UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-09253

Wells Fargo Funds Trust

(Exact name of registrant as specified in charter)

525 Market St., San Francisco, CA 94105

(Address of principal executive offices) (Zip code)

C. David Messman

Wells Fargo Funds Management, LLC

525 Market St., San Francisco, CA 94105

(Name and address of agent for service)

Registrant’s telephone number, including area code: 800-222-8222

Date of fiscal year end: Registrant is making a filing for 11 of its series, Wells Fargo Advantage Dow Jones Target Today Fund, Wells Fargo Advantage Dow Jones Target 2010 Fund, Wells Fargo Advantage Dow Jones Target 2015 Fund, Wells Fargo Advantage Dow Jones Target 2020 Fund, Wells Fargo Advantage Dow Jones Target 2025 Fund, Wells Fargo Advantage Dow Jones Target 2030 Fund, Wells Fargo Advantage Dow Jones Target 2035 Fund, Wells Fargo Advantage Dow Jones Target 2040 Fund, Wells Fargo Advantage Dow Jones Target 2045 Fund, Wells Fargo Advantage Dow Jones Target 2050 Fund, Wells Fargo Advantage Dow Jones Target 2055 Fund. Each series had a February 28 fiscal year end.

Date of reporting period: August 31, 2013

| ITEM 1. | REPORT TO STOCKHOLDERS |

Wells Fargo Advantage Dow Jones Target Date FundsSM

Semi-Annual Report

August 31, 2013

| n | | Wells Fargo Advantage Dow Jones Target Today FundSM |

| n | | Wells Fargo Advantage Dow Jones Target 2010 FundSM |

| n | | Wells Fargo Advantage Dow Jones Target 2015 FundSM |

| n | | Wells Fargo Advantage Dow Jones Target 2020 FundSM |

| n | | Wells Fargo Advantage Dow Jones Target 2025 FundSM |

| n | | Wells Fargo Advantage Dow Jones Target 2030 FundSM |

| n | | Wells Fargo Advantage Dow Jones Target 2035 FundSM |

| n | | Wells Fargo Advantage Dow Jones Target 2040 FundSM |

| n | | Wells Fargo Advantage Dow Jones Target 2045 FundSM |

| n | | Wells Fargo Advantage Dow Jones Target 2050 FundSM |

| n | | Wells Fargo Advantage Dow Jones Target 2055 FundSM |

Reduce clutter. Save trees.

Sign up for electronic delivery of prospectuses and shareholder reports at wellsfargo.com/advantagedelivery

Contents

The views expressed and any forward-looking statements are as of August 31, 2013, unless otherwise noted, and are those of the Fund managers and/or Wells Fargo Funds Management, LLC. Discussions of individual securities, or the markets generally, or any Wells Fargo Advantage Fund are not intended as individual recommendations. Future events or results may vary significantly from those expressed in any forward-looking statements; the views expressed are subject to change at any time in response to changing circumstances in the market. Wells Fargo Funds Management, LLC, disclaims any obligation to publicly update or revise any views expressed or forward-looking statements.

NOT FDIC INSURED ¡ NO BANK GUARANTEE ¡ MAY LOSE VALUE

Wells Fargo investment history

| | |

| 1932 | | Keystone creates one of the first mutual fund families. |

| 1971 | | Wells Fargo & Company introduces one of the first institutional index funds. |

| 1978 | | Wells Fargo applies Markowitz and Sharpe’s research on Modern Portfolio Theory to introduce one of the industry’s first tactical asset allocation models in institutional separately managed accounts. |

| 1984 | | Wells Fargo Stagecoach Funds launches its first asset allocation fund. |

| 1989 | | The Tactical Asset Allocation (TAA) Model is first applied to Wells Fargo’s asset allocation mutual funds. |

| 1994 | | Wells Fargo introduces the LifePath Funds, one of the first suites of target date funds (now the Wells Fargo Advantage Dow Jones Target Date FundsSM). |

| 1996 | | Evergreen Investments and Keystone Funds merge. |

| 1997 | | Wells Fargo launches the Wells Fargo Advantage WealthBuilder PortfoliosSM, a fund-of-funds suite of products that includes the use of quantitative models to shift assets among investment styles. |

| 1999 | | Norwest Advantage Funds and Stagecoach Funds are reorganized into Wells Fargo Funds after the merger of Norwest and Wells Fargo. |

| 2002 | | Evergreen Retail and Evergreen Institutional companies form the umbrella asset management company, Evergreen Investments. |

| 2005 | | The integration of Strong Funds with Wells Fargo Funds creates Wells Fargo Advantage Funds, resulting in one of the top 20 mutual fund companies in the United States. |

| 2006 | | Wells Fargo Advantage Funds relaunches the target date product line as Wells Fargo Advantage Dow Jones Target Date Funds. |

| 2010 | | The mergers and reorganizations of Evergreen and Wells Fargo Advantage mutual funds are completed, unifying the families under the brand of Wells Fargo Advantage Funds. |

Wells Fargo Advantage Funds®

Wells Fargo Advantage Funds skillfully guides institutions, financial advisors, and individuals through the investment terrain to help them reach their financial objectives. Everything we do on behalf of investors is backed by our unique combination of qualifications.

Strength

Our organization is built on the standards of integrity and service established by our parent company—Wells Fargo & Company—more than 150 years ago. And, because we’re part of a highly diversified financial enterprise, we offer the depth of resources to help investors succeed.

Expertise

Our multi-boutique model offers investors access to the independent thinking of premier investment managers that have been chosen for their time-tested strategies. While each team specializes in a specific investment strategy, collectively they provide investors a wide choice of distinct investment styles. Our dedication to investment excellence doesn’t end with our expertise in manager selection—risk management, analysis, and rigorous ongoing review seek to ensure each manager’s investment process remains consistent.

Partnership

Our collaborative approach is built around understanding the needs and goals of our clients. By adhering to core principles of sound judgment and steady guidance, we support you through every stage of the investment decision process.

Carefully consider the investment objectives, risks, charges, and expenses before investing. For a current prospectus and, if available, a summary prospectus, for Wells Fargo Advantage Funds, containing this and other information, visit wellsfargoadvantagefunds.com. Read it carefully before investing.

Wells Fargo Funds Management, LLC, a wholly owned subsidiary of Wells Fargo & Company, provides investment advisory and administrative services for Wells Fargo Advantage Funds. Other affiliates of Wells Fargo & Company provide subadvisory and other services for the Funds. The Funds are distributed by Wells Fargo Funds Distributor, LLC, Member FINRA/SIPC, an affiliate of Wells Fargo & Company.

“Dow Jones®” and “Dow Jones Target Date IndexesSM” are service marks of Dow Jones Trademark Holdings LLC (“Dow Jones”); have been licensed to CME Group Index Services LLC (“CME Indexes”); and have been sublicensed for use for certain purposes by Global Index Advisors, Inc., and Wells Fargo Funds Management, LLC. The Wells Fargo Advantage Dow Jones Target Date FundsSM, based on the Dow Jones Target Date Indexes, are not sponsored, endorsed, sold, or promoted by Dow Jones, CME Indexes, or their respective affiliates, and none of them makes any representation regarding the advisability of investing in such product(s).

NOT FDIC INSURED ¡ NO BANK GUARANTEE ¡ MAY LOSE VALUE

Not part of the semi-annual report.

Wells Fargo Advantage Funds offers more than 100 mutual funds across a wide range of asset classes, representing over $229 billion in assets under management, as of August 31, 2013.

| | | | |

| Equity funds | | | | |

Asia Pacific Fund | | Enterprise Fund† | | Opportunity Fund† |

C&B Large Cap Value Fund | | Global Opportunities Fund | | Precious Metals Fund |

C&B Mid Cap Value Fund | | Growth Fund | | Premier Large Company Growth Fund |

Capital Growth Fund | | Index Fund | | Small Cap Opportunities Fund |

Common Stock Fund | | International Equity Fund | | Small Cap Value Fund |

Disciplined U.S. Core Fund | | International Value Fund | | Small Company Growth Fund |

Discovery Fund† | | Intrinsic Small Cap Value Fund | | Small Company Value Fund |

Diversified Equity Fund | | Intrinsic Value Fund | | Small/Mid Cap Value Fund |

Diversified International Fund | | Intrinsic World Equity Fund | | Special Mid Cap Value Fund |

Emerging Growth Fund | | Large Cap Core Fund | | Special Small Cap Value Fund |

Emerging Markets Equity Fund | | Large Cap Growth Fund | | Specialized Technology Fund |

Emerging Markets Equity Income Fund | | Large Company Value Fund | | Traditional Small Cap Growth Fund |

Endeavor Select Fund† | | Omega Growth Fund | | Utility and Telecommunications Fund |

| Bond funds | | | | |

Adjustable Rate Government Fund | | High Yield Municipal Bond Fund | | Short-Term Bond Fund |

California Limited-Term Tax-Free Fund | | Income Plus Fund | | Short-Term High Yield Bond Fund |

California Tax-Free Fund | | Inflation-Protected Bond Fund | | Short-Term Municipal Bond Fund |

Colorado Tax-Free Fund | | Intermediate Tax/AMT-Free Fund | | Strategic Income Fund |

Conservative Income Fund | | International Bond Fund | | Strategic Municipal Bond Fund |

Core Bond Fund | | Minnesota Tax-Free Fund | | Ultra Short-Term Income Fund |

Emerging Markets Local Bond Fund | | Municipal Bond Fund | | Ultra Short-Term Municipal Income Fund |

Government Securities Fund | | North Carolina Tax-Free Fund | | Wisconsin Tax-Free Fund |

High Income Fund | | Pennsylvania Tax-Free Fund | | |

High Yield Bond Fund | | Short Duration Government Bond Fund | | |

| Asset allocation funds | | | | |

Absolute Return Fund | | WealthBuilder Equity Portfolio† | | Target 2020 Fund† |

Asset Allocation Fund | | WealthBuilder Growth Allocation Portfolio† | | Target 2025 Fund† |

Diversified Capital Builder Fund | | WealthBuilder Growth Balanced Portfolio† | | Target 2030 Fund† |

Diversified Income Builder Fund | | WealthBuilder Moderate Balanced Portfolio† | | Target 2035 Fund† |

Growth Balanced Fund | | WealthBuilder Tactical Equity Portfolio† | | Target 2040 Fund† |

Index Asset Allocation Fund | | Target Today Fund† | | Target 2045 Fund† |

Moderate Balanced Fund | | Target 2010 Fund† | | Target 2050 Fund† |

WealthBuilder Conservative Allocation Portfolio† | | Target 2015 Fund† | | Target 2055 Fund† |

| Money market funds | | | | |

100% Treasury Money Market Fund | | Heritage Money Market Fund† | | National Tax-Free Money Market Fund |

California Municipal Money Market Fund | | Money Market Fund | | Treasury Plus Money Market Fund |

Cash Investment Money Market Fund | | Municipal Cash Management Money Market Fund | | |

Government Money Market Fund | | Municipal Money Market Fund | | |

| Variable trust funds1 | | | | |

VT Discovery Fund† | | VT Intrinsic Value Fund | | VT Small Cap Growth Fund |

VT Index Asset Allocation Fund | | VT Omega Growth Fund | | VT Small Cap Value Fund |

VT International Equity Fund | | VT Opportunity Fund† | | VT Total Return Bond Fund |

An investment in a money market fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although the Wells Fargo Advantage Money Market Funds seek to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in a money market fund.

| 1. | The variable trust funds are generally available only through insurance company variable contracts. |

| † | In this report, the Wells Fargo Advantage Discovery FundSM, Wells Fargo Advantage Endeavor Select FundSM, Wells Fargo Advantage Enterprise FundSM, Wells Fargo Advantage Opportunity FundSM, Wells Fargo Advantage WealthBuilder Conservative Allocation PortfolioSM, Wells Fargo Advantage WealthBuilder Equity PortfolioSM, Wells Fargo Advantage WealthBuilder Growth Allocation PortfolioSM, Wells Fargo Advantage WealthBuilder Growth Balanced PortfolioSM, Wells Fargo Advantage WealthBuilder Moderate Balanced PortfolioSM, Wells Fargo Advantage WealthBuilder Tactical Equity PortfolioSM, Wells Fargo Advantage Dow Jones Target Today FundSM, Wells Fargo Advantage Dow Jones Target 2010 FundSM, Wells Fargo Advantage Dow Jones Target 2015 FundSM, Wells Fargo Advantage Dow Jones Target 2020 FundSM, Wells Fargo Advantage Dow Jones Target 2025 FundSM, Wells Fargo Advantage Dow Jones Target 2030 FundSM, Wells Fargo Advantage Dow Jones Target 2035 FundSM, Wells Fargo Advantage Dow Jones Target 2040 FundSM, Wells Fargo Advantage Dow Jones Target 2045 FundSM, Wells Fargo Advantage Dow Jones Target 2050 FundSM, Wells Fargo Advantage Dow Jones Target 2055 FundSM, Wells Fargo Advantage Heritage Money Market FundSM, Wells Fargo Advantage VT Discovery FundSM, and Wells Fargo Advantage VT Opportunity FundSM are referred to as the Discovery Fund, Endeavor Select Fund, Enterprise Fund, Opportunity Fund, WealthBuilder Conservative Allocation Portfolio, WealthBuilder Equity Portfolio, WealthBuilder Growth Allocation Portfolio, WealthBuilder Growth Balanced Portfolio, WealthBuilder Moderate Balanced Portfolio, WealthBuilder Tactical Equity Portfolio, Target Today Fund, Target 2010 Fund, Target 2015 Fund, Target 2020 Fund, Target 2025 Fund, Target 2030 Fund, Target 2035 Fund, Target 2040 Fund, Target 2045 Fund, Target 2050 Fund, Target 2055 Fund, Heritage Money Market Fund, VT Discovery Fund, and VT Opportunity Fund, respectively. |

Not part of the semi-annual report.

| | | | |

| 2 | | Wells Fargo Advantage Dow Jones Target Date Funds | | Letter to shareholders (unaudited) |

Karla M. Rabusch

President

Wells Fargo Advantage Funds

The past six months were marked by modest U.S. economic growth, accommodative monetary policies, and indications of better economic growth from the eurozone.

Dear Valued Shareholder:

We are pleased to offer you this semi-annual report for the Wells Fargo Advantage Dow Jones Target Date FundsSM for the six-month period that ended August 31, 2013. The past six months were marked by modest U.S. economic growth, accommodative monetary policies, and indications of better economic growth from the eurozone. In this environment, U.S. equities advanced, while bonds generally had negative results due to interest rates moving higher.

Economic growth continued to advance modestly.

Economic news generally improved during the period. The good news from the past six months was that the U.S. economy advanced, with signs of sustainable economic growth appearing in improved housing data and labor statistics, including a steadily declining unemployment rate. The economy was held back by the effects of the federal sequester, or automatic spending cuts, and little improvement in household income expectations.

Global economic growth improved in Europe and varied elsewhere. The eurozone produced a positive gross domestic product report, a welcome change from its sustained recession. China’s economic growth appeared to stabilize. Other emerging markets, however, faced slower economic growth and financial-market fallout from the prospect of the U.S. Federal Reserve (Fed) scaling back its quantitative easing program.

All eyes were on the Fed.

Announcements following each Federal Open Market Committee (FOMC) meeting reaffirmed the Fed’s commitment to a highly accommodative monetary policy. However, Fed Chairman Ben Bernanke’s comments on June 19, 2013, after the previous day’s FOMC meeting, roiled the bond markets by indicating that tapering of its bond-buying program could begin later this year and that it could end as soon as mid-2014. As a result, long-term U.S. interest rates rose by more than 100 basis points (bps; 100 bps equals 1.00%), while short-term rates remained ultra low.

Financial market results were mixed.

With continued economic growth as a tailwind and fewer political uncertainties in the six-month period that ended August 31, 2013, U.S. equities, as measured by the Russell 3000® Index1, rose 9.4%. Meanwhile, non-U.S. equities, as measured by the Morgan Stanley Capital International All Country World Ex. USA Index (Gross)2, were little changed. Given investor expectations for the Fed to scale back its quantitative easing program and a subsequent rise in interest rates, investment-grade bonds, as measured by the Barclays U.S. Aggregate Bond Index3, declined 2.6%.

Our target date funds reflected the broader financial-market movements, as expected.

Our target date series is passively managed across nine equity and four fixed-income asset allocations. Longer-dated funds, for those with investors

| 1. | The Russell 3000® Index measures the performance of the 3,000 largest U.S. companies based on total market capitalization, which represents approximately 98% of the investable U.S. equity market. You cannot invest directly in an index. |

| 2. | The Morgan Stanley Capital International All Country World Ex. USA (MSCI ACWI Ex. USA) Index (Gross) is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets excluding the United States. You cannot invest directly in an index. Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indexes or any securities or financial products. This report is not approved, reviewed, or produced by MSCI. |

| 3. | The Barclays U.S. Aggregate Bond Index is composed of the Barclays Government/Credit Index and the Mortgage-Backed Securities Index and includes U.S. Treasury issues, agency issues, corporate bond issues, and mortgage-backed securities. You cannot invest directly in an index. |

| | | | | | |

| Letter to shareholders (unaudited) | | Wells Fargo Advantage Dow Jones Target Date Funds | | | 3 | |

planning to retire further into the future, are more heavily weighted in equity allocations. These funds tended to do best over the past six months, reflecting positive equity returns. Shorter-dated funds for those investors near or in retirement experienced lower or slightly negative results due to their higher allocation to bonds, which had negative performance as the result of rising interest rates. The target date represents the year in which investors may likely begin withdrawing assets. The Funds gradually seek to reduce market risk as the target date approaches and after it arrives by decreasing equity exposure and increasing fixed-income exposure. The principal value is not guaranteed at any time, including at the target date.

We believe our strategy offers the appropriate risk/return trade-off to help plan participants reach their retirement goals. The most important thing we can do for investors near or in retirement is to protect them from devastating losses that cannot be recouped. For investors with longer time horizons, our funds offer attractive upside potential within their investments across diverse asset classes.

Don’t let short-term uncertainty derail long-term investment goals.

Periods of uncertainty can present challenges, but experience has taught us that maintaining long-term investment goals can be an effective way to plan for the future. To help you create a sound strategy based on your personal goals and risk tolerance, Wells Fargo Advantage Funds offers more than 100 mutual funds and other investments spanning a wide range of asset classes and investment styles. Although diversification cannot guarantee an investment profit or prevent losses, we believe it can be an effective way to manage investment risk and potentially smooth out overall portfolio performance. We encourage investors to know their investments and to understand that appropriate levels of risk-taking may unlock opportunities.

Thank you for choosing to invest with Wells Fargo Advantage Funds. We appreciate your confidence in us and remain committed to helping you meet your financial needs. For current information about your fund investments, contact your investment professional, visit our website at wellsfargoadvantagefunds.com, or call us directly at 1-800-222-8222. We are available 24 hours a day, 7 days a week.

Sincerely,

Karla M. Rabusch

President

Wells Fargo Advantage Funds

We believe our strategy offers the appropriate risk/return trade-off to help plan participants reach their retirement goals.

| | | | |

| 4 | | Wells Fargo Advantage Dow Jones Target Date Funds | | Performance highlights (unaudited) |

Wells Fargo Advantage Dow Jones Target Date Funds1

Investment objective

Each Fund’s objective is to approximate, before fees and

expenses, the total return of the appropriate Dow Jones

Target Date Index as specified in the following table:

| | |

Wells Fargo Advantage Dow

Jones Target Date Funds | | Corresponding Dow Jones

Target Date Index |

| Target Today Fund | | Dow Jones Target Today Index |

| Target 2010 Fund | | Dow Jones Target 2010 Index |

| Target 2015 Fund | | Dow Jones Target 2015 Index |

| Target 2020 Fund | | Dow Jones Target 2020 Index |

| Target 2025 Fund | | Dow Jones Target 2025 Index |

| Target 2030 Fund | | Dow Jones Target 2030 Index |

| Target 2035 Fund | | Dow Jones Target 2035 Index |

| Target 2040 Fund | | Dow Jones Target 2040 Index |

| Target 2045 Fund | | Dow Jones Target 2045 Index |

| Target 2050 Fund | | Dow Jones Target 2050 Index |

| Target 2055 Fund | | Dow Jones Target 2055 Index |

Adviser

Wells Fargo Funds Management, LLC

Subadviser

Global Index Advisors, Inc.

Portfolio managers

Rodney H. Alldredge

James P. Lauder

Paul T. Torregrosa, Ph.D.

The target date represents the year in which investors may likely begin withdrawing assets. The Funds gradually seek to reduce market risk as the target date approaches and after it arrives by decreasing equity exposure and increasing fixed income exposure. The principal value is not guaranteed at any time, including at the target date.

Stock values fluctuate in response to the activities of individual companies and general market and economic conditions. Bond values fluctuate in response to the financial condition of individual issuers, general market and economic conditions, and changes in interest rates. In general, when interest rates rise, bond values fall and investors may lose principal value. The use of derivatives may reduce returns and/or increase volatility. Certain investment strategies tend to increase the total risk of an investment (relative to the broader market). These Funds are exposed to foreign investment risk, mortgage- and asset-backed securities risk, smaller-company investment risk, and allocation methodology risk (risk that the allocation methodology of the Dow Jones Target Date Index, whose total returns the Funds seek to approximate, before fees and expenses, will not meet an investor’s goals). Consult the prospectus for additional information on these and other risks.

Please see footnotes on page 17.

| | | | | | |

| Performance highlights (unaudited) | | Wells Fargo Advantage Dow Jones Target Date Funds | | | 5 | |

Target Today Fund

Average annual total returns2 (%) as of August 31, 2013

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Including sales charge | | | Excluding sales charge | | | Expense ratios3 (%) | |

| | | Inception date | | 1 year | | | 5 year | | | 10 year | | | 1 year | | | 5 year | | | 10 year | | | Gross | | | Net4 | |

| Class A (STWRX) | | 3-1-1994 | | | (6.91 | ) | | | 2.92 | | | | 3.66 | | | | (1.27 | ) | | | 4.15 | | | | 4.27 | | | | 1.08 | | | | 0.81 | |

| Class B (WFOKX)* | | 8-1-1998 | | | (7.01 | ) | | | 3.01 | | | | 3.72 | | | | (2.01 | ) | | | 3.37 | | | | 3.72 | | | | 1.83 | | | | 1.56 | |

| Class C (WFODX) | | 12-1-1998 | | | (2.97 | ) | | | 3.35 | | | | 3.49 | | | | (1.97 | ) | | | 3.35 | | | | 3.49 | | | | 1.83 | | | | 1.56 | |

| Class R (WFRRX) | | 6-28-2013 | | | – | | | | – | | | | – | | | | (1.35 | ) | | | 4.08 | | | | 4.24 | | | | 1.33 | | | | 1.06 | |

| Class R4 (WOTRX) | | 11-30-2012 | | | – | | | | – | | | | – | | | | (0.68 | ) | | | 4.68 | | | | 4.80 | | | | 0.75 | | | | 0.45 | |

| Class R6 (WOTDX)** | | 6-30-2004 | | | – | | | | – | | | | – | | | | (0.68 | ) | | | 4.68 | | | | 4.79 | | | | 0.60 | | | | 0.30 | |

| Administrator Class (WFLOX) | | 11-8-1999 | | | – | | | | – | | | | – | | | | (1.01 | ) | | | 4.33 | | | | 4.52 | | | | 0.92 | | | | 0.65 | |

| Investor Class (WFBTX) | | 1-31-2007 | | | – | | | | – | | | | – | | | | (1.19 | ) | | | 4.28 | | | | 4.48 | | | | 1.14 | | | | 0.86 | |

| Dow Jones Target Today Index5 | | – | | | – | | | | – | | | | – | | | | (0.21 | ) | | | 5.17 | | | | 5.38 | | | | – | | | | – | |

| Russell 3000® Index6 | | – | | | – | | | | – | | | | – | | | | 20.32 | | | | 7.63 | | | | 7.60 | | | | – | | | | – | |

| Barclays U.S. Aggregate Bond Index7 | | – | | | – | | | | – | | | | – | | | | (2.47 | ) | | | 4.93 | | | | 4.77 | | | | – | | | | – | |

| * | | Class B shares are closed to investment, except in connection with the reinvestment of any distributions and permitted exchanges. |

| ** | | On June 1, 2013, Institutional Class was renamed Class R6. |

Figures quoted represent past performance, which is no guarantee of future results and do not reflect the deduction of taxes that a shareholder may pay on fund distributions or the redemption of fund shares. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance shown without sales charges would be lower if sales charges were reflected. Current performance may be lower or higher than the performance data quoted and assumes the reinvestment of dividends and capital gains. Current month-end performance is available on the Fund’s website, wellsfargoadvantagefunds.com.

Index returns do not include transaction costs associated with buying and selling securities, any mutual fund fees or expenses, or any taxes. It is not possible to invest directly in an index.

For Class A shares, the maximum front-end sales charge is 5.75%. For Class B shares, the maximum contingent deferred sales charge is 5.00%. For Class C shares, the maximum contingent deferred sales charge is 1.00%. Performance including sales charge assumes the sales charge for the corresponding time period. Class R, Class R4, Class R6, Administrator Class, and Investor Class shares are sold without a front-end sales charge or contingent deferred sales charge.

Please see footnotes on page 17.

| | | | |

| 6 | | Wells Fargo Advantage Dow Jones Target Date Funds | | Performance highlights (unaudited) |

Target 2010 Fund

Average annual total returns8 (%) as of August 31, 2013

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Including sales charge | | | Excluding sales charge | | | Expense ratios3 (%) | |

| | | Inception date | | 1 year | | | 5 year | | | 10 year | | | 1 year | | | 5 year | | | 10 year | | | Gross | | | Net4 | |

| Class A (STNRX) | | 3-1-1994 | | | (5.69 | ) | | | 2.62 | | | | 3.97 | | | | 0.10 | | | | 3.85 | | | | 4.59 | | | | 1.08 | | | | 0.83 | |

| Class B (SPTBX)* | | 3-1-1997 | | | (5.60 | ) | | | 2.73 | | | | 4.04 | | | | (0.60 | ) | | | 3.09 | | | | 4.04 | | | | 1.83 | | | | 1.58 | |

| Class C (WFOCX) | | 12-1-1998 | | | (1.68 | ) | | | 3.08 | | | | 3.81 | | | | (0.68 | ) | | | 3.08 | | | | 3.81 | | | | 1.83 | | | | 1.58 | |

| Class R (WFARX) | | 6-28-2013 | | | – | | | | – | | | | – | | | | (0.06 | ) | | | 3.77 | | | | 4.55 | | | | 1.33 | | | | 1.08 | |

| Class R4 (WFORX) | | 11-30-2012 | | | – | | | | – | | | | – | | | | 0.50 | | | | 4.38 | | | | 5.09 | | | | 0.75 | | | | 0.47 | |

| Class R6 (WFOAX)** | | 6-30-2004 | | | – | | | | – | | | | – | | | | 0.60 | | | | 4.40 | | | | 5.10 | | | | 0.60 | | | | 0.32 | |

| Administrator Class (WFLGX) | | 11-8-1999 | | | – | | | | – | | | | – | | | | 0.26 | | | | 4.04 | | | | 4.84 | | | | 0.92 | | | | 0.67 | |

| Investor Class (WFCTX) | | 1-31-2007 | | | – | | | | – | | | | – | | | | 0.15 | | | | 3.99 | | | | 4.80 | | | | 1.14 | | | | 0.88 | |

| Dow Jones Target 2010 Index5 | | – | | | – | | | | – | | | | – | | | | 1.17 | | | | 4.86 | | | | 6.15 | | | | – | | | | – | |

| Russell 3000® Index6 | | – | | | – | | | | – | | | | – | | | | 20.32 | | | | 7.63 | | | | 7.60 | | | | – | | | | – | |

| Barclays U.S. Aggregate Bond Index7 | | – | | | – | | | | – | | | | – | | | | (2.47 | ) | | | 4.93 | | | | 4.77 | | | | – | | | | – | |

| * | | Class B shares are closed to investment, except in connection with the reinvestment of any distributions and permitted exchanges. |

| ** | | On June 1, 2013, Institutional Class was renamed Class R6. |

Figures quoted represent past performance, which is no guarantee of future results and do not reflect the deduction of taxes that a shareholder may pay on fund distributions or the redemption of fund shares. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance shown without sales charges would be lower if sales charges were reflected. Current performance may be lower or higher than the performance data quoted and assumes the reinvestment of dividends and capital gains. Current month-end performance is available on the Fund’s website, wellsfargoadvantagefunds.com.

Index returns do not include transaction costs associated with buying and selling securities, any mutual fund fees or expenses, or any taxes. It is not possible to invest directly in an index.

For Class A shares, the maximum front-end sales charge is 5.75%. For Class B shares, the maximum contingent deferred sales charge is 5.00%. For Class C shares, the maximum contingent deferred sales charge is 1.00%. Performance including sales charge assumes the sales charge for the corresponding time period. Class R, Class R4, Class R6, Administrator Class, and Investor Class shares are sold without a front-end sales charge or contingent deferred sales charge.

Please see footnotes on page 17.

| | | | | | |

| Performance highlights (unaudited) | | Wells Fargo Advantage Dow Jones Target Date Funds | | | 7 | |

Target 2015 Fund

Average annual total returns9 (%) as of August 31, 2013

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Including sales charge | | | Excluding sales charge | | | Expense ratios3 (%) | |

| | | Inception date | | 1 year | | | 5 year | | | Since

inception | | | 1 year | | | 5 year | | | Since

inception | | | Gross | | | Net4 | |

| Class A (WFACX) | | 11-30-2012 | | | (3.45 | ) | | | 2.98 | | | | 2.13 | | | | 2.43 | | | | 4.21 | | | | 3.11 | | | | 1.08 | | | | 0.84 | |

| Class R (WFBRX) | | 6-28-2013 | | | – | | | | – | | | | – | | | | 2.09 | | | | 3.96 | | | | 2.90 | | | | 1.33 | | | | 1.09 | |

| Class R4 (WFSRX) | | 11-30-2012 | | | – | | | | – | | | | – | | | | 2.85 | | | | 4.55 | | | | 3.42 | | | | 0.75 | | | | 0.48 | |

| Class R6 (WFSCX)* | | 6-29-2007 | | | – | | | | – | | | | – | | | | 2.82 | | | | 4.54 | | | | 3.42 | | | | 0.60 | | | | 0.33 | |

| Administrator Class (WFFFX) | | 6-29-2007 | | | – | | | | – | | | | – | | | | 2.43 | | | | 4.23 | | | | 3.13 | | | | 0.92 | | | | 0.68 | |

| Investor Class (WFQEX) | | 6-29-2007 | | | – | | | | – | | | | – | | | | 2.25 | | | | 4.14 | | | | 3.07 | | | | 1.14 | | | | 0.89 | |

| Dow Jones Target 2015 Index5 | | – | | | – | | | | – | | | | – | | | | 3.32 | | | | 4.98 | | | | 3.93 | | | | – | | | | – | |

| Russell 3000® Index6 | | – | | | – | | | | – | | | | – | | | | 20.32 | | | | 7.63 | | | | 3.95 | | | | – | | | | – | |

| Barclays U.S. Aggregate Bond Index7 | | – | | | – | | | | – | | | | – | | | | (2.47 | ) | | | 4.93 | | | | 5.29 | | | | – | | | | – | |

| * | | On June 1, 2013, Institutional Class was renamed Class R6. |

Figures quoted represent past performance, which is no guarantee of future results and do not reflect the deduction of taxes that a shareholder may pay on fund distributions or the redemption of fund shares. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance shown without sales charges would be lower if sales charges were reflected. Current performance may be lower or higher than the performance data quoted and assumes the reinvestment of dividends and capital gains. Current month-end performance is available on the Fund’s website, wellsfargoadvantagefunds.com.

Index returns do not include transaction costs associated with buying and selling securities, any mutual fund fees or expenses, or any taxes. It is not possible to invest directly in an index.

For Class A shares, the maximum front-end sales charge is 5.75%. Performance including sales charge assumes the sales charge for the corresponding time period. Class R, Class R4, Class R6, Administrator Class, and Investor Class shares are sold without a front-end sales charge or contingent deferred sales charge.

Please see footnotes on page 17.

| | | | |

| 8 | | Wells Fargo Advantage Dow Jones Target Date Funds | | Performance highlights (unaudited) |

Target 2020 Fund

Average annual total returns2 (%) as of August 31, 2013

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Including sales charge | | | Excluding sales charge | | | Expense ratios3 (%) | |

| | | Inception date | | 1 year | | | 5 year | | | 10 year | | | 1 year | | | 5 year | | | 10 year | | | Gross | | | Net4 | |

| Class A (STTRX) | | 3-1-1994 | | | (1.20 | ) | | | 3.05 | | | | 4.69 | | | | 4.83 | | | | 4.28 | | | | 5.31 | | | | 1.06 | | | | 0.86 | |

| Class B (STPBX)* | | 3-1-1997 | | | (0.97 | ) | | | 3.14 | | | | 4.75 | | | | 4.03 | | | | 3.49 | | | | 4.75 | | | | 1.81 | | | | 1.61 | |

| Class C (WFLAX) | | 12-1-1998 | | | 3.13 | | | | 3.51 | | | | 4.53 | | | | 4.13 | | | | 3.51 | | | | 4.53 | | | | 1.81 | | | | 1.61 | |

| Class R (WFURX) | | 6-28-2013 | | | – | | | | – | | | | – | | | | 4.74 | | | | 4.21 | | | | 5.28 | | | | 1.31 | | | | 1.11 | |

| Class R4 (WFLRX) | | 11-30-2012 | | | – | | | | – | | | | – | | | | 5.37 | | | | 4.81 | | | | 5.85 | | | | 0.73 | | | | 0.50 | |

| Class R6 (WFOBX)** | | 6-30-2004 | | | – | | | | – | | | | – | | | | 5.39 | | | | 4.82 | | | | 5.85 | | | | 0.58 | | | | 0.35 | |

| Administrator Class (WFLPX) | | 11-8-1999 | | | – | | | | – | | | | – | | | | 5.07 | | | | 4.49 | | | | 5.58 | | | | 0.90 | | | | 0.70 | |

| Investor Class (WFDTX) | | 1-31-2007 | | | – | | | | – | | | | – | | | | 4.97 | | | | 4.42 | | | | 5.54 | | | | 1.12 | | | | 0.91 | |

| Dow Jones Target 2020 Index5 | | – | | | – | | | | – | | | | – | | | | 5.94 | | | | 5.20 | | | | 7.23 | | | | – | | | | – | |

| Russell 3000® Index6 | | – | | | – | | | | – | | | | – | | | | 20.32 | | | | 7.63 | | | | 7.60 | | | | – | | | | – | |

| Barclays U.S. Aggregate Bond Index7 | | – | | | – | | | | – | | | | – | | | | (2.47 | ) | | | 4.93 | | | | 4.77 | | | | – | | | | – | |

| * | | Class B shares are closed to investment, except in connection with the reinvestment of any distributions and permitted exchanges. |

| ** | | On June 1, 2013, Institutional Class was renamed Class R6. |

Figures quoted represent past performance, which is no guarantee of future results and do not reflect the deduction of taxes that a shareholder may pay on fund distributions or the redemption of fund shares. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance shown without sales charges would be lower if sales charges were reflected. Current performance may be lower or higher than the performance data quoted and assumes the reinvestment of dividends and capital gains. Current month-end performance is available on the Fund’s website, wellsfargoadvantagefunds.com.

Index returns do not include transaction costs associated with buying and selling securities, any mutual fund fees or expenses, or any taxes. It is not possible to invest directly in an index.

For Class A shares, the maximum front-end sales charge is 5.75%. For Class B shares, the maximum contingent deferred sales charge is 5.00%. For Class C shares, the maximum contingent deferred sales charge is 1.00%. Performance including sales charge assumes the sales charge for the corresponding time period. Class R, Class R4, Class R6, Administrator Class, and Investor Class shares are sold without a front-end sales charge or contingent deferred sales charge.

Please see footnotes on page 17.

| | | | | | |

| Performance highlights (unaudited) | | Wells Fargo Advantage Dow Jones Target Date Funds | | | 9 | |

Target 2025 Fund

Average annual total returns10 (%) as of August 31, 2013

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Including sales charge | | | Excluding sales charge | | | Expense ratios3 (%) | |

| | | Inception date | | 1 year | | | 5 year | | | Since inception | | | 1 year | | | 5 year | | | Since

inception | | | Gross | | | Net4 | |

| Class A (WFAYX) | | 11-30-2012 | | | 1.63 | | | | 3.63 | | | | 1.73 | | | | 7.82 | | | | 4.87 | | | | 2.71 | | | | 1.06 | | | | 0.86 | |

| Class R (WFHRX) | | 6-28-2013 | | | – | | | | – | | | | – | | | | 7.58 | | | | 4.63 | | | | 2.51 | | | | 1.31 | | | | 1.11 | |

| Class R4 (WFGRX) | | 11-30-2012 | | | – | | | | – | | | | – | | | | 8.26 | | | | 5.22 | | | | 3.02 | | | | 0.73 | | | | 0.50 | |

| Class R6 (WFTYX)* | | 6-29-2007 | | | – | | | | – | | | | – | | | | 8.32 | | | | 5.23 | | | | 3.03 | | | | 0.59 | | | | 0.35 | |

| Administrator Class (WFTRX) | | 6-29-2007 | | | – | | | | – | | | | – | | | | 7.83 | | | | 4.88 | | | | 2.75 | | | | 0.90 | | | | 0.70 | |

| Investor Class (WFGYX) | | 6-29-2007 | | | – | | | | – | | | | – | | | | 7.76 | | | | 4.83 | | | | 2.69 | | | | 1.12 | | | | 0.91 | |

| Dow Jones Target 2025 Index5 | | – | | | – | | | | – | | | | – | | | | 8.74 | | | | 5.55 | | | | 3.43 | | | | – | | | | – | |

| Russell 3000® Index6 | | – | | | – | | | | – | | | | – | | | | 20.32 | | | | 7.63 | | | | 3.95 | | | | – | | | | – | |

| Barclays U.S. Aggregate Bond Index7 | | – | | | – | | | | – | | | | – | | | | (2.47 | ) | | | 4.93 | | | | 5.29 | | | | – | | | | – | |

| * | | On June 1, 2013, Institutional Class was renamed Class R6. |

Figures quoted represent past performance, which is no guarantee of future results and do not reflect the deduction of taxes that a shareholder may pay on fund distributions or the redemption of fund shares. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance shown without sales charges would be lower if sales charges were reflected. Current performance may be lower or higher than the performance data quoted and assumes the reinvestment of dividends and capital gains. Current month-end performance is available on the Fund’s website, wellsfargoadvantagefunds.com.

Index returns do not include transaction costs associated with buying and selling securities, any mutual fund fees or expenses, or any taxes. It is not possible to invest directly in an index.

For Class A shares, the maximum front-end sales charge is 5.75%. Performance including sales charge assumes the sales charge for the corresponding time period. Class R, Class R4, Class R6, Administrator Class, and Investor Class shares are sold without a front-end sales charge or contingent deferred sales charge.

Please see footnotes on page 17.

| | | | |

| 10 | | Wells Fargo Advantage Dow Jones Target Date Funds | | Performance highlights (unaudited) |

Target 2030 Fund

Average annual total returns2 (%) as of August 31, 2013

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Including sales charge | | | Excluding sales charge | | | Expense ratios3 (%) | |

| | | Inception date | | 1 year | | | 5 year | | | 10 year | | | 1 year | | | 5 year | | | 10 year | | | Gross | | | Net4 | |

| Class A (STHRX) | | 3-1-1994 | | | 4.12 | | | | 3.76 | | | | 5.36 | | | | 10.45 | | | | 5.00 | | | | 5.99 | | | | 1.07 | | | | 0.87 | |

| Class B (SGPBX)* | | 3-1-1997 | | | 4.63 | | | | 3.88 | | | | 5.43 | | | | 9.63 | | | | 4.22 | | | | 5.43 | | | | 1.82 | | | | 1.62 | |

| Class C (WFDMX) | | 12-1-1998 | | | 8.65 | | | | 4.22 | | | | 5.20 | | | | 9.65 | | | | 4.22 | | | | 5.20 | | | | 1.82 | | | | 1.62 | |

| Class R (WFJRX) | | 6-28-2013 | | | – | | | | – | | | | – | | | | 10.36 | | | | 4.93 | | | | 5.95 | | | | 1.32 | | | | 1.12 | |

| Class R4 (WTHRX) | | 11-30-2012 | | | – | | | | – | | | | – | | | | 11.03 | | | | 5.54 | | | | 6.51 | | | | 0.74 | | | | 0.51 | |

| Class R6 (WFOOX)** | | 6-30-2004 | | | – | | | | – | | | | – | | | | 11.04 | | | | 5.54 | | | | 6.51 | | | | 0.59 | | | | 0.36 | |

| Administrator Class (WFLIX) | | 11-8-1999 | | | – | | | | – | | | | – | | | | 10.65 | | | | 5.21 | | | | 6.25 | | | | 0.91 | | | | 0.71 | |

| Investor Class (WFETX) | | 1-31-2007 | | | – | | | | – | | | | – | | | | 10.53 | | | | 5.14 | | | | 6.20 | | | | 1.13 | | | | 0.92 | |

| Dow Jones Target 2030 Index5 | | – | | | – | | | | – | | | | – | | | | 11.48 | | | | 5.84 | | | | 8.23 | | | | – | | | | – | |

| Russell 3000® Index6 | | – | | | – | | | | – | | | | – | | | | 20.32 | | | | 7.63 | | | | 7.60 | | | | – | | | | – | |

| Barclays U.S. Aggregate Bond Index7 | | – | | | – | | | | – | | | | – | | | | (2.47 | ) | | | 4.93 | | | | 4.77 | | | | – | | | | – | |

| * | | Class B shares are closed to investment, except in connection with the reinvestment of any distributions and permitted exchanges. |

| ** | | On June 1, 2013, Institutional Class was renamed Class R6. |

Figures quoted represent past performance, which is no guarantee of future results and do not reflect the deduction of taxes that a shareholder may pay on fund distributions or the redemption of fund shares. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance shown without sales charges would be lower if sales charges were reflected. Current performance may be lower or higher than the performance data quoted and assumes the reinvestment of dividends and capital gains. Current month-end performance is available on the Fund’s website, wellsfargoadvantagefunds.com.

Index returns do not include transaction costs associated with buying and selling securities, any mutual fund fees or expenses, or any taxes. It is not possible to invest directly in an index.

For Class A shares, the maximum front-end sales charge is 5.75%. For Class B shares, the maximum contingent deferred sales charge is 5.00%. For Class C shares, the maximum contingent deferred sales charge is 1.00%. Performance including sales charge assumes the sales charge for the corresponding time period. Class R, Class R4, Class R6, Administrator Class, and Investor Class shares are sold without a front-end sales charge or contingent deferred sales charge.

Please see footnotes on page 17.

| | | | | | |

| Performance highlights (unaudited) | | Wells Fargo Advantage Dow Jones Target Date Funds | | | 11 | |

Target 2035 Fund

Average annual total returns10 (%) as of August 31, 2013

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Including sales charge | | | Excluding sales charge | | | Expense ratios3 (%) | |

| | | Inception date | | 1 year | | | 5 year | | | Since

inception | | | 1 year | | | 5 year | | | Since

inception | | | Gross | | | Net4 | |

| Class A (WFQBX) | | 11-30-2012 | | | 6.54 | | | | 4.33 | | | | 1.62 | | | | 13.00 | | | | 5.58 | | | | 2.60 | | | | 1.09 | | | | 0.88 | |

| Class R (WFKRX) | | 6-28-2013 | | | – | | | | – | | | | – | | | | 12.61 | | | | 5.22 | | | | 2.32 | | | | 1.34 | | | | 1.13 | |

| Class R4 (WTTRX) | | 11-30-2012 | | | – | | | | – | | | | – | | | | 13.39 | | | | 5.91 | | | | 2.90 | | | | 0.76 | | | | 0.52 | |

| Class R6 (WFQRX)* | | 6-29-2007 | | | – | | | | – | | | | – | | | | 13.46 | | | | 5.93 | | | | 2.91 | | | | 0.61 | | | | 0.37 | |

| Administrator Class (WFQWX) | | 6-29-2007 | | | – | | | | – | | | | – | | | | 13.04 | | | | 5.49 | | | | 2.57 | | | | 0.93 | | | | 0.72 | |

| Investor Class (WFQTX) | | 6-29-2007 | | | – | | | | – | | | | – | | | | 12.91 | | | | 5.43 | | | | 2.52 | | | | 1.15 | | | | 0.93 | |

| Dow Jones Target 2035 Index5 | | – | | | – | | | | – | | | | – | | | | 13.89 | | | | 6.09 | | | | 3.17 | | | | – | | | | – | |

| Russell 3000® Index6 | | – | | | – | | | | – | | | | – | | | | 20.32 | | | | 7.63 | | | | 3.95 | | | | – | | | | – | |

| Barclays U.S. Aggregate Bond Index7 | | – | | | – | | | | – | | | | – | | | | (2.47 | ) | | | 4.93 | | | | 5.29 | | | | – | | | | – | |

| * | | On June 1, 2013, Institutional Class was renamed Class R6. |

Figures quoted represent past performance, which is no guarantee of future results and do not reflect the deduction of taxes that a shareholder may pay on fund distributions or the redemption of fund shares. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance shown without sales charges would be lower if sales charges were reflected. Current performance may be lower or higher than the performance data quoted and assumes the reinvestment of dividends and capital gains. Current month-end performance is available on the Fund’s website, wellsfargoadvantagefunds.com.

Index returns do not include transaction costs associated with buying and selling securities, any mutual fund fees or expenses, or any taxes. It is not possible to invest directly in an index.

For Class A shares, the maximum front-end sales charge is 5.75%. Performance including sales charge assumes the sales charge for the corresponding time period. Class R, Class R4, Class R6, Administrator Class, and Investor Class shares are sold without a front-end sales charge or contingent deferred sales charge.

Please see footnotes on page 17.

| | | | |

| 12 | | Wells Fargo Advantage Dow Jones Target Date Funds | | Performance highlights (unaudited) |

Target 2040 Fund

Average annual total returns2 (%) as of August 31, 2013

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Including sales charge | | | Excluding sales charge | | | Expense ratios3 (%) | |

| | | Inception date | | 1 year | | | 5 year | | | 10 year | | | 1 year | | | 5 year | | | 10 year | | | Gross | | | Net4 | |

| Class A (STFRX) | | 3-1-1994 | | | 8.08 | | | | 4.29 | | | | 5.96 | | | | 14.70 | | | | 5.53 | | | | 6.59 | | | | 1.08 | | | | 0.88 | |

| Class B (SLPBX)* | | 3-1-1997 | | | 8.76 | | | | 4.38 | | | | 6.02 | | | | 13.76 | | | | 4.72 | | | | 6.02 | | | | 1.83 | | | | 1.63 | |

| Class C (WFOFX) | | 7-1-1998 | | | 12.77 | | | | 4.73 | | | | 5.79 | | | | 13.77 | | | | 4.73 | | | | 5.79 | | | | 1.83 | | | | 1.63 | |

| Class R (WFMRX) | | 6-28-2013 | | | – | | | | – | | | | – | | | | 14.54 | | | | 5.45 | | | | 6.55 | | | | 1.33 | | | | 1.13 | |

| Class R4 (WTFRX) | | 11-30-2012 | | | – | | | | – | | | | – | | | | 15.11 | | | | 6.03 | | | | 7.11 | | | | 0.75 | | | | 0.52 | |

| Class R6 (WFOSX)** | | 6-30-2004 | | | – | | | | – | | | | – | | | | 15.22 | | | | 6.06 | | | | 7.12 | | | | 0.60 | | | | 0.37 | |

| Administrator Class (WFLWX) | | 11-8-1999 | | | – | | | | – | | | | – | | | | 14.82 | | | | 5.72 | | | | 6.85 | | | | 0.92 | | | | 0.72 | |

| Investor Class (WFFTX) | | 1-31-2007 | | | – | | | | – | | | | – | | | | 14.71 | | | | 5.65 | | | | 6.80 | | | | 1.14 | | | | 0.93 | |

| Dow Jones Target 2040 Index5 | | – | | | – | | | | – | | | | – | | | | 15.65 | | | | 6.31 | | | | 8.64 | | | | – | | | | – | |

| Russell 3000® Index6 | | – | | | – | | | | – | | | | – | | | | 20.32 | | | | 7.63 | | | | 7.60 | | | | – | | | | – | |

| Barclays U.S. Aggregate Bond Index7 | | – | | | – | | | | – | | | | – | | | | (2.47 | ) | | | 4.93 | | | | 4.77 | | | | – | | | | – | |

| * | | Class B shares are closed to investment, except in connection with the reinvestment of any distributions and permitted exchanges. |

| ** | | On June 1, 2013, Institutional Class was renamed Class R6. |

Figures quoted represent past performance, which is no guarantee of future results and do not reflect the deduction of taxes that a shareholder may pay on fund distributions or the redemption of fund shares. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance shown without sales charges would be lower if sales charges were reflected. Current performance may be lower or higher than the performance data quoted and assumes the reinvestment of dividends and capital gains. Current month-end performance is available on the Fund’s website, wellsfargoadvantagefunds.com.

Index returns do not include transaction costs associated with buying and selling securities, any mutual fund fees or expenses, or any taxes. It is not possible to invest directly in an index.

For Class A shares, the maximum front-end sales charge is 5.75%. For Class B shares, the maximum contingent deferred sales charge is 5.00%. For Class C shares, the maximum contingent deferred sales charge is 1.00%. Performance including sales charge assumes the sales charge for the corresponding time period. Class R, Class R4, Class R6, Administrator Class, and Investor Class shares are sold without a front-end sales charge or contingent deferred sales charge.

Please see footnotes on page 17.

| | | | | | |

| Performance highlights (unaudited) | | Wells Fargo Advantage Dow Jones Target Date Funds | | | 13 | |

Target 2045 Fund

Average annual total returns10 (%) as of August 31, 2013

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Including sales charge | | | Excluding sales charge | | | Expense ratios3 (%) | |

| | | Inception date | | 1 year | | | 5 year | | | Since inception | | | 1 year | | | 5 year | | | Since inception | | | Gross | | | Net4 | |

| Class A (WFQVX) | | 11-30-2012 | | | 9.09 | | | | 4.79 | | | | 1.83 | | | | 15.70 | | | | 6.03 | | | | 2.82 | | | | 1.12 | | | | 0.88 | |

| Class R (WFNRX) | | 6-28-2013 | | | – | | | | – | | | | – | | | | 15.39 | | | | 5.76 | | | | 2.56 | | | | 1.37 | | | | 1.13 | |

| Class R4 (WFFRX) | | 11-30-2012 | | | – | | | | – | | | | – | | | | 16.21 | | | | 6.39 | | | | 3.13 | | | | 0.79 | | | | 0.52 | |

| Class R6 (WFQPX)* | | 6-29-2007 | | | – | | | | – | | | | – | | | | 16.08 | | | | 6.36 | | | | 3.12 | | | | 0.64 | | | | 0.37 | |

| Administrator Class (WFQYX) | | 6-29-2007 | | | – | | | | – | | | | – | | | | 15.71 | | | | 6.05 | | | | 2.83 | | | | 0.96 | | | | 0.72 | |

| Investor Class (WFQSX) | | 6-29-2007 | | | – | | | | – | | | | – | | | | 15.47 | | | | 5.94 | | | | 2.73 | | | | 1.18 | | | | 0.93 | |

| Dow Jones Target 2045 Index5 | | – | | | – | | | | – | | | | – | | | | 16.56 | | | | 6.48 | | | | 3.33 | | | | – | | | | – | |

| Russell 3000® Index6 | | – | | | – | | | | – | | | | – | | | | 20.32 | | | | 7.63 | | | | 3.95 | | | | – | | | | – | |

| Barclays U.S. Aggregate Bond Index7 | | – | | | – | | | | – | | | | – | | | | (2.47 | ) | | | 4.93 | | | | 5.29 | | | | – | | | | – | |

| * | | On June 1, 2013, Institutional Clas was renamed Class R6. |

Figures quoted represent past performance, which is no guarantee of future results and do not reflect the deduction of taxes that a shareholder may pay on fund distributions or the redemption of fund shares. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance shown without sales charges would be lower if sales charges were reflected. Current performance may be lower or higher than the performance data quoted and assumes the reinvestment of dividends and capital gains. Current month-end performance is available on the Fund’s website, wellsfargoadvantagefunds.com.

Index returns do not include transaction costs associated with buying and selling securities, any mutual fund fees or expenses, or any taxes. It is not possible to invest directly in an index.

For Class A shares, the maximum front-end sales charge is 5.75%. Performance including sales charge assumes the sales charge for the corresponding time period. Class R, Class R4, Class R6, Administrator Class, and Investor Class shares are sold without a front-end sales charge or contingent deferred sales charge.

Please see footnotes on page 17.

| | | | |

| 14 | | Wells Fargo Advantage Dow Jones Target Date Funds | | Performance highlights (unaudited) |

Target 2050 Fund

Average annual total returns11 (%) as of August 31, 2013

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Including sales charge | | | Excluding sales charge | | | Expense ratios3 (%) | |

| | | Inception date | | 1 year | | | 5 year | | | Since

inception | | | 1 year | | | 5 year | | | Since

inception | | | Gross | | | Net4 | |

| Class A (WFQAX) | | 11-30-2012 | | | 9.13 | | | | 4.72 | | | | 1.82 | | | | 15.75 | | | | 5.98 | | | | 2.80 | | | | 1.10 | | | | 0.88 | |

| Class C (WFQCX) | | 11-30-2012 | | | 13.88 | | | | 5.19 | | | | 2.03 | | | | 14.88 | | | | 5.19 | | | | 2.03 | | | | 1.85 | | | | 1.63 | |

| Class R (WFWRX) | | 6-28-2013 | | | – | | | | – | | | | – | | | | 15.45 | | | | 5.72 | | | | 2.55 | | | | 1.35 | | | | 1.13 | |

| Class R4 (WQFRX) | | 11-30-2012 | | | – | | | | – | | | | – | | | | 16.16 | | | | 6.32 | | | | 3.11 | | | | 0.77 | | | | 0.52 | |

| Class R6 (WFQFX)* | | 6-29-2007 | | | – | | | | – | | | | – | | | | 16.25 | | | | 6.34 | | | | 3.12 | | | | 0.62 | | | | 0.37 | |

| Administrator Class (WFQDX) | | 6-29-2007 | | | – | | | | – | | | | – | | | | 15.89 | | | | 6.00 | | | | 2.80 | | | | 0.94 | | | | 0.72 | |

| Investor Class (WFQGX) | | 6-29-2007 | | | – | | | | – | | | | – | | | | 15.64 | | | | 5.91 | | | | 2.73 | | | | 1.16 | | | | 0.93 | |

| Dow Jones Target 2050 Index5 | | – | | | – | | | | – | | | | – | | | | 16.66 | | | | 6.50 | | | | 3.34 | | | | – | | | | – | |

| Russell 3000® Index6 | | – | | | – | | | | – | | | | – | | | | 20.32 | | | | 7.63 | | | | 3.95 | | | | – | | | | – | |

| Barclays U.S. Aggregate Bond Index7 | | – | | | – | | | | – | | | | – | | | | (2.47 | ) | | | 4.93 | | | | 5.29 | | | | – | | | | – | |

| * | | On June 1, 2013, Institutional Class was renamed Class R6. |

Figures quoted represent past performance, which is no guarantee of future results and do not reflect the deduction of taxes that a shareholder may pay on fund distributions or the redemption of fund shares. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance shown without sales charges would be lower if sales charges were reflected. Current performance may be lower or higher than the performance data quoted and assumes the reinvestment of dividends and capital gains. Current month-end performance is available on the Fund’s website, wellsfargoadvantagefunds.com.

Index returns do not include transaction costs associated with buying and selling securities, any mutual fund fees or expenses, or any taxes. It is not possible to invest directly in an index.

For Class A shares, the maximum front-end sales charge is 5.75%. For Class C shares, the maximum contingent deferred sales charge is 1.00%. Performance including sales charge assumes the sales charge for the corresponding time period. Class R, Class R4, Class R6, Administrator Class, and Investor Class shares are sold without a front-end sales charge or contingent deferred sales charge.

Please see footnotes on page 17.

| | | | | | |

| Performance highlights (unaudited) | | Wells Fargo Advantage Dow Jones Target Date Funds | | | 15 | |

Target 2055 Fund

Average annual total returns10 (%) as of August 31, 2013

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Including sales charge | | | Excluding sales charge | | | Expense ratios3 (%) | |

| | | Inception date | | 1 year | | | Since

inception | | | 1 year | | | Since

inception | | | Gross | | | Net4 | |

| Class A (WFQZX) | | 11-30-2012 | | | 9.08 | | | | 3.97 | | | | 15.77 | | | | 6.85 | | | | 1.60 | | | | 0.88 | |

| Class R (WFYRX) | | 6-28-2013 | | | – | | | | – | | | | 15.49 | | | | 6.31 | | | | 1.85 | | | | 1.13 | |

| Class R4 (WFVRX) | | 11-30-2012 | | | – | | | | – | | | | 16.18 | | | | 7.23 | | | | 1.27 | | | | 0.52 | |

| Class R6 (WFQUX)* | | 6-30-2011 | | | – | | | | – | | | | 16.19 | | | | 7.23 | | | | 1.12 | | | | 0.37 | |

| Administrator Class (WFLHX) | | 6-30-2011 | | | – | | | | – | | | | 15.84 | | | | 6.90 | | | | 1.44 | | | | 0.72 | |

| Investor Class (WFQHX) | | 6-30-2011 | | | – | | | | – | | | | 15.68 | | | | 6.81 | | | | 1.66 | | | | 0.93 | |

| Dow Jones Target 2055 Index5 | | – | | | – | | | | – | | | | 16.66 | | | | 7.37 | | | | – | | | | – | |

| Russell 3000® Index6 | | – | | | – | | | | – | | | | 20.32 | | | | 12.58 | | | | – | | | | – | |

| Barclays U.S. Aggregate Bond Index7 | | – | | | – | | | | – | | | | (2.47 | ) | | | 2.87 | | | | – | | | | – | |

| * | | On June 1, 2013, Institutional Class was renamed Class R6. |

Figures quoted represent past performance, which is no guarantee of future results and do not reflect the deduction of taxes that a shareholder may pay on fund distributions or the redemption of fund shares. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance shown without sales charges would be lower if sales charges were reflected. Current performance may be lower or higher than the performance data quoted, which assumes the reinvestment of dividends and capital gains. Current month-end performance is available on the Fund’s website, wellsfargoadvantagefunds.com.

Index returns do not include transaction costs associated with buying and selling securities, any mutual fund fees or expenses, or any taxes. It is not possible to invest directly in an index.

For Class A shares, the maximum front-end sales charge is 5.75%. Performance including sales charge assumes the sales charge for the corresponding time period. Class R, Class R4, Class R6, Administrator Class, and Investor Class shares are sold without a front-end sales charge or contingent deferred sales charge.

Please see footnotes on page 17.

| | | | |

| 16 | | Wells Fargo Advantage Dow Jones Target Date Funds | | Performance highlights (unaudited) |

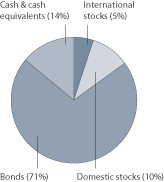

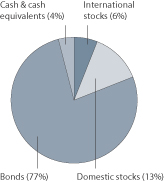

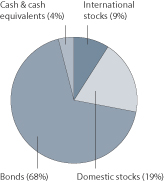

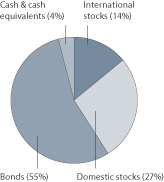

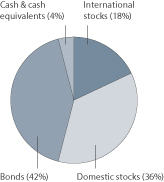

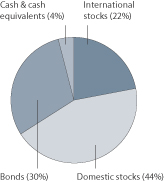

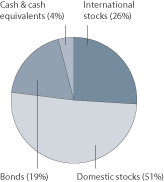

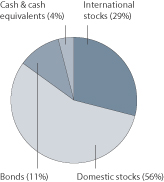

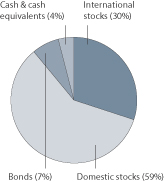

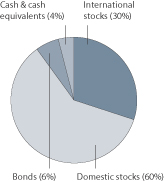

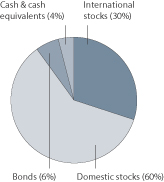

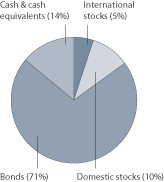

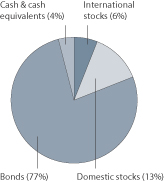

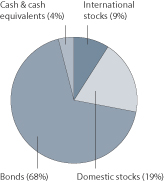

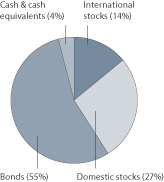

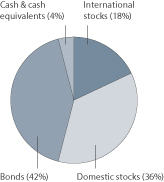

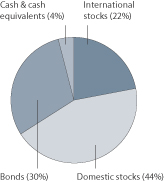

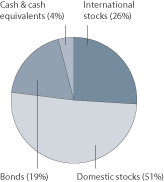

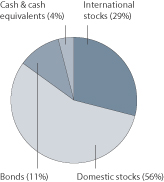

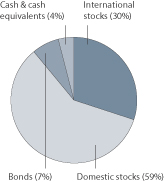

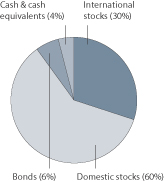

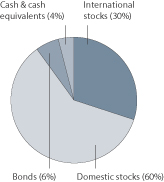

Portfolio allocation12 as of August 31, 2013

| | | | |

| Target Today Fund | | Target 2010 Fund | | Target 2015 Fund |

| | | |

| |  | |  |

| | | | |

| Target 2020 Fund | | Target 2025 Fund | | Target 2030 Fund |

| | | |

| |  | |  |

| | | | |

| Target 2035 Fund | | Target 2040 Fund | | Target 2045 Fund |

| | | |

| |  | |  |

Please see footnotes on page 17.

| | | | | | |

| Performance highlights (unaudited) | | Wells Fargo Advantage Dow Jones Target Date Funds | | | 17 | |

| | |

| Target 2050 Fund | | Target 2055 Fund |

| | |

| |  |

| | 1. | The Funds are gateway funds that invest in various master portfolios which in turn invest in a combination of equity, fixed income, and money market securities using an asset allocation strategy designed to replicate, before fees and expenses, the total return of the Dow Jones Target Date Indexes that have the same target year as the Funds. References to the investment activities of the Funds are intended to refer to the investment activities of the underlying master portfolios in which the Funds invest. |

| | 2. | Historical performance shown for Class R shares prior to their inception reflects the performance of the Class A shares and has been adjusted to reflect the higher expenses applicable to Class R shares. Historical performance shown for Class R4 shares prior to their inception reflects the performance of Class R6 shares and includes the expenses applicable to Class R6. Effective June 1, 2013, Institutional Class was renamed Class R6 and modified to assume the features and attributes of Class R6. Historical performance shown for Class R6 shares from inception through May 31, 2013, reflects Institutional Class performance and expenses. Historical performance shown for Class R6 shares prior to their inception reflects the performance of Administrator Class shares, and includes the higher expenses applicable to Administrator Class shares. Historical performance shown for Investor Class shares prior to their inception reflects the performance of Administrator Class shares and has been adjusted to reflect the higher expenses applicable to Investor Class shares (except during those periods in which expenses of the Investor Class would have been lower than those of Administrator Class no such adjustment is reflected). |

| | 3. | Reflects the expense ratios as stated in the most recent prospectuses. |

| | 4. | The Adviser has committed through June 30, 2015, to waive fees and/or reimburse expenses to the extent necessary to cap the Fund’s Total Annual Fund Operating Expenses After Fee Waiver, excluding certain expenses, at the amounts shown. Brokerage commissions, stamp duty fees, interest, taxes, acquired fund fees and expenses, and extraordinary expenses are excluded from the cap. Fees from the underlying master portfolio(s) are included in the cap. Without this cap, the Fund’s returns would have been lower. |

| | 5. | The Dow Jones Target Date Indexes (each an “index” or collectively the “indexes”) are a series of indexes designed as benchmarks for multi-asset class portfolios with risk profiles that became more conservative over time. The index weightings among the major asset classes are adjusted monthly based on a published set of index rules. The indexes with longer time horizons have higher allocations to equity securities, while the indexes with shorter time horizons replace some of their stock allocations with allocations to fixed income securities and money market instruments. You cannot invest directly in an index. |

| | 6. | The Russell 3000® Index measures the performance of the 3,000 largest U.S. companies based on total market capitalization, which represents approximately 98% of the investable U.S. equity market. You cannot invest directly in an index. |

| | 7. | The Barclays U.S. Aggregate Bond Index is composed of the Barclays Government/Credit Index and the Barclays U.S.Mortgage-Backed Securities Index and includes U.S. Treasury issues, agency issues, corporate bond issues, and mortgage-backed securities. You cannot invest directly in an index. |

| | 8. | Historical performance shown for Class R shares prior to their inception reflects the performance of Class A shares and has been adjusted to reflect the higher expenses applicable to Class R shares. Historical performance shown for Class R4 shares prior to their inception reflects the performance of Class R6 shares and has been adjusted to reflect the higher expenses applicable to Class R6 shares at that time. If these expenses had not been included, returns would be higher. Effective June 1, 2013, Institutional Class was renamed Class R6 and modified to assume the features and attributes of Class R6. Historical performance shown for Class R6 shares from inception through May 31, 2013, reflects Institutional Class performance and expenses. Historical performance shown for Class R6 shares prior to their inception reflects the performance of Administrator Class shares, and includes the higher expenses applicable to Administrator Class shares. Historical performance shown for Investor Class shares prior to their inception reflects the performance of Administrator Class shares and has been adjusted to reflect the higher expenses applicable to Investor Class shares (except during those periods in which expenses of Investor Class would have been lower than those of Administrator Class no such adjustment is reflected). |

| | 9. | Historical performance shown for Class R shares prior to their inception reflects the performance of Investor Class shares and has been adjusted to reflect the higher expenses applicable to Class R shares. Historical performance shown for Class A shares prior to their inception reflects the performance of Class R6 shares and has been adjusted to reflect the higher expenses applicable to Class A shares. Historical performance shown for Class R4 shares prior to their inception reflects the performance of Class R6 shares and has been adjusted to reflect the higher expenses applicable to Class R6 shares at that time. If these expenses had not been included, returns would be higher. Effective June 1, 2013, Institutional Class was renamed Class R6 and modified to assume the features and attributes of Class R6. Historical performance shown for Class R6 shares from inception through May 31, 2013 reflects Institutional Class performance and expenses. Historical performance shown for Class R6 shares prior to their inception reflects the performance of Administrator Class shares, and includes the higher expenses applicable to Administrator Class shares. |

| 10. | Historical performance shown for Class R shares prior to their inception reflects the performance of Investor Class shares and has been adjusted to reflect the higher expenses applicable to Class R shares. Historical performance shown for Class A shares prior to their inception reflects the performance of Class R6 shares and has been adjusted to reflect the higher expenses applicable to Class A shares. Historical performance shown for Class R4 shares prior to their inception reflects the performance of Class R6 shares and includes the expenses applicable to Class R6. Effective June 1, 2013, Institutional Class was renamed Class R6 and modified to assume the features and attributes of Class R6. Historical performance shown for Class R6 shares from inception through May 31, 2013, reflects Institutional Class performance and expenses. Historical performance shown for Class R6 shares prior to their inception reflects the performance of Administrator Class shares, and includes the higher expenses applicable to Administrator Class shares. |

| 11. | Historical performance shown for Class R shares prior to their inception reflects the performance of Investor Class shares and has been adjusted to reflect the higher expenses applicable to Class R shares. Historical performance shown for Class A and Class C shares prior to their inception reflects the performance of Class R6 shares and has been adjusted to reflect the higher expenses applicable to Class A and Class C shares. Historical performance shown for Class R4 shares prior to their inception reflects the performance of Class R6 shares and includes the expenses applicable to Class R6. Effective June 1, 2013, Institutional Class was renamed Class R6 and modified to assume the features and attributes of Class R6. Historical performance shown for Class R6 shares from inception through May 31, 2013, reflects Institutional Class performance and expenses. Historical performance shown for Class R6 shares prior to their inception reflects the performance of Administrator Class shares, and includes the higher expenses applicable to Administrator Class shares. |

| 12. | Each chart represents the composite of the portfolio allocations of the master portfolios in which the Fund invests and is calculated based on the total investments of the master portfolios. Portfolio holdings are subject to change and may have changed since the date specified. See Portfolio of investments or Summary portfolio of investments of each master portfolio which is also included in this report. |

| | | | |

| 18 | | Wells Fargo Advantage Dow Jones Target Date Funds | | Fund expenses (unaudited) |

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and contingent deferred sales charges (if any) on redemptions and (2) ongoing costs, including management fees, distribution (12b-1) and/or shareholder service fees, and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the six-month period and held for the entire period from March 1, 2013 to August 31, 2013.

Actual expenses

The “Actual” line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the “Actual” line under the heading entitled “Expenses paid during period” for your applicable class of shares to estimate the expenses you paid on your account during this period.

Hypothetical example for comparison purposes

The “Hypothetical” line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) and contingent deferred sales charges. Therefore, the “Hypothetical” line of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | |

| Target Today Fund | | Beginning

account value

3-1-2013 | | | Ending

account value

8-31-2013 | | | Expenses

paid during

the period¹ | | | Net annual

expense ratio | |

Class A | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 984.30 | | | $ | 4.45 | | | | 0.89 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,020.72 | | | $ | 4.53 | | | | 0.89 | % |

Class B | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 980.28 | | | $ | 8.19 | | | | 1.64 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,016.94 | | | $ | 8.34 | | | | 1.64 | % |

Class C | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 980.14 | | | $ | 8.19 | | | | 1.64 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,016.94 | | | $ | 8.34 | | | | 1.64 | % |

Class R | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 983.97 | | | $ | 5.30 | | | | 1.06 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,019.86 | | | $ | 5.40 | | | | 1.06 | % |

Class R4 | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 986.41 | | | $ | 2.25 | | | | 0.45 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,022.94 | | | $ | 2.29 | | | | 0.45 | % |

Class R62 | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 986.93 | | | $ | 2.05 | | | | 0.41 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,023.14 | | | $ | 2.09 | | | | 0.41 | % |

Administrator Class | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 985.28 | | | $ | 3.65 | | | | 0.73 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,021.53 | | | $ | 3.72 | | | | 0.73 | % |

Investor Class | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 984.01 | | | $ | 4.30 | | | | 0.86 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,020.87 | | | $ | 4.38 | | | | 0.86 | % |

Please see footnotes on page 23.

| | | | | | |

| Fund expenses (unaudited) | | Wells Fargo Advantage Dow Jones Target Date Funds | | | 19 | |

| | | | | | | | | | | | | | | | |

| Target 2010 Fund | | Beginning

account value

3-1-2013 | | | Ending

account value

8-31-2013 | | | Expenses

paid during

the period¹ | | | Net annual

expense ratio | |

Class A | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 988.72 | | | $ | 4.56 | | | | 0.91 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,020.62 | | | $ | 4.63 | | | | 0.91 | % |

Class B | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 985.11 | | | $ | 8.36 | | | | 1.67 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,016.79 | | | $ | 8.49 | | | | 1.67 | % |

Class C | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 985.16 | | | $ | 8.31 | | | | 1.66 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,016.84 | | | $ | 8.44 | | | | 1.66 | % |

Class R | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 987.68 | | | $ | 5.41 | | | | 1.08 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,019.76 | | | $ | 5.50 | | | | 1.08 | % |

Class R4 | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 990.32 | | | $ | 2.36 | | | | 0.47 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,022.84 | | | $ | 2.40 | | | | 0.47 | % |

Class R62 | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 991.07 | | | $ | 2.16 | | | | 0.43 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,023.04 | | | $ | 2.19 | | | | 0.43 | % |

Administrator Class | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 989.57 | | | $ | 3.76 | | | | 0.75 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,021.42 | | | $ | 3.82 | | | | 0.75 | % |

Investor Class | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 988.81 | | | $ | 4.46 | | | | 0.89 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,020.72 | | | $ | 4.53 | | | | 0.89 | % |

| Target 2015 Fund | | | | | | | | | | | | |

Class A | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 996.57 | | | $ | 4.23 | | | | 0.84 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,020.97 | | | $ | 4.28 | | | | 0.84 | % |

Class R | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 995.35 | | | $ | 5.48 | | | | 1.09 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,019.71 | | | $ | 5.55 | | | | 1.09 | % |

Class R4 | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 998.58 | | | $ | 2.42 | | | | 0.48 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,022.79 | | | $ | 2.45 | | | | 0.48 | % |

Class R62 | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 998.98 | | | $ | 2.12 | | | | 0.42 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,023.09 | | | $ | 2.14 | | | | 0.42 | % |

Administrator Class | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 998.30 | | | $ | 3.83 | | | | 0.76 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,021.37 | | | $ | 3.87 | | | | 0.76 | % |

Investor Class | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 995.97 | | | $ | 4.53 | | | | 0.90 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,020.67 | | | $ | 4.58 | | | | 0.90 | % |

Please see footnotes on page 23.

| | | | |

| 20 | | Wells Fargo Advantage Dow Jones Target Date Funds | | Fund expenses (unaudited) |

| | | | | | | | | | | | | | | | |

| Target 2020 Fund | | Beginning

account value

3-1-2013 | | | Ending

account value

8-31-2013 | | | Expenses

paid during

the period¹ | | | Net annual

expense ratio | |