Filing under Rule 425 under

the U.S. Securities Act of 1933

Filing by: Sankyo Company, Limited

Subject Company: Daiichi Pharmaceutical Co., Ltd.

and Sankyo Company, Limited

SEC File No. 132-02290

June 3, 2005

To the Shareholders of Sankyo Company, Limited

Notice Regarding the Business Integration

with Daiichi Pharmaceutical Co., Ltd.

We would like to express our thanks to our shareholders for their continued understanding and support of Sankyo’s business activities.

We held a company information meeting on May 13, 2005 and the content of its items discussed at that meeting has been posted on our website. This notice is intended to further explain the key points regarding the significance and benefits of the business integration with Daiichi Pharmaceutical Co., Ltd. (“Daiichi”).

Please note that at a later date, we will be sending our shareholders a pamphlet covering the content of the proposed management integration in detail under a separate cover. We would sincerely appreciate it if you could refer to this pamphlet to ensure your understanding of the proposed business integration.

The Japan-based “Global Pharma Innovator”

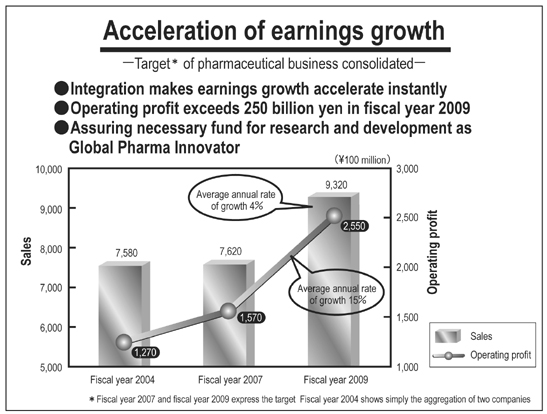

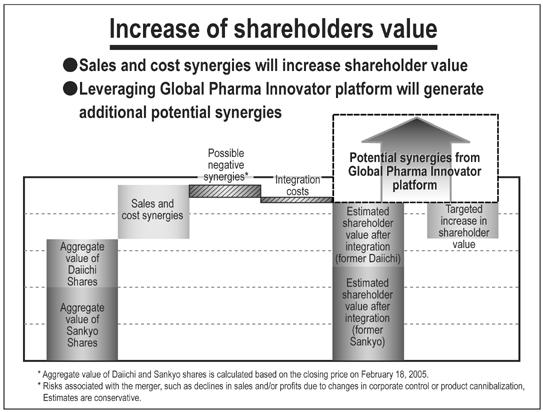

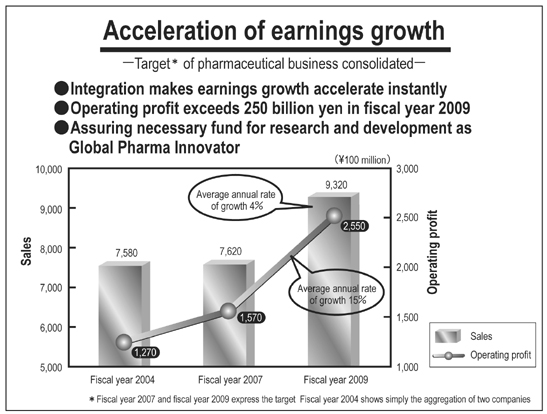

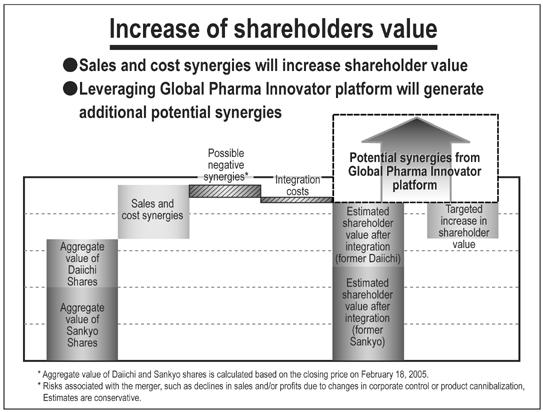

The purpose of the business integration is to create a Japan-based “Global Pharma Innovator” that will serve unmet medical needs of patients and healthcare professionals, provide innovative products and services and occupy a competitive position in the world’s major markets. As a result of this business integration, we are confident that our corporate value consistently and steadily increase as shown in the accompanying supplemental information, and that this business integration will lead to the maximization of shareholder value.

Returning Profit to Our Shareholders

As in the past, we regard returning a portion of profits to our shareholders as one of our highest priorities and we are committed to raising the return to shareholders to the highest level among Japanese pharmaceutical companies. Specifically, we have set the target of raising the ratio of dividends over shareholders equity (DOE) * to 5% for the fiscal year ended March 31, 2010.

* DOE is the ratio of cash dividends per share to shareholders’ equity per share. The Company paid a cash dividend of ¥30 per share for the year ended March 31, 2004, and is scheduling a dividend of ¥40 per share for the year ended March 31, 2005. Thus, the DOE for the fiscal year ended March 31, 2004 was 1.8% and that for the fiscal year ended March 31, 2005 will be 2.4%. However, the figures cited for the fiscal year ended March 31, 2004 and the fiscal year ended March 31, 2005 are based on the Company’s shareholders’ equity and dividends. Please note that the calculations of figures for the fiscal year ended March 31, 2010 are based on targets for shareholders’ equity and dividends subsequent to the integration with Daiichi.

Concentration of Management Resources in Priority Businesses

The Company manages its business activities according to a policy of concentrating management resources in priority businesses, principally in the field of cardiovascular treatments. Following the proposed business integration, we intend to follow the same policy. Daiichi is a leading company in Japan conducting an active R&D program in fields that are also priority businesses for Sankyo, including not only the communicable diseases but also the cardiovascular medicines. We intend to increase our new drug development capabilities and make significant increases in profitability by combining the product portfolio and drug development pipelines of both companies to realize major synergies. (Please refer to the attached supplementary information.)

Stock Transfer Ratio

With respect to the stock transfer ratio for the proposed business integration, from the standpoint of securing shareholder profit, we have received advice from experienced professionals, having analyzed and considered the issues from a number of viewpoints and have undertaken repeated negotiations. Based on this, the Board of Directors of Sankyo made its final decision on the transfer ratio based on its judgment that the ratio would help enhance shareholder value.

We, the Board of Directors of Sankyo are fully aware that our shareholders have entrusted the management of the Company to us. We have reached unanimous agreement on the judgment that business integration is the best strategy for fulfilling our mission of maximizing shareholder value. We request your understanding that this integration will increase shareholder value and is indispensable for us to become as a “Global Pharma Innovator”.

SANKYO COMPANY, LIMITED

Takashi Shoda, President

Note: The Company conducted an information meeting regarding the management integration with Daiichi on May 13, 2005. A video and related presentation documents may be found on Sankyo’s Website (http://www.sankyo.co.jp).

Filings with the U.S. SEC

Daiichi Pharmaceutical Co., Ltd. and Sankyo Company, Limited have filed a registration statement on Form F-4 with the U.S. SEC in connection with the proposed business integration of Daiichi and Sankyo under a new holding company by way of a joint stock transfer. The Form F-4 contains a prospectus and other documents. After the Form F-4 has been declared effective, Daiichi and Sankyo plan to mail the prospectus contained in the Form F-4 to their U.S. shareholders prior to the shareholders’ meetings at which the share exchange will be voted upon. The Form F-4 and prospectus contain important information about Daiichi and Sankyo, the joint stock transfer and related matters. U.S. shareholders of Daiichi and Sankyo are urged to read the Form F-4, the prospectus and the other documents filed with the U.S. SEC in connection with the joint stock transfer carefully before they make any decision at the shareholders’ meeting with respect to the joint stock transfer. The Form F-4, the prospectus and all other documents filed with the U.S. SEC in connection with the joint stock transfer are available, free of charge, on the U.S. SEC’s web site at www.sec.gov. In addition, the prospectus and all other documents filed with the U.S. SEC in connection with the business integration are available to shareholders, free of charge, by calling, writing or e-mailing:

| | |

Sankyo Company, Limited Mr. Shigemichi Kondo Corporate Communications Department 3-5-1, Nihonbashi Honcho Chuo-ku, Tokyo 103-8426, Japan Telephone: 81-3-5255-7034 E-mail: shige-k@sankyo.co.jp | | Daiichi Pharmaceutical Co., Ltd. Mr. Toshio Takahashi Corporate Communications Department 14-10 Nihonbashi, 3-chome Chuo-ku, Tokyo 103-8234, Japan Telephone: 81-3-3273-7107 E-mail: andokb5o@daiichipharm.co.jp |

You may read and copy any reports and other information filed with, or submitted to, the U.S. SEC at the U.S. SEC’s public reference rooms at 100 F Street, N.E., Washington, D.C. 20549 or at the other public reference rooms in New York, New York and Chicago, Illinois. Please call the U.S. SEC at 1-800-SEC-0330 for further information on public reference rooms. Filings with the U.S. SEC also are available to the public from commercial document-retrieval services and at the web site maintained by the U.S. SEC at http//www.sec.gov.

Forward-Looking Statements

This communication contains forward-looking information and statements about Daiichi and Sankyo and their combined businesses after completion of the joint stock transfer. Forward-looking statements are statements that are not historical facts. These statements include financial projections and estimates and their underlying assumptions, statements regarding plans, objectives and expectations with respect to future operations, products and services, and statements regarding future performance. Forward-looking statements are generally identified by the words “expects,” “anticipates,” “believes,” “intends,” “estimates” and similar expressions. Although the management of Daiichi and Sankyo believe that the expectations reflected in such forward-looking statements are reasonable, investors and holders of Daiichi and Sankyo securities are cautioned that forward-looking information and statements are subject to various risks and uncertainties, many of which are difficult to predict and generally beyond the control of Daiichi and Sankyo, that could cause actual results and developments to differ materially from those expressed in, or implied or projected by, the forward-looking information and statements. These risks and uncertainties include those discussed or identified in the public filings with the SEC and the local filings made by Daiichi and Sankyo, including those listed under “Cautionary Statement Concerning Forward-Looking Statements” and “Risk Factors” in the prospectus included in the registration statement on Form F-4 that Daiichi and Sankyo have filed with the U.S. SEC. Other than as required by applicable law, neither Daiichi nor Sankyo undertakes any obligation to update or revise any forward-looking information or statements.