UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF

REGISTERED MANAGEMENT COMPANY

| Investment Company Act file number: | 811-834 |

| Name of Registrant: | Vanguard Windsor Funds |

| Address of Registrant: | P.O. Box 2600 Valley Forge, PA 19482 |

| Name and address of agent for service: | Heidi Stam, Esquire P.O. Box 876 Valley Forge, PA 19482 |

Registrant’s telephone number, including area code: (610) 669-1000

| Date of fiscal year end: | October 31 |

| Date of reporting period: | November 1, 2006 - April 30, 2007 |

| Item 1: | Reports to Shareholders |

|

|

|

| |

| Vanguard® Windsor™ Fund |

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

| > Semiannual Report |

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

| April 30, 2007 |

|

| |

|

|

|

| |

|

| |||

|

|

| ||

|

|

| ||

|

|

| ||

|

|

| ||

|

|

| ||

|

|

| ||

|

|

| ||

|

|

| ||

|

|

| ||

|

|

| ||

|

|

| ||

|

|

| ||

|

|

| ||

|

|

| ||

|

|

| ||

|

|

| ||

|

|

| ||

|

|

| ||

|

|

| ||

|

|

| ||

|

|

| ||

|

|

| ||

> | For the six months ended April 30, 2007, Vanguard Windsor Fund outperformed its benchmarks and the broad U.S. stock market, with the fund’s Investor Shares gaining 10.1%. |

> | A number of the fund’s top ten holdings produced healthy returns, a tribute to the stock-selection skills of Windsor’s advisors. |

> | The fund’s allocations to the consumer-oriented and information technology sectors garnered solid gains. |

Contents |

|

|

|

Your Fund’s Total Returns | 1 |

Chairman’s Letter | 2 |

Advisors’ Report | 6 |

Fund Profile | 9 |

Performance Summary | 10 |

Financial Statements | 11 |

About Your Fund’s Expenses | 23 |

Trustees Approve Advisory Agreements | 25 |

Glossary | 27 |

Please note: The opinions expressed in this report are just that—informed opinions. They should not be considered promises or advice. Also, please keep in mind that the information and opinions cover the period through the date on the cover of this report. Of course, the risks of investing in your fund are spelled out in the prospectus.

Your Fund’s Total Returns

Six Months Ended April 30, 2007 |

|

|

| Ticker | Total |

| Symbol | Returns |

Vanguard Windsor Fund |

|

|

Investor Shares | VWNDX | 10.1% |

Admiral™ Shares1 | VWNEX | 10.2 |

Russell 1000 Value Index |

| 9.8 |

Average Multi-Cap Value Fund2 |

| 9.7 |

Dow Jones Wilshire 5000 Index |

| 9.1 |

Your Fund’s Performance at a Glance | ||||

October 31, 2006–April 30, 2007 |

|

|

|

|

|

|

| Distributions Per Share | |

| Starting | Ending | Income | Capital |

| Share Price | Share Price | Dividends | Gains |

Vanguard Windsor Fund |

|

|

|

|

Investor Shares | $19.27 | $19.47 | $0.151 | $1.529 |

Admiral Shares | 65.04 | 65.72 | 0.539 | 5.159 |

1 A lower-cost class of shares available to many longtime shareholders and to those with significant investments in the fund.

2 Derived from data provided by Lipper Inc.

1

Chairman’s Letter

Dear Shareholder,

For the six-month period ended April 30, 2007, the Investor Shares of Vanguard Windsor Fund returned 10.1%, and the lower-cost Admiral Shares gained 10.2%. The fund outperformed both of its value benchmarks and bested the broad U.S. stock market by 1 percentage point.

Windsor Fund’s relatively large weighting in the information technology sector and its holdings in consumer-oriented sectors helped the fund excel. Strong showings by a number of its major holdings—among them Cisco Systems, Arrow Electronics, and Alcoa—were major contributors to your fund’s six-month gain.

Stocks soared to a new high in the final month of the period

The U.S. stock market was particularly volatile during the fiscal half-year. The Dow Jones Industrial Average crept up gradually through the first three months, fell steeply in late February, then recovered in March and climbed steadily through April. The Dow closed above 13,000 for the first time on April 25, and gained 5.9% overall for the month, its best single-month performance since December 2003.

During the period, the market was buoyed by economic reports that showed slower, but broadly based, growth in the domestic economy, and by strong profit reports from a host of blue-chip companies. Once again, international stocks outperformed

2

U.S. equities. In a marked turnaround from recent years, large-capitalization stocks outpaced small-cap issues.

The bond market produced modest half-year gains

The Federal Reserve Board maintained its target for the federal funds rate at 5.25% throughout the six-month period. The inversion of the yield curve continued, with yields of long-term bonds remaining lower than short-term yields. As inflation fears abated, the premium generally paid for long-term bonds—and for the longer commitment of capital—diminished.

Money market instruments continued to be a bright spot in the fixed income firmament, returning 2.5% for the half-year, as measured by the Citigroup 3-Month Treasury Bill Index. The yield of 3-month U.S. Treasuries was 4.8% at the end of the period. For the six months, the broad taxable bond market returned 2.6%, while municipal bonds posted a return of 1.6%.

Sound stock selection helped Windsor outpace the market

In accordance with Windsor Fund’s deep-value style of investing, the fund’s two investment advisors seek out companies that are financially solid but temporarily out of favor with investors. During the six-month period, many of the deeply discounted stocks your fund favors flourished, and the fund outperformed its benchmark index, the average return of its peer group, and the broad U.S. stock market.

Market Barometer |

|

|

|

|

|

| Total Returns |

|

| Periods Ended April 30, 2007 | |

| Six Months | One Year | Five Years1 |

Stocks |

|

|

|

Russell 1000 Index (Large-caps) | 9.1% | 15.2% | 9.1% |

Russell 2000 Index (Small-caps) | 6.9 | 7.8 | 11.1 |

Dow Jones Wilshire 5000 Index (Entire market) | 9.1 | 14.5 | 9.7 |

MSCI All Country World Index ex USA (International) | 16.1 | 19.7 | 18.3 |

|

|

|

|

Bonds |

|

|

|

Lehman Aggregate Bond Index (Broad taxable market) | 2.6% | 7.4% | 5.1% |

Lehman Municipal Bond Index | 1.6 | 5.8 | 5.2 |

Citigroup 3-Month Treasury Bill Index | 2.5 | 5.0 | 2.6 |

|

|

|

|

CPI |

|

|

|

Consumer Price Index | 2.4% | 2.6% | 2.8% |

1 Annualized.

3

Several of the fund’s largest holdings had excellent half-year returns. Top-ten holdings Cisco Systems (+11%), Alcoa (+24%), and Goodrich (+30%), all made significant contributions. On the other hand, Bank of America, the fund’s third-largest holding, returned –3% for the period. A number of the fund’s large airline stocks also struggled.

Windsor’s managers select equities primarily on the basis of each stock’s individual merits, not its membership or weighting in a benchmark—and, as a result, the fund’s sector weightings can vary considerably from those of the Russell 1000 Value Index. During the past six months, the advisors’ stock selections led to heavy weightings in the consumer discretionary and information technology sectors, which added considerably to the fund’s performance.

Superior stock selection in the consumer staples sector also boosted the fund’s overall gain. The advisors’ selections underperformed the benchmark in the energy, industrials, and financials sectors, although the penalties were modest.

Windsor’s reliance on two investment advisors continues to serve the fund well. Wellington Management Company and AllianceBernstein independently manage their portions of the portfolio, and their distinct investment approaches add considerably to the fund’s diversification.

Annualized Expense Ratios1 |

|

|

|

Your fund compared with its peer group |

|

|

|

|

|

| Average |

| Investor | Admiral | Multi-Cap |

| Shares | Shares | Value Fund |

Windsor Fund | 0.32% | 0.22% | 1.31% |

1 Fund expense ratios reflect the six months ended April 30, 2007. Peer-group expense ratio is derived from data provided by Lipper Inc. and captures information through year-end 2006.

4

A balanced strategy positions you for the long term

At Vanguard, we always encourage shareholders to evaluate their investments from a long-term perspective. In our view, a stock fund like Windsor should be part of a carefully considered, balanced portfolio with an asset allocation that reflects your personal appetite for risk, your time horizon, and your investment goals.

Over time, a well-diversified portfolio that holds both value and growth stock funds, as well as bond and money market funds, can help position you to reap the rewards of the markets’ best-performing assets while muting the impact of the worst-performing ones. With its low expenses and long-term focus on value investing, Vanguard Windsor Fund can play an important role in such an investment plan.

Thank you for investing with Vanguard.

Sincerely,

John J. Brennan

Chairman and Chief Executive Officer

May 14, 2007

5

Advisors’ Report

During the fiscal half-year ended April 30, 2007, the Investor Shares of Vanguard Windsor Fund returned 10.1%, and the lower-cost Admiral Shares returned 10.2%. This performance reflected the combined efforts of your fund’s two independent advisors. The use of two advisors provides exposure to distinct, yet complementary, investment approaches, enhancing the fund’s diversification.

The advisors, the percentage of fund assets each manages, and brief descriptions of their investment strategies are presented in the table below. The advisors have also prepared a discussion of the investment environment during the six-month period and of how their portfolio positioning reflects this assessment.

Wellington Management Company, LLP

Portfolio Manager:

David R. Fassnacht, CFA

Senior Vice President and Partner

Our contrarian approach entails maintaining a long-term investment horizon while looking for value amid shorter-term market price dislocations. As a consequence, during periods of market uncertainty, such as those that occurred during the late spring and early summer of 2006, many of our cheap stocks have a tendency to become cheaper. These periods of market pressure give us an opportunity to add to existing holdings and uncover new ideas.

Vanguard Windsor Fund Investment Advisors |

| ||

|

|

|

|

| Fund Assets Managed |

| |

Investment Advisor | % | $ Million | Investment Strategy |

Wellington Management | 67 | 16,696 | An opportunistic, contrarian investment approach that |

Company, LLP |

|

| seeks to identify significantly undervalued securities |

|

|

| utilizing bottom-up fundamental analysis. As part of |

|

|

| its long-term strategy, the advisor seeks to take |

|

|

| advantage of short- and intermediate-term market- |

|

|

| price dislocations that result from the market’s |

|

|

| shorter-term focus. |

AllianceBernstein L.P. | 30 | 7,317 | A value focus that couples rigorous fundamental |

|

|

| company research with quantitative risk controls |

|

|

| to capture value opportunities. |

Cash Investments1 | 3 | 734 | — |

1 These short-term reserves are invested by Vanguard in equity index products to simulate investment in stocks. Each advisor also may maintain a modest cash position.

6

Among sectors, the materials group was a big contributor to our six-month performance, as holdings such as Alcoa, Owens-Illinois, and Celanese all rebounded strongly. Technology distribution companies Arrow Electronics and Avnet, which we purchased aggressively in mid-2006, also performed robustly. Other important successes during the period included R.H. Donnelley, Goodrich, Unilever, and Deere & Co.

The most significant shortfall came from our airline holdings, US Airways and UAL, which were hurt by the combination of poor winter weather, spiking jet fuel prices, and weakening consumer demand. Our underweight positions in the solidly performing energy and utilities sectors also modestly dragged on the portfolio’s performance relative to the benchmark index.

In recent months, many stocks within the consumer discretionary sector have come under selling pressure. Many companies in this group have seen their earnings hurt by fallout from the bursting of the U.S. housing bubble and news about excesses in consumer lending. Although we anticipate continued earnings pressure through 2008 for companies dependent on U.S. housing or consumer durables, we are seeing more attractive value opportunities in this sector—for example, Home Depot, Circuit City, Ford, and Centex, all of which we purchased in recent months.

We are keeping an eye on growing inflationary pressures created by rapidly rising food commodity prices, a tight labor market, and a weak U.S. dollar. We believe these pressures are likely to prevent the Federal Reserve Board from reducing short-term interest rates anytime soon. The current implosion of the U.S. subprime mortgage industry is bound to curtail residential construction, but we expect the overall economy to remain resilient. Our biggest concern remains the possibility of an extraneous shock to the global economy that would cause a rapid contraction in liquidity. We continue to monitor companies’ need for external capital in order to mitigate the fund’s exposure to this risk.

AllianceBernstein L.P.

Portfolio Managers:

Marilyn G. Fedak, CFA

Chief Investment Officer and Chair of the U.S. Equity Investment Policy Group

John D. Phillips, Jr., CFA

Senior Portfolio Manager

The benign economic conditions of the past few years, coupled with generally high corporate profitability—and the belief that these conditions can persist indefinitely—have heightened investors’ appetite for risk, as evidenced by unusually low levels of market volatility, shrinking risk premiums in both the equity and fixed income markets, and compressed valuation spreads.

7

In this environment, investors have been willing to pay higher multiples than usual for companies at or near peak cyclical earnings, and have been less willing to pay a normal premium for higher and more stable long-term earnings growth potential. The resulting compression in stock valuations has limited the value opportunity.

Our research and experience show that when valuation spreads are narrow, the return potential on any individual investment is likely to be modest and the vulnerability to forecast error large. With such asymmetry in possible outcomes, it is simply not prudent to be overly concentrated in any one stock or sector. In this regard, we are keeping our portfolio risk low. No one can say what will eventually disrupt the market’s complacency. But when that change comes and deep-value opportunities become more plentiful, we will adjust our risk profile accordingly.

For now, we continue to rely on our bottom-up research to find the opportunities that do exist. One value theme that has emerged recently lies in mega-cap stocks, which are attractively valued after years of underperformance versus smaller-cap stocks. To capture this opportunity, our portfolio retains a sizable tilt toward mega-caps. As of April 30, the largest 50 companies in the Standard & Poor’s 500 Index made up 52% of our portfolio, versus an average of not quite 33% over the past eight years.

The mega-cap bargains we own include such prominent consumer staples players as Procter & Gamble, PepsiCo, and Altria, as well as financial services giants such as global insurer American International Group and the three largest banks in the United States—Citigroup, Bank of America, and JPMorgan Chase. Our holdings also include blue chips such as Microsoft and General Electric, which have been ignored by investors in recent years despite huge cash flows that are being returned to shareholders.

We also have identified a number of classic value opportunities farther down the capitalization spectrum. These include Sara Lee and Federated Department Stores, which have executed successful business restructurings that our analyses suggest are not yet reflected in their stock prices. Black & Decker became a bargain amid investor worries about the slowing housing market, an outlook that we view as overly gloomy. A shift to outsource most of its manufacturing has made the company’s cost structure much less sensitive to swings in the housing cycle. The company’s new product line, which is based on a breakthrough battery technology, should fuel earnings growth over the long term.

8

Fund Profile

As of April 30, 2007

Portfolio Characteristics |

|

| |

|

| Comparative | Broad |

| Fund | Index1 | Index2 |

Number of Stocks | 143 | 599 | 4,921 |

Median Market Cap | $57.2B | $50.3B | $32.1B |

Price/Earnings Ratio | 17.5x | 14.7x | 18.0x |

Price/Book Ratio | 2.3x | 2.2x | 2.9x |

Yield |

| 2.4% | 1.7% |

Investor Shares | 1.3% |

|

|

Admiral Shares | 1.4% |

|

|

Return on Equity | 16.4% | 17.6% | 18.0% |

Earnings Growth Rate | 18.0% | 19.4% | 20.8% |

Foreign Holdings | 15.6% | 0.0% | 1.0% |

Turnover Rate | 41%3 | — | — |

Expense Ratio |

| — | — |

Investor Shares | 0.32%3 |

|

|

Admiral Shares | 022%3 |

|

|

Short-Term Reserves | 1% | — | — |

Sector Diversification (% of portfolio) |

| ||

|

| Comparative | Broad |

| Fund | Index1 | Index2 |

Consumer Discretionary | 12% | 9% | 12% |

Consumer Staples | 7 | 8 | 8 |

Energy | 7 | 14 | 10 |

Financials | 22 | 35 | 22 |

Health Care | 12 | 7 | 11 |

Industrials | 9 | 7 | 11 |

Information Technology | 17 | 3 | 15 |

Materials | 6 | 4 | 4 |

Telecommunication Services | 5 | 6 | 3 |

Utilities | 1 | 7 | 4 |

Other | 1 | 0 | 0 |

Short-Term Reserves | 1% | — | — |

Volatility Measures4 |

| |

| Fund Versus | Fund Versus |

| Comparative Index1 | Broad Index2 |

R-Squared | 0.86 | 0.92 |

Beta | 1.13 | 1.00 |

Ten Largest Holdings5 (% of total net assets) |

| |

|

|

|

Cisco Systems, Inc. | communications equipment | 4.0% |

Sanofi-Aventis | pharmaceuticals | 3.5 |

Bank of America Corp. | diversified financial services | 3.5 |

Microsoft Corp. | systems software | 3.2 |

Wyeth | pharmaceuticals | 3.2 |

Sprint Nextel Corp. | wireless telecommunication services | 3.0 |

Citigroup, Inc. | diversified financial services | 2.2 |

Comcast Corp. | broadcasting and cable TV | 2.0 |

Goodrich Corp. | aerospace and defense | 1.9 |

Alcoa Inc. | aluminum | 1.8 |

Top Ten |

| 28.3% |

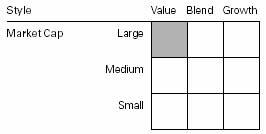

Investment Focus

1 Russell 1000 Value Index.

2 Dow Jones Wilshire 5000 Index.

3 Annualized.

4 For an explanation of R-squared, beta, and other terms used here, see the Glossary on page 27.

5 “Ten Largest Holdings” excludes any temporary cash investments and equity index products.

9

Performance Summary

All of the returns in this report represent past performance, which is not a guarantee of future results that may be achieved by the fund. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at www.vanguard.com/performance.) Note, too, that both investment returns and principal value can fluctuate widely, so an investor’s shares, when sold, could be worth more or less than their original cost. The returns shown do not reflect taxes that a shareholder would pay on fund distributions or on the sale of fund shares.

Fiscal-Year Total Returns (%): October 31, 1996–April 30, 2007

Average Annual Total Returns: Periods Ended March 31, 2007

This table presents average annual total returns through the latest calendar quarter—rather than through the end of the fiscal period. Securities and Exchange Commission rules require that we provide this information.

| Inception Date | One Year | Five Years | Ten Years |

Investor Shares | 10/23/1958 | 14.57% | 8.56% | 9.47% |

Admiral Shares | 11/12/2001 | 14.69 | 8.66 | 9.852 |

1 Six months ended April 30, 2007.

2 Return since inception.

Note: See Financial Highlights tables on pages 17 and 18 for dividend and capital gains information.

10

Financial Statements (unaudited)

Statement of Net Assets

As of April 30, 2007

The fund provides a complete list of its holdings four times in each fiscal year, at the quarter-ends. For the second and fourth fiscal quarters, the lists appear in the fund’s semiannual and annual reports to shareholders. For the first and third fiscal quarters, the fund files the lists with the Securities and Exchange Commission on Form N-Q. Shareholders can look up the fund’s Forms N-Q on the SEC’s website at www.sec.gov. Forms N-Q may also be reviewed and copied at the SEC’s Public Reference Room (see the back cover of this report for further information).

|

|

| Market |

|

|

| Value• |

|

| Shares | ($000) |

Common Stocks (96.8%)1 |

|

| |

Consumer Discretionary (11.4%) |

|

| |

* | Comcast Corp. |

|

|

| Special Class A | 18,855,600 | 497,788 |

*2 | R.H. Donnelley Corp. | 5,557,705 | 434,001 |

| Home Depot, Inc. | 9,047,100 | 342,614 |

* | Viacom Inc. Class B | 6,002,500 | 247,603 |

| Time Warner, Inc. | 11,361,600 | 234,390 |

| McDonald’s Corp. | 2,765,000 | 133,494 |

| Circuit City Stores, Inc. | 6,134,800 | 107,052 |

| CBS Corp. | 3,215,000 | 102,141 |

| Clear Channel Communications, Inc. | 2,508,800 | 88,887 |

| Ford Motor Co. | 10,453,000 | 84,042 |

| DaimlerChrysler AG | 930,000 | 74,874 |

| Centex Corp. | 1,617,100 | 72,398 |

| Federated Department Stores, Inc. | 1,600,000 | 70,272 |

* | Lear Corp. | 1,549,118 | 56,884 |

| VF Corp. | 528,836 | 46,437 |

* | Office Depot, Inc. | 1,233,722 | 41,478 |

* | Cablevision Systems NY Group Class A | 1,175,400 | 38,530 |

| BorgWarner, Inc. | 468,800 | 36,524 |

| Black & Decker Corp. | 394,177 | 35,760 |

| Limited Brands, Inc. | 1,270,000 | 35,014 |

| Autoliv, Inc. | 600,000 | 34,890 |

* | Interpublic Group of Cos., Inc. | 323,100 | 4,097 |

* | Comcast Corp. Class A | 127,474 | 3,398 |

|

|

| 2,822,568 |

Consumer Staples (7.0%) |

|

| |

| Japan Tobacco, Inc. | 69,175 | 337,871 |

| Unilever NV | 9,090,839 | 277,425 |

| Bunge Ltd. | 2,839,800 | 215,143 |

| Altria Group, Inc. | 2,049,800 | 141,272 |

| The Procter & Gamble Co. | 1,704,000 | 109,584 |

| Safeway, Inc. | 2,891,600 | 104,965 |

| The Kroger Co. | 3,291,350 | 97,128 |

| The Clorox Co. | 1,280,000 | 85,862 |

|

|

| Market |

|

|

| Value• |

|

| Shares | ($000) |

| Sara Lee Corp. | 4,450,000 | 73,025 |

| PepsiCo, Inc. | 1,090,000 | 72,038 |

| Kellogg Co. | 1,060,000 | 56,085 |

| Avon Products, Inc. | 1,292,700 | 51,449 |

| Unilever NV ADR | 1,639,400 | 50,002 |

| Kraft Foods Inc. | 1,418,510 | 47,478 |

| Molson Coors Brewing Co. Class B | 135,000 | 12,728 |

|

|

| 1,732,055 |

Energy (6.7%) |

|

| |

| ExxonMobil Corp. | 5,269,008 | 418,254 |

| Chevron Corp. | 2,683,478 | 208,748 |

| ConocoPhillips Co. | 2,458,798 | 170,518 |

| GlobalSantaFe Corp. | 2,588,400 | 165,476 |

* | Newfield Exploration Co. | 2,954,300 | 129,251 |

| Total SA ADR | 1,567,800 | 115,531 |

| EnCana Corp. | 1,958,238 | 102,710 |

| Petroleo Brasileiro Series A ADR | 834,300 | 74,436 |

* | Petro-Canada (New York Shares) | 1,662,900 | 73,716 |

| BP PLC ADR | 1,025,000 | 69,003 |

| Petro-Canada | 1,330,000 | 59,136 |

| Petroleo Brasileiro ADR | 564,800 | 57,175 |

|

|

| 1,643,954 |

Financials (21.6%) |

|

| |

| Capital Markets (3.6%) |

|

|

| UBS AG (New York Shares) | 6,583,300 | 427,256 |

* | E*TRADE Financial Corp. | 9,091,100 | 200,731 |

| Merrill Lynch & Co., Inc. | 1,800,000 | 162,414 |

| The Goldman Sachs Group, Inc. | 335,000 | 73,234 |

* | TD Ameritrade Holding Corp. | 2,347,800 | 40,030 |

|

|

|

|

| Commercial Banks (1.2%) |

|

|

| National City Corp. | 2,362,600 | 86,353 |

| SunTrust Banks, Inc. | 830,000 | 70,069 |

| Commerce Bancorp, Inc. | 1,978,400 | 66,158 |

11

|

|

| Market |

|

|

| Value• |

|

| Shares | ($000) |

| Wells Fargo & Co. | 1,020,000 | 36,608 |

| Wachovia Corp. | 487,162 | 27,057 |

|

|

|

|

| Consumer Finance (1.4%) |

|

|

| Capital One Financial Corp. | 4,638,300 | 344,440 |

|

|

|

|

| Diversified Financial Services (7.4%) |

|

|

| Bank of America Corp. | 16,794,098 | 854,820 |

| Citigroup, Inc. | 10,220,946 | 548,047 |

| JPMorgan Chase & Co. | 4,903,100 | 255,452 |

| CIT Group Inc. | 2,823,100 | 168,398 |

|

|

|

|

| Insurance (6.7%) |

|

|

| American International Group, Inc. | 6,102,700 | 426,640 |

| ACE Ltd. | 4,931,100 | 293,203 |

| Aegon NV | 9,046,865 | 186,720 |

| MetLife, Inc. | 1,773,100 | 116,493 |

| PartnerRe Ltd. | 1,405,600 | 101,231 |

| The Allstate Corp. | 1,365,700 | 85,110 |

| The Travelers Cos., Inc. | 1,416,917 | 76,655 |

| XL Capital Ltd. Class A | 980,000 | 76,420 |

| Genworth Financial Inc. | 1,910,000 | 69,696 |

| The Hartford Financial Services Group Inc. | 566,200 | 57,299 |

| Everest Re Group, Ltd. | 439,500 | 44,231 |

| IPC Holdings Ltd. | 1,319,600 | 39,562 |

| MBIA, Inc. | 550,000 | 38,258 |

| RenaissanceRe Holdings Ltd. | 657,250 | 35,590 |

| Fidelity National Financial, Inc. Class A | 275,000 | 7,010 |

|

|

|

|

| Thrifts & Mortgage Finance (1.3%) |

|

|

| Fannie Mae | 2,319,000 | 136,635 |

| Freddie Mac | 1,650,000 | 106,887 |

| Countrywide Financial Corp. | 2,354,800 | 87,316 |

* | Dime Bancorp Inc.— Litigation Tracking Warrants | 7,457,300 | 2,461 |

|

|

| 5,348,484 |

Health Care (11.1%) |

|

| |

| Wyeth | 14,075,600 | 781,196 |

| Sanofi-Aventis ADR | 10,575,000 | 484,969 |

| Sanofi-Aventis | 4,259,623 | 389,912 |

| Astellas Pharma Inc. | 6,386,300 | 279,366 |

| Pfizer Inc. | 9,005,000 | 238,272 |

| Bristol-Myers Squibb Co. | 6,768,900 | 195,350 |

| Aetna Inc. | 2,906,700 | 136,266 |

| Merck & Co., Inc. | 2,422,300 | 124,603 |

| AmerisourceBergen Corp. | 1,359,800 | 67,976 |

| McKesson Corp. | 650,000 | 38,240 |

|

|

| 2,736,150 |

|

|

| Market |

|

|

| Value• |

|

| Shares | ($000) |

Industrials (9.0%) |

|

| |

2 | Goodrich Corp. | 8,224,600 | 467,486 |

| Tyco International Ltd. | 11,151,800 | 363,883 |

*2 | UAL Corp. | 8,805,500 | 294,104 |

| General Electric Co. | 7,330,000 | 270,184 |

| Deere & Co. | 2,286,300 | 250,121 |

| American Standard Cos., Inc. | 2,701,100 | 148,723 |

* | US Airways Group Inc. | 3,349,900 | 123,745 |

| Northrop Grumman Corp. | 1,160,000 | 85,388 |

| Ingersoll-Rand Co. | 1,635,000 | 73,003 |

* | US Airways Group Private Placement | 1,471,675 | 54,364 |

| Eaton Corp. | 537,800 | 47,977 |

| SPX Corp. | 564,012 | 39,977 |

|

|

| 2,218,955 |

Information Technology (15.9%) |

|

| |

* | Cisco Systems, Inc. | 37,143,500 | 993,217 |

| Microsoft Corp. | 26,238,600 | 785,584 |

*2 | Arrow Electronics, Inc. | 9,283,217 | 366,873 |

* | Flextronics International Ltd. | 22,984,400 | 256,276 |

| Seagate Technology | 11,151,581 | 247,008 |

| LM Ericsson Telephone Co. ADR Class B | 6,234,300 | 237,963 |

* | Symantec Corp. | 10,600,000 | 186,560 |

* | Corning, Inc. | 7,578,200 | 179,755 |

* | Nortel Networks Corp. | 6,006,500 | 137,429 |

| Texas Instruments, Inc. | 3,309,700 | 113,754 |

| International Business Machines Corp. | 980,000 | 100,166 |

* | Sun Microsystems, Inc. | 18,664,600 | 97,429 |

| KLA-Tencor Corp. | 1,550,300 | 86,119 |

* | Nokia Corp. ADR | 1,550,000 | 39,138 |

* | Solectron Corp. | 10,387,300 | 34,797 |

* | Sanmina-SCI Corp. | 8,423,608 | 29,061 |

| Accenture Ltd. | 700,000 | 27,370 |

* | Unisys Corp. | 3,349,200 | 26,258 |

|

|

| 3,944,757 |

Materials (5.7%) |

|

| |

| Alcoa Inc. | 12,890,568 | 457,486 |

| E.I. du Pont de Nemours & Co. | 7,975,500 | 392,155 |

* | Owens-Illinois, Inc. | 5,275,800 | 158,749 |

* | Smurfit-Stone Container Corp. | 10,678,463 | 128,675 |

^ | Arcelor Mittal Class A New York Registered Shares | 1,640,000 | 87,609 |

| Chemtura Corp. | 7,697,300 | 84,901 |

| Celanese Corp. Series A | 1,669,450 | 55,376 |

| Dow Chemical Co. | 1,222,500 | 54,536 |

|

|

| 1,419,487 |

12

|

|

| Market |

|

|

| Value• |

|

| Shares | ($000) |

Telecommunication Services (5.2%) |

|

| |

| Sprint Nextel Corp. | 37,633,882 | 753,807 |

| Verizon Communications Inc. | 6,930,242 | 264,597 |

| AT&T Inc. | 3,835,717 | 148,519 |

| Embarq Corp. | 1,547,341 | 92,902 |

* | Crown Castle International Corp. | 850,100 | 29,192 |

|

|

| 1,289,017 |

Utilities (1.1%) |

|

| |

| Entergy Corp. | 1,009,600 | 114,226 |

| Constellation Energy Group, Inc. | 831,425 | 74,097 |

| American Electric Power Co., Inc. | 1,055,300 | 52,997 |

* | Allegheny Energy, Inc. | 800,000 | 42,768 |

|

|

| 284,088 |

Other (1.2%) |

|

| |

3 | Miscellaneous |

| 291,036 |

|

|

|

|

Exchange-Traded Funds (0.9%) |

|

| |

4 | Vanguard Value ETF | 1,689,100 | 120,484 |

4^ | Vanguard Total Stock Market ETF | 696,000 | 102,402 |

|

|

| 222,886 |

Total Common Stocks |

|

| |

(Cost $18,452,481) |

| 23,953,437 | |

Temporary Cash Investments (3.6%)1 |

|

| |

Money Market Fund (2.2%) |

|

| |

5 | Vanguard Market Liquidity Fund, 5.259% | 521,754,848 | 521,755 |

5 | Vanguard Market Liquidity Fund, 5.259%—Note G | 19,114,570 | 19,115 |

|

| Face | Market |

|

| Amount | Value• |

|

| ($000) | ($000) |

| Repurchase Agreement (1.3%) |

|

|

| Banc of America Securities, LLC 5.240%, 5/1/07 |

|

|

| (Dated 4/30/07,Repurchase Value |

|

|

| $310,545,000, collateralized by Federal National |

|

|

| Mortgage Assn.5.000%, 5/1/35) | 310,500 | 310,500 |

| U.S. Agency Obligation (0.1%) |

|

|

6 | Federal Home Loan Mortgage Corp. |

|

|

7 | 5.197%, 7/9/07 | 30,000 | 29,707 |

| Total Temporary Cash Investments |

|

|

| (Cost $881,075) |

| 881,077 |

| Total Investments (100.4%) |

|

|

| (Cost $19,333,556) |

| 24,834,514 |

| Other Assets and Liabilities—Net (–0.4%) |

| (87,369) |

| Net Assets (100%) |

| 24,747,145 |

|

|

|

|

| Statement of Assets and Liabilities |

|

|

| Assets |

|

|

| Investments in Securities, at Value |

| 24,834,514 |

| Receivables for Investment Securities Sold |

| 63,172 |

| Receivables for Capital Shares Issued |

| 13,903 |

| Other Assets—Note C |

| 36,405 |

| Total Assets |

| 24,947,994 |

| Liabilities |

|

|

| Payables for Investment Securities Purchased |

| 78,630 |

| Security Lending Collateral Payable to Brokers—Note G |

| 19,115 |

| Payables for Capital Shares Redeemed |

| 23,163 |

| Other Liabilities |

| 79,941 |

| Total Liabilities |

| 200,849 |

| Net Assets |

| 24,747,145 |

13

At April 30, 2007, net assets consisted of:8 |

|

| Amount |

| ($000) |

Paid-in Capital | 17,944,852 |

Undistributed Net Investment Income | 77,528 |

Accumulated Net Realized Gains | 1,203,503 |

Unrealized Appreciation (Depreciation) |

|

Investment Securities | 5,500,958 |

Futures Contracts | 20,310 |

Foreign Currencies | (6) |

Net Assets | 24,747,145 |

|

|

Investor Shares—Net Assets |

|

Applicable to 768,137,277 outstanding $.001 |

|

par value shares of beneficial interest |

|

(unlimited authorization) | 14,955,243 |

Net Asset Value Per Share— |

|

Investor Shares | $19.47 |

|

|

Admiral Shares—Net Assets |

|

Applicable to 149,000,359 outstanding $.001 |

|

par value shares of beneficial interest |

|

(unlimited authorization) | 9,791,902 |

Net Asset Value Per Share— |

|

Admiral Shares | $65.72 |

• See Note A in Notes to Financial Statements.

* Non-income-producing security.

^ | Part of security position is on loan to broker-dealers. See Note G in Notes to Financial Statements. |

1 The fund invests a portion of its cash reserves in equity markets through the use of index futures contracts. After giving effect to futures investments, the fund’s effective common stock and temporary cash investment positions represent 98.9% and 1.5%, respectively, of net assets. See Note E in Notes to Financial Statements.

2 Considered an affiliated company of the fund as the fund owns more than 5% of the outstanding voting securities of such company. See Note I in Notes to Financial Statements.

3 Securities representing up to 5% of the market value of unaffiliated securities are permitted to be combined and reported as “miscellaneous securities” provided that they have been held for less than one year and not previously reported by name.

4 Considered an affiliated company of the fund as the issuer is another member of The Vanguard Group.

5 Affiliated money market fund available only to Vanguard funds and certain trusts and accounts managed by Vanguard. Rate shown is the 7-day yield.

6 The issuer operates under a congressional charter; its securities are neither issued nor guaranteed by the U.S. government. If needed, access to additional funding from the U.S. Treasury (beyond the issuer’s line of credit) would require congressional action.

7 Securities with a value of $29,707,000 have been segregated as initial margin for open futures contracts.

8 See Note E in Notes to Financial Statements for the tax-basis components of net assets.

ADR—American Depositary Receipt.

14

Statement of Operations

| Six Months Ended |

| April 30, 2007 |

| ($000) |

Investment Income |

|

Income |

|

Dividends1,2 | 202,410 |

Interest2 | 22,297 |

Security Lending | 529 |

Total Income | 225,236 |

Expenses |

|

Investment Advisory Fees—Note B |

|

Basic Fee | 14,675 |

Performance Adjustment | (883) |

The Vanguard Group—Note C |

|

Management and Administrative |

|

Investor Shares | 13,449 |

Admiral Shares | 4,130 |

Marketing and Distribution |

|

Investor Shares | 1,271 |

Admiral Shares | 723 |

Custodian Fees | 182 |

Shareholders’ Reports |

|

Investor Shares | 100 |

Admiral Shares | 19 |

Trustees’ Fees and Expenses | 15 |

Total Expenses | 33,681 |

Expenses Paid Indirectly—Note D | (411) |

Net Expenses | 33,270 |

Net Investment Income | 191,966 |

Realized Net Gain (Loss) |

|

Investment Securities Sold2 | 1,186,489 |

Futures Contracts | 39,144 |

Foreign Currencies | 567 |

Realized Net Gain (Loss) | 1,226,200 |

Change in Unrealized Appreciation (Depreciation) |

|

Investment Securities | 899,135 |

Futures Contracts | 63 |

Foreign Currencies | 21 |

Change in Unrealized Appreciation (Depreciation) | 899,219 |

Net Increase (Decrease) in Net Assets Resulting from Operations | 2,317,385 |

1 Dividends are net of foreign withholding taxes of $4,061,000.

2 Dividend income, interest income, and realized net gain (loss) from affiliated companies of the fund were $5,846,000, $11,362,000, and $40,675,000, respectively.

15

Statement of Changes in Net Assets

| Six Months Ended | Year Ended |

| April 30, | October 31, |

| 2007 | 2006 |

| ($000) | ($000) |

Increase (Decrease) in Net Assets |

|

|

Operations |

|

|

Net Investment Income | 191,966 | 337,353 |

Realized Net Gain (Loss) | 1,226,200 | 1,980,297 |

Change in Unrealized Appreciation (Depreciation) | 899,219 | 1,604,186 |

Net Increase (Decrease) in Net Assets Resulting from Operations | 2,317,385 | 3,921,836 |

Distributions |

|

|

Net Investment Income |

|

|

Investor Shares | (109,629) | (192,991) |

Admiral Shares | (75,193) | (128,970) |

Realized Capital Gain1 |

|

|

Investor Shares | (1,110,085) | (1,113,365) |

Admiral Shares | (719,706) | (659,656) |

Total Distributions | (2,014,613) | (2,094,982) |

Capital Share Transactions—Note H |

|

|

Investor Shares | 626,354 | 147,757 |

Admiral Shares | 691,222 | 730,142 |

Net Increase (Decrease) from Capital Share Transactions | 1,317,576 | 877,899 |

Total Increase (Decrease) | 1,620,348 | 2,704,753 |

Net Assets |

|

|

Beginning of Period | 23,126,797 | 20,422,044 |

End of Period2 | 24,747,145 | 23,126,797 |

1 Includes fiscal 2007 and 2006 short-term gain distributions totaling $0 and $226,319,000, respectively. Short-term gain distributions are treated as ordinary income dividends for tax purposes.

2 Net Assets—End of Period includes undistributed net investment income of $77,528,000 and $69,817,000.

16

Financial Highlights

Windsor Fund Investor Shares |

|

|

|

|

|

|

| Six Months |

|

|

|

|

|

| Ended |

|

|

| ||

For a Share Outstanding | April 30, | Year Ended October 31, | ||||

Throughout Each Period | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 |

Net Asset Value, Beginning of Period | $19.27 | $17.81 | $16.75 | $15.23 | $11.81 | $14.27 |

Investment Operations |

|

|

|

|

|

|

Net Investment Income | .153 | .277 | .2651 | .214 | .17 | .164 |

Net Realized and Unrealized Gain (Loss) |

|

|

|

|

|

|

on Investments | 1.727 | 3.007 | 1.163 | 1.501 | 3.42 | (2.143) |

Total from Investment Operations | 1.880 | 3.284 | 1.428 | 1.715 | 3.59 | (1.979) |

Distributions |

|

|

|

|

|

|

Dividends from Net Investment Income | (.151) | (.265) | (.280) | (.195) | (.17) | (.169) |

Distributions from Realized Capital Gains | (1.529) | (1.559) | (.088) | — | — | (.312) |

Total Distributions | (1.680) | (1.824) | (.368) | (.195) | (.17) | (.481) |

Net Asset Value, End of Period | $19.47 | $19.27 | $17.81 | $16.75 | $15.23 | $11.81 |

|

|

|

|

|

|

|

Total Return | 10.12% | 19.72% | 8.54% | 11.30% | 30.66% | –14.55% |

|

|

|

|

|

|

|

Ratios/Supplemental Data |

|

|

|

|

|

|

Net Assets, End of Period (Millions) | $14,955 | $14,140 | $12,871 | $15,130 | $13,733 | $11,012 |

Ratio of Total Expenses to |

|

|

|

|

|

|

Average Net Assets2 | 0.32%* | 0.36% | 0.37% | 0.39% | 0.48% | 0.45% |

Ratio of Net Investment Income to |

|

|

|

|

|

|

Average Net Assets | 1.55%* | 1.50% | 1.47%1 | 1.32% | 1.27% | 1.16% |

Portfolio Turnover Rate | 41%* | 38% | 32% | 28% | 23% | 30% |

1 Net investment income per share and the ratio of net investment income to average net assets include $0.03 and 0.17%, respectively, resulting from a special dividend from Microsoft Corp. in November 2004.

2 Includes performance-based investment advisory fee increases (decreases) of (0.01%), 0.02%, 0.04%, 0.04%, 0.08%, and 0.08%.

* | Annualized. |

17

Windsor Fund Admiral Shares |

|

|

|

|

|

|

| Six Months |

|

|

|

| Nov. 12, |

| Ended |

|

| 20011 to | ||

For a Share Outstanding | April 30, | Year Ended October 31, | Oct. 31, | |||

Throughout Each Period | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 |

Net Asset Value, Beginning of Period | $65.04 | $60.12 | $56.56 | $51.41 | $39.88 | $50.00 |

Investment Operations |

|

|

|

|

|

|

Net Investment Income | .548 | 1.00 | .9682 | .787 | .605 | .556 |

Net Realized and Unrealized Gain (Loss) |

|

|

|

|

|

|

on Investments | 5.830 | 10.15 | 3.896 | 5.082 | 11.537 | (9.030) |

Total from Investment Operations | 6.378 | 11.15 | 4.864 | 5.869 | 12.142 | (8.474) |

Distributions |

|

|

|

|

|

|

Dividends from Net Investment Income | (.539) | (.97) | (1.007) | (.719) | (.612) | (.592) |

Distributions from Realized Capital Gains | (5.159) | (5.26) | (.297) | — | — | (1.054) |

Total Distributions | (5.698) | (6.23) | (1.304) | (.719) | (.612) | (1.646) |

Net Asset Value, End of Period | $65.72 | $65.04 | $60.12 | $56.56 | $51.41 | $39.88 |

|

|

|

|

|

|

|

Total Return | 10.18% | 19.85% | 8.62% | 11.46% | 30.72% | –17.61% |

|

|

|

|

|

|

|

Ratios/Supplemental Data |

|

|

|

|

|

|

Net Assets, End of Period (Millions) | $9,792 | $8,987 | $7,551 | $4,195 | $3,321 | $2,214 |

Ratio of Total Expenses to |

|

|

|

|

|

|

Average Net Assets3 | 0.22%* | 0.25% | 0.27% | 0.28% | 0.37% | 0.40%* |

Ratio of Net Investment Income to |

|

|

|

|

|

|

Average Net Assets | 1.65%* | 1.61% | 1.57%2 | 1.43% | 1.36% | 1.22%* |

Portfolio Turnover Rate | 41%* | 38% | 32% | 28% | 23% | 30% |

1 Inception.

2 Net investment income per share and the ratio of net investment income to average net assets include $0.110 and 0.17%, respectively, resulting from a special dividend from Microsoft Corp. in November 2004.

3 Includes performance-based investment advisory fee increases (decreases) of (0.01%), 0.02%, 0.04%, 0.04%, 0.08%, and 0.08%.

* | Annualized. |

See accompanying Notes, which are an integral part of the Financial Statements.

18

Notes to Financial Statements

Vanguard Windsor Fund is registered under the Investment Company Act of 1940 as an open-end investment company, or mutual fund. The fund files reports with the SEC under the company name Vanguard Windsor Funds. The fund offers two classes of shares, Investor Shares and Admiral Shares. Investor Shares are available to any investor who meets the fund’s minimum purchase requirements. Admiral Shares are designed for investors who meet certain administrative, service, tenure, and account-size criteria.

A. The following significant accounting policies conform to generally accepted accounting principles for U.S. mutual funds. The fund consistently follows such policies in preparing its financial statements.

1. Security Valuation: Securities are valued as of the close of trading on the New York Stock Exchange (generally 4 p.m., Eastern time) on the valuation date. Equity securities are valued at the latest quoted sales prices or official closing prices taken from the primary market in which each security trades; such securities not traded on the valuation date are valued at the mean of the latest quoted bid and asked prices. Securities for which market quotations are not readily available, or whose values have been affected by events occurring before the fund’s pricing time but after the close of the securities’ primary markets, are valued at their fair values calculated according to procedures adopted by the board of trustees. These procedures include obtaining quotations from an independent pricing service, monitoring news to identify significant market- or security-specific events, and evaluating changes in the values of foreign market proxies (for example, ADRs, futures contracts, or exchange-traded funds), between the time the foreign markets close and the fund’s pricing time. When fair-value pricing is employed, the prices of securities used by a fund to calculate its net asset value may differ from quoted or published prices for the same securities. Investments in Vanguard Market Liquidity Fund are valued at that fund’s net asset value. Temporary cash investments acquired over 60 days to maturity are valued using the latest bid prices or using valuations based on a matrix system (which considers such factors as security prices, yields, maturities, and ratings), both as furnished by independent pricing services. Other temporary cash investments are valued at amortized cost, which approximates market value.

2. Foreign Currency: Securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollars using exchange rates obtained from an independent third party as of the fund’s pricing time on the valuation date. Realized gains (losses) and unrealized appreciation (depreciation) on investment securities include the effects of changes in exchange rates since the securities were purchased, combined with the effects of changes in security prices. Fluctuations in the value of other assets and liabilities resulting from changes in exchange rates are recorded as unrealized foreign currency gains (losses) until the assets or liabilities are settled in cash, at which time they are recorded as realized foreign currency gains (losses).

3. Futures Contracts: The fund uses index futures contracts to a limited extent, with the objective of maintaining full exposure to the stock market while maintaining liquidity. The fund may purchase or sell futures contracts to achieve a desired level of investment, whether to accommodate portfolio turnover or cash flows from capital share transactions. The primary risks associated with the use of futures contracts are imperfect correlation between changes in market values of stocks held by the fund and the prices of futures contracts, and the possibility of an illiquid market.

Futures contracts are valued at their quoted daily settlement prices. The aggregate principal amounts of the contracts are not recorded in the Statement of Net Assets. Fluctuations in the value of the contracts are recorded in the Statement of Net Assets as an asset (liability) and in the Statement of Operations as unrealized appreciation (depreciation) until the contracts are closed, when they are recorded as realized futures gains (losses).

19

4. Repurchase Agreements: The fund may invest in repurchase agreements. Securities pledged as collateral for repurchase agreements are held by a custodian bank until the agreements mature. Each agreement requires that the market value of the collateral be sufficient to cover payments of interest and principal; however, in the event of default or bankruptcy by the other party to the agreement, retention of the collateral may be subject to legal proceedings.

5. Federal Income Taxes: The fund intends to continue to qualify as a regulated investment company and distribute all of its taxable income. Accordingly, no provision for federal income taxes is required in the financial statements.

6. Distributions: Distributions to shareholders are recorded on the ex-dividend date.

7. Security Lending: The fund may lend its securities to qualified institutional borrowers to earn additional income. Security loans are required to be secured at all times by collateral at least equal to the market value of securities loaned. The fund invests cash collateral received in Vanguard Market Liquidity Fund, and records a liability for the return of the collateral, during the period the securities are on loan. Security lending income represents the income earned on investing cash collateral, less expenses associated with the loan.

8. Other: Dividend income is recorded on the ex-dividend date. Interest income includes income distributions received from Vanguard Market Liquidity Fund and is accrued daily. Security transactions are accounted for on the date securities are bought or sold. Costs used to determine realized gains (losses) on the sale of investment securities are those of the specific securities sold.

Each class of shares has equal rights as to assets and earnings, except that each class separately bears certain class-specific expenses related to maintenance of shareholder accounts (included in Management and Administrative expenses) and shareholder reporting. Marketing and distribution expenses are allocated to each class of shares based on a method approved by the board of trustees. Income, other non-class-specific expenses, and gains and losses on investments are allocated to each class of shares based on its relative net assets.

B. Wellington Management Company, LLP, and AllianceBernstein L.P. each provide investment advisory services to a portion of the fund for a fee calculated at an annual percentage rate of average net assets managed by the advisor. The basic fees of each advisor are subject to quarterly adjustments based on performance for the preceding three years relative to a designated market index: for Wellington Management Company, LLP, the S&P 500 Index; and for AllianceBernstein L.P., the Russell 1000 Value Index.

The Vanguard Group manages the cash reserves of the fund on an at-cost basis.

For the six months ended April 30, 2007, the aggregate investment advisory fee represented an effective annual basic rate of 0.12% of the fund’s average net assets before a decrease of $883,000 (0.01%) based on performance.

C. The Vanguard Group furnishes at cost corporate management, administrative, marketing, and distribution services. The costs of such services are allocated to the fund under methods approved by the board of trustees. The fund has committed to provide up to 0.40% of its net assets in capital contributions to Vanguard. At April 30, 2007, the fund had contributed capital of $2,216,000 to Vanguard (included in Other Assets), representing 0.01% of the fund’s net assets and 2.22% of Vanguard’s capitalization. The fund’s trustees and officers are also directors and officers of Vanguard.

20

D. The fund has asked its investment advisors to direct certain security trades, subject to obtaining the best price and execution, to brokers who have agreed to rebate to the fund part of the commissions generated. Such rebates are used solely to reduce the fund’s management and administrative expenses. The fund’s custodian bank has also agreed to reduce its fees when the fund maintains cash on deposit in the non-interest-bearing custody account. For the six months ended April 30, 2007, these arrangements reduced the fund’s management and administrative expenses by $411,000.

E. Distributions are determined on a tax basis and may differ from net investment income and realized capital gains for financial reporting purposes. Differences may be permanent or temporary. Permanent differences are reclassified among capital accounts in the financial statements to reflect their tax character. Temporary differences arise when certain items of income, expense, gain, or loss are recognized in different periods for financial statement and tax purposes; these differences will reverse at some time in the future. Differences in classification may also result from the treatment of short-term gains as ordinary income for tax purposes. The fund’s tax-basis capital gains and losses are determined only at the end of each fiscal year.

During the six months ended April 30, 2007, the fund realized net foreign currency gains of $567,000, which increased distributable net income for tax purposes; accordingly, such gains have been reclassified from accumulated net realized gains to undistributed net investment income.

At April 30, 2007, the cost of investment securities for tax purposes was $19,333,556,000. Net unrealized appreciation of investment securities for tax purposes was $5,500,958,000, consisting of unrealized gains of $5,733,654,000 on securities that had risen in value since their purchase and $232,696,000 in unrealized losses on securities that had fallen in value since their purchase.

At April 30, 2007, the aggregate settlement value of open futures contracts expiring in June 2007 and the related unrealized appreciation (depreciation) were:

|

|

| ($000) |

|

| Aggregate | Unrealized |

| Number of | Settlement | Appreciation |

Futures Contracts | Long Contracts | Value | (Depreciation) |

S&P 500 Index | 661 | 245,958 | 11,804 |

E-mini S&P 500 Index | 2,790 | 207,632 | 6,278 |

S&P MidCap 400 Index | 135 | 59,279 | 2,228 |

Unrealized appreciation (depreciation) on open futures contracts is required to be treated as realized gain (loss) for tax purposes.

F. During the six months ended April 30, 2007, the fund purchased $4,731,961,000 of investment securities and sold $5,013,766,000 of investment securities, other than temporary cash investments.

G. The market value of securities on loan to broker-dealers at April 30, 2007, was $18,559,000, for which the fund received cash collateral of $19,115,000.

21

H. Capital share transactions for each class of shares were:

| Six Months Ended | Year Ended | ||

| April 30, 2007 | October 31, 2006 | ||

| Amount | Shares | Amount | Shares |

| ($000) | (000) | ($000) | (000) |

Investor Shares |

|

|

|

|

Issued | 677,521 | 35,497 | 1,159,762 | 64,777 |

Issued in Lieu of Cash Distributions | 1,186,362 | 63,476 | 1,264,434 | 73,315 |

Redeemed | (1,237,529) | (64,626) | (2,276,439) | (126,975) |

Net Increase (Decrease)—Investor Shares | 626,354 | 34,347 | 147,757 | 11,117 |

Admiral Shares |

|

|

|

|

Issued | 670,055 | 10,289 | 1,018,466 | 16,817 |

Issued in Lieu of Cash Distributions | 726,269 | 11,519 | 716,143 | 12,308 |

Redeemed | (705,102) | (10,981) | (1,004,467) | (16,557) |

Net Increase (Decrease)—Admiral Shares | 691,222 | 10,827 | 730,142 | 12,568 |

I. Certain of the fund’s investments are in companies that are considered to be affiliated companies of the fund because the fund owns more than 5% of the outstanding voting securities of the company. Transactions during the period in securities of these companies were as follows:

|

|

| Current Period Transactions |

| |

| October 31, 2006 |

| Proceeds from |

| April 30, 2007 |

| Market | Purchases | Securities | Dividend | Market |

| Value | at Cost | Sold | Income | Value |

| ($000) | ($000) | ($000) | ($000) | ($000) |

Arrow Electronics, Inc. | 371,949 | — | 125,557 | — | 366,873 |

Goodrich Corp. | 360,819 | 17,280 | 15,209 | 3,343 | 467,486 |

Lear Corp. | 186,399 | — | 177,099 | — | n/a1 |

R.H. Donnelley Corp. | 347,867 | 26,916 | 51,835 | — | 434,001 |

UAL Corp. | 307,686 | 76,513 | 61,325 | — | 294,104 |

| 1,574,720 |

|

| 3,343 | 1,562,464 |

J. In June 2006, the Financial Accounting Standards Board issued Interpretation No. 48 (“FIN

48”), “Accounting for Uncertainty in Income Taxes.” FIN 48 establishes the minimum threshold for recognizing, and a system for measuring, the benefits of tax-return positions in financial statements. FIN 48 will be effective for the fund’s fiscal year beginning November 1, 2007. Management is in the process of analyzing the fund’s tax positions for purposes of implementing FIN 48; based on the analysis completed to date, management does not believe the adoption of FIN 48 will result in any material impact to the fund’s financial statements.

1 At April 30, 2007, the security is still held but the issuer is no longer an affiliated company of the fund.

22

About Your Fund’s Expenses

As a shareholder of the fund, you incur ongoing costs, which include costs for portfolio management, administrative services, and shareholder reports (like this one), among others. Operating expenses, which are deducted from a fund’s gross income, directly reduce the investment return of the fund.

A fund’s expenses are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The following examples are intended to help you understand the ongoing costs (in dollars) of investing in your fund and to compare these costs with those of other mutual funds. The examples are based on an investment of $1,000 made at the beginning of the period shown and held for the entire period.

The table below illustrates your fund’s costs in two ways:

• Based on actual fund return. This section helps you to estimate the actual expenses that you paid over the period. The “Ending Account Value” shown is derived from the fund’s actual return, and the third column shows the dollar amount that would have been paid by an investor who started with $1,000 in the fund. You may use the information here, together with the amount you invested, to estimate the expenses that you paid over the period.

To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for your fund under the heading “Expenses Paid During Period.”

• Based on hypothetical 5% yearly return. This section is intended to help you compare your fund’s costs with those of other mutual funds. It assumes that the fund had a yearly return of 5% before expenses, but that the expense ratio is unchanged. In this case—because the return used is not the fund’s actual return—the results do not apply to your investment. The example is useful in making comparisons because the Securities and Exchange Commission requires all mutual funds to calculate expenses based on a 5% return. You can assess your fund’s costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

Six Months Ended April 30, 2007 |

|

|

|

| Beginning | Ending | Expenses |

| Account Value | Account Value | Paid During |

Windsor Fund | 10/31/2006 | 4/30/2007 | Period1 |

Based on Actual Fund Return |

|

|

|

Investor Shares | $1,000.00 | $1,101.20 | $1.67 |

Admiral Shares | 1,000.00 | 1,101.77 | 1.15 |

Based on Hypothetical 5% Yearly Return |

|

|

|

Investor Shares | $1,000.00 | $1,023.21 | $1.61 |

Admiral Shares | 1,000.00 | 1,023.70 | 1.10 |

1 The calculations are based on expenses incurred in the most recent six-month period. The fund’s annualized six-month expense ratios for that period are 0.32% for Investor Shares and 0.22% for Admiral Shares. The dollar amounts shown as “Expenses Paid” are equal to the annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent six-month period, then divided by the number of days in the most recent 12-month period.

23

Note that the expenses shown in the table on page 23 are meant to highlight and help you compare ongoing costs only and do not reflect transaction costs incurred by the fund for buying and selling securities. Further, the expenses do not include any account service fee described in the prospectus. If such a fee were applied to your account, your costs would be higher. Your fund does not charge transaction fees, such as purchase or redemption fees, nor does it carry a “sales load.”

The calculations assume no shares were bought or sold during the period. Your actual costs may have been higher or lower, depending on the amount of your investment and the timing of any purchases or redemptions.

You can find more information about the fund’s expenses, including annual expense ratios, in the Financial Statements section of this report. For additional information on operating expenses and other shareholder costs, please refer to your fund’s current prospectus.

24

Trustees Approve Advisory Agreements

The board of trustees of Vanguard Windsor Fund has renewed the fund’s investment advisory agreements with Wellington Management Company, LLP, and AllianceBernstein L.P. The board determined that retention of the advisors was in the best interests of the fund and its shareholders.

The board approved a change to the process for the quarterly calculation of the fund’s asset-based advisory base fee schedules. The calculations will be based on the average daily net assets managed by each advisor rather than the average month-end net assets.

The board also approved changes to Wellington Management’s performance adjustment schedule. The performance schedule will now be based on a “linear” rather than a “step” approach. The board concluded that this change would better align the interests of Wellington Management with those of the fund shareholders because the advisor’s compensation will be more closely linked to its performance.

The board based its decisions upon an evaluation of each advisor’s investment staff, portfolio management process, and performance. The trustees considered the factors discussed below, among others. However, no single factor determined whether the board approved the agreements. Rather, it was the totality of the circumstances that drove the board’s decision.

Nature, extent, and quality of services

The board considered the quality of the fund’s investment management over both short- and long-term periods and took into account the organizational depth and stability of each advisor. The board noted the following:

Wellington Management Company. Wellington Management, which was founded in 1928, is among the nation’s oldest and most respected institutional investment managers. The firm has advised the fund since its inception in 1958. The advisor’s contrarian process involves buying stocks of high-quality companies that are out of favor with investors. Stocks are selected using a bottom-up approach, supported by Wellington Management’s deep industry research capabilities.

AllianceBernstein. For more than 40 years, the investment professionals at AllianceBernstein have been known for their commitment to value investing and their objectivity in investment research. AllianceBernstein has managed assets of the fund since 1999. The advisor continues to employ a sound process, creating a portfolio with specific risk and return expectations compared with the Russell 1000 Value Index, the fund’s benchmark. Stocks are selected through a bottom-up approach, in which AllianceBernstein uses a proprietary dividend discount model as the primary valuation tool.

The board concluded that each advisor’s experience, stability, depth, and performance, among other factors, warranted continuation of the advisory agreements.

Investment performance

The board considered the short- and long-term performance of the fund, including any periods of outperformance or underperformance of a relevant benchmark and peer group. The board concluded that each advisor has carried out the fund’s investment strategy in disciplined fashion and that performance results have allowed the fund to remain competitive versus its benchmark and its average peer fund. Information about the fund’s most recent performance can be found in the Performance Summary portion of this report.

25

Cost

The board concluded that the fund’s expense ratio was far below the average expense ratio charged by funds in its peer group. The fund’s advisory fee rate was also well below the peer-group average. Information about the fund’s expense ratio appears in the About Your Fund’s Expenses section of this report as well as in the Financial Statements section, which also includes information about the advisory fee rate.

The board did not consider profitability of Wellington Management or AllianceBernstein in determining whether to approve the advisory fees, because the firms are independent of Vanguard and the advisory fees are the result of arm’s-length negotiations.

The benefit of economies of scale

The board concluded that the fund’s shareholders benefit from economies of scale because of breakpoints in the advisory fee schedules. The breakpoints reduce the effective rate of the fees as the fund’s assets managed by the firms increase.

The board will consider whether to renew the advisory agreements again after a one-year period.

26

Glossary

Beta. A measure of the magnitude of a fund’s past share-price fluctuations in relation to the ups and downs of a given market index. The index is assigned a beta of 1.00. Compared with a given index, a fund with a beta of 1.20 typically would have seen its share price rise or fall by 12% when the index rose or fell by 10%. A fund’s beta should be reviewed in conjunction with its R-squared (see definition below). The lower the R-squared, the less correlation there is between the fund and the index, and the less reliable beta is as an indicator of volatility.

Earnings Growth Rate. The average annual rate of growth in earnings over the past five years for the stocks now in a fund.

Expense Ratio. The percentage of a fund’s average net assets used to pay its annual administrative and advisory expenses. These expenses directly reduce returns to investors.

Foreign Holdings. The percentage of a fund represented by stocks or depositary receipts of companies based outside the United States.

Inception Date. The date on which the assets of a fund (or one of its share classes) are first invested in accordance with the fund’s investment objective. For funds with a subscription period, the inception date is the day after that period ends. Investment performance is measured from the inception date.

Median Market Cap. An indicator of the size of companies in which a fund invests; the midpoint of market capitalization (market price x shares outstanding) of a fund’s stocks, weighted by the proportion of the fund’s assets invested in each stock. Stocks representing half of the fund’s assets have market capitalizations above the median, and the rest are below it.

Price/Book Ratio. The share price of a stock divided by its net worth, or book value, per share. For a fund, the weighted average price/book ratio of the stocks it holds.

Price/Earnings Ratio. The ratio of a stock’s current price to its per-share earnings over the past year. For a fund, the weighted average P/E of the stocks it holds. P/E is an indicator of market expectations about corporate prospects; the higher the P/E, the greater the expectations for a company’s future growth.

R-Squared. A measure of how much of a fund’s past returns can be explained by the returns from the market in general, as measured by a given index. If a fund’s total returns were precisely synchronized with an index’s returns, its R-squared would be 1.00. If the fund’s returns bore no relationship to the index’s returns, its R-squared would be 0.

Return on Equity. The annual average rate of return generated by a company during the past five years for each dollar of shareholder’s equity (net income divided by shareholder’s equity). For a fund, the weighted average return on equity for the companies whose stocks it holds.

Short-Term Reserves. The percentage of a fund invested in highly liquid, short-term securities that can be readily converted to cash.

Turnover Rate. An indication of the fund’s trading activity. Funds with high turnover rates incur higher transaction costs and may be more likely to distribute capital gains (which may be taxable to investors). The turnover rate excludes in-kind transactions, which have minimal impact on costs.

Yield. A snapshot of a fund’s income from interest and dividends. The yield, expressed as a percentage of the fund’s net asset value, is based on income earned over the past 30 days and is annualized, or projected forward for the coming year. The index yield is based on the current annualized rate of income provided by securities in the index.

27

The People Who Govern Your Fund

The trustees of your mutual fund are there to see that the fund is operated and managed in your best interests since, as a shareholder, you are a part owner of the fund. Your fund’s trustees also serve on the board of directors of The Vanguard Group, Inc., which is owned by the Vanguard funds and provides services to them on an at-cost basis.

A majority of Vanguard’s board members are independent, meaning that they have no affiliation with Vanguard or the funds they oversee, apart from the sizable personal investments they have made as private individuals.

Our independent board members bring distinguished backgrounds in business, academia, and public service to their task of working with Vanguard officers to establish the policies and oversee the activities of the funds. Among board members’ responsibilities are selecting investment advisors for the funds; monitoring fund operations, performance, and costs; reviewing contracts; nominating and selecting new trustees/directors; and electing Vanguard officers.

Each trustee serves a fund until its termination; or until the trustee’s retirement, resignation, or death; or otherwise as specified in the fund’s organizational documents. Any trustee may be removed at a shareholders’ meeting by a vote representing two-thirds of the net asset value of all shares of the fund together with shares of other Vanguard funds organized within the same trust. The table on these two pages shows information for each trustee and executive officer of the fund. The mailing address of the trustees and officers is P.O. Box 876, Valley Forge, PA 19482.

Chairman of the Board, Chief Executive Officer, and Trustee | |

|

|

John J. Brennan1 |

|

Born 1954 | Principal Occupation(s) During the Past Five Years: Chairman of the Board, Chief Executive |

Trustee since May 1987; | Officer, and Director/Trustee of The Vanguard Group, Inc., and of each of the investment |

Chairman of the Board and | companies served by The Vanguard Group. |

Chief Executive Officer |

|

147 Vanguard Funds Overseen |

|

|

|

Independent Trustees |

|

|

|

Charles D. Ellis |

|

Born 1937 | Principal Occupation(s) During the Past Five Years: Applecore Partners (pro bono ventures |

Trustee since January 2001 | in education); Senior Advisor to Greenwich Associates (international business strategy |

147 Vanguard Funds Overseen | consulting); Successor Trustee of Yale University; Overseer of the Stern School of Business |

| at New York University; Trustee of the Whitehead Institute for Biomedical Research. |

|

|

Rajiv L. Gupta |

|

Born 1945 | Principal Occupation(s) During the Past Five Years: Chairman and Chief Executive Officer |

Trustee since December 20012 | of Rohm and Haas Co. (chemicals); Board Member of the American Chemistry Council; |

147 Vanguard Funds Overseen | Director of Tyco International, Ltd. (diversified manufacturing and services) since 2005; |

| Trustee of Drexel University and of the Chemical Heritage Foundation. |

|

|

Amy Gutmann |

|

Born 1949 | Principal Occupation(s) During the Past Five Years: President of the University of |

Trustee since June 2006 | Pennsylvania since 2004; Professor in the School of Arts and Sciences, Annenberg School |

147 Vanguard Funds Overseen | for Communication, and Graduate School of Education of the University of Pennsylvania |

| since 2004; Provost (2001–2004) and Laurance S. Rockefeller Professor of Politics and the |

| University Center for Human Values (1990–2004), Princeton University; Director of Carnegie |

| Corporation of New York since 2005 and of Schuylkill River Development Corporation and |

| Greater Philadelphia Chamber of Commerce since 2004. |

JoAnn Heffernan Heisen |

|

Born 1950 | Principal Occupation(s) During the Past Five Years: Corporate Vice President and Chief |

Trustee since July 1998 | Global Diversity Officer since 2006, Vice President and Chief Information Officer |

147 Vanguard Funds Overseen | (1997–2005), and Member of the Executive Committee of Johnson & Johnson |

| (pharmaceuticals/consumer products); Director of the University Medical Center |

| at Princeton and Women’s Research and Education Institute. |

|

|

André F. Perold |

|

Born 1952 | Principal Occupation(s) During the Past Five Years: George Gund Professor of Finance |

Trustee since December 2004 | and Banking, Harvard Business School; Senior Associate Dean, Director of Faculty |

147 Vanguard Funds Overseen | Recruiting, and Chair of Finance Faculty, Harvard Business School; Director and Chairman |

| of UNX, Inc. (equities trading firm) since 2003; Chair of the Investment Committee of |

| HighVista Strategies LLC (private investment firm) since 2005; Director of registered |

| investment companies advised by Merrill Lynch Investment Managers and affiliates |

| (1985–2004), Genbel Securities Limited (South African financial services firm) |

| (1999–2003), Gensec Bank (1999–2003), Sanlam, Ltd. (South African insurance |

| company) (2001–2003), and Stockback, Inc. (credit card firm) (2000–2002). |

|

|

Alfred M. Rankin, Jr. |

|

Born 1941 | Principal Occupation(s) During the Past Five Years: Chairman, President, Chief Executive |

Trustee since January 1993 | Officer, and Director of NACCO Industries, Inc. (forklift trucks/housewares/lignite); Director |

147 Vanguard Funds Overseen | of Goodrich Corporation (industrial products/aircraft systems and services). |

|

|

J. Lawrence Wilson |

|

Born 1936 | Principal Occupation(s) During the Past Five Years: Retired Chairman and Chief Executive |

Trustee since April 1985 | Officer of Rohm and Haas Co. (chemicals); Director of Cummins Inc. (diesel engines) and |

147 Vanguard Funds Overseen | AmerisourceBergen Corp. (pharmaceutical distribution); Trustee of Vanderbilt University |

| and of Culver Educational Foundation. |

|

|

Executive Officers1 |

|

|

|

Heidi Stam |

|

Born 1956 | Principal Occupation(s) During the Past Five Years: Managing Director of The Vanguard |

Secretary since July 2005 | Group, Inc., since 2006; General Counsel of The Vanguard Group since 2005; Secretary of |

147 Vanguard Funds Overseen | The Vanguard Group, and of each of the investment companies served by The Vanguard |

| Group, since 2005; Principal of The Vanguard Group (1997–2006). |

|

|

Thomas J. Higgins |

|

Born 1957 | Principal Occupation(s) During the Past Five Years: Principal of The Vanguard Group, Inc.; |

Treasurer since July 1998 | Treasurer of each of the investment companies served by The Vanguard Group. |

147 Vanguard Funds Overseen |

|

Vanguard Senior Management Team |

|

|

|

|

|

R. Gregory Barton | Kathleen C. Gubanich | Michael S. Miller |

Mortimer J. Buckley | Paul A. Heller | Ralph K. Packard |

James H. Gately | F. William McNabb, III | George U. Sauter |

|

|

|

Founder |

|

|

|

|

|

John C. Bogle |

|

|

Chairman and Chief Executive Officer, 1974–1996 |

| |