UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x | | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2008 |

or

| ¨ | | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to |

Commission File Number: 1-14925

STANCORP FINANCIAL GROUP, INC.

(Exact name of registrant as specified in its charter)

| | |

| Oregon | | 93-1253576 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

1100 SW Sixth Avenue, Portland, Oregon, 97204

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code: (971) 321-7000

Securities registered pursuant to Section 12(b) of the Act:

| | |

| TITLE OF EACH CLASS | | NAME OF EACH EXCHANGE ON WHICH REGISTERED |

Common Stock | | New York Stock Exchange |

Series A Preferred Share Purchase Rights | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: NONE

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of the 10-K or any amendment to the Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer x Accelerated filer ¨ Non-accelerated filer ¨ Smaller reporting company ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant as of June 30, 2008, was approximately $2.28 billion based upon the closing price of $46.96 on June 30, 2008. For this purpose, directors and executive officers of the registrant are assumed to be affiliates.

As of February 20, 2009, there were 48,972,080 shares of the registrant’s common stock, no par value, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive Proxy Statement for its 2009 Annual Meeting of Shareholders are incorporated by reference in Part III.

| | |

| 2 | | STANCORP FINANCIAL GROUP, INC. |

Part I

As used in this Form 10-K, the terms “StanCorp,” “Company,” “we,” “us” and “our” refer to StanCorp Financial Group, Inc. and its subsidiaries, unless the context otherwise requires.

AVAILABLE INFORMATION

StanCorp files its annual, quarterly and current reports, proxy statements and other information with the United States Securities and Exchange Commission (“SEC”). You may read and copy any document StanCorp files with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Room 1580, Washington, DC 20549, U.S.A. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330 (or 1-202-551-8090). The SEC maintains an Internet site that contains annual, quarterly and current reports, proxy and information statements and other information regarding issuers that file electronically with the SEC. StanCorp’s electronic SEC filings are available to the public atwww.sec.gov.

StanCorp’s Internet site for investors iswww.stancorpfinancial.com. StanCorp publishes its annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 (“Exchange Act”), as amended, on its Internet site free of charge. StanCorp makes these reports available as soon as reasonably practicable after it electronically files such material with, or furnishes it to, the SEC. StanCorp also makes available onwww.stancorpfinancial.com (i) its Corporate Governance Guidelines, (ii) its codes of business ethics (including any waivers granted to executive officers or directors), and (iii) the charters of the audit, organization and compensation, and nominating and corporate governance committees of its board of directors. These documents are also available in print without charge to any person who requests them by writing or telephoning:

Shareholder Relations Department

StanCorp Financial Group, Inc.

1100 SW Sixth Avenue

Portland, OR 97204

(800) 378-8360

FORWARD-LOOKING STATEMENTS

Some of the statements contained or incorporated by reference in this Annual Report on Form 10-K, including those relating to the Company’s strategy, growth prospects

and other statements that are predictive in nature, that depend on or refer to future events or conditions, or that include words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “estimates,” “seeks” and similar expressions, are forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934 (“Exchange Act”), as amended. These statements are not historical facts but instead represent only management’s expectations, estimates and projections regarding future events. Similarly, these statements are not guarantees of future performance and involve uncertainties that are difficult to predict, which may include, but are not limited to, the factors listed in Part II, Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Forward-looking Statements” of this Report. As a provider of financial products and services, our results of operations may vary significantly in response to economic trends, interest rate changes, investment performance, claims experience, operating expenses and pricing. Caution should be used when extrapolating historical results or conditions to future periods.

Our actual results and financial condition may differ materially from the anticipated results and financial condition in any such forward-looking statements. Given these uncertainties or circumstances, readers are cautioned not to place undue reliance on such statements. We assume no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

GENERAL

We are a holding company for our insurance and asset management subsidiaries and are headquartered in Portland, Oregon. Our insurance businesses offer group and individual disability insurance, group life and accidental death and dismemberment (“AD&D”) insurance, and group dental insurance. Through our insurance subsidiaries, we have the authority to underwrite insurance products in all 50 states. Our asset management businesses offer full-service 401(k) plans, 457 plans, defined benefit plans, money purchase pension plans, profit sharing plans, 403(b) plans and non-qualified deferred compensation products and services through an affiliated broker-dealer. Our asset management businesses also offer investment advisory and management services, financial planning services, commercial mortgage loan origination and servicing, individual fixed annuities, group annuity contracts and retirement plan trust products.

Part I

MISSION AND STRATEGY

Our mission is to exceed customers’ needs for financial products and services in growing markets where the application of specialized expertise creates potential for superior shareholder returns. Our vision is to lead the financial services industry in integrity, expertise and customer service. We operate in select financial products and services growth markets and seek to compete on expertise, differentiation and customer service, while maintaining a strong financial position.

StanCorp’s long-term strategy includes:

| | • | | Maintaining strong growth rates in traditional risk acceptance businesses (disability and group life insurance). |

| | • | | Seek opportunities to further penetrate markets with limited presence to expand growth opportunities. |

| | • | | Further diversify our earnings base, and take advantage of market opportunities, demographic trends and capital synergies, by increasing our asset accumulation and asset administration businesses. |

Our ability to accomplish this strategy is dependent on a number of factors, some of which involve risks or uncertainties. See “Competition” and “Key Factors Affecting Results of Operations” below, Item 1A, “Risk Factors,” and Part II, Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Forward-looking Statements” of this Report.

DEVELOPMENT OF STANCORP

StanCorp, headquartered in Portland, Oregon, was incorporated under the laws of Oregon in 1998 as a parent holding company and conducts business through its subsidiaries: Standard Insurance Company (“Standard”); The Standard Life Insurance Company of New York; Standard Retirement Services, Inc. (“Standard Retirement Services”); StanCorp Equities, Inc. (“StanCorp Equities”); StanCorp Mortgage Investors, LLC (“StanCorp Mortgage Investors”); StanCorp Investment Advisers, Inc. (“StanCorp Investment Advisers”); and StanCorp Real Estate, LLC (“StanCorp Real Estate”). The Company, through our subsidiaries, has operations throughout the United States.

The Standardis a service mark of StanCorp and its subsidiaries and is used as a brand mark and marketing name by Standard and The Standard Life Insurance Company of New York. Through our subsidiaries, we have the authority to underwrite insurance products in all 50 states.

Standard, a leading provider of group insurance products and services and our largest subsidiary,

underwrites group and individual disability insurance and annuity products, group life and AD&D insurance, and group dental insurance, and provides retirement plan products. Founded in 1906, Standard is domiciled in Oregon, licensed in all states except New York, and licensed in the District of Columbia and the U.S. Territories of Guam and the Virgin Islands.

The Standard Life Insurance Company of New York was organized in 2000 and is licensed to provide group long term and short term disability, life, AD&D and dental insurance in New York.

Standard Retirement Services administers and services StanCorp’s retirement plans group annuity contracts and trust products. Retirement plans products are offered in all 50 states through Standard or Standard Retirement Services.

StanCorp Equities is a limited broker-dealer and member of the Financial Industry Regulatory Authority. StanCorp Equities serves as principal underwriter and distributor for group variable annuity contracts issued by Standard and as the broker of record for certain retirement plans using the trust platform. StanCorp Equities carries no customer accounts but provides supervision and oversight for the distribution of group variable annuity contracts and of the sales activities of all registered representatives employed by StanCorp Equities and its affiliates.

StanCorp Mortgage Investors originates and services fixed-rate commercial mortgage loans for the investment portfolios of our insurance subsidiaries. StanCorp Mortgage Investors also generates additional fee income from the origination and servicing of commercial mortgage loans participated to institutional investors.

StanCorp Investment Advisers is a Securities and Exchange Commission (“SEC”) registered investment adviser providing performance analysis, fund selection support, model portfolios and other investment advisory, financial planning and investment management services to its retirement plans clients, individual investors and subsidiaries of StanCorp.

StanCorp Real Estate is a property management company that owns and manages our Hillsboro, Oregon home office properties and other investment properties and manages the Portland, Oregon home office properties owned by Standard.

MARKET POSITION

Based on mid-year 2008 insurance industry in force premium statistics in the United States, provided by JHA and LIMRA International, we have leading market

| | |

| 4 | | STANCORP FINANCIAL GROUP, INC. |

positions with single digit market share in group long term and short term disability insurance and group life insurance. Based on a 2008 survey by LIMRA International we also have single digit market share for individual disability insurance. The positions are as follows:

| | • | | 4th largest provider of group long term disability insurance. |

| | • | | 5th largest provider of group short term disability insurance. |

| | • | | 8th largest provider of individual disability insurance. |

| | • | | 9th largest provider of group life insurance. |

FINANCIAL STRENGTH RATINGS

Financial strength ratings, which gauge claims paying ability, are an important factor in establishing the competitive position of insurance companies. Ratings are important in maintaining public confidence in our company and in our ability to market our products. Rating organizations continually review the financial performance and condition of insurance companies, including ours. In addition, credit ratings on our 10-year senior notes (“Senior Notes”) and junior subordinated debentures (“Subordinated Debt”) are tied to our financial strength ratings. A ratings downgrade could increase surrender levels for our annuity products, could adversely affect our ability to market our products and could increase costs of future debt issuances. Standard & Poor’s, Moody’s Investors Service, Inc. and A.M. Best Company provide financial strength and credit ratings.

Standard’s financial strength ratings as of February 2009 were:

| | • | | AA- (Very Strong) by Standard & Poor’s—4th of 20 ratings. |

| | • | | A1 (Good) by Moody’s—5th of 21 ratings. |

| | • | | A (Excellent) by A.M. Best—3rd of 13 ratings. |

CREDIT RATINGS

Standard & Poor’s, Moody’s Investors Service, Inc. and A.M. Best Company provide credit ratings on StanCorp’s Senior Notes. As of February 2009, ratings from these agencies were A-, Baa1 and bbb+, respectively. As of February 2009, Standard’s issuer credit rating from A.M. Best was a+.

Standard & Poor’s, Moody’s Investor Services, Inc. and A.M. Best Company also provide credit ratings on StanCorp’s Subordinated Debt. As of February 2009, ratings from these agencies were BBB, Baa2 and bbb-, respectively.

SEGMENTS

We operate through two reportable segments: Insurance Services and Asset Management, as well as an Other category, which includes net capital gains and losses, return on capital not allocated to the product segments, holding company expenses, interest on debt and adjustments made in consolidation and other unallocated expenses. Resources are allocated, and performance is evaluated at the segment level. The Insurance Services segment offers group and individual disability insurance, group life and AD&D insurance, and group dental insurance. The Asset Management segment offers full-service 401(k) plans, 457 plans, defined benefit plans, money purchase pension plans, profit sharing plans, 403(b) plans and non-qualified deferred compensation products and services through an affiliated broker-dealer. This segment also offers investment management and financial planning services, commercial mortgage loan origination and servicing, individual fixed annuities, group annuity contracts and retirement plan trust products.

Total revenues for 2008 were $2.67 billion, and included revenues of $2.46 billion from our Insurance Services segment and $333.2 million from our Asset Management segment. Net capital gains and losses are recorded in our Other category, and net capital losses were $128.8 million for 2008. Excluding net capital losses, revenue for 2008 from our Other category was $6.8 million. See Part II, Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Consolidated Results of Operations—Revenues” and Item 8, “Financial Statements and Supplementary Data—Notes to Consolidated Financial Statements—Note 3—Segments” for segment information regarding revenues, expenses and total assets for the years 2008, 2007 and 2006.

Insurance Services Segment

The Insurance Services segment sells disability, life, AD&D and dental insurance products to employer groups ranging in size from two lives to over 661,000 lives, and has about 29,000 group insurance policies in force, covering approximately 7.7 million employees as of December 31, 2008. This segment also sells disability insurance to individuals.

Our group insurance products are sold by sales representatives through independent employee benefit brokers and consultants. The sales representatives, who are employees of the Company, are compensated through salary and incentive compensation programs and are located in 41 field offices in principal metropolitan areas of

Part I

the United States. The field offices also provide sales support and customer service through field administrative staff. The Company’s arrangements with brokers include compensation established at the time of sale (commissions or fees), and, in some situations, also include compensation related to the overall performance of a block of business (performance related compensation). In most cases, the overall performance of a block of business is measured in terms of volume and persistency (customer retention).

Group long term disability insurance contributed 39.6% of 2008 premiums for the segment. Group long term disability insurance provides partial replacement of earnings to insured employees who become disabled for extended periods of time.

The Company’s basic long term disability product covers disabilities that occur during the policy period at both work and elsewhere. In order to receive long term disability benefits, an employee must be continuously disabled beyond a specified waiting period, which generally ranges from 30 to 180 days. The benefits usually are reduced by other income that the disabled employee receives from sources such as social security disability, workers compensation and sick leave. The benefits also may be subject to certain maximum amounts and benefit periods. Historically, approximately 50% of all claims filed under our long term disability policies close within 24 months. However, claims caused by more severe disabling conditions may be paid over much longer periods, including up to normal retirement age or longer.

Generally, group long term disability policies offer rate guarantees for periods from one to three years. While we can prospectively re-price and re-underwrite coverages at the end of these guarantee periods, we must pay benefits with respect to claims incurred during these periods without being able to increase guaranteed premium rates during the same periods.

Group life and AD&D insurance contributed 39.6% of 2008 premiums for the segment. Group life insurance products provide coverage to insured employees for a specified period and have no cash value (amount of cash available to an insured employee on the surrender of, or withdrawal from, the life insurance policy). Coverage is offered to insured employees and their dependents. AD&D insurance is usually provided in conjunction with group life insurance, and is payable after the accidental death or dismemberment of the insured in an amount based on the face amount of the policy or dismemberment schedule.

Group short term disability insurance contributed 10.2% of 2008 premiums for the segment. Our basic short term disability products generally cover only disabilities occurring outside of work. Short term disability insurance generally requires a short waiting period, ranging from one to 30 days, before an insured employee may receive benefits, with maximum benefit periods generally not exceeding 26 weeks. Group short term disability benefits also may be reduced by other income, such as sick leave, that a disabled insured employee may receive.

Group dental insurance contributed 3.6% of 2008 premiums for the segment. Group dental products provide coverage to insured employees and their dependents for preventive, basic and major dental expenses, and also include an option to purchase orthodontia benefits. We offer three dental plans including a traditional plan, a reduced cost plan and a cost containment plan, which are differentiated by levels of service and cost. Standard has a strategic marketing alliance with Ameritas Life Insurance Corp. (“Ameritas”), which offers Standard’s policyholders flexible dental coverage options and access to Ameritas’ nationwide preferred provider organization panel of dentists.

Individual disability insurance contributed 7.0% of 2008 premiums for the segment. The products include non-cancelable disability coverage, which provides insurance at a guaranteed fixed premium rate for the life of the contract, and guaranteed renewable coverage where premium rates are guaranteed for limited periods and subject to change thereafter. This segment also sells business overhead expense coverage, which reimburses covered operating expenses when the insured is disabled, and business equity buy-out coverage, which provides payment for the purchase, by other owners or partners, of the insured’s ownership interest in a business in the event of total disability. Non-cancelable disability insurance policies represented 70.1% of individual disability sales based on annualized new premiums for 2008.

Our individual disability insurance products are sold nationally by sales representatives through master general agents and brokers, primarily to physicians, lawyers, executives, other professionals and small business owners. The compensation paid to master general agents and brokers is based primarily on a percentage of premiums. Master general agents and some brokers are eligible for a bonus based on sales volume and persistency of business they have written.

| | |

| 6 | | STANCORP FINANCIAL GROUP, INC. |

Asset Management Segment

The Asset Management segment offers full-service 401(k) plans, 457 plans, defined benefit plans, money purchase pension plans, profit sharing plans, 403(b) plans and non-qualified deferred compensation products and services through an affiliated broker-dealer. This segment also offers investment management and financial planning services, commercial mortgage loan origination and servicing, individual fixed annuities, group annuity contracts and retirement plan trust products. Beginning in the third quarter of 2006, this segment included the former operations of Invesmart, Inc. (“Invesmart”), a national retirement financial services company. In the third quarter of 2007, this segment also added $1.7 billion of assets under administration acquired from DPA, Inc., a retirement business based in Portland, Oregon.

Investment services for 401(k), defined benefit, and other 401(a) qualified plans and governmental 457 plans are provided through a non-registered group annuity contract with third party brand name mutual funds through a separate account and, for certain plans, a stable value investment option managed by Standard. These plan services also are provided through a trust product offering third party brand name mutual funds. For the trust product offering, plans can choose from any mutual fund that our trading partners are able to trade. Mutual funds offered through the group annuity separate account as of December 31, 2008, are limited to those funds that have been evaluated through a due diligence process. Representative fund companies are: Black Rock Funds, Brandywine Fund, Inc., Davis Funds, Dodge & Cox, Fidelity Investments, Franklin Templeton, T. Rowe Price, and Vanguard Funds.

The 403(b) and non-qualified deferred compensation plan services are provided through a registered group variable annuity contract, with a stable value investment option managed by Standard and separate account investment options from AllianceBernstein, Alger, Allianz Global Investors, American Century Investments, Black Rock Funds, Davis Funds, Delaware Investments Mutual Funds, The Dreyfus Corporation, Federated Investors Funds, Fidelity Investments, Franklin Templeton, GE, Goldman Sachs, Lincoln National Funds, Morgan Stanley Funds, Neuberger & Berman Funds, Pimco Funds, Principal Funds, Royce Funds, T. Rowe Price, Universal Institutional Funds, Inc., Vanguard Funds, Van Kampen Funds and Victory Capital Management. Certain plan services also are provided through a trust product offering third party investment options. Funds offered in our

retirement plans are regularly evaluated for performance, expense ratios, risk statistics, style consistency, industry diversification and management through the investment advisory service we provide to our customers. Funds are added and removed as part of this evaluation process. StanCorp Investment Advisers provides fund performance analysis and selection support to 85% of our group annuity plan sponsors. All group annuity contracts are distributed by StanCorp Equities.

The target market for retirement plans is businesses with $1 million to $25 million in plan assets. Our retirement plans products and services are sold primarily through registered investment advisors, brokers, employee benefit consultants, and other distributors served by our sales representatives throughout the United States. These distributors are compensated usually based on a percentage of the deposits or assets under administration. Compensation is disclosed to the customer by either Standard or Standard Retirement Services. Most of our retirement plan customers receive financial, record keeping and administrative services, although the option is available to receive only financial and record keeping services or financial services alone.

The primary sources of revenue for the retirement plans business include plan administration fees, asset-based fees and investment income on general account assets under administration, a portion of which is credited to policyholders. In addition, premiums and benefits to policyholders reflect the conversion of retirement plan assets into life-contingent annuities, which is an option that can be selected by plan participants at the time of retirement.

In two third-party industry surveys for 2008, The Standard’s retirement plans business was recognized as follows:

| | • | | The Standard earned a total of five Best in Class awards in PLANSPONSOR magazine’s 2008 Defined Contribution Plan Survey. The Standard received one Best in Class award in the under $5 million in assets category, and four additional Best in Class awards in the $5 to $50 million in assets category. |

| | • | | In the Boston Research Group’s 2008 survey of small defined contribution plans (under $5 million in assets). The Standard was rated seventh in terms of overall satisfaction by plan sponsors. Twenty-two providers were included in the survey. |

In July 2007, Standard Retirement Services acquired DPA, Inc., a retirement business based in Portland, Oregon. The acquisition of DPA, Inc. added $1.7 billion to

Part I

assets under administration. Retirement plans assets under administration were $14.47 billion at December 31, 2008.

The individual annuity products sold by this segment are primarily fixed-rate and indexed deferred annuities, although we also market life-contingent immediate annuities. The target market for fixed-rate and indexed annuities is any individual seeking conservative investments to meet their retirement or other financial goals. The fixed-rate annuity product portfolio includes deferred annuities with initial interest rate guarantees generally ranging from one to six years and a full array of single premium immediate annuity income payment options. The Company launched an indexed annuity product in January 2006 and uses over the counter call-spread options to hedge the index performance of the policies.

Fixed-rate annuities are distributed through master general agents, brokers and financial institutions and compensation is primarily based on a percentage of premiums and deposits related to the business sold.

Master general agents are eligible for a bonus based on the volume of annuity business sold by financial institutions and brokers they coordinate.

Most of our annuity business deposits are not recorded as premiums, but rather are recorded as liabilities. Individual fixed annuity deposits earn investment income, a portion of which is credited to policyholders. Annuity premiums consist of premiums on life-contingent annuities, which are a small portion of total sales.

Our investment advisory business, StanCorp Investment Advisers, is a SEC-registered investment adviser providing performance analysis, fund selection support, model portfolios and other investment advisory and investment management services. Our target market is our retirement plan clients, individual investors with $250,000 to $2 million in portfolio assets and the subsidiaries of StanCorp.

Our commercial mortgage loans subsidiary, StanCorp Mortgage Investors, originates, underwrites and services, fixed-rate commercial mortgage loans, generally between $250,000 and $5 million or higher per loan for the investment portfolios of our insurance subsidiaries. It also generates additional fee income from the origination and servicing of commercial mortgage loans participated to institutional investors. The target market for commercial mortgage loans is small retail, office, and industrial properties located throughout the continental United States.

Other

In addition to our two segments, we report our holding company and corporate activity in “Other.” This category

includes net capital gains and losses on investments, return on capital not allocated to the product segments, holding company expenses, interest on debt, unallocated expenses and adjustments made in consolidation.

COMPETITION

Competition for sale of our products comes primarily from other insurers and financial services companies such as banks, broker-dealers and mutual funds. Some competitors have greater financial resources, offer a broader array of products and may have higher financial strength ratings. Pricing is a competitive issue in the markets we serve. We do not seek to compete primarily on price. While we believe our products and service provide superior value to our customers, a significant price difference between our products and those of some of our competitors may result in periods of declining new sales, reduced persistency (customer retention), lower premium growth, and increased sales force attrition. See “Key Factors Affecting Results of Operations—Pricing.”

KEY FACTORS AFFECTING RESULTS OF OPERATIONS

Group insurance is our largest business and represented 92%, 93% and 93% of total premiums for the years ended December 31, 2008, 2007 and 2006, respectively. In addition to competition, three primary factors can have a critical impact on the financial results of our Insurance Services segment operations: claims experience, economic conditions and pricing.

Claims Experience. We have a large and well-diversified group insurance business. However, claims experience can fluctuate widely, particularly from quarter to quarter. The predominant factors affecting claims experience are incidence (number of claims) and severity (length of time a disability claim is paid and the size of the claim). These factors can fluctuate widely within and between our insurance products.

Employment Levels and Benefits. The rate of wage and employment growth can influence premium growth in our group insurance business and impact the growth of assets under administration in our retirement plans business. In our group insurance business premium rates are based, in part, on total salaries covered. For our retirement plans business the growth in wages and employment affect the growth in assets for the retirement plans we administer, which is a primary driver of administrative fee revenue.

In addition, economic conditions can impact demand for the group insurance products we offer, and can increase competition as insurers compete to grow market share as overall market growth declines.

| | |

| 8 | | STANCORP FINANCIAL GROUP, INC. |

Interest Rates and Equity Markets. Our financial results are sensitive to changing interest rates. Changes in interest rates effect product pricing for our insurance businesses because premiums collected today must be invested to provide a return sufficient to meet the future claims of policyholders. For that reason, we closely monitor changes in interest rates and make changes to our pricing, as appropriate. Interest rates also affect the discount rates we use to establish reserves.

For those products in our asset accumulation businesses where deposits are invested in securities managed by the Company, achieving adequate interest rates is important to meet customer obligations. In addition, changes in equity markets also impact assets under administration for our retirement plans business impacting administrative fee revenue.

Pricing. One of the key components of our pricing decisions for many of our insurance products is the investment return available to us. In periods of decreasing interest rates, the returns available to us from our primary investments, fixed maturity securities and commercial mortgage loans, decline. This may require us to increase the price of some of our products in order to maintain our targeted returns. If our competitors do not make similar adjustments to their product pricing or if they have a higher return on investments, our products may be more expensive than those offered by competitors. Alternatively, in periods when interest rates are increasing, we may be able to reduce premium rates, and therefore reduce pricing pressure to customers. Given the negative financial consequences of under-pricing, we believe that our practice of maintaining a disciplined approach to product pricing provides the best long-term pricing stability, stable renewal pricing for our customers, higher levels of persistency, and therefore, the best long-term financial success for our company.

RISK MANAGEMENT

We manage risk through sound product design and underwriting, effective claims management, pricing discipline, distribution expertise, broad diversification of risk by customer geography, industry, size and occupation, maintenance of a strong financial position, maintenance of reinsurance and risk pool arrangements, and sufficient alignment of assets and liabilities to meet financial obligations.

Diversification of Products

We achieve earnings diversification by offering multiple insurance products such as group life, group long term

disability, and individual disability products. These products have differing price, market and risk characteristics. Our strategy is to further diversify our earnings base, and take advantage of market opportunities, demographic trends and capital synergies, by increasing our asset accumulation and asset administration businesses. The Company experienced a decline of 12.0% in assets under administration during 2008. The decrease in assets under administration was primarily due to declining equity markets. The lower levels of assets under administration were partially offset by continued new net deposit growth. The Company recognizes the current volatility in the capital markets and does not provide specific short-term guidance on overall asset growth.

Diversification by Customer Industry, Geography and Size

We seek to diversify risk by customer industry, geography and size measured by the number of insured employees. Over half of our group insurance premiums come from industries we believe to be resistant to the effects a recession may have on employment. These industries include the public sector, education, health care and utilities. Industries we believe are more likely to experience job growth during this recession represent approximately 47% of the U.S. workforce and approximately 69% of our block of group business. Industries we believe are more likely to experience job losses represent approximately 53% of the U.S. workforce, but only approximately 31% of our group business. In force premium distribution by industry, geography and customer size for group long term disability and group life products was as follows as of December 31, 2008:

| | | |

| Customer Industry | |

Public | | 28 | % |

Education | | 20 | |

Professional | | 10 | |

Manufacturing | | 10 | |

Health Care | | 10 | |

Finance | | 7 | |

Retail | | 1 | |

Services | | 2 | |

Utilities | | 1 | |

Other | | 11 | |

Total | | 100 | % |

| | | |

| Customer Geography | |

Northeast | | 15 | % |

Southeast | | 17 | |

Central | | 30 | |

West | | 38 | |

Total | | 100 | % |

Part I

| | | |

| Customer Size (Employees) | |

2-99 | | 13 | % |

100-2,499 | | 38 | |

2,500-7,499 | | 18 | |

7,500 and above | | 31 | |

Total | | 100 | % |

Reinsurance

In order to limit our losses from large exposures, we enter into reinsurance agreements with other insurance companies. We review our retention limits based on size and experience. The maximum retention limit per individual for group life and AD&D is $750,000. Our maximum retention limit for group disability insurance is $15,000 of monthly benefit per individual. During 2007, we increased our maximum retention limit from $5,000 to $5,500 of monthly benefit per individual for individual disability policies with effective dates on or after September 1, 2007. On certain business acquired from Minnesota Life Insurance Company (“Minnesota Life”), we have a maximum retention of $6,000 of monthly benefit per individual.

Standard participates in a reinsurance and third party administration arrangement with Northwestern Mutual Life Insurance (“Northwestern Mutual”) under which Northwestern Mutual group long term and short term disability products are sold using Northwestern Mutual’s agency distribution system. Generally, Standard assumes 60% of the risk, and receives 60% of the premiums for the policies issued. If Standard were to become unable to meet its obligations, Northwestern Mutual would retain the reinsured liabilities. Therefore, in accordance with an agreement with Northwestern Mutual, Standard established a trust for the benefit of Northwestern Mutual with the market value of assets in the trust equal to Northwestern Mutual’s reinsurance receivable from Standard. The market value of assets required to be maintained in the trust at December 31, 2008, was $221.7 million. Premiums assumed by Standard for the Northwestern Mutual business accounted for 3% of the Company’s total premiums for each of the three years 2008, 2007 and 2006. In addition to assuming risk, Standard provides product design, pricing, underwriting, legal support, claims management and other administrative services under the arrangement.

Standard maintains a strategic marketing alliance with Ameritas that offers Standard’s policyholders more flexible dental coverage options and access to Ameritas’ nationwide preferred provider organization panel of dentists. As part of this alliance, Standard and Ameritas entered into a

reinsurance agreement that provides for 21% of the net dental premiums written by Standard and the risk associated with these premiums to be ceded to Ameritas.

In addition to product-specific reinsurance arrangements, we maintain reinsurance coverage for certain catastrophe losses related to group life and AD&D. This agreement excludes nuclear, biological and chemical acts of terrorism. Through a combination of this agreement and our participation in a catastrophe reinsurance pool discussed below, we have coverage of up to $429.0 million per event.

Subsequent to the terrorist events of September 11, 2001, we entered into a catastrophe reinsurance pool with other insurance companies. This pool spreads catastrophe losses on group life and AD&D over 27 participating members. The annual fee paid by the Company in 2008 to participate in the pool was less than $30 thousand. As a member of the pool, we are exposed to maximum potential losses experienced by other participating members of up to $105.2 million for a single event for losses submitted by a single company and a maximum of $263.5 million for a single event for losses submitted by multiple companies. The Company’s percentage share of losses experienced by pool members will change over time as it is a function of our group life and AD&D in force relative to the total group life and AD&D in force for all pool participants. The reinsurance pool includes war or nuclear, biological and chemical acts of terrorism.

The Terrorism Risk Insurance Act of 2002 (“TRIA”), which has been extended through 2014, provides for federal government assistance to property and casualty insurers in the event of material losses due to terrorist acts on behalf of a foreign person or foreign interest. Due to the concentration of risk present in group life insurance and the fact that group life insurance is not covered under TRIA, an occurrence of a significant catastrophe or a change in the on-going nature and availability of reinsurance and catastrophe reinsurance could have a material adverse effect on the Company.

Asset/Liability and Interest Rate Risk Management

See Part II, Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources—Asset/Liability and Interest Rate Risk Management.”

INVESTMENTS

Investment management is an integral part of our business. Investments are maintained to ensure that asset

| | |

| 10 | | STANCORP FINANCIAL GROUP, INC. |

types and maturities are appropriate for the Company’s policy reserves and other liabilities so that we can meet our obligations to policyholders under a wide variety of economic conditions. A substantial portion of our insurance subsidiaries’ policy liabilities result from long term disability reserves that have proven to be very stable over time, and annuity products on which interest rates can be adjusted periodically, subject to minimum interest rate guarantees. Policyholders or claimants may not withdraw funds from the large block of disability reserves. Instead, claim payments are issued monthly over periods that may extend for many years. Holding these stable long-term reserves makes it possible to allocate a significant portion of invested assets to long-term fixed-rate investments, including commercial mortgage loans. The ability to allocate a significant portion of investments to commercial mortgage loans, combined with StanCorp Mortgage Investors’ unique expertise with respect to its market niche for fixed-rate commercial mortgage loans, allows us to enhance the yield on the overall investment portfolio beyond that available through fixed maturity securities with an equivalent risk profile. See Part II, Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources—Investing Cash Flows” and Item 8, “Financial Statements and Supplementary Data—Notes to Consolidated Financial Statements.”

REGULATION

State and Federal Laws and Regulations

Standard sells its products in and is regulated by all states except New York, and sells its products and is regulated in the District of Columbia. The Standard Life Insurance Company of New York sells its products in and is regulated by New York. The insurance industry in the United States is subject to extensive regulation. Such regulation relates to, among other things, terms and provisions of insurance policies, market conduct practices, maintenance of capital and payment of distributions, and financial reporting on a statutory basis of accounting.

We market registered group variable annuity products, which are part of a registered investment company under the Investment Company Act of 1940. These products are subject to that act and the rules under which, among other things, regulate the relationship between a registered investment company and its investment adviser.

As registered investment advisers, StanCorp Investment Advisers is subject to regulation under the Investment Advisers Act of 1940. This Act establishes, among other

things, recordkeeping and reporting requirements, disclosure requirements, limitations on transactions between the adviser’s account and an advisory client’s account, limitations on transactions between the accounts of advisory clients, and general anti-fraud prohibitions.

The Sarbanes-Oxley Act of 2002 and rules promulgated by the SEC and the New York Stock Exchange thereunder have imposed substantial regulations and disclosure requirements in the areas of corporate governance (including director independence, director selection and audit committee, corporate governance committee and compensation committee responsibilities), equity compensation plans, auditor independence, pre-approval of auditor fees and services, disclosure of executive compensation and internal control procedures.

Violation of applicable laws and regulations can result in legal or administrative proceedings, which can result in fines, penalties, cease and desist orders or suspension or expulsion of our license to sell insurance in a particular state.

Capital Requirement—Risk-Based Capital

The National Association of Insurance Commissioners has a tool to aid in the assessment of the statutory capital and surplus of life and health insurers. This tool, known as Risk-based Capital (“RBC”), augments statutory minimum capital and surplus requirements. RBC employs a risk-based formula that applies prescribed factors to the various risk elements inherent in an insurer’s business to arrive at minimum capital requirements in proportion to the amount of risk assumed by the insurer. The RBC model determines an appropriate Company Action Level based on the Company’s business and assets. Capital below the Company Action Level RBC would require the Company to prepare and submit an RBC plan to the commissioner of the state of domicile outlining the capital level it plans on maintaining. Capital below the Authorized Control Level, which is 50% of the company action level, is the capital level at which the state of domicile is authorized to take whatever regulatory actions considered necessary to protect the best interest of the policyholders and creditors of the insurer.

State insurance departments require insurance enterprises to maintain minimum levels of capital and surplus. As of December 31, 2008, the insurance subsidiaries’ capital was approximately 314% of the company action level of RBC required by regulators, which is 629% of the authorized control level RBC required by our states of domicile. See Part II, Item 7, “Management’s

Part I

Discussion and Analysis of Financial Condition and Results of Operations—Capital Management.”

EMPLOYEES

At December 31, 2008, StanCorp and its subsidiaries had 3,436 full-time equivalent employees, 69% of which were located in Portland, Oregon and the surrounding metropolitan area. At December 31, 2008, none of the Company’s employees were represented by unions.

Risk factors that may affect our business are as follows:

| | • | | Our reserves for future policy benefits and claims related to our current and future business, as well as reserves related to businesses we may acquire in the future, may prove to be inadequate—For certain of our product lines, we establish and carry as a liability actuarially determined reserves that are calculated to meet our obligations for future policy benefits and claims. These reserves do not represent an exact calculation of our future benefit liabilities but are instead estimates based on assumptions, which can be materially affected by changes in the national or regional economy, changes in social perceptions about work ethics, emerging medical perceptions regarding physiological or psychological causes of disability, emerging or changing health issues and changes in industry regulation. Claims experience on our products can fluctuate widely from period to period. If actual events vary materially from our assumptions used when establishing the reserves to meet our obligations for future policy benefits and claims, we may be required to increase our reserves, which could have a material adverse effect on our business, financial position, results of operations or cash flows. |

| | • | | Differences between actual claims experience and underwriting and reserving assumptions may adversely affect our financial results—Our long term disability products provide coverage for claims incurred during the policy period. Generally, group policies offer rate guarantees for periods from one to three years. While we can prospectively re-price and re-underwrite coverages at the end of these guarantee periods, we must pay benefits with respect to claims incurred during these periods without being able to increase guaranteed premium rates during these periods. Historically, approximately 50% of all claims filed under our long term disability policies close within 24 months. However, claims caused by more severe |

| | disabling conditions may be paid over much longer periods, including, in some cases, up to normal retirement age or longer. Longer duration claims, in addition to a higher volume of claims than we expect, expose us to the possibility that we may pay benefits in excess of the amount that we anticipated when the policy was underwritten. The profitability of our long term disability products is thus subject to volatility resulting from the difference between our actual claims experience and our assumptions at the time of underwriting. |

| | • | | We are exposed to concentration risk on our group life insurance business—Due to the nature of group life insurance coverage, we are subject to geographical concentration risk from the occurrence of a catastrophe. |

| | • | | Catastrophic losses from a disease pandemic could have an adverse effect on us—Our life insurance operations are exposed to the risk of loss from an occurrence of catastrophic mortality caused by a disease pandemic, such as could arise from the avian flu, which could have a material adverse effect on our business, financial position, results of operations or cash flows. |

| | • | | Catastrophic losses from terrorism or other factors could have an adverse effect on us—An occurrence of a significant catastrophic event, including natural disasters, terrorism, or other disasters, or a change in the nature and availability of reinsurance and catastrophe reinsurance, could have a material adverse effect on our business, financial position, results of operations or cash flows. |

| | • | | We may be exposed to disintermediation risk during periods of increasing interest rates—In periods of increasing interest rates, withdrawals of annuity contracts may increase as policyholders seek to invest in investments with higher perceived returns. This process, referred to as disintermediation, may lead to cash outflows. These outflows may require investment assets to be sold at a time when the prices of those assets are adversely affected by the increase in interest rates, which may result in realized investment losses. A significant portion of our investment portfolio consists of commercial mortgage loans, which are relatively illiquid, thus increasing our liquidity risk in the event of disintermediation during a period of rising interest rates. |

| | |

| 12 | | STANCORP FINANCIAL GROUP, INC. |

| | • | | Our profitability may be adversely affected by declining interest rates—During periods of declining interest rates, annuity products may be relatively more attractive investments, resulting in increases in the percentage of policies remaining in force from year to year during a period when our new investments carry lower returns. During these periods, lower returns on our investments could prove inadequate for us to meet contractually guaranteed minimum payments to holders of our annuity products. In addition, the profitability of our life and disability insurance products can be affected by declining interest rates. A factor in pricing our insurance products is prevailing interest rates. Longer duration claims and premium rate guarantee periods can expose us to interest rate risk when portfolio yields are less than those assumed when pricing these products. Mortgages and bonds in our investment portfolio are more likely to be prepaid or redeemed as borrowers seek to borrow at lower interest rates, and we may be required to reinvest those funds in lower interest-bearing investments. |

| | • | | Our investment portfolio is subject to risks of market value fluctuations, defaults, delinquencies and liquidity—Our general account investments primarily consist of fixed maturity securities, commercial mortgage loans and real estate. The market values of our investments vary with changing economic and market conditions and interest rates. In addition, we are subject to default risk on our fixed maturity securities portfolio and its corresponding impact on credit spreads, and delinquency and default risk on our commercial mortgage loans. Due to declining values of fixed maturity securities and the related decline in market activity, our fixed maturity securities portfolio has become less liquid. Our commercial mortgage loans are also relatively illiquid. We may have difficulty selling fixed maturity securities and commercial mortgage loans at attractive prices, in a timely manner, or both if we require significant amounts of cash on short notice. |

| | • | | Our business is subject to significant competition—Each of our business segments faces competition from other insurers and financial services companies, such as banks, broker-dealers, mutual funds, and managed care providers for employer groups, individual consumers and distributors. Since many of our competitors have greater financial resources, offer a broader array of products and, with respect to other |

| | insurers, may have higher financial strength ratings than we do, the possibility exists that any one of our business segments could be adversely affected by competition, which in turn could have a material adverse effect on our business, financial position, results of operations or cash flows. |

| | • | | A significant downgrade in our financial strength ratings may negatively affect our business—Financial strength ratings, which rate our claims paying ability, are important factors in establishing the competitive position of insurance companies. Ratings are important to maintaining public confidence in our company and in our ability to market our products. Rating organizations continually review the financial performance and condition of insurance companies, including our company. A significant ratings downgrade could increase our surrender levels for our annuity products, could adversely affect our ability to market our products, could increase costs of future debt issuances, and could thereby have a material adverse effect on our business, financial position, results of operations or cash flows. |

| | • | | Our profitability may be affected by changes in state and federal regulation—Our business is subject to comprehensive state regulation and supervision throughout the United States. While we cannot predict the impact of potential or future state or federal legislation or regulation on our business, future laws and regulations, or the interpretation thereof, could have a material adverse effect on our business, financial position, results of operations or cash flows. |

| | • | | Our business is subject to litigation risk—In the normal course of business, we are a plaintiff or defendant in actions arising out of our insurance business and investment operations. We are from time to time involved in various governmental and administrative proceedings. While the outcome of any pending or future litigation cannot be predicted, as of the date hereof, we do not believe that any pending litigation will have a material adverse effect on our results of operations and financial condition. However, no assurances can be given that such litigation would not materially and adversely affect our business, financial position, results of operations or cash flows. |

Part I

| | • | | The concentration of our investments in California may subject us to losses resulting from an economic downturn as well as certain catastrophes in this state—Our commercial mortgage loans are concentrated in the western region of the U.S., particularly in California. Due to this concentration, we are exposed to potential losses resulting from the risk of an economic downturn in California as well as to certain catastrophes, such as earthquakes and fires, which may affect the region. Although we diversify our commercial mortgage loan portfolio within California by both location and type of property in an effort to reduce earthquake exposure, such diversification may not eliminate the risk of such losses, which could have a material adverse effect on our business, financial position, results of operations or cash flows. |

| | • | | We may be exposed to environmental liability from our commercial mortgage loan and real estate investments—As a commercial mortgage lender, we customarily conduct environmental assessments prior to making commercial mortgage loans secured by real estate and before taking title through foreclosure to real estate collateralizing delinquent commercial mortgage loans held by us. Based on our environmental assessments, we believe that any compliance costs associated with environmental laws and regulations or any remediation of affected properties would not have a material adverse effect on our results of operations or financial condition. However, we cannot provide assurance that material compliance costs will not be incurred by us. |

| | • | | As a holding company, we depend on the ability of our subsidiaries to transfer funds to us in sufficient amounts to pay dividends to shareholders, make payments on debt securities and meet our other obligations—We are a holding company for our insurance and asset management subsidiaries and do not have any significant operations of our own. Dividends and permitted payments from our subsidiaries are our principal source of cash to pay dividends to shareholders, make payments on debt securities and meet our other obligations. As a result, our ability to pay dividends to shareholders and interest payments on debt securities primarily will depend upon the receipt of dividends and other distributions from our subsidiaries. |

Many of our subsidiaries are non-insurance businesses and have no regulatory restrictions on dividends. Our insurance subsidiaries, however, are regulated by

insurance laws and regulations that limit the maximum amount of dividends, distributions and other payments that they could declare and pay to us without prior approval of the states in which the subsidiaries are domiciled. Under Oregon law, Standard Insurance Company (“Standard”) may pay dividends only from the earned surplus arising from its business. Oregon law gives the Director of the Oregon Department of Consumer and Business Services—Insurances Division (“Oregon Insurance Division”) broad discretion regarding the approval of dividends. Oregon law requires us to receive the prior approval of the Oregon Insurance Division to pay a dividend if such dividend exceeds certain statutory limitations; however, it is at the Oregon Insurance Division’s discretion to request prior approval of dividends at any time. See Part II, Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Capital Management—Dividends from Insurance Subsidiaries.”

| | • | | Our ability to refinance debt and raise capital in future years depends not only on contributions from our subsidiaries but also on market conditions and availability of credit in the market—We do not have any significant debt maturities in the short-term. Our 10-year Senior Notes (“Senior Notes”) of $250 million will mature in September 2012, and our junior subordinated debt (“Subordinated Debt”) of $300 million will mature in 2067 with a call option in 2017. We maintain a $200 million senior unsecured revolving credit facility (“Facility”) for general corporate purposes, which will expire on June 15, 2013 and had no outstanding balance on December 31, 2008. The Facility is composed of a syndication of six banks. Commitments from the banks toward the available line of credit range from $10.0 million to $52.5 million per bank. Should a bank from this syndication default, the available line of credit would be reduced by that bank’s commitment toward the line. At no time since the inception of the Facility agreement 2.5 years ago has the company drawn down funds in excess of $25 million on the line. For a full discussion of debt maturities See Part II, Item 8, “Financial Statements and Supplementary Data—Notes to Consolidated Financial Statements—Note 9—Long-Term Debt.” |

| | • | | Our business may be affected by employment and wage levels—Factors in the growth of StanCorp’s group insurance and retirement plans businesses are |

| | |

| 14 | | STANCORP FINANCIAL GROUP, INC. |

| | the employment levels, benefit offerings, and salary and wage growth of its employer groups. Current economic conditions may cause our employer groups to experience lower levels of insured employees, to limit benefit offerings, or to reduce or slow the growth of wage levels. If these outcomes arise they may adversely affect premium levels for our group businesses and revenues in our retirement plans business. |

| | • | | Our profitability may be adversely affected by declining equity markets—Current economic conditions have resulted in a substantial decline in U.S. and global equity markets. The value of equity assets under administration is a significant component from which our administrative fee income is derived and our revenue from administrative fees was reduced as a result of the decreased equity values. Sustained equity market declines could result in further decreases in the value of the assets under administration in our retirement plans, and could further reduce our ability to earn administrative fee income derived from the value of those assets. |

| | • | | Declining equity markets could effect the funding status of Company sponsored pension plans—Our estimates of liabilities and expenses for pension and other post-retirement benefits incorporate significant assumptions including the rate used to discount the future estimated liability, the long-term rate of return on plan assets and assumptions relating to the employee work force. A decline in the rate of return on plan assets or in the discount rate, or a change in workforce assumptions could affect our results of operations or shareholders’ equity in a particular period. We may have to contribute more cash or record higher pension-related expenses in future periods as a result of decreases in the value of investments held by the Company’s plans. |

| | • | | A continuing US recession or continued disruption in global financial markets could adversely affect us—A continuing U.S. recession, or a continued disruption in the global financial markets, present risks and uncertainties that we currently cannot predict. If the current economic downturn conditions continue or worsen we face risks that may include: |

| | • | | Declines in revenues and profitability as a result of lower levels of insured employees by our customers, including loss of employer groups due to business bankruptcy or failure. |

| | • | | Declines in revenues and profitability as a result of lower levels of assets under administration. |

| | • | | Increased pricing pressure and competition as customers seek to reduce benefit costs. |

| | • | | Reduction in value of our general account investment portfolio. |

| | • | | Reductions to our banking group or to our committed credit availability due to combinations or failures of financial institutions. |

| | • | | Increases in corporate tax rates to finance government spending programs. |

| Item 1B. | | Unresolved Staff Comments |

None.

Principal properties owned by Standard Insurance Company (“Standard”) and used by the Company consist of two office buildings in downtown Portland, Oregon: the Standard Insurance Center, with approximately 460,000 square feet; and the Standard Plaza, with approximately 220,000 square feet. Both of our business segments use the facilities described above. The Company also owns two buildings with 72,000 square feet of office space each in Hillsboro, Oregon, which are used by StanCorp Mortgage Investors, LLC and our group insurance claims operations. In addition, Standard leases approximately 160,000 square feet of office space located in downtown Portland, Oregon, for home office and claims operations and 60,000 square feet of offsite storage. The Company leases 67 offices under commitments of varying terms to support its sales and regional processing offices throughout the United States. Management believes that the capacity and types of facilities are suitable and adequate. See Part II, Item 8, “Financial Statements and Supplementary Data—Notes to Consolidated Financial Statements—Note 1 Summary of Significant Accounting Policies—Property and equipment, net.”

| Item 3. | | Legal Proceedings |

In the normal course of business, the Company is involved in various legal actions and other state and federal proceedings. A number of actions or proceedings were pending as of December 31, 2008. In some instances, lawsuits include claims for punitive damages and similar types of relief in unspecified or substantial amounts, in addition to amounts for alleged contractual liability or other compensatory damages. In the opinion of management, the ultimate liability, if any, arising from the

Part I

actions or proceedings is not expected to have a material adverse effect on the Company’s business, financial position, results of operations or cash flows.

| Item 4. | | Submission of Matters to a Vote of Security Holders |

There were no matters submitted to a vote of StanCorp’s shareholders during the fourth quarter of 2008.

| Item 4A. | | Executive Officers of the Registrant |

The information with respect to executive officers is set forth pursuant to General Instruction G of Form 10-K.

The following table sets forth the executive officers of StanCorp:

| | | | |

| Name | | Age (as of

February 27,

2009) | | Position |

Floyd F. Chadee | | 52 | | Senior Vice President and Chief Financial Officer of StanCorp and Standard Insurance Company |

Scott A. Hibbs* | | 47 | | Vice President, Asset Management Group of Standard Insurance Company |

Kim W. Ledbetter*(1) | | 56 | | Senior Vice President, Asset Management Group of Standard Insurance Company |

J. Gregory Ness | | 51 | | President and Chief Operating Officer of StanCorp and Standard Insurance Company |

David M. O’Brien* | | 52 | | Senior Vice President Information Technologies of Standard Insurance Company |

Eric E. Parsons | | 60 | | Chairman and Chief Executive Officer of StanCorp and Standard Insurance Company |

Karen M. Weisz* | | 41 | | Vice President Human Resources and Corporate Services of Standard Insurance Company |

Michael T. Winslow | | 54 | | Senior Vice President and General Counsel of StanCorp and Standard Insurance Company |

| | * | | Denotes an officer of a subsidiary who is not an officer of StanCorp but who is considered an “executive officer” of StanCorp under the regulations of the Securities and Exchange Commission. |

| | (1) | | Mr. Ledbetter retired from his position with the Company effective January 2, 2009. |

Set forth below is biographical information for the executive officers of StanCorp:

Floyd F. Chadee, Ph.D., FSA, has been senior vice president and chief financial officer of StanCorp and Standard Insurance Company (“Standard”) since April 2008. Prior to this position, Mr. Chadee served as senior vice president and chief financial officer at Assurant Employee Benefits, a part of Assurant, Inc., and had been with Assurant Employee Benefits since 1998.

Scott A. Hibbshas been vice president, Asset Management Group of Standard since January 2009. Since September 2007, Mr. Hibbs was a vice president for the Insurance Services group under Mr. Ness, which included responsibility for the individual disability insurance area and The Standard Life Insurance Company of New York. From July 2005 to September 2007 Mr. Hibbs was vice president for the Asset Management group under Mr. Ledbetter, which included responsibility for StanCorp Investment Advisers, Inc. (“StanCorp Investment Advisors”). From July 2004 to July 2005, Mr. Hibbs was vice president of corporate strategy and business development. Prior to July 2004, Mr. Hibbs was assistant vice president of investor relations and financial planning. Mr. Hibbs has been with the Company since 2000.

Kim W. Ledbetter, FSA, CLU, was senior vice president, Asset Management group of Standard from the Company’s segment realignment in January 2006 until January 2, 2009. Mr. Ledbetter retired from Standard on January 2, 2009. From June 2004 to January 2006, Mr. Ledbetter was senior vice president, asset management and individual disability of Standard, which included responsibility for Standard’s investment operations, including StanCorp Mortgage Investors, LLC (“StanCorp Mortgage Investors”), StanCorp Investment Advisers, our real estate department, and the individual insurance and retirement plans divisions. From 1997 to June 2004, Mr. Ledbetter was senior vice president, retirement plans division of Standard.

J. Gregory Ness, LLIF, has been president and chief operating officer of StanCorp and Standard since September 2008. Prior to this appointment, Mr. Ness served as senior vice president, Insurance Services group of Standard since the Company’s segment realignment in January 2006. From April 2004 to January 2006, Mr. Ness was senior vice president, group insurance division of Standard. From 1999 to April 2004, Mr. Ness was senior vice president, investments of Standard.

David M. O’Brien has been senior vice president of information technology at Standard since June 2006,

| | |

| 16 | | STANCORP FINANCIAL GROUP, INC. |

and was designated as an executive officer effective in January 2009. From May 2004 to June 2006, Mr. O’Brien was vice president of information technology. Prior to joining Standard in 2004, Mr. O’Brien served as chief information officer for FEI Company.

Eric E. Parsons has been chairman and chief executive officer of StanCorp and Standard since May 2004. Mr. Parsons has served as chief executive officer since January 2003 and was president from May 2002 until September 2008. Mr. Parsons was senior vice president and chief financial officer of StanCorp from its incorporation until 2002 and was chief financial officer of Standard from 1998 through 2002.

Karen M. Weisz has been vice president of human resources and corporate services for Standard since January

2009. From January 2008 to January 2009, Ms. Weisz was vice president of human resources. Prior to joining Standard, Ms. Weisz served as human resources director of new and emerging platform business groups at Intel Corporation and served Intel in various other human resource functions for more than 12 years.

Michael T. Winslow, JD, has been senior vice president and general counsel of StanCorp and Standard since July 2004. Mr. Winslow has also performed the duties of assistant corporate secretary since February 2007. From 2001 to July 2004, Mr. Winslow was vice president, general counsel and corporate secretary of StanCorp and Standard. Prior to joining StanCorp, Mr. Winslow served as assistant general counsel and chief compliance officer for PacifiCorp.

Part II

| Item 5. | | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

StanCorp’s common stock is listed on the New York Stock Exchange under the symbol “SFG.” As of February 23, 2009, there were 38,712 shareholders of record of common stock.

The following tables set forth the high and low sales prices as reported by the New York Stock Exchange at the close of the trading day and cash dividends paid per share of common stock by calendar quarter:

| | | | | | | | | | | | |

| | | 2008 |

| | | 4th Qtr | | 3rd Qtr | | 2nd Qtr | | 1st Qtr |

High | | $ | 50.48 | | $ | 54.00 | | $ | 55.28 | | $ | 51.77 |

Low | | | 23.92 | | | 43.13 | | | 46.96 | | | 42.96 |

Dividend Paid | | | 0.75 | | | — | | | — | | | — |

| | | | | | | | | | | | |

| | | 2007 |

| | | 4th Qtr | | 3rd Qtr | | 2nd Qtr | | 1st Qtr |

High | | $ | 55.13 | | $ | 52.79 | | $ | 52.89 | | $ | 49.82 |

Low | | | 49.28 | | | 41.44 | | | 46.99 | | | 44.88 |

Dividend Paid | | | 0.72 | | | — | | | — | | | — |

The declaration and payment of dividends in the future is subject to the discretion of StanCorp’s board of directors. It is anticipated that annual dividends will be paid in December of each year depending on StanCorp’s financial condition, results of operations, cash requirements, future prospects, regulatory restrictions on the distributions from the insurance subsidiaries, the ability of the insurance subsidiaries to maintain adequate capital and other factors deemed relevant by StanCorp’s board of directors. See Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Capital Management.” See also Part I, Item 1A, “Risk Factors.”

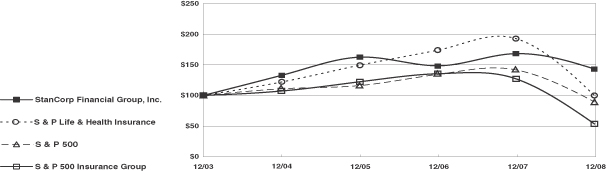

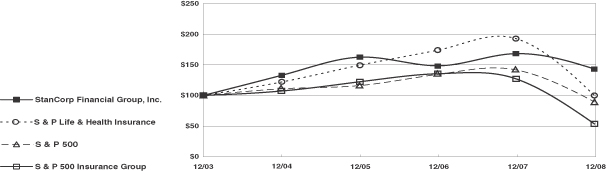

The following graph provides a comparison of the cumulative total shareholder return on the Company’s common stock with the cumulative total return of the Standard & Poor’s (“S&P”) 500 Index, the S&P Life and Health Insurance Index and the S&P Insurance Group Index. The comparison assumes $100 was invested on December 31, 2003, in the Company’s common stock and in each of the foregoing indexes, and assumes the reinvestment of dividends. The graph covers the period of time beginning December 31, 2003, through December 31, 2008.

|

|

Comparison of Five Year Cumulative Total Return Among StanCorp Financial Group, Inc., the S&P 500 Index, the S&P Life & Health Insurance Index and the S&P 500 Insurance Group |

| | |

| 18 | | STANCORP FINANCIAL GROUP, INC. |

From time to time, the board of directors has authorized share repurchase programs. Share repurchases are to be effected in the open market or in negotiated transactions in compliance with the safe harbor provisions of Rule 10b-18 under regulations of the Securities Exchange Act of 1934 (“Exchange Act”). Execution of the share repurchase program is based upon management’s assessment of market conditions for its common stock and other potential growth opportunities. On May 7, 2007, the board of directors authorized a share repurchase program of up to 6.0 million shares of StanCorp common stock. The share repurchase program will be effected in the open market or in negotiated transactions, and it replaced our previous share repurchase program, which had 1.2 million shares remaining that were canceled upon authorization of the new program. On November 3, 2008, the board of directors extended the expiration date of the share repurchase program to December 31, 2009.

During 2008, the Company repurchased 0.5 million shares of common stock at a total cost of $24.9 million for a volume weighted-average price of $47.31 per common share. At December 31, 2008, there were 0.9 million shares remaining under the Company’s current share repurchase program. During 2008, the Company acquired 5,245 shares of common stock from executive officers and directors to cover tax liabilities of these officers and directors resulting from the release of performance-based shares and retention-based shares at a total cost of $0.3 million for a volume weighted-average price of $51.33 per common share. Repurchases are made at market prices on the date of repurchase. Information required by Item 5 with respect to securities authorized for issuance under equity compensation plans is contained in Part III, Item 12 of this Form 10-K.

The following table sets forth share purchases made, for the periods indicated.

| | | | | | | | | |

| | | (a) Total Number of

Shares Purchased | | (b) Average Price

Paid per Share | | (c) Total Number

of Shares Purchased

as Part of Publicly

Announced Plans

or Programs | | (d) Maximum Number

of Shares that May Yet be Purchased Under

the Plans or Programs |

Period: | | | | | | | | | |

October 1-31, 2008 | | 20,000 | | $ | 30.78 | | 20,000 | | 894,800 |

November 1-30, 2008 | | — | | | — | | — | | 894,800 |

December 1-31, 2008 | | — | | | — | | — | | 894,800 |

| | |

| | | | |

| | |

| | | 20,000 | | | 30.78 | | 20,000 | | |

Part II

| Item 6. | | Selected Financial Data |

The following financial data at or for the years ended December 31, should be read in conjunction with Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and Item 8, “Financial Statements and Supplementary Data.”

| | | | | | | | | | | | | | | | | | | | |

| (In millions—except share data) | | 2008 | | | 2007 | | | 2006 | | | 2005 | | | 2004 | |

Income Statement Data: | | | | | | | | | | | | | | | | | | | | |