UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-09253

Allspring Funds Trust

(Exact name of registrant as specified in charter)

1415 Vantage Park Drive, 3rd Floor, Charlotte, NC 28203

(Address of principal executive offices) (Zip code)

Matthew Prasse

Allspring Funds Management, LLC

1415 Vantage Park Drive, 3rd Floor, Charlotte, NC 28203

(Name and address of agent for service)

Registrant’s telephone number, including area code: 800-222-8222

Date of fiscal year end: October 31

Registrant is making a filing for 8 of its series: Allspring Managed Account CoreBuilder Shares—Series EM, Allspring Emerging Markets Equity Fund, Allspring Emerging Markets Equity Income Fund, Allspring Global Long/Short Equity Fund, Allspring International Equity Fund, Allspring Special Global Small Cap Fund, Allspring Special International Small Cap Fund and Allspring U.S. Long/Short Equity Fund.

Date of reporting period: April 30, 2024

ITEM 1. REPORT TO STOCKHOLDERS

2

Allspring Managed Account

Allspring Managed Account CoreBuilder® Shares – Series EM

The views expressed and any forward-looking statements are as of April 30, 2024, unless otherwise noted, and are those of the portfolio managers and/or Allspring Global Investments. Discussions of individual securities or the markets generally are not intended as individual recommendations. Future events or results may vary significantly from those expressed in any forward-looking statements. The views expressed are subject to change at any time in response to changing circumstances in the market. Allspring Global Investments disclaims any obligation to publicly update or revise any views expressed or forward-looking statements.

Allspring Managed Account | 1

|

Beginning in July 2024, the Fund will be required by the Securities and Exchange Commission to send shareholders a paper copy of a new tailored shareholder report in place of the full shareholder report that you are now receiving. The tailored shareholder report will contain concise information about the Fund, including certain expense and performance information and fund statistics. If you wish to receive this new tailored shareholder report electronically, please follow the instructions on the back cover of this report. |

Other information that is currently included in the shareholder report, such as the Fund’s financial statements, will be available online and upon request, free of charge, in paper or electronic format. |

2 | Allspring Managed Account

This page is intentionally left blank.

Performance highlights (unaudited)

Performance highlights

| The Fund seeks to achieve long-term capital appreciation and current income. |

| Allspring Funds Management, LLC |

| Allspring Global Investments, LLC |

| Alison Shimada, Elaine Tse |

Average annual total returns (%) as of April 30, 2024 |

| | | | |

| | | | | |

Allspring Managed Account CoreBuilder® Shares - Series EM (ACBEX) | | | | | |

MSCI ACWI ex USA Index (Net)3 | | | | | |

MSCI EM Index (Net) (USD)4 | | | | | |

Figures quoted represent past performance, which is no guarantee of future results, and do not reflect taxes that a shareholder may pay on an investment in a fund. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted, which assumes the reinvestment of dividends and capital gains. Current month-end performance is available by calling 1-888-877-9275.

Index returns do not include transaction costs associated with buying and selling securities, any mutual fund fees or expenses, or any taxes. It is not possible to invest directly in an index.

Shares are sold without a front-end sales charge or contingent deferred sales charge.

|

| Based on the Fund’s inception date. |

| Reflects the expense ratios as stated in the most recent prospectus, which include the impact of 0.02% in acquired fund fees and expenses. The expense ratios shown are subject to change and may differ from the annualized expense ratios shown in the Financial Highlights of this report, which do not include acquired fund fees and expenses. |

| Generally, no ordinary fees or expenses are charged to the Fund. Allspring Funds Management, LLC has contractually committed to irrevocably absorb and pay or reimburse all ordinary operating expenses of the Fund, except portfolio transactions or other investment related costs (e.g., commissions), fees payable for services provided by the Fund’s securities lending agent (if any), interest, taxes, leverage expenses and other expenses not incurred in the ordinary course of the Fund’s business. This commitment has an indefinite term. |

| The Morgan Stanley Capital International (MSCI) All Country World Index (ACWI) ex USA Index (Net) is a free-float-adjusted market-capitalization-weighted index that is designed to measure the equity market performance of developed and emerging markets, excluding the U.S. Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indexes or any securities or financial products. This report is not approved, reviewed, or produced by MSCI. You cannot invest directly in an index. |

| MSCI Emerging Markets (EM) Index (Net) (USD) is a free-float-adjusted market-capitalization-weighted index that is designed to measure the equity market performance of emerging markets. You cannot invest directly in an index. |

Investing involves risk, including the possible loss of principal. Stock values fluctuate in response to the activities of individual companies and general market and economic conditions. Foreign investments are especially volatile and can rise or fall dramatically due to differences in the political and economic conditions of the host country. These risks are generally intensified in emerging markets. The use of derivatives may reduce returns and/or increase volatility. Certain investment strategies tend to increase the total risk of an investment (relative to the broader market). This fund is exposed to smaller-company securities risk. Consult the Fund’s prospectus for additional information on these and other risks.

CoreBuilder Shares are a series of investment options within the separately managed accounts advised or subadvised by Allspring Funds Management, LLC. The shares are fee-waived mutual funds that enable certain separately managed account investors to achieve greater diversification than smaller managed accounts might otherwise achieve.

Please remember that shares of the Fund may be purchased only by or on behalf of separately managed account clients where Allspring Funds Management, LLC has an agreement to serve as investment adviser or subadviser to the account with the separately managed account sponsor (typically a registered investment adviser or broker/dealer) or directly with the client.

4 | Allspring Managed Account

Performance highlights (unaudited)

Ten largest holdings (%) as of April 30, 20241 |

Samsung Electronics Co. Ltd., Preferred stock | |

Samsung Electronics Co. Ltd. | |

Power Grid Corp. of India Ltd. | |

Midea Group Co. Ltd. Class A | |

| |

| |

| |

| |

Embassy Office Parks REIT | |

China Resources Land Ltd. | |

| Figures represent the percentage of the Fund’s net assets. Holdings are subject to change and may have changed since the date specified. |

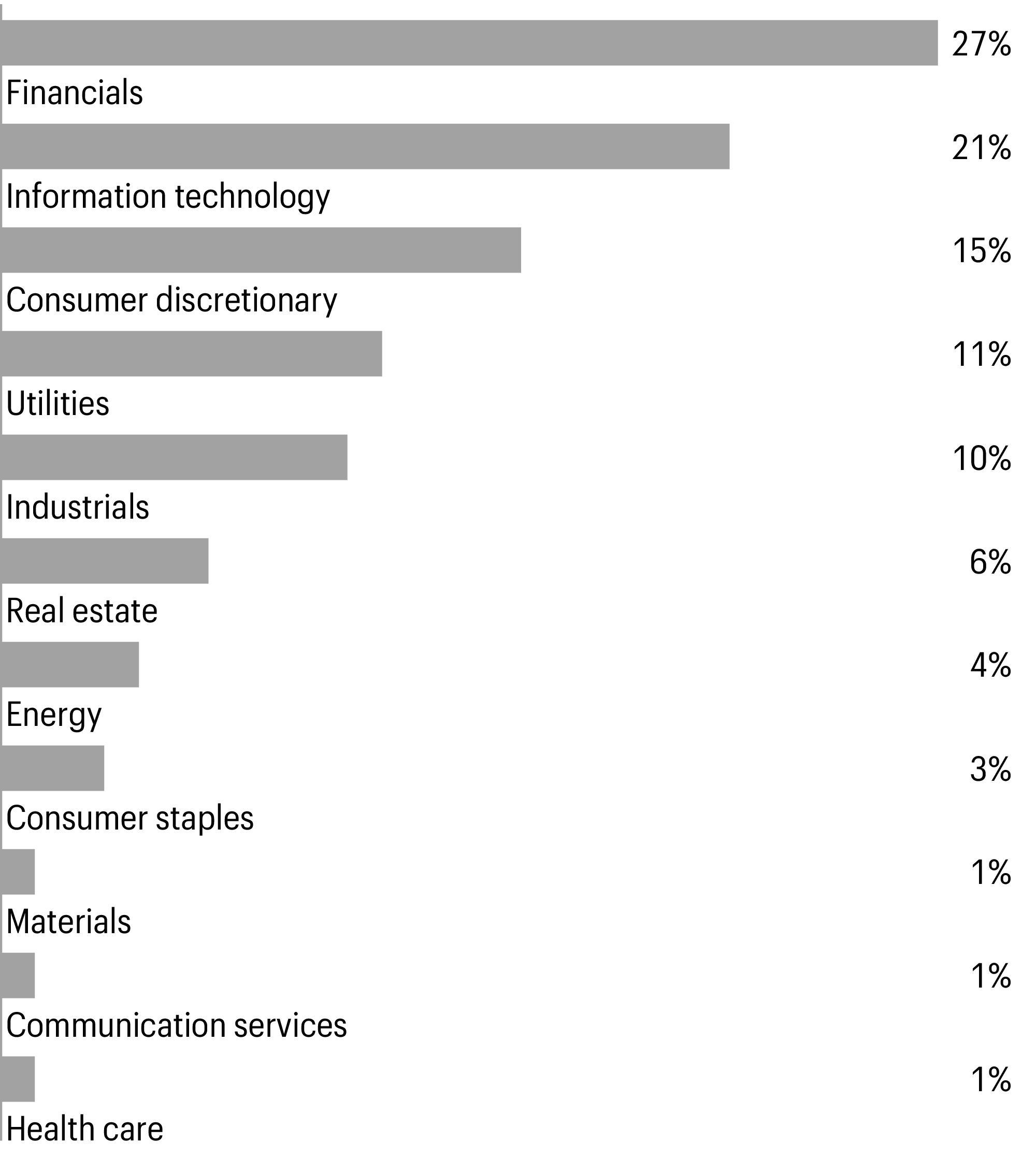

Sector allocation as of April 30, 20241 |

| Figures represent the percentage of the Fund’s long-term investments. Allocations are subject to change and may have changed since the date specified. |

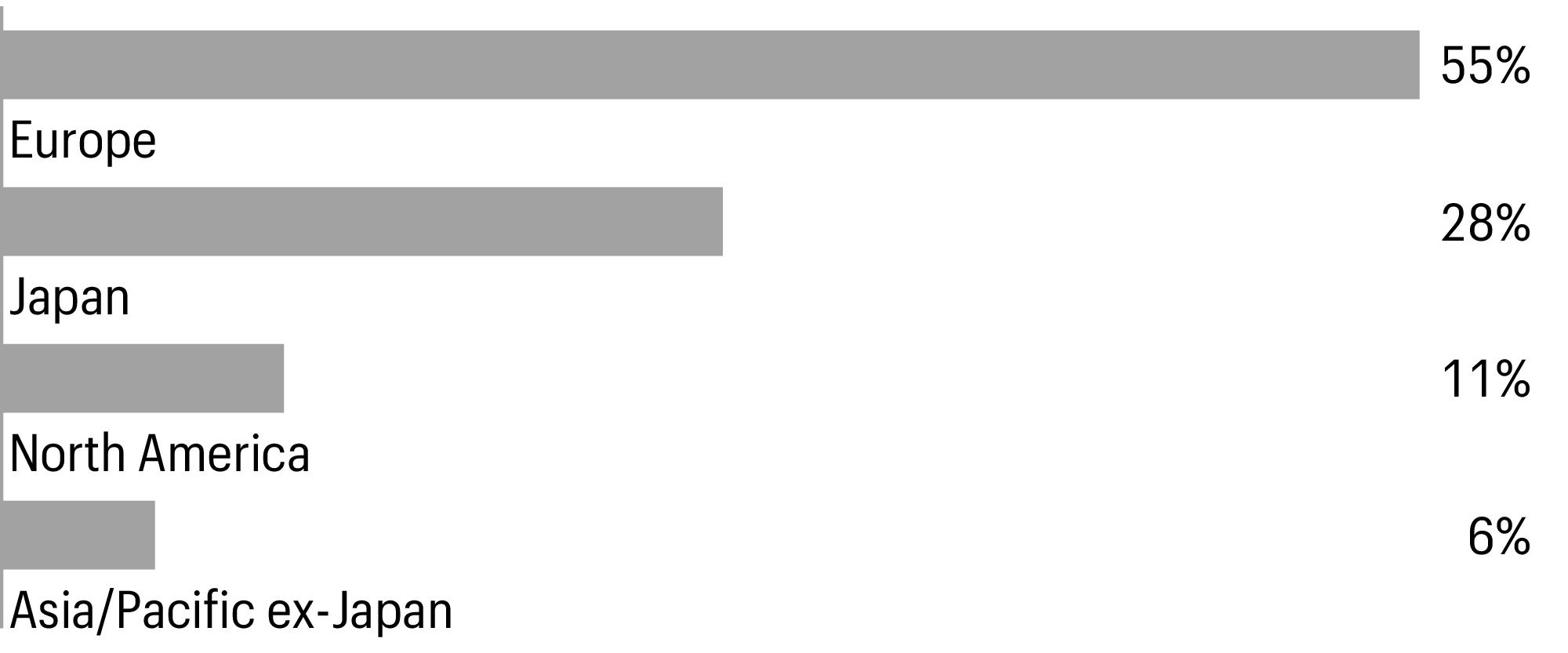

Geographic allocation as of April 30, 20241 |

| Figures represent the percentage of the Fund’s long-term investments. Allocations are subject to change and may have changed since the date specified. |

Allspring Managed Account | 5

Fund expenses (unaudited)

Fund expenses

As a shareholder of the Fund, you incur ongoing costs and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the six-month period and held for the entire period from November 1, 2023 to April 30, 2024.

The “Actual” line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000= 8.6), then multiply the result by the number in the “Actual” line under the heading entitled “Expenses paid during period” for your applicable class of shares to estimate the expenses you paid on your account during this period.

Hypothetical example for comparison purposes

The “Hypothetical” line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only. Therefore, the “Hypothetical” line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

| Beginning

account value

11-1-2023 | Ending

account value

4-30-2024 | | Annualized net

expense ratio |

| | | | |

Hypothetical (5% return before expenses) | | | | |

| Expenses paid is equal to the annualized net expense ratio multiplied by the average account value over the period, multiplied by 182 divided by 366 (to reflect the one-half-year period). |

| Generally, no ordinary fees or expenses are charged to the Fund. Allspring Funds Management, LLC has contractually committed to irrevocably absorb and pay or reimburse all ordinary operating expenses of the Fund, except portfolio transactions or other investment related costs (e.g., commissions), fees payable for services provided by the Fund’s securities lending agent (if any), interest, taxes, leverage expenses and other expenses not incurred in the ordinary course of the Fund’s business. This commitment has an indefinite term. |

6 | Allspring Managed Account

Portfolio of investments—April 30, 2024 (unaudited)

| | | | | |

| | | | | | |

| | | | | | |

B3 SA - Brasil Bolsa Balcao (Financials, Capital markets) | | | | | | |

Banco BTG Pactual SA (Financials, Capital markets) | | | | | | |

| | | | | | |

| | | | | | |

China International Capital Corp. Ltd. Class H (Financials, Capital markets)144A | | | | | | |

China Oilfield Services Ltd. Class H (Energy, Energy equipment & services) | | | | | | |

China Resources Land Ltd. (Real estate, Real estate management & development) | | | | | | |

China State Construction International Holdings Ltd. (Industrials, Construction & engineering) | | | | | | |

Chinasoft International Ltd. (Information technology, IT services) | | | | | | |

Foxconn Industrial Internet Co. Ltd. Class A (Information technology, Electronic equipment, instruments & components) | | | | | | |

Fuyao Glass Industry Group Co. Ltd. Class H (Consumer discretionary, Automobile components)144A | | | | | | |

Gree Electric Appliances, Inc. of Zhuhai Class A (Consumer discretionary, Household durables) | | | | | | |

Inner Mongolia Yili Industrial Group Co. Ltd. Class A (Consumer staples, Food products) | | | | | | |

Midea Group Co. Ltd. Class A (Consumer discretionary, Household durables) | | | | | | |

Weichai Power Co. Ltd. Class H (Industrials, Machinery) | | | | | | |

| | | | | | |

| | | | | | |

Jumbo SA (Consumer discretionary, Specialty retail) | | | | | | |

National Bank of Greece SA (Financials, Banks)† | | | | | | |

| | | | | | |

| | | | | | |

Richter Gedeon Nyrt (Health care, Pharmaceuticals) | | | | | | |

| | | | | | |

360 ONE WAM Ltd. (Financials, Capital markets) | | | | | | |

Ashok Leyland Ltd. (Industrials, Machinery) | | | | | | |

Bajaj Auto Ltd. (Consumer discretionary, Automobiles) | | | | | | |

Embassy Office Parks REIT (Real estate, Office REITs) | | | | | | |

GAIL India Ltd. (Utilities, Gas utilities) | | | | | | |

LIC Housing Finance Ltd. (Financials, Financial services) | | | | | | |

NHPC Ltd. (Utilities, Independent power and renewable electricity producers) | | | | | | |

Power Finance Corp. Ltd. (Financials, Financial services) | | | | | | |

Power Grid Corp. of India Ltd. (Utilities, Electric utilities) | | | | | | |

Ujjivan Financial Services Ltd. (Financials, Consumer finance) | | | | | | |

| | | | | | |

| | | | | | |

Indofood CBP Sukses Makmur Tbk. PT (Consumer staples, Food products) | | | | | | |

The accompanying notes are an integral part of these financial statements.

Allspring Managed Account | 7

Portfolio of investments—April 30, 2024 (unaudited)

| | | | | |

| | | | | | |

CIMB Group Holdings Bhd. (Financials, Banks) | | | | | | |

Malaysia Airports Holdings Bhd. (Industrials, Transportation infrastructure) | | | | | | |

| | | | | | |

| | | | | | |

Bolsa Mexicana de Valores SAB de CV (Financials, Capital markets) | | | | | | |

| | | | | | |

Bank of the Philippine Islands (Financials, Banks) | | | | | | |

| | | | | | |

Bank Polska Kasa Opieki SA (Financials, Banks) | | | | | | |

LPP SA (Consumer discretionary, Textiles, apparel & luxury goods) | | | | | | |

| | | | | | |

| | | | | | |

Al Rajhi Bank (Financials, Banks) | | | | | | |

Arabian Drilling Co. (Energy, Energy equipment & services) | | | | | | |

Etihad Etisalat Co. (Communication services, Wireless telecommunication services) | | | | | | |

Saudi Awwal Bank (Financials, Banks) | | | | | | |

United International Transportation Co. (Industrials, Ground transportation) | | | | | | |

| | | | | | |

| | | | | | |

BOC Aviation Ltd. (Industrials, Trading companies & distributors)144A | | | | | | |

Yangzijiang Shipbuilding Holdings Ltd. (Industrials, Machinery) | | | | | | |

| | | | | | |

| | | | | | |

Doosan Bobcat, Inc. (Industrials, Machinery) | | | | | | |

Fila Holdings Corp. (Consumer discretionary, Textiles, apparel & luxury goods) | | | | | | |

Kia Corp. (Consumer discretionary, Automobiles) | | | | | | |

Samsung Electronics Co. Ltd. (Information technology, Technology hardware, storage & peripherals) | | | | | | |

| | | | | | |

| | | | | | |

Cathay Financial Holding Co. Ltd. (Financials, Insurance) | | | | | | |

Chroma ATE, Inc. (Information technology, Electronic equipment, instruments & components) | | | | | | |

Delta Electronics, Inc. (Information technology, Electronic equipment, instruments & components) | | | | | | |

E Ink Holdings, Inc. (Information technology, Electronic equipment, instruments & components) | | | | | | |

MediaTek, Inc. (Information technology, Semiconductors & semiconductor equipment) | | | | | | |

Quanta Computer, Inc. (Information technology, Technology hardware, storage & peripherals) | | | | | | |

Teco Electric & Machinery Co. Ltd. (Industrials, Electrical equipment) | | | | | | |

| | | | | | |

The accompanying notes are an integral part of these financial statements.

8 | Allspring Managed Account

Portfolio of investments—April 30, 2024 (unaudited)

| | | | | |

| | | | | | |

PTT Exploration & Production PCL (Energy, Oil, gas & consumable fuels) | | | | | | |

| | | | | | |

BIM Birlesik Magazalar AS (Consumer staples, Consumer staples distribution & retail) | | | | | | |

United Arab Emirates: 0.74% | | | | | | |

Abu Dhabi Commercial Bank PJSC (Financials, Banks) | | | | | | |

Total common stocks (Cost $4,378,948) | | | | | | |

| | | | | |

| | | | | | |

| | | | | | |

LG Chem Ltd. (Materials, Chemicals) | | | | | | |

Samsung Electronics Co. Ltd. (Information technology, Technology hardware, storage & peripherals) | | | | | | |

Total preferred stocks (Cost $388,166) | | | | | | |

| | | | | |

Short-term investments: 2.64% | | | | | | |

Investment companies: 2.64% | | | | | | |

Allspring Government Money Market Fund Select Class♠∞ | | | | | | |

Total short-term investments (Cost $141,698) | | | | | | |

Total investments in securities (Cost $4,908,812) | | | | | | |

Other assets and liabilities, net | | | | | | |

| | | | | | |

| The security may be resold in transactions exempt from registration, normally to qualified institutional buyers, pursuant to Rule 144A under the Securities Act of 1933. |

| Non-income-earning security |

| The issuer of the security is an affiliated person of the Fund as defined in the Investment Company Act of 1940. |

| The rate represents the 7-day annualized yield at period end. |

|

| Real estate investment trust |

Investments in affiliates

An affiliated investment is an investment in which the Fund owns at least 5% of the outstanding voting shares of the issuer or as a result of other relationships, such as the Fund and the issuer having the same investment manager. Transactions with issuers that were affiliates of the Fund at the end of the period were as follows:

| | | | | Net

change in

unrealized

gains

(losses) | | | Income

from

affiliated

securities |

| | | | | | | | |

Allspring Government Money Market Fund Select Class | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

Allspring Managed Account | 9

Statement of assets and liabilities—April 30, 2024 (unaudited)

Financial statements

Statement of assets and liabilities

| |

Investments in unaffiliated securities, at value (cost $4,767,114) | |

Investments in affiliated securities, at value (cost $141,698) | |

Foreign currency, at value (cost $25,900) | |

Receivable for investments sold | |

| |

| |

Prepaid expenses and other assets | |

| |

| |

Payable for investments purchased | |

Professional fees payable | |

Accrued expenses and other liabilities | |

| |

| |

| |

| |

Total distributable earnings | |

| |

Computation of net asset value per share | |

| |

| |

Net asset value per share | |

1 The Fund has an unlimited number of authorized shares.

The accompanying notes are an integral part of these financial statements.

10 | Allspring Managed Account

Statement of operations—six months ended April 30, 2024 (unaudited)

Statement of operations

| |

Dividends (net of foreign withholdings taxes of $9,018) | |

Income from affiliated securities | |

| |

| |

| |

Custody and accounting fees | |

| |

| |

Shareholder report expenses | |

Trustees’ fees and expenses | |

| |

| |

Less: Fee waivers and/or expense reimbursements | |

| |

| |

Realized and unrealized gains (losses) on investments | |

Net realized gains (losses) on | |

| |

Foreign currency and foreign currency translations | |

Forward foreign currency contracts | |

Net realized gains on investments | |

Net change in unrealized gains (losses) on | |

| |

Foreign currency and foreign currency translations | |

Net change in unrealized gains (losses) on investments | |

Net realized and unrealized gains (losses) on investments | |

Net increase in net assets resulting from operations | |

The accompanying notes are an integral part of these financial statements.

Allspring Managed Account | 11

Statement of changes in net assets

Statement of changes in net assets

|

Six months ended

April 30, 2024 (unaudited) | year ended October 31, 20231 |

| | | | |

| | | | |

Net realized gains on investments | | | | |

Net change in unrealized gains (losses) on investments | | | | |

Net increase in net assets resulting from operations | | | | |

Distributions to shareholders from | | | | |

Net investment income and net realized gains | | | | |

Capital share transactions | | | | |

Proceeds from shares sold | | | | |

Reinvestment of distributions | | | | |

Payment for shares redeemed | | | | |

Net increase in net assets resulting from capital share transactions | | | | |

Total increase in net assets | | | | |

| | | | |

| | | | |

| | | | |

1 For the period from November 16, 2022 (commencement of operations) to October 31, 2023

The accompanying notes are an integral part of these financial statements.

12 | Allspring Managed Account

Financial highlights

(For a share outstanding throughout the period)

| Six months ended

April 30, 2024

(unaudited) | |

| |

Net asset value, beginning of period | | |

| | |

Net realized and unrealized gains (losses) on investments | | |

Total from investment operations | | |

Distributions to shareholders from | | |

| | |

| | |

Total distributions to shareholders | | |

Net asset value, end of period | | |

| | |

Ratios to average net assets (annualized) | | |

| | |

| | |

| | |

| | |

| | |

Net assets, end of period (000s omitted) | | |

| For the period from November 16, 2022 (commencement of operations) to October 31, 2023 |

| Calculated based upon average shares outstanding |

| Returns for periods of less than one year are not annualized. |

| The manager has contractually committed to irrevocably absorb and pay or reimburse all ordinary operating expenses of the Fund, except portfolio transactions or other investment-related costs (e.g., commissions), fees payable for services provided by the Fund’s securities lending agent (if any), interest, taxes, leverage expenses, and other expenses not incurred in the ordinary course of the Fund’s business. This commitment has an indefinite term. |

The accompanying notes are an integral part of these financial statements.

Allspring Managed Account | 13

Notes to financial statements (unaudited)

Notes to financial statements

Allspring Funds Trust (the “Trust”), a Delaware statutory trust organized on March 10, 1999, is an open-end management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”). As an investment company, the Trust follows the accounting and reporting guidance in Financial Accounting Standards Board (“FASB”) Accounting Standards Codification Topic 946, Financial Services – Investment Companies. These financial statements report on the Allspring Managed Account CoreBuilder Shares - Series EM (the “Fund”) which is a diversified series of the Trust.

The Fund is a special purpose fund invested primarily in foreign equity securities and is intended to be used in combination with selected individual securities to effectively model institutional-level investment strategies. The Fund is intended to help enable certain separately managed account investors to achieve greater diversification than smaller managed accounts might otherwise achieve.

2.

SIGNIFICANT ACCOUNTING POLICIES

The following significant accounting policies, which are consistently followed in the preparation of the financial statements of the Fund, are in conformity with U.S. generally accepted accounting principles which require management to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

All investments are valued each business day as of the close of regular trading on the New York Stock Exchange (generally 4 p.m. Eastern Time), although the Fund may deviate from this calculation time under unusual or unexpected circumstances.

Equity securities and exchange-traded funds that are listed on a foreign or domestic exchange or market are valued at the official closing price or, if none, the last sales price.

The values of securities denominated in foreign currencies are translated into U.S. dollars at rates provided by an independent foreign currency pricing source at a time each business day specified by the Valuation Committee at Allspring Funds Management, LLC (“Allspring Funds Management”).

Many securities markets and exchanges outside the U.S. close prior to the close of the New York Stock Exchange and therefore may not fully reflect trading or events that occur after the close of the principal exchange in which the foreign securities are traded, but before the close of the New York Stock Exchange. If such trading or events are expected to materially affect the value of such securities, then fair value pricing procedures implemented by Allspring Funds Management are applied. These procedures take into account multiple factors including movements in U.S. securities markets after foreign exchanges close. Foreign securities that are fair valued under these procedures are categorized as Level 2 and the application of these procedures may result in transfers between Level 1 and Level 2. Depending on market activity, such fair valuations may be frequent. Such fair value pricing may result in net asset values that are higher or lower than net asset values based on the last reported sales price or latest quoted bid price. On April 30, 2024, such fair value pricing was used in pricing certain foreign securities.

Forward foreign currency contracts are recorded at the forward rate provided by an independent foreign currency pricing source at a time each business day specified by the Valuation Committee at Allspring Funds Management.

Investments in registered open-end investment companies (other than those listed on a foreign or domestic exchange or market) are valued at net asset value.

Investments which are not valued using the methods discussed above are valued at their fair value, as determined in good faith by Allspring Funds Management, which was named the valuation designee by the Board of Trustees. As the valuation designee, Allspring Funds Management is responsible for day-to-day valuation activities for the Allspring Funds. In connection with these responsibilities, Allspring Funds Management has established a Valuation Committee and has delegated to it the authority to take any actions regarding the valuation of portfolio securities that the Valuation Committee deems necessary or appropriate, including determining the fair value of portfolio securities. On a quarterly basis, the Board of Trustees receives reports of valuation actions taken by the Valuation Committee. On at least an annual basis, the Board of Trustees receives an assessment of the adequacy and effectiveness of Allspring Funds Management’s process for determining the fair value of the portfolio of investments.

Foreign currency translation

The accounting records of the Fund are maintained in U.S. dollars. The values of other assets and liabilities denominated in foreign currencies are translated into U.S. dollars at rates provided by an independent foreign currency pricing source at a time each business day specified by the Valuation Committee. Purchases and sales of securities, and income and expenses are converted at the rate of exchange on the respective dates of such transactions. Net realized foreign exchange gains or losses arise from sales of foreign currencies, currency gains or losses realized between the trade and settlement dates on securities transactions, and the difference between the amounts of dividends, interest and foreign withholding taxes recorded and the U.S. dollar equivalent of the amounts actually paid or received. Net unrealized foreign exchange gains and losses arise from changes in the fair value of assets and liabilities other than investments in securities resulting from changes in exchange rates. The changes in net assets arising from changes in exchange rates of securities and the changes in net assets resulting from changes in market prices of securities are not separately presented. Such changes are included in net realized and unrealized gains or losses from investments.

14 | Allspring Managed Account

Notes to financial statements (unaudited)

Forward foreign currency contracts

A forward foreign currency contract is an agreement between two parties to purchase or sell a specific currency for an agreed-upon price at a future date. The Fund enters into forward foreign currency contracts to facilitate transactions in foreign-denominated securities and to attempt to minimize the risk to the Fund from adverse changes in the relationship between currencies. Forward foreign currency contracts are recorded at the forward rate and marked-to-market daily. When the contracts are closed, realized gains and losses arising from such transactions are recorded as realized gains or losses on forward foreign currency contracts. The Fund is subject to foreign currency risk and may be exposed to risks if the counterparties to the contracts are unable to meet the terms of their contracts or if the value of the foreign currency changes unfavorably. The Fund’s maximum risk of loss from counterparty credit risk is the unrealized gains on the contracts. This risk may be mitigated if there is a master netting arrangement between the Fund and the counterparty.

Security transactions and income recognition

Securities transactions are recorded on a trade date basis. Realized gains or losses are recorded on the basis of identified cost.

Dividend income is recognized on the ex-dividend date, except for certain dividends from foreign securities, which are recorded as soon as the custodian verifies the ex-dividend date. Dividend income is recorded net of foreign taxes withheld where recovery of such taxes is not assured.

Interest earned on cash balances held at the custodian is recorded as interest income.

Distributions received from REIT investments may be characterized as ordinary income, capital gains, or a return of capital to the Fund based on information provided by the REIT. The proper characterization of REIT distributions is generally not known until after the end of each calendar year. As such, estimates may be used in reporting the character of income and distributions for financial statement purposes.

Distributions to shareholders

Distributions to shareholders are recorded on the ex-dividend date and paid from net investment income monthly and any net realized gains are paid at least annually. Such distributions are determined in accordance with income tax regulations and may differ from U.S. generally accepted accounting principles. Dividend sources are estimated at the time of declaration. The tax character of distributions is determined as of the Fund’s fiscal year end. Therefore, a portion of the Fund’s distributions made prior to the Fund’s fiscal year end may be categorized as a tax return of capital at year end.

The Fund intends to qualify as a regulated investment company by distributing substantially all of its investment company taxable income and any net realized capital gains (after reduction for capital loss carryforwards) sufficient to relieve it from all, or substantially all, federal income taxes. Accordingly, no provision for federal income taxes was required.

The Fund’s income and federal excise tax returns and all financial records supporting those returns for the fiscal years since commencement of operations are subject to examination by the federal and Delaware revenue authorities. The Fund is not subject to examination by federal and state tax authorities for taxes before 2023, the year the Fund commenced operations.

As of April 30, 2024, the aggregate cost of all investments for federal income tax purposes was $4,920,344 and the unrealized gains (losses) consisted of:

3.

FAIR VALUATION MEASUREMENTS

Fair value measurements of investments are determined within a framework that has established a fair value hierarchy based upon the various data inputs utilized in determining the value of the Fund’s investments. The three-level hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1) and the lowest priority to unobservable inputs (Level 3). The Fund’s investments are classified within the fair value hierarchy based on the lowest level of input that is significant to the fair value measurement. The inputs are summarized into three broad levels as follows:

•Level 1—quoted prices in active markets for identical securities

•Level 2—other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.)

•Level 3—significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments)

The inputs or methodologies used for valuing investments in securities are not necessarily an indication of the risk associated with investing in those securities.

Allspring Managed Account | 15

Notes to financial statements (unaudited)

The following is a summary of the inputs used in valuing the Fund’s assets and liabilities as of April 30, 2024:

| | Other significant

observable inputs

(Level 2) | Significant

unobservable inputs

(Level 3) | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

Additional sector, industry or geographic detail, if any, is included in the Portfolio of Investments.

At April 30, 2024, the Fund did not have any transfers into/out of Level 3.

4.

TRANSACTIONS WITH AFFILIATES

The Trust has entered into an investment management contract with Allspring Funds Management, a wholly owned subsidiary of Allspring Global Investments Holdings, LLC, a holding company indirectly owned by certain private funds of GTCR LLC and Reverence Capital Partners, L.P. The manager is responsible for implementing investment policies and guidelines and for supervising the subadviser, who is responsible for day-to-day portfolio management of the Fund. For providing these services, Allspring Funds Management does not receive a fee from the Fund but is entitled to receive fees from separately managed account sponsors of the wrap-fee programs. Out of these fees, Allspring Funds Management pays Allspring Global Investments, LLC, an affiliate of Allspring Funds Management and a wholly owned subsidiary of Allspring Global Investments Holdings, LLC, for its services as the subadviser to the Fund.

Generally, no ordinary operating fees or expenses are charged to the Fund. Allspring Funds Management has contractually committed to irrevocably absorb and pay or reimburse all ordinary operating expenses of the Fund, except portfolio transactions or other investment-related costs (e.g., commissions), fees payable for services provided by the Fund’s securities lending agent (if any), interest, taxes, leverage expenses, and other expenses not incurred in the ordinary course of the Fund’s business. This commitment has an indefinite term.

The Fund may purchase or sell portfolio investment securities to certain affiliates pursuant to Rule 17a-7 under the 1940 Act and under procedures adopted by the Board of Trustees. The procedures have been designed to ensure that these interfund transactions, which do not incur broker commissions, are effected at current market prices. Pursuant to these procedures, the Fund did not have any interfund transactions during the six months ended April 30, 2024.

5.

INVESTMENT PORTFOLIO TRANSACTIONS

Purchases and sales of investments, excluding U.S. government obligations (if any) and short-term securities, for the six months ended April 30, 2024 were $3,533,573 and $3,522,494, respectively.

16 | Allspring Managed Account

Notes to financial statements (unaudited)

The Trust (excluding the money market funds), Allspring Master Trust and Allspring Variable Trust are parties to a $350,000,000 revolving credit agreement whereby the Fund is permitted to use bank borrowings for temporary or emergency purposes, such as to fund shareholder redemption requests. Interest under the credit agreement is charged to the Fund based on a borrowing rate equal to the higher of the Federal Funds rate or the overnight bank funding rate in effect on that day plus a spread. In addition, an annual commitment fee based on the unused balance is allocated to each participating fund.

For the six months ended April 30, 2024, there were no borrowings by the Fund under the agreement.

Concentration risk exists when a shareholder owns a large amount of shares of the Fund. A fund with a concentration of ownership may be more affected by the investment activity of those shareholders than would be a fund that does not have any ownership concentration. As of April 30, 2024, Allspring Funds Management or one of its affiliates owned 100% of the Fund.

As of the end of the period, the Fund concentrated its portfolio of investments in the financial sector and Asia/Pacific ex-Japan. A fund that invests a substantial portion of its assets in any sector or geographic region may be more affected by changes in that sector or geographic region than would be a fund whose investments are not heavily weighted in any sector or geographic region.

Under the Fund’s organizational documents, the officers and Trustees have been granted certain indemnification rights against certain liabilities that may arise out of performance of their duties to the Fund. The Fund has entered into a separate agreement with each Trustee that converts indemnification rights currently existing under the Fund’s organizational documents into contractual rights that cannot be changed in the future without the consent of the Trustee. Additionally, in the normal course of business, the Fund may enter into contracts with service providers that contain a variety of indemnification clauses. The Fund’s maximum exposure under these arrangements is dependent on future claims that may be made against the Fund and, therefore, cannot be estimated.

Allspring Managed Account | 17

Other information (unaudited)

Other information

A description of the policies and procedures used to determine how to vote proxies relating to portfolio securities is available without charge, upon request, by calling 1-866-259-3305, visiting our website at allspringglobal.com, or visiting the SEC website at sec.gov. Information regarding how the proxies related to portfolio securities were voted during the most recent 12-month period ended June 30 is available on the website at allspringglobal.com or by visiting the SEC website at sec.gov.

Quarterly portfolio holdings information

The Fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. Shareholders may view the filed Form N-PORT by visiting the SEC website at sec.gov.

18 | Allspring Managed Account

Other information (unaudited)

Board of trustees and officers

Each of the Trustees and Officers listed in the table below acts in identical capacities for each fund in the Allspring family of funds, which consists of 99 mutual funds comprising the Allspring Funds Trust, Allspring Variable Trust, Allspring Master Trust and four closed-end funds (collectively the “Fund Complex”). This table should be read in conjunction with the Prospectus and the Statement of Additional Information*. The mailing address of each Trustee and Officer is 1415 Vantage Park Drive, 3rd Floor, Charlotte, NC 28203. Each Trustee and Officer serves an indefinite term, however, each Trustee serves such term until reaching the mandatory retirement age established by the Trustees.

| Position held and

length of | Principal occupations during past five years or longer | Current other

public company or

investment

company

directorships |

William R. Ebsworth

(Born 1957) | | Retired. From 1984 to 2013, equities analyst, portfolio manager, research director and chief investment officer at Fidelity Management and Research Company in Boston, Tokyo, and Hong Kong, and retired in 2013 as Chief Investment Officer of Fidelity Strategic Advisers, Inc. where he led a team of investment professionals managing client assets. Prior thereto, Board member of Hong Kong Securities Clearing Co., Hong Kong Options Clearing Corp., the Thailand International Fund, Ltd., Fidelity Investments Life Insurance Company, and Empire Fidelity Investments Life Insurance Company. Serves on the Investment Company Institute’s Board of Governors since 2022 and Executive Committee since 2023 as well as the Vice Chairman of the Governing Council of the Independent Directors Council since 2023. Audit Committee Chair and Investment Committee Chair of the Vincent Memorial Hospital Foundation (non-profit organization). Mr. Ebsworth is a CFA charterholder. | |

Jane A. Freeman

(Born 1953) | Trustee,

since 2015;

Chair Liaison,

| Retired. From 2012 to 2014 and 1999 to 2008, Chief Financial Officer of Scientific Learning Corporation. From 2008 to 2012, Ms. Freeman provided consulting services related to strategic business projects. Prior to 1999, Portfolio Manager at Rockefeller & Co. and Scudder, Stevens & Clark. Board member of the Harding Loevner Funds from 1996 to 2014, serving as both Lead Independent Director and chair of the Audit Committee. Board member of the Russell Exchange Traded Funds Trust from 2011 to 2012 and the chair of the Audit Committee. Ms. Freeman is also an inactive Chartered Financial Analyst. | |

Isaiah Harris, Jr.

(Born 1952) | Trustee,

since 2009;

Audit Committee Chair,

since 2019 | Retired. Member of the Advisory Board of CEF of East Central Florida. Chairman of the Board of CIGNA Corporation from 2009 to 2021, and Director from 2005 to 2008. From 2003 to 2011, Director of Deluxe Corporation. Prior thereto, President and CEO of BellSouth Advertising and Publishing Corp. from 2005 to 2007, President and CEO of BellSouth Enterprises from 2004 to 2005 and President of BellSouth Consumer Services from 2000 to 2003. Emeritus member of the Iowa State University Foundation Board of Governors. Emeritus Member of the Advisory board of Iowa State University School of Business. Advisory Board Member, Palm Harbor Academy (private school). Advisory Board Member, Fellowship of Christian Athletes. Mr. Harris is a certified public accountant (inactive status). | |

David F. Larcker

(Born 1950) | | Distinguished Visiting Fellow at the Hoover Institution since 2022. James Irvin Miller Professor of Accounting at the Graduate School of Business (Emeritus), Stanford University, Director of the Corporate Governance Research Initiative and Senior Faculty of The Rock Center for Corporate Governance since 2006. From 2005 to 2008, Professor of Accounting at the Graduate School of Business, Stanford University. Prior thereto, Ernst & Young Professor of Accounting at The Wharton School, University of Pennsylvania from 1985 to 2005. | |

Olivia S. Mitchell

(Born 1953) | | International Foundation of Employee Benefit Plans Professor since 1993, Wharton School of the University of Pennsylvania. Director of Wharton’s Pension Research Council and Boettner Center on Pensions & Retirement Research, and Research Associate at the National Bureau of Economic Research. Previously taught at Cornell University from 1978 to 1993. | |

Timothy J. Penny

(Born 1951) | Trustee,

since 1996;

Chair,

since 2018 | President and Chief Executive Officer of Southern Minnesota Initiative Foundation, a non-profit organization, since 2007. Vice Chair of the Economic Club of Minnesota, since 2007. Co-Chair of the Committee for a Responsible Federal Budget, since 1995. Member of the Board of Trustees of NorthStar Education Finance, Inc., a non-profit organization, from 2007-2022. Senior Fellow of the University of Minnesota Humphrey Institute from 1995 to 2017. | |

** Length of service dates reflect the Trustee’s commencement of service with the Trust’s predecessor entities, where applicable.

*** Ms. Freeman will serve as Chair Liaison through June 2024, at which time Ms. Wheelock will assume the role.

*

The Statement of Additional Information includes additional information about the Trustees and is available, without charge, upon request, by call 1-888-877-9275 or by visiting the website at allspringglobal.com.

Allspring Managed Account | 19

Other information (unaudited)

| Position held and length of service** | Principal occupations during past five years or longer | Current other public company or investment company directorships |

James G. Polisson

(Born 1959) | Trustee,

since 2018;

Nominating and Governance Committee Chair,

since 2024 | Retired. Chief Marketing Officer, Source (ETF) UK Services, Ltd, from 2015 to 2017. From 2012 to 2015, Principal of The Polisson Group, LLC, a management consulting, corporate advisory and principal investing company. Chief Executive Officer and Managing Director at Russell Investments, Global Exchange Traded Funds from 2010 to 2012. Managing Director of Barclays Global Investors from 1998 to 2010 and Global Chief Marketing Officer for iShares and Barclays Global Investors from 2000 to 2010. Trustee of the San Francisco Mechanics’ Institute, a non- profit organization, from 2013 to 2015. Board member of the Russell Exchange Traded Fund Trust from 2011 to 2012. Director of Barclays Global Investors Holdings Deutschland GmbH from 2006 to 2009. Mr. Polisson is an attorney and has a retired status with the Massachusetts and District of Columbia Bar Associations. | |

Pamela Wheelock

(Born 1959) | Trustee,

since January 2020;

previously Trustee from

January 2018 to

| Retired. Executive and Senior Financial leadership positions in the public, private and nonprofit sectors. Interim President and CEO, McKnight Foundation, 2020. Interim Commissioner, Minnesota Department of Human Services, 2019. Chief Operating Officer, Twin Cities Habitat for Humanity, 2017-2019. Vice President for University Services, University of Minnesota, 2012- 2016. Interim President and CEO, Blue Cross and Blue Shield of Minnesota, 2011-2012. Executive Vice-President and Chief Financial Officer, Minnesota Wild, 2002-2008. Commissioner, Minnesota Department of Finance, 1999-2002. Chair of the Board of Directors of Destination Medical Center Corporation. Board member of the Minnesota Wild Foundation. | |

** Length of service dates reflect the Trustee’s commencement of service with the Trust’s predecessor entities, where applicable.

*** Ms. Freeman will serve as Chair Liaison through June 2024, at which time Ms. Wheelock will assume the role.

20 | Allspring Managed Account

Other information (unaudited)

Officers1

| Position held and

length of service | Principal occupations during past five years or longer |

| | President and Chief Executive Officer of Allspring Funds Management, LLC since 2017 and Head of Global Fund Governance of Allspring Global Investments since 2022. Prior thereto, co-president of Galliard Capital Management, LLC, an affiliate of Allspring Funds Management, LLC, from 2019 to 2022 and Head of Affiliated Managers, Allspring Global Investments, from 2014 to 2019 and Executive Vice President responsible for marketing, investments and product development for Allspring Funds Management, LLC, from 2009 to 2014. |

Jeremy DePalma

(Born 1974) | Treasurer,

since 2012

(for certain funds in

the Fund Complex);

since 2021 (for

the remaining funds in the Complex) | Senior Vice President of Allspring Funds Management, LLC since 2009. Senior Vice President of Evergreen Investment Management Company, LLC from 2008 to 2010 and head of the Fund Reporting and Control Team within Fund Administration from 2005 to 2010. |

Christopher Baker

(Born 1976) | Chief Compliance Officer,

since 2022 | Global Chief Compliance Officer for Allspring Global Investments since 2022. Prior thereto, Chief Compliance Officer for State Street Global Advisors from 2018 to 2021. Senior Compliance Officer for the State Street divisions of Alternative Investment Solutions, Sector Solutions, and Global Marketing from 2015 to 2018. From 2010 to 2015 Vice President, Global Head of Investment and Marketing Compliance for State Street Global Advisors. |

Matthew Prasse

(Born 1983) | Chief Legal Officer,

since 2022;

Secretary,

since 2021 | Senior Counsel of the Allspring Legal Department since 2021. Senior Counsel of the Wells Fargo Legal Department from 2018 to 2021. Previously, Counsel for Barings LLC from 2015 to 2018. Prior to joining Barings, Associate at Morgan, Lewis & Bockius LLP from 2008 to 2015. |

1 For those Officers with tenures at Allspring Global Investments and/or Allspring Funds Management, LLC that began prior to 2021, such tenures include years of service during which these businesses/entities were known as Wells Fargo Asset Management and Wells Fargo Funds Management, LLC, respectively.

Allspring Managed Account | 21

For more information

More information about Allspring Funds is available free upon request. To obtain literature, please write, visit the Fund’s website, or call:

Allspring Funds

Attn: Managed Account Services

P.O. Box 1450

Milwaukee, WI 53201

Website: allspringglobal.com

Telephone: 1-888-877-9275

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Fund. If this report is used for promotional purposes, distribution of the report must be accompanied or preceded by a current prospectus. Before investing, please consider the investment objectives, risks, charges, and expenses of the investment. For a current prospectus and, if available, a summary prospectus, containing this information, call 1-888-877-9275 or visit the Fund’s website at allspringglobal.com. Read the prospectus carefully before you invest or send money.

Allspring Global InvestmentsTM is the trade name for the asset management firms of Allspring Global Investments Holdings, LLC, a holding company indirectly owned by certain private funds of GTCR LLC and Reverence Capital Partners, L.P. These firms include but are not limited to Allspring Global Investments, LLC, and Allspring Funds Management, LLC. Certain products managed by Allspring entities are distributed by Allspring Funds Distributor, LLC (a broker-dealer and Member FINRA/SIPC).

This material is for general informational and educational purposes only and is NOT intended to provide investment advice or a recommendation of any kind - including a recommendation for any specific investment, strategy, or plan.

© 2024 Allspring Global Investments Holdings, LLC. All rights reserved.

ALL-05022024-zryovz8m 06-24

SAR4904 04-24

Allspring Emerging Markets Equity Fund

The views expressed and any forward-looking statements are as of April 30, 2024, unless otherwise noted, and are those of the portfolio managers and/or Allspring Global Investments. Discussions of individual securities or the markets generally are not intended as individual recommendations. Future events or results may vary significantly from those expressed in any forward-looking statements. The views expressed are subject to change at any time in response to changing circumstances in the market. Allspring Global Investments disclaims any obligation to publicly update or revise any views expressed or forward-looking statements.

Allspring Emerging Markets Equity Fund | 1

Letter to shareholders (unaudited)

Dear Shareholder:

We are pleased to offer you this semi-annual report for the Allspring Emerging Markets Equity Fund for the six-month period that ended April 30, 2024. Globally, stocks and bonds had strongly positive returns for the period. However, markets were volatile as investors focused on persistently high inflation and the impact of aggressive central bank rate hikes. Riskier assets rallied as investors anticipated an end to the tight monetary policy.

For the period, U.S. stocks, based on the S&P 500 Index,1 returned 20.98%. International stocks, as measured by the MSCI ACWI ex USA Index (Net),2 gained 17.69% while the MSCI EM Index (Net) (USD),3 returned 15.40%. Among bond indexes, the Bloomberg U.S. Aggregate Bond Index4 advanced 4.97%, the Bloomberg Global Aggregate ex-USD Index (unhedged)5 gained 3.92%, the Bloomberg Municipal Bond Index6 returned 7.06%, and the ICE BofA U.S. High Yield Index7 gained 8.94%.

Investors remained focused on central bank monetary policies.

As the six-month period began in November, the market mood brightened as cooling inflation inspired confidence that central banks could hold off on further rate hikes. Overall annual inflation in the U.S. fell to 3.1% in November while 12-month inflation in the U.K. and the eurozone eased to 4.6% and 2.4%, respectively—far below their peak levels of mid-2022. Third quarter annualized U.S. GDP growth was raised to an estimated 5.2% while U.S. job totals rose by close to 200,000 in November, indicating a slight cooling of the labor market. All of this fresh evidence added to confidence for a U.S. soft economic landing, leading to a more buoyant mood heading into winter.

The broad year-end rally among stocks and bonds that began in November continued through December as investors became more confident that monetary policy would ease in 2024. Supporting the bubbly market mood were a series of reports confirming lower inflationary trends in the U.S. and Europe. During the period, it appeared more likely that the U.S. economy could achieve a soft landing, cooling enough to lower inflation without the pain of a recession. However, by year-end, an expectations gap developed. Capital markets priced in a total of 1.50 percentage points in federal funds rate cuts in 2024—twice as much as the three cuts of 0.25% hinted at by Fed officials.

1

The S&P 500 Index consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market-value-weighted index with each stock’s weight in the index proportionate to its market value. You cannot invest directly in an index.

2

The Morgan Stanley Capital International (MSCI) All Country World Index (ACWI) ex USA Index (Net) is a free-float-adjusted market-capitalization-weighted index that is designed to measure the equity market performance of developed and emerging markets, excluding the U.S. Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indexes or any securities or financial products. This report is not approved, reviewed, or produced by MSCI. You cannot invest directly in an index.

3

The MSCI Emerging Markets (EM) Index (Net) (USD) is a free-float-adjusted market-capitalization-weighted index that is designed to measure the equity market performance of emerging markets. You cannot invest directly in an index.

4

The Bloomberg U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment-grade, U.S.-dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, mortgage-backed securities (agency fixed-rate and hybrid adjustable-rate mortgage pass-throughs), asset-backed securities, and commercial mortgage-backed securities. You cannot invest directly in an index.

5

The Bloomberg Global Aggregate ex-USD Index (unhedged) is an unmanaged index that provides a broad-based measure of the global investment-grade fixed-income markets excluding the U.S.-dollar-denominated debt market. You cannot invest directly in an index.

6

The Bloomberg Municipal Bond Index is an unmanaged index composed of long-term tax-exempt bonds with a minimum credit rating of Baa. You cannot invest directly in an index.

7

The ICE BofA U.S. High Yield Index is a market-capitalization-weighted index of domestic and Yankee high yield bonds. The index tracks the performance of high yield securities traded in the U.S. bond market. Returns shown are net of transaction costs beginning on July 1, 2022. You cannot invest directly in an index. Copyright 2024. ICE Data Indices, LLC. All rights reserved.

2 | Allspring Emerging Markets Equity Fund

Letter to shareholders (unaudited)

Financial market performance was mixed in January 2024 as U.S. stocks had modest gains while non-U.S. equities, particularly those in emerging markets, and fixed income assets were held back by central bank pushback on market optimism over rate cuts. Overall, optimism was supported by hints of a soft landing for the U.S. economy. Key data included a surprisingly strong gain of 353,000 jobs in January, an unemployment rate of just 3.7%, and a rise of just 3.1% in the annual Consumer Price Index1 (CPI) in January. However, that resilience helped tone down expectations of a rate cut in March to a more likely second quarter initial move.

In February, stocks were supported by positive economic data and strong corporate earnings. However, fixed income investments were under pressure as resilient inflation curbed expectations on the timing of interest rate cuts. The S&P 500 Index had solid monthly gains along with emerging market equities, which benefited from a rebound in China.

The first quarter of 2024 closed with ongoing stock market momentum and a more muted sense of confidence in fixed income markets as investors adjusted to the prospect of greater-than-expected economic strength. On the flip side, expectations on the timing of an initial Fed rate cut were pushed back from March to June and then beyond. Additionally, the number of quarter-point rate cuts forecast by the market fell from six as projected in December 2023 to two to three cuts by fiscal period-end.

Markets retreated broadly in April as U.S. annual inflation continued to resist monetary policy efforts and expectations for its downward trajectory, with an April CPI reading of 3.4%. The timing of a Fed initial rate cut came into greater question in April. Not only was there less confidence regarding when a first cut would take place but also whether any rate reductions would occur at all in 2024. Market expectations continued to recede to a possible September Fed first cut. Meanwhile, eurozone annual inflation held steady in April at 2.4%. Developed market stocks and fixed income securities of all types were in the red for April.

Don’t let short-term uncertainty derail long-term investment goals.

Periods of investment uncertainty can present challenges, but experience has taught us that maintaining long-term investment goals can be an effective way to plan for the future. To help you create a sound strategy based on your personal goals and risk tolerance, Allspring Funds offers a wide variety of mutual funds spanning many asset classes and investment styles. Although diversification cannot guarantee an investment profit or prevent losses, we believe it can be an effective way to manage investment risk and potentially smooth out overall portfolio performance. We encourage investors to know their investments and to understand that appropriate levels of risk-taking may unlock opportunities.

Thank you for choosing to invest with Allspring Funds. We appreciate your confidence in us and remain committed to helping you meet your financial needs.

Andrew Owen

President

Allspring Funds

“ The first quarter of 2024 closed with ongoing stock market momentum and a more muted sense of confidence in fixed income markets as investors adjusted to the prospect of greater-than-expected economic strength. ”

For further information about your fund, contact your investment professional, visit our website at allspringglobal.com, or call us directly at 1-800-222-8222.

1

The Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. You cannot invest directly in an index.

Allspring Emerging Markets Equity Fund | 3

Letter to shareholders (unaudited)

|

Beginning in July 2024, the Fund will be required by the Securities and Exchange Commission to send shareholders a paper copy of a new tailored shareholder report in place of the full shareholder report that you are now receiving. The tailored shareholder report will contain concise information about the Fund, including certain expense and performance information and fund statistics. If you wish to receive this new tailored shareholder report electronically, please follow the instructions on the back cover of this report. |

Other information that is currently included in the shareholder report, such as the Fund’s financial statements, will be available online and upon request, free of charge, in paper or electronic format. |

4 | Allspring Emerging Markets Equity Fund

This page is intentionally left blank.

Performance highlights (unaudited)

Performance highlights

| The Fund seeks long-term capital appreciation. |

| Allspring Funds Management, LLC |

| Allspring Global Investments, LLC |

| Derrick Irwin, CFA, Richard Peck, CFA, Yi (Jerry) Zhang, Ph.D., CFA |

Average annual total returns (%) as of April 30, 2024 |

| | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

Administrator Class (EMGYX) | | | | | | | | | |

Institutional Class (EMGNX) | | | | | | | | | |

MSCI ACWI ex USA Index (Net)3 | | | | | | | | | |

MSCI Emerging Markets Index (Net) (USD)4 | | | | | | | | | |

Figures quoted represent past performance, which is no guarantee of future results, and do not reflect taxes that a shareholder may pay on an investment in a fund. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance shown without sales charges would be lower if sales charges were reflected. Current performance may be lower or higher than the performance data quoted, which assumes the reinvestment of dividends and capital gains. Current month-end performance is available on the Fund’s website, allspringglobal.com.

Index returns do not include transaction costs associated with buying and selling securities, any mutual fund fees or expenses, or any taxes. It is not possible to invest directly in an index.

For Class A shares, the maximum front-end sales charge is 5.75%. For Class C shares, the maximum contingent deferred sales charge is 1.00%. Performance including a contingent deferred sales charge assumes the sales charge for the corresponding time period. Class R6, Administrator Class and Institutional Class shares are sold without a front-end sales charge or contingent deferred sales charge.

|

| Reflects the expense ratios as stated in the most recent prospectuses. The expense ratios shown are subject to change and may differ from the annualized expense ratios shown in the Financial Highlights of this report. |

| The manager has contractually committed through February 28, 2025, to waive fees and/or reimburse expenses to the extent necessary to cap total annual fund operating expenses after fee waivers at 1.43% for Class A, 2.18% for Class C, 1.01% for Class R6, 1.36% for Administrator Class and 1.11% for Institutional Class. Brokerage commissions, stamp duty fees, interest, taxes, acquired fund fees and expenses (if any), and extraordinary expenses are excluded from the expense caps. Prior to or after the commitment expiration date, the caps may be increased or the commitment to maintain the caps may be terminated only with the approval of the Board of Trustees. Without these caps, the Fund’s returns would have been lower. The expense ratio paid by an investor is the net expense ratio (the total annual fund operating expenses after fee waivers) as stated in the prospectuses. |

| The Morgan Stanley Capital International (MSCI) All Country World Index (ACWI) ex USA Index (Net) is a free-float-adjusted market-capitalization-weighted index that is designed to measure the equity market performance of developed and emerging markets, excluding the U.S. Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indexes or any securities or financial products. This report is not approved, reviewed, or produced by MSCI. You cannot invest directly in an index. |

| MSCI Emerging Markets (EM) Index (Net) (USD) is a free-float-adjusted market-capitalization-weighted index that is designed to measure the equity market performance of emerging markets. You cannot invest directly in an index. |

Investing involves risk, including the possible loss of principal. Stock values fluctuate in response to the activities of individual companies and general market and economic conditions. Foreign investments are especially volatile and can rise or fall dramatically due to differences in the political and economic conditions of the host country. These risks are generally intensified in emerging markets. Consult the Fund’s prospectus for additional information on these and other risks.

CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute. |

6 | Allspring Emerging Markets Equity Fund

Performance highlights (unaudited)

Ten largest holdings (%) as of April 30, 20241 |

Samsung Electronics Co. Ltd. | |

Taiwan Semiconductor Manufacturing Co. Ltd. ADR | |

| |

Taiwan Semiconductor Manufacturing Co. Ltd. | |

Reliance Industries Ltd. GDR | |

Fomento Economico Mexicano SAB de CV ADR | |

| |

| |

| |

| |

| Figures represent the percentage of the Fund’s net assets. Holdings are subject to change and may have changed since the date specified. |

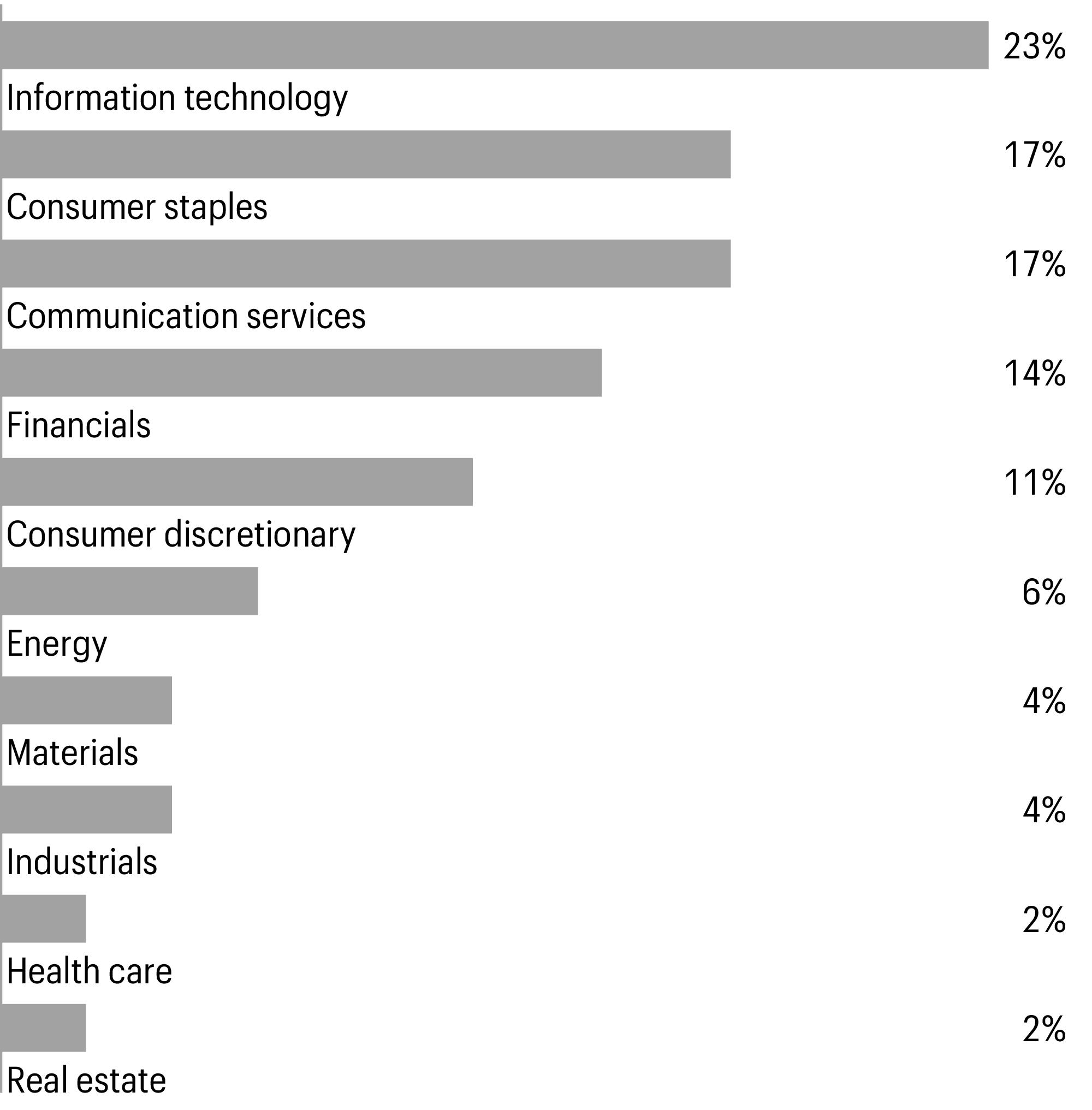

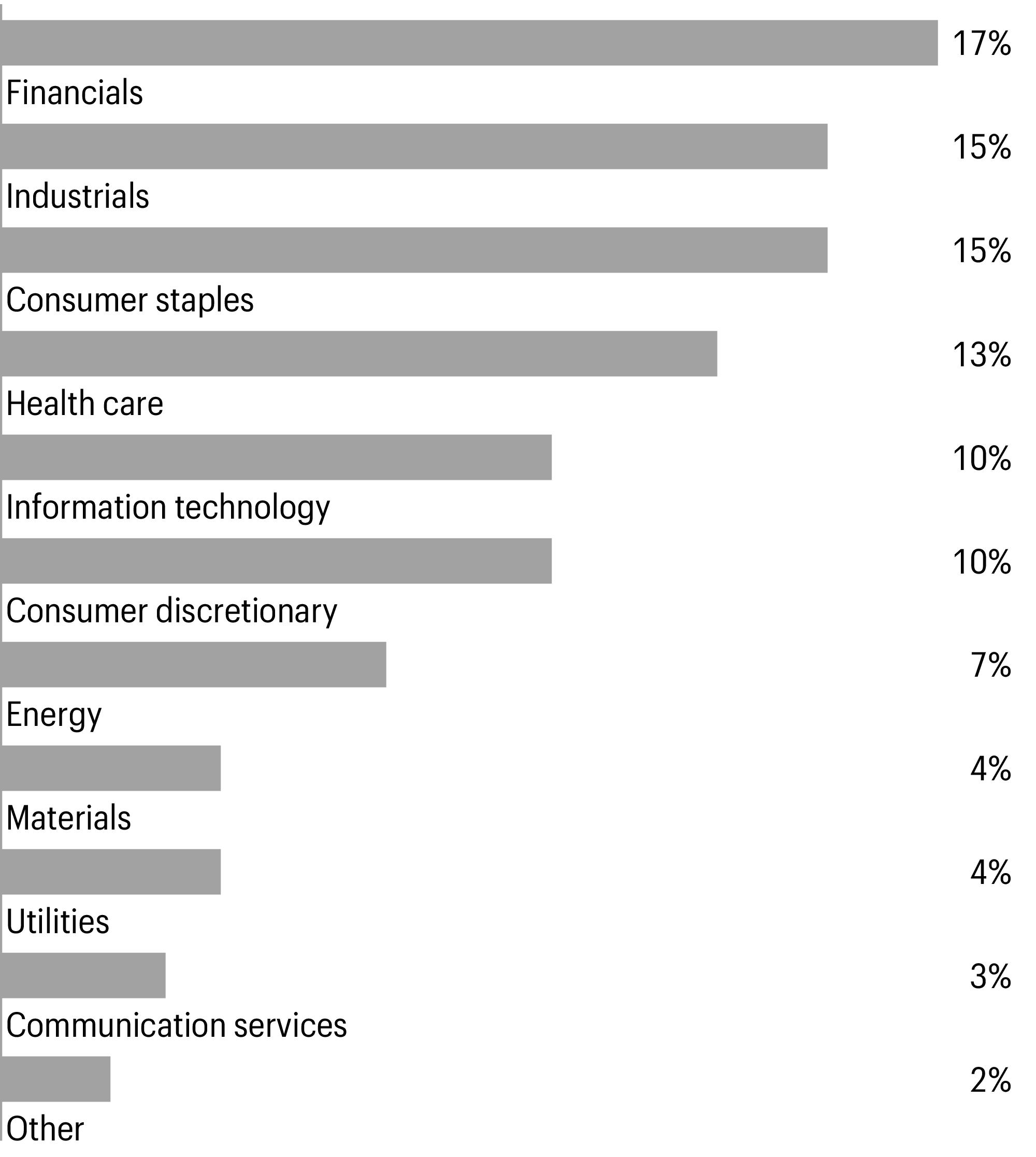

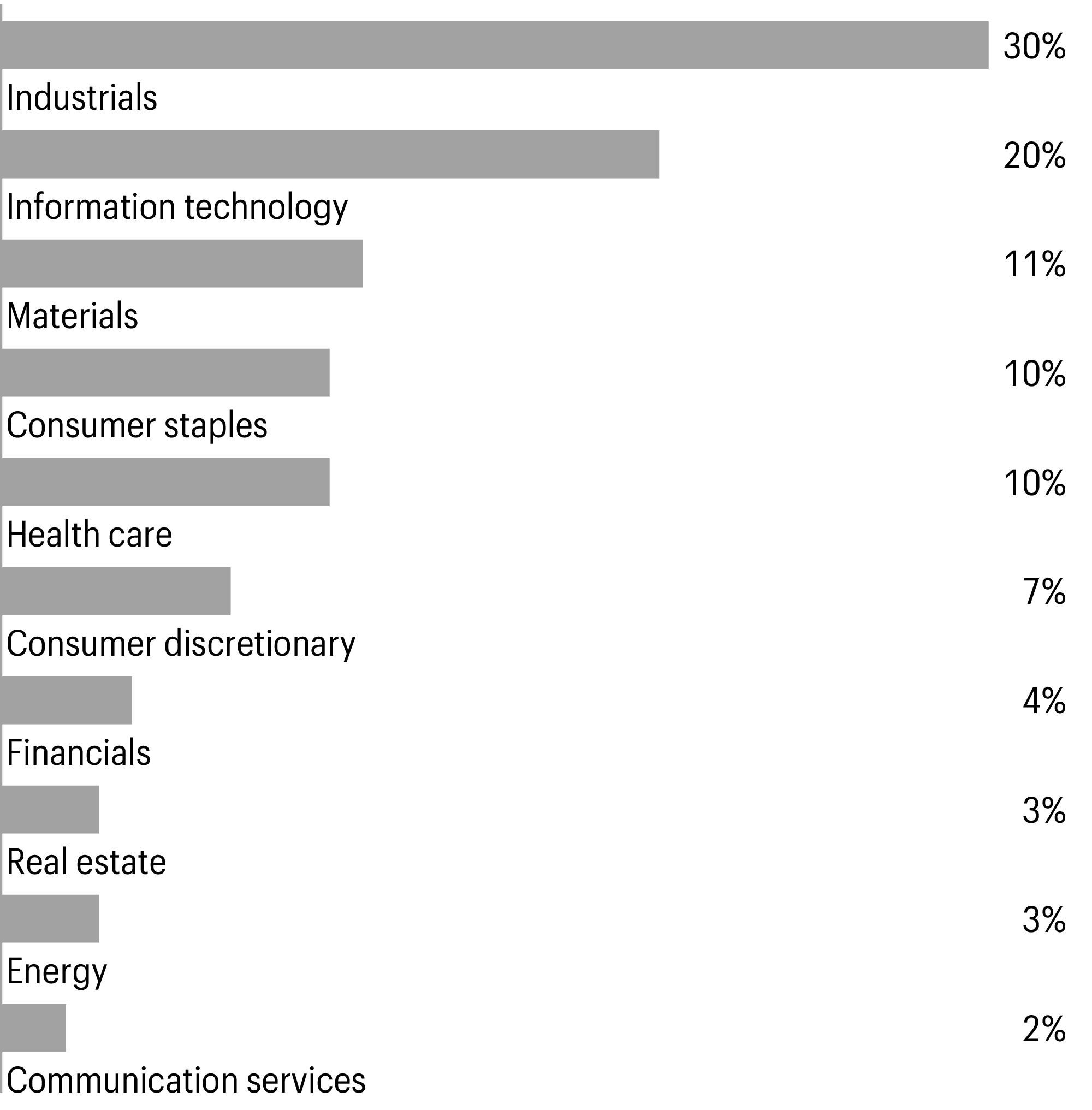

Sector allocation as of April 30, 20241 |

| Figures represent the percentage of the Fund’s long-term investments. Allocations are subject to change and may have changed since the date specified. |

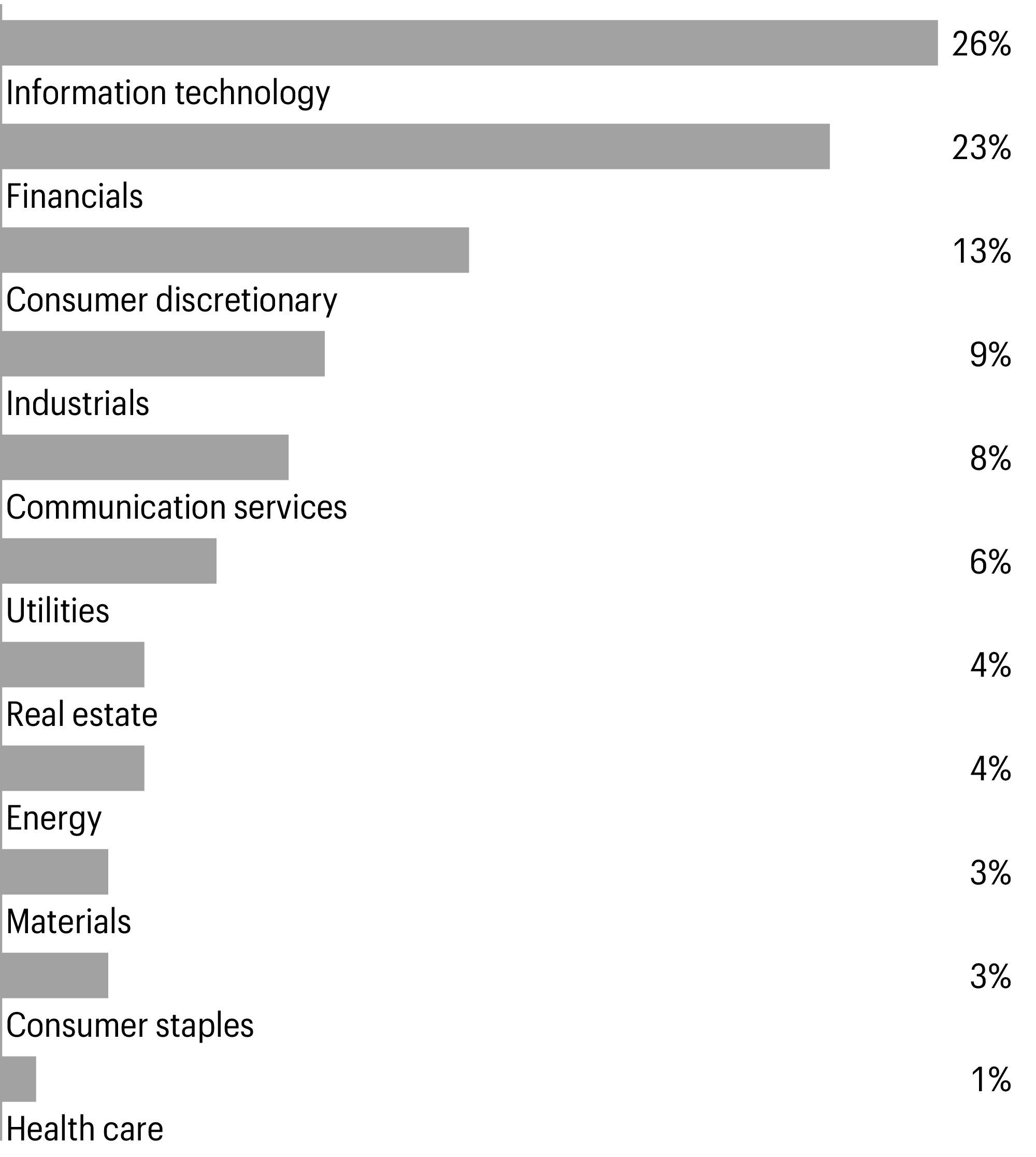

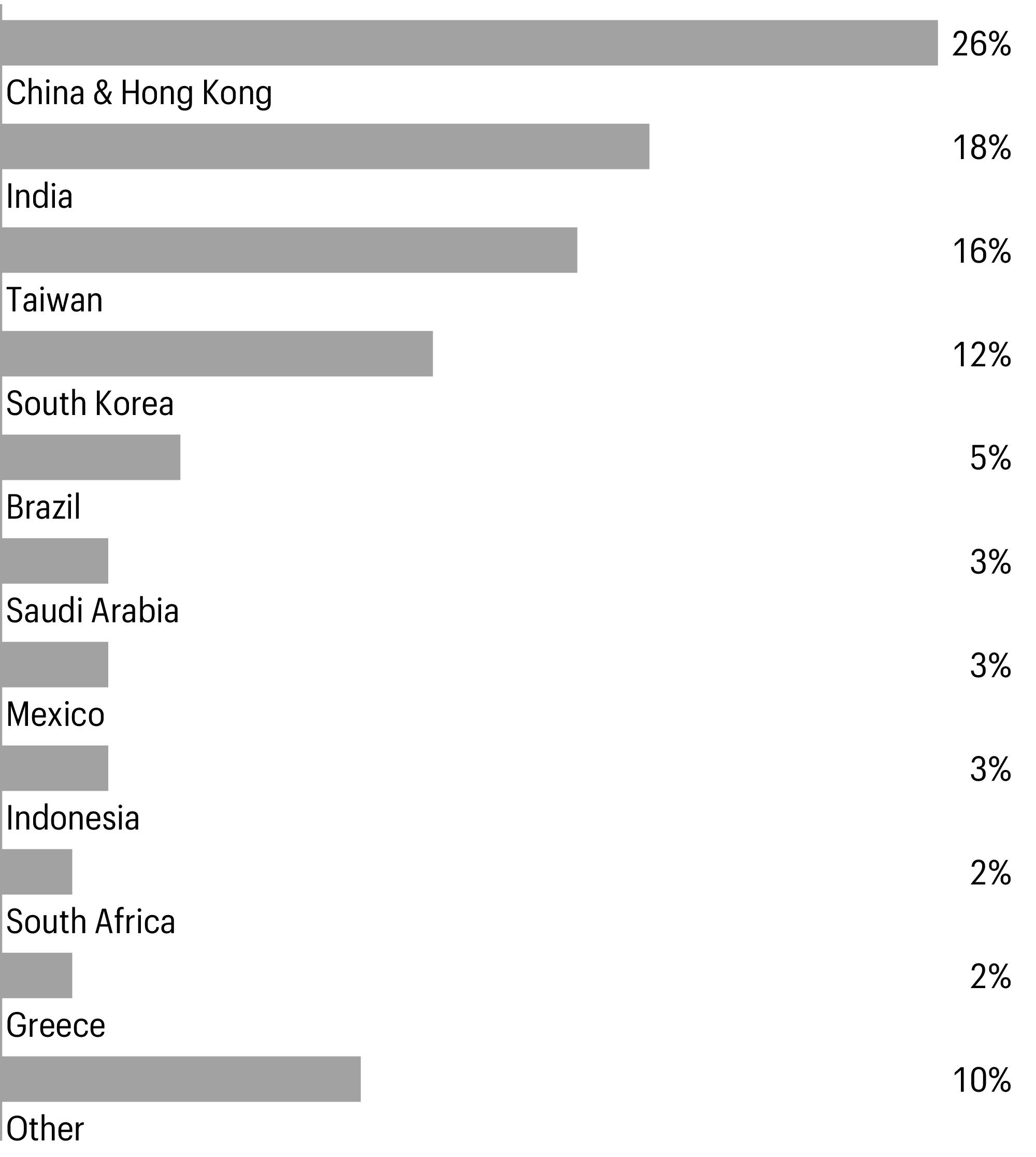

Country allocation as of April 30, 20241 |

| Figures represent the percentage of the Fund’s long-term investments. Allocations are subject to change and may have changed since the date specified. |

Allspring Emerging Markets Equity Fund | 7

Fund expenses (unaudited)

Fund expenses

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and contingent deferred sales charges (if any) on redemptions and (2) ongoing costs, including management fees, distribution (12b-1) and/or shareholder servicing fees, and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the six-month period and held for the entire period from November 1, 2023 to April 30, 2024.

The “Actual” line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000= 8.6), then multiply the result by the number in the “Actual” line under the heading entitled “Expenses paid during period” for your applicable class of shares to estimate the expenses you paid on your account during this period.

Hypothetical example for comparison purposes

The “Hypothetical” line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) and contingent deferred sales charges. Therefore, the “Hypothetical” line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| Beginning

account value

11-1-2023 | Ending

account value

4-30-2024 | | Annualized net

expense ratio |

| | | | |

| | | | |

Hypothetical (5% return before expenses) | | | | |

| | | | |

| | | | |

Hypothetical (5% return before expenses) | | | | |

| | | | |

| | | | |

Hypothetical (5% return before expenses) | | | | |

| | | | |

| | | | |

Hypothetical (5% return before expenses) | | | | |

| | | | |

| | | | |

Hypothetical (5% return before expenses) | | | | |

| Expenses paid is equal to the annualized net expense ratio of each class multiplied by the average account value over the period, multiplied by 182 divided by 366 (to reflect the one-half-year period). |

8 | Allspring Emerging Markets Equity Fund

Portfolio of investments—April 30, 2024 (unaudited)

| | | | | |

| | | | | | |

| | | | | | |

Atacadao SA (Consumer staples, Consumer staples distribution & retail) | | | | | | |

B3 SA - Brasil Bolsa Balcao (Financials, Capital markets) | | | | | | |

Banco Bradesco SA ADR (Financials, Banks) | | | | | | |

Cia Brasileira de Aluminio (Materials, Metals & mining) | | | | | | |

Diagnosticos da America SA (Health care, Health care providers & services)† | | | | | | |

Hapvida Participacoes e Investimentos SA (Health care, Health care providers & services)144A† | | | | | | |

Lojas Renner SA (Consumer discretionary, Specialty retail) | | | | | | |

Magazine Luiza SA (Consumer discretionary, Broadline retail)† | | | | | | |

Multiplan Empreendimentos Imobiliarios SA (Real estate, Real estate management & development) | | | | | | |

Petroleo Brasileiro SA ADR (Energy, Oil, gas & consumable fuels) | | | | | | |

Raia Drogasil SA (Consumer staples, Consumer staples distribution & retail) | | | | | | |

Suzano SA (Materials, Paper & forest products) | | | | | | |

Vale SA ADR (Materials, Metals & mining) | | | | | | |

| | | | | | |

| | | | | | |

Banco Santander Chile ADR (Financials, Banks) | | | | | | |

Falabella SA (Consumer discretionary, Broadline retail)† | | | | | | |

Sociedad Quimica y Minera de Chile SA ADR (Industrials, Electrical equipment) | | | | | | |

| | | | | | |

| | | | | | |

Agora, Inc. ADR (Information technology, Software)† | | | | | | |

Alibaba Group Holding Ltd. (Consumer discretionary, Broadline retail) | | | | | | |

Alibaba Group Holding Ltd. ADR (Consumer discretionary, Broadline retail) | | | | | | |

Bilibili, Inc. ADR (Communication services, Entertainment)† | | | | | | |

China Literature Ltd. (Communication services, Media)144A† | | | | | | |

China Meidong Auto Holdings Ltd. (Consumer discretionary, Specialty retail) | | | | | | |

FinVolution Group ADR (Financials, Consumer finance) | | | | | | |

GreenTree Hospitality Group Ltd. ADR (Consumer discretionary, Hotels, restaurants & leisure)† | | | | | | |

Hua Medicine (Health care, Pharmaceuticals)144A† | | | | | | |

Kingdee International Software Group Co. Ltd. (Information technology, Software)† | | | | | | |

Li Ning Co. Ltd. (Consumer discretionary, Textiles, apparel & luxury goods) | | | | | | |

Meituan Class B (Consumer discretionary, Hotels, restaurants & leisure)144A† | | | | | | |

The accompanying notes are an integral part of these financial statements.

Allspring Emerging Markets Equity Fund | 9

Portfolio of investments—April 30, 2024 (unaudited)

| | | | | |

| | | | | | |

Shandong Weigao Group Medical Polymer Co. Ltd. Class H (Health care, Health care equipment & supplies) | | | | | | |

Tencent Holdings Ltd. (Communication services, Interactive media & services) | | | | | | |

Tencent Music Entertainment Group ADR (Communication services, Entertainment)† | | | | | | |

Tongdao Liepin Group (Communication services, Interactive media & services)† | | | | | | |

Trip.com Group Ltd. ADR (Consumer discretionary, Hotels, restaurants & leisure)† | | | | | | |

Tsingtao Brewery Co. Ltd. Class H (Consumer staples, Beverages) | | | | | | |

Vipshop Holdings Ltd. ADR (Consumer discretionary, Broadline retail) | | | | | | |

Want Want China Holdings Ltd. (Consumer staples, Food products) | | | | | | |

Weibo Corp. ADR (Communication services, Interactive media & services) | | | | | | |

Wuxi Biologics Cayman, Inc. (Health care, Life sciences tools & services)144A† | | | | | | |

Xiaomi Corp. Class B (Information technology, Technology hardware, storage & peripherals)144A† | | | | | | |

Zepp Health Corp. ADR (Information technology, Electronic equipment, instruments & components)♠† | | | | | | |

Zhou Hei Ya International Holdings Co. Ltd. (Consumer staples, Food products)144A | | | | | | |

| | | | | | |

| | | | | | |

Bancolombia SA ADR (Financials, Banks) | | | | | | |

| | | | | | |

AIA Group Ltd. (Financials, Insurance) | | | | | | |

Johnson Electric Holdings Ltd. (Consumer discretionary, Automobile components) | | | | | | |

Sun Art Retail Group Ltd. (Consumer staples, Consumer staples distribution & retail) | | | | | | |

WH Group Ltd. (Consumer staples, Food products)144A | | | | | | |

| | | | | | |

| | | | | | |

Axis Bank Ltd. (Financials, Banks) | | | | | | |

Bajaj Finance Ltd. (Financials, Consumer finance) | | | | | | |

Bharti Airtel Ltd. (Communication services, Wireless telecommunication services) | | | | | | |

Bharti Airtel Ltd. (Partly Paid) (Communication services, Wireless telecommunication services) | | | | | | |

Dalmia Bharat Ltd. (Materials, Construction materials) | | | | | | |

Fortis Healthcare Ltd. (Health care, Health care providers & services) | | | | | | |

HDFC Bank Ltd. (Financials, Banks) | | | | | | |

The accompanying notes are an integral part of these financial statements.

10 | Allspring Emerging Markets Equity Fund

Portfolio of investments—April 30, 2024 (unaudited)

| | | | | |

| | | | | | |

HDFC Bank Ltd. ADR (Financials, Banks) | | | | | | |

IDFC First Bank Ltd. (Financials, Banks)† | | | | | | |

ITC Ltd. (Consumer staples, Tobacco) | | | | | | |

Kotak Mahindra Bank Ltd. (Financials, Banks) | | | | | | |

Reliance Industries Ltd. (Energy, Oil, gas & consumable fuels) | | | | | | |

Reliance Industries Ltd. GDR (Energy, Oil, gas & consumable fuels)144A | | | | | | |

SBI Life Insurance Co. Ltd. (Financials, Insurance)144A | | | | | | |

UltraTech Cement Ltd. (Materials, Construction materials) | | | | | | |

| | | | | | |

| | | | | | |

Astra International Tbk. PT (Industrials, Industrial conglomerates) | | | | | | |

Bank Central Asia Tbk. PT (Financials, Banks) | | | | | | |

Bank Rakyat Indonesia Persero Tbk. PT (Financials, Banks) | | | | | | |

Telkom Indonesia Persero Tbk. PT (Communication services, Diversified telecommunication services) | | | | | | |

Telkom Indonesia Persero Tbk. PT ADR (Communication services, Diversified telecommunication services) | | | | | | |

| | | | | | |

| | | | | | |

Allegro.eu SA (Consumer discretionary, Broadline retail)144A† | | | | | | |