Exhibit 99.2 CONSOLIDATED INTERIM CONDENSED FINANCIAL STATEMENTS September 30, 2017 and 2016 (U.S. dollars)

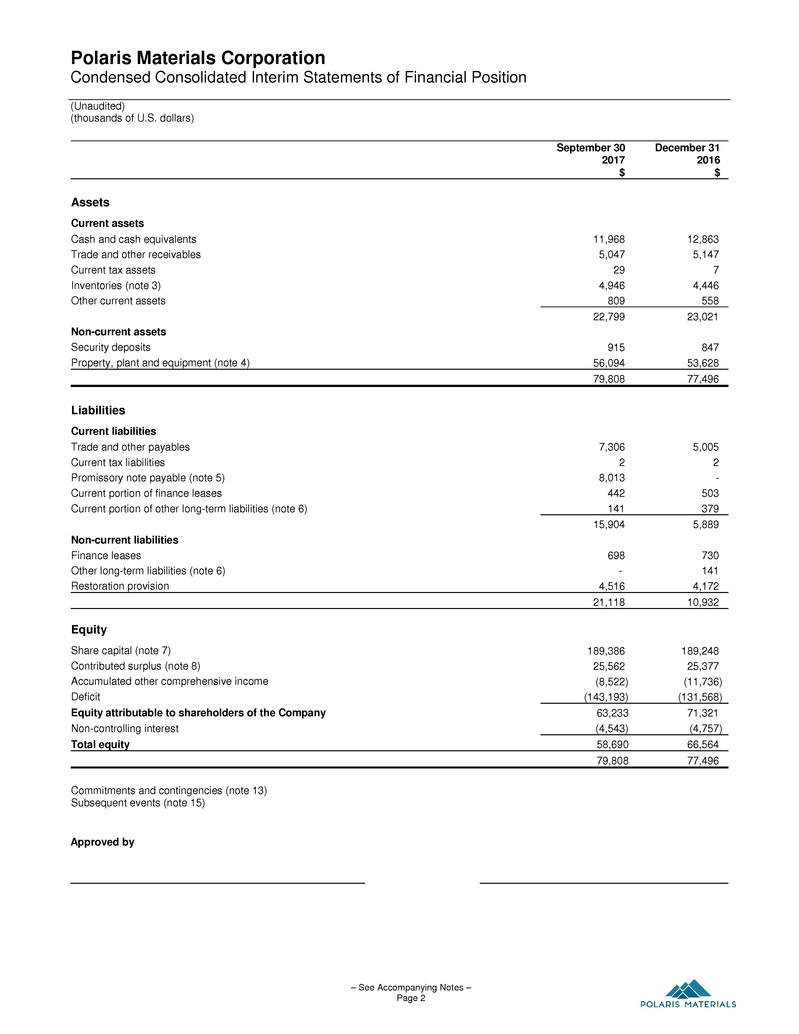

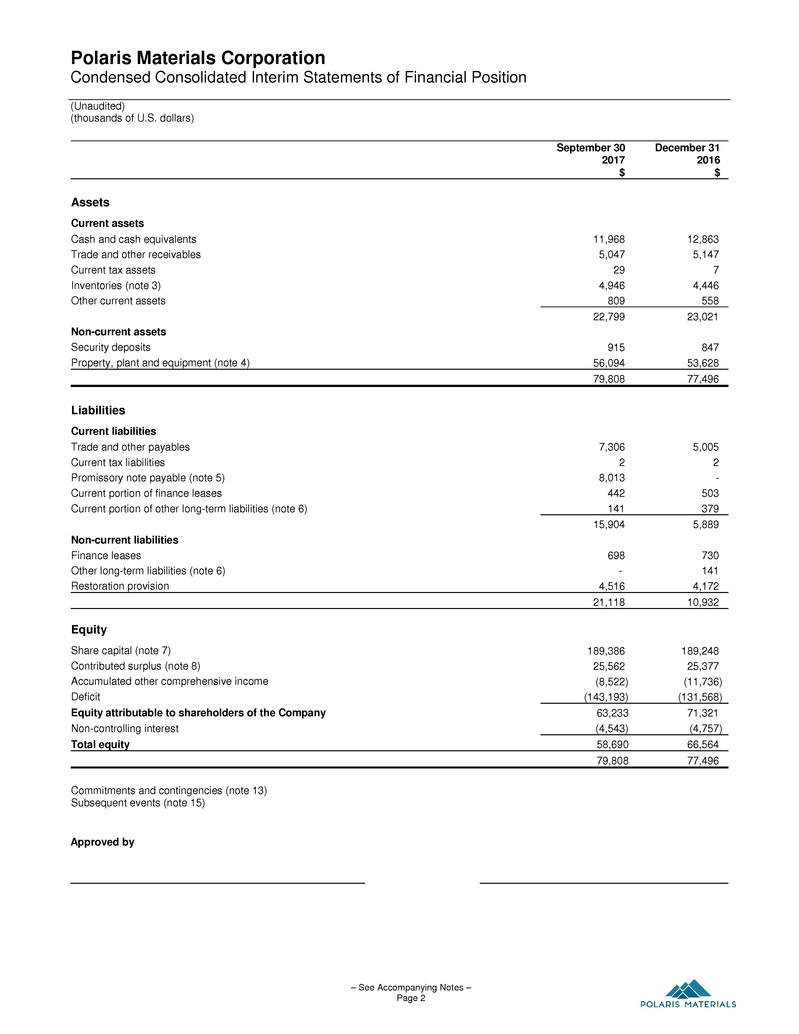

Polaris Materials Corporation Condensed Consolidated Interim Statements of Financial Position (Unaudited) (thousands of U.S. dollars) – See Accompanying Notes – Page 2 September 30 2017 December 31 2016 $ $ Assets Current assets Cash and cash equivalents 11,968 12,863 Trade and other receivables 5,047 5,147 Current tax assets 29 7 Inventories (note 3) 4,946 4,446 Other current assets 809 558 22,799 23,021 Non-current assets Security deposits 915 847 Property, plant and equipment (note 4) 56,094 53,628 79,808 77,496 Liabilities Current liabilities Trade and other payables 7,306 5,005 Current tax liabilities 2 2 Promissory note payable (note 5) 8,013 - Current portion of finance leases 442 503 Current portion of other long-term liabilities (note 6) 141 379 15,904 5,889 Non-current liabilities Finance leases 698 730 Other long-term liabilities (note 6) - 141 Restoration provision 4,516 4,172 21,118 10,932 Equity Share capital (note 7) 189,386 189,248 Contributed surplus (note 8) 25,562 25,377 Accumulated other comprehensive income (8,522) (11,736) Deficit (143,193) (131,568) Equity attributable to shareholders of the Company 63,233 71,321 Non-controlling interest (4,543) (4,757) Total equity 58,690 66,564 79,808 77,496 Commitments and contingencies (note 13) Subsequent events (note 15) Approved by

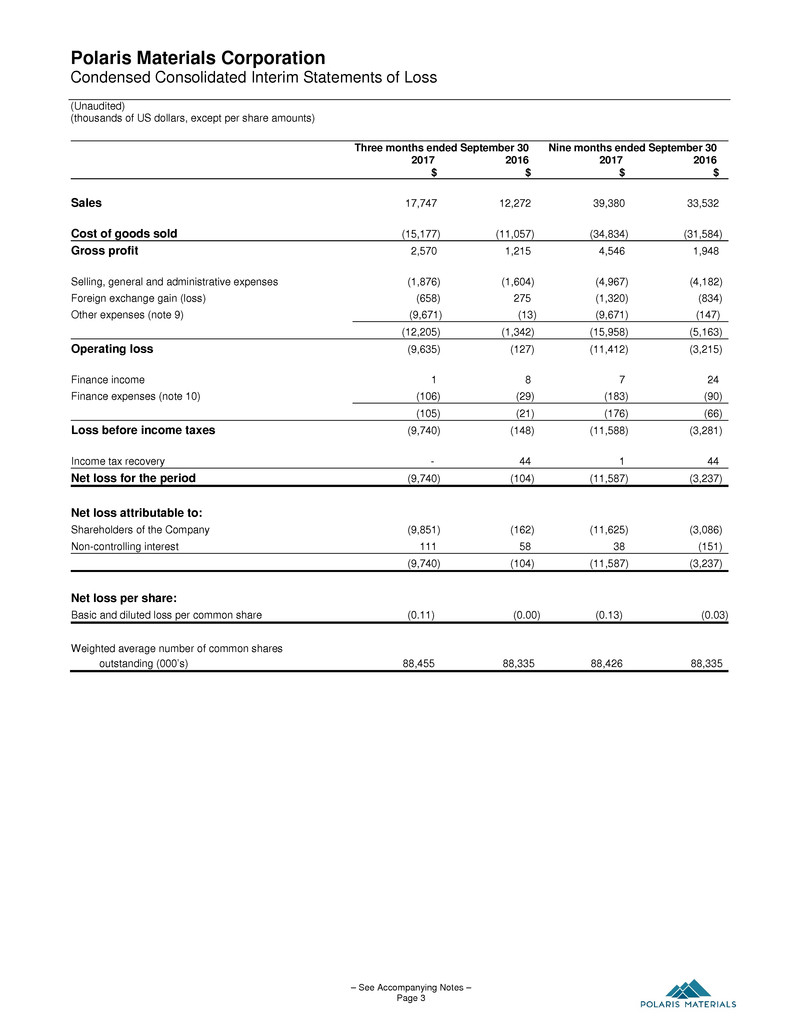

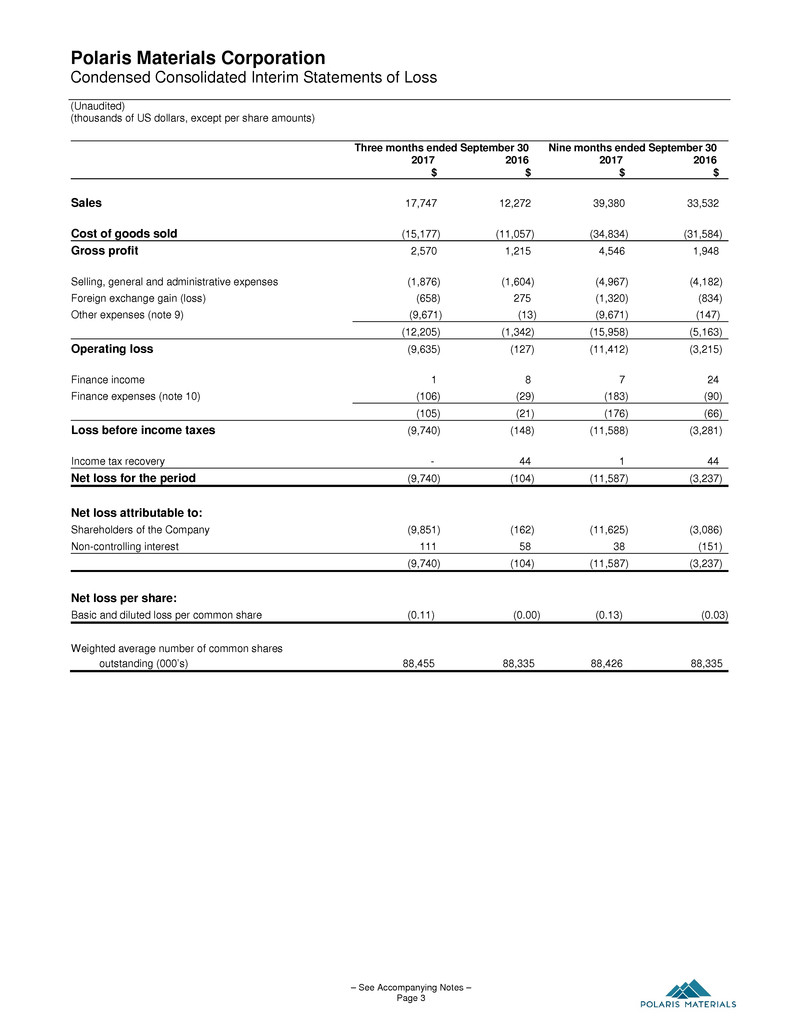

Polaris Materials Corporation Condensed Consolidated Interim Statements of Loss (Unaudited) (thousands of US dollars, except per share amounts) – See Accompanying Notes – Page 3 Three months ended September 30 Nine months ended September 30 2017 2016 2017 2016 $ $ $ $ Sales 17,747 12,272 39,380 33,532 Cost of goods sold (15,177) (11,057) (34,834) (31,584) Gross profit 2,570 1,215 4,546 1,948 Selling, general and administrative expenses (1,876) (1,604) (4,967) (4,182) Foreign exchange gain (loss) (658) 275 (1,320) (834) Other expenses (note 9) (9,671) (13) (9,671) (147) (12,205) (1,342) (15,958) (5,163) Operating loss (9,635) (127) (11,412) (3,215) Finance income 1 8 7 24 Finance expenses (note 10) (106) (29) (183) (90) (105) (21) (176) (66) Loss before income taxes (9,740) (148) (11,588) (3,281) Income tax recovery - 44 1 44 Net loss for the period (9,740) (104) (11,587) (3,237) Net loss attributable to: Shareholders of the Company (9,851) (162) (11,625) (3,086) Non-controlling interest 111 58 38 (151) (9,740) (104) (11,587) (3,237) Net loss per share: Basic and diluted loss per common share (0.11) (0.00) (0.13) (0.03) Weighted average number of common shares outstanding (000’s) 88,455 88,335 88,426 88,335

Polaris Materials Corporation Condensed Consolidated Interim Statements of Comprehensive Income (Loss) (Unaudited) (thousands of U.S. dollars) – See Accompanying Notes – Page 4 Three months ended September 30 Nine months ended September 30 2017 2016 2017 2016 $ $ $ $ Net loss for the period (9,740) (104) (11,587) (3,237) Other comprehensive income (loss) – items that may be reclassified to profit or loss Foreign currency translation 1,917 (727) 3,390 2,474 Comprehensive loss for the period (7,823) (831) (8,197) (763) Comprehensive income (loss) attributable to: Shareholders of the Company (8,027) (857) (8,411) (746) Non-controlling interest 204 26 214 (17) (7,823) (831) (8,197) (763) Polaris Materials Corporation Condensed Consolidated Interim Statements of Changes in Equity (Unaudited) (thousands of U.S. dollars, except number of common shares) Attributable to equity holders of the Company Number of common shares (000’s) Amount of common shares $ Contributed surplus $ Accumulated other comprehensive income (loss) $ Deficit $ Shareholders’ equity $ Non- controlling interest $ Total $ December 31, 2015 88,335 189,248 24,516 (13,048) (127,643) 73,073 (4,723) 68,350 Share-based employee benefits - - 609 - - 609 - 609 Other comprehensive income - - - 2,340 - 2,340 134 2,474 Net loss - - - - (3,086) (3,086) (151) (3,237) September 30, 2016 88,335 189,248 25,125 (10,708) (130,729) 72,936 (4,740) 68,196 Share-based employee benefits - - 252 - - 252 - 252 Other comprehensive loss - - - (1,028) - (1,028) (50) (1,078) Net loss - - - - (839) (839) 33 (806) December 31, 2016 88,335 189,248 25,377 (11,736) (131,568) 71,321 (4,757) 66,564 Share-based employee benefits - - 238 - - 238 - 238 Options exercised 120 138 (53) - - 85 - 85 Other comprehensive income - - - 3,214 - 3,214 176 3,390 Net loss - - - - (11,625) (11,625) 38 (11,587) September 30, 2017 88,455 189,386 25,562 (8,522) (143,193) 62,233 (4,543) 58,690

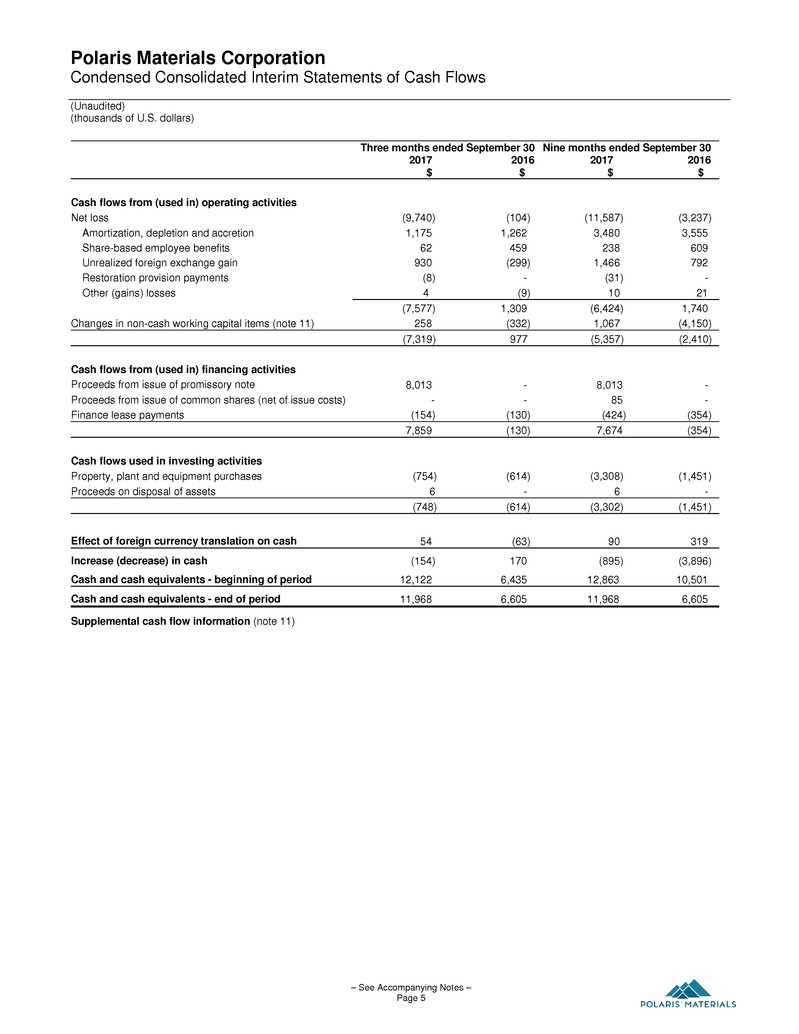

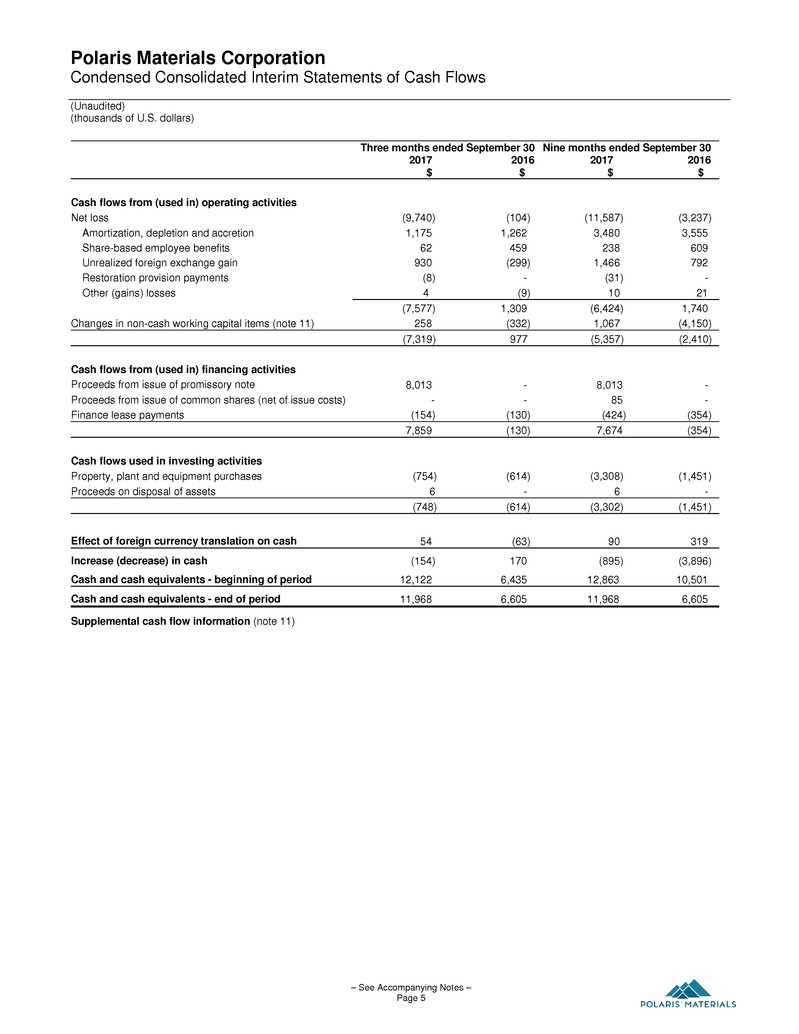

Polaris Materials Corporation Condensed Consolidated Interim Statements of Cash Flows (Unaudited) (thousands of U.S. dollars) – See Accompanying Notes – Page 5 Three months ended September 30 Nine months ended September 30 2017 2016 2017 2016 $ $ $ $ Cash flows from (used in) operating activities Net loss (9,740) (104) (11,587) (3,237) Amortization, depletion and accretion 1,175 1,262 3,480 3,555 Share-based employee benefits 62 459 238 609 Unrealized foreign exchange gain 930 (299) 1,466 792 Restoration provision payments (8) - (31) - Other (gains) losses 4 (9) 10 21 (7,577) 1,309 (6,424) 1,740 Changes in non-cash working capital items (note 11) 258 (332) 1,067 (4,150) (7,319) 977 (5,357) (2,410) Cash flows from (used in) financing activities Proceeds from issue of promissory note 8,013 - 8,013 - Proceeds from issue of common shares (net of issue costs) - - 85 - Finance lease payments (154) (130) (424) (354) 7,859 (130) 7,674 (354) Cash flows used in investing activities Property, plant and equipment purchases (754) (614) (3,308) (1,451) Proceeds on disposal of assets 6 - 6 - (748) (614) (3,302) (1,451) Effect of foreign currency translation on cash 54 (63) 90 319 Increase (decrease) in cash (154) 170 (895) (3,896) Cash and cash equivalents - beginning of period 12,122 6,435 12,863 10,501 Cash and cash equivalents - end of period 11,968 6,605 11,968 6,605 Supplemental cash flow information (note 11)

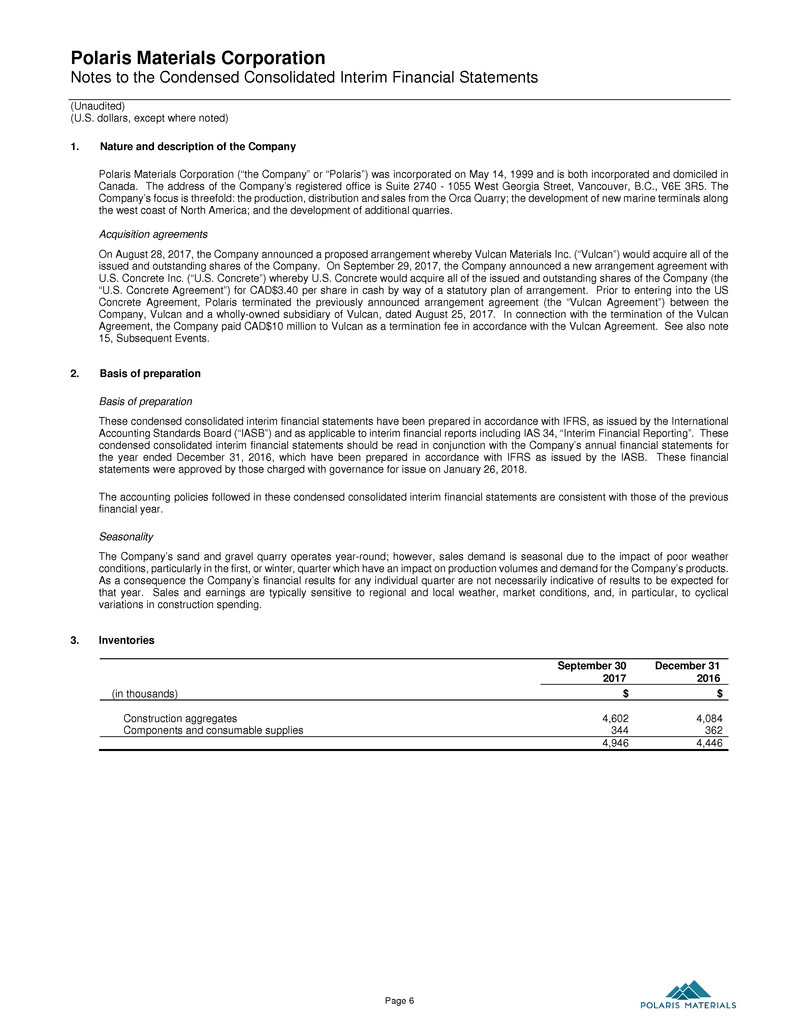

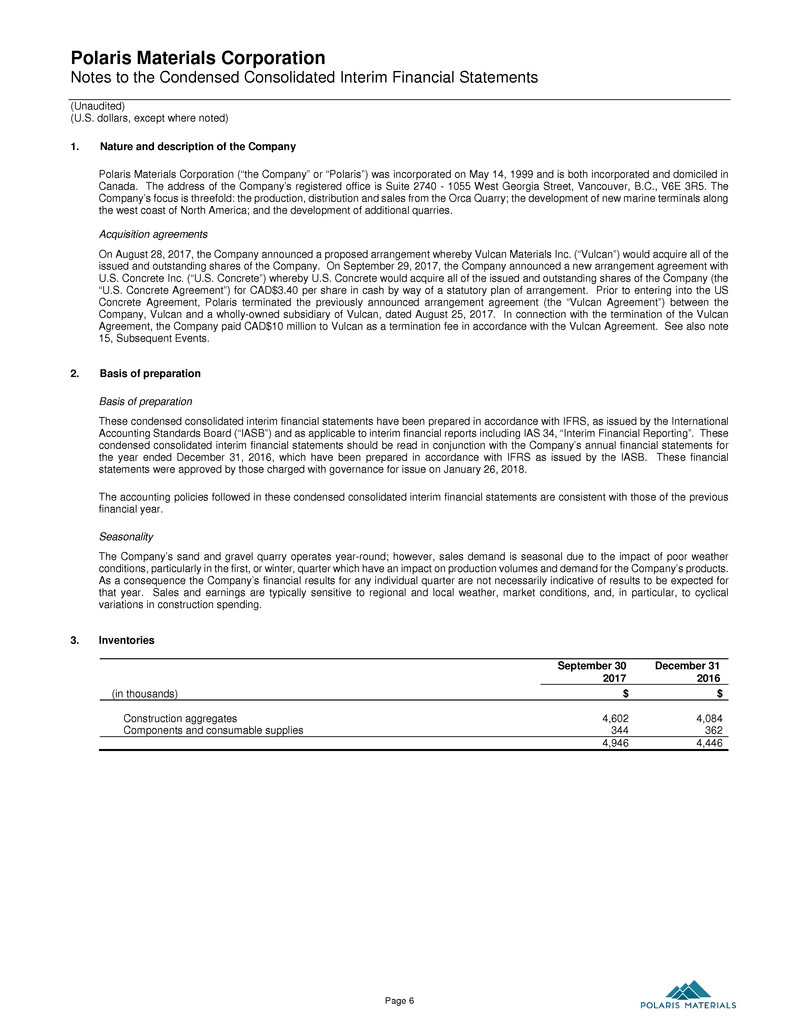

Polaris Materials Corporation Notes to the Condensed Consolidated Interim Financial Statements (Unaudited) (U.S. dollars, except where noted) Page 6 1. Nature and description of the Company Polaris Materials Corporation (“the Company” or “Polaris”) was incorporated on May 14, 1999 and is both incorporated and domiciled in Canada. The address of the Company’s registered office is Suite 2740 - 1055 West Georgia Street, Vancouver, B.C., V6E 3R5. The Company’s focus is threefold: the production, distribution and sales from the Orca Quarry; the development of new marine terminals along the west coast of North America; and the development of additional quarries. Acquisition agreements On August 28, 2017, the Company announced a proposed arrangement whereby Vulcan Materials Inc. (“Vulcan”) would acquire all of the issued and outstanding shares of the Company. On September 29, 2017, the Company announced a new arrangement agreement with U.S. Concrete Inc. (“U.S. Concrete”) whereby U.S. Concrete would acquire all of the issued and outstanding shares of the Company (the “U.S. Concrete Agreement”) for CAD$3.40 per share in cash by way of a statutory plan of arrangement. Prior to entering into the US Concrete Agreement, Polaris terminated the previously announced arrangement agreement (the “Vulcan Agreement”) between the Company, Vulcan and a wholly-owned subsidiary of Vulcan, dated August 25, 2017. In connection with the termination of the Vulcan Agreement, the Company paid CAD$10 million to Vulcan as a termination fee in accordance with the Vulcan Agreement. See also note 15, Subsequent Events. 2. Basis of preparation Basis of preparation These condensed consolidated interim financial statements have been prepared in accordance with IFRS, as issued by the International Accounting Standards Board (“IASB”) and as applicable to interim financial reports including IAS 34, “Interim Financial Reporting”. These condensed consolidated interim financial statements should be read in conjunction with the Company’s annual financial statements for the year ended December 31, 2016, which have been prepared in accordance with IFRS as issued by the IASB. These financial statements were approved by those charged with governance for issue on January 26, 2018. The accounting policies followed in these condensed consolidated interim financial statements are consistent with those of the previous financial year. Seasonality The Company’s sand and gravel quarry operates year-round; however, sales demand is seasonal due to the impact of poor weather conditions, particularly in the first, or winter, quarter which have an impact on production volumes and demand for the Company’s products. As a consequence the Company’s financial results for any individual quarter are not necessarily indicative of results to be expected for that year. Sales and earnings are typically sensitive to regional and local weather, market conditions, and, in particular, to cyclical variations in construction spending. 3. Inventories September 30 2017 December 31 2016 (in thousands) $ $ Construction aggregates 4,602 4,084 Components and consumable supplies 344 362 4,946 4,446

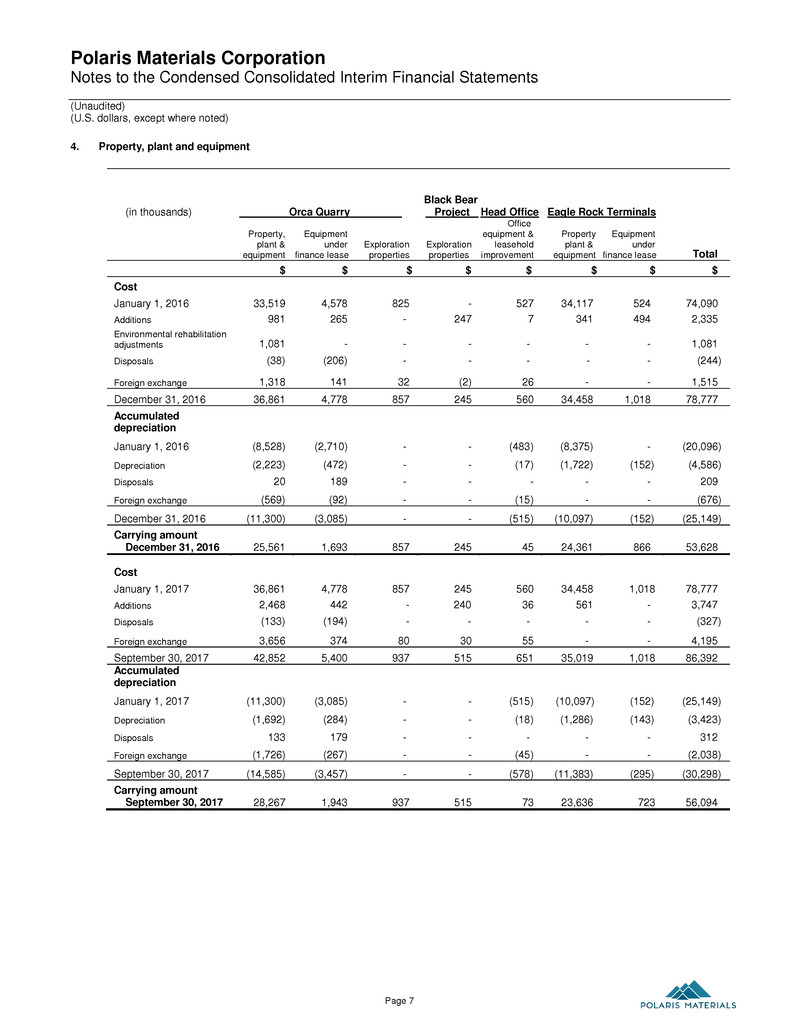

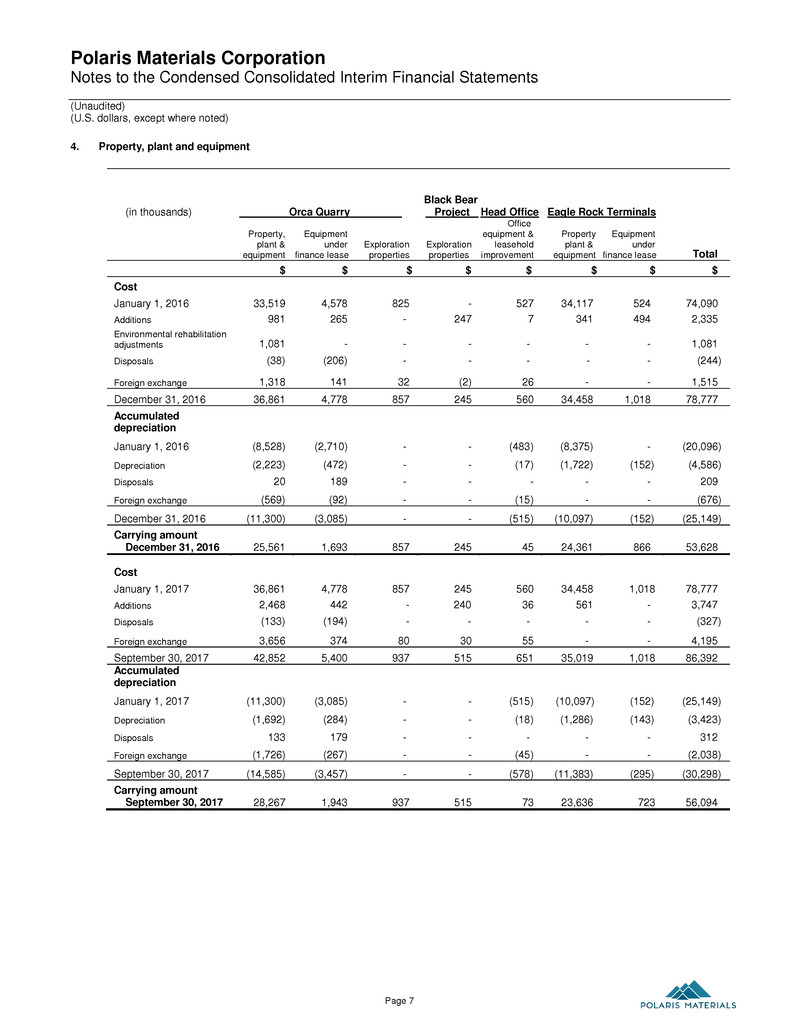

Polaris Materials Corporation Notes to the Condensed Consolidated Interim Financial Statements (Unaudited) (U.S. dollars, except where noted) Page 7 4. Property, plant and equipment (in thousands) Orca Quarry y Black Bear Project Head Office Eagle Rock Terminals Property, plant & equipment Equipment under finance lease Exploration properties Exploration properties Office equipment & leasehold improvement Property plant & equipment Equipment under finance lease Total $ $ $ $ $ $ $ $ Cost January 1, 2016 33,519 4,578 825 - 527 34,117 524 74,090 Additions 981 265 - 247 7 341 494 2,335 Environmental rehabilitation adjustments 1,081 - - - - - - 1,081 Disposals (38) (206) - - - - - (244) Foreign exchange 1,318 141 32 (2) 26 - - 1,515 December 31, 2016 36,861 4,778 857 245 560 34,458 1,018 78,777 Accumulated depreciation January 1, 2016 (8,528) (2,710) - - (483) (8,375) - (20,096) Depreciation (2,223) (472) - - (17) (1,722) (152) (4,586) Disposals 20 189 - - - - - 209 Foreign exchange (569) (92) - - (15) - - (676) December 31, 2016 (11,300) (3,085) - - (515) (10,097) (152) (25,149) Carrying amount December 31, 2016 25,561 1,693 857 245 45 24,361 866 53,628 Cost January 1, 2017 36,861 4,778 857 245 560 34,458 1,018 78,777 Additions 2,468 442 - 240 36 561 - 3,747 Disposals (133) (194) - - - - - (327) Foreign exchange 3,656 374 80 30 55 - - 4,195 September 30, 2017 42,852 5,400 937 515 651 35,019 1,018 86,392 Accumulated depreciation January 1, 2017 (11,300) (3,085) - - (515) (10,097) (152) (25,149) Depreciation (1,692) (284) - - (18) (1,286) (143) (3,423) Disposals 133 179 - - - - - 312 Foreign exchange (1,726) (267) - - (45) - - (2,038) September 30, 2017 (14,585) (3,457) - - (578) (11,383) (295) (30,298) Carrying amount September 30, 2017 28,267 1,943 937 515 73 23,636 723 56,094

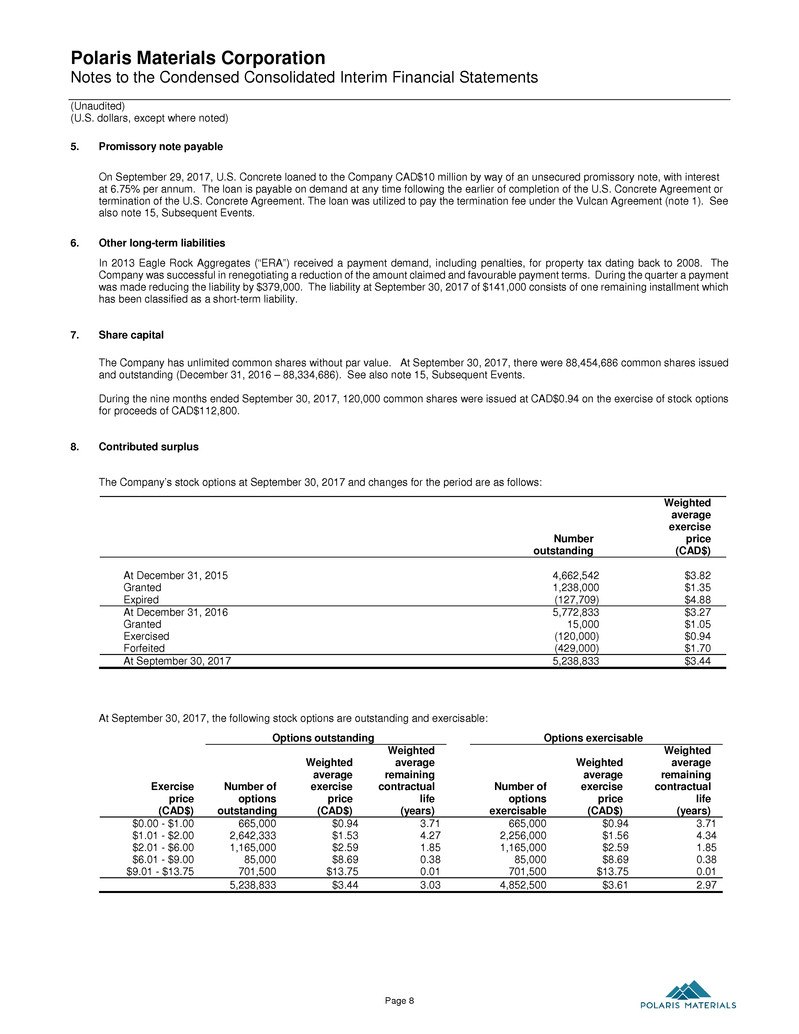

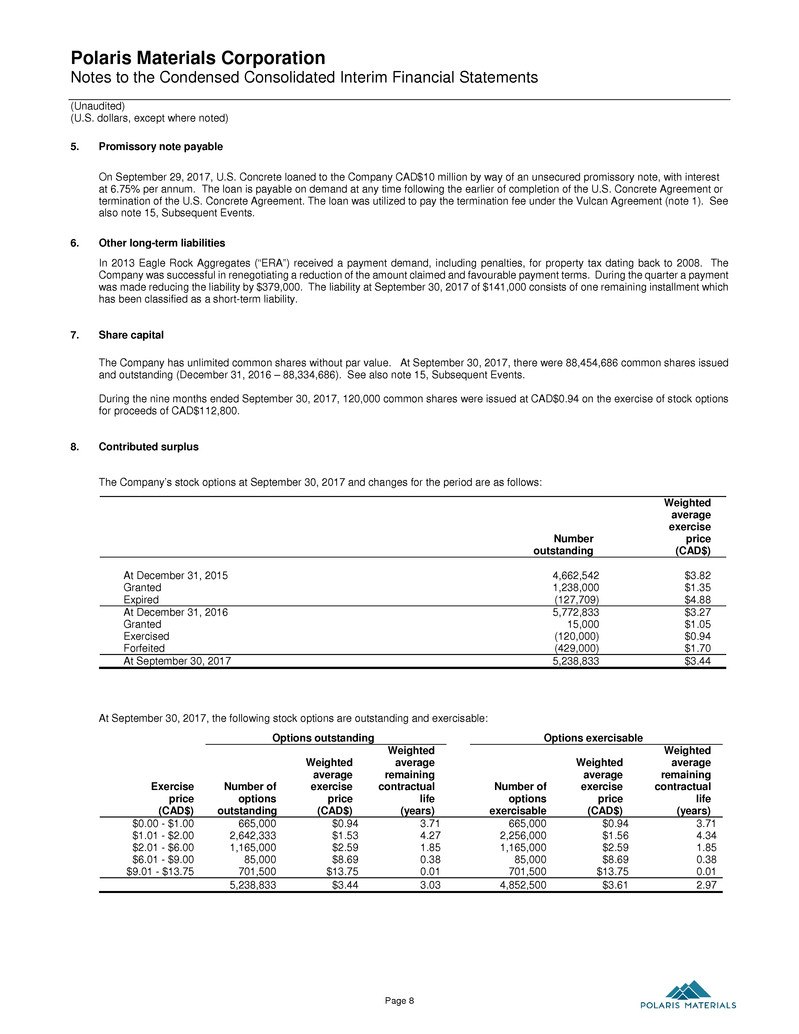

Polaris Materials Corporation Notes to the Condensed Consolidated Interim Financial Statements (Unaudited) (U.S. dollars, except where noted) Page 8 5. Promissory note payable On September 29, 2017, U.S. Concrete loaned to the Company CAD$10 million by way of an unsecured promissory note, with interest at 6.75% per annum. The loan is payable on demand at any time following the earlier of completion of the U.S. Concrete Agreement or termination of the U.S. Concrete Agreement. The loan was utilized to pay the termination fee under the Vulcan Agreement (note 1). See also note 15, Subsequent Events. 6. Other long-term liabilities In 2013 Eagle Rock Aggregates (“ERA”) received a payment demand, including penalties, for property tax dating back to 2008. The Company was successful in renegotiating a reduction of the amount claimed and favourable payment terms. During the quarter a payment was made reducing the liability by $379,000. The liability at September 30, 2017 of $141,000 consists of one remaining installment which has been classified as a short-term liability. 7. Share capital The Company has unlimited common shares without par value. At September 30, 2017, there were 88,454,686 common shares issued and outstanding (December 31, 2016 – 88,334,686). See also note 15, Subsequent Events. During the nine months ended September 30, 2017, 120,000 common shares were issued at CAD$0.94 on the exercise of stock options for proceeds of CAD$112,800. 8. Contributed surplus The Company’s stock options at September 30, 2017 and changes for the period are as follows: Number Weighted average exercise price outstanding (CAD$) At December 31, 2015 4,662,542 $3.82 Granted 1,238,000 $1.35 Expired (127,709) $4.88 At December 31, 2016 5,772,833 $3.27 Granted 15,000 $1.05 Exercised (120,000) $0.94 Forfeited (429,000) $1.70 At September 30, 2017 5,238,833 $3.44 At September 30, 2017, the following stock options are outstanding and exercisable: Options outstanding Options exercisable Exercise price Number of options Weighted average exercise price Weighted average remaining contractual life Number of options Weighted average exercise price Weighted average remaining contractual life (CAD$) outstanding (CAD$) (years) exercisable (CAD$) (years) $0.00 - $1.00 665,000 $0.94 3.71 665,000 $0.94 3.71 $1.01 - $2.00 2,642,333 $1.53 4.27 2,256,000 $1.56 4.34 $2.01 - $6.00 1,165,000 $2.59 1.85 1,165,000 $2.59 1.85 $6.01 - $9.00 85,000 $8.69 0.38 85,000 $8.69 0.38 $9.01 - $13.75 701,500 $13.75 0.01 701,500 $13.75 0.01 5,238,833 $3.44 3.03 4,852,500 $3.61 2.97

Polaris Materials Corporation Notes to the Condensed Consolidated Interim Financial Statements (Unaudited) (U.S. dollars, except where noted) Page 9 9. Other expenses Three months ended September 30 Nine months ended September 30 2017 2016 2017 2016 (in thousands) $ $ $ $ Termination fee (notes 1 and 5) 8,141 - 8,141 - Professional fees related to acquisition 1,530 - 1,530 - Other losses - 13 - 147 9,671 13 9,671 147 10. Finance expense Three months ended September 30 Nine months ended September 30 2017 2016 2017 2016 (in thousands) $ $ $ $ Interest on debt 86 11 126 36 Accretion of restoration provision 20 18 57 54 106 29 183 90 11. Supplemental cash flow information Three months ended September 30 Nine months ended September 30 2017 2016 2017 2016 (in thousands) $ $ $ $ Changes in non-cash working capital items Trade and other receivables (1,855) 1,330 106 (3,292) Current tax assets - (9) (22) (9) Inventories (37) 445 (342) 624 Other current assets (630) (480) (230) (90) Trade and other payables 2,780 (1,579) 1,555 (1,311) Current tax liabilities - (39) - (72) 258 (332) 1,067 (4,150) Taxes paid Taxes paid - - 22 33 12. Related party transactions During the three months ended September 30, 2017, the Company accrued for or paid for the following services provided by related parties. David Singleton provided to the Company management and marketing services at a cost of $10,320 (three months ended September 30, 2016 - $5,920). Navigator Management Ltd. (“Navigator”), an entity controlled by a director of the Company, Marco Romero, provided consulting services to the Company at a cost of CAD$9,000 (three months ended September 30, 2016 - CAD$9,000). The Company has agreed to pay Navigator a retainer of CAD$3,000 per month plus expenses under an agreement. During the nine months ended September 30, 2017, the Company accrued for or paid, David Singleton for management and marketing services at a cost of $29,820 (nine months ended September 30, 2016 - $27,295) and Navigator for consulting services at a cost of CAD$27,000 (nine months ended September 30, 2016 - CAD$27,000). These costs are included in general and administrative expenses. Transactions with related parties are recorded at the price agreed between the parties. At September 30, 2017, accounts payable included; $7,800 due to David Singleton, (December 31, 2016 - $Nil) and CAD$3,000 due to Navigator, (December 31, 2016 - CAD$3,000).

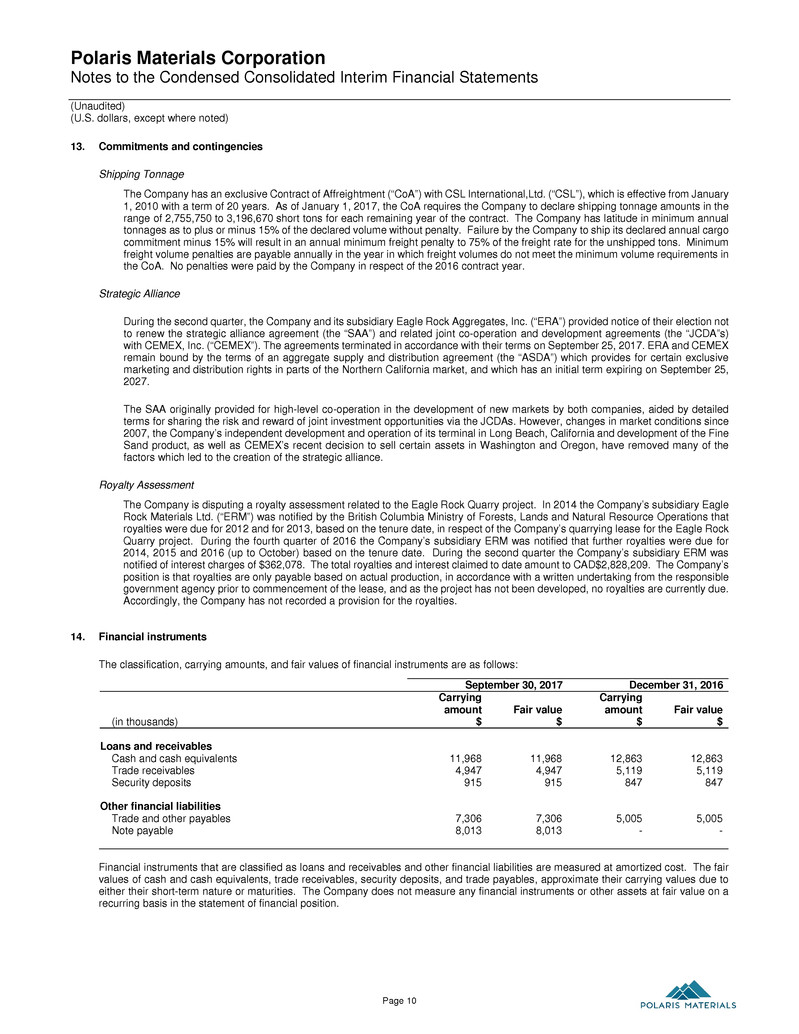

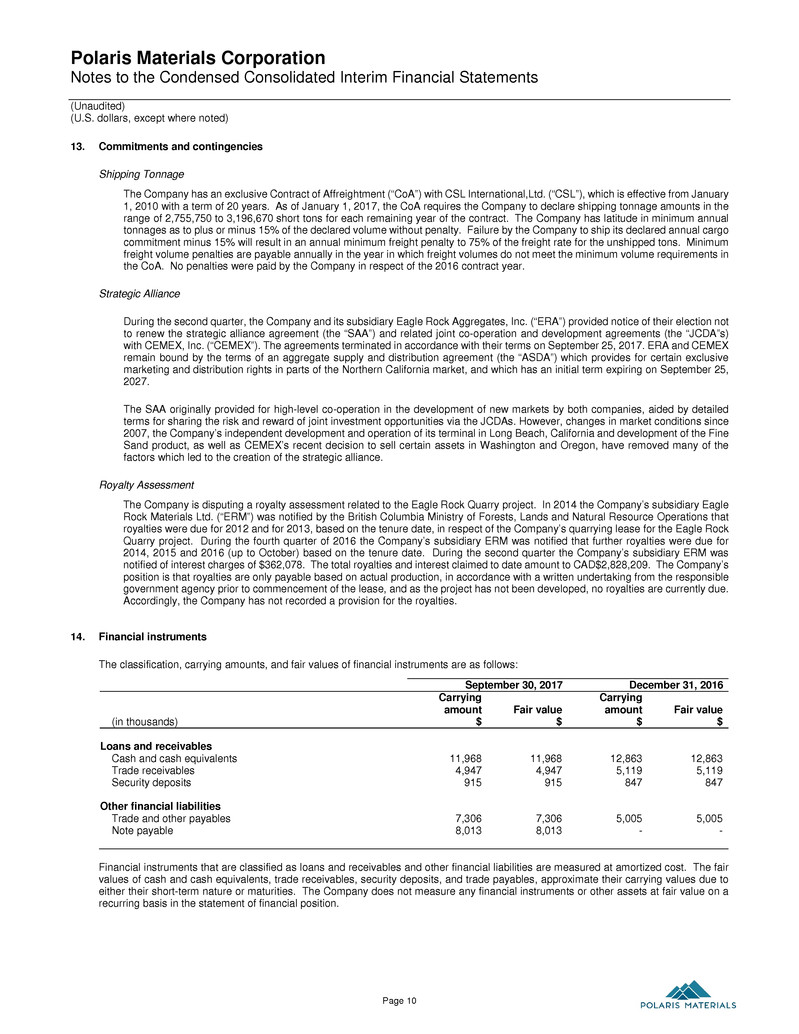

Polaris Materials Corporation Notes to the Condensed Consolidated Interim Financial Statements (Unaudited) (U.S. dollars, except where noted) Page 10 13. Commitments and contingencies Shipping Tonnage The Company has an exclusive Contract of Affreightment (“CoA”) with CSL International,Ltd. (“CSL”), which is effective from January 1, 2010 with a term of 20 years. As of January 1, 2017, the CoA requires the Company to declare shipping tonnage amounts in the range of 2,755,750 to 3,196,670 short tons for each remaining year of the contract. The Company has latitude in minimum annual tonnages as to plus or minus 15% of the declared volume without penalty. Failure by the Company to ship its declared annual cargo commitment minus 15% will result in an annual minimum freight penalty to 75% of the freight rate for the unshipped tons. Minimum freight volume penalties are payable annually in the year in which freight volumes do not meet the minimum volume requirements in the CoA. No penalties were paid by the Company in respect of the 2016 contract year. Strategic Alliance During the second quarter, the Company and its subsidiary Eagle Rock Aggregates, Inc. (“ERA”) provided notice of their election not to renew the strategic alliance agreement (the “SAA”) and related joint co-operation and development agreements (the “JCDA”s) with CEMEX, Inc. (“CEMEX”). The agreements terminated in accordance with their terms on September 25, 2017. ERA and CEMEX remain bound by the terms of an aggregate supply and distribution agreement (the “ASDA”) which provides for certain exclusive marketing and distribution rights in parts of the Northern California market, and which has an initial term expiring on September 25, 2027. The SAA originally provided for high-level co-operation in the development of new markets by both companies, aided by detailed terms for sharing the risk and reward of joint investment opportunities via the JCDAs. However, changes in market conditions since 2007, the Company’s independent development and operation of its terminal in Long Beach, California and development of the Fine Sand product, as well as CEMEX’s recent decision to sell certain assets in Washington and Oregon, have removed many of the factors which led to the creation of the strategic alliance. Royalty Assessment The Company is disputing a royalty assessment related to the Eagle Rock Quarry project. In 2014 the Company’s subsidiary Eagle Rock Materials Ltd. (“ERM”) was notified by the British Columbia Ministry of Forests, Lands and Natural Resource Operations that royalties were due for 2012 and for 2013, based on the tenure date, in respect of the Company’s quarrying lease for the Eagle Rock Quarry project. During the fourth quarter of 2016 the Company’s subsidiary ERM was notified that further royalties were due for 2014, 2015 and 2016 (up to October) based on the tenure date. During the second quarter the Company’s subsidiary ERM was notified of interest charges of $362,078. The total royalties and interest claimed to date amount to CAD$2,828,209. The Company’s position is that royalties are only payable based on actual production, in accordance with a written undertaking from the responsible government agency prior to commencement of the lease, and as the project has not been developed, no royalties are currently due. Accordingly, the Company has not recorded a provision for the royalties. 14. Financial instruments The classification, carrying amounts, and fair values of financial instruments are as follows: September 30, 2017 December 31, 2016 (in thousands) Carrying amount $ Fair value $ Carrying amount $ Fair value $ Loans and receivables Cash and cash equivalents 11,968 11,968 12,863 12,863 Trade receivables 4,947 4,947 5,119 5,119 Security deposits 915 915 847 847 Other financial liabilities Trade and other payables 7,306 7,306 5,005 5,005 Note payable 8,013 8,013 - - Financial instruments that are classified as loans and receivables and other financial liabilities are measured at amortized cost. The fair values of cash and cash equivalents, trade receivables, security deposits, and trade payables, approximate their carrying values due to either their short-term nature or maturities. The Company does not measure any financial instruments or other assets at fair value on a recurring basis in the statement of financial position.

Polaris Materials Corporation Notes to the Condensed Consolidated Interim Financial Statements (Unaudited) (U.S. dollars, except where noted) Page 11 15. Subsequent events Promissory Note Payable On November 14, 2017, U.S. Concrete loaned to the Company an additional CAD$16.5 million by way of an unsecured promissory note, with interest at 6.75% per annum. The loan is payable on demand and was utilized to pay; certain completion fees, payments to option and deferred share unit holders specified under the US Concrete Agreement, and for general working capital purposes. Acquisition by US Concrete On November 15, 2017, Polaris shareholders, together with option holders and deferred unit holders, together holding approximately 99.8% of the common shares and other securities collectively represented at the special meeting, voted in favour of the special resolution approving the acquisition of the Company by US Concrete. On November 16, 2017, the Company received court approval of the US Concrete Agreement. On November 17, 2017, US Concrete acquired, through a wholly-owned subsidiary, all of the issued and outstanding common shares of Polaris and amalgamated the Company and the wholly-owned subsidiary. In addition, option holders and holders of deferred share units were paid an aggregate of approximately CAD$8.4 million pursuant to the US Concrete Agreement. Polaris common shares were delisted from the Toronto Stock Exchange on November 20, 2017. Completion Fee The Company retained a financial advisor to assist in the sale of the Company. Upon closing of the US Concrete Agreement, the Company paid a completion fee of CAD$5.7 million to the financial advisor.