SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q/A

(Amendment No. 2)

x QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended June 30, 2008

or

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ____ to _____

Commission file number 000-28767

China 3C Group

(Exact Name of Registrant as Specified in Its Charter)

| Nevada | 88-0403070 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

368 HuShu Nan Road

HangZhou City, Zhejiang Province, China 310014

(Address of Principal Executive Offices) (Zip Code)

086-0571-88381700

(Registrant’s telephone number, including area code)

______________________________________________________________________

(Former name, former address and former fiscal year, if changed since last report)

Indicate by check whether the issuer (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer o Accelerated filer x Non-accelerated filer (Do not check if a smaller reporting company) o Smaller reporting company o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). o Yes x No

As of August 8, 2008 the registrant had 53,194,844 shares of common stock outstanding.

EXPLANATORY NOTE

We are filing this Amendment No. 2 to Quarterly Report on Form 10-Q/A to amend (a) Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations of Part I, (b) Item 4 Controls and Procedures, of Part I and (c) the notes to the financial statements contained in the Report of Independent Registered Public Accounting Firm.

Except as specifically referenced herein, this Amendment No. 2 to Quarterly Report on Form 10-Q/A does not reflect any event occurring subsequent to August 11, 2008, the filing date of the original report.

TABLE OF CONTENTS

| PART I. FINANCIAL INFORMATION | | |

| | | |

| Item 1. Financial Statements: | | |

| | | |

| Report of Independent Registered Public Accounting Firm | | 1 |

| | | |

| Consolidated Balance Sheets as of June 30, 2008 (Unaudited) and December 31, 2007 | | 2 |

| | | |

| Consolidated Statements of Income for the Six Months Ended June 30, 2008 and 2007 (Unaudited) | | 3 |

| | | |

| Consolidated Statements of Income for the Three Months Ended June 30, 2008 and 2007 (Unaudited) | | 4 |

| | | |

| Consolidated Statements of Cash Flows for the Six Months Ended June 30, 2008 and 2007 (Unaudited) | | 5 |

| | | |

| Consolidated Statement of Stockholders’ Equity for the Six Months Ended June 30, 2008 (Unaudited) and the Year Ended December 31, 2007 | | 6 |

| | | |

| Notes to Consolidated Financial Statements | | 7 - 24 |

| | | |

| Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations | | 25 |

| | | |

| Item 3. Qualitative and Quantitative Disclosure about Market Risk | | 34 |

| | | |

| Item 4. Controls and Procedures | | 35 |

| | | |

| PART II. OTHER INFORMATION | | |

| | | |

| Item 1. Legal Proceedings | | 35 |

| | | |

| Item 1A. Risk Factors | | 35 |

| | | |

| Item 2. Unregistered Sales of Equity Securities and Use of Proceeds | | 40 |

| | | |

| Item 3. Defaults Upon Senior Securities | | 40 |

| | | |

| Item 4. Submission of Matters to a Vote of Security Holders | | 40 |

| | | |

| Item 5. Other Information | | 40 |

| | | |

| Item 6. Exhibits | | 40 |

| | | |

| Signatures | | 41 |

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements.

MORGENSTERN, SVOBODA & BAER, CPA’s, P.C.

CERTIFIED PUBLIC ACCOUNTANTS

40 Exchange Place, Suite 1820

New York, NY 10005

TEL: (212) 925-9490

FAX: (212) 226-9134

E-MAIL: MORGENCPA@CS.COM

Report of Independent Registered Public Accounting Firm

Board of Directors and Stockholders of

China 3C Group

We have reviewed the accompanying consolidated balance sheets of China 3C Group as of June 30, 2008 and the consolidated statements of operations for the six months ended June 30, 2008 & 2007 and consolidated statements of cash flows and shareholders equity for the six months then ended. These financial statements are the responsibility of the Company's management.

We conducted our review in accordance with standards of the Public Company Accounting Oversight Board (United States). A review of interim financial information consists principally of applying analytical procedures and making inquiries of persons responsible for financial and accounting matters. It is substantially less in scope than an audit conducted in accordance with standards of the Public Company Accounting Oversight Board (United States), the objective of which is the expression of an opinion regarding the financial statements taken as a whole. Accordingly, we do not express such an opinion.

Based on our reviews, we are not aware of any material modifications that should be made to the accompanying interim financial statements referred to above for them to be in conformity with accounting principles generally accepted in the United States of America.

We have previously audited, in accordance with auditing standards of the Public Company Accounting Oversight Board (United States), the consolidated balance sheet of China 3C Group as of December 31, 2007 and the related consolidated statements of income retained earnings and comprehensive income, and consolidated statements of cash flows for the year then ended; and in our report dated March 4, 2008 we expressed an unqualified opinion on those financial statements. In our opinion, the information set forth in the accompanying consolidated balance sheet as of December 31, 2007, is fairly stated, in all material respects, in relation to the consolidated balance sheet from which it has been derived.

Morgenstern, Svoboda & Baer CPA’s P.C.

Certified Public Accountants

New York, New York

August 6, 2008

CHINA 3C GROUP AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEET S

AS OF JUNE 30, 2008 AND DECEMBER 31, 2007

| | | 6/30/2008 | | | 12/31/2007 | |

| ASSETS | | | | | | |

| Current Assets | | | | | | |

| Cash and cash equivalents | | $ | 25,993,638 | | | $ | 24,952,614 | |

| Accounts receivable, net | | | 19,099,910 | | | | 8,077,533 | |

| Inventory | | | 12,991,176 | | | | 6,725,371 | |

| Advance to supplier | | | 2,478,134 | | | | 2,572,285 | |

| Prepaid expenses | | | 147,185 | | | | 382,769 | |

| Total Current Assets | | | 60,710,043 | | | | 42,710,572 | |

| | | | | | | | | |

| Property & equipment, net | | | 79,709 | | | | 89,414 | |

| Goodwill | | | 20,348,278 | | | | 20,348,278 | |

| Refundable deposits | | | 52,619 | | | | 48,541 | |

| Total Assets | | $ | 81,190,649 | | | $ | 63,196,805 | |

| | | | | | | | | |

| LIABILITIES AND STOCKHOLDERS' EQUITY | | | | | | | | |

| | | | | | | | | |

| Current Liabilities | | | | | | | | |

| Accounts payable and accrued expenses | | $ | 5,210,024 | | | $ | 3,108,235 | |

| Income tax payable | | | 2,428,862 | | | | 2,684,487 | |

| Total Current Liabilities | | | 7,638,886 | | | | 5,792,722 | |

| | | | | | | | | |

| Stockholders' Equity | | | | | | | | |

| | | | | | | | | |

Common stock, $.001 par value, 100,000,000 shares authorized, 52,673,938 and 52,673,938 issued and outstanding | | | 52,674 | | | | 52,674 | |

| Additional paid in capital | | | 19,465,776 | | | | 19,465,776 | |

| Subscription receivable | | | (50,000 | ) | | | (50,000 | ) |

| Statutory reserve | | | 7,234,295 | | | | 7,234,295 | |

| Other comprehensive income | | | 4,694,974 | | | | 1,872,334 | |

| Retained earnings | | | 42,154,044 | | | | 28,829,004 | |

| Total Stockholders' Equity | | | 73,551,763 | | | | 57,404,083 | |

| Total Liabilities and Stockholders' Equity | | $ | 81,190,649 | | | $ | 63,196,805 | |

The accompanying notes are an integral part of these consolidated financial statements.

CHINA 3C GROUP AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF INCOME

FOR THE SIX MONTHS ENDING JUNE 30, 2008 AND 2007

| | | 2008 | | | 2007 | |

| | | | | | | |

| Sales, net | | $ | 146,668,847 | | | $ | 149,021,667 | |

| | | | | | | | | |

| Cost of sales | | | 123,246,750 | | | | 123,651,187 | |

| Gross profit | | | 23,422,097 | | | | 25,370,480 | |

| | | | | | | | | |

| General and administrative expenses | | | 6,312,088 | | | | 6,740,395 | |

| Income from operations | | | 17,110,009 | | | | 18,630,085 | |

| | | | | | | | | |

| Other (Income) Expense | | | | | | | | |

| Interest income | | | (65,567 | ) | | | (31,446 | ) |

| Other (income) expense | | | (311,929 | ) | | | 5,693 | |

| Gain on asset disposal | | | (2,161 | ) | | | - | |

| | | | | | | | | |

| Total Other (Income) Expense | | | (379,657 | ) | | | (25,753 | ) |

| Income before income taxes | | | 17,489,666 | | | | 18,655,838 | |

| | | | | | | | | |

| Provision for income taxes | | | 4,164,627 | | | | 6,690,523 | |

| Net income | | $ | 13,325,039 | | | $ | 11,965,315 | |

| | | | | | | | | |

| Net income per share: | | | | | | | | |

| Basic | | $ | 0.25 | | | $ | 0.23 | |

| Diluted | | $ | 0.25 | | | $ | 0.23 | |

| | | | | | | | | |

| Weighted average number of shares outstanding: | | | | | | | | |

| Basic | | | 52,673,938 | | | | 52,608,938 | |

| Diluted | | | 53,073,938 | | | | 52,608,938 | |

| | | | | | | | | |

| Comprehensive Income | | | | | | | | |

| Net Income | | $ | 13,325,039 | | | $ | 11,965,315 | |

| Foreign curreny translation adjustment | | | 2,822,640 | | | | 386,280 | |

| | | | | | | | | |

| Comprehensive Income | | $ | 16,147,679 | | | $ | 12,351,595 | |

The accompanying notes are an integral part of these consolidated financial statements.

CHINA 3C GROUP AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF INCOME

FOR THE THREE MONTHS ENDING JUNE 30, 2008 AND 2007

| | | 2008 | | | 2007 | |

| | | | | | | | | |

| Sales, net | | $ | 78,515,392 | | | $ | 64,498,473 | |

| | | | | | | | | |

| Cost of sales | | | 65,639,675 | | | | 53,060,275 | |

| Gross profit | | | 12,875,717 | | | | 11,438,198 | |

| | | | | | | | | |

| General and administrative expenses | | | 3,326,044 | | | | 3,014,233 | |

| Income from operations | | | 9,549,673 | | | | 8,423,965 | |

| | | | | | | | | |

| Other (Income) Expense | | | | | | | | |

| Interest income | | | (29,472 | ) | | | (17,655 | ) |

| Other (income) expense | | | (326,904 | ) | | | (1,171 | ) |

| Total Other (Income) Expense | | | (356,376 | ) | | | (18,826 | ) |

| Income before income taxes | | | 9,906,049 | | | | 8,442,791 | |

| | | | | | | | | |

| Provision for income taxes | | | 2,354,054 | | | | 2,941,264 | |

| Net income | | $ | 7,551,995 | | | $ | 5,501,527 | |

| | | | | | | | | |

| Net income per share: | | | | | | | | |

| Basic | | $ | 0.14 | | | $ | 0.10 | |

| Diluted | | $ | 0.14 | | | $ | 0.10 | |

| | | | | | | | | |

| Weighted average number of shares outstanding: | | | | | | | | |

| Basic | | | 52,673,938 | | | | 52,608,938 | |

| Diluted | | | 53,073,938 | | | | 52,608,938 | |

| Comprehensive Income | | | | | | | | |

| Net Income | | $ | 7,551,995 | | | $ | 5,501,527 | |

| Foreign currency translation adjustment | | | 1,222,590 | | | | 393,131 | |

| | | | | | | | | |

| Comprehensive Income | | $ | 8,774,585 | | | $ | 5,894,658 | |

The accompanying notes are an integral part of these consolidated financial statements.

CHINA 3C GROUP AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

FOR THE SIX MONTHS ENDED JUNE 30, 2008 AND 2007

| | | 2008 | | | 2007 | |

| CASH FLOWS FROM OPERATING ACTIVITIES | | | | | | |

| Net Income | | $ | 13,325,040 | | | $ | 11,965,315 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | | | | | | |

| Depreciation | | | 20,069 | | | | 21,767 | |

| Gain on asset disposition | | | (2,161 | ) | | | - | |

| Provision for bad debts | | | 17,445 | | | | 2,419 | |

| Stock based compensation | | | 226,293 | | | | 851,400 | |

| Amortization of deferred consulting expense | | | | | | | - | |

| (Increase) / decrease in assets: | | | | | | | | |

| Accounts receivables | | | (11,039,822 | ) | | | 726,962 | |

| Inventory | | | (6,265,805 | ) | | | (2,094,249 | ) |

| Prepaid expense | | | 9,291 | | | | 28,585 | |

| Advance to supplier | | | 94,151 | | | | (30,695 | ) |

| Deposits | | | (4,078 | ) | | | (37,649 | ) |

| Increase / (decrease) in current liabilities: | | | | | | | | |

| Accounts payable and accrued expenses | | | 2,101,789 | | | | 1,092,296 | |

| Income tax payable | | | (255,625 | ) | | | 381,880 | |

| Total Adjustments | | | (15,098,453 | ) | | | 942,716 | |

| | | | | | | | | |

| Net cash provided by (used in) operating activities | | | (1,773,413 | ) | | | 12,908,031 | |

| | | | | | | | | |

| CASH FLOWS FROM INVESTING ACTIVITIES | | | | | | | | |

| Purchase of property & equipment | | | (10,650 | ) | | | (62,253 | ) |

| Proceeds from asset sales | | | 2,447 | | | | - | |

| Net cash used in investing activities | | | (8,203 | ) | | | (62,253 | ) |

| | | | | | | | | |

| CASH FLOWS FROM FINANCING ACTIVITIES | | | | | | | | |

| Payments of notes- other | | | - | | | | (4,500,000 | ) |

| Net cash used in financing activities | | | | | | | (4,500,000 | ) |

| Effect of exchange rate changes on cash and cash equivalents | | | 2,822,640 | | | | 386,280 | |

| | | | | | | | | |

| Net change in cash and cash equivalents | | | 1,041,024 | | | | 8,732,058 | |

| Cash and cash equivalents, beginning balance | | | 24,952,614 | | | | 6,498,450 | |

| Cash and cash equivalents, ending balance | | $ | 25,993,638 | | | $ | 15,230,508 | |

| SUPPLEMENTAL DISCLOSURES: | | | | | | | | |

| Cash paid during the year for: | | | | | | | | |

| Income tax payments | | $ | 4,420,252 | | | $ | 6,308,643 | |

| Interest payments | | $ | - | | | $ | - | |

The accompanying notes are an integral part of these consolidated financial statements.

CHINA 3C GROUP AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF STOCKHOLDERS' EQUITY

FOR THE SIX MONTHS ENDED JUNE 30, 2008 AND THE YEAR ENDED DECEMBER 31, 2007

| | | | | | | | | Additional | | | Other | | | | | | | | | | | | Total | |

| | | Common Stock | | | Paid-In | | | Comprehensive | | | Subscription | | | Statutory | | | | | | Stockholders' | |

| | | Shares | | | Amount | | | Capital | | | Income | | | Receivable | | | Reserve | | | Retained Earnings | | | Equity | |

| Balance December 31, 2006 | | | 52,488,938 | | | $ | 52,489 | | | $ | 17,352,691 | | | $ | 427,616 | | | $ | (50,000 | ) | | $ | 3,320,755 | | | $ | 9,822,844 | | | $ | 30,926,395 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Foreign currency translation adjustments | | | | | | | | | | | | | | | 1,444,718 | | | | | | | | | | | | | | | | 1,444,718 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Income for the years ended December 31, 2007 | | | | | | | | | | | | | | | | | | | | | | | | | | | 22,919,700 | | | | 22,919,700 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Stock based compensation | | | 185,000 | | | | 185 | | | | 2,113,085 | | | | | | | | | | | | | | | | | | | | 2,113,270 | |

| Transferred To statutory reserve | | | | | | | | | | | | | | | | | | | | | | | 3,913,540 | | | | (3,913,540 | ) | | | - | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance December 31, 2007 | | | 52,673,938 | | | | 52,674 | | | | 19,465,776 | | | | 1,872,334 | | | | (50,000 | ) | | | 7,234,295 | | | | 28,829,004 | | | | 57,404,083 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Foreign currency translation adjustments | | | | | | | | | | | | | | | 2,822,640 | | | | | | | | | | | | | | | | 2,822,640 | |

| Income for the three months ended June 30, 2008 | | | | | | | | | | | | | | | | | | | | | | | | | | | 13,325,040 | | | | 13,325,040 | |

| Balance June 30, 2008 | | | 52,673,938 | | | $ | 52,674 | | | $ | 19,465,776 | | | $ | 4,694,974 | | | $ | (50,000 | ) | | $ | 7,234,295 | | | $ | 42,154,044 | | | $ | 73,551,763 | |

The accompanying notes are an integral part of these consolidated financial statements

CHINA 3C GROUP AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

JUNE 30, 2008

Note 1 - ORGANIZATION

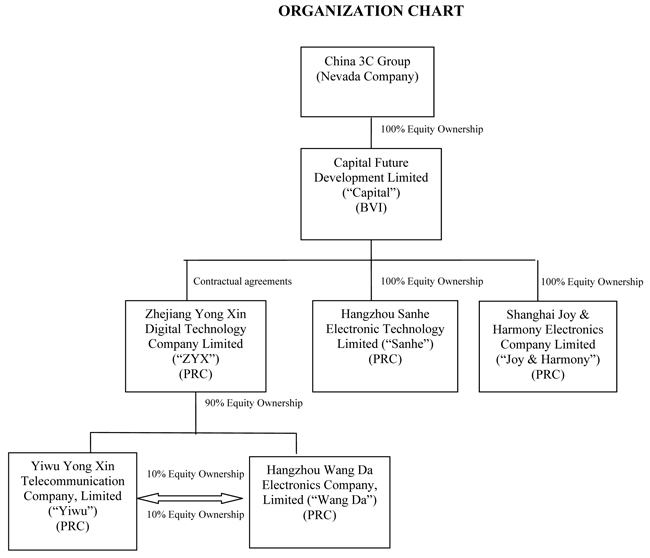

China 3C Group was incorporated on August, 20, 1998 under the laws of the State of Nevada. Capital Future Developments Limited - BVI (Capital) was incorporated on July 22, 2004 under the laws of the British Virgin Islands. Zhejiang Yong Xin Digital Technology Co., Ltd. (Zhejiang), Yiwu Yong Xin Communication Ltd. (Yiwu), Hangzhou Wandga Electronics Co., Ltd. (Wang Da), Hangzhou Sanhe Electronic Technology, Limited (“Sanhe”), and Shanghai Joy & Harmony Electronics Company Limited (Joy & Harmony) were incorporated under the laws of Peoples Republic of China on July 11, 2005, July 18, 1997, March, 30, 1998, April 12, 2004, and August 20, 2003, respectively.

On December 21, 2005 Capital became a wholly owned subsidiary of China 3C Group through a reverse merger. China 3C Group acquired all of the issued and outstanding capital stock of Capital pursuant to a Merger Agreement dated as of December 21, 2005 by and among China 3C Group, XY Acquisition Corporation, Capital and the shareholders of Capital (the “Merger Agreement”). Pursuant to the Merger Agreement, Capital became a wholly owned subsidiary of China 3C Group and, in exchange for the Capital shares, China 3C Group issued 35,000,000 new shares of its common stock to the shareholders of Capital, representing 93% of the then issued and outstanding capital stock of China 3C Group and a cash consideration of $500,000.

On August 3, 2006, Capital completed the acquisition of a 100% interest in Sanhe for a cash and stock transaction valued at approximately $8,750,000. The consideration consisted of 915,751 newly issued shares of the Company’s common stock and $5,000,000 in cash.

On November 28, 2006, Capital completed the acquisition of a 100% interest in Joy & Harmony for a cash and stock transaction valued at approximately $18,500,000. The consideration consisted of 2,723,110 shares of the Company’s common stock and $7,500,000 in cash.

On August 15, 2007, the Company changed its ownership structure. As a result, instead of Capital owning 100% of Zhejiang, as previously was the case, Capital entered into contractual agreements with Zhejiang whereby Capital owns a 100% interest in the revenues of Zhejiang. Capital does not have an equity interest in Zhejiang, but is deemed to have all the economic benefits and liabilities by contract. Under this structure, Zhejiang is now a wholly foreign owned enterprise (WOFE) of Capital. The contractual agreements give Capital and its’ equity owners an obligation to absorb any losses and rights to receive revenue. Capital will be unable to make significant decisions about the activities of Zhejiang and cannot carry out its principal activities without financial support. These characteristics as defined in Financial Accounting Standards Board (FASB) interpretation 46, Consolidation of Variable Interest Entities (VIEs), qualifies the business operations of Zhejiang to be consolidated with Capital and ultimately with China 3C Group. Zhejiang owns 90% of the issued and outstanding capital stock of each of Wang Da and Yiwu.

The Company is engaged in the business of the resale and distribution of mobile phone, facsimile machines, DVD players, stereos, speakers, MP3 and MP4 players, iPods, electronic dictionaries, CD players, radios, Walkman, and audio systems.

Note 2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation

The accompanying consolidated financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America. The Company's functional currency is the Chinese Renminbi, however the accompanying consolidated financial statements have been translated and presented in United States Dollars.

Translation Adjustment

As of June 30, 2008 and December 31, 2007, the accounts of Zhejiang, Wang Da, Yiwu, Sanhe, and Joy & Harmony were maintained, and its financial statements were expressed, in Chinese Yuan Renminbi (CNY). Such financial statements were translated into U.S. Dollars (USD) in accordance with Statement of Financial Accounts Standards (SFAS) No. 52, Foreign Currency Translation, with the CNY as the functional currency. According to the Statement, all assets and liabilities were translated at the current exchange rate, stockholders equity are translated at the historical rates and income statement items are translated at the average exchange rate for the period. The resulting translation adjustments are reported under other comprehensive income in accordance with SFAS No. 130, Reporting Comprehensive Income as a component of shareholders equity. Transaction gains and losses are reflected in the income statement.

CHINA 3C GROUP AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

JUNE 30, 2008

Note 2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

Use of Estimates

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Principles of Consolidation

The consolidated financial statements include the accounts of China 3C Group and its wholly owned subsidiaries Capital, Zhejiang, Wang Da, Yiwu, Joy & Harmony, and Sanhe, collectively referred to within as the Company. All material intercompany accounts, transactions and profits have been eliminated in consolidation.

Risks and Uncertainties

The Company is subject to substantial risks from, among other things, intense competition associated with the industry in general, other risks associated with financing, liquidity requirements, rapidly changing customer requirements, limited operating history, foreign currency exchange rates and the volatility of public markets.

Contingencies

Certain conditions may exist as of the date the financial statements are issued, which may result in a loss to the Company but which will only be resolved when one or more future events occur or fail to occur. The Company’s management and legal counsel assess such contingent liabilities, and such assessment inherently involves an exercise of judgment. In assessing loss contingencies related to legal proceedings that are pending against the Company or unasserted claims that may result in such proceedings, the Company’s legal counsel evaluates the perceived merits of any legal proceedings or unasserted claims as well as the perceived merits of the amount of relief sought or expected to be sought.

If the assessment of a contingency indicates that it is probable that a material loss has been incurred and the amount of the liability can be estimated, then the estimated liability would be accrued in the Company’s financial statements. If the assessment indicates that a potential material loss contingency is not probable but is reasonably possible, or is probable but cannot be estimated, then the nature of the contingent liability, together with an estimate of the range of possible loss if determinable and material would be disclosed.

Loss contingencies considered to be remote by management are generally not disclosed unless they involve guarantees, in which case the guarantee would be disclosed.

CHINA 3C GROUP AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

JUNE 30, 2008

Note 2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED )

Cash and Cash Equivalents

Cash and cash equivalents include cash in hand and cash in time deposits, certificates of deposit and all highly liquid debt instruments with original maturities of three months or less.

Accounts Receivable

The Company maintains reserves for potential credit losses on accounts receivable. Management reviews the composition of accounts receivable and analyzes historical bad debts, customer concentrations, customer credit worthiness, current economic trends and changes in customer payment patterns to evaluate the adequacy of these reserves. Terms of the sales vary. Reserves are recorded primarily on a specific identification basis. Allowance for doubtful debts amounted to $128,017 and $103,803 as at June 30, 2008 and December 31, 2007, respectively.

Inventories

Inventories are valued at the lower of cost (determined on a weighted average basis) or market. The Management compares the cost of inventories with the market value and allowance is made for writing down their inventories to market value, if lower. As of June 30, 2008 and December 31, 2007 inventory consisted of finished goods valued at $12,991,176 and $6,725,371, respectively.

Property, Plant & Equipment

Property and equipment are stated at cost. Expenditures for maintenance and repairs are charged to earnings as incurred; additions, renewals and betterments are capitalized. When property and equipment are retired or otherwise disposed of, the related cost and accumulated depreciation are removed from the respective accounts, and any gain or loss is included in operations. Depreciation of property and equipment is provided using the straight-line method for substantially all assets with estimated lives of:

| Furniture and Fixtures & Office Equipment | 5 years |

| Automobile | 5 years |

As of June 30, 2008 and December 31, 2007 Property, Plant & Equipment consist of the following:

| | | 2008 | | | 2007 | |

| Automobile | | $ | 132,627 | | | $ | 138,330 | |

| Office equipment | | | 116,262 | | | | 105,612 | |

| | | | 248,889 | | | | 243,942 | |

| Accumulated depreciation | | | (169,180 | ) | | | (154,528 | ) |

| | | $ | 79,709 | | | $ | 89,414 | |

CHINA 3C GROUP AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTSJUNE 30, 2008

Note 2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED )

Long-Lived Assets

Effective January 1, 2002, the Company adopted Statement of Financial Accounting Standards No. 144, Accounting for the Impairment or Disposal of Long-Lived Assets (SFAS 144), which addresses financial accounting and reporting for the impairment or disposal of long-lived assets and supersedes SFAS No. 121, Accounting for the Impairment of Long-Lived Assets and for Long-Lived Assets to be Disposed Of, and the accounting and reporting provisions of APB Opinion No. 30, Reporting the Results of Operations for a Disposal of a Segment of a Business. The Company periodically evaluates the carrying value of long-lived assets to be held and used in accordance with SFAS 144. SFAS 144 requires impairment losses to be recorded on long-lived assets used in operations when indicators of impairment are present and the undiscounted cash flows estimated to be generated by those assets are less than the assets carrying amounts. In that event, a loss is recognized based on the amount by which the carrying amount exceeds the fair market value of the long-lived assets. Loss on long-lived assets to be disposed of is determined in a similar manner, except that fair market values are reduced for the cost of disposal. Based on its review, the Company believes that, as of June 30, 2008 there were no significant impairments of its long-lived assets.

Fair Value of Financial Instruments

Statement of Financial Accounting Standard No. 107, Disclosures about fair value of financial instruments, requires that the Company disclose estimated fair values of financial instruments. The carrying amounts reported in the statements of financial position for current assets and current liabilities qualifying as financial instruments are a reasonable estimate of fair value.

Revenue Recognition

The Company’s revenue recognition policies are in compliance with Staff Accounting Bulletin (SAB) 104. Sales revenue is recognized at the date of shipment to customers when a formal arrangement exists, the price is fixed or determinable, the delivery is completed, no other significant obligations of the Company exist and collectibility is reasonably assured. Payments received before all of the relevant criteria for revenue recognition are satisfied are recorded as unearned revenue.

Share Based Payment

In December 2002, the FASB issued SFAS No. 148, “Accounting for Stock-Based Compensation-Transition and Disclosure-an amendment of SFAS 123.” This statement amended SFAS 123, “Accounting for Stock-Based Compensation,” to provide alternative methods of transition for a voluntary charge to the fair value based method of accounting for stock-based employee compensation. In addition, this statement amended the disclosure requirements of SFAS No. 123 to require prominent disclosures in both annual and interim financial statements about the method of accounting for stock-based employee compensation and the effect of the method used on reported results. Effective for 2006 the Company adopted SFAS 123 (R), “Share-Based Payment” which supersedes APB Opinion No. 25, “Accounting for Stock Issued to Employees” and eliminates the intrinsic value method that was provided in SFAS 123 for accounting of stock-based compensation to employees. The Company made no employee stock-based compensation grants before December 31, 2005 and therefore has no unrecognized stock compensation related liabilities or expense unvested or vested prior to 2006.

CHINA 3C GROUP AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

JUNE 30, 2008

Note 2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED )

Advertising

Advertising expenses consist primarily of costs of promotion for corporate image and product marketing and costs of direct advertising. The Company expenses all advertising costs as incurred.

Income Taxes

The Company utilizes SFAS No. 109, Accounting for Income Taxes, which requires the recognition of deferred tax assets and liabilities for the expected future tax consequences of events that have been included in the financial statements or tax returns. Under this method, deferred income taxes are recognized for the tax consequences in future years of differences between the tax bases of assets and liabilities and their financial reporting amounts at each period end based on enacted tax laws and statutory tax rates applicable to the periods in which the differences are expected to affect taxable income. Valuation allowances are established, when necessary, to reduce deferred tax assets to the amount expected to be realized.

Basic and Diluted Earnings per Share

Earnings per share are calculated in accordance with the Statement of Financial Accounting Standards No. 128 (SFAS No. 128), Earnings per share. SFAS No. 128 superseded Accounting Principles Board Opinion No.15 (APB 15). Net loss per share for all periods presented has been restated to reflect the adoption of SFAS No. 128. Basic net loss per share is based upon the weighted average number of common shares outstanding. Diluted net loss per share is based on the assumption that all dilutive convertible shares and stock options were converted or exercised. Dilution is computed by applying the treasury stock method. Under this method, options and warrants are assumed to be exercised at the beginning of the period (or at the time of issuance, if later), and as if funds obtained thereby were used to purchase common stock at the average market price during the period.

Statement of Cash Flows

In accordance with Statement of Financial Accounting Standards No. 95, Statement of Cash Flows, cash flows from the Company’s operations is based upon the local currencies. As a result, amounts related to assets and liabilities reported on the statement of cash flows will not necessarily agree with changes in the corresponding balances on the balance sheet.

CHINA 3C GROUP AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

JUNE 30, 2008

Note 2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

Concentration of Credit Risk

Financial instruments that potentially subject the Company to concentrations of credit risk are cash, accounts receivable and other receivables arising from its normal business activities. The Company places its cash in what it believes to be credit-worthy financial institutions. The Company has a diversified customer base, most of which are in China. The Company controls credit risk related to accounts receivable through credit approvals, credit limits and monitoring procedures. The Company routinely assesses the financial strength of its customers and, based upon factors surrounding the credit risk, establishes an allowance, if required, for uncollectible accounts and, as a consequence, believes that its accounts receivable credit risk exposure beyond such allowance is limited.

Segment Reporting

Statement of Financial Accounting Standards No. 131, Disclosure about Segments of an Enterprise and Related Information requires use of the management approach¨ model for segment reporting. The management approach model is based on the way a company's management organizes segments within the company for making operating decisions and assessing performance. Reportable segments are based on products and services, geography, legal structure, management structure, or any other manner in which management disaggregates a company.

Recent accounting pronouncements

In December 2004, the FASB issued FASB Statement No. 123R, "Share-Based Payment”, an Amendment of FASB Statement No. 123" ("FAS No. 123R"). FAS No. 123R requires companies to recognize in the statement of operations the grant-date fair value of stock options and other equity-based compensation issued to employees. FAS No. 123R is effective beginning in the Company's first quarter of fiscal 2006.

In May 2005, the FASB issued SFAS No. 154, "Accounting Changes and Error Corrections." This statement applies to all voluntary changes in accounting principle and requires retrospective application to prior periods' financial statements of changes in accounting principle, unless this would be impracticable. This statement also makes a distinction between "retrospective application" of an accounting principle and the "restatement" of financial statements to reflect the correction of an error. This statement is effective for accounting changes and corrections of errors made in fiscal years beginning after December 15, 2005.

In June 2005, the EITF reached consensus on Issue No. 05-6, Determining the Amortization Period for Leasehold Improvements ("EITF 05-6.") EITF 05-6 provides guidance on determining the amortization period for leasehold improvements acquired in a business combination or acquired subsequent to lease inception. The guidance in EITF 05-6 will be applied prospectively and is effective for periods beginning after June 29, 2005. EITF 05-6 is not expected to have a material effect on its consolidated financial position or results of operations.

CHINA 3C GROUP AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

JUNE 30, 2008

Note 2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

In June 2005, the FASB Staff issued FASB Staff Position 150-5 (FSP 150-5), Issuers Accounting under FASB Statement No. 150 for Freestanding Warrants and Other Similar Instruments on Shares that are Redeemable. FSP 150-5 addresses whether freestanding warrants and other similar instruments on shares that are redeemable, either puttable or mandatorily redeemable, would be subject to the requirements of FASB Statement No. 150, Accounting for Certain Financial Instruments with Characteristics of Both Liabilities and Equity, regardless of the timing or the redemption feature or the redemption price. The FSP is effective after June 30, 2005.

On February 16, 2006, FASB issued SFAS No. 155, Accounting for Certain Hybrid Financial Instruments. SFAS No. 155 amends SFAS No 133, Accounting for Derivative Instruments and Hedging Activities, and SFAF No. 140, Accounting for Transfers and Servicing of Financial Assets and Extinguishments of Liabilities. SFAS No. 155, permits fair value re-measurement for any hybrid financial instrument that contains an embedded derivative that otherwise would require bifurcation, clarifies which interest-only strips and principal-only strips are not subject to the requirements of SFAS No. 133, establishes a requirement to evaluate interest in securitized financial assets to identify interests that are freestanding derivatives or that are hybrid financial instruments that contain an embedded derivative requiring bifurcation, clarifies that concentrations of credit risk in the form of subordination are not embedded derivatives, and amends SFAS No. 140 to eliminate the prohibition on the qualifying special-purpose entity from holding a derivative financial instrument that pertains to a beneficial interest other than another derivative financial instrument. This statement is effective for all financial instruments acquired or issued after the beginning of the Company’s first fiscal year that begins after September 15, 2006.

In March 2006, the FASB issued FASB Statement No. 156, Accounting for Servicing of Financial Assets - an amendment to FASB Statement No. 140. Statement 156 requires that an entity recognize a servicing asset or servicing liability each time it undertakes an obligation to service a financial asset by entering into a service contract under certain situations. The new standard is effective for fiscal years beginning after September 15, 2006. The Company does not expect its adoption of this new standard to have a material impact on its financial position, results of operations or cash flows.

In July 2006, the FASB issued Interpretation No. 48, Accounting for uncertainty in Income Taxe s - an interpretation of FASB Statement 109 (FIN 48) . FIN 48 clarifies the accounting for Income Taxes by prescribing the minimum recognition threshold a tax position is required to meet before being recognized in the financial statements. It also provides guidance on derecognition, measurement, classification, interest and penalties, accounting in interim periods, disclosure and transition and clearly scopes income taxes out of SFAS No. 5, Accounting for Contingencies . FIN 48 is effective for fiscal years beginning after December 15, 2006. We did not have a material impact on our consolidated financial position, results of operations or cash flows.

In September, 2006, FASB issued SFAS No. 157, Fair Value Measurements. This statement defines fair value, establishes a framework for measuring fair value in generally accepted accounting principles (GAAP), and expands disclosures about fair value measurements. This statements applies under other accounting pronouncements that require or permit fair value measurements, the Board having previously concluded in those accounting pronouncements that fair value is the relevant measurement attribute. Accordingly, this statement does not require any new fair value measurements. However, for some entities, the application of this statement will change current practice. This statement is effective for financial statements issued for fiscal years beginning after November 15, 2007, and interim periods within those fiscal years. The management is currently evaluating the effect of this pronouncement on financial statements.

CHINA 3C GROUP AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

JUNE 30, 2008

Note 2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

In September 2006, FASB issued SFAS No. 158, Employers’ Accounting for Defined Benefit Pension and Other Postretirement Plans - an amendment of FASB Statements No. 87, 88, 106, and 132(R). This statement improves financial reporting by requiring an employer to recognize the over funded or under funded status of a defined benefit postretirement plan (other than a multiemployer plan) as an asset or liability in its statement of financial position and to recognize changes in that funded statues in the year in which the changes occur through comprehensive income of a business entity or changes in unrestricted net assets of a not-for-profit organization. This statement also improves financial reporting by requiring an employer to measure the funded status of a plan as of the date of its year-end statement of financial position, with limited exceptions. An employer with publicly traded equity securities is required to initially recognize the funded status of a defined benefit postretirement plan and to provide the required disclosures as of the end of the fiscal year ending after December 15, 2006. An employer without publicly traded equity securities is required to recognize the funded status of a defined benefit postretirement plan and to provide the required disclosures as of the end of the fiscal year ending after June 15, 2007. However, an employer without publicly traded equity securities is required to disclose the following information in the notes to financial statements for a fiscal year ending after December 15, 2006, but before June 16, 2007, unless it has applied the recognition provisions of this statement in preparing those financial statements.

| | a. | A brief description of the provisions of this statement |

| | b. | The date that adoption is required |

| | c. | The date the employer plans to adopt the recognition provisions of this statement, if earlier. |

The requirement to measure plan assets and benefit obligations as of the date of the employer’s fiscal year-end statement of financial position is effective for fiscal years ending after December 15, 2008.

The Company believes that the adoption of these standards will have no material impact on its financial statements.

In September 2006, the Securities and Exchange Commission issued Staff Accounting Bulletin No. 108 (SAB 108). SAB 108 was issued to provide interpretive guidance on how the effects of the carryover reversal of prior year misstatements should be considered in quantifying a current year misstatement. The provisions of SAB 108 are effective for the Company for its December 31, 2006 year-end. The adoption of SAB 108 had no impact on the Company’s consolidated financial statements.

In February, 2007, FASB issued SFAS No. 159, The Fair Value Option for Financial Assets and Financial Liabilities – Including an Amendment of FABS Statement No. 115. This statement permits entities to choose to measure many financial instruments and certain other items at fair value. This statement is expected to expand the use of fair value measurement, which is consistent with the Board’s long-term measurement objectives for accounting for financial instruments. This statement is effective as of the beginning of an entity’s first fiscal year that begins after November 15, 2007. The management is currently evaluating the effect of this pronouncement on financial statements.

In December 2007, the FASB issued SFAS No. 160, Noncontrolling Interests in Consolidated Financial Statements. This Statement amends ARB 51 to establish accounting and reporting standards for the noncontrolling (minority) interest in a subsidiary and for the deconsolidation of a subsidiary. It clarifies that a noncontrolling interest in a subsidiary is an ownership interest in the consolidated entity that should be reported as equity in the consolidated financial statements. SFAS No. 160 is effective for the Company’s fiscal year beginning October 1, 2009. Management is currently evaluating the effect of this pronouncement on financial statements.

CHINA 3C GROUP AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

JUNE 30, 2008

Note 2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

In March 2008, the FASB issued FASB No. 161, Disclosures about Derivative Instruments and Hedging Activities. The new standard is intended to improve financial reporting about derivative instruments and hedging activities by requiring enhanced disclosures to enable investors to better understand their effects on an entity’s financial position, financial performance, and cash flows. It is effective for financial statements issued for fiscal years and interim periods beginning after November 15, 2008, with early application encouraged. The new standard also improves transparency about the location and amounts of derivative instruments in an entity’s financial statements; how derivative instruments and related hedged items are accounted for under Statement 133; and how derivative instruments and related hedged items affect its financial position, financial performance, and cash flows. Management is currently evaluating the effect of this pronouncement on financial statements.

In May, 2008, the FASB issued SFAS No. 162, The Hierarchy of Generally Accepted Accounting Principles, which will provide framework for selecting accounting principles to be used in preparing financial statements that are presented in conformity with U.S. generally accepted accounting principles (GAAP) for nongovernmental entities. With the issuance of SFAS No. 162, the GAAP hierarchy for nongovernmental entities will move from auditing literature to accounting literature. The Company is currently assessing the impact of SFAS No. 162 on its financial position and results of operations.

In May 2008, the FASB issued SFAS No. 163, Accounting for Financial Guarantee Insurance Contracts. SFAS No. 163 clarifies how SFAS No. 60, Accounting and Reporting by Insurance Enterprises, applies to financial guarantee insurance contracts issued by insurance enterprises, and addresses the recognition and measurement of premium revenue and claim liabilities. It requires expanded disclosures about contracts, and recognition of claim liability prior to an event of default when there is evidence that credit deterioration has occurred in an insured financial obligation. It also requires disclosure about (a) the risk-management activities used by an insurance enterprise to evaluate credit deterioration in its insured financial obligations, and (b) the insurance enterprise's surveillance or watch list. The Company is currently evaluating the impact of SFAS No. 163.

Note 3 - ADVANCE TO SUPPLIER

Advance to suppliers represents payments to suppliers for payments of finished goods. As of June 30, 2008 and December 31, 2007 the Company had paid $ 2,478,134 and $2,572,285, respectively as advances to suppliers.

Note 4 - COMMON STOCK

On December 20, 2005, the Company completed a private offering of 1,000,000 shares of its common stock at a per share price of $0.10 to an unaffiliated individual, resulting in gross proceeds to the Company of $100,000. The proceeds were to be used for the Company’s proposed plan to identify and complete a merger or acquisition with private entities.

On December 20, 2005, the Company issued a warrant to purchase 4,000,000 shares of its common stock to two individuals at $0.10 per share, which was the fair value of the shares at the date of issuance. The warrant was issued as consideration for financial consulting services to be provided from December 20, 2005 to December 19, 2006. The warrants were exercised on December 30, 2005. The shares were issued subsequently in 2006.

On December 21, 2005, the Company agreed to purchase all of the issued and outstanding shares of Capital from its shareholders for approximately $500,000 in cash and 35,000,000 shares of the Company’s common stock, or approximately 93% of the total issued and outstanding shares.

CHINA 3C GROUP AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

JUNE 30, 2008

Note 4 - COMMON STOCK (CONTINUED)

On December 21, 2005, the Company announced a plan named the China 3C Group 2005 Equity Incentive Plan (¨Plan¨) for providing incentives to attract, retain and motivate eligible persons whose presence and potential contributions are important to the success of the Company. 5,000,000 shares of common stock were allocated to the Plan.

On December 21, 2005, the Company agreed to issue 4,980,000 shares under the Plan to a number of consultants who were engaged to provide various services to the Company during the period from January 1, 2005 to December 20, 2005. These shares were valued at $0.10 per share, or $498,000, and were expensed as consulting fees in the statements of operations. The shares were issued subsequently in 2006.

On March 6, 2007, the Company issues 180,000 shares of common stock, $.001 par value, issuable pursuant to the China 3C Group amended 2005 Equity Incentive Plan. Under Rule 405 and Rule 144, of the Securities Act of 1933, as amended, these securities are deemed “restricted securities”.

On December 21, 2005, the Company issued 2,256,795 shares of the Company’s common stock to a company for guarantee fees related to the acquisition of Capital. The guarantee was valued at $225,680, which was the fair value of the shares issued at the date of the transaction and was expensed as consulting fees in the statement of operations.

Pursuant to share exchange agreement, dated August 3, 2006, the company issued 915,751 shares of restricted common stock, to the former shareholders of Hangzhou Sanhe Electronic Technology Ltd. The shares were valued at $3,750,000, which was the fair value of the shares at the date of exchange agreement. This amount is included in the cost of net assets and goodwill purchased.

Pursuant to share exchange agreement, dated November 28, 2006, the company issued 2,723,110 shares of newly issued shares of Common Stock to the former shareholders of Shanghai Joy & Harmony Electronics Company Limited. The shares were valued at $11,000,000, which was the fair value of the shares at the date of exchange agreement. This amount is included in the cost of net assets and goodwill purchased.

Note 5 - ACQUISITIONS

(a) Hangzhou Sanhe Electronic Technology Ltd.

On August 3, 2006, the Company completed the acquisition of a 100% interest in Hangzhou Sanhe Electronic Technology Ltd. ("HSET") for a cash and stock transaction valued at approximately US$8.75 million (“HSET Share Exchange Transaction”). This amount is included in the cost of net assets and goodwill purchased.

The stock consideration consisted of 915,751 newly issued shares of the Company’s common stock, which were divided proportionally among the HSET shareholders in accordance with their respective ownership interests in HSET immediately before the completion of the HSET Share Exchange Transaction. The cash consideration consisted of $5,000,000 in cash, again divided proportionally among the HSET shareholders in accordance with their respective ownership interests in HSET immediately before the completion of the HSET Share Exchange Transaction and payable no later than the first anniversary of the Merger Transaction, as defined elsewhere in this Quarterly Report on Form 10-Q/A. The obligation to pay the cash consideration is evidenced by two interest-free promissory notes between the Company and each of the HSET shareholders. The form of the promissory note is attached as an exhibit to the Share Exchange Agreement.

HSET is a home electronics retail chain in Eastern China. It has 200 retail stores in Shanghai City, Zhejiang Province and Jiangsu Province. HSET specializes in the sale of home electronics, including DVD players, audio systems, speakers, televisions and air conditioners.

CHINA 3C GROUP AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

JUNE 30, 2008

Note 5 - ACQUISITIONS (CONTINUED)

The main purpose of the acquisition of the 100% interest in HSET is to increase the Company’s presence, distribution markets, and increase product lines. The purchase price was determined based on arms' length negotiations between China 3C and Hangzhou Sanhe Electronic Technology, Ltd.

The acquisition had been accounted for as a purchase business combination and the results of operations from the acquisition date have been included in the Company's consolidated financial statements in accordance with SFAS 94. The allocation of the purchase price is as follows:

| Cash acquired | | $ | 1,235,283 | |

| Other tangible assets acquired | | | | |

| Accounts Receivable | | | 1,207,653 | |

| Inventory | | | 667,504 | |

| Trade Deposits | | | 694,695 | |

| Prepaid Expenses | | | 2,333 | |

| Property Plant & Equipment | | | 966 | |

| Goodwill | | | 5,854,096 | |

| | | | | |

| Total assets acquired | | | 9,662,530 | |

| Liabilities assumed | | | | |

| Accounts & Income Taxes payable | | | 626,091 | |

| Statutory reserves | | | 286,439 | |

| | | | | |

| Total | | $ | 8,750,000 | |

The excess of purchase price over tangible assets acquired and liabilities assumed of $5,854,096 was recorded as goodwill. At the time of the acquisition no identifiable intangibles assets existed under the contractual-legal or the separability criterion as required under SFAS 141.

Prior to the acquisition, Hangzhou Sanhe Electronic Technology, Ltd. prepared its financial statements under accounting principles generally accepted in the United States of America.

(b) Shanghai Joy & Harmony Electronics Company Limited

On November 28, 2006, the Company completed the acquisition of a 100% interest in Shanghai Joy & Harmony Electronics Company Limited (“Joy & Harmony”) for a cash and stock transaction valued at approximately US$18.5 million (“Joy & Harmony Share Exchange Transaction”). This amount is included in the cost of net assets and goodwill purchased.

The stock consideration consisted of 2,723,110 shares of the Company’s common stock, which were divided proportionally among the Joy & Harmony shareholders in accordance with their respective ownership interests in Joy & Harmony immediately before the completion of the Joy & Harmony Share Exchange Transaction. The cash consideration consisted of $7,500,000 in cash, again divided proportionally among the Joy & Harmony shareholders in accordance with their respective ownership interests in Joy & Harmony immediately before the completion of the Joy & Harmony Share Exchange Transaction. The cash component was payable by the Company as follows: $3,000,000 within 10 business days after the closing and $4,500,000 is payable six months after the closing as evidenced by a promissory note.

CHINA 3C GROUP AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

JUNE 30, 2008

Note 5 - ACQUISITIONS (CONTINUED)

Joy & Harmony is engaged in the business of distributing MP3 and MP4 players, iPods, electronic dictionaries, CD players, radios, Walkman, and audio systems and speakers at company maintained shops at various retail establishments.

The main purpose of the acquisition of the 100% interest in Joy & Harmony is to increase the Company’s presence, distribution markets, and increase product lines. The purchase price was determined based on arms' length negotiations between China 3C and Shanghai Joy & Harmony Electronics Company Limited.

The acquisition had been accounted for as a purchase business combination and the results of operations from the acquisition date have been included in the Company's consolidated financial statements in accordance with SFAS 94. The allocation of the purchase price is as follows:

| Cash acquired | | $ | 214,561 | |

| Other tangible assets acquired | | | | |

| Accounts Receivable | | | 3,599,680 | |

| Inventory | | | 1,021,435 | |

| Trade Deposits | | | 300,304 | |

| Prepaid Expenses | | | 4,387 | |

| Property Plant & Equipment | | | 11,342 | |

| Goodwill | | | 14,494,182 | |

| | | | | |

| Total assets acquired | | | 19,645,891 | |

| Liabilities assumed | | | | |

| Accounts & Income Taxes payable | | | 767,277 | |

| Statutory reserves | | | 378,614 | |

| | | | | |

| Total | | $ | 18,500,000 | |

The excess of purchase price over tangible assets acquired and liabilities assumed of $14,494,182 was recorded as goodwill. At the time of the acquisition no identifiable intangibles assets existed under the contractual-legal or the separability criterion as required under SFAS 141.

Prior to the acquisition, Joy & Harmony prepared its financial statements under accounting principles generally accepted in the United States of America.

The results of operations for Hangzhou Sanhe Electronic Technology Ltd. and Shanghai Joy & Harmony Electronics Company Limited have been included in the Company’s consolidated statements of operations since the completion of the acquisitions during the year ended December 31, 2006. The following unaudited pro forma financial information presents the combined results of the Company and the 2006 acquisitions as if the acquisitions had occurred at the beginning of 2005 (in thousands, except per share amounts):

| | Year Ended | | Year Ended | |

| | December 31, | | December 31, | |

| | 2006 | | 2005 | |

| | | | | | | |

| Net revenues | | $ | 193,591 | | | $ | 58,768 | |

| Net income (loss) | | $ | 15,457 | | | $ | 3,538 | |

| Net income (loss) per share — basic | | $ | .33 | | | $ | .09 | |

| Net income (loss) per share — diluted | | $ | .33 | | | $ | .09 | |

CHINA 3C GROUP AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

JUNE 30, 2008

Note 6 - STOCK WARRANTS, OPTIONS, AND COMPENSATION

On December 20, 2005, the Company issued a warrant for 4,000,000 shares to two individuals with an exercise price of $0.10. The warrants were issued for consulting services to be provided from December 20, 2005 to December 19, 2006. The warrant was exercisable immediately and was exercised on December 30, 2005.

The Company is amortizing the fair value of the warrants, $400,000, over the period of the agreement. The fair value of the warrants was calculated assuming 293% volatility, term of the warrant of 3 years, risk free rate of 4% and dividend yield of 0%. For the year ended December 31, 2006 and December 31, 2005, $387,945 and $12,055 of consulting fees were expensed relating to the warrants, respectively.

On December 8, 2006, the Company issued, to a newly appointed Board member, an option grant (incentive stock options) to purchase 50,000 shares of common stock at the closing price as of December 7, 2006. The options expire 10 years from issuance.

On January 2, 2007, the Company issued, to an other newly appointed Board member, an option grant (incentive stock options) to purchase 50,000 shares of common stock at the closing price as of January 2, 2007. The options expire 10 years from issuance. As of December 17, 2007, the Board member resigned.

On May 7, 2007, the Board of Directors appointed Joseph Levinson to serve as a member of the Board of Directors of the Company. Mr. Levinson has been named chairman of the Nominating Committee of the Company. In addition, Mr. Levinson is in charge of investor relations for the Company.

As compensation for the services set forth herein, Mr. Levinson receives:

| | · | A monthly grant during his Term of 1,000 shares of the Company’s Common Stock, |

| | · | An annual grant of Stock Options to purchase 300,000 shares of common stock of the Company. The annual grant of Stock Options shall vest immediately upon issuance. The exercise price of the initial grant of Stock Options shares shall be based on the closing price of the common stock of the Company on May 7, 2007. On May 7, 2008, Mr. Levinson became vested in an additional grant of Stock Options to purchase an additional 300,000 shares of common stock of the Company based on the closing price of the common stock on May 7, 2008 of $1.82. |

Stock options—The three stock option grants have a ten-year life and were fully vested upon issuance. The option holder has no voting or dividend rights. The grant price was equal the market price at the date of grant. The Company records the expense of the stock options over the related vesting period. The options were valued using the Black-Scholes option-pricing model at the date of grant stock option pricing.

| | | Six Months ended | |

| | | June 30, 2008 | |

| Expected Volatility | | | 153 | % |

| Expected term (in years) | | | | |

| Todd L. Mavis | | | 2 | |

| Kenneth T. Berents | | | 9 | |

| Joseph Levinson | | | 9 | |

| Expected dividends | | | - | |

| Risk-free rate of return (weighted average) | | | 3 | % |

| Weighted average grant-date fair value | | | 3.8-6.15 | |

Expected volatility is based on the historical volatility of the Company’s stock price. The expected term represents the estimated average period of time that the options remain outstanding. No dividend payouts were assumed, as the Company has no plans to declare dividends during the expected term of the stock

CHINA 3C GROUP AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

JUNE 30, 2008

Note 6 - STOCK WARRANTS, OPTIONS, AND COMPENSATION (CONTINUED)

options. The risk-free rate of return reflects the weighted average interest rate offered for zero coupon treasury bonds over the expected term of the options. Based upon this calculation and pursuant to ETIF 96-18 the company recorded a $226,293 and a $899,952 service period expense for these warrants for the six months ending June 30, 2008 and the year ending December 31, 2007.

| | | | | | | | | Aggregate |

| | | | | Exercise | | Remaining | | Intrinsic |

| | | Total | | Price | | Life | | Value |

| | | | | | | | | | |

| Outstanding, December 31, 2007 | | | 400,000 | | | | | | |

| Granted in 2008 | | | - | | | | | | |

| Exercised in 2008 | | | - | | | | | | |

| Outstanding, June 30, 2008 | | | 400,000 | | | | | | |

Note 7 – STOCK EXCHANGE AGREEMENT

On December 21, 2005 Capital Future Developments Ltd - BVI became a wholly owned subsidiary of China 3C Group through a reverse merger. China 3C Group acquired all of the issued and outstanding capital stock of Capital Future Developments Ltd. - BVI pursuant to a Merger Agreement dated at December 21, 2005 by and among China 3C Group, XY Acquisition Corporation, Capital Future Developments Ltd. - BVI and the shareholders of Capital Future Developments Ltd - BVI (the "Merger Agreement"). Pursuant to the Merger Agreement, Capital Future Developments Ltd. - BVI became a wholly owned subsidiary of China 3C Group and, in exchange for the Capital Future Developments Ltd. BVI shares, China 3C Group issued 35,000,000 shares of its common stock to the shareholders of Capital Future Developments Ltd. - BVI, representing 93% of the issued and outstanding capital stock of China 3C Group at that time and a cash consideration of $500,000. As a result of the exchange agreement, the reorganization was treated as an acquisition by the accounting acquirer that is being accounted for as a recapitalization and as a reverse merger by the legal acquirer for accounting purposes. Pursuant to the recapitalization, all capital stock shares and amounts and per share data were retroactively restated.

Note 8 - COMPENSATED ABSENCES

Regulation 45 of local PRC labor law entitles employees to annual vacation leave after one year of service. In general all leave must be utilized annually, with proper notification, any unutilized leave is cancelled.

Note 9 - INCOME TAXES

The Company through its subsidiaries, Zhejiang, Wang Da, Sanhe, and Yiwu, is governed by the Income Tax Laws of the PRC. Operations in the United States of America have incurred net accumulated operating losses of approximately $2,300,000 as of December 31, 2007 for income tax purposes. However, a hundred percent allowance has been created on the deferred tax asset of approximately $920,000 due to uncertainty of its realization.

Pursuant to the PRC Income Tax Laws, the Enterprise Income Tax (“EIT) is at a statutory rate of 25%, which is comprises of 22% national income tax and 3% local income tax.

CHINA 3C GROUP AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

JUNE 30, 2008

Note 9 - INCOME TAXES (CONTINUED)

The following is a reconciliation of income tax expense:

| 6/30/2008 | | U.S. | | | State | | | International | | | Total | |

| Current | | $ | - | | | $ | - | | | $ | 4,164,627 | | | $ | 4,164,627 | |

| Deferred | | | - | | | | - | | | | | | | | | |

| Total | | $ | - | | | $ | - | | | $ | 4,164,627 | | | $ | 4,164,627 | |

| 6/30/2007 | | U.S. | | | State | | | International | | | Total | |

| Current | | $ | - | | | $ | - | | | $ | 6,690,523 | | | $ | 6,690,523 | |

| Deferred | | | - | | | | - | | | | - | | | | - | |

| Total | | $ | - | | | $ | - | | | $ | 6,690,523 | | | $ | 6,690,523 | |

Reconciliation of the differences between the statutory U.S. Federal income tax rate and the effective rate is as follows:

| | | 6/30/2008 | | 6/30/2007 | |

| | | | | | |

| US statutory tax rate | | | 34 | % | 34 | % |

| Foreign income not recognized in US | | | (34 | )% | (34 | )% |

| PRC income tax | | | 25 | % | 34 | % |

| | | | | | | |

| Effective rate | | | 25 | % | 34 | % |

Note 10 - COMMITMENTS

The Company leases various office facilities under operating leases that terminate thru 2011. The Company also has management agreements that terminated in 2007 and were subsequently renewed in 2008. Rent expense for the six months ending June 30, 2008 and 2007 was $99,181 and $59,377 respectively. The future minimum obligations under these agreements are as follows:

| 2009 | | $ | 135,875 | |

| 2010 | | $ | 59,304 | |

| 2011 | | $ | 27,935 | |

| 2012 | | $ | 4,373 | |

In addition, the Company is committed to pay $111,516 under a advertising agreement expiring March 31, 2009.

CHINA 3C GROUP AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

JUNE 30, 2008

Note 11 - STATUTORY RESERVE

In accordance with the laws and regulations of the PRC, a wholly-owned Foreign Invested Enterprises income, after the payment of the PRC income taxes, shall be allocated to the statutory surplus reserves and statutory public welfare fund. Prior to January 1, 2006 the proportion of allocation for reserve was 10 percent of the profit after tax to the surplus reserve fund and additional 5-10 percent to the public affair fund. The public welfare fund reserve was limited to 50 percent of the registered capital. Effective January 1, 2006, there is now only one fund requirement. The reserve is 10 percent of income after tax, not to exceed 50 percent of registered capital.

Statutory Reserve funds are restricted for set off against losses, expansion of production and operation or increase in register capital of the respective company. Statutory public welfare fund is restricted to the capital expenditures for the collective welfare of employees. These reserves are not transferable to the Company in the form of cash dividends, loans or advances. These reserves are therefore not available for distribution except in liquidation. As of June 30, 2008 and December 31, 2007, the Company had allocated $7,234,295 to these non-distributable reserve funds.

Note 12 - OTHER COMPREHENSIVE INCOME

Balances of related after-tax components comprising accumulated other comprehensive income, included in stockholders equity, at June 30, 2008 and December 31, 2007 are as follows:

| | | Foreign Currency Translation Adjustment | | | Accumulated Other Comprehensive Income | |

| Balance at December 31, 2006 | | $ | 427,616 | | | $ | 427,616 | |

| Change for 2007 | | | 1,444,718 | | | | 1,444,718 | |

| Balance at December 31, 2007 | | | 1,872,334 | | | | 1,872,334 | |

| Change for 2008 | | | 2,822,640 | | | | 2,822,640 | |

| Balance at June 30, 2008 | | $ | 4,694,974 | | | $ | 4,694,974 | |

Note 13 - CURRENT VULNERABILITY DUE TO CERTAIN RISK FACTORS

The Company’s operations are carried out in the PRC. Accordingly, the Company’s business, financial condition and results of operations may be influenced by the political, economic and legal environments in the PRC and by the general state of the PRC's economy. The Company’s business may be influenced by changes in governmental policies with respect to laws and regulations, anti-inflationary measures, currency conversion and remittance abroad, and rates and methods of taxation, among other things.

Note 14 – MAJOR CUSTOMERS AND CREDIT RISK

During the period ended June 30, 2008, no customer accounted for more than 10% of the Company’s sales or accounts receivable. At June 30, 2008 four (4) vendors comprised more than 57% of the Company’s accounts payable. No vendors accounted for more than 10% of the Company’s purchases during 2008.

Note 15 - SEGMENT INFORMATION

The Company separately operates and prepares accounting and other financial reports to management for four of its major business organizations (Wang Da, Sanhe, Yiwu and Joy & Harmony). Each of the individual operating companies corresponds to different product groups. Wang Da is mainly operating mobile phones, Sanhe is mainly operating home appliances, Yiwu is mainly operating office communication products, and Joy & Harmony is mainly operating consumer electronics. All segments are accounted for using the accounting principals described in Note 2.

The Company has identified four reportable segments required by SFAS 131: (1) mobile phones, (2) home electronics, (3) office communication products, and (4) consumer electronics.

The following tables present summarized information by segment (in thousands):

| | | Three Months Ended June 30, 2008 | |

| | | Mobile Phones | | | Home Electronics | | | Office Communication Products | | | Consumer Electronics | | | Other | | | Total | |

| Sales, net | | $ | 25,529 | | | $ | 18,648 | | | $ | 17,030 | | | $ | 17,309 | | | $ | - | | | $ | 78,516 | |

| Cost of sales | | | 21,769 | | | | 15,137 | | | | 14,112 | | | | 14,621 | | | | - | | | | 65,639 | |

| Gross profit | | | 3,760 | | | | 3,511 | | | | 2,918 | | | | 2,688 | | | | - | | | | 12,877 | |

| Income from operations | | | 2,371 | | | | 2,399 | | | | 2,222 | | | | 2,097 | | | | 461 | | | | 9,550 | |

| Total assets | | $ | 22,326 | | | $ | 21,739 | | | $ | 16,418 | | | $ | 19,251 | | | $ | 1,456 | | | $ | 81,190 | |

| | | Three Months Ended June 30, 2007 | |

| | | Mobile Phones | | | Home Electronics | | | Office Communication Products | | | Consumer Electronics | | | Other | | | Total | |

| Sales, net | | $ | 19,482 | | | $ | 16,057 | | | $ | 14,362 | | | $ | 14,598 | | | $ | - | | | $ | 64,499 | |

| Cost of sales | | | 16,435 | | | | 11,950 | | | | 12,452 | | | | 12,223 | | | | - | | | | 53,060 | |

| Gross profit | | | 3,047 | | | | 4,107 | | | | 1,910 | | | | 2,375 | | | | - | | | | 11,439 | |

| Income from operations | | | 2,385 | | | | 2,918 | | | | 1,366 | | | | 2,058 | | | | (303) | | | | 8,424 | |

| Total assets | | $ | 12,522 | | | $ | 12,221 | | | $ | 10,673 | | | $ | 13,052 | | | $ | 1,696 | | | $ | 50,164 | |

Forward Looking Statements

We have included, and from time to time may make in our public filings, press releases or other public statements, certain statements, including, without limitation, those under “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Item 2. In some cases, these statements are identifiable through the use of words such as “anticipate”, “believe”, “estimate”, “expect”, “intend”, “plan”, “project”, “target”, “can”, “could”, “may”, “should”, “will”, “would”, and similar expressions. You are cautioned not to place undue reliance on these forward-looking statements. In addition, our management may make forward-looking statements to analysts, investors, representatives of the media and others. These forward-looking statements are not historical facts and represent only our beliefs regarding future events, many of which, by their nature, are inherently uncertain and beyond our control.

The following discussion should be read in conjunction with the Consolidated Financial Statements and Notes thereto appearing elsewhere in this Form 10-Q/A. The following discussion contains forward-looking statements. Our actual results may differ significantly from those projected in the forward-looking statements. Factors that may cause future results to differ materially from those projected in the forward-looking statements include, but are not limited to, those discussed in “Risk Factors” and elsewhere in this Form 10-Q/A.

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Overview

China 3C Group was incorporated on August 20, 1998 under the laws of the State of Nevada. Capital Future Developments Limited (“CFDL”) was incorporated on July 22, 2004 under the laws of the British Virgin Islands. Zhejiang Yong Xin Digital Technology Co., Ltd. (“Zhejiang”), Yiwu Yong Xin Communication Ltd. (“Yiwu”), Hangzhou Wandga Electronics Co., Ltd. (“Wang Da”), Hangzhou Sanhe Electronic Technology, Limited (“Sanhe”), and Shanghai Joy & Harmony Electronic Development Co., Ltd. (“SJHE”) were incorporated under the laws of Peoples Republic of China on July 11, 2005, July 18, 1997, March 30, 1998, April 12, 2004, and August 25, 2003, respectively. China 3C Group owns 100% of CFDL and CFDL own 100% of the capital stock of SJHE and Sanhe. Until August 14, 2007, when it made the change to its ownership structure described in the next paragraph in order to comply with certain requirements of PRC law, CFDL owned 100% of the capital stock of Zhenjiang. Zhejiang owns 90% and Yiwu owns 10% of Wang Da. Zhejiang owns 90% and Wang Da owns 10% of Yiwu. Collectively the six corporations are referred to herein as the Company.

On December 21, 2005 CFDL became a wholly owned subsidiary of China 3C Group through a merger with a wholly owned subsidiary of the Company (“Merger Transaction”). China 3C Group acquired all of the issued and outstanding capital stock of CFDL pursuant to a Merger Agreement dated at December 21, 2005 by and among China 3C Group, XY Acquisition Corporation, CFDL and the shareholders of CFDL (the “Merger Agreement”). Pursuant to the Merger Agreement, CFDL became a wholly owned subsidiary of China 3C Group and, in exchange for the CFDL shares, China 3C Group issued 35,000,000 shares of its common stock to the shareholders of CFDL, representing 93% of the issued and outstanding capital stock of China 3C Group at that time and a cash consideration of $500,000. On August 15, 2007, in order to comply with the requirements of PRC law, the Company recapitalized its ownership structure. As a result, instead of CFDL owning 100% of Zhejiang as previously was the case, CFDL entered into contractual agreements with Zhejiang whereby CFDL owns a 100% interest in the revenues of Zhejiang. CFDL does not have an equity interest in Zhejiang, but is deemed to have all the economic benefits and liabilities by contract. Under this structure, Zhejiang is now a wholly foreign owned enterprise (WOFE) of CFDL. The contractual agreements give CFDL and its’ equity owners an obligation to absorb, any losses, and rights to receive revenue. CFDL will be unable to make significant decisions about the activities of Zhejiang and can not carry out its principal activities without financial support. These characteristics as defined in Financial Accounting Standards Board (FASB) interpretation 46, Consolidation of Variable Interest Entities (VIEs), qualifies the business operations of (Zhejiang) to be consolidated with (CFDL) and ultimately with China 3C Group.

As a result of the Merger Agreement, the reorganization was treated as an acquisition by the accounting acquiree that is being accounted for as a recapitalization and as a reverse merger by the legal acquirer for accounting purposes. Pursuant to the recapitalization, all capital stock shares and amounts and per share data have been retroactively restated. Accordingly, the financial statements include the following:

(1) The balance sheet consists of the net assets of the accounting acquirer at historical cost and the net assets of the legal acquirer at historical cost.

(2) The statements of operations include the operations of the accounting acquirer for the period presented and the operations of the legal acquirer from the date of the merger.