UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2006

COMMISSION FILE NUMBER: 000-26125

RUBIO’S RESTAURANTS, INC.

(Exact Name of Registrant as Specified in Its Charter)

| DELAWARE | 33-0100303 |

| (State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification Number) |

| | |

1902 WRIGHT PLACE, SUITE 300, CARLSBAD, CALIFORNIA 92008

(Address of Principal Executive Offices)

(760) 929-8226

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class | Name of Each Exchange on Which Registered |

| Common Stock, par value $0.001 per share | The NASDAQ Stock Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes o No þ

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer or a non-accelerated filer, as defined in Rule 12b-2 of the Act.

Large accelerated filer o Accelerated filer o Non-accelerated filer þ

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No þ

The aggregate market value of the voting stock held by non-affiliates of the registrant based upon the closing sale price of the registrant’s common stock on June 25, 2006 as reported on the Nasdaq Global Market was approximately $59 million. This amount excludes 2,583,895 shares of the registrant’s common stock held by the executive officers, directors and each person who beneficially owns 10% or more of the registrant’s outstanding common stock. Exclusion of such shares should not be construed to indicate that any such person possesses the power, direct or indirect, to direct or cause the direction of the management or policies of the registrant or that such person is controlled by or under common control with the registrant.

As of March 21, 2007, there were 9,793,491 shares of the registrant’s common stock, par value $0.001 per share, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of our definitive proxy statement for the 2007 annual meeting of stockholders are incorporated by reference into PART III of this annual report on Form 10-K. Our 2007 annual meeting of stockholders is scheduled to be held on July 26, 2007. We intend to file our definitive proxy statement with the Securities and Exchange Commission not later than 120 days after the conclusion of our fiscal year ended December 31, 2006. In addition, certain exhibits filed with our prior registration statements and Forms 10-K, 8-K, S-8 and 10-Q are incorporated by reference in PART IV of this annual report.

RUBIO’S RESTAURANTS, INC.

TABLE OF CONTENTS

| | | |

| | | Page |

| PART I | | |

| Item 1. | Business | 3 |

| Item 1A. | Risk Factors | 10 |

| Item 1B. | Unresolved Staff Comments | 15 |

| Item 2. | Properties | 15 |

| Item 3. | Legal Proceedings | 15 |

| Item 4. | Submission of Matters to a Vote of Security Holders | 15 |

| | | |

| PART II | | |

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 15 |

| Item 6. | Selected Consolidated Financial Data | 17 |

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 18 |

| Item 7A. | Quantitative and Qualitative Disclosures About Market Risk | 24 |

| Item 8. | Consolidated Financial Statements and Supplementary Data | 24 |

| Item 9. | Changes in and Disagreements With Accountants on Accounting and Financial Disclosure | 24 |

| Item 9A. | Controls and Procedures | 24 |

| Item 9B. | Other Information | 24 |

| | | |

| PART III | | |

| Item 10. | Directors and Executive Officers and Corporate Governance | 24 |

| Item 11. | Executive Compensation | 25 |

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 25 |

| Item 13. | Certain Relationships and Related Transactions, and Director Independence | 25 |

| Item 14. | Principal Accountant Fees and Services | 25 |

| | | |

| PART IV | | |

| Item 15. | Exhibits and Consolidated Financial Statement Schedules | 26 |

| | | |

| | Signatures | 28 |

FORWARD-LOOKING STATEMENTS

This annual report on Form 10-K and the documents we incorporate by reference contain projections, estimates and other forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are principally contained in the section captioned “Business” under Item 1 below and the section captioned “Management’s Discussion and Analysis of Financial Condition and Results of Operations” under Item 7 below. In some cases, you can identify forward-looking statements by terms such as may, will, should, expect, plan, intend, forecast, anticipate, believe, estimate, predict, potential, continue or the negative of these terms or other comparable terminology. These forward-looking statements involve a number of risks and uncertainties, including but not limited to, those factors discussed under “Risk Factors” under Item 1A below and including, among others, increased product costs, labor expense and other restaurant costs, the success of our promotions and marketing strategies, our ability to recruit and retain qualified personnel, adverse effects of weather, adequacy of reserves related to store closures or stores to be sold, asset write-downs, implementation costs related to our marketing and concept positioning initiatives, our ability to manage ongoing and unanticipated costs, such as costs to comply with the Sarbanes-Oxley Act and other regulatory initiatives and litigation costs, our ability to implement a franchise strategy, our ability to open additional or maintain existing restaurants in the coming periods, and the effects of ever-increasing competition. As a result of these risks and uncertainties, our actual results or performance may differ materially from any future results or performance expressed or implied by the forward-looking statements. These forward-looking statements represent beliefs and assumptions only as of the date of this annual report. We undertake no obligation to release publicly the results of any revisions or updates to these forward-looking statements to reflect events or circumstances arising after the date of this annual report.

PART I.

Item 1. BUSINESS

As of March 21, 2007, we owned and operated 162 fast-casual Mexican restaurants, three licensed locations, and one franchised restaurant that offer high-quality, fresh and distinctive Mexican cuisine, at attractive prices; including chargrilled chicken, steak and fresh seafood items such as burritos, tacos and quesadillas inspired by the Baja, California region of Mexico. We were incorporated in California in 1985 and re-incorporated in Delaware in October 1997. We have a wholly-owned subsidiary, Rubio’s Restaurants of Nevada, Inc., which was incorporated in Nevada in 1997. Our restaurants are located in California, Arizona, Nevada, Colorado and Utah. As of March 21, 2007, we had approximately 3,300 employees.

RUBIO’S FRESH MEXICAN GRILL® CONCEPT

The Rubio’s Fresh Mexican Grill® concept evolved from the original “Rubio’s, Home of the Fish Taco®” concept, which our co-founder Ralph Rubio first developed following his college spring break trips to the Baja peninsula of Mexico in the mid-1970s. Ralph and his father, Raphael, opened the first Rubio’s® restaurant nearly 25 years ago in the Mission Bay area of San Diego, California and introduced fish tacos to America. Building on the initial success of the concept, we expanded our menu and upgraded our restaurant layout over the years to appeal to a broader customer base, including a concept name change to Rubio’s Baja Grill® in 1997 to reflect these improvements. In 2002, Rubio’s further evolved, completing a transformation from Rubio’s original fish taco concept to Rubio’s Fresh Mexican Grill. The Rubio’s concept now features grilled chicken, steak and seafood items as well as our original, Baja-style World Famous Fish TacosSM. We believe Rubio’s Fresh Mexican Grill is well positioned as an innovator in the fast-casual Mexican grill segment. The critical elements of our market positioning are as follows:

| | • | FRESHLY PREPARED HIGH QUALITY FOOD WITH BOLD, DISTINCTIVE TASTES AND FLAVORS. We differentiate ourselves from competitive restaurants by offering high-quality, flavorful, and made-to-order products using Baja-inspired recipes at attractive prices. Our menu strategy is predicated on developing unique, distinctive and flavorful products that generate strong guest loyalty. Rubio’s excels with seafood, and our signature items include our World Famous Fish Tacos, Baja Grill® Burritos with chargrilled chicken or steak and our authentic Street Tacos. Rubio’s also offers a number of burritos, tacos, and quesadillas prepared in a variety of ways featuring grilled, marinated chicken, steak, pork, shrimp and Mahi Mahi. In addition, we serve freshly-prepared salads and bowls. Our menu also includes HealthMex® offerings which are lower in fat and calories, and Kid’s Meals designed especially for children. Our guacamole, chips, beans and rice are prepared fresh daily in our restaurants. Guests may enhance and customize their meals at our complimentary salsa bar which features a variety of freshly- prepared salsas. Our menu is served at lunch and dinner, as well as breakfast in a limited number of our restaurants. |

| | • | CASUAL, FUN DINING EXPERIENCE. Our restaurants are designed to create a fun and casual ambiance by capturing the relaxed, comfortable and colorful atmosphere inspired by the Baja, California region of Mexico. Our design elements include colorful Mexican tiles, saltwater aquariums with tropical fish, Baja beach photos and tropical prints, surfboards on the walls and authentic palm-thatched patio umbrellas, or palapas, in most locations. We believe our restaurants have broad appeal to a wide range of guests. |

| | • | EXCELLENT DINING VALUE. Our restaurants offer high-quality food typically associated with sit-down, casual dining restaurants, but generally at prices substantially lower than those found at casual dining restaurants. In addition to attractive prices, we offer the convenience and service platform of a traditional fast-casual or quick-service format. We provide guests a clean and comfortable environment in which to enjoy their meals on site. We also offer guests the convenience of take-out service for both individual meals and large party orders. We believe the strong value we deliver to our guests is critical to generating guest satisfaction, repeat business, and continued loyalty. |

OUR BUSINESS STRATEGIES

Our business objective is to become a leading fast-casual Mexican restaurant brand. To achieve this objective, we are pursuing the following strategies:

| | • | CREATE A DISTINCTIVE CONCEPT AND BRAND. Our restaurants provide guests with a fun and casual dining experience which we believe helps to promote frequent visits and strong guest loyalty. Our key initiatives are designed to deliver a great guest experience, enhance the performance of our existing restaurants, and strengthen our brand identity. These initiatives include developing proprietary menu offerings with bold, intense flavors, upgrading the ambiance of our restaurants, and delivering best-in-class service standards. We strive to promote awareness and generate trial through regional and local media campaigns and neighborhood brand-building efforts. |

| | • | ACHIEVE FAVORABLE RESTAURANT-LEVEL ECONOMICS. We believe we are able to achieve favorable operating results in our core markets due to the appeal of our concept, careful site selection, cost-effective development, consistent application of our management and training programs, and a focus on continuously improving of our economic model. We utilize centralized and local restaurant information and accounting systems, which allow our management to monitor and control labor, food and other direct operating expenses on a real-time basis and provide them with timely access to financial and operating data. We believe we achieve a lower-than-average product cost compared to our competitors, due to our lower cost and high product mix seafood items versus a less diverse menu made up of higher cost items such as chicken and steak. As we expand and optimize our menu, we continue to focus on creating highly desirable, high-margin items. We also believe that our culture and emphasis on training leads to lower employee turnover rates, and higher productivity, compared to industry averages. |

| | • | FOCUS ON BUILDING SALES AT EXISTING RESTAURANTS. We regularly conduct and evaluate marketing research to analyze our markets, customer base, product mix, and competition in order to remain relevant in the eyes of our consumers. Rubio’s marketing mix includes a combination of regional radio, in-store merchandising, public relations, neighborhood marketing, e-marketing, and print media tactics. We periodically implement new products and promotions to increase traffic in our restaurants. |

| | • | ENSURE A HIGH-QUALITY GUEST EXPERIENCE. We strive to provide a consistent, high-quality guest experience in order to generate frequent visits and customer loyalty. We focus on creating a fun, team-like culture for our restaurant employees which we believe fosters a friendly and inviting atmosphere for our guests. Through extensive training, experienced restaurant-level management, and rigorous operational controls, we seek to ensure prompt, friendly and efficient service for our guests. We utilize an interactive voice response (IVR) and web-based guest feedback program to continually monitor our performance against guest expectations. We also seek out and respond to direct comments and questions from guests who utilize our toll-free guest comment line and “contact us” page on our website. |

| | • | EXECUTE FOCUSED REGIONAL EXPANSION STRATEGY. We believe that our restaurant concept has significant opportunities for expansion in both our existing and neighboring markets. An expansion strategy focused primarily on company-owned unit growth will allow us to grow our brand and maintain the quality of food and service expected by our customers. Our current expansion plan calls for a multi-year development strategy, including the opening of 16 to 20 new restaurants in 2007 and an annual growth rate of 10% to 15% for the next three to five years. We generally target high-traffic, high-visibility end-cap locations in urban and suburban markets with medium to high family income levels. |

UNIT ECONOMICS

For purposes of analyzing our store operating results, and to eliminate the effects of start-up, training, and other costs associated with new store openings, we measure comparable store results on only those units that have been open for at least 15 months. During fiscal 2006, we had 145 units that were open for over 15 months. These units generated average sales of $998,000 per unit, average operating income of $118,000, or 11.8% of sales, and average operating cash flows of $169,000, or 16.9% of sales. Comparable store sales increased 2.0% in fiscal 2006 following an increase of 1.2% in fiscal 2005 and an increase of 4.3% in fiscal 2004.

As of December 31, 2006, we had 130 units in California, our largest state market. During fiscal 2006, 119 of these units were open for over 15 months. These units generated average sales of $1,036,000 per unit, average operating income of $125,000, or 12.1% of sales, and average operating cash flows of $179,000, or 17.3% of sales.

As of December 31, 2006, we had 32 units outside of California. During fiscal 2006, 26 of these units were open for over 15 months. These units generated average sales of $826,000 per unit, average operating income of $85,000, or 10.3% of sales, and average restaurant operating cash flows of $121,000 or 14.6% of sales.

These results are not necessarily indicative of our future results or the results we may obtain in other units currently open, or those we may open in the future.

EXISTING LOCATIONS

The following table sets forth information about our existing and proposed units as of March 21, 2007. We also license our concept to other restaurant operators for three non-traditional locations in the San Diego and Los Angeles areas of California at Petco Park Stadium, the San Diego International Airport food court and the Honda Center in Anaheim, California. The majority of our units are in high-traffic retail centers and are not stand-alone units.

| Company-Owned and Operated Locations | | Opened | | Under Construction | | Signed Leases | |

| Los Angeles Area | | | 70 | | | — | | | 2 | |

| San Diego Area | | | 43 | | | — | | | 1 | |

| Phoenix/Tucson Area | | | 23 | | | — | | | 3 | |

| Denver Area | | | 3 | | | — | | | — | |

| San Francisco Area | | | 9 | | | — | | | — | |

| Sacramento Area | | | 8 | | | — | | | 2 | |

| Las Vegas Area | | | 4 | | | — | | | — | |

| Salt Lake City Area | | | 2 | | | — | | | — | |

| Total Company-Owned Locations | | | 162 | | | — | | | 8 | |

| | | | | | | | | | | |

Franchise and Licensed Locations | | | | | | | | | | |

| Los Angeles Area | | | 1 | | | — | | | — | |

| San Diego Area | | | 2 | | | — | | | — | |

| Las Vegas Area | | | 1 | | | — | | | 1 | |

| Total Franchised and Licensed Locations | | | 4 | | | — | | | 1 | |

| | | | | | | | | | | |

We currently lease all of our restaurant locations with the exception of one owned building. We plan to continue to lease substantially all of our future restaurant locations in order to minimize the cash investment associated with each unit.

Historically, our restaurants have ranged from 1,800 to 3,300 square feet, excluding our smaller, food court locations. We expect the size of our future sites to range from 2,300 to 2,800 square feet. We intend to continue to develop restaurants that will require, on average, a total cash investment of approximately $525,000 to $575,000, excluding estimated pre-opening expenses of approximately $55,000 to $65,000 per unit, which includes approximately $20,000 to $30,000 of non-cash rent expense during the build-out period.

EXPANSION AND SITE SELECTION

We currently plan to open 16 to 20 company-owned units in fiscal 2007 in our existing geographic markets. Our three to five year expansion plan calls for an annual unit growth rate of 10% to 15%. We opened our first unit outside of California in Phoenix, Arizona in April 1997. We currently operate a total of 32 units outside of California, including 23 in Arizona, 3 in Colorado, 4 in Nevada, and 2 in Utah.

Our expansion strategy targets major metropolitan areas that have attractive demographic characteristics. Once a metropolitan area is selected, we identify viable trade areas that have high-traffic patterns, strong demographics, such as medium to high family incomes, high education levels and high density of both daytime employment and residential developments, limited competition and strong retail and entertainment developments. Within a desirable trade area, we select sites that provide specific levels of visibility, accessibility, parking, co-tenancy and exposure to a large number of potential guests.

We believe that the quality of our site selection criteria is critical to our continuing success. Therefore, our senior management team is actively involved in the selection of new sites and markets, personally visiting all new markets and all sites prior to final approval. Each new market and site must be approved by our Real Estate Site Approval Committee, which consists of members of senior management. This process allows us to analyze each potential location, taking into account its effect on all aspects of our business, such as marketing, personnel, food service and supply chain dynamics.

In connection with our strategy to expand into selected markets, we initiated a franchising program in late 2000. This franchising strategy requires us to devote management and financial resources to build the operational infrastructure needed to support the franchise of our restaurants. As of March 21, 2007, we have one signed franchise development agreement. This agreement represents a commitment to open five units in five years. The franchisee under this agreement opened its first unit in April 2006 and is scheduled to open its second restaurant in July 2007.

MENU

Our made-to-order menu features made-to-order burritos, soft-shell tacos, and quesadillas and salads made with marinated, chargrilled chicken breast and steak, as well as seafood representative of the Baja, California region of Mexico, such as chargrilled Mahi Mahi, sautéed shrimp and our signature Baja-style fish taco. The menu features many of Rubio’s favorites bundled as meal combo deals with rice, beans, chips and a drink. The goal of our menu is to maintain our heritage of offering distinctive fish and seafood items, while also including offerings of chicken, pork, and beef items. Side items including our guacamole, chips, beans and rice and are all made fresh daily in our restaurants. Each of our restaurants also provide self-serve salsa bars where guests may choose from four different salsas made fresh every day in every restaurant. Our prices range from about $1.30 for Baja-style Street Tacos to $7.99 for Three Taco Mix & Match Combos, which includes three tacos, fresh chips, beans and a soft drink. Most restaurants also offer a selection of imported Mexican and domestic beers.

Our HealthMex menu items, designed to have less than 20% calories from fat and offered in most of our restaurants, include tacos, burritos served on whole-wheat tortillas, and salads, all made with chargrilled chicken or Mahi Mahi.

Our Kid’s Meals combine a choice of chicken taquitos, chicken bites, a World Famous Fish Taco, a cheese quesadilla or a bean & cheese burrito, along with a side dish of beans, rice, or chips, and a small drink, churro and a toy surprise.

From time to time, we introduce limited-time-only products and promotions to provide added variety and encourage guest frequency.

DECOR AND ATMOSPHERE

We believe that the decor and atmosphere of our restaurants are critical factors in our guests’ overall dining experience. In 2005, we began a multi-year re-image program for our existing restaurants so that our interiors and exteriors display distinctive designs that match our high-quality, fresh food. During 2006, we re-imaged 75 of our restaurants and plan to re-image approximately 6 to 10 more in 2007, which will complete our re-imaging program. The Company re-imaged 27 restaurants in 2005.

MARKETING

Our marketing mix includes a combination of regional radio advertising, in-store merchandising, public relations, neighborhood marketing, e-marketing, and print media tactics. We use radio advertising as a marketing tool to increase brand awareness, attract new guests, and encourage existing guests to visit more frequently. Our advertising is designed to increase sales and transactions by conveying our brand positioning and creating awareness of new or limited-time products or promotions.

Local store marketing, public relations, and e-marketing are used to increase community awareness and generate traffic on a local level. A variety of programs are available for our restaurant general managers to target various business-building opportunities within the local community and trade area surrounding each restaurant. We believe word-of-mouth advertising is also a key component in attracting and retaining guests.

As part of our expansion strategy, we select markets which we believe will support multiple units and the efficient use of broadcast advertising. We sometimes utilize local public relations initiatives to help establish brand awareness for new restaurants as we build toward media efficiency. In fiscal 2006, we spent approximately $5.3 million on marketing. We expect our marketing expenditures to

increase as we add new restaurants and focus on building awareness to drive new guests to our units and increase repeat visits by existing customers.

OPERATIONS

UNIT MANAGEMENT AND EMPLOYEES

We currently have approximately 3,300 employees. Our typical restaurant employs one general manager, one to two assistant managers and 18 to 22 hourly employees, approximately 40% of which are full-time employees and approximately 60% of which are part-time employees. The general manager is responsible for the day-to-day operations of the restaurant, including food quality, service, staffing and product ordering. We seek to train and develop from within, or hire experienced general managers and staff and to motivate and retain them by providing opportunities for increased responsibilities and advancement, as well as performance-based cash incentives. These performance incentives are tied to sales and profitability. We also have granted general managers options to purchase shares of our common stock when hired or promoted. All hourly employees in our restaurants are eligible for self funded health benefits immediately upon hire. All full-time restaurant management are eligible for health benefits the first day of the month following their hire date. Full time corporate employees are eligible for health benefits on their hire date. Employees over 21 years of age who have worked for us for more than one year are eligible to participate in our 401(k) plan.

We currently employ 17 district managers, each of whom reports to one of three regional directors. These district managers oversee restaurant management in all phases of operation, as well as assist in opening new units. These district managers are eligible to participate in our cash bonus plan, and the three regional directors are eligible to participate in our cash bonus and stock incentive plans.

TRAINING

We strive to maintain quality and consistency in each of our units through the careful training and supervision of personnel and the establishment of, and adherence to, high standards of personnel performance, food and beverage preparation, guest service, and maintenance of facilities. We have implemented a training program that is designed to teach new managers the technical and supervisory skills necessary to direct the operations of our restaurants in a professional and profitable manner. Each manager must successfully complete a five-week training course, which includes hands-on experience in both the kitchen and dining areas of our restaurants. They are also required to study our operations manuals and to view videotapes relating to food and beverage handling (particularly food safety and sanitation), preparation and service. In addition, we maintain a continuing education program to provide our unit managers with ongoing training and support. We strive to maintain a team-oriented atmosphere and attempt to instill enthusiasm and dedication in our employees. We regularly solicit employee suggestions concerning how we can improve our operations in order to be responsive to both them and our guests.

QUALITY CONTROLS

Our emphasis on superior guest service is complemented by our quality control programs. We utilize an interactive voice response (IVR) and web-based guest feedback program to continually monitor our performance against guest expectations. We also seek out and respond to direct comments and questions from guests who utilize our toll-free guest comment line and the “contact us” page on our website. District managers are directly responsible for ensuring that guest comments are addressed appropriately to achieve a high level of guest satisfaction. Our Director of Food and Beverage is responsible for ensuring product consistency and quality among our restaurants.

HOURS OF OPERATION

Our units are generally open Sunday through Thursday from 10:30 a.m. until 10:00 p.m., and on Friday and Saturday from 10:30 a.m. to 11:00 p.m.

MANAGEMENT INFORMATION SYSTEMS

All of our restaurants use computerized point-of-sale systems, which are designed to improve operating efficiency, provide corporate management timely access to financial and marketing data, and reduce restaurant and corporate administrative time and expense. These systems record each order and print the food requests in the kitchen for the cooks to prepare. The data captured for use by operations and corporate management includes gross and net sales amounts, cash and credit card receipts and quantities of each menu item sold. Sales and receipt information is transmitted to the corporate office daily, where it is reviewed and reconciled by the accounting department before being recorded in the accounting system. The daily sales information is transmitted nightly to the corporate office and distributed to management via an intranet web page each morning. A Windows-based back office system is used in

all operating units to manage food cost, labor cost and sales reporting. On a weekly basis, a report of actual food cost compared to ideal food cost is also generated.

Our corporate systems provide management with operating reports that show restaurant performance comparisons with budget and prior year results both for the current accounting period and year-to-date, as well as trend formats by both dollars and percent of sales. These systems allow us to closely monitor restaurant sales, cost of sales, labor expense and other restaurant trends on a daily, weekly and monthly basis. We believe these systems enable both unit and corporate management to supervise the operational and financial performance of our units on a real-time basis, and will accommodate future expansion.

PURCHASING

We strive to obtain consistent high-quality ingredients at competitive prices from reliable sources. To attain operating efficiencies and to provide fresh ingredients for our food products while obtaining the lowest possible ingredient prices for the required quality, employees at the corporate office control the purchase of food items from a variety of national, regional and local suppliers at negotiated prices. Most food, produce and other products are shipped from a central distributor directly to the units two to three times per week. We do not maintain a central food product warehouse or commissary. We do, however, maintain some products in third party warehouses for certain seafood items. Except for our contract with our central distributor, our contract with Coca-Cola North America FoodService, and several contracts ranging from six to 12 months for fish, chicken and some beef, we do not have any long-term contracts with our food suppliers. In the past, we have not experienced delays in receiving our food and beverage inventories, restaurant supplies or equipment.

COMPETITION

The restaurant industry is intensely competitive. There are many different segments within the restaurant industry that are distinguished by types of service, food types and price/value relationships. We position our restaurants in the high-quality, attractively priced, fast-casual Mexican food segment of the industry. In this segment, our direct competitors include, among others, Baja Fresh, La Salsa, Chipotle and Qdoba. We also compete indirectly with full-service Mexican restaurants including Chevy’s, On The Border, Chi Chi’s and El Torito and fast food restaurants, particularly those focused on Mexican food such as El Pollo Loco, Taco Bell and Del Taco. Competition in this industry segment is based primarily upon food quality, price, restaurant ambiance, service and location. Although we believe we compete favorably with respect to each of these factors, many of our direct and indirect competitors are well-established national, regional or local chains and have substantially greater financial, marketing, personnel and other resources. We also compete with many other retail establishments for site locations.

TRADEMARKS AND SERVICE MARKS

We have maintained registrations for two trademarks and nine service marks including, but not limited to, “Rubio’s,” “Rubio’s Baja Grill, Home of the Fish Taco,” “Home of the Fish Taco,” “HealthMex,” “Fish (Pesky) Caricature,” “Baja Grill,” “Best of Baja,” “True Baja,” “Rubio’s Crispy Shrimp” and “Rubio’s Fresh Mexican Grill” with the United States Patents and Trademark Office. In addition, we have filed applications for “Rubio’s Baja Gourmet Burritos,” “Rubio’s Street Tacos,” “Street Tacos,” “Rubio’s Lettuce Tacos,” “Cerveza Time,” “Rubio’s Street Burritos,” “Street Burrito,” “Taco Meal Deals,” “Burrito Meal Deals,” “Street Meal Deals” and “World Famous Fish Tacos.” We believe that our trademarks, service marks and other proprietary rights have significant value and are important to the marketing of our restaurant concept.

SEASONALITY

Our business is subject to seasonal fluctuations. Historically, sales in most of our restaurants have been higher during the second and third quarters of each fiscal year, during the warmer spring and summer months, particularly because most of our restaurants offer patio seating. As a result, our highest earnings generally occur in the second and third quarters of each fiscal year.

GOVERNMENT REGULATION

Our restaurants are subject to licensing and regulation by state and local health, sanitation, safety, fire and other authorities, including licensing and permit requirements for the sale of alcoholic beverages and food. To date we have not experienced an inability to obtain or maintain any necessary licenses, permits or approvals. In addition, the development and construction of additional units are also subject to compliance with applicable zoning, land use and environmental regulations.

SEC FILINGS; INTERNET ADDRESS

Our Internet address is www.rubios.com. We file our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to those reports with the SEC and make such filings available, free of charge, on www.rubios.com, as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. The information found on our website shall not be deemed incorporated by reference by any general statement incorporating by reference this report into any filing under the Securities Act of 1933 or under the Securities Exchange Act of 1934, except to the extent we specifically incorporate the information found on our website by reference, and shall not otherwise be deemed filed under such Acts.

Our filings are also available through the SEC website, www.sec.gov, and at the SEC Public Reference Room at 100 F Street, NE Washington DC 20549. For more information about the SEC Public Reference Room, you can call the SEC at 1-800-SEC-0330.

MANAGEMENT

OUR EXECUTIVE OFFICERS

As of March 21, 2007 our executive officers are as follows:

NAME | | AGE | | POSITION WITH THE COMPANY |

| Dan Pittard | | 57 | | President and Chief Executive Officer |

| John Fuller | | 44 | | Chief Financial Officer |

| Lawrence Rusinko | | 46 | | Vice President of Marketing |

| Carl Arena | | 53 | | Vice President of Development |

| Gerry Leneweaver | | 60 | | Vice President of People Services |

DAN PITTARD has been President and Chief Executive Officer and a member of our Board of Directors since August 2006. Mr. Pittard’s diverse background brings unique qualifications for leadership at Rubio’s. He has served in key executive positions at companies including McKinsey & Company, PepsiCo, Inc. and Amoco Corp. (now part of BP p.l.c.). Mr. Pittard served a wide range of clients as a partner at McKinsey & Company from 1980 to 1992, including consumer companies for whom he helped develop profitable growth strategies and build new organizational capabilities. During his tenure at PepsiCo, Inc. from 1992 to 1995, he held several senior executive positions including Senior Vice President, Operations for PepsiCo Foods International, and Senior Vice President and General Manager, New Ventures for Frito-Lay. In this latter position, he worked with Taco Bell Corp. to create retail products and introduce them into supermarkets. At Amoco Corp. from 1995 to 1998, he served as Group Vice President. As Group Vice President he had responsibility for several businesses with over $8 billion in revenues, including Amoco Corp.’s retail business that had 8,000 locations. During his tenure, he entered into a strategic alliance with McDonald’s Corporation to build joint locations. From 1998 to 1999, Mr. Pittard served as Senior Vice President, Strategy and Business Development for Gateway, Inc. In 1999, Mr. Pittard formed Pittard Investments LLC, and in 2004, he formed Pittard Partners LLC. Through these entities, Mr. Pittard has invested in and consulted for private companies. He served on the Board of Novatel Wireless, a publicly-traded company, from 2002-2004. Mr. Pittard graduated from the Georgia Institute of Technology with a B.S. degree in Industrial Management and received an M.B.A. from the Harvard Graduate School of Business Administration.

JOHN FULLER has been Chief Financial Officer since June 2003. Prior to joining Rubio’s in 2003, Mr. Fuller served as Corporate Controller of Del Taco from March 2002 until June 2003. Prior to that, Mr. Fuller served as Senior Vice President/CFO for Edwards Theaters from October 1998 until October 2001 and as Vice President/Controller of CKE Restaurants, Inc. from September 1994 until October 1998. Mr. Fuller is a certified public accountant and spent nine years with KPMG LLP in their Orange County audit department. Mr. Fuller holds a Bachelor of Arts degree in Economics from the University of California, Los Angeles.

LAWRENCE RUSINKO has been Vice President of Marketing since October 2005. Prior to joining Rubio’s in 2005, Mr. Rusinko served as Senior Vice President of Marketing at Friendly’s, a family dining and ice cream concept, from July 2003 until May 2005. Prior to that, Mr. Rusinko served for over 8 years at Panera Bread as Director of Marketing from May 1995 until March 1997 and as Vice President of Marketing from April 1997 until July 2003, and spent 6 ½ years in various marketing positions of progressive responsibility at Taco Bell. Mr. Rusinko holds a Bachelor of Science degree in Industrial Engineering from Northwestern University and an MBA from the J.L. Kellogg Graduate School of Management at Northwestern University.

CARL ARENA has been Vice President of Development since January 2005. Prior to joining Rubio’s, Mr. Arena served as Executive Director, Development for Johnny Rockets Group, Inc. from May of 2004 to January of 2005. Prior to that, from October of 2000 to May of 2004, Mr. Arena was Managing Member of Arena Realty Advisors, LLC, in Orange County, where he worked with such clients as CKE Restaurants and Yum Brands. He also spent 13 years with CKE Restaurants, where he was Vice President of Real Estate. Mr. Arena holds a Bachelor of Arts degree in History from California State University, Fullerton and a Juris Doctor degree from Western State University School of Law.

GERRY LENEWEAVER has been Vice President of People Services since June 2005. Prior to joining Rubio’s, Mr. Leneweaver led his own human resources consulting firm, AGL Associates, in Boston, most recently from February 2004 to May 2005. Prior to that, Mr. Leneweaver served as Senior Vice President of Human Resources at American Hospitality Concepts, Inc (The Ground Round, Inc.) from May 1999 to February 2004. He has also been in senior management roles at TGI Friday’s, Inc., The Limited, Inc., Atari, Inc., and PepsiCo, Inc. (Pizza Hut and Frito-Lay). He holds a Bachelor of Science degree in Industrial Relations from LaSalle University in Philadelphia.

Item 1A. RISK FACTORS

Any investment in our common stock involves a high degree of risk. You should consider carefully the following information about these risks, together with the other information contained in this annual report, before you decide to buy our common stock. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also impair our operations. If any of the following risks actually occur, our business would likely suffer and our results could differ materially from those expressed in any forward-looking statements contained in this annual report including those contained in the section captioned “Business” under Item 1 above and the section captioned “Management’s Discussion and Analysis of Financial Condition and Results of Operations” under Item 7 below. In such case, the trading price of our common stock could decline, and you may lose all or part of the money you paid to buy our common stock.

WE MAY NOT ACHIEVE OUR EXPECTED REVENUES, COMPARABLE STORE SALES AND OVERALL EARNINGS PER SHARE DUE TO VARIOUS RISKS THAT AFFECT THE FOOD SERVICE INDUSTRY.

We and other companies in the food service industry face a variety of risks that may impact our business and results of operations. Our expected sales levels and earnings rely heavily on the acceptability and quality of the products we serve. If any variances are experienced with respect to the recognition of our brand, the acceptance of our promotions in the market, the effectiveness of our advertising campaigns or the ability to manage our ongoing operations, including the ability to absorb unexpected costs, we could fall short of our revenue and earnings expectations. Factors that could have a significant impact on earnings include:

| · | labor costs for our hourly and management personnel, including increases in federal or state minimum wage requirements; |

| · | the cost, availability and quality of foods and beverages, particularly chicken, beef, fish, cheese and produce; |

| · | costs related to our leases; |

| · | impact of weather on revenues and costs of food; |

| · | timing of new restaurant openings and related expenses; |

| · | the cost of store closings; |

| · | the amount of sales contributed by new and existing restaurants; |

| · | our ability to achieve and sustain profitability on a quarterly or annual basis; |

| · | the ability of our marketing initiatives and operating improvement initiatives to increase sales; |

| · | negative publicity relating to food quality, illness, obesity, injury or other health concerns related to certain foods; |

| · | changes in consumer preferences, traffic patterns and demographics; |

| · | the type, number and location of existing or new competitors in the fast-casual restaurant industry; |

| · | insurance and utility costs; and |

| · | general economic conditions. |

OUR CURRENT PLANS TO INCREASE OUR BRAND RECOGNITION COULD HAVE A MATERIAL ADVERSE IMPACT ON THE COMPANY.

We are working on a number of projects designed to improve the strength of our brand and increase sales. These projects include a restaurant re-image program for existing restaurants, and new menu items.

The implementation of these projects has capital costs and expenses associated with it. The recent re-imaging cost ranges from $65,000 to $75,000 per location. There is a risk that if these changes do not result in further increased sales, either through increased transactions or higher average check or both, there could be a material adverse impact on our company’s earnings. Also, the capital requirements of these projects could have an adverse material impact on our cash balances and long-term liquidity.

OUR FAILURE OR INABILITY TO ENFORCE OUR CURRENT AND FUTURE TRADEMARKS AND TRADE NAMES COULD ADVERSELY AFFECT OUR EFFORTS TO ESTABLISH BRAND EQUITY.

Our ability to successfully expand our concept will depend on our ability to establish and maintain "brand equity" through the use of our current and future trademarks, service marks, trade dress and other proprietary intellectual property, including our name and logos. We currently hold two registered trademarks and have nine service marks relating to our brand and we have filed applications for twelve additional marks. Some or all of the rights in our intellectual property may not be enforceable, even if registered against any prior users of similar intellectual property or our competitors who seek to utilize similar intellectual property in areas where we operate or intend to conduct operations. If we fail to enforce any of our intellectual property rights, we may be unable to capitalize on our efforts to establish brand equity. It is also possible that we will encounter claims from prior users of similar intellectual property in areas where we operate or intend to conduct operations, which could result in additional expenditures and divert management’s time and attention from our operations.

IF WE ARE NOT ABLE TO SUCCESSFULLY PURSUE OUR EXPANSION STRATEGY, OUR BUSINESS AND RESULTS OF OPERATIONS MAY BE ADVERSELY IMPACTED.

We currently plan to open 16 to 20 company-owned restaurants in 2007. None of the planned 2007 openings are outside California or Arizona. In addition, our three to five year expansion plan target is an annual growth rate of 10% to 15%. Our ability to successfully achieve our expansion strategy will depend on a variety of factors, many of which are beyond our control.

These factors include, among others:

| · | our ability to operate our restaurants profitably; |

| · | our ability to respond effectively to the intense competition in the restaurant industry generally, and in the fast-casual restaurant industry segment; |

| · | our ability to locate suitable high-quality restaurant sites or negotiate acceptable lease terms; |

| · | our ability to obtain required local, state and federal governmental approvals and permits related to construction of the sites, and the sale of food and alcoholic beverages; |

| · | our dependence on contractors to construct new restaurants in a timely manner; |

| · | our ability to attract, train and retain qualified and experienced restaurant personnel and management; and |

| · | our need for additional capital and our ability to obtain such capital on favorable terms or at all. |

If we are not able to successfully address these factors, we may not be able to expand at the rate contemplated and may have to adjust our expansion strategy, and our business and results of operations may be adversely impacted.

WE MAY NOT BE SUCCESSFUL IN FULLY IMPLEMENTING AND EXECUTING A FRANCHISE PROGRAM.

We started a franchise program by entering into agreements with three franchisee groups between 2001 and 2002. In April 2003, our relationship with one of the franchisee groups was terminated when the group defaulted on its franchise agreement and closed its franchised location. We re-opened this unit as a company-owned restaurant in May 2003, but subsequently closed it in December 2005. In September 2003, we agreed to acquire a franchisee’s location and then in December 2006 acquired their other restaurant and development territory. In addition, in June 2006, we acquired all 4 units owned by the third original franchise group. Currently we have one franchisee that has a five year, five unit development agreement for which they have opened their first unit in 2006 and plan to open their second unit in July 2007. Restaurant companies typically rely on franchise revenues as a significant source of revenues and potential for growth. The opening and success of our franchised restaurants depend on a number of factors, including availability of suitable sites, our ability to obtain acceptable lease or purchase terms for new locations, permitting and government regulatory compliance and our ability to meet construction schedules. The franchisees may not have all of the business abilities or access to financial resources necessary to open our restaurants or to successfully develop or operate our restaurants in their franchise areas in a manner consistent with our standards. Our inability to successfully execute our franchising program could adversely affect our business and results of operations.

IF THE AMOUNTS THAT WE HAVE ACCRUED IN CONNECTION WITH THE CLOSURE OF SELECTED STORES ARE INADEQUATE OR WE CLOSE MORE STORES THAN ANTICIPATED, WE MAY EXPERIENCE ADVERSE EFFECTS ON OUR EARNINGS EXPECTATIONS.

Our accruals for expenses related to store closures are estimates. Estimates are inherently uncertain, and actual results may deviate, perhaps substantially, from our estimates as a result of the many risks and uncertainties affecting our business, including, but not limited to, those set forth in these risk factors. The amounts we have recorded for store closures are based on our current assessments of the conditions of these locations. The market for, and physical condition of, these locations may change in the future and materially affect our future earnings. We review these accruals on a quarterly basis and may make adjustments that have a material positive or negative impact on our future earnings.

OUR OPERATING RESULTS MAY FLUCTUATE SIGNIFICANTLY DUE TO SEASONALITY AND OTHER FACTORS, WHICH COULD HAVE A NEGATIVE EFFECT ON THE PRICE OF OUR COMMON STOCK.

Our business is subject to seasonal fluctuations. Historically, sales in most of our restaurants have been higher during the second and third quarters of each fiscal year. As a result, we generally find our highest earnings occur in the second and third quarters of each fiscal year. Accordingly, results for any one quarter or for any year are not necessarily indicative of results to be expected for any other quarter or for any other year and should not be relied upon as the sole measure of our future performance. Comparable unit sales for any particular future period may increase or decrease versus our previous performance.

THE RESTAURANT INDUSTRY IS INTENSELY COMPETITIVE AND WE MAY NOT HAVE THE RESOURCES TO COMPETE ADEQUATELY.

The restaurant industry is intensely competitive. There are many different segments within the restaurant industry that are distinguished by types of service, food types and price/value relationships. We position our restaurants in the high-quality, fast casual Mexican restaurant segment of the industry. In this segment, our direct competitors include, among others, Baja Fresh, La Salsa, Chipotle and Qdoba. We also compete indirectly with full-service Mexican restaurants including Chevy’s, On The Border, Chi Chi’s and El Torito and fast food restaurants, particularly those focused on Mexican food such as El Pollo Loco, Taco Bell and Del Taco. Competition in our industry segment is based primarily upon food quality, price, restaurant ambiance, service and location. Many of our direct and indirect competitors are well-established national, regional or local chains and have substantially greater financial, marketing, personnel and other resources than we do. We also compete with many other retail establishments for site locations. If we are unable to compete effectively in our industry segment, our business and operations will be adversely affected.

THE ABILITY TO ATTRACT AND RETAIN HIGHLY QUALIFIED PERSONNEL TO OPERATE, MANAGE AND SUPPORT OUR RESTAURANTS IS EXTREMELY IMPORTANT AND OUR FAILURE TO DO SO COULD ADVERSELY AFFECT US.

Our success and the success of our individual restaurants depend upon our ability to attract and retain highly motivated, well-qualified restaurant operators and management personnel, as well as a sufficient number of qualified employees, including guest service and kitchen staff, to keep pace with our expansion schedule. Qualified individuals needed to fill these positions are in short supply in some geographic areas. Our ability to recruit and retain such individuals may delay the planned openings of new restaurants or result in higher employee turnover in existing restaurants, which could have a material adverse effect on our business or results of operations. We also face significant competition in the recruitment of qualified employees. In addition, we are heavily dependent upon the services of our officers and key management involved in restaurant operations, marketing, product development, finance, purchasing, real estate development, information technologies, human resources and administration. The loss of any of these individuals could have a material adverse effect on our business and results of operations. We generally do not have long-term employment contracts with key personnel.

VARIOUS GOVERNMENT REGULATIONS MAY IMPACT OUR BUSINESS.

The restaurant industry is subject to licensing and regulation by state and local health, sanitation, safety, fire and other authorities, including licensing requirements and regulations related to the preparation and sale of food and the sale of alcoholic beverages, as well as laws governing our relationships with employees. See “Labor and Employment Laws and Regulations May Impact our Business” below. The inability to obtain or maintain such licenses or to comply with applicable regulations could adversely affect our results of operations. We are also subject to federal regulation and certain state laws, governing the offer and sale of franchises. Many state franchise laws impose substantive requirements on franchise agreements, including limitations on non-competition provisions and on provisions concerning the termination or non-renewal of a franchise. The failure to obtain or retain licenses or approvals to sell franchises could adversely affect us and our franchisees. Changes in, and the cost of compliance with, government regulations could also have a material adverse effect on our operations.

WE ARE REQUIRED TO EVALUATE OUR INTERNAL CONTROLS UNDER SECTION 404 OF THE SARBANES-OXLEY ACT OF 2002 AND ANY ADVERSE RESULTS FROM SUCH EVALUATION COULD RESULT IN A LOSS OF INVESTOR CONFIDENCE IN OUR FINANCIAL REPORTS AND HAVE AN ADVERSE EFFECT ON OUR STOCK PRICE.

Pursuant to Section 404 of the Sarbanes-Oxley Act of 2002, beginning as early as with the annual report on Form 10-K for our fiscal year ending December 30, 2007, we will be required to furnish a report by our management on our internal control over financial reporting. Such report must contain, among other matters, an assessment of the effectiveness of our internal control over financial reporting and audited consolidated financial statements as of the end of our fiscal year. This assessment must include disclosure of any material weaknesses in our internal control over financial reporting identified by management. Each year we must perform the system and process documentation and evaluation needed to comply with Section 404, which is both costly and challenging. During this process, if our management identifies one or more material weaknesses in our internal control over financial reporting, we will be unable to assert such internal control is effective. If we are unable to assert that our internal control over financial reporting is effective (or if our auditors are unable to attest that our management's report is fairly stated or they are unable to express an unqualified opinion on the effectiveness of our internal controls), investors could lose confidence in the accuracy and completeness of our financial reports, which could have an adverse effect on our stock price.

Furthermore, our independent registered public accounting firm may be required to attest to whether our assessment of the effectiveness of our internal control over financial reporting is fairly stated in all material respects, and separately report on whether it believes we maintained effective internal control over financial reporting. We have in the past discovered, and may in the future discover, areas of internal controls that need improvement. We may be required to obtain the auditor attestment as early as the annual report on Form 10-K for our fiscal year ending December 30, 2007.

LABOR AND EMPLOYMENT LAWS AND REGULATIONS, PARTICULARLY STATE MINIMUM WAGE LAWS, MAY IMPACT OUR BUSINESS.

A substantial number of our employees are subject to various federal and state minimum wage requirements. Many of our employees work in restaurants located in California and receive salaries equal to or slightly greater than the California minimum wage. California’s current hourly minimum wage is $7.50. Any increase in the hourly minimum wage in California or other states or jurisdictions where we do business may increase the cost of labor and reduce our profitability.

Additionally, the State of California has increased benefits required to be provided to employees covered under workers’ compensation insurance. Federal and state laws may also require us to provide paid and unpaid leave to our employees, which could result in significant additional expense to us.

IF WE ARE NOT ABLE TO ANTICIPATE AND REACT TO INCREASES IN OUR FOOD AND LABOR COSTS, OUR PROFITABILITY COULD BE ADVERSELY AFFECTED.

Our restaurant operating costs principally consist of food and labor costs. Our profitability is dependent on our ability to anticipate and react to changes in these costs. Various factors beyond our control, including adverse weather conditions and short supply, may affect our food costs. Changes in government regulations could also affect both our food costs and labor costs. We may be unable to anticipate and react to changing costs, whether through our purchasing practices, menu composition or menu price adjustments in the future. In the event that cost increases cause us to increase our menu prices, we face the risk that our guests will choose to patronize lower-priced restaurants. Failure to react in a timely manner to changing food and labor costs, or to retain guests if we are forced to raise menu prices, could have a material adverse effect on our business and results of operations.

OUR RESTAURANTS ARE CONCENTRATED IN THE WESTERN REGION OF THE UNITED STATES, AND THEREFORE, OUR BUSINESS IS SUBJECT TO FLUCTUATIONS IF ADVERSE CONDITIONS OCCUR IN THAT REGION.

As of March 21, 2007, all but five of our existing restaurants are located in the western region of the United States. Accordingly, we are susceptible to fluctuations in our business caused by adverse economic or other conditions in this region, including natural disasters, terrorist activities or similar events. Our significant investment in, and long-term commitment to, each of our units limits our ability to respond quickly or effectively to changes in local competitive conditions or other changes that could affect our operations. In addition, some of our competitors have many more units than we do. Consequently, adverse economic or other conditions in a region, a decline in the profitability of several existing units or the introduction of several unsuccessful new units in a geographic area, could have a more significant effect on our results of operations than would be the case for a company with a larger number of restaurants or with more geographically dispersed restaurants.

WE MAY NOT RECEIVE FINAL COURT APPROVAL FOR THE PROPOSED SETTLEMENT OF THE CONSOLIDATED CLASS ACTION LAWSUITS FILED AGAINST US RELATED TO CALIFORNIA EXEMPT EMPLOYEE LAWS, AND IF WE ARE REQUIRED TO CONTINUE LITIGATION, OUR BUSINESS MAY BE HARMED.

During 2001, two similar class action lawsuits were filed against us. These lawsuits were consolidated into one action. The consolidated action involves the issue of whether current and former employees in the general manager and assistant manager positions who worked in our California restaurants during specified time periods were misclassified as exempt and deprived of overtime pay. The consolidated complaint also asserts claims for alleged missed meal and rest breaks. In addition to unpaid overtime, these cases seek to recover waiting time penalties, interest, attorneys’ fees and other types of relief on behalf of the current and former employees that these former employees purport to represent. On March 19, 2007, we entered into a settlement agreement with the class action representatives to settle the consolidated action. Although we deny the allegations underlying the consolidated action, we have agreed to the proposed settlement to avoid significant legal fees, other expenses and management time that would have to be devoted to pursue a victory in litigation. The settlement, which is subject to final documentation and court approval, provides for a settlement payment of $7.5 million in the aggregate (including attorneys’ fees and costs, fees for administering the settlement and any employer taxes). Under the settlement agreement, the parties have agreed to cooperate to obtain court approval of the settlement. The court granted preliminary approval of the settlement on March 23, 2007, and the parties expect the court will make its final decision in mid-2007. The settlement agreement will become effective and binding on the parties only if approved by the court. We can not assure you that the court will approve the settlement on the terms set forth in the settlement agreement, or at all. If the court does not approve the settlement, we intend to continue to vigorously defend against the consolidated action. Regardless of merit or eventual outcome, this consolidation action may result in the expenditure of a significant amount of cash on legal fees, expenses, payment of settlements or damages. Further, this action may divert our management team’s time and attention from our business and operations.

AS A RESTAURANT SERVICE PROVIDER, OUR BUSINESS MAY BE ADVERSELY AFFECTED BY NEGATIVE PUBLICITY OR CLAIMS FROM OUR GUESTS.

We may be the subject of complaints or litigation from guests alleging food-related illness, injuries suffered on our premises or other food quality, health or operational concerns. Adverse publicity resulting from such allegations may materially affect us and our restaurants, regardless of whether such allegations are true or whether we are ultimately held liable. A lawsuit or claim could result in an adverse decision against us that could have a material adverse effect on our business and results of operations.

OUR CURRENT INSURANCE MAY NOT PROVIDE ADEQUATE LEVELS OF COVERAGE AGAINST LOSSES, CLAIMS OR THE EFFECTS OF ADVERSE PUBLICITY.

We may incur certain losses that are uninsurable or that we believe are not economically insurable, such as losses due to earthquakes and other natural disasters. In view of the location of many of our existing and planned units, our operations are particularly susceptible to damage and disruption caused by earthquakes. Further, although we maintain insurance coverage for employee-related litigation, the deductible per incident is high and because of the high cost, we carry only limited insurance for the effects of such claims. In addition, punitive damage awards are generally not covered by insurance. We may also be subject to litigation which, regardless of the outcome, could result in adverse publicity and damages. Such litigation, adverse publicity or damages could have a material adverse effect on our business and results of operations. From time to time, employee related claims are brought against us. These claims and expenses related to these claims typically have not been material to our overall financial performance. We may, however, experience claims or be the subject of complaints or allegations from former, current or prospective employees from time to time that are material in nature and that may have a material adverse effect on our financial results.

WE MAY INCUR SIGNIFICANT REAL ESTATE RELATED COSTS AND LIABILITIES WHICH COULD ADVERSELY AFFECT OUR FINANCIAL CONDITION.

The majority of our units are leased locations in multi-unit retail centers. The age and condition of the real estate we occupy varies. Some of our locations may require significant repairs due to normal deterioration or due to sudden and unanticipated incidents, such as plumbing failures. It is difficult to predict how many of our unit locations will require major repairs or refurbishment and it is also difficult to predict what portion of these potential costs would be covered by insurance. Also, as a lessee of real estate, we are subject to and have received claims that our operations at these locations may have caused property damage or personal injury to others. The fact that the majority of our units are located in multi-unit retail buildings means that if there is a plumbing failure or other event in one of our units, neighboring tenants may be affected, which can subject us to liability for property damage and personal injuries. If we were to incur increased real estate costs and liabilities, it could adversely affect our financial condition and results of operations.

SALES BY OUR EXISTING STOCKHOLDERS OF A LARGE NUMBER OF SHARES OF OUR COMMON STOCK COULD CAUSE OUR STOCK PRICE TO DECLINE.

The Company has a limited number of institutional stockholders, each of whom holds more than 5% of the Company’s outstanding stock. The market price of our common stock could decline as a result of sales by one of these stockholders of a large number of shares of our common stock in the market or the perception that such sales could occur. These sales also might make it more difficult for us to sell equity securities in the future at a time and at a price that we deem appropriate.

THE INTERESTS OF OUR CONTROLLING STOCKHOLDERS MAY CONFLICT WITH YOUR INTERESTS.

As of March 21, 2007, our executive officers, directors and entities affiliated with them, in the aggregate, beneficially own approximately 30.5% of our outstanding common stock. These stockholders may be able to influence the outcome of matters requiring stockholder approval, including the election of directors and approval of significant corporate transactions. This concentration of ownership may also have the effect of delaying or preventing a change in control of our Company and could also depress our stock price.

Item 1B. UNRESOLVED STAFF COMMENTS

None.

Item 2. PROPERTIES

Our corporate headquarters, consisting of approximately 16,500 square feet, are located in Carlsbad, California. The principal executive offices of our wholly-owned subsidiary, Rubio’s Restaurants of Nevada, Inc. are also located in Carlsbad, California. We occupy our headquarters under a lease that was extended until March 31, 2011, with options to extend the lease for an additional eight years. We lease each of our restaurant facilities with the exception of one unit in El Cajon, California where we own the building but lease the land. The majority of our leases are for 10-year terms and include options to extend the terms. The majority of the leases also include both fixed rate and percentage-of-sales rent provisions.

Item 3. LEGAL PROCEEDINGS

During 2001, two similar class action lawsuits were filed against us. The lawsuits were eventually consolidated into one action. The consolidated action involves the issue of whether current and former employees in the general manager and assistant manager positions who worked in our California restaurants during specified time periods were misclassified as exempt and deprived of overtime pay. The consolidated complaint also asserts claims for alleged missed meal and rest breaks. In addition to unpaid overtime, these cases seek to recover waiting time penalties, interest, attorneys’ fees and other types of relief on behalf of the current and former employees that these former employees purport to represent.

On March 19, 2007, we entered into a settlement agreement with the class action representatives to settle the consolidated action. Although we deny the allegations underlying the consolidated action, we have agreed to the proposed settlement to avoid significant legal fees, other expenses and management time that would have to be devoted to pursue a victory in litigation. The settlement, which received preliminary court approval on March 23, 2007, however, is subject to final documentation and court approval, provides for a settlement payment of $7.5 million in the aggregate (including attorneys’ fees and costs, fees for administering the settlement and any employer taxes). Under the settlement agreement, the parties have agreed to cooperate to obtain court approval of the settlement. The parties expect that the court will hold a preliminary hearing on the approval of the settlement in late March 2007, and the parties expect the court will make its final decision in mid-2007. The settlement agreement will become effective and binding on the parties only if approved by the court. We can not assure you that the court will approve the settlement on the terms set forth in the settlement agreement, or at all. If the court does not approve the settlement, we intend to continue to vigorously defend against the consolidated action.

We are not aware of any other litigation that we believe could have a material adverse effect on our financial position, results of operations or business.

Item 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

No matter was submitted to a vote of our stockholders during the quarter ended December 31, 2006.

PART II

Item 5. MARKET FOR THE REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Market Information for Common Stock

Our common stock is listed on the NASDAQ Global Market under the symbol “RUBO.” Our common stock began trading on May 21, 1999. The closing sales price of our common stock as reported on Nasdaq on March 21, 2007 was $10.00. As of March 21, 2007, there were approximately 4,235 beneficial holders of our common stock, including 324 holders of record.

The following table sets forth, for the periods indicated, the high and low sales prices for our common stock for each quarter of our two most recent fiscal years, as regularly reported on NASDAQ. Such quotations represent inter-dealer prices without retail markup, markdown or commission and may not necessarily represent actual transactions.

| | | High | | Low | |

| 2005: | | | | | |

| First Quarter | | $ | 12.48 | | $ | 9.66 | |

| Second Quarter | | $ | 10.40 | | $ | 8.15 | |

| Third Quarter | | $ | 10.59 | | $ | 8.51 | |

| Fourth Quarter | | $ | 9.59 | | $ | 8.12 | |

| 2006: | | | | | | | |

| First Quarter | | $ | 8.28 | | | 10.22 | |

| Second Quarter | | $ | 7.08 | | | 8.75 | |

| Third Quarter | | $ | 8.50 | | | 9.69 | |

| Fourth Quarter | | $ | 8.80 | | | 10.50 | |

Dividend Policy

Since our initial public offering in May 1999, we have not declared or paid any cash dividends on our common stock. We currently intend to retain all earnings for the operation and expansion of our business and do not intend to pay any cash dividends in the foreseeable future.

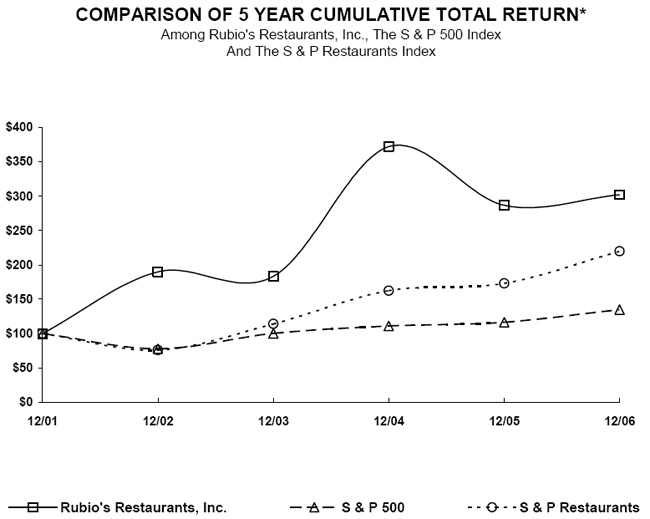

Stock Performance Graph

Recent Sales of Unregistered Securities

None.

Purchases of Equity Securities

There were no repurchases during the fourth quarter of 2006.

Item 6. SELECTED CONSOLIDATED FINANCIAL DATA

Our fiscal year is 52 or 53 weeks, ending the last Sunday in December. Fiscal 2006 includes 53 weeks. Fiscal 2005, 2004, 2003, and 2002 include 52 weeks.

The following selected consolidated financial data should be read in conjunction with our consolidated financial statements and the notes thereto appearing elsewhere in this report and with Management’s Discussion and Analysis of Financial Condition and Results of Operations included under Item 7 of this report. These historical results are not necessarily indicative of the results to be expected in the future.

| | | Fiscal Years | |

| | | 2006 | | 2005 | | 2004 | | 2003 | | 2002 | |

| | | (in thousands, except per share data) | |

| CONSOLIDATED STATEMENTS OF OPERATIONS DATA: | | | | | | | | | | | |

| Restaurant sales | | $ | 151,995 | | $ | 140,496 | | $ | 137,197 | | $ | 124,786 | | $ | 119,310 | |

| Franchise and licensing revenues | | | 273 | | | 261 | | | 203 | | | 204 | | | 253 | |

| Total revenues | | | 152,268 | | | 140,757 | | | 137,400 | | | 124,990 | | | 119,563 | |

| Costs and expenses: | | | | | | | | | | | | | | | | |

| Cost of sales | | | 42,079 | | | 37,997 | | | 37,426 | | | 36,052 | | | 32,580 | |

| Restaurant labor | | | 48,472 | | | 45,801 | | | 44,791 | | | 42,355 | | | 38,844 | |

| Restaurant occupancy and other | | | 35,987 | | | 33,732 | | | 31,438 | | | 30,471 | | | 27,976 | |

| General and administrative expenses | | | 23,429 | | | 15,844 | | | 11,412 | | | 10,315 | | | 9,625 | |

| Depreciation and amortization | | | 8,215 | | | 7,764 | | | 7,322 | | | 6,993 | | | 6,525 | |

| Pre-opening expenses | | | 537 | | | 147 | | | 218 | | | 488 | | | 277 | |

| Asset impairment and store closure expense (reversal) | | | (405 | ) | | 275 | | | (10 | ) | | 2,071 | | | (811 | ) |

| Loss on disposal/sale of property | | | 281 | | | 520 | | | 39 | | | 233 | | | 248 | |

| Total costs and expenses | | | 158,595 | | | 142,080 | | | 132,636 | | | 128,978 | | | 115,264 | |

| Operating income (loss) | | | (6,327 | ) | | (1,323 | ) | | 4,764 | | | (3,988 | ) | | 4,299 | |

| Other income (expense), net | | | 482 | | | 444 | | | 154 | | | (6 | ) | | (14 | ) |

| Income (loss) before income taxes | | | (5,845 | ) | | (879 | ) | | 4,918 | | | (3,994 | ) | | 4,285 | |

| Income tax (expense) benefit | | | 2,384 | | | 651 | | | (1,878 | ) | | 1,569 | | | (1,706 | ) |

| Net income (loss) | | $ | (3,461 | ) | $ | (228 | ) | $ | 3,040 | | $ | (2,425 | ) | $ | 2,579 | |

| | | | | | | | | | | | | | | | | |

| Net income (loss) per share | | | | | | | | | | | | | | | | |

| Basic | | $ | (0.36 | ) | $ | (0.02 | ) | $ | 0.33 | | $ | (0.27 | ) | $ | 0.29 | |

| Diluted | | | (0.36 | ) | | (0.02 | ) | | 0.32 | | | (0.27 | ) | | 0.28 | |

| Shares used in calculating net income (loss) per share | | | | | | | | | | | | | | | | |

| Basic | | | 9,592 | | | 9,378 | | | 9,135 | | | 9,093 | | | 9,017 | |

| Diluted | | | 9,592 | | | 9,378 | | | 9,388 | | | 9,093 | | | 9,137 | |

| SELECTED OPERATING DATA: | | | | | | | | | | | |

| Percentage change in comparable store sales (1) | | | 2.0 | % | | 1.2 | % | | 4.3 | % | | 1.8 | % | | 1.6 | % |

| Percentage change in number of transactions (2) | | | (1.0 | %) | | 0.2 | % | | 4.0 | % | | (3.1 | %) | | (0.2 | %) |

| Percentage change in price per transaction (3) | | | 3.0 | % | | 1.0 | % | | 0.3 | % | | 5.1 | % | | 1.8 | % |

| | | Fiscal Years | |

| | | 2006 | | 2005 | | 2004 | | 2003 | | 2002 | |

| CONSOLIDATED BALANCE SHEET DATA: | | | | | | | | | | | |

| Cash and cash equivalents | | $ | 9,946 | | $ | 8,022 | | $ | 7,315 | | $ | 6,483 | | $ | 8,578 | |

| Total assets | | | 67,505 | | | 58,591 | | | 57,188 | | | 52,306 | | | 51,506 | |

| Long-term debt, including current portion | | | — | | | — | | | — | | | — | | | 1,000 | |

| Total stockholders’ equity | | | 40,502 | | | 40,965 | | | 39,740 | | | 35,150 | | | 37,319 | |

| (1) | Comparable store sales are computed on a daily basis, and then aggregated to determine comparable store sales on a quarterly or annual basis. A restaurant is included in this computation after it has been open for 15 months. As a result, a restaurant may be included in this computation for only a portion of a given quarter or year. |

| (2) | Numbers of transactions are compiled by the Company’s point-of-sales system. |

| (3) | Price per transaction is derived from the Company’s net sales, which reflects discounts and coupons. |

Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

THE FOLLOWING DISCUSSION OF OUR FINANCIAL CONDITION AND RESULTS OF OPERATIONS SHOULD BE READ IN CONJUNCTION WITH OUR CONSOLIDATED FINANCIAL STATEMENTS AND NOTES THERETO APPEARING ELSEWHERE IN THIS REPORT. SEE “RISK FACTORS” UNDER ITEM 1A OF THIS REPORT REGARDING CERTAIN FACTORS KNOWN TO US THAT COULD AFFECT OUR FUTURE OPERATING RESULTS.

OVERVIEW

We opened our first restaurant under the name “Rubio’s, Home of the Fish Taco” in 1983. As of March 21, 2007, we have grown to 166 restaurants, including 162 Company-operated, three licensed locations and one franchised location. We position our restaurants in the high-quality, fresh and distinctive fast-casual Mexican cuisine segment of the restaurant industry. Our business strategy is to become a leading brand in this industry segment.

During 2006, we continued to focus on ways to improve our economic model. We believe that shifting our focus to great taste rather than price and increasing the price of our combo meals were two key drivers for our sales growth during the fourth quarter. In addition, we priced our promotional events at higher points and provided our guests with more food and sides than before. We also invested in research to better understand our guests’ needs and how we compare to our competition. We have commenced a number of additional initiatives with the goal to improve to go orders and catering from a guest convenience view point as well as multiple in-restaurant programs to improve overall service and satisfaction.