & Allergy

CS-003

DW-908e

IGE025

CS-712

23

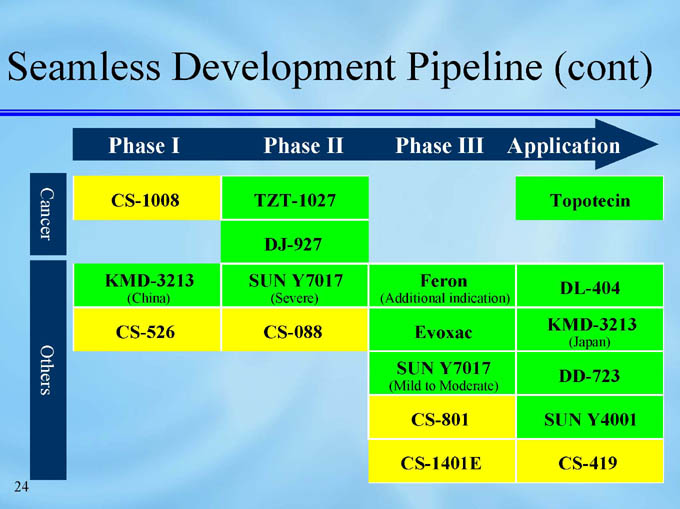

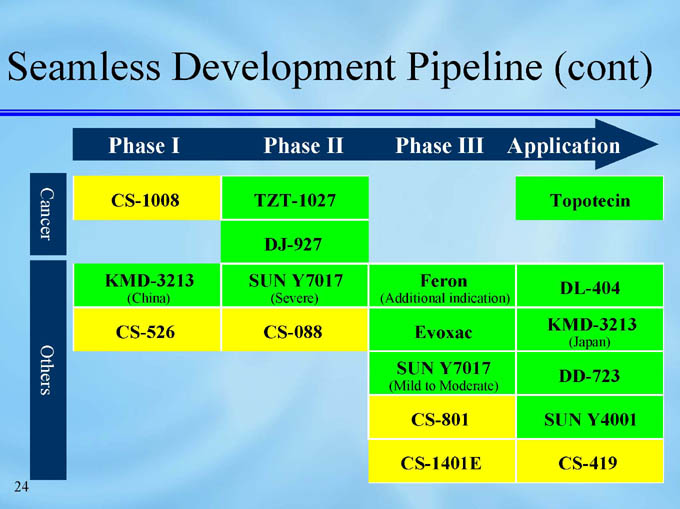

Seamless Development Pipeline (cont)

Phase III

Phase II

Phase I

Application

Cancer

TZT-1027

CS-1008

Topotecin

DJ-927

Others

SUN Y7017

KMD-3213

Feron

DL-404

(Severe)

(China)

(Additional indication)

KMD-3213

CS-088

CS-526

Evoxac

(Japan)

SUN Y7017

DD-723

(Mild to Moderate)

CS-801

SUN Y4001

CS-1401E

CS-419

24

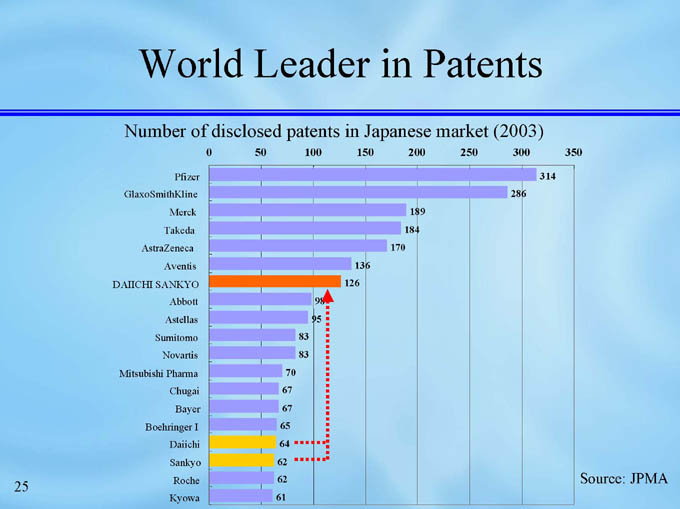

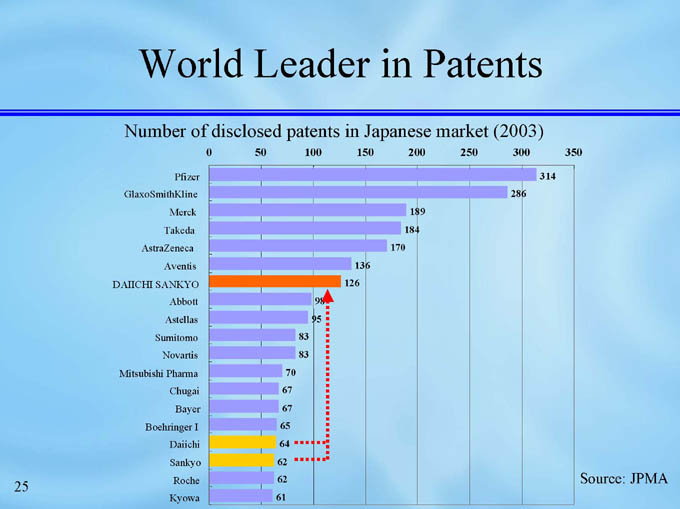

World Leader in Patents

Number of disclosed patents in Japanese market (2003)

300

250

200

150

100

50

0

350

314

Pfizer

286

GlaxoSmithKline

189

Merck

184

Takeda

170

AstraZeneca

136

Aventis

126

DAIICHI SANKYO

98

Abbott

95

Astellas

83

Sumitomo

83

Novartis

70

Mitsubishi Pharma

67

Chugai

67

Bayer

65

Boehringer I

64

Daiichi

62

Sankyo

62

Source: JPMA

Roche

61

Kyowa

25

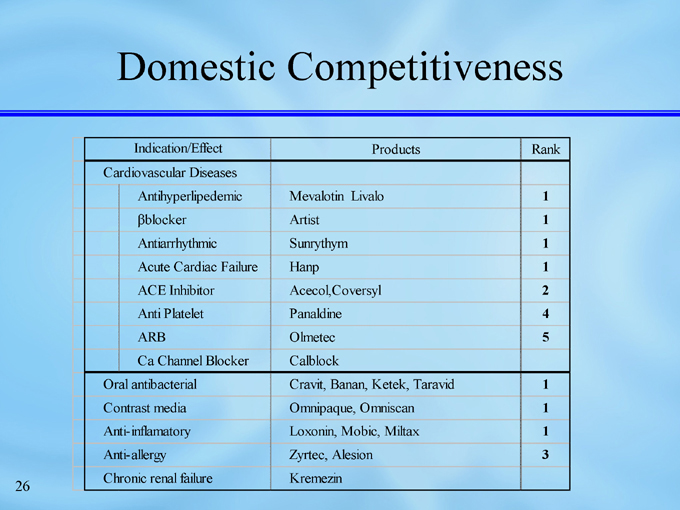

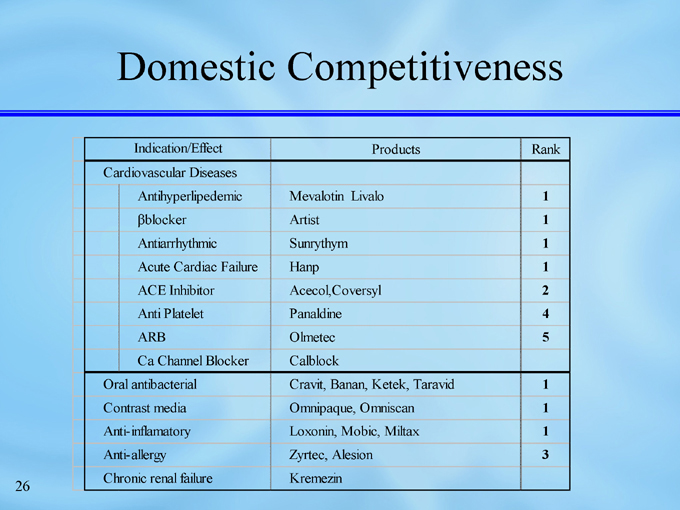

Domestic Competitiveness

Indication/Effect

Rank

Products

Cardiovascular Diseases

1

Mevalotin Livalo

Antihyperlipedemic

1

Artist

ßblocker

1

Sunrythym

Antiarrhythmic

1

Hanp

Acute Cardiac Failure

2

Acecol,Coversyl

ACE Inhibitor

4

Panaldine

Anti Platelet

5

Olmetec

ARB

Calblock

Ca Channel Blocker

1

Cravit, Banan, Ketek, Taravid

Oral antibacterial

1

Omnipaque, Omniscan

Contrast media

1

Loxonin, Mobic, Miltax

Anti-inflamatory

3

Zyrtec, Alesion

Anti-allergy

Kremezin

Chronic renal failure

26

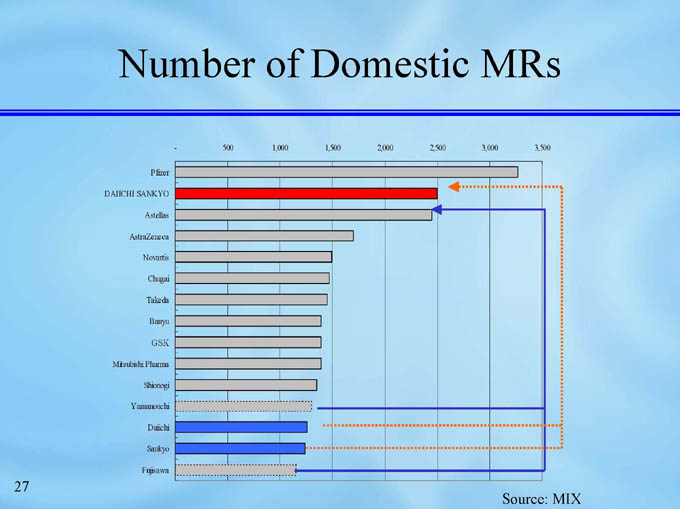

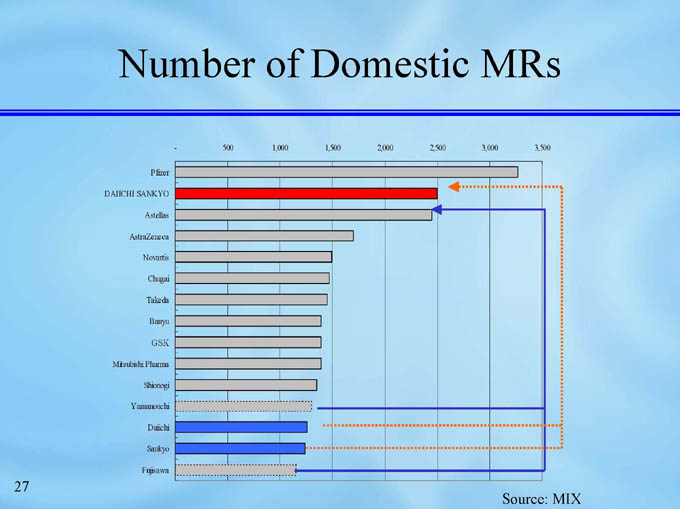

Number of Domestic MRs

3,000

2,500

2,000

1,500

1,000

500

-

3,500

Pfizer

DAIICHI SANKYO

Astellas

AstraZeneca

Novartis

Chugai

Takeda

Banyu

GSK

Mitsubishi Pharma

Shionogi

Yamanouchi

Daiichi

Sankyo

Fujisawa

Source: MIX

27

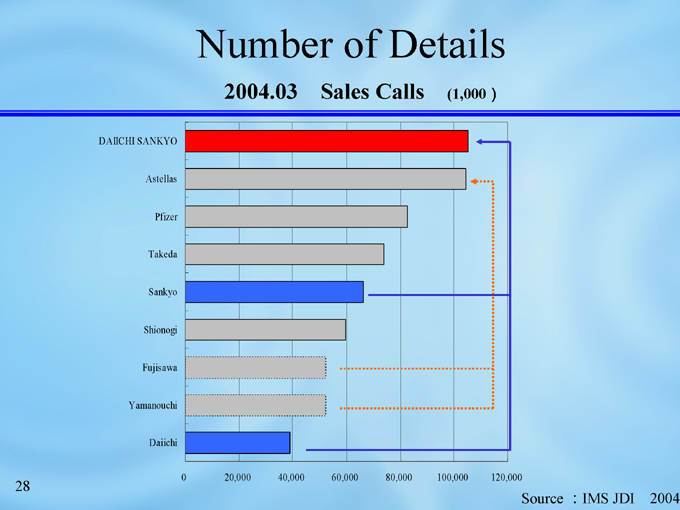

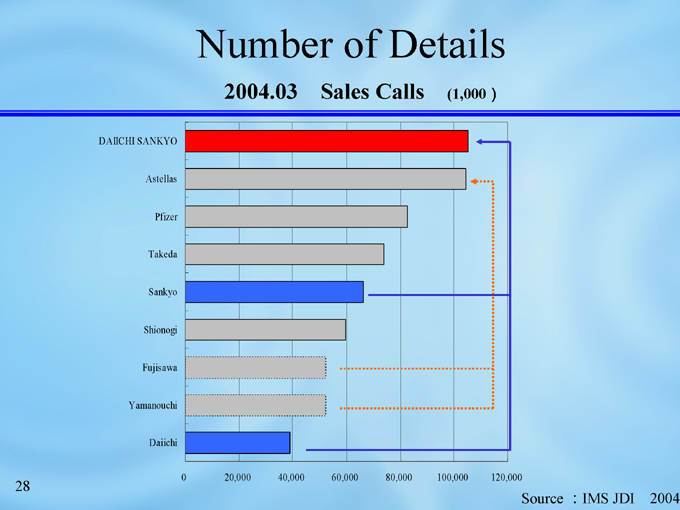

Number of Details

2004.03 Sales Calls (1,000)

DAIICHI SANKYO

Astellas

Pfizer

Takeda

Sankyo

Shionogi

Fujisawa

Yamanouchi

Daiichi

100,000

80,000

60,000

40,000

20,000

0

120,000

Source :IMS JDI 2004

28

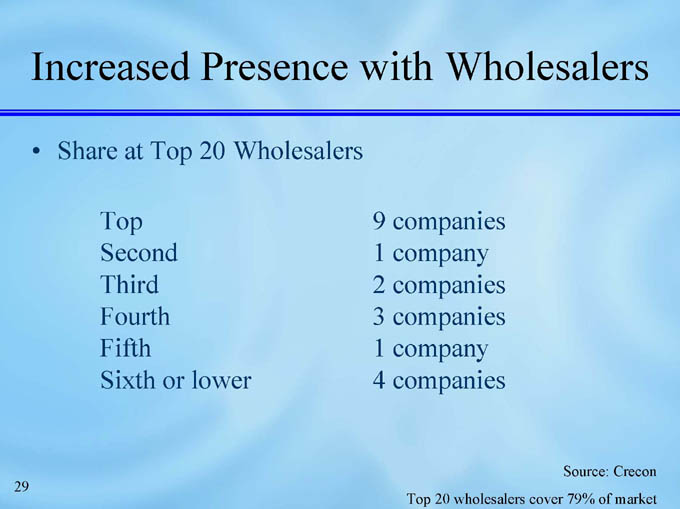

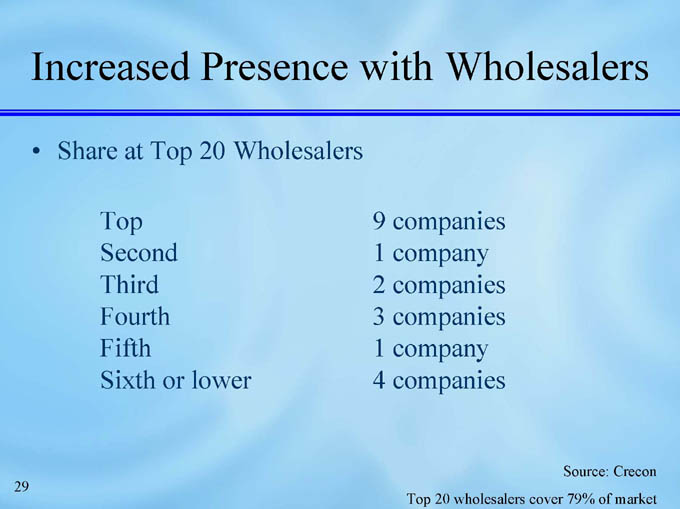

Increased Presence with Wholesalers

Share at Top 20 Wholesalers

Top 9 companies

Second 1 company

Third 2 companies

Fourth 3 companies

Fifth 1 company

Sixth or lower 4 companies

Source: Crecon

Top 20 wholesalers cover 79% of market

29

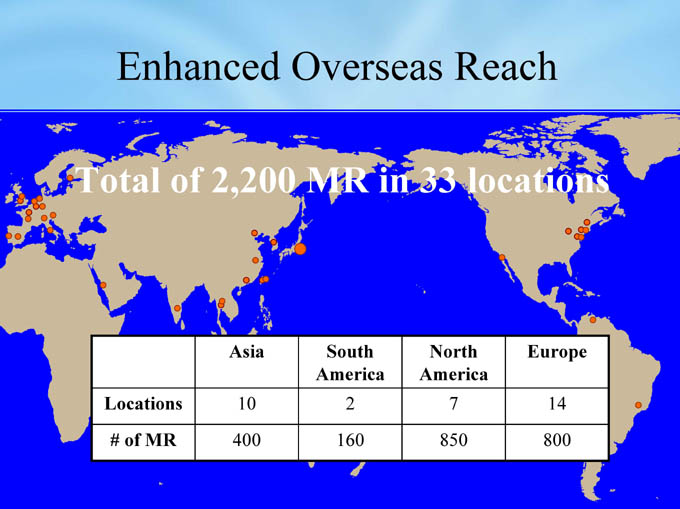

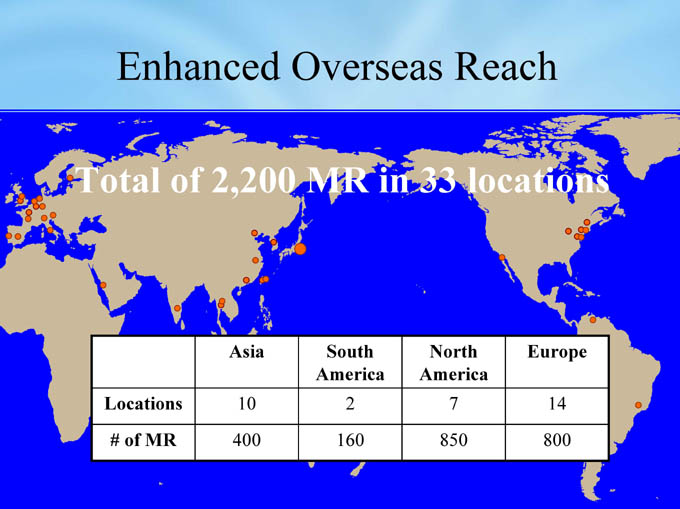

Enhanced Overseas Reach

Total of 2,200 MR in 33 locations

Asia

South

North

Europe

South America

America

Locations

10

2

7

14

10

2

7

14

of MR

#

of MR

#

400

160

850

800

30

Others

Integration provides:

Expansion of corporate strategy options arising from increased scale

Increased operational efficiency

Outstanding personnel resources

31

Outline of Holding Company

32

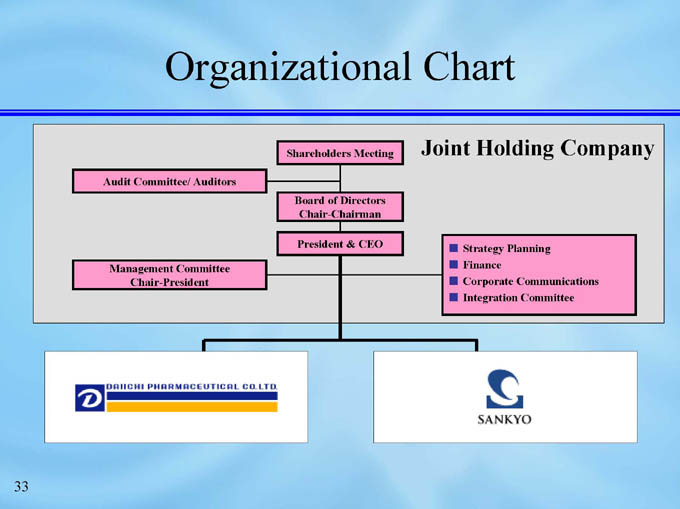

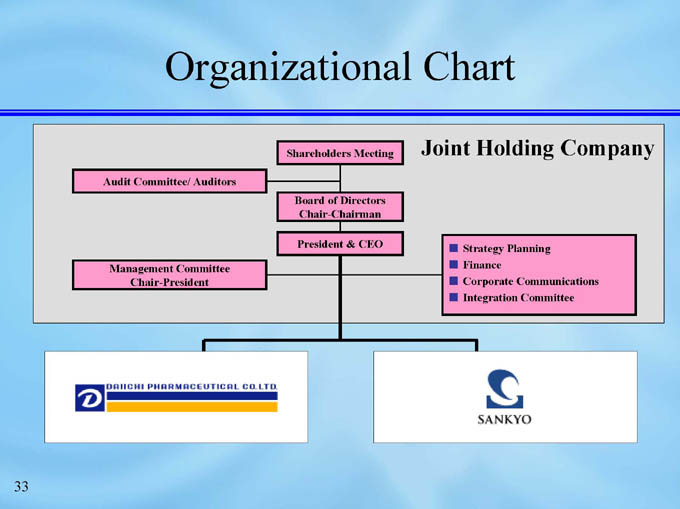

Organizational Chart

Joint Holding Company

Shareholders Meeting

Audit Committee/ Auditors

Board of Directors

Chair-Chairman

President & CEO

Strategy Planning

Finance

Corporate Communications

Integration Committee

Management Committee

Chair-President

33

Directors and Officers

Representative Director & Chairman

Kiyoshi Morita

Representative Director & President CEO

Takashi Shoda

Executive Director Hiroyuki Nagasako

Executive Director Hideho Kawamura

Executive Director Yasuhiro Ikegami

Executive Director Tsutomu Une

Non-executive Director 4 (to be appointed)

Corporate Auditor 2 (to be appointed)

External Corporate Auditor 2 (to be appointed)

34

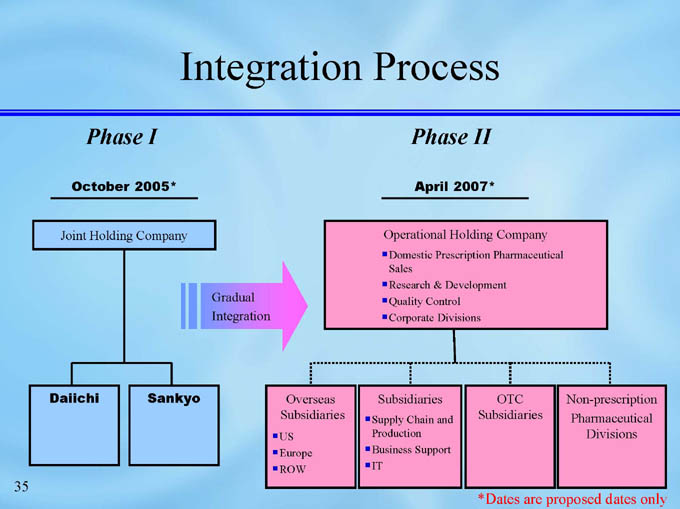

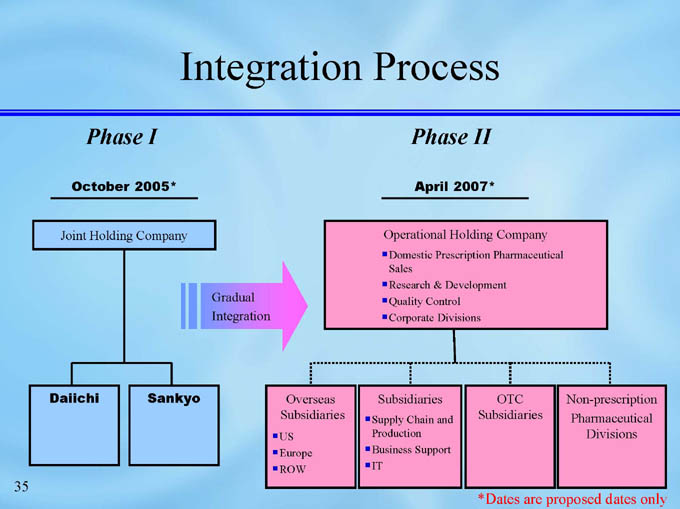

Integration Process

Phase I

Phase II

October 2005*

April 2007*

Operational Holding Company

Joint Holding Company

Domestic Prescription Pharmaceutical Sales

Research & Development

Quality Control

Corporate Divisions

Gradual

Integration

Daiichi

Non-prescription

Pharmaceutical Divisions

OTC Subsidiaries

Subsidiaries

Overseas

Subsidiaries

Sankyo

Supply Chain and Production

Business Support

IT

US

Europe

ROW

*Dates are proposed dates only

35

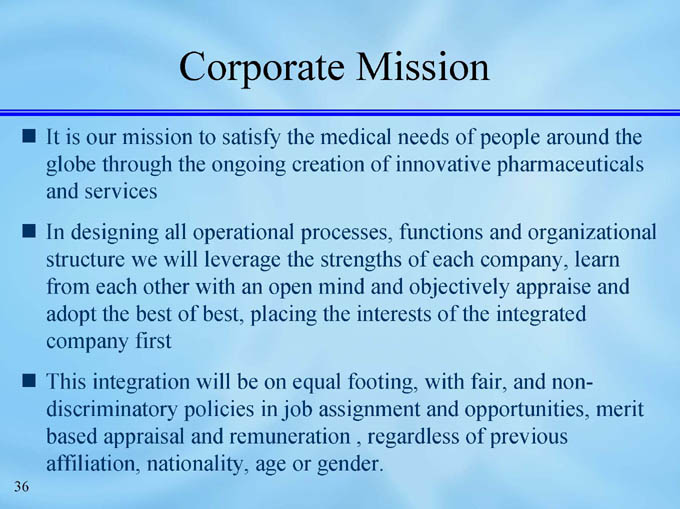

Corporate Mission

It is our mission to satisfy the medical needs of people around the globe through the ongoing creation of innovative pharmaceuticals and services

In designing all operational processes, functions and organizational structure we will leverage the strengths of each company, learn from each other with an open mind and objectively appraise and adopt the best of best, placing the interests of the integrated company first

This integration will be on equal footing, with fair, and non-discriminatory policies in job assignment and opportunities, merit based appraisal and remuneration , regardless of previous affiliation, nationality, age or gender.

36

A Japan based

global pharma-innovator

DAIICHI SANKYO

37

Filings with the U.S. SEC

Sankyo Co., Ltd, and Daiichi Pharmaceutical Co., Ltd may file a registration statement on Form F-4 with the U.S. SEC in connection with the proposed business combination of Daiichi Pharmaceutical Co., Ltd and Sankyo Co., Ltd, under a new holding company by way of a joint share transfer. The Form F-4 (if filed) will contain a prospectus and other documents. If a Form F-4 is filed and declared effective, Sankyo Co., Ltd. and Daiichi Pharmaceutical Co., Ltd plan to mail the prospectus contained in the Form F-4 to their U.S. shareholders prior to the shareholders meetings at which the share exchange will be voted upon. The Form F-4 (if filed) and prospectus will contain important information about Sankyo Co., Ltd and Daiichi Pharmaceutical Co., Ltd, the joint share transfer and related matters. U.S. shareholders of Sankyo Co., Ltd are urged to read the Form F-4, the prospectus and the other documents that may be filed with the U.S. SEC in connection with the joint share transfer carefully before they make any decision at the shareholders meeting with respect to the joint share transfer. The Form F-4 (if filed), the prospectus and all other documents filed with the U.S. SEC in connection with the joint share transfer will be available when filed, free of charge, on the U.S. SEC’s web site at www.sec.gov. In addition, the prospectus and all other documents filed with the U.S. SEC in connection with the business combination will be made available to shareholders, free of charge, by calling, writing or e-mailing:

Sankyo Co., Ltd: Daiichi Pharmaceutical Co., Ltd;

Mr Shigemichi Kondo Mr Toshio Takahashi

Corporate Communications Dept Corporate Communications Dept

3-5-1 Nihonbashi-honcho, Chuo-ku, Tokyo 14-10 Nihonbashi, 3-chome, Chuo-ku, Tokyo,

Tel: +813-5255-7034 Tel: +813-3273-7107

shige-k@sankyo.co.jp andokb5o@daiichipharm.co.jp

You may read and copy any reports and other information filed with, or submitted to, the U.S. SEC at the U.S. SEC’s public reference rooms at 450 Fifth Street, N.W., Washington, D.C. 20549 or at the other public reference rooms in New York, New York and Chicago, Illinois. Please call the U.S. SEC at 1-800-SEC-0330 for further information on public reference rooms. Filings with the U.S. SEC also are available to the public from commercial document-retrieval services and at the web site maintained by the U.S. SEC at http//www.sec.gov.

38

Forward-Looking Statements

This communication contains forward-looking information and statements about Sankyo Co.,Ltd and Daiichi Pharmaceutical Co., Ltd and their combined businesses after completion of the joint share transfer. Forward-looking statements are statements that are not historical facts. These statements include financial projections and estimates and their underlying assumptions, statements regarding plans, objectives and expectations with respect to future operations, products and services, and statements regarding future performance. Forward-looking statements are generally identified by the words “expect,” “anticipates,” “believes,” “intends,” “estimates” and similar expressions. Although the management of Sankyo Co., Ltd and Daiichi Pharmaceutical Co,. Ltd believe that the expectations reflected in such forward-looking statements are reasonable, investors and holders of Sankyo Co., Ltd and Daiichi Pharmaceutical Co., Ltd, securities are cautioned that forward-looking information and statements are subject to various risks and uncertainties, many of which are difficult to predict and generally beyond the control of Sankyo Co., Ltd and Daiichi Pharmaceutical Co., Ltd, that could cause actual results and developments to differ materially from those expressed in, or implied or projected by, the forward-looking information and statements. These risks and uncertainties include those discussed or identified in the public filings with the SEC and the local filings made by Sankyo Co., Ltd and Daiichi Pharmaceutical Co., Ltd. including those listed under “Cautionary Statement Concerning Forward-Looking Statements” and “Risk Factors” in the prospectus included in the registration statement on Form F-4 that Sankyo Co., Ltd and Daiichi Pharmaceutical Co., Ltd. may file with the U.S. SEC. Other than as required by applicable law, neither Sankyo Co, Ltd nor Daiichi Pharmaceutical Co., Ltd undertakes any obligation to update or revise any forward-looking information or statements.

39