Filing under Rule 425 under

the U.S. Securities Act of 1933

Filing by: Daiichi Pharmaceutical Co., Ltd.

Subject Company: Daiichi Pharmaceutical Co., Ltd.

and Sankyo Company, Limited

SEC File No. 132-02290

A Global Pharma Innovator

May 13, 2005 (Friday)

Focus of this Presentation

This presentation contains statements concerning forecasts for Sankyo Co., Ltd. (“Sankyo”), Daiichi Pharmaceutical Co., Ltd. (“Daiichi”) and their group companies. These statements are based on assumptions and judgments made with information available at the time of preparation, and as such are subject to existing and unforeseen risks, as well as uncertainties and other factors.

Risks, uncertainties and other factors may cause business performance, management actions and financial results to differ significantly from those presented in this material.

This presentation is not disclosure material in accordance with the Securities Exchange Law, and as such there is no guarantee as to the accuracy of the information.

Readers are therefore cautioned not to rely solely on this presentation when making an evaluation of the proposed business integration.

1

Contents

1 Transaction Overview

2 Benefits of Transaction

3 Integration Strategy and Global Growth

4 Management Structure and Integration Schedule

2

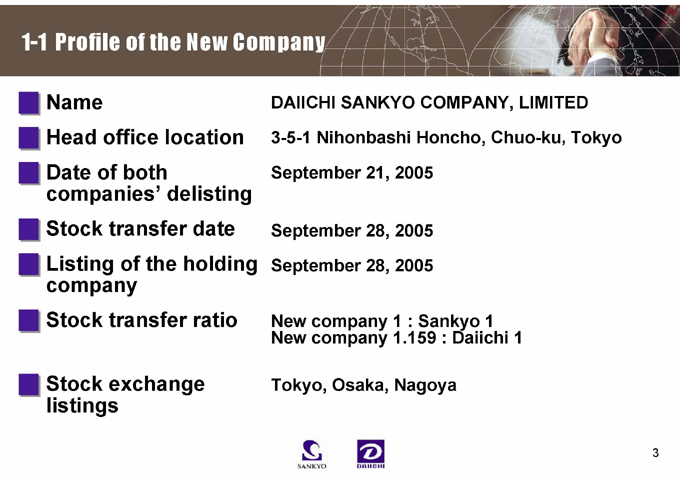

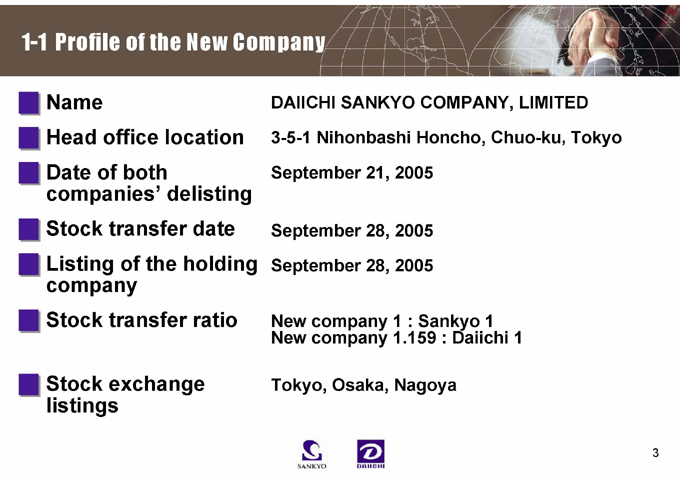

1-1 Profile of the New Company

Name DAIICHI SANKYO COMPANY, LIMITED

Head office location 3-5-1 Nihonbashi Honcho, Chuo-ku, Tokyo

Date of both companies’ delisting September 21, 2005

Stock transfer date September 28, 2005

Listing of the holding company September 28, 2005

Stock transfer ratio New company 1 : Sankyo 1 New company 1.159 : Daiichi 1

Stock exchange listings Tokyo, Osaka, Nagoya

3

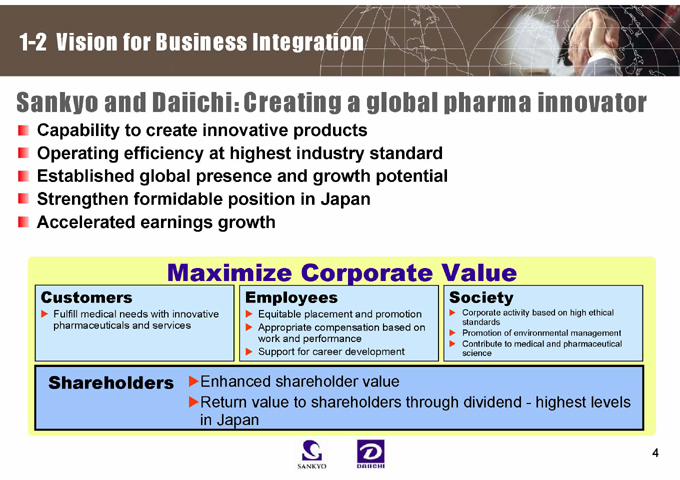

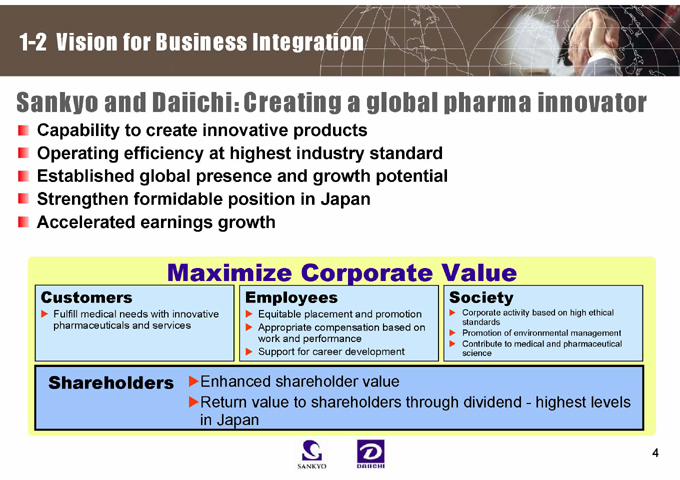

1-2 Vision for Business Integration

Sankyo and Daiichi: Creating a global pharma innovator

Capability to create innovative products

Operating efficiency at highest industry standard Established global presence and growth potential Strengthen formidable position in Japan Accelerated earnings growth

Maximize Corporate Value

Customers

Fulfill medical needs with innovative pharmaceuticals and services

Employees

Equitable placement and promotion Appropriate compensation based on work and performance Support for career development

Society

Corporate activity based on high ethical standards Promotion of environmental management Contribute to medical and pharmaceutical science

Shareholders

Enhanced shareholder value

Return value to shareholders through dividend—highest levels in Japan

4

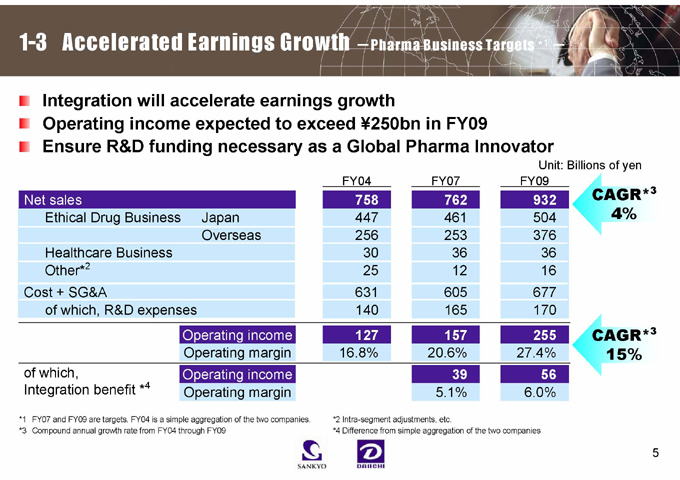

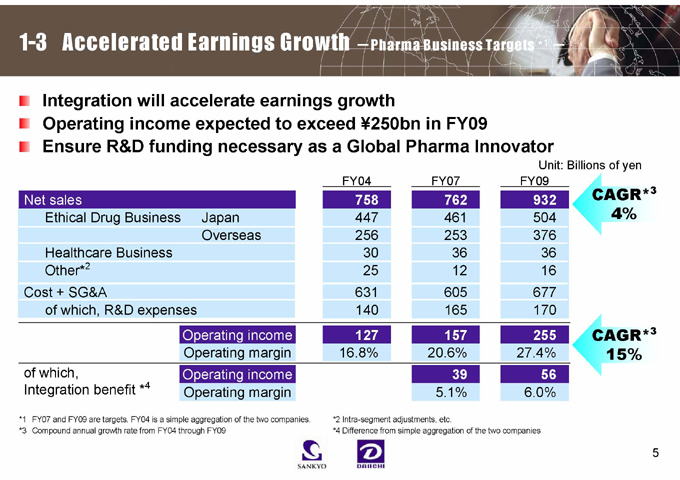

1-3 Accelerated Earnings Growth -Pharma Business Targets *1 -

Integration will accelerate earnings growth

Operating income expected to exceed ¥250bn in FY09 Ensure R&D funding necessary as a Global Pharma Innovator

Net sales Operating income 127 157 255 758 762 932

Unit: Billions of yen

FY04 FY07 FY09

Ethical Drug Business Japan 447 461 504

Overseas 256 253 376

Healthcare Business 30 36 36

Other*2 25 12 16

Cost + SG&A 631 605 677

of which, R&D expenses 140 165 170

Operating margin 16.8% 20.6% 27.4%

of which, Operating income 39 56

Integration benefit *4 Operating margin 5.1% 6.0%

CAGR*3 4%

CAGR*3 15%

*1 FY07 and FY09 are targets. FY04 is a simple aggregation of the two companies.

*3 Compound annual growth rate from FY04 through FY09

*2 Intra-segment adjustments, etc.

*4 Difference from simple aggregation of the two companies

5

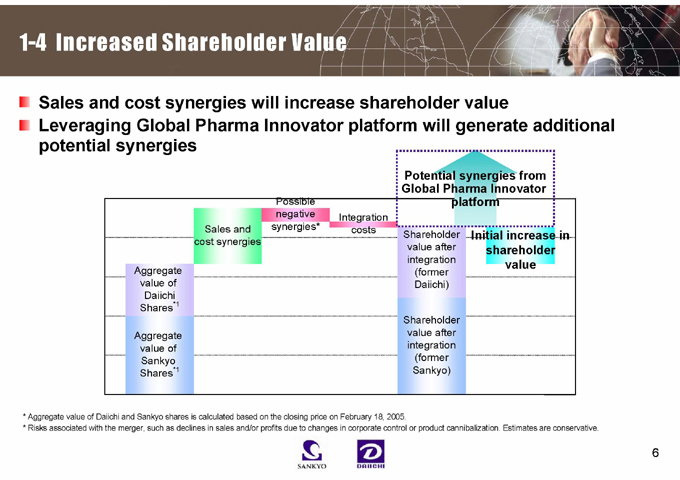

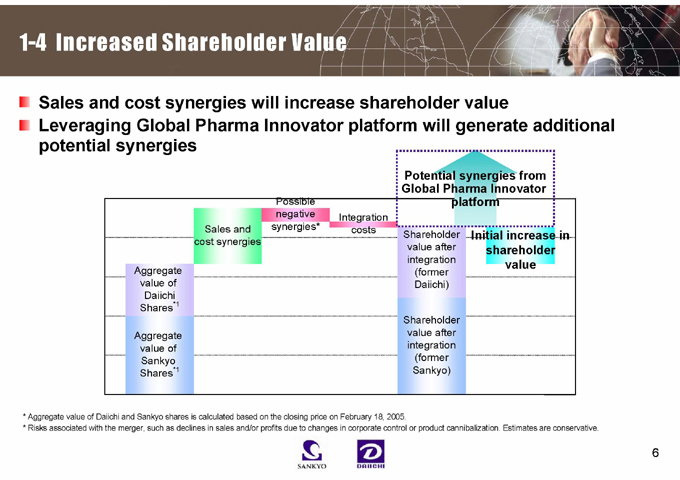

1-4 Increased Shareholder Value

Sales and cost synergies will increase shareholder value

Leveraging Global Pharma Innovator platform will generate additional potential synergies

Potential synergies from Global Pharma Innovator platform

Sales and cost synergies

Possible negative synergies*

Integration costs

Aggregate value of Daiichi Shares*1

Aggregate value of Sankyo Shares*1

Shareholder value after integration (former Daiichi)

Shareholder value after integration (former Sankyo)

Initial increase in shareholder value

* Aggregate value of Daiichi and Sankyo shares is calculated based on the closing price on February 18, 2005.

* Risks associated with the merger, such as declines in sales and/or profits due to changes in corporate control or product cannibalization. Estimates are conservative.

6

1-5 Shareholder Returns at Highest Levels in Japan

Committed to return value to shareholders at highest levels in Japan

Committed to growing DPS (dividend per share) in FY05 and increase further

Targeted to deliver DOE (Dividend on Equity) of 5% for FY09

7

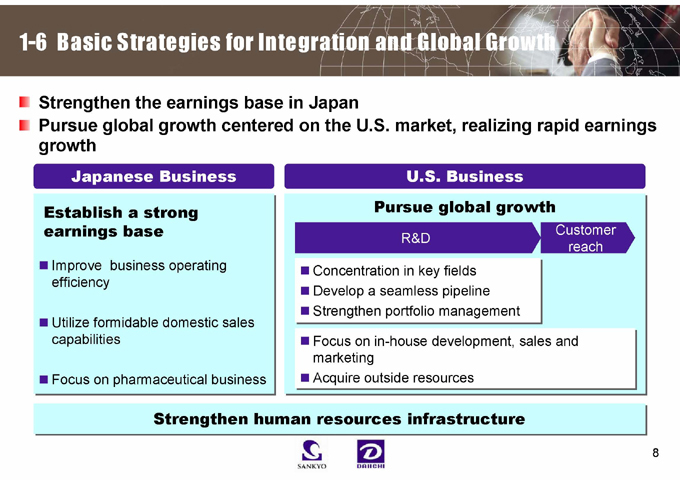

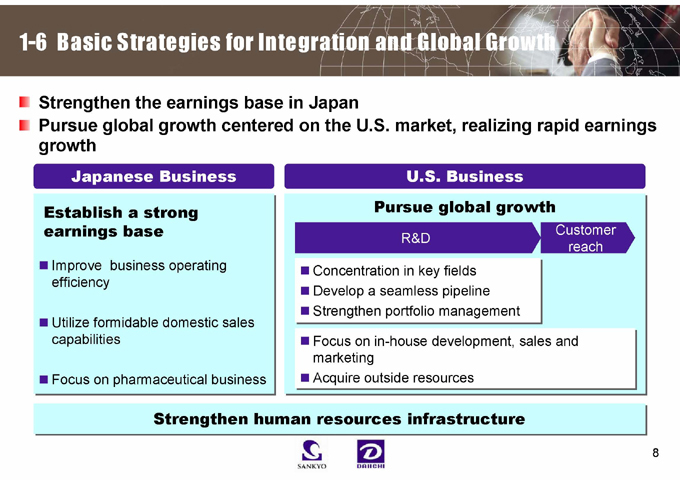

1-6 Basic Strategies for Integration and Global Growth

Strengthen the earnings base in Japan

Pursue global growth centered on the U.S. market, realizing rapid earnings growth

Japanese Business

Establish a strong earnings base

Improve business operating efficiency

Utilize formidable domestic sales capabilities

Focus on pharmaceutical business

U.S. Business

Pursue global growth

R&D

Customer reach

Concentration in key fields Develop a seamless pipeline Strengthen portfolio management

Focus on in-house development, sales and marketing Acquire outside resources

Strengthen human resources infrastructure

8

1 Transaction Overview

2 Benefits of Transaction

3 Integration Strategy and Global Growth

4 Management Structure and Integration Schedule

9

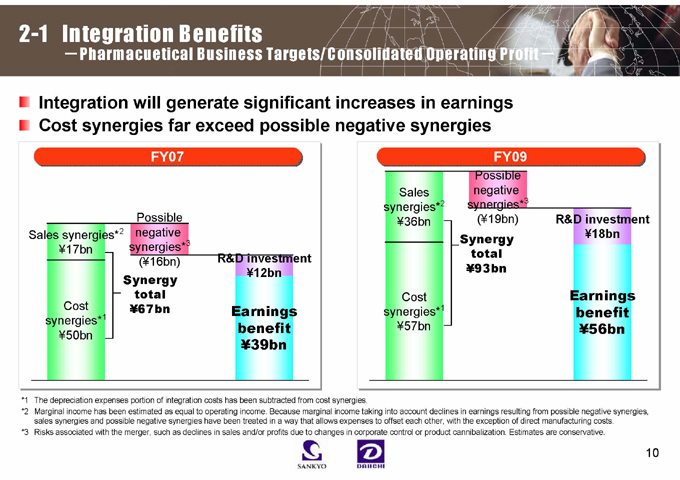

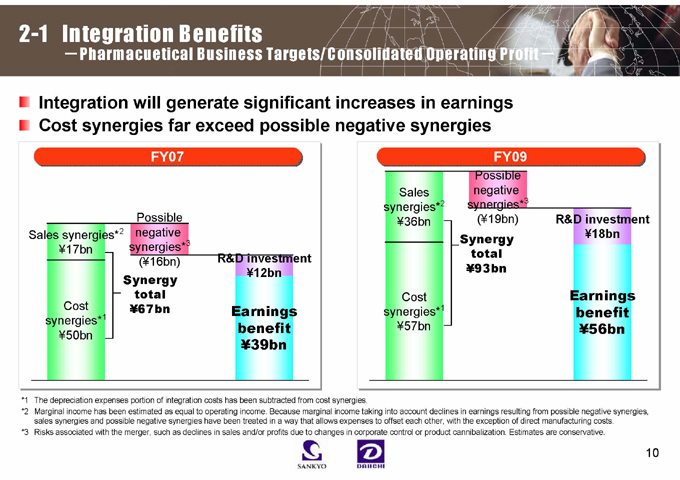

2-1 Integration Benefits

- Pharmacuetical Business Targets/Consolidated Operating Profit-

Integration will generate significant increases in earnings Cost synergies far exceed possible negative synergies

FY07

Sales synergies*2 ¥17bn

Possible negative synergies*3 (¥16bn)

R&D investment ¥12bn

Cost synergies*1 ¥50bn

Synergy total ¥67bn

Earnings benefit ¥39bn

FY09

Sales synergies*2 ¥36bn

Possible negative synergies*3 (¥19bn)

R&D investment ¥18bn

Synergy total ¥93bn

Cost synergies*1 ¥57bn

Earnings benefit ¥56bn

*1 The depreciation expenses portion of integration costs has been subtracted from cost synergies.

*2 Marginal income has been estimated as equal to operating income. Because marginal income taking into account declines in earnings resulting from possible negative synergies, sales synergies and possible negative synergies have been treated in a way that allows expenses to offset each other, with the exception of direct manufacturing costs.

*3 Risks associated with the merger, such as declines in sales and/or profits due to changes in corporate control or product cannibalization. Estimates are conservative.

10

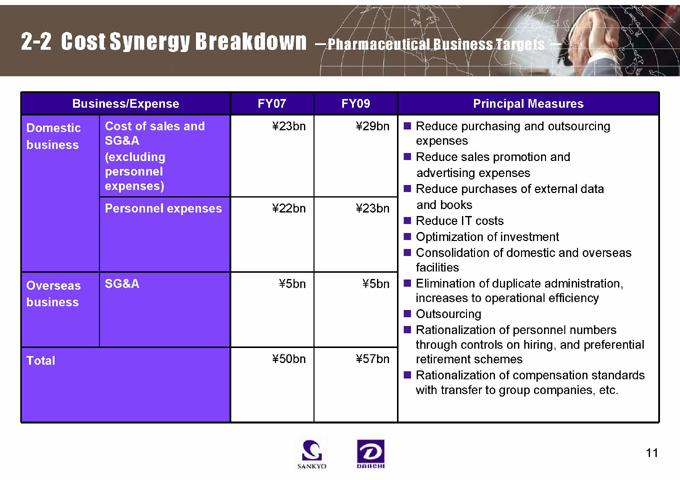

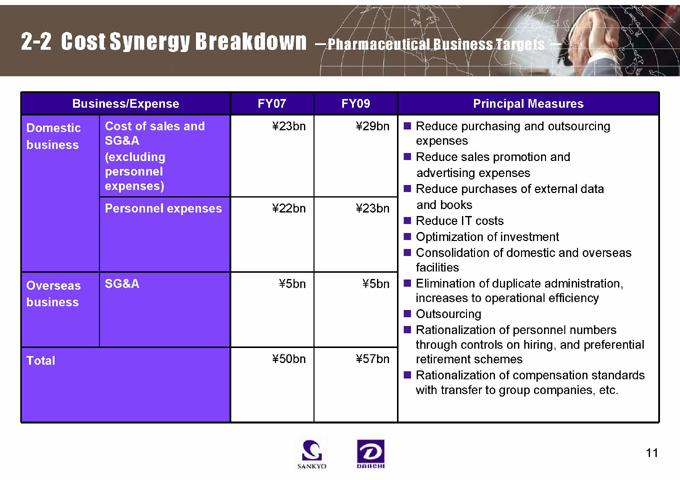

2-2 Cost Synergy Breakdown -Pharmaceutical Business Targets -

Business/Expense FY07 FY09

Domestic Cost of sales and ¥23bn ¥29bn

business SG&A

(excluding personnel expenses)

Personnel expenses ¥22bn ¥23bn

Overseas business SG&A ¥5bn ¥5bn

Total ¥50bn ¥57bn

Principal Measures

Reduce purchasing and outsourcing expenses Reduce sales promotion and advertising expenses Reduce purchases of external data and books Reduce IT costs Optimization of investment Consolidation of domestic and overseas facilities Elimination of duplicate administration, increases to operational efficiency Outsourcing Rationalization of personnel numbers through controls on hiring, and preferential retirement schemes Rationalization of compensation standards with transfer to group companies, etc.

11

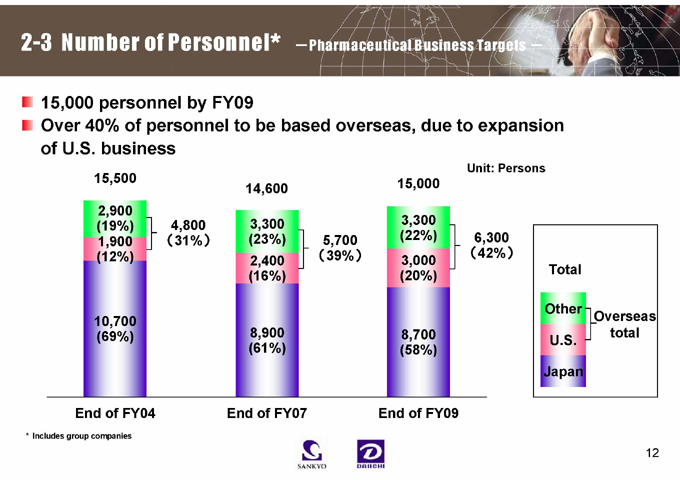

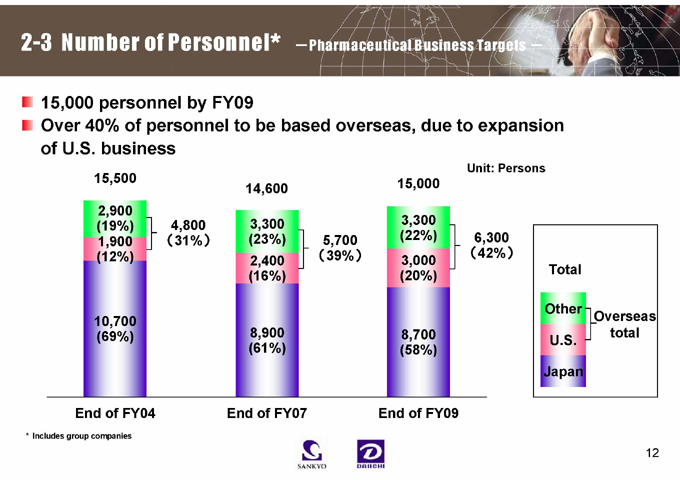

2-3 Number of Personnel* -Pharmaceutical Business Targets -

15,000 personnel by FY09

Over 40% of personnel to be based overseas, due to expansion of U.S. business

15,500

2,900 (19%) 1,900 (12%)

10,700 (69%)

4,800 (31%)

14,600

3,300 (23%) 2,400 (16%)

8,900 (61%)

5,700 (39%)

15,000

3,300 (22%) 3,000 (20%)

8,700 (58%)

Unit: Persons

6,300 (42%)

Total

Other U.S. Japan

Overseas total

End of FY04 End of FY07 End of FY09

* Includes group companies

12

2-4.1 Sales Synergies -Pharmaceutical Business Targets-

Grow sales of the Company’s high-margin products, both in Japan and overseas

Income increase benefits (net sales)

¥20bn ¥4bn

¥16bn

¥40bn ¥5bn

¥35bn

Total Overseas Japan

FY07 FY09

Earnings increase benefits (operating income*)

¥17bn ¥3bn

¥14bn

¥36bn ¥4bn

¥32bn

FY07 FY09

* Marginal income has been estimated as equal to operating income. Because of marginal income taking into account declines in earnings resulting from possible negative synergies, sales synergies and possible negative synergies have been treated in a way that allows expenses to offset each other, with the exception of direct manufacturing costs.

13

2-4.2 Measures to Generate Sales Synergies

Domestic Ethical Drugs -

Collaboration*1 will begin in October 2005

Focus on leading products from each company, in major drug markets

Olmetec, Mevalotin, Cravit, Calblock, etc.

Strategic utilization of the formidable marketing abilities of both companies

Over 2,500 MRs provide more than ten million pieces of information annually*2

Emphasis on cardiovascular diseases

*1 Cooperative sales efforts, including co-promotion, and scientific lectures

*2 IMS JDI fiscal 2004

14

2-4.3 Emphasis on the Cardiovascular Disease Field

Numerous products and development projects

Extensive skills and knowledge in cardiovascular-related fields

Maximization of Olmetec at the earliest opportunity through prioritization in the cardiovascular field

Begin collaboration from October 2005

Provide the greatest number of details for ARB*1 in Japan Integrate and utilize expertise and know-how

*1 Angiotensin II receptor blocker (blood pressure lowering agent)

15

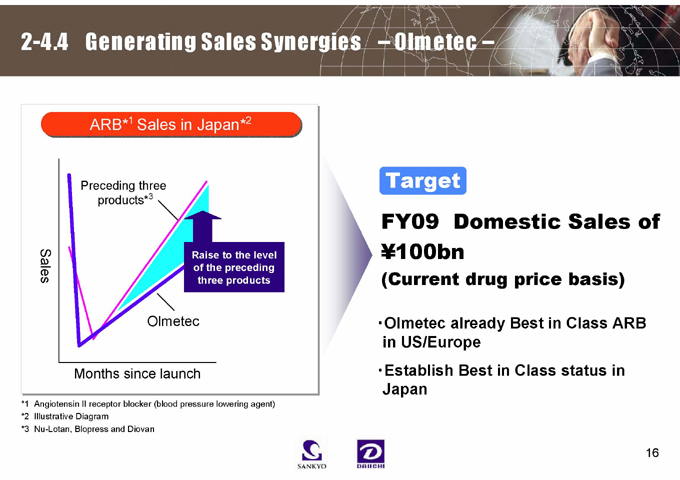

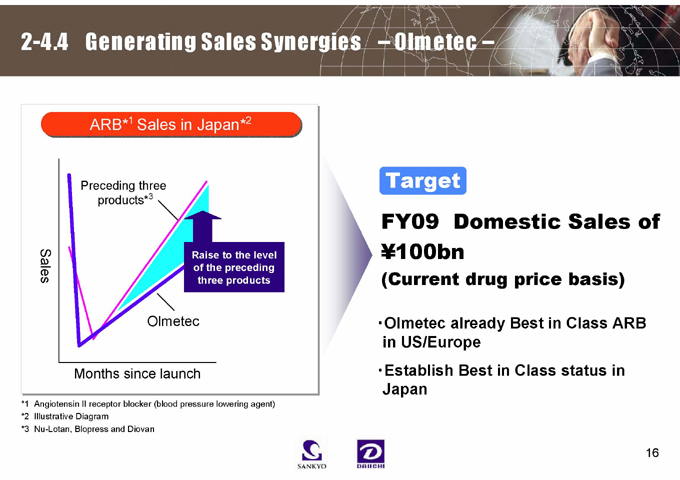

2-4.4 Generating Sales Synergies – Olmetec –

ARB*1Sales in Japan* 2

Preceding three products*3

Sales

Raise to the level of the preceding three products

Olmetec

Months since launch

*1 Angiotensin II receptor blocker (blood pressure lowering agent)

*2 Illustrative Diagram

*3 Nu-Lotan, Blopress and Diovan

Target

FY09 Domestic Sales of ¥100bn

(Current drug price basis)

·Olmetec already Best in Class ARB in US/Europe·Establish Best in Class status in Japan

16

2-5 Focus on the Pharmaceutical Business

The Daiichi Sankyo Group will focus on the pharmaceutical business All 15 non-pharma affiliates will be made wholly independent Target for completion March 2007

Affiliates currently represent

¥170bn in sales

¥9bn in operating income

17

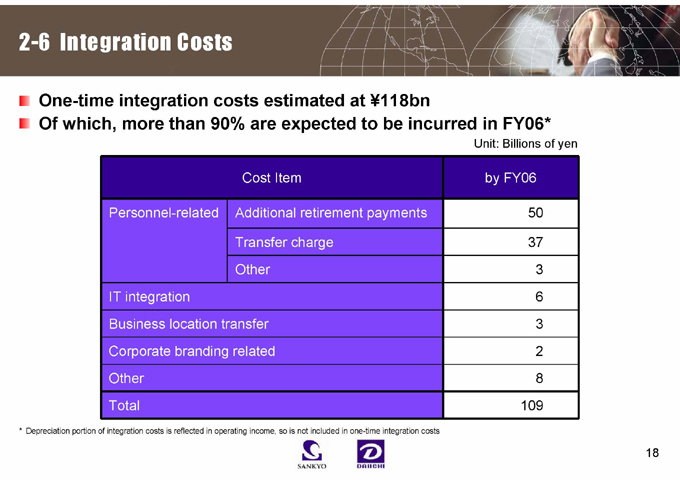

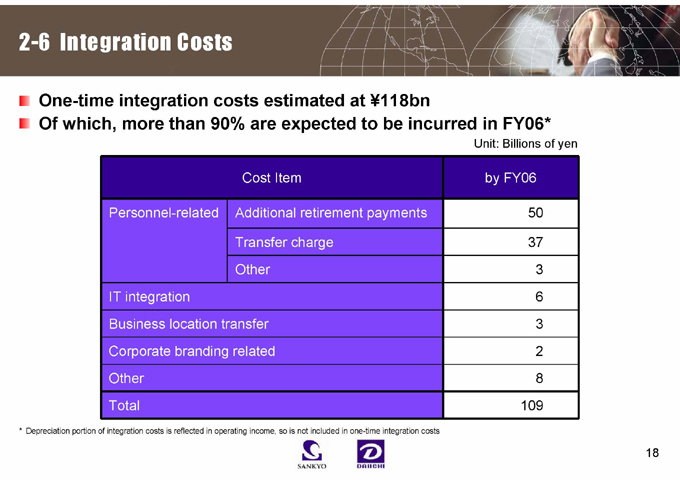

2-6 Integration Costs

One-time integration costs estimated at ¥118bn

Of which, more than 90% are expected to be incurred in FY06*

Unit: Billions of yen

Cost Item by FY06

Personnel-related Additional retirement payments 50

Transfer charge 37

Other 3

IT integration 6

Business location transfer 3

Corporate branding related 2

Other 8

Total 109

* Depreciation portion of integration costs is reflected in operating income, so is not included in one-time integration costs

18

1 Transaction Overview

2 Benefits of Transaction

3 Integration Strategy and Global Growth

4 Management Structure and Integration Schedule

19

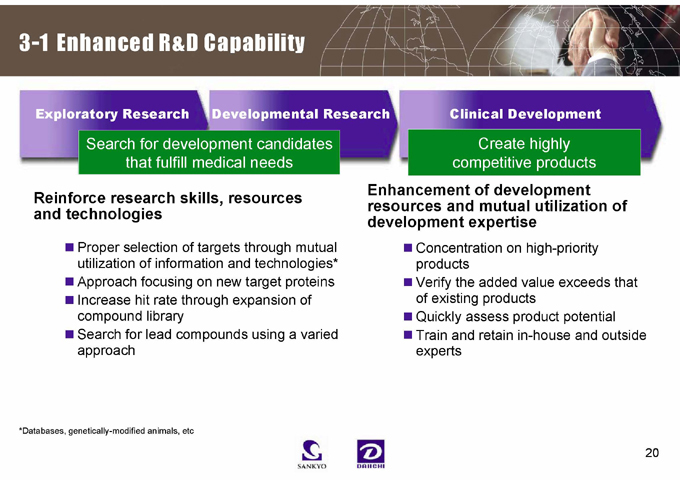

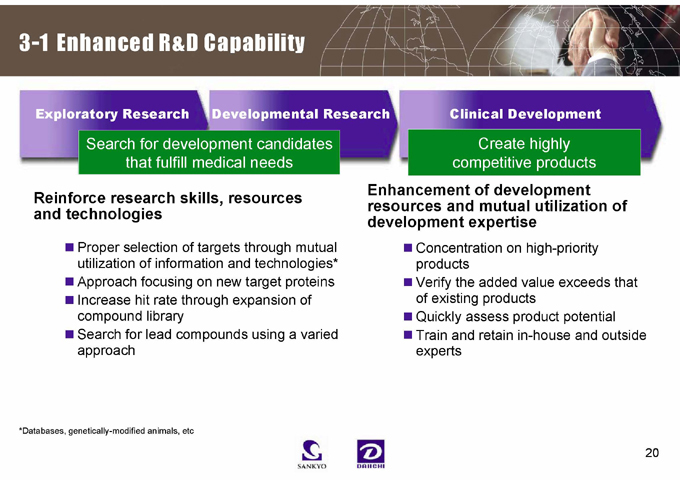

3-1 Enhanced R&D Capability

Exploratory Research

Developmental Research

Clinical Development

Search for development candidates that fulfill medical needs

Create highly competitive products

Reinforce research skills, resources and technologies

Proper selection of targets through mutual utilization of information and technologies* Approach focusing on new target proteins Increase hit rate through expansion of compound library Search for lead compounds using a varied approach

Enhancement of development resources and mutual utilization of development expertise

Concentration on high-priority products Verify the added value exceeds that of existing products Quickly assess product potential Train and retain in-house and outside experts

*Databases, genetically-modified animals, etc

20

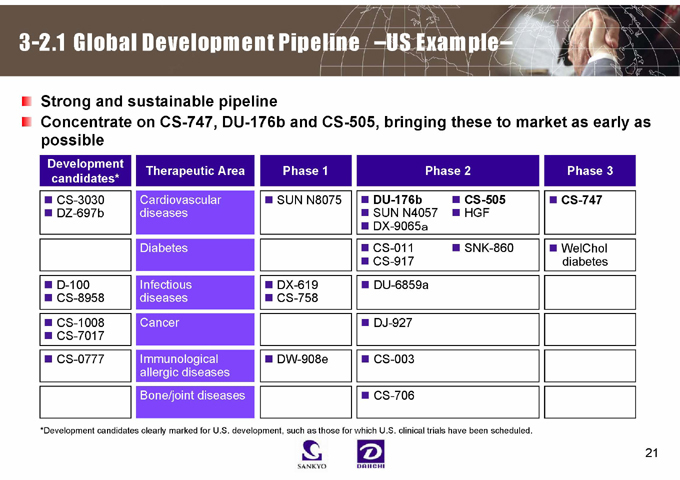

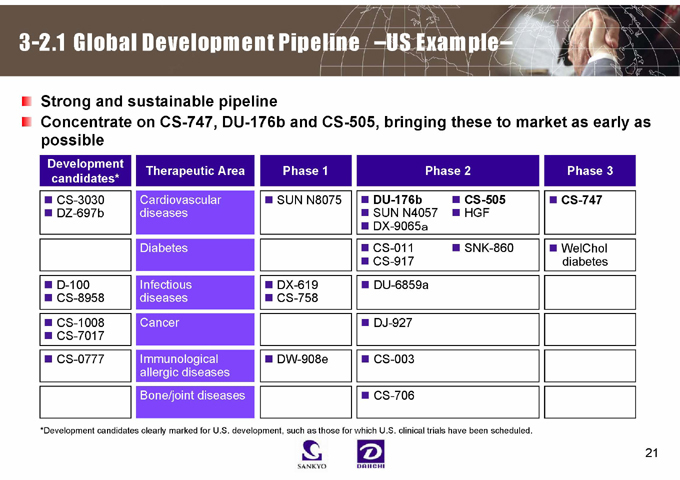

3-2.1 Global Development Pipeline –US Example–

Strong and sustainable pipeline

Concentrate on CS-747, DU-176b and CS-505, bringing these to market as early as possible

Development candidates* Therapeutic Area Phase 1 Phase 2 Phase 3

CS-3030 Cardiovascular SUN N8075 DU-176b CS-505 CS-747

DZ-697b diseases SUN N4057 HGF

DX-9065a

Diabetes CS-011 SNK-860 WelChol

CS-917 diabetes

D-100 Infectious DX-619 DU-6859a

CS-8958 diseases CS-758

CS-1008 Cancer DJ-927

CS-7017

CS-0777 Immunological DW-908e CS-003

allergic diseases

Bone/joint diseases CS-706

*Development candidates clearly marked for U.S. development, such as those for which U.S. clinical trials have been scheduled.

21

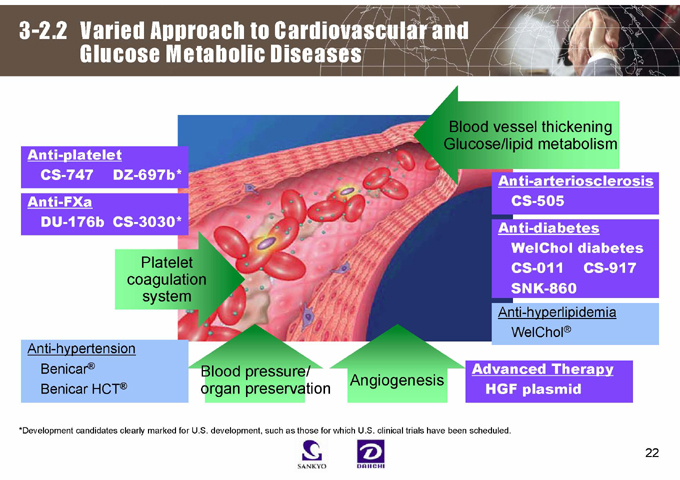

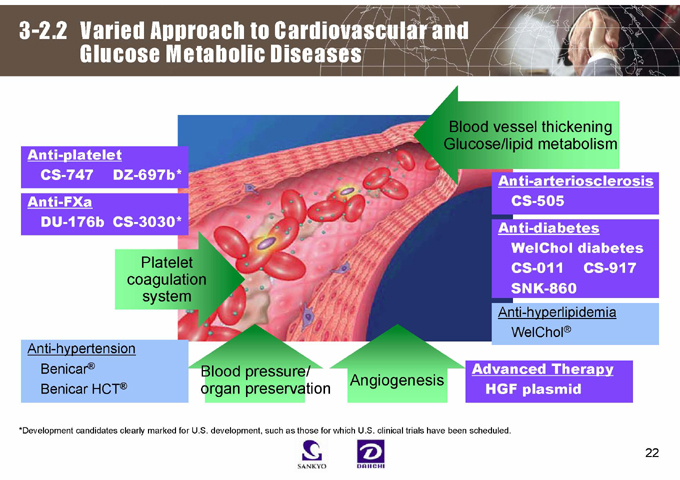

3-2.2 Varied Approach to Cardiovascular and Glucose Metabolic Diseases

Anti-platelet CS-747 DZ-697b*

Anti-FXa

DU-176b CS-3030*

Blood vessel thickening Glucose/lipid metabolism

Platelet coagulation system

Anti-arteriosclerosis CS-505 Anti-diabetes WelChol diabetes CS-011 CS-917 SNK-860

Anti-hypertension Benicar® Benicar HCT®

Blood pressure/ organ preservation

Angiogenesis

Anti-hyperlipidemia WelChol®

Advanced Therapy HGF plasmid

*Development candidates clearly marked for U.S. development, such as those for which U.S. clinical trials have been scheduled.

22

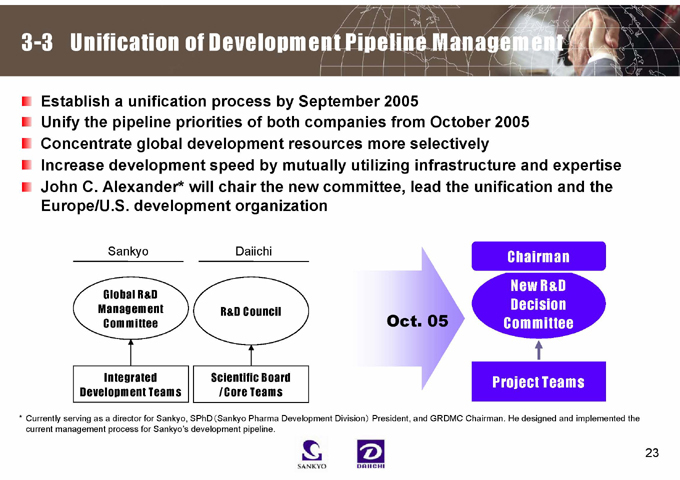

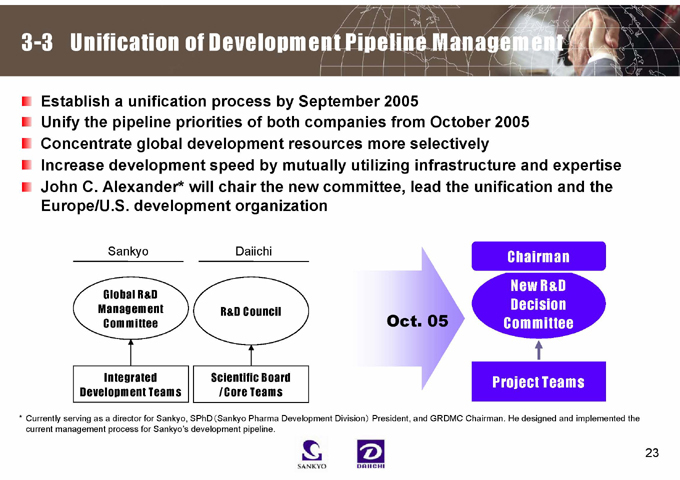

3-3 Unification of Development Pipeline Management

Establish a unification process by September 2005

Unify the pipeline priorities of both companies from October 2005 Concentrate global development resources more selectively

Increase development speed by mutually utilizing infrastructure and expertise John C. Alexander* will chair the new committee, lead the unification and the Europe/U.S. development organization

Sankyo

Global R&D Management Committee

Integrated Development Teams

Daiichi

R&D Council

Scientific Board /Core Teams

Oct. 05

Chairman

New R&D Decision Committee

Project Teams

* Currently serving as a director for Sankyo, SPhD (Sankyo Pharma Development Division) President, and GRDMC Chairman. He designed and implemented the current management process for Sankyo’s development pipeline.

23

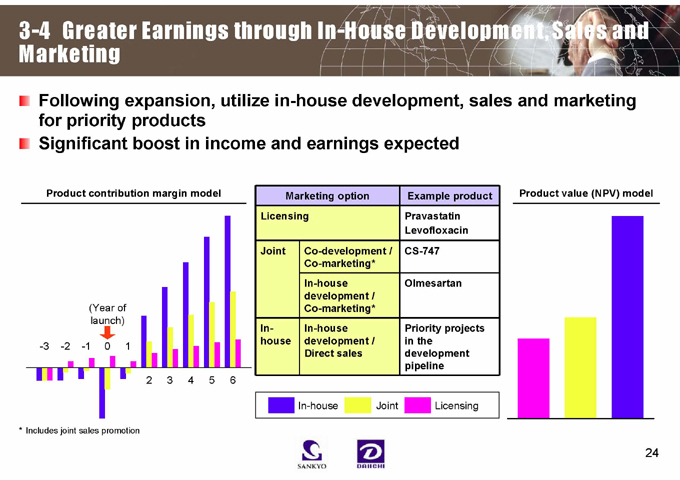

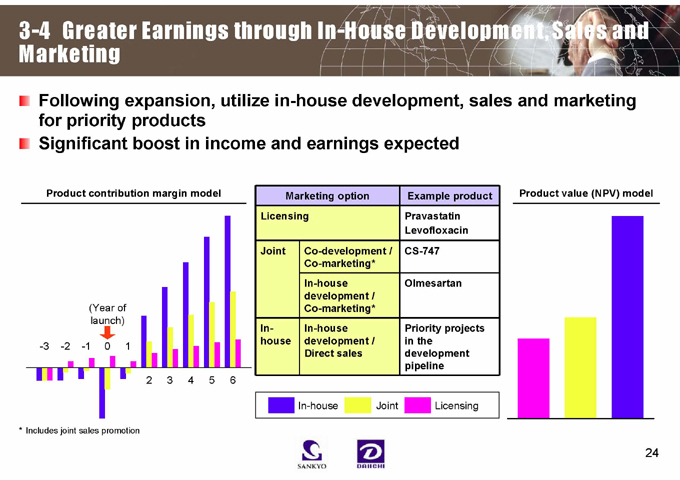

Following expansion, utilize in-house development, sales and marketing for priority products Significant boost in income and earnings expected

Product contribution margin model

(Year of launch)

-3 -2 -1 0 1

2 3 4 5 6

* Includes joint sales promotion

Marketing option Example product

Licensing Pravastatin

Levofloxacin

Joint Co-development / CS-747

Co-marketing*

In-house Olmesartan

development /

Co-marketing*

In- In-house Priority projects

house development / in the

Direct sales development

pipeline

Product value (NPV) model

In-house

Joint

Licensing

24

3-4 Greater Earnings through In-House Development, Sales and Marketing

3-5 Strengthen Human Resources Infrastructure

Effectively utilize the exceptional employees of both companies through the introduction and strict adherence to a new HR system

Introduction of a new HR system

Build new classification, compensation and evaluation systems

Ensure equal employment opportunities and compensation reflecting work and results

Equitable placement and promotion

Based on ability, irrespective of former company affiliation or age Employ highly objective and transparent evaluation criteria

Self-responsibility and self-actualization

Full support of career development

25

1 Transaction Overview

2 Benefits of Transaction

3 Integration Strategy and Global Growth

4 Management Structure and Integration Schedule

26

27

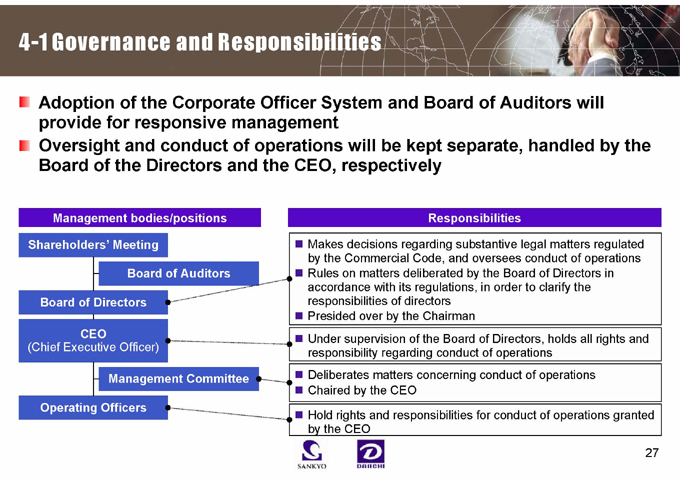

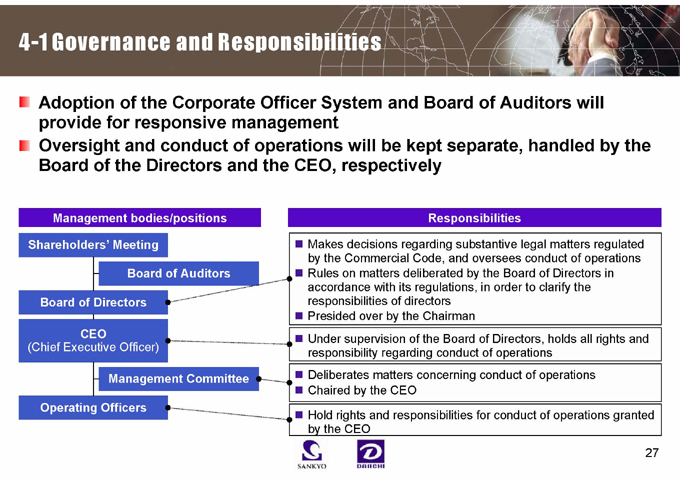

4-1 Governance and Responsibilities

Adoption of the Corporate Officer System and Board of Auditors will provide for responsive management Oversight and conduct of operations will be kept separate, handled by the Board of the Directors and the CEO, respectively

Management bodies/positions

Shareholders’ Meeting

Board of Auditors

Board of Directors

CEO

(Chief Executive Officer)

Management Committee

Operating Officers

Responsibilities

Makes decisions regarding substantive legal matters regulated by the Commercial Code, and oversees conduct of operations Rules on matters deliberated by the Board of Directors in accordance with its regulations, in order to clarify the responsibilities of directors Presided over by the Chairman

Under supervision of the Board of Directors, holds all rights and responsibility regarding conduct of operations

Deliberates matters concerning conduct of operations Chaired by the CEO

Hold rights and responsibilities for conduct of operations granted by the CEO

28

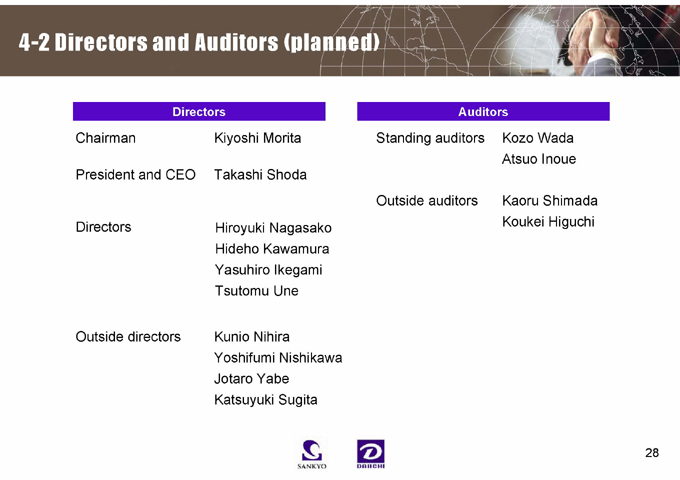

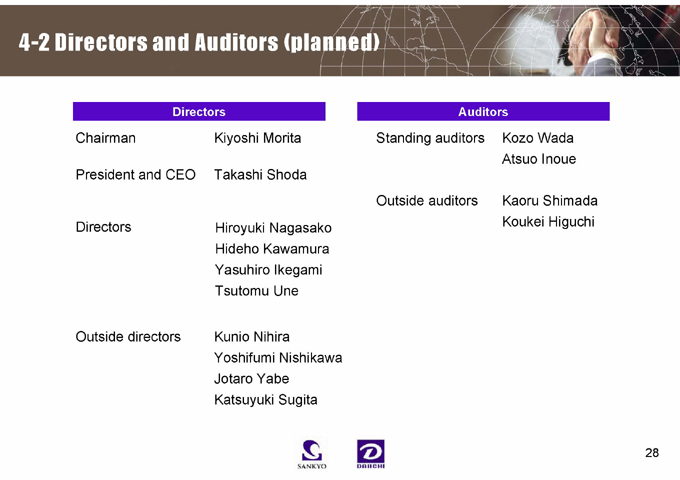

4-2 Directors and Auditors (planned)

Directors

Chairman Kiyoshi Morita

President and CEO Takashi Shoda

Directors Hiroyuki Nagasako

Hideho Kawamura

Yasuhiro Ikegami

Tsutomu Une

Outside directors Kunio Nihira

Yoshifumi Nishikawa

Jotaro Yabe

Katsuyuki Sugita

Auditors

Standing auditors Kozo Wada

Atsuo Inoue

Outside auditors Kaoru Shimada

Koukei Higuchi

29

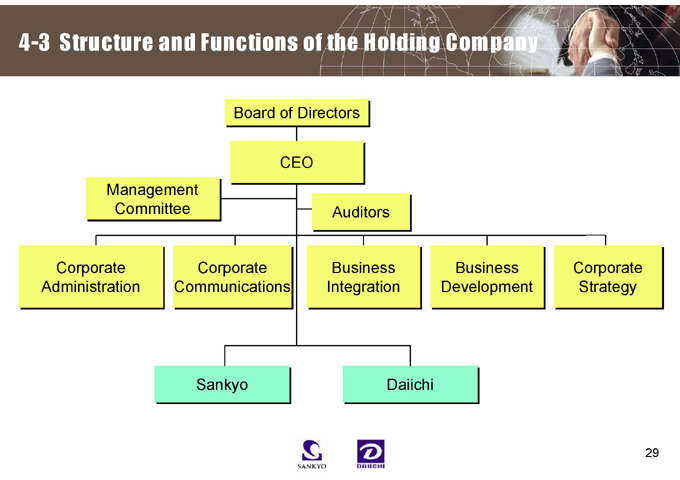

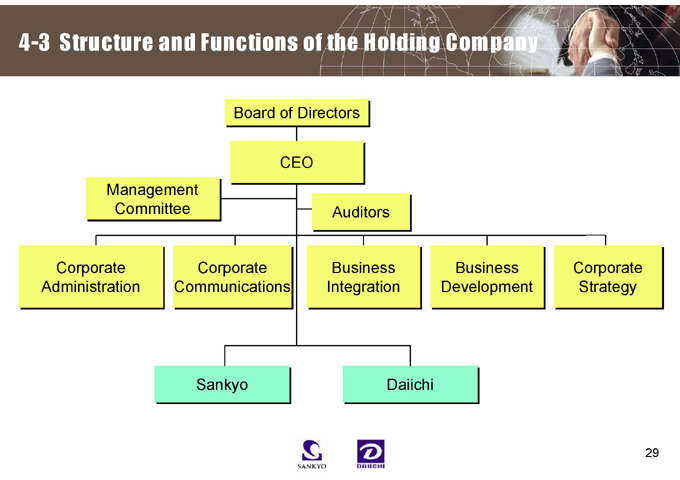

4-3 Structure and Functions of the Holding Company

Board of Directors

CEO

Management Committee

Auditors

Corporate Administration

Corporate Communications

Business Integration

Business Development

Corporate Strategy

Sankyo

Daiichi

30

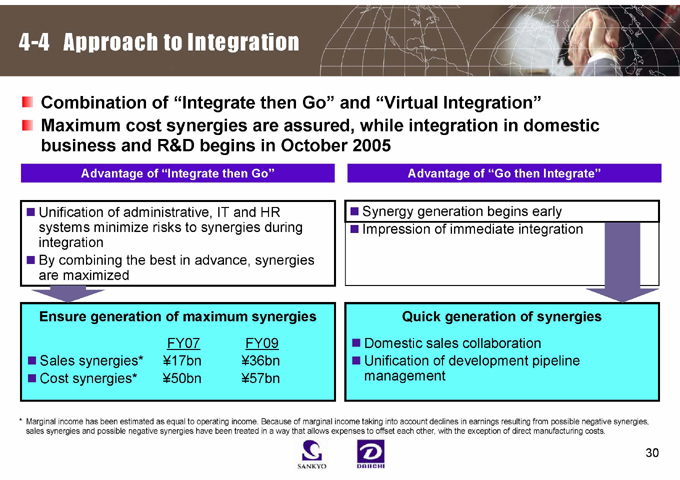

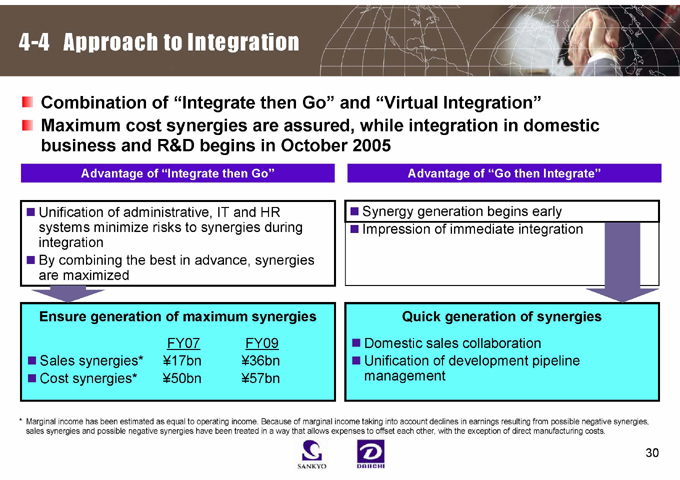

4-4 Approach to Integration

Combination of “Integrate then Go” and “Virtual Integration” Maximum cost synergies are assured, while integration in domestic business and R&D begins in October 2005

Advantage of “Integrate then Go”

Advantage of “Go then Integrate”

Unification of administrative, IT and HR systems minimize risks to synergies during integration By combining the best in advance, synergies are maximized

Synergy generation begins early

Impression of immediate integration

Ensure generation of maximum synergies

FY07 FY09

Sales synergies* ¥17bn ¥36bn Cost synergies* ¥50bn ¥57bn

Quick generation of synergies

Domestic sales collaboration Unification of development pipeline management

* Marginal income has been estimated as equal to operating income. Because of marginal income taking into account declines in earnings resulting from possible negative synergies, sales synergies and possible negative synergies have been treated in a way that allows expenses to offset each other, with the exception of direct manufacturing costs.

31

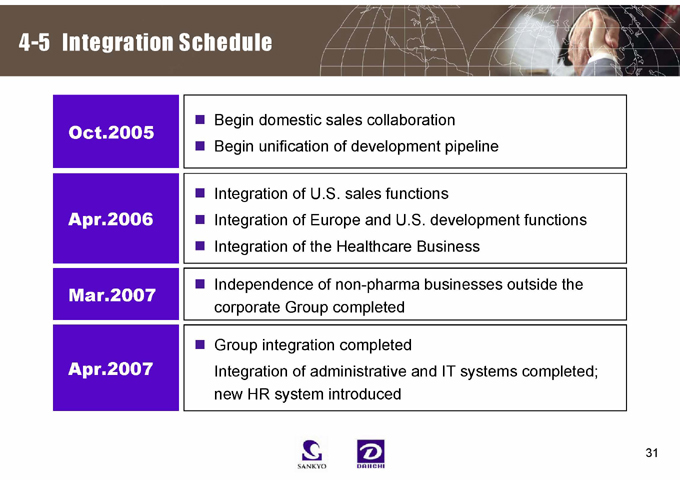

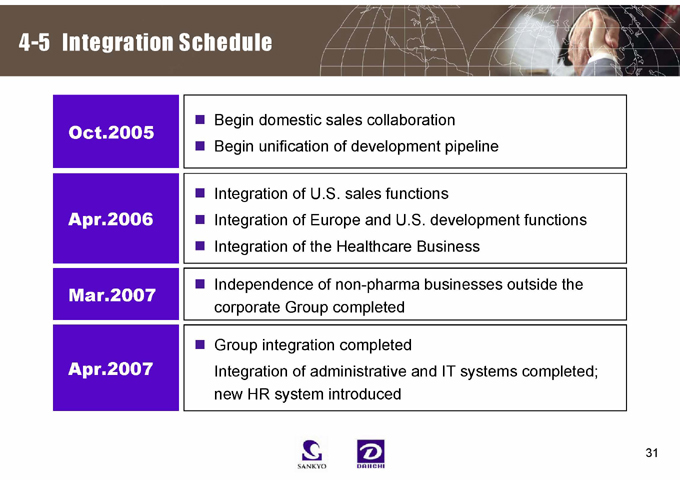

4-5 Integration Schedule

Oct.2005

Begin domestic sales collaboration Begin unification of development pipeline

Apr.2006

Integration of U.S. sales functions

Integration of Europe and U.S. development functions Integration of the Healthcare Business

Mar.2007

Independence of non-pharma businesses outside the corporate Group completed

Apr.2007

Group integration completed

Integration of administrative and IT systems completed; new HR system introduced

32

Global Pharma Innovator

Daiichi Sankyo building a strong global competitor

33

Filings with the U.S. SEC

Daiichi Pharmaceutical Co., Ltd. and Sankyo Company, Limited may file a registration statement on Form F-4 with the U.S. SEC in connection with the proposed business combination of Daiichi and Sankyo under a new holding company by way of a joint stock transfer. The Form F-4 (if filed) will contain a prospectus and other documents. If a Form F-4 is filed and declared effective, Daiichi and Sankyo plan to mail the prospectus contained in the Form F-4 to their U.S. shareholders prior to the shareholders meetings at which the stock exchange will be voted upon. The Form F-4 (if filed) and prospectus will contain important information about Daiichi and Sankyo, the joint stock transfer and related matters. U.S. shareholders of Daiichi and Sankyo are urged to read the Form F-4, the prospectus and the other documents that may be filed with the U.S. SEC in connection with the joint stock transfer carefully before they make any decision at the shareholders meeting with respect to the joint stock transfer. The Form F-4 (if filed), the prospectus and all other documents filed with the U.S. SEC in connection with the joint stock transfer will be available when filed, free of charge, on the U.S. SEC’s web site at www.sec.gov. In addition, the prospectus and all other documents filed with the U.S. SEC in connection with the business combination will be made available to shareholders, free of charge, by calling, writing or e-mailing:

Sankyo Company, Limited

Mr. Shigemichi Kondo

Corporate Communications Department 3-5-1, Nihonbashi Honcho Chuo-ku, Tokyo 103-8426, Japan Telephone: 81-3-5255-7034 E-mail:shige-k@sankyo.co.jp

Daiichi Pharmaceutical Co., Ltd.

Mr. Toshio Takahashi

Corporate Communications Department

14-10 Nihonbashi, 3-chome

Chuo-ku, Tokyo 103-8234, Japan

Telephone: 81-3-3273-7107

E-mail: andokb5o@daiichipharm.co.jp

You may read and copy any reports and other information filed with, or submitted to, the U.S. SEC at the U.S. SEC’s public reference rooms at 100 F Street, N.E., Washington, D.C. 20549 or at the other public reference rooms in New York, New York and Chicago, Illinois. Please call the U.S. SEC at 1-800-SEC-0330 for further information on public reference rooms. Filings with the U.S. SEC also are available to the public from commercial document-retrieval services and at the web site maintained by the U.S. SEC at http//www.sec.gov.

34

Forward-Looking Statements

This communication contains forward-looking information and statements about Daiichi and Sankyo and their combined businesses after completion of the joint stock transfer. Forward-looking statements are statements that are not historical facts. These statements include financial projections and estimates and their underlying assumptions, statements regarding plans, objectives and expectations with respect to future operations, products and services, and statements regarding future performance. Forward-looking statements are generally identified by the words “expects,” “anticipates,” “believes,” “intends,” “estimates” and similar expressions. Although the management of Daiichi and Sankyo believe that the expectations reflected in such forward-looking statements are reasonable, investors and holders of Daiichi and Sankyo securities are cautioned that forward-looking information and statements are subject to various risks and uncertainties, many of which are difficult to predict and generally beyond the control of Daiichi and Sankyo, that could cause actual results and developments to differ materially from those expressed in, or implied or projected by, the forward-looking information and statements. These risks and uncertainties include those discussed or identified in the public filings with the SEC and the local filings made by Daiichi and Sankyo, including those listed under “Cautionary Statement Concerning Forward-Looking Statements” and “Risk Factors” in the prospectus included in the registration statement on Form F-4 that Daiichi and Sankyo may file with the U.S. SEC. Other than as required by applicable law, neither Daiichi nor Sankyo undertakes any obligation to update or revise any forward-looking information or statements.