QuickLinks -- Click here to rapidly navigate through this document

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

| Filed by the Registrant ý | ||||

| Filed by a Party other than the Registrant o | ||||

Check the appropriate box: | ||||

| o | Preliminary Proxy Statement | |||

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

| ý | Definitive Proxy Statement | |||

| o | Definitive Additional Materials | |||

| o | Soliciting Material Pursuant to §240.14a-11(c) or §240.14a-12 | |||

INSWEB CORPORATION (Name of Registrant as Specified In Its Charter) | ||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

| Payment of Filing Fee (Check the appropriate box): | ||||

| ý | No fee required. | |||

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

| o | Fee paid previously with preliminary materials. | |||

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

![]()

April 29, 2002

Dear Stockholder:

This year's annual meeting of stockholders will be held on Tuesday, May 28, 2002, at 9:00 a.m. local time, at the corporate headquarters of InsWeb Corporation, located at 11290 Pyrites Way, Suite 200, Gold River, California 95670. You are cordially invited to attend.

The Notice of Annual Meeting of Stockholders and a Proxy Statement, which describe the formal business to be conducted at the meeting, follow this letter.

After reading the Proxy Statement, please promptly mark, sign and return the enclosed proxy card in the postage-paid envelope to assure that your shares will be represented. Your shares cannot be voted unless you date, sign, and return the enclosed proxy card or attend the annual meeting in person. Regardless of the number of shares you own, your careful consideration of, and vote on, the matters before our stockholders are important.

A copy of InsWeb's Annual Report to Stockholders is also enclosed for your information. At the annual meeting we will review InsWeb's activities over the past year and our plans for the future. The Board of Directors and management look forward to seeing you at the annual meeting.

| Very truly yours, | |

| |

Hussein A. Enan Chairman of the Board and Chief Executive Officer |

![]()

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS TO BE HELD MAY 28, 2002

TO THE STOCKHOLDERS:

Please take notice that the annual meeting of the stockholders of InsWeb Corporation, a Delaware corporation ("InsWeb"), will be held on Tuesday, May 28, 2002, at 9:00 a.m. local time, at the corporate headquarters of InsWeb, located at 11290 Pyrites Way, Suite 200, Gold River, California 95670, for the following purposes:

- 1.

- To elect one (1) Class III director to hold office for a three-year term and until his successor is elected and qualified.

- 2.

- To consider and ratify the appointment of Ernst & Young LLP as InsWeb's independent auditor for the year ending December 31, 2002.

- 3.

- To consider and approve amendments to InsWeb's 1997 Stock Option Plan (i) to increase the size of options granted automatically to directors for attendance at meetings of the Board of Directors and committees of the Board and (ii) to limit to 250,000 shares the maximum number of shares of Common Stock for which options may be granted to any employee in the fiscal year of the employee's commencement of service and to 250,000 shares in any subsequent fiscal year.

- 4.

- To transact such other business as may properly come before the meeting.

Stockholders of record at the close of business on April 2, 2002 are entitled to notice of, and to vote at, this meeting and any adjournment or postponement. For ten days prior to the meeting, a complete list of stockholders entitled to vote at the meeting will be available for examination by any stockholder, for any purpose relating to the meeting, during ordinary business hours at InsWeb's principal offices located at 11290 Pyrites Way, Suite 200, Gold River, California 95670.

| By order of the Board of Directors, | |

| |

L. Eric Loewe Senior Vice President, Secretary and General Counsel |

Gold River, California

April 29, 2002

| | Page | ||

|---|---|---|---|

| PROXY STATEMENT FOR ANNUAL MEETING OF STOCKHOLDERS | 3 | ||

| SOLICITATION AND VOTING OF PROXIES | 3 | ||

| INFORMATION ABOUT INSWEB | 3 | ||

| Stock Ownership of Certain Beneficial Owners and Management | 3 | ||

| Management | 5 | ||

| EXECUTIVE COMPENSATION AND OTHER MATTERS | 7 | ||

| Executive Compensation | 7 | ||

| Stock Options Granted in Fiscal 2001 | 8 | ||

| Option Exercises and Fiscal 2001 Year-End Values | 9 | ||

| Employment Contracts and Termination of Employment and Change of Control Arrangements | 9 | ||

| Compensation Of Directors | 10 | ||

| Compensation Committee Interlocks and Insider Participation | 10 | ||

| Certain Relationships And Related Transactions | 10 | ||

| Section 16(a) Beneficial Ownership Reporting Compliance | 12 | ||

| REPORT OF THE COMPENSATION COMMITTEE ON EXECUTIVE COMPENSATION | 13 | ||

| REPORT OF THE AUDIT COMMITTEE | 14 | ||

| COMPARISON OF STOCKHOLDER RETURN | 15 | ||

| PROPOSAL NO. 1: ELECTION OF DIRECTORS | 16 | ||

| PROPOSAL NO. 2: RATIFICATION OF APPOINTMENT OF INDEPENDENT AUDITOR | 17 | ||

| Principal Accounting Firm Fees | 17 | ||

| Changes in and Disagreements With Accountants on Accounting and Financial Disclosure | 17 | ||

| Vote Required and Board of Directors' Recommendation | 17 | ||

| PROPOSAL NO. 3: APPROVAL OF AMENDMENTS TO INSWEB'S 1997 STOCK OPTION PLAN | 19 | ||

| STOCKHOLDER PROPOSALS TO BE PRESENTED AT NEXT ANNUAL MEETING | 25 | ||

| TRANSACTION OF OTHER BUSINESS | 26 | ||

PROXY STATEMENT FOR ANNUAL MEETING OF STOCKHOLDERS

The accompanying proxy is solicited by the Board of Directors of InsWeb Corporation, a Delaware corporation ("InsWeb"), for use at its annual meeting of stockholders to be held on May 28, 2002, or any adjournment or postponement thereof, for the purposes set forth in the accompanying Notice of Annual Meeting of Stockholders. The date of this Proxy Statement is April 29, 2002, the approximate date on which this Proxy Statement and the accompanying form of proxy were first sent or given to stockholders.

SOLICITATION AND VOTING OF PROXIES

The cost of soliciting proxies will be borne by InsWeb. In addition to soliciting stockholders by mail, InsWeb will request banks and brokers, and other custodians, nominees and fiduciaries, to solicit their customers who have stock of InsWeb registered in the names of such persons and will reimburse them for their reasonable, out-of-pocket costs. InsWeb may use the services of its officers, directors and others to solicit proxies, personally or by telephone, without additional compensation. In addition, InsWeb has retained American Stock Transfer & Trust Co., a registrar and transfer agent firm, for assistance in connection with the annual meeting at no additional cost except for reasonable out-of-pocket expenses.

On April 2, 2002, there were 7,038,797 shares of InsWeb's Common Stock outstanding, all of which are entitled to vote with respect to all matters to be acted upon at the annual meeting. Each stockholder of record as of that date is entitled to one vote for each share of Common Stock held by him or her. InsWeb's bylaws provide that a majority of all of the shares of the stock entitled to vote, whether present in person or represented by proxy, shall constitute a quorum for the transaction of business at the meeting. Votes for and against, abstentions and "broker non-votes" will each be counted as present for purposes of determining the presence of a quorum.

All valid proxies received before the meeting will be exercised. All shares represented by a proxy will be voted, and where a stockholder specifies by means of his or her proxy a choice with respect to any matter to be acted upon, the shares will be voted in accordance with that specification. If no choice is indicated on the proxy, the shares will be voted in favor of the proposal. A stockholder giving a proxy has the power to revoke his or her proxy at any time before the time it is exercised by delivering to the Secretary of InsWeb a written instrument revoking the proxy or a duly executed proxy with a later date, or by attending the meeting and voting in person.

Stock Ownership of Certain Beneficial Owners and Management

The following table sets forth, as of April 2, 2002, certain information with respect to the beneficial ownership of InsWeb's Common Stock by (i) each stockholder known by InsWeb to be the beneficial owner of more than 5% of InsWeb's Common Stock, (ii) each director and director-nominee of InsWeb, (iii) the Chief Executive Officer and each of the other executive officers of InsWeb that

3

received a total salary and bonus in excess of $100,000 in the year ended December 31, 2001, and (iv) all current directors and executive officers of InsWeb as a group.

| Name of Beneficial Owner(1) | Number of Shares Beneficially Owned | Percent of Common Stock Outstanding(2) | |||

|---|---|---|---|---|---|

| 5% Stockholders | |||||

| SOFTBANK Corp.(3) | 1,532,020 | 21.8 | % | ||

| Intuit Inc.(4) | 1,169,898 | 16.6 | |||

| Nationwide Mutual Insurance Company(5) | 531,947 | 7.6 | |||

| Directors and Executive Officers | |||||

| Hussein A. Enan(6) | 1,143,401 | 16.2 | |||

| Stephen M. Bennett(4) | 1,174,487 | 16.7 | |||

| James M. Corroon(7) | 4,085 | * | |||

| Ronald D. Fisher(8) | 1,535,769 | 21.8 | |||

| Robert A. Puccinelli(9) | 19,276 | * | |||

| Mark P. Guthrie(10) | 88,210 | 1.3 | |||

| William D. Griffin(11) | 5,556 | * | |||

| L. Eric Loewe(12) | 18,955 | * | |||

| Current directors and executive officers as a group (8 persons)(13) | 3,989,739 | 56.7 |

- *

- Less than 1%.

- (1)

- The persons named in the table above have sole voting and investment power with respect to all shares of Common Stock shown as beneficially owned by them, subject to community property laws where applicable and to the information contained in the footnotes to this table.

- (2)

- Calculated on the basis of 7,038,797 shares of Common Stock outstanding as of April 2, 2002, except that shares of Common Stock underlying options exercisable within 60 days following April 2, 2002 are deemed outstanding for purposes of calculating the beneficial ownership of Common Stock of the holders of such options.

- (3)

- Based on a Schedule 13D/A filed by SOFTBANK Corp. with the Securities and Exchange Commission on December 7, 2001. Consists of 1,071,543 shares held by SOFTBANK America, Inc., 107,445 shares held by SOFTBANK Ventures, Inc., 117,677 shares held by SOFTVEN No. 2 Investment Enterprise Partnership and 235,355 shares held by SOFTBANK Finance Corp., each of which is an affiliate of SOFTBANK Corp. The address for SOFTBANK Corp. is 1-16-8 Nihonbashi-Kakigaracho, Chuo-Ku, Tokyo 103 0014.

- (4)

- Based on a Schedule 13G filed by Intuit Inc. with the Securities and Exchange Commission on February 5, 2001. Consists of 1,169,898 shares beneficially owned by Intuit Insurance Services Inc., a wholly-owned subsidiary of Intuit Inc. Intuit, Inc. and Mr. Bennett disclaim beneficial ownership with respect to these shares. Mr. Bennett is president, chief executive officer and a director of Intuit Inc., and may be deemed to have voting or investment control with respect to these shares. The shares attributed to Mr. Bennett include 4,589 shares subject to options held by Mr. Bennett exercisable within 60 days following April 2, 2002. The address for Intuit Inc. is P.O. Box 7850, 2550 Garcia Avenue, Mountain View, California 94039-7850.

- (5)

- Consists of 531,947 shares held by Nationwide Mutual Insurance Company. The address for Nationwide Mutual Insurance Company is One Nationwide Plaza, Columbus, OH 43215.

- (6)

- Includes 16,250 shares held by Mr. Enan's spouse. Includes 15,046 shares subject to options exercisable within 60 days following April 2, 2002. The address for Mr. Enan is c/o InsWeb Corporation, 11290 Pyrites Way, Suite 200, Gold River, California 95670.

4

- (7)

- Includes 4,085 shares subject to options exercisable within 60 days following April 2, 2002.

- (8)

- Includes 1,532,020 shares held by entities affiliated with SOFTBANK Corp. Mr. Fisher is vice chairman of SOFTBANK Holdings Inc., an affiliate of SOFTBANK Corp., and may be deemed to have voting or investment control with respect to these shares. Mr. Fisher disclaims beneficial ownership with respect to these shares. See footnote 3. Includes 3,333 shares subject to options exercisable within 60 days following April 2, 2002.

- (9)

- Includes 6,776 shares subject to options exercisable within 60 days following April 2, 2002.

- (10)

- Includes 77,087 shares subject to options exercisable within 60 days following April 2, 2002.

- (11)

- Includes 5,556 shares subject to options exercisable within 60 days following April 2, 2002.

- (12)

- Includes 18,955 shares subject to options exercisable within 60 days following April 2, 2002.

- (13)

- Includes 141,452 shares subject to options exercisable within 60 days following April 2, 2002.

Management

Directors. This section sets forth for InsWeb's current directors, including the Class III nominee to be elected at this meeting, their ages and information concerning their backgrounds.

| Name | Position with InsWeb | Age | Director Since | |||

|---|---|---|---|---|---|---|

| Class III director nominated for election at the 2002 Annual Meeting of Stockholders: | ||||||

Hussein A. Enan | Chairman of the Board and Chief Executive Officer | 56 | 1995 | |||

Class I director whose term expires at the 2003 Annual Meeting of Stockholders: | ||||||

Robert A. Puccinelli | Director | 64 | 1998 | |||

Class II directors whose terms expire at the 2004 Annual Meeting of Stockholders: | ||||||

Stephen M. Bennett | Director | 48 | 2001 | |||

James M. Corroon | Vice Chairman of the Board | 62 | 1996 | |||

Ronald D. Fisher | Director | 54 | 1999 | |||

Hussein A. Enan co-founded InsWeb in February 1995 and has served as its Chairman of the Board and Chief Executive Officer since its inception. He served as InsWeb's President from May 1999 to June 2000. From March 1992 to November 1994, Mr. Enan was a general partner at E.W. Blanch, a reinsurance intermediary that merged with his own wholly owned company, Enan & Company, a reinsurance intermediary, in March 1992. Mr. Enan founded Enan & Company in February 1979. From November 1970 to March 1979, Mr. Enan held various executive positions at BEP International, a Canadian reinsurance intermediary.

Robert A. Puccinelli has been a director of InsWeb since May 1998. From October 1985 to May 1995, Mr. Puccinelli was chairman and chief executive officer of Industrial Indemnity, a nationwide property and casualty insurance company.

Stephen M. Bennett has been a director of InsWeb since January 2001. Mr. Bennett has been President and Chief Executive Officer and a Director of Intuit Inc. since January 2000. Prior to joining Intuit, Mr. Bennett was an Executive Vice President and a member of the Board of Directors of GE Capital, the financial services subsidiary of General Electric Corporation, positions he held from December 1999 to January 2000. From July 1999 to November 1999, he was President and Chief Executive Officer of GE Capital e-Business. He was President and Chief Executive Officer of GE

5

Capital Vendor Financial Services from April 1996 through June 1999. Mr. Bennett was elected to the InsWeb Board of Directors in connection with InsWeb's acquisition of assets and related liabilities of Intuit Inc. in January 2001. See "Executive Compensation and Other Matters—Certain Relationships and Related Transactions" below.

James M. Corroon has been a director of InsWeb since August 1996 and has served as Vice Chairman of the Board since May 1999. From July 1999 to December 2000, he was a full-time employee of InsWeb and a member of the senior management team. Mr. Corroon has been a director of Willis Corroon of California, an insurance services firm, since January 1996. From October 1966 to December 1995, Mr. Corroon held various management positions with Willis Corroon and its predecessor entity, Corroon & Black Corporation.

Ronald D. Fisher has been a director of InsWeb since September 1999. Mr. Fisher has been vice chairman of SOFTBANK Holdings Inc., an affiliate of SOFTBANK Corp., since October 1995. From January 1990 to September 1995, Mr. Fisher was chief executive officer of Phoenix Technologies, Ltd., a developer and marketer of system software products. Mr. Fisher is a director of E*Trade Group, Inc., SOFTBANK Corporation, Global Sports, Inc., Key 3media Group, Inc. and People PC, Inc.

Meetings of the Board of Directors. During the year ended December 31, 2001, the Board of Directors of InsWeb held eight meetings. During that period the Audit Committee of the Board held four meetings and the Compensation Committee of the Board held four meetings. During this period, InsWeb had no standing nominating committee of the Board. No director attended fewer than 75% of the total number of meetings of the Board and all of the committees of the Board on which such director served held during that period.

The members of the Audit Committee during 2001 were Messrs. Fisher, Puccinelli and former director Robert C. Nevins. Mr. Nevins resigned from the Board and the Audit Committee on February 6, 2002. Mr. Stephen M. Bennett now serves on the Audit Committee The functions of the Audit Committee include, among others: recommending to the Board the retention of an independent auditor, subject to stockholder approval; reviewing and approving the planned scope, proposed fee arrangements and results of InsWeb's annual audit; reviewing the adequacy of accounting and financial controls; and reviewing the independence of InsWeb's accountants. For additional information concerning the Audit Committee, see "Report of the Audit Committee" and "Principal Accounting Firm Fees" below.

The members of the Compensation Committee during 2001 were Mr. Fisher, Mr. Puccinelli and former director Robert C. Nevins who resigned from the Board and the Compensation Committee on February 6, 2002. Mr. Stephen M. Bennett now serves on the Compensation Committee. The Compensation Committee reviews and determines the salary and bonus criteria of and stock option grants to all executive officers. For additional information about the Compensation Committee, see "Report of the Compensation Committee on Executive Compensation" and "Executive Compensation and Other Matters" below.

6

EXECUTIVE COMPENSATION AND OTHER MATTERS

Executive Compensation

The following table sets forth information for the fiscal years ended December 31, 2001, 2000 and 1999 concerning the compensation of the Chief Executive Officer and each of the executive officers of InsWeb that received total salary and bonus compensation in excess of $100,000 in the year ended December 31, 2001.

| | | | | Long term Compensation Awards | | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | Annual Compensation | | |||||||||||

| Name and Principal Position | | Securities Underlying Options(2) | All other Compensation | |||||||||||

| Year | Salary | Bonus(1) | ||||||||||||

| Hussein A. Enan Chairman of the Board and Chief Executive Officer | 2001 2000 1999 | $ | 250,000 225,000 196,750 | — 22,500 31,125 | 41,667 — 53,750 | $ | 4,538 4,500 4,800 | (3) (3) (3) | ||||||

Mark P. Guthrie President and Chief Operating Officer | 2001 2000 1999 | $ | 240,000 235,417 174,583 | $ | 240,000 258,500 26,292 | 25,000 54,167 14,375 | $ | 4,512 161,159 4,286 | (3) (4) (3) | |||||

L. Eric Loewe Senior Vice President, Secretary, and General Counsel | 2001 2000 1999 | $ | 175,000 160,625 148,625 | $ | 15,000 83,400 — | 8,333 13,333 5,750 | $ | 471 53,846 — | (3) (5) | |||||

William D. Griffin(6) Chief Financial Officer | 2001 2000 1999 | $ | 130,769 — — | — — — | 16,667 — — | — — — | ||||||||

- (1)

- Except for retention bonuses paid in connection with InsWeb's restructuring and relocation in 2001 to Messrs. Guthrie and Loewe in the amounts of $240,000 and $15,000 and in 2000 for, $240,000 and $75,000, respectively, bonuses are based on performance. See "Report of the Compensation Committee on Executive Compensation."

- (2)

- The number of underlying securities are as adjusted for a one-for-six reverse split of InsWeb's Common Stock effective December 20, 2001.

- (3)

- Represents employer contributions to InsWeb's 401(k) plan.

- (4)

- Represents $156,636 in reimbursement for relocation expenses incurred in connection with the relocation of InsWeb's corporate offices from Redwood City, California to the Sacramento, California area, and $4,523 in employer contributions to InsWeb's 401(k) plan.

- (5)

- Represents reimbursement for relocation expenses incurred in connection with the relocation of InsWeb's corporate offices from Redwood City, California to the Sacramento, California area.

- (6)

- Mr. Griffin became an executive officer in May 2001.

7

Stock Options Granted in Fiscal 2001

The following table provides the specified information concerning grants of options to purchase InsWeb's Common Stock made during the year ended December 31, 2001, to the persons named in the Summary Compensation Table.

OPTION GRANTS IN LAST FISCAL YEAR

| | Individual Grants | | | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | Number of Securities Underlying Options Granted(2) | % of Total Options Granted to Employees in Fiscal Year | | | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term(1) | ||||||||||

| Name | Exercise Price ($/Sh)(3) | Expiration Date | |||||||||||||

| 5% | 10% | ||||||||||||||

| Hussein A. Enan | 41,667 | 15.4 | $ | 6.12 | 4/17/2011 | $ | 160,368 | $ | 406,404 | ||||||

Mark P. Guthrie | 2,779 22,221 | 1.0 8.2 | $ | 6.12 6.12 | 4/17/2011 4/17/2011 | $ | 10,695 85,526 | $ | 27,104 216,739 | ||||||

William D. Griffin | 16,667 | 6.2 | $ | 6.24 | 5/07/2011 | $ | 65,405 | $ | 165,749 | ||||||

L. Eric Loewe | 927 7,407 | 0.3 2.7 | $ | 6.12 6.12 | 4/17/2011 4/17/2011 | $ | 3,567 28,507 | $ | 9,038 72,242 | ||||||

- (1)

- Potential gains are net of exercise price, but before taxes associated with exercise. These amounts represent certain assumed rates of appreciation only, based on the Securities and Exchange Commission rules. Actual gains, if any, on stock option exercises are dependent on the future performance of InsWeb's Common Stock, overall market conditions and the option holders' continued employment through the vesting period. The amounts reflected in this table may not necessarily be achieved.

- (2)

- The number of underlying securities are as adjusted for a one-for-six reverse split of InsWeb's Common Stock effective December 20, 2001. Options granted under the 1997 Stock Option Plan generally vest over a three-year period from the date of grant. These options generally vest at the rate of one-third on the first anniversary of the date of grant and 1/36th per month thereafter for each full month of the optionee's continuous employment with InsWeb. Of options granted on April 17, 2001, one-half vested on October 17, 2001, and the remaining one-half vested on April 17, 2002. Under the 1997 Stock Option Plan, the Board retains discretion to modify the terms, including the prices, of outstanding options. For additional information regarding options, see "Report of the Compensation Committee on Executive Compensation."

- (3)

- All options were granted at market value on the date of grant.

8

Option Exercises and Fiscal 2001 Year-End Values

The following table provides the specified information concerning unexercised options held as of December 31, 2001, by the persons named in the Summary Compensation Table above. No options were exercised by such persons during 2001.

AGGREGATE OPTION EXERCISES IN LAST FISCAL YEAR AND FISCAL YEAR-END VALUES

| | Number of Securities Underlying Unexercised Options at Fiscal Year-End | Value of Unexercised In-the-Money Options at Fiscal Year-End(1) | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Name | ||||||||||

| Exercisable(2) | Unexercisable(2) | Exercisable | Unexercisable | |||||||

| Hussein A. Enan | 9,259 | 32,408 | $ | — | $ | — | ||||

| Mark P. Guthrie | 67,332 | 37,546 | $ | — | $ | — | ||||

| L. Eric Loewe | 15,667 | 13,950 | $ | — | $ | — | ||||

| William D. Griffin | — | 16,667 | $ | — | $ | — | ||||

- (1)

- Based on a fair market value of $4.25, the closing price of InsWeb's Common Stock on December 31, 2001, as reported by The Nasdaq National Market, less the exercise price payable for such shares. The exercise price of each of the options listed in this table is greater than $4.25.

- (2)

- The number of underlying securities are as adjusted for a one-for-six reverse split of InsWeb's Common Stock effective December 20, 2001. These options generally vest over a three-year period from the date of grant. See Footnote (2) of "Option Grants in Last Fiscal Year." The options listed in the "Exercisable" column had vested as of December 31, 2001 and the options listed in the "Unexercisable" column had not yet vested as of December 31, 2001.

Employment Contracts and Termination of Employment and Change of Control Arrangements

In July 1999, InsWeb entered into an employment agreement with Hussein A. Enan, InsWeb's Chairman of the Board and Chief Executive Officer. The agreement has a term of three years, expiring in July 2002, and provides for annual one-year extensions of the term thereafter unless either party provides notice to the other that it elects not to renew the agreement. The agreement fixes Mr. Enan's base salary at $250,000 per year, subject to periodic review by the Board of Directors, and also entitles him to such incentive-based compensation as the Board of Directors may award from time to time as well as other benefits provided to other InsWeb senior executives. The agreement requires Mr. Enan to devote his full time and attention to the affairs of InsWeb. If InsWeb terminates Mr. Enan's employment other than for "cause" (which is defined to include conviction of a felony or a crime involving moral turpitude, commission of an act of theft or fraud against InsWeb, or repeated failure or inability to perform his duties under the agreement) or if Mr. Enan voluntarily terminates his employment for "good reason" following certain specified actions by InsWeb (including a material reduction in his duties or responsibilities or a breach of the agreement by InsWeb that is not promptly cured), Mr. Enan will be entitled to receive severance payments equal to his then current base salary for a period equal to the greater of the unexpired term of the agreement or 12 months. Upon any other termination of Mr. Enan's employment, he will be entitled only to accrued salary through the date of termination and any other vested benefits. The agreement also prohibits Mr. Enan from soliciting the employment of InsWeb's officers, employees and consultants for a period of one year following any termination for "cause," or any voluntary termination, other than for "good reason."

In June 2000, InsWeb entered into a Retention Agreement with Mark P. Guthrie, InsWeb's President. The agreement provided that Mr. Guthrie would receive two bonus payments, each in the amount of $240,000, if he remained an employee in good standing of InsWeb through October 31, 2000 and April 30, 2001, respectively. Mr. Guthrie has remained an employee in good standing of InsWeb

9

since the execution of the agreement, and those bonuses were paid to him on October 31, 2000 and April 30, 2001, respectively.

InsWeb's stock option plans provide that, in the event of a change in control of InsWeb, each outstanding option must be assumed or an equivalent option substituted by the acquiring corporation, or the option will become fully vested. The option terminates if it is not assumed, substituted for or exercised prior to a change in control. Further, the option agreements applicable to options granted under the 1997 Stock Option Plan typically provide for full acceleration of vesting if, within 12 months following a change in control, the optionee's employment is terminated without cause or the optionee resigns for "good reason," as defined in the option agreement.

Compensation Of Directors

Directors of InsWeb do not receive cash compensation for their services as directors or members of committees of the Board, but are reimbursed for reasonable expenses incurred in attending meetings of the Board. Since June 1999, under InsWeb's 1997 Stock Option Plan, non-employee directors have been eligible to receive vested options to purchase 187 shares of Common Stock for each regularly scheduled Board meeting attended and vested options to purchase 62 shares for attending any meeting of a Board committee on which they serve, at an exercise price equal to the fair market value of InsWeb's Common Stock on the date of grant.

Compensation Committee Interlocks and Insider Participation

Mr. Bennett is a member of InsWeb's Compensation Committee and serves as President, Chief Executive Officer and a director of Intuit, from which InsWeb purchased business assets at a cost of approximately $30.1 million in January 2001. In addition, InsWeb and Intuit are parties to an amended license and distribution agreement, pursuant to which InsWeb will pay Intuit a portion of the transaction fees from Intuit internet traffic on a quarterly basis through January 2006. These transactions are described more fully in "Certain Relationships And Related Transactions—Purchase of Assets From Intuit."

Certain Relationships And Related Transactions

Purchase of Assets From Intuit

In January 2001, InsWeb acquired from Intuit certain assets and related liabilities associated with an online insurance shopping and purchasing service operated by Intuit Insurance Services, Inc., a wholly owned subsidiary of Intuit, Inc. InsWeb did not acquire any of Intuit's revenue producing relationships with insurance carriers; however, InsWeb acquired the right to be assigned all Internet traffic from the licensing agreements that Intuit had previously negotiated with its strategic partners.

In connection with the acquisition, InsWeb and Intuit entered into a license and distribution agreement, under which Intuit and InsWeb have granted one another licenses to create links between their respective websites in order to create and operate a co-branded insurance center. This agreement also provides that InsWeb will be the exclusive aggregator of online consumer insurance services for Quicken.com, an Intuit website. The original agreement required InsWeb to pay Intuit fixed fees totaling $20.5 million plus additional amounts associated with consumers linking from the Quicken.com website over the five year term of the agreement for Internet traffic in excess of certain minimums to the InsWeb co-branded insurance center. Intuit has also entered into covenant not to compete with InsWeb for a period of five years.

The purchase cost of approximately $30.1 million was comprised of 1,170,000 shares of InsWeb's common stock issued to Intuit with a fair value at issuance of $12.5 million, long-term marketing commitments of $17.0 million, which represent the present value of the fixed fees due over the term of

10

the license and distribution agreement, and other acquisition related expenses of $548,000 consisting primarily of payments to a financial advisor and other professional fees. InsWeb recorded a long-lived asset of $17.0 million for prepaid marketing costs and an intangible asset of $13.1 million relating to the beneficial terms of the license and distribution agreement. The fair value of the intangible asset was estimated based on the expected Internet traffic to be received from Intuit by InsWeb. Both long-lived assets were amortized over the five-year term of the license and distribution agreement. Amortization of these assets was included as a component of sales and marketing expense.

In the fourth quarter of 2001, as a result of significantly lower than anticipated traffic levels, InsWeb reassessed the recoverability of the assets recorded in connection with the purchase by comparing the estimated future undiscounted cash flows expected to be generated relating to these assets to their carrying amounts. Based on this evaluation, InsWeb determined that the long-lived asset for prepaid marketing costs and the intangible asset relating to the beneficial terms of the license and distribution agreement with a total carrying amount of $24.5 million were impaired and recorded an impairment charge of $18.5 million in the fourth quarter of 2001 as the carrying value of these assets was in excess of fair value. The fair value of the acquired assets was based on estimated future cash flows to be generated from the license and distribution agreement, discounted using a rate that is commensurate with the risk involved.

On March 28, 2002, InsWeb amended its license and distribution agreement with Intuit, Inc. Under the amended agreement, InsWeb will make the originally agreed upon fixed payments (long-term marketing commitments) only through May 31, 2003 ($3.0 million in 2002 and $2.0 million in 2003). Fixed payments previously payable to Intuit after May 31, 2003 have been forgiven ($2.0 million in 2003, $5.0 million in 2004 and $6.0 million in 2005). Effective November 1, 2003 and through the remainder of the agreement (January 2006), InsWeb will pay Intuit a portion of the transaction fees from the Intuit internet traffic on a quarterly basis. The effect of this amendment was accounted for in InsWeb's results of operations for the quarter ended March 31, 2002. The net result of this amended contract was a $9.3 million extraordinary gain.

Investment in Finance All K.K.

In 1998, InsWeb entered into an agreement with SOFTBANK Corp., a principal stockholder of InsWeb, to develop, implement and market an online insurance marketplace in Japan and the Republic of Korea. The venture was carried out exclusively through InsWeb Japan K.K., a Japanese corporation, in which InsWeb owned an equity interest. In conjunction with this agreement, InsWeb also entered into an agreement in August 1999 to provide consulting and hosting services to assist InsWeb Japan K.K. in developing its Internet strategy. For the year ended December 31, 2000, $1.4 million was billed under this contract and included in development and maintenance fees. No such services were provided for the years ended December 31, 2001 and 1999. At December 31, 2001 and 2000, no amounts were due from InsWeb Japan K.K. Although this consulting and hosting services agreement has not been terminated, InsWeb does not expect to provide such services to InsWeb Japan K.K. in the future.

InsWeb's initial interest in InsWeb Japan K.K. was purchased in exchange for a promissory note payable to SOFTBANK Corp. in the principal amount of ¥240,000,000, or U.S. $2,089,137. The promissory note accrues interest at 5% per annum, which is payable quarterly. The promissory note, together with all accrued and unpaid interest, is due and payable on December 15, 2002. Interest expense related to this note for the years ended December 31, 2001, 2000 and 1999, were $65,000 $70,000 and $43,000 respectively. As of December 31, 2001 and 2000, $1.1 million and $1.3 million were outstanding under this promissory note, respectively.

In 1999, InsWeb sold a portion of its interest in InsWeb Japan K.K. to a stockholder for $783,000. As a result of this sale, InsWeb's interest in InsWeb Japan K.K. decreased from 40% to 25%. InsWeb used the proceeds from the sale to partially repay the promissory note payable to SOFTBANK Corp..

11

In 2000, InsWeb invested an additional $708,000 as part of an additional sale of capital stock by InsWeb Japan K.K. As a result of this additional investment, InsWeb maintained its 25% interest in InsWeb Japan K.K.

In 2001, InsWeb and other investors entered into an agreement pursuant to which a new privately-held holding company, Finance All K.K., controls InsWeb Japan K.K. and two other Internet companies in which InsWeb does not hold a financial interest (the "Reorganization"). The purpose of the Reorganization was to create a holding company that will collectively create an online financial marketplace consisting of various business-to-consumer financial services. The online market place will provide services in the insurance, consumer loan, and home loan (mortgage) marketplace in Japan and the Republic of Korea. In exchange for its shares in InsWeb Japan K.K., InsWeb acquired a 14% ownership interest in Finance All K.K. and was also granted the right to designate a member of the Board of Finance All K.K. However, this Board position does not allow InsWeb to exercise significant influence over the policies with the respect to the operations of Finance All K.K. Furthermore, InsWeb is not required to fund any losses or guarantee any indebtedness of Finance All K.K.

InsWeb's investment interest in Finance All K.K. is being accounted for under the cost method. Prior to the Reorganization, InsWeb accounted for its investment in InsWeb Japan K.K. under the equity method. InsWeb's proportionate share of InsWeb Finance All K.K. net losses are included as a component of interest income and other, net. It is not practical to estimate the fair value of InsWeb's investment in Finance All K.K. because of the lack of a quoted market price and the inability to estimate fair value without incurring excessive costs. The carrying value at December 31, 2001 represents InsWeb's cost less its proportionate share of InsWeb Japan K.K.'s losses through the date of the Reorganization. At December 31, 2001, management believes the carrying value is not impaired.

Commercial Transactions

InsWeb and Yahoo! Inc. entered into a license agreement dated as of February 12, 1998 and amended as of March 31, 1999 and September 24, 2001. SOFTBANK Corp., a principal stockholder of InsWeb, is also an affiliate of Yahoo!. In addition, Ronald Fisher, a director of InsWeb, is vice chairman of SOFTBANK Holdings Inc., an affiliate of SOFTBANK Corp. During 2001, InsWeb recognized approximately $3.3 million in marketing expenses in connection with its agreement with Yahoo!.

Other Transactions

InsWeb is a party to an employment agreement with Mr. Enan and a retention agreement with Mr. Guthrie. See "Management Employment Contracts and Termination of Employment and Change of Control Arrangements."

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires InsWeb's executive officers, directors and persons who beneficially own more than 10% of InsWeb's Common Stock to file initial reports of ownership and reports of changes in ownership with the Securities and Exchange Commission. Such persons are required by SEC regulations to furnish InsWeb with copies of all Section 16(a) forms filed by such persons.

Based solely on InsWeb's review of such forms furnished to InsWeb and written representations from certain reporting persons, InsWeb believes that all filing requirements applicable to InsWeb's executive officers, directors and more than 10% stockholders were complied with.

12

REPORT OF THE COMPENSATION COMMITTEE

ON EXECUTIVE COMPENSATION

The Compensation Committee of the Board of Directors is comprised of non-employee members of InsWeb's Board of Directors. The members of the Compensation Committee during fiscal 2001 were Messrs. Fisher, Puccinelli, and former director Nevins. Mr. Bennett joined the Compensation Committee in March, 2002. The Compensation Committee is responsible for setting and administering the policies governing annual compensation of the executive officers of InsWeb. The Compensation Committee reviews the performance and compensation levels for executive officers and sets salary levels.

The goals of InsWeb's executive officer compensation policies are to attract, retain and reward executive officers who contribute to InsWeb's success, to align executive officer compensation with InsWeb's performance and to motivate executive officers to achieve InsWeb's business objectives. InsWeb uses salary, bonus compensation and option grants to attain these goals. The Compensation Committee reviews compensation surveys prepared by management of InsWeb and by outside compensation consultants to compare InsWeb's compensation package with that of similarly sized high technology companies in InsWeb's geographic area.

Base salaries of executive officers are reviewed annually by the Compensation Committee and adjustments are made based on (i) salary recommendations from the President and Chief Executive Officer, (ii) individual performance of executive officers for the previous fiscal year, (iii) financial results of InsWeb for the previous year and (iv) reports to the Compensation Committee from outside compensation consultants concerning competitive salaries, scope of responsibilities of the officer position and levels paid by similarly-sized high technology companies in InsWeb's geographic area. InsWeb seeks to compensate the executive officers between the median and 75% quartile range of compensation levels paid by similarly sized high technology companies in InsWeb's geographical area.

InsWeb strongly believes that equity ownership by executive officers provides incentives to build stockholder value and aligns the interests of executive officers with those of the stockholders, and therefore makes periodic grants of stock options under the 1997 Stock Option Plan and the Senior Executive Nonstatutory Stock Option Plan. The size of an option grant to an executive officer has generally been determined with reference to similarly sized high technology companies in InsWeb's geographical area, the responsibilities and expected future contributions of the executive officer, previous grants to that officer, as well as recruitment and retention considerations. To assist InsWeb in retaining and motivating key employees, option grants generally vest over a three-year period from the date of grant. On, April 17, 2001, the Compensation Committee approved stock option grants to certain of the executive officers consistent with these criteria. See "Option Grants in Last Fiscal Year."

Mr. Enan's compensation as Chief Executive Officer was established pursuant to his employment agreement, the terms of which were set by arms-length bargaining, approved by the Compensation Committee and ratified by the Board of Directors in July 1999. This agreement provides certain change-of-control benefits and severance benefits generally consistent with similar benefits provided to other executive officers.

| COMPENSATION COMMITTEE | ||

Stephen M. Bennett(Chair) Ronald D. Fisher Robert A. Puccinelli |

13

The Audit Committee oversees InsWeb's financial reporting process on behalf of the Board of Directors. Management has the primary responsibility for the financial statements and the reporting process, including internal control systems. On November 27, 2001, InsWeb dismissed PricewaterhouseCoopers LLP as its independent accountants. The Audit Committee participated in and approved the decision to change independent accountants. InsWeb engaged Ernst & Young LLP as its new independent auditors for the year ending December 31, 2001 on November 29, 2001. Ernst & Young's responsibility is to express an opinion on InsWeb's financial statements based on their audit which was conducted in accordance with auditing standards generally accepted in the United States.

The Audit Committee consists of three directors, each of whom, in the judgment of the Board, is an "independent director" as defined in the Marketplace Rules of The Nasdaq Stock Market. The members of the Audit Committee during fiscal 2001 were Messrs. Fisher, Puccinelli and former director Nevins. Mr. Bennett joined the Audit Committee in March 2002. The Audit Committee acts pursuant to a written charter that has been adopted by the Board of Directors.

The Audit Committee has discussed and reviewed with the auditors all matters required to be discussed regarding Statement on Auditing Standards No. 61—Communication with Audit Committees. The Audit Committee also has discussed and reviewed the financial statements with management. The Audit Committee has met with Ernst & Young, with and without management present, to discuss the overall scope of Ernst & Youngs" audit, the results of its examinations, its evaluations of InsWeb's internal controls and the overall quality of its financial reporting.

The Audit Committee has received from the auditors a formal written statement describing all relationships between the auditors and InsWeb that might bear on the auditors' independence consistent with Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees), discussed with the auditors any relationships that may impact their objectivity and independence, and satisfied itself as to the auditors' independence.

Based on the review and discussions referred to above, the committee recommended to the Board of Directors that InsWeb's audited financial statements be included in InsWeb's Annual Report on Form 10-K for the fiscal year ended December 31, 2001.

| AUDIT COMMITTEE | ||

Stephen M. Bennett Ronald D. Fisher Robert A. Puccinelli (Chair) |

14

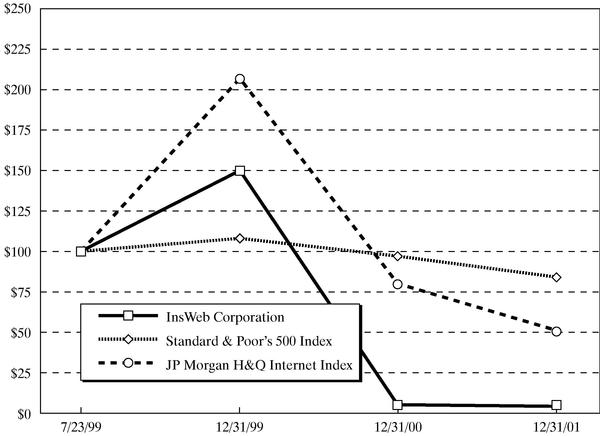

COMPARISON OF STOCKHOLDER RETURN

Set forth below is a line graph comparing the annual percentage change in the cumulative total return on InsWeb's Common Stock with the cumulative total returns of the Standard & Poor's 500 Index and the JP Morgan H&Q Internet Index for the period commencing on July 23, 1999 and ending on December 31, 2001.(1)

Comparison of Cumulative Total Return From July 23, 1999 through December 31, 2001(1):

InsWeb Corporation, Standard & Poor's 500 Index

and JP Morgan H&Q Internet Index

| | 7/23/99 | 12/31/99 | 12/31/00 | 12/31/01 | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| InsWeb Corporation | $ | 100.00 | $ | 150.35 | $ | 5.18 | $ | 4.17 | ||||

| Standard & Poor's 500 Index | $ | 100.00 | $ | 108.00 | $ | 97.05 | $ | 84.30 | ||||

| JP Morgan H&Q Internet Index | $ | 100.00 | $ | 206.78 | $ | 79.56 | $ | 51.19 | ||||

- (1)

- Assumes that $100.00 was invested on July 23, 1999, at the closing price on the date of InsWeb's initial public offering, in InsWeb's Common Stock and each index. No cash dividends have been declared on InsWeb's Common Stock. Stockholder returns over the indicated period should not be considered indicative of future stockholder returns.

15

PROPOSAL NO. 1

ELECTION OF DIRECTORS

InsWeb has a classified Board of Directors consisting of, one Class III director (Mr. Enan) and one Class I director (Mr. Puccinelli), three Class II directors (Messrs. Bennett, Corroon and Fisher) who will serve until the Annual Meetings of Stockholders to be held in 2002, 2003 and 2004, respectively, and until their respective successors are duly elected and qualified. At each annual meeting of stockholders, directors are elected for a term of three years to succeed those directors whose terms expire at the annual meeting dates.

The term of the Class III director will expire on the date of the upcoming annual meeting. Accordingly, one person is to be elected to serve as the Class III director of the Board of Directors at the meeting. Management's nominee for election by the stockholders to the position is the current Class III member of the Board of Directors: Mr. Enan. Please see "Information About InsWeb—Management" above for information concerning the nominee. If elected, the nominee will serve as a director until InsWeb's Annual Meeting of Stockholders in 2005 and until a successor is elected and qualified. If the nominee declines to serve or becomes unavailable for any reason, or if a vacancy occurs before the election (although InsWeb knows of no reason to anticipate that this will occur), the proxies may be voted for such substitute nominees as InsWeb may designate.

If a quorum is present and voting, the nominee for Class III director receiving the highest number of votes will be elected as Class III director. Abstentions and broker non-votes have no effect on the vote.

The Board of Directors recommends a vote "FOR" the nominee named above.

16

PROPOSAL NO. 2

RATIFICATION OF APPOINTMENT OF INDEPENDENT AUDITOR

The Board of Directors of InsWeb has selected Ernst & Young LLP as independent auditor to audit the consolidated financial statements of InsWeb for the fiscal year ending December 31, 2002. Ernst & Young LLP has acted in such capacity since its appointment in fiscal year 2001. A representative of Ernst & Young LLP is expected to be present at the annual meeting, with the opportunity to make a statement if the representative desires to do so, and is expected to be available to respond to appropriate questions.

Principal Accounting Firm Fees

The following table sets forth the aggregate fees billed to InsWeb for the year ended December 31, 2001 by PricewaterhouseCoopers LLP and by InsWeb's principal accounting firm Ernst & Young LLP.

| Audit Fees | $ | 199,815 | ||

| Financial Information Systems Design and Implementation Fees | — | |||

| All Other Fees | 70,451 | (1) | ||

| $ | 270,266 | |||

- (1)

- Includes fees for audit of employee benefit plan, tax-related services and accounting consultation.

The Audit Committee considered the role of Ernst & Young LLP in providing non-audit services to InsWeb and has concluded that such services are compatible with Ernst & Youngs' independence as InsWeb's auditors.

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure

On November 27, 2001, InsWeb dismissed PricewaterhouseCoopers as its independent accountants. The Audit Committee of InsWeb's Board of Directors participated in and approved the decision to change independent accountants.

InsWeb engaged Ernst & Young as its new independent auditors for the year ending December 31, 2001 on November 29, 2001. The Audit Committee participated in and approved the decision to retain Ernst & Young as InsWeb's independent auditors. During the two most recent fiscal years and through November 28, 2001, InsWeb had not consulted with Ernst & Young regarding either the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on InsWeb's financial statements.

The reports of PricewaterhouseCoopers on InsWeb's financial statements for the past two fiscal years contained no adverse opinion or disclaimer of opinion and were not qualified or modified as to uncertainty, audit scope or accounting principles. In connection with its audits of InsWeb's two most recent fiscal years and through November 27, 2001, there were no disagreements with PricewaterhouseCoopers on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which disagreements if not resolved to the satisfaction of PricewaterhouseCoopers would have caused them to make reference thereto in their report on the financial statements for such years. In addition, during the two most recent fiscal years and through November 27, 2001, there were no reportable events (as defined in Regulation S-K item 304(a)(l)(v)).

Vote Required and Board of Directors' Recommendation

The affirmative vote of a majority of the votes cast affirmatively or negatively at the annual meeting of stockholders at which a quorum representing a majority of all outstanding shares of Common Stock of InsWeb is present and voting, either in person or by proxy, is required for approval

17

of this proposal. Abstentions and broker non-votes will each be counted as present for purposes of determining the presence of a quorum. Neither abstentions nor broker non-votes will have any effect on the outcome of the proposal.

The Board of Directors recommends a vote "FOR" ratification of the appointment of Ernst & Young LLP as InsWeb's independent auditor for the fiscal year ending December 31, 2002.

18

PROPOSAL NO. 3

APPROVAL OF AMENDMENTS TO INSWEB'S 1997 STOCK OPTION PLAN

At the annual meeting, the stockholders will be asked to approve an amendment to the InsWeb Corporation 1997 Stock Option Plan (the "Plan") to increase the sizes of the options to purchase shares of Common Stock that are granted automatically to InsWeb's directors for their attendance at each regularly scheduled Board meeting and each meeting of a committee of the Board on which they serve. Under the amendment to the Plan approved by the Board on April 16, 2002, subject to stockholder approval at the annual meeting, options granted for attendance at regularly scheduled Board meetings would increase from 187 shares to 500 shares, while options granted for attendance at committee meetings on which a director serves would increase from 62 shares to 100 shares. In addition, all directors will be eligible for these automatic grants. Prior to the proposed amendment, only non-employee directors were eligible.

In addition, the Board has amended the Plan, subject to stockholder approval at the annual meeting, to establish limits on the numbers of shares of Common Stock for which options may be granted to any employee in any fiscal year in order to qualify stock option-related compensation as "performance-based compensation" under Section 162(m) of the Internal Revenue Code (the "Code"). Under these limits, no employee may be granted options for more than 250,000 shares during the fiscal year in which the employee's service with InsWeb commences or for more than 250,000 shares in any subsequent fiscal year.

Directors of InsWeb do not receive cash compensation for their services as directors or members of committees of the Board, but are reimbursed for reasonable expenses incurred in attending meetings of the Board. Since June 1999, as proportionately adjusted for the one-for six reverse split of InsWeb's Common in December 2001, nonemployee directors have been eligible to receive vested options to purchase 187 shares of Common Stock for each regularly scheduled Board meeting attended and vested options to purchase 62 shares for attending any meeting of a Board committee on which they serve, at an exercise price equal to the fair market value of the Common Stock on the date of grant. The Board has determined that the current program of nonemployee director options is inadequate. The Board believes it is in the best interests of InsWeb to extend the terms of the automatic grant program to all directors. The proposed amendment to the sizes of the options to be granted automatically to nonemployee directors under the Plan is intended to ensure that the director option program is competitive and will provide sufficient equity incentives to attract and retain the services of highly qualified and experienced Board members. In addition, the Board believes it to be in the best interests of InsWeb and its stockholders to qualify stock-option-related compensation as "performance-based compensation" for purposes of Section 162(m) of the Code in order to preserve the availability to InsWeb of a federal income tax deduction, as further described below.

Summary of the Plan, as amended

The following summary of the Plan, as amended pursuant to this proposal, is qualified in its entirety by the specific language of the Plan, a copy of which is available to any stockholder upon request.

General. The purpose of the Plan is to advance the interests of InsWeb and its stockholders by providing an incentive to attract, retain and reward InsWeb's employees, directors and consultants and by motivating such persons to contribute to InsWeb's growth and profitability. The Plan provides for the grant to employees of incentive stock options within the meaning of Section 422 of the Code, and the grant to employees, directors and consultants of nonstatutory stock options.

Shares Subject to Plan. Currently, a maximum of 1,097,968 (as proportionately adjusted for the one-for-six reverse split of InsWeb's Common Stock in December 2001) of the authorized but unissued

19

or reacquired shares of Common Stock may be issued under the Plan. This maximum share authorization increases automatically on each January 1 during the term of the Plan by an amount equal to five percent of the number of shares of InsWeb Common Stock issued and outstanding as of the immediately preceding December 31. However, the maximum number of shares issuable under the Plan is reduced at any time by shares subject to options outstanding or issued upon the exercise of options under InsWeb's Senior Executive Nonstatutory Stock Option Plan.

If any outstanding option expires, terminates or is canceled, or if shares acquired pursuant to an option are repurchased by InsWeb at their original exercise price, the expired or repurchased shares are returned to the Plan and again become available for grant. Also, the maximum number of shares that may be issued under the Plan is increased by the number of shares surrendered in payment of the exercise price of options or withheld upon the exercise of options in satisfaction of an optionee's tax withholding obligations. In any event, no more than the sum of 905,726 shares and up to an additional 175,000 shares for each year during the term of the Plan will be cumulatively available for issuance upon the exercise of incentive stock options. Appropriate adjustments will be made to the maximum number of shares issuable under the Plan, to the foregoing limit on incentive stock option shares, to the "Grant Limit" described below, to the numbers of shares to be subject to automatically granted director options, and to the number of shares and their exercise price under outstanding options upon any stock dividend, stock split, reverse stock split, recapitalization, combination, reclassification, or similar change in the capital structure of InsWeb.

To enable InsWeb to deduct in full for federal income tax purposes the compensation recognized by certain executive officers in connection with options granted under the Plan, the Board of Directors has amended the Plan, subject to stockholder approval, in order to qualify such compensation as "performance-based compensation" under Section 162(m) of the Code. To comply with Section 162(m), the Plan, as amended, limits the number of shares for which options may be granted to any employee. Under this limitation (the "Grant Limit"), no employee may be granted options for more than 250,000 shares in any fiscal year, and no employee may be granted options for more than 250,000 shares in the fiscal year in which the employee's service with InsWeb commences. The Grant Limit is subject to appropriate adjustment in the event of certain changes in InsWeb's capital structure, as previously described.

Administration. The Plan is administered by the Board of Directors or a duly appointed committee of the Board, which, in the case of options intended to qualify for the performance-based compensation exemption under Section 162(m) of the Code, must be comprised solely of two or more "outside directors" within the meaning of Section 162(m). (For purposes of this discussion, the term "Board" refers to either the Board of Directors or such committee.) Subject to the provisions of the Plan, the Board determines the persons to whom options are to be granted, the number of shares to be covered by each option, whether an option is to be an incentive stock option or a nonstatutory stock option, the timing and terms of exercisability and vesting of each option, the purchase price and the type of consideration to be paid to InsWeb upon the exercise of each option, the time of expiration of each option, and all other terms and conditions of the options. However, the Plan permits the Board to delegate to an officer of InsWeb the authority to grant options without further Board approval to eligible persons who are neither officers nor directors of InsWeb. Any such options must comply with the compensation policy approved by the Board and must conform to the provisions of the Plan and the appropriate standard form of stock option agreement approved by the Board. The Board has by resolution delegated such authority to Hussein Enan, the Chairman of the Board and Chief Executive Officer.

The Board may amend, modify, extend, cancel or renew any option, waive any restrictions or conditions applicable to any option, and accelerate, continue, extend or defer the exercisability or vesting of any option. The Plan provides, subject to certain limitations, for indemnification by InsWeb of any director, officer or employee against all reasonable expenses, including attorneys' fees, incurred

20

in connection with any legal action arising from such person's action or failure to act in administering the Plan. The Board will interpret the Plan and options granted thereunder, and all determinations of the Board will be final and binding on all persons having an interest in the Plan or any option.

Eligibility. Options may be granted under the Plan to employees, directors and consultants of InsWeb or of any present or future parent or subsidiary corporations of InsWeb. In addition, options may be granted to prospective service providers in connection with written offers of employment or other service relationship, provided that no shares may be purchased prior to such person's commencement of service. As of April 16, 2002, InsWeb had approximately 176 employees, including four executive officers and in addition, five directors and no consultants who were eligible under the Plan. While any eligible person may be granted a nonstatutory stock option, only employees may be granted incentive stock options.

Terms and Conditions of Options. Each option granted under the Plan is evidenced by a written agreement between InsWeb and the optionee specifying the number of shares subject to the option and the other terms and conditions of the option, consistent with the requirements of the Plan. Incentive stock options must have an exercise price at least equal to the fair market value of a share of the Common Stock on the date of grant, while nonstatutory stock options must have an exercise price equal to at least 85% of such fair market value. However, any incentive stock option granted to a person who at the time of grant owns stock possessing more than 10% of the total combined voting power of all classes of stock of InsWeb or any parent or subsidiary corporation of InsWeb (a "Ten Percent Stockholder") must have an exercise price equal to at least 110% of the fair market value of a share of Common Stock on the date of grant. As of April 16, 2002, the closing price of InsWeb's Common Stock, as reported on the Nasdaq National Market, was $4.85 per share.

The Plan provides that the option exercise price may be paid in cash, by check, or in cash equivalent; by the assignment of the proceeds of a sale or loan with respect to some or all of the shares being acquired upon the exercise of the option; to the extent legally permitted, by tender of shares of Common Stock owned by the optionee having a fair market value not less than the exercise price or by means of a promissory note for the amount in excess of the par value of the stock purchased if the optionee is an employee; by such other lawful consideration as approved by the Board; or by any combination of these. Nevertheless, the Board may restrict the forms of payment permitted in connection with any option grant. No option may be exercised unless the optionee has made adequate provision for federal, state, local and foreign taxes, if any, relating to the exercise of the option.

Options will become vested and exercisable at such times or upon such events and subject to such terms, conditions, performance criteria or restrictions as specified by the Board. The maximum term of an option granted under the Plan is ten years, provided that an incentive stock option granted to a Ten Percent Stockholder must have a term not exceeding five years. An option generally will remain exercisable for three months following the optionee's termination of service. However, if such termination results from the optionee's death or disability, the option generally will remain exercisable for 12 months. In any event, the option must be exercised no later than its expiration date. Incentive stock options are nontransferable by the optionee other than by will or by the laws of descent and distribution, and are exercisable during the optionee's lifetime only by the optionee. Nonstatutory stock options granted under the Plan may be assigned or transferred to the extent permitted by the Board and set forth in the option agreement.

Director Option Program. In addition to authorizing the Board to grant options to employees, directors and consultants on a discretionary basis, the Plan currently provides for the automatic grant of options to nonemployee directors. Subject to stockholder approval, the Board has amended the Plan to extend the automatic option grant program to all directors. As amended, the Plan would provide for the grant of an option to purchase 500 shares of Common Stock to all directors in attendance at a regularly scheduled meeting of the Board and an option to purchase 100 shares of Common Stock to

21

each committee member in attendance at a meeting of a committee of the Board. The numbers of shares for which such director options are granted is subject to appropriate adjustment in the event of certain changes in InsWeb's capital structure, as previously described. The per-share exercise price of each such option will equal the fair market value of a share of Common Stock on the date of grant, which is the date of the applicable meeting. Generally, the fair market value of a share of Common Stock is determined by the closing price reported on the Nasdaq National Market. Options granted to directors for meeting attendance are immediately exercisable and vested in full upon grant and have a term of ten years from the date of grant. Such options remain exercisable for three months following the director's termination of service for any reason other than death, disability or termination of service following a Change in Control (as described below). In the event of a director's death or disability, the options remain exercisable for 12 months following such termination of service.

Change in Control. The Plan defines a "Change in Control" of InsWeb as any of the following events as a result of which the stockholders of InsWeb immediately before the event do not retain immediately after the event, in substantially the same proportions as their ownership of shares of InsWeb's voting stock immediately before the event, direct or indirect beneficial ownership of more than 50% of the total combined voting power of the voting stock of InsWeb, its successor or the corporation to which the assets of InsWeb were transferred: (i) a sale or exchange by the stockholders in a single or series of related transactions of more than 50% of InsWeb's voting stock; (ii) a merger or consolidation in which InsWeb is a party; (iii) the sale, exchange or transfer of all or substantially all of the assets of InsWeb; or (iv) a liquidation or dissolution of InsWeb. If a Change in Control occurs, the surviving, continuing, successor or purchasing corporation or parent thereof may either assume InsWeb's rights and obligations under the outstanding options or substitute substantially equivalent options for such corporation's stock. If the acquiring corporation elects not to assume or substitute for the outstanding options, such options automatically will become immediately exercisable and vested in full as of the date ten days prior to, but conditioned upon the consummation of, the Change in Control. Options that are not assumed, replaced or exercised prior to the Change in Control will terminate. Furthermore, options granted under the Plan generally provide that if they are assumed or replaced in connection with a Change in Control but, within 12 months following the Change in Control, the optionee is terminated without "Cause" (as defined in the stock option agreement) or resigns for "Good Reason" (as defined in the stock option agreement), then the option automatically will become immediately exercisable and vested in full, and will remain exercisable for six months following the optionee's termination of service (but in any event no later than the option's expiration date).

Termination or Amendment. The Plan will continue in effect until the earlier of its termination by the Board or the date on which all shares available for issuance under the Plan have been issued and all restrictions on such shares under the terms of the Plan and the agreements evidencing options granted under the Plan have lapsed, provided that options may not be granted under the Plan after June 30, 2007. The Board may terminate or amend the Plan at any time. However, without stockholder approval, the Board may not amend the Plan to increase the total number of shares of Common Stock issuable thereunder, change the class of persons eligible to receive incentive stock options, or effect any other change that would require stockholder approval under any applicable law, regulation or rule. No termination or amendment of the Plan may adversely affect an outstanding option without the consent of the optionee, unless the amendment is required to preserve an option's status as an incentive stock option or is necessary to comply with any applicable law, regulation or rule.

Summary of U.S. Federal Income Tax Consequences

The following summary is intended only as a general guide as to the U.S. federal income tax consequences under current law of participation in the Plan and does not attempt to describe all

22

possible federal or other tax consequences of such participation or tax consequences based on particular circumstances.

Incentive Stock Options. An optionee recognizes no taxable income for regular income tax purposes as a result of the grant or exercise of an incentive stock option qualifying under Section 422 of the Code. However, the Internal Revenue Service has proposed regulations under which federal employment taxes would be imposed, beginning January 1, 2003, on the exercise of incentive stock options.

Optionees who neither dispose of their shares within two years following the date the option was granted nor within one year following the exercise of the option will normally recognize a capital gain or loss equal to the difference, if any, between the sale price and the purchase price of the shares. If an optionee satisfies such holding periods upon a sale of the shares, InsWeb will not be entitled to any deduction for federal income tax purposes. If an optionee disposes of shares within two years after the date of grant or within one year after the date of exercise (a "disqualifying disposition"), the difference between the fair market value of the shares on the exercise date and the option exercise price (not to exceed the gain realized on the sale if the disposition is a transaction with respect to which a loss, if sustained, would be recognized) will be taxed as ordinary income at the time of disposition. Any gain in excess of that amount will be a capital gain. If a loss is recognized, there will be no ordinary income, and such loss will be a capital loss. Any ordinary income recognized by the optionee upon the disqualifying disposition of the shares generally should be deductible by InsWeb for federal income tax purposes, except to the extent such deduction is limited by applicable provisions of the Code.

The difference between the option exercise price and the fair market value of the shares on the exercise date of an incentive stock option is treated as an adjustment in computing the optionee's alternative minimum taxable income and may be subject to an alternative minimum tax which is paid if such tax exceeds the regular tax for the year. Special rules may apply with respect to certain subsequent sales of the shares in a disqualifying disposition, certain basis adjustments for purposes of computing the alternative minimum taxable income on a subsequent sale of the shares and certain tax credits which may arise with respect to optionees subject to the alternative minimum tax.

Nonstatutory Stock Options. Options not designated or qualifying as incentive stock options will be nonstatutory stock options having no special tax status. An optionee generally recognizes no taxable income as the result of the grant of such an option. Upon exercise of a nonstatutory stock option, the optionee normally recognizes ordinary income in the amount of the difference between the option exercise price and the fair market value of the shares on the exercise date. If the optionee is an employee, such ordinary income generally is subject to withholding of income and employment taxes. Upon the sale of stock acquired by the exercise of a nonstatutory stock option, any gain or loss, based on the difference between the sale price and the fair market value on the exercise date, will be taxed as capital gain or loss. No tax deduction is available to InsWeb with respect to the grant of a nonstatutory stock option or the sale of the stock acquired pursuant to such grant. InsWeb generally should be entitled to a deduction equal to the amount of ordinary income recognized by the optionee as a result of the exercise of a nonstatutory stock option, except to the extent such deduction is limited by applicable provisions of the Code.

Amended Plan Benefits and Additional Information

As of the date of this proxy statement, no options have been granted under the Plan conditioned upon stockholder approval of this proposal. The following table sets forth the numbers of shares for which options would have been granted automatically under the Plan during the fiscal year ending December 31, 2001 to each person named in the Summary Compensation Table, to all current executive officers as a group, to each current director who is not an executive officer, and to all current directors who are not executive officers as a group had the proposed amendment to the nonemployee

23

director option program been in effect during such fiscal year. Future grants to all other persons under the Plan will be made at the discretion of the Board, and, accordingly, are not yet determinable. Consequently it is not possible to determine the benefits that might be received by optionees receiving discretionary grants under the Plan.

| Name and position | Numbers of shares for which options would have been granted in fiscal 2001 had Plan amendment been effective | |

|---|---|---|

| Hussein A. Enan | 43,667 | |

| Mark P. Guthrie | 25,000 | |

| L. Eric Loewe | 8,333 | |

| William D. Griffin | 16,667 | |

| Total executive group | 93,667 | |

Robert A. Puccinelli, Director | 6,133 | |

| Stephen M. Bennett, Director | 4,833 | |

| James M. Corroon, Vice Chairman of the Board | 5,333 | |

| Ronald D. Fisher, Director | 6,133 | |

| Total non-executive director group | 22,432 |

The aggregate numbers of shares of Common Stock subject to options granted to certain persons under the Plan since its adoption are as follows: Hussein A. Enan, Chairman of the Board and Chief Executive Officer, 141,667 shares; Mark P. Guthrie President and Chief Operating Officer, 192,604 shares; L. Eric Loewe, Senior Vice President, Secretary and General Counsel, 54,917 shares; William D. Griffin, Chief Financial Officer, 56,667 shares; all current executive officers as a group, an aggregate of 445,855 shares; all current directors who are not executive officers as a group, an aggregate of 19,599 shares; and all employees, including current officers who are not executive officers, as a group, an aggregate of 749,359 shares. Since its adoption, no options have been granted under the Plan to any nominee for election as a director, or any associate of any such director, nominee or executive officer, and no other person has been granted five percent or more of the total amount of options granted under the Plan.

Vote Required and Board of Directors Recommendation

Approval of this proposal requires a number of votes "For" the proposal that represents a majority of the shares present or represented by proxy and entitled to vote at the Annual Meeting, with abstentions and broker non-votes each being counted as present for purposes of determining the presence of a quorum, abstentions having the same effect as a negative vote and broker non-votes having no effect on the outcome of the vote.