UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-09253

Wells Fargo Funds Trust

(Exact name of registrant as specified in charter)

525 Market St., San Francisco, CA 94105

(Address of principal executive offices) (Zip code)

C. David Messman

Wells Fargo Funds Management, LLC

525 Market St., San Francisco, CA 94105

(Name and address of agent for service)

Registrant’s telephone number, including area code: 800-222-8222

Date of fiscal year end: October 31

Date of reporting period: Registrant is making a filing for 16 of its series, Wells Fargo Advantage Emerging Markets Local Bond Fund, Wells Fargo Advantage International Bond Fund, Wells Fargo Advantage Strategic Income Fund, Wells Fargo Advantage Asia Pacific Fund, Wells Fargo Advantage Diversified International Fund, Wells Fargo Advantage Emerging Markets Equity Fund, Wells Fargo Advantage Emerging Markets Equity Income Fund, Wells Fargo Advantage Global Opportunities Fund, Wells Fargo Advantage International Equity Fund, Wells Fargo Advantage Intrinsic World Equity Fund, Wells Fargo Advantage Intrinsic Small Cap Value Fund, Wells Fargo Advantage Small Cap Opportunities Fund, Wells Fargo Advantage Small Cap Value Fund, Wells Fargo Advantage Small/Mid Cap Value Fund, Wells Fargo Advantage Special Small Cap Value Fund, and Wells Fargo Advantage Traditional Small Cap Growth Fund. Each series has an April 30, 2013 fiscal year end.

| ITEM 1. | REPORT TO STOCKHOLDERS |

Wells Fargo Advantage

Emerging Markets Local Bond Fund

Semi-Annual Report

April 30, 2013

Reduce clutter. Save trees.

Sign up for electronic delivery of prospectuses and shareholder reports at wellsfargo.com/advantagedelivery

Contents

The views expressed and any forward-looking statements are as of April 30, 2013, unless otherwise noted, and are those of the Fund managers and/or Wells Fargo Funds Management, LLC. Discussions of individual securities, or the markets generally, or any Wells Fargo Advantage Fund are not intended as individual recommendations. Future events or results may vary significantly from those expressed in any forward-looking statements; the views expressed are subject to change at any time in response to changing circumstances in the market. Wells Fargo Funds Management, LLC, disclaims any obligation to publicly update or revise any views expressed or forward-looking statements.

NOT FDIC INSURED ¡ NO BANK GUARANTEE ¡ MAY LOSE VALUE

Wells Fargo investment history

| | |

| 1932 | | Keystone creates one of the first mutual fund families. |

| 1971 | | Wells Fargo & Company introduces one of the first institutional index funds. |

| 1978 | | Wells Fargo applies Markowitz and Sharpe’s research on Modern Portfolio Theory to introduce one of the industry’s first tactical asset allocation models in institutional separately managed accounts. |

| 1984 | | Wells Fargo Stagecoach Funds launches its first asset allocation fund. |

| 1989 | | The Tactical Asset Allocation (TAA) Model is first applied to Wells Fargo’s asset allocation mutual funds. |

| 1994 | | Wells Fargo introduces the LifePath Funds, one of the first suites of target date funds (now the Wells Fargo Advantage Dow Jones Target Date FundsSM). |

| 1996 | | Evergreen Investments and Keystone Funds merge. |

| 1997 | | Wells Fargo launches the Wells Fargo Advantage WealthBuilder PortfoliosSM, a fund-of-funds suite of products that includes the use of quantitative models to shift assets among investment styles. |

| 1999 | | Norwest Advantage Funds and Stagecoach Funds are reorganized into Wells Fargo Funds after the merger of Norwest and Wells Fargo. |

| 2002 | | Evergreen Retail and Evergreen Institutional companies form the umbrella asset management company, Evergreen Investments. |

| 2005 | | The integration of Strong Funds with Wells Fargo Funds creates Wells Fargo Advantage Funds, resulting in one of the top 20 mutual fund companies in the United States. |

| 2006 | | Wells Fargo Advantage Funds relaunches the target date product line as Wells Fargo Advantage Dow Jones Target Date Funds. |

| 2010 | | The mergers and reorganizations of Evergreen and Wells Fargo Advantage mutual funds are completed, unifying the families under the brand of Wells Fargo Advantage Funds. |

Wells Fargo Advantage Funds®

Wells Fargo Advantage Funds skillfully guides institutions, financial advisors, and individuals through the investment terrain to help them reach their financial objectives. Everything we do on behalf of investors is backed by our unique combination of qualifications.

Strength

Our organization is built on the standards of integrity and service established by our parent company—Wells Fargo & Company—more than 150 years ago. And, because we’re part of a highly diversified financial enterprise, we offer the depth of resources to help investors succeed.

Expertise

Our multi-boutique model offers investors access to the independent thinking of premier investment managers that have been chosen for their time-tested strategies. While each team specializes in a specific investment strategy, collectively they provide investors a wide choice of distinct investment styles. Our dedication to investment excellence doesn’t end with our expertise in manager selection—risk management, analysis, and rigorous ongoing review seek to ensure each manager’s investment process remains consistent.

Partnership

Our collaborative approach is built around understanding the needs and goals of our clients. By adhering to core principles of sound judgment and steady guidance, we support you through every stage of the investment decision process.

Carefully consider the investment objectives, risks, charges, and expenses before investing. For a current prospectus and, if available, a summary prospectus, for Wells Fargo Advantage Funds, containing this and other information, visit wellsfargoadvantagefunds.com. Read it carefully before investing.

Wells Fargo Funds Management, LLC, a wholly owned subsidiary of Wells Fargo & Company, provides investment advisory and administrative services for Wells Fargo Advantage Funds. Other affiliates of Wells Fargo & Company provide subadvisory and other services for the Funds. The Funds are distributed by Wells Fargo Funds Distributor, LLC, Member FINRA/SIPC, an affiliate of Wells Fargo & Company.

“Dow Jones®” and “Dow Jones Target Date IndexesSM” are service marks of Dow Jones Trademark Holdings LLC (“Dow Jones”); have been licensed to CME Group Index Services LLC (“CME Indexes”); and have been sublicensed for use for certain purposes by Global Index Advisors, Inc., and Wells Fargo Funds Management, LLC. The Wells Fargo Advantage Dow Jones Target Date FundsSM, based on the Dow Jones Target Date Indexes, are not sponsored, endorsed, sold, or promoted by Dow Jones, CME Indexes, or their respective affiliates, and none of them makes any representation regarding the advisability of investing in such product(s).

NOT FDIC INSURED ¡ NO BANK GUARANTEE ¡ MAY LOSE VALUE

Not part of the semi-annual report.

Wells Fargo Advantage Funds offers more than 100 mutual funds across a wide range of asset classes, representing over $228 billion in assets under management, as of April 30, 2013.

| | | | |

| Equity funds | | | | |

Asia Pacific Fund | | Enterprise Fund† | | Opportunity Fund† |

C&B Large Cap Value Fund | | Global Opportunities Fund | | Precious Metals Fund |

C&B Mid Cap Value Fund | | Growth Fund | | Premier Large Company Growth Fund |

Capital Growth Fund | | Index Fund | | Small Cap Opportunities Fund |

Common Stock Fund | | International Equity Fund | | Small Cap Value Fund |

Disciplined U.S. Core Fund | | International Value Fund | | Small Company Growth Fund |

Discovery Fund† | | Intrinsic Small Cap Value Fund | | Small Company Value Fund |

Diversified Equity Fund | | Intrinsic Value Fund | | Small/Mid Cap Value Fund |

Diversified International Fund | | Intrinsic World Equity Fund | | Special Mid Cap Value Fund |

Emerging Growth Fund | | Large Cap Core Fund | | Special Small Cap Value Fund |

Emerging Markets Equity Fund | | Large Cap Growth Fund | | Specialized Technology Fund |

Emerging Markets Equity Income Fund | | Large Company Value Fund | | Traditional Small Cap Growth Fund |

Endeavor Select Fund† | | Omega Growth Fund | | Utility and Telecommunications Fund |

| Bond funds | | | | |

Adjustable Rate Government Fund | | High Yield Municipal Bond Fund | | Short-Term Bond Fund |

California Limited-Term Tax-Free Fund | | Income Plus Fund | | Short-Term High Yield Bond Fund |

California Tax-Free Fund | | Inflation-Protected Bond Fund | | Short-Term Municipal Bond Fund |

Colorado Tax-Free Fund | | Intermediate Tax/AMT-Free Fund | | Strategic Income Fund |

Conservative Income Fund | | International Bond Fund | | Strategic Municipal Bond Fund |

Core Bond Fund | | Minnesota Tax-Free Fund | | Ultra Short-Term Income Fund |

Emerging Markets Local Bond Fund | | Municipal Bond Fund | | Ultra Short-Term Municipal Income Fund |

Government Securities Fund | | North Carolina Tax-Free Fund | | Wisconsin Tax-Free Fund |

High Income Fund | | Pennsylvania Tax-Free Fund | | |

High Yield Bond Fund | | Short Duration Government Bond Fund | | |

| Asset allocation funds | | | | |

Absolute Return Fund | | WealthBuilder Equity Portfolio† | | Target 2020 Fund† |

Asset Allocation Fund | | WealthBuilder Growth Allocation Portfolio† | | Target 2025 Fund† |

Diversified Capital Builder Fund | | WealthBuilder Growth Balanced Portfolio† | | Target 2030 Fund† |

Diversified Income Builder Fund | | WealthBuilder Moderate Balanced Portfolio† | | Target 2035 Fund† |

Growth Balanced Fund | | WealthBuilder Tactical Equity Portfolio† | | Target 2040 Fund† |

Index Asset Allocation Fund | | Target Today Fund† | | Target 2045 Fund† |

Moderate Balanced Fund | | Target 2010 Fund† | | Target 2050 Fund† |

WealthBuilder Conservative Allocation Portfolio† | | Target 2015 Fund† | | Target 2055 Fund† |

| Money market funds | | | | |

100% Treasury Money Market Fund | | Heritage Money Market Fund† | | National Tax-Free Money Market Fund |

California Municipal Money Market Fund | | Money Market Fund | | Treasury Plus Money Market Fund |

Cash Investment Money Market Fund | | Municipal Cash Management Money Market Fund | | |

Government Money Market Fund | | Municipal Money Market Fund | | |

| Variable trust funds1 | | | | |

VT Discovery Fund† | | VT Intrinsic Value Fund | | VT Small Cap Growth Fund |

VT Index Asset Allocation Fund | | VT Omega Growth Fund | | VT Small Cap Value Fund |

VT International Equity Fund | | VT Opportunity Fund† | | VT Total Return Bond Fund |

An investment in a money market fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although the Wells Fargo Advantage Money Market Funds seek to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in a money market fund.

| 1. | The variable trust funds are generally available only through insurance company variable contracts. |

| † | In this report, the Wells Fargo Advantage Discovery FundSM, Wells Fargo Advantage Endeavor Select FundSM, Wells Fargo Advantage Enterprise FundSM, Wells Fargo Advantage Opportunity FundSM, Wells Fargo Advantage WealthBuilder Conservative Allocation PortfolioSM, Wells Fargo Advantage WealthBuilder Equity PortfolioSM, Wells Fargo Advantage WealthBuilder Growth Allocation PortfolioSM, Wells Fargo Advantage WealthBuilder Growth Balanced PortfolioSM, Wells Fargo Advantage WealthBuilder Moderate Balanced PortfolioSM, Wells Fargo Advantage WealthBuilder Tactical Equity PortfolioSM, Wells Fargo Advantage Dow Jones Target Today FundSM, Wells Fargo Advantage Dow Jones Target 2010 FundSM, Wells Fargo Advantage Dow Jones Target 2015 FundSM, Wells Fargo Advantage Dow Jones Target 2020 FundSM, Wells Fargo Advantage Dow Jones Target 2025 FundSM, Wells Fargo Advantage Dow Jones Target 2030 FundSM, Wells Fargo Advantage Dow Jones Target 2035 FundSM, Wells Fargo Advantage Dow Jones Target 2040 FundSM, Wells Fargo Advantage Dow Jones Target 2045 FundSM, Wells Fargo Advantage Dow Jones Target 2050 FundSM, Wells Fargo Advantage Dow Jones Target 2055 FundSM, Wells Fargo Advantage Heritage Money Market FundSM, Wells Fargo Advantage VT Discovery FundSM, and Wells Fargo Advantage VT Opportunity FundSM are referred to as the Discovery Fund, Endeavor Select Fund, Enterprise Fund, Opportunity Fund, WealthBuilder Conservative Allocation Portfolio, WealthBuilder Equity Portfolio, WealthBuilder Growth Allocation Portfolio, WealthBuilder Growth Balanced Portfolio, WealthBuilder Moderate Balanced Portfolio, WealthBuilder Tactical Equity Portfolio, Target Today Fund, Target 2010 Fund, Target 2015 Fund, Target 2020 Fund, Target 2025 Fund, Target 2030 Fund, Target 2035 Fund, Target 2040 Fund, Target 2045 Fund, Target 2050 Fund, Target 2055 Fund, Heritage Money Market Fund, VT Discovery Fund, and VT Opportunity Fund, respectively. |

Not part of the semi-annual report.

| | | | |

| 2 | | Wells Fargo Advantage Emerging Markets Local Bond Fund | | Letter to shareholders (unaudited) |

Karla M. Rabusch

President

Wells Fargo Advantage Funds

During the period, global fixed-income markets trended toward higher bond prices and lower yields but fluctuated between periods of risk aversion and corresponding recoveries in investor confidence.

Dear Valued Shareholder:

We are pleased to offer you this semi-annual report for the Wells Fargo Advantage Emerging Markets Local Bond Fund for the six-month period ended April 30, 2013. During the period, global fixed-income markets trended toward higher bond prices and lower yields but fluctuated between periods of risk aversion and corresponding recoveries in investor confidence. On the whole, global bond markets generated positive returns during the period, benefiting from deepening rallies in the corporate bond and securitized sectors and most notably in high yield and emerging markets debt. The lower-rated credit tiers and longest-maturity segments of the fixed-income markets outperformed the higher-quality and shorter-maturity segments during the period, overcoming spates of risk aversion that flared up intermittently.

Global credit markets rallied after European Central Bank (ECB) actions.

The six-month period started after the watershed announcements of the ECB in late summer 2012, which largely declared that the euro would be preserved and that every measure would be taken to fortify the European credit markets. These actions bolstered the global credit markets and inspired an ongoing rally in high-yield corporate debt and emerging markets debt over the final two months of 2012 and into 2013. Global bond markets had been enthralled by central bank policies in Europe—decisive policymaking would bolster markets, while reescalating crises in Greece and Spain would undercut confidence and damage security pricing. But the ECB’s actions proved effective—despite continued economic woes across Europe, the announced central bank policies revitalized global credit markets. While no measure could serve as a panacea, coordinated policymaking certainly offered much-needed tonic to Europe and provided a foundation of confidence for the riskier areas of the global credit markets to rally.

Improving economic trends strengthened in the U.S. while Europe’s recession persisted.

Despite problems in Europe during the period—this time in the form of Italian politics and a bank debt crisis in Cyprus—higher-yielding global debt securities continued to perform well. Investors continued to shun most higher-quality sovereign markets in preference for higher-yielding corporate debt. In November and December 2012, high yield and emerging markets debt outperformed higher-rated sovereign debt. These trends largely carried over in the first four months of 2013, as investors rallied to the higher-yielding, lower-rated areas of the global bond markets on increasing confidence in the intentions of the ECB to support credit and a distaste for low yields from the higher-rated sovereign debt sectors.

Despite global credit markets performing well, economic conditions across the globe continued to be mixed and, at times, volatile. In the U.S., growth remained relatively healthy compared with developed Europe and Japan, but employment levels remained disappointing. U.S. Treasury yields remained near historic lows, with negative real yields—not a good outlook for the U.S. dollar or long-term investment in U.S. Treasuries. But more problematic was the eurozone, which remained firmly in recession. Fortunately, there appeared to be the political will to do whatever is necessary to preserve the single euro currency. The pain suffered in the periphery regions outside of core Europe during the period led to cheaper labor costs and lower Social Security and welfare costs. This internal devaluation within the European monetary union marketplace allowed the periphery markets to better compete in the European Union, which strengthened economic optimism during the period. It appeared to many investors that growth in the periphery may well hit bottom in 2013 and start to pick up from what is admittedly a low base, thus providing an investing foundation that strengthened security valuations during the period.

Japan’s newly elected government took little time to deploy a new political mandate, announcing significant quantitative easing policies to deliberately

| | | | | | |

| Letter to shareholders (unaudited) | | Wells Fargo Advantage Emerging Markets Local Bond Fund | | | 3 | |

weaken the currency. The Bank of Japan’s new mandate to target 2% inflation and to intervene in foreign exchange markets while buying foreign bonds may have the political weight to deal with Japan’s problems once and for all. Although this policy direction may help finally break the vicious cycle that is the Japanese economy, the circumstances indicated an unattractive market for bond investments and further currency depreciation to come. Consequently, the Japanese yen deteriorated precipitously throughout the period.

China also had new leaders in place, and investors looked for signs that political stability may resume with the new cabinet entering. Optimism that a shift from an export-led economy to a consumer-led economy appeared to develop in the early months of 2013. With the continued expansion of the offshore Renminbi-based markets, bond yields of 3.5%, and a firming currency, China increasingly appeared to demonstrate signs of being a high-quality candidate for investment, thus generally improving security valuations during the period.

Nonetheless, the longer-term picture around the globe remained largely consistent throughout the period—smaller, more dynamic economies with trade surpluses, healthier growth, and higher interest rates appeared to demonstrate the best characteristics for investment, particularly Asian and South American economies, while the largest economies with languid growth and high deficits underperformed. Optimism across the global markets continued to produce rallies in lower-rated securities while also pricing in some caution for intermittent periods of volatility that may persist in 2013, as markets attempt to balance uncertain growth prospects with deficit control and credit-risk contagion. Despite ongoing concerns across Europe, the six-month period largely produced positive performance across the global fixed-income markets, with strong returns most notably in high-yield corporate bonds and emerging markets debt.

Don’t let short-term uncertainty derail long-term investment goals.

Periods of uncertainty can present challenges, but experience has taught us that maintaining a long-term investment strategy based on individual goals and risk tolerance can be an effective way to plan for the future. To help you create a sound strategy based on your personal goals and risk tolerance, Wells Fargo

Advantage Funds offers more than 100 mutual funds and other investments spanning a wide range of asset classes and investment styles. Although diversification1 cannot guarantee an investment profit or prevent losses, we believe it can be an effective way to manage investment risk and potentially smooth out overall portfolio performance.

Thank you for choosing to invest with Wells Fargo Advantage Funds. We appreciate your confidence in us and remain committed to helping you meet your financial needs. For current information about your fund investments, contact your investment professional, visit our website at wellsfargoadvantagefunds.com, or call us directly at 1-800-222-8222. We are available 24 hours a day, 7 days a week.

Sincerely,

Karla M. Rabusch

President

Wells Fargo Advantage Funds

Despite ongoing concerns across Europe, the six-month period largely produced positive performance across the global fixed-income markets, with strong returns most notably in high-yield corporate bonds and emerging markets debt.

| 1. | Diversification does not assure or guarantee better performance and cannot eliminate the risk of investment losses. |

| | | | |

| 4 | | Wells Fargo Advantage Emerging Markets Local Bond Fund | | Performance highlights (unaudited) |

Investment objective

The Fund seeks total return, consisting of income and capital appreciation.

Adviser

Wells Fargo Funds Management, LLC

Subadviser

First International Advisors, LLC

Portfolio managers

Michael Lee

Tony Norris

Alex Perrin

Christopher Wightman

Peter Wilson

Average annual total returns (%) as of April 30, 2013

| | | | | | | | | | | | | | | | | | |

| | | | | Including sales charge | | | Excluding sales charge | | | Expense ratios1 (%) | |

| | | Inception date | | Since inception | | | Since inception | | | Gross | | | Net2 | |

| Class A (WLBAX) | | 5-31-2012 | | | 10.35 | | | | 15.54 | | | | 2.27 | | | | 1.23 | |

| Class C (WLBEX) | | 5-31-2012 | | | 13.77 | | | | 14.77 | | | | 3.02 | | | | 1.98 | |

| Administrator Class (WLBDX) | | 5-31-2012 | | | – | | | | 15.61 | | | | 2.21 | | | | 1.10 | |

| Institutional Class (WLBIX) | | 5-31-2012 | | | – | | | | 15.86 | | | | 1.94 | | | | 0.90 | |

JPMorgan GBI-EM Global Diversified

Composite Index3 | | – | | | – | | | | 19.03 | | | | – | | | | – | |

Figures quoted represent past performance, which is no guarantee of future results and do not reflect the deduction of taxes that a shareholder may pay on fund distributions or the redemption of fund shares. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance shown without sales charges would be lower if sales charges were reflected. Current performance may be lower or higher than the performance data quoted, which assumes the reinvestment of dividends and capital gains. Current month-end performance is available on the Fund’s website, wellsfargoadvantagefunds.com.

Index returns do not include transaction costs associated with buying and selling securities, any mutual fund fees or expenses, or any taxes. It is not possible to invest directly in an index.

For Class A shares, the maximum front-end sales charge is 4.50%. For Class C shares, the maximum contingent deferred sales charge is 1.00%. Performance including sales charge assumes the sales charge for the corresponding time period. Administrator Class and Institutional Class shares are sold without a front-end sales charge or contingent deferred sales charge.

Bond values fluctuate in response to the financial condition of individual issuers, general market and economic conditions, and changes in interest rates. In general, when interest rates rise, bond values fall and investors may lose principal value. Foreign investments are especially volatile and can rise or fall dramatically due to differences in the political and economic conditions of the host country. These risks are generally intensified in emerging markets. The use of derivatives may reduce returns and/or increase volatility. Certain investment strategies tend to increase the total risk of an investment (relative to the broader market). The Fund is exposed to high-yield securities risk and regional risk. Consult the Fund’s prospectus for additional information on these and other risks.

Please see footnotes on page 5.

| | | | | | |

| Performance highlights (unaudited) | | Wells Fargo Advantage Emerging Markets Local Bond Fund | | | 5 | |

| | | | |

| Ten largest long-term holdings4 (%) as of April 30, 2013 | |

Russia, 7.00%, 1-25-2013 | | | 9.32 | |

Brazil, 10.00%, 1-1-2017 | | | 8.64 | |

Indonesia, 7.38%, 9-15-2016 | | | 4.76 | |

Hungary, 6.75%, 11-24-2017 | | | 4.68 | |

Republic of South Africa, 2.60%, 3-31-2028 | | | 4.53 | |

Brazil, 8.50%, 1-5-2024 | | | 4.52 | |

Turkey, 9.00%, 3-8-2017 | | | 4.47 | |

Inter-American Development Bank, 8.00%, 1-26-2016 | | | 3.93 | |

Poland, 4.00%, 10-25-2023 | | | 3.92 | |

Thailand, 3.25%, 6-16-2017 | | | 3.77 | |

|

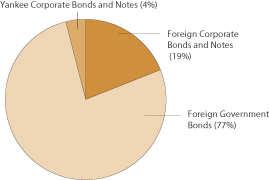

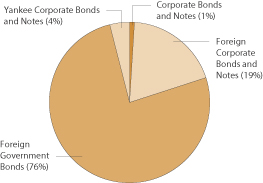

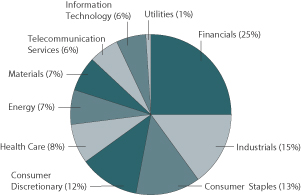

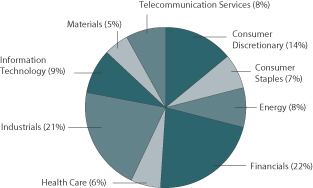

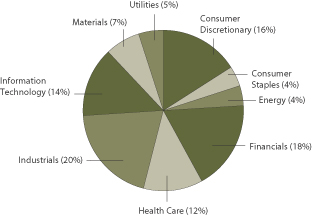

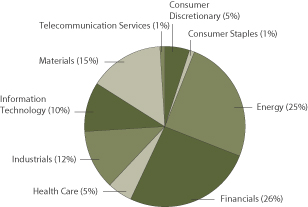

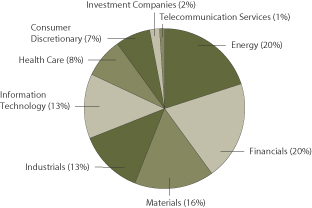

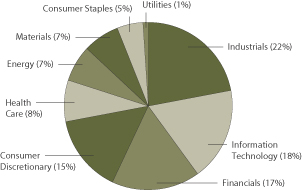

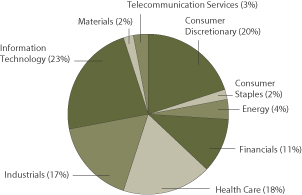

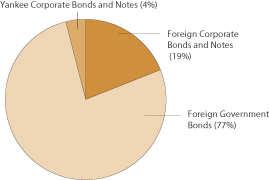

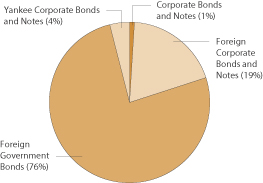

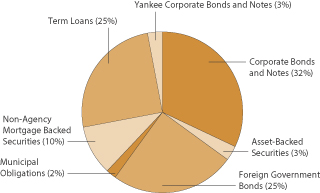

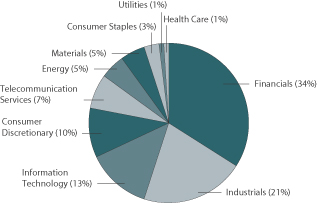

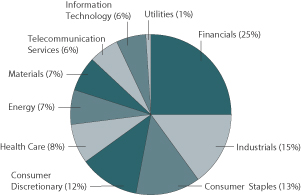

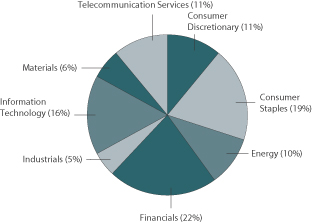

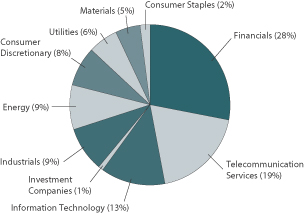

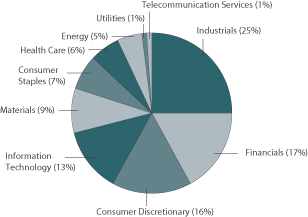

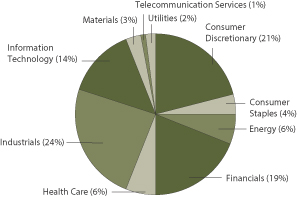

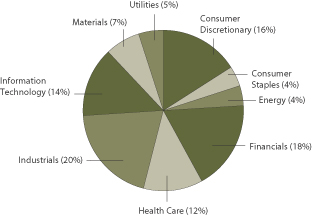

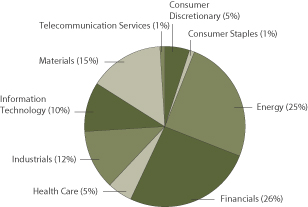

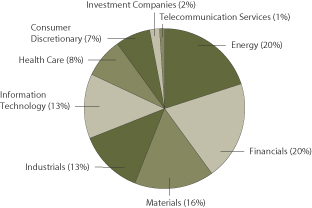

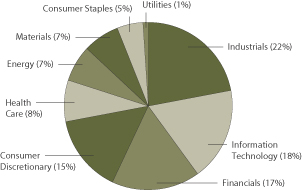

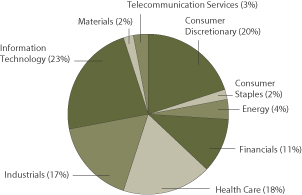

| Portfolio allocation5 as of April 30, 2013 |

|

|

| 1. | Reflects the expense ratios as stated in the most recent prospectuses. |

| 2. | The Adviser has committed through February 28, 2014, to waive fees and/or reimburse expenses to the extent necessary to cap the Fund’s Total Annual Fund Operating Expenses After Fee Waiver, excluding certain expenses, at the amounts shown. Brokerage commissions, stamp duty fees, interest, taxes, acquired fund fees and expenses, and extraordinary expenses are excluded from the cap. Without this cap, the Fund’s returns would have been lower. |

| 3. | The JPMorgan GBI-EM Global Diversified Composite Index is an unmanaged index of debt instruments of 31 emerging countries. You cannot invest directly in an index. |

| 4. | The ten largest long-term holdings are calculated based on the value of the securities divided by total net assets of the Fund. Holdings are subject to change and may have changed since the date specified. |

| 5. | Portfolio allocation is subject to change and is calculated based on the total long-term investments of the Fund. |

| | | | |

| 6 | | Wells Fargo Advantage Emerging Markets Local Bond Fund | | Fund expenses (unaudited) |

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and contingent deferred sales charges (if any) on redemptions and (2) ongoing costs, including management fees, distribution (12b-1) and/or shareholder service fees, and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the six-month period and held for the entire period from November 1, 2012 to April 30, 2013.

Actual expenses

The “Actual” line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the “Actual” line under the heading entitled “Expenses paid during period” for your applicable class of shares to estimate the expenses you paid on your account during this period.

Hypothetical example for comparison purposes

The “Hypothetical” line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) and contingent deferred sales charges. Therefore, the “Hypothetical” line of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | |

| | | Beginning

account value

11-1-2012 | | | Ending

account value

4-30-2013 | | | Expenses

paid during

the period1 | | | Net annual

expense ratio | |

Class A | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,053.44 | | | $ | 6.26 | | | | 1.23 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,018.70 | | | $ | 6.16 | | | | 1.23 | % |

Class C | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,049.58 | | | $ | 10.06 | | | | 1.98 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,014.98 | | | $ | 9.89 | | | | 1.98 | % |

Administrator Class | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,053.67 | | | $ | 5.60 | | | | 1.10 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,019.34 | | | $ | 5.51 | | | | 1.10 | % |

Institutional Class | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,055.08 | | | $ | 4.59 | | | | 0.90 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,020.33 | | | $ | 4.51 | | | | 0.90 | % |

| 1. | Expenses paid is equal to the annualized expense ratio of each class multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year divided by the number of days in the fiscal year (to reflect the one-half-year period). |

| | | | | | |

| Portfolio of investments—April 30, 2013 (unaudited) | | Wells Fargo Advantage Emerging Markets Local Bond Fund | | | 7 | |

| | | | | | | | | | | | | | | | |

| Security name | | Interest rate | | | Maturity date | | | Principal | | | Value | |

| | | | | | | | | | | | | | | | |

| | | | |

Foreign Corporate Bonds and Notes @: 18.92% | | | | | | | | | | | | | | | | |

| | | | |

| Germany: 3.19% | | | | | | | | | | | | | | | | |

KFW (Financials, Commercial Banks, TRY) | | | 7.50 | % | | | 8-2-2013 | | | | 600,000 | | | $ | 337,058 | |

KFW (Financials, Commercial Banks, TRY) | | | 8.50 | | | | 4-15-2015 | | | | 1,000,000 | | | | 595,621 | |

| | | | |

| | | | | | | | | | | | | | | 932,679 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Ireland: 0.75% | | | | | | | | | | | | | | | | |

RZD Capital Limited (Industrials, Road & Rail, RUB) | | | 8.30 | | | | 4-2-2019 | | | | 6,500,000 | | | | 218,951 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Luxembourg: 3.66% | | | | | | | | | | | | | | | | |

European Investment Bank (Financials, Commercial Banks, ZAR) | | | 6.00 | | | | 10-21-2019 | | | | 7,300,000 | | | | 818,351 | |

European Investment Bank (Financials, Commercial Banks, HUF) | | | 6.50 | | | | 1-5-2015 | | | | 54,000,000 | | | | 251,184 | |

| | | | |

| | | | | | | | | | | | | | | 1,069,535 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Mexico: 1.66% | | | | | | | | | | | | | | | | |

America Movil Sab De CV (Telecommunication Services, Wireless Telecommunication Services, MXN) | | | 6.45 | | | | 12-5-2022 | | | | 3,000,000 | | | | 268,588 | |

Petroleos Mexicanos Company (Energy, Oil, Gas & Consumable Fuels, MXN) | | | 7.65 | | | | 11-24-2021 | | | | 2,300,000 | | | | 218,004 | |

| | | | |

| | | | | | | | | | | | | | | 486,592 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Netherlands: 0.88% | | | | | | | | | | | | | | | | |

Rabobank Nederland (Financials, Commercial Banks, TRY) | | | 9.50 | | | | 1-22-2014 | | | | 450,000 | | | | 258,792 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Russia: 0.72% | | | | | | | | | | | | | | | | |

Sberbank Rossii (Financials, Commercial Banks, RUB) | | | 7.00 | | | | 1-31-2016 | | | | 6,500,000 | | | | 209,295 | |

| | | | | | | | | | | | | | | | |

| | | | |

| South Africa: 0.97% | | | | | | | | | | | | | | | | |

Foodcorp Limited (Consumer Staples, Food & Staples Retailing, EUR) | | | 8.75 | | | | 3-1-2018 | | | | 100,000 | | | | 144,535 | |

Transnet Limited (Industrials, Road & Rail, ZAR) | | | 10.80 | | | | 11-6-2023 | | | | 1,000,000 | | | | 140,049 | |

| | | | |

| | | | | | | | | | | | | | | 284,584 | |

| | | | | | | | | | | | | | | | |

| | | | |

| United States: 7.09% | | | | | | | | | | | | | | | | |

Inter-American Development Bank (Financials, Commercial Banks, MXN) | | | 8.00 | | | | 1-26-2016 | | | | 12,500,000 | | | | 1,148,979 | |

International Bank for Reconstruction & Development (Financials, Diversified Financial Services, MXN) | | | 6.50 | | | | 9-11-2013 | | | | 6,900,000 | | | | 573,603 | |

International Bank for Reconstruction & Development (Financials, Diversified Financial Services, MXN) | | | 7.50 | | | | 3-5-2020 | | | | 3,600,000 | | | | 351,512 | |

| | | | |

| | | | | | | | | | | | | | | 2,074,094 | |

| | | | | | | | | | | | | | | | |

| | | | |

Total Foreign Corporate Bonds and Notes (Cost $5,414,367) | | | | | | | | | | | | | | | 5,534,522 | |

| | | | | | | | | | | | | | | | |

| | | | |

Foreign Government Bonds @: 75.72% | | | | | | | | | | | | | | | | |

Brazil (BRL) | | | 8.50 | | | | 1-5-2024 | | | | 2,375,000 | | | | 1,321,192 | |

Brazil (BRL) | | | 10.00 | | | | 1-1-2017 | | | | 4,750,000 | | | | 2,527,769 | |

Chile (CLP) | | | 5.50 | | | | 8-5-2020 | | | | 238,000,000 | | | | 534,824 | |

Colombia (COP) | | | 7.75 | | | | 4-14-2021 | | | | 975,000,000 | | | | 668,204 | |

Hungary (HUF) | | | 6.75 | | | | 11-24-2017 | | | | 290,000,000 | | | | 1,369,993 | |

Indonesia (IDR) | | | 7.38 | | | | 9-15-2016 | | | | 12,500,000,000 | | | | 1,393,794 | |

Malaysia (MYR) | | | 3.26 | | | | 3-1-2018 | | | | 2,350,000 | | | | 776,188 | |

Malaysia (MYR) | | | 4.26 | | | | 9-15-2016 | | | | 3,125,000 | | | | 1,068,187 | |

Mexico (MXN) | | | 6.50 | | | | 6-9-2022 | | | | 8,500,000 | | | | 804,699 | |

Mexico (MXN) | | | 7.75 | | | | 11-13-2042 | | | | 5,300,000 | | | | 592,727 | |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 8 | | Wells Fargo Advantage Emerging Markets Local Bond Fund | | Portfolio of investments—April 30, 2013 (unaudited) |

| | | | | | | | | | | | | | | | |

| Security name | | Interest rate | | | Maturity date | | | Principal | | | Value | |

| | | | | | | | | | | | | | | | |

| | | | |

Foreign Government Bonds @ (continued) | | | | | | | | | | | | | | | | |

Nigeria (NGN) | | | 15.10 | % | | | 4-27-2017 | | | | 80,000,000 | | | $ | 556,962 | |

Poland (PLN) ¤ | | | 0.00 | | | | 7-25-2013 | | | | 1,880,000 | | | | 591,455 | |

Poland (PLN) | | | 4.00 | | | | 10-25-2023 | | | | 3,400,000 | | | | 1,146,801 | |

Republic of South Africa (ZAR) | | | 2.60 | | | | 3-31-2028 | | | | 9,963,282 | | | | 1,324,045 | |

Romania (RON) | | | 6.00 | | | | 4-30-2016 | | | | 1,800,000 | | | | 563,652 | |

Russia (RUB) | | | 7.00 | | | | 1-25-2023 | | | | 81,500,000 | | | | 2,727,639 | |

Russia (RUB) | | | 7.50 | | | | 3-15-2018 | | | | 25,400,000 | | | | 868,850 | |

Thailand (THB) | | | 3.25 | | | | 6-16-2017 | | | | 32,000,000 | | | | 1,102,325 | |

Turkey (TRY) | | | 6.30 | | | | 2-14-2018 | | | | 1,590,000 | | | | 903,757 | |

Turkey (TRY) | | | 9.00 | | | | 3-8-2017 | | | | 2,100,000 | | | | 1,307,265 | |

| | | | |

Total Foreign Government Bonds (Cost $21,386,327) | | | | | | | | | | | | | | | 22,150,328 | |

| | | | | | | | | | | | | | | | |

| | | | |

Yankee Corporate Bonds and Notes: 3.35% | | | | | | | | | | | | | | | | |

| | | | |

| Brazil: 1.70% | | | | | | | | | | | | | | | | |

BFF International Limited Company (Consumer Staples, Food Products) | | | 7.25 | | | | 1-28-2020 | | | $ | 100,000 | | | | 120,377 | |

ITAU Unibanco Holdings SA (Financials, Commercial Banks) 144A | | | 5.13 | | | | 5-13-2023 | | | | 200,000 | | | | 207,750 | |

Petroplus Finance Limited (Energy, Oil, Gas & Consumable Fuels) | | | 5.75 | | | | 1-20-2020 | | | | 150,000 | | | | 169,331 | |

| | | | |

| | | | | | | | | | | | | | | 497,458 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Luxembourg: 0.58% | | | | | | | | | | | | | | | | |

TNK BP Finance SA (Energy, Oil, Gas & Consumable Fuels) | | | 6.63 | | | | 3-20-2017 | | | | 150,000 | | | | 171,000 | |

| | | | | | | | | | | | | | | | |

| | | | |

| United Kingdom: 0.41% | | | | | | | | | | | | | | | | |

Sable International Finance Limited (Telecommunication Services, Diversified Telecommunication Services) | | | 7.75 | | | | 2-15-2017 | | | | 110,000 | | | | 118,800 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Virgin Islands (British): 0.66% | | | | | | | | | | | | | | | | |

Gold Fields Orogen Holdings (Materials, Metals & Mining) | | | 4.88 | | | | 10-7-2020 | | | | 200,000 | | | | 192,384 | |

| | | | | | | | | | | | | | | | |

| | | | |

Total Yankee Corporate Bonds and Notes (Cost $943,937) | | | | | | | | | | | | | | | 979,642 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | Yield | | | | | | Shares | | | | |

| | | | |

Short-Term Investments: 0.22% | | | | | | | | | | | | | | | | |

| | | | |

| Investment Companies: 0.22% | | | | | | | | | | | | | | | | |

Wells Fargo Advantage Cash Investment Money Market Fund, Select Class (l)(u) | | | 0.13 | | | | | | | | 64,734 | | | | 64,734 | |

| | | | | | | | | | | | | | | | |

| | | | |

Total Short-Term Investments (Cost $64,734) | | | | | | | | | | | | | | | 64,734 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | |

| Total investments in securities | | | | | | | | |

| (Cost $27,809,365) * | | | 98.21 | % | | | 28,729,226 | |

Other assets and liabilities, net | | | 1.79 | | | | 523,110 | |

| | | | | | | | |

| Total net assets | | | 100.00 | % | | $ | 29,252,336 | |

| | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| | | | | | |

| Portfolio of investments—April 30, 2013 (unaudited) | | Wells Fargo Advantage Emerging Markets Local Bond Fund | | | 9 | |

| @ | Foreign bond principal is denominated in local currency. |

| ¤ | Security issued in zero coupon form with no periodic interest payments. |

| 144A | Security that may be resold to “qualified institutional buyers” under Rule 144A or security offered pursuant to Section 4(2) of the Securities Act of 1933, as amended. |

| (l) | Investment in an affiliate |

| (u) | Rate shown is the 7-day annualized yield at period end. |

| * | Cost for federal income tax purposes is $27,859,083 and unrealized appreciation (depreciation) consists of: |

| | | | |

Gross unrealized appreciation | | $ | 1,053,488 | |

Gross unrealized depreciation | | | (183,345 | ) |

| | | | |

Net unrealized appreciation | | $ | 870,143 | |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 10 | | Wells Fargo Advantage Emerging Markets Local Bond Fund | | Statement of assets and liabilities—April 30, 2013 (unaudited) |

| | | | |

| | | | |

| |

Assets | | | | |

Investments | | | | |

In unaffiliated securities, at value (see cost below) | | $ | 28,664,492 | |

In affiliated securities, at value (see cost below) | | | 64,734 | |

| | | | |

Total investments, at value (see cost below) | | | 28,729,226 | |

Foreign currency, at value (see cost below) | | | 48,326 | |

Receivable for interest | | | 473,570 | |

Unrealized gains on forward foreign currency contracts | | | 67,654 | |

Prepaid expenses and other assets | | | 17,232 | |

| | | | |

Total assets | | | 29,336,008 | |

| | | | |

| |

Liabilities | | | | |

Unrealized losses on forward foreign currency contracts | | | 32,187 | |

Advisory fee payable | | | 815 | |

Distribution fees payable | | | 367 | |

Due to other related parties | | | 3,400 | |

Shareholder report expenses payable | | | 11,160 | |

Custodian and accounting fees payable | | | 13,767 | |

Professional fees payable | | | 19,524 | |

Accrued expenses and other liabilities | | | 2,452 | |

| | | | |

Total liabilities | | | 83,672 | |

| | | | |

Total net assets | | $ | 29,252,336 | |

| | | | |

| |

NET ASSETS CONSIST OF | | | | |

Paid-in capital | | $ | 27,260,348 | |

Overdistributed net investment income | | | (15,123 | ) |

Accumulated net realized gains on investments | | | 1,048,424 | |

Net unrealized gains on investments | | | 958,687 | |

| | | | |

Total net assets | | $ | 29,252,336 | |

| | | | |

| |

COMPUTATION OF NET ASSET VALUE AND OFFERING PRICE PER SHARE1 | | | | |

Net assets – Class A | | $ | 868,385 | |

Shares outstanding – Class A | | | 80,485 | |

Net asset value per share – Class A | | | $10.79 | |

Maximum offering price per share – Class A2 | | | $11.30 | |

Net assets – Class C | | $ | 602,066 | |

Shares outstanding – Class C | | | 55,821 | |

Net asset value per share – Class C | | | $10.79 | |

Net assets – Administrator Class | | $ | 13,878,340 | |

Shares outstanding – Administrator Class | | | 1,285,731 | |

Net asset value per share – Administrator Class | | | $10.79 | |

Net assets – Institutional Class | | $ | 13,903,545 | |

Shares outstanding – Institutional Class | | | 1,288,579 | |

Net asset value per share – Institutional Class | | | $10.79 | |

| |

Investments in unaffiliated securities, at cost | | $ | 27,744,631 | |

| | | | |

Investments in affiliated securities, at cost | | $ | 64,734 | |

| | | | |

Total investments, at cost | | $ | 27,809,365 | |

| | | | |

Foreign currency, at cost | | $ | 48,616 | |

| | | | |

| 1. | The Fund has an unlimited number of authorized shares. |

| 2. | Maximum offering price is computed as 100/95.50 of net asset value. On investments of $50,000 or more, the offering price is reduced. |

The accompanying notes are an integral part of these financial statements.

| | | | | | |

| Statement of operations—six months ended April 30, 2013 (unaudited) | | Wells Fargo Advantage Emerging Markets Local Bond Fund | | | 11 | |

| | | | |

| | | | |

| |

Investment income | | | | |

Interest* | | $ | 705,616 | |

Income from affiliated securities | | | 279 | |

| | | | |

Total investment income | | | 705,895 | |

| | | | |

| |

Expenses | | | | |

Advisory fee | | | 91,421 | |

Administration fees | | | | |

Fund level | | | 7,032 | |

Class A | | | 564 | |

Class C | | | 467 | |

Administrator Class | | | 6,706 | |

Institutional Class | | | 5,372 | |

Shareholder servicing fees | | | | |

Class A | | | 881 | |

Class C | | | 729 | |

Administrator Class | | | 16,765 | |

Distribution fees | | | | |

Class C | | | 2,187 | |

Custody and accounting fees | | | 17,879 | |

Professional fees | | | 19,862 | |

Registration fees | | | 54,364 | |

Shareholder report expenses | | | 12,380 | |

Trustees’ fees and expenses | | | 7,018 | |

Other fees and expenses | | | 3,192 | |

| | | | |

Total expenses | | | 246,819 | |

Less: Fee waivers and/or expense reimbursements | | | (102,512 | ) |

| | | | |

Net expenses | | | 144,307 | |

| | | | |

Net investment income | | | 561,588 | |

| | | | |

| |

REALIZED AND UNREALIZED GAINS (LOSSES) ON INVESTMENTS | | | | |

| |

Net realized gains (losses) on: | | | | |

Unaffiliated securities | | | 1,048,847 | |

Forward foreign currency contract transactions | | | (226 | ) |

| | | | |

Net realized gains on investments | | | 1,048,621 | |

| | | | |

| |

Net change in unrealized gains (losses) on: | | | | |

Unaffiliated securities | | | (87,210 | ) |

Forward foreign currency contract transactions | | | (20,231 | ) |

| | | | |

Net change in unrealized gains (losses) on investments | | | (107,441 | ) |

| | | | |

Net realized and unrealized gains (losses) on investments | | | 941,180 | |

| | | | |

Net increase in net assets resulting from operations | | $ | 1,502,768 | |

| | | | |

| |

* Net of foreign interest withholding taxes in the amount of | | | $4,536 | |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 12 | | Wells Fargo Advantage Emerging Markets Local Bond Fund | | Statement of changes in net assets |

| | | | | | | | | | | | | | | | |

| | | Six months ended April 30, 2013 (unaudited) | | | Year ended October 31, 20121 | |

| | | | |

Operations | | | | | | | | | | | | | | | | |

Net investment income | | | | | | $ | 561,588 | | | | | | | $ | 315,569 | |

Net realized gains on investments | | | | | | | 1,048,621 | | | | | | | | 1,056,816 | |

Net change in unrealized gains (losses) on investments | | | | | | | (107,441 | ) | | | | | | | 1,066,128 | |

| | | | | | | | | | | | | | | | |

Net increase in net assets resulting from operations | | | | | | | 1,502,768 | | | | | | | | 2,438,513 | |

| | | | | | | | | | | | | | | | |

| | | | |

Distributions to shareholders from | | | | | | | | | | | | | | | | |

Net investment income | | | | | | | | | | | | | | | | |

Class A | | | | | | | (26,441 | ) | | | | | | | (5,880 | ) |

Class C | | | | | | | (21,162 | ) | | | | | | | (4,142 | ) |

Administrator Class | | | | | | | (539,432 | ) | | | | | | | (143,107 | ) |

Institutional Class | | | | | | | (558,184 | ) | | | | | | | (154,350 | ) |

Net realized gains | | | | | | | | | | | | | | | | |

Class A | | | | | | | (10,611 | ) | | | | | | | 0 | |

Class C | | | | | | | (10,327 | ) | | | | | | | 0 | |

Administrator Class | | | | | | | (237,700 | ) | | | | | | | 0 | |

Institutional Class | | | | | | | (237,957 | ) | | | | | | | 0 | |

| | | | | | | | | | | | | | | | |

Total distributions to shareholders | | | | | | | (1,641,814 | ) | | | | | | | (307,479 | ) |

| | | | | | | | | | | | | | | | |

| | | | |

| | | Shares | | | | | | | | Shares | | | | | |

Capital share transactions | | | | | | | | | | | | | | | | |

Proceeds from shares sold | | | | | | | | | | | | | | | | |

Class A | | | 24,641 | | | | 263,754 | | | | 53,037 | | | | 532,766 | |

Class C | | | 4,298 | | | | 46,499 | | | | 50,000 | | | | 500,000 | |

Administrator Class | | | 0 | | | | 0 | | | | 1,200,000 | | | | 12,000,000 | |

Institutional Class | | | 0 | | | | 0 | | | | 1,200,000 | | | | 12,000,000 | |

| | | | | | | | | | | | | | | | |

| | | | | | | 310,253 | | | | | | | | 25,032,766 | |

| | | | | | | | | | | | | | | | |

Reinvestment of distributions | | | | | | | | | | | | | | | | |

Class A | | | 3,447 | | | | 37,052 | | | | 554 | | | | 5,880 | |

Class C | | | 2,926 | | | | 31,489 | | | | 391 | | | | 4,142 | |

Administrator Class | | | 72,235 | | | | 777,132 | | | | 13,496 | | | | 143,107 | |

Institutional Class | | | 74,020 | | | | 796,141 | | | | 14,559 | | | | 154,350 | |

| | | | | | | | | | | | | | | | |

| | | | | | | 1,641,814 | | | | | | | | 307,479 | |

| | | | | | | | | | | | | | | | |

Payment for shares redeemed | | | | | | | | | | | | | | | | |

Class A | | | (1,194 | ) | | | (12,952 | ) | | | 0 | | | | 0 | |

Class C | | | (1,794 | ) | | | (19,012 | ) | | | 0 | | | | 0 | |

| | | | | | | | | | | | | | | | |

| | | | | | | (31,964 | ) | | | | | | | 0 | |

| | | | | | | | | | | | | | | | |

Net increase in net assets resulting from capital share transactions | | | | | | | 1,920,103 | | | | | | | | 25,340,245 | |

| | | | | | | | | | | | | | | | |

Total increase in net assets | | | | | | | 1,781,057 | | | | | | | | 27,471,279 | |

| | | | | | | | | | | | | | | | |

| | | | |

Net assets | | | | | | | | | | | | | | | | |

Beginning of period | | | | | | | 27,471,279 | | | | | | | | 0 | |

| | | | | | | | | | | | | | | | |

End of period | | | | | | $ | 29,252,336 | | | | | | | $ | 27,471,279 | |

| | | | | | | | | | | | | | | | |

Undistributed (overdistributed) net investment income | | | | | | $ | (15,123 | ) | | | | | | $ | 568,508 | |

| | | | | | | | | | | | | | | | |

| 1. | For the period from May 31, 2012 (commencement of operations) to October 31, 2012 |

The accompanying notes are an integral part of these financial statements.

| | | | | | |

| Financial highlights | | Wells Fargo Advantage Emerging Markets Local Bond Fund | | | 13 | |

(For a share outstanding throughout each period)

| | | | | | | | |

| CLASS A | | Six months ended

April 30, 2013

(unaudited) | | | Year ended

October 31, 20121 | |

Net asset value, beginning of period | | $ | 10.85 | | | $ | 10.00 | |

Net investment income | | | 0.20 | 2 | | | 0.11 | |

Net realized and unrealized gains (losses) on investments | | | 0.37 | | | | 0.85 | |

| | | | | | | | |

Total from investment operations | | | 0.57 | | | | 0.96 | |

Distributions to shareholders from | | | | | | | | |

Net investment income | | | (0.43 | ) | | | (0.11 | ) |

Net realized gains | | | (0.20 | ) | | | 0.00 | |

| | | | | | | | |

Total distributions to shareholders | | | (0.63 | ) | | | (0.11 | ) |

Net asset value, end of period | | $ | 10.79 | | | $ | 10.85 | |

Total return3 | | | 5.34 | % | | | 9.67 | % |

Ratios to average net assets (annualized) | | | | | | | | |

Gross expenses | | | 1.92 | % | | | 2.20 | % |

Net expenses | | | 1.23 | % | | | 1.23 | % |

Net investment income | | | 3.83 | % | | | 2.62 | % |

Supplemental data | | | | | | | | |

Portfolio turnover rate | | | 62 | % | | | 120 | % |

Net assets, end of period (000s omitted) | | | $868 | | | | $581 | |

| 1. | For the period from May 31, 2012 (commencement of class operations) to October 31, 2012 |

| 2. | Calculated based upon average shares outstanding |

| 3. | Total return calculations do not include any sales charges. Returns for periods of less than one year are not annualized. |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 14 | | Wells Fargo Advantage Emerging Markets Local Bond Fund | | Financial highlights |

(For a share outstanding throughout each period)

| | | | | | | | |

| CLASS C | | Six months ended

April 30, 2013

(unaudited) | | | Year ended

October 31, 20121 | |

Net asset value, beginning of period | | $ | 10.85 | | | $ | 10.00 | |

Net investment income | | | 0.16 | 2 | | | 0.08 | |

Net realized and unrealized gains (losses) on investments | | | 0.37 | | | | 0.85 | |

| | | | | | | | |

Total from investment operations | | | 0.53 | | | | 0.93 | |

Distributions to shareholders from | | | | | | | | |

Net investment income | | | (0.39 | ) | | | (0.08 | ) |

Net realized gains | | | (0.20 | ) | | | 0.00 | |

| | | | | | | | |

Total distributions to shareholders | | | (0.59 | ) | | | (0.08 | ) |

Net asset value, end of period | | $ | 10.79 | | | $ | 10.85 | |

Total return3 | | | 4.96 | % | | | 9.35 | % |

Ratios to average net assets (annualized) | | | | | | | | |

Gross expenses | | | 2.67 | % | | | 2.95 | % |

Net expenses | | | 1.98 | % | | | 1.98 | % |

Net investment income | | | 3.03 | % | | | 1.89 | % |

Supplemental data | | | | | | | | |

Portfolio turnover rate | | | 62 | % | | | 120 | % |

Net assets, end of period (000s omitted) | | | $602 | | | | $547 | |

| 1. | For the period from May 31, 2012 (commencement of class operations) to October 31, 2012 |

| 2. | Calculating based upon average shares outstanding |

| 3. | Total return calculations do not include any sales charges. Returns for periods of less than one year are not annualized. |

The accompanying notes are an integral part of these financial statements.

| | | | | | |

| Financial highlights | | Wells Fargo Advantage Emerging Markets Local Bond Fund | | | 15 | |

(For a share outstanding throughout each period)

| | | | | | | | |

| ADMINISTRATOR CLASS | | Six months ended

April 30, 2013

(unaudited) | | | Year ended

October 31, 20121 | |

Net asset value, beginning of period | | $ | 10.85 | | | $ | 10.00 | |

Net investment income | | | 0.21 | 2 | | | 0.12 | |

Net realized and unrealized gains (losses) on investments | | | 0.36 | | | | 0.85 | |

| | | | | | | | |

Total from investment operations | | | 0.57 | | | | 0.97 | |

Distributions to shareholders from | | | | | | | | |

Net investment income | | | (0.43 | ) | | | (0.12 | ) |

Net realized gains | | | (0.20 | ) | | | 0.00 | |

| | | | | | | | |

Total distributions to shareholders | | | (0.63 | ) | | | (0.12 | ) |

Net asset value, end of period | | $ | 10.79 | | | $ | 10.85 | |

Total return3 | | | 5.37 | % | | | 9.72 | % |

Ratios to average net assets (annualized) | | | | | | | | |

Gross expenses | | | 1.87 | % | | | 2.16 | % |

Net expenses | | | 1.10 | % | | | 1.10 | % |

Net investment income | | | 3.92 | % | | | 2.77 | % |

Supplemental data | | | | | | | | |

Portfolio turnover rate | | | 62 | % | | | 120 | % |

Net assets, end of period (000s omitted) | | | $13,878 | | | | $13,166 | |

| 1. | For the period from May 31, 2012 (commencement of class operations) to October 31, 2012 |

| 2. | Calculated based upon average shares outstanding |

| 3. | Returns for periods of less than one year are not annualized. |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 16 | | Wells Fargo Advantage Emerging Markets Local Bond Fund | | Financial highlights |

(For a share outstanding throughout each period)

| | | | | | | | |

| INSTITUTIONAL CLASS | | Six months ended

April 30, 2013

(unaudited) | | | Year ended

October 31, 20121 | |

Net asset value, beginning of period | | $ | 10.85 | | | $ | 10.00 | |

Net investment income | | | 0.22 | 2 | | | 0.13 | |

Net realized and unrealized gains (losses) on investments | | | 0.37 | | | | 0.85 | |

| | | | | | | | |

Total from investment operations | | | 0.59 | | | | 0.98 | |

Distributions to shareholders from | | | | | | | | |

Net investment income | | | (0.45 | ) | | | (0.13 | ) |

Net realized gains | | | (0.20 | ) | | | 0.00 | |

| | | | | | | | |

Total distributions to shareholders | | | (0.65 | ) | | | (0.13 | ) |

Net asset value, end of period | | $ | 10.79 | | | $ | 10.85 | |

Total return3 | | | 5.51 | % | | | 9.82 | % |

Ratios to average net assets (annualized) | | | | | | | | |

Gross expenses | | | 1.60 | % | | | 1.94 | % |

Net expenses | | | 0.90 | % | | | 0.90 | % |

Net investment income | | | 4.12 | % | | | 2.97 | % |

Supplemental data | | | | | | | | |

Portfolio turnover rate | | | 62 | % | | | 120 | % |

Net assets, end of period (000s omitted) | | | $13,904 | | | | $13,177 | |

| 1. | For the period from May 31, 2012 (commencement of class operations) to October 31, 2012 |

| 2. | Calculated based upon average shares outstanding |

| 3. | Returns for periods of less than one year are not annualized. |

The accompanying notes are an integral part of these financial statements.

| | | | | | |

| Notes to financial statements (unaudited) | | Wells Fargo Advantage Emerging Markets Local Bond Fund | | | 17 | |

1. ORGANIZATION

Wells Fargo Funds Trust (the “Trust”), a Delaware statutory trust organized on March 10, 1999, is an open-end management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”). These financial statements report on Wells Fargo Advantage Emerging Markets Local Bond Fund (the “Fund”) which is a diversified series of the Trust.

2. SIGNIFICANT ACCOUNTING POLICIES

The following significant accounting policies, which are consistently followed in the preparation of the financial statements of the Fund, are in conformity with U.S. generally accepted accounting principles which require management to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Securities valuation

All investments are valued each business day as of the close of regular trading on the New York Stock Exchange (normally 4 p.m. Eastern Time).

Securities denominated in foreign currencies are translated into U.S. dollars using the rates of exchange in effect on the day of valuation at a time specified by the Management Valuation Team of Wells Fargo Funds Management, LLC (“Funds Management”).

Fixed income securities acquired with maturities exceeding 60 days are valued based on evaluated bid prices received from an independent pricing service which may utilize both transaction data and market information such as yield, prices of securities of comparable quality, coupon rate, maturity, type of issue, trading characteristics and other market data. If valuations are not available from the independent pricing service or values received are deemed not representative of market value, values will be obtained from a broker-dealer or otherwise determined based on the Fund’s Valuation Procedures.

Short-term securities with maturities of 60 days or less generally are valued at amortized cost which approximates fair value. The amortized cost method involves valuing a security at its cost, plus accretion of discount or minus amortization of premium over the period until maturity.

Investments in registered open-end investment companies are valued at net asset value.

Investments which are not valued using any of the methods discussed above are valued at their fair value, as determined by procedures established in good faith and approved by the Board of Trustees. The Board of Trustees has established a Valuation Committee comprised of the Trustees and has delegated to it the authority to take any actions regarding the valuation of portfolio securities that the Valuation Committee deems necessary or appropriate, including determining the fair value of portfolio securities, unless the determination has been delegated to the Management Valuation Team. The Board of Trustees retains the authority to make or ratify any valuation decisions or approve any changes to the Valuation Procedures as it deems appropriate. On a quarterly basis, the Board of Trustees receives reports on any valuation actions taken by the Valuation Committee or the Management Valuation Team which may include items for ratification.

Valuations of fair valued securities are compared to the next actual sales price when available, or other appropriate market information to assess the continued appropriateness of the fair valuation methodology used. These securities are fair valued on a day-to-day basis, taking into consideration changes to appropriate market information and any significant changes to the input factors considered in the valuation process until there is a readily available price provided on the exchange or by an independent pricing service. Valuations received from an independent pricing service or broker quotes are periodically validated by comparisons to most recent trades and valuations provided by other independent pricing services in addition to the review of prices by the adviser and/or subadviser. Unobservable inputs used in determining fair valuations are identified based on the type of security, taking into consideration factors utilized by market participants in valuing the investment, knowledge about the issuer and the current market environment.

Foreign currency translation

The accounting records of the Fund are maintained in U.S. dollars. Assets, including investment securities, and liabilities denominated in foreign currency are translated into U.S. dollars at the rates of exchange at a time specified by the Management Valuation Team on the date of valuation. Purchases and sales of securities, and income and expenses are translated at the rate of exchange on the respective dates of such transactions. Reported net realized foreign exchange gains or losses arise from sales of foreign currencies, currency gains or losses realized between the trade and settlement dates on securities transactions, and the difference between the amounts of dividends, interest and foreign withholding

| | | | |

| 18 | | Wells Fargo Advantage Emerging Markets Local Bond Fund | | Notes to financial statements (unaudited) |

taxes recorded and the U.S. dollar equivalent of the amounts actually paid or received. Net unrealized foreign exchange gains and losses arise from changes in the fair value of assets and liabilities other than investments in securities resulting in changes in exchange rates.

The changes in net assets arising from changes in exchange rates and the changes in net assets resulting from changes in market prices of securities are not separately presented. Such changes are recorded with net realized and unrealized gains or losses from investments. Gains and losses from certain foreign currency transactions are treated as ordinary income for U.S. federal income tax purposes.

Forward foreign currency contracts

The Fund may be subject to foreign currency exchange rate risk in the normal course of pursuing its investment objectives. A forward foreign currency contract is an agreement between two parties to purchase or sell a specific currency for an agreed-upon price at a future date. The Fund enters into forward foreign currency contracts to facilitate transactions in foreign-denominated securities and to attempt to minimize the risk to the Fund from adverse changes in the relationship between currencies. Forward foreign currency contracts are recorded at the forward rate and marked-to-market daily. When the contracts are closed, realized gains and losses arising from such transactions are recorded as realized gains or losses on forward foreign currency contract transactions. The Fund could be exposed to risks if the counterparties to the contracts are unable to meet the terms of their contracts or if the value of the foreign currency changes unfavorably. The Fund’s maximum risk of loss from counterparty credit risk is the unrealized gains or losses on the contracts. This risk is mitigated by having a master netting arrangement between the Fund and the counterparty.

Security transactions and income recognition

Securities transactions are recorded on a trade date basis. Realized gains or losses are recorded on the basis of identified cost.

Interest income is accrued daily and bond discounts are accreted and premiums are amortized daily based on the effective interest method. To the extent debt obligations are placed on non-accrual status, any related interest income may be reduced by writing off interest receivables when the collection of all or a portion of interest has become doubtful based on consistently applied procedures. If the issuer subsequently resumes interest payments or when the collectability of interest is reasonably assured, the debt obligation is removed from non-accrual status.

Income from foreign securities is recorded net of foreign taxes withheld where recovery of such taxes is not assured.

Distributions to shareholders

Distributions to shareholders from net investment income and net realized gains, if any, are recorded on the ex-dividend date. Such distributions are determined in conformity with federal income tax regulations, which may differ in amount or character from net investment income and realized gains recognized for purposes of U.S. generally accepted accounting principles.

Federal and other taxes

The Fund intends to continue to qualify as a regulated investment company by distributing substantially all of its investment company taxable income and any net realized capital gains (after reduction for capital loss carryforwards) sufficient to relieve it from all, or substantially all, federal income taxes. Accordingly, no provision for federal income taxes was required.

The Fund’s income and federal excise tax returns and all financial records supporting those returns since commencement of operations are subject to examination by the federal and Delaware revenue authorities. Management has analyzed the Fund’s tax positions taken on federal, state, and foreign tax returns for all open tax years and does not believe that there are any uncertain tax positions that require recognition of a tax liability.

Class allocations

The separate classes of shares offered by the Fund differ principally in applicable sales charges, distribution, shareholder servicing, and administration fees. Shareholders of each class bear certain expenses that pertain to that particular class. All shareholders bear the common expenses of the Fund, earn income from the portfolio, and are allocated any unrealized gains and losses pro rata based on the average daily net assets of each class, without distinction between share classes. Dividends are determined separately for each class based on income and expenses allocable to each class. Realized gains and losses are allocated to each class pro rata based upon the net assets of each class on the date realized. Differences in per share dividend rates generally result from the relative weightings of pro rata income and realized gain allocations and from differences in separate class expenses, including distribution, shareholder servicing, and administration fees.

| | | | | | |

| Notes to financial statements (unaudited) | | Wells Fargo Advantage Emerging Markets Local Bond Fund | | | 19 | |

3. FAIR VALUATION MEASUREMENTS

Fair value measurements of investments are determined within a framework that has established a fair value hierarchy based upon the various data inputs utilized in determining the value of the Fund’s investments. The three-level hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1) and the lowest priority to significant unobservable inputs (Level 3). The Fund’s investments are classified within the fair value hierarchy based on the lowest level of input that is significant to the fair value measurement. The inputs are summarized into three broad levels as follows:

| n | | Level 1 – quoted prices in active markets for identical securities |

| n | | Level 2 – other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, use of amortized cost, etc.) |

| n | | Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

The inputs or methodologies used for valuing investments in securities are not necessarily an indication of the risk associated with investing in those securities.

As of April 30, 2013, the inputs used in valuing investments in securities were as follows:

| | | | | | | | | | | | | | | | |

| Investments in securities | | Quoted prices (Level 1) | | | Significant other

observable inputs (Level 2) | | | Significant unobservable inputs (Level 3) | | | Total | |

Foreign corporate bonds and notes | | $ | 0 | | | $ | 5,534,522 | | | $ | 0 | | | $ | 5,534,522 | |

Foreign government bonds | | | 0 | | | | 22,150,328 | | | | 0 | | | | 22,150,328 | |

Yankee corporate bonds and notes | | | 0 | | | | 979,642 | | | | 0 | | | | 979,642 | |

Short-term investments | | | | | | | | | | | | | | | | |

Investment companies | | | 64,734 | | | | 0 | | | | 0 | | | | 64,734 | |

| | | $ | 64,734 | | | $ | 28,664,492 | | | $ | 0 | | | $ | 28,729,226 | |

As of April 30, 2013, the inputs used in valuing the Fund’s other financial instruments were as follows:

| | | | | | | | | | | | | | | | |

| Other financial instruments | | Quoted prices (Level 1) | | | Significant other

observable inputs (Level 2) | | | Significant unobservable inputs (Level 3) | | | Total | |

Forward foreign currency contracts+ | | $ | 0 | | | $ | 35,467 | | | $ | 0 | | | $ | 35,467 | |

| + | Forward foreign currency contracts are presented at the unrealized gains or losses on the instrument. |

Transfers in and transfers out are recognized at the end of the reporting period. For the six months ended April 30, 2013, the Fund did not have any transfers into/out of Level 1 or Level 2.

4. TRANSACTIONS WITH AFFILIATES AND OTHER EXPENSES

Advisory fee

The Trust has entered into an advisory contract with Funds Management, an indirect wholly owned subsidiary of Wells Fargo & Company (“Wells Fargo”). The adviser is responsible for implementing investment policies and guidelines and for supervising the subadviser, who is responsible for day-to-day portfolio management of the Fund.

Pursuant to the contract, Funds Management is entitled to receive an annual advisory fee starting at 0.65% and declining to 0.55% as the average daily net assets of the Fund increase. For the six months ended April 30, 2013, the advisory fee was equivalent to an annual rate of 0.65% of the Fund’s average daily net assets.

Funds Management has retained the services of a subadviser to provide daily portfolio management to the Fund. The fee for subadvisory services is borne by Funds Management. First International Advisors, LLC, an affiliate of Funds Management, is the subadviser to the Fund and is entitled to receive a fee from Funds Management at an annual rate starting at 0.45% and declining to 0.30% as the average daily net assets of the Fund increase.

Administration and transfer agent fees

The Trust has entered into an administration agreement with Funds Management. Under this agreement, for providing administrative services, which includes paying fees and expenses for services provided by the transfer agent, sub-transfer

| | | | |

| 20 | | Wells Fargo Advantage Emerging Markets Local Bond Fund | | Notes to financial statements (unaudited) |

agents, omnibus account servicers and record-keepers, Funds Management is entitled to receive from the Fund an annual fund level administration fee starting at 0.05% and declining to 0.03% as the average daily net assets of the Fund increase and a class level administration fee which is calculated based on the average daily net assets of each class as follows:

| | | | |

| | | Class level administration fee | |

Class A, Class C | | | 0.16 | % |

Administrator Class | | | 0.10 | |

Institutional Class | | | 0.08 | |

Funds Management has contractually waived and/or reimbursed advisory and administration fees to the extent necessary to maintain certain net operating expense ratios for the Fund. Waiver of fees and/or reimbursement of expenses by Funds Management were made first from fund level expenses on a proportionate basis and then from class specific expenses. Funds Management has committed through February 28, 2014 to waive fees and/or reimburse expenses to the extent necessary to cap the Fund’s expenses at 1.23% for Class A shares, 1.98% for Class C shares, 1.10% for Administration Class shares, and 0.90% for Institutional Class shares.

Distribution fees

The Trust has adopted a Distribution Plan for Class C shares of the Fund pursuant to Rule 12b-1 under the 1940 Act. Distribution fees are charged to Class C shares and paid to Wells Fargo Funds Distributor, LLC, the principal underwriter, at an annual rate of 0.75% of the average daily net assets of Class C shares.

For the six months ended April 30, 2013, Wells Fargo Funds Distributor, LLC received $210 from the sale of Class A shares.

Shareholder servicing fees

The Trust has entered into contracts with one or more shareholder servicing agents, whereby Class A, Class C and Administrator Class of the Fund is charged a fee at an annual rate of 0.25% of the average daily net assets of each respective class.

A portion of these total shareholder servicing fees were paid to affiliates of Wells Fargo.

5. INVESTMENT PORTFOLIO TRANSACTIONS

Purchases and sales of investments, excluding U.S. government obligations (if any) and short-term securities, for the six months ended April 30, 2013 were $18,353,815 and $16,968,999, respectively.

6. DERIVATIVE TRANSACTIONS

During the six months ended April 30, 2013, the Fund entered into forward foreign currency exchange contracts for economic hedging purposes.

At April 30, 2013, the Fund had forward foreign currency contracts outstanding as follows:

Forward foreign currency contracts to buy:

| | | | | | | | | | | | | | | | | | |

| Exchange date | | Counterparty | | Contracts to

receive | | | U.S. value at

April 30, 2013 | | | In exchange

for U.S. $ | | | Unrealized

gains

(losses) | |

| 5-7-2013 | | State Street Bank | | | 35,000,000 | THB | | $ | 1,192,227 | | | $ | 1,173,315 | | | $ | 18,912 | |

| 5-7-2013 | | State Street Bank | | | 10,000,000,000 | IDR | | | 1,027,922 | | | | 1,029,156 | | | | (1,234 | ) |

| 5-28-2013 | | State Street Bank | | | 7,100,000 | MYR | | | 2,329,285 | | | | 2,280,758 | | | | 48,527 | |

Forward foreign currency contracts to sell:

| | | | | | | | | | | | | | | | | | |

| Exchange date | | Counterparty | | Contracts to

deliver | | | U.S. value at

April 30, 2013 | | | In exchange

for U.S. $ | | | Unrealized

gains

(losses) | |

| 5-7-2013 | | State Street Bank | | | 10,000,000,000 | IDR | | $ | 1,027,923 | | | $ | 1,027,538 | | | $ | (385 | ) |

| 5-28-2013 | | State Street Bank | | | 3,100,000 | MYR | | | 1,017,012 | | | | 1,017,227 | | | | 215 | |

| 7-29-2013 | | State Street Bank | | | 2,000,000 | TRY | | | 1,105,756 | | | | 1,098,874 | | | | (6,882 | ) |

| 7-31-2013 | | State Street Bank | | | 10,000,000 | ZAR | | | 1,101,238 | | | | 1,077,552 | | | | (23,686 | ) |

| | | | | | |

| Notes to financial statements (unaudited) | | Wells Fargo Advantage Emerging Markets Local Bond Fund | | | 21 | |

The Fund had average contract amounts of $4,630,022 and $4,435,183 in forward foreign currency contracts to buy and forward foreign currency contracts to sell, respectively, during the six months ended April 30, 2013.

The fair value, realized gains or losses and change in unrealized gains or losses, if any, on derivative instruments are reflected in the appropriate financial statements.

7. BANK BORROWINGS

The Trust (excluding the money market funds and certain other funds in the Trust) and Wells Fargo Variable Trust are parties to a $150,000,000 revolving credit agreement with State Street Bank and Trust Company, whereby the Fund is permitted to use bank borrowings for temporary or emergency purposes, such as to fund shareholder redemption requests. Interest under the credit agreement is charged to the Fund based on a borrowing rate equal to the higher of the Federal Funds rate in effect on that day plus 1.25% or the overnight LIBOR rate in effect on that day plus 1.25%. In addition, an annual commitment fee equal to 0.10% of the unused balance is allocated to each participating fund. For the six months ended April 30, 2013, the Fund paid $30 in commitment fees.

For the six months ended April 30, 2013, there were no borrowings by the Fund under the agreement.

8. INDEMNIFICATION

Under the Trust’s organizational documents, the officers and directors are indemnified against certain liabilities that may arise out of performance of their duties to the Trust. Additionally, in the normal course of business, the Trust may enter into contracts with service providers that contain a variety of indemnification clauses. The Trust’s maximum exposure under these arrangements is dependent on future claims that may be made against the Fund and, therefore, cannot be estimated.

9. NEW ACCOUNTING PRONOUNCEMENT