UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-09253

Allspring Funds Trust

(Exact name of registrant as specified in charter)

525 Market St., San Francisco, CA 94105

(Address of principal executive offices) (Zip code)

Matthew Prasse

Allspring Funds Management, LLC

525 Market St., San Francisco, CA 94105

(Name and address of agent for service)

Registrant’s telephone number, including area code: 800-222-8222

Date of fiscal year end: October 31

Registrant is making a filing for 5 of its series:

Allspring Emerging Markets Equity Fund, Allspring Emerging Markets Equity Income Fund, Allspring Global Small Cap Fund, Allspring International Equity Fund and Allspring Special International Small Cap Fund.

Date of reporting period: October 31, 2021

| ITEM 1. | REPORT TO STOCKHOLDERS |

Emerging Markets Equity Fund

| 2 | |

| 6 | |

| 10 | |

| 11 | |

| Financial statements | |

| 18 | |

| 19 | |

| 20 | |

| 21 | |

| 26 | |

| 34 | |

| 35 | |

| Board considerations | |

| 39 | |

| 42 | |

| 47 |

| 1 | The S&P 500 Index consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market-value-weighted index with each stock's weight in the index proportionate to its market value. You cannot invest directly in an index. |

| 2 | The Morgan Stanley Capital International (MSCI) All Country World Index (ACWI) ex USA Index (Net) is a free-float-adjusted market-capitalization-weighted index that is designed to measure the equity market performance of developed and emerging markets, excluding the U.S. Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indexes or any securities or financial products. This report is not approved, reviewed, or produced by MSCI. You cannot invest directly in an index. |

| 3 | The MSCI Emerging Markets (EM) Index (Net) (USD) is a free-float-adjusted market-capitalization-weighted index that is designed to measure equity market performance of emerging markets. You cannot invest directly in an index. |

| 4 | The Bloomberg U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment-grade, U.S.-dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, mortgage-backed securities (agency fixed-rate and hybrid adjustable-rate mortgage pass-throughs), asset-backed securities, and commercial mortgage-backed securities. You cannot invest directly in an index. |

| 5 | The Bloomberg Global Aggregate ex-USD Index (unhedged) is an unmanaged index that provides a broad-based measure of the global investment-grade fixed-income markets excluding the U.S.-dollar-denominated debt market. You cannot invest directly in an index. |

| 6 | The Bloomberg Municipal Bond Index is an unmanaged index composed of long-term tax-exempt bonds with a minimum credit rating of Baa. You cannot invest directly in an index. |

| 7 | The ICE BofA U.S. High Yield Index is a market-capitalization-weighted index of domestic and Yankee high-yield bonds. The index tracks the performance of high-yield securities traded in the U.S. bond market. You cannot invest directly in an index. Copyright 2021. ICE Data Indices, LLC. All rights reserved. |

“ Municipal debt experienced its first monthly performance drop since February of this year, slowing a rally that made it one of the best-performing sectors of the bond market.” |

| 1 | As of September 30, 2021, assets under management (AUM) includes $93 billion from Galliard Capital Management, LLC, an investment advisor that is not part of the Allspring trade name/GIPS firm. |

President

Allspring Funds

| Investment objective | The Fund seeks long-term capital appreciation. |

| Manager | Allspring Funds Management, LLC |

| Subadviser | Allspring Global Investments, LLC |

| Portfolio managers | Derrick Irwin, CFA®‡, Richard Peck, CFA®‡, Yi (Jerry) Zhang, Ph.D., CFA®‡ |

| Average annual total returns (%) as of October 31, 2021 | |||||||||||

| Including sales charge | Excluding sales charge | Expense ratios1 (%) | |||||||||

| Inception date | 1 year | 5 year | 10 year | 1 year | 5 year | 10 year | Gross | Net 2 | |||

| Class A (EMGAX) | 9-6-1994 | 3.68 | 7.14 | 3.65 | 10.00 | 8.42 | 4.26 | 1.55 | 1.45 | ||

| Class C (EMGCX) | 9-6-1994 | 8.14 | 7.62 | 3.50 | 9.14 | 7.62 | 3.50 | 2.30 | 2.20 | ||

| Class R6 (EMGDX)3 | 6-28-2013 | – | – | – | 10.47 | 8.88 | 4.72 | 1.12 | 1.02 | ||

| Administrator Class (EMGYX) | 9-6-1994 | – | – | – | 10.09 | 8.74 | 4.50 | 1.47 | 1.37 | ||

| Institutional Class (EMGNX) | 7-30-2010 | – | – | – | 10.39 | 8.81 | 4.67 | 1.22 | 1.12 | ||

| MSCI EM Index (Net) (USD)4 | – | – | – | – | 16.96 | 9.39 | 4.88 | – | – | ||

| 1 | Reflects the expense ratios as stated in the most recent prospectuses, which include the impact of 0.01% in acquired fund fees and expenses. The expense ratios shown are subject to change and may differ from the annualized expense ratios shown in the financial highlights of this report, which do not include acquired fund fees and expenses. |

| 2 | The manager has contractually committed through February 28, 2023, to waive fees and/or reimburse expenses to the extent necessary to cap total annual fund operating expenses after fee waivers at 1.44% for Class A, 2.19% for Class C, 1.01% for Class R6, 1.36% for Administrator Class, and 1.11% for Institutional Class. Brokerage commissions, stamp duty fees, interest, taxes, acquired fund fees and expenses (if any), and extraordinary expenses are excluded from the expense caps. Prior to or after the commitment expiration date, the caps may be increased or the commitment to maintain the caps may be terminated only with the approval of the Board of Trustees. Without these caps, the Fund’s returns would have been lower. The expense ratio paid by an investor is the net expense ratio (the total annual fund operating expenses after fee waivers) as stated in the prospectuses. |

| 3 | Historical performance shown for the Class R6 shares prior to their inception reflects the performance of the Institutional Class shares, and includes the higher expenses applicable to the Institutional Class shares. If these expenses had not been included, returns for the Class R6 shares would be higher. |

| 4 | The Morgan Stanley Capital International (MSCI) Emerging Markets (EM) Index (Net) (USD) is a free-float-adjusted market-capitalization-weighted index that is designed to measure the equity market performance of emerging markets. Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed, or produced by MSCI. You cannot invest directly in an index. |

| ‡ | CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute. |

| 1 | The chart compares the performance of Class A shares for the most recent ten years with the MSCI EM Index (Net) (USD). The chart assumes a hypothetical investment of $10,000 in Class A shares and reflects all operating expenses and assumes the maximum initial sales charge of 5.75%. |

| ■ | The Fund underperformed its benchmark, the MSCI EM Index (Net) (USD), for the 12-month period that ended October 31, 2021. |

| ■ | The primary sector detractors included information technology (IT) and materials and country detractors included Brazil, Taiwan, and India. |

| ■ | Stock selection was the largest driver of underperformance. Primary sector contributors included communication services and real estate and country contributors included China, Mexico, and Indonesia |

| Ten largest holdings (%) as of October 31, 20211 | |

| Samsung Electronics Company Limited | 5.47 |

| Tencent Holdings Limited | 4.65 |

| Taiwan Semiconductor Manufacturing Company Limited ADR | 4.63 |

| Bilibili Incorporated ADR | 3.23 |

| Taiwan Semiconductor Manufacturing Company Limited | 3.00 |

| Meituan Dianping | 2.99 |

| Li Ning Company Limited | 2.86 |

| Alibaba Group Holding Limited ADR | 2.70 |

| Reliance Industries Limited GDR | 2.56 |

| Fomento Economico Mexicano SAB de CV ADR | 2.42 |

| 1 | Figures represent the percentage of the Fund's net assets. Holdings are subject to change and may have changed since the date specified. |

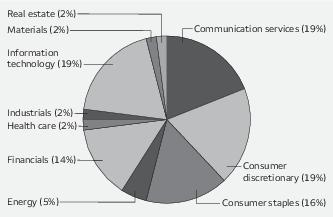

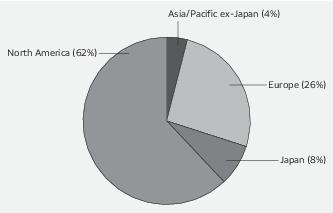

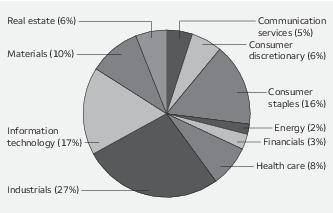

| Sector allocation as of October 31, 20211 |

| 1 | Figures represent the percentage of the Fund's long-term investments. These amounts are subject to change and may have changed since the date specified. |

| * | This security was no longer held at the end of the reporting period. |

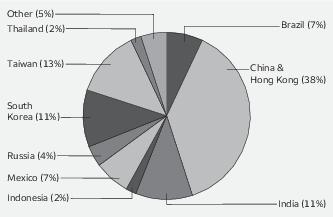

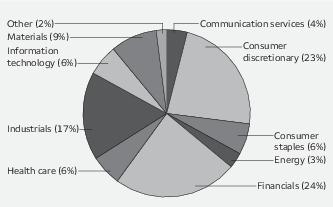

| Country allocation as of October 31, 20211 |

| 1 | Figures represent the percentage of the Fund's long-term investments. These amounts are subject to change and may have changed since the date specified. |

| * | This security was no longer held at the end of the reporting period. |

| Beginning account value 5-1-2021 | Ending account value 10-31-2021 | Expenses paid during the period1 | Annualized net expense ratio | |

| Class A | ||||

| Actual | $1,000.00 | $ 885.85 | $ 6.89 | 1.45% |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,017.90 | $ 7.38 | 1.45% |

| Class C | ||||

| Actual | $1,000.00 | $ 882.56 | $10.44 | 2.20% |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,014.12 | $11.17 | 2.20% |

| Class R6 | ||||

| Actual | $1,000.00 | $ 887.67 | $ 4.85 | 1.02% |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,020.06 | $ 5.19 | 1.02% |

| Administrator Class | ||||

| Actual | $1,000.00 | $ 886.36 | $ 6.51 | 1.37% |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,018.30 | $ 6.97 | 1.37% |

| Institutional Class | ||||

| Actual | $1,000.00 | $ 887.35 | $ 5.33 | 1.12% |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,019.56 | $ 5.70 | 1.12% |

| Shares | Value | |||||

| Common stocks: 93.18% | ||||||

| Argentina: 0.27% | ||||||

| MercadoLibre Incorporated (Consumer discretionary, Internet & direct marketing retail) † | 11,216 | $ 16,611,120 | ||||

| Brazil: 5.85% | ||||||

| Ambev SA ADR (Consumer staples, Beverages) | 4,164,500 | 12,326,920 | ||||

| Americanas SA (Consumer discretionary, Internet & direct marketing retail) † | 13,779,759 | 72,514,767 | ||||

| Atacadao Distribuicao Comercio e Industria Limitada (Consumer staples, Food & staples retailing) | 9,227,000 | 27,204,593 | ||||

| B3 Brasil Bolsa Balcao SA (Financials, Capital markets) | 21,529,015 | 45,432,256 | ||||

| Banco Bradesco SA ADR (Financials, Banks) | 5,222,979 | 18,280,427 | ||||

| Banco Inter SA (Financials, Banks) | 755,400 | 4,751,533 | ||||

| BK Brasil Operacao e Assessoria a Restaurantes SA (Consumer discretionary, Hotels, restaurants & leisure) † | 3,855,794 | 4,693,523 | ||||

| BRF Brazil Foods SA ADR (Consumer staples, Food products) †« | 11,057,912 | 45,669,177 | ||||

| Companhia Brasileira de Aluminio (Materials, Metals & mining) † | 3,412,600 | 7,721,553 | ||||

| Diagnosticos da America SA (Health care, Health care providers & services) | 2,880,473 | 17,878,552 | ||||

| Hapvida Participacoes e Investimentos SA (Health care, Health care providers & services) 144A | 19,117,335 | 39,089,629 | ||||

| Lojas Renner SA (Consumer discretionary, Multiline retail) | 6,097,175 | 34,819,085 | ||||

| Magazine Luiza SA (Consumer discretionary, Multiline retail) | 8,121,700 | 15,556,111 | ||||

| Multiplan Empreendimentos Imobiliarios SA (Real estate, Real estate management & development) | 2,446,906 | 8,029,466 | ||||

| Raia Drogasil SA (Consumer staples, Food & staples retailing) | 1,968,000 | 8,107,304 | ||||

| 362,074,896 | ||||||

| Chile: 1.14% | ||||||

| Banco Santander Chile SA ADR (Financials, Banks) | 1,190,492 | 21,095,518 | ||||

| S.A.C.I. Falabella (Consumer discretionary, Multiline retail) | 17,793,830 | 49,205,900 | ||||

| 70,301,418 | ||||||

| China: 30.78% | ||||||

| 51job Incorporated ADR (Industrials, Professional services) † | 917,541 | 54,648,742 | ||||

| Agora Incorporated ADR (Information technology, Software) † | 539,765 | 11,766,877 | ||||

| Alibaba Group Holding Limited ADR (Consumer discretionary, Internet & direct marketing retail) † | 1,014,837 | 167,387,210 | ||||

| Alibaba Group Holding Limited ADR (Consumer discretionary, Internet & direct marketing retail) † | 1,670,000 | 34,986,183 | ||||

| Bilibili Incorporated ADR (Communication services, Entertainment) † | 2,732,012 | 200,256,480 | ||||

| China Life Insurance Company Limited Class H (Financials, Insurance) | 23,043,190 | 40,160,100 | ||||

| China Literature Limited (Communication services, Media) 144A† | 2,779,968 | 19,347,763 |

| Shares | Value | |||||

| China: (continued) | ||||||

| China MeiDong Auto Holdings Limited (Consumer discretionary, Specialty retail) | 12,373,400 | $ 64,248,488 | ||||

| FinVolution Group ADR (Financials, Consumer finance) | 4,401,985 | 26,940,148 | ||||

| Greentree Hospitality Group Limited (Consumer discretionary, Hotels, restaurants & leisure) † | 2,531,768 | 20,431,368 | ||||

| Hua Medicine Limited (Health care, Pharmaceuticals) 144A† | 8,733,136 | 4,646,897 | ||||

| Koolearn Technology Holding Limited (Consumer discretionary, Diversified consumer services) 144A†« | 13,413,215 | 7,326,800 | ||||

| Li Ning Company Limited (Consumer discretionary, Textiles, apparel & luxury goods) | 15,909,707 | 176,876,763 | ||||

| Meituan Dianping (Consumer discretionary, Internet & direct marketing retail) † | 5,337,600 | 184,951,733 | ||||

| New Oriental Education & Technology Group Incorporated ADR (Consumer discretionary, Diversified consumer services) † | 6,781,890 | 13,902,875 | ||||

| Pinduoduo Incorporated ADR (Consumer discretionary, Internet & direct marketing retail) † | 303,563 | 26,992,822 | ||||

| Shandong Weigao Group Medical Polymer Company Limited Class H (Health care, Health care equipment & supplies) | 29,990,600 | 51,111,800 | ||||

| Tencent Holdings Limited (Communication services, Interactive media & services) | 4,654,700 | 287,759,231 | ||||

| Tencent Music Entertainment ADR (Communication services, Entertainment) † | 2,896,603 | 22,767,300 | ||||

| Tongdao Liepin Group (Communication services, Interactive media & services) † | 1,636,260 | 2,363,802 | ||||

| Trip.com Group Limited ADR (Consumer discretionary, Internet & direct marketing retail) † | 2,194,013 | 62,661,011 | ||||

| Tsingtao Brewery Company Limited Class H (Consumer staples, Beverages) | 6,522,500 | 56,711,924 | ||||

| Uxin Limited ADR (Consumer discretionary, Internet & direct marketing retail) † | 3,950,000 | 9,480,000 | ||||

| Uxin Limited ADR Class A (Consumer discretionary, Internet & direct marketing retail) ♦ | 23,979,831 | 19,183,865 | ||||

| Vipshop Holdings Limited ADR (Consumer discretionary, Internet & direct marketing retail) † | 6,128,039 | 68,388,915 | ||||

| Want Want China Holdings Limited (Consumer staples, Food products) | 77,825,800 | 60,316,120 | ||||

| Weibo Corporation ADR (Communication services, Interactive media & services) † | 2,031,212 | 91,363,916 | ||||

| Xiaomi Corporation Class B (Information technology, Technology hardware, storage & peripherals) 144A† | 27,921,900 | 76,618,799 | ||||

| Zepp Health Corporation ADR Class A (Information technology, Electronic equipment, instruments & components) † | 2,439,291 | 20,026,579 | ||||

| Zhou Hei Ya International Holding Company Limited (Consumer staples, Food products) 144A | 25,612,726 | 23,076,307 | ||||

| 1,906,700,818 | ||||||

| Colombia: 0.29% | ||||||

| Bancolombia SA ADR (Financials, Banks) | 499,100 | 17,932,663 | ||||

| Hong Kong: 4.57% | ||||||

| AIA Group Limited (Financials, Insurance) | 11,077,500 | 125,076,586 | ||||

| Johnson Electric Holdings Limited (Industrials, Electrical equipment) | 4,183,050 | 9,290,290 |

| Shares | Value | |||||

| Hong Kong: (continued) | ||||||

| Sun Art Retail Group Limited (Consumer staples, Food & staples retailing) « | 84,455,400 | $ 49,714,765 | ||||

| WH Group Limited (Consumer staples, Food products) 144A | 140,938,195 | 98,903,996 | ||||

| 282,985,637 | ||||||

| India: 10.57% | ||||||

| Axis Bank Limited (Financials, Banks) † | 4,251,923 | 42,132,401 | ||||

| Bajaj Finance Limited (Financials, Consumer finance) | 420,281 | 41,534,609 | ||||

| Bandhan Bank Limited (Financials, Banks) 144A | 1,416,131 | 5,511,812 | ||||

| Bharti Airtel Limited (Communication services, Wireless telecommunication services) † | 4,869,052 | 44,563,957 | ||||

| Bharti Airtel Limited (Communication services, Wireless telecommunication services) † | 347,789 | 621,207 | ||||

| Dalmia Bharat Limited (Materials, Construction materials) | 624,658 | 16,786,152 | ||||

| Fortis Healthcare Limited (Health care, Health care providers & services) † | 5,634,970 | 18,384,084 | ||||

| HDFC Bank Limited (Financials, Banks) | 2,200,000 | 46,503,898 | ||||

| HDFC Bank Limited ADR (Financials, Banks) | 428,752 | 30,831,556 | ||||

| Housing Development Finance Corporation Limited (Financials, Thrifts & mortgage finance) | 1,115,700 | 42,384,867 | ||||

| Indus Towers Limited (Communication services, Diversified telecommunication services) | 1,373,851 | 4,981,228 | ||||

| ITC Limited (Consumer staples, Tobacco) | 19,483,960 | 58,076,219 | ||||

| JM Financial Limited (Financials, Capital markets) | 11,571,429 | 13,583,222 | ||||

| Kotak Mahindra Bank Limited (Financials, Banks) | 1,117,262 | 30,305,673 | ||||

| Max Financial Services Limited (Financials, Insurance) † | 925,389 | 12,031,833 | ||||

| Oberoi Realty Limited (Real estate, Real estate management & development) † | 964,750 | 11,663,643 | ||||

| Reliance Industries Limited (Energy, Oil, gas & consumable fuels) | 750,000 | 25,402,721 | ||||

| Reliance Industries Limited GDR (Energy, Oil, gas & consumable fuels) 144A | 2,332,274 | 158,594,632 | ||||

| SBI Life Insurance Company Limited (Financials, Insurance) 144A | 964,273 | 14,751,663 | ||||

| SH Kelkar & Company Limited (Materials, Chemicals) | 1,244,001 | 2,638,142 | ||||

| Spandana Sphoorty Financial Limited (Financials, Consumer finance) † | 440,254 | 3,000,239 | ||||

| Ultra Tech Cement Limited (Materials, Construction materials) | 296,000 | 30,184,737 | ||||

| 654,468,495 | ||||||

| Indonesia: 2.06% | ||||||

| PT Astra International Tbk (Consumer discretionary, Automobiles) | 79,651,000 | 33,873,109 | ||||

| PT Bank Central Asia Tbk (Financials, Banks) | 62,747,500 | 33,106,586 | ||||

| PT Blue Bird Tbk (Industrials, Road & rail) | 4,605,309 | 481,091 | ||||

| PT Link Net Tbk (Communication services, Diversified telecommunication services) | 38,278,161 | 10,510,114 |

| Shares | Value | |||||

| Indonesia: (continued) | ||||||

| PT Telekomunikasi Indonesia Persero Tbk (Communication services, Diversified telecommunication services) | 49,000,000 | $ 13,142,756 | ||||

| PT Telekomunikasi Indonesia Persero Tbk ADR (Communication services, Diversified telecommunication services) « | 1,387,471 | 36,476,613 | ||||

| 127,590,269 | ||||||

| Luxembourg: 0.13% | ||||||

| InPost SA (Industrials, Industrial conglomerates) † | 577,122 | 8,229,999 | ||||

| Mexico: 7.04% | ||||||

| America Movil SAB de CV ADR (Communication services, Wireless telecommunication services) | 4,707,304 | 83,695,865 | ||||

| Banco Santander Mexico SA ADR Class B (Financials, Banks) | 3,029,336 | 19,539,217 | ||||

| Banco Santander Mexico SA Class B (Financials, Banks) | 2,977,800 | 3,796,738 | ||||

| Becle SAB de CV ADR (Consumer staples, Beverages) | 12,667,225 | 28,917,796 | ||||

| Cemex SAB de CV ADR (Materials, Construction materials) † | 4,981,948 | 32,033,926 | ||||

| Fibra Uno Administracion SAB de CV (Real estate, Equity REITs) | 68,940,122 | 68,578,478 | ||||

| Fomento Economico Mexicano SAB de CV ADR (Consumer staples, Beverages) | 1,828,182 | 150,258,279 | ||||

| Grupo Financiero Banorte SAB de CV (Financials, Banks) | 4,200,488 | 26,551,948 | ||||

| Walmart de Mexico SAB de CV (Consumer staples, Food & staples retailing) | 6,542,900 | 22,795,911 | ||||

| 436,168,158 | ||||||

| Nigeria: 0.13% | ||||||

| IHS Holding Limited (Communication services, Diversified telecommunication services) † | 493,367 | 8,298,433 | ||||

| Peru: 0.11% | ||||||

| Compania de Minas Buenaventura SA ADR (Materials, Metals & mining) † | 896,695 | 7,065,957 | ||||

| Philippines: 0.57% | ||||||

| Ayala Corporation (Industrials, Industrial conglomerates) | 837,624 | 14,339,804 | ||||

| San Miguel Food & Beverage Incorporated (Consumer staples, Food products) | 3,495,810 | 5,270,414 | ||||

| SM Investments Corporation (Industrials, Industrial conglomerates) | 812,873 | 15,560,850 | ||||

| 35,171,068 | ||||||

| Russia: 3.71% | ||||||

| Fix Price Group Limited GDR (Consumer discretionary, Specialty retail) | 1,972,714 | 17,182,339 | ||||

| Headhunter Group plc ADR (Industrials, Professional services) | 314,160 | 16,606,498 | ||||

| Lukoil PJSC ADR (Energy, Oil, gas & consumable fuels) | 471,149 | 48,057,198 | ||||

| Magnit PJSC (Consumer staples, Food & staples retailing) | 152,816 | 13,993,180 | ||||

| Ozon Holdings plc ADR (Consumer discretionary, Internet & direct marketing retail) †« | 84,713 | 3,812,085 |

| Shares | Value | |||||

| Russia: (continued) | ||||||

| Sberbank PJSC ADR (Financials, Banks) | 1,740,395 | $ 34,842,708 | ||||

| Yandex NV Class A (Communication services, Interactive media & services) † | 1,147,406 | 95,051,113 | ||||

| 229,545,121 | ||||||

| South Africa: 1.93% | ||||||

| AngloGold Ashanti Limited ADR (Materials, Metals & mining) | 178,308 | �� 3,295,132 | ||||

| MTN Group Limited (Communication services, Wireless telecommunication services) † | 4,118,543 | 36,933,422 | ||||

| Shoprite Holdings Limited (Consumer staples, Food & staples retailing) | 3,331,500 | 39,583,236 | ||||

| Standard Bank Group Limited (Financials, Banks) | 2,177,090 | 19,302,344 | ||||

| Tiger Brands Limited (Consumer staples, Food products) | 1,631,933 | 20,584,257 | ||||

| 119,698,391 | ||||||

| South Korea: 9.96% | ||||||

| KT Corporation ADR (Communication services, Diversified telecommunication services) | 4,744,713 | 60,779,774 | ||||

| KT&G Corporation (Consumer staples, Tobacco) | 332,091 | 23,047,863 | ||||

| Naver Corporation (Communication services, Interactive media & services) | 282,500 | 98,393,308 | ||||

| Samsung Electronics Company Limited (Information technology, Technology hardware, storage & peripherals) | 5,670,800 | 338,729,057 | ||||

| Samsung Life Insurance Company Limited (Financials, Insurance) | 693,337 | 39,931,180 | ||||

| SK Hynix Incorporated (Information technology, Semiconductors & semiconductor equipment) | 635,500 | 56,015,147 | ||||

| 616,896,329 | ||||||

| Taiwan: 12.26% | ||||||

| 104 Corporation (Industrials, Professional services) | 1,655,000 | 10,563,766 | ||||

| Mediatek Incorporated (Information technology, Semiconductors & semiconductor equipment) | 3,721,881 | 122,195,636 | ||||

| President Chain Store Corporation (Consumer staples, Food & staples retailing) | 3,770,000 | 38,095,187 | ||||

| Taiwan Semiconductor Manufacturing Company Limited (Information technology, Semiconductors & semiconductor equipment) | 8,755,224 | 185,755,512 | ||||

| Taiwan Semiconductor Manufacturing Company Limited ADR (Information technology, Semiconductors & semiconductor equipment) | 2,524,552 | 287,041,562 | ||||

| Uni-President Enterprises Corporation (Consumer staples, Food products) | 48,312,368 | 115,705,763 | ||||

| 759,357,426 | ||||||

| Thailand: 1.75% | ||||||

| PTT Exploration & Production PCL (Energy, Oil, gas & consumable fuels) | 1,933,139 | 6,845,290 | ||||

| PTT PCL (Energy, Oil, gas & consumable fuels) | 21,559,000 | 25,013,833 | ||||

| Siam Commercial Bank PCL (Financials, Banks) | 8,405,100 | 31,915,697 | ||||

| Thai Beverage PCL (Consumer staples, Beverages) | 84,427,000 | 44,451,739 | ||||

| 108,226,559 |

| Shares | Value | |||||

| Turkey: 0.06% | ||||||

| Avivasa Emeklilik Ve Hayat SA (Financials, Insurance) | 1,901,979 | $ 3,891,401 | ||||

| Total Common stocks (Cost $4,198,458,270) | 5,771,214,158 |

| Interest rate | Maturity date | Principal | ||||

| Convertible debentures: 0.00% | ||||||

| Brazil: 0.00% | ||||||

| Lupatech SA (Energy, Energy equipment & services) ♦† | 6.50% | 4-15-2049 | $ 303,000 | 0 | ||

| Total Convertible debentures (Cost $160,691) | 0 |

| Shares | ||||||

| Investment companies: 0.49% | ||||||

| United States: 0.49% | ||||||

| iShares MSCI Emerging Markets EMEA ETF | 600,000 | 30,552,000 | ||||

| Total Investment companies (Cost $30,178,920) | 30,552,000 |

| Dividend yield | ||||||

| Preferred stocks: 0.28% | ||||||

| Brazil: 0.28% | ||||||

| Lojas Americanas SA (Consumer discretionary, Multiline retail) | 4.74 | 20,187,917 | 17,276,948 | |||

| Total Preferred stocks (Cost $35,609,205) | 17,276,948 |

| Yield | ||||||

| Short-term investments: 6.28% | ||||||

| Investment companies: 6.28% | ||||||

| Allspring Government Money Market Fund Select Class ♠∞ | 0.03 | 342,869,585 | 342,869,585 | |||

| Securities Lending Cash Investments LLC ♠∩∞ | 0.03 | 46,289,014 | 46,289,014 | |||

| Total Short-term investments (Cost $389,158,599) | 389,158,599 | |||||

| Total investments in securities (Cost $4,653,565,685) | 100.23% | 6,208,201,705 | ||||

| Other assets and liabilities, net | (0.23) | (14,292,069) | ||||

| Total net assets | 100.00% | $6,193,909,636 |

| † | Non-income-earning security |

| 144A | The security may be resold in transactions exempt from registration, normally to qualified institutional buyers, pursuant to Rule 144A under the Securities Act of 1933. |

| ♦ | The security is fair valued in accordance with procedures approved by the Board of Trustees. |

| « | All or a portion of this security is on loan. |

| ♠ | The issuer of the security is an affiliated person of the Fund as defined in the Investment Company Act of 1940. |

| ∩ | The investment is a non-registered investment company purchased with cash collateral received from securities on loan. |

| ∞ | The rate represents the 7-day annualized yield at period end. |

| Abbreviations: | |

| ADR | American depositary receipt |

| GDR | Global depositary receipt |

| REIT | Real estate investment trust |

| Value, beginning of period | Purchases | Sales proceeds | Net realized gains (losses) | Net change in unrealized gains (losses) | Value, end of period | Shares, end of period | Income from affiliated securities | |||

| Short-term investments | ||||||||||

| Allspring Government Money Market Fund Select Class | $199,808,582 | $1,608,841,722 | $(1,465,780,719) | $0 | $0 | $ 342,869,585 | 342,869,585 | $ 121,620 | ||

| Securities Lending Cash Investments LLC | 20,105,794 | 531,916,134 | (505,732,914) | 0 | 0 | 46,289,014 | 46,289,014 | 37,129 # | ||

| $0 | $0 | $389,158,599 | $158,749 | |||||||

| # | Amount shown represents income before fees and rebates. |

| Assets | |

Investments in unaffiliated securities (including $44,778,369 of securities loaned), at value (cost $4,264,407,086) | $ 5,819,043,106 |

Investments in affiliated securities, at value (cost $389,158,599) | 389,158,599 |

Foreign currency, at value (cost $48,295,580) | 47,292,741 |

Receivable for Fund shares sold | 10,169,366 |

Receivable for dividends | 2,487,769 |

Receivable for securities lending income, net | 35,960 |

Prepaid expenses and other assets | 552,039 |

Total assets | 6,268,739,580 |

| Liabilities | |

Payable upon receipt of securities loaned | 46,288,514 |

Contingent tax liability | 15,390,255 |

Management fee payable | 5,079,846 |

Payable for Fund shares redeemed | 3,927,879 |

Payable for investments purchased | 3,472,769 |

Administration fees payable | 662,692 |

Distribution fee payable | 7,989 |

Total liabilities | 74,829,944 |

Total net assets | $6,193,909,636 |

| Net assets consist of | |

Paid-in capital | $ 4,694,403,251 |

Total distributable earnings | 1,499,506,385 |

Total net assets | $6,193,909,636 |

| Computation of net asset value and offering price per share | |

Net assets – Class A | $ 232,734,972 |

Shares outstanding – Class A1 | 7,730,163 |

Net asset value per share – Class A | $30.11 |

Maximum offering price per share – Class A2 | $31.95 |

Net assets – Class C | $ 12,259,984 |

Shares outstanding – Class C1 | 491,381 |

Net asset value per share – Class C | $24.95 |

Net assets – Class R6 | $ 536,456,409 |

Shares outstanding – Class R61 | 17,058,567 |

Net asset value per share – Class R6 | $31.45 |

Net assets – Administrator Class | $ 78,117,900 |

Shares outstanding – Administrator Class1 | 2,449,461 |

Net asset value per share – Administrator Class | $31.89 |

Net assets – Institutional Class | $ 5,334,340,371 |

Shares outstanding – Institutional Class1 | 169,758,739 |

Net asset value per share – Institutional Class | $31.42 |

| 1 | The Fund has an unlimited number of authorized shares. |

| 2 | Maximum offering price is computed as 100/94.25 of net asset value. On investments of $50,000 or more, the offering price is reduced. |

| Investment income | |

Dividends (net of foreign withholdings taxes of $11,561,044) | $ 76,832,420 |

Income from affiliated securities | 1,031,348 |

Total investment income | 77,863,768 |

| Expenses | |

Management fee | 61,833,103 |

| Administration fees | |

Class A | 529,019 |

Class C | 33,956 |

Class R6 | 160,008 |

Administrator Class | 113,746 |

Institutional Class | 6,872,031 |

| Shareholder servicing fees | |

Class A | 629,784 |

Class C | 40,363 |

Administrator Class | 216,163 |

| Distribution fee | |

Class C | 120,937 |

Custody and accounting fees | 595,619 |

Professional fees | 62,174 |

Registration fees | 106,008 |

Shareholder report expenses | 429,088 |

Trustees’ fees and expenses | 19,219 |

Other fees and expenses | 139,932 |

Total expenses | 71,901,150 |

| Less: Fee waivers and/or expense reimbursements | |

Fund-level | (681,818) |

Class A | (22,902) |

Class C | (6) |

Class R6 | (26,196) |

Administrator Class | (1,385) |

Institutional Class | (254,107) |

Net expenses | 70,914,736 |

Net investment income | 6,949,032 |

| Realized and unrealized gains (losses) on investments | |

Net realized gains on investments | 133,343,798 |

Net change in unrealized gains (losses) on investments (Net of deferred capital gains taxes of $(15,390,255)) | 261,905,138 |

Net realized and unrealized gains (losses) on investments | 395,248,936 |

Net increase in net assets resulting from operations | $402,197,968 |

| Year ended October 31, 2021 | Year ended October 31, 2020 | |||

| Operations | ||||

Net investment income | $ 6,949,032 | $ 19,314,250 | ||

Payment from affiliate | 0 | 814,760 | ||

Net realized gains on investments | 133,343,798 | 28,501,702 | ||

Net change in unrealized gains (losses) on investments | 261,905,138 | 343,880,924 | ||

Net increase in net assets resulting from operations | 402,197,968 | 392,511,636 | ||

| Distributions to shareholders from | ||||

| Net investment income and net realized gains | ||||

Class A | (153,789) | (1,592,205) | ||

Class R6 | (1,997,619) | (3,433,287) | ||

Administrator Class | (99,238) | (690,072) | ||

Institutional Class | (16,550,884) | (37,764,049) | ||

Total distributions to shareholders | (18,801,530) | (43,479,613) | ||

| Capital share transactions | Shares | Shares | ||

| Proceeds from shares sold | ||||

Class A | 1,279,782 | 41,046,133 | 865,603 | 22,093,065 |

Class C | 62,037 | 1,713,686 | 62,810 | 1,341,561 |

Class R6 | 9,192,248 | 309,903,863 | 3,888,578 | 97,521,245 |

Administrator Class | 498,122 | 17,534,140 | 466,599 | 12,164,727 |

Institutional Class | 70,742,883 | 2,393,030,346 | 55,315,223 | 1,422,431,335 |

| 2,763,228,168 | 1,555,551,933 | |||

| Reinvestment of distributions | ||||

Class A | 4,479 | 141,490 | 54,378 | 1,460,585 |

Class R6 | 50,522 | 1,661,164 | 89,034 | 2,487,612 |

Administrator Class | 2,928 | 97,946 | 23,753 | 668,417 |

Institutional Class | 498,950 | 16,405,460 | 1,335,293 | 37,308,081 |

| 18,306,060 | 41,924,695 | |||

| Payment for shares redeemed | ||||

Class A | (1,235,712) | (40,017,608) | (2,247,714) | (55,922,187) |

Class C | (452,222) | (11,814,354) | (579,377) | (12,172,959) |

Class R6 | (3,539,255) | (119,511,518) | (5,956,259) | (150,951,408) |

Administrator Class | (598,958) | (20,572,954) | (1,900,708) | (50,457,674) |

Institutional Class | (40,944,202) | (1,393,110,438) | (48,926,107) | (1,252,304,510) |

| (1,585,026,872) | (1,521,808,738) | |||

Net increase in net assets resulting from capital share transactions | 1,196,507,356 | 75,667,890 | ||

Total increase in net assets | 1,579,903,794 | 424,699,913 | ||

| Net assets | ||||

Beginning of period | 4,614,005,842 | 4,189,305,929 | ||

End of period | $ 6,193,909,636 | $ 4,614,005,842 | ||

| Year ended October 31 | |||||

| Class A | 2021 | 2020 | 2019 | 2018 | 2017 |

Net asset value, beginning of period | $27.39 | $25.29 | $21.16 | $24.83 | $20.49 |

Net investment income (loss) | (0.07) 1 | 0.00 2 | 0.10 | 0.07 | (0.03) 1 |

Payment from affiliate | 0.00 | 0.00 2 | 0.00 | 0.00 | 0.00 |

Net realized and unrealized gains (losses) on investments | 2.81 | 2.28 | 4.11 | (3.70) | 4.50 |

Total from investment operations | 2.74 | 2.28 | 4.21 | (3.63) | 4.47 |

| Distributions to shareholders from | |||||

Net investment income | (0.02) | (0.18) | (0.08) | (0.04) | (0.13) |

Net asset value, end of period | $30.11 | $27.39 | $25.29 | $21.16 | $24.83 |

Total return3 | 10.00% | 9.03% 4 | 19.95% | (14.65)% | 21.99% |

| Ratios to average net assets (annualized) | |||||

Gross expenses | 1.48% | 1.54% | 1.57% | 1.58% | 1.58% |

Net expenses | 1.46% | 1.52% | 1.57% | 1.57% | 1.58% |

Net investment income (loss) | (0.21)% | 0.13% | 0.43% | 0.38% | (0.13)% |

| Supplemental data | |||||

Portfolio turnover rate | 9% | 12% | 8% | 11% | 13% |

Net assets, end of period (000s omitted) | $232,735 | $210,393 | $227,811 | $201,515 | $268,384 |

| 1 | Calculated based upon average shares outstanding |

| 2 | Amount is less than $0.005. |

| 3 | Total return calculations do not include any sales charges. |

| 4 | During the year ended October 31, 2020, the Fund received a payment from an affiliate that had an impact of less than 0.005% on total return. See Note 4 in the Notes to Financial Statements for additional information. |

| Year ended October 31 | |||||

| Class C | 2021 | 2020 | 2019 | 2018 | 2017 |

Net asset value, beginning of period | $22.86 | $21.09 | $17.71 | $20.92 | $17.28 |

Net investment loss | (0.27) 1 | (0.14) 1 | (0.07) 1 | (0.08) 1 | (0.08) |

Payment from affiliate | 0.00 | 0.04 | 0.00 | 0.00 | 0.00 |

Net realized and unrealized gains (losses) on investments | 2.36 | 1.87 | 3.45 | (3.13) | 3.72 |

Total from investment operations | 2.09 | 1.77 | 3.38 | (3.21) | 3.64 |

Net asset value, end of period | $24.95 | $22.86 | $21.09 | $17.71 | $20.92 |

Total return2 | 9.14% | 8.39% 3 | 19.09% | (15.34)% | 21.06% |

| Ratios to average net assets (annualized) | |||||

Gross expenses | 2.23% | 2.29% | 2.32% | 2.33% | 2.31% |

Net expenses | 2.22% | 2.28% | 2.32% | 2.32% | 2.31% |

Net investment loss | (0.98)% | (0.64)% | (0.37)% | (0.38)% | (0.43)% |

| Supplemental data | |||||

Portfolio turnover rate | 9% | 12% | 8% | 11% | 13% |

Net assets, end of period (000s omitted) | $12,260 | $20,149 | $29,484 | $49,103 | $69,845 |

| 1 | Calculated based upon average shares outstanding |

| 2 | Total return calculations do not include any sales charges. |

| 3 | During the year ended October 31, 2020, the Fund received a payment from an affiliate which had a 0.18% impact on the total return. See Note 4 in the Notes to Financial Statements for additional information. |

| Year ended October 31 | |||||

| Class R6 | 2021 | 2020 | 2019 | 2018 | 2017 |

Net asset value, beginning of period | $28.59 | $26.39 | $22.10 | $26.00 | $21.46 |

Net investment income | 0.08 1 | 0.17 | 0.22 1 | 0.23 1 | 0.17 1 |

Net realized and unrealized gains (losses) on investments | 2.92 | 2.33 | 4.27 | (3.92) | 4.59 |

Total from investment operations | 3.00 | 2.50 | 4.49 | (3.69) | 4.76 |

| Distributions to shareholders from | |||||

Net investment income | (0.14) | (0.30) | (0.20) | (0.21) | (0.22) |

Net asset value, end of period | $31.45 | $28.59 | $26.39 | $22.10 | $26.00 |

Total return | 10.47% | 9.49% | 20.50% | (14.33)% | 22.53% |

| Ratios to average net assets (annualized) | |||||

Gross expenses | 1.05% | 1.11% | 1.14% | 1.16% | 1.14% |

Net expenses | 1.04% | 1.11% | 1.14% | 1.15% | 1.14% |

Net investment income | 0.23% | 0.55% | 0.88% | 0.90% | 0.76% |

| Supplemental data | |||||

Portfolio turnover rate | 9% | 12% | 8% | 11% | 13% |

Net assets, end of period (000s omitted) | $536,456 | $324,637 | $351,829 | $326,131 | $192,929 |

| 1 | Calculated based upon average shares outstanding |

| Year ended October 31 | |||||

| Administrator Class | 2021 | 2020 | 2019 | 2018 | 2017 |

Net asset value, beginning of period | $29.01 | $26.50 | $22.18 | $26.08 | $21.53 |

Net investment income (loss) | (0.05) 1 | 0.05 1 | 0.13 1 | 0.12 1 | 0.10 1 |

Payment from affiliate | 0.00 | 0.31 | 0.00 | 0.00 | 0.00 |

Net realized and unrealized gains (losses) on investments | 2.97 | 2.35 | 4.30 | (3.90) | 4.61 |

Total from investment operations | 2.92 | 2.71 | 4.43 | (3.78) | 4.71 |

| Distributions to shareholders from | |||||

Net investment income | (0.04) | (0.20) | (0.11) | (0.12) | (0.16) |

Net asset value, end of period | $31.89 | $29.01 | $26.50 | $22.18 | $26.08 |

Total return | 10.09% | 10.25% 2 | 20.09% | (14.57)% | 22.10% |

| Ratios to average net assets (annualized) | |||||

Gross expenses | 1.40% | 1.46% | 1.49% | 1.50% | 1.48% |

Net expenses | 1.38% | 1.43% | 1.46% | 1.46% | 1.46% |

Net investment income (loss) | (0.13)% | 0.20% | 0.54% | 0.48% | 0.42% |

| Supplemental data | |||||

Portfolio turnover rate | 9% | 12% | 8% | 11% | 13% |

Net assets, end of period (000s omitted) | $78,118 | $73,888 | $104,869 | $103,740 | $144,421 |

| 1 | Calculated based upon average shares outstanding |

| 2 | During the year ended October 31, 2020, the Fund received a payment from an affiliate which had a 1.16% impact on the total return. See Note 4 in the Notes to Financial Statements for additional information. |

| Year ended October 31 | |||||

| Institutional Class | 2021 | 2020 | 2019 | 2018 | 2017 |

Net asset value, beginning of period | $28.57 | $26.38 | $22.10 | $25.99 | $21.46 |

Net investment income | 0.04 1 | 0.14 | 0.19 | 0.19 | 0.19 1 |

Net realized and unrealized gains (losses) on investments | 2.92 | 2.34 | 4.28 | (3.89) | 4.55 |

Total from investment operations | 2.96 | 2.48 | 4.47 | (3.70) | 4.74 |

| Distributions to shareholders from | |||||

Net investment income | (0.11) | (0.29) | (0.19) | (0.19) | (0.21) |

Net asset value, end of period | $31.42 | $28.57 | $26.38 | $22.10 | $25.99 |

Total return | 10.39% | 9.42% | 20.40% | (14.35)% | 22.42% |

| Ratios to average net assets (annualized) | |||||

Gross expenses | 1.15% | 1.21% | 1.25% | 1.25% | 1.23% |

Net expenses | 1.14% | 1.18% | 1.19% | 1.19% | 1.20% |

Net investment income | 0.12% | 0.49% | 0.81% | 0.75% | 0.82% |

| Supplemental data | |||||

Portfolio turnover rate | 9% | 12% | 8% | 11% | 13% |

Net assets, end of period (000s omitted) | $5,334,340 | $3,984,940 | $3,475,314 | $2,790,071 | $3,423,366 |

| 1 | Calculated based upon average shares outstanding |

| Gross unrealized gains | $2,094,219,494 |

| Gross unrealized losses | (613,213,989) |

| Net unrealized gains | $1,481,005,505 |

| ■ | Level 1 – quoted prices in active markets for identical securities |

| ■ | Level 2 – other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) |

| ■ | Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

| Quoted prices (Level 1) | Other significant observable inputs (Level 2) | Significant unobservable inputs (Level 3) | Total | |

| Assets | ||||

| Investments in: | ||||

| Common stocks | ||||

| Argentina | $ 16,611,120 | $ 0 | $0 | $ 16,611,120 |

| Brazil | 362,074,896 | 0 | 0 | 362,074,896 |

| Chile | 70,301,418 | 0 | 0 | 70,301,418 |

| China | 1,887,516,953 | 19,183,865 | 0 | 1,906,700,818 |

| Colombia | 17,932,663 | 0 | 0 | 17,932,663 |

| Hong Kong | 282,985,637 | 0 | 0 | 282,985,637 |

| India | 654,468,495 | 0 | 0 | 654,468,495 |

| Indonesia | 127,590,269 | 0 | 0 | 127,590,269 |

| Luxembourg | 8,229,999 | 0 | 0 | 8,229,999 |

| Mexico | 436,168,158 | 0 | 0 | 436,168,158 |

| Nigeria | 8,298,433 | 0 | 0 | 8,298,433 |

| Peru | 7,065,957 | 0 | 0 | 7,065,957 |

| Philippines | 35,171,068 | 0 | 0 | 35,171,068 |

| Russia | 229,545,121 | 0 | 0 | 229,545,121 |

| South Africa | 119,698,391 | 0 | 0 | 119,698,391 |

| South Korea | 616,896,329 | 0 | 0 | 616,896,329 |

| Taiwan | 759,357,426 | 0 | 0 | 759,357,426 |

| Thailand | 108,226,559 | 0 | 0 | 108,226,559 |

| Turkey | 3,891,401 | 0 | 0 | 3,891,401 |

| Convertible debentures | 0 | 0 | 0 | 0 |

| Investment companies | 30,552,000 | 0 | 0 | 30,552,000 |

| Preferred stocks | ||||

| Brazil | 17,276,948 | 0 | 0 | 17,276,948 |

| Short-term investments | ||||

| Investment companies | 389,158,599 | 0 | 0 | 389,158,599 |

| Total assets | $6,189,017,840 | $19,183,865 | $0 | $6,208,201,705 |

| Average daily net assets | Management fee |

| First $1 billion | 1.050% |

| Next $1 billion | 1.025 |

| Next $2 billion | 1.000 |

| Next $1 billion | 0.975 |

| Next $3 billion | 0.965 |

| Next $2 billion | 0.955 |

| Over $10 billion | 0.945 |

| Class-level administration fee | |

| Class A | 0.21% |

| Class C | 0.21 |

| Class R6 | 0.03 |

| Administrator Class | 0.13 |

| Institutional Class | 0.13 |

| Expense ratio caps | |

| Class A | 1.44% |

| Class C | 2.19 |

| Class R6 | 1.01 |

| Administrator Class | 1.36 |

| Institutional Class | 1.11 |

| Counterparty | Value of securities on loan | Collateral received1 | Net amount |

| Bank of America Securities Incorporated | $13,017,760 | $(13,017,760) | $0 |

| Barclays Capital Incorporated | 8,685,374 | (8,685,374) | 0 |

| Citigroup Global Markets Incorporated | 546,462 | (546,462) | 0 |

| JPMorgan Securities LLC | 14,983,227 | (14,983,227) | 0 |

| Morgan Stanley & Co. LLC | 6,669,710 | (6,669,710) | 0 |

| UBS Securities LLC | 875,836 | (875,836) | 0 |

| Undistributed ordinary income | Unrealized gains | Capital loss carryforward |

| $27,855,271 | $1,480,002,666 | $(8,344,422) |

Allspring Funds Trust:

| Shares voted “For” | 95,280,657 | |

| Shares voted “Against” | 571,567 | |

| Shares voted “Abstain” | 618,276 |

| Shares voted “For” | 95,270,009 | |

| Shares voted “Against” | 571,207 | |

| Shares voted “Abstain” | 629,284 |

| Name and year of birth | Position held and length of service* | Principal occupations during past five years or longer | Current other public company or investment company directorships |

| William R. Ebsworth (Born 1957) | Trustee, since 2015 | Retired. From 1984 to 2013, equities analyst, portfolio manager, research director and chief investment officer at Fidelity Management and Research Company in Boston, Tokyo, and Hong Kong, and retired in 2013 as Chief Investment Officer of Fidelity Strategic Advisers, Inc. where he led a team of investment professionals managing client assets. Prior thereto, Board member of Hong Kong Securities Clearing Co., Hong Kong Options Clearing Corp., the Thailand International Fund, Ltd., Fidelity Investments Life Insurance Company, and Empire Fidelity Investments Life Insurance Company. Audit Committee Chair and Investment Committee Chair of the Vincent Memorial Hospital Endowment (non-profit organization). Mr. Ebsworth is a CFA® charterholder. | N/A |

| Jane A. Freeman (Born 1953) | Trustee, since 2015; Chair Liaison, since 2018 | Retired. From 2012 to 2014 and 1999 to 2008, Chief Financial Officer of Scientific Learning Corporation. From 2008 to 2012, Ms. Freeman provided consulting services related to strategic business projects. Prior to 1999, Portfolio Manager at Rockefeller & Co. and Scudder, Stevens & Clark. Board member of the Harding Loevner Funds from 1996 to 2014, serving as both Lead Independent Director and chair of the Audit Committee. Board member of the Russell Exchange Traded Funds Trust from 2011 to 2012 and the chair of the Audit Committee. Ms. Freeman is also an inactive Chartered Financial Analyst. | N/A |

| Isaiah Harris, Jr. (Born 1952) | Trustee, since 2009; Audit Committee Chair, since 2019 | Retired. Chairman of the Board of CIGNA Corporation since 2009, and Director since 2005. From 2003 to 2011, Director of Deluxe Corporation. Prior thereto, President and CEO of BellSouth Advertising and Publishing Corp. from 2005 to 2007, President and CEO of BellSouth Enterprises from 2004 to 2005 and President of BellSouth Consumer Services from 2000 to 2003. Emeritus member of the Iowa State University Foundation Board of Governors. Emeritus Member of the Advisory Board of Iowa State University School of Business. Advisory Board Member, Palm Harbor Academy (private school). Mr. Harris is a certified public accountant (inactive status). | CIGNA Corporation |

| Judith M. Johnson** (Born 1949) | Trustee, since 2008 | Retired. Prior thereto, Chief Executive Officer and Chief Investment Officer of Minneapolis Employees Retirement Fund from 1996 to 2008. Ms. Johnson is an attorney, certified public accountant and a certified managerial accountant. | N/A |

| David F. Larcker (Born 1950) | Trustee, since 2009 | James Irvin Miller Professor of Accounting at the Graduate School of Business (Emeritus), Stanford University, Director of the Corporate Governance Research Initiative and Senior Faculty of The Rock Center for Corporate Governance since 2006. From 2005 to 2008, Professor of Accounting at the Graduate School of Business, Stanford University. Prior thereto, Ernst & Young Professor of Accounting at The Wharton School, University of Pennsylvania from 1985 to 2005. | N/A |

| Name and year of birth | Position held and length of service* | Principal occupations during past five years or longer | Current other public company or investment company directorships |

| Olivia S. Mitchell (Born 1953) | Trustee, since 2006; Nominating and Governance Committee Chair, since 2018 | International Foundation of Employee Benefit Plans Professor, Wharton School of the University of Pennsylvania since 1993. Director of Wharton’s Pension Research Council and Boettner Center on Pensions & Retirement Research, and Research Associate at the National Bureau of Economic Research. Previously, Cornell University Professor from 1978 to 1993. | N/A |

| Timothy J. Penny (Born 1951) | Trustee, since 1996; Chair, since 2018 | President and Chief Executive Officer of Southern Minnesota Initiative Foundation, a non-profit organization, since 2007. Member of the Board of Trustees of NorthStar Education Finance, Inc., a non-profit organization, since 2007. | N/A |

| James G. Polisson (Born 1959) | Trustee, since 2018 | Retired. Chief Marketing Officer, Source (ETF) UK Services, Ltd, from 2015 to 2017. From 2012 to 2015, Principal of The Polisson Group, LLC, a management consulting, corporate advisory and principal investing company. Chief Executive Officer and Managing Director at Russell Investments, Global Exchange Traded Funds from 2010 to 2012. Managing Director of Barclays Global Investors from 1998 to 2010 and Global Chief Marketing Officer for iShares and Barclays Global Investors from 2000 to 2010. Trustee of the San Francisco Mechanics’ Institute, a non-profit organization, from 2013 to 2015. Board member of the Russell Exchange Traded Fund Trust from 2011 to 2012. Director of Barclays Global Investors Holdings Deutschland GmbH from 2006 to 2009. Mr. Polisson is an attorney and has a retired status with the Massachusetts and District of Columbia Bar Associations. | N/A |

| Pamela Wheelock (Born 1959) | Trustee, since January 2020; previously Trustee from January 2018 to July 2019 | Board member of the Destination Medical Center Economic Development Agency, Rochester, Minnesota since 2019. Interim President of the McKnight Foundation from January to September 2020. Acting Commissioner, Minnesota Department of Human Services, July 2019 through September 2019. Human Services Manager (part-time), Minnesota Department of Human Services, October 2019 through December 2019. Chief Operating Officer, Twin Cities Habitat for Humanity from 2017 to 2019. Vice President of University Services, University of Minnesota from 2012 to 2016. Prior thereto, on the Board of Directors, Governance Committee and Finance Committee for the Minnesota Philanthropy Partners (Saint Paul Foundation) from 2012 to 2018, Interim Chief Executive Officer of Blue Cross Blue Shield of Minnesota from 2011 to 2012, Chairman of the Board from 2009 to 2012 and Board Director from 2003 to 2015. Vice President, Leadership and Community Engagement, Bush Foundation, Saint Paul, Minnesota (a private foundation) from 2009 to 2011. Executive Vice President and Chief Financial Officer, Minnesota Sports and Entertainment from 2004 to 2009 and Senior Vice President from 2002 to 2004. Executive Vice President of the Minnesota Wild Foundation from 2004 to 2008. Commissioner of Finance, State of Minnesota, from 1999 to 2002. Currently Board Chair of the Minnesota Wild Foundation since 2010. | N/A |

| Name and year of birth | Position held and length of service | Principal occupations during past five years or longer |

| Andrew Owen (Born 1960) | President, since 2017 | President, Chief Executive Officer and Director of Allspring Funds Management, LLC since 2017 and co-president of Galliard Capital Management, LLC, an affiliate of Allspring Funds Management, LLC, since 2019. Prior thereto, Head of Affiliated Managers, Allspring Global Investments, from 2014 to 2019 and Executive Vice President responsible for marketing, investments and product development for Allspring Funds Management, LLC, from 2009 to 2014. In addition, Mr. Owen was an Executive Vice President of Wells Fargo & Company from 2014 to 2021. |

| Jeremy DePalma (Born 1974) | Treasurer, since 2012 (for certain funds in the Fund Complex); since 2021 (for the remaining funds in the Fund Complex) | Senior Vice President of Allspring Funds Management, LLC since 2009. Senior Vice President of Evergreen Investment Management Company, LLC from 2008 to 2010 and head of the Fund Reporting and Control Team within Fund Administration. |

| Kate McKinley (Born 1977) | Chief Legal Officer and Chief Compliance Officer, since 2021 | Chief Legal Officer of Allspring Global Investments since 2021. Prior thereto, held various roles at State Street Global Advisors, Inc. beginning in 2010, including serving as Senior Vice President and General Counsel from 2019 to 2021. Previously served as Assistant General Counsel for Bank of America Corporation from 2005 to 2010 and as an Associate at WilmerHale from 2002 to 2005. |

| Matthew Prasse (Born 1983) | Secretary, since 2021 | Senior Counsel of the Allspring Legal Department since 2021. Senior Counsel of the Wells Fargo Legal Department from 2018 to 2021. Previously, Counsel for Barings LLC from 2015 to 2018. Prior to joining Barings, Associate at Morgan, Lewis & Bockius LLP from 2008 to 2015. |

| Wells Fargo Adjustable Rate Government Fund |

| Wells Fargo Asset Allocation Fund |

| Wells Fargo Conservative Income Fund |

| Wells Fargo Diversified Capital Builder Fund |

| Wells Fargo Diversified Income Builder Fund |

| Wells Fargo Emerging Markets Equity Fund |

| Wells Fargo Emerging Markets Equity Income Fund |

| Wells Fargo Global Small Cap Fund |

| Wells Fargo Government Securities Fund |

| Wells Fargo High Yield Bond Fund |

| Wells Fargo Income Plus Fund |

| Wells Fargo Index Asset Allocation Fund |

| Wells Fargo International Bond Fund |

| Wells Fargo International Equity Fund |

| Wells Fargo Precious Metals Fund |

| Wells Fargo Short Duration Government Bond Fund |

| Wells Fargo Short-Term Bond Plus Fund |

| Wells Fargo Short-Term High Yield Bond Fund |

| Wells Fargo Ultra Short-Term Income Fund |

| Wells Fargo Utility and Telecommunications Fund |

| ■ | Information regarding the Transaction: information about the structure, financing sources and material terms and conditions of the Transaction, including the expected impact on the businesses conducted by the Advisers and by Wells Fargo Funds Distributor LLC, as the distributor of Fund shares. |

| ■ | Information regarding NewCo, GTCR and Reverence Capital: (i) information about NewCo, including information about its expected financial condition and access to capital, and senior leadership team; (ii) the experience of senior management at GTCR and Reverence Capital in acquiring portfolio companies; (iii) the plan to operationalize NewCo, including the transition of necessary infrastructure services through a transition services agreement with Wells Fargo under which Wells Fargo will continue to provide NewCo with certain services for a specified period of time after the closing; and (iv) information regarding regulatory matters, compliance, and risk management functions at NewCo, including resources to be dedicated thereto. |

| ■ | Impact of the Transaction on WFAM and Service Providers: (i) information regarding any changes to personnel and/or other resources of the Advisers as a result of the Transaction, including assurances regarding comparable and competitive compensation arrangements to attract and retain highly qualified personnel; and (ii) information about the organizational and operating structure with respect to NewCo, the Advisers and the Funds. |

| ■ | Impact of the Transaction on the Funds and their Shareholders: (i) information regarding anticipated benefits to the Funds as a result of the Transaction; (ii) a commitment that the Funds would not bear any expenses, directly or indirectly, in connection with the Transaction; (iii) confirmation that the Advisers intend to continue to manage the Funds in a manner consistent with each Fund’s current investment objectives and principal investments strategies; and (iv) a commitment that neither NewCo nor WFAM will take any steps that would impose any “unfair burden” (as that term is used in section 15(f)(1)(B) of the 1940 Act) on the Funds as a result of the Transaction. |

P.O. Box 219967

Kansas City, MO 64121-9967

1-800-222-8222 or visit the Fund's website at allspringglobal.com. Read the prospectus carefully before you invest or send money.

A238/AR238 10-21

Equity Income Fund

| 2 | |

| 6 | |

| 10 | |

| 11 | |

| Financial statements | |

| 16 | |

| 17 | |

| 18 | |

| 19 | |

| 25 | |

| 33 | |

| 34 | |

| Board considerations | |

| 38 | |

| 42 | |

| 47 |

| 1 | The S&P 500 Index consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market-value-weighted index with each stock's weight in the index proportionate to its market value. You cannot invest directly in an index. |

| 2 | The Morgan Stanley Capital International (MSCI) All Country World Index (ACWI) ex USA Index (Net) is a free-float-adjusted market-capitalization-weighted index that is designed to measure the equity market performance of developed and emerging markets, excluding the U.S. Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indexes or any securities or financial products. This report is not approved, reviewed, or produced by MSCI. You cannot invest directly in an index. |

| 3 | The MSCI Emerging Markets (EM) Index (Net) (USD) is a free-float-adjusted market-capitalization-weighted index that is designed to measure equity market performance of emerging markets. You cannot invest directly in an index. |

| 4 | The Bloomberg U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment-grade, U.S.-dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, mortgage-backed securities (agency fixed-rate and hybrid adjustable-rate mortgage pass-throughs), asset-backed securities, and commercial mortgage-backed securities. You cannot invest directly in an index. |

| 5 | The Bloomberg Global Aggregate ex-USD Index (unhedged) is an unmanaged index that provides a broad-based measure of the global investment-grade fixed-income markets excluding the U.S.-dollar-denominated debt market. You cannot invest directly in an index. |

| 6 | The Bloomberg Municipal Bond Index is an unmanaged index composed of long-term tax-exempt bonds with a minimum credit rating of Baa. You cannot invest directly in an index. |

| 7 | The ICE BofA U.S. High Yield Index is a market-capitalization-weighted index of domestic and Yankee high-yield bonds. The index tracks the performance of high-yield securities traded in the U.S. bond market. You cannot invest directly in an index. Copyright 2021. ICE Data Indices, LLC. All rights reserved. |

| 1 | As of September 30, 2021, assets under management (AUM) includes $93 billion from Galliard Capital Management, LLC, an investment advisor that is not part of the Allspring trade name/GIPS firm. |

President

Allspring Funds

| Investment objective | The Fund seeks long-term capital appreciation and current income. |

| Manager | Allspring Funds Management, LLC |

| Subadviser | Allspring Global Investments, LLC |

| Portfolio managers | Alison Shimada, Elaine Tse |

| Average annual total returns (%) as of October 31, 2021 | |||||||||||

| Including sales charge | Excluding sales charge | Expense ratios1 (%) | |||||||||

| Inception date | 1 year | 5 year | Since inception | 1 year | 5 year | Since inception | Gross | Net 2 | |||

| Class A (EQIAX) | 5-31-2012 | 17.75 | 5.18 | 4.78 | 24.93 | 6.44 | 5.44 | 1.66 | 1.55 | ||

| Class C (EQICX) | 5-31-2012 | 23.00 | 5.62 | 4.65 | 24.00 | 5.62 | 4.65 | 2.41 | 2.30 | ||

| Class R (EQIHX)3 | 9-30-2015 | – | – | – | 24.58 | 6.22 | 5.21 | 1.91 | 1.80 | ||

| Class R6 (EQIRX)4 | 9-30-2015 | – | – | – | 25.44 | 6.89 | 5.89 | 1.23 | 1.17 | ||

| Administrator Class (EQIDX) | 5-31-2012 | – | – | – | 25.03 | 6.58 | 5.63 | 1.58 | 1.45 | ||

| Institutional Class (EQIIX) | 5-31-2012 | – | – | – | 25.27 | 6.80 | 5.84 | 1.33 | 1.22 | ||

| MSCI EM Index (Net) (USD)5 | – | – | – | – | 16.96 | 9.39 | 6.09 * | – | – | ||

| MSCI EM High Dividend Yield Index (Net) (USD)6 | – | – | – | – | 27.21 | 5.87 | 2.98 * | – | – | ||

| * | Based on the inception date of the oldest Fund class. |

| 1 | Reflects the expense ratios as stated in the most recent prospectuses. The expense ratios shown are subject to change and may differ from the annualized expense ratios shown in the financial highlights of this report. |

| 2 | The manager has contractually committed through February 28, 2022, to waive fees and/or reimburse expenses to the extent necessary to cap total annual fund operating expenses after fee waivers at 1.55% for Class A, 2.30% for Class C, 1.80% for Class R, 1.17% for Class R6, 1.45% for Administrator Class, and 1.22% for Institutional Class. Brokerage commissions, stamp duty fees, interest, taxes, acquired fund fees and expenses (if any), and extraordinary expenses are excluded from the expense caps. Prior to or after the commitment expiration date, the caps may be increased or the commitment to maintain the caps may be terminated only with the approval of the Board of Trustees. Without these caps, the Fund’s returns would have been lower. The expense ratio paid by an investor is the net expense ratio (the total annual fund operating expenses after fee waivers) as stated in the prospectuses. |

| 3 | Historical performance shown for the Class R shares prior to their inception reflects the performance of the Administrator Class shares, adjusted to reflect the higher expenses applicable to the Class R shares. |

| 4 | Historical performance shown for the Class R6 shares prior to their inception reflects the performance of the Institutional Class shares, and includes the higher expenses applicable to the Institutional Class shares. If these expenses had not been included, returns for the Class R6 shares would be higher. |

| 5 | The Morgan Stanley Capital International (MSCI) Emerging Markets (EM) Index (Net) (USD) is a free-float-adjusted market-capitalization-weighted index that is designed to measure the equity market performance of emerging markets. Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed, or produced by MSCI. You cannot invest directly in an index. |

| 1 | The chart compares the performance of Class A shares for the most recent ten years with the MSCI EM Index (Net) (USD) and MSCI EM High Dividend Yield Index (Net) (USD). The chart assumes a hypothetical investment of $10,000 in Class A shares and reflects all operating expenses and assumes the maximum initial sales charge of 5.75%. |

| 6 | The MSCI EM High Dividend Yield Index (Net) (USD) is based on the MSCI EM Index, its parent index, and includes large and mid-cap stocks. The index is designed to reflect the performance of equities in the parent index (excluding REITs) with higher dividend income and quality characteristics than average dividend yields that are both sustainable and persistent. The index also applies quality screens and reviews 12-month past performance to omit stocks with potentially deteriorating fundamentals that could force them to cut or reduce dividends. You cannot invest directly in an index. |

| ■ | The Fund outperformed the MSCI EM Index (Net) (USD) for the 12-month period that ended October 31, 2021. |

| ■ | Stock selection within the consumer discretionary, information technology (IT), and communication services sectors added value but was partially offset by unfavorable stock selection in the energy, financials, and materials sectors, as well as underweight positions within the energy and materials sectors. |

| ■ | Stock selection within China/Hong Kong, Korea, and Taiwan drove positive performance during the period but was partially offset by positioning in India, Saudi Arabia, and Thailand. |

| Ten largest holdings (%) as of October 31, 20211 | |

| Taiwan Semiconductor Manufacturing Company Limited | 6.99 |

| Samsung Electronics Company Limited | 3.01 |

| Alibaba Group Holding Limited ADR | 2.26 |

| Power Grid Corporation of India Limited | 1.65 |

| Midea Group Company Limited Class A | 1.63 |

| Infosys Limited | 1.55 |

| Baidu Incorporated Class A | 1.53 |

| China Construction Bank Class H | 1.48 |

| Postal Savings Bank of China Company Limited Class H | 1.47 |

| Manappuram Finance Limited | 1.40 |

| 1 | Figures represent the percentage of the Fund's net assets. Holdings are subject to change and may have changed since the date specified. |

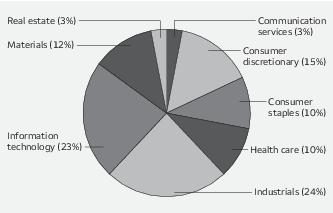

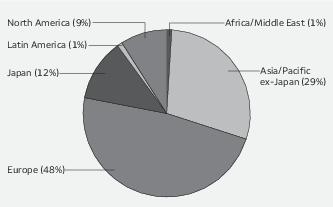

| Sector allocation as of October 31, 20211 |

| 1 | Figures represent the percentage of the Fund's long-term investments. These amounts are subject to change and may have changed since the date specified. |

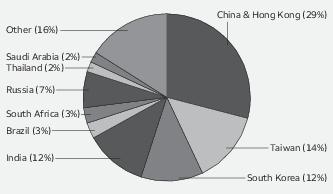

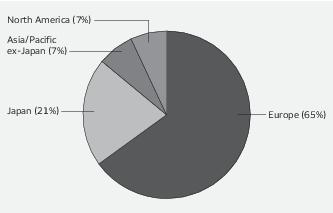

| Country allocation as of October 31, 20211 |

| 1 | Figures represent the percentage of the Fund's long-term investments. These amounts are subject to change and may have changed since the date specified. |

| Beginning account value 5-1-2021 | Ending account value 10-31-2021 | Expenses paid during the period1 | Annualized net expense ratio | |

| Class A | ||||

| Actual | $1,000.00 | $ 976.68 | $ 7.67 | 1.54% |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,017.44 | $ 7.83 | 1.54% |

| Class C | ||||

| Actual | $1,000.00 | $ 973.00 | $11.44 | 2.30% |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,013.61 | $11.67 | 2.30% |

| Class R | ||||

| Actual | $1,000.00 | $ 975.82 | $ 8.96 | 1.80% |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,016.13 | $ 9.15 | 1.80% |

| Class R6 | ||||

| Actual | $1,000.00 | $ 978.83 | $ 5.84 | 1.17% |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,019.31 | $ 5.96 | 1.17% |

| Administrator Class | ||||

| Actual | $1,000.00 | $ 977.37 | $ 7.23 | 1.45% |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,017.90 | $ 7.38 | 1.45% |

| Institutional Class | ||||

| Actual | $1,000.00 | $ 978.37 | $ 6.08 | 1.22% |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,019.06 | $ 6.21 | 1.22% |

| Shares | Value | |||||

| Common stocks: 94.45% | ||||||

| Brazil: 2.30% | ||||||

| Ambev SA (Consumer staples, Beverages) | 826,800 | $ 2,488,985 | ||||

| Banco BTG Pactual SA (Financials, Capital markets) | 459,172 | 1,834,638 | ||||

| BB Seguridade Participacoes SA (Financials, Insurance) | 720,700 | 2,820,841 | ||||

| Companhia Brasileira de Aluminio (Materials, Metals & mining) † | 720,400 | 1,630,020 | ||||

| 8,774,484 | ||||||

| Chile: 1.61% | ||||||

| Banco Santander Chile SA (Financials, Banks) | 59,051,931 | 2,584,203 | ||||

| Sociedad Quimica Minera de Chile (Materials, Chemicals) | 65,120 | 3,574,437 | ||||

| 6,158,640 | ||||||

| China: 25.88% | ||||||

| Alibaba Group Holding Limited ADR (Consumer discretionary, Internet & direct marketing retail) † | 411,000 | 8,610,372 | ||||

| Baidu Incorporated Class A (Communication services, Interactive media & services) † | 280,344 | 5,837,122 | ||||

| Baoshan Iron & Steel Company Limited Class A (Materials, Metals & mining) | 1,799,710 | 2,005,209 | ||||

| Beijing Jingneng Power Company Class H (Utilities, Electric utilities) | 6,088,000 | 1,838,802 | ||||

| China Construction Bank Class H (Financials, Banks) | 8,345,000 | 5,673,806 | ||||

| China International Capital Corporation Limited Class H (Financials, Capital markets) 144A | 987,600 | 2,457,417 | ||||

| China Merchants Bank Company Limited Class H (Financials, Banks) | 356,500 | 3,003,480 | ||||

| China Resources Land Limited (Real estate, Real estate management & development) | 1,162,000 | 4,525,236 | ||||

| China State Construction International Holdings (Industrials, Construction & engineering) | 3,184,000 | 3,269,733 | ||||

| China Yongda Automobile Service Holding Company (Consumer discretionary, Specialty retail) | 1,821,500 | 2,912,340 | ||||

| ENN Energy Holdings Limited (Utilities, Gas utilities) | 131,800 | 2,281,789 | ||||

| Gree Electric Appliances Incorporated Class A (Consumer discretionary, Household durables) | 471,040 | 2,697,735 | ||||

| Inner Mongolia Yili Industrial Group Company Limited Class A (Consumer staples, Food products) | 574,078 | 3,857,508 | ||||

| Kunlun Energy Company Limited (Utilities, Gas utilities) | 2,154,000 | 1,971,143 | ||||

| Lenovo Group Limited (Information technology, Technology hardware, storage & peripherals) | 2,692,000 | 2,927,102 | ||||

| Lomon Billions Group Company Limited (Materials, Chemicals) | 443,675 | 1,968,330 | ||||

| Midea Group Company Limited Class A (Consumer discretionary, Household durables) | 581,159 | 6,245,418 | ||||

| Nari Technology Company Limited (Industrials, Electrical equipment) | 421,701 | 2,565,409 | ||||

| Nine Dragons Paper Holdings Limited (Materials, Paper & forest products) | 1,669,000 | 2,097,914 | ||||

| Ping An Insurance Group Company Class H (Financials, Insurance) | 725,000 | 5,208,855 | ||||

| Postal Savings Bank of China Company Limited Class H (Financials, Banks) 144A | 7,700,000 | 5,601,440 | ||||

| Shimao Property Holding Limited (Real estate, Real estate management & development) | 1,504,000 | 2,366,038 | ||||

| Tingyi Holding Corporation (Consumer staples, Food products) | 2,614,000 | 4,891,696 | ||||

| Topsports International Holdings Limited (Consumer discretionary, Specialty retail) 144A | 3,187,000 | 3,874,946 | ||||

| Universal Scientific Industrial Shanghai Company Limited Class A (Information technology, Electronic equipment, instruments & components) | 742,000 | 1,609,389 | ||||

| Xinyangfeng Agricultural Technology Company Limited (Materials, Chemicals) | 775,900 | 2,201,857 |

| Shares | Value | |||||

| China: (continued) | ||||||

| Zhejiang NHU Company Limited (Health care, Biotechnology) | 918,918 | $ 3,897,213 | ||||

| Zoomlion Heavy Industry Science and Technology Company Limited Class H (Industrials, Machinery) | 3,370,000 | 2,434,214 | ||||

| 98,831,513 | ||||||

| Hong Kong: 2.49% | ||||||

| China Merchants Port Holdings Company Limited (Industrials, Transportation infrastructure) | 2,056,000 | 3,435,255 | ||||

| Chow Tai Fook Jewellery Company Limited (Consumer discretionary, Specialty retail) | 1,622,400 | 3,319,659 | ||||

| Hong Kong Exchanges & Clearing Limited (Financials, Capital markets) | 45,500 | 2,753,216 | ||||

| 9,508,130 | ||||||

| India: 11.94% | ||||||

| Embassy Office Parks REIT (Real estate, Equity REITs) | 845,809 | 3,949,302 | ||||

| Gail India Limited (Utilities, Gas utilities) | 2,095,598 | 4,165,659 | ||||

| Hero Motorcorp Limited (Consumer discretionary, Automobiles) | 62,473 | 2,216,803 | ||||

| ICICI Securities Limited (Financials, Capital markets) 144A | 327,311 | 3,225,848 | ||||

| Indus Towers Limited (Communication services, Diversified telecommunication services) | 511,062 | 1,852,978 | ||||

| Infosys Limited (Information technology, IT services) | 266,578 | 5,937,207 | ||||

| LIC Housing Finance Limited (Financials, Diversified financial services) | 796,893 | 4,329,734 | ||||

| Mahanagar Gas Limited (Utilities, Gas utilities) | 129,318 | 1,732,414 | ||||

| Manappuram Finance Limited (Financials, Consumer finance) | 1,925,059 | 5,342,155 | ||||

| Oil & Natural Gas Corporation Limited (Energy, Oil, gas & consumable fuels) | 1,433,536 | 2,853,432 | ||||

| Power Grid Corporation of India Limited (Utilities, Electric utilities) | 2,544,814 | 6,288,862 | ||||

| Tech Mahindra Limited (Information technology, IT services) | 187,462 | 3,699,734 | ||||

| 45,594,128 | ||||||

| Indonesia: 1.88% | ||||||

| PT Bank Rakyat Indonesia Tbk (Financials, Banks) | 10,614,000 | 3,184,013 | ||||

| PT Telekomunikasi Indonesia Persero Tbk (Communication services, Diversified telecommunication services) | 14,838,000 | 3,979,841 | ||||

| 7,163,854 | ||||||

| Malaysia: 1.73% | ||||||

| Genting Malaysia Bhd (Consumer discretionary, Hotels, restaurants & leisure) | 5,443,800 | 4,167,314 | ||||

| RHB Bank Bhd (Financials, Banks) | 1,809,600 | 2,438,437 | ||||

| 6,605,751 | ||||||

| Mexico: 2.11% | ||||||

| America Movil SAB de CV ADR (Communication services, Wireless telecommunication services) | 120,238 | 2,137,832 | ||||

| Grupo Financiero Banorte SAB de CV (Financials, Banks) | 473,000 | 2,989,908 | ||||

| Walmart de Mexico SAB de CV (Consumer staples, Food & staples retailing) | 835,691 | 2,911,605 | ||||

| 8,039,345 | ||||||

| Netherlands: 1.33% | ||||||

| Prosus NV (Consumer discretionary, Internet & direct marketing retail) | 21,163 | 1,849,847 | ||||

| X5 Retail Group NV (Consumer staples, Food & staples retailing) | 94,496 | 3,218,175 | ||||

| 5,068,022 |

| Shares | Value | |||||

| Panama: 0.72% | ||||||

| Copa Holdings SA Class A (Industrials, Airlines) † | 37,262 | $ 2,755,898 | ||||

| Peru: 0.96% | ||||||

| Southern Copper Corporation (Materials, Metals & mining) | 61,200 | 3,671,388 | ||||

| Philippines: 0.83% | ||||||

| Bank of the Philippine Islands (Financials, Banks) | 936,740 | 1,615,742 | ||||

| International Container Terminal Services Incorporated (Industrials, Transportation infrastructure) | 435,210 | 1,554,013 | ||||

| 3,169,755 | ||||||

| Poland: 0.53% | ||||||

| Powszechny Zaklad Ubezpieczen SA (Financials, Insurance) | 203,157 | 2,031,748 | ||||

| Qatar: 0.76% | ||||||

| Qatar National Bank (Financials, Banks) | 512,942 | 2,888,028 | ||||

| Russia: 6.39% | ||||||

| Alrosa PJSC (Materials, Metals & mining) | 2,014,160 | 3,560,558 | ||||

| Detsky Mir PJSC (Consumer discretionary, Multiline retail) | 1,077,930 | 2,078,395 | ||||

| Fix Price Group Limited GDR (Consumer discretionary, Specialty retail) | 220,629 | 1,921,679 | ||||

| Lukoil PJSC ADR (Energy, Oil, gas & consumable fuels) | 38,883 | 3,966,066 | ||||

| Mobile TeleSystems PJSC (Communication services, Wireless telecommunication services) | 518,030 | 2,271,302 | ||||

| Moscow Exchange MICEX-RTS PJSC (Financials, Capital markets) | 1,272,530 | 3,114,488 | ||||

| Rosneft Oil Company PJSC (Energy, Oil, gas & consumable fuels) | 302,430 | 2,708,529 | ||||

| Sberbank PJSC ADR (Financials, Banks) | 239,911 | 4,803,018 | ||||

| 24,424,035 | ||||||

| Saudi Arabia: 1.92% | ||||||

| Jarir Marketing Company (Consumer discretionary, Specialty retail) | 52,294 | 2,827,381 | ||||

| National Commercial Bank (Financials, Banks) | 256,496 | 4,506,408 | ||||

| 7,333,789 | ||||||

| Singapore: 0.76% | ||||||

| BOC Aviation Limited (Industrials, Trading companies & distributors) 144A | 332,200 | 2,914,035 | ||||

| South Africa: 3.36% | ||||||

| Absa Group Limited (Financials, Banks) | 282,140 | 2,585,899 | ||||

| Impala Platinum Holdings Limited (Materials, Metals & mining) | 168,832 | 2,188,350 | ||||

| Mr Price Group Limited (Consumer discretionary, Specialty retail) | 128,316 | 1,679,743 | ||||

| Standard Bank Group Limited (Financials, Banks) | 312,338 | 2,769,227 | ||||

| The Bidvest Group Limited (Industrials, Industrial conglomerates) | 289,065 | 3,621,876 | ||||

| 12,845,095 | ||||||

| South Korea: 9.14% | ||||||

| Doosan Bobcat Incorporated (Industrials, Machinery) † | 80,557 | 2,623,075 | ||||

| Hana Financial Group Incorporated (Financials, Banks) | 101,805 | 3,920,436 | ||||

| Kangwon Land Incorporated (Consumer discretionary, Hotels, restaurants & leisure) † | 123,288 | 2,933,042 | ||||

| KB Financial Group Incorporated (Financials, Banks) | 110,238 | 5,339,498 | ||||

| Kia Corporation (Consumer discretionary, Automobiles) | 30,289 | 2,205,805 | ||||

| Samsung Electronics Company Limited (Information technology, Technology hardware, storage & peripherals) | 192,431 | 11,494,317 |

| Shares | Value | |||||

| South Korea: (continued) | ||||||

| Samsung Fire & Marine Insurance Company Limited (Financials, Insurance) | 14,730 | $ 2,911,839 | ||||

| SK Telecom Company Limited (Communication services, Wireless telecommunication services) ♦ | 13,161 | 3,485,798 | ||||

| 34,913,810 | ||||||

| Taiwan: 14.02% | ||||||

| Advantech Company Limited (Information technology, Technology hardware, storage & peripherals) | 252,000 | 3,289,498 | ||||

| CTBC Financial Holding Company Limited (Financials, Banks) | 3,346,000 | 2,791,492 | ||||