UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-09253

Wells Fargo Funds Trust

(Exact name of registrant as specified in charter)

525 Market St., San Francisco, CA 94105

(Address of principal executive offices) (Zip code)

C. David Messman

Wells Fargo Funds Management, LLC

525 Market St., San Francisco, CA 94105

(Name and address of agent for service)

Registrant’s telephone number, including area code: 800-643-9691

Date of fiscal year end: February 28, 2003

Date of reporting period: August 31, 2003

ITEM 1. REPORT TO SHAREHOLDERS

WELLS FARGO

FUNDS

Wells Fargo Outlook Funds®

Semi-Annual Report

Wells Fargo Outlook Today Fund®

Wells Fargo Outlook 2010 FundSM

Wells Fargo Outlook 2020 FundSM

Wells Fargo Outlook 2030 FundSM

Wells Fargo Outlook 2040 FundSM

August 31, 2003

TABLEOFCONTENTS

NOT FDIC INSURED–NO BANK GUARANTEE–MAY LOSE VALUE

��

This page is intentionally left blank —

| | | OUTLOOKFUNDSSHAREHOLDERLETTER |

|

DEARVALUEDSHAREHOLDER,

We are pleased to provide you with this Wells Fargo Outlook Funds® semi-annual report for the six-month period ended August 31, 2003. On the following pages, you will find a discussion of the Wells Fargo Outlook Funds, including performance highlights, strategic outlook, and facts and figures about each Fund’s portfolio.

THE ECONOMY: A WEAK RECOVERY

With the economy mired in weakness at the beginning of the reporting period, the Federal Reserve Board (the Fed) cut short-term interest rates from 1.25% to 1%, the lowest level in half a century. Still, unemployment remained relatively high and a record fiscal year 2003 federal budget deficit suggested that tax revenues were not growing nearly fast enough to cover spending demands of the war and other programs. On the plus side, consumer spending remained a positive factor for the economy. In the final months of the period, business confidence improved, followed by a gradual increase in new orders. Although firms remained cautious about increased hiring, the number of layoff announcements had fallen to a two-year low.

STOCKS: STRONGEST RALLY IN FOUR YEARS

The S&P 500 Index returned 20.87% for the six-month reporting period, with small- and mid-cap domestic stocks outperforming large cap stocks. Similar to how uncertainty leading up to the war in Iraq caused stocks to stumble in early 2003, the war’s launch and relatively brief engagement caused stocks to rally as investors became more confident about the future. In the early stages of the rally, stronger sentiment drove the market higher—particularly hopes that the economy was not as fragile as investors feared. By period end, the market was driven by news about the improving health of the economy.

BONDS: BEGINNING TO WANE

Generally speaking, bonds have done well over the past three years, providing a strong counterpoint to declining stocks during that time. However, long- and intermediate-term U.S. government bonds underperformed equities during the reporting period. Returns for mortgage-backed bonds were restrained by record financing early in the period, as investors in such bonds saw their capital returned earlier than expected. Later in the period, bond yields—and hence mortgage rates—began increasing, the cost of borrowing rose sharply and the rate of mortgage refinancing declined.

LOOKING AHEAD: POSITIVE OUTLOOK FOR STOCKS COULD SIGNAL A CHALLENGING TIME FOR BONDS

An improving economy could be a positive sign for stocks, and investors are hopeful of the possibility of low interest rates, contained inflation and increased corporate profits. Such an environment is typically more challenging for bonds, however, because interest rates typically rise when the economy strengthens. Worsening federal budget deficits are also a major concern, since massive U.S. government borrowing would exert upward pressure on interest rates and inflation. Although some of the U.S. dollar’s weakness has unwound lately, the dollar’s fall over the past twelve months should continue to boost corporate earnings overseas. The improvement in sentiment towards the U.S. dollar makes the currency a little more attractive, although it continues to be weighed down by its relative overvaluation and the unattractive level of U.S. interest rates.

During this period of mixed economic data, it is important to ensure that your investment portfolio is properly allocated. The Wells Fargo Outlook Funds are globally diversified allocation funds designed to maximize assets while gradually reducing the potential for investment risk over specific periods of time. Each Wells Fargo Outlook Fund’s portfolio may be allocated across asset classes covering a variety of equity, fixed-income and cash investments and may include international exposure.

We would like to thank you for your investment in Wells Fargo Funds. Please know that through each market cycle, we are committed to helping you meet your financial needs. If you have any questions about your investment, please contact your investment professional or call us at 1-800-222-8222. You may also visit our Web site at www.wellsfargofunds.com.

Sincerely,

Karla M. Rabusch

President

Wells Fargo Funds

1

| WELLSFARGOOUTLOOKFUNDS | | PERFORMANCEHIGHLIGHTS |

|

WELLSFARGOOUTLOOKFUNDS

INVESTMENT OBJECTIVE

Each of the Wells Fargo Outlook Funds (each, a Fund, and collectively, the Funds) seeks to provide investors with an asset allocation strategy designed to maximize assets for retirement or for other purposes consistent with the quantitatively measured risk that investors, on average, may be willing to accept given their investment time horizons.

ADVISER

Wells Fargo Funds Management, LLC

SUB-ADVISER

Barclays Global Fund Advisors

FUND MANAGERS

Team Managed

INCEPTION DATE

03/01/94

PERFORMANCE HIGHLIGHTS

During most of the six-month reporting period that ended August 31, 2003, economic recovery remained sluggish, although near the end of the period the recovery began to gain momentum. During the period, the S&P 500 Index returned 20.87%, with small- and mid-cap stocks being the best performers.

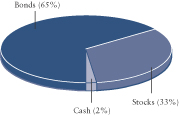

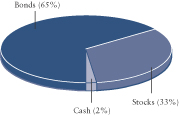

Performance of all of the Wells Fargo Outlook Funds during the reporting period was driven by the positive performance of the stock market. The Wells Fargo Outlook Today Fund Class A shares returned 7.47%,1 excluding sales charges, over the six-month reporting period, underperforming the other Wells Fargo Outlook Funds due to its greater exposure to bonds. The Wells Fargo Outlook Today Fund, a Fund suited to investors with short-term investment horizons, completed the six-month period with an allocation of 33% stocks, 65% bonds and 2% cash.

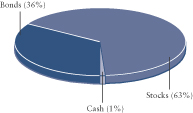

The Wells Fargo Outlook 2010 Fund Class A shares returned 10.69%,1 excluding sales charges, over the six-month reporting period.

The Wells Fargo Outlook 2020 Fund, with a higher percentage of equities than the Wells Fargo Outlook 2010 and Outlook Today Funds, also performed better than those Wells Fargo Outlook Funds with higher exposure to bonds. The Fund’s Class A shares returned 13.46%,1 excluding sales charges, over the six-month reporting period.

The Wells Fargo Outlook 2030 Fund Class A shares returned 15.78%,1 excluding sales charges, over the six-month reporting period.

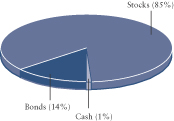

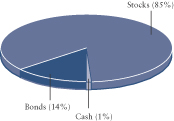

The Wells Fargo Outlook 2040 Fund Class A shares returned 18.33%,1 excluding sales charges, over the six-month reporting period. As equity prices rose, the Wells Fargo Outlook Funds with longer time horizons and consequently higher equity allocations, such as the Wells Fargo Outlook 2040 Fund with 85% of its portfolio invested in stocks as of August 31, 2003, outperformed the Wells Fargo Outlook Funds with shorter time horizons and lower equity allocations. By 2040, the Wells Fargo Outlook 2040 Fund should resemble the Wells Fargo Outlook Today Fund in its present composition, with adjustments reflecting market conditions at that time.

The majority of the domestic equity holdings for each of the Funds was invested in stocks of the S&P 500 Index. All of the sectors of the S&P 500 Index reported positive returns for the reporting period, with the Information Technology, Financial, and Consumer Discretionary sectors reporting the best performance.

A number of factors help to explain the performance of the equity market during the reporting period. Corporate earnings continued to improve, perhaps signaling that an increase in capital spending and new hiring may be on the horizon. Although consumer confidence was tenuous during the reporting period, apparently due to the joblessness of the current recovery, consumer spending remained strong and provided the safety net the economy needed to avoid slipping.

As various signs of economic improvement began to appear, bonds began to lose some of their recent gains, driving yields up from their previously low levels. The Funds’ worst performing holdings were long-term U.S. government bonds, followed by intermediate-term U.S. government bonds and cash.

STRATEGIC OUTLOOK

We believe that, although the economy is showing signs of improvement, the flow of good news will remain at a trickle rather than a flood. The lackluster labor market continues to dampen the economic recovery. An improvement in the labor market could translate into increased consumer spending, although at a slower pace than previous recoveries, due to the potential for rising interest rates. If firms cannot count on a sharp rise in consumer spending to use up their excess capacity, then they may be unlikely to raise their capital spending as much as they did during previous upturns.

2

PERFORMANCEHIGHLIGHTS | | WELLSFARGOOUTLOOKFUNDS |

|

AVERAGE ANNUAL TOTAL RETURNS1 (%) (AS OF AUGUST 31, 2003)

| | | With Load2

| | Without load

|

| Fund Name | | 6-months* | | 1-Year | | | 5-Year | | Life of

Fund

(3/1/94) | | 6-months* | | | 1-Year | | 5-Year | | | Life of

Fund

(3/1/94) |

| | | | | | | | |

Wells Fargo Outlook Today Fund – A | | 1.25 | | (0.40 | ) | | 2.95 | | 5.06 | | 7.47 | | | 5.65 | | 4.18 | | | 5.72 |

| | | | | | | | |

Wells Fargo Outlook Today Fund – B | | 2.19 | | 0.11 | | | 3.29 | | 5.20 | | 7.19 | | | 5.11 | | 3.64 | | | 5.20 |

| | | | | | | | |

Wells Fargo Outlook Today Fund – C | | 5.06 | | 2.95 | | | 3.41 | | 5.08 | | 7.10 | | | 5.03 | | 3.62 | | | 5.19 |

| | | | | | | | |

Wells Fargo Outlook Today Fund – I | | 7.62 | | 6.05 | | | 4.36 | | 5.81 | | 7.62 | | | 6.05 | | 4.36 | | | 5.81 |

| | | | | | | | |

Wells Fargo Outlook 2010 Fund – A | | 4.28 | | 0.75 | | | 2.68 | | 6.45 | | 10.69 | | | 6.93 | | 3.90 | | | 7.12 |

| | | | | | | | |

Wells Fargo Outlook 2010 Fund – B | | 5.32 | | 1.35 | | | 3.00 | | 6.55 | | 10.32 | | | 6.35 | | 3.35 | | | 6.55 |

| | | | | | | | |

Wells Fargo Outlook 2010 Fund – C | | 8.29 | | 4.32 | | | 3.14 | | 6.44 | | 10.34 | | | 6.38 | | 3.35 | | | 6.55 |

| | | | | | | | |

Wells Fargo Outlook 2010 Fund – I | | 10.86 | | 7.28 | | | 4.04 | | 7.19 | | 10.86 | | | 7.28 | | 4.04 | | | 7.19 |

| | | | | | | | |

Wells Fargo Outlook 2020 Fund – A | | 6.96 | | 1.34 | | | 1.65 | | 6.79 | | 13.46 | | | 7.51 | | 2.87 | | | 7.46 |

| | | | | | | | |

Wells Fargo Outlook 2020 Fund – B | | 8.09 | | 1.94 | | | 1.98 | | 6.90 | | 13.09 | | | 6.94 | | 2.35 | | | 6.90 |

| | | | | | | | |

Wells Fargo Outlook 2020 Fund – C | | 11.05 | | 4.84 | | | 2.12 | | 6.78 | | 13.12 | | | 6.89 | | 2.33 | | | 6.89 |

| | | | | | | | |

Wells Fargo Outlook 2020 Fund – I | | 13.58 | | 7.80 | | | 3.08 | | 7.58 | | 13.58 | | | 7.80 | | 3.08 | | | 7.58 |

| | | | | | | | |

Wells Fargo Outlook 2030 Fund – A | | 9.11 | | 2.34 | | | 1.22 | | 7.22 | | 15.78 | | | 8.55 | | 2.43 | | | 7.89 |

| | | | | | | | |

Wells Fargo Outlook 2030 Fund – B | | 10.35 | | 2.99 | | | 1.54 | | 7.32 | | 15.35 | | | 7.99 | | 1.91 | | | 7.32 |

| | | | | | | | |

Wells Fargo Outlook 2030 Fund – C | | 13.27 | | 5.87 | | | 1.68 | | 7.19 | | 15.37 | | | 7.97 | | 1.88 | | | 7.30 |

| | | | | | | | |

Wells Fargo Outlook 2030 Fund – I | | 15.90 | | 8.87 | | | 2.61 | | 7.99 | | 15.90 | | | 8.87 | | 2.61 | | | 7.99 |

| | | | | | | | |

Wells Fargo Outlook 2040 Fund – A | | 11.53 | | 3.71 | | | 0.62 | | 7.48 | | 18.33 | | | 10.07 | | 1.83 | | | 8.15 |

| | | | | | | | |

Wells Fargo Outlook 2040 Fund – B | | 12.93 | | 4.46 | | | 0.91 | | 7.56 | | 17.93 | | | 9.46 | | 1.30 | | | 7.56 |

| | | | | | | | |

Wells Fargo Outlook 2040 Fund – C | | 15.81 | | 7.42 | | | 1.09 | | 7.44 | | 17.94 | | | 9.48 | | 1.29 | | | 7.56 |

| | | | | | | | |

Wells Fargo Outlook 2040 Fund – I | | 18.58 | | 10.37 | | | 2.05 | | 8.28 | | 18.58 | | | 10.37 | | 2.05 | | | 8.28 |

| | | | | | | |

iMoneyNet All Taxable Money Fund Average3 | | | | | | | | | 0.33 | | | 0.84 | | 3.47 | | | 4.10 |

| | | | | | | |

Lehman Brothers Aggregate Bond Index4 | | | | | | | | | (0.36 | ) | | 4.36 | | 6.56 | | | 7.04 |

| | | | | | |

Morgan Stanley Capital International/ Europe, Australasia and Far East Index5 | | | | | | 22.65 | | | 9.11 | | (0.68 | ) | | 1.81 |

| | | | | | | | |

Russell 3000 Index6 | | | | | | | | | | | 22.82 | | | 13.93 | | 3.51 | | | 10.07 |

| | | | | | | | |

S&P 500 Index7 | | | | | | | | | | | 20.87 | | | 12.06 | | 2.48 | | | 10.39 |

| | | | | | | | |

Wilshire 5000 Index8 | | | | | | | | | | | 23.56 | | | 14.87 | | 3.53 | | | 9.84 |

| * | | Returns for periods of less than one year are not annualized. |

3

WELLSFARGOOUTLOOKFUNDS | | PERFORMANCEHIGHLIGHTS |

|

Wells Fargo Outlook Today Fund

Wells Fargo Outlook 2020 Fund

Wells Fargo Outlook 2040 Fund

Wells Fargo Outlook 2010 Fund

Wells Fargo Outlook 2030 Fund

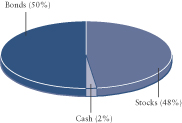

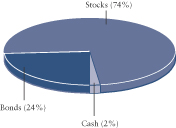

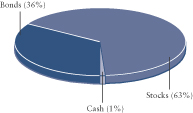

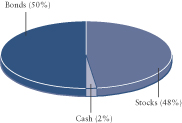

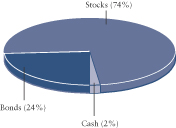

PORTFOLIO ALLOCATION9 (AS OF AUGUST 31, 2003)

FUND CHARACTERISTICS (AS OF AUGUST 31, 2003)

| | | Wells Fargo

Outlook

Today

Fund | | Wells Fargo

Outlook

2010 Fund | | Wells Fargo

Outlook

2020 Fund | | Wells Fargo

Outlook

2030 Fund | | Wells Fargo

Outlook

2040 Fund |

Weighted Average Coupon of Bond Portfolio | | 4.22% | | 4.62% | | 4.77% | | 6.05% | | 7.31% |

Weighted Average Maturity of Bond Portfolio | | 3.71 years | | 3.72 years | | 6.87 years | | 13.68 years | | 17.71 years |

Estimated Duration of Bond Portfolio | | 3.25 years | | 3.25 years | | 4.69 years | | 8.09 years | | 10.08 years |

Number of Holdings | | 756 | | 813 | | 955 | | 949 | | 895 |

PORTFOLIO ALLOCATION BY ASSET CLASS (AS OF AUGUST 31, 2003)

| Asset Class | | Wells Fargo

Outlook

Today

Fund | | Wells Fargo

Outlook

2010 Fund | | Wells Fargo

Outlook

2020 Fund | | Wells Fargo

Outlook

2030 Fund | | Wells Fargo Outlook

2040 Fund |

| | | | | |

DOMESTIC STOCKS | | | | | | | | | | |

Large Cap Growth | | 9% | | 15% | | 19% | | 23% | | 28% |

Large Cap Value | | 11% | | 16% | | 21% | | 23% | | 27% |

Mid Cap Growth | | 1% | | 2% | | 2% | | 3% | | 4% |

Mid Cap Value | | 0% | | 0% | | 3% | | 4% | | 5% |

Small Cap Growth | | 1% | | 2% | | 2% | | 2% | | 1% |

Small Cap Value | | 2% | | 2% | | 1% | | 1% | | 0% |

| | | | | |

INTERNATIONAL STOCKS | | | | | | | | | | |

Europe/Australasia/Far East (except Japan) | | 7% | | 9% | | 12% | | 15% | | 16% |

Japan | | 2% | | 2% | | 3% | | 3% | | 4% |

| | | | | |

BONDS | | | | | | | | | | |

Intermediate-Term Government | | 65% | | 50% | | 31% | | 11% | | 0% |

Long-Term Government | | 0% | | 0% | | 5% | | 13% | | 14% |

| | | | | |

CASH EQUIVALENTS | | | | | | | | | | |

U.S. Treasury Bills | | 2% | | 2% | | 1% | | 2% | | 1% |

TOTAL | | 100% | | 100% | | 100% | | 100% | | 100% |

4

PERFORMANCEHIGHLIGHTS | | WELLSFARGOOUTLOOKFUNDS |

|

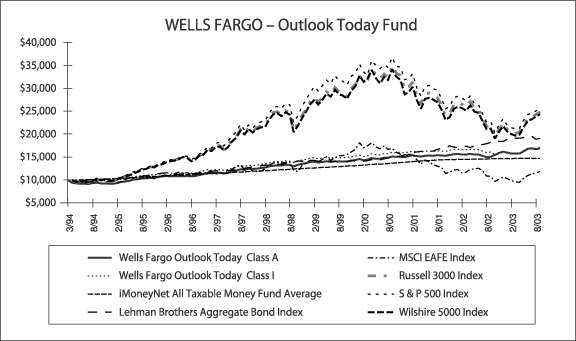

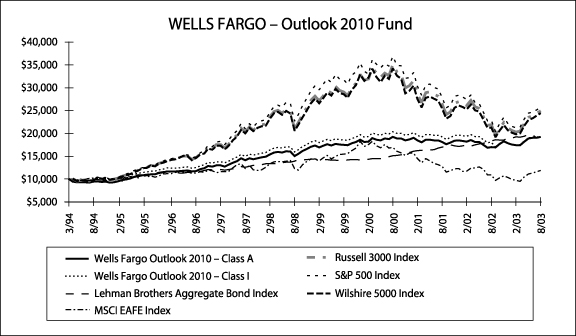

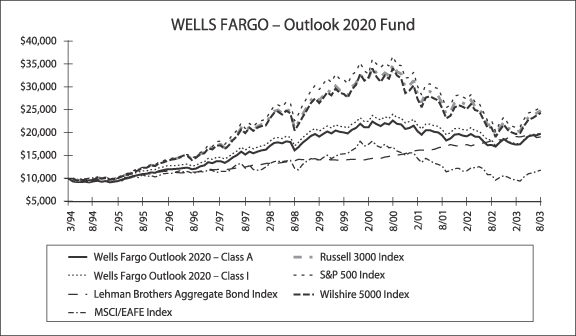

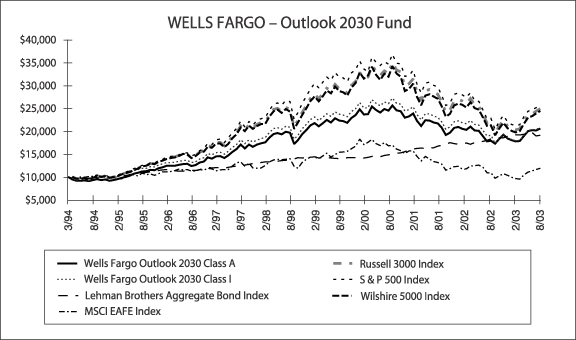

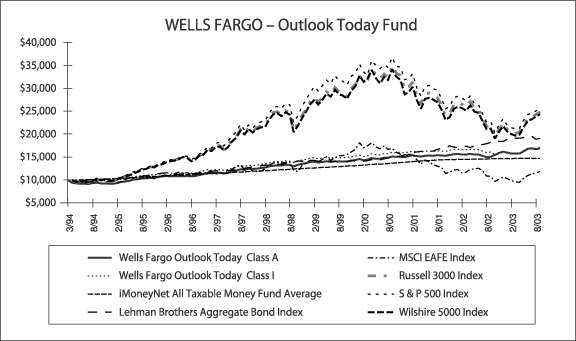

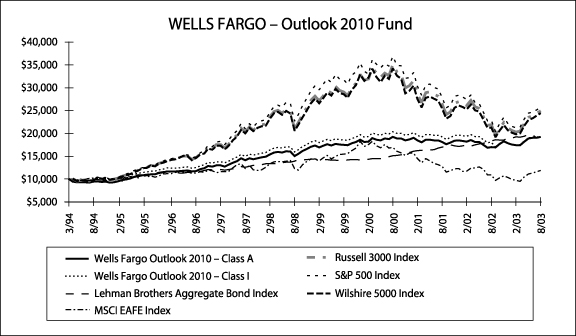

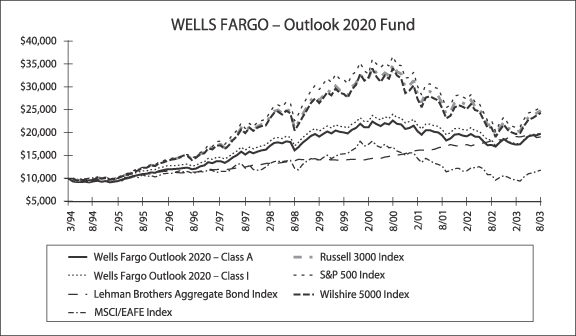

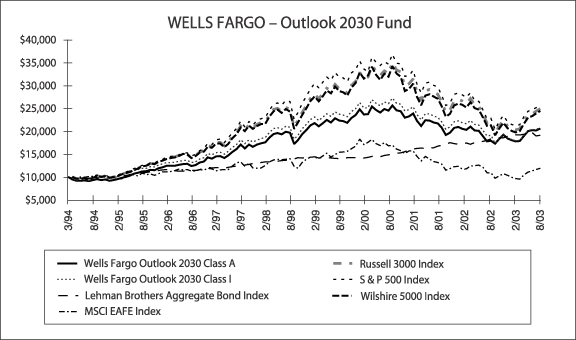

GROWTH OF $10,000 INVESTMENT CHARTS10

5

| WELLSFARGOOUTLOOKFUNDS | | PERFORMANCEHIGHLIGHTS |

|

6

PERFORMANCEHIGHLIGHTS | | WELLSFARGOOUTLOOKFUNDS |

|

1 Figures quoted represent past performance, which is no guarantee of future results and do not reflect the deduction of taxes that a shareholder may pay on fund distributions or the redemption of fund shares. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The Funds’ Adviser has committed through June 30, 2004 to waive fees and/or reimburse expenses to the extent necessary to maintain a certain net operating expense ratio for the Funds. Actual reductions of operating expenses can increase total return to shareholders. Without these reductions, the Funds’ returns would have been lower.

Performance shown for Class A, Class B and Class C shares of each of the Wells Fargo Outlook Funds (formerly LifePath Funds) for periods prior to November 8, 1999, reflects performance of the Class A, Class B and Class C shares of the corresponding Stagecoach LifePath Funds, their predecessor funds. Performance shown for the Class B shares of the Outlook Today Fund (formerly LifePath Opportunity Fund) for periods prior to August 1, 1998 reflects the performance of the Class A shares of the Outlook Today Fund adjusted to reflect the Class B shares contingent-deferred sales charge (CDSC) and expenses. Performance shown for the Class B shares of all other Outlook Funds for periods prior to March 1, 1997 reflects the performance of the Class A shares of the corresponding Outlook Funds adjusted to reflect the Class B share CDSCs and expenses. Performance shown for the Class C shares of the Outlook 2040 Fund (formerly LifePath 2040 Fund) for periods prior to July 1, 1998 reflects the performance of the Class B shares of the Outlook 2040 Fund adjusted to reflect the Class C shares CDSCs and expenses. Performance shown for the Class C shares of all other Outlook Funds for periods prior to December 1, 1998 reflects the performance of the Class B shares of the corresponding Outlook Funds adjusted to reflect the Class C share CDSCs and expenses. Performance shown for Institutional Class shares of each of the Wells Fargo Outlook Funds for periods prior to November 8, 1999, reflects performance of the Class A shares of the corresponding Stagecoach LifePath Funds, their predecessor funds, adjusted to reflect the sales charges and expenses of the Institutional Class shares. Effective at the close of business November 5, 1999, the Stagecoach Funds were reorganized into the Wells Fargo Funds.

2 For Class A shares, the maximum front-end sales charge is 5.75%. The maximum contingent deferred sales charge (“CDSC”) for Class B shares is 5.00%. For Class C shares, the maximum front-end sales charge is 1.00% and the maximum CDSC is 1.00%. Performance including sales charge assumes the maximum sales charge for the period shown. Institutional Class shares are sold without sales charges.

3 The iMoneyNet All Taxable Money Fund Average includes all taxable retail and institutional money funds. It is made up of funds in the Treasury Retail, Treasury Institutional, Treasury & Repo Retail, Treasury & Repo Institutional, Government & Agency Retail, Government & Agency Institutional, First Tier Retail, First Tier Institutional, Second Tier Retail, and Second Tier Institutional categories.

4 The Lehman Brothers Aggregate Bond Index is composed of the Lehman Brothers Government/Credit Index and the Lehman Brothers Mortgage-Backed Securities Index and includes Treasury issues, agency issues, corporate bond issues and mortgage-backed securities. The Fund is a professionally managed mutual fund. You cannot invest directly in an index.

5 The Morgan Stanley Capital International/Europe, Australasia and Far East (“MSCI EAFE”) Stock Index is an unmanaged group of securities widely regarded by investors to be representations of the stock markets of Europe, Australasia and the Far East. You cannot invest directly in an Index.

6 The Fund has selected the Russell 3000 Index to replace the Wilshire 5000 Index going forward because the Russell 3000 Index is more representative of the breadth of the Fund’s holdings. The Russell 3000 Index measures the performance of the 3,000 largest U.S. companies based on total market capitalization, which represents approximately 98% of the investable U.S. equity market. You cannot invest in an index.

7 “Standard & Poor’s”, “S&P”, “S&P 500”, “Standard & Poor’s 500” and “500” are trademarks of McGraw-Hill, Inc. and have been licensed. The Funds are not sponsored, endorsed, sold or promoted by Standard & Poor’s and Standard & Poor’s makes no representation regarding the advisability of investing in the Funds. The S&P 500 Index is an unmanaged index of 500 widely held common stocks representing, among others, industrial, financial, utility, and transportation companies listed or traded on national exchanges or over-the-counter markets. You cannot invest directly in an index.

7

| WELLSFARGOOUTLOOKFUNDS | | PERFORMANCEHIGHLIGHTS |

|

8 “Wilshire 5000” is a trademark and “Wilshire” is a service mark of Wilshire Associates Incorporated. The Funds are not sponsored, endorsed, sold or promoted by Wilshire Associates Incorporated or any of its subsidiaries or affiliates, and it makes no representation regarding the advisability of investing in the Funds. The Wilshire 5000 Index is comprised of over 6,500 U.S. equity securities with readily available price data. The Index includes all New York Stock Exchange and American Stock Exchange issues, and active over-the-counter equity issues. You cannot invest directly in an index.

9 Portfolio holdings are subject to change.

10 The charts compare the performance of the Wells Fargo Outlook Funds Class A and Institutional Class shares for the life of the Fund with the S&P 500 Index, Lehman Brothers Aggregate Bond Index, MSCI EAFE, the iMoneyNet All Taxable Money Fund Average, the Russell 3000 Index and the Wilshire 5000 Index. The charts assume a hypothetical $10,000 investment in Class A and Institutional Class shares and reflects all operating expenses and, for Class A shares, assumes the maximum initial sales charge of 5.75%. The indexes presented do not incur expenses and are not available directly for investment. Had these indexes incurred operating expenses, their performance would have been lower.

8

PORTFOLIOOFINVESTMENTS —AUGUST 31, 2003 (UNAUDITED) | | WELLSFARGOOUTLOOKTODAYFUND |

|

| Shares | | Security Name | | Value |

| Common Stock – 33.80% | | | |

|

| AGRICULTURAL PRODUCTION CROPS — 0.01% |

385 | | Alico Incorporated | | $ | 10,896 |

| | | | |

|

|

|

| AMUSEMENT & RECREATION SERVICES — 0.07% |

| 314 | | Harrah's Entertainment Incorporated | | | 13,005 |

| 584 | | International Game Technology | | | 15,091 |

| 1,170 | | Penn National Gaming Incorporated† | | | 25,916 |

| | |

| | | | | | 54,012 |

| | | | |

|

|

|

| APPAREL & ACCESSORY STORES — 0.18% |

| 750 | | Christopher & Banks Corporation† | | | 22,274 |

| 1,944 | | Gap Incorporated | | | 40,610 |

| 556 | | Kohl’s Corporation† | | | 35,167 |

| 1,312 | | Limited Brands | | | 22,252 |

| 766 | | Nordstrom Incorporated | | | 19,970 |

| | |

| | | | | | 140,273 |

| | | | |

|

|

|

APPAREL & OTHER FINISHED PRODUCTS MADE

FROM FABRICS & SIMILAR MATERIALS — 0.10% |

| 3,402 | | Benetton Group SpA ADR | | | 69,333 |

| 271 | | Liz Claiborne Incorporated | | | 9,341 |

| | |

| | | | | | 78,674 |

| | | | |

|

|

|

AUTOMOTIVE DEALERS & GASOLINE SERVICE

STATIONS — 0.07% |

| 86 | | AutoZone Incorporated† | | | 7,894 |

| 289 | | CarMax Incorporated | | | 11,141 |

| 1,142 | | MarineMax Incorporated† | | | 16,582 |

| 721 | | United Auto Group Incorporated† | | | 18,458 |

| | |

| | | | | | 54,075 |

| | | | |

|

|

|

AUTOMOTIVE REPAIR, SERVICES, &

PARKING — 0.03% |

| 682 | | Ryder System Incorporated | | | 20,480 |

| | | | |

|

|

|

| BANKS — 0.11% |

| 4,413 | | Sanpaolo IMI SpA ADR | | | 85,171 |

| | | | |

|

|

|

BUILDING CONSTRUCTION-GENERAL

CONTRACTORS & OPERATIVE BUILDERS — 0.01% |

| 15 | | Centex Corporation | | | 1,130 |

| 16 | | KB Home | | | 916 |

| 1 | | MDC Holdings Incorporated | | | 26 |

| | |

| | | | | | 2,072 |

| | | | |

|

|

|

BUILDING MATERIALS, HARDWARE, GARDEN

SUPPLY & MOBILE HOME DEALERS — 0.27% |

| 1,198 | | Central Garden & Pet Company† | | | 33,340 |

| 3,539 | | Home Depot Incorporated | | | 113,815 |

| 1,078 | | Lowe's Companies Incorporated | | | 59,139 |

| 261 | | Sherwin-Williams Company | | | 7,851 |

| | |

| | | | | | 214,145 |

| | | | |

|

|

|

| BUSINESS SERVICES — 2.17% |

| 690 | | Adobe Systems Incorporated | | | 26,793 |

| 193 | | Advo Incorporated† | | | 8,521 |

| 2,872 | | Akamai Technologies Incorporated† | | | 11,948 |

| Shares | | Security Name | | Value |

| 227 | | Arbitron Incorporated† | | $ | 8,394 |

| 951 | | Automatic Data Processing Incorporated | | | 37,954 |

| 188 | | Avocent Corporation† | | | 5,490 |

| 1,508 | | BEA Systems Incorporated† | | | 20,433 |

| 1,121 | | BMC Software Incorporated† | | | 16,456 |

| 2,366 | | Cendant Corporation† | | | 42,541 |

| 571 | | Citrix Systems Incorporated† | | | 11,757 |

| 451 | | Cognizant Technology Solutions Corporation† | | | 15,708 |

| 1,409 | | Computer Associates International Incorporated | | | 36,113 |

| 552 | | Computer Sciences Corporation† | | | 23,499 |

| 1,339 | | Compuware Corporation† | | | 7,967 |

| 1,400 | | Concord EFS Incorporated† | | | 19,390 |

| 707 | | Datastream Systems Incorporated† | | | 6,681 |

| 98 | | Deluxe Corporation | | | 4,185 |

| 593 | | Digimarc Corporation† | | | 9,785 |

| 1,332 | | eBay Incorporated† | | | 73,966 |

| 1,614 | | Electro Rent Corporation | | | 19,336 |

| 296 | | Electronic Arts Incorporated† | | | 26,566 |

| 971 | | Electronic Data Systems Corporation | | | 21,197 |

| 2,605 | | Enterasys Networks Incorporated† | | | 15,031 |

| 836 | | Equifax Incorporated | | | 19,178 |

| 982 | | eUniverse Incorporated†(a) | | | 1,748 |

| 809 | | F5 Networks Incorporated† | | | 15,864 |

| 209 | | Factset Research Systems Incorporated | | | 10,147 |

| 1,242 | | FalconStor Software Incorporated† | | | 7,353 |

| 1,323 | | First Data Corporation | | | 50,803 |

| 60 | | Hudson Highland Group Incorporated† | | | 1,253 |

| 110 | | Hyperion Solutions Corporation† | | | 3,628 |

| 1,115 | | IMS Health Incorporated | | | 21,709 |

| 1,042 | | Interpublic Group of Companies Incorporated | | | 15,786 |

| 356 | | Intuit Incorporated† | | | 16,134 |

| 16,604 | | Microsoft Corporation | | | 440,335 |

| 708 | | Mindspeed Technologies Incorporated† | | | 2,492 |

| 800 | | Monster Worldwide Incorporated† | | | 21,856 |

| 468 | | NCR Corporation† | | | 13,577 |

| 723 | | Novell Incorporated† | | | 3,637 |

| 317 | | Omnicom Group Incorporated | | | 24,758 |

| 8,705 | | Oracle Corporation† | | | 111,250 |

| 1,000 | | PeopleSoft Incorporated† | | | 18,100 |

| 757 | | Radisys Corporation† | | | 13,437 |

| 3,567 | | Rentokil Initial plc ADR | | | 59,242 |

| 982 | | Reuters Group plc ADR | | | 23,195 |

| 1,846 | | SAP AG ADR | | | 55,269 |

| 1,300 | | Secure Computing Corporation† | | | 14,157 |

| 1,378 | | Siebel Systems Incorporated† | | | 13,890 |

| 7,434 | | Sun Microsystems Incorporated† | | | 28,695 |

9

| WELLSFARGOOUTLOOKTODAYFUND | | PORTFOLIOOFINVESTMENTS —AUGUST 31, 2003 (UNAUDITED) |

|

| Shares | | Security Name | | Value |

| Common Stock (Continued) | | | |

| 653 | | Sungard Data Systems Incorporated† | | $ | 18,415 |

| 172 | | Symantec Corporation† | | | 9,878 |

| 168 | | Synopsys Incorporated† | | | 11,459 |

| 1,100 | | Transaction Systems Architects Incorporated Class A† | | | 15,664 |

| 1,668 | | Unisys Corporation† | | | 21,651 |

| 721 | | Vastera Incorporated† | | | 3,915 |

| 905 | | Veritas Software Corporation† | | | 31,204 |

| 930 | | Verity Incorporated† | | | 11,086 |

| 700 | | Websense Incorporated† | | | 16,660 |

| 1,264 | | WPP Group plc ADR | | | 58,005 |

| 1,284 | | Yahoo! Incorporated† | | | 42,886 |

| | |

| | | | | | 1,718,027 |

| | | | |

|

|

|

| CHEMICALS & ALLIED PRODUCTS — 3.46% |

| 2,404 | | Abbott Laboratories | | | 96,881 |

| 439 | | Air Products & Chemicals Incorporated | | | 20,773 |

| 2,644 | | Akzo Nobel NV ADR | | | 86,274 |

| 144 | | Alberto-Culver Company Class B | | | 8,220 |

| 2,061 | | Amgen Incorporated† | | | 135,820 |

| 2,440 | | AstraZeneca plc ADR | | | 96,746 |

| 1,146 | | Aventis SA ADR | | | 56,154 |

| 99 | | Avery Dennison Corporation | | | 5,420 |

| 353 | | Avon Products Incorporated | | | 22,627 |

| 144 | | Barr Laboratories Incorporated† | | | 9,744 |

| 519 | | Biogen Incorporated† | | | 20,480 |

| 2,906 | | Bristol-Myers Squibb Company | | | 73,725 |

| 1,412 | | Centerpulse ADR | | | 38,858 |

| 489 | | Chiron Corporation† | | | 24,851 |

| 421 | | Clorox Company | | | 18,040 |

| 812 | | Colgate-Palmolive Company | | | 44,887 |

| 1,400 | | Corixa Corporation† | | | 11,130 |

| 1,572 | | Dow Chemical Company | | | 54,281 |

| 1,395 | | E I Du Pont de Nemours & Company | | | 62,412 |

| 113 | | Eastman Chemical Company | | | 4,047 |

| 305 | | Ecolab Incorporated | | | 7,866 |

| 1,771 | | Eli Lilly & Company | | | 117,825 |

| 807 | | Forest Laboratories Incorporated† | | | 37,929 |

| 256 | | Genentech Incorporated† | | | 20,326 |

| 555 | | Genzyme Corporation† | | | 26,168 |

| 812 | | Georgia Gulf Corporation | | | 18,148 |

| 97 | | Gilead Sciences Incorporated† | | | 6,470 |

| 1,725 | | Gillette Company | | | 55,994 |

| 3,238 | | GlaxoSmithKline plc ADR | | | 125,732 |

| 743 | | Great Lakes Chemical Corporation | | | 15,744 |

| 432 | | IDEC Pharmaceuticals Corporation† | | | 15,012 |

| 464 | | International Flavors & Fragrances Incorporated | | | 14,616 |

| 900 | | King Pharmaceuticals Incorporated† | | | 12,645 |

| 134 | | Martek Biosciences Corporation† | | | 6,913 |

| 546 | | MedImmune Incorporated† | | | 19,039 |

| 3,343 | | Merck & Company Incorporated | | | 168,220 |

| 842 | | MGI Pharma Incorporated† | | | 32,493 |

| Shares | | Security Name | | Value |

| 164 | | Neurocrine Biosciences Incorporated† | | $ | 8,776 |

| 3,583 | | Novartis AG ADR | | | 132,464 |

| 1,104 | | Novo Nordisk A/S ADR | | | 39,468 |

| 1,307 | | OraSure Technologies Incorporated† | | | 11,763 |

| 139 | | OSI Pharmaceuticals Incorporated† | | | 5,296 |

| 850 | | Penwest Pharmaceuticals† | | | 18,598 |

| 12,251 | | Pfizer Incorporated | | | 366,550 |

| 245 | | PPG Industries Incorporated | | | 13,453 |

| 197 | | Praxair Incorporated | | | 12,573 |

| 1,614 | | Procter & Gamble Company | | | 140,886 |

| 1,550 | | Roche Holding AG ADR | | | 118,695 |

| 510 | | Rohm & Haas Company | | | 18,528 |

| 2,508 | | Schering-Plough Corporation | | | 38,097 |

| 300 | | Sepracor Incorporated† | | | 8,076 |

| 7,000 | | Shiseido Company Limited ADR | | | 73,252 |

| 111 | | Sigma-Aldrich Corporation | | | 6,077 |

| 2,292 | | Unifi Incorporated† | | | 15,792 |

| 515 | | Watson Pharmaceuticals Incorporated† | | | 21,167 |

| 2,005 | | WR Grace & Company† | | | 6,755 |

| 2,053 | | Wyeth | | | 87,971 |

| | |

| | | | | | 2,736,747 |

| | | | |

|

|

|

| COMMERCIAL SERVICES — 0.03% |

| 4,900 | | Stewart Enterprises Incorporated† | | | 20,188 |

| | | | |

|

|

|

| COMMUNICATIONS — 1.96% |

| 778 | | Alltel Corporation | | | 35,632 |

| 1,937 | | AT&T Corporation | | | 43,195 |

| 6,650 | | AT&T Wireless Services Incorporated† | | | 57,323 |

| 1,061 | | Avaya Incorporated† | | | 11,087 |

| 871 | | Beasley Broadcast Group Incorporated Class A† | | | 12,778 |

| 3,874 | | BellSouth Corporation | | | 97,625 |

| 1,139 | | British Sky Broadcasting Group plc ADR† | | | 48,385 |

| 2,005 | | BT Group plc ADR† | | | 58,847 |

| 593 | | CenturyTel Incorporated | | | 20,613 |

| 568 | | Certegy Incorporated† | | | 17,182 |

| 1,302 | | Clear Channel Communications Incorporated† | | | 58,746 |

| 7,624 | | Comcast Corporation† | | | 226,814 |

| 3,827 | | Deutsche Telekom AG ADR | | | 54,879 |

| 168 | | Echostar Communications Corporation† | | | 6,199 |

| 1,569 | | France Telecom SA ADR | | | 38,911 |

| 1 | | ITC Deltacom Incorporated† | | | 4 |

| 170 | | Liberty Corporation | | | 7,293 |

| 1,837 | | Nextel Communications Incorporated† | | | 35,417 |

| 1,658 | | Nippon Telegraph & Telephone Corporation ADR | | | 36,791 |

| 1,502 | | NTT DoCoMo Incorporated ADR† | | | 38,857 |

| 2,349 | | Qwest Communications International† | | | 10,453 |

10

PORTFOLIOOFINVESTMENTS —AUGUST 31, 2003 (UNAUDITED) | | WELLSFARGOOUTLOOKTODAYFUND |

|

| Shares | | Security Name | | Value |

| Common Stock (Continued) | | | |

| 6,107 | | SBC Communications Incorporated | | $ | 137,346 |

| 2,309 | | Sprint Corporation (FON Group) | | | 34,104 |

| 3,205 | | Sprint Corporation (PCS Group)† | | | 16,634 |

| 699 | | Telecom Corporation of New Zealand Limited ADR | | | 16,217 |

| 2,598 | | Telefonica SA ADR† | | | 92,229 |

| 514 | | Tivo Incorporated† | | | 5,587 |

| 203 | | Univision Communications Incorporated† | | | 7,610 |

| 4,322 | | Verizon Communications Incorporated | | | 152,654 |

| 9,383 | | Vodafone Group plc ADR | | | 171,709 |

| | |

| | | | | | 1,551,121 |

| | | | |

|

|

|

CONSTRUCTION SPECIAL TRADE

CONTRACTORS — 0.02% |

| 111 | | EMCOR Group Incorporated† | | | 4,892 |

| 193 | | Whirlpool Corporation | | | 13,429 |

| | |

| | | | | | 18,321 |

| | | | |

|

|

|

| DEPOSITORY INSTITUTIONS — 4.11% |

| 5,236 | | ABN AMRO Holding NV ADR | | | 92,363 |

| 2,122 | | Allied Irish Banks plc ADR | | | 59,586 |

| 1,098 | | AmSouth Bancorporation | | | 23,651 |

| 5,215 | | Banco Bilbao Vizcaya Argentaria

SA ADR | | | 56,061 |

| 1,279 | | Banco Comercial Portugues SA ADR | | | 11,319 |

| 5,739 | | Banco Santander Central Hispano SA ADR | | | 49,241 |

| 2,379 | | Bank of America Corporation | | | 188,536 |

| 1,592 | | Bank of New York Company Incorporated | | | 46,837 |

| 2,220 | | Bank One Corporation | | | 87,623 |

| 1,482 | | Bankunited Financial Corporation Class A† | | | 32,219 |

| 3,203 | | Barclays plc ADR | | | 94,745 |

| 1,026 | | BB&T Corporation | | | 37,470 |

| 3,818 | | BNP Paribas SA ADR | | | 95,111 |

| 395 | | Cascade Bancorp | | | 7,118 |

| 1,212 | | Central Coast Bancorp† | | | 20,859 |

| 590 | | Charter One Financial Incorporated | | | 18,290 |

| 416 | | Chittenden Corporation | | | 11,997 |

| 9,319 | | Citigroup Incorporated | | | 403,979 |

| 145 | | City Bank Lynnwood WA | | | 4,710 |

| 272 | | Coastal Financial Corporation | | | 4,189 |

| 293 | | Comerica Incorporated | | | 14,457 |

| 119 | | Corus Bankshares Incorporated | | | 6,164 |

| 1,319 | | Deutsche Bank AG | | | 76,819 |

| 1,062 | | Fifth Third Bancorp | | | 62,233 |

| 196 | | First Bancorp | | | 6,019 |

| 949 | | First of Long Island Corporation | | | 40,760 |

| 153 | | First Tennessee National Corporation | | | 6,327 |

| 1,156 | | Firstfed America Bancorp Incorporated | | | 23,004 |

| 2,213 | | FleetBoston Financial Corporation | | | 65,483 |

| Shares | | Security Name | | Value |

| 125 | | Golden West Financial Corporation | | $ | 10,784 |

| 2,791 | | HBOS plc ADR | | | 93,238 |

| 2,841 | | HSBC Holdings plc ADR | | | 182,733 |

| 1,334 | | Huntington Bancshares Incorporated | | | 26,680 |

| 634 | | Itla Capital Corporation† | | | 28,530 |

| 4,018 | | JP Morgan Chase & Company | | | 137,496 |

| 1,000 | | KeyCorp | | | 27,180 |

| 727 | | Marshall & Ilsley Corporation | | | 22,537 |

| 131 | | MB Financial Incorporated | | | 5,633 |

| 921 | | Mellon Financial Corporation | | | 28,873 |

| 592 | | National Australia Bank | | | 59,851 |

| 1,093 | | National City Corporation | | | 34,626 |

| 412 | | New York Community Bancorp Incorporated | | | 12,673 |

| 558 | | Northern Trust Corporation | | | 23,570 |

| 330 | | PNC Financial Services Group | | | 15,708 |

| 501 | | Regions Financial Corporation | | | 17,665 |

| 785 | | SouthTrust Corporation | | | 22,757 |

| 784 | | State Street Corporation | | | 34,457 |

| 6,014 | | Sumitomo Mitsui Financial Group Incorporated | | | 20,978 |

| 1,040 | | Sun Bancorp Incorporated† | | | 22,506 |

| 402 | | SunTrust Banks Incorporated | | | 24,574 |

| 1,148 | | Synovus Financial Corporation | | | 28,069 |

| 1,009 | | Troy Financial Corporation | | | 35,557 |

| 555 | | Union Planters Corporation | | | 17,705 |

| 3,939 | | US Bancorp | | | 94,142 |

| 1,037 | | USB Holding Company Incorporated | | | 19,091 |

| 2,439 | | Wachovia Corporation | | | 102,804 |

| 1,662 | | Washington Mutual Incorporated | | | 64,785 |

| 2,915 | | Wells Fargo & Company‡ | | | 146,158 |

| 2,472 | | Westpac Banking Corporation ADR | | | 126,418 |

| 771 | | Wintrust Financial Corporation | | | 27,263 |

| 1,088 | | WSFS Financial Corporation | | | 47,546 |

| 999 | | Yardville National Bancorp | | | 21,978 |

| 233 | | Zions Bancorporation | | | 12,974 |

| | |

| | | | | | 3,244,709 |

| | | | |

|

|

|

| EATING & DRINKING PLACES — 0.17% |

| 1,079 | | Darden Restaurants Incorporated | | | 23,521 |

| 2,416 | | McDonald's Corporation | | | 54,167 |

| 121 | | PF Chang's China Bistro Incorporated† | | | 5,627 |

| 229 | | Rare Hospitality International Incorporated† | | | 8,720 |

| 747 | | Wendy's International Incorporated | | | 23,568 |

| 546 | | Yum! Brands Incorporated† | | | 16,189 |

| | |

| | | | | | 131,792 |

| | | | |

|

|

|

| EDUCATIONAL SERVICES — 0.06% |

| 405 | | Apollo Group Incorporated

Class A† | | | 25,948 |

| 152 | | Corinthian Colleges Incorporated† | | | 8,748 |

| 141 | | ITT Educational Services Incorporated† | | | 6,112 |

| 104 | | Strayer Education Incorporated | | | 9,932 |

| | |

| | | | | | 50,740 |

| | | | |

|

|

11

| WELLSFARGOOUTLOOKTODAYFUND | | PORTFOLIOOFINVESTMENTS —AUGUST 31, 2003 (UNAUDITED) |

|

| Shares | | Security Name | | Value |

| Common Stock (Continued) | | | |

|

| ELECTRIC, GAS, & SANITARY SERVICES — 1.34% |

| 2,178 | | AES Corporation† | | $ | 14,113 |

| 1,156 | | Allied Waste Industries Incorporated† | | | 12,785 |

| 421 | | Ameren Corporation | | | 17,893 |

| 424 | | American Electric Power Company Incorporated | | | 12,003 |

| 685 | | American States Water Company | | | 17,139 |

| 232 | | Black Hills Corporation | | | 7,519 |

| 2,000 | | Calpine Corporation† | | | 11,280 |

| 815 | | CenterPoint Energy Incorporated | | | 6,919 |

| 212 | | CH Energy Group Incorporated | | | 9,381 |

| 523 | | Cinergy Corporation | | | 17,897 |

| 764 | | CMS Energy Corporation† | | | 5,096 |

| 464 | | Consolidated Edison Incorporated | | | 18,342 |

| 607 | | Constellation Energy Group Incorporated | | | 22,089 |

| 516 | | Dominion Resources Incorporated | | | 31,259 |

| 434 | | DTE Energy Company | | | 15,151 |

| 2,159 | | Duke Energy Corporation | | | 36,876 |

| 1,802 | | E.ON AG ADR | | | 93,596 |

| 1,252 | | Edison International† | | | 23,613 |

| 1,456 | | El Paso Corporation | | | 10,687 |

| 6,728 | | Endesa SA ADR | | | 105,293 |

| 361 | | Entergy Corporation | | | 18,934 |

| 473 | | Exelon Corporation | | | 27,860 |

| 680 | | FirstEnergy Corporation | | | 19,897 |

| 399 | | FPL Group Incorporated | | | 24,682 |

| 182 | | Kinder Morgan Incorporated | | | 9,692 |

| 3,094 | | National Grid Transco plc ADR | | | 95,450 |

| 572 | | Nicor Incorporated | | | 19,442 |

| 807 | | NiSource Incorporated | | | 15,607 |

| 850 | | Peoples Energy Corporation | | | 34,128 |

| 1,222 | | PG&E Corporation† | | | 27,092 |

| 483 | | Progress Energy Incorporated | | | 19,557 |

| 402 | | Public Service Enterprise Group Incorporated | | | 17,021 |

| 3,890 | | Scottish Power plc ADR | | | 91,804 |

| 252 | | Sempra Energy | | | 7,497 |

| 728 | | South Jersey Industries Incorporated | | | 27,919 |

| 1,340 | | Southern Company | | | 38,029 |

| 40 | | Texas Genco Holdings Incorporated | | | 980 |

| 600 | | TXU Corporation | | | 13,200 |

| 174 | | UIL Holdings Corporation | | | 6,273 |

| 889 | | Waste Management Incorporated | | | 23,656 |

| 1,282 | | Williams Companies Incorporated | | | 11,705 |

| 1,257 | | Xcel Energy Incorporated | | | 18,414 |

| | |

| | | | | | 1,057,770 |

| | | | |

|

|

|

ELECTRONIC & OTHER ELECTRICAL EQUIPMENT & COMPONENTS, EXCEPT

COMPUTER EQUIPMENT — 2.99% |

| 2,023 | | Acuity Brands Incorporated | | | 36,232 |

| 1,652 | | Advanced Micro Devices Incorporated† | | | 18,651 |

| 773 | | Altera Corporation† | | | 17,346 |

| Shares | | Security Name | | Value |

| 218 | | Ametek Incorporated | | $ | 9,147 |

| 612 | | Analog Devices Incorporated† | | | 25,092 |

| 907 | | Andrew Corporation† | | | 11,229 |

| 1,214 | | Applied Micro Circuits Corporation† | | | 7,053 |

| 830 | | Broadcom Corporation† | | | 22,808 |

| 1,459 | | Canon Incorporated ADR | | | 70,703 |

| 721 | | Catapult Communications Corporation† | | | 9,597 |

| 2,484 | | Chartered Semiconductor Manufacturing Limited ADR† | | | 16,320 |

| 1,400 | | CIENA Corporation† | | | 9,100 |

| 1,293 | | Comverse Technology Incorporated† | | | 21,322 |

| 2,126 | | Conexant Systems Incorporated† | | | 11,650 |

| 238 | | Cree Incorporated† | | | 3,765 |

| 757 | | Cubic Corporation | | | 19,962 |

| 584 | | Emerson Electric Company | | | 32,564 |

| 1,340 | | Fujitsu Limited ADR | | | 32,042 |

| 15,122 | | General Electric Company | | | 447,158 |

| 9,848 | | Intel Corporation | | | 281,850 |

| 311 | | Interdigital Communications Corporation† | | | 5,520 |

| 2,546 | | International Business Machines Corporation | | | 208,797 |

| 757 | | Jabil Circuit Incorporated† | | | 21,310 |

| 3,942 | | JDS Uniphase Corporation† | | | 13,560 |

| 2,933 | | Koninklijke Philips Electronics NV NY Shares | | | 71,565 |

| 720 | | Linear Technology Corporation | | | 29,678 |

| 1,809 | | LSI Logic Corporation† | | | 20,876 |

| 692 | | Maxim Integrated Products | | | 31,078 |

| 606 | | Maytag Corporation | | | 16,423 |

| 1,345 | | Medis Technologies Limited† | | | 15,373 |

| 1,764 | | Micron Technology Incorporated† | | | 25,331 |

| 8,000 | | Minebea Company Limited ADR | | | 79,671 |

| 800 | | Molex Incorporated | | | 23,536 |

| 4,837 | | Motorola Incorporated | | | 51,901 |

| 1,204 | | Mykrolis Corporation† | | | 15,170 |

| 700 | | National Semiconductor Corporation† | | | 20,398 |

| 1,047 | | Network Appliance Incorporated† | | | 23,463 |

| 4,262 | | Nokia Oyj ADR | | | 69,428 |

| 385 | | Novellus Systems Incorporated† | | | 15,385 |

| 540 | | NVIDIA Corporation† | | | 9,806 |

| 303 | | Omron Corporation ADR | | | 61,415 |

| 2,678 | | Pioneer Corporation ADR | | | 59,693 |

| 1,200 | | PMC-Sierra Incorporated† | | | 17,112 |

| 250 | | QLogic Corporation† | | | 12,255 |

| 1,218 | | Qualcomm Incorporated | | | 50,279 |

| 318 | | Rambus Incorporated† | | | 5,298 |

| 835 | | Remec Incorporated† | | | 7,565 |

| 1,900 | | Sanmina-SCI Corporation† | | | 17,062 |

| 900 | | Seachange International Incorporated† | | | 9,207 |

| 315 | | Skyworks Solutions Incorporated† | | | 3,572 |

| 2,629 | | Solectron Corporation† | | | 15,590 |

| 1,001 | | Sony Corporation ADR | | | 32,983 |

| 1,658 | | STMicroelectronics NV ADR | | | 41,351 |

12

PORTFOLIOOFINVESTMENTS —AUGUST 31, 2003 (UNAUDITED) | | WELLSFARGOOUTLOOKTODAYFUND |

|

| Shares | | Security Name | | Value |

| Common Stock (Continued) | | | |

| 1,791 | | Tellabs Incorporated† | | $ | 11,695 |

| 3,578 | | Texas Instruments Incorporated | | | 85,335 |

| 894 | | Thomas & Betts Corporation† | | | 15,270 |

| 457 | | Tollgrade Communications Incorporated† | | | 8,048 |

| 700 | | Vitesse Semiconductor Corporation† | | | 4,781 |

| 855 | | Xilinx Incorporated† | | | 26,369 |

| | |

| | | | | | 2,356,740 |

| | | | |

|

|

|

ENGINEERING, ACCOUNTING, RESEARCH

MANAGEMENT & RELATED SERVICES — 0.27% |

| 921 | | Antigenics Incorporated† | | | 13,023 |

| 693 | | Atrix Laboratories Incorporated† | | | 20,929 |

| 450 | | Charles River Associates Incorporated† | | | 15,138 |

| 150 | | Corporate Executive Board Company† | | | 6,623 |

| 2,107 | | First Consulting Group Incorporated† | | | 9,903 |

| 437 | | Fluor Corporation | | | 16,099 |

| 1,000 | | Gene Logic Incorporated† | | | 5,130 |

| 1,100 | | Millennium Pharmaceutical† | | | 15,290 |

| 578 | | Monsanto Company | | | 14,860 |

| 337 | | Moody's Corporation | | | 17,477 |

| 983 | | Paychex Incorporated | | | 35,388 |

| 771 | | Per-Se Technologies Incorporated† | | | 12,390 |

| 215 | | Quest Diagnostic Incorporated† | | | 12,900 |

| 1,472 | | Quintiles Transnational† | | | 20,960 |

| | |

| | | | | | 216,110 |

| | | | |

|

|

|

FABRICATED METAL PRODUCTS, EXCEPT

MACHINERY & TRANSPORTATION EQUIPMENT — 0.21% |

| 133 | | Ball Corporation | | | 7,023 |

| 606 | | Crane Company | | | 15,508 |

| 211 | | Fortune Brands Incorporated | | | 11,900 |

| 988 | | Griffon Corporation† | | | 18,624 |

| 1,342 | | Gulf Island Fabrication Incorporated† | | | 21,083 |

| 408 | | Illinois Tool Works Incorporated | | | 29,494 |

| 976 | | Masco Corporation | | | 24,195 |

| 159 | | Simpson Manufacturing Company Incorporated† | | | 7,568 |

| 596 | | Snap-On Incorporated | | | 17,582 |

| 578 | | Watts Industries Incorporated Class A | | | 10,612 |

| | |

| | | | | | 163,589 |

| | | | |

|

|

|

| FINANCIAL SERVICES — 0.03% |

| 1,547 | | Janus Capital Group Incorporated | | | 26,717 |

| | | | |

|

|

|

| FOOD & KINDRED PRODUCTS — 1.22% |

| 52 | | Adolph Coors Company | | | 2,868 |

| 129 | | American Italian Pasta Company

Class A† | | | 5,382 |

| 672 | | Anheuser-Busch Companies Incorporated | | | 34,635 |

| 2,080 | | Archer-Daniels-Midland Company | | | 28,850 |

| 3,929 | | Cadbury Schweppes plc ADR | | | 96,575 |

| Shares | | Security Name | | Value |

| 880 | | Campbell Soup Company | | $ | 21,296 |

| 3,373 | | Coca-Cola Company | | | 146,793 |

| 1,029 | | Coca-Cola Enterprises Incorporated | | | 19,026 |

| 1,116 | | ConAgra Foods Incorporated | | | 24,552 |

| 208 | | Del Monte Foods Company† | | | 1,868 |

| 2,028 | | Diageo plc ADR | | | 88,705 |

| 548 | | General Mills Incorporated | | | 25,405 |

| 981 | | Hercules Incorporated† | | | 10,987 |

| 103 | | Hershey Foods Corporation | | | 7,200 |

| 498 | | Heinz (HJ) Company | | | 16,115 |

| 764 | | Kellogg Company | | | 25,617 |

| 10,035 | | Kirin Brewery Company Limited | | | 70,446 |

| 3,116 | | Nestle SA ADR | | | 169,645 |

| 518 | | Pepsi Bottling Group Incorporated | | | 12,494 |

| 2,383 | | PepsiCo Incorporated | | | 106,139 |

| 1,400 | | Sara Lee Corporation | | | 26,572 |

| 1,464 | | Topps Company Incorporated | | | 13,088 |

| 258 | | WM Wrigley Jr Company | | | 13,686 |

| | |

| | | | | | 967,944 |

| | | | |

|

|

|

| FOOD STORES — 0.31% |

| 1,107 | | Albertson's Incorporated | | | 23,269 |

| 2,790 | | Coles Myer Limited ADR | | | 105,881 |

| 1,586 | | Great Atlantic & Pacific Tea Company Incorporated† | | | 15,178 |

| 5,252 | | Koninklijke Ahold NV ADR | | | 48,844 |

| 1,014 | | Kroger Company† | | | 19,479 |

| 169 | | Panera Bread Company† | | | 7,461 |

| 717 | | Starbucks Corporation† | | | 20,391 |

| 843 | | Winn-Dixie Stores Incorporated | | | 8,472 |

| | |

| | | | | | 248,975 |

| | | | |

|

|

|

| FORESTRY — 0.04% |

| 505 | | Weyerhaeuser Company | | | 30,048 |

| | | | |

|

|

|

| FURNITURE & FIXTURES — 0.05% |

| 1,232 | | Leggett & Platt Incorporated | | | 28,533 |

| 589 | | Newell Rubbermaid Incorporated | | | 13,989 |

| | |

| | | | | | 42,522 |

| | | | |

|

|

|

| GENERAL MERCHANDISE STORES — 0.85% |

| 658 | | Big Lots Incorporated† | | | 12,041 |

| 633 | | Dillard’s Incorporated Class A | | | 9,577 |

| 962 | | Dollar General Corporation | | | 22,059 |

| 525 | | Federated Department Stores Incorporated | | | 22,943 |

| 721 | | Fred's Incorporated | | | 25,776 |

| 600 | | JC Penney Company Incorporated | | | 12,732 |

| 600 | | May Department Stores Company | | | 16,548 |

| 2,193 | | Mitsukoshi Limited ADR† | | | 60,144 |

| 586 | | Sears Roebuck & Company | | | 25,796 |

| 950 | | ShopKo Stores Incorporated† | | | 13,082 |

| 1,470 | | Target Corporation | | | 59,682 |

| 861 | | TJX Companies Incorporated | | | 18,649 |

| 6,354 | | Wal-Mart Stores Incorporated | | | 375,965 |

| | |

| | | | | | 674,994 |

| | | | |

|

|

13

| WELLSFARGOOUTLOOKTODAYFUND | | PORTFOLIOOFINVESTMENTS —AUGUST 31, 2003 (UNAUDITED) |

|

| Shares | | Security Name | | Value |

| Common Stock (Continued) | | | |

|

| HEALTH SERVICES — 0.15% |

| 680 | | Apria Healthcare Group Incorporated† | | $ | 17,612 |

| 914 | | HCA Incorporated | | | 34,723 |

| 915 | | Manor Care Incorporated | | | 25,254 |

| 461 | | Matria Healthcare Incorporated† | | | 7,132 |

| 648 | | Sierra Health Services Incorporated† | | | 12,642 |

| 1,340 | | Tenet Healthcare Corporation† | | | 21,507 |

| | |

| | | | | | 118,870 |

| | | | |

|

|

|

HOME FURNITURE, FURNISHINGS, & EQUIPMENT

STORES — 0.18% |

| 558 | | Bed Bath & Beyond Incorporated† | | | 24,011 |

| 525 | | Best Buy Company Incorporated† | | | 27,305 |

| 621 | | Brookstone Incorporated† | | | 17,543 |

| 921 | | Circuit City Stores Incorporated | | | 9,606 |

| 493 | | Cost Plus Incorporated† | | | 19,838 |

| 1,012 | | Movie Gallery Incorporated† | | | 21,667 |

| 549 | | RadioShack Corporation | | | 16,690 |

| 257 | | Ultimate Electronics Incorporated† | | | 3,297 |

| | |

| | | | | | 139,957 |

| | | | |

|

|

|

HOTELS, ROOMING HOUSES, CAMPS, & OTHER

LODGE PLACES — 0.06% |

| 1,685 | | Hilton Hotels Corporation | | | 25,747 |

| 470 | | Marriott International Incorporated | | | 19,190 |

| | |

| | | | | | 44,937 |

| | | | |

|

|

|

INDUSTRIAL & COMMERCIAL MACHINERY &

COMPUTER EQUIPMENT — 1.85% |

| 492 | | 3M Company | | | 70,095 |

| 925 | | Apple Computer Incorporated† | | | 20,933 |

| 3,307 | | Applied Materials Incorporated† | | | 71,431 |

| 1,209 | | Baker Hughes Incorporated | | | 40,453 |

| 172 | | Black & Decker Corporation | | | 7,358 |

| 284 | | Briggs & Stratton Corporation | | | 16,699 |

| 1,500 | | Brocade Communications Systems Incorporated† | | | 8,460 |

| 674 | | Caterpillar Incorporated | | | 48,413 |

| 10,918 | | Cisco Systems Incorporated† | | | 209,080 |

| 1,442 | | Computer Network Technology Corporation† | | | 11,392 |

| 378 | | Deere & Company | | | 21,361 |

| 3,977 | | Dell Incorporated† | | | 129,770 |

| 719 | | Dover Corporation | | | 27,336 |

| 170 | | Eaton Corporation | | | 15,919 |

| 4,817 | | EMC Corporation† | | | 61,417 |

| 785 | | Gardner Denver Incorporated† | | | 18,479 |

| 1,320 | | Gateway Incorporated† | | | 7,616 |

| 707 | | General Binding Corporation | | | 8,597 |

| 638 | | Global Imaging Systems Incorporated† | | | 16,403 |

| 6,098 | | Hewlett-Packard Company | | | 121,472 |

| 640 | | Hitachi Limited ADR | | | 34,970 |

| Shares | | Security Name | | Value |

| 407 | | Ingersoll-Rand Company Class A | | $ | 24,225 |

| 623 | | Juniper Networks Incorporated† | | | 10,728 |

| 620 | | Kadant Incorporated† | | | 11,718 |

| 303 | | Lexmark International Incorporated† | | | 20,313 |

| 450 | | Lufkin Industries Incorporated | | | 11,565 |

| 11,986 | | Makita Corporation | | | 105,477 |

| 6,604 | | NEC Corporation | | | 49,860 |

| 665 | | Pall Corporation | | | 16,625 |

| 38 | | Palm Incorporated† | | | 694 |

| 34 | | Pitney Bowes Incorporated | | | 1,326 |

| 154 | | Sandisk Corporation† | | | 9,311 |

| 1,760 | | Siemens AG | | | 109,613 |

| 360 | | Stanley Works | | | 10,897 |

| 595 | | United Technologies Corporation | | | 47,749 |

| 1,794 | | Vivendi Universal SA ADR† | | | 30,319 |

| 1,278 | | Watsco Incorporated | | | 23,643 |

| 379 | | Western Digital Corporation† | | | 4,353 |

| | |

| | | | | | 1,456,070 |

| | | | |

|

|

|

INSURANCE AGENTS, BROKERS & SERVICE — 0.12% |

| 622 | | AON Corporation | | | 13,808 |

| 130 | | Hilb, Rogal & Hamilton Company | | | 3,900 |

| 1,310 | | Humana Incorporated† | | | 23,043 |

795 | | Marsh & Mclennan Companies Incorporated | | | 39,750 |

403 | | Medco Health Solutions Incorporated† | | | 10,765 |

| | |

| | | | | | 91,266 |

| | | | |

|

|

|

| INSURANCE CARRIERS — 1.44% |

| 622 | | ACE Limited | | | 20,028 |

| 1,783 | | Aegon NV ADR | | | 22,216 |

| 347 | | Aetna Incorporated | | | 19,779 |

| 1,179 | | AFLAC Incorporated | | | 37,740 |

| 1,188 | | Allstate Corporation | | | 42,471 |

| 252 | | AMBAC Financial Group Incorporated | | | 16,360 |

| 4,789 | | American International Group Incorporated | | | 285,281 |

| 216 | | Anthem Incorporated† | | | 15,811 |

| 3,440 | | AXA ADR | | | 61,163 |

| 204 | | Chubb Corporation | | | 13,860 |

| 171 | | CIGNA Corporation | | | 8,153 |

| 411 | | Cincinnati Financial Corporation | | | 16,584 |

| 726 | | Cobalt Corporation | | | 14,368 |

| 490 | | Hartford Financial Services Group Incorporated | | | 26,078 |

| 3,630 | | ING Group NV ADR | | | 71,620 |

| 655 | | John Hancock Financial Services Incorporated | | | 19,997 |

| 69 | | Kansas City Life Insurance Company | | | 3,036 |

| 406 | | Landamerica Financial Group Incorporated | | | 18,635 |

| 333 | | Lincoln National Corporation | | | 11,795 |

| 113 | | Loews Corporation | | | 4,651 |

14

PORTFOLIOOFINVESTMENTS —AUGUST 31, 2003 (UNAUDITED) | | WELLSFARGOOUTLOOKTODAYFUND |

|

| Shares | | Security Name | | Value |

| Common Stock (Continued) |

| 26 | | Markel Corporation† | | $ | 6,988 |

| 281 | | MBIA Incorporated | | | 15,865 |

| 1,284 | | MetLife Incorporated | | | 36,491 |

| 213 | | MGIC Investment Corporation | | | 12,007 |

| 1,146 | | Millea Holdings Incorporated ADR | | | 58,606 |

| 777 | | Principal Financial Group | | | 24,444 |

| 787 | | ProAssurance Corporation† | | | 20,257 |

| 436 | | Progressive Corporation | | | 30,843 |

| 1,123 | | Prudential Financial Incorporated | | | 40,888 |

| 225 | | Safeco Corporation | | | 8,114 |

| 413 | | St Paul Companies Incorporated | | | 14,356 |

| 180 | | Torchmark Corporation | | | 7,265 |

| 1,809 | | Travelers Property Casualty Corporation Class B† | | | 28,021 |

| 926 | | UnitedHealth Group Incorporated | | | 45,772 |

| 900 | | UnumProvident Corporation | | | 12,690 |

| 264 | | WellPoint Health Networks Incorporated† | | | 20,592 |

| 290 | | XL Capital Limited Class A | | | 21,968 |

| | |

| | | | | | 1,134,793 |

| | | | |

|

|

|

LUMBER & WOOD PRODUCTS, EXCEPT

FURNITURE — 0.02% |

| 2,135 | | Champion Enterprises Incorporated† | | | 15,479 |

| | | | |

|

|

|

MEASURING, ANALYZING, & CONTROLLING

INSTRUMENTS: PHOTOGRAPHIC, MEDICAL &

OPTICAL GOODS — 1.01% |

| 766 | | Advanced Medical Optics Incorporated† | | | 12,708 |

| 1,269 | | Agilent Technologies Incorporated† | | | 30,862 |

| 642 | | Aksys Limited† | | | 6,407 |

| 231 | | Allergan Incorporated | | | 18,355 |

| 556 | | Analogic Corporation | | | 28,640 |

| 1,285 | | Anaren Incorporated† | | | 15,407 |

| 768 | | Applera Corporation-Applied Biosystems Group | | | 16,712 |

| 356 | | Bausch & Lomb Incorporated | | | 15,009 |

| 1,092 | | Baxter International Incorporated | | | 30,685 |

| 330 | | Becton Dickinson & Company | | | 12,058 |

| 517 | | Biomet Incorporated | | | 15,370 |

| 670 | | Boston Scientific Corporation† | | | 40,267 |

| 121 | | CR Bard Incorporated | | | 8,107 |

| 585 | | Conmed Corporation† | | | 12,443 |

| 850 | | Cyberonics Incorporated† | | | 23,401 |

| 383 | | Danaher Corporation | | | 29,587 |

| 700 | | Eastman Kodak Company | | | 19,523 |

| 351 | | ESCO Technologies Incorporated† | | | 16,515 |

| 626 | | Flir Systems Incorporated† | | | 16,439 |

| 594 | | Guidant Corporation | | | 29,819 |

| 685 | | Integra LifeSciences Holdings Corporation† | | | 18,502 |

| 454 | | KLA-Tencor Corporation† | | | 26,949 |

| 1,969 | | Medtronic Incorporated | | | 97,623 |

| 407 | | Millipore Corporation | | | 18,478 |

| 685 | | Ocular Sciences Incorporated† | | | 15,488 |

| 493 | | PolyMedica Corporation | | | 22,195 |

| Shares | | Security Name | | Value |

| 660 | | Raytheon Company | | $ | 21,160 |

| 155 | | Resmed Incorporated† | | | 6,712 |

| 390 | | Ricoh Company Limited | | | 35,880 |

| 245 | | St Jude Medical Incorporated† | | | 12,757 |

| 307 | | Stryker Corporation | | | 23,271 |

| 648 | | Teradyne Incorporated† | | | 11,551 |

| 928 | | Thermo Electron Corporation† | | | 21,149 |

| 112 | | Trimble Navigation Limited† | | | 2,996 |

| 647 | | Viasys Healthcare Incorporated† | | | 14,299 |

| 835 | | X-Rite Incorporated | | | 9,519 |

| 2,219 | | Xerox Corporation† | | | 23,921 |

| 328 | | Zimmer Holdings Incorporated† | | | 16,971 |

| | |

| | | | | | 797,735 |

| | | | |

|

|

|

| MEMBERSHIP ORGANIZATIONS — 0.02% |

| 312 | | Cooper Industries Limited Class A | | | 15,878 |

| | | | |

|

|

|

| METAL MINING — 0.20% |

| 968 | | Newmont Mining Corporation | | | 38,004 |

| 416 | | Phelps Dodge Corporation† | | | 19,964 |

| 1,162 | | Rio Tinto plc ADR | | | 102,883 |

| | |

| | | | | | 160,851 |

| | | | |

|

|

|

MINING & QUARRYING OF NONMETALLIC

MINERALS, EXCEPT FUELS — 0.02% |

| 453 | | Vulcan Materials Company | | | 18,759 |

| | | | |

|

|

|

MISCELLANEOUS MANUFACTURING INDUSTRIES — 0.16% |

| 1,264 | | Hasbro Incorporated | | | 23,384 |

| 1,008 | | Mattel Incorporated | | | 19,475 |

| 3,981 | | Tyco International Limited | | | 81,929 |

| | |

| | | | | | 124,788 |

| | | | |

|

|

|

| MISCELLANEOUS RETAIL — 0.30% |

| 642 | | 1-800-Flowers.Com Incorporated Class A† | | | 6,087 |

| 873 | | Costco Wholesale Corporation† | | | 28,015 |

| 637 | | CVS Corporation | | | 20,766 |

| 578 | | GSI Commerce Incorporated† | | | 6,936 |

| 771 | | Hancock Fabrics Incorporated/Delaware | | | 13,122 |

| 731 | | J Jill Group Incorporated† | | | 10,899 |

| 781 | | Longs Drug Stores Corporation | | | 17,885 |

| 1,235 | | Office Depot Incorporated† | | | 22,526 |

| 1,257 | | PC Connection Incorporated† | | | 13,199 |

| 498 | | Sports Authority Incorporated† | | | 16,125 |

| 916 | | Staples Incorporated† | | | 22,561 |

| 1,667 | | Walgreen Company | | | 54,294 |

| 385 | | Whitehall Jewellers Incorporated† | | | 4,062 |

| | |

| | | | | | 236,477 |

| | | | |

|

|

|

| MISCELLANEOUS SERVICES — 0.07% |

| 3,852 | | Adecco SA ADR | | | 48,921 |

| 152 | | D&B Corporation† | | | 6,399 |

| | |

| | | | | | 55,320 |

| | | | |

|

|

|

| MOTION PICTURES — 0.31% |

| 9,313 | | AOL Time Warner Incorporated† | | | 152,361 |

| 4,368 | | Walt Disney Company | | | 89,544 |

| | |

| | | | | | 241,905 |

| | | | |

|

|

15

| WELLSFARGOOUTLOOKTODAYFUND | | PORTFOLIOOFINVESTMENTS —AUGUST 31, 2003 (UNAUDITED) |

|

| Shares | | Security Name | | Value |

| Common Stock (Continued) |

|

MOTOR FREIGHT TRANSPORTATION &

WAREHOUSING — 0.16% |

| 128 | | Landstar System Incorporated† | | $ | 7,899 |

| 1,837 | | United Parcel Service Incorporated | | | 115,290 |

| 153 | | USF Corporation | | | 4,873 |

| | |

| | | | | | 128,062 |

| | | | |

|

|

|

| NON-DEPOSITORY CREDIT INSTITUTIONS — 0.61% |

| 1,997 | | American Express Company | | | 89,965 |

| 597 | | Capital One Financial Corporation | | | 31,880 |

| 2,000 | | Charter Municipal Mortgage Acceptance Company | | | 36,300 |

| 133 | | Countrywide Financial Corporation | | | 9,024 |

| 1,376 | | Fannie Mae | | | 89,151 |

| 1,184 | | Freddie Mac | | | 62,930 |

| 2,471 | | MBNA Corporation | | | 57,673 |

| 1,477 | | ORIX Corporation ADR | | | 49,480 |

| 253 | | Providian Financial Corporation | | | 2,593 |

| 630 | | SLM Corporation | | | 25,313 |

| 493 | | WFS Financial Incorporated† | | | 19,237 |

| 899 | | World Acceptance Corporation† | | | 12,532 |

| | |

| | | | | | 486,078 |

| | | | |

|

|

|

| OIL & GAS EXTRACTION — 0.89% |

| 569 | | Anadarko Petroleum Corporation | | | 24,752 |

| 207 | | Apache Corporation | | | 14,279 |

| 4,349 | | BHP Billiton Limited ADR | | | 62,060 |

| 359 | | Burlington Resources Incorporated | | | 17,383 |

| 523 | | Devon Energy Corporation | | | 27,065 |

| 1,104 | | ENI SpA-ADR | | | 84,335 |

| 113 | | Evergreen Resources Incorporated† | | | 6,313 |

| 1,720 | | Halliburton Company | | | 41,590 |

| 434 | | Kerr-McGee Corporation | | | 19,074 |

| 3,070 | | Magnum Hunter Resources Incorporated† | | | 24,560 |

| 210 | | Nabors Industries Limited† | | | 8,432 |

| 185 | | Noble Corporation† | | | 6,693 |

| 885 | | Plains Exploration & Production company† | | | 10,806 |

| 885 | | Plains Resources Incorporated† | | | 12,045 |

| 4,896 | | Repsol YPF SA ADR | | | 82,889 |

| 902 | | Rowan Companies Incorporated† | | | 22,586 |

| 1,067 | | Schlumberger Limited | | | 52,827 |

| 950 | | Southwestern Energy Company† | | | 17,252 |

| 143 | | Stone Energy Corporation† | | | 5,534 |

| 1,848 | | Total Fina Elf SA ADR | | | 142,314 |

| 1,104 | | Transocean Incorporated† | | | 23,316 |

| | |

| | | | | | 706,105 |

| | | | |

|

|

|

| PAPER & ALLIED PRODUCTS — 0.35% |

| 235 | | Bemis Company Incorporated | | | 10,639 |

| 338 | | Boise Cascade Corporation | | | 9,211 |

| 849 | | Chesapeake Corporation | | | 20,206 |

| 1,968 | | Glatfelter | | | 25,446 |

| 955 | | International Paper Company | | | 38,725 |

| 620 | | Kimberly-Clark Corporation | | | 31,688 |

| 497 | | MeadWestvaco Corporation | | | 12,599 |

| Shares | | Security Name | | Value |

| 632 | | Pactiv Corporation† | | $ | 12,691 |

| 215 | | Potlatch Corporation | | | 6,340 |

| 2,956 | | Stora Enso Oyj ADR | | | 38,103 |

| 231 | | Temple-Inland Incorporated | | | 11,499 |

| 3,084 | | UPM-Kymmene Oyj ADR | | | 56,067 |

| | |

| | | | | | 273,214 |

| | | | |

|

|

|

| PERSONAL SERVICES — 0.07% |

| 751 | | Cintas Corporation | | | 29,988 |

| 283 | | H&R Block Incorporated | | | 12,480 |

| 270 | | Regis Corporation | | | 9,339 |

| | |

| | | | | | 51,807 |

| | | | |

|

|

|

PETROLEUM REFINING & RELATED INDUSTRIES — 1.25% |

| 307 | | Amerada Hess Corporation | | | 14,474 |

| 17 | | Ashland Incorporated | | | 562 |

| 3,754 | | BP plc ADR | | | 156,617 |

| 1,791 | | ChevronTexaco Corporation | | | 130,510 |

| 1,303 | | ConocoPhillips | | | 72,760 |

| 11,865 | | Exxon Mobil Corporation | | | 447,311 |

| 669 | | Marathon Oil Corporation | | | 18,658 |

| 2,478 | | Royal Dutch Petroleum Company NY Shares | | | 111,188 |

| 371 | | Sunoco Incorporated | | | 15,074 |

| 667 | | Unocal Corporation† | | | 20,424 |

| | |

| | | | | | 987,578 |

| | | | |

|

|

|

| PRIMARY METAL INDUSTRIES — 0.22% |

| 1,840 | | Alcoa Incorporated | | | 52,551 |

| 707 | | Engelhard Corporation | | | 19,845 |

| 4,320 | | Kubota Corporation ADR | | | 72,144 |

| 581 | | United States Steel Corporation | | | 10,696 |

| 1,417 | | Worthington Industries | | | 21,397 |

| | |

| | | | | | 176,633 |

| | | | |

|

|

|

PRINTING, PUBLISHING, & ALLIED INDUSTRIES — 0.66% |

| 721 | | American Greetings Corporation† | | | 13,337 |

| 771 | | Bowne & Company Incorporated | | | 11,203 |

| 711 | | Consolidated Graphics Incorporated† | | | 17,583 |

| 377 | | Dow Jones & Company Incorporated | | | 16,011 |

| 395 | | Gannett Company Incorporated | | | 30,976 |

| 107 | | Knight-Ridder Incorporated | | | 7,261 |

| 367 | | McGraw-Hill Companies Incorporated | | | 22,387 |

| 526 | | Meredith Corporation | | | 24,943 |

| 448 | | New York Times Company | | | 19,887 |

| 1,126 | | News Corporation Limited ADR | | | 38,678 |

| 6,527 | | Pearson plc ADR | | | 64,944 |

| 2,929 | | Reed Elsevier NV ADR | | | 65,317 |

| 654 | | RR Donnelley & Sons Company | | | 16,442 |

| 499 | | Tribune Company | | | 23,079 |

| 3,393 | | Viacom Incorporated Class B | | | 152,685 |

| | |

| | | | | | 524,733 |

| | | | |

|

|

16

PORTFOLIOOFINVESTMENTS —AUGUST 31, 2003 (UNAUDITED) | | WELLSFARGOOUTLOOKTODAYFUND |

|

| Shares | | Security Name | | Value |

| Common Stock (Continued) |

|

| RAILROAD TRANSPORTATION — 0.08% |

| 522 | | Burlington Northern Santa Fe Corporation | | $ | 14,798 |

| 453 | | CSX Corporation | | | 14,623 |

| 896 | | Norfolk Southern Corporation | | | 17,060 |

| 316 | | Union Pacific Corporation | | | 19,257 |

| | |

| | | | | | 65,738 |

| | | | |

|

|

|

RUBBER & MISCELLANEOUS PLASTICS PRODUCTS — 0.14% |

| 1,213 | | Cooper Tire & Rubber Company | | | 21,833 |

| 451 | | Nike Incorporated Class B | | | 25,698 |

| 1,327 | | Schulman A Incorporated | | | 21,259 |

| 305 | | Sealed Air Corporation† | | | 14,841 |

| 811 | | Tupperware Corporation | | | 13,244 |

| 557 | | West Pharmaceutical Services Incorporated | | | 16,153 |

| | |

| | | | | | 113,028 |

| | | | |

|

|

|

SECURITY & COMMODITY BROKERS, DEALERS,

EXCHANGES & SERVICES — 0.66% |

| 181 | | Bear Stearns Companies Incorporated | | | 12,666 |

| 3,650 | | Charles Schwab Corporation | | | 39,639 |

| 2,347 | | Credit Suisse Group ADR | | | 73,860 |

| 651 | | Franklin Resources Incorporated | | | 28,117 |

| 814 | | Goldman Sachs Group Incorporated | | | 72,031 |

| 361 | | Lehman Brothers Holdings Incorporated | | | 23,729 |

| 1,681 | | Merrill Lynch & Company Incorporated | | | 90,404 |

| 1,979 | | Morgan Stanley | | | 96,555 |

| 3,672 | | Nomura Holdings Incorporated ADR | | | 53,795 |

| 658 | | T Rowe Price Group Incorporated | | | 27,965 |

| | |

| | | | | | 518,761 |

| | | | |

|

|

|

STONE, CLAY, GLASS, & CONCRETE PRODUCTS — 0.33% |

| 2,680 | | Corning Incorporated† | | | 22,110 |

| 2,582 | | Hanson plc ADR | | | 84,044 |

| 4,589 | | Holcim Limited ADR† | | | 90,926 |

| 3,922 | | Lafarge SA ADR | | | 66,517 |

| | |

| | | | | | 263,597 |

| | | | |

|

|

|

| TEXTILE MILL PRODUCTS — 0.05% |

| 1,764 | | Interface Incorporated | | | 10,073 |

| 474 | | Oxford Industries Incorporated | | | 28,250 |

| | |

| | | | | | 38,323 |

| | | | |

|

|

|

| TOBACCO PRODUCTS — 0.18% |

| 2,734 | | Altria Group Incorporated | | | 112,695 |

| 125 | | Universal Corporation | | | 5,238 |

| 732 | | UST Incorporated | | | 24,449 |

| | |

| | | | | | 142,382 |

| | | | |

|

|

|

| TRANSPORTATION BY AIR — 0.28% |

| 9,391 | | BAA plc ADR | | | 67,736 |

| 800 | | Delta Air Lines Incorporated | | | 10,296 |

| Shares | | Security Name | | Value |

| 647 | | FedEx Corporation | | $ | 43,414 |

| 5,026 | | Japan Airlines System ADR | | | 59,228 |

| 2,334 | | Southwest Airlines Company | | | 39,888 |

| | |

| | | | | | 220,562 |

| | | | |

|

|

|

| TRANSPORTATION EQUIPMENT — 0.96% |

| 3,458 | | BAE Systems plc ADR | | | 37,358 |

| 1,587 | | Boeing Company | | | 59,338 |

| 809 | | Brunswick Corporation | | | 21,827 |

| 1,989 | | DaimlerChrysler AG | | | 76,039 |

| 2,600 | | Delphi Corporation | | | 23,556 |

| 4,409 | | Fiat SpA ADR | | | 29,937 |

| 4,200 | | Ford Motor Company | | | 48,552 |

| 389 | | General Dynamics Corporation | | | 33,497 |

| 777 | | General Motors Corporation | | | 31,935 |

| 781 | | Goodrich Corporation | | | 20,329 |

| 458 | | Harley-Davidson Incorporated | | | 22,818 |

| 2,198 | | Honda Motor Company Limited ADR | | | 44,751 |

| 1,976 | | Honeywell International Incorporated | | | 57,284 |

| 145 | | ITT Industries Incorporated | | | 9,437 |

| 248 | | Johnson Controls Incorporated | | | 24,552 |

| 785 | | Lockheed Martin Corporation | | | 40,216 |

| 320 | | Northrop Grumman Corporation | | | 30,554 |

| 284 | | PACCAR Incorporated | | | 24,197 |

| 419 | | Sequa Corporation† | | | 18,394 |

| 496 | | Sports Resorts International Incorporated† | | | 2,455 |

| 149 | | Superior Industries International Incorporated | | | 6,447 |

| 317 | | Textron Incorporated | | | 14,265 |

| 185 | | Thor Industries Incorporated | | | 10,025 |

| 1,237 | | Toyota Motor Corporation ADR | | | 68,517 |

| | |

| | | | | | 756,280 |

| | | | |

|

|

|

| TRANSPORTATION SERVICES — 0.02% |

| 139 | | Expeditors International of Washington Incorporated | | | 5,242 |

| 454 | | Sabre Holdings Corporation | | | 10,269 |

| | |

| | | | | | 15,511 |

| | | | |

|

|

|

| WATER TRANSPORTATION — 0.06% |

| 1,243 | | Carnival Corporation | | | 42,995 |

| 255 | | Kirby Corporation† | | | 7,446 |

| | |

| | | | | | 50,441 |

| | | | |

|

|

|

| WHOLESALE TRADE–DURABLE GOODS — 0.57% |

| 524 | | 1-800 Contacts Incorporated† | | | 10,858 |

| 534 | | Imagistics International Incorporated† | | | 15,272 |

| 4,363 | | Johnson & Johnson | | | 216,318 |

| 518 | | Kyocera Corporation ADR | | | 32,805 |

| 3,448 | | Mitsubishi Corporation ADR | | | 58,274 |

| 397 | | Mitsui & Company Limited ADR | | | 50,621 |

| 2,402 | | Nissan Motor Company Limited ADR | | | 52,123 |

| 237 | | Grainger WW Incorporated | | | 11,810 |

| | |

| | | | | | 448,081 |

| | | | |

|

|

17

| WELLSFARGOOUTLOOKTODAYFUND | | PORTFOLIOOFINVESTMENTS —AUGUST 31, 2003 (UNAUDITED) |

|

| Shares | | Security Name | | Value |

| Common Stock (Continued) |

|

WHOLESALE TRADE NON-DURABLE GOODS — 0.21% |

| 321 | | Advanced Marketing Services Incorporated | | $ | 3,290 |

| 275 | | AmerisourceBergen Corporation | | | 16,008 |

| 53 | | Brown-Forman Corporation Class B | | | 4,189 |

| 774 | | Cardinal Health Incorporated | | | 44,064 |

| 672 | | McKesson Corporation | | | 22,001 |

| 977 | | Safeway Incorporated† | | | 23,849 |

| 655 | | Supervalu Incorporated | | | 15,786 |

| 1,255 | | Sysco Corporation | | | 39,482 |

| | |

| | | | | | 168,669 |

| | | | |

|

|

TOTAL COMMON STOCK

(Cost $27,468,955) | | | 26,705,520 |

| | | | |

|

|

|

| Real Estate Investment Trust — 0.32% |

| 547 | | Alexandria Real Estate Equities Incorporated | | | 25,572 |

| 2,513 | | Boykin Lodging Company | | | 19,601 |

| 126 | | Capital Automotive REIT | | | 3,600 |

| 308 | | Chelsea Property Group Incorporated | | | 14,153 |

| 1,585 | | Entertainment Properties Trust | | | 49,531 |

| 615 | | Equity Office Properties Trust | | | 17,109 |

| 936 | | Equity Residential | | | 27,219 |

| 293 | | Home Properties of New York Incorporated | | | 10,973 |

| 3,634 | | Mid Atlantic Realty Trust | | | 76,387 |

| 156 | | Simon Property Group Incorporated | | | 6,663 |

TOTAL REAL ESTATE INVESTMENT

TRUST (Cost $200,165) | | | 250,808 |

| | | | |

|

|

| Principal | | Interest Rate | | Maturity

Date | | |

| US Treasury Obligations — 63.80% | | |

| |

| US TREASURY BONDS — 1.89% | | |

| $ | 580,000 | | 3.25% | | 8/15/07 | | 585,030 |

| | 500,000 | | 11.63% | | 11/15/04 | | 560,391 |

| | 300,000 | | 10.75% | | 8/15/05 | | 350,613 |

| | | |

| | | | | | | | 1,496,034 |

| | | | | | |

|

| Principal | | Interest Rate | | Maturity

Date | | Value |

| |

| US TREASURY NOTES — 61.91% | | | |

| $ | 1,970,000 | | 5.75% | | 11/15/05 | | $ | 2,125,675 |

| | 3,000,000 | | 5.00% | | 2/15/11 | | | 3,168,399 |

| | 2,675,000 | | 5.00% | | 8/15/11 | | | 2,816,272 |

| | 390,000 | | 4.88% | | 2/15/12 | | | 405,768 |

| | 1,840,000 | | 4.00% | | 11/15/12 | | | 1,784,081 |

| | 10,315,000 | | 1.63% | | 1/31/05 | | | 10,325,078 |

| | 4,710,000 | | 2.00% | | 5/15/06 | | | 4,673,389 |

| | 800,000 | | 7.25% | | 8/15/04 | | | 845,125 |

| | 600,000 | | 7.88% | | 11/15/04 | | | 645,867 |

| | 3,850,000 | | 6.50% | | 5/15/05 | | | 4,156,194 |

| | 2,120,000 | | 5.63% | | 2/15/06 | | | 2,293,988 |

| | 1,890,000 | | 6.50% | | 10/15/06 | | | 2,110,007 |

| | 450,000 | | 6.25% | | 2/15/07 | | | 501,680 |

| | 2,750,000 | | 6.13% | | 8/15/07 | | | 3,067,647 |

| | 2,990,000 | | 5.63% | | 5/15/08 | | | 3,285,146 |

| | 2,930,000 | | 4.75% | | 11/15/08 | | | 3,100,306 |

| | 600,000 | | 5.50% | | 5/15/09 | | | 657,914 |

| | 600,000 | | 6.00% | | 8/15/04 | | | 626,765 |

| | 800,000 | | 5.88% | | 11/15/04 | | | 842,218 |

| | 1,390,000 | | 6.75% | | 5/15/05 | | | 1,506,193 |

| | | |

| | | | | | | | | 48,937,712 |

| | | | | | |

|

TOTAL US TREASURY OBLIGATIONS (Cost $49,665,637) | | | 50,433,746 |

| | | | | | |

|

| |

| Short Term Investments — 1.51% | | | |

| |

| US TREASURY BILLS — 1.51% | | | |

| | 48,000 | | 0.84%^ | | 9/18/03 | | | 47,982 |

| | 18,000 | | 0.84%^ | | 9/18/03 | | | 17,993 |

| | 105,000 | | 0.88%^ | | 10/16/03 | | | 104,876 |

| | 70,000 | | 0.88%^ | | 10/16/03 | | | 69,918 |