UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-09253

Wells Fargo Funds Trust

(Exact name of registrant as specified in charter)

525 Market St., San Francisco, CA 94105

(Address of principal executive offices) (Zip code)

Matthew Prasse

Wells Fargo Funds Management, LLC

525 Market St., San Francisco, CA 94105

(Name and address of agent for service)

Registrant’s telephone number, including area code: 800-222-8222

Date of fiscal year end: September 30

Registrant is making a filing for 12 of its series:

Wells Fargo Diversified Capital Builder Fund, Wells Fargo Diversified Income Builder Fund, Wells Fargo Index Asset Allocation Fund, Wells Fargo International Bond Fund, Wells Fargo Income Plus Fund, Wells Fargo Global Investment Grade Credit Fund, Wells Fargo C&B Mid Cap Value Fund, Wells Fargo Common Stock Fund, Wells Fargo Discovery Fund, Wells Fargo Enterprise Fund, Wells Fargo Opportunity Fund, and Wells Fargo Special Mid Cap Value Fund.

| Date of reporting period: | September 30, 2021 |

ITEM 1. REPORT TO STOCKHOLDERS

C&B Mid Cap Value Fund

| 2 | |

| 6 | |

| 10 | |

| 11 | |

| Financial statements | |

| 15 | |

| 16 | |

| 17 | |

| 18 | |

| 23 | |

| 30 | |

| 31 | |

| Board considerations | |

| 35 | |

| 39 | |

| 45 |

| 1 | The S&P 500 Index consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market-value-weighted index with each stock's weight in the index proportionate to its market value. You cannot invest directly in an index. |

| 2 | The Morgan Stanley Capital International (MSCI) All Country World Index (ACWI) ex USA Index (Net) is a free-float-adjusted market-capitalization-weighted index that is designed to measure the equity market performance of developed and emerging markets, excluding the U.S. Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indexes or any securities or financial products. This report is not approved, reviewed, or produced by MSCI. You cannot invest directly in an index. |

| 3 | The MSCI Emerging Markets (EM) Index (Net) is a free-float-adjusted market-capitalization-weighted index that is designed to measure equity market performance of emerging markets. You cannot invest directly in an index. |

| 4 | The Bloomberg U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment-grade, U.S.-dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, mortgage-backed securities (agency fixed-rate and hybrid adjustable-rate mortgage pass-throughs), asset-backed securities, and commercial mortgage-backed securities. You cannot invest directly in an index. |

| 5 | The Bloomberg Global Aggregate ex-USD Index (unhedged) is an unmanaged index that provides a broad-based measure of the global investment-grade fixed-income markets excluding the U.S.-dollar-denominated debt market. You cannot invest directly in an index. |

| 6 | The Bloomberg Municipal Bond Index is an unmanaged index composed of long-term tax-exempt bonds with a minimum credit rating of Baa. You cannot invest directly in an index. |

| 7 | The ICE BofA U.S. High Yield Index is a market-capitalization-weighted index of domestic and Yankee high-yield bonds. The index tracks the performance of high-yield securities traded in the U.S. bond market. You cannot invest directly in an index. Copyright 2021. ICE Data Indices, LLC. All rights reserved. |

President

Wells Fargo Funds

| 1 | As of September 30, 2021, assets under management (AUM) includes $93 billion from Galliard Capital Management, an investment advisor that is not part of the Allspring trade name/GIPS firm. |

| Investment objective | The Fund seeks maximum long-term return (current income and capital appreciation), consistent with minimizing risk to principal. |

| Manager | Allspring Funds Management, LLC |

| Subadviser | Cooke & Bieler, L.P. |

| Portfolio managers | Andrew B. Armstrong, CFA®‡, Wesley Lim, CFA®‡, Steve Lyons, CFA®‡, Michael M. Meyer, CFA®‡, Edward W. O'Connor, CFA®‡, R. James O'Neil, CFA®‡, Mehul Trivedi, CFA®‡, William Weber, CFA®‡ |

| Average annual total returns (%) as of September 30, 2021 | |||||||||||

| Including sales charge | Excluding sales charge | Expense ratios1 (%) | |||||||||

| Inception date | 1 year | 5 year | 10 year | 1 year | 5 year | 10 year | Gross | Net 2 | |||

| Class A (CBMAX) | 7-26-2004 | 32.92 | 10.00 | 13.13 | 41.04 | 11.31 | 13.80 | 1.27 | 1.25 | ||

| Class C (CBMCX) | 7-26-2004 | 38.98 | 10.53 | 12.97 | 39.98 | 10.53 | 12.97 | 2.02 | 2.00 | ||

| Class R6 (CBMYX)3 | 7-31-2018 | – | – | – | 41.66 | 11.77 | 14.21 | 0.84 | 0.80 | ||

| Administrator Class (CBMIX) | 7-26-2004 | – | – | – | 41.19 | 11.43 | 13.88 | 1.19 | 1.15 | ||

| Institutional Class (CBMSX) | 7-26-2004 | – | – | – | 41.55 | 11.70 | 14.17 | 0.94 | 0.90 | ||

| Russell Midcap® Value Index4 | – | – | – | – | 42.40 | 10.59 | 13.93 | – | – | ||

| 1 | Reflects the expense ratios as stated in the most recent prospectuses. The expense ratios shown are subject to change and may differ from the annualized expense ratios shown in the financial highlights of this report. |

| 2 | The manager has contractually committed through January 31, 2022, to waive fees and/or reimburse expenses to the extent necessary to cap total annual fund operating expenses after fee waivers at 1.25% for Class A, 2.00% for Class C, 0.80% for Class R6, 1.15% for Administrator Class, and 0.90% for Institutional Class. Brokerage commissions, stamp duty fees, interest, taxes, acquired fund fees and expenses (if any), and extraordinary expenses are excluded from the expense caps. Prior to or after the commitment expiration date, the caps may be increased or the commitment to maintain the caps may be terminated only with the approval of the Board of Trustees. Without these caps, the Fund’s returns would have been lower. The expense ratio paid by an investor is the net expense ratio (the total annual fund operating expenses after fee waivers) as stated in the prospectuses. |

| 3 | Historical performance shown for the Class R6 shares prior to their inception reflects the performance of the Institutional Class shares, and includes the higher expenses applicable to the Institutional Class shares. If these expenses had not been included, returns for the Class R6 shares would be higher. |

| 4 | The Russell Midcap® Value Index measures the performance of those Russell Midcap companies with lower price/book ratios and lower forecasted growth values. The stocks are also members of the Russell 1000® Value Index. You cannot invest directly in an index |

| ‡ | CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute. |

| 1 | The chart compares the performance of Class A shares for the most recent ten years with the Russell Midcap® Value Index. The chart assumes a hypothetical investment of $10,000 in Class A shares and reflects all operating expenses and assumes the maximum initial sales charge of 5.75%. |

| ■ | The Fund underperformed its benchmark, the Russell® Midcap Value Index, for the 12-month period that ended September 30, 2021. |

| ■ | Stock selection had a slightly negative impact, with financials stocks detracting most from relative performance. Materials and energy stocks also detracted from relative results. |

| ■ | Sector allocation effect was positive, particularly due to the underweights to utilities and consumer staples as well as the overweight to financials. |

| Ten largest holdings (%) as of September 30, 20211 | |

| Helen of Troy Limited | 3.89 |

| Arrow Electronics Incorporated | 3.47 |

| Gildan Activewear Incorporated | 3.44 |

| FirstCash Financial Services Incorporated | 3.39 |

| Fidelity National Financial Incorporated | 3.29 |

| Leidos Holdings Incorporated | 3.13 |

| AerCap Holdings NV | 3.10 |

| IAA Incorporated | 3.09 |

| Arch Capital Group Limited | 3.07 |

| Gentex Corporation | 2.98 |

| 1 | Figures represent the percentage of the Fund's net assets. Holdings are subject to change and may have changed since the date specified. |

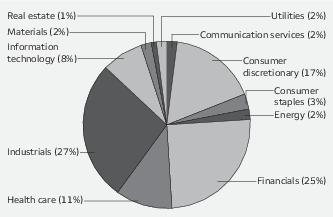

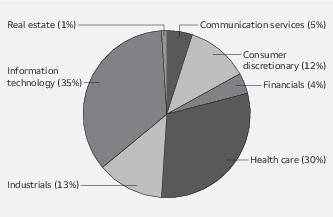

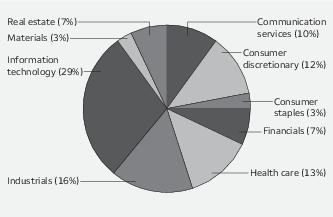

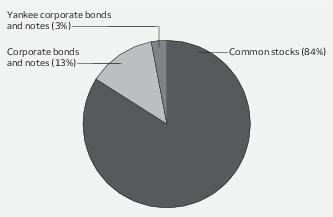

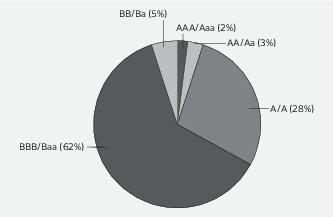

| Sector allocation as of September 30, 20211 |

| 1 | Figures represent the percentage of the Fund's long-term investments. These amounts are subject to change and may have changed since the date specified. |

| Beginning account value 4-1-2021 | Ending account value 9-30-2021 | Expenses paid during the period1 | Annualized net expense ratio | |

| Class A | ||||

| Actual | $1,000.00 | $1,018.51 | $ 6.27 | 1.24% |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,018.85 | $ 6.28 | 1.24% |

| Class C | ||||

| Actual | $1,000.00 | $1,014.75 | $10.05 | 1.99% |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,015.09 | $10.05 | 1.99% |

| Class R6 | ||||

| Actual | $1,000.00 | $1,020.84 | $ 4.05 | 0.80% |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,021.06 | $ 4.05 | 0.80% |

| Administrator Class | ||||

| Actual | $1,000.00 | $1,019.12 | $ 5.82 | 1.15% |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,019.30 | $ 5.82 | 1.15% |

| Institutional Class | ||||

| Actual | $1,000.00 | $1,020.43 | $ 4.56 | 0.90% |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,020.56 | $ 4.56 | 0.90% |

| Shares | Value | ||||

| Common stocks: 99.77% | |||||

| Communication services: 2.09% | |||||

| Media: 2.09% | |||||

| Omnicom Group Incorporated | 203,450 | $ 14,741,987 | |||

| Consumer discretionary: 17.28% | |||||

| Auto components: 2.98% | |||||

| Gentex Corporation | 635,500 | 20,958,790 | |||

| Household durables: 5.56% | |||||

| Helen of Troy Limited † | 122,050 | 27,422,194 | |||

| Whirlpool Corporation | 57,700 | 11,762,722 | |||

| 39,184,916 | |||||

| Leisure products: 1.48% | |||||

| Hasbro Incorporated | 116,920 | 10,431,602 | |||

| Specialty retail: 2.25% | |||||

| American Eagle Outfitters Incorporated | 615,530 | 15,880,674 | |||

| Textiles, apparel & luxury goods: 5.01% | |||||

| Gildan Activewear Incorporated | 664,330 | 24,254,688 | |||

| HanesBrands Incorporated | 644,600 | 11,061,336 | |||

| 35,316,024 | |||||

| Consumer staples: 2.53% | |||||

| Food products: 2.53% | |||||

| General Mills Incorporated | 178,100 | 10,653,942 | |||

| Ingredion Incorporated | 80,920 | 7,202,689 | |||

| 17,856,631 | |||||

| Energy: 1.81% | |||||

| Oil, gas & consumable fuels: 1.81% | |||||

| The Williams Companies Incorporated | 491,200 | 12,741,728 | |||

| Financials: 24.78% | |||||

| Banks: 0.91% | |||||

| Commerce Bancshares Incorporated | 92,098 | 6,417,389 | |||

| Capital markets: 2.28% | |||||

| State Street Corporation | 189,440 | 16,049,357 | |||

| Consumer finance: 3.39% | |||||

| FirstCash Financial Services Incorporated | 272,760 | 23,866,500 | |||

| Insurance: 16.28% | |||||

| Alleghany Corporation † | 27,100 | 16,921,511 | |||

| Arch Capital Group Limited † | 566,000 | 21,609,880 | |||

| Fidelity National Financial Incorporated | 511,800 | 23,205,012 | |||

| Globe Life Incorporated | 189,800 | 16,897,894 | |||

| Progressive Corporation | 152,394 | 13,774,894 |

| Shares | Value | ||||

| Insurance (continued) | |||||

| RenaissanceRe Holdings Limited | 108,050 | $ 15,062,170 | |||

| The Allstate Corporation | 57,100 | 7,269,401 | |||

| 114,740,762 | |||||

| Thrifts & mortgage finance: 1.92% | |||||

| Essent Group Limited | 306,900 | 13,506,669 | |||

| Health care: 11.27% | |||||

| Health care equipment & supplies: 5.30% | |||||

| Baxter International Incorporated | 89,500 | 7,198,485 | |||

| Dentsply Sirona Incorporated | 231,000 | 13,409,550 | |||

| Integra LifeSciences Holdings Corporation † | 244,660 | 16,754,317 | |||

| 37,362,352 | |||||

| Health care providers & services: 1.05% | |||||

| Laboratory Corporation of America Holdings † | 26,150 | 7,359,656 | |||

| Life sciences tools & services: 2.87% | |||||

| Syneos Health Incorporated † | 231,400 | 20,242,872 | |||

| Pharmaceuticals: 2.05% | |||||

| Perrigo Company plc | 305,170 | 14,443,696 | |||

| Industrials: 26.91% | |||||

| Aerospace & defense: 4.07% | |||||

| BWX Technologies Incorporated | 295,950 | 15,939,867 | |||

| Huntington Ingalls Industries Incorporated | 66,000 | 12,741,960 | |||

| 28,681,827 | |||||

| Building products: 1.57% | |||||

| Armstrong World Industries Incorporated | 115,990 | 11,073,565 | |||

| Commercial services & supplies: 3.89% | |||||

| IAA Incorporated † | 398,830 | 21,764,153 | |||

| Steelcase Incorporated Class A | 445,000 | 5,642,600 | |||

| 27,406,753 | |||||

| Electrical equipment: 2.52% | |||||

| Acuity Brands Incorporated | 49,000 | 8,495,129 | |||

| AMETEK Incorporated | 74,400 | 9,226,344 | |||

| 17,721,473 | |||||

| Machinery: 8.63% | |||||

| Colfax Corporation † | 405,122 | 18,595,100 | |||

| Gates Industrial Corporation plc † | 450,000 | 7,321,500 | |||

| PACCAR Incorporated | 119,000 | 9,391,480 | |||

| Stanley Black & Decker Incorporated | 61,250 | 10,737,738 | |||

| Woodward Incorporated | 130,550 | 14,778,260 | |||

| 60,824,078 | |||||

| Professional services: 3.13% | |||||

| Leidos Holdings Incorporated | 229,200 | 22,032,996 | |||

| Trading companies & distributors: 3.10% | |||||

| AerCap Holdings NV † | 377,900 | 21,846,399 |

| Shares | Value | ||||

| Information technology: 7.93% | |||||

| Electronic equipment, instruments & components: 5.00% | |||||

| Arrow Electronics Incorporated † | 217,306 | $ 24,401,291 | |||

| TE Connectivity Limited | 78,590 | 10,784,120 | |||

| 35,185,411 | |||||

| IT services: 1.65% | |||||

| Amdocs Limited | 153,600 | 11,629,056 | |||

| Semiconductors & semiconductor equipment: 1.28% | |||||

| MKS Instruments Incorporated | 59,760 | 9,018,382 | |||

| Materials: 2.14% | |||||

| Metals & mining: 1.32% | |||||

| Reliance Steel & Aluminum Company | 65,150 | 9,278,663 | |||

| Paper & forest products: 0.82% | |||||

| Schweitzer-Mauduit International Incorporated | 166,200 | 5,760,492 | |||

| Real estate: 0.83% | |||||

| Real estate management & development: 0.83% | |||||

| CBRE Group Incorporated Class A † | 60,100 | 5,851,336 | |||

| Utilities: 2.20% | |||||

| Gas utilities: 2.20% | |||||

| Atmos Energy Corporation | 175,820 | 15,507,324 | |||

| Total Common stocks (Cost $556,787,956) | 702,919,360 |

| Yield | |||||

| Short-term investments: 0.94% | |||||

| Investment companies: 0.94% | |||||

| Wells Fargo Government Money Market Fund Select Class ♠∞ | 0.03% | 6,643,193 | 6,643,193 | ||

| Total Short-term investments (Cost $6,643,193) | 6,643,193 | ||||

| Total investments in securities (Cost $563,431,149) | 100.71% | 709,562,553 | |||

| Other assets and liabilities, net | (0.71) | (5,026,517) | |||

| Total net assets | 100.00% | $704,536,036 |

| † | Non-income earning security |

| ♠ | The issuer of the security is an affiliated person of the Fund as defined in the Investment Company Act of 1940. |

| ∞ | The rate represents the 7-day annualized yield at period end. |

| Value, beginning of period | Purchases | Sales proceeds | Net realized gains (losses) | Net change in unrealized gains (losses) | Value, end of period | Shares, end of period | Income from affiliated securities | |||

| Short-term investments | ||||||||||

| Securities Lending Cash Investments LLC | $ 0 | $ 38,771,400 | $ (38,771,400) | $0 | $0 | $ 0 | 0 | $ 183# | ||

| Wells Fargo Government Money Market Fund Select Class | 10,498,142 | 238,581,529 | (242,436,478) | 0 | 0 | 6,643,193 | 6,643,193 | 7,174 | ||

| $0 | $0 | $6,643,193 | $7,357 | |||||||

| # | Amount shown represents income before fees and rebates. |

| Assets | |

Investments in unaffiliated securities, at value (cost $556,787,956) | $ 702,919,360 |

Investments in affiliated securites, at value (cost $6,643,193) | 6,643,193 |

Receivable for Fund shares sold | 818,437 |

Receivable for dividends | 354,057 |

Receivable for investments sold | 239,150 |

Receivable for securities lending income, net | 1,250 |

Prepaid expenses and other assets | 78,960 |

Total assets | 711,054,407 |

| Liabilities | |

Payable for investments purchased | 5,789,080 |

Management fee payable | 437,585 |

Payable for Fund shares redeemed | 182,274 |

Administration fees payable | 85,439 |

Distribution fee payable | 2,682 |

Trustees’ fees and expenses payable | 402 |

Overdraft due to custodian bank | 12 |

Accrued expenses and other liabilities | 20,897 |

Total liabilities | 6,518,371 |

Total net assets | $704,536,036 |

| Net assets consist of | |

Paid-in capital | $ 509,585,232 |

Total distributable earnings | 194,950,804 |

Total net assets | $704,536,036 |

| Computation of net asset value and offering price per share | |

Net assets – Class A | $ 138,604,134 |

Shares outstanding – Class A1 | 2,862,117 |

Net asset value per share – Class A | $48.43 |

Maximum offering price per share – Class A2 | $51.38 |

Net assets – Class C | $ 4,240,036 |

Shares outstanding – Class C1 | 94,845 |

Net asset value per share – Class C | $44.70 |

Net assets – Class R6 | $ 21,853,058 |

Shares outstanding – Class R61 | 446,212 |

Net asset value per share – Class R6 | $48.97 |

Net assets – Administrator Class | $ 25,616,529 |

Shares outstanding – Administrator Class1 | 522,512 |

Net asset value per share – Administrator Class | $49.03 |

Net assets – Institutional Class | $ 514,222,279 |

Shares outstanding – Institutional Class1 | 10,509,445 |

Net asset value per share – Institutional Class | $48.93 |

| 1 | The Fund has an unlimited number of authorized shares |

| 2 | Maximum offering price is computed as 100/94.25 of net asset value. On investments of $50,000 or more, the offering price is reduced. |

| Investment income | |

Dividends (net of foreign withholdings taxes of $24,016) | $ 8,188,394 |

Income from affiliated securities | 9,331 |

Total investment income | 8,197,725 |

| Expenses | |

Management fee | 4,723,338 |

| Administration fees | |

Class A | 283,893 |

Class C | 8,674 |

Class R6 | 5,316 |

Administrator Class | 34,868 |

Institutional Class | 585,664 |

| Shareholder servicing fees | |

Class A | 337,967 |

Class C | 10,326 |

Administrator Class | 66,942 |

| Distribution fee | |

Class C | 30,765 |

Custody and accounting fees | 22,448 |

Professional fees | 42,111 |

Registration fees | 106,937 |

Shareholder report expenses | 82,326 |

Trustees’ fees and expenses | 19,272 |

Other fees and expenses | 13,984 |

Total expenses | 6,374,831 |

| Less: Fee waivers and/or expense reimbursements | |

Class A | (10,626) |

Class C | (178) |

Class R6 | (3,410) |

Administrator Class | (5,233) |

Institutional Class | (89,206) |

Net expenses | 6,266,178 |

Net investment income | 1,931,547 |

| Realized and unrealized gains (losses) on investments | |

Net realized gains on investments | 63,781,946 |

Net change in unrealized gains (losses) on investments | 119,031,625 |

Net realized and unrealized gains (losses) on investments | 182,813,571 |

Net increase in net assets resulting from operations | $184,745,118 |

| Year ended September 30, 2021 | Year ended September 30, 2020 | |||

| Operations | ||||

Net investment income | $ 1,931,547 | $ 2,315,458 | ||

Net realized gains (losses) on investments | 63,781,946 | (13,737,886) | ||

Net change in unrealized gains (losses) on investments | 119,031,625 | (31,020,572) | ||

Net increase (decrease) in net assets resulting from operations | 184,745,118 | (42,443,000) | ||

| Distributions to shareholders from | ||||

| Net investment income and net realized gains | ||||

Class A | (227,113) | (3,368,775) | ||

Class C | 0 | (116,894) | ||

Class R6 | (81,410) | (485,361) | ||

Administrator Class | (56,758) | (945,399) | ||

Institutional Class | (1,735,542) | (8,727,328) | ||

Total distributions to shareholders | (2,100,823) | (13,643,757) | ||

| Capital share transactions | Shares | Shares | ||

| Proceeds from shares sold | ||||

Class A | 266,477 | 11,903,917 | 960,999 | 33,921,828 |

Class C | 62,834 | 2,564,058 | 27,501 | 911,966 |

Class R6 | 174,904 | 8,622,402 | 81,470 | 2,854,895 |

Administrator Class | 94,814 | 4,369,994 | 317,699 | 12,268,162 |

Institutional Class | 4,488,272 | 206,320,931 | 7,166,530 | 244,342,104 |

| 233,781,302 | 294,298,955 | |||

| Reinvestment of distributions | ||||

Class A | 5,249 | 219,839 | 79,402 | 3,248,552 |

Class C | 0 | 0 | 2,989 | 113,505 |

Class R6 | 1,185 | 50,016 | 6,228 | 257,557 |

Administrator Class | 1,331 | 56,369 | 22,658 | 938,447 |

Institutional Class | 41,072 | 1,733,252 | 210,740 | 8,708,954 |

| 2,059,476 | 13,267,015 | |||

| Payment for shares redeemed | ||||

Class A | (459,731) | (20,683,839) | (686,660) | (23,231,821) |

Class C | (68,723) | (2,762,614) | (53,935) | (1,754,560) |

Class R6 | (79,525) | (3,851,168) | (115,303) | (4,078,132) |

Administrator Class | (254,333) | (11,616,949) | (258,443) | (8,985,442) |

Institutional Class | (3,100,252) | (134,469,367) | (4,458,883) | (151,411,494) |

| (173,383,937) | (189,461,449) | |||

Net increase in net assets resulting from capital share transactions | 62,456,841 | 118,104,521 | ||

Total increase in net assets | 245,101,136 | 62,017,764 | ||

| Net assets | ||||

Beginning of period | 459,434,900 | 397,417,136 | ||

End of period | $ 704,536,036 | $ 459,434,900 | ||

| Year ended September 30 | |||||

| Class A | 2021 | 2020 | 2019 | 2018 | 2017 |

Net asset value, beginning of period | $34.40 | $39.67 | $37.88 | $35.07 | $29.27 |

Net investment income (loss) | 0.03 | 0.10 1 | 0.16 | 0.06 | (0.00) 1,2 |

Net realized and unrealized gains (losses) on investments | 14.08 | (4.21) | 1.69 | 2.75 | 5.82 |

Total from investment operations | 14.11 | (4.11) | 1.85 | 2.81 | 5.82 |

| Distributions to shareholders from | |||||

Net investment income | (0.08) | (0.15) | (0.06) | (0.00) 3 | (0.02) |

Net realized gains | 0.00 | (1.01) | 0.00 | 0.00 | 0.00 |

Total distributions to shareholders | (0.08) | (1.16) | (0.06) | (0.00) 3 | (0.02) |

Net asset value, end of period | $48.43 | $34.40 | $39.67 | $37.88 | $35.07 |

Total return4 | 41.04% | (10.81)% | 4.91% | 8.02% | 19.89% |

| Ratios to average net assets (annualized) | |||||

Gross expenses | 1.25% | 1.27% | 1.29% | 1.29% | 1.30% |

Net expenses | 1.24% | 1.25% | 1.25% | 1.25% | 1.25% |

Net investment income (loss) | 0.05% | 0.29% | 0.43% | 0.16% | (0.00)% |

| Supplemental data | |||||

Portfolio turnover rate | 47% | 45% | 42% | 39% | 54% |

Net assets, end of period (000s omitted) | $138,604 | $104,922 | $106,975 | $111,354 | $115,258 |

| 1 | Calculated based upon average shares outstanding |

| 2 | Amount is more than $(0.005). |

| 3 | Amount is less than $0.005. |

| 4 | Total return calculations do not include any sales charges. |

| Year ended September 30 | |||||

| Class C | 2021 | 2020 | 2019 | 2018 | 2017 |

Net asset value, beginning of period | $31.94 | $36.98 | $35.51 | $33.12 | $27.83 |

Net investment loss | (0.30) 1 | (0.16) 1 | (0.12) 1 | (0.20) 1 | (0.26) 1 |

Net realized and unrealized gains (losses) on investments | 13.06 | (3.87) | 1.59 | 2.59 | 5.55 |

Total from investment operations | 12.76 | (4.03) | 1.47 | 2.39 | 5.29 |

| Distributions to shareholders from | |||||

Net realized gains | 0.00 | (1.01) | 0.00 | 0.00 | 0.00 |

Net asset value, end of period | $44.70 | $31.94 | $36.98 | $35.51 | $33.12 |

Total return2 | 39.98% | (11.32)% | 4.14% | 7.22% | 19.01% |

| Ratios to average net assets (annualized) | |||||

Gross expenses | 1.99% | 2.01% | 2.04% | 2.04% | 2.05% |

Net expenses | 1.99% | 2.00% | 2.00% | 2.00% | 2.00% |

Net investment loss | (0.72)% | (0.47)% | (0.36)% | (0.59)% | (0.74)% |

| Supplemental data | |||||

Portfolio turnover rate | 47% | 45% | 42% | 39% | 54% |

Net assets, end of period (000s omitted) | $4,240 | $3,217 | $4,592 | $8,371 | $8,567 |

| 1 | Calculated based upon average shares outstanding |

| 2 | Total return calculations do not include any sales charges. |

| Year ended September 30 | ||||

| Class R6 | 2021 | 2020 | 2019 | 2018 1 |

Net asset value, beginning of period | $34.77 | $40.06 | $38.27 | $37.39 |

Net investment income | 0.24 | 0.27 | 0.35 2 | 0.08 2 |

Net realized and unrealized gains (losses) on investments | 14.20 | (4.25) | 1.67 | 0.80 |

Total from investment operations | 14.44 | (3.98) | 2.02 | 0.88 |

| Distributions to shareholders from | ||||

Net investment income | (0.24) | (0.30) | (0.23) | 0.00 |

Net realized gains | 0.00 | (1.01) | 0.00 | 0.00 |

Total distributions to shareholders | (0.24) | (1.31) | (0.23) | 0.00 |

Net asset value, end of period | $48.97 | $34.77 | $40.06 | $38.27 |

Total return3 | 41.66% | (10.42)% | 5.39% | 2.35% |

| Ratios to average net assets (annualized) | ||||

Gross expenses | 0.82% | 0.84% | 0.86% | 0.86% |

Net expenses | 0.80% | 0.80% | 0.80% | 0.80% |

Net investment income | 0.49% | 0.73% | 0.95% | 1.24% |

| Supplemental data | ||||

Portfolio turnover rate | 47% | 45% | 42% | 39% |

Net assets, end of period (000s omitted) | $21,853 | $12,156 | $15,112 | $26 |

| 1 | For the period from July 31, 2018 (commencement of class operations) to September 30, 2018 |

| 2 | Calculated based upon average shares outstanding |

| 3 | Returns for periods of less than one year are not annualized. |

| Year ended September 30 | |||||

| Administrator Class | 2021 | 2020 | 2019 | 2018 | 2017 |

Net asset value, beginning of period | $34.80 | $40.14 | $38.35 | $35.52 | $29.63 |

Net investment income | 0.07 1 | 0.14 1 | 0.20 1 | 0.10 1 | 0.04 1 |

Net realized and unrealized gains (losses) on investments | 14.25 | (4.27) | 1.70 | 2.78 | 5.89 |

Total from investment operations | 14.32 | (4.13) | 1.90 | 2.88 | 5.93 |

| Distributions to shareholders from | |||||

Net investment income | (0.09) | (0.20) | (0.11) | (0.05) | (0.04) |

Net realized gains | 0.00 | (1.01) | 0.00 | 0.00 | 0.00 |

Total distributions to shareholders | (0.09) | (1.21) | (0.11) | (0.05) | (0.04) |

Net asset value, end of period | $49.03 | $34.80 | $40.14 | $38.35 | $35.52 |

Total return | 41.19% | (10.74)% | 5.03% | 8.13% | 20.02% |

| Ratios to average net assets (annualized) | |||||

Gross expenses | 1.17% | 1.19% | 1.21% | 1.21% | 1.22% |

Net expenses | 1.15% | 1.15% | 1.15% | 1.15% | 1.15% |

Net investment income | 0.14% | 0.38% | 0.53% | 0.26% | 0.12% |

| Supplemental data | |||||

Portfolio turnover rate | 47% | 45% | 42% | 39% | 54% |

Net assets, end of period (000s omitted) | $25,617 | $23,691 | $24,036 | $20,960 | $21,267 |

| 1 | Calculated based upon average shares outstanding |

| Year ended September 30 | |||||

| Institutional Class | 2021 | 2020 | 2019 | 2018 | 2017 |

Net asset value, beginning of period | $34.74 | $40.04 | $38.26 | $35.41 | $29.53 |

Net investment income | 0.19 | 0.23 1 | 0.28 | 0.19 | 0.16 |

Net realized and unrealized gains (losses) on investments | 14.20 | (4.25) | 1.70 | 2.78 | 5.82 |

Total from investment operations | 14.39 | (4.02) | 1.98 | 2.97 | 5.98 |

| Distributions to shareholders from | |||||

Net investment income | (0.20) | (0.27) | (0.20) | (0.12) | (0.10) |

Net realized gains | 0.00 | (1.01) | 0.00 | 0.00 | 0.00 |

Total distributions to shareholders | (0.20) | (1.28) | (0.20) | (0.12) | (0.10) |

Net asset value, end of period | $48.93 | $34.74 | $40.04 | $38.26 | $35.41 |

Total return | 41.55% | (10.52)% | 5.29% | 8.41% | 20.30% |

| Ratios to average net assets (annualized) | |||||

Gross expenses | 0.92% | 0.94% | 0.96% | 0.96% | 0.97% |

Net expenses | 0.90% | 0.90% | 0.90% | 0.90% | 0.90% |

Net investment income | 0.39% | 0.64% | 0.79% | 0.56% | 0.37% |

| Supplemental data | |||||

Portfolio turnover rate | 47% | 45% | 42% | 39% | 54% |

Net assets, end of period (000s omitted) | $514,222 | $315,449 | $246,702 | $200,335 | $105,550 |

| 1 | Calculated based upon average shares outstanding |

| Gross unrealized gains | $143,612,987 |

| Gross unrealized losses | (6,711,525) |

| Net unrealized gains | $136,901,462 |

| ■ | Level 1 – quoted prices in active markets for identical securities |

| ■ | Level 2 – other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) |

| ■ | Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

| Quoted prices (Level 1) | Other significant observable inputs (Level 2) | Significant unobservable inputs (Level 3) | Total | |

| Assets | ||||

| Investments in: | ||||

| Common stocks | ||||

| Communication services | $ 14,741,987 | $0 | $0 | $ 14,741,987 |

| Consumer discretionary | 121,772,006 | 0 | 0 | 121,772,006 |

| Consumer staples | 17,856,631 | 0 | 0 | 17,856,631 |

| Energy | 12,741,728 | 0 | 0 | 12,741,728 |

| Financials | 174,580,677 | 0 | 0 | 174,580,677 |

| Health care | 79,408,576 | 0 | 0 | 79,408,576 |

| Industrials | 189,587,091 | 0 | 0 | 189,587,091 |

| Information technology | 55,832,849 | 0 | 0 | 55,832,849 |

| Materials | 15,039,155 | 0 | 0 | 15,039,155 |

| Real estate | 5,851,336 | 0 | 0 | 5,851,336 |

| Utilities | 15,507,324 | 0 | 0 | 15,507,324 |

| Short-term investments | ||||

| Investment companies | 6,643,193 | 0 | 0 | 6,643,193 |

| Total assets | $709,562,553 | $0 | $0 | $709,562,553 |

| Average daily net assets | Management fee |

| First $500 million | 0.750% |

| Next $500 million | 0.725 |

| Next $1 billion | 0.700 |

| Next $2 billion | 0.675 |

| Next $1 billion | 0.650 |

| Next $5 billion | 0.640 |

| Next $2 billion | 0.630 |

| Next $4 billion | 0.620 |

| Over $16 billion | 0.610 |

| Class-level administration fee | |

| Class A | 0.21% |

| Class C | 0.21 |

| Class R6 | 0.03 |

| Administrator Class | 0.13 |

| Institutional Class | 0.13 |

| Expense ratio caps | |

| Class A | 1.25% |

| Class C | 2.00 |

| Class R6 | 0.80 |

| Administrator Class | 1.15 |

| Institutional Class | 0.90 |

| Year ended September 30 | ||

| 2021 | 2020 | |

| Ordinary income | $2,100,823 | $5,458,221 |

| Long-term capital gain | 0 | 8,185,536 |

| Undistributed ordinary income | Undistributed long-term gain | Unrealized gains |

| $9,100,303 | $48,949,039 | $136,901,462 |

Wells Fargo Funds Trust:

| Name and year of birth | Position held and length of service* | Principal occupations during past five years or longer | Current other public company or investment company directorships |

| William R. Ebsworth (Born 1957) | Trustee, since 2015 | Retired. From 1984 to 2013, equities analyst, portfolio manager, research director and chief investment officer at Fidelity Management and Research Company in Boston, Tokyo, and Hong Kong, and retired in 2013 as Chief Investment Officer of Fidelity Strategic Advisers, Inc. where he led a team of investment professionals managing client assets. Prior thereto, Board member of Hong Kong Securities Clearing Co., Hong Kong Options Clearing Corp., the Thailand International Fund, Ltd., Fidelity Investments Life Insurance Company, and Empire Fidelity Investments Life Insurance Company. Audit Committee Chair and Investment Committee Chair of the Vincent Memorial Hospital Endowment (non-profit organization). Mr. Ebsworth is a CFA® charterholder. | N/A |

| Jane A. Freeman (Born 1953) | Trustee, since 2015; Chair Liaison, since 2018 | Retired. From 2012 to 2014 and 1999 to 2008, Chief Financial Officer of Scientific Learning Corporation. From 2008 to 2012, Ms. Freeman provided consulting services related to strategic business projects. Prior to 1999, Portfolio Manager at Rockefeller & Co. and Scudder, Stevens & Clark. Board member of the Harding Loevner Funds from 1996 to 2014, serving as both Lead Independent Director and chair of the Audit Committee. Board member of the Russell Exchange Traded Funds Trust from 2011 to 2012 and the chair of the Audit Committee. Ms. Freeman is also an inactive Chartered Financial Analyst. | N/A |

| Isaiah Harris, Jr. (Born 1952) | Trustee, since 2009; Audit Committee Chair, since 2019 | Retired. Chairman of the Board of CIGNA Corporation since 2009, and Director since 2005. From 2003 to 2011, Director of Deluxe Corporation. Prior thereto, President and CEO of BellSouth Advertising and Publishing Corp. from 2005 to 2007, President and CEO of BellSouth Enterprises from 2004 to 2005 and President of BellSouth Consumer Services from 2000 to 2003. Emeritus member of the Iowa State University Foundation Board of Governors. Emeritus Member of the Advisory Board of Iowa State University School of Business. Advisory Board Member, Palm Harbor Academy (private school). Mr. Harris is a certified public accountant (inactive status). | CIGNA Corporation |

| Judith M. Johnson (Born 1949) | Trustee, since 2008 | Retired. Prior thereto, Chief Executive Officer and Chief Investment Officer of Minneapolis Employees Retirement Fund from 1996 to 2008. Ms. Johnson is an attorney, certified public accountant and a certified managerial accountant. | N/A |

| David F. Larcker (Born 1950) | Trustee, since 2009 | James Irvin Miller Professor of Accounting at the Graduate School of Business (Emeritus), Stanford University, Director of the Corporate Governance Research Initiative and Senior Faculty of The Rock Center for Corporate Governance since 2006. From 2005 to 2008, Professor of Accounting at the Graduate School of Business, Stanford University. Prior thereto, Ernst & Young Professor of Accounting at The Wharton School, University of Pennsylvania from 1985 to 2005. | N/A |

| Name and year of birth | Position held and length of service* | Principal occupations during past five years or longer | Current other public company or investment company directorships |

| Olivia S. Mitchell (Born 1953) | Trustee, since 2006; Nominating and Governance Committee Chair, since 2018 | International Foundation of Employee Benefit Plans Professor, Wharton School of the University of Pennsylvania since 1993. Director of Wharton’s Pension Research Council and Boettner Center on Pensions & Retirement Research, and Research Associate at the National Bureau of Economic Research. Previously, Cornell University Professor from 1978 to 1993. | N/A |

| Timothy J. Penny (Born 1951) | Trustee, since 1996; Chair, since 2018 | President and Chief Executive Officer of Southern Minnesota Initiative Foundation, a non-profit organization, since 2007. Member of the Board of Trustees of NorthStar Education Finance, Inc., a non-profit organization, since 2007. | N/A |

| James G. Polisson (Born 1959) | Trustee, since 2018 | Retired. Chief Marketing Officer, Source (ETF) UK Services, Ltd, from 2015 to 2017. From 2012 to 2015, Principal of The Polisson Group, LLC, a management consulting, corporate advisory and principal investing company. Chief Executive Officer and Managing Director at Russell Investments, Global Exchange Traded Funds from 2010 to 2012. Managing Director of Barclays Global Investors from 1998 to 2010 and Global Chief Marketing Officer for iShares and Barclays Global Investors from 2000 to 2010. Trustee of the San Francisco Mechanics’ Institute, a non-profit organization, from 2013 to 2015. Board member of the Russell Exchange Traded Fund Trust from 2011 to 2012. Director of Barclays Global Investors Holdings Deutschland GmbH from 2006 to 2009. Mr. Polisson is an attorney and has a retired status with the Massachusetts and District of Columbia Bar Associations. | N/A |

| Pamela Wheelock (Born 1959) | Trustee, since January 2020; previously Trustee from January 2018 to July 2019 | Board member of the Destination Medical Center Economic Development Agency, Rochester, Minnesota since 2019. Interim President of the McKnight Foundation from January to September 2020. Acting Commissioner, Minnesota Department of Human Services, July 2019 through September 2019. Human Services Manager (part-time), Minnesota Department of Human Services, October 2019 through December 2019. Chief Operating Officer, Twin Cities Habitat for Humanity from 2017 to 2019. Vice President of University Services, University of Minnesota from 2012 to 2016. Prior thereto, on the Board of Directors, Governance Committee and Finance Committee for the Minnesota Philanthropy Partners (Saint Paul Foundation) from 2012 to 2018, Interim Chief Executive Officer of Blue Cross Blue Shield of Minnesota from 2011 to 2012, Chairman of the Board from 2009 to 2012 and Board Director from 2003 to 2015. Vice President, Leadership and Community Engagement, Bush Foundation, Saint Paul, Minnesota (a private foundation) from 2009 to 2011. Executive Vice President and Chief Financial Officer, Minnesota Sports and Entertainment from 2004 to 2009 and Senior Vice President from 2002 to 2004. Executive Vice President of the Minnesota Wild Foundation from 2004 to 2008. Commissioner of Finance, State of Minnesota, from 1999 to 2002. Currently Board Chair of the Minnesota Wild Foundation since 2010. | N/A |

| Name and year of birth | Position held and length of service | Principal occupations during past five years or longer |

| Andrew Owen (Born 1960) | President, since 2017 | President, Chief Executive Officer and Director of Allspring Funds Management, LLC since 2017 and co-president of Galliard Capital Management, LLC, an affiliate of Allspring Funds Management, LLC, since 2019. Prior thereto, Head of Affiliated Managers, Allspring Global Investments, from 2014 to 2019 and Executive Vice President responsible for marketing, investments and product development for Allspring Funds Management, LLC, from 2009 to 2014. In addition, Mr. Owen was an Executive Vice President of Wells Fargo & Company from 2014 to 2021. |

| Jeremy DePalma (Born 1974) | Treasurer, since 2012 (for certain funds in the Fund Complex); since 2021 (for the remaining funds in the Fund Complex) | Senior Vice President of Allspring Funds Management, LLC since 2009. Senior Vice President of Evergreen Investment Management Company, LLC from 2008 to 2010 and head of the Fund Reporting and Control Team within Fund Administration. |

| Kate McKinley (Born 1977) | Chief Legal Officer and Chief Compliance Officer, since 2021 | Chief Legal Officer of Allspring Global Investments since 2021. Prior thereto, held various roles at State Street Global Advisors, Inc. beginning in 2010, including serving as Senior Vice President and General Counsel from 2019 to 2021. Previously served as Assistant General Counsel for Bank of America Corporation from 2005 to 2010 and as an Associate at WilmerHale from 2002 to 2005. |

| Matthew Prasse (Born 1983) | Secretary, since 2021 | Senior Counsel of the Allspring Legal Department since 2021. Senior Counsel of the Wells Fargo Legal Department from 2018 to 2021. Previously, Counsel for Barings LLC from 2015 to 2018. Prior to joining Barings, Associate at Morgan, Lewis & Bockius LLP from 2008 to 2015. |

| Wells Fargo C&B Mid Cap Value Fund |

| Wells Fargo California Limited-Term Tax-Free Fund |

| Wells Fargo California Tax-Free Fund |

| Wells Fargo Classic Value Fund |

| Wells Fargo Common Stock Fund |

| Wells Fargo Disciplined Small Cap Fund |

| Wells Fargo Disciplined U.S. Core Fund |

| Wells Fargo Discovery Fund |

| Wells Fargo Diversified Equity Fund |

| Wells Fargo Endeavor Select Fund |

| Wells Fargo Enterprise Fund |

| Wells Fargo Fundamental Small Cap Growth Fund |

| Wells Fargo Growth Fund |

| Wells Fargo High Yield Municipal Bond Fund |

| Wells Fargo Intermediate Tax/AMT-Free Fund |

| Wells Fargo Large Cap Core Fund |

| Wells Fargo Large Cap Growth Fund |

| Wells Fargo Large Company Value Fund |

| Wells Fargo Minnesota Tax-Free Fund |

| Wells Fargo Municipal Bond Fund |

| Wells Fargo Omega Growth Fund |

| Wells Fargo Opportunity Fund |

| Wells Fargo Pennsylvania Tax-Free Fund |

| Wells Fargo Premier Large Company Growth Fund |

| Wells Fargo Short-Term Municipal Bond Fund |

| Wells Fargo Small Cap Fund |

| Wells Fargo Special Mid Cap Value Fund |

| Wells Fargo Special Small Cap Value Fund |

| Wells Fargo Strategic Municipal Bond Fund |

| Wells Fargo Ultra Short-Term Municipal Income Fund |

| Wells Fargo Wisconsin Tax-Free Fund |

| ■ | Information regarding the Transaction: information about the structure, financing sources and material terms and conditions of the Transaction, including the expected impact on the businesses conducted by the Advisers and by Wells Fargo Funds Distributor LLC, as the distributor of Fund shares. |

| ■ | Information regarding NewCo, GTCR and Reverence Capital: (i) information about NewCo, including information about its expected financial condition and access to capital, and senior leadership team; (ii) the experience of senior management at GTCR and Reverence Capital in acquiring portfolio companies; (iii) the plan to operationalize NewCo, including the transition of necessary infrastructure services through a transition services agreement with Wells Fargo under which Wells Fargo will continue to provide NewCo with certain services for a specified period of time after the closing; and (iv) information regarding regulatory matters, compliance, and risk management functions at NewCo, including resources to be dedicated thereto. |

| ■ | Impact of the Transaction on WFAM and Service Providers: (i) information regarding any changes to personnel and/or other resources of the Advisers as a result of the Transaction, including assurances regarding comparable and competitive compensation arrangements to attract and retain highly qualified personnel; and (ii) information about the organizational and operating structure with respect to NewCo, the Advisers and the Funds. |

| ■ | Impact of the Transaction on the Funds and their Shareholders: (i) information regarding anticipated benefits to the Funds as a result of the Transaction; (ii) a commitment that the Funds would not bear any expenses, directly or indirectly, in connection with the Transaction; (iii) confirmation that the Advisers intend to continue to manage the Funds in a manner consistent with each Fund’s current investment objectives and principal investments strategies; and (iv) a commitment that neither NewCo nor WFAM will take any steps that would impose any “unfair burden” (as that term is used in section 15(f)(1)(B) of the 1940 Act) on the Funds as a result of the Transaction. |

P.O. Box 219967

Kansas City, MO 64121-9967

1-800-222-8222 or visit the Fund's website at allspringglobal.com. Read the prospectus carefully before you invest or send money.

A228/AR228 09-21

| 2 | |

| 6 | |

| 10 | |

| 11 | |

| Financial statements | |

| 16 | |

| 17 | |

| 18 | |

| 19 | |

| 24 | |

| 31 | |

| 32 | |

| Board considerations | |

| 36 | |

| 39 | |

| 45 |

| 1 | The S&P 500 Index consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market-value-weighted index with each stock's weight in the index proportionate to its market value. You cannot invest directly in an index. |

| 2 | The Morgan Stanley Capital International (MSCI) All Country World Index (ACWI) ex USA Index (Net) is a free-float-adjusted market-capitalization-weighted index that is designed to measure the equity market performance of developed and emerging markets, excluding the U.S. Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indexes or any securities or financial products. This report is not approved, reviewed, or produced by MSCI. You cannot invest directly in an index. |

| 3 | The MSCI Emerging Markets (EM) Index (Net) is a free-float-adjusted market-capitalization-weighted index that is designed to measure equity market performance of emerging markets. You cannot invest directly in an index. |

| 4 | The Bloomberg U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment-grade, U.S.-dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, mortgage-backed securities (agency fixed-rate and hybrid adjustable-rate mortgage pass-throughs), asset-backed securities, and commercial mortgage-backed securities. You cannot invest directly in an index. |

| 5 | The Bloomberg Global Aggregate ex-USD Index (unhedged) is an unmanaged index that provides a broad-based measure of the global investment-grade fixed-income markets excluding the U.S.-dollar-denominated debt market. You cannot invest directly in an index. |

| 6 | The Bloomberg Municipal Bond Index is an unmanaged index composed of long-term tax-exempt bonds with a minimum credit rating of Baa. You cannot invest directly in an index. |

| 7 | The ICE BofA U.S. High Yield Index is a market-capitalization-weighted index of domestic and Yankee high-yield bonds. The index tracks the performance of high-yield securities traded in the U.S. bond market. You cannot invest directly in an index. Copyright 2021. ICE Data Indices, LLC. All rights reserved. |

President

Wells Fargo Funds

| 1 | As of September 30, 2021, assets under management (AUM) includes $93 billion from Galliard Capital Management, an investment advisor that is not part of the Allspring trade name/GIPS firm. |

| Investment objective | The Fund seeks long-term capital appreciation. |

| Manager | Allspring Funds Management, LLC |

| Subadviser | Allspring Global Investments, LLC |

| Portfolio managers | Christopher G. Miller, CFA®‡, Garth B. Newport, CFA®‡ |

| Average annual total returns (%) as of September 30, 2021 | |||||||||||

| Including sales charge | Excluding sales charge | Expense ratios1 (%) | |||||||||

| Inception date | 1 year | 5 year | 10 year | 1 year | 5 year | 10 year | Gross | Net 2 | |||

| Class A (SCSAX) | 11-30-2000 | 35.51 | 11.73 | 13.21 | 43.77 | 13.06 | 13.89 | 1.27 | 1.26 | ||

| Class C (STSAX) | 11-30-2000 | 41.64 | 12.29 | 13.07 | 42.64 | 12.29 | 13.07 | 2.02 | 2.01 | ||

| Class R6 (SCSRX)3 | 6-28-2013 | – | – | – | 44.37 | 13.52 | 14.36 | 0.84 | 0.83 | ||

| Administrator Class (SCSDX) | 7-30-2010 | – | – | – | 43.96 | 13.61 | 14.25 | 1.19 | 1.10 | ||

| Institutional Class (SCNSX) | 7-30-2010 | – | – | – | 44.32 | 13.50 | 14.33 | 0.94 | 0.85 | ||

| Russell 2500™ Index4 | – | – | – | – | 45.03 | 14.25 | 15.27 | – | – | ||

| 1 | Reflects the expense ratios as stated in the most recent prospectuses. The expense ratios shown are subject to change and may differ from the annualized expense ratios shown in the financial highlights of this report. |

| 2 | The manager has contractually committed through January 31, 2022, to waive fees and/or reimburse expenses to the extent necessary to cap total annual fund operating expenses after fee waivers at 1.26% for Class A, 2.01% for Class C, 0.83% for Class R6, 1.10% for Administrator Class, and 0.85% for Institutional Class. Brokerage commissions, stamp duty fees, interest, taxes, acquired fund fees and expenses (if any), and extraordinary expenses are excluded from the expense caps. Prior to or after the commitment expiration date, the caps may be increased or the commitment to maintain the caps may be terminated only with the approval of the Board of Trustees. Without these caps, the Fund’s returns would have been lower. The expense ratio paid by an investor is the net expense ratio (the total annual fund operating expenses after fee waivers) as stated in the prospectuses. |

| 3 | Historical performance shown for the Class R6 shares prior to their inception reflects the performance of the Institutional Class shares, and includes the higher expenses applicable to the Institutional Class shares. If these expenses had not been included, returns for the Class R6 shares would be higher. |

| 4 | The Russell 2500TM Index measures the performance of the 2,500 smallest companies in the Russell 3000® Index, which represents approximately 16% of the total market capitalization of the Russell 3000® Index. You cannot invest directly in an index. |

| ‡ | CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute. |

| 1 | The chart compares the performance of Class A shares for the most recent ten years with the Russell 2500™ Index. The chart assumes a hypothetical investment of $10,000 in Class A shares and reflects all operating expenses and assumes the maximum initial sales charge of 5.75%. |

| ■ | The Fund lagged its benchmark, the Russell 2500TM Index, for the 12-month period that ended September 30, 2021. |

| ■ | Stock selection in financials and real estate, in addition to the Fund’s underweight to the outperforming energy sector, were the leading detractors from performance over the period. |

| ■ | Stock selection in consumer discretionary and health care were the leading contributors to performance for the period. |

| Ten largest holdings (%) as of September 30, 20211 | |

| Bio-Rad Laboratories Incorporated Class A | 2.31 |

| Sun Communities Incorporated | 2.10 |

| Carlisle Companies Incorporated | 1.97 |

| Masonite International Corporation | 1.96 |

| ON Semiconductor Corporation | 1.92 |

| LivaNova plc | 1.89 |

| Marvell Technology Incorporated | 1.81 |

| Atkore International Incorporated | 1.77 |

| VICI Properties Incorporated | 1.71 |

| United Rentals Incorporated | 1.68 |

| 1 | Figures represent the percentage of the Fund's net assets. Holdings are subject to change and may have changed since the date specified. |

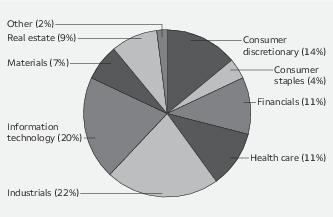

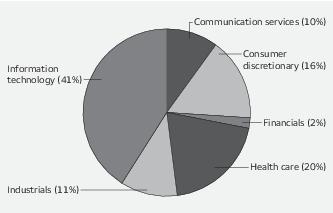

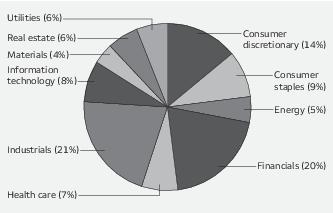

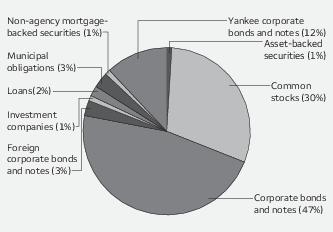

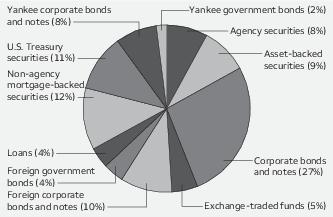

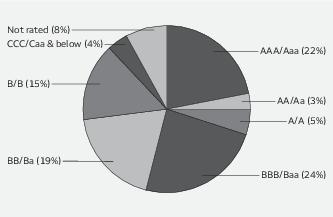

| Sector allocation as of September 30, 20211 |

| 1 | Figures represent the percentage of the Fund's long-term investments. These amounts are subject to change and may have changed since the date specified. |

| Beginning account value 4-1-2021 | Ending account value 9-30-2021 | Expenses paid during the period1 | Annualized net expense ratio | |

| Class A | ||||

| Actual | $1,000.00 | $1,056.13 | $ 6.34 | 1.23% |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,018.90 | $ 6.23 | 1.23% |

| Class C | ||||

| Actual | $1,000.00 | $1,051.74 | $10.13 | 1.97% |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,015.19 | $ 9.95 | 1.97% |

| Class R6 | ||||

| Actual | $1,000.00 | $1,058.52 | $ 4.23 | 0.82% |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,020.96 | $ 4.15 | 0.82% |

| Administrator Class | ||||

| Actual | $1,000.00 | $1,056.91 | $ 5.67 | 1.10% |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,019.55 | $ 5.57 | 1.10% |

| Institutional Class | ||||

| Actual | $1,000.00 | $1,057.92 | $ 4.39 | 0.85% |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,020.81 | $ 4.31 | 0.85% |

| Shares | Value | ||||

| Common stocks: 97.95% | |||||

| Communication services: 0.79% | |||||

| Interactive media & services: 0.79% | |||||

| Bumble Incorporated Class A † | 171,203 | $ 8,556,726 | |||

| Consumer discretionary: 13.74% | |||||

| Auto components: 1.13% | |||||

| Dana Incorporated | 550,064 | 12,233,423 | |||

| Diversified consumer services: 1.86% | |||||

| Houghton Mifflin Harcourt Company † | 663,132 | 8,905,863 | |||

| Service Corporation International | 187,338 | 11,288,988 | |||

| 20,194,851 | |||||

| Hotels, restaurants & leisure: 2.46% | |||||

| Jack In The Box Incorporated | 131,796 | 12,827,705 | |||

| Planet Fitness Incorporated Class A † | 176,797 | 13,887,404 | |||

| 26,715,109 | |||||

| Household durables: 1.20% | |||||

| Mohawk Industries Incorporated † | 73,266 | 12,997,388 | |||

| Internet & direct marketing retail: 2.35% | |||||

| Revolve Group Incorporated † | 272,397 | 16,825,963 | |||

| The RealReal Incorporated † | 659,015 | 8,685,818 | |||

| 25,511,781 | |||||

| Specialty retail: 3.90% | |||||

| Burlington Stores Incorporated † | 57,402 | 16,277,485 | |||

| Tractor Supply Company | 56,573 | 11,462,256 | |||

| Ulta Beauty Incorporated † | 40,210 | 14,512,593 | |||

| 42,252,334 | |||||

| Textiles, apparel & luxury goods: 0.84% | |||||

| Levi Strauss & Company Class A | 371,793 | 9,112,646 | |||

| Consumer staples: 3.91% | |||||

| Food products: 1.30% | |||||

| Nomad Foods Limited † | 513,461 | 14,150,985 | |||

| Household products: 1.10% | |||||

| Church & Dwight Company Incorporated | 144,086 | 11,897,181 | |||

| Personal products: 1.51% | |||||

| e.l.f. Beauty Incorporated † | 384,686 | 11,175,128 | |||

| The Honest Company Incorporated †« | 504,768 | 5,239,492 | |||

| 16,414,620 | |||||

| Financials: 11.25% | |||||

| Banks: 1.87% | |||||

| Pinnacle Financial Partners Incorporated | 113,978 | 10,723,050 | |||

| Sterling Bancorp | 384,621 | 9,600,140 | |||

| 20,323,190 |

| Shares | Value | ||||

| Capital markets: 2.26% | |||||

| Cboe Global Markets Incorporated | 128,045 | $ 15,859,654 | |||

| Raymond James Financial Incorporated | 93,293 | 8,609,032 | |||

| 24,468,686 | |||||

| Consumer finance: 1.12% | |||||

| Discover Financial Services | 98,682 | 12,123,084 | |||

| Insurance: 5.05% | |||||

| Arch Capital Group Limited † | 365,162 | 13,941,885 | |||

| Axis Capital Holdings Limited | 266,737 | 12,280,571 | |||

| CNO Financial Group Incorporated | 352,307 | 8,293,307 | |||

| First American Financial Corporation | 116,754 | 7,828,356 | |||

| Reinsurance Group of America Incorporated | 111,597 | 12,416,282 | |||

| 54,760,401 | |||||

| Thrifts & mortgage finance: 0.95% | |||||

| Essent Group Limited | 233,666 | 10,283,641 | |||

| Health care: 11.04% | |||||

| Biotechnology: 0.60% | |||||

| Neurocrine Biosciences Incorporated † | 45,800 | 4,392,678 | |||

| Sage Therapeutics Incorporated † | 48,590 | 2,153,023 | |||

| 6,545,701 | |||||

| Health care equipment & supplies: 4.08% | |||||

| Haemonetics Corporation † | 144,063 | 10,169,407 | |||

| Integer Holdings Corporation † | 151,577 | 13,541,889 | |||

| LivaNova plc † | 258,751 | 20,490,492 | |||

| 44,201,788 | |||||

| Health care providers & services: 3.20% | |||||

| HealthEquity Incorporated † | 225,923 | 14,630,773 | |||

| Humana Incorporated | 30,832 | 11,998,273 | |||

| Laboratory Corporation of America Holdings † | 28,649 | 8,062,975 | |||

| 34,692,021 | |||||

| Health care technology: 0.33% | |||||

| Schrodinger Incorporated † | 65,532 | 3,583,290 | |||

| Life sciences tools & services: 2.83% | |||||

| Bio-Rad Laboratories Incorporated Class A † | 33,507 | 24,994,547 | |||

| Codexis Incorporated † | 244,032 | 5,676,184 | |||

| 30,670,731 | |||||

| Industrials: 22.06% | |||||

| Aerospace & defense: 1.15% | |||||

| MTU Aero Engines AG | 55,469 | 12,470,634 | |||

| Building products: 7.98% | |||||

| Armstrong World Industries Incorporated | 165,499 | 15,800,190 | |||

| Carlisle Companies Incorporated | 107,649 | 21,399,545 | |||

| Masonite International Corporation † | 200,349 | 21,263,039 |

| Shares | Value | ||||

| Building products (continued) | |||||

| Rexnord Corporation | 253,083 | $ 16,270,706 | |||

| The AZEK Company Incorporated † | 322,035 | 11,763,939 | |||

| 86,497,419 | |||||

| Commercial services & supplies: 3.53% | |||||

| IAA Incorporated † | 272,976 | 14,896,300 | |||

| Republic Services Incorporated | 111,222 | 13,353,313 | |||

| Stericycle Incorporated † | 147,648 | 10,035,635 | |||

| 38,285,248 | |||||

| Construction & engineering: 0.94% | |||||

| APi Group Corporation † | 498,117 | 10,136,681 | |||

| Electrical equipment: 3.05% | |||||

| Atkore International Incorporated † | 220,541 | 19,169,424 | |||

| Sensata Technologies Holding plc † | 254,291 | 13,914,804 | |||

| 33,084,228 | |||||

| Machinery: 1.41% | |||||

| Ingersoll Rand Incorporated † | 303,035 | 15,275,994 | |||

| Professional services: 1.09% | |||||

| Dun & Bradstreet Holdings Incorporated † | 705,208 | 11,854,546 | |||

| Trading companies & distributors: 2.91% | |||||

| Air Lease Corporation | 338,159 | 13,303,175 | |||

| United Rentals Incorporated † | 52,024 | 18,256,782 | |||

| 31,559,957 | |||||

| Information technology: 19.36% | |||||

| IT services: 3.33% | |||||

| EVO Payments Incorporated Class A † | 532,875 | 12,618,480 | |||

| Genpact Limited | 317,158 | 15,068,177 | |||

| Paya Holdings Incorporated Class A † | 775,393 | 8,428,522 | |||

| 36,115,179 | |||||

| Semiconductors & semiconductor equipment: 4.76% | |||||

| Brooks Automation Incorporated | 108,562 | 11,111,321 | |||

| Marvell Technology Incorporated | 324,983 | 19,599,725 | |||

| ON Semiconductor Corporation † | 455,801 | 20,862,012 | |||

| 51,573,058 | |||||

| Software: 11.27% | |||||

| 8x8 Incorporated † | 560,005 | 13,098,517 | |||

| Black Knight Incorporated † | 208,622 | 15,020,784 | |||

| Fair Isaac Corporation † | 29,696 | 11,816,929 | |||

| Instructure Holdings Incorporated †« | 561,491 | 12,684,082 | |||

| Mimecast Limited † | 260,193 | 16,548,275 | |||

| New Relic Incorporated † | 79,795 | 5,726,887 | |||

| Pagerduty Incorporated † | 310,853 | 12,875,531 | |||

| Riskfied Limited Class A † | 237,363 | 5,414,250 | |||

| SPS Commerce Incorporated † | 69,277 | 11,175,073 | |||

| Zendesk Incorporated † | 153,142 | 17,824,197 | |||

| 122,184,525 |

| Shares | Value | ||||

| Materials: 6.57% | |||||

| Chemicals: 3.97% | |||||

| Ashland Global Holdings Incorporated | 177,494 | $ 15,818,265 | |||

| Quaker Chemical Corporation | 53,755 | 12,778,639 | |||

| Westlake Chemical Corporation | 158,602 | 14,454,986 | |||

| 43,051,890 | |||||

| Containers & packaging: 1.35% | |||||

| Crown Holdings Incorporated | 145,541 | 14,667,622 | |||

| Metals & mining: 1.25% | |||||

| Steel Dynamics Incorporated | 230,991 | 13,508,354 | |||

| Real estate: 9.23% | |||||

| Equity REITs: 9.23% | |||||

| American Homes 4 Rent Class A | 272,307 | 10,380,343 | |||

| CoreSite Realty Corporation | 107,536 | 14,898,037 | |||

| Four Corners Property Trust Incorporated | 277,583 | 7,455,879 | |||

| Life Storage Incorporated | 78,637 | 9,022,809 | |||

| SBA Communications Corporation | 51,485 | 17,019,396 | |||

| Sun Communities Incorporated | 123,264 | 22,816,166 | |||

| VICI Properties Incorporated | 650,545 | 18,481,983 | |||

| 100,074,613 | |||||

| Total Common stocks (Cost $712,189,271) | 1,062,029,525 |

| Investment companies: 1.22% | |||||

| Exchange-traded funds: 1.22% | |||||

| SPDR S&P Biotech ETF « | 105,436 | 13,254,360 | |||

| Total Investment companies (Cost $7,461,832) | 13,254,360 |

| Yield | |||||

| Short-term investments: 1.75% | |||||

| Investment companies: 1.75% | |||||

| Securities Lending Cash Investments LLC ♠∩∞ | 0.02% | 9,154,560 | 9,154,560 | ||

| Wells Fargo Government Money Market Fund Select Class ♠∞ | 0.03 | 9,767,019 | 9,767,019 | ||

| Total Short-term investments (Cost $18,921,579) | 18,921,579 | ||||

| Total investments in securities (Cost $738,572,682) | 100.92% | 1,094,205,464 | |||

| Other assets and liabilities, net | (0.92) | (10,001,969) | |||

| Total net assets | 100.00% | $1,084,203,495 |

| † | Non-income earning security |

| « | All or a portion of this security is on loan. |

| ♠ | The issuer of the security is an affiliated person of the Fund as defined in the Investment Company Act of 1940. |

| ∩ | The investment is a non-registered investment company purchased with cash collateral received from securities on loan. |

| ∞ | The rate represents the 7-day annualized yield at period end. |

| Abbreviations: | |

| REIT | Real estate investment trust |

| Value, beginning of period | Purchases | Sales proceeds | Net realized gains (losses) | Net change in unrealized gains (losses) | Value, end of period | Shares, end of period | Income from affiliated securities | |||

| Short-term investments | ||||||||||

| Securities Lending Cash Investments LLC | $14,083,400 | $216,101,381 | $(221,030,221) | $0 | $0 | $ 9,154,560 | 9,154,560 | $ 9,484# | ||

| Wells Fargo Government Money Market Fund Select Class | 1,768,345 | 345,007,673 | (337,008,999) | 0 | 0 | 9,767,019 | 9,767,019 | 2,378 | ||

| $0 | $0 | $18,921,579 | $11,862 | |||||||

| # | Amount shown represents income before fees and rebates. |

| Assets | |

Investments in unaffiliated securities (including $8,884,358 of securities loaned), at value (cost $719,651,103) | $ 1,075,283,885 |

Investments in affiliated securites, at value (cost $18,921,579) | 18,921,579 |

Receivable for dividends | 706,220 |

Receivable for Fund shares sold | 134,607 |

Receivable for securities lending income, net | 11,757 |

Total assets | 1,095,058,048 |

| Liabilities | |

Payable upon receipt of securities loaned | 9,154,560 |

Management fee payable | 702,336 |

Payable for Fund shares redeemed | 454,868 |

Administration fees payable | 181,579 |

Distribution fee payable | 1,452 |

Trustees’ fees and expenses payable | 352 |

Accrued expenses and other liabilities | 359,406 |

Total liabilities | 10,854,553 |

Total net assets | $1,084,203,495 |

| Net assets consist of | |

Paid-in capital | $ 574,961,952 |

Total distributable earnings | 509,241,543 |

Total net assets | $1,084,203,495 |

| Computation of net asset value and offering price per share | |

Net assets – Class A | $ 945,398,678 |

Shares outstanding – Class A1 | 38,653,263 |

Net asset value per share – Class A | $24.46 |

Maximum offering price per share – Class A2 | $25.95 |

Net assets – Class C | $ 2,404,752 |

Shares outstanding – Class C1 | 155,609 |

Net asset value per share – Class C | $15.45 |

Net assets – Class R6 | $ 35,279,936 |

Shares outstanding – Class R61 | 1,336,007 |

Net asset value per share – Class R6 | $26.41 |

Net assets – Administrator Class | $ 2,918,019 |

Shares outstanding – Administrator Class1 | 113,859 |

Net asset value per share – Administrator Class | $25.63 |

Net assets – Institutional Class | $ 98,202,110 |

Shares outstanding – Institutional Class1 | 3,734,294 |

Net asset value per share – Institutional Class | $26.30 |

| 1 | The Fund has an unlimited number of authorized shares |

| 2 | Maximum offering price is computed as 100/94.25 of net asset value. On investments of $50,000 or more, the offering price is reduced. |

| Investment income | |

Dividends (net of foreign withholdings taxes of $17,206) | $ 7,574,555 |

Income from affiliated securities | 165,653 |

Total investment income | 7,740,208 |

| Expenses | |

Management fee | 8,174,791 |

| Administration fees | |

Class A | 1,919,258 |

Class C | 5,631 |

Class R6 | 10,597 |

Administrator Class | 3,897 |

Institutional Class | 138,349 |

| Shareholder servicing fees | |

Class A | 2,284,831 |

Class C | 6,689 |

Administrator Class | 7,495 |

| Distribution fee | |

Class C | 19,706 |

Custody and accounting fees | 47,369 |

Professional fees | 53,909 |

Registration fees | 64,915 |

Shareholder report expenses | 39,079 |

Trustees’ fees and expenses | 19,272 |

Other fees and expenses | 20,195 |

Total expenses | 12,815,983 |

| Less: Fee waivers and/or expense reimbursements | |

Class A | (192,402) |

Class C | (49) |

Class R6 | (214) |

Administrator Class | (2,193) |

Institutional Class | (78,565) |

Net expenses | 12,542,560 |

Net investment loss | (4,802,352) |

| Realized and unrealized gains (losses) on investments | |

Net realized gains on investments | 203,359,423 |

Net change in unrealized gains (losses) on investments | 163,798,610 |

Net realized and unrealized gains (losses) on investments | 367,158,033 |

Net increase in net assets resulting from operations | $362,355,681 |

| Year ended September 30, 2021 | Year ended September 30, 2020 | |||

| Operations | ||||

Net investment loss | $ (4,802,352) | $ (664,027) | ||

Payment from affiliate | 0 | 50,779 | ||

Net realized gains on investments | 203,359,423 | 27,866,230 | ||

Net change in unrealized gains (losses) on investments | 163,798,610 | (71,534,111) | ||

Net increase (decrease) in net assets resulting from operations | 362,355,681 | (44,281,129) | ||

| Distributions to shareholders from | ||||

| Net investment income and net realized gains | ||||

Class A | (41,250,405) | (106,772,268) | ||

Class C | (198,543) | (1,096,288) | ||

Class R6 | (1,470,087) | (4,612,059) | ||

Administrator Class | (144,145) | (452,132) | ||

Institutional Class | (4,334,480) | (18,968,188) | ||

Total distributions to shareholders | (47,397,660) | (131,900,935) | ||

| Capital share transactions | Shares | Shares | ||

| Proceeds from shares sold | ||||

Class A | 498,107 | 11,395,288 | 829,934 | 14,670,933 |

Class C | 17,699 | 254,296 | 30,986 | 364,118 |

Class R6 | 256,338 | 6,353,621 | 435,113 | 8,658,699 |

Administrator Class | 33,690 | 750,889 | 40,426 | 781,386 |

Institutional Class | 612,736 | 14,909,575 | 936,815 | 17,943,308 |

| 33,663,669 | 42,418,444 | |||

| Reinvestment of distributions | ||||

Class A | 1,909,343 | 39,351,568 | 5,292,160 | 101,875,798 |

Class C | 14,844 | 194,453 | 74,887 | 945,077 |

Class R6 | 65,677 | 1,456,720 | 222,029 | 4,582,449 |

Administrator Class | 6,031 | 130,085 | 20,980 | 414,636 |

Institutional Class | 189,157 | 4,178,481 | 903,544 | 18,584,525 |

| 45,311,307 | 126,402,485 | |||

| Payment for shares redeemed | ||||

Class A | (4,162,369) | (93,186,950) | (7,019,117) | (123,527,409) |

Class C | (135,039) | (1,857,466) | (386,221) | (4,798,830) |

Class R6 | (427,869) | (10,640,310) | (826,169) | (14,778,156) |

Administrator Class | (45,790) | (1,112,388) | (107,155) | (1,980,852) |

Institutional Class | (3,682,134) | (84,645,028) | (2,368,945) | (43,202,567) |

| (191,442,142) | (188,287,814) | |||

Net decrease in net assets resulting from capital share transactions | (112,467,166) | (19,466,885) | ||

Total increase (decrease) in net assets | 202,490,855 | (195,648,949) | ||

| Net assets | ||||

Beginning of period | 881,712,640 | 1,077,361,589 | ||

End of period | $1,084,203,495 | $ 881,712,640 | ||

| Year ended September 30 | |||||

| Class A | 2021 | 2020 | 2019 | 2018 | 2017 |

Net asset value, beginning of period | $17.88 | $21.07 | $24.58 | $24.06 | $21.50 |

Net investment loss | (0.12) | (0.03) | (0.01) | (0.04) | (0.09) |

Net realized and unrealized gains (losses) on investments | 7.75 | (0.52) | (0.20) | 3.10 | 3.48 |

Total from investment operations | 7.63 | (0.55) | (0.21) | 3.06 | 3.39 |

| Distributions to shareholders from | |||||

Net investment income | 0.00 | (0.00) 1 | 0.00 | 0.00 | 0.00 |

Net realized gains | (1.05) | (2.64) | (3.30) | (2.54) | (0.83) |

Total distributions to shareholders | (1.05) | (2.64) | (3.30) | (2.54) | (0.83) |

Net asset value, end of period | $24.46 | $17.88 | $21.07 | $24.58 | $24.06 |

Total return2 | 43.77% | (3.48)% | 0.91% | 13.62% | 16.10% |

| Ratios to average net assets (annualized) | |||||

Gross expenses | 1.25% | 1.27% | 1.26% | 1.25% | 1.25% |

Net expenses | 1.23% | 1.23% | 1.26% | 1.25% | 1.25% |

Net investment loss | (0.50)% | (0.14)% | (0.03)% | (0.18)% | (0.38)% |

| Supplemental data | |||||

Portfolio turnover rate | 48% | 61% | 40% | 33% | 35% |

Net assets, end of period (000s omitted) | $945,399 | $722,547 | $870,369 | $971,731 | $942,596 |

| 1 | Amount is less than $0.005. |

| 2 | Total return calculations do not include any sales charges. |

| Year ended September 30 | |||||

| Class C | 2021 | 2020 | 2019 | 2018 | 2017 |

Net asset value, beginning of period | $11.70 | $14.72 | $18.40 | $18.75 | $17.04 |

Net investment loss | (0.18) 1 | (0.11) 1 | (0.11) 1 | (0.17) 1 | (0.20) 1 |

Payment from affiliate | 0.00 | 0.05 | 0.00 | 0.00 | 0.00 |

Net realized and unrealized gains (losses) on investments | 4.98 | (0.32) | (0.27) | 2.36 | 2.74 |

Total from investment operations | 4.80 | (0.38) | (0.38) | 2.19 | 2.54 |

| Distributions to shareholders from | |||||

Net realized gains | (1.05) | (2.64) | (3.30) | (2.54) | (0.83) |

Net asset value, end of period | $15.45 | $11.70 | $14.72 | $18.40 | $18.75 |

Total return2 | 42.64% | (3.88)% 3 | 0.17% | 12.74% | 15.29% |

| Ratios to average net assets (annualized) | |||||

Gross expenses | 1.99% | 2.01% | 2.01% | 2.00% | 2.00% |

Net expenses | 1.99% | 2.01% | 2.01% | 2.00% | 2.00% |

Net investment loss | (1.26)% | (0.92)% | (0.78)% | (0.94)% | (1.14)% |

| Supplemental data | |||||

Portfolio turnover rate | 48% | 61% | 40% | 33% | 35% |

Net assets, end of period (000s omitted) | $2,405 | $3,020 | $7,925 | $16,541 | $18,978 |

| 1 | Calculated based upon average shares outstanding |

| 2 | Total return calculations do not include any sales charges. |

| 3 | During the year ended September 30, 2020, the Fund received a payment from an affiliate which had a 0.39% impact on the total return. See Note 4 in the Notes to Financial Statements for additional information. |

| Year ended September 30 | |||||

| Class R6 | 2021 | 2020 | 2019 | 2018 | 2017 |

Net asset value, beginning of period | $19.16 | $22.39 | $25.80 | $25.03 | $22.25 |

Net investment income (loss) | (0.02) 1 | 0.05 1 | 0.09 1 | 0.05 1 | 0.01 |

Net realized and unrealized gains (losses) on investments | 8.32 | (0.56) | (0.20) | 3.26 | 3.60 |

Total from investment operations | 8.30 | (0.51) | (0.11) | 3.31 | 3.61 |

| Distributions to shareholders from | |||||

Net investment income | 0.00 | (0.08) | 0.00 | 0.00 | 0.00 |

Net realized gains | (1.05) | (2.64) | (3.30) | (2.54) | (0.83) |

Total distributions to shareholders | (1.05) | (2.72) | (3.30) | (2.54) | (0.83) |

Net asset value, end of period | $26.41 | $19.16 | $22.39 | $25.80 | $25.03 |

Total return | 44.37% | (3.10)% | 1.31% | 14.12% | 16.56% |

| Ratios to average net assets (annualized) | |||||

Gross expenses | 0.82% | 0.84% | 0.83% | 0.82% | 0.82% |

Net expenses | 0.82% | 0.83% | 0.83% | 0.82% | 0.82% |

Net investment income (loss) | (0.09)% | 0.27% | 0.40% | 0.20% | 0.05% |

| Supplemental data | |||||

Portfolio turnover rate | 48% | 61% | 40% | 33% | 35% |

Net assets, end of period (000s omitted) | $35,280 | $27,628 | $36,069 | $36,477 | $115,641 |

| 1 | Calculated based upon average shares outstanding |

| Year ended September 30 | |||||

| Administrator Class | 2021 | 2020 | 2019 | 2018 | 2017 |

Net asset value, beginning of period | $18.67 | $21.56 | $25.04 | $24.42 | $21.78 |

Net investment income (loss) | (0.09) 1 | 0.00 1,2 | 0.03 | (0.01) 1 | (0.06) 1 |

Payment from affiliate | 0.00 | 0.32 | 0.00 | 0.00 | 0.00 |

Net realized and unrealized gains (losses) on investments | 8.10 | (0.54) | (0.21) | 3.17 | 3.53 |

Total from investment operations | 8.01 | (0.22) | (0.18) | 3.16 | 3.47 |

| Distributions to shareholders from | |||||

Net investment income | 0.00 | (0.03) | 0.00 | 0.00 | 0.00 |

Net realized gains | (1.05) | (2.64) | (3.30) | (2.54) | (0.83) |

Total distributions to shareholders | (1.05) | (2.67) | (3.30) | (2.54) | (0.83) |

Net asset value, end of period | $25.63 | $18.67 | $21.56 | $25.04 | $24.42 |

Total return | 43.96% | (1.68)% 3 | 1.03% | 13.84% | 16.26% |

| Ratios to average net assets (annualized) | |||||

Gross expenses | 1.17% | 1.17% | 1.18% | 1.17% | 1.17% |

Net expenses | 1.10% | 1.10% | 1.10% | 1.10% | 1.10% |

Net investment income (loss) | (0.36)% | 0.01% | 0.14% | (0.04)% | (0.27)% |

| Supplemental data | |||||

Portfolio turnover rate | 48% | 61% | 40% | 33% | 35% |

Net assets, end of period (000s omitted) | $2,918 | $2,239 | $3,572 | $6,141 | $6,336 |

| 1 | Calculated based upon average shares outstanding |

| 2 | Amount is less than $0.005. |

| 3 | During the year ended September 30, 2020, the Fund received a payment from an affiliate which had a 1.69% impact on the total return. See Note 4 in the Notes to Financial Statements for additional information. |

| Year ended September 30 | |||||

| Institutional Class | 2021 | 2020 | 2019 | 2018 | 2017 |

Net asset value, beginning of period | $19.09 | $22.32 | $25.73 | $24.97 | $22.20 |

Net investment income (loss) | (0.03) 1 | 0.05 1 | 0.08 1 | 0.05 1 | 0.00 1,2 |

Net realized and unrealized gains (losses) on investments | 8.29 | (0.56) | (0.19) | 3.25 | 3.60 |

Total from investment operations | 8.26 | (0.51) | (0.11) | 3.30 | 3.60 |

| Distributions to shareholders from | |||||

Net investment income | 0.00 | (0.08) | 0.00 | 0.00 | 0.00 |

Net realized gains | (1.05) | (2.64) | (3.30) | (2.54) | (0.83) |

Total distributions to shareholders | (1.05) | (2.72) | (3.30) | (2.54) | (0.83) |

Net asset value, end of period | $26.30 | $19.09 | $22.32 | $25.73 | $24.97 |

Total return | 44.32% | (3.13)% | 1.31% | 14.12% | 16.55% |

| Ratios to average net assets (annualized) | |||||

Gross expenses | 0.92% | 0.94% | 0.93% | 0.92% | 0.92% |

Net expenses | 0.85% | 0.85% | 0.85% | 0.85% | 0.85% |

Net investment income (loss) | (0.14)% | 0.24% | 0.37% | 0.21% | 0.02% |

| Supplemental data | |||||

Portfolio turnover rate | 48% | 61% | 40% | 33% | 35% |

Net assets, end of period (000s omitted) | $98,202 | $126,279 | $159,426 | $172,197 | $167,552 |

| 1 | Calculated based upon average shares outstanding |

| 2 | Amount is less than $0.005. |

| Gross unrealized gains | $353,251,479 |

| Gross unrealized losses | (16,417,034) |

| Net unrealized gains | $336,834,445 |

| Paid-in capital | Total distributable earnings |

| $164,977 | $(164,977) |

| ■ | Level 1 – quoted prices in active markets for identical securities |

| ■ | Level 2 – other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) |

| ■ | Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

| Quoted prices (Level 1) | Other significant observable inputs (Level 2) | Significant unobservable inputs (Level 3) | Total | |

| Assets | ||||

| Investments in: | ||||

| Common stocks | ||||

| Communication services | $ 8,556,726 | $ 0 | $0 | $ 8,556,726 |

| Consumer discretionary | 149,017,532 | 0 | 0 | 149,017,532 |

| Consumer staples | 42,462,786 | 0 | 0 | 42,462,786 |

| Financials | 121,959,002 | 0 | 0 | 121,959,002 |

| Health care | 119,693,531 | 0 | 0 | 119,693,531 |

| Industrials | 226,694,073 | 12,470,634 | 0 | 239,164,707 |

| Information technology | 209,872,762 | 0 | 0 | 209,872,762 |

| Materials | 71,227,866 | 0 | 0 | 71,227,866 |

| Real estate | 100,074,613 | 0 | 0 | 100,074,613 |

| Investment companies | 13,254,360 | 0 | 0 | 13,254,360 |