UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-09253

Wells Fargo Funds Trust

(Exact name of registrant as specified in charter)

525 Market St., San Francisco, CA 94105

(Address of principal executive offices) (Zip code)

C. David Messman

Wells Fargo Funds Management, LLC

525 Market St., San Francisco, CA 94105

(Name and address of agent for service)

Registrant’s telephone number, including area code: 800-222-8222

Date of fiscal year end: January 31

Registrant is making a filing for 10 of its series:

Wells Fargo 100% Treasury Money Fund, Wells Fargo California Municipal Money Market Fund, Wells Fargo Cash Investment Money Market Fund, Wells Fargo Government Money Market Fund, Wells Fargo Heritage Money Market Fund, Wells Fargo Money Market Fund, Wells Fargo Municipal Cash Management Money Market Fund, Wells Fargo Municipal Money Market Fund, Wells Fargo National Tax-Free Money Market Fund, and Wells Fargo Treasury Plus Money Market Fund.

Date of reporting period: July 31, 2016

| ITEM 1. | REPORT TO STOCKHOLDERS |

| | |

Semi-Annual Report July 31, 2016 | |  |

Retail Money Market Funds

| | ¡ | Wells Fargo California Municipal Money Market Fund |

For further information about your Fund, contact your investment professional, visit our website at wellsfargofunds.com, or call us directly at 1-800-222-8222. We are available 24 hours a day, 7 days a week.

| | | | |

| 2 | | Wells Fargo California Municipal Money Market Fund | | Performance highlights (unaudited) |

The Fund is currently closed to new investors.1

Investment objective

The Fund seeks current income exempt from regular federal income tax and California individual income tax, while preserving capital and liquidity.

Manager

Wells Fargo Funds Management, LLC

Subadviser

Wells Capital Management Incorporated

Portfolio managers

James Randazzo

Jeffrey L. Weaver, CFA®

| | | | | | | | | | | | | | |

| Average annual total returns (%) as of July 31, 20162 | | | | | | | | | | |

| | | | | | | Expense ratios3 (%) |

| | | Inception date | | 1 year | | 5 year | | 10 year | | | | Gross | | Net4 |

Class A (SGCXX) | | 1-1-1992 | | 0.03 | | 0.02 | | 0.58 | | | | 0.64 | | 0.64 |

Administrator Class (WCMXX) | | 6-30-2010 | | 0.07 | | 0.03 | | 0.69 | | | | 0.37 | | 0.30 |

Premier Class (WCTXX)* | | 3-31-2008 | | 0.11 | | 0.03 | | 0.70 | | | | 0.25 | | 0.20 |

Service Class (WFCXX) | | 11-8-1999 | | 0.03 | | 0.02 | | 0.64 | | | | 0.54 | | 0.45 |

Sweep Class | | 6-30-2010 | | 0.03 | | 0.02 | | 0.64 | | | | 0.99 | | 0.99 |

| | | | | | | |

| Yield summary (%) as of July 31, 20164 | | | | | | | | | | | | | | |

| | | Class A | | Administrator Class | | Premier Class* | | Service Class | | Sweep Class | | | | |

7-day current yield | | 0.01 | | 0.15 | | 0.24 | | 0.01 | | 0.01 | | | | |

7-day compound yield | | 0.01 | | 0.15 | | 0.24 | | 0.01 | | 0.01 | | | | |

30-day simple yield | | 0.01 | | 0.12 | | 0.22 | | 0.01 | | 0.01 | | | | |

30-day compound yield | | 0.01 | | 0.12 | | 0.22 | | 0.01 | | 0.01 | | | | |

* Effective April 1, 2016, Institutional Class was renamed Premier Class.

Figures quoted represent past performance, which is no guarantee of future results, and do not reflect taxes that a shareholder may pay on fund distributions or the redemption of fund shares. Investment returns will fluctuate. The Fund’s yield figures more closely reflect the current earnings of the Fund than the total return figures. Current performance may be lower or higher than the performance data quoted, which assumes the reinvestment of dividends and capital gains. Current month-end performance is available on the Fund’s website, wellsfargofunds.com.

Each class is sold without a front-end sales charge or contingent deferred sales charge.

An investment in a money market fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although the Fund seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in a money market fund. A portion of the Fund’s income may be subject to federal, state, and/or local income taxes or the alternative minimum tax (AMT).

Please see footnotes on page 4.

| | | | |

| Performance highlights (unaudited) | | Wells Fargo California Municipal Money Market Fund | | 3 |

| | | | | | | | | | | | | | | | | | |

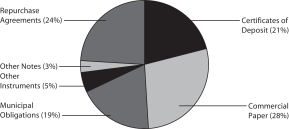

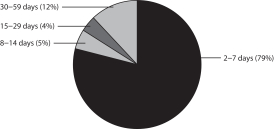

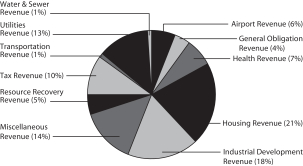

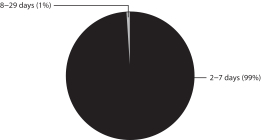

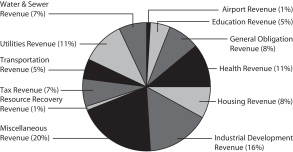

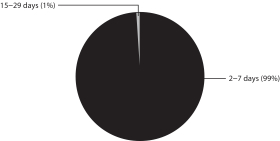

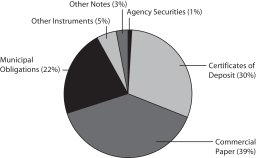

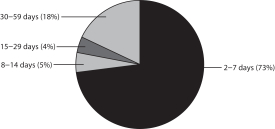

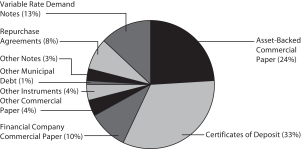

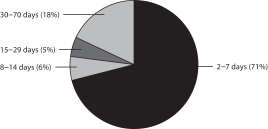

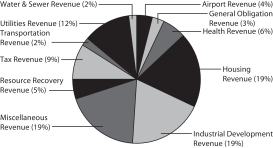

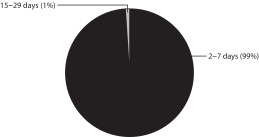

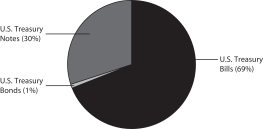

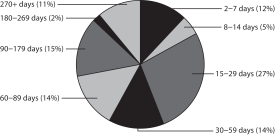

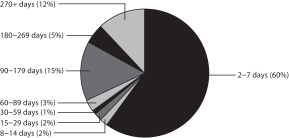

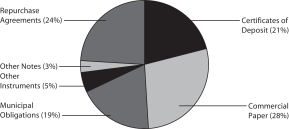

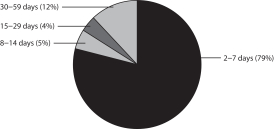

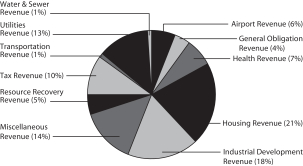

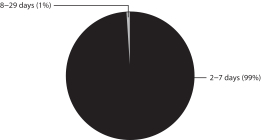

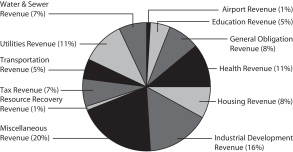

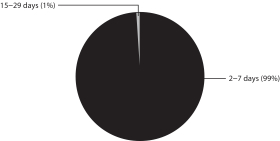

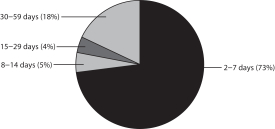

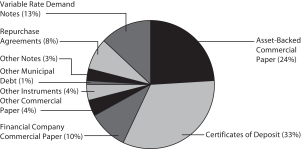

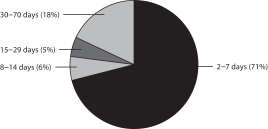

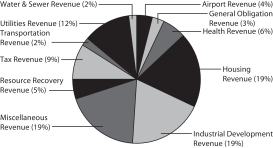

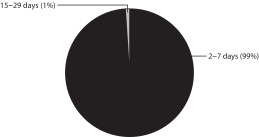

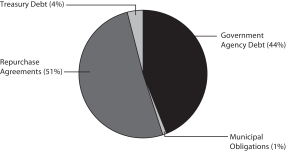

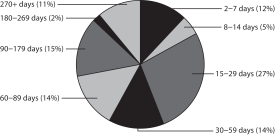

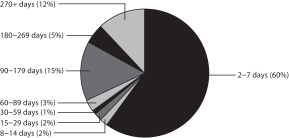

| Revenue source distribution as of July 31, 20165 | | | | | | | | | | Effective maturity distribution as of July 31, 20165 | | | |

| | Airport Revenue | | | 2% | | | | | | | 2-7 days | | | 98% | | | |

| | | Education Revenue | | | 5% | | | | | | | 15-29 days | | | 2% | | | |

| | | General Obligation Revenue | | | 10% | | | | | | | | | | | | | |

| | | Health Revenue | | | 8% | | | | | | | | | | | | | |

| | | Housing Revenue | | | 17% | | | | | | | | | | | | | |

| | | Industrial Development Revenue | | | 3% | | | | | | | | | | | | | |

| | | Miscellaneous Revenue | | | 12% | | | | | | | | | | | | | |

| | | Resource Recovery Revenue | | | 3% | | | | | | | | | | | | | |

| | | Tax Revenue | | | 5% | | | | | | | | | | | | | |

| | | Transportation Revenue | | | 5% | | | | | | | | | | | | | |

| | | Utilities Revenue | | | 20% | | | | | | | | | | | | | |

| | | Water & Sewer Revenue | | | 10% | | | | | | | | | | | | | |

| | | | | |

Weighted average maturity as of July 31, 20166 | | | | | | | | | | | | | | | | |

| | | 6 days | | | | | | | | | | | | | |

| | | | | |

Weighted average life as of July 31, 20167 | | | | | | | | | | | | | | | | |

| | | 6 days | | | | | | | | | | | | | |

| 1 | Please see the Fund’s current Statement of Additional Information for further details. |

| 2 | Historical performance shown for Administrator Class shares prior to their inception reflects the performance of Premier Class shares, and has not been adjusted to reflect higher expenses applicable to Administrator Class shares. If these expenses had been adjusted, returns would be lower. Historical performance shown for Premier Class shares prior to their inception reflects the performance of Service Class shares, and includes the higher expenses applicable to Service Class shares. If these expenses had not been included, returns would be higher. Historical performance shown for Sweep Class shares prior to their inception reflects the performance of Service Class shares, and has not been adjusted to reflect the higher expenses applicable to Sweep Class shares. If these expenses had been adjusted, returns would be lower. |

| 3 | Reflects the expense ratios as stated in the most recent prospectuses. The expense ratios shown are subject to change and may differ from the annualized expense ratios shown in the financial highlights of this report. |

| 4 | The manager has contractually committed through May 31, 2017, to waive fees and/or reimburse expenses to the extent necessary to cap the Fund’s Total Annual Fund Operating Expenses After Fee Waiver at 0.65% for Class A, 0.30% for Administrator Class, 0.20% for Premier Class, 0.45% for Service Class, and 1.00% for Sweep Class. After this time, the cap may be increased or the commitment to maintain the cap may be terminated only with the approval of the Board of Trustees. Brokerage commissions, stamp duty fees, interest, taxes, acquired fund fees and expenses, and extraordinary expenses are excluded from the cap. Without this cap, the Fund’s returns would have been lower. Without waived fees and/or reimbursed expenses, the Fund’s 7-day current yield would have been (0.19)%, 0.08%, 0.20%, (0.09)%, and (0.54)% for Class A, Administrator Class, Premier Class, Service Class, and Sweep Class, respectively. |

| 5 | Amounts are calculated based on the total investments of the Fund. These amounts are subject to change and may have changed since the date specified. |

| 6 | Weighted Average Maturity (WAM): WAM is an average of the effective maturities of all securities held in the portfolio, weighted by each security’s percentage of total investments. The maturity of a portfolio security is the period remaining until the date on which the principal amount is unconditionally required to be paid, or in the case of a security called for redemption, the date on which the redemption payment is unconditionally required to be made. WAM calculations allow for the maturities of certain securities with demand features or periodic interest rate resets to be shortened. WAM is a way to measure a fund’s sensitivity to potential interest rate changes. Rule 2a-7 under the Investment Company Act of 1940 requires money market funds to maintain a WAM of 60 calendar days or less. WAM is subject to change and may have changed since the date specified. |

| 7 | Weighted Average Life (WAL): WAL is an average of the final maturities of all securities held in the portfolio, weighted by their percentage of total investments. The maturity of a portfolio security is the period remaining until the date on which the principal amount is unconditionally required to be paid, or in the case of a security called for redemption, the date on which the redemption payment is unconditionally required to be made. In contrast to WAM, the calculation of WAL allows for the maturities of certain securities with demand features to be shortened, but not the periodic interest rate resets. WAL is a way to measure a fund’s potential sensitivity to credit spread changes. Rule 2a-7 under the Investment Company Act of 1940 requires money market funds to maintain a WAL of 120 calendar days or less. WAL is subject to change and may have changed since the date specified. |

| | | | |

| 4 | | Wells Fargo California Municipal Money Market Fund | | Fund expenses (unaudited) |

As a shareholder of the Fund, you incur ongoing costs, including management fees, distribution (12b-1) and/or shareholder servicing fees, and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the six-month period and held for the entire period from February 1, 2016 to July 31, 2016.

Actual Expenses

The “Actual” line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the “Actual” line under the heading entitled “Expenses paid during period” for your applicable class of shares to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The “Hypothetical” line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sakes charges (loads) and contingent deferred sales charges. Therefore, the “Hypothetical” line of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your cost would have been higher.

| | | | | | | | | | | | | | | | |

| | | Beginning account | | | Ending | | | Expenses | | | | |

| | | value | | | account value | | | paid during | | | Annualized net | |

| | | 2-1-2016 | | | 7-31-2016 | | | the period¹ | | | expense ratio | |

Class A | | | | | | | | | | | | | | | | |

Actual | | | $1,000.00 | | | | $1,000.05 | | | | $1.60 | | | | 0.32% | |

Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,023.34 | | | | $1.61 | | | | 0.32% | |

Administrator Class | | | | | | | | | | | | | | | | |

Actual | | | $1,000.00 | | | | $1,000.41 | | | | $1.20 | | | | 0.24% | |

Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,023.73 | | | | $1.21 | | | | 0.24% | |

Institutional Class | | | | | | | | | | | | | | | | |

Actual | | | $1,000.00 | | | | $1,000.77 | | | | $0.85 | | | | 0.17% | |

Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,024.08 | | | | $0.86 | | | | 0.17% | |

Service Class | | | | | | | | | | | | | | | | |

Actual | | | $1,000.00 | | | | $1,000.05 | | | | $1.45 | | | | 0.29% | |

Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,023.49 | | | | $1.46 | | | | 0.29% | |

Sweep Class | | | | | | | | | | | | | | | | |

Actual | | | $1,000.00 | | | | $1,000.04 | | | | $1.60 | | | | 0.32% | |

Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,023.34 | | | | $1.61 | | | | 0.32% | |

| 1 | Expenses paid is equal to the annualized net expense ratio of each class multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year divided by the number of days in the fiscal year (to reflect the one-half-year period). |

| | | | |

| Portfolio of investments — July 31, 2016 (unaudited) | | Wells Fargo California Municipal Money Market Fund | | 5 |

| | | | | | | | | | | | | | | | | | | | |

Security name | | Interest rate | | Maturity date | | Principal | | Value |

| | | | |

Municipal Obligations : 87.90% | | | | | | | | | | | | | | | | | |

| | | | |

California : 87.90% | | | | | | | | | | | | | | | | | |

| | | | |

Other Municipal Debt : 3.44% | | | | | | | | | | | | | | | | | |

California GO Series A2 (GO Revenue) | | | | 0.43 | % | | 8-3-2016 | | | $ | 14,000,000 | | | | $ | 14,000,000 | |

Los Angeles County CA Capital Asset Leasing Corporation Series B- TE (Housing Revenue) | | | | 0.42 | | | 8-15-2016 | | | | 15,000,000 | | | | | 15,000,000 | |

Los Angeles County CA Metropolitan Transportation Authority Series A (Transportation Revenue) | | | | 0.43 | | | 8-4-2016 | | | | 5,000,000 | | | | | 5,000,000 | |

San Jose CA Unified School District Santa Clara County Election of 2002 Series C (GO Revenue, National Insured) | | | | 5.00 | | | 8-1-2017 | | | | 1,295,000 | | | | | 1,295,000 | |

| | | | |

| | | | | | | | | | | | | | | | 35,295,000 | |

| | | | | | | | | | | | | | | | | | |

| | | | |

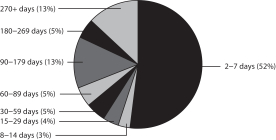

Variable Rate Demand Notes ø: 84.46% | | | | | | | | | | | | | | | | | |

Association of Bay Area Governments Finance Authority for Nonprofit Corporation California Menlo School (Education Revenue, Northern Trust Company LOC) | | | | 0.45 | | | 9-1-2033 | | | | 11,400,000 | | | | | 11,400,000 | |

Association of Bay Area Governments Finance Authority for Nonprofit Corporation California MFHR Fine Arts Building Projects Series A (Housing Revenue, FNMA Insured, FNMA LIQ) | | | | 0.52 | | | 7-15-2035 | | | | 6,100,000 | | | | | 6,100,000 | |

Association of Bay Area Governments Finance Authority for Nonprofit Corporation California San Francisco University High School Series A (Education Revenue, Northern Trust Company LOC) | | | | 0.45 | | | 4-1-2036 | | | | 5,895,000 | | | | | 5,895,000 | |

Bakersfield CA Waste Water Tender Option Bond Trust Receipts/Certificates Series XM0076 (Water & Sewer Revenue, AGM Insured, Bank of America NA LIQ) 144A | | | | 0.60 | | | 9-15-2032 | | | | 10,630,000 | | | | | 10,630,000 | |

Burbank CA Unified School District Series 2013 ROC RR II R-14055 (GO Revenue, Citibank NA LIQ) 144A | | | | 0.46 | | | 2-1-2021 | | | | 5,520,000 | | | | | 5,520,000 | |

California Alternative Energy Source Financing Authority GE Capital Corporation Series A (Utilities Revenue) | | | | 0.45 | | | 10-1-2020 | | | | 25,330,000 | | | | | 25,330,000 | |

California CDA Charter Court Apartments Series L (Housing Revenue, FHLMC LIQ) | | | | 0.52 | | | 9-1-2040 | | | | 3,555,000 | | | | | 3,555,000 | |

California CDA MFHR Desert Palms Series A (Housing Revenue, FHLMC LOC) | | | | 0.52 | | | 8-1-2045 | | | | 7,000,000 | | | | | 7,000,000 | |

California CDA MFHR Granite Oaks Apartments Series R (Housing Revenue, FNMA Insured, FNMA LIQ) | | | | 0.46 | | | 10-15-2030 | | | | 3,985,000 | | | | | 3,985,000 | |

California CDA MFHR Imperial Park Apartments Series OO (Housing Revenue, FHLMC LOC) | | | | 0.50 | | | 11-1-2040 | | | | 6,620,000 | | | | | 6,620,000 | |

California CDA Motion Picture & Television Fund Series A (Health Revenue, Northern Trust Company LOC) | | | | 0.54 | | | 3-1-2031 | | | | 20,450,000 | | | | | 20,450,000 | |

California CDA Oakmont Senior Living Series Y (Housing Revenue, FNMA Insured, FNMA LIQ) | | | | 0.46 | | | 8-1-2031 | | | | 9,100,000 | | | | | 9,100,000 | |

California CDA Seasons Senior Apartments Series B (Housing Revenue, FNMA Insured, FNMA LIQ) | | | | 0.46 | | | 5-15-2037 | | | | 5,265,000 | | | | | 5,265,000 | |

California CDA Sutter Health Series A (Health Revenue, Ambac Insured, Credit Suisse LIQ) 144A | | | | 0.47 | | | 8-15-2038 | | | | 6,000,000 | | | | | 6,000,000 | |

California CDA Sutter Health Series B (Health Revenue, Credit Suisse LIQ) 144A | | | | 0.47 | | | 11-15-2048 | | | | 13,713,253 | | | | | 13,713,253 | |

California Enterprise Development Authority Pocino Foods Company Project Series A (Industrial Development Revenue, City National Bank LOC) | | | | 0.47 | | | 11-1-2033 | | | | 7,550,000 | | | | | 7,550,000 | |

California GO Kindergarten Series A2 (GO Revenue, State Street Bank & Trust Company LOC) | | | | 0.32 | | | 5-1-2034 | | | | 12,655,000 | | | | | 12,655,000 | |

California HFA Series 3206 (Housing Revenue, Morgan Stanley Bank LIQ) 144A | | | | 0.67 | | | 8-1-2037 | | | | 13,695,000 | | | | | 13,695,000 | |

California HFFA City of Hope Series B (Health Revenue) | | | | 0.43 | | | 11-15-2042 | | | | 14,450,000 | | | | | 14,450,000 | |

California HFFA St. Joseph Health System Series B (Health Revenue, U.S. Bank NA LOC) | | | | 0.38 | | | 7-1-2041 | | | | 3,100,000 | | | | | 3,100,000 | |

California HFFA Tender Option Bond Trust Receipts/Certificates Series XF0236 (Health Revenue, TD Bank NA LIQ) 144A | | | | 0.47 | | | 8-15-2031 | | | | 9,500,000 | | | | | 9,500,000 | |

California Infrastructure & Economic Development Bank Pacific Gas & Electric Company Series A (Utilities Revenue, Union Bank NA LOC) | | | | 0.39 | | | 11-1-2026 | | | | 19,700,000 | | | | | 19,700,000 | |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 6 | | Wells Fargo California Municipal Money Market Fund | | Portfolio of investments — July 31, 2016 (unaudited) |

| | | | | | | | | | | | | | | | | | | | |

Security name | | Interest rate | | Maturity date | | Principal | | Value |

| | | | |

Variable Rate Demand Notes ø(continued) | | | | | | | | | | | | | | | | | | | | |

| | | | |

California Infrastructure & Economic Development Bank Pacific Gas & Electric Company Series B (Utilities Revenue, Union Bank NA LOC) | | | | 0.39 | % | | | | 11-1-2026 | | | | $ | 7,635,000 | | | | $ | 7,635,000 | |

California Infrastructure & Economic Development Bank ROC RR-II-R- 11527 (Transportation Revenue, Ambac Insured, Citibank NA LIQ) 144A | | | | 0.46 | | | | | 7-1-2030 | | | | | 9,900,000 | | | | | 9,900,000 | |

California Infrastructure & Economic Development Bank Saddleback Valley Christian Schools Project Series A (Miscellaneous Revenue, East West Bank LOC) 144A | | | | 0.46 | | | | | 12-1-2040 | | | | | 14,250,000 | | | | | 14,250,000 | |

California Municipal Finance Authority Chevron USA Recovery Zone Project Series A (Industrial Development Revenue) | | | | 0.26 | | | | | 11-1-2035 | | | | | 9,525,000 | | | | | 9,525,000 | |

California Municipal Finance Authority High Desert Partnership (Education Revenue, Union Bank NA LOC) | | | | 0.50 | | | | | 4-1-2042 | | | | | 1,240,000 | | | | | 1,240,000 | |

California PCFA Exempt Facilities Exxon Mobil Project (Industrial Development Revenue) | | | | 0.34 | | | | | 12-1-2029 | | | | | 8,995,000 | | | | | 8,995,000 | |

California PCFA Pacific Gas & Electric Project Series B (Utilities Revenue, Canadian Imperial Bank LOC) | | | | 0.41 | | | | | 11-1-2026 | | | | | 22,600,000 | | | | | 22,600,000 | |

California PCFA Pacific Gas & Electric Project Series C (Utilities Revenue, Mizuho Bank Limited LOC) | | | | 0.41 | | | | | 11-1-2026 | | | | | 8,000,000 | | | | | 8,000,000 | |

California PCFA Pacific Gas & Electric Project Series E (Utilities Revenue, Sumitomo Mitsui Banking LOC) | | | | 0.36 | | | | | 11-1-2026 | | | | | 19,190,000 | | | | | 19,190,000 | |

California PCFA Solid Waste John B. & Ann M. Verwey Project (Resource Recovery Revenue, CoBank LOC) | | | | 0.50 | | | | | 5-1-2028 | | | | | 3,400,000 | | | | | 3,400,000 | |

California PCFA Solid Waste Milk Time Dairy Farms Project (Resource Recovery Revenue, CoBank LOC) | | | | 0.53 | | | | | 11-1-2027 | | | | | 6,000,000 | | | | | 6,000,000 | |

California PCFA Solid Waste Milk Time Dairy Farms Project (Resource Recovery Revenue, Rabobank LOC) | | | | 0.54 | | | | | 11-1-2027 | | | | | 1,400,000 | | | | | 1,400,000 | |

California PCFA Waste Connection Incorporated Project (Resource Recovery Revenue, Bank of America NA LOC) | | | | 0.53 | | | | | 8-1-2018 | | | | | 10,100,000 | | | | | 10,100,000 | |

California Series B3 (GO Revenue, Citibank NA LOC) | | | | 0.30 | | | | | 5-1-2034 | | | | | 11,900,000 | | | | | 11,900,000 | |

California Statewide CDA PCR Chevron USA Incorporated Project (Resource Recovery Revenue) | | | | 0.26 | | | | | 5-15-2024 | | | | | 10,400,000 | | | | | 10,400,000 | |

California Statewide Communities Concord Green Apartments Project (Housing Revenue, East West Bank LOC) | | | | 0.52 | | | | | 6-1-2028 | | | | | 8,700,000 | | | | | 8,700,000 | |

California Tender Option Bond Trust Receipts/Certificates Series XF0279 (GO Revenue, State Street Bank & Trust Company LIQ) 144A | | | | 0.46 | | | | | 7-1-2042 | | | | | 10,000,000 | | | | | 10,000,000 | |

California Tender Option Bond Trust Receipts/Certificates Series XM0147 (Education Revenue, Morgan Stanley Bank LIQ) 144A | | | | 0.48 | | | | | 1-1-2039 | | | | | 10,000,000 | | | | | 10,000,000 | |

California Tender Option Bond Trust Receipts/Certificates Series ZF0261 (Water & Sewer Revenue, TD Bank NA LIQ) 144A | | | | 0.47 | | | | | 11-1-2039 | | | | | 7,850,000 | | | | | 7,850,000 | |

California Tender Option Bond Trust Receipts/Certificates Series ZF0300 (Education Revenue, AGM Insured, JPMorgan Chase & Company LIQ) 144A | | | | 0.52 | | | | | 5-1-2030 | | | | | 4,775,000 | | | | | 4,775,000 | |

California Tender Option Bond Trust Receipts/Certificates Series ZF0323 (GO Revenue, JPMorgan Chase & Company LIQ) 144A | | | | 0.56 | | | | | 2-1-2019 | | | | | 5,340,000 | | | | | 5,340,000 | |

California University Systemwide Series A (Education Revenue, AGM Insured, Bank of America NA LIQ) 144A | | | | 0.56 | | | | | 11-1-2033 | | | | | 5,685,000 | | | | | 5,685,000 | |

Elsinore Valley CA Municipal Water District Series A Eclipse Funding Trust Solar Eclipse 2007-0069 (Miscellaneous Revenue, U.S. Bank NA LOC, U.S. Bank NA LIQ) 144A | | | | 0.51 | | | | | 7-1-2034 | | | | | 25,550,000 | | | | | 25,550,000 | |

Irvine CA Improvement Bond Act of 1915 Assessment District #03-19 Series B (Miscellaneous Revenue, U.S. Bank NA LOC) | | | | 0.35 | | | | | 9-2-2029 | | | | | 10,900,000 | | | | | 10,900,000 | |

Irvine CA Improvement Bond Act of 1915 Reassessment District #04- 20 Series A (Miscellaneous Revenue, Sumitomo Mitsui Banking LOC) | | | | 0.47 | | | | | 9-2-2050 | | | | | 21,600,000 | | | | | 21,600,000 | |

Irvine CA Improvement Bond Act of 1915 Reassessment District #05- 21 Series A (Miscellaneous Revenue, U.S. Bank NA LOC) 144A | | | | 0.35 | | | | | 9-2-2050 | | | | | 13,844,000 | | | | | 13,844,000 | |

Irvine CA Improvement Bond Act of 1915 Reassessment District #87-8 (Miscellaneous Revenue, State Street Bank & Trust Company LOC) | | | | 0.35 | | | | | 9-2-2024 | | | | | 100,000 | | | | | 100,000 | |

Irvine CA Improvement Bond Act of 1915 Reassessment District #97- 17 (Miscellaneous Revenue, State Street Bank & Trust Company LOC) | | | | 0.35 | | | | | 9-2-2023 | | | | | 21,800,000 | | | | | 21,800,000 | |

Irvine Ranch CA Water District Series A (Water & Sewer Revenue, U.S. Bank NA LOC) | | | | 0.34 | | | | | 10-1-2041 | | | | | 4,500,000 | | | | | 4,500,000 | |

JPMorgan Chase PUTTER/DRIVER Trust Series 3841 (Transportation Revenue, Ambac Insured, JPMorgan Chase & Company LIQ) 144A | | | | 0.47 | | | | | 7-1-2024 | | | | | 31,735,000 | | | | | 31,735,000 | |

JPMorgan Chase PUTTER/DRIVER Trust Series 4414 (Airport Revenue, JPMorgan Chase & Company LIQ) 144A | | | | 0.47 | | | | | 5-15-2021 | | | | | 5,000,000 | | | | | 5,000,000 | |

The accompanying notes are an integral part of these financial statements.

| | | | |

| Portfolio of investments — July 31, 2016 (unaudited) | | Wells Fargo California Municipal Money Market Fund | | 7 |

| | | | | | | | | | | | | | | | | | | | |

Security name | | Interest rate | | Maturity date | | Principal | | Value |

| | | | |

Variable Rate Demand Notes ø(continued) | | | | | | | | | | | | | | | | | | | | |

| | | | |

Los Angeles CA Certificate of Participation Samuel A. Fryer Yavney Series A (Education Revenue, California Bank & Trust LOC) | | | | 0.44 | % | | | | 8-1-2038 | | | | $ | 7,150,000 | | | | $ | 7,150,000 | |

Los Angeles CA IDA Megatoys Project (Industrial Development Revenue, East West Bank LOC) | | | | 0.50 | | | | | 7-1-2031 | | | | | 3,000,000 | | | | | 3,000,000 | |

Los Angeles CA Tender Option Bond Trust Receipts/Certificates Series XF0041 (Airport Revenue, JPMorgan Chase & Company LIQ) 144A | | | | 0.52 | | | | | 11-15-2025 | | | | | 8,000,000 | | | | | 8,000,000 | |

Los Angeles CA Tender Option Bond Trust Receipts/Certificates Series ZF0158 (Airport Revenue, JPMorgan Chase & Company LIQ) 144A | | | | 0.52 | | | | | 8-1-2022 | | | | | 3,060,000 | | | | | 3,060,000 | |

Manteca CA RDA Amended Merger Project (Tax Revenue, State Street Bank & Trust Company LOC) | | | | 0.35 | | | | | 10-1-2042 | | | | | 9,915,000 | | | | | 9,915,000 | |

Modesto CA MFHR Live Oak Apartments Project (Housing Revenue, FNMA Insured, FNMA LIQ) | | | | 0.52 | | | | | 9-15-2024 | | | | | 3,875,000 | | | | | 3,875,000 | |

Northern California Power Agency Hydroelectric Project Series A (Utilities Revenue, Bank of Montreal LOC) | | | | 0.41 | | | | | 7-1-2032 | | | | | 24,200,000 | | | | | 24,200,000 | |

Orange County CA Water District Series A (Water & Sewer Revenue, Citibank NA LOC) | | | | 0.43 | | | | | 8-1-2042 | | | | | 20,550,000 | | | | | 20,550,000 | |

Sacramento CA Housing Authority Lofts at Natomas Apartments Series F (Housing Revenue, FNMA Insured, FNMA LIQ) | | | | 0.46 | | | | | 6-15-2036 | | | | | 5,190,000 | | | | | 5,190,000 | |

Sacramento CA MUD Tender Option Bond Trust Receipts/Certificates Series XM0067 (Utilities Revenue, Bank of America NA LIQ) 144A | | | | 0.75 | | | | | 8-15-2026 | | | | | 9,970,000 | | | | | 9,970,000 | |

Sacramento County CA Housing Authority Logan Park Apartments Series E (Housing Revenue, FHLMC LOC) | | | | 0.52 | | | | | 5-1-2042 | | | | | 10,000,000 | | | | | 10,000,000 | |

Sacramento County CA Housing Authority MFHR Cascades Series D (Housing Revenue, FNMA Insured, FNMA LIQ) | | | | 0.46 | | | | | 9-15-2035 | | | | | 6,535,000 | | | | | 6,535,000 | |

Sacramento County CA Housing Authority Shenandoah Apartments Series F (Housing Revenue, FNMA Insured, FNMA LIQ) | | | | 0.46 | | | | | 9-15-2036 | | | | | 5,205,000 | | | | | 5,205,000 | |

Sacramento County CA Sanitation Districts Financing Authority PUTTER Series 2821 (Water & Sewer Revenue, AGM/FGIC Insured, JPMorgan Chase & Company LIQ) 144A | | | | 0.51 | | | | | 3-1-2026 | | | | | 6,620,000 | | | | | 6,620,000 | |

San Diego CA Community College District Tender Option Bond Trust Receipts/Certificates Series XM0290 (GO Revenue, Royal Bank of Canada LIQ) 144A | | | | 0.46 | | | | | 8-1-2019 | | | | | 11,000,000 | | | | | 11,000,000 | |

San Diego County CA Regional Transportation Commission Limited Tax Series A (Tax Revenue, JPMorgan Chase & Company SPA) | | | | 0.43 | | | | | 4-1-2038 | | | | | 18,000,000 | | | | | 18,000,000 | |

San Diego County CA Regional Transportation Commission Limited Tax Series C (Tax Revenue, Mizuho Corporate Bank SPA) | | | | 0.43 | | | | | 4-1-2038 | | | | | 13,400,000 | | | | | 13,400,000 | |

San Francisco CA City & County RDA Orlando Cepeda Place Series D (Housing Revenue, Citibank NA LOC) | | | | 0.50 | | | | | 11-1-2033 | | | | | 5,825,000 | | | | | 5,825,000 | |

San Francisco CA Tender Option Bond Trust Receipts/Certificates Series XF0226 (Water & Sewer Revenue, State Street Bank & Trust Company LIQ) 144A | | | | 0.47 | | | | | 11-1-2043 | | | | | 4,130,000 | | | | | 4,130,000 | |

San Francisco CA Tender Option Bond Trust Receipts/Certificates Series XM0237 (Water & Sewer Revenue, Bank of America NA LIQ) 144A | | | | 0.46 | | | | | 11-1-2036 | | | | | 8,500,000 | | | | | 8,500,000 | |

San Francisco City & County CA Public Utilities Commission Series 3153X (Water & Sewer Revenue, Morgan Stanley Bank LIQ) 144A | | | | 0.47 | | | | | 11-1-2039 | | | | | 1,509,500 | | | | | 1,509,500 | |

San Francisco City & County CA RDA Fillmore Center 1999 Issue B1 (Housing Revenue, FHLMC LIQ) | | | | 0.47 | | | | | 12-1-2017 | | | | | 27,500,000 | | | | | 27,500,000 | |

San Joaquin CA Delta Community College Tender Option Bond Trust Receipts/Certificates Series ZF0180 (GO Revenue, JPMorgan Chase & Company LIQ) 144A | | | | 0.54 | | | | | 8-1-2022 | | | | | 2,415,000 | | | | | 2,415,000 | |

San Jose CA MFHR Raintree Apartments Series A (Housing Revenue, FHLMC LIQ) | | | | 0.52 | | | | | 2-1-2038 | | | | | 10,600,000 | | | | | 10,600,000 | |

San Jose CA Turnleaf Apartments Series A (Housing Revenue, FHLMC LIQ) | | | | 0.47 | | | | | 6-1-2036 | | | | | 4,230,000 | | | | | 4,230,000 | |

San Luis Obispo County CA Community College District Series ZF2097 (GO Revenue, Morgan Stanley Bank LIQ) 144A | | | | 0.50 | | | | | 8-1-2040 | | | | | 3,290,000 | | | | | 3,290,000 | |

San Luis Obispo County CA Community College District Series ZF2098 (GO Revenue, Morgan Stanley Bank LIQ) 144A | | | | 0.50 | | | | | 8-1-2040 | | | | | 3,290,000 | | | | | 3,290,000 | |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 8 | | Wells Fargo California Municipal Money Market Fund | | Portfolio of investments — July 31, 2016 (unaudited) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Security name | | | | Interest rate | | Maturity date | | Principal | | Value |

| | | | | |

Variable Rate Demand Notes ø(continued) | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | |

San Luis Obispo County CA Financing Authority Series 3030 Nacimiento Water Project Series A (Water & Sewer Revenue, BHAC/MBIA Insured, Morgan Stanley Bank LIQ) 144A | | | | | | | | | 0.47 | % | | | | 9-1-2038 | | | | $ | 23,570,000 | | | | $ | 23,570,000 | |

San Marcos CA Unified School District Series 3269 (GO Revenue, Morgan Stanley Bank LIQ) 144A | | | | | | | | | 0.47 | | | | | 8-1-2031 | | | | | 5,000,000 | | | | | 5,000,000 | |

Santa Clara County CA Refunding Bond Sub Series B (Utilities Revenue, Bank of Tokyo-Mitsubishi LOC) | | | | | | | | | 0.43 | | | | | 7-1-2027 | | | | | 25,500,000 | | | | | 25,500,000 | |

Southern California Public Power Authority Magnolia Power Project Series 1A (Utilities Revenue, U.S. Bank NA LOC) | | | | | | | | | 0.43 | | | | | 7-1-2036 | | | | | 14,900,000 | | | | | 14,900,000 | |

Tahoe Forest California Hospital District (Health Revenue, U.S. Bank NA LOC) | | | | | | | | | 0.35 | | | | | 7-1-2033 | | | | | 2,030,000 | | | | | 2,030,000 | |

Ventura County CA Community College District Series 2015 PUTTER Series XF0138 (GO Revenue, JPMorgan Chase & Company LIQ) 144A | | | | | | | | | 0.47 | | | | | 2-1-2023 | | | | | 6,000,000 | | | | | 6,000,000 | |

| | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | 867,086,753 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Total Municipal Obligations (Cost $902,381,753) | | | | | | | | | | | | | | | | | | | | | | | | 902,381,753 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | |

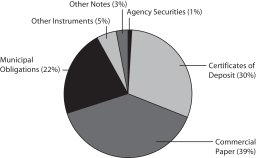

Other : 1.46% | | | | | | | | | | | | | | | | | | | | | | | | | |

Nuveen California Dividend Advantage Municipal Fund Variable Rate Demand Preferred Shares Series 3 (Deutsche Bank LIQ) ±§144A | | | | | | | | | 0.56 | | | | | 3-1-2040 | | | | | 6,000,000 | | | | | 6,000,000 | |

Nuveen California Dividend Advantage Municipal Fund Variable Rate Demand Preferred Shares Series 5 (Citibank NA LIQ) ±§144A | | | | | | | | | 0.62 | | | | | 8-1-2040 | | | | | 9,000,000 | | | | | 9,000,000 | |

| | | | | |

Total Other (Cost $15,000,000) | | | | | | | | | | | | | | | | | | | | | | | | 15,000,000 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | |

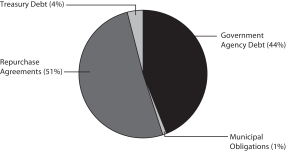

Repurchase Agreements : 3.60% | | | | | | | | | | | | | | | | | | | | | | | | | |

Societe Generale, dated 7-29-2016, maturity value $37,001,018 ^^ | | | | | | | | | 0.33 | | | | | 8-1-2016 | | | | | 37,000,000 | | | | | 37,000,000 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Total Repurchase Agreements (Cost $37,000,000) | | | | | | | | | | | | | | | | | | | | | | | | 37,000,000 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Total investments in securities (Cost $954,381,753)* | | | | 92.96 | % | | | | | | | | | | | | | | | | | | | 954,381,753 | |

| | | | | |

| Other assets and liabilities, net | | | | 7.04 | | | | | | | | | | | | | | | | | | | | 72,297,455 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Total net assets | | | | 100.00 | % | | | | | | | | | | | | | | | | | | $ | 1,026,679,208 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| ø | Variable rate demand notes are subject to a demand feature which reduces the effective maturity. The maturity date shown represents the final maturity date of the security. The interest rate is determined and reset by the issuer daily, weekly, or monthly depending upon the terms of the security. The rate shown is the rate in effect at period end. |

| 144A | The security may be resold in transactions exempt from registration, normally to qualified institutional buyers, pursuant to Rule 144A under the Securities Act of 1933. |

| ± | Variable rate investment. The rate shown is the rate in effect at period end. |

| § | The security is subject to a demand feature which reduces the effective maturity. |

| ^^ | Collateralized by U.S. government securities, 0.00% to 8.13%, 7-31-2016 to 8-15-2045, fair value including accrued interest is $37,740,000. |

| * | Cost for federal income tax purposes is substantially the same as for financial reporting purposes. |

| The | accompanying notes are an integral part of these financial statements. |

| | | | |

| Statement of assets and liabilities–July 31, 2016 (unaudited) | | Wells Fargo California Municipal Money Market Fund | | 9 |

| | | | |

Assets | | | | |

Investments in unaffiliated securities, at amortized cost | | $ | 954,381,753 | |

Cash | | | 46,386 | |

Receivable for investments sold | | | 72,052,910 | |

Receivable for Fund shares sold | | | 32 | |

Receivable for interest | | | 602,720 | |

Prepaid expenses and other assets | | | 29,195 | |

| | | | |

Total assets | | | 1,027,112,996 | |

| | | | |

| |

Liabilities | | | | |

Dividends payable | | | 101,175 | |

Payable for Fund shares redeemed | | | 4,696 | |

Management fee payable | | | 21,173 | |

Distribution fee payable | | | 16 | |

Administration fees payable | | | 119,473 | |

Custodian and accounting fees payable | | | 65,797 | |

Shareholder servicing fees payable | | | 94,913 | |

Accrued expenses and other liabilities | | | 26,545 | |

| | | | |

Total liabilities | | | 433,788 | |

| | | | |

Total net assets | | $ | 1,026,679,208 | |

| | | | |

| |

NET ASSETS CONSIST OF | | | | |

Paid-in capital | | $ | 1,026,565,426 | |

Overdistributed net investment income | | | (152) | |

Accumulated net realized gains on investments | | | 113,934 | |

| | | | |

Total net assets | | $ | 1,026,679,208 | |

| | | | |

| |

COMPUTATION OF NET ASSET VALUE PER SHARE | | | | |

Net assets - Class A | | $ | 423,791,696 | |

Shares outstanding - Class A1 | | | 423,739,999 | |

Net asset value per share - Class A | | $ | 1.00 | |

Net assets - Administrator Class | | $ | 50,128 | |

Shares outstanding - Administrator Class1 | | | 50,122 | |

Net asset value per share - Administrator Class | | $ | 1.00 | |

Net assets - Premier Class | | $ | 584,976,254 | |

Shares outstanding - Premier Class1 | | | 584,904,887 | |

Net asset value per share - Premier Class | | $ | 1.00 | |

Net assets - Service Class | | $ | 17,800,946 | |

Shares outstanding - Service Class1 | | | 17,798,773 | |

Net asset value per share - Service Class | | $ | 1.00 | |

Net assets - Sweep Class | | $ | 60,184 | |

Shares outstanding - Sweep Class1 | | | 60,176 | |

Net asset value per share - Sweep Class | | $ | 1.00 | |

| 1 | The Fund has an unlimited number of authorized shares. |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 10 | | Wells Fargo California Municipal Money Market Fund | | Statement of operations–six months ended July 31, 2016 (unaudited) |

| | | | |

Investment income | | | | |

Interest | | $ | 1,783,674 | |

| | | | |

| |

Expenses | | | | |

Management fee | | | 842,874 | |

Administration fees | | | | |

Class A | | | 478,529 | |

Administrator Class | | | 25 | |

Premier Class1 | | | 257,879 | |

Service Class | | | 26,403 | |

Sweep Class | | | 57 | |

Shareholder servicing fees | | | | |

Class A | | | 543,784 | |

Administrator Class | | | 25 | |

Service Class | | | 54,252 | |

Sweep Class | | | 64 | |

Distribution fee | | | | |

Sweep Class | | | 92 | |

Custody and accounting fees | | | 29,505 | |

Professional fees | | | 22,800 | |

Registration fees | | | 15,919 | |

Shareholder report expenses | | | 8,807 | |

Trustees’ fees and expenses | | | 11,223 | |

Other fees and expenses | | | 9,558 | |

| | | | |

Total expenses | | | 2,301,796 | |

Less: Fee waivers and/or expense reimbursements | | | (1,006,501) | |

| | | | |

Net expenses | | | 1,295,295 | |

| | | | |

Net investment income | | | 488,379 | |

| | | | |

Net realized gains on investments | | | 64,784 | |

| | | | |

Net increase in net assets resulting from operations | | $ | 553,163 | |

| | | | |

| | 1 | Effective April 1, 2016, Institutional Class was renamed Premier Class. |

The accompanying notes are an integral part of these financial statements.

| | | | |

| Statement of changes in net assets | | Wells Fargo California Municipal Money Market Fund | | 11 |

| | | | | | | | | | | | | | | | |

| | | Six months ended | | | | | | | |

| | | July 31, 2016 | | | Year ended | |

| | | (unaudited) | | | January 31, 2016 | |

| |

Operations | | | | | | | | | | | | | | | | |

Net investment income | | | | | | $ | 488,379 | | | | | | | $ | 112,186 | |

Net realized gains on investments | | | | | | | 64,784 | | | | | | | | 311,774 | |

| | | | |

Net increase in net assets resulting from operations | | | | | | | 553,163 | | | | | | | | 423,960 | |

| | | | |

| | | | |

Distributions to shareholders from | | | | | | | | | | | | | | | | |

Net investment income | | | | | | | | | | | | | | | | |

Class A | | | | | | | (21,809) | | | | | | | | (45,318) | |

Administrator Class | | | | | | | (20) | | | | | | | | (8) | |

Premier Class1 | | | | | | | (464,282) | | | | | | | | (60,185) | |

Service Class | | | | | | | (2,266) | | | | | | | | (5,346) | |

Sweep Class | | | | | | | (2) | | | | | | | | (1,329) | |

Net realized gains | | | | | | | | | | | | | | | | |

Class A | | | | | | | 0 | | | | | | | | (113,446) | |

Administrator Class | | | | | | | 0 | | | | | | | | (12) | |

Premier Class1 | | | | | | | 0 | | | | | | | | (161,423) | |

Service Class | | | | | | | 0 | | | | | | | | (12,232) | |

Sweep Class | | | | | | | 0 | | | | | | | | (13) | |

| | | | |

Total distributions to shareholders | | | | | | | (488,379) | | | | | | | | (399,312) | |

| | | | |

| | | | |

| Capital share transactions | | Shares | | | | | | Shares | | | | |

Proceeds from shares sold | | | | | | | | | | | | | | | | |

Class A | | | 336,514,606 | | | | 336,514,606 | | | | 1,007,509,902 | | | | 1,007,509,902 | |

Premier Class1 | | | 1,023,709,350 | | | | 1,023,709,350 | | | | 1,768,363,722 | | | | 1,768,363,722 | |

Service Class | | | 22,749,250 | | | | 22,749,250 | | | | 49,450,855 | | | | 49,450,855 | |

Sweep Class | | | 8,248 | | | | 8,248 | | | | 50,005 | | | | 50,005 | |

| | | | |

| | | | | | | 1,382,981,454 | | | | | | | | 2,825,374,484 | |

| | | | |

Reinvestment of distributions | | | | | | | | | | | | | | | | |

Class A | | | 20,834 | | | | 20,834 | | | | 143,766 | | | | 143,766 | |

Administrator Class | | | 20 | | | | 20 | | | | 20 | | | | 20 | |

Premier Class1 | | | 27,762 | | | | 27,762 | | | | 31,668 | | | | 31,668 | |

Service Class | | | 912 | | | | 912 | | | | 7,910 | | | | 7,910 | |

Sweep Class | | | 2 | | | | 2 | | | | 1,342 | | | | 1,342 | |

| | | | |

| | | | | | | 49,530 | | | | | | | | 184,706 | |

| | | | |

Payment for shares redeemed | | | | | | | | | | | | | | | | |

Class A | | | (364,936,412) | | | | (364,936,412) | | | | (1,003,710,430) | | | | (1,003,710,430) | |

Administrator Class | | | 0 | | | | 0 | | | | (50,000) | | | | (50,000) | |

Premier Class1 | | | (1,122,674,906) | | | | (1,122,674,906) | | | | (1,755,840,961) | | | | (1,755,840,961) | |

Service Class | | | (58,632,138) | | | | (58,632,138) | | | | (52,339,853) | | | | (52,339,853) | |

Sweep Class | | | 0 | | | | 0 | | | | (25,562,208) | | | | (25,562,208) | |

| | | | |

| | | | | | | (1,546,243,456) | | | | | | | | (2,837,503,452) | |

| | | | |

Net decrease in net assets resulting from capital share transactions | | | | | | | (163,212,472) | | | | | | | | (11,944,262) | |

| | | | |

Total decrease in net assets | | | | | | | (163,147,688) | | | | | | | | (11,919,614) | |

| | | | |

| | | | |

Net assets | | | | | | | | | | | | | | | | |

Beginning of period | | | | | | | 1,189,826,896 | | | | | | | | 1,201,746,510 | |

| | | | |

End of period | | | | | | $ | 1,026,679,208 | | | | | | | $ | 1,189,826,896 | |

| | | | |

Overdistributed net investment income | | | | | | $ | (152) | | | | | | | $ | (152) | |

| | | | |

| | 1 | Effective April 1, 2016, Institutional Class was renamed Premier Class. |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 12 | | Wells Fargo California Municipal Money Market Fund | | Financial highlights |

(For a share outstanding throughout each period)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six months ended

July 31, 2016 | | | Year ended January 31 | |

| CLASS A | | (unaudited) | | | 2016 | | | 2015 | | | 2014 | | | 2013 | | | 2012 | |

Net asset value, beginning of period | | | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | |

Net investment income | | | | | 0.001 | | | | 0.001 | | | | 0.001 | | | | 0.001 | | | | 0.001 | | | | 0.001 | |

Net realized gains on investments | | | | | 0.001 | | | | 0.001 | | | | 0.001 | | | | 0.001 | | | | 0.001 | | | | 0.001 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | | | 0.001 | | | | 0.001 | | | | 0.001 | | | | 0.001 | | | | 0.001 | | | | 0.001 | |

Distributions to shareholders from | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | | | (0.00)1 | | | | (0.00)1 | | | | (0.00)1 | | | | (0.00)1 | | | | (0.00)1 | | | | (0.00)1 | |

Net realized gains | | | | | 0.00 | | | | (0.00)1 | | | | (0.00)1 | | | | (0.00)1 | | | | (0.00)1 | | | | (0.00)1 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Total distributions to shareholders | | | | | (0.00)1 | | | | (0.00)1 | | | | (0.00)1 | | | | (0.00)1 | | | | (0.00)1 | | | | (0.00)1 | |

Net asset value, end of period | | | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | |

Total return2 | | | | | 0.00% | | | | 0.03% | | | | 0.02% | | | | 0.01% | | | | 0.02% | | | | 0.02% | |

Ratios to average net assets (annualized) | | | | | | | | | | | | | | | | | | | | | | | | | | |

Gross expenses | | | | | 0.64% | | | | 0.64% | | | | 0.63% | | | | 0.63% | | | | 0.64% | | | | 0.63% | |

Net expenses | | | | | 0.32% | | | | 0.07% | | | | 0.07% | | | | 0.10% | | | | 0.17% | | | | 0.16% | |

Net investment income | | | | | 0.01% | | | | 0.01% | | | | 0.01% | | | | 0.01% | | | | 0.01% | | | | 0.01% | |

Supplemental data | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (000s omitted) | | | | | $423,792 | | | | $452,174 | | | | $448,217 | | | | $649,144 | | | | $623,898 | | | | $1,128,321 | |

| | 1 | Amount is less than $0.005. |

| | 2 | Returns for periods of less than one year are not annualized. |

The accompanying notes are an integral part of these financial statements.

| | | | |

| Financial highlights | | Wells Fargo California Municipal Money Market Fund | | 13 |

(For a share outstanding throughout each period)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six months ended

July 31, 2016 | | | Year ended January 31 | |

| ADMINISTRATOR CLASS | | (unaudited) | | | 2016 | | | 2015 | | | 2014 | | | 2013 | | | 2012 | |

Net asset value, beginning of period | | | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | |

Net investment income | | | | | 0.001 | | | | 0.001 | | | | 0.001 | | | | 0.001 | | | | 0.001 | | | | 0.001 | |

Net realized gains on investments | | | | | 0.001 | | | | 0.001 | | | | 0.001 | | | | 0.001 | | | | 0.001 | | | | 0.001 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | | | 0.001 | | | | 0.001 | | | | 0.001 | | | | 0.001 | | | | 0.001 | | | | 0.001 | |

Distributions to shareholders from | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | | | (0.00)1 | | | | (0.00)1 | | | | (0.00)1 | | | | (0.00)1 | | | | (0.00)1 | | | | (0.00)1 | |

Net realized gains | | | | | 0.00 | | | | (0.00)1 | | | | (0.00)1 | | | | (0.00)1 | | | | (0.00)1 | | | | (0.00)1 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Total distributions to shareholders | | | | | (0.00)1 | | | | (0.00)1 | | | | (0.00)1 | | | | (0.00)1 | | | | (0.00)1 | | | | (0.00)1 | |

Net asset value, end of period | | | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | |

Total return2 | | | | | 0.04% | | | | 0.03% | | | | 0.02% | | | | 0.01% | | | | 0.02% | | | | 0.02% | |

Ratios to average net assets (annualized) | | | | | | | | | | | | | | | | | | | | | | | | | | |

Gross expenses | | | | | 0.36% | | | | 0.36% | | | | 0.36% | | | | 0.36% | | | | 0.36% | | | | 0.36% | |

Net expenses | | | | | 0.24% | | | | 0.07% | | | | 0.07% | | | | 0.10% | | | | 0.17% | | | | 0.15% | |

Net investment income | | | | | 0.08% | | | | 0.01% | | | | 0.01% | | | | 0.01% | | | | 0.01% | | | | 0.01% | |

Supplemental data | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (000s omitted) | | | | | $50 | | | | $50 | | | | $100 | | | | $100 | | | | $100 | | | | $100 | |

| | 1 | Amount is less than $0.005. |

| | 2 | Returns for periods of less than one year are not annualized. |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 14 | | Wells Fargo California Municipal Money Market Fund | | Financial highlights |

(For a share outstanding throughout each period)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six months ended

July 31, 2016 | | | Year ended January 31 | |

| PREMIER CLASS1 | | (unaudited) | | | 2016 | | | 2015 | | | 2014 | | | 2013 | | | 2012 | |

Net asset value, beginning of period | | | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | |

Net investment income | | | | | 0.002 | | | | 0.002 | | | | 0.002 | | | | 0.002 | | | | 0.002 | | | | 0.002 | |

Net realized gains on investments | | | | | 0.002 | | | | 0.002 | | | | 0.002 | | | | 0.002 | | | | 0.002 | | | | 0.002 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | | | 0.002 | | | | 0.002 | | | | 0.002 | | | | 0.002 | | | | 0.002 | | | | 0.002 | |

Distributions to shareholders from | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | | | (0.00)2 | | | | (0.00)2 | | | | (0.00)2 | | | | (0.00)2 | | | | (0.00)2 | | | | (0.00)2 | |

Net realized gains | | | | | 0.00 | | | | (0.00)2 | | | | (0.00)2 | | | | (0.00)2 | | | | (0.00)2 | | | | (0.00)2 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Total distributions to shareholders | | | | | (0.00)2 | | | | (0.00)2 | | | | (0.00)2 | | | | (0.00)2 | | | | (0.00)2 | | | | (0.00)2 | |

Net asset value, end of period | | | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | |

Total return3 | | | | | 0.08% | | | | 0.03% | | | | 0.02% | | | | 0.01% | | | | 0.02% | | | | 0.03% | |

Ratios to average net assets (annualized) | | | | | | | | | | | | | | | | | | | | | | | | | | |

Gross expenses | | | | | 0.25% | | | | 0.25% | | | | 0.24% | | | | 0.24% | | | | 0.25% | | | | 0.24% | |

Net expenses | | | | | 0.17% | | | | 0.07% | | | | 0.07% | | | | 0.10% | | | | 0.16% | | | | 0.14% | |

Net investment income | | | | | 0.14% | | | | 0.01% | | | | 0.01% | | | | 0.01% | | | | 0.01% | | | | 0.02% | |

Supplemental data | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (000s omitted) | | | | | $584,976 | | | | $683,865 | | | | $671,300 | | | | $613,101 | | | | $780,069 | | | | $884,793 | |

| 1 | Effective April 1, 2016, Institutional Class was renamed Premier Class. |

| 2 | Amount is less than $0.005. |

| 3 | Returns for periods of less than one year are not annualized. |

The accompanying notes are an integral part of these financial statements.

| | | | |

| Financial highlights | | Wells Fargo California Municipal Money Market Fund | | 15 |

(For a share outstanding throughout each period)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six months ended

July 31, 2016 | | | Year ended January 31 | |

| SERVICE CLASS | | (unaudited) | | | 2016 | | | 2015 | | | 2014 | | | 2013 | | | 2012 | |

Net asset value, beginning of period | | | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | |

Net investment income | | | | | 0.001 | | | | 0.001 | | | | 0.001 | | | | 0.001 | | | | 0.001 | | | | 0.001 | |

Net realized gains on investments | | | | | 0.001 | | | | 0.001 | | | | 0.001 | | | | 0.001 | | | | 0.001 | | | | 0.001 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | | | 0.001 | | | | 0.001 | | | | 0.001 | | | | 0.001 | | | | 0.001 | | | | 0.001 | |

Distributions to shareholders from | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | | | (0.00)1 | | | | (0.00)1 | | | | (0.00)1 | | | | (0.00)1 | | | | (0.00)1 | | | | (0.00)1 | |

Net realized gains | | | | | 0.00 | | | | (0.00)1 | | | | (0.00)1 | | | | (0.00)1 | | | | (0.00)1 | | | | (0.00)1 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Total distributions to shareholders | | | | | (0.00)1 | | | | (0.00)1 | | | | (0.00)1 | | | | (0.00)1 | | | | (0.00)1 | | | | (0.00)1 | |

Net asset value, end of period | | | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | |

Total return2 | | | | | 0.01% | | | | 0.03% | | | | 0.02% | | | | 0.01% | | | | 0.02% | | | | 0.02% | |

Ratios to average net assets (annualized) | | | | | | | | | | | | | | | | | | | | | | | | | | |

Gross expenses | | | | | 0.53% | | | | 0.53% | | | | 0.53% | | | | 0.53% | | | | 0.53% | | | | 0.53% | |

Net expenses | | | | | 0.29% | | | | 0.07% | | | | 0.07% | | | | 0.10% | | | | 0.17% | | | | 0.15% | |

Net investment income | | | | | 0.01% | | | | 0.01% | | | | 0.01% | | | | 0.01% | | | | 0.01% | | | | 0.01% | |

Supplemental data | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (000s omitted) | | | | | $17,801 | | | | $53,686 | | | | $56,564 | | | | $69,935 | | | | $67,724 | | | | $106,229 | |

| 1 | Amount is less than $0.005. |

| 2 | Returns for periods of less than one year are not annualized. |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 16 | | Wells Fargo California Municipal Money Market Fund | | Financial highlights |

(For a share outstanding throughout each period)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six months ended

July 31, 2016 | | | Year ended January 31 | |

| SWEEP CLASS | | (unaudited) | | | 2016 | | | 2015 | | | 2014 | | | 2013 | | | 2012 | |

Net asset value, beginning of period | | | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | |

Net investment income | | | | | 0.001 | | | | 0.001 | | | | 0.001 | | | | 0.001 | | | | 0.001 | | | | 0.001 | |

Net realized gains on investments | | | | | 0.001 | | | | 0.001 | | | | 0.001 | | | | 0.001 | | | | 0.001 | | | | 0.001 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | | | 0.001 | | | | 0.001 | | | | 0.001 | | | | 0.001 | | | | 0.001 | | | | 0.001 | |

Distributions to shareholders from | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | | | (0.00)1 | | | | (0.00)1 | | | | (0.00)1 | | | | (0.00)1 | | | | (0.00)1 | | | | (0.00)1 | |

Net realized gains | | | | | 0.00 | | | | (0.00)1 | | | | (0.00)1 | | | | (0.00)1 | | | | (0.00)1 | | | | (0.00)1 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Total distributions to shareholders | | | | | (0.00)1 | | | | (0.00)1 | | | | (0.00)1 | | | | (0.00)1 | | | | (0.00)1 | | | | (0.00)1 | |

Net asset value, end of period | | | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | |

Total return2 | | | | | 0.00% | | | | 0.03% | | | | 0.02% | | | | 0.01% | | | | 0.02% | | | | 0.02% | |

Ratios to average net assets (annualized) | | | | | | | | | | | | | | | | | | | | | | | | | | |

Gross expenses | | | | | 0.98% | | | | 0.99% | | | | 0.98% | | | | 0.98% | | | | 0.99% | | | | 0.98% | |

Net expenses | | | | | 0.32% | | | | 0.07% | | | | 0.07% | | | | 0.10% | | | | 0.17% | | | | 0.17% | |

Net investment income | | | | | 0.01% | | | | 0.01% | | | | 0.01% | | | | 0.01% | | | | 0.01% | | | | 0.01% | |

Supplemental data | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (000s omitted) | | | | | $60 | | | | $52 | | | | $25,566 | | | | $59,574 | | | | $76,028 | | | | $120,909 | |

| 1 | Amount is less than $0.005. |

| 2 | Returns for periods of less than one year are not annualized. |

The accompanying notes are an integral part of these financial statements.

| | | | |

| Notes to financial statements (unaudited) | | Wells Fargo California Municipal Money Market Fund | | 17 |

1. ORGANIZATION

Wells Fargo Funds Trust (the “Trust”), a Delaware statutory trust organized on March 10, 1999, is an open-end management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”). As an investment company, the Trust follows the accounting and reporting guidance in Financial Accounting Standards Board (“FASB”) Accounting Standards Codification Topic 946, Financial Services – Investment Companies. These financial statements report on the Wells Fargo California Municipal Money Market Fund (the “Fund”) which is a diversified series of the Trust.

2. SIGNIFICANT ACCOUNTING POLICIES

The following significant accounting policies, which are consistently followed in the preparation of the financial statements of the Fund, are in conformity with U.S. generally accepted accounting principles which require management to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Securities valuation

As permitted under Rule 2a-7 of the 1940 Act, portfolio securities are valued at amortized cost, which approximates fair value. The amortized cost method involves valuing a security at its cost, plus accretion of discount or minus amortization of premium over the period until maturity.

Investments which are not valued using the method discussed above are valued at their fair value, as determined in good faith by the Board of Trustees of the Fund. The Board of Trustees has established a Valuation Committee comprised of the Trustees and has delegated to it the authority to take any actions regarding the valuation of portfolio securities that the Valuation Committee deems necessary or appropriate, including determining the fair value of portfolio securities, unless the determination has been delegated to the Management Valuation Team of Wells Fargo Funds Management, LLC (“Funds Management”). The Board of Trustees retains the authority to make or ratify any valuation decisions or approve any changes to the Valuation Procedures as it deems appropriate. On a quarterly basis, the Board of Trustees receives reports on any valuation actions taken by the Valuation Committee or the Management Valuation Team which may include items for ratification.

Valuations of fair valued securities are compared to the next actual sales price when available, or other appropriate market values, to assess the continued appropriateness of the fair valuation methodologies used. These securities are fair valued on a day-to-day basis, taking into consideration changes to appropriate market information and any significant changes to the inputs considered in the valuation process until there is a readily available price provided on an exchange or by an independent pricing service. Valuations received from an independent pricing service or independent broker-dealer quotes are periodically validated by comparisons to most recent trades and valuations provided by other independent pricing services in addition to the review of prices by the manager and/or subadviser. Unobservable inputs used in determining fair valuations are identified based on the type of security, taking into consideration factors utilized by market participants in valuing the investment, knowledge about the issuer and the current market environment.

Repurchase agreements

The Fund may invest in repurchase agreements and may participate in pooled repurchase agreement transactions with other funds advised by Funds Management. The repurchase agreements must be fully collateralized based on values that are marked-to-market daily. The collateral may be held by an agent bank under a tri-party agreement. It is the custodian’s responsibility to value collateral daily and to take action to obtain additional collateral as necessary to maintain market value equal to or greater than the resale price. The repurchase agreements are collateralized by instruments such as U.S. Treasury, federal agency, or high-grade corporate obligations. There could be potential loss to the Fund in the event that the Fund is delayed or prevented from exercising its rights to dispose of the collateral, including the risk of a possible decline in the value of the underlying obligations during the period in which the Fund seeks to assert its rights.

Security transactions and income recognition

Securities transactions are recorded on a trade date basis. Realized gains or losses are recorded on the basis of identified cost.

Interest income is accrued daily and bond discounts are accreted and premiums are amortized daily based on the effective interest method. To the extent debt obligations are placed on non-accrual status, any related interest income may be reduced by writing off interest receivables when the collection of all or a portion of interest has become doubtful based on consistently applied procedures. If the issuer subsequently resumes interest payments or when the collectability of interest is reasonably assured, the debt obligation is removed from non-accrual status.

Distributions to shareholders

Distributions to shareholders from net investment income are accrued daily and paid monthly. Distributions from net realized gains, if any, are recorded on the ex-dividend date. Such distributions are determined in conformity with federal income tax regulations, which may differ in amount or character from net investment income and realized gains recognized for purposes of U.S. generally accepted accounting principles.

Federal and other taxes

The Fund intends to continue to qualify as a regulated investment company by distributing substantially all of its investment company taxable and tax-exempt income and any net realized capital gains (after reduction for capital loss carryforwards) sufficient to relieve it from all, or substantially all, federal income taxes. Accordingly, no provision for federal income taxes was required.

| | | | |

| 18 | | Wells Fargo California Municipal Money Market Fund | | Notes to financial statements (unaudited) |

The Fund’s income and federal excise tax returns and all financial records supporting those returns for the prior three fiscal years are subject to examination by the federal and Delaware revenue authorities. Management has analyzed the Fund’s tax positions taken on federal, state, and foreign tax returns for all open tax years and does not believe that there are any uncertain tax positions that require recognition of a tax liability.

Class allocations

The separate classes of shares offered by the Fund differ principally in distribution, shareholder servicing, and administration fees. Class specific expenses are charged directly to that share class. Investment income, common expenses, and realized and unrealized gains (losses) on investments are allocated daily to each class of shares based on the relative proportion of net assets of each class.

3. FAIR VALUATION MEASUREMENTS

Fair value measurements of investments are determined within a framework that has established a fair value hierarchy based upon the various data inputs utilized in determining the value of the Fund’s investments. The three-level hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1) and the lowest priority to significant unobservable inputs (Level 3). The Fund’s investments are classified within the fair value hierarchy based on the lowest level of input that is significant to the fair value measurement. The inputs are summarized into three broad levels as follows:

| | |

| Level 1 – | | quoted prices in active markets for identical securities |

Level 2 – | | other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, use of amortized cost, etc.) |

| Level 3 – | | significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

The inputs or methodologies used for valuing investments in securities are not necessarily an indication of the risk associated with investing in those securities.

At July 31, 2016, all of the Fund’s investments in securities were valued using Level 2 inputs since the primary inputs include the credit quality of the issuer and short-term interest rates (both of which are observable) in addition to the use of amortized cost.

The Fund recognizes transfers between levels within the fair value hierarchy at the end of the reporting period. At July 31, 2016, the Fund did not have any transfers into/out of Level 1, Level 2, or Level 3

4. TRANSACTIONS WITH AFFILIATES

Management fee

Funds Management, an indirect wholly owned subsidiary of Wells Fargo & Company (“Wells Fargo”), is the manager of the Fund and provides advisory and fund-level administrative services under an investment management agreement. Under the investment management agreement, Funds Management is responsible for, among other services, implementing the investment objectives and strategies of the Fund, supervising the subadviser, providing fund-level administrative services in connection with the Fund’s operations, and providing any other fund-level administrative services reasonably necessary for the operation of the Fund. As compensation for its services under the investment management agreement, Funds Management is entitled to receive an annual management fee starting at 0.15% and declining to 0.13% as the average daily net assets of the Fund increase. For the six months ended July 31, 2016, the management fee was equivalent to an annual rate of 0.15% of the Fund’s average daily net assets.

Funds Management has retained the services of a subadviser to provide daily portfolio management to the Fund. The fee for subadvisory services is borne by Funds Management. Wells Capital Management Incorporated, an affiliate of Funds Management and an indirect wholly owned subsidiary of Wells Fargo, is the subadviser to the Fund and is entitled to receive a fee from Funds Management at an annual rate starting at 0.05% and declining to 0.01% as the average daily net assets of the Fund increase.

Administration fees

Under a class-level administration agreement, Funds Management provides class-level administrative services to the Fund, which includes paying fees and expenses for services provided by the transfer agent, sub-transfer agents, omnibus account servicers and record-keepers. As compensation for its services under the class-level administration agreement, Funds Management receives an annual fee which is calculated based on the average daily net assets of each class as follows:

| | | | | |

| | | Class-level |

| | | administration fee |

Class A, Sweep Class | | | | 0.22 | % |

| |

Administrator Class | | | | 0.10 | |

| |

Premier Class1 | | | | 0.08 | |

| |

Service Class | | | | 0.12 | |

1 Effective April 1, 2016, Institutional Class was renamed Premier Class.

| | | | |

| Notes to financial statements (unaudited) | | Wells Fargo California Municipal Money Market Fund | | 19 |

Funds Management has contractually waived and/or reimbursed management and administration fees to the extent necessary to maintain certain net operating expense ratios for the Fund. Waiver of fees and/or reimbursement of expenses by Funds Management were made first from fund level expenses on a proportionate basis and then from class specific expenses. Funds Management has committed through May 31, 2017 to waive fees and/or reimburse expenses to the extent necessary to cap the Fund’s expenses at 0.65% for Class A shares, 0.30% for Administrator Class shares, 0.20% for Premier Class shares, 0.45% for Service Class shares, and 1.00% for Sweep Class shares. After this time, the cap may be increased or the commitment to maintain the cap may be terminated only with the approval of the Board of Trustees. During the six months ended July 31, 2016, Funds Management voluntarily waived additional expenses to maintain a positive yield.

Distribution fee

The Trust has adopted a distribution plan for Sweep Class shares of the Fund pursuant to Rule 12b-1 under the 1940 Act. A distribution fee is charged to Sweep Class shares and paid to Wells Fargo Funds Distributor, LLC, the principal underwriter, at an annual rate of 0.35% of the average daily net assets of Sweep Class shares.

Shareholder servicing fees

The Trust has entered into contracts with one or more shareholder servicing agents, whereby Class A, Service Class, and Sweep Class of the Fund are charged a fee at an annual rate of 0.25% of the respective average daily net assets of each class. Administrator Class is charged a fee at an annual rate of 0.10% of its average daily net assets.

A portion of these total shareholder servicing fees were paid to affiliates of Wells Fargo.

5. INDEMNIFICATION

Under the Trust’s organizational documents, the officers and Trustees have been granted certain indemnification rights against certain liabilities that may arise out of performance of their duties to the Trust. Additionally, in the normal course of business, the Trust may enter into contracts with service providers that contain a variety of indemnification clauses. The Trust’s maximum exposure under these arrangements is dependent on future claims that may be made against the Fund and, therefore, cannot be estimated.

6. SUBSEQUENT DISTRIBUTIONS

On August 31, 2016, the Fund declared distributions from short-term capital gains and long-term capital gains to shareholders of record on August 31, 2016. The per share amounts payable on August 31, 2016 were as follows:

| | | | | | | | |

| | | Short-term capital gains | | | Long-term capital gains | |

Class A | | $ | 0.000297665 | | | $ | 0.000074577 | |

Administrator Class | | | 0.000297665 | | | | 0.000074577 | |

Premier Class | | | 0.000297665 | | | | 0.000074577 | |

Service Class | | | 0.000297665 | | | | 0.000074577 | |

Sweep Class | | | 0.000297665 | | | | 0.000074577 | |

These distributions are not reflected in the accompanying financial statements. The final determination of the source of all distributions is subject to change and made after the Fund’s tax year-end.

7. SUBSEQUENT EVENT

Effective at the close of business on September 1, 2016, under a plan of liquidation and termination approved by the Board of Trustees, all shares of the Fund were automatically redeemed and the Fund was liquidated.

| | | | |

| 20 | | Wells Fargo California Municipal Money Market Fund | | Other information (unaudited) |

PROXY VOTING INFORMATION

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities is available, upon request, by calling 1-800-222-8222, visiting our website at wellsfargofunds.com, or visiting the SEC website at sec.gov. Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 is available on the Fund’s website at wellsfargofunds.com or by visiting the SEC website at sec.gov.

PORTFOLIO HOLDINGS INFORMATION

The complete portfolio holdings for the Fund are publicly available on the Fund’s website (wellsfargofunds.com) on a 1-day delayed basis. The Fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q, which is available by visiting the SEC website at sec.gov. In addition, the Fund’s Form N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC, and at regional offices in New York City, at 233 Broadway, and in Chicago, at 175 West Jackson Boulevard, Suite 900. Information about the Public Reference Room may be obtained by calling 1-800-SEC-0330.

| | | | |

| Other information (unaudited) | | Wells Fargo California Municipal Money Market Fund | | 21 |

BOARD OF TRUSTEES AND OFFICERS

Each of the Trustees and Officers1 listed in the table below acts in identical capacities for each fund in the Wells Fargo family of funds, which consists of 139 mutual funds comprising the Wells Fargo Funds Trust, Wells Fargo Variable Trust, Wells Fargo Master Trust and four closed-end funds (collectively the “Fund Complex”). This table should be read in conjunction with the Prospectus and the Statement of Additional Information2. The mailing address of each Trustee and Officer is 525 Market Street, 12th Floor, San Francisco, CA 94105. Each Trustee and Officer serves an indefinite term, however, each Trustee serves such term until reaching the mandatory retirement age established by the Trustees.

Independent Trustees

| | | | | | |

Name and year of birth | | Position held and length of service* | | Principal occupations during past five years or longer | | Current other public

company or

investment company

directorships |

| | | |

William R. Ebsworth (Born 1957) | | Trustee, since 2015 | | Retired. From 1984 to 2013, equities analyst, portfolio manager, research director and chief financial officer at Fidelity Management and Research Company in Boston, Tokyo, and Hong Kong and retired in 2013 as Chief Investment Officer of Fidelity Strategic Advisers, Inc. where he lead a team of investment professionals managing client assets. Prior thereto, Board member of Hong Kong Securities Clearing Co., Hong Kong Options Clearing Corp., the Thailand International Fund, Ltd., Fidelity Investments Life Insurance Company, and Empire Fidelity Investments Life Insurance Company. Mr. Ebsworth is a CFA® charterholder and an Adjunct Lecturer, Finance, at Babson College. | | Asset Allocation Trust |

| | | |

Jane A. Freeman (Born 1953) | | Trustee, since 2015 | | Retired. From 2012 to 2014 and 1999 to 2008, Chief Financial Officer of Scientific Learning Corporation. From 2008 to 2012, Ms. Freeman provided consulting services related to strategic business projects. Prior to 1999, Portfolio Manager at Rockefeller & Co. and Scudder, Stevens & Clark. Board member of the Harding Loevner Funds from 1996 to 2014, serving as both Lead Independent Director and chair of the Audit Committee. Board member of the Russell Exchange Traded Funds Trust from 2011 to 2012 and the chair of the Audit Committee. Ms. Freeman is Chair of Taproot Foundation (non-profit organization), a Board Member of Ruth Bancroft Garden (non-profit organization) and an inactive chartered financial analyst. | | Asset Allocation Trust |

| | | |

Peter G. Gordon (Born 1942) | | Trustee, since 1998; Chairman, since 2005 | | Co-Founder, Retired Chairman, President and CEO of Crystal Geyser Water Company. Trustee Emeritus, Colby College. | | Asset Allocation Trust |

| | | |

Isaiah Harris, Jr. (Born 1952) | | Trustee, since 2009 | | Retired. Chairman of the Board of CIGNA Corporation since 2009, and Director since 2005. From 2003 to 2011, Director of Deluxe Corporation. Prior thereto, President and CEO of BellSouth Advertising and Publishing Corp. from 2005 to 2007, President and CEO of BellSouth Enterprises from 2004 to 2005 and President of BellSouth Consumer Services from 2000 to 2003. Emeritus member of the Iowa State University Foundation Board of Governors. Emeritus Member of the Advisory Board of Iowa State University School of Business. Advisory Board Member, Palm Harbor Academy (charter school). Advisory Board Member, Child Evangelism Fellowship (non-profit). Mr. Harris is a certified public accountant (inactive status). | | CIGNA Corporation; Asset Allocation Trust |

| | | |

Judith M. Johnson (Born 1949) | | Trustee, since 2008; Audit Committee Chairman, since 2008 | | Retired. Prior thereto, Chief Executive Officer and Chief Investment Officer of Minneapolis Employees Retirement Fund from 1996 to 2008. Ms. Johnson is an attorney, certified public accountant and a certified managerial accountant. | | Asset Allocation Trust |

| | | |