UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-09255

Wells Fargo Variable Trust

(Exact name of registrant as specified in charter)

525 Market St., San Francisco, CA 94105

(Address of principal executive offices) (Zip code)

C. David Messman

Wells Fargo Funds Management, LLC

525 Market St., San Francisco, CA 94105

(Name and address of agent for service)

Registrant’s telephone number, including area code: 800-222-8222

Date of fiscal year end: December 31

Registrant is making a filing for 6 of its series:

Wells Fargo VT Discovery Fund, Wells Fargo VT Index Asset Allocation Fund, Wells Fargo VT International Equity Fund, Wells Fargo VT Omega Growth Fund, Wells Fargo VT Opportunity Fund, and Wells Fargo VT Small Cap Growth Fund.

Date of reporting period: June 30, 2018

| ITEM 1. | REPORT TO STOCKHOLDERS |

Semi-Annual Report

June 30, 2018

Wells Fargo VT Discovery Fund

Reduce clutter. Save trees.

Sign up for electronic delivery of prospectuses and shareholder reports at wellsfargo.com/advantagedelivery

Contents

The views expressed and any forward-looking statements are as of June 30, 2018, unless otherwise noted, and are those of the Fund managers and/or Wells Fargo Funds Management, LLC. Discussions of individual securities, or the markets generally, or any Wells Fargo Fund are not intended as individual recommendations. Future events or results may vary significantly from those expressed in any forward-looking statements. The views expressed are subject to change at any time in response to changing circumstances in the market. Wells Fargo Funds Management, LLC and the Fund disclaim any obligation to publicly update or revise any views expressed or forward-looking statements.

NOT FDIC INSURED ◾ NO BANK GUARANTEE ◾ MAY LOSE VALUE

| | | | |

| 2 | | Wells Fargo VT Discovery Fund | | Letter to shareholders (unaudited) |

Andrew Owen

President

Wells Fargo Funds

Globally, economies strengthened, equity markets advanced, and foreign bonds outperformed fixed-income investments in the U.S.

During February 2018, the U.S. stock market endured a loss of more than 10% before recovering in March and April.

Dear Shareholder:

We are pleased to offer you this semi-annual report for the Wells Fargo VT Discovery Fund for the six-month period that ended June 30, 2018. Globally, economies strengthened, equity markets advanced, and foreign bonds outperformed fixed-income investments in the U.S.

For the period, U.S. stocks, as measured by the S&P 500 Index,1 gained 2.65%, and international stocks, as measured by the MSCI ACWI ex USA Index (Net),2 dropped 3.77%. Emerging market stocks, as measured by the MSCI EM Index (Net),3 fell 6.66%. In bond markets, the Bloomberg Barclays U.S. Aggregate Bond Index4 declined 1.62% while fixed-income investments outside the U.S. lost 1.31 %, according to the Bloomberg Barclays Global Aggregate ex-USD Index.5 The Bloomberg Barclays Municipal Bond Index6 fell 0.25%, and the ICE BofAML U.S. High Yield Index7 was up 0.08%.

Volatility reemerged during the first quarter of 2018 as economic signals were mixed.

The first quarter of 2018 began with stock market gains in January after the U.S. announced tax reform measures intended to lower rates for individuals and corporations. Then, investor optimism was supplanted by several concerns. Trade tensions emerged, particularly between the U.S. and China, as the U.S. threatened to impose tariffs on a broad range of imported products. Increasing interest rates and inflation also caused concern. During February 2018, the U.S. stock market endured a loss of more than 10% before recovering in March and April. The S&P 500 Index closed the first quarter with a negative return, the first negative quarterly return for the index since 2014.

The U.S. Federal Reserve (Fed) increased the federal funds rate by 25 basis points (bps; 100 bps equal 1.00%) in March and the rate of inflation reached the Fed’s 2% target for the first time in a year. The unemployment rate fell to 4.1% by March 2018 and wage growth data improved. The third revision of gross domestic product growth for the first quarter by the U.S. Bureau of Economic Analysis released during June was lowered to 2.0%.

Overseas, investment market returns reversed the strong returns of 2017—the MSCI ACWI ex USA Index (Net) gained 27.19% for the 12-month period—falling 0.43% through the end of the second quarter of 2018. Although central banks, including the European Central Bank and the Bank of Japan, maintained low interest rates and quantitative easing measures that are generally supportive of

| 1 | The S&P 500 Index consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market-value-weighted index with each stock’s weight in the index proportionate to its market value. You cannot invest directly in an index. |

| 2 | The Morgan Stanley Capital International (MSCI) All Country World Index (ACWI) ex USA Index (Net) is a free-float-adjusted market-capitalization-weighted index that is designed to measure the equity market performance of developed markets, excluding the United States and Canada. Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed, or produced by MSCI. You cannot invest directly in an index. |

| 3 | The MSCI Emerging Markets (EM) Index (Net) is a free-float-adjusted market-capitalization-weighted index that is designed to measure large- and mid-cap equity market performance of emerging markets. The MSCI EM Index (Net) consists of the following 24 emerging market country indices: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Pakistan, Peru, the Philippines, Poland, Qatar, Russia, South Africa, Taiwan, Thailand, Turkey, and the United Arab Emirates. You cannot invest directly in an index. |

| 4 | The Bloomberg Barclays U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment-grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, mortgage-backed securities (agency fixed-rate and hybrid adjustable-rate mortgage pass-throughs), asset-backed securities, and commercial mortgage-backed securities. You cannot invest directly in an index. |

| 5 | The Bloomberg Barclays Global Aggregate ex-USD Index is an unmanaged index that provides a broad-based measure of the global investment-grade fixed-income markets excluding the U.S. dollar-denominated debt market. You cannot invest directly in an index. |

| 6 | The Bloomberg Barclays Municipal Bond Index is an unmanaged index composed of long-term tax-exempt bonds with a minimum credit rating of Baa. You cannot invest directly in an index. |

| 7 | The ICE BofAML U.S. High Yield Index is a market-capitalization-weighted index of domestic and Yankee high-yield bonds. The index tracks the performance of high-yield securities traded in the U.S. bond market. You cannot invest directly in an index. Copyright 2018. ICE Data Indices, LLC. All rights reserved. |

| 8 | The Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. You cannot invest directly in an index. |

| | | | | | |

| Letter to shareholders (unaudited) | | Wells Fargo VT Discovery Fund | | | 3 | |

businesses and equity markets, the U.S. dollar strengthened relative to local currencies, which served to restrain returns.

Global trade tensions escalated during the second quarter of 2018.

Global trade tensions escalated as the second quarter of 2018 opened and equity markets fell in response before resuming upward momentum later in April. The CPI8 for All Urban Consumers added 0.2% in May after a similar increase in April. On a year-over-year basis, the all-items index rose 2.8% for the 12 months that ended May 31, continuing its upward trend since the beginning of the year. The index for all items less food and energy rose 2.2% for the same 12-month period.

During June 2018, the Fed increased the federal funds rate by another 25 bps. Market expectations increased that the Fed might announce two more rate increases in 2018. The unemployment rate fell to an 18-year low of 3.8% in May and wage growth data improved. Internationally, central banks maintained their low interest rates and monetary policies that were accommodative of business activity.

Interest rates generally increased and the bond markets tended to decline. Long-term interest rates in the U.S. trended higher—rates on the 10-year and 30-year Treasury bonds moved from 2.46% and 2.81%, respectively, at the beginning of the year on January 1, 2018, to 2.85% and 2.98%, respectively, on June 30, 2018, well off their highest levels during the first half of the year of 3.11% and 3.25%, respectively, on May 17, 2018.

Despite the positive economic and business trends globally, international stock values fell and U.S. stock gains moderated during most of the second quarter of 2018 due to escalating tensions as the U.S. imposed tariffs on foreign goods and countries outside of the U.S. imposed tariffs of their own on U.S. products in response.

Don’t let short-term uncertainty derail long-term investment goals.

Periods of investment uncertainty can present challenges, but experience has taught us that maintaining long-term investment goals can be an effective way to plan for the future. To help you create a sound strategy based on your personal goals and risk tolerance, Wells Fargo Funds offers more than 100 mutual funds spanning a wide range of asset classes and investment styles. Although diversification cannot guarantee an investment profit or prevent losses, we believe it can be an effective way to manage investment risk and potentially smooth out overall portfolio performance. We encourage investors to know their investments and to understand that appropriate levels of risk-taking may unlock opportunities.

Thank you for choosing to invest with Wells Fargo Funds. We appreciate your confidence in us and remain committed to helping you meet your financial needs.

Sincerely,

Andrew Owen

President

Wells Fargo Funds

For further information about your Fund, contact your investment professional, visit our website at wellsfargofunds.com, or call us directly at 1-800-260-5969.

| | | | |

| 4 | | Wells Fargo VT Discovery Fund | | Performance highlights (unaudited) |

Investment objective

The Fund seeks long-term capital appreciation.

Manager

Wells Fargo Funds Management, LLC

Subadviser

Wells Capital Management Incorporated

Portfolio managers

Michael T. Smith, CFA®

Christopher J. Warner, CFA®

Average annual total returns (%) as of June 30, 2018

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | Expense ratios1 (%) | |

| | | Inception date | | 1 year | | | 5 year | | | 10 year | | | Gross | | | Net2 | |

| Class 2 | | 5-8-1992 | | | 20.59 | | | | 12.46 | | | | 10.58 | | | | 1.17 | | | | 1.16 | |

| Russell 2500TM Growth Index3 | | – | | | 21.53 | | | | 13.87 | | | | 11.38 | | | | – | | | | – | |

Figures quoted represent past performance, which is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted and assumes the reinvestment of dividends and capital gains. Current month-end performance is available by calling 1-800-260-5969. Performance figures of the Fund do not reflect fees charged pursuant to the terms of variable life insurance policies and variable annuity contracts. If these charges had been reflected, performance would have been lower.

Shares are sold without a front-end sales charge or a contingent deferred sales charge.

Index returns do not include transaction costs associated with buying and selling securities, any mutual fund fees or expenses, or any taxes. It is not possible to invest directly in an index.

Stock values fluctuate in response to the activities of individual companies and general market and economic conditions. Smaller-company stocks tend to be more volatile and less liquid than those of larger companies. Certain investment strategies tend to increase the total risk of an investment (relative to the broader market). The Fund is exposed to foreign investment risk. Consult the Fund’s prospectus for additional information on these and other risks.

Please refer to the prospectus provided by your participating insurance company for detailed information describing the separate accounts for information regarding surrender charges, mortality and expense risk fees, and other charges that may be assessed by the participating insurance companies.

Please see footnotes on page 5.

| | | | | | |

| Performance highlights (unaudited) | | Wells Fargo VT Discovery Fund | | | 5 | |

| | | | |

| Ten largest holdings (%) as of June 30, 20184 | |

Waste Connections Incorporated | | | 2.67 | |

WEX Incorporated | | | 2.52 | |

Take-Two Interactive Software Incorporated | | | 2.10 | |

Gartner Incorporated | | | 2.05 | |

The Brink’s Company | | | 1.85 | |

Vail Resorts Incorporated | | | 1.85 | |

WellCare Health Plans Incorporated | | | 1.81 | |

Veeva Systems Incorporated Class A | | | 1.80 | |

Bright Horizons Family Solutions Incorporated | | | 1.78 | |

ICU Medical Incorporated | | | 1.77 | |

|

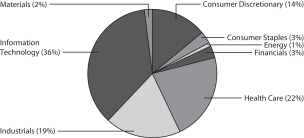

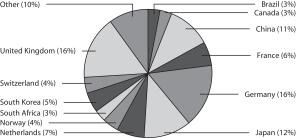

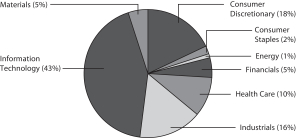

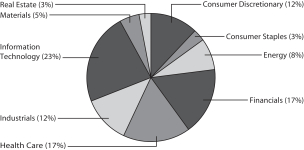

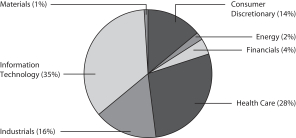

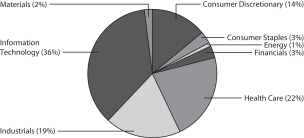

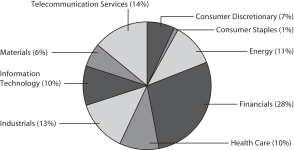

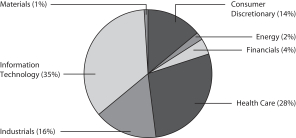

| Sector distribution as of June 30, 20185 |

|

|

| 1 | Reflects the expense ratios as stated in the most recent prospectuses, which include the impact of 0.01% in acquired fund fees and expenses. The expense ratios shown are subject to change and may differ from the annualized expense ratios shown in the financial highlights of this report. |

| 2 | The manager has committed through April 30, 2019, to waive fees and/or reimburse expenses to the extent necessary to cap the Fund’s Total Annual Fund Operating Expenses After Fee Waiver at 1.15% for Class 2. After this time, the cap may be increased or the commitment to maintain the cap may be terminated only with the approval of the Board of Trustees. Brokerage commissions, stamp duty fees, interest, taxes, acquired fund fees and expenses (if any), and extraordinary expenses are excluded from the expense cap. Without this cap, the Fund’s returns would have been lower. The expense ratio paid by an investor is the net expense ratio (the total annual fund operating expenses after fee waivers) as stated in the prospectus. |

| 3 | The Russell 2500TM Growth Index measures the performance of those Russell 2500 companies with higher price/book ratios and higher forecasted growth values. You cannot invest directly in an index. |

| 4 | The ten largest holdings, excluding cash, cash equivalents and any money markets funds, are calculated based on the value of the investments divided by total net assets of the Fund. Holdings are subject to change and may have changed since the date specified. |

| 5 | Amounts are calculated based on the total long-term investments of the Fund. These amounts are subject to change and may have changed since the date specified. |

| | | | |

| 6 | | Wells Fargo VT Discovery Fund | | Fund expenses (unaudited) |

As a shareholder of the Fund, you incur ongoing costs, including management fees, distribution (12b-1) fees, and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the six-month period and held for the entire period from January 1, 2018 to June 30, 2018.

Actual expenses

The “Actual” line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the “Actual” line under the heading entitled “Expenses paid during period” for your applicable class of shares to estimate the expenses you paid on your account during this period.

Hypothetical example for comparison purposes

The “Hypothetical” line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any separate account charges assessed by participating insurance companies. Therefore, the “Hypothetical” line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these separate account charges assessed by participating insurance companies were included, your costs would have been higher.

| | | | | | | | | | | | | | | | |

| | | Beginning

account value

1-1-2018 | | | Ending

account value

6-30-2018 | | | Expenses

paid during

the period¹ | | | Annualized net

expense ratio | |

Class 2 | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,155.15 | | | $ | 6.15 | | | | 1.15 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,019.09 | | | $ | 5.76 | | | | 1.15 | % |

| 1 | Expenses paid is equal to the annualized net expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year divided by the number of days in the fiscal year (to reflect the one-half-year period). |

| | | | | | |

| Portfolio of investments—June 30, 2018 (unaudited) | | Wells Fargo VT Discovery Fund | | | 7 | |

| | | | | | | | | | | | | | | | |

| Security name | | | | | | | | Shares | | | Value | |

| | | | |

Common Stocks: 97.24% | | | | | | | | | | | | | | | | |

| | | | |

Consumer Discretionary: 13.59% | | | | | | | | | | | | | | | | |

| | | | |

| Diversified Consumer Services: 3.31% | | | | | | | | | | | | | | | | |

Adtalem Global Education Incorporated † | | | | | | | | | | | 48,400 | | | $ | 2,328,040 | |

Bright Horizons Family Solutions Incorporated † | | | | | | | | | | | 26,200 | | | | 2,686,024 | |

| | | | |

| | | | | | | | | | | | | | | 5,014,064 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Hotels, Restaurants & Leisure: 7.36% | | | | | | | | | | | | | | | | |

Eldorado Resorts Incorporated Ǡ | | | | | | | | | | | 44,600 | | | | 1,743,860 | |

Hilton Grand Vacations Incorporated † | | | | | | | | | | | 60,800 | | | | 2,109,760 | |

Melco Crown Entertainment Limited ADR | | | | | | | | | | | 72,100 | | | | 2,018,800 | |

Six Flags Entertainment Corporation « | | | | | | | | | | | 35,092 | | | | 2,458,195 | |

Vail Resorts Incorporated | | | | | | | | | | | 10,200 | | | | 2,796,738 | |

| | | | |

| | | | | | | | | | | | | | | 11,127,353 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Household Durables: 1.38% | | | | | | | | | | | | | | | | |

NVR Incorporated † | | | | | | | | | | | 700 | | | | 2,079,245 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Specialty Retail: 1.54% | | | | | | | | | | | | | | | | |

Burlington Stores Incorporated † | | | | | | | | | | | 15,516 | | | | 2,335,623 | |

| | | | | | | | | | | | | | | | |

| | | | |

Consumer Staples: 3.07% | | | | | | | | | | | | | | | | |

| | | | |

| Beverages: 1.58% | | | | | | | | | | | | | | | | |

National Beverage Corporation Ǡ | | | | | | | | | | | 22,400 | | | | 2,394,560 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Food Products: 1.49% | | | | | | | | | | | | | | | | |

Lamb Weston Holdings Incorporated | | | | | | | | | | | 32,900 | | | | 2,253,979 | |

| | | | | | | | | | | | | | | | |

| | | | |

Energy: 1.18% | | | | | | | | | | | | | | | | |

| | | | |

| Oil, Gas & Consumable Fuels: 1.18% | | | | | | | | | | | | | | | | |

Diamondback Energy Incorporated | | | | | | | | | | | 13,600 | | | | 1,789,352 | |

| | | | | | | | | | | | | | | | |

| | | | |

Financials: 2.68% | | | | | | | | | | | | | | | | |

| | | | |

| Capital Markets: 1.44% | | | | | | | | | | | | | | | | |

Raymond James Financial Incorporated | | | | | | | | | | | 24,400 | | | | 2,180,140 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Consumer Finance: 1.24% | | | | | | | | | | | | | | | | |

SLM Corporation † | | | | | | | | | | | 163,200 | | | | 1,868,640 | |

| | | | | | | | | | | | | | | | |

| | | | |

Health Care: 20.99% | | | | | | | | | | | | | | | | |

| | | | |

| Biotechnology: 4.26% | | | | | | | | | | | | | | | | |

Array BioPharma Incorporated † | | | | | | | | | | | 68,007 | | | | 1,141,157 | |

CRISPR Therapeutics AG Ǡ | | | | | | | | | | | 12,827 | | | | 753,715 | |

Exelixis Incorporated † | | | | | | | | | | | 57,710 | | | | 1,241,919 | |

Flexion Therapeutics Incorporated Ǡ | | | | | | | | | | | 63,568 | | | | 1,643,233 | |

Sarepta Therapeutics Incorporated † | | | | | | | | | | | 9,403 | | | | 1,242,889 | |

TG Therapeutics Incorporated Ǡ | | | | | | | | | | | 31,800 | | | | 418,170 | |

| | | | |

| | | | | | | | | | | | | | | 6,441,083 | |

| | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 8 | | Wells Fargo VT Discovery Fund | | Portfolio of investments—June 30, 2018 (unaudited) |

| | | | | | | | | | | | | | | | |

| Security name | | | | | | | | Shares | | | Value | |

| | | | |

| Health Care Equipment & Supplies: 8.51% | | | | | | | | | | | | | | | | |

Haemonetics Corporation † | | | | | | | | | | | 14,300 | | | $ | 1,282,424 | |

Hill-Rom Holdings Incorporated | | | | | | | | | | | 26,300 | | | | 2,297,042 | |

Hologic Incorporated † | | | | | | | | | | | 42,700 | | | | 1,697,325 | |

ICU Medical Incorporated † | | | | | | | | | | | 9,100 | | | | 2,672,215 | |

Insulet Corporation † | | | | | | | | | | | 24,899 | | | | 2,133,844 | |

iRhythm Technologies Incorporated † | | | | | | | | | | | 18,000 | | | | 1,460,340 | |

Nevro Corporation † | | | | | | | | | | | 16,600 | | | | 1,325,510 | |

| | | | |

| | | | | | | | | | | | | | | 12,868,700 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Health Care Providers & Services: 3.94% | | | | | | | | | | | | | | | | |

Amedisys Incorporated † | | | | | | | | | | | 22,922 | | | | 1,958,914 | |

Molina Healthcare Incorporated † | | | | | | | | | | | 13,000 | | | | 1,273,220 | |

WellCare Health Plans Incorporated † | | | | | | | | | | | 11,100 | | | | 2,733,264 | |

| | | | |

| | | | | | | | | | | | | | | 5,965,398 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Health Care Technology: 1.80% | | | | | | | | | | | | | | | | |

Veeva Systems Incorporated Class A † | | | | | | | | | | | 35,400 | | | | 2,720,844 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Life Sciences Tools & Services: 1.24% | | | | | | | | | | | | | | | | |

Bio-Rad Laboratories Incorporated Class A † | | | | | | | | | | | 6,500 | | | | 1,875,510 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Pharmaceuticals: 1.24% | | | | | | | | | | | | | | | | |

GW Pharmaceuticals plc Ǡ | | | | | | | | | | | 6,600 | | | | 920,964 | |

MyoKardia Incorporated † | | | | | | | | | | | 9,079 | | | | 450,772 | |

Wave Life Sciences Limited † | | | | | | | | | | | 13,200 | | | | 504,900 | |

| | | | |

| | | | | | | | | | | | | | | 1,876,636 | |

| | | | | | | | | | | | | | | | |

| | | | |

Industrials: 18.43% | | | | | | | | | | | | | | | | |

| | | | |

| Aerospace & Defense: 4.25% | | | | | | | | | | | | | | | | |

BWX Technologies Incorporated | | | | | | | | | | | 34,200 | | | | 2,131,344 | |

Curtiss-Wright Corporation | | | | | | | | | | | 19,694 | | | | 2,343,980 | |

Mercury Computer Systems Incorporated † | | | | | | | | | | | 51,260 | | | | 1,950,956 | |

| | | | |

| | | | | | | | | | | | | | | 6,426,280 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Building Products: 1.46% | | | | | | | | | | | | | | | | |

A.O. Smith Corporation | | | | | | | | | | | 37,400 | | | | 2,212,210 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Commercial Services & Supplies: 4.52% | | | | | | | | | | | | | | | | |

The Brink’s Company | | | | | | | | | | | 35,100 | | | | 2,799,225 | |

Waste Connections Incorporated | | | | | | | | | | | 53,743 | | | | 4,045,773 | |

| | | | |

| | | | | | | | | | | | | | | 6,844,998 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Machinery: 2.45% | | | | | | | | | | | | | | | | |

Evoqua Water Technologies Company † | | | | | | | | | | | 106,437 | | | | 2,181,959 | |

Nordson Corporation | | | | | | | | | | | 11,900 | | | | 1,528,079 | |

| | | | |

| | | | | | | | | | | | | | | 3,710,038 | |

| | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| | | | | | |

| Portfolio of investments—June 30, 2018 (unaudited) | | Wells Fargo VT Discovery Fund | | | 9 | |

| | | | | | | | | | | | | | | | |

| Security name | | | | | | | | Shares | | | Value | |

| | | | |

| Professional Services: 1.32% | | | | | | | | | | | | | | | | |

TransUnion | | | | | | | | | | | 27,850 | | | $ | 1,995,174 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Road & Rail: 1.26% | | | | | | | | | | | | | | | | |

Saia Incorporated † | | | | | | | | | | | 23,600 | | | | 1,908,060 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Trading Companies & Distributors: 3.17% | | | | | | | | | | | | | | | | |

SiteOne Landscape Supply Incorporated † | | | | | | | | | | | 30,150 | | | | 2,531,696 | |

Univar Incorporated † | | | | | | | | | | | 86,080 | | | | 2,258,739 | |

| | | | |

| | | | | | | | | | | | | | | 4,790,435 | |

| | | | | | | | | | | | | | | | |

| | | | |

Information Technology: 35.36% | | | | | | | | | | | | | | | | |

| | | | |

| Electronic Equipment, Instruments & Components: 5.11% | | | | | | | | | | | | | | | | |

Littelfuse Incorporated | | | | | | | | | | | 8,357 | | | | 1,906,900 | |

Novanta Incorporated † | | | | | | | | | | | 29,800 | | | | 1,856,540 | |

Universal Display Corporation « | | | | | | | | | | | 17,200 | | | | 1,479,200 | |

Zebra Technologies Corporation Class A † | | | | | | | | | | | 17,400 | | | | 2,492,550 | |

| | | | |

| | | | | | | | | | | | | | | 7,735,190 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Internet Software & Services: 8.84% | | | | | | | | | | | | | | | | |

Box Incorporated Class A † | | | | | | | | | | | 53,600 | | | | 1,339,464 | |

DocuSign Incorporated Ǡ | | | | | | | | | | | 16,626 | | | | 880,347 | |

Envestnet Incorporated † | | | | | | | | | | | 28,200 | | | | 1,549,590 | |

Etsy Incorporated † | | | | | | | | | | | 53,000 | | | | 2,236,070 | |

LogMeIn Incorporated | | | | | | | | | | | 18,300 | | | | 1,889,475 | |

Match Group Incorporated Ǡ | | | | | | | | | | | 32,200 | | | | 1,247,428 | |

MercadoLibre Incorporated | | | | | | | | | | | 7,560 | | | | 2,259,911 | |

Yandex NV Class A † | | | | | | | | | | | 54,885 | | | | 1,970,372 | |

| | | | |

| | | | | | | | | | | | | | | 13,372,657 | |

| | | | | | | | | | | | | | | | |

| | | | |

| IT Services: 13.31% | | | | | | | | | | | | | | | | |

Black Knight Incorporated † | | | | | | | | | | | 47,900 | | | | 2,565,045 | |

EPAM Systems Incorporated † | | | | | | | | | | | 15,719 | | | | 1,954,343 | |

Euronet Worldwide Incorporated † | | | | | | | | | | | 26,793 | | | | 2,244,450 | |

First Data Corporation Class A † | | | | | | | | | | | 126,100 | | | | 2,639,273 | |

Gartner Incorporated † | | | | | | | | | | | 23,300 | | | | 3,096,570 | |

GreenSky Incorporated Class A † | | | | | | | | | | | 31,185 | | | | 659,563 | |

Switch Incorporated Class A « | | | | | | | | | | | 129,999 | | | | 1,582,088 | |

Total System Services Incorporated | | | | | | | | | | | 18,700 | | | | 1,580,524 | |

WEX Incorporated † | | | | | | | | | | | 20,000 | | | | 3,809,600 | |

| | | | |

| | | | | | | | | | | | | | | 20,131,456 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Semiconductors & Semiconductor Equipment: 1.11% | | | | | | | | | | | | | | | | |

Teradyne Incorporated | | | | | | | | | | | 43,900 | | | | 1,671,273 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Software: 6.21% | | | | | | | | | | | | | | | | |

Globant SA Ǡ | | | | | | | | | | | 34,800 | | | | 1,976,292 | |

Proofpoint Incorporated † | | | | | | | | | | | 17,121 | | | | 1,974,223 | |

Take-Two Interactive Software Incorporated † | | | | | | | | | | | 26,900 | | | | 3,183,884 | |

The Ultimate Software Group Incorporated † | | | | | | | | | | | 8,800 | | | | 2,264,328 | |

| | | | |

| | | | | | | | | | | | | | | 9,398,727 | |

| | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 10 | | Wells Fargo VT Discovery Fund | | Portfolio of investments—June 30, 2018 (unaudited) |

| | | | | | | | | | | | | | | | |

| Security name | | | | | | | | Shares | | | Value | |

| | | | |

| Technology Hardware, Storage & Peripherals: 0.78% | | | | | | | | | | | | | | | | |

NCR Corporation † | | | | | | | | | | | 39,500 | | | $ | 1,184,210 | |

| | | | | | | | | | | | | | | | |

| | | | |

Materials: 1.94% | | | | | | | | | | | | | | | | |

| | | | |

| Chemicals: 0.70% | | | | | | | | | | | | | | | | |

Albemarle Corporation « | | | | | | | | | | | 11,300 | | | | 1,065,929 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Construction Materials: 1.24% | | | | | | | | | | | | | | | | |

Vulcan Materials Company | | | | | | | | | | | 14,500 | | | | 1,871,367 | |

| | | | | | | | | | | | | | | | |

| | | | |

Total Common Stocks (Cost $114,703,030) | | | | | | | | | | | | | | | 147,109,131 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | Yield | | | | | | | | | | |

| Short-Term Investments: 13.15% | | | | | | | | | | | | | | | | |

| | | | |

| Investment Companies: 13.15% | | | | | | | | | | | | | | | | |

Securities Lending Cash Investment LLC (l)(r)(u) | | | 2.09 | % | | | | | | | 15,443,361 | | | | 15,444,905 | |

Wells Fargo Government Money Market Fund Select Class (l)(u) | | | 1.83 | | | | | | | | 4,457,195 | | | | 4,457,195 | |

| | | | |

Total Short-Term Investments (Cost $19,901,840) | | | | | | | | | | | | | | | 19,902,100 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | |

| Total investments in securities (Cost $134,604,870) | | | 110.39 | % | | | 167,011,231 | |

Other assets and liabilities, net | | | (10.39 | ) | | | (15,721,206 | ) |

| | | | | | | | |

| Total net assets | | | 100.00 | % | | $ | 151,290,025 | |

| | | | | | | | |

| † | Non-income-earning security |

| « | All or a portion of this security is on loan. |

| (l) | The issuer of the security is an affiliated person of the Fund as defined in the Investment Company Act of 1940. |

| (r) | The investment is a non-registered investment company purchased with cash collateral received from securities on loan. |

| (u) | The rate represents the 7-day annualized yield at period end. |

Abbreviations:

| ADR | American depositary receipt |

Investments in Affiliates

An affiliated investment is an investment in which the Fund owns at least 5% of the outstanding voting shares of the issuer or as a result of other relationships, such as the Fund and the issuer having the same investment manager. Transactions with issuers that were either affiliated persons of the Fund at the beginning of the period or the end of the period were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Shares,

beginning of

period | | | Shares

purchased | | | Shares

sold | | | Shares,

end of

period | | | Net

realized

gains

(losses) | | | Net

change in

unrealized

gains

(losses) | | | Income

from

affiliated

securities | | | Value,

end

of period | | | % of net assets | |

Short-Term Investments | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Investment Companies | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Securities Lending Cash Investment LLC | | | 9,357,894 | | | | 56,603,949 | | | | 50,518,482 | | | | 15,443,361 | | | $ | 0 | | | $ | 0 | | | $ | 51,518 | | | $ | 15,444,905 | | | | | |

Wells Fargo Government Money Market Fund Select Class | | | 1,291,715 | | | | 21,770,303 | | | | 18,604,823 | | | | 4,457,195 | | | | 0 | | | | 0 | | | | 20,814 | | | | 4,457,195 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | $ | 0 | | | $ | 0 | | | $ | 72,332 | | | $ | 19,902,100 | | | | 13.15 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| | | | | | |

| Statement of assets and liabilities—June 30, 2018 (unaudited) | | Wells Fargo VT Discovery Fund | | | 11 | |

| | | | |

| | | | |

| |

Assets | | | | |

Investments in unaffiliated securities (including $15,115,500 of securities loaned), at value (cost $114,703,030) | | $ | 147,109,131 | |

Investments in affiliated securities, at value (cost $19,901,840) | | | 19,902,100 | |

Receivable for investments sold | | | 208,663 | |

Receivable for Fund shares sold | | | 51,945 | |

Receivable for dividends | | | 38,658 | |

Receivable for securities lending income | | | 6,538 | |

Prepaid expenses and other assets | | | 2,528 | |

| | | | |

Total assets | | | 167,319,563 | |

| | | | |

| |

Liabilities | | | | |

Payable upon receipt of securities loaned | | | 15,444,650 | |

Payable for investments purchased | | | 365,458 | |

Management fee payable | | | 97,245 | |

Payable for Fund shares redeemed | | | 61,175 | |

Distribution fee payable | | | 32,650 | |

Administration fee payable | | | 10,448 | |

Trustees’ fees and expenses payable | | | 639 | |

Accrued expenses and other liabilities | | | 17,273 | |

| | | | |

Total liabilities | | | 16,029,538 | |

| | | | |

Total net assets | | $ | 151,290,025 | |

| | | | |

| |

NET ASSETS CONSIST OF | | | | |

Paid-in capital | | $ | 92,169,245 | |

Accumulated net investment loss | | | (414,685 | ) |

Accumulated net realized gains on investments | | | 27,129,104 | |

Net unrealized gains on investments | | | 32,406,361 | |

| | | | |

Total net assets | | $ | 151,290,025 | |

| | | | |

| |

COMPUTATION OF NET ASSET VALUE PER SHARE | | | | |

Net assets – Class 2 | | $ | 151,290,025 | |

Shares outstanding – Class 21 | | | 4,418,648 | |

Net asset value per share – Class 2 | | | $34.24 | |

| 1 | The Fund has an unlimited number of authorized shares. |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 12 | | Wells Fargo VT Discovery Fund | | Statement of operations—six months ended June 30, 2018 (unaudited) |

| | | | |

| | | | |

| |

Investment income | | | | |

Dividends (net of foreign withholding taxes of $2,288) | | $ | 366,891 | |

Securities lending income from affiliates, net | | | 51,518 | |

Income from affiliated securities | | | 20,814 | |

| | | | |

Total investment income | | | 439,223 | |

| | | | |

| |

Expenses | | | | |

Management fee | | | 556,897 | |

Administration fee | | | | |

Class 2 | | | 59,402 | |

Distribution fee | | | | |

Class 2 | | | 185,632 | |

Custody and accounting fees | | | 10,979 | |

Professional fees | | | 19,065 | |

Shareholder report expenses | | | 14,028 | |

Trustees’ fees and expenses | | | 9,095 | |

Other fees and expenses | | | 3,892 | |

| | | | |

Total expenses | | | 858,990 | |

Less: Fee waivers and/or expense reimbursements | | | (5,082 | ) |

| | | | |

Net expenses | | | 853,908 | |

| | | | |

Net investment loss | | | (414,685 | ) |

| | | | |

| |

REALIZED AND UNREALIZED GAINS (LOSSES) ON INVESTMENTS | | | | |

Net realized gains on investments | | | 9,465,083 | |

Net change in unrealized gains (losses) on investments | | | 2,250,765 | |

| | | | |

Net realized and unrealized gains (losses) on investments | | | 11,715,848 | |

| | | | |

Net increase in net assets resulting from operations | | $ | 11,301,163 | |

| | | | |

The accompanying notes are an integral part of these financial statements.

| | | | | | |

| Statement of changes in net assets | | Wells Fargo VT Discovery Fund | | | 13 | |

| | | | | | | | | | | | | | | | |

| | | Six months ended

June 30, 2018 (unaudited) | | | Year ended

December 31, 2017 | |

| | | | |

Operations | | | | | | | | | | | | | | | | |

Net investment loss | | | | | | $ | (414,685 | ) | | | | | | $ | (908,347 | ) |

Net realized gains on investments | | | | | | | 9,465,083 | | | | | | | | 18,740,756 | |

Net change in unrealized gains (losses) on investments | | | | | | | 2,250,765 | | | | | | | | 16,114,650 | |

| | | | |

Net increase in net assets resulting from operations | | | | | | | 11,301,163 | | | | | | | | 33,947,059 | |

| | | | |

| | | | |

Distributions to shareholders from | | | | | | | | | | | | | | | | |

Net realized gains – Class 2 | | | | | | | 0 | | | | | | | | (7,089,124 | ) |

| | | | |

| | | | |

Capital share transactions | | | Shares | | | | | | | | Shares | | | | | |

Proceeds from shares sold – Class 2 | | | 152,453 | | | | 5,059,927 | | | | 374,458 | | | | 10,970,353 | |

Reinvestment of distributions – Class 2 | | | 0 | | | | 0 | | | | 244,790 | | | | 7,089,124 | |

Payment for shares redeemed – Class 2 | | | (307,907 | ) | | | (10,245,764 | ) | | | (674,278 | ) | | | (19,662,185 | ) |

| | | | |

Net decrease in net assets resulting from capital share transactions | | | | | | | (5,185,837 | ) | | | | | | | (1,602,708 | ) |

| | | | |

Total increase in net assets | | | | | | | 6,115,326 | | | | | | | | 25,255,227 | |

| | | | |

| | | | |

Net assets | | | | | | | | | | | | | | | | |

Beginning of period | | | | | | | 145,174,699 | | | | | | | | 119,919,472 | |

| | | | |

End of period | | | | | | $ | 151,290,025 | | | | | | | $ | 145,174,699 | |

| | | | |

Undistributed (accumulated) net investment income (loss) | | | | | | $ | (414,685 | ) | | | | | | $ | 0 | |

| | | | |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 14 | | Wells Fargo VT Discovery Fund | | Financial highlights |

(For a share outstanding throughout each period)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six months ended June 30, 2018 (unaudited) | | | Year ended December 31 | |

| CLASS 2 | | 2017 | | | 2016 | | | 2015 | | | 2014 | | | 2013 | |

Net asset value, beginning of period | | | $31.74 | | | | $25.91 | | | | $25.99 | | | | $30.71 | | | | $35.20 | | | | $25.16 | |

Net investment loss | | | (0.09 | ) | | | (0.20 | ) | | | (0.13 | ) | | | (0.21 | ) | | | (0.22 | ) | | | (0.17 | ) |

Net realized and unrealized gains (losses) on investments | | | 2.59 | | | | 7.60 | | | | 2.00 | | | | 0.21 | | | | 0.16 | | | | 11.06 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 2.50 | | | | 7.40 | | | | 1.87 | | | | 0.00 | | | | (0.06 | ) | | | 10.89 | |

Distributions to shareholders from | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | (0.00 | )1 |

Net realized gains | | | 0.00 | | | | (1.57 | ) | | | (1.95 | ) | | | (4.72 | ) | | | (4.43 | ) | | | (0.85 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total distributions to shareholders | | | 0.00 | | | | (1.57 | ) | | | (1.95 | ) | | | (4.72 | ) | | | (4.43 | ) | | | (0.85 | ) |

Net asset value, end of period | | | $34.24 | | | | $31.74 | | | | $25.91 | | | | $25.99 | | | | $30.71 | | | | $35.20 | |

Total return2 | | | 7.88 | % | | | 29.13 | % | | | 7.65 | % | | | (1.46 | )% | | | 0.36 | % | | | 43.80 | % |

Ratios to average net assets (annualized) | | | | | | | | | | | | | | | | | | | | | | | | |

Gross expenses | | | 1.16 | % | | | 1.16 | % | | | 1.18 | % | | | 1.17 | % | | | 1.14 | % | | | 1.16 | % |

Net expenses | | | 1.15 | % | | | 1.15 | % | | | 1.15 | % | | | 1.15 | % | | | 1.14 | % | | | 1.15 | % |

Net investment loss | | | (0.56 | )% | | | (0.68 | )% | | | (0.52 | )% | | | (0.72 | )% | | | (0.68 | )% | | | (0.56 | )% |

Supplemental data | | | | | | | | | | | | | | | | | | | | | | | | |

Portfolio turnover rate | | | 28 | % | | | 75 | % | | | 85 | % | | | 90 | % | | | 79 | % | | | 88 | % |

Net assets, end of period (000s omitted) | | | $151,290 | | | | $145,175 | | | | $119,919 | | | | $126,839 | | | | $138,490 | | | | $158,451 | |

| 1 | Amount is less than $0.005. |

| 2 | Returns for periods of less than one year are not annualized. Performance figures of the Fund do not reflect fees charged pursuant to the terms of variable life insurance policies and variable annuity contracts. |

The accompanying notes are an integral part of these financial statements.

| | | | | | |

| Notes to financial statements (unaudited) | | Wells Fargo VT Discovery Fund | | | 15 | |

1. ORGANIZATION

Wells Fargo Variable Trust (the “Trust”), a Delaware statutory trust organized on March 10, 1999, is an open-end management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”). As an investment company, the Trust follows the accounting and reporting guidance in Financial Accounting Standards Board Accounting Standards Codification Topic 946, Financial Services – Investment Companies. These financial statements report on the Wells Fargo VT Discovery Fund (the “Fund”) which is a diversified series of the Trust. The Trust offers shares of the Fund to separate accounts of various life insurance companies as funding vehicles for certain variable annuity contracts and variable life insurance policies.

2. SIGNIFICANT ACCOUNTING POLICIES

The following significant accounting policies, which are consistently followed in the preparation of the financial statements of the Fund, are in conformity with U.S. generally accepted accounting principles which require management to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Securities valuation

All investments are valued each business day as of the close of regular trading on the New York Stock Exchange (generally 4 p.m. Eastern Time), although the Fund may deviate from this calculation time under unusual or unexpected circumstances.

Equity securities that are listed on a foreign or domestic exchange or market are valued at the official closing price or, if none, the last sales price. If no sale occurs on the principal exchange or market that day, a fair value price will be determined in accordance with the Fund’s Valuation Procedures.

Investments in registered open-end investment companies are valued at net asset value. Interests in non-registered investment companies that are redeemable at net asset value are fair valued normally at net asset value.

Investments which are not valued using any of the methods discussed above are valued at their fair value, as determined in good faith by the Board of Trustees of the Fund. The Board of Trustees has established a Valuation Committee comprised of the Trustees and has delegated to it the authority to take any actions regarding the valuation of portfolio securities that the Valuation Committee deems necessary or appropriate, including determining the fair value of portfolio securities, unless the determination has been delegated to the Wells Fargo Asset Management Pricing Committee at Wells Fargo Funds Management, LLC (“Funds Management”). The Board of Trustees retains the authority to make or ratify any valuation decisions or approve any changes to the Valuation Procedures as it deems appropriate. On a quarterly basis, the Board of Trustees receives reports on any valuation actions taken by the Valuation Committee or the Wells Fargo Asset Management Pricing Committee which may include items for ratification.

Valuations of fair valued securities are compared to the next actual sales price when available, or other appropriate market values, to assess the continued appropriateness of the fair valuation methodologies used. These securities are fair valued on a day-to-day basis, taking into consideration changes to appropriate market information and any significant changes to the inputs considered in the valuation process until there is a readily available price provided on an exchange or by an independent pricing service. Valuations received from an independent pricing service or independent broker-dealer quotes are periodically validated by comparisons to most recent trades and valuations provided by other independent pricing services in addition to the review of prices by the manager and/or subadviser. Unobservable inputs used in determining fair valuations are identified based on the type of security, taking into consideration factors utilized by market participants in valuing the investment, knowledge about the issuer and the current market environment.

Securities lending

The Fund may lend its securities from time to time in order to earn additional income in the form of fees or interest on securities received as collateral or the investment of any cash received as collateral. The Fund continues to receive interest or dividends on the securities loaned. The Fund receives collateral in the form of cash or securities with a value at least equal to the value of the securities on loan. The value of the loaned securities is determined at the close of each business day and any additional required collateral is delivered to the Fund on the next business day. In a securities lending transaction, the net asset value of the Fund will be affected by an increase or decrease in the value of the securities loaned and by an increase or decrease in the value of the instrument in which collateral is invested. The amount of securities lending activity undertaken by the Fund fluctuates from time to time. In the event of default or bankruptcy by the borrower, the Fund may be prevented from recovering the loaned securities or gaining access to the collateral or may experience delays or costs in doing so. In addition, the investment of any cash collateral received may lose all or part of its value. The Fund has the right under the lending agreement to recover the securities from the borrower on demand.

| | | | |

| 16 | | Wells Fargo VT Discovery Fund | | Notes to financial statements (unaudited) |

The Fund lends its securities through an unaffiliated securities lending agent. Cash collateral received in connection with its securities lending transactions is invested in Securities Lending Cash Investments, LLC (the “Securities Lending Fund”). The Securities Lending Fund is exempt from registration under Section 3(c)(7) of the 1940 Act and is managed by Funds Management and is subadvised by Wells Capital Management Incorporated (“WellsCap”), an affiliate of Funds Management and an indirect wholly owned subsidiary of Wells Fargo & Company (“Wells Fargo”). Funds Management receives an advisory fee starting at 0.05% and declining to 0.01% as the average daily net assets of the Securities Lending Fund increase. All of the fees received by Funds Management are paid to WellsCap for its services as subadviser. The Securities Lending Fund seeks to provide a positive return compared to the daily Fed Funds Open Rate by investing in high-quality, U.S. dollar-denominated short-term money market instruments. Securities Lending Fund investments are valued at the evaluated bid price provided by an independent pricing service. Income earned from investment in the Securities Lending Fund is included in securities lending income from affiliates (net of fees and rebates) on the Statement of Operations.

Security transactions and income recognition

Securities transactions are recorded on a trade date basis. Realized gains or losses are recorded on the basis of identified cost.

Dividend income is recognized on the ex-dividend date. Dividend income is recorded net of foreign taxes withheld where recovery of such taxes is not assured.

Distributions to shareholders

Distributions to shareholders from net investment income and any net realized gains are recorded on the ex-dividend date and paid at least annually. Such distributions are determined in accordance with income tax regulations and may differ from U.S. generally accepted accounting principles. Dividend sources are estimated at the time of declaration. The tax character of distributions is determined as of the Fund’s fiscal year end. Therefore, a portion of the Fund’s distributions made prior to the Fund’s fiscal year end may be categorized as a tax return of capital at year end.

Federal and other taxes

The Fund intends to continue to qualify as a regulated investment company by distributing substantially all of its investment company taxable income and any net realized capital gains (after reduction for capital loss carryforwards) sufficient to relieve it from all, or substantially all, federal income taxes. Accordingly, no provision for federal income taxes was required.

The Fund’s income and federal excise tax returns and all financial records supporting those returns for the prior three fiscal years are subject to examination by the federal and Delaware revenue authorities. Management has analyzed the Fund’s tax positions taken on federal, state, and foreign tax returns for all open tax years and does not believe that there are any uncertain tax positions that require recognition of a tax liability.

As of June 30, 2018, the aggregate cost of all investments for federal income tax purposes was $134,859,463 and the unrealized gains (losses) consisted of:

| | | | |

Gross unrealized gains | | $ | 35,194,753 | |

Gross unrealized losses | | | (3,042,985 | ) |

Net unrealized gains | | $ | 32,151,768 | |

3. FAIR VALUATION MEASUREMENTS

Fair value measurements of investments are determined within a framework that has established a fair value hierarchy based upon the various data inputs utilized in determining the value of the Fund’s investments. The three-level hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1) and the lowest priority to unobservable inputs (Level 3). The Fund’s investments are classified within the fair value hierarchy based on the lowest level of input that is significant to the fair value measurement. The inputs are summarized into three broad levels as follows:

| ∎ | | Level 1 – quoted prices in active markets for identical securities |

| ∎ | | Level 2 – other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) |

| ∎ | | Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

| | | | | | |

| Notes to financial statements (unaudited) | | Wells Fargo VT Discovery Fund | | | 17 | |

The inputs or methodologies used for valuing investments in securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary of the inputs used in valuing the Fund’s assets and liabilities as of June 30, 2018:

| | | | | | | | | | | | | | | | |

| | | Quoted prices

(Level 1) | | | Other significant

observable inputs

(Level 2) | | | Significant

unobservable inputs (Level 3) | | | Total | |

Assets | | | | | | | | | | | | | | | | |

Investments in: | | | | | | | | | | | | | | | | |

| | | | |

Common stocks | | | | | | | | | | | | | | | | |

Consumer discretionary | | $ | 20,556,285 | | | $ | 0 | | | $ | 0 | | | $ | 20,556,285 | |

Consumer staples | | | 4,648,539 | | | | 0 | | | | 0 | | | | 4,648,539 | |

Energy | | | 1,789,352 | | | | 0 | | | | 0 | | | | 1,789,352 | |

Financials | | | 4,048,780 | | | | 0 | | | | 0 | | | | 4,048,780 | |

Health care | | | 31,748,171 | | | | 0 | | | | 0 | | | | 31,748,171 | |

Industrials | | | 27,887,195 | | | | 0 | | | | 0 | | | | 27,887,195 | |

Information technology | | | 53,493,513 | | | | 0 | | | | 0 | | | | 53,493,513 | |

Materials | | | 2,937,296 | | | | 0 | | | | 0 | | | | 2,937,296 | |

| | | | |

Short-term investments | | | | | | | | | | | | | | | | |

Investment companies | | | 4,457,195 | | | | 0 | | | | 0 | | | | 4,457,195 | |

Investments measured at net asset value* | | | | | | | | | | | | | | | 15,444,905 | |

Total assets | | $ | 151,566,326 | | | $ | 0 | | | $ | 0 | | | $ | 167,011,231 | |

| * | Investments that are measured at fair value using the net asset value per share (or its equivalent) as a practical expedient have not been categorized in the fair value hierarchy. The fair value amount presented in the table is intended to permit reconciliation of the fair value hierarchy to the amounts presented in the Statement of Assets and Liabilities. The Fund’s investment in Securities Lending Cash Investments, LLC valued at $15,444,905 does not have a redemption period notice, can be redeemed daily and does not have any unfunded commitments. |

The Fund recognizes transfers between levels within the fair value hierarchy at the end of the reporting period. At June 30, 2018, the Fund did not have any transfers into/out of Level 1, Level 2, or Level 3.

4. TRANSACTIONS WITH AFFILIATES

Management fee

Funds Management, an indirect wholly owned subsidiary of Wells Fargo, is the manager of the Fund and provides advisory and fund-level administrative services under an investment management agreement. Under the investment management agreement, Funds Management is responsible for, among other services, implementing the investment objectives and strategies of the Fund, supervising the subadviser and providing fund-level administrative services in connection with the Fund’s operations. As compensation for its services under the investment management agreement, Funds Management is entitled to receive an annual management fee starting at 0.75% and declining to 0.58% as the average daily net assets of the Fund increase. For the six months ended June 30, 2018, the management fee was equivalent to an annual rate of 0.75% of the Fund’s average daily net assets.

Funds Management has retained the services of a subadviser to provide daily portfolio management to the Fund. The fee for subadvisory services is borne by Funds Management. WellsCap is the subadviser to the Fund and is entitled to receive a fee from Funds Management at an annual rate starting at 0.45% and declining to 0.35% as the average daily net assets of the Fund increase.

Administration fee

Under a class-level administration agreement, Funds Management provides class-level administrative services to the Fund, which includes paying fees and expenses for services provided by the transfer agent, sub-transfer agents, omnibus account servicers and record-keepers. As compensation for its services under the class-level administration agreement, Funds Management receives a class level administration fee of 0.08% which is calculated based on the average daily net assets of Class 2 shares.

Funds Management has contractually waived and/or reimbursed management and administration fees to the extent necessary to maintain certain net operating expense ratios for the Fund. When Class 2 of the Fund has exceeded its

| | | | |

| 18 | | Wells Fargo VT Discovery Fund | | Notes to financial statements (unaudited) |

expense cap, Funds Management has waived fees and/or reimbursed expenses from fund level expenses on a proportionate basis and then from class specific expenses; otherwise, waivers and/or reimbursements are applied against class specific expenses before fund level expenses. Funds Management has committed through April 30, 2019 to waive fees and/or reimburse expenses to the extent necessary to cap the Fund’s expenses at 1.15% for Class 2 shares. After this time, the cap may be increased or the commitment to maintain the cap may be terminated only with the approval of the Board of Trustees.

Distribution fee

The Trust has adopted a distribution plan for Class 2 shares of the Fund pursuant to Rule 12b-1 under the 1940 Act. A distribution fee is charged to Class 2 shares and paid to Wells Fargo Funds Distributor, LLC (“Funds Distributor”), the principal underwriter, at an annual rate of 0.25% of the average daily net assets of Class 2 shares.

Interfund transactions

The Fund may purchase or sell portfolio investment securities to certain other Wells Fargo affiliates pursuant to Rule 17a-7 under the 1940 Act and under procedures adopted by the Board of Trustees. The procedures have been designed to ensure that these interfund transactions, which do not incur broker commissions, are effected at current market prices.

5. INVESTMENT PORTFOLIO TRANSACTIONS

Purchases and sales of investments, excluding U.S. government obligations (if any) and short-term securities, for the six months ended June 30, 2018 were $41,033,368 and $49,418,213, respectively.

6. BANK BORROWINGS

The Trust and Wells Fargo Funds Trust (excluding the money market funds and certain other funds) are parties to a $280,000,000 revolving credit agreement whereby the Fund is permitted to use bank borrowings for temporary or emergency purposes, such as to fund shareholder redemption requests. Interest under the credit agreement is charged to the Fund based on a borrowing rate equal to the higher of the Federal Funds rate in effect on that day plus 1.25% or the overnight LIBOR rate in effect on that day plus 1.25%. In addition, an annual commitment fee equal to 0.25% of the unused balance is allocated to each participating fund.

For the six months ended June 30, 2018, there were no borrowings by the Fund under the agreement.

7. CONCENTRATION RISK

Concentration risks result from exposure to a limited number of sectors. A fund that invests a substantial portion of its assets in any sector may be more affected by changes in that sector than would be a fund whose investments are not heavily weighted in any sector.

8. INDEMNIFICATION

Under the Trust’s organizational documents, the officers and Trustees have been granted certain indemnification rights against certain liabilities that may arise out of performance of their duties to the Trust. Additionally, in the normal course of business, the Trust may enter into contracts with service providers that contain a variety of indemnification clauses. The Trust’s maximum exposure under these arrangements is dependent on future claims that may be made against the Fund and, therefore, cannot be estimated.

9. SUBSEQUENT DISTRIBUTIONS

On July 13, 2018, the Fund declared distributions from short-term capital gains and long-term capital gains to shareholders of record on July 12, 2018. The per share amounts payable on July 16, 2018 were as follows:

| | | | | | | | |

| | | Short-term

capital gains | | | Long-term

capital gains | |

Class 2 | | | $0.37573 | | | | $3.66118 | |

These distributions are not reflected in the accompanying financial statements.

| | | | | | |

| Other information (unaudited) | | Wells Fargo VT Discovery Fund | | | 19 | |

PROXY VOTING INFORMATION

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities is available, upon request, by calling 1-800-260-5969, visiting our website at wellsfargofunds.com, or visiting the SEC website at sec.gov. Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 is available on the Fund’s website at wellsfargofunds.com or by visiting the SEC website at sec.gov.

PORTFOLIO HOLDINGS INFORMATION

The complete portfolio holdings for the Fund are publicly available monthly on the Fund’s website (wellsfargofunds.com), on a one-month delayed basis. In addition, top ten holdings information (excluding derivative positions) for the Fund is publicly available on the Fund’s website on a monthly, seven-day or more delayed basis. The Fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q, which is available by visiting the SEC website at sec.gov. In addition, the Fund’s Form N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC, and at regional offices in New York City, at 233 Broadway, and in Chicago, at 175 West Jackson Boulevard, Suite 900. Information about the Public Reference Room may be obtained by calling 1-800-SEC-0330.

| | | | |

| 20 | | Wells Fargo VT Discovery Fund | | Other information (unaudited) |

BOARD OF TRUSTEES AND OFFICERS

Each of the Trustees and Officers1 listed in the table below acts in identical capacities for each fund in the Wells Fargo family of funds, which consists of 154 mutual funds comprising the Wells Fargo Funds Trust, Wells Fargo Variable Trust, Wells Fargo Master Trust and four closed-end funds (collectively the “Fund Complex”). This table should be read in conjunction with the Prospectus and the Statement of Additional Information2. The mailing address of each Trustee and Officer is 525 Market Street, 12th Floor, San Francisco, CA 94105. Each Trustee and Officer serves an indefinite term, however, each Trustee serves such term until reaching the mandatory retirement age established by the Trustees.

Independent Trustees

| | | | | | |

Name and year of birth | | Position held and length of service* | | Principal occupations during past five years or longer | | Current other public company or investment company directorships |

William R. Ebsworth (Born 1957) | | Trustee, since 2015 | | Retired. From 1984 to 2013, equities analyst, portfolio manager, research director and chief investment officer at Fidelity Management and Research Company in Boston, Tokyo, and Hong Kong, and retired in 2013 as Chief Investment Officer of Fidelity Strategic Advisers, Inc. where he led a team of investment professionals managing client assets. Prior thereto, Board member of Hong Kong Securities Clearing Co., Hong Kong Options Clearing Corp., the Thailand International Fund, Ltd., Fidelity Investments Life Insurance Company, and Empire Fidelity Investments Life Insurance Company. Board member of the Forté Foundation (non-profit organization) and the Vincent Memorial Hospital Endowment (non-profit organization), where he serves on the Investment Committee and as a Chair of the Audit Committee. Mr. Ebsworth is a CFA® charterholder. | | Asset Allocation Trust |

Jane A. Freeman (Born 1953) | | Trustee, since 2015; Chair Liaison, since 2018 | | Retired. From 2012 to 2014 and 1999 to 2008, Chief Financial Officer of Scientific Learning Corporation. From 2008 to 2012, Ms. Freeman provided consulting services related to strategic business projects. Prior to 1999, Portfolio Manager at Rockefeller & Co. and Scudder, Stevens & Clark. Board member of the Harding Loevner Funds from 1996 to 2014, serving as both Lead Independent Director and chair of the Audit Committee. Board member of the Russell Exchange Traded Funds Trust from 2011 to 2012 and the chair of the Audit Committee. Ms. Freeman is a Board Member of Ruth Bancroft Garden (non-profit organization) and the Glimmerglass Festival. She is also an inactive Chartered Financial Analyst. | | Asset Allocation Trust |

Isaiah Harris, Jr. (Born 1952) | | Trustee, since 2009 | | Retired. Chairman of the Board of CIGNA Corporation since 2009, and Director since 2005. From 2003 to 2011, Director of Deluxe Corporation. Prior thereto, President and CEO of BellSouth Advertising and Publishing Corp. from 2005 to 2007, President and CEO of BellSouth Enterprises from 2004 to 2005 and President of BellSouth Consumer Services from 2000 to 2003. Emeritus member of the Iowa State University Foundation Board of Governors. Emeritus Member of the Advisory Board of Iowa State University School of Business. Advisory Board Member, Palm Harbor Academy (charter school). Advisory Board Member, Child Evangelism Fellowship (non-profit). Mr. Harris is a certified public accountant (inactive status). | | CIGNA Corporation; Asset Allocation Trust |

Judith M. Johnson (Born 1949) | | Trustee, since 2008; Audit Committee Chairman, since 2009 | | Retired. Prior thereto, Chief Executive Officer and Chief Investment Officer of Minneapolis Employees Retirement Fund from 1996 to 2008. Ms. Johnson is an attorney, certified public accountant and a certified managerial accountant. | | Asset Allocation Trust |

David F. Larcker (Born 1950) | | Trustee, since 2009 | | James Irvin Miller Professor of Accounting at the Graduate School of Business, Stanford University, Director of the Corporate Governance Research Initiative and Senior Faculty of The Rock Center for Corporate Governance since 2006. From 2005 to 2008, Professor of Accounting at the Graduate School of Business, Stanford University. Prior thereto, Ernst & Young Professor of Accounting at The Wharton School, University of Pennsylvania from 1985 to 2005. | | Asset Allocation Trust |

| | | | | | |

| Other information (unaudited) | | Wells Fargo VT Discovery Fund | | | 21 | |

| | | | | | |

Name and year of birth | | Position held and length of service* | | Principal occupations during past five years or longer | | Current other public company or investment company directorships |

Olivia S. Mitchell (Born 1953) | | Trustee, since 2006; Governance Committee Chairman, since 2018 | | International Foundation of Employee Benefit Plans Professor, Wharton School of the University of Pennsylvania since 1993. Director of Wharton’s Pension Research Council and Boettner Center on Pensions & Retirement Research, and Research Associate at the National Bureau of Economic Research. Previously, Cornell University Professor from 1978 to 1993. | | Asset Allocation Trust |

Timothy J. Penny (Born 1951) | | Trustee, since 1996; Chairman, since 2018; Vice Chairman, from 2017 to 2018 | | President and Chief Executive Officer of Southern Minnesota Initiative Foundation, a non-profit organization, since 2007. Member of the Board of Trustees of NorthStar Education Finance, Inc., a non-profit organization, since 2007. | | Asset Allocation Trust |

James G. Polisson (Born 1959) | | Trustee, since 2018; Advisory Board Member, from 2017 to 2018 | | Retired. Chief Marketing Officer, Source (ETF) UK Services, Ltd, from 2015 to 2017. From 2012 to 2015, Principal of The Polisson Group, LLC, a management consulting, corporate advisory and principal investing company. Chief Executive Officer and Managing Director at Russell Investments, Global Exchange Traded Funds from 2010 to 2012. Managing Director of Barclays Global Investors from 1998 to 2010 and Global Chief Marketing Officer for iShares and Barclays Global Investors from 2000 to 2010. Trustee of the San Francisco Mechanics’ Institute, a non-profit organization, from 2013 to 2015. Board member of the Russell Exchange Traded Fund Trust from 2011 to 2012. Director of Barclays Global Investors Holdings Deutschland GmbH from 2006 to 2009. Mr. Polisson is an attorney and has a retired status with the Massachusetts and District of Columbia Bar Associations. | | Asset Allocation Trust |

Michael S. Scofield (Born 1943) | | Trustee, since 2010 | | Served on the Investment Company Institute’s Board of Governors and Executive Committee from 2008-2011 as well the Governing Council of the Independent Directors Council from 2006-2011 and the Independent Directors Council Executive Committee from 2008-2011. Trustee of the Evergreen Fund complex (and its predecessors) from 1984 to 2010. Chairman of the Evergreen Funds from 2000-2010. Former Trustee of the Mentor Funds. Retired Attorney, Law Offices of Michael S. Scofield. | | Asset Allocation Trust |

Pamela Wheelock (Born 1959) | | Trustee, since 2018; Advisory Board Member, from 2017 to 2018 | | Chief Operating Officer, Twin Cities Habitat for Humanity, since January, 2017. Vice President of University Services, University of Minnesota from 2012 to 2017. Prior thereto, on the Board of Directors, Goverance Committee and Finance Committee for the Minnesota Philanthropy Partners (Saint Paul Foundation) from 2012 to 2018, Interim President and Chief Executive Officer of Blue Cross Blue shield of Minnesota of Minnesota from 2010 to 2011, Chairman of the Board from 2009 to 2011 and Board Director 2003 to 2015. Vice President, Leadership and Community Engagement, Bush Foundation, Saint Paul, Minnesota (a private foundation) from 2009 to 2011. Executive Vice President and Chief Financial Officer, Minnesota Sports and Entertainment from 2004 to 2009 and Senior Vice President from 2002 to 2004. Commissioner of Finance, State of Minnesota, from 1999 to 2002. Currently the Board Chair of the Minnesota Wild Foundation since 2010. | | Asset Allocation Trust |

| * | Length of service dates reflect the Trustee’s commencement of service with the Trust’s predecessor entities, where applicable. |

| | | | |

| 22 | | Wells Fargo VT Discovery Fund | | Other information (unaudited) |

Officers

| | | | | | |

Name and year of birth | | Position held and length of service | | Principal occupations during past five years or longer | | |

Andrew Owen (Born 1960) | | President, since 2017 | | Executive Vice President of Wells Fargo & Company and Head of Affiliated Managers, Wells Fargo Asset Management, since 2014. In addition, Mr. Owen is currently President, Chief Executive Officer and Director of Wells Fargo Funds Management, LLC since 2017. Prior thereto, Executive Vice President responsible for marketing, investments and product development for Wells Fargo Funds Management, LLC, from 2009 to 2014. | | |

Jeremy DePalma1 (Born 1974) | | Treasurer, since 2012 | | Senior Vice President of Wells Fargo Funds Management, LLC since 2009. Senior Vice President of Evergreen Investment Management Company, LLC from 2008 to 2010 and head of the Fund Reporting and Control Team within Fund Administration from 2005 to 2010. | | |

Alexander Kymn3 (Born 1973) | | Secretary, since 2018; Chief Legal Officer, since 2018 | | Senior Company Counsel of Wells Fargo Bank, N.A. since 2018 (previously Senior Counsel from 2007 to 2018). Vice President of Wells Fargo Funds Management, LLC from 2008 to 2014. | | |

Michael H. Whitaker (Born 1967) | | Chief Compliance Officer, since 2016 | | Senior Vice President and Chief Compliance Officer since 2016. Senior Vice President and Chief Compliance Officer for Fidelity Investments from 2007 to 2016. | | |

David Berardi (Born 1975) | | Assistant Treasurer, since 2009 | | Vice President of Wells Fargo Funds Management, LLC since 2009. Vice President of Evergreen Investment Management Company, LLC from 2008 to 2010. Manager of Fund Reporting and Control for Evergreen Investment Management Company, LLC from 2004 to 2010. | | |

| 1 | Jeremy DePalma acts as Treasurer of 77 funds and Assistant Treasurer of 77 funds in the Fund Complex. |

| 2 | The Statement of Additional Information includes additional information about the Trustees and is available, without charge, upon request, by calling 1-800-260-5969 or by visiting the website at wellsfargofunds.com. |

| 3 | Alexander Kymn became the Secretary and Chief Legal Officer effective April 17, 2018. |

| | | | | | |

| Other information (unaudited) | | Wells Fargo VT Discovery Fund | | | 23 | |

BOARD CONSIDERATION OF INVESTMENT MANAGEMENT AND SUB-ADVISORY AGREEMENTS:

Wells Fargo VT Discovery Fund

Under the Investment Company Act of 1940 (the “1940 Act”), the Board of Trustees (the “Board”) of Wells Fargo Variable Trust (the “Trust”) must determine annually whether to approve the continuation of the Trust’s investment management and sub-advisory agreements. In this regard, at an in-person meeting held on May 22-23, 2018 (the “Meeting”), the Board, all the members of which have no direct or indirect interest in the investment management and sub-advisory agreements and are not “interested persons” of the Trust, as defined in the 1940 Act (the “Independent Trustees”), reviewed and approved for Wells Fargo VT Discovery Fund (the “Fund”): (i) an investment management agreement (the “Management Agreement”) with Wells Fargo Funds Management, LLC (“Funds Management”); and (ii) an investment sub-advisory agreement (the “Sub-Advisory Agreement”) with Wells Capital Management Incorporated (the “Sub-Adviser”), an affiliate of Funds Management. The Management Agreement and the Sub-Advisory Agreement are collectively referred to as the “Advisory Agreements.”

At the Meeting, the Board considered the factors and reached the conclusions described below relating to the selection of Funds Management and the Sub-Adviser and the approval of the Advisory Agreements. Prior to the Meeting, including at an in-person meeting in April 2018, the Trustees conferred extensively among themselves and with representatives of Funds Management about these matters. Also, the Board has adopted a team-based approach, with each team consisting of a sub-set of Trustees, to assist the full Board in the discharge of its duties in reviewing investment performance and other matters throughout the year. The Independent Trustees were assisted in their evaluation of the Advisory Agreements by independent legal counsel, from whom they received separate legal advice and with whom they met separately.

In providing information to the Board, Funds Management and the Sub-Adviser were guided by a detailed set of requests for information submitted to them by independent legal counsel on behalf of the Independent Trustees at the start of the Board’s annual contract renewal process earlier in 2018. In considering and approving the Advisory Agreements, the Trustees considered the information they believed relevant, including but not limited to the information discussed below. The Board considered not only the specific information presented in connection with the Meeting, but also the knowledge gained over time through interaction with Funds Management and the Sub-Adviser about various topics. In this regard, the Board reviewed reports of Funds Management at each of its quarterly meetings, which included, among other things, portfolio reviews and investment performance reports. In addition, the Board and the teams mentioned above confer with portfolio managers at various times throughout the year. The Board did not identify any particular information or consideration that was all-important or controlling, and each individual Trustee may have attributed different weights to various factors.