Reserves and Economics Report

Vadda Energy Corporation

as of

December 31, 2010

Prepared for:

Mr. Daro Blankenship

Chief Executive Officer

Vadda Energy Corporation

September 1, 2011

Mr. Daro Blankenship

Chief Executive Officer

Vadda Energy Corporation

1660 South Stemmons Freeway, Suite 440

Lewisville, TX 75067

Dear Mr. Blankenship:

Pursuant to your request, we prepared a reserves and economics report for certain oil and gas interests (the “Reserves”) located in Pennsylvania and Kentucky as of December 31, 2010, (the “Valuation Date”) for Vadda Energy Corporation (the “Company”). The underlying analysis upon which this report is based was completed on April 27, 2011. It is our understanding that the proved reserves estimated in this report constitute all proved reserves owned by the Company. This reserve evaluation was performed for financial reporting purposes related to the Company’s registration statement on Form 10, to be filed with the U.S. Securities and Exchange Commission. No other use for this analysis is intended or should be inferred.

This reserve evaluation and report were prepared by Gregory E. Scheig and staff under his direct supervision. Mr. Scheig holds a Bachelor of Science Degree in Petroleum Engineering from the University of Texas at Austin. Mr. Scheig also earned a Masters in Business Administration from the University of Texas. Mr. Scheig has over 20 years of energy related consulting experience and is a member of the Society of Petroleum Engineers. In addition Mr. Scheig is a Chartered Financial Analyst and a Certified Public Accountant. A copy of Mr. Scheig’s resume is attached.

We performed a calculation engagement and present our report in conformity with the Statement on Standards for Valuation Services No. 1 (SSVS) of the American Institute of Certified Public Accountants (AICPA). SSVS defines a calculation engagement as “an engagement to estimate value in which a valuation analyst determines an estimate of the value of a subject interest by performing appropriate procedures, as outlined in the AICPA Statement on Standards for Valuation Services, and is free to apply the valuation approaches and methods he or she deems appropriate in the circumstances. The valuation analyst expresses the results of the calculation engagement as a conclusion of value, which may be either a single amount or a range.”

Mr. Daro Blankenship

September 1, 2011

Page 2

SSVS addresses a summary report as follows: “The summary report is structured to provide an abridged version of the information that would be provided in a detailed report, and therefore, need not contain the same level of detail as a detailed report.”

The Company’s natural gas and crude oil properties consist of working interests owned on various leases located in Kentucky and Pennsylvania. As of the Valuation Date, the Company owned interests in 65 producing or capable of producing natural gas wells located in Centre, Clearfield, and Westmoreland Counties of Pennsylvania. The Company also owned working interests in 14 producing or capable of producing oil wells located in Warren County, Kentucky. These interests represent 100% of the Company’s proved reserves and comprise the Reserves referred to herein.

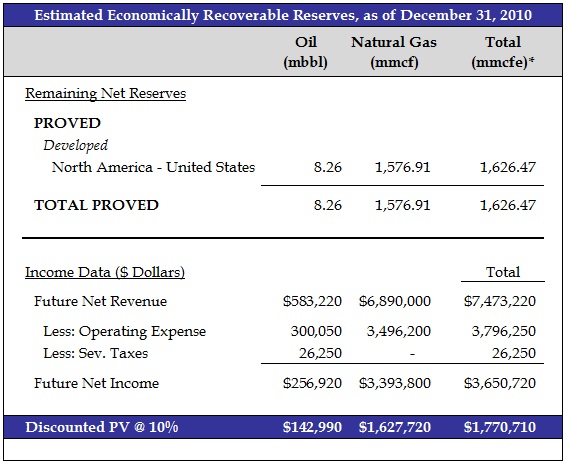

Results of the analysis are summarized in the following graphic:

* Total mmcf equivalent - oil (bbl) converted to gas (mcf) at 1 bbl to 6 mcf rate.

950 E. State Highway 114 • Suite 120 • Southlake • Texas • 76092 • Tel: 817.481.4900 • Fax: 817.481.4905

www.valuescopeinc.com

Mr. Daro Blankenship

September 1, 2011

Page 3

RESERVE CATEGORIES

SEC regulations define reserves as the “estimated remaining quantities of oil and gas related substances anticipated to be economically producible, as of a given date, by application of development projects to known accumulations. In addition, there must exist, or there must be a reasonable expectation that there will exist, the legal right to produce or a revenue interest in the production of oil and gas, installed means of delivering oil and gas or related substances to market, and all permits and financing required to implement the project.”1

Oil and gas reserves fall into one of the following categories: proved, probable, and possible. These categories are further divided into appropriate reserve status categories: developed and undeveloped. The developed reserve category is further divided into the appropriate reserve status subcategories: producing and non-producing. Non-producing reserves include shut-in and behind-pipe reserves.

Proved reserves are defined as those reserves “(i) in projects that extract oil and gas through wells, can be expected to be recovered through existing wells with existing equipment and operating methods, and (ii) in projects that extract oil and gas in other ways, can be expected to be recovered through extraction technology installed and operational at the time of the reserves estimate.”2 The estimates shown in this report are for proved reserves. No study has been performed to determine whether probable or possible reserves might be established for these properties.

RESERVE ESTIMATES

During the preparation of this report, 100% of the Company’s reserves were reviewed. The assumptions, data, methods, and procedures used in the development of this reserve report were appropriate for the purposes of Item 1202 of Regulation S-K. Reserve estimates were made based on technical and economic data including, but not limited to, well logs, geologic maps, seismic data, well test data, production data, historical price and cost information, and property ownership interests. The reserves in this report have been estimated using deterministic methods; these estimates have been prepared using standard engineering and geosciences methods, or a combination of methods, including performance analysis, volumetric analysis, analogy, and statistical analysis, that we considered to be appropriate and necessary to categorize and estimate reserves in accordance with SEC definitions and guidelines.

We used all methods and procedures that we considered necessary, under the circumstances, in the preparation of this report. We did not perform any field inspection of the properties, nor did we examine the mechanical operation or condition of the wells and facilities. We have not investigated possible environmental liability related to the properties; therefore, our estimates do not include any costs due to such possible liability.

| 1 | SEC Rule 4-10(a)(26) of Regulation S-X. |

| 2 | SEC Rule 4-10(a)(22) of Regulation S-X. |

Mr. Daro Blankenship

September 1, 2011

Page 4

Reserve estimates are strictly technical judgments. The accuracy of any reserve estimate is a function of the quality of data available and of engineering and geological interpretations. The reserve estimates presented in this report are believed reasonable; however, they are estimates only and should be accepted with the understanding that reservoir performance subsequent to the date of the estimate may justify their revision.

PRICING AND EXPENSE PARAMETERS

Pursuant to SEC guidelines, prices used in this report are based on the 12-month un-weighted arithmetic average of the first-day-of-the-month price for each month in the period from January 2010 through December 2010. For oil and gas prices, the SEC 2010 12-month average West Texas Intermediate crude spot price of $79.43 per barrel and Henry Hub spot price of $4.38 per MMBTU, respectively, were adjusted by lease for energy content, transportation fees, and regional price differentials. All prices were held constant throughout the lives of the properties. The average adjusted product prices, weighted by production over the remaining lives of the properties, are $70.57 per barrel of oil and $4.37 per MCF of gas.

Lease operating expenses were estimated for each well based on 2010 expense data provided by the Company. A 4.5% Kentucky severance tax was applied to the Company’s oil reserves in that state. Currently, there are no severance taxes in Pennsylvania.

Future net revenue to the Vadda interest is prior to deducting state production taxes. Future net income is after deductions for state production taxes and operating expenses, but prior to consideration of any income taxes. The future net income has been discounted at an annual rate of 10 percent to determine its present worth, which is shown to indicate the effect of time on the value of money. Future net income presented in this report, whether discounted or undiscounted, should not be construed as being representative of the fair market value of the properties.

REGULATION

The Company’s exploration and production operations are subject to various types of regulation at the U.S. federal, state and local levels. Such regulation includes requirements for permits to drill and to conduct other operations and for provision of financial assurances (such as bonds) covering drilling and well operations.

Mr. Daro Blankenship

September 1, 2011

Page 5

Other activities subject to regulation include, but are not limited to:

| • | the method of drilling and completing wells; |

| • | the surface use and restoration of properties upon which wells are drilled; |

| • | the plugging and abandoning of wells; |

| • | the disposal of fluids used or other wastes generated in connection with operations; |

| • | the marketing, transportation and reporting of production; and |

| • | the valuation and payment of royalties. |

The Company’s operations are also subject to various conservation regulations. These include the regulation of the size of drilling and spacing units (regarding the density of wells that may be drilled in a particular area) and the unitization or pooling of natural gas and oil properties. In this regard, some states, including Kentucky, where the Company holds oil properties, allow the forced pooling or integration of tracts to facilitate exploration, while other states rely on voluntary pooling of lands and leases. In Pennsylvania, where the Company holds natural gas interests, pooling is generally involuntary, but is currently voluntary with respect to drilling in the Marcellus Shale, where the Company currently conducts operations. As of the date of this report, a law has been recommended by the state’s Marcellus Shale Advisory Commission, which if passed by the legislature will require forced pooling within the Marcellus Shale. In areas where pooling is voluntary, it may be more difficult to form units and, therefore, more difficult to fully develop a project if the operator owns less than 100% of the leasehold. In addition, state conservation laws establish maximum rates of production from natural gas and oil wells, generally prohibit the venting or flaring of natural gas and impose certain requirements regarding the ratability of production. The effect of these regulations is to limit the amount of natural gas and oil the Company can produce and to limit the number of wells and the locations at which the Company can drill. There is currently no price regulation of the Company’s sales of natural gas, oil and natural gas liquids, although governmental agencies may elect to regulate certain sales in the future.

The business operations of the Company and its ownership and operation of natural gas and oil interests are subject to various federal, state and local environmental, health and safety laws and regulations pertaining to the release, emission or discharge of materials into the environment, the generation, storage, transportation, handling and disposal of materials (including solid and hazardous wastes), the safety of employees, or otherwise relating to pollution, preservation, remediation or protection of human health and safety, natural resources, wildlife or the environment. The Company must take into account the cost of complying with environmental regulations in planning, designing, constructing, drilling, operating and abandoning wells and related surface facilities. In most instances, the regulatory frameworks relate to the handling of drilling and production materials, the disposal of drilling and production wastes, and the protection of water and air. In addition, the Company’s operations may require the Company to obtain permits for, among other things,

Mr. Daro Blankenship

September 1, 2011

Page 6

| • | the construction and operation of underground injection wells to dispose of produced saltwater and other non-hazardous oilfield wastes; and |

| • | the construction and operation of surface pits to contain drilling muds and other non-hazardous fluids associated with drilling operations. |

Federal, state and local laws may require the Company to remove or remediate previously disposed wastes, including wastes disposed of or released by the Company or prior owners or operators in accordance with current laws or otherwise, to suspend or cease operations at contaminated areas, or to perform remedial well plugging operations or response actions to reduce the risk of future contamination. Federal laws, including the Comprehensive Environmental Response, Compensation, and Liability Act, or CERCLA, and analogous state laws impose joint and several liability, without regard to fault or legality of the original conduct, on classes of persons who are considered responsible for releases of a hazardous substance into the environment. These persons include the owner or operator of the site where the release occurred, and persons that disposed of or arranged for the disposal of hazardous substances at the site. CERCLA and analogous state laws also authorize the U.S. Environmental Protection Agency (EPA), state environmental agencies and, in some cases, third parties to take action to prevent or respond to threats to human health or the environment and to seek to recover from responsible classes of persons the costs of such actions.

Other federal and state laws, in particular the federal Resource Conservation and Recovery Act, regulate hazardous and non-hazardous wastes. Under a longstanding legal framework, certain wastes generated by the Company’s natural gas and oil operations are not subject to federal regulations governing hazardous wastes, though they may be regulated under other federal and state laws. These wastes may in the future be designated as hazardous wastes and may thus become subject to more rigorous and costly compliance and disposal requirements.

Vast quantities of natural gas and oil deposits exist in deep shale and other formations. It is customary in the industry to recover natural gas and oil from these deep shale formations through the use of hydraulic fracturing, combined with sophisticated horizontal drilling. Hydraulic fracturing is the process of creating or expanding cracks, or fractures, in formations underground where water, sand and other additives are pumped under high pressure into a shale formation. These formations are generally geologically separated and isolated from fresh ground water supplies by protective rock layers. Legislative and regulatory efforts at the federal level and in some states have sought to render permitting and compliance requirements more stringent for hydraulic fracturing. If passed into law, such efforts could have an adverse effect on the Company’s operations.

The Company has made and will continue to make expenditures to comply with environmental, health and safety regulations and requirements. These are necessary business costs in the natural gas and oil industry. Although the Company is not fully insured against all environmental, health and safety risks, and the Company’s insurance does not cover any penalties or fines that may be issued by a governmental authority, the Company maintains insurance coverage which is customary in the industry. Moreover, it is possible that other developments, such as stricter and more comprehensive environmental, health and safety laws and regulations, as well as claims for damages to property or persons, resulting from company operations, could result in substantial costs and liabilities, including civil and criminal penalties. The Company asserts that they are in material compliance with existing environmental, health and safety regulations.

Mr. Daro Blankenship

September 1, 2011

Page 7

Various state governments and regional organizations comprising state governments are considering enacting new legislation and promulgating new regulations governing or restricting the emission of greenhouse gases from stationary sources such as the Company’s equipment and operations. Legislative and regulatory proposals for restricting greenhouse gas emissions or otherwise addressing climate change could require the Company to incur additional operating costs and could adversely affect demand for the natural gas and oil that the Company sells. The potential increase in the Company’s operating costs could include new or increased costs to obtain permits, operate and maintain the Company’s equipment and facilities, install new emission controls on the Company’s equipment and facilities, acquire allowances to authorize the Company’s greenhouse gas emissions, pay taxes related to the Company’s greenhouse gas emissions and administer and manage a greenhouse gas emissions program. Moreover, incentives to conserve energy or use alternative energy sources could reduce demand for natural gas and oil.

The Company has not incurred any costs associated with the above regulations to date; however, there can be no assurance that the costs required to comply with the regulations above will not be substantial. Furthermore, if the Company was deemed not to be in compliance with applicable environmental laws, the Company could be forced to expend substantial amounts to be in compliance, which would have a materially adverse effect on the Company’s available cash and liquidity, and/or could force the Company to curtail or abandon current business operations.

GENERAL

All data used in this assignment was provided by the Company or obtained from public industry information sources. A field inspection of the properties was not made in connection with the preparation of this report.

In evaluating the information at our disposal related to this report, we have excluded from our consideration all matters that require a legal or accounting interpretation or any interpretation other than those of an engineering or geological nature. In assessing the conclusions of this report pertaining to all aspects of oil and gas valuations, especially pertaining to reserve valuations, there are uncertainties inherent in the interpretation of engineering data, and such conclusions represent only informed professional judgments.

Mr. Daro Blankenship

September 1, 2011

Page 8

We relied on information received as indicative of the Company and its operations as of the Valuation Date. We made limited investigation as to the accuracy and completeness of such information and did not verify this information as part of this assignment. Therefore, we express no opinion or other form of assurance regarding the accuracy of the data. Our analysis was based in part on this information as well as on other data we developed.

We are independent of Vadda Energy Corporation, and we have no current or prospective economic interest in the business or property that is the subject of this report. Our fee for this assignment was in no way influenced by the results of our analysis. The Assumptions and Limiting Conditions is an important component of this report.

Should you have questions regarding this report, please contact Gregory E. Scheig, CPA/ABV/CFF, CFA, ValueScope’s Energy Practice Leader, at 817-481-4997.

Respectfully submitted,

ValueScope, Inc.

APPENDICES

| SUMMARY ECONOMIC REPORTS | A |

| | |

| DETAILED ECONOMIC REPORTS | B |

| | |

| PRODUCTION FORECAST GRAPHS | C |

ASSUMPTIONS AND LIMITING CONDITIONS

This valuation by ValueScope, Inc. is subject to and governed by the following Assumptions and Limiting Conditions and other terms, assumptions and conditions contained in the engagement letter.

LIMITATION ON DISTRIBUTION AND USE

The report, the final estimate of value, and the prospective financial analyses included therein are intended solely for the information of the person or persons to whom they are addressed and solely for the purposes stated; they should not be relied upon for any other purpose, and no party other than the Company or other related entities mentioned in this document may rely on them for any purpose whatsoever. Neither the valuation report, its contents, nor any reference to the appraiser or ValueScope, Inc. may be referred to or quoted in any registration statement, prospectus, offering memorandum, sales brochure, other appraisal, loan or other agreement or document given to third parties without our prior written consent. In addition, except as set forth in the report, our analysis and report are not intended for general circulation or publication, nor are they to be reproduced or distributed to third parties without our prior written consent; provided, however, that if ValueScope, Inc. fails to inform the Company whether ValueScope, Inc. will provide such consent within five (5) business days after receiving the Company's request thereof, then ValueScope, Inc.’s consent shall be deemed conclusively to have been provided without any further action by the Company or ValueScope, Inc.

No change of any item in this report shall be made by anyone other than ValueScope, and we shall have no responsibility for any such unauthorized change.

The valuation may not be used in conjunction with any other appraisal or study. The value conclusion(s) stated in this appraisal is based on the program of utilization described in the report, and may not be separated into parts. The appraisal was prepared solely for the purpose, function and party so identified in the report. The report may not be reproduced, in whole or in part, and the findings of the report may not be utilized by a third party for any purpose, without the express written consent of ValueScope, Inc.

As required by new U.S. Treasury rules, we inform you that, unless expressly stated otherwise, any U.S. federal tax advice contained in this report, including attachments, is not intended or written to be used, and cannot be used, by any person for the purpose of avoiding any penalties that may be imposed by the Internal Revenue Service.

NOT A FAIRNESS OPINION

Neither our opinion nor our report are to be construed as an opinion of the fairness of an actual or proposed transaction, a solvency opinion, or an investment recommendation, but, instead, are the expression of our determination of fair value as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date, including our analysis whether impairment of goodwill exists.

OPERATIONAL ASSUMPTIONS

Unless stated otherwise, our analysis (i) assumes that, as of the valuation date, the Company and its assets will continue to operate as configured as a going concern, (ii) is based on the past, present and future projected financial condition of the Company and its assets as of the valuation date, and (iii) assumes that the Company has no undisclosed real or contingent assets or liabilities, other than in the ordinary course of business, that would have a material effect on our analysis.

COMPETENT MANAGEMENT ASSUMED

It should be specifically noted that the valuation assumes the property will be competently managed and maintained over the expected period of ownership. This appraisal engagement does not entail an evaluation of management’s effectiveness, nor are we responsible for future marketing efforts and other management or ownership actions upon which actual results will depend.

NO OBLIGATION TO PROVIDE SERVICES AFTER COMPLETION

Valuation assignments are accepted with the understanding that there is no obligation to furnish services after completion of this engagement. If the need for subsequent services related to a valuation assignment (e.g., including testimony, preparation for testimony, other activity compelled by legal process, updates, conferences, reprint or copy services, document production or interrogatory response preparation, whether by request of the Company or by subpoena or other legal process initiated by a party other than the Company) is requested, special arrangements for such services acceptable to ValueScope, Inc. must be made in advance. ValueScope, Inc. reserves the right to make adjustments to the analysis, opinion and conclusion set forth in the report as we deem reasonably necessary based upon consideration of additional or more reliable data that may become available.

In all matters that may be potentially challenged by a Court or other party, we do not take responsibility for the degree of reasonableness of contrary positions that others may choose to take, nor for the costs or fees that may be incurred in the defense of our recommendations against challenge(s). We will, however, retain our supporting workpapers for your matter(s), and will be available to assist in defending our professional positions taken, at our then current rates, plus direct expenses at actual, and according to our then current Standard Professional Agreement.

NO OPINION IS RENDERED AS TO LEGAL FEE OR PROPERTY TITLE

No opinion is rendered as to legal fee or property title. No opinion is intended in matters that require legal, engineering or other professional advice that has been or will be obtained from professional sources.

LIENS AND ENCUMBRANCES

ValueScope will give no consideration to liens or encumbrances except as specifically stated. We will assume that all required licenses and permits are in full force and effect, and we make no independent on-site tests to identify the presence of any potential environmental risks. We assume no responsibility for the acceptability of the valuation approaches used in our report as legal evidence in any particular court or jurisdiction.

INFORMATION PROVIDED BY OTHERS

Information furnished by others is presumed to be reliable; no responsibility, whether legal or otherwise, is assumed for its accuracy and cannot be guaranteed as being certain. All financial data, operating histories and other data relating to income and expenses attributed to the business have been provided by management or its representatives and have been accepted without further verification except as specifically stated in the report.

PROSPECTIVE FINANCIAL INFORMATION

Valuation reports may contain prospective financial information, estimates or opinions that represent reasonable expectations at a particular point in time, but such information, estimates or opinions are not offered as forecasts, prospective financial statements or opinions, predictions or as assurances that a particular level of income or profit will be achieved, that events will occur or that a particular price will be offered or accepted. Actual results achieved during the period covered by our prospective financial analysis will vary from those described in our report, and the variations may be material.

Any use of management’s projections or forecasts in our analysis will not constitute an examination, review or compilation of prospective financial statements in accordance with standards established by the American Institute of Certified Public Accountants (AICPA). We will not express an opinion or any other form of assurance on the reasonableness of the underlying assumptions or whether any of the prospective financial statements, if used, are presented in conformity with AICPA presentation guidelines.

REGULATORY AND ENVIRONMENTAL CONSIDERATIONS

The report assumes all required licenses, certificates of occupancy, consents, or legislative or administrative authority from any local, state or national government, or private entity or organization have been or can be obtained or reviewed for any use on which the opinion contained in the report are based.

ValueScope is not an environmental consultant or auditor, and it takes no responsibility for any actual or potential environmental liabilities. Any person entitled to rely on this report, wishing to know whether such liabilities exist, or the scope and their effect on the value of the property, is encouraged to obtain a professional environmental assessment. ValueScope does not conduct or provide environmental assessments and has not performed one for the subject property.

ValueScope has not determined independently whether the Company is subject to any present or future liability relating to environmental matters (including, but not limited to CERCLA/Superfund liability) nor the scope of any such liabilities. ValueScope’s valuation takes no such liabilities into account, except as they have been reported to ValueScope by the Company or by an environmental consultant working for the Company, and then only to the extent that the liability was reported to us in an actual or estimated dollar amount. Such matters, if any, are noted in the report. To the extent such information has been reported to us, ValueScope has relied on it without verification and offers no warranty or representation as to its accuracy or completeness.

Unless otherwise stated, no effort has been made to determine the possible effect, if any, on the subject business due to future federal, state, or local legislation, including any environmental or ecological matters or interpretations thereof.

ValueScope has not made a specific compliance survey or analysis of the subject property to determine whether it is subject to, or in compliance with, the American Disabilities Act of 1990, and this valuation does not consider the effect, if any, of noncompliance.

ValueScope expresses no opinion for matters that require legal or other specialized expertise, investigation, or knowledge beyond that customarily employed by business appraisers.

POTENTIAL FUTURE SALES

Any decision to purchase, sell or transfer any interest in the subject company or its subsidiaries shall be your sole responsibility, as well as the structure to be utilized and the price to be accepted.

The selection of the price to be accepted requires consideration of factors beyond the information we will provide or have provided. An actual transaction involving the subject business might be concluded at a higher value or at a lower value, depending upon the circumstances of the transaction and the business, and the knowledge and motivations of the buyers and sellers at that time. Due to the economic and individual motivational influences which may affect the sale of a business interest, the appraiser assumes no responsibility for the actual price of any subject business interest if sold or transferred.

INDEMNIFICATION BY THE COMPANY

The following indemnifications apply only to the extent that any losses, claims, damages, judgments or liabilities are not caused by fraud, bad faith, gross negligence or willful malfeasance on the part of ValueScope.

The Company agrees to indemnify and hold harmless ValueScope, and its respective principals, affiliate, agents and employees (“Indemnified Party”) against any losses, claims, damages, judgments or liabilities arising out of or based upon any professional advisory services rendered pursuant to this agreement. Furthermore, the Company agrees to indemnify ValueScope and any Indemnified Party against any losses, claims, damages, judgments or liabilities incurred as a result of a third party initiating a lawsuit against any Indemnified Party based upon any consulting services rendered to the Company pursuant to this agreement. In consideration for this indemnification agreement, ValueScope will provide professional advisory services.

The Company agrees to reimburse ValueScope and any Indemnified Party for any necessary and reasonable expenses, attorneys’ fees or costs incurred in the enforcement of any part of the indemnity agreement 30 days after receiving written notice from ValueScope.

The obligations of ValueScope under this agreement are solely corporate obligations, and no officer, director, employee, agent, shareholder or controlling person in ValueScope shall be subjected to any personal liability whatsoever to any person, nor will any such claim be asserted by or on behalf of you or your affiliates.

GOVERNING LAW

This Agreement shall be governed by and construed in accordance with the laws of the State of Texas, without regard to conflicts of law principles. The parties hereby irrevocably submit to the jurisdiction of the federal or state courts in the State of Texas, specifically and exclusively in the Tarrant County Court or the Federal District Court for the Northern District of Texas, over any dispute or proceeding arising out of this Agreement and agree that all claims in respect of such dispute or proceeding shall be heard and determined in such court. The parties to this Agreement hereby irrevocably waive, to the fullest extent permitted by applicable law, any objection that they may have to the venue of any such dispute brought in such court or any defense of inconvenient forum for the maintenance of such dispute.

APPENDIX A

SUMMARY ECONOMIC REPORTS

APPENDIX B

DETAILED ECONOMIC REPORTS 3

| 3 | Page numbers on detailed economic reports for each property correlate to page numbers on production forecast graphs presented in Appendix C. |

APPENDIX C

PRODUCTION FORECAST GRAPHS 4

| 4 | Page numbers on production forecast graphs for each property correlate to page numbers on detailed economic reports presented in Appendix B. |