Exhibit 99.1 CONSOLIDATED FINANCIAL STATEMENTS December 31, 2016 and 2015 (U.S. dollars)

Page 2 Management’s Responsibility for Financial Reporting The consolidated financial statements of Polaris Materials Corporation have been prepared by and are the responsibility of the board of directors and management of the Company. The consolidated financial statements are prepared in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board and reflect management’s best estimates and judgement based on currently available information. Management has developed and maintains a system of internal controls to provide assurance, on a reasonable and cost effective basis, that the Company’s assets are safeguarded, transactions are authorized and financial information is accurate and reliable. The Audit Committee of the Board of Directors, consisting of three independent directors, meets periodically with management and the independent auditors to review the scope and results of the annual audit, and to review the financial statements and related financial reporting matters prior to submitting the financial statements to the Board for approval. The consolidated financial statements have been audited by the Company’s independent auditors, PricewaterhouseCoopers LLP, who are appointed by the shareholders. Their report outlines the scope of their audit and gives their opinion on the consolidated financial statements. “Ken Palko” Ken Palko President and Chief Executive Officer “Darren McDonald” Darren McDonald Vice President, Finance and Chief Financial Officer January 26, 2018

PricewaterhouseCoopers LLP PricewaterhouseCoopers Place, 250 Howe Street, Suite 1400, Vancouver, British Columbia, Canada V6C 3S7 T: +1 604 806 7000, F: +1 604 806 7806, www.pwc.com/ca “PwC” refers to PricewaterhouseCoopers LLP, an Ontario limited liability partnership. Report of Independent Auditors To the Shareholder of Polaris Materials Corporation We have audited the accompanying consolidated financial statements of Polaris Materials Corporation, which comprise the consolidated statements of financial position as of December 31, 2016 and December 31, 2015, and the related consolidated statements of income (loss), comprehensive loss, changes in equity and cash flows for the years then ended. Management's Responsibility for the consolidated Financial Statements Management is responsible for the preparation and fair presentation of the consolidated financial statements in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board; this includes the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of consolidated financial statements that are free from material misstatement, whether due to fraud or error. Auditors’ Responsibility Our responsibility is to express an opinion on the consolidated financial statements based on our audits. We conducted our audits in accordance with auditing standards generally accepted in the United States of America. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the consolidated financial statements are free from material misstatement. An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the consolidated financial statements. The procedures selected depend on our judgment, including the assessment of the risks of material misstatement of the consolidated financial statements, whether due to fraud or error. In making those risk assessments, we consider internal control relevant to the Company's preparation and fair presentation of the consolidated financial statements in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company's internal control. Accordingly, we express no such opinion. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluating the overall presentation of the consolidated financial statements. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion. Opinion In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of Polaris Materials Corporation as of December 31, 2016 and December 31, 2015, and the results of its operations and its cash flows for the years then ended in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board. /s/ PricewaterhouseCoopers LLP Vancouver, British Columbia January 26, 2018

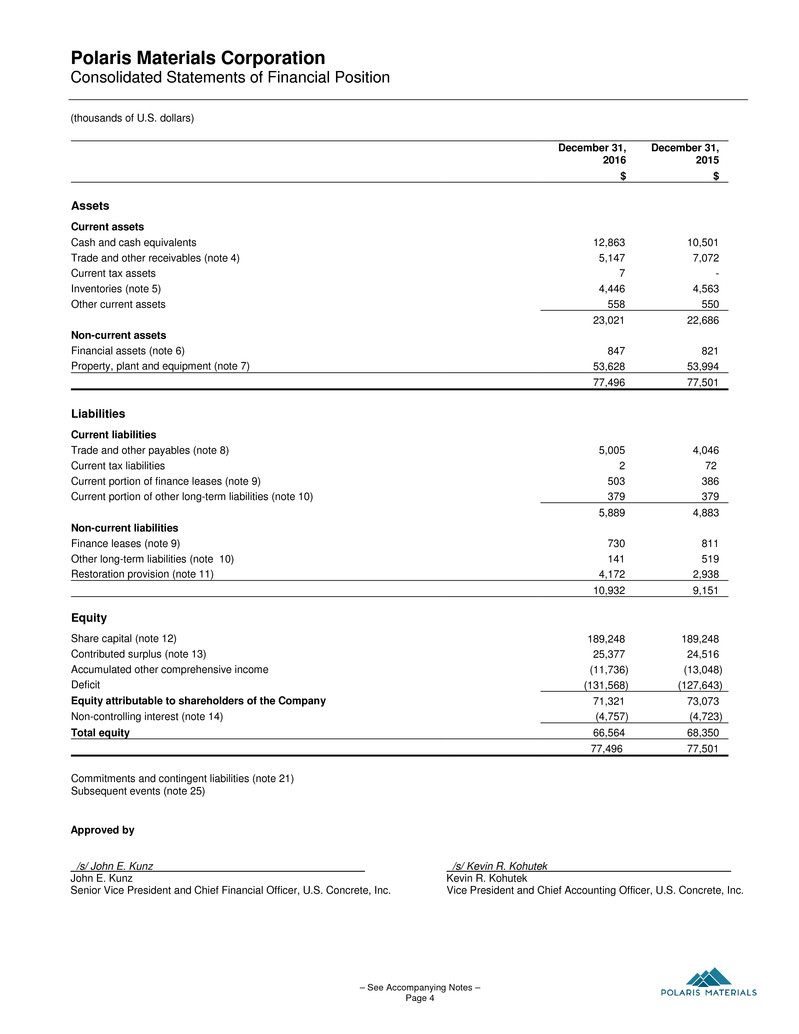

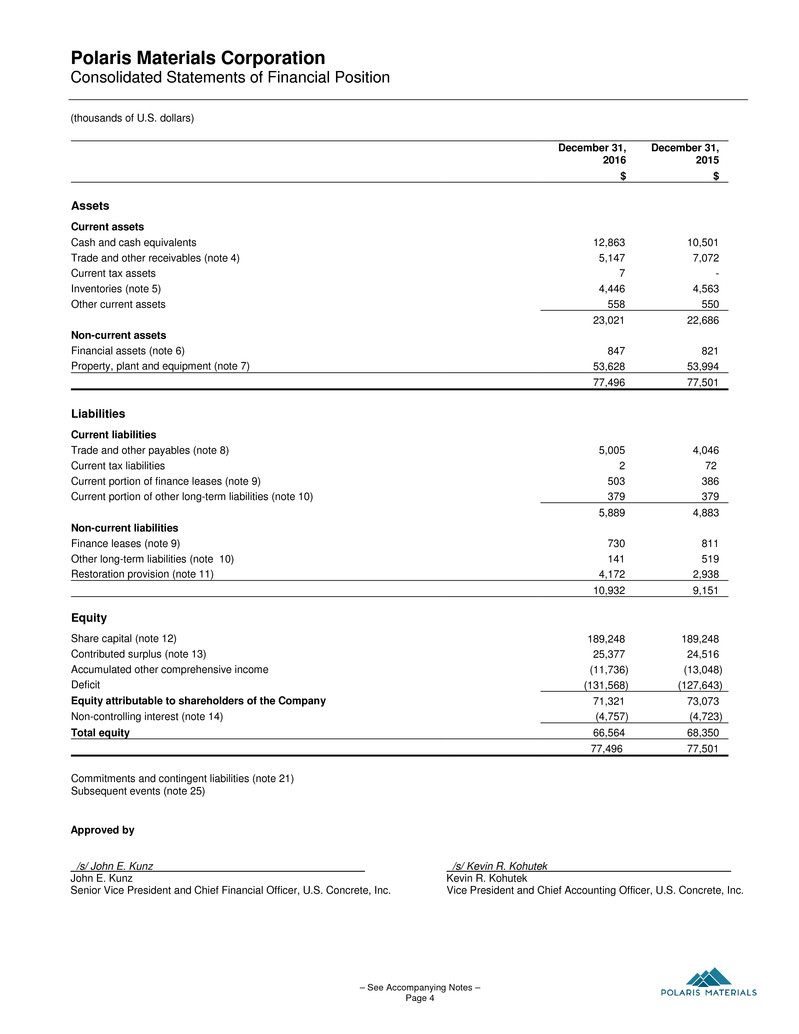

Polaris Materials Corporation Consolidated Statements of Financial Position (thousands of U.S. dollars) – See Accompanying Notes – Page 4 December 31, 2016 December 31, 2015 $ $ Assets Current assets Cash and cash equivalents 12,863 10,501 Trade and other receivables (note 4) 5,147 7,072 Current tax assets 7 - Inventories (note 5) 4,446 4,563 Other current assets 558 550 23,021 22,686 Non-current assets Financial assets (note 6) 847 821 Property, plant and equipment (note 7) 53,628 53,994 77,496 77,501 Liabilities Current liabilities Trade and other payables (note 8) 5,005 4,046 Current tax liabilities 2 72 Current portion of finance leases (note 9) 503 386 Current portion of other long-term liabilities (note 10) 379 379 5,889 4,883 Non-current liabilities Finance leases (note 9) 730 811 Other long-term liabilities (note 10) 141 519 Restoration provision (note 11) 4,172 2,938 10,932 9,151 Equity Share capital (note 12) 189,248 189,248 Contributed surplus (note 13) 25,377 24,516 Accumulated other comprehensive income (11,736) (13,048) Deficit (131,568) (127,643) Equity attributable to shareholders of the Company 71,321 73,073 Non-controlling interest (note 14) (4,757) (4,723) Total equity 66,564 68,350 77,496 77,501 Commitments and contingent liabilities (note 21) Subsequent events (note 25) Approved by /s/ John E. Kunz /s/ Kevin R. Kohutek John E. Kunz Kevin R. Kohutek Senior Vice President and Chief Financial Officer, U.S. Concrete, Inc. Vice President and Chief Accounting Officer, U.S. Concrete, Inc.

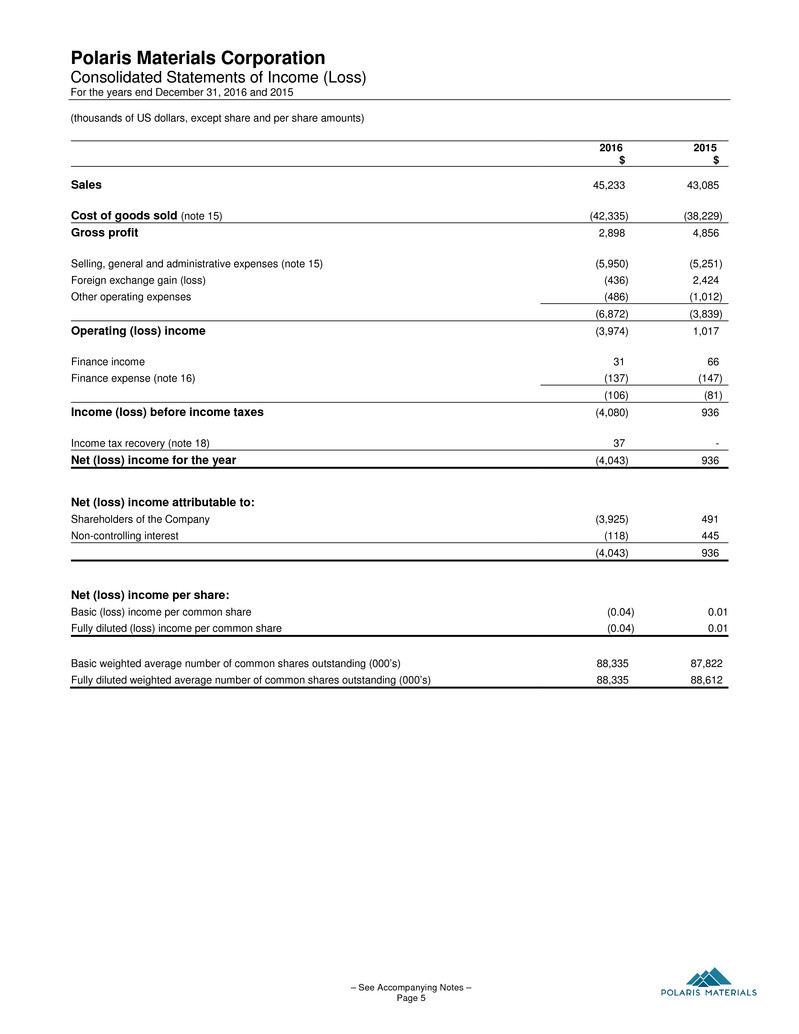

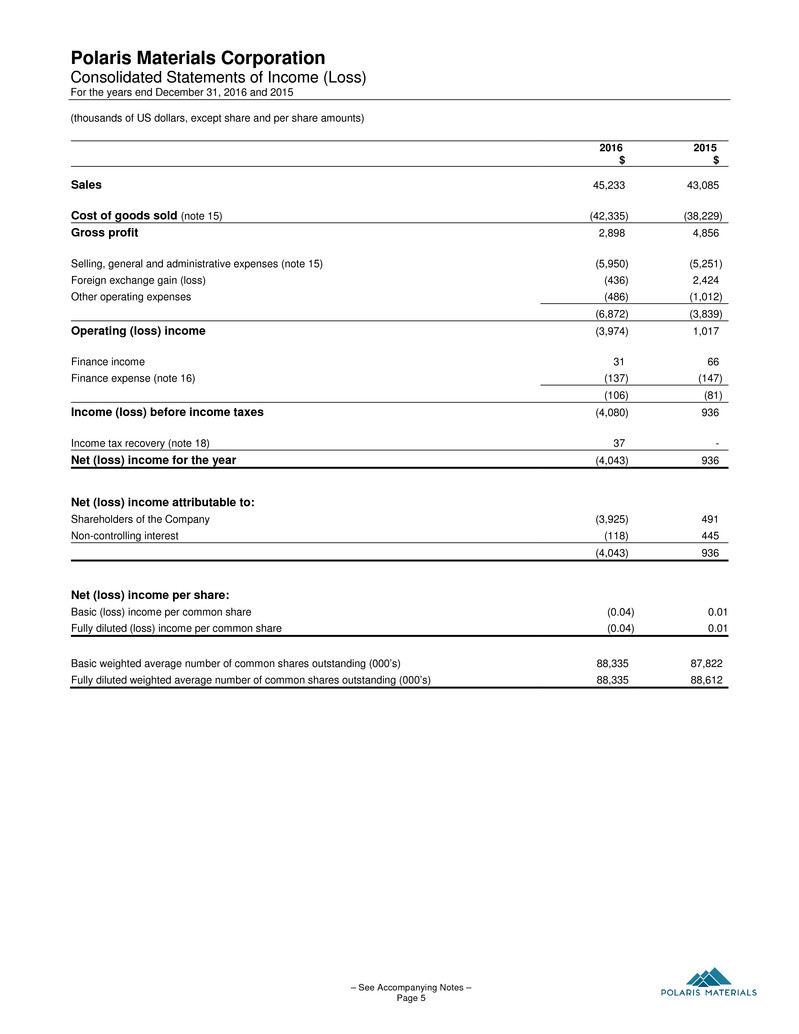

Polaris Materials Corporation Consolidated Statements of Income (Loss) For the years end December 31, 2016 and 2015 (thousands of US dollars, except share and per share amounts) – See Accompanying Notes – Page 5 2016 2015 $ $ Sales 45,233 43,085 Cost of goods sold (note 15) (42,335) (38,229) Gross profit 2,898 4,856 Selling, general and administrative expenses (note 15) (5,950) (5,251) Foreign exchange gain (loss) (436) 2,424 Other operating expenses (486) (1,012) (6,872) (3,839) Operating (loss) income (3,974) 1,017 Finance income 31 66 Finance expense (note 16) (137) (147) (106) (81) Income (loss) before income taxes (4,080) 936 Income tax recovery (note 18) 37 - Net (loss) income for the year (4,043) 936 Net (loss) income attributable to: Shareholders of the Company (3,925) 491 Non-controlling interest (118) 445 (4,043) 936 Net (loss) income per share: Basic (loss) income per common share (0.04) 0.01 Fully diluted (loss) income per common share (0.04) 0.01 Basic weighted average number of common shares outstanding (000’s) 88,335 87,822 Fully diluted weighted average number of common shares outstanding (000’s) 88,335 88,612

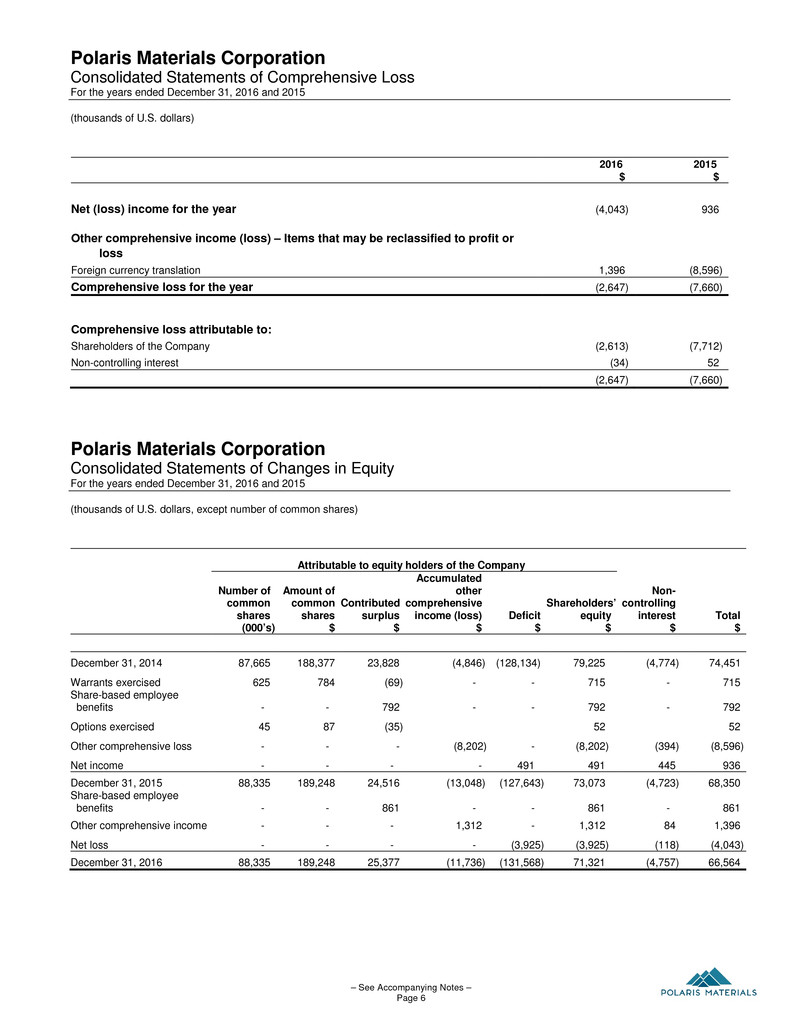

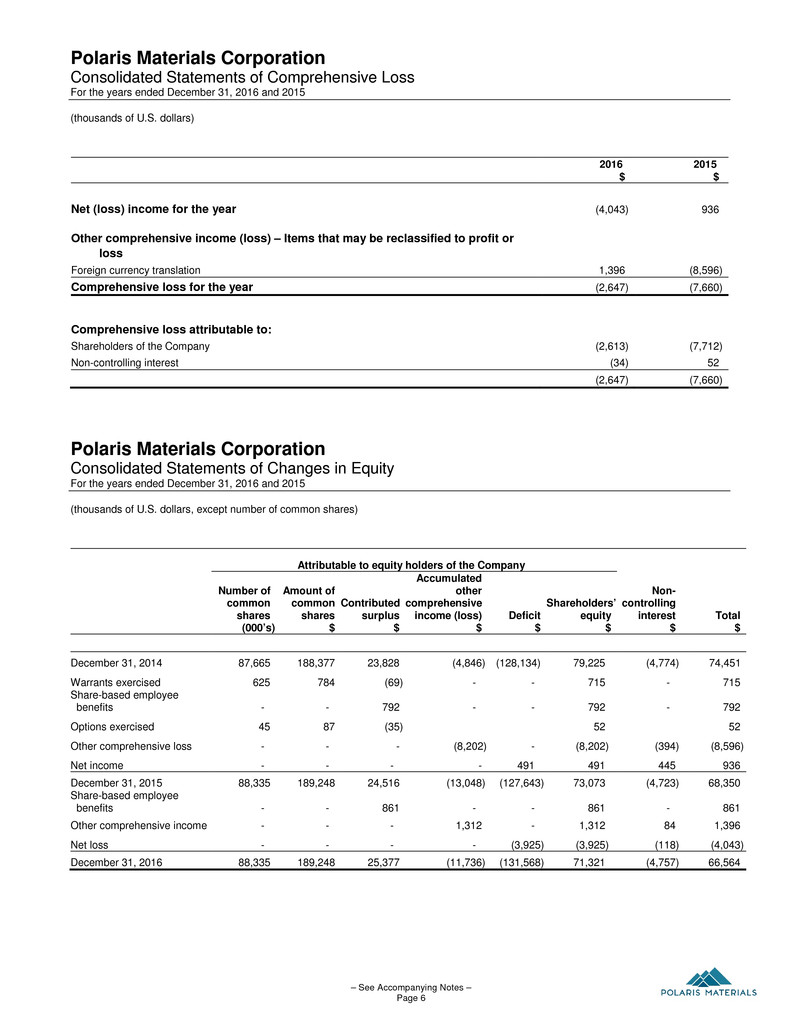

Polaris Materials Corporation Consolidated Statements of Comprehensive Loss For the years ended December 31, 2016 and 2015 (thousands of U.S. dollars) – See Accompanying Notes – Page 6 2016 2015 $ $ Net (loss) income for the year (4,043) 936 Other comprehensive income (loss) – Items that may be reclassified to profit or loss Foreign currency translation 1,396 (8,596) Comprehensive loss for the year (2,647) (7,660) Comprehensive loss attributable to: Shareholders of the Company (2,613) (7,712) Non-controlling interest (34) 52 (2,647) (7,660) Polaris Materials Corporation Consolidated Statements of Changes in Equity For the years ended December 31, 2016 and 2015 (thousands of U.S. dollars, except number of common shares) Attributable to equity holders of the Company Number of common shares (000’s) Amount of common shares $ Contributed surplus $ Accumulated other comprehensive income (loss) $ Deficit $ Shareholders’ equity $ Non- controlling interest $ Total $ December 31, 2014 87,665 188,377 23,828 (4,846) (128,134) 79,225 (4,774) 74,451 Warrants exercised 625 784 (69) - - 715 - 715 Share-based employee benefits - - 792 - - 792 - 792 Options exercised 45 87 (35) 52 52 Other comprehensive loss - - - (8,202) - (8,202) (394) (8,596) Net income - - - - 491 491 445 936 December 31, 2015 88,335 189,248 24,516 (13,048) (127,643) 73,073 (4,723) 68,350 Share-based employee benefits - - 861 - - 861 - 861 Other comprehensive income - - - 1,312 - 1,312 84 1,396 Net loss - - - - (3,925) (3,925) (118) (4,043) December 31, 2016 88,335 189,248 25,377 (11,736) (131,568) 71,321 (4,757) 66,564

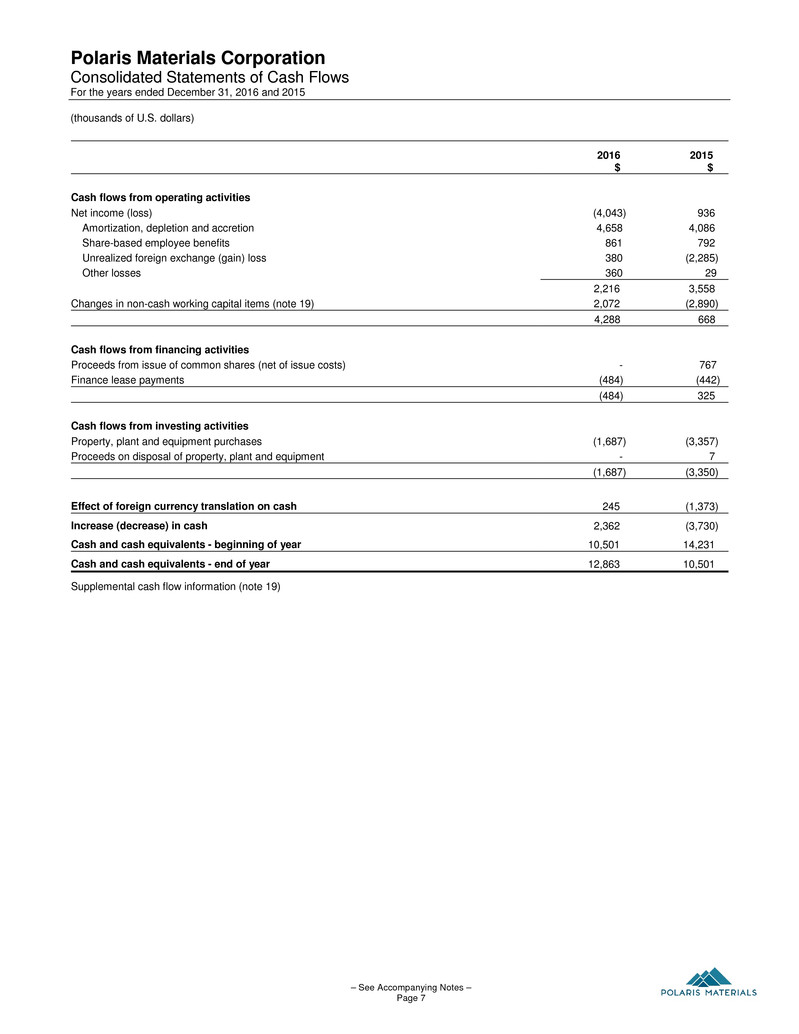

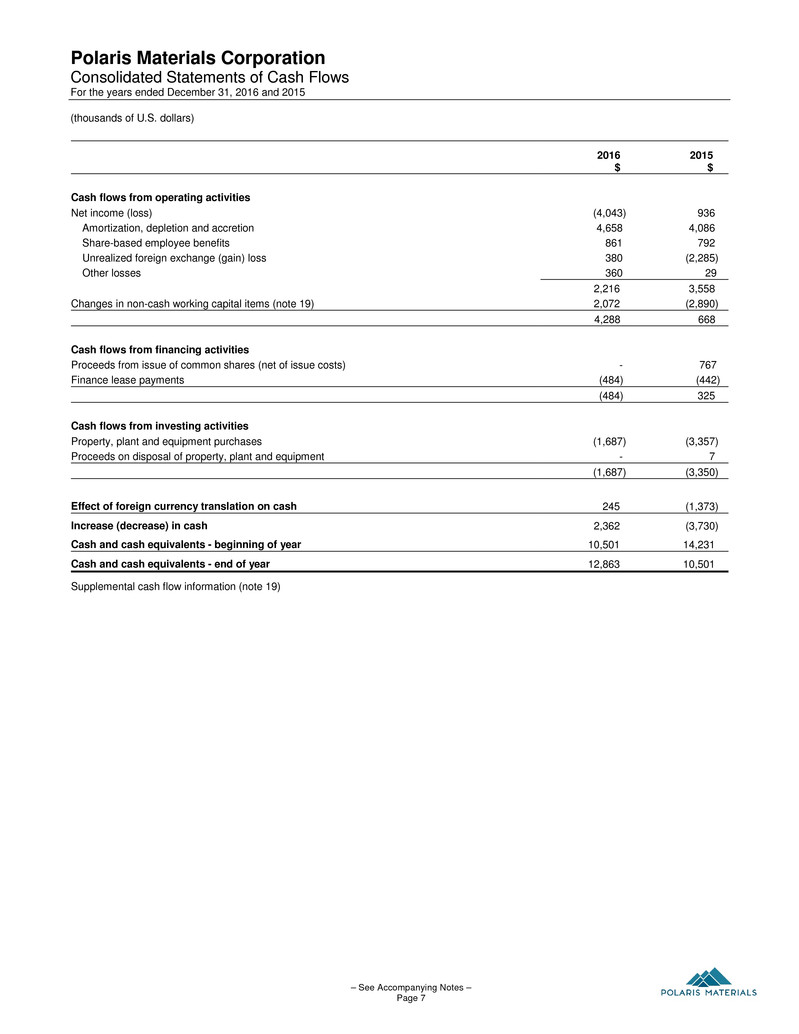

Polaris Materials Corporation Consolidated Statements of Cash Flows For the years ended December 31, 2016 and 2015 (thousands of U.S. dollars) – See Accompanying Notes – Page 7 2016 2015 $ $ Cash flows from operating activities Net income (loss) (4,043) 936 Amortization, depletion and accretion 4,658 4,086 Share-based employee benefits 861 792 Unrealized foreign exchange (gain) loss 380 (2,285) Other losses 360 29 2,216 3,558 Changes in non-cash working capital items (note 19) 2,072 (2,890) 4,288 668 Cash flows from financing activities Proceeds from issue of common shares (net of issue costs) - 767 Finance lease payments (484) (442) (484) 325 Cash flows from investing activities Property, plant and equipment purchases (1,687) (3,357) Proceeds on disposal of property, plant and equipment - 7 (1,687) (3,350) Effect of foreign currency translation on cash 245 (1,373) Increase (decrease) in cash 2,362 (3,730) Cash and cash equivalents - beginning of year 10,501 14,231 Cash and cash equivalents - end of year 12,863 10,501 Supplemental cash flow information (note 19)

Polaris Materials Corporation Notes to the Consolidated Financial Statements For the years ended December 31, 2016 and 2015 (U.S dollars, except where noted) Page 8 1. Nature and description of the Company Polaris Materials Corporation (“the Company”), was incorporated on May 14, 1999 and is both incorporated and domiciled in Canada. The address of the Company’s registered office is Suite 2740 - 1055 West Georgia Street, Vancouver, B.C., V6E 3R5. The Company’s focus is threefold: the production, distribution and sales of aggregates from the Orca Quarry; the development of new aggregate marine terminals along the west coast of North America; and the development of additional aggregate quarries. 2. Basis of preparation These consolidated financial statements have been prepared in compliance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board. The Company has consistently applied the same accounting policies in all periods presented. These financial statements were approved by those charged with governance for issue on January 26, 2018. 3. Summary of significant accounting policies Basis of measurement These financial statements have been prepared on a historical cost basis except for financial instruments classified as fair value through profit or loss, which are stated at their fair value. Principles of consolidation These consolidated financial statements include the financial statements of the Company and the entities controlled by the Company. Control is defined as the exposure, or rights, to variable returns from involvement with an investee and the ability to affect those returns through power over the investee. Power over an investee exists when the Company has existing rights that give it the ability to direct the activities that significantly affect the investee’s returns. The financial statements of subsidiaries are included in the consolidated financial statements from the date that control commences until the date that control ceases. Where necessary, adjustments are made to the financial statements of subsidiaries to bring their accounting policies into line with those of the Company. Inter-company balances and transactions, including any unrealized income and expenses arising from intercompany transactions, are eliminated in preparing the consolidated financial statements. The consolidated financial statements include the accounts of the Company and its subsidiaries (“Group”). The subsidiaries and the Company’s ownership interests therein, are as follows: Company Location Ownership interest Status Eagle Rock Materials Ltd. Canada 70 % Consolidated subsidiary Eagle Rock Aggregates, Inc. United States 70 % Consolidated subsidiary Quality Rock Holdings Ltd. Canada 100 % Consolidated subsidiary Polaris Aggregates Inc. United States 100 % Consolidated subsidiary Orca Sand & Gravel Limited Partnership Canada 88 % Consolidated subsidiary Orca Sand & Gravel Ltd. Canada 88 % Consolidated subsidiary Quality Sand & Gravel Ltd. Canada 100 % Consolidated subsidiary 1045016 BC Ltd. Canada 100 % Consolidated subsidiary Significant accounting judgments and estimates The preparation of financial statements requires management to use judgment in; applying its accounting policies, determining estimates, and making assumptions about the future. Estimates and other judgments are continuously evaluated and are based on management’s experience and other factors, including expectations about future events that are believed to be reasonable under the circumstances. The following discusses the most significant accounting judgments and estimates that the company has made in the preparation of the financial statements: (i) Determination of mineral reserves Reserves are estimates of the amount of product that can be economically and legally extracted from the Company’s properties. In order to estimate reserves, estimates are required about a range of geological, technical and economic factors, including quantities, production techniques, production costs, capital costs, transport costs, demand, prices and exchange rates. Estimating the quantity of reserves requires the size, shape and depth of deposits to be determined by analyzing geological data. This process may require

Polaris Materials Corporation Notes to the Consolidated Financial Statements For the years ended December 31, 2016 and 2015 (U.S dollars, except where noted) Page 9 3. Significant accounting policies (continued) complex and difficult geological judgments to interpret the data. Changes in estimates of proven and probable reserves may impact the carrying value of property, plant and equipment, restoration provisions, recognition of deferred tax amounts and depreciation, depletion and amortization. (ii) Asset values and impairment charges If the recoverable amount of an asset or cash-generating unit is estimated to be less than its carrying amount, the carrying amount of the asset or cash-generating unit is reduced to its recoverable amount. An impairment loss is recognized immediately in the statement of income (loss). When necessary, management’s determination of recoverable amounts include estimates of sales volumes and prices, costs of disposal, recoverable reserves, operating costs and capital costs. Although management makes its best estimate of these factors, it is possible that changes could occur that could adversely affect management’s estimate of the net cash flow to be generated from its assets or cash-generating units. For quarrying property interests the Company considers both external and internal sources of information in assessing whether there are any indications of impairment. External sources of information the Company considers include changes in the market, economic and legal environment in which the Company operates that are not within its control and affect the recoverable amount of quarrying property interests. Internal sources of information the Company considers include indications of economic performance of the assets. In determining the recoverable amounts of the Company’s quarrying property interests, the Company’s management makes estimates of the discounted future after-tax cash flows expected to be derived from the Company’s properties, costs of disposal of the quarrying properties and the appropriate discount rate. Reductions in price forecasts, increases in estimated future costs of production, increases in estimated future non-expansionary capital expenditures, reductions in the amount of recoverable reserves and resources, and/or adverse current economics may result in a write-down of the carrying amounts of the Company’s quarrying interests. (iii) Estimated Reclamation and Closure Costs The Company’s provision for reclamation and closure cost obligations represents management’s best estimate of the present value of the future cash outflows required to settle the liability which reflects estimates of future costs, inflation, assumptions about risks associated with the future cash outflows, and the applicable risk-free interest rates for discounting the future cash outflows. Changes in the above factors may result in a change to the provision recognized by the Company. Changes to reclamation and closure cost obligations are recorded with a corresponding change to the carrying amounts of related quarrying properties. Adjustments to the carrying amounts of related quarrying properties result in a change to future depletion expense. Foreign currency translation The Company’s presentation currency is the United States dollar (“US dollar”). The functional currency of the Company and for each subsidiary of the Company is the currency of the primary economic environment in which it operates. The functional currency of aggregate sales and terminal operations is the US dollar. The Company translates non-US dollar balances for these operations into US dollars as follows: (i) Property, plant and equipment using historical rates; (ii) Other assets and liabilities using the closing exchange rate as at the balance sheet date with translation gains and losses recorded in net income for the period; and (iii) Income and expenses using the average exchange rate for the period, except for expenses that relate to nonmonetary assets and liabilities measured at historical cost The functional currency of the quarrying operations and the corporate head office is the Canadian dollar. The Company translates these operations into US dollars as follows: (i) Assets and liabilities using the closing exchange rate as at the balance sheet date with translation gains and losses recorded in other comprehensive income; and (ii) Income and expenses using the average exchange rate for the period with translation gains and losses recorded in other comprehensive income Inventories Construction aggregates inventory is stated at the lower of cost and net realizable value. Cost for construction aggregates inventory is determined on an average cost basis. Such costs include fuel, freight in, depreciation, depletion, repair parts and supplies, raw materials, direct labour and production overhead. Consumable supplies are stated at the lower of cost and net realizable value. Costs for consumable supplies are determined on a first-in, first-out basis. When inventories have been written down to net realizable value (“NRV”), the Company makes a new assessment of NRV in each subsequent period. If the circumstances that caused the write-down no longer exist, the remaining amount of the write-down is reversed.

Polaris Materials Corporation Notes to the Consolidated Financial Statements For the years ended December 31, 2016 and 2015 (U.S dollars, except where noted) Page 10 3. Significant accounting policies (continued) Property, plant and equipment Expenditures incurred to develop new aggregate properties or marine receiving terminals are capitalized. Costs are written down to the recoverable amount if impaired, or written off if the property or interest is sold, allowed to lapse or abandoned. The Company capitalizes exploration and evaluation expenditures as a component of property, plant and equipment once the legal right to explore new aggregate properties has been acquired. Exploration expenditures relate to the initial search for deposits with economic potential and to detailed assessments of deposits or other projects that have been identified as having economic potential. Once an economically viable reserve has been determined for an area and the decision to proceed with development has been approved, exploration and evaluation assets attributable to that area are first tested for impairment and then reclassified to development costs within property, plant and equipment. Management assesses exploration and evaluation assets for impairment at each reporting date when facts and circumstances suggest that the carrying amount may exceed its recoverable amount. Exploration and evaluation expenditures are recorded at cost less accumulated impairment losses. Developed property, plant and equipment are carried at cost less accumulated depreciation and depletion and accumulated impairment. Capitalized costs for quarries are depleted using a unit of production method over the estimated economic life of the quarry to which they relate following the commencement of operations. Capitalized costs for marine receiving terminals are amortized over the useful lives of the assets following the commencement of operations. Depreciation of production related assets is included in cost of goods sold. Property, plant and equipment is depreciated or depleted over its estimated useful life using the following rates: Quarry property costs Units of production Property, plant & equipment 3 to 25 years Equipment under finance lease 3 to 10 years Office equipment 3 to 10 years Leasehold improvements Life of lease The cost of equipment held under finance leases is equal to the lower of the net present value of the minimum lease payments or the fair value of the leased asset at the inception of the lease and is amortized over the term of the lease, except when there is reasonable certainty that the leased assets will be purchased at the end of the lease, in which case they are amortized over the estimated useful life. Equipment is derecognized upon disposal or when no future economic benefits are expected to arise from the continued use of the asset. Any gain or loss arising on disposal of the asset, determined as the difference between the net disposal proceeds and the carrying amount of the asset, is recognized in statement of income (loss). Where an item of plant and equipment comprises significant components with different useful lives, the components are accounted for as separate items of plant and equipment. Expenditures incurred to replace a component of an item of property, plant and equipment that is accounted for separately, including major inspection and overhaul expenditures are capitalized. Useful lives, residual values and depreciation methods are reassessed annually for all property, plant and equipment with the impact of any changes in estimate accounted for on a prospective basis. Impairment of long-lived assets At each financial position reporting date the carrying amounts of the Company’s assets are reviewed to determine whether there is any indication that those assets are impaired. If any such indication exists, the recoverable amount of the asset is estimated in order to determine the extent of the impairment, if any. The recoverable amount is the higher of fair value less costs of disposal and the value in use. Fair value is determined as the amount that would be obtained from the sale of the asset in an arm’s length transaction between knowledgeable and willing parties. In assessing value in use, the estimated future cash flows are discounted to their present value using a pre-tax discount rate that reflects current market assessments of the time value of money and the risks specific to the asset. Future cash flows are based on expected future production, estimated aggregate prices, and estimated operating, capital, and reclamation costs. Assumptions underlying future cash flow estimates are subject to risks and uncertainties. Any differences between significant assumptions used and actual market conditions and/or the Company’s performance could have a material effect on the Company’s financial position and results of operations. If the recoverable amount of an asset is estimated to be less than its carrying amount, the carrying amount of the asset is reduced to its recoverable amount and the impairment loss is recognized in the statement of income (loss) for the period. For the purposes of impairment testing, exploration and evaluation assets are allocated to cash-generating units to which the exploration activity relates. For an asset that

Polaris Materials Corporation Notes to the Consolidated Financial Statements For the years ended December 31, 2016 and 2015 (U.S dollars, except where noted) Page 11 3. Significant accounting policies (continued) does not generate largely independent cash inflows, the recoverable amount is determined for the cash generating unit to which the asset belongs. Where an impairment loss subsequently reverses, the carrying amount of the asset (or cash-generating unit) is increased to the revised estimate of its recoverable amount, but so that the increased carrying amount does not exceed the carrying amount that would have been determined had no impairment loss been recognized for the asset (or cash-generating unit) in prior years. A reversal of an impairment loss is recognized immediately in the statement of income (loss). Restoration Provisions The Company recognizes liabilities for statutory, contractual, legal or constructive obligations associated with the retirement of property, plant and equipment. The Company records the present value of any environmental rehabilitation and decommissioning costs as a long- term liability in the period in which the related environmental disturbance occurs, based on the net present value of the estimated future costs that are required by current legal and regulatory requirements. Discount rates using a pre-tax rate that reflect the time value of money and the risks specific to the obligation are used to calculate the net present value. The net present value of future rehabilitation cost estimates arising from the decommissioning of plant and other site work is capitalized to quarrying assets along with a corresponding increase in the rehabilitation provision in the period incurred. The rehabilitation asset is depreciated on the same basis as quarrying assets. The liability is accreted over time through periodic charges to profit or loss and it is reduced by actual costs of decommissioning and reclamation. The obligation is adjusted at the end of each fiscal period to reflect the passage of time and changes in the estimated future costs underlying the obligation. Provisions Provisions are recorded when a present legal or constructive obligation exists as a result of past events where it is probable that an outflow of resources embodying economic benefits will be required to settle the obligation, and a reliable estimate of the amount of the obligation can be made. Share based payments The Company applies the fair value method of accounting for all stock option awards to employees and others providing similar services. Under this method the Company recognizes a compensation expense for all share options awarded based on the fair value of the options on the date of grant. The fair value is determined by using a Black-Scholes option pricing model. The fair value of all share options granted, and estimated to eventually vest, is recorded, over the vesting period, as a charge to the statement of income (loss) and a credit to contributed surplus. At the end of each reporting period, the Company revises its estimate of the number of equity instruments expected to vest. The impact of the revision of original estimates, if any, is charged to the statement of income (loss) such that the cumulative expense reflects the revised estimate, with a corresponding adjustment to contributed surplus. Consideration paid on exercise of share options in addition to the fair value attributed to stock options granted is credited to share capital. The Company established a deferred share unit (“DSU”) plan that allows directors to receive incentive compensation in the form of deferred share units. DSUs may only be exercised when the holder ceases to be a director. Directors receive common shares upon exercise of a DSU. Vesting terms of the DSUs are established by the directors at the time the DSUs are granted. Income taxes Income tax on the profit or loss for the periods presented comprises current and deferred tax. Income tax is recognized in the statement of income (loss) except to the extent that it relates to items recognized directly in equity, in which case it is recognized in equity. Current income taxes are calculated based on taxable income for the current year at enacted or substantially enacted statutory tax rates. Deferred income taxes are calculated using the liability method of accounting. Temporary differences arising from the difference between the tax basis of an asset or liability and its carrying amount on the balance sheet are used to calculate deferred income tax liabilities or assets. Deferred income tax assets and liabilities are measured using enacted or substantially enacted tax rates and laws that are expected to apply when the temporary differences are expected to reverse. Deferred income tax assets are recognized only to the extent that it is probable that future taxable profits will be available against which the asset can be utilized.

Polaris Materials Corporation Notes to the Consolidated Financial Statements For the years ended December 31, 2016 and 2015 (U.S dollars, except where noted) Page 12 3. Significant accounting policies (continued) Deferred tax assets or liabilities are not recorded for temporary differences arising from the initial recognition of assets or liabilities that affect neither accounting nor taxable profit at the time of the transaction; and differences relating to investments in subsidiaries to the extent that it is not probable that they will reverse in the foreseeable future. Deferred tax assets and liabilities are offset when there is a legally enforceable right to set off current tax assets against current tax liabilities and when they relate to income taxes levied by the same taxation authority and the Company intends to settle its current tax assets and liabilities on a net basis. Financial instruments All financial assets are initially recorded at fair value and designated upon inception into one of the following four categories: i. Held to maturity - measured at amortized cost. ii. Available-for-sale - measured at fair value. iii. Loans and receivables - measured at amortized cost. iv. Fair-value-through-profit-or-loss (“FVTPL”) - measured at fair value with gains and losses recognized through statement of income (loss). Financial assets classified as available-for-sale are measured at fair value with gains and losses recognized in other comprehensive income (loss) except for impairment losses. Interest calculated using the effective interest method and foreign exchange gains and losses on monetary items, will be recognised in profit and loss. Transaction costs associated with FVTPL financial assets are expensed as incurred, while transaction costs associated with all other financial assets are included in the initial carrying amount of the asset. Cash and cash equivalents, trade and other receivables and security deposits are designated as loans and receivables. All financial liabilities are initially recorded at fair value and designated upon inception as FVTPL or other financial liabilities. Financial liabilities classified as other financial liabilities are initially recognized at fair value less directly attributable transaction costs. After initial recognition, other financial liabilities are subsequently measured at amortized cost using the effective interest rate method. The effective interest rate method is a method of calculating the amortized cost of a financial liability and of allocating interest expense over the relevant period. The effective interest rate is the rate that discounts estimated future cash payments through the expected life of the financial liability. The Company’s trade and other payables are classified as other financial liabilities. Revenue recognition Revenue from the sale of construction aggregates, net of any discounts, is recognized on the sale of products at the time the Company has transferred to the buyer the significant risks and rewards of ownership; the Company retains neither continuing managerial involvement to the degree usually associated with ownership nor effective control over the goods sold; the amount of revenue can be measured reliability; it is probable that the economic benefits associated with the transaction will flow to the entity; and the costs incurred or to be incurred in respect of the transaction can be measured reliably. Earnings per share Earnings per share are calculated using the weighted average number of common shares outstanding during the year. The calculation of diluted earnings per share assumes that outstanding in the money options and warrants are exercised and the proceeds are used to repurchase shares of the Company at the average market price of the shares for the period. The effect is to increase the number of shares used to calculate diluted earnings per share and is only recognized when the effect is dilutive. Accounting standards and amendments issued but not yet adopted (i) IFRS 9, Financial Instruments addresses classification and measurement of financial instruments and provides guidance on hedge accounting. For financial assets, it replaces the multiple category and measurement models in IAS 39, Financial Instruments – Recognition and Measurement for debt instruments with a new mixed measurement model having only two categories: amortized cost and fair value through profit or loss. IFRS 9 also replaces the models for measuring equity instruments. Such instruments are either recognized at fair value through profit or loss or at fair value through other comprehensive income. Where equity instruments are measured at fair value through other comprehensive income, dividends are recognized in profit or loss to the extent that they do not clearly represent a return of investment; however, other gains and losses (including impairments) associated with such instruments remain in accumulated comprehensive income indefinitely. Requirements for financial liabilities largely carry forward existing requirements in IAS 39 except that fair value changes due to credit risk for liabilities designated at fair value through profit

Polaris Materials Corporation Notes to the Consolidated Financial Statements For the years ended December 31, 2016 and 2015 (U.S dollars, except where noted) Page 13 3. Significant accounting policies (continued) (i) and loss are generally recorded in other comprehensive income. IFRS 9 is effective for annual periods beginning on or after January 1, 2018. The Company is currently assessing the effect of this standard on its financial statements. (ii) IFRS 15, Revenue from Contracts with Customers (IFRS 15), replaces IAS 18, Revenue and IAS 11, Construction Contracts and the related interpretations on revenue recognition. The new revenue standard introduces a single, principles based, five-step model for the recognition of revenue when control of a good or service is transferred to the customer. The five steps are; identify the contract(s) with the customer, identify the performance obligations in the contract, determine transaction price, allocate the transaction price and recognize revenue when the performance obligation is satisfied. IFRS 15 also requires enhanced disclosures about revenue to help investors better understand the nature, amount, timing and uncertainty of revenue and cash flows from contracts with customers and improves the comparability of revenue from contracts with customers. IFRS 15 will be effective for annual periods beginning on or after January 1, 2018. The Company is currently assessing the effect of this standard on its financial statements. (iii) In January 2016, the IASB issued IFRS 16 “Leases” (“IFRS 16”). This standard is effective for annual periods beginning on or after January 1, 2019, and permits early adoption, provided IFRS 15, has been applied, or is applied at the same date as IFRS 16. IFRS 16 requires lessees to recognize assets and liabilities for most leases. The Company is in the process of determining the impact of IFRS 16 on its consolidated financial statements.

Polaris Materials Corporation Notes to the Consolidated Financial Statements For the years ended December 31, 2016 and 2015 (U.S dollars, except where noted) Page 14 4. Trade and other receivables December 31, 2016 December 31, 2015 (in thousands) $ $ Trade receivables 5,115 7,029 Accrued interest 3 1 Other taxes receivable 28 37 Other receivables 1 5 5,147 7,072 On December 21, 2016 the Company entered into a factoring agreement with Bank of America (“BOA”) and one of the Company’s main customers which allows the Company to factor the trade receivables from this customer. At the time of factoring, the Company has transferred to BOA the risks and reward of ownership and the receivables are considered to be settled. 5. Inventories December 31, 2016 December 31, 2015 (in thousands) $ $ Construction aggregates 4,084 4,046 Components and consumable supplies 362 517 4,446 4,563 6. Financial assets December 31, 2016 December 31, 2015 (in thousands) $ $ Loans and receivables measured at amortized cost: Orca quarry security deposits 847 821 Total financial assets 847 821 Orca Quarry security deposits The Company maintains CAD$1,137,524 (December 31, 2015 - CAD$1,136,310) in interest-bearing term deposits for safekeeping agreements required by reclamation and remediation performance bonds on the Orca Quarry. The deposits are automatically renewed each year until returned to the Company upon completion of the performance bond, as such, their carrying value approximates fair value. As at December 31, 2016, deposits earn interest at a rate of 0.05% to 0.83% (December 31, 2015 - 0.05% to 0.85%).

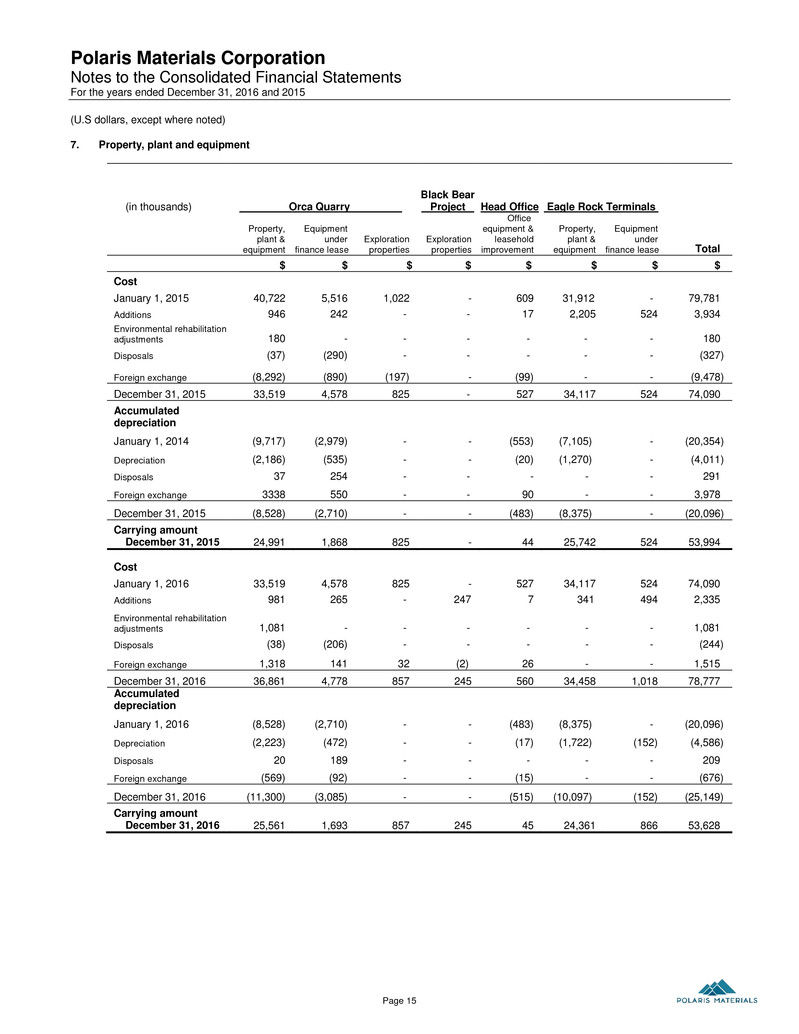

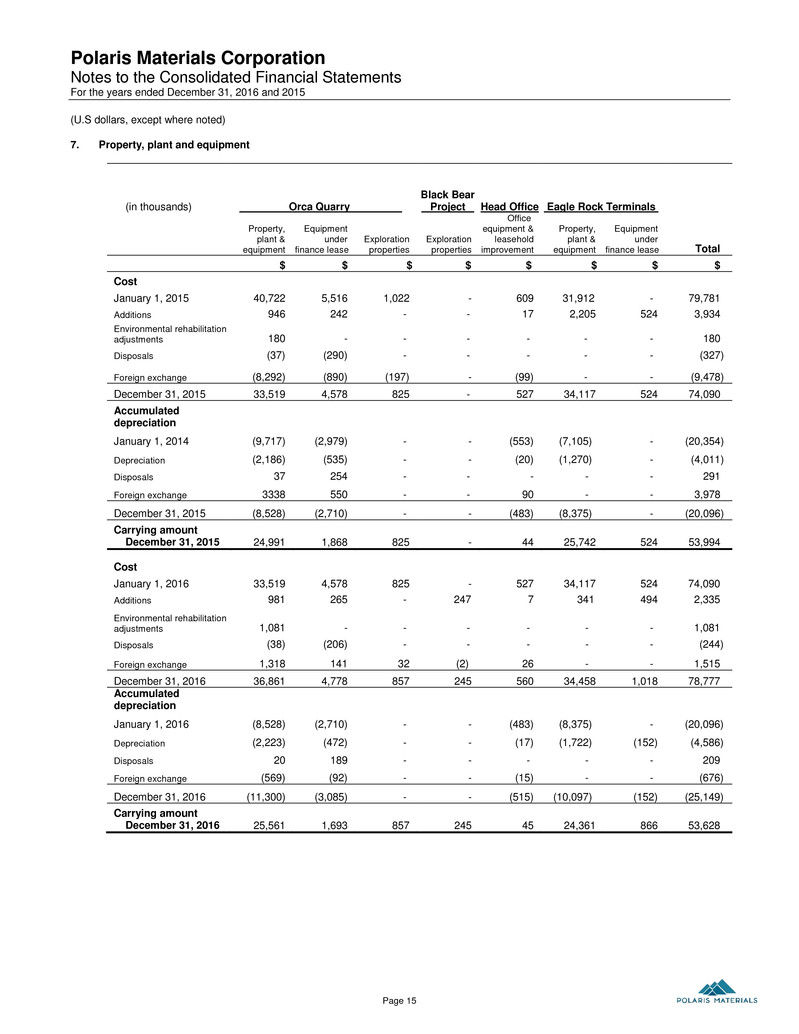

Polaris Materials Corporation Notes to the Consolidated Financial Statements For the years ended December 31, 2016 and 2015 (U.S dollars, except where noted) Page 15 7. Property, plant and equipment (in thousands) Orca Quarry y Black Bear Project l Head Office Eagle Rock Terminals t Property, plant & equipment Equipment under finance lease Exploration properties Exploration properties Office equipment & leasehold improvement Property, plant & equipment Equipment under finance lease Total $ $ $ $ $ $ $ $ Cost January 1, 2015 40,722 5,516 1,022 - 609 31,912 - 79,781 Additions 946 242 - - 17 2,205 524 3,934 Environmental rehabilitation adjustments 180 - - - - - - 180 Disposals (37) (290) - - - - - (327) Foreign exchange (8,292) (890) (197) - (99) - - (9,478) December 31, 2015 33,519 4,578 825 - 527 34,117 524 74,090 Accumulated depreciation January 1, 2014 (9,717) (2,979) - - (553) (7,105) - (20,354) Depreciation (2,186) (535) - - (20) (1,270) - (4,011) Disposals 37 254 - - - - - 291 Foreign exchange 3338 550 - - 90 - - 3,978 December 31, 2015 (8,528) (2,710) - - (483) (8,375) - (20,096) Carrying amount December 31, 2015 24,991 1,868 825 - 44 25,742 524 53,994 Cost January 1, 2016 33,519 4,578 825 - 527 34,117 524 74,090 Additions 981 265 - 247 7 341 494 2,335 Environmental rehabilitation adjustments 1,081 - - - - - - 1,081 Disposals (38) (206) - - - - - (244) Foreign exchange 1,318 141 32 (2) 26 - - 1,515 December 31, 2016 36,861 4,778 857 245 560 34,458 1,018 78,777 Accumulated depreciation January 1, 2016 (8,528) (2,710) - - (483) (8,375) - (20,096) Depreciation (2,223) (472) - - (17) (1,722) (152) (4,586) Disposals 20 189 - - - - - 209 Foreign exchange (569) (92) - - (15) - - (676) December 31, 2016 (11,300) (3,085) - - (515) (10,097) (152) (25,149) Carrying amount December 31, 2016 25,561 1,693 857 245 45 24,361 866 53,628

Polaris Materials Corporation Notes to the Consolidated Financial Statements For the years ended December 31, 2016 and 2015 (U.S dollars, except where noted) Page 16 8. Trade and other payables December 31, 2016 December 31, 2015 (in thousands) $ $ Trade payables 2,950 1,820 Accrued liabilities 705 941 Royalties 750 825 Community benefit fund 600 460 5,005 4,046 9. Finance leases Included in property, plant and equipment is quarrying and terminal equipment that the Company has acquired pursuant to lease agreements. The Company’s lease agreements terminate between October 2017 and May 2020. The equipment is the security for the indebtedness. In April 2016 the Company financed $493,000 for a lease on terminal equipment at 0.00% interest. The new lease has been accounted for as finance leases and terminates March 2020. Monthly lease payments are $10,285. The equipment is the security for the indebtedness. Future minimum lease payments are as follows: (in thousands) $ 2017 530 2018 506 2019 194 2020 41 Total minimum lease payments 1,271 Less: Interest portion 38 Present value of capital lease obligations 1,233 Less: current portion 503 Non-current portion 730 10. Other long-term liabilities In 2013 Eagle Rock Aggregates (“ERA”) received a payment demand, including penalties, for property tax dating back to 2008. The Company was successful in renegotiating a reduction of the amount claimed and favourable payment terms. During 2016 a payment was made reducing the liability by $379,000. The liability at December 31, 2016 of $519,000 consists of two remaining annual installments. Of this amount $141,000 has been classified as a long-term liability based on the agreement with the County.

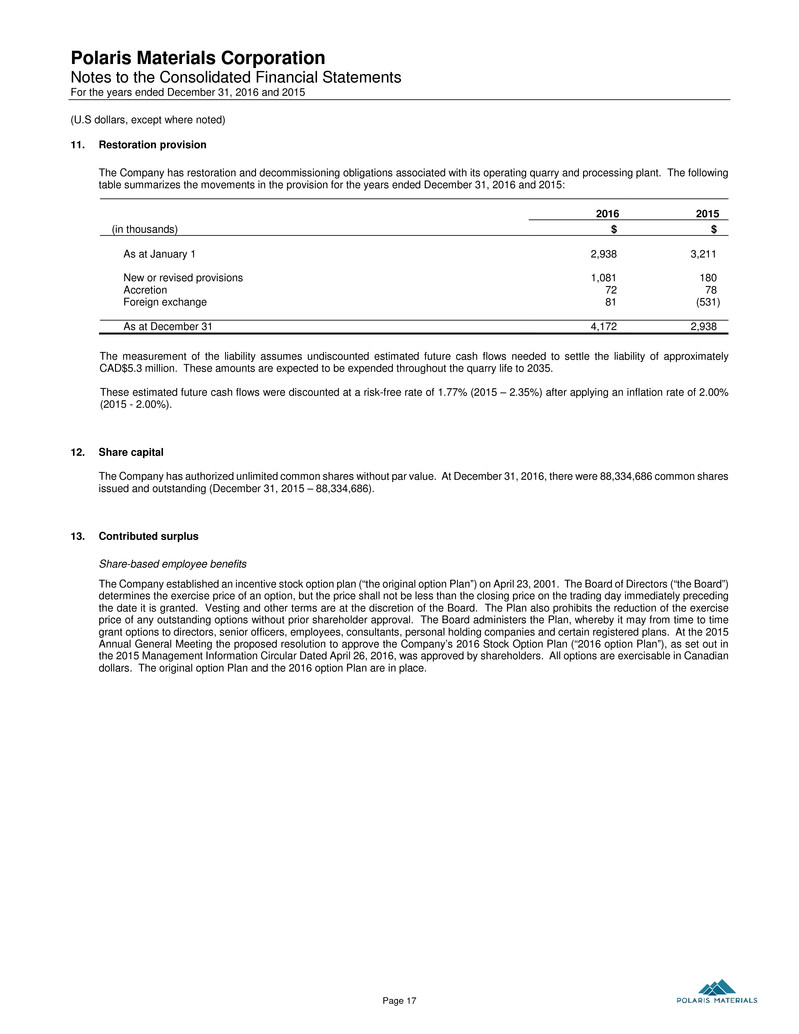

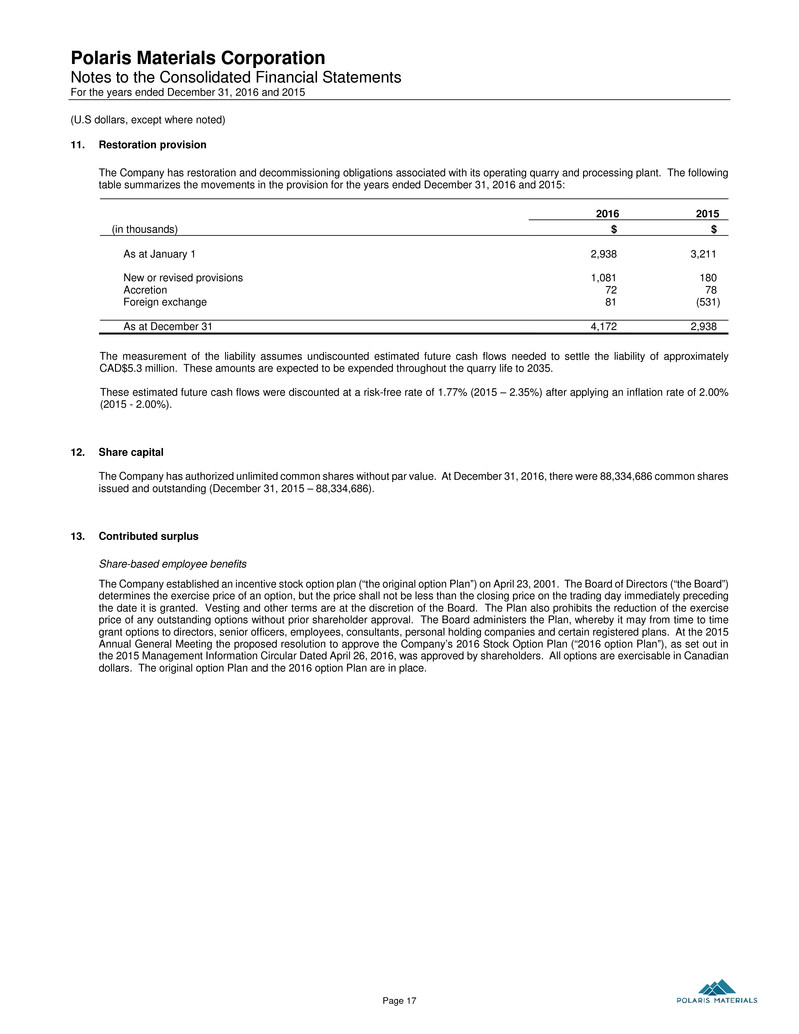

Polaris Materials Corporation Notes to the Consolidated Financial Statements For the years ended December 31, 2016 and 2015 (U.S dollars, except where noted) Page 17 11. Restoration provision The Company has restoration and decommissioning obligations associated with its operating quarry and processing plant. The following table summarizes the movements in the provision for the years ended December 31, 2016 and 2015: 2016 2015 (in thousands) $ $ As at January 1 2,938 3,211 New or revised provisions 1,081 180 Accretion 72 78 Foreign exchange 81 (531) As at December 31 4,172 2,938 The measurement of the liability assumes undiscounted estimated future cash flows needed to settle the liability of approximately CAD$5.3 million. These amounts are expected to be expended throughout the quarry life to 2035. These estimated future cash flows were discounted at a risk-free rate of 1.77% (2015 – 2.35%) after applying an inflation rate of 2.00% (2015 - 2.00%). 12. Share capital The Company has authorized unlimited common shares without par value. At December 31, 2016, there were 88,334,686 common shares issued and outstanding (December 31, 2015 – 88,334,686). 13. Contributed surplus Share-based employee benefits The Company established an incentive stock option plan (“the original option Plan”) on April 23, 2001. The Board of Directors (“the Board”) determines the exercise price of an option, but the price shall not be less than the closing price on the trading day immediately preceding the date it is granted. Vesting and other terms are at the discretion of the Board. The Plan also prohibits the reduction of the exercise price of any outstanding options without prior shareholder approval. The Board administers the Plan, whereby it may from time to time grant options to directors, senior officers, employees, consultants, personal holding companies and certain registered plans. At the 2015 Annual General Meeting the proposed resolution to approve the Company’s 2016 Stock Option Plan (“2016 option Plan”), as set out in the 2015 Management Information Circular Dated April 26, 2016, was approved by shareholders. All options are exercisable in Canadian dollars. The original option Plan and the 2016 option Plan are in place.

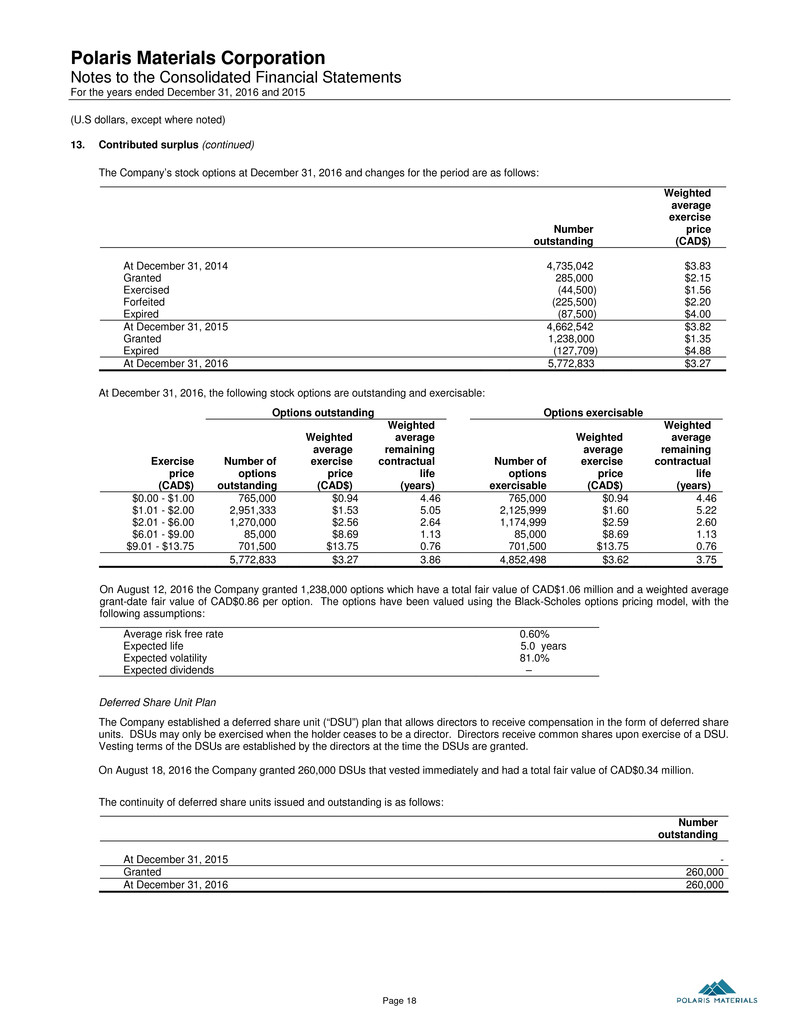

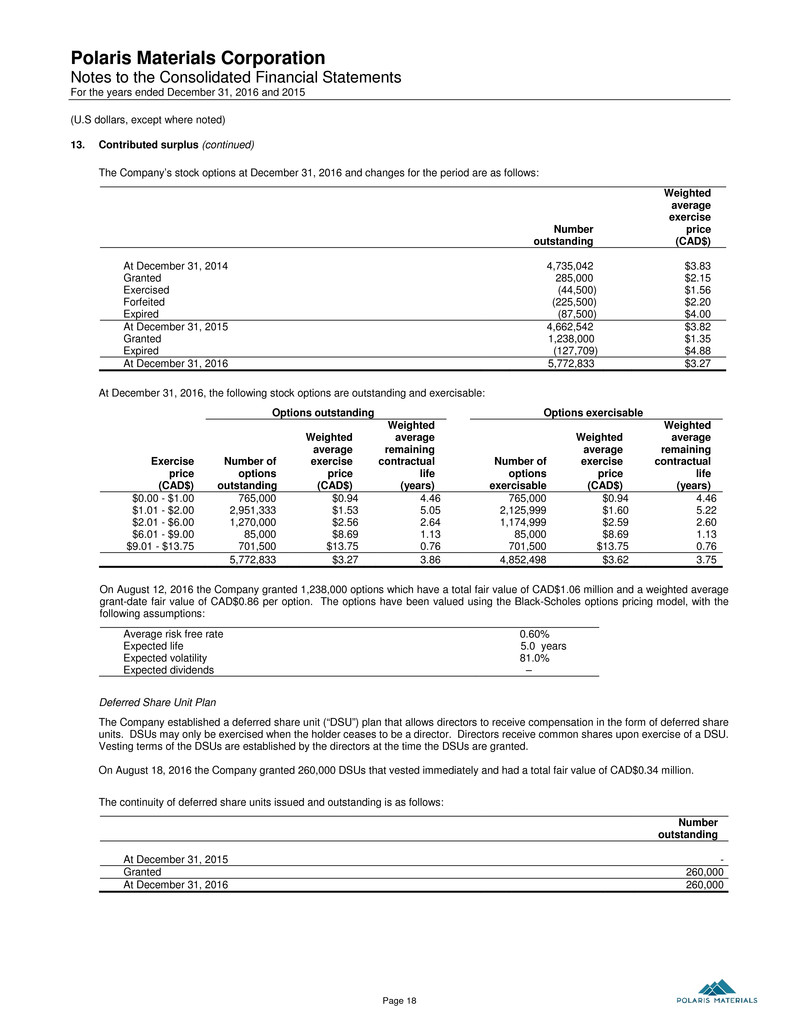

Polaris Materials Corporation Notes to the Consolidated Financial Statements For the years ended December 31, 2016 and 2015 (U.S dollars, except where noted) Page 18 13. Contributed surplus (continued) The Company’s stock options at December 31, 2016 and changes for the period are as follows: Number Weighted average exercise price outstanding (CAD$) At December 31, 2014 4,735,042 $3.83 Granted 285,000 $2.15 Exercised (44,500) $1.56 Forfeited (225,500) $2.20 Expired (87,500) $4.00 At December 31, 2015 4,662,542 $3.82 Granted 1,238,000 $1.35 Expired (127,709) $4.88 At December 31, 2016 5,772,833 $3.27 At December 31, 2016, the following stock options are outstanding and exercisable: Options outstanding Options exercisable Exercise price Number of options Weighted average exercise price Weighted average remaining contractual life Number of options Weighted average exercise price Weighted average remaining contractual life (CAD$) outstanding (CAD$) (years) exercisable (CAD$) (years) $0.00 - $1.00 765,000 $0.94 4.46 765,000 $0.94 4.46 $1.01 - $2.00 2,951,333 $1.53 5.05 2,125,999 $1.60 5.22 $2.01 - $6.00 1,270,000 $2.56 2.64 1,174,999 $2.59 2.60 $6.01 - $9.00 85,000 $8.69 1.13 85,000 $8.69 1.13 $9.01 - $13.75 701,500 $13.75 0.76 701,500 $13.75 0.76 5,772,833 $3.27 3.86 4,852,498 $3.62 3.75 On August 12, 2016 the Company granted 1,238,000 options which have a total fair value of CAD$1.06 million and a weighted average grant-date fair value of CAD$0.86 per option. The options have been valued using the Black-Scholes options pricing model, with the following assumptions: Average risk free rate 0.60% Expected life 5.0 years Expected volatility 81.0% Expected dividends – Deferred Share Unit Plan The Company established a deferred share unit (“DSU”) plan that allows directors to receive compensation in the form of deferred share units. DSUs may only be exercised when the holder ceases to be a director. Directors receive common shares upon exercise of a DSU. Vesting terms of the DSUs are established by the directors at the time the DSUs are granted. On August 18, 2016 the Company granted 260,000 DSUs that vested immediately and had a total fair value of CAD$0.34 million. The continuity of deferred share units issued and outstanding is as follows: Number outstanding At December 31, 2015 - Granted 260,000 At December 31, 2016 260,000

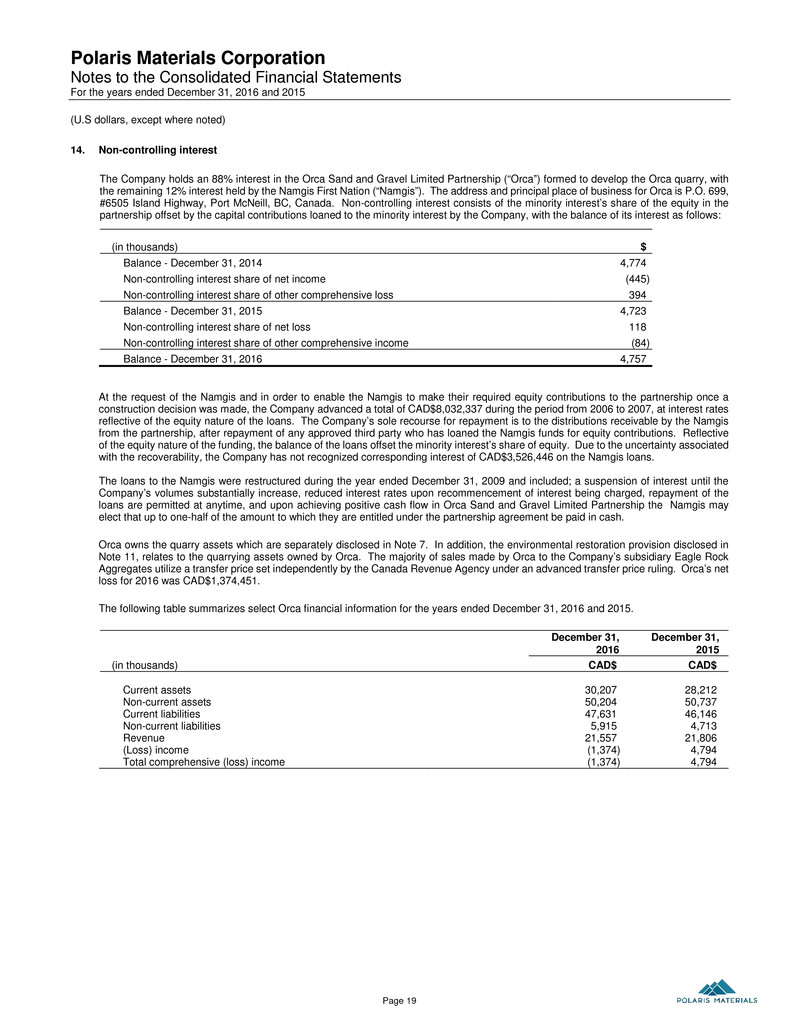

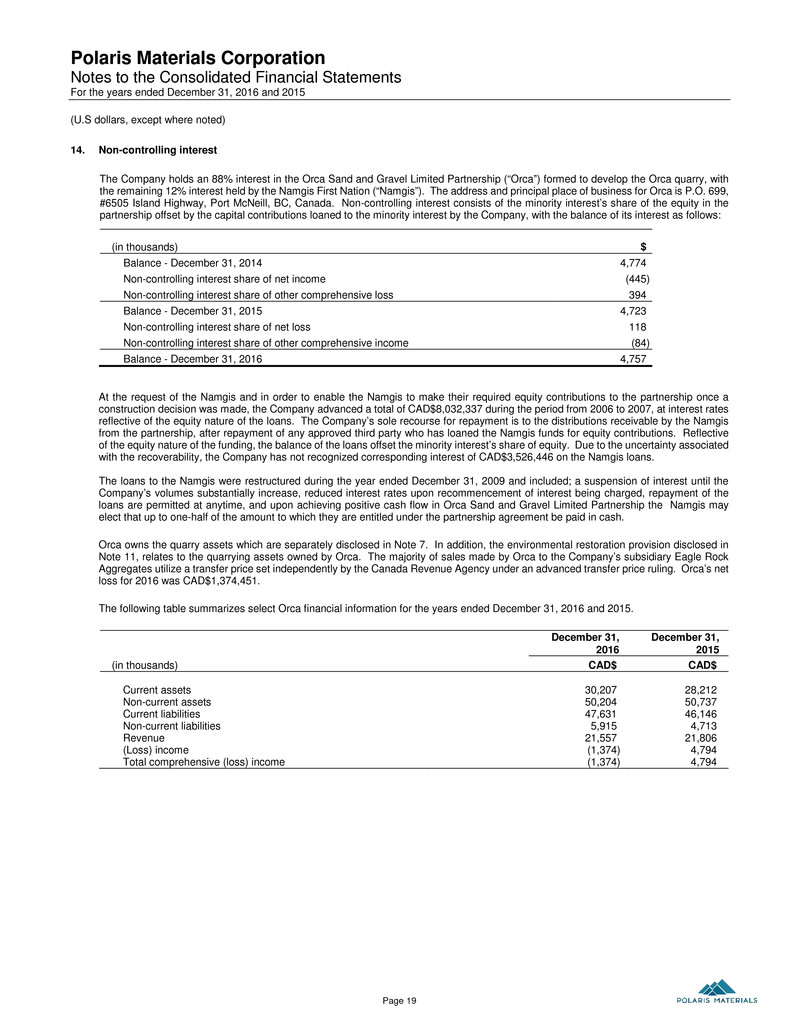

Polaris Materials Corporation Notes to the Consolidated Financial Statements For the years ended December 31, 2016 and 2015 (U.S dollars, except where noted) Page 19 14. Non-controlling interest The Company holds an 88% interest in the Orca Sand and Gravel Limited Partnership (“Orca”) formed to develop the Orca quarry, with the remaining 12% interest held by the Namgis First Nation (“Namgis”). The address and principal place of business for Orca is P.O. 699, #6505 Island Highway, Port McNeill, BC, Canada. Non-controlling interest consists of the minority interest’s share of the equity in the partnership offset by the capital contributions loaned to the minority interest by the Company, with the balance of its interest as follows: (in thousands) $ Balance - December 31, 2014 4,774 Non-controlling interest share of net income (445) Non-controlling interest share of other comprehensive loss 394 Balance - December 31, 2015 4,723 Non-controlling interest share of net loss 118 Non-controlling interest share of other comprehensive income (84) Balance - December 31, 2016 4,757 At the request of the Namgis and in order to enable the Namgis to make their required equity contributions to the partnership once a construction decision was made, the Company advanced a total of CAD$8,032,337 during the period from 2006 to 2007, at interest rates reflective of the equity nature of the loans. The Company’s sole recourse for repayment is to the distributions receivable by the Namgis from the partnership, after repayment of any approved third party who has loaned the Namgis funds for equity contributions. Reflective of the equity nature of the funding, the balance of the loans offset the minority interest’s share of equity. Due to the uncertainty associated with the recoverability, the Company has not recognized corresponding interest of CAD$3,526,446 on the Namgis loans. The loans to the Namgis were restructured during the year ended December 31, 2009 and included; a suspension of interest until the Company’s volumes substantially increase, reduced interest rates upon recommencement of interest being charged, repayment of the loans are permitted at anytime, and upon achieving positive cash flow in Orca Sand and Gravel Limited Partnership the Namgis may elect that up to one-half of the amount to which they are entitled under the partnership agreement be paid in cash. Orca owns the quarry assets which are separately disclosed in Note 7. In addition, the environmental restoration provision disclosed in Note 11, relates to the quarrying assets owned by Orca. The majority of sales made by Orca to the Company’s subsidiary Eagle Rock Aggregates utilize a transfer price set independently by the Canada Revenue Agency under an advanced transfer price ruling. Orca’s net loss for 2016 was CAD$1,374,451. The following table summarizes select Orca financial information for the years ended December 31, 2016 and 2015. December 31, 2016 December 31, 2015 (in thousands) CAD$ CAD$ Current assets 30,207 28,212 Non-current assets 50,204 50,737 Current liabilities 47,631 46,146 Non-current liabilities 5,915 4,713 Revenue 21,557 21,806 (Loss) income (1,374) 4,794 Total comprehensive (loss) income (1,374) 4,794

Polaris Materials Corporation Notes to the Consolidated Financial Statements For the years ended December 31, 2016 and 2015 (U.S dollars, except where noted) Page 20 15. Expenses by nature 2016 2015 (in thousands) $ $ Cost of materials and consumables 5,918 5,377 Change in inventories 101 (1,816) Salaries, wages, and employee benefits 7,160 6,503 Share based employee benefits 861 792 Annual minimum freight volume penalty - 300 Amortization, depletion and depreciation 4,658 4,086 Distribution costs 21,927 20,873 Royalties and through-put 3,668 3,613 Utilities and rental payments 1,548 1,720 Professional and consulting fees 1,036 705 Operations support 1,170 1,143 Other 238 184 Total cost of goods sold, sales costs, general expenses, and administrative costs 48,285 43,480 16. Finance expense 2016 2015 (in thousands) $ $ Interest on supply chain financing 18 - Interest on finance leases 47 69 Accretion of restoration provision 72 78 137 147 17. Compensation of key management Key management personnel include the members of the Board of Directors and the Senior leadership team. Compensation for key management personnel (including directors) was as follows: 2016 2015 (in thousands) $ $ Salaries and other benefits 1,329 1,643 Share based benefits 655 550 1,984 2,193

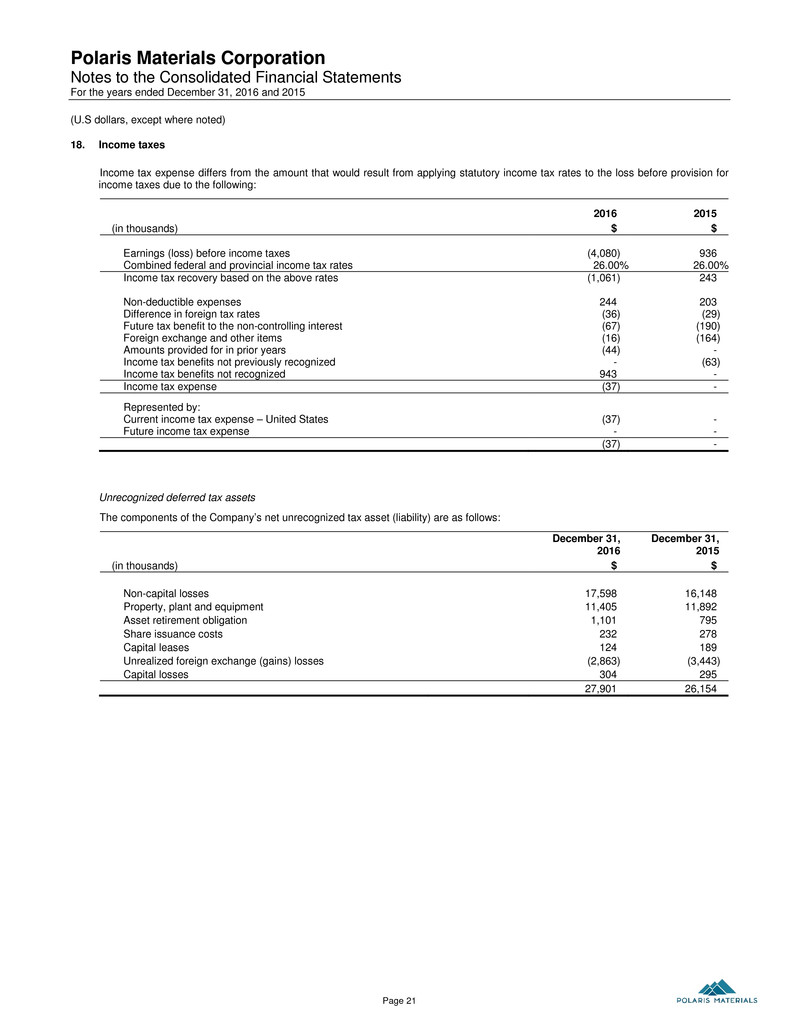

Polaris Materials Corporation Notes to the Consolidated Financial Statements For the years ended December 31, 2016 and 2015 (U.S dollars, except where noted) Page 21 18. Income taxes Income tax expense differs from the amount that would result from applying statutory income tax rates to the loss before provision for income taxes due to the following: 2016 2015 (in thousands) $ $ Earnings (loss) before income taxes (4,080) 936 Combined federal and provincial income tax rates 26.00% 26.00% Income tax recovery based on the above rates (1,061) 243 Non-deductible expenses 244 203 Difference in foreign tax rates (36) (29) Future tax benefit to the non-controlling interest (67) (190) Foreign exchange and other items (16) (164) Amounts provided for in prior years (44) - Income tax benefits not previously recognized - (63) Income tax benefits not recognized 943 - Income tax expense (37) - Represented by: Current income tax expense – United States (37) - Future income tax expense - - (37) - Unrecognized deferred tax assets The components of the Company’s net unrecognized tax asset (liability) are as follows: December 31, 2016 December 31, 2015 (in thousands) $ $ Non-capital losses 17,598 16,148 Property, plant and equipment 11,405 11,892 Asset retirement obligation 1,101 795 Share issuance costs 232 278 Capital leases 124 189 Unrealized foreign exchange (gains) losses (2,863) (3,443) Capital losses 304 295 27,901 26,154

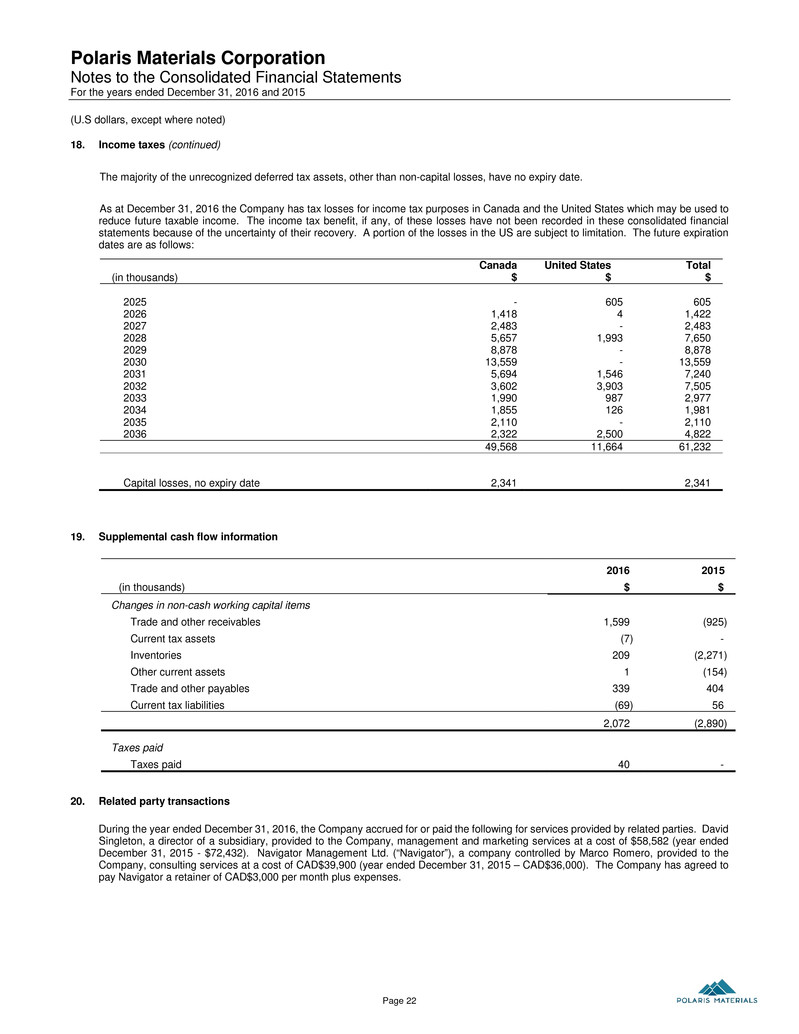

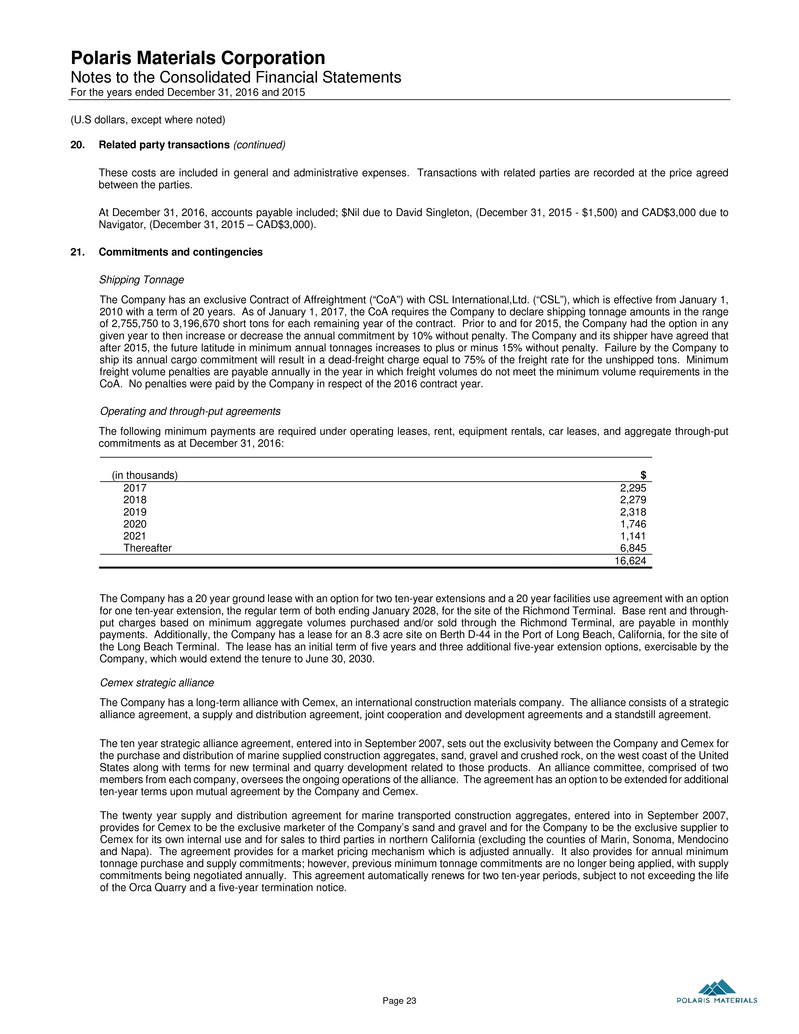

Polaris Materials Corporation Notes to the Consolidated Financial Statements For the years ended December 31, 2016 and 2015 (U.S dollars, except where noted) Page 22 18. Income taxes (continued) The majority of the unrecognized deferred tax assets, other than non-capital losses, have no expiry date. As at December 31, 2016 the Company has tax losses for income tax purposes in Canada and the United States which may be used to reduce future taxable income. The income tax benefit, if any, of these losses have not been recorded in these consolidated financial statements because of the uncertainty of their recovery. A portion of the losses in the US are subject to limitation. The future expiration dates are as follows: (in thousands) Canada $ United States $ Total $ 2025 - 605 605 2026 1,418 4 1,422 2027 2,483 - 2,483 2028 5,657 1,993 7,650 2029 8,878 - 8,878 2030 13,559 - 13,559 2031 5,694 1,546 7,240 2032 3,602 3,903 7,505 2033 1,990 987 2,977 2034 1,855 126 1,981 2035 2,110 - 2,110 2036 2,322 2,500 4,822 49,568 11,664 61,232 Capital losses, no expiry date 2,341 2,341 19. Supplemental cash flow information 2016 2015 (in thousands) $ $ Changes in non-cash working capital items Trade and other receivables 1,599 (925) Current tax assets (7) - Inventories 209 (2,271) Other current assets 1 (154) Trade and other payables 339 404 Current tax liabilities (69) 56 2,072 (2,890) Taxes paid Taxes paid 40 - 20. Related party transactions During the year ended December 31, 2016, the Company accrued for or paid the following for services provided by related parties. David Singleton, a director of a subsidiary, provided to the Company, management and marketing services at a cost of $58,582 (year ended December 31, 2015 - $72,432). Navigator Management Ltd. (“Navigator”), a company controlled by Marco Romero, provided to the Company, consulting services at a cost of CAD$39,900 (year ended December 31, 2015 – CAD$36,000). The Company has agreed to pay Navigator a retainer of CAD$3,000 per month plus expenses.

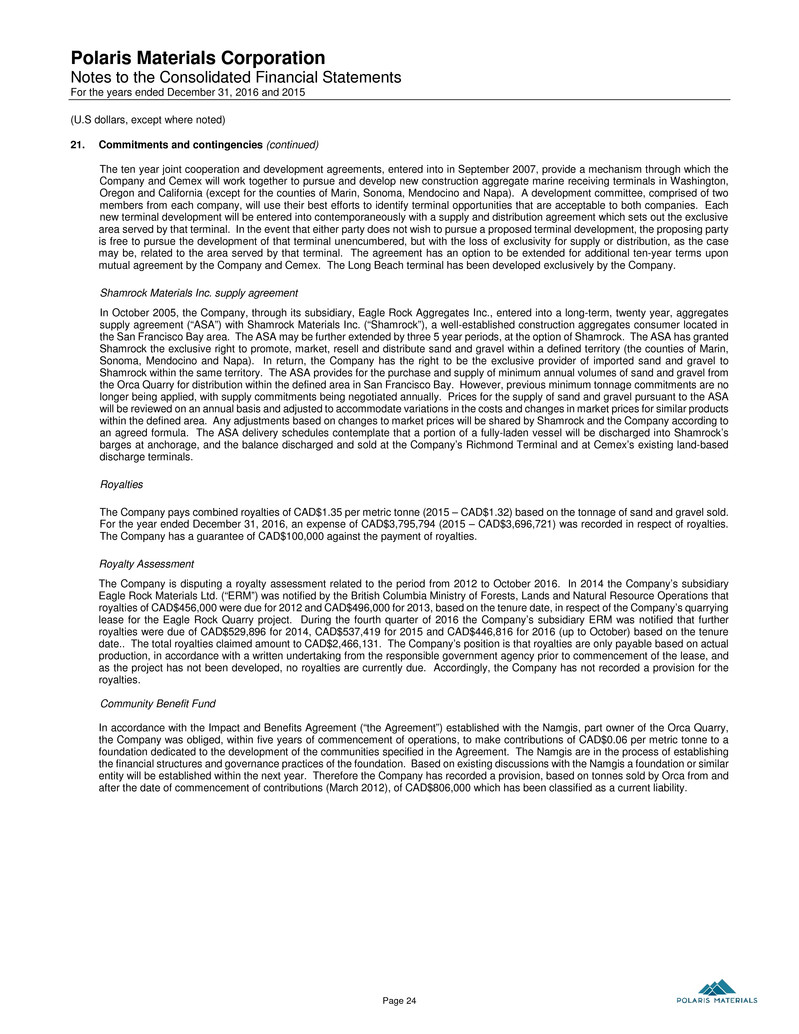

Polaris Materials Corporation Notes to the Consolidated Financial Statements For the years ended December 31, 2016 and 2015 (U.S dollars, except where noted) Page 23 20. Related party transactions (continued) These costs are included in general and administrative expenses. Transactions with related parties are recorded at the price agreed between the parties. At December 31, 2016, accounts payable included; $Nil due to David Singleton, (December 31, 2015 - $1,500) and CAD$3,000 due to Navigator, (December 31, 2015 – CAD$3,000). 21. Commitments and contingencies Shipping Tonnage The Company has an exclusive Contract of Affreightment (“CoA”) with CSL International,Ltd. (“CSL”), which is effective from January 1, 2010 with a term of 20 years. As of January 1, 2017, the CoA requires the Company to declare shipping tonnage amounts in the range of 2,755,750 to 3,196,670 short tons for each remaining year of the contract. Prior to and for 2015, the Company had the option in any given year to then increase or decrease the annual commitment by 10% without penalty. The Company and its shipper have agreed that after 2015, the future latitude in minimum annual tonnages increases to plus or minus 15% without penalty. Failure by the Company to ship its annual cargo commitment will result in a dead-freight charge equal to 75% of the freight rate for the unshipped tons. Minimum freight volume penalties are payable annually in the year in which freight volumes do not meet the minimum volume requirements in the CoA. No penalties were paid by the Company in respect of the 2016 contract year. Operating and through-put agreements The following minimum payments are required under operating leases, rent, equipment rentals, car leases, and aggregate through-put commitments as at December 31, 2016: (in thousands) $ 2017 2,295 2018 2,279 2019 2,318 2020 1,746 2021 1,141 Thereafter 6,845 16,624 The Company has a 20 year ground lease with an option for two ten-year extensions and a 20 year facilities use agreement with an option for one ten-year extension, the regular term of both ending January 2028, for the site of the Richmond Terminal. Base rent and through- put charges based on minimum aggregate volumes purchased and/or sold through the Richmond Terminal, are payable in monthly payments. Additionally, the Company has a lease for an 8.3 acre site on Berth D-44 in the Port of Long Beach, California, for the site of the Long Beach Terminal. The lease has an initial term of five years and three additional five-year extension options, exercisable by the Company, which would extend the tenure to June 30, 2030. Cemex strategic alliance The Company has a long-term alliance with Cemex, an international construction materials company. The alliance consists of a strategic alliance agreement, a supply and distribution agreement, joint cooperation and development agreements and a standstill agreement. The ten year strategic alliance agreement, entered into in September 2007, sets out the exclusivity between the Company and Cemex for the purchase and distribution of marine supplied construction aggregates, sand, gravel and crushed rock, on the west coast of the United States along with terms for new terminal and quarry development related to those products. An alliance committee, comprised of two members from each company, oversees the ongoing operations of the alliance. The agreement has an option to be extended for additional ten-year terms upon mutual agreement by the Company and Cemex. The twenty year supply and distribution agreement for marine transported construction aggregates, entered into in September 2007, provides for Cemex to be the exclusive marketer of the Company’s sand and gravel and for the Company to be the exclusive supplier to Cemex for its own internal use and for sales to third parties in northern California (excluding the counties of Marin, Sonoma, Mendocino and Napa). The agreement provides for a market pricing mechanism which is adjusted annually. It also provides for annual minimum tonnage purchase and supply commitments; however, previous minimum tonnage commitments are no longer being applied, with supply commitments being negotiated annually. This agreement automatically renews for two ten-year periods, subject to not exceeding the life of the Orca Quarry and a five-year termination notice.

Polaris Materials Corporation Notes to the Consolidated Financial Statements For the years ended December 31, 2016 and 2015 (U.S dollars, except where noted) Page 24 21. Commitments and contingencies (continued) The ten year joint cooperation and development agreements, entered into in September 2007, provide a mechanism through which the Company and Cemex will work together to pursue and develop new construction aggregate marine receiving terminals in Washington, Oregon and California (except for the counties of Marin, Sonoma, Mendocino and Napa). A development committee, comprised of two members from each company, will use their best efforts to identify terminal opportunities that are acceptable to both companies. Each new terminal development will be entered into contemporaneously with a supply and distribution agreement which sets out the exclusive area served by that terminal. In the event that either party does not wish to pursue a proposed terminal development, the proposing party is free to pursue the development of that terminal unencumbered, but with the loss of exclusivity for supply or distribution, as the case may be, related to the area served by that terminal. The agreement has an option to be extended for additional ten-year terms upon mutual agreement by the Company and Cemex. The Long Beach terminal has been developed exclusively by the Company. Shamrock Materials Inc. supply agreement In October 2005, the Company, through its subsidiary, Eagle Rock Aggregates Inc., entered into a long-term, twenty year, aggregates supply agreement (“ASA”) with Shamrock Materials Inc. (“Shamrock”), a well-established construction aggregates consumer located in the San Francisco Bay area. The ASA may be further extended by three 5 year periods, at the option of Shamrock. The ASA has granted Shamrock the exclusive right to promote, market, resell and distribute sand and gravel within a defined territory (the counties of Marin, Sonoma, Mendocino and Napa). In return, the Company has the right to be the exclusive provider of imported sand and gravel to Shamrock within the same territory. The ASA provides for the purchase and supply of minimum annual volumes of sand and gravel from the Orca Quarry for distribution within the defined area in San Francisco Bay. However, previous minimum tonnage commitments are no longer being applied, with supply commitments being negotiated annually. Prices for the supply of sand and gravel pursuant to the ASA will be reviewed on an annual basis and adjusted to accommodate variations in the costs and changes in market prices for similar products within the defined area. Any adjustments based on changes to market prices will be shared by Shamrock and the Company according to an agreed formula. The ASA delivery schedules contemplate that a portion of a fully-laden vessel will be discharged into Shamrock’s barges at anchorage, and the balance discharged and sold at the Company’s Richmond Terminal and at Cemex’s existing land-based discharge terminals. Royalties The Company pays combined royalties of CAD$1.35 per metric tonne (2015 – CAD$1.32) based on the tonnage of sand and gravel sold. For the year ended December 31, 2016, an expense of CAD$3,795,794 (2015 – CAD$3,696,721) was recorded in respect of royalties. The Company has a guarantee of CAD$100,000 against the payment of royalties. Royalty Assessment The Company is disputing a royalty assessment related to the period from 2012 to October 2016. In 2014 the Company’s subsidiary Eagle Rock Materials Ltd. (“ERM”) was notified by the British Columbia Ministry of Forests, Lands and Natural Resource Operations that royalties of CAD$456,000 were due for 2012 and CAD$496,000 for 2013, based on the tenure date, in respect of the Company’s quarrying lease for the Eagle Rock Quarry project. During the fourth quarter of 2016 the Company’s subsidiary ERM was notified that further royalties were due of CAD$529,896 for 2014, CAD$537,419 for 2015 and CAD$446,816 for 2016 (up to October) based on the tenure date.. The total royalties claimed amount to CAD$2,466,131. The Company’s position is that royalties are only payable based on actual production, in accordance with a written undertaking from the responsible government agency prior to commencement of the lease, and as the project has not been developed, no royalties are currently due. Accordingly, the Company has not recorded a provision for the royalties. Community Benefit Fund In accordance with the Impact and Benefits Agreement (“the Agreement”) established with the Namgis, part owner of the Orca Quarry, the Company was obliged, within five years of commencement of operations, to make contributions of CAD$0.06 per metric tonne to a foundation dedicated to the development of the communities specified in the Agreement. The Namgis are in the process of establishing the financial structures and governance practices of the foundation. Based on existing discussions with the Namgis a foundation or similar entity will be established within the next year. Therefore the Company has recorded a provision, based on tonnes sold by Orca from and after the date of commencement of contributions (March 2012), of CAD$806,000 which has been classified as a current liability.

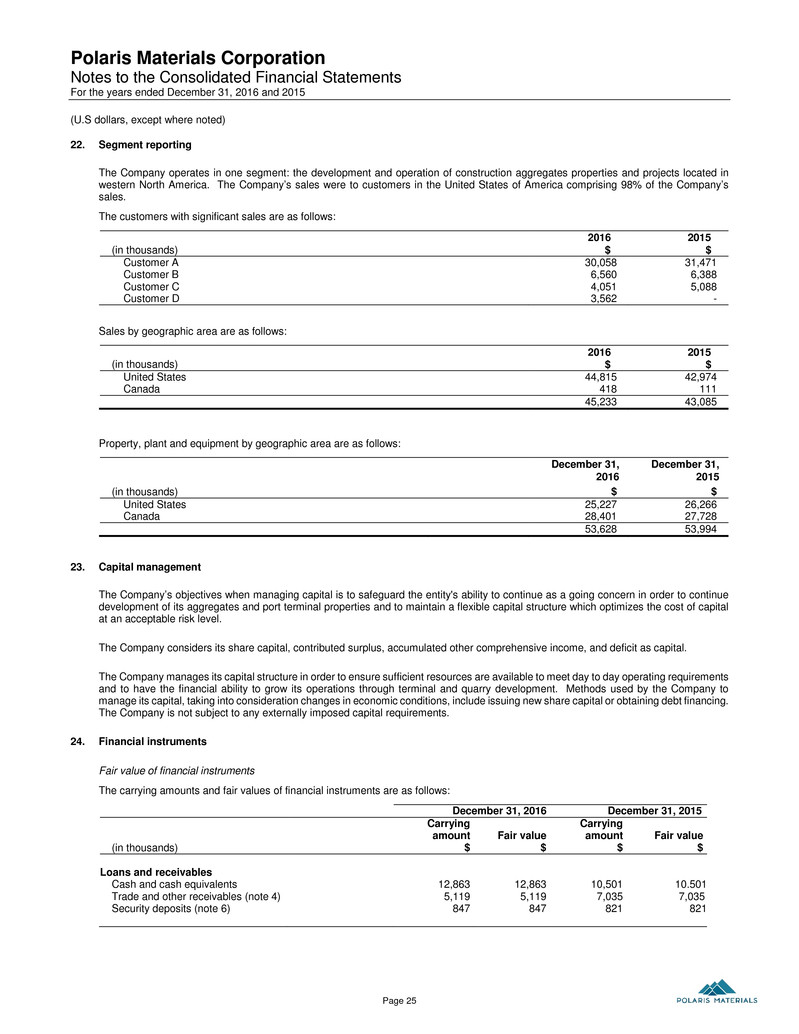

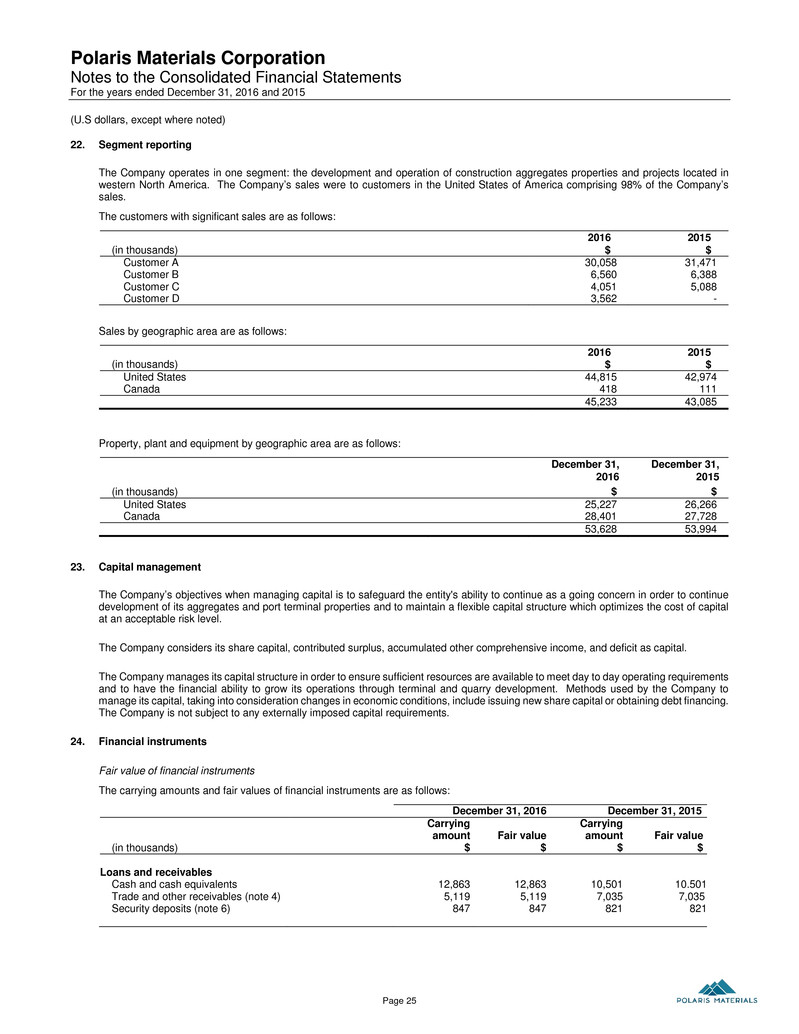

Polaris Materials Corporation Notes to the Consolidated Financial Statements For the years ended December 31, 2016 and 2015 (U.S dollars, except where noted) Page 25 22. Segment reporting The Company operates in one segment: the development and operation of construction aggregates properties and projects located in western North America. The Company’s sales were to customers in the United States of America comprising 98% of the Company’s sales. The customers with significant sales are as follows: 2016 2015 (in thousands) $ $ Customer A 30,058 31,471 Customer B 6,560 6,388 Customer C 4,051 5,088 Customer D 3,562 - Sales by geographic area are as follows: 2016 2015 (in thousands) $ $ United States 44,815 42,974 Canada 418 111 45,233 43,085 Property, plant and equipment by geographic area are as follows: December 31, 2016 December 31, 2015 (in thousands) $ $ United States 25,227 26,266 Canada 28,401 27,728 53,628 53,994 23. Capital management The Company’s objectives when managing capital is to safeguard the entity's ability to continue as a going concern in order to continue development of its aggregates and port terminal properties and to maintain a flexible capital structure which optimizes the cost of capital at an acceptable risk level. The Company considers its share capital, contributed surplus, accumulated other comprehensive income, and deficit as capital. The Company manages its capital structure in order to ensure sufficient resources are available to meet day to day operating requirements and to have the financial ability to grow its operations through terminal and quarry development. Methods used by the Company to manage its capital, taking into consideration changes in economic conditions, include issuing new share capital or obtaining debt financing. The Company is not subject to any externally imposed capital requirements. 24. Financial instruments Fair value of financial instruments The carrying amounts and fair values of financial instruments are as follows: December 31, 2016 December 31, 2015 (in thousands) Carrying amount $ Fair value $ Carrying amount $ Fair value $ Loans and receivables Cash and cash equivalents 12,863 12,863 10,501 10.501 Trade and other receivables (note 4) 5,119 5,119 7,035 7,035 Security deposits (note 6) 847 847 821 821

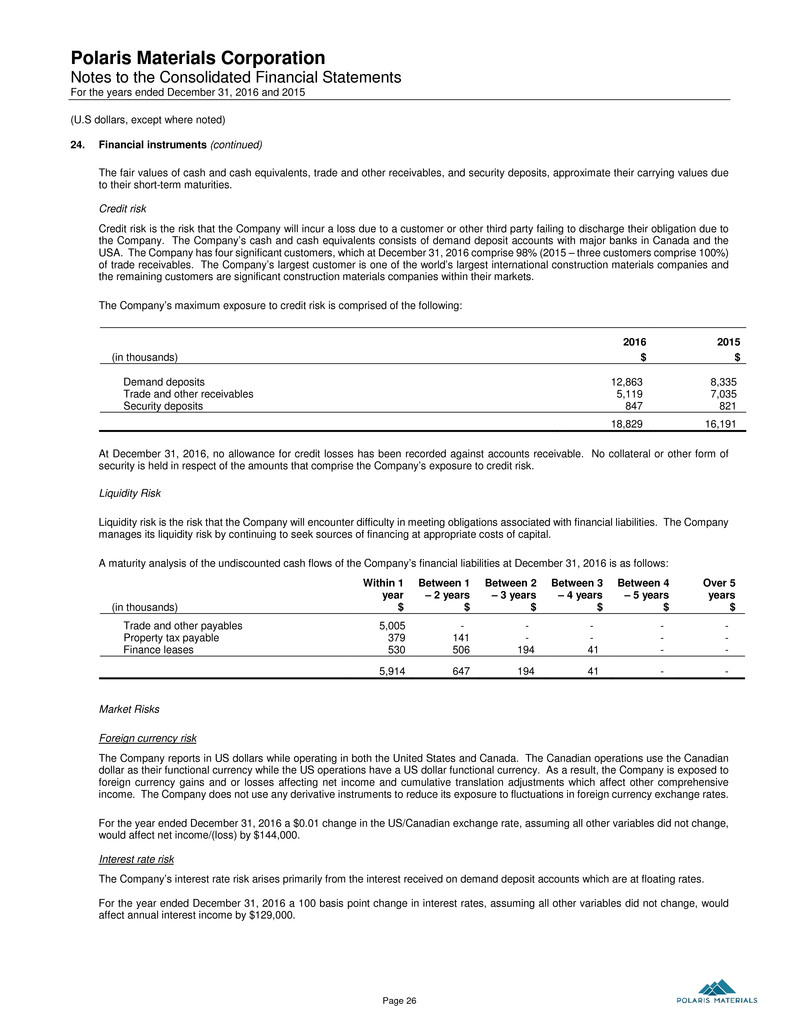

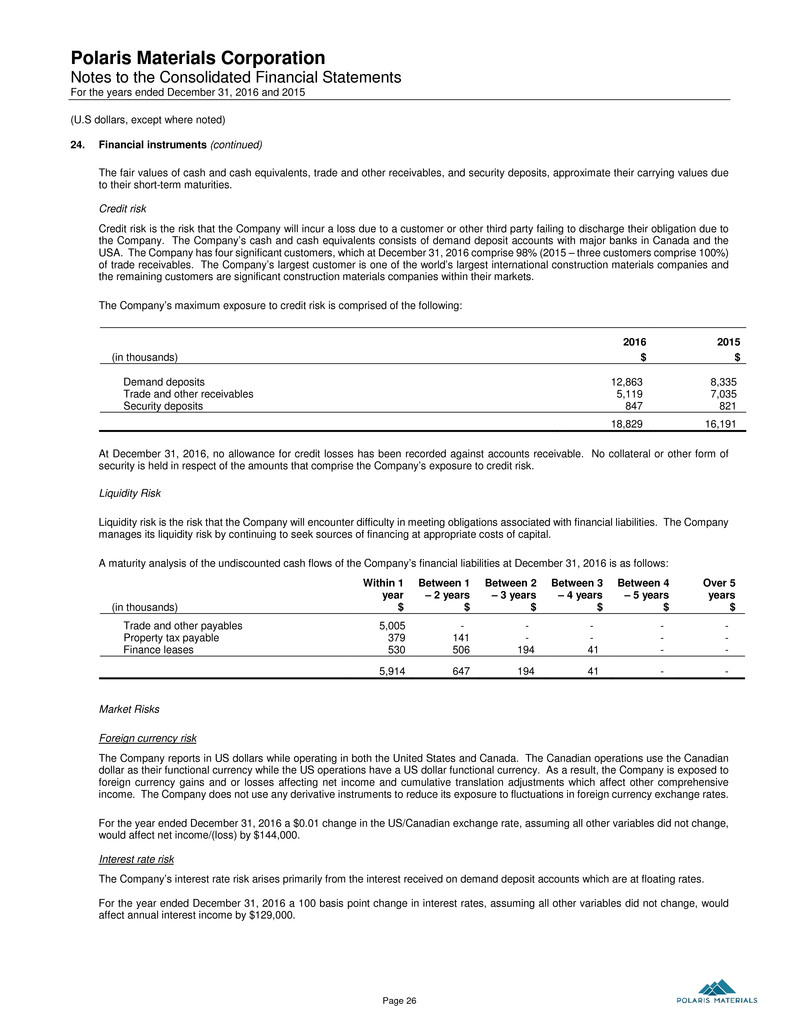

Polaris Materials Corporation Notes to the Consolidated Financial Statements For the years ended December 31, 2016 and 2015 (U.S dollars, except where noted) Page 26 24. Financial instruments (continued) The fair values of cash and cash equivalents, trade and other receivables, and security deposits, approximate their carrying values due to their short-term maturities. Credit risk Credit risk is the risk that the Company will incur a loss due to a customer or other third party failing to discharge their obligation due to the Company. The Company’s cash and cash equivalents consists of demand deposit accounts with major banks in Canada and the USA. The Company has four significant customers, which at December 31, 2016 comprise 98% (2015 – three customers comprise 100%) of trade receivables. The Company’s largest customer is one of the world’s largest international construction materials companies and the remaining customers are significant construction materials companies within their markets. The Company’s maximum exposure to credit risk is comprised of the following: 2016 2015 (in thousands) $ $ Demand deposits 12,863 8,335 Trade and other receivables 5,119 7,035 Security deposits 847 821 18,829 16,191 At December 31, 2016, no allowance for credit losses has been recorded against accounts receivable. No collateral or other form of security is held in respect of the amounts that comprise the Company’s exposure to credit risk. Liquidity Risk Liquidity risk is the risk that the Company will encounter difficulty in meeting obligations associated with financial liabilities. The Company manages its liquidity risk by continuing to seek sources of financing at appropriate costs of capital. A maturity analysis of the undiscounted cash flows of the Company’s financial liabilities at December 31, 2016 is as follows: (in thousands) Within 1 year $ Between 1 – 2 years $ Between 2 – 3 years $ Between 3 – 4 years $ Between 4 – 5 years $ Over 5 years $ Trade and other payables 5,005 - - - - - Property tax payable 379 141 - - - - Finance leases 530 506 194 41 - - 5,914 647 194 41 - - Market Risks Foreign currency risk The Company reports in US dollars while operating in both the United States and Canada. The Canadian operations use the Canadian dollar as their functional currency while the US operations have a US dollar functional currency. As a result, the Company is exposed to foreign currency gains and or losses affecting net income and cumulative translation adjustments which affect other comprehensive income. The Company does not use any derivative instruments to reduce its exposure to fluctuations in foreign currency exchange rates. For the year ended December 31, 2016 a $0.01 change in the US/Canadian exchange rate, assuming all other variables did not change, would affect net income/(loss) by $144,000. Interest rate risk The Company’s interest rate risk arises primarily from the interest received on demand deposit accounts which are at floating rates. For the year ended December 31, 2016 a 100 basis point change in interest rates, assuming all other variables did not change, would affect annual interest income by $129,000.

Polaris Materials Corporation Notes to the Consolidated Financial Statements For the years ended December 31, 2016 and 2015 (U.S dollars, except where noted) Page 27 25. Subsequent events Acquisition by US Concrete On November 15, 2017, Polaris shareholders, together with option holders and deferred unit holders, together holding approximately 99.8% of the common shares and other securities collectively represented at the special meeting, voted in favour of the special resolution approving the acquisition of the Company by US Concrete, Inc. (“US Concrete”). On November 16, 2017, the Company received court approval of the acquisition of the Company by US Concrete. On November 17, 2017, US Concrete acquired, through a wholly-owned subsidiary, all of the issued and outstanding common shares of Polaris and amalgamated the Company and the wholly-owned subsidiary. In addition, option holders and holders of deferred share units were paid an aggregate of approximately CAD$8.4 million pursuant to the US Concrete Agreement. Polaris common shares were delisted from the Toronto Stock Exchange on November 20, 2017.