Filing under Rule 425 under

the U.S. Securities Act of 1933

Filing by: Sankyo Company, Limited

Subject Company: Daiichi Pharmaceutical Co., Ltd.

and Sankyo Company, Limited

SEC File No. 132-02292

Consolidated Financial Results

for Fiscal 2004

(The Fiscal Year Ended March 31, 2005)

This document has been prepared as a guide for non-Japanese investors and contains forward-looking statements that are based on managements’ estimates, assumptions and projections at the time of publication. A number of factors could cause actual results to differ materially from expectations.

Consolidated Financial Results

for Fiscal 2004

(The Fiscal Year Ended March 31, 2005)

Sankyo Co., Ltd.

| | |

| Listed exchanges: | | Tokyo, Osaka, Nagoya, Fukuoka and Sapporo |

| |

| Head office: | | Tokyo, Japan |

| |

| Stock code: | | 4501 |

| |

| Homepage: | | http://www.sankyo.co.jp |

| |

| Address: | | 3-5-1 Nihonbashi Honcho, Chuo-ku Tokyo 103-8426, Japan |

| |

| Meeting of Board of Directors for year-end closing: | | May 13, 2005 |

| |

| U.S. accounting standards: | | Not adopted |

| 1. | Consolidated Financial Results for Fiscal 2004 |

(1) Consolidated Financial Results

| | | | | | | | | | | | | | | |

| | | Net sales

| | | Operating income

| | | Recurring income

| |

| | | (¥ Million) | | % | | | (¥ Million) | | % | | | (¥ Million) | | % | |

Fiscal 2004 | | 587,830 | | (1.4 | ) | | 84,925 | | (11.1 | ) | | 82,506 | | (12.2 | ) |

Fiscal 2003 | | 596,345 | | 4.6 | | | 95,555 | | 19.7 | | | 93,975 | | 17.1 | |

| | | | | | | | | | |

| | | Net income

| | Net income

per share

| | Fully

diluted net

income per

share

| | Return on

equity

(ROE)

|

| | | (¥ Million) | | % | | (¥) | | (¥) | | (%) |

Fiscal 2004 | | 48,282 | | 11.2 | | 111.78 | | 111.74 | | 6.9 |

Fiscal 2003 | | 43,411 | | 28.3 | | 98.57 | | 98.56 | | 6.5 |

| | | | |

| | | Ratio of

recurring income to

total assets

| | Ratio of

recurring

income to

net sales

|

| | | (%) | | (%) |

Fiscal 2004 | | 8.7 | | 14.0 |

Fiscal 2003 | | 10.2 | | 15.8 |

| | | | | | | | |

| Notes: | | 1. | | Gain on investments in subsidiaries and affiliates accounted for by the equity method: |

| | | | |

| | | | | Fiscal 2004: | | | | None |

| | | | |

| | | | | Fiscal 2003: | | | | None |

| | |

| | | 2. | | Average number of outstanding shares (consolidated) during the period: |

| | | | |

| | | | | Fiscal 2004: | | | | 429,527,836 shares |

| | | | |

| | | | | Fiscal 2003: | | | | 437,053,274 shares |

| | | | |

| | | 3. | | Changes in accounting procedures: | | Yes | | |

| | |

| | | 4. | | Percentages for net sales, operating income, recurring income and net income represent year-on-year changes. |

Page 3

(2) Consolidated Financial Position

| | | | | | | | |

| | | Total assets

| | Shareholders’

equity

| | Shareholders’

equity ratio

| | Shareholders’

equity per

share

|

| | | (¥ Million) | | (¥ Million) | | (%) | | (¥) |

Fiscal 2004 | | 976,230 | | 716,587 | | 73.4 | | 1,667.76 |

| | | | |

Fiscal 2003 | | 927,244 | | 682,594 | | 73.6 | | 1,588.35 |

| | | | |

| Notes: | | Outstanding shares (consolidated) at the end of the period: |

| | |

| | | Fiscal 2004: | | 429,508,509 shares |

| | |

| | | Fiscal 2003: | | 429,542,651 shares |

(3) Consolidated Cash Flows

| | | | | | | | | | |

| | | Net cash

provided by

(used in)

operating

activities

| | Net cash

provided by

(used in)

investing

activities

| | | Net cash

provided by

(used in)

financing

activities

| | | Cash and cash

equivalents at

the end of

period

|

| | | (¥ Million) | | (¥ Million) | | | (¥ Million) | | | (¥ Million) |

Fiscal 2004 | | 96,703 | | (16,265 | ) | | (12,716 | ) | | 262,530 |

| | | | |

Fiscal 2003 | | 71,207 | | (49,168 | ) | | (31,657 | ) | | 194,789 |

(4) Scope of Consolidation and Application of Equity Method:

| | | | | | |

Number of consolidated subsidiaries: | | 37 |

| |

Number of non-consolidated subsidiaries accounted for by the equity method: | | 0 |

| |

Number of affiliates accounted for by the equity method: | | 0 |

(5) Changes in Scope of Consolidation and Application of Equity Method:

| | | | | | |

| | | Consolidated subsidiaries: | | (Newly included) | | 0 |

| | | | | (Excluded) | | 1 |

| | | Companies accounted for by the equity method: | | (Newly included) | | 0 |

| | | | | (Excluded) | | 0 |

| | | | | | | |

2. Consolidated Results ‘Forecast for Fiscal 2005’

| | | | | | |

| | | Net sales

| | Recurring

income

| | Net

income

|

| | | (¥ Million) | | (¥ Million) | | (¥ Million) |

Interim period of Fiscal 2005 | | 279,000 | | 36,000 | | 23,000 |

| | | |

Fiscal 2005 | | 557,000 | | 63,000 | | 37,000 |

(Reference) Projected net income per share for Fiscal 2005: ¥85.52

The forecasts above have been based on the information available to management on the date of their announcement. The results could differ materially from these projections for a wide variety of reasons. For detailed information of ‘Forecast for Fiscal 2005’ please refer page 18,19 and 21 of the attached information.

Page 4

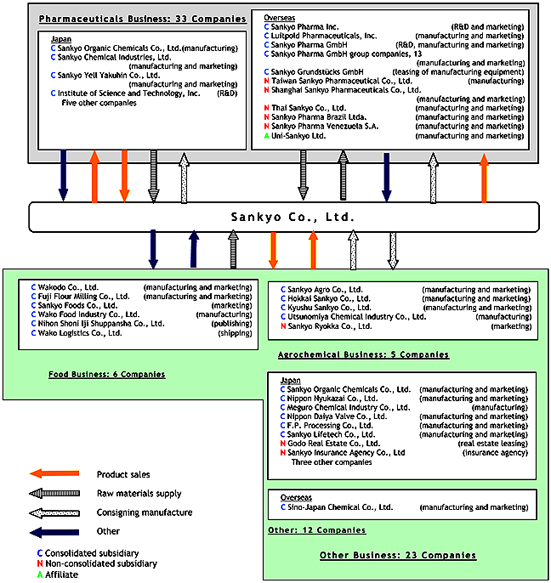

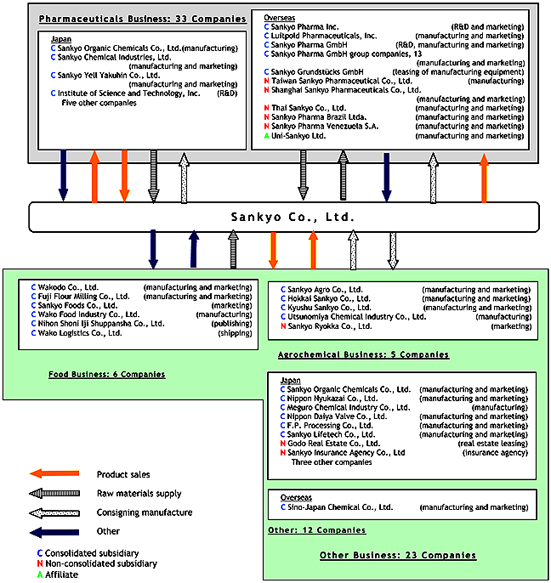

I. State of the Group

The Sankyo Group consists of Sankyo Co., Ltd. (the “Company”), its 51 subsidiaries, and its three affiliates, for a total of 55 companies. The group’s main operating activities consist of the manufacture and sales of pharmaceuticals, food products, agrochemicals, veterinary drugs and chemical products.

The following chart shows the organization of the Sankyo Group.

Page 5

Consolidated Subsidiaries

| | | | | | | | | | | | | | | | | | |

Name

| | Location

| | Capital/ Investment (Million yen)

| | Major

Operating

Activities

| | Percentage

of Voting

Rights Held (%)

| | Details of Relationship

|

| | | | | | Mutual

Directors

| | Capital Support

Provided by Sankyo

| | Operating

Transactions

| | Facilities Leased by

Sankyo

| | Other

|

| | | | | | | | | |

| Wakodo Co., Ltd. | | Chiyoda-ku, Tokyo | | 2,918 | | Food | | 61.6 (0.7) | | Yes | | — | | Sankyo purchases and markets products | | — | | — |

| | | | | | | | | |

| Fuji Flour Milling Co., Ltd. | | Shizuoka-shi | | 500 | | Food | | 66.6 (0.4) | | Yes | | Facility-related capital | | Sankyo purchases raw materials | | Research facilities and warehouses | | — |

| | | | | | | | | |

| Sankyo Organic Chemicals Co., Ltd. | | Takatsu-ku, Kawasaki-shi | | 300 | | Pharmaceu-ticals and other | | 93.4 | | Yes | | — | | Sankyo purchases raw materials and consigns manufacturing | | Manufacturing facilities | | — |

| | | | | | | | | |

| Nippon Nyukazai Co., Ltd. | | Chuo-ku, Tokyo | | 300 | | Other | | 100.0 | | Yes | | Loan guarantees | | Sankyo purchases raw materials | | Land | | — |

| | | | | | | | | |

| Nippon Daiya Valve Co., Ltd. | | Shinagawa-ku, Tokyo | | 96 | | Other | | 100.0 | | Yes | | — | | Sankyo purchases research and manufacturing facilities | | Land and buildings | | — |

| | | | | | | | | |

| Sankyo Chemical Industries, Ltd. | | Chuo-ku, Tokyo | | 65 | | Pharmaceu-ticals | | 100.0 | | Yes | | Facility-related and working capital | | Sankyo purchases raw materials and consigns manufacturing | | — | | — |

| | | | | | | | | |

| Hokkai Sankyo Co., Ltd. | | Kitahiroshima-shi | | 52 | | Agrochemi-cals | | 96.2 | | Yes | | — | | — | | — | | — |

| | | | | | | | | |

| Kyushu Sankyo Co., Ltd. | | Tosu-shi | | 40 | | Agrochemi-cals | | 100.0 (100.0) | | Yes | | — | | — | | — | | — |

| | | | | | | | | |

| Meguro Chemical Industry Co., Ltd. | | Meguro-ku, Tokyo | | 40 | | Other | | 100.0 | | Yes | | — | | Sankyo purchases materials and consigns manufacturing | | Manufacturing facilities | | — |

| | | | | | | | | |

| Sankyo Foods Co., Ltd. | | Chiyoda-ku, Tokyo | | 20 | | Food | | 100.0 | | Yes | | — | | Sankyo purchases raw materials | | Offices | | — |

| | | | | | | | | |

| Utsunomiya Chemical Industry Co., Ltd. | | Utsunomiya-shi | | 20 | | Agrochemi-cals | | 100.0 (100.0) | | Yes | | Facility-related capital | | — | | — | | — |

| | | | | | | | | |

| F.P. Processing Co., Ltd. | | Ikuno-ku, Osaka-shi | | 30 | | Other | | 100.0 | | Yes | | Working capital | | Sankyo purchases materials | | — | | — |

| | | | | | | | | |

| Institute of Science and Technology, Inc. | | Shinagawa-ku, Tokyo | | 20 | | Pharmaceu-ticals | | 100.0 | | Yes | | — | | Sankyo consigns pharmaceutical testing | | Offices | | — |

| | | | | | | | | |

| Sankyo Yell Yakuhin Co., Ltd. | | Chiyoda-ku, Tokyo | | 96 | | Pharmaceu-ticals | | 100.0 | | Yes | | Facility-related and working capital | | Sankyo purchases products | | — | | — |

| | | | | | | | | |

| Nihon Shoni Iji Shuppansya Co., Ltd. | | Shinjuku-ku, Tokyo | | 20 | | Food | | 100.0 (100.0) | | No | | — | | — | | — | | — |

| | | | | | | | | |

| Wako Logistics Co., Ltd. | | Chofu-shi | | 21 | | Food | | 100.0 (100.0) | | No | | — | | — | | — | | — |

| | | | | | | | | |

| Wako Food Industry Co., Ltd. | | Nagano-shi | | 25 | | Food | | 100.0 (100.0) | | Yes | | — | | — | | — | | — |

| | | | | | | | | |

| Sankyo Agro Co., Ltd. | | Bunkyo-ku, Tokyo | | 350 | | Agrochemi-cals | | 100.0 | | Yes | | — | | Sankyo conducts R&D for the company | | Land, buildings and offices | | — |

| | | | | | | | | |

| Sankyo Lifetech Co., Ltd. | | Bunkyo-ku, Tokyo | | 300 | | Other | | 100.0 | | Yes | | — | | Sankyo conducts R&D and manufacturing for the company | | Offices | | — |

| | | | | | | | | |

| Sino-Japan Chemical Co., Ltd. | | Taipei, Taiwan | | 144 million NT$ | | Other | | 52.0 (3.4) | | Yes | | — | | — | | — | | — |

| | | | | | | | | |

| Sankyo Pharma Inc. | | Parsippany, U.S. | | 20.1 million U.S. dollars | | Pharmaceu-ticals | | 100.0 | | Yes | | Guarantee for liabilities relating to joint sales promotional contracts, office lease contracts and automotive lease contracts | | Sankyo markets products and consigns pharmaceutical-related R&D | | — | | Sankyo

provides

pharmaceutical

technology |

| | | | | | | | | |

| Luitpold Pharmaceuticals, Inc. | | Shirley, U.S. | | 0.2 million U.S. dollars | | Pharmaceu-ticals | | 100.0 (100.0) | | Yes | | — | | — | | — | | — |

| | | | | | | | | |

| Sankyo Grundstücks GmbH | | Munich, Germany | | 5.1 million euros | | Pharmaceu-ticals | | 100.0 | | No | | — | | — | | — | | — |

| | | | | | | | | |

| Sankyo Pharma GmbH | | Munich, Germany | | 16.0 million euros | | Pharmaceu-ticals | | 100.0 | | Yes | | — | | Sankyo markets raw materials and consigns manufacturing and pharmaceutical-related R&D | | — | | Sankyo

provides

pharmaceutical

technology |

| | | | | | | | | |

| Sankyo Pharma UK Ltd. | | Amersham, UK | | 19.5 million pounds | | Pharmaceu-ticals | | 100.0 (100.0) | | No | | — | | — | | — | | — |

| | | | | | | | | |

| Sankyo Pharma Espana S.A. | | Madrid, Spain | | 120 thousand euros | | Pharmaceu-ticals | | 100.0 (100.0) | | No | | — | | — | | — | | — |

| | | | | | | | | |

| Sankyo Pharma Italia S.p.A. | | Rome, Italy | | 120 thousand euros | | Pharmaceu-ticals | | 100.0 (100.0) | | No | | — | | — | | — | | — |

| | | | | | | | | |

| Sankyo Pharma Portugal Lda. | | Porto Salvo, Portugal | | 349 thousand euros | | Pharmaceu-ticals | | 100.0 (100.0) | | No | | — | | — | | — | | — |

| | | | | | | | | |

| Sankyo Pharmazeutika Austria GmbH | | Vienna, Austria | | 18 thousand euros | | Pharmaceu-ticals | | 100.0 (100.0) | | No | | — | | — | | — | | — |

| | | | | | | | | |

| Sankyo Pharma (Schweiz) AG | | Thalwil, Switzerland | | 3 million Swiss Francs | | Pharmaceu-ticals | | 100.0 (100.0) | | No | | — | | — | | — | | — |

| | | | | | | | | |

| Sankyo Pharma Nederland B.V. | | Zwanenburg, the Netherlands | | 18 thousand euros | | Pharmaceu-ticals | | 100.0 (100.0) | | No | | — | | — | | — | | — |

Page 6

| | | | | | | | | | | | | | | | | | |

Name

| | Location

| | Capital/ Investment (Million yen)

| | Major

Operating

Activities

| | Percentage

of Voting

Rights Held (%)

| | Details of Relationship

|

| | | | | | Mutual

Directors

| | Capital Support

Provided by Sankyo

| | Operating

Transactions

| | Facilities Leased by

Sankyo

| | Other

|

| | | | | | | | | |

| N.V. Sankyo Pharma Belgium S.A. | | Louvain-La-Nueve, Belgium | | 62 thousand euros | | Pharmaceu-ticals | | 100.0 (100.0) | | No | | — | | — | | — | | — |

| | | | | | | | | |

| Oy Sankyo Pharma Finland Ab | | Helsinki, Finland | | 25 thousand euros | | Pharmaceu-ticals | | 100.0 (100.0) | | No | | — | | — | | — | | — |

| | | | | | | | | |

| Sankyo Manufacturing France S.a.r.l. | | Altkirch, France | | 457 thousand euros | | Pharmaceu-ticals | | 100.0 (100.0) | | No | | — | | — | | — | | — |

| | | | | | | | | |

| Dignos-Chemie GmbH | | Munich, Germany | | 40 thousand euros | | Pharmaceu-ticals | | 100.0 (100.0) | | No | | — | | — | | — | | — |

| | | | | | | | | |

| Sankyo Pharma France S.A.S. | | Neully-sur-Seine, France | | 2,182 thousand euros | | Pharmaceu-ticals | | 100.0 (100.0) | | No | | — | | — | | — | | — |

| | | | | | | | | |

| Dismed AG | | Zug, Switzerland | | 100 thousand Swiss Francs | | Pharmaceu-ticals | | 100.0 (100.0) | | No | | — | | — | | — | | — |

Notes:

| 1. | The terms used in the ‘Major Operating Activities’ column are the same as those used in the business segment information section. |

| 2. | Those subsidiaries submitting notification or reports relating to securities (‘yukashoken todokedesho’ or ‘yukashoken hokokusyo’) are as follows: Wakodo Co., Ltd. and Fuji Flour Milling Co., Ltd. Both companies are listed, on the Tokyo and Nagoya Stock Exchanges, respectively. |

| 3. | Figures in parentheses under the ‘Percentage of Voting Rights Held’ column represent voting rights owned indirectly and have been included in the respective total. |

| 4. | Sankyo Trading Co., Ltd., which had been a consolidated subsidiary of the Company until the year ended March 31, 2004, has been excluded from the scope of consolidation effective the current period due to sale of the Company’s entire shares in this company. |

| 5. | The Company sold its entire shares of Nippon Daiya Valve Co., Ltd. in April 2005. |

| 6. | Kyushu Sankyo Co., Ltd. was integrated into Sankyo Agro Co., Ltd. and Utsunomiya Chemical Industry Co., Ltd. in April 2005. |

| 7. | Sankyo Foods Co., Ltd. decided that it would transfer its business in July 2005. |

Page 7

II. Management Policies

1. Basic Management Objective

The Sankyo Group’s business philosophy is to “contribute, as a company involved with human life, to healthy and full lives for people around the world by developing innovative pharmaceuticals that are highly appraised internationally.” This philosophy and a firm ethical vision are the foundations upon which the Group intends to fulfill its social mission.

Amid a challenging operating environment marked by intensifying competition in new drug development, the worldwide implementation of measures to curb medical expenses, and the emergence of truly global competition spurred by the increasingly borderless nature of the pharmaceutical market, Sankyo is pushing forward with various restructuring that aim to bolster competitiveness. In addition, on February 25, 2005, Sankyo and Daiichi Pharmaceutical Co., Ltd., entered into a basic agreement to integrate their businesses. This proactive management decision will facilitate the early achievement of Group sales of ¥1 trillion, an operating income ratio of 20% or more, and an ROE of 10% or more by fiscal 2010—targets set out in a management vision.

Sankyo will continue to conduct its business activities in line with its business philosophy to maintain the trust of its stakeholders-shareholders, customers, staff, and society.

2. Profit Distribution

Sankyo, having taken into consideration numerous factors including the Company’s future financial outlook, medium- to long-term financing needs, and financial structure, is working to maintain or enhance retained earnings. At the same time, the Company places considerable importance on distributing profits to shareholders. Sankyo will continue to provide stable dividends while taking a flexible and strategic approach to acquiring treasury stock. Retained earnings are primarily invested in new drug R&D and the globalization of the Group’s sales organization with the objective of boosting corporate value.

3. Reduction of Number of Shares of Common Stock per Unit

On August 1, 2002, Sankyo reduced the size of its stock unit from 1,000 shares to 100 shares of common stock in order to promote the wider circulation of the Company’s stock and expand its shareholder base. Going forward, Sankyo will strive to enhance information provision to individual investors.

4. Medium-to-Long-Term Management Strategies and Goals

Amid increasingly competitive conditions in Japan and overseas spurred by globalization and borderless markets, Sankyo continues to face a challenging operating environment over the medium term, compounded by intensified competition and competition from generic versions of the mainstay product Mevalotin®, an antihyperlipidemic agent, in Japan and the upcoming expiration of the patent for this drug in fiscal 2006 in the United States.

To promote its flexible and appropriate response to the changing global environment, Sankyo completely revamped its management team, including the selection of a new president, in June 2003, forging onward with business reforms under the new regime. In addition, on February 25, 2005, Sankyo and Daiichi entered into the aforementioned agreement to integrate their businesses. This proactive management decision will facilitate the early achievement of Group sales of ¥1 trillion, an operating income ratio of 20% or more, and an ROE of 10% or more by fiscal 2010—targets set out in the management vision.

Page 8

5. Issues to be Addressed

(1) Realizing the Business Integration with Daiichi

On February 25, 2005, Sankyo concluded a basic agreement to integrate the businesses with Daiichi. On May 13, 2005, Sankyo and Daiichi signed a definitive agreement. Subject to approval at Sankyo’s 151st Ordinary General Shareholders Meeting to be held on June 29, 2005, the companies plan to establish the holding company DAIICHI SANKYO COMPANY, LTD., on September 28, 2005. In addition, Sankyo and Daiichi aim to complete the integration of their pharmaceutical operations under the operational holding company by April 2007. We aim to strengthen R&D capabilities, enhance the development pipeline, bolster domestic sales strength, achieve expanded corporate strategy options via increased scale, improve operational efficiency, and enhance human resources through the integration.

(2) Maximizing Sales of the Antihypertensive Agent Olmesartan

Sales of Sankyo’s strategic global product olmesartan, an antihypertensive agent sold as Benicar® in the United States and Olmetec® in Japan and Europe, are showing steady growth. The product was first brought to market in the United States and Germany in 2002 and is currently offered in 27 countries around the world. Olmesartan was launched in Japan on May 11, 2004, and we expect its approval for long-term use to push sales even higher in 2005 and beyond. Sankyo is redoubling its efforts to maximize global sales of olmesartan making use of its own infrastructure and some alliances in sales and promotion.

(3) Reinforcement of the Development Pipeline Management

A robust development pipeline is crucial to emerging as a winner in the face of global competition. Sankyo established three global organizations in fiscal 2003 to bolster pipeline management.

| i) | The Global R&D Management Committee (GRDMC) makes decisions regarding investment and resource allocation within R&D units and prioritizes drugs in the pipeline. |

| ii) | The Global Licensing Committee (GLC) makes decisions regarding policies and strategies for such licensing matters as acquiring and leveraging the resources of other companies. |

| iii) | The Global Marketing Management Committee (GMMC) formulates strategies to extend the life cycles of products on the market and increase sales. |

These three committees all operate from a global perspective and gather at product strategy conferences to ensure that the Sankyo Group’s pipeline is optimized.

Page 9

(4) Putting the Emphasis on Performance and Roles

In fiscal 2003, Sankyo introduced a new personnel system for managerial-level staff to motivate both the individual and the organization. This system clarifies the roles of employees and appropriately links performance to compensation. In October 2004, we expanded this personnel system to include all employees.

We also divided the Company into individual organizational units that are accountable for given functions, for example, marketing, R&D, or supply chain activities, and delegated responsibility and authority for operations in their particular areas to the units. This enables each unit to make autonomous decisions and take swift action. In addition, Sankyo introduced a performance management system to track unit performance to ensure that management resources are effectively invested in units.

(5) Strengthening Group Internal Functions

To heighten the competitiveness of the entire Sankyo Group, we are restructuring functions related to pharmaceutical operations. In April 2004, we established a Supply Chain Management Division to oversee procurement, production, and related functions. We also realigned headquarters functions, establishing a Corporate Division to handle strategic functions and a Business Operation Division to manage routine functions. These initiatives are designed to create an organization that is clearly partitioned by function and to thereby strengthen functions within the Group and enhance cost-competitiveness. In addition, Sankyo has outsourced its information system operations to Hitachi, Ltd., and will establish a joint company with the Hitachi Group for the provision of information system services.

(6) Reexamining Non-Pharmaceutical Operations

In order to concentrate management resources in pharmaceutical operations, we are restructuring our non-pharmaceutical businesses within the Group. In fiscal 2003, we spun off the Crop Protection Division and the Special Merchandise Division and moved forward with the realignment and consolidation of Group companies, withdrawing from operations handling such medical products as diagnostic reagents and medical devices. In addition, in fiscal 2004 Sankyo transferred the stock of Sankyo Trading Co., Ltd., and decided to sell its shares in the consolidated subsidiary Nippon Daiya Valve Co., Ltd., and transfer the business of Sankyo Foods Co., Ltd. Going forward, Sankyo will focus further on its pharmaceutical operations.

Page 10

6. Corporate Governance

In the area of corporate governance, we have structured management to respond to changes in the business environment with greater speed and flexibility and maintain a focus on improving the environment to ensure the transparency of management and maintain the trust of our shareholders. In line with this policy, in June 2003, Sankyo reduced the number of Directors and introduced an Executive Officer System, clarifying Directors’ responsibilities in management decision-making and the auditing of business operations, and executive officers’ responsibilities in business operations as part of efforts to strengthen corporate governance.

(1) Improvement of Management

Sankyo’s Board of Directors is devoted to making decisions related to management strategies and other important issues as well as supervising business operations. To reinforce the supervisory functions of general executive operations, enhance transparency, and create a management framework better equipped to rapidly address global issues, Sankyo appointed one director from the Company’s U.S.-based subsidiary Sankyo Pharma Inc., and two directors from outside the Group to its Board of Directors.

In addition, four corporate auditors, including outside auditors, make up the Board of Corporate Auditors, which audits the legality and soundness of Sankyo’s operations.

(2) Introduction of Corporate Officer System

Corporate Officers are appointed by the Board to perform specific business operations for a period of one year under the supervision of a representative director. This system clarifies Directors’ responsibilities in connection with management decision making and the auditing of business operations and Corporate Officers’ responsibilities in connection with business operations. The executive officers appointed are individuals with outstanding professional skills in the areas of business for which they are responsible and are accorded a status equivalent to that of directors.

(3) Establishment of an Executive Appointment Nomination Committee and a Remuneration Committee

To enhance the transparency of management, Sankyo formed the Executive Appointment Nomination Committee and the Remuneration Committee as ad hoc units. The Executive Appointment Nomination Committee deliberates on matters related to the appointment and removal of Board members and corporate officers as well as promotions and reports its findings to the Board. The Remuneration Committee reviews and establishes individual compensation packages for Board members and corporate officers.

Page 11

(4) Compliance

We introduced the Sankyo Compliance Program and are continuing to educate our directors and employees with the aim of ensuring strict compliance with laws and adherence to corporate ethics. In addition, Sankyo established the Environmental & Compliance Program Management Department in April 2004 as a part of efforts to reinforce the functions of headquarters. As a company involved with human life, we remain committed to maintaining high ethics and building a business culture that emphasizes the corporation’s social responsibilities.

7. Business Risks

Examples of the types of risks that may affect the performance of the Sankyo Group are as follows:

(1) Risks Associated with the Product Qualities and Side Effects

Unanticipated side effects, accidents, or changes in laws and regulations may result in the recall or discontinuation of products. Although every effort is made to ensure the reliability and quality of clinical trials, there is a chance that unanticipated side effects or incidents involving product contamination will arise.

(2) Risks Associated with Legal Regulations and Government Policies

Changes in Pharmaceutical Affairs Law regulations may result in a product no longer complying with regulations or the cancellation of manufacturing or sales approval. Such instances may require product recall or discontinuation, which may affect business performance.

In addition, the Company may be adversely affected by medical policy and health insurance system trends. The Sankyo Group sells pharmaceuticals throughout the world, and, as pharmaceutical prices are strongly influenced by the medical policies and health insurance systems of individual countries, these trends may affect business performance.

(3) Risks Associated with Pharmaceutical R&D

There is a possibility that R&D will not proceed as planned, delaying the launch of potential new products. If a new drug candidate does not meet expectations in terms of efficacy or leaves doubt as to its safety in clinical trials, the development period may be extended or development may be delayed or discontinued and this may affect business performance.

(4) Risks Associated with Exchange Rate Fluctuations

The Company may be adversely affected by exchange rate fluctuations. The Sankyo Group is developing its business globally and is engaged in manufacturing, sales, importing and exporting. Therefore, exchange rate fluctuations may affect its business performance.

Page 12

(5) Other Risks

Economic conditions in various countries, including inflation and interest rate fluctuations, may affect the Sankyo Group’s business performance.

A breakdown of law and order due to war or political upheaval may result in the destruction of or damage to business offices or may force the scaling down or withdrawal from certain businesses, which may affect business performance.

Page 13

III. Results of Operations and Financial Position

I. Results of Operations

1. Overview of Fiscal 2004

(¥ 100 Millions of yen)

| | | | | | | | | | | |

| | | Net sales

| | | Operating

income

| | | Recurring

income

| | | Net income

|

Fiscal 2004 | | 5,878 | | | 849 | | | 825 | | | 482 |

Fiscal 2003 | | 5,963 | | | 955 | | | 939 | | | 434 |

Change (%) | | (1.4 | ) | | (11.1 | ) | | (12.2 | ) | | 11.2 |

(1) Overview of performance

During the fiscal year under review, the pharmaceutical industry was marked by intense change. Market conditions in Japan are becoming increasingly fierce as the government pushes forward with measures designed to curb medical expenses, including the promotion of generic drug use and the April 2004 national health insurance (NHI) drug price revisions. Overseas, pharmaceutical markets in Europe and the United States continue to expand; however, operating conditions are becoming ever more unpredictable as government plans to contain medical costs gradually take shape. Furthermore, globalization and borderless markets are contributing to an unprecedented pace of change in the business environment.

Against this backdrop, net sales for the fiscal year under review was down a slight 1.4% from the previous fiscal year, to ¥587.8 billion, operating income slid 11.1%, to ¥84.9 billion, and recurring income declined 12.2%, to ¥82.5 billion. Net income rose 11.2%, to ¥48.2 billion.

Sales of the antihypertensive agent olmesartan, which is offered in the United States as Benicar® and in Europe and Japan as Olmetec®, soared on the back of the drug’s strong performance in Europe and the United States and its May 2004 launch in Japan. Nevertheless, lower sales of the flagship antihyperlipidemic agent Mevalotin® and the withdrawal from medical products operations resulted in a decline in net sales. Operating income and ordinary income declined mainly as a result of lower sales and higher selling, general, and administrative expenses stemming from increased investment aimed at enhancing MR forces to maximize sales of olmesartan. Net income, however, rose due to a major increase in extraordinary profits primarily attributable to proceeds from the sale of land on the site of the Company’s former Tanashi Plant and an improvement in the corporate tax rate due to reduced losses at overseas subsidiaries, which more than countered the posting of an impairment loss resulting from the early application of asset impairment accounting as an extraordinary loss.

Page 14

(2) Segment Information

Business Segments

(¥ 100 Millions of yen)

| | | | | | | | | | | | | | | | | | | | |

| | | Net sales

| | | Operating income

| |

| | | Fiscal 2004

| | Fiscal 2003

| | Change

| | | Change��(%)

| | | Fiscal 2004

| | Fiscal 2003

| | Change

| | | Change (%)

| |

Pharm. | | 4,556 | | 4,680 | | (123 | ) | | (2.6 | ) | | 774 | | 891 | | (116 | ) | | (13.0 | ) |

Other | | 1,348 | | 1,327 | | 20 | | | 1.6 | | | 65 | | 55 | | 10 | | | 19.6 | |

1) Pharmaceuticals

Sales in the pharmaceuticals segment totaled ¥455.6 billion, a 2.6% decline from the previous fiscal year, and operating income came to ¥77.4 billion, down 13.0%. Despite a strong showing from the antihypertensive agent olmesartan, encouraged by the drug’s May 2004 introduction under the trade name Olmetec®, sales of pharmaceuticals lost ground due to the withdrawal from the medical products business and a substantial decline in sales of the mainstay product Mevalotin®, an antihyperlipidemic agent, owing to the expiration of the patent for this agent in Europe, national health insurance (NHI) drug price revisions, and intensifying competition in Japan and overseas.

Overseas, sales of the antihypertensive agent Benicar® and the diuretic/olmesartan combination Benicar® HCT grew in the United States, thanks to the co-promotion efforts of Sankyo Pharma Inc. (SPI) and Forest Laboratories, Inc. In addition, Luitpold Pharmaceuticals Inc., saw a steady climb in sales of the antianemia agent Venofer®. In Europe, the Sankyo Pharma GmbH (SPG) Group recorded expanded sales of the antihypertensive agent Olmetec®, which the SPG Group has been successively launching throughout Europe, and steady sales of Lopresor® and Lomir®, antihypertensive drugs licensed in from Novartis Pharma Co., Ltd., throughout the fiscal year in France, Italy, Belgium, Switzerland, and Portugal.

Sales of health care products were up, thanks in part to the strong showing of Lamisil® AT, a switched OTC product for the treatment of athlete’s foot and ringworm licensed-in from Novartis Pharma Co., Ltd., in February 2004, in a lackluster market.

Operating income declined, mainly due to lower sales of Mevalotin® and a rise in selling, general and administrative expenses stemming from increased investments aimed at bolstering the sales of SPI and the SPG Group.

2) Other

Sales in this segment climbed 1.6% from the previous fiscal year, to ¥134.8 billion, and operating income jumped 19.6%, to ¥6.5 billion.

Although improved corporate earnings spurred growth in capital investment and consumer spending edged up, market conditions remained tough amid an uncertain economic outlook, skyrocketing oil prices, and increasingly fierce corporate competition. In this setting, Wakodo Co., Ltd., saw an expansion in sales of dried milk for infants and Nippon Nyukazai Co., Ltd., saw a rise in sales of glycol products. In addition, Sankyo Agro Co., Ltd., and Sankyo Lifetech Co., Ltd., which were established on April 1, 2003, following the spin-off of the Crop Protection Company and the Special Merchandise Company, recorded steady growth in sales.

Operating income rose as a result of ongoing efforts to improve operational efficiency through cost control and other measures. In addition, the Company transferred the stock of Sankyo Trading Co., Ltd., and entered into agreements to transfer the stock of Nippon Daiya Valve Co., Ltd., and the business of Sankyo Foods Co., Ltd., as part of initiatives to increase its focus on the pharmaceutical business.

Page 15

Geographic Segments

(¥ 100 Millions of yen)

| | | | | | | | | | | | | | | | | | | | | | |

| | | Net sales

| | | Operating income

| |

| | | Fiscal 2004

| | Fiscal 2003

| | Change

| | | Change (%)

| | | Fiscal 2004

| | | Fiscal 2003

| | | Change

| | | Change (%)

| |

Japan | | 4,738 | | 5,078 | | (340 | ) | | (6.7 | ) | | 733 | | | 1,005 | | | (272 | ) | | (27.1 | ) |

North America | | 803 | | 641 | | 161 | | | 25.2 | | | 131 | | | 29 | | | 101 | | | 345.4 | |

Other | | 526 | | 371 | | 155 | | | 41.9 | | | (13 | ) | | (62 | ) | | 49 | | | | |

1) Japan

Sales totaled ¥473.8 billion, down 6.7% from the previous fiscal year, and operating income was ¥73.3 billion, falling 27.1%.

A steady climb in sales of Olmetec® following the drug’s May 2004 launch in Japan were countered by the withdrawal from medical products operations and a marked decline in sales of Mevalotin®, resulting in an overall decrease in sales in Japan.

Lower sales and a rise in selling, general, and administrative expenses brought about by such factors as costs related to business reforms, the realignment of Group functions, and the upcoming business integration with Daiichi led to a substantial decline in operating income.

2) North America

Sales rose 25.2% from the previous fiscal year, to ¥80.3 billion, and operating income soared 345.4%, to ¥13.1 billion.

Intensified competition caused sales of the antihyperlipidemic agent WelChol® at Sankyo Pharma Inc. to slip; however, those of Benicar® and Benicar® HCT were up. In addition, Luitpold Pharmaceuticals Inc., continued to see growth in sales of Venofer®.

Operating income rose dramatically, primarily owing to markedly higher net sales that countered an increase sales promotion costs and other selling, general, and administrative costs associated with sales expansion initiatives.

3) Other

Sales rose 41.9%, to ¥52.6 billion, and the operating loss shrank from ¥6.2 billion in the previous fiscal year, to ¥1.3 billion.

Page 16

In Europe, the Sankyo Pharma GmbH (SPG) Group saw growth in sales of Olmetec®, Lopresor®, and Lomir®.

Although increased investment directed at bolstering sales forces and other factors led to higher selling, general, and administrative expenses, the operating loss was reduced, thanks to expanded sales.

(3) Dividends

In the fiscal year under review, the Company paid an interim dividend of ¥15.00 per share. The Company also paid a year-end dividend of ¥25.00 per share, reflecting a ¥10.00 increase from initial projections in light of such factors as an increase in free cash flow due to the sale of land on the site of the Company’s former Tanashi Plant, resulting in a total dividend for the year of ¥40.00 per share.

This increased the dividend payout ratio to 45.9%, and the dividend to shareholders’ equity ratio to 2.4% on a non-consolidated basis.

2. R&D Activities

In the fiscal year under review, research and development costs amounted to ¥86.5 billion, or 14.7% of sales on a consolidated basis.

We have concentrated our management resources on creating and bringing new world-class drugs to market at the earliest possible date, focusing on six key research areas including cardiovascular disease.

As for R&D activities, Sankyo implemented major organizational reform focused on integrating its global R&D organization in October 2003. This reform was based on the successes of the R&D restructuring program that Sankyo launched in July 2002—the R&D ReDesign (RDRD) Project. Sankyo is working to leverage the realignments to achieve the RDRD Project goals of prioritizing drugs in the pipeline, expediting decision-making, and rapidly developing innovative new drugs.

Sankyo’s principal global development products include CS-747 [Phase III (U.S. and Europe); Phase I (Japan)], a treatment for ischemic disease being jointly developed with the Eli Lilly and Company; CS-505 [Phase II/III (U.S. and Europe); Phase I preparations (Japan)], an anti-arteriosclerotic agent being developed in-house; Fidarestat® [Phase III preparations (U.S. and Europe)], a diabetic neuropathy agent being jointly developed with Sanwa Kagaku Kenkyusho; CS-011 [Phase II (U.S. and Europe)], an antidiabetic agent being developed in-house; and CS-917 [Phase II (U.S. and Europe)], an antidiabetic agent being jointly developed with Metabasis.

Sankyo has given top priority to the development of two of these agents—CS-747 and CS-505. In August 2004, Sankyo presented results of Phase II trials of CS-747 (generic name: prasugrel) showing the agent to have a safety profile similar to that of the standard treatment clopidogrel at an European Society of Cardiology meeting in Munich, Germany. In addition, in March 2005, the Company presented data from early phase trials of CS-747 comparing the agent to clopidogrel at an American College of Cardiology meeting in Orlando, Florida. In these trials, CS-747 demonstrated more than ten times greater inhibition of platelet aggregation, quicker onset (more rapid effect), and more consistent action than clopidogrel. On the basis of results obtained to date, we are preparing to enter Phase III trials to demonstrate the superiority of CS-747 over clopidogrel. Turning to CS-505, three clinical trials of this agent are currently in progress. As a first-in-class treatment, CS-505 has great potential provided that these trials produce promising results.

In addition, Sankyo is focusing on the life cycle management of such products as olmesartan and Loxonin®.

Page 17

3. Overseas Deployment

As far as overseas activities are concerned, we have worked actively, considering the global development of the pharmaceuticals business, to select research, development, supply chain, and sales as our top-priority business issues. Above all, we are striving to maximize sales of the antihypertensive agent olmesartan, which is marketed in the United States as Benicar® and in Europe as Olmetec®.

In the United States, Sankyo Pharma Inc. (SPI) began selling Benicar® in May 2002 under a co-romotion agreement with Forest Laboratories, Inc., and, in September 2003, launched the diuretic/olmesartan combination Benicar® HCT. Sales of both these products are showing steady growth.

In Europe, the Sankyo Pharma GmbH (SPG) Group began selling Olmetec® in Germany in October 2002 and currently offers this product in all major European countries, including Britain, France, Spain, and Italy. Furthermore, SPG licensed-in the antihypertensive drugs Lopresor® and Lomir® from Novartis Pharma Co., Ltd., in November 2003. These products are already being sold in some European countries, and we hope to see synergistic effects for Olmetec® sales.

Sankyo aims to make the most of olmesartan not only in Europe and the United States but around the globe. Going forward, Shanghai Sankyo Pharmaceuticals Co., Ltd., Sankyo Pharma Brazil Ltda., and Sankyo Pharma Venezuela S.A., will begin preparing for the market introduction of olmesartan. In addition, Sankyo has selected Pfizer Inc. to co-promote the drug in thirteen other countries in Oceania, Asia, and Latin America and DaeWoong Pharma Co., Ltd., to handle it in the Republic of Korea. Olmesartan is currently available in 27 countries and is experiencing solid sales growth.

Page 18

4. Outlook for Fiscal 2005

(¥ 100 Millions of yen)

| | | | | | | | | |

| | | Net sales

| | | Recurring

income

| | | Net income

| |

Fiscal 2005 | | 5,570 | | | 630 | | | 370 | |

Fiscal 2004 | | 5,878 | | | 825 | | | 482 | |

Change (%) | | (5.2 | ) | | (23.6 | ) | | (23.4 | ) |

(1) Overview of performance

We anticipate operating conditions to remain challenging over the next year; however, the Group will continue to work to bolster its operating efficiency and proactively engage in business activities. Our forecast is that net sales will edge down 5.2%, to ¥557.0 billion, recurring income will decline 23.6%, to ¥63.0 billion, and net income will retreat 23.4%, to ¥37.0 billion.

Meanwhile, Nippon Daiya Valve Co., Ltd., the stock of which was transferred to Seika Corporation in April 2005, and Sankyo Foods Co., Ltd., the business of which is slated to be transferred to a joint venture with Oriental Yeast Co., Ltd., in July 2005, will be excluded from the scope of consolidation from fiscal 2005.

(2) Outlook by Segment

Business Segments

1) Pharmaceuticals

We forecast that net sales of pharmaceuticals will decline ¥26.0billion.

Overseas, we anticipate a substantial decline in sales of bulk exports of the antihyperlipidemic agent Mevalotin® to Bristol-Myers Squibb Company due to expiration of the drug’s patent in Europe, competing products in the United States, and other factors. However, we predict that growth in sales of olmesartan, an antihypertensive agent sold in 27 countries, including major European countries and the United States, will lead to a sharp increase in overall sales.

In Japan, we expect to see sales of olmesartan soar with the lifting of restrictions on its period of use in May 2005. However, we anticipate a decline in revenues as a result of the conclusion of a joint sales agreement with Kirin Brewery Co., Ltd., for Espo®, a drug for the treatment of renal anemia, and Gran®, a drug for the treatment of leukopenia, at the end of March 2005 and fiercer competition of our flagship product Mevalotin®.

We forecast that operating income will decline as a result of lower sales, and higher selling, general, and administrative expenses due to a rise in R&D and sales promotion costs.

2) Other

We forecast that net sales in this segment will decline approximately ¥5.0 billion due to the exclusion of Sankyo Foods Co., Ltd., and Nippon Daiya Valve Co., Ltd., from the scope of consolidation.

Page 19

Although we anticipate a decline in sales, we expect operating income to remain at about the same level as in fiscal 2004.

Geographic Segments

1) Japan

Sales in this segment are expected to decline next year. We forecast that nonpharmaceutical sales will decrease approximately ¥5.0 billion and that sales of pharmaceuticals will contract to ¥38.0 billion or more, as reduced exports of the antihyperlipidemic agent Mevalotin® to Bristol-Myers Squibb Company and the conclusion of a joint sales agreement with Kirin Brewery Co., Ltd., for Espo® and Gran® outweigh expanded sales of the antihypertensive agent olmesartan.

We anticipate a decline in operating income, owing to substantially lower sales.

2) North America

Although sales of the antianemia agent Venofer® are projected to decline due to lowering of the drug’s reimbursement price, marked growth in those of the antihypertensive agent Benicar® and its diuretic combination Benicar® HCT are expected to bring about a ¥7.0 billion rise in the segment’s sales.

Operating income is forecast to lose ground due to a rise in sales promotion costs stemming from initiatives to boost Benicar® sales, which is expected to outweigh the increase in sales.

3) Other

We project a ¥1.0 billion increase in this segment’s sales as expanded sales of the antihypertensive agent olmesartan are expected to more than counter a decline in sales of the antihyperlipidemic agent Mevalotin® in Europe.

Although sales are forecast to rise, we expect operating income to decline as a result of higher personnel costs arising from efforts to bolster our global sales framework.

The exchange rates used for translation of revenues and expenses of overseas subsidiaries for fiscal 2004 are as follows:

1 US$ = ¥105.0

1 euro = ¥140.0

Page 20

II. Financial Position

1. Overview of Fiscal 2004

Cash Flow Analysis

(¥ 100 Millions of yen)

| | | | | | | | |

| | | Fiscal 2004

| | | Fiscal 2003

| | | Change

|

Net cash provided by (used in) operating activities | | 967 | | | 712 | | | 254 |

Net cash provided by (used in) investing activities | | (162 | ) | | (491 | ) | | 329 |

Net cash provided by (used in) financing activities | | (127 | ) | | (316 | ) | | 189 |

Effect of exchange rate changes on cash and cash equivalents | | (1 | ) | | (8 | ) | | 7 |

Net increase (decrease) in cash and cash equivalents | | 675 | | | (105 | ) | | 781 |

| | |

|

| |

|

| |

|

Cash and cash equivalents at the end of period | | 2,625 | | | 1,947 | | | 677 |

| | |

|

| |

|

| |

|

Cash and cash equivalents at the end of fiscal 2004 rose ¥67.7 billion from the previous fiscal year, to ¥262.5 billion. Contributing factors are summarized as follows:

Cash Flows from Operating Activities

Net cash provided by operating activities increased ¥25.4 billion from the corresponding amount for the previous fiscal year, to ¥96.7 billion. This is mainly a result of a ¥12.8 billion reduction in corporate tax payments, which offset a ¥4.9 billion decline in income before income taxes and minority interests that includes an impairment loss of ¥15.8 billion that does not affect cash flows.

Cash Flows from Investing Activities

Net cash used in investing activities declined ¥32.9 billion from the corresponding amount for the previous fiscal year, to ¥16.2 billion, largely as a result of a ¥19.9 billion reduction in expenditure of purchases of intangible fixed assets and a ¥10.2 billion increase in income from the sale of property, plant and equipment.

Cash Flows from Financing Activities

Cash used in financing activities declined ¥18.9 billion from the prior year, to ¥12.7 billion, primarily reflecting a ¥19.9 billion decrease in purchases of treasury stock.

Page 21

Trends in key cash flow indicators are summarized as follows:

| | | | | | | | |

| | | Fiscal 2001

| | Fiscal 2002

| | Fiscal 2003

| | Fiscal 2004

|

Shareholders’ equity ratio (%) | | 71.2 | | 71.9 | | 73.6 | | 73.4 |

Fair value shareholders’ equity ratio (%) | | 94.2 | | 75.3 | | 104.9 | | 99.4 |

Debt redemption period (year) | | 0.6 | | 0.4 | | 0.3 | | 0.2 |

Interest coverage ratio (%) | | 77.1 | | 157.5 | | 212.4 | | 269.8 |

Shareholders’ equity ratio: Shareholders’ equity/total assets

Fair value shareholders’ equity ratio: Total fair value of outstanding shares/total assets

Debt redemption period: Interest-bearing debt/cash flows from operating activities

Interest coverage ratio: Cash flows from operating activities/interest payments

Notes:

| 1. | All of the figures in the aforementioned indices were calculated on a consolidated basis. |

| 2. | The total fair value of outstanding shares was calculated by multiplying the closing stock price at the end of the fiscal year by the total number of outstanding shares at the end of the fiscal year (excluding treasury shares). |

| 3. | Cash flows from operating activities represent net cash provided by operating activities in the consolidated statements of cash flows. Interest-bearing debt represents all liabilities subject to the payment of interest in the consolidated balance sheets. In addition, interest payments are reflected as “interest paid” in the consolidated statements of cash flows. |

2. Outlook for Fiscal 2004

Important issues that are likely to impact cash flows over the next year are as follows:

Cash Flows from Operating Activities

We project a ¥11.2 billion decline in net income and a reduction in cash flows from operating activities.

Cash Flows from Investing Activities

We expect a ¥10 billion decrease in income from the sale of tangible fixed assets as compared with fiscal 2004 in which the Company generated substantial income mainly from the sale of the former Tanashi Plant site. Purchases of tangible fixed assets are also anticipated to decline about a ¥9.0 billion.

Cash Flows from Financing Activities

We plan to increase dividend payments by approximately ¥7.5 billion as compared with the corresponding amount in the current fiscal year.

Page 22

IV. Consolidated Financial Statements

1. Consolidated Balance Sheets

(Millions of yen)

| | | | | | | | | | | | | | | |

| | | | | As of March 31, 2004

| | As of March 31, 2005

| | Change

| |

| | | See Note:

| | Amount

| | | %

| | Amount

| | | %

| | Amount

| |

ASSETS | | | | | | | | | | | | | | | |

Current assets | | | | | | | | | | | | | | | |

Cash and deposits | | | | 156,660 | | | | | 175,960 | | | | | 19,299 | |

Trade notes and accounts receivable | | | | 170,468 | | | | | 162,442 | | | | | (8,026 | ) |

Marketable securities | | | | 93,614 | | | | | 146,632 | | | | | 53,017 | |

Inventories | | | | 89,945 | | | | | 89,979 | | | | | 34 | |

Deferred tax assets | | | | 18,100 | | | | | 21,832 | | | | | 3,732 | |

Other | | | | 9,487 | | | | | 9,704 | | | | | 216 | |

Allowance for doubtful accounts | | | | (2,460 | ) | | | | (483 | ) | | | | 1,976 | |

| | | | |

|

| | | |

|

| | | |

|

|

Total current assets | | | | 535,816 | | | 57.8 | | 606,067 | | | 62.1 | | 70,251 | |

| | | | | | |

Fixed assets | | | | | | | | | | | | | | | |

Tangible fixed assets | | 1 | | | | | | | | | | | | | |

Buildings and structures | | 2,4 | | 107,998 | | | | | 111,966 | | | | | 3,968 | |

Machinery, equipment and vehicles | | 2,4 | | 36,172 | | | | | 31,831 | | | | | (4,341 | ) |

Land | | 4 | | 29,933 | | | | | 30,655 | | | | | 721 | |

Construction in progress | | | | 8,687 | | | | | 10,005 | | | | | 1,317 | |

Other | | 2,4 | | 11,735 | | | | | 11,980 | | | | | 245 | |

| | | | |

|

| | | |

|

| | | |

|

|

Total tangible fixed assets | | | | 194,527 | | | 21.0 | | 196,439 | | | 20.1 | | 1,912 | |

| | | | | | |

Intangible fixed assets | | | | | | | | | | | | | | | |

Consolidation goodwill | | | | 1,143 | | | | | 845 | | | | | (298 | ) |

Other | | | | 41,891 | | | | | 24,181 | | | | | (17,710 | ) |

| | | | |

|

| | | |

|

| | | |

|

|

Total intangible fixed assets | | | | 43,035 | | | 4.6 | | 25,026 | | | 2.6 | | (18,008 | ) |

Investments and other assets | | | | | | | | | | | | | | | |

Investment securities | | 3,4 | | 117,891 | | | | | 114,480 | | | | | (3,411 | ) |

Long-term loans | | | | 5,739 | | | | | 5,876 | | | | | 137 | |

Deferred tax assets | | | | 13,783 | | | | | 14,967 | | | | | 1,183 | |

Other | | 3 | | 17,008 | | | | | 13,702 | | | | | (3,306 | ) |

Allowance for doubtful accounts | | | | (558 | ) | | | | (329 | ) | | | | 228 | |

| | | | |

|

| | | |

|

| | | |

|

|

Total investments and other assets | | | | 153,865 | | | 16.6 | | 148,696 | | | 15.2 | | (5,168 | ) |

| | | | |

|

| | | |

|

| | | |

|

|

Total fixed assets | | | | 391,427 | | | 42.2 | | 370,163 | | | 37.9 | | (21,264 | ) |

| | | | |

|

| |

| |

|

| |

| |

|

|

Total assets | | | | 927,244 | | | 100.0 | | 976,230 | | | 100.0 | | 48,986 | |

| | | | |

|

| |

| |

|

| |

| |

|

|

Page 23

(Millions of yen)

| | | | | | | | | | | | | | | | | |

| | | | | As of March 31, 2004

| | | As of March 31, 2005

| | | Change

| |

| | | See

Note:

| | Amount

| | | %

| | | Amount

| | | %

| | | Amount

| |

LIABILITIES | | | | | | | | | | | | | | | | | |

Current liabilities | | | | | | | | | | | | | | | | | |

Trade notes and accounts payable | | | | 50,907 | | | | | | 54,435 | | | | | | 3,527 | |

Short-term bank loans | | 4 | | 15,578 | | | | | | 16,699 | | | | | | 1,120 | |

Income taxes payable | | | | 11,564 | | | | | | 16,904 | | | | | | 5,340 | |

Deferred tax liabilities | | | | 544 | | | | | | 689 | | | | | | 145 | |

Accrued bonuses | | | | 13,295 | | | | | | 13,481 | | | | | | 186 | |

Allowance for sales returns | | | | 461 | | | | | | 476 | | | | | | 15 | |

Allowance for sales rebates | | | | 1,004 | | | | | | 1,022 | | | | | | 18 | |

Other | | | | 61,402 | | | | | | 70,002 | | | | | | 8,599 | |

| | | | |

|

| | | | |

|

| | | | |

|

|

Total current liabilities | | | | 154,758 | | | 16.7 | | | 173,712 | | | 17.8 | | | 18,954 | |

Long-term liabilities | | | | | | | | | | | | | | | | | |

Long-term debt | | 4 | | 4,671 | | | | | | 3,373 | | | | | | (1,297 | ) |

Deferred tax liabilities | | | | 70 | | | | | | 441 | | | | | | 371 | |

Retirement and severance benefits | | | | 70,152 | | | | | | 66,843 | | | | | | (3,308 | ) |

Directors’ retirement and severance benefits | | | | 1,820 | | | | | | 1,830 | | | | | | 10 | |

Other | | | | 4,333 | | | | | | 4,006 | | | | | | (327 | ) |

| | | | |

|

| | | | |

|

| | | | |

|

|

Total long-term liabilities | | | | 81,048 | | | 8.7 | | | 76,495 | | | 7.8 | | | (4,552 | ) |

| | | | |

|

| | | | |

|

| | | | |

|

|

Total liabilities | | | | 235,806 | | | 25.4 | | | 250,208 | | | 25.6 | | | 14,402 | |

| | | | | | |

MINORITY INTERESTS | | | | | | | | | | | | | | | | | |

Minority interests | | | | 8,843 | | | 1.0 | | | 9,434 | | | 1.0 | | | 591 | |

| | | | | | |

SHAREHOLDERS’ EQUITY | | | | | | | | | | | | | | | | | |

Common stock | | 8 | | 68,793 | | | 7.4 | | | 68,793 | | | 7.0 | | | — | |

Capital surplus | | | | 66,862 | | | 7.2 | | | 66,862 | | | 6.8 | | | — | |

Retained earnings | | | | 546,422 | | | 58.9 | | | 580,514 | | | 59.5 | | | 34,091 | |

Valuation difference on other securities | | | | 27,920 | | | 3.0 | | | 27,857 | | | 2.9 | | | (63 | ) |

Translation adjustments | | | | (7,068 | ) | | (0.7 | ) | | (7,026 | ) | | (0.7 | ) | | 41 | |

Treasury stock | | 9 | | (20,336 | ) | | (2.2 | ) | | (20,412 | ) | | (2.1 | ) | | (76 | ) |

| | | | |

|

| | | | |

|

| | | | |

|

|

Total shareholders’ equity | | | | 682,594 | | | 73.6 | | | 716,587 | | | 73.4 | | | 33,993 | |

| | | | |

|

| |

|

| |

|

| |

|

| |

|

|

Total liabilities, minority interests and shareholders’ equity | | | | 927,244 | | | 100.0 | | | 976,230 | | | 100.0 | | | 48,986 | |

| | | | |

|

| |

|

| |

|

| |

|

| |

|

|

Page 24

2. Consolidated Statements of Income

(Millions of yen)

| | | | | | | | | | | | | | | | |

| | | | | Fiscal 2003

| | Fiscal 2004

| | Change

| |

| | | See

Note:

| | Amount

| | %

| | Amount

| | %

| | Amount

| | | %

| |

Net sales | | | | 596,345 | | 100.0 | | 587,830 | | 100.0 | | (8,515 | ) | | (1.4 | ) |

Cost of sales | | 1 | | 221,601 | | 37.2 | | 213,874 | | 36.4 | | (7,727 | ) | | (3.5 | ) |

| | | | |

| | | |

| | | |

|

| | | |

Gross profit | | | | 374,744 | | 62.8 | | 373,956 | | 63.6 | | (787 | ) | | (0.2 | ) |

Provision for sales returns | | | | 51 | | 0.0 | | 15 | | 0.0 | | (36 | ) | | | |

| | | | |

| | | |

| | | |

|

| | | |

Adjusted gross profit | | | | 374,692 | | 62.8 | | 373,940 | | 63.6 | | (751 | ) | | (0.2 | ) |

Selling, general and administrative expenses | | | | 279,137 | | 46.8 | | 289,015 | | 49.2 | | 9,877 | | | 3.5 | |

Advertising and promotional expenses | | | | 47,842 | | | | 51,738 | | | | 3,896 | | | | |

Salaries and bonuses | | | | 47,233 | | | | 46,401 | | | | (831 | ) | | | |

Provision for accrued bonuses | | | | 7,330 | | | | 8,282 | | | | 951 | | | | |

Retirement and severance benefits | | | | 3,979 | | | | 3,976 | | | | (3 | ) | | | |

Provision for directors’ retirement and severance benefits | | | | 384 | | | | 248 | | | | (136 | ) | | | |

Provision for doubtful accounts | | | | 83 | | | | — | | | | (83 | ) | | | |

Research and development costs | | 1 | | 86,720 | | | | 86,551 | | | | (169 | ) | | | |

Amortization of consolidation goodwill | | | | 305 | | | | 389 | | | | 84 | | | | |

Other | | | | 85,257 | | | | 91,427 | | | | 6,169 | | | | |

| | | | |

| | | |

| | | |

|

| | | |

Operating income | | | | 95,555 | | 16.0 | | 84,925 | | 14.4 | | (10,629 | ) | | (11.1 | ) |

Non-operating income | | | | 5,122 | | 0.9 | | 6,425 | | 1.1 | | 1,302 | | | 25.4 | |

Interest income | | | | 1,060 | | | | 1,178 | | | | 117 | | | | |

Dividend income | | | | 1,370 | | | | 2,126 | | | | 756 | | | | |

Amortization of consolidation goodwill | | | | 2 | | | | 11 | | | | 8 | | | | |

Rent received | | | | 785 | | | | 889 | | | | 104 | | | | |

Other | | | | 1,904 | | | | 2,219 | | | | 315 | | | | |

| | | | |

| | | |

| | | |

|

| | | |

Non-operating expenses | | | | 6,701 | | 1.1 | | 8,844 | | 1.5 | | 2,142 | | | 32.0 | |

Interest expense | | | | 336 | | | | 358 | | | | 22 | | | | |

Loss on disposal of inventories | | | | 2,995 | | | | 3,983 | | | | 987 | | | | |

Charitable donations | | | | 1,173 | | | | 737 | | | | (436 | ) | | | |

Other | | | | 2,195 | | | | 3,765 | | | | 1,569 | | | | |

| | | | |

| | | |

| | | |

|

| | | |

Recurring income | | | | 93,975 | | 15.8 | | 82,506 | | 14.0 | | (11,469 | ) | | (12.2 | ) |

| | | | |

| | | |

| | | |

|

| | | |

Page 25

(Millions of yen)

| | | | | | | | | | | | | | | | | | |

| | | | | Fiscal 2003

| | Fiscal 2004

| | | Change

| |

| | | See

Note:

| | Amount

| | %

| | Amount

| | | %

| | | Amount

| | | %

| |

Extraordinary income | | | | 4,524 | | 0.7 | | 15,775 | | | 2.7 | | | 11,251 | | | | |

Proceeds from sales of fixed assets | | 2 | | 4,127 | | | | 12,179 | | | | | | 8,052 | | | | |

Reversal of allowance for doubtful accounts | | | | — | | | | 2,026 | | | | | | 2,026 | | | | |

Proceeds from sales of investment securities | | | | 111 | | | | 983 | | | | | | 872 | | | | |

Proceeds from sales of stock in affiliates | | | | 285 | | | | 544 | | | | | | 258 | | | | |

Reversal of allowance for directors’ retirement and severance | | | | — | | | | 41 | | | | | | 41 | | | | |

| | | | |

| | | |

|

| | | | |

|

| | | |

Extraordinary losses | | | | 15,908 | | 2.7 | | 20,603 | | | 3.5 | | | 4,695 | | | | |

Loss on disposal of fixed assets | | 3 | | 1,974 | | | | 2,333 | | | | | | 359 | | | | |

Loss on impairment of fixed assets | | 4 | | — | | | | 15,865 | | | | | | 15,865 | | | | |

Loss on valuation of investments in affiliates | | | | — | | | | 1,483 | | | | | | 1,483 | | | | |

Additional retirement payment | | | | 3,181 | | | | 662 | | | | | | (2,518 | ) | | | |

Loss on valuation of investments | | | | — | | | | 249 | | | | | | 249 | | | | |

Loss on sale of investment securities | | | | 77 | | | | 5 | | | | | | (71 | ) | | | |

Loss on valuation of investment securities | | | | — | | | | 4 | | | | | | 4 | | | | |

Loss from termination of distribution agreement for GlucoWatch | | 5 | | 9,650 | | | | — | | | | | | (9,650 | ) | | | |

Loss on restructuring of plants | | 6 | | 1,024 | | | | — | | | | | | (1,024 | ) | | | |

| | | | |

| | | |

|

| | | | |

|

| | | |

Income before income taxes and minority interests | | | | 82,592 | | 13.8 | | 77,678 | | | 13.2 | | | (4,914 | ) | | (5.9 | ) |

| | | | |

| | | |

|

| | | | |

|

| | | |

Income taxes | | | | 33,110 | | 5.5 | | 33,224 | | | 5.7 | | | 113 | | | | |

Income tax adjustment | | | | 5,554 | | 0.9 | | (4,550 | ) | | (0.8 | ) | | (10,104 | ) | | | |

Minority interests | | | | 515 | | 0.1 | | 722 | | | 0.1 | | | 206 | | | | |

| | | | |

| | | |

|

| |

|

| |

|

| |

|

|

Net income | | | | 43,411 | | 7.3 | | 48,282 | | | 8.2 | | | 4,870 | | | 11.2 | |

| | | | |

| | | |

|

| |

|

| |

|

| |

|

|

Page 26

Consolidated Statements of Retained Earnings

(Millions of yen)

| | | | | | | | | | | | | |

| | | | | Fiscal 2003

| | Fiscal 2004

| | Change

| |

| | | See

Note:

| | Amount

| | Amount

| | Amount

| |

CAPITAL SURPLUS | | | | | | | | | | | | | |

Capital surplus at beginning of year | | | | | | 66,862 | | | | 66,862 | | — | |

Increase in capital surplus | | | | | | — | | | | — | | — | |

Decrease in capital surplus | | | | | | — | | | | — | | — | |

| | | | | | |

| | | |

| |

|

|

Capital surplus at end of year | | | | | | 66,862 | | | | 66,862 | | — | |

| | | | | | |

| | | |

| |

|

|

RETAINED EARNINGS | | | | | | | | | | | | | |

Retained earnings at beginning of year | | | | | | 532,429 | | | | 546,422 | | 13,993 | |

Increase in retained earnings | | | | | | | | | | | | | |

Net income | | | | 43,411 | | | | 48,282 | | | | | |

Increase due to merger with a non-consolidated subsidiary | | | | — | | | | 117 | | | | | |

Increase due to initial consolidation of subsidiaries | | | | 80 | | 43,492 | | — | | 48,399 | | 4,907 | |

| | | | |

| | | |

| | | | | |

Decrease in retained earnings | | | | | | | | | | | | | |

Cash dividends | | | | 10,983 | | | | 13,959 | | | | | |

Bonuses to directors | | | | | | | | | | | | | |

Bonuses to directors | | | | 344 | | | | 326 | | | | | |

Bonuses to statutory auditors | | | | 23 | | | | 21 | | | | | |

Elimination of treasury stock with earnings | | | | 18,147 | | 29,498 | | — | | 14,308 | | (15,190 | ) |

| | | | | | |

| | | |

| |

|

|

Retained earnings at end of year | | | | | | 546,422 | | | | 580,514 | | 34,091 | |

| | | | | | |

| | | |

| |

|

|

Page 27

3. Consolidated Statements of Cash Flows

(Millions of yen)

| | | | | | | | | | | |

| | | | | Fiscal

2003

| | | Fiscal

2004

| | | Change

| |

| | | See

Note:

| | Amount

| | | Amount

| | | Amount

| |

Cash flows from operating activities: | | | | | | | | | | | |

Income before income taxes and minority interests | | | | 82,592 | | | 77,678 | | | (4,914 | ) |

Depreciation | | | | 27,847 | | | 28,811 | | | 963 | |

Loss on impairment of fixed assets | | | | — | | | 15,865 | | | 15,865 | |

Profit on sale of marketable and investment securities | | | | (322 | ) | | (1,064 | ) | | (741 | ) |

Loss on valuation of marketable and investment securities | | | | 4 | | | 1,736 | | | 1,732 | |

Amortization of consolidation goodwill | | | | 302 | | | 378 | | | 75 | |

Decrease in allowance for doubtful accounts | | | | (348 | ) | | (2,021 | ) | | (1,673 | ) |

Increase in retirement and severance benefits | | | | (9,802 | ) | | (3,498 | ) | | 6,303 | |

Increase in accrued bonuses | | | | 1 | | | 224 | | | 222 | |

Interest and dividend income | | | | (2,430 | ) | | (3,304 | ) | | (874 | ) |

Interest expense | | | | 336 | | | 358 | | | 22 | |

Gain on sale of fixed assets | | | | (2,536 | ) | | (10,731 | ) | | (8,194 | ) |

Decrease in trade receivables | | | | 6,355 | | | 8,147 | | | 1,791 | |

Decrease (increase) in inventories | | | | (3,885 | ) | | 122 | | | 4,007 | |

Increase (decrease) in trade payables | | | | (6,528 | ) | | 3,473 | | | 10,001 | |

Other | | | | 19,113 | | | 6,329 | | | (12,783 | ) |

| | | | |

|

| |

|

| |

|

|

Subtotal | | | | 110,698 | | | 122,504 | | | 11,806 | |

Interest and dividends received | | | | 2,590 | | | 3,407 | | | 817 | |

Interest paid | | | | (335 | ) | | (358 | ) | | (23 | ) |

Income taxes paid | | | | (41,746 | ) | | (28,851 | ) | | 12,895 | |

| | | | |

|

| |

|

| |

|

|

Net cash provided by operating activities | | | | 71,207 | | | 96,703 | | | 25,495 | |

| | | | |

|

| |

|

| |

|

|

Cash flows from investing activities: | | | | | | | | | | | |

Purchases of time deposits | | | | (9,604 | ) | | (7,889 | ) | | 1,714 | |

Refunds of time deposits upon maturity | | | | 9,763 | | | 10,842 | | | 1,079 | |

Purchases of marketable securities | | | | (40,572 | ) | | (62,969 | ) | | (22,397 | ) |

Proceeds from sale and maturities of marketable securities | | | | 58,103 | | | 77,786 | | | 19,683 | |

Purchases of tangible fixed assets | | | | (26,457 | ) | | (27,282 | ) | | (825 | ) |

Proceeds from sale of tangible fixed assets | | | | 4,493 | | | 14,696 | | | 10,202 | |

Purchases of intangible fixed assets | | | | (22,399 | ) | | (2,439 | ) | | 19,959 | |

Purchases of investment securities | | | | (22,779 | ) | | (21,704 | ) | | 1,075 | |

Proceeds from sale of investment securities | | | | 1,100 | | | 1,561 | | | 460 | |

Proceeds from sale of stock in a consolidated subsidiary | | 2 | | — | | | 527 | | | 527 | |

Payment on loans receivable | | | | (566 | ) | | (904 | ) | | (338 | ) |

Proceeds from collection of loans | | | | 1,067 | | | 1,342 | | | 274 | |

Other | | | | (1,316 | ) | | 169 | | | 1,486 | |

| | | | |

|

| |

|

| |

|

|

Net cash used in investing activities | | | | (49,168 | ) | | (16,265 | ) | | 32,902 | |

| | | | |

|

| |

|

| |

|

|

Page 28

(Millions of yen)

| | | | | | | | | | | |

| | | | | Fiscal

2003

| | | Fiscal

2004

| | | Change

| |

| | | See

Note:

| | Amount

| | | Amount

| | | Amount

| |

Cash flows from financing activities: | | | | | | | | | | | |

Net increase in short-term bank loans | | | | 2,203 | | | 2,365 | | | 161 | |

Proceeds from long-term debt | | | | 29 | | | 470 | | | 440 | |

Repayment of long-term debt | | | | (2,757 | ) | | (1,282 | ) | | 1,475 | |

Purchases of treasury stock | | | | (20,020 | ) | | (76 | ) | | 19,943 | |

Dividends paid to shareholders | | | | (10,987 | ) | | (13,960 | ) | | (2,973 | ) |

Dividends paid to minority interests | | | | (126 | ) | | (109 | ) | | 17 | |

Other | | | | — | | | (123 | ) | | (123 | ) |

| | | | |

|

| |

|

| |

|

|

Net cash used in financing activities | | | | (31,657 | ) | | (12,716 | ) | | 18,940 | |

| | | | |

|

| |

|

| |

|

|

Effect of exchange rate changes on cash and cash equivalents | | | | (890 | ) | | (123 | ) | | 767 | |

| | | | |

|

| |

|

| |

|

|

Net increase (decrease) in cash and cash equivalents | | | | (10,509 | ) | | 67,596 | | | 78,106 | |

| | | | |

|

| |

|

| |

|

|

Cash and cash equivalents at beginning of year | | | | 205,050 | | | 194,789 | | | (10,260 | ) |

| | | | |

|

| |

|

| |

|

|

Increase arising from inclusion in consolidation | | | | 249 | | | — | | | (249 | ) |

| | | | |

|

| |

|

| |

|

|

Increase due to merger with non-consolidated subsidiary | | | | — | | | 144 | | | 144 | |

| | | | |

|

| |

|

| |

|

|

Cash and cash equivalents at end of year | | | | 194,789 | | | 262,530 | | | 67,740 | |

| | | | |

|

| |

|

| |

|

|

Page 29

Significant Items for the Preparation of the Consolidated Financial Statements

| | |

| Consolidated subsidiaries: | | 37 |

The names of the consolidated subsidiaries are included in ‘1. State of the Group.’

In addition, Sankyo Trading Co., Ltd., which had been a consolidated subsidiary of the Company until the year ended March 31, 2004, has been excluded from the scope of consolidation effective the current period due to sale of the Company’s entire shares in this company.

| | |

| Non-consolidated subsidiaries: | | 14 |

| 2. | Application of the Equity Method |

| | |

Non-consolidated subsidiaries accounted for by the equity method: | | None |

Affiliated companies accounted for by the equity method: | | None |

Non-consolidated subsidiaries not accounted for by the equity method: | | 14 |

Affiliated companies not accounted for by the equity method: | | 3 |

| 3. | Fiscal Year End of Consolidated Subsidiaries |

The fiscal years for 18 of the Company’s overseas consolidated subsidiaries ended on December 31, 2004. Financial statements as of this date were used in the preparation of the consolidated financial statements. However, necessary adjustments were made in those cases where important transactions took place between this date and March 31, 2005.

| 4. | Accounting Principles and Methods |

| (1) | Principles and Methods of Valuation of Important Assets |

| | |

Securities: |

Held-to-maturity securities |

Mainly the amortized cost method (straight-line method) |

Other securities |

Securities with determinable market value: |

Mainly the market value method based on the market value at the end of the fiscal year. Valuation differences are dealt with by means of the direct capital influx method, with the cost of securities sold calculated by the moving average method. |

Securities without determinable market value: |

Mainly stated at cost based on the moving average method |

Derivatives: | | Market value method |

Inventories: | | Mainly stated at cost by the weighted average method at the Company and its domestic consolidated subsidiaries. Mainly stated at the lower of cost or market by the weighted average method at the overseas consolidated subsidiaries. |

| (2) | Depreciation of Important Fixed Assets |

Tangible Fixed Assets

The Company and its domestic consolidated subsidiaries account for property, plant and equipment by the declining balance method. However, buildings (excluding annexes) acquired since April 1, 1998, have been accounted for by the straight-line method. Overseas consolidated subsidiaries account for property, plant and equipment mainly by the straight-line method. The major useful lives are as follows:

| | |

Buildings and structures: | | 2~60 years |

Machinery, equipment and vehicles: | | 2~17 years |

Intangible Fixed Assets

Computed by the straight-line method. Software for in-house use is amortized over the estimated useful lives (a five-year period) by the straight-line method.

Page 30

| (3) | Recording Methods for Important Allowances |

Allowance for Doubtful Accounts

The Company and its consolidated subsidiaries cover the risk of credit losses by making additions to this allowance on the basis of the actual default rates for standard loans, and on an individual basis for loans considered unlikely to be repaid in full.

Accrued Bonuses

To prepare for accrued bonuses, the Company and the majority of its consolidated subsidiaries make provisions based on a portion of the estimated total amount payable for the fiscal year.

Allowance for Sales Returns

To prepare for sales return losses incurred after the end of the fiscal year, the Company and four of its domestic consolidated subsidiaries make the maximum possible provision calculated by the accounts receivable method as regulated by the Corporate Tax Law in Japan.

Allowance for Sales Rebates

To prepare for future sales rebates, the Company records an amount calculated by multiplying the sales rebate rate for the fiscal year by the wholesaler’s inventory amounts or the accounts receivable at the end of the fiscal year.

Retirement and Severance Benefits

To prepare for retirement and severance benefits, the Company and its domestic consolidated subsidiaries make provisions for the amount based on projected benefit obligation and plan assets at the end of the fiscal year. Provisions are made for six of the Company’s overseas consolidated subsidiaries in accordance with generally accepted accounting principles in the countries in question.

Prior service cost is amortized by the straight-line method over a set time period (five years), which is less than the estimated average remaining years of service of the eligible employees when the prior service cost was recognized.

At the Company itself, actuarial gain and loss are booked when they occur. At the domestic consolidated subsidiaries, the straight-line method is used to calculate an amount to be treated as an expense during the fiscal year after the gain or loss was initially recorded. This calculation is, in turn, based upon a set time period (five years) which is less than the average remaining years of service of the eligible employees when the actuarial gain or loss was recorded.

Directors’ Retirement and Severance Benefits

To prepare for directors’ retirement and severance benefits, the Company and its domestic consolidated subsidiaries make provisions for an amount based on the total benefits required to be paid at the end of the fiscal year in accordance with internal regulations. Two overseas consolidated subsidiaries make provisions for the amount generated by the end of the fiscal year.

Page 31

| (4) | Translation of Assets and Liabilities Denominated in Foreign Currencies into Yen |