UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-09253

Allspring Funds Trust

(Exact name of registrant as specified in charter)

525 Market St., San Francisco, CA 94105

(Address of principal executive offices) (Zip code)

Matthew Prasse

Allspring Funds Management, LLC

525 Market St., San Francisco, CA 94105

(Name and address of agent for service)

Registrant’s telephone number, including area code: 800-222-8222

Date of fiscal year end: April 30

Registrant is making a filing for 1 of its series: Allspring Absolute Return Fund

Date of reporting period: April 30, 2022

ITEM 1. REPORT TO STOCKHOLDERS

| 2 | |

| 6 | |

| 10 | |

| 12 | |

| Financial statements | |

| 13 | |

| 14 | |

| 15 | |

| 16 | |

| 22 | |

| 27 | |

| 28 | |

| 32 |

| 1 | The S&P 500 Index consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market-value-weighted index with each stock's weight in the index proportionate to its market value. You cannot invest directly in an index. |

| 2 | The Morgan Stanley Capital International (MSCI) All Country World Index (ACWI) ex USA Index (Net) is a free-float-adjusted market-capitalization-weighted index that is designed to measure the equity market performance of developed and emerging markets, excluding the U.S. Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indexes or any securities or financial products. This report is not approved, reviewed, or produced by MSCI. You cannot invest directly in an index. |

| 3 | The MSCI Emerging Markets (EM) Index (Net) (USD) is a free-float-adjusted market-capitalization-weighted index that is designed to measure equity market performance of emerging markets. You cannot invest directly in an index. |

| 4 | The Bloomberg U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment-grade, U.S.-dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, mortgage-backed securities (agency fixed-rate and hybrid adjustable-rate mortgage pass-throughs), asset-backed securities, and commercial mortgage-backed securities. You cannot invest directly in an index. |

| 5 | The Bloomberg Global Aggregate ex-USD Index (unhedged) is an unmanaged index that provides a broad-based measure of the global investment-grade fixed-income markets excluding the U.S.-dollar-denominated debt market. You cannot invest directly in an index. |

| 6 | The Bloomberg Municipal Bond Index is an unmanaged index composed of long-term tax-exempt bonds with a minimum credit rating of Baa. You cannot invest directly in an index. |

| 7 | The ICE BofA U.S. High Yield Index is a market-capitalization-weighted index of domestic and Yankee high-yield bonds. The index tracks the performance of high-yield securities traded in the U.S. bond market. You cannot invest directly in an index. Copyright 2022. ICE Data Indices, LLC. All rights reserved. |

| 1 | The Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. You cannot invest directly in an index. |

“ The Russian invasion of Ukraine dominated the financial world in February and March. Equity, bond, and commodities markets were shaken by fear, uncertainty, and an upending of demand-supply dynamics.” |

President

Allspring Funds

| 1 | The MSCI ACWI (Net) is a free-float-adjusted market-capitalization-weighted index that is designed to measure the equity market performance of developed and emerging markets. You cannot invest directly in an index. |

| Investment objective | The Fund seeks a positive total return. |

| Manager | Allspring Funds Management, LLC |

| Portfolio managers | Ben Inker, CFA®‡*, John Thorndike* |

| Average annual total returns (%) as of April 30, 2022 | |||||||||||

| Including sales charge | Excluding sales charge | Expense ratios1 (%) | |||||||||

| Inception date | 1 year | 5 year | 10 year | 1 year | 5 year | 10 year | Gross | Net 2 | |||

| Class A (WARAX) | 3-1-2012 | -10.39 | 0.18 | 1.75 | -4.89 | 1.36 | 2.36 | 1.59 | 1.59 | ||

| Class C (WARCX) | 3-1-2012 | -6.59 | 0.65 | 1.63 | -5.59 | 0.65 | 1.63 | 2.34 | 2.34 | ||

| Class R (WARHX)3 | 9-30-2015 | – | – | – | -5.05 | 1.40 | 2.26 | 1.84 | 1.84 | ||

| Class R6 (WARRX)4 | 10-31-2014 | – | – | – | -4.50 | 1.81 | 2.80 | 1.16 | 1.16 | ||

| Administrator Class (WARDX) | 3-1-2012 | – | – | – | -4.81 | 1.56 | 2.53 | 1.51 | 1.47 | ||

| Institutional Class (WABIX)5 | 11-30-2012 | – | – | – | -4.59 | 1.71 | 2.74 | 1.26 | 1.23 | ||

| MSCI ACWI Index (Net)6 | – | – | – | – | -5.44 | 9.46 | 9.21 | – | – | ||

| Bloomberg U.S. TIPS 1-10 Year Index7 | – | – | – | – | 1.52 | 3.59 | 2.02 | – | – | ||

| CPI 8 | – | – | – | – | 8.26 | 3.41 | 2.31 | – | – | ||

| 1 | Reflects the expense ratios as stated in the most recent prospectuses, which include the impact of 0.90% in acquired fund fees and expenses and underlying GMO fees. The expense ratios shown are subject to change and may differ from the annualized expense ratios shown in the financial highlights of this report, which do not include the expenses of GMO Benchmark-Free Allocation Fund and other acquired fund fees and expenses. |

| 2 | The manager has contractually committed through August 31, 2022, to waive fees and/or reimburse expenses to the extent necessary to cap total annual fund operating expenses after fee waivers at 0.71% for Class A, 1.46% for Class C, 0.96% for Class R, 0.28% for Class R6, 0.57% for Administrator Class, and 0.33% for Institutional Class. Brokerage commissions, stamp duty fees, interest, taxes, acquired fund fees and expenses (if any, including the expenses of GMO Benchmark-Free Allocation Fund), and extraordinary expenses are excluded from the expense caps. Prior to or after the commitment expiration date, the caps may be increased or the commitment to maintain the caps may be terminated only with the approval of the Board of Trustees. Without these caps, the Fund’s returns would have been lower. The expense ratio paid by an investor is the net expense ratio (the total annual fund operating expenses after fee waivers) as stated in the prospectuses. |

| 3 | Historical performance shown for the Class R shares prior to their inception reflects the performance of the Administrator Class shares, adjusted to reflect the higher expenses applicable to the Class R shares. |

| 4 | Historical performance shown for the Class R6 shares prior to their inception reflects the performance of the Institutional Class shares, and includes the higher expenses applicable to the Institutional Class shares. If these expenses had not been included, returns for the Class R6 shares would be higher. |

| 5 | Historical performance shown for the Institutional Class shares prior to their inception reflects the performance of the Administrator Class shares, and includes the higher expenses applicable to the Administrator Class shares. If these expenses had not been included, returns for the Institutional Class shares would be higher. |

| 6 | The Morgan Stanley Capital International (MSCI) All Country World Index (ACWI) Index (Net) is a free-float-adjusted market-capitalization-weighted index that is designed to measure the equity market performance of developed and emerging markets. Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed, or produced by MSCI. You cannot invest directly in an index. |

| ‡ | CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute. |

| * | The Fund invests substantially all of its investable assets directly in GMO Benchmark-Free Allocation Fund, an investment company advised by Grantham, Mayo, Van Otterloo & Co. LLC (GMO). Mr. Inker and Mr. Thorndike have been responsible for coordinating the portfolio management of GMO Benchmark-Free Allocation Fund since 2003 and 2019, respectively. |

| 7 | The Bloomberg U.S. Treasury Inflation-Protected Securities (TIPS) 1-10 Year Index is an unmanaged index of U.S. Treasury securities with maturities of less than 10 years and more than 1 year. You cannot invest directly in an index. |

| 8 | The Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. You cannot invest directly in an index. |

| ■ | The Fund (Class A, excluding sales charges) outperformed the MSCI ACWI Index (Net) but underperformed the Bloomberg U.S. TIPS 1–10 Year Index and the Consumer Price Index for the 12-month period that ended April 30, 2022. |

| ■ | The exposure to the Equity Dislocation strategy, an actively managed equity long/short strategy designed to monetize the valuation disparity between value stocks and growth stocks, was the biggest contributor to performance as it enjoyed a very strong 12 months. |

| ■ | Long positions in emerging market equities and Japanese equities were the biggest detractors from performance. |

| Holdings (%) as of April 30, 20221 | |

| GMO Implementation Fund | 87.98 |

| GMO Opportunistic Income Fund, Class VI | 3.37 |

| GMO SGM Major Markets Fund, Class VI | 2.66 |

| GMO Emerging Country Debt Fund, Class VI | 2.29 |

| 1 | Each holding represents the Fund's allocable portion of the investments of the GMO Benchmark-Free Allocation Fund. Figures represent each holding as a percentage of the Fund's net assets. Holdings are subject to change and may have changed since the date specified. |

| * | The S&P 500 Index consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market-value-weighted index with each stock's weight in the index proportionate to its market value. You cannot invest directly in an index. |

| ** | The Morgan Stanley Capital International (MSCI) Emerging Markets (EM) Index (Net) (USD) is a free-float-adjusted market-capitalization-weighted index that is designed to measure equity market performance of emerging markets. You cannot invest directly in an index. |

| *** | The MSCI World ex USA Index (Net) is a free-float adjusted market-capitalization-weighted index that is designed to measure the equity market performance of developed markets, excluding the U.S. You cannot invest directly in an index. |

| † | The Bloomberg U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment-grade, U.S.-dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, mortgage-backed securities (agency fixed-rate and hybrid adjustable-rate mortgage pass-throughs), asset-backed securities, and commercial mortgage-backed securities. You cannot invest directly in an index. |

| †† | The MSCI Europe, Australasia, Far East (EAFE) Index (Net) is a free-float-adjusted market-capitalization-weighted index that is designed to measure the equity market performance of developed markets, excluding the U.S. and Canada. You cannot invest directly in an index. |

| ††† | The MSCI ACWI Value Index captures large and mid cap securities exhibiting overall value style characteristics across 23 Developed Markets countries and 24 Emerging Markets (EM) countries. The value investment style characteristics for index construction are defined using three variables: book value to price, 12-month forward earnings to price and dividend yield. You cannot invest directly in an index. |

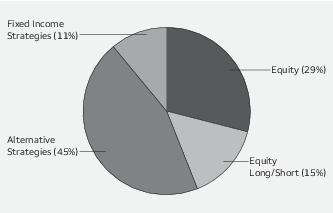

| Portfolio composition as of April 30, 20221 |

| 1 | Figures represent the portfolio allocation of the GMO Benchmark-Free Allocation Fund. These amounts are subject to change and may have changed since the date specified. Equities in the Equity Long/Short segment are hedged with a basket of short index futures positions. |

| * | The MSCI ACWI Growth Index captures large and mid cap securities exhibiting overall growth style characteristics across 23 Developed Markets countries and 24 Emerging Markets (EM) countries. The growth investment style characteristics for index construction are defined using five variables: long-term forward EPS growth rate, short-term forward EPS growth rate, current internal growth rate and long-term historical EPS growth trend and long-term historical sales per share growth trend. You cannot invest directly in an index. |

| Allspring Absolute Return Fund (excluding GMO Benchmark-Free Allocation Fund and its underlying fund expenses) | Beginning account value 11-1-2021 | Ending account value 4-30-2022 | Expenses paid during the period1 | Annualized net expense ratio |

| Class A | ||||

| Actual | $1,000.00 | $ 983.08 | $3.44 | 0.70% |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,021.32 | $3.51 | 0.70% |

| Class C | ||||

| Actual | $1,000.00 | $ 980.03 | $7.02 | 1.43% |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,017.70 | $7.15 | 1.43% |

| Class R | ||||

| Actual | $1,000.00 | $ 982.25 | $4.13 | 0.84% |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,020.63 | $4.21 | 0.84% |

| Class R6 | ||||

| Actual | $1,000.00 | $ 985.17 | $1.33 | 0.27% |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,023.46 | $1.35 | 0.27% |

| Administrator Class | ||||

| Actual | $1,000.00 | $ 983.53 | $2.80 | 0.57% |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,021.97 | $2.86 | 0.57% |

| Institutional Class | ||||

| Actual | $1,000.00 | $ 985.14 | $1.62 | 0.33% |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,023.16 | $1.66 | 0.33% |

| Allspring Absolute Return Fund (including GMO Benchmark-Free Allocation Fund and its underlying fund expenses) | Beginning account value 11-1-2021 | Ending account value 4-30-2022 | Expenses paid during the period1 | Annualized net expense ratio |

| Class A | ||||

| (Actual) | $1,000.00 | $ 983.08 | $ 8.61 | 1.75% |

| (Hypothetical) (5% return before expenses) | $1,000.00 | $1,016.11 | $ 8.76 | 1.75% |

| Class C | ||||

| (Actual) | $1,000.00 | $ 980.03 | $12.19 | 2.48% |

| (Hypothetical) (5% return before expenses) | $1,000.00 | $1,012.49 | $12.38 | 2.48% |

| Class R | ||||

| (Actual) | $1,000.00 | $ 982.25 | $ 9.30 | 1.89% |

| (Hypothetical) (5% return before expenses) | $1,000.00 | $1,015.41 | $ 9.45 | 1.89% |

| Class R6 | ||||

| (Actual) | $1,000.00 | $ 985.17 | $ 6.51 | 1.32% |

| (Hypothetical) (5% return before expenses) | $1,000.00 | $1,018.24 | $ 6.62 | 1.32% |

| Administrator Class | ||||

| (Actual) | $1,000.00 | $ 983.53 | $ 7.98 | 1.62% |

| (Hypothetical) (5% return before expenses) | $1,000.00 | $1,016.75 | $ 8.11 | 1.62% |

| Institutional Class | ||||

| (Actual) | $1,000.00 | $ 985.14 | $ 6.80 | 1.38% |

| (Hypothetical) (5% return before expenses) | $1,000.00 | $1,017.94 | $ 6.91 | 1.38% |

| Shares | Value | ||||

| Investment companies: 96.39% | |||||

| Multi-asset funds: 96.39% | |||||

| GMO Benchmark-Free Allocation Fund Class MF ♠ | 52,234,240 | $ 1,301,677,274 | |||

| Total Investment companies (Cost $1,240,834,628) | 1,301,677,274 | ||||

| Total investments in securities (Cost $1,240,834,628) | 96.39% | 1,301,677,274 | |||

| Other assets and liabilities, net | 3.61 | 48,775,949 | |||

| Total net assets | 100.00% | $1,350,453,223 |

| ♠ | The issuer of the security is an affiliated person of the Fund as defined in the Investment Company Act of 1940. |

| Value, beginning of period | Purchases | Sales proceeds | Net realized gains (losses) on affiliated investment companies | Net change in unrealized gains (losses) on affiliated investment companies | Value, end of period | |

| Investment companies | ||||||

| GMO Benchmark-Free Allocation Fund Class MF | $1,681,440,024 | $83,861,185 | $(363,756,410) | $21,350,266 | $(121,217,791) | $1,301,677,274 |

| Shares, end of period | Dividends from affiliated investment companies | |

| Investment companies | ||

| GMO Benchmark-Free Allocation Fund Class MF | 52,234,240 | $34,695,369 |

| Assets | |

Investments in affiliated investment companies, at value (cost $1,240,834,628) | $ 1,301,677,274 |

Cash | 48,275,594 |

Receivable for investments sold | 1,724,406 |

Receivable for Fund shares sold | 1,307,972 |

Prepaid expenses and other assets | 30,337 |

Total assets | 1,353,015,583 |

| Liabilities | |

Payable for Fund shares redeemed | 1,444,319 |

Shareholder report expenses payable | 576,273 |

Management fee payable | 223,576 |

Administration fees payable | 176,836 |

Distribution fees payable | 36,781 |

Trustees’ fees and expenses payable | 2,677 |

Accrued expenses and other liabilities | 101,898 |

Total liabilities | 2,562,360 |

Total net assets | $1,350,453,223 |

| Net assets consist of | |

Paid-in capital | $ 1,753,632,756 |

Total distributable loss | (403,179,533) |

Total net assets | $1,350,453,223 |

| Computation of net asset value and offering price per share | |

Net assets – Class A | $ 325,368,899 |

Shares outstanding – Class A1 | 31,909,702 |

Net asset value per share – Class A | $10.20 |

Maximum offering price per share – Class A2 | $10.82 |

Net assets – Class C | $ 58,948,101 |

Shares outstanding – Class C1 | 5,768,354 |

Net asset value per share – Class C | $10.22 |

Net assets – Class R | $ 129,868 |

Shares outstanding – Class R1 | 12,372 |

Net asset value per share – Class R | $10.50 |

Net assets – Class R6 | $ 10,494,410 |

Shares outstanding – Class R61 | 1,025,527 |

Net asset value per share – Class R6 | $10.23 |

Net assets – Administrator Class | $ 32,644,457 |

Shares outstanding – Administrator Class1 | 3,162,129 |

Net asset value per share – Administrator Class | $10.32 |

Net assets – Institutional Class | $ 922,867,488 |

Shares outstanding – Institutional Class1 | 90,198,365 |

Net asset value per share – Institutional Class | $10.23 |

| 1 | The Fund has an unlimited number of authorized shares. |

| 2 | Maximum offering price is computed as 100/94.25 of net asset value. On investments of $50,000 or more, the offering price is reduced. |

| Investment income | |

Dividends from affiliated investment companies | $ 34,695,369 |

| Expenses | |

Management fee | 3,342,781 |

| Administration fees | |

Class A | 723,291 |

Class C | 191,908 |

Class R | 291 |

Class R6 | 4,348 |

Administrator Class | 47,050 |

Institutional Class | 1,378,130 |

| Shareholder servicing fees | |

Class A | 860,896 |

Class C | 225,913 |

Class R | 347 |

Administrator Class | 88,903 |

| Distribution fees | |

Class C | 676,711 |

Class R | 248 |

Custody and accounting fees | 16,315 |

Professional fees | 38,553 |

Registration fees | 86,222 |

Shareholder report expenses | 150,852 |

Trustees’ fees and expenses | 20,409 |

Other fees and expenses | 11,249 |

Total expenses | 7,864,417 |

| Less: Fee waivers and/or expense reimbursements | |

Class A | (587) |

Class C | (26) |

Administrator Class | (15,451) |

Institutional Class | (392,479) |

Net expenses | 7,455,874 |

Net investment income | 27,239,495 |

| Realized and unrealized gains (losses) on investments | |

Net realized gains from affiliated investment companies | 21,350,266 |

Net change in unrealized gains (losses) from affiliated investment companies | (121,217,791) |

Net realized and unrealized gains (losses) on investments | (99,867,525) |

Net decrease in net assets resulting from operations | $ (72,628,030) |

| Year ended April 30, 2022 | Year ended April 30, 2021 | |||

| Operations | ||||

Net investment income | $ 27,239,495 | $ 45,466,218 | ||

Payment from affiliate | 0 | 840,939 | ||

Net realized gains on investments | 21,350,266 | 36,313,309 | ||

Net change in unrealized gains (losses) on investments | (121,217,791) | 161,469,734 | ||

Net increase (decrease) in net assets resulting from operations | (72,628,030) | 244,090,200 | ||

| Distributions to shareholders from | ||||

| Net investment income and net realized gains | ||||

Class A | (10,481,984) | (10,520,302) | ||

Class C | (532,511) | (4,555,046) | ||

Class R | (4,113) | (4,635) | ||

Class R6 | (465,159) | (664,227) | ||

Administrator Class | (1,001,636) | (1,426,677) | ||

Institutional Class | (33,821,801) | (43,198,445) | ||

Total distributions to shareholders | (46,307,204) | (60,369,332) | ||

| Capital share transactions | Shares | Shares | ||

| Proceeds from shares sold | ||||

Class A | 7,290,999 | 78,841,319 | 11,820,545 | 126,171,861 |

Class C | 589,758 | 6,324,386 | 539,919 | 5,719,127 |

Class R | 312 | 3,363 | 19,612 | 220,705 |

Class R6 | 51,639 | 555,443 | 191,804 | 2,049,670 |

Administrator Class | 349,123 | 3,791,366 | 416,961 | 4,487,504 |

Institutional Class | 18,008,528 | 194,524,182 | 21,087,448 | 223,635,756 |

| 284,040,059 | 362,284,623 | |||

| Reinvestment of distributions | ||||

Class A | 889,292 | 9,310,884 | 841,654 | 8,871,030 |

Class C | 49,212 | 517,714 | 425,622 | 4,430,727 |

Class R | 81 | 869 | 0 | 0 |

Class R6 | 33,116 | 347,390 | 48,540 | 512,585 |

Administrator Class | 91,916 | 974,308 | 129,752 | 1,380,557 |

Institutional Class | 2,590,846 | 27,177,971 | 3,231,759 | 34,127,379 |

| 38,329,136 | 49,322,278 | |||

| Payment for shares redeemed | ||||

Class A | (8,176,385) | (87,937,649) | (10,187,273) | (107,936,942) |

Class C | (6,952,463) | (74,485,079) | (14,448,329) | (150,591,212) |

Class R | (1,005) | (11,161) | (9,225) | (103,350) |

Class R6 | (620,382) | (6,656,095) | (1,187,226) | (12,405,073) |

Administrator Class | (918,724) | (10,060,721) | (2,900,787) | (30,662,202) |

Institutional Class | (37,495,597) | (405,316,293) | (81,795,286) | (864,473,835) |

| (584,466,998) | (1,166,172,614) | |||

Net decrease in net assets resulting from capital share transactions | (262,097,803) | (754,565,713) | ||

Total decrease in net assets | (381,033,037) | (570,844,845) | ||

| Net assets | ||||

Beginning of period | 1,731,486,260 | 2,302,331,105 | ||

End of period | $1,350,453,223 | $ 1,731,486,260 | ||

| Year ended April 30 | |||||

| Class A | 2022 | 2021 | 2020 | 2019 | 2018 |

Net asset value, beginning of period | $11.07 | $10.11 | $11.15 | $11.40 | $10.90 |

Net investment income | 0.17 1 | 0.22 | 0.29 1 | 0.27 1 | 0.19 1 |

Net realized and unrealized gains (losses) on investments | (0.70) | 1.09 | (1.04) | (0.24) | 0.51 |

Total from investment operations | (0.53) | 1.31 | (0.75) | 0.03 | 0.70 |

| Distributions to shareholders from | |||||

Net investment income | (0.34) | (0.35) | (0.29) | (0.28) | (0.20) |

Net asset value, end of period | $10.20 | $11.07 | $10.11 | $11.15 | $11.40 |

Total return2 | (4.89)% | 13.16% | (6.99)% | 0.42% | 6.45% |

| Ratios to average net assets (annualized) | |||||

Gross expenses3 | 0.70% | 0.69% | 0.69% | 0.69% | 0.68% |

Net expenses3 | 0.70% | 0.69% | 0.69% | 0.69% | 0.68% |

Net investment income | 1.62% | 2.33% | 2.68% | 2.43% | 1.67% |

| Supplemental data | |||||

Portfolio turnover rate | 6% | 5% | 4% | 5% | 5% |

Net assets, end of period (000s omitted) | $325,369 | $353,134 | $297,590 | $415,011 | $516,085 |

| 1 | Calculated based upon average shares outstanding |

| 2 | Total return calculations do not include any sales charges. |

| 3 | Ratios do not include net expenses of GMO Benchmark-Free Allocation Fund, Class MF. Including net expenses allocated from GMO Benchmark-Free Allocation Fund, Class MF, the ratios would be increased by the following amounts: |

| Year ended April 30, 2022 | 0.70% |

| Year ended April 30, 2021 | 0.67% |

| Year ended April 30, 2020 | 0.61% |

| Year ended April 30, 2019 | 0.60% |

| Year ended April 30, 2018 | 0.60% |

| Year ended April 30 | |||||

| Class C | 2022 | 2021 | 2020 | 2019 | 2018 |

Net asset value, beginning of period | $10.90 | $9.95 | $10.96 | $11.19 | $10.70 |

Net investment income | 0.06 1 | 0.12 1 | 0.12 | 0.19 1 | 0.10 1 |

Payment from affiliate | 0.00 | 0.05 | 0.00 | 0.00 | 0.00 |

Net realized and unrealized gains (losses) on investments | (0.67) | 1.08 | (0.95) | (0.24) | 0.50 |

Total from investment operations | (0.61) | 1.25 | (0.83) | (0.05) | 0.60 |

| Distributions to shareholders from | |||||

Net investment income | (0.07) | (0.30) | (0.18) | (0.18) | (0.11) |

Net asset value, end of period | $10.22 | $10.90 | $9.95 | $10.96 | $11.19 |

Total return2 | (5.59)% | 12.66% 3 | (7.73)% | (0.31)% | 5.60% |

| Ratios to average net assets (annualized) | |||||

Gross expenses4 | 1.43% | 1.44% | 1.44% | 1.44% | 1.43% |

Net expenses4 | 1.43% | 1.44% | 1.44% | 1.44% | 1.43% |

Net investment income | 0.61% | 1.18% | 1.71% | 1.78% | 0.88% |

| Supplemental data | |||||

Portfolio turnover rate | 6% | 5% | 4% | 5% | 5% |

Net assets, end of period (000s omitted) | $58,948 | $131,690 | $254,485 | $419,656 | $629,813 |

| 1 | Calculated based upon average shares outstanding |

| 2 | Total return calculations do not include any sales charges. |

| 3 | During the year ended April 30, 2021, the Fund received a payment from an affiliate that had an impact of 0.53% on total return. See Note 4 in the Notes to Financial Statements for additional information. |

| 4 | Ratios do not include net expenses of GMO Benchmark-Free Allocation Fund, Class MF. Including net expenses allocated from GMO Benchmark-Free Allocation Fund, Class MF, the ratios would be increased by the following amounts: |

| Year ended April 30, 2022 | 0.70% |

| Year ended April 30, 2021 | 0.67% |

| Year ended April 30, 2020 | 0.61% |

| Year ended April 30, 2019 | 0.60% |

| Year ended April 30, 2018 | 0.60% |

| Year ended April 30 | |||||

| Class R | 2022 | 2021 | 2020 | 2019 | 2018 |

Net asset value, beginning of period | $11.41 | $10.33 | $11.12 | $11.37 | $10.82 |

Net investment income | 0.16 1 | 0.18 | 0.12 | 0.27 | 0.12 |

Payment from affiliate | 0.00 | 0.02 | 0.00 | 0.00 | 0.00 |

Net realized and unrealized gains (losses) on investments | (0.73) | 1.25 | (0.91) | (0.26) | 0.55 |

Total from investment operations | (0.57) | 1.45 | (0.79) | 0.01 | 0.67 |

| Distributions to shareholders from | |||||

Net investment income | (0.34) | (0.37) | 0.00 | (0.26) | (0.12) |

Net asset value, end of period | $10.50 | $11.41 | $10.33 | $11.12 | $11.37 |

Total return | (5.05)% | 14.17% 2 | (7.10)% | 0.21% | 6.21% |

| Ratios to average net assets (annualized) | |||||

Gross expenses3 | 0.88% | 0.88% | 0.91% | 0.85% | 0.93% |

Net expenses3 | 0.88% | 0.88% | 0.91% | 0.85% | 0.93% |

Net investment income | 1.40% | 4.51% | 0.21% | 2.42% | 0.85% |

| Supplemental data | |||||

Portfolio turnover rate | 6% | 5% | 4% | 5% | 5% |

Net assets, end of period (000s omitted) | $130 | $148 | $27 | $262 | $368 |

| 1 | Calculated based upon average shares outstanding |

| 2 | During the year ended April 30, 2021, the Fund received a payment from an affiliate that had an impact of 0.22% on total return. See Note 4 in the Notes to Financial Statements for additional information. |

| 3 | Ratios do not include net expenses of GMO Benchmark-Free Allocation Fund, Class MF. Including net expenses allocated from GMO Benchmark-Free Allocation Fund, Class MF, the ratios would be increased by the following amounts: |

| Year ended April 30, 2022 | 0.70% |

| Year ended April 30, 2021 | 0.67% |

| Year ended April 30, 2020 | 0.61% |

| Year ended April 30, 2019 | 0.60% |

| Year ended April 30, 2018 | 0.60% |

| Year ended April 30 | |||||

| Class R6 | 2022 | 2021 | 2020 | 2019 | 2018 |

Net asset value, beginning of period | $11.10 | $10.11 | $11.15 | $11.41 | $10.91 |

Net investment income | 0.21 1 | 0.28 | 0.35 | 0.34 | 0.31 1 |

Net realized and unrealized gains (losses) on investments | (0.70) | 1.08 | (1.05) | (0.27) | 0.45 |

Total from investment operations | (0.49) | 1.36 | (0.70) | 0.07 | 0.76 |

| Distributions to shareholders from | |||||

Net investment income | (0.38) | (0.37) | (0.34) | (0.33) | (0.26) |

Net asset value, end of period | $10.23 | $11.10 | $10.11 | $11.15 | $11.41 |

Total return | (4.50)% | 13.62% | (6.57)% | 0.86% | 6.97% |

| Ratios to average net assets (annualized) | |||||

Gross expenses2 | 0.27% | 0.26% | 0.26% | 0.26% | 0.25% |

Net expenses2 | 0.27% | 0.26% | 0.26% | 0.26% | 0.25% |

Net investment income | 1.91% | 2.63% | 3.05% | 2.64% | 2.69% |

| Supplemental data | |||||

Portfolio turnover rate | 6% | 5% | 4% | 5% | 5% |

Net assets, end of period (000s omitted) | $10,494 | $17,332 | $25,363 | $31,838 | $46,753 |

| 1 | Calculated based upon average shares outstanding |

| 2 | Ratios do not include net expenses of GMO Benchmark-Free Allocation Fund, Class MF. Including net expenses allocated from GMO Benchmark-Free Allocation Fund, Class MF, the ratios would be increased by the following amounts: |

| Year ended April 30, 2022 | 0.70% |

| Year ended April 30, 2021 | 0.67% |

| Year ended April 30, 2020 | 0.61% |

| Year ended April 30, 2019 | 0.60% |

| Year ended April 30, 2018 | 0.60% |

| Year ended April 30 | |||||

| Administrator Class | 2022 | 2021 | 2020 | 2019 | 2018 |

Net asset value, beginning of period | $11.18 | $10.15 | $11.18 | $11.43 | $10.92 |

Net investment income | 0.17 1 | 0.24 1 | 0.27 1 | 0.27 1 | 0.19 1 |

Payment from affiliate | 0.00 | 0.06 | 0.00 | 0.00 | 0.00 |

Net realized and unrealized gains (losses) on investments | (0.70) | 1.08 | (1.01) | (0.24) | 0.53 |

Total from investment operations | (0.53) | 1.38 | (0.74) | 0.03 | 0.72 |

| Distributions to shareholders from | |||||

Net investment income | (0.33) | (0.35) | (0.29) | (0.28) | (0.21) |

Net asset value, end of period | $10.32 | $11.18 | $10.15 | $11.18 | $11.43 |

Total return | (4.81)% | 13.76% 2 | (6.85)% | 0.48% | 6.62% |

| Ratios to average net assets (annualized) | |||||

Gross expenses3 | 0.61% | 0.61% | 0.61% | 0.60% | 0.60% |

Net expenses3 | 0.57% | 0.57% | 0.57% | 0.57% | 0.57% |

Net investment income | 1.60% | 2.20% | 2.42% | 2.44% | 1.70% |

| Supplemental data | |||||

Portfolio turnover rate | 6% | 5% | 4% | 5% | 5% |

Net assets, end of period (000s omitted) | $32,644 | $40,694 | $60,846 | $116,871 | $212,965 |

| 1 | Calculated based upon average shares outstanding |

| 2 | During the year ended April 30, 2021, the Fund received a payment from an affiliate that had an impact of 0.62% on total return. See Note 4 in the Notes to Financial Statements for additional information. |

| 3 | Ratios do not include net expenses of GMO Benchmark-Free Allocation Fund, Class MF. Including net expenses allocated from GMO Benchmark-Free Allocation Fund, Class MF, the ratios would be increased by the following amounts: |

| Year ended April 30, 2022 | 0.70% |

| Year ended April 30, 2021 | 0.67% |

| Year ended April 30, 2020 | 0.61% |

| Year ended April 30, 2019 | 0.60% |

| Year ended April 30, 2018 | 0.60% |

| Year ended April 30 | |||||

| Institutional Class | 2022 | 2021 | 2020 | 2019 | 2018 |

Net asset value, beginning of period | $11.10 | $10.11 | $11.15 | $11.41 | $10.92 |

Net investment income | 0.21 1 | 0.26 1 | 0.33 1 | 0.31 1 | 0.24 |

Net realized and unrealized gains (losses) on investments | (0.71) | 1.09 | (1.04) | (0.25) | 0.50 |

Total from investment operations | (0.50) | 1.35 | (0.71) | 0.06 | 0.74 |

| Distributions to shareholders from | |||||

Net investment income | (0.37) | (0.36) | (0.33) | (0.32) | (0.25) |

Net asset value, end of period | $10.23 | $11.10 | $10.11 | $11.15 | $11.41 |

Total return | (4.59)% | 13.57% | (6.65)% | 0.76% | 6.78% |

| Ratios to average net assets (annualized) | |||||

Gross expenses2 | 0.37% | 0.36% | 0.36% | 0.36% | 0.35% |

Net expenses2 | 0.33% | 0.33% | 0.33% | 0.33% | 0.33% |

Net investment income | 1.90% | 2.43% | 3.00% | 2.82% | 2.07% |

| Supplemental data | |||||

Portfolio turnover rate | 6% | 5% | 4% | 5% | 5% |

Net assets, end of period (000s omitted) | $922,867 | $1,188,488 | $1,664,020 | $2,890,106 | $4,189,647 |

| 1 | Calculated based upon average shares outstanding |

| 2 | Ratios do not include net expenses of GMO Benchmark-Free Allocation Fund, Class MF. Including net expenses allocated from GMO Benchmark-Free Allocation Fund, Class MF, the ratios would be increased by the following amounts: |

| Year ended April 30, 2022 | 0.70% |

| Year ended April 30, 2021 | 0.67% |

| Year ended April 30, 2020 | 0.61% |

| Year ended April 30, 2019 | 0.60% |

| Year ended April 30, 2018 | 0.60% |

| Gross unrealized gains | $1,422,270 |

| Gross unrealized losses | 0 |

| Net unrealized gains | $1,422,270 |

| ■ | Level 1 – quoted prices in active markets for identical securities |

| ■ | Level 2 – other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) |

| ■ | Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

| Average daily net assets | Management fee |

| First $1 billion | 0.225% |

| Next $4 billion | 0.200 |

| Next $5 billion | 0.175 |

| Next $10 billion | 0.165 |

| Over $20 billion | 0.160 |

| Class-level administration fee | |

| Class A | 0.21% |

| Class C | 0.21 |

| Class R | 0.21 |

| Class R6 | 0.03 |

| Administrator Class | 0.13 |

| Institutional Class | 0.13 |

| Expense ratio caps | |

| Class A | 0.71% |

| Class C | 1.46 |

| Class R | 0.96 |

| Class R6 | 0.28 |

| Administrator Class | 0.57 |

| Institutional Class | 0.33 |

| Undistributed ordinary income | Unrealized gains | Capital loss carryforward |

| $27,238,487 | $1,422,270 | $(431,840,290) |

Allspring Funds Trust:

| Creditable foreign taxes paid | Per share amount | Foreign income as % of ordinary income distributions |

| $ 3,623,678 | $ 0.02744 | 100% |

| Name and year of birth | Position held and length of service* | Principal occupations during past five years or longer | Current other public company or investment company directorships |

| William R. Ebsworth (Born 1957) | Trustee, since 2015 | Retired. From 1984 to 2013, equities analyst, portfolio manager, research director and chief investment officer at Fidelity Management and Research Company in Boston, Tokyo, and Hong Kong, and retired in 2013 as Chief Investment Officer of Fidelity Strategic Advisers, Inc. where he led a team of investment professionals managing client assets. Prior thereto, Board member of Hong Kong Securities Clearing Co., Hong Kong Options Clearing Corp., the Thailand International Fund, Ltd., Fidelity Investments Life Insurance Company, and Empire Fidelity Investments Life Insurance Company. Audit Committee Chair and Investment Committee Chair of the Vincent Memorial Hospital Endowment (non-profit organization). Mr. Ebsworth is a CFA® charterholder. | N/A |

| Jane A. Freeman (Born 1953) | Trustee, since 2015; Chair Liaison, since 2018 | Retired. From 2012 to 2014 and 1999 to 2008, Chief Financial Officer of Scientific Learning Corporation. From 2008 to 2012, Ms. Freeman provided consulting services related to strategic business projects. Prior to 1999, Portfolio Manager at Rockefeller & Co. and Scudder, Stevens & Clark. Board member of the Harding Loevner Funds from 1996 to 2014, serving as both Lead Independent Director and chair of the Audit Committee. Board member of the Russell Exchange Traded Funds Trust from 2011 to 2012 and the chair of the Audit Committee. Ms. Freeman is also an inactive Chartered Financial Analyst. | N/A |

| Isaiah Harris, Jr. (Born 1952) | Trustee, since 2009; Audit Committee Chair, since 2019 | Retired. Chairman of the Board of CIGNA Corporation from 2009 to 2021, and Director from 2005 to 2008. From 2003 to 2011, Director of Deluxe Corporation. Prior thereto, President and CEO of BellSouth Advertising and Publishing Corp. from 2005 to 2007, President and CEO of BellSouth Enterprises from 2004 to 2005 and President of BellSouth Consumer Services from 2000 to 2003. Emeritus member of the Iowa State University Foundation Board of Governors. Emeritus Member of the Advisory Board of Iowa State University School of Business. Advisory Board Member, Palm Harbor Academy (private school). Advisory Board Member, Fellowship of Christian Athletes. Mr. Harris is a certified public accountant (inactive status). | N/A |

| David F. Larcker (Born 1950) | Trustee, since 2009 | James Irvin Miller Professor of Accounting at the Graduate School of Business (Emeritus), Stanford University, Director of the Corporate Governance Research Initiative and Senior Faculty of The Rock Center for Corporate Governance since 2006. From 2005 to 2008, Professor of Accounting at the Graduate School of Business, Stanford University. Prior thereto, Ernst & Young Professor of Accounting at The Wharton School, University of Pennsylvania from 1985 to 2005. | N/A |

Appendix (unaudited)

GMO Benchmark-Free Allocation Fund

(A Series of GMO Trust)

Schedule of Investments

(showing percentage of total net assets)

April 30, 2022 (Unaudited)

| Shares | Description | Value ($) | ||||||||

| MUTUAL FUNDS — 99.9% |

| |||||||||

| Affiliated Issuers — 99.9% |

| |||||||||

| 5,631,069 | GMO Emerging Country Debt Fund, Class VI | 114,592,264 | ||||||||

| 359,589,193 | GMO Implementation Fund | 4,397,775,830 | ||||||||

| 6,658,505 | GMO Opportunistic Income Fund, Class VI | 168,260,431 | ||||||||

| 4,632,781 | GMO SGM Major Markets Fund, Class VI | 132,914,484 | ||||||||

|

| |||||||||

| TOTAL MUTUAL FUNDS (COST $5,155,251,927) | 4,813,543,009 | |||||||||

|

| |||||||||

| SHORT-TERM INVESTMENTS — 0.1% |

| |||||||||

| Money Market Funds — 0.1% |

| |||||||||

| 3,991,953 | State Street Institutional Treasury Money Market Fund – Premier Class, 0.35%(a) | 3,991,953 | ||||||||

|

| |||||||||

| TOTAL SHORT-TERM INVESTMENTS (COST $3,991,953) | 3,991,953 | |||||||||

|

| |||||||||

| TOTAL INVESTMENTS — 100.0% (Cost $5,159,243,880) | 4,817,534,962 | |||||||||

| Other Assets and Liabilities (net) — 0.0% | 403,610 | |||||||||

|

| |||||||||

| TOTAL NET ASSETS — 100.0% | $ | 4,817,938,572 | ||||||||

|

| |||||||||

Notes to Schedule of Investments:

| (a) | The rate disclosed is the 7 day net yield as of April 30, 2022. |

32 | Allspring Absolute Return Fund

Appendix (unaudited)

GMO Benchmark-Free Allocation Fund

(A Series of GMO Trust)

Statement of Assets and Liabilities — April 30, 2022 (Unaudited)

Assets: | ||||

Investments in affiliated issuers, at value(a) | $ | 4,813,543,009 | ||

Investments in unaffiliated issuers, at value(b) | 3,991,953 | |||

Receivable for Fund shares sold | 7,800,039 | |||

Dividends and interest receivable | 398 | |||

Receivable for expenses reimbursed and/or waived by GMO | 236,020 | |||

|

| |||

Total assets | 4,825,571,419 | |||

|

| |||

Liabilities: | ||||

Payable for investments purchased | 2,190,000 | |||

Payable for Fund shares repurchased | 2,118,799 | |||

Payable to affiliate for: | ||||

Management fee | 2,587,473 | |||

Supplemental support fee – Class MF | 108,946 | |||

Shareholder service fee | 384,852 | |||

Payable to Trustees and related expenses | 24,867 | |||

Accrued expenses | 217,910 | |||

|

| |||

Total liabilities | 7,632,847 | |||

|

| |||

Net assets | $ | 4,817,938,572 | ||

|

| |||

Net assets consist of: | ||||

Paid-in capital | $ | 5,384,257,675 | ||

Distributable earnings (accumulated loss) | (566,319,103 | ) | ||

|

| |||

| $ | 4,817,938,572 | |||

|

| |||

Net assets attributable to: | ||||

Class III | $ | 1,667,804,759 | ||

|

| |||

Class IV | $ | 1,197,474,892 | ||

|

| |||

Class MF | $ | 1,301,883,275 | ||

|

| |||

Class R6 | $ | 284,499,135 | ||

|

| |||

Class I | $ | 366,276,511 | ||

|

| |||

Shares outstanding: | ||||

Class III | 66,980,407 | |||

|

| |||

Class IV | 48,085,679 | |||

|

| |||

Class MF | 52,234,240 | |||

|

| |||

Class R6 | 11,433,626 | |||

|

| |||

Class I | 14,729,427 | |||

|

| |||

Net asset value per share: | ||||

Class III | $ | 24.90 | ||

|

| |||

Class IV | $ | 24.90 | ||

|

| |||

Class MF | $ | 24.92 | ||

|

| |||

Class R6 | $ | 24.88 | ||

|

| |||

Class I | $ | 24.87 | ||

(a) Cost of investments – affiliated issuers: | $ | 5,155,251,927 | ||

(b) Cost of investments – unaffiliated issuers: | $ | 3,991,953 | ||

For further information regarding GMO Benchmark-Free Allocation Fund, please refer to its audited financial statements for the fiscal year ended February 28, 2022, which are available at:

https://www.sec.gov/Archives/edgar/data/0000772129/000119312522138489/d282302dncsr.htm

Allspring Absolute Return Fund | 33

P.O. Box 219967

Kansas City, MO 64121-9967

1-800-222-8222 or visit the Fund's website at allspringglobal.com. Read the prospectus carefully before you invest or send money.

A260/AR260 04-22

ITEM 2. CODE OF ETHICS

(a) As of the end of the period covered by the report, Allspring Funds Trust has adopted a code of ethics that applies to its President and Treasurer. A copy of the code of ethics is filed as an exhibit to this Form N-CSR.

(c) During the period covered by this report, there were no amendments to the provisions of the code of ethics adopted in Item 2(a) above.

(d) During the period covered by this report, there were no implicit or explicit waivers to the provisions of the code of ethics adopted in Item 2(a) above.

ITEM 3. AUDIT COMMITTEE FINANCIAL EXPERT

The Board of Trustees of Allspring Funds Trust has determined that Isaiah Harris is an audit committee financial expert, as defined in Item 3 of Form N-CSR. Mr. Harris is independent for purposes of Item 3 of Form N-CSR.

ITEM 4. PRINCIPAL ACCOUNTANT FEES AND SERVICES

(a), (b), (c), (d) The following table presents aggregate fees billed in each of the last two fiscal years for services rendered

to the Registrant by the Registrant’s principal accountant. These fees were billed to the registrant and were approved by

the Registrant’s audit committee.

| Fiscal year ended | Fiscal year ended | |||||||

| April 30, 2022 | April 30, 2021 | |||||||

Audit fees | $ | 25,160 | $ | 24,250 | ||||

Audit-related fees | — | — | ||||||

Tax fees (1) | 4,565 | 4,440 | ||||||

All other fees | — | — | ||||||

|

|

|

| |||||

| $ | 29,725 | $ | 28,690 | |||||

|

|

|

| |||||

| (1) | Tax fees consist of fees for tax compliance, tax advice, tax planning and excise tax. |

(e) The Chair of the Audit Committees is authorized to pre-approve: (1) audit services for the mutual funds of Allspring Funds Trust; (2) non-audit tax or compliance consulting or training services provided to the Funds by the independent auditors (“Auditors”) if the fees for any particular engagement are not anticipated to exceed $50,000; and (3) non-audit tax or compliance consulting or training services provided by the Auditors to a Fund’s investment adviser and its controlling entities (where pre-approval is required because the engagement relates directly to the operations and financial reporting of the Fund) if the fee to the Auditors for any particular engagement is not anticipated to exceed $50,000. For any such pre-approval sought from the Chair, Management shall prepare a brief description of the proposed services.

If the Chair approves of such service, he or she shall sign the statement prepared by Management.

Such written statement shall be presented to the full Committees at their next regularly scheduled meetings.

(f) Not applicable

(g) Not applicable

(h) Not applicable

ITEM 5. AUDIT COMMITTEE OF LISTED REGISTRANTS

Not applicable.

ITEM 6. INVESTMENTS

A Portfolio of Investments for each series of Allspring Funds Trust is included as part of the report to shareholders filed under Item 1 of this Form.

ITEM 7. DISCLOSURE OF PROXY VOTING POLICIES AND PROCEDURES FOR CLOSED-END MANAGEMENT INVESTMENT COMPANIES

Not applicable.

ITEM 8. PORTFOLIO MANAGERS OF CLOSED-END MANAGEMENT INVESTMENT COMPANIES

Not applicable.

ITEM 9. PURCHASES OF EQUITY SECURITIES BY CLOSED-END MANAGEMENT INVESTMENT COMPANY AND AFFILIATED PURCHASERS

Not applicable.

ITEM 10. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

There have been no material changes to the procedures by which shareholders may recommend nominees to the registrant’s Board of Trustees that have been implemented since the registrant’s last provided disclosure in response to the requirements of this Item.

ITEM 11. CONTROLS AND PROCEDURES

(a) The President and Treasurer have concluded that the Allspring Funds Trust disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940) provide reasonable assurances that material information relating to the registrant is made known to them by the appropriate persons based on their evaluation of these controls and procedures as of a date within 90 days of the filing of this report.

(b) There were no significant changes in the registrant’s internal controls over financial reporting (as defined in Rule 30a-3(d) under the Investment Company Act of 1940) that occurred during the most recent fiscal half-year of the period covered by this report that materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting.

ITEM 12. DISCLOSURES OF SECURITIES LENDING ACTIVITES FOR CLOSED-END MANAGEMENT INVESTMENT COMPANIES

Not applicable.

ITEM 13. EXHIBITS

| (a)(1) | Code of Ethics. | |

| (a)(2) | Certifications pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. | |

| (b) | Certifications pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Allspring Funds Trust | ||

| By: | /s/ Andrew Owen | |

| Andrew Owen | ||

| President | ||

| Date: June 27, 2022 | ||

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the date indicated.

| Allspring Funds Trust | ||

| By: | /s/ Andrew Owen | |

| Andrew Owen | ||

| President | ||

| Date: June 27, 2022 | ||

| By: | /s/Jeremy DePalma | |

| Jeremy DePalma | ||

| Treasurer | ||

| Date: June 27, 2022 | ||