UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number:811-09253

Wells Fargo Funds Trust

(Exact name of registrant as specified in charter)

525 Market St., San Francisco, CA 94105

(Address of principal executive offices) (Zip code)

Alexander Kymn

Wells Fargo Funds Management, LLC

525 Market St., San Francisco, CA 94105

(Name and address of agent for service)

Registrant’s telephone number, including area code:800-222-8222

Date of fiscal year end: January 31

Registrant is making a filing for 8 of its series:

Wells Fargo 100% Treasury Money Market Fund, Wells Fargo Cash Investment Money Market Fund, Wells Fargo Government Money Market Fund, Wells Fargo Heritage Money Market Fund, Wells Fargo Money Market Fund, Wells Fargo Municipal Cash Management Money Market Fund, Wells Fargo NationalTax-Free Money Market Fund, and Wells Fargo Treasury Plus Money Market Fund.

Date of reporting period: January 31, 2019

| ITEM 1. | REPORT TO STOCKHOLDERS |

Annual Report

January 31, 2019

Retail Money Market Funds

| ∎ | | Wells Fargo Money Market Fund |

Beginning on January 1, 2021, as permitted by new regulations adopted by the Securities and Exchange Commission, paper copies of the Wells Fargo Funds’ annual and semi-annual shareholder reports issued after this date will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Funds’ website, and you will be notified by mail each time a report is posted and provided with a website address to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically at any time by contacting your financial intermediary (such as a broker-dealer or bank) or, if you are a direct investor, by calling 1-800-222-8222 or by enrolling at wellsfargo.com/advantagedelivery.

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports; if you invest directly with the Fund, you can call 1-800-222-8222. Your election to receive reports in paper will apply to all Wells Fargo Funds held in your account with your financial intermediary or, if you are a direct investor, to all Wells Fargo Funds that you hold.

Reduce clutter. Save trees.

Sign up for electronic delivery of prospectuses and shareholder reports atwellsfargo.com/advantagedelivery

Contents

The views expressed and any forward-looking statements are as of January 31, 2019, unless otherwise noted, and are those of the Fund managers and/or Wells Fargo Funds Management, LLC. Discussions of individual securities, or the markets generally, or any Wells Fargo Fund are not intended as individual recommendations. Future events or results may vary significantly from those expressed in any forward-looking statements. The views expressed are subject to change at any time in response to changing circumstances in the market. Wells Fargo Funds Management, LLC and the Fund disclaim any obligation to publicly update or revise any views expressed or forward-looking statements.

INVESTMENT PRODUCTS: NOT FDIC INSURED ◾ NO BANK GUARANTEE ◾ MAY LOSE VALUE

| | | | |

| 2 | | Wells Fargo Money Market Fund | | Letter to shareholders (unaudited) |

Andrew Owen

President

Wells Fargo Funds

Global trade tensions escalated during the second quarter of 2018.

Dear Shareholder:

We are pleased to offer you this annual report for the Wells Fargo Money Market Fund for the12-month period that ended January 31, 2019. An upward trend for short-term interest rates, inflation concerns, trade tensions, and geopolitical events contributed to investment market volatility throughout the year.

For the period, U.S. stocks, as measured by the S&P 500 Index,1 fell 2.31% and international stocks, as measured by the MSCI ACWI ex USA Index (Net),2 declined 12.58%. Based on the MSCI EM Index (Net),3 emerging market stocks lost 14.24%. For bond investors, the Bloomberg Barclays U.S. Aggregate Bond Index4 added 2.25% while the Bloomberg Barclays Global Aggregateex-USD Index5 fell 3.26%. The Bloomberg Barclays Municipal Bond Index6 added 3.26%, and the ICE BofAML U.S. High Yield Index7 gained 1.57%.

A move to normalize U.S. monetary policy influenced markets.

Through January 2018, the S&P 500 Index and MSCI ACWI ex USA Index (Net) delivered positive returns every month for more than a year. In February 2018, that streak ended. The S&P 500 Index fell 3.69% during February and the MSCI ACWI ex USA Index (Net) dropped 4.72%. For the quarter, the S&P 500 Index recorded its first negative quarterly return since 2014. The MSCI ACWI ex USA Index (Net) fell 1.18% for the quarter.

During the year, the U.S. Federal Reserve (Fed) sought to normalize accommodative monetary policies in place since the 2008 global financial crisis and recession. Short-term interest rates, as measured by U.S. Treasury bills—maturities ranging from 3 to 12 months—increased an average of 89 basis points (bps; 100 bps equal 1.00%). Rates for10-year and30-year Treasuries increased 17 bps and 18 bps, respectively. Slower growth of long-term rates raised concerns for a flattening yield curve, sometimes associated with recessions. The Fed raised the federal funds rate by 25 bps in March 2018 to a target range of between 1.50% and 1.75%. The Bank of England (BOE) indicated a bias to increase rates later in 2018. The European Central Bank, the Bank of Japan, and the People’s Bank of China (PBOC) maintained low interest rates.

Global trade tensions heightened investor concerns.

Global trade tensions escalated during the second quarter of 2018. Atit-for-tat tariff spat intensified between the U.S. and other governments. The Fed raised the federal funds rate by 25 bps to a target range of between 1.75% and 2.00% in June. Market index results reflected the global concerns. The MSCI ACWI ex USA Index (Net) lost 2.61% while the Bloomberg Barclays Global Aggregateex-USD Index dropped 4.76%.

| 1 | The S&P 500 Index consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market-value-weighted index with each stock’s weight in the index proportionate to its market value. You cannot invest directly in an index. |

| 2 | The Morgan Stanley Capital International (MSCI) All Country World Index (ACWI) ex USA Index (Net) is a free-float-adjusted market-capitalization-weighted index that is designed to measure the equity market performance of developed markets, excluding the United States and Canada. Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed, or produced by MSCI. You cannot invest directly in an index. |

| 3 | The MSCI Emerging Markets (EM) Index (Net) is a free-float-adjusted market-capitalization-weighted index that is designed to measure large- andmid-cap equity market performance of emerging markets. The MSCI EM Index (Net) consists of the following 24 emerging market country indices: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Pakistan, Peru, the Philippines, Poland, Qatar, Russia, South Africa, Taiwan, Thailand, Turkey, and the United Arab Emirates. You cannot invest directly in an index. |

| 4 | The Bloomberg Barclays U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment-grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, mortgage-backed securities (agency fixed-rate and hybrid adjustable-rate mortgage pass-throughs), asset-backed securities, and commercial mortgage-backed securities. You cannot invest directly in an index. |

| 5 | The Bloomberg Barclays Global Aggregateex-USD Index is an unmanaged index that provides a broad-based measure of the global investment-grade fixed-income markets excluding the U.S. dollar-denominated debt market. You cannot invest directly in an index. |

| 6 | The Bloomberg Barclays Municipal Bond Index is an unmanaged index composed of long-termtax-exempt bonds with a minimum credit rating of Baa. You cannot invest directly in an index. |

| 7 | The ICE BofAML U.S. High Yield Index is a market-capitalization-weighted index of domestic and Yankee high-yield bonds. The index tracks the performance of high-yield securities traded in the U.S. bond market. You cannot invest directly in an index. Copyright 2019. ICE Data Indices, LLC. All rights reserved. |

| | | | | | |

| Letter to shareholders (unaudited) | | Wells Fargo Money Market Fund | | | 3 | |

Not all news was bad. The U.S. Bureau of Economic Analysis reported second-quarter gross domestic product (GDP) annualized growth of 4.2%. Hiring improved. Employment data remained strong. Consumer confidence and spending increased. The S&P 500 Index recorded a 3.43% second-quarter gain. Stocks of companies with smaller capitalizations were even better, as measured by the Russell 2000® Index,8 adding 7.75%.

Investors appeared to shake off lingering concerns during the third quarter.

Favorable third-quarter economic indicators and corporate earnings reports encouraged domestic stock investors. U.S. trade negotiations with Mexico and Canada progressed. The Conference Board Consumer Confidence Index®9 reached its highest level in 18 years during September. The Fed raised the federal funds rate by 25 bps to a target range of between 2.00% and 2.25% in September. For the quarter that ended September 30, 2018, the S&P 500 Index added 7.71%.

Investors in international markets were not as reassured. Tensions between the U.S. and China increased. The U.S. imposed $200 billion in tariffs on Chinese goods. China reacted with $60 billion in tariffs on U.S. goods. Economic growth in China caused concern. The BOE raised its monetary policy rate to 0.75% in August. During the quarter, the MSCI ACWI ex USA Index (Net) gained 0.71%. The MSCI EM Index (Net) declined 1.09%. In fixed-income markets, U.S. bonds were flat, as measured by the Bloomberg Barclays U.S. Aggregate Bond Index. The Bloomberg Barclays Global Aggregateex-USD Index fell 1.74%.

Conflicting data unsettled markets during the fourth quarter.

For the S&P 500 Index and the MSCI ACWI ex USA Index (Net), negative stock market performance during October and December bracketed positive November returns. December’s S&P 500 Index performance was the worst since 1931. Globally, fixed-income investments fared better than stocks during the last two months of the year.

November’s U.S.mid-term elections shifted control of the House of Representatives from Republicans to Democrats, presaging potential partisan clashes. The Bureau of Economic Analysis reported that third-quarter U.S. GDP grew at an annualized 3.4% rate, solid, but lower than the second quarter rate. Brexit efforts stalled ahead of the March 2019 deadline. The PBOC cut reserve requirement ratios, accelerated infrastructure spending, and cut taxes even as the value of the yuan declined to low levels last seen in 2008.

After the Fed increased the federal funds rate by 25 bps to a target range of between 2.25% and 2.50% in December—the ninth such increase since the Fed began three years ago to raise rates from near zero—it softened its outlook for further interest rate increases in 2019.

The market climbs a wall of worry.

Investors entered 2019 with reasons to be concerned. A partial U.S government shutdown driven by partisan spending and immigration policy disputes extended into January. Investors expected high levels of stock market volatility to continue based on the VIX10.

Favorable third-quarter economic indicators and corporate earnings reports encouraged domestic stock investors.

| 8 | The Russell 2000® Index measures the performance of the 2,000 smallest companies in the Russell 3000® Index, which represents approximately 8% of the total market capitalization of the Russell 3000® Index. You cannot invest directly in an index. |

| 9 | The Conference Board Consumer Confidence Index® measures the degree of optimism on the state of the U.S. economy that consumers are expressing through their activities of savings and spending. You cannot invest directly in an index. |

| 10 | The Chicago Board Options Exchange Market Volatility Index (VIX) is a popular measure of the implied volatility of S&P 500 Index options. It represents one measure of the market’s expectation of stock market volatility over the next30-day period. You cannot invest directly in an index. |

| | | | |

| 4 | | Wells Fargo Money Market Fund | | Letter to shareholders (unaudited) |

January’s returns tended to support the investing adage that markets climb a wall of worry. The S&P 500 Index gained 8.01% for the month that ended January 31, 2019, its best monthly performance in 30 years. Returns for the MSCI ACWI ex USA Index (Net), the Bloomberg Barclays U.S. Aggregate Bond Index, and the Bloomberg Barclays Global Aggregateex-USD Index also were positive.

Don’t let short-term uncertainty derail long-term investment goals.

Periods of investment uncertainty can present challenges, but experience has taught us that maintaining long-term investment goals can be an effective way to plan for the future. To help you create a sound strategy based on your personal goals and risk tolerance, Wells Fargo Funds offers more than 100 mutual funds spanning a wide range of asset classes and investment styles. Although diversification cannot guarantee an investment profit or prevent losses, we believe it can be an effective way to manage investment risk and potentially smooth out overall portfolio performance. We encourage investors to know their investments and to understand that appropriate levels of risk-taking may unlock opportunities.

Thank you for choosing to invest with Wells Fargo Funds. We appreciate your confidence in us and remain committed to helping you meet your financial needs.

Sincerely,

Andrew Owen

President

Wells Fargo Funds

For further information about your Fund, contact your investment professional, visit our website atwellsfargofunds.com, or call us directly at1-800-222-8222.

This page is intentionally left blank.

| | | | |

| 6 | | Wells Fargo Money Market Fund | | Performance highlights (unaudited) |

Investment objective

The Fund seeks current income, while preserving capital and liquidity.

Manager

Wells Fargo Funds Management, LLC

Subadvisers

Wells Capital Management Incorporated

Wells Capital Management Singapore

Portfolio managers

Michael C. Bird, CFA®‡

Jeffrey L. Weaver, CFA®‡

Laurie White

Average annual total returns (%) as of January 31, 2019

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Including sales charge | | | Excluding sales charge | | | Expense ratios1 (%) | |

| | | Inception date | | 1 year | | | 5 year | | | 10 year | | | 1 year | | | 5 year | | | 10 year | | | Gross | | | Net2 | |

| | | | | | | | | |

| Class A (STGXX) | | 7-1-1992 | | | – | | | | – | | | | – | | | | 1.61 | | | | 0.46 | | | | 0.24 | | | | 0.70 | | | | 0.60 | |

| | | | | | | | | |

| Class C*,3 | | 6-30-2010 | | | -0.16 | | | | 0.18 | | | | 0.10 | | | | 0.84 | | | | 0.18 | | | | 0.10 | | | | 1.45 | | | | 1.35 | |

| | | | | | | | | |

| Premier Class (WMPXX)4 | | 3-31-2016 | | | – | | | | – | | | | – | | | | 2.03 | | | | 0.70 | | | | 0.36 | | | | 0.31 | | | | 0.20 | |

| | | | | | | | | |

| Service Class (WMOXX)5 | | 6-30-2010 | | | – | | | | – | | | | – | | | | 1.72 | | | | 0.53 | | | | 0.28 | | | | 0.60 | | | | 0.50 | |

Yield summary (%) as of January 31, 20192

| | | | | | | | | | | | | | |

| | | | |

| | | Class A | | Class C* | | | Premier Class | | | Service Class | |

| | | | |

| 7-day current yield | | 2.09 | | | 1.34 | | | | 2.49 | | | | 2.19 | |

| | | | |

| 7-day compound yield | | 2.11 | | | 1.34 | | | | 2.52 | | | | 2.21 | |

| | | | |

| 30-day simple yield | | 2.09 | | | 1.34 | | | | 2.49 | | | | 2.19 | |

| | | | |

| 30-day compound yield | | 2.11 | | | 1.34 | | | | 2.51 | | | | 2.21 | |

| * | | Class C shares are available only to shareholders making an exchange out of Class C shares of another mutual fund within the Wells Fargo family of funds. |

Figures quoted represent past performance, which is no guarantee of future results, and do not reflect taxes that a shareholder may pay on fund distributions or the redemption of fund shares. Investment returns will fluctuate. The Fund’s yield figures more closely reflect the current earnings of the Fund than the total return figures. Current performance may be lower or higher than the performance data quoted, which assumes the reinvestment of dividends and capital gains. Current month-end performance is available on the Fund’s website,wellsfargofunds.com.

Class A shares, Premier Class shares, and Service Class shares are sold without a front-end sales charge or contingent deferred sales charge. For Class C shares, the maximum contingent deferred sales charge is 1.00%. Performance including a contingent deferred sales charge assumes the sales charge for the corresponding time period.

For retail money market funds: You could lose money by investing in the Fund. Although the Fund seeks to preserve the value of your investment at $1.00 per share, it cannot guarantee it will do so. The Fund may impose a fee upon sale of your shares or may temporarily suspend your ability to sell shares if the Fund’s liquidity falls below required minimums because of market conditions or other factors. An investment in the Fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. The Fund’s sponsor has no legal obligation to provide financial support to the Fund, and you should not expect that the sponsor will provide financial support to the Fund at any time.

Please see footnotes on page 7.

| | | | | | |

| Performance highlights (unaudited) | | Wells Fargo Money Market Fund | | | 7 | |

|

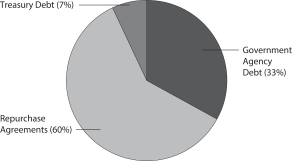

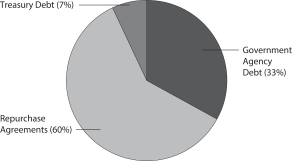

| Portfolio composition as of January 31, 20196 |

|

|

|

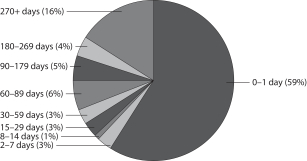

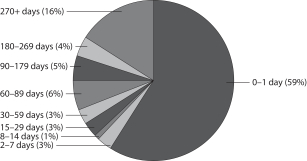

| Effective maturity distribution as of January 31, 20196 |

|

|

|

| Weighted average maturity as of January 31, 20197 |

|

19 days |

|

| Weighted average life as of January 31, 20198 |

|

55 days |

| ‡ | CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute. |

| 1 | Reflects the expense ratios as stated in the most recent prospectuses. The expense ratios shown are subject to change and may differ from the annualized expense ratios shown in the financial highlights of this report. |

| 2 | The manager has contractually committed through May 31, 2019, to waive fees and/or reimburse expenses to the extent necessary to cap the expenses of each class after fee waivers at at the amounts shown. Brokerage commissions, stamp duty fees, interest, taxes, acquired fund fees and expenses (if any), and extraordinary expenses are excluded from the expense cap. Prior to or after the commitment expiration date, the cap may be increased or the commitment to maintain the cap may be terminated only with the approval of the Board of Trustees. Without this cap, the Fund’s returns would have been lower. Without waived fees and/or reimbursed expenses, the Fund’s 7-day current yield would have been 1.98%, 1.23%, 2.37%, and 2.08% for Class A, Class C, Premier Class, and Service Class, respectively. The expense ratio paid by an investor is the net expense ratio (the total annual fund operating expenses after fee waivers) as stated in the prospectuses. |

| 3 | Historical performance shown for the Class C shares prior to their inception reflects the performance of the former Class B shares. Class B and Class C shares had the same expenses. |

| 4 | Historical performance shown for the Premier Class shares prior to their inception reflects the performance of the Class A shares, and includes the higher expenses applicable to Class A shares. If these expenses had not been included, returns for Premier Class shares would be higher. |

| 5 | Historical performance shown for Service Class shares prior to their inception reflects the performance of the former Investor Class shares, and includes the higher expenses applicable to the former Investor Class shares. If these expenses had not been included, returns for Service Class shares would be higher. |

| 6 | Amounts are calculated based on the total investments of the Fund. These amounts are subject to change and may have changed since the date specified. |

| 7 | Weighted Average Maturity (WAM): WAM is an average of the effective maturities of all securities held in the portfolio, weighted by each security’s percentage of total investments. The maturity of a portfolio security is the period remaining until the date on which the principal amount is unconditionally required to be paid, or in the case of a security called for redemption, the date on which the redemption payment is unconditionally required to be made. WAM calculations allow for the maturities of certain securities with demand features or periodic interest rate resets to be shortened. WAM is a way to measure a fund’s sensitivity to potential interest rate changes. WAM is subject to change and may have changed since the date specified. |

| 8 | Weighted Average Life (WAL): WAL is an average of the final maturities of all securities held in the portfolio, weighted by their percentage of total investments. The maturity of a portfolio security is the period remaining until the date on which the principal amount is unconditionally required to be paid, or in the case of a security called for redemption, the date on which the redemption payment is unconditionally required to be made. In contrast to WAM, the calculation of WAL allows for the maturities of certain securities with demand features to be shortened, but not the periodic interest rate resets. WAL is a way to measure a fund’s potential sensitivity to credit spread changes. WAL is subject to change and may have changed since the date specified. |

| 9 | Crane Data LLC is a money market and mutual fund information company that collects, tracks, and maintains data about money markets, money market mutual funds based on types of funds, bank savings, and cash investments. The data includes performance, statistics, and related information. Crane Data LLC distributes rankings, news, and indexes, including the Crane Prime Institutional Money Market Index, based on the data. Crane Data publishes Money Fund Intelligence, Money Fund Intelligence XLS, Money Fund Wisdom, the Crane Money Fund Indexes, and other products. |

| | | | |

| 8 | | Wells Fargo Money Market Fund | | Performance highlights (unaudited) |

MANAGERS’ DISCUSSION

For most of the reporting period, continued economic improvement allowed the Federal Open Market Committee (FOMC) to remove policy accommodation on a fairly predictable quarterly basis. The U.S. economy achieved above-trend growth, low unemployment, and moderating inflation at the same time as fiscal policy was proving to be an economic tailwind. The FOMC’s Summary of Economic Projections (SEP) through September reflected this scenario and provided the market with some clarity as to the path of future interest rate policy. However, the economic landscape changed in the fourth quarter as the U.S. engaged in various trade wars, the midterm elections disrupted the legislative composition, and financial conditions tightened. These factors began softening economic data and confidence, leading to increased volatility in risk assets. At the conclusion of the FOMC policy meeting on December 19, 2018, the federal funds target rate was raised to a target range of between 2.25% to 2.50% while the rate of interest on excess reserves (IOER) was increased by only 20 basis points (bps; 100 bps equal 1.00%) to 2.40%. That was the second time the IOER rate was increased 5 bps less than the increase in the target rate in an effort to keep the effective federal funds rate from drifting to the upper level of the target range.

In the accompanying SEP, the FOMC provided insight on its view of the economy, inflation, and the corresponding monetary policy expected over the next few years. And the December projections did not disappoint market observers, with the FOMC marginally decreasing its outlook on growth and inflation and correspondingly lowering the glide path for its target rate to 2.875% and decreasing its median outlook for the number of interest rate hikes in 2019 from three to two. Comparing the September and December target rate projections, the longer-term section points to an expectation of the eventual neutral rate being marginally lower at 2.75% and lowered 2020 and 2021 median interest rate expectations at 3.125%. On the growth front, the 2019 median gross domestic product projection edged down 0.2% to 2.3% while 2020 and 2021 growth projections remained unchanged at 2.0% and 1.8%, respectively. Core inflation in the 2019 to 2021 projections all declined 0.1% to 2.0%. The lower expectations for interest rates in the next three years show the FOMC members are less concerned regarding the potential for inflationary pressures and more focused on balancing a somewhat softer economy. In fact, the statement released at the conclusion of the January 2019 FOMC meeting removed the wording of “some further gradual increases,” citing increasing downside risk from abroad, weaker domestic data, and tighter financial conditions.

As the FOMC’s expectations for rate increases moved lower, the market expectations for federal funds rate increases, as measured by federal funds futures, moved even lower still. Market participants are barely pricing in any rate hike in 2019 and may even be starting to prepare for a possible rate cut toward the end of 2019 and into 2020. The U.S. Federal Reserve will have plenty of opportunities to adjust expectations starting in 2019 as Chair Jerome Powell will conduct a press conference after each FOMC meeting instead of only quarterly. On the heels of the FOMC lowering its economic and inflation projections, risk assets underperformed and U.S. equities are teetering near bear-market territory.

The rise in short rates has brought not only attention but perhaps also nontraditional money market investors (those who typically invest in longer-term debt or equities) into the short end of the market. The Crane Prime Institutional Money Market Index, maintained by Crane Data LLC9, was up over $61 billion during the period, with all prime assets up over $152 billion. Investors reexamining this product may be realizing that the changes implemented from the 2010 money market reform have made a material difference in the construction of prime money market fund portfolios. The added liquidity requirements and maturity restrictions have had a beneficial impact on dampening net asset value (NAV) volatility even as the FOMC continued to raise rates and credit spreads widened. In addition, added transparency of holdings can provide a daily view of the portfolio construction process and allow shareholders to assess portfolio risks.

Strategic outlook

The FOMC has pivoted from a gradually removing accommodation outlook to a data-dependent stance requiring what it terms as “patience.” Going forward, money market investors should continue to look toward the FOMC and other market indicators for future rate guidance. As we get more clarity as to the end of the tightening cycle, money market participants may look to extend weighted average maturities (WAMs) to capture higher yields. Our strategy of emphasizing highly liquid portfolios, relatively short WAMs, and a position in securities that reset frequently allows us to capture elevated London Interbank Offered Rate levels with minimal NAV pricing pressures and afford the flexibility to add longer-dated securities as opportunities arise.

Please see footnotes on page 7.

| | | | | | |

| Fund expenses (unaudited) | | Wells Fargo Money Market Fund | | | 9 | |

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including contingent deferred sales charges (if any) on redemptions and (2) ongoing costs, including management fees, distribution (12b-1) and/or shareholder servicing fees, and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the six-month period and held for the entire period from August 1, 2018 to January 31, 2019.

Actual expenses

The “Actual” line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the “Actual” line under the heading entitled “Expenses paid during period” for your applicable class of shares to estimate the expenses you paid on your account during this period.

Hypothetical example for comparison purposes

The “Hypothetical” line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as contingent deferred sales charges. Therefore, the “Hypothetical” line of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | |

| | | Beginning account value 8-1-2018 | | | Ending account value 1-31-2019 | | | Expenses

paid during the period¹ | | | Annualized net expense ratio | |

Class A | | | | | | | | | | | | | | | | |

| | | | |

Actual | | $ | 1,000.00 | | | $ | 1,009.25 | | | $ | 3.04 | | | | 0.60 | % |

| | | | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,022.18 | | | $ | 3.06 | | | | 0.60 | % |

Class C | | | | | | | | | | | | | | | | |

| | | | |

Actual | | $ | 1,000.00 | | | $ | 1,005.43 | | | $ | 6.82 | | | | 1.35 | % |

| | | | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,018.40 | | | $ | 6.87 | | | | 1.35 | % |

Premier Class | | | | | | | | | | | | | | | | |

| | | | |

Actual | | $ | 1,000.00 | | | $ | 1,011.27 | | | $ | 1.01 | | | | 0.20 | % |

| | | | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,024.20 | | | $ | 1.02 | | | | 0.20 | % |

Service Class | | | | | | | | | | | | | | | | |

| | | | |

Actual | | $ | 1,000.00 | | | $ | 1,009.74 | | | $ | 2.53 | | | | 0.50 | % |

| | | | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,022.69 | | | $ | 2.55 | | | | 0.50 | % |

| 1 | Expenses paid is equal to the annualized net expense ratio of each class multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year divided by the number of days in the fiscal year (to reflect the one-half-year period). |

| | | | |

| 10 | | Wells Fargo Money Market Fund | | Portfolio of investments—January 31, 2019 |

| | | | | | | | | | | | | | | | |

| Security name | | Interest rate | | | Maturity date | | | Principal | | | Value | |

| | | | |

Certificates of Deposit: 19.61% | | | | | | | | | | | | | | | | |

| | | | |

Bank of Montreal (1 Month LIBOR +0.15%) ± | | | 2.66 | % | | | 3-12-2019 | | | $ | 5,000,000 | | | $ | 5,000,000 | |

| | | | |

Bank of Montreal (1 Month LIBOR +0.22%) ± | | | 2.73 | | | | 10-4-2019 | | | | 3,000,000 | | | | 3,000,000 | |

| | | | |

Bank of Montreal (3 Month LIBOR +0.22%) ± | | | 2.99 | | | | 12-10-2019 | | | | 5,000,000 | | | | 5,000,000 | |

| | | | |

Bank of Nova Scotia (1 Month LIBOR +0.20%) ± | | | 2.71 | | | | 8-14-2019 | | | | 3,000,000 | | | | 3,000,000 | |

| | | | |

Bank of Nova Scotia (3 Month LIBOR +0.10%) ± | | | 2.89 | | | | 9-16-2019 | | | | 2,000,000 | | | | 2,000,000 | |

| | | | |

Canadian Imperial Bank (3 Month LIBOR +0.20%) ± | | | 2.74 | | | | 5-1-2019 | | | | 7,000,000 | | | | 7,001,869 | |

| | | | |

Canadian Imperial Bank (3 Month LIBOR +0.19%) ± | | | 2.94 | | | | 1-30-2020 | | | | 5,000,000 | | | | 4,999,598 | |

| | | | |

China Construction Bank Corporation NY (1 Month LIBOR +0.25%) ± | | | 2.76 | | | | 7-19-2019 | | | | 7,000,000 | | | | 7,000,000 | |

| | | | |

Commonwealth Bank of Australia (3 Month LIBOR +0.25%) ± | | | 3.06 | | | | 4-3-2019 | | | | 2,000,000 | | | | 2,000,000 | |

| | | | |

First Abu Dhabi Bank | | | 2.38 | | | | 2-1-2019 | | | | 10,000,000 | | | | 10,000,000 | |

| | | | |

HSBC Bank USA NA | | | 2.42 | | | | 2-1-2019 | | | | 15,000,000 | | | | 15,000,000 | |

| | | | |

HSBC Bank USA NA (3 Month LIBOR +0.13%) ± | | | 2.73 | | | | 8-9-2019 | | | | 2,000,000 | | | | 2,000,000 | |

| | | | |

HSBC Bank USA NA (3 Month LIBOR +0.18%) ± | | | 2.80 | | | | 5-10-2019 | | | | 2,500,000 | | | | 2,500,000 | |

| | | | |

Mizuho Bank Limited (1 Month LIBOR +0.19%) ± | | | 2.71 | | | | 4-10-2019 | | | | 5,000,000 | | | | 5,000,000 | |

| | | | |

Mizuho Bank Limited (3 Month LIBOR +0.30%) ± | | | 3.04 | | | | 4-30-2019 | | | | 2,000,000 | | | | 2,000,817 | |

| | | | |

MUFG Bank Limited (1 Month LIBOR +0.30%) ± | | | 2.82 | | | | 5-1-2019 | | | | 4,000,000 | | | | 4,000,000 | |

| | | | |

National Bank of Kuwait | | | 2.37 | | | | 2-1-2019 | | | | 5,450,000 | | | | 5,450,000 | |

| | | | |

Nordea Bank AB (1 Month LIBOR +0.17%) ± | | | 2.68 | | | | 6-13-2019 | | | | 5,000,000 | | | | 5,000,000 | |

| | | | |

Norinchukin Bank | | | 2.75 | | | | 4-8-2019 | | | | 15,000,000 | | | | 15,000,000 | |

| | | | |

Oversea Chinese Banking (1 Month LIBOR +0.14%) ± | | | 2.65 | | | | 3-13-2019 | | | | 4,000,000 | | | | 4,000,000 | |

| | | | |

Oversea Chinese Banking (1 Month LIBOR +0.20%) ± | | | 2.71 | | | | 9-19-2019 | | | | 2,000,000 | | | | 2,000,000 | |

| | | | |

Skandinaviska Enskilda Banken AB (3 Month LIBOR +0.27%) ± | | | 3.03 | | | | 7-26-2019 | | | | 4,000,000 | | | | 4,001,535 | |

| | | | |

State Street Bank & Trust (1 Month LIBOR +0.27%) ± | | | 2.78 | | | | 5-15-2019 | | | | 3,000,000 | | | | 3,000,000 | |

| | | | |

Sumitomo Mitsui Banking Corporation (1 Month LIBOR +0.19%) ± | | | 2.69 | | | | 3-27-2019 | | | | 4,000,000 | | | | 4,000,000 | |

| | | | |

Sumitomo Mitsui Banking Corporation (1 Month LIBOR +0.20%) ± | | | 2.70 | | | | 3-28-2019 | | | | 3,000,000 | | | | 3,000,000 | |

| | | | |

Sumitomo Mitsui Trust NY (1 Month LIBOR +0.18%) ± | | | 2.69 | | | | 2-6-2019 | | | | 2,000,000 | | | | 2,000,002 | |

| | | | |

Sumitomo Mitsui Trust NY (1 Month LIBOR +0.30%) ± | | | 2.81 | | | | 5-21-2019 | | | | 5,000,000 | | | | 5,000,000 | |

| | | | |

Sumitomo Mitsui Trust NY (3 Month LIBOR +0.12%) ± | | | 2.92 | | | | 7-8-2019 | | | | 5,000,000 | | | | 5,000,000 | |

| | | | |

Sumitomo Mitsui Trust NY (3 Month LIBOR +0.15%) ± | | | 2.93 | | | | 4-18-2019 | | | | 3,000,000 | | | | 3,000,000 | |

| | | | |

Svenska Handelsbanken (3 Month LIBOR +0.27%) ± | | | 3.03 | | | | 10-21-2019 | | | | 5,000,000 | | | | 5,002,345 | |

| | | | |

Svenska Handelsbanken (3 Month LIBOR +0.15%) ± | | | 2.95 | | | | 10-2-2019 | | | | 7,000,000 | | | | 7,000,000 | |

| | | | |

US Bank NA (1 Month LIBOR +0.26%) ± | | | 2.77 | | | | 7-23-2019 | | | | 3,000,000 | | | | 3,000,000 | |

| |

Total Certificates of Deposit (Cost $154,956,166) | | | | 154,956,166 | |

| | | | | | | | | | | | | | | | |

| | | | |

Commercial Paper: 48.22% | | | | | | | | | | | | | | | | |

| | | | |

| Asset-Backed Commercial Paper: 25.02% | | | | | | | | | | | | | | | | |

| | | | |

Alpine Securitization LLC (1 Month LIBOR +0.18%) ±144A | | | 2.68 | | | | 4-1-2019 | | | | 2,000,000 | | | | 2,000,142 | |

| | | | |

Alpine Securitization LLC (1 Month LIBOR +0.20%) ±144A | | | 2.71 | | | | 3-6-2019 | | | | 1,000,000 | | | | 1,000,109 | |

| | | | |

Alpine Securitization LLC (1 Month LIBOR +0.20%) ±144A | | | 2.72 | | | | 6-28-2019 | | | | 5,000,000 | | | | 5,000,000 | |

| | | | |

Anglesea Funding LLC (1 Month LIBOR +0.20%) ±144A | | | 2.71 | | | | 3-8-2019 | | | | 2,000,000 | | | | 2,000,000 | |

| | | | |

Anglesea Funding LLC (1 Month LIBOR +0.20%) ±144A | | | 2.71 | | | | 3-15-2019 | | | | 6,000,000 | | | | 6,000,000 | |

| | | | |

Anglesea Funding LLC (1 Month LIBOR +0.20%) ±144A%% | | | 2.71 | | | | 7-31-2019 | | | | 4,000,000 | | | | 4,000,000 | |

| | | | |

Anglesea Funding LLC (1 Month LIBOR +0.25%) ±144A | | | 2.75 | | | | 5-20-2019 | | | | 8,000,000 | | | | 8,000,000 | |

| | | | |

Atlantic Asset Securitization Corporation 144A(z) | | | 2.84 | | | | 3-4-2019 | | | | 2,238,000 | | | | 2,232,565 | |

| | | | |

Bennington Stark Capital Company 144A(z) | | | 2.85 | | | | 4-8-2019 | | | | 5,000,000 | | | | 4,974,058 | |

| | | | |

Cedar Spring Capital Corporation 144A(z) | | | 2.52 | | | | 2-6-2019 | | | | 6,000,000 | | | | 5,997,900 | |

| | | | |

Chesham Finance Limited 144A(z) | | | 2.55 | | | | 2-1-2019 | | | | 8,000,000 | | | | 8,000,000 | |

| | | | |

Collateralized Commercial Paper II Company LLC (3 Month LIBOR +0.26%) ±144A | | | 3.06 | | | | 12-31-2019 | | | | 3,000,000 | | | | 3,000,000 | |

The accompanying notes are an integral part of these financial statements.

| | | | | | |

| Portfolio of investments—January 31, 2019 | | Wells Fargo Money Market Fund | | | 11 | |

| | | | | | | | | | | | | | | | |

| Security name | | Interest rate | | | Maturity date | | | Principal | | | Value | |

|

| Asset-Backed Commercial Paper(continued) | |

| | | | |

Collateralized Commercial Paper II Company LLC (3 Month LIBOR +0.27%) ±144A | | | 3.07 | % | | | 1-8-2020 | | | $ | 5,000,000 | | | $ | 5,000,000 | |

| | | | |

Concord Minutemen Capital Company 144A(z) | | | 2.55 | | | | 2-8-2019 | | | | 3,000,000 | | | | 2,998,513 | |

| | | | |

Concord Minutemen Capital Company 144A(z) | | | 2.66 | | | | 2-11-2019 | | | | 4,500,000 | | | | 4,496,688 | |

| | | | |

Concord Minutemen Capital Company 144A(z) | | | 2.83 | | | | 4-2-2019 | | | | 3,000,000 | | | | 2,985,950 | |

| | | | |

Concord Minutemen Capital Company 144A(z) | | | 2.85 | | | | 2-27-2019 | | | | 1,300,000 | | | | 1,297,343 | |

| | | | |

Concord Minutemen Capital Company 144A(z) | | | 2.87 | | | | 4-9-2019 | | | | 6,000,000 | | | | 5,968,175 | |

| | | | |

Crown Point Capital Company LLC (1 Month LIBOR +0.20%) ±144A | | | 2.72 | | | | 3-11-2019 | | | | 5,000,000 | | | | 5,000,000 | |

| | | | |

Crown Point Capital Company LLC (1 Month LIBOR +0.23%) ±144A | | | 2.74 | | | | 5-15-2019 | | | | 8,000,000 | | | | 8,000,000 | |

| | | | |

Great Bridge Capital Company LLC 144A(z) | | | 2.71 | | | | 2-21-2019 | | | | 5,000,000 | | | | 4,992,500 | |

| | | | |

Great Bridge Capital Company LLC 144A(z) | | | 2.77 | | | | 2-5-2019 | | | | 5,000,000 | | | | 4,998,466 | |

| | | | |

Institutional Secured Funding LLC 144A(z) | | | 2.57 | | | | 2-1-2019 | | | | 17,000,000 | | | | 17,000,000 | |

| | | | |

Kells Funding LLC 144A(z) | | | 2.71 | | | | 2-6-2019 | | | | 3,000,000 | | | | 2,998,875 | |

| | | | |

Komatsu Finance America Incorporated 144A(z) | | | 2.49 | | | | 2-7-2019 | | | | 2,000,000 | | | | 1,999,170 | |

| | | | |

Komatsu Finance America Incorporated 144A(z) | | | 2.50 | | | | 2-12-2019 | | | | 10,000,000 | | | | 9,992,361 | |

| | | | |

Komatsu Finance America Incorporated 144A(z) | | | 2.50 | | | | 2-19-2019 | | | | 5,000,000 | | | | 4,993,750 | |

| | | | |

Legacy Capital Company 144A(z) | | | 2.77 | | | | 2-21-2019 | | | | 9,334,000 | | | | 9,319,688 | |

| | | | |

Lexington Parker Capital Company LLC 144A(z) | | | 2.50 | | | | 2-6-2019 | | | | 4,000,000 | | | | 3,998,611 | |

| | | | |

Liberty Funding LLC 144A(z) | | | 2.72 | | | | 4-18-2019 | | | | 7,000,000 | | | | 6,960,100 | |

| | | | |

LMA Americas LLC 144A(z) | | | 2.86 | | | | 2-27-2019 | | | | 2,550,000 | | | | 2,544,770 | |

| | | | |

LMA Americas LLC 144A(z) | | | 2.87 | | | | 2-26-2019 | | | | 2,000,000 | | | | 1,996,042 | |

| | | | |

LMA Americas LLC 144A(z) | | | 2.87 | | | | 3-5-2019 | | | | 1,000,000 | | | | 997,467 | |

| | | | |

Manhattan Asset Funding Company LLC 144A(z) | | | 2.56 | | | | 2-15-2019 | | | | 3,000,000 | | | | 2,997,025 | |

| | | | |

Mountcliff Funding LLC 144A(z) | | | 2.50 | | | | 2-1-2019 | | | | 7,000,000 | | | | 7,000,000 | |

| | | | |

Mountcliff Funding LLC (1 Month LIBOR +0.25%) ±144A | | | 2.75 | | | | 8-30-2019 | | | | 8,000,000 | | | | 8,000,000 | |

| | | | |

Old Line Funding LLC (1 Month LIBOR +0.19%) ±144A | | | 2.70 | | | | 5-13-2019 | | | | 3,000,000 | | | | 3,000,000 | |

| | | | |

Old Line Funding LLC (1 Month LIBOR +0.22%) ±144A | | | 2.74 | | | | 8-1-2019 | | | | 2,000,000 | | | | 2,000,000 | |

| | | | |

Victory Receivables Corporation 144A(z) | | | 2.55 | | | | 2-1-2019 | | | | 3,000,000 | | | | 3,000,000 | |

| | | | |

White Plains Capital 144A(z) | | | 2.95 | | | | 4-16-2019 | | | | 4,974,000 | | | | 4,944,043 | |

| | | | |

White Plains Capital 144A(z) | | | 3.02 | | | | 3-5-2019 | | | | 2,000,000 | | | | 1,994,667 | |

| | | | |

White Plains Capital 144A(z) | | | 3.02 | | | | 4-9-2019 | | | | 4,000,000 | | | | 3,977,667 | |

| |

| | | | 197,656,645 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Financial Company Commercial Paper: 16.88% | | | | | | | | | | | | | | | | |

| | | | |

Banco Santander Chile 144A(z) | | | 2.96 | | | | 3-5-2019 | | | | 3,500,000 | | | | 3,490,822 | |

| | | | |

Bank of Nova Scotia (1 Month LIBOR +0.18%) ±144A | | | 2.70 | | | | 7-2-2019 | | | | 4,000,000 | | | | 4,000,000 | |

| | | | |

Bank of Nova Scotia (1 Month LIBOR +0.19%) ±144A | | | 2.70 | | | | 5-6-2019 | | | | 2,000,000 | | | | 2,000,000 | |

| | | | |

BNZ International Funding Limited (1 Month LIBOR +0.19%) ±144A | | | 2.69 | | | | 5-20-2019 | | | | 3,000,000 | | | | 3,000,000 | |

| | | | |

BNZ International Funding Limited (3 Month LIBOR +0.15%) ±144A | | | 2.90 | | | | 4-26-2019 | | | | 3,000,000 | | | | 3,000,000 | |

| | | | |

CME Group Incorporated 144A(z) | | | 2.50 | | | | 2-12-2019 | | | | 10,000,000 | | | | 9,992,361 | |

| | | | |

CME Group Incorporated 144A(z) | | | 2.52 | | | | 2-5-2019 | | | | 7,000,000 | | | | 6,998,040 | |

| | | | |

Commonwealth Bank of Australia (3 Month LIBOR +0.10%) ±144A | | | 2.68 | | | | 5-3-2019 | | | | 4,000,000 | | | | 4,000,000 | |

| | | | |

Commonwealth Bank of Australia (1 Month LIBOR +0.21%) ±144A | | | 2.72 | | | | 9-16-2019 | | | | 2,000,000 | | | | 2,000,000 | |

| | | | |

Commonwealth Bank of Australia (3 Month LIBOR +0.60%) ±144A | | | 3.40 | | | | 12-19-2019 | | | | 4,000,000 | | | | 4,011,614 | |

| | | | |

DBS Bank Limited (1 Month LIBOR +0.14%) ±144A | | | 2.64 | | | | 3-21-2019 | | | | 3,000,000 | | | | 3,000,000 | |

| | | | |

Federation des Caisses (z) | | | 2.50 | | | | 2-1-2019 | | | | 5,000,000 | | | | 5,000,000 | |

| | | | |

Federation des Caisses (1 Month LIBOR +0.26%) ±144A | | | 2.78 | | | | 2-11-2019 | | | | 3,000,000 | | | | 3,000,000 | |

| | | | |

Federation des Caisses (3 Month LIBOR +0.13%) ±144A | | | 2.81 | | | | 5-22-2019 | | | | 1,000,000 | | | | 1,000,000 | |

| | | | |

Federation des Caisses (1 Month LIBOR +0.30%) ±144A | | | 2.81 | | | | 6-25-2019 | | | | 2,000,000 | | | | 2,000,000 | |

| | | | |

HSBC Bank Incorporated (1 Month LIBOR +0.42%) ±144A | | | 2.93 | | | | 5-7-2019 | | | | 2,000,000 | | | | 2,000,000 | |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 12 | | Wells Fargo Money Market Fund | | Portfolio of investments—January 31, 2019 |

| | | | | | | | | | | | | | | | |

| Security name | | Interest rate | | | Maturity date | | | Principal | | | Value | |

| | | | |

| Financial Company Commercial Paper(continued) | | | | | | | | | | | | | | | | |

| | | | |

ING Funding LLC (1 Month LIBOR +0.25%) ± | | | 2.77 | % | | | 2-11-2019 | | | $ | 2,000,000 | | | $ | 2,000,001 | |

| | | | |

JPMorgan Securities (1 Month LIBOR +0.15%) ± | | | 2.65 | | | | 2-28-2019 | | | | 3,000,000 | | | | 3,000,000 | |

| | | | |

Macquarie Bank Limited 144A(z) | | | 2.54 | | | | 2-25-2019 | | | | 4,000,000 | | | | 3,993,253 | |

| | | | |

Macquarie Bank Limited 144A(z) | | | 2.65 | | | | 2-14-2019 | | | | 5,000,000 | | | | 4,995,215 | |

| | | | |

National Australia Bank Limited (1 Month LIBOR +0.20%) ±144A | | | 2.72 | | | | 8-2-2019 | | | | 3,000,000 | | | | 3,000,000 | |

| | | | |

National Australia Bank Limited (1 Month LIBOR +0.27%) ±144A | | | 2.77 | | | | 5-21-2019 | | | | 3,000,000 | | | | 3,000,000 | |

| | | | |

Oversea-Chinese Banking Corporation (3 Month LIBOR +0.14%) ±144A | | | 2.75 | | | | 5-10-2019 | | | | 2,000,000 | | | | 2,000,000 | |

| | | | |

Oversea-Chinese Banking Corporation (1 Month LIBOR +0.25%) ±144A | | | 2.77 | | | | 5-8-2019 | | | | 2,000,000 | | | | 2,000,000 | |

| | | | |

Skandinaviska Enskilda Banken AB 144A(z) | | | 2.72 | | | | 4-4-2019 | | | | 10,000,000 | | | | 9,953,500 | |

| | | | |

Toronto Dominion Bank (3 Month LIBOR +0.14%) ±144A | | | 2.70 | | | | 5-2-2019 | | | | 3,000,000 | | | | 3,000,000 | |

| | | | |

Toronto Dominion Bank (3 Month LIBOR +0.08%) ± | | | 2.71 | | | | 8-16-2019 | | | | 3,000,000 | | | | 3,000,000 | |

| | | | |

Toronto Dominion Bank (1 Month LIBOR +0.37%) ±144A | | | 2.88 | | | | 11-7-2019 | | | | 3,000,000 | | | | 3,000,000 | |

| | | | |

Toronto Dominion Bank (3 Month LIBOR +0.21%) ±144A | | | 2.98 | | | | 12-6-2019 | | | | 5,000,000 | | | | 5,000,000 | |

| | | | |

UBS AG London (3 Month LIBOR +0.08%) ±144A | | | 2.67 | | | | 2-7-2019 | | | | 5,000,000 | | | | 5,000,000 | |

| | | | |

United Overseas Bank Limited 144A(z) | | | 2.61 | | | | 3-21-2019 | | | | 9,000,000 | | | | 8,968,800 | |

| | | | |

Westpac Banking Corporation (3 Month LIBOR +0.07%) ±144A | | | 2.63 | | | | 8-2-2019 | | | | 4,000,000 | | | | 4,000,000 | |

| | | | |

Westpac Banking Corporation (1 Month LIBOR +0.21%) ±144A | | | 2.72 | | | | 9-19-2019 | | | | 4,000,000 | | | | 3,999,838 | |

| | | | |

Westpac Banking Corporation (3 Month LIBOR +0.10%) ±144A | | | 2.81 | | | | 5-31-2019 | | | | 5,000,000 | | | | 5,000,000 | |

| |

| | | | 133,403,444 | |

| | | | | | | | | | | | | | | | |

|

Other Commercial Paper: 6.32% | |

| | | | |

CNPC Finance Limited 144A(z) | | | 2.80 | | | | 2-6-2019 | | | | 7,000,000 | | | | 6,997,278 | |

| | | | |

Koch Industries Incorporated (z) | | | 2.48 | | | | 2-22-2019 | | | | 5,000,000 | | | | 4,992,767 | |

| | | | |

Koch Industries Incorporated (z) | | | 2.49 | | | | 2-5-2019 | | | | 3,000,000 | | | | 2,999,170 | |

| | | | |

Koch Industries Incorporated (z) | | | 2.50 | | | | 2-4-2019 | | | | 7,000,000 | | | | 6,998,540 | |

| | | | |

Koch Industries Incorporated (z) | | | 2.50 | | | | 2-12-2019 | | | | 3,000,000 | | | | 2,997,708 | |

| | | | |

Salt River Project Agricultural Improvement and Power District (z) | | | 2.59 | | | | 2-19-2019 | | | | 10,000,000 | | | | 9,987,100 | |

| | | | |

Toyota Credit Canada Incorporated (1 Month LIBOR +0.19%) ± | | | 2.70 | | | | 7-5-2019 | | | | 3,000,000 | | | | 3,000,000 | |

| | | | |

Toyota Finance Australia Limited (3 Month LIBOR +0.08%) ± | | | 2.73 | | | | 2-15-2019 | | | | 3,000,000 | | | | 3,000,000 | |

| | | | |

Toyota Finance Australia Limited (3 Month LIBOR +0.09%) ± | | | 2.91 | | | | 3-22-2019 | | | | 2,000,000 | | | | 2,000,000 | |

| | | | |

Toyota Motor Finance (3 Month LIBOR +0.10%) ± | | | 2.68 | | | | 4-30-2019 | | | | 3,000,000 | | | | 3,000,000 | |

| | | | |

Toyota Motor Finance (3 Month LIBOR +0.13%) ± | | | 2.87 | | | | 6-4-2019 | | | | 4,000,000 | | | | 4,000,000 | |

| |

| | | | 49,972,563 | |

| | | | | | | | | | | | | | | | |

| |

Total Commercial Paper (Cost $381,032,652) | | | | 381,032,652 | |

| | | | | | | | | | | | | | | | |

| | | | |

Municipal Obligations: 16.67% | | | | | | | | | | | | | | | | |

| | | | |

California: 2.28% | | | | | | | | | | | | | | | | |

| | | | |

| Other Municipal Debt: 2.28% | | | | | | | | | | | | | | | | |

| | | | |

California Imperial Irrigation District Series B (Utilities Revenue) | | | 2.60 | | | | 2-20-2019 | | | | 5,000,000 | | | | 5,000,000 | |

| | | | |

California Series B-5 (Miscellaneous Revenue) | | | 2.55 | | | | 2-6-2019 | | | | 5,000,000 | | | | 5,000,000 | |

| | | | |

Orange County CA Water District Series B (Water Utilities) | | | 2.58 | | | | 2-14-2019 | | | | 8,000,000 | | | | 8,000,000 | |

| |

| | | | 18,000,000 | |

| | | | | | | | | | | | | | | | |

| | | | |

Colorado: 2.64% | | | | | | | | | | | | | | | | |

| | | | |

| Variable Rate Demand Notes ø: 2.64% | | | | | | | | | | | | | | | | |

| | | | |

Colorado HFA MFHR Class II Series B (Housing Revenue, FHLB SPA) | | | 2.55 | | | | 5-1-2052 | | | | 3,895,000 | | | | 3,895,000 | |

| | | | |

Colorado Southern Ute Indian Tribe Reservation Series 2007 (Miscellaneous Revenue) | | | 2.55 | | | | 1-1-2027 | | | | 5,450,000 | | | | 5,450,000 | |

| | | | |

Colorado Tender Option Bond Trust Receipts/Certificates Series 2017-TPG007 (Health Revenue, Bank of America NA LIQ) 144A | | | 3.01 | | | | 10-29-2027 | | | | 11,500,000 | | | | 11,500,000 | |

| |

| | | | 20,845,000 | |

| | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| | | | | | |

| Portfolio of investments—January 31, 2019 | | Wells Fargo Money Market Fund | | | 13 | |

| | | | | | | | | | | | | | | | |

| Security name | | Interest rate | | | Maturity date | | | Principal | | | Value | |

| | | | |

Georgia: 4.00% | | | | | | | | | | | | | | | | |

| | | | |

| Other Municipal Debt: 0.25% | | | | | | | | | | | | | | | | |

| | | | |

Municipal Electric Authority of Georgia (Utilities Revenue) | | | 2.57 | % | | | 2-19-2019 | | | $ | 2,000,000 | | | $ | 2,000,000 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Variable Rate Demand Notes ø: 3.75% | | | | | | | | | | | | | | | | |

| | | | |

Columbus GA Housing Development Authority Puttable Floating Option Taxable Notes Series TN-024 (Housing Revenue, ACA Insured, Bank of America NA LIQ) 144A | | | 2.72 | | | | 10-1-2039 | | | | 4,595,000 | | | | 4,595,000 | |

| | | | |

Georgia Tender Option Bond Trust Receipts/Certificates Series 2018-TPG010 (Miscellaneous Revenue, Bank of America NA LIQ) 144A | | | 2.79 | | | | 7-1-2020 | | | | 20,040,000 | | | | 20,040,000 | |

| | | | |

Macon-Bibb County GA Industrial Authority Development Kumho Tire Georgia Incorporated Series A (Industrial Development Revenue, Korea Development Bank LOC) | | | 2.66 | | | | 12-1-2022 | | | | 5,000,000 | | | | 5,000,000 | |

| |

| | | | 29,635,000 | |

| | | | | | | | | | | | | | | | |

| | | | |

Kentucky: 0.51% | | | | | | | | | | | | | | | | |

| | | | |

| Variable Rate Demand Note ø: 0.51% | | | | | | | | | | | | | | | | |

| | | | |

Kentucky Housing Corporation Series O (Housing Revenue, Kentucky Housing Corporation SPA) | | | 2.51 | | | | 1-1-2036 | | | | 4,000,000 | | | | 4,000,000 | |

| | | | | | | | | | | | | | | | |

|

New Hampshire: 0.63% | |

| | | | |

| Variable Rate Demand Note ø: 0.63% | | | | | | | | | | | | | | | | |

| | | | |

New Hampshire National Business Finance Authority CJ Foods Manufacturing Beaumont Corporation Series A (Industrial Development Revenue, Kookmin Bank LOC) 144A | | | 2.66 | | | | 10-1-2028 | | | | 5,000,000 | | | | 5,000,000 | |

| | | | | | | | | | | | | | | | |

| | | | |

New Jersey: 0.88% | | | | | | | | | | | | | | | | |

| | | | |

| Variable Rate Demand Note ø: 0.88% | | | | | | | | | | | | | | | | |

| | | | |

Jets Stadium Development Series A-4B (Miscellaneous Revenue, Sumitomo Mitsui Banking Corporation LOC) 144A## | | | 2.50 | | | | 4-1-2047 | | | | 6,970,000 | | | | 6,970,000 | |

| | | | | | | | | | | | | | | | |

| | | | |

New York: 2.41% | | | | | | | | | | | | | | | | |

| | | | |

| Other Municipal Debt: 0.64% | | | | | | | | | | | | | | | | |

| | | | |

Long Island Power Authority Series 2015 (Miscellaneous Revenue) | | | 2.65 | | | | 3-12-2019 | | | | 5,000,000 | | | | 5,000,000 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Variable Rate Demand Notes ø: 1.77% | | | | | | | | | | | | | | | | |

| | | | |

New York HFA Manhattan West Residential Housing Project Series B-2 (Housing Revenue, Bank of China LOC) | | | 2.60 | | | | 11-1-2049 | | | | 10,000,000 | | | | 10,000,000 | |

| | | | |

RBC Municipal Products Incorporated Trust Series E-51 Invesco Van Kampen Trust (Miscellaneous Revenue, Royal Bank of Canada LOC) 144A | | | 2.81 | | | | 12-1-2019 | | | | 4,000,000 | | | | 4,000,000 | |

| |

| | | | 14,000,000 | |

| | | | | | | | | | | | | | | | |

| | | | |

Oregon: 1.14% | | | | | | | | | | | | | | | | |

| | | | |

| Other Municipal Debt: 0.25% | | | | | | | | | | | | | | | | |

| | | | |

Port of Portland Oregon International Airport Revenue Series C (Transportation Revenue) | | | 2.83 | | | | 4-3-2019 | | | | 2,000,000 | | | | 2,000,000 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Variable Rate Demand Note ø: 0.89% | | | | | | | | | | | | | | | | |

| | | | |

Oregon Tender Option Bond Trust Receipts/Certificates Series ZF2515 (Miscellaneous Revenue, Bank of America NA LIQ) 144A | | | 2.61 | | | | 5-1-2035 | | | | 7,000,000 | | | | 7,000,000 | |

| | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 14 | | Wells Fargo Money Market Fund | | Portfolio of investments—January 31, 2019 |

| | | | | | | | | | | | | | | | |

| Security name | | Interest rate | | | Maturity date | | | Principal | | | Value | |

| | | | |

Other: 1.04% | | | | | | | | | | | | | | | | |

| | | | |

| Variable Rate Demand Notes ø: 1.04% | | | | | | | | | | | | | | | | |

| | | | |

SSAB AB Series A (Miscellaneous Revenue, DNB Banking ASA LOC) | | | 2.49 | % | | | 6-1-2035 | | | $ | 1,000,000 | | | $ | 1,000,000 | |

| | | | |

Steadfast Crestvilla LLC Series A (Health Revenue, American AgCredit LOC) | | | 2.50 | | | | 2-1-2056 | | | | 4,240,000 | | | | 4,240,000 | |

| | | | |

Steadfast Crestvilla LLC Series B (Health Revenue, U.S. Bank NA LOC) | | | 2.50 | | | | 2-1-2056 | | | | 3,000,000 | | | | 3,000,000 | |

| |

| | | | 8,240,000 | |

| | | | | | | | | | | | | | | | |

| | | | |

Pennsylvania: 1.14% | | | | | | | | | | | | | | | | |

| | | | |

| Other Municipal Debt: 0.89% | | | | | | | | | | | | | | | | |

| | | | |

University of Pittsburgh (Education Revenue) | | | 2.72 | | | | 2-1-2019 | | | | 7,000,000 | | | | 7,000,000 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Variable Rate Demand Note ø: 0.25% | | | | | | | | | | | | | | | | |

| | | | |

RBC Municipal Products Incorporated Trust Series E-52 Invesco Van Kampen Trust (Miscellaneous Revenue, Royal Bank of Canada LOC) 144A | | | 2.81 | | | | 12-1-2019 | | | | 2,000,000 | | | | 2,000,000 | |

| | | | | | | | | | | | | | | | |

| |

Total Municipal Obligations (Cost $131,690,000) | | | | 131,690,000 | |

| | | | | | | | | | | | | | | | |

| | | | |

Other Instruments: 0.88% | | | | | | | | | | | | | | | | |

| | | | |

Invesco Dynamic Credit Opportunities Fund Series W-7 § | | | 2.56 | | | | 6-1-2028 | | | | 5,000,000 | | | | 5,000,000 | |

| | | | |

Sumitomo Mitsui Trust Banking Limited 144A | | | 2.05 | | | | 3-6-2019 | | | | 2,000,000 | | | | 1,998,834 | |

| |

Total Other Instruments (Cost $6,998,834) | | | | 6,998,834 | |

| | | | | | | | | | | | | | | | |

| | | | |

Other Notes: 0.51% | | | | | | | | | | | | | | | | |

| | | | |

| Corporate Bonds and Notes: 0.51% | | | | | | | | | | | | | | | | |

| | | | |

Cellmark Incorporated Secured øø§ | | | 2.49 | | | | 6-1-2038 | | | | 4,000,000 | | | | 4,000,000 | |

| | | | | | | | | | | | | | | | |

| |

Total Other Notes (Cost $4,000,000) | | | | 4,000,000 | |

| | | | | | | | | | | | | | | | |

| | | | |

Repurchase Agreements ^^: 14.18% | | | | | | | | | | | | | | | | |

| | | | |

Bank of America Corporation, dated 1-31-2019, maturity value $35,002,499 (1) | | | 2.57 | | | | 2-1-2019 | | | | 35,000,000 | | | | 35,000,000 | |

| | | | |

Bank of Nova Scotia, dated 1-31-2019, maturity value $35,002,499 (2) | | | 2.57 | | | | 2-1-2019 | | | | 35,000,000 | | | | 35,000,000 | |

| | | | |

BNP Paribas, dated 1-31-2019, maturity value $8,000,578 (3) | | | 2.60 | | | | 2-1-2019 | | | | 8,000,000 | | | | 8,000,000 | |

| | | | |

GX Clarke & Company, dated 1-31-2019, maturity value $34,002,456 (4) | | | 2.60 | | | | 2-1-2019 | | | | 34,000,000 | | | | 34,000,000 | |

| |

Total Repurchase Agreements (Cost $112,000,000) | | | | 112,000,000 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | |

| Total investments in securities (Cost $790,677,652) | | | 100.07 | % | | | 790,677,652 | |

| | |

Other assets and liabilities, net | | | (0.07 | ) | | | (562,751 | ) |

| | | | | | | | |

| Total net assets | | | 100.00 | % | | $ | 790,114,901 | |

| | | | | | | | |

| ± | Variable rate investment. The rate shown is the rate in effect at period end. |

| 144A | The security may be resold in transactions exempt from registration, normally to qualified institutional buyers, pursuant to Rule 144A under the Securities Act of 1933. |

| %% | The security is issued on a when-issued basis. |

| (z) | Zero coupon security. The rate represents the current yield to maturity. |

| ø | Variable rate demand notes are subject to a demand feature which reduces the effective maturity. The maturity date shown represents the final maturity date of the security. The interest rate is determined and reset by the issuer daily, weekly, or monthly depending upon the terms of the security. The rate shown is the rate in effect at period end. |

| ## | All or a portion of this security is segregated for when-issued securities. |

| § | The security is subject to a demand feature which reduces the effective maturity. |

The accompanying notes are an integral part of these financial statements.

| | | | | | |

| Portfolio of investments—January 31, 2019 | | Wells Fargo Money Market Fund | | | 15 | |

| øø | The interest rate is determined and reset by the issuer periodically depending upon the terms of the security. The rate shown is the rate in effect at period end. |

| | (1) | U.S. government securities, 3.00% to 3.50%, 8-20-2042 to 10-20-2046, fair value including accrued interest is $36,050,000. |

| | (2) | U.S. government securities, 2.00% to 7.00%, 12-1-2023 to 1-20-2049, fair value including accrued interest is $36,048,726. |

| | (3) | U.S. government securities, 1.13% to 7.00%, 2-28-2019 to 12-1-2048, fair value including accrued interest is $8,232,524. |

| | (4) | U.S. government securities, 1.38% to 10.00%, 2-15-2019 to 2-1-2057, fair value including accrued interest is $34,984,992. |

Abbreviations:

| ACA | ACA Financial Guaranty Corporation |

| FHLB | Federal Home Loan Bank |

| HFA | Housing Finance Authority |

| LIBOR | London Interbank Offered Rate |

| MFHR | Multifamily housing revenue |

| SPA | Standby purchase agreement |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 16 | | Wells Fargo Money Market Fund | | Statement of assets and liabilities—January 31, 2019 |

| | | | |

| | | �� | |

| |

Assets | | | | |

Investments in unaffiliated securities, at amortized cost | | $ | 678,677,652 | |

Investments in repurchase agreements, at amortized cost | | | 112,000,000 | |

Cash | | | 12,308 | |

Receivable for Fund shares sold | | | 3,610,101 | |

Receivable for interest | | | 1,164,226 | |

Prepaid expenses and other assets | | | 59,336 | |

| | | | |

Total assets | | | 795,523,623 | |

| | | | |

| |

Liabilities | | | | |

Payable for investments purchased | | | 4,000,000 | |

Payable for Fund shares redeemed | | | 1,021,831 | |

Administration fees payable | | | 108,637 | |

Management fee payable | | | 53,929 | |

Dividends payable | | | 40,508 | |

Distribution fee payable | | | 6,555 | |

Trustees’ fees and expenses payable | | | 2,076 | |

Accrued expenses and other liabilities | | | 175,186 | |

| | | | |

Total liabilities | | | 5,408,722 | |

| | | | |

Total net assets | | $ | 790,114,901 | |

| | | | |

| |

NET ASSETS CONSIST OF | | | | |

Paid-in capital | | $ | 790,449,841 | |

Total distributable loss | | | (334,940 | ) |

| | | | |

Total net assets | | $ | 790,114,901 | |

| | | | |

| |

COMPUTATION OF NET ASSET VALUE PER SHARE | | | | |

Net assets – Class A | | $ | 474,039,960 | |

Shares outstanding – Class A1 | | | 473,834,763 | |

Net asset value per share – Class A | | | $1.00 | |

Net assets – Class C | | $ | 8,228,757 | |

Shares outstanding – Class C1 | | | 8,224,999 | |

Net asset value per share – Class C | | | $1.00 | |

Net assets – Premier Class | | $ | 295,962,073 | |

Shares outstanding – Premier Class1 | | | 295,836,904 | |

Net asset value per share – Premier Class | | | $1.00 | |

Net assets – Service Class | | $ | 11,884,111 | |

Shares outstanding – Service Class1 | | | 11,878,963 | |

Net asset value per share – Service Class | | | $1.00 | |

| 1 | The Fund has an unlimited number of authorized shares. |

The accompanying notes are an integral part of these financial statements.

| | | | | | |

| Statement of operations—year ended January 31, 2019 | | Wells Fargo Money Market Fund | | | 17 | |

| | | | |

| | | | |

| |

Investment income | | | | |

Interest | | $ | 13,092,960 | |

| | | | |

| |

Expenses | | | | |

Management fee | | | 1,403,356 | |

Administration fees | | | | |

Class A | | | 1,028,372 | |

Class C | | | 16,194 | |

Premier Class | | | 75,603 | |

Service Class | | | 14,413 | |

Shareholder servicing fees | | | | |

Class A | | | 1,168,604 | |

Class C | | | 18,402 | |

Service Class | | | 30,026 | |

Distribution fee | | | | |

Class C | | | 55,206 | |

Custody and accounting fees | | | 26,200 | |

Professional fees | | | 50,877 | |

Registration fees | | | 147,231 | |

Shareholder report expenses | | | 548 | |

Trustees’ fees and expenses | | | 23,744 | |

Other fees and expenses | | | 15,071 | |

| | | | |

Total expenses | | | 4,073,847 | |

Less: Fee waivers and/or expense reimbursements | | | (842,755 | ) |

| | | | |

Net expenses | | | 3,231,092 | |

| | | | |

Net investment income | | | 9,861,868 | |

| | | | |

Net realized gains on investments | | | 10,335 | |

| | | | |

Net increase in net assets resulting from operations | | $ | 9,872,203 | |

| | | | |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 18 | | Wells Fargo Money Market Fund | | Statement of changes in net assets |

| | | | | | | | | | | | | | | | |

| | | Year ended

January 31, 2019 | | | Year ended

January 31, 2018¹ | |

| | | |

Operations | | | | | | | | | | | | |

Net investment income | | | | | | $ | 9,861,868 | | | | | | | $ | 3,274,201 | |

Net realized gains on investments | | | | | | | 10,335 | | | | | | | | 33,646 | |

| | | | |

Net increase in net assets resulting from operations | | | | | | | 9,872,203 | | | | | | | | 3,307,847 | |

| | | | |

| | | |

Distributions to shareholders from net investment income and net realized gains | | | | | | | | | | | | |

Class A | | | | | | | (7,460,070 | ) | | | | | | | (3,150,526 | ) |

Class B | | | | | | | N/A | | | | | | | | (4 | )2 |

Class C | | | | | | | (63,691 | ) | | | | | | | (3,401 | ) |

Premier Class | | | | | | | (2,133,009 | ) | | | | | | | (1,098 | ) |

Service Class | | | | | | | (205,098 | ) | | | | | | | (119,172 | ) |

| | | | |

Total distributions to shareholders | | | | | | | (9,861,868 | ) | | | | | | | (3,274,201 | ) |

| | | | |

| | | | |

Capital share transactions | | | Shares | | | | | | | | Shares | | | | | |

Proceeds from shares sold | | | | | | | | | | | | | | | | |

Class A | | | 189,447,415 | | | | 189,447,415 | | | | 106,393,075 | | | | 106,393,075 | |

Class C | | | 10,651,512 | | | | 10,651,512 | | | | 3,338,043 | | | | 3,338,043 | |

Premier Class | | | 422,176,563 | | | | 422,176,563 | | | | 6,501 | | | | 6,501 | |

Service Class | | | 2,334,760 | | | | 2,334,760 | | | | 4,295,757 | | | | 4,295,757 | |

| | | | |

| | | | |

| | | | | | | 624,610,250 | | | | | | | | 114,033,376 | |

| | | | |

Reinvestment of distributions | | | | | | | | | | | | | | | | |

Class A | | | 7,366,361 | | | | 7,366,361 | | | | 3,062,652 | | | | 3,062,652 | |

Class B | | | N/A | | | | N/A | | | | 4 | 2 | | | 4 | 2 |

Class C | | | 62,701 | | | | 62,701 | | | | 3,322 | | | | 3,322 | |

Premier Class | | | 2,040,299 | | | | 2,040,299 | | | | 564 | | | | 564 | |

Service Class | | | 198,869 | | | | 198,869 | | | | 110,385 | | | | 110,385 | |

| | | | |

| | | | |

| | | | | | | 9,668,230 | | | | | | | | 3,176,927 | |

| | | | |

Payment for shares redeemed | | | | | | | | | | | | | | | | |

Class A | | | (185,079,647 | ) | | | (185,079,647 | ) | | | (187,066,557 | ) | | | (187,066,557 | ) |

Class B | | | N/A | | | | N/A | | | | (195,599 | )2 | | | (195,599 | )2 |

Class C | | | (10,246,505 | ) | | | (10,246,505 | ) | | | (8,870,153 | ) | | | (8,870,153 | ) |

Premier Class | | | (128,480,875 | ) | | | (128,480,875 | ) | | | (6,507 | ) | | | (6,507 | ) |

Service Class | | | (2,556,663 | ) | | | (2,556,663 | ) | | | (14,094,565 | ) | | | (14,094,565 | ) |

| | | | |

| | | | |

| | | | | | | (326,363,690 | ) | | | | | | | (210,233,381 | ) |

| | | | |

Net increase (decrease) in net assets resulting from capital share transactions | | | | | | | 307,914,790 | | | | | | | | (93,023,078 | ) |

| | | | |

Total increase (decrease) in net assets | | | | | | | 307,925,125 | | | | | | | | (92,989,432 | ) |

| | | | |

| | |

Net assets | | | | | | | | |

Beginning of period | | | | | | | 482,189,776 | | | | | | | | 575,179,208 | |

| | | | |

End of period | | | | | | $ | 790,114,901 | | | | | | | $ | 482,189,776 | |

| | | | |

| ¹ | Effective for all filings after November 4, 2018, the SEC prospectively eliminated the requirement to parenthetically disclose undistributed net investment income at the end of the period and permitted the aggregation of distributions, with the exception of tax basis returns of capital. Overdistributed net investment income at January 31, 2018 was $355,511. The disaggregated distributions information for the year ended January 31, 2018 is included in Note 5,Distributions to Shareholders, in the notes to the financial statements. |

| ² | For the period from February 1, 2017 to July 5, 2017. Effective at the close of business on July 5, 2017, Class B shares were converted to Class A shares and are no longer offered by the Fund. |

The accompanying notes are an integral part of these financial statements.

| | | | | | |

| Financial highlights | | Wells Fargo Money Market Fund | | | 19 | |

(For a share outstanding throughout each period)

| | | | | | | | | | | | | | | | | | | | |

| | | Year ended January 31 | |

| CLASS A | | 2019 | | | 2018 | | | 2017 | | | 2016 | | | 2015 | |

Net asset value, beginning of period | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | |

Net investment income | | | 0.02 | | | | 0.01 | | | | 0.00 | 1 | | | 0.00 | 1 | | | 0.00 | 1 |

Net realized gains on investments | | | 0.00 | 1 | | | 0.00 | 1 | | | 0.00 | 1 | | | 0.00 | 1 | | | 0.00 | 1 |

| | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 0.02 | | | | 0.01 | | | | 0.00 | 1 | | | 0.00 | 1 | | | 0.00 | 1 |

Distributions to shareholders from | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.02 | ) | | | (0.01 | ) | | | (0.00 | )1 | | | (0.00 | )1 | | | (0.00 | )1 |

Net asset value, end of period | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | |

Total return | | | 1.61 | % | | | 0.64 | % | | | 0.05 | % | | | 0.01 | % | | | 0.01 | % |

Ratios to average net assets (annualized) | | | | | | | | | | | | | | | | | | | | |

Gross expenses | | | 0.76 | % | | | 0.85 | % | | | 0.83 | % | | | 0.82 | % | | | 0.83 | % |

Net expenses | | | 0.62 | % | | | 0.65 | % | | | 0.55 | % | | | 0.29 | % | | | 0.19 | % |

Net investment income | | | 1.60 | % | | | 0.63 | % | | | 0.03 | % | | | 0.01 | % | | | 0.01 | % |

Supplemental data | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (000s omitted) | | | $474,040 | | | | $462,416 | | | | $539,989 | | | | $1,205,785 | | | | $876,562 | |

| 1 | Amount is less than $0.005. |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 20 | | Wells Fargo Money Market Fund | | Financial highlights |

(For a share outstanding throughout each period)

| | | | | | | | | | | | | | | | | | | | |

| | | Year ended January 31 | |

| CLASS C | | 2019 | | | 2018 | | | 2017 | | | 2016 | | | 2015 | |

Net asset value, beginning of period | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | |

Net investment income | | | 0.01 | | | | 0.00 | 1 | | | 0.00 | 1 | | | 0.00 | 1 | | | 0.00 | 1 |

Net realized gains on investments | | | 0.00 | 1 | | | 0.00 | 1 | | | 0.00 | 1 | | | 0.00 | 1 | | | 0.00 | 1 |

| | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 0.01 | | | | 0.00 | 1 | | | 0.00 | 1 | | | 0.00 | 1 | | | 0.00 | 1 |

Distributions to shareholders from | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.01 | ) | | | (0.00 | )1 | | | (0.00 | )1 | | | (0.00 | )1 | | | (0.00 | )1 |

Net asset value, end of period | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | |

Total return2 | | | 0.84 | % | | | 0.04 | % | | | 0.01 | % | | | 0.01 | % | | | 0.01 | % |

Ratios to average net assets (annualized) | | | | | | | | | | | | | | | | | | | | |

Gross expenses | | | 1.51 | % | | | 1.60 | % | | | 1.58 | % | | | 1.57 | % | | | 1.58 | % |

Net expenses | | | 1.37 | % | | | 1.23 | % | | | 0.60 | % | | | 0.29 | % | | | 0.19 | % |

Net investment income | | | 0.87 | % | | | 0.03 | % | | | 0.01 | % | | | 0.01 | % | | | 0.01 | % |

Supplemental data | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (000s omitted) | | | $8,229 | | | | $7,763 | | | | $13,293 | | | | $16,617 | | | | $13,628 | |

| 1 | Amount is less than $0.005. |

| 2 | Total return calculations do not include any sales charges. |

The accompanying notes are an integral part of these financial statements.

| | | | | | |

| Financial highlights | | Wells Fargo Money Market Fund | | | 21 | |

(For a share outstanding throughout each period)

| | | | | | | | | | | | |

| | | Year ended January 31 | |

| PREMIER CLASS | | 2019 | | | 2018 | | | 2017¹ | |

Net asset value, beginning of period | | | $1.00 | | | | $1.00 | | | | $1.00 | |

Net investment income | | | 0.02 | | | | 0.01 | | | | 0.00 | 2 |

Net realized gains on investments | | | 0.00 | 2 | | | 0.00 | 2 | | | 0.00 | 2 |

| | | | | | | | | | | | |

Total from investment operations | | | 0.02 | | | | 0.01 | | | | 0.00 | 2 |

Distributions to shareholders from | | | | | | | | | | | | |

Net investment income | | | (0.02 | ) | | | (0.01 | ) | | | (0.00 | )2 |

Net asset value, end of period | | | $1.00 | | | | $1.00 | | | | $1.00 | |

Total return3 | | | 2.03 | % | | | 1.09 | % | | | 0.36 | % |

Ratios to average net assets (annualized) | | | | | | | | | | | | |

Gross expenses | | | 0.33 | % | | | 0.45 | % | | | 0.45 | % |

Net expenses | | | 0.20 | % | | | 0.20 | % | | | 0.20 | % |

Net investment income | | | 2.26 | % | | | 1.08 | % | | | 0.43 | % |

Supplemental data | | | | | | | | | | | | |

Net assets, end of period (000s omitted) | | | $295,962 | | | | $101 | | | | $100 | |

| 1 | For the period from March 31, 2016 (commencement of class operations) to January 31, 2017 |

| 2 | Amount is less than $0.005. |

| 3 | Returns for periods of less than one year are not annualized. |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 22 | | Wells Fargo Money Market Fund | | Financial highlights |

(For a share outstanding throughout each period)

| | | | | | | | | | | | | | | | | | | | |

| | | Year ended January 31 | |

| SERVICE CLASS | | 2019 | | | 2018 | | | 2017 | | | 2016 | | | 2015 | |

Net asset value, beginning of period | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | |

Net investment income | | | 0.02 | | | | 0.01 | | | | 0.00 | 1 | | | 0.00 | 1 | | | 0.00 | 1 |

Net realized gains on investments | | | 0.00 | 1 | | | 0.00 | 1 | | | 0.00 | 1 | | | 0.00 | 1 | | | 0.00 | 1 |

| | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 0.02 | | | | 0.01 | | | | 0.00 | 1 | | | 0.00 | 1 | | | 0.00 | 1 |

Distributions to shareholders from | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.02 | ) | | | (0.01 | ) | | | (0.00 | )1 | | | (0.00 | )1 | | | (0.00 | )1 |

Net asset value, end of period | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | | | | $1.00 | |

Total return | | | 1.72 | % | | | 0.79 | % | | | 0.11 | % | | | 0.01 | % | | | 0.01 | % |

Ratios to average net assets (annualized) | | | | | | | | | | | | | | | | | | | | |

Gross expenses | | | 0.66 | % | | | 0.74 | % | | | 0.72 | % | | | 0.72 | % | | | 0.73 | % |

Net expenses | | | 0.50 | % | | | 0.50 | % | | | 0.50 | % | | | 0.28 | % | | | 0.19 | % |

Net investment income | | | 1.71 | % | | | 0.74 | % | | | 0.05 | % | | | 0.01 | % | | | 0.01 | % |

Supplemental data | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (000s omitted) | | | $11,884 | | | | $11,910 | | | | $21,602 | | | | $274,245 | | | | $281,157 | |

| 1 | Amount is less than $0.005. |

The accompanying notes are an integral part of these financial statements.

| | | | | | |

| Notes to financial statements | | Wells Fargo Money Market Fund | | | 23 | |

1. ORGANIZATION