UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-09253

Wells Fargo Funds Trust

(Exact name of registrant as specified in charter)

| 525 Market St., San Francisco, CA | | 94105 |

| (Address of principal executive offices) | | (Zip code) |

C. David Messman

Wells Fargo Funds Management, LLC

525 Market St., San Francisco, CA 94105

(Name and address of agent for service)

Registrant’s telephone number, including area code: 800-643-9691

Date of fiscal year end: | | March 31, 2003 |

Date of reporting period: | | September 30, 2003 |

| ITEM 1. | | REPORT TO SHAREHOLDERS |

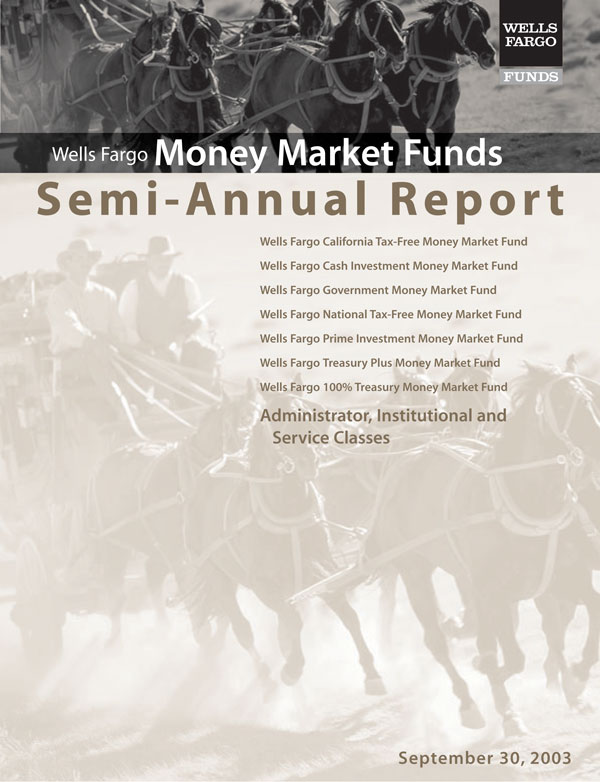

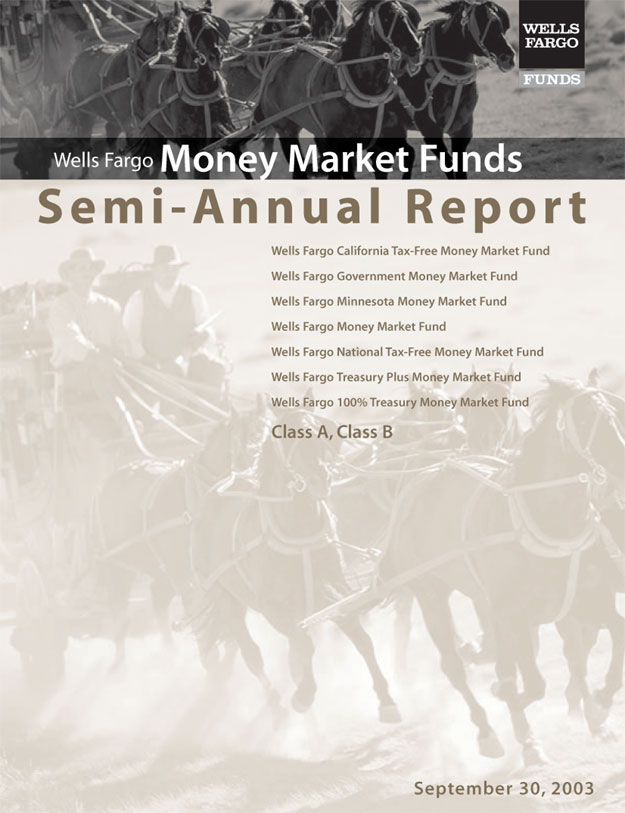

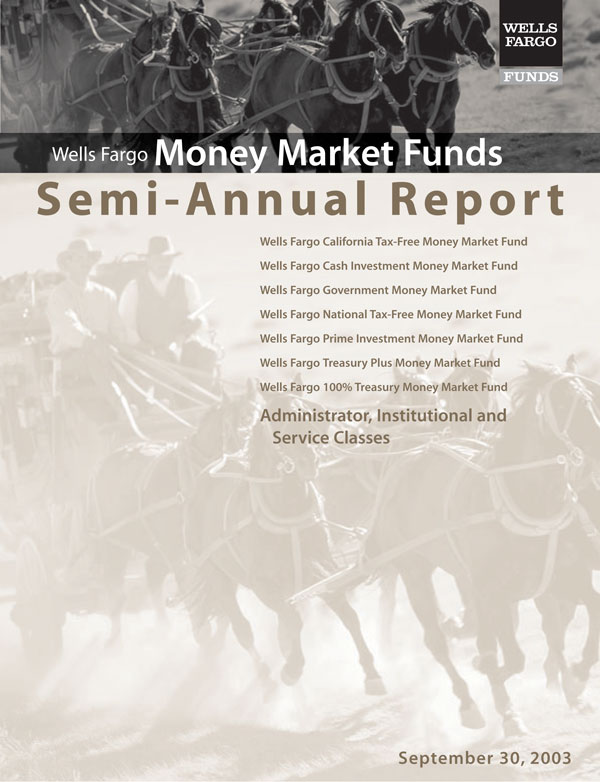

Wells Fargo Money Market Funds

Semi-Annual Report

Wells Fargo California Tax-Free Money Market Fund

Wells Fargo Government Money Market Fund

Wells Fargo Minnesota Money Market Fund

Wells Fargo Money Market Fund

Wells Fargo National Tax-Free Money Market Fund

Wells Fargo Treasury Plus Money Market Fund

Well Fargo 100% Treasury Money Market Fund

Class A, Class B

September 30, 2003

| | | WELLSFARGOMONEYMARKETFUNDS |

|

TABLEOFCONTENTS

NOT FDIC INSURED–NO BANK GUARANTEE–MAY LOSE VALUE

This page is intentionally left blank —

WELLSFARGOMONEYMARKETFUNDS | | SHAREHOLDERLETTER |

|

DEARVALUEDSHAREHOLDER,

We are pleased to provide you with this Wells Fargo Money Market Funds semi-annual report for the six-month period ending September 30, 2003. On the following pages, you will find the money market overview and facts and figures about each Fund’s portfolio.

OVERVIEW OF FINANCIAL MARKETS

Despite attempts by the federal government to boost the economy early in the year, the economy remained mired in weakness early in the reporting period. The Federal Reserve Board (the Fed) cut short-term interest rates from 1.25% to 1% in June, the lowest level in half a century. Still, unemployment continued to rise and a record fiscal year 2003 federal budget deficit loomed on the horizon, suggesting that tax revenues were not growing fast enough to cover government spending.

Market volatility that was caused by uncertainty over the possibility of war in Iraq was followed by uncertainty over the direction and magnitude of changes in Fed policy. Mortgage refinancing and consumer spending activity remained strong despite a back-up in intermediate-term interest rates. Economic growth began picking up steam during the summer, while corporate earnings exceeded expectations. Even employment data began showing improvement in September. Indeed, there were reasons to be optimistic about the U.S. economy as the end of 2003 approached.

WELLS FARGO MONEY MARKET FUNDS

The Fed’s decision to cut interest rates by just a quarter percentage point to 1% at its June 25, 2003 policy meeting brought interest rates down to levels not seen since the 1950s. Unfortunately, the rate cut did not meet investor expectations and interest rates were volatile through the end of the period in reaction to comments from the Fed and changing views on the outlook for economic growth. Despite a challenging environment for investors, the Wells Fargo Money Market Funds achieved their investment objectives of maintaining a stable net asset value.

It is important to remember that no one can accurately predict the future direction of short-term interest rates. We continue to maintain a more prudent investment strategy and do not pursue strategies that seek to boost yield at the expense of safety and liquidity. We believe that the pursuit of additional yield creates volatility that can potentially undermine Fund performance during uncertain markets.

INVESTMENT STRATEGIES IN CHALLENGING TIMES

Investors are counting on reasonably good earnings growth to propel stocks higher during the balance of 2003, overcoming potential hurdles to any future rally created by seemingly “rich” valuations and by upward pressure on interest rates. With pricing power still weak throughout much of the economy, most businesses will rely on further cost cutting to propel margins enough to sustain double-digit earnings growth. Meanwhile, bond investors may insulate portfolios from a potential rise in interest rates by gradually moving away from longer-term securities as well as by investing in high coupon bonds or mortgage-backed securities that hold up better in a rising interest rate environment. Regardless of what lies ahead, investors should continue to follow the fundamentals of investing—asset allocation and diversification—in an effort to achieve their long-term financial goals.

We would like to thank you for choosing Wells Fargo Funds. We appreciate your confidence in us during this uncertain time period. Through each market cycle, we are committed to helping you meet your financial needs. If you have any questions about your investment, please contact your investment professional or call us at 1-800-222-8222. You may also visit our Web site at www.wellsfargofunds.com.

Sincerely,

Karla M. Rabusch

President

Wells Fargo Funds

1

| WELLSFARGOMONEYMARKETFUNDS | | MONEYMARKETOVERVIEW |

|

MONEYMARKETOVERVIEW

This report covers the six-month period ended September 30, 2003.

This reporting period can be divided into two distinct segments. During the first three months of the period, interest rates moved lower as slow economic growth led many to believe that the Federal Reserve Board (the Fed) would continue its attempt to spur growth by aggressively lowering short-term interest rates. The second half of the period was characterized by rising interest rates, the result of the Fed’s interest rate cut in June not meeting investor expectations.

PRIME MONEY MARKET SECURITIES

For the first three months of the period, the yield curve flattened. Short-term money market investments (those maturing in less than three months) remained stable, while longer-term money market investments (those maturing in more than thirteen months) declined. By mid-June, the yield on one-year investments had declined 25 basis points to below 1%, while the Federal Funds rate remained near 1.25%. Despite warnings that their expectations were unrealistic, investors continued to expect a 50 basis point reduction in the Federal Funds rate in June. When the rate was lowered only 25 basis points, the market began to re-evaluate its outlook for continued regular rate cuts and the yields on longer-term money market investments began to move higher. By the end of the period, the one-year London Interbank Offered Rate (LIBOR) stood at 1.30% after peaking at 1.50% near the end of August.

The amount of commercial paper outstanding continued to decline during the period, as issuers took advantage of the record low bond yields to extend their debt. The amount of top rated commercial paper outstanding fell by more than 5% during the period, from $1.207 trillion to $1.144 trillion, reflecting a decrease of nearly 20% from the peak of $1.413 trillion in December 2000.

Credit quality also remained a concern during the reporting period. While the pace of downgrades slowed somewhat, accounting issues at some of the Government Sponsored Entities, and questions about corporate governance policies at the New York Stock Exchange, did not help to restore investor confidence in management policies, abilities, and integrity.

U.S. TREASURY SECURITIES

Although the Fed eventually did cut the Federal Funds rate by 25 basis points to 1.00%, Treasury bills had been pricing based on the assumption that there would be a 50 basis point cut. Even the one-year Treasury note traded below 0.90% in the days preceding the June rate cut. These low rates coincided with quarter-end demand pressures in June, causing the short-end of the Treasury market (less than three months) to remain overpriced for an unusually longer period of time than what typically follows a market disappointment. Eventually Treasury bill pricing became more reasonable, and the longer end of the market became relatively cheap. As budget deficit projections ballooned, expectations of a greater supply of Treasury bills and the general expectation of higher interest rates drove the price of Treasury bills into the mid 0.90’s to low 1.00’s.

Over this reporting period, the supply of Treasury bills greatly contracted: the issuance of Treasury bills for the first week of April stood at $72 billion, and declined to $44 billion by the end of the period. While the April issuance was largely due to seasonal factors, Treasury bill issuance did not meet expectations as the period progressed and Treasuries became more expensive. Evidence of this could be seen during September, when the U.S. Treasury Department had to issue cash management bills to cover a temporary cash shortfall early in the month. Continued issuance may point to the need for the Treasury to increase auction size in the coming months.

U.S. GOVERNMENT AGENCY SECURITIES

Spreads between U.S. Government agency offerings and money market securities continued to tighten during the period. Interest rates, concerns over the ability of government agencies to manage interest rate risk, losses in the Federal Home Loan Bank of New York’s bond portfolio, and an accounting scandal at the Federal Home Loan Mortgage Corporation (FHLMC) drove yields on U.S. Government agency securities higher on a relative basis. For a period in June, after the FHLMC accounting issues were made public, FHLMC discount notes traded more cheaply than A-1/P-1 bank commercial paper. Eighteen month floating rate paper from the Federal National Mortgage Association (FNMA) and FHLMC traded at similar discount margins to one-year asset-backed conduit program floaters. The number of callable issues continued to increase, but at a slower pace as rates declined in September. By the end of the period, changes in the regulation of FNMA and FHLMC seemed inevitable (although it may be a long and arduous process).

2

MONEYMARKETOVERVIEW | | WELLSFARGOMONEYMARKETFUNDS |

|

TAX-FREE SECURITIES

The number of new municipal issues continued to increase swiftly as issuers found that it was often cheaper to issue variable rate securities than use the swap market to hedge interest rate risk. As variable rates surged to 103% of the one-month LIBOR in mid-April, the vast supply of variable rate demand notes increased, making it somewhat easier to invest the seasonal July cash inflows.

Fixed rate municipal securities were volatile during the reporting period. One-year paper started the period at 1.10% and interest rates plummeted to 0.80% at the peak of note season in late June. California was on the verge of running out of cash, as legislative parties were at odds over approving a budget. Standard and Poor’s was one of the driving forces behind breaking the stalemate by downgrading the state from A to BBB in late July. The price of California Revenue Anticipation Warrants (RAWs) plummeted as their yields skyrocketed from 1.15% to 2.00%.

Texas issued record-breaking Tax and Revenue Anticipation Notes in late August, exceeding municipal demand and splitting the one-year sector into three markets – the general market, the California market, and the Texas market. The one-year municipal securities markets finally settled down in early September as rates hovered near 1.00% for general market paper, 1.10% for Texas paper, and 1.60% for California RAWs.

STRATEGIC OUTLOOK

While the overnight interest rate has been stable, longer money market rates have increased considerably since the mid-point of the reporting period. With the U.S. economy picking up steam and the U.S. dollar weakening overseas, we believe that interest rates may continue to move higher. That increase, when accompanied by outflows from institutional investors, could trigger a challenging period for all money market funds. However, we do not believe that aggressively positioning a money market fund to boost its yield at the risk of jeopardizing its net asset value (NAV) would be appropriate, and we will continue to position the portfolios and select their investments in an ongoing effort to maintain a stable $1.00 NAV.

The views expressed are as of September 30, 2003 and are those of the Funds’ manager. The views are subject to change at any time in response to changing circumstances in the market and are not intended to predict or guarantee the future performance of any individual security, market sector or the markets generally, or the Wells Fargo Money Market Funds.

3

WELLSFARGOMONEYMARKETFUNDS | | MONEYMARKETOVERVIEW |

|

PRIMARY INVESTMENTS*

Wells Fargo

Money Market

Fund Name | | U.S. Treasury Securities | | Repurchase Agreements | | U.S. Government Obligations | | Commercial Paper | | Certificates of Deposit/ Bankers Acceptances | | Time Deposits | | Floating/ Variable Rate Notes/Bonds | | Mortgage and Other Asset-

Backed Securities | | Corporate Notes/

Bonds | | Municipal Obligations |

| | | | | | | | | | |

100% Treasury | | X | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | |

Treasury Plus | | X | | X | | | | | | | | | | | | | | | | |

| | | | | | | | | | |

Government | | X | | X | | X | | | | | | | | | | | | | | |

| | | | | | | | | | |

Money Market | | X | | X | | X | | X | | X | | X | | X | | X | | X | | |

| | | | | | | | | | |

National Tax-Free | | | | | | | | | | | | | | | | | | | | X |

| | | | | | | | | | |

Minnesota | | | | | | | | | | | | | | | | | | | | X |

| | | | | | | | | | |

California Tax-Free | | | | | | | | | | | | | | | | | | | | X |

* The chart highlights some of the primary investments that the Funds may make as part of their investment strategies. The chart does not identify all of the permitted investments for each Fund.

4

PERFORMANCEHIGHLIGHTS | | WELLSFARGOMONEYMARKETFUNDS |

|

WELLSFARGOCALIFORNIATAX-FREEMONEYMARKET

FUND —CLASSA

INVESTMENT OBJECTIVE

The Wells Fargo California Tax-Free Money Market Fund (the Fund) seeks a high level of income exempt from federal income tax and California individual income tax, while preserving capital and liquidity.

FUNDMANAGERS

Dave Sylvester

Julio Bonilla

INCEPTIONDATE

01/01/92

AVERAGE ANNUAL TOTAL RETURN1 (%) (AS OF SEPTEMBER 30, 2003)

| | | 6-Month* | | 1-Year | | 5-Year | | 10-Year |

| | | | |

Wells Fargo California Tax-Free Money Market Fund – Class A | | 0.19 | | 0.49 | | 1.81 | | 2.27 |

| | | | |

Benchmark | | | | | | | | |

| | | | |

iMoneyNet All State Specific California Money Fund Average2 | | 0.25 | | 0.63 | | 2.00 | | 2.67 |

| * Returns for periods of less than one year are not annualized. | | | | | | | | |

| FUND YIELD SUMMARY (AS OF SEPTEMBER 30, 2003) | |

|

| |

7-Day Current Yield | | 0.39% | |

| |

7-Day Compound Yield | | 0.39% | |

| |

30-Day Simple Yield | | 0.28% | |

| |

30-Day Compound Yield | | 0.28% | |

| FUND CHARACTERISTICS3 (AS OF SEPTEMBER 30, 2003) |

|

| |

Average Maturity | | 42 days |

| |

Number of Holdings | | 252 |

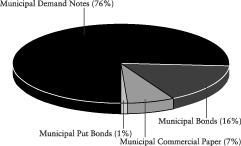

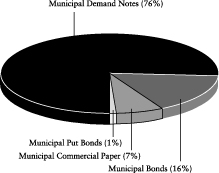

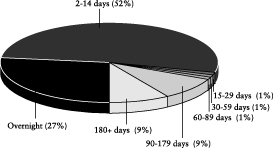

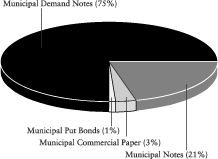

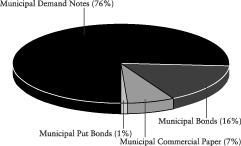

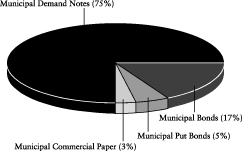

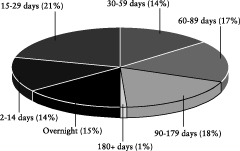

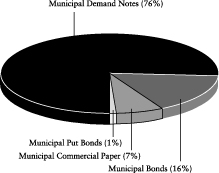

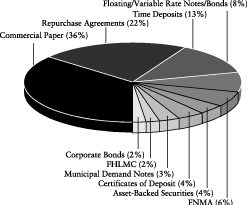

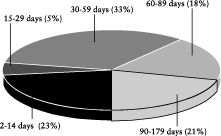

PORTFOLIO COMPOSITION3 (AS OF SEPTEMBER 30, 2003)

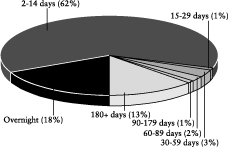

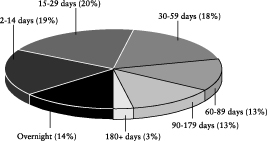

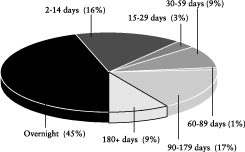

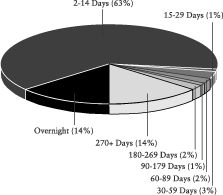

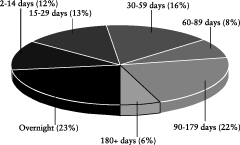

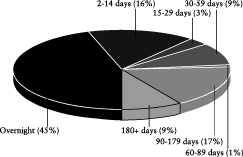

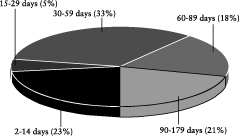

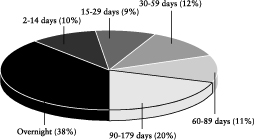

MATURITY DISTRIBUTION3 (AS OF SEPTEMBER 30, 2003)

The Fund is sold without a front-end sales charge or contingent deferred sales charge. Other fees and expenses apply to a continued investment in the Fund and are described in the Fund’s Statement of Additional Information. An investment in a Wells Fargo Money Market Fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although the Wells Fargo Money Market Funds seek to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in money market funds.

1 Figures quoted represent past performance, which is no guarantee of future results. Investment returns will fluctuate. The Fund’s yield figures more closely reflect the current earnings of the Fund than the total return figures. The Fund’s Adviser has committed through July 31, 2004 to waive fees and/or reimburse expenses to the extent necessary to maintain a certain net operating expense ratio for the Fund. Actual reductions of operating expenses can increase total return to shareholders. Without these reductions, the Fund’s 7-day current yield would have been 0.20%.

Performance shown for the Class A shares of the Wells Fargo California Tax-Free Money Market Fund for periods prior to November 8, 1999, reflects performance of the Class A shares of the Stagecoach California Tax-Free Money Market Fund, its predecessor fund. Effective at the close of business November 5, 1999, the Stagecoach Funds were reorganized into the Wells Fargo Funds.

2 The iMoneyNet All State Specific California Money Fund Average is an average of California retail state tax-free and municipal money funds.

3 Portfolio holdings and characteristics are subject to change.

5

| WELLSFARGOMONEYMARKETFUNDS | | PERFORMANCEHIGHLIGHTS |

|

WELLSFARGOGOVERNMENTMONEYMARKETFUND — CLASSA

INVESTMENT OBJECTIVE

The Wells Fargo Government Money Market Fund (the Fund) seeks high current income, while preserving capital and liquidity.

FUNDMANAGERS

Dave Sylvester

Laurie White

INCEPTIONDATE

11/16/87

AVERAGE ANNUAL TOTAL RETURN1 (%) (AS OF SEPTEMBER 30, 2003)

| | | 6-Month* | | 1-Year | | 5-Year | | 10-Year |

| | | | |

Wells Fargo Government Money Market Fund – Class A | | 0.24 | | 0.65 | | 3.27 | | 3.92 |

| | | | |

Benchmark | | | | | | | | |

| | | | |

iMoneyNet First Tier Retail Money Fund Average2 | | 0.23 | | 0.62 | | 3.59 | | 4.90 |

| * | | Returns for periods of less than one year are not annualized. |

| FUND YIELD SUMMARY (AS OF SEPTEMBER 30, 2003) |

|

| |

7-Day Current Yield | | 0.45% |

| |

7-Day Compound Yield | | 0.45% |

| |

30-Day Simple Yield | | 0.44% |

| |

30-Day Compound Yield | | 0.44% |

| FUND CHARACTERISTICS3 (AS OF SEPTEMBER 30, 2003) |

|

| |

Weighted Average Maturity | | 58 days |

| |

Number of Holdings | | 108 |

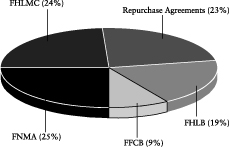

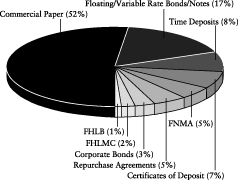

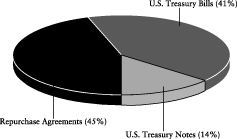

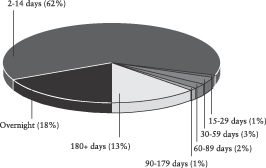

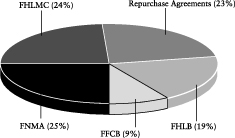

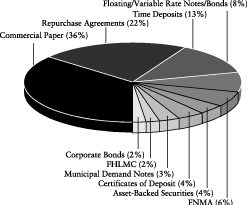

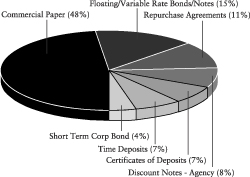

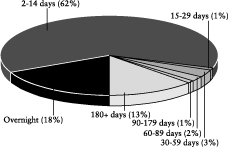

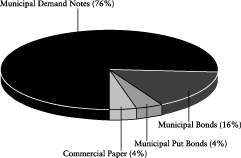

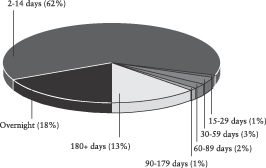

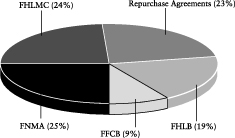

PORTFOLIO COMPOSITION3 (AS OF SEPTEMBER 30, 2003)

MATURITY DISTRIBUTION3 (AS OF SEPTEMBER 30, 2003)

The Fund is sold without a front-end sales charge or contingent deferred sales charge. Other fees and expenses apply to a continued investment in the Fund and are described in the Fund’s Statement of Additional Information. An investment in a Wells Fargo Money Market Fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although the Wells Fargo Money Market Funds seek to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in money market funds.

1 Figures quoted represent past performance, which is no guarantee of future results. Investment returns will fluctuate. The Fund’s yield figures more closely reflect the current earnings of the Fund than the total return figures. The Fund’s Adviser has committed through July 31, 2004 to waive fees and/or reimburse expenses to the extent necessary to maintain a certain net operating expense ratio for the Fund. Actual reductions of operating expenses can increase total return to shareholders. Without these reductions, the Fund’s 7-day current yield would have been 0.45%.

Performance shown for the Class A shares of the Wells Fargo Government Money Market Fund for periods prior to November 8, 1999, reflects performance of the Service Class (formerly Single Class) shares, adjusted for expenses, of the Norwest Advantage U.S. Government Fund (the accounting survivor of a merger of the Norwest Advantage U.S. Government Fund and the Stagecoach Government Money Market Fund), its predecessor fund. Effective at the close of business November 5, 1999, the Stagecoach Funds and the Norwest Advantage Funds were reorganized into the Wells Fargo Funds.

2 The iMoneyNet First Tier Retail Money Fund Average is an average of non-governmental retail funds that do not hold any second tier securities. Portfolio holdings of first tier funds include U.S. Treasury securities, U.S. other securities, repos, time deposits, domestic bank obligations, foreign bank obligations, first tier commercial paper, floating rate notes, and asset-backed commercial paper.

3 Portfolio holdings and characteristics are subject to change.

6

| PERFORMANCEHIGHLIGHTS | | WELLSFARGOMONEYMARKETFUNDS |

|

WELLSFARGOMINNESOTAMONEYMARKETFUND —CLASSA

INVESTMENT OBJECTIVE

The Wells Fargo Minnesota Money Market Fund (the Fund) seeks to provide a high level of income exempt from federal income tax, but not the federal AMT, and Minnesota individual income tax, while preserving capital and liquidity.

FUNDMANAGERS

Dave Sylvester

Julio Bonilla

INCEPTIONDATE

8/14/00

AVERAGE ANNUAL TOTAL RETURN1 (%) (AS OF SEPTEMBER 30, 2003)

| | | 6-Month* | | 1-Year | | Life of Fund |

| | | |

Wells Fargo Minnesota Money Market Fund – Class A | | 0.16 | | 0.46 | | 1.51 |

| | | |

Benchmark | | | | | | |

| | | |

iMoneyNet All State Specific Minnesota Retail Money Fund Average2 | | 0.17 | | 0.46 | | 1.53 |

| * | | Returns for periods of less than one year are not annualized. |

| FUND YIELD SUMMARY (AS OF SEPTEMBER 30, 2003) |

|

| |

7-Day Current Yield | | 0.33% |

| |

7-Day Compound Yield | | 0.33% |

| |

30-Day Simple Yield | | 0.23% |

| |

30-Day Compound Yield | | 0.23% |

| FUND CHARACTERISTICS3 (AS OF SEPTEMBER 30, 2003) |

|

| |

Weighted Average Maturity | | 50 days |

| |

Number of Holdings | | 61 |

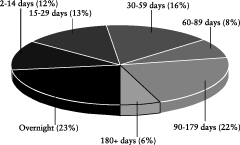

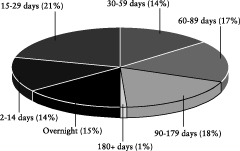

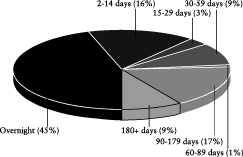

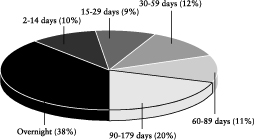

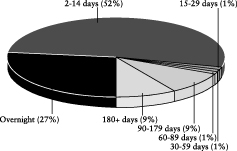

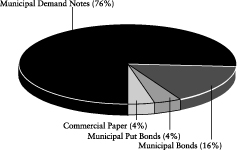

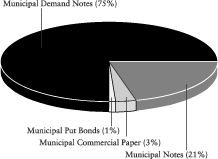

PORTFOLIO COMPOSITION3 (AS OF SEPTEMBER 30, 2003)

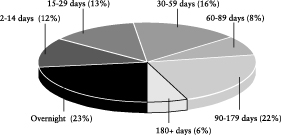

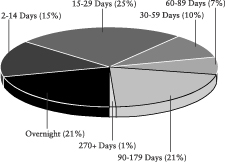

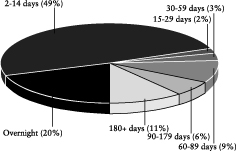

MATURITY DISTRIBUTION3 (AS OF SEPTEMBER 30, 2003)

The Fund is sold without a front-end sales charge or contingent deferred sales charge. Other fees and expenses apply to a continued investment in the Fund and are described in the Fund’s Statement of Additional Information. An investment in a Wells Fargo Money Market Fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although the Wells Fargo Money Market Funds seek to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in money market funds.

1 Figures quoted represent past performance, which is no guarantee of future results. Investment returns will fluctuate. The Fund’s yield figures more closely reflect the current earnings of the Fund than the total return figures. The Fund’s Adviser has committed through July 31, 2004 to waive fees and/or reimburse expenses to the extent necessary to maintain a certain net operating expense ratio for the Fund. The Fund’s Adviser also has voluntarily waived fees and/or reimbursed expenses, which reduced operating expenses. Actual reductions of operating expenses increased total return to shareholders. Without these reductions, the Fund’s 7-day current yield would have been 0.24%.

2 The iMoneyNet All State Specific Minnesota Retail Money Fund Average consists of only Minnesota retail state tax-free and municipal money funds.

3 Portfolio holdings and characteristics are subject to change.

7

WELLSFARGOMONEYMARKETFUNDS | | PERFORMANCEHIGHLIGHTS |

|

WELLSFARGOMONEYMARKETFUND — CLASSAANDCLASSB

INVESTMENT OBJECTIVE

The Wells Fargo Money Market Fund (the Fund) seeks high current income, while preserving capital and liquidity.

FUNDMANAGERS

Dave Sylvester

Laurie White

INCEPTIONDATE

07/01/92

AVERAGE ANNUAL TOTAL RETURN1(%) (AS OF SEPTEMBER 30, 2003)

| | | 6-Month* | | 1-Year | | 5-Year | | 10-Year |

| | | | |

Wells Fargo Money Market Fund – Class A | | 0.23 | | 0.64 | | 3.31 | | 3.98 |

| | | | |

Wells Fargo Money Market Fund – Class B | | 0.07 | | 0.17 | | 2.62 | | 3.29 |

| | | | |

Benchmark | | | | | | | | |

| | | | |

iMoneyNet First Tier Retail Money Fund Average2 | | 0.23 | | 0.62 | | 3.59 | | 4.90 |

* Returns for periods of less than one year are not annualized.

| FUND YIELD SUMMARY CLASS A (AS OF SEPTEMBER 30, 2003) |

|

| |

7-Day Current Yield | | 0.36% |

| |

7-Day Compound Yield | | 0.36% |

| |

30-Day Simple Yield | | 0.35% |

| |

30-Day Compound Yield | | 0.35% |

| FUND YIELD SUMMARY CLASS B (AS OF SEPTEMBER 30, 2003) |

|

| |

7-Day Current Yield | | 0.10% |

| |

7-Day Compound Yield | | 0.10% |

| |

30-Day Simple Yield | | 0.10% |

| |

30-Day Compound Yield | | 0.10% |

| FUND CHARACTERISTICS3 (AS OF SEPTEMBER 30, 2003) |

|

| |

Average Maturity | | 50 days |

| |

Number of Holdings | | 116 |

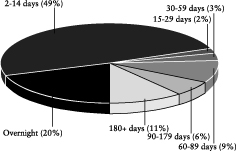

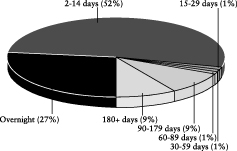

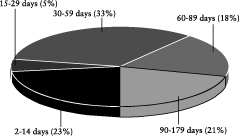

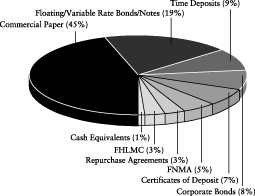

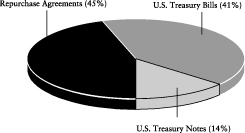

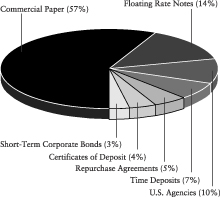

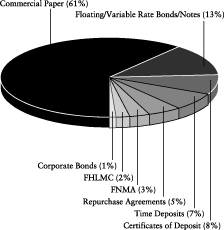

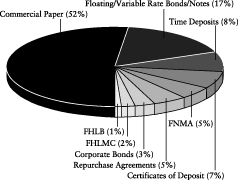

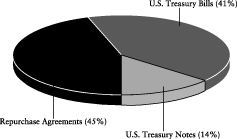

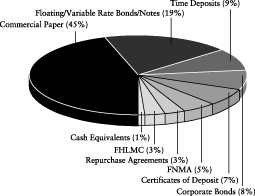

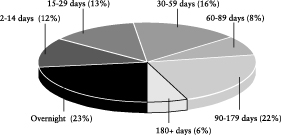

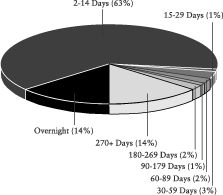

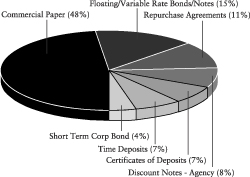

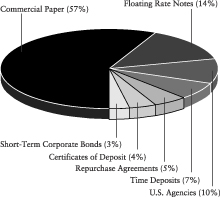

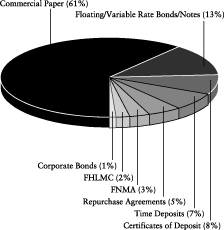

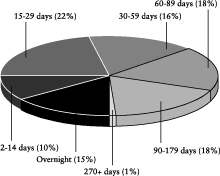

PORTFOLIO COMPOSITION3 (AS OF SEPTEMBER 30, 2003)

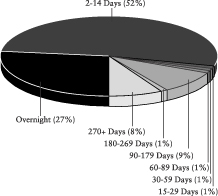

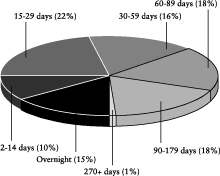

MATURITY DISTRIBUTION3 (AS OF SEPTEMBER 30, 2003)

The Fund is sold without a front-end sales charge, but the Fund’s Class B shares are subject to a contingent deferred sales charge. Other fees and expenses apply to a continued investment in the Fund and are described in the Fund’s Statement of Additional Information. An investment in a Wells Fargo Money Market Fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although the Wells Fargo Money Market Funds seek to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in money market funds.

1 Figures quoted represent past performance, which is no guarantee of future results. Investment returns will fluctuate. The Fund’s yield figures more closely reflect the current earnings of the Fund than the total return figures. The Fund’s Adviser has committed through July 31, 2004 to waive fees and/or reimburse expenses to the extent necessary to maintain a certain net operating expense ratio for the Fund. The Fund’s Adviser also has voluntarily waived fees and/or reimbursed expenses, which reduced operating expenses. Actual reductions of operating expenses increased total return to shareholders. Without these reductions, the Fund’s 7-day current yield would have been 0.19% for the Class A shares and 0.00% for the Class B shares. Performance shown for the Class A shares of the Wells Fargo Money Market Fund for periods prior to November 8, 1999, reflects performance of the Class A shares of the Stagecoach Money Market Fund (the accounting survivor of a merger of the Norwest Advantage Ready Cash Investment Fund, Stagecoach Prime Money Market Fund and the Stagecoach Money Market), its predecessor fund. Performance shown for the Class B shares of the Wells Fargo Money Market Fund for periods prior to November 8, 1999, reflects performance of the Class S shares of the Stagecoach Money Market Fund (the accounting survivor of a merger of the Norwest Advantage Ready Cash Investment Fund, the Stagecoach Prime Money Market Fund and the Stagecoach Money Market Fund), its predecessor fund. Effective at the close of business November 5, 1999, the Stagecoach and Norwest Advantage Funds were reorganized into the Wells Fargo Funds.

2 The iMoneyNet First Tier Retail Money Fund Average is an average of non-government retail funds that do not hold any second tier securities. Portfolio holdings of first tier funds include U.S. Treasury securities, U.S. other securities, repos, time deposits, domestic bank obligations, foreign bank obligations, first tier commercial paper, floating rate notes and asset-backed commercial paper.

3 Portfolio holdings and characteristics are subject to change.

8

PERFORMANCEHIGHLIGHTS | | WELLSFARGOMONEYMARKETFUNDS |

|

WELLSFARGONATIONALTAX-FREEMONEYMARKETFUND —CLASSA

INVESTMENT OBJECTIVE

The Wells Fargo National Tax-Free Money Market Fund (the Fund) seeks high current income exempt from federal income taxes, while preserving capital and liquidity.

FUNDMANAGERS

Dave Sylvester

Julio Bonilla

INCEPTIONDATE

08/03/93

AVERAGE ANNUAL TOTAL RETURN1(%) (AS OF SEPTEMBER 30, 2003)

| | | 6-Month* | | 1-Year | | 5-Year | | 10-Year |

| | | | |

Wells Fargo National Tax-Free Money Market Fund – Class A | | 0.22 | | 0.58 | | 2.13 | | 2.58 |

| | | | |

Benchmark | | | | | | | | |

| | | | |

iMoneyNet All Tax-Free Money Fund Average2 | | 0.26 | | 0.64 | | 2.22 | | 2.83 |

| * Returns for periods of less than one year are not annualized. | | | | | | | | |

| FUND YIELD SUMMARY (AS OF SEPTEMBER 30, 2003) |

|

| |

7-Day Current Yield | | 0.47% |

| |

7-Day Compound Yield | | 0.48% |

| |

30-Day Simple Yield | | 0.36% |

| |

30-Day Compound Yield | | 0.36% |

| FUND CHARACTERISTICS3 (AS OF SEPTEMBER 30, 2003) |

|

| |

Weighted Average Maturity | | 37 days |

| |

Number of Holdings | | 316 |

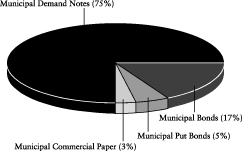

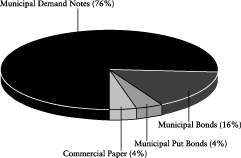

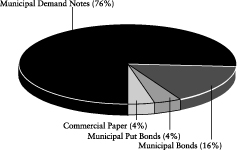

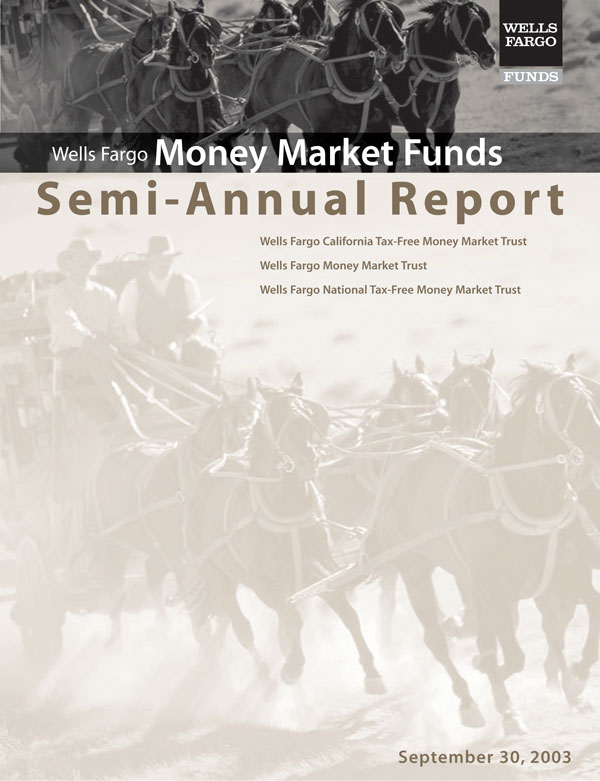

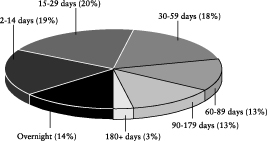

PORTFOLIO COMPOSITION3 (AS OF SEPTEMBER 30, 2003)

MATURITY DISTRIBUTION3 (AS OF SEPTEMBER 30, 2003)

The Fund is sold without a front-end sales charge or contingent deferred sales charge. Other fees and expenses apply to a continued investment in the Fund and are described in the Fund’s Statement of Additional Information. An investment in a Wells Fargo Money Market Fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although the Wells Fargo Money Market Funds seek to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in money market funds.

1 Figures quoted represent past performance, which is no guarantee of future results. Investment returns will fluctuate. The Fund’s yield figures more closely reflect the current earnings of the Fund than the total return figures. The Fund’s Adviser has committed through July 31, 2004 to waive fees and/or reimburse expenses to the extent necessary to maintain a certain net operating expense ratio for the Fund. Actual reductions of operating expenses can increase total return to shareholders. Without these reductions, the Fund’s 7-day current yield would have been 0.47%.

Performance shown for the Class A shares of the Wells Fargo National Tax-Free Money Market Fund for the period prior to July 28, 2003, reflects performance of the Service Class shares of the Wells Fargo National Tax-Free Money Market Fund, adjusted for Class A fees and expenses. Performance shown for periods prior to November 8, 1999, reflects performance of the Service Class (formerly Institutional Class) shares of the Norwest Advantage Municipal Money Market Fund (the accounting survivor of a merger of the Norwest Advantage Municipal Money Market Fund and the Stagecoach National Tax-Free Money Market Fund), its predecessor fund. Effective at the close of business November 5, 1999, the Stagecoach and Norwest Advantage Funds were reorganized into the Wells Fargo Funds.

2 The iMoneyNet All Tax-Free Money Fund Average includes tax-free and municipal retail and institutional money funds. It is made up of funds in the National Tax-Free Retail, National Tax-Free Institutional, State-Specific Retail and State-Specific Institutional categories.

3 Portfolio holdings and characteristics are subject to change.

9

WELLSFARGOMONEYMARKETFUNDS | | PERFORMANCEHIGHLIGHTS |

|

WELLSFARGOTREASURYPLUSMONEYMARKETFUND —CLASSA

INVESTMENT OBJECTIVE

The Wells Fargo Treasury Plus Money Market Fund (the Fund) seeks current income and stability of principal.

FUNDMANAGERS

Dave Sylvester

Laurie White

INCEPTIONDATE

10/01/85

AVERAGE ANNUAL TOTAL RETURN1 (%) (AS OF SEPTEMBER 30, 2003)

| | | 6-Month* | | 1-Year | | 5-Year | | 10-Year |

| | | | |

Wells Fargo Treasury Plus Money Market Fund – Class A | | 0.26 | | 0.68 | | 3.25 | | 3.95 |

| | | | |

Benchmark | | | | | | | | |

| | | | |

iMoneyNet Treasury & Repo Retail Money Fund Average2 | | 0.21 | | 0.56 | | 3.38 | | 4.65 |

* Returns for periods of less than one year are not annualized.

| FUND YIELD SUMMARY (AS OF SEPTEMBER 30, 2003) |

|

| |

7-Day Current Yield | | 0.39% |

| |

7-Day Compound Yield | | 0.39% |

| |

30-Day Simple Yield | | 0.38% |

| |

30-Day Compound Yield | | 0.39% |

| FUND CHARACTERISTICS3 (AS OF SEPTEMBER 30, 2003) |

|

| |

Weighted Average Maturity | | 51 days |

| |

Number of Holdings | | 32 |

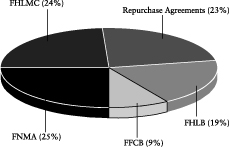

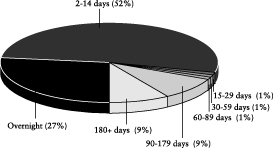

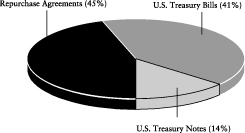

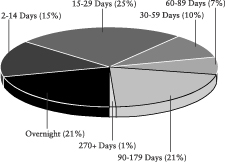

PORTFOLIO COMPOSITION3 (AS OF SEPTEMBER 30, 2003)

MATURITY DISTRIBUTION3 (AS OF SEPTEMBER 30, 2003)

The Fund is sold without a front-end sales charge or contingent deferred sales charge. Other fees and expenses apply to a continued investment in the Fund and are described in the Fund’s Statement of Additional Information. An investment in a Wells Fargo Money Market Fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although the Wells Fargo Money Market Funds seek to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in money market funds. The U.S. Treasury guarantee applies to the underlying securities and NOT to shares of the Fund.

1 Figures quoted represent past performance, which is no guarantee of future results. Investment returns will fluctuate. The Fund’s yield figures more closely reflect the current earnings of the Fund than the total return figures. The Fund’s Adviser has committed through July 31, 2004 to waive fees and/or reimburse expenses to the extent necessary to maintain a certain net operating expense ratio for the Fund. Actual reductions of operating expenses can increase total return to shareholders. Without these reductions, the Fund’s 7-day current yield would have been 0.39%.

Performance shown for the Class A shares of the Wells Fargo Treasury Plus Money Market Fund for the periods prior to July 28, 2003, reflects performance of the Service Class shares of the Wells Fargo Treasury Plus Money Market Fund, adjusted for Class A fees and expenses. Performance shown for periods prior to November 8, 1999, reflects performance of the Service Class shares of the Stagecoach Treasury Plus Money Market Fund (the accounting survivor of a merger between the Norwest Advantage Treasury Plus Fund and the Stagecoach Treasury Plus Money Market Fund), its predecessor fund. Effective at the close of business November 5, 1999, the Stagecoach and Norwest Advantage Funds were reorganized into the Wells Fargo Funds. Performance shown for the period prior to October 1, 1995, through September 6, 1996, reflects performance of the Pacific American U.S. Treasury Portfolio, the predecessor portfolio. In July 1995, the Pacific American U.S. Treasury Portfolio was renamed the Pacifica Treasury Money Market Fund. Performance shown for periods prior to October 1, 1995, reflects performance of the shares of the predecessor portfolio.

2 The iMoneyNet Treasury & Repo Retail Money Fund Average is an average of retail government funds holding U.S. Treasuries and repurchase agreements backed by the U.S. Treasury.

3 Portfolio holdings and characteristics are subject to change.

10

| PERFORMANCEHIGHLIGHTS | | WELLSFARGOMONEYMARKETFUNDS |

|

WELLSFARGO 100%TREASURYMONEYMARKETFUND —CLASSA

INVESTMENT OBJECTIVE

The Wells Fargo 100% Treasury Money Market Fund (the Fund) seeks stability of principal and current income that is exempt from most state and local individual income taxes.

FUNDMANAGERS

Dave Sylvester

Laurie White

INCEPTIONDATE

12/03/90

AVERAGE ANNUAL TOTAL RETURN1 (%) (AS OF SEPTEMBER 30, 2003)

| | | 6-Month* | | 1-Year | | 5-Year | | 10-Year |

| | | | |

Wells Fargo 100% Treasury Money Market Fund – Class A | | 0.21 | | 0.60 | | 3.10 | | 3.76 |

| | | | |

Benchmarks | | | | | | | | |

| | | | |

iMoneyNet Treasury Retail Money Fund Average2 | | 0.22 | | 0.63 | | 3.40 | | 4.64 |

| | | | |

91 Day U.S. Treasury Bill3 | | 0.84 | | 1.89 | | 4.54 | | 5.01 |

* Returns for periods of less than one year are not annualized.

| FUND YIELD SUMMARY (AS OF SEPTEMBER 30, 2003) | |

|

| |

7-Day Current Yield | | 0.31% | |

| |

7-Day Compound Yield | | 0.31% | |

| |

30-Day Simple Yield | | 0.32% | |

| |

30-Day Compound Yield | | 0.32% | |

| FUND CHARACTERISTICS4 (AS OF SEPTEMBER 30, 2003) |

|

| |

Average Maturity | | 53 days |

| |

Number of Holdings | | 31 |

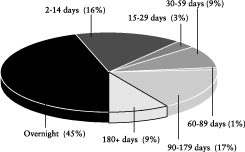

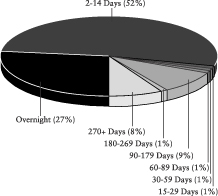

PORTFOLIO COMPOSITION4 (AS OF SEPTEMBER 30, 2003)

MATURITY DISTRIBUTION4 (AS OF SEPTEMBER 30, 2003)

The Fund is sold without a front-end sales charge or contingent deferred sales charge. Other fees and expenses apply to a continued investment in the Fund and are described in the Fund’s Statement of Additional Information. An investment in a Wells Fargo Money Market Fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although the Wells Fargo Money Market Funds seek to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in money market funds.

1 Figures quoted represent past performance, which is no guarantee of future results. Investment returns will fluctuate. The Fund’s yield figures more closely reflect the current earnings of the Fund than the total return figures. The Fund’s Adviser has committed through July 31, 2004 to waive fees and/or reimburse expenses to the extent necessary to maintain a certain net operating expense ratio for the Fund. Actual reductions of operating expenses can increase total return to shareholders. Without these reductions, the Fund’s 7-day current yield would have been 0.08%.

Performance shown for the Class A shares of the Wells Fargo 100% Treasury Money Market Fund for periods prior to November 8, 1999 reflects performance of the Service Class (formerly Single Class) shares, adjusted for expenses, of the Norwest Advantage Treasury Fund, its predecessor fund. Effective at the close of business November 5, 1999, the Norwest Advantage Funds were reorganized into the Wells Fargo Funds.

2 The iMoneyNet Treasury Retail Money Fund Average includes only retail funds that hold 100% in U.S. Treasury securities.

3 Estimated monthly return (12th root of annualized discount rate) which is based on the discount rate quoted on the last business day of the month of 91 day U.S. Treasury Bills. These figures are calculated on a 365 day basis.

4 Portfolio holdings and characteristics are subject to change.

11

WELLSFARGOMONEYMARKETFUNDS | | PORTFOLIOOFINVESTMENTS — SEPTEMBER 30, 2003 (UNAUDITED) |

|

CALIFORNIATAX-FREEMONEYMARKETFUND

| Principal | | Security Name | | Interest Rate | | | Maturity Date | | Value |

|

| Municipal Securities – 99.85% |

|

| California – 93.77% |

| | | | |

| $ | 6,000,000 | | ABAG Finance Authority For Nonprofit Corporations California Housing Revenue Series A Societe Generale LOC§ | | 1.10 | % | | 07/01/2008 | | $ | 6,000,000 |

| | | | |

| | 9,865,000 | | ABAG Finance Authority For Nonprofit Corporations California MFHR Gaia Building Project Series A Collateralized By FNMA§ | | 1.05 | | | 09/15/2032 | | | 9,865,000 |

| | | | |

| | 1,150,000 | | Alameda County CA CTFS Participation Santa Rita Jail Project Lease Revenue Prerefunded 12/01/03 @ 102 MBIA Insured§ | | 5.70 | | | 12/01/2014 | | | 1,181,779 |

| | | | |

| | 5,500,000 | | Alvord CA University School District CTFS Participation Food Services Bridge Funding Program Lease Revenue FSA Insured§ | | 1.05 | | | 06/01/2037 | | | 5,500,000 |

| | | | |

| | 4,400,000 | | Anaheim CA CTFS Participation Lease Revenue AMBAC Insured§ | | 1.00 | | | 08/01/2019 | | | 4,400,000 |

| | | | |

| | 3,900,000 | | Anaheim CA Housing Authority MFHR Collateralized By FNMA§ | | 1.10 | | | 07/15/2020 | | | 3,900,000 |

| | | | |

| | 10,244,000 | | Anaheim CA Housing Authority MFHR Fountain Anaheim Hills Series A Collateralized By FNMA§ | | 1.15 | | | 02/15/2033 | | | 10,244,000 |

| | | | |

| | 4,345,000 | | Anaheim CA Housing Authority MFHR Monterrey Apartments Series B Collateralized By FNMA§ | | 1.10 | | | 05/15/2027 | | | 4,345,000 |

| | | | |

| | 6,300,000 | | Anaheim CA Housing Authority MFHR Sea Wind Apartments Project Series C Collateralized By FNMA§ | | 1.15 | | | 07/15/2033 | | | 6,300,000 |

| | | | |

| | 8,160,000 | | Anaheim CA Public Financing Authority Lease Revenue FSA Insured§ | | 1.13 | | | 09/01/2024 | | | 8,160,000 |

| | | | |

| | 37,000,000 | | Bay Area Toll Authority CA Toll Bridge Revenue San Francisco Bay Area Project Series A AMBAC Insured§ | | 1.00 | | | 04/01/2036 | | | 37,000,000 |

| | | | |

| | 4,300,000 | | Bay Area Toll Authority CA Toll Bridge Revenue San Francisco Bay Area Series B§ | | 1.00 | | | 04/01/2029 | | | 4,300,000 |

| | | | |

| | 700,000 | | Bay Area Toll Authority California Toll Bridge Revenue San Francisco Bay Area Project Series C AMBAC Insured§ | | 1.05 | | | 04/01/2037 | | | 700,000 |

| | | | |

| | 11,000,000 | | Buena Park CA MFHR Walden Glen Apartments Project Series A§ | | 1.15 | | | 02/15/2033 | | | 11,000,000 |

| | | | |

| | 13,000,000 | | California Cities Home Ownership Authority Housing Revenue Lease Purchase Program Project Series A Collateralized By FHLMC§ | | 1.10 | | | 09/01/2006 | | | 13,000,000 |

| | | | |

| | 3,000,000 | | California Communities Housing Finance Agency Lease Revenue Series A Collateralized By FHLMC§ | | 1.10 | | | 02/01/2007 | | | 3,000,000 |

| | | | |

| | 2,420,000 | | California Educational Facilities Authority Revenue CTFS Series 113 General Obligation of University§ | | 1.08 | | | 12/01/2027 | | | 2,420,000 |

| | | | |

| | 10,500,000 | | California Educational Facilities Authority Revenue Loyola Maramount University Series B MBIA Insured§ | | 1.10 | | | 10/01/2027 | | | 10,500,000 |

| | | | |

| | 8,290,000 | | California Educational Facilities Authority Revenue Santa Clara University Series B MBIA Insured§ | | 1.10 | | | 02/01/2032 | | | 8,290,000 |

| | | | |

| | 980,000 | | California HFA Revenue CTFS Series 150 MBIA Insured§ | | 1.13 | | | 02/01/2029 | | | 980,000 |

| | | | |

| | 75,000 | | California HFA Revenue CTFS Series 412 AMBAC Insured§ | | 1.13 | | | 08/01/2029 | | | 75,000 |

| | | | |

| | 3,400,000 | | California HFA Revenue Home Mortgage Series B§ | | 1.28 | | | 08/01/2033 | | | 3,400,000 |

| | | | |

| | 5,800,000 | | California HFA Revenue Home Mortgage Series M§ | | 1.20 | | | 08/01/2033 | | | 5,800,000 |

| | | | |

| | 4,415,000 | | California HFA Revenue Home Mortgage Series U§ | | 1.10 | | | 02/01/2017 | | | 4,415,000 |

| | | | |

| | 10,925,000 | | California HFA Revenue Home Mortgage Series U§ | | 1.14 | | | 02/01/2031 | | | 10,925,000 |

| | | | |

| | 31,960,000 | | California HFA Revenue Home Mortgages FSA Insured§ | | 1.14 | | | 02/01/2032 | | | 31,960,000 |

| | | | |

| | 6,800,000 | | California HFA Revenue Home Mortgages Series F FSA Insured§ | | 1.07 | | | 02/01/2034 | | | 6,800,000 |

| | | | |

| | 5,600,000 | | California HFA Revenue Home Mortgages Series M§ | | 1.20 | | | 02/01/2025 | | | 5,600,000 |

| | | | |

| | 1,470,000 | | California HFA Revenue MBIA Insured§ | | 1.15 | | | 08/01/2016 | | | 1,470,000 |

| | | | |

| | 9,100,000 | | California HFA Revenue MFHR Series D§ | | 1.23 | | | 02/01/2031 | | | 9,100,000 |

| | | | |

| | 2,050,000 | | California HFA Revenue Series 112-A§ | | 1.15 | | | 08/01/2026 | | | 2,050,000 |

| | | | |

| | 6,900,000 | | California HFA Revenue Series F§ | | 1.20 | | | 02/01/2033 | | | 6,900,000 |

| | | | |

| | 17,800,000 | | California HFFA Revenue Adventist Health Systems Series B KBC Bank NV LOC§ | | 1.20 | | | 09/01/2025 | | | 17,800,000 |

12

PORTFOLIOOFINVESTMENTS — SEPTEMBER 30, 2003 (UNAUDITED) | | WELLSFARGOMONEYMARKETFUNDS |

|

CALIFORNIATAX-FREEMONEYMARKETFUND

| Principal | | Security Name | | Interest Rate | | | Maturity Date | | Value |

|

| California (continued) |

| | | | |

| $ | 2,845,000 | | California HFFA Revenue CTFS Series 26 FSA Insured§ | | 1.08 | % | | 06/01/2022 | | $ | 2,845,000 |

| | | | |

| | 7,200,000 | | California HFFA Revenue Scripps Health Series A Bank One NA LOC§ | | 1.05 | | | 10/01/2023 | | | 7,200,000 |

| | | | |

| | 13,155,000 | | California HFFA Revenue Series A MBIA Insured§ | | 1.20 | | | 09/01/2028 | | | 13,155,000 |

| | | | |

| | 8,530,000 | | California HFFA Revenue Series B MBIA Insured§ | | 1.20 | | | 09/01/2028 | | | 8,530,000 |

| | | | |

| | 7,120,000 | | California HFFA Revenue Series C MBIA Insured§ | | 1.20 | | | 09/01/2015 | | | 7,120,000 |

| | | | |

| | 15,500,000 | | California Infrastructure & Economic Development Bank Revenue J Paul Getty Series D§ | | 1.00 | | | 04/01/2033 | | | 15,500,000 |

| | | | |

| | 18,000,000 | | California Infrastructure & Economic Development Bank Series 2002 | | 0.80 | | | 11/19/2003 | | | 18,000,000 |

| | | | |

| | 15,000,000 | | California Infrastructure & Economic Development Bank Series 2002 | | 0.80 | | | 12/09/2003 | | | 15,000,000 |

| | | | |

| | 76,000,000 | | California School Cash Reserve Program Authority Pool Series A | | 2.00 | | | 07/06/2004 | | | 76,632,672 |

| | | | |

| | 8,300,000 | | California State Department Water Reserve & Power Supply Revenue Series 764 FSA Insured§ | | 1.08 | | | 05/01/2012 | | | 8,300,000 |

| | | | |

| | 29,200,000 | | California State Department Water Reserve & Power Supply Revenue Series B-1 Bank of New York LOC§ | | 1.20 | | | 05/01/2022 | | | 29,200,000 |

| | | | |

| | 24,400,000 | | California State Department Water Reserve & Power Supply Revenue Series B-4 Bayerische Landesbank LOC§ | | 1.15 | | | 05/01/2022 | | | 24,400,000 |

| | | | |

| | 1,900,000 | | California State Department Water Reserve & Power Supply Revenue Series B-5 Bayerische Landesbank LOC§ | | 1.15 | | | 05/01/2022 | | | 1,900,000 |

| | | | |

| | 26,800,000 | | California State Department Water Reserve & Power Supply Revenue Series C-14 Westdeutsche Landesbank LOC§ | | 1.10 | | | 05/01/2022 | | | 26,800,000 |

| | | | |

| | 17,800,000 | | California State Department Water Reserve & Power Supply Revenue Series C-3 AMBAC Insured§ | | 1.05 | | | 05/01/2022 | | | 17,800,000 |

| | | | |

| | 9,000,000 | | California State Department Water Reserve Center Valley Project Revenue Putters Series 127 FGIC Insured§ | | 1.10 | | | 12/01/2022 | | | 9,000,000 |

| | | | |

| | 3,200,000 | | California State Economic Development Financing Authority Industrial Development Revenue Serra Microchassis Project US Bank NA LOC§ | | 1.20 | | | 08/01/2027 | | | 3,200,000 |

| | | | |

| | 2,005,000 | | California State Economic Development Financing Authority Industrial Development Revenue Serra Mission Project Series A US Bank NA LOC§ | | 1.20 | | | 08/01/2027 | | | 2,005,000 |

| | | | |

| | 4,995,000 | | California State Floater CTFS Series 471X MBIA Insured§ | | 1.13 | | | 09/01/2024 | | | 4,995,000 |

| | | | |

| | 9,000,000 | | California State Floats PA 315 FSA Insured§ | | 1.15 | | | 12/01/2003 | | | 9,000,000 |

| | | | |

| | 1,420,000 | | California State Floats PT 153A§ | | 1.15 | | | 12/01/2008 | | | 1,420,000 |

| | | | |

| | 11,500,000 | | California State Merlots-B 45 Wachovia Bank Insured§ | | 1.09 | | | 10/01/2029 | | | 11,500,000 |

| | | | |

| | 10,395,000 | | California State Public Works Board Lease Revenue CTFS Series 210 AMBAC Insured§ | | 1.08 | | | 01/01/2011 | | | 10,395,000 |

| | | | |

| | 19,570,000 | | California State Public Works Board Lease Revenue CTFS Series D AMBAC Insured§ | | 1.11 | | | 12/01/2019 | | | 19,570,000 |

| | | | |

| | 8,875,000 | | California State Public Works Board Lease Revenue Roc Series II-R-133 AMBAC Insured§ | | 1.11 | | | 12/01/2014 | | | 8,875,000 |

| | | | |

| | 4,205,000 | | California State Public Works Board Lease Revenue Roc Series II-R-160 AMBAC Insured§ | | 1.11 | | | 10/01/2012 | | | 4,205,000 |

| | | | |

| | 6,425,000 | | California State Putters Series 239Z AMBAC Insured§ | | 1.13 | | | 12/01/2032 | | | 6,425,000 |

| | | | |

| | 26,400,000 | | California State Series C-1 Bank of America NA LOC§ | | 1.10 | | | 05/01/2033 | | | 26,400,000 |

| | | | |

| | 20,800,000 | | California Statewide CDA Davis Retirement Care Project§ | | 1.20 | | | 11/15/2028 | | | 20,800,000 |

| | | | |

| | 6,400,000 | | California Statewide CDA MFHR Canyon Country Apartments Series M Collaterlized By FHLMC§ | | 1.15 | | | 12/01/2034 | | | 6,400,000 |

| | | | |

| | 6,750,000 | | California Statewide CDA MFHR Crocker Oaks Apartments Projectseries H Collateralized By FNMA§ | | 1.15 | | | 03/15/2034 | | | 6,750,000 |

| | | | |

| | 3,985,000 | | California Statewide CDA MFHR Granite Oaks Apartments Series R Collateralized By FNMA§ | | 1.15 | | | 10/15/2030 | | | 3,985,000 |

13

WELLSFARGOMONEYMARKETFUNDS | | PORTFOLIOOFINVESTMENTS — SEPTEMBER 30, 2003 (UNAUDITED) |

|

CALIFORNIATAX-FREEMONEYMARKETFUND

| Principal | | Security Name | | Interest Rate | | | Maturity Date | | Value |

| | | |

| California (continued) | | | | | | | | |

| | | | |

| $ | 2,160,000 | | California Statewide CDA MFHR Greenback Manorapartments Series A Collateralized By FHLB§ | | 1.10 | % | | 02/01/2028 | | $ | 2,160,000 |

| | | | |

| | 17,200,000 | | California Statewide CDA MFHR IAC Project Series W-1 Bank of America NA LOC§ | | 1.10 | | | 08/01/2034 | | | 17,200,000 |

| | | | |

| | 2,800,000 | | California Statewide CDA MFHR IAC Project Series W-2 Bank of America NA LOC§ | | 1.10 | | | 09/15/2029 | | | 2,800,000 |

| | | | |

| | 700,000 | | California Statewide CDA MFHR IAC Project Series W-3 Bank of America NA LOC§ | | 1.10 | | | 04/01/2025 | | | 700,000 |

| | | | |

| | 13,700,000 | | California Statewide CDA Revenue Childrens Hospital of Los Angeles Series Bambac Insured§ | | 1.00 | | | 08/15/2032 | | | 13,700,000 |

| | | | |

| | 9,180,000 | | California Statewide CDA Revenue CTFS Participation House Ear Institute

JP Morgan Chase & Company LOC§ | | 1.20 | | | 12/01/2018 | | | 9,180,000 |

| | | | |

| | 1,000,000 | | California Statewide CDA Revenue Fremont Rideout Health Group Series A AMBAC Insured§ | | 1.15 | | | 01/01/2031 | | | 1,000,000 |

| | | | |

| | 10,000,000 | | California Statewide CDA Revenue Series A AMBAC Insured§ | | 1.00 | | | 08/15/2032 | | | 10,000,000 |

| | | | |

| | 37,000,000 | | California Statewide CDA Revenue TRAN Series A-1 FSA Insured§ | | 2.00 | | | 06/30/2004 | | | 37,306,351 |

| | | | |

| | 11,090,000 | | California Statewide CDA Solid Waste Facilities Revenue Chevron USA Project Chevron Corporation LOC§ | | 1.18 | | | 12/15/2024 | | | 11,090,000 |

| | | | |

| | 16,420,000 | | Camarillo CA MFHR Hacienda de Camarillo Project Collateralized By FNMA§ | | 1.15 | | | 10/15/2026 | | | 16,420,000 |

| | | | |

| | 2,400,000 | | Camarillo CA MFHR Heritage Park Project Series A Collateralized By FNMA§ | | 1.10 | | | 07/15/2019 | | | 2,400,000 |

| | | | |

| | 5,000,000 | | Castaic Union School District California CTFS Participation School Facility Bridge Funding Program FSA Insured§ | | 1.05 | | | 09/01/2036 | | | 5,000,000 |

| | | | |

| | 5,100,000 | | Colton CA Redevelopment Agency CTFS Participation Las Palomas Association Project City National Bank LOC§ | | 1.05 | | | 11/01/2015 | | | 5,100,000 |

| | | | |

| | 5,985,000 | | Compton CA University School District Merlots Series B39 MBIA Insured§ | | 1.09 | | | 09/01/2027 | | | 5,985,000 |

| | | | |

| | 7,825,000 | | Contra Costa County CA Home Mortgage Revenue CTFS Series A§ | | 1.15 | | | 12/01/2010 | | | 7,825,000 |

| | | | |

| | 7,000,000 | | Contra Costa County CA MFHR Delta Square Apartments Project Series H Collateralized By FNMA§ | | 1.10 | | | 10/15/2029 | | | 7,000,000 |

| | | | |

| | 745,000 | | Contra Costa County CA MFHR El Cerrito Royale Project Series A Bank of America LOC§ | | 1.10 | | | 12/01/2017 | | | 745,000 |

| | | | |

| | 3,300,000 | | Contra Costa County CA MFHR Lafayette Town Center Apartments Series I Collateralized By FNMA§ | | 1.15 | | | 07/15/2032 | | | 3,300,000 |

| | | | |

| | 1,000,000 | | Contra Costa County CA MFHR Series B Collateralized By FNMA§ | | 1.10 | | | 11/15/2022 | | | 1,000,000 |

| | | | |

| | 32,000,000 | | Contra Costa County CA TRAN Series A | | 2.50 | | | 11/17/2003 | | | 32,043,332 |

| | | | |

| | 1,550,000 | | Covina CA Redevelopment Agency MFHR Shadowhills Apartments Series A Collateralized By FNMA§ | | 1.08 | | | 12/01/2015 | | | 1,550,000 |

| | | | |

| | 2,390,000 | | Eagle Tax-Exempt Trust CTF Series 950501 (California State) MBIA Insured§ | | 1.11 | | | 02/01/2006 | | | 2,390,000 |

| | | | |

| | 4,000,000 | | Eagle Tax-Exempt Trust CTF Series 970503 (California State Public Works Board Lease Revenue Series C) AMBAC Insured§ | | 1.11 | | | 09/01/2017 | | | 4,000,000 |

| | | | |

| | 4,400,000 | | Escondido CA Community Development Common CTFS Participation Bank of America NT & SA LOC§ | | 1.10 | | | 10/01/2016 | | | 4,400,000 |

| | | | |

| | 21,710,000 | | Fresno CA Union School District Anticipation Notes | | 1.10 | | | 02/19/2004 | | | 21,710,336 |

| | | | |

| | 6,865,000 | | Garden Grove CA Housing Authority MFHR Floats PT 1385 Collateralized By GNMA§ | | 1.15 | | | 03/23/2006 | | | 6,865,000 |

| | | | |

| | 2,725,000 | | Golden Gate Bridge Highway & Transportation District Morgan Guaranty Trust Company of New York LOC | | 0.85 | | | 10/08/2003 | | | 2,725,000 |

| | | | |

| | 4,000,000 | | Hayward CA MFHR Shorewood Series A FGIC Insured§ | | 1.05 | | | 08/01/2014 | | | 4,000,000 |

| | | | |

| | 3,700,000 | | Hayward CA MFHR Tennyson Gardens Apartments Project Series A US Bank NA LOC§ | | 1.20 | | | 08/01/2032 | | | 3,700,000 |

14

| PORTFOLIOOFINVESTMENTS — SEPTEMBER 30, 2003 (UNAUDITED) | | WELLSFARGOMONEYMARKETFUNDS |

|

CALIFORNIATAX-FREEMONEYMARKETFUND

| Principal | | Security Name | | Interest Rate | | | Maturity Date | | Value |

| | | |

| California (continued) | | | | | | | | |

| | | | |

| $ | 1,000,000 | | Hemet CA MFHR Sunwest Retirement Series A Collateralized By FHLMC§ | | 1.10 | % | | 01/01/2025 | | $ | 1,000,000 |

| | | | |

| | 1,760,000 | | Irvine CA Industrial Revenue Irvine East Investment Company Project Bank of America NA LOC§ | | 1.05 | | | 12/01/2005 | | | 1,760,000 |

| | | | |

| | 6,600,000 | | Irvine Ranch CA Water District CTFS Participation Capital Improvement Project Landesbank Baden LOC§ | | 1.15 | | | 08/01/2016 | | | 6,600,000 |

| | | | |

| | 2,000,000 | | Irvine Ranch CA Water District State Street B&T Company LOC§ | | 1.15 | | | 01/01/2021 | | | 2,000,000 |

| | | | |

| | 5,500,000 | | Lancaster CA Redevelopment Agency MFHR 20Th Street Apartments Project Series C Collateralized By FNMA§ | | 1.10 | | | 12/01/2026 | | | 5,500,000 |

| | | | |

| | 4,450,000 | | Livermore CA Redevelopment Agency MFHR Series 2002A Livermore Apartments Project Bank of America NA LOC§ | | 1.25 | | | 11/01/2040 | | | 4,450,000 |

| | | | |

| | 2,135,000 | | Long Beach CA Harbor Revenue Series 418 FGIC Insured§ | | 1.13 | | | 05/15/2020 | | | 2,135,000 |

| | | | |

| | 2,800,000 | | Long Beach CA Hbr Rev PA 651 FGIC Insured§ | | 1.15 | | | 05/15/2019 | | | 2,800,000 |

| | | | |

| | 7,140,000 | | Los Angeles CA Community Redevelopment Agency MFHR Series A Rowan Lofts Project FNMA Insured§ | | 1.15 | | | 12/01/2034 | | | 7,140,000 |

| | | | |

| | 12,000,000 | | Los Angeles CA Convention & Exhibition Center Authority Lease Revenue Series C1 AMBAC Insured§ | | 0.97 | | | 08/15/2021 | | | 12,000,000 |

| | | | |

| | 6,305,000 | | Los Angeles CA Convention & Exhibition Center Authority Lease Revenue Series D AMBAC Insured§ | | 0.97 | | | 08/15/2021 | | | 6,305,000 |

| | | | |

| | 12,000,000 | | Los Angeles CA Department of Airports Revenue Series C1 Los Angeles International Airport§ | | 1.05 | | | 05/15/2020 | | | 12,000,000 |

| | | | |

| | 6,795,000 | | Los Angeles CA Harbor Department Revenue Transportation Receipts Class F Series 7 MBIA Insured§ | | 1.11 | | | 11/01/2026 | | | 6,795,000 |

| | | | |

| | 7,300,000 | | Los Angeles CA MFHR Broadway Plaza Project Series L§ | | 1.10 | | | 12/01/2034 | | | 7,300,000 |

| | | | |

| | 2,500,000 | | Los Angeles CA MFHR Fountain Park Project Series P§ | | 1.05 | | | 04/15/2033 | | | 2,500,000 |

| | | | |

| | 3,700,000 | | Los Angeles CA MFHR LA Bera Apartment Project Series G Citibank NA LOC§ | | 1.05 | | | 12/01/2030 | | | 3,700,000 |

| | | | |

| | 100,000 | | Los Angeles CA MFHR Loans To Lenders Program Series A FHLB LOC§ | | 1.25 | | | 08/01/2026 | | | 100,000 |

| | | | |

| | 5,300,000 | | Los Angeles CA MFHR Masselin Manor Housing Project Bank of America Nt & SA LOC§ | | 1.10 | | | 07/01/2015 | | | 5,300,000 |

| | | | |

| | 9,000,000 | | Los Angeles CA Union School District COP Multiple Properties Project Series B§ | | 2.25 | | | 10/01/2003 | | | 9,000,000 |

| | | | |

| | 18,300,000 | | Los Angeles CA Union School District Merlots Series A22§ | | 1.09 | | | 07/01/2022 | | | 18,300,000 |

| | | | |

| | 5,000,000 | | Los Angeles CA Union School District Merlots Series B12§ | | 1.09 | | | 01/01/2027 | | | 5,000,000 |

| | | | |

| | 55,500,000 | | Los Angeles CA Union School District TRAN Series A | | 2.00 | | | 07/01/2004 | | | 55,944,576 |

| | | | |

| | 5,000,000 | | Los Angeles CA Wastewater System Sewer Revenue ROCS RR II R 4034§ | | 1.11 | | | 06/01/2022 | | | 5,000,000 |

| | | | |

| | 10,200,000 | | Los Angeles CA Wastewater System Sewer Revenue Series A FGIC Insured§ | | 1.25 | | | 12/01/2031 | | | 10,200,000 |

| | | | |

| | 8,600,000 | | Los Angeles CA Wastewater System Sewer Revenue Series B FGIC Insured§ | | 1.25 | | | 12/01/2031 | | | 8,600,000 |

| | | | |

| | 5,995,000 | | Los Angeles CA Water & Power Revenue Series 182 FSA Insured§ | | 1.10 | | | 07/01/2022 | | | 5,995,000 |

| | | | |

| | 10,595,000 | | Los Angeles CA Water & Power Revenue Series 184 FSA Insured§ | | 1.10 | | | 07/01/2022 | | | 10,595,000 |

| | | | |

| | 4,200,000 | | Los Angeles CA Water & Power Revenue Subseries A-2§ | | 1.05 | | | 07/01/2035 | | | 4,200,000 |

| | | | |

| | 16,700,000 | | Los Angeles CA Water & Power Revenue Subseries A-4§ | | 1.05 | | | 07/01/2035 | | | 16,700,000 |

| | | | |

| | 6,300,000 | | Los Angeles CA Water & Power Revenue Subseries A-6§ | | 1.05 | | | 07/01/2035 | | | 6,300,000 |

| | | | |

| | 20,000,000 | | Los Angeles CA Water & Power Revenue Subseries A-7§ | | 1.05 | | | 07/01/2035 | | | 20,000,000 |

| | | | |

| | 3,000,000 | | Los Angeles CA Water & Power Revenue Subseries B-1 Dexia Insured§ | | 1.05 | | | 07/01/2035 | | | 3,000,000 |

| | | | |

| | 20,900,000 | | Los Angeles CA Water & Power Revenue Subseries B-2§ | | 1.05 | | | 07/01/2034 | | | 20,900,000 |

| | | | |

| | 20,500,000 | | Los Angeles CA Water & Power Revenue Subseries B-3§ | | 1.18 | | | 07/01/2034 | | | 20,500,000 |

| | | | |

| | 1,450,000 | | Los Angeles CA Water & Power Revenue Subseries B-6§ | | 1.20 | | | 07/01/2034 | | | 1,450,000 |

| | | | |

| | 7,100,000 | | Los Angeles CA Water & Power Revenue Subseries B-7§ | | 1.05 | | | 07/01/2034 | | | 7,100,000 |

| | | | |

| | 13,600,000 | | Los Angeles CA Water & Power Revenue Subseries B-8 Bank of America NA LOC§ | | 1.05 | | | 07/01/2034 | | | 13,600,000 |

15

WELLSFARGOMONEYMARKETFUNDS | | PORTFOLIOOFINVESTMENTS — SEPTEMBER 30, 2003 (UNAUDITED) |

|

CALIFORNIATAX-FREEMONEYMARKETFUND

| Principal | | Security Name | | Interest Rate | | | Maturity Date | | Value |

| | | |

| California (continued) | | | | | | | | |

| | | | |

| $ | 18,670,000 | | Los Angeles County CA Metropolitan Transportation Authority Revenue FSA Insured§ | | 1.11 | % | | 07/01/2016 | | $ | 18,670,000 |

| | | | |

| | 20,200,000 | | Los Angeles County CA Metropolitan Transportation Authority Revenue FSA Insured§ | | 1.11 | | | 07/01/2021 | | | 20,200,000 |

| | | | |

| | 10,000,000 | | Los Angeles County CA Metropolitan Transportation Authority Revenue FSA Insured§ | | 1.11 | | | 07/01/2025 | | | 10,000,000 |

| | | | |

| | 3,000,000 | | Los Angeles County CA MFHR Authority Revenue P Float PT 639§ | | 1.22 | | | 10/01/2031 | | | 3,000,000 |

| | | | |

| | 5,850,000 | | Los Angeles County CA Pension Obligation Series B§ | | 1.01 | | | 06/30/2007 | | | 5,850,000 |

| | | | |

| | 1,305,000 | | Los Angeles County CA Pension Obligation Series C§ | | 1.00 | | | 06/30/2007 | | | 1,305,000 |

| | | | |

| | 5,000,000 | | Los Angeles County CA Sanitation District Revenue Series A | | 5.25 | | | 10/01/2019 | | | 5,100,000 |

| | | | |

| | 12,800,000 | | Los Angeles County CA Schools TRAN Series A | | 1.75 | | | 06/30/2004 | | | 12,878,504 |

| | | | |

| | 10,000,000 | | Los Angeles County CA Transportation Common Sales Revenue Series A FGIC Insured§ | | 1.00 | | | 07/01/2012 | | | 10,000,000 |

| | | | |

| | 9,055,000 | | Metropolitan Water District Southern CA Waterworks Revenue MBIA Insured§ | | 1.14 | | | 07/01/2030 | | | 9,055,000 |

| | | | |

| | 4,965,000 | | Metropolitan Water District Southern CA Waterworks Revenue Merlots A21§ | | 1.09 | | | 07/01/2021 | | | 4,965,000 |

| | | | |

| | 56,145,000 | | Metropolitan Water District Southern CA Waterworks Revenue Series A§ | | 1.03 | | | 07/01/2025 | | | 56,145,000 |

| | | | |

| | 3,400,000 | | Metropolitan Water District Southern CA Waterworks Revenue Series A AMBAC Insured§ | | 1.05 | | | 06/01/2023 | | | 3,400,000 |

| | | | |

| | 6,850,000 | | Metropolitan Water District Southern CA Waterworks Revenue Series B-3§ | | 1.15 | | | 07/01/2035 | | | 6,850,000 |

| | | | |

| | 11,100,000 | | Modesto CA Irrigation District Financing Authority Revenue Series SG66 MBIA Insured§ | | 1.14 | | | 10/01/2015 | | | 11,100,000 |

| | | | |

| | 6,500,000 | | Modesto CA MFHR Live Oak Apartments Project Collateralized By FNMA§ | | 1.10 | | | 09/15/2024 | | | 6,500,000 |

| | | | |

| | 5,620,000 | | Modesto CA PFA Lease Revenue Series 354 AMBAC Insured§ | | 1.08 | | | 09/01/2029 | | | 5,620,000 |

| | | | |

| | 31,900,000 | | Msr Public Power Agency CA Utility Tax Revenue San Juan Project Series F MBIA Insured§ | | 1.20 | | | 07/01/2022 | | | 31,900,000 |

| | | | |

| | 4,170,000 | | Msr Public Power Agency CA Utility Tax Revenue San Juan Project Series II R 134 MBIA Insured§ | | 1.11 | | | 07/01/2013 | | | 4,170,000 |

| | | | |

| | 2,400,000 | | Newport Beach CA Revenue Hoag Memorial Hospital Series A§ | | 1.23 | | | 10/01/2026 | | | 2,400,000 |

| | | | |

| | 19,700,000 | | Newport Beach CA Revenue Hoag Memorial Hospital Series B§ | | 1.23 | | | 10/01/2026 | | | 19,700,000 |

| | | | |

| | 10,500,000 | | Newport Beach CA Revenue Hoag Memorial Hospital Series C§ | | 1.23 | | | 10/01/2026 | | | 10,500,000 |

| | | | |

| | 2,965,000 | | Norwalk LA Mirada CA Union School District Series A§ | | 2.00 | | | 08/01/2004 | | | 2,993,907 |

| | | | |

| | 11,800,000 | | Orange County CA Apartment Development Revenue Bluffs Apartment Project Series C FHLMC LOC§ | | 1.10 | | | 12/01/2029 | | | 11,800,000 |

| | | | |

| | 4,000,000 | | Orange County CA Apartment Development Revenue Park Ridge Villas Project FNMA LOC§ | | 1.10 | | | 11/15/2028 | | | 4,000,000 |

| | | | |

| | 5,600,000 | | Orange County CA Apartment Development Revenue Seaside Meadows Partners Project Series 1984C FHLMC LOC§ | | 1.00 | | | 08/01/2008 | | | 5,600,000 |

| | | | |

| | 8,000,000 | | Orange County CA Apartment Development Revenue Series A FHLMC LOC§ | | 1.10 | | | 12/01/2006 | | | 8,000,000 |

| | | | |

| | 26,805,000 | | Orange County CA Apartment Development Revenue Series B Aliso Creek Project FHLMC LOC§ | | 1.05 | | | 11/01/2022 | | | 26,805,000 |

| | | | |

| | 7,449,000 | | Orange County CA Apartment Development Revenue Series D Harbor Pointe Project FHLMC LOC§ | | 1.10 | | | 12/01/2022 | | | 7,449,000 |

| | | | |

| | 9,098,000 | | Orange County CA Improvement Assessment District Number 88 Series 1 KBC Bank NV LOC§ | | 1.20 | | | 09/02/2018 | | | 9,098,000 |

| | | | |

| | 12,490,000 | | Orange County CA Sanitation Districts COP AMBAC Insured§ | | 1.05 | | | 08/01/2013 | | | 12,490,000 |

| | | | |

| | 1,375,000 | | Orange County CA Special Financing Authority Teeter Plan Revenue Series B AMBAC Insured§ | | 1.05 | | | 11/01/2014 | | | 1,375,000 |

16

| PORTFOLIOOFINVESTMENTS — SEPTEMBER 30, 2003 (UNAUDITED) | | WELLSFARGOMONEYMARKETFUNDS |

|

CALIFORNIATAX-FREEMONEYMARKETFUND

| Principal | | Security Name | | Interest Rate | | | Maturity Date | | Value |

|

| California (continued) |

| | | | |

| $ | 3,050,000 | | Orange County CA Special Financing Authority Teeter Plan Revenue Series D AMBAC Insured§ | | 1.05 | % | | 11/01/2014 | | $ | 3,050,000 |

| | | | |

| | 3,000,000 | | Orange County CA Special Financing Authority Teeter Plan Revenue Series E AMBAC Insured§ | | 1.05 | | | 11/01/2014 | | | 3,000,000 |

| | | | |

| | 5,000,000 | | Pacific CA HFA Lease Revenue Series A FHLMC Insured§ | | 1.10 | | | 02/01/2007 | | | 5,000,000 |

| | | | |

| | 720,000 | | Palo Alto CA USD Series II R 93§ | | 1.11 | | | 08/01/2016 | | | 720,000 |

| | | | |

| | 10,000,000 | | Port of Oakland CA | | 0.80 | | | 10/07/2003 | | | 10,000,000 |

| | | | |

| | 12,000,000 | | Port of Oakland CA Series D | | 0.80 | | | 10/08/2003 | | | 12,000,000 |

| | | | |

| | 6,000,000 | | Port of Oakland CA Series D | | 0.90 | | | 10/09/2003 | | | 6,000,000 |

| | | | |

| | 14,000,000 | | Port of Oakland CA Series D | | 0.80 | | | 10/14/2003 | | | 14,000,000 |

| | | | |

| | 11,400,000 | | Port of Oakland CA Series D | | 0.80 | | | 10/15/2003 | | | 11,400,000 |

| | | | |

| | 4,995,000 | | Port of Oakland CA Transportation Revenue FGIC Insured§ | | 1.15 | | | 05/01/2008 | | | 4,995,000 |

| | | | |

| | 7,285,000 | | Port of Oakland CA Transportation Revenue MBIA Insured§ | | 1.15 | | | 05/01/2010 | | | 7,285,000 |

| | | | |

| | 18,290,000 | | Port of Oakland CA Transportation Revenue Series 5 FGIC Insured§ | | 1.08 | | | 11/01/2012 | | | 18,290,000 |

| | | | |

| | 2,690,000 | | Rancho Mirage CA JT Powers Financing Authority Certificates of Participation EISenhower Medical Center Project§ | | 1.07 | | | 07/01/2022 | | | 2,690,000 |

| | | | |

| | 2,245,000 | | Riverside County CA Asset Lending Corporation Leasehold Revenue MBIA Insured§ | | 1.08 | | | 06/01/2016 | | | 2,245,000 |

| | | | |

| | 8,100,000 | | Riverside County CA Community Facilities District Series 88-4 KBC Bank LOC§ | | 1.10 | | | 09/01/2014 | | | 8,100,000 |

| | | | |

| | 5,000,000 | | Riverside County CA IDA Bank of America NA LOC§ | | 1.10 | | | 06/01/2026 | | | 5,000,000 |

| | | | |

| | 22,400,000 | | Riverside San Bernadino CA Housing & Finance Agency Lease Revenue Series A Societe Generale LOC§ | | 1.10 | | | 07/01/2006 | | | 22,400,000 |

| | | | |

| | 3,000,000 | | Roaring Fork Municipal Products Limited Liability Corporation Series 2000-12 Class A§ | | 1.24 | | | 03/01/2034 | | | 3,000,000 |

| | | | |

| | 7,000,000 | | Sacramento County CA HFA MFHR Arlington Creek Apartment Series 1 Collateralized By FNMA§ | | 1.15 | | | 05/15/2034 | | | 7,000,000 |

| | | | |

| | 6,300,000 | | Sacramento County CA HFA MFHR Hidden Oaks Apartments Project Series C Collateralized By FNMA§ | | 1.15 | | | 05/15/2029 | | | 6,300,000 |

| | | | |

| | 6,000,000 | | Sacramento County CA Housing Authority MFHR Normandy Park Apartments Series A§ | | 1.15 | | | 02/15/2033 | | | 6,000,000 |

| | | | |

| | 2,500,000 | | Sacramento County CA MFHR Series C Collateralized By FHLMC§ | | 1.05 | | | 04/15/2007 | | | 2,500,000 |

| | | | |

| | 5,200,000 | | Sacramento County CA MFHR Suncreek Apartments Project Series A§ | | 1.10 | | | 04/01/2026 | | | 5,200,000 |

| | | | |

| | 7,600,000 | | Sacramento County CA Sanitation District Financing Authority Revenue Subordinate Lien Sacramento Regulation C Credit Agricole Indosuez LOC§ | | 1.05 | | | 12/01/2030 | | | 7,600,000 |

| | | | |

| | 6,115,000 | | San Bernadino County CA MFHR Green Valley Apartments Project Series A Collateralized By FNMA§ | | 1.10 | | | 05/15/2029 | | | 6,115,000 |

| | | | |

| | 5,665,000 | | San Bernardino CA Community College District Series RR II R-3006 MBIA Insured§ | | 1.11 | | | 08/01/2023 | | | 5,665,000 |

| | | | |

| | 39,000,000 | | San Bernardino County CA TRAN | | 1.50 | | | 07/01/2004 | | | 39,202,625 |

| | | | |

| | 3,395,000 | | San Diego CA Area HFA Lease Revenue Series B Collateralized By FNMA§ | | 1.10 | | | 06/01/2006 | | | 3,395,000 |

| | | | |

| | 57,260,000 | | San Diego CA County & School District Revenue Anticipation Notes Series A | | 1.75 | | | 06/30/2004 | | | 57,619,750 |

| | | | |

| | 14,825,000 | | San Diego CA HFA MFHR Stratton Apartments Project Series A Collateralized By FNMA§ | | 1.15 | | | 01/15/2033 | | | 14,825,000 |

| | | | |

| | 16,830,000 | | San Diego CA MFHR Collateralized By FHLMC§ | | 1.13 | | | 09/01/2004 | | | 16,830,000 |

| | | | |

| | 32,595,000 | | San Diego CA MFHR Collateralized By FHLMC§ | | 1.13 | | | 03/01/2032 | | | 32,595,000 |

| | | | |

| | 10,200,000 | | San Diego CA MFHR Collateralized By FNMA§ | | 1.05 | | | 08/01/2014 | | | 10,200,000 |

| | | | |

| | 11,050,000 | | San Diego CA MFHR Paseo Series A§ | | 1.05 | | | 12/01/2022 | | | 11,050,000 |

| | | | |

| | 19,130,000 | | San Diego CA Public Facilities Financing Authority Sewer Revenue Series SG 130§ | | 1.11 | | | 05/15/2029 | | | 19,130,000 |

17

WELLSFARGOMONEYMARKETFUNDS | | PORTFOLIOOFINVESTMENTS — SEPTEMBER 30, 2003 (UNAUDITED) |

|

CALIFORNIATAX-FREEMONEYMARKETFUND

| Principal | | Security Name | | Interest Rate | | | Maturity Date | | Value |

|

| California (continued) |

| | | | |

| $ | 5,430,000 | | San Diego CA Public Facilities Financing Authority Water Revenue Class A§ | | 1.11 | % | | 08/01/2012 | | $ | 5,430,000 |

| | | | |

| | 6,621,000 | | San Diego CA Union School District Floaters Series 759 FSA Insured§ | | 1.08 | | | 07/01/2026 | | | 6,621,000 |

| | | | |

| | 5,826,000 | | San Diego CA Union School District Series 758§ | | 1.08 | | | 07/01/2027 | | | 5,826,000 |

| | | | |

| | 11,580,000 | | San Diego CA Union School District Series PA-804§ | | 1.11 | | | 07/01/2022 | | | 11,580,000 |

| | | | |

| | 4,975,000 | | San Francisco CA City & County CTFS Series C-6§ | | 1.10 | | | 06/15/2007 | | | 4,975,000 |

| | | | |

| | 15,800,000 | | San Francisco CA City & County Finance Corporation Lease Revenue Moscone Center Expansion Project Series 1 AMBAC Insured§ | | 1.03 | | | 04/01/2030 | | | 15,800,000 |

| | | | |

| | 10,700,000 | | San Francisco CA City & County Public Utilities Commission For Clean Water Merlots Series B20 MBIA Insured§ | | 1.09 | | | 10/01/2022 | | | 10,700,000 |

| | | | |

| | 1,500,000 | | San Jose CA MFHR Almaden Lake Village Apartments Project Series A Collateralized By FNMA§ | | 1.12 | | | 03/01/2032 | | | 1,500,000 |

| | | | |

| | 19,000,000 | | San Jose CA MFHR Evans Lane Apartments Project Series H Bank of America NA LOC§ | | 1.10 | | | 04/15/2036 | | | 19,000,000 |

| | | | |

| | 2,000,000 | | San Jose CA Redevelopment Agency Tax Allocation Putters Series 158Z Morgan Guaranty LOC§ | | 1.10 | | | 08/01/2014 | | | 2,000,000 |

| | | | |

| | 6,857,500 | | San Jose CA Union School District Santa Clara County Floaters Series 761 FSA Insured§ | | 1.08 | | | 08/01/2027 | | | 6,857,500 |

| | | | |

| | 8,690,000 | | San Jose-Santa Clara CA Water Financing Authority Sewer Revenue Floats SG 49§ | | 1.11 | | | 11/15/2020 | | | 8,690,000 |

| | | | |

| | 2,200,000 | | San Leandro CA MFHR Haas Avenue Apartments Series B Security Pacific National LOC§ | | 1.05 | | | 10/01/2007 | | | 2,200,000 |

| | | | |

| | 5,800,000 | | Santa Ana CA Health Facility Revenue Multi-Modal Town & Country Project BNP Paribas LOC§ | | 1.20 | | | 10/01/2020 | | | 5,800,000 |

| | | | |

| | 9,000,000 | | Santa Barbara County CA TRAN Series A | | 2.00 | | | 07/23/2004 | | | 9,086,649 |

| | | | |

| | 6,165,000 | | Santa Clara CA Electric Revenue Series A AMBAC Insured§ | | 1.05 | | | 07/01/2010 | | | 6,165,000 |

| | | | |

| | 2,395,000 | | Santa Clara CA Electric Revenue Series B AMBAC Insured§ | | 1.05 | | | 07/01/2010 | | | 2,395,000 |

| | | | |

| | 5,900,000 | | Santa Clara County CA MFHR Benton Park Center Apartments Project Series A Collateralized By FNMA§ | | 1.15 | | | 12/15/2025 | | | 5,900,000 |

| | | | |

| | 11,400,000 | | Santa Clara County CA MFHR Foxchase Apartments Project Series E FGIC Insured§ | | 1.05 | | | 11/01/2007 | | | 11,400,000 |

| | | | |

| | 6,150,000 | | Simi Valley CA MFHR Series A§ | | 1.10 | | | 07/01/2023 | | | 6,150,000 |

| | | | |

| | 24,000,000 | | Sonoma County CA TRAN | | 2.50 | | | 10/14/2003 | | | 24,008,072 |

| | | | |

| | 30,595,000 | | South Orange County CA PFA Special Tax Revenue Series 146§ | | 1.10 | | | 08/15/2015 | | | 30,595,000 |

| | | | |

| | 2,300,000 | | Southeast Resource Recovery Facilities Authority Lease Revenue Refunding Bonds Series B§ | | 1.04 | | | 12/01/2018 | | | 2,300,000 |

| | | | |

| | 1,300,000 | | Southern CA Public Power Authority Power Revenue Palo Verde Project Series C§ | | 1.00 | | | 07/01/2017 | | | 1,300,000 |

| | | | |

| | 13,400,000 | | Southern CA Public Power Authority Power Revenue Series A§ | | 1.05 | | | 07/01/2023 | | | 13,400,000 |

| | | | |

| | 7,620,000 | | Southern CA Public Power Authority Power Revenue Series B§ | | 1.00 | | | 07/01/2009 | | | 7,620,000 |

| | | | |

| | 7,400,000 | | Stanford University | | 0.90 | | | 02/06/2004 | | | 7,400,000 |

| | | | |

| | 2,000,000 | | Stockton CA Health Facilities Revenue Series A§ | | 1.15 | | | 12/01/2032 | | | 2,000,000 |

| | | | |

| | 5,000,000 | | Tahoe Forest CA Hospital District Revenue§ | | 1.15 | | | 07/01/2033 | | | 5,000,000 |

| | | | |

| | 3,100,000 | | Tulare CA Local Health Care District Health Facility Revenue§ | | 1.15 | | | 12/01/2032 | | | 3,100,000 |

| | | | |

| | 26,550,000 | | Turlock CA Irrigation District COP Capital Improvement Project Societe Generale LOC§ | | 1.20 | | | 01/01/2031 | | | 26,550,000 |

| | | | |

| | 3,000,000 | | University CA Education Facilities Revenue Series 480 MBIA Insured§ | | 1.13 | | | 09/01/2022 | | | 3,000,000 |

| | | | |

| | 7,000,000 | | University of California | | 0.80 | | | 10/06/2003 | | | 7,000,000 |

| | | | |

| | 10,000,000 | | University of California | | 0.85 | | | 10/10/2003 | | | 10,000,000 |

| | | | |

| | 7,500,000 | | University of California | | 0.85 | | | 10/16/2003 | | | 7,500,000 |

| | | | |

| | 15,000,000 | | University of California | | 0.90 | | | 10/20/2003 | | | 15,000,000 |

18

PORTFOLIOOFINVESTMENTS — SEPTEMBER 30, 2003 (UNAUDITED) | | WELLSFARGOMONEYMARKETFUNDS |

|

CALIFORNIATAX-FREEMONEYMARKETFUND

| Principal | | Security Name | | Interest Rate | | | Maturity Date | | Value |

|

| California (continued) |

| | | | |

| $ | 18,000,000 | | University of California | | 0.85 | % | | 11/18/2003 | | $ | 18,000,000 |

| | | | |

| | 15,000,000 | | University of California | | 0.85 | | | 12/08/2003 | | | 15,000,000 |

| | | | |

| | 3,700,000 | | Vacaville CA MFHR Quail Run Project Series A§ | | 1.05 | | | 07/15/2018 | | | 3,700,000 |

| | | | |

| | 4,800,000 | | Vallejo CA MFHR Hillside Terrace Apartments Series A Collaterized By FNMA§ | | 1.10 | | | 03/15/2027 | | | 4,800,000 |

| | | | |

| | | | | | | | | | | | 2,354,424,053 |

| | | | | | | | | | |

|

|

|

| Other – 4.43% |

| | | | |

| | 17,995,000 | | ABN AMRO Munitops CTFS Tr 1998-20 Munitops Certificates AMBAC Insured§ | | 1.13 | | | 07/05/2006 | | | 17,995,000 |

| | | | |

| | 13,176,000 | | ABN AMRO Munitops CTFS Tr 1998-25 Munitops Certificates FGIC Insured§ | | 1.13 | | | 07/05/2006 | | | 13,176,000 |

| | | | |

| | 17,000,000 | | ABN AMRO Munitops CTFS Tr 2000-5 Munitops Certificates FGIC Insured§^ | | 1.16 | | | 05/07/2008 | | | 17,000,000 |

| | | | |

| | 2,700,000 | | Municipal Securities Trust Series 2001 136 Class A§ | | 1.20 | | | 12/06/2018 | | | 2,700,000 |

| | | | |