UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-09253

Wells Fargo Funds Trust

(Exact name of registrant as specified in charter)

525 Market St., San Francisco, CA 94105

(Address of principal executive offices) (Zip code)

C. David Messman

Wells Fargo Funds Management, LLC

525 Market St., San Francisco, CA 94105

(Name and address of agent for service)

Registrant’s telephone number, including area code: 800-222-8222

Date of fiscal year end: October 31

Registrant is making a filing for 7 of its series:

Wells Fargo Asia Pacific Fund, Wells Fargo Diversified International Fund, Wells Fargo Emerging Markets Equity Fund, Wells Fargo Emerging Markets Equity Income Fund, Wells Fargo Global Small Cap Fund, Wells Fargo International Equity Fund, and Wells Fargo Intrinsic World Equity Fund.

Date of reporting period: October 31, 2017

ITEM 1. REPORT TO STOCKHOLDERS

Annual Report

October 31, 2017

Wells Fargo Asia Pacific Fund

Reduce clutter. Save trees.

Sign up for electronic delivery of prospectuses and shareholder reports at wellsfargo.com/advantagedelivery

Contents

The views expressed and any forward-looking statements are as of October 31, 2017, unless otherwise noted, and are those of the Fund managers and/or Wells Fargo Funds Management, LLC. Discussions of individual securities, or the markets generally, or any Wells Fargo Fund are not intended as individual recommendations. Future events or results may vary significantly from those expressed in any forward-looking statements. The views expressed are subject to change at any time in response to changing circumstances in the market. Wells Fargo Funds Management, LLC and the Fund disclaim any obligation to publicly update or revise any views expressed or forward-looking statements.

NOT FDIC INSURED ◾ NO BANK GUARANTEE ◾ MAY LOSE VALUE

| | | | |

| 2 | | Wells Fargo Asia Pacific Fund | | Letter to shareholders (unaudited) |

Andrew Owen

President

Wells Fargo Funds

Global stocks generally delivered double-digit results; bond markets had smaller but positive results as well.

Dear Shareholder:

We are pleased to offer you this annual report for the Wells Fargo Asia Pacific Fund for the 12-month period that ended October 31, 2017. Global stocks generally delivered double-digit results; bond markets had smaller but positive results as well. U.S. and international stocks performed similarly overall with returns of 23.63% and 23.64%, respectively, for the 12-month period, as measured by the S&P 500 Index1 and the MSCI ACWI ex USA Index (Net),2 respectively. Within fixed income, the Bloomberg Barclays U.S. Aggregate Bond Index3 returned 0.90% and the Bloomberg Barclays Municipal Bond Index4 returned 2.19% as interest rates rose from low levels.

Election results and central banks’ policies commanded investor attention as 2016 closed.

During the last two months of 2016, investors appeared intent on the prospective outcomes of elections in the U.S. and central-bank actions globally. Following Donald Trump’s election victory in November, U.S. stocks rallied. Investors appeared optimistic that the new administration would pursue progrowth policies. Favorable economic news supported stocks, and interest rates moved higher. At their mid-December meeting, U.S. Federal Reserve (Fed) officials raised the target interest rate by a quarter percentage point to a range of 0.50% to 0.75%. The fourth quarter also saw the implementation of the U.S. Securities and Exchange Commission’s amended rule for money market funds, which included the possibility of liquidity fees and redemption gates and, for institutional prime and municipal money market funds, floating net asset values (NAVs). Outside of the U.S., the prospects for faster U.S. growth appeared to trigger some acceleration in Europe.

Financial markets gained during the first two quarters of 2017 on positive economic data.

Stocks rallied globally through the first quarter of 2017, supported by signs of improvement in the U.S. and global economies. In the U.S., hiring remained strong, and business and consumer sentiment improved. In March, Fed officials raised their target interest rate by a quarter percentage point to a range of 0.75% to 1.00%. With the Fed’s target interest-rate increase, short-term bond yields rose during the quarter. Meanwhile, longer-term Treasury yields were little changed, leading to positive performance. Investment-grade and high-yield bonds benefited from strong demand. Municipal bond returns were positive in the quarter, helped by strong demand and constrained new-issue supply. Outside the U.S., stocks in emerging markets generally outperformed stocks in the U.S. and international developed markets because they benefited from both global economic growth and recent weakening of the U.S. dollar. Stocks in Asia, Europe, and Latin America also outperformed the U.S. market during the quarter.

| 1 | The S&P 500 Index consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market-value-weighted index with each stock’s weight in the index proportionate to its market value. You cannot invest directly in an index. |

| 2 | The Morgan Stanley Capital International (MSCI) All Country World Index (ACWI) ex USA Index (Net) is a free-float-adjusted market-capitalization-weighted index that is designed to measure the equity market performance of developed markets, excluding the United States and Canada. Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indexes or any securities or financial products. This report is not approved, reviewed, or produced by MSCI. You cannot invest directly in an index. |

| 3 | The Bloomberg Barclays U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment-grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, mortgage-backed securities (agency fixed-rate and hybrid adjustable-rate mortgage pass-throughs), asset-backed securities, and commercial mortgage-backed securities. You cannot invest directly in an index. |

| 4 | The Bloomberg Barclays Municipal Bond Index is an unmanaged index composed of long-term tax-exempt bonds with a minimum credit rating of Baa. You cannot invest directly in an index. |

| | | | | | |

| Letter to shareholders (unaudited) | | Wells Fargo Asia Pacific Fund | | | 3 | |

Globally, stocks marked continued gains through the second quarter of 2017. Steady, albeit modest, economic growth both in the U.S. and abroad and generally favorable corporate earnings announcements supported higher valuations. U.S. inflation trended lower despite a continued decline in the unemployment rate. Ten-year U.S. Treasury yields declined, resulting in stronger prices for long-term bonds. As was widely expected, Fed officials raised the target interest rate in June by a quarter percentage point to a range of 1.00% to 1.25%. In addition, the Fed indicated that it planned to start selling bonds that accumulated on its balance sheet during quantitative easing programs conducted since 2008.

As global growth improved in the third quarter of 2017, financial markets generally advanced.

Most stock markets worldwide moved higher during the quarter and ended the period at or near all-time highs. Moderate acceleration in global economic growth was supported by improving corporate earnings, low inflation pressure, and still-low interest rates. Corporate earnings reports were favorable overall as companies continued to benefit from healthy operating leverage. Global commodity prices climbed during the quarter. Oil prices rebounded, partly due to a better balance between supply and demand. While North Korea’s recent missile launches and nuclear testing raised serious concerns around the world, the heightened geopolitical risk had relatively minimal impact on the quarter’s stock returns. In the U.S., economic data released during the quarter reflected a generally healthy economy. Second-quarter economic output grew at a 3.1% annual rate, and consumers displayed more willingness to spend. Meanwhile, the Fed maintained the target range for the federal funds rate at 1.00% to 1.25%, noting that inflation had remained below the Fed’s 2.00% objective. Reflecting continued confidence in the U.S. economy, the Fed also stated the possibility of one more 0.25% increase in the federal funds rate by the end of 2017 and announced plans to begin the process of unwinding its $4.5 trillion portfolio of bonds and other assets in October. Outside the U.S., stocks in the Asia Pacific region benefited from solid earnings reports and investors’ willingness to take on risk despite the rising tensions between North Korea and the U.S. In Europe, markets were supported by better-than-expected economic growth, which has led to narrowing of the gap between Europe’s growth rate and that of the U.S. In emerging markets, many countries benefited from stronger currencies versus the U.S. dollar. Also, commodity prices were on an upward trajectory, which benefited many companies that rely on natural resources for exports.

Positive economic and market news continued into October.

October proved to be a strong month for U.S. stocks. The S&P 500 Index delivered 11 record closes amid rising consumer confidence and signs the economy was continuing to gain momentum, including news in late October that economic output was estimated to have grown at a 3.0% annual rate in the third quarter. At its October meeting, the Fed, in a unanimous vote, left short-term interest rates unchanged but signaled it could make another rate increase before the end of 2017 if the economy remains on track. The Fed also began the process of unwinding its quantitative easing program. Outside the U.S., international stocks generally delivered positive results in October as global economic growth continued to strengthen.

| | | | |

| 4 | | Wells Fargo Asia Pacific Fund | | Letter to shareholders (unaudited) |

Don’t let short-term uncertainty derail long-term investment goals.

Periods of investment uncertainty can present challenges, but experience has taught us that maintaining long-term investment goals can be an effective way to plan for the future. To help you create a sound strategy based on your personal goals and risk tolerance, Wells Fargo Funds offers more than 100 mutual funds spanning a wide range of asset classes and investment styles. Although diversification cannot guarantee an investment profit or prevent losses, we believe it can be an effective way to manage investment risk and potentially smooth out overall portfolio performance. We encourage investors to know their investments and to understand that appropriate levels of risk-taking may unlock opportunities.

Thank you for choosing to invest with Wells Fargo Funds. We appreciate your confidence in us and remain committed to helping you meet your financial needs.

Sincerely,

Andrew Owen

President

Wells Fargo Funds

Although diversification cannot guarantee an investment profit or prevent losses, we believe it can be an effective way to manage investment risk and potentially smooth out overall portfolio performance.

For further information about your Fund, contact your investment professional, visit our website at wellsfargofunds.com, or call us directly at 1-800-222-8222. We are available 24 hours a day, 7 days a week.

This page is intentionally left blank.

| | | | |

| 6 | | Wells Fargo Asia Pacific Fund | | Performance highlights (unaudited) |

Investment objective

The Fund seeks long-term capital appreciation.

Manager

Wells Fargo Funds Management, LLC

Subadviser

Wells Capital Management Incorporated

Portfolio managers

Anthony L.T. Cragg

Alison Shimada

Average annual total returns (%) as of October 31, 20171

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Including sales charge | | | Excluding sales charge | | | Expense ratios2 (%) | |

| | | Inception date | | 1 year | | | 5 year | | | 10 year | | | 1 year | | | 5 year | | | 10 year | | | Gross | | | Net3 | |

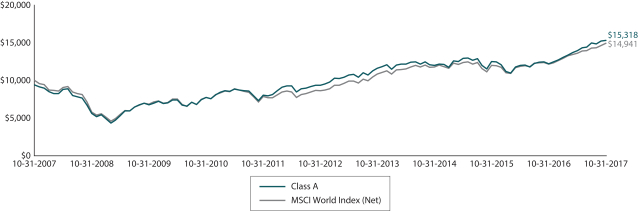

| Class A (WFAAX) | | 7-31-2007 | | | 18.60 | | | | 9.10 | | | | 0.96 | | | | 25.84 | | | | 10.39 | | | | 1.56 | | | | 1.69 | | | | 1.60 | |

| Class C (WFCAX) | | 7-31-2007 | | | 23.86 | | | | 9.57 | | | | 0.79 | | | | 24.86 | | | | 9.57 | | | | 0.79 | | | | 2.44 | | | | 2.35 | |

| Administrator Class (WFADX) | | 7-30-2010 | | | – | | | | – | | | | – | | | | 25.83 | | | | 10.56 | | | | 1.67 | | | | 1.61 | | | | 1.50 | |

| Institutional Class (WFPIX) | | 7-30-2010 | | | – | | | | – | | | | – | | | | 26.25 | | | | 10.77 | | | | 1.81 | | | | 1.36 | | | | 1.25 | |

| MSCI AC Asia Pacific Index (Net)4 | | – | | | – | | | | – | | | | – | | | | 23.70 | | | | 9.22 | | | | 2.27 | | | | – | | | | – | |

Figures quoted represent past performance, which is no guarantee of future results, and do not reflect taxes that a shareholder may pay on fund distributions or the redemption of fund shares. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance shown without sales charges would be lower if sales charges were reflected. Current performance may be lower or higher than the performance data quoted, which assumes the reinvestment of dividends and capital gains. Current month-end performance is available on the Fund’s website, wellsfargofunds.com.

Please keep in mind that high double-digit returns were primarily achieved during favorable market conditions. You should not expect that such favorable returns can be consistently achieved. A fund’s performance, especially for short time periods, should not be the sole factor in making your investment decision.

Index returns do not include transaction costs associated with buying and selling securities, any mutual fund fees or expenses, or any taxes. It is not possible to invest directly in an index.

For Class A shares, the maximum front-end sales charge is 5.75%. For Class C shares, the maximum contingent deferred sales charge is 1.00%. Performance including a contingent deferred sales charge assumes the sales charge for the corresponding time period. Administrator Class and Institutional Class shares are sold without a front-end sales charge or contingent deferred sales charge.

Stock values fluctuate in response to the activities of individual companies and general market and economic conditions. Foreign investments are especially volatile and can rise or fall dramatically due to differences in the political and economic conditions of the host country. These risks are generally intensified in emerging markets. The use of derivatives may reduce returns and/or increase volatility. Certain investment strategies tend to increase the total risk of an investment (relative to the broader market). The Fund is exposed to geographic risk and smaller-company securities risk. Consult the Fund’s prospectus for additional information on these and other risks.

Please see footnotes on page 7.

| | | | | | |

| Performance highlights (unaudited) | | Wells Fargo Asia Pacific Fund | | | 7 | |

|

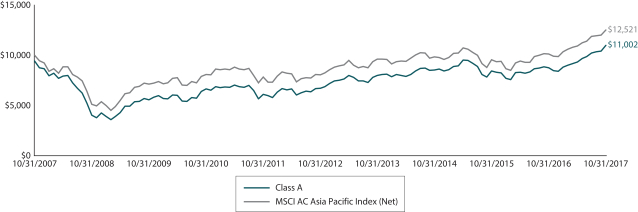

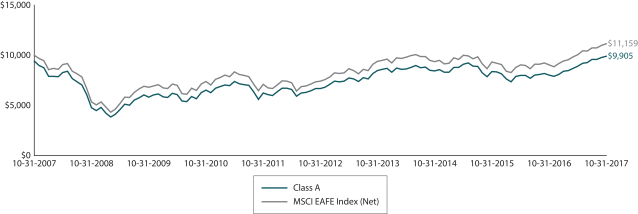

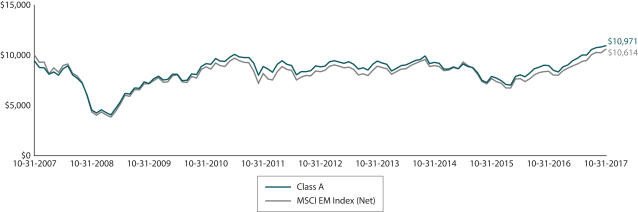

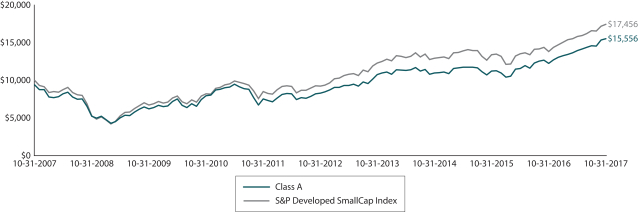

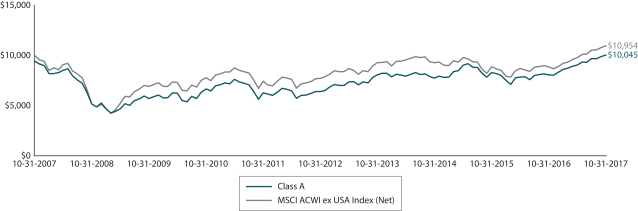

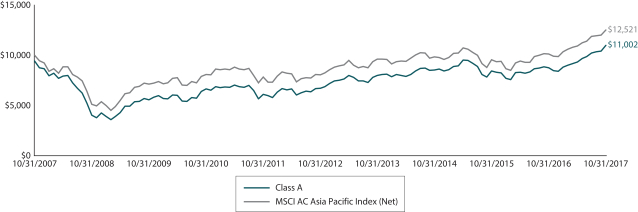

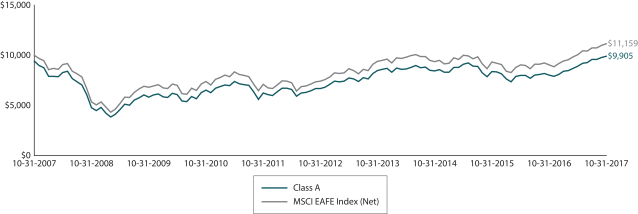

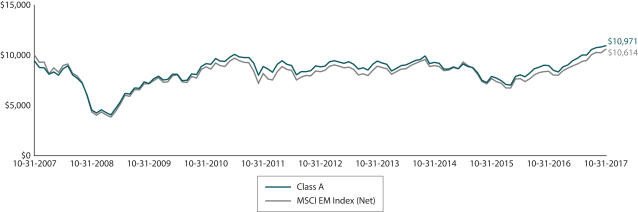

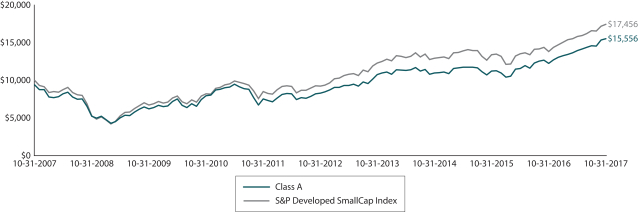

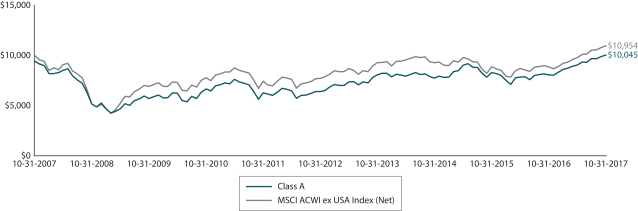

| Growth of $10,000 investment as of October 31, 20175 |

|

|

| 1 | Historical performance shown for Administrator and Institutional Class shares prior to their inception reflects the performance of Class A shares, and includes the higher expenses applicable to Class A shares. If these expenses had not been included, returns for Administrator and Institutional Class shares would be higher. |

| 2 | Reflects the expense ratios as stated in the most recent prospectuses. The expense ratios shown are subject to change and may differ from the annualized expense ratios shown in the financial highlights of this report. |

| 3 | The manager has contractually committed through February 28, 2018 to waive fees and/or reimburse expenses to the extent necessary to cap the Fund’s Total Annual Operating Expenses After Fee Waivers at the amounts shown. After this time, the cap may be increased or the commitment to maintain the cap may be terminated only with the approval of the Board of Trustees. Brokerage commissions, stamp duty fees, interest, taxes, acquired fees and expenses, and extraordinary expenses are excluded from the expense cap. Without this cap, the Fund’s returns would have been lower. The expense ratio paid by an investor is the net expense ratio or the Fund’s Total Annual Fund Operating Expenses After Fee Waivers, as stated in the prospectuses. |

| 4 | The Morgan Stanley Capital International (MSCI) All Country (AC) Asia Pacific Index (Net) is a free-float-adjusted market-capitalization-weighted index that is designed to measure the equity market performance of the developed and emerging markets in the Pacific region. The MSCI AC Asia Pacific Index (Net) consists of the following 13 developed and emerging markets countries: Australia, China, Hong Kong, India, Indonesia, Japan, Korea, Malaysia, New Zealand, the Philippines, Singapore, Taiwan, and Thailand. Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indexes or any securities or financial products. This report is not approved, reviewed, or produced by MSCI. You cannot invest directly in an index. |

| 5 | The chart compares the performance of Class A shares for the most recent ten years with the MSCI AC Asia Pacific Index (Net). The chart assumes a hypothetical investment of $10,000 in Class A shares and reflects all operating expenses and assumes the maximum initial sales charge of 5.75%. |

| 6 | The ten largest holdings, excluding cash and cash equivalents, are calculated based on the value of the investments divided by total net assets of the Fund. Holdings are subject to change and may have changed since the date specified. |

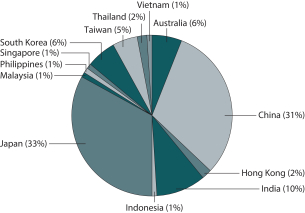

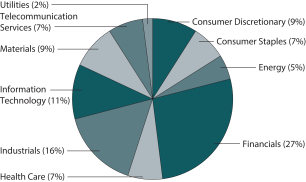

| 7 | Amounts are calculated based on the total long-term investments of the Fund. These amounts are subject to change and may have changed since the date specified. |

| * | This security was no longer held at the end of the reporting period. |

| | | | |

| 8 | | Wells Fargo Asia Pacific Fund | | Performance highlights (unaudited) |

MANAGER’S DISCUSSION

Fund highlights

| ∎ | | The Fund outperformed its benchmark, the MSCI AC Asia Pacific Index (Net), for the 12-month period that ended October 31, 2017. |

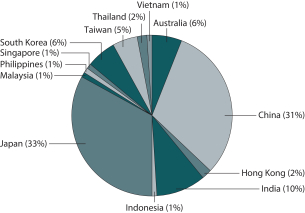

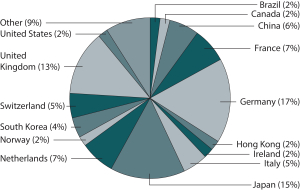

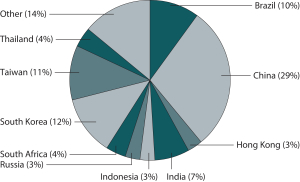

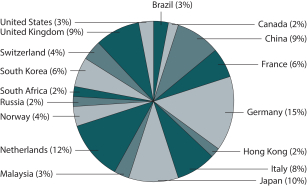

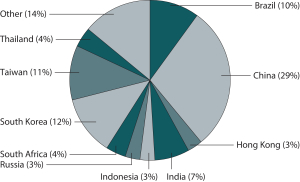

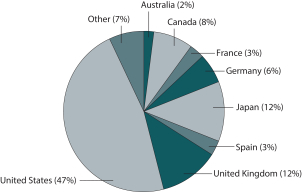

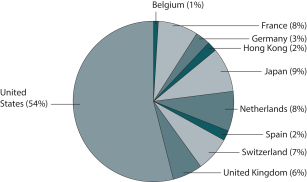

| ∎ | | Overall country allocation contributed to relative returns for the period, led by an overweight to China/Hong Kong and an underweight to Japan. Stock selection contributed the bulk of positive attribution in China/Hong Kong and Japan. |

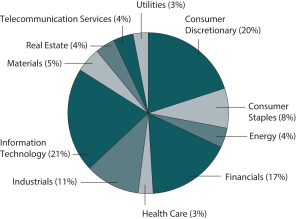

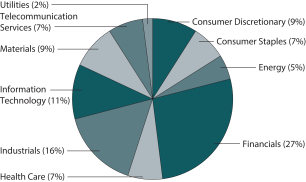

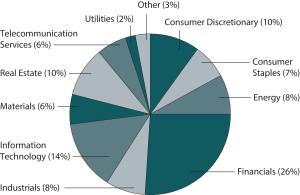

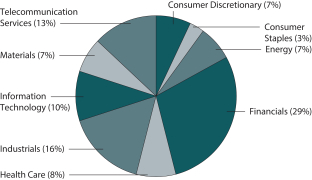

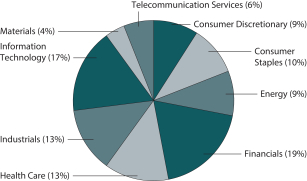

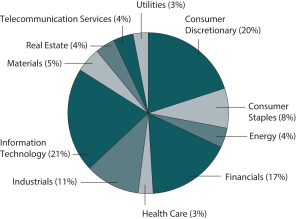

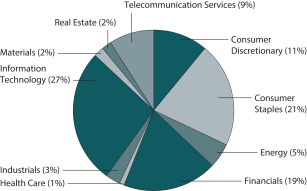

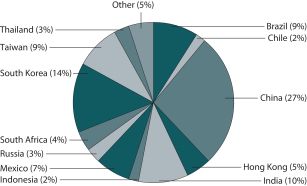

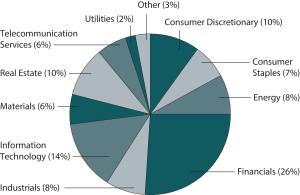

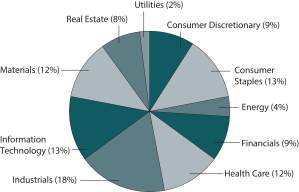

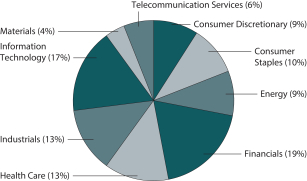

| ∎ | | Allocation at the sector level did not have a material impact on performance. Stock selection contributed the majority of positive attribution, particularly in the consumer discretionary and consumer staples sectors; selection within real estate and utilities was negative. |

| | | | |

| Ten largest holdings (%) as of October 31, 20176 | |

Alibaba Group Holding Limited ADR | | | 2.33 | |

Taiwan Semiconductor Manufacturing Company Limited | | | 2.11 | |

Mitsubishi UFJ Financial Group Incorporated | | | 2.02 | |

Toyota Motor Corporation | | | 1.97 | |

Tencent Holdings Limited | | | 1.93 | |

Samsung Electronics Company Limited | | | 1.84 | |

Macromill Incorporated | | | 1.69 | |

China Construction Bank H Shares | | | 1.58 | |

Sekisui House Limited | | | 1.54 | |

Hitachi Limited | | | 1.51 | |

|

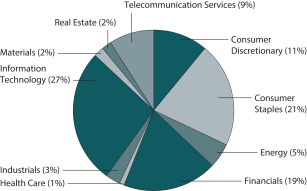

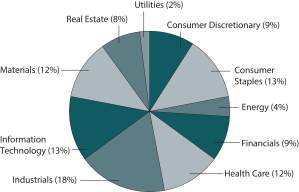

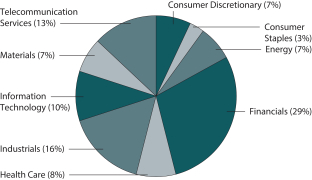

| Sector distribution as of October 31, 20177 |

|

|

The Fund outperformed its benchmark during a volatile market.

During the 12-month period, returns in the Asia Pacific region appreciated significantly as earnings growth accelerated in Asian emerging markets. Consensus earnings estimates called for 15.9% earnings growth at the beginning of the period, and actual earnings delivered, moving from negative territory to double-digit growth toward the end of the period, which provided a catalyst for investors to allocate to the asset class after two-plus years of negative earnings growth from 2013 to 2015.

Information technology (IT) led the index in terms of absolute performance; the sector rose 49.4%, making it the largest positive contributor to the index. Against this backdrop, the portfolio’s overweight position to IT as a whole and Chinese IT, which appreciated 64.8%, resulted in positive attribution.

In the consumer discretionary sector, the Fund benefited from investments in Japanese shares such as Macromill, Incorporated; Suzuki Motor Corporation; and Ryohin Keikaku Company, Limited. Japanese stocks also led in the consumer staples sector as names such as Matsumotokiyoshi Holdings Company, Limited, and KOSE Corporation outperformed. Holdings in China A shares also contributed to relative outperformance and benefited from MSCI’s decision to begin including China A shares in the MSCI AC World Index and the MSCI Emerging Markets Index in June 2017. Midea Group Company Limited, Inner Mongolia Yili Industrial Group Company Limited, and Huayu Automotive Systems

Company Limited represent China A shares that contributed to outperformance during the period.

Real estate was the largest detractor due to stock selection, particularly within China/Hong Kong, which returned 34.3% as a whole. The portfolio participated in Chinese real estate through a holding in China Overseas Land & Investment Limited; however, it was the highly levered names such as China Evergrande Group* (482% return, 400% total debt/equity) and Sunac China Holdings Limited* (661% return, 529% total debt/equity) that saw the largest increases.

The team increased the Fund’s position within India from 5.2% of the portfolio at the beginning of the period to 10% by the end of the period, primarily in the industrials and consumer discretionary sectors, while reducing the position in Indonesia, particularly within the telecommunication services and real estate sectors. Chinese consumer discretionary

Please see footnotes on page 7.

| | | | | | |

| Performance highlights (unaudited) | | Wells Fargo Asia Pacific Fund | | | 9 | |

also saw a lift, given the addition of new positions in the China A-share market and tourism and the reduction of exposure to Taiwanese IT as the tech up cycle began to wind down toward the end of the period.

|

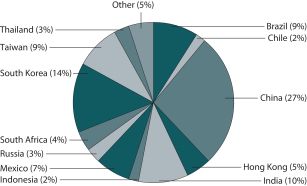

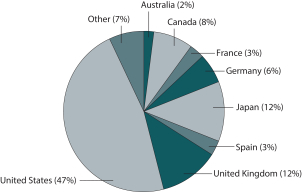

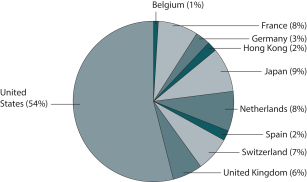

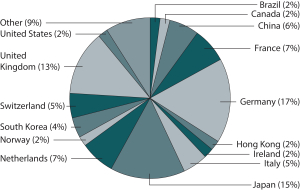

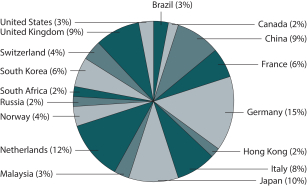

| Country allocation as of October 31, 20177 |

|

|

Our investment outlook on the Asia Pacific region remains positive.

Chinese equities may consolidate at current levels after very strong market performance year to date, rising more than 45%. The new economy sectors have dramatically outperformed this year and we continue to like IT and consumption sectors for growth, but we expect market performance to broaden out. Above and beyond the internet giants of Baidu, Incorporated; Alibaba Group Holding Limited; and Tencent Holdings Limited, we are finding more investment opportunities in IT in the China A-share market. We expect the economic and political environment to remain stable following the 19th National Party Congress. President Xi has been elevated to the highest status, with his thoughts incorporated in the Party constitution. The new Politburo Standing

Committee members fully support his agenda for balanced, quality growth and accelerated state-owned enterprise reform.

The Korean equity outlook is supported by earnings growth, most notably in the IT sector, and recovery in the industrials sector. Taiwan’s economy continues to be supported by global expansion, boosting exports and industrial production; however, the improvement in the external environment has not fed through to domestic demand.

We remain bullish on India, as we are positive on the reform momentum, which appears to be accelerating. In particular, the goods and services tax (GST) was implemented in July and there are limited disruptions thus far. We are positive on stocks that will benefit from market-share loss from informal sectors as a result of both demonetization and GST. We agree with Bank Indonesia’s view that economic growth in Indonesia should accelerate in the second half on higher infrastructure spending. While we do not have a positive structural view on Thailand due to the overall indebtedness of households and the fluid political situation, we are closely monitoring cyclical upturns and are tactically positioned with strong, but reasonably valued, franchises.

Japan remains one of the large developed markets in which equity performance lagged. Prime Minister Abe’s victory in the snap elections solidified chances for further labor reform and other domestic policies.

We remain cautious on the Australian market due to the deterioration of household savings rates and recent weak earnings announcements. New Zealand macroeconomic trends are supportive of a stronger market, but we are limited by the availability of attractive names in the near term.

Please see footnotes on page 7.

| | | | |

| 10 | | Wells Fargo Asia Pacific Fund | | Fund expenses (unaudited) |

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and contingent deferred sales charges (if any) on redemptions and (2) ongoing costs, including management fees, distribution (12b-1) and/or shareholder servicing fees, and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the six-month period and held for the entire period from May 1, 2017 to October 31, 2017.

Actual expenses

The “Actual” line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the “Actual” line under the heading entitled “Expenses paid during period” for your applicable class of shares to estimate the expenses you paid on your account during this period.

Hypothetical example for comparison purposes

The “Hypothetical” line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) and contingent deferred sales charges. Therefore, the “Hypothetical” line of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | |

| | | Beginning

account value

5-1-2017 | | | Ending

account value

10-31-2017 | | | Expenses

paid during

the period¹ | | | Annualized net

expense ratio | |

Class A | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,177.76 | | | $ | 8.78 | | | | 1.60 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,017.14 | | | $ | 8.13 | | | | 1.60 | % |

Class C | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,173.95 | | | $ | 12.88 | | | | 2.35 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,013.36 | | | $ | 11.93 | | | | 2.35 | % |

Administrator Class | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,177.69 | | | $ | 8.23 | | | | 1.50 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,017.65 | | | $ | 7.63 | | | | 1.50 | % |

Institutional Class | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,180.00 | | | $ | 6.87 | | | | 1.25 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,018.90 | | | $ | 6.36 | | | | 1.25 | % |

| 1 | Expenses paid is equal to the annualized net expense ratio of each class multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year divided by the number of days in the fiscal year (to reflect the one-half-year period). |

| | | | | | |

| Portfolio of investments—October 31, 2017 | | Wells Fargo Asia Pacific Fund | | | 11 | |

| | | | | | | | | | | | | | | | |

| Security name | | | | | | | | Shares | | | Value | |

| | | |

Common Stocks: 88.89% | | | | | | | | | | | | | |

| | | |

| Australia: 5.73% | | | | | | | | | | | | | |

Australia & New Zealand Banking Group Limited (Financials, Banks) | | | | | | | | | | | 34,415 | | | $ | 788,078 | |

BHP Billiton Limited (Materials, Metals & Mining) | | | | | | | | | | | 90,171 | | | | 1,831,588 | |

IOOF Holdings Limited (Financials, Capital Markets) | | | | | | | | | | | 88,767 | | | | 731,011 | |

Medibank Private Limited (Financials, Insurance) | | | | | | | | | | | 306,927 | | | | 721,163 | |

MYOB Group Limited (Information Technology, Internet Software & Services) | | | | | | | | | | | 256,900 | | | | 737,319 | |

Northern Star Resources Limited (Materials, Metals & Mining) | | | | | | | | | | | 297,009 | | | | 1,186,588 | |

Rio Tinto Limited (Materials, Metals & Mining) | | | | | | | | | | | 24,585 | | | | 1,306,780 | |

Suncorp Group Limited (Financials, Insurance) | | | | | | | | | | | 106,752 | | | | 1,109,522 | |

Woodside Petroleum Limited (Energy, Oil, Gas & Consumable Fuels) | | | | | | | | | | | 43,439 | | | | 1,021,651 | |

| | | | |

| | | | | | | | | | | | | | | 9,433,700 | |

| | | | | | | | | | | | | | | | |

| | | |

| China: 21.46% | | | | | | | | | | | | | |

3SBio Incorporated (Health Care, Biotechnology)† | | | | | | | | | | | 557,500 | | | | 997,603 | |

Alibaba Group Holding Limited ADR (Information Technology, Internet Software & Services) † | | | | | | | | | | | 20,750 | | | | 3,836,468 | |

AviChina Industry & Technology Company Limited H Shares (Industrials, Aerospace & Defense) | | | | | | | | | | | 2,137,000 | | | | 1,240,881 | |

Baidu Incorporated ADR (Information Technology, Internet Software & Services) † | | | | | | | | | | | 7,255 | | | | 1,769,785 | |

Bank of China Limited H Shares (Financials, Banks) | | | | | | | | | | | 2,682,000 | | | | 1,337,322 | |

Beijing Enterprises Water Group Limited (Utilities, Water Utilities) | | | | | | | | | | | 1,906,000 | | | | 1,600,264 | |

BYD Company Limited H Shares (Consumer Discretionary, Automobiles)« | | | | | | | | | | | 131,000 | | | | 1,147,723 | |

China Communications Construction Company Limited H Shares (Industrials, Construction & Engineering) | | | | | | | | | | | 406,000 | | | | 492,837 | |

China Construction Bank H Shares (Financials, Banks) | | | | | | | | | | | 2,910,000 | | | | 2,596,149 | |

China Everbright International Limited (Industrials, Commercial Services & Supplies) | | | | | | | | | | | 579,000 | | | | 816,392 | |

China Galaxy Securities Company Limited H Shares (Financials, Capital Markets) | | | | | | | | | | | 689,500 | | | | 600,995 | |

China Merchants Bank Company Limited H Shares (Financials, Banks) | | | | | | | | | | | 276,500 | | | | 1,054,410 | |

China Mobile Limited (Telecommunication Services, Wireless Telecommunication Services) | | | | | | | | | | | 151,500 | | | | 1,521,525 | |

China Petroleum & Chemical Corporation H Shares (Energy, Oil, Gas & Consumable Fuels) | | | | | | | | | | | 1,140,000 | | | | 837,311 | |

China Resources Phoenix Healthcare Holdings Company Limited (Health Care, Health Care Providers & Services) « | | | | | | | | | | | 565,000 | | | | 741,610 | |

Ctrip.com International Limited ADR (Consumer Discretionary, Internet & Direct Marketing Retail) † | | | | | | | | | | | 13,300 | | | | 636,937 | |

Hengan International Group Company Limited (Consumer Staples, Personal Products) | | | | | | | | | | | 101,000 | | | | 995,578 | |

Huaneng Renewables Corporation Limited H Shares (Utilities, Independent Power & Renewable Electricity Producers) | | | | | | | | | | | 4,424,000 | | | | 1,519,768 | |

Industrial & Commercial Bank of China Limited H Shares (Financials, Banks) | | | | | | | | | | | 2,715,000 | | | | 2,154,210 | |

JD.com Incorporated ADR (Consumer Discretionary, Internet & Direct Marketing Retail) † | | | | | | | | | | | 18,700 | | | | 701,624 | |

PetroChina Company Limited H Shares (Energy, Oil, Gas & Consumable Fuels) | | | | | | | | | | | 1,222,000 | | | | 797,290 | |

PICC Property & Casualty Company Limited H Shares (Financials, Insurance) | | | | | | | | | | | 390,000 | | | | 772,861 | |

Ping An Insurance (Group) Company of China Limited H Shares (Financials, Insurance) | | | | | | | | | | | 231,000 | | | | 2,028,290 | |

Shanghai Fosun Pharmaceutical Company Limited H Shares (Health Care, Pharmaceuticals) | | | | | | | | | | | 235,000 | | | | 1,173,283 | |

Tencent Holdings Limited (Information Technology, Internet Software & Services) | | | | | | | | | | | 70,800 | | | | 3,174,538 | |

Yum China Holdings Incorporated (Consumer Discretionary, Hotels, Restaurants & Leisure) † | | | | | | | | | | | 19,400 | | | | 782,790 | |

| | | | |

| | | | | | | | | | | | | | | 35,328,444 | |

| | | | | | | | | | | | | | | | |

| | | |

| Hong Kong: 1.96% | | | | | | | | | | | | | |

China Overseas Land & Investment Limited (Real Estate, Real Estate Management & Development) | | | | | | | | | | | 426,000 | | | | 1,381,521 | |

Li & Fung Limited (Consumer Discretionary, Textiles, Apparel & Luxury Goods) | | | | | | | | | | | 1,842,000 | | | | 927,918 | |

Sun Art Retail Group Limited (Consumer Staples, Food & Staples Retailing) | | | | | | | | | | | 910,000 | | | | 919,168 | |

| | | | |

| | | | | | | | | | | | | | | 3,228,607 | |

| | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 12 | | Wells Fargo Asia Pacific Fund | | Portfolio of investments—October 31, 2017 |

| | | | | | | | | | | | | | | | |

| Security name | | | | | | | | Shares | | | Value | |

| | | |

| India: 9.32% | | | | | | | | | | | | | |

Bharat Electronics Limited (Industrials, Aerospace & Defense) | | | | | | | | | | | 462,102 | | | $ | 1,317,005 | |

Bharat Petroleum Corporation Limited (Energy, Oil, Gas & Consumable Fuels) | | | | | | | | | | | 98,018 | | | | 819,601 | |

Emami Limited (Consumer Staples, Personal Products) | | | | | | | | | | | 64,915 | | | | 1,261,043 | |

HDFC Bank Limited (Financials, Banks) | | | | | | | | | | | 79,100 | | | | 2,208,578 | |

Hindalco Industries Limited (Materials, Metals & Mining) | | | | | | | | | | | 475,352 | | | | 1,962,431 | |

ICICI Bank Limited (Financials, Banks) | | | | | | | | | | | 186,670 | | | | 864,885 | |

Indian Hotels Company Limited (Consumer Discretionary, Hotels, Restaurants & Leisure) | | | | | | | | | | | 335,643 | | | | 586,859 | |

Indian Hotels Company Limited (Interim Shares) (Consumer Discretionary, Hotels, Restaurants & Leisure) (a) | | | | | | | | | | | 67,128 | | | | 117,371 | |

Larsen & Toubro Limited (Industrials, Construction & Engineering) | | | | | | | | | | | 72,054 | | | | 1,359,733 | |

MakeMyTrip Limited (Consumer Discretionary, Internet & Direct Marketing Retail) † | | | | | | | | | | | 27,600 | | | | 753,474 | |

Maruti Suzuki India Limited (Consumer Discretionary, Automobiles) | | | | | | | | | | | 6,760 | | | | 856,986 | |

Reliance Industries Limited (Energy, Oil, Gas & Consumable Fuels) | | | | | | | | | | | 153,310 | | | | 2,226,940 | |

Tata Motors Limited (Consumer Discretionary, Automobiles) † | | | | | | | | | | | 152,900 | | | | 1,011,288 | |

| | | | |

| | | | | | | | | | | | | | | 15,346,194 | |

| | | | | | | | | | | | | | | | |

| | | |

| Indonesia: 1.32% | | | | | | | | | | | | | |

PT Bank Rakyat Indonesia Tbk (Financials, Banks) | | | | | | | | | | | 809,400 | | �� | | 930,997 | |

PT Cikarang Listrindo Tbk (Utilities, Independent Power & Renewable Electricity Producers) | | | | | | | | | | | 6,279,300 | | | | 506,974 | |

PT Telekomunikasi Indonesia Persero Tbk (Telecommunication Services, Diversified Telecommunication Services) | | | | | | | | | | | 2,451,200 | | | | 728,357 | |

| | | | |

| | | | | | | | | | | | | | | 2,166,328 | |

| | | | | | | | | | | | | | | | |

| | | |

| Japan: 33.13% | | | | | | | | | | | | | |

Ezaki Glico Company Limited (Consumer Staples, Food Products) | | | | | | | | | | | 14,900 | | | | 824,247 | |

FANUC Corporation (Industrials, Machinery) | | | | | | | | | | | 3,700 | | | | 858,089 | |

Hitachi Limited (Information Technology, Electronic Equipment, Instruments & Components) | | | | | | | | | | | 316,000 | | | | 2,492,872 | |

Honda Motor Company Limited (Consumer Discretionary, Automobiles) | | | | | | | | | | | 23,000 | | | | 712,625 | |

J.Front Retailing Company Limited (Consumer Discretionary, Multiline Retail) | | | | | | | | | | | 70,100 | | | | 1,028,335 | |

Japan Airlines Company Limited (Industrials, Airlines) | | | | | | | | | | | 51,000 | | | | 1,735,808 | |

Japan Rental Housing Investment Incorporated (Real Estate, Equity REITs) | | | | | | | | | | | 1,900 | | | | 1,313,399 | |

Japan Tobacco Incorporated (Consumer Staples, Tobacco) | | | | | | | | | | | 35,800 | | | | 1,179,742 | |

Kao Corporation (Consumer Staples, Personal Products) | | | | | | | | | | | 13,500 | | | | 811,627 | |

KOSE Corporation (Consumer Staples, Personal Products) | | | | | | | | | | | 7,700 | | | | 929,783 | |

Kubota Corporation (Industrials, Machinery) | | | | | | | | | | | 71,200 | | | | 1,328,445 | |

Kura Corporation (Consumer Discretionary, Hotels, Restaurants & Leisure) | | | | | | | | | | | 27,800 | | | | 1,242,021 | |

Kyushu Railway Company (Industrials, Road & Rail) | | | | | | | | | | | 61,400 | | | | 1,957,478 | |

Macromill Incorporated (Consumer Discretionary, Media) | | | | | | | | | | | 92,700 | | | | 2,780,062 | |

Matsumotokiyoshi Holdings Company Limited (Consumer Staples, Food & Staples Retailing) | | | | | | | | | | | 31,600 | | | | 2,262,205 | |

Mitsubishi UFJ Financial Group Incorporated (Financials, Banks) | | | | | | | | | | | 496,700 | | | | 3,330,845 | |

Mitsui Fudosan Company Limited (Real Estate, Real Estate Management & Development) | | | | | | | | | | | 82,400 | | | | 1,903,016 | |

Nintendo Company Limited (Information Technology, Software) | | | | | | | | | | | 4,100 | | | | 1,579,350 | |

Nippon Telegraph & Telephone Corporation (Telecommunication Services, Diversified Telecommunication Services) | | | | | | | | | | | 18,900 | | | | 909,720 | |

NTT DOCOMO Incorporated (Telecommunication Services, Wireless Telecommunication Services) | | | | | | | | | | | 34,100 | | | | 822,023 | |

Obayashi Corporation (Industrials, Construction & Engineering) | | | | | | | | | | | 131,500 | | | | 1,711,622 | |

ORIX Corporation (Financials, Diversified Financial Services) | | | | | | | | | | | 109,800 | | | | 1,871,926 | |

Otsuka Corporation (Information Technology, IT Services) | | | | | | | | | | | 18,700 | | | | 1,266,347 | |

Panasonic Corporation (Consumer Discretionary, Household Durables) | | | | | | | | | | | 139,700 | | | | 2,089,265 | |

Recruit Holdings Company Limited (Industrials, Professional Services) | | | | | | | | | | | 56,100 | | | | 1,369,628 | |

Ryohin Keikaku Company Limited (Consumer Discretionary, Multiline Retail) | | | | | | | | | | | 5,500 | | | | 1,615,584 | |

Sekisui House Limited (Consumer Discretionary, Household Durables) | | | | | | | | | | | 136,500 | | | | 2,534,203 | |

The accompanying notes are an integral part of these financial statements.

| | | | | | |

| Portfolio of investments—October 31, 2017 | | Wells Fargo Asia Pacific Fund | | | 13 | |

| | | | | | | | | | | | | | | | |

| Security name | | | | | | | | Shares | | | Value | |

| | | |

| Japan (continued) | | | | | | | | | | | | | |

SoftBank Group Corporation (Telecommunication Services, Wireless Telecommunication Services) | | | | | | | | | | | 20,100 | | | $ | 1,758,363 | |

Sony Corporation (Consumer Discretionary, Household Durables) | | | | | | | | | | | 40,400 | | | | 1,567,963 | |

Sumitomo Mitsui Trust Holdings Incorporated (Financials, Banks) | | | | | | | | | | | 43,400 | | | | 1,696,610 | |

Suzuki Motor Corporation (Consumer Discretionary, Automobiles) | | | | | | | | | | | 14,900 | | | | 809,177 | |

Tokyo Electron Limited (Information Technology, Semiconductors & Semiconductor Equipment) | | | | | | | | | | | 8,200 | | | | 1,424,660 | |

Toyota Motor Corporation (Consumer Discretionary, Automobiles) | | | | | | | | | | | 52,800 | | | | 3,245,873 | |

Tsukui Corporation (Health Care, Health Care Providers & Services) | | | | | | | | | | | 125,200 | | | | 896,291 | |

Yahoo! Japan Corporation (Information Technology, Internet Software & Services) | | | | | | | | | | | 149,800 | | | | 667,944 | |

| | | | |

| | | | | | | | | | | | | | | 54,527,148 | |

| | | | | | | | | | | | | | | | |

| | | |

| Malaysia: 1.33% | | | | | | | | | | | | | |

Genting Malaysia Bhd (Consumer Discretionary, Hotels, Restaurants & Leisure) | | | | | | | | | | | 585,300 | | | | 695,420 | |

IHH Healthcare Bhd (Health Care, Health Care Providers & Services) | | | | | | | | | | | 549,000 | | | | 731,395 | |

Sime Darby Bhd (Industrials, Industrial Conglomerates) | | | | | | | | | | | 353,200 | | | | 767,554 | |

| | | | |

| | | | | | | | | | | | | | | 2,194,369 | |

| | | | | | | | | | | | | | | | |

| | | |

| Philippines: 1.11% | | | | | | | | | | | | | |

GT Capital Holdings Incorporated (Financials, Diversified Financial Services) | | | | | | | | | | | 26,135 | | | | 597,371 | |

Semirara Mining & Power Corporation (Energy, Oil, Gas & Consumable Fuels) | | | | | | | | | | | 1,499,440 | | | | 1,234,406 | |

| | | | |

| | | | | | | | | | | | | | | 1,831,777 | |

| | | | | | | | | | | | | | | | |

| | | |

| Singapore: 0.98% | | | | | | | | | | | | | |

Genting Singapore plc (Consumer Discretionary, Hotels, Restaurants & Leisure) | | | | | | | | | | | 947,900 | | | | 848,388 | |

Singapore Telecommunications Limited (Telecommunication Services, Diversified Telecommunication Services) | | | | | | | | | | | 277,700 | | | | 763,976 | |

| | | | |

| | | | | | | | | | | | | | | 1,612,364 | |

| | | | | | | | | | | | | | | | |

| | | |

| South Korea: 4.83% | | | | | | | | | | | | | |

Celltrion Healthcare Company Limited (Health Care, Health Care Providers & Services) † | | | | | | | | | | | 9,700 | | | | 509,957 | |

Hana Financial Group Incorporated (Financials, Banks) | | | | | | | | | | | 18,391 | | | | 787,119 | |

KB Financial Group Incorporated (Financials, Banks) | | | | | | | | | | | 15,723 | | | | 819,586 | |

Korea Electric Power Corporation (Utilities, Electric Utilities) | | | | | | | | | | | 26,713 | | | | 934,663 | |

LG Chem Limited (Materials, Chemicals) | | | | | | | | | | | 3,049 | | | | 1,098,114 | |

Samsung Electronics Company Limited (Information Technology, Technology Hardware, Storage & Peripherals) | | | | | | | | | | | 1,231 | | | | 3,025,995 | |

Samsung SDI Company Limited (Information Technology, Electronic Equipment, Instruments & Components) | | | | | | | | | | | 4,254 | | | | 782,188 | |

| | | | |

| | | | | | | | | | | | | | | 7,957,622 | |

| | | | | | | | | | | | | | | | |

| | | |

| Taiwan: 5.36% | | | | | | | | | | | | | |

Hon Hai Precision Industry Company Limited (Information Technology, Electronic Equipment, Instruments & Components) | | | | | | | | | | | 441,085 | | | | 1,638,009 | |

Siliconware Precision Industries Company (Information Technology, Semiconductors & Semiconductor Equipment) | | | | | | | | | | | 493,000 | | | | 781,359 | |

Taiwan Paiho Limited (Consumer Discretionary, Textiles, Apparel & Luxury Goods) | | | | | | | | | | | 228,000 | | | | 941,196 | |

Taiwan Semiconductor Manufacturing Company Limited (Information Technology, Semiconductors & Semiconductor Equipment) | | | | | | | | | | | 431,000 | | | | 3,472,637 | |

Uni-President Enterprises Corporation (Consumer Staples, Food Products) | | | | | | | | | | | 413,000 | | | | 862,713 | |

United Microelectronics Corporation (Information Technology, Semiconductors & Semiconductor Equipment) | | | | | | | | | | | 2,180,000 | | | | 1,120,377 | |

| | | | |

| | | | | | | | | | | | | | | 8,816,291 | |

| | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 14 | | Wells Fargo Asia Pacific Fund | | Portfolio of investments—October 31, 2017 |

| | | | | | | | | | | | | | | | |

| Security name | | | | | | | | Shares | | | Value | |

| | | |

| Thailand: 1.82% | | | | | | | | | | | | | |

Land & Houses PCL (Real Estate, Real Estate Management & Development) | | | | | | | | | | | 5,322,700 | | | $ | 1,746,461 | |

Thai Beverage PCL (Consumer Staples, Beverages) | | | | | | | | | | | 1,732,800 | | | | 1,245,796 | |

| | | | |

| | | | | | | | | | | | | | | 2,992,257 | |

| | | | | | | | | | | | | | | | |

| | | |

| Vietnam: 0.54% | | | | | | | | | | | | | |

Masan Group Corporation (Consumer Staples, Food Products) | | | | | | | | | | | 336,000 | | | | 880,220 | |

| | | | | | | | | | | | | | | | |

| | | |

Total Common Stocks (Cost $116,074,001) | | | | | | | | | | | | 146,315,321 | |

| | | | | | | | | | | | | | | | |

| | | |

| | | | Expiration date | | | | | | | |

| Participation Notes: 8.90% | |

|

| China: 8.90% | |

HSBC Bank plc (Baoshan Iron & Steel Company Limited Class A) (Materials, Metals & Mining) †(a)144A | | | | | | | 2-19-2019 | | | | 870,995 | | | | 1,007,530 | |

HSBC Bank plc (China International Travel Service Corporation Class A) (Consumer Discretionary, Hotels, Restaurants & Leisure) †(a) | | | | | | | 12-23-2024 | | | | 191,000 | | | | 1,191,698 | |

HSBC Bank plc (Han’s Laser Technology Industry Group Company Limited Class A) (Industrials, Machinery) †(a) | | | | | | | 3-18-2019 | | | | 178,169 | | | | 1,285,495 | |

HSBC Bank plc (Hangzhou Hikvision Digital Technology Company Limited Class A) (Information Technology, Electronic Equipment, Instruments & Components) †(a) | | | | | | | 6-18-2018 | | | | 511,261 | | | | 3,028,735 | |

HSBC Bank plc (Huayu Automotive Systems Company Limited Class A) (Consumer Discretionary, Auto Components) †(a) | | | | | | | 12-2-2019 | | | | 233,800 | | | | 896,681 | |

HSBC Bank plc (Inner Mongolia Yili Industrial Group Company Limited Class A) (Consumer Staples, Food Products) †(a) | | | | | | | 9-25-2023 | | | | 277,800 | | | | 1,238,046 | |

HSBC Bank plc (Midea Group Company Limited Class A) (Consumer Discretionary, Household Durables) †(a) | | | | | | | 5-8-2018 | | | | 175,000 | | | | 1,346,032 | |

HSBC Bank plc (Songcheng Performance Development Company Limited Class A) (Consumer Discretionary, Hotels, Restaurants & Leisure) †(a) | | | | | | | 10-12-2020 | | | | 415,952 | | | | 1,264,054 | |

UBS AG (China Vanke Company Limited Class A) (Real Estate, Real Estate Management & Development) † | | | | | | | 10-31-2018 | | | | 187,200 | | | | 815,897 | |

UBS AG (GoerTek Incorporated Class A) (Information Technology, Electronic Equipment, Instruments & Components) †(a) | | | | | | | 7-24-2018 | | | | 331,400 | | | | 1,106,566 | |

UBS AG (Han’s Laser Technology Industry Group Company Limited Class A) (Industrials, Machinery) †(a) | | | | | | | 3-19-2018 | | | | 203,912 | | | | 1,471,232 | |

| | | |

Total Participation Notes (Cost $9,427,469) | | | | | | | | | | | | 14,651,966 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | Dividend yield | | | | | | | | | | |

| Preferred Stocks: 1.11% | | | | | | | | | | | | | |

| | | | |

| South Korea: 1.11% | | | | | | | | | | | | | | | | |

Samsung Electronics Company Limited (Information Technology, Technology Hardware, Storage & Peripherals) | | | 2.06 | % | | | | | | | 910 | | | | 1,819,431 | |

| | | | | | | | | | | | | | | | |

| | | |

Total Preferred Stocks (Cost $630,728) | | | | | | | | | | | | 1,819,431 | |

| | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| | | | | | |

| Portfolio of investments—October 31, 2017 | | Wells Fargo Asia Pacific Fund | | | 15 | |

| | | | | | | | | | | | | | | | |

| Security name | | Yield | | | | | | Shares | | | Value | |

| | | |

Short-Term Investments: 1.24% | | | | | | | | | | | | | |

| | | | |

| Investment Companies: 1.24% | | | | | | | | | | | | | | | | |

Securities Lending Cash Investment LLC (l)(r)(u) | | | 1.26 | % | | | | | | | 993,151 | | | $ | 993,250 | |

Wells Fargo Government Money Market Fund Select Class (l)(u) | | | 0.96 | | | | | | | | 1,050,305 | | | | 1,050,305 | |

| | | |

Total Short-Term Investments (Cost $2,043,555) | | | | | | | | | | | | 2,043,555 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | |

| Total investments in securities (Cost $128,175,753) | | | 100.14 | % | | | 164,830,273 | |

Other assets and liabilities, net | | | (0.14 | ) | | | (234,846 | ) |

| | | | | | | | |

| Total net assets | | | 100.00 | % | | $ | 164,595,427 | |

| | | | | | | | |

| † | Non-income-earning security |

| « | All or a portion of this security is on loan. |

| (a) | The security is fair valued in accordance with procedures approved by the Board of Trustees. |

| 144A | The security may be resold in transactions exempt from registration, normally to qualified institutional buyers, pursuant to Rule 144A under the Securities Act of 1933. |

| (l) | The issuer of the security is an affiliated person of the Fund as defined in the Investment Company Act of 1940. |

| (r) | The investment is a non-registered investment company purchased with cash collateral received from securities on loan. |

| (u) | The rate represents the 7-day annualized yield at period end. |

Investments in Affiliates

An affiliated investment is an investment in which the Fund owns at least 5% of the outstanding voting shares of the issuer or as a result of other relationships, such as the Fund and the issuer having the same investment manager. Transactions with issuers that were either affiliated persons of the Fund at the beginning of the period or the end of the period were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Shares, beginning of period | | | Shares purchased | | | Shares sold | | | Shares, end of period | | | Net realized gains | | | Net

change in unrealized gains (losses) | | | Income from affiliated securities | | | Value, end of period | | | % of net

assets | |

Short-Term Investments | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Investment companies | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Securities Lending Cash Investment LLC | | | 1,315,692 | | | | 47,838,370 | | | | 48,160,911 | | | | 993,151 | | | $ | 59 | | | $ | (59 | ) | | $ | 42,173 | | | $ | 993,250 | | | | | |

Wells Fargo Government Money Market Fund Select Class | | | 1,975,446 | | | | 62,511,814 | | | | 63,436,955 | | | | 1,050,305 | | | | 0 | | | | 0 | | | | 18,048 | | | | 1,050,305 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | $ | 59 | | | $ | (59 | ) | | $ | 60,221 | | | $ | 2,043,555 | | | | 1.24 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 16 | | Wells Fargo Asia Pacific Fund | | Statement of assets and liabilities—October 31, 2017 |

| | | | |

| | | | |

| |

Assets | | | | |

Investments in unaffiliated securities (including $937,167 of securities loaned), at value (cost $126,132,198) | | $ | 162,786,718 | |

Investments in affiliated securities, at value (cost $2,043,555) | | | 2,043,555 | |

Foreign currency, at value (cost $931,367) | | | 931,337 | |

Receivable for investments sold | | | 399,252 | |

Receivable for Fund shares sold | | | 100,718 | |

Receivable for dividends | | | 369,722 | |

Receivable for securities lending income | | | 5,008 | |

Prepaid expenses and other assets | | | 43,726 | |

| | | | |

Total assets | | | 166,680,036 | |

| | | | |

| |

Liabilities | | | | |

Payable upon receipt of securities loaned | | | 993,250 | |

Payable for investments purchased | | | 815,897 | |

Management fee payable | | | 131,009 | |

Payable for Fund shares redeemed | | | 86,816 | |

Administration fees payable | | | 26,365 | |

Distribution fee payable | | | 1,440 | |

Trustees’ fees and expenses payable | | | 1,383 | |

Accrued expenses and other liabilities | | | 28,449 | |

| | | | |

Total liabilities | | | 2,084,609 | |

| | | | |

Total net assets | | $ | 164,595,427 | |

| | | | |

| |

NET ASSETS CONSIST OF | | | | |

Paid-in capital | | $ | 127,814,392 | |

Undistributed net investment income | | | 516,058 | |

Accumulated net realized losses on investments | | | (387,403 | ) |

Net unrealized gains on investments | | | 36,652,380 | |

| | | | |

Total net assets | | $ | 164,595,427 | |

| | | | |

| |

COMPUTATION OF NET ASSET VALUE AND OFFERING PRICE PER SHARE | | | | |

Net assets – Class A | | $ | 126,265,147 | |

Shares outstanding – Class A1 | | | 8,396,146 | |

Net asset value per share – Class A | | | $15.04 | |

Maximum offering price per share – Class A2 | | | $15.96 | |

Net assets – Class C | | $ | 2,308,678 | |

Shares outstanding – Class C1 | | | 162,147 | |

Net asset value per share – Class C | | | $14.24 | |

Net assets – Administrator Class | | $ | 2,000,020 | |

Shares outstanding – Administrator Class1 | | | 135,265 | |

Net asset value per share – Administrator Class | | | $14.79 | |

Net assets – Institutional Class | | $ | 34,021,582 | |

Shares outstanding – Institutional Class1 | | | 2,305,821 | |

Net asset value per share – Institutional Class | | | $14.75 | |

| 1 | The Fund has an unlimited number of authorized shares. |

| 2 | Maximum offering price is computed as 100/94.25 of net asset value. On investments of $50,000 or more, the offering price is reduced. |

The accompanying notes are an integral part of these financial statements.

| | | | | | |

| Statement of operations—year ended October 31, 2017 | | Wells Fargo Asia Pacific Fund | | | 17 | |

| | | | |

| | | | |

| |

Investment income | | | | |

Dividends (net of foreign withholding taxes of $351,945) | | $ | 3,184,882 | |

Income from affiliated securities | | | 60,221 | |

| | | | |

Total investment income | | | 3,245,103 | |

| | | | |

| |

Expenses | | | | |

Management fee | | | 1,472,590 | |

Administration fees | | | | |

Class A | | | 246,060 | |

Class C | | | 4,444 | |

Administrator Class | | | 5,081 | |

Institutional Class | | | 31,282 | |

Shareholder servicing fees | | | | |

Class A | | | 292,929 | |

Class C | | | 5,291 | |

Administrator Class | | | 9,771 | |

Distribution fee | | | | |

Class C | | | 15,872 | |

Custody and accounting fees | | | 95,193 | |

Professional fees | | | 53,212 | |

Registration fees | | | 71,288 | |

Shareholder report expenses | | | 24,522 | |

Trustees’ fees and expenses | | | 21,512 | |

Other fees and expenses | | | 25,970 | |

| | | | |

Total expenses | | | 2,375,017 | |

Less: Fee waivers and/or expense reimbursements | | | (91,134 | ) |

| | | | |

Net expenses | | | 2,283,883 | |

| | | | |

Net investment income | | | 961,220 | |

| | | | |

| |

REALIZED AND UNREALIZED GAINS (LOSSES) ON INVESTMENTS | | | | |

| |

Net realized gains on: | | | | |

Unaffiliated securities | | | 4,252,801 | |

Affiliated securities | | | 59 | |

| | | | |

Net realized gains on investments | | | 4,252,860 | |

| | | | |

|

Net change in unrealized gains (losses) on: | |

Unaffiliated securities | | | 29,328,740 | |

Affiiliated securities | | | (59 | ) |

| | | | |

Net change in unrealized gains (losses) on investments | | | 29,328,681 | |

| | | | |

Net realized and unrealized gains (losses) on investments | | | 33,581,541 | |

| | | | |

Net increase in net assets resulting from operations | | $ | 34,542,761 | |

| | | | |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 18 | | Wells Fargo Asia Pacific Fund | | Statement of changes in net assets |

| | | | | | | | | | | | | | | | |

| | | Year ended

October 31, 2017 | | | Year ended

October 31, 2016 | |

| | | | |

Operations | | | | | | | | | | | | | | | | |

Net investment income | | | | | | $ | 961,220 | | | | | | | $ | 1,443,500 | |

Net realized gains (losses) on investments | | | | | | | 4,252,860 | | | | | | | | (3,319,116 | ) |

Net change in unrealized gains (losses) on investments | | | | | | | 29,328,681 | | | | | | | | 5,861,420 | |

| | | | |

Net increase in net assets resulting from operations | | | | | | | 34,542,761 | | | | | | | | 3,985,804 | |

| | | | |

| | | | |

Distributions to shareholders from | | | | | | | | | | | | | | | | |

Net investment income | | | | | | | | | | | | | | | | |

Class A | | | | | | | (1,463,867 | ) | | | | | | | (2,403,259 | ) |

Class C | | | | | | | (6,107 | ) | | | | | | | (44,466 | ) |

Administrator Class | | | | | | | (50,069 | ) | | | | | | | (274,359 | ) |

Institutional Class | | | | | | | (295,073 | ) | | | | | | | (250,376 | ) |

| | | | |

Total distributions to shareholders | | | | | | | (1,815,116 | ) | | | | | | | (2,972,460 | ) |

| | | | |

| | | | |

Capital share transactions | | | Shares | | | | | | | | Shares | | | | | |

Proceeds from shares sold | | | | | | | | | | | | | | | | |

Class A | | | 620,409 | | | | 7,822,027 | | | | 1,604,531 | | | | 18,556,341 | |

Class C | | | 5,243 | | | | 62,877 | | | | 13,686 | | | | 149,151 | |

Administrator Class | | | 60,384 | | | | 741,557 | | | | 70,112 | | | | 783,199 | |

Institutional Class | | | 1,809,183 | | | | 22,286,904 | | | | 334,375 | | | | 3,796,409 | |

| | | | |

| | | | | | | 30,913,365 | | | | | | | | 23,285,100 | |

| | | | |

Reinvestment of distributions | | | | | | | | | | | | | | | | |

Class A | | | 124,042 | | | | 1,419,041 | | | | 203,382 | | | | 2,336,858 | |

Class C | | | 449 | | | | 4,899 | | | | 3,274 | | | | 35,719 | |

Administrator Class | | | 4,266 | | | | 47,951 | | | | 24,161 | | | | 272,051 | |

Institutional Class | | | 25,127 | | | | 281,166 | | | | 20,214 | | | | 227,203 | |

| | | | |

| | | | | | | 1,753,057 | | | | | | | | 2,871,831 | |

| | | | |

Payment for shares redeemed | | | | | | | | | | | | | | | | |

Class A | | | (2,264,628 | ) | | | (28,673,054 | ) | | | (3,431,646 | ) | | | (39,403,961 | ) |

Class C | | | (37,870 | ) | | | (444,028 | ) | | | (132,110 | ) | | | (1,420,868 | ) |

Administrator Class | | | (885,130 | ) | | | (10,601,230 | ) | | | (337,011 | ) | | | (3,756,219 | ) |

Institutional Class | | | (389,294 | ) | | | (5,004,838 | ) | | | (434,461 | ) | | | (4,818,709 | ) |

| | | | |

| | | | | | | (44,723,150 | ) | | | | | | | (49,399,757 | ) |

| | | | |

Net decrease in net assets resulting from capital share transactions | | | | | | | (12,056,728 | ) | | | | | | | (23,242,826 | ) |

| | | | |

Total increase (decrease) in net assets | | | | | | | 20,670,917 | | | | | | | | (22,229,482 | ) |

| | | | |

| | | | |

Net assets | | | | | | | | | | | | | | | | |

Beginning of period | | | | | | | 143,924,510 | | | | | | | | 166,153,992 | |

| | | | |

End of period | | | | | | $ | 164,595,427 | | | | | | | $ | 143,924,510 | |

| | | | |

Undistributed net investment income | | | | | | $ | 516,058 | | | | | | | $ | 1,270,787 | |

| | | | |

The accompanying notes are an integral part of these financial statements.

| | | | | | |

| Financial highlights | | Wells Fargo Asia Pacific Fund | | | 19 | |

(For a share outstanding throughout each period)

| | | | | | | | | | | | | | | | | | | | |

| | | Year ended October 31 | |

| CLASS A | | 2017 | | | 2016 | | | 2015 | | | 2014 | | | 2013 | |

Net asset value, beginning of period | | | $12.11 | | | | $11.92 | | | | $12.18 | | | | $11.72 | | | | $10.19 | |

Net investment income | | | 0.08 | | | | 0.11 | 1 | | | 0.04 | 1 | | | 0.09 | 1 | | | 0.12 | 1 |

Net realized and unrealized gains (losses) on investments | | | 3.00 | | | | 0.29 | | | | (0.16 | ) | | | 0.67 | | | | 1.79 | |

| | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 3.08 | | | | 0.40 | | | | (0.12 | ) | | | 0.76 | | | | 1.91 | |

Distributions to shareholders from | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.15 | ) | | | (0.21 | ) | | | (0.14 | ) | | | (0.30 | ) | | | (0.38 | ) |

Net asset value, end of period | | | $15.04 | | | | $12.11 | | | | $11.92 | | | | $12.18 | | | | $11.72 | |

Total return2 | | | 25.84 | % | | | 3.47 | % | | | (0.95 | )% | | | 6.61 | % | | | 19.24 | % |

Ratios to average net assets (annualized) | | | | | | | | | | | | | | | | | | | | |

Gross expenses | | | 1.66 | % | | | 1.69 | % | | | 1.72 | % | | | 1.71 | % | | | 1.79 | % |

Net expenses | | | 1.60 | % | | | 1.60 | % | | | 1.60 | % | | | 1.60 | % | | | 1.60 | % |

Net investment income | | | 0.58 | % | | | 0.97 | % | | | 0.34 | % | | | 0.80 | % | | | 1.08 | % |

Supplemental data | | | | | | | | | | | | | | | | | | | | |

Portfolio turnover rate | | | 63 | % | | | 52 | % | | | 113 | % | | | 113 | % | | | 187 | % |

Net assets, end of period (000s omitted) | | | $126,265 | | | | $120,108 | | | | $137,578 | | | | $6,755 | | | | $8,720 | |

| 1 | Calculated based upon average shares outstanding |

| 2 | Total return calculations do not include any sales charges. |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 20 | | Wells Fargo Asia Pacific Fund | | Financial highlights |

(For a share outstanding throughout each period)

| | | | | | | | | | | | | | | | | | | | |

| | | Year ended October 31 | |

| CLASS C | | 2017 | | | 2016 | | | 2015 | | | 2014 | | | 2013 | |

Net asset value, beginning of period | | | $11.44 | | | | $11.29 | | | | $11.57 | | | | $11.15 | | | | $9.73 | |

Net investment income (loss) | | | (0.02 | )1 | | | 0.02 | 1 | | | (0.00 | )1,2 | | | 0.01 | 1 | | | 0.05 | |

Net realized and unrealized gains (losses) on investments | | | 2.85 | | | | 0.28 | | | | (0.20 | ) | | | 0.63 | | | | 1.69 | |

| | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 2.83 | | | | 0.30 | | | | (0.20 | ) | | | 0.64 | | | | 1.74 | |

Distributions to shareholders from | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.03 | ) | | | (0.15 | ) | | | (0.08 | ) | | | (0.22 | ) | | | (0.32 | ) |

Net asset value, end of period | | | $14.24 | | | | $11.44 | | | | $11.29 | | | | $11.57 | | | | $11.15 | |

Total return3 | | | 24.86 | % | | | 2.75 | % | | | (1.71 | )% | | | 5.76 | % | | | 18.44 | % |

Ratios to average net assets (annualized) | | | | | | | | | | | | | | | | | | | | |

Gross expenses | | | 2.41 | % | | | 2.44 | % | | | 2.46 | % | | | 2.46 | % | | | 2.54 | % |

Net expenses | | | 2.35 | % | | | 2.35 | % | | | 2.35 | % | | | 2.35 | % | | | 2.35 | % |

Net investment income (loss) | | | (0.17 | )% | | | 0.14 | % | | | (0.01 | )% | | | 0.12 | % | | | 0.37 | % |

Supplemental data | | | | | | | | | | | | | | | | | | | | |

Portfolio turnover rate | | | 63 | % | | | 52 | % | | | 113 | % | | | 113 | % | | | 187 | % |

Net assets, end of period (000s omitted) | | | $2,309 | | | | $2,223 | | | | $3,495 | | | | $2,427 | | | | $1,980 | |

| 1 | Calculated based upon average shares outstanding |

| 2 | Amount is less than $0.005. |

| 3 | Total return calculations do not include any sales charges. |

The accompanying notes are an integral part of these financial statements.

| | | | | | |

| Financial highlights | | Wells Fargo Asia Pacific Fund | | | 21 | |

(For a share outstanding throughout each period)

| | | | | | | | | | | | | | | | | | | | |

| | | Year ended October 31 | |

| ADMINISTRATOR CLASS | | 2017 | | | 2016 | | | 2015 | | | 2014 | | | 2013 | |

Net asset value, beginning of period | | | $11.88 | | | | $11.72 | | | | $11.99 | | | | $11.54 | | | | $10.04 | |

Net investment income | | | 0.04 | 1 | | | 0.12 | | | | 0.11 | 1 | | | 0.12 | 1 | | | 0.14 | 1 |

Net realized and unrealized gains (losses) on investments | | | 3.00 | | | | 0.29 | | | | (0.21 | ) | | | 0.65 | | | | 1.77 | |

| | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 3.04 | | | | 0.41 | | | | (0.10 | ) | | | 0.77 | | | | 1.91 | |

Distributions to shareholders from | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.13 | ) | | | (0.25 | ) | | | (0.17 | ) | | | (0.32 | ) | | | (0.41 | ) |

Net asset value, end of period | | | $14.79 | | | | $11.88 | | | | $11.72 | | | | $11.99 | | | | $11.54 | |

Total return | | | 25.83 | % | | | 3.60 | % | | | (0.83 | )% | | | 6.86 | % | | | 19.57 | % |

Ratios to average net assets (annualized) | | | | | | | | | | | | | | | | | | | | |

Gross expenses | | | 1.58 | % | | | 1.61 | % | | | 1.56 | % | | | 1.52 | % | | | 1.61 | % |

Net expenses | | | 1.50 | % | | | 1.47 | % | | | 1.40 | % | | | 1.40 | % | | | 1.40 | % |

Net investment income | | | 0.36 | % | | | 1.07 | % | | | 0.87 | % | | | 1.04 | % | | | 1.26 | % |

Supplemental data | | | | | | | | | | | | | | | | | | | | |

Portfolio turnover rate | | | 63 | % | | | 52 | % | | | 113 | % | | | 113 | % | | | 187 | % |

Net assets, end of period (000s omitted) | | | $2,000 | | | | $11,357 | | | | $14,048 | | | | $13,956 | | | | $12,577 | |

| 1 | Calculated based upon average shares outstanding |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 22 | | Wells Fargo Asia Pacific Fund | | Financial highlights |

(For a share outstanding throughout each period)

| | | | | | | | | | | | | | | | | | | | |

| | | Year ended October 31 | |

| INSTITUTIONAL CLASS | | 2017 | | | 2016 | | | 2015 | | | 2014 | | | 2013 | |

Net asset value, beginning of period | | | $11.89 | | | | $11.73 | | | | $12.00 | | | | $11.55 | | | | $10.05 | |

Net investment income | | | 0.21 | | | | 0.13 | | | | 0.15 | 1 | | | 0.14 | 1 | | | 0.18 | 1 |

Net realized and unrealized gains (losses) on investments | | | 2.85 | | | | 0.30 | | | | (0.23 | ) | | | 0.65 | | | | 1.74 | |

| | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 3.06 | | | | 0.43 | | | | (0.08 | ) | | | 0.79 | | | | 1.92 | |

Distributions to shareholders from | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.20 | ) | | | (0.27 | ) | | | (0.19 | ) | | | (0.34 | ) | | | (0.42 | ) |

Net asset value, end of period | | | $14.75 | | | | $11.89 | | | | $11.73 | | | | $12.00 | | | | $11.55 | |

Total return | | | 26.25 | % | | | 3.83 | % | | | (0.65 | )% | | | 6.99 | % | | | 19.70 | % |

Ratios to average net assets (annualized) | | | | | | | | | | | | | | | | | | | | |

Gross expenses | | | 1.33 | % | | | 1.36 | % | | | 1.36 | % | | | 1.27 | % | | | 1.33 | % |

Net expenses | | | 1.25 | % | | | 1.25 | % | | | 1.25 | % | | | 1.25 | % | | | 1.25 | % |

Net investment income | | | 1.11 | % | | | 1.28 | % | | | 1.27 | % | | | 1.15 | % | | | 1.62 | % |

Supplemental data | | | | | | | | | | | | | | | | | | | | |

Portfolio turnover rate | | | 63 | % | | | 52 | % | | | 113 | % | | | 113 | % | | | 187 | % |

Net assets, end of period (000s omitted) | | | $34,022 | | | | $10,237 | | | | $11,034 | | | | $502 | | | | $129 | |

| 1 | Calculated based upon average shares outstanding |

The accompanying notes are an integral part of these financial statements.

| | | | | | |

| Notes to financial statements | | Wells Fargo Asia Pacific Fund | | | 23 | |

1. ORGANIZATION

Wells Fargo Funds Trust (the “Trust”), a Delaware statutory trust organized on March 10, 1999, is an open-end management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”). As an investment company, the Trust follows the accounting and reporting guidance in Financial Accounting Standards Board Accounting Standards Codification Topic 946, Financial Services – Investment Companies. These financial statements report on the Wells Fargo Asia Pacific Fund (the “Fund”) which is a diversified series of the Trust.

2. SIGNIFICANT ACCOUNTING POLICIES

The following significant accounting policies, which are consistently followed in the preparation of the financial statements of the Fund, are in conformity with U.S. generally accepted accounting principles which require management to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Securities valuation

All investments are valued each business day as of the close of regular trading on the New York Stock Exchange (generally 4 p.m. Eastern Time), although the Fund may deviate from this calculation time under unusual or unexpected circumstances.

Equity securities that are listed on a foreign or domestic exchange or market are valued at the official closing price or, if none, the last sales price. If no sale occurs on the principal exchange or market that day, a fair value price will be determined in accordance with the Fund’s Valuation Procedures.

The values of securities denominated in foreign currencies are translated into U.S. dollars at rates provided by an independent foreign currency pricing source at a time each business day specified by the Management Valuation Team of Wells Fargo Funds Management, LLC (“Funds Management”).

Many securities markets and exchanges outside the U.S. close prior to the close of the New York Stock Exchange and therefore may not fully reflect trading or events that occur after the close of the principal exchange in which the foreign securities are traded, but before the close of the New York Stock Exchange. If such trading or events are expected to materially affect the value of such securities, then fair value pricing procedures approved by the Board of Trustees of the Fund are applied. These procedures take into account multiple factors including movements in U.S. securities markets after foreign exchanges close. Foreign securities that are fair valued under these procedures are categorized as Level 2 and the application of these procedures may result in transfers between Level 1 and Level 2. Depending on market activity, such fair valuations may be frequent. Such fair value pricing may result in net asset values that are higher or lower than net asset values based on the last reported sales price or latest quoted bid price. On October 31, 2017, such fair value pricing was not used in pricing foreign securities.

Investments in registered open-end investment companies are valued at net asset value. Interests in non-registered investment companies that are redeemable at net asset value are fair valued normally at net asset value.

Investments which are not valued using any of the methods discussed above are valued at their fair value, as determined in good faith by the Board of Trustees. The Board of Trustees has established a Valuation Committee comprised of the Trustees and has delegated to it the authority to take any actions regarding the valuation of portfolio securities that the Valuation Committee deems necessary or appropriate, including determining the fair value of portfolio securities, unless the determination has been delegated to the Management Valuation Team. The Board of Trustees retains the authority to make or ratify any valuation decisions or approve any changes to the Valuation Procedures as it deems appropriate. On a quarterly basis, the Board of Trustees receives reports on any valuation actions taken by the Valuation Committee or the Management Valuation Team which may include items for ratification.

Valuations of fair valued securities are compared to the next actual sales price when available, or other appropriate market values, to assess the continued appropriateness of the fair valuation methodologies used. These securities are fair valued on a day-to-day basis, taking into consideration changes to appropriate market information and any significant changes to the inputs considered in the valuation process until there is a readily available price provided on an exchange or by an independent pricing service. Valuations received from an independent pricing service or independent broker-dealer quotes are periodically validated by comparisons to most recent trades and valuations provided by other independent pricing services in addition to the review of prices by the manager and/or subadviser. Unobservable inputs used in determining fair valuations are identified based on the type of security, taking into consideration factors utilized by market participants in valuing the investment, knowledge about the issuer and the current market environment.

| | | | |

| 24 | | Wells Fargo Asia Pacific Fund | | Notes to financial statements |

Foreign currency translation

The accounting records of the Fund are maintained in U.S. dollars. The values of other assets and liabilities denominated in foreign currencies are translated into U.S. dollars at rates provided by an independent foreign currency pricing source at a time each business day specified by the Management Valuation Team. Purchases and sales of securities, and income and expenses are converted at the rate of exchange on the respective dates of such transactions. Net realized foreign exchange gains or losses arise from sales of foreign currencies, currency gains or losses realized between the trade and settlement dates on securities transactions, and the difference between the amounts of dividends, interest and foreign withholding taxes recorded and the U.S. dollar equivalent of the amounts actually paid or received. Net unrealized foreign exchange gains and losses arise from changes in the fair value of assets and liabilities other than investments in securities resulting from changes in exchange rates. The changes in net assets arising from changes in exchange rates of securities and the changes in net assets resulting from changes in market prices of securities are not separately presented. Such changes are included in net realized and unrealized gains or losses from investments.

Participation notes