As filed with the Securities and Exchange Commission on March 8, 2013

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-09303 & 811-09923

Kinetics Mutual Funds, Inc. & Kinetics Portfolios Trust

(Exact name of registrant as specified in charter)

555 Taxter Road, Suite 175

Elmsford, NY 10523

(Address of principal executive offices) (Zip code)

U.S. Bancorp Fund Services, LLC

615 E. Michigan Street

Milwaukee, WI 53202

(Name and address of agent for service)

(800) 930-3828

Registrant's telephone number, including area code

Date of fiscal year end: December 31, 2012

Date of reporting period: December 31, 2012

Item 1. Report to Stockholders.

| KINETICS MUTUAL FUNDS, INC. |

| Table of Contents |

| December 31, 2012 |

| | Page |

| Shareholders’ Letter | 2 |

| Year 2012 Annual Investment Commentary | 7 |

| KINETICS MUTUAL FUNDS, INC. — FEEDER FUNDS | |

| Growth of 10,000 Investment | 13 |

| Expense Example | 23 |

| Statements of Assets & Liabilities | 33 |

| Statements of Operations | 37 |

| Statements of Changes in Net Assets | 41 |

| Notes to Financial Statements | 52 |

| Results of Shareholder Meeting | 67 |

| Financial Highlights | 68 |

| Report of Independent Registered Public Accounting Firm | 97 |

| KINETICS PORTFOLIOS TRUST — MASTER INVESTMENT PORTFOLIOS | |

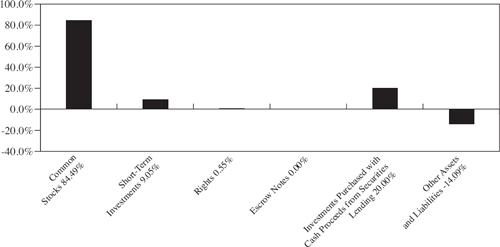

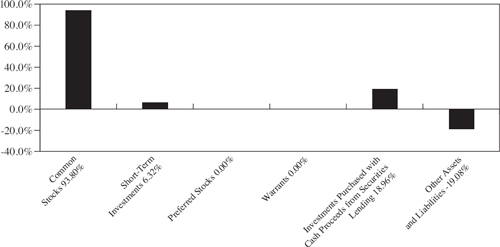

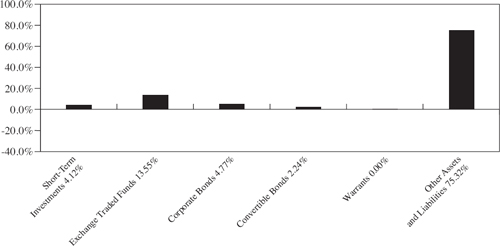

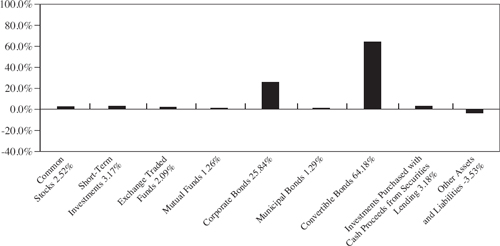

| Allocation of Portfolio Assets | 98 |

| Portfolio of Investments — The Internet Portfolio | 106 |

| Portfolio of Investments — The Global Portfolio | 111 |

| Portfolio of Investments — The Paradigm Portfolio | 115 |

| Portfolio of Investments — The Medical Portfolio | 121 |

| Portfolio of Investments — The Small Cap Opportunities Portfolio | 124 |

| Portfolio of Investments — The Market Opportunities Portfolio | 128 |

| Portfolio of Investments — The Water Infrastructure Portfolio | 132 |

| Portfolio of Investments — The Multi-Disciplinary Portfolio | 134 |

| Portfolio of Options Written — The Water Infrastructure Portfolio | 139 |

| Portfolio of Options Written — The Multi-Disciplinary Portfolio | 145 |

| Portfolio of Securities Sold Short | 167 |

| Statements of Assets & Liabilities | 168 |

| Statements of Operations | 172 |

| Statements of Changes in Net Assets | 176 |

| Notes to Financial Statements | 180 |

| Report of Independent Registered Public Accounting Firm | 205 |

| Results of Shareholder Meeting | 206 |

| Management of the Funds and the Portfolios | 207 |

| Privacy Policy | 212 |

| KINETICS MUTUAL FUNDS, INC. |

| Shareholders’ Letter |

Dear Fellow Shareholders:

We are pleased to present the Kinetics Mutual Funds (“Funds”) Annual Report for the twelve-month period ended December 31, 2012. As of our last letter, at mid-year, there were various uncertainties weighing heavily on equity prices, namely the presidential election, the “fiscal cliff,” instability in the European currency union, and slowing economic data in emerging markets, among others. These concerns have since been resolved or assuaged, at least in part, and equity prices have reacted positively worldwide. Typically, such broad market and broad asset class (macro) rallies are not the most constructive for fundamental value investors; however, the latter half of 2012 proved to be fruitful for our Funds, as the No-load Classes of the Funds completed the year as follows (No-Load Class): The Paradigm Fund +21.78%, The Multi-Disciplinary Fund +15.38%, The Small Cap Opportunities Fund +26.74%, The Market Opportunities Fund +17.52%, The Internet Fund +23.24%, The Medical Fund +8.86%, The Water Infrastructure Fund (now, the Alternative Income Fund) +9.90%, and The Global Fund +23.16%. These results compare to returns of 16.00% for the S&P 500 Index and 16.13% for the MSCI All Country World Index.

Our Funds achieved attractive returns for 2012 in both absolute and relative terms. As a result, investors might be concerned about the risk of complacency; however, we recognize that the investment process must be perpetual. We continue to diligently monitor our existing portfolio positions in addition to myriad potential new investments. We believe that it is futile to attempt to determine the precise driver(s) of gains in security prices, as there may be a multitude of drivers, particularly in shorter time periods. Regardless, we have analyzed all of the companies whose securities we own and compared their business fundamentals with those of one and two years ago, when their shares were trading at materially lower levels. In aggregate, our portfolio companies have grown intrinsic value at rates consistent with or

above those of their respective equity prices. Accordingly, we remain quite optimistic with regard to many investment opportunities.

In 2012, many equity prices were driven higher by the combination of slightly higher earnings and/or cash flows and expansion of the valuation multiples assigned to them. In short, the fundamentals of the companies did in fact improve, but the improvements were not on the same scale as was their share price appreciation. In many cases, such multiples expansion is justified, particularly in light of the continued near-zero percent interest rate policy maintained by much of the developed world. However, we prefer to rely on the underlying returns of the businesses to drive shares prices, and view multiples expansion as a potential enhancement to base returns. Not all companies are capable of consistently growing underlying business values at high levels, particularly in the current environment of low economic growth and tepid inflation; hence, we must be very selective in our investment process. A common characteristic that we have identified amongst the “compounders,” companies that reliably compound underlying value, is the existence of an owner-operator.

Owner-operators are broadly defined as corporate management teams that have considerable personal wealth invested alongside their shareholders. The actions of these management teams over the past several years stand in stark contrast to “agent” managers. Owner-operators have actively allocated capital into attractive opportunities and engaged in various corporate actions (share repurchases and spin-offs, to name but a few) aimed at enhancing shareholder value. Compare this to the actions undertaken by most “agent” corporate managers, who have focused on cost-cutting measures to maintain margins (at the possible expense of future growth) and who have amassed large cash balances earning nearly no return. The latter group of companies is likely to find it difficult to grow revenues or earnings at historical levels. Additionally, should confidence in equity markets continue to recover, these

companies will struggle to effectively allocate capital in an increasingly competitive environment. An easily observable divide exists between companies that have positioned themselves aggressively during an advantageous environment and those that will need to chase opportunities as prices rise; we are pleased to own many of the former.

It is a relief that none of the perceived catastrophic macroeconomic events came to fruition over the past two years. It is important for us as value investors to attempt to ignore this “noise” to the greatest extent possible, while always purchasing securities with a considerable embedded margin of safety. Even if a severely disruptive event were to occur, a company with a conservative valuation, appropriate business model and proven management team is likely to minimize or avoid permanent impairment of value. This is not to be confused with temporary price volatility, which we expect will remain a part of capital markets for the foreseeable future. We hope that communicating these attributes of our holdings to investors in all of our funds will enable you to share our confidence.

Shareholders can continue to access additional information from our website, www.kineticsfunds.com. This website provides a broad array of information, including recent portfolio holdings, quarterly investment commentaries, conference call transcripts, newsflashes, recent performance data, and online access to account information.

Kinetics offers the following funds to investors:

The Paradigm Fund focuses on companies that are valued attractively and currently have, or are expected to soon have, sustainable high business returns. The Fund has produced attractive returns since its inception in an environment that should be described as difficult for equity investors. The Paradigm Fund is Kinetics’ flagship fund.

The Multi-Disciplinary Fund seeks to utilize stock options and fixed-income investments in order to provide investors with equity-like returns, but with more muted volatility. At times, the options strategies of the Fund may cause the manager to purchase equity securities.

The Small Cap Opportunities Fund focuses on undervalued and special situation small capitalization equities that have the potential for rewarding long-term investment results. The same investment fundamentals employed by The Paradigm Fund are used to identify such opportunities.

The Medical Fund is a sector fund, offering an investment in scientific discovery within the promising field of medical research, particularly in the development of cancer treatments and therapies. As a sector fund, The Medical Fund is likely to have heightened volatility.

The Internet Fund is a sector fund that focuses on companies engaged in the evolution of Internet-related developments. As such, this Fund has been, and is likely to continue to be, quite volatile. The Internet Fund is not designed to be a major component of one’s equity exposure. More recently, this Fund has been focusing on content companies, which we believe will be the winners in the next generation of Internet development.

The Global Fund is focused on selecting long life cycle international companies that can generate long-term wealth through their business operations. This Fund is presently finding exciting opportunities in the more developed markets.

The Market Opportunities Fund focuses on those companies that benefit from increasing transactional volume or throughput, such as publicly-traded exchanges and credit card processors, or companies that act as facilitators, such as gaming companies, airports and publicly-traded toll roads.

The Alternative Income Fund underwent a proxy vote on December 21, 2012, wherein the shareholders approved a change from the Kinetics Water Infrastructure Fund’s investment objective and to one of the Fund’s fundamental investment restrictions. As a result of the proxy, The Water Infrastructure Fund has been renamed The Alternative Income Fund. The primary investment objective of the Alternative Income Fund is to provide current income and gains, with a secondary objective of obtaining long-term growth of capital. Consistent with this change, prospectively, the Fund will seek to generate a total return that exceeds that of most short-term U.S. fixed income indexes, with limited market value variability.

Peter B. Doyle

President

Kinetics Mutual Funds, Inc.

| KINETICS MUTUAL FUNDS, INC. |

| Investment Commentary |

Dear Fellow Shareholders,

The S&P 500 Index completed 2012 by returning 16.00%, while the NASDAQ Composite returned 15.91% over the same period. Equity markets ultimately achieved strong gains for the year despite episodes of increased volatility and high correlation. In the second half of the year, markets began to stabilize, and many of the high quality companies whose stock price declined unreasonably in 2011 led the rebound. As such, the Funds prospered and achieved (No-Load Class) returns of 21.78% in the Paradigm Fund, 26.74% in the Small Cap Opportunities Fund, 17.52% in the Market Opportunities Fund, 8.86% in the Medical Fund, 23.24% in the Internet Fund, 15.38% in the Multi-Disciplinary Fund, 23.16% in the Global Fund and 9.90% in the Water Infrastructure Fund (now, the Alternative Income Fund).

Steadfast investors were able to achieve very attractive returns in global capital markets during 2012, with price performance generally increasing as one moved further out on the perceived risk spectrum (i.e., most equity benchmarks outperformed most fixed income benchmarks). It’s important to recognize that this is the perceived risk spectrum, which is not necessarily reflective of the actual risk incurred. Academic thought generally concludes that outsized gains can be achieved solely by assuming outsized risk; hence, an equity investor should have the potential for a larger return than a U.S. Treasury investor. Further, the Treasury investor sacrifices some potential investment appreciation in exchange for the relative certainty that the interest payments will be made and the principal capital returned. This relationship holds true only in the rare occasions where markets are efficiently priced. In contrast, great opportunities lie in the extremes of inefficient pricing. We do not believe that capital markets are currently at an extreme in terms of prices, but it is our view that there is likely far more risk in safe haven fixed income assets than many realize and less risk in some assets described as higher risk than many believe.

Consider an investor in investment grade U.S. corporate bonds, an asset class that has steadily attracted investor capital over the past several years. These bonds currently trade at a relatively small premium to U.S. Treasury bonds of similar duration in terms of yield to maturity. Many such corporate bonds that were issued prior to the credit crisis currently trade well above par value,

reflecting their high coupon payments. Now also consider an investor in the equity of a consumer company that enjoys reliable cash flows, moderate pricing power and is traded at an earnings multiple in line with the broader markets. In the scenario where interest rates increase in the United States, one could argue that the corporate bond investor will incur more severe and more permanent losses. Nonetheless, the bond investor is commonly recognized as assuming less risk than the equity investor.

The well documented and widely recognized risks are rarely those that cause the most damage to investors. The list of global macro concerns is expansive and well appreciated by the marketplace. However, few have seriously considered the impact of interest rate increases on low yielding (both nominal and real) fixed income securities. What about the risk of reinvesting new capital into fixed income as earlier vintage bonds paying higher coupons mature? Even though we are confident that our equity portfolios currently have less real risk than such fixed income portfolios, we acknowledge that many investors are simply unwillingly to accept the volatility of equity markets. As a solution, we offer two distinct yield-generating strategies in funds that we encourage investors to consider, the Multi-Disciplinary Fund and Alternative Income Fund.

The performance of the Paradigm Fund continues to be driven by owner-operated companies with business activities primarily in the United States. Top contributing owner-operator positions include several consumer businesses that exhibited resiliency during the crisis and subsequent tepid recovery. We believe that these businesses are currently much better positioned compared to five years ago as a result of attrition and astute capital allocation; however, their market valuations fail to reflect this development.

The Small Cap Opportunities Fund also maintains a high weighting in owner-operated companies, predominately those conducting business in the United States. The Fund benefitted from strong performance amongst allocations to real estate oriented owner-operators. A number of North American real estate companies in the small capitalization universe are in various stages of development. Accordingly, most of these companies do not currently generate a yield; hence, their equity is available at a material discount to the yield being generating by their REIT peers. We believe that investors are paying a

premium for dividend yield and, accordingly, are ignoring the fundamentals of most REIT opportunities.

The Market Opportunities Fund continues to hold a variety of owner-operated companies that facilitate capital market activity. In aggregate the financial industry performed well, although the “facilitators” lagged the strong gains achieved by the conventional, lending based financial companies. We believe that these facilitators are capable of achieving equal or greater unleveraged returns on equity (i.e., adjusted returns on assets) than their leveraged peers, but with far less risk. We expect such companies to be primary beneficiaries of a continued upswing in the investment cycle.

The Medical Fund maintained its large allocation to multi-national major pharmaceutical companies and later stage biotechnology firms. The share prices of most major pharmaceutical companies appreciated for the year and continue to appear inexpensive on a quantitative basis. However these companies largely underperformed broad equity indexes. Concerns regarding patent expirations and cash flow disruptions outweighed attractive dividend yields and product pipelines. Further, many of the mature biotechnology firms also recorded gains for the year, but underperformed their less developed peers.

The Internet Fund maintained its historic methodology of allocating capital to companies that are beneficiaries of the Internet and related disruptive technologies. The Fund’s performance was driven by its focus upon owner-operated companies that own and provide media content. We believe that the technological innovation that facilitated additional channels for content to be distributed to consumers (i.e., satellite radio, internet TV, among others) will ultimately result in original content commanding an ever higher price premium.

The Multi-Disciplinary Fund was able to achieve “equity-like” returns with materially less price volatility through a two-pronged approach of selling put options related to high quality owner-operator companies and utilizing the resulting income to make advantageous fixed income investments. The Fund benefitted from high implied volatility experienced in the middle of the year. As a result, the premiums received from selling put securities were elevated and high yield bonds prices were subdued, both trends ultimately reversing throughout the second half of the year.

The Global Fund is primarily positioned with a diverse selection of global owner-operated companies. Many of these companies have various lines of business, with revenues generated across several countries. The performance of the Fund was bolstered by investments in consumer companies located in continental Europe, but with internationally diverse sales. The Fund also benefitted from companies that had meaningful exposures to secular trends in unique local or regional economies.

The Alternative Income Fund (formerly, The Water Infrastructure Fund) experienced a mandate shift effective January 1, 2013, effectively replacing a multi-disciplinary approach to water infrastructure investing with a more conservative broad option income strategy. The performance of the Fund during the year ended December 31, 2012, was primarily driven by premiums received on water related companies, bolstered by income and capital appreciation on related fixed income securities. Over the next several years the performance of the Fund will likely be primarily driven by income generated on conservative, far out of the money put options. The complimentary short-term fixed income portfolio will probably contribute minimal performance until interest rates rise and/or corporate bond spreads widen in the United States.

Peter B. Doyle

Chief Investment Strategist

Disclosure

This material is intended to be reviewed in conjunction with a current prospectus, which includes all fees and expenses that apply to a continued investment, as well as information regarding the risk factors, policies and objectives of the Funds. Read it carefully before investing.

Mutual Fund investing involves risk. Principal loss is possible. Because The Internet Fund, The Medical Fund and The Market Opportunities Fund invest in a single industry or geographic region, their shares are subject to a higher degree of risk than funds with a higher level of diversification. Internet, biotechnology and certain capital markets or gaming stocks are subject to a rate of change in technology, obsolescence and competition that is generally higher than that of other industries, hence they may experience extreme price and volume fluctuations.

International investing [for all Funds] presents special risks including currency exchange fluctuation, government regulations, and the potential for political and economic instability. Accordingly, the share prices for these Funds are expected to be more volatile than that of U.S.-only funds. Past performance is no guarantee of future performance.

Because smaller companies [for The Small Cap Opportunities Fund] often have narrower markets and limited financial resources, they present more risk than larger, more well established, companies.

Non-investment grade debt securities [for all Funds], i.e., junk bonds, are subject to greater credit risk, price volatility and risk of loss than investment grade securities.

Further, options contain special risks including the imperfect correlation between the value of the option and the value of the underlying asset. Investments [for The Multi- Disciplinary Fund and The Alternative Income Fund] in futures, swaps and other derivative instruments may result in loss as derivative instruments may be illiquid, difficult to price and leveraged so that small changes may produce disproportionate losses to the Funds. To the extent the Funds segregate assets to cover derivative positions, they may impair their ability to meet current obligations, to honor requests for redemption

and to manage the investments in a manner consistent with their respective investment objectives. Purchasing and writing put and call options and, in particular, writing “uncovered” options are highly specialized activities that entail greater than ordinary investment risk.

As non-diversified Funds, the value of Fund shares may fluctuate more than shares invested in a broader range of industries and companies. Unlike other investment companies that directly acquire and manage their own portfolios of securities, The Kinetics Mutual Funds pursue their investment objectives by investing all of their investable assets in a corresponding portfolio series of the Kinetics Portfolios Trust.

The information concerning the Funds included in the shareholder report contains certain forward-looking statements about the factors that may affect the performance of the Funds in the future. These statements are based on Fund management’s predictions and expectations concerning certain future events and their expected impact on the Funds, such as performance of the economy as a whole and of specific industry sectors, changes in the levels of interest rates, the impact of developing world events, and other factors that may influence the future performance of the Funds. Management believes these forward-looking statements to be reasonable, although they are inherently uncertain and difficult to predict. Actual events may cause adjustments in portfolio management strategies from those currently expected to be employed.

The Nasdaq Composite (NASDAQ) and the Standard & Poor’s 500 Index (S&P 500) each represent an unmanaged, broad-basket of stocks. They are typically used as a proxy for overall market performance.

Distributor: Kinetics Funds Distributor LLC is not an affiliate of Kinetics Mutual Funds, Inc. Kinetics Funds Distributor LLC is an affiliate of Kinetics Asset Management LLC, Investment Adviser to Kinetics Mutual Funds, Inc.

For more information, log onto www.kineticsfunds.com.January 1, 2013 — Kinetics Asset Management LLC ®

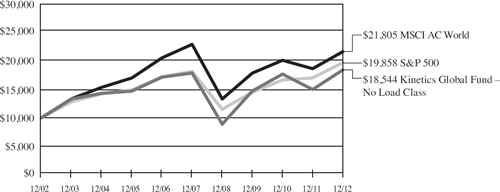

How a $10,000 Investment Has Grown: The charts show the growth of a $10,000 investment in the Feeder Funds as compared to the performance of two or more representative market indices. The tables below the charts show the average annual total returns on an investment over various periods. Returns for periods greater than one year are average annual total returns. The annual returns assume the reinvestment of all dividends and distributions, however, the graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Past performance is not predictive of future performance. Current performance may be lower or higher than the returns quoted below. The performance data reflects voluntary fee waivers and expense reimbursements made by the Adviser and the returns would have been lower if these waivers and expense reimbursements were not in effect. Investment return and principal value will fluctuate, so that your shares, when redeemed, may be worth more or less than their original costs. S&P 500 Index — The S&P 500 Index is a capital-weighted index, representing the aggregate market value of the common equity of 500 stocks primarily traded on the New York Stock Exchange. The S&P 500 is unmanaged and includes the reinvestment of dividends and does not reflect the payments of transaction costs and advisory fees associated with an investment in the Funds. The securities that comprise the S&P 500 may differ substantially from the securities in the Funds’ portfolios. It is not possible to directly invest in an index. NASDAQ Composite Index — The NASDAQ Composite Index is a broad-based capitalization-weighted index of all NASDAQ stocks. The NASDAQ Composite is unmanaged and does not include the reinvestment of dividends and does not reflect the payment of transaction costs or advisory fees associated with an investment in the Funds. The securities that comprise the NASDAQ Composite may differ substantially from the securities in the Funds’ portfolios. It is not possible to directly invest in an index. CBOE S&P 500 BuyWrite Index (BXM) — The CBOE S&P 500 BuyWrite Index (BXM) is a benchmark index designed to track the performance of a hypothetical buy-write strategy on the S&P 500 Index. The securities that comprise the CBOE S&P 500 BuyWrite Index may differ substantially from the securities in The Multi-Disciplinary Fund’s portfolio. It is not possible to directly invest in an index. CBOE S&P 500 PutWrite Index (PUT) — The CBOE S&P 500 Put-Write Index (PUT) is a benchmark index designed to track the performance of a passive program that sells near-term, at-the-money S&P 500 Index puts. |

The securities that comprise the CBOE S&P 500 Put-Write Index may differ substantially from the securities in The Multi-Disciplinary Fund’s portfolio. It is not possible to directly invest in an index. MSCI ACWI Index — The MSCI ACWI Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. The MSCI ACWI consists of 45 country indices comprising 24 developed and 21 emerging market country indices. MSCI EAFE Index — The MSCI EAFE Index is a free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the US & Canada. RUSSELL 2000 Index — The Russell 2000 Index is a subset of the Russell 3000® Index representing approximately 10% of the total market capitalization of that index. It includes approximately 2000 of the smallest securities based on a combination of their market cap and current index membership. The Russell 2000 Index measures the performance of the small-cap segment of the U.S. equity universe. ISE Water Index — The ISE Water Index includes companies engaged in water distribution, water filtration, flow technology, and other water solutions. Palisades Water Index — The Palisades Water Index is a modified equal-dollar weighted index comprised of companies publicly traded in the United States that are positioned to benefit significantly from the escalating global demand for water and the ecological imperative of sustainable water resource governance. Accordingly, the Index serves as a proxy for measuring the increasing value of water resulting from the impact of temporal and spatial scarcity on the relationship between human health, ecological sustainability and economic growth. |

The Internet Fund

December 31, 2002 — December 31, 2012

| | | Ended 12/31/2012 |

| | | | | Advisor | Advisor | | | | | | |

| | | No Load | Class A | Class A | Advisor | | | NASDAQ |

| | | Class | (No Load) | (Load Adjusted)(1) | Class C | S&P 500 | Composite |

| One Year | | 23.24 | % | 22.92 | % | 15.86 | % | 22.32 | % | 16.00 | % | 15.91 | % |

| Five Years | | 4.68 | % | 4.42 | % | 3.19 | % | 3.90 | % | 1.66 | % | 2.63 | % |

| Ten Years | | 10.90 | % | 10.69 | % | 10.04 | % | N/A | | 7.10 | % | 8.50 | % |

| Since Inception | | | | | | | | | | | | | |

| No Load Class | | | | | | | | | | | | | |

| (10/21/96) | | 14.84 | % | N/A | | N/A | | N/A | | 6.31 | % | 5.67 | % |

| Since Inception | | | | | | | | | | | | | |

| Advisor Class A | | | | | | | | | | | | | |

| (4/26/01) | | N/A | | 5.82 | % | 5.28 | % | N/A | | 3.25 | % | 3.44 | % |

| Since Inception | | | | | | | | | | | | | |

| Advisor Class C | | | | | | | | | | | | | |

| (2/16/07) | | N/A | | N/A | | N/A | | 7.20 | % | 1.85 | % | 3.29 | % |

(1) Reflects front-end sales charge of 5.75%.

Returns for periods greater than one year are average annual total returns.

The Global Fund

December 31, 2002 — December 31, 2012

| | | Ended 12/31/2012 |

| | | | | Advisor | Advisor | | | | | | |

| | | No Load | Class A | Class A | Advisor | | | MSCI AC |

| | | Class | (No Load) | (Load Adjusted)(1) | Class C | S&P 500 | World |

| One Year | | 23.16 | % | 22.94 | % | 15.85 | % | 22.04 | % | 16.00 | % | 16.13 | % |

| Five Years | | 0.60 | % | N/A | | N/A | | N/A | | 1.66 | % | –1.16 | % |

| Ten Years | | 6.37 | % | N/A | | N/A | | N/A | | 7.10 | % | 8.11 | % |

| Since Inception | | | | | | | | | | | | | |

| No Load Class | | | | | | | | | | | | | |

| (12/31/99) | | –3.84 | % | N/A | | N/A | | N/A | | 1.66 | % | 1.82 | % |

| Since Inception | | | | | | | | | | | | | |

| Advisor Class A | | | | | | | | | | | | | |

| (5/19/08) | | N/A | | 2.10 | % | 0.79 | % | N/A | | 2.26 | % | –1.14 | % |

| Since Inception | | | | | | | | | | | | | |

| Advisor Class C | | | | | | | | | | | | | |

| (5/19/08) | | N/A | | N/A | | N/A | | 1.42 | % | 2.26 | % | –1.14 | % |

(1) Reflects front-end sales charge of 5.75%.

Returns for periods greater than one year are average annual total returns.

The Paradigm Fund

December 31, 2002 — December 31, 2012

| | | Ended 12/31/2012 |

| | | | | Advisor | Advisor | | | | | | | | |

| | | No Load | Class A | Class A | Advisor | Institutional | | | MSCI AC |

| | | Class | (No Load) | (Load Adjusted)(1) | Class C | Class | S&P 500 | World |

| One Year | | 21.78 | % | 21.49 | % | 14.48 | % | 20.85 | % | 21.99 | % | 16.00 | % | 16.13 | % |

| Five Years | | –4.15 | % | –4.39 | % | –5.51 | % | –4.88 | % | –3.98 | % | 1.66 | % | –1.16 | % |

| Ten Years | | 10.02 | % | 9.72 | % | 9.08 | % | 9.17 | % | N/A | | 7.10 | % | 8.11 | % |

| Since Inception | | | | | | | | | | | | | | | |

| No Load Class | | | | | | | | | | | | | | | |

| (12/31/99) | | 7.72 | % | N/A | | N/A | | N/A | | N/A | | 1.66 | % | 1.82 | % |

| Since Inception | | | | | | | | | | | | | | | |

| Advisor Class A | | | | | | | | | | | | | | | |

| (4/26/01) | | N/A | | 7.95 | % | 7.40 | % | N/A | | N/A | | 3.25 | % | 4.02 | % |

| Since Inception | | | | | | | | | | | | | | | |

| Advisor Class C | | | | | | | | | | | | | | | |

| (6/28/02) | | N/A | | N/A | | N/A | | 8.12 | % | N/A | | 5.65 | % | 6.40 | % |

| Since Inception | | | | | | | | | | | | | | | |

| Institutional Class | | | | | | | | | | | | | | | |

| (5/27/05) | | N/A | | N/A | | N/A | | N/A | | 4.77 | % | 4.49 | % | 4.75 | % |

(1) Reflects front-end sales charge of 5.75%.

Returns for periods greater than one year are average annual total returns.

The Medical Fund

December 31, 2002 — December 31, 2012

| | | Ended 12/31/2012 | |

| | | | | Advisor | Advisor | | | | | | |

| | | No Load | Class A | Class A | Advisor | | | NASDAQ |

| | | Class | (No Load) | (Load Adjusted)(1) | Class C | S&P 500 | Composite |

| One Year | | 8.86 | % | 8.60 | % | 2.33 | % | 8.08 | % | 16.00 | % | 15.91 | % |

| Five Years | | 3.40 | % | 3.19 | % | 1.97 | % | 2.64 | % | 1.66 | % | 2.63 | % |

| Ten Years | | 7.44 | % | 7.17 | % | 6.54 | % | N/A | | 7.10 | % | 8.50 | % |

| Since Inception | | | | | | | | | | | | | |

| No Load Class | | | | | | | | | | | | | |

| (9/30/99) | | 7.56 | % | N/A | | N/A | | N/A | | 2.70 | % | 0.72 | % |

| Since Inception | | | | | | | | | | | | | |

| Advisor Class A | | | | | | | | | | | | | |

| (4/26/01) | | N/A | | 2.87 | % | 2.36 | % | N/A | | 3.25 | % | 3.44 | % |

| Since Inception | | | | | | | | | | | | | |

| Advisor Class C | | | | | | | | | | | | | |

| (2/16/07) | | N/A | | N/A | | N/A | | 3.85 | % | 1.85 | % | 3.29 | % |

(1) Reflects front-end sales charge of 5.75%.

Returns for periods greater than one year are average annual total returns.

The Small Cap Opportunities Fund

December 31, 2002 — December 31, 2012

| | | Ended 12/31/2012 |

| | | | | Advisor | Advisor | | | | | | | | |

| | | No Load | Class A | Class A | Advisor | Institutional | | | | |

| | | Class | (No Load) | (Load Adjusted)(1) | Class C | Class | S&P 500 | Russell 2000 |

| One Year | | 26.74 | % | 26.44 | % | 19.14 | % | 25.77 | % | 27.04 | % | 16.00 | % | 16.35 | % |

| Five Years | | –3.66 | % | –3.90 | % | –5.03 | % | –4.39 | % | –3.47 | % | 1.66 | % | 3.56 | % |

| Ten Years | | 10.83 | % | 10.55 | % | 9.90 | % | N/A | | N/A | | 7.10 | % | 9.72 | % |

| Since Inception | | | | | | | | | | | | | | | |

| No Load Class | | | | | | | | | | | | | | | |

| (3/20/00) | | 8.47 | % | N/A | | N/A | | N/A | | N/A | | 1.74 | % | 4.85 | % |

| Since Inception | | | | | | | | | | | | | | | |

| Advisor Class A | | | | | | | | | | | | | | | |

| (12/30/01) | | N/A | | 6.00 | % | 5.43 | % | N/A | | N/A | | 4.05 | % | 6.55 | % |

| Since Inception | | | | | | | | | | | | | | | |

| Advisor Class C | | | | | | | | | | | | | | | |

| (2/16/07) | | N/A | | N/A | | N/A | | –2.03 | % | N/A | | 1.85 | % | 2.06 | % |

| Since Inception | | | | | | | | | | | | | | | |

| Institutional Class | | | | | | | | | | | | | | | |

| (8/12/05) | | N/A | | N/A | | N/A | | N/A | | 3.97 | % | 4.21 | % | 4.88 | % |

(1) Reflects front-end sales charge of 5.75%.

Returns for periods greater than one year are average annual total returns.

The Market Opportunities Fund

January 31, 2006 — December 31, 2012

| | | Ended 12/31/2012 |

| | | | | Advisor | Advisor | | | | | | | | |

| | | No Load | Class A | Class A | Advisor | Institutional | | | | |

| | | Class | (No Load) | (Load Adjusted)(1) | Class C | Class | S&P 500 | MSCI EAFE |

| One Year | | 17.52 | % | 17.26 | % | 10.48 | % | 16.70 | % | 17.83 | % | 16.00 | % | 17.32 | % |

| Five Years | | –3.94 | % | –4.17 | % | –5.30 | % | –4.61 | % | N/A | | 1.66 | % | –3.69 | % |

| Since Inception | | | | | | | | | | | | | | | |

| No Load Class | | | | | | | | | | | | | | | |

| (1/31/06) | | 4.15 | % | N/A | | N/A | | N/A | | N/A | | 3.78 | % | 1.34 | % |

| Since Inception | | | | | | | | | | | | | | | |

| Advisor Class A | | | | | | | | | | | | | | | |

| (1/31/06) | | N/A | | 3.89 | % | 3.01 | % | N/A | | N/A | | 3.78 | % | 1.34 | % |

| Since Inception | | | | | | | | | | | | | | | |

| Advisor Class C | | | | | | | | | | | | | | | |

| (2/16/07) | | N/A | | N/A | | N/A | | –0.46 | % | N/A | | 1.85 | % | –2.09 | % |

| Since Inception | | | | | | | | | | | | | | | |

| Institutional Class | | | | | | | | | | | | | | | |

| (5/19/08) | | N/A | | N/A | | N/A | | N/A | | –0.59 | % | 2.26 | % | –3.88 | % |

(1) Reflects front-end sales charge of 5.75%.

Returns for periods greater than one year are average annual total returns.

The Water Infrastructure Fund

June 29, 2007 — December 31, 2012

| | | Ended 12/31/2012 | |

| | | | | | | Advisor | | | | | | | | | | |

| | | | | Advisor | Class A | | | | | | | | | |

| | | No Load | Class A | (Load | Advisor | Institutional | S&P | ISE | Palisades |

| | | Class | (No Load) | Adjusted)(1) | Class C | Class | 500 | Water | Water |

| One Year | | 9.90 | % | 9.61 | % | 3.37 | % | 8.96 | % | 10.17 | % | 16.00 | % | 25.61 | % | 28.73 | % |

| Five Years | | –2.77 | % | –2.99 | % | –4.14 | % | –3.49 | % | –2.47 | % | 1.66 | % | 3.04 | % | 0.77 | % |

| Since Inception | | | | | | | | | | | | | | | | | |

| No Load Class | | | | | | | | | | | | | | | | | |

| (6/29/07) | | –2.05 | % | N/A | | N/A | | N/A | | N/A | | 1.25 | % | 3.26 | % | 1.56 | % |

| Since Inception | | | | | | | | | | | | | | | | | |

| Advisor Class A | | | | | | | | | | | | | | | | | |

| ( 6/29/07) | | N/A | | –2.28 | % | –3.32 | % | N/A | | N/A | | 1.25 | % | 3.26 | % | 1.56 | % |

| Since Inception | | | | | | | | | | | | | | | | | |

| Advisor Class C | | | | | | | | | | | | | | | | | |

| ( 6/29/07) | | N/A | | N/A | | N/A | | –2.77 | % | N/A | | 1.25 | % | 3.26 | % | 1.56 | % |

| Since Inception | | | | | | | | | | | | | | | | | |

| Institutional Class | | | | | | | | | | | | | | | | | |

| ( 6/29/07) | | N/A | | N/A | | N/A | | N/A | | –1.76 | % | 1.25 | % | 3.26 | % | 1.56 | % |

(1) Reflects front-end sales charge of 5.75%.

Returns for periods greater than one year are average annual total returns.

The Multi-Disciplinary Fund

February 11, 2008 — December 31, 2012

| | | Ended 12/31/2012 | |

| | | | | | | Advisor | | | | | | | | | | |

| | | | | Advisor | Class A | | | | | | | | | | |

| | | No Load | Class A | (Load | Advisor | Institutional | S&P | CBOE | CBOE |

| | | Class | (No Load) | Adjusted)(1) | Class C | Class | 500 | Buy | Put |

| One Year | | 15.38 | % | 15.12 | % | 8.53 | % | 14.48 | % | 15.55 | % | 16.00 | % | 5.20 | % | 8.14 | % |

| Since Inception | | | | | | | | | | | | | | | | | |

| No Load Class | | | | | | | | | | | | | | | | | |

| (2/11/08) | | 5.87 | % | N/A | | N/A | | N/A | | N/A | | 3.59 | % | 2.46 | % | 5.04 | % |

| Since Inception | | | | | | | | | | | | | | | | | |

| Advisor Class A | | | | | | | | | | | | | | | | | |

| ( 2/11/08) | | N/A | | 5.60 | % | 4.33 | % | N/A | | N/A | | 3.59 | % | 2.46 | % | 5.04 | % |

| Since Inception | | | | | | | | | | | | | | | | | |

| Advisor Class C | | | | | | | | | | | | | | | | | |

| ( 2/11/08) | | N/A | | N/A | | N/A | | 5.07 | % | N/A | | 3.59 | % | 2.46 | % | 5.04 | % |

| Since Inception | | | | | | | | | | | | | | | | | |

| Institutional Class | | | | | | | | | | | | | | | | | |

| ( 2/11/08) | | N/A | | N/A | | N/A | | N/A | | 6.06 | % | 3.59 | % | 2.46 | % | 5.04 | % |

(1) Reflects front-end sales charge of 5.75%.

Returns for periods greater than one year are average annual total returns.

| KINETICS MUTUAL FUNDS, INC. — THE FEEDER FUNDS |

| Expense Example |

| December 31, 2012 |

Shareholders incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, reinvestments of dividends or other distributions made by a Fund, redemption fees, and exchange fees, and (2), ongoing costs, including management fees, distribution and/or service (12b-1) fees, and other Fund expenses. This example is intended to help investors understand the ongoing costs (in dollars) of investing in a series of Kinetics Mutual Funds, Inc. (each a “Feeder Fund” and collectively the “Feeder Funds”), and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested on July 1, 2012 and held for the entire period from July 1, 2012 to December 31, 2012.

Actual Expenses

The first line and second line items of the table below provide information about actual account values and actual expenses before and after expense reimbursement. Unlike other mutual funds that directly acquire and manage their own portfolio securities, each Feeder Fund invests all or generally all of its investable assets in a corresponding series of The Kinetics Portfolios Trust (each, a “Master Portfolio”, and together the “Master Portfolios”), a separately registered investment company. The Master Portfolio, in turn, invests in securities. With this type of organization, expenses can accrue specifically to the Master Portfolio or the Feeder Fund or both. Each Feeder Fund records its proportionate share of the Master Portfolio’s expenses, including directed brokerage credits, on a daily basis. Any expense reductions include Fund-specific expenses as well as the expenses allocated from the Master Portfolio.

The Feeder Funds will charge shareholder fees for outgoing wire transfers, returned checks, and exchanges executed by telephone between a Feeder Fund and any other Feeder Fund. The Feeder Funds’ transfer agent charges a $5.00 transaction fee to shareholder accounts for telephone exchanges between any two Feeder Funds. The Feeder Funds’ transfer agent does not charge a transaction fee for written exchange requests. IRA accounts are assessed a $15.00 annual fee. Finally, as a disincentive to market-timing transactions, the Feeder Funds will assess a 2.00% fee on the redemption or exchange of Fund shares held for less than 30 days. These fees will be paid to the Feeder Funds to help offset transaction costs. The Feeder Funds reserve the right to waive the redemption fee, subject to their sole discretion, in instances deemed not to be disadvantageous to the Feeder Funds or shareholders as described in the Feeder Funds’ prospectus.

| KINETICS MUTUAL FUNDS, INC. — THE FEEDER FUNDS |

Expense Example — (Continued) |

| December 31, 2012 |

You may use the information provided in the first line, together with the amounts you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The third and fourth line items of the table below provide information about hypothetical account values and hypothetical expenses before and after expense reimbursements based on the Feeder Funds’ actual expense ratios and an assumed rate of return of 5% per year before expenses, which are not the Feeder Funds’ actual returns. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses one paid for the period. You may use this information to compare the ongoing costs of investing in the Feeder Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. Please note that the expenses shown in the table are meant to highlight one’s ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help one determine the relative total costs of owning different funds. If these transactional costs had been included, one’s costs would have been higher.

| KINETICS MUTUAL FUNDS, INC. — THE FEEDER FUNDS |

Expense Example — (Continued) |

| December 31, 2012 |

| | | Beginning | | | Ending | | | | | | | |

| | | Account | | | Account | | | | | | Expenses Paid | |

| | | Value | | | Value | | | Annualized | | During Period* | |

| | | (7/1/12) | | | (12/31/12) | | | Expense Ratio | | (7/1/12 to 12/31/12) | |

| | | | | | | | | | | | | |

| The Internet Fund | | | | | | | | | | | | |

| No Load Class Actual — before | | | | | | | | | | | | |

| expense reimbursement | | $ | 1,000.00 | | | $ | 1,135.30 | | | | 1.91 | % | | $ | 10.25 | |

| No Load Class Actual — after | | | | | | | | | | | | | | | | |

| expense reimbursement | | $ | 1,000.00 | | | $ | 1,135.30 | | | | 1.89 | % | | $ | 10.14 | |

| No Load Class Hypothetical | | | | | | | | | | | | | | | | |

| (5% return before expenses) — | | | | | | | | | | | | | | | | |

| before expense | | | | | | | | | | | | | | | | |

| reimbursement | | $ | 1,000.00 | | | $ | 1,015.50 | | | | 1.91 | % | | $ | 9.68 | |

| No Load Class Hypothetical | | | | | | | | | | | | | | | | |

| (5% return before expenses) — | | | | | | | | | | | | | | | | |

| after expense | | | | | | | | | | | | | | | | |

| reimbursement | | $ | 1,000.00 | | | $ | 1,015.60 | | | | 1.89 | % | | $ | 9.58 | |

| Advisor Class A Actual — | | | | | | | | | | | | | | | | |

| before expense | | | | | | | | | | | | | | | | |

| reimbursement | | $ | 1,000.00 | | | $ | 1,133.80 | | | | 2.16 | % | | $ | 11.59 | |

| Advisor Class A Actual — | | | | | | | | | | | | | | | | |

| after expense | | | | | | | | | | | | | | | | |

| reimbursement | | $ | 1,000.00 | | | $ | 1,133.80 | | | | 2.14 | % | | $ | 11.48 | |

| Advisor Class A Hypothetical | | | | | | | | | | | | | | | | |

| (5% return before expenses) — | | | | | | | | | | | | | | | | |

| before expense | | | | | | | | | | | | | | | | |

| reimbursement | | $ | 1,000.00 | | | $ | 1,014.24 | | | | 2.16 | % | | $ | 10.94 | |

| Advisor Class A Hypothetical | | | | | | | | | | | | | | | | |

| (5% return before expenses) — | | | | | | | | | | | | | | | | |

| after expense | | | | | | | | | | | | | | | | |

| reimbursement | | $ | 1,000.00 | | | $ | 1,014.34 | | | | 2.14 | % | | $ | 10.84 | |

| Advisor Class C Actual — before | | | | | | | | | | | | | | | | |

| expense reimbursement | | $ | 1,000.00 | | | $ | 1,130.90 | | | | 2.66 | % | | $ | 14.25 | |

| Advisor Class C Actual — after | | | | | | | | | | | | | | | | |

| expense reimbursement | | $ | 1,000.00 | | | $ | 1,130.90 | | | | 2.64 | % | | $ | 14.14 | |

| Advisor Class C Hypothetical | | | | | | | | | | | | | | | | |

| (5% return before expenses) — | | | | | | | | | | | | | | | | |

| before expense | | | | | | | | | | | | | | | | |

| reimbursement | | $ | 1,000.00 | | | $ | 1,011.73 | | | | 2.66 | % | | $ | 13.45 | |

| Advisor Class C Hypothetical | | | | | | | | | | | | | | | | |

| (5% return before expenses) — | | | | | | | | | | | | | | | | |

| after expense | | | | | | | | | | | | | | | | |

| reimbursement | | $ | 1,000.00 | | | $ | 1,011.83 | | | | 2.64 | % | | $ | 13.35 | |

| | | | | | | | | | | | | | | | | |

| The Global Fund | | | | | | | | | | | | | | | | |

| No Load Class Actual — before | | | | | | | | | | | | | | | | |

| expense reimbursement | | $ | 1,000.00 | | | $ | 1,146.80 | | | | 3.36 | % | | $ | 18.13 | |

| No Load Class Actual — after | | | | | | | | | | | | | | | | |

| expense reimbursement | | $ | 1,000.00 | | | $ | 1,146.80 | | | | 1.39 | % | | $ | 7.50 | |

| KINETICS MUTUAL FUNDS, INC. — THE FEEDER FUNDS |

Expense Example — (Continued) |

| December 31, 2012 |

| | | Beginning | | | Ending | | | | | | | |

| | | Account | | | Account | | | | | | Expenses Paid | |

| | | Value | | | Value | | | Annualized | | During Period* | |

| | | (7/1/12) | | | (12/31/12) | | | Expense Ratio | | (7/1/12 to 12/31/12) | |

| No Load Class Hypothetical | | | | | | | | | | | | |

| (5% return before expenses) — | | | | | | | | | | | | |

| before expense | | | | | | | | | | | | |

| reimbursement | | $ | 1,000.00 | | | $ | 1,008.21 | | | | 3.36 | % | | $ | 16.96 | |

| No Load Class Hypothetical | | | | | | | | | | | | | | | | |

| (5% return before expenses) — | | | | | | | | | | | | | | | | |

| after expense | | | | | | | | | | | | | | | | |

| reimbursement | | $ | 1,000.00 | | | $ | 1,018.11 | | | | 1.39 | % | | $ | 7.05 | |

| Advisor Class A Actual — before | | | | | | | | | | | | | | | | |

| expense reimbursement | | $ | 1,000.00 | | | $ | 1,144.70 | | | | 3.61 | % | | $ | 19.46 | |

| Advisor Class A Actual — after | | | | | | | | | | | | | | | | |

| expense reimbursement | | $ | 1,000.00 | | | $ | 1,144.70 | | | | 1.64 | % | | $ | 8.84 | |

| Advisor Class A Hypothetical | | | | | | | | | | | | | | | | |

| (5% return before expenses) — | | | | | | | | | | | | | | | | |

| before expense | | | | | | | | | | | | | | | | |

| reimbursement | | $ | 1,000.00 | | | $ | 1,006.95 | | | | 3.61 | % | | $ | 18.21 | |

| Advisor Class A Hypothetical | | | | | | | | | | | | | | | | |

| (5% return before expenses) — | | | | | | | | | | | | | | | | |

| after expense | | | | | | | | | | | | | | | | |

| reimbursement | | $ | 1,000.00 | | | $ | 1,016.86 | | | | 1.64 | % | | $ | 8.31 | |

| Advisor Class C Actual — before | | | | | | | | | | | | | | | | |

| expense reimbursement | | $ | 1,000.00 | | | $ | 1,140.80 | | | | 4.11 | % | | $ | 22.12 | |

| Advisor Class C Actual — after | | | | | | | | | | | | | | | | |

| expense reimbursement | | $ | 1,000.00 | | | $ | 1,140.80 | | | | 2.14 | % | | $ | 11.52 | |

| Advisor Class C Hypothetical | | | | | | | | | | | | | | | | |

| (5% return before expenses) — | | | | | | | | | | | | | | | | |

| before expense | | | | | | | | | | | | | | | | |

| reimbursement | | $ | 1,000.00 | | | $ | 1,004.44 | | | | 4.11 | % | | $ | 20.71 | |

| Advisor Class C Hypothetical | | | | | | | | | | | | | | | | |

| (5% return before expenses) — | | | | | | | | | | | | | | | | |

| after expense | | | | | | | | | | | | | | | | |

| reimbursement | | $ | 1,000.00 | | | $ | 1,014.34 | | | | 2.14 | % | | $ | 10.84 | |

| | | | | | | | | | | | | | | | | |

| The Paradigm Fund | | | | | | | | | | | | | | | | |

| No Load Class Actual — before | | | | | | | | | | | | | | | | |

| expense reimbursement | | $ | 1,000.00 | | | $ | 1,106.60 | | | | 1.78 | % | | $ | 9.43 | |

| No Load Class Actual — after | | | | | | | | | | | | | | | | |

| expense reimbursement | | $ | 1,000.00 | | | $ | 1,106.60 | | | | 1.64 | % | | $ | 8.68 | |

| No Load Class Hypothetical | | | | | | | | | | | | | | | | |

| (5% return before expenses) — | | | | | | | | | | | | | | | | |

| before expense | | | | | | | | | | | | | | | | |

| reimbursement | | $ | 1,000.00 | | | $ | 1,016.15 | | | | 1.78 | % | | $ | 9.02 | |

| No Load Class Hypothetical | | | | | | | | | | | | | | | | |

| (5% return before expenses) — | | | | | | | | | | | | | | | | |

| after expense | | | | | | | | | | | | | | | | |

| reimbursement | | $ | 1,000.00 | | | $ | 1,016.86 | | | | 1.64 | % | | $ | 8.31 | |

| KINETICS MUTUAL FUNDS, INC. — THE FEEDER FUNDS |

Expense Example — (Continued) |

| December 31, 2012 |

| | | Beginning | | | Ending | | | | | | | |

| | | Account | | | Account | | | | | | Expenses Paid | |

| | | Value | | | Value | | | Annualized | | During Period* | |

| | | (7/1/12) | | | (12/31/12) | | | Expense Ratio | | (7/1/12 to 12/31/12) | |

| Advisor Class A Actual — before | | | | | | | | | | | | |

| expense reimbursement | | $ | 1,000.00 | | | $ | 1,105.20 | | | | 2.03 | % | | $ | 10.74 | |

| Advisor Class A Actual — after | | | | | | | | | | | | | | | | |

| expense reimbursement | | $ | 1,000.00 | | | $ | 1,105.20 | | | | 1.89 | % | | $ | 10.00 | |

| Advisor Class A Hypothetical | | | | | | | | | | | | | | | | |

| (5% return before expenses) — | | | | | | | | | | | | | | | | |

| before expense | | | | | | | | | | | | | | | | |

| reimbursement | | $ | 1,000.00 | | | $ | 1,014.89 | | | | 2.03 | % | | $ | 10.28 | |

| Advisor Class A Hypothetical | | | | | | | | | | | | | | | | |

| (5% return before expenses) — | | | | | | | | | | | | | | | | |

| after expense | | | | | | | | | | | | | | | | |

| reimbursement | | $ | 1,000.00 | | | $ | 1,015.60 | | | | 1.89 | % | | $ | 9.58 | |

| Advisor Class C Actual — before | | | | | | | | | | | | | | | | |

| expense reimbursement | | $ | 1,000.00 | | | $ | 1,102.10 | | | | 2.53 | % | | $ | 13.37 | |

| Advisor Class C Actual — after | | | | | | | | | | | | | | | | |

| expense reimbursement | | $ | 1,000.00 | | | $ | 1,102.10 | | | | 2.39 | % | | $ | 12.63 | |

| Advisor Class C Hypothetical | | | | | | | | | | | | | | | | |

| (5% return before expenses) — | | | | | | | | | | | | | | | | |

| before expense | | | | | | | | | | | | | | | | |

| reimbursement | | $ | 1,000.00 | | | $ | 1,012.38 | | | | 2.53 | % | | $ | 12.80 | |

| Advisor Class C Hypothetical | | | | | | | | | | | | | | | | |

| (5% return before expenses) — | | | | | | | | | | | | | | | | |

| after expense | | | | | | | | | | | | | | | | |

| reimbursement | | $ | 1,000.00 | | | $ | 1,013.08 | | | | 2.39 | % | | $ | 12.09 | |

| Institutional Class Actual — before | | | | | | | | | | | | | | | | |

| expense reimbursement | | $ | 1,000.00 | | | $ | 1,107.40 | | | | 1.73 | % | | $ | 9.16 | |

| Institutional Class Actual — after | | | | | | | | | | | | | | | | |

| expense reimbursement | | $ | 1,000.00 | | | $ | 1,107.40 | | | | 1.44 | % | | $ | 7.63 | |

| Institutional Class Hypothetical | | | | | | | | | | | | | | | | |

| (5% return before expenses) — | | | | | | | | | | | | | | | | |

| before expense | | | | | | | | | | | | | | | | |

| reimbursement | | $ | 1,000.00 | | | $ | 1,016.40 | | | | 1.73 | % | | $ | 8.77 | |

| Institutional Class Hypothetical | | | | | | | | | | | | | | | | |

| (5% return before expenses) — | | | | | | | | | | | | | | | | |

| after expense | | | | | | | | | | | | | | | | |

| reimbursement | | $ | 1,000.00 | | | $ | 1,017.86 | | | | 1.44 | % | | $ | 7.30 | |

| | | | | | | | | | | | | | | | | |

| The Medical Fund | | | | | | | | | | | | | | | | |

| No Load Class Actual — before | | | | | | | | | | | | | | | | |

| expense reimbursement | | $ | 1,000.00 | | | $ | 1,002.50 | | | | 2.20 | % | | $ | 11.07 | |

| No Load Class Actual — after | | | | | | | | | | | | | | | | |

| expense reimbursement | | $ | 1,000.00 | | | $ | 1,002.50 | | | | 1.39 | % | | $ | 7.00 | |

| No Load Class Hypothetical | | | | | | | | | | | | | | | | |

| (5% return before expenses) — | | | | | | | | | | | | | | | | |

| before expense | | | | | | | | | | | | | | | | |

| reimbursement | | $ | 1,000.00 | | | $ | 1,014.04 | | | | 2.20 | % | | $ | 11.14 | |

| KINETICS MUTUAL FUNDS, INC. — THE FEEDER FUNDS |

Expense Example — (Continued) |

| December 31, 2012 |

| | | Beginning | | | Ending | | | | | | | |

| | | Account | | | Account | | | | | | Expenses Paid | |

| | | Value | | | Value | | | Annualized | | During Period* | |

| | | (7/1/12) | | | (12/31/12) | | | Expense Ratio | | (7/1/12 to 12/31/12) | |

| No Load Class Hypothetical | | | | | | | | | | | | |

| (5% return before expenses) — | | | | | | | | | | | | |

| after expense | | | | | | | | | | | | |

| reimbursement | | $ | 1,000.00 | | | $ | 1,018.11 | | | | 1.39 | % | | $ | 7.05 | |

| Advisor Class A Actual — before | | | | | | | | | | | | | | | | |

| expense reimbursement | | $ | 1,000.00 | | | $ | 1,001.10 | | | | 2.45 | % | | $ | 12.32 | |

| Advisor Class A Actual — after | | | | | | | | | | | | | | | | |

| expense reimbursement | | $ | 1,000.00 | | | $ | 1,001.10 | | | | 1.64 | % | | $ | 8.25 | |

| Advisor Class A Hypothetical | | | | | | | | | | | | | | | | |

| (5% return before expenses) — | | | | | | | | | | | | | | | | |

| before expense | | | | | | | | | | | | | | | | |

| reimbursement | | $ | 1,000.00 | | | $ | 1,012.78 | | | | 2.45 | % | | $ | 12.40 | |

| Advisor Class A Hypothetical | | | | | | | | | | | | | | | | |

| (5% return before expenses) — | | | | | | | | | | | | | | | | |

| after expense | | | | | | | | | | | | | | | | |

| reimbursement | | $ | 1,000.00 | | | $ | 1,016.86 | | | | 1.64 | % | | $ | 8.31 | |

| Advisor Class C Actual — before | | | | | | | | | | | | | | | | |

| expense reimbursement | | $ | 1,000.00 | | | $ | 999.30 | | | | 2.95 | % | | $ | 14.83 | |

| Advisor Class C Actual — after | | | | | | | | | | | | | | | | |

| expense reimbursement | | $ | 1,000.00 | | | $ | 999.30 | | | | 2.14 | % | | $ | 10.75 | |

| Advisor Class C Hypothetical | | | | | | | | | | | | | | | | |

| (5% return before expenses) — | | | | | | | | | | | | | | | | |

| before expense | | | | | | | | | | | | | | | | |

| reimbursement | | $ | 1,000.00 | | | $ | 1,010.27 | | | | 2.95 | % | | $ | 14.91 | |

| Advisor Class C Hypothetical | | | | | | | | | | | | | | | | |

| (5% return before expenses) — | | | | | | | | | | | | | | | | |

| after expense | | | | | | | | | | | | | | | | |

| reimbursement | | $ | 1,000.00 | | | $ | 1,014.34 | | | | 2.14 | % | | $ | 10.84 | |

| | | | | | | | | | | | | | | | | |

| The Small Cap Opportunities Fund | | | | | | | | | | | | | | | | |

| No Load Class Actual — before | | | | | | | | | | | | | | | | |

| expense reimbursement | | $ | 1,000.00 | | | $ | 1,129.20 | | | | 1.90 | % | | $ | 10.17 | |

| No Load Class Actual — after | | | | | | | | | | | | | | | | |

| expense reimbursement | | $ | 1,000.00 | | | $ | 1,129.20 | | | | 1.64 | % | | $ | 8.78 | |

| No Load Class Hypothetical | | | | | | | | | | | | | | | | |

| (5% return before expenses) — | | | | | | | | | | | | | | | | |

| before expense | | | | | | | | | | | | | | | | |

| reimbursement | | $ | 1,000.00 | | | $ | 1,015.55 | | | | 1.90 | % | | $ | 9.63 | |

| No Load Class Hypothetical | | | | | | | | | | | | | | | | |

| (5% return before expenses) — | | | | | | | | | | | | | | | | |

| after expense | | | | | | | | | | | | | | | | |

| reimbursement | | $ | 1,000.00 | | | $ | 1,016.86 | | | | 1.64 | % | | $ | 8.31 | |

| Advisor Class A Actual — before | | | | | | | | | | | | | | | | |

| expense reimbursement | | $ | 1,000.00 | | | $ | 1,128.00 | | | | 2.15 | % | | $ | 11.50 | |

| Advisor Class A Actual — after | | | | | | | | | | | | | | | | |

| expense reimbursement | | $ | 1,000.00 | | | $ | 1,128.00 | | | | 1.89 | % | | $ | 10.11 | |

| KINETICS MUTUAL FUNDS, INC. — THE FEEDER FUNDS |

Expense Example — (Continued) |

| December 31, 2012 |

| | | Beginning | | | Ending | | | | | | | |

| | | Account | | | Account | | | | | | Expenses Paid | |

| | | Value | | | Value | | | Annualized | | During Period* | |

| | | (7/1/12) | | | (12/31/12) | | | Expense Ratio | | (7/1/12 to 12/31/12) | |

| Advisor Class A Hypothetical | | | | | | | | | | | | |

| (5% return before expenses) — | | | | | | | | | | | | |

| before expense | | | | | | | | | | | | |

| reimbursement | | $ | 1,000.00 | | | $ | 1,014.29 | | | | 2.15 | % | | $ | 10.89 | |

| Advisor Class A Hypothetical | | | | | | | | | | | | | | | | |

| (5% return before expenses) — | | | | | | | | | | | | | | | | |

| after expense | | | | | | | | | | | | | | | | |

| reimbursement | | $ | 1,000.00 | | | $ | 1,015.60 | | | | 1.89 | % | | $ | 9.58 | |

| Advisor Class C Actual — before | | | | | | | | | | | | | | | | |

| expense reimbursement | | $ | 1,000.00 | | | $ | 1,124.70 | | | | 2.65 | % | | $ | 14.15 | |

| Advisor Class C Actual — after | | | | | | | | | | | | | | | | |

| expense reimbursement | | $ | 1,000.00 | | | $ | 1,124.70 | | | | 2.39 | % | | $ | 12.76 | |

| Advisor Class C Hypothetical | | | | | | | | | | | | | | | | |

| (5% return before expenses) — | | | | | | | | | | | | | | | | |

| before expense | | | | | | | | | | | | | | | | |

| reimbursement | | $ | 1,000.00 | | | $ | 1,011.78 | | | | 2.65 | % | | $ | 13.40 | |

| Advisor Class C Hypothetical | | | | | | | | | | | | | | | | |

| (5% return before expenses) — | | | | | | | | | | | | | | | | |

| after expense | | | | | | | | | | | | | | | | |

| reimbursement | | $ | 1,000.00 | | | $ | 1,013.08 | | | | 2.39 | % | | $ | 12.09 | |

| Institutional Class Actual — before | | | | | | | | | | | | | | | | |

| expense reimbursement | | $ | 1,000.00 | | | $ | 1,130.40 | | | | 1.85 | % | | $ | 9.91 | |

| Institutional Class Actual — after | | | | | | | | | | | | | | | | |

| expense reimbursement | | $ | 1,000.00 | | | $ | 1,130.40 | | | | 1.44 | % | | $ | 7.71 | |

| Institutional Class Hypothetical | | | | | | | | | | | | | | | | |

| (5% return before expenses) — | | | | | | | | | | | | | | | | |

| before expense | | | | | | | | | | | | | | | | |

| reimbursement | | $ | 1,000.00 | | | $ | 1,015.80 | | | | 1.85 | % | | $ | 9.37 | |

| Institutional Class Hypothetical | | | | | | | | | | | | | | | | |

| (5% return before expenses) — | | | | | | | | | | | | | | | | |

| after expense | | | | | | | | | | | | | | | | |

| reimbursement | | $ | 1,000.00 | | | $ | 1,017.86 | | | | 1.44 | % | | $ | 7.30 | |

| | | | | | | | | | | | | | | | | |

| The Market Opportunities Fund | | | | | | | | | | | | | | | | |

| No Load Class Actual — before | | | | | | | | | | | | | | | | |

| expense reimbursement | | $ | 1,000.00 | | | $ | 1,088.70 | | | | 1.98 | % | | $ | 10.40 | |

| No Load Class Actual — after | | | | | | | | | | | | | | | | |

| expense reimbursement | | $ | 1,000.00 | | | $ | 1,088.70 | | | | 1.64 | % | | $ | 8.61 | |

| No Load Class Hypothetical | | | | | | | | | | | | | | | | |

| (5% return before expenses) — | | | | | | | | | | | | | | | | |

| before expense | | | | | | | | | | | | | | | | |

| reimbursement | | $ | 1,000.00 | | | $ | 1,015.15 | | | | 1.98 | % | | $ | 10.03 | |

| No Load Class Hypothetical | | | | | | | | | | | | | | | | |

| (5% return before expenses) — | | | | | | | | | | | | | | | | |

| after expense | | | | | | | | | | | | | | | | |

| reimbursement | | $ | 1,000.00 | | | $ | 1,016.86 | | | | 1.64 | % | | $ | 8.31 | |

| Advisor Class A Actual — before | | | | | | | | | | | | | | | | |

| expense reimbursement | | $ | 1,000.00 | | | $ | 1,088.10 | | | | 2.23 | % | | $ | 11.70 | |

| KINETICS MUTUAL FUNDS, INC. — THE FEEDER FUNDS |

Expense Example — (Continued) |

| December 31, 2012 |

| | | Beginning | | | Ending | | | | | | | |

| | | Account | | | Account | | | | | | Expenses Paid | |

| | | Value | | | Value | | | Annualized | | During Period* | |

| | | (7/1/12) | | | (12/31/12) | | | Expense Ratio | | (7/1/12 to 12/31/12) | |

| Advisor Class A Actual — after | | | | | | | | | | | | |

| expense reimbursement | | $ | 1,000.00 | | | $ | 1,088.10 | | | | 1.89 | % | | $ | 9.92 | |

| Advisor Class A Hypothetical | | | | | | | | | | | | | | | | |

| (5% return before expenses) — | | | | | | | | | | | | | | | | |

| before expense | | | | | | | | | | | | | | | | |

| reimbursement | | $ | 1,000.00 | | | $ | 1,013.89 | | | | 2.23 | % | | $ | 11.29 | |

| Advisor Class A Hypothetical | | | | | | | | | | | | | | | | |

| (5% return before expenses) — | | | | | | | | | | | | | | | | |

| after expense | | | | | | | | | | | | | | | | |

| reimbursement | | $ | 1,000.00 | | | $ | 1,015.60 | | | | 1.89 | % | | $ | 9.58 | |

| Advisor Class C Actual — before | | | | | | | | | | | | | | | | |

| expense reimbursement | | $ | 1,000.00 | | | $ | 1,085.00 | | | | 2.73 | % | | $ | 14.31 | |

| Advisor Class C Actual — after | | | | | | | | | | | | | | | | |

| expense reimbursement | | $ | 1,000.00 | | | $ | 1,085.00 | | | | 2.39 | % | | $ | 12.53 | |

| Advisor Class C Hypothetical | | | | | | | | | | | | | | | | |

| (5% return before expenses) — | | | | | | | | | | | | | | | | |

| before expense | | | | | | | | | | | | | | | | |

| reimbursement | | $ | 1,000.00 | | | $ | 1,011.38 | | | | 2.73 | % | | $ | 13.80 | |

| Advisor Class C Hypothetical | | | | | | | | | | | | | | | | |

| (5% return before expenses) — | | | | | | | | | | | | | | | | |

| after expense | | | | | | | | | | | | | | | | |

| reimbursement | | $ | 1,000.00 | | | $ | 1,013.08 | | | | 2.39 | % | | $ | 12.09 | |

| Institutional Class Actual — before | | | | | | | | | | | | | | | | |

| expense reimbursement | | $ | 1,000.00 | | | $ | 1,089.70 | | | | 1.93 | % | | $ | 10.14 | |

| Institutional Class Actual — after | | | | | | | | | | | | | | | | |

| expense reimbursement | | $ | 1,000.00 | | | $ | 1,089.70 | | | | 1.44 | % | | $ | 7.56 | |

| Institutional Class Hypothetical | | | | | | | | | | | | | | | | |

| (5% return before expenses) — | | | | | | | | | | | | | | | | |

| before expense | | | | | | | | | | | | | | | | |

| reimbursement | | $ | 1,000.00 | | | $ | 1,015.40 | | | | 1.93 | % | | $ | 9.78 | |

| Institutional Class Hypothetical | | | | | | | | | | | | | | | | |

| (5% return before expenses) — | | | | | | | | | | | | | | | | |

| after expense | | | | | | | | | | | | | | | | |

| reimbursement | | $ | 1,000.00 | | | $ | 1,017.86 | | | | 1.44 | % | | $ | 7.30 | |

| | | | | | | | | | | | | | | | | |

| The Water Infrastructure Fund | | | | | | | | | | | | | | | | |

| No Load Class Actual — before | | | | | | | | | | | | | | | | |

| expense reimbursement | | $ | 1,000.00 | | | $ | 1,037.70 | | | | 2.50 | % | | $ | 12.81 | |

| No Load Class Actual — after | | | | | | | | | | | | | | | | |

| expense reimbursement | | $ | 1,000.00 | | | $ | 1,037.70 | | | | 1.64 | % | | $ | 8.40 | |

| No Load Class Hypothetical | | | | | | | | | | | | | | | | |

| (5% return before expenses) — | | | | | | | | | | | | | | | | |

| before expense | | | | | | | | | | | | | | | | |

| reimbursement | | $ | 1,000.00 | | | $ | 1,012.53 | | | | 2.50 | % | | $ | 12.65 | |

| No Load Class Hypothetical | | | | | | | | | | | | | | | | |

| (5% return before expenses) — | | | | | | | | | | | | | | | | |

| after expense | | | | | | | | | | | | | | | | |

| reimbursement | | $ | 1,000.00 | | | $ | 1,016.86 | | | | 1.64 | % | | $ | 8.31 | |

| KINETICS MUTUAL FUNDS, INC. — THE FEEDER FUNDS |

Expense Example — (Continued) |

| December 31, 2012 |

| | | Beginning | | | Ending | | | | | | | |

| | | Account | | | Account | | | | | | Expenses Paid | |

| | | Value | | | Value | | | Annualized | | During Period* | |

| | | (7/1/12) | | | (12/31/12) | | | Expense Ratio | | (7/1/12 to 12/31/12) | |

| Advisor Class A Actual — before | | | | | | | | | | | | |

| expense reimbursement | | $ | 1,000.00 | | | $ | 1,036.20 | | | | 2.75 | % | | $ | 14.08 | |

| Advisor Class A Actual — after | | | | | | | | | | | | | | | | |

| expense reimbursement | | $ | 1,000.00 | | | $ | 1,036.20 | | | | 1.89 | % | | $ | 9.67 | |

| Advisor Class A Hypothetical | | | | | | | | | | | | | | | | |

| (5% return before expenses) — | | | | | | | | | | | | | | | | |

| before expense | | | | | | | | | | | | | | | | |

| reimbursement | | $ | 1,000.00 | | | $ | 1,011.27 | | | | 2.75 | % | | $ | 13.90 | |

| Advisor Class A Hypothetical | | | | | | | | | | | | | | | | |

| (5% return before expenses) — | | | | | | | | | | | | | | | | |

| after expense | | | | | | | | | | | | | | | | |

| reimbursement | | $ | 1,000.00 | | | $ | 1,015.60 | | | | 1.89 | % | | $ | 9.58 | |

| Advisor Class C Actual — before | | | | | | | | | | | | | | | | |

| expense reimbursement | | $ | 1,000.00 | | | $ | 1,033.10 | | | | 3.25 | % | | $ | 16.61 | |

| Advisor Class C Actual — after | | | | | | | | | | | | | | | | |

| expense reimbursement | | $ | 1,000.00 | | | $ | 1,033.10 | | | | 2.39 | % | | $ | 12.21 | |

| Advisor Class C Hypothetical | | | | | | | | | | | | | | | | |

| (5% return before expenses) — | | | | | | | | | | | | | | | | |

| before expense | | | | | | | | | | | | | | | | |

| reimbursement | | $ | 1,000.00 | | | $ | 1,008.76 | | | | 3.25 | % | | $ | 16.41 | |

| Advisor Class C Hypothetical | | | | | | | | | | | | | | | | |

| (5% return before expenses) — | | | | | | | | | | | | | | | | |

| after expense | | | | | | | | | | | | | | | | |

| reimbursement | | $ | 1,000.00 | | | $ | 1,013.08 | | | | 2.39 | % | | $ | 12.09 | |

| Institutional Class Actual — before | | | | | | | | | | | | | | | | |

| expense reimbursement | | $ | 1,000.00 | | | $ | 1,038.20 | | | | 2.45 | % | | $ | 12.55 | |

| Institutional Class Actual — after | | | | | | | | | | | | | | | | |

| expense reimbursement | | $ | 1,000.00 | | | $ | 1,038.20 | | | | 1.44 | % | | $ | 7.38 | |

| Institutional Class Hypothetical | | | | | | | | | | | | | | | | |

| (5% return before expenses) — | | | | | | | | | | | | | | | | |

| before expense | | | | | | | | | | | | | | | | |

| reimbursement | | $ | 1,000.00 | | | $ | 1,012.78 | | | | 2.45 | % | | $ | 12.40 | |

| Institutional Class Hypothetical | | | | | | | | | | | | | | | | |

| (5% return before expenses) — | | | | | | | | | | | | | | | | |

| after expense | | | | | | | | | | | | | | | | |

| reimbursement | | $ | 1,000.00 | | | $ | 1,017.86 | | | | 1.44 | % | | $ | 7.30 | |

| | | | | | | | | | | | | | | | | |

| The Multi-Disciplinary Fund | | | | | | | | | | | | | | | | |

| No Load Class Actual — before | | | | | | | | | | | | | | | | |

| expense reimbursement | | $ | 1,000.00 | | | $ | 1,083.80 | | | | 1.96 | % | | $ | 10.27 | |

| No Load Class Actual — after | | | | | | | | | | | | | | | | |

| expense reimbursement | | $ | 1,000.00 | | | $ | 1,083.80 | | | | 1.49 | % | | $ | 7.80 | |

| No Load Class Hypothetical | | | | | | | | | | | | | | | | |

| (5% return before expenses) — | | | | | | | | | | | | | | | | |

| before expense | | | | | | | | | | | | | | | | |

| reimbursement | | $ | 1,000.00 | | | $ | 1,015.25 | | | | 1.96 | % | | $ | 9.93 | |

| KINETICS MUTUAL FUNDS, INC. — THE FEEDER FUNDS |

Expense Example — (Continued) |

| December 31, 2012 |

| | | Beginning | | | Ending | | | | | | | |

| | | Account | | | Account | | | | | | Expenses Paid | |

| | | Value | | | Value | | | Annualized | | During Period* | |

| | | (7/1/12) | | | (12/31/12) | | | Expense Ratio | | (7/1/12 to 12/31/12) | |

| No Load Class Hypothetical | | | | | | | | | | | | |

| (5% return before expenses) — | | | | | | | | | | | | |

| after expense | | | | | | | | | | | | |

| reimbursement | | $ | 1,000.00 | | | $ | 1,017.61 | | | | 1.49 | % | | $ | 7.56 | |

| Advisor Class A Actual — before | | | | | | | | | | | | | | | | |

| expense reimbursement | | $ | 1,000.00 | | | $ | 1,082.90 | | | | 2.21 | % | | $ | 11.57 | |

| Advisor Class A Actual — after | | | | | | | | | | | | | | | | |

| expense reimbursement | | $ | 1,000.00 | | | $ | 1,082.90 | | | | 1.74 | % | | $ | 9.11 | |

| Advisor Class A Hypothetical | | | | | | | | | | | | | | | | |

| (5% return before expenses) — | | | | | | | | | | | | | | | | |

| before expense | | | | | | | | | | | | | | | | |

| reimbursement | | $ | 1,000.00 | | | $ | 1,013.99 | | | | 2.21 | % | | $ | 11.19 | |

| Advisor Class A Hypothetical | | | | | | | | | | | | | | | | |

| (5% return before expenses) — | | | | | | | | | | | | | | | | |

| after expense | | | | | | | | | | | | | | | | |

| reimbursement | | $ | 1,000.00 | | | $ | 1,016.35 | | | | 1.74 | % | | $ | 8.82 | |

| Advisor Class C Actual — before | | | | | | | | | | | | | | | | |

| expense reimbursement | | $ | 1,000.00 | | | $ | 1,079.80 | | | | 2.71 | % | | $ | 14.17 | |

| Advisor Class C Actual — after | | | | | | | | | | | | | | | | |

| expense reimbursement | | $ | 1,000.00 | | | $ | 1,079.80 | | | | 2.24 | % | | $ | 11.71 | |

| Advisor Class C Hypothetical | | | | | | | | | | | | | | | | |

| (5% return before expenses) — | | | | | | | | | | | | | | | | |

| before expense | | | | | | | | | | | | | | | | |

| reimbursement | | $ | 1,000.00 | | | $ | 1,011.48 | | | | 2.71 | % | | $ | 13.70 | |

| Advisor Class C Hypothetical | | | | | | | | | | | | | | | | |

| (5% return before expenses) — | | | | | | | | | | | | | | | | |

| after expense | | | | | | | | | | | | | | | | |

| reimbursement | | $ | 1,000.00 | | | $ | 1,013.84 | | | | 2.24 | % | | $ | 11.34 | |

| Institutional Class Actual — before | | | | | | | | | | | | | | | | |

| expense reimbursement | | $ | 1,000.00 | | | $ | 1,084.50 | | | | 1.91 | % | | $ | 10.01 | |

| Institutional Class Actual — after | | | | | | | | | | | | | | | | |

| expense reimbursement | | $ | 1,000.00 | | | $ | 1,084.50 | | | | 1.29 | % | | $ | 6.76 | |

| Institutional Class Hypothetical | | | | | | | | | | | | | | | | |

| (5% return before expenses) — | | | | | | | | | | | | | | | | |

| before expense | | | | | | | | | | | | | | | | |

| reimbursement | | $ | 1,000.00 | | | $ | 1,015.50 | | | | 1.91 | % | | $ | 9.68 | |

| Institutional Class Hypothetical | | | | | | | | | | | | | | | | |

| (5% return before expenses) — | | | | | | | | | | | | | | | | |

| after expense | | | | | | | | | | | | | | | | |

| reimbursement | | $ | 1,000.00 | | | $ | 1,018.61 | | | | 1.29 | % | | $ | 6.55 | |

| | | |

| Note: | Each Feeder Fund records its proportionate share of the respective Master Portfolio’s expenses on a daily basis. Any expense reductions include Feeder Fund-specific expenses as well as the expenses allocated for the Master Portfolio. |

| * | Expenses are equal to the Feeder Fund’s annualized expense ratio before expense reimbursement and after expense reimbursement multiplied by the average account value over the period, multiplied by 184/366. |

| KINETICS MUTUAL FUNDS, INC. — THE FEEDER FUNDS |

| Statements of Assets & Liabilities |

| December 31, 2012 |

| | | The Internet Fund | | | The Global Fund | |

| ASSETS: | | | | | | |

| Investments in the Master Portfolio, at value* | | $ | 156,697,785 | | | $ | 6,530,964 | |

| Receivable from Adviser | | | — | | | | 15,645 | |

| Receivable for Fund shares sold | | | 510,784 | | | | 1,038 | |

| Prepaid expenses and other assets | | | 21,904 | | | | 14,030 | |

| Total Assets | | | 157,230,473 | | | | 6,561,677 | |

| LIABILITIES: | | | | | | | | |

| Payable for Master Portfolio interest purchased | | | 51,396 | | | | 770 | |

| Payable to Directors and Officers | | | 2,738 | | | | 117 | |

| Payable for Fund shares repurchased | | | 459,388 | | | | 268 | |

| Payable for shareholder servicing fees | | | 32,906 | | | | 1,361 | |

| Payable for distribution fees | | | 597 | | | | 454 | |

| Accrued expenses and other liabilities | | | 83,020 | | | | 13,245 | |

| Total Liabilities | | | 630,045 | | | | 16,215 | |

| Net Assets | | $ | 156,600,428 | | | $ | 6,545,462 | |

| NET ASSETS CONSIST OF: | | | | | | | | |

| Paid in capital | | $ | 116,134,188 | | | $ | 6,395,325 | |

| Accumulated net investment income (loss) | | | 43,841 | | | | (78,186 | ) |

| Accumulated net realized gain (loss) on investments | | | | | | | | |

| and foreign currency | | | 2,435,857 | | | | (409,858 | ) |

| Net unrealized appreciation on: | | | | | | | | |

| Investments and foreign currency | | | 37,986,542 | | | | 638,181 | |

| Net Assets | | $ | 156,600,428 | | | $ | 6,545,462 | |

| CALCULATION OF NET ASSET VALUE PER SHARE — NO LOAD CLASS: | | | | | | | | |

| Net Assets | | $ | 155,036,350 | | | $ | 5,068,976 | |

| Shares outstanding | | | 3,590,465 | | | | 1,076,195 | |

| Net asset value per share (offering price and redemption price) | | $ | 43.18 | | | $ | 4.71 | |

| CALCULATION OF NET ASSET VALUE PER SHARE — ADVISOR CLASS A: | | | | | | | | |

| Net Assets | | $ | 1,379,053 | | | $ | 1,093,010 | |

| Shares outstanding | | | 32,605 | | | | 232,238 | |

| Net asset value per share (redemption price) | | $ | 42.30 | | | $ | 4.71 | |

| Offering price per share ($42.30 divided by .9425 and $4.71 | | | | | | | | |

| divided by .9425) | | $ | 44.88 | | | $ | 5.00 | |

| CALCULATION OF NET ASSET VALUE PER SHARE — ADVISOR CLASS C: | | | | | | | | |

| Net Assets | | $ | 185,025 | | | $ | 383,476 | |

| Shares outstanding | | | 4,536 | | | | 82,947 | |

| Net asset value per share (offering price and redemption price) | | $ | 40.79 | | | $ | 4.62 | |

| | | |

| * | Each Feeder Fund invests all or generally all its assets directly in the corresponding Master Portfolio.The financial statements for the Master Portfolios, along with the portfolio of investments in securities, are contained elsewhere in this report and should be read in conjunction with the Feeder Funds’ financial statements. |