UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-09253

Wells Fargo Funds Trust

(Exact name of registrant as specified in charter)

525 Market St., San Francisco, CA 94105

(Address of principal executive offices) (Zip code)

C. David Messman

Wells Fargo Funds Management, LLC

525 Market St., San Francisco, CA 94105

(Name and address of agent for service)

Registrant’s telephone number, including area code: 800-222-8222

Date of fiscal year end: March 31

Registrant is making a filing for 9 of its series:

Wells Fargo Intrinsic Small Cap Value Fund, Wells Fargo Small Cap Core Fund, Wells Fargo Small Cap Opportunities Fund, Wells Fargo Small Cap Value Fund, Wells Fargo Special Small Cap Value Fund, Wells Fargo Traditional Small Cap Growth Fund, Wells Fargo Precious Metals Fund, Wells Fargo Specialized Technology Fund, and Wells Fargo Utility and Telecommunications Fund.

Date of reporting period: March 31, 2018

| ITEM 1. | REPORT TO STOCKHOLDERS |

Annual Report

March 31, 2018

Wells Fargo Intrinsic Small Cap Value Fund

Reduce clutter. Save trees.

Sign up for electronic delivery of prospectuses and shareholder reports at wellsfargo.com/advantagedelivery

Contents

The views expressed and any forward-looking statements are as of March 31, 2018, unless otherwise noted, and are those of the Fund managers and/or Wells Fargo Funds Management, LLC. Discussions of individual securities, or the markets generally, or any Wells Fargo Fund are not intended as individual recommendations. Future events or results may vary significantly from those expressed in any forward-looking statements. The views expressed are subject to change at any time in response to changing circumstances in the market. Wells Fargo Funds Management, LLC and the Fund disclaim any obligation to publicly update or revise any views expressed or forward-looking statements.

NOT FDIC INSURED ◾ NO BANK GUARANTEE ◾ MAY LOSE VALUE

| | | | |

| 2 | | Wells Fargo Intrinsic Small Cap Value Fund | | Letter to shareholders (unaudited) |

Andrew Owen

President

Wells Fargo Funds

Dear Shareholder:

We are pleased to offer you this annual report for the Wells Fargo Intrinsic Small Cap Value Fund for the 12-month period that ended March 31, 2018. During the last three quarters of 2017, investors enjoyed consistently rising equity values globally. Short-term interest rates tended to increase, while long-term rates remained flat to lower. During the final two months of the first quarter of 2018, equity market volatility returned, stocks reversed year-to-date gains, and bond yields rose while prices fell.

For the period, U.S. stocks, as measured by the S&P 500 Index,1 gained 13.99% and international stocks, as measured by the MSCI ACWI ex USA Index (Net),2 added 16.53%. Emerging market stocks, as measured by the MSCI EM Index (Net),3 added 24.93%. In bond markets, the Bloomberg Barclays U.S. Aggregate Bond Index4 added 1.20% and the Bloomberg Barclays Municipal Bond Index5 added 2.66% while fixed-income investments outside the U.S. gained 11.75%, according to the Bloomberg Barclays Global Aggregate ex-USD Index.6 The ICE BofAML U.S. High Yield Index7 earned 3.69%.

Through the last nine months of 2017, stocks advanced on synchronized global growth, which led to higher investor and consumer confidence. The first quarter of 2018 began with strong stock market gains in January. A strong January 2018 U.S. employment report and inflation concerns prompted equity volatility in February. Investor optimism for growth was supplanted with concerns over trade tensions, increased interest rates, and the prospect of new data privacy regulations.

Reactions to U.S. interest rate increases were uneven across the yield curve and globally.

The U.S. Federal Reserve (Fed) increased the federal funds rate three times during the 12-month period for a combined 75 basis points (bps; 100 bps equals 1.00%). Following an increase in March 2017, short-term bond yields in the U.S. rose while longer-term Treasury yields were little changed. Municipal bond returns were positive, helped by strong demand and constrained new-issue supply. The Fed raised the target interest rate once again in June 2017 to a range of 1.00% to 1.25%. Ten-year U.S. Treasury yields declined, the yield curve flattened, and long-term bond prices benefited.

| 1 | The S&P 500 Index consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market-value-weighted index with each stock’s weight in the index proportionate to its market value. You cannot invest directly in an index. |

| 2 | The Morgan Stanley Capital International (MSCI) All Country World Index (ACWI) ex USA Index (Net) is a free-float-adjusted market-capitalization-weighted index that is designed to measure the equity market performance of developed markets, excluding the United States and Canada. Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed, or produced by MSCI. You cannot invest directly in an index. |

| 3 | The MSCI Emerging Markets (EM) Index (Net) is a free-float-adjusted market-capitalization-weighted index that is designed to measure large- and mid-cap equity market performance of emerging markets. The MSCI EM Index (Net) consists of the following 24 emerging market country indices: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Pakistan, Peru, the Philippines, Poland, Qatar, Russia, South Africa, Taiwan, Thailand, Turkey, and the United Arab Emirates. You cannot invest directly in an index. |

| 4 | The Bloomberg Barclays U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment-grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, mortgage-backed securities (agency fixed-rate and hybrid adjustable-rate mortgage pass-throughs), asset-backed securities, and commercial mortgage-backed securities. You cannot invest directly in an index. |

| 5 | The Bloomberg Barclays Municipal Bond Index is an unmanaged index composed of long-term tax-exempt bonds with a minimum credit rating of Baa. You cannot invest directly in an index. |

| 6 | The Bloomberg Barclays Global Aggregate ex-USD Index is an unmanaged index that provides a broad-based measure of the global investment-grade fixed-income markets excluding the U.S. dollar-denominated debt market. You cannot invest directly in an index. |

| 7 | The ICE BofAML U.S. High Yield Index is a market-capitalization-weighted index of domestic and Yankee high-yield bonds. The index tracks the performance of high-yield securities traded in the U.S. bond market. You cannot invest directly in an index. Copyright 2018. ICE Data Indices, LLC. All rights reserved. |

| | | | | | |

| Letter to shareholders (unaudited) | | Wells Fargo Intrinsic Small Cap Value Fund | | | 3 | |

Internationally, central banks maintained low interest rates and accommodative monetary policies that supported business activity and stock values in foreign markets. A weaker U.S. dollar was generally supportive of business activity in regions around the globe. The Bank of Japan continued its accommodative monetary policies, and industrial production, retail sales, and fixed asset investment increased in China.

Growth continued through the summer of 2017.

Globally, stocks moved higher during the third quarter of 2017. Low inflation and interest rates supported accelerating global economic growth and corporate earnings. Brief episodes of geopolitical tensions, often associated with North Korea’s advancing nuclear missile program, flaring conflicts in the Middle East, and uncertainty surrounding U.S. trade policies, did not discourage investing activity.

In the U.S., economic data released during the quarter reflected a generally healthy economy. Second-quarter economic output grew at a 3.1% annual rate. Stocks in international developed and emerging markets continued to benefit from improving economic growth.

Positive economic and market news continued as 2017 closed and 2018 began.

During the fourth quarter of 2017, stock markets continued the move higher. Third-quarter economic output in the U.S. grew at a 3.2% annual rate. The unemployment rate fell to a 17-year low of 4.1%. Tax reform passed and wage growth data improved, encouraging increased business and consumer spending.

Fed officials announced in October 2017 plans to begin unwinding its $4.5 trillion portfolio of bonds and other assets accumulated during rounds of quantitative easing conducted since the 2008–2009 recession. Still, restrained inflation kept long-term bond rates steady and the flattened yield curve persisted. The Fed raised the federal funds rate target to a range of 1.25% to 1.50% in December 2017 and began selling bonds held in its portfolio.

2018 opened with continued stock advances, then volatility.

Improving business and economic data globally continued to support stocks through January 2018. Political wrangling in the U.S. over budget resolutions could not dissuade investors from buying stocks as payrolls and factory orders increased. Long-term interest rates in the U.S. trended higher as the yield curve steepened—the 10-year Treasury rate moved from 2.46% to 2.84% and the 30-year rate moved from 2.81% to 3.08% during January 2018.

Investor sentiment shifted in February as inflation concerns emerged in the U.S. when readings from the Producer Price Index in January rose 2.5% year over year. During February, the U.S. market endured a loss from January’s high of nearly 12% before recovering much of that loss. The Fed raised the federal funds rate in March 2018. Bond yields rose across the yield curve.

During January 2018, purchasing managers’ indices in China, the eurozone, India, and Japan reported data for December that indicated continued growth. Despite positive economic signals and business fundamentals, international stock values fell during February and March 2018, swept up in the selling momentum in U.S. markets.

Globally, stocks moved higher during the third quarter of 2017.

During February, the U.S. market endured a loss from January’s high of nearly 12% before recovering much of that loss.

| | | | |

| 4 | | Wells Fargo Intrinsic Small Cap Value Fund | | Letter to shareholders (unaudited) |

Don’t let short-term uncertainty derail long-term investment goals.

Periods of investment uncertainty can present challenges, but experience has taught us that maintaining long-term investment goals can be an effective way to plan for the future. To help you create a sound strategy based on your personal goals and risk tolerance, Wells Fargo Funds offers more than 100 mutual funds spanning a wide range of asset classes and investment styles. Although diversification cannot guarantee an investment profit or prevent losses, we believe it can be an effective way to manage investment risk and potentially smooth out overall portfolio performance. We encourage investors to know their investments and to understand that appropriate levels of risk-taking may unlock opportunities.

Thank you for choosing to invest with Wells Fargo Funds. We appreciate your confidence in us and remain committed to helping you meet your financial needs.

Sincerely,

Andrew Owen

President

Wells Fargo Funds

For further information about your Fund, contact your investment professional, visit our website at wellsfargofunds.com, or call us directly at 1-800-222-8222.

This page is intentionally left blank.

| | | | |

| 6 | | Wells Fargo Intrinsic Small Cap Value Fund | | Performance highlights (unaudited) |

Investment objective

The Fund seeks long-term capital appreciation.

Manager

Wells Fargo Funds Management, LLC

Subadviser

Wells Capital Management Incorporated

Portfolio managers

Ann Miletti

Christopher G. Miller, CFA®

Average annual total returns (%) as of March 31, 2018

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Including sales charge | | | Excluding sales charge | | | Expense ratios1 (%) | |

| | | Inception date | | 1 year | | | 5 year | | | 10 year | | | 1 year | | | 5 year | | | 10 year | | | Gross | | | Net2 | |

| Class A (WFSMX) | | 3-31-2008 | | | 2.54 | | | | 8.92 | | | | 8.13 | | | | 8.78 | | | | 10.22 | | | | 8.78 | | | | 1.49 | | | | 1.36 | |

| Class C (WSCDX) | | 3-31-2008 | | | 6.96 | | | | 9.40 | | | | 7.97 | | | | 7.96 | | | | 9.40 | | | | 7.97 | | | | 2.24 | | | | 2.11 | |

| Administrator Class (WFSDX) | | 4-8-2005 | | | – | | | | – | | | | – | | | | 8.94 | | | | 10.42 | | | | 9.01 | | | | 1.41 | | | | 1.21 | |

| Institutional Class (WFSSX) | | 4-8-2005 | | | – | | | | – | | | | – | | | | 9.15 | | | | 10.65 | | | | 9.24 | | | | 1.16 | | | | 1.01 | |

| Russell 2000® Value Index3 | | – | | | – | | | | – | | | | – | | | | 5.13 | | | | 9.96 | | | | 8.61 | | | | – | | | | – | |

Figures quoted represent past performance, which is no guarantee of future results, and do not reflect taxes that a shareholder may pay on fund distributions or the redemption of fund shares. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance shown without sales charges would be lower if sales charges were reflected. Current performance may be lower or higher than the performance data quoted, which assumes the reinvestment of dividends and capital gains. Current month-end performance is available on the Fund’s website, wellsfargofunds.com.

Index returns do not include transaction costs associated with buying and selling securities, any mutual fund fees or expenses, or any taxes. It is not possible to invest directly in an index.

For Class A shares, the maximum front-end sales charge is 5.75%. For Class C shares, the maximum contingent deferred sales charge is 1.00%. Performance including a contingent deferred sales charge assumes the sales charge for the corresponding time period. Administrator Class and Institutional Class shares are sold without a front-end sales charge or contingent deferred sales charge.

Stock values fluctuate in response to the activities of individual companies and general market and economic conditions. Smaller-company stocks tend to be more volatile and less liquid than those of larger companies. Certain investment strategies tend to increase the total risk of an investment (relative to the broader market). Consult the Fund’s prospectus for additional information on these and other risks.

Please see footnotes on page 7.

| | | | | | |

| Performance highlights (unaudited) | | Wells Fargo Intrinsic Small Cap Value Fund | | | 7 | |

|

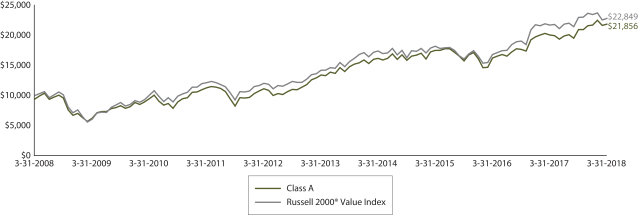

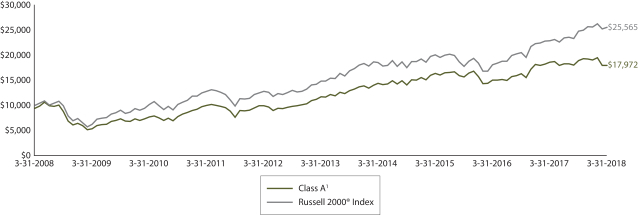

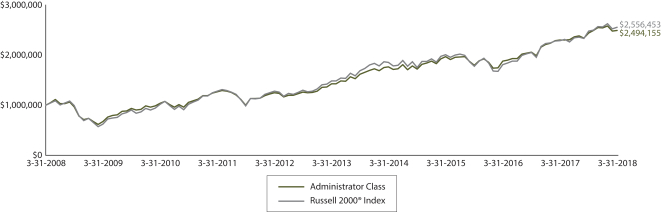

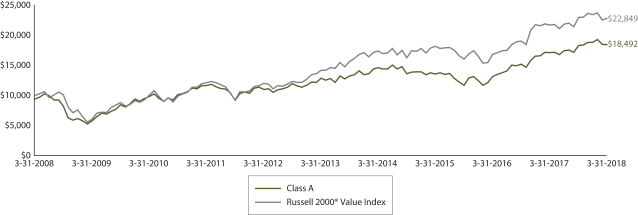

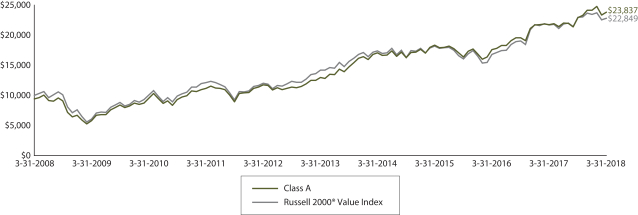

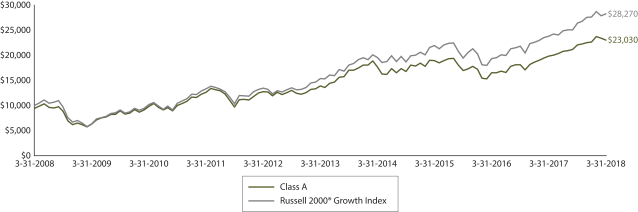

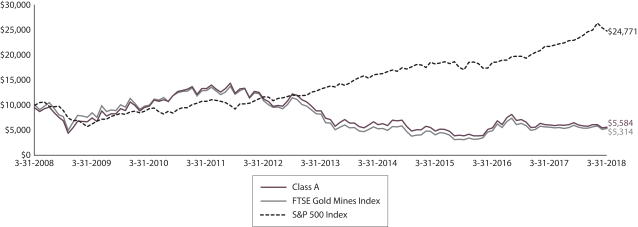

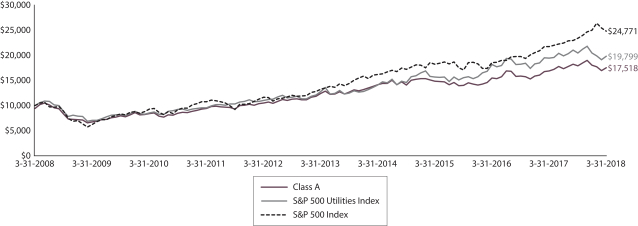

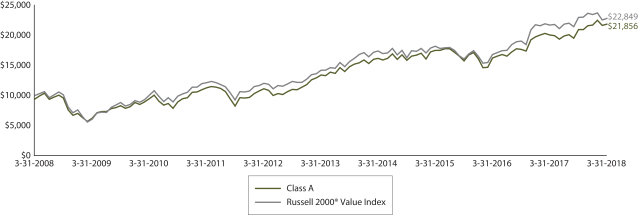

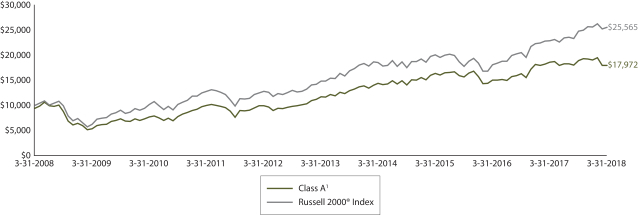

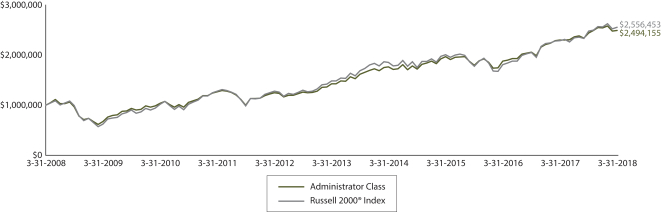

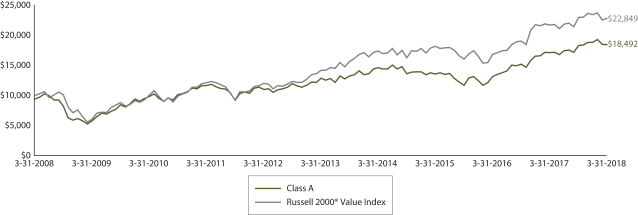

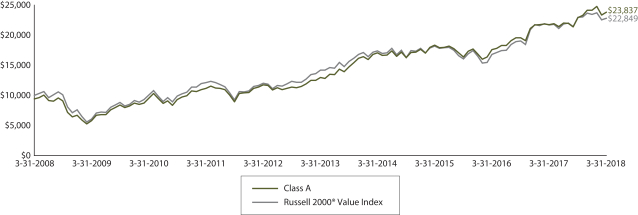

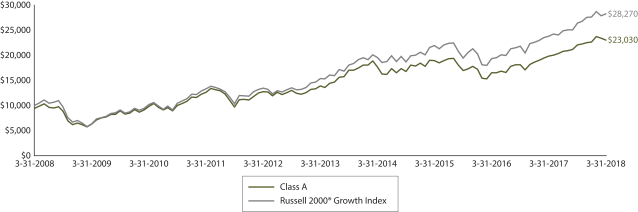

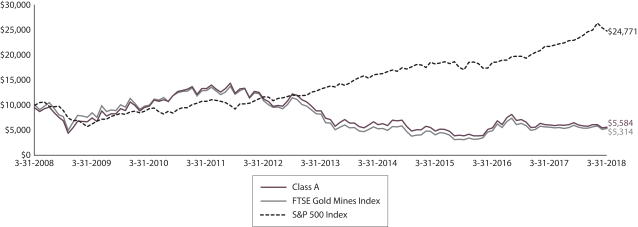

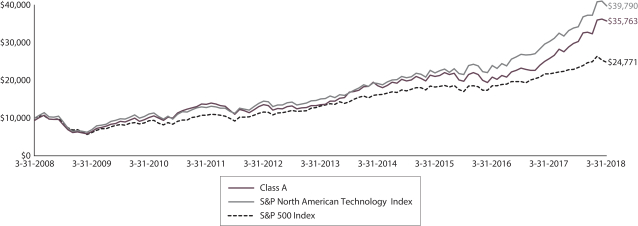

| Growth of $10,000 investment as of March 31, 20184 |

|

|

| 1 | Reflects the expense ratios as stated in the most recent prospectuses, which include the impact of 0.01% in acquired fund fees and expenses. The expense ratios shown are subject to change and may differ from the annualized expense ratios shown in the financial highlights of this report, which do not include acquired fund fees and expenses. |

| 2 | The manager has contractually committed through July 31, 2018, to waive fees and/or reimburse expenses to the extent necessary to cap the Fund’s Total Annual Fund Operating Expenses After Fee Waivers at the 1.35% for Class A, 2.10% for Class C, 1.20% for Administrator Class, and 1.00% for Institutional Class. After this time, the cap may be increased or the commitment to maintain the cap may be terminated only with the approval of the Board of Trustees. Brokerage commissions, stamp duty fees, interest, taxes, acquired fund fees and expenses (if any), and extraordinary expenses are excluded from the expense cap. Without this cap, the Fund’s returns would have been lower. The expense ratio paid by an investor is the net expense ratio (the total annual fund operating expenses after fee waivers) as stated in the prospectuses. |

| 3 | The Russell 2000® Value Index measures the performance of those Russell 2000 companies with lower price/book ratios and lower forecasted growth values. You cannot invest directly in an index. |

| 4 | The chart compares the performance of Class A shares for the most recent ten years with the Russell 2000® Value Index. The chart assumes a hypothetical investment of $10,000 in Class A shares and reflects all operating expenses and assumes the maximum initial sales charge of 5.75%. |

| 5 | The ten largest holdings, excluding cash and cash equivalents, are calculated based on the value of the investments divided by total net assets of the Fund. Holdings are subject to change and may have changed since the date specified. |

| 6 | Amounts are calculated based on the total long-term investments of the Fund. These amounts are subject to change and may have changed since the date specified. |

| | | | |

| 8 | | Wells Fargo Intrinsic Small Cap Value Fund | | Performance highlights (unaudited) |

MANAGER’S DISCUSSION

Fund highlights

| ∎ | | The Fund outperformed its benchmark, the Russell 2000® Value Index, for the 12-month period that ended March 31, 2018. |

| ∎ | | Stock selection in the health care, energy, and materials sectors contributed the most to performance relative to the index. |

| ∎ | | Stock selection in the consumer staples sector detracted from performance relative to the index. |

The U.S. stock market rallied for most of the reporting period, with many stock market indices hitting new all-time highs in January 2018 before pulling back in the subsequent two months. Market volatility hit an all-time low in late 2017, and larger-cap and growth stocks tended to outperform smaller-cap and value stocks. The small-cap value segment of the U.S. stock market, represented by the Russell 2000® Value Index, followed a similar pattern and ended with a 5.1% gain for the period.

A number of factors influenced the U.S. stock market during the period. From our perspective, the outcome of the November 2016 U.S. presidential election likely had the biggest impact; the U.S. stock market generally rallied since the election through the latter part of January 2018 as investors expected businesses to benefit from the new administration’s progrowth positioning. In December 2017, the Tax Cuts and Jobs Act of 2017 was passed by the U.S. Congress and signed into law. The U.S. Federal Reserve (Fed) raised its benchmark interest rate by 0.25% three times during the reporting period, most recently to a range of 1.50% to 1.75% at its March 2018 meeting. The Fed also released a fairly detailed outline of its plans to reduce the size of its balance sheet of approximately $4.5 trillion and began implementing the reduction. Overall, the U.S. economy remained resilient, with 15 straight quarters of growth in gross domestic product, and continued to experience favorable trends in employment, wages, and consumer confidence.

Throughout all of the market and economic events that occurred during the reporting period, we continued to seek well-positioned companies—those with good business models, strong management teams, and healthy cash flows—trading at attractive discounts to their private market valuations (PMVs). The PMV represents the expected price that would be paid for the entire company as a stand-alone private entity.

| | | | |

| Ten largest holdings (%) as of March 31, 20185 | |

Zions Bancorporation | | | 2.19 | |

Sterling BanCorp | | | 2.17 | |

Webster Financial Corporation | | | 2.16 | |

WPX Energy Incorporated | | | 2.13 | |

RSP Permian Incorporated | | | 2.08 | |

Bio-Rad Laboratories Incorporated Class A | | | 1.91 | |

LegacyTexas Financial Group | | | 1.85 | |

National General Holdings Corporation | | | 1.83 | |

Stifel Financial Corporation | | | 1.82 | |

Haemonetics Corporation | | | 1.78 | |

Portfolio holdings in the health care, energy, and materials sectors were the largest contributors to relative performance.

Health care was the best-performing sector in the index, rising almost 25% during the reporting period. The Fund’s overweight position and stock selection outperformed the sector, making it the largest contributor to relative performance. Holdings in the health care equipment and services industry, including Haemonetics Corporation, STERIS plc, and Integer Holdings Corporation, outperformed their peers. Haemonetics, a global health care company providing innovative blood management solutions, rose 80% during the period on reporting strong financial results

after implementing cost-cutting measures and experiencing sequential growth. Even though energy was one of the worst-performing sectors in the index, declining over 18%, the Fund’s overweight position in high-quality companies gained 3.6% during the period. West Texas Intermediate crude oil prices rose 28% and, along with debt reduction and operational improvements, aided the performance of the Fund’s energy holdings. In the materials sector, holdings in the chemicals and mining industries outperformed their peers.

Please see footnotes on page 7.

| | | | | | |

| Performance highlights (unaudited) | | Wells Fargo Intrinsic Small Cap Value Fund | | | 9 | |

|

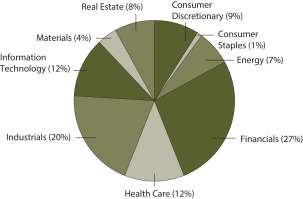

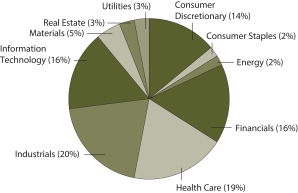

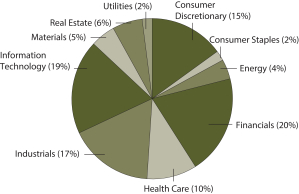

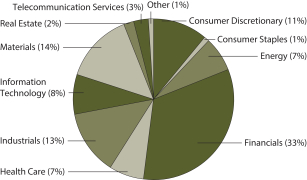

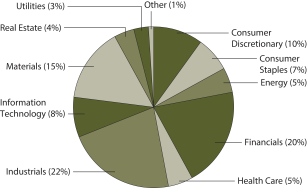

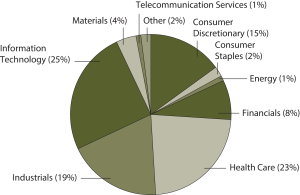

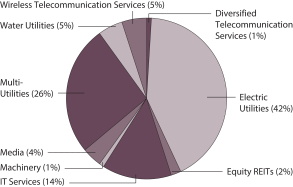

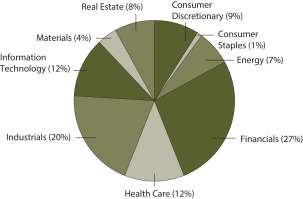

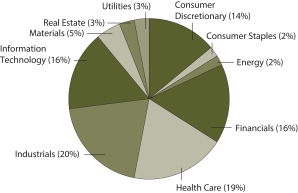

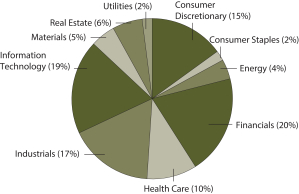

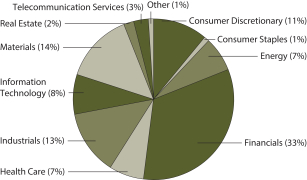

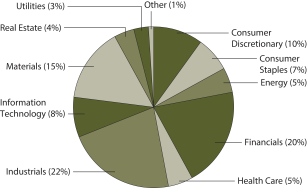

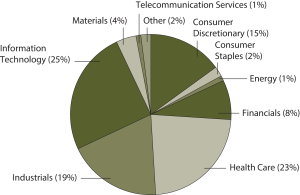

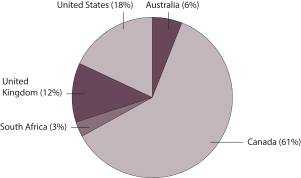

| Sector distribution as of March 31, 20186 |

|

|

Stock selection in the consumer staples sector detracted from relative performance.

The consumer staples sector in the index declined 5.6% during the reporting period, with the Fund’s holdings in the food products industry underperforming the benchmark, making it the leading detractor from relative performance. TreeHouse Foods, Incorporated, is a food and beverage manufacturing company operating in the U.S. and Canada, specializing in the production of private label products. The company has been dealing with a competitive pricing environment that negatively affected margins and future earnings potential, causing the stock to decline 54% during the period.

Our methodology includes buying stocks at a discount to their estimated PMV and selling stocks as they approach or exceed the upper end of their PMV range.

Our bottom-up investment process leads us to be overweight or underweight certain sectors. This positioning changes over time based on macroeconomic and industry-specific factors. During the reporting period, our process led us to be overweight the industrials, health care, and information technology sectors and underweight utilities, real estate, and financials. Through our disciplined investment process, we remain keenly aware of both price and enterprise values on a company-by-company basis. Our proprietary database of historical company acquisitions across industries, sectors, and time frames enables us to maintain an extensive foundation for assessing the PMV of companies compared with their public stock prices. We strive to take advantage of those price discrepancies for the benefit of Fund shareholders by purchasing stocks when we believe they are selling at a discount to their PMV.

Similar themes may prevail for the rest of 2018.

Looking ahead to the rest of the year, the policies of the U.S. government, the impact of tax reform, interest rates, and energy prices are themes that likely could influence the overall market and the relative performance of the Fund. Now that tax reform has been accomplished, the U.S. administration has turned its sights on trade agreements, further reduction of commercial business regulations, and infrastructure.

The Fed has signaled more rate hikes in 2018 if labor markets tighten further, global economic risks remain balanced, and inflation measures hit the Fed’s target. Volatility in commodity prices and global currencies likely may continue to drive global stock markets.

Please see footnotes on page 7.

| | | | |

| 10 | | Wells Fargo Intrinsic Small Cap Value Fund | | Fund expenses (unaudited) |

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and contingent deferred sales charges (if any) on redemptions and (2) ongoing costs, including management fees, distribution (12b-1) and/or shareholder servicing fees, and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the six-month period and held for the entire period from October 1, 2017 to March 31, 2018.

Actual expenses

The “Actual” line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the “Actual” line under the heading entitled “Expenses paid during period” for your applicable class of shares to estimate the expenses you paid on your account during this period.

Hypothetical example for comparison purposes

The “Hypothetical” line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) and contingent deferred sales charges. Therefore, the “Hypothetical” line of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | |

| | | Beginning account value 10-1-2017 | | | Ending

account value

3-31-2018 | | | Expenses

paid during

the period¹ | | | Annualized net

expense ratio | |

Class A | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,042.07 | | | $ | 6.87 | | | | 1.35 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,018.20 | | | $ | 6.79 | | | | 1.35 | % |

Class C | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,038.27 | | | $ | 10.67 | | | | 2.10 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,014.46 | | | $ | 10.55 | | | | 2.10 | % |

Administrator Class | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,042.94 | | | $ | 6.11 | | | | 1.20 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,018.95 | | | $ | 6.04 | | | | 1.20 | % |

Institutional Class | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,044.08 | | | $ | 5.10 | | | | 1.00 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,019.95 | | | $ | 5.04 | | | | 1.00 | % |

| 1 | Expenses paid is equal to the annualized net expense ratio of each class multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year divided by the number of days in the fiscal year (to reflect the one-half-year period). |

| | | | | | |

| Portfolio of investments—March 31, 2018 | | Wells Fargo Intrinsic Small Cap Value Fund | | | 11 | |

| | | | | | | | | | | | | | | | |

| Security name | | | | | | | | Shares | | | Value | |

| | | | |

Common Stocks: 98.57% | | | | | | | | | | | | | | | | |

| | | | |

Consumer Discretionary: 9.08% | | | | | | | | | | | | | | | | |

| | | | |

| Auto Components: 3.08% | | | | | | | | | | | | | | | | |

Dana Incorporated | | | | | | | | | | | 48,651 | | | $ | 1,253,250 | |

Tenneco Incorporated | | | | | | | | | | | 22,694 | | | | 1,245,220 | |

| | | | |

| | | | | | | | | | | | | | | 2,498,470 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Diversified Consumer Services: 0.87% | | | | | | | | | | | | | | | | |

Houghton Mifflin Harcourt Company † | | | | | | | | | | | 101,436 | | | | 704,980 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Hotels, Restaurants & Leisure: 1.32% | | | | | | | | | | | | | | | | |

Playa Hotels & Resorts NV † | | | | | | | | | | | 43,812 | | | | 447,759 | |

Red Robin Gourmet Burgers Incorporated † | | | | | | | | | | | 10,851 | | | | 629,358 | |

| | | | |

| | | | | | | | | | | | | | | 1,077,117 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Leisure Products: 1.26% | | | | | | | | | | | | | | | | |

Callaway Golf Company | | | | | | | | | | | 62,612 | | | | 1,024,332 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Media: 1.33% | | | | | | | | | | | | | | | | |

Lions Gate Entertainment Class B | | | | | | | | | | | 29,235 | | | | 703,979 | |

MDC Partners Incorporated Class A † | | | | | | | | | | | 52,393 | | | | 377,230 | |

| | | | |

| | | | | | | | | | | | | | | 1,081,209 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Textiles, Apparel & Luxury Goods: 1.22% | | | | | | | | | | | | | | | | |

Carter’s Incorporated | | | | | | | | | | | 9,500 | | | | 988,950 | |

| | | | | | | | | | | | | | | | |

| | | | |

Consumer Staples: 0.54% | | | | | | | | | | | | | | | | |

| | | | |

| Food Products: 0.54% | | | | | | | | | | | | | | | | |

TreeHouse Foods Incorporated † | | | | | | | | | | | 11,464 | | | | 438,727 | |

| | | | | | | | | | | | | | | | |

| | | | |

Energy: 7.08% | | | | | | | | | | | | | | | | |

| | | | |

| Energy Equipment & Services: 0.50% | | | | | | | | | | | | | | | | |

Forum Energy Technologies Incorporated † | | | | | | | | | | | 36,707 | | | | 403,777 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Oil, Gas & Consumable Fuels: 6.58% | | | | | | | | | | | | | | | | |

Encana Corporation | | | | | | | | | | | 79,606 | | | | 875,666 | |

Matador Resources Company † | | | | | | | | | | | 35,423 | | | | 1,059,502 | |

RSP Permian Incorporated † | | | | | | | | | | | 35,961 | | | | 1,685,852 | |

WPX Energy Incorporated † | | | | | | | | | | | 116,852 | | | | 1,727,073 | |

| | | | |

| | | | | | | | | | | | | | | 5,348,093 | |

| | | | | | | | | | | | | | | | |

| | | | |

Financials: 26.49% | | | | | | | | | | | | | | | | |

| | | | |

| Banks: 18.12% | | | | | | | | | | | | | | | | |

Ameris Bancorp | | | | | | | | | | | 24,770 | | | | 1,310,333 | |

First Midwest Bancorp Incorporated | | | | | | | | | | | 26,628 | | | | 654,783 | |

LegacyTexas Financial Group | | | | | | | | | | | 35,088 | | | | 1,502,468 | |

PacWest Bancorp | | | | | | | | | | | 28,348 | | | | 1,404,076 | |

Pinnacle Financial Partners Incorporated | | | | | | | | | | | 19,790 | | | | 1,270,518 | |

Renasant Corporation | | | | | | | | | | | 22,504 | | | | 957,770 | |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 12 | | Wells Fargo Intrinsic Small Cap Value Fund | | Portfolio of investments—March 31, 2018 |

| | | | | | | | | | | | | | | | |

| Security name | | | | | | | | Shares | | | Value | |

| | | | |

| Banks (continued) | | | | | | | | | | | | | | | | |

Sterling BanCorp | | | | | | | | | | | 77,993 | | | $ | 1,758,742 | |

United Community Bank | | | | | | | | | | | 36,202 | | | | 1,145,793 | |

Webster Financial Corporation | | | | | | | | | | | 31,608 | | | | 1,751,083 | |

Wintrust Financial Corporation | | | | | | | | | | | 13,726 | | | | 1,181,122 | |

Zions Bancorporation | | | | | | | | | | | 33,704 | | | | 1,777,212 | |

| | | | |

| | | | | | | | | | | | | | | 14,713,900 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Capital Markets: 1.82% | | | | | | | | | | | | | | | | |

Stifel Financial Corporation | | | | | | | | | | | 24,937 | | | | 1,477,019 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Insurance: 5.26% | | | | | | | | | | | | | | | | |

CNO Financial Group Incorporated | | | | | | | | | | | 64,324 | | | | 1,393,901 | |

First American Financial Corporation | | | | | | | | | | | 13,727 | | | | 805,500 | |

Maiden Holdings Limited | | | | | | | | | | | 89,420 | | | | 581,230 | |

National General Holdings Corporation | | | | | | | | | | | 61,230 | | | | 1,488,501 | |

| | | | |

| | | | | | | | | | | | | | | 4,269,132 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Thrifts & Mortgage Finance: 1.29% | | | | | | | | | | | | | | | | |

Essent Group Limited † | | | | | | | | | | | 24,740 | | | | 1,052,934 | |

| | | | | | | | | | | | | | | | |

| | | | |

Health Care: 12.35% | | | | | | | | | | | | | | | | |

| | | | |

| Health Care Equipment & Supplies: 7.49% | | | | | | | | | | | | | | | | |

AngioDynamics Incorporated † | | | | | | | | | | | 81,559 | | | | 1,406,893 | |

Haemonetics Corporation † | | | | | | | | | | | 19,770 | | | | 1,446,373 | |

Integer Holdings Corporation † | | | | | | | | | | | 21,594 | | | | 1,221,141 | |

STERIS plc | | | | | | | | | | | 14,273 | | | | 1,332,527 | |

Wright Medical Group NV † | | | | | | | | | | | 33,878 | | | | 672,140 | |

| | | | |

| | | | | | | | | | | | | | | 6,079,074 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Health Care Providers & Services: 1.45% | | | | | | | | | | | | | | | | |

Envision Healthcare Corporation † | | | | | | | | | | | 30,579 | | | | 1,175,151 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Life Sciences Tools & Services: 3.41% | | | | | | | | | | | | | | | | |

Bio-Rad Laboratories Incorporated Class A † | | | | | | | | | | | 6,212 | | | | 1,553,497 | |

Bruker Corporation | | | | | | | | | | | 40,747 | | | | 1,219,150 | |

| | | | |

| | | | | | | | | | | | | | | 2,772,647 | |

| | | | | | | | | | | | | | | | |

| | | | |

Industrials: 19.47% | | | | | | | | | | | | | | | | |

| | | | |

| Aerospace & Defense: 0.83% | | | | | | | | | | | | | | | | |

Aerojet Rocketdyne Holdings † | | | | | | | | | | | 24,064 | | | | 673,070 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Airlines: 1.10% | | | | | | | | | | | | | | | | |

Spirit Airlines Incorporated †« | | | | | | | | | | | 23,555 | | | | 889,908 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Commercial Services & Supplies: 4.57% | | | | | | | | | | | | | | | | |

Interface Incorporated | | | | | | | | | | | 56,041 | | | | 1,412,233 | |

KAR Auction Services Incorporated | | | | | | | | | | | 24,751 | | | | 1,341,504 | |

Steelcase Incorporated Class A | | | | | | | | | | | 70,737 | | | | 962,023 | |

| | | | |

| | | | | | | | | | | | | | | 3,715,760 | |

| | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| | | | | | |

| Portfolio of investments—March 31, 2018 | | Wells Fargo Intrinsic Small Cap Value Fund | | | 13 | |

| | | | | | | | | | | | | | | | |

| Security name | | | | | | | | Shares | | | Value | |

| | | | |

| Construction & Engineering: 0.45% | | | | | | | | | | | | | | | | |

Valmont Industries Incorporated | | | | | | | | | | | 2,483 | | | $ | 363,263 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Machinery: 4.53% | | | | | | | | | | | | | | | | |

Altra Holdings Incorporated « | | | | | | | | | | | 24,987 | | | | 1,148,153 | |

ITT Incorporated | | | | | | | | | | | 26,366 | | | | 1,291,407 | |

Rexnord Corporation † | | | | | | | | | | | 41,785 | | | | 1,240,179 | |

| | | | |

| | | | | | | | | | | | | | | 3,679,739 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Road & Rail: 2.86% | | | | | | | | | | | | | | | | |

Avis Budget Group Incorporated †« | | | | | | | | | | | 22,107 | | | | 1,035,492 | |

Genesee & Wyoming Incorporated Class A † | | | | | | | | | | | 18,138 | | | | 1,283,989 | |

| | | | |

| | | | | | | | | | | | | | | 2,319,481 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Trading Companies & Distributors: 5.13% | | | | | | | | | | | | | | | | |

Air Lease Corporation | | | | | | | | | | | 23,246 | | | | 990,745 | |

GATX Corporation « | | | | | | | | | | | 14,003 | | | | 959,065 | |

MRC Global Incorporated † | | | | | | | | | | | 73,543 | | | | 1,209,047 | |

WESCO International Incorporated † | | | | | | | | | | | 16,253 | | | | 1,008,499 | |

| | | | |

| | | | | | | | | | | | | | | 4,167,356 | |

| | | | | | | | | | | | | | | | |

| | | | |

Information Technology: 11.90% | | | | | | | | | | | | | | | | |

| | | | |

| Communications Equipment: 1.58% | | | | | | | | | | | | | | | | |

Infinera Corporation † | | | | | | | | | | | 117,808 | | | | 1,279,395 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Electronic Equipment, Instruments & Components: 6.85% | | | | | | | | | | | | | | | | |

Anixter International Incorporated † | | | | | | | | | | | 14,556 | | | | 1,102,617 | |

Avnet Incorporated | | | | | | | | | | | 30,232 | | | | 1,262,488 | |

Synnex Corporation | | | | | | | | | | | 8,624 | | | | 1,021,082 | |

VeriFone Systems Incorporated † | | | | | | | | | | | 63,869 | | | | 982,305 | |

Zebra Technologies Corporation Class A † | | | | | | | | | | | 8,576 | | | | 1,193,693 | |

| | | | |

| | | | | | | | | | | | | | | 5,562,185 | |

| | | | | | | | | | | | | | | | |

| | | | |

| IT Services: 2.42% | | | | | | | | | | | | | | | | |

Conduent Incorporated † | | | | | | | | | | | 68,092 | | | | 1,269,235 | |

WEX Incorporated † | | | | | | | | | | | 4,434 | | | | 694,453 | |

| | | | |

| | | | | | | | | | | | | | | 1,963,688 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Technology Hardware, Storage & Peripherals: 1.05% | | | | | | | | | | | | | | | | |

Diebold Nixdorf Incorporated « | | | | | | | | | | | 55,484 | | | | 854,454 | |

| | | | | | | | | | | | | | | | |

| | | | |

Materials: 3.62% | | | | | | | | | | | | | | | | |

| | | | |

| Chemicals: 0.70% | | | | | | | | | | | | | | | | |

PolyOne Corporation | | | | | | | | | | | 13,399 | | | | 569,725 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Metals & Mining: 2.92% | | | | | | | | | | | | | | | | |

Reliance Steel & Aluminum Company | | | | | | | | | | | 16,133 | | | | 1,383,243 | |

Royal Gold Incorporated | | | | | | | | | | | 11,533 | | | | 990,339 | |

| | | | |

| | | | | | | | | | | | | | | 2,373,582 | |

| | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 14 | | Wells Fargo Intrinsic Small Cap Value Fund | | Portfolio of investments—March 31, 2018 |

| | | | | | | | | | | | | | | | |

| Security name | | | | | | | | Shares | | | Value | |

| | | | |

Real Estate: 8.04% | | | | | | | | | | | | | | | | |

| | | | |

| Equity REITs: 8.04% | | | | | | | | | | | | | | | | |

Cousins Properties Incorporated | | | | | | | | | | | 92,354 | | | $ | 801,633 | |

Four Corners Property Trust Incorporated | | | | | | | | | | | 35,235 | | | | 813,576 | |

Hudson Pacific Properties Incorporated | | | | | | | | | | | 38,184 | | | | 1,242,126 | |

Outfront Media Incorporated | | | | | | | | | | | 36,946 | | | | 692,368 | |

Physicians Realty Trust | | | | | | | | | | | 66,772 | | | | 1,039,640 | |

Retail Opportunity Investment Corporation | | | | | | | | | | | 59,777 | | | | 1,056,260 | |

Taubman Centers Incorporated | | | | | | | | | | | 15,558 | | | | 885,406 | |

| | | | |

| | | | | | | | | | | | | | | 6,531,009 | |

| | | | | | | | | | | | | | | | |

| | | | |

Total Common Stocks (Cost $65,559,386) | | | | | | | | | | | | | | | 80,048,127 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | Yield | | | | | | | | | | |

| Short-Term Investments: 6.74% | | | | | | | | | | | | | | | | |

| | | | |

| Investment Companies: 6.74% | | | | | | | | | | | | | | | | |

Securities Lending Cash Investment LLC (l)(r)(u) | | | 1.89 | % | | | | | | | 4,579,892 | | | | 4,580,350 | |

Wells Fargo Government Money Market Fund Select Class (l)(u) | | | 1.54 | | | | | | | | 893,311 | | | | 893,311 | |

| | | | |

Total Short-Term Investments (Cost $5,473,592) | | | | | | | | | | | | | | | 5,473,661 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | |

| Total investments in securities (Cost $71,032,978) | | | 105.31 | % | | | 85,521,788 | |

Other assets and liabilities, net | | | (5.31 | ) | | | (4,310,851 | ) |

| | | | | | | | |

| Total net assets | | | 100.00 | % | | $ | 81,210,937 | |

| | | | | | | | |

| † | Non-income-earning security |

| « | All or a portion of this security is on loan. |

| (l) | The issuer of the security is an affiliated person of the Fund as defined in the Investment Company Act of 1940. |

| (r) | The investment is a non-registered investment company purchased with cash collateral received from securities on loan. |

| (u) | The rate represents the 7-day annualized yield at period end. |

Investments in Affiliates

An affiliated investment is an investment in which the Fund owns at least 5% of the outstanding voting shares of the issuer or as a result of other relationships, such as the Fund and the issuer having the same investment manager. Transactions with issuers that were either affiliated persons of the Portfolio at the beginning of the period or the end of the period were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Shares,

beginning of

period | | | Shares

purchased | | | Shares

sold | | | Shares,

end of

period | | | Net

realized

gains

(losses) | | | Net

change in

unrealized

gains

(losses) | | | Income

from

affiliated

securities | | | Value, end

of period | | | % of

net

assets | |

Short-Term Investments | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Investment companies | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Securities Lending Cash Investment LLC | | | 6,194,706 | | | | 55,772,053 | | | | 57,386,867 | | | | 4,579,892 | | | $ | 239 | | | $ | (229 | ) | | $ | 13,832 | | | $ | 4,580,350 | | | | | |

Wells Fargo Government Money Market Fund Select Class | | | 3,115,232 | | | | 23,681,112 | | | | 25,903,033 | | | | 893,311 | | | | 0 | | | | 0 | | | | 17,244 | | | | 893,311 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | $ | 239 | | | $ | (229 | ) | | $ | 31,076 | | | $ | 5,473,661 | | | | 6.74 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| | | | | | |

| Statement of assets and liabilities—March 31, 2018 | | Wells Fargo Intrinsic Small Cap Value Fund | | | 15 | |

| | | | |

| | | | |

| |

Assets | | | | |

Investments in unaffiliated securities (including $4,550,752 of securities loaned), at value (cost $65,559,386) | | $ | 80,048,127 | |

Investments in affiliated securities, at value (cost $5,473,592) | | | 5,473,661 | |

Cash | | | 37,106 | |

Receivable for investments sold | | | 355,601 | |

Receivable for Fund shares sold | | | 3,576 | |

Receivable for dividends | | | 79,182 | |

Receivable for securities lending income | | | 1,768 | |

Prepaid expenses and other assets | | | 30,321 | |

| | | | |

Total assets | | | 86,029,342 | |

| | | | |

| |

Liabilities | | | | |

Payable upon receipt of securities loaned | | | 4,579,825 | |

Payable for investments purchased | | | 71,451 | |

Management fee payable | | | 46,061 | |

Payable for Fund shares redeemed | | | 42,662 | |

Administration fees payable | | | 13,049 | |

Distribution fee payable | | | 560 | |

Trustees’ fees and expenses payable | | | 457 | |

Accrued expenses and other liabilities | | | 64,340 | |

| | | | |

Total liabilities | | | 4,818,405 | |

| | | | |

Total net assets | | $ | 81,210,937 | |

| | | | |

| |

NET ASSETS CONSIST OF | | | | |

Paid-in capital | | $ | 67,232,207 | |

Accumulated net realized losses on investments | | | (510,080 | ) |

Net unrealized gains on investments | | | 14,488,810 | |

| | | | |

Total net assets | | $ | 81,210,937 | |

| | | | |

| |

COMPUTATION OF NET ASSET VALUE AND OFFERING PRICE PER SHARE | | | | |

Net assets – Class A | | $ | 50,992,747 | |

Shares outstanding – Class A1 | | | 1,620,811 | |

Net asset value per share – Class A | | | $31.46 | |

Maximum offering price per share – Class A2 | | | $33.38 | |

Net assets – Class C | | $ | 839,833 | |

Shares outstanding – Class C1 | | | 28,661 | |

Net asset value per share – Class C | | | $29.30 | |

Net assets – Administrator Class | | $ | 1,346,618 | |

Shares outstanding – Administrator Class1 | | | 42,003 | |

Net asset value per share – Administrator Class | | | $32.06 | |

Net assets – Institutional Class | | $ | 28,031,739 | |

Shares outstanding – Institutional Class1 | | | 863,736 | |

Net asset value per share – Institutional Class | | | $32.45 | |

| 1 | The Fund has an unlimited number of authorized shares. |

| 2 | Maximum offering price is computed as 100/94.25 of net asset value. On investments of $50,000 or more, the offering price is reduced. |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 16 | | Wells Fargo Intrinsic Small Cap Value Fund | | Statement of operations—year ended March 31, 2018 |

| | | | |

| | | | |

| |

Investment income | | | | |

Dividends (net of foreign withholding taxes of $1,097) | | $ | 859,915 | |

Income from affiliated securities | | | 31,076 | |

| | | | |

Total investment income | | | 890,991 | |

| | | | |

| |

Expenses | | | | |

Management fee | | | 695,648 | |

Administration fees | | | | |

Class A | | | 106,688 | |

Class C | | | 1,752 | |

Administrator Class | | | 4,303 | |

Institutional Class | | | 34,961 | |

Shareholder servicing fees | | | | |

Class A | | | 127,010 | |

Class C | | | 2,085 | |

Administrator Class | | | 8,275 | |

Distribution fee | | | | |

Class C | | | 6,256 | |

Custody and accounting fees | | | 15,576 | |

Professional fees | | | 40,553 | |

Registration fees | | | 62,519 | |

Shareholder report expenses | | | 36,318 | |

Trustees’ fees and expenses | | | 23,965 | |

Interest expense | | | 1,661 | |

Other fees and expenses | | | 10,622 | |

| | | | |

Total expenses | | | 1,178,192 | |

Less: Fee waivers and/or expense reimbursements | | | (164,512 | ) |

| | | | |

Net expenses | | | 1,013,680 | |

| | | | |

Net investment loss | | | (122,689 | ) |

| | | | |

| |

REALIZED AND UNREALIZED GAINS (LOSSES) ON INVESTMENTS | | | | |

| |

Net realized gains on: | | | | |

Unaffiliated securities | | | 8,078,919 | |

Affiliated securities | | | 239 | |

| | | | |

Net realized gains on investments | | | 8,079,158 | |

| | | | |

| |

Net change in unrealized gains (losses) on: | | | | |

Unaffiliated securities | | | (1,592,378 | ) |

Affiliated securities | | | (229 | ) |

| | | | |

Net change in unrealized gains (losses) on investments | | | (1,592,607 | ) |

| | | | |

Net realized and unrealized gains (losses) on investments | | | 6,486,551 | |

| | | | |

Net increase in net assets resulting from operations | | $ | 6,363,862 | |

| | | | |

The accompanying notes are an integral part of these financial statements.

| | | | | | |

| Statement of changes in net assets | | Wells Fargo Intrinsic Small Cap Value Fund | | | 17 | |

| | | | | | | | | | | | | | | | |

| | | Year ended

March 31, 2018 | | | Year ended

March 31, 2017 | |

| | | |

Operations | | | | | | | | | | | | |

Net investment loss | | | | | | $ | (122,689 | ) | | | | | | $ | (475,847 | ) |

Net realized gains on investments | | | | | | | 8,079,158 | | | | | | | | 15,786,751 | |

Net change in unrealized gains (losses) on investments | | | | | | | (1,592,607 | ) | | | | | | | 8,093,313 | |

| | | | |

Net increase in net assets resulting from operations | | | | | | | 6,363,862 | | | | | | | | 23,404,217 | |

| | | | |

| | | |

Distributions to shareholders from | | | | | | | | | | | | |

Net investment income | | | | | | | | | | | | | | | | |

Class A | | | | | | | 0 | | | | | | | | (256,325 | ) |

Administrator Class | | | | | | | 0 | | | | | | | | (23,316 | ) |

Institutional Class | | | | | | | 0 | | | | | | | | (465,017 | ) |

| | | | |

Total distributions to shareholders | | | | | | | 0 | | | | | | | | (744,658 | ) |

| | | | |

| | | | |

Capital share transactions | | | Shares | | | | | | | | Shares | | | | | |

Proceeds from shares sold | | | | | | | | | | | | | | | | |

Class A | | | 56,287 | | | | 1,697,291 | | | | 94,698 | | | | 2,625,025 | |

Class C | | | 3,291 | | | | 88,944 | | | | 26,166 | | | | 698,694 | |

Administrator Class | | | 9,745 | | | | 302,977 | | | | 20,547 | | | | 548,375 | |

Institutional Class | | | 134,112 | | | | 4,360,186 | | | | 642,995 | | | | 18,321,155 | |

| | | | |

| | | | | | | 6,449,398 | | | | | | | | 22,193,249 | |

| | | | |

Reinvestment of distributions | | | | | | | | | | | | | | | | |

Class A | | | 0 | | | | 0 | | | | 8,734 | | | | 248,050 | |

Administrator Class | | | 0 | | | | 0 | | | | 314 | | | | 9,086 | |

Institutional Class | | | 0 | | | | 0 | | | | 12,540 | | | | 365,784 | |

| | | | |

| | | | | | | 0 | | | | | | | | 622,920 | |

| | | | |

Payment for shares redeemed | | | | | | | | | | | | | | | | |

Class A | | | (261,867 | ) | | | (7,767,468 | ) | | | (401,261 | ) | | | (10,930,489 | ) |

Class C | | | (11,065 | ) | | | (298,907 | ) | | | (2,636 | ) | | | (65,871 | ) |

Administrator Class | | | (115,713 | ) | | | (3,702,140 | ) | | | (77,690 | ) | | | (2,099,588 | ) |

Institutional Class | | | (1,288,079 | ) | | | (37,985,828 | ) | | | (1,582,608 | ) | | | (40,376,065 | ) |

| | | | |

| | | | | | | (49,754,343 | ) | | | | | | | (53,472,013 | ) |

| | | | |

Net decrease in net assets resulting from capital share transactions | | | | | | | (43,304,945 | ) | | | | | | | (30,655,844 | ) |

| | | | |

Total decrease in net assets | | | | | | | (36,941,083 | ) | | | | | | | (7,996,285 | ) |

| | | | |

| | |

Net assets | | | | | | | | |

Beginning of period | | | | | | | 118,152,020 | | | | | | | | 126,148,305 | |

| | | | |

End of period | | | | | | $ | 81,210,937 | | | | | | | $ | 118,152,020 | |

| | | | |

Undistributed net investment income | | | | | | $ | 0 | | | | | | | $ | 0 | |

| | | | |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 18 | | Wells Fargo Intrinsic Small Cap Value Fund | | Financial highlights |

(For a share outstanding throughout each period)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Year ended March 31 | | | Year ended

October 31, 2013 | |

| CLASS A | | 2018 | | | 2017 | | | 2016 | | | 2015 | | | 20141 | | |

Net asset value, beginning of period | | | $28.92 | | | | $23.49 | | | | $25.50 | | | | $23.53 | | | | $22.16 | | | | $15.96 | |

Net investment income (loss) | | | (0.08 | )2 | | | (0.15 | )2 | | | 0.22 | 2 | | | 0.04 | | | | 0.02 | | | | 0.03 | |

Net realized and unrealized gains (losses) on investments | | | 2.62 | | | | 5.71 | | | | (2.09 | ) | | | 1.93 | | | | 1.35 | | | | 6.17 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 2.54 | | | | 5.56 | | | | (1.87 | ) | | | 1.97 | | | | 1.37 | | | | 6.20 | |

Distributions to shareholders from | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.00 | | | | (0.13 | ) | | | (0.14 | ) | | | 0.00 | | | | 0.00 | | | | 0.00 | |

Net asset value, end of period | | | $31.46 | | | | $28.92 | | | | $23.49 | | | | $25.50 | | | | $23.53 | | | | $22.16 | |

Total return3 | | | 8.78 | % | | | 23.68 | % | | | (7.36 | )% | | | 8.37 | % | | | 6.33 | % | | | 38.66 | % |

Ratios to average net assets (annualized) | | | | | | | | | | | | | | | | | | | | |

Gross expenses | | | 1.54 | % | | | 1.48 | % | | | 1.47 | % | | | 1.46 | % | | | 1.57 | % | | | 1.56 | % |

Net expenses | | | 1.35 | % | | | 1.35 | % | | | 1.35 | % | | | 1.40 | % | | | 1.44 | % | | | 1.45 | % |

Net investment income (loss) | | | (0.26 | )% | | | (0.57 | )% | | | 0.95 | % | | | 0.15 | % | | | 0.19 | % | | | 0.11 | % |

Supplemental data | | | | | | | | | | | | | | | | | | | | |

Portfolio turnover rate | | | 27 | % | | | 142 | % | | | 66 | % | | | 60 | % | | | 22 | % | | | 75 | % |

Net assets, end of period (000s omitted) | | | $50,993 | | | | $52,817 | | | | $49,898 | | | | $817 | | | | $908 | | | | $967 | |

| 1 | For the five months ended March 31, 2014. The Fund changed its fiscal year end from October 31 to March 31, effective March 31, 2014. |

| 2 | Calculated based upon average shares outstanding |

| 3 | Total return calculations do not include any sales charges. Returns for periods of less than one year are not annualized. |

The accompanying notes are an integral part of these financial statements.

| | | | | | |

| Financial highlights | | Wells Fargo Intrinsic Small Cap Value Fund | | | 19 | |

(For a share outstanding throughout each period)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Year ended March 31 | | | Year ended

October 31, 2013 | |

| CLASS C | | 2018 | | | 2017 | | | 2016 | | | 2015 | | | 20141 | | |

Net asset value, beginning of period | | | $27.14 | | | | $22.11 | | | | $24.04 | | | | $22.35 | | | | $21.12 | | | | $15.32 | |

Net investment loss | | | (0.28 | )2 | | | (0.39 | )2 | | | (0.00 | )2,3 | | | (0.14 | )2 | | | (0.05 | ) | | | (0.13 | )2 |

Net realized and unrealized gains (losses) on investments | | | 2.44 | | | | 5.42 | | | | (1.93 | ) | | | 1.83 | | | | 1.28 | | | | 5.93 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 2.16 | | | | 5.03 | | | | (1.93 | ) | | | 1.69 | | | | 1.23 | | | | 5.80 | |

Net asset value, end of period | | | $29.30 | | | | $27.14 | | | | $22.11 | | | | $24.04 | | | | $22.35 | | | | $21.12 | |

Total return4 | | | 7.96 | % | | | 22.75 | % | | | (8.03 | )% | | | 7.56 | % | | | 6.02 | % | | | 37.60 | % |

Ratios to average net assets (annualized) | | | | | | | | | | | | | | | | | | | | |

Gross expenses | | | 2.29 | % | | | 2.22 | % | | | 2.22 | % | | | 2.21 | % | | | 2.33 | % | | | 2.30 | % |

Net expenses | | | 2.10 | % | | | 2.10 | % | | | 2.12 | % | | | 2.15 | % | | | 2.19 | % | | | 2.20 | % |

Net investment loss | | | (1.02 | )% | | | (1.52 | )% | | | (0.00 | )% | | | (0.62 | )% | | | (0.54 | )% | | | (0.66 | )% |

Supplemental data | | | | | | | | | | | | | | | | | | | | |

Portfolio turnover rate | | | 27 | % | | | 142 | % | | | 66 | % | | | 60 | % | | | 22 | % | | | 75 | % |

Net assets, end of period (000s omitted) | | | $840 | | | | $989 | | | | $285 | | | | $304 | | | | $429 | | | | $418 | |

| 1 | For the five months ended March 31, 2014. The Fund changed its fiscal year end from October 31 to March 31, effective March 31, 2014. |

| 2 | Calculated based upon average shares outstanding |

| 3 | Amount is more than $(0.005). |

| 4 | Total return calculations do not include any sales charges. Returns for periods of less than one year are not annualized. |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 20 | | Wells Fargo Intrinsic Small Cap Value Fund | | Financial highlights |

(For a share outstanding throughout each period)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Year ended March 31 | | | Year ended

October 31, 2013 | |

| ADMINISTRATOR CLASS | | 2018 | | | 2017 | | | 2016 | | | 2015 | | | 20141 | | |

Net asset value, beginning of period | | | $29.43 | | | | $23.89 | | | | $25.95 | | | | $23.90 | | | | $22.49 | | | | $16.16 | |

Net investment income (loss) | | | (0.03 | )2 | | | (0.10 | )2 | | | 0.22 | 2 | | | 0.07 | 2 | | | 0.04 | 2 | | | 0.09 | |

Net realized and unrealized gains (losses) on investments | | | 2.66 | | | | 5.80 | | | | (2.08 | ) | | | 1.98 | | | | 1.37 | | | | 6.24 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 2.63 | | | | 5.70 | | | | (1.86 | ) | | | 2.05 | | | | 1.41 | | | | 6.33 | |

Distributions to shareholders from | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.00 | | | | (0.16 | ) | | | (0.20 | ) | | | 0.00 | | | | (0.00 | )3 | | | 0.00 | |

Net asset value, end of period | | | $32.06 | | | | $29.43 | | | | $23.89 | | | | $25.95 | | | | $23.90 | | | | $22.49 | |

Total return4 | | | 8.94 | % | | | 23.86 | % | | | (7.17 | )% | | | 8.58 | % | | | 6.43 | % | | | 38.99 | % |

Ratios to average net assets (annualized) | | | | | | | | | | | | | | | | | | | | |

Gross expenses | | | 1.46 | % | | | 1.40 | % | | | 1.37 | % | | | 1.30 | % | | | 1.42 | % | | | 1.40 | % |

Net expenses | | | 1.20 | % | | | 1.20 | % | | | 1.20 | % | | | 1.20 | % | | | 1.20 | % | | | 1.20 | % |

Net investment income (loss) | | | (0.10 | )% | | | (0.38 | )% | | | 0.91 | % | | | 0.27 | % | | | 0.45 | % | | | 0.52 | % |

Supplemental data | | | | | | | | | | | | | | | | | | | | |

Portfolio turnover rate | | | 27 | % | | | 142 | % | | | 66 | % | | | 60 | % | | | 22 | % | | | 75 | % |

Net assets, end of period (000s omitted) | | | $1,347 | | | | $4,355 | | | | $4,893 | | | | $5,110 | | | | $10,498 | | | | $11,182 | |

| 1 | For the five months ended March 31, 2014. The Fund changed its fiscal year end from October 31 to March 31, effective March 31, 2014. |

| 2 | Calculated based upon average shares outstanding |

| 3 | Amount is less than $0.005. |

| 4 | Returns for periods of less than one year are not annualized. |

The accompanying notes are an integral part of these financial statements.

| | | | | | |

| Financial highlights | | Wells Fargo Intrinsic Small Cap Value Fund | | | 21 | |

(For a share outstanding throughout each period)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Year ended March 31 | | | Year ended

October 31, 2013 | |

| INSTITUTIONAL CLASS | | 2018 | | | 2017 | | | 2016 | | | 2015 | | | 20141 | | |

Net asset value, beginning of period | | | $29.73 | | | | $24.13 | | | | $26.22 | | | | $24.19 | | | | $22.78 | | | | $16.32 | |

Net investment income (loss) | | | 0.03 | 2 | | | (0.07 | )2 | | | 0.33 | | | | 0.14 | 2 | | | 0.06 | 2 | | | 0.12 | 2 |

Net realized and unrealized gains (losses) on investments | | | 2.69 | | | | 5.89 | | | | (2.17 | ) | | | 1.99 | | | | 1.39 | | | | 6.34 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 2.72 | | | | 5.82 | | | | (1.84 | ) | | | 2.13 | | | | 1.45 | | | | 6.46 | |

Distributions to shareholders from | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.00 | | | | (0.22 | ) | | | (0.25 | ) | | | (0.10 | ) | | | (0.04 | ) | | | 0.00 | |

Net asset value, end of period | | | $32.45 | | | | $29.73 | | | | $24.13 | | | | $26.22 | | | | $24.19 | | | | $22.78 | |

Total return3 | | | 9.15 | % | | | 24.14 | % | | | (7.02 | )% | | | 8.83 | % | | | 6.50 | % | | | 39.40 | % |

Ratios to average net assets (annualized) | | | | | | | | | | | | | | | | | | | | |

Gross expenses | | | 1.21 | % | | | 1.15 | % | | | 1.12 | % | | | 1.03 | % | | | 1.15 | % | | | 1.10 | % |

Net expenses | | | 1.00 | % | | | 1.00 | % | | | 1.00 | % | | | 1.00 | % | | | 1.00 | % | | | 1.00 | % |

Net investment income (loss) | | | 0.08 | % | | | (0.26 | )% | | | 1.10 | % | | | 0.57 | % | | | 0.64 | % | | | 0.58 | % |

Supplemental data | | | | | | | | | | | | | | | | | | | | |

Portfolio turnover rate | | | 27 | % | | | 142 | % | | | 66 | % | | | 60 | % | | | 22 | % | | | 75 | % |

Net assets, end of period (000s omitted) | | | $28,032 | | | | $59,991 | | | | $71,072 | | | | $84,563 | | | | $79,312 | | | | $71,934 | |

| 1 | For the five months ended March 31, 2014. The Fund changed its fiscal year end from October 31 to March 31, effective March 31, 2014. |

| 2 | Calculated based upon average shares outstanding |

| 3 | Returns for periods of less than one year are not annualized. |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 22 | | Wells Fargo Intrinsic Small Cap Value Fund | | Notes to financial statements |

1. ORGANIZATION

Wells Fargo Funds Trust (the “Trust”), a Delaware statutory trust organized on March 10, 1999, is an open-end management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”). As an investment company, the Trust follows the accounting and reporting guidance in Financial Accounting Standards Board Accounting Standards Codification Topic 946, Financial Services – Investment Companies. These financial statements report on the Wells Fargo Intrinsic Small Cap Value Fund (the “Fund”) which is a diversified series of the Trust.

2. SIGNIFICANT ACCOUNTING POLICIES

The following significant accounting policies, which are consistently followed in the preparation of the financial statements of the Fund, are in conformity with U.S. generally accepted accounting principles which require management to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Securities valuation

All investments are valued each business day as of the close of regular trading on the New York Stock Exchange (generally 4 p.m. Eastern Time), although the Fund may deviate from this calculation time under unusual or unexpected circumstances.

Equity securities that are listed on a foreign or domestic exchange or market are valued at the official closing price or, if none, the last sales price. If no sale occurs on the primary exchange or market that day, the prior day’s price will be deemed “stale” and a fair value price will be determined in accordance with the Fund’s Valuation Procedures.

Investments in registered open-end investment companies are valued at net asset value. Interests in non-registered investment vehicles that are redeemable at net asset value are fair valued at net asset value when available.

Investments which are not valued using any of the methods discussed above are valued at their fair value, as determined in good faith by the Board of Trustees of the Fund. The Board of Trustees has established a Valuation Committee comprised of the Trustees and has delegated to it the authority to take any actions regarding the valuation of portfolio securities that the Valuation Committee deems necessary or appropriate, including determining the fair value of portfolio securities, unless the determination has been delegated to the Wells Fargo Asset Management Pricing Committee at Wells Fargo Funds Management, LLC (“Funds Management”). The Board of Trustees retains the authority to make or ratify any valuation decisions or approve any changes to the Valuation Procedures as it deems appropriate. On a quarterly basis, the Board of Trustees receives reports on any valuation actions taken by the Valuation Committee or the Wells Fargo Asset Management Pricing Committee which may include items for ratification.

Valuations of fair valued securities are compared to the next actual sales price when available, or other appropriate market values, to assess the continued appropriateness of the fair valuation methodologies used. These securities are fair valued on a day-to-day basis, taking into consideration changes to appropriate market information and any significant changes to the inputs considered in the valuation process until there is a readily available price provided on an exchange or by an independent pricing service. Valuations received from an independent pricing service or independent broker-dealer quotes are periodically validated by comparisons to most recent trades and valuations provided by other independent pricing services in addition to the review of prices by the adviser and/or subadviser. Unobservable inputs used in determining fair valuations are identified based on the type of security, taking into consideration factors utilized by market participants in valuing the investment, knowledge about the issuer and the current market environment.

Securities lending

The Fund may lend its securities from time to time in order to earn additional income in the form of fees or interest on securities received as collateral or the investment of any cash received as collateral. The Fund continues to receive interest or dividends on the securities loaned. The Fund receives collateral in the form of cash or securities with a value at least equal to the value of the securities on loan. The value of the loaned securities is determined at the close of each business day and any additional required collateral is delivered to the Fund on the next business day. In a securities lending transaction, the net asset value of the Fund will be affected by an increase or decrease in the value of the securities loaned and by an increase or decrease in the value of the instrument in which collateral is invested. The amount of securities lending activity undertaken by the Fund fluctuates from time to time. In the event of default or bankruptcy by the borrower, the Fund may be prevented from recovering the loaned securities or gaining access to the collateral or may experience delays or costs in doing so. In addition, the investment of any cash collateral received may lose all or part of its value. The Fund has the right under the lending agreement to recover the securities from the borrower on demand.

| | | | | | |

| Notes to financial statements | | Wells Fargo Intrinsic Small Cap Value Fund | | | 23 | |

The Fund lends its securities through an unaffiliated securities lending agent. Cash collateral received in connection with its securities lending transactions is invested in Securities Lending Cash Investments, LLC (the “Securities Lending Fund”). The Securities Lending Fund is exempt from registration under Section 3(c)(7) of the 1940 Act and is managed by Funds Management and is subadvised by Wells Capital Management Incorporated (“WellsCap”), an affiliate of Funds Management and an indirect wholly owned subsidiary of Wells Fargo & Company (“Wells Fargo”). Funds Management receives an advisory fee starting at 0.05% and declining to 0.01% as the average daily net assets of the Securities Lending Fund increase. All of the fees received by Funds Management are paid to WellsCap for its services as subadviser. The Securities Lending Fund seeks to provide a positive return compared to the daily Fed Funds Open Rate by investing in high-quality, U.S. dollar-denominated short-term money market instruments. Securities Lending Fund investments are valued at the evaluated bid price provided by an independent pricing service. Income earned from investment in the Securities Lending Fund, if any, is included in income from affiliated securities on the Statement of Operations.

Security transactions and income recognition

Securities transactions are recorded on a trade date basis. Realized gains or losses are recorded on the basis of identified cost.

Dividend income is recognized on the ex-dividend date. Dividend income from foreign securities is recorded net of foreign taxes withheld where recovery of such taxes is not assured.

Distributions to shareholders

Distributions to shareholders from net investment income and any net realized gains are recorded on the ex-dividend date and paid at least annually. Such distributions are determined in accordance with income tax regulations and may differ from U.S. generally accepted accounting principles. Dividend sources are estimated at the time of declaration. The tax character of distributions is determined as of the Fund’s fiscal year end. Therefore, a portion of the Fund’s distributions made prior to the Fund’s fiscal year end may be categorized as a tax return of capital at year end.

Federal and other taxes

The Fund intends to continue to qualify as a regulated investment company by distributing substantially all of its investment company taxable income and any net realized capital gains (after reduction for capital loss carryforwards) sufficient to relieve it from all, or substantially all, federal income taxes. Accordingly, no provision for federal income taxes was required.

The Fund’s income and federal excise tax returns and all financial records supporting those returns for the prior three fiscal years are subject to examination by the federal and Delaware revenue authorities. Management has analyzed the Fund’s tax positions taken on federal, state, and foreign tax returns for all open tax years and does not believe that there are any uncertain tax positions that require recognition of a tax liability.

As of March 31, 2018, the aggregate cost of all investments for federal income tax purposes was $71,543,058 and the unrealized gains (losses) consisted of:

| | | | |

Gross unrealized gains | | $ | 17,165,646 | |

Gross unrealized losses | | | (3,186,916 | ) |

Net unrealized gains | | $ | 13,978,730 | |

Reclassifications are made to the Fund’s capital accounts for permanent tax differences to reflect income and gains available for distribution (or available capital loss carryforwards) under federal income tax regulations. U.S. generally accepted accounting principles require that certain components of net assets be adjusted to reflect permanent differences between financial and tax reporting. These reclassifications have no effect on net assets or net asset values per share. The primary permanent differences causing such reclassifications are due to expiration of capital loss carryforwards and net operating losses. At March 31, 2018, as a result of permanent book-to-tax differences, the following reclassification adjustments were made on the Statement of Assets and Liabilities:

| | | | |

| Paid-in capital | | Undistributed net

investment income | | Accumulated net

realized losses

on investments |

| $(365,228) | | $122,689 | | $242,539 |

| | | | |

| 24 | | Wells Fargo Intrinsic Small Cap Value Fund | | Notes to financial statements |

Class allocations

The separate classes of shares offered by the Fund differ principally in applicable sales charges, distribution, shareholder servicing, and administration fees. Class specific expenses are charged directly to that share class. Investment income, common expenses, and realized and unrealized gains (losses) on investments are allocated daily to each class of shares based on the relative proportion of net assets of each class.

3. FAIR VALUATION MEASUREMENTS

Fair value measurements of investments are determined within a framework that has established a fair value hierarchy based upon the various data inputs utilized in determining the value of the Fund’s investments. The three-level hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1) and the lowest priority to unobservable inputs (Level 3). The Fund’s investments are classified within the fair value hierarchy based on the lowest level of input that is significant to the fair value measurement. The inputs are summarized into three broad levels as follows:

| ∎ | | Level 1 – quoted prices in active markets for identical securities |

| ∎ | | Level 2 – other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) |

| ∎ | | Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

The inputs or methodologies used for valuing investments in securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary of the inputs used in valuing the Fund’s assets and liabilities as of March 31, 2018:

| | | | | | | | | | | | | | | | |

| | | Quoted prices

(Level 1) | | | Other significant

observable inputs

(Level 2) | | | Significant

unobservable inputs (Level 3) | | | Total | |

Assets | | | | | | | | | | | | | | | | |

Investments in: | | | | | | | | | | | | | | | | |

| | | | |

Common stocks | | | | | | | | | | | | | | | | |

Consumer discretionary | | $ | 7,375,058 | | | $ | 0 | | | $ | 0 | | | $ | 7,375,058 | |

Consumer staples | | | 438,727 | | | | 0 | | | | 0 | | | | 438,727 | |

Energy | | | 5,751,870 | | | | 0 | | | | 0 | | | | 5,751,870 | |

Financials | | | 21,512,985 | | | | 0 | | | | 0 | | | | 21,512,985 | |

Health care | | | 10,026,872 | | | | 0 | | | | 0 | | | | 10,026,872 | |

Industrials | | | 15,808,577 | | | | 0 | | | | 0 | | | | 15,808,577 | |

Information technology | | | 9,659,722 | | | | 0 | | | | 0 | | | | 9,659,722 | |

Materials | | | 2,943,307 | | | | 0 | | | | 0 | | | | 2,943,307 | |

Real estate | | | 6,531,009 | | | | 0 | | | | 0 | | | | 6,531,009 | |

| | | | |

Short-term investments | | | | | | | | | | | | | | | | |

Investment companies | | | 893,311 | | | | 0 | | | | 0 | | | | 893,311 | |

Investments measured at net asset value* | | | | | | | | | | | | | | | 4,580,350 | |

Total assets | | $ | 80,941,438 | | | $ | 0 | | | $ | 0 | | | $ | 85,521,788 | |

| * | Investments that are measured at fair value using the net asset value per share (or its equivalent) as a practical expedient have not been categorized in the fair value hierarchy. The fair value amount presented in the table is intended to permit reconciliation of the fair value hierarchy to the amounts presented in the Statement of Assets and Liabilities. The Fund’s investment in Securities Lending Cash Investments, LLC valued at $4,580,350 does not have a redemption period notice, can be redeemed daily and does not have any unfunded commitments. |

The Fund recognizes transfers between levels within the fair value hierarchy at the end of the reporting period. At March 31, 2018, the Fund did not have any transfers into/out of Level 1, Level 2, or Level 3.

| | | | | | |

| Notes to financial statements | | Wells Fargo Intrinsic Small Cap Value Fund | | | 25 | |

4. TRANSACTIONS WITH AFFILIATES

Management fee

Funds Management, an indirect wholly owned subsidiary of Wells Fargo, is the manager of the Fund and provides advisory and fund-level administrative services under an investment management agreement. Under the investment management agreement, Funds Management is responsible for, among other services, implementing the investment objectives and strategies of the Fund, supervising the subadviser, providing fund-level administrative services in connection with the Fund’s operations, and providing any other fund-level administrative services reasonably necessary for the operation of the Fund. As compensation for its services under the investment management agreement, Funds Management is entitled to receive an annual management fee starting at 0.85% and declining to 0.71% as the average daily net assets of the Fund increase. For the year ended March 31, 2018, the management fee was equivalent to an annual rate of 0.85% of the Fund’s average daily net assets.