Filing under Rule 425 under

the U.S. Securities Act of 1933

Filing by: Daiichi Pharmaceutical Co., Ltd.

Subject Company: Daiichi Pharmaceutical Co., Ltd.

and Sankyo Company, Limited

SEC File No. 132-02290

(English translation of previously published information)

This document has been prepared as a guide for non-Japanese investors and contains forward-looking statements that are based on management’s estimates, assumptions and projections at the time of publication. A number of factors could cause actual results to differ materially from expectations.

Daiichi Pharmaceutical Co., Ltd.

FASF

April 27, 2005

Summary of Consolidated Financial Results (Consolidated)

for Fiscal Year 2004, Ended March 31, 2005

(English Translation of “Kessan Tanshin”)

Listed company name: Daiichi Pharmaceutical Co., Ltd.

Stock code number: 4505

Stock listings: Tokyo Stock Exchange, Osaka Securities Exchange

Head office: Tokyo, Japan

URL: http://www.daiichipharm.co.jp/

Representative: Mr. Kiyoshi Morita, President and CEO

Contact: Mr. Toshio Takahashi, General Manager, Corporate Communications Department

Telephone: (03) 3272-0611

Meeting of the Board of Directors held on: April 27, 2005

Application of U.S. GAAP: No

1. Financial results for the fiscal year (April 1, 2004—March 31, 2005)

(1) Consolidated Operating Results

(Figures less than ¥1 million, except per share amounts, have been omitted)

| | | | | | | | | |

| | | Net sales

(% change from previous year)

| | | Operating income (% change from previous year)

| | | Ordinary income (% change from previous year)

| |

| | | Millions of yen | | | Millions of yen | | | Millions of yen | |

Fiscal Year 2004 | | 328,534 (1.8 | %) | | 56,063 (21.6 | %) | | 57,320 (22.7 | %) |

Fiscal Year 2003 | | 322,767 (0.2 | %) | | 46,114 (D12.4 | %) | | 46,731 (D13.0 | %) |

| | | | | | | | | | | | | |

| | | Net income

(% change from

previous year)

| | | Basic net

income per

share

| | Diluted net

income per

share

| | Return on

equity

| | Ratio of

ordinary

income to

total assets

| | Ratio of

ordinary

income to

net sales

|

| | | Millions of yen | | | Yen | | Yen | | % | | % | | % |

Fiscal Year 2004 | | 37,175 (39.4 | %) | | 137.95 | | 137.90 | | 8.5 | | 10.7 | | 17.4 |

Fiscal Year 2003 | | 26,661 (96.5 | %) | | 97.25 | | 97.23 | | 6.5 | | 9.0 | | 14.5 |

Notes

| | | | |

1. Investment income (loss) from affiliated companies accounted for using the equity accounting method: |

| | | For the year ended March 31, 2005 | | D¥399 million |

| | | For the year ended March 31, 2004 | | ¥— million |

| 2. Weighted -average number of common shares issued and outstanding during the year (consolidated): |

| | | For the year ended March 31, 2005 | | 268,481,535 shares |

| | | For the year ended March 31, 2004 | | 272,515,920 shares |

3. Changes in method of accounting presentation: None |

4. Percentages in parentheses under net sales, operating income, ordinary income, and net income indicate changes from the previous fiscal year. |

1

(2) Consolidated Financial Position

| | | | | | | | |

| | | Total assets

| | Shareholders’ equity

| | Shareholders’

equity ratio

| | Shareholders’ equity

per share

|

| | | Millions of yen | | Millions of yen | | % | | Yen |

Fiscal Year 2004 | | 546,555 | | 448,563 | | 82.1 | | 1,670.71 |

Fiscal Year 2003 | | 521,808 | | 422,130 | | 80.9 | | 1,564.59 |

| | | | |

Notes : Total common shares issued and outstanding at end of year (consolidated) |

| | | March 31, 2005: | | 268,404,023 shares |

| | | March 31, 2004: | | 269,700,226 shares |

(3) Consolidated Cash Flows

| | | | | | | | | | |

| | | Cash flows from

operating activities

| | Cash flows from

investing activities

| | Cash flows from

financing activities

| | Cash and cash

equivalents at

year-end

|

| | | Millions of yen | | Millions of yen | | Millions of yen | | Millions of yen |

Fiscal Year 2004 | | 35,571 | | D | 21,989 | | D | 12,369 | | 91,571 |

Fiscal Year 2003 | | 47,505 | | D | 27,419 | | D | 18,470 | | 90,346 |

| (4) | Notes regarding the scope of consolidation and application of the equity method of accounting |

| | |

Consolidated subsidiaries : | | 31 |

Non-consolidated subsidiaries accounted for under the equity method : | | 0 |

Affiliated companies accounted for under the equity method : | | 2 |

(5) Changes in the scope of consolidation and application of the equity method of accounting

| | | | |

Consolidated subsidiaries | | | | |

(increase) | | 3 | | |

(decrease) | | 0 | | |

Equity method affiliates | | | | |

(increase) | | 2 | | |

(decrease) | | 0 | | |

2. Forecasts of Consolidated Results Fiscal Year 2005 (April 1, 2005—March 31, 2006)

| | | | | | |

| | | Net sales

| | Ordinary income

| | Net income

|

| | | Millions of yen | | Millions of yen | | Millions of yen |

Interim 6-month period | | 159,000 | | 22,000 | | 12,000 |

Full year | | 333,000 | | 52,000 | | 18,000 |

Reference: Forecasted basic net income per share for the year: ¥ 66.55

| * | Note: The forecast figures shown above are based on information that was available at the time of preparation and may contain some uncertainties. Actual performance and other factors may differ from these forecasts due to changes in circumstances and other developments. More information concerning these forecasts can be found in the attached Supplementary Information on page 16-17. |

2

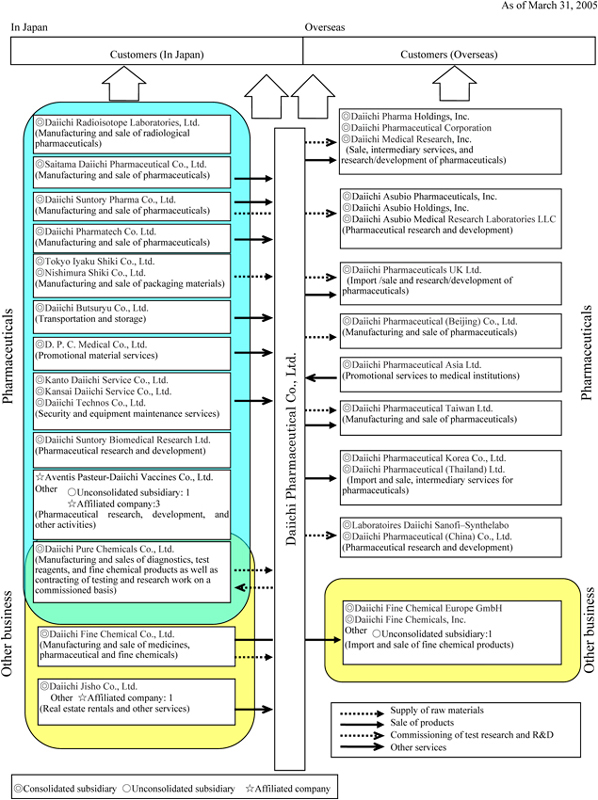

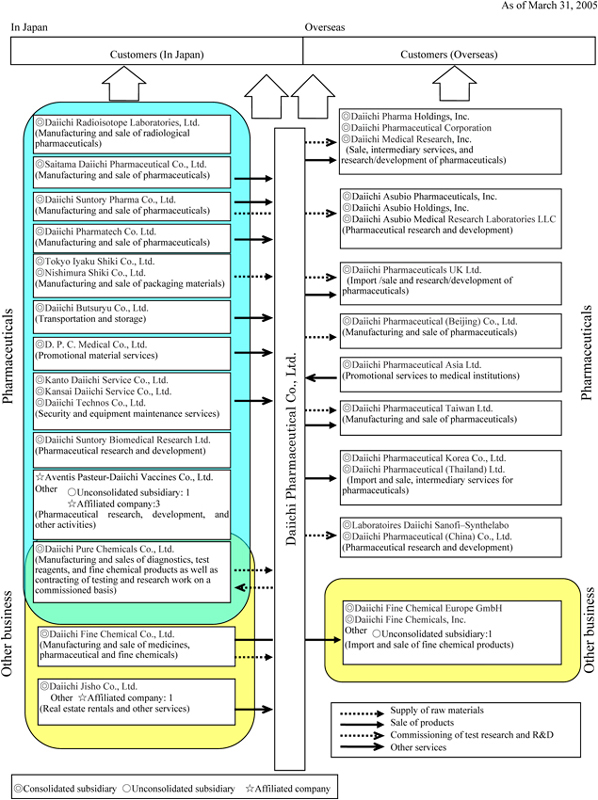

1. State of the Group

The Company’s corporate Group comprises Daiichi Pharmaceutical Co., Ltd. (the parent Company), its 34 subsidiaries (including 31 consolidated subsidiaries and 3 unconsolidated subsidiaries), and 5 affiliated companies, for a total of 40 Group companies. The principal lines of business of Group companies, the positioning of principal companies within the Group, and the business and geographic segment to which each company belongs are shown below.

| | | | |

Business Classification

| | Lines of Business

| | Principal Group Companies

|

Pharmaceuticals | | | | Japan |

| | Prescription drugs | | Daiichi Pharmaceutical Co., Ltd. |

| | | | | Daiichi Pure Chemicals Co., Ltd. |

| | | Diagnostic and radiopharmaceuticals | | Daiichi Radioisotope Laboratories, Ltd. |

| | | | | Daiichi Fine Chemical Co., Ltd. |

| | | | | Saitama Daiichi Pharmaceutical Co., Ltd. |

| | | | | Daiichi Suntory Pharma Co., Ltd. |

| | | | | Daiichi Pharmatech Co., Ltd. |

| | | OTC drugs | | Tokyo Iyaku Shiki Co., Ltd. |

| | | | | Nishimura Shiki Co., Ltd. |

| | | Animal drug products | | Daiichi Butsuryu Co., Ltd. |

| | | | | D. P. C. Medical Co., Ltd. |

| | | | | Kanto Daiichi Service Co., Ltd. |

| | | | | Kansai Daiichi Service Co., Ltd. |

| | | | | Daiichi Technos Co., Ltd. |

| | | | | Daiichi Suntory Biomedical Research Ltd. |

| | | | | Unconsolidated subsidiary: 2 company; affiliated companies: 4 |

| | | | | Total 21 companies |

| | | | | Overseas |

| | | | | Daiichi Pharma Holdings, Inc. |

| | | | | Daiichi Pharmaceutical Corporation |

| | | | | Daiichi Medical Research, Inc. |

| | | | | Daiichi Pharmaceuticals UK Ltd. |

| | | | | Daiichi Pharmaceutical (Beijing) Co., Ltd. |

| | | | | Daiichi Pharmaceutical (China) Co., Ltd. |

| | | | | Daiichi Pharmaceutical Asia Ltd. |

| | | | | Daiichi Pharmaceutical Taiwan Ltd. |

| | | | | Daiichi Pharmaceutical Korea Co., Ltd. |

| | | | | Daiichi Pharmaceutical (Thailand) Ltd. |

| | | | | Laboratoires Daiichi Sanofi–Synthelabo |

| | | | | Daiichi Asubio Pharmaceuticals, Inc. |

| | | | | Daiichi Asubio Holdings, Inc. |

| | | | | Daiichi Asubio Medical Research Laboratories LLC |

| | | | | Total 14 companies |

| | | | | Japan |

Other Business | | Fine chemical business | | Daiichi Pure Chemicals Co., Ltd. |

| | | | | Daiichi Fine Chemical Co., Ltd. |

| | | | | Daiichi Jisho Co., Ltd. |

| | | | | |

| | | Safety research business | | Other affiliated company: 1 |

| | | | | |

| | | | | Total 4 companies |

| | | | | Overseas |

| | | Other business | | Daiichi Fine Chemicals, Inc. |

| | | | | Daiichi Fine Chemical Europe GmbH |

| | | | | Unconsolidated subsidiary: 1 |

| | | | | Total 3 companies |

Note

| 1. | The number of companies by business line includes those companies that are engaged in more than one business. |

| 2. | For the fiscal year under review, three newly-established companies have been included in the scope of consolidation: Daiichi Pharmaceutical Corporation, Daiichi Medical Research, Inc., and Daiichi Pharmatech Co., Ltd. |

Also, please note that the former corporate name of Daiichi Pharmaceutical Corporation has been changed to Daiichi Pharma Holdings, Inc. as of April 1, 2004.

| 3. | As of May 7, 2004, the corporate name of Suntory Pharmaceutical Inc. was changed to Daiichi Asubio Pharmaceuticals, Inc.; as of July 30, 2004, the corporate name of Suntory Pharmaceutical Holding Inc. was changed to Daiichi Asubio Holdings, Inc.; and, as of September 14, 2004, the corporate name of Suntory Pharmaceutical Research Laboratories LLC was changed to Daiichi Asubio Medical Research Laboratories LLC. |

3

4

2. Management Policy

1. Basic Policies

With its corporate slogan “Enriching the Quality of Life,” the Daiichi Pharmaceutical Co., Ltd. and its Group companies has adopted the philosophy of contributing to healthier and happier lives globally by developing innovative technologies and providing superior pharmaceutical products.

The Daiichi Group’s GLOBAL 10 long-term vision calls for the Group to become an “R&D-driven global pharmaceutical company” that develops products that meet global standards and provides them throughout the world. To realize this vision, the Group has made proceeded with diverse business reforms, and striven to improve its operations in a manner that accords with its social mission.

However, in view of such worldwide trends as progressive globalization and stepped-up cost-containment measures in the healthcare environment, we recognize that it is crucial to adopt a new corporate strategy that will enable us to build the stronger corporate foundation and management resources needed to overcome global competition.

Sharing in the recognition of the need for this strategy, Daiichi and Sankyo Co., Ltd., on February 25, signed a basic agreement calling for the establishment of a joint holding company to be called DAIICHI SANKYO COMPANY, LIMITED, with the target date for the company’s founding set at October 1, 2005, and the integration of their operations in the prescription drug business scheduled for April, 2007. The goal of integration is to realize the philosophy and vision jointly held by the two companies.

By maximizing synergies generated by the integration, the two companies are aiming to become the Japan-based “global pharma-innovator.” Having outstanding R&D and marketing capabilities competitive in the major world markets, this company will seek to “contribute to better human health throughout the world” on a still-higher level.

2. Basic Policy Regarding Distribution of Profits

Positioning the distribution of profits earned from business activities as one of its most important management tasks, Daiichi emphasizes the distribution of profits to shareholders in a manner that reflects corporate performance. The level of cash dividends is determined in line with this emphasis while reflecting the comprehensive consideration of such factors as the need to bolster internal reserves to build a foundation for corporate growth.

Regarding cash dividends, the Company seeks to maintain stable growth in cash dividends and in the dividend payout ratio while concurrently making flexible and timely moves to repurchase its outstanding shares with the goal of boosting income per share.

Regarding internal reserves, the Company plans to used them to fund such investments as those for engaging in leading-edge research, strengthening the product development pipeline, engaging in corporate alliances, and strengthening the foundations for international operations.

5

3. Policy Regarding the Reduction of the Basic Trading Unit of Shares

Aiming to increase the liquidity of its shares and expand its shareholder base, the Company reduced the trading unit size from 1,000 shares to 100 shares as of August 1, 2002.

4. Management Indicator Performance Goals

The Daiichi Group has set its If consolidated net sales target at ¥345.0 billion for fiscal 2006. A new target and other goals are to be set in light of the basic agreement for integration with Sankyo Co., Ltd.

5. Medium- and Long-Term Strategies and Essential Tasks

Regarding overseas pharmaceutical markets, while the industrialized countries are making sustained efforts to reduce healthcare costs, marketing competition is becoming increasingly intense in the United States and other countries, and development competition in the search for breakthrough products involves the use of leading-edge technologies that are accompanied by increased R&D expenses. These and other factors are making the overseas operating environment more challenging.

In Japan, growth in the pharmaceutical market is being slowed by healthcare system reform measures implemented against the backdrop of demographic graying, and the growing presence of overseas-based companies is contributing to an intensification of competition for market share.

Aiming to use new global development drug candidates to realize its corporate objectives, the Daiichi Group has designated the period through fiscal 2006 for reforms that will create the foundation required for achievement of its corporate objectives. Accordingly, it is taking measures to attain the following management goals.

(1) Expanding Global R&D Operations

Daiichi is giving strategic emphasis to the tasks of building a global R&D system able to create pharmaceutical products in line with global standards, continuously creating high-quality drug development candidates, and strengthening its system for evaluating drug development candidates in line with global standards and from both scientific and business perspectives.

Recognizing the need to transform conventional R&D operations in order to promote the smooth operation of a global R&D system, in October 2004 the Company established a new organizational system within an R&D Division designed to integrate R&D operations. Within the R&D Division system, the Company is working to promote progress in domestic and overseas R&D projects through functional collaboration between its Tokyo Research and Development Center and U.S.-based Daiichi Medical Research, Inc. Through this initiative, the Company is seeking to boost R&D productivity, integrate science and business, and firmly instill global thinking and action mechanisms.

6

Regarding drug discovery research, Daiichi has chosen for four therapeutic domains—infectious diseases, cancer, thrombosis and other cardiovascular diseases, and allergies and other immune system disorders. Research advances are being promoted by augmenting the quality and efficiency of drug discovery system's performance. Competitively superior drug discovery technologies are being implemented by stepping up collaboration with leading-edge research institutions in Japan and overseas as well as with Daiichi Suntory Pharma Co., Ltd., and other Daiichi Group members.

In clinical development operations, Daiichi Medical Research now provides more-sophisticated drug candidate evaluation capabilities. Working in cooperation with the Daiichi Group’s other internal research facilities, the U.S.-based company is now undertaking comprehensive evaluation of a number of promising drug candidates—including such oral antithrombotic agents as DU-176b, an oral factor-Xa inhibitor; such quinolone agents for treating drug-resistant infections as DX-619; such anti-allergy agents as DW-908e; and the anticancer chemotherapeutic agent DJ-927. In preparation for the advance of these candidates to the proof-of-concept (POC) testing stage, the Company is creating systems for performing POC studies in line with global standards.

(2) Strengthening Domestic and Overseas Prescription Drug Business

Amid increasingly intense marketing competition, Daiichi has the policy of working to further reinforce the market positions of its domestic and overseas prescription drug businesses.

In the domestic prescription drug business, the Company is aiming to expand its current market share. To do this, it is striving to increase the number of prescriptions for established drugs—such asCravit, a broad-spectrum oral antibacterial agent;Artist, a long-acting beta-blocker;Sunrythm, an anti-arrhythmic agent; andHANP, an agent for treating acute cardiac insufficiency—while also expeditiously launching and developing the markets for drugs for which applications were already made—such asPlavix (clopidogrel sulfate), a new anti-platelet agent; and KMD-3213 (silodosin), an agent for treating dysuria. The Company is also strengthening its marketing operations aimed at the hospital market while taking steps to respond to such changes in the medical therapy environment as the creation of medical institution networks and the spread of diagnostic and therapeutic guidelines.

In the overseas prescription drug business, the Company is working to ensure that its licensee maintains the top share of the quinolone market in the United States, which is the largest export market for bulk shipments of its mainstay antibacterial agent levofloxacin, by working through the licensee to obtain approval for additional indications and taking other steps to expand sales of products containing levefloxacin in the United States.

(3) Building a Resilient Corporate Structure by Resolutely Implementing Structural Reforms

To transform the entire Daiichi Group into an enterprise featuring high levels of profitability and management efficiency as well as strong overall competitiveness, the Company has established a task force, the Structural Reform Headquarters, that is working to

| | 1) | consolidate functions within the Group and integrate and consolidate networks of research, manufacturing, and distribution facilities, |

| | 2) | optimize the size of the Group’s workforce, and |

7

| | 3) | restructure ancillary businesses. |

Particularly noteworthy among functional and facility consolidation measures was the establishment of Daiichi Pharmatech Co., Ltd., which began operating smoothly in April 2005. Created through the spin-off of three factories from the parent Company and subsequent integration of these factories with two Group manufacturing service companies, Daiichi Pharmatech is working to further increase manufacturing efficiency and strengthen cost-competitiveness.

Other noteworthy measures include the shift of the Tochigi Research Center’s protein research unit and Daiichi Fine Chemical’s drug discovery units to the Tokyo Research and Development Center, in October 2004 and April 2005, respectively. A decision has been made to increase distribution efficiency and cut costs by shifting the functions of distribution centers in Sapporo and Shizuoka to the Tokyo Distribution Center, and the Company is assiduously moving ahead with measures to prepare for the implementation of this decision.

To consolidate planning and administration functions, the Company is proceeding with the consolidation of Group companies’ accounting, personnel, remuneration, and IT units as well as with the introduction of enterprise resource planning (ERP) systems. The personnel and remuneration functions of major Group companies have already been consolidated in the Company’s Business Center facility.

Aiming to optimize the size of the Group’s workforce, steps were taken to hire additional staff to work for Daiichi Medical Research and as the parent Company’s Medical Representatives (sales representatives in the field) in domestic prescription drug marketing. In contrast, at many other Group companies such operational reform measures as those to reevaluate operations, consolidate functions, and introduce electronic information systems have enabled workforce right-sizing.

Regarding the reorganization of non-core businesses, the Company transferred its veterinary and livestock feed products business to Meiji Seika Kaisha, Ltd. This transfer was smoothly implemented in June 2004.

(4) Other Issues

With respect to manufacturing and technology, the Group is striving to upgrade its overall technological strength and thereby boost its cost-competitiveness and provide additional high-value-added products. At the same time, the Group is working to fortify its supply chain management initiative to ensure stable supplies, optimize inventory levels, and enhance its product quality assurance systems in line with global standards.

In the area of post-marketing-surveillance (PMS) and reliability assurance, the Company is taking various measures in accord with the complete implementation of Japan’s amended Pharmaceutical Affairs Law in April 2005, which calls for appropriate responses to new post-manufacturing/marketing safety administration standards and new regulatory responsibility definitions. Organizational restructuring responses include the October 2004 establishment and reorganization of functional units within the newly created and independent PMS Administration and Reliability Assurance Division.

Regarding environmental management, the Company recognizes the importance of conserving the global environment. In line with the Daiichi Environmental Charter, the Group has created an organizational framework for guiding environmental conservation activities, such as the proactive launch of various programs aimed at realizing a recycling-oriented society. These efforts will be made public in the fiscal 2004 edition of the Daiichi Environmental Report.

8

Regarding the issues associated with the alleged formation of a bulk vitamin marketing cartel, settlements were reached with all but a few relevant parties in the United States. In Europe, an appeal was filed in February 2002 in response to a notification of the levying of a fine received from the European Commission.

In the United States, Mylan Laboratories Inc. and other companies have filed applications for permission to manufacture generic versions of products containing of Daiichi’s mainstay product, levofloxacin. Having determined that such applications constitute attempts to infringe Daiichi’s patents, Daiichi and its licensee together filed suit against the Mylan Laboratories-led group in a federal district court, which decided in favor of Daiichi and the licensee in December 2004. However, the Mylan Laboratories-led group was dissatisfied with the decision and has appealed it. Daiichi intends to continue vigorously defending its intellectual property assets.

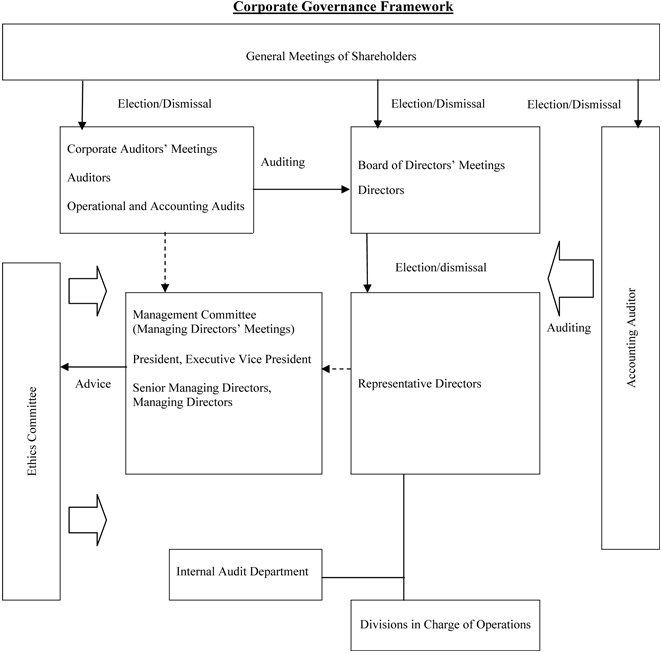

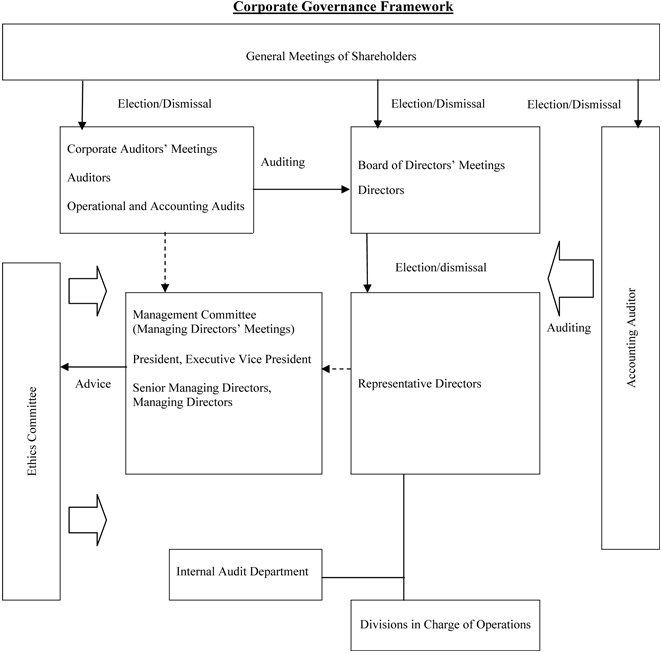

6. Basic Policy Regarding Corporate Governance and Implementation of Related Measures

(1) Basic Policy Regarding Corporate Governance

Recognizing that increasing shareholder value is an important management issue, Daiichi is working to strengthen its capabilities regarding legal compliance, highly transparent management, rapid and appropriate management decision-making, and supervisory systems.

(2) Implementation of Corporate Governance Related Measures

| | 1) | Management and Administration Organization System for Decision-Making, Execution, and Supervisory Tasks and Other Corporate Governance Systems |

Held every month in principle are Board of Directors’ Meetings, where directors decide issues related to operational execution and the supervision of the execution of tasks by directors. Serving as a management council or executive board, Managing Directors’ Meetings are held once every week in principle, to discuss operational execution matters and to expedite and ensure the appropriateness of management decision-making. Currently there are no external directors.

Aiming to reinforce corporate governance with particular attention to such goals as increasing management transparency, strengthening decision-making capabilities, and establishing flexible and dynamic operational execution systems, changes will be made to appoint external directors and adopt single-year terms for directors upon approval at the coming 127th Ordinary General Meeting of Shareholders, and the Company is moving ahead with the introduction of an executive officer system and functional reevaluation of the Management Committee.

Directors’ remuneration is determined within a predetermined remuneration framework using a rational method that takes corporate performance into consideration.

Daiichi has adopted an auditor system. To promote the Company’s sound and sustained management, corporate auditors participate and express opinions at Board of Directors’ Meetings and Managing Directors’ Meetings as well as at other important meetings in accordance with regulations for Corporate Auditors’ Meetings and corporate auditor’s execution of duties. In addition, corporate auditors have the task of performing financial and operational audits for the Company and other Group companies. Corporate Auditors’ Meeting is currently composed of four members, including two external corporate auditors

9

Regarding internal control systems, Daiichi is strengthening its Internal Audit Department and other internal auditing units and also conducts audits of its compliance system, risk management system, and other internal control systems.

Daiichi has commissioned KPMG AZSA & CO. as its independent auditor, giving it the role of auditing the Company’s financial statements from an independent standpoint.

Daiichi Group companies make sustained efforts to ensure rigorous legal compliance and have instituted the “Daiichi Conduct Guidelines.” The Company has employee hot-lines and the Ethics Committee that include advisory lawyers and directors as members.

| | 2) | External Directors’ and External Auditors’ Personal, Capital, Transactional, or Other Relationships of Vested Interest with the Company |

The external auditors have no vested interest in the Company.

| | 3) | Measures Taken During the Past Year to Strengthen Corporate Governance |

To clarify the Group management staff roles of the Company’s planning and administration departments, these departments were reorganized as “corporate” departments, and Group management capabilities were strengthened.

To promote rigorous legal compliance and thorough awareness of the “Daiichi Conduct Guidelines” among all employees, measures were taken, including the organization of training seminars for each management stratum and the implementation of questionnaire-based surveys.

Responding to the full implementation of Japan’s new Personal Information Protection Law in April 2005, the Company has instituted new policies, regulations, and handling standards related to personal information. It has also taken various measures to create a personal information protection system, including the establishment of the Personal Information Protection Committee to act as an operational administrative organ.

Daiichi is continuing efforts to ensure the timely disclosure of information related to changes in the Company’s situation as well as to ensure the transparency of the Company’s management processes.

10

11

3. Results of Operations and Financial Position

1. Overview of Fiscal Year 2004

(Millions of Yen)

| | | | | | | | |

| | | Net sales

| | Operating income

| | Ordinary income

| | Net income

|

Fiscal Year 2003 | | 322,767 | | 46,114 | | 46,731 | | 26,661 |

Fiscal Year 2004 | | 328,534 | | 56,063 | | 57,320 | | 37,175 |

Change (%) | | 1.8 | | 21.6 | | 22.7 | | 39.4 |

(1) Overview of Performance during the Fiscal Year

During the year, overseas pharmaceutical markets were characterized by a further intensification of global competition centered on “global-mega” companies and associated with both new drug-related R&D and marketing activities. The Japanese pharmaceutical market was affected by changes in the healthcare systems—such as the growing scope of application of the comprehensive hospital therapy evaluation system and the conversion of national university hospitals and other national hospitals into independent corporations—and an average 4.2% reduction in National Health Insurance (NHI) drug reimbursement prices was implemented in April 2004.

Against this backdrop, the Daiichi Group worked to expand the markets for its products while emphasizing the promotion of appropriate drug use through the provision of information related to drug efficacy and safety. As a result, higher revenue from domestic sales of prescription drugs and a rise in bulk levofloxacin exports more than offset a revenue decline associated with the transfer of veterinary and livestock feed products business to another company. Consequently, net sales advanced 1.8% from the previous fiscal year, to ¥328,534 million. Reflecting the reduction in cost of sales as well as cost-cutting measures with respect to R&D expenses, operating income totaled ¥56,063 million, up 21.6% from the previous fiscal year, and double-digit growth was achieved in ordinary income, which amounted to ¥57,320 million, up 22.7% from the previous fiscal year. While ¥7.3 billion in extraordinary restructuring expenses associated with the spin-off of the parent Company’s manufacturing operations was recorded, this was more than offset by extraordinary gains of ¥11.7 billion on the return of the substitutional retirement portion of its Employee’s Pension Fund and ¥3.8 billion on the shift to a new retirement payment system. Thus, net income surged 39.4% from the previous fiscal year, to ¥37,175 million.

The share of consolidated net sales derived from overseas operations was 20.9%.

In light of this strong performance, the Company has decided to increase year-end cash dividends by ¥10 per share and disburse total year-end cash dividends of ¥25 per share. As ¥15 per share interim cash dividends have already been disbursed, cash dividends applicable to the fiscal year under review will total ¥40 per share.

The Company intends to keep emphasis on the distribution of profits to shareholders after the integration with Sankyo Co., Ltd. scheduled for October 2005.

12

(2) Overview of Performance by Business Segment

Business segment

(Millions of Yen)

| | | | | | | | | | | | | | | | |

| | | Net sales

| | Operating income

|

Business segment

| | Fiscal 2003

| | Fiscal 2004

| | Increase

(Decrease)

| | Fiscal 2003

| | Fiscal 2004

| | Increase

(Decrease)

|

Pharmaceutical | | 304,564 | | 311,844 | | | 7,280 | | | 53,126 | | | 64,096 | | | 10,969 |

Other | | 18,203 | | 16,689 | | D | 1,513 | | | 65 | | D | 78 | | D | 144 |

Subtotal | | 322,767 | | 328,534 | | | 5,766 | | | 53,192 | | | 64,017 | | | 10,824 |

Eliminations | | — | | — | | | — | | D | 7,077 | | D | 7,953 | | D | 876 |

Consolidated | | 322,767 | | 328,534 | | | 5,766 | | | 46,114 | | | 56,063 | | | 9,948 |

Note: Sales are the value of sales to external customers.

Pharmaceutical Business

<Prescription Drugs>

Although conditions in the domestic prescription drug market were negatively affected by the April 2004 revision of drug reimbursement prices, sales of the mainstay broad-spectrum oral antibacterial agentCravit were steady, and increased sales were recorded for such products asMobic, a nonsteroidal anti-inflammatory agent marketed in Japan exclusively by Daiichi since July 2004;Artist, a long-acting beta-blocker for treating high blood pressure, angina, and chronic cardiac insufficiency; andZyrtec, an anti-allergy agent. As a result, total domestic prescription drug sales advanced 1.9% from the previous fiscal year, to ¥205,859 million.

Overseas prescription drug sales were negatively affected by a decline in a U.S. subsidiary's sales ofFLOXIN Otic, an antibacterial otic solution for treating ear infections, as well as by the appreciation of the yen. However, the completion of U.S. inventory adjustments for levofloxacin enabled a recovery in bulk sales of this product, and patent licensing royalty income grew. Thus, overseas sales of prescription drugs rose 6.2% from the previous fiscal year, to ¥61,318 million.

<Diagnostics and Radiopharmaceuticals>

Measures aimed at restraining medical costs kept market conditions challenging, and sales of such products as in vivo radiopharmaceuticals for cardiac imaging applications declined. However, strong sales of such in vitro diagnostics products as testing kits for influenza—which was prevalent in Japan during the year under and mainstay cholesterol measuring agents for export boosted total sales of diagnostics and radiopharmaceuticals products 2.1% from the previous fiscal year, to ¥32,923 million.

<OTC Drugs>

Karoyan Gush, a hair-growth accelerator launched in June 2004, made a significant contribution to performance during the year, and sales of such products asPatecs anti-inflammatory analgesic poultices and the vitamin C productCystina C were robust. Accordingly, OTC Drug sales advanced 16.3% from the previous fiscal year, to ¥10,199 million.

13

<Veterinary and Livestock Feed Products>

Reflecting the Company’s June 2004 transfer of its veterinary and livestock feed products business to Meiji Seika Kaisha, Ltd., segment sales dropped 59.1% from the previous fiscal year, to ¥1,544 million.

Other Businesses

Sales of fine chemical products decreased 10.6%, to ¥12,967 million, reflecting drops in sales of such products as calcium pantothenate to customers in North America and Europe. Total sales in the other businesses segment, which includes fine chemicals, declined 8.3%, to ¥16,689 million.

R&D Activities

By conducting research programs that enable the identification of additional drug target molecules and the acquisition of innovative new drug discovery “seeds,” Daiichi is seeking to continuously generate high-quality drug development candidates. Moreover, the Company is proactively undertaking POC testing programs coordinated by Daiichi Medical Research.

Regarding collaborative research initiatives, Daiichi is collaborating with the U.S.-based UCSF Cancer Research Institute and U.S.-based Rigel Pharmaceuticals Inc., in research aimed at developing molecularly-targeted anti-cancer agents and is conducting research related to genomic drug discovery with Japan-based Kazusa DNA Research Institute and Celestar Lexico-Sciences, Inc. All of these research programs are expected to facilitate new drug discovery.

Recognizing the importance of strategies for obtaining additional leading-edge technologies, Daiichi and MediBIC ALLIANCE jointly established a drug development venture investment fund in March 2005. The objectives of this fund are to facilitate the collection of information on drug discovery technologies as well as collaborative research activities.

With respect to drug development operations, Daiichi has applications pending in Japan forPlavix (clopidogrel sulfate), an antiplatelet agent;Sonazoid (DD-723), an ultrasonic contrast medium product; and KMD-3213 (silodosin), an agent for treating dysuria jointly developed with Kissei Pharmaceutical Co., Ltd. In addition, Aventis Pasteur-Daiichi Vaccines Co., Ltd. has an application pending in Japan forActHIB,the first haemophilus influenzae type b conjugate vaccine for pediatric use.

In May 2004, Daiichi submitted a supplemental application for the anticancer agentTopotecin (irinotecan hydrochloride), for the additional indication of pancreatic cancer. In February 2005, the Company submitted a supplemental application for the natural interferon beta agentFeron, for the additional indication of Hepatitis C -induced liver cirrhosis.

In April 2005, approval was received for the anti-spasticity agentGabalonIntrathecal Injection (continuous administration of baclofen into the intrathecal cavity) developed as an orphan drug (an agent for rare diseases). The agent is used with a programmable pump system, which was developed by Medtronic Japan Co., Ltd. and approval was given for the system in March 2005.

Also in April 2005, approval was received forAdenoscan(adenosine), an adjunctive agent for myocardial scintigraphy imaging for which the domestic application was submitted by Daiichi Suntory Pharma.

14

Daiichi decided to discontinue its participation in development for anticancer agent TZT-1027, licensed from TEIKOKU HORMONE MFG. CO., LTD., as a result of its reevaluation of development plans, aimed at and strategy of making selective and concentrated investments of R&D resources.

Other noteworthy products under development include DU-6859a (Gracevit, sitafloxacin), a quinolone antibacterial agent that was discovered and developed in-house, and HGF DNA plasmid, an agent for treating peripheral artery disease and ischemic heart disease for which exclusive marketing rights for Japan, the United States, and Europe have been obtained from AnGes MG, Inc.

Daiichi Suntory Pharma is proceeding with domestic clinical trials of (SUN Y7017 (memantine hydrochloride), an agent for treating Alzheimer’s disease.

Manufacturing and Technologies

Aiming to realize considerable reduction in cost of sales, the Daiichi Group has introduced a new levofloxacin manufacturing method involving a new synthesis technology. The switch to the new manufacturing method has been completed with respect to levofloxacin exported to the United States, which is the principal market for this product.

Daiichi Suntory Pharma began constructing a bio bulk manufacturing facility at its Chiyoda Pharma Factory that is designed to meet needs associated with growing sales ofHANP injectable 1000 as well as newly developed products. This facility is scheduled to be completed in October 2005.

Group-wide Initiatives

Daiichi has undertaken various reforms designed to increase the soundness and stability of its pension system. Along with completing the return of its Employees’ Welfare Pension Fund’s substitutional portion, the Company has undertaken fundamental reform aimed at unification of the pension plans of domestic Group companies. These companies have introduced new pension systems involving defined contributions and benefits.

Regarding moves to introduce and upgrade electronic information systems, the Company is been proceeding with the introduction of enterprise resource planning (ERP) systems at major domestic Group companies. Consolidated accounting, personnel, and remuneration systems have already been inaugurated and the Company is moving forward steadily with the introduction of supply-chain management systems.

2. Forecast for the current Fiscal Year

| | | | | | | | | | | |

| | | (Millions of Yen) |

| | | | |

| | | Net sales

| | Operating income

| | Ordinary income

| | Net

income

|

Fiscal Year 2004 results | | 328,534 | | | 56,063 | | | 57,320 | | | 37,175 |

Fiscal Year 2005 forecast | | 333,000 | | | 53,000 | | | 52,000 | | | 18,000 |

Change (%) | | 1.4 | | D | 5.5 | | D | 9.3 | | D | 51.6 |

15

<Net Sales>

In the domestic prescription drug business, Daiichi projects that it will face a severe operating environment due to such factors as the increasing effect of government measures aimed at restraining medical costs and the rising market share of major global drug companies. Against this backdrop, the Company will concentrate its efforts on maintaining the top market share of its mainstay productCravit, as well as increasing sales of such major products for cardiovascular diseases asArtist,Sunrythm, andHANP. In addition, the Company anticipates the launch of new products during the latter half of the year such asPlavix will help increase net sales in the domestic prescription drug business.

In the overseas prescription drug business, the Company expects that revenues from its mainstay bulk exports of levofloxacin to the United States will continue to increase in light of the favorable growth in sales by its licensee. The Company is basing its projections on the premise that exchange rates during the fiscal year will be approximately US$1=¥105 and 1 Euro=¥130.

Rising sales are projected in OTC drug operations due to such factors as growing sales of the hair-growth acceleratorKaroyan Gush. Sales of diagnostics and radiopharmaceuticals, for which market conditions are severe, are expected to be approximately unchanged.

Consequently, net sales are projected to increase, albeit by a small margin.

<Profitability>

Having started operating Daiichi Pharmatech in April 2005, the Company is further stepping up its efforts to reduce the cost of sales, and it intends to place still greater emphasis on reducing non-strategic expenses. The Company is seeking to restrain R&D expenses by strengthening is capabilities for accurately evaluating drug candidates at early development stages and continuing to concentrate its operations in core therapeutic domains; nevertheless R&D expenses are projected to increase owing to the full-scale start of clinical trial programs in the United States and Europe for DU-176b, an oral factor-Xa inhibitor during the next fiscal year.

While the domestic and overseas operating environments are expected to be more challenging, the Company is doing its utmost to secure the profits required to fund the R&D programs needed to build new corporate growth paths, expeditiously realize the medium-to-long-term corporate growth capabilities that its R&D results make possible, and proceed steadily and quickly with such structural reform measures as those aimed at merging and eliminating certain distribution facilities. The Company plans to implement these strategies in a manner that maximizes the benefits of the upcoming business integration.

Based on the above projections, Daiichi anticipates that it will record higher sales but lower profits during fiscal 2005. Specifically, the Company is aiming to record ¥333.0 billion in consolidated net sales, ¥53.0 billion in operating income, and ¥52.0 billion in ordinary income. After accounting for the effect of converting Daiichi Suntory Pharma into a wholly owned subsidiary, net income is expected to amount to ¥18.0 billion.

16

II . Financial Position

1. Overview of Changes in the Fiscal Year Under Review

<Assets, Liabilities, and Shareholders’ Equity>

At the end of the fiscal year, total assets amounted to ¥546.5 billion, up ¥24.7 billion from the previous fiscal year end. Total current assets were affected by a ¥13.4 billion rise in marketable securities, while long-term assets were affected by a ¥15.4 expense on prepaid pension liabilities that accompanied the return of the substitutional retirement portion of its Welfare Pension Fund.

Regarding liabilities, such factors as the introduction of a specified contribution pension system led to a ¥14.4 billion decrease in reserves for employees’ retirement benefits, and an accompanying ¥9.1 billion increase in deferred income taxes. Shareholders’ equity was affected by a ¥28.2 billion rise in retained earnings.

<Consolidated Cash Flows>

| | | | | | | | | |

| | | (Millions of Yen) |

| | | |

Accounting Items

| | Fiscal Year 2003

| | Fiscal Year 2004

| | Increase

(Decrease)

|

Net cash provided by (used in) operating activities | | | 47,505 | | | 35,571 | | D | 11,934 |

Net cash provided by (used in) investing activities | | D | 27,419 | | D | 21,989 | | | 5,430 |

Net cash provided by (used in) financing activities | | D | 18,470 | | D | 12,369 | | | 6,101 |

Effect of exchange rate changes on cash and cash equivalents | | D | 207 | | | 12 | | | 220 |

Increase (decrease) in cash and cash equivalents | | | 1,407 | | | 1,225 | | D | 182 |

Cash and cash equivalents at end of year | | | 90,346 | | | 91,571 | | | 1,225 |

Net cash provided by operating activities amounted to ¥35.6 billion, down ¥11.9 billion from the previous year. Although net income grew ¥17.1 billion, the decrease in net cash provided by operating activities reflected such factors as a decrease in reserves for employees’ retirement benefits as well as such factors increasing accounts receivable and a rise in royalty income.

Net cash used in investing activities totaled ¥22.0 billion, down ¥5.4 billion from the previous year. This decrease mainly reflected a drop in the acquisition of investment securities.

Net cash used in financing activities amounted to ¥12.4 billion, down ¥6.1 billion from the previous year. This decrease mainly reflected a drop in the acquisition of treasury stock.

As a result, total cash and cash equivalents at the end of year were ¥91.6 billion, up ¥1.2 billion from the previous fiscal year.

2. Projection of Changes in the Current Fiscal Year

In the next fiscal year, Daiichi projects that its net sales will increase by a small margin, but the Company also anticipates that profits will decline due to its proactive augmentation of R&D investment. Accordingly, the Company projects that the level of net cash provided by operating activities during the next fiscal year will be lower than that in the year under review.

17

Cash flows from investing activities are expected to be affected by higher spending accompanying the conversion of Daiichi Suntory Pharma into a wholly owned subsidiary, although the levels of cash used to acquire tangible fixed assets and of long-term funds under management are projected to remain approximately unchanged.

Cash flows from financing activities are projected to be affected by a rise in cash dividend payments.

In light of the above factors, the balance of cash and cash equivalents at the end of the next fiscal year is projected to decrease from the level at the end of the year under review.

<Principal Financial Indicators>

| | | | | | |

| | | Fiscal Year 2002

| | Fiscal Year 2003

| | Fiscal Year 2004

|

Shareholders’ equity ratio (%) | | 78.4 | | 80.9 | | 82.1 |

Market capitalization ratio (%) | | 85.3 | | 104.4 | | 123.3 |

Interest-bearing debt ratio (years) | | 0.0 | | 0.0 | | 0.0 |

Interest coverage ratio (times) | | 2,040.3 | | 48,280.4 | | 51,372.9 |

Notes:

| 1. | Shareholders’ equity ratio = total shareholders’ equity/total assets |

| 2. | Market capitalization ratio = total market value (Closing stock prices on balance sheet date x number of outstanding shares at the balance sheet date less the number of treasury shares)/ total assets |

| 3. | Interest-bearing debt ratio = interest-bearing debt/operating cash flow |

| 4. | Interest coverage ratio = operating cash flow/interest paid |

| 5. | All indicators are calculated based on consolidated figures. |

| 6. | Interest-bearing debt includes all consolidated balance sheets liability items on which interest is paid. |

| 7. | Operating cash flow equals the value of operating cash flows in the consolidated statements of cash flows less the value of “interest expense” and “corporate income taxes” (from the consolidated statements of income). |

| 8. | Interest expense equals the “interest expense” item list on the consolidated statements of cash flows. |

18

III. Business Risk and Other Risks

With regard to business activities, financial accounting, and other items described in this report, issues that could potentially exert a large influence on investors’ decisions include those described below the following. Forward-looking statements are based on judgments made by the Group as of March 31, 2005.

(1) R&D Risks

The R&D of new drug development candidates entails large financial expenditures over lengthy time periods. If during those time periods, the expected efficacy of a drug under development cannot be confirmed, there is a possibility that the relevant R&D project will be terminated. Moreover, in the case of cooperative R&D activities in collaboration with other parties, such events as contract changes or annulments could cause a project to fail.

(2) Manufacturing and Procurement Risks

The Group manufactures products at its own factories using its own technologies, and it depends on specific suppliers for a portion of the products and materials used in the manufacture of certain products. Because of this, if for some reason manufacturing or procurement activities are delayed or halted, there is a possibility that such event would affect the Group’s profitability and financial situation.

The Group conducts manufacturing operations in accordance with regulations based on the Pharmaceutical Affairs Law; however, if a product quality problem requiring a product recall or similar event should occur, there is a possibility that it would affect the Group’s profitability and financial situation.

(3) Marketing Risks

In the case of such an event as the occurrence of an unanticipated side effect, the launch by other companies of products that compete in the same therapeutic domains as the Group’s products, or the launch of competing generic versions of the Group’s products after the expiration of relevant patents, there is a possibility that the Group’s sales could be adversely affected and therefore the Group’s profitability and financial situation could also be affected.

In the case of such an event as the expiration or annulment of marketing or technology out-licensing contracts or a change in the terms of such contracts, the Group’s profitability and financial situation could be affected.

Aggregate sales of Cravit,Panaldine, andOmnipaqueaccount for more than 40% of the Group’s consolidated net sales. If side effects or other factors that have the effect of decreasing sales of these products were to arise, there is a possibility that such an event would have a large influence on the Group’s profitability and financial situation.

(4) Legislative, Regulatory, and Government Administration Risks

Prescription drug products in Japan are subject to a variety of regulations and administrative procedures based on the Pharmaceutical Affairs Law. Moreover, trends in other government measures related to healthcare systems and health insurance systems, such as the biannual revision of National Health Insurance (NHI) drug reimbursement prices, may affect the Group’s profitability and financial situation. Similarly, drug-related operations are liable to be affected by diverse regulations in other countries.

19

(5) Intellectual Property Risks

If some of the Group’s business activities are alleged to infringe on the patent rights or other intellectual property rights of another party, there is a possibility that such activities might have to be discontinued or related litigation undertaken. On the other hand, if another party should infringe on the patent rights or other intellectual property rights of the Group, there is a possibility that related litigation might have to be undertaken to defend those rights. These possibilities could affect the Group’s profitability and financial situation.

(6) Environmental Risks

Chemical substances used in drug-related research and manufacturing processes include substances that can affect human health and natural ecosystems. Each of the Group’s facilities is implementing measures to prevent air and water pollution, shifting to the use, where possible, of substances with relatively small environmental impact, and making other environmental conservation efforts. However, in the unlikely case of a determination that it is determined that the Group’s activities have caused serious adverse environmental impact, there is a possibility that the Group’s profitability and financial situation could be affected.

(7) Litigation Risks

In addition to fair trade issues, the Group’s activities have the potential for other difficulties with regard to various other issues—such as drugs side effects, manufacturer’s liability issues, and labor issues—that could become the subject of litigation. There is a possibility that such litigation could affect the Group’s profitability and financial situation.

(8) Currency Exchange Risks

Most of the Group’s overseas sales transactions are conducted in foreign currencies. Moreover, the revenues and assets of overseas subsidiaries are translated into yen for inclusion in the Group’s consolidated accounting items. Because of these circumstances, there is a possibility that changes in currency exchange rates could affect the Group’s profitability and financial situation.

(9) Other Risks

In addition to risks already described, other types of risks that could affect the Group’s profitability and financial situation include those associated with the interruption of business activities due to earthquakes or other large-scale disasters, the interruption of computer system operations due to network viruses or other technical problems, fluctuations in stock prices and interest rates, and the emergence of uncollectible accounts receivable or loans that could follow the deterioration of transactional partners’ financial position or of the state of affairs in a relevant country.

20

4. Consolidated Financial Statements

(1) Consolidated Balance Sheets

(Millions of yen)

| | | | | | | | | | | | | | | | | | | |

| | | See Note

| | Fiscal Year 2003 (As of March 31, 2004)

| | Fiscal Year 2004 (As of March 31, 2005)

| | Change

|

| | | | Amount

| | %

| | Amount

| | %

| | Amount

|

ASSETS | | | | | | | | | | | | | | | | | | | |

I Current assets: | | | | | | | | | | | | | | | | | | | |

1. Cash and time deposits | | | | | | | 21,977 | | | | | | | 16,395 | | | | | |

2. Trade notes and accounts receivable | | | | | | | 81,211 | | | | | | | 88,168 | | | | | |

3. Investment securities | | | | | | | 94,124 | | | | | | | 107,514 | | | | | |

4. Mortgage-backed securities | | | | | | | 20,000 | | | | | | | 20,000 | | | | | |

5. Inventories | | | | | | | 39,145 | | | | | | | 40,486 | | | | | |

6. Deferred tax assets | | | | | | | 16,111 | | | | | | | 13,826 | | | | | |

7. Other current assets | | | | | | | 10,891 | | | | | | | 13,496 | | | | | |

Allowance for doubtful accounts | | | | | | D | 256 | | | | | | D | 50 | | | | | |

| | | | | | |

|

| | | | | |

|

| | | |

|

|

Total current assets | | | | | | | 283,205 | | 54.27 | | | | | 299,836 | | 54.86 | | | 16,631 |

II Non-current assets: | | | | | | | | | | | | | | | | | | | |

1. Property, plant and equipment: | | | | | | | | | | | | | | | | | | | |

(1) Buildings and structures | | *1 | | 141,605 | | | | | | | 141,983 | | | | | | | | |

Less accumulated depreciation | | | | 82,945 | | | 58,660 | | | | 86,013 | | | 55,969 | | | | | |

| | | | |

| | | | | | |

| | | | | | | | |

(2) Machinery, equipment and vehicles | | *1 | | 113,440 | | | | | | | 112,430 | | | | | | | | |

Less accumulated depreciation | | | | 90,465 | | | 22,975 | | | | 92,724 | | | 19,705 | | | | | |

| | | | |

| | | | | | |

| | | | | | | | |

(3) Land | | *1 | | | | | 17,722 | | | | | | | 17,526 | | | | | |

(4) Construction in progress | | | | | | | 1,244 | | | | | | | 6,029 | | | | | |

(5) Other fixed assets | | *1 | | 38,582 | | | | | | | 38,264 | | | | | | | | |

Less accumulated depreciation | | | | 31,899 | | | 6,683 | | | | 31,892 | | | 6,372 | | | | | |

| | | | |

| |

|

| | | |

| |

|

| | | |

|

|

Total property, plant and equipment, net | | | | | | | 107,286 | | 20.56 | | | | | 105,602 | | 19.32 | | D | 1,683 |

2. Intangible assets: | | | | | | | | | | | | | | | | | | | |

Other intangible assets, net | | | | | | | 7,564 | | | | | | | 6,796 | | | | | |

| | | | | | |

|

| | | | | |

|

| | | |

|

|

Total intangible assets, net | | | | | | | 7,564 | | 1.45 | | | | | 6,796 | | 1.24 | | D | 768 |

| | | | | | |

|

| | | | | |

|

| | | |

|

|

21

(Millions of yen)

| | | | | | | | | | | | | | | | | | | |

| | | See Note

| | Fiscal Year 2003 (As of March 31, 2004)

| | Fiscal Year 2004 (As of March 31, 2005)

| | Change

|

| | | | Amount

| | %

| | Amount

| | %

| | Amount

|

3. Investments and other assets: | | | | | | | | | | | | | | | | | | | |

(1) Investment securities | | *2 | | | | | 112,077 | | | | | | | 105,461 | | | | | |

(2) Long-term loans | | | | | | | 924 | | | | | | | 763 | | | | | |

(3) Prepaid pension costs | | | | | | | — | | | | | | | 15,493 | | | | | |

(4) Deferred tax assets | | | | | | | 3,437 | | | | | | | 3,167 | | | | | |

(5) Other assets | | *2 | | | | | 7,375 | | | | | | | 9,756 | | | | | |

Allowance for doubtful accounts | | | | | | D | 62 | | | | | | D | 323 | | | | | |

| | | | | | |

|

| | | | | |

|

| | | |

|

|

Total investments and other assets | | | | | | | 123,752 | | 23.72 | | | | | 134,319 | | 24.58 | | | 10,566 |

| | | | | | |

|

| | | | | |

|

| | | |

|

|

Total non-current assets | | | | | | | 238,603 | | 45.73 | | | | | 246,718 | | 45.14 | | | 8,115 |

| | | | | | |

|

| | | | | |

|

| | | |

|

|

Total assets | | | | | | | 521,808 | | 100.00 | | | | | 546,555 | | 100.00 | | | 24,746 |

| | | | | | |

|

| | | | | |

|

| | | |

|

|

LIABILITIES | | | | | | | | | | | | | | | | | | | |

I Current liabilities: | | | | | | | | | | | | | | | | | | | |

1. Trade notes and accounts payable | | | | | | | 14,115 | | | | | | | 17,182 | | | | | |

2. Short-term bank loans | | *1 | | | | | 18 | | | | | | | 18 | | | | | |

3. Income taxes payable | | | | | | | 9,962 | | | | | | | 8,401 | | | | | |

4. Allowance for sales returns | | | | | | | 491 | | | | | | | 448 | | | | | |

5. Allowance for sales discounts | | | | | | | 1,488 | | | | | | | 1,421 | | | | | |

6. Accrued expenses and other current liabilities | | | | | | | 45,460 | | | | | | | 46,867 | | | | | |

| | | | | | |

|

| | | | | |

|

| | | |

|

|

Total current liabilities | | | | | | | 71,536 | | 13.71 | | | | | 74,339 | | 13.60 | | | 2,803 |

| | | | | | |

|

| | | | | |

|

| | | |

|

|

II Non-current liabilities: | | | | | | | | | | | | | | | | | | | |

1. Long-term debt | | *1 | | | | | 23 | | | | | | | 5 | | | | | |

2. Deferred tax liabilities | | | | | | | 679 | | | | | | | 9,791 | | | | | |

3. Accrued retirement and severance costs | | | | | | | 19,090 | | | | | | | 4,754 | | | | | |

4. Accrued directors’ retirement and severance costs | | | | | | | 2,670 | | | | | | | 2,200 | | | | | |

5. Other non-current liabilities | | | | | | | 717 | | | | | | | 5,318 | | | | | |

| | | | | | |

|

| | | | | |

|

| | | |

|

|

Total non-current liabilities | | | | | | | 23,182 | | 4.44 | | | | | 22,070 | | 4.04 | | D | 1,112 |

| | | | | | |

|

| | | | | |

|

| | | |

|

|

Total liabilities | | | | | | | 94,718 | | 18.15 | | | | | 96,409 | | 17.64 | | | 1,690 |

MINORITY INTERESTS | | | | | | | | | | | | | | | | | | | |

Minority Interests | | | | | | | 4,959 | | 0.95 | | | | | 1,582 | | 0.29 | | D | 3,377 |

22

(Millions of yen)

| | | | | | | | | | | | | | | | | | | | | |

| | | See Note

| | Fiscal Year 2003 (As of March 31, 2004)

| | Fiscal Year 2004 (As of March 31, 2005)

| | Change

|

| | | | Amount

| | %

| | Amount

| | %

| | Amount

|

SHAREHOLDERS’ EQUITY | | | | | | | | | | | | | | | | | | | | | |

I Common stock | | *4 | | | | | 45,246 | | | 8.67 | | | | | 45,246 | | | 8.28 | | | — |

II Additional paid-in-capital | | | | | | | 48,961 | | | 9.38 | | | | | 49,130 | | | 8.99 | | | 169 |

III Retained earnings | | | | | | | 347,973 | | | 66.69 | | | | | 376,144 | | | 68.82 | | | 28,170 |

IV Net unrealized gain on investment securities | | | | | | | 17,873 | | | 3.43 | | | | | 18,215 | | | 3.33 | | | 342 |

V Foreign currency translation adjustments | | | | | | D | 1,524 | | D | 0.29 | | | | D | 1,305 | | D | 0.24 | | | 218 |

VI Treasury stock at cost | | *5 | | | | D | 36,400 | | D | 6.98 | | | | D | 38,867 | | D | 7.11 | | D | 2,467 |

| | | | | | |

|

| | | | | | |

|

| | | | |

|

|

Total shareholders’ equity | | | | | | | 422,130 | | | 80.90 | | | | | 448,563 | | | 82.07 | | | 26,433 |

| | | | | | |

|

| |

|

| | | |

|

| |

|

| |

|

|

Total liabilities, minority interests and shareholders’ equity | | | | | | | 521,808 | | | 100.00 | | | | | 546,555 | | | 100.00 | | | 24,746 |

| | | | | | |

|

| |

|

| | | |

|

| |

|

| |

|

|

23

(2) Consolidated Statements of Income

(Millions of yen)

| | | | | | | | | | | | | | | | | |

| | | | | Fiscal Year 2003

(For the year ended March 31, 2004)

| | Fiscal Year 2004

(For the year ended March 31, 2005)

| | Change

|

| | | See

Note

| | Amount

| | %

| | Amount

| | %

| | Amount

|

I Net sales | | | | | | 322,767 | | 100.00 | | | | 328,534 | | 100.00 | | | 5,766 |

II Cost of sales | | *1 | | | | 103,474 | | 32.06 | | | | 100,834 | | 30.69 | | D | 2,639 |

| | | | | | |

| | | | | |

| | | |

|

|

Gross profit | | | | | | 219,293 | | 67.94 | | | | 227,699 | | 69.31 | | | 8,406 |

III Selling, general and administrative: | | | | | | | | | | | | | | | | | |

1. Salaries and bonuses | | | | 37,584 | | | | | | 38,076 | | | | | | | |

2. Retirement and severance costs | | | | 4,828 | | | | | | 3,429 | | | | | | | |

3. Research and development expenses | | *1 | | 59,048 | | | | | | 57,416 | | | | | | | |

4. Other | | | | 71,716 | | 173,178 | | 53.65 | | 72,713 | | 171,636 | | 52.24 | | D | 1,541 |

| | | | |

| |

| | | |

| |

| | | |

|

|

Operating income | | | | | | 46,114 | | 14.29 | | | | 56,063 | | 17.06 | | | 9,948 |

IV Non-operating income: | | | | | | | | | | | | | | | | | |

1. Interest income | | | | 742 | | | | | | 738 | | | | | | | |

2. Dividend income | | | | 469 | | | | | | 735 | | | | | | | |

3. Foreign exchange gains | | | | — | | | | | | 297 | | | | | | | |

4. Other income | | | | 1,168 | | 2,380 | | 0.74 | | 1,023 | | 2,795 | | 0.85 | | | 415 |

| | | | |

| | | | | |

| | | | | | | |

V Non-operating expenses: | | | | | | | | | | | | | | | | | |

1. Interest expense | | | | 1 | | | | | | 1 | | | | | | | |

2. Loss on disposal and write-down of inventories | | | | 682 | | | | | | 626 | | | | | | | |

3. Foreign exchange losses | | | | 568 | | | | | | — | | | | | | | |

4. Equity in net losses of affiliated companies | | | | — | | | | | | 399 | | | | | | | |

5. Other expenses | | | | 511 | | 1,764 | | 0.55 | | 510 | | 1,538 | | 0.47 | | D | 225 |

| | | | |

| |

| | | |

| |

| | | |

|

|

Ordinary income | | | | | | 46,731 | | 14.48 | | | | 57,320 | | 17.45 | | | 10,589 |

VI Extraordinary gains: | | | | | | | | | | | | | | | | | |

1. Realized gain on sale of investment securities | | | | 1,331 | | | | �� | | 283 | | | | | | | |

2. Gain on sale of land | | | | 881 | | | | | | 384 | | | | | | | |

3. Gain from the return of the substitutional portion of the employees’ pension fund to the government | | | | — | | | | | | 11,747 | | | | | | | |

4. Gain from the transfer to the defined contribution pension plan | | | | — | | | | | | 3,769 | | | | | | | |

5. Gain on sale of the veterinary and livestock feed product business | | *2 | | — | | | | | | 800 | | | | | | | |

6. Reversal of allowance for doubtful accounts | | | | 113 | | 2,325 | | 0.72 | | — | | 16,983 | | 5.17 | | | 14,657 |

24

(Millions of yen)

| | | | | | | | | | | | | | | | | | | | |

| | | | | Fiscal Year 2003

(For the year ended March 31, 2004)

| | Fiscal Year 2004

(For the year ended March 31, 2005)

| | Change

|

| | | See

Note

| | Amount

| | %

| | Amount

| | %

| | Amount

|

VII Extraordinary losses: | | | | | | | | | | | | | | | | | | | | |

1. Restructuring charge | | *3 | | — | | | | | | | | 7,316 | | | | | | | | |

2. Impairment of investment securities | | | | 61 | | | | | | | | 32 | | | | | | | | |

3. Loss on settlement of an employee pension fund plan | | *4 | | — | | | | | | | | 381 | | | | | | | | |

4. Loss on settlement of vitamin-related anti-trust litigations | | *5 | | — | | | | | | | | 111 | | | | | | | | |

5. Loss on disposal of fixed assets | | *6 | | 1,387 | | | 1,448 | | | 0.45 | | 1,792 | | | 9,633 | | | 2.93 | | 8,184 |

| | | | |

| |

|

| | | | |

| |

|

| | | | |

|

Net income before income taxes and minority interests | | | | | | | 47,608 | | | 14.75 | | | | | 64,670 | | | 19.68 | | 17,062 |

Income tax expense—current | | | | 21,465 | | | | | | | | 17,357 | | | | | | | | |

Income tax expense—deferred | | | | 953 | | | 22,418 | | | 6.95 | | 11,486 | | | 28,843 | | | 8.78 | | 6,425 |

| | | | |

| | | | | | | |

| | | | | | | | |

Minority interests in net losses of subsidiaries | | | | | | D | 1,472 | | D | 0.46 | | | | D | 1,348 | | D | 0.41 | | 124 |

| | | | | | |

|

| | | | | | |

|

| | | | |

|

Net income | | | | | | | 26,661 | | | 8.26 | | | | | 37,175 | | | 11.32 | | 10,513 |

25

(3) Consolidated Statements of Retained Earnings

(Millions of yen)

| | | | | | | | | | | | |

| | | | | Fiscal Year 2003 (For the year ended March 31, 2004)

| | Fiscal Year 2004

(For the year ended March 31, 2005)

| | Change

|

| | | See

Note

| | Amount

| | Amount

| | Amount

|

ADDITIONAL PAID-IN CAPITAL | | | | | | | | | | | | |

I Additional paid-in capital, beginning of year | | | | | | 48,961 | | | | 48,961 | | — |

II Increase in additional paid-in capital | | | | | | | | | | | | |

1. Gain on reissuance of treasury stock | | | | — | | — | | 169 | | 169 | | 169 |

| | | | |

| |

| |

| |

| |

|

III. Additional paid-in capital, end of year | | | | | | 48,961 | | | | 49,130 | | 169 |

| | | | | | |

| | | |

| |

|

RETAINED EARNINGS | | | | | | | | | | | | |

I Retained earnings, beginning of year | | | | | | 329,730 | | | | 347,973 | | 18,243 |

II Increase in retained earnings: | | | | | | | | | | | | |

1. Net income | | | | 26,661 | | 26,661 | | 37,175 | | 37,175 | | 10,513 |

| | | | |

| | | |

| | | | |

III Decrease in retained earnings: | | | | | | | | | | | | |

1. Cash dividends | | | | 8,217 | | | | 8,071 | | | | |

2. Bonuses to directors | | | | 201 | | | | 160 | | | | |

3. Changes in scope of investments accounted for under the equity method | | | | — | | 8,418 | | 772 | | 9,004 | | 586 |

| | | | | | |

| | | |

| |

|

IV Retained earnings, end of year | | | | | | 347,973 | | | | 376,144 | | 28,170 |

| | | | | | |

| | | |

| |

|

26

(4) Consolidated Statements of Cash Flows

| | | | | | | | | | | |

| | | | | | | (Millions of yen) |

| | | | |

| | | | | Fiscal Year 2003

(For the year ended March 31, 2004)

| | Fiscal Year 2004

(For the year ended March 31, 2005)

| | Change

|

| | | See

Note

| | Amount

| | Amount

| | Amount

|

I Cash flows from operating activities: | | | | | | | | | | | |

Net income before income taxes and minority interests | | | | | 47,608 | | | 64,670 | | | 17,062 |

Depreciation | | | | | 17,366 | | | 15,946 | | D | 1,419 |

| | | | |

Amortization of goodwill | | | | | — | | | 3 | | | 3 |

Decrease in accrued retirement and severance costs | | | | D | 6,003 | | D | 14,807 | | D | 8,803 |

Increase in prepaid pension costs | | | | | — | | D | 15,493 | | D | 15,493 |

| | | | |

Interest and dividend income | | | | D | 1,211 | | D | 1,474 | | D | 262 |

Interest expense | | | | | 1 | | | 1 | | | 0 |

Impairment of investment securities | | | | | 62 | | | 34 | | D | 28 |

Loss on disposal of fixed assets | | | | | 1,387 | | | 1,792 | | | 404 |

Loss on fines, penalties and settlements | | | | | — | | | 111 | | | 111 |

Equity in net losses of affiliated companies | | | | | — | | | 399 | | | 399 |

Decrease (increase) in trade notes and accounts receivable | | | | | 7,382 | | D | 6,793 | | D | 14,175 |

Decrease (increase) in inventories | | | | | 6,607 | | D | 1,290 | | D | 7,898 |

Increase (decrease) in trade notes and accounts payable | | | | D | 158 | | | 3,011 | | | 3,170 |

Increase (decrease) in accrued expenses and other liabilities | | | | D | 1,562 | | | 1,457 | | | 3,020 |

Other, net | | | | D | 2,136 | | | 5,803 | | | 7,940 |

| | | | |

|

| |

|

| |

|

|

Subtotal | | | | | 69,344 | | | 53,373 | | D | 15,970 |

| | | | |

|

| |

|

| |

|

|

Interest and dividends received | | | | | 1,208 | | | 1,501 | | | 293 |

Interest paid | | | | D | 1 | | D | 1 | | | 0 |

Fines, penalties and settlements paid | | | | D | 7 | | D | 89 | | D | 82 |

Income taxes paid | | | | D | 23,038 | | D | 19,212 | | | 3,825 |

| | | | |

|

| |

|

| |

|

|

| Net cash provided by operating activities | | | | | 47,505 | | | 35,571 | | D | 11,934 |

| | | | |

|

| |

|

| |

|

|

27

| | | | | | | | | | | | | |

| | | | | | | | | (Millions of yen) |

| | | | | |

| | | | | | | Fiscal Year 2003

(For the year ended March 31, 2004)

| | Fiscal Year 2004

(For the year ended March 31, 2005)

| | Change

|

| | | | | See

Note

| | Amount

| | Amount

| | Amount

|

| II | | Cash flows from investing activities: | | | | | | | | | | | |

| | | Purchases of time deposits | | | | D | 4,088 | | D | 7,800 | | D | 3,712 |

| | | Proceeds from sale of time deposits | | | | | 150 | | | 8,267 | | | 8,117 |

| | | Purchases of investment securities | | | | D | 22,368 | | D | 26,601 | | D | 4,233 |

| | | Proceeds from sale of investment securities | | | | | 21,682 | | | 25,210 | | | 3,527 |

| | | Acquisitions of property, plant and equipment | | | | D | 11,213 | | D | 10,753 | | | 459 |

| | | Acquisitions of intangible assets | | | | D | 1,416 | | D | 2,546 | | D | 1,130 |

| | | Purchases of non-current investment securities | | | | D | 35,798 | | D | 24,443 | | | 11,354 |

| | | Proceeds from sale of non-current investment securities | | | | | 24,531 | | | 22,181 | | D | 2,349 |

| | | Other, net | | | | | 1,102 | | D | 5,500 | | D | 6,602 |

| | | Net cash used in investing activities | | | | D | 27,419 | | D | 21,989 | | | 5,430 |

| III | | Cash flows from financing activities: | | | | | | | | | | | |

| | | Repayment of long-term debt | | | | D | 19 | | D | 18 | | | 0 |

| | | Dividends paid | | | | D | 8,217 | | D | 8,071 | | | 145 |

| | | Purchases of treasury stock | | | | D | 10,214 | | D | 4,263 | | | 5,951 |

| | | Other, net | | | | D | 19 | | D | 15 | | | 3 |

| | | Net cash used in financing activities | | | | D | 18,470 | | D | 12,369 | | | 6,101 |

| IV | | Effect of exchange rate changes on cash and cash equivalents | | | | D | 207 | | | 12 | | | 220 |

| V | | Net increase in cash and cash equivalents | | | | | 1,407 | | | 1,225 | | D | 182 |

| VI | | Cash and cash equivalents, beginning of year | | | | | 88,938 | | | 90,346 | | | 1,407 |

| VII | | Cash and cash equivalents, end of year | | | | | 90,346 | | | 91,571 | | | 1,225 |

28

Basis of Presentation and Summary of Significant Accounting Policies

Fiscal Year 2003

(For the year ended March 31, 2004)

1. Scope of consolidation

(1) Consolidated subsidiaries: 28

Principal consolidated subsidiaries:

In Japan

Daiichi Pure Chemicals Co., Ltd.

Daiichi Radioisotope Laboratories, Ltd.

Daiichi Fine Chemical Co., Ltd.

Saitama Daiichi Pharmaceutical Co., Ltd.

Daiichi Suntory Pharma Co., Ltd.

Overseas

Daiichi Pharmaceutical Corporation

Daiichi Pharmaceutical (Beijing) Co., Ltd.

Daiichi Pharmaceutical (China) Co., Ltd.

(2) Non-consolidated subsidiaries: 2

During the fiscal year, the Company excluded one newly established subsidiary from the scope of consolidation, and thereby increased the number of non-consolidated subsidiaries to two. Non-consolidated subsidiaries are small in size and are not material when measured by the amounts of assets, sales, net income (based on the Company’s ownership percentage), retained earnings (based on the Company’s ownership percentage), and other indicators. They have therefore been excluded from the scope of consolidation.

2. Application of the Equity Method

(1) –

(2) For the fiscal year, net income (based on the Company’s equity percentage), retained earnings (based on the Company’s equityownership percentage) and other indicators of the Company’s two non-consolidated subsidiaries and five of its 20%-50% owned affiliated companies (i.e. Aventis Pasteur-Daiichi Vaccine Co., Ltd. and 6 other companies) are not material or significant to the Company as a whole. Therefore, these companies have not been accounted for under the equity method but, rather, are rather reported in the Company’s investment account under the cost method.

(3) —

Fiscal Year 2004

(For the year ended March 31, 2005)

1. Scope of consolidation

(1) Consolidated subsidiaries: 31

Principal consolidated subsidiaries:

In Japan

Daiichi Pure Chemicals Co., Ltd.

Daiichi Radioisotope Laboratories, Ltd.

Daiichi Fine Chemical Co., Ltd.

Saitama Daiichi Pharmaceutical Co., Ltd.

Daiichi Suntory Pharma Co., Ltd.

Overseas

Daiichi Pharmaceutical Corporation

Daiichi Medical Research, Inc.

Daiichi Pharmaceutical (Beijing) Co., Ltd.

Daiichi Pharmaceutical (China) Co., Ltd.

For the fiscal year, three newly-established subsidiaries have been added to the scope of consolidation: Daiichi Pharmaceutical Corporation, Daiichi Medical Research, Inc., and Daiichi Pharmatech, Co., Ltd. Also, during the fiscal year, the former corporate name of Daiichi Pharmaceutical Corporation was changed to Daiichi Pharmaceutical Holdings, Inc.

(2) Non-consolidated subsidiaries: 3

During the fiscal year, the Company excluded one newly established subsidiary from the scope of consolidation, and thereby increased the number of non-consolidated subsidiaries to three. Non-consolidated subsidiaries are small in size and are not material when measured by the amounts of assets, sales, net income (based on the Company’s ownership percentage), retained earnings (based on the Company’s ownership percentage), and other indicators. They have therefore been excluded from the scope of consolidation.

2. Application of the Equity Method

(1) Affiliated companies accounted for under the equity method: 2

Names of principal companies:

Aventis Pasteur Daiichi Vaccine Co., Ltd., plus one other company.

Since the significance of these affiliates to the consolidated financial statements has increased, they are been included in the scope of companies accounted for under the equity method beginning this fiscal year.

(2) For the fiscal year, net income (based on the Company’s equity percentage), retained earnings (based on the Company’s equity percentage) and other indicators of the Company’s three non-consolidated subsidiaries and three of its 20%-50% owned affiliated companies are not material or significant to for the Company as a whole. Therefore, these companies have not been accounted for under the equity method but, rather, are reported in the Company’s investment accounts under the cost method.

(3) The equity method of accounting is applied on the basis of the affiliated companies’ fiscal years. One affiliated company has a fiscal year-end date that is different from the Company’s fiscal year-end.

29

Fiscal Year 2003

(For the year ended March 31, 2004)

3. Fiscal Year-end of Consolidated Subsidiaries

The fiscal year-end of the following consolidated subsidiaries is December 31: Daiichi Pharmaceutical (China) Co., Ltd.; Daiichi Pharmaceutical (Beijing) Co., Ltd.; Suntory Pharmaceutical Inc.; Suntory Pharmaceutical Holdings, Inc.; and Suntory Research Laboratories LLC.