UNITED STATES |

|

| |

| SECURITIES AND EXCHANGE COMMISSION |

|

|

| Washington, D.C. 20549 |

|

|

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant o | |

Filed by a Party other than the Registrant o | |

Check the appropriate box: | |

o | Preliminary Proxy Statement |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x | Definitive Proxy Statement |

o | Definitive Additional Materials |

o | Soliciting Material Pursuant to §240.14a-12 |

INSWEB CORPORATION | ||||

(Name of Registrant as Specified In Its Charter) | ||||

| ||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

|

|

| ||

Payment of Filing Fee (Check the appropriate box): | ||||

x | No fee required. | |||

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | ||

|

|

| ||

| (2) | Aggregate number of securities to which transaction applies: | ||

|

|

| ||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | ||

|

|

| ||

| (4) | Proposed maximum aggregate value of transaction: | ||

|

|

| ||

| (5) | Total fee paid: | ||

|

|

| ||

o | Fee paid previously with preliminary materials. | |||

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid: | ||

|

|

| ||

| (2) | Form, Schedule or Registration Statement No.: | ||

|

|

| ||

| (3) | Filing Party: | ||

|

|

| ||

| (4) | Date Filed: | ||

|

|

| ||

|

|

| ||

|

| Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. | ||

June 3, 2005

Dear Stockholder:

This year’s annual meeting of stockholders will be held on Monday, July 18, 2005, at 3:30 p.m. local time, at the corporate headquarters of InsWeb Corporation, located at 11290 Pyrites Way, Suite 200, Gold River, California 95670. You are cordially invited to attend.

The Notice of Annual Meeting of Stockholders and a Proxy Statement, which describe the formal business to be conducted at the meeting, follow this letter.

After reading the Proxy Statement, please promptly mark, sign and return the enclosed proxy card in the postage-paid envelope to assure that your shares will be represented. Your shares cannot be voted unless you date, sign, and return the enclosed proxy card or attend the annual meeting in person. Regardless of the number of shares you own, your careful consideration of, and vote on, the matters before our stockholders are important.

A copy of InsWeb’s Annual Report to Stockholders is also enclosed for your information. At the annual meeting we will review InsWeb’s activities over the past year and our plans for the future. The Board of Directors and management look forward to seeing you at the annual meeting.

Very truly yours, | |

|

|

| L. Eric Loewe |

| Senior Vice President, Secretary and |

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS TO BE HELD JULY 18, 2005

TO THE STOCKHOLDERS:

Please take notice that the annual meeting of the stockholders of InsWeb Corporation, a Delaware corporation (“InsWeb”), will be held on Monday, July 18, 2005, at 3:30 p.m. local time, at the corporate headquarters of InsWeb, located at 11290 Pyrites Way, Suite 200, Gold River, California 95670, for the following purposes:

1. To elect two (2) Class III directors to hold office for a three-year term and until their respective successors are elected and qualified.

2. To consider and ratify the appointment of Ernst & Young LLP as InsWeb’s independent registered public accounting firm for the year ending December 31, 2005.

3. To transact such other business as may properly come before the meeting.

Stockholders of record at the close of business on May 20, 2005 are entitled to notice of, and to vote at, this meeting and any adjournment or postponement. For ten days prior to the meeting, a complete list of stockholders entitled to vote at the meeting will be available for examination by any stockholder, for any purpose relating to the meeting, during ordinary business hours at InsWeb’s principal offices located at 11290 Pyrites Way, Suite 200, Gold River, California 95670.

By order of the Board of Directors, | |

|

|

| L. Eric Loewe |

| Senior Vice President, Secretary and |

Gold River, California

June 3, 2005

TABLE OF CONTENTS

PROXY STATEMENT FOR ANNUAL MEETING OF STOCKHOLDERS

The accompanying proxy is solicited by the Board of Directors of InsWeb Corporation, a Delaware corporation (“InsWeb” or the “Company”), for use at its annual meeting of stockholders to be held on July 18, 2005, or any adjournment or postponement thereof, for the purposes set forth in the accompanying Notice of Annual Meeting of Stockholders. The date of this Proxy Statement is June 3, 2005, the approximate date on which this Proxy Statement and the accompanying form of proxy were first sent or given to stockholders.

SOLICITATION AND VOTING OF PROXIES

The cost of soliciting proxies will be borne by InsWeb. In addition to soliciting stockholders by mail, InsWeb will request banks and brokers, and other custodians, nominees and fiduciaries, to solicit their customers who have stock of InsWeb registered in the names of such persons and will reimburse them for their reasonable, out-of-pocket costs. InsWeb may use the services of its officers, directors and others to solicit proxies, personally or by telephone, without additional compensation. In addition, InsWeb has retained American Stock Transfer & Trust Co., a registrar and transfer agent firm, for assistance in connection with the annual meeting at no additional cost except for reasonable out-of-pocket expenses.

On May 20, 2005, there were 4,044,061 shares of InsWeb’s Common Stock outstanding, all of which are entitled to vote with respect to all matters to be acted upon at the annual meeting. Each stockholder of record as of that date is entitled to one vote for each share of Common Stock held by him or her. InsWeb’s bylaws provide that a majority of all of the shares of the stock entitled to vote, whether present in person or represented by proxy, shall constitute a quorum for the transaction of business at the meeting. Votes for and against, abstentions and “broker non-votes” will each be counted as present for purposes of determining the presence of a quorum.

All valid proxies received before the meeting will be exercised. All shares represented by a proxy will be voted, and where a stockholder specifies by means of his or her proxy a choice with respect to any matter to be acted upon, the shares will be voted in accordance with that specification. If no choice is indicated on the proxy, the shares will be voted in favor of the proposal. A stockholder giving a proxy has the power to revoke his or her proxy at any time before the time it is exercised by delivering to the Secretary of InsWeb a written instrument revoking the proxy or a duly executed proxy with a later date, or by attending the meeting and voting in person.

1

Stock Ownership of Certain Beneficial Owners and Management

The following table sets forth, as of May 20, 2005, certain information with respect to the beneficial ownership of InsWeb’s Common Stock by (i) each stockholder known by InsWeb to be the beneficial owner of more than 5% of InsWeb’s Common Stock, (ii) each director of InsWeb, (iii) the Chief Executive Officer and each of the other executive officers of InsWeb that received a total salary and bonus in excess of $100,000 for the year ended December 31, 2004, and (iv) all current directors and executive officers of InsWeb as a group.

Name of Beneficial Owner(1) |

|

|

| Number of Shares |

| Percent of |

| ||||

5% Stockholders |

|

|

|

|

|

|

|

|

| ||

Hassan Elsawaf(3) |

|

| 431,536 |

|

|

| 9.6 | % |

| ||

Lloyd I. Miller III(4) |

|

| 270,980 |

|

|

| 6.0 | % |

| ||

Directors and Executive Officers |

|

|

|

|

|

|

|

|

| ||

Hussein A. Enan(5) |

|

| 1,393,413 |

|

|

| 30.9 | % |

| ||

James M. Corroon(6) |

|

| 26,273 |

|

|

| * |

|

| ||

Dennis H. Chookaszian(7) |

|

| 27,783 |

|

|

| * |

|

| ||

Robert A. Puccinelli(8) |

|

| 42,290 |

|

|

| * |

|

| ||

Thomas W. Orr(9) |

|

| 27,367 |

|

|

| * |

|

| ||

William D. Griffin(10) |

|

| 101,668 |

|

|

| 2.3 | % |

| ||

L. Eric Loewe(11) |

|

| 82,581 |

|

|

| 1.8 | % |

| ||

Current directors and executive officers as a group (7 persons)(12) |

|

| 1,701,375 |

|

|

| 37.8 | % |

| ||

* Less than 1%.

(1) The persons named in the table above have sole voting and investment power with respect to all shares of Common Stock shown as beneficially owned by them, subject to community property laws where applicable and to the information contained in the footnotes to this table.

(2) Calculated on the basis of 4,044,061 shares of Common Stock outstanding as of May 20, 2005, except that shares of Common Stock underlying options exercisable within 60 days following May 20, 2005 are deemed outstanding for purposes of calculating the beneficial ownership of Common Stock of the holders of such options.

(3) The address for Mr. Elsawaf is c/o InsWeb Corporation, 11290 Pyrites Way, Suite 200, Gold River, California 95670.

(4) The address for Mr. Miller is 4500 Gordon Drive, Naples, Florida 34102.

(5) Includes 41,250 shares held by Mr. Enan’s spouse. Includes 165,334 shares subject to options exercisable within 60 days following May 20, 2005. The address for Mr. Enan is c/o InsWeb Corporation, 11290 Pyrites Way, Suite 200, Gold River, California 95670.

(6) Includes 26,273 shares subject to options exercisable within 60 days following May 20, 2005.

(7) Includes 416 shares held by Mr. Chookaszian’s spouse, which he disclaims beneficial ownership of. Includes 27,367 shares subject to options exercisable within 60 days following May 20, 2005.

(8) Includes 29,790 shares subject to options exercisable within 60 days following May 20, 2005.

(9) Includes 27,367 shares subject to options exercisable within 60 days following May 20, 2005.

(10) Includes 101,668 shares subject to options exercisable within 60 days following May 20, 2005.

2

(11) Includes 81,281 shares subject to options exercisable within 60 days following May 20, 2005.

(12) Includes 459,080 shares subject to options exercisable within 60 days following May 20, 2005.

Executive Officers of the Registrant

As of May 20, 2005, InsWeb’s executive officers were as follows:

Name |

|

|

| Position With InsWeb |

| Age |

| ||

Hussein A. Enan |

| Chairman of the Board and Chief Executive Officer |

|

| 59 |

|

| ||

William D. Griffin |

| Chief Financial Officer |

|

| 47 |

|

| ||

L. Eric Loewe |

| Senior Vice President, General Counsel and Secretary |

|

| 47 |

|

| ||

Hussein A. Enan co-founded InsWeb in February 1995 and has served as its Chairman of the Board since its inception. Mr. Enan served as InsWeb’s Chief Executive Officer from February 1995 to June 2002 and was reinstated to that position in August 2004. Mr. Enan also served as InsWeb’s President from May 1999 to June 2000. From March 1992 to November 1994, Mr. Enan was a general partner at E.W. Blanch, a reinsurance intermediary that merged with his own wholly-owned company, Enan & Company, a reinsurance intermediary, in March 1992. Mr. Enan founded Enan & Company in February 1979.

William D. Griffin joined InsWeb in May 20001 as Chief Financial Officer. From August 1999 to February 2001, Mr. Griffin was Chief Financial Officer of ZipSend, Inc., an Internet services company, of which he was a co-founder. From October 1998 through August 1999, Mr. Griffin provided consulting services to various early stage Internet and technology companies. Prior to that, from May 1990 through September 1998, Mr. Griffin was Senior Vice President and Chief Financial Officer of Inference Corporation, a customer services software company.

L. Eric Loewe joined InsWeb in October 1998 as Corporate Counsel, Legal and Regulatory, responsible for all regulatory compliance issues, and has served as Senior Vice President and General Counsel since September 2000 and as Secretary since July 2001. Mr. Loewe held various positions with the National Association of Independent Insurers (the “NAII”) from January 1980 to September 1998. As Senior Counsel for the NAII, Mr. Loewe was responsible for legislation and regulations affecting its 570 member companies. Mr. Loewe is a member of the Illinois and California bars.

3

Directors

This section sets forth certain information about InsWeb’s current directors, including the Class III nominees to be elected at this meeting.

Name |

|

|

| Position with InsWeb |

| Age |

| Director |

| ||||

Class I director whose term expires at the 2006 Annual Meeting of Stockholders: |

|

|

|

|

|

|

|

|

|

|

| ||

Robert A. Puccinelli(1)(2)(3) |

| Director |

|

| 67 |

|

|

| 1998 |

|

| ||

Class II directors whose terms expire at the 2007 Annual Meeting of Stockholders: |

|

|

|

|

|

|

|

|

|

|

| ||

James M. Corroon(1)(3) |

| Vice Chairman of the Board |

|

| 65 |

|

|

| 1996 |

|

| ||

Thomas W. Orr(1)(2)(3) |

| Director |

|

| 71 |

|

|

| 2003 |

|

| ||

Class III directors standing for election at the 2005 Annual Meeting of Stockholders: |

|

|

|

|

|

|

|

|

|

|

| ||

Hussein A. Enan |

| Chairman of the Board |

|

| 59 |

|

|

| 1995 |

|

| ||

Dennis H. Chookaszian(2)(3) |

| Director |

|

| 61 |

|

|

| 2003 |

|

| ||

(1) Member of the Audit Committee.

(2) Member of the Compensation Committee.

(3) Member of the Nominating and Corporate Governance Committee.

Robert A. Puccinelli has been a director of InsWeb since May 1998. From October 1985 to May 1995, Mr. Puccinelli was Chairman and Chief Executive Officer of Industrial Indemnity, a nationwide property and casualty insurance company.

James M. Corroon has been a director of InsWeb since August 1996 and has served as Vice Chairman of the Board since May 1999. From July 1999 to December 2000, he was a full-time employee of InsWeb and a member of the senior management team. Mr. Corroon is currently the Vice Chairman of Fort Point Insurance Services, Inc., an insurance brokerage firm. Mr. Corroon has been a director of Willis Corroon of California, an insurance services firm, since January 1996. From October 1966 to December 1995, Mr. Corroon held various management positions with Willis Corroon and its predecessor entity, Corroon & Black Corporation.

Thomas W. Orr has been a director of InsWeb since January 2003. Mr. Orr was a partner in the accounting firm of Bregante and Company from January 1992 to June 2002. From 1987 to 1991, Mr. Orr was Chief Financial Officer of Scripps League Newspaper, Inc. Prior to 1987, Mr. Orr worked for the accounting firm of Arthur Young & Company (predecessor to Ernst & Young, LLP) from 1958 until he retired as an audit partner in 1986.

Dennis H. Chookaszian has been a director of InsWeb since April 2003. From November 1999 to February 2001, Mr. Chookaszian was Chairman and Chief Executive Officer of mPower Advisors, L.L.C., an online investment advisory service firm. From September 1992 to February 1999, Mr. Chookaszian served as Chairman and Chief Executive Officer of the CNA insurance company, and prior to that held the positions of President and Chief Operating Officer (1990-1992) and Chief Financial Officer (1975-1990), respectively, of that company. Mr. Chookaszian serves on the boards of the Chicago Mercantile Exchange, Sapient Corporation, a business consulting and technology services firm, and Career Education Corporation, a postsecondary education provider.

The Board of Directors has determined that, other than Mr. Enan, each of the members of the Board has no material relationship with InsWeb and is an independent director for purposes of the Nasdaq Marketplace Rules.

4

General Corporate Governance Matters

Available Information

You may obtain free copies of our annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K and amendments to those reports, as well as other Corporate Governance Materials on our website at http://investor.insweb.com, or by contacting our corporate office by calling (916) 853-3300, or by sending an e-mail message to investor@insweb.com.

We electronically file our annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K with the Securities and Exchange Commission (SEC) pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934. Any materials we file with the SEC are accessible to the public at the SEC’s Public Reference Room at 450 Fifth Street, NW, Washington, DC 20549. The public may also utilize the SEC’s Internet website, which contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. The address of the SEC website is http://www.sec.gov.

Board Meetings and Committees

During the year ended December 31, 2004, the Board of Directors of InsWeb held twelve meetings. During that period, the Audit Committee of the Board held nine meetings, the Compensation Committee of the Board held six meetings, and the Nominating and Corporate Governance Committee of the Board held one meeting. No director attended or participated in fewer than 75% of the total number of meetings of the Board and any of the committees of the Board on which such director served during that period.

Audit Committee. The current members of the Audit Committee are Messrs. Orr, Puccinelli and Corroon. Mr. Fisher served as a member until he resigned from the Board in April 2004 and was replaced by Mr. Corroon. Mr. Orr is chairman of the committee. Each of the members of the Audit Committee is independent for purposes of the Nasdaq Marketplace Rules as they apply to audit committee members. Mr. Orr is an “audit committee financial expert,” as defined in the rules of the Securities and Exchange Commission. The functions of the Audit Committee include retention of independent registered public accounting firm, reviewing and approving the planned scope, proposed fee arrangements and results of InsWeb’s annual audit, reviewing the adequacy of accounting and financial controls, and reviewing the independence of InsWeb’s accountants. For additional information concerning the Audit Committee, see “Report of the Audit Committee” and “Principal Accounting Firm Fees” below.

Compensation Committee. The current members of the Compensation Committee are Messrs. Chookaszian, Orr and Puccinelli. Mr. Fisher served as a member until he resigned from the Board in April 2004 and was replaced by Mr. Chookaszian. Mr. Chookaszian is chairman of the committee. The Compensation Committee reviews and determines the salary and bonus criteria of and stock option grants to all executive officers. For additional information about the Compensation Committee, see “Report of the Compensation Committee on Executive Compensation” and “Executive Compensation and Other Matters” below.

Nominating and Corporate Governance Committee. In April 2004, the Board established a Nominating and Corporate Governance Committee. The current members of the Nominating and Corporate Governance Committee are Messrs. Chookaszian, Corroon, Orr and Puccinelli, each of whom is independent for purposes of the Nasdaq Marketplace Rules. Mr. Corroon is chairman of the committee. The functions of the Nominating and Corporate Governance Committee include selecting, evaluating and recommending to the Board qualified candidates for election or appointment to the Board, and recommending corporate governance principles, codes of conduct and compliance mechanisms applicable to the Company.

5

Director Nominations

The Nominating and Corporate Governance Committee determines the criteria for selecting new directors, including desired board skills and attributes, and identifies and actively seeks individuals qualified to become directors. The Committee will consider any nominations of director candidates validly made by stockholders. To be considered for the election of directors at InsWeb’s 2006 annual meeting, nominations of a director by a stockholder should be sent to the attention of the Corporate Secretary at the Company’s headquarters before February 3, 2006.

Stockholder Communications with Directors; Director Attendance at Annual Meetings

Stockholders may communicate with any and all members of our Board of Directors by transmitting correspondence by mail or facsimile addressed to one or more directors by name (or to the Chairman, for a communication addressed to the entire Board) at the following address and fax number:

Name of the Director(s)

c/o Corporate Secretary

InsWeb Corporation

11290 Pyrites Way

Suite 200

Gold River, CA 95670

(916-853-3327) (FAX)

Communications from our stockholders received as indicated above will be forwarded to the indicated director or directors unless the communication is primarily commercial in nature or relates to an improper or irrelevant topic.

We do not have a policy regarding directors’ attendance at annual meetings. One director attended the 2004 Annual Meeting.

Committee Charters and Other Corporate Governance Materials

The Board has adopted a Code of Business Conduct and Ethics that applies to the Company’s senior officers and members of the Board of Directors (the “Code”). A copy of the Code is available on the Company’s website at http://investor.insweb.com/index.cfm, and was included as Exhibit 14.1 to the Company’s Annual Report on Form 10-K for the year ended December 31, 2003 filed with the Securities and Exchange Commission.

The Board has also adopted a written charter for each of the Audit Committee and Compensation Committee. Each charter is available on the Company’s website at http://investor.insweb.com/index.cfm. The Board also adopted a written charter for the Nominating and Corporate Governance Committee, which is attached as Appendix A to this proxy and in the future will be available on the Company’s website at: http://investor.insweb.com/index.cfm.

6

EXECUTIVE COMPENSATION AND OTHER MATTERS

The following table sets forth information for the years ended December 31, 2004, 2003 and 2002 concerning the compensation of the Chief Executive Officer and each of the other executive officers of InsWeb that received total salary and bonus compensation in excess of $100,000 for the year ended December 31, 2004.

|

|

|

|

|

|

| Long term |

|

|

| ||||||||||

|

|

|

| Annual Compensation |

| Securities |

| All other |

| |||||||||||

Name and Principal Position |

|

|

| Year |

| Salary |

| Bonus(1) |

| Options |

| Compensation(2) |

| |||||||

Hussein A. Enan(3) |

| 2004 |

| $ | 250,000 |

| $ | — |

|

| — |

|

|

| $ | 6,240 |

|

| ||

Chairman of the Board and |

| 2003 |

| 250,000 |

| — |

|

| 6,000 |

|

|

| 6,250 |

|

| |||||

Chief Executive Officer |

| 2002 |

| 250,000 |

| — |

|

| 101,000 |

|

|

| 5,904 |

|

| |||||

William D. Griffin |

| 2004 |

| $ | 208,000 |

| $ | 54,600 |

|

| 25,000 |

|

|

| $ | 6,240 |

|

| ||

Chief Financial Officer |

| 2003 |

| 205,846 |

| — |

|

| 45,000 |

|

|

| 6,000 |

|

| |||||

|

| 2002 |

| 200,000 |

| — |

|

| 40,000 |

|

|

| 2,077 |

|

| |||||

L. Eric Loewe |

| 2004 |

| $ | 182,000 |

| $ | 31,850 |

|

| 15,000 |

|

|

| $ | 4,600 |

|

| ||

Senior Vice President, Secretary and |

| 2003 |

| 180,117 |

| — |

|

| 25,000 |

|

|

| 4,810 |

|

| |||||

General Counsel |

| 2002 |

| 175,000 |

| 27,700 |

|

| 25,000 |

|

|

| 3,096 |

|

| |||||

(1) Bonuses are based on performance except for retention bonus in the amount of $27,700 in 2002 paid to Mr. Loewe in connection with InsWeb’s restructuring and relocation. See “Report of the Compensation Committee on Executive Compensation” below.

(2) Represents employer contributions to InsWeb’s 401(k) plan.

(3) Mr. Enan was Chief Executive Officer until June 2002 and was reinstated in August 2004.

7

Stock Options Granted in Fiscal 2004

The following table provides the specified information concerning grants of options to purchase InsWeb’s Common Stock made during the year ended December 31, 2004, to the persons named in the Summary Compensation Table.

OPTION GRANTS IN LAST FISCAL YEAR

| Individual Grants |

|

|

| ||||||||||||||||||||||||

|

| Number of |

| % of Total |

|

|

|

|

| Potential Realizable Value at |

| |||||||||||||||||

|

| Securities |

| Options |

|

|

|

|

| Assumed Annual Rates of |

| |||||||||||||||||

|

| Underlying |

| Granted to |

| Exercise |

|

|

| Stock Price Appreciation for |

| |||||||||||||||||

|

| Options |

| Employees in |

| Price |

| Expiration |

| Option Term(1) |

| |||||||||||||||||

Name |

|

|

| Granted(2) |

| Fiscal Year |

| ($/Sh)(3) |

| Date |

| 5% |

| 10% |

| |||||||||||||

Hussein A. Enan |

|

| — |

|

|

| — |

|

|

| — |

|

| — |

|

| — |

|

|

| — |

|

| |||||

William D. Griffin |

|

| 19,444 |

|

|

| 7.2 |

|

|

| $ | 5.00 |

|

| 4/01/2014 |

|

| $ | 61,141 |

|

|

| $ | 154,944 |

|

| ||

|

|

| 5,556 |

|

|

| 2.1 |

|

|

| $ | 5.00 |

|

| 4/01/2014 |

|

| $ | 17,471 |

|

|

| $ | 44,274 |

|

| ||

L. Eric Loewe |

|

| 15,000 |

|

|

| 5.5 |

|

|

| $ | 5.00 |

|

| 4/01/2014 |

|

| $ | 47,167 |

|

|

| $ | 119,531 |

|

| ||

(1) Potential gains are net of exercise price, but before taxes associated with exercise. These amounts represent certain assumed rates of appreciation only, based on the Securities and Exchange Commission rules. Actual gains, if any, on stock option exercises are dependent on the future performance of InsWeb’s Common Stock, overall market conditions and the option holders’ continued employment through the vesting period. The amounts reflected in this table may not necessarily be achieved.

(2) Options granted under the 1997 Stock Option Plan generally vest and become exercisable over a three-year period from the date of grant. These options generally vest at the rate of one-third on the first anniversary of the date of grant and 1/36th per month thereafter for each full month of the optionee’s continuous employment with InsWeb. Under the 1997 Stock Option Plan, the Board retains discretion to modify the terms, including the prices, of outstanding options. For additional information regarding options, see “Report of the Compensation Committee on Executive Compensation.”

(3) All options were granted at market value of InsWeb’s Common Stock on the date of grant.

Option Exercises and Fiscal 2004 Year-End Values

The following table provides the specified information concerning exercises of options to purchase InsWeb’s Common Stock in the fiscal year ended December 31, 2004, and unexercised options held as of December 31, 2004, by the persons named in the Summary Compensation Table above.

AGGREGATE OPTION EXERCISES IN LAST FISCAL YEAR AND FISCAL YEAR-END VALUES

|

| Shares |

|

|

| Number of Securities |

| Value of Unexercised |

| |||||||||||||||||||||

|

| Acquired on |

| Value |

| Options at Fiscal Year-End |

| Fiscal Year-End(1) |

| |||||||||||||||||||||

Name |

|

|

| Exercise |

| Realized |

| Exercisable(2) |

| Unexercisable(2) |

| Exercisable |

| Unexercisable |

| |||||||||||||||

Hussein A. Enan |

|

| — |

|

|

| $ | — |

|

|

| 137,556 |

|

|

| 11,111 |

|

|

| $ | 1,100 |

|

|

| $ | — |

|

| ||

William D. Griffin |

|

| — |

|

|

| $ | — |

|

|

| 82,779 |

|

|

| 43,888 |

|

|

| $ | 17,500 |

|

|

| $ | 14,000 |

|

| ||

L. Eric Loewe |

|

| — |

|

|

| $ | — |

|

|

| 69,058 |

|

|

| 25,558 |

|

|

| $ | 9,722 |

|

|

| $ | 7,777 |

|

| ||

(1) Based on a fair market value of $2.75, the closing price of InsWeb’s Common Stock on December 31, 2004, as reported by The NASDAQ National Market, less the exercise price payable for such shares.

8

(2) These options generally vest over a three-year period from the date of grant. See Footnote (2) of “Option Grants in Last Fiscal Year.” The options listed in the “Exercisable” column had vested as of December 31, 2004 and the options listed in the “Unexercisable” column had not yet vested as of December 31, 2004.

Equity Compensation Plan Information

The following presents all compensation plans as of December 31, 2004 (approved and not previously approved by security holders) under which equity securities of the registrant are authorized for issuance:

|

| Number of securities |

| Weighted average |

| Number of |

| |||||||

Equity compensation plans approved by security holders |

|

| 1,144,000 |

|

|

| $ | 8.54 |

|

|

| 1,047,000 |

|

|

Equity compensation plans not approved by security holders |

|

| — |

|

|

| — |

|

|

| — |

|

| |

Compensation Committee Interlocks and Insider Participation

None of our Compensation Committee members is an officer or employee of the Company. None of our executive officers serves as a member of the Board of Directors or compensation committee of any entity that has one or more of its executive officers serving on our compensation committee.

Each non-employee director receives an annual retainer of $30,000 payable on a quarterly basis, and fees of $2,500 for each regularly scheduled Board meeting attended. The chairman of the Audit Committee will receive an additional fee of $2,500 for each regularly scheduled Audit Committee meeting attended. The annual retainer relates to the twelve-month period from April 2004 through March 2005. In addition, each director will be reimbursed for reasonable expenses incurred in attending meetings of the Board.

All directors receive an annual grant of options to purchase 5,000 shares, with the date of grant being on or about July 1 of each year that they serve. All options granted to directors are fully vested and exercisable at the time of grant. The per-share exercise price of each such option will equal the fair market value of a share of Common Stock on the date of grant. Options granted to directors have a term of ten years from the date of grant.

9

Employment Contracts and Termination of Employment and Change of Control Arrangements

We have no long-term employment agreements with any of our key personnel. However, the executive officers and certain other key members of management are eligible to participate in the InsWeb Executive Retention and Severance Plan approved by the Board of Directors on June 14, 2004. Participants in the Plan are entitled to receive cash severance payments and health and medical benefits in the event their employment is terminated in connection with a change in control. Participants will also receive the benefits if InsWeb terminates their employment other than for “cause” or if the participant voluntarily terminates his employment for “good reason” following certain specified actions by InsWeb. Upon any other termination of employment, the participant will be entitled only to accrued salary and any other vested benefits through the date of termination.

InsWeb’s 1997 Stock Option Plan provides that, in the event of a change in control of InsWeb, any outstanding option that is not assumed or substituted by the acquiring corporation will become fully vested. Further, the option agreements applicable to options granted under the 1997 Stock Option Plan provide for full acceleration of vesting if, within 12 months following a change in control, the optionee’s employment is terminated without cause or the optionee resigns for “good reason,” as defined in such option agreements.

Certain Relationships and Related Transactions

Negotiated Common Stock Repurchases

On March 31, 2005, the Company purchased 755,821 shares of InsWeb common stock, consisting of 531,947 shares held by Nationwide Mutual Insurance Company and 223,874 shares held by Century Capital Partners, L.P. These shares represented 16% of InsWeb Corporation’s then total outstanding Common Stock and were purchased for approximately $1.7 million, or $2.30 per share.

Commercial Transactions

InsWeb and Yahoo! Inc. entered into a license agreement dated as of February 12, 1998 and amended as of March 31, 1999 and September 24, 2001. During 2004, InsWeb entered into a number of limited duration advertising contracts with Yahoo! Inc. SOFTBANK Corp., a 5% stockholder of InsWeb during part of 2004, is an affiliate of Yahoo! Inc. In addition, Ronald Fisher, a director of InsWeb until his resignation in April 2004, is vice chairman of SOFTBANK Holdings Inc., an affiliate of SOFTBANK Corp. For 2004, 2003 and 2002, InsWeb recognized $453,000, $338,000 and $1,085,000, respectively, in direct marketing expense as a result of transactions with Yahoo! Inc.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires InsWeb’s executive officers, directors and persons who beneficially own more than 10% of InsWeb’s Common Stock (collectively, “Reporting Persons”) to file initial reports of ownership and reports of changes in ownership with the Securities and Exchange Commission. Reporting Persons are required by SEC regulations to furnish InsWeb with copies of all Section 16(a) forms they file.

Based solely on InsWeb’s review of reports furnished to InsWeb and representations from certain Reporting Persons, InsWeb believes that all filing requirements applicable to Reporting Persons were complied with.

10

REPORT OF THE COMPENSATION COMMITTEE

ON EXECUTIVE COMPENSATION

The current members of the Compensation Committee are Mr. Chookaszian, Mr. Orr and Mr. Puccinelli. The Compensation Committee is responsible for setting and administering the policies governing annual compensation of the executive officers of InsWeb. The Compensation Committee reviews the performance and compensation levels for executive officers and sets salary levels. The Compensation Committee acts pursuant to a written charter that has been adopted by the Board of Directors.

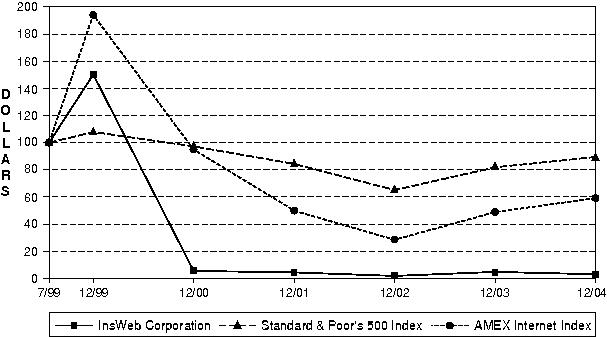

The goals of InsWeb’s executive officer compensation policies are to attract, retain and reward executive officers who contribute to InsWeb’s success, to align executive officer compensation with InsWeb’s performance and to motivate executive officers to achieve InsWeb’s business objectives. InsWeb uses salary, bonus compensation and option grants to attain these goals. The Compensation Committee reviews compensation surveys prepared by management of InsWeb and by outside compensation consultants to compare InsWeb’s compensation package with that of similarly sized high technology companies in InsWeb’s geographic area. In preparing the performance graph set forth in the section entitled “Comparison of Stockholder Return,” InsWeb has selected the AMEX Internet Index as its published industry index; however, the companies included in InsWeb’s salary surveys are not necessarily those included in this index, because companies in the index may not compete with InsWeb for executive talent, and companies which do compete for executive officers may not be publicly traded.

Base salaries of executive officers are reviewed annually by the Compensation Committee and adjustments are made based on (i) salary recommendations from the Chairman and Chief Executive Officer, (ii) individual performance of executive officers for the previous fiscal year, (iii) financial results of InsWeb for the previous year and (iv) reports to the Compensation Committee from outside compensation consultants concerning competitive salaries, scope of responsibilities of the officer position and levels paid by similarly-sized high technology companies in InsWeb’s geographic area.

InsWeb strongly believes that equity ownership by executive officers provides incentives to build stockholder value and aligns the interests of executive officers with those of the stockholders, and therefore makes periodic grants of stock options under the 1997 Stock Option Plan and the Senior Executive Nonstatutory Stock Option Plan. Historically, the size of an option grant to an executive officer has generally been determined with reference to similarly sized high technology companies in InsWeb’s geographical area, the responsibilities and expected future contributions of the executive officer, previous grants to that officer, as well as recruitment and retention considerations. To assist InsWeb in retaining and motivating key employees, option grants generally vest over a three-year period from the date of grant. During 2004, the Compensation Committee approved stock option grants to certain of the executive officers consistent with these criteria. See “Option Grants in Last Fiscal Year.”

Mr. Enan’s compensation as Chief Executive Officer during the 2004 fiscal year was determined by the Compensation Committee using the same general philosophy and criteria used for other executive officers as described above.

COMPENSATION COMMITTEE | |

| Dennis H. Chookaszian (Chair) |

| Thomas W. Orr |

| Robert A. Puccinelli |

11

The current members of the Audit Committee are Mr. Orr, Mr. Corroon and Mr. Puccinelli. The Audit Committee acts pursuant to a written charter that has been adopted by the Board of Directors.

The Audit Committee oversees the Company’s financial reporting process on behalf of the Board of Directors. Management has the primary responsibility for the financial statements and the reporting process, including the system of internal control. In fulfilling its oversight responsibilities, the Audit Committee reviewed the audited financial statements in the Annual Report with management, including a discussion of the quality, not just the acceptability, of the accounting principles; the reasonableness of significant judgments; and the clarity of disclosures in the financial statements.

The Audit Committee reviewed with the independent registered public accounting firm, Ernst & Young LLP, who are responsible for expressing an opinion on the conformity, in all material respects, of those audited financial statements with United States generally accepted accounting principles, their judgments as to the quality, not just the acceptability, of the Company’s accounting principles and such other matters as are required to be discussed with the committee under generally accepted auditing standards (including Statement on Auditing Standards No. 61). In addition, the Audit Committee has discussed with the independent registered public accounting firm the auditors’ independence from management and the Company, including the matters in the written disclosures required by the Independence Standards Board (including Independence Standards Board Standard No. 1), and considered the compatibility of non-audit services with the auditors’ independence.

The Audit Committee discussed with the Company’s independent registered public accounting firm the overall scope and plans for their respective audits. The Audit Committee meets with the independent registered public accounting firm, with and without management present, to discuss the results of their examinations, their evaluations of the Company’s internal control, and the overall quality of the Company’s financial reporting.

In reliance on the reviews and discussions referred to above, the Audit Committee recommended to the Board of Directors (and the board has approved) that the audited financial statements be included in the Annual Report on Form 10-K for the year ended December 31, 2004 for filing with the Securities and Exchange Commission.

| AUDIT COMMITTEE |

| Thomas W. Orr (Chair) |

| James M. Corroon |

| Robert A. Puccinelli |

12

The following table sets forth the aggregate fees billed to InsWeb for the years ended December 31, 2004 and 2003 by InsWeb’s principal accounting firm, Ernst & Young LLP:

|

| 2004 |

| 2003 |

| ||

Audit Fees(1) |

| $ | 506,500 |

| $ | 283,000 |

|

Audit-Related Fees(2) |

| 27,500 |

| 72,500 |

| ||

Tax Fees(3) |

| 56,105 |

| 55,052 |

| ||

All Other Fees |

| — |

| — |

| ||

|

| $ | 590,105 |

| $ | 410,552 |

|

(1) Audit fees include the audit of InsWeb’s financial statements (including required quarterly reviews) and other procedures required to be performed by the independent registered public accounting firm to be able to form an opinion on the Company’s consolidated financial statements.

(2) Audit-related fees include assurance and related services that are reasonably related to the performance of the audit or review of the Company’s financial statements or that are traditionally performed by the independent registered public accounting firm. Audit-related services in 2004 and 2003 consisted of the audit of the Company’s employee benefit plan. Audit-related services in 2003 also included consultations related to the Sarbanes-Oxley Act of 2002.

(3) Tax fees include tax return preparation, tax compliance, tax planning and tax advice.

The Audit Committee considered the role of Ernst & Young LLP in providing non-audit services to InsWeb and has concluded that such services are compatible with Ernst & Young’s independence as InsWeb’s independent registered public accounting firm.

Pre-Approval Policies and Procedures

The Audit Committee has adopted a policy that requires advance approval of all audit, audit-related, tax services, and other services performed by the independent registered public accounting firm. The policy provides for pre-approval by the Audit Committee of specifically defined audit and non-audit services. Unless the specific service has been pre-approved with respect to that year, the Audit Committee must approve the permitted service before the independent registered public accounting firm is engaged to perform it. The Audit Committee has delegated to the chair of the Audit Committee the authority to approve permitted services, provided that the chair reports any decisions to the Audit Committee at its next scheduled meeting.

13

COMPARISON OF STOCKHOLDER RETURN

Set forth below is a line graph comparing the annual percentage change in the cumulative total return on InsWeb’s Common Stock with the cumulative total returns of the Standard & Poor’s 500 Index and the AMEX Internet Index for the period commencing on July 23, 1999 and ending on December 31, 2004.(1)

|

| 7/23/99 |

| 12/31/99 |

| 12/31/00 |

| 12/31/01 |

| 12/31/02 |

| 12/31/03 |

| 12/31/04 |

|

| |||||||||||||||||||

InsWeb Corporation |

| $ | 100.00 |

|

| $ | 150.35 |

|

|

| $ | 5.18 |

|

|

| $ | 4.17 |

|

|

| $ | 1.59 |

|

|

| $ | 4.52 |

|

|

| $ | 2.75 |

|

| |

Standard & Poor’s 500 Index |

| $ | 100.00 |

|

| $ | 108.00 |

|

|

| $ | 97.05 |

|

|

| $ | 84.30 |

|

|

| $ | 64.84 |

|

|

| $ | 81.94 |

|

|

| $ | 89.31 |

|

| |

AMEX Internet Index |

| $ | 100.00 |

|

| $ | 194.32 |

|

|

| $ | 94.76 |

|

|

| $ | 49.46 |

|

|

| $ | 28.13 |

|

|

| $ | 48.69 |

|

|

| $ | 58.88 |

|

| |

(1) Assumes that $100.00 was invested on July 23, 1999, at the closing price on the date of InsWeb’s initial public offering, in InsWeb’s Common Stock and each index. No cash dividends have been declared on InsWeb’s Common Stock. Stockholder returns over the indicated period should not be considered indicative of future stockholder returns.

14

PROPOSAL NO. 1

ELECTION OF DIRECTORS

InsWeb has a classified Board of Directors consisting of one Class I director (Mr. Puccinelli), two Class II directors (Mr. Corroon and Mr. Orr), and two Class III directors (Mr. Enan and Mr. Chookaszian) who will serve until the Annual Meetings of Stockholders to be held in 2006, 2007 and 2005, respectively, and until their respective successors are duly elected and qualified. At each annual meeting of stockholders, directors are elected for a term of three years to succeed those directors whose terms expire at the annual meeting date.

The term of the Class III directors will expire on the date of the 2005 annual meeting. Accordingly, two persons are to be elected to serve as the Class III directors of the Board of Directors at the meeting. Management’s nominees for election by the stockholders to the position are the current Class III Directors, Mr. Enan and Mr. Chookaszian. Please see “Information About InsWeb-Management” above for information concerning the nominees. If elected, the nominees will serve as directors until InsWeb’s Annual Meeting of Stockholders in 2008 and until their successors are elected and qualified. If a nominee declines to serve or becomes unavailable for any reason, or if a vacancy occurs before the election (although InsWeb knows of no reason to anticipate that this will occur), the proxies may be voted for such substitute nominees as InsWeb may designate.

Vote Required and Board of Directors’ Recommendation

If a quorum is present, the two nominees for Class III director receiving the highest number of votes will be elected as Class III directors. Abstentions and broker non-votes have no effect on the vote.

The Board of Directors recommends a vote “FOR” the nominees named above.

15

PROPOSAL NO. 2

RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC

ACCOUNTING FIRM

The Board of Directors of InsWeb has selected Ernst & Young LLP as independent registered public accounting firm to audit the consolidated financial statements of InsWeb for the fiscal year ending December 31, 2005. Ernst & Young LLP has acted in such capacity since its appointment in fiscal year 2001. A representative of Ernst & Young LLP is expected to be present at the annual meeting, with the opportunity to make a statement if the representative desires to do so, and is expected to be available to respond to appropriate questions.

Vote Required and Board of Directors’ Recommendation

The affirmative vote of a majority of the votes cast affirmatively or negatively at the annual meeting of stockholders at which a quorum representing a majority of all outstanding shares of Common Stock of InsWeb is present, either in person or by proxy, is required for approval of this proposal. Abstentions and broker non-votes will each be counted as present for purposes of determining the presence of a quorum. Neither abstentions nor broker non-votes will have any effect on the outcome of the proposal.

The Board of Directors recommends a vote “FOR” ratification of the appointment of Ernst & Young LLP as InsWeb’s independent registered public accounting firm for the fiscal year ending December 31, 2005.

16

STOCKHOLDER PROPOSALS TO BE PRESENTED

AT NEXT ANNUAL MEETING

Under InsWeb’s bylaws, in order for stockholder business to be properly brought before a meeting by a stockholder, such stockholder must have given timely notice thereof in writing to the Secretary of InsWeb. To be timely, such notice must be delivered to or mailed and received at InsWeb’s principal executive offices, not less than 30 days nor more than 60 days prior to the meeting; provided, however, that in the event that less than 40 days’ notice or prior public disclosure of the date of the meeting is given or made to stockholders, notice by the stockholder to be timely must be so received not later than the close of business on the 10th day following the day on which such notice of the date of the annual meeting was mailed or such public disclosure was made.

In connection with InsWeb’s next annual meeting of stockholders, under the Securities and Exchange Commission Rule 14a-4, management may solicit proxies that confer discretionary authority to vote with respect to any non-management proposal unless InsWeb has received notice of the proposal not later than April 19, 2006.

Proposals of stockholders intended to be included in InsWeb’s proxy statement for the next annual meeting of the stockholders of InsWeb must be received by InsWeb at its offices at 11290 Pyrites Way, Suite 200, Gold River, California 95670, no later than February 3, 2006, and satisfy the conditions established by the Securities and Exchange Commission for stockholder proposals to be included in InsWeb’s proxy statement for that meeting.

At the date of this Proxy Statement, the Board of Directors knows of no other business that will be conducted at the 2005 Annual Meeting of Stockholders of InsWeb other than as described in this Proxy Statement. If any other matter or matters are properly brought before the meeting, or any adjournment or postponement of the meeting, it is the intention of the persons named in the accompanying form of proxy to vote the proxy on such matters in accordance with their best judgment.

By Order of the Board of Directors | |

|

|

| L. Eric Loewe |

| Senior Vice President, Secretary and |

| General Counsel |

June 3, 2005 |

|

17

THE NOMINATING AND CORPORATE GOVERNANCE COMMITTEE

OF THE BOARD OF DIRECTORS

This Charter specifies the scope of the responsibilities of the Nominating and Corporate Governance Committee (the “Committee”) of the Board of Directors (the “Board”) of InsWeb Corporation (the “Company”) and the manner in which those responsibilities shall be performed, including its structure, processes and membership requirements.

The primary responsibilities of the Committee are to (i) identify individuals qualified to become Board members; (ii) select, or recommend to the Board, director nominees for each election of directors; (iii) develop and recommend to the Board criteria for selecting qualified director candidates; (iv) consider committee member qualifications, appointment and removal; (v) recommend corporate governance principles, codes of conduct and compliance mechanisms applicable to the Company, and (vi) provide oversight in the evaluation of the Board and each committee.

II. ORGANIZATION AND MEMBERSHIP REQUIREMENTS

The Committee shall be comprised of three or more directors, each of whom shall satisfy the independence requirements established by the rules of Nasdaq, provided that one director who does not meet the independence criteria of Nasdaq may, subject to the approval of the Board, serve on the Committee pursuant to, and subject to the limitation under, the “exceptional and limited circumstances” exception as provided under the rules of Nasdaq.

The members of the Committee shall be appointed by the Board and shall serve until their successors are duly elected and qualified or their earlier resignation or removal. Any member of the Committee may be removed or replaced by the Board. Unless a chairman is elected by the full Board, the members of the Committee may designate a chairman by majority vote of the full Committee membership. The Committee may, from time to time, delegate duties or responsibilities to subcommittees or to one member of the Committee.

A majority of the members shall represent a quorum of the Committee, and, if a quorum is present, any action approved by at least a majority of the members present shall represent the valid action of the Committee.

The Committee shall have the authority to obtain advice or assistance from consultants, legal counsel, accounting or other advisors as appropriate to perform its duties hereunder, and to determine the terms, costs and fees for such engagements. Without limitation, the Committee shall have the sole authority to retain or terminate any search firm to be used to identify director candidates and to determine and approve the terms, costs and fees for such engagements. The fees and costs of any consultant or advisor engaged by the Committee to assist the Committee in performing its duties hereunder shall be borne by the Company.

III. MEETINGS

The Committee shall meet as often as it deems necessary to fulfill its responsibilities hereunder, and may meet with management or individual directors at any time it deems appropriate to discuss any matters before the Committee.

The Committee shall maintain written minutes of its meetings, which minutes will be filed with the minutes of the meetings of the Board.

A-1

IV. COMMITTEE AUTHORITY AND RESPONSIBILITY

To fulfill its responsibilities and duties hereunder, the Committee shall:

A. Nominating Functions

1. Evaluate and select, or recommend to the Board, director nominees for each election of directors, except that if the Company is at any time legally required by contract or otherwise to provide any third party with the ability to nominate a director, the Committee need not evaluate or propose such nomination, unless required by contract or requested by the Board.

2. Determine criteria for selecting new directors, including desired board skills and attributes, and identify and actively seek individuals qualified to become directors.

3. Consider any nominations of director candidates validly made by stockholders.

4. Review and make recommendations to the Board concerning qualifications, appointment and removal of committee members.

B. Corporate Governance Functions

1. Develop, recommend for Board approval, and review on an ongoing basis the adequacy of the corporate governance principles applicable to the Company. Such principles shall include director qualification standards, director responsibilities, committee responsibilities, director access to management and independent advisors, director orientation and continuing education, management succession and annual performance evaluation of the Board and committees.

2. Review, at least annually, the Company’s compliance with the Nasdaq corporate governance listing requirements, and report to the Board regarding the same.

3. Assist the Board in developing criteria for the evaluation of Board and committee performance.

4. Evaluate the Committee’s own performance on an annual basis.

5. If requested by the Board, assist the Board in its evaluation of the performance of the Board and each committee of the Board.

6. Review and recommend to the Board changes to the Company’s bylaws as needed.

7. Make regular reports to the Board regarding the foregoing.

8. Review and reassess the adequacy of this Charter as appropriate and recommend any proposed changes to the Board for approval.

9. Perform any other activities consistent with this Charter, the Company’s Bylaws and governing law, as the Committee or the Board deems necessary or appropriate.

A-2

ANNUAL MEETING OF STOCKHOLDERS OF

INSWEB CORPORATION

July 18, 2005

Please date, sign and mail

your proxy card in the

envelope provided as soon

as possible.

\/ Please detach along perforated line and mail in the envelope provided \/

The Board of Directors recommends a Vote “FOR” the following proposals: | ||||||||||||

|

|

|

|

|

|

| ||||||

1. | To elect the following two (2) persons as Class III directors to hold office for a three-year term and until his respective successor is elected and qualified: |

2. |

To consider, approve and ratify the appointment of Ernst & Young LLP as independent auditors for | FOR | AGAINST | ABSTAIN | ||||||

|

| NOMINEES: |

| InsWeb for the fiscal year ending December 31, 2005 |

|

|

| |||||

o | FOR ALL NOMINEES | O HUSSEIN A. ENAN |

|

| ||||||||

o | WITHOLD AUTHORITY |

|

| WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING IN PERSON, YOU ARE URGED TO SIGN AND PROMPTLY MAIL THIS PROXY IN THE | ||||||||

| ||||||||||||

|

|

| RETURN ENVELOPE SO THAT YOUR STOCK MAY BE REPRESENTED AT THE MEETING. | |||||||||

|

|

|

| |||||||||

|

|

|

| |||||||||

|

|

|

| |||||||||

|

|

|

|

|

|

| ||||||

|

|

|

|

|

|

| ||||||

|

|

|

|

|

|

| ||||||

INSTRUCTION | To withhold authority to vote for any individual | • |

|

|

|

|

| |||||

| nominee(s), mark “FOR ALL EXCEPT” and fill in the circle next to each nominee you wish to withold as shown here. |

|

|

|

|

| ||||||

|

|

|

|

|

|

|

| |||||

|

|

|

|

|

|

|

| |||||

|

|

|

|

|

|

|

| |||||

|

|

|

|

|

|

|

| |||||

|

|

|

|

|

|

|

| |||||

|

|

|

|

|

|

|

| |||||

|

|

|

|

|

|

|

| |||||

|

|

|

|

|

|

|

| |||||

|

|

|

| MARK “X” HERE IF YOU PLAN TO ATTEND THE MEETING. | o | |||||||

To change the address on your account, please check the box at the right and indicate | o |

|

|

|

|

| ||||||

your new address in the address space above. Please note that changes to the |

|

|

|

|

| |||||||

registered name(s) on the account may not be submitted via this method. |

|

|

| |||||||||

|

|

|

|

|

|

| ||||||

|

|

|

|

|

|

| ||||||

Signature of Stockholder |

| Date |

| Signature of Stockholder |

| Date |

|

| Please sign exactly as your name or names appear on this Proxy. When shares are held jointly, each holder should sign. When signing as executor, adminsitrator, attorney, trustee or guardian, please give full title as such. If the signer is a corporation, please sign full corporate name by duly authorized officer giving full title as such. If signer is a partnership, please sign in partnership name by authorized person. |

INSWEB CORPORATION

PROXY FOR THE ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JULY 18, 2005

SOLICITED BY THE BOARD OF DIRECTORS

The undersigned hereby appoints Hussein A. Enan with full power of substitution, to represent the undersigned and to vote all of the shares of stock in InsWeb Corporation, a Delaware corporation (“InsWeb”), which the undersigned is entitled to vote at the Annual Meeting of Stockholders of InsWeb to be held at the corporate headquarters of InsWeb, located at 11290 Pyrites Way, Suite 200, Gold River, California 95670 on July 18, 2005, at 3:30 p.m. local time, and at any adjournment or postponement thereof (1) as hereinafter specified upon the proposals listed on the reverse side and as more particularly described in the Proxy Statement of InsWeb dated June 3, 2005 (the “Proxy Statement”), receipt of which is hereby acknowledged, and (2) in their discretion upon such other matters as may properly come before the meeting.

THE SHARES REPRESENTED HEREBY SHALL BE VOTED AS SPECIFIED. IF NO SPECIFICATION IS MADE, SUCH SHARES SHALL BE VOTED FOR PROPOSALS 1 AND 2.

(Continued and to be signed on the reverse side)