UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-09253

Wells Fargo Funds Trust

(Exact name of registrant as specified in charter)

525 Market St., San Francisco, CA 94105

(Address of principal executive offices) (Zip code)

C. David Messman

Wells Fargo Funds Management, LLC

525 Market St., San Francisco, CA 94105

(Name and address of agent for service)

Registrant’s telephone number, including area code: 800-222-8222

Date of fiscal year end: September 30

Registrant is making a filing for 11 of its series:

Wells Fargo Diversified Capital Builder Fund, Wells Fargo Diversified Income Builder Fund, Wells Fargo Index Asset Allocation Fund, Wells Fargo International Bond Fund, Wells Fargo Strategic Income Fund, Wells Fargo C&B Mid Cap Value Fund, Wells Fargo Common Stock Fund, Wells Fargo Discovery Fund, Wells Fargo Enterprise Fund, Wells Fargo Opportunity Fund, and Wells Fargo Special Mid Cap Value Fund.

Date of reporting period: September 30, 2017

| ITEM 1. | REPORT TO STOCKHOLDERS |

Annual Report

September 30, 2017

Wells Fargo Diversified Capital Builder Fund

Reduce clutter. Save trees.

Sign up for electronic delivery of prospectuses and shareholder reports at wellsfargo.com/advantagedelivery

Contents

The views expressed and any forward-looking statements are as of September 30, 2017, unless otherwise noted, and are those of the Fund managers and/or Wells Fargo Funds Management, LLC. Discussions of individual securities, or the markets generally, or any Wells Fargo Fund are not intended as individual recommendations. Future events or results may vary significantly from those expressed in any forward-looking statements. The views expressed are subject to change at any time in response to changing circumstances in the market. Wells Fargo Funds Management, LLC and the Fund disclaim any obligation to publicly update or revise any views expressed or forward-looking statements.

NOT FDIC INSURED ◾ NO BANK GUARANTEE ◾ MAY LOSE VALUE

| | | | |

| 2 | | Wells Fargo Diversified Capital Builder Fund | | Letter to shareholders (unaudited) |

Andrew Owen

President

Wells Fargo Funds

Favorable economic news supported stocks, and interest rates moved higher.

Hiring remained strong, and business and consumer sentiment improved.

Dear Shareholder:

We are pleased to offer you this annual report for the Wells Fargo Diversified Capital Builder Fund for the 12-month period that ended September 30, 2017. Despite heightened market volatility at times, global stocks generally delivered double-digit results and bond markets had smaller but positive results as well. U.S. and international stocks returned 18.61% and 19.61%, respectively, for the 12-month period, as measured by the S&P 500 Index1 and the MSCI ACWI ex USA Index (Net),2 respectively; within fixed income, the Bloomberg Barclays U.S. Aggregate Bond Index3 returned 0.07% and the Bloomberg Barclays Municipal Bond Index4 returned 0.87% as interest rates rose from low levels.

Election results and central banks’ policies commanded investor attention as 2016 closed.

During the fourth quarter of 2016, investors appeared intent on the prospective outcomes of elections in the U.S. and central-bank actions globally. Following Donald Trump’s election victory, U.S. stocks rallied. Investors appeared optimistic that the new administration would pursue progrowth policies. Favorable economic news supported stocks, and interest rates moved higher. At their mid-December meeting, U.S. Federal Reserve (Fed) officials raised the target interest rate by a quarter percentage point to a range of 0.50% to 0.75%. The fourth quarter also saw the implementation of the U.S. Securities and Exchange Commission’s new rules for money market funds, which included floating net asset values (NAVs) as well as the possibility of liquidity fees and redemption gates for institutional prime and municipal money market funds. In the year leading up to money market fund reform implementation, nearly $1 trillion in assets moved from money market funds subject to floating NAVs into government money market funds, which continued to transact at a stable $1.00 NAV. Outside of the U.S., the prospects for faster U.S. growth appeared to trigger some acceleration in Europe.

Financial markets gained during the first two quarters of 2017 on positive economic data.

Stocks rallied globally through the first quarter of 2017, supported by signs of improvement in the U.S. and global economies. U.S. economic data released during the quarter reflected a healthy economy. Hiring remained strong, and business and consumer sentiment improved. In March, Fed officials raised their target interest rate by a quarter percentage point to a range of 0.75% to 1.00%. With the Fed’s target interest-rate increase, short-term bond yields rose during the quarter. Meanwhile, longer-term Treasury yields were little changed, leading to positive performance. Investment-grade and high-yield bonds benefited from strong demand. Municipal bond returns were positive in the quarter, helped by strong demand and constrained new-issue supply. Outside of the U.S., stocks in emerging markets generally outperformed stocks in the U.S. and international

| 1 | The S&P 500 Index consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market-value-weighted index with each stock’s weight in the index proportionate to its market value. You cannot invest directly in an index. |

| 2 | The Morgan Stanley Capital International (MSCI) All Country World Index (ACWI) ex USA Index (Net) is a free-float-adjusted market-capitalization-weighted index that is designed to measure the equity market performance of developed markets, excluding the United States and Canada. Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indexes or any securities or financial products. This report is not approved, reviewed, or produced by MSCI. You cannot invest directly in an index. |

| 3 | The Bloomberg Barclays U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment-grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, mortgage-backed securities (agency fixed-rate and hybrid adjustable-rate mortgage pass-throughs), asset-backed securities, and commercial mortgage-backed securities. You cannot invest directly in an index. |

| 4 | The Bloomberg Barclays Municipal Bond Index is an unmanaged index composed of long-term tax-exempt bonds with a minimum credit rating of Baa. You cannot invest directly in an index. |

| | | | | | |

| Letter to shareholders (unaudited) | | Wells Fargo Diversified Capital Builder Fund | | | 3 | |

developed markets because they benefited from both global economic growth and recent weakening in the U.S. dollar. Stocks in Asia, Europe, and Latin America also outperformed the U.S. market during the quarter.

Globally, stocks marked continued gains through the second quarter of 2017. Steady, albeit modest, economic growth both in the U.S. and abroad and generally favorable corporate earnings announcements supported higher valuations. U.S. inflation trended lower despite a continued decline in the unemployment rate. Ten-year U.S. Treasury yields declined, resulting in stronger prices for long-term bonds. As was widely expected, the Fed raised the target interest rate in June by a quarter percentage point to a range of 1.00% to 1.25%. In addition, the Fed indicated that it would begin to sell bonds accumulated on its balance sheet during quantitative easing programs conducted since 2008. Later in the third quarter, the Fed confirmed that the initiative to reduce the bonds that it holds likely would begin in October.

Volatility increased during the third quarter of 2017.

Early in July and again in August, volatility expectations increased and then receded—as measured by the CBOE VIX5—amid geopolitical tensions, particularly in Asia, and declining investor optimism following unsuccessful efforts to reform health care laws in the U.S. which suggested to some that President Trump and Congress would be unable to move forward with tax and regulatory reforms.

During the quarter, economic momentum increased in Europe; the European Central Bank held its rates steady at low levels and continued its quantitative easing bond-buying program, which is intended to spark economic activity. The Bank of England suggested it could hike interest rates in November, and the pound gained against other currencies. The Bank of Japan also maintained accommodative policies intended to support business activity and economic growth. In Germany, Angela Merkel was reelected chancellor; in Japan, Prime Minister Shinzo Abe called for snap elections as his popularity increased after North Korea’s aggressive program of missile launches. Both political developments were indicative of the type of political consistency in developed markets that reassure financial markets.

In emerging markets, many countries benefited from stronger currencies versus the U.S. dollar. In addition, commodity prices were on an upward trajectory, which benefited many companies that rely on natural resources for exports.

As the quarter closed, optimism returned as economic growth continued. The second-quarter gross domestic product measure was revised higher from 2.6% annualized to 3.0%. Consumer spending and residential and nonresidential investment increased. While inflation continued to trail the Fed’s targets, expectations remained for an additional short-term interest-rate hike before year-end.

| 5 | The Chicago Board Options Exchange Market Volatility Index (CBOE VIX) is a popular measure of the implied volatility of S&P 500 Index options. It represents one measure of the market’s expectation of stock market volatility over the next 30-day period. You cannot invest directly in an index. |

| | | | |

| 4 | | Wells Fargo Diversified Capital Builder Fund | | Letter to shareholders (unaudited) |

Don’t let short-term uncertainty derail long-term investment goals.

Periods of investment uncertainty can present challenges, but experience has taught us that maintaining long-term investment goals can be an effective way to plan for the future. To help you create a sound strategy based on your personal goals and risk tolerance, Wells Fargo Funds offers more than 100 mutual funds spanning a wide range of asset classes and investment styles. Although diversification cannot guarantee an investment profit or prevent losses, we believe it

can be an effective way to manage investment risk and potentially smooth out overall portfolio performance. We encourage investors to know their investments and to understand that appropriate levels of risk-taking may unlock opportunities.

Thank you for choosing to invest with Wells Fargo Funds. We appreciate your confidence in us and remain committed to helping you meet your financial needs.

Sincerely,

Andrew Owen

President

Wells Fargo Funds

For further information about your Fund, contact your investment professional, visit our website at wellsfargofunds.com, or call us directly at 1-800-222-8222. We are available 24 hours a day, 7 days a week.

This page is intentionally left blank.

| | | | |

| 6 | | Wells Fargo Diversified Capital Builder Fund | | Performance highlights (unaudited) |

Investment objective

The Fund seeks long-term total return, consisting of capital appreciation and current income.

Manager

Wells Fargo Funds Management, LLC

Subadviser

Wells Capital Management Incorporated

Portfolio manager

Margaret Patel

Average annual total returns (%) as of September 30, 20171

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Including sales charge | | | Excluding sales charge | | | Expense ratios2 (%) | |

| | | Inception date | | 1 year | | | 5 year | | | 10 year | | | 1 year | | | 5 year | | | 10 year | | | Gross | | | Net3 | |

| Class A (EKBAX) | | 1-20-1998 | | | 7.06 | | | | 12.41 | | | | 5.80 | | | | 13.62 | | | | 13.75 | | | | 6.42 | | | | 1.14 | | | | 1.14 | |

| Class C (EKBCX) | | 1-22-1998 | | | 11.85 | | | | 12.89 | | | | 5.63 | | | | 12.85 | | | | 12.89 | | | | 5.63 | | | | 1.89 | | | | 1.89 | |

| Administrator Class (EKBDX) | | 7-30-2010 | | | – | | | | – | | | | – | | | | 13.75 | | | | 13.97 | | | | 6.61 | | | | 1.06 | | | | 1.05 | |

| Institutional Class (EKBYX) | | 1-26-1998 | | | – | | | | – | | | | – | | | | 14.11 | | | | 14.19 | | | | 6.81 | | | | 0.81 | | | | 0.78 | |

| Diversified Capital Builder Blended Index4 | | – | | | – | | | | – | | | | – | | | | 16.13 | | | | 12.30 | | | | 7.68 | | | | – | | | | – | |

ICE BofAML U.S. Cash Pay High Yield Index5 | | – | | | – | | | | – | | | | – | | | | 9.06 | | | | 6.35 | | | | 7.65 | | | | – | | | | – | |

| Russell 1000® Index6 | | – | | | – | | | | – | | | | – | | | | 18.54 | | | | 14.27 | | | | 7.55 | | | | – | | | | – | |

Figures quoted represent past performance, which is no guarantee of future results, and do not reflect taxes that a shareholder may pay on fund distributions or the redemption of fund shares. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance shown without sales charges would be lower if sales charges were reflected. Current performance may be lower or higher than the performance data quoted, which assumes the reinvestment of dividends and capital gains. Current month-end performance is available on the Fund’s website, wellsfargofunds.com.

Index returns do not include transaction costs associated with buying and selling securities, any mutual fund fees or expenses, or any taxes. It is not possible to invest directly in an index.

For Class A shares, the maximum front-end sales charge is 5.75%. For Class C shares, the maximum contingent deferred sales charge is 1.00%. Performance including a contingent deferred sales charge assumes the sales charge for the corresponding time period. Administrator Class and Institutional Class shares are sold without a front-end sales charge or contingent deferred sales charge.

Balanced funds may invest in stocks and bonds. Stock values fluctuate in response to the activities of individual companies and general market and economic conditions. Bond values fluctuate in response to the financial condition of individual issuers, general market and economic conditions, and changes in interest rates. Changes in market conditions and government policies may lead to periods of heightened volatility in the bond market and reduced liquidity for certain bonds held by the Fund. In general, when interest rates rise, bond values fall and investors may lose principal value. Interest-rate changes and their impact on the Fund and its share price can be sudden and unpredictable. Certain investment strategies tend to increase the total risk of an investment (relative to the broader market). The Fund is exposed to foreign investment risk, high-yield securities risk, and smaller-company securities risk. Consult the Fund’s prospectus for additional information on these and other risks.

Please see footnotes on page 7.

| | | | | | |

| Performance highlights (unaudited) | | Wells Fargo Diversified Capital Builder Fund | | | 7 | |

|

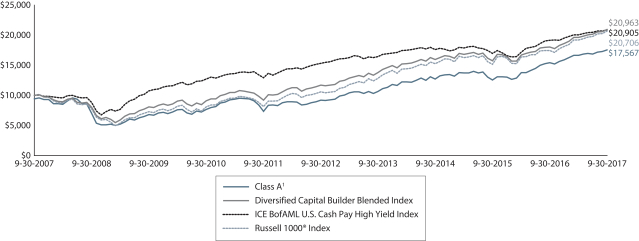

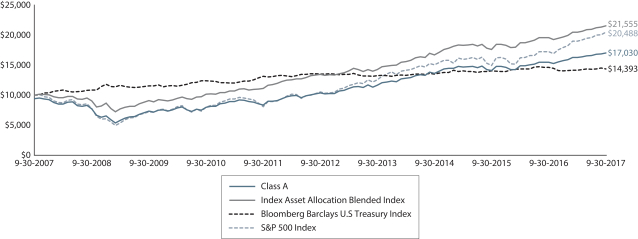

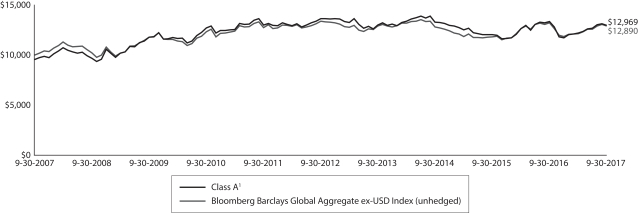

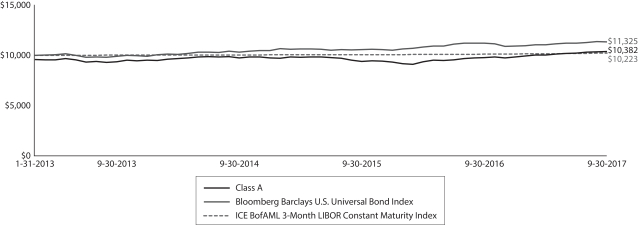

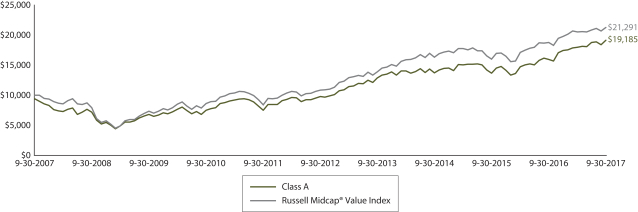

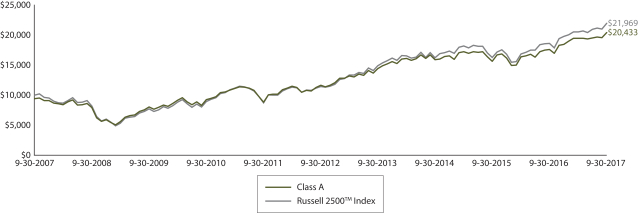

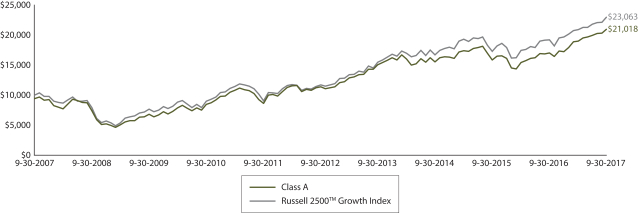

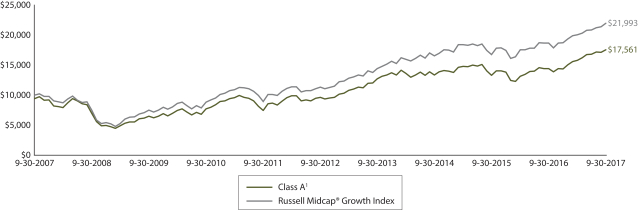

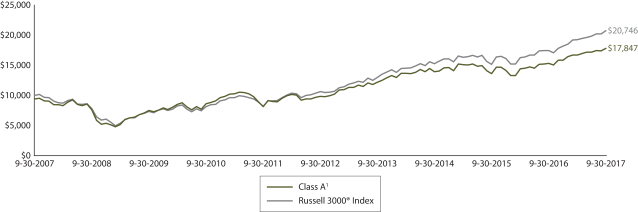

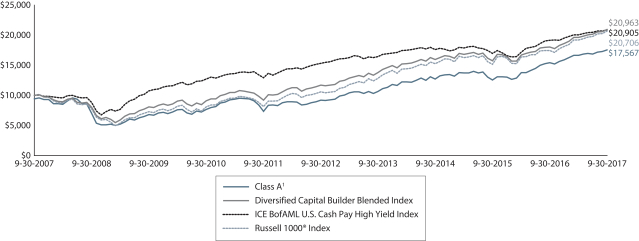

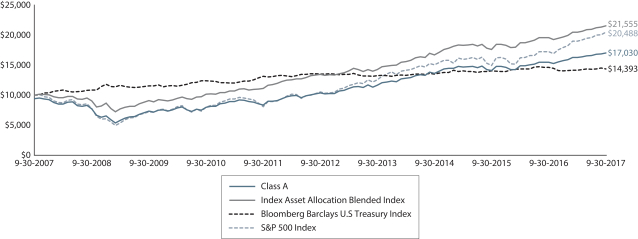

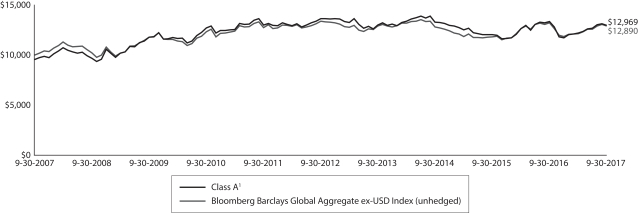

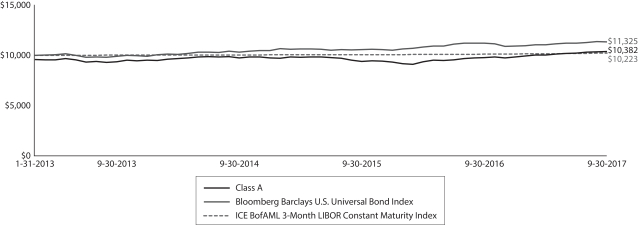

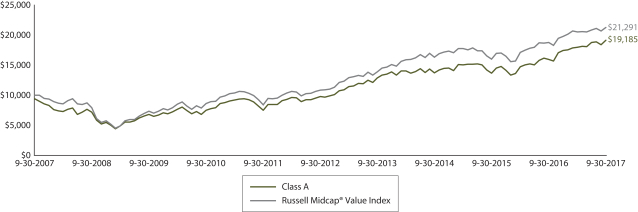

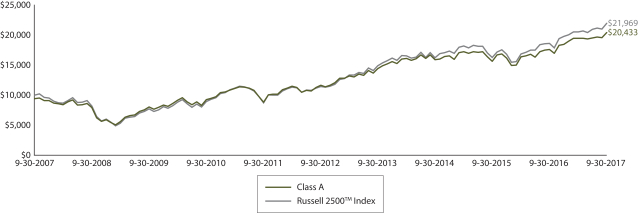

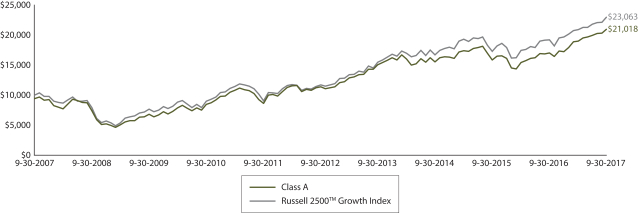

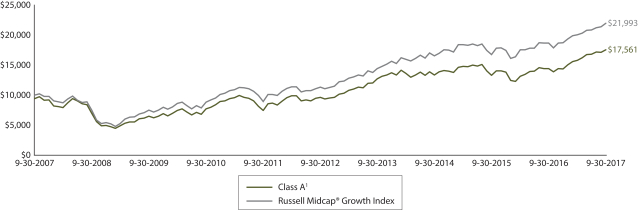

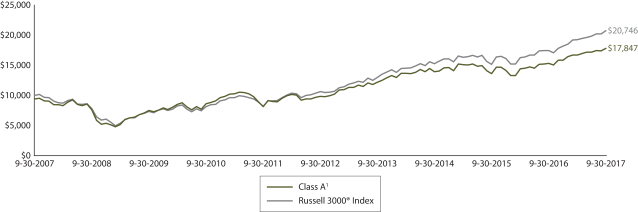

| Growth of $10,000 investment as of September 30, 20177 |

|

|

| 1 | Historical performance shown for Administrator Class shares prior to their inception reflects the performance of Institutional Class shares and has been adjusted to reflect the higher expenses applicable to Administrator Class shares. Historical performance shown for all classes of the Fund prior to July 12, 2010, is based on the performance of the Fund’s predecessor, Evergreen Diversified Capital Builder Fund. |

| 2 | Reflects the expense ratios as stated in the most recent prospectuses. The expense ratios shown are subject to change and may differ from the annualized expense ratios shown in the financial highlights of this report. |

| 3 | The manager has contractually committed through January 31, 2018, to waive fees and/or reimburse expenses to the extent necessary to cap the Fund’s Total Annual Fund Operating Expenses After Fee Waivers at 1.20% for Class A, 1.95% for Class C, 1.05% for Administrator Class, and 0.78% for Institutional Class. After this time, the cap may be increased or the commitment to maintain the cap may be terminated only with the approval of the Board of Trustees. Brokerage commissions, stamp duty fees, interest, taxes, acquired fund fees and expenses, and extraordinary expenses are excluded from the expense cap. Without this cap, the Fund’s returns would have been lower. The expense ratio paid by an investor is the net expense ratio or the Fund’s Total Annual Fund Operating Expenses After Fee Waivers, as stated in the prospectuses. |

| 4 | Source: Wells Fargo Funds Management, LLC. The Diversified Capital Builder Blended Index is composed of the Russell 1000® Index (75%) and the ICE BofAML U.S. Cash Pay High Yield Index (25%). You cannot invest directly in an index. |

| 5 | The ICE BofAML U.S. Cash Pay High Yield Index (formerly known as BofA Merrill Lynch High Yield U.S. Corporates, Cash Pay Index) is an unmanaged market index that provides a broad-based performance measure of the non-investment grade U.S. domestic bond index. You cannot invest directly in an index. |

| 6 | The Russell 1000® Index measures the performance of the 1,000 largest companies in the Russell 3000® Index, which represents approximately 92% of the total market capitalization of the Russell 3000® Index. You cannot invest directly in an index. |

| 7 | The chart compares the performance of Class A shares for the most recent ten years with the Diversified Capital Builder Blended Index, the ICE BofAML U.S. Cash Pay High Yield Index, and the Russell 1000® Index. The chart assumes a hypothetical investment of $10,000 in Class A shares and reflects all operating expenses and assumes the maximum initial sales charge of 5.75%. |

| 8 | The ten largest holdings, excluding cash and cash equivalents, are calculated based on the value of the investments divided by total net assets of the Fund. Holdings are subject to change and may have changed since the date specified. |

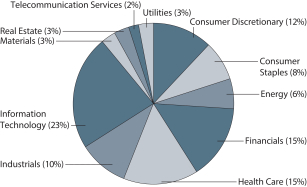

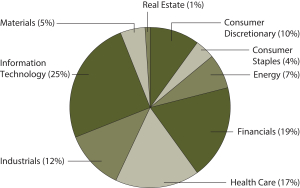

| 9 | Amounts are calculated based on the total long-term investments of the Fund. These amounts are subject to change and may have changed since the date specified. |

| * | This security was not held in the Fund at the end of the reporting period. |

| | | | |

| 8 | | Wells Fargo Diversified Capital Builder Fund | | Performance highlights (unaudited) |

MANAGER’S DISCUSSION

Fund highlights

| ∎ | | The Fund underperformed its benchmark, the Diversified Capital Builder Blended Index, for the 12-month period that ended September 30, 2017. |

| ∎ | | The Fund underperformed the benchmark because of a below-benchmark weighting to the financials sector; a relative overweight in the energy sector; and a relative underweight in the information technology (IT) sector, particularly of several large IT companies that make up a significant portion of the sector. |

| ∎ | | In the Fund’s bond portfolio, holdings outperformed the bond portion of the benchmark index, the ICE BofAML U.S. Cash Pay High Yield Index as the portfolio had somewhat longer-than-average duration compared with that bond index. |

Equities advanced with relatively low volatility during the period.

Prices for stocks held up better than high-yield bonds during the period. Equities advanced with relatively low volatility over the course of the period, reflecting continuing, though modest, economic growth. Bond performance was more mixed, with prices of both Treasury and investment-grade corporate bonds declining slightly as their yields rose; in contrast, the high-yield bond sector generally experienced modest price gains as yields for this sector declined.

In the stock market, stocks advanced steadily throughout the period, with only very small short-lived pullbacks before continuing to advance. Many investors were concerned that stock prices would decline if interest rates went up or if economic growth remained very modest or that companies would not be able to maintain their historically high profit margins and profit growth. However, these concerns did not negatively affect the stock market’s advance, as investors focused more on rising profits than they did on the relatively small rise in interest rates. In addition, it became clear that the Federal Reserve was sensitive to market concerns about rising rates and it would attempt to adjust interest rates in a gradual manner, which was judged as unlikely to affect economic growth and stock valuations adversely.

The Fund had outperformance relative to its equity benchmark in the health care, industrials, utilities, and real estate sectors. The Fund also benefitted from one takeover in the industrials sector. Equity detractors were primarily in the energy sector, as well as several health care and IT issues. In the Fund’s equity portfolio, outperformers in the IT sector included Broadcom Limited, Amphenol Corporation, and Adobe Systems Incorporated. In the industrials sector, several defense-focused companies contributed to performance, such as Orbital ATK, Incorporated, which received a takeover bid from Northrop Grumman Corporation*; Raytheon Company; and Huntington Ingalls Industries, Incorporated. Real estate companies contributing were Crown Castle International Corporation and Equinix, Incorporated. Detractors among stock holdings were primarily in the energy sector, including Kinder Morgan, Incorporated, and Plains All American Pipeline, L.P. Also underperforming were health care pharmaceuticals company Allergan plc and IT company QUALCOMM Incorporated.

In the bond market, once again fears of sharply higher interest rates proved overstated as the rate rise in the Treasury market proved modest. To illustrate, the yield to maturity of representative Treasury bonds maturing in 10 years yielded 1.60% at the beginning of the period and had a yield at the end of the period of 2.33%. Investment-grade corporate bonds reflected this gently rising rate trend. Bond prices and yields move in opposite directions.

| | | | |

| Ten largest holdings (%) as of September 30, 20178 | |

Microsoft Corporation | | | 4.27 | |

Broadcom Limited | | | 3.61 | |

Kinder Morgan Incorporated | | | 3.31 | |

Amphenol Corporation Class A | | | 3.24 | |

Alphabet Incorporated Class A | | | 3.10 | |

Leidos Holdings Incorporated | | | 2.89 | |

Adobe Systems Incorporated | | | 2.69 | |

LyondellBasell Industries NV Class A | | | 2.68 | |

Andeavor Logistics LP | | | 2.63 | |

Allergan plc | | | 2.61 | |

High-yield bonds, which are somewhat more sensitive to prospects of future economic growth than are investment-grade bonds, had declines in yield and small increases in prices, with the average yield to maturity declining from 6.25% at the beginning of the period to 5.43% at the end of the period. High-yield bonds benefited not only from their wide yield spread over comparable maturity Treasury bonds—from a difference of about 510 basis points (bps; 100 bps equal 1.00%) in excess of Treasury rates at the beginning of the period to 366 bps at period-end—but also from diminished concerns about the potential for sharp rises in Treasury rates and default rates. Investors’ increased risk appetites caused high-yield bond yields to decline in the face of modestly rising Treasury rates.

Please see footnotes on page 7.

| | | | | | |

| Performance highlights (unaudited) | | Wells Fargo Diversified Capital Builder Fund | | | 9 | |

|

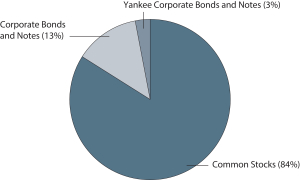

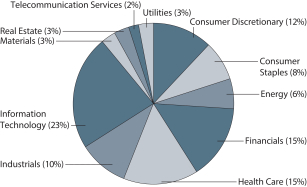

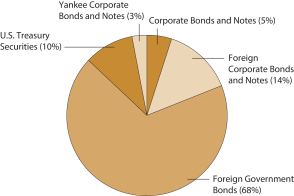

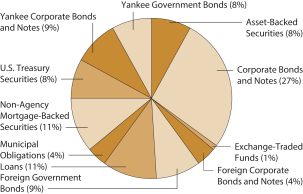

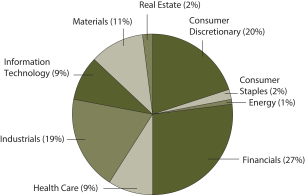

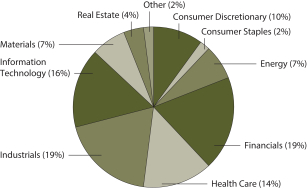

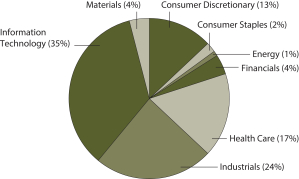

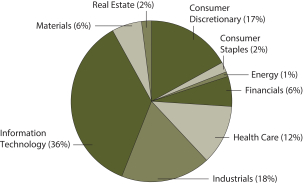

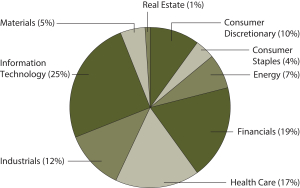

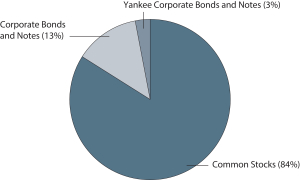

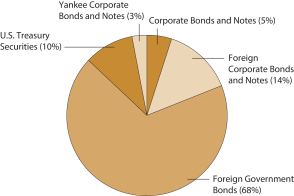

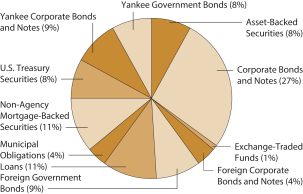

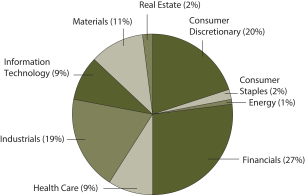

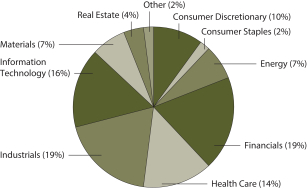

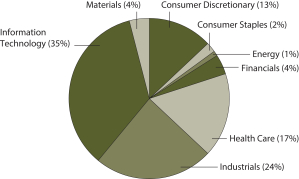

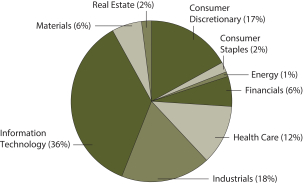

| Portfolio allocation as of September 30, 20179 |

|

|

While intermediate Treasury yields slightly increased in the fiscal year, resulting in drops in prices, yields for high-yield bonds generally declined over the same period, resulting in price gains. Because of our somewhat longer duration, many of our holdings benefited from the drops in yield, allowing prices to rise somewhat. Relative underperformers in the bond portfolio included several energy bonds and select industrials and specialty pharmaceutical bonds. Bonds that outperformed included Tronox Finance plc, Rayonier Advanced Materials Incorporated, and Koppers Holdings Incorporated* in the basic materials sector as well as IT companies Micron Technology, Incorporated, and Seagate Technology plc. Underperformers in the bond

portfolio included energy companies Plains All American Pipeline, L.P.; Tennessee Gas Pipeline Company, LLC; and several general industrials companies, such as TransDigm Group Incorporated.

Our outlook remains one of cautious optimism.

While the pace of economic growth is modest compared with previous recoveries after recessions, the current expansion is one of the longest. We believe the intrinsic dynamism, creativity, and basis strengths of the U.S. economy should provide opportunities for the stock market over the next year. Slow but steady gains in employment should help stimulate demand for goods and services. Furthermore, the expansion of low-cost shale gas and petroleum liquids should continue to provide a boon to both businesses and consumers, improving the competitive positions of U.S. companies and offering some cost relief to consumers for utility and fuel costs.

We are somewhat cautious that the high-yield bond market might not offer the relative outperformance we have seen over the past few years. However, we believe that by concentrating our holdings in companies with above-average credit quality, our holdings may provide enough income above that of risk-free alternatives to compensate for their credit risk.

Please see footnotes on page 7.

| | | | |

| 10 | | Wells Fargo Diversified Capital Builder Fund | | Fund expenses (unaudited) |

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and contingent deferred sales charges (if any) on redemptions and (2) ongoing costs, including management fees, distribution (12b-1) and/or shareholder servicing fees, and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the six-month period and held for the entire period from April 1, 2017 to September 30, 2017.

Actual expenses

The “Actual” line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the “Actual” line under the heading entitled “Expenses paid during period” for your applicable class of shares to estimate the expenses you paid on your account during this period.

Hypothetical example for comparison purposes

The “Hypothetical” line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) and contingent deferred sales charges. Therefore, the “Hypothetical” line of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | |

| | | Beginning

account value

4-1-2017 | | | Ending

account value

9-30-2017 | | | Expenses

paid during

the period¹ | | | Annualized net

expense ratio | |

Class A | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,052.67 | | | $ | 5.73 | | | | 1.11 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,019.49 | | | $ | 5.64 | | | | 1.11 | % |

Class C | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,049.85 | | | $ | 9.58 | | | | 1.86 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,015.72 | | | $ | 9.42 | | | | 1.86 | % |

Administrator Class | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,054.75 | | | $ | 5.30 | | | | 1.03 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,019.91 | | | $ | 5.21 | | | | 1.03 | % |

Institutional Class | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,056.04 | | | $ | 4.02 | | | | 0.78 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,021.16 | | | $ | 3.95 | | | | 0.78 | % |

| 1 | Expenses paid is equal to the annualized net expense ratio of each class multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year divided by the number of days in the fiscal year (to reflect the one-half-year period). |

| | | | | | |

| Portfolio of investments—September 30, 2017 | | Wells Fargo Diversified Capital Builder Fund | | | 11 | |

| | | | | | | | | | | | | | | | |

| Security name | | | | | | | | Shares | | | Value | |

| | | | |

Common Stocks: 83.11% | | | | | | | | | | | | | | | | |

| | | | |

Consumer Discretionary: 1.27% | | | | | | | | | | | | | | | | |

| | | | |

| Household Durables: 1.27% | | | | | | | | | | | | | | | | |

Leggett & Platt Incorporated | | | | | | | | | | | 250,000 | | | $ | 11,932,500 | |

| | | | | | | | | | | | | | | | |

| | | | |

Consumer Staples: 1.46% | | | | | | | | | | | | | | | | |

| | | | |

| Food & Staples Retailing: 0.63% | | | | | | | | | | | | | | | | |

CVS Health Corporation | | | | | | | | | | | 60,000 | | | | 4,879,200 | |

Sysco Corporation | | | | | | | | | | | 20,000 | | | | 1,079,000 | |

| | | | |

| | | | | | | | | | | | | | | 5,958,200 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Food Products: 0.83% | | | | | | | | | | | | | | | | |

ConAgra Foods Incorporated | | | | | | | | | | | 120,000 | | | | 4,048,800 | |

Lamb Weston Holdings Incorporated | | | | | | | | | | | 80,001 | | | | 3,751,247 | |

| | | | |

| | | | | | | | | | | | | | | 7,800,047 | |

| | | | | | | | | | | | | | | | |

| | | | |

Energy: 12.98% | | | | | | | | | | | | | | | | |

| | | | |

| Oil, Gas & Consumable Fuels: 12.98% | | | | | | | | | | | | | | | | |

Andeavor Logistics LP | | | | | | | | | | | 495,000 | | | | 24,779,700 | |

EOG Resources Incorporated | | | | | | | | | | | 35,000 | | | | 3,385,900 | |

EQT Corporation | | | | | | | | | | | 100,000 | | | | 6,524,000 | |

Kinder Morgan Incorporated | | | | | | | | | | | 1,625,000 | | | | 31,167,500 | |

ONEOK Incorporated | | | | | | | | | | | 150,000 | | | | 8,311,500 | |

Plains All American Pipeline LP | | | | | | | | | | | 1,120,000 | | | | 23,732,800 | |

The Williams Companies Incorporated | | | | | | | | | | | 810,000 | | | | 24,308,100 | |

| | | | |

| | | | | | | | | | | | | | | 122,209,500 | |

| | | | | | | | | | | | | | | | |

| | | | |

Health Care: 13.54% | | | | | | | | | | | | | | | | |

| | | | |

| Health Care Equipment & Supplies: 6.98% | | | | | | | | | | | | | | | | |

Abbott Laboratories | | | | | | | | | | | 380,000 | | | | 20,276,800 | |

Becton Dickinson & Company | | | | | | | | | | | 120,000 | | | | 23,514,000 | |

C.R. Bard Incorporated | | | | | | | | | | | 5,000 | | | | 1,602,500 | |

Teleflex Incorporated | | | | | | | | | | | 80,000 | | | | 19,357,600 | |

West Pharmaceutical Services Incorporated | | | | | | | | | | | 10,000 | | | | 962,600 | |

| | | | |

| | | | | | | | | | | | | | | 65,713,500 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Life Sciences Tools & Services: 3.72% | | | | | | | | | | | | | | | | |

Thermo Fisher Scientific Incorporated | | | | | | | | | | | 100,000 | | | | 18,920,000 | |

Waters Corporation † | | | | | | | | | | | 90,000 | | | | 16,156,800 | |

| | | | |

| | | | | | | | | | | | | | | 35,076,800 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Pharmaceuticals: 2.84% | | | | | | | | | | | | | | | | |

Allergan plc | | | | | | | | | | | 120,000 | | | | 24,594,000 | |

Eli Lilly & Company | | | | | | | | | | | 25,000 | | | | 2,138,500 | |

| | | | |

| | | | | | | | | | | | | | | 26,732,500 | |

| | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 12 | | Wells Fargo Diversified Capital Builder Fund | | Portfolio of investments—September 30, 2017 |

| | | | | | | | | | | | | | | | |

| Security name | | | | | | | | Shares | | | Value | |

| | | | |

Industrials: 12.61% | | | | | | | | | | | | | | | | |

| | | | |

| Aerospace & Defense: 6.66% | | | | | | | | | | | | | | | | |

Curtiss-Wright Corporation | | | | | | | | | | | 130,000 | | | $ | 13,590,200 | |

Huntington Ingalls Industries Incorporated | | | | | | | | | | | 65,000 | | | | 14,718,600 | |

Lockheed Martin Corporation | | | | | | | | | | | 29,000 | | | | 8,998,410 | |

Orbital ATK Incorporated | | | | | | | | | | | 30,000 | | | | 3,994,800 | |

Raytheon Company | | | | | | | | | | | 115,000 | | | | 21,456,700 | |

| | | | |

| | | | | | | | | | | | | | | 62,758,710 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Building Products: 0.46% | | | | | | | | | | | | | | | | |

Apogee Enterprises Incorporated | | | | | | | | | | | 90,000 | | | | 4,343,400 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Electrical Equipment: 1.13% | | | | | | | | | | | | | | | | |

AMETEK Incorporated | | | | | | | | | | | 80,000 | | | | 5,283,200 | |

Eaton Corporation plc | | | | | | | | | | | 70,000 | | | | 5,375,300 | |

| | | | |

| | | | | | | | | | | | | | | 10,658,500 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Industrial Conglomerates: 1.12% | | | | | | | | | | | | | | | | |

Honeywell International Incorporated | | | | | | | | | | | 40,000 | | | | 5,669,600 | |

Roper Industries Incorporated | | | | | | | | | | | 20,000 | | | | 4,868,000 | |

| | | | |

| | | | | | | | | | | | | | | 10,537,600 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Machinery: 3.24% | | | | | | | | | | | | | | | | |

Cummins Incorporated | | | | | | | | | | | 10,000 | | | | 1,680,300 | |

IDEX Corporation | | | | | | | | | | | 95,000 | | | | 11,539,650 | |

John Bean Technologies Corporation | | | | | | | | | | | 130,000 | | | | 13,143,000 | |

Oshkosh Corporation | | | | | | | | | | | 50,000 | | | | 4,127,000 | |

| | | | |

| | | | | | | | | | | | | | | 30,489,950 | |

| | | | | | | | | | | | | | | | |

| | | | |

Information Technology: 31.46% | | | | | | | | | | | | | | | | |

| | | | |

| Communications Equipment: 0.04% | | | | | | | | | | | | | | | | |

CommScope Holdings Incorporated † | | | | | | | | | | | 10,000 | | | | 332,100 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Electronic Equipment, Instruments & Components: 5.90% | | | | | | | | | | | | | | | | |

Amphenol Corporation Class A | | | | | | | | | | | 360,000 | | | | 30,470,400 | |

Corning Incorporated | | | | | | | | | | | 670,000 | | | | 20,046,400 | |

FLIR Systems Incorporated | | | | | | | | | | | 130,000 | | | | 5,058,300 | |

| | | | |

| | | | | | | | | | | | | | | 55,575,100 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Internet Software & Services: 3.10% | | | | | | | | | | | | | | | | |

Alphabet Incorporated Class A † | | | | | | | | | | | 30,000 | | | | 29,211,600 | |

| | | | | | | | | | | | | | | | |

| | | | |

| IT Services: 2.89% | | | | | | | | | | | | | | | | |

Leidos Holdings Incorporated | | | | | | | | | | | 460,000 | | | | 27,241,200 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Semiconductors & Semiconductor Equipment: 10.87% | | | | | | | | | | | | | | | | |

Broadcom Limited | | | | | | | | | | | 140,000 | | | | 33,955,600 | |

Cypress Semiconductor Corporation « | | | | | | | | | | | 600,000 | | | | 9,012,000 | |

Microsemi Corporation † | | | | | | | | | | | 290,000 | | | | 14,929,200 | |

The accompanying notes are an integral part of these financial statements.

| | | | | | |

| Portfolio of investments—September 30, 2017 | | Wells Fargo Diversified Capital Builder Fund | | | 13 | |

| | | | | | | | | | | | | | | | |

| Security name | | | | | | | | Shares | | | Value | |

| | | | |

| Semiconductors & Semiconductor Equipment (continued) | | | | | | | | | | | | | | | | |

QUALCOMM Incorporated | | | | | | | | | | | 70,000 | | | $ | 3,628,800 | |

Texas Instruments Incorporated | | | | | | | | | | | 145,000 | | | | 12,997,800 | |

Versum Materials Incorporated | | | | | | | | | | | 170,000 | | | | 6,599,400 | |

Xilinx Incorporated | | | | | | | | | | | 300,000 | | | | 21,249,000 | |

| | | | |

| | | | | | | | | | | | | | | 102,371,800 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Software: 7.74% | | | | | | | | | | | | | | | | |

Adobe Systems Incorporated † | | | | | | | | | | | 170,000 | | | | 25,360,600 | |

Microsoft Corporation | | | | | | | | | | | 540,000 | | | | 40,224,600 | |

Synopsys Incorporated † | | | | | | | | | | | 90,000 | | | | 7,247,700 | |

| | | | |

| | | | | | | | | | | | | | | 72,832,900 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Technology Hardware, Storage & Peripherals: 0.92% | | | | | | | | | | | | | | | | |

Western Digital Corporation | | | | | | | | | | | 100,000 | | | | 8,640,000 | |

| | | | | | | | | | | | | | | | |

| | | | |

Materials: 6.16% | | | | | | | | | | | | | | | | |

| | | | |

| Chemicals: 4.84% | | | | | | | | | | | | | | | | |

Ashland Global Holdings Incorporated | | | | | | | | | | | 120,000 | | | | 7,846,800 | |

Celanese Corporation Series A | | | | | | | | | | | 45,000 | | | | 4,692,150 | |

DowDuPont Incorporated | | | | | | | | | | | 100,000 | | | | 6,923,000 | |

LyondellBasell Industries NV Class A | | | | | | | | | | | 255,000 | | | | 25,257,750 | |

Olin Corporation | | | | | | | | | | | 25,000 | | | | 856,250 | |

| | | | |

| | | | | | | | | | | | | | | 45,575,950 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Containers & Packaging: 1.32% | | | | | | | | | | | | | | | | |

Sealed Air Corporation | | | | | | | | | | | 290,000 | | | | 12,388,800 | |

| | | | | | | | | | | | | | | | |

| | | | |

Real Estate: 1.85% | | | | | | | | | | | | | | | | |

| | | | |

| Equity REITs: 1.85% | | | | | | | | | | | | | | | | |

Crown Castle International Corporation | | | | | | | | | | | 20,000 | | | | 1,999,600 | |

Equinix Incorporated | | | | | | | | | | | 5,000 | | | | 2,231,500 | |

Sabra Health Care REIT Incorporated | | | | | | | | | | | 250,000 | | | | 5,485,000 | |

Saul Centers Incorporated | | | | | | | | | | | 125,000 | | | | 7,738,750 | |

| | | | |

| | | | | | | | | | | | | | | 17,454,850 | |

| | | | | | | | | | | | | | | | |

| | | | |

Utilities: 1.78% | | | | | | | | | | | | | | | | |

| | | | |

| Gas Utilities: 1.78% | | | | | | | | | | | | | | | | |

Atmos Energy Corporation | | | | | | | | | | | 200,000 | | | | 16,768,000 | |

| | | | | | | | | | | | | | | | |

| | | | |

Total Common Stocks (Cost $666,973,093) | | | | | | | | | | | | | | | 782,603,507 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | Interest rate | | | Maturity date | | | Principal | | | | |

Corporate Bonds and Notes: 13.30% | | | | | | | | | | | | | | | | |

| | | | |

Consumer Discretionary: 0.64% | | | | | | | | | | | | | | | | |

| | | | |

| Auto Components: 0.06% | | | | | | | | | | | | | | | | |

Dana Holding Corporation | | | 5.50 | % | | | 12-15-2024 | | | $ | 500,000 | | | | 525,000 | |

| | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 14 | | Wells Fargo Diversified Capital Builder Fund | | Portfolio of investments—September 30, 2017 |

| | | | | | | | | | | | | | | | |

| Security name | | Interest rate | | | Maturity date | | | Principal | | | Value | |

| | | | |

| Hotels, Restaurants & Leisure: 0.22% | | | | | | | | | | | | | | | | |

Speedway Motorsports Incorporated | | | 5.13 | % | | | 2-1-2023 | | | $ | 2,000,000 | | | $ | 2,065,000 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Media: 0.31% | | | | | | | | | | | | | | | | |

McGraw-Hill Global Education Holdings LLC 144A« | | | 7.88 | | | | 5-15-2024 | | | | 3,000,000 | | | | 2,958,750 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Specialty Retail: 0.05% | | | | | | | | | | | | | | | | |

Group 1 Automotive Incorporated | | | 5.00 | | | | 6-1-2022 | | | | 500,000 | | | | 518,125 | |

| | | | | | | | | | | | | | | | |

| | | | |

Consumer Staples: 0.11% | | | | | | | | | | | | | | | | |

| | | | |

| Food Products: 0.11% | | | | | | | | | | | | | | | | |

Lamb Weston Holdings Incorporated 144A | | | 4.63 | | | | 11-1-2024 | | | | 1,000,000 | | | | 1,042,500 | |

| | | | | | | | | | | | | | | | |

| | | | |

Energy: 0.72% | | | | | | | | | | | | | | | | |

| | | | |

| Oil, Gas & Consumable Fuels: 0.72% | | | | | | | | | | | | | | | | |

Plains All American Pipeline LP | | | 4.65 | | | | 10-15-2025 | | | | 6,000,000 | | | | 6,176,773 | |

Tennessee Gas Pipeline Company | | | 7.00 | | | | 3-15-2027 | | | | 534,000 | | | | 632,184 | |

| | | | |

| | | | | | | | | | | | | | | 6,808,957 | |

| | | | | | | | | | | | | | | | |

| | | | |

Health Care: 2.61% | | | | | | | | | | | | | | | | |

| | | | |

| Health Care Equipment & Supplies: 0.28% | | | | | | | | | | | | | | | | |

Teleflex Incorporated | | | 4.88 | | | | 6-1-2026 | | | | 2,500,000 | | | | 2,593,750 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Health Care Providers & Services: 2.15% | | | | | | | | | | | | | | | | |

AMN Healthcare Incorporated 144A | | | 5.13 | | | | 10-1-2024 | | | | 10,512,000 | | | | 10,893,060 | |

DaVita HealthCare Partners Incorporated | | | 5.13 | | | | 7-15-2024 | | | | 1,000,000 | | | | 995,625 | |

HealthSouth Corporation | | | 5.13 | | | | 3-15-2023 | | | | 1,000,000 | | | | 1,033,450 | |

West Street Merger Sub Incorporated 144A | | | 6.38 | | | | 9-1-2025 | | | | 7,400,000 | | | | 7,363,000 | |

| | | | |

| | | | | | | | | | | | | | | 20,285,135 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Health Care Technology: 0.18% | | | | | | | | | | | | | | | | |

Quintiles IMS Holdings Incorporated 144A | | | 4.88 | | | | 5-15-2023 | | | | 1,600,000 | | | | 1,664,000 | |

| | | | | | | | | | | | | | | | |

| | | | |

Industrials: 2.04% | | | | | | | | | | | | | | | | |

| | | | |

| Aerospace & Defense: 1.31% | | | | | | | | | | | | | | | | |

Huntington Ingalls Industries Incorporated 144A | | | 5.00 | | | | 11-15-2025 | | | | 5,200,000 | | | | 5,616,000 | |

Moog Incorporated 144A | | | 5.25 | | | | 12-1-2022 | | | | 1,500,000 | | | | 1,568,985 | |

TransDigm Group Incorporated | | | 6.38 | | | | 6-15-2026 | | | | 3,500,000 | | | | 3,585,330 | |

TransDigm Group Incorporated | | | 6.50 | | | | 5-15-2025 | | | | 1,500,000 | | | | 1,545,000 | |

| | | | |

| | | | | | | | | | | | | | | 12,315,315 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Commercial Services & Supplies: 0.17% | | | | | | | | | | | | | | | | |

Acco Brands Corporation 144A | | | 5.25 | | | | 12-15-2024 | | | | 1,500,000 | | | | 1,556,250 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Machinery: 0.34% | | | | | | | | | | | | | | | | |

Oshkosh Corporation | | | 5.38 | | | | 3-1-2025 | | | | 2,000,000 | | | | 2,120,000 | |

SPX FLOW Incorporated 144A | | | 5.88 | | | | 8-15-2026 | | | | 1,000,000 | | | | 1,055,000 | |

| | | | |

| | | | | | | | | | | | | | | 3,175,000 | |

| | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| | | | | | |

| Portfolio of investments—September 30, 2017 | | Wells Fargo Diversified Capital Builder Fund | | | 15 | |

| | | | | | | | | | | | | | | | |

| Security name | | Interest rate | | | Maturity date | | | Principal | | | Value | |

| | | | |

| Trading Companies & Distributors: 0.22% | | | | | | | | | | | | | | | | |

Wesco Distribution Incorporated | | | 5.38 | % | | | 6-15-2024 | | | $ | 2,000,000 | | | $ | 2,110,000 | |

| | | | | | | | | | | | | | | | |

| | | | |

Information Technology: 3.64% | | | | | | | | | | | | | | | | |

| | | | |

| Communications Equipment: 0.67% | | | | | | | | | | | | | | | | |

CommScope Incorporated 144A | | | 5.50 | | | | 6-15-2024 | | | | 6,000,000 | | | | 6,277,500 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Electronic Equipment, Instruments & Components: 1.57% | | | | | | | | | | | | | | | | |

Belden Incorporated 144A | | | 5.25 | | | | 7-15-2024 | | | | 3,000,000 | | | | 3,127,500 | |

TTM Technologies Incorporated 144A | | | 5.63 | | | | 10-1-2025 | | | | 11,505,000 | | | | 11,641,620 | |

| | | | |

| | | | | | | | | | | | | | | 14,769,120 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Semiconductors & Semiconductor Equipment: 0.50% | | | | | | | | | | | | | | | | |

Micron Technology Incorporated 144A | | | 5.25 | | | | 8-1-2023 | | | | 1,500,000 | | | | 1,564,500 | |

Versum Materials Incorporated 144A | | | 5.50 | | | | 9-30-2024 | | | | 3,000,000 | | | | 3,180,000 | |

| | | | |

| | | | | | | | | | | | | | | 4,744,500 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Software: 0.79% | | | | | | | | | | | | | | | | |

Nuance Communications Company | | | 6.00 | | | | 7-1-2024 | | | | 2,000,000 | | | | 2,165,600 | |

Symantec Corporation 144A | | | 5.00 | | | | 4-15-2025 | | | | 5,000,000 | | | | 5,228,150 | |

| | | | |

| | | | | | | | | | | | | | | 7,393,750 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Technology Hardware, Storage & Peripherals: 0.11% | | | | | | | | | | | | | | | | |

Diebold Incorporated | | | 8.50 | | | | 4-15-2024 | | | | 1,000,000 | | | | 1,084,020 | |

| | | | | | | | | | | | | | | | |

| | | | |

Materials: 3.15% | | | | | | | | | | | | | | | | |

| | | | |

| Chemicals: 2.80% | | | | | | | | | | | | | | | | |

A. Schulman Incorporated | | | 6.88 | | | | 6-1-2023 | | | | 2,375,000 | | | | 2,464,063 | |

Koppers Incorporated 144A | | | 6.00 | | | | 2-15-2025 | | | | 8,190,000 | | | | 8,804,250 | |

Olin Corporation | | | 5.50 | | | | 8-15-2022 | | | | 6,000,000 | | | | 6,465,000 | |

Rayonier Advanced Materials Products Incorporated 144A | | | 5.50 | | | | 6-1-2024 | | | | 6,835,000 | | | | 6,621,406 | |

Valvoline Incorporated 144A | | | 4.38 | | | | 8-15-2025 | | | | 2,000,000 | | | | 2,035,200 | |

| | | | |

| | | | | | | | | | | | | | | 26,389,919 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Containers & Packaging: 0.35% | | | | | | | | | | | | | | | | |

Berry Plastics Corporation | | | 5.13 | | | | 7-15-2023 | | | | 3,120,000 | | | | 3,260,400 | |

| | | | | | | | | | | | | | | | |

| | | | |

Real Estate: 0.39% | | | | | | | | | | | | | | | | |

| | | | |

| Equity REITs: 0.39% | | | | | | | | | | | | | | | | |

Equinix Incorporated | | | 5.75 | | | | 1-1-2025 | | | | 1,000,000 | | | | 1,076,250 | |

Iron Mountain Incorporated 144A | | | 5.38 | | | | 6-1-2026 | | | | 2,000,000 | | | | 2,095,000 | |

Iron Mountain Incorporated | | | 5.75 | | | | 8-15-2024 | | | | 500,000 | | | | 515,625 | |

| | | | |

| | | | | | | | | | | | | | | 3,686,875 | |

| | | | | | | | | | | | | | | | |

| | | | |

Total Corporate Bonds and Notes (Cost $121,459,495) | | | | | | | | | | | | | | | 125,223,866 | |

| | | | | | | | | | | | | | | | |

| | | | |

Yankee Corporate Bonds and Notes: 2.72% | | | | | | | | | | | | | | | | |

| | | | |

Financials: 0.55% | | | | | | | | | | | | | | | | |

| | | | |

| Diversified Financial Services: 0.55% | | | | | | | | | | | | | | | | |

Tronox Finance plc 144A | | | 5.75 | | | | 10-1-2025 | | | | 5,000,000 | | | | 5,125,000 | |

| | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 16 | | Wells Fargo Diversified Capital Builder Fund | | Portfolio of investments—September 30, 2017 |

| | | | | | | | | | | | | | | | |

| Security name | | Interest rate | | | Maturity date | | | Principal | | | Value | |

| | | | |

Health Care: 0.29% | | | | | | | | | | | | | | | | |

| | | | |

| Pharmaceuticals: 0.29% | | | | | | | | | | | | | | | | |

Mallinckrodt plc 144A« | | | 5.50 | % | | | 4-15-2025 | | | $ | 3,000,000 | | | $ | 2,700,000 | |

| | | | | | | | | | | | | | | | |

| | | | |

Industrials: 0.22% | | | | | | | | | | | | | | | | |

| | | | |

| Electrical Equipment: 0.22% | | | | | | | | | | | | | | | | |

Sensata Technologies BV 144A | | | 4.88 | | | | 10-15-2023 | | | | 2,000,000 | | | | 2,102,500 | |

| | | | | | | | | | | | | | | | |

| | | | |

Information Technology: 1.66% | | | | | | | | | | | | | | | | |

| | | | |

| Technology Hardware, Storage & Peripherals: 1.66% | | | | | | | | | | | | | | | | |

Seagate HDD | | | 4.75 | | | | 6-1-2023 | | | | 9,500,000 | | | | 9,628,630 | |

Seagate HDD | | | 4.88 | | | | 6-1-2027 | | | | 6,396,000 | | | | 6,028,466 | |

| | | | |

| | | | | | | | | | | | | | | 15,657,096 | |

| | | | | | | | | | | | | | | | |

| | | | |

Total Yankee Corporate Bonds and Notes (Cost $24,461,887) | | | | | | | | | | | | | | | 25,584,596 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | Yield | | | | | | Shares | | | | |

| Short-Term Investments: 1.53% | | | | | | | | | | | | | | | | |

| | | | |

| Investment Companies: 1.53% | | | | | | | | | | | | | | | | |

Securities Lending Cash Investment LLC (l)(r)(u) | | | 1.25 | | | | | | | | 8,312,789 | | | | 8,313,620 | |

Wells Fargo Government Money Market Fund Select Class (l)(u) | | | 0.92 | | | | | | | | 6,114,337 | | | | 6,114,337 | |

| | | | |

Total Short-Term Investments (Cost $14,427,957) | | | | | | | | | | | | | | | 14,427,957 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | |

| Total investments in securities (Cost $827,322,432) | | | 100.66 | % | | | 947,839,926 | |

Other assets and liabilities, net | | | (0.66 | ) | | | (6,242,206 | ) |

| | | | | | | | |

| Total net assets | | | 100.00 | % | | $ | 941,597,720 | |

| | | | | | | | |

| † | Non-income-earning security |

| « | All or a portion of this security is on loan. |

| 144A | The security may be resold in transactions exempt from registration, normally to qualified institutional buyers, pursuant to Rule 144A under the Securities Act of 1933. |

| (l) | The issuer of the security is an affiliated person of the Fund as defined in the Investment Company Act of 1940. |

| (r) | The investment is a non-registered investment company purchased with cash collateral received from securities on loan. |

| (u) | The rate represents the 7-day annualized yield at period end. |

Investments in Affiliates

An affiliated investment is an investment in which the Fund owns at least 5% of the outstanding voting shares of the issuer or as a result of other relationships, such as the Fund and the issuer having the same investment manager. Transactions with issuers that were either affiliated persons of the Fund at the beginning of the period or the end of the period were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Shares,

beginning of

period | | | Shares

purchased | | | Shares

sold | | | Shares,

end of

period | | | Net

realized

gains

(losses) | | | Net change

in

unrealized

gains

(losses) | | | Income

from

affiliated

securities | | | Value,

end

of period | | | % of net assets | |

Short-Term Investments | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

Investment companies | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Securities Lending Cash Investment LLC | | | 9,035,155 | | | | 128,916,157 | | | | 129,638,523 | | | | 8,312,789 | | | $ | 651 | | | $ | 0 | | | $ | 33,559 | | | $ | 8,313,620 | | | | | |

Wells Fargo Government Money Market Fund Select Class | | | 3,773,354 | | | | 310,875,081 | | | | 308,534,098 | | | | 6,114,337 | | | | 0 | | | | 0 | | | | 60,110 | | | | 6,114,337 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | $ | 651 | | | $ | 0 | | | $ | 93,669 | | | $ | 14,427,957 | | | | 1.53 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| | | | | | |

| Statement of assets and liabilities—September 30, 2017 | | Wells Fargo Diversified Capital Builder Fund | | | 17 | |

| | | | |

| | | | |

| |

Assets | | | | |

Investments in unaffiliated securities, (including $8,191,683 of securities on loan) at value (cost $812,894,475) | | $ | 933,411,969 | |

Investments in affiliated securities, at value (cost $14,427,957) | | | 14,427,957 | |

Receivable for Fund shares sold | | | 998,316 | |

Receivable for dividends and interest | | | 2,454,652 | |

Receivable for securities lending income | | | 1,825 | |

Prepaid expenses and other assets | | | 184,018 | |

| | | | |

Total assets | | | 951,478,737 | |

| | | | |

| |

Liabilities | | | | |

Payable upon receipt of securities loaned | | | 8,312,132 | |

Payable for Fund shares redeemed | | | 620,032 | |

Management fee payable | | | 495,373 | |

Administration fees payable | | | 147,828 | |

Distribution fees payable | | | 73,734 | |

Accrued expenses and other liabilities | | | 231,918 | |

| | | | |

Total liabilities | | | 9,881,017 | |

| | | | |

Total net assets | | $ | 941,597,720 | |

| | | | |

| |

NET ASSETS CONSIST OF | | | | |

Paid-in capital | | $ | 775,456,065 | |

Overdistributed net investment income | | | (26,224 | ) |

Accumulated net realized gains on investments | | | 45,650,385 | |

Net unrealized gains on investments | | | 120,517,494 | |

| | | | |

Total net assets | | $ | 941,597,720 | |

| | | | |

| |

COMPUTATION OF NET ASSET VALUE AND OFFERING PRICE PER SHARE | | | | |

Net assets – Class A | | $ | 551,272,488 | |

Shares outstanding – Class A1 | | | 53,501,424 | |

Net asset value per share – Class A | | | $10.30 | |

Maximum offering price per share – Class A2 | | | $10.93 | |

Net assets – Class C | | $ | 117,346,204 | |

Shares outstanding – Class C1 | | | 11,413,694 | |

Net asset value per share – Class C | | | $10.28 | |

Net assets – Administrator Class | | $ | 10,224,786 | |

Shares outstanding – Administrator Class1 | | | 991,106 | |

Net asset value per share – Administrator Class | | | $10.32 | |

Net assets – Institutional Class | | $ | 262,754,242 | |

Shares outstanding – Institutional Class1 | | | 25,642,399 | |

Net asset value per share – Institutional Class | | | $10.25 | |

| 1 | The Fund has an unlimited number of authorized shares. |

| 2 | Maximum offering price is computed as 100/94.25 of net asset value. On investments of $50,000 or more, the offering price is reduced. |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 18 | | Wells Fargo Diversified Capital Builder Fund | | Statement of operations—year ended September 30, 2017 |

| | | | |

| | | | |

| |

Investment income | | | | |

Dividends | | $ | 11,686,948 | |

Interest | | | 9,030,608 | |

Income from affiliated securities | | | 93,669 | |

| | | | |

Total investment income | | | 20,811,225 | |

| | | | |

| |

Expenses | | | | |

Management fee | | | 5,177,214 | |

Administration fees | | | | |

Class A | | | 1,089,132 | |

Class B | | | 1,234 | 1 |

Class C | | | 196,491 | |

Administrator Class | | | 22,832 | |

Institutional Class | | | 248,254 | |

Shareholder servicing fees | | | | |

Class A | | | 1,296,585 | |

Class B | | | 1,469 | 1 |

Class C | | | 233,918 | |

Administrator Class | | | 43,619 | |

Distribution fees | | | | |

Class B | | | 4,406 | 1 |

Class C | | | 701,755 | |

Custody and accounting fees | | | 40,126 | |

Professional fees | | | 45,984 | |

Registration fees | | | 64,461 | |

Shareholder report expenses | | | 50,534 | |

Trustees’ fees and expenses | | | 20,118 | |

Other fees and expenses | | | 5,198 | |

| | | | |

Total expenses | | | 9,243,330 | |

Less: Fee waivers and/or expense reimbursements | | | (14,870 | ) |

| | | | |

Net expenses | | | 9,228,460 | |

| | | | |

Net investment income | | | 11,582,765 | |

| | | | |

| |

REALIZED AND UNREALIZED GAINS (LOSSES) ON INVESTMENTS | | | | |

| |

Net realized gains on: | | | | |

Unaffiliated securities | | | 45,194,556 | |

Affiliated securities | | | 651 | |

| | | | |

Net realized gains on investments | | | 45,195,207 | |

Net change in unrealized gains (losses) on investments | | | 48,014,577 | |

| | | | |

Net realized and unrealized gains (losses) on investments | | | 93,209,784 | |

| | | | |

Net increase in net assets resulting from operations | | $ | 104,792,549 | |

| | | | |

| 1 | For the period from October 1, 2016 to May 5, 2017. Effective at the close of business on May 5, 2017, Class B shares were converted to Class A shares and are no longer offered by the Fund. |

The accompanying notes are an integral part of these financial statements.

| | | | | | |

| Statement of changes in net assets | | Wells Fargo Diversified Capital Builder Fund | | | 19 | |

| | | | | | | | | | | | | | | | |

| | | Year ended

September 30, 2017 | | | Year ended

September 30, 2016 | |

| | | | |

Operations | | | | | | | | | | | | | | | | |

Net investment income | | | | | | $ | 11,582,765 | | | | | | | $ | 10,579,137 | |

Net realized gains on investments | | | | | | | 45,195,207 | | | | | | | | 56,562,113 | |

Net change in unrealized gains (losses) on investments | | | | | | | 48,014,577 | | | | | | | | 57,125,458 | |

| | | | |

Net increase in net assets resulting from operations | | | | | | | 104,792,549 | | | | | | | | 124,266,708 | |

| | | | |

| | | | |

Distributions to shareholders from | | | | | | | | | | | | | | | | |

Net investment income | | | | | | | | | | | | | | | | |

Class A | | | | | | | (7,661,442 | ) | | | | | | | (7,154,781 | ) |

Class B | | | | | | | (3,723 | )1 | | | | | | | (13,202 | ) |

Class C | | | | | | | (923,064 | ) | | | | | | | (576,356 | ) |

Administrator Class | | | | | | | (276,788 | ) | | | | | | | (281,790 | ) |

Institutional Class | | | | | | | (3,377,945 | ) | | | | | | | (2,192,889 | ) |

Net realized gains | | | | | | | | | | | | | | | | |

Class A | | | | | | | (37,599,086 | ) | | | | | | | (38,200,806 | ) |

Class B | | | | | | | (82,941 | )1 | | | | | | | (258,301 | ) |

Class C | | | | | | | (5,700,242 | ) | | | | | | | (5,148,475 | ) |

Administrator Class | | | | | | | (1,444,857 | ) | | | | | | | (504,792 | ) |

Institutional Class | | | | | | | (11,035,158 | ) | | | | | | | (9,439,938 | ) |

| | | | |

Total distributions to shareholders | | | | | | | (68,105,246 | ) | | | | | | | (63,771,330 | ) |

| | | | |

| | | | |

Capital share transactions | | | Shares | | | | | | | | Shares | | | | | |

Proceeds from shares sold | | | | | | | | | | | | | | | | |

Class A | | | 10,742,727 | | | | 105,549,123 | | | | 3,675,778 | | | | 34,640,601 | |

Class B | | | 8,989 | 1 | | | 89,544 | 1 | | | 6,490 | | | | 57,479 | |

Class C | | | 6,100,806 | | | | 60,045,789 | | | | 1,407,777 | | | | 13,010,103 | |

Administrator Class | | | 1,150,741 | | | | 11,315,314 | | | | 1,842,765 | | | | 16,600,389 | |

Institutional Class | | | 15,573,690 | | | | 152,910,373 | | | | 2,616,107 | | | | 24,432,480 | |

| | | | |

| | | | | | | 329,910,143 | | | | | | | | 88,741,052 | |

| | | | |

Reinvestment of distributions | | | | | | | | | | | | | | | | |

Class A | | | 4,536,323 | | | | 43,125,024 | | | | 5,090,728 | | | | 43,117,960 | |

Class B | | | 7,409 | 1 | | | 70,848 | 1 | | | 25,632 | | | | 216,784 | |

Class C | | | 629,617 | | | | 5,974,204 | | | | 606,197 | | | | 5,111,831 | |

Administrator Class | | | 179,684 | | | | 1,707,679 | | | | 89,236 | | | | 775,222 | |

Institutional Class | | | 1,417,203 | | | | 13,422,904 | | | | 1,260,658 | | | | 10,654,067 | |

| | | | |

| | | | | | | 64,300,659 | | | | | | | | 59,875,864 | |

| | | | |

Payment for shares redeemed | | | | | | | | | | | | | | | | |

Class A | | | (8,712,586 | ) | | | (86,111,676 | ) | | | (5,956,354 | ) | | | (54,335,024 | ) |

Class B | | | (166,895 | )1 | | | (1,667,192 | )1 | | | (212,484 | ) | | | (1,934,449 | ) |

Class C | | | (2,103,704 | ) | | | (20,778,345 | ) | | | (1,077,109 | ) | | | (9,826,218 | ) |

Administrator Class | | | (2,486,279 | ) | | | (24,695,561 | ) | | | (650,695 | ) | | | (5,982,660 | ) |

Institutional Class | | | (3,745,131 | ) | | | (36,861,266 | ) | | | (2,203,621 | ) | | | (20,087,169 | ) |

| | | | |

| | | | | | | (170,114,040 | ) | | | | | | | (92,165,520 | ) |

| | | | |

Net increase in net assets resulting from capital share transactions | | | | | | | 224,096,762 | | | | | | | | 56,451,396 | |

| | | | |

Total increase in net assets | | | | | | | 260,784,065 | | | | | | | | 116,946,774 | |

| | | | |

| | | | |

Net assets | | | | | | | | | | | | | | | | |

Beginning of period | | | | | | �� | 680,813,655 | | | | | | | | 563,866,881 | |

| | | | |

End of period | | | | | | $ | 941,597,720 | | | | | | | $ | 680,813,655 | |

| | | | |

Undistributed (overdistributed) net investment income | | | | | | $ | (26,224 | ) | | | | | | $ | 422,976 | |

| | | | |

| 1 | For the period from October 1, 2016 to May 5, 2017. Effective at the close of business on May 5, 2017, Class B shares were converted to Class A shares and are no longer offered by the Fund. |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 20 | | Wells Fargo Diversified Capital Builder Fund | | Financial highlights |

(For a share outstanding throughout each period)

| | | | | | | | | | | | | | | | | | | | |

| | | Year ended September 30 | |

| CLASS A | | 2017 | | | 2016 | | | 2015 | | | 2014 | | | 2013 | |

Net asset value, beginning of period | | | $9.96 | | | | $9.12 | | | | $9.31 | | | | $7.89 | | | | $6.93 | |

Net investment income | | | 0.14 | 1 | | | 0.17 | | | | 0.11 | | | | 0.09 | | | | 0.12 | |

Net realized and unrealized gains (losses) on investments | | | 1.12 | | | | 1.71 | | | | (0.20 | ) | | | 1.41 | | | | 0.96 | |

| | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 1.26 | | | | 1.88 | | | | (0.09 | ) | | | 1.50 | | | | 1.08 | |

Distributions to shareholders from | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.14 | ) | | | (0.15 | ) | | | (0.10 | ) | | | (0.08 | ) | | | (0.12 | ) |

Net realized gains | | | (0.78 | ) | | | (0.89 | ) | | | 0.00 | | | | 0.00 | | | | 0.00 | |

| | | | | | | | | | | | | | | | | | | | |

Total distributions to shareholders | | | (0.92 | ) | | | (1.04 | ) | | | (0.10 | ) | | | (0.08 | ) | | | (0.12 | ) |

Net asset value, end of period | | | $10.30 | | | | $9.96 | | | | $9.12 | | | | $9.31 | | | | $7.89 | |

Total return2 | | | 13.62 | % | | | 22.85 | % | | | (1.05 | )% | | | 19.10 | % | | | 15.75 | % |

Ratios to average net assets (annualized) | | | | | | | | | | | | | | | | | | | | |

Gross expenses | | | 1.12 | % | | | 1.14 | % | | | 1.19 | % | | | 1.21 | % | | | 1.20 | % |

Net expenses | | | 1.12 | % | | | 1.14 | % | | | 1.19 | % | | | 1.20 | % | | | 1.20 | % |

Net investment income | | | 1.43 | % | | | 1.77 | % | | | 1.17 | % | | | 1.09 | % | | | 1.66 | % |

Supplemental data | | | | | | | | | | | | | | | | | | | | |

Portfolio turnover rate | | | 54 | % | | | 73 | % | | | 69 | % | | | 82 | % | | | 70 | % |

Net assets, end of period (000s omitted) | | | $551,272 | | | | $467,503 | | | | $402,303 | | | | $431,388 | | | | $399,535 | |

| 1 | Calculated based upon average shares outstanding. |

| 2 | Total return calculations do not include any sales charges. |

The accompanying notes are an integral part of these financial statements.

| | | | | | |

| Financial highlights | | Wells Fargo Diversified Capital Builder Fund | | | 21 | |

(For a share outstanding throughout each period)

| | | | | | | | | | | | | | | | | | | | |

| | | Year ended September 30 | |

| CLASS C | | 2017 | | | 2016 | | | 2015 | | | 2014 | | | 2013 | |

Net asset value, beginning of period | | | $9.96 | | | | $9.12 | | | | $9.32 | | | | $7.90 | | | | $6.94 | |

Net investment income | | | 0.08 | | | | 0.10 | | | | 0.05 | | | | 0.03 | | | | 0.07 | |

Net realized and unrealized gains (losses) on investments | | | 1.11 | | | | 1.72 | | | | (0.22 | ) | | | 1.41 | | | | 0.96 | |

| | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 1.19 | | | | 1.82 | | | | (0.17 | ) | | | 1.44 | | | | 1.03 | |

Distributions to shareholders from | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.09 | ) | | | (0.09 | ) | | | (0.03 | ) | | | (0.02 | ) | | | (0.07 | ) |

Net realized gains | | | (0.78 | ) | | | (0.89 | ) | | | 0.00 | | | | 0.00 | | | | 0.00 | |

| | | | | | | | | | | | | | | | | | | | |

Total distributions to shareholders | | | (0.87 | ) | | | (0.98 | ) | | | (0.03 | ) | | | (0.02 | ) | | | (0.07 | ) |

Net asset value, end of period | | | $10.28 | | | | $9.96 | | | | $9.12 | | | | $9.32 | | | | $7.90 | |

Total return1 | | | 12.85 | % | | | 21.96 | % | | | (1.88 | )% | | | 18.21 | % | | | 14.86 | % |

Ratios to average net assets (annualized) | | | | | | | | | | | | | | | | | | | | |

Gross expenses | | | 1.87 | % | | | 1.89 | % | | | 1.94 | % | | | 1.96 | % | | | 1.95 | % |

Net expenses | | | 1.87 | % | | | 1.89 | % | | | 1.94 | % | | | 1.95 | % | | | 1.95 | % |

Net investment income | | | 0.65 | % | | | 1.03 | % | | | 0.41 | % | | | 0.34 | % | | | 0.91 | % |

Supplemental data | | | | | | | | | | | | | | | | | | | | |

Portfolio turnover rate | | | 54 | % | | | 73 | % | | | 69 | % | | | 82 | % | | | 70 | % |

Net assets, end of period (000s omitted) | | | $117,346 | | | | $67,630 | | | | $53,373 | | | | $45,670 | | | | $39,758 | |

| 1 | Total return calculations do not include any sales charges. |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 22 | | Wells Fargo Diversified Capital Builder Fund | | Financial highlights |

(For a share outstanding throughout each period)

| | | | | | | | | | | | | | | | | | | | |

| | | Year ended September 30 | |

| ADMINISTRATOR CLASS | | 2017 | | | 2016 | | | 2015 | | | 2014 | | | 2013 | |

Net asset value, beginning of period | | | $9.97 | | | | $9.12 | | | | $9.32 | | | | $7.90 | | | | $6.94 | |

Net investment income | | | 0.16 | 1 | | | 0.18 | 1 | | | 0.14 | 1 | | | 0.12 | 1 | | | 0.14 | 1 |

Net realized and unrealized gains (losses) on investments | | | 1.12 | | | | 1.73 | | | | (0.22 | ) | | | 1.41 | | | | 0.96 | |

| | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 1.28 | | | | 1.91 | | | | (0.08 | ) | | | 1.53 | | | | 1.10 | |

Distributions to shareholders from | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.15 | ) | | | (0.17 | ) | | | (0.12 | ) | | | (0.11 | ) | | | (0.14 | ) |

Net realized gains | | | (0.78 | ) | | | (0.89 | ) | | | 0.00 | | | | 0.00 | | | | 0.00 | |

| | | | | | | | | | | | | | | | | | | | |

Total distributions to shareholders | | | (0.93 | ) | | | (1.06 | ) | | | (0.12 | ) | | | (0.11 | ) | | | (0.14 | ) |

Net asset value, end of period | | | $10.32 | | | | $9.97 | | | | $9.12 | | | | $9.32 | | | | $7.90 | |

Total return | | | 13.75 | % | | | 23.14 | % | | | (0.92 | )% | | | 19.39 | % | | | 16.06 | % |

Ratios to average net assets (annualized) | | | | | | | | | | | | | | | | | | | | |

Gross expenses | | | 1.04 | % | | | 1.06 | % | | | 1.05 | % | | | 1.04 | % | | | 1.04 | % |

Net expenses | | | 1.04 | % | | | 1.03 | % | | | 0.95 | % | | | 0.95 | % | | | 0.95 | % |

Net investment income | | | 1.58 | % | | | 1.89 | % | | | 1.41 | % | | | 1.33 | % | | | 1.84 | % |

Supplemental data | | | | | | | | | | | | | | | | | | | | |

Portfolio turnover rate | | | 54 | % | | | 73 | % | | | 69 | % | | | 82 | % | | | 70 | % |

Net assets, end of period (000s omitted) | | | $10,225 | | | | $21,398 | | | | $7,898 | | | | $9,411 | | | | $6,836 | |

| 1 | Calculated based upon average shares outstanding. |

The accompanying notes are an integral part of these financial statements.

| | | | | | |

| Financial highlights | | Wells Fargo Diversified Capital Builder Fund | | | 23 | |

(For a share outstanding throughout each period)

| | | | | | | | | | | | | | | | | | | | |

| | | Year ended September 30 | |

| INSTITUTIONAL CLASS | | 2017 | | | 2016 | | | 2015 | | | 2014 | | | 2013 | |

Net asset value, beginning of period | | | $9.90 | | | | $9.07 | | | | $9.27 | | | | $7.85 | | | | $6.90 | |

Net investment income | | | 0.19 | | | | 0.20 | | | | 0.15 | | | | 0.13 | 1 | | | 0.15 | |

Net realized and unrealized gains (losses) on investments | | | 1.11 | | | | 1.71 | | | | (0.21 | ) | | | 1.41 | | | | 0.95 | |

| | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 1.30 | | | | 1.91 | | | | (0.06 | ) | | | 1.54 | | | | 1.10 | |

Distributions to shareholders from | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.17 | ) | | | (0.19 | ) | | | (0.14 | ) | | | (0.12 | ) | | | (0.15 | ) |

Net realized gains | | | (0.78 | ) | | | (0.89 | ) | | | 0.00 | | | | 0.00 | | | | 0.00 | |

| | | | | | | | | | | | | | | | | | | | |

Total distributions to shareholders | | | (0.95 | ) | | | (1.08 | ) | | | (0.14 | ) | | | (0.12 | ) | | | (0.15 | ) |

Net asset value, end of period | | | $10.25 | | | | $9.90 | | | | $9.07 | | | | $9.27 | | | | $7.85 | |

Total return | | | 14.11 | % | | | 23.28 | % | | | (0.75 | )% | | | 19.68 | % | | | 16.17 | % |

Ratios to average net assets (annualized) | | | | | | | | | | | | | | | | | | | | |

Gross expenses | | | 0.79 | % | | | 0.81 | % | | | 0.79 | % | | | 0.78 | % | | | 0.77 | % |

Net expenses | | | 0.78 | % | | | 0.78 | % | | | 0.77 | % | | | 0.78 | % | | | 0.77 | % |

Net investment income | | | 1.71 | % | | | 2.14 | % | | | 1.58 | % | | | 1.52 | % | | | 2.08 | % |

Supplemental data | | | | | | | | | | | | | | | | | | | | |

Portfolio turnover rate | | | 54 | % | | | 73 | % | | | 69 | % | | | 82 | % | | | 70 | % |

Net assets, end of period (000s omitted) | | | $262,754 | | | | $122,769 | | | | $97,251 | | | | $100,160 | | | | $149,790 | |

| 1 | Calculated based upon average shares outstanding. |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 24 | | Wells Fargo Diversified Capital Builder Fund | | Notes to financial statements |

1. ORGANIZATION

Wells Fargo Funds Trust (the “Trust”), a Delaware statutory trust organized on March 10, 1999, is an open-end management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”). As an investment company, the Trust follows the accounting and reporting guidance in Financial Accounting Standards Board Accounting Standards Codification Topic 946, Financial Services – Investment Companies. These financial statements report on the Wells Fargo Diversified Capital Builder Fund (the “Fund”) which is a diversified series of the Trust.

Effective at the close of business on May 5, 2017, Class B shares were converted to Class A shares and are no longer offered by the Fund. Information for Class B shares reflected in the financial statements represents activity through May 5, 2017.

2. SIGNIFICANT ACCOUNTING POLICIES

The following significant accounting policies, which are consistently followed in the preparation of the financial statements of the Fund, are in conformity with U.S. generally accepted accounting principles which require management to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Securities valuation

All investments are valued each business day as of the close of regular trading on the New York Stock Exchange (generally 4 p.m. Eastern Time), although the Fund may deviate from this calculation time under unusual or unexpected circumstances.

Equity securities that are listed on a foreign or domestic exchange or market are valued at the official closing price or, if none, the last sales price. If no sale occurs on the principal exchange or market that day, a fair value price will be determined in accordance with the Fund’s Valuation Procedures.

Debt securities are valued at the evaluated bid price provided by an independent pricing service or, if a reliable price is not available, the quoted bid price from an independent broker-dealer.

Investments in registered open-end investment companies are valued at net asset value. Interests in non-registered investment companies that are redeemable at net asset value are fair valued normally at net asset value.

Investments which are not valued using any of the methods discussed above are valued at their fair value, as determined in good faith by the Board of Trustees of the Fund. The Board of Trustees has established a Valuation Committee comprised of the Trustees and has delegated to it the authority to take any actions regarding the valuation of portfolio securities that the Valuation Committee deems necessary or appropriate, including determining the fair value of portfolio securities, unless the determination has been delegated to the Management Valuation Team of Wells Fargo Funds Management, LLC (“Funds Management”). The Board of Trustees retains the authority to make or ratify any valuation decisions or approve any changes to the Valuation Procedures as it deems appropriate. On a quarterly basis, the Board of Trustees receives reports on any valuation actions taken by the Valuation Committee or the Management Valuation Team which may include items for ratification.