UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-09253

Allspring Funds Trust

(Exact name of registrant as specified in charter)

525 Market St., San Francisco, CA 94105

(Address of principal executive offices) (Zip code)

Matthew Prasse

Allspring Funds Management, LLC

525 Market St., San Francisco, CA 94105

(Name and address of agent for service)

Registrant’s telephone number, including area code: 800-222-8222

Date of fiscal year end: September 30

Registrant is making a filing for 12 of its series:

Allspring Diversified Capital Builder Fund, Allspring Diversified Income Builder Fund, Allspring Index Asset Allocation Fund, Allspring International Bond Fund, Allspring Income Plus Fund, Allspring Global Investment Grade Credit Fund, Allspring C&B Mid Cap Value Fund, Allspring Common Stock Fund, Allspring Discovery SMID Cap Growth Fund, Allspring Discovery Mid Cap Growth Fund, Allspring Opportunity Fund and Allspring Special Mid Cap Value Fund.

Date of reporting period: March 31, 2022

ITEM 1. REPORT TO STOCKHOLDERS

Semi-Annual Report

March 31, 2022

Allspring

C&B Mid Cap Value Fund

The views expressed and any forward-looking statements are as of March 31, 2022, unless otherwise noted, and are those of the Fund's portfolio managers and/or Allspring Global Investments. Discussions of individual securities or the markets generally are not intended as individual recommendations. Future events or results may vary significantly from those expressed in any forward-looking statements. The views expressed are subject to change at any time in response to changing circumstances in the market. Allspring Global Investments disclaims any obligation to publicly update or revise any views expressed or forward-looking statements.

Allspring C&B Mid Cap Value Fund | 1

Letter to shareholders (unaudited)

Andrew Owen

President

Allspring Funds

Dear Shareholder:

We are pleased to offer you this semi-annual report for Allspring C&B Mid Cap Value Fund for the six-month period that ended March 31, 2022. Global stocks and bonds broadly declined during a challenging period. Despite progress on a global economic recovery from COVID-19, persistently high inflation, concerns regarding anticipated tightening of central bank monetary policy, and turmoil caused by the Russian invasion of Ukraine all led to a retreat from financial market gains made earlier in 2021. Among major indexes, the U.S. large-cap-dominated S&P 500 Index was an exception in escaping a half-year loss.

For the six-month period, U.S. stocks, based on the S&P 500 Index,1 gained 5.92%. International stocks, as measured by the MSCI ACWI ex USA Index (Net),2 returned -3.72%, while the MSCI EM Index (Net) (USD),3 trailed both developed market benchmarks with a return of -8.20%. The Bloomberg U.S. Aggregate Bond Index,4returned -5.92%, the Bloomberg Global Aggregate ex-USD Index (unhedged),5 returned -7.26%, the Bloomberg Municipal Bond Index6 returned -5.55%, and the ICE BofA U.S. High Yield Index,7 lost 3.89%.

Inflationary concerns and the Russian-Ukraine war caused markets to retreat.

Elevated inflation pressures and the ongoing global supply bottleneck continued in October, but strong corporate earnings provided a bright spot in the U.S., the eurozone, and many Asian countries. Government bond yields rose globally as central banks prepared to tighten monetary policy. Commodity prices continued to rise, driven by sharply higher energy costs.

In November, as COVID-19 hospitalizations rose, most major global asset classes declined. Two exceptions were U.S. investment-grade bonds and Treasury Inflation-Protected Securities. President Biden signed a long-awaited $550 billion infrastructure bill to upgrade U.S. roads, bridges, and railways. Meanwhile, the Consumer Price Index8, a measure of domestic inflation conditions, jumped to its highest level in 31 years. While the threat of consistently high inflation led the U.S. Federal Reserve (Fed) to discuss a faster pace of tapering, the Omicron strain created uncertainty. Commodities lost ground for the month, driven by sharp declines in oil prices (and energy costs in general) as well as precious metals.

“Elevated inflation pressures and the ongoing global supply bottleneck continued in October, but strong corporate earnings provided a bright spot in the U.S., the eurozone, and many Asian countries.”

| 1 | The S&P 500 Index consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market-value-weighted index with each stock's weight in the index proportionate to its market value. You cannot invest directly in an index. |

| 2 | The Morgan Stanley Capital International (MSCI) All Country World Index (ACWI) ex USA Index (Net) is a free-float-adjusted market-capitalization-weighted index that is designed to measure the equity market performance of developed and emerging markets, excluding the U.S. Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indexes or any securities or financial products. This report is not approved, reviewed, or produced by MSCI. You cannot invest directly in an index. |

| 3 | The MSCI Emerging Markets (EM) Index (Net) (USD) is a free-float-adjusted market-capitalization-weighted index that is designed to measure equity market performance of emerging markets. You cannot invest directly in an index. |

| 4 | The Bloomberg U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment-grade, U.S.-dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, mortgage-backed securities (agency fixed-rate and hybrid adjustable-rate mortgage pass-throughs), asset-backed securities, and commercial mortgage-backed securities. You cannot invest directly in an index. |

| 5 | The Bloomberg Global Aggregate ex-USD Index (unhedged) is an unmanaged index that provides a broad-based measure of the global investment-grade fixed-income markets excluding the U.S.-dollar-denominated debt market. You cannot invest directly in an index. |

| 6 | The Bloomberg Municipal Bond Index is an unmanaged index composed of long-term tax-exempt bonds with a minimum credit rating of Baa. You cannot invest directly in an index. |

| 7 | The ICE BofA U.S. High Yield Index is a market-capitalization-weighted index of domestic and Yankee high-yield bonds. The index tracks the performance of high-yield securities traded in the U.S. bond market. You cannot invest directly in an index. Copyright 2022. ICE Data Indices, LLC. All rights reserved. |

| 8 | The Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. You cannot invest directly in an index. |

2 | Allspring C&B Mid Cap Value Fund

Letter to shareholders (unaudited)

Global volatility lessened in December as data indicated a lower risk of severe disease and death from the Omicron variant. Even so, several countries introduced restrictions on travel and hospitality, among other sectors, in an effort to reduce the spread. In the U.S., data indicated a stable economy overall, with robust corporate earnings. Consumer spending potential looked strong heading into 2022 on elevated household savings and the lowest household debt ratio since 1973. U.S. corporate and high-yield bonds had monthly gains while Treasuries declined. Bonds were strongly affected by the projection of three 25-basis-point (bp; 100 bps equal 1.00%) policy rate hikes in 2022 by senior Federal Open Market Committee members, up from previous projections of just one hike.

In January 2022, the main focus was on potential U.S. interest rate hikes and the Russia-Ukraine conflict. The Fed hinted that a March interest rate hike was likely. Meanwhile, Russia threatened a potential invasion of Ukraine, which could disrupt Russia’s massive energy supplies and drive demand from non-Russian oil-producing countries. Elsewhere overseas, Europe saw food and energy prices spike, leading to rising inflation. Within fixed income, corporate bonds struggled in January, underperforming government bonds, as investors focused on continued elevated inflation and ongoing uncertainty over the U.S. monetary path.

The Russian invasion of Ukraine dominated the financial world in February and March. Equity, bond, and commodities markets were shaken by fear, uncertainty, and an upending of demand-supply dynamics. Major global stock indexes were down in February, along with global bonds overall, with ongoing high levels of volatility in March along with mixed results that favored U.S. large-cap stocks. Prices of commodities spiked, including crude oil, natural gas, wheat, and precious metals, on elevated concerns of supply shortages. All of this fed already-high inflation concerns and added to expectations of more aggressive central bank interest rate hikes. Sweeping sanctions against Russia and corporate pullouts contributed to market volatility. Despite the geopolitical turmoil, the U.S. economic outlook remained largely unchanged, with a healthy job market and signs of economic resilience accompanying higher prices.

Don’t let short-term uncertainty derail long-term investment goals.

Periods of investment uncertainty can present challenges, but experience has taught us that maintaining long-term investment goals can be an effective way to plan for the future. To help you create a sound strategy based on your personal goals and risk tolerance, Allspring Funds offers more than 100 mutual funds spanning a wide range of asset classes and investment styles. Although diversification cannot guarantee an investment profit or prevent losses, we believe it can be an effective way to manage investment risk and potentially smooth out overall portfolio performance. We encourage investors to know their investments and to understand that appropriate levels of risk-taking may unlock opportunities.

Information on transaction closing.

On November 1, 2021, GTCR LLC and Reverence Capital Partners, L.P. announced the beginning of Allspring Global Investments™ with the close of the transaction to acquire Wells Fargo Funds Management, LLC; Wells Capital Management LLC; Galliard Capital Management LLC.; Wells Fargo Asset Management (International) Ltd.; Wells Fargo Asset Management Luxembourg S.A.; and Wells Fargo Funds Distributor, LLC, as well as Wells Fargo Bank, N.A.’s business of acting as trustee to its collective investment trusts and all related Wells Fargo Asset Management legal entities. The transaction closed on November 1, 2021, forming Allspring Global Investments, a privately held asset management firm with $451 billion in AUM1 as of March 31, 2022.

“ The Russian invasion of Ukraine dominated the financial world in February and March. Equity, bond, and commodities markets were shaken by fear, uncertainty, and an upending of demand-supply dynamics.”

| 1 | Figures are as of March 31, 2022, unless otherwise noted. Please note that the assets under management figures provided have been adjusted to eliminate any duplication of reporting among assets directed by multiple investment teams and includes $91.2B from Galliard Capital Management ($74.7B stable value; $16.5B fixed income), an investment advisor that is not part of the Allspring trade name/GIPS firm. |

Allspring C&B Mid Cap Value Fund | 3

Letter to shareholders (unaudited)

For further information about your Fund, contact your investment professional, visit our website at allspringglobal.com, or call us directly at 1-800-222-8222. |

Allspring Global Investments™ is a leading independent asset management firm with a full breadth of investment capabilities across diverse asset classes, serving the needs of its institutional and wealth management clients around the world. Allspring operates across 18 offices globally supported by more than 480 investment professionals. Allspring and its investment teams provide a broad range of differentiated investment products and solutions to help its diverse range of clients meet their investment objectives.

As part of this transition, all mutual funds within the Wells Fargo Funds family were rebranded as Allspring Funds. Each individual fund had “Wells Fargo” removed from its fund name and replaced with “Allspring.” The fund name changes went into effect on December 6, 2021.

Allspring Global Investments™ is the trade name for the asset management firm of Allspring Global Investments Holdings, LLC, a holding company indirectly owned by certain private funds of GTCR LLC and Reverence Capital Partners, L.P.

Thank you for choosing to invest with Allspring Funds. We appreciate your confidence in us and remain committed to helping you meet your financial needs.

Sincerely,

Andrew Owen

President

Allspring Funds

Notice to Shareholders

Russia launched a large-scale invasion of Ukraine on February 24, 2022. As a result of this military action, the United States and many other countries have instituted various economic sanctions against Russian and Belarus individuals and entities. The situation has led to increased financial market volatility and could have severe adverse effects on regional and global economic markets, including the markets for certain securities and commodities, such as oil and natural gas. The extent and duration of the military action, resulting sanctions imposed, other punitive action taken and the resulting market disruptions cannot be easily predicted.

Our solidarity and support goes out to our impacted employees and the people affected in Ukraine and their families. Allspring has a dedicated team of investment professionals actively monitoring the situation for any new developments and the potential impact to our clients and investment products. As the situation remains fluid, we are focused on the assessment of risks, valuation, and liquidity of impacted securities. Please visit our website at allspringglobal.com and click on “Russia-Ukraine Portfolio Impacts” for further information.

4 | Allspring C&B Mid Cap Value Fund

This page is intentionally left blank.

Performance highlights (unaudited)

| Investment objective | The Fund seeks maximum long-term return (current income and capital appreciation), consistent with minimizing risk to principal. |

| Manager | Allspring Funds Management, LLC |

| Subadviser | Cooke & Bieler, L.P. |

| Portfolio managers | Andrew B. Armstrong, CFA®‡, Wesley Lim, CFA®‡, Steve Lyons, CFA®‡, Michael M. Meyer, CFA®‡, Edward W. O'Connor, CFA®‡, R. James O'Neil, CFA®‡, Mehul Trivedi, CFA®‡, William Weber, CFA®‡ |

| Average annual total returns (%) as of March 31, 2022 |

| | | Including sales charge | | Excluding sales charge | | Expense ratios1 (%) |

| | Inception date | 1 year | 5 year | 10 year | | 1 year | 5 year | 10 year | | Gross | Net 2 |

| Class A (CBMAX) | 7-26-2004 | -2.52 | 7.76 | 10.51 | | 3.42 | 9.04 | 11.17 | | 1.26 | 1.26 |

| Class C (CBMCX) | 7-26-2004 | 1.66 | 8.27 | 10.36 | | 2.66 | 8.27 | 10.36 | | 2.01 | 2.01 |

| Class R6 (CBMYX)3 | 7-31-2018 | – | – | – | | 3.89 | 9.51 | 11.58 | | 0.83 | 0.81 |

| Administrator Class (CBMIX) | 7-26-2004 | – | – | – | | 3.53 | 9.15 | 11.26 | | 1.18 | 1.16 |

| Institutional Class (CBMSX) | 7-26-2004 | – | – | – | | 3.80 | 9.43 | 11.54 | | 0.93 | 0.91 |

| Russell Midcap® Value Index4 | – | – | – | – | | 11.45 | 9.99 | 12.01 | | – | – |

Figures quoted represent past performance, which is no guarantee of future results, and do not reflect taxes that a shareholder may pay on an investment in a fund. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance shown without sales charges would be lower if sales charges were reflected. Current performance may be lower or higher than the performance data quoted, which assumes the reinvestment of dividends and capital gains. Current month-end performance is available on the Fund’s website, allspringglobal.com.

Index returns do not include transaction costs associated with buying and selling securities, any mutual fund fees or expenses, or any taxes. It is not possible to invest directly in an index.

For Class A shares, the maximum front-end sales charge is 5.75%. For Class C shares, the maximum contingent deferred sales charge is 1.00%. Performance including a contingent deferred sales charge assumes the sales charge for the corresponding time period. Class R6, Administrator Class and Institutional Class shares are sold without a front-end sales charge or contingent deferred sales charge.

| 1 | Reflects the expense ratios as stated in the most recent prospectuses, which include the impact of 0.01% in acquired fund fees and expenses. The expense ratios shown are subject to change and may differ from the annualized expense ratios shown in the financial highlights of this report, which do not include acquired fund fees and expenses. |

| 2 | The manager has contractually committed through January 31, 2023, to waive fees and/or reimburse expenses to the extent necessary to cap total annual fund operating expenses after fee waivers at 1.25% for Class A, 2.00% for Class C, 0.80% for Class R6, 1.15% for Administrator Class, and 0.90% for Institutional Class. Brokerage commissions, stamp duty fees, interest, taxes, acquired fund fees and expenses (if any), and extraordinary expenses are excluded from the expense caps. Prior to or after the commitment expiration date, the caps may be increased or the commitment to maintain the caps may be terminated only with the approval of the Board of Trustees. Without these caps, the Fund’s returns would have been lower. The expense ratio paid by an investor is the net expense ratio (the total annual fund operating expenses after fee waivers) as stated in the prospectuses. |

| 3 | Historical performance shown for the Class R6 shares prior to their inception reflects the performance of the Institutional Class shares, and includes the higher expenses applicable to the Institutional Class shares. If these expenses had not been included, returns for the Class R6 shares would be higher. |

| 4 | The Russell Midcap® Value Index measures the performance of those Russell Midcap companies with lower price/book ratios and lower forecasted growth values. The stocks are also members of the Russell 1000® Value Index. You cannot invest directly in an index |

Stock values fluctuate in response to the activities of individual companies and general market and economic conditions. Smaller-company stocks tend to be more volatile and less liquid than those of larger companies. Consult the Fund’s prospectus for additional information on these and other risks.

| ‡ | CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute. |

6 | Allspring C&B Mid Cap Value Fund

Performance highlights (unaudited)

| Ten largest holdings (%) as of March 31, 20221 |

| Helen of Troy Limited | 3.41 |

| Arrow Electronics Incorporated | 3.40 |

| Arch Capital Group Limited | 3.20 |

| Fidelity National Financial Incorporated | 2.89 |

| Gildan Activewear Incorporated | 2.74 |

| State Street Corporation | 2.67 |

| Globe Life Incorporated | 2.63 |

| Gentex Corporation | 2.56 |

| Enovis Corporation | 2.55 |

| Atmos Energy Corporation | 2.49 |

| 1 | Figures represent the percentage of the Fund's net assets. Holdings are subject to change and may have changed since the date specified. |

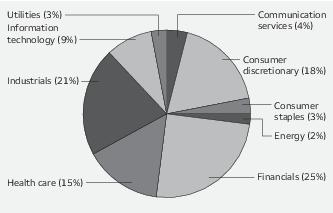

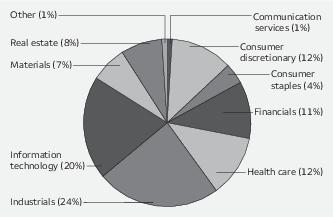

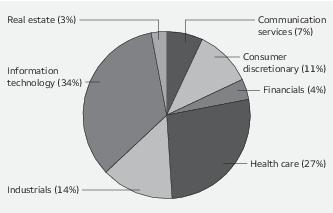

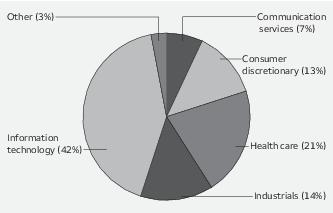

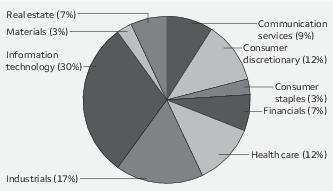

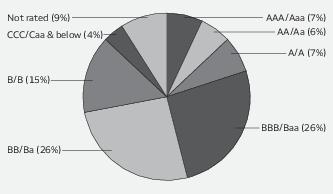

| Sector allocation as of March 31, 20221 |

| 1 | Figures represent the percentage of the Fund's long-term investments. These amounts are subject to change and may have changed since the date specified. |

Allspring C&B Mid Cap Value Fund | 7

Fund expenses (unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and contingent deferred sales charges (if any) on redemptions and (2) ongoing costs, including management fees, distribution (12b-1) and/or shareholder servicing fees, and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the six-month period and held for the entire period from October 1, 2021 to March 31, 2022.

Actual expenses

The “Actual” line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the “Actual” line under the heading entitled “Expenses paid during period” for your applicable class of shares to estimate the expenses you paid on your account during this period.

Hypothetical example for comparison purposes

The “Hypothetical” line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) and contingent deferred sales charges. Therefore, the “Hypothetical” line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | Beginning

account value

10-1-2021 | Ending

account value

3-31-2022 | Expenses

paid during

the period1 | Annualized net

expense ratio |

| Class A | | | | |

| Actual | $1,000.00 | $1,015.44 | $ 6.23 | 1.24% |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,018.75 | $ 6.24 | 1.24% |

| Class C | | | | |

| Actual | $1,000.00 | $1,011.68 | $ 9.98 | 1.99% |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,015.01 | $10.00 | 1.99% |

| Class R6 | | | | |

| Actual | $1,000.00 | $1,017.65 | $ 4.02 | 0.80% |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,020.94 | $ 4.03 | 0.80% |

| Administrator Class | | | | |

| Actual | $1,000.00 | $1,015.92 | $ 5.78 | 1.15% |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,019.20 | $ 5.79 | 1.15% |

| Institutional Class | | | | |

| Actual | $1,000.00 | $1,017.17 | $ 4.53 | 0.90% |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,020.44 | $ 4.53 | 0.90% |

1 Expenses paid is equal to the annualized net expense ratio of each class multiplied by the average account value over the period, multiplied by 182 divided by 365 (to reflect the one-half-year period).

8 | Allspring C&B Mid Cap Value Fund

Portfolio of investments—March 31, 2022 (unaudited)

| | | | | Shares | Value |

| Common stocks: 97.13% | | | | | |

| Communication services: 4.27% | | | | | |

| Entertainment: 1.88% | | | | | |

| Activision Blizzard Incorporated | | | | 158,350 | $ 12,685,419 |

| Media: 2.39% | | | | | |

| Omnicom Group Incorporated | | | | 189,950 | 16,122,956 |

| Consumer discretionary: 17.01% | | | | | |

| Auto components: 2.56% | | | | | |

| Gentex Corporation | | | | 592,068 | 17,270,624 |

| Household durables: 5.04% | | | | | |

| Helen of Troy Limited † | | | | 117,780 | 23,066,035 |

| Whirlpool Corporation | | | | 63,650 | 10,997,447 |

| | | | | | 34,063,482 |

| Leisure products: 1.38% | | | | | |

| Hasbro Incorporated | | | | 113,420 | 9,291,366 |

| Specialty retail: 3.45% | | | | | |

| American Eagle Outfitters Incorporated « | | | | 732,430 | 12,304,824 |

| CarMax Incorporated † | | | | 114,150 | 11,013,192 |

| | | | | | 23,318,016 |

| Textiles, apparel & luxury goods: 4.58% | | | | | |

| Gildan Activewear Incorporated | | | | 493,680 | 18,503,126 |

| HanesBrands Incorporated | | | | 837,458 | 12,469,750 |

| | | | | | 30,972,876 |

| Consumer staples: 2.61% | | | | | |

| Food products: 2.61% | | | | | |

| General Mills Incorporated | | | | 166,400 | 11,268,608 |

| Ingredion Incorporated | | | | 73,320 | 6,389,838 |

| | | | | | 17,658,446 |

| Energy: 1.92% | | | | | |

| Oil, gas & consumable fuels: 1.92% | | | | | |

| The Williams Companies Incorporated | | | | 388,800 | 12,989,808 |

| Financials: 24.90% | | | | | |

| Banks: 0.97% | | | | | |

| Commerce Bancshares Incorporated | | | | 91,302 | 6,536,310 |

| Capital markets: 2.67% | | | | | |

| State Street Corporation | | | | 207,250 | 18,055,620 |

| Consumer finance: 2.49% | | | | | |

| FirstCash Holdings Incorporated | | | | 238,515 | 16,777,145 |

| Insurance: 16.72% | | | | | |

| Alleghany Corporation † | | | | 16,208 | 13,728,176 |

| Arch Capital Group Limited † | | | | 446,285 | 21,609,120 |

The accompanying notes are an integral part of these financial statements.

Allspring C&B Mid Cap Value Fund | 9

Portfolio of investments—March 31, 2022 (unaudited)

| | | | | Shares | Value |

| Insurance (continued) | | | | | |

| Fidelity National Financial Incorporated | | | | 400,277 | $ 19,549,529 |

| Globe Life Incorporated | | | | 176,300 | 17,735,780 |

| Progressive Corporation | | | | 143,494 | 16,356,881 |

| RenaissanceRe Holdings Limited | | | | 81,051 | 12,847,394 |

| The Allstate Corporation | | | | 80,400 | 11,136,204 |

| | | | | | 112,963,084 |

| Thrifts & mortgage finance: 2.05% | | | | | |

| Essent Group Limited | | | | 335,770 | 13,837,082 |

| Health care: 14.19% | | | | | |

| Health care equipment & supplies: 8.92% | | | | | |

| Baxter International Incorporated | | | | 172,250 | 13,356,265 |

| Dentsply Sirona Incorporated | | | | 304,800 | 15,002,256 |

| Enovis Corporation | | | | 433,772 | 17,259,788 |

| Integra LifeSciences Holdings Corporation † | | | | 227,963 | 14,648,902 |

| | | | | | 60,267,211 |

| Health care providers & services: 1.16% | | | | | |

| Laboratory Corporation of America Holdings † | | | | 29,640 | 7,814,882 |

| Life sciences tools & services: 2.05% | | | | | |

| Syneos Health Incorporated † | | | | 171,234 | 13,861,392 |

| Pharmaceuticals: 2.06% | | | | | |

| Perrigo Company plc | | | | 361,310 | 13,885,143 |

| Industrials: 20.95% | | | | | |

| Aerospace & defense: 5.67% | | | | | |

| BWX Technologies Incorporated | | | | 255,230 | 13,746,688 |

| Huntington Ingalls Industries Incorporated | | | | 53,310 | 10,632,146 |

| Woodward Incorporated | | | | 111,650 | 13,946,202 |

| | | | | | 38,325,036 |

| Building products: 1.72% | | | | | |

| Armstrong World Industries Incorporated | | | | 128,740 | 11,587,887 |

| Commercial services & supplies: 2.40% | | | | | |

| IAA Incorporated † | | | | 423,904 | 16,214,326 |

| Electrical equipment: 2.44% | | | | | |

| Acuity Brands Incorporated | | | | 25,680 | 4,861,224 |

| AMETEK Incorporated | | | | 87,060 | 11,594,651 |

| | | | | | 16,455,875 |

| Machinery: 4.50% | | | | | |

| Gates Industrial Corporation plc † | | | | 512,460 | 7,717,648 |

| PACCAR Incorporated | | | | 89,857 | 7,913,706 |

| Stanley Black & Decker Incorporated | | | | 105,740 | 14,781,395 |

| | | | | | 30,412,749 |

| Professional services: 1.92% | | | | | |

| Leidos Holdings Incorporated | | | | 120,380 | 13,003,448 |

The accompanying notes are an integral part of these financial statements.

10 | Allspring C&B Mid Cap Value Fund

Portfolio of investments—March 31, 2022 (unaudited)

| | | | | Shares | Value |

| Trading companies & distributors: 2.30% | | | | | |

| AerCap Holdings NV † | | | | 308,600 | $ 15,516,408 |

| Information technology: 8.79% | | | | | |

| Electronic equipment, instruments & components: 5.32% | | | | | |

| Arrow Electronics Incorporated † | | | | 193,666 | 22,974,598 |

| TE Connectivity Limited | | | | 98,900 | 12,953,922 |

| | | | | | 35,928,520 |

| IT services: 1.63% | | | | | |

| Amdocs Limited | | | | 134,250 | 11,036,693 |

| Semiconductors & semiconductor equipment: 1.84% | | | | | |

| MKS Instruments Incorporated | | | | 82,593 | 12,388,950 |

| Utilities: 2.49% | | | | | |

| Gas utilities: 2.49% | | | | | |

| Atmos Energy Corporation | | | | 140,620 | 16,802,684 |

| Total Common stocks (Cost $524,524,561) | | | | | 656,043,438 |

| | | Yield | | | |

| Short-term investments: 4.74% | | | | | |

| Investment companies: 4.74% | | | | | |

| Allspring Government Money Market Fund Select Class ♠∞ | | 0.18% | | 20,356,811 | 20,356,811 |

| Securities Lending Cash Investments LLC ♠∩∞ | | 0.40 | | 11,677,725 | 11,677,725 |

| Total Short-term investments (Cost $32,034,536) | | | | | 32,034,536 |

| Total investments in securities (Cost $556,559,097) | 101.87% | | | | 688,077,974 |

| Other assets and liabilities, net | (1.87) | | | | (12,602,920) |

| Total net assets | 100.00% | | | | $675,475,054 |

| † | Non-income-earning security |

| « | All or a portion of this security is on loan. |

| ♠ | The issuer of the security is an affiliated person of the Fund as defined in the Investment Company Act of 1940. |

| ∩ | The investment is a non-registered investment company purchased with cash collateral received from securities on loan. |

| ∞ | The rate represents the 7-day annualized yield at period end. |

The accompanying notes are an integral part of these financial statements.

Allspring C&B Mid Cap Value Fund | 11

Portfolio of investments—March 31, 2022 (unaudited)

Investments in affiliates

An affiliated investment is an investment in which the Fund owns at least 5% of the outstanding voting shares of the issuer or as a result of other relationships, such as the Fund and the issuer having the same investment manager. Transactions with issuers that were affiliates of the Fund at the end of the period were as follows:

| | Value,

beginning of

period | Purchases | Sales

proceeds | Net

realized

gains

(losses) | | Net

change in

unrealized

gains

(losses) | | Value,

end of

period | Shares,

end

of period | Income

from

affiliated

securities |

| Short-term investments | | | | | | | | | |

| Allspring Government Money Market Fund Select Class | $6,643,193 | $185,331,910 | $(171,618,292) | $0 | | $0 | | $ 20,356,811 | 20,356,811 | $ 2,410 |

| Securities Lending Cash Investments LLC | 0 | 52,990,410 | (41,312,685) | 0 | | 0 | | 11,677,725 | 11,677,725 | 2,235 # |

| | | | | $0 | | $0 | | $32,034,536 | | $4,645 |

| # | Amount shown represents income before fees and rebates. |

The accompanying notes are an integral part of these financial statements.

12 | Allspring C&B Mid Cap Value Fund

Statement of assets and liabilities—March 31, 2022 (unaudited)

| | |

| Assets | |

Investments in unaffiliated securities (including $11,342,196 of securities loaned), at value (cost $524,524,561)

| $ 656,043,438 |

Investments in affiliated securities, at value (cost $32,034,536)

| 32,034,536 |

Receivable for Fund shares sold

| 881,011 |

Receivable for dividends

| 595,338 |

Receivable for investments sold

| 115,665 |

Receivable for securities lending income, net

| 2,269 |

Prepaid expenses and other assets

| 64,531 |

Total assets

| 689,736,788 |

| Liabilities | |

Payable upon receipt of securities loaned

| 11,677,725 |

Payable for investments purchased

| 1,527,531 |

Payable for Fund shares redeemed

| 486,254 |

Management fee payable

| 446,006 |

Administration fees payable

| 86,506 |

Trustees’ fees and expenses payable

| 2,830 |

Distribution fee payable

| 1,657 |

Accrued expenses and other liabilities

| 33,225 |

Total liabilities

| 14,261,734 |

Total net assets

| $675,475,054 |

| Net assets consist of | |

Paid-in capital

| $ 534,757,952 |

Total distributable earnings

| 140,717,102 |

Total net assets

| $675,475,054 |

| Computation of net asset value and offering price per share | |

Net assets – Class A

| $ 131,785,069 |

Shares outstanding – Class A1

| 2,943,400 |

Net asset value per share – Class A

| $44.77 |

Maximum offering price per share – Class A2

| $47.50 |

Net assets – Class C

| $ 2,602,089 |

Shares outstanding – Class C1

| 63,672 |

Net asset value per share – Class C

| $40.87 |

Net assets – Class R6

| $ 22,262,761 |

Shares outstanding – Class R61

| 492,193 |

Net asset value per share – Class R6

| $45.23 |

Net assets – Administrator Class

| $ 16,948,559 |

Shares outstanding – Administrator Class1

| 373,477 |

Net asset value per share – Administrator Class

| $45.38 |

Net assets – Institutional Class

| $ 501,876,576 |

Shares outstanding – Institutional Class1

| 11,102,169 |

Net asset value per share – Institutional Class

| $45.21 |

| 1 | The Fund has an unlimited number of authorized shares. |

| 2 | Maximum offering price is computed as 100/94.25 of net asset value. On investments of $50,000 or more, the offering price is reduced. |

The accompanying notes are an integral part of these financial statements.

Allspring C&B Mid Cap Value Fund | 13

Statement of operations—six months ended March 31, 2022 (unaudited)

| | |

| Investment income | |

Dividends (net of foreign withholdings taxes of $27,638)

| $ 5,586,570 |

Income from affiliated securities

| 6,048 |

Total investment income

| 5,592,618 |

| Expenses | |

Management fee

| 2,646,914 |

| Administration fees | |

Class A

| 145,666 |

Class C

| 3,688 |

Class R6

| 3,348 |

Administrator Class

| 14,513 |

Institutional Class

| 341,966 |

| Shareholder servicing fees | |

Class A

| 173,412 |

Class C

| 4,388 |

Administrator Class

| 27,819 |

| Distribution fee | |

Class C

| 13,147 |

Custody and accounting fees

| 12,858 |

Professional fees

| 22,960 |

Registration fees

| 52,221 |

Shareholder report expenses

| 41,043 |

Trustees’ fees and expenses

| 10,683 |

Other fees and expenses

| 6,999 |

Total expenses

| 3,521,625 |

| Less: Fee waivers and/or expense reimbursements | |

Class A

| (2,819) |

Class R6

| (1,590) |

Administrator Class

| (1,324) |

Institutional Class

| (35,853) |

Net expenses

| 3,480,039 |

Net investment income

| 2,112,579 |

| Realized and unrealized gains (losses) on investments | |

Net realized gains on investments

| 23,748,311 |

Net change in unrealized gains (losses) on investments

| (14,612,527) |

Net realized and unrealized gains (losses) on investments

| 9,135,784 |

Net increase in net assets resulting from operations

| $ 11,248,363 |

The accompanying notes are an integral part of these financial statements.

14 | Allspring C&B Mid Cap Value Fund

Statement of changes in net assets

| | | | | |

| | Six months ended

March 31, 2022

(unaudited) | Year ended

September 30, 2021 |

| Operations | | | | |

Net investment income

| | $ 2,112,579 | | $ 1,931,547 |

Net realized gains on investments

| | 23,748,311 | | 63,781,946 |

Net change in unrealized gains (losses) on investments

| | (14,612,527) | | 119,031,625 |

Net increase in net assets resulting from operations

| | 11,248,363 | | 184,745,118 |

| Distributions to shareholders from | | | | |

| Net investment income and net realized gains | | | | |

Class A

| | (12,663,809) | | (227,113) |

Class C

| | (414,701) | | 0 |

Class R6

| | (2,090,622) | | (81,410) |

Administrator Class

| | (2,175,381) | | (56,758) |

Institutional Class

| | (48,137,552) | | (1,735,542) |

Total distributions to shareholders

| | (65,482,065) | | (2,100,823) |

| Capital share transactions | Shares | | Shares | |

| Proceeds from shares sold | | | | |

Class A

| 63,484 | 2,985,901 | 266,477 | 11,903,917 |

Class C

| 1,835 | 84,101 | 62,834 | 2,564,058 |

Class R6

| 45,887 | 2,139,621 | 174,904 | 8,622,402 |

Administrator Class

| 29,068 | 1,377,378 | 94,814 | 4,369,994 |

Institutional Class

| 2,755,517 | 128,482,456 | 4,488,272 | 206,320,931 |

| | | 135,069,457 | | 233,781,302 |

| Reinvestment of distributions | | | | |

Class A

| 268,854 | 12,251,625 | 5,249 | 219,839 |

Class C

| 9,954 | 414,701 | 0 | 0 |

Class R6

| 35,855 | 1,655,325 | 1,185 | 50,016 |

Administrator Class

| 46,879 | 2,165,321 | 1,331 | 56,369 |

Institutional Class

| 1,041,927 | 48,045,059 | 41,072 | 1,733,252 |

| | | 64,532,031 | | 2,059,476 |

| Payment for shares redeemed | | | | |

Class A

| (251,055) | (11,739,331) | (459,731) | (20,683,839) |

Class C

| (42,962) | (1,846,121) | (68,723) | (2,762,614) |

Class R6

| (35,761) | (1,693,288) | (79,525) | (3,851,168) |

Administrator Class

| (224,982) | (10,709,959) | (254,333) | (11,616,949) |

Institutional Class

| (3,204,720) | (148,440,069) | (3,100,252) | (134,469,367) |

| | | (174,428,768) | | (173,383,937) |

Net increase in net assets resulting from capital share transactions

| | 25,172,720 | | 62,456,841 |

Total increase (decrease) in net assets

| | (29,060,982) | | 245,101,136 |

| Net assets | | | | |

Beginning of period

| | 704,536,036 | | 459,434,900 |

End of period

| | $ 675,475,054 | | $ 704,536,036 |

The accompanying notes are an integral part of these financial statements.

Allspring C&B Mid Cap Value Fund | 15

Financial highlights

(For a share outstanding throughout each period)

| | | Year ended September 30 |

| Class A | Six months ended

March 31, 2022

(unaudited) | 2021 | 2020 | 2019 | 2018 | 2017 |

Net asset value, beginning of period

| $48.43 | $34.40 | $39.67 | $37.88 | $35.07 | $29.27 |

Net investment income (loss)

| 0.08 1 | 0.03 | 0.10 1 | 0.16 | 0.06 | (0.00) 1,2 |

Net realized and unrealized gains (losses) on investments

| 0.75 | 14.08 | (4.21) | 1.69 | 2.75 | 5.82 |

Total from investment operations

| 0.83 | 14.11 | (4.11) | 1.85 | 2.81 | 5.82 |

| Distributions to shareholders from | | | | | | |

Net investment income

| (0.04) | (0.08) | (0.15) | (0.06) | (0.00) 3 | (0.02) |

Net realized gains

| (4.45) | 0.00 | (1.01) | 0.00 | 0.00 | 0.00 |

Total distributions to shareholders

| (4.49) | (0.08) | (1.16) | (0.06) | (0.00) 3 | (0.02) |

Net asset value, end of period

| $44.77 | $48.43 | $34.40 | $39.67 | $37.88 | $35.07 |

Total return4

| 1.54% | 41.04% | (10.81)% | 4.91% | 8.02% | 19.89% |

| Ratios to average net assets (annualized) | | | | | | |

Gross expenses

| 1.24% | 1.25% | 1.27% | 1.29% | 1.29% | 1.30% |

Net expenses

| 1.24% | 1.24% | 1.25% | 1.25% | 1.25% | 1.25% |

Net investment income (loss)

| 0.32% | 0.05% | 0.29% | 0.43% | 0.16% | (0.00)% |

| Supplemental data | | | | | | |

Portfolio turnover rate

| 24% | 47% | 45% | 42% | 39% | 54% |

Net assets, end of period (000s omitted)

| $131,785 | $138,604 | $104,922 | $106,975 | $111,354 | $115,258 |

| 1 | Calculated based upon average shares outstanding |

| 2 | Amount is more than $(0.005) |

| 3 | Amount is less than $0.005. |

| 4 | Total return calculations do not include any sales charges. Returns for periods of less than one year are not annualized. |

The accompanying notes are an integral part of these financial statements.

16 | Allspring C&B Mid Cap Value Fund

Financial highlights

(For a share outstanding throughout each period)

| | | Year ended September 30 |

| Class C | Six months ended

March 31, 2022

(unaudited) | 2021 | 2020 | 2019 | 2018 | 2017 |

Net asset value, beginning of period

| $44.70 | $31.94 | $36.98 | $35.51 | $33.12 | $27.83 |

Net investment loss

| (0.09) 1 | (0.30) 1 | (0.16) 1 | (0.12) 1 | (0.20) 1 | (0.26) 1 |

Net realized and unrealized gains (losses) on investments

| 0.71 | 13.06 | (3.87) | 1.59 | 2.59 | 5.55 |

Total from investment operations

| 0.62 | 12.76 | (4.03) | 1.47 | 2.39 | 5.29 |

| Distributions to shareholders from | | | | | | |

Net realized gains

| (4.45) | 0.00 | (1.01) | 0.00 | 0.00 | 0.00 |

Net asset value, end of period

| $40.87 | $44.70 | $31.94 | $36.98 | $35.51 | $33.12 |

Total return2

| 1.19% | 39.98% | (11.32)% | 4.14% | 7.22% | 19.01% |

| Ratios to average net assets (annualized) | | | | | | |

Gross expenses

| 1.99% | 1.99% | 2.01% | 2.04% | 2.04% | 2.05% |

Net expenses

| 1.99% | 1.99% | 2.00% | 2.00% | 2.00% | 2.00% |

Net investment loss

| (0.43)% | (0.72)% | (0.47)% | (0.36)% | (0.59)% | (0.74)% |

| Supplemental data | | | | | | |

Portfolio turnover rate

| 24% | 47% | 45% | 42% | 39% | 54% |

Net assets, end of period (000s omitted)

| $2,602 | $4,240 | $3,217 | $4,592 | $8,371 | $8,567 |

| 1 | Calculated based upon average shares outstanding |

| 2 | Total return calculations do not include any sales charges. Returns for periods of less than one year are not annualized. |

The accompanying notes are an integral part of these financial statements.

Allspring C&B Mid Cap Value Fund | 17

Financial highlights

(For a share outstanding throughout each period)

| | | Year ended September 30 |

| Class R6 | Six months ended

March 31, 2022

(unaudited) | 2021 | 2020 | 2019 | 2018 1 |

Net asset value, beginning of period

| $48.97 | $34.77 | $40.06 | $38.27 | $37.39 |

Net investment income

| 0.18 | 0.24 | 0.27 | 0.35 2 | 0.08 2 |

Net realized and unrealized gains (losses) on investments

| 0.77 | 14.20 | (4.25) | 1.67 | 0.80 |

Total from investment operations

| 0.95 | 14.44 | (3.98) | 2.02 | 0.88 |

| Distributions to shareholders from | | | | | |

Net investment income

| (0.24) | (0.24) | (0.30) | (0.23) | 0.00 |

Net realized gains

| (4.45) | 0.00 | (1.01) | 0.00 | 0.00 |

Total distributions to shareholders

| (4.69) | (0.24) | (1.31) | (0.23) | 0.00 |

Net asset value, end of period

| $45.23 | $48.97 | $34.77 | $40.06 | $38.27 |

Total return3

| 1.79% | 41.66% | (10.42)% | 5.39% | 2.35% |

| Ratios to average net assets (annualized) | | | | | |

Gross expenses

| 0.81% | 0.82% | 0.84% | 0.86% | 0.86% |

Net expenses

| 0.80% | 0.80% | 0.80% | 0.80% | 0.80% |

Net investment income

| 0.77% | 0.49% | 0.73% | 0.95% | 1.24% |

| Supplemental data | | | | | |

Portfolio turnover rate

| 24% | 47% | 45% | 42% | 39% |

Net assets, end of period (000s omitted)

| $22,263 | $21,853 | $12,156 | $15,112 | $26 |

| 1 | For the period from July 31, 2018 (commencement of class operations) to September 30, 2018 |

| 2 | Calculated based upon average shares outstanding |

| 3 | Returns for periods of less than one year are not annualized. |

The accompanying notes are an integral part of these financial statements.

18 | Allspring C&B Mid Cap Value Fund

Financial highlights

(For a share outstanding throughout each period)

| | | Year ended September 30 |

| Administrator Class | Six months ended

March 31, 2022

(unaudited) | 2021 | 2020 | 2019 | 2018 | 2017 |

Net asset value, beginning of period

| $49.03 | $34.80 | $40.14 | $38.35 | $35.52 | $29.63 |

Net investment income

| 0.09 1 | 0.07 1 | 0.14 1 | 0.20 1 | 0.10 1 | 0.04 1 |

Net realized and unrealized gains (losses) on investments

| 0.77 | 14.25 | (4.27) | 1.70 | 2.78 | 5.89 |

Total from investment operations

| 0.86 | 14.32 | (4.13) | 1.90 | 2.88 | 5.93 |

| Distributions to shareholders from | | | | | | |

Net investment income

| (0.06) | (0.09) | (0.20) | (0.11) | (0.05) | (0.04) |

Net realized gains

| (4.45) | 0.00 | (1.01) | 0.00 | 0.00 | 0.00 |

Total distributions to shareholders

| (4.51) | (0.09) | (1.21) | (0.11) | (0.05) | (0.04) |

Net asset value, end of period

| $45.38 | $49.03 | $34.80 | $40.14 | $38.35 | $35.52 |

Total return2

| 1.59% | 41.19% | (10.74)% | 5.03% | 8.13% | 20.02% |

| Ratios to average net assets (annualized) | | | | | | |

Gross expenses

| 1.16% | 1.17% | 1.19% | 1.21% | 1.21% | 1.22% |

Net expenses

| 1.15% | 1.15% | 1.15% | 1.15% | 1.15% | 1.15% |

Net investment income

| 0.38% | 0.14% | 0.38% | 0.53% | 0.26% | 0.12% |

| Supplemental data | | | | | | |

Portfolio turnover rate

| 24% | 47% | 45% | 42% | 39% | 54% |

Net assets, end of period (000s omitted)

| $16,949 | $25,617 | $23,691 | $24,036 | $20,960 | $21,267 |

| 1 | Calculated based upon average shares outstanding |

| 2 | Returns for periods of less than one year are not annualized. |

The accompanying notes are an integral part of these financial statements.

Allspring C&B Mid Cap Value Fund | 19

Financial highlights

(For a share outstanding throughout each period)

| | | Year ended September 30 |

| Institutional Class | Six months ended

March 31, 2022

(unaudited) | 2021 | 2020 | 2019 | 2018 | 2017 |

Net asset value, beginning of period

| $48.93 | $34.74 | $40.04 | $38.26 | $35.41 | $29.53 |

Net investment income

| 0.16 1 | 0.19 | 0.23 1 | 0.28 | 0.19 | 0.16 |

Net realized and unrealized gains (losses) on investments

| 0.77 | 14.20 | (4.25) | 1.70 | 2.78 | 5.82 |

Total from investment operations

| 0.93 | 14.39 | (4.02) | 1.98 | 2.97 | 5.98 |

| Distributions to shareholders from | | | | | | |

Net investment income

| (0.20) | (0.20) | (0.27) | (0.20) | (0.12) | (0.10) |

Net realized gains

| (4.45) | 0.00 | (1.01) | 0.00 | 0.00 | 0.00 |

Total distributions to shareholders

| (4.65) | (0.20) | (1.28) | (0.20) | (0.12) | (0.10) |

Net asset value, end of period

| $45.21 | $48.93 | $34.74 | $40.04 | $38.26 | $35.41 |

Total return2

| 1.74% | 41.55% | (10.52)% | 5.29% | 8.41% | 20.30% |

| Ratios to average net assets (annualized) | | | | | | |

Gross expenses

| 0.91% | 0.92% | 0.94% | 0.96% | 0.96% | 0.97% |

Net expenses

| 0.90% | 0.90% | 0.90% | 0.90% | 0.90% | 0.90% |

Net investment income

| 0.67% | 0.39% | 0.64% | 0.79% | 0.56% | 0.37% |

| Supplemental data | | | | | | |

Portfolio turnover rate

| 24% | 47% | 45% | 42% | 39% | 54% |

Net assets, end of period (000s omitted)

| $501,877 | $514,222 | $315,449 | $246,702 | $200,335 | $105,550 |

| 1 | Calculated based upon average shares outstanding |

| 2 | Returns for periods of less than one year are not annualized. |

The accompanying notes are an integral part of these financial statements.

20 | Allspring C&B Mid Cap Value Fund

Notes to financial statements (unaudited)

1. ORGANIZATION

Allspring Funds Trust (the "Trust"), a Delaware statutory trust organized on March 10, 1999, is an open-end management investment company registered under the Investment Company Act of 1940, as amended (the "1940 Act"). As an investment company, the Trust follows the accounting and reporting guidance in Financial Accounting Standards Board ("FASB") Accounting Standards Codification Topic 946, Financial Services – Investment Companies. These financial statements report on the Allspring C&B Mid Cap Value Fund (the "Fund") which is a diversified series of the Trust.

Effective on November 1, 2021, the sale transaction of Wells Fargo Asset Management ("WFAM") by Wells Fargo & Company to GTCR LLC and Reverence Capital Partners, L.P. was closed. In connection with the closing of the transaction, WFAM became known as Allspring Global Investments (“Allspring”) and various entities that provided services to the Fund changed their names to "Allspring", including Allspring Funds Management, LLC, the investment manager to the Fund, Allspring Global Investments, LLC and Allspring Global Investments (UK) Limited, both registered investment advisers providing subadvisory services to certain funds, and Allspring Funds Distributor, LLC, the Fund's principal underwriter. Consummation of the transaction resulted in a new investment management agreement and subadvisory agreement which became effective on the date of the Special Meeting of Shareholders approving the agreements.

2. SIGNIFICANT ACCOUNTING POLICIES

The following significant accounting policies, which are consistently followed in the preparation of the financial statements of the Fund, are in conformity with U.S. generally accepted accounting principles which require management to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

Securities valuation

All investments are valued each business day as of the close of regular trading on the New York Stock Exchange (generally 4 p.m. Eastern Time), although the Fund may deviate from this calculation time under unusual or unexpected circumstances.

Equity securities that are listed on a foreign or domestic exchange or market are valued at the official closing price or, if none, the last sales price. If no sale occurs on the principal exchange or market that day, a fair value price will be determined in accordance with the Fund’s Valuation Procedures.

Investments in registered open-end investment companies are valued at net asset value. Interests in non-registered investment companies that are redeemable at net asset value are fair valued normally at net asset value.

Investments which are not valued using any of the methods discussed above are valued at their fair value, as determined in good faith by the Board of Trustees. The Board of Trustees has established a Valuation Committee comprised of the Trustees and has delegated to it the authority to take any actions regarding the valuation of portfolio securities that the Valuation Committee deems necessary or appropriate, including determining the fair value of portfolio securities, unless the determination has been delegated to the Allspring Global Investments Pricing Committee at Allspring Funds Management, LLC ("Allspring Funds Management"). The Board of Trustees retains the authority to make or ratify any valuation decisions or approve any changes to the Valuation Procedures as it deems appropriate. On a quarterly basis, the Board of Trustees receives reports on any valuation actions taken by the Valuation Committee or the Allspring Global Investments Pricing Committee which may include items for ratification.

Securities lending

The Fund may lend its securities from time to time in order to earn additional income in the form of fees or interest on securities received as collateral or the investment of any cash received as collateral. When securities are on loan, the Fund receives interest or dividends on those securities. Cash collateral received in connection with its securities lending transactions is invested in Securities Lending Cash Investments, LLC (the "Securities Lending Fund"), an affiliated non-registered investment company. Investments in Securities Lending Fund are valued at the evaluated bid price provided by an independent pricing service. Income earned from investment in the Securities Lending Fund (net of fees and rebates), if any, is included in income from affiliated securities on the Statement of Operations.

In a securities lending transaction, the net asset value of the Fund is affected by an increase or decrease in the value of the securities loaned and by an increase or decrease in the value of the instrument in which collateral is invested. The amount of securities lending activity undertaken by the Fund fluctuates from time to time. The Fund has the right under the lending agreement to recover the securities from the borrower on demand. In the event of default or bankruptcy by the borrower, the Fund may be prevented from recovering the loaned securities or gaining access to the collateral or may experience delays or costs in doing so. In such an event, the terms of the agreement allow the unaffiliated securities lending agent to use the

Allspring C&B Mid Cap Value Fund | 21

Notes to financial statements (unaudited)

collateral to purchase replacement securities on behalf of the Fund or pay the Fund the market value of the loaned securities. The Fund bears the risk of loss with respect to depreciation of its investment of the cash collateral.

Security transactions and income recognition

Securities transactions are recorded on a trade date basis. Realized gains or losses are recorded on the basis of identified cost.

Dividend income is recognized on the ex-dividend date. Dividend income is recorded net of foreign taxes withheld where recovery of such taxes is not assured.

Distributions to shareholders

Distributions to shareholders from net investment income and any net realized gains are recorded on the ex-dividend date and paid at least annually. Such distributions are determined in accordance with income tax regulations and may differ from U.S. generally accepted accounting principles. Dividend sources are estimated at the time of declaration. The tax character of distributions is determined as of the Fund's fiscal year end. Therefore, a portion of the Fund's distributions made prior to the Fund’s fiscal year end may be categorized as a tax return of capital at year end.

Federal and other taxes

The Fund intends to continue to qualify as a regulated investment company by distributing substantially all of its investment company taxable income and any net realized capital gains (after reduction for capital loss carryforwards) sufficient to relieve it from all, or substantially all, federal income taxes. Accordingly, no provision for federal income taxes was required.

The Fund’s income and federal excise tax returns and all financial records supporting those returns for the prior three fiscal years are subject to examination by the federal and Delaware revenue authorities. Management has analyzed the Fund's tax positions taken on federal, state, and foreign tax returns for all open tax years and does not believe that there are any uncertain tax positions that require recognition of a tax liability.

As of March 31, 2022, the aggregate cost of all investments for federal income tax purposes was $552,079,870 and the unrealized gains (losses) consisted of:

| Gross unrealized gains | $145,964,119 |

| Gross unrealized losses | (9,966,015) |

| Net unrealized gains | $135,998,104 |

Class allocations

The separate classes of shares offered by the Fund differ principally in applicable sales charges, distribution, shareholder servicing, and administration fees. Class specific expenses are charged directly to that share class. Investment income, common fund-level expenses, and realized and unrealized gains (losses) on investments are allocated daily to each class of shares based on the relative proportion of net assets of each class.

3. FAIR VALUATION MEASUREMENTS

Fair value measurements of investments are determined within a framework that has established a fair value hierarchy based upon the various data inputs utilized in determining the value of the Fund’s investments. The three-level hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1) and the lowest priority to unobservable inputs (Level 3). The Fund’s investments are classified within the fair value hierarchy based on the lowest level of input that is significant to the fair value measurement. The inputs are summarized into three broad levels as follows:

| ■ | Level 1 – quoted prices in active markets for identical securities |

| ■ | Level 2 – other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) |

| ■ | Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

The inputs or methodologies used for valuing investments in securities are not necessarily an indication of the risk associated with investing in those securities.

22 | Allspring C&B Mid Cap Value Fund

Notes to financial statements (unaudited)

The following is a summary of the inputs used in valuing the Fund’s assets and liabilities as of March 31, 2022:

| | Quoted prices

(Level 1) | Other significant

observable inputs

(Level 2) | Significant

unobservable inputs

(Level 3) | Total |

| Assets | | | | |

| Investments in: | | | | |

| Common stocks | | | | |

| Communication services | $ 28,808,375 | $0 | $0 | $ 28,808,375 |

| Consumer discretionary | 114,916,364 | 0 | 0 | 114,916,364 |

| Consumer staples | 17,658,446 | 0 | 0 | 17,658,446 |

| Energy | 12,989,808 | 0 | 0 | 12,989,808 |

| Financials | 168,169,241 | 0 | 0 | 168,169,241 |

| Health care | 95,828,628 | 0 | 0 | 95,828,628 |

| Industrials | 141,515,729 | 0 | 0 | 141,515,729 |

| Information technology | 59,354,163 | 0 | 0 | 59,354,163 |

| Utilities | 16,802,684 | 0 | 0 | 16,802,684 |

| Short-term investments | | | | |

| Investment companies | 32,034,536 | 0 | 0 | 32,034,536 |

| Total assets | $688,077,974 | $0 | $0 | $688,077,974 |

Additional sector, industry or geographic detail, if any, is included in the Portfolio of Investments.

For the six months ended March 31, 2022, the Fund did not have any transfers into/out of Level 3.

4. TRANSACTIONS WITH AFFILIATES AND OTHER EXPENSES

Management fee

Allspring Funds Management, a wholly owned subsidiary of Allspring Global Investments Holdings, LLC, a holding company indirectly owned by certain private funds of GTCR LLC and Reverence Capital Partners, L.P., is the manager of the Fund and provides advisory and fund-level administrative services under an investment management agreement. Under the investment management agreement, Allspring Funds Management is responsible for, among other services, implementing the investment objectives and strategies of the Fund, supervising the subadviser and providing fund-level administrative services in connection with the Fund’s operations. As compensation for its services under the investment management agreement, Allspring Funds Management is entitled to receive a management fee at the following annual rate based on the Fund’s average daily net assets:

| Average daily net assets | Management fee |

| First $500 million | 0.750% |

| Next $500 million | 0.725 |

| Next $1 billion | 0.700 |

| Next $2 billion | 0.675 |

| Next $1 billion | 0.650 |

| Next $5 billion | 0.640 |

| Next $2 billion | 0.630 |

| Next $4 billion | 0.620 |

| Over $16 billion | 0.610 |

For the six months ended March 31, 2022, the management fee was equivalent to an annual rate of 0.74% of the Fund’s average daily net assets.

Allspring Funds Management has retained the services of a subadviser to provide daily portfolio management to the Fund. The fee for subadvisory services is borne by Allspring Funds Management. Cooke & Bieler, L.P., which is not an affiliate of Allspring

Allspring C&B Mid Cap Value Fund | 23

Notes to financial statements (unaudited)

Funds Management, is the subadviser to the Fund and is entitled to receive a fee from Allspring Funds Management at an annual rate starting at 0.45% and declining to 0.35% as the average daily net assets of the Fund increase.

Administration fees

Under a class-level administration agreement, Allspring Funds Management provides class-level administrative services to the Fund, which includes paying fees and expenses for services provided by the transfer agent, sub-transfer agents, omnibus account servicers and record-keepers. As compensation for its services under the class-level administration agreement, Allspring Funds Management receives an annual fee which is calculated based on the average daily net assets of each class as follows:

| | Class-level

administration fee |

| Class A | 0.21% |

| Class C | 0.21 |

| Class R6 | 0.03 |

| Administrator Class | 0.13 |

| Institutional Class | 0.13 |

Waivers and/or expense reimbursements

Allspring Funds Management has contractually committed to waive and/or reimburse management and administration fees to the extent necessary to maintain certain net operating expense ratios for the Fund. When each class of the Fund has exceeded its expense cap, Allspring Funds Management will waive fees and/or reimburse expenses from fund-level expenses on a proportionate basis and then from class specific expenses. When only certain classes exceed their expense caps, waivers and/or reimbursements are applied against class specific expenses before fund-level expenses. Allspring Funds Management has contractually committed through January 31, 2023 to waive fees and/or reimburse expenses to the extent necessary to cap expenses. Prior to or after the commitment expiration date, the caps may be increased or the commitment to maintain the caps may be terminated only with the approval of the Board of Trustees. As of March 31, 2022, the contractual expense caps are as follows:

| | Expense ratio caps |

| Class A | 1.25% |

| Class C | 2.00 |

| Class R6 | 0.80 |

| Administrator Class | 1.15 |

| Institutional Class | 0.90 |

Distribution fee

The Trust has adopted a distribution plan for Class C shares of the Fund pursuant to Rule 12b-1 under the 1940 Act. A distribution fee is charged to Class C shares and paid to Allspring Funds Distributor, LLC ("Allspring Funds Distributor"), the principal underwriter, an affiliate of Allspring Funds Management, at an annual rate of 0.75% of the average daily net assets of Class C shares.

In addition, Allspring Funds Distributor is entitled to receive the front-end sales charge from the purchase of Class A shares and a contingent deferred sales charge on the redemption of certain Class A shares. Allspring Funds Distributor is also entitled to receive the contingent deferred sales charges from redemptions of Class C shares. For the six months ended March 31, 2022, Allspring Funds Distributor received $483 from the sale of Class A shares and $8 in contingent deferred sales charges from redemptions of Class C shares. No contingent deferred sales charges were incurred by Class A shares for the six months ended March 31, 2022.

24 | Allspring C&B Mid Cap Value Fund

Notes to financial statements (unaudited)

Shareholder servicing fees

The Trust has entered into contracts with one or more shareholder servicing agents, whereby Class A, Class C and Administrator Class of the Fund are charged a fee at an annual rate of 0.25% of the average daily net assets of each respective class. A portion of these total shareholder servicing fees were paid to affiliates, and to certain entities that were affiliates of the Fund until November 1, 2021.

Interfund transactions

The Fund may purchase or sell portfolio investment securities to certain affiliates pursuant to Rule 17a-7 under the 1940 Act and under procedures adopted by the Board of Trustees. The procedures have been designed to ensure that these interfund transactions, which do not incur broker commissions, are effected at current market prices.

5. INVESTMENT PORTFOLIO TRANSACTIONS

Purchases and sales of investments, excluding U.S. government obligations (if any) and short-term securities, for the six months ended March 31, 2022 were $165,519,170 and $221,530,810, respectively.

6. SECURITIES LENDING TRANSACTIONS

The Fund lends its securities through an unaffiliated securities lending agent and receives collateral in the form of cash or securities with a value at least equal to the value of the securities on loan. The value of the loaned securities is determined at the close of each business day and any increases or decreases in the required collateral are exchanged between the Fund and the counterparty on the next business day. Cash collateral received is invested in the Securities Lending Fund which seeks to provide a positive return compared to the daily Federal Funds Open Rate by investing in high-quality, U.S. dollar-denominated short-term money market instruments and is exempt from registration under Section 3(c)(7) of the 1940 Act. Securities Lending Fund is managed by Allspring Funds Management and is subadvised by Allspring Global Investments, LLC ("Allspring Investments"), an affiliate of Allspring Funds Management and a wholly owned subsidiary of Allspring Global Investments Holdings, LLC. Allspring Funds Management receives an advisory fee starting at 0.05% and declining to 0.01% as the average daily net assets of the Securities Lending Fund increase. All of the fees received by Allspring Funds Management are paid to Allspring Investments for its services as subadviser.

In the event of counterparty default or the failure of a borrower to return a loaned security, the Fund has the right to use the collateral to offset any losses incurred. As of March 31, 2022, the Fund had securities lending transactions with the following counterparties which are subject to offset:

| Counterparty | Value of

securities on

loan | Collateral

received1 | Net amount |

| Barclays Capital Incorporated | $ 812,004 | $ (812,004) | $0 |

| BNP Paribas Securities Corporation | 8,852,740 | (8,852,740) | 0 |

| JPMorgan Securities LLC | 1,677,452 | (1,677,452) | 0 |

1 Collateral received within this table is limited to the collateral for the net transaction with the counterparty.

7. BANK BORROWINGS

The Trust (excluding the money market funds), Allspring Master Trust and Allspring Variable Trust are parties to a $350,000,000 revolving credit agreement whereby the Fund is permitted to use bank borrowings for temporary or emergency purposes, such as to fund shareholder redemption requests. Interest under the credit agreement is charged to the Fund based on a borrowing rate equal to the higher of the Federal Funds rate in effect on that day plus 1.25% or the overnight bank funding rate in effect on that day plus 1.25%. In addition, an annual commitment fee equal to 0.25% of the unused balance is allocated to each participating fund.

For the six months ended March 31, 2022, there were no borrowings by the Fund under the agreement.

8. CONCENTRATION RISKS

As of the end of the period, the Fund concentrated its portfolio of investments in the financials sector. A fund that invests a substantial portion of its assets in any sector may be more affected by changes in that sector than would be a fund whose investments are not heavily weighted in any sector.

Allspring C&B Mid Cap Value Fund | 25

Notes to financial statements (unaudited)

9. INDEMNIFICATION

Under the Fund's organizational documents, the officers and Trustees have been granted certain indemnification rights against certain liabilities that may arise out of performance of their duties to the Fund. The Fund has entered into a separate agreement with each Trustee that converts indemnification rights currently existing under the Fund’s organizational documents into contractual rights that cannot be changed in the future without the consent of the Trustee. Additionally, in the normal course of business, the Fund may enter into contracts with service providers that contain a variety of indemnification clauses. The Fund’s maximum exposure under these arrangements is dependent on future claims that may be made against the Fund and, therefore, cannot be estimated.

10. CORONAVIRUS (COVID-19) PANDEMIC

On March 11, 2020, the World Health Organization announced that it had made the assessment that coronavirus disease 2019 (“COVID-19”) is a pandemic. The impacts of COVID-19 are affecting the entire global economy, individual companies and investment products, the funds, and the market in general. There is significant uncertainty around the extent and duration of business disruptions related to COVID-19 and the impacts may last for an extended period of time. COVID-19 has led to significant uncertainty and volatility in the financial markets.

26 | Allspring C&B Mid Cap Value Fund

Other information (unaudited)

PROXY VOTING INFORMATION

A description of the policies and procedures used to determine how to vote proxies relating to portfolio securities is available without charge, upon request, by calling 1-800-222-8222, visiting our website at allspringglobal.com, or visiting the SEC website at sec.gov. Information regarding how the proxies related to portfolio securities were voted during the most recent 12-month period ended June 30 is available on the website at allspringglobal.com or by visiting the SEC website at sec.gov.

SPECIAL MEETING OF SHAREHOLDERS

On February 18, 2022, a Special Meeting of Shareholders for the Fund was held to consider the following proposals. The results of the proposals are indicated below.

Proposal 1 – To consider and approve a new investment management agreement with Wells Fargo Funds Management, LLC*.

| Shares voted “For” | | 4,731,522 |

| Shares voted “Against” | | 153,688 |

| Shares voted “Abstain” | | 277,752 |

Proposal 2 – To consider and approve a new subadvisory agreement with Wells Capital Management, LLC**.

| Shares voted “For” | | 4,726,335 |

| Shares voted “Against” | | 137,346 |

| Shares voted “Abstain” | | 299,281 |

* Effective November 1, 2021, known as Allspring Funds Management, LLC.

** Effective November 1, 2021, known as Allspring Global Investments, LLC.

QUARTERLY PORTFOLIO HOLDINGS INFORMATION

The Fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. Shareholders may view the filed Form N-PORT by visiting the SEC website at sec.gov.

Allspring C&B Mid Cap Value Fund | 27

Other information (unaudited)

BOARD OF TRUSTEES AND OFFICERS

Each of the Trustees and Officers listed in the table below acts in identical capacities for each fund in the Allspring family of funds, which consists of 138 mutual funds comprising the Allspring Funds Trust, Allspring Variable Trust, Allspring Master Trust and four closed-end funds (collectively the “Fund Complex”). This table should be read in conjunction with the Prospectus and the Statement of Additional Information1. The mailing address of each Trustee and Officer is 525 Market Street, 12th Floor, San Francisco, CA 94105. Each Trustee and Officer serves an indefinite term, however, each Trustee serves such term until reaching the mandatory retirement age established by the Trustees.

Independent Trustees

Name and

year of birth | Position held and

length of service* | Principal occupations during past five years or longer | Current other

public company or

investment

company

directorships |

William R. Ebsworth

(Born 1957) | Trustee,

since 2015 | Retired. From 1984 to 2013, equities analyst, portfolio manager, research director and chief investment officer at Fidelity Management and Research Company in Boston, Tokyo, and Hong Kong, and retired in 2013 as Chief Investment Officer of Fidelity Strategic Advisers, Inc. where he led a team of investment professionals managing client assets. Prior thereto, Board member of Hong Kong Securities Clearing Co., Hong Kong Options Clearing Corp., the Thailand International Fund, Ltd., Fidelity Investments Life Insurance Company, and Empire Fidelity Investments Life Insurance Company. Audit Committee Chair and Investment Committee Chair of the Vincent Memorial Hospital Endowment (non-profit organization). Mr. Ebsworth is a CFA® charterholder. | N/A |

Jane A. Freeman

(Born 1953) | Trustee,

since 2015;

Chair Liaison,

since 2018 | Retired. From 2012 to 2014 and 1999 to 2008, Chief Financial Officer of Scientific Learning Corporation. From 2008 to 2012, Ms. Freeman provided consulting services related to strategic business projects. Prior to 1999, Portfolio Manager at Rockefeller & Co. and Scudder, Stevens & Clark. Board member of the Harding Loevner Funds from 1996 to 2014, serving as both Lead Independent Director and chair of the Audit Committee. Board member of the Russell Exchange Traded Funds Trust from 2011 to 2012 and the chair of the Audit Committee. Ms. Freeman is also an inactive Chartered Financial Analyst. | N/A |

Isaiah Harris, Jr.

(Born 1952) | Trustee,

since 2009; Audit

Committee

Chair,

since 2019 | Retired. Chairman of the Board of CIGNA Corporation from 2009 to 2021, and Director from 2005 to 2008. From 2003 to 2011, Director of Deluxe Corporation. Prior thereto, President and CEO of BellSouth Advertising and Publishing Corp. from 2005 to 2007, President and CEO of BellSouth Enterprises from 2004 to 2005 and President of BellSouth Consumer Services from 2000 to 2003. Emeritus member of the Iowa State University Foundation Board of Governors. Emeritus Member of the Advisory Board of Iowa State University School of Business. Advisory Board Member, Palm Harbor Academy (private school). Advisory Board Member, Fellowship of Christian Athletes. Mr. Harris is a certified public accountant (inactive status). | N/A |

David F. Larcker

(Born 1950) | Trustee,

since 2009 | James Irvin Miller Professor of Accounting at the Graduate School of Business (Emeritus), Stanford University, Director of the Corporate Governance Research Initiative and Senior Faculty of The Rock Center for Corporate Governance since 2006. From 2005 to 2008, Professor of Accounting at the Graduate School of Business, Stanford University. Prior thereto, Ernst & Young Professor of Accounting at The Wharton School, University of Pennsylvania from 1985 to 2005. | N/A |

28 | Allspring C&B Mid Cap Value Fund

Other information (unaudited)

Name and

year of birth | Position held and

length of service* | Principal occupations during past five years or longer | Current other

public company or

investment

company

directorships |

Olivia S. Mitchell

(Born 1953) | Trustee,

since 2006;

Nominating and

Governance

Committee Chair,

since 2018 | International Foundation of Employee Benefit Plans Professor since 1993, Wharton School of the University of Pennsylvania. Director of Wharton’s Pension Research Council and Boettner Center on Pensions & Retirement Research, and Research Associate at the National Bureau of Economic Research. Previously taught at Cornell University from 1978 to 1993. | N/A |

Timothy J. Penny

(Born 1951) | Trustee,

since 1996;

Chair,

since 2018 | President and Chief Executive Officer of Southern Minnesota Initiative Foundation, a non-profit organization, since 2007. Member of the Board of Trustees of NorthStar Education Finance, Inc., a non-profit organization, since 2007. | N/A |

James G. Polisson

(Born 1959) | Trustee,