0001081400allspring:ALLSPRINGIndexMSCIACWIexUSAIndexNet15869AdditionalIndexMember2024-03-310001081400allspring:ALLSPRINGIndexMSCIEMIndexNetUSD15876BroadBasedIndexMember2021-05-310001081400allspring:ALLSPRINGIndexMSCIACWIIndexNet15884AdditionalIndexMember2015-04-300001081400allspring:ALLSPRINGIndexMSCIACWIIndexNet15882AdditionalIndexMember2024-03-310001081400allspring:ALLSPRINGIndexMSCIACWIexUSAIndexNet15933AdditionalIndexMember2022-04-300001081400allspring:ALLSPRINGIndexMSCIACWIIndexNet16038AdditionalIndexMember2021-12-310001081400allspring:ALLSPRINGIndexMSCIWorldexUSASmallCapIndexNet16042BroadBasedIndexMember2024-01-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-09253

Allspring Funds Trust

(Exact name of registrant as specified in charter)

1415 Vantage Park Drive, 3rd Floor, Charlotte, NC 28203

(Address of principal executive offices) (Zip code)

Matthew Prasse

Allspring Funds Management, LLC

1415 Vantage Park Drive, 3rd Floor, Charlotte, NC 28203

(Name and address of agent for service)

Registrant’s telephone number, including area code: 800-222-8222

Date of fiscal year end: October 31

Registrant is making a filing for 7 of its series: Allspring CoreBuilder Shares-Series EM, Allspring Emerging Markets Equity Fund, Allspring Emerging Markets Equity Income Fund, Allspring Global Long/Short Equity Fund, Allspring International Equity Fund, Allspring Special Global Small Cap Fund and Allspring Special International Small Cap Fund.

Date of reporting period: October 31, 2024

ITEM 1. REPORT TO STOCKHOLDERS

Annual Shareholder Report

Managed Account CoreBuilder Shares - Series EM

This annual shareholder report contains important information about Managed Account CoreBuilder Shares - Series EM for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at allspringglobal.com. You can also request this information by contacting us at 1-888-877-9275.

What were the Fund costs for the past year?

The table explains the costs you would have paid within the reporting period based on a hypothetical $10,000 investment.

| CLASS NAME | COSTS OF A $10,000 INVESTMENT | COSTS PAID AS A % OF A $10,000 INVESTMENT |

|---|

| Managed Account CoreBuilder Shares - Series EM | $0 | 0.00% |

The manager has contractually committed to irrevocably absorb and pay or reimburse all ordinary operating expenses of the Fund. This commitment has an indefinite term. Without this commitment, the costs shown above would have been higher. See the prospectus for expenses excluded from this commitment.

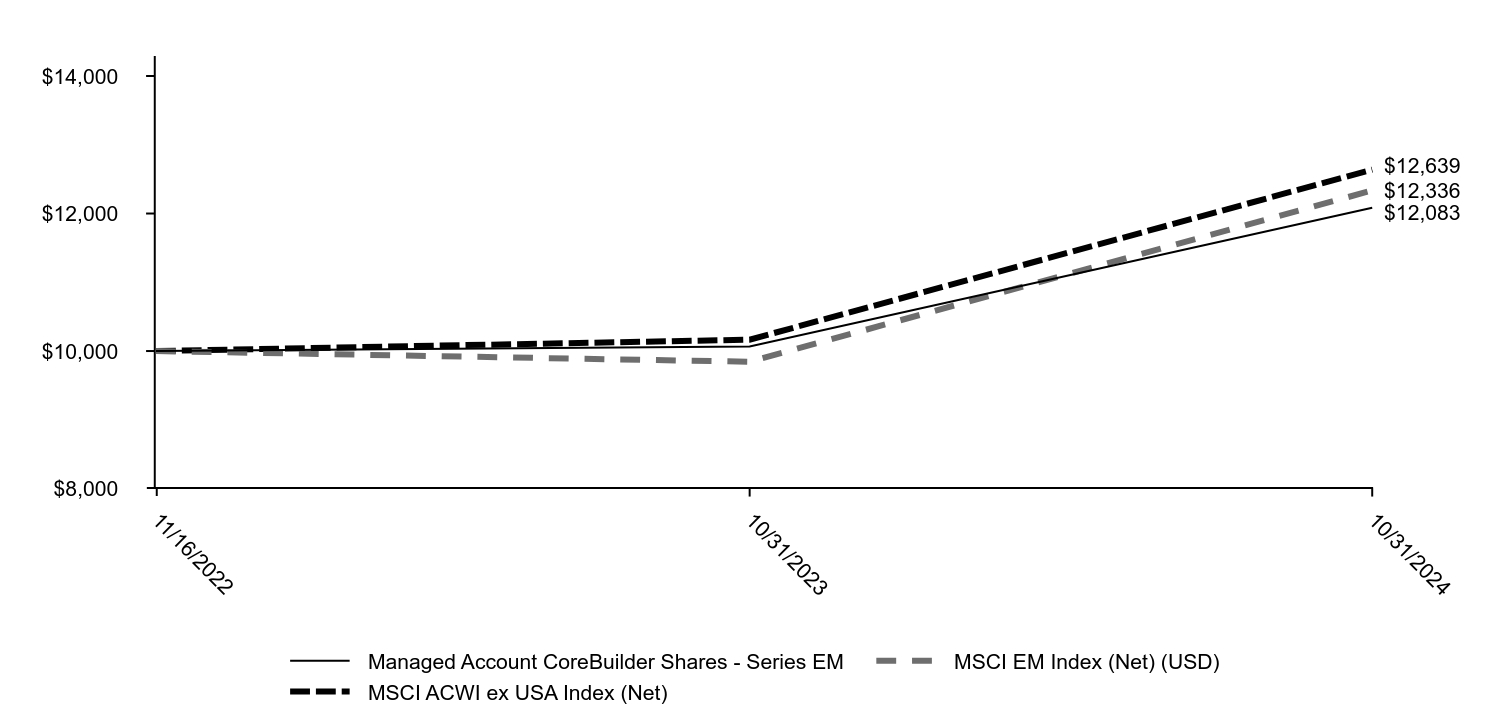

How did the Fund perform last year and what affected its performance?

Emerging market equities rose sharply, led by countries within Asia Pacific, as strength from artificial intelligence (AI) and semiconductor demand, stable growth, and improving fundamentals bolstered China and Taiwan. India rose sharply on strong corporate earnings, positive economic data, and market inflows as investors revered its infrastructure investments and technological innovation. In contrast, weakness in Latin America was caused by higher inflation, weakening currencies, and political concerns.

Contributors included Bajaj Auto, on strong earnings and a promising outlook for two-wheelers and electric vehicles. Aircraft manufacturer Embraer had better-than-expected earnings and an upgrade to investment grade. Samsung Electronics Ltd. Pfd., detracted, falling after its HBM chips failed to pass NVIDIA’s suitability for inclusion into its AI processors, as did Arabian Drilling Co., which faltered after three of its offshore drilling rigs were suspended.

We remain optimistic about emerging markets on improved economic momentum, accommodative policies, attractive valuations, a favorable emerging market growth premium, and low investor positioning.

Total return based on a $10,000 investment

| Managed Account CoreBuilder Shares - Series EM | MSCI EM Index (Net) (USD) | MSCI ACWI ex USA Index (Net) |

|---|

| 11/16/2022 | $10,000 | $10,000 | $10,000 |

| 10/31/2023 | $10,066 | $9,844 | $10,165 |

| 10/31/2024 | $12,083 | $12,336 | $12,639 |

Managed Account CoreBuilder Shares - Series EM

Annual Shareholder Report | October 31, 2024

AVERAGE ANNUAL TOTAL RETURNS (%)

| Total net assets | $6,256,351 |

| # of portfolio holdings | 63 |

| Portfolio turnover rate | 107% |

| Total advisory fees paid | $0 |

| AATR | 1 Year | Since Inception (11/16/2022) |

|---|

| Managed Account CoreBuilder Shares - Series EM | 20.04 | 10.15 |

| MSCI EM Index (Net) (USD) (Strategy) | 25.32 | 11.33 |

| MSCI ACWI ex USA Index (Net) (Regulatory) | 24.33 | 12.72 |

Figures quoted represent past performance, which is no guarantee of future results, and do not reflect taxes that a shareholder may pay on an investment in a fund.

What did the Fund invest in?

(Based on long-term investments)

TOP TEN HOLDINGS (% OF NET ASSETS)

| Samsung Electronics Co. Ltd. Korea Exchange | 4.4 |

| Embassy Office Parks REIT | 3.6 |

| Samsung Electronics Co. Ltd. Preferred Stock | 3.3 |

| 360 ONE WAM Ltd. | 3.0 |

| Power Grid Corp. of India Ltd. | 2.9 |

| GAIL India Ltd. | 2.6 |

| LIC Housing Finance Ltd. | 2.6 |

| Nippon Life India Asset Management Ltd. | 2.4 |

| Bajaj Auto Ltd. | 2.1 |

| Midea Group Co. Ltd. Class A | 2.1 |

COUNTRY ALLOCATION (% OF LONG-TERM INVESTMENTS)

| India | 30.4 |

| China | 20.3 |

| South Korea | 12.7 |

| Taiwan | 12.4 |

| Saudi Arabia | 4.2 |

| Malaysia | 3.2 |

| Thailand | 3.1 |

| United Arab Emirates | 2.1 |

| Greece | 2.0 |

| Indonesia | 1.5 |

| Other | 8.1 |

SECTOR ALLOCATION (% OF LONG-TERM INVESTMENTS)

| Financials | 26.9 |

| Information technology | 20.2 |

| Consumer discretionary | 13.7 |

| Real estate | 10.3 |

| Industrials | 9.1 |

| Utilities | 8.9 |

| Consumer staples | 4.6 |

| Health care | 4.0 |

| Communication services | 2.3 |

You can find additional information on the Fund's website at allspringglobal.com, including its:

- Prospectus - Financial Information - Fund holdings - Proxy voting information

Annual Shareholder Report

Emerging Markets Equity Fund

This annual shareholder report contains important information about Emerging Markets Equity Fund for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at allspringglobal.com. You can also request this information by contacting us at 1-800-222-8222.

This report describes changes to the Fund that occurred either during or after the reporting period.

What were the Fund costs for the past year?

The table explains the costs you would have paid within the reporting period based on a hypothetical $10,000 investment.

| CLASS NAME | COSTS OF A $10,000 INVESTMENT | COSTS PAID AS A % OF A $10,000 INVESTMENT |

|---|

| Institutional Class | $123 | 1.11% |

The manager has contractually committed to waive fees and/or reimburse certain expenses to the extent necessary to cap the Fund's total annual fund operating expense ratio at a specific amount. Without this cap, the costs shown above may have been higher. Please see the prospectus for the amount and the expiration date of the cap. Prior to or after the commitment expiration date, the cap may be increased or the commitment to maintain the cap may be terminated only with the approval of the Board of Trustees.

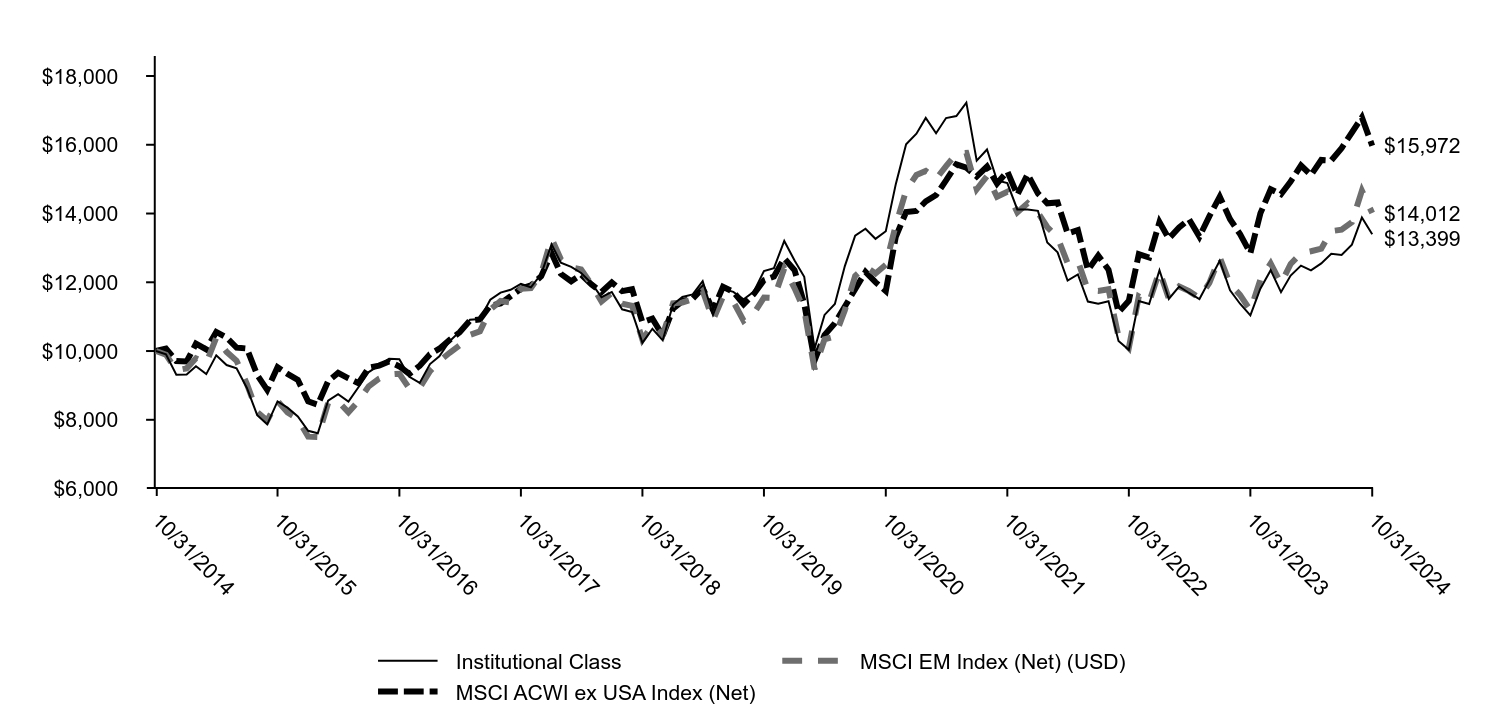

How did the Fund perform last year and what affected its performance?

Improving company fundamentals and macro tailwinds supported emerging market equities during the period. Key drivers included growing corporate focus on return on capital, momentum factor performance, China’s efforts to resuscitate its economy, resilient Indian economic growth, monetary easing, and demand for technology related to artificial intelligence. All sectors and 22 out of 24 countries rose. The top sectors were information technology (IT), financials, and consumer discretionary. Leading countries were Taiwan, India, and China. The portfolio benefited from strong stock selection in Taiwan, Poland, Chile, IT, and consumer discretionary. Taiwan Semiconductor Manufacturing Company Limited and Bharti Airtel Limited, the Indian telecom provider, were leading contributors. The portfolio was hurt by stock selection in India, Mexico, and financials and by being underweight to the strong Mexico market. Samsung Electronics Company, Limited, and AIA Group Limited, a pan-Asia insurance firm, were the largest detractors. During the period, the portfolio added exposure to Poland, materials, and industrials and reduced exposure to Mexico and consumer staples.

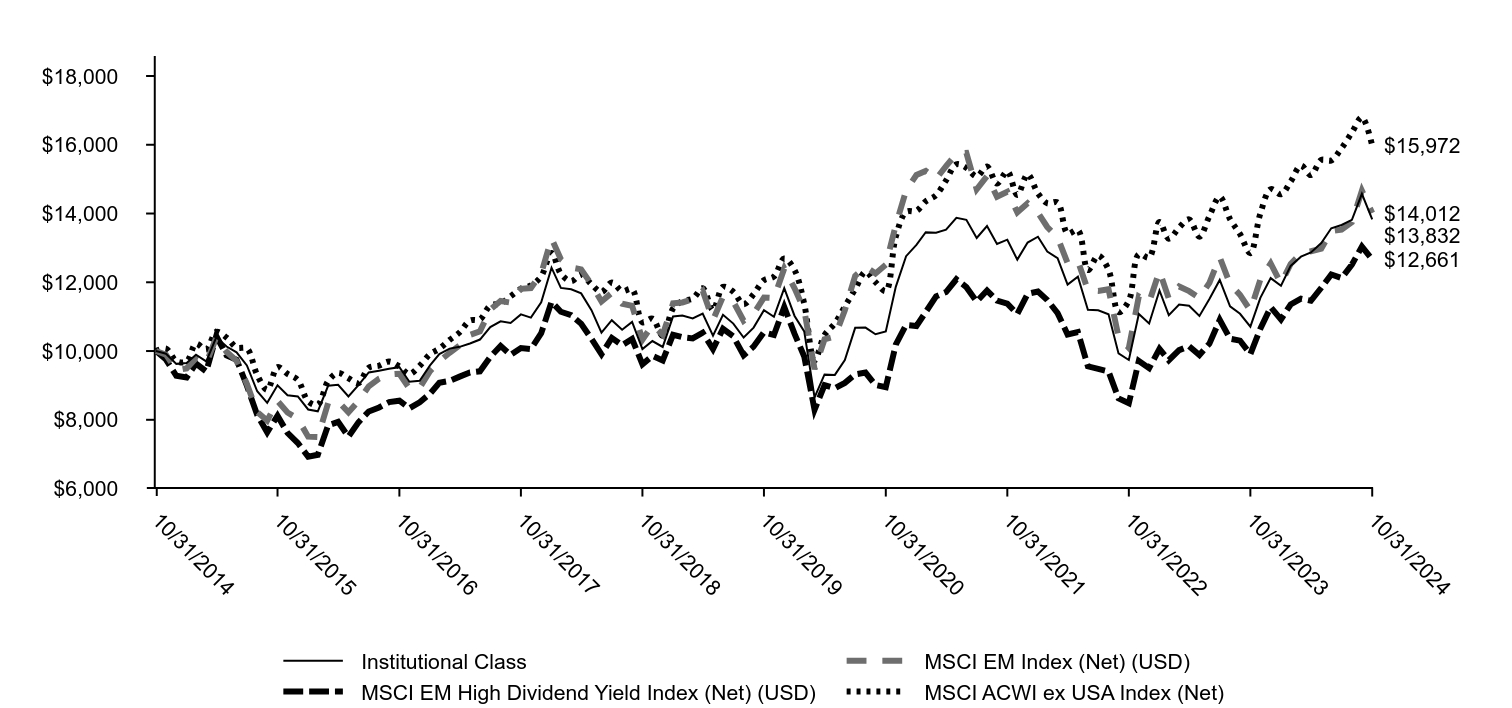

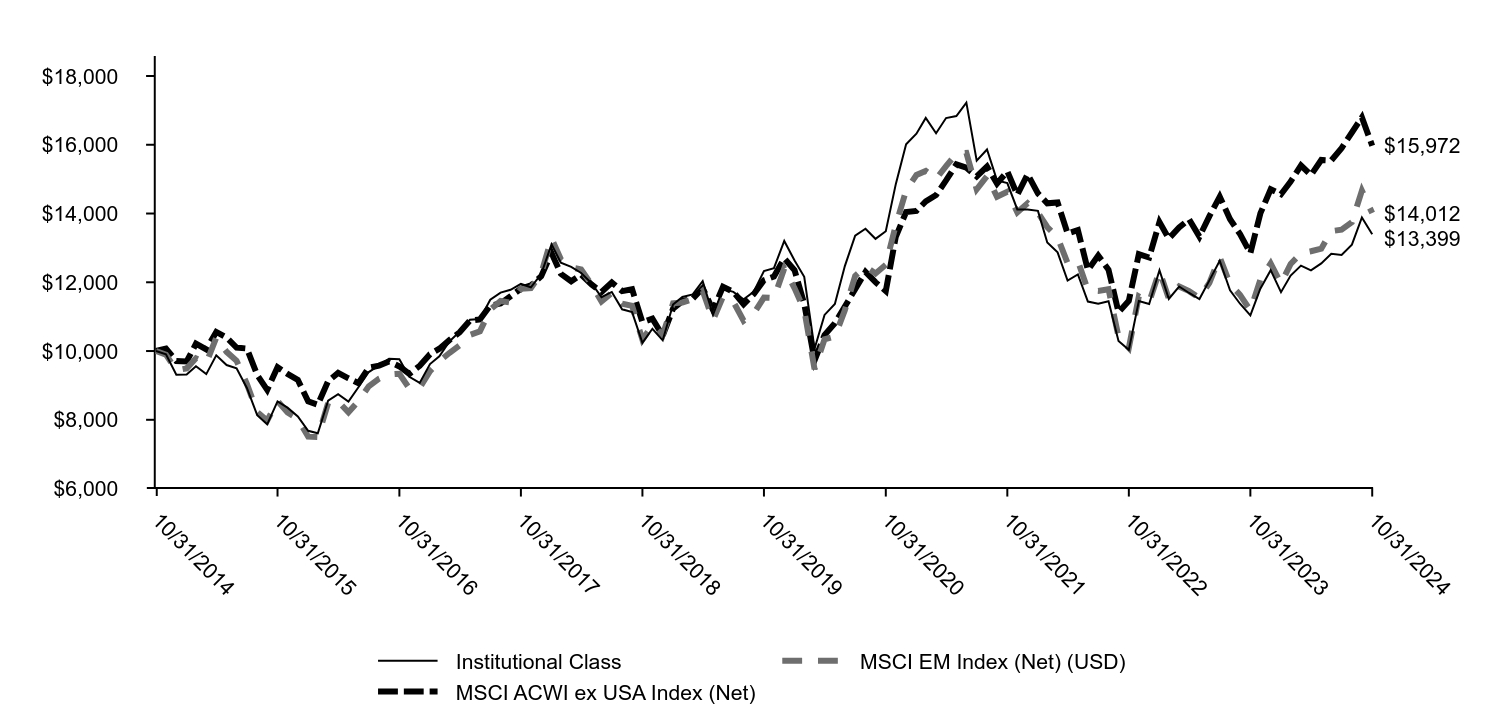

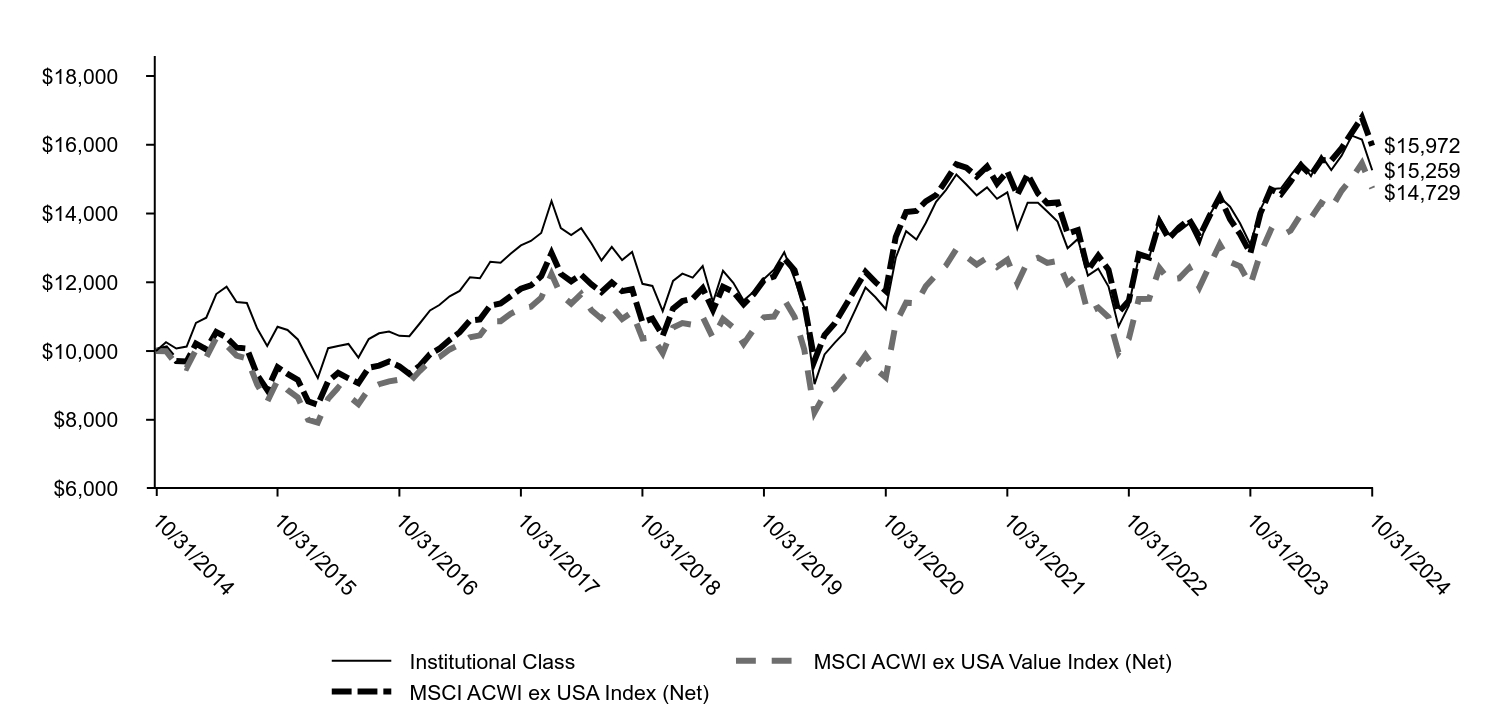

Total return based on a $10,000 investment

| Institutional Class | MSCI EM Index (Net) (USD) | MSCI ACWI ex USA Index (Net) |

|---|

| 10/31/2014 | $10,000 | $10,000 | $10,000 |

| 11/30/2014 | $9,902 | $9,894 | $10,072 |

| 12/31/2014 | $9,311 | $9,438 | $9,709 |

| 1/31/2015 | $9,320 | $9,495 | $9,695 |

| 2/28/2015 | $9,558 | $9,789 | $10,213 |

| 3/31/2015 | $9,329 | $9,650 | $10,048 |

| 4/30/2015 | $9,877 | $10,392 | $10,556 |

| 5/31/2015 | $9,594 | $9,976 | $10,391 |

| 6/30/2015 | $9,500 | $9,717 | $10,101 |

| 7/31/2015 | $8,925 | $9,043 | $10,073 |

| 8/31/2015 | $8,134 | $8,225 | $9,303 |

| 9/30/2015 | $7,869 | $7,978 | $8,872 |

| 10/31/2015 | $8,534 | $8,547 | $9,532 |

| 11/30/2015 | $8,354 | $8,213 | $9,335 |

| 12/31/2015 | $8,097 | $8,030 | $9,159 |

| 1/31/2016 | $7,679 | $7,509 | $8,536 |

| 2/29/2016 | $7,606 | $7,497 | $8,439 |

| 3/31/2016 | $8,557 | $8,489 | $9,125 |

| 4/30/2016 | $8,743 | $8,535 | $9,365 |

| 5/31/2016 | $8,530 | $8,217 | $9,207 |

| 6/30/2016 | $8,948 | $8,545 | $9,066 |

| 7/31/2016 | $9,389 | $8,975 | $9,515 |

| 8/31/2016 | $9,580 | $9,198 | $9,575 |

| 9/30/2016 | $9,776 | $9,317 | $9,693 |

| 10/31/2016 | $9,762 | $9,339 | $9,553 |

| 11/30/2016 | $9,248 | $8,909 | $9,332 |

| 12/31/2016 | $9,073 | $8,929 | $9,571 |

| 1/31/2017 | $9,620 | $9,417 | $9,910 |

| 2/28/2017 | $9,845 | $9,705 | $10,068 |

| 3/31/2017 | $10,287 | $9,950 | $10,324 |

| 4/30/2017 | $10,563 | $10,168 | $10,544 |

| 5/31/2017 | $10,912 | $10,469 | $10,887 |

| 6/30/2017 | $10,931 | $10,574 | $10,920 |

| 7/31/2017 | $11,492 | $11,205 | $11,323 |

| 8/31/2017 | $11,699 | $11,455 | $11,382 |

| 9/30/2017 | $11,781 | $11,409 | $11,593 |

| 10/31/2017 | $11,952 | $11,809 | $11,812 |

| 11/30/2017 | $11,855 | $11,833 | $11,908 |

| 12/31/2017 | $12,238 | $12,257 | $12,174 |

| 1/31/2018 | $13,104 | $13,279 | $12,852 |

| 2/28/2018 | $12,571 | $12,667 | $12,246 |

| 3/31/2018 | $12,446 | $12,431 | $12,030 |

| 4/30/2018 | $12,270 | $12,376 | $12,222 |

| 5/31/2018 | $11,974 | $11,938 | $11,940 |

| 6/30/2018 | $11,566 | $11,442 | $11,715 |

| 7/31/2018 | $11,719 | $11,693 | $11,995 |

| 8/31/2018 | $11,214 | $11,377 | $11,744 |

| 9/30/2018 | $11,131 | $11,316 | $11,798 |

| 10/31/2018 | $10,237 | $10,331 | $10,838 |

| 11/30/2018 | $10,649 | $10,757 | $10,941 |

| 12/31/2018 | $10,311 | $10,472 | $10,446 |

| 1/31/2019 | $11,353 | $11,389 | $11,235 |

| 2/28/2019 | $11,573 | $11,414 | $11,454 |

| 3/31/2019 | $11,648 | $11,510 | $11,523 |

| 4/30/2019 | $12,031 | $11,752 | $11,827 |

| 5/31/2019 | $11,054 | $10,900 | $11,192 |

| 6/30/2019 | $11,807 | $11,580 | $11,866 |

| 7/31/2019 | $11,722 | $11,438 | $11,723 |

| 8/31/2019 | $11,508 | $10,881 | $11,361 |

| 9/30/2019 | $11,722 | $11,088 | $11,653 |

| 10/31/2019 | $12,325 | $11,556 | $12,059 |

| 11/30/2019 | $12,409 | $11,540 | $12,166 |

| 12/31/2019 | $13,203 | $12,401 | $12,693 |

| 1/31/2020 | $12,632 | $11,823 | $12,352 |

| 2/29/2020 | $12,160 | $11,199 | $11,375 |

| 3/31/2020 | $10,068 | $9,474 | $9,728 |

| 4/30/2020 | $11,050 | $10,342 | $10,465 |

| 5/31/2020 | $11,371 | $10,421 | $10,808 |

| 6/30/2020 | $12,471 | $11,187 | $11,296 |

| 7/31/2020 | $13,354 | $12,187 | $11,800 |

| 8/31/2020 | $13,557 | $12,457 | $12,305 |

| 9/30/2020 | $13,264 | $12,257 | $12,003 |

| 10/31/2020 | $13,486 | $12,509 | $11,745 |

| 11/30/2020 | $14,855 | $13,666 | $13,324 |

| 12/31/2020 | $16,014 | $14,671 | $14,045 |

| 1/31/2021 | $16,322 | $15,121 | $14,075 |

| 2/28/2021 | $16,782 | $15,236 | $14,354 |

| 3/31/2021 | $16,336 | $15,006 | $14,535 |

| 4/30/2021 | $16,777 | $15,380 | $14,963 |

| 5/31/2021 | $16,834 | $15,737 | $15,431 |

| 6/30/2021 | $17,227 | $15,764 | $15,331 |

| 7/31/2021 | $15,536 | $14,703 | $15,079 |

| 8/31/2021 | $15,863 | $15,088 | $15,365 |

| 9/30/2021 | $14,963 | $14,488 | $14,873 |

| 10/31/2021 | $14,887 | $14,631 | $15,228 |

| 11/30/2021 | $14,120 | $14,035 | $14,542 |

| 12/31/2021 | $14,115 | $14,298 | $15,143 |

| 1/31/2022 | $14,077 | $14,027 | $14,585 |

| 2/28/2022 | $13,157 | $13,608 | $14,297 |

| 3/31/2022 | $12,870 | $13,301 | $14,320 |

| 4/30/2022 | $12,051 | $12,561 | $13,420 |

| 5/31/2022 | $12,227 | $12,616 | $13,517 |

| 6/30/2022 | $11,440 | $11,778 | $12,354 |

| 7/31/2022 | $11,374 | $11,749 | $12,777 |

| 8/31/2022 | $11,450 | $11,798 | $12,366 |

| 9/30/2022 | $10,292 | $10,415 | $11,130 |

| 10/31/2022 | $10,034 | $10,092 | $11,463 |

| 11/30/2022 | $11,455 | $11,588 | $12,816 |

| 12/31/2022 | $11,366 | $11,425 | $12,720 |

| 1/31/2023 | $12,350 | $12,328 | $13,752 |

| 2/28/2023 | $11,516 | $11,528 | $13,269 |

| 3/31/2023 | $11,877 | $11,877 | $13,593 |

| 4/30/2023 | $11,689 | $11,743 | $13,830 |

| 5/31/2023 | $11,511 | $11,546 | $13,327 |

| 6/30/2023 | $12,056 | $11,984 | $13,925 |

| 7/31/2023 | $12,625 | $12,730 | $14,491 |

| 8/31/2023 | $11,766 | $11,946 | $13,836 |

| 9/30/2023 | $11,376 | $11,633 | $13,399 |

| 10/31/2023 | $11,038 | $11,181 | $12,847 |

| 11/30/2023 | $11,815 | $12,076 | $14,003 |

| 12/31/2023 | $12,353 | $12,548 | $14,706 |

| 1/31/2024 | $11,713 | $11,966 | $14,560 |

| 2/29/2024 | $12,197 | $12,535 | $14,929 |

| 3/31/2024 | $12,485 | $12,845 | $15,396 |

| 4/30/2024 | $12,348 | $12,903 | $15,119 |

| 5/31/2024 | $12,549 | $12,976 | $15,558 |

| 6/30/2024 | $12,827 | $13,488 | $15,543 |

| 7/31/2024 | $12,793 | $13,528 | $15,903 |

| 8/31/2024 | $13,096 | $13,746 | $16,356 |

| 9/30/2024 | $13,887 | $14,664 | $16,797 |

| 10/31/2024 | $13,399 | $14,012 | $15,972 |

Emerging Markets Equity Fund

Annual Shareholder Report | October 31, 2024

AVERAGE ANNUAL TOTAL RETURNS (%)

| Total net assets | $3,882,963,501 |

| # of portfolio holdings | 122 |

| Portfolio turnover rate | 10% |

| Total advisory fees paid | $36,864,032 |

| AATR | 1 Year | 5 Years | 10 Years |

|---|

| Institutional Class | 21.38 | 1.68 | 2.97 |

| MSCI EM Index (Net) (USD) (Strategy) | 25.32 | 3.93 | 3.43 |

| MSCI ACWI ex USA Index (Net) (Regulatory) | 24.33 | 5.78 | 4.79 |

Figures quoted represent past performance, which is no guarantee of future results, and do not reflect taxes that a shareholder may pay on an investment in a fund.

What did the Fund invest in?

(Based on long-term investments)

TOP TEN HOLDINGS (% OF NET ASSETS)

| Taiwan Semiconductor Manufacturing Co. Ltd. ADR | 6.5 |

| Taiwan Semiconductor Manufacturing Co. Ltd. | 5.3 |

| Tencent Holdings Ltd. | 5.3 |

| Samsung Electronics Co. Ltd. Korea Exchange | 4.8 |

| Reliance Industries Ltd. London Stock Exchange GDR | 3.7 |

| Meituan Class B | 2.5 |

| Bharti Airtel Ltd. | 2.3 |

| HDFC Bank Ltd. | 2.2 |

| WH Group Ltd. | 2.1 |

| Alibaba Group Holding Ltd. New York Stock Exchange ADR | 2.1 |

COUNTRY ALLOCATION (% OF LONG-TERM INVESTMENTS)

| China | 20.6 |

| India | 17.2 |

| Taiwan | 15.9 |

| South Korea | 12.6 |

| Brazil | 5.3 |

| Mexico | 4.5 |

| Hong Kong | 4.4 |

| Indonesia | 4.1 |

| South Africa | 3.6 |

| Thailand | 2.6 |

| Other | 9.2 |

SECTOR ALLOCATION (% OF LONG-TERM INVESTMENTS)

| Information technology | 22.5 |

| Communication services | 17.1 |

| Consumer staples | 15.5 |

| Financials | 14.0 |

| Consumer discretionary | 13.1 |

| Energy | 5.7 |

| Industrials | 4.5 |

| Materials | 4.2 |

| Real estate | 1.7 |

| Health care | 1.7 |

This is a summary of certain changes and planned changes to the Fund since November 1, 2023.

On October 16, 2024, Prashant Paroda was added as a portfolio manager to the Fund.

You can find additional information on the Fund's website at allspringglobal.com, including its:

- Prospectus - Financial Information - Fund holdings - Proxy voting information

Annual Shareholder Report

Emerging Markets Equity Fund

This annual shareholder report contains important information about Emerging Markets Equity Fund for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at allspringglobal.com. You can also request this information by contacting us at 1-800-222-8222.

This report describes changes to the Fund that occurred either during or after the reporting period.

What were the Fund costs for the past year?

The table explains the costs you would have paid within the reporting period based on a hypothetical $10,000 investment.

| CLASS NAME | COSTS OF A $10,000 INVESTMENT | COSTS PAID AS A % OF A $10,000 INVESTMENT |

|---|

| Class R6 | $112 | 1.01% |

The manager has contractually committed to waive fees and/or reimburse certain expenses to the extent necessary to cap the Fund's total annual fund operating expense ratio at a specific amount. Without this cap, the costs shown above may have been higher. Please see the prospectus for the amount and the expiration date of the cap. Prior to or after the commitment expiration date, the cap may be increased or the commitment to maintain the cap may be terminated only with the approval of the Board of Trustees.

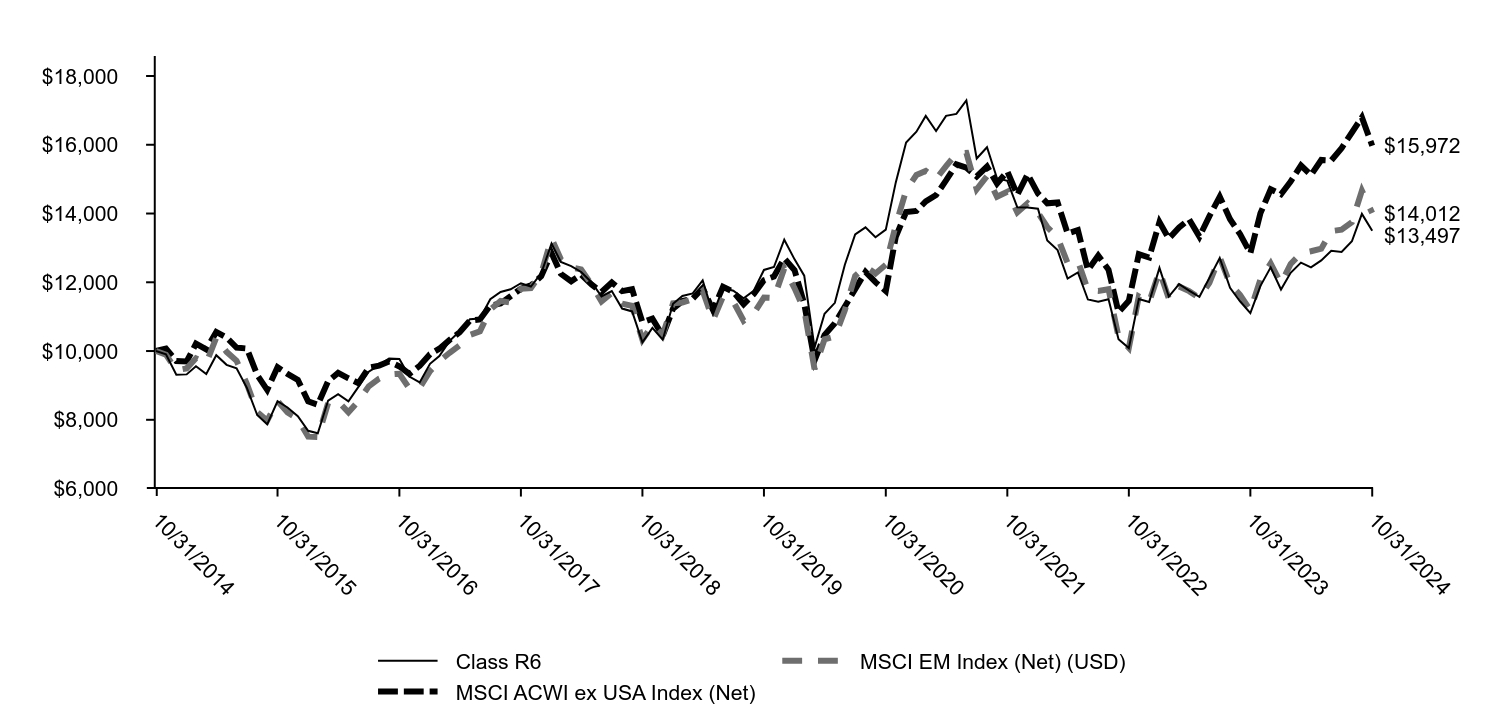

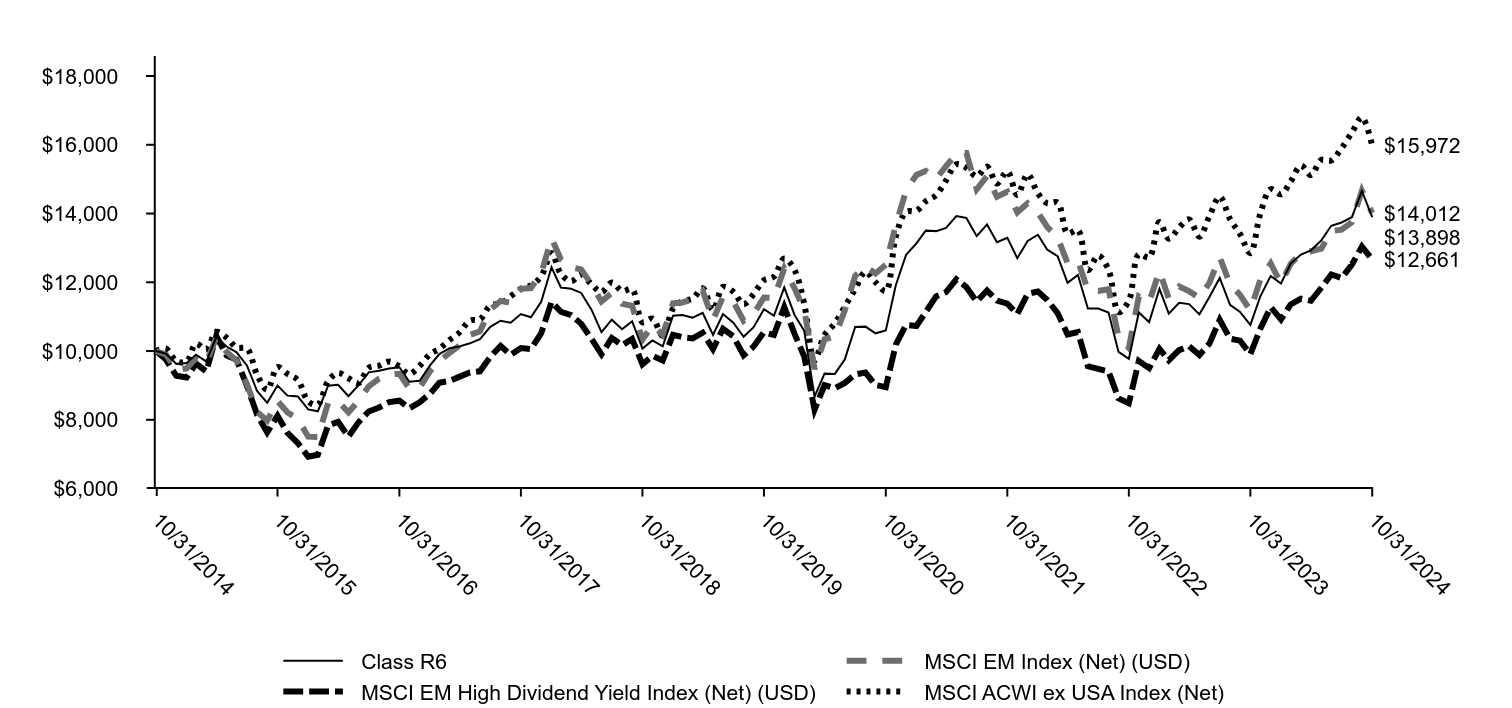

How did the Fund perform last year and what affected its performance?

Improving company fundamentals and macro tailwinds supported emerging market equities during the period. Key drivers included growing corporate focus on return on capital, momentum factor performance, China’s efforts to resuscitate its economy, resilient Indian economic growth, monetary easing, and demand for technology related to artificial intelligence. All sectors and 22 out of 24 countries rose. The top sectors were information technology (IT), financials, and consumer discretionary. Leading countries were Taiwan, India, and China. The portfolio benefited from strong stock selection in Taiwan, Poland, Chile, IT, and consumer discretionary. Taiwan Semiconductor Manufacturing Company Limited and Bharti Airtel Limited, the Indian telecom provider, were leading contributors. The portfolio was hurt by stock selection in India, Mexico, and financials and by being underweight to the strong Mexico market. Samsung Electronics Company, Limited, and AIA Group Limited, a pan-Asia insurance firm, were the largest detractors. During the period, the portfolio added exposure to Poland, materials, and industrials and reduced exposure to Mexico and consumer staples.

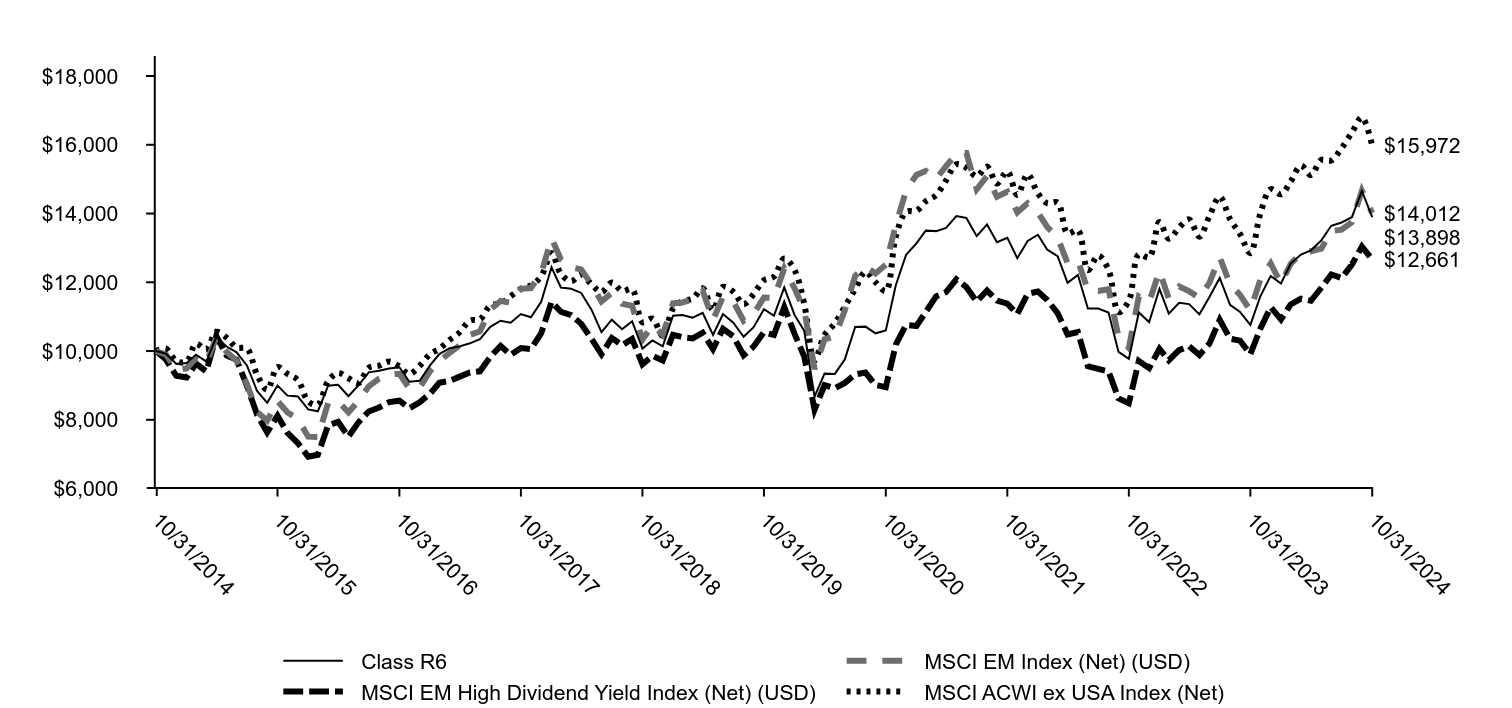

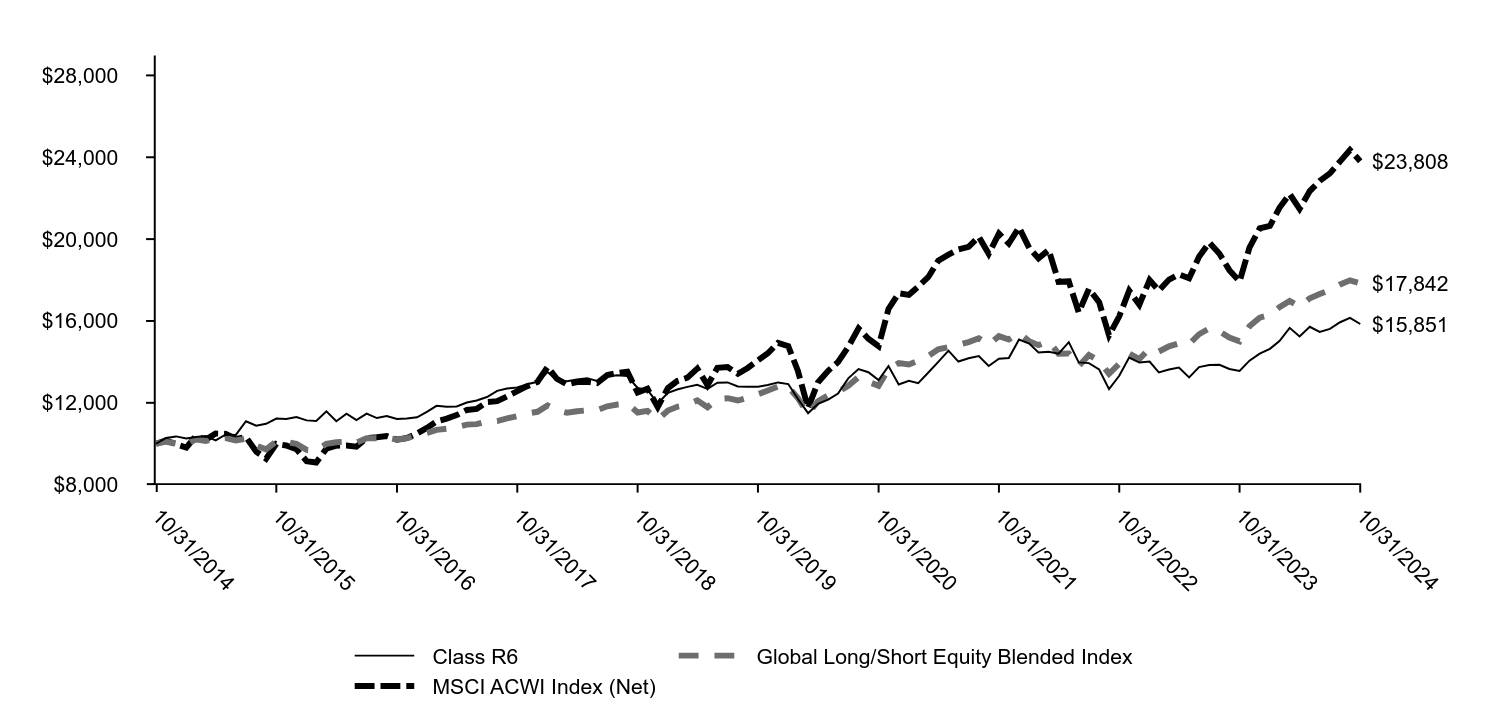

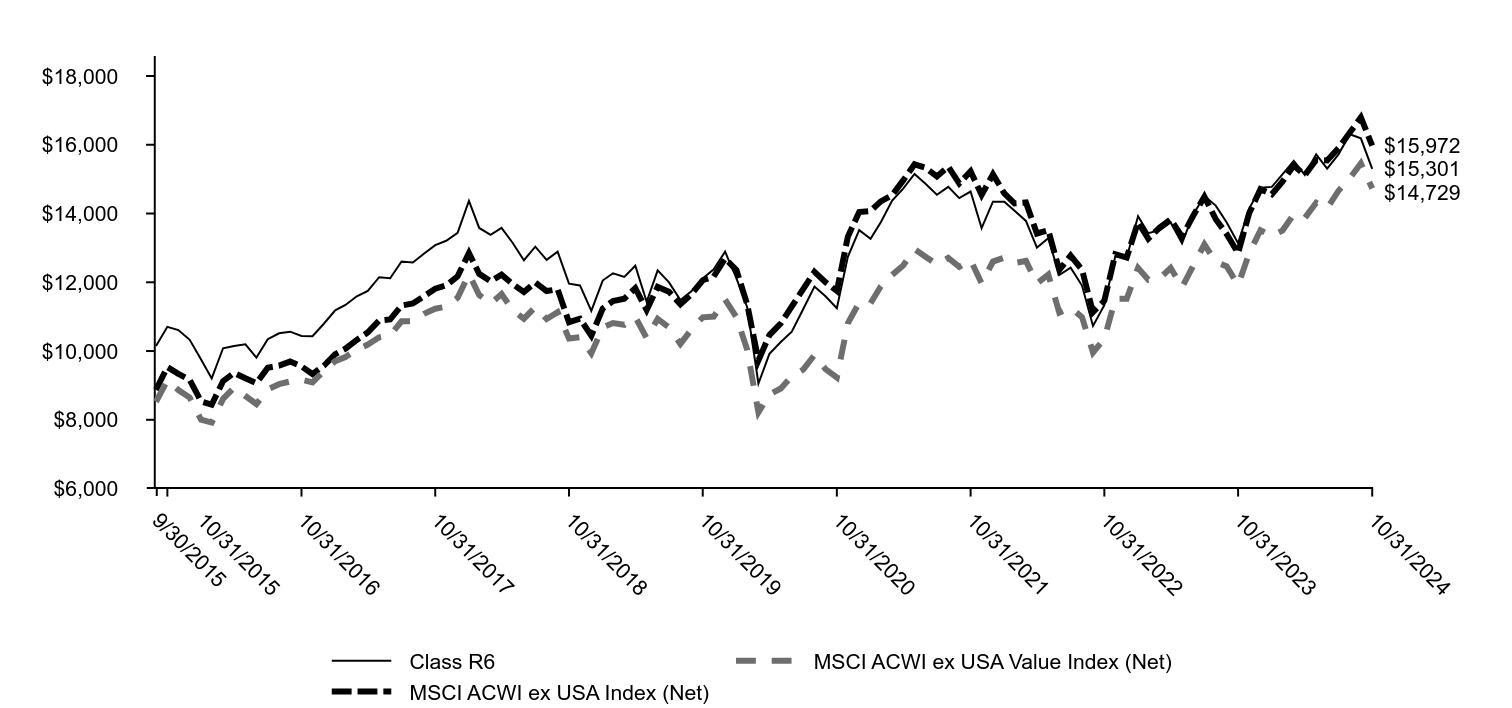

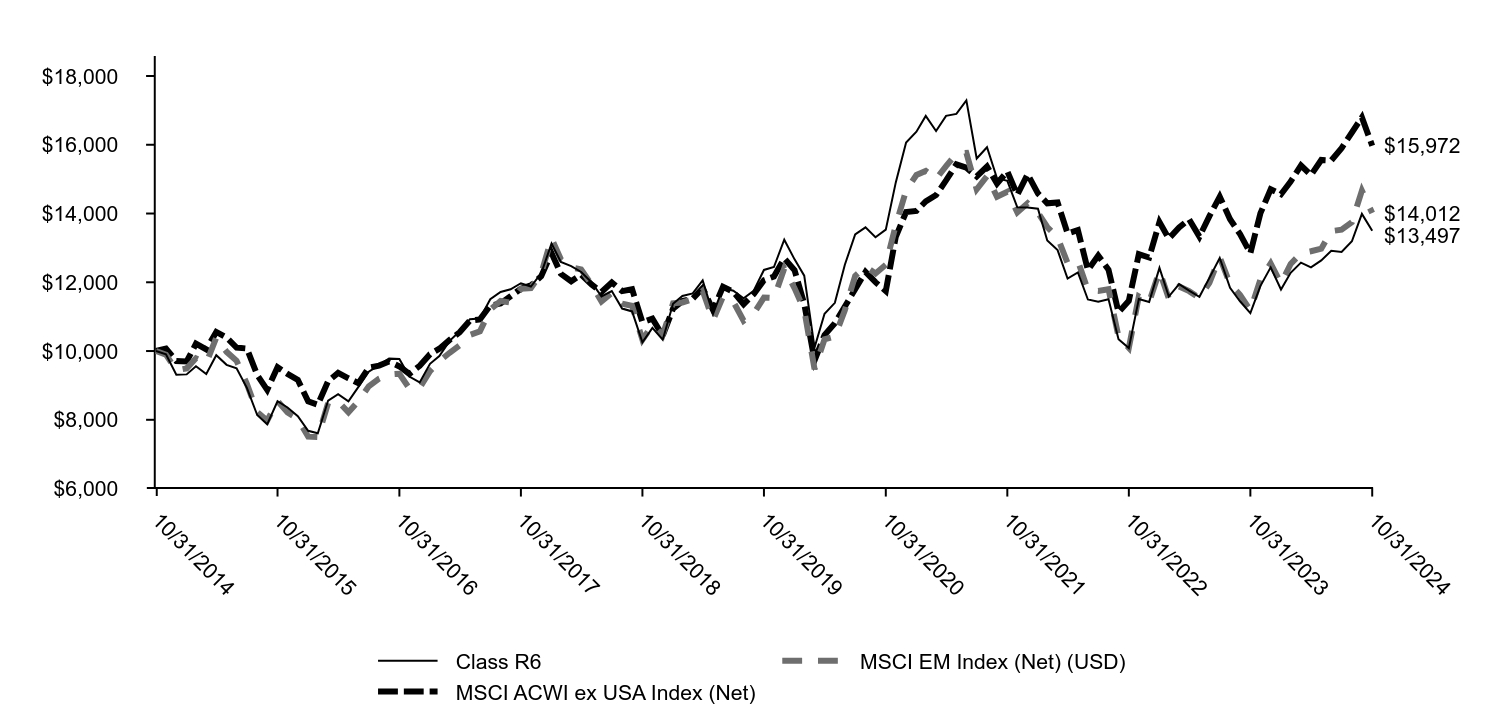

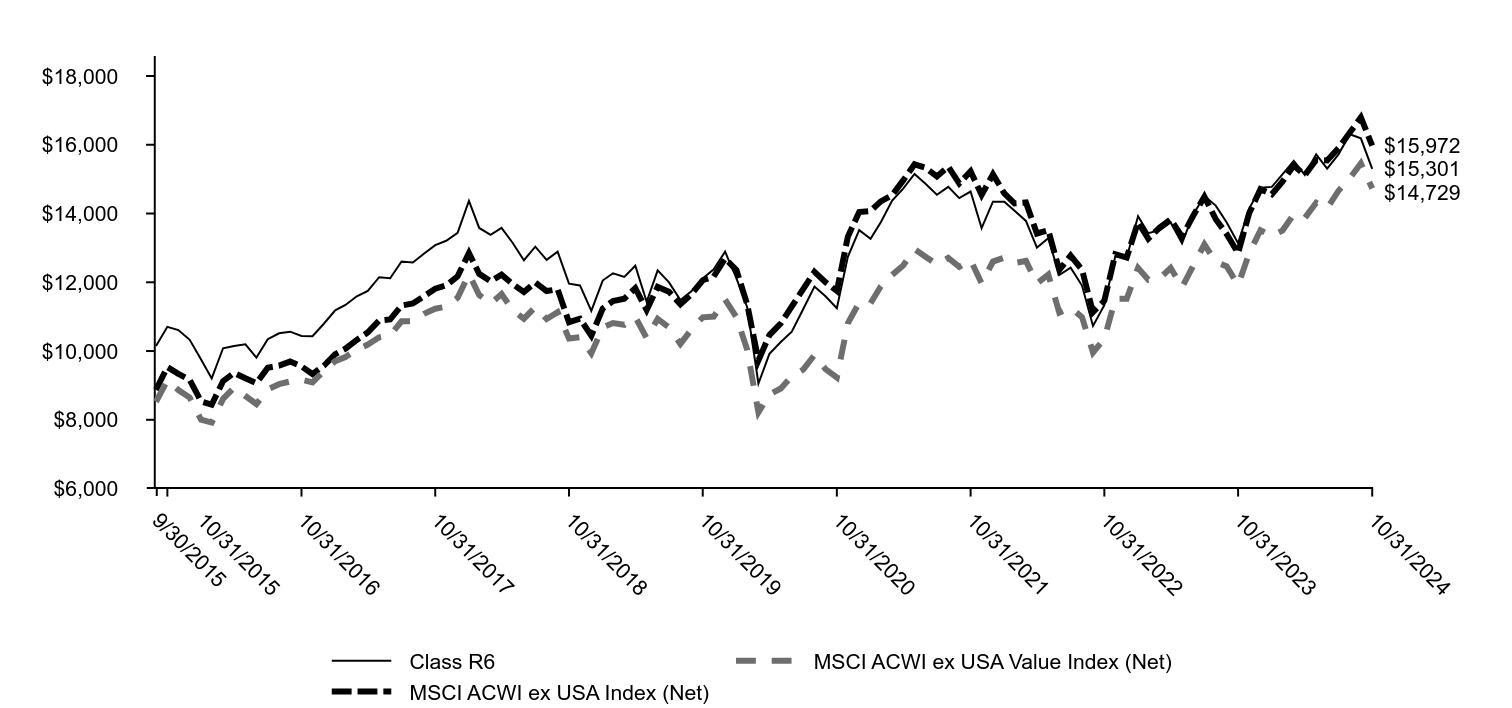

Total return based on a $10,000 investment

| Class R6 | MSCI EM Index (Net) (USD) | MSCI ACWI ex USA Index (Net) |

|---|

| 10/31/2014 | $10,000 | $10,000 | $10,000 |

| 11/30/2014 | $9,902 | $9,894 | $10,072 |

| 12/31/2014 | $9,312 | $9,438 | $9,709 |

| 1/31/2015 | $9,321 | $9,495 | $9,695 |

| 2/28/2015 | $9,559 | $9,789 | $10,213 |

| 3/31/2015 | $9,330 | $9,650 | $10,048 |

| 4/30/2015 | $9,878 | $10,392 | $10,556 |

| 5/31/2015 | $9,599 | $9,976 | $10,391 |

| 6/30/2015 | $9,500 | $9,717 | $10,101 |

| 7/31/2015 | $8,930 | $9,043 | $10,073 |

| 8/31/2015 | $8,139 | $8,225 | $9,303 |

| 9/30/2015 | $7,869 | $7,978 | $8,872 |

| 10/31/2015 | $8,539 | $8,547 | $9,532 |

| 11/30/2015 | $8,359 | $8,213 | $9,335 |

| 12/31/2015 | $8,105 | $8,030 | $9,159 |

| 1/31/2016 | $7,681 | $7,509 | $8,536 |

| 2/29/2016 | $7,608 | $7,497 | $8,439 |

| 3/31/2016 | $8,560 | $8,489 | $9,125 |

| 4/30/2016 | $8,747 | $8,535 | $9,365 |

| 5/31/2016 | $8,537 | $8,217 | $9,207 |

| 6/30/2016 | $8,956 | $8,545 | $9,066 |

| 7/31/2016 | $9,398 | $8,975 | $9,515 |

| 8/31/2016 | $9,589 | $9,198 | $9,575 |

| 9/30/2016 | $9,785 | $9,317 | $9,693 |

| 10/31/2016 | $9,771 | $9,339 | $9,553 |

| 11/30/2016 | $9,256 | $8,909 | $9,332 |

| 12/31/2016 | $9,085 | $8,929 | $9,571 |

| 1/31/2017 | $9,628 | $9,417 | $9,910 |

| 2/28/2017 | $9,854 | $9,705 | $10,068 |

| 3/31/2017 | $10,296 | $9,950 | $10,324 |

| 4/30/2017 | $10,577 | $10,168 | $10,544 |

| 5/31/2017 | $10,927 | $10,469 | $10,887 |

| 6/30/2017 | $10,945 | $10,574 | $10,920 |

| 7/31/2017 | $11,507 | $11,205 | $11,323 |

| 8/31/2017 | $11,719 | $11,455 | $11,382 |

| 9/30/2017 | $11,797 | $11,409 | $11,593 |

| 10/31/2017 | $11,972 | $11,809 | $11,812 |

| 11/30/2017 | $11,876 | $11,833 | $11,908 |

| 12/31/2017 | $12,262 | $12,257 | $12,174 |

| 1/31/2018 | $13,125 | $13,279 | $12,852 |

| 2/28/2018 | $12,591 | $12,667 | $12,246 |

| 3/31/2018 | $12,470 | $12,431 | $12,030 |

| 4/30/2018 | $12,299 | $12,376 | $12,222 |

| 5/31/2018 | $12,002 | $11,938 | $11,940 |

| 6/30/2018 | $11,589 | $11,442 | $11,715 |

| 7/31/2018 | $11,746 | $11,693 | $11,995 |

| 8/31/2018 | $11,236 | $11,377 | $11,744 |

| 9/30/2018 | $11,152 | $11,316 | $11,798 |

| 10/31/2018 | $10,257 | $10,331 | $10,838 |

| 11/30/2018 | $10,674 | $10,757 | $10,941 |

| 12/31/2018 | $10,331 | $10,472 | $10,446 |

| 1/31/2019 | $11,376 | $11,389 | $11,235 |

| 2/28/2019 | $11,601 | $11,414 | $11,454 |

| 3/31/2019 | $11,676 | $11,510 | $11,523 |

| 4/30/2019 | $12,055 | $11,752 | $11,827 |

| 5/31/2019 | $11,081 | $10,900 | $11,192 |

| 6/30/2019 | $11,835 | $11,580 | $11,866 |

| 7/31/2019 | $11,755 | $11,438 | $11,723 |

| 8/31/2019 | $11,535 | $10,881 | $11,361 |

| 9/30/2019 | $11,750 | $11,088 | $11,653 |

| 10/31/2019 | $12,359 | $11,556 | $12,059 |

| 11/30/2019 | $12,444 | $11,540 | $12,166 |

| 12/31/2019 | $13,239 | $12,401 | $12,693 |

| 1/31/2020 | $12,666 | $11,823 | $12,352 |

| 2/29/2020 | $12,193 | $11,199 | $11,375 |

| 3/31/2020 | $10,101 | $9,474 | $9,728 |

| 4/30/2020 | $11,085 | $10,342 | $10,465 |

| 5/31/2020 | $11,402 | $10,421 | $10,808 |

| 6/30/2020 | $12,510 | $11,187 | $11,296 |

| 7/31/2020 | $13,395 | $12,187 | $11,800 |

| 8/31/2020 | $13,599 | $12,457 | $12,305 |

| 9/30/2020 | $13,310 | $12,257 | $12,003 |

| 10/31/2020 | $13,532 | $12,509 | $11,745 |

| 11/30/2020 | $14,905 | $13,666 | $13,324 |

| 12/31/2020 | $16,066 | $14,671 | $14,045 |

| 1/31/2021 | $16,379 | $15,121 | $14,075 |

| 2/28/2021 | $16,840 | $15,236 | $14,354 |

| 3/31/2021 | $16,398 | $15,006 | $14,535 |

| 4/30/2021 | $16,840 | $15,380 | $14,963 |

| 5/31/2021 | $16,897 | $15,737 | $15,431 |

| 6/30/2021 | $17,292 | $15,764 | $15,331 |

| 7/31/2021 | $15,600 | $14,703 | $15,079 |

| 8/31/2021 | $15,928 | $15,088 | $15,365 |

| 9/30/2021 | $15,025 | $14,488 | $14,873 |

| 10/31/2021 | $14,949 | $14,631 | $15,228 |

| 11/30/2021 | $14,179 | $14,035 | $14,542 |

| 12/31/2021 | $14,176 | $14,298 | $15,143 |

| 1/31/2022 | $14,138 | $14,027 | $14,585 |

| 2/28/2022 | $13,214 | $13,608 | $14,297 |

| 3/31/2022 | $12,936 | $13,301 | $14,320 |

| 4/30/2022 | $12,107 | $12,561 | $13,420 |

| 5/31/2022 | $12,285 | $12,616 | $13,517 |

| 6/30/2022 | $11,499 | $11,778 | $12,354 |

| 7/31/2022 | $11,432 | $11,749 | $12,777 |

| 8/31/2022 | $11,509 | $11,798 | $12,366 |

| 9/30/2022 | $10,345 | $10,415 | $11,130 |

| 10/31/2022 | $10,086 | $10,092 | $11,463 |

| 11/30/2022 | $11,513 | $11,588 | $12,816 |

| 12/31/2022 | $11,429 | $11,425 | $12,720 |

| 1/31/2023 | $12,419 | $12,328 | $13,752 |

| 2/28/2023 | $11,584 | $11,528 | $13,269 |

| 3/31/2023 | $11,948 | $11,877 | $13,593 |

| 4/30/2023 | $11,759 | $11,743 | $13,830 |

| 5/31/2023 | $11,579 | $11,546 | $13,327 |

| 6/30/2023 | $12,128 | $11,984 | $13,925 |

| 7/31/2023 | $12,705 | $12,730 | $14,491 |

| 8/31/2023 | $11,841 | $11,946 | $13,836 |

| 9/30/2023 | $11,448 | $11,633 | $13,399 |

| 10/31/2023 | $11,104 | $11,181 | $12,847 |

| 11/30/2023 | $11,890 | $12,076 | $14,003 |

| 12/31/2023 | $12,435 | $12,548 | $14,706 |

| 1/31/2024 | $11,790 | $11,966 | $14,560 |

| 2/29/2024 | $12,277 | $12,535 | $14,929 |

| 3/31/2024 | $12,572 | $12,845 | $15,396 |

| 4/30/2024 | $12,435 | $12,903 | $15,119 |

| 5/31/2024 | $12,636 | $12,976 | $15,558 |

| 6/30/2024 | $12,917 | $13,488 | $15,543 |

| 7/31/2024 | $12,882 | $13,528 | $15,903 |

| 8/31/2024 | $13,192 | $13,746 | $16,356 |

| 9/30/2024 | $13,989 | $14,664 | $16,797 |

| 10/31/2024 | $13,497 | $14,012 | $15,972 |

Emerging Markets Equity Fund

Annual Shareholder Report | October 31, 2024

AVERAGE ANNUAL TOTAL RETURNS (%)

| Total net assets | $3,882,963,501 |

| # of portfolio holdings | 122 |

| Portfolio turnover rate | 10% |

| Total advisory fees paid | $36,864,032 |

| AATR | 1 Year | 5 Years | 10 Years |

|---|

| Class R6 | 21.55 | 1.78 | 3.04 |

| MSCI EM Index (Net) (USD) (Strategy) | 25.32 | 3.93 | 3.43 |

| MSCI ACWI ex USA Index (Net) (Regulatory) | 24.33 | 5.78 | 4.79 |

Figures quoted represent past performance, which is no guarantee of future results, and do not reflect taxes that a shareholder may pay on an investment in a fund.

What did the Fund invest in?

(Based on long-term investments)

TOP TEN HOLDINGS (% OF NET ASSETS)

| Taiwan Semiconductor Manufacturing Co. Ltd. ADR | 6.5 |

| Taiwan Semiconductor Manufacturing Co. Ltd. | 5.3 |

| Tencent Holdings Ltd. | 5.3 |

| Samsung Electronics Co. Ltd. Korea Exchange | 4.8 |

| Reliance Industries Ltd. London Stock Exchange GDR | 3.7 |

| Meituan Class B | 2.5 |

| Bharti Airtel Ltd. | 2.3 |

| HDFC Bank Ltd. | 2.2 |

| WH Group Ltd. | 2.1 |

| Alibaba Group Holding Ltd. New York Stock Exchange ADR | 2.1 |

COUNTRY ALLOCATION (% OF LONG-TERM INVESTMENTS)

| China | 20.6 |

| India | 17.2 |

| Taiwan | 15.9 |

| South Korea | 12.6 |

| Brazil | 5.3 |

| Mexico | 4.5 |

| Hong Kong | 4.4 |

| Indonesia | 4.1 |

| South Africa | 3.6 |

| Thailand | 2.6 |

| Other | 9.2 |

SECTOR ALLOCATION (% OF LONG-TERM INVESTMENTS)

| Information technology | 22.5 |

| Communication services | 17.1 |

| Consumer staples | 15.5 |

| Financials | 14.0 |

| Consumer discretionary | 13.1 |

| Energy | 5.7 |

| Industrials | 4.5 |

| Materials | 4.2 |

| Real estate | 1.7 |

| Health care | 1.7 |

This is a summary of certain changes and planned changes to the Fund since November 1, 2023.

On October 16, 2024, Prashant Paroda was added as a portfolio manager to the Fund.

You can find additional information on the Fund's website at allspringglobal.com, including its:

- Prospectus - Financial Information - Fund holdings - Proxy voting information

Annual Shareholder Report

Emerging Markets Equity Fund

This annual shareholder report contains important information about Emerging Markets Equity Fund for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at allspringglobal.com. You can also request this information by contacting us at 1-800-222-8222.

This report describes changes to the Fund that occurred either during or after the reporting period.

What were the Fund costs for the past year?

The table explains the costs you would have paid within the reporting period based on a hypothetical $10,000 investment.

| CLASS NAME | COSTS OF A $10,000 INVESTMENT | COSTS PAID AS A % OF A $10,000 INVESTMENT |

|---|

| Class C | $240 | 2.18% |

The manager has contractually committed to waive fees and/or reimburse certain expenses to the extent necessary to cap the Fund's total annual fund operating expense ratio at a specific amount. Without this cap, the costs shown above may have been higher. Please see the prospectus for the amount and the expiration date of the cap. Prior to or after the commitment expiration date, the cap may be increased or the commitment to maintain the cap may be terminated only with the approval of the Board of Trustees.

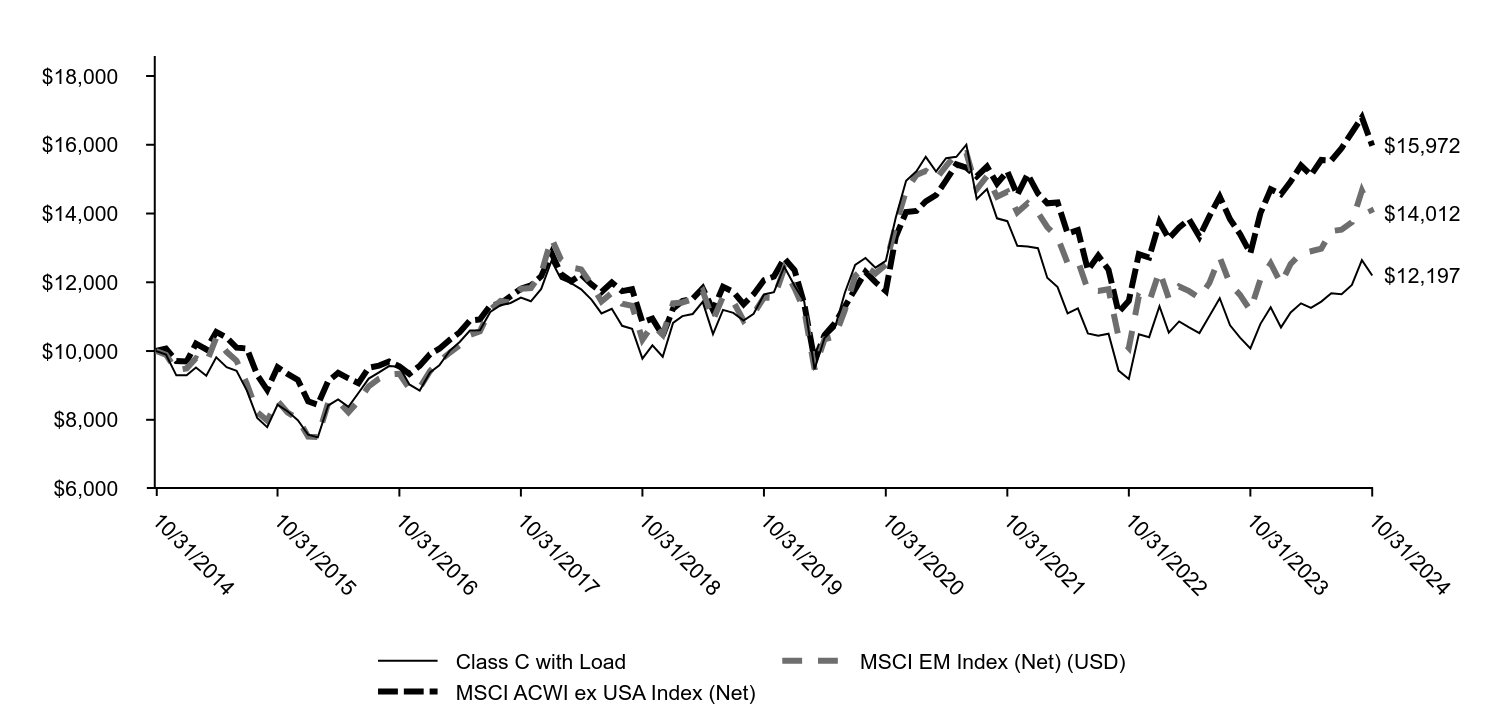

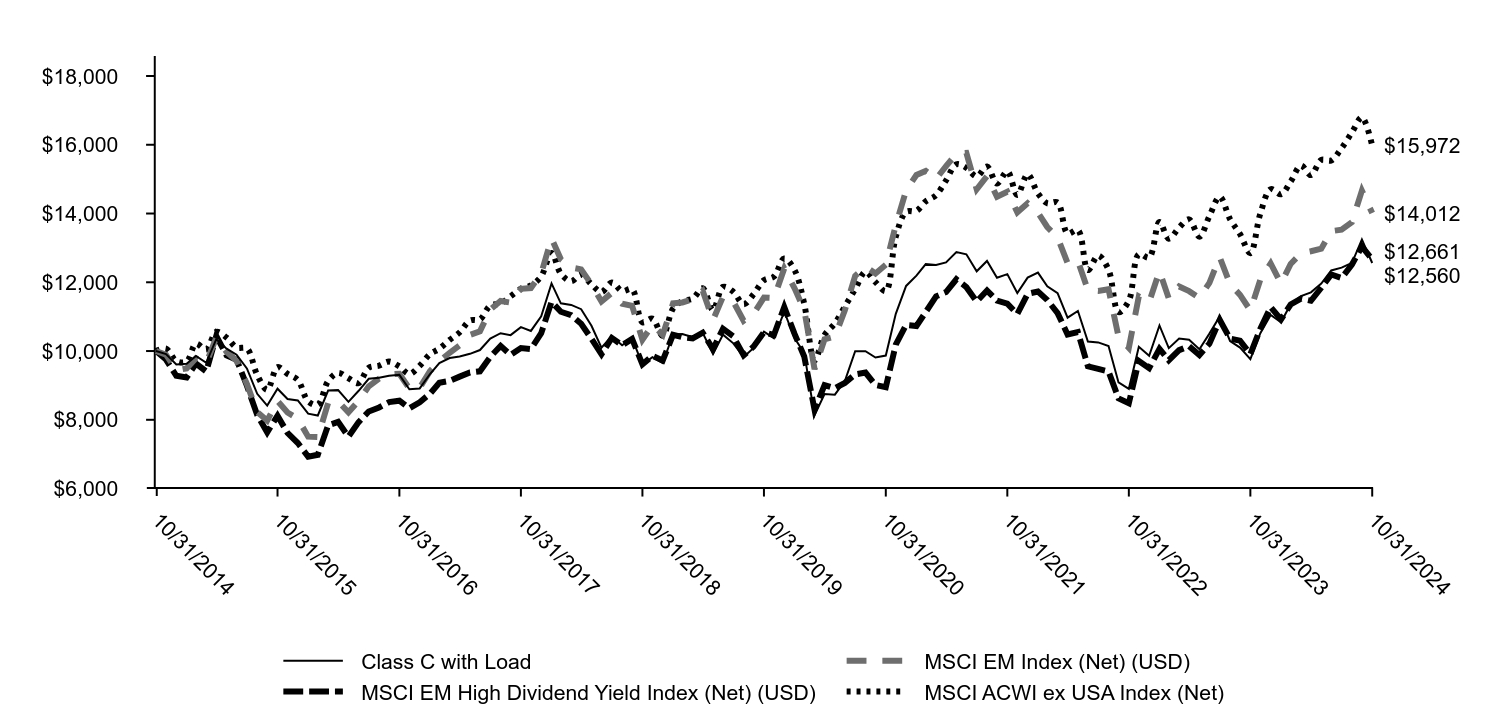

How did the Fund perform last year and what affected its performance?

Improving company fundamentals and macro tailwinds supported emerging market equities during the period. Key drivers included growing corporate focus on return on capital, momentum factor performance, China’s efforts to resuscitate its economy, resilient Indian economic growth, monetary easing, and demand for technology related to artificial intelligence. All sectors and 22 out of 24 countries rose. The top sectors were information technology (IT), financials, and consumer discretionary. Leading countries were Taiwan, India, and China. The portfolio benefited from strong stock selection in Taiwan, Poland, Chile, IT, and consumer discretionary. Taiwan Semiconductor Manufacturing Company Limited and Bharti Airtel Limited, the Indian telecom provider, were leading contributors. The portfolio was hurt by stock selection in India, Mexico, and financials and by being underweight to the strong Mexico market. Samsung Electronics Company, Limited, and AIA Group Limited, a pan-Asia insurance firm, were the largest detractors. During the period, the portfolio added exposure to Poland, materials, and industrials and reduced exposure to Mexico and consumer staples.

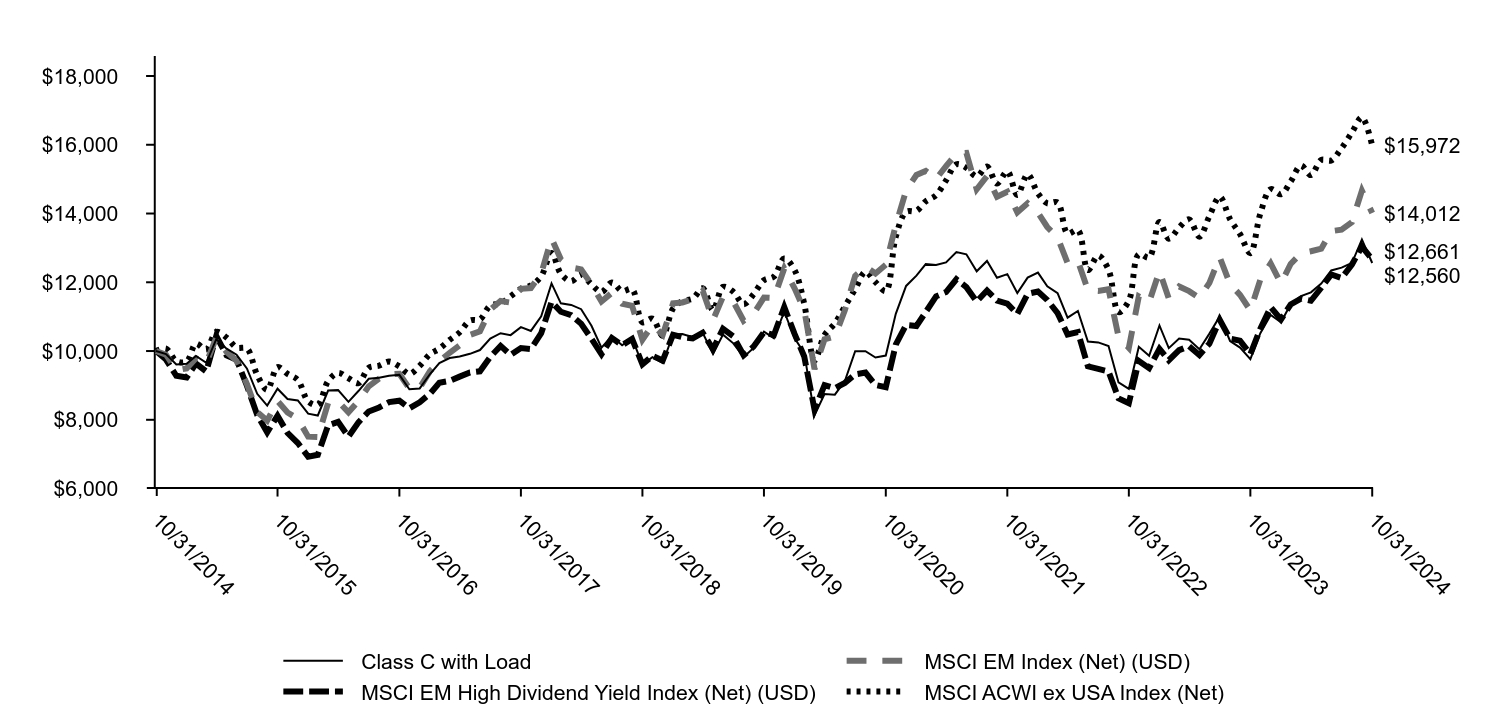

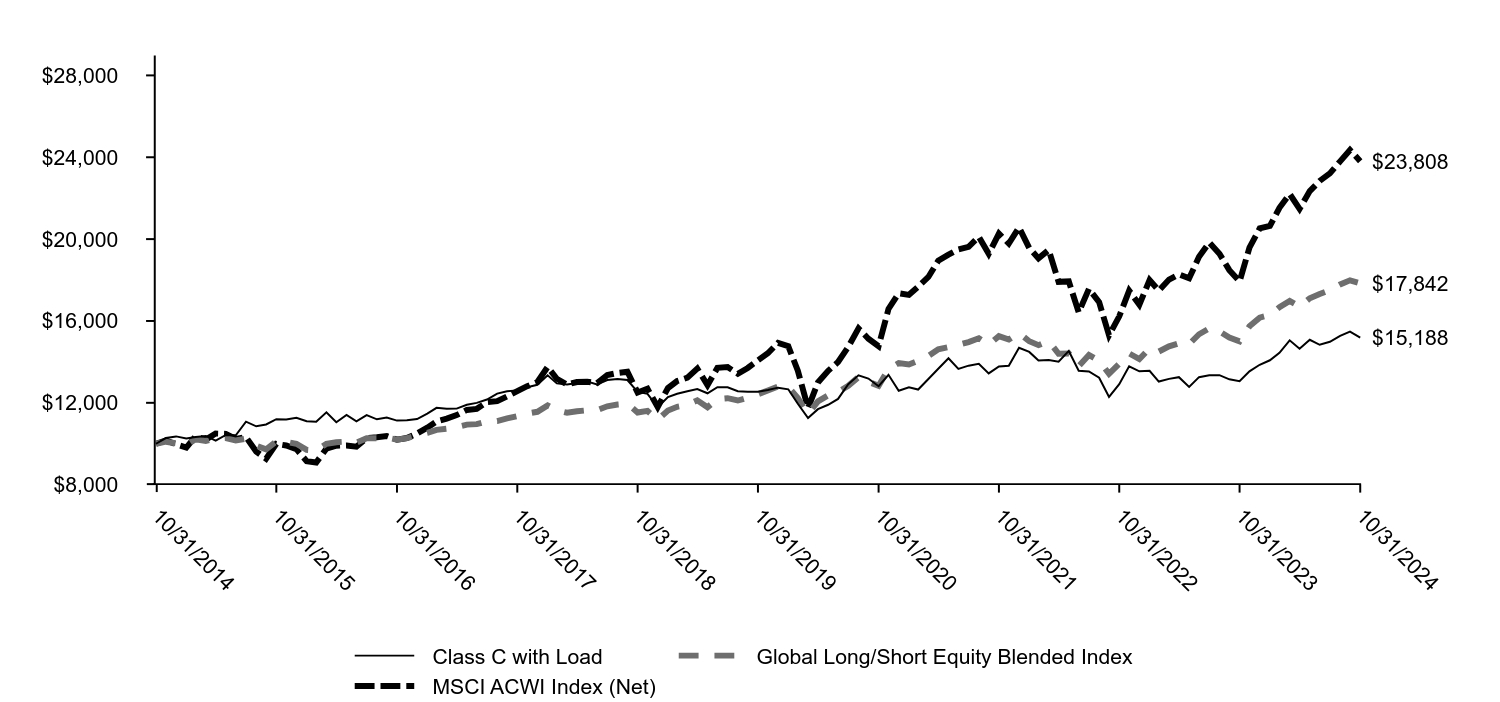

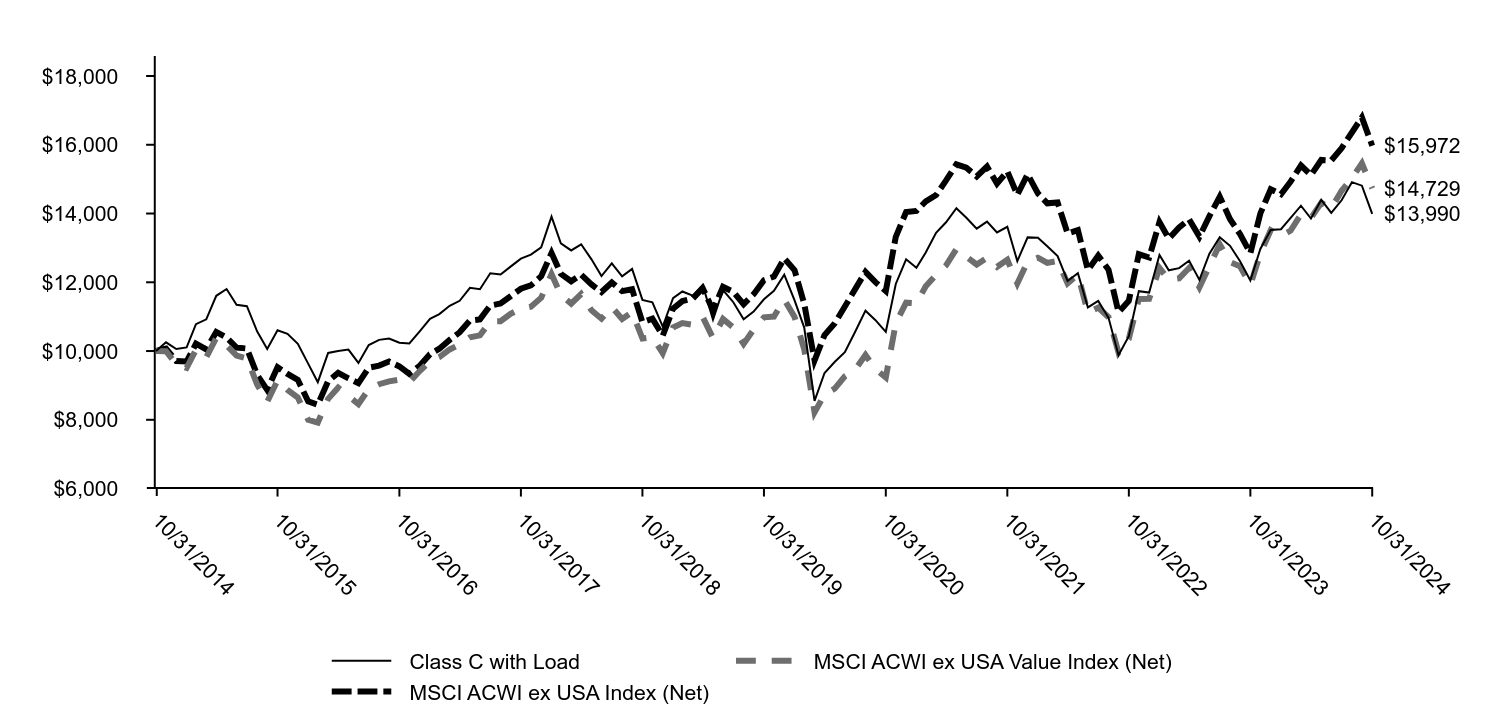

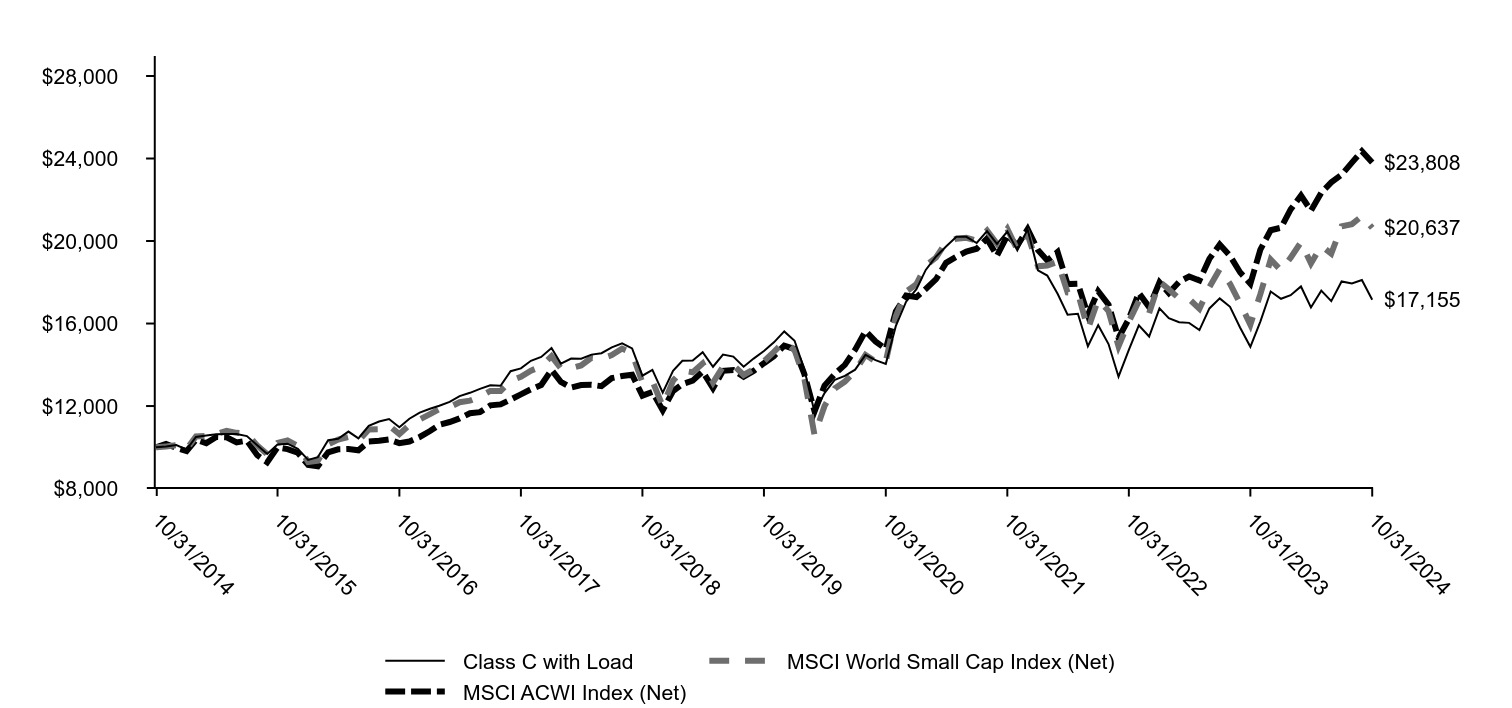

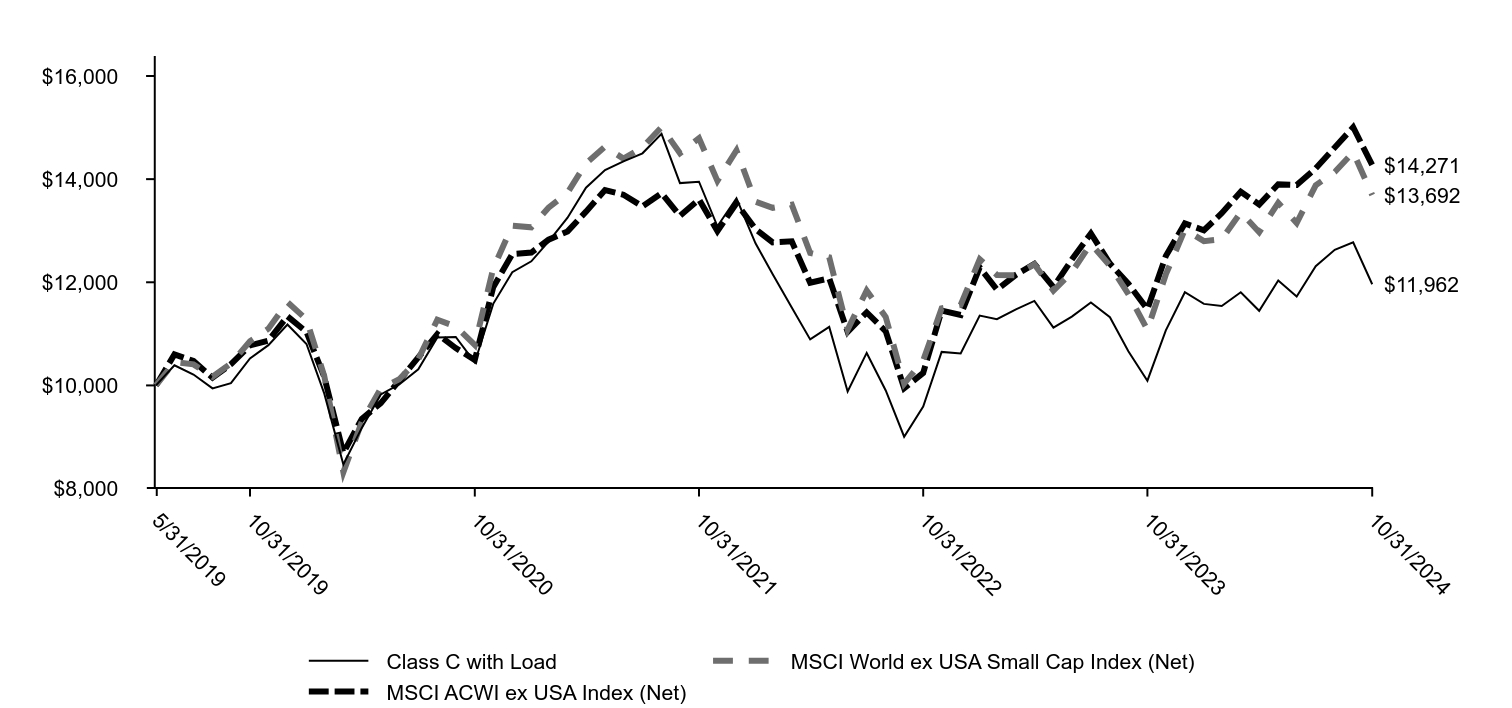

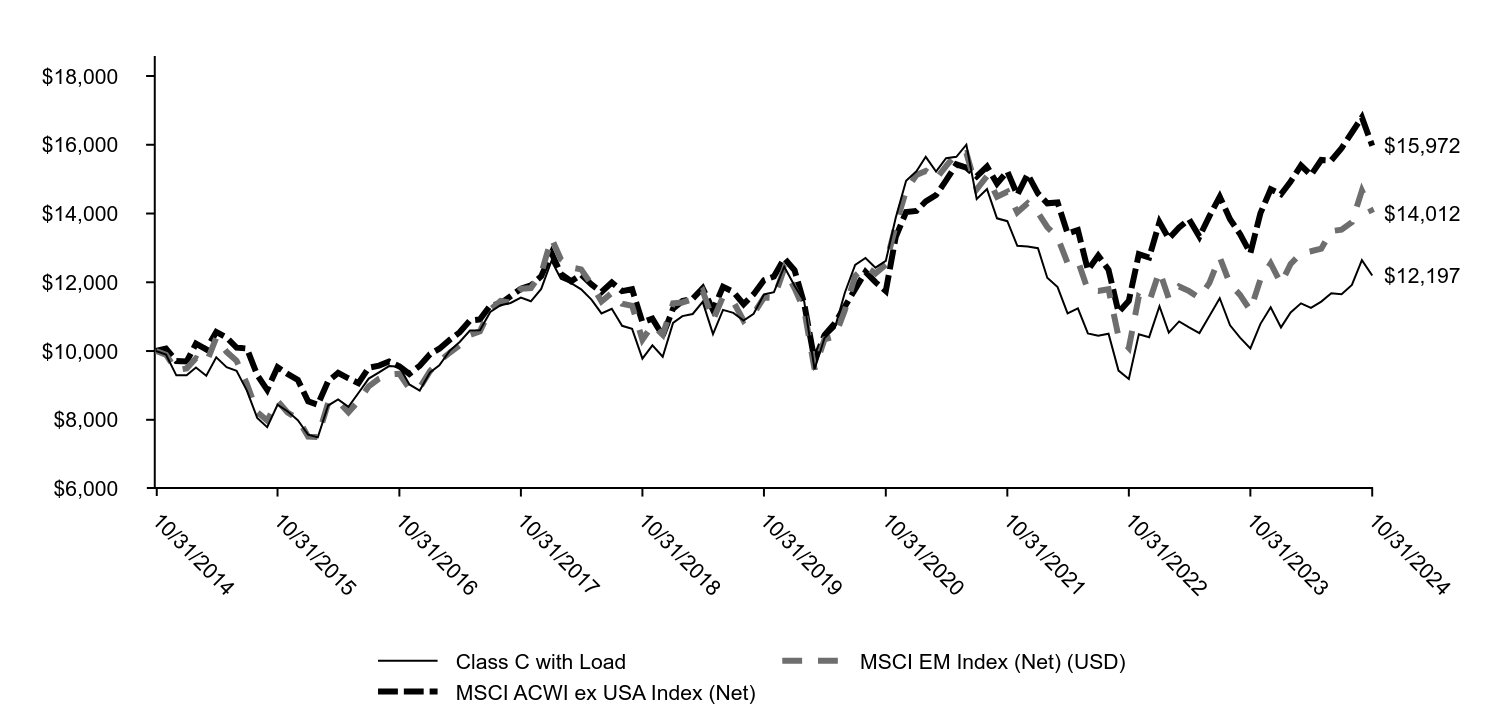

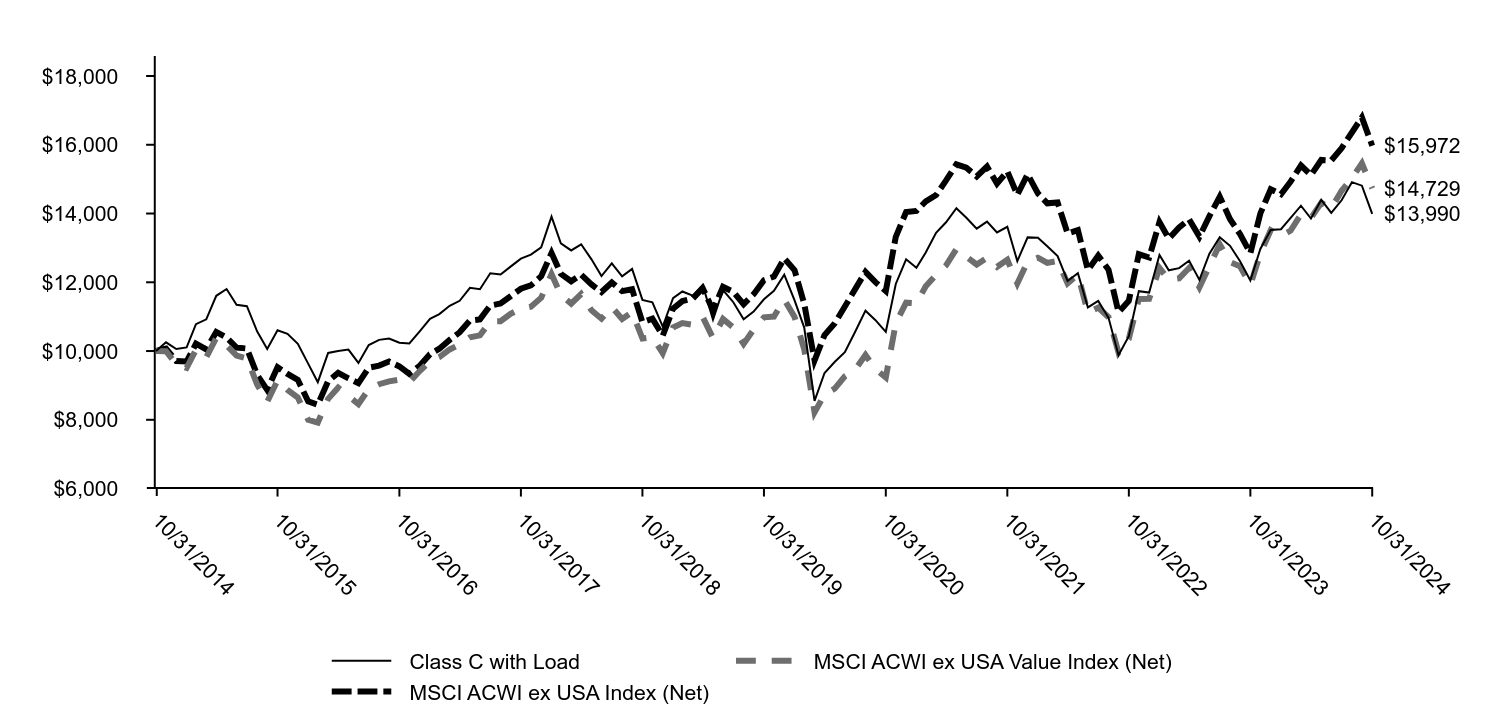

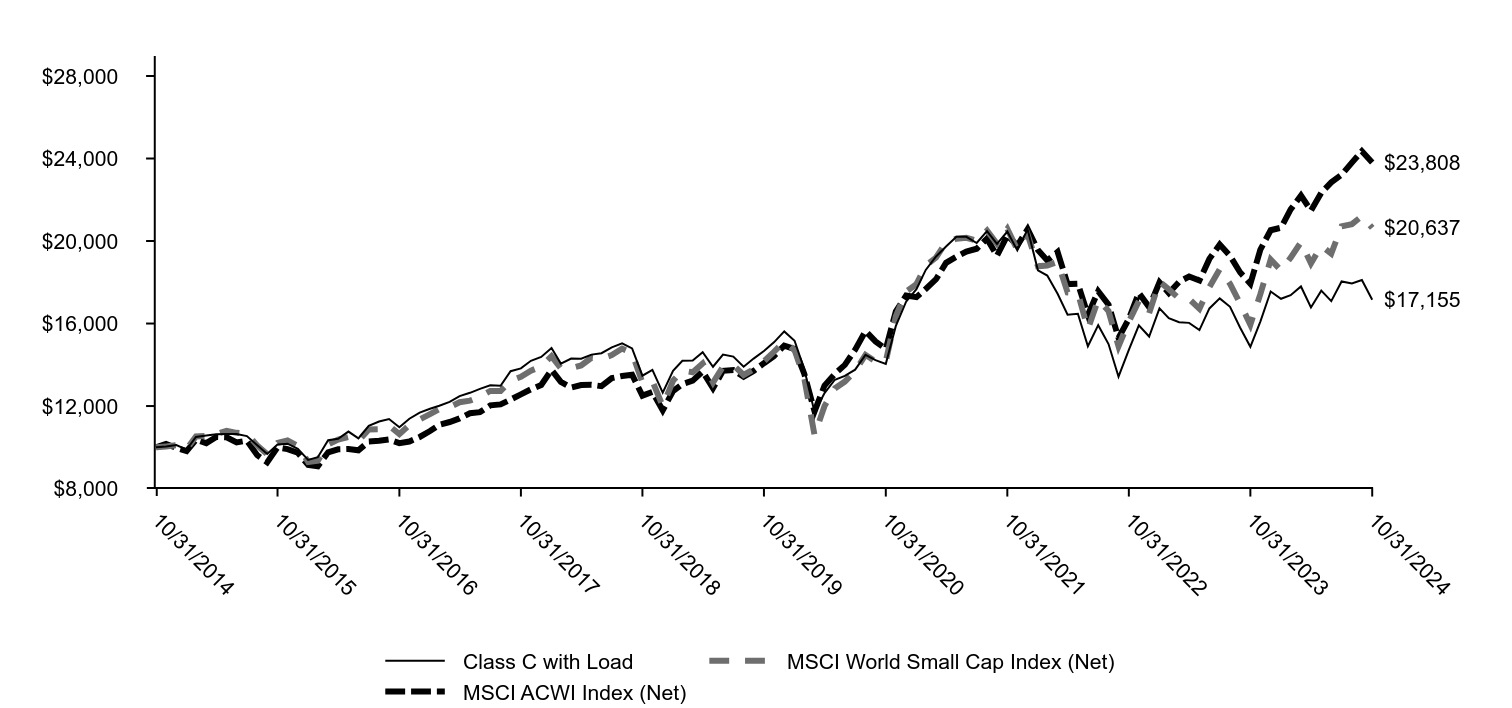

Total return based on a $10,000 investment

| Class C with Load | MSCI EM Index (Net) (USD) | MSCI ACWI ex USA Index (Net) |

|---|

| 10/31/2014 | $10,000 | $10,000 | $10,000 |

| 11/30/2014 | $9,895 | $9,894 | $10,072 |

| 12/31/2014 | $9,293 | $9,438 | $9,709 |

| 1/31/2015 | $9,293 | $9,495 | $9,695 |

| 2/28/2015 | $9,520 | $9,789 | $10,213 |

| 3/31/2015 | $9,282 | $9,650 | $10,048 |

| 4/30/2015 | $9,818 | $10,392 | $10,556 |

| 5/31/2015 | $9,531 | $9,976 | $10,391 |

| 6/30/2015 | $9,426 | $9,717 | $10,101 |

| 7/31/2015 | $8,851 | $9,043 | $10,073 |

| 8/31/2015 | $8,056 | $8,225 | $9,303 |

| 9/30/2015 | $7,786 | $7,978 | $8,872 |

| 10/31/2015 | $8,437 | $8,547 | $9,532 |

| 11/30/2015 | $8,250 | $8,213 | $9,335 |

| 12/31/2015 | $7,990 | $8,030 | $9,159 |

| 1/31/2016 | $7,565 | $7,509 | $8,536 |

| 2/29/2016 | $7,488 | $7,497 | $8,439 |

| 3/31/2016 | $8,415 | $8,489 | $9,125 |

| 4/30/2016 | $8,592 | $8,535 | $9,365 |

| 5/31/2016 | $8,377 | $8,217 | $9,207 |

| 6/30/2016 | $8,780 | $8,545 | $9,066 |

| 7/31/2016 | $9,199 | $8,975 | $9,515 |

| 8/31/2016 | $9,382 | $9,198 | $9,575 |

| 9/30/2016 | $9,564 | $9,317 | $9,693 |

| 10/31/2016 | $9,542 | $9,339 | $9,553 |

| 11/30/2016 | $9,028 | $8,909 | $9,332 |

| 12/31/2016 | $8,851 | $8,929 | $9,571 |

| 1/31/2017 | $9,376 | $9,417 | $9,910 |

| 2/28/2017 | $9,586 | $9,705 | $10,068 |

| 3/31/2017 | $10,006 | $9,950 | $10,324 |

| 4/30/2017 | $10,265 | $10,168 | $10,544 |

| 5/31/2017 | $10,596 | $10,469 | $10,887 |

| 6/30/2017 | $10,602 | $10,574 | $10,920 |

| 7/31/2017 | $11,137 | $11,205 | $11,323 |

| 8/31/2017 | $11,331 | $11,455 | $11,382 |

| 9/30/2017 | $11,397 | $11,409 | $11,593 |

| 10/31/2017 | $11,552 | $11,809 | $11,812 |

| 11/30/2017 | $11,447 | $11,833 | $11,908 |

| 12/31/2017 | $11,806 | $12,257 | $12,174 |

| 1/31/2018 | $12,628 | $13,279 | $12,852 |

| 2/28/2018 | $12,104 | $12,667 | $12,246 |

| 3/31/2018 | $11,977 | $12,431 | $12,030 |

| 4/30/2018 | $11,795 | $12,376 | $12,222 |

| 5/31/2018 | $11,496 | $11,938 | $11,940 |

| 6/30/2018 | $11,093 | $11,442 | $11,715 |

| 7/31/2018 | $11,231 | $11,693 | $11,995 |

| 8/31/2018 | $10,734 | $11,377 | $11,744 |

| 9/30/2018 | $10,646 | $11,316 | $11,798 |

| 10/31/2018 | $9,779 | $10,331 | $10,838 |

| 11/30/2018 | $10,166 | $10,757 | $10,941 |

| 12/31/2018 | $9,834 | $10,472 | $10,446 |

| 1/31/2019 | $10,817 | $11,389 | $11,235 |

| 2/28/2019 | $11,016 | $11,414 | $11,454 |

| 3/31/2019 | $11,077 | $11,510 | $11,523 |

| 4/30/2019 | $11,430 | $11,752 | $11,827 |

| 5/31/2019 | $10,491 | $10,900 | $11,192 |

| 6/30/2019 | $11,198 | $11,580 | $11,866 |

| 7/31/2019 | $11,110 | $11,438 | $11,723 |

| 8/31/2019 | $10,889 | $10,881 | $11,361 |

| 9/30/2019 | $11,082 | $11,088 | $11,653 |

| 10/31/2019 | $11,646 | $11,556 | $12,059 |

| 11/30/2019 | $11,712 | $11,540 | $12,166 |

| 12/31/2019 | $12,452 | $12,401 | $12,693 |

| 1/31/2020 | $11,900 | $11,823 | $12,352 |

| 2/29/2020 | $11,441 | $11,199 | $11,375 |

| 3/31/2020 | $9,470 | $9,474 | $9,728 |

| 4/30/2020 | $10,381 | $10,342 | $10,465 |

| 5/31/2020 | $10,674 | $10,421 | $10,808 |

| 6/30/2020 | $11,695 | $11,187 | $11,296 |

| 7/31/2020 | $12,507 | $12,187 | $11,800 |

| 8/31/2020 | $12,706 | $12,457 | $12,305 |

| 9/30/2020 | $12,424 | $12,257 | $12,003 |

| 10/31/2020 | $12,623 | $12,509 | $11,745 |

| 11/30/2020 | $13,887 | $13,666 | $13,324 |

| 12/31/2020 | $14,953 | $14,671 | $14,045 |

| 1/31/2021 | $15,229 | $15,121 | $14,075 |

| 2/28/2021 | $15,649 | $15,236 | $14,354 |

| 3/31/2021 | $15,218 | $15,006 | $14,535 |

| 4/30/2021 | $15,610 | $15,380 | $14,963 |

| 5/31/2021 | $15,649 | $15,737 | $15,431 |

| 6/30/2021 | $16,002 | $15,764 | $15,331 |

| 7/31/2021 | $14,423 | $14,703 | $15,079 |

| 8/31/2021 | $14,710 | $15,088 | $15,365 |

| 9/30/2021 | $13,860 | $14,488 | $14,873 |

| 10/31/2021 | $13,777 | $14,631 | $15,228 |

| 11/30/2021 | $13,059 | $14,035 | $14,542 |

| 12/31/2021 | $13,043 | $14,298 | $15,143 |

| 1/31/2022 | $12,993 | $14,027 | $14,585 |

| 2/28/2022 | $12,131 | $13,608 | $14,297 |

| 3/31/2022 | $11,861 | $13,301 | $14,320 |

| 4/30/2022 | $11,093 | $12,561 | $13,420 |

| 5/31/2022 | $11,242 | $12,616 | $13,517 |

| 6/30/2022 | $10,514 | $11,778 | $12,354 |

| 7/31/2022 | $10,442 | $11,749 | $12,777 |

| 8/31/2022 | $10,502 | $11,798 | $12,366 |

| 9/30/2022 | $9,431 | $10,415 | $11,130 |

| 10/31/2022 | $9,188 | $10,092 | $11,463 |

| 11/30/2022 | $10,486 | $11,588 | $12,816 |

| 12/31/2022 | $10,403 | $11,425 | $12,720 |

| 1/31/2023 | $11,302 | $12,328 | $13,752 |

| 2/28/2023 | $10,536 | $11,528 | $13,269 |

| 3/31/2023 | $10,862 | $11,877 | $13,593 |

| 4/30/2023 | $10,687 | $11,743 | $13,830 |

| 5/31/2023 | $10,522 | $11,546 | $13,327 |

| 6/30/2023 | $11,018 | $11,984 | $13,925 |

| 7/31/2023 | $11,536 | $12,730 | $14,491 |

| 8/31/2023 | $10,747 | $11,946 | $13,836 |

| 9/30/2023 | $10,389 | $11,633 | $13,399 |

| 10/31/2023 | $10,077 | $11,181 | $12,847 |

| 11/30/2023 | $10,784 | $12,076 | $14,003 |

| 12/31/2023 | $11,275 | $12,548 | $14,706 |

| 1/31/2024 | $10,687 | $11,966 | $14,560 |

| 2/29/2024 | $11,123 | $12,535 | $14,929 |

| 3/31/2024 | $11,387 | $12,845 | $15,396 |

| 4/30/2024 | $11,257 | $12,903 | $15,119 |

| 5/31/2024 | $11,438 | $12,976 | $15,558 |

| 6/30/2024 | $11,683 | $13,488 | $15,543 |

| 7/31/2024 | $11,655 | $13,528 | $15,903 |

| 8/31/2024 | $11,924 | $13,746 | $16,356 |

| 9/30/2024 | $12,642 | $14,664 | $16,797 |

| 10/31/2024 | $12,197 | $14,012 | $15,972 |

Emerging Markets Equity Fund

Annual Shareholder Report | October 31, 2024

AVERAGE ANNUAL TOTAL RETURNS (%)

| Total net assets | $3,882,963,501 |

| # of portfolio holdings | 122 |

| Portfolio turnover rate | 10% |

| Total advisory fees paid | $36,864,032 |

| AATR | 1 Year | 5 Years | 10 Years |

|---|

| Class C | 20.17 | 0.62 | 2.01 |

| Class C with Load | 19.17 | 0.62 | 2.01 |

| MSCI EM Index (Net) (USD) (Strategy) | 25.32 | 3.93 | 3.43 |

| MSCI ACWI ex USA Index (Net) (Regulatory) | 24.33 | 5.78 | 4.79 |

Figures quoted represent past performance, which is no guarantee of future results, and do not reflect taxes that a shareholder may pay on an investment in a fund.

What did the Fund invest in?

(Based on long-term investments)

TOP TEN HOLDINGS (% OF NET ASSETS)

| Taiwan Semiconductor Manufacturing Co. Ltd. ADR | 6.5 |

| Taiwan Semiconductor Manufacturing Co. Ltd. | 5.3 |

| Tencent Holdings Ltd. | 5.3 |

| Samsung Electronics Co. Ltd. Korea Exchange | 4.8 |

| Reliance Industries Ltd. London Stock Exchange GDR | 3.7 |

| Meituan Class B | 2.5 |

| Bharti Airtel Ltd. | 2.3 |

| HDFC Bank Ltd. | 2.2 |

| WH Group Ltd. | 2.1 |

| Alibaba Group Holding Ltd. New York Stock Exchange ADR | 2.1 |

COUNTRY ALLOCATION (% OF LONG-TERM INVESTMENTS)

| China | 20.6 |

| India | 17.2 |

| Taiwan | 15.9 |

| South Korea | 12.6 |

| Brazil | 5.3 |

| Mexico | 4.5 |

| Hong Kong | 4.4 |

| Indonesia | 4.1 |

| South Africa | 3.6 |

| Thailand | 2.6 |

| Other | 9.2 |

SECTOR ALLOCATION (% OF LONG-TERM INVESTMENTS)

| Information technology | 22.5 |

| Communication services | 17.1 |

| Consumer staples | 15.5 |

| Financials | 14.0 |

| Consumer discretionary | 13.1 |

| Energy | 5.7 |

| Industrials | 4.5 |

| Materials | 4.2 |

| Real estate | 1.7 |

| Health care | 1.7 |

This is a summary of certain changes and planned changes to the Fund since November 1, 2023.

On October 16, 2024, Prashant Paroda was added as a portfolio manager to the Fund.

You can find additional information on the Fund's website at allspringglobal.com, including its:

- Prospectus - Financial Information - Fund holdings - Proxy voting information

Annual Shareholder Report

Emerging Markets Equity Fund

This annual shareholder report contains important information about Emerging Markets Equity Fund for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at allspringglobal.com. You can also request this information by contacting us at 1-800-222-8222.

This report describes changes to the Fund that occurred either during or after the reporting period.

What were the Fund costs for the past year?

The table explains the costs you would have paid within the reporting period based on a hypothetical $10,000 investment.

| CLASS NAME | COSTS OF A $10,000 INVESTMENT | COSTS PAID AS A % OF A $10,000 INVESTMENT |

|---|

| Class A | $157 | 1.42% |

The manager has contractually committed to waive fees and/or reimburse certain expenses to the extent necessary to cap the Fund's total annual fund operating expense ratio at a specific amount. Without this cap, the costs shown above may have been higher. Please see the prospectus for the amount and the expiration date of the cap. Prior to or after the commitment expiration date, the cap may be increased or the commitment to maintain the cap may be terminated only with the approval of the Board of Trustees.

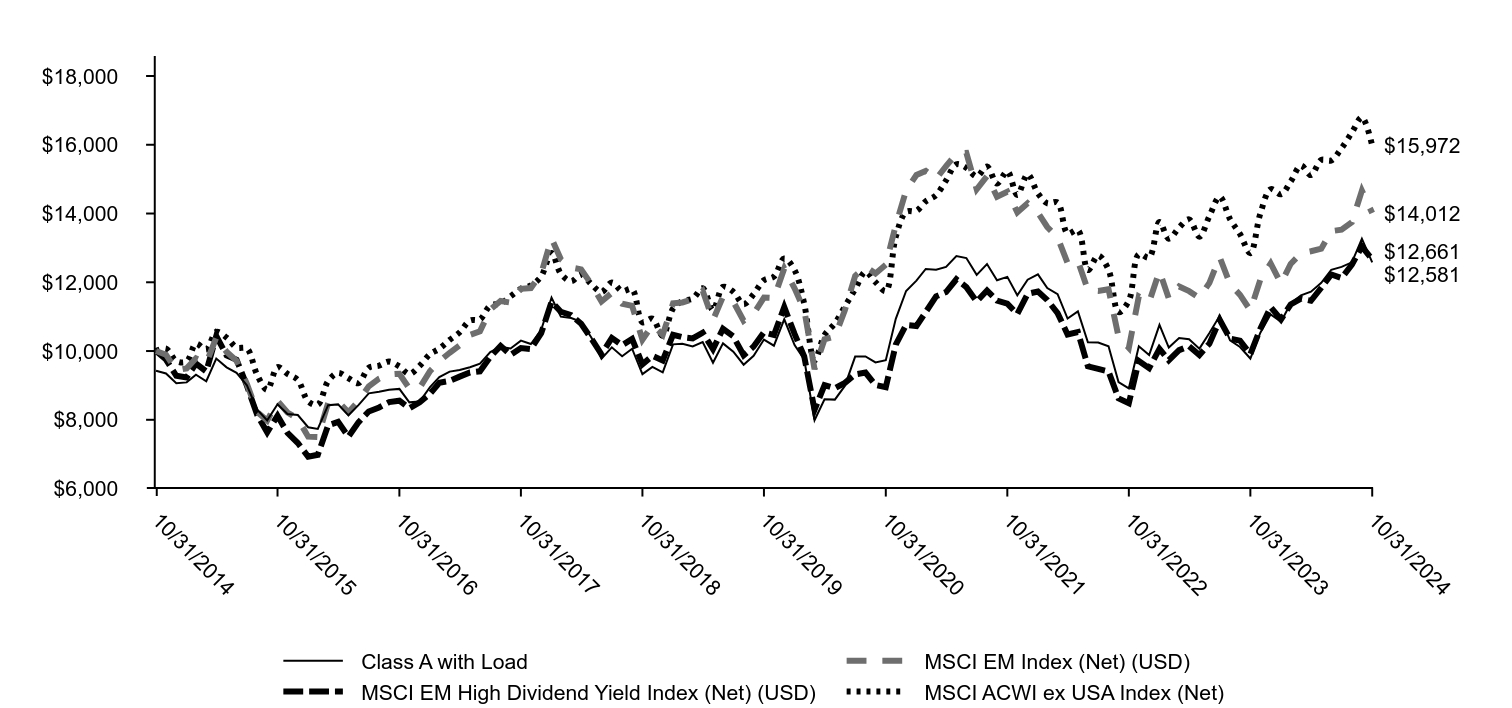

How did the Fund perform last year and what affected its performance?

Improving company fundamentals and macro tailwinds supported emerging market equities during the period. Key drivers included growing corporate focus on return on capital, momentum factor performance, China’s efforts to resuscitate its economy, resilient Indian economic growth, monetary easing, and demand for technology related to artificial intelligence. All sectors and 22 out of 24 countries rose. The top sectors were information technology (IT), financials, and consumer discretionary. Leading countries were Taiwan, India, and China. The portfolio benefited from strong stock selection in Taiwan, Poland, Chile, IT, and consumer discretionary. Taiwan Semiconductor Manufacturing Company Limited and Bharti Airtel Limited, the Indian telecom provider, were leading contributors. The portfolio was hurt by stock selection in India, Mexico, and financials and by being underweight to the strong Mexico market. Samsung Electronics Company, Limited, and AIA Group Limited, a pan-Asia insurance firm, were the largest detractors. During the period, the portfolio added exposure to Poland, materials, and industrials and reduced exposure to Mexico and consumer staples.

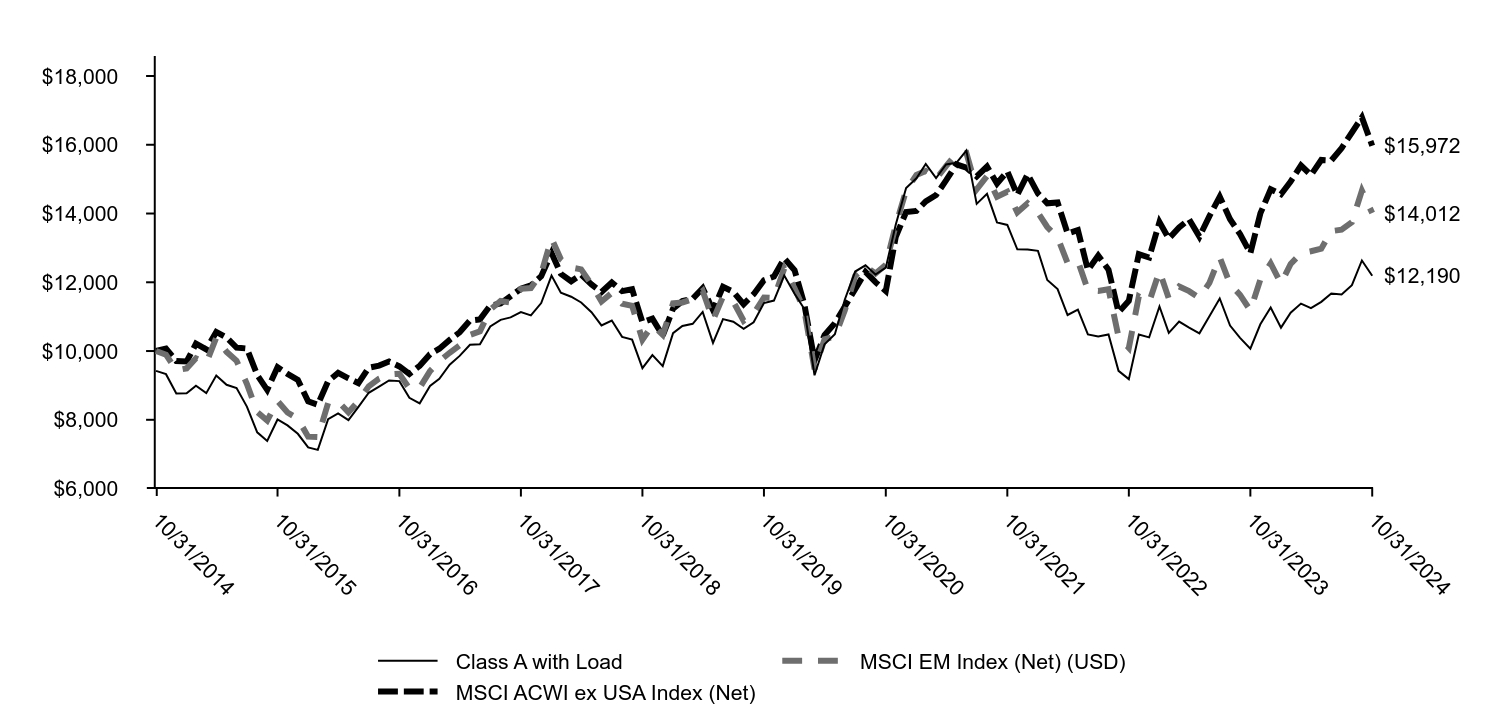

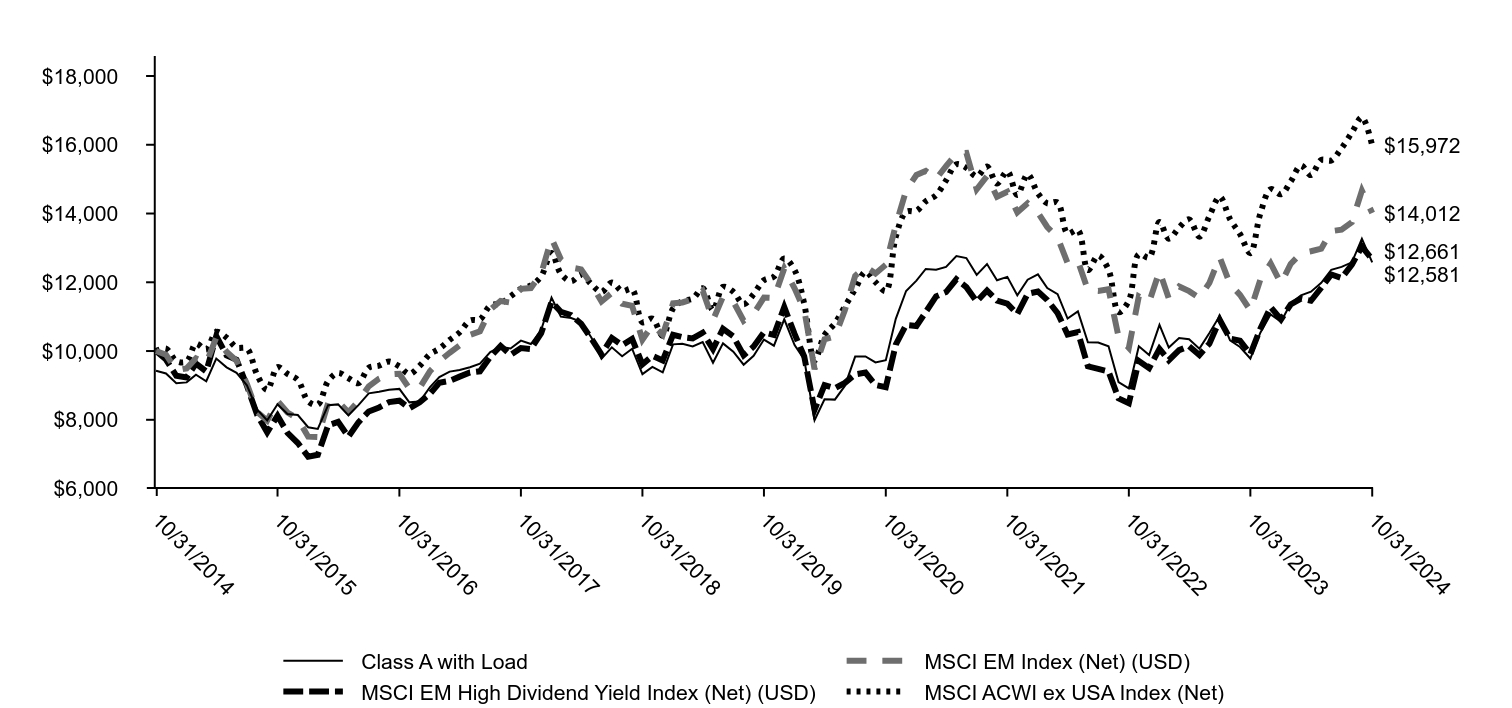

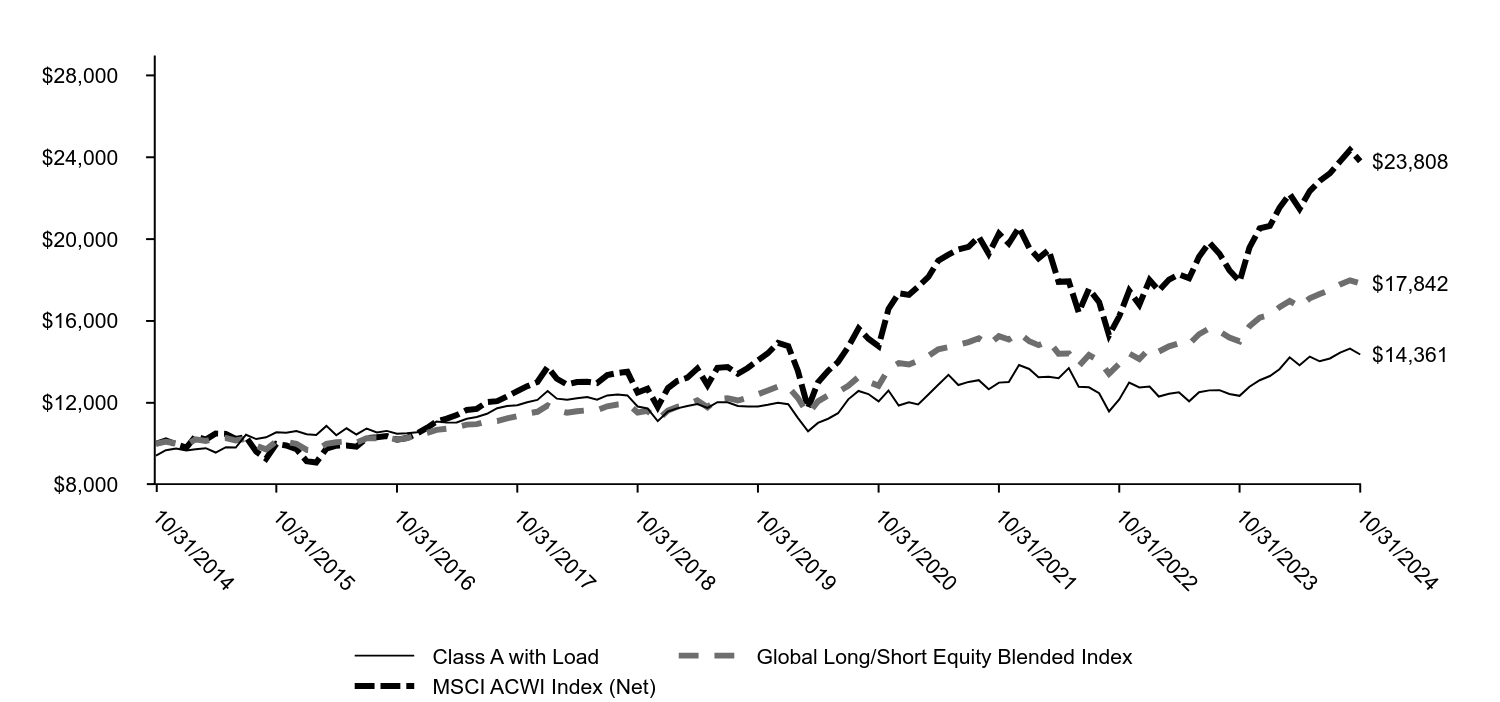

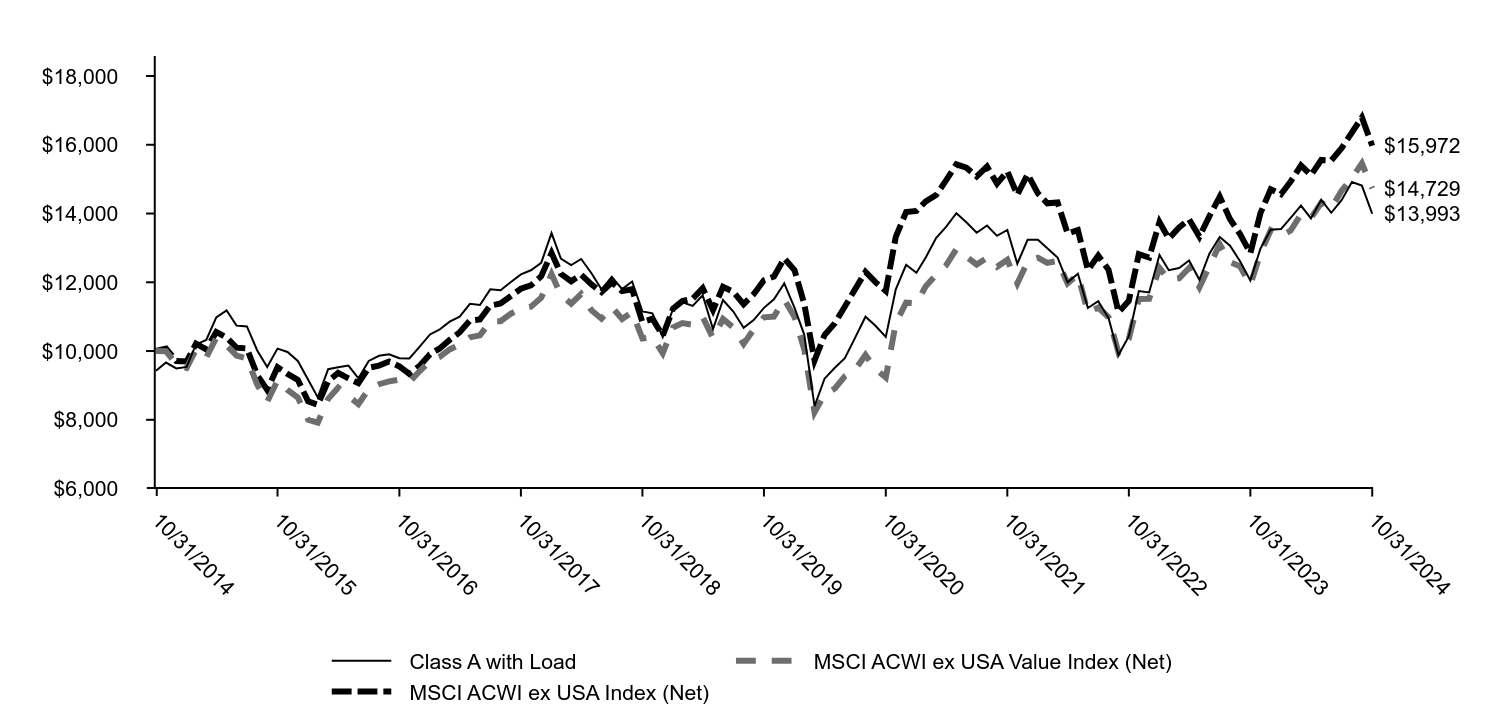

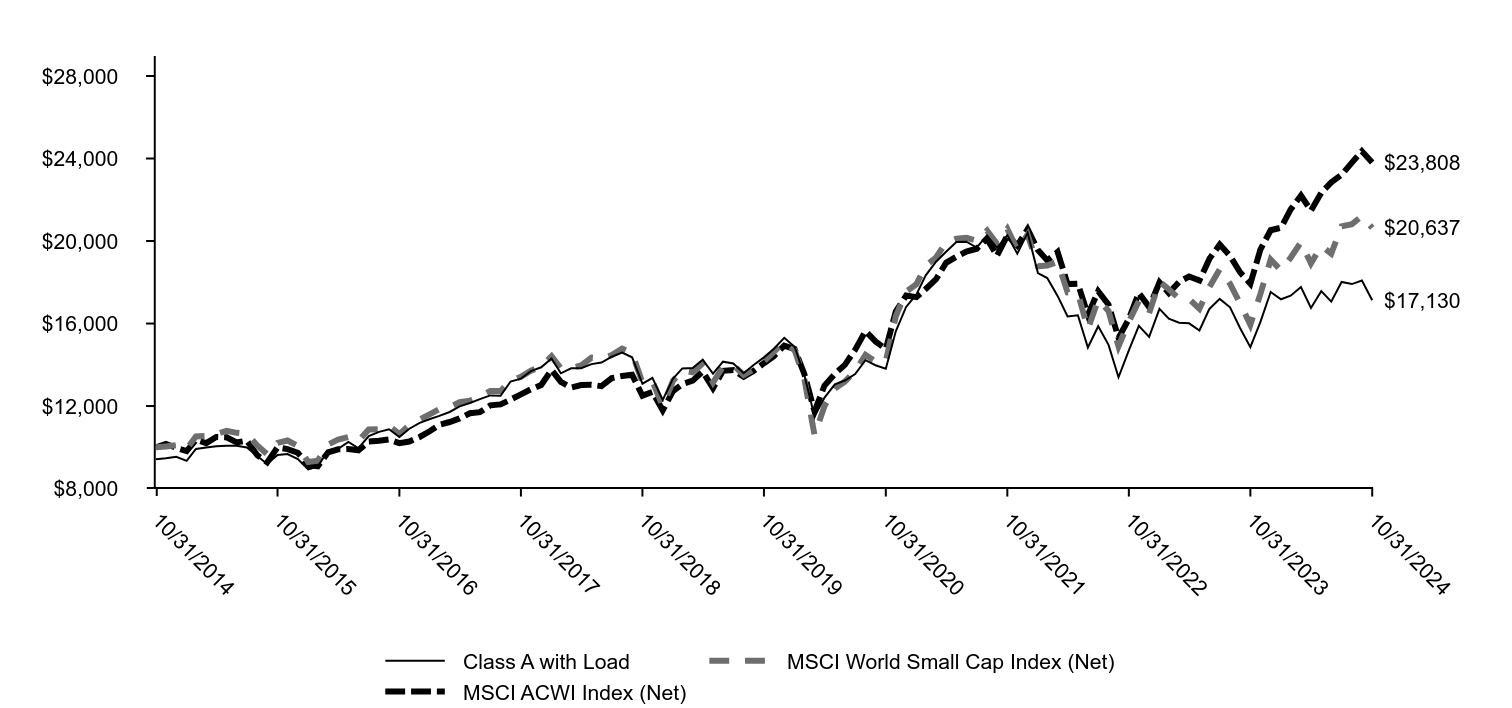

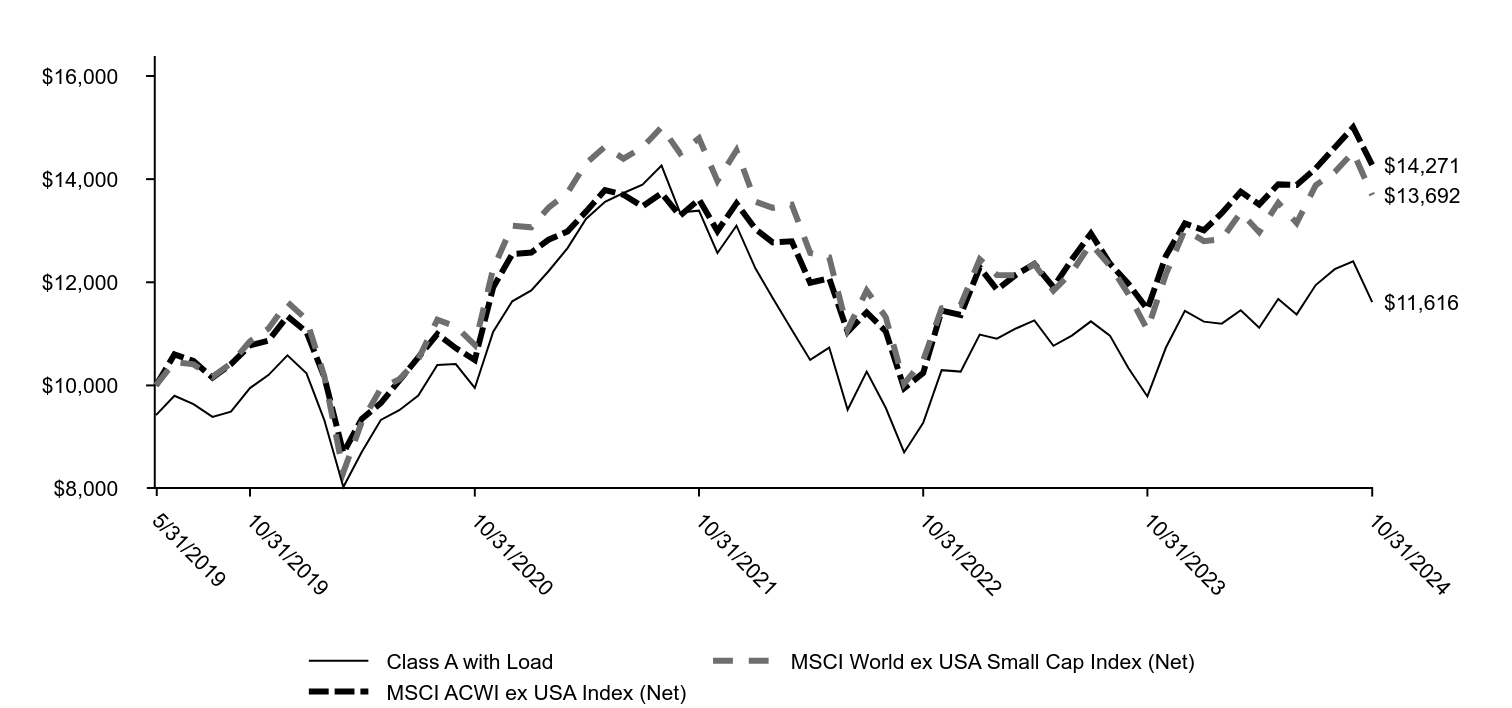

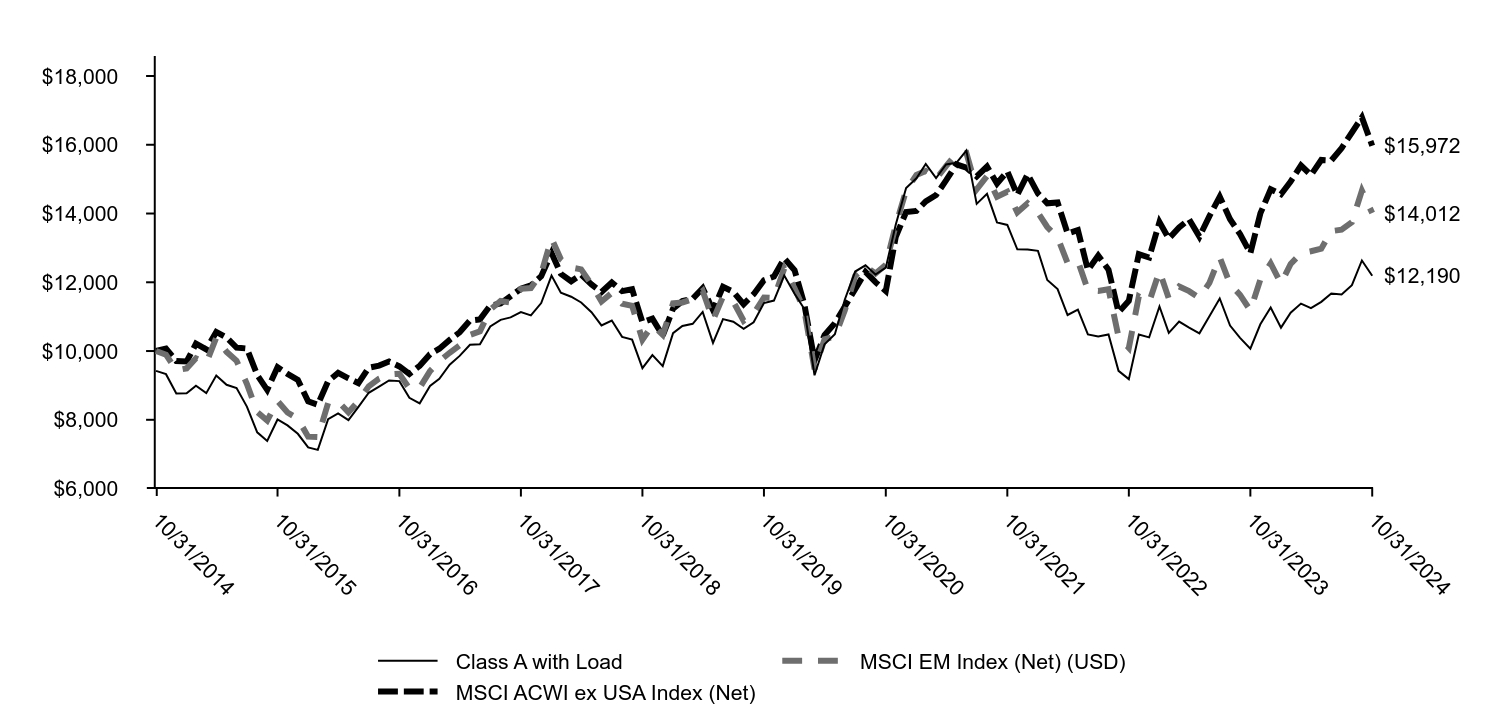

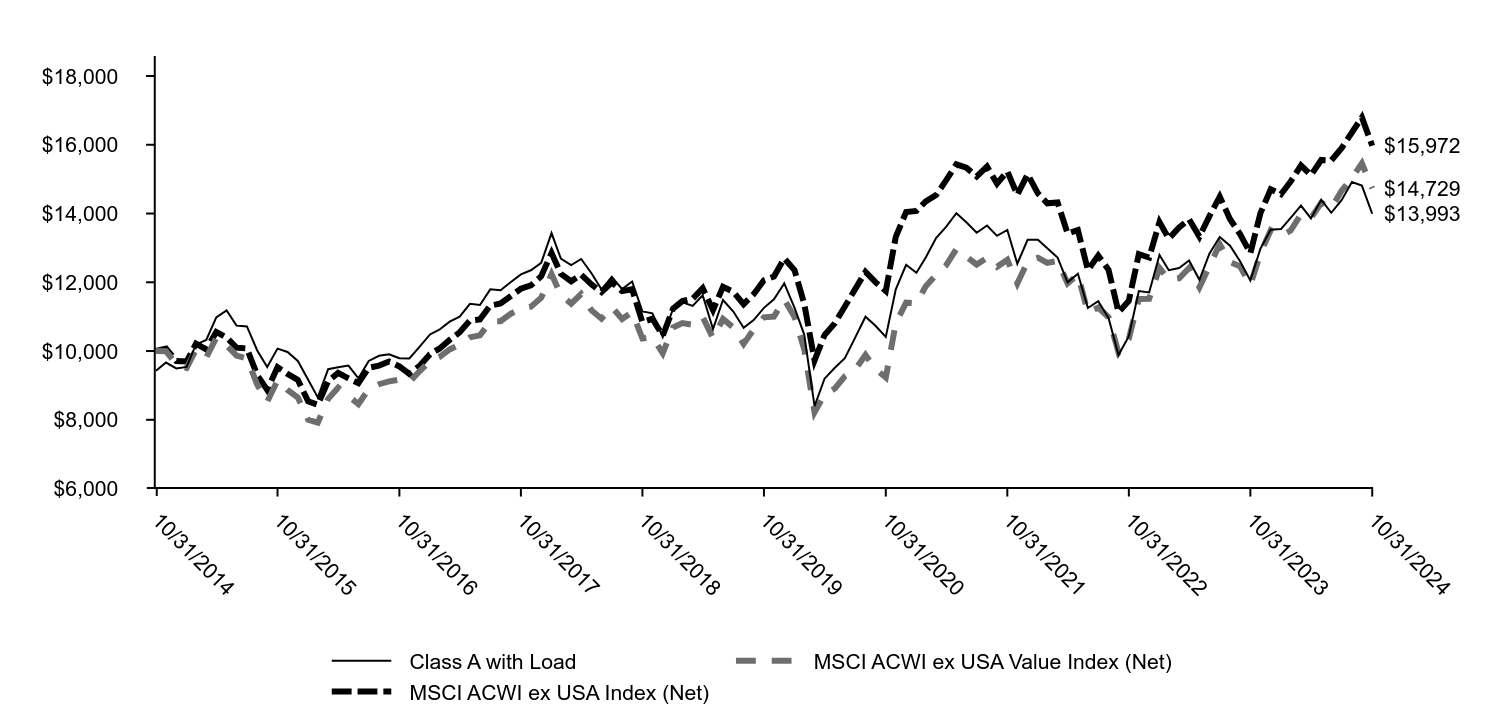

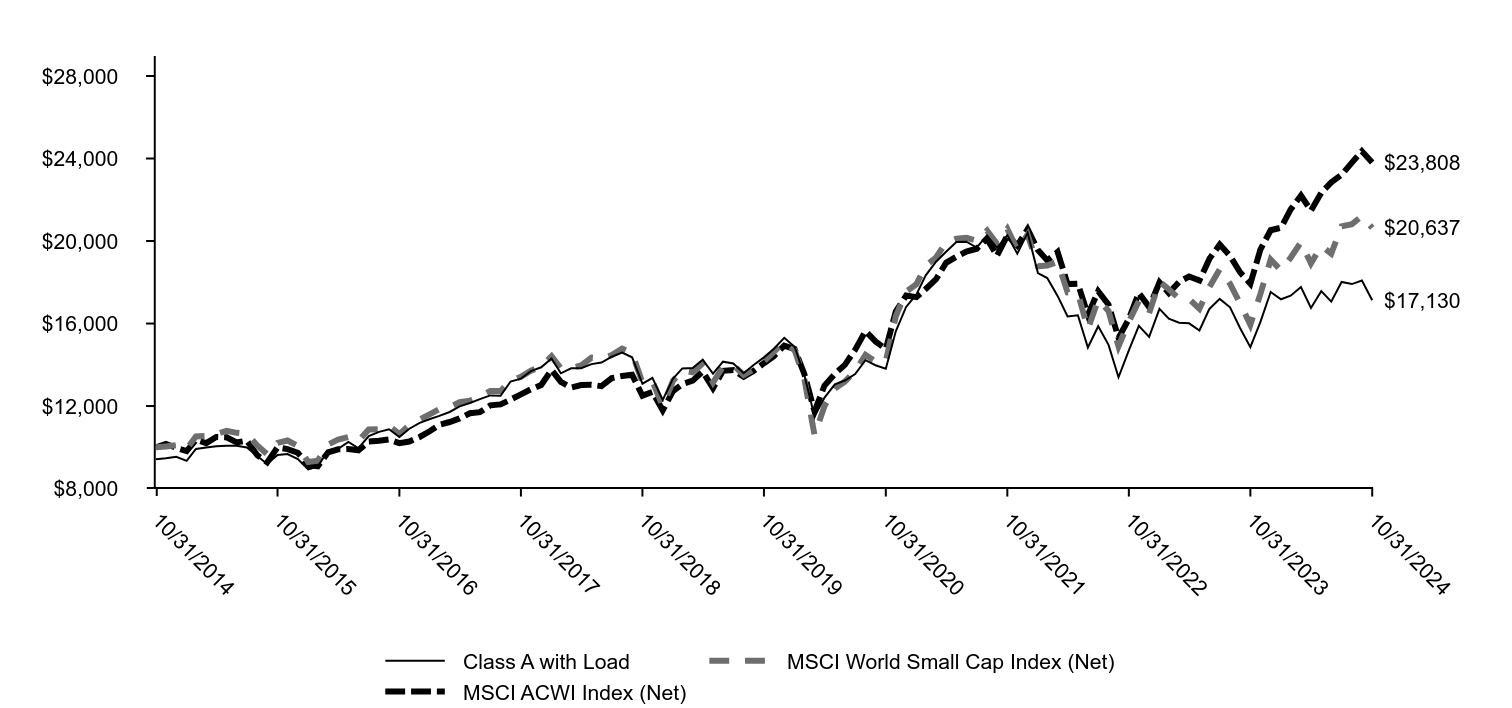

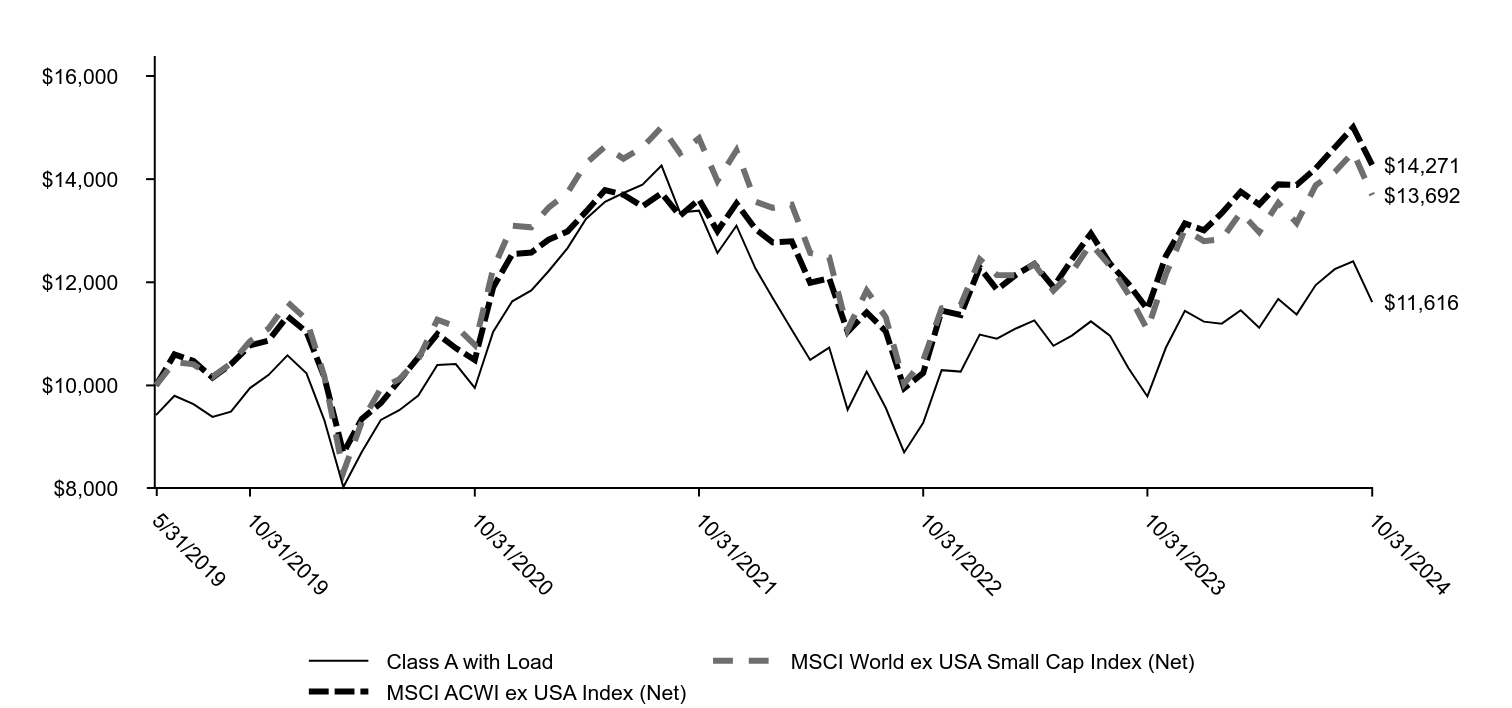

Total return based on a $10,000 investment

| Class A with Load | MSCI EM Index (Net) (USD) | MSCI ACWI ex USA Index (Net) |

|---|

| 10/31/2014 | $9,424 | $10,000 | $10,000 |

| 11/30/2014 | $9,327 | $9,894 | $10,072 |

| 12/31/2014 | $8,766 | $9,438 | $9,709 |

| 1/31/2015 | $8,770 | $9,495 | $9,695 |

| 2/28/2015 | $8,992 | $9,789 | $10,213 |

| 3/31/2015 | $8,775 | $9,650 | $10,048 |

| 4/30/2015 | $9,288 | $10,392 | $10,556 |

| 5/31/2015 | $9,018 | $9,976 | $10,391 |

| 6/30/2015 | $8,925 | $9,717 | $10,101 |

| 7/31/2015 | $8,385 | $9,043 | $10,073 |

| 8/31/2015 | $7,637 | $8,225 | $9,303 |

| 9/30/2015 | $7,385 | $7,978 | $8,872 |

| 10/31/2015 | $8,009 | $8,547 | $9,532 |

| 11/30/2015 | $7,836 | $8,213 | $9,335 |

| 12/31/2015 | $7,593 | $8,030 | $9,159 |

| 1/31/2016 | $7,197 | $7,509 | $8,536 |

| 2/29/2016 | $7,125 | $7,497 | $8,439 |

| 3/31/2016 | $8,016 | $8,489 | $9,125 |

| 4/30/2016 | $8,185 | $8,535 | $9,365 |

| 5/31/2016 | $7,989 | $8,217 | $9,207 |

| 6/30/2016 | $8,377 | $8,545 | $9,066 |

| 7/31/2016 | $8,786 | $8,975 | $9,515 |

| 8/31/2016 | $8,965 | $9,198 | $9,575 |

| 9/30/2016 | $9,143 | $9,317 | $9,693 |

| 10/31/2016 | $9,125 | $9,339 | $9,553 |

| 11/30/2016 | $8,639 | $8,909 | $9,332 |

| 12/31/2016 | $8,478 | $8,929 | $9,571 |

| 1/31/2017 | $8,984 | $9,417 | $9,910 |

| 2/28/2017 | $9,191 | $9,705 | $10,068 |

| 3/31/2017 | $9,603 | $9,950 | $10,324 |

| 4/30/2017 | $9,859 | $10,168 | $10,544 |

| 5/31/2017 | $10,181 | $10,469 | $10,887 |

| 6/30/2017 | $10,195 | $10,574 | $10,920 |

| 7/31/2017 | $10,715 | $11,205 | $11,323 |

| 8/31/2017 | $10,908 | $11,455 | $11,382 |

| 9/30/2017 | $10,979 | $11,409 | $11,593 |

| 10/31/2017 | $11,132 | $11,809 | $11,812 |

| 11/30/2017 | $11,038 | $11,833 | $11,908 |

| 12/31/2017 | $11,396 | $12,257 | $12,174 |

| 1/31/2018 | $12,195 | $13,279 | $12,852 |

| 2/28/2018 | $11,696 | $12,667 | $12,246 |

| 3/31/2018 | $11,580 | $12,431 | $12,030 |

| 4/30/2018 | $11,413 | $12,376 | $12,222 |

| 5/31/2018 | $11,131 | $11,938 | $11,940 |

| 6/30/2018 | $10,744 | $11,442 | $11,715 |

| 7/31/2018 | $10,888 | $11,693 | $11,995 |

| 8/31/2018 | $10,412 | $11,377 | $11,744 |

| 9/30/2018 | $10,331 | $11,316 | $11,798 |

| 10/31/2018 | $9,501 | $10,331 | $10,838 |

| 11/30/2018 | $9,882 | $10,757 | $10,941 |

| 12/31/2018 | $9,562 | $10,472 | $10,446 |

| 1/31/2019 | $10,522 | $11,389 | $11,235 |

| 2/28/2019 | $10,729 | $11,414 | $11,454 |

| 3/31/2019 | $10,793 | $11,510 | $11,523 |

| 4/30/2019 | $11,139 | $11,752 | $11,827 |

| 5/31/2019 | $10,238 | $10,900 | $11,192 |

| 6/30/2019 | $10,928 | $11,580 | $11,866 |

| 7/31/2019 | $10,851 | $11,438 | $11,723 |

| 8/31/2019 | $10,644 | $10,881 | $11,361 |

| 9/30/2019 | $10,838 | $11,088 | $11,653 |

| 10/31/2019 | $11,396 | $11,556 | $12,059 |

| 11/30/2019 | $11,468 | $11,540 | $12,166 |

| 12/31/2019 | $12,199 | $12,401 | $12,693 |

| 1/31/2020 | $11,668 | $11,823 | $12,352 |

| 2/29/2020 | $11,228 | $11,199 | $11,375 |

| 3/31/2020 | $9,295 | $9,474 | $9,728 |

| 4/30/2020 | $10,198 | $10,342 | $10,465 |

| 5/31/2020 | $10,488 | $10,421 | $10,808 |

| 6/30/2020 | $11,500 | $11,187 | $11,296 |

| 7/31/2020 | $12,312 | $12,187 | $11,800 |

| 8/31/2020 | $12,494 | $12,457 | $12,305 |

| 9/30/2020 | $12,226 | $12,257 | $12,003 |

| 10/31/2020 | $12,426 | $12,509 | $11,745 |

| 11/30/2020 | $13,682 | $13,666 | $13,324 |

| 12/31/2020 | $14,744 | $14,671 | $14,045 |

| 1/31/2021 | $15,025 | $15,121 | $14,075 |

| 2/28/2021 | $15,443 | $15,236 | $14,354 |

| 3/31/2021 | $15,030 | $15,006 | $14,535 |

| 4/30/2021 | $15,429 | $15,380 | $14,963 |

| 5/31/2021 | $15,475 | $15,737 | $15,431 |

| 6/30/2021 | $15,833 | $15,764 | $15,331 |

| 7/31/2021 | $14,281 | $14,703 | $15,079 |

| 8/31/2021 | $14,571 | $15,088 | $15,365 |

| 9/30/2021 | $13,741 | $14,488 | $14,873 |

| 10/31/2021 | $13,668 | $14,631 | $15,228 |

| 11/30/2021 | $12,960 | $14,035 | $14,542 |

| 12/31/2021 | $12,955 | $14,298 | $15,143 |

| 1/31/2022 | $12,914 | $14,027 | $14,585 |

| 2/28/2022 | $12,068 | $13,608 | $14,297 |

| 3/31/2022 | $11,804 | $13,301 | $14,320 |

| 4/30/2022 | $11,048 | $12,561 | $13,420 |

| 5/31/2022 | $11,203 | $12,616 | $13,517 |

| 6/30/2022 | $10,484 | $11,778 | $12,354 |

| 7/31/2022 | $10,420 | $11,749 | $12,777 |

| 8/31/2022 | $10,484 | $11,798 | $12,366 |

| 9/30/2022 | $9,424 | $10,415 | $11,130 |

| 10/31/2022 | $9,183 | $10,092 | $11,463 |

| 11/30/2022 | $10,479 | $11,588 | $12,816 |

| 12/31/2022 | $10,397 | $11,425 | $12,720 |

| 1/31/2023 | $11,295 | $12,328 | $13,752 |

| 2/28/2023 | $10,530 | $11,528 | $13,269 |

| 3/31/2023 | $10,855 | $11,877 | $13,593 |

| 4/30/2023 | $10,681 | $11,743 | $13,830 |

| 5/31/2023 | $10,516 | $11,546 | $13,327 |

| 6/30/2023 | $11,011 | $11,984 | $13,925 |

| 7/31/2023 | $11,529 | $12,730 | $14,491 |

| 8/31/2023 | $10,740 | $11,946 | $13,836 |

| 9/30/2023 | $10,383 | $11,633 | $13,399 |

| 10/31/2023 | $10,071 | $11,181 | $12,847 |

| 11/30/2023 | $10,777 | $12,076 | $14,003 |

| 12/31/2023 | $11,268 | $12,548 | $14,706 |

| 1/31/2024 | $10,680 | $11,966 | $14,560 |

| 2/29/2024 | $11,116 | $12,535 | $14,929 |

| 3/31/2024 | $11,380 | $12,845 | $15,396 |

| 4/30/2024 | $11,250 | $12,903 | $15,119 |

| 5/31/2024 | $11,430 | $12,976 | $15,558 |

| 6/30/2024 | $11,676 | $13,488 | $15,543 |

| 7/31/2024 | $11,648 | $13,528 | $15,903 |

| 8/31/2024 | $11,917 | $13,746 | $16,356 |

| 9/30/2024 | $12,634 | $14,664 | $16,797 |

| 10/31/2024 | $12,190 | $14,012 | $15,972 |

Emerging Markets Equity Fund

Annual Shareholder Report | October 31, 2024

AVERAGE ANNUAL TOTAL RETURNS (%)

| Total net assets | $3,882,963,501 |

| # of portfolio holdings | 122 |

| Portfolio turnover rate | 10% |

| Total advisory fees paid | $36,864,032 |

| AATR | 1 Year | 5 Years | 10 Years |

|---|

| Class A | 21.04 | 1.36 | 2.61 |

| Class A with Load | 14.08 | 0.16 | 2.00 |

| MSCI EM Index (Net) (USD) (Strategy) | 25.32 | 3.93 | 3.43 |

| MSCI ACWI ex USA Index (Net) (Regulatory) | 24.33 | 5.78 | 4.79 |

Figures quoted represent past performance, which is no guarantee of future results, and do not reflect taxes that a shareholder may pay on an investment in a fund.

What did the Fund invest in?

(Based on long-term investments)

TOP TEN HOLDINGS (% OF NET ASSETS)

| Taiwan Semiconductor Manufacturing Co. Ltd. ADR | 6.5 |

| Taiwan Semiconductor Manufacturing Co. Ltd. | 5.3 |

| Tencent Holdings Ltd. | 5.3 |

| Samsung Electronics Co. Ltd. Korea Exchange | 4.8 |

| Reliance Industries Ltd. London Stock Exchange GDR | 3.7 |

| Meituan Class B | 2.5 |

| Bharti Airtel Ltd. | 2.3 |

| HDFC Bank Ltd. | 2.2 |

| WH Group Ltd. | 2.1 |

| Alibaba Group Holding Ltd. New York Stock Exchange ADR | 2.1 |

COUNTRY ALLOCATION (% OF LONG-TERM INVESTMENTS)

| China | 20.6 |

| India | 17.2 |

| Taiwan | 15.9 |

| South Korea | 12.6 |

| Brazil | 5.3 |

| Mexico | 4.5 |

| Hong Kong | 4.4 |

| Indonesia | 4.1 |

| South Africa | 3.6 |

| Thailand | 2.6 |

| Other | 9.2 |

SECTOR ALLOCATION (% OF LONG-TERM INVESTMENTS)

| Information technology | 22.5 |

| Communication services | 17.1 |

| Consumer staples | 15.5 |

| Financials | 14.0 |

| Consumer discretionary | 13.1 |

| Energy | 5.7 |

| Industrials | 4.5 |

| Materials | 4.2 |

| Real estate | 1.7 |

| Health care | 1.7 |

This is a summary of certain changes and planned changes to the Fund since November 1, 2023.

On October 16, 2024, Prashant Paroda was added as a portfolio manager to the Fund.

You can find additional information on the Fund's website at allspringglobal.com, including its:

- Prospectus - Financial Information - Fund holdings - Proxy voting information

Annual Shareholder Report

Emerging Markets Equity Fund

This annual shareholder report contains important information about Emerging Markets Equity Fund for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at allspringglobal.com. You can also request this information by contacting us at 1-800-222-8222.

This report describes changes to the Fund that occurred either during or after the reporting period.

What were the Fund costs for the past year?

The table explains the costs you would have paid within the reporting period based on a hypothetical $10,000 investment.

| CLASS NAME | COSTS OF A $10,000 INVESTMENT | COSTS PAID AS A % OF A $10,000 INVESTMENT |

|---|

| Administrator Class | $150 | 1.36% |

The manager has contractually committed to waive fees and/or reimburse certain expenses to the extent necessary to cap the Fund's total annual fund operating expense ratio at a specific amount. Without this cap, the costs shown above may have been higher. Please see the prospectus for the amount and the expiration date of the cap. Prior to or after the commitment expiration date, the cap may be increased or the commitment to maintain the cap may be terminated only with the approval of the Board of Trustees.

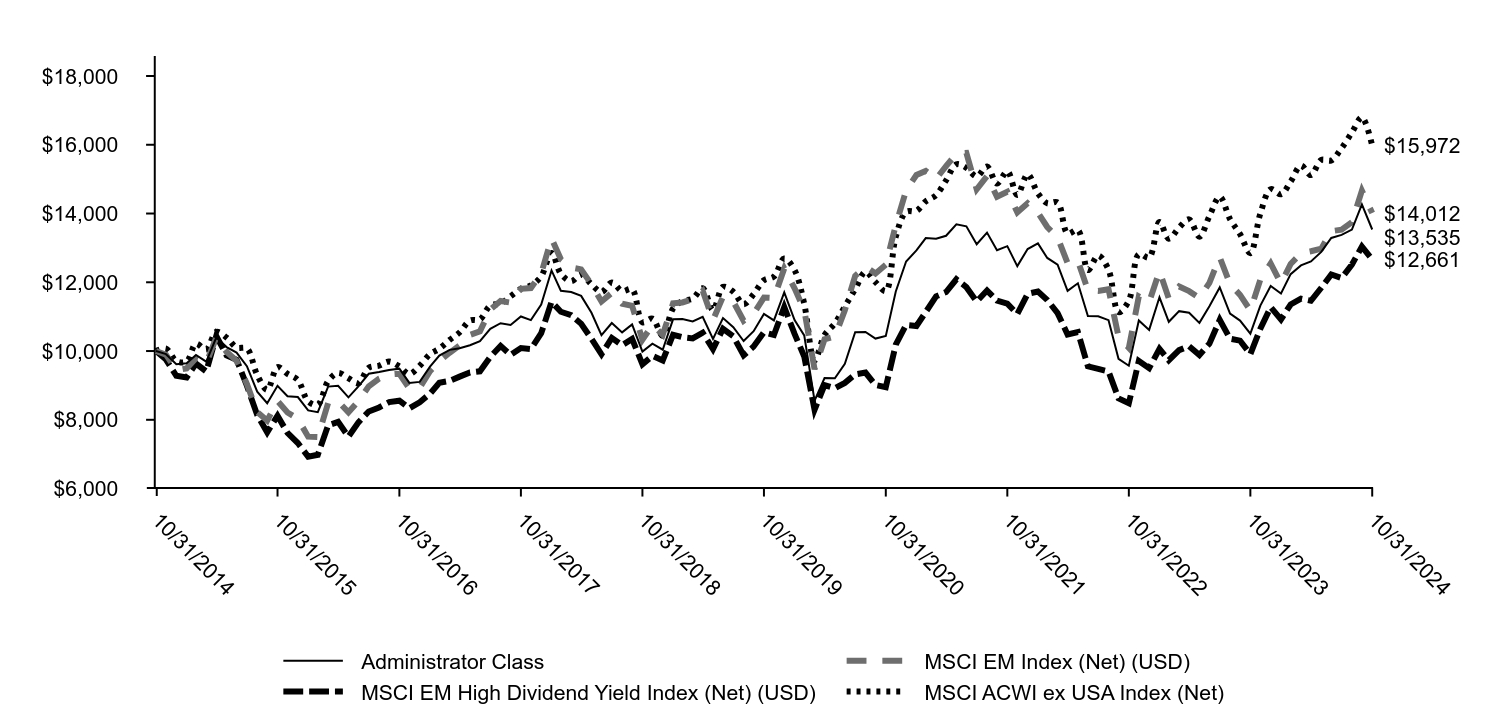

How did the Fund perform last year and what affected its performance?

Improving company fundamentals and macro tailwinds supported emerging market equities during the period. Key drivers included growing corporate focus on return on capital, momentum factor performance, China’s efforts to resuscitate its economy, resilient Indian economic growth, monetary easing, and demand for technology related to artificial intelligence. All sectors and 22 out of 24 countries rose. The top sectors were information technology (IT), financials, and consumer discretionary. Leading countries were Taiwan, India, and China. The portfolio benefited from strong stock selection in Taiwan, Poland, Chile, IT, and consumer discretionary. Taiwan Semiconductor Manufacturing Company Limited and Bharti Airtel Limited, the Indian telecom provider, were leading contributors. The portfolio was hurt by stock selection in India, Mexico, and financials and by being underweight to the strong Mexico market. Samsung Electronics Company, Limited, and AIA Group Limited, a pan-Asia insurance firm, were the largest detractors. During the period, the portfolio added exposure to Poland, materials, and industrials and reduced exposure to Mexico and consumer staples.

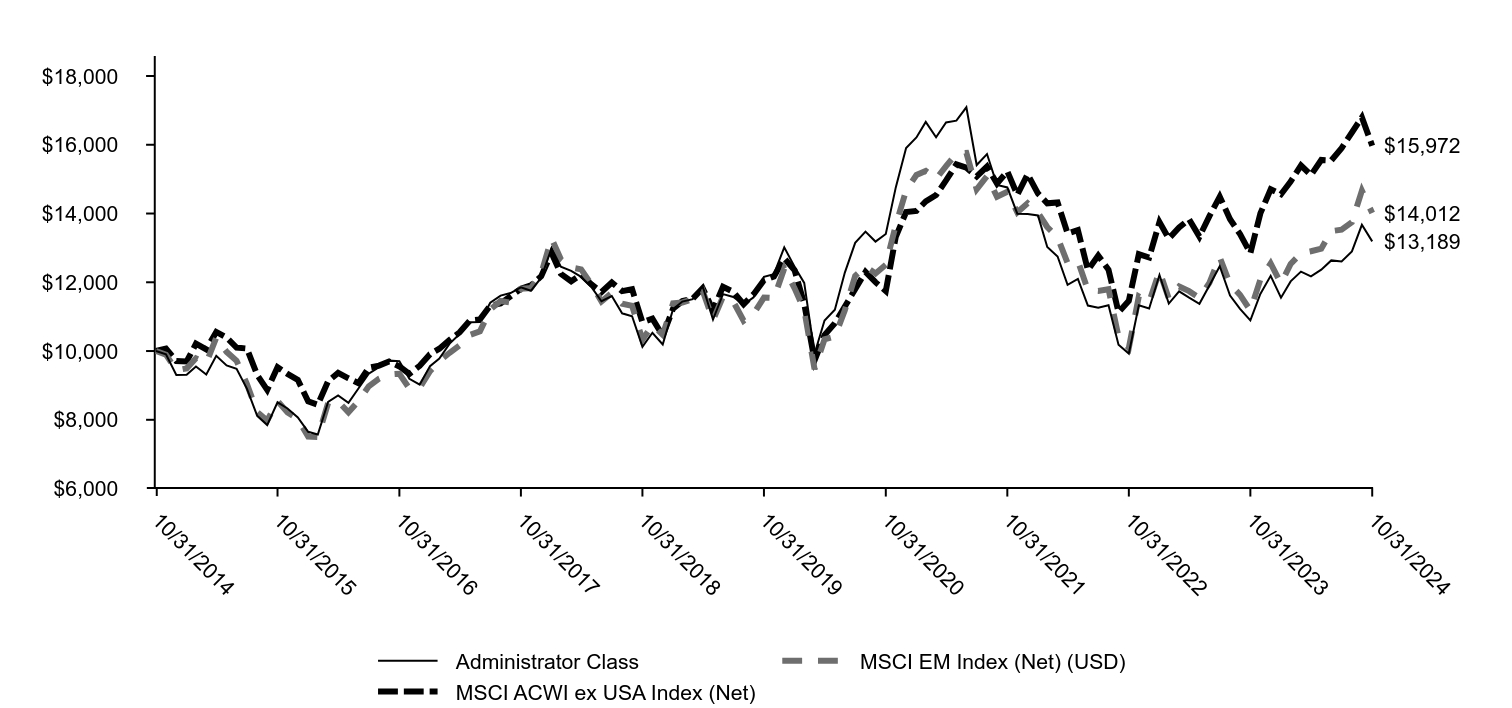

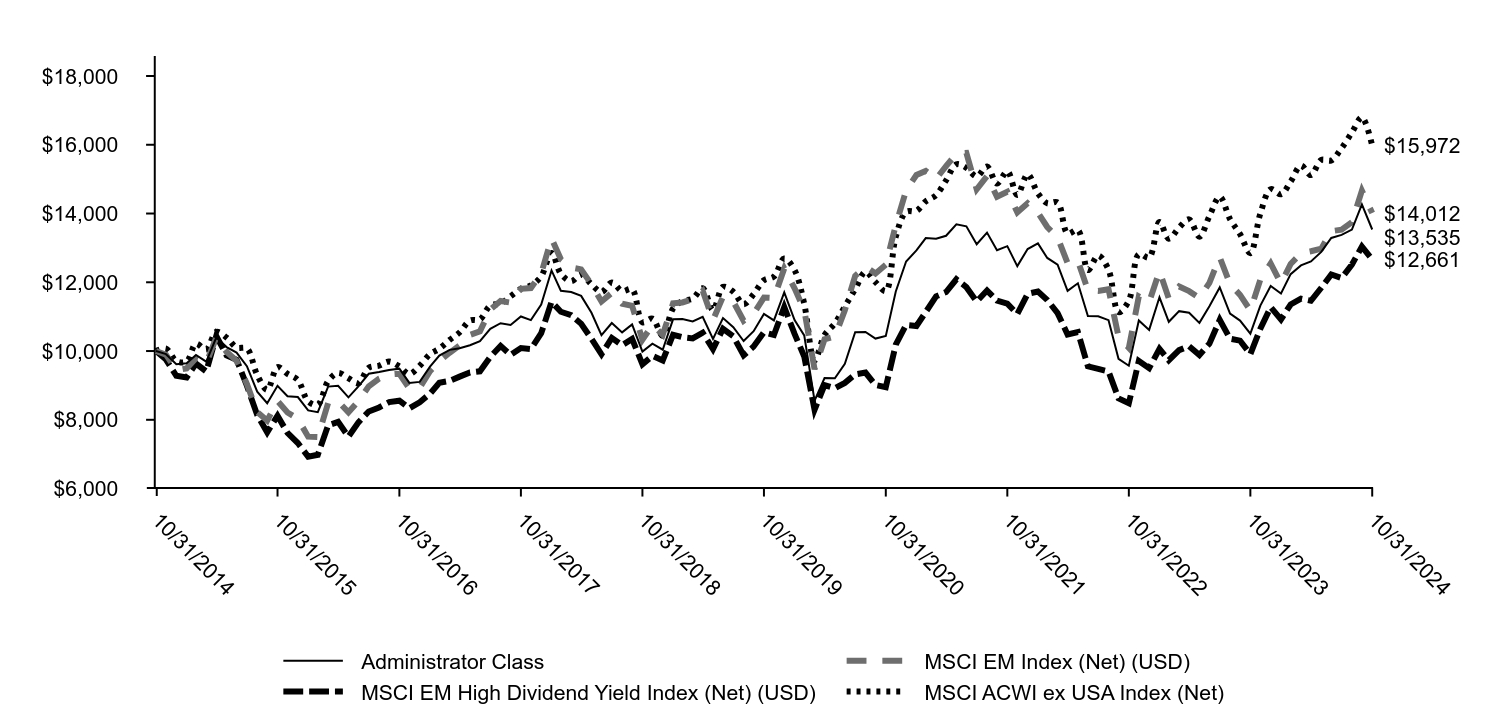

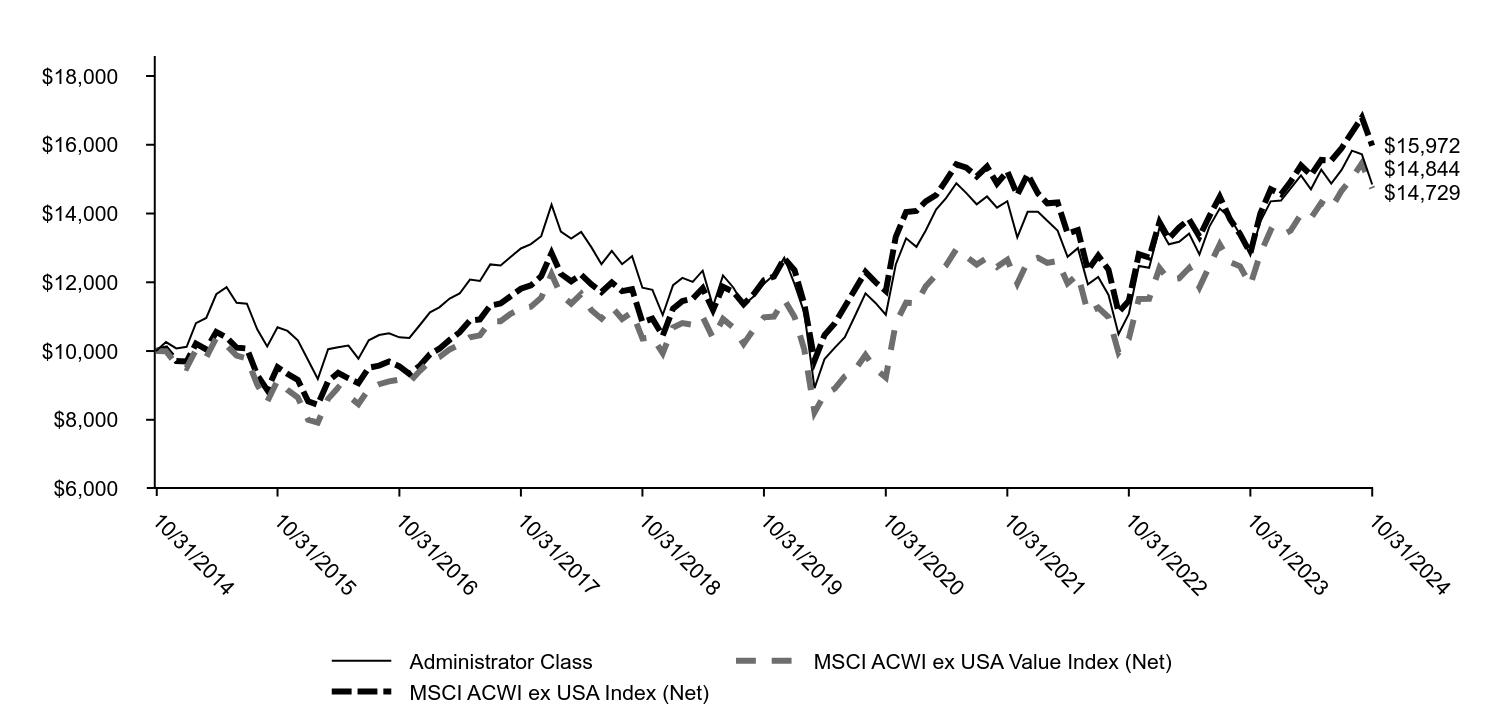

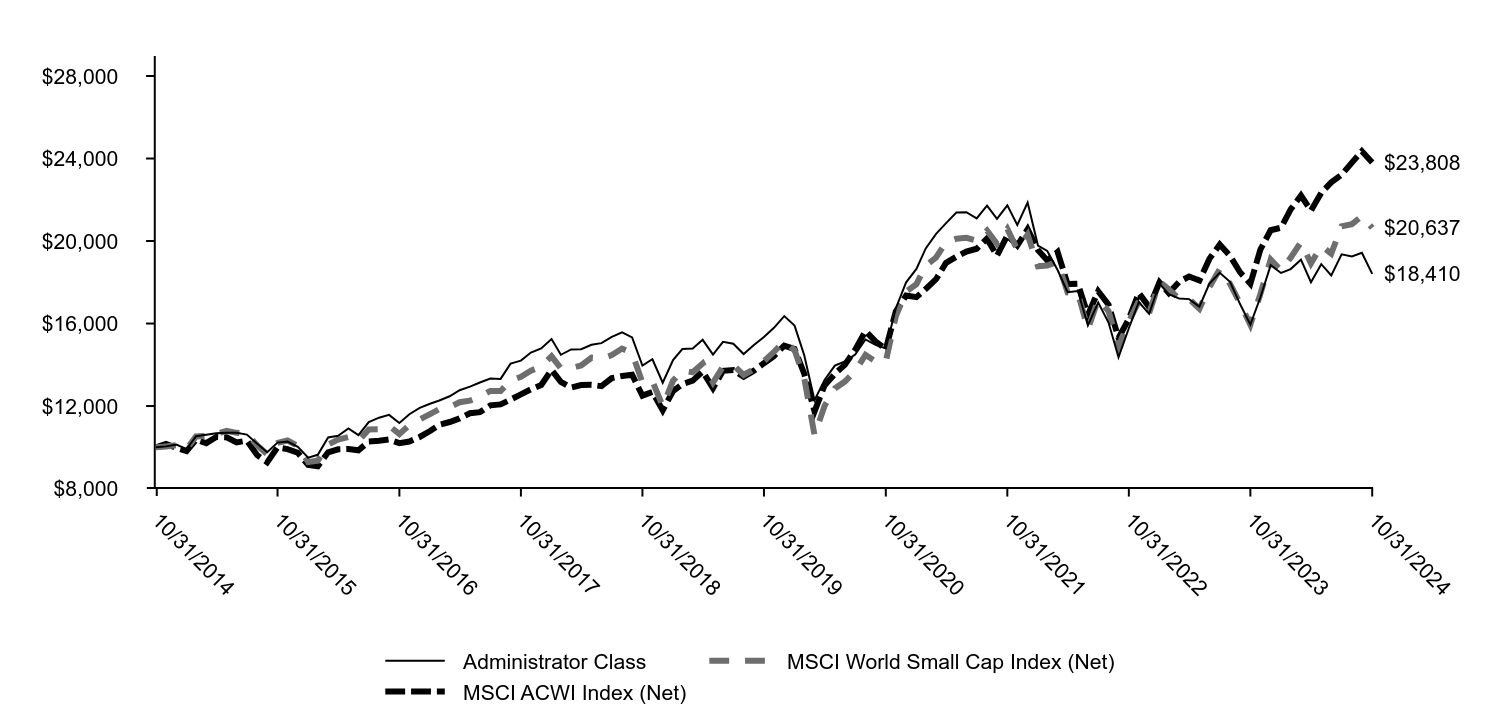

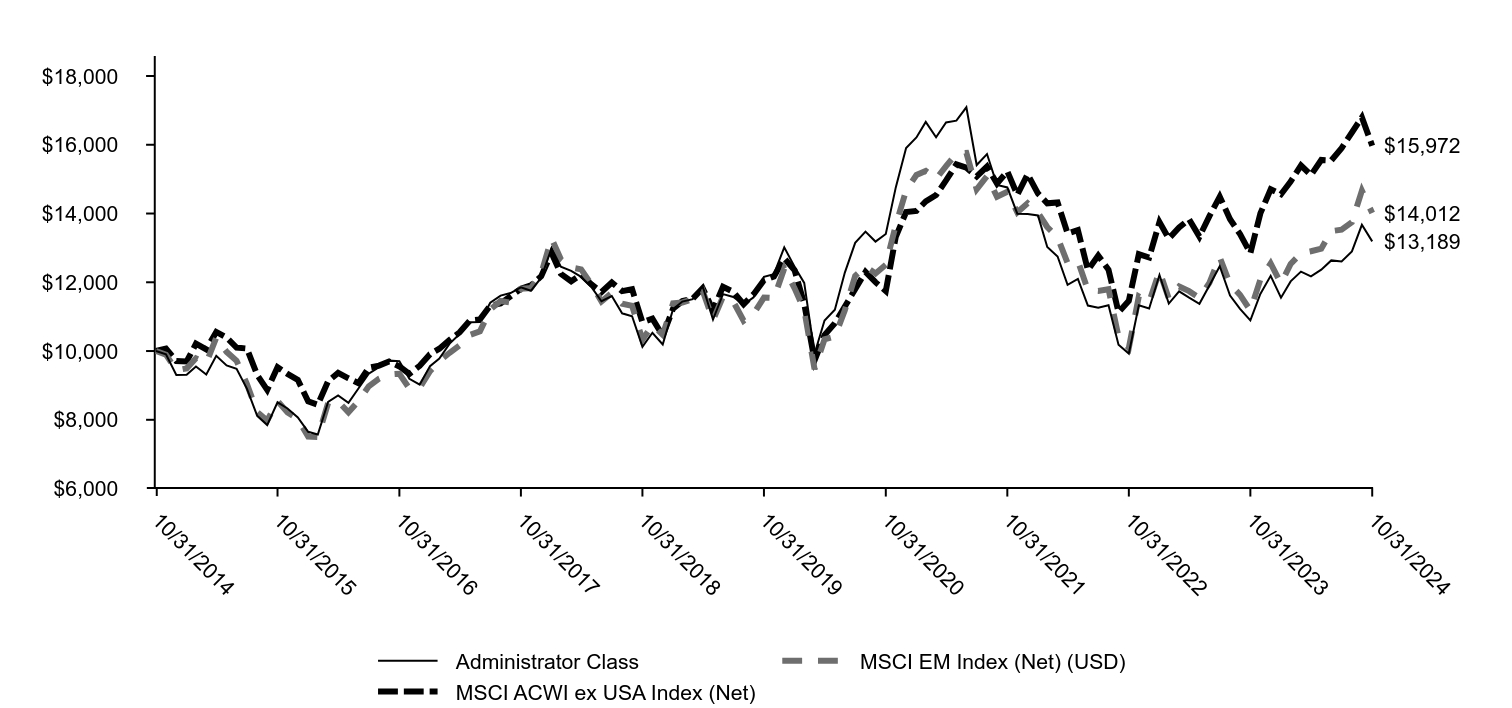

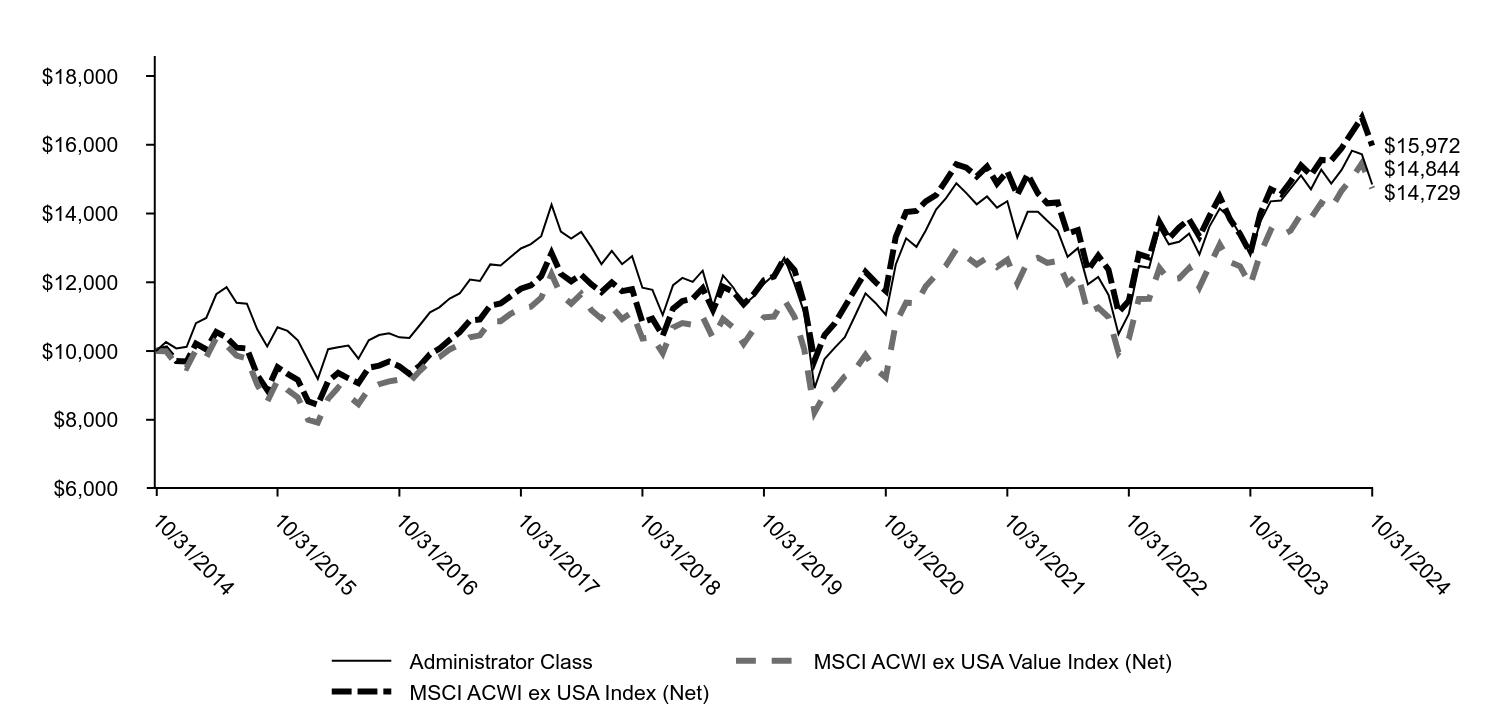

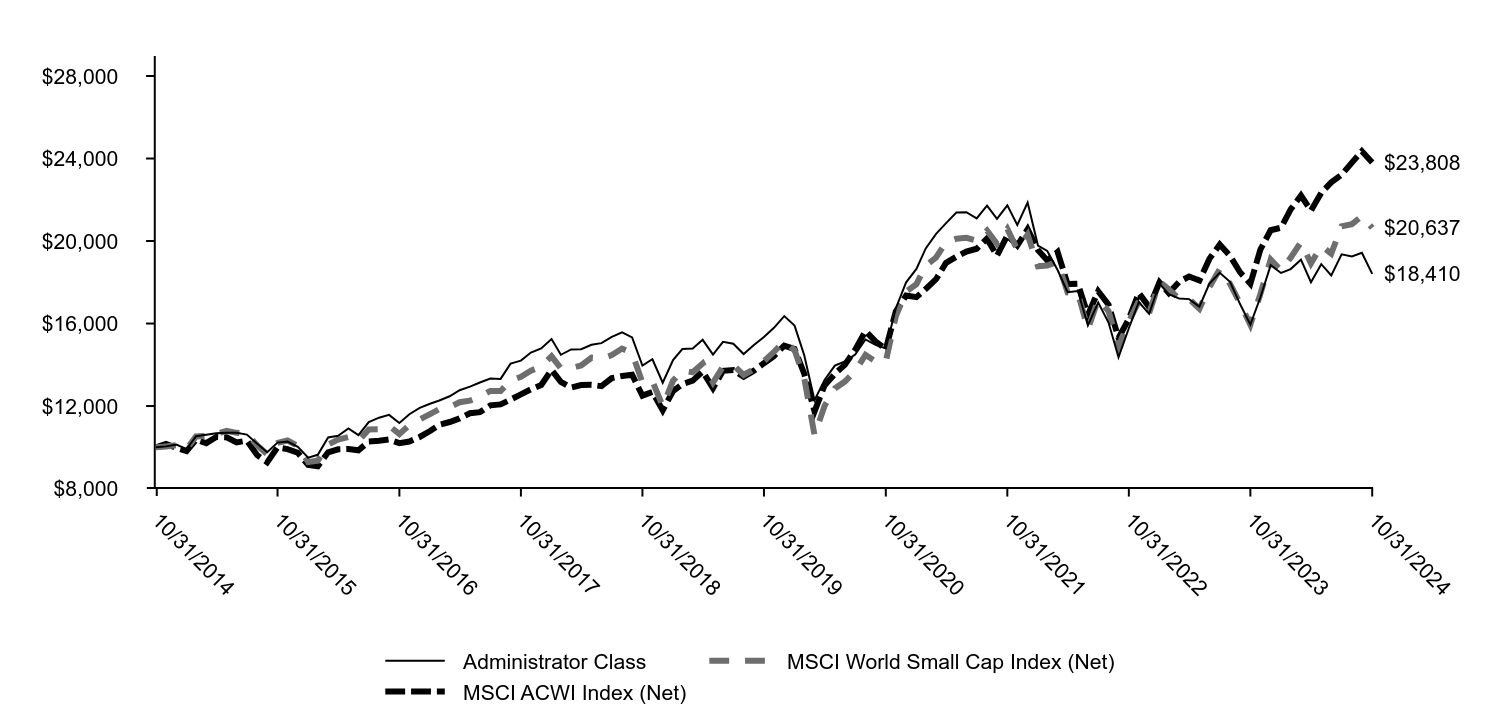

Total return based on a $10,000 investment

| Administrator Class | MSCI EM Index (Net) (USD) | MSCI ACWI ex USA Index (Net) |

|---|

| 10/31/2014 | $10,000 | $10,000 | $10,000 |

| 11/30/2014 | $9,902 | $9,894 | $10,072 |

| 12/31/2014 | $9,302 | $9,438 | $9,709 |

| 1/31/2015 | $9,311 | $9,495 | $9,695 |

| 2/28/2015 | $9,549 | $9,789 | $10,213 |

| 3/31/2015 | $9,316 | $9,650 | $10,048 |

| 4/30/2015 | $9,862 | $10,392 | $10,556 |

| 5/31/2015 | $9,580 | $9,976 | $10,391 |

| 6/30/2015 | $9,481 | $9,717 | $10,101 |

| 7/31/2015 | $8,908 | $9,043 | $10,073 |

| 8/31/2015 | $8,115 | $8,225 | $9,303 |

| 9/30/2015 | $7,846 | $7,978 | $8,872 |

| 10/31/2015 | $8,509 | $8,547 | $9,532 |

| 11/30/2015 | $8,330 | $8,213 | $9,335 |

| 12/31/2015 | $8,070 | $8,030 | $9,159 |

| 1/31/2016 | $7,651 | $7,509 | $8,536 |

| 2/29/2016 | $7,574 | $7,497 | $8,439 |

| 3/31/2016 | $8,521 | $8,489 | $9,125 |

| 4/30/2016 | $8,706 | $8,535 | $9,365 |

| 5/31/2016 | $8,494 | $8,217 | $9,207 |

| 6/30/2016 | $8,909 | $8,545 | $9,066 |

| 7/31/2016 | $9,341 | $8,975 | $9,515 |

| 8/31/2016 | $9,531 | $9,198 | $9,575 |

| 9/30/2016 | $9,725 | $9,317 | $9,693 |

| 10/31/2016 | $9,707 | $9,339 | $9,553 |

| 11/30/2016 | $9,193 | $8,909 | $9,332 |

| 12/31/2016 | $9,020 | $8,929 | $9,571 |

| 1/31/2017 | $9,561 | $9,417 | $9,910 |

| 2/28/2017 | $9,779 | $9,705 | $10,068 |

| 3/31/2017 | $10,216 | $9,950 | $10,324 |

| 4/30/2017 | $10,493 | $10,168 | $10,544 |

| 5/31/2017 | $10,838 | $10,469 | $10,887 |

| 6/30/2017 | $10,847 | $10,574 | $10,920 |

| 7/31/2017 | $11,406 | $11,205 | $11,323 |

| 8/31/2017 | $11,611 | $11,455 | $11,382 |

| 9/30/2017 | $11,688 | $11,409 | $11,593 |

| 10/31/2017 | $11,852 | $11,809 | $11,812 |

| 11/30/2017 | $11,752 | $11,833 | $11,908 |

| 12/31/2017 | $12,134 | $12,257 | $12,174 |

| 1/31/2018 | $12,987 | $13,279 | $12,852 |

| 2/28/2018 | $12,453 | $12,667 | $12,246 |

| 3/31/2018 | $12,334 | $12,431 | $12,030 |

| 4/30/2018 | $12,156 | $12,376 | $12,222 |

| 5/31/2018 | $11,860 | $11,938 | $11,940 |

| 6/30/2018 | $11,449 | $11,442 | $11,715 |

| 7/31/2018 | $11,599 | $11,693 | $11,995 |

| 8/31/2018 | $11,097 | $11,377 | $11,744 |

| 9/30/2018 | $11,011 | $11,316 | $11,798 |

| 10/31/2018 | $10,125 | $10,331 | $10,838 |

| 11/30/2018 | $10,531 | $10,757 | $10,941 |

| 12/31/2018 | $10,191 | $10,472 | $10,446 |

| 1/31/2019 | $11,219 | $11,389 | $11,235 |

| 2/28/2019 | $11,439 | $11,414 | $11,454 |

| 3/31/2019 | $11,508 | $11,510 | $11,523 |

| 4/30/2019 | $11,879 | $11,752 | $11,827 |

| 5/31/2019 | $10,916 | $10,900 | $11,192 |

| 6/30/2019 | $11,655 | $11,580 | $11,866 |

| 7/31/2019 | $11,572 | $11,438 | $11,723 |

| 8/31/2019 | $11,356 | $10,881 | $11,361 |

| 9/30/2019 | $11,563 | $11,088 | $11,653 |

| 10/31/2019 | $12,159 | $11,556 | $12,059 |

| 11/30/2019 | $12,237 | $11,540 | $12,166 |

| 12/31/2019 | $13,018 | $12,401 | $12,693 |

| 1/31/2020 | $12,454 | $11,823 | $12,352 |

| 2/29/2020 | $11,982 | $11,199 | $11,375 |

| 3/31/2020 | $9,921 | $9,474 | $9,728 |

| 4/30/2020 | $10,887 | $10,342 | $10,465 |

| 5/31/2020 | $11,201 | $10,421 | $10,808 |

| 6/30/2020 | $12,283 | $11,187 | $11,296 |

| 7/31/2020 | $13,147 | $12,187 | $11,800 |

| 8/31/2020 | $13,475 | $12,457 | $12,305 |

| 9/30/2020 | $13,184 | $12,257 | $12,003 |

| 10/31/2020 | $13,406 | $12,509 | $11,745 |

| 11/30/2020 | $14,760 | $13,666 | $13,324 |

| 12/31/2020 | $15,906 | $14,671 | $14,045 |

| 1/31/2021 | $16,211 | $15,121 | $14,075 |

| 2/28/2021 | $16,664 | $15,236 | $14,354 |

| 3/31/2021 | $16,220 | $15,006 | $14,535 |

| 4/30/2021 | $16,650 | $15,380 | $14,963 |

| 5/31/2021 | $16,701 | $15,737 | $15,431 |

| 6/30/2021 | $17,090 | $15,764 | $15,331 |

| 7/31/2021 | $15,411 | $14,703 | $15,079 |

| 8/31/2021 | $15,730 | $15,088 | $15,365 |

| 9/30/2021 | $14,832 | $14,488 | $14,873 |

| 10/31/2021 | $14,758 | $14,631 | $15,228 |

| 11/30/2021 | $13,995 | $14,035 | $14,542 |

| 12/31/2021 | $13,984 | $14,298 | $15,143 |

| 1/31/2022 | $13,942 | $14,027 | $14,585 |

| 2/28/2022 | $13,028 | $13,608 | $14,297 |

| 3/31/2022 | $12,749 | $13,301 | $14,320 |

| 4/30/2022 | $11,928 | $12,561 | $13,420 |

| 5/31/2022 | $12,100 | $12,616 | $13,517 |

| 6/30/2022 | $11,324 | $11,778 | $12,354 |

| 7/31/2022 | $11,259 | $11,749 | $12,777 |

| 8/31/2022 | $11,334 | $11,798 | $12,366 |

| 9/30/2022 | $10,183 | $10,415 | $11,130 |

| 10/31/2022 | $9,927 | $10,092 | $11,463 |

| 11/30/2022 | $11,329 | $11,588 | $12,816 |

| 12/31/2022 | $11,237 | $11,425 | $12,720 |

| 1/31/2023 | $12,211 | $12,328 | $13,752 |

| 2/28/2023 | $11,382 | $11,528 | $13,269 |

| 3/31/2023 | $11,738 | $11,877 | $13,593 |

| 4/30/2023 | $11,551 | $11,743 | $13,830 |

| 5/31/2023 | $11,373 | $11,546 | $13,327 |

| 6/30/2023 | $11,907 | $11,984 | $13,925 |

| 7/31/2023 | $12,469 | $12,730 | $14,491 |

| 8/31/2023 | $11,616 | $11,946 | $13,836 |

| 9/30/2023 | $11,228 | $11,633 | $13,399 |

| 10/31/2023 | $10,891 | $11,181 | $12,847 |

| 11/30/2023 | $11,659 | $12,076 | $14,003 |

| 12/31/2023 | $12,187 | $12,548 | $14,706 |

| 1/31/2024 | $11,553 | $11,966 | $14,560 |

| 2/29/2024 | $12,026 | $12,535 | $14,929 |

| 3/31/2024 | $12,310 | $12,845 | $15,396 |

| 4/30/2024 | $12,173 | $12,903 | $15,119 |

| 5/31/2024 | $12,366 | $12,976 | $15,558 |

| 6/30/2024 | $12,636 | $13,488 | $15,543 |

| 7/31/2024 | $12,603 | $13,528 | $15,903 |

| 8/31/2024 | $12,896 | $13,746 | $16,356 |

| 9/30/2024 | $13,672 | $14,664 | $16,797 |

| 10/31/2024 | $13,189 | $14,012 | $15,972 |

Emerging Markets Equity Fund

Annual Shareholder Report | October 31, 2024

AVERAGE ANNUAL TOTAL RETURNS (%)

| Total net assets | $3,882,963,501 |

| # of portfolio holdings | 122 |

| Portfolio turnover rate | 10% |

| Total advisory fees paid | $36,864,032 |

| AATR | 1 Year | 5 Years | 10 Years |

|---|

| Administrator Class | 21.11 | 1.64 | 2.81 |

| MSCI EM Index (Net) (USD) (Strategy) | 25.32 | 3.93 | 3.43 |

| MSCI ACWI ex USA Index (Net) (Regulatory) | 24.33 | 5.78 | 4.79 |

Figures quoted represent past performance, which is no guarantee of future results, and do not reflect taxes that a shareholder may pay on an investment in a fund.

What did the Fund invest in?

(Based on long-term investments)

TOP TEN HOLDINGS (% OF NET ASSETS)

| Taiwan Semiconductor Manufacturing Co. Ltd. ADR | 6.5 |

| Taiwan Semiconductor Manufacturing Co. Ltd. | 5.3 |

| Tencent Holdings Ltd. | 5.3 |

| Samsung Electronics Co. Ltd. Korea Exchange | 4.8 |

| Reliance Industries Ltd. London Stock Exchange GDR | 3.7 |

| Meituan Class B | 2.5 |

| Bharti Airtel Ltd. | 2.3 |

| HDFC Bank Ltd. | 2.2 |

| WH Group Ltd. | 2.1 |

| Alibaba Group Holding Ltd. New York Stock Exchange ADR | 2.1 |

COUNTRY ALLOCATION (% OF LONG-TERM INVESTMENTS)

| China | 20.6 |

| India | 17.2 |

| Taiwan | 15.9 |

| South Korea | 12.6 |

| Brazil | 5.3 |

| Mexico | 4.5 |

| Hong Kong | 4.4 |

| Indonesia | 4.1 |

| South Africa | 3.6 |

| Thailand | 2.6 |

| Other | 9.2 |

SECTOR ALLOCATION (% OF LONG-TERM INVESTMENTS)

| Information technology | 22.5 |

| Communication services | 17.1 |

| Consumer staples | 15.5 |

| Financials | 14.0 |

| Consumer discretionary | 13.1 |

| Energy | 5.7 |

| Industrials | 4.5 |

| Materials | 4.2 |

| Real estate | 1.7 |

| Health care | 1.7 |

This is a summary of certain changes and planned changes to the Fund since November 1, 2023.

On October 16, 2024, Prashant Paroda was added as a portfolio manager to the Fund.

You can find additional information on the Fund's website at allspringglobal.com, including its:

- Prospectus - Financial Information - Fund holdings - Proxy voting information

Annual Shareholder Report

Emerging Markets Equity Income Fund

This annual shareholder report contains important information about Emerging Markets Equity Income Fund for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at allspringglobal.com. You can also request this information by contacting us at 1-800-222-8222.

This report describes changes to the Fund that occurred either during or after the reporting period.

What were the Fund costs for the past year?

The table explains the costs you would have paid within the reporting period based on a hypothetical $10,000 investment.

| CLASS NAME | COSTS OF A $10,000 INVESTMENT | COSTS PAID AS A % OF A $10,000 INVESTMENT |

|---|

| Institutional Class | $140 | 1.22% |

The manager has contractually committed to waive fees and/or reimburse certain expenses to the extent necessary to cap the Fund's total annual fund operating expense ratio at a specific amount. Without this cap, the costs shown above may have been higher. Please see the prospectus for the amount and the expiration date of the cap. Prior to or after the commitment expiration date, the cap may be increased or the commitment to maintain the cap may be terminated only with the approval of the Board of Trustees.

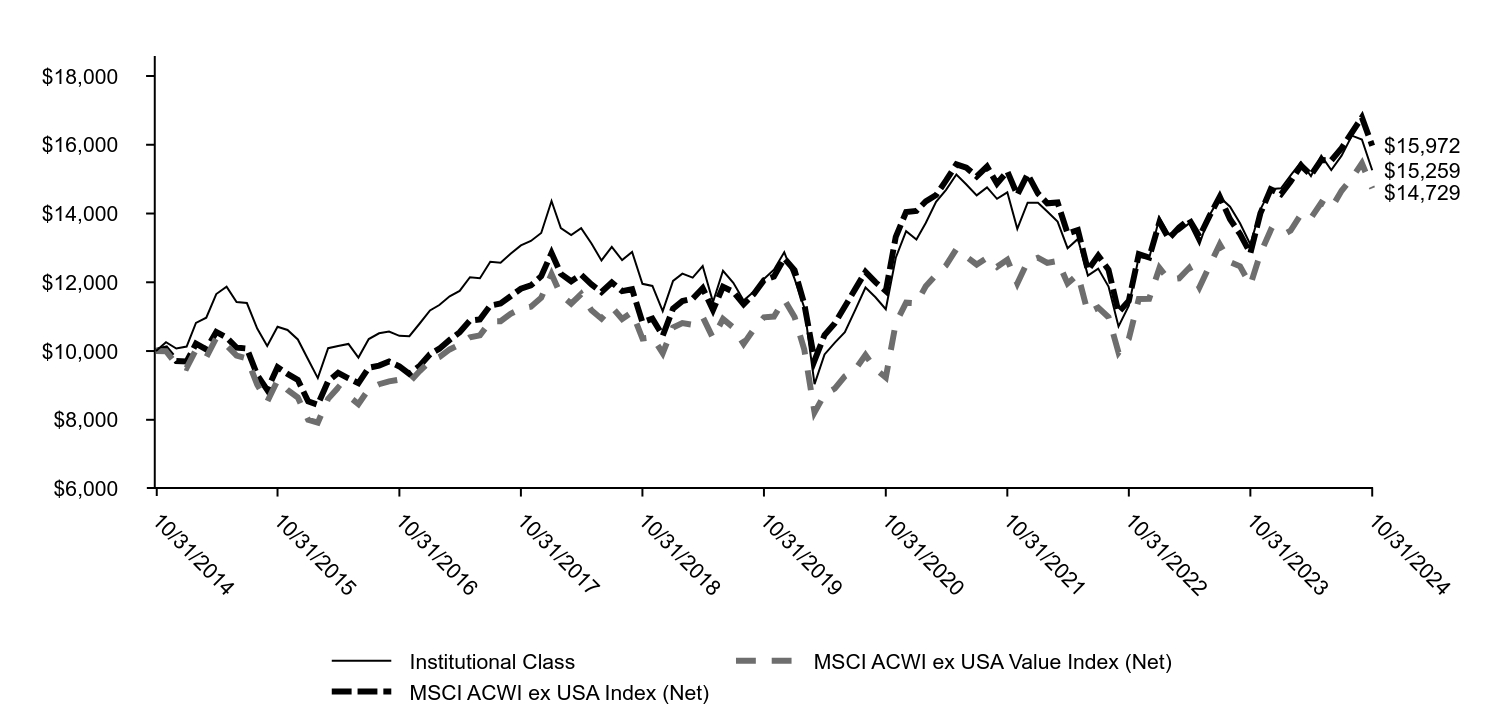

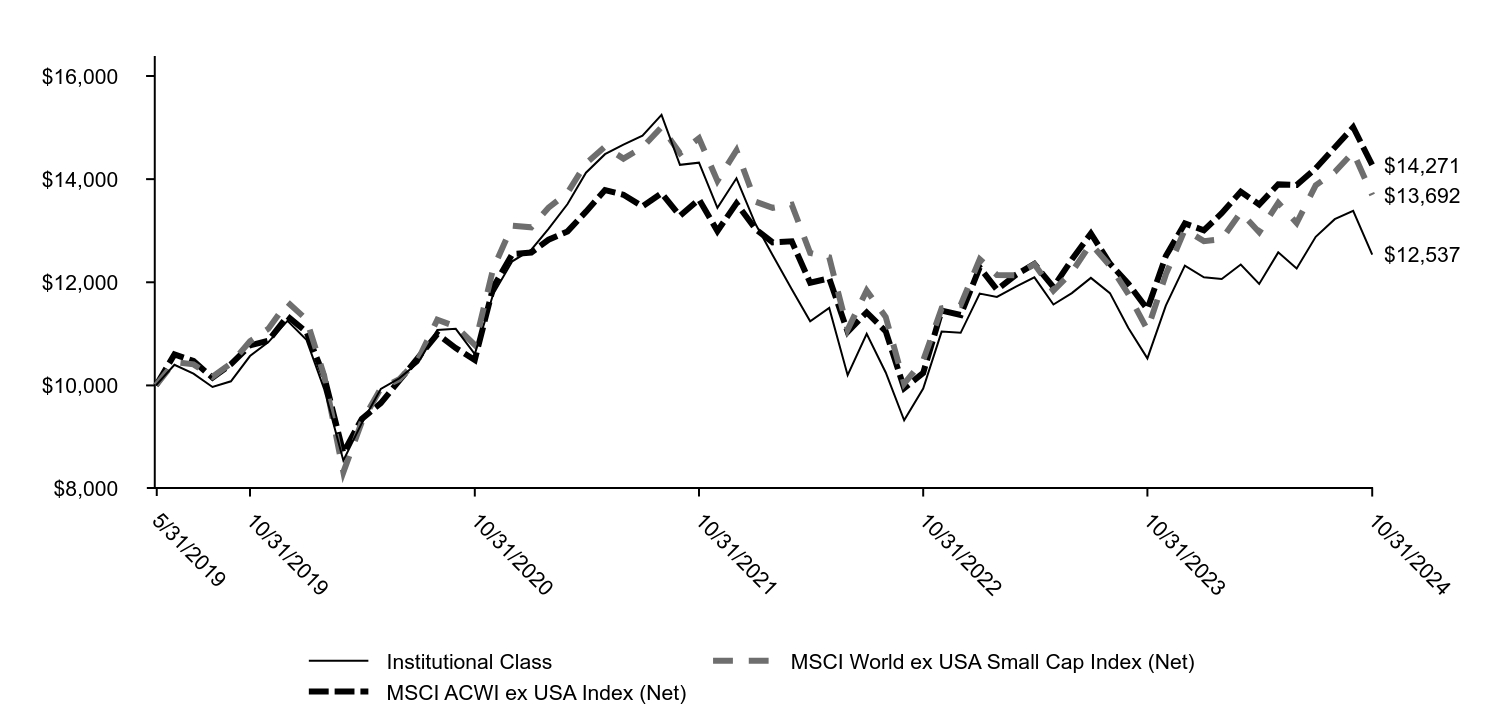

How did the Fund perform last year and what affected its performance?

Emerging market equities rose sharply, led by countries within Asia Pacific, as strength from artificial intelligence (AI) and semiconductor demand, stable growth, and improving fundamentals bolstered China and Taiwan. India rose sharply on strong corporate earnings, positive economic data, and market inflows as investors revered its infrastructure investments and technological innovation. In contrast, weakness in Latin America was caused by higher inflation, weakening currencies, and political concerns.

Contributors included Bajaj Auto, on strong earnings and a promising outlook for two-wheelers and electric vehicles. Aircraft manufacturer Embraer had better-than-expected earnings and an upgrade to investment grade. Samsung Electronics Ltd. Pfd., detracted, falling after its HBM chips failed to pass NVIDIA’s suitability for inclusion into its AI processors, as did Arabian Drilling Co., which faltered after three of its offshore drilling rigs were suspended.

We remain optimistic about emerging markets on improved economic momentum, accommodative policies, attractive valuations, a favorable emerging market growth premium, and low investor positioning.

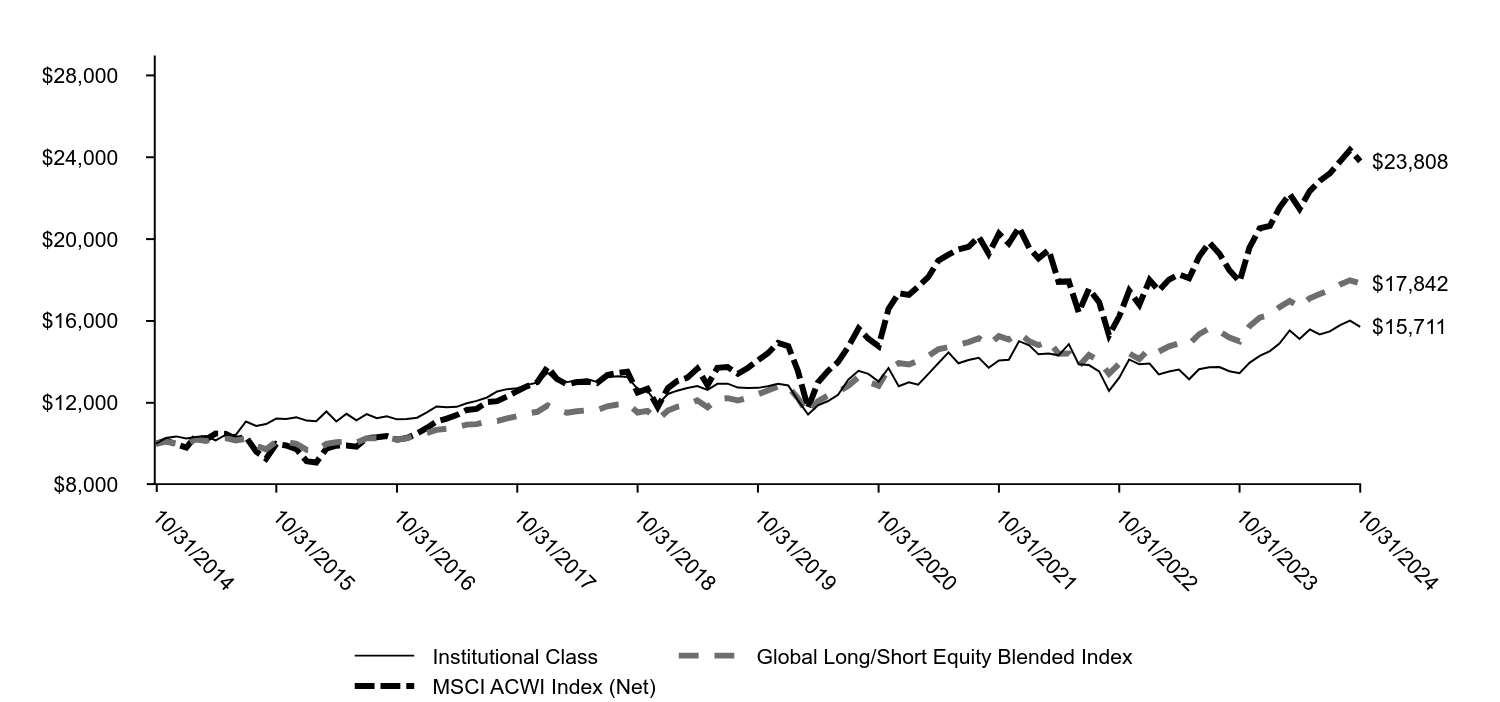

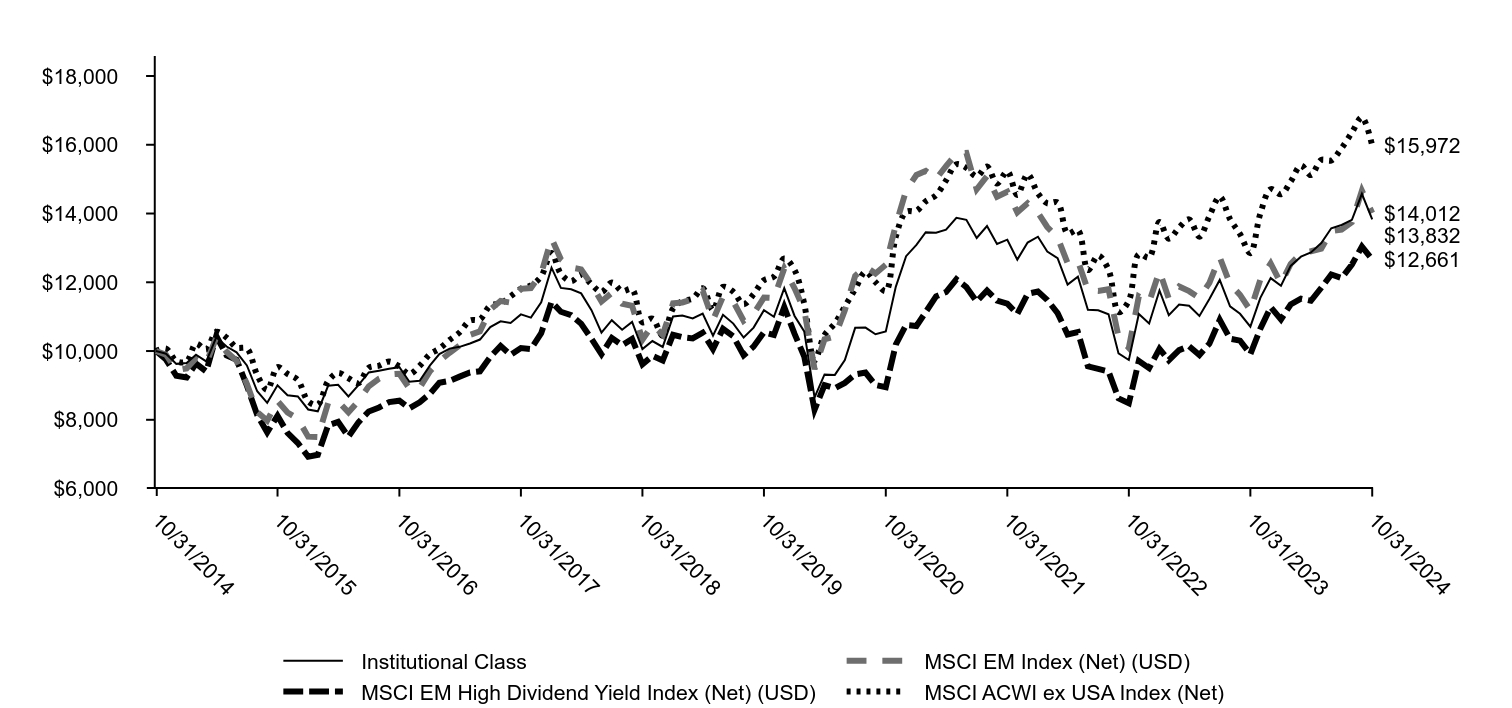

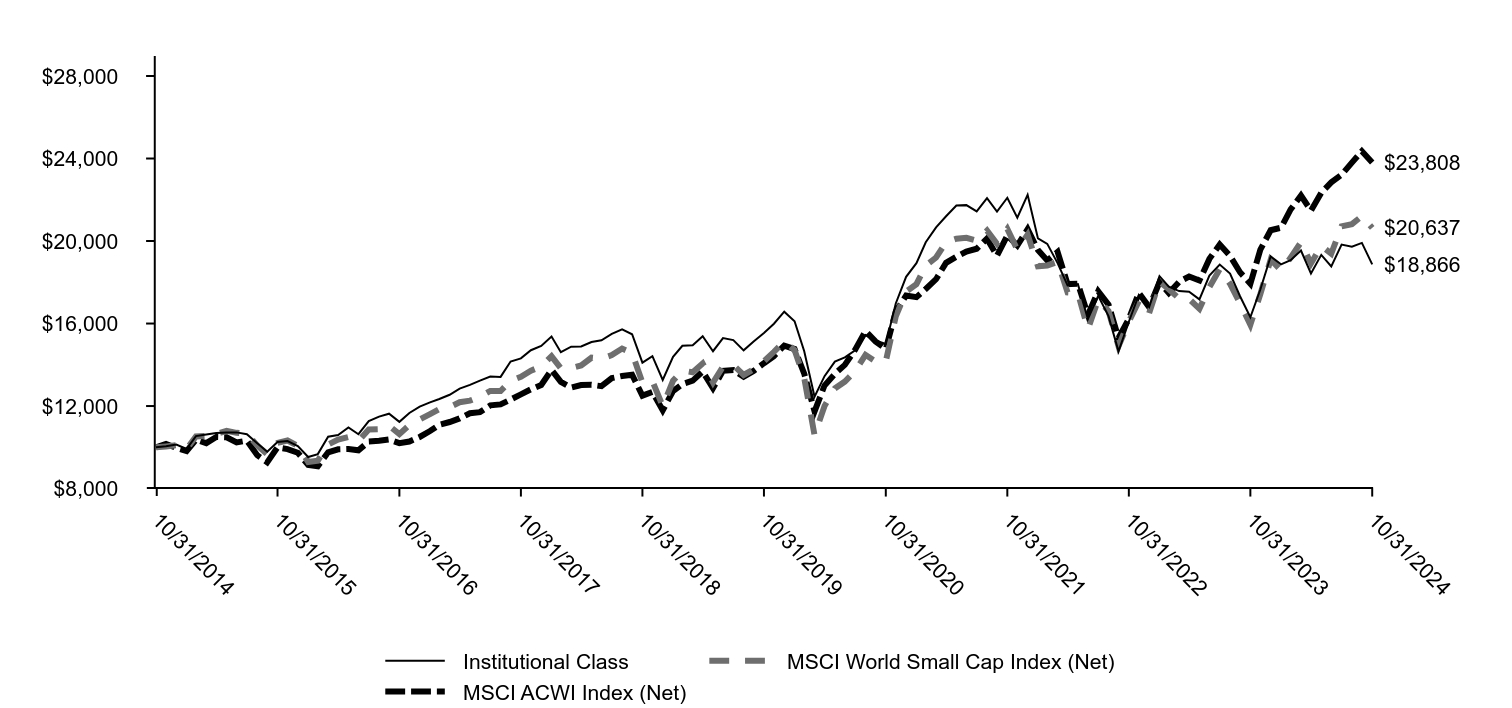

Total return based on a $10,000 investment

| Institutional Class | MSCI EM Index (Net) (USD) | MSCI EM High Dividend Yield Index (Net) (USD) | MSCI ACWI ex USA Index (Net) |

|---|

| 10/31/2014 | $10,000 | $10,000 | $10,000 | $10,000 |

| 11/30/2014 | $9,922 | $9,894 | $9,753 | $10,072 |

| 12/31/2014 | $9,627 | $9,438 | $9,281 | $9,709 |

| 1/31/2015 | $9,654 | $9,495 | $9,231 | $9,695 |

| 2/28/2015 | $9,893 | $9,789 | $9,634 | $10,213 |

| 3/31/2015 | $9,698 | $9,650 | $9,407 | $10,048 |

| 4/30/2015 | $10,401 | $10,392 | $10,438 | $10,556 |

| 5/31/2015 | $10,132 | $9,976 | $9,873 | $10,391 |

| 6/30/2015 | $9,964 | $9,717 | $9,749 | $10,101 |

| 7/31/2015 | $9,580 | $9,043 | $8,991 | $10,073 |

| 8/31/2015 | $8,830 | $8,225 | $8,140 | $9,303 |

| 9/30/2015 | $8,494 | $7,978 | $7,635 | $8,872 |

| 10/31/2015 | $9,005 | $8,547 | $8,119 | $9,532 |

| 11/30/2015 | $8,712 | $8,213 | $7,617 | $9,335 |

| 12/31/2015 | $8,680 | $8,030 | $7,326 | $9,159 |

| 1/31/2016 | $8,300 | $7,509 | $6,928 | $8,536 |

| 2/29/2016 | $8,246 | $7,497 | $6,983 | $8,439 |

| 3/31/2016 | $8,990 | $8,489 | $7,840 | $9,125 |

| 4/30/2016 | $9,017 | $8,535 | $7,939 | $9,365 |

| 5/31/2016 | $8,681 | $8,217 | $7,507 | $9,207 |

| 6/30/2016 | $9,007 | $8,545 | $7,926 | $9,066 |

| 7/31/2016 | $9,376 | $8,975 | $8,242 | $9,515 |

| 8/31/2016 | $9,428 | $9,198 | $8,359 | $9,575 |

| 9/30/2016 | $9,484 | $9,317 | $8,514 | $9,693 |

| 10/31/2016 | $9,530 | $9,339 | $8,555 | $9,553 |

| 11/30/2016 | $9,106 | $8,909 | $8,333 | $9,332 |

| 12/31/2016 | $9,137 | $8,929 | $8,511 | $9,571 |

| 1/31/2017 | $9,584 | $9,417 | $8,758 | $9,910 |

| 2/28/2017 | $9,909 | $9,705 | $9,077 | $10,068 |

| 3/31/2017 | $10,070 | $9,950 | $9,132 | $10,324 |

| 4/30/2017 | $10,122 | $10,168 | $9,256 | $10,544 |

| 5/31/2017 | $10,220 | $10,469 | $9,375 | $10,887 |

| 6/30/2017 | $10,334 | $10,574 | $9,410 | $10,920 |

| 7/31/2017 | $10,697 | $11,205 | $9,828 | $11,323 |

| 8/31/2017 | $10,864 | $11,455 | $10,150 | $11,382 |

| 9/30/2017 | $10,816 | $11,409 | $9,887 | $11,593 |

| 10/31/2017 | $11,066 | $11,809 | $10,086 | $11,812 |

| 11/30/2017 | $10,971 | $11,833 | $10,055 | $11,908 |

| 12/31/2017 | $11,418 | $12,257 | $10,517 | $12,174 |

| 1/31/2018 | $12,424 | $13,279 | $11,433 | $12,852 |

| 2/28/2018 | $11,836 | $12,667 | $11,143 | $12,246 |

| 3/31/2018 | $11,796 | $12,431 | $11,041 | $12,030 |

| 4/30/2018 | $11,676 | $12,376 | $10,792 | $12,222 |

| 5/31/2018 | $11,190 | $11,938 | $10,355 | $11,940 |

| 6/30/2018 | $10,534 | $11,442 | $9,905 | $11,715 |

| 7/31/2018 | $10,896 | $11,693 | $10,382 | $11,995 |

| 8/31/2018 | $10,621 | $11,377 | $10,169 | $11,744 |

| 9/30/2018 | $10,849 | $11,316 | $10,352 | $11,798 |

| 10/31/2018 | $10,057 | $10,331 | $9,615 | $10,838 |

| 11/30/2018 | $10,290 | $10,757 | $9,860 | $10,941 |

| 12/31/2018 | $10,119 | $10,472 | $9,727 | $10,446 |

| 1/31/2019 | $11,006 | $11,389 | $10,474 | $11,235 |

| 2/28/2019 | $11,031 | $11,414 | $10,402 | $11,454 |

| 3/31/2019 | $10,948 | $11,510 | $10,367 | $11,523 |

| 4/30/2019 | $11,089 | $11,752 | $10,534 | $11,827 |

| 5/31/2019 | $10,446 | $10,900 | $10,054 | $11,192 |

| 6/30/2019 | $11,054 | $11,580 | $10,649 | $11,866 |

| 7/31/2019 | $10,799 | $11,438 | $10,427 | $11,723 |

| 8/31/2019 | $10,393 | $10,881 | $9,876 | $11,361 |

| 9/30/2019 | $10,681 | $11,088 | $10,132 | $11,653 |

| 10/31/2019 | $11,188 | $11,556 | $10,547 | $12,059 |

| 11/30/2019 | $10,997 | $11,540 | $10,467 | $12,166 |

| 12/31/2019 | $11,830 | $12,401 | $11,281 | $12,693 |

| 1/31/2020 | $11,020 | $11,823 | $10,497 | $12,352 |

| 2/29/2020 | $10,571 | $11,199 | $9,841 | $11,375 |

| 3/31/2020 | $8,649 | $9,474 | $8,289 | $9,728 |

| 4/30/2020 | $9,320 | $10,342 | $9,010 | $10,465 |

| 5/31/2020 | $9,306 | $10,421 | $8,916 | $10,808 |

| 6/30/2020 | $9,739 | $11,187 | $9,073 | $11,296 |

| 7/31/2020 | $10,675 | $12,187 | $9,319 | $11,800 |

| 8/31/2020 | $10,683 | $12,457 | $9,373 | $12,305 |

| 9/30/2020 | $10,489 | $12,257 | $9,012 | $12,003 |

| 10/31/2020 | $10,568 | $12,509 | $8,947 | $11,745 |

| 11/30/2020 | $11,867 | $13,666 | $10,188 | $13,324 |

| 12/31/2020 | $12,759 | $14,671 | $10,761 | $14,045 |

| 1/31/2021 | $13,087 | $15,121 | $10,729 | $14,075 |

| 2/28/2021 | $13,457 | $15,236 | $11,136 | $14,354 |

| 3/31/2021 | $13,441 | $15,006 | $11,591 | $14,535 |

| 4/30/2021 | $13,532 | $15,380 | $11,715 | $14,963 |

| 5/31/2021 | $13,876 | $15,737 | $12,087 | $15,431 |

| 6/30/2021 | $13,817 | $15,764 | $11,858 | $15,331 |

| 7/31/2021 | $13,290 | $14,703 | $11,441 | $15,079 |

| 8/31/2021 | $13,636 | $15,088 | $11,760 | $15,365 |

| 9/30/2021 | $13,116 | $14,488 | $11,465 | $14,873 |

| 10/31/2021 | $13,239 | $14,631 | $11,381 | $15,228 |

| 11/30/2021 | $12,659 | $14,035 | $11,077 | $14,542 |

| 12/31/2021 | $13,157 | $14,298 | $11,662 | $15,143 |

| 1/31/2022 | $13,325 | $14,027 | $11,733 | $14,585 |

| 2/28/2022 | $12,894 | $13,608 | $11,484 | $14,297 |

| 3/31/2022 | $12,701 | $13,301 | $11,103 | $14,320 |

| 4/30/2022 | $11,932 | $12,561 | $10,482 | $13,420 |

| 5/31/2022 | $12,160 | $12,616 | $10,550 | $13,517 |

| 6/30/2022 | $11,199 | $11,778 | $9,556 | $12,354 |

| 7/31/2022 | $11,184 | $11,749 | $9,479 | $12,777 |

| 8/31/2022 | $11,069 | $11,798 | $9,405 | $12,366 |

| 9/30/2022 | $9,931 | $10,415 | $8,624 | $11,130 |

| 10/31/2022 | $9,739 | $10,092 | $8,480 | $11,463 |

| 11/30/2022 | $11,077 | $11,588 | $9,712 | $12,816 |

| 12/31/2022 | $10,799 | $11,425 | $9,503 | $12,720 |

| 1/31/2023 | $11,761 | $12,328 | $10,062 | $13,752 |

| 2/28/2023 | $11,044 | $11,528 | $9,732 | $13,269 |

| 3/31/2023 | $11,353 | $11,877 | $10,026 | $13,593 |

| 4/30/2023 | $11,316 | $11,743 | $10,141 | $13,830 |

| 5/31/2023 | $11,019 | $11,546 | $9,882 | $13,327 |

| 6/30/2023 | $11,517 | $11,984 | $10,216 | $13,925 |

| 7/31/2023 | $12,068 | $12,730 | $10,906 | $14,491 |

| 8/31/2023 | $11,302 | $11,946 | $10,357 | $13,836 |

| 9/30/2023 | $11,084 | $11,633 | $10,302 | $13,399 |

| 10/31/2023 | $10,708 | $11,181 | $9,910 | $12,847 |

| 11/30/2023 | $11,546 | $12,076 | $10,648 | $14,003 |

| 12/31/2023 | $12,122 | $12,548 | $11,278 | $14,706 |

| 1/31/2024 | $11,900 | $11,966 | $10,921 | $14,560 |

| 2/29/2024 | $12,477 | $12,535 | $11,354 | $14,929 |

| 3/31/2024 | $12,744 | $12,845 | $11,523 | $15,396 |

| 4/30/2024 | $12,866 | $12,903 | $11,462 | $15,119 |

| 5/31/2024 | $13,140 | $12,976 | $11,840 | $15,558 |

| 6/30/2024 | $13,572 | $13,488 | $12,226 | $15,543 |

| 7/31/2024 | $13,667 | $13,528 | $12,125 | $15,903 |

| 8/31/2024 | $13,817 | $13,746 | $12,515 | $16,356 |

| 9/30/2024 | $14,574 | $14,664 | $13,040 | $16,797 |

| 10/31/2024 | $13,832 | $14,012 | $12,661 | $15,972 |

Emerging Markets Equity Income Fund

Annual Shareholder Report | October 31, 2024

AVERAGE ANNUAL TOTAL RETURNS (%)

| Total net assets | $366,585,468 |

| # of portfolio holdings | 101 |

| Portfolio turnover rate | 81% |

| Total advisory fees paid | $3,662,734 |

| AATR | 1 Year | 5 Years | 10 Years |

|---|

| Institutional Class | 29.17 | 4.33 | 3.30 |

| MSCI EM Index (Net) (USD) (Strategy) | 25.32 | 3.93 | 3.43 |

| MSCI EM High Dividend Yield Index (Net) (USD) | 27.75 | 3.72 | 2.39 |

| MSCI ACWI ex USA Index (Net) (Regulatory) | 24.33 | 5.78 | 4.79 |

Figures quoted represent past performance, which is no guarantee of future results, and do not reflect taxes that a shareholder may pay on an investment in a fund.

What did the Fund invest in?

(Based on long-term investments)

TOP TEN HOLDINGS (% OF NET ASSETS)

| Taiwan Semiconductor Manufacturing Co. Ltd. | 9.7 |

| Tencent Holdings Ltd. | 5.6 |

| Alibaba Group Holding Ltd. | 3.8 |

| Infosys Ltd. | 2.2 |

| Samsung Electronics Co. Ltd. Korea Exchange | 2.2 |

| Embassy Office Parks REIT | 1.9 |

| Samsung Electronics Co. Ltd. | 1.7 |

| Power Grid Corp. of India Ltd. | 1.6 |

| 360 ONE WAM Ltd. | 1.6 |

| KB Financial Group, Inc. | 1.4 |

COUNTRY ALLOCATION (% OF LONG-TERM INVESTMENTS)

| China | 28.1 |

| India | 17.9 |

| Taiwan | 17.6 |

| South Korea | 8.5 |

| South Africa | 5.1 |

| Brazil | 5.0 |

| Saudi Arabia | 2.2 |

| Hong Kong | 2.1 |

| Indonesia | 1.9 |

| Malaysia | 1.6 |

| Other | 10.0 |

SECTOR ALLOCATION (% OF LONG-TERM INVESTMENTS)

| Information technology | 25.2 |

| Financials | 23.0 |

| Consumer discretionary | 13.7 |

| Communication services | 9.3 |

| Industrials | 6.4 |

| Utilities | 6.2 |

| Real estate | 5.9 |

| Consumer staples | 3.7 |

| Health care | 3.2 |

| Materials | 2.0 |

| Energy | 1.4 |

This is a summary of certain changes and planned changes to the Fund since November 1, 2023.

At a meeting held on August 13-14, 2024, the Board of Trustees of the Fund approved a name change for the Fund to the Allspring Emerging Markets Equity Advantage Fund, effective January 8, 2025.

You can find additional information on the Fund's website at allspringglobal.com, including its:

- Prospectus - Financial Information - Fund holdings - Proxy voting information

Annual Shareholder Report

Emerging Markets Equity Income Fund

This annual shareholder report contains important information about Emerging Markets Equity Income Fund for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at allspringglobal.com. You can also request this information by contacting us at 1-800-222-8222.

This report describes changes to the Fund that occurred either during or after the reporting period.

What were the Fund costs for the past year?

The table explains the costs you would have paid within the reporting period based on a hypothetical $10,000 investment.

| CLASS NAME | COSTS OF A $10,000 INVESTMENT | COSTS PAID AS A % OF A $10,000 INVESTMENT |

|---|

| Class R6 | $134 | 1.17% |

The manager has contractually committed to waive fees and/or reimburse certain expenses to the extent necessary to cap the Fund's total annual fund operating expense ratio at a specific amount. Without this cap, the costs shown above may have been higher. Please see the prospectus for the amount and the expiration date of the cap. Prior to or after the commitment expiration date, the cap may be increased or the commitment to maintain the cap may be terminated only with the approval of the Board of Trustees.

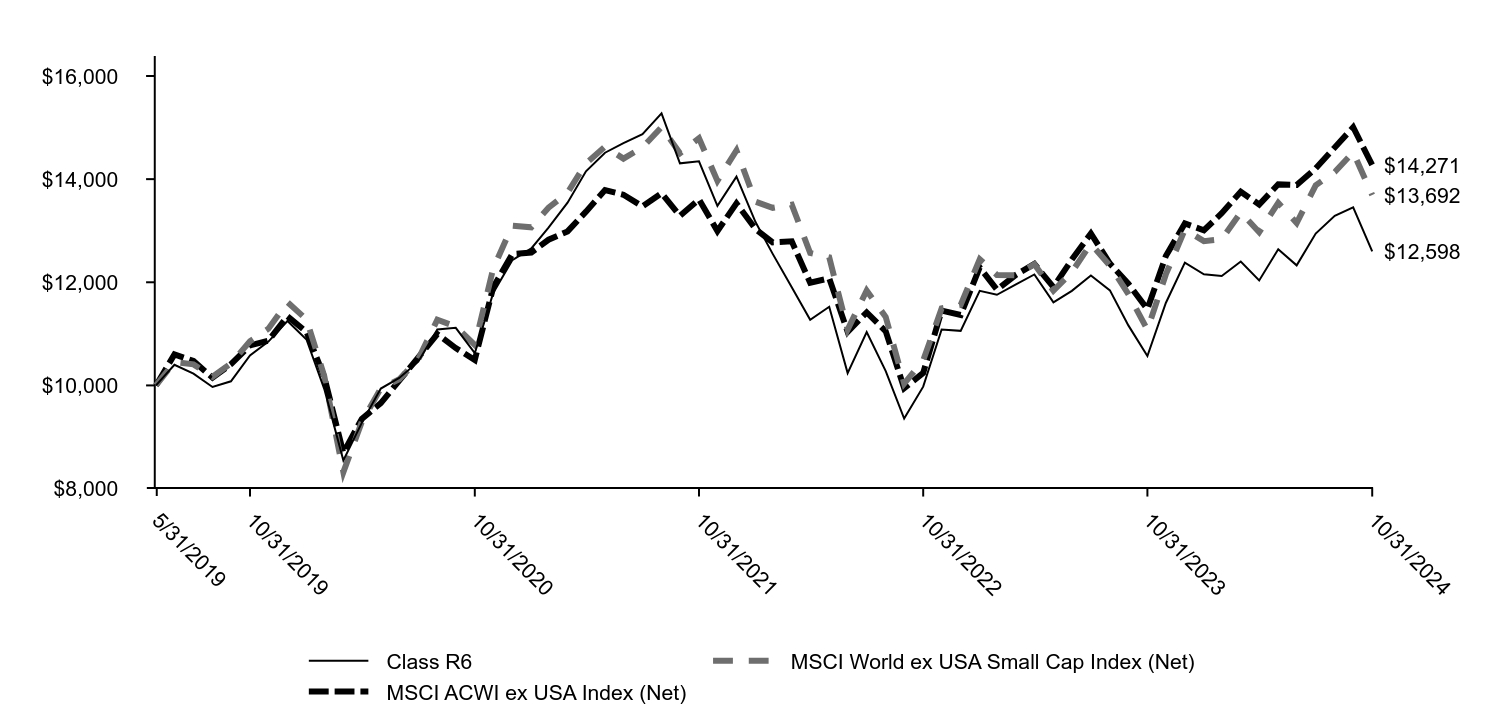

How did the Fund perform last year and what affected its performance?

Emerging market equities rose sharply, led by countries within Asia Pacific, as strength from artificial intelligence (AI) and semiconductor demand, stable growth, and improving fundamentals bolstered China and Taiwan. India rose sharply on strong corporate earnings, positive economic data, and market inflows as investors revered its infrastructure investments and technological innovation. In contrast, weakness in Latin America was caused by higher inflation, weakening currencies, and political concerns.

Contributors included Bajaj Auto, on strong earnings and a promising outlook for two-wheelers and electric vehicles. Aircraft manufacturer Embraer had better-than-expected earnings and an upgrade to investment grade. Samsung Electronics Ltd. Pfd., detracted, falling after its HBM chips failed to pass NVIDIA’s suitability for inclusion into its AI processors, as did Arabian Drilling Co., which faltered after three of its offshore drilling rigs were suspended.

We remain optimistic about emerging markets on improved economic momentum, accommodative policies, attractive valuations, a favorable emerging market growth premium, and low investor positioning.

Total return based on a $10,000 investment

| Class R6 | MSCI EM Index (Net) (USD) | MSCI EM High Dividend Yield Index (Net) (USD) | MSCI ACWI ex USA Index (Net) |

|---|

| 10/31/2014 | $10,000 | $10,000 | $10,000 | $10,000 |

| 11/30/2014 | $9,922 | $9,894 | $9,753 | $10,072 |

| 12/31/2014 | $9,627 | $9,438 | $9,281 | $9,709 |

| 1/31/2015 | $9,654 | $9,495 | $9,231 | $9,695 |

| 2/28/2015 | $9,893 | $9,789 | $9,634 | $10,213 |

| 3/31/2015 | $9,698 | $9,650 | $9,407 | $10,048 |

| 4/30/2015 | $10,401 | $10,392 | $10,438 | $10,556 |

| 5/31/2015 | $10,132 | $9,976 | $9,873 | $10,391 |

| 6/30/2015 | $9,964 | $9,717 | $9,749 | $10,101 |

| 7/31/2015 | $9,580 | $9,043 | $8,991 | $10,073 |

| 8/31/2015 | $8,830 | $8,225 | $8,140 | $9,303 |

| 9/30/2015 | $8,494 | $7,978 | $7,635 | $8,872 |

| 10/31/2015 | $8,996 | $8,547 | $8,119 | $9,532 |

| 11/30/2015 | $8,704 | $8,213 | $7,617 | $9,335 |

| 12/31/2015 | $8,681 | $8,030 | $7,326 | $9,159 |

| 1/31/2016 | $8,301 | $7,509 | $6,928 | $8,536 |

| 2/29/2016 | $8,247 | $7,497 | $6,983 | $8,439 |

| 3/31/2016 | $8,991 | $8,489 | $7,840 | $9,125 |

| 4/30/2016 | $9,020 | $8,535 | $7,939 | $9,365 |

| 5/31/2016 | $8,684 | $8,217 | $7,507 | $9,207 |

| 6/30/2016 | $9,002 | $8,545 | $7,926 | $9,066 |

| 7/31/2016 | $9,381 | $8,975 | $8,242 | $9,515 |

| 8/31/2016 | $9,425 | $9,198 | $8,359 | $9,575 |

| 9/30/2016 | $9,490 | $9,317 | $8,514 | $9,693 |

| 10/31/2016 | $9,527 | $9,339 | $8,555 | $9,553 |

| 11/30/2016 | $9,105 | $8,909 | $8,333 | $9,332 |

| 12/31/2016 | $9,137 | $8,929 | $8,511 | $9,571 |

| 1/31/2017 | $9,584 | $9,417 | $8,758 | $9,910 |

| 2/28/2017 | $9,910 | $9,705 | $9,077 | $10,068 |

| 3/31/2017 | $10,082 | $9,950 | $9,132 | $10,324 |

| 4/30/2017 | $10,135 | $10,168 | $9,256 | $10,544 |

| 5/31/2017 | $10,225 | $10,469 | $9,375 | $10,887 |

| 6/30/2017 | $10,348 | $10,574 | $9,410 | $10,920 |

| 7/31/2017 | $10,704 | $11,205 | $9,828 | $11,323 |

| 8/31/2017 | $10,881 | $11,455 | $10,150 | $11,382 |

| 9/30/2017 | $10,825 | $11,409 | $9,887 | $11,593 |

| 10/31/2017 | $11,076 | $11,809 | $10,086 | $11,812 |

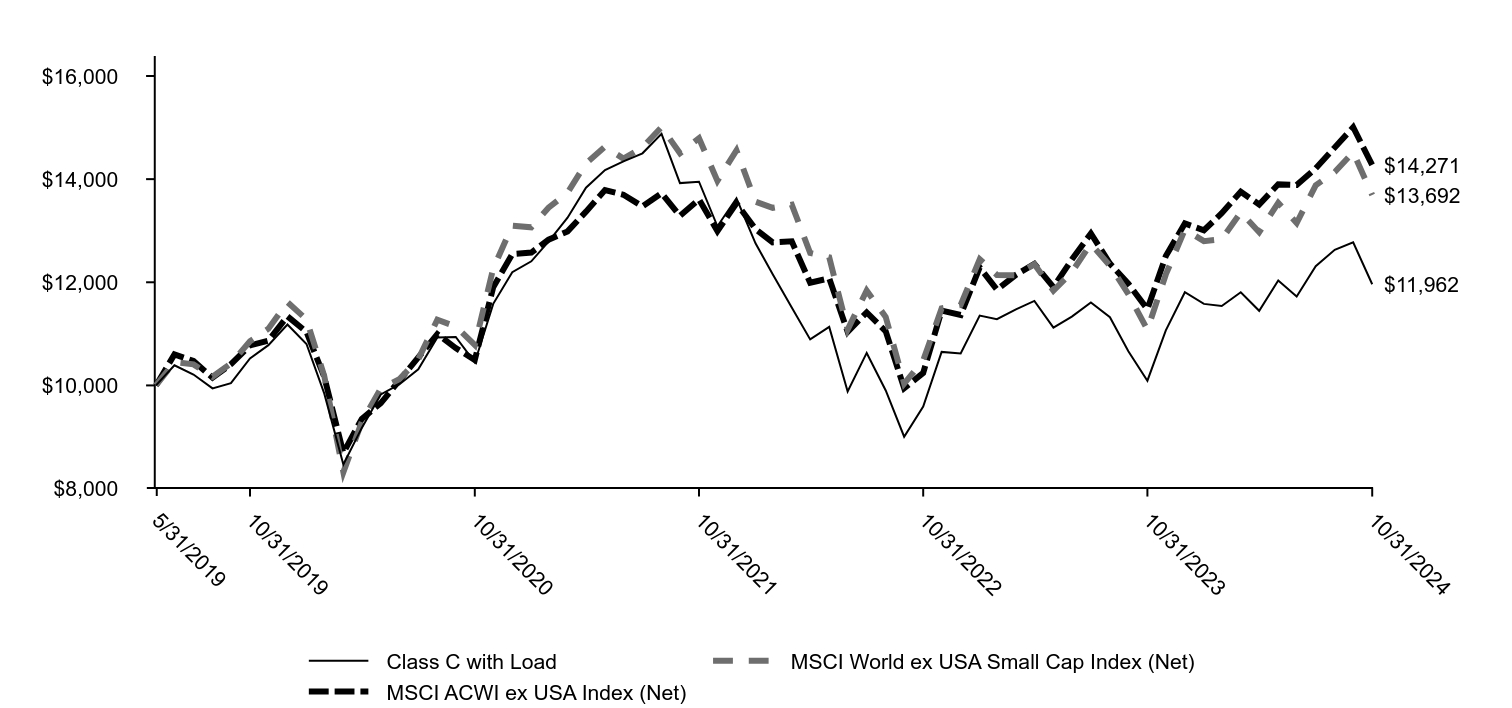

| 11/30/2017 | $10,982 | $11,833 | $10,055 | $11,908 |