Filing under Rule 425 under

the U.S. Securities Act of 1933

Filing by: Sankyo Company, Limited

Subject Company: Daiichi Pharmaceutical Co., Ltd.

and Sankyo Company, Limited

SEC File No. 132-02292

To Our Shareholders

We are providing this pamphlet to explain the key points of the business integration of Sankyo Company, Limited, and Daiichi Pharmaceutical Co., Ltd.

We would sincerely appreciate your understanding of the objectives of the business integration and ask that you give us your support by voting in favor of the integration proposal at the 151st General Meeting of Shareholders, to be held on June 29, 2005.

We are aiming to become a Japan-

Objective of the business integration:

Maximizing Corporate Value

The business integration will enable us to capture the value generated by world-class pharmaceuticals and translate this into corporate value and value for shareholders, then provide it in the form of a higher return to our shareholders.

For Customers

Fulfill medical needs with innovative pharmaceuticals and services

For Employees

Recruit and allocate human resources fairly

Provide compensation appropriate to performance

Support for career development

For Society

Corporate activities based on high ethical standards

Promotion of environmentally-conscious management

Contributions to medical and pharmaceutical sciences

2 Sankyo Co., Ltd.

based Global Pharma Innovator.

For Our Shareholders

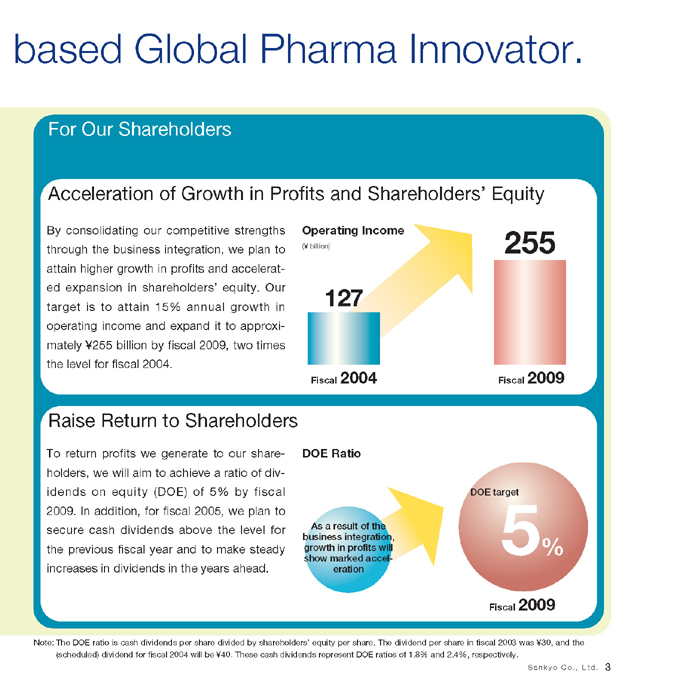

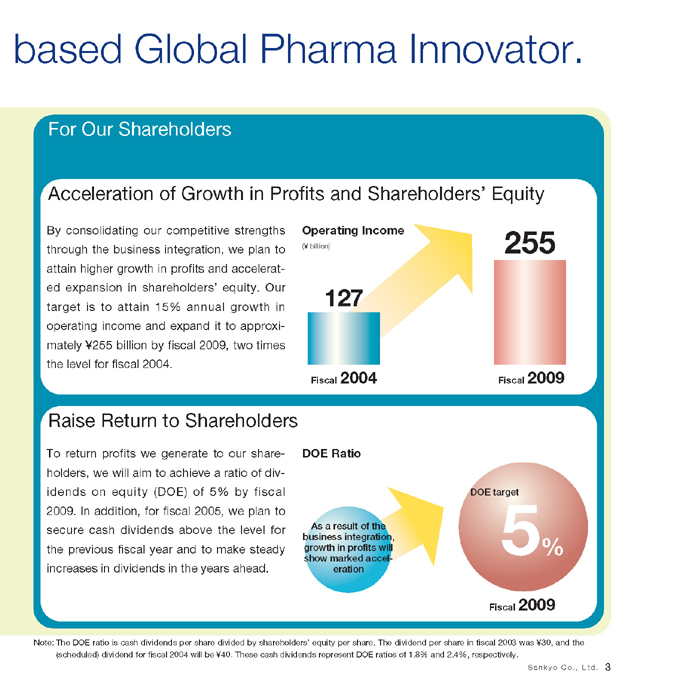

Acceleration of Growth in Profits and Shareholders’ Equity

By consolidating our competitive strengths through the business integration, we plan to attain higher growth in profits and accelerated expansion in shareholders’ equity. Our target is to attain 15% annual growth in operating income and expand it to approximately ¥255 billion by fiscal 2009, two times the level for fiscal 2004.

Operating Income

(¥ billion)

127

Fiscal 2004

255

Fiscal 2009

Raise Return to Shareholders

To return profits we generate to our shareholders, we will aim to achieve a ratio of dividends on equity (DOE) of 5% by fiscal 2009. In addition, for fiscal 2005, we plan to secure cash dividends above the level for the previous fiscal year and to make steady increases in dividends in the years ahead.

DOE Ratio

As a result of the business integration, growth in profits will show marked acceleration

DOE target

5%

Fiscal 2009

Note: The DOE ratio is cash dividends per share divided by shareholders’ equity per share. The dividend per share in fiscal 2003 was ¥30, and the (scheduled) dividend for fiscal 2004 will be ¥40. These cash dividends represent DOE ratios of 1.8% and 2.4%, respectively.

Sankyo Co., Ltd. 3

Increasing Shareholder Value

The business integration will have the objective of creating a Japan-based Global Pharma Innovator and which will have the mission of providing a steady stream of innovative products and services that satisfy unmet medical needs and occupy a unique competitive position in the world’s major markets.

We believe positive sales and cost synergies resulting from the business integration will substantially outweigh the possible negative synergies and integration costs, and will increase shareholder value of Sankyo and Daiichi.

The most important objective of the business integration will be to create the potential synergies from Global Pharma Innovator platform. Specifically, the integration will combine the R&D capabilities of the two companies that created the antihyperlipidemic agent Mevalotin® (pravastatin) and the broad-spectrum oral antibacterial agent Cravit® (levofloxacin). We believe this combination will yield true synergies and enable the combined companies to bring promising drugs in their pipelines to market as quickly as possible.

As a result of the business integration, we are confident that the corporate value of Sankyo will expand on a sustained and stable basis and that this will lead to the maximization of shareholder value.

Aggregate value of Daiichi shares

Aggregate value of Sankyo shares

Sales and cost synergies

Possible negative synergies*

Integration costs

Estimated shareholder value after integration (Former Daiichi)

Estimated shareholder value after integration (Former Sankyo)

Targeted increase in shareholder value

Potential synergies from Global Pharma Innovator platform

Note: The aggregate values of Sankyo and Daiichi shares are calculated based on the closing prices on February 18, 2005.

* Risks associated with the merger, such as a decline in sales and/or profits due to changes in corporate control or product cannibalization

4 Sankyo Co., Ltd.

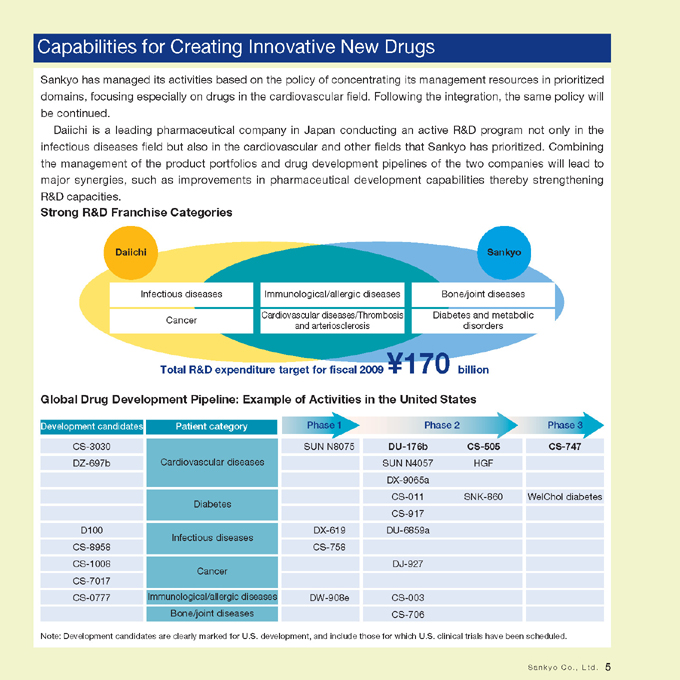

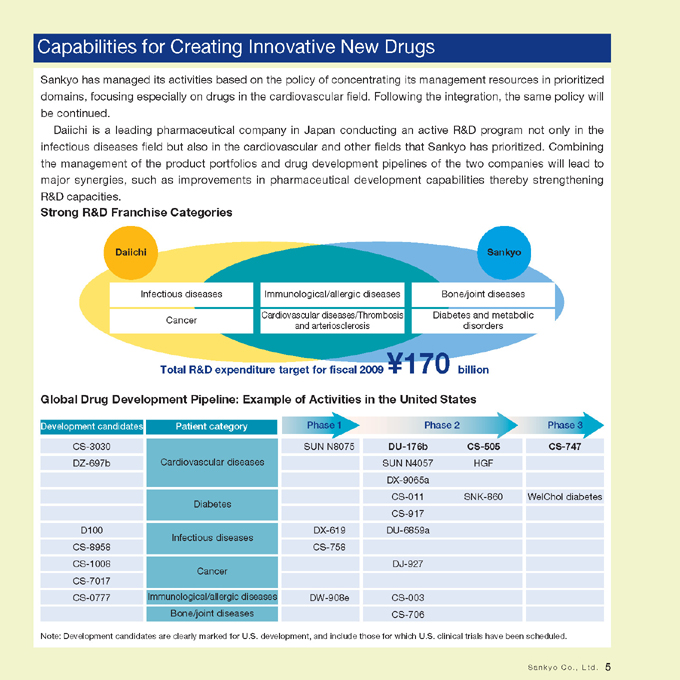

Capabilities for Creating Innovative New Drugs

Sankyo has managed its activities based on the policy of concentrating its management resources in prioritized domains, focusing especially on drugs in the cardiovascular field. Following the integration, the same policy will be continued.

Daiichi is a leading pharmaceutical company in Japan conducting an active R&D program not only in the infectious diseases field but also in the cardiovascular and other fields that Sankyo has prioritized. Combining the management of the product portfolios and drug development pipelines of the two companies will lead to major synergies, such as improvements in pharmaceutical development capabilities thereby strengthening R&D capacities.

Strong R&D Franchise Categories

Daiichi

Infectious diseases

Cancer

Immunological/allergic diseases

Cardiovascular diseases/Thrombosis and arteriosclerosis

Sankyo

Bone/joint diseases

Diabetes and metabolic disorders

Total R&D expenditure target for fiscal 2009 ¥170 billion

Global Drug Development Pipeline: Example of Activities in the United States

Development candidates Patient category Phase 1 Phase 2 Phase 3

CS-3030 SUN N8075 DU-176b CS-505 CS-747

DZ-697b Cardiovascular diseases SUN N4057 HGF

DX-9065a

CS-011 SNK-860 WelChol diabetes

Diabetes

CS-917

D100 DX-619 DU-6859a

Infectious diseases

CS-8958 CS-758

CS-1008 DJ-927

Cancer

CS-7017

CS-0777 Immunological/allergic diseases DW-908e CS-003

Bone/joint diseases CS-706

Note: Development candidates are clearly marked for U.S. development, and include those for which U.S. clinical trials have been scheduled.

Sankyo Co., Ltd. 5

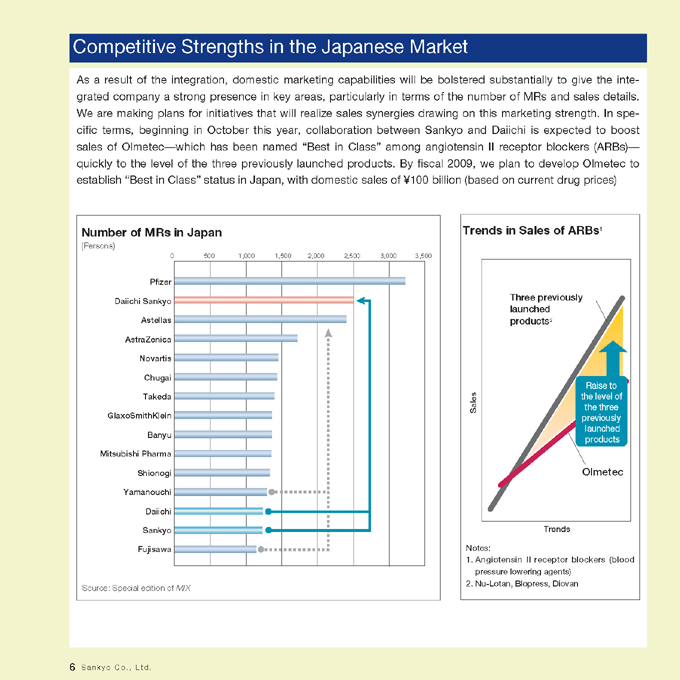

Competitive Strengths in the Japanese Market

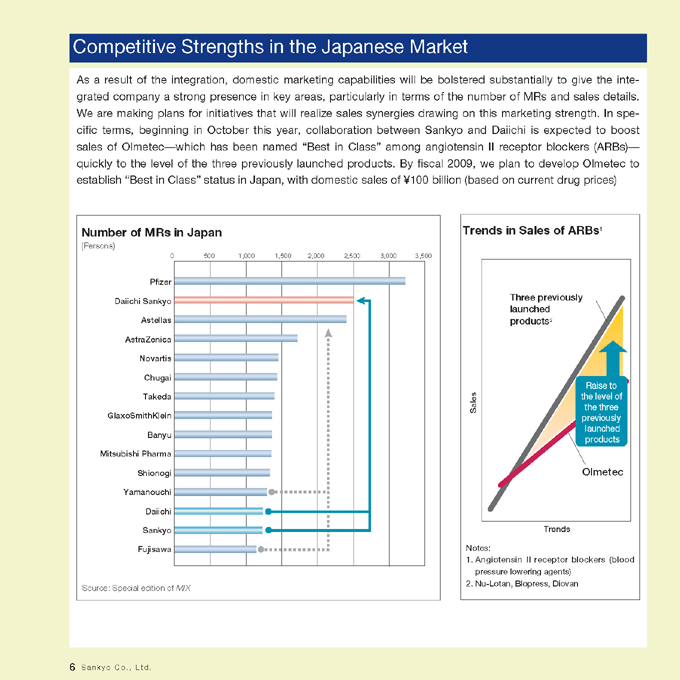

As a result of the integration, domestic marketing capabilities will be bolstered substantially to give the integrated company a strong presence in key areas, particularly in terms of the number of MRs and sales details. We are making plans for initiatives that will realize sales synergies drawing on this marketing strength. In specific terms, beginning in October this year, collaboration between Sankyo and Daiichi is expected to boost sales of Olmetec—which has been named “Best in Class” among angiotensin II receptor blockers (ARBs)—quickly to the level of the three previously launched products. By fiscal 2009, we plan to develop Olmetec to establish “Best in Class” status in Japan, with domestic sales of ¥100 billion (based on current drug prices)

Number of MRs in Japan

(Persons)

0 500 1,000 1,500 2,000 2,500 3,000 3,500

Pfizer

Daiichi Sankyo

Astellas

AstraZenica

Novartis

Chugai

Takeda

GlaxoSmithKlein

Banyu

Mitsubishi Pharma

Shionogi

Yamanouchi

Daiichi

Sankyo

Fujisawa

Source: Special edition of MIX

Trends in Sales of ARBs1

Sales

Three previously launched products2

Raise to the level of the three previously launched products

Olmetec

Trends

Notes:

1. Angiotensin II receptor blockers (blood pressure lowering agents)

2. Nu-Lotan, Blopress, Diovan

6 Sankyo Co., Ltd.

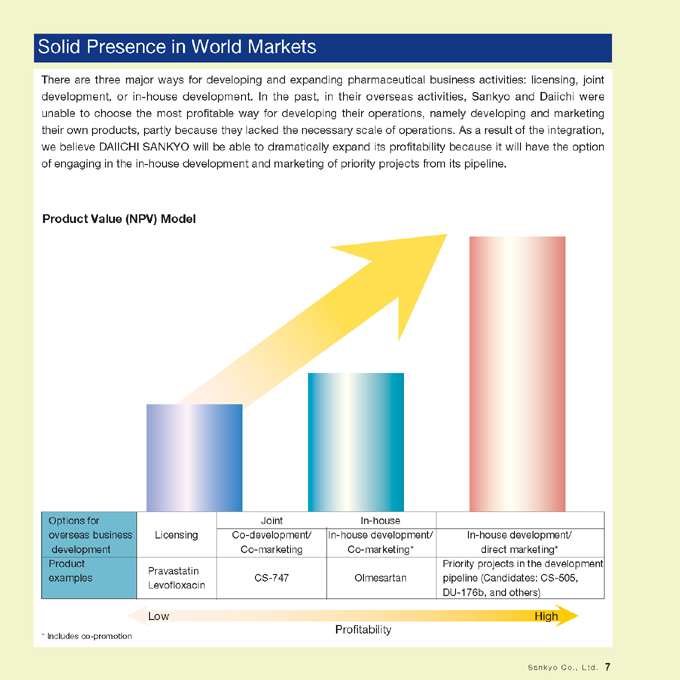

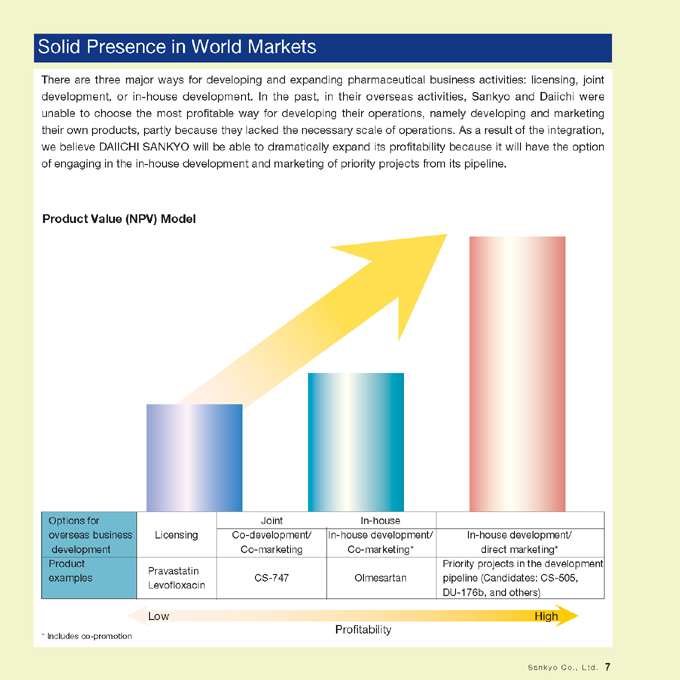

Solid Presence in World Markets

There are three major ways for developing and expanding pharmaceutical business activities: licensing, joint development, or in-house development. In the past, in their overseas activities, Sankyo and Daiichi were unable to choose the most profitable way for developing their operations, namely developing and marketing their own products, partly because they lacked the necessary scale of operations. As a result of the integration, we believe DAIICHI SANKYO will be able to dramatically expand its profitability because it will have the option of engaging in the in-house development and marketing of priority projects from its pipeline.

Product Value (NPV) Model

Options for overseas business development

Joint

In-house

Licensing

Co-development/ Co-marketing

In-house development/Co-marketing*

In-house development/ direct marketing*

Product examples

Priority projects in the development pipeline (Candidates: CS-505, DU-176b, and others)

Pravastatin Levofloxacin

CS-747 Olmesartan

Low High Profitability

* Includes co-promotion

Sankyo Co., Ltd. 7

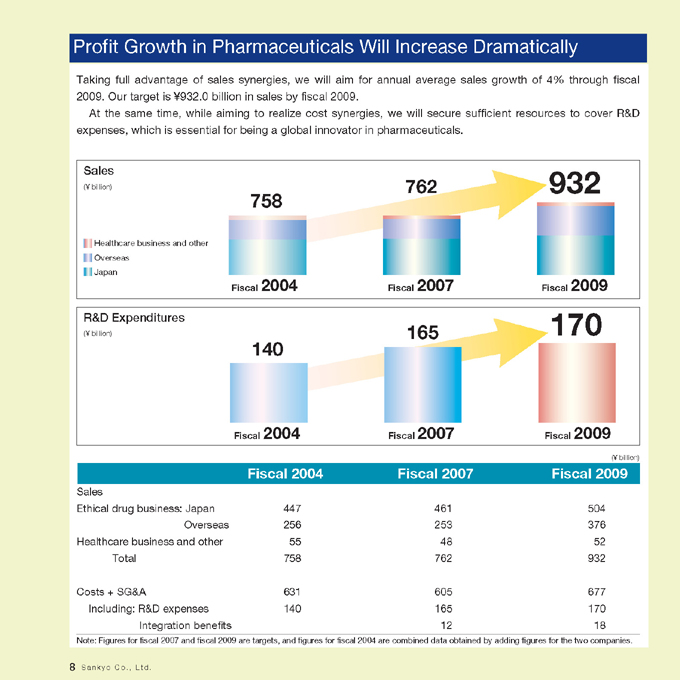

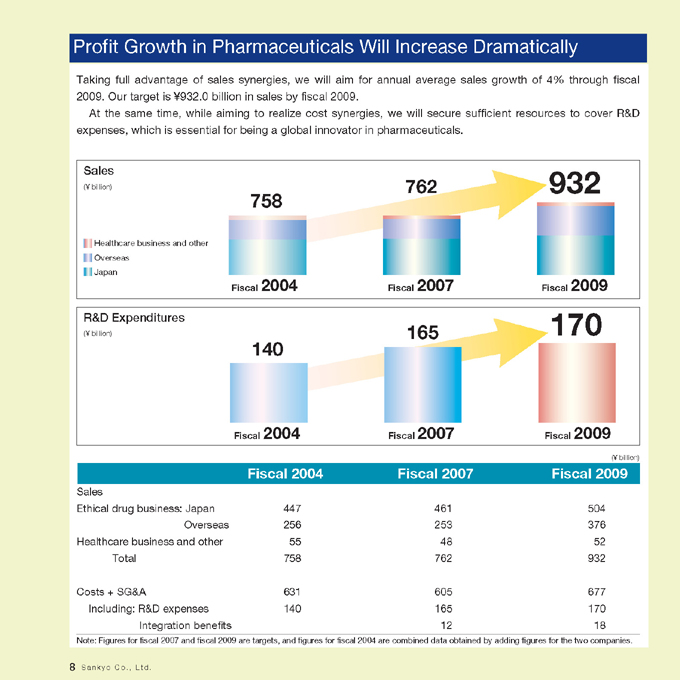

Profit Growth in Pharmaceuticals Will Increase Dramatically

Taking full advantage of sales synergies, we will aim for annual average sales growth of 4% through fiscal 2009. Our target is ¥932.0 billion in sales by fiscal 2009.

At the same time, while aiming to realize cost synergies, we will secure sufficient resources to cover R&D expenses, which is essential for being a global innovator in pharmaceuticals.

Sales

(¥ billion)

Healthcare business and other Overseas Japan

758

762

932

Fiscal 2004 Fiscal 2007 Fiscal 2009

R&D Expenditures

(¥ billion)

165

170

140

Fiscal 2004 Fiscal 2007 Fiscal 2009

(¥ billion)

Fiscal 2004 Fiscal 2007 Fiscal 2009

Sales

Ethical drug business: Japan 447 461 504

Overseas 256 253 376

Healthcare business and other 55 48 52

Total 758 762 932

Costs + SG&A 631 605 677

Including: R&D expenses 140 165 170

Integration benefits 12 18

Note: Figures for fiscal 2007 and fiscal 2009 are targets, and figures for fiscal 2004 are combined data obtained by adding figures for the two companies.

8 Sankyo Co., Ltd.

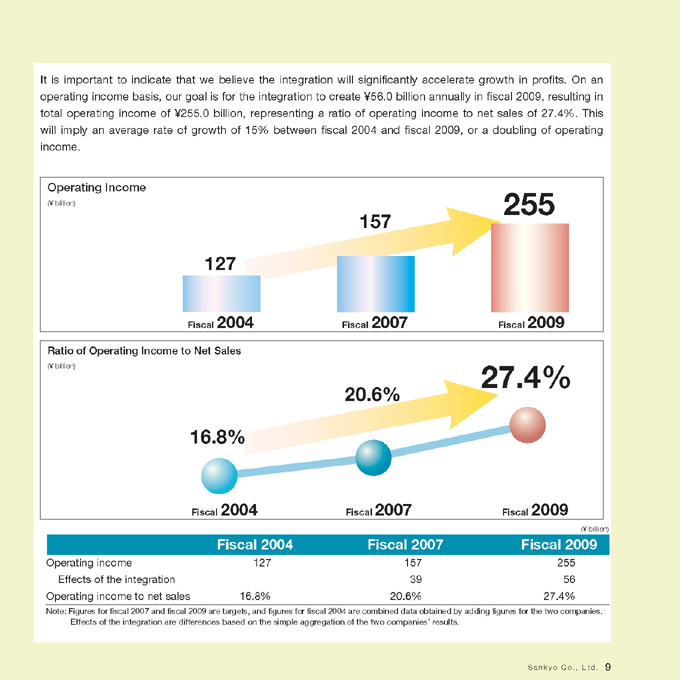

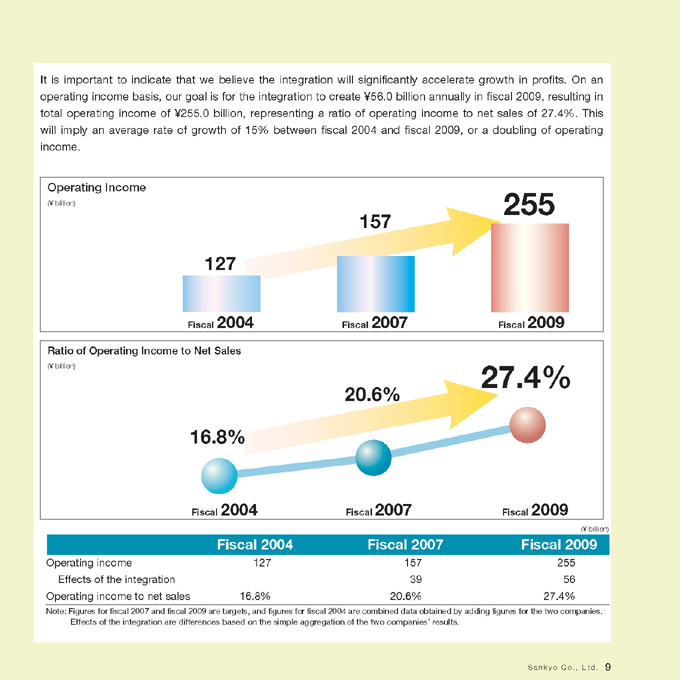

It is important to indicate that we believe the integration will significantly accelerate growth in profits. On an operating income basis, our goal is for the integration to create ¥56.0 billion annually in fiscal 2009, resulting in total operating income of ¥255.0 billion, representing a ratio of operating income to net sales of 27.4%. This will imply an average rate of growth of 15% between fiscal 2004 and fiscal 2009, or a doubling of operating income.

Operating Income

(¥ billion)

127

157

255

Fiscal 2004 Fiscal 2007 Fiscal 2009

Ratio of Operating Income to Net Sales

(¥ billion)

16.8%

20.6%

27.4%

Fiscal 2004 Fiscal 2007 Fiscal 2009

(¥ billion)

Fiscal 2004 Fiscal 2007 Fiscal 2009

Operating income 127 157 255

Effects of the integration 39 56

Operating income to net sales 16.8% 20.6% 27.4%

Note: Figures for fiscal 2007 and fiscal 2009 are targets, and figures for fiscal 2004 are combined data obtained by adding figures for the two companies.

Effects of the integration are differences based on the simple aggregation of the two companies’ results.

Sankyo Co., Ltd. 9

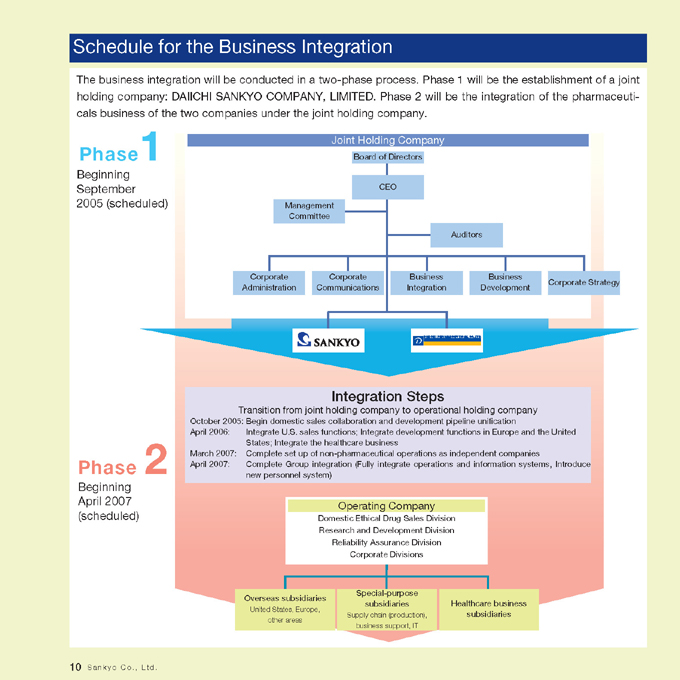

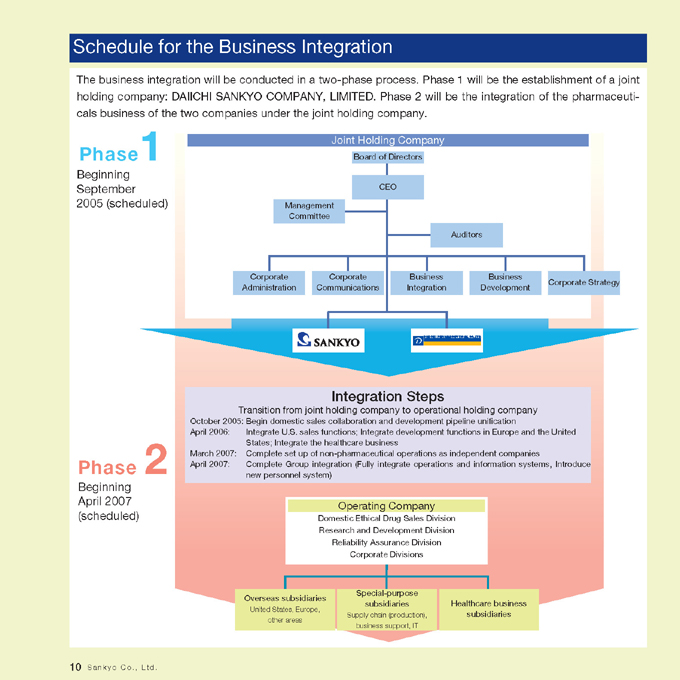

Schedule for the Business Integration

The business integration will be conducted in a two-phase process. Phase 1 will be the establishment of a joint holding company: DAIICHI SANKYO COMPANY, LIMITED. Phase 2 will be the integration of the pharmaceuticals business of the two companies under the joint holding company.

Phase1

Beginning September 2005 (scheduled)

Joint Holding Company

Board of Directors

CEO

Management Committee

Auditors

Corporate Administration

Corporate Communications

Business Integration

Business Development

Corporate Strategy

Phase 2

Beginning April 2007 (scheduled)

Integration Steps

Transition from joint holding company to operational holding company

October 2005: Begin domestic sales collaboration and development pipeline unification

April 2006: Integrate U.S. sales functions; Integrate development functions in Europe and the United States; Integrate the healthcare business

March 2007: Complete set up of non-pharmaceutical operations as independent companies

April 2007: Complete Group integration (Fully integrate operations and information systems, Introduce new personnel system)

Operating Company

Domestic Ethical Drug Sales Division Research and Development Division Reliability Assurance Division Corporate Divisions

Overseas subsidiaries

United States, Europe, other areas

Special-purpose subsidiaries

Supply chain (production), business support, IT

Healthcare business subsidiaries

10 Sankyo Co., Ltd.

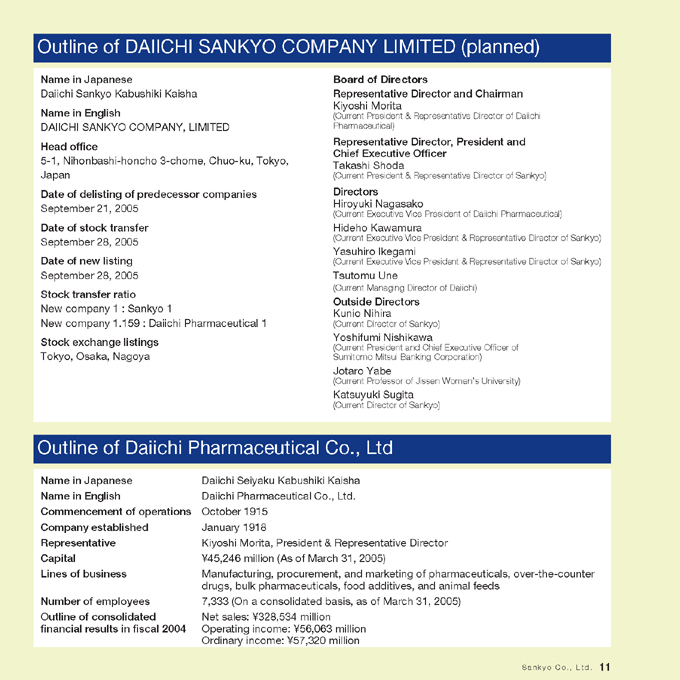

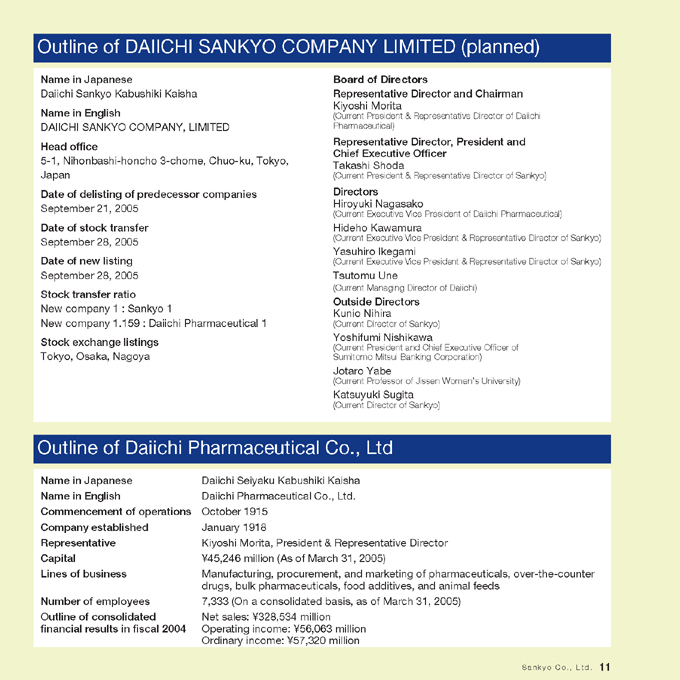

Outline of DAIICHI SANKYO COMPANY LIMITED (planned)

Name in Japanese

Daiichi Sankyo Kabushiki Kaisha

Name in English

DAIICHI SANKYO COMPANY, LIMITED

Head office

5-1, Nihonbashi-honcho 3-chome, Chuo-ku, Tokyo, Japan

Date of delisting of predecessor companies

September 21, 2005

Date of stock transfer

September 28, 2005

Date of new listing

September 28, 2005

Stock transfer ratio

New company 1 : Sankyo 1

New company 1.159 : Daiichi Pharmaceutical 1

Stock exchange listings

Tokyo, Osaka, Nagoya

Board of Directors

Representative Director and Chairman

Kiyoshi Morita

(Current President & Representative Director of Daiichi Pharmaceutical)

Representative Director, President and Chief Executive Officer

Takashi Shoda

(Current President & Representative Director of Sankyo)

Directors

Hiroyuki Nagasako

(Current Executive Vice President of Daiichi Pharmaceutical)

Hideho Kawamura

(Current Executive Vice President & Representative Director of Sankyo)

Yasuhiro Ikegami

(Current Executive Vice President & Representative Director of Sankyo)

Tsutomu Une

(Current Managing Director of Daiichi)

Outside Directors

Kunio Nihira

(Current Director of Sankyo)

Yoshifumi Nishikawa

(Current President and Chief Executive Officer of Sumitomo Mitsui Banking Corporation)

Jotaro Yabe

(Current Professor of Jissen Women’s University)

Katsuyuki Sugita

(Current Director of Sankyo)

Outline of Daiichi Pharmaceutical Co., Ltd

Name in Japanese Daiichi Seiyaku Kabushiki Kaisha Name in English Daiichi Pharmaceutical Co., Ltd.

Commencement of operations October 1915 Company established January 1918

Representative Kiyoshi Morita, President & Representative Director Capital ¥45,246 million (As of March 31, 2005)

Lines of business Manufacturing, procurement, and marketing of pharmaceuticals, over-the-counter drugs, bulk pharmaceuticals, food additives, and animal feeds Number of employees 7,333 (On a consolidated basis, as of March 31, 2005) Outline of consolidated Net sales: ¥328,534 million financial results in fiscal 2004 Operating income: ¥56,063 million Ordinary income: ¥57,320 million

Sankyo Co., Ltd. 11

Filings with the U.S. SEC Daiichi Pharmaceutical Co., Ltd. and Sankyo Company, Limited have filed a registration statement on Form F-4 with the U.S. SEC in connection with the proposed business integration of Daiichi and Sankyo under a new holding company by way of a joint stock transfer. The Form F-4 contains a prospectus and other documents. After the Form F-4 has been declared effective, Daiichi and Sankyo plan to mail the prospectus contained in the Form F-4 to their U.S. shareholders prior to the shareholders’ meetings at which the share exchange will be voted upon. The Form F-4 and prospectus contain important information about Daiichi and Sankyo, the joint stock transfer and related matters. U.S. shareholders of Daiichi and Sankyo are urged to read the Form F-4, the prospectus and the other documents filed with the U.S. SEC in connection with the joint stock transfer carefully before they make any decision at the shareholders’ meeting with respect to the joint stock transfer. The Form F-4, the prospectus and all other documents filed with the U.S. SEC in connection with the joint stock transfer are available, free of charge, on the U.S. SEC’s web site at www.sec.gov. In addition, the prospectus and all other documents filed with the U.S. SEC in connection with the business integration are available to shareholders, free of charge, by calling, writing or e-mailing:

Sankyo Company, Limited

Mr. Shigemichi Kondo

Corporate Communications Department

3-5-1, Nihonbashi Honcho

Chuo-ku, Tokyo 103-8426, Japan

Telephone: 81-3-5255-7034

E-mail: shige-k@sankyo.co.jp

Daiichi Pharmaceutical Co., Ltd.

Mr. Toshio Takahashi

Corporate Communications Department

14-10 Nihonbashi, 3-chome

Chuo-ku, Tokyo 103-8234,

Japan Telephone: 81-3-3273-7107

E-mail: andokb5o@daiichipharm.co.jp

You may read and copy any reports and other information filed with, or submitted to, the U.S. SEC at the U.S. SEC’s public reference rooms at 100 F Street, N.E., Washington, D.C. 20549 or at the other public reference rooms in New York, New York and Chicago, Illinois. Please call the U.S. SEC at 1-800-SEC-0330 for further information on public reference rooms. Filings with the U.S. SEC also are available to the public from commercial document-retrieval services and at the web site maintained by the U.S. SEC at http//www.sec.gov.

Forward-Looking Statements This communication contains forward-looking information and statements about Daiichi and Sankyo and their combined businesses after completion of the joint stock transfer. Forward-looking statements are statements that are not historical facts. These statements include financial projections and estimates and their underlying assumptions, statements regarding plans, objectives and expectations with respect to future operations, products and services, and statements regarding future performance. Forward-looking statements are generally identified by the words “expects,” “anticipates,” “believes,” “intends,” “estimates” and similar expressions. Although the management of Daiichi and Sankyo believe that the expectations reflected in such forward-looking statements are reasonable, investors and holders of Daiichi and Sankyo securities are cautioned that forward-looking information and statements are subject to various risks and uncertainties, many of which are difficult to predict and generally beyond the control of Daiichi and Sankyo, that could cause actual results and developments to differ materially from those expressed in, or implied or projected by, the forward-looking information and statements. These risks and uncertainties include those discussed or identified in the public filings with the SEC and the local filings made by Daiichi and Sankyo, including those listed under “Cautionary Statement Concerning Forward-Looking Statements” and “Risk Factors” in the prospectus included in the registration statement on Form F-4 that Daiichi and Sankyo have filed with the U.S. SEC. Other than as required by applicable law, neither Daiichi nor Sankyo undertakes any obligation to update or revise any forward-looking information or statements.