Securities registered pursuant to Section 12(b) of the Act: None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definition of “accelerated filer large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter was $23,575,360.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date. 84,911,326 as of March 18, 2008

None.

We have made forward-looking statements in this document within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, that are based on management’s current reasonable expectations, estimates and projections. Words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “estimates,” variations of such words and similar expressions are intended to identify such forward-looking statements. Forward-looking statements are subject to risks and uncertainties, many of which are difficult to predict and generally beyond our control, that could cause actual results to differ materially from those expressed or implied in the forward-looking statements. Such risks include, but are not limited to, risks relating to economic, competitive and other factors affecting our operations, markets, products and services and marketing and sales strategies, as well as the risks noted under the section in this report entitled “Risk Factors.” We do not undertake any obligation to revise these forward-looking statements to reflect future events or circumstances.

We are engaged in one reportable industry segment. Financial information regarding this segment is contained in our financial statements and notes thereto included in this report.

For information regarding revenues from external customers attributed to our domestic operations and to all foreign countries, see Note 1 to our financial statements for the fiscal year ended December 31, 2007.

At December 31, 2007, we had six full-time employees. None of our employees is represented by a labor union or is subject to a collective bargaining agreement. We believe that our employee relations are good.

We are a technology company that has developed a range of fuel additive products that improve the combustion characteristics of petroleum-based fuels and renewable liquid fuels. This provides significant benefits including improvement in fuel economy, clean up and prevention of fuel system deposits and a reduction in harmful emissions. Unlike traditional petroleum-based fuel additives, all of our products contain environmentally-friendly detergent surfactants. These surfactants decrease the energy required to create new surfaces at liquid-air, liquid-water and liquid-solid (pipe wall) interfaces, which in turn create the beneficial effects of our technology. The surfactant products are manufactured by an Air Products, Inc. subsidiary (see “Manufacturing Partner”), pursuant to a manufacturing and supply contract from chemical raw materials supplied by Air Products, Inc. and other third parties.

We have developed additive products for diesel, bio-diesel fuel blends, gasoline and kerosene (heating oil) fuels. The process of blending our products with fuel is easily accomplished through a variety of blending mechanisms, including automatic direct injection and manual splash blending. The surfactant base of our technology and products is unlike other conventional fuel additive technologies. Because of the unique character of surfactant molecules, our formulations provide an effective coating of the fuel system, increasing lubricity (reducing engine wear and tear), while the detergent character of the molecules prevents deposit formation on fuel injectors. In addition, the dispersal of the surfactant molecules throughout the fuel results in greater fuel atomization through engine fuel injectors, increasing combustion efficiency, improved fuel economy and emissions reduction.

Our additive products are easily blended into motor fuels, or combined with base motor fuels plus other fuel formulations, including bio-diesel, synthetic diesel, ethanol and urea/water, creating environmentally-friendly finished fuel blends. The resulting fuel blends improve fuel economy, enhance fuel system lubricity and reduce harmful engine emissions, while decreasing usage of petroleum-based fuels through the combination of our products with the alternative and renewable fuels. With the increasing pressure from public and private efforts around the world to reduce the level of harmful engine emissions, combined with the high cost of base fuel, we believe our technology is poised to become one of the leading fuel performance enhancement technologies available to facilitate the worldwide effort to address these issues.

We have funded and completed several independent laboratory testing efforts conducted by various well-regarded laboratories in the United States, Canada, Europe, South Africa, China and Thailand to confirm the efficacy of our technology. We have completed customer-focused field-testing, which has validated independent laboratory test results. Additional field-testing and various other laboratory testing efforts are currently underway to further our product commercialization efforts.

Our surfactant-based additive formulations are composed of a complex mixture of chemical molecules which, when blended into petroleum distillates, lower the base fuel’s overall surface tension in the combustion chamber. This allows for improved atomization of the fuel in the induction and combustion chambers, resulting in a more complete and efficient burn, improving fuel economy and reducing harmful emissions. Due to their inherent lubricity, detergency and emulsification properties, our additives also (i) substantially increase fuel lubricity; (ii) eliminate phase separation when combining petroleum-based fuels with oxygenates, such as ethanol; (iii) act as a detergent in the fuel delivery system and significantly reduce deposits on fuel injector heads; and (iv) co-solve any free water in the system.

Once the additive is blended with a base fuel, the blend forms a stable solution. No additional mixing or agitation is required for the fuel blend to remain perfectly mixed.

Research and development costs are expensed as incurred. Research and development expense paid to external vendors for 2007, 2006 and 2005 was $138,247, $530,110, and $310,230, respectively.

We have filed three patents resulting in five national applications pertaining to different uses of our proprietary technology relating to our fuel additives and fuel blends.

Additional patent applications for extension of our technology are constantly evaluated as additional scientific, technical data and laboratory testing results become available.

There are two primary methods of product testing: laboratory bench tests and field trials. We utilize both testing methods to further develop the body of test data necessary to support marketing and sales efforts. As IFT has matured, we have become aware of the importance of developing and managing specific testing protocols for field-based testing and adhering to already developed, industry recognized testing standards when engaged in laboratory bench tests. Numerous variables exist in any testing protocol and if not carefully managed, one change in one variable can skew test results. To address this challenge, standardized testing and trial evaluation protocols, both industry prescribed and custom developed, are followed whenever laboratory or field-testing is undertaken. The use of these protocols allows us to: (i) effectively analyze and interpret test results; (ii) ensure testing is structured and conducted in a controlled way; (iii) ensure we will have full access to all testing results conducted by third parties; and (iv) assist our marketing and sales efforts through potential client recognition of and attention to results generated from industry adopted testing protocols.

In addition to extensive field-based customer trials completed or under way, we have funded extensive laboratory bench testing at numerous well-known independent testing laboratories, including:

Test results have confirmed the effectiveness of our additive formulations. In particular, IFT fuel blends tested have achieved: (i) an increase in fuel economy; (ii) an increase in lubricity; and (iii) a reduction in harmful emissions.

In 2001, we signed a manufacturing agreement with Tomah, a specialty chemical manufacturer, establishing Tomah as our exclusive manufacture and supplier of our fuel performance enhancement products. The agreement allows us to consider sourcing the supply of our products from others, but allows Tomah the right of first refusal to meet the terms of other supplier proposals. If Tomah elects not to meet the third party terms, we then have the right to contract with the third party for the manufacture and supply of our products. The agreement covers existing and to-be-developed fuel performance enhancement additive products utilizing our technology. The agreement also provides for Tomah and us to cooperate and work together to optimize the effectiveness of and reduce the manufacturing and supply costs of the additive product formulations, as well as collaborate on product research and development activities. The agreement has a 15-year term.

Tomah, headquartered in Milton, Wisconsin, with production facilities in both Wisconsin and Louisiana, was purchased by Air Products, Inc., a worldwide manufacturer and supplier of chemical, industrial gases and other industrial products, in 2005. Tomah specializes in the manufacturing of specialty chemicals with an emphasis on industrial surfactants. Tomah manufactures products for a variety of industries, including fuel additives, mining and industrial and institutional cleaning. Tomah markets and distributes its products to companies around the world. Originally founded in 1967, Tomah was acquired by Exxon in 1984 and operated as a division of Exxon Chemical until 1994, when it was spun off in a management buyout. Tomah excels at custom manufacturing and in developing products designed to meet specific needs. We chose Tomah as our manufacturing and supply partner because of their manufacturing capabilities, rapid response times, service level, industry contacts and technical expertise. We believe our relationship with Tomah and Air Products, Inc. to be excellent.

Government regulations across the globe regarding motor fuels are continually changing. Most regulation focuses on fuel emissions. However, there is also growing concern about dependence on hydrocarbon-based fuels. This is driving legislation and regulation toward mandating alternative fuels such as bio-fuels and providing incentives for their development and use. Fuels regulation exists at various levels of government and enforcement around the globe. However, we believe the consistent pattern of regulations designed to reduce harmful emissions and reduce dependence on oil for fuel needs will only become more stringent. This will be an advantage to us as many of our product’s benefits reduce fuel consumption and improve performance of alternative fuel blends. We believe that as fuels regulatory compliance becomes more burdensome to fuel manufacturers, suppliers and users, demand for the benefits our products deliver should increase. One of our strategies is to monitor government fuel related regulatory activity in the countries strategic to our business plan. This surveillance program is designed to support the product development and intellectual property process to ensure our products respond to the changing regulatory climate and are protected as quickly as possible to maintain competitive advantage. The surveillance program also supports the marketing of our products to accentuate their attributes in helping customers meet the new regulatory compliance directives.

As an example, in January 2000, the Environmental Protection Agency in the United States (“EPA”) enacted a stringent and far-reaching set of diesel emission standards that requires the significant reduction in harmful emissions, especially PM and NOx. These regulations were phased in beginning in 2004. PM in diesel emissions is to be reduced by 90% and NOx is to be reduced by 95%. Of equal importance to diesel fuel producers, the EPA also requires 97% of the sulfur currently in diesel fuel be eliminated beginning in 2006. The elimination of sulfur in diesel fuel will likely cause a decrease in diesel fuel lubricity. Our products are well-positioned to benefit from the more stringent environmental rules, as tests have shown positive PM reduction effects and increased lubricity attributes when our products are added to base diesel fuel.

Current efforts are being demonstrated in the United States to encourage the development of alternative fuels and the required use of ethanol. In an effort to reduce dependence on foreign oil and keep up with increasing demand for petroleum products, the United States Department of Energy (“DOE”) has created and sponsored programs that encourage the use of these alternative fuels. The programs, such as the one derived from the Energy Policy and the ethanol and bio-diesel subsidy programs implemented by the DOE and other government agencies, in response to the 2005 energy legislation, provide significant incentives for the adoption of targeted fuel blends, the performance of which can be enhanced by the use of our products. We believe our products are well-positioned to help fuel producers and consumers comply with current and future fuels related regulatory standards and take advantage of existing incentive programs in the United States and the rest of the world.

Our product slate and business is a part of the hydrocarbon fuels and lubricants additive industry. The industry is composed of a few relatively large companies and a large number of smaller participants. We fall into the latter category. The large firms capture their revenue through sales of proprietary, branded products, or by sales to fuel refiners to meet state and federal fuel specifications, or fuel wholesalers and retailers trying to differentiate their own branded products. The common denominator is all industry participants produce products which are added to hydrocarbon fuels to allow the fuel, or the overall fuel system, to perform better with the additive than without. They do not make the fuel itself.

The main thrust of industry participants’ products centers around improved engine cleanliness and efficiency (e.g., detergency characteristics applicable to fuel injector nozzles), improved fuel flow (e.g., mitigation of fuel problems caused by low ambient temperature) and fuel system protection (e.g., improved lubricity). These are common focus areas for the full range of gasoline and distillate fuels. Additives designed to address specific problem areas in specific fuel applications (e.g., Cetane improver in diesel fuel) and static electricity dissipation in turbine engines are also significant.

The primary market for IFT is fuel economy improvement. Although many companies make claims regarding the ability of their respective products to improve fuel economy, we are not aware of any fuel additive formulation that has consistently demonstrated the ability to achieve the fuel economy improvement achieved by IFT products in independent laboratory testing and field trials. The potential market for IFT products is virtually every gallon of diesel fuel and bio-diesel fuel blend consumed in the world today.

The breadth of existing technologies making claims to have solved engine emissions problems runs the gamut from alternative fueled vehicles (electric cars, fuel cell vehicles, etc.) to engine magnets. Despite the vast amount of research that has been performed with the intention of solving emissions problems, no single technology has yet to gain widespread acceptance from both the public (regulatory) and private sectors. The United States government and the governments of other countries have tried using economic incentives and tax breaks to promote the development of a variety of emissions reduction technologies. However the base cost of many of these incentives coupled with issues such as lack of appropriate infrastructure (e.g., compressed natural gas storage and delivery systems) and technical limitations (e.g., keeping alternative fuels emulsified, significant loss of power and fuel economy with present alternative fuels), currently makes market acceptance of many technologies not economically feasible over the long term.

Given these limitations, it is unlikely that the global marketplace will accept just one technology, or a limited number of technologies to solve the harmful engine emissions problem. We believe the “natural selection” expected to take place over the coming decade for new technologies may evolve on a market-by-market basis and will be largely dependent upon local regulatory conditions. Signs of the changing emissions regulatory environment can be seen in:

Because the efforts to reduce harmful engine emissions are so widespread throughout the world, the market for competitive alternatives to existing solutions is relatively robust. In general, these efforts can be placed into four categories:

As a result of the pursuit by, primarily, governments around the world to mandate cleaner fuels and less dependence on hydrocarbon-based fuels through all the disparate efforts currently underway, we believe no one competitor or technology will come to dominate world market demand for additive technology. Rather, we believe a combination of technologies that maximizes individual product and technology strengths, limits their weaknesses, and delivers the highest cost/value relationship will be used.

Our industry and competitor product slate and technology is constantly evolving. Many competitors make very similar product benefit claims; such as detergency, lubricity and anti-corrosion, with a few now beginning to make fuel economy claims as well. Our challenge is to increase our product visibility and to rise above all the industry claims “clutter” by differentiating our products from our competitors’ products. We believe the multi-functional nature of our technology, focusing on fuel economy and providing all other traditional fuel and fuel system benefits together with the capability to mitigate adverse performance impacts of emerging alternative fuels and fuel blends, packaged into one product, differentiates our products from those of our competitors.

Our primary marketing and sales focus is to identify and work with industry peers and established in-country or global commercial distributors to partner with us to secure an expanding and sustainable revenue stream. We continue to pursue direct sales to end-users where we deem direct sales to be the most efficient customer reach platform. However, where direct sale to end-users is not an efficient model for us, we seek out industry distribution partners whose focus is end-user sales. We believe established fuel and lubricant additive companies will have an interest in using our products either as a line extension of their existing products or as blend stock, either replacing existing raw materials used to formulate existing blends or as an addition to existing product blends.

Our marketing and sales efforts are primarily directed at commercial industrial users of diesel fuels within specific market segments like rail, power generation and road transport vehicles (trucks and buses). We have no current plans on attempting to penetrate the retail market either on a branded or unbranded basis. In North America, we believe direct sales to commercial industrial customers and to industry distribution partners provide the best sales and distribution model. Direct sales to end-users allow us to maximize the product value chain benefits for the end-user and us. In other areas around the world, sales to in-country distributors will likely provide the most cost-effective and efficient marketing and sales model and allows us to leverage our marketing and sales resources to the greatest benefit. This distribution model adds tremendous value to us by reaching customers we could not efficiently sell to directly, economically or politically. Utilization of distributors in these circumstances extends our product reach and boosts sales. Several distribution agreements are now in place.

We market our products within identified targeted markets and industry segments. The marketing efforts focus on those companies within the preferred industry segments that will benefit the most from usage of our products. These efforts are supplemented by sharing test data with targeted companies in order to generate industry interest in our products. Marketing efforts include sponsorship of field trials, communication through trade media with messages directed at both technical and non-technical business professionals emphasizing fuel performance enhancement through technical innovation, fuel efficiency, maintenance cost savings, improved air quality and “no harm” to engine or environment evidence. Communication openness, transparency and willingness to share trial and testing data are the keys to the engagement process.

We have assembled a marketing and technology team of experienced industry professionals to pursue commercial opportunities for our fuel additive technology. We believe significant gains are being achieved in product exposure to the targeted markets and industry segments.

We believe an expeditious means of achieving product awareness and market acceptance is through field engagements with strategic commercial users of motor fuels. We are always seeking companies recognized as leaders in their industry to try our products in a field trial setting. Formal trials have been completed with several such companies and the efficacy of our technology has been validated. Additional field-trials are currently underway, or have been committed to, which upon completion should lead to additional commercial opportunities.

We believe that our products and value proposition are well-positioned to help commercial industrial customers; (i) realize fuel economy and engine maintenance cost improvements; (ii) take advantage of existing incentive programs in the United States and the rest of the world; and (iii) conform to current and future emissions standards.

Going forward, we believe our commercial success will be facilitated by our proprietary technology, the ever-increasing cost of fuel and emissions compliance directives, the marketing and sales infrastructure now in place along with future enhancement and the professionalism and dedication of our employees and consultants.

Our website is www.internationalfuel.com. We make available free of charge through our website our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC.

Because we have transitioned from a development stage to a commercialization phase for our products with a new technology and little market and sales visibility, we may not be able to create market demand for our products.

We are currently engaged in extensive marketing and sales efforts including additional laboratory testing and customer field trials to generate purchasing interest in our products. We have only a limited marketing history. There is a substantial risk of failure associated with development stage businesses attempting to make the transition to self-sustaining commercial entities because of the lack of established customer relationships and knowledge and acceptance of the new products being marketed. We have experienced in the past, are continuing to experience, and may experience in the future, some of the problems, delays and expenses associated with this transition, many of which are beyond our control, including but not limited to those depicted below:

We have a history of operating losses and due to our current lack of sustainable sales and the possibility of not achieving our sales goals, we may not become profitable or be able to sustain profitability.

Since our inception we have incurred significant net losses. We reported net losses of $2,722,725 and $5,242,979 for the twelve months ended December 31, 2007 and December 31, 2006, respectively. Our accumulated deficit as of December 31, 2007 was $52,581,103. We expect to continue to incur net losses and negative cash flow in the near to mid-term future. The magnitude of these losses will depend, in large part, on our ability to realize product sales revenue from the marketing and sale of our products. To date, we have not had any material operating revenue from the sale of our products and there can be no assurance we will be able generate material revenues. Our ability to generate revenues will be dependent upon, among other things, being able to; (1) overcome negative connotations on the part of industrial fuel consumers regarding fuel additives in general; (2) convince potential customers of the efficacy and economic and environmental benefits of our products; and (3) generate the acceptance of our technology and products by potential customers and thereby create the opportunity to sell our products at a sufficient profit margin. Because we do not yet have a material, recurring revenue stream resulting from the sale of our products, there can be no assurance that we will be successful in these efforts. Should we achieve profitability, there is no assurance we can maintain, or increase, our level of profitability in the future.

In its March 28, 2008 report, our independent registered public accounting firm expressed substantial doubt about our ability to continue as a going concern. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

We have only a limited product sales history upon which to base any projection of the likelihood we will prove successful; therefore, we may not achieve profitable operations, or even generate meaningful operating revenues.

Our fuel performance enhancing technology is a relatively new approach to increasing fuel performance in internal combustion engines and, therefore, may never prove commercially viable on a wide-scale basis. It is possible that we may not be able to reproduce, on a sustainable basis, the preliminary performance results achieved in certain of our research and development efforts.

We are not certain how many laboratory and customer field trial test programs will be necessary to demonstrate to potential customers sufficient fuel economy and other economic and environmental benefit from our products, nor is there any assurance that such test programs, even if positive results are observed, will convince potential customers of the efficacy of our products leading to subsequent sales orders. The success of any given product in the marketplace is dependent upon many factors, with one of the most important factors being the ability to demonstrate a sustainable and meaningful economic benefit to product end-users. If our products are unable to provide this sustainable economic benefit, or potential customers do not recognize these economic benefits, our business could fail.

If projected sales and revenues do not materialize as planned, we will require additional financing to continue operations.

Including a $1 million equity commitment from one of our Directors, we believe we have sufficient funds available to provide resources for our operations through at least the first half of 2008. However, failure to achieve significant, sustained sales and revenues by the end of this period will require us to obtain additional financing. Our budget for the next twelve months emphasizes the continued field and laboratory testing and customer support marketing of our products. Cash requirements during the next twelve-month period are expected to average approximately $175,000 per month. In addition, unexpected changes may occur in our current operations that could exhaust available cash resources sooner than anticipated. If anticipated product sales do not materialize, or are significantly less than anticipated, we will need to raise additional funds to continue operations. If this future financing is not available, our business may fail. We currently have no other firm commitments from third parties to provide any additional financing. Consequently, we cannot assure investors that additional financing, if necessary, will be available to us on acceptable terms, or at all.

We are dependent on third parties for the distribution of our products outside North America and they may experience the same delays, customer acceptance problems or other product commercialization issues we have experienced, which would negatively impact our commercialization efforts in these regions.

We have entered into distribution and sales agency agreements with certain third parties to help us achieve rapid customer trialing and acceptance of our products, and to oversee certain elements of our field-testing program. If these third parties elect to discontinue their efforts, we may not be able to commercialize our products in a timely manner, or to commercialize them at all.

Although certain of these agreements contain progress milestones, we are not able to control the amount of time and effort these third parties put forth on our behalf. It is possible that any of these third parties may not perform as expected, may not achieve the contractual milestones and may breach or terminate their agreements with us before completing their work. Any failure of a third party to provide the services for which we have contracted could prevent or significantly delay us from commercializing our products.

As we currently purchase all of our product supply requirements from a single, outside source and have no in-house product manufacturing capability, any business complications arising with either our supplier or with our supplier relationship could create adverse consequences with our product supply chain.

We currently contract with a single, outside specialty chemical manufacturing company for the production and supply of 100% of our product needs. We have no in-house product manufacturing capability and, therefore, are exposed to potential product supply disruptions caused by adverse business circumstances with our supplier (for example, raw material shortages, plant breakdowns and other adverse circumstances affecting the supply of our products from this supplier). There can be no assurances that, in the event of a supply disruption, we would be able to quickly contract with another manufacturer for the continued supply of our products. We, therefore, could be without adequate supply of our products and could lose sales for an extended period of time as a result.

There is a risk that one or more of the raw material suppliers currently supplying raw materials to our contract manufacturer could stop making a building block raw material necessary for production of our product and, therefore, cause a supply shortage until substitution raw materials could be identified and located.

If the supplier were no longer able to obtain building block raw materials necessary for production of our product, suitable substitutes would have to be identified and obtained. There can be no assurances that, in the event of a raw material supply disruption, our manufacturer would be able to quickly identify and obtain a suitable substitute component and, therefore, we could be without product inventory and could lose sales for an extended period of time.

Products developed by our competitors could severely impact our product commercialization and customer acceptance efforts, thereby reducing the sales of our products and severely impacting our ability to meet our sales goals or to continue operations.

We face competition from companies who are developing and marketing products similar to those we are developing and marketing. The petroleum/fossil fuels industry has spawned a large number of efforts to create technologies that help improve the performance of internal combustion engines and reduce harmful emissions. Some of these companies have significantly greater marketing, financial and managerial resources than us. We cannot provide any assurance that our competitors will not succeed in developing and distributing products that will render our products obsolete or non-competitive. Such competition could potentially force us out of business.

Our products are designed for use in internal combustion engines and the development of alternative engine design and technology could severely reduce the market potential for our products.

Our products are designed for, and marketed to, customers utilizing internal combustion engines. Significant efforts now exist to develop alternatives to internal combustion engines. In addition, the regulatory environment is becoming increasingly restrictive with regard to the performance of internal combustion engines and the harmful emissions they produce. If alternatives to internal combustion engines become commercially viable, it is possible that the potential market for our products could be reduced, if not eliminated.

If we are unable to protect our technology and intellectual property from use by competitors, there is a risk that we will sustain losses, or that our business could fail.

Our success will depend, in part, on our ability to obtain and enforce intellectual property protection for our technology in both the United States and other countries. We have taken steps to protect our intellectual property through patent applications in the United States Patent and Trademark Office and its international counterparts under the Patent Cooperation Treaty. We cannot provide any assurance that patents will be issued as a result of these applications or that, with respect to any patents, issued or pending, the claims allowed are, or will be, sufficiently broad enough to protect the key aspects of our technology, or that the patent laws will provide effective legal or injunctive remedies to stop any infringement of our patents. In addition, we cannot provide assurance that any patent rights owned by us will not be challenged, invalidated or circumvented, or that our competitors will not independently develop or patent technologies that are substantially equivalent or superior to our technology. If we are forced to defend our patents in court, well-funded adversaries could use such actions as part of a strategy for depleting the resources of a small company such as ours. We cannot provide assurance that we will have sufficient resources to successfully prosecute our interests in any litigation that may be brought.

Because of the nature of our products, we may be subject to government approvals and regulations that reduce or prevent our ability to commercialize our products, increase our costs of operations and decrease our ability to generate income.

We are subject to United States and international laws and regulations regarding the products we sell. There is no single regulatory authority to which we must apply for certification or approval to sell our products in the United States, or outside its borders. Any changes in policy or regulations by regulatory agencies in countries in which we intend to do business may cause delays or rejections of our attempts to obtain necessary approvals for the sale of our products.

There can be no assurance that we will obtain regulatory approvals and certifications for our products in all of the markets we seek to conduct business. Even if we are granted such regulatory approvals and certifications, we may be subject to limitations imposed on the use of our products. In the future, we may be required to comply with certain restrictive regulations, or potential future regulations, rules, or directives that could adversely impact our ability to sell our products. We cannot guarantee that restrictive regulations will not, in the future, be imposed. Such potential regulatory conditions or compliance with such regulations may increase our cost of operations or decrease our ability to generate income.

We create products that may have harmful effects on the environment if not stored and handled properly prior to use, which could result in significant liability and compliance expense.

The blending of base fuels with our current or future products involves the controlled use of materials that could be hazardous to the environment. We cannot eliminate the risk of accidental contamination or discharge to the environment of these materials and any resulting problems that occur. Federal, state and local laws and regulations govern the use, manufacture, storage, handling and disposal of these materials. We may be named a defendant in any suit that arises from the improper handling, storage or disposal of these products. We could be subject to civil damages in the event of an improper or unauthorized release of, or exposure of individuals to, these materials. Claimants may sue us for injury or contamination that results from use by third parties of our products, and our liability may exceed our total assets. Compliance with environmental laws and regulations may be expensive, and current or future environmental regulations may impair our research, development and sales and marketing efforts. Although we carry product and general liability insurance with limits we deem sufficient, there can be no assurance that an event, or series of events, will not occur that will require, in the aggregate, resources in excess of these limits.

If we lose any key personnel or are unable to attract qualified personnel and consultants, we may lose business prospects and sales, or be unable to otherwise fully operate our business.

We are dependent on the principal members of our management staff, the loss of any of whom could impair our product development and commercialization efforts underway. Furthermore, we depend on our ability to attract and retain additional qualified personnel to develop and manage our future business and markets. We may have to recruit qualified personnel with competitive compensation packages, equity participation and other benefits that may reduce the working capital available for our operations. We cannot provide assurance that we will be able to obtain qualified personnel on reasonable terms, or that we will be able to retain our existing management staff.

We may have difficulties managing growth, which could lead to lost sales opportunities.

While we have not yet achieved any meaningful, sustained revenues through the sale of our products, should certain events occur, such as a large recurring order from a well-known company or endorsement of our products from a well-known commercial entity, sales may escalate rapidly. Rapid growth could strain our human and infrastructure resources, potentially leading to higher operating costs, lost sales opportunities, or both. Our ability to manage operations and control growth will be dependent upon our ability to improve our operational, financial and management controls, reporting systems and procedures, and to attract and retain adequate numbers of qualified employees. Should we be unable to successfully provide the resources needed to manage growth, product sales and customer satisfaction could suffer and higher costs and losses could occur.

Our shares are quoted on the Over-The-Counter Bulletin Board and are subject to a high degree of volatility and liquidity risk.

Our common stock is currently quoted on the OTC Bulletin Board. As such, we believe our stock price is more volatile and the share liquidity characteristics to be of higher risk than if we were listed on one of the national exchanges. Also, if our stock were no longer quoted on the OTC Bulletin Board, the ability to trade our stock would become even more limited and investors may not be able to sell their shares.

Future sales of our common stock may cause our stock price to decline.

Our stock price may decline by future sales of our shares or the perception that such sales may occur. As of March 18, 2008, approximately 32,469,130 shares of common stock held by existing shareholders constitute “restricted shares” as defined in Rule 144 under the Securities Act. In general, Rule 144 sets out rules for the sale of restricted securities, quantity and timing, by third parties and affiliates of IFT. Specifically, Rule 144 permits the sale of shares, under certain circumstances, without any quantity limitation, by persons who are not affiliates of IFT, and who have beneficially owned the shares for a minimum period of two years.

As of March 18, 2008, approximately 99.85% of our outstanding restricted shares of common stock are eligible for sale pursuant to Rule 144. The possible sale of these shares may, in the future, have a depressive effect on the price of our securities. Moreover, such sales, if substantial, might also adversely affect our ability to raise additional equity capital.

None.

We maintain our administrative offices at 7777 Bonhomme Avenue, Suite 1920, St. Louis, Missouri 63105. On January 1, 2002, we entered into a five-year lease agreement for office space and administrative services of $4,249 per month for approximately 2,100 square feet. On July 21, 2006, this lease agreement was extended an additional five years through December 31, 2011. The new base rent beginning January 1, 2007 is $3,731 per month and increases annually.

We are subject to various lawsuits and claims with respect to matters arising out of the normal course of business. While the impact on future financial results is not subject to reasonable estimation because considerable uncertainty exists, management believes, after consulting with counsel, that it is more likely than not that the ultimate liabilities resulting from such lawsuits and claims will not materially affect our financial position, results of operations or liquidity.

In December 2005, a former employee of IFT and a former consultant to IFT filed a joint lawsuit against us and certain of our Directors in the St. Louis County, Missouri Circuit Court. The relief sought by the plaintiffs included payment of compensation up to $120,000 per year under the former employee’s Employment Agreement, issuance of up to 4,832,616 shares of IFT stock under a Share Purchase Agreement entered into between each plaintiff and IFT in April 2001, and release from the plaintiffs’ non-competition obligations. The plaintiffs also alleged they were harmed by certain misrepresentations of IFT and were seeking an undetermined amount of damages for such alleged misrepresentations. We filed counter-claims against the plaintiffs, seeking monetary damages and enforcement of the plaintiffs’ non-competition obligations. During the second quarter of 2007, this case was dismissed by the Missouri Circuit Court with no compensation paid to any party.

On July 31, 2006, we received notice from the American Arbitration Association ("AAA") of a Demand for Arbitration dated July 27, 2006 received by the AAA naming IFT as Respondent and TPG Capital Partners (“TPG”), the prior Blencathia Acquisition Corporation (“Blencathia”) owner, as the Claimant. The arbitration had been requested by TPG to resolve an alleged aggregate proceeds shortfall from the sale of IFT securities issued in the Blencathia merger. TPG has claimed they sold some or all of the 300,000 shares and the sales have not generated at least $500,000 of proceeds, as guaranteed in the merger documents.

In an effort to resolve this matter prior to submission to binding arbitration, both TPG and IFT participated in a non-binding mediation conference on January 30, 2007, which did not resolve the matter. Informal discussions are ongoing. It is not expected that the ultimate settlement of this matter, through the mediation or binding arbitration process, and considering we have recorded a liability for the shortfall amount, will have an additional adverse material effect on IFT.

On December 4, 2007, our annual meeting of stockholders was held in St. Louis, Missouri. At this meeting the following Directors were elected to the Board of Directors: Jonathan R. Burst, Rex Carr, David B. Norris, Harry F. Demetriou and Gary Kirk. All Directors will serve on our Board of Directors until the next annual meeting of stockholders or their resignation from the Board of Directors. A summary of the vote for Directors follows:

The stockholders also voted to ratify the appointment of our independent registered public accounting firm, BDO Seidman, LLP. 55,740,548 shares, being more than a majority of our outstanding stock, were voted in favor of the ratification, 3,122,369 shares were voted against the ratification, and 2,794,960 shares abstained from the vote regarding ratification of the appointment of BDO Seidman, LLP as our independent registered public accounting firm for 2007. No broker non-votes were received for the vote on our Directors or ratification of our independent registered public accounting firm.

PART II

| Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

Our common stock is traded on the OTC Bulletin Board system under the symbol “IFUE.OB.” The range of reported high and low sales prices shown below is as reported by the OTC Bulletin Board. The quotations shown reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not necessarily represent actual transactions.

| | | 2007 | | | 2006 | |

| | | High | | | Low | | | High | | | Low | |

| | | | | | | | | | | | | |

| First quarter | | $ | 0.61 | | | $ | 0.36 | | | $ | 2.25 | | | $ | 1.05 | |

| Second quarter | | $ | 0.57 | | | $ | 0.27 | | | $ | 1.40 | | | $ | 0.80 | |

| Third quarter | | $ | 0.57 | | | $ | 0.28 | | | $ | 1.58 | | | $ | 0.78 | |

| Fourth quarter | | $ | 0.35 | | | $ | 0.16 | | | $ | 1.15 | | | $ | 0.46 | |

As of the close of business on March 18, 2008, the last reported sales price per share of our common stock was $0.43. As of March 18, 2008, we estimate there were 1,264 record holders of our common stock. Such number does not include persons whose shares are held by a bank, brokerage house or clearing company, but does include such bank, brokerage houses and clearing companies.

We have not declared or paid a cash dividend to shareholders. The Board of Directors presently intends to retain any future earnings to finance our operations and does not expect to authorize cash dividends in the foreseeable future.

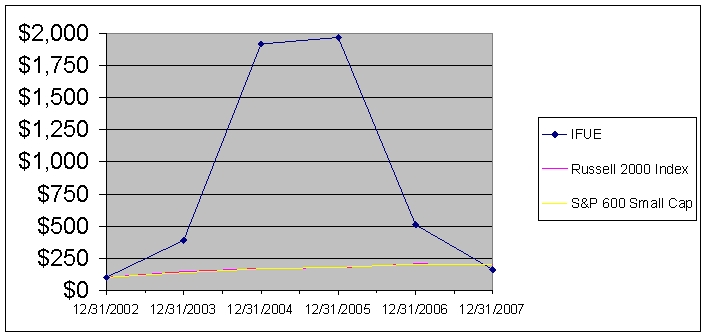

Performance Graph

The performance graph below and the information contained therein shall not be deemed to be “soliciting material” or to be “filed” with the SEC, or incorporated by reference into any future filing with the SEC, or subject to the liabilities of Section 18 of the Securities Exchange Act of 1934, except to the extent that IFT specifically incorporates it by reference into a document filed under the Securities Act of 1933 or the Securities Exchange Act of 1934.

| | | 12/31/2002 | | | 12/31/2003 | | | 12/31/2004 | | | 12/31/2005 | | | 12/31/2006 | | | 12/31/2007 | |

| International Fuel Technology, Inc. | | $ | 100.00 | | | $ | 390.00 | | | $ | 1,920.00 | | | $ | 1,970.00 | | | $ | 510.00 | | | $ | 160.00 | |

| Russell 2000 Index | | $ | 100.00 | | | $ | 145.37 | | | $ | 170.08 | | | $ | 175.73 | | | $ | 205.61 | | | $ | 199.96 | |

| S&P 600 Small Cap Index | | $ | 100.00 | | | $ | 137.53 | | | $ | 167.23 | | | $ | 178.35 | | | $ | 203.45 | | | $ | 200.97 | |

The above graph compares the performance of our stock from December 31, 2002 through December 31, 2007 against the performance of the Russell 2000 Index and the S&P 600 Small Cap Index for the same period. Historical stock price performance is not necessarily indicative of future stock price performance. The graph assumes an investment of $100 on December 31, 2002 in our common stock (at the last reported sale price on such date), the Russell 2000 Index and the S&P 600 Small Cap Index and assumes the reinvestment of any dividends.

The following tables set forth certain information concerning the statements of operations and balance sheets of IFT and should be read in conjunction with the financial statements and the notes thereto appearing elsewhere in this report.

Selected Statement of Operations Data (in Thousands of Dollars, Except Earnings Per Share and Weighted-average shares)

| | | Fiscal Year Ended December 31, | |

| | | 2007 | | | 2006 | | | 2005 | | | 2004 | | | 2003 | |

| Revenues | | $ | 133 | | | $ | 235 | | | $ | 563 | | | $ | 24 | | | $ | 9 | |

| Operating expenses | | $ | 2,885 | | | $ | 5,639 | | | $ | 5,924 | | | $ | 4,543 | | | $ | 2,817 | |

| Net loss | | $ | (2,723 | ) | | $ | (5,243 | ) | | $ | (5,330 | ) | | $ | (4,519 | ) | | $ | (2,619 | ) |

| Basic and diluted net loss per common share | | $ | (0.03 | ) | | $ | (0.06 | ) | | $ | (0.07 | ) | | $ | (0.06 | ) | | $ | (0.04 | ) |

| Weighted- average shares | | | 84,861,326 | | | | 84,515,581 | | | | 80,924,325 | | | | 74,910,974 | | | | 70,140,774 | |

Selected Balance Sheet Data (in Thousands of Dollars)

| | | Fiscal Year Ended December 31, | |

| | | 2007 | | | 2006 | | | 2005 | | | 2004 | | | 2003 | |

| Cash and cash equivalents | | $ | 364 | | | $ | 655 | | | $ | 3,382 | | | $ | 530 | | | $ | 359 | |

| Short-term investments | | $ | - | | | $ | 1,507 | | | $ | 2,481 | | | $ | - | | | $ | - | |

| Total assets | | $ | 2,994 | | | $ | 5,090 | | | $ | 8,851 | | | $ | 3,819 | | | $ | 4,027 | |

| Long-term debt | | $ | 500 | | | $ | - | | | $ | - | | | $ | - | | | $ | - | |

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

The following is management’s discussion and analysis of certain significant factors that have affected our financial condition, results of operations and cash flows during the periods included in the accompanying financial statements. This discussion should be read in conjunction with the financial statements and notes included elsewhere in this Form 10-K.

Overview

We are a fuel performance enhancement technology company transitioning to a commercial enterprise. Our focus is marketing and selling our technology to large, commercial fuel consumers in global markets. We believe the macro economic environment for our technology and products is excellent now and will continue to be so for the foreseeable future. We believe ever-increasing fuel environmental regulations will likely result in increased demand for additive products to help offset adverse fuel performance and engine impacts resulting from these regulations. In addition, we believe the increase in the price of oil, along with the higher prices expected in the future, will increase demand for fuel efficiency and conservation. Our products and technology are uniquely positioned to benefit from this macro environment by offering fuel performance enhancement solutions that specifically address these macro developments and trends.

Building upon the momentum generated during 2006, additional progress toward our corporate and product commercialization goals was accomplished in 2007. Continued favorable laboratory testing and field trial results during 2007 has led to further positive directional movement to commercial acceptance of our products. Commercial progress during 2007 is summarized below:

U.S. Road Transport:

| · | We began selling to and have had repeat orders from three sizeable truck fleet operators: a municipal bus company and two grocery store chains. |

| · | In the late third quarter/early fourth quarter of 2007, we commenced large-scale field trials with four additional truck fleet operators: three grocery store chains with combined revenues in excess of $20 billion; and one bakery operation. |

| · | We commenced discussions with dozens of additional truck fleet operators and expect many to commence large-scale field trials in the first half of 2008. |

European Railroad:

| · | We completed extensive rail engine testing at MI Technologies in the U.K. As a result of these successful rail engine tests, conducted according to industry accepted standards, we received commitments from multiple U.K. rail operators to run field trials in the first half of 2008. |

| · | Additional rail testing at MI Technologies was completed using a B-20 bio-diesel blend. Test results confirmed that use of DiesoLIFTTM 10 increased power and fuel efficiency, offsetting losses in power and fuel economy commonly observed with B-20 bio-diesel use. These additional test results provide us an advantage in marketing to European rail operators as bio-diesel fuel usage is growing in the European market (see below). |

European Bio-Diesel:

| · | We signed distribution agreements with three prominent European-based fuel additive distribution companies to market and sell DiesoLIFTTM BD-3 in their respective territories. A product variation of DiesoLIFTTM 10, DiesoLIFTTM BD-3, addresses the two major drawbacks associated with bio-diesel use: oxidation stability and deposit control. This essentially means that bio-diesel has a limited shelf life without the benefit of specific fuel additives. |

In addition, we continued to develop commercial opportunities in India, Indonesia, The Philippines and Brazil.

| · | India: through our distribution partner in India, Nulon India, we are engaged in a number of large-scale field trials with bus and truck fleet companies. Most of these trials commenced in late third quarter/early fourth quarter of 2007. These trials should be complete in the first quarter of 2008. |

| · | Indonesia: after extensive discussions with PLN, the national power company of Indonesia, PLN has agreed to commence a field trial at one of its stationary power generation facilities. The three to six-month trial is scheduled to begin in the first half of 2008. If successful, we believe that sales to PLN could begin in the second half of 2008. |

| · | The Philippines: We completed an extensive field trial in 2006 at a stationary power generation facility operated by NPC, the national power company of The Philippines. A 7% improvement in fuel economy was achieved which convinced NPC to request a negotiated bid process with the government procurement policy board. Unfortunately this request is still pending. Recent discussions with NPC lead us to believe that eventually we will be selling additive to NPC. |

| · | Brazil: We have been working with the two largest railroad operators in Brazil. Preliminary laboratory testing has been completed and we expect to begin field trials with both rail operators in the first half of 2008. |

Specific business trends have developed as a result of our commercialization efforts. Although consistent customer sales and revenue streams have not yet materialized, the number and magnitude of customer trials is increasing at a rapid rate. We believe the commercialization process for our products is composed of four distinct stages:

| · | Stage 1 - independent laboratory testing; |

| · | Stage 2 - initial customer contact detailing independent laboratory results generated; |

| · | Stage 3 – small-scale field trials with potential customers; and |

| · | Stage 4 – large-scale field trials with potential customers to confirm favorable results generated from initial small-scale trials. |

We have Stage 3 and Stage 4 activities underway with several potential customers in the trucking and stationary power industries. Also, we believe favorable results from laboratory testing aimed at the rail industry in the United States and Europe will lead to a significant Stage 2 effort during the first half of 2008. At the conclusion of these active trials and tests, we anticipate results that correlate closely with the positive, observed testing results obtained during 2006 and 2007. We believe these validations by potential customers will provide additional support of the efficacy of our products in improving fuel economy, lowering maintenance expenses and lowering engine emissions. We believe the successful demonstration of these product attributes, both in the laboratory and in real world field-testing, will lead to customer sales during 2008.

Results of Operations

Comparison of the Twelve Months Ended December 31, 2007 and the Twelve Months Ended December 31, 2006

Net revenue for the twelve months ended December 31, 2007 was $133,420, as compared to $234,584 for the twelve-month period ended December 31, 2006. This decrease in net revenue of $101,164 was primarily due to decreased sales volume from our distributor network ($144,230), partially offset by increased sales volume to end-user customers ($43,066). Sales revenue for 2007 was split between sales to end-user customers (54% of sales revenue) and contractual purchases by our distributor network (46% of sales revenue).

Sales revenue for 2006 was due primarily to contractual purchases by our distributor network, which included net sales of approximately $184,000 to Fuel Technologies Ltd. (“FTL”), a then-related party to us. Sales revenue generated during 2007 and 2006 resulted primarily from the sale of DiesoLIFTTM.

At the end of the second quarter of 2006, we recorded $25,136 for a contra-revenue international marketing fee paid to FT Marketing Ltd. (“FTM”) for sales revenues and subsequent cash collections generated from FTM sales leads. These fees are included in the 2006 net revenue totals described above.

FTM is a marketing affiliate of FTL. FTL was formed for the purpose of marketing and distributing our products. Mr. Friedland, who owns more than five percent of our common stock, is the Chairman of FTL.

Operating Expenses

Total operating expense was $2,885,044 for the twelve months ended December 31, 2007, as compared to $5,638,698 for the twelve-month period ended December 31, 2006. This represents a $2,753,654 decrease from the prior period, and was primarily attributable to decreases in stock-based compensation expense, other selling, general and administrative expense, depreciation and amortization and cost of operations due to decreased sales. These fluctuations are more fully described below.

Selling, General and Administrative Expense

Selling, general and administrative expense for the twelve months ended December 31, 2007 was $2,622,739 (including stock-based compensation expense of $118,972) as compared to $5,062,882 (including stock-based compensation of $1,261,955) for the twelve-month period ended December 31, 2006, representing a $2,440,143, or 48%, decrease from the prior period.

The stock-based compensation expense decrease of $1,142,983 between 2007 and 2006 was primarily due to:

| (1) | the timing of employee options vesting in 2006 and 2007 (approximate $878,000 decrease); |

| (2) | the reversal of approximately $381,000 of expense previously recorded for unvested employee options that were forfeited during 2007. Approximately $85,000 of expense was recorded in 2007 and approximately $296,000 of expense was recorded in 2006 for applicable options; |

| (3) | lower 2007 expense related to non-employee stock–based compensation due to quarterly-revaluation and a decreasing stock price from the prior period (approximate $175,000 decrease); and |

| (4) | the modification of terms related to previously granted employee stock options (approximate $207,000 increase). |

The remaining decrease in other selling, general and administrative expense is primarily due to:

| (1) | a decrease of $735,076 in other professional services due a charge recorded in 2006 associated with a 1999 merger ($500,000) and less legal fee expense (approximately $213,000) primarily due to less intellectual property protection litigation in the current period; and |

| (2) | a decrease of $391,863 in research and development expense as a result of increased customer field trials and reduced independent product testing activities compared to the prior period. |

Depreciation and Amortization Expense

Depreciation and amortization expense was $177,437 for the twelve months ended December 31, 2007, as compared to $407,498 for the twelve-month period ended December 31, 2006. This decrease of $230,061 is primarily attributable to our intellectually property becoming fully amortized during the second quarter of 2007.

Interest Income

Net interest income generated from our short-term investment in interest bearing securities for the twelve months ended December 31, 2007 was $28,899, compared to $161,135 for the twelve-month period ended December 31, 2006. The decrease in net interest income is primarily attributable to a lower amount of funds invested in securities, as investments were utilized to fund operations upon maturity.

Provision for Income Taxes

We have operated at a net loss since inception and have not recorded or paid any income taxes. We have significant net operating loss carry-forwards that would be recognized at such time as we demonstrate the ability to operate on a profitable basis for an extended period of time. The deferred income tax asset resulting primarily from the net operating loss carry-forwards has been fully reserved with a valuation allowance.

Net Loss

Net loss for the twelve months ended December 31, 2007 was $2,722,725, as compared to $5,242,979 for the twelve months ended December 31, 2006. The decrease in net loss was primarily due to decreases in stock-based compensation expense, other selling, general and administrative expense and depreciation and amortization, as described above. The basic and diluted net loss per common share for the twelve months ended December 31, 2007 and 2006 was $(0.03) and $(0.06), respectively.

Comparison of the Twelve Months Ended December 31, 2006 and the Twelve Months Ended December 31, 2005

Net revenue for the twelve months ended December 31, 2006 was $234,584, as compared to $563,481 for the twelve-month period ended December 31, 2005. This decrease in net revenue of $328,897 was due to decreased sales volume and marketing fees (described below). Sales revenue for 2006 was due primarily to contractual purchases by our distributor network, which included net sales of approximately $184,000 to FTL, a then-related party to us. Sales revenue generated during 2006 resulted primarily from the sale of DiesoLIFTTM.

At the end of the second quarter of 2006, we recorded $25,136 for a contra-revenue international marketing fee paid to FTM for sales revenues and subsequent cash collections generated from FTM sales leads. These fees are included in the 2006 net revenue totals described above.

Operating Expenses

Total operating expense was $5,638,698 for the twelve months ended December 31, 2006, as compared to $5,923,926 for the twelve-month period ended December 31, 2005. This represents a $285,228 decrease from the prior period, and was primarily attributable a decrease in stock-based compensation expense (described below) and a decrease in cost of operations due to decreased sales. These decreases were partially offset by increases in other selling, general and administrative expense (described below).

Selling, General and Administrative Expense

Selling, general and administrative expense for the twelve months ended December 31, 2006 was $5,062,882 (including stock-based compensation expense of $1,261,955) as compared to $5,144,398 (including stock-based compensation of $1,985,160) for the twelve-month period ended December 31, 2005, representing a decrease of $81,516, or 2%, from the prior period. Offsetting the decrease in stock-based compensation expense (described below) were increases of (1) $500,000 in other professional services due to a charge in 2006 associated with a 1999 merger and (2) $219,880 in research and development expense as a result of increased independent product testing activities in 2006.

The stock-based compensation expense decrease of $723,205 between 2006 and 2005 was primarily due to (1) lower 2006 expense related to securities issued to Directors for Board services of $492,260 as the 2005 expense included a cumulative payout for years 2000 through 2005, (2) lower 2006 expense related to non-employee stock–based compensation of $1,020,959 due primarily to the second quarter of 2005 issuance of options with an immediate vesting to FTM that yielded $720,000 of stock compensation expense and (3) increased 2006 employee stock-based compensation expense primarily as a result of adopting SFAS 123R as of January 1, 2006.

Depreciation and Amortization Expense

Depreciation and amortization expense was relatively unchanged at $407,498 for the twelve months ended December 31, 2006, as compared to $402,137 for the twelve-month period ended December 31, 2005.

Interest Income

Interest income generated from our short-term investment in interest bearing securities for the twelve-month period ended December 31, 2006 was $161,135. We had nominal interest income during the comparable prior year period, as our cash management investing program began late in 2005.

Provision for Income Taxes

We have operated at a net loss since inception and have not recorded or paid any income taxes. We have significant net operating loss carry-forwards that would be recognized at such time as we demonstrate the ability to operate on a profitable basis for an extended period of time. The deferred income tax asset resulting primarily from the net operating loss carry-forwards has been fully reserved with a valuation allowance.

Net Loss

Net loss for the twelve months ended December 31, 2006 was $5,242,979, as compared to $5,329,747 for the twelve months ended December 31, 2005. The decrease in net loss was primarily due to a decrease in stock-based compensation expense, partially offset by other increased selling, general and administrative expenses, described above. The basic and diluted net loss per common share for the twelve months ended December 31, 2006 and 2005 was $(0.06) and $(0.07), respectively.

New Accounting Pronouncements

In June 2006, the Financial Accounting Standards Board (“FASB”) issued FASB Interpretation No. 48, Accounting for Uncertainty in Income Taxes - an interpretation of FASB Statement No. 109 (“FIN 48”), which establishes that the financial statement effects of a tax position taken or expected to be taken in a tax return are to be recognized in the financial statements when it is more likely than not, based on the technical merits, that the position will be sustained upon examination. FIN 48 is effective for fiscal years beginning after December 15, 2006. We adopted the provisions of FIN 48 effective January 1, 2007 with no impact to our financial statements. No uncertain tax positions have been identified through December 31, 2007.

In September 2006, the FASB issued Statement of Financial Accounting Standards (“SFAS”) No. 157, Fair Value Measurements (“SFAS 157”), which provides guidance on how to measure assets and liabilities that use fair value. SFAS 157 will apply whenever another U.S. generally accepted accounting principles (“GAAP”) standard requires (or permits) assets or liabilities to be measured at fair value but does not expand the use of fair value to any new circumstances. This standard also will require additional disclosures in both annual and quarterly reports. SFAS 157 will be effective for financial statements issued for fiscal years beginning after November 15, 2007. In February 2008, the FASB agreed to defer the effective date of SFAS 157 for one year for non-financial assets and non-financial liabilities that are not recognized or disclosed at fair value in the financial statements on a recurring basis. There is no deferral for financial assets and financial liabilities, nor for the rare non-financial assets and non-financial liabilities that are re-measured at fair value at least annually. We are currently evaluating the potential impact this standard may have on our financial position and results of operations, but do not believe the impact of the adoption will be material.

In February 2007, the FASB issued SFAS No. 159, The Fair Value Option for Financial Assets and Financial Liabilities ("SFAS 159"). SFAS 159 permits entities to choose to measure certain financial instruments and other eligible items at fair value when the items are not otherwise currently required to be measured at fair value, and if so chosen, specifies related accounting and disclosure requirements. If elected, SFAS 159 will be effective as of the beginning of the first fiscal year that begins after November 15, 2007, with earlier adoption permitted if all of the requirements of SFAS 157 are adopted. The impact of the adoption of SFAS 159 will be dependent on the extent to which we choose to elect to measure eligible items at fair value.

In December 2007, the FASB issued SFAS No. 141(revised 2007), Business Combinations, Applying the Acquisition Method (“SFAS 141R”), a revision of SFAS 141, Business Combinations. SFAS 141R establishes requirements for the recognition and measurement of acquired assets, liabilities, goodwill, and non-controlling interests. SFAS 141R also provides disclosure requirements related to business combinations. SFAS 141R is effective for fiscal years beginning after December 15, 2008. SFAS 141R will be applied prospectively to business combinations with an acquisition date on or after the effective date. We do not expect the adoption of SFAS 141 will have a material impact on our financial statements.

In December 2007, the FASB issued SFAS No. 160, Non-Controlling Interests in Consolidated Financial Statements an amendment of ARB No. 51 (“SFAS 160”). SFAS 160 establishes new standards for the accounting for and reporting of non-controlling interests (formerly minority interests) and for the loss of control of partially owned and consolidated subsidiaries. SFAS 160 does not change the criteria for consolidating a partially owned entity. SFAS 160 is effective for fiscal years beginning after December 15, 2008. The provisions of SFAS 160 will be applied prospectively upon adoption except for the presentation and disclosure requirements, which will be applied retrospectively. We do not expect the adoption of SFAS 160 will have a material impact on our financial statements.

Critical Accounting Policies and Estimates

Revenue Recognition

We recognize revenue from the sale of our products when the products are shipped, and title and risk of loss has passed to the buyer. A portion of our revenues are from sales to product distributors. Product distributors do not have the option to return product that is not immediately sold to an end-user. Therefore, our revenue recognition is not conditional on whether a distributor is able to sell product to an ultimate product end-user. Our sales policies for end-users are consistent with product distributor sales policies.

Valuation of long-lived intangible assets

We asses the impairment of identifiable long-lived intangible assets whenever events or changes in circumstances indicate that the carrying value of the intangible asset overstates its continuing worth to us and may not be recoverable. Factors we consider important, which could trigger an impairment review, include the following:

| 1. | Significant under-performance relative to expected historical or projected future operating results; |

| 2. | Significant changes in the manner of our use of the acquired assets or the strategy for our overall business; |

| 3. | Significant negative industry or economic trends; |

| 4. | Significant decline in our stock price for a sustained period; and |

| 5. | Our market capitalization relative to net book value. |

Valuation of goodwill

We test goodwill for impairment at least annually in the fourth quarter. We will also review goodwill for impairment throughout the year if any events or changes in circumstances indicate the carrying value may not be recoverable (such triggers for impairment review are described above in the Valuation of long-lived intangible assets section).

To test impairment, we use the market approach to determine the fair value of the Company. Following this approach, the fair value of the business exceeded the carrying value of the business as of December 31, 2007. As a result, no impairment of goodwill was recorded.

Deferred income taxes

Deferred income taxes are recognized for the tax consequences of “temporary differences” by applying enacted statutory rates applicable to future years to differences between the financial statement carrying amounts and the tax basis of existing assets and liabilities. At December 31, 2007, our deferred income tax assets consisted principally of net operating loss carry-forwards, and have been fully offset with a valuation allowance because it is more likely than not that a tax benefit will not be realized from the assets in the future.

Liquidity and Capital Resources

A critical component of our operating plan affecting our ability to execute the product commercialization process is the cash resources needed to pursue our marketing and sales objectives. Until we are able to generate positive and sustainable operating cash flow, our ability to attract additional capital resources in the future will be critical to continue the funding of our operations.

While we cannot make any assurances as to the accuracy of our projections of future capital needs, we believe that, as a result of a fourth quarter 2007 debt financing (subsequently exchanged for common shares on March 31, 2008) and equity commitment (both transactions entered into with related parties, Board members of IFT and significant shareholders), we have adequate cash and cash equivalents balances and commitments to fund operations through at least mid-2008. As we will not likely be able to generate positive and sustainable operating cash flows by this time, we will need to raise additional capital to fund our future operations. Although management believes we will secure additional funding necessary to continue operations beyond mid-2008, if we are unable to secure this additional funding, we will need to significantly curtail operations. Of the approximate $2.1 million of cash we project to need to fund operations during 2008, $364,242 is available from cash and cash equivalents as of December 31, 2007 and another $1 million is available under an equity commitment. We intend to address the cash resources shortfall through placements of debt and/or equity financing.

Cash used in operating activities was $2,296,701 for the twelve months ended December 31, 2007, compared to $3,704,013 for the twelve months ended December 31, 2006. The decrease in cash outflow from operating activities was due primarily to lower net losses and a $129,198 decrease in non-cash and investment working capital in 2007 compared to a corresponding $636,541 increase in 2006.

Cash provided by investing activities was $1,506,102 for the twelve months ended December 31, 2007, as compared to $944,541 of cash provided by investing activities for the twelve months ended December 31, 2006. The increase in cash provided by investing activities was primarily due to all outstanding short-term investments maturing during 2007, with the proceeds utilized to fund operations.

Cash provided by financing activities was $500,000 for the twelve months ended December 31, 2007, as compared to $32,301 for the twelve months ended December 31, 2006. This increase in financing cash flow was primarily due to cash proceeds obtained from the issuance of a $500,000 note payable to a related party, which was subsequently settled on March 31, 2008 with 1,000,000 shares of IFT common shares. During 2006, we received minimal proceeds from the exercise of stock options.

Net cash decreased by $290,599 for the twelve months ended December 31, 2007, as compared to a decrease in net cash of $2,727,171 for the twelve months ended December 31, 2006.

Cash used in operating activities was $3,704,013 for the twelve months ended December 31, 2006, compared to $2,503,949 for the twelve months ended December 31, 2005. The increase in cash outflow from operating activities was due primarily to an increase in inventory due to an inventory buy-back from a distributor and a decrease in accounts payable due to timing of payments related to inventory purchases and legal expenses.

Cash provided by investing activities was $944,541 for the twelve months ended December 31, 2006, as compared to $2,487,793 of cash used in investing activities for the twelve months ended December 31, 2005. The decrease in cash used in investing activities was primarily due to the net redemption of short-term investments in 2006, compared to purchases of those investments in 2005.