June 19, 2013

United States Securities and Exchange Commission

100 F Street, NE

Washington, DC 20549

Attention: Mr. William H. Thompson

Ms. Yolanda Goubadia

Re: Bio-Matrix Scientific Group, Inc..

Form 10-K for the Fiscal Year ended September 30, 2012

Filed March 6 2013

Form 10-Q for the Fiscal Quarters ended December 31, 2012 and March 31, 2013

Filed March 31, 2013 and May 17,2013

File No. 000-32201

Dear Mr. Thompson and Ms. Goubadia :

The following responses address the comments of the Staff (the “Staff”) as set forth in its letter dated May 30, 2013 (the “Comment Letter”) relating to the abovementioned Exchange Act filings made by Bio-Matrix Scientific Group, Inc. (The "Company").

On behalf of the Company, we respond as set forth below. The numbers of the responses in this letter correspond to the numbers of the Staff’s comments as set forth in the Comment Letter.

1 and 2.

The Company intends to include the following revisions to Part I Item I (Business and Principal products and Services) and Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations. by amendment

Item 1. Business

We were organized October 6, 1998, under the laws of the State of Delaware as Tasco International, Inc.

Through our wholly owned subsidiary, Regen BioPharma, Inc., we intend to engage primarily in the development of regenerative medical applications which we intend to license from other entities up to the point of successful completion of Phase I and or Phase II clinical trials after which we would either attempt to sell or license those developed applications or, alternatively, advance the application further to Phase III clinical trials

On June 5, 2012 Oregon Health & Science University (“OHSU”) granted to Regen BioPharma, Inc. (“Regen”) an exclusive option (“OHSU Option Agreement’)) to enter into an agreement to be granted:

(a)

an exclusive, worldwide, royalty bearing license to US patent No. 6,821,513 “Method for enhancing hematopoiesis” issued Nov. 23, 2004 (“Patent Rights”) and

(b)

A non-exclusive, worldwide, royalty bearing license to, among other items, all inventions that are the subject of the invention disclosure giving rise to, or that are described in, patent applications included in the Patent Rights that do not issue into patents. (“Know-How”).

Pursuant to the OHSU Option Agreement”, Regen will have a period of six months (“Term”) in which to evaluate the Patent Rights and Know-How and execute an exclusive, worldwide, royalty bearing license in the Field of Use under the Patent Rights and a non-exclusive, royalty bearing license in the Field of Use to use the Know-How to make, have made, offer to sell, sell and import Licensed Products for the Field of Use.

Field of Use is defined in the Agreement as all therapeutic uses related to treatment of diseases. Licensed Products are defined in the OHSU Option Agreement as any method, procedure, service or process that incorporates, uses, used, is covered by, infringes or would infringe any of the Option Rights or the Know -How, as the case may be.

Pursuant to the OHSU Option Agreement, Regen is required to pay OHSU an option issue payment of $5,000 which shall be credited towards satisfaction of the upfront license issue payment payable provided Regen exercises the option granted herein and executes a license agreement within the Term. The OHSU Option Agreement may be extended by mutual agreement for an additional 6 months for an additional option issue payment of $10,000 which may also be credited towards satisfaction of an upfront license issue payment.

On December 5, 2012 Regen and OHSU executed an amendment to the OHSU Option Agreement extending the term of the agreement to June 5, 2013. Consideration from Regen for this extension consists of the payment by Regen to OHSU of an additional amount of $10,000 on or prior to 30 days from December 5, 2012.

On June 5, 2013 Regen entered into an agreement with OHSU (“License Agreement”) whereby OHSU granted to the Company an exclusive, worldwide, royalty bearing license to US patent No. 6,821,513 “Method for enhancing hematopoiesis” issued Nov. 23, 2004 (“Patent Rights”) and A non-exclusive, worldwide, royalty bearing license to, among other items, all inventions that are the subject of the invention disclosure giving rise to, or that are described in, patent applications included in the Patent Rights that do not issue into patents. (“Know-How”).

Pursuant to the License Agreement Regen shall be obligated to make the following payments to OHSU:

1. An upfront license issue payment of $35,000 payable 30 days from the effective date of the License Agreement

2. $25,000 on the enrollment of the first patient in a Phase I clinical trial anywhere in the world for each Licensed Product.

3. $150,000 on the enrollment of the first patient in a Phase III clinical trial anywhere in the world for each Licensed Product.

4. $250,000 on the first regulatory approval anywhere in the world for each Licensed Product.

5. the sum of $9,167.12, which represents Patent Costs incurred by OHSU as of April 30, 2012.

Regen shall also be obligated to pay the following royalties to OHSU pursuant to the License Agreement, if executed:

1) 2% Of Net Sales outside the Least Developed Countries; which percentage may be reduced in half where the Licensed Product embodies solely the Know-How and not the Patent Rights.

2) 0% Of Net Sales solely within any of the Least Developed Countries, so long as the Net Sales received by Regen and/or Sublicensees solely cover Regen's or Sublicensees' reasonable and documented direct costs to manufacture the Licensed Products ("Costs").

3) 1% Of Net Sales solely within any of the Least Developed Countries that exceed Costs.

“Least Developed Countries" means each country identified as a low-income economy by the World Bank Group and by the United Nations on their respective websites at the time the Licensed Product is transferred, and all other countries mutually agreed to in writing by OHSU and Regen. Net Sales" means the gross invoiced amount, and/or the monetary equivalent of any other consideration actually received by Regen and/or its Sublicensees, for the transfer of a Licensed Product, less certain expenses.

Commencing on the first January 1 to occur after the first Net Sale, and for each year thereafter, Regen will pay to OHSU minimum annual royalty of Ten Thousand Dollars (“Minimum Royalty”). Minimum Royalties will be credited against any subsequent royalty payments made by Regen, but only for the year in which the Minimum Royalty was received.

The License Agreement shall also require Regen to:

(a) Pay OHSU a license maintenance payment of $1,000 by each anniversary of the effective date of the License Agreement for the first four years until the first Net Sale and a license maintenance payment of $5,000) by each anniversary of the effective date of the License Agreement beginning in year 5 until the first Net Sale

(b) Pay a percentage of all remuneration received by Regen from a Technology Sublicensee (any person or entity that directly or indirectly obtains any rights in or to the licensed technology from Regen to use the licensed technology to further develop or modify the licensed technology or to incorporate the licensed technology into such Technology Sublicensee’s products or services) whether in the form of money, equipment, property, equity, debt financing or any other cash or noncash consideration, other than sales generating royalty payments to OHSU

(c) Reimburse OHSU for all out-of-pocket costs and expenses incurred by OHSU in connection with the preparation, filing, prosecution, defense, including interference and opposition proceedings, and maintenance of the Patent Rights.

On May 1, 2013 Dr. Wei Ping Min (“Min”) entered into an agreement (“Agreement”) whereby Min assigned to Regen all right, title and interest in US Patent # 8,389,708 as well as all Patent applications from the same family corresponding to numbers PCT/CA2006/000984, CA2612200 and EP1898936.(“Min IP”)

US Patent # 8,389,708 was granted to Min with regard to his invention of a method directed to the silencing of immunosuppressive cancer causing genes using short interfering RNA (siRNA) leading to an increase in the immune response, a decrease in tumor-induced immunosuppression and a decrease in in vivo tumor progression.

As consideration for the Min IP, Regen is required to:

(a) negotiate in good faith with Min with regards to a proposed consulting agreement whereby Min shall perform certain mutually agreed upon tasks for the benefit of Regen for consideration to Min consisting of One Hundred Thousand United States Dollars ($100,000 ) of the common shares of the Company valued as of the date of issuance and to be paid over a twelve month period in twelve equal installments (“Consulting Shares”) and registered under the Securities Act of 1933 on Form S-8.

(b) Cause to be issued to Min 100,000 of the Company’s preferred shares (“Assignor Preferred Shares”) exchangeable into common shares of the Company (“Exchange Common Shares”) under the following terms and conditions:

(i) A sufficient number of common shares shall be authorized for issuance by the Company in order that the required number of Exchange Common Shares may be issued

(ii) Subject to (i) above, upon any date subsequent to the date of the completion of a satisfactory review by the United States Food and Drug Administration (“FDA”) of an Investigational New Drug Application (“IND”) for the Min IP submitted by Regen which shall result in the ability of Regen to lawfully begin clinical testing of the Min IP on human subjects within the United States Min shall be permitted, at his option, to exchange 33,333 of the Assignor Preferred Shares into that number of Exchange Common Shares having a value of Three Hundred Thirty Three Thousand United States Dollars ($333,000) such shares being valued at a price per share equal to the closing price as of the day written notice is given by Min to Regen of Min’s intent to exchange.

(iii) Subject to (i) above, upon any date subsequent to the date that manufacturing procedures for the manufacture of the Min IP have been developed by Regen which comply to the Current Good Manufacturing Practices (“cGMP“) requirements of the Food Drug and Cosmetics Act of 1938 and the rules and regulations promulgated thereunder as they may apply to the manufacture of the Min IP Min shall be permitted, at Min’s option, to exchange 33,333 of the Assignor Preferred Shares into that number of Exchange Common Shares having a value of Three Hundred Thirty Three Thousand United States Dollars ($333,000) such shares being valued at a price per share equal to the closing price as of the day written notice is given by Min to Regen of Min’s intent to exchange.

(iv) Subject to (i) above, upon any date subsequent to the date that, in connection with a lawfully administered Phase I clinical trial of the Min IP being conducted by Regen within the United States on human subjects, both of (1) a clinical trial protocol has been completed and (2) a Principal Investigator has been appointed, Min shall be permitted, at Min’s option, to exchange 33,333 of the Assignor Preferred Shares into that number of Exchange Common Shares having a value of Three Hundred Thirty Three Thousand United States Dollars ($333,000) such shares being valued at a price per share equal to the closing price as of the day written notice is given by Min to Regen of Min’s intent to exchange.

(c) Subject to sufficient number of common shares having been authorized for issuance by the Company, Min shall receive, upon successful completion of a lawfully administered Phase I clinical trial of the Min IP being conducted by Regen within the United States on human subjects, the results of which (1) shall indicate that the Min IP can be safely tolerated by human subjects (2) shall not indicate that use of the Min IP in human subjects result in side effects of such severity that commencement of a Phase II clinical trial could not occur, and (3) establishes the optimal dosage and/or method of administration( as applicable )of the Min IP , Min shall receive that number of the common shares of BMSN which, at a price per share equal to the closing price of the shares as of the day of issuance, shall equal One Million United States Dollars ($1,000,000)

Pursuant to the Agreement, Min shall be entitled to additional consideration for productivity and deliverables over and above listed items (“”Bonus””). The eligibility of Min to receive a Bonus as well as the nature and amount of any Bonus shall be at the sole discretion and determination of the Chief Executive Officer of the Company.

Principal Products and Services

Through our wholly owned subsidiary, Regen BioPharma ,Inc.(“Regen”) , we intend to engage primarily in the development of regenerative medical applications which we intend to license from other entities up to the point of successful completion of Phase I and or Phase II clinical trials after which we would either attempt to sell or license those developed applications or, alternatively, advance the application further to Phase III clinical trials.

The Company has begun development of HemaXellerate, a cellular drug designed to heal damaged bone marrow. HemaXellerate I(TM) is a patient-specific composition of cells that have been demonstrated to repair damaged bone marrow and stimulate production of blood cells based on previous animal studies. The initial application of HemaXellerate will be the treatment of severe aplastic anemia (AA) which is characterized by immune-mediated bone marrow hypoplasia and pancytopenia. The HemaXellerate treatment consists of the use of autologous stromal vascular fraction(SVF) cells extracted from the patient’s own adipose tissue as a treatment for immune suppressant refractory aplastic anemia. SVF preparations contain significant numbers of cellular populations with therapeutic activity that would be relevant to aplastic anemia; namely, a) mesenchymal stem cells (MSC), which suppress pathological immune responses and accelerate hematopoiesis; b) endothelial cells, which assist in repairing damaged bone marrow hematopoietic microenvironment and stimulate hematopoiesis; and c) T regulatory cells, which possess anti-inflammatory properties.

On February 5, 2013 Regen filed an Investigational New Drug (IND) application with the United States Food and Drug Administration to initiate clinical trials assessing the company’s HemaXellerate drug currently in development in patients with drug-refractory aplastic anemia.

We have yet to successfully develop a regenerative medical application. Other than the exclusive and nonexclusive licenses granted under the Company’s license agreement with OHSU the Company has not been granted any license to develop and commercialize any third party intellectual property. Other than all right, title and interest in US Patent # 8,389,708 granted pursuant to that agreement entered into between Regen and Dr. Wei Ping Min the Company has been granted no patents.

Item 7.

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

As of September 30, 2012 we had cash of $75,752 and as of September 30, 2011 we had cash of $331.

The increase in cash of approximately 22,786% is primarily attributable to increased net borrowings by the Company of approximately $316,812 offset by expenses paid attributable to the operation of the Company.

As of September 30, 2012 we had Prepaid Expenses of $15,000 and as of September 30, 2011 we had Prepaid Expenses of $39,925..

The decrease in Prepaid Expenses of approximately 62% is primarily attributable to:

The incurrence by the Company of expenses related to the derecognition of $39,925 of Prepaid Expenses.

The payment by the Company of $15,000 to employees of the Company as an advance against work to be performed outside the current contractual scope of their employment.

As of September 30, 2012 we had Deferred Financing Costs of $65,000 and as of September 30, 2011 we had Deferred Financing Costs of $0.

The increase in Deferred Financing Costs are primarily attributable to the issuance of 5,000,000 Common Shares to the order of Capital Path Securities in consideration for services rendered as Placement Agent in connection with the April 26, 2012 Equity Purchase Agreement and Registration Rights Agreement (the Company executed with Southridge Partners II, LP.

As if September 30,2012 we had an Investment in Subsidiary of $0 and as of September 30, 2011 we had an Investment in Subsidiary of $41,735,443.

The reduction in Investment in Subsidiary is primarily attributable to:

(a) Decrease in Investment In Subsidiary resulting from recognition of $399,082 of Equity in Net Loss of the subsidiary during the nine months ended June 30, 2012

(b) Reclassification of Investment In Subsidiary as Available for Sale Securities as a result of Company’s ownership of the subsidiary falling to below 20% during the three months ended June 30, 2012.

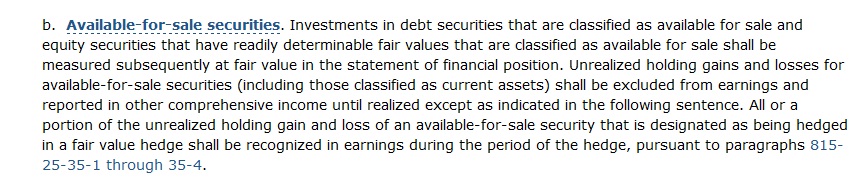

As if September 30,2012 we had Available for Sale Securities of $22,000 and as of September 30, 2011 we had Available for Sale Securities of $0. The increase in Available for Sale Securities is primarily attributable to reclassification of Investment In Subsidiary as Available for Sale Securities as a result of Company’s ownership of the subsidiary falling to below 20% during the three months ended June 30, 2012 offset by subsequent remeasurement based on unrealized loss.

As of September 30, 2012 we had Property and Equipment (Net of Accumulated Depreciation) of $0 and as of September 30, 2011 we had Property and Equipment (Net of Accumulated Depreciation) of $20,789. The decrease in Property and Equipment (Net of Accumulated Depreciation) of100% is attributable to the abandonment by the Company of Computer Equipment and Office Equipment during the quarter ended September 30, 2012.

As of September 30, 2012 we had Notes Payable of $817,020 and as of September 30, 2011 we had Notes Payable of $169,575.

The increase in Notes Payable of approximately 382% is primarily attributable to:

| | (a) | Reclassification of $700,000 of Accrued Salaries as Notes Payable due to transfer of all rights to and interest in the Accrued Salaries to a nonrelated third party. |

| | (b) | Additional Borrowings of $199,571 |

Offset by:

| | (b) | Reclassification of $396,479 of Notes Payable to Convertible Notes Payable |

As of September 30, 2012 we had Accrued Payroll of $307,692 and as of September 30, 2011 we had Accrued Payroll of $627,000

The decrease in Accrued Payroll of approximately 51% is primarily attributable to:

| | (a) | Reclassification of $700,000 of Accrued Salaries as Notes Payable due to transfer of all rights to and interest in the Accrued Salaries to a nonrelated third party offset by |

| | (b) | Accrual of $83,871 in salaries payable to employees of Regen |

| | (c) | Accrual of $296,281 in salaries payable to the Company’s CEO |

As of September 30, 2012 we had Accrued Payroll Taxes of $27,769 and as of September 30, 2011 we had Accrued Payroll Taxes of $23,780

The increase in Accrued Payroll Taxes of approximately 17% is primarily attributable to employer tax obligations incurred but not yet paid arising from vesting of Restricted Stock Awards.

As of September 30, 2012 we had Accrued Interest of $210,069 and as of September 20, 2011 we had Accrued Interest of $154,930.

The increase in Accrued Interest of approximately 36% is primarily attributable to the incurring by the Company of $55,139 in interest expense during the year ended September 30, 2012 accrued but unpaid.

As of September 30, 2012 we had Amounts due to Affiliate of $39,140 and as of September 30, 2011 we had Amounts due to Affiliate of $59,500.

The decrease in Amounts Due to Affiliate (Entest BioMedical, Inc.) of approximately 34% is primarily attributable to:

| | (a) | Payments by the Company to Entest BioMedical, Inc. of $20,600 during the year ended September 30, 2012 offset by |

| | (b) | Payments made during the year ended September 30, 2012 by Entest BioMedical, Inc on behalf of the Company of $240. |

Material Changes in Results of Operations:

Revenues were $0 for the twelve months ended September 30, 2012 and the same period ended September 30, 2011. Net Losses were $1,752,809 for the year ended September 30, 2012. Net Income was $40,826,647 for the same period ended September 30, 2011. The decrease was primarily attributable to a noncash gain of $42,182,649 resulting from the deconsolidation of Entest BioMedical, Inc. recognized by the Company during the year ended September 30, 2012.

Other material factors contributing to the decrease include:

| | (a) | A 235% increase in consulting expenses incurred by the Company during the year ended September 30, 2012 when compared to the year ended September 30, 2011 which was primarily attributable to $75,000 in non voting convertible preferred stock issued to Southridge Partners II, LP in accordance with the terms and conditions of that Equity Purchase Agreement (the "Purchase Agreement") entered into by and between the Company and Southridge Partners II, LP as well as an increase in legal fees incurred by the Company resulting from litigation. |

| | (b) | $41,688 recognized by the Company resulting from a loss on the early extinguishment of $77,500 of convertible debt during the twelve months ended September 30, 2012. |

| | (c) | $374,388 of interest expense recognized resulting from amortization of discounts recognized on convertible debentures issued during the twelve months ended September 30, 2012. |

| | (d) | $20,789 loss recognized resulting from abandonment of Office and Computer equipment during the twelve months ended September 30, 2012 |

| | (e) | $66,372 in expenses incurred by the Company during the twelve months ended September 30, 2012 resulting from stock issued pursuant to contractual obligations with convertible debt holders. |

As of September 30, 2012 we had $75,752 Cash on Hand and current liabilities of $1,841,238 (exclusive of convertible debt discount attributable to a beneficial conversion feature). We feel we will not be able to satisfy our cash requirements over the next twelve months and shall be required to seek additional financing.

During the twelve months ended September 30, 2012 we satisfied our cash requirements primarily through the issuance of Convertible Notes for cash, borrowings pursuant to lines of credit provided to the Company by Bio-Technology Partners Business Trust and Venture Bridge Advisors (collectively the “LOC Notes”) and borrowings from David Koos.

Funds lent to the Company pursuant to the LOC Notes may be disbursed to, or for the benefit of, the Company by Lender in Lender's sole and absolute discretion and principal and any accrued but unpaid interest are due and payable at the demand of the Lender. As there is no contractual obligation binding the Lender to disperse any minimum amount and any and as all disbursements are at the Lender’s discretion the company can give no assurance that funding pursuant to the LOC Notes will be made available to the Company in the future. There can also be no assurance given by the Company that funds will continue to be lent to the Company by David Koos

Management plans to raise additional funds by offering securities for cash.

On April 26, 2012 the Company executed an Equity Purchase Agreement (the "Purchase Agreement") and Registration Rights Agreement (the "Rights Agreement") with Southridge Partners II, LP, and a Delaware limited partnership ("Southridge").

Under the terms of the Purchase Agreement, Southridge will purchase, at the Company's election, up to $20,000,000 of the Company's registered common stock (the "Shares"). During the term of the Purchase Agreement, the Company may at any time deliver a "put notice" to Southridge thereby requiring Southridge to purchase a certain dollar amount of the Shares. Simultaneous with the delivery of such Shares, Southridge shall deliver payment for the Shares. Subject to certain restrictions, the purchase price for the Shares shall be equal to 91% of the Market Price, as such capitalized term is defined in the Purchase Agreement, on such date on which the Purchase Price is calculated in accordance with the terms and conditions of this Agreement.

Market Price, as such term is defined in the Purchase Agreement, means the lowest Closing Price, as such term is defined in the Purchase Agreement, during the Valuation Period, as such term is defined in the Purchase Agreement.

Closing Price is defined in the Purchase Agreement as the closing bid price for the Company’s common stock on the principal market over which the Company’s common shares trade on a day on which that principal market is open for business as reported by Bloomberg Finance L.P.

Valuation Period , as such term is defined in the Purchase Agreement, means the period of 5 Trading Days immediately following the Clearing Date, as such term is defined in the Purchase Agreement, associated with the applicable Put Notice during which the Purchase Price of the Shares is valued.

Clearing Date, as such term is defined in the Purchase Agreement, means the date in which the Estimated Put Shares (as defined in Section 2.2(a) of the Purchase Agreement) have been deposited into Southridge’s brokerage account and Southridge’s broker has confirmed with Southridge that Southridge may execute trades of such Estimated Put Shares.

The definition of Estimated Put Shares in Section 2.2(a) of the Purchase Agreement is that number of Shares equal to the dollar amount indicated in the Put Notice divided by the Closing Price on the Trading Day immediately preceding the Put Date, multiplied by 125%. Pursuant to the Purchase Agreement, on a Put Date the Company will be required to the applicable number of Estimated Put Shares to Southridge’s brokerage account. At the end of the Valuation Period the Purchase Price shall be established and the number of Shares shall be determined for a particular Put. If the number of Estimated Put Shares initially delivered to Southridge is greater than the Put Shares purchased by Southridge pursuant to such Put, then immediately after the Valuation Period Southridge shall deliver to Company any excess Estimated Put Shares associated with such Put. If the number of Estimated Put Shares delivered to Investor is less than the Shares purchased by Southridge pursuant to a Put, then immediately after the Valuation Period the Company shall deliver to Southridge the difference between the Estimated Put Shares and the Shares issuable pursuant to such Put.

The number of Shares sold to Southridge shall not exceed the number of such shares that, when aggregated with all other shares of common stock of the Company then beneficially owned by Southridge, would result in Southridge owning more than 9.99% of all of the Company's common stock then outstanding. Additionally, Southridge may not execute any short sales of the Company's common stock.

The Purchase Agreement shall terminate (i) on the date on which Southridge shall have purchased Shares pursuant to this Agreement for an aggregate Purchase Price of $20,000,000, or (ii) on the date occurring 24 months from the date on which the Agreement was executed and delivered by the Company and Southridge.

Under the terms of the Rights Agreement, the Company agreed to file a registration statement with the Securities and Exchange Commission within 90 days of the date on which the Purchase Agreement was executed and delivered by the Company and Southridge.

The registration statement shall be filed with respect to not less than the maximum allowable number of Shares issuable pursuant to a put notice to Southridge that has been exercised or may be exercised in accordance with the terms and conditions of the Purchase Agreement permissible under Rule 415, promulgated under the Securities Act of 1933.

The Company is obligated to keep such registration statement effective until (i) three months after the last closing of a sale of Shares under the Purchase Agreement, (ii) the date when Southridge may sell all the Shares under Rule 144 without volume limitations, or (iii) the date Southridge no longer owns any of the Shares.

The Purchase Agreement requires the Company to reserve and keep available until the consummation of such Closing, free of preemptive rights sufficient shares of common stock for the purpose of enabling the Company to satisfy its obligation to issue the Shares.

The Purchase Agreement also required the Company to issue to Southridge shares of a newly designated preferred stock with a stated value of $50,000 convertible at the option of Southridge into shares of the Company’s common stock at a conversion price equal to seventy percent (70%) of the lowest Closing Price for the five (5) trading days immediately preceding a conversion notice. The Preferred Stock has no registration rights.

There is no guarantee that we will be able to raise any capital through any type of offerings.. We cannot assure that we will be successful in obtaining additional financing necessary to implement our business plan. We have not received any commitment or expression of interest from any financing source that has given us any assurance that we will obtain the amount of additional financing in the future that we currently anticipate. For these and other reasons, we are not able to assure that we will obtain any additional financing or, if we are successful, that we can obtain any such financing on terms that may be reasonable in light of our current circumstances. In the event that we are unable to raise additional capital there is risk that the Company may not be able to continue as a going concern.

Other than what is disclosed in this document, The Company is unaware of any trends, demands or uncertainties that will result in the Company’s liquidity increasing or decreasing in any material way.

As of June 11, 2013 we are not party to any binding agreements which would commit us to any material capital expenditures.

3. The audited financial statements have been revised to correct the error:

https://www.sec.gov/Archives/edgar/data/1079282/000155479513000348/0001554795-13-000348-index.htm

4. Corrected report has been filed by amendment

5. Corrected report has been filed by amendment

6.

Investment in Subsidiary represents 10,000,000 common shares of Entest Biomedical, Inc., a publicly traded Nevada corporation, which is owned by the Company.

On July 10, 2009 JB Clothing Company, a publicly traded Nevada corporation, acquired 100% of Entest Biomedical, Inc., a California corporation, from the Company for consideration consisting of 10,000,000 newly issued shares of JB Clothing (JB Clothing was eventually renamed Entest Biomedical, Inc.) resulting in the Company having become Entest Nevada’s largest shareholder owning 71% of Entest Nevada. Financial statements were consolidated until February 4, 2011.

On February 4, 2011 the Company’s interest in Entest Nevada fell to below 50% as a result of additional stock issuances to third parties by Entest. Deconsolidation is required as of the date a parent no longer has a controlling financial interest. (ASC 810-10 40-4).

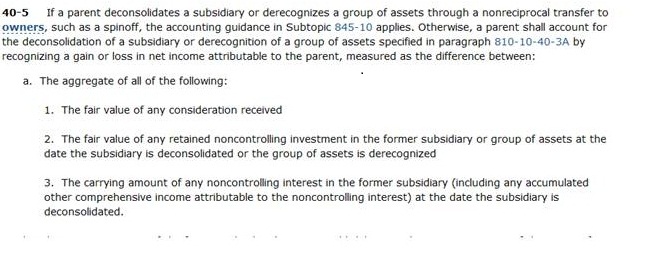

ASC 810-10 40-5 provides the following guidance regarding deconsolidation of majority owned subsidiaries:

The gain was recognized as follows:

1. Consideration received being the excess of Entest liabilities eliminated from the consolidated Balance Sheet over Entest assets eliminated from the balance sheet as of the deconsolidation date ($182,649) plus

2. The fair value (calculated utilizing Level 1 inputs in accordance with ASC 820) of the retained noncontrolling interest (42,000,000)

The historical cost of the 10,000,000 shares of Entest Nevada stock owned by the Company was 100% of the stock of Entest California. At the time Entest California was transferred to Entest Nevada, equity, book value, and sunk costs of Entest California were negligible.

No OCI was applicable as Entest’s results were consolidated with the Company’s from the date of the acquisition of the 10 million shares . Loss attributable to noncontrolling interest during the period of consolidation is still recognized on the balance sheet.

From the deconsolidation date until the quarter ended June 30, 2012 , the Investment in Entest was accounted for under the Equity Method as the Company’s ownership interest was over 20%. Under the Equity Method, the shareholder’s proportionate share of the investee’s net income increases the carrying value of the investment whereas the shareholder’s proportionate share of net losses decreases the carrying value of the investment.

(ASC 323-10-35.4)

By June 30, 2012 the Company’s interest in Entest fell below 20% ( as a result of additional stock issuances by Entest) and the 10,000,000 shares were reclassified as Available for Sale.

7. Although “Deficit attributable to noncontrolling interest in subsidiary” is clearly labeled as such in the Company’s Balance Sheet and presented in equity, the Company acknowledges that equity attributable to Bio Matrix Scientific Group, Inc is not presented as a separate line item in the balance sheet. The Company has amended the balance sheet to present equity attributable to Bio Matrix Scientific Group, Inc as a separate line item in the balance sheet.

8. Equity in Net Income (Losses) of Entest Biomedical, Inc. represents the Company’s proportionate share of Entest’s net losses during those periods when 10,000,000 common shares of Entest were accounted for under the Equity Method.

9. All majority owned subsidiaries---all entities in which a parent has a controlling financial interest--- are generally required to be consolidated (ASC -810-10-15-10). ASC-810-10-15-8 states that the usual condition for a controlling financial interest is ownership of more than 50% of the outstanding voting shares. From July 10, 2009 (the date of the acquisition of 10,000,000 shares of Entest) to February 4, 2011 the Company owned greater than 50% but less than 100% of Entest Biomedical. Non controlling interest in losses of investee during the consolidation period is reflected separately in the balance sheet under Deficit attributable to noncontrolling interest in subsidiary.

From the deconsolidation date until the quarter ended June 30, 2012 , the Investment in Entest was accounted for under the Equity Method as the Company’s ownership interest was over 20%. Under the Equity Method, the shareholder’s proportionate share of the investee’s net income increases the carrying value of the investment whereas the shareholder’s proportionate share of net losses decreases the carrying value of the investment. Equity in Losses of Entest during this period is reflected separately in the Balance Sheet as Equity in Earnings (Loss) of subsidiary.

| 26,547,311 | Retained earnings as per Statement of Shareholders equity |

| 663,649 | Add back | Equity in Earnings (Loss) of subsidiary | |

| 536,961 | Add Back | Equity in Earnings (Loss) of subsidiary | |

| 27,747,921 | Total Retained earnings as per Balance Sheet | | | | | |

| | | | | | | |

10.

On July 10, 2009 JB Clothing Company, a publicly traded Nevada corporation, acquired 100% of Entest Biomedical, Inc., a California corporation, from the Company for consideration consisting of 10,000,000 newly issued shares of JB Clothing (JB Clothing was eventually renamed Entest Biomedical, Inc.) resulting in the Company having become Entest Nevada’s largest shareholder owning 71% of Entest Nevada. Financial statements were consolidated until February 4, 2011.

On February 4, 2011 the Company’s interest in Entest Nevada fell to below 50% as a result of additional stock issuances to third parties by Entest. Deconsolidation is required as of the date a parent no longer has a controlling financial interest. (ASC 810-10 40-4).

ASC 810-10 40-5 provides the following guidance regarding deconsolidation of majority owned subsidiaries:

The gain was recognized as follows:

1. Consideration received being the excess of Entest liabilities eliminated from the consolidated Balance Sheet over Entest assets eliminated from the balance sheet as of the deconsolidation date ($182,649) plus

2. The fair value (calculated utilizing Level 1 inputs in accordance with ASC 820) of the retained noncontrolling interest (42,000,000 representing the stock price multiplied by the number of shares).

11. The Loss on Sale of Available for sale Securities to which you refer is an error which occurred during the Edgarization process where the number (487,900) was transposed from the column “From Inception to September 30, 2012” to the column “12 months Ended September 30, 2011”. This loss was actually incurred during the quarter ended March 31, 2009 and was realized as a result of the liquidation of 1,000,000 common shares of Freedom Environmental Services, Inc. This typographical error was corrected in an amended 10-K.

12. Equity in Net Income(Loss) of Subsidiary represents the Company’s proportionate share of Entest’s net losses during that period when 10,000,000 shares of Entest were accounted for under the Equity Method. The Company is permitted, under ASC 320-10-5-3, to make the required disclosures regarding investments accounted for under the Equity Method within the Notes to Financial Statements.

As of September 30, 2012 10,000,000 shares of Entest Biomedical, Inc. (the Company’s sole investment security) was no longer accounted for under the equity method as the Company’s ownership fell to below 20%.

The Company believes that Note 14 of the Company’s Notes to consolidated Financial Statements As of September 30, 2011

http://www.sec.gov/Archives/edgar/data/1079282/000139390511000850/bmsn_10k.htm

materially addresses the disclosure requirements of ASC 320-10-5-3

“NOTE 14. DECONSOLIDATION OF ENTEST BIOMEDICAL, INC.

Effective February 4, 2011 the Company’s ownership of Entest BioMedical, Inc. fell to approximately 49%. and commencing February 4, 2011 the Company’s financial statements reflect the Company’s ownership of Entest under the equity method of accounting. A gain of $42,182,649 was recognized in accordance with ASC 810-10-40-5. Fair value of the Company’s investment in Entest BioMedical, Inc. resulting from deconsolidation was calculated utilizing Level 1 inputs in accordance with ASC 820. As of September 30, 2011 , the Company’s ownership of Entest is 47.9%.”

13. ASC 810-10-55 requires that consolidated income and income attributable to noncontrolling interest be presented separately on the face of the parent’s consolidated income statement. Net Income( Loss) attributable to noncontrolling interest is presented separately on the Company’s consolidated income statement.

14 ASC 360-10-45-5 relates to the accounting for gain or loss on sale of a disposal group that is not considered a component of an entity and requires that a gain or loss recognized on the sale of a long lived asset be included in income from continuing operations. Gain or loss on long lived assets disposed by abandonment are accounted for in a substantially similar manner as per ASC 360-10-45-5 (During the quarter ended September 30, 2012 the Company abandoned $20,789 of Computer Equipment and Office Equipment) .

Income from continuing operations is defined in the ASC as follows:

It is therefore the opinion of the Company that, although included in Other Income, the presentation of gains and losses on disposal of Long Lived Assets meet the requirements of the ASC due to inclusion in Net Income (Loss) before “Net Income ( Loss) attributable to Noncontrolling Interest” and “Equity in Net Income (Loss) of subsidiary”

15. Securities issued pursuant to contractual obligations represent the expense recorded in connection with securities issued pursuant to contractual obligations to certain debt holders.

These obligations are described in the Notes to Financial statements for the year ended September 30, 2012 as follows:

“On April 23, 2012, for no additional consideration, the Company agreed to amend the terms of $25,000 of outstanding convertible debt to allow conversion at the Holder’s option into common shares of the Company at a conversion price per share equal to 60% (the “Discount”) of the lowest closing bid price for the Company’s common stock during the 5 trading days immediately preceding a conversion date, as reported by Bloomberg (the “Closing Bid Price”); provided that if the closing bid price for the common stock on the date in which the conversion shares are deposited into Holder’s brokerage account and confirmation has been received that Holder may execute trades of the conversion shares ( Clearing Date) is lower than the Closing Bid Price, then the purchase price for the conversion shares would be adjusted such that the Discount shall be taken from the closing bid price on the Clearing Date, and the Company shall issue additional shares to Purchaser to reflect such adjusted Purchase Price(“Reset”). The Company has agreed on a limitation on conversion equal to 9.99% of the Company’s outstanding common stock. “

“On April 23, 2012, for no additional consideration, the Company agreed to amend the terms of $10,000 of outstanding convertible debt to allow conversion at the Holder’s option into common shares of the Company at a conversion price per share equal to 60% (the “Discount”) of the lowest closing bid price for the Company’s common stock during the 5 trading days immediately preceding a conversion date, as reported by Bloomberg (the “Closing Bid Price”); provided that if the closing bid price for the common stock on the date in which the conversion shares are deposited into Holder’s brokerage account and confirmation has been received that Holder may execute trades of the conversion shares ( Clearing Date) is lower than the Closing Bid Price, then the purchase price for the conversion shares would be adjusted such that the Discount shall be taken from the closing bid price on the Clearing Date, and the Company shall issue additional shares to Purchaser to reflect such adjusted Purchase Price(“Reset”). The Company has agreed on a limitation on conversion equal to 9.99% of the Company’s outstanding common stock”

“On April 23, 2012, for no additional consideration, the Company agreed to amend the terms of $15,000 of outstanding convertible debt to allow conversion at the Holder’s option into common shares of the Company at a conversion price per share equal to 60% (the “Discount”) of the lowest closing bid price for the Company’s common stock during the 5 trading days immediately preceding a conversion date, as reported by Bloomberg (the “Closing Bid Price”); provided that if the closing bid price for the common stock on the date in which the conversion shares are deposited into Holder’s brokerage account and confirmation has been received that Holder may execute trades of the conversion shares ( Clearing Date) is lower than the Closing Bid Price, then the purchase price for the conversion shares would be adjusted such that the Discount shall be taken from the closing bid price on the Clearing Date, and the Company shall issue additional shares to Purchaser to reflect such adjusted Purchase Price(“Reset”). The Company has agreed on a limitation on conversion equal to 9.99% of the Company’s outstanding common stock.”

“On May 3, 2012, for no additional consideration, the Company agreed to amend the terms of $10,000 of outstanding convertible debt to allow conversion at the Holder’s option into common shares of the Company at a conversion price per share equal to 60% (the “Discount”) of the lowest closing bid price for the Company’s common stock during the 5 trading days immediately preceding a conversion date, as reported by Bloomberg (the “Closing Bid Price”); provided that if the closing bid price for the common stock on the date in which the conversion shares are deposited into Holder’s brokerage account and confirmation has been received that Holder may execute trades of the conversion shares ( Clearing Date) is lower than the Closing Bid Price, then the purchase price for the conversion shares would be adjusted such that the Discount shall be taken from the closing bid price on the Clearing Date, and the Company shall issue additional shares to Purchaser to reflect such adjusted Purchase Price(“Reset”). The Company has agreed on a limitation on conversion equal to 9.99% of the Company’s outstanding common stock”

“On May 4, 2012, for no additional consideration, the Company agreed to amend the terms of $80,000 of outstanding convertible debt to allow conversion at the Holder’s option into common shares of the Company at a conversion price per share equal to 60% (the “Discount”) of the lowest closing bid price for the Company’s common stock during the 5 trading days immediately preceding a conversion date, as reported by Bloomberg (the “Closing Bid Price”); provided that if the closing bid price for the common stock on the date in which the conversion shares are deposited into Holder’s brokerage account and confirmation has been received that Holder may execute trades of the conversion shares ( Clearing Date) is lower than the Closing Bid Price, then the purchase price for the conversion shares would be adjusted such that the Discount shall be taken from the closing bid price on the Clearing Date, and the Company shall issue additional shares to Purchaser to reflect such adjusted Purchase Price(“Reset”). The Company has agreed on a limitation on conversion equal to 9.99% of the Company’s outstanding common stock. “

“On June 1, 2012, for no additional consideration, the Company agreed to amend the terms of $40,000 of outstanding convertible debt to allow conversion at the Holder’s option into common shares of the Company at a conversion price per share equal to 60% (the “Discount”) of the lowest closing bid price for the Company’s common stock during the 5 trading days immediately preceding a conversion date, as reported by Bloomberg (the “Closing Bid Price”); provided that if the closing bid price for the common stock on the date in which the conversion shares are deposited into Holder’s brokerage account and confirmation has been received that Holder may execute trades of the conversion shares (Clearing Date) is lower than the Closing Bid Price, then the purchase price for the conversion shares would be adjusted such that the Discount shall be taken from the closing bid price on the Clearing Date, and the Company shall issue additional shares to Purchaser to reflect such adjusted Purchase Price (“Reset”). The Company has agreed on a limitation on conversion equal to 9.99% of the Company’s outstanding common stock. “

“On June 7, 2012, for no additional consideration, the Company agreed to amend the terms of $40,000 of outstanding convertible debt to allow conversion at the Holder’s option into common shares of the Company at a conversion price per share equal to 60% (the “Discount”) of the lowest closing bid price for the Company’s common stock during the 5 trading days immediately preceding a conversion date, as reported by Bloomberg (the “Closing Bid Price”); provided that if the closing bid price for the common stock on the date in which the conversion shares are deposited into Holder’s brokerage account and confirmation has been received that Holder may execute trades of the conversion shares (Clearing Date) is lower than the Closing Bid Price, then the purchase price for the conversion shares would be adjusted such that the Discount shall be taken from the closing bid price on the Clearing Date, and the Company shall issue additional shares to Purchaser to reflect such adjusted Purchase Price (“Reset”). The Company has agreed on a limitation on conversion equal to 9.99% of the Company’s outstanding common stock. “

“On June 7, 2012, for no additional consideration, the Company agreed to amend the terms of $31,000 of outstanding debt to allow conversion at the Holder’s option into common shares of the Company at a conversion price per share equal to 60% (the “Discount”) of the lowest closing bid price for the Company’s common stock during the 7 trading days immediately preceding a conversion date, as reported by Bloomberg (the “Closing Bid Price”); provided that if the closing bid price for the common stock on the date in which the conversion shares are deposited into Holder’s brokerage account and confirmation has been received that Holder may execute trades of the conversion shares (Clearing Date) is lower than the Closing Bid Price, then the purchase price for the conversion shares would be adjusted such that the Discount shall be taken from the closing bid price on the Clearing Date, and the Company shall issue additional shares to Purchaser to reflect such adjusted Purchase Price (“Reset”). The Company has agreed on a limitation on conversion equal to 9.99% of the Company’s outstanding common stock.”

“On June 7, 2012, for no additional consideration, the Company agreed to amend the terms of $15,000 of outstanding debt to allow conversion at the Holder’s option into common shares of the Company at a conversion price per share equal to 60% (the “Discount”) of the lowest closing bid price for the Company’s common stock during the 7 trading days immediately preceding a conversion date, as reported by Bloomberg (the “Closing Bid Price”); provided that if the closing bid price for the common stock on the date in which the conversion shares are deposited into Holder’s brokerage account and confirmation has been received that Holder may execute trades of the conversion shares (Clearing Date) is lower than the Closing Bid Price, then the purchase price for the conversion shares would be adjusted such that the Discount shall be taken from the closing bid price on the Clearing Date, and the Company shall issue additional shares to Purchaser to reflect such adjusted Purchase Price (“Reset”). The Company has agreed on a limitation on conversion equal to 9.99% of the Company’s outstanding common stock.”

“On June 7, 2012, for no additional consideration, the Company agreed to amend the terms of $15,000 of outstanding debt to allow conversion at the Holder’s option into common shares of the Company at a conversion price per share equal to 60% (the “Discount”) of the lowest closing bid price for the Company’s common stock during the 7 trading days immediately preceding a conversion date, as reported by Bloomberg (the “Closing Bid Price”); provided that if the closing bid price for the common stock on the date in which the conversion shares are deposited into Holder’s brokerage account and confirmation has been received that Holder may execute trades of the conversion shares (Clearing Date) is lower than the Closing Bid Price, then the purchase price for the conversion shares would be adjusted such that the Discount shall be taken from the closing bid price on the Clearing Date, and the Company shall issue additional shares to Purchaser to reflect such adjusted Purchase Price (“Reset”). The Company has agreed on a limitation on conversion equal to 9.99% of the Company’s outstanding common stock. “

“On June 7, 2012, for no additional consideration, the Company agreed to amend the terms of $10,000 of outstanding debt to allow conversion at the Holder’s option into common shares of the Company at a conversion price per share equal to 60% (the “Discount”) of the lowest closing bid price for the Company’s common stock during the 7 trading days immediately preceding a conversion date, as reported by Bloomberg (the “Closing Bid Price”); provided that if the closing bid price for the common stock on the date in which the conversion shares are deposited into Holder’s brokerage account and confirmation has been received that Holder may execute trades of the conversion shares (Clearing Date) is lower than the Closing Bid Price, then the purchase price for the conversion shares would be adjusted such that the Discount shall be taken from the closing bid price on the Clearing Date, and the Company shall issue additional shares to Purchaser to reflect such adjusted Purchase Price (“Reset”). The Company has agreed on a limitation on conversion equal to 9.99% of the Company’s outstanding common stock. “

“On June 7, 2012, for no additional consideration, the Company agreed to amend the terms of $21,000 of outstanding debt to allow conversion at the Holder’s option into common shares of the Company at a conversion price per share equal to 60% (the “Discount”) of the lowest closing bid price for the Company’s common stock during the 7 trading days immediately preceding a conversion date, as reported by Bloomberg (the “Closing Bid Price”); provided that if the closing bid price for the common stock on the date in which the conversion shares are deposited into Holder’s brokerage account and confirmation has been received that Holder may execute trades of the conversion shares (Clearing Date) is lower than the Closing Bid Price, then the purchase price for the conversion shares would be adjusted such that the Discount shall be taken from the closing bid price on the Clearing Date, and the Company shall issue additional shares to Purchaser to reflect such adjusted Purchase Price (“Reset”). The Company has agreed on a limitation on conversion equal to 9.99% of the Company’s outstanding common stock. “

“On June 22, 2012, for no additional consideration, the Company agreed to amend the terms of $22,300 of outstanding debt to allow conversion at the Holder’s option into common shares of the Company at a conversion price per share equal to 60% (the “Discount”) of the lowest closing bid price for the Company’s common stock during the 7 trading days immediately preceding a conversion date, as reported by Bloomberg (the “Closing Bid Price”); provided that if the closing bid price for the common stock on the date in which the conversion shares are deposited into Holder’s brokerage account and confirmation has been received that Holder may execute trades of the conversion shares (Clearing Date) is lower than the Closing Bid Price, then the purchase price for the conversion shares would be adjusted such that the Discount shall be taken from the closing bid price on the Clearing Date, and the Company shall issue additional shares to Purchaser to reflect such adjusted Purchase Price (“Reset”). The Company has agreed on a limitation on conversion equal to 9.99% of the Company’s outstanding common stock. “

“On June 22, 2012, for no additional consideration, the Company agreed to amend the terms of $17,179 of outstanding debt to allow conversion at the Holder’s option into common shares of the Company at a conversion price per share equal to 60% (the “Discount”) of the lowest closing bid price for the Company’s common stock during the 7 trading days immediately preceding a conversion date, as reported by Bloomberg (the “Closing Bid Price”); provided that if the closing bid price for the common stock on the date in which the conversion shares are deposited into Holder’s brokerage account and confirmation has been received that Holder may execute trades of the conversion shares (Clearing Date) is lower than the Closing Bid Price, then the purchase price for the conversion shares would be adjusted such that the Discount shall be taken from the closing bid price on the Clearing Date, and the Company shall issue additional shares to Purchaser to reflect such adjusted Purchase Price (“Reset”). The Company has agreed on a limitation on conversion equal to 9.99% of the Company’s outstanding common stock. “

“On June 22, 2012, for no additional consideration, the Company agreed to amend the terms of $5,000 of outstanding debt to allow conversion at the Holder’s option into common shares of the Company at a conversion price per share equal to 60% (the “Discount”) of the lowest closing bid price for the Company’s common stock during the 5 trading days immediately preceding a conversion date, as reported by Bloomberg (the “Closing Bid Price”); provided that if the closing bid price for the common stock on the date in which the conversion shares are deposited into Holder’s brokerage account and confirmation has been received that Holder may execute trades of the conversion shares (Clearing Date) is lower than the Closing Bid Price, then the purchase price for the conversion shares would be adjusted such that the Discount shall be taken from the closing bid price on the Clearing Date, and the Company shall issue additional shares to Purchaser to reflect such adjusted Purchase Price (“Reset”). The Company has agreed on a limitation on conversion equal to 9.99% of the Company’s outstanding common stock. “

The contractual obligations are defined in the above description as a Reset. The Company does not consider these expenses to be part of “Operating Income(Expenses)” and have therefore recognized them as “Other Income (Expenses)”

16. ASC 810-10-50-1A(c) is applicable to disclosures regarding less than wholly owned subsidiaries. Subsidiaries are defined in the ASC Master Glossary as entities in which the Company has a controlling financial interest (i.e. greater than 50%). As of FYE 2012 and FYE 2011 there were no less than wholly owned subsidiaries in which the Company had a controlling financial interest. As such, the Company believes ASC 810-10-50-1A(c) is not applicable.

17. Net Income (Loss) Available to Common Shareholders includes both of “Loss attributable to Non Controlling interest in subsidiary” as well as “Equity in Loss of Entest” and is equal to Net Income (Loss) as defined in ASC 810-10-45-20 ( ASC 810-10-45-20 defines “net income” as attributable to both the controlling and non-controlling interests). As such, the Company believes that the requirement of ASC-230-10-45-28 has been complied with.

18. Conversions of debt to stock are not included in the cash flow statements for Form 10-K for the Fiscal Year ended September 30, 2012 or any subsequent quarters filed , but are instead disclosed in Supplemental Schedules entitled “Supplemental Disclosure of Noncash investing and financing activities”.

19. Unrealized Losses on Available for Sale Securities represent the change in market value as of the end of each reporting period for the Company’s only investment securities (10,000,000 Common Shares of Entest Biomedical Inc, a publicly traded company with a readily ascertainable fair market value) in accordance with ASC 320-10-35-1(b).

As to why there is no OCI reported for FYE 2011, as stated previously, The Loss on Sale of Available for Sale Securities reported for FYE 2011 was an error which occurred during the Edgarization process where the number (487,900) was transposed from the column “From Inception to September 30, 2012” to the column “12 months Ended September 30, 2011”. This loss was actually incurred during the quarter ended March 31, 2009 and was realized as a result of the liquidation of 1,000,000 common shares of Freedom Environmental Services, Inc. This typographical error was corrected in an amended 10-K. During FYE 2011 the Company held no securities classified as Available for Sale.

20. The only items recognized in Other Comprehensive Income for FYE 2012 as well as the Quarters ended December 31, 2012 and March 31, 2013 are Unrealized Gains/Losses which do not constitute taxable events. The Company does not believe that any Reclassification Adjustments are required as Reclassification Adjustments are defined in ASC 220 10 20

21. Subsidiaries are defined in the ASC Master Glossary (ASC 810-10) as entities in which the Company has a controlling financial interest (i.e. greater than 50%). As of FYE 2012 and FYE 2011 there were no less than wholly owned subsidiaries in which the Company had a controlling financial interest. As such, the Company believes ASC 810-10-50-1A (regarding less than wholly owned subsidiaries) is not applicable

22. The Company shall revise the Shareholder’s Equity disclosure in the Notes to read as follows (FYE 2012 Note 9 to Notes to Financial Statements):

NOTE 9. STOCKHOLDERS' EQUITY

The stockholders' equity section of the Company contains the following classes of capital stock as September 30, 2012:

Preferred stock, $ 0.0001 par value; 20,000,000 shares authorized, following series issued and outstanding:

1,963,821 Preferred Shares issued and outstanding.

94,852 Series AA Preferred Shares issued and outstanding.

With respect to each matter submitted to a vote of stockholders of the Corporation, each holder of Series AA Preferred Stock shall be entitled to cast that number of votes which is equivalent to the number of shares of Series AA Preferred Stock owned by such holder times ten thousand (10,0000).

On any voluntary or involuntary liquidation, dissolution or winding up of the Corporation, the holders of the Series AA Preferred Stock shall receive, out of assets legally available for distribution to the Company's stockholders, a ratable share in the assets of the Corporation.

725,409 Series B Preferred Shares issued and outstanding.

With respect to each matter submitted to a vote of stockholders of the Corporation, each holder of Series B Preferred Stock shall be entitled to cast that number of votes which is equivalent to the number of shares of Series B Preferred Stock owned by such holder times two (2).

On any voluntary or involuntary liquidation, dissolution or winding up of the Corporation, the holders of the Series B Preferred Stock shall receive, out of assets legally available for distribution to the Company's stockholders, a ratable share in the assets of the Corporation.

Non Voting Convertible Preferred Stock , $1.00 Par value, 200,000 shares authorized , 75000 shares issued and outstanding

Common stock, $ 0.0001 par value;1,000,000,000 shares authorized: 323,507,887 shares issued and outstanding.

With respect to each matter submitted to a vote of stockholders of the Corporation, each holder of Common Stock shall be entitled to cast that number of votes which is equivalent to the number of shares of Common Stock owned by such holder times one (1).

On any voluntary or involuntary liquidation, dissolution or winding up of the Corporation, the holders of the Common Stock shall receive, out of assets legally available for distribution to the Company's stockholders, a ratable share in the assets of the Corporation.

Each Non Voting Convertible Preferred Stock shall convert at the option of the holder into shares of the corporation’s common stock at a conversion price equal to seventy percent (70%) of the lowest Closing Price for the five (5) trading days immediately preceding written receipt by the corporation of the holder’s intent to convert.

“CLOSING PRICE" shall mean the closing bid price for the corporation’s common stock on the Principal Market on a Trading Day as reported by Bloomberg Finance L.P.

“PRINCIPAL MARKET" shall mean the principal trading exchange or market for the corporation’s common stock.

“TRADING DAY” shall mean a day on which the Principal Market shall be open for business.

On any voluntary or involuntary liquidation, dissolution or winding up of the Corporation, the holders of the Non Voting Convertible Preferred shall receive, out of assets legally available for distribution to the Company's stockholders, a ratable share in the assets of the Corporation.

Similar amendments shall be made to the applicable portions of the Notes to Financial Statements for the quarters ended 12/31/2012 and 3/31/2013.

23.

FYE 2012

As of September 30, 2012 the Aggregate Amount of Convertible Debentures outstanding was $365,880 and the Aggregate Amount of Unamortized discount was $65,371.

FYE 2011

As of September 30, 2011 the Aggregate Amount of Convertible Debentures outstanding was $313,701 and the Aggregate Amount of Unamortized discount was $0.

As of the Quarter Ended March 31, 2013 the Aggregate Amount of Convertible Debentures outstanding was $391,701 and the Aggregate Amount of Unamortized discount was $23,834.

24.

90,000 shares of Series AA Preferred Stock was issued to the Company’s CEO Fair Value is defined in the ASC as the amount at which an asset could be bought and sold in a current transaction between willing parties.

As:

| a) | There is no public market for the Company’s AA Preferred Stock |

| b) | The Company operates in a highly regulated industry against competitors with much greater resources. |

| c) | The Company has yet to achieve revenue or profits |

| d) | The Series AA Stock has no stated dividend nor does it have a stated liquidation preference |

It was determined that fair value would equal the par value ($0.0001)

25. This revision shall be done by amendment

26. Seale and beers were not retained until December 4, 2012.

http://www.sec.gov/Archives/edgar/data/1079282/000110262412000979/biomatrix8k.htm

As such, there were no billings by Seale and Beers during the twelve months ended September 30, 2012.

27.

The Purchase Agreement referred to in the comment is filed as Exhibit 10.14 and is incorporated by reference to Exhibit 10.1 of Form 8-K dated May 7, 2012

http://www.sec.gov/Archives/edgar/data/1079282/000139390512000208/bmsn_ex101.htm

28.

Consents were filed

http://www.sec.gov/Archives/edgar/data/1079282/000110262413000535/exh23_1.htm

http://www.sec.gov/Archives/edgar/data/1079282/000110262413000535/exh23_3.htm

29 Corrections will be made by amendment

30. Comments will be addressed to the extent applicable.

31 Corrections will be made by amendment

32. Corrections will be made by amendment

The Company acknowledges that:

The Company is responsible for the adequacy and accuracy of the disclosure in the filing;

Staff comments or changes to disclosure in response to staff comments do not foreclose the Commission from taking any action with respect to the filing; and

The Company may not assert staff comments as a defense in any proceeding initiated by

Thank you for your kind assistance and the courtesies that you have extended to assist us in fulfilling our obligations under the Securities and Exchange Act of 1934. If, at any time, you have any further questions, please let us know.

Sincerely,

David R. Koos,

Chairman & CEO