UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-09253

Allspring Funds Trust

(Exact name of registrant as specified in charter)

525 Market St., San Francisco, CA 94105

(Address of principal executive offices) (Zip code)

Matthew Prasse

Allspring Funds Management, LLC

525 Market St., San Francisco, CA 94105

(Name and address of agent for service)

Registrant’s telephone number, including area code: 800-222-8222

Date of fiscal year end: July 31

Registrant is making a filing for 9 of its series:

Allspring Disciplined U.S. Core Fund, Allspring Discovery Large Cap Growth Fund, Allspring Growth Fund, Allspring Special Large Cap Value Fund, Allspring Large Cap Core Fund, Allspring Large Cap Growth Fund, Allspring Large Company Value Fund, Allspring Discovery All Cap Growth Fund and Allspring Premier Large Company Growth Fund.

Date of reporting period: July 31, 2022

ITEM 1. REPORT TO STOCKHOLDERS

Special Large Cap Value Fund

| 2 | |

| 6 | |

| 10 | |

| 11 | |

| Financial statements | |

| 14 | |

| 15 | |

| 16 | |

| 17 | |

| 23 | |

| 29 | |

| 30 |

| 1 | The S&P 500 Index consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market-value-weighted index with each stock's weight in the index proportionate to its market value. You cannot invest directly in an index. |

| 2 | The Morgan Stanley Capital International (MSCI) All Country World Index (ACWI) ex USA Index (Net) is a free-float-adjusted market-capitalization-weighted index that is designed to measure the equity market performance of developed and emerging markets, excluding the U.S. Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indexes or any securities or financial products. This report is not approved, reviewed, or produced by MSCI. You cannot invest directly in an index. |

| 3 | The MSCI Emerging Markets (EM) Index (Net) (USD) is a free-float-adjusted market-capitalization-weighted index that is designed to measure equity market performance of emerging markets. You cannot invest directly in an index. |

| 4 | The Bloomberg U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment-grade, U.S.-dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, mortgage-backed securities (agency fixed-rate and hybrid adjustable-rate mortgage pass-throughs), asset-backed securities, and commercial mortgage-backed securities. You cannot invest directly in an index. |

| 5 | The Bloomberg Global Aggregate ex-USD Index (unhedged) is an unmanaged index that provides a broad-based measure of the global investment-grade fixed-income markets excluding the U.S.-dollar-denominated debt market. You cannot invest directly in an index. |

| 6 | The Bloomberg Municipal Bond Index is an unmanaged index composed of long-term tax-exempt bonds with a minimum credit rating of Baa. You cannot invest directly in an index. |

| 7 | The ICE BofA U.S. High Yield Index is a market-capitalization-weighted index of domestic and Yankee high-yield bonds. The index tracks the performance of high-yield securities traded in the U.S. bond market. You cannot invest directly in an index. Copyright 2022. ICE Data Indices, LLC. All rights reserved. |

| 1 | The Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. You cannot invest directly in an index. |

| 2 | The MSCI ACWI (Net) is a free-float-adjusted market-capitalization-weighted index that is designed to measure the equity market performance of developed and emerging markets. You cannot invest directly in an index. |

President

Allspring Funds

| Manager | Allspring Funds Management, LLC |

| Subadviser | Allspring Global Investments, LLC |

| Portfolio managers | James M. Tringas, CFA ®‡, Bryant VanCronkhite, CFA ®‡, CPA, Shane Zweck, CFA ®‡ |

| Average annual total returns (%) as of July 31, 2022 | |||||||||||

| Including sales charge | Excluding sales charge | Expense ratios1 (%) | |||||||||

| Inception date | 1 year | 5 year | 10 year | 1 year | 5 year | 10 year | Gross | Net 2 | |||

| Class A (EIVAX) | 8-1-2006 | -10.73 | 6.94 | 9.49 | -5.29 | 8.21 | 10.14 | 1.19 | 1.11 | ||

| Class C (EIVCX) | 8-1-2006 | -6.99 | 7.45 | 9.47 | -5.99 | 7.45 | 9.47 | 1.94 | 1.86 | ||

| Class R (EIVTX)3 | 3-1-2013 | – | – | – | -5.47 | 8.00 | 9.91 | 1.44 | 1.36 | ||

| Class R6 (EIVFX)4 | 11-30-2012 | – | – | – | -4.86 | 8.86 | 10.68 | 0.76 | 0.65 | ||

| Administrator Class (EIVDX) | 7-30-2010 | – | – | – | -5.07 | 8.40 | 10.34 | 1.11 | 0.95 | ||

| Institutional Class (EIVIX) | 8-1-2006 | – | – | – | -4.96 | 8.65 | 10.59 | 0.86 | 0.70 | ||

| Russell 1000® Value Index5 | – | – | – | – | -1.43 | 8.26 | 11.10 | – | – | ||

| 1 | Reflects the expense ratios as stated in the most recent prospectuses. The expense ratios shown are subject to change and may differ from the annualized expense ratios shown in the financial highlights of this report. |

| 2 | The manager has contractually committed through November 30, 2022, to waive fees and/or reimburse expenses to the extent necessary to cap total annual fund operating expenses after fee waivers at 1.11% for Class A, 1.86% for Class C, 1.36% for Class R, 0.65% for Class R6, 0.95% for Administrator Class, and 0.70% for Institutional Class. Brokerage commissions, stamp duty fees, interest, taxes, acquired fund fees and expenses (if any), and extraordinary expenses are excluded from the expense caps. Prior to or after the commitment expiration date, the caps may be increased or the commitment to maintain the caps may be terminated only with the approval of the Board of Trustees. Without these caps, the Fund’s returns would have been lower. The expense ratio paid by an investor is the net expense ratio (the total annual fund operating expenses after fee waivers) as stated in the prospectuses. |

| 3 | Historical performance shown for the Class R shares prior to their inception reflects the performance of the Institutional Class shares, adjusted to reflect the higher expenses applicable to the Class R shares. |

| 4 | Historical performance shown for the Class R6 shares prior to their inception reflects the performance of the Institutional Class shares, and includes the higher expenses applicable to the Institutional Class shares. If these expenses had not been included, returns for the Class R6 shares would be higher. |

| 5 | The Russell 1000® Value Index measures the performance of those Russell 1000 companies with lower price/book ratios and lower forecasted growth values. You cannot invest directly in an index. |

| ‡ | CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute. |

| 1 | The chart compares the performance of Class A shares for the most recent ten years with the Russell 1000® Value Index. The chart assumes a hypothetical investment of $10,000 in Class A shares and reflects all operating expenses and assumes the maximum initial sales charge of 5.75%. |

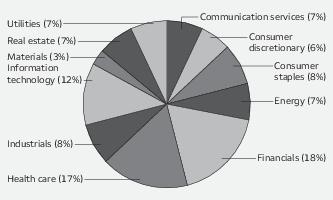

| ■ | The Fund underperformed its benchmark, the Russell 1000® Value Index, for the 12-month period that ended July 31, 2022. |

| ■ | Stock selection in health care and an overweight in the information technology (IT) sector detracted from the Fund’s relative performance. |

| ■ | Stock selection in materials and an underweight in the communication services sector contributed to relative performance. |

| Ten largest holdings (%) as of July 31, 20221 | |

| General Motors Company | 4.14 |

| Caterpillar Incorporated | 4.00 |

| Walmart Incorporated | 3.78 |

| American International Group Incorporated | 3.65 |

| D.R. Horton Incorporated | 3.36 |

| Cigna Corporation | 3.32 |

| NextEra Energy Incorporated | 3.23 |

| AerCap Holdings NV | 3.14 |

| Alphabet Incorporated Class C | 2.86 |

| ConocoPhillips | 2.79 |

| 1 | Figures represent the percentage of the Fund's net assets. Holdings are subject to change and may have changed since the date specified. |

| * | This security was no longer held at the end of the reporting period. |

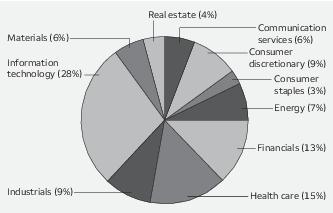

| Sector allocation as of July 31, 20221 |

| 1 | Figures represent the percentage of the Fund's long-term investments. These amounts are subject to change and may have changed since the date specified. |

| Beginning account value 2-1-2022 | Ending account value 7-31-2022 | Expenses paid during the period1 | Annualized net expense ratio | |

| Class A | ||||

| Actual | $1,000.00 | $ 917.39 | $5.18 | 1.09% |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,019.39 | $5.46 | 1.09% |

| Class C | ||||

| Actual | $1,000.00 | $ 914.10 | $8.83 | 1.86% |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,015.57 | $9.30 | 1.86% |

| Class R | ||||

| Actual | $1,000.00 | $ 916.80 | $6.18 | 1.30% |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,018.35 | $6.51 | 1.30% |

| Class R6 | ||||

| Actual | $1,000.00 | $ 919.48 | $3.09 | 0.65% |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,021.57 | $3.26 | 0.65% |

| Administrator Class | ||||

| Actual | $1,000.00 | $ 918.26 | $4.33 | 0.91% |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,020.28 | $4.56 | 0.91% |

| Institutional Class | ||||

| Actual | $1,000.00 | $ 918.81 | $3.33 | 0.70% |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,021.32 | $3.51 | 0.70% |

| Shares | Value | ||||

| Common stocks: 96.98% | |||||

| Communication services: 5.49% | |||||

| Interactive media & services: 2.86% | |||||

| Alphabet Incorporated Class C † | 192,080 | $ 22,404,211 | |||

| Media: 2.63% | |||||

| Comcast Corporation Class A | 547,340 | 20,536,197 | |||

| Consumer discretionary: 7.50% | |||||

| Automobiles: 4.14% | |||||

| General Motors Company † | 891,925 | 32,341,201 | |||

| Household durables: 3.36% | |||||

| D.R. Horton Incorporated | 336,829 | 26,282,767 | |||

| Consumer staples: 7.91% | |||||

| Beverages: 2.20% | |||||

| Keurig Dr. Pepper Incorporated | 444,617 | 17,224,463 | |||

| Food & staples retailing: 3.78% | |||||

| Walmart Incorporated | 224,009 | 29,580,388 | |||

| Food products: 1.93% | |||||

| Mondelez International Incorporated Class A | 235,102 | 15,055,932 | |||

| Energy: 7.38% | |||||

| Oil, gas & consumable fuels: 7.38% | |||||

| ConocoPhillips | 224,205 | 21,844,293 | |||

| EOG Resources Incorporated | 179,215 | 19,932,292 | |||

| Exxon Mobil Corporation | 164,134 | 15,909,509 | |||

| 57,686,094 | |||||

| Financials: 13.19% | |||||

| Banks: 4.33% | |||||

| Bank of America Corporation | 564,157 | 19,074,148 | |||

| JPMorgan Chase & Company | 128,153 | 14,783,730 | |||

| 33,857,878 | |||||

| Capital markets: 4.68% | |||||

| Intercontinental Exchange Incorporated | 182,570 | 18,620,314 | |||

| The Goldman Sachs Group Incorporated | 53,946 | 17,985,057 | |||

| 36,605,371 | |||||

| Insurance: 3.65% | |||||

| American International Group Incorporated | 550,656 | 28,507,461 | |||

| Mortgage REITs: 0.53% | |||||

| Annaly Capital Management Incorporated | 603,771 | 4,153,944 | |||

| Health care: 16.38% | |||||

| Biotechnology: 1.22% | |||||

| Vertex Pharmaceuticals Incorporated † | 33,960 | 9,522,724 |

| Shares | Value | ||||

| Health care equipment & supplies: 7.50% | |||||

| Abbott Laboratories | 77,427 | $ 8,427,157 | |||

| Medtronic plc | 201,420 | 18,635,378 | |||

| Stryker Corporation | 65,464 | 14,058,394 | |||

| Teleflex Incorporated | 73,027 | 17,560,072 | |||

| 58,681,001 | |||||

| Health care providers & services: 4.90% | |||||

| Cigna Corporation | 94,359 | 25,982,694 | |||

| Humana Incorporated | 25,562 | 12,320,884 | |||

| 38,303,578 | |||||

| Pharmaceuticals: 2.76% | |||||

| Merck & Company Incorporated | 241,688 | 21,592,406 | |||

| Industrials: 15.28% | |||||

| Aerospace & defense: 0.23% | |||||

| Raytheon Technologies Corporation | 19,422 | 1,810,325 | |||

| Commercial services & supplies: 2.57% | |||||

| Waste Management Incorporated | 122,020 | 20,079,611 | |||

| Industrial conglomerates: 2.76% | |||||

| Honeywell International Incorporated | 111,972 | 21,550,131 | |||

| Machinery: 6.58% | |||||

| Caterpillar Incorporated | 157,861 | 31,295,943 | |||

| Parker-Hannifin Corporation | 58,715 | 16,973,919 | |||

| Stanley Black & Decker Incorporated | 32,813 | 3,193,689 | |||

| 51,463,551 | |||||

| Trading companies & distributors: 3.14% | |||||

| AerCap Holdings NV † | 547,919 | 24,579,646 | |||

| Information technology: 15.48% | |||||

| IT services: 7.99% | |||||

| Accenture plc Class A | 58,242 | 17,837,195 | |||

| Akamai Technologies Incorporated † | 182,478 | 17,558,033 | |||

| Fiserv Incorporated † | 124,596 | 13,167,305 | |||

| Visa Incorporated Class A | 65,565 | 13,906,992 | |||

| 62,469,525 | |||||

| Semiconductors & semiconductor equipment: 2.38% | |||||

| NXP Semiconductors NV | 101,361 | 18,638,261 | |||

| Software: 5.11% | |||||

| Microsoft Corporation | 69,520 | 19,517,045 | |||

| Salesforce.com Incorporated † | 111,097 | 20,444,070 | |||

| 39,961,115 | |||||

| Materials: 5.14% | |||||

| Construction materials: 2.78% | |||||

| Vulcan Materials Company | 131,456 | 21,733,620 |

| Shares | Value | ||||

| Containers & packaging: 2.36% | |||||

| Avery Dennison Corporation | 96,909 | $ 18,457,288 | |||

| Utilities: 3.23% | |||||

| Electric utilities: 3.23% | |||||

| NextEra Energy Incorporated | 298,606 | 25,229,222 | |||

| Total Common stocks (Cost $643,774,284) | 758,307,911 |

| Yield | |||||

| Short-term investments: 3.08% | |||||

| Investment companies: 3.08% | |||||

| Allspring Government Money Market Fund Select Class ♠∞ | 1.76% | 24,131,967 | 24,131,967 | ||

| Total Short-term investments (Cost $24,131,967) | 24,131,967 | ||||

| Total investments in securities (Cost $667,906,251) | 100.06% | 782,439,878 | |||

| Other assets and liabilities, net | (0.06) | (494,209) | |||

| Total net assets | 100.00% | $781,945,669 |

| † | Non-income-earning security |

| ♠ | The issuer of the security is an affiliated person of the Fund as defined in the Investment Company Act of 1940. |

| ∞ | The rate represents the 7-day annualized yield at period end. |

| Value, beginning of period | Purchases | Sales proceeds | Net realized gains (losses) | Net change in unrealized gains (losses) | Value, end of period | Shares, end of period | Income from affiliated securities | |

| Short-term investments | ||||||||

| Allspring Government Money Market Fund Select Class | $11,505,493 | $197,185,166 | $(184,558,692) | $0 | $0 | $24,131,967 | 24,131,967 | $63,318 |

| Assets | |

Investments in unaffiliated securities, at value (cost $643,774,284) | $ 758,307,911 |

Investments in affiliated securities, at value (cost $24,131,967) | 24,131,967 |

Receivable for dividends | 513,338 |

Receivable for Fund shares sold | 164,071 |

Prepaid expenses and other assets | 29,925 |

Total assets | 783,147,212 |

| Liabilities | |

Payable for Fund shares redeemed | 489,247 |

Management fee payable | 363,882 |

Shareholder servicing fees payable | 136,013 |

Administration fees payable | 95,230 |

Trustees’ fees and expenses payable | 1,905 |

Distribution fees payable | 1,164 |

Accrued expenses and other liabilities | 114,102 |

Total liabilities | 1,201,543 |

Total net assets | $781,945,669 |

| Net assets consist of | |

Paid-in capital | $ 605,654,177 |

Total distributable earnings | 176,291,492 |

Total net assets | $781,945,669 |

| Computation of net asset value and offering price per share | |

Net assets – Class A | $ 249,213,013 |

Shares outstanding – Class A1 | 21,376,475 |

Net asset value per share – Class A | $11.66 |

Maximum offering price per share – Class A2 | $12.37 |

Net assets – Class C | $ 1,923,436 |

Shares outstanding – Class C1 | 170,574 |

Net asset value per share – Class C | $11.28 |

Net assets – Class R | $ 104,262 |

Shares outstanding – Class R1 | 8,847 |

Net asset value per share – Class R | $11.79 |

Net assets – Class R6 | $ 42,877,797 |

Shares outstanding – Class R61 | 3,755,018 |

Net asset value per share – Class R6 | $11.42 |

Net assets – Administrator Class | $ 436,334,805 |

Shares outstanding – Administrator Class1 | 34,997,129 |

Net asset value per share – Administrator Class | $12.47 |

Net assets – Institutional Class | $ 51,492,356 |

Shares outstanding – Institutional Class1 | 4,373,766 |

Net asset value per share – Institutional Class | $11.77 |

| 1 | The Fund has an unlimited number of authorized shares. |

| 2 | Maximum offering price is computed as 100/94.25 of net asset value. On investments of $50,000 or more, the offering price is reduced. |

| Investment income | |

Dividends (net of foreign withholdings taxes of $40,728) | $ 13,655,499 |

Income from affiliated securities | 63,318 |

Total investment income | 13,718,817 |

| Expenses | |

Management fee | 5,843,914 |

| Administration fees | |

Class A | 584,069 |

Class C | 4,610 |

Class R | 219 |

Class R6 | 8,780 |

Administrator Class | 620,968 |

Institutional Class | 77,916 |

| Shareholder servicing fees | |

Class A | 675,503 |

Class C | 5,466 |

Class R | 261 |

Administrator Class | 1,181,523 |

| Distribution fees | |

Class C | 16,345 |

Class R | 192 |

Custody and accounting fees | 38,210 |

Professional fees | 40,138 |

Registration fees | 77,043 |

Shareholder report expenses | 24,006 |

Trustees’ fees and expenses | 20,098 |

Other fees and expenses | 18,915 |

Total expenses | 9,238,176 |

| Less: Fee waivers and/or expense reimbursements | |

Fund-level | (588,570) |

Class A | (13,182) |

Class R6 | (7,393) |

Administrator Class | (475,185) |

Institutional Class | (45,211) |

Net expenses | 8,108,635 |

Net investment income | 5,610,182 |

| Realized and unrealized gains (losses) on investments | |

Net realized gains on investments | 76,574,770 |

Net change in unrealized gains (losses) on investments | (125,314,708) |

Net realized and unrealized gains (losses) on investments | (48,739,938) |

Net decrease in net assets resulting from operations | $ (43,129,756) |

| Year ended July 31, 2022 | Year ended July 31, 2021 | |||

| Operations | ||||

Net investment income | $ 5,610,182 | $ 7,480,555 | ||

Payment from affiliate | 0 | 91,336 | ||

Net realized gains on investments | 76,574,770 | 141,881,141 | ||

Net change in unrealized gains (losses) on investments | (125,314,708) | 87,092,988 | ||

Net increase (decrease) in net assets resulting from operations | (43,129,756) | 236,546,020 | ||

| Distributions to shareholders from | ||||

| Net investment income and net realized gains | ||||

Class A | (53,341,156) | (2,978,223) | ||

Class C | (416,230) | 0 | ||

Class R | (18,487) | (777) | ||

Class R6 | (1,180,752) | (209,259) | ||

Administrator Class | (87,453,886) | (5,693,424) | ||

Institutional Class | (12,533,899) | (1,346,136) | ||

Total distributions to shareholders | (154,944,410) | (10,227,819) | ||

| Capital share transactions | Shares | Shares | ||

| Proceeds from shares sold | ||||

Class A | 324,090 | 4,276,971 | 440,636 | 5,715,815 |

Class C | 36,301 | 482,008 | 20,672 | 266,040 |

Class R | 948 | 12,262 | 942 | 12,698 |

Class R6 | 3,978,072 | 49,735,620 | 345,499 | 4,430,363 |

Administrator Class | 171,967 | 2,395,405 | 174,108 | 2,515,174 |

Institutional Class | 1,030,473 | 15,516,545 | 518,647 | 6,693,911 |

| 72,418,811 | 19,634,001 | |||

| Reinvestment of distributions | ||||

Class A | 3,914,851 | 50,679,898 | 224,806 | 2,850,540 |

Class C | 33,272 | 416,230 | 0 | 0 |

Class R | 1,414 | 18,487 | 49 | 634 |

Class R6 | 92,916 | 1,180,752 | 9,761 | 121,435 |

Administrator Class | 5,964,339 | 82,619,695 | 399,009 | 5,342,733 |

Institutional Class | 904,435 | 11,838,887 | 105,062 | 1,339,551 |

| 146,753,949 | 9,654,893 | |||

| Payment for shares redeemed | ||||

Class A | (2,509,378) | (32,782,415) | (2,696,686) | (34,836,613) |

Class C | (60,475) | (791,051) | (259,632) | (3,123,585) |

Class R | (1,052) | (16,024) | (73) | (909) |

Class R6 | (1,355,475) | (18,601,665) | (351,081) | (4,814,715) |

Administrator Class | (2,691,847) | (37,718,367) | (2,587,756) | (35,964,411) |

Institutional Class | (1,720,987) | (23,698,526) | (3,857,032) | (51,528,718) |

| (113,608,048) | (130,268,951) | |||

Net increase (decrease) in net assets resulting from capital share transactions | 105,564,712 | (100,980,057) | ||

Total increase (decrease) in net assets | (92,509,454) | 125,338,144 | ||

| Net assets | ||||

Beginning of period | 874,455,123 | 749,116,979 | ||

End of period | $ 781,945,669 | $ 874,455,123 | ||

| Year ended July 31 | |||||

| Class A | 2022 | 2021 | 2020 | 2019 | 2018 |

Net asset value, beginning of period | $14.98 | $11.35 | $13.13 | $13.05 | $12.61 |

Net investment income | 0.06 | 0.11 | 0.14 | 0.10 | 0.11 |

Payment from affiliate | 0.00 | 0.00 1 | 0.00 | 0.00 | 0.00 |

Net realized and unrealized gains (losses) on investments | (0.59) | 3.66 | (0.58) | 0.94 | 1.39 |

Total from investment operations | (0.53) | 3.77 | (0.44) | 1.04 | 1.50 |

| Distributions to shareholders from | |||||

Net investment income | (0.09) | (0.14) | (0.10) | (0.12) | (0.06) |

Net realized gains | (2.70) | 0.00 | (1.24) | (0.84) | (1.00) |

Total distributions to shareholders | (2.79) | (0.14) | (1.34) | (0.96) | (1.06) |

Net asset value, end of period | $11.66 | $14.98 | $11.35 | $13.13 | $13.05 |

Total return2 | (5.29)% | 33.49% 3 | (4.25)% | 9.03% | 12.43% |

| Ratios to average net assets (annualized) | |||||

Gross expenses | 1.17% | 1.18% | 1.18% | 1.18% | 1.18% |

Net expenses | 1.09% | 1.09% | 1.10% | 1.10% | 1.10% |

Net investment income | 0.52% | 0.77% | 1.20% | 0.81% | 0.83% |

| Supplemental data | |||||

Portfolio turnover rate | 40% | 46% | 34% | 27% | 21% |

Net assets, end of period (000s omitted) | $249,213 | $294,248 | $245,977 | $291,111 | $289,683 |

| 1 | Amount is less than $0.005. |

| 2 | Total return calculations do not include any sales charges. |

| 3 | During the year ended July 31, 2021, the Fund received a payment from an affiliate that had an impact of less than 0.005% on total return. See Note 4 in the Notes to Financial Statements for additional information. |

| Year ended July 31 | |||||

| Class C | 2022 | 2021 | 2020 | 2019 | 2018 |

Net asset value, beginning of period | $14.59 | $10.99 | $12.75 | $12.69 | $12.31 |

Net investment income (loss) | (0.03) 1 | 0.01 1 | 0.05 1 | 0.00 1,2 | 0.01 1 |

Payment from affiliate | 0.00 | 0.05 | 0.00 | 0.00 | 0.00 |

Net realized and unrealized gains (losses) on investments | (0.58) | 3.54 | (0.57) | 0.92 | 1.37 |

Total from investment operations | (0.61) | 3.60 | (0.52) | 0.92 | 1.38 |

| Distributions to shareholders from | |||||

Net investment income | 0.00 | 0.00 | 0.00 | (0.02) | 0.00 |

Net realized gains | (2.70) | 0.00 | (1.24) | (0.84) | (1.00) |

Total distributions to shareholders | (2.70) | 0.00 | (1.24) | (0.86) | (1.00) |

Net asset value, end of period | $11.28 | $14.59 | $10.99 | $12.75 | $12.69 |

Total return3 | (5.99)% | 32.76% 4 | (4.99)% | 8.16% | 11.65% |

| Ratios to average net assets (annualized) | |||||

Gross expenses | 1.92% | 1.93% | 1.94% | 1.94% | 1.93% |

Net expenses | 1.86% | 1.86% | 1.86% | 1.86% | 1.86% |

Net investment income (loss) | (0.24)% | 0.05% | 0.44% | 0.03% | 0.08% |

| Supplemental data | |||||

Portfolio turnover rate | 40% | 46% | 34% | 27% | 21% |

Net assets, end of period (000s omitted) | $1,923 | $2,356 | $4,401 | $7,370 | $19,874 |

| 1 | Calculated based upon average shares outstanding |

| 2 | Amount is less than $0.005. |

| 3 | Total return calculations do not include any sales charges. |

| 4 | During the year ended July 31, 2021, the Fund received a payment from an affiliate that had an impact of 0.50% on total return. See Note 4 in the Notes to Financial Statements for additional information. |

| Year ended July 31 | |||||

| Class R | 2022 | 2021 | 2020 | 2019 | 2018 |

Net asset value, beginning of period | $15.11 | $11.42 | $13.22 | $13.15 | $12.70 |

Net investment income | 0.04 | 0.07 | 0.11 | 0.06 | 0.05 |

Payment from affiliate | 0.00 | 0.03 | 0.00 | 0.00 | 0.00 |

Net realized and unrealized gains (losses) on investments | (0.61) | 3.71 | (0.59) | 0.95 | 1.44 |

Total from investment operations | (0.57) | 3.81 | (0.48) | 1.01 | 1.49 |

| Distributions to shareholders from | |||||

Net investment income | (0.05) | (0.12) | (0.08) | (0.10) | (0.04) |

Net realized gains | (2.70) | 0.00 | (1.24) | (0.84) | (1.00) |

Total distributions to shareholders | (2.75) | (0.12) | (1.32) | (0.94) | (1.04) |

Net asset value, end of period | $11.79 | $15.11 | $11.42 | $13.22 | $13.15 |

Total return | (5.47)% | 33.51% 1 | (4.56)% | 8.70% | 12.21% |

| Ratios to average net assets (annualized) | |||||

Gross expenses | 1.36% | 1.41% | 1.41% | 1.43% | 1.44% |

Net expenses | 1.33% | 1.36% | 1.36% | 1.36% | 1.36% |

Net investment income | 0.30% | 0.49% | 0.95% | 0.55% | 0.56% |

| Supplemental data | |||||

Portfolio turnover rate | 40% | 46% | 34% | 27% | 21% |

Net assets, end of period (000s omitted) | $104 | $114 | $76 | $88 | $74 |

| 1 | During the year ended July 31, 2021, the Fund received a payment from an affiliate that had an impact of 0.23% on total return. See Note 4 in the Notes to Financial Statements for additional information. |

| Year ended July 31 | |||||

| Class R6 | 2022 | 2021 | 2020 | 2019 | 2018 |

Net asset value, beginning of period | $14.73 | $11.16 | $12.93 | $12.92 | $12.49 |

Net investment income | 0.18 | 0.16 | 0.19 1 | 0.16 1 | 0.16 |

Net realized and unrealized gains (losses) on investments | (0.64) | 3.60 | (0.57) | 1.00 | 1.39 |

Total from investment operations | (0.46) | 3.76 | (0.38) | 1.16 | 1.55 |

| Distributions to shareholders from | |||||

Net investment income | (0.15) | (0.19) | (0.15) | (0.31) | (0.12) |

Net realized gains | (2.70) | 0.00 | (1.24) | (0.84) | (1.00) |

Total distributions to shareholders | (2.85) | (0.19) | (1.39) | (1.15) | (1.12) |

Net asset value, end of period | $11.42 | $14.73 | $11.16 | $12.93 | $12.92 |

Total return | (4.86)% | 34.05% | (3.87)% | 10.38% | 12.96% |

| Ratios to average net assets (annualized) | |||||

Gross expenses | 0.75% | 0.76% | 0.76% | 0.76% | 0.75% |

Net expenses | 0.65% | 0.65% | 0.65% | 0.65% | 0.65% |

Net investment income | 0.97% | 1.22% | 1.67% | 1.27% | 1.29% |

| Supplemental data | |||||

Portfolio turnover rate | 40% | 46% | 34% | 27% | 21% |

Net assets, end of period (000s omitted) | $42,878 | $15,313 | $11,552 | $4,231 | $2,578 |

| 1 | Calculated based upon average shares outstanding |

| Year ended July 31 | |||||

| Administrator Class | 2022 | 2021 | 2020 | 2019 | 2018 |

Net asset value, beginning of period | $15.83 | $11.99 | $13.81 | $13.68 | $13.17 |

Net investment income | 0.09 | 0.13 | 0.17 | 0.12 | 0.13 |

Payment from affiliate | 0.00 | 0.00 1 | 0.00 | 0.00 | 0.00 |

Net realized and unrealized gains (losses) on investments | (0.63) | 3.88 | (0.62) | 1.00 | 1.47 |

Total from investment operations | (0.54) | 4.01 | (0.45) | 1.12 | 1.60 |

| Distributions to shareholders from | |||||

Net investment income | (0.12) | (0.17) | (0.13) | (0.15) | (0.09) |

Net realized gains | (2.70) | 0.00 | (1.24) | (0.84) | (1.00) |

Total distributions to shareholders | (2.82) | (0.17) | (1.37) | (0.99) | (1.09) |

Net asset value, end of period | $12.47 | $15.83 | $11.99 | $13.81 | $13.68 |

Total return | (5.07)% | 33.75% 2 | (4.15)% | 9.21% | 12.63% |

| Ratios to average net assets (annualized) | |||||

Gross expenses | 1.09% | 1.11% | 1.11% | 1.11% | 1.10% |

Net expenses | 0.92% | 0.92% | 0.93% | 0.95% | 0.95% |

Net investment income | 0.70% | 0.94% | 1.37% | 0.96% | 0.98% |

| Supplemental data | |||||

Portfolio turnover rate | 40% | 46% | 34% | 27% | 21% |

Net assets, end of period (000s omitted) | $436,335 | $499,628 | $402,567 | $464,041 | $469,464 |

| 1 | Amount is less than $0.005. |

| 2 | During the year ended July 31, 2021, the Fund received a payment from an affiliate that had an impact of 0.03% on total return. See Note 4 in the Notes to Financial Statements for additional information. |

| Year ended July 31 | |||||

| Institutional Class | 2022 | 2021 | 2020 | 2019 | 2018 |

Net asset value, beginning of period | $15.10 | $11.44 | $13.22 | $13.14 | $12.68 |

Net investment income | 0.12 1 | 0.16 1 | 0.19 1 | 0.15 1 | 0.22 |

Net realized and unrealized gains (losses) on investments | (0.61) | 3.70 | (0.58) | 0.94 | 1.35 |

Total from investment operations | (0.49) | 3.86 | (0.39) | 1.09 | 1.57 |

| Distributions to shareholders from | |||||

Net investment income | (0.14) | (0.20) | (0.15) | (0.17) | (0.11) |

Net realized gains | (2.70) | 0.00 | (1.24) | (0.84) | (1.00) |

Total distributions to shareholders | (2.84) | (0.20) | (1.39) | (1.01) | (1.11) |

Net asset value, end of period | $11.77 | $15.10 | $11.44 | $13.22 | $13.14 |

Total return | (4.96)% | 34.01% | (3.86)% | 9.44% | 12.96% |

| Ratios to average net assets (annualized) | |||||

Gross expenses | 0.85% | 0.86% | 0.86% | 0.86% | 0.85% |

Net expenses | 0.70% | 0.70% | 0.70% | 0.70% | 0.70% |

Net investment income | 0.92% | 1.22% | 1.59% | 1.22% | 1.24% |

| Supplemental data | |||||

Portfolio turnover rate | 40% | 46% | 34% | 27% | 21% |

Net assets, end of period (000s omitted) | $51,492 | $62,796 | $84,544 | $106,869 | $137,263 |

| 1 | Calculated based upon average shares outstanding |

| Gross unrealized gains | $160,673,359 |

| Gross unrealized losses | (47,019,007) |

| Net unrealized gains | $113,654,352 |

| ■ | Level 1 – quoted prices in active markets for identical securities |

| ■ | Level 2 – other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) |

| ■ | Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

| Quoted prices (Level 1) | Other significant observable inputs (Level 2) | Significant unobservable inputs (Level 3) | Total | |

| Assets | ||||

| Investments in: | ||||

| Common stocks | ||||

| Communication services | $ 42,940,408 | $0 | $0 | $ 42,940,408 |

| Consumer discretionary | 58,623,968 | 0 | 0 | 58,623,968 |

| Consumer staples | 61,860,783 | 0 | 0 | 61,860,783 |

| Energy | 57,686,094 | 0 | 0 | 57,686,094 |

| Financials | 103,124,654 | 0 | 0 | 103,124,654 |

| Health care | 128,099,709 | 0 | 0 | 128,099,709 |

| Industrials | 119,483,264 | 0 | 0 | 119,483,264 |

| Information technology | 121,068,901 | 0 | 0 | 121,068,901 |

| Materials | 40,190,908 | 0 | 0 | 40,190,908 |

| Utilities | 25,229,222 | 0 | 0 | 25,229,222 |

| Short-term investments | ||||

| Investment companies | 24,131,967 | 0 | 0 | 24,131,967 |

| Total assets | $782,439,878 | $0 | $0 | $782,439,878 |

| Average daily net assets | Management fee |

| First $500 million | 0.700% |

| Next $500 million | 0.675 |

| Next $1 billion | 0.650 |

| Next $2 billion | 0.625 |

| Next $1 billion | 0.600 |

| Next $3 billion | 0.590 |

| Next $2 billion | 0.565 |

| Next $2 billion | 0.555 |

| Next $4 billion | 0.530 |

| Over $16 billion | 0.505 |

| Class-level administration fee | |

| Class A | 0.21% |

| Class C | 0.21 |

| Class R | 0.21 |

| Class R6 | 0.03 |

| Administrator Class | 0.13 |

| Institutional Class | 0.13 |

| Expense ratio caps | |

| Class A | 1.11% |

| Class C | 1.86 |

| Class R | 1.36 |

| Class R6 | 0.65 |

| Administrator Class | 0.95 |

| Institutional Class | 0.70 |

| Year ended July 31 | ||

| 2022 | 2021 | |

| Ordinary income | $ 17,276,792 | $10,227,819 |

| Long-term capital gain | 137,667,618 | 0 |

| Undistributed ordinary income | Undistributed long-term gain | Unrealized gains |

| $16,706,918 | $46,011,352 | $113,654,352 |

Allspring Funds Trust:

| Name and year of birth | Position held and length of service* | Principal occupations during past five years or longer | Current other public company or investment company directorships |

| William R. Ebsworth (Born 1957) | Trustee, since 2015 | Retired. From 1984 to 2013, equities analyst, portfolio manager, research director and chief investment officer at Fidelity Management and Research Company in Boston, Tokyo, and Hong Kong, and retired in 2013 as Chief Investment Officer of Fidelity Strategic Advisers, Inc. where he led a team of investment professionals managing client assets. Prior thereto, Board member of Hong Kong Securities Clearing Co., Hong Kong Options Clearing Corp., the Thailand International Fund, Ltd., Fidelity Investments Life Insurance Company, and Empire Fidelity Investments Life Insurance Company. Audit Committee Chair and Investment Committee Chair of the Vincent Memorial Hospital Endowment (non-profit organization). Mr. Ebsworth is a CFA® charterholder. | N/A |

| Jane A. Freeman (Born 1953) | Trustee, since 2015; Chair Liaison, since 2018 | Retired. From 2012 to 2014 and 1999 to 2008, Chief Financial Officer of Scientific Learning Corporation. From 2008 to 2012, Ms. Freeman provided consulting services related to strategic business projects. Prior to 1999, Portfolio Manager at Rockefeller & Co. and Scudder, Stevens & Clark. Board member of the Harding Loevner Funds from 1996 to 2014, serving as both Lead Independent Director and chair of the Audit Committee. Board member of the Russell Exchange Traded Funds Trust from 2011 to 2012 and the chair of the Audit Committee. Ms. Freeman is also an inactive Chartered Financial Analyst. | N/A |

| Isaiah Harris, Jr. (Born 1952) | Trustee, since 2009; Audit Committee Chair, since 2019 | Retired. Chairman of the Board of CIGNA Corporation from 2009 to 2021, and Director from 2005 to 2008. From 2003 to 2011, Director of Deluxe Corporation. Prior thereto, President and CEO of BellSouth Advertising and Publishing Corp. from 2005 to 2007, President and CEO of BellSouth Enterprises from 2004 to 2005 and President of BellSouth Consumer Services from 2000 to 2003. Emeritus member of the Iowa State University Foundation Board of Governors. Emeritus Member of the Advisory Board of Iowa State University School of Business. Advisory Board Member, Palm Harbor Academy (private school). Advisory Board Member, Fellowship of Christian Athletes. Mr. Harris is a certified public accountant (inactive status). | N/A |

| David F. Larcker (Born 1950) | Trustee, since 2009 | James Irvin Miller Professor of Accounting at the Graduate School of Business (Emeritus), Stanford University, Director of the Corporate Governance Research Initiative and Senior Faculty of The Rock Center for Corporate Governance since 2006. From 2005 to 2008, Professor of Accounting at the Graduate School of Business, Stanford University. Prior thereto, Ernst & Young Professor of Accounting at The Wharton School, University of Pennsylvania from 1985 to 2005. | N/A |

| Name and year of birth | Position held and length of service* | Principal occupations during past five years or longer | Current other public company or investment company directorships |

| Olivia S. Mitchell (Born 1953) | Trustee, since 2006; Nominating and Governance Committee Chair, since 2018 | International Foundation of Employee Benefit Plans Professor since 1993, Wharton School of the University of Pennsylvania. Director of Wharton’s Pension Research Council and Boettner Center on Pensions & Retirement Research, and Research Associate at the National Bureau of Economic Research. Previously taught at Cornell University from 1978 to 1993. | N/A |

| Timothy J. Penny (Born 1951) | Trustee, since 1996; Chair, since 2018 | President and Chief Executive Officer of Southern Minnesota Initiative Foundation, a non-profit organization, since 2007. Member of the Board of Trustees of NorthStar Education Finance, Inc., a non-profit organization, since 2007. | N/A |

| James G. Polisson (Born 1959) | Trustee, since 2018 | Retired. Chief Marketing Officer, Source (ETF) UK Services, Ltd, from 2015 to 2017. From 2012 to 2015, Principal of The Polisson Group, LLC, a management consulting, corporate advisory and principal investing company. Chief Executive Officer and Managing Director at Russell Investments, Global Exchange Traded Funds from 2010 to 2012. Managing Director of Barclays Global Investors from 1998 to 2010 and Global Chief Marketing Officer for iShares and Barclays Global Investors from 2000 to 2010. Trustee of the San Francisco Mechanics’ Institute, a non-profit organization, from 2013 to 2015. Board member of the Russell Exchange Traded Fund Trust from 2011 to 2012. Director of Barclays Global Investors Holdings Deutschland GmbH from 2006 to 2009. Mr. Polisson is an attorney and has a retired status with the Massachusetts and District of Columbia Bar Associations. | N/A |

| Pamela Wheelock (Born 1959) | Trustee, since January 2020; previously Trustee from January 2018 to July 2019 | Board member of the Destination Medical Center Economic Development Agency, Rochester, Minnesota since 2019. Interim President of the McKnight Foundation from January to September 2020. McKnight Foundation Consultant, November 2020 to February 2021. Acting Commissioner, Minnesota Department of Human Services, July 2019 through September 2019. Consultant (part-time), Minnesota Department of Human Services, October 2019 through December 2019. Chief Operating Officer, Twin Cities Habitat for Humanity from 2017 to 2019. Vice President of University Services, University of Minnesota from 2012 to 2016. Prior thereto, on the Board of Directors, Governance Committee and Finance Committee for the Minnesota Philanthropy Partners (Saint Paul Foundation) from 2012 to 2018, Interim Chief Executive Officer of Blue Cross Blue Shield of Minnesota from 2011 to 2012, Chairman of the Board from 2009 to 2012 and Board Director from 2003 to 2015. Vice President, Leadership and Community Engagement, Bush Foundation, Saint Paul, Minnesota (a private foundation) from 2009 to 2011. Executive Vice President and Chief Financial Officer, Minnesota Sports and Entertainment from 2004 to 2009 and Senior Vice President from 2002 to 2004. Executive Vice President of the Minnesota Wild Foundation from 2004 to 2008. Commissioner of Finance, State of Minnesota, from 1999 to 2002. Currently Board Chair of the Minnesota Wild Foundation since 2010. | N/A |

| Name and year of birth | Position held and length of service | Principal occupations during past five years or longer |

| Andrew Owen (Born 1960) | President, since 2017 | President, Chief Executive Officer and Director of Allspring Funds Management, LLC since 2017 and co-president of Galliard Capital Management, LLC, an affiliate of Allspring Funds Management, LLC, since 2019. Prior thereto, Head of Affiliated Managers, Allspring Global Investments, from 2014 to 2019 and Executive Vice President responsible for marketing, investments and product development for Allspring Funds Management, LLC, from 2009 to 2014. In addition, Mr. Owen was an Executive Vice President of Wells Fargo & Company from 2014 to 2021. |

| Jeremy DePalma (Born 1974) | Treasurer, since 2012 (for certain funds in the Fund Complex); since 2021 (for the remaining funds in the Fund Complex) | Senior Vice President of Allspring Funds Management, LLC since 2009. Senior Vice President of Evergreen Investment Management Company, LLC from 2008 to 2010 and head of the Fund Reporting and Control Team within Fund Administration from 2005 to 2010. |

| Kate McKinley (Born 1977) | Chief Legal Officer, since 2021 | Chief Legal Officer of Allspring Global Investments since 2021. Prior thereto, held various roles at State Street Global Advisors beginning in 2010, including serving as Senior Vice President and General Counsel from 2019 to 2021, and Chief Operating Officer of the Institutional Client Group from 2016 - 2019. Prior to working at State Street Global Advisors served as Assistant General Counsel for Bank of America Corporation from 2005 to 2010 and as an Associate at WilmerHale from 2002 to 2005. |

| Christopher Baker (Born 1976) | Chief Compliance Officer, since 2022 | Global Chief Compliance Officer for Allspring Global Investments since 2022. Prior thereto, Chief Compliance Officer for State Street Global Advisors from 2018 to 2021. Senior Compliance Officer for the State Street divisions of Alternative Investment Solutions, Sector Solutions, and Global Marketing from 2015 to 2018. From 2010 to 2015 Vice President, Global Head of Investment and Marketing Compliance for State Street Global Advisors. |

| Matthew Prasse (Born 1983) | Secretary, since 2021 | Senior Counsel of the Allspring Legal Department since 2021. Senior Counsel of the Wells Fargo Legal Department from 2018 to 2021. Previously, Counsel for Barings LLC from 2015 to 2018. Prior to joining Barings, Associate at Morgan, Lewis & Bockius LLP from 2008 to 2015. |

P.O. Box 219967

Kansas City, MO 64121-9967

1-800-222-8222 or visit the Fund's website at allspringglobal.com. Read the prospectus carefully before you invest or send money.

A207/AR207 07-22

Disciplined U.S. Core Fund

| 2 | |

| 6 | |

| 10 | |

| 11 | |

| Financial statements | |

| 18 | |

| 19 | |

| 20 | |

| 21 | |

| 27 | |

| 33 | |

| 34 |

| 1 | The S&P 500 Index consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market-value-weighted index with each stock's weight in the index proportionate to its market value. You cannot invest directly in an index. |

| 2 | The Morgan Stanley Capital International (MSCI) All Country World Index (ACWI) ex USA Index (Net) is a free-float-adjusted market-capitalization-weighted index that is designed to measure the equity market performance of developed and emerging markets, excluding the U.S. Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indexes or any securities or financial products. This report is not approved, reviewed, or produced by MSCI. You cannot invest directly in an index. |

| 3 | The MSCI Emerging Markets (EM) Index (Net) (USD) is a free-float-adjusted market-capitalization-weighted index that is designed to measure equity market performance of emerging markets. You cannot invest directly in an index. |

| 4 | The Bloomberg U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment-grade, U.S.-dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, mortgage-backed securities (agency fixed-rate and hybrid adjustable-rate mortgage pass-throughs), asset-backed securities, and commercial mortgage-backed securities. You cannot invest directly in an index. |

| 5 | The Bloomberg Global Aggregate ex-USD Index (unhedged) is an unmanaged index that provides a broad-based measure of the global investment-grade fixed-income markets excluding the U.S.-dollar-denominated debt market. You cannot invest directly in an index. |

| 6 | The Bloomberg Municipal Bond Index is an unmanaged index composed of long-term tax-exempt bonds with a minimum credit rating of Baa. You cannot invest directly in an index. |

| 7 | The ICE BofA U.S. High Yield Index is a market-capitalization-weighted index of domestic and Yankee high-yield bonds. The index tracks the performance of high-yield securities traded in the U.S. bond market. You cannot invest directly in an index. Copyright 2022. ICE Data Indices, LLC. All rights reserved. |

| 1 | The Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. You cannot invest directly in an index. |

| 2 | The MSCI ACWI (Net) is a free-float-adjusted market-capitalization-weighted index that is designed to measure the equity market performance of developed and emerging markets. You cannot invest directly in an index. |

President

Allspring Funds

| Manager | Allspring Funds Management, LLC |

| Subadviser | Allspring Global Investments, LLC |

| Portfolio managers | Justin P. Carr, CFA®‡, Robert M. Wicentowski, CFA®‡ |

| Average annual total returns (%) as of July 31, 2022 | |||||||||||

| Including sales charge | Excluding sales charge | Expense ratios1 (%) | |||||||||

| Inception date | 1 year | 5 year | 10 year | 1 year | 5 year | 10 year | Gross | Net 2 | |||

| Class A (EVSAX) | 2-28-1990 | -9.14 | 10.06 | 12.49 | -3.60 | 11.36 | 13.16 | 0.86 | 0.86 | ||

| Class C (EVSTX) | 6-30-1999 | -5.30 | 10.55 | 12.48 | -4.30 | 10.55 | 12.48 | 1.61 | 1.61 | ||

| Class R (EVSHX)3 | 9-30-2015 | – | – | – | -3.82 | 11.09 | 12.87 | 1.11 | 1.11 | ||

| Class R6 (EVSRX)4 | 9-30-2015 | – | – | – | -3.15 | 11.85 | 13.65 | 0.43 | 0.43 | ||

| Administrator Class (EVSYX) | 2-21-1995 | – | – | – | -3.49 | 11.49 | 13.30 | 0.78 | 0.74 | ||

| Institutional Class (EVSIX) | 7-30-2010 | – | – | – | -3.24 | 11.77 | 13.60 | 0.53 | 0.48 | ||

| S&P 500 Index5 | – | – | – | – | -4.64 | 12.83 | 13.80 | – | – | ||

| 1 | Reflects the expense ratios as stated in the most recent prospectuses. The expense ratios shown are subject to change and may differ from the annualized expense ratios shown in the financial highlights of this report. |

| 2 | The manager has contractually committed through November 30, 2022, to waive fees and/or reimburse expenses to the extent necessary to cap total annual fund operating expenses after fee waivers at 0.87% for Class A, 1.62% for Class C, 1.12% for Class R, 0.43% for Class R6, 0.74% for Administrator Class, and 0.48% for Institutional Class. Brokerage commissions, stamp duty fees, interest, taxes, acquired fund fees and expenses (if any), and extraordinary expenses are excluded from the expense caps. Prior to or after the commitment expiration date, the caps may be increased or the commitment to maintain the caps may be terminated only with the approval of the Board of Trustees. Without these caps, the Fund’s returns would have been lower. The expense ratio paid by an investor is the net expense ratio (the total annual fund operating expenses after fee waivers) as stated in the prospectuses. |

| 3 | Historical performance shown for the Class R shares prior to their inception reflects the performance of the Administrator Class shares, adjusted to reflect the higher expenses applicable to the Class R shares. |

| 4 | Historical performance shown for the Class R6 shares prior to their inception reflects the performance of the Institutional Class shares, and includes the higher expenses applicable to the Institutional Class shares. If these expenses had not been included, returns for the Class R6 shares would be higher. |

| 5 | The S&P 500 Index consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market-value weighted index with each stock’s weight in the index proportionate to its market value. You cannot invest directly in an index. |

| ‡ | CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute. |

| 1 | The chart compares the performance of Class A shares for the most recent ten years with the S&P 500 Index. The chart assumes a hypothetical investment of $10,000 in Class A shares and reflects all operating expenses and assumes the maximum initial sales charge of 5.75%. |

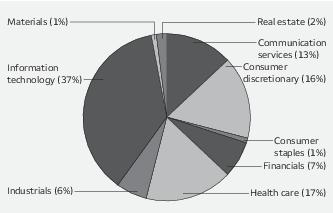

| ■ | The Fund outperformed its benchmark, the S&P 500 Index, for the 12-month period that ended July 31, 2022. |

| ■ | Stock selection was the main contributor to Fund performance, adding value in 7 of the 11 sectors. The Fund benefited from positive stock selection in the health care, industrials, and communications services sectors. |

| ■ | Negative stock selection effects detracted from relative performance within the consumer discretionary, financials, and consumer staples sectors. Sector-weighting decisions contributed modestly to performance. Variation in sector weights versus the Index were relatively small, as is typical for the strategy. |

| Ten largest holdings (%) as of July 31, 20221 | |

| Apple Incorporated | 7.31 |

| Microsoft Corporation | 6.36 |

| Amazon.com Incorporated | 3.20 |

| Alphabet Incorporated Class C | 2.32 |

| Tesla Motors Incorporated | 2.00 |

| Alphabet Incorporated Class A | 1.93 |

| Exxon Mobil Corporation | 1.83 |

| Johnson & Johnson | 1.65 |

| Berkshire Hathaway Incorporated Class B | 1.62 |

| UnitedHealth Group Incorporated | 1.34 |

| 1 | Figures represent the percentage of the Fund's net assets. Holdings are subject to change and may have changed since the date specified. |

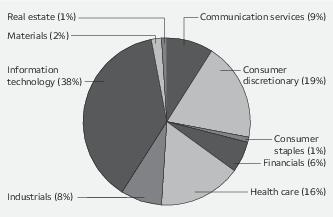

| Sector allocation as of July 31, 20221 |

| 1 | Figures represent the percentage of the Fund's long-term investments. These amounts are subject to change and may have changed since the date specified. |

| Beginning account value 2-1-2022 | Ending account value 7-31-2022 | Expenses paid during the period1 | Annualized net expense ratio | |

| Class A | ||||

| Actual | $1,000.00 | $ 922.13 | $3.96 | 0.83% |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,020.68 | $4.16 | 0.83% |

| Class C | ||||

| Actual | $1,000.00 | $ 918.96 | $7.57 | 1.59% |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,016.91 | $7.95 | 1.59% |

| Class R | ||||

| Actual | $1,000.00 | $ 921.10 | $5.14 | 1.08% |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,019.44 | $5.41 | 1.08% |

| Class R6 | ||||

| Actual | $1,000.00 | $ 924.47 | $1.96 | 0.41% |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,022.76 | $2.06 | 0.41% |

| Administrator Class | ||||

| Actual | $1,000.00 | $ 922.67 | $3.38 | 0.71% |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,021.27 | $3.56 | 0.71% |

| Institutional Class | ||||

| Actual | $1,000.00 | $ 924.07 | $2.29 | 0.48% |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,022.41 | $2.41 | 0.48% |

| Shares | Value | ||||

| Common stocks: 98.80% | |||||

| Communication services: 8.25% | |||||

| Diversified telecommunication services: 1.05% | |||||

| AT&T Incorporated | 135,603 | $ 2,546,624 | |||

| Verizon Communications Incorporated | 160,991 | 7,436,174 | |||

| 9,982,798 | |||||

| Entertainment: 1.33% | |||||

| Activision Blizzard Incorporated | 71,434 | 5,711,148 | |||

| Netflix Incorporated † | 11,489 | 2,583,876 | |||

| The Walt Disney Company † | 25,128 | 2,666,081 | |||

| Warner Bros. Discovery Incorporated † | 108,054 | 1,620,810 | |||

| 12,581,915 | |||||

| Interactive media & services: 5.33% | |||||

| Alphabet Incorporated Class A † | 157,020 | 18,264,566 | |||

| Alphabet Incorporated Class C † | 188,180 | 21,949,315 | |||

| Meta Platforms Incorporated Class A † | 64,194 | 10,213,265 | |||

| 50,427,146 | |||||

| Media: 0.54% | |||||

| Comcast Corporation Class A | 136,531 | 5,122,643 | |||

| Consumer discretionary: 10.88% | |||||

| Automobiles: 2.40% | |||||

| General Motors Company † | 105,497 | 3,825,321 | |||

| Tesla Motors Incorporated † | 21,211 | 18,908,546 | |||

| 22,733,867 | |||||

| Hotels, restaurants & leisure: 1.27% | |||||

| Chipotle Mexican Grill Incorporated † | 541 | 846,243 | |||

| Darden Restaurants Incorporated | 24,813 | 3,088,970 | |||

| McDonald's Corporation | 24,198 | 6,373,027 | |||

| Starbucks Corporation | 20,173 | 1,710,267 | |||

| 12,018,507 | |||||

| Household durables: 0.86% | |||||

| D.R. Horton Incorporated | 59,332 | 4,629,676 | |||

| PulteGroup Incorporated | 79,906 | 3,485,500 | |||

| 8,115,176 | |||||

| Internet & direct marketing retail: 3.20% | |||||

| Amazon.com Incorporated † | 224,540 | 30,301,673 | |||

| Multiline retail: 0.65% | |||||

| Target Corporation | 37,890 | 6,190,468 | |||

| Specialty retail: 1.84% | |||||

| AutoZone Incorporated † | 1,297 | 2,772,195 | |||

| Bath & Body Works Incorporated | 20,842 | 740,725 | |||

| Best Buy Company Incorporated | 16,579 | 1,276,417 | |||

| Lowe's Companies Incorporated | 29,327 | 5,617,000 | |||

| The Home Depot Incorporated | 23,384 | 7,037,181 | |||

| 17,443,518 |

| Shares | Value | ||||

| Textiles, apparel & luxury goods: 0.66% | |||||

| Nike Incorporated Class B | 35,453 | $ 4,074,259 | |||

| Tapestry Incorporated | 63,870 | 2,147,948 | |||

| 6,222,207 | |||||

| Consumer staples: 5.68% | |||||

| Beverages: 0.68% | |||||

| Monster Beverage Corporation † | 19,992 | 1,991,603 | |||

| PepsiCo Incorporated | 10,715 | 1,874,696 | |||

| The Coca-Cola Company | 40,813 | 2,618,970 | |||

| 6,485,269 | |||||

| Food & staples retailing: 1.67% | |||||

| Costco Wholesale Corporation | 11,078 | 5,996,521 | |||

| Walmart Incorporated | 74,060 | 9,779,623 | |||

| 15,776,144 | |||||

| Food products: 1.90% | |||||

| Archer Daniels Midland Company | 83,315 | 6,895,983 | |||

| Bunge Limited | 47,905 | 4,423,069 | |||

| Tyson Foods Incorporated Class A | 75,826 | 6,673,446 | |||

| 17,992,498 | |||||

| Household products: 1.01% | |||||

| The Procter & Gamble Company | 68,949 | 9,577,706 | |||

| Tobacco: 0.42% | |||||

| Altria Group Incorporated | 59,226 | 2,597,652 | |||

| Philip Morris International Incorporated | 14,428 | 1,401,680 | |||

| 3,999,332 | |||||

| Energy: 4.55% | |||||

| Oil, gas & consumable fuels: 4.55% | |||||

| Chevron Corporation | 66,087 | 10,823,729 | |||

| Diamondback Energy Incorporated | 48,224 | 6,173,636 | |||

| EOG Resources Incorporated | 48,722 | 5,418,861 | |||

| EQT Corporation | 76,250 | 3,357,288 | |||

| Exxon Mobil Corporation | 178,664 | 17,317,902 | |||

| 43,091,416 | |||||

| Financials: 10.26% | |||||

| Banks: 3.29% | |||||

| Bank of America Corporation | 106,418 | 3,597,993 | |||

| Citigroup Incorporated | 53,235 | 2,762,897 | |||

| JPMorgan Chase & Company | 92,138 | 10,629,040 | |||

| Regions Financial Corporation | 285,046 | 6,037,274 | |||

| Signature Bank | 4,474 | 830,240 | |||

| US Bancorp | 103,339 | 4,877,601 | |||

| Zions Bancorporation | 43,882 | 2,393,763 | |||

| 31,128,808 | |||||

| Capital markets: 1.73% | |||||

| Bank of New York Mellon Corporation | 58,265 | 2,532,197 |

| Shares | Value | ||||

| Capital markets (continued) | |||||

| CME Group Incorporated | 8,330 | $ 1,661,668 | |||

| Northern Trust Corporation | 39,390 | 3,930,334 | |||

| The Carlyle Group Incorporated | 81,817 | 3,183,499 | |||

| The Goldman Sachs Group Incorporated | 15,183 | 5,061,860 | |||

| 16,369,558 | |||||

| Consumer finance: 0.65% | |||||

| Capital One Financial Corporation | 45,394 | 4,985,623 | |||

| Synchrony Financial | 33,621 | 1,125,631 | |||

| 6,111,254 | |||||

| Diversified financial services: 1.62% | |||||

| Berkshire Hathaway Incorporated Class B † | 51,037 | 15,341,722 | |||

| Insurance: 2.97% | |||||

| Arch Capital Group Limited † | 81,011 | 3,596,888 | |||

| Everest Reinsurance Group Limited | 18,448 | 4,821,385 | |||

| Fidelity National Financial Incorporated | 24,656 | 985,254 | |||

| Lincoln National Corporation | 35,260 | 1,810,248 | |||

| MetLife Incorporated | 115,407 | 7,299,493 | |||

| Old Republic International Corporation | 146,426 | 3,407,333 | |||

| Prudential Financial Incorporated | 31,062 | 3,105,889 | |||

| The Hartford Financial Services Group Incorporated | 48,567 | 3,131,114 | |||

| 28,157,604 | |||||

| Health care: 14.31% | |||||

| Biotechnology: 2.42% | |||||

| AbbVie Incorporated | 46,548 | 6,680,103 | |||

| Exelixis Incorporated † | 183,966 | 3,848,569 | |||

| Moderna Incorporated † | 7,838 | 1,286,137 | |||

| United Therapeutics Corporation † | 14,489 | 3,347,973 | |||

| Vertex Pharmaceuticals Incorporated † | 27,804 | 7,796,520 | |||

| 22,959,302 | |||||

| Health care equipment & supplies: 1.23% | |||||

| Abbott Laboratories | 62,579 | 6,811,098 | |||

| Edwards Lifesciences Corporation † | 23,388 | 2,351,430 | |||

| Medtronic plc | 26,512 | 2,452,890 | |||

| 11,615,418 | |||||

| Health care providers & services: 4.85% | |||||

| AmerisourceBergen Corporation | 39,212 | 5,722,207 | |||

| CVS Health Corporation | 85,611 | 8,191,260 | |||

| Elevance Health Incorporated | 17,725 | 8,456,598 | |||

| McKesson Corporation | 20,861 | 7,125,700 | |||

| Molina Healthcare Incorporated † | 11,337 | 3,715,362 | |||

| UnitedHealth Group Incorporated | 23,422 | 12,702,687 | |||

| 45,913,814 | |||||

| Life sciences tools & services: 1.05% | |||||

| Danaher Corporation | 5,785 | 1,686,154 | |||

| Maravai LifeSciences Holdings Class A † | 50,049 | 1,305,778 | |||

| Thermo Fisher Scientific Incorporated | 11,604 | 6,943,950 | |||

| 9,935,882 |

| Shares | Value | ||||

| Pharmaceuticals: 4.76% | |||||

| Bristol-Myers Squibb Company | 125,007 | $ 9,223,016 | |||

| Eli Lilly & Company | 3,139 | 1,034,897 | |||

| Johnson & Johnson | 89,611 | 15,638,912 | |||

| Merck & Company Incorporated | 92,357 | 8,251,174 | |||

| Pfizer Incorporated | 215,603 | 10,890,108 | |||

| 45,038,107 | |||||

| Industrials: 8.00% | |||||

| Aerospace & defense: 1.15% | |||||

| General Dynamics Corporation | 25,903 | 5,871,433 | |||

| Lockheed Martin Corporation | 12,018 | 4,973,169 | |||

| 10,844,602 | |||||

| Air freight & logistics: 1.47% | |||||

| Expeditors International of Washington Incorporated | 24,795 | 2,634,469 | |||

| FedEx Corporation | 26,685 | 6,220,007 | |||

| United Parcel Service Incorporated Class B | 26,197 | 5,105,533 | |||

| 13,960,009 | |||||

| Airlines: 0.23% | |||||

| Delta Air Lines Incorporated † | 68,626 | 2,182,307 | |||

| Building products: 1.05% | |||||

| Builders FirstSource Incorporated † | 29,877 | 2,031,636 | |||

| Masco Corporation | 89,120 | 4,935,466 | |||

| Owens Corning Incorporated | 32,010 | 2,968,607 | |||

| 9,935,709 | |||||

| Commercial services & supplies: 0.46% | |||||

| Waste Management Incorporated | 26,754 | 4,402,638 | |||

| Construction & engineering: 0.45% | |||||

| Quanta Services Incorporated | 30,648 | 4,251,797 | |||

| Electrical equipment: 1.32% | |||||

| Acuity Brands Incorporated | 23,746 | 4,331,270 | |||

| AMETEK Incorporated | 13,063 | 1,613,281 | |||

| Eaton Corporation plc | 16,634 | 2,468,319 | |||

| Regal Rexnord Corporation | 30,574 | 4,106,088 | |||

| 12,518,958 | |||||

| Machinery: 1.50% | |||||

| AGCO Corporation | 25,398 | 2,766,350 | |||

| Crane Holdings Company | 20,187 | 1,997,100 | |||

| Cummins Incorporated | 11,349 | 2,511,647 | |||

| Deere & Company | 6,956 | 2,387,160 | |||

| Parker-Hannifin Corporation | 15,693 | 4,536,689 | |||

| 14,198,946 | |||||

| Road & rail: 0.37% | |||||

| CSX Corporation | 108,081 | 3,494,259 |

| Shares | Value | ||||

| Information technology: 27.42% | |||||

| Communications equipment: 1.04% | |||||

| Cisco Systems Incorporated | 217,200 | $ 9,854,364 | |||

| Electronic equipment, instruments & components: 0.48% | |||||

| Keysight Technologies Incorporated † | 20,519 | 3,336,389 | |||

| Zebra Technologies Corporation Class A † | 3,322 | 1,188,246 | |||

| 4,524,635 | |||||

| IT services: 3.57% | |||||

| Accenture plc Class A | 28,299 | 8,666,852 | |||

| Amdocs Limited | 64,274 | 5,595,694 | |||

| Cognizant Technology Solutions Corporation Class A | 9,175 | 623,533 | |||

| MasterCard Incorporated Class A | 14,740 | 5,214,865 | |||

| PayPal Holdings Incorporated † | 29,061 | 2,514,648 | |||

| Visa Incorporated Class A | 52,931 | 11,227,194 | |||

| 33,842,786 | |||||

| Semiconductors & semiconductor equipment: 5.42% | |||||

| Advanced Micro Devices Incorporated † | 28,555 | 2,697,591 | |||

| Applied Materials Incorporated | 47,704 | 5,055,670 | |||

| Broadcom Incorporated | 20,435 | 10,942,534 | |||

| Intel Corporation | 83,341 | 3,026,112 | |||

| KLA Corporation | 11,763 | 4,511,581 | |||

| Lam Research Corporation | 1,944 | 972,991 | |||

| Micron Technology Incorporated | 62,770 | 3,882,952 | |||

| NVIDIA Corporation | 67,451 | 12,251,125 | |||

| Qualcomm Incorporated | 55,391 | 8,035,018 | |||

| 51,375,574 | |||||

| Software: 9.14% | |||||

| Adobe Incorporated † | 10,135 | 4,156,566 | |||

| Cadence Design Systems Incorporated † | 7,543 | 1,403,601 | |||

| Fortinet Incorporated † | 50,455 | 3,009,641 | |||

| Intuit Incorporated | 10,425 | 4,755,572 | |||

| Microsoft Corporation | 214,599 | 60,246,523 | |||

| Oracle Corporation | 77,431 | 6,027,229 | |||

| Roper Technologies Incorporated | 5,330 | 2,327,451 | |||

| Salesforce.com Incorporated † | 25,043 | 4,608,413 | |||

| 86,534,996 | |||||

| Technology hardware, storage & peripherals: 7.77% | |||||

| Apple Incorporated | 425,735 | 69,186,201 | |||

| HP Incorporated | 130,322 | 4,351,452 | |||

| 73,537,653 | |||||

| Materials: 2.87% | |||||

| Chemicals: 1.17% | |||||

| Celanese Corporation Series A | 20,523 | 2,411,658 | |||

| LyondellBasell Industries NV Class A | 53,243 | 4,745,016 | |||

| Westlake Chemical Corporation | 40,520 | 3,944,217 | |||

| 11,100,891 |

| Shares | Value | ||||

| Metals & mining: 1.12% | |||||

| Alcoa Corporation | 29,386 | $ 1,495,454 | |||

| Cleveland-Cliffs Incorporated † | 154,589 | 2,737,771 | |||

| Freeport-McMoRan Incorporated | 52,491 | 1,656,091 | |||

| Reliance Steel & Aluminum Company | 24,925 | 4,741,981 | |||

| 10,631,297 | |||||

| Paper & forest products: 0.58% | |||||

| Louisiana-Pacific Corporation | 85,426 | 5,435,656 | |||

| Real estate: 3.32% | |||||

| Equity REITs: 3.32% | |||||

| Alexandria Real Estate Equities Incorporated | 28,088 | 4,656,429 | |||

| CubeSmart | 39,789 | 1,825,121 | |||

| Extra Space Storage Incorporated | 31,157 | 5,904,875 | |||

| Gaming and Leisure Properties Incorporated | 59,138 | 3,074,585 | |||

| Prologis Incorporated | 32,750 | 4,341,340 | |||

| Public Storage Incorporated | 8,997 | 2,936,711 | |||

| SBA Communications Corporation | 10,057 | 3,377,040 | |||

| Weyerhaeuser Company | 146,269 | 5,312,490 | |||

| 31,428,591 | |||||

| Utilities: 3.26% | |||||

| Electric utilities: 1.30% | |||||

| NextEra Energy Incorporated | 49,983 | 4,223,064 | |||

| NRG Energy Incorporated | 136,076 | 5,136,869 | |||

| The Southern Company | 37,611 | 2,891,910 | |||

| 12,251,843 | |||||

| Independent power & renewable electricity producers: 0.64% | |||||

| AES Corporation | 272,560 | 6,056,283 | |||

| Multi-utilities: 1.32% | |||||

| DTE Energy Company | 50,415 | 6,569,075 | |||

| Sempra Energy | 35,852 | 5,944,262 | |||

| 12,513,337 | |||||

| Total Common stocks (Cost $531,365,526) | 935,510,883 |

| Yield | |||||

| Short-term investments: 0.95% | |||||

| Investment companies: 0.95% | |||||

| Allspring Government Money Market Fund Select Class ♠∞ | 1.76% | 8,984,426 | 8,984,426 | ||

| Total Short-term investments (Cost $8,984,426) | 8,984,426 | ||||

| Total investments in securities (Cost $540,349,952) | 99.75% | 944,495,309 | |||

| Other assets and liabilities, net | 0.25 | 2,409,283 | |||

| Total net assets | 100.00% | $946,904,592 |

| † | Non-income-earning security |

| ♠ | The issuer of the security is an affiliated person of the Fund as defined in the Investment Company Act of 1940. |

| ∞ | The rate represents the 7-day annualized yield at period end. |

| Abbreviations: | |

| REIT | Real estate investment trust |

| Value, beginning of period | Purchases | Sales proceeds | Net realized gains (losses) | Net change in unrealized gains (losses) | Value, end of period | Shares, end of period | Income from affiliated securities | |

| Short-term investments | ||||||||

| Allspring Government Money Market Fund Select Class | $19,482,368 | $124,864,160 | $(135,362,102) | $0 | $0 | $8,984,426 | 8,984,426 | $43,677 |

| Description | Number of contracts | Expiration date | Notional cost | Notional value | Unrealized gains | Unrealized losses |

| Long | ||||||

| E-Mini S&P 500 Index | 43 | 9-16-2022 | $8,383,693 | $8,887,025 | $503,332 | $0 |

| Assets | |

Investments in unaffiliated securities, at value (cost $531,365,526) | $ 935,510,883 |

Investments in affiliated securities, at value (cost $8,984,426) | 8,984,426 |

Cash at broker segregated for futures contracts | 1,587,600 |

Receivable for dividends | 1,071,700 |

Receivable for Fund shares sold | 397,672 |

Receivable for daily variation margin on open futures contracts | 131,617 |

Prepaid expenses and other assets | 121,335 |

Total assets | 947,805,233 |

| Liabilities | |

Payable for Fund shares redeemed | 353,744 |

Management fee payable | 263,359 |

Administration fees payable | 107,453 |

Shareholder servicing fees payable | 104,379 |

Distribution fees payable | 11,669 |

Trustees’ fees and expenses payable | 181 |

Accrued expenses and other liabilities | 59,856 |

Total liabilities | 900,641 |

Total net assets | $946,904,592 |

| Net assets consist of | |

Paid-in capital | $ 438,443,676 |

Total distributable earnings | 508,460,916 |

Total net assets | $946,904,592 |

| Computation of net asset value and offering price per share | |

Net assets – Class A | $ 453,828,731 |

Shares outstanding – Class A1 | 22,408,039 |

Net asset value per share – Class A | $20.25 |

Maximum offering price per share – Class A2 | $21.49 |

Net assets – Class C | $ 21,380,995 |

Shares outstanding – Class C1 | 1,163,956 |

Net asset value per share – Class C | $18.37 |

Net assets – Class R | $ 3,139,931 |

Shares outstanding – Class R1 | 153,699 |

Net asset value per share – Class R | $20.43 |

Net assets – Class R6 | $ 277,956,007 |

Shares outstanding – Class R61 | 13,283,173 |

Net asset value per share – Class R6 | $20.93 |

Net assets – Administrator Class | $ 47,830,718 |

Shares outstanding – Administrator Class1 | 2,277,560 |

Net asset value per share – Administrator Class | $21.00 |

Net assets – Institutional Class | $ 142,768,210 |

Shares outstanding – Institutional Class1 | 6,901,663 |

Net asset value per share – Institutional Class | $20.69 |

| 1 | The Fund has an unlimited number of authorized shares. |

| 2 | Maximum offering price is computed as 100/94.25 of net asset value. On investments of $50,000 or more, the offering price is reduced. |

| Investment income | |

Dividends | $ 16,330,291 |

Income from affiliated securities | 43,677 |

Total investment income | 16,373,968 |

| Expenses | |

Management fee | 3,631,487 |

| Administration fees | |

Class A | 1,040,299 |

Class C | 51,826 |

Class R | 8,045 |

Class R6 | 93,384 |

Administrator Class | 65,879 |

Institutional Class | 203,337 |

| Shareholder servicing fees | |

Class A | 1,238,452 |

Class C | 61,547 |

Class R | 9,577 |

Administrator Class | 117,718 |

| Distribution fees | |

Class C | 184,640 |

Class R | 9,406 |

Custody and accounting fees | 55,473 |

Professional fees | 49,874 |

Registration fees | 74,970 |

Shareholder report expenses | 51,367 |

Trustees’ fees and expenses | 21,862 |

Other fees and expenses | 94,773 |

Total expenses | 7,063,916 |

| Less: Fee waivers and/or expense reimbursements | |

Class A | (19,852) |

Administrator Class | (9,134) |

Institutional Class | (49,829) |

Net expenses | 6,985,101 |

Net investment income | 9,388,867 |

| Realized and unrealized gains (losses) on investments | |

| Net realized gains (losses) on | |

Unaffiliated securities | 100,849,324 |

Futures contracts | (135,799) |

Net realized gains on investments | 100,713,525 |

| Net change in unrealized gains (losses) on | |

Unaffiliated securities | (140,544,573) |

Futures contracts | 434,829 |

Net change in unrealized gains (losses) on investments | (140,109,744) |

Net realized and unrealized gains (losses) on investments | (39,396,219) |

Net decrease in net assets resulting from operations | $ (30,007,352) |

| Year ended July 31, 2022 | Year ended July 31, 2021 | |||

| Operations | ||||

Net investment income | $ 9,388,867 | $ 9,224,638 | ||

Net realized gains on investments | 100,713,525 | 81,986,097 | ||

Net change in unrealized gains (losses) on investments | (140,109,744) | 220,705,162 | ||

Net increase (decrease) in net assets resulting from operations | (30,007,352) | 311,915,897 | ||

| Distributions to shareholders from | ||||

| Net investment income and net realized gains | ||||

Class A | (41,800,708) | (40,144,770) | ||

Class C | (2,103,959) | (2,202,870) | ||

Class R | (325,019) | (330,477) | ||

Class R6 | (27,186,743) | (25,321,636) | ||

Administrator Class | (4,249,188) | (4,226,866) | ||

Institutional Class | (13,233,665) | (13,403,739) | ||

Total distributions to shareholders | (88,899,282) | (85,630,358) | ||

| Capital share transactions | Shares | Shares | ||

| Proceeds from shares sold | ||||

Class A | 872,276 | 19,043,317 | 1,622,096 | 32,886,449 |

Class C | 66,563 | 1,291,580 | 39,264 | 713,151 |

Class R | 32,976 | 767,963 | 17,104 | 349,021 |

Class R6 | 374,988 | 8,156,586 | 3,552,924 | 75,931,420 |

Administrator Class | 261,446 | 6,154,474 | 136,923 | 2,833,092 |

Institutional Class | 837,224 | 18,892,679 | 1,077,100 | 22,113,375 |

| 54,306,599 | 134,826,508 | |||

| Reinvestment of distributions | ||||

Class A | 1,721,849 | 39,080,723 | 1,978,592 | 37,660,984 |

Class C | 100,635 | 2,069,063 | 123,928 | 2,147,585 |

Class R | 14,203 | 325,019 | 17,031 | 327,043 |

Class R6 | 1,103,953 | 25,895,916 | 1,222,488 | 23,967,764 |

Administrator Class | 164,016 | 3,859,677 | 190,727 | 3,751,963 |

Institutional Class | 509,416 | 11,813,677 | 620,802 | 12,045,656 |

| 83,044,075 | 79,900,995 | |||

| Payment for shares redeemed | ||||

Class A | (3,094,354) | (68,315,947) | (3,799,753) | (76,614,099) |

Class C | (305,748) | (6,087,730) | (605,272) | (11,024,914) |

Class R | (72,052) | (1,563,821) | (46,393) | (946,015) |

Class R6 | (2,713,444) | (63,086,684) | (3,781,193) | (78,637,749) |

Administrator Class | (325,023) | (7,511,866) | (847,387) | (17,290,465) |

Institutional Class | (1,475,152) | (33,016,713) | (2,582,056) | (52,693,521) |

| (179,582,761) | (237,206,763) | |||

Net decrease in net assets resulting from capital share transactions | (42,232,087) | (22,479,260) | ||

Total increase (decrease) in net assets | (161,138,721) | 203,806,279 | ||

| Net assets | ||||

Beginning of period | 1,108,043,313 | 904,237,034 | ||

End of period | $ 946,904,592 | $1,108,043,313 | ||

| Year ended July 31 | |||||

| Class A | 2022 | 2021 | 2020 | 2019 | 2018 |

Net asset value, beginning of period | $22.77 | $18.22 | $17.29 | $17.70 | $16.30 |

Net investment income | 0.16 | 0.14 | 0.23 | 0.25 | 0.24 |

Net realized and unrealized gains (losses) on investments | (0.78) | 6.18 | 1.47 | 0.38 | 1.90 |

Total from investment operations | (0.62) | 6.32 | 1.70 | 0.63 | 2.14 |

| Distributions to shareholders from | |||||

Net investment income | (0.16) | (0.33) | (0.33) | (0.19) | (0.15) |

Net realized gains | (1.74) | (1.44) | (0.44) | (0.85) | (0.59) |

Total distributions to shareholders | (1.90) | (1.77) | (0.77) | (1.04) | (0.74) |

Net asset value, end of period | $20.25 | $22.77 | $18.22 | $17.29 | $17.70 |

Total return1 | (3.60)% | 36.73% | 9.97% | 4.31% | 13.28% |

| Ratios to average net assets (annualized) | |||||

Gross expenses | 0.84% | 0.85% | 0.86% | 0.84% | 0.83% |

Net expenses | 0.84% | 0.85% | 0.85% | 0.84% | 0.83% |

Net investment income | 0.73% | 0.76% | 1.25% | 1.40% | 1.33% |

| Supplemental data | |||||

Portfolio turnover rate | 25% | 36% | 50% | 63% | 73% |

Net assets, end of period (000s omitted) | $453,829 | $521,702 | $421,005 | $434,367 | $480,602 |

| 1 | Total return calculations do not include any sales charges. |

| Year ended July 31 | |||||

| Class C | 2022 | 2021 | 2020 | 2019 | 2018 |

Net asset value, beginning of period | $20.82 | $16.70 | $15.85 | $16.28 | $15.04 |

Net investment income (loss) | (0.00) | 0.02 | 0.11 | 0.12 | 0.09 |

Net realized and unrealized gains (losses) on investments | (0.71) | 5.64 | 1.32 | 0.35 | 1.76 |

Total from investment operations | (0.71) | 5.66 | 1.43 | 0.47 | 1.85 |

| Distributions to shareholders from | |||||

Net investment income | 0.00 | (0.10) | (0.14) | (0.05) | (0.02) |

Net realized gains | (1.74) | (1.44) | (0.44) | (0.85) | (0.59) |

Total distributions to shareholders | (1.74) | (1.54) | (0.58) | (0.90) | (0.61) |

Net asset value, end of period | $18.37 | $20.82 | $16.70 | $15.85 | $16.28 |

Total return1 | (4.30)% | 35.80% | 9.09% | 3.59% | 12.41% |

| Ratios to average net assets (annualized) | |||||

Gross expenses | 1.59% | 1.60% | 1.60% | 1.59% | 1.58% |

Net expenses | 1.59% | 1.60% | 1.60% | 1.59% | 1.58% |

Net investment income (loss) | (0.02)% | 0.02% | 0.51% | 0.66% | 0.58% |

| Supplemental data | |||||

Portfolio turnover rate | 25% | 36% | 50% | 63% | 73% |

Net assets, end of period (000s omitted) | $21,381 | $27,121 | $29,141 | $38,708 | $52,647 |

| 1 | Total return calculations do not include any sales charges. |

| Year ended July 31 | |||||

| Class R | 2022 | 2021 | 2020 | 2019 | 2018 |

Net asset value, beginning of period | $22.96 | $18.38 | $17.44 | $17.88 | $16.51 |

Net investment income | 0.04 | 0.07 | 0.18 | 0.19 1 | 0.18 1 |

Net realized and unrealized gains (losses) on investments | (0.73) | 6.25 | 1.49 | 0.41 | 1.94 |

Total from investment operations | (0.69) | 6.32 | 1.67 | 0.60 | 2.12 |

| Distributions to shareholders from | |||||

Net investment income | (0.10) | (0.30) | (0.29) | (0.19) | (0.16) |

Net realized gains | (1.74) | (1.44) | (0.44) | (0.85) | (0.59) |

Total distributions to shareholders | (1.84) | (1.74) | (0.73) | (1.04) | (0.75) |

Net asset value, end of period | $20.43 | $22.96 | $18.38 | $17.44 | $17.88 |

Total return | (3.82)% | 36.38% | 9.68% | 4.07% | 12.97% |

| Ratios to average net assets (annualized) | |||||

Gross expenses | 1.09% | 1.10% | 1.10% | 1.09% | 1.08% |

Net expenses | 1.09% | 1.10% | 1.10% | 1.09% | 1.08% |

Net investment income | 0.48% | 0.51% | 0.97% | 1.15% | 1.04% |

| Supplemental data | |||||

Portfolio turnover rate | 25% | 36% | 50% | 63% | 73% |