Life is Complex.

Nuveen makes things e-simple.

It only takes a minute to sign up for e-Reports. Once enrolled, you’ll receive an e-mail as soon as your Nuveen Fund information is ready—no more waiting for delivery by regular mail. Just click on the link within the e-mail to see the report and save it on your computer if you wish.

Free e-Reports

right to your e-mail!

www.investordelivery.com

If you receive your Nuveen Fund

dividends and statements from your

financial advisor or brokerage account.

or

www.nuveen.com/client-access

If you receive your Nuveen Fund

dividends and statements directly from

Nuveen.

NOT FDIC INSURED MAY LOSE

VALUE NO BANK GUARANTEE

Table of Contents

| | |

| Chairman’s Letter to Shareholders | 4 |

| | |

| Portfolio Manager’s Comments | 5 |

| | |

| Fund Leverage | 7 |

| | |

| Common Share Information | 9 |

| | |

| Risk Considerations | 11 |

| | |

| Performance Overview and Holding Summaries | 12 |

| | |

| Portfolios of Investments | 16 |

| | |

| Statement of Assets and Liabilities | 103 |

| | |

| Statement of Operations | 104 |

| | |

| Statement of Changes in Net Assets | 105 |

| | |

| Statement of Cash Flows | 106 |

| | |

| Financial Highlights | 108 |

| | |

| Notes to Financial Statements | 111 |

| | |

| Additional Fund Information | 125 |

| | |

| Glossary of Terms Used in this Report | 126 |

| | |

| Reinvest Automatically, Easily and Conveniently | 128 |

3

Chairman’s Letter

to Shareholders

Dear Shareholders,

The worries weighing on markets at the end of 2018 appeared to dissipate in early 2019 as positive economic and corporate earnings news, more dovish signals from central banks and trade progress boosted investor confidence. However, political noise and trade disputes have resurfaced in the headlines more recently, knocking stock market indexes off their recent highs and rallying U.S. Treasury bonds and other safe-haven assets. Investors are concerned that increased tariffs and a protracted stalemate between the U.S. and China, Mexico and other trading partners could dampen business and consumer sentiment, weakening spending and potentially impacting the global economy. Additionally, political uncertainty and the risk of policy error appear elevated. In the U.S. in particular, low interest rate levels and the widening federal deficit have constrained the available policy tools for countering recessionary pressures. As the current U.S. economic expansion reaches the 10-year mark this summer, it’s important to note that economic expansions don’t die of old age, but mature economic cycles can be more vulnerable to an exogenous shock.

Until a clearer picture on trade emerges, more bouts of market turbulence are likely in the meantime. While the downside risks warrant careful monitoring, we believe the likelihood of a near-term recession remains low. Global economic growth is moderating, with demand driven by the historically low unemployment in the U.S., Japan and across Europe. Central banks across the developed world continue to emphasize their readiness to adjust policy, and China’s authorities remain committed to keeping economic growth rates steady with fiscal and monetary policy.

The opportunity set may be narrower, but there is still scope for gains in this environment. Patience and maintaining perspective can help you weather periodic market volatility. We encourage you to work with your financial advisor to assess short-term market movements in the context of your time horizon, risk tolerance and investment goals. On behalf of the other members of the Nuveen Fund Board, we look forward to continuing to earn your trust in the months and years ahead.

Sincerely,

Terence J. Toth

Chairman of the Board

June 24, 2019

4

Portfolio Manager’s Comments

Nuveen Quality Municipal Income Fund (NAD)

Nuveen AMT-Free Quality Municipal Income Fund (NEA)

These Funds feature portfolio management by Nuveen Asset Management, LLC (NAM), an affiliate of Nuveen, LLC. Portfolio manager Christopher L. Drahn, CFA, reviews key investment strategies and the six-month performance of these two national Funds.

During May 2019 (subsequent to the close of this reporting period), the Board of Trustees approved the merger of the Nuveen Texas Quality Municipal Income Fund (NTX) into the acquiring Fund, the Nuveen Quality Municipal Income Fund (NAD) and the Nuveen North Carolina Quality Municipal Income Fund (NNC) into the acquiring Fund the Nuveen AMT-Free Quality Municipal Income Fund (NEA). In order for each reorganization to occur, it must be approved by shareholders.

What key strategies were used to manage these Funds during the six-month reporting period ended April 30, 2019?

During the six-month reporting period, a significant decline in interest rates along with a tailwind from technical supply-demand conditions drove strong performance in municipal bonds. After raising its benchmark interest rate in December 2018, the Federal Reserve (Fed) subsequently adopted a more dovish tone and downgraded its economic forecast. As markets repriced the possibility of no rate hikes (or a potential rate cut) in 2019, U.S. Treasury yields declined and municipal market yields fell even further. Demand for municipal bonds rose, shifting municipal bond fund flows from outflows at the end of 2018 to exceptionally strong inflows in the first four months of 2019. Renewed interest in the tax advantages of municipal bond investments also boosted demand in the new year. Under the new tax laws, some taxpayers had smaller refunds or larger tax bills than they expected, particularly in high tax states. However, supply has not kept pace with the elevated demand, as issuance volumes remain lower. The tight supply-demand conditions further supported municipal bond prices in this reporting period.

Our trading activity continued to focus on pursuing the Funds’ investment objectives. We remained comfortable with the Funds’ broad positioning, maintaining overweight allocations to lower investment grade credits (and corresponding underweights to high grade bonds). Health care and transportation remained the Funds’ largest sector weights. NAD marginally added to alternative minimum tax (AMT) transportation sector bonds during the reporting period, which continued to offer reasonable incremental yield. (NEA does not invest in AMT bonds.) NAD also bought bonds of the newly named Virgin Trains USA Passenger Project, increasing its net exposure to the project after the old Brightline Passenger Rail Project Bonds were called. The Florida rail system is the country’s first privately owned and operated high-speed train, which currently connects Miami, Ft. Lauderdale and West Palm Beach and plans to add Orlando.

This material is not intended to be a recommendation or investment advice, does not constitute a solicitation to buy, sell or hold a security or an investment strategy and is not provided in a fiduciary capacity. The information provided does not take into account the specific objectives or circumstances of any particular investor, or suggest any specific course of action. Investment decisions should be made based on an investor’s objectives and circumstances and in consultation with his or her advisors.Certain statements in this report are forward-looking statements. Discussions of specific investments are for illustration only and are not intended as recommendations of individual investments. The forward-looking statements and other views expressed herein are those of the portfolio manager as of the date of this report. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and the views expressed herein are subject to change at any time, due to numerous market and other factors. The Funds disclaim any obligation to update publicly or revise any forward-looking statements or views expressed herein.

The ratings disclosed are the lowest rating given by one of the following national rating agencies: Standard & Poor’s Group (S&P), Moody’s Investors Service, Inc. (Moody’s) or Fitch, Inc. (Fitch). Credit ratings are subject to change. AAA, AA, A and BBB are investment grade ratings, while BB, B, CCC, CC, C and D are below investment grade ratings. Holdings designated N/R are not rated by these national rating agencies.

Bond insurance guarantees only the payment of principal and interest on the bond when due, and not the value of the bonds themselves, which will fluctuate with the bond market and the financial success of the issuer and the insurer. Insurance relates specifically to the bonds in the portfolio and not to the share prices of a Fund. No representation is made as to the insurers’ ability to meet their commitments.

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this section.

5

Portfolio Manager’s Comments (continued)

To fund new purchases, we frequently used the proceeds from called or maturing bonds. Additionally, both NAD and NEA also took advantage of prevailing market conditions late in 2018, when interest rates were rising, to sell bonds with lower book yields and reinvest the proceeds into long-term bonds offering higher yield levels. These one-for-one transactions capitalized on the tax loss (which can be used to offset future taxable gains) and helped boost the Funds’ income distribution capabilities.

As of April 30, 2019, the Funds continued to use inverse floating rate securities. We employ inverse floaters for a variety of reasons, including duration management and income and total return enhancement.

How did the Funds perform during the six-month reporting period ended April 30, 2019?

The tables in each Fund's Performance Overview and Holding Summaries section of this report provide the Funds’ total returns for the six-month, one-year, five-year and ten-year periods ended April 30, 2019. Each Fund's total returns at net asset value (NAV) are compared with the performance of a corresponding market index.

For the six months ended April 30, 2019, the total returns on common share NAV for the two Funds outperformed the returns for the national S&P Municipal Bond Index and the secondary benchmark, composed of 80% S&P Municipal Bond Investment Grade Index and 20% S&P Municipal Bond High Yield Index.

Yield curve and duration positioning was the main driver of the Funds’ outperformance in this reporting period. Both Funds benefited from an overweight to longer duration bonds, which were the best performing segment, and an underweight to shorter duration bonds, which underperformed.

Credit rating and sector allocations had an overall neutral impact on relative performance in this reporting period. The weak performance of the tobacco sector, and by extension the single B ratings category (which is dominated by tobacco settlement bonds), was a small detractor for both Funds. The Funds’ overweight allocations to pre-refunded bonds, which lagged along with other shorter-dated, high quality bonds, had a slightly negative impact. NAD and NEA also held underweight allocations to Puerto Rico bonds, which was a drag on relative returns as Puerto Rico bonds performed well amid progress on the Commonwealth’s debt restructuring.

In addition, the use of regulatory leverage was an important factor affecting performance of the Funds. Leverage is discussed in more detail later in the Fund Leverage section of this report.

An Update on FirstEnergy Solutions Corp.

FirstEnergy Solutions Corp. and all of its subsidiaries filed for protection under Chapter 11 of the U.S. Bankruptcy Code on April 1, 2018. FirstEnergy Solutions and its subsidiaries specialize in coal and nuclear energy production. It is one of the main energy producers in the state of Ohio and a major energy provider in Pennsylvania. Because of the challenging market environment for nuclear and coal power in the face of inexpensive natural gas, FirstEnergy Corp., FirstEnergy Solution's parent announced in late 2016 that it would begin a strategic review of its generation assets. FirstEnergy Solutions is a unique corporate issuer in that the majority of its debt was issued in the municipal market to finance pollution control and waste disposal for its coal and nuclear plants. A substantial amount of bondholders, of which Nuveen Funds are included, entered into an “Agreement in Principal” with FirstEnergy Corp., to resolve potential claims that bondholders may have against FirstEnergy Corp. The agreement is subject to the approval of the FirstEnergy Corp. board of directors, FirstEnergy Solutions and the bankruptcy court.

In terms of FirstEnergy holdings, shareholders should note that NEA had no exposure to FirstEnergy, while NAD had 0.06% and it should be noted that this exposure is senior lien secured and had a negligible effect on relative performance.

6

Fund Leverage

IMPACT OF THE FUNDS’ LEVERAGE STRATEGIES ON PERFORMANCE

One important factor impacting the returns of the Funds’ common shares relative to their comparative benchmarks was the Funds’ use of leverage through their issuance of preferred shares and/or investments in inverse floating rate securities, which represent leveraged investments in underlying bonds. The Funds use leverage because our research has shown that, over time, leveraging provides opportunities for additional income, particularly in the recent market environment where short-term market rates are at or near historical lows, meaning that the short-term rates the Fund has been paying on its leveraging instruments in recent years have been much lower than the interest the Fund has been earning on its portfolio of long-term bonds that it has bought with the proceeds of that leverage.

However, use of leverage can expose Fund common shares to additional price volatility. When a Fund uses leverage, the Fund common shares will experience a greater increase in their net asset value if the municipal bonds acquired through the use of leverage increase in value, but will also experience a correspondingly larger decline in their net asset value if the bonds acquired through leverage decline in value, which will make the shares’ net asset value more volatile, and total return performance more variable, over time.

In addition, common share income in levered funds will typically decrease in comparison to unlevered funds when short-term interest rates increase and increase when short-term interest rates decrease. Over the last few quarters, short-term interest rates have indeed increased from their extended lows after the 2007-09 financial crisis. This increase has reduced common share net income, and also reduced potential for long-term total returns. Nevertheless, the ability to effectively borrow at current short-term rates is still resulting in enhanced common share income, and management believes that the advantages of continuation of leverage outweigh the associated increase in risk and volatility described above.

Leverage had a positive impact on the total return performance of the Funds during the reporting period.

As of April 30, 2019, the Funds’ percentages of leverage are as shown in the accompanying table.

| | | |

| | NAD | NEA |

| Effective Leverage* | 38.46% | 38.49% |

| Regulatory Leverage* | 36.59% | 36.34% |

| * | Effective leverage is a Fund’s effective economic leverage, and includes both regulatory leverage and the leverage effects of certain derivative and other investments in a Fund’s portfolio that increase the Fund’s investment exposure. Currently, the leverage effects of Tender Option Bond (TOB) inverse floater holdings are included in effective leverage values, in addition to any regulatory leverage. Regulatory leverage consists of preferred shares issued or borrowings of a Fund. Both of these are part of a Fund’s capital structure. A Fund, however, may from time to time borrow on a typically transient basis in connection with its day-to-day operations, primarily in connection with the need to settle portfolio trades. Such incidental borrowings are excluded from the calculation of a Fund’s effective leverage ratio. Regulatory leverage is subject to asset coverage limits set forth in the Investment Company Act of 1940. |

7

Fund Leverage (continued)

THE FUNDS’ REGULATORY LEVERAGE

As of April 30, 2019, the Funds have issued and outstanding preferred shares as shown in the accompanying table.

| | | | | | | | | | |

| | | Variable Rate Preferred* | | | Variable Rate Remarketed Preferred** | | | | |

| | | Shares Issued at Liquidation Preference | | | Shares Issued at Liquidation Preference | | | Total | |

| NAD | | $ | 1,152,500,000 | | | $ | 632,000,000 | | | $ | 1,784,500,000 | |

| NEA | | $ | 758,000,000 | | | $ | 1,490,300,000 | | | $ | 2,248,300,000 | |

| * | Preferred shares of the Fund featuring a floating rate dividend based on a predetermined formula or spread to an index rate. Includes the following preferred shares AMTP, iMTP, VMTP, MFP- VRM and VRDP in Special Rate Mode, where applicable. See Notes to Financial Statements, Note 4 – Fund Shares, Preferred Shares for further details. |

| ** | Preferred shares of the Fund featuring floating rate dividends set by a remarketing agent via a regular remarketing. Includes the following preferred shares VRDP not in Special Rate Mode, MFP-VRRM and MFP-VRDM, where applicable. See Notes to Financial Statements, Note 4 – Fund Shares, Preferred Shares for further details. |

Refer to Notes to Financial Statements, Note 4 — Fund Shares, Preferred Shares for further details on preferred shares and each Fund’s respective transactions.

8

Common Share Information

COMMON SHARE DISTRIBUTION INFORMATION

The following information regarding the Funds’ distributions is current as of April 30, 2019. Each Fund’s distribution levels may vary over time based on each Fund’s investment activity and portfolio investment value changes.

During the current reporting period, each Fund’s distributions to common shareholders were as shown in the accompanying table.

| | | | | | | |

| | | Per Common | |

| | | Share Amounts | |

| Monthly Distributions (Ex-Dividend Date) | | NAD | | | NEA | |

| November 2018 | | $ | 0.0535 | | | $ | 0.0535 | |

| December | | | 0.0535 | | | | 0.0535 | |

| January | | | 0.0535 | | | | 0.0535 | |

| February | | | 0.0535 | | | | 0.0535 | |

| March | | | 0.0535 | | | | 0.0535 | |

| April 2019 | | | 0.0535 | | | | 0.0535 | |

| Total Distributions from Net Investment Income | | $ | 0.3210 | | | $ | 0.3210 | |

| | |

| Yields | | | | | | | | |

| Market Yield* | | | 4.73 | % | | | 4.82 | % |

| Tax-Equivalent Yield* | | | 6.21 | % | | | 6.31 | % |

| * | Market Yield is based on the Fund’s current annualized monthly dividend divided by the Fund’s current market price as of the end of the reporting period. Taxable-Equivalent Yield represents the yield that must be earned on a fully taxable investment in order to equal the yield of the Fund on an after-tax basis. It is based on a federal income tax rate of 23.8 and 23.7% for NAD and NEA, respectively. Your actual federal income tax rate may differ from the assumed rate. The Taxable-Equivalent Yield also takes into account the percentage of the Fund’s income generated and paid by the Fund (based on payments made during the previous calendar year) that was not exempt from federal income tax. Separately, if the comparison were instead to investments that generate qualified dividend income, which is taxable at a rate lower than an individual’s ordinary graduated tax rate, the fund’s Taxable-Equivalent Yield would be lower. |

Each Fund seeks to pay regular monthly dividends out of its net investment income at a rate that reflects its past and projected net income performance. To permit each Fund to maintain a more stable monthly dividend, the Fund may pay dividends at a rate that may be more or less than the amount of net income actually earned by the Fund during the period. Distributions to common shareholders are determined on a tax basis, which may differ from amounts recorded in the accounting records. In instances where the monthly dividend exceeds the earned net investment income, the Fund would report a negative undistributed net ordinary income. Refer to Note 6 – Income Tax Information for additional information regarding the amounts of undistributed net ordinary income and undistributed net long-term capital gains and the character of the actual distributions paid by the Fund during the period.

All monthly dividends paid by each Fund during the current reporting period were paid from net investment income. If a portion of the Fund’s monthly distributions is sourced or comprised of elements other than net investment income, including capital gains and/or a return of capital, shareholders will be notified of those sources. For financial reporting purposes, the per share amounts of each Fund’s distributions for the reporting period are presented in this report’s Financial Highlights. For income tax purposes, distribution information for each Fund as of its most recent tax year end is presented in Note 6 – Income Tax Information within the Notes to Financial Statements of this report.

COMMON SHARE REPURCHASES

During August 2018, the Funds’ Board of Trustees reauthorized an open-market share repurchase program, allowing each Fund to repurchase an aggregate of up to approximately 10% of its outstanding common shares.

9

Common Share Information (continued)

As of April 30, 2019, and since the inception of the Funds’ repurchase programs, the Funds have cumulatively repurchased and retired their outstanding common shares as shown in the accompanying table.

| | | | | | | |

| | | NAD | | | NEA | |

| Common shares cumulatively repurchased and retired | | | 17,900 | | | | 75,000 | |

| Common shares authorized for repurchase | | | 20,190,000 | | | | 26,280,000 | |

During the current reporting period, the Funds did not repurchase any of their outstanding common shares.

OTHER COMMON SHARE INFORMATION

As of April 30, 2019, and during the current reporting period, the Funds’ common share prices were trading at a premium/(discount) to their common share NAVs as shown in the accompanying table.

| | | | | | | |

| | | NAD | | | NEA | |

| Common share NAV | | $ | 15.32 | | | $ | 14.99 | |

| Common share price | | $ | 13.57 | | | $ | 13.32 | |

| Premium/(Discount) to NAV | | | (11.42 | )% | | | (11.14 | )% |

| 6-month average premium/(discount) to NAV | | | (12.17 | )% | | | (12.01 | )% |

10

Risk Considerations

Fund shares are not guaranteed or endorsed by any bank or other insured depository institution, and are not federally insured by the Federal Deposit Insurance Corporation.

Nuveen Quality Municipal Income Fund (NAD)

Investing in closed-end funds involves risk; principal loss is possible. There is no guarantee the Fund’s investment objectives will be achieved. Closed-end fund shares may frequently trade at a discount or premium to their net asset value. Debt or fixed income securities such as those held by the Fund, are subject to market risk, credit risk, interest rate risk, derivatives risk, liquidity risk, and income risk. As interest rates rise, bond prices fall. Leverage increases return volatility and magnifies the Fund’s potential return and its risks; there is no guarantee a fund’s leverage strategy will be successful. These and other risk considerations such as inverse floater risk and tax risk are described in more detail on the Fund’s web page at www.nuveen.com/NAD.

Nuveen AMT-Free Quality Municipal Income Fund (NEA)

Investing in closed-end funds involves risk; principal loss is possible. There is no guarantee the Fund’s investment objectives will be achieved. Closed-end fund shares may frequently trade at a discount or premium to their net asset value. Debt or fixed income securities such as those held by the Fund, are subject to market risk, credit risk, interest rate risk, derivatives risk, liquidity risk, and income risk. As interest rates rise, bond prices fall. Leverage increases return volatility and magnifies the Fund’s potential return and its risks; there is no guarantee a fund’s leverage strategy will be successful. These and other risk considerations such as inverse floater risk and tax risk are described in more detail on the Fund’s web page at www.nuveen.com/NEA.

11

| | |

NAD | Nuveen Quality Municipal Income Fund |

| | Performance Overview and Holding Summaries as of April 30, 2019 |

| |

| Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this section. |

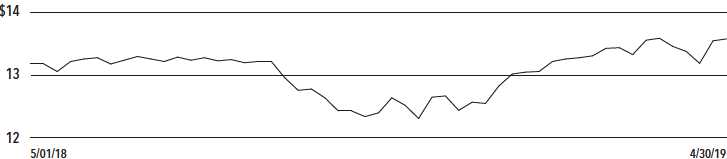

Average Annual Total Returns as of April 30, 2019 |

| |

| | Cumulative | Average Annual |

| | 6-Month | 1-Year | 5-Year | 10-Year |

| NAD at Common Share NAV | 8.55% | 7.89% | 5.57% | 7.94% |

| NAD at Common Share Price | 12.05% | 9.42% | 5.48% | 7.84% |

| S&P Municipal Bond Index | 5.36% | 5.84% | 3.55% | 4.74% |

| NAD Custom Blended Fund Performance Benchmark | 5.36% | 6.13% | 3.70% | 4.81% |

Past performance is not predictive of future results. Current performance may be higher or lower than the data shown. Returns do not reflect the deduction of taxes that shareholders may have to pay on Fund distributions or upon the sale of Fund shares. Returns at NAV are net of Fund expenses, and assume reinvestment of distributions. Comparative index return information is provided for the Fund’s shares at NAV only. Indexes are not available for direct investment.

Common Share Price Performance — Weekly Closing Price

12

This data relates to the securities held in the Fund’s portfolio of investments as of the end of the reporting period. It should not be construed as a measure of performance for the Fund itself. Holdings are subject to change.

The ratings disclosed are the lowest rating given by one of the following national rating agencies: Standard & Poor’s Group, Moody’s Investors Service, Inc. or Fitch, Inc. Credit ratings are subject to change. AAA, AA, A and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below-investment grade ratings. Holdings designated N/R are not rated by these national rating agencies.

| | |

Fund Allocation | |

(% of net assets) | |

| Long-Term Municipal Bonds | 158.3% |

| Corporate Bonds | 0.0% |

| Investment Companies | 0.0% |

| Short-Term Municipal Bonds | 0.3% |

| Other Assets Less Liabilities | 1.8% |

Net Assets Plus Floating Rate Obligations, | |

AMTP Shares, net of deferred offering costs, |

MFP Shares, net of deferred offering | |

costs & VRDP Shares, net of deferred | |

offering costs | 160.4% |

| Floating Rate Obligations | (2.8)% |

| AMTP Shares, net of deferred | |

| offering costs | (17.6)% |

| MFP Shares, net of deferred | |

| offering costs | (19.6)% |

| VRDP Shares, net of deferred | |

| offering costs | (20.4)% |

Net Assets | 100% |

| | |

Portfolio Credit Quality | |

(% of total investment exposure) | |

| U.S. Guaranteed | 8.5% |

| AAA | 1.3% |

| AA | 19.8% |

| A | 38.7% |

| BBB | 21.5% |

| BB or Lower | 7.7% |

| N/R (not rated) | 2.5% |

| N/A (not applicable) | 0.0% |

Total | 100% |

| | |

Portfolio Composition | |

(% of total investments) | |

| Transportation | 29.7% |

| Health Care | 15.8% |

| Tax Obligation/Limited | 13.5% |

| Tax Obligation/General | 9.1% |

| U.S. Guaranteed | 8.5% |

| Utilities | 6.4% |

| Education and Civic Organizations | 5.2% |

| Other | 11.8% |

Total | 100% |

| | |

States and Territories | |

(% of total municipal bonds) | |

| Illinois | 12.1% |

| Texas | 10.4% |

| California | 10.4% |

| Colorado | 6.5% |

| Florida | 6.1% |

| Ohio | 5.1% |

| New York | 4.7% |

| Pennsylvania | 3.2% |

| Washington | 2.9% |

| New Jersey | 2.8% |

| South Carolina | 2.6% |

| Missouri | 2.4% |

| Arizona | 2.1% |

| Louisiana | 2.0% |

| Virginia | 2.0% |

| Nevada | 1.8% |

| Michigan | 1.4% |

| Tennessee | 1.4% |

| Oregon | 1.3% |

| Other | 18.8% |

Total | 100% |

13

| | |

| NEA | Nuveen AMT-Free Quality Municipal Income Fund Performance Overview and Holding Summaries as of April 30, 2019 |

| |

| Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this section. |

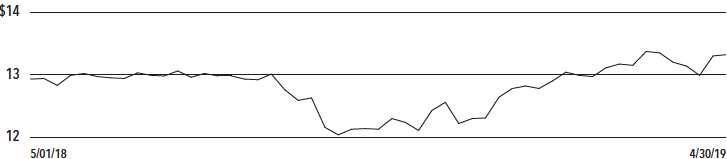

Average Annual Total Returns as of April 30, 2019 |

| |

| | Cumulative | Average Annual |

| | 6-Month | 1-Year | 5-Year | 10-Year |

| NEA at Common Share NAV | 8.21% | 7.68% | 5.83% | 6.49% |

| NEA at Common Share Price | 12.58% | 9.51% | 5.61% | 6.47% |

| S&P Municipal Bond Index | 5.36% | 5.84% | 3.55% | 4.74% |

| NEA Custom Blended Fund Performance Benchmark | 5.36% | 6.13% | 3.70% | 4.81% |

Past performance is not predictive of future results. Current performance may be higher or lower than the data shown. Returns do not reflect the deduction of taxes that shareholders may have to pay on Fund distributions or upon the sale of Fund shares. Returns at NAV are net of Fund expenses, and assume reinvestment of distributions. Comparative index return information is provided for the Fund’s shares at NAV only. Indexes are not available for direct investment.

Common Share Price Performance — Weekly Closing Price

14

This data relates to the securities held in the Fund’s portfolio of investments as of the end of the reporting period. It should not be construed as a measure of performance for the Fund itself. Holdings are subject to change.

The ratings disclosed are the lowest rating given by one of the following national rating agencies: Standard & Poor’s Group, Moody’s Investors Service, Inc. or Fitch, Inc. Credit ratings are subject to change. AAA, AA, A and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below-investment grade ratings. Holdings designated N/R are not rated by these national rating agencies.

| | |

Fund Allocation | |

(% of net assets) | |

| Long-Term Municipal Bonds | 157.6% |

| Corporate Bonds | 0.0% |

| Short-Term Municipal Bonds | 0.2% |

| Other Assets Less Liabilities | 1.5% |

Net Assets Plus Floating Rate | |

Obligations, MFP Shares, net of | |

deferred offering costs & VRDP | |

Shares, net of deferred offering costs | 159.3% |

| Floating Rate Obligations | (2.4)% |

| MFP Shares, net of deferred | |

| offering costs | (24.3)% |

| VRDP Shares, net of deferred | |

| offering costs | (32.6)% |

Net Assets | 100% |

| | |

Portfolio Credit Quality | |

(% of total investment exposure) | |

| U.S. Guaranteed | 8.7% |

| AAA | 2.2% |

| AA | 24.0% |

| A | 33.8% |

| BBB | 20.9% |

| BB or Lower | 7.9% |

| N/R (not rated) | 2.5% |

Total | 100% |

| | |

Portfolio Composition | |

(% of total investments) | |

| Health Care | 19.7% |

| Transportation | 18.8% |

| Tax Obligation/Limited | 14.8% |

| Tax Obligation/General | 12.6% |

| U.S. Guaranteed | 8.8% |

| Education and Civic Organizations | 6.0% |

| Water and Sewer | 5.5% |

| Utilities | 5.2% |

| Consumer Staples | 5.0% |

| Other | 3.6% |

Total | 100% |

| | |

States and Territories | |

(% of total municipal bonds) | |

| Illinois | 14.2% |

| California | 8.0% |

| Texas | 8.0% |

| Colorado | 6.5% |

| Ohio | 5.8% |

| Florida | 4.5% |

| New York | 4.2% |

| Pennsylvania | 4.0% |

| New Jersey | 3.8% |

| Michigan | 3.5% |

| Nevada | 3.3% |

| South Carolina | 2.4% |

| Missouri | 2.3% |

| Indiana | 2.3% |

| Washington | 2.2% |

| Georgia | 2.1% |

| Wisconsin | 2.0% |

| Louisiana | 1.9% |

| Other | 19.0% |

Total | 100% |

15

| | |

| NAD | Nuveen Quality Municipal Income Fund Portfolio of Investments April 30, 2019 (Unaudited) |

| | | | | | |

Principal | | | Optional Call | | |

Amount (000) | | Description (1) | Provisions (2) | Ratings (3) | Value |

| | | LONG-TERM INVESTMENTS – 158.3% (99.8% of Total Investments) | | | |

| | | MUNICIPAL BONDS – 158.3% (99.8% of Total Investments) | | | |

| | | Alabama – 1.5% (0.9% of Total Investments) | | | |

| | | Alabama State Port Authority, Docks Facilities Revenue Bonds, Refunding Series 2017A: | | | |

| $ 5,000 | | 5.000%, 10/01/33 – AGM Insured (AMT) | 10/27 at 100.00 | BBB+ | $ 5,764,550 |

| 5,455 | | 5.000%, 10/01/34 – AGM Insured (AMT) | 10/27 at 100.00 | BBB+ | 6,266,104 |

| 5,550 | | 5.000%, 10/01/35 – AGM Insured (AMT) | 10/27 at 100.00 | BBB+ | 6,365,906 |

| 17,500 | | Lower Alabama Gas District, Alabama, Gas Project Revenue Bonds, Series 2016A, | No Opt. Call | A3 | 22,505,175 |

| | | 5.000%, 9/01/46 | | | |

| 4,165 | | Tuscaloosa County Industrial Development Authority, Alabama, Gulf Opportunity Zone | 5/29 at 100.00 | N/R | 4,468,753 |

| | | Bonds, Hunt Refining Project, Refunding Series 2019A, 5.250%, 5/01/44, 144A (WI/DD, | | | |

| | | Settling 5/16/19) | | | |

| 37,670 | | Total Alabama | | | 45,370,488 |

| | | Alaska – 0.7% (0.5% of Total Investments) | | | |

| | | Alaska Industrial Development and Export Authority, Power Revenue Bonds, Snettisham | | | |

| | | Hydroelectric Project, Refunding Series 2015: | | | |

| 1,580 | | 5.000%, 1/01/24 (AMT) | No Opt. Call | Baa2 | 1,720,099 |

| 3,400 | | 5.000%, 1/01/25 (AMT) | No Opt. Call | Baa2 | 3,746,052 |

| 1,000 | | 5.000%, 1/01/28 (AMT) | 7/25 at 100.00 | Baa2 | 1,092,320 |

| 1,075 | | 5.000%, 1/01/29 (AMT) | 7/25 at 100.00 | Baa2 | 1,168,009 |

| 300 | | 5.000%, 1/01/31 (AMT) | 7/25 at 100.00 | Baa2 | 324,396 |

| | | Northern Tobacco Securitization Corporation, Alaska, Tobacco Settlement Asset-Backed | | | |

| | | Bonds, Series 2006A: | | | |

| 205 | | 4.625%, 6/01/23 | 5/19 at 100.00 | A3 | 205,057 |

| 14,500 | | 5.000%, 6/01/32 | 5/19 at 100.00 | B3 | 14,499,420 |

| 22,060 | | Total Alaska | | | 22,755,353 |

| | | Arizona – 3.3% (2.1% of Total Investments) | | | |

| 980 | | Apache County Industrial Development Authority, Arizona, Pollution Control Revenue | 3/22 at 100.00 | A– | 1,030,196 |

| | | Bonds, Tucson Electric Power Company, Series 2012A, 4.500%, 3/01/30 | | | |

| 2,500 | | Arizona Health Facilities Authority, Revenue Bonds, Scottsdale Lincoln Hospitals | 12/24 at 100.00 | A2 | 2,762,250 |

| | | Project, Refunding Series 2014A, 5.000%, 12/01/39 | | | |

| 2,000 | | Arizona Industrial Development Authority, Arizona, Education Revenue Bonds, Academies of | 1/28 at 100.00 | AA– | 2,241,000 |

| | | Math & Science Projects, Series 2018A, 5.000%, 7/01/48 | | | |

| | | Arizona Sports and Tourism Authority, Tax Revenue Bonds, Multipurpose Stadium Facility | | | |

| | | Project, Refunding Senior Series 2012A: | | | |

| 1,490 | | 5.000%, 7/01/30 | 7/22 at 100.00 | A | 1,586,969 |

| 2,500 | | 5.000%, 7/01/32 | 7/22 at 100.00 | A | 2,654,125 |

| 2,335 | | 5.000%, 7/01/36 | 7/22 at 100.00 | A | 2,464,476 |

| 11,795 | | Maricopa County Industrial Development Authority, Arizona, Revenue Bonds, Banner Health, | 1/27 at 100.00 | AA– | 12,638,814 |

| | | Refunding Series 2016A, 4.000%, 1/01/36 | | | |

| 9,740 | | Phoenix Civic Improvement Corporation, Arizona, Airport Revenue Bonds, Junior Lien | 7/20 at 100.00 | A+ (4) | 10,120,152 |

| | | Series 2010A, 5.000%, 7/01/40 (Pre-refunded 7/01/20) | | | |

| 12,935 | | Phoenix Civic Improvement Corporation, Arizona, Airport Revenue Bonds, Senior Lien | 7/27 at 100.00 | AA– | 14,806,306 |

| | | Series 2017A, 5.000%, 7/01/47 (AMT) | | | |

| 6,000 | | Phoenix Civic Improvement Corporation, Arizona, Airport Revenue Bonds, Senior Lien | 7/28 at 100.00 | AA– | 6,948,120 |

| | | Series 2018, 5.000%, 7/01/48 (AMT) | | | |

| 7,000 | | Phoenix Civic Improvement Corporation, Arizona, Revenue Bonds, Civic Plaza Expansion | No Opt. Call | AA | 9,749,950 |

| | | Project, Series 2005B, 5.500%, 7/01/39 – FGIC Insured | | | |

| 1,000 | | Pima County Industrial Development Authority, Arizona, Revenue Bonds, Tucson Electric | 10/20 at 100.00 | A– | 1,041,500 |

| | | Power Company, Series 2010A, 5.250%, 10/01/40 | | | |

| 1,000 | | Pinal County Electrical District 4, Arizona, Electric System Revenue Bonds, Refunding | 12/25 at 100.00 | AA | 1,051,310 |

| | | Series 2015, 4.000%, 12/01/38 – AGM Insured | | | |

16

| | | | | | |

Principal | | | Optional Call | | |

Amount (000) | | Description (1) | Provisions (2) | Ratings (3) | Value |

| | | Arizona (continued) | | | |

| | | Salt Verde Financial Corporation, Arizona, Senior Gas Revenue Bonds, Citigroup Energy | | | |

| | | Inc. Prepay Contract Obligations, Series 2007: | | | |

| $ 500 | | 5.500%, 12/01/29 | No Opt. Call | BBB+ | $ 629,235 |

| 24,765 | | 5.000%, 12/01/37 | No Opt. Call | BBB+ | 31,229,160 |

| 1,100 | | Student and Academic Services LLC, Arizona, Lease Revenue Bonds, Northern Arizona | 6/24 at 100.00 | A2 | 1,235,729 |

| | | University Project, Series 2014, 5.000%, 6/01/34 – BAM Insured | | | |

| 728 | | Watson Road Community Facilities District, Arizona, Special Assessment Revenue Bonds, | 6/19 at 100.00 | N/R | 719,199 |

| | | Series 2005, 6.000%, 7/01/30 | | | |

| 88,368 | | Total Arizona | | | 102,908,491 |

| | | Arkansas – 0.1% (0.0% of Total Investments) | | | |

| 2,055 | | Arkansas State University, Student Fee Revenue Bonds, Jonesboro Campus, Series 2013, | 12/23 at 100.00 | A1 | 2,254,499 |

| | | 4.875%, 12/01/43 | | | |

| | | California – 16.5% (10.4% of Total Investments) | | | |

| 1,500 | | ABAG Finance Authority for Non-Profit Corporations, California, Cal-Mortgage Insured | 5/20 at 100.00 | AA– (4) | 1,569,765 |

| | | Revenue Bonds, Channing House, Series 2010, 6.000%, 5/15/30 (Pre-refunded 5/15/20) | | | |

| | | Alameda Corridor Transportation Authority, California, Revenue Bonds, Refunding | | | |

| | | Subordinate Lien Series 2004A: | | | |

| 185 | | 0.000%, 10/01/20 – AMBAC Insured | No Opt. Call | Baa2 | 178,390 |

| 9,015 | | 0.000%, 10/01/20 – AMBAC Insured (ETM) | No Opt. Call | N/R (4) | 8,815,408 |

| 1,535 | | Alameda Corridor Transportation Authority, California, Revenue Bonds, Senior Lien Series | No Opt. Call | A– | 808,884 |

| | | 1999A, 0.000%, 10/01/37 – NPFG Insured | | | |

| | | Anaheim Public Financing Authority, California, Lease Revenue Bonds, Public Improvement | | | |

| | | Project, Series 1997C: | | | |

| 2,945 | | 0.000%, 9/01/27 | No Opt. Call | A2 | 2,407,390 |

| 7,150 | | 0.000%, 9/01/28 – AGM Insured | No Opt. Call | A2 | 5,650,788 |

| 2,455 | | 0.000%, 9/01/32 – AGM Insured | No Opt. Call | A2 | 1,642,469 |

| 200 | | 0.000%, 9/01/35 – AGM Insured | No Opt. Call | A2 | 117,094 |

| | | Bay Area Toll Authority, California, Revenue Bonds, San Francisco Bay Area Toll Bridge, | | | |

| | | Series 2013S-4: | | | |

| 10,000 | | 5.000%, 4/01/38 (Pre-refunded 4/01/23) | 4/23 at 100.00 | A1 (4) | 11,358,100 |

| 3,500 | | 5.250%, 4/01/53 (Pre-refunded 4/01/23) | 4/23 at 100.00 | A1 (4) | 4,008,550 |

| 1,055 | | Brisbane School District, San Mateo County, California, General Obligation Bonds, | No Opt. Call | A2 | 624,750 |

| | | Election 2003 Series 2005, 0.000%, 7/01/35 – AGM Insured | | | |

| | | Byron Unified School District, Contra Costa County, California, General Obligation | | | |

| | | Bonds, Series 2007B: | | | |

| 60 | | 0.000%, 8/01/32 (ETM) | No Opt. Call | A2 (4) | 43,400 |

| 1,640 | | 0.000%, 8/01/32 | No Opt. Call | A2 | 1,080,563 |

| | | Calexico Unified School District, Imperial County, California, General Obligation Bonds, | | | |

| | | Series 2005B: | | | |

| 3,685 | | 0.000%, 8/01/31 – FGIC Insured | No Opt. Call | A3 | 2,523,451 |

| 4,505 | | 0.000%, 8/01/33 – FGIC Insured | No Opt. Call | A3 | 2,834,816 |

| 2,820 | | California County Tobacco Securitization Agency, Tobacco Settlement Asset-Backed Bonds, | 6/19 at 100.00 | BBB+ | 2,827,501 |

| | | Sonoma County Tobacco Securitization Corporation, Series 2005, 5.000%, 6/01/26 | | | |

| 7,000 | | California Health Facilities Financing Authority, California, Revenue Bonds, Sutter | 11/26 at 100.00 | A+ | 8,044,820 |

| | | Health, Refunding Series 2016B, 5.000%, 11/15/46 | | | |

| 22,520 | | California Health Facilities Financing Authority, California, Revenue Bonds, Sutter | 11/27 at 100.00 | A+ | 26,094,825 |

| | | Health, Refunding Series 2017A, 5.000%, 11/15/48 | | | |

| 2,275 | | California Health Facilities Financing Authority, California, Revenue Bonds, Sutter | 11/27 at 100.00 | AA– | 2,441,120 |

| | | Health, Series 2018A, 4.000%, 11/15/42 | | | |

| 5,950 | | California Health Facilities Financing Authority, Revenue Bonds, Providence Health & | 10/19 at 100.00 | AA– | 6,043,712 |

| | | Services, Series 2009B, 5.500%, 10/01/39 | | | |

| 710 | | California Health Facilities Financing Authority, Revenue Bonds, Saint Joseph Health | 7/23 at 100.00 | AA– | 788,164 |

| | | System, Series 2013A, 5.000%, 7/01/37 | | | |

17

| | |

NAD | Nuveen Quality Municipal Income Fund |

| | Portfolio of Investments (continued) |

| | April 30, 2019 (Unaudited) |

| | | | | | |

Principal | | | Optional Call | | |

Amount (000) | | Description (1) | Provisions (2) | Ratings (3) | Value |

| | | California (continued) | | | |

| | | California Health Facilities Financing Authority, Revenue Bonds, Stanford Hospitals and | | | |

| | | Clinics, Tender Option Bond Trust 2016-XG0049: | | | |

| $ 790 | | 7.158%, 8/15/51 , 144A (IF), (6) | 8/22 at 100.00 | AA– | $ 917,601 |

| 825 | | 7.162%, 8/15/51 , 144A (IF), (6) | 8/22 at 100.00 | AA– | 958,378 |

| 2,140 | | 7.162%, 8/15/51 , 144A (IF), (6) | 8/22 at 100.00 | AA– | 2,485,974 |

| 5,600 | | California Municipal Finance Authority, Revenue Bonds, Linxs APM Project, Senior Lien | 6/28 at 100.00 | BBB+ | 6,398,112 |

| | | Series 2018A, 5.000%, 12/31/43 (AMT) | | | |

| 3,250 | | California Municipal Finance Authority, Revenue Bonds, Community Medical Centers, | 2/27 at 100.00 | A– | 3,657,225 |

| | | Series 2017A, 5.000%, 2/01/42 | | | |

| 810 | | California State Public Works Board, Lease Revenue Bonds, Various Capital Projects, | 11/19 at 100.00 | A+ (4) | 829,983 |

| | | Series 2009-I, 6.375%, 11/01/34 (Pre-refunded 11/01/19) | | | |

| | | California State Public Works Board, Lease Revenue Bonds, Various Capital Projects, | | | |

| | | Series 2010A-1: | | | |

| 1,530 | | 5.750%, 3/01/30 (Pre-refunded 3/01/20) | 3/20 at 100.00 | A+ (4) | 1,585,386 |

| 1,000 | | 6.000%, 3/01/35 (Pre-refunded 3/01/20) | 3/20 at 100.00 | A+ (4) | 1,038,250 |

| 815 | | California State Public Works Board, Lease Revenue Bonds, Various Capital Projects, | 11/23 at 100.00 | A+ | 904,169 |

| | | Series 2013I, 5.000%, 11/01/38 | | | |

| | | California State, General Obligation Bonds, Various Purpose Series 2010: | | | |

| 2,100 | | 5.250%, 3/01/30 | 3/20 at 100.00 | AA– | 2,162,937 |

| 3,000 | | 5.500%, 3/01/40 | 3/20 at 100.00 | AA– | 3,085,410 |

| 4,250 | | 5.250%, 11/01/40 | 11/20 at 100.00 | AA– | 4,452,895 |

| 500 | | California Statewide Communities Development Authority, California, Revenue Bonds, Loma | 12/24 at 100.00 | BB– | 543,715 |

| | | Linda University Medical Center, Series 2014A, 5.250%, 12/01/44 | | | |

| | | California Statewide Communities Development Authority, California, Revenue Bonds, Loma | | | |

| | | Linda University Medical Center, Series 2016A: | | | |

| 6,000 | | 5.000%, 12/01/46, 144A | 6/26 at 100.00 | BB– | 6,524,400 |

| 3,070 | | 5.250%, 12/01/56, 144A | 6/26 at 100.00 | BB– | 3,374,268 |

| 5,480 | | California Statewide Communities Development Authority, California, Revenue Bonds, Loma | 6/28 at 100.00 | BB– | 6,231,418 |

| | | Linda University Medical Center, Series 2018A, 5.500%, 12/01/58, 144A | | | |

| | | California Statewide Communities Development Authority, Revenue Bonds, American Baptist | | | |

| | | Homes of the West, Series 2010: | | | |

| 900 | | 6.000%, 10/01/29 | 10/19 at 100.00 | BBB+ | 915,750 |

| 1,030 | | 6.250%, 10/01/39 | 10/19 at 100.00 | BBB+ | 1,049,055 |

| | | California Statewide Community Development Authority, Revenue Bonds, Daughters of | | | |

| | | Charity Health System, Series 2005A: | | | |

| 2,640 | | 5.750%, 7/01/30 | 6/19 at 100.00 | CC | 2,584,349 |

| 7,230 | | 5.500%, 7/01/39 | 6/19 at 100.00 | CC | 7,106,945 |

| 6,025 | | California Statewide Community Development Authority, Revenue Bonds, Methodist Hospital | 8/19 at 100.00 | N/R (4) | 6,102,662 |

| | | Project, Series 2009, 6.750%, 2/01/38 (Pre-refunded 8/01/19) | | | |

| 4,890 | | Clovis Unified School District, Fresno County, California, General Obligation Bonds, | No Opt. Call | Baa2 | 4,188,383 |

| | | Series 2006B, 0.000%, 8/01/26 – NPFG Insured | | | |

| 1,000 | | Coachella Valley Unified School District, Riverside County, California, General | No Opt. Call | A– | 722,690 |

| | | Obligation Bonds, Series 2005A, 0.000%, 8/01/30 – FGIC Insured | | | |

| 5,045 | | Culver City Redevelopment Agency, California, Tax Allocation Revenue Bonds, | 11/21 at 61.42 | AA– (4) | 2,983,108 |

| | | Redevelopment Project, Capital Appreciation Series 2011A, 0.000%, 11/01/27 | | | |

| | | (Pre-refunded 11/01/21) | | | |

| 1,260 | | Davis Redevelopment Agency, California, Tax Allocation Bonds, Davis Redevelopment | 12/21 at 100.00 | A+ | 1,425,199 |

| | | Project, Subordinate Series 2011A, 7.000%, 12/01/36 | | | |

| 4,000 | | East Bay Municipal Utility District, Alameda and Contra Costa Counties, California, | 6/24 at 100.00 | Aa1 | 4,491,240 |

| | | Water System Revenue Bonds, Series 2014C, 5.000%, 6/01/44 | | | |

| 3,010 | | El Camino Community College District, California, General Obligation Bonds, Election of | No Opt. Call | AA+ | 2,653,676 |

| | | 2002 Series 2012C, 0.000%, 8/01/25 | | | |

| 3,500 | | Foothill/Eastern Transportation Corridor Agency, California, Toll Road Revenue Bonds, | No Opt. Call | BBB– | 2,172,940 |

| | | Refunding Senior Lien Series 2015A, 0.000%, 1/15/34 – AGM Insured | | | |

18

| | | | | | |

Principal | | | Optional Call | | |

Amount (000) | | Description (1) | Provisions (2) | Ratings (3) | Value |

| | | California (continued) | | | |

| | | Foothill/Eastern Transportation Corridor Agency, California, Toll Road Revenue Bonds, | | | |

| | | Refunding Series 2013A: | | | |

| $ 1,480 | | 5.750%, 1/15/46 | 1/24 at 100.00 | Baa3 | $ 1,703,465 |

| 6,480 | | 6.000%, 1/15/49 | 1/24 at 100.00 | Baa3 | 7,586,654 |

| 1,500 | | Gavilan Joint Community College District, Santa Clara and San Benito Counties, | 8/21 at 100.00 | AA (4) | 1,646,265 |

| | | California, General Obligation Bonds, Election of 2004 Series 2011D, 5.750%, 8/01/35 | | | |

| | | (Pre-refunded 8/01/21) | | | |

| 9,930 | | Golden State Tobacco Securitization Corporation, California, Enhanced Tobacco Settlement | 6/25 at 100.00 | A+ | 11,164,299 |

| | | Asset-Backed Revenue Bonds, Refunding Series 2015A, 5.000%, 6/01/45 | | | |

| | | Golden State Tobacco Securitization Corporation, California, Enhanced Tobacco Settlement | | | |

| | | Asset-Backed Revenue Bonds, Series 2005A: | | | |

| 1,455 | | 0.000%, 6/01/24 – AMBAC Insured | No Opt. Call | A+ | 1,315,509 |

| 3,500 | | 0.000%, 6/01/26 – AGM Insured | No Opt. Call | A1 | 3,010,735 |

| 3,000 | | Golden State Tobacco Securitization Corporation, California, Tobacco Settlement | 6/22 at 100.00 | N/R | 2,944,800 |

| | | Asset-Backed Bonds, Series 2018A-1, 5.000%, 6/01/47 | | | |

| 5,945 | | Golden State Tobacco Securitization Corporation, California, Tobacco Settlement | 6/22 at 100.00 | N/R | 5,835,612 |

| | | Asset-Backed Bonds, Series 2018A-2, 5.000%, 6/01/47 | | | |

| 2,500 | | Huntington Beach Union High School District, Orange County, California, General | No Opt. Call | AA– | 1,717,450 |

| | | Obligation Bonds, Series 2007, 0.000%, 8/01/32 – FGIC Insured | | | |

| 9,740 | | Huntington Park Redevelopment Agency, California, Single Family Residential Mortgage | No Opt. Call | AA+ (4) | 10,102,620 |

| | | Revenue Refunding Bonds, Series 1986A, 8.000%, 12/01/19 (ETM) | | | |

| 5,000 | | Kern Community College District, California, General Obligation Bonds, Safety, Repair & | No Opt. Call | AA | 4,492,900 |

| | | Improvement, Election 2002 Series 2006, 0.000%, 11/01/24 – AGM Insured | | | |

| 1,045 | | Lake Tahoe Unified School District, El Dorado County, California, General Obligation | No Opt. Call | A– | 738,418 |

| | | Bonds, Series 2001B, 0.000%, 8/01/31 – NPFG Insured | | | |

| 90 | | Los Angeles Department of Airports, California, Revenue Bonds, Los Angeles International | 5/26 at 100.00 | AA– | 102,452 |

| | | Airport, Subordinate Lien Series 2016A, 5.000%, 5/15/42 (AMT) | | | |

| | | Los Angeles Department of Airports, California, Revenue Bonds, Los Angeles International | | | |

| | | Airport, Subordinate Lien Series 2016B: | | | |

| 2,000 | | 5.000%, 5/15/41 (AMT) | 5/26 at 100.00 | AA– | 2,279,360 |

| 20,015 | | 5.000%, 5/15/46 (AMT) | 5/26 at 100.00 | AA– | 22,723,430 |

| 4,615 | | Los Angeles Department of Airports, California, Revenue Bonds, Los Angeles International | 5/28 at 100.00 | AA– | 5,390,089 |

| | | Airport, Subordinate Lien Series 2018A, 5.000%, 5/15/44 (AMT) | | | |

| 2,665 | | Los Angeles Department of Water and Power, California, Power System Revenue Bonds, | 1/24 at 100.00 | AA | 2,974,113 |

| | | Series 2014B, 5.000%, 7/01/43 | | | |

| 15,000 | | Los Angeles Department of Water and Power, California, Waterworks Revenue Bonds, | 1/21 at 100.00 | Aa2 | 15,800,400 |

| | | Series 2011A, 5.000%, 7/01/41 | | | |

| 2,000 | | Los Rios Community College District, Sacramento County, California, General Obligation | 8/19 at 100.00 | AA (4) | 2,019,340 |

| | | Bonds, Series 2009D, 5.375%, 8/01/34 (Pre-refunded 8/01/19) | | | |

| 250 | | Lynwood Redevelopment Agency, California, Tax Allocation Revenue Bonds, Project Area A, | 9/21 at 100.00 | A | 279,555 |

| | | Subordinate Lien Series 2011A, 7.000%, 9/01/31 | | | |

| 500 | | Madera County, California, Certificates of Participation, Children’s Hospital Central | 3/20 at 100.00 | A1 (4) | 516,885 |

| | | California, Series 2010, 5.375%, 3/15/36 (Pre-refunded 3/15/20) | | | |

| 6,215 | | Martinez Unified School District, Contra Costa County, California, General Obligation | 8/24 at 100.00 | AA | 7,436,807 |

| | | Bonds, Series 2011, 5.875%, 8/01/31 | | | |

| 5,955 | | Mount San Antonio Community College District, Los Angeles County, California, General | 8/35 at 100.00 | AA | 5,411,547 |

| | | Obligation Bonds, Election of 2008, Series 2013A, 6.250%, 8/01/43, (5) | | | |

| 2,700 | | M-S-R Energy Authority, California, Gas Revenue Bonds, Citigroup Prepay Contracts, | No Opt. Call | BBB+ | 3,979,071 |

| | | Series 2009A, 7.000%, 11/01/34 | | | |

| 2,200 | | M-S-R Energy Authority, California, Gas Revenue Bonds, Citigroup Prepay Contracts, | No Opt. Call | BBB+ | 3,246,386 |

| | | Series 2009C, 6.500%, 11/01/39 | | | |

| 290 | | Natomas Union School District, Sacramento County, California, General Obligation | No Opt. Call | Baa2 | 304,961 |

| | | Refunding Bonds, Series 1999, 5.950%, 9/01/21 – NPFG Insured | | | |

19

| | |

NAD | Nuveen Quality Municipal Income Fund |

| | Portfolio of Investments (continued) |

| April 30, 2019 (Unaudited) |

| | | | | | |

Principal | | | Optional Call | | |

Amount (000) | | Description (1) | Provisions (2) | Ratings (3) | Value |

| | | California (continued) | | | |

| $ 14,065 | | Ontario Redevelopment Financing Authority, San Bernardino County, California, Revenue | No Opt. Call | Baa2 | $ 15,917,360 |

| | | Bonds, Redevelopment Project 1, Refunding Series 1995, 7.400%, 8/01/25 – NPFG Insured | | | |

| 3,615 | | Palomar Pomerado Health Care District, California, Certificates of Participation, | 11/19 at 100.00 | N/R (4) | 3,707,942 |

| | | Series 2009, 6.750%, 11/01/39 (Pre-refunded 11/01/19) | | | |

| 890 | | Palomar Pomerado Health Care District, California, Certificates of Participation, | 11/20 at 100.00 | Ba1 (4) | 923,767 |

| | | Series 2010, 5.250%, 11/01/21 (Pre-refunded 11/01/20) | | | |

| 13,145 | | Perris, California, GNMA Mortgage-Backed Securities Program Single Family Mortgage | No Opt. Call | AA+ (4) | 16,615,411 |

| | | Revenue Bonds, Series 1988B, 8.200%, 9/01/23 (ETM) | | | |

| 2,500 | | Petaluma, Sonoma County, California, Wastewater Revenue Bonds, Refunding Series 2011, | 5/21 at 100.00 | AA (4) | 2,704,800 |

| | | 5.500%, 5/01/32 (Pre-refunded 5/01/21) | | | |

| 6,000 | | Placentia-Yorba Linda Unified School District, Orange County, California, Certificates | No Opt. Call | A2 (4) | 4,116,060 |

| | | of Participation, Series 2006, 0.000%, 10/01/34 – FGIC Insured (ETM) | | | |

| 7,080 | | Pomona, California, GNMA/FNMA Collateralized Securities Program Single Family Mortgage | No Opt. Call | AA+ (4) | 7,907,440 |

| | | Revenue Bonds, Series 1990A, 7.600%, 5/01/23 (ETM) | | | |

| 2,000 | | Poway Unified School District, San Diego County, California, General Obligation Bonds, | No Opt. Call | AA– | 964,920 |

| | | School Facilities Improvement District 2007-1, Series 2011A, 0.000%, 8/01/41 | | | |

| 5,000 | | Rialto Unified School District, San Bernardino County, California, General Obligation | 8/36 at 100.00 | A1 | 5,347,600 |

| | | Bonds, Series 2011A, 7.350%, 8/01/41 – AGM Insured, (5) | | | |

| 5,000 | | Riverside County Asset Leasing Corporation, California, Leasehold Revenue Bonds, | No Opt. Call | A1 | 4,355,800 |

| | | Riverside County Hospital Project, Series 1997, 0.000%, 6/01/25 – NPFG Insured | | | |

| 4,615 | | Riverside County Redevelopment Agency, California, Tax Allocation Bonds, Jurupa Valley | No Opt. Call | A | 2,297,578 |

| | | Project Area, Series 2011B, 0.000%, 10/01/38 | | | |

| 330 | | Riverside County Transportation Commission, California, Toll Revenue Senior Lien Bonds, | 6/23 at 100.00 | BBB | 362,842 |

| | | Series 2013A, 5.750%, 6/01/48 | | | |

| 14,900 | | San Francisco Airports Commission, California, Revenue Bonds, San Francisco | 5/26 at 100.00 | A+ | 16,927,145 |

| | | International Airport, Second Series 2016B, 5.000%, 5/01/46 (AMT) | | | |

| | | San Francisco Airports Commission, California, Revenue Bonds, San Francisco | | | |

| | | International Airport, Second Series 2018D: | | | |

| 11,615 | | 5.000%, 5/01/43 (AMT) | 5/28 at 100.00 | A+ | 13,577,470 |

| 12,285 | | 5.000%, 5/01/48 (AMT) | 5/28 at 100.00 | A+ | 14,292,983 |

| 11,025 | | San Francisco Airports Commission, California, Revenue Bonds, San Francisco | 5/29 at 100.00 | A+ | 12,975,433 |

| | | International Airport, Second Series 2019A, 5.000%, 5/01/49 (AMT) | | | |

| 660 | | San Francisco Redevelopment Finance Authority, California, Tax Allocation Revenue Bonds, | 8/19 at 100.00 | A– (4) | 668,270 |

| | | Mission Bay North Redevelopment Project, Series 2009C, 6.500%, 8/01/39 (Pre-refunded 8/01/19) | | | |

| 2,000 | | San Francisco, California, Community Facilities District 6, Mission Bay South Public | 8/22 at 29.31 | N/R | 539,580 |

| | | Improvements, Special Tax Refunding Bonds, Series 2013C, 0.000%, 8/01/43 | | | |

| 2,000 | | San Joaquin Hills Transportation Corridor Agency, Orange County, California, Toll Road | 1/25 at 100.00 | BBB– | 2,219,440 |

| | | Revenue Bonds, Refunding Junior Lien Series 2014B, 5.250%, 1/15/44 | | | |

| | | San Joaquin Hills Transportation Corridor Agency, Orange County, California, Toll Road | | | |

| | | Revenue Bonds, Refunding Senior Lien Series 2014A: | | | |

| 15,350 | | 5.000%, 1/15/44 | 1/25 at 100.00 | BBB | 17,123,846 |

| 25,840 | | 5.000%, 1/15/50 | 1/25 at 100.00 | BBB | 28,589,634 |

| | | San Jose, California, Airport Revenue Bonds, Refunding Series 2017A: | | | |

| 5,000 | | 5.000%, 3/01/41 (AMT) | 3/27 at 100.00 | A– | 5,732,650 |

| 5,000 | | 5.000%, 3/01/47 (AMT) | 3/27 at 100.00 | A– | 5,695,200 |

| 6,660 | | San Ysidro School District, San Diego County, California, General Obligation Bonds, | 8/25 at 38.93 | A1 | 2,121,610 |

| | | Refunding Series 2015, 0.000%, 8/01/43 | | | |

| 880 | | Santee Community Development Commission, California, Santee Redevelopment Project Tax | 2/21 at 100.00 | A (4) | 964,260 |

| | | Allocation Bonds, Series 2011A, 7.000%, 8/01/31 (Pre-refunded 2/01/21) | | | |

| 2,460 | | Santee School District, San Diego County, California, General Obligation Bonds, Capital | No Opt. Call | AA | 1,616,786 |

| | | Appreciation, Election 2006, Series 2008D, 0.000%, 8/01/33 – AGC Insured | | | |

20

| | | | | | |

Principal | | | Optional Call | | |

Amount (000) | | Description (1) | Provisions (2) | Ratings (3) | Value |

| | | California (continued) | | | |

| $ 5,000 | | Solano Community College District, Solano and Yolo Counties, California, General | 8/23 at 100.00 | Aa3 | $ 5,560,400 |

| | | Obligation Bonds, Election 2012 Series 2013A, 5.000%, 8/01/43 | | | |

| 1,145 | | Southern Kern Unified School District, Kern County, California, General Obligation | No Opt. Call | A2 | 820,461 |

| | | Bonds, Series 2006C, 0.000%, 11/01/30 – AGM Insured | | | |

| 1,175 | | Southern Kern Unified School District, Kern County, California, General Obligation | No Opt. Call | A2 | 684,473 |

| | | Bonds, Series 2010B, 0.000%, 11/01/35 – AGM Insured | | | |

| | | Union City Community Redevelopment Agency, California, Tax Allocation Revenue Bonds, | | | |

| | | Redevelopment Project, Subordinate Lien Series 2011: | | | |

| 1,000 | | 6.375%, 12/01/23 (Pre-refunded 12/01/21) | 12/21 at 100.00 | A+ (4) | 1,125,920 |

| 1,000 | | 6.500%, 12/01/24 (Pre-refunded 12/01/21) | 12/21 at 100.00 | A+ (4) | 1,128,800 |

| 1,000 | | 6.625%, 12/01/25 (Pre-refunded 12/01/21) | 12/21 at 100.00 | A+ (4) | 1,131,960 |

| 1,325 | | 6.750%, 12/01/26 (Pre-refunded 12/01/21) | 12/21 at 100.00 | A+ (4) | 1,504,034 |

| 2,410 | | Victor Elementary School District, San Bernardino County, California, General Obligation | No Opt. Call | A+ | 2,037,751 |

| | | Bonds, Series 2002A, 0.000%, 8/01/26 – FGIC Insured | | | |

| 2,000 | | West Contra Costa Unified School District, Contra Costa County, California, General | 8/21 at 100.00 | A+ (4) | 2,161,940 |

| | | Obligation Bonds, Election 2010 Series 2011A, 5.000%, 8/01/41 (Pre-refunded 8/01/21) | | | |

| 3,750 | | Wiseburn School District, Los Angeles County, California, General Obligation Bonds, | 8/31 at 100.00 | Aa3 | 3,606,112 |

| | | Series 2011B, 7.300%, 8/01/36 – AGM Insured, (5) | | | |

| 4,000 | | Yuba Community College District, California, General Obligation Bonds, Election 2006 | 8/21 at 100.00 | Aa2 (4) | 4,345,920 |

| | | Series 2011C, 5.250%, 8/01/47 (Pre-refunded 8/01/21) | | | |

| 492,185 | | Total California | | | 508,546,799 |

| | | Colorado – 10.3% (6.5% of Total Investments) | | | |

| 3,000 | | Anthem West Metropolitan District, Colorado, General Obligation Bonds, Refunding | 12/25 at 100.00 | A3 | 3,433,590 |

| | | Series 2015, 5.000%, 12/01/35 – BAM Insured | | | |

| 4,195 | | Boulder Larimer & Weld Counties School District RE-1J Saint Vrain Valley, Colorado, | 12/26 at 100.00 | Aa2 | 4,590,588 |

| | | General Obligation Bonds, Series 2016C, 4.000%, 12/15/34 | | | |

| 1,775 | | Centerra Metropolitan District 1, Loveland, Colorado, Special Revenue Bonds, Refunding & | 12/22 at 103.00 | N/R | 1,903,350 |

| | | Improvement Series 2017, 5.000%, 12/01/29, 144A | | | |

| 2,945 | | Colorado Educational and Cultural Facilities Authority, Charter School Revenue Bonds, | 8/23 at 100.00 | BB+ | 3,327,821 |

| | | Community Leadership Academy, Inc. Second Campus Project, Series 2013, 7.350%, 8/01/43 | | | |

| 1,715 | | Colorado Educational and Cultural Facilities Authority, Charter School Revenue Bonds, | 8/26 at 100.00 | A+ | 1,651,339 |

| | | Flagstaff Academy Project, Refunding Series 2016, 3.625%, 8/01/46 | | | |

| 500 | | Colorado Educational and Cultural Facilities Authority, Charter School Revenue Bonds, | 1/24 at 100.00 | A+ | 535,300 |

| | | Liberty Common Charter School, Series 2014A, 5.000%, 1/15/44 | | | |

| 1,000 | | Colorado Educational and Cultural Facilities Authority, Charter School Revenue Bonds, | 8/24 at 100.00 | A+ | 1,109,330 |

| | | Peak-to-Peak Charter School, Refunding Series 2014, 5.000%, 8/15/30 | | | |

| 3,915 | | Colorado Educational and Cultural Facilities Authority, Charter School Revenue Bonds, | 6/26 at 100.00 | A+ | 3,575,491 |

| | | Weld County School District 6 – Frontier Academy, Refunding & Improvement Series 2016, | | | |

| | | 3.250%, 6/01/46 | | | |

| 1,250 | | Colorado Educational and Cultural Facilities Authority, Revenue Bonds, University | No Opt. Call | A+ | 1,353,313 |

| | | Corporation for Atmospheric Research Project, Refunding Series 2012A, 4.500%, 9/01/22 | | | |

| 545 | | Colorado Educational and Cultural Facilities Authority, Revenue Bonds, University | 9/27 at 100.00 | A2 | 570,343 |

| | | Corporation for Atmospheric Research Project, Refunding Series 2017, 3.625%, 9/01/31 | | | |

| | | Colorado Educational and Cultural Facilities Authority, Revenue Bonds, University of | | | |

| | | Denver, Series 2017A: | | | |

| 1,200 | | 4.000%, 3/01/36 | 3/27 at 100.00 | A1 | 1,299,960 |

| 1,600 | | 4.000%, 3/01/37 | 3/27 at 100.00 | A1 | 1,725,248 |

| 1,465 | | Colorado Health Facilities Authority, Colorado, Revenue Bonds, American Baptist Homes | 8/19 at 100.00 | N/R (4) | 1,486,843 |

| | | Project, Series 2009A, 7.750%, 8/01/39 (Pre-refunded 8/01/19) | | | |

| 6,765 | | Colorado Health Facilities Authority, Colorado, Revenue Bonds, Catholic Health | 7/19 at 100.00 | BBB+ | 6,808,499 |

| | | Initiatives, Series 2009A, 5.500%, 7/01/34 | | | |

| 2,300 | | Colorado Health Facilities Authority, Colorado, Revenue Bonds, Catholic Health | 2/21 at 100.00 | BBB+ | 2,380,684 |

| | | Initiatives, Series 2011A, 5.000%, 2/01/41 | | | |

21

| | |

NAD | Nuveen Quality Municipal Income Fund |

| | Portfolio of Investments (continued) |

| April 30, 2019 (Unaudited) |

| | | | | | |

Principal | | | Optional Call | | |

Amount (000) | | Description (1) | Provisions (2) | Ratings (3) | Value |

| | | Colorado (continued) | | | |

| | | Colorado Health Facilities Authority, Colorado, Revenue Bonds, Catholic Health | | | |

| | | Initiatives, Series 2013A: | | | |

| $ 3,020 | | 5.250%, 1/01/40 | 1/23 at 100.00 | BBB+ | $ 3,255,439 |

| 4,890 | | 5.250%, 1/01/45 | 1/23 at 100.00 | BBB+ | 5,258,070 |

| 4,600 | | Colorado Health Facilities Authority, Colorado, Revenue Bonds, Christian Living | 1/24 at 102.00 | N/R | 4,925,174 |

| | | Neighborhoods Project, Refunding Series 2016, 5.000%, 1/01/37 | | | |

| 270 | | Colorado Health Facilities Authority, Colorado, Revenue Bonds, Evangelical Lutheran Good | 6/23 at 100.00 | BBB | 297,702 |

| | | Samaritan Society Project, Series 2013, 5.625%, 6/01/43 | | | |

| | | Colorado Health Facilities Authority, Colorado, Revenue Bonds, Evangelical Lutheran Good | | | |

| | | Samaritan Society Project, Series 2013A: | | | |

| 2,670 | | 5.000%, 6/01/28 | 6/25 at 100.00 | BBB | 3,038,327 |

| 6,425 | | 5.000%, 6/01/40 | 6/25 at 100.00 | BBB | 7,052,208 |

| 665 | | Colorado Health Facilities Authority, Colorado, Revenue Bonds, Frasier Meadows Project, | 5/27 at 100.00 | BB+ | 728,335 |

| | | Refunding & Improvement Series 2017A, 5.250%, 5/15/47 | | | |

| 9,000 | | Colorado Health Facilities Authority, Colorado, Revenue Bonds, Sisters of Charity of | 1/20 at 100.00 | AA– | 9,165,510 |

| | | Leavenworth Health Services Corporation, Series 2010A, 5.000%, 1/01/40 | | | |

| 625 | | Colorado Health Facilities Authority, Colorado, Revenue Bonds, Total Longterm Care | 11/20 at 100.00 | N/R (4) | 665,575 |

| | | National Obligated Group Project, Series 2010A, 6.000%, 11/15/30 (Pre-refunded 11/15/20) | | | |

| 1,075 | | Colorado High Performance Transportation Enterprise, C-470 Express Lanes Revenue Bonds, | 12/24 at 100.00 | BBB | 1,164,612 |

| | | Senior Lien Series 2017, 5.000%, 12/31/51 | | | |

| 2,000 | | Colorado Mesa University, Colorado, Enterprise Revenue Bonds, Series 2012B, | 5/21 at 100.00 | Aa2 | 2,035,360 |

| | | 4.250%, 5/15/37 | | | |

| 2,775 | | Colorado State Board of Governors, Colorado State University Auxiliary Enterprise System | 3/28 at 100.00 | AA | 3,269,672 |

| | | Revenue Bonds, Refunding Series 2017C, 5.000%, 3/01/43 | | | |

| 2,360 | | Colorado State Board of Governors, Colorado State University Auxiliary Enterprise System | 3/28 at 100.00 | AA | 2,518,096 |

| | | Revenue Bonds, Refunding Series 2017E, 4.000%, 3/01/43 | | | |

| 3,000 | | Commerce City, Colorado, Sales and Use Tax Revenue Bonds, Series 2014, 5.000%, | 8/24 at 100.00 | A2 | 3,349,710 |

| | | 8/01/44 – AGM Insured | | | |

| 7,250 | | Commerce City, Colorado, Sales and Use Tax Revenue Bonds, Series 2016, 5.000%, 8/01/46 | 8/26 at 100.00 | A2 | 8,260,867 |

| 2,000 | | Denver City and County, Colorado, Airport System Revenue Bonds, Series 2012B, | 11/22 at 100.00 | AA– | 2,191,120 |

| | | 5.000%, 11/15/32 | | | |

| 1,100 | | Denver City and County, Colorado, Airport System Revenue Bonds, Subordinate Lien | 11/23 at 100.00 | A | 1,210,209 |

| | | Series 2013A, 5.250%, 11/15/43 (AMT) | | | |

| 4,515 | | Denver City and County, Colorado, Airport System Revenue Bonds, Subordinate Lien | 11/23 at 100.00 | A | 4,990,475 |

| | | Series 2013B, 5.000%, 11/15/43 | | | |

| | | Denver City and County, Colorado, Airport System Revenue Bonds, Subordinate Lien | | | |

| | | Series 2018A: | | | |

| 20,460 | | 5.000%, 12/01/43 (AMT) | 12/28 at 100.00 | A | 23,878,048 |

| 29,230 | | 5.000%, 12/01/48 (AMT) | 12/28 at 100.00 | A+ | 33,963,506 |

| 1,820 | | Denver City and County, Colorado, Dedicated Tax Revenue Bonds, Refunding & Improvement | 8/26 at 100.00 | AA– | 1,918,771 |

| | | Series 2016A, 4.000%, 8/01/46 | | | |

| 2,005 | | Denver City and County, Colorado, Special Facilities Airport Revenue Bonds, United | 10/23 at 100.00 | BB | 2,162,553 |

| | | Airlines, Inc. Project, Refunding Series 2017, 5.000%, 10/01/32 (AMT) | | | |

| | | Denver Convention Center Hotel Authority, Colorado, Revenue Bonds, Convention Center | | | |

| | | Hotel, Refunding Senior Lien Series 2016: | | | |

| 2,955 | | 5.000%, 12/01/28 | 12/26 at 100.00 | Baa2 | 3,370,916 |

| 2,000 | | 5.000%, 12/01/29 | 12/26 at 100.00 | BBB– | 2,271,580 |

| 2,635 | | 5.000%, 12/01/35 | 12/26 at 100.00 | Baa2 | 2,997,550 |

| 1,605 | | 5.000%, 12/01/40 | 12/26 at 100.00 | BBB– | 1,798,065 |

| | | E-470 Public Highway Authority, Colorado, Senior Revenue Bonds, Capital Appreciation | | | |

| | | Series 2010A: | | | |

| 385 | | 0.000%, 9/01/35 | No Opt. Call | BBB+ | 218,984 |

| 150 | | 0.000%, 9/01/37 | No Opt. Call | BBB+ | 77,762 |

| 75 | | 0.000%, 9/01/38 | No Opt. Call | BBB+ | 37,258 |

| 20 | | 0.000%, 9/01/39 | No Opt. Call | BBB+ | 9,499 |

| 110 | | 0.000%, 9/01/41 | No Opt. Call | BBB+ | 47,933 |

22

| | | | | | |

Principal | | | Optional Call | | |

Amount (000) | | Description (1) | Provisions (2) | Ratings (3) | Value |

| | | Colorado (continued) | | | |

| | | E-470 Public Highway Authority, Colorado, Senior Revenue Bonds, Series 1997B: | | | |

| $ 1,420 | | 0.000%, 9/01/23 – NPFG Insured | No Opt. Call | BBB+ | $ 1,288,224 |

| 18,380 | | 0.000%, 9/01/25 – NPFG Insured | No Opt. Call | BBB+ | 15,793,750 |

| | | E-470 Public Highway Authority, Colorado, Senior Revenue Bonds, Series 2000B: | | | |

| 1,045 | | 0.000%, 9/01/29 – NPFG Insured | No Opt. Call | BBB+ | 774,188 |

| 2,175 | | 0.000%, 9/01/30 – NPFG Insured | No Opt. Call | BBB+ | 1,540,792 |

| 25,050 | | 0.000%, 9/01/31 – NPFG Insured | No Opt. Call | BBB+ | 16,935,804 |

| 23,305 | | 0.000%, 9/01/32 – NPFG Insured | No Opt. Call | BBB+ | 15,068,547 |

| 100 | | 0.000%, 9/01/33 – NPFG Insured | No Opt. Call | BBB+ | 61,931 |

| 12,500 | | E-470 Public Highway Authority, Colorado, Senior Revenue Bonds, Series 2006A, 0.000%, | 9/26 at 54.77 | BBB+ | 5,292,875 |

| | | 9/01/38 – NPFG Insured | | | |

| | | E-470 Public Highway Authority, Colorado, Toll Revenue Bonds, Series 2004A: | | | |

| 385 | | 0.000%, 9/01/28 – NPFG Insured | No Opt. Call | BBB+ | 297,351 |

| 60,000 | | 0.000%, 3/01/36 – NPFG Insured | No Opt. Call | BBB+ | 33,201,000 |

| | | E-470 Public Highway Authority, Colorado, Toll Revenue Bonds, Series 2004B: | | | |

| 345 | | 0.000%, 9/01/28 – NPFG Insured | 9/20 at 63.99 | BBB+ | 213,327 |

| 13,000 | | 0.000%, 9/01/34 – NPFG Insured | 9/20 at 45.40 | BBB+ | 5,672,940 |

| 14,500 | | 0.000%, 3/01/36 – NPFG Insured | 9/20 at 41.72 | A | 5,811,745 |

| 500 | | Eagle County Air Terminal Corporation, Colorado, Airport Terminal Project Revenue Bonds, | 5/21 at 100.00 | Baa2 | 534,075 |

| | | Refunding Series 2011A, 5.500%, 5/01/22 (AMT) | | | |

| 4,000 | | Ebert Metropolitan District (In the City and County of Denver, Colorado), Limited Tax | 12/28 at 100.00 | A2 | 4,664,640 |

| | | General Obligation Refunding Bonds, Series 2018A-1, 5.000%, 12/01/43 – BAM Insured | | | |

| 1,860 | | Metropolitan State University of Denver, Colorado, Institutional Enterprise Revenue | 12/25 at 100.00 | Aa2 | 1,964,662 |

| | | Bonds, Aerospace and Engineering Sciences Building Project, Series 2016, 4.000%, 12/01/40 | | | |

| | | Park 70 Metropolitan District, City of Aurora, Colorado, General Obligation Refunding | | | |

| | | and Improvement Bonds, Series 2016: | | | |

| 1,565 | | 5.000%, 12/01/36 | 12/26 at 100.00 | Baa3 | 1,706,633 |

| 2,100 | | 5.000%, 12/01/46 | 12/26 at 100.00 | Baa3 | 2,273,103 |

| 3,000 | | Park Creek Metropolitan District, Colorado, Senior Limited Property Tax Supported | 12/19 at 100.00 | AA (4) | 3,080,940 |

| | | Revenue Bonds, Refunding Series 2009, 6.250%, 12/01/30 (Pre-refunded 12/01/19) – AGC Insured | | | |

| 6,705 | | Park Creek Metropolitan District, Colorado, Senior Limited Property Tax Supported | 12/25 at 100.00 | A | 7,383,144 |

| | | Revenue Bonds, Refunding Series 2015A, 5.000%, 12/01/45 | | | |

| 5,715 | | Park Creek Metropolitan District, Colorado, Senior Limited Property Tax Supported | 12/20 at 100.00 | A2 (4) | 6,116,936 |

| | | Revenue Refunding Bonds, Series 2011, 6.125%, 12/01/41 (Pre-refunded 12/01/20) – AGM Insured | | | |

| 700 | | Public Authority for Colorado Energy, Natural Gas Purchase Revenue Bonds, Colorado | No Opt. Call | A+ | 1,044,225 |

| | | Springs Utilities, Series 2008, 6.500%, 11/15/38 | | | |

| | | Regional Transportation District, Colorado, Denver Transit Partners Eagle P3 Project | | | |

| | | Private Activity Bonds, Series 2010: | | | |

| 2,500 | | 6.500%, 1/15/30 | 7/20 at 100.00 | BBB+ | 2,609,725 |

| 3,115 | | 6.000%, 1/15/34 | 7/20 at 100.00 | Baa3 | 3,233,432 |

| 2,615 | | 6.000%, 1/15/41 | 7/20 at 100.00 | Baa3 | 2,714,422 |

| 1,500 | | Sierra Ridge Metropolitan District 2, Douglas County, Colorado, General Obligation | 12/21 at 103.00 | N/R | 1,543,410 |

| | | Bonds, Limited Tax Series 2016A, 5.500%, 12/01/46 | | | |

| 750 | | Thompson Crossing Metropolitan District 2, Johnstown, Larimer County, Colorado, General | 12/26 at 100.00 | AA | 851,910 |

| | | Obligation Bonds, Limited Tax Convertible to Unlimited Tax, Series 2016B, 5.000%, 12/01/36 – | | | |

| | | AGM Insured | | | |

| | | Traditions Metropolitan District 2, Colorado, Limited Tax General Obligation Bonds, | | | |

| | | Refunding Series 2016: | | | |

| 1,050 | | 5.000%, 12/01/32 – BAM Insured | 12/26 at 100.00 | Baa2 | 1,207,647 |

| 1,000 | | 4.125%, 12/01/37 – BAM Insured | 12/26 at 100.00 | Baa2 | 1,062,110 |

| 2,000 | | Vista Ridge Metropolitan District, In the Town of Erie, Weld County, Colorado, General | 12/26 at 100.00 | Baa1 | 2,123,020 |

| | | Obligation Refunding Bonds, Series 2016A, 4.000%, 12/01/36 – BAM Insured | | | |

| 368,740 | | Total Colorado | | | 317,947,093 |

23

| | |

NAD | Nuveen Quality Municipal Income Fund |

| | Portfolio of Investments (continued) |

| | April 30, 2019 (Unaudited) |

| |

| |

| |

Principal | | | Optional Call | | |

Amount (000) | | Description (1) | Provisions (2) | Ratings (3) | Value |

| | | Connecticut – 1.4% (0.9% of Total Investments) | | | |

| $ 3,430 | | Connecticut Health and Educational Facilities Authority, Revenue Bonds, Sacred Heart | 7/22 at 100.00 | A2 (4) | $ 3,784,971 |

| | | University, Series 2012H, 5.000%, 7/01/24 (Pre-refunded 7/01/22) – AGM Insured | | | |

| | | Connecticut Municipal Electric Energy Cooperative, Power Supply System Revenue Bonds, | | | |

| | | Tender Option Bond Trust 2016-XG0059: | | | |

| 1,295 | | 10.721%, 1/01/32 , 144A (IF), (6) | 1/23 at 100.00 | A+ | 1,809,516 |

| 190 | | 10.645%, 1/01/38 , 144A (IF), (6) | 1/23 at 100.00 | A+ | 262,211 |

| | | Connecticut State, Special Tax Obligation Bonds, Transportation Infrastructure Purposes | | | |

| | | Series 2018A: | | | |

| 14,775 | | 5.000%, 1/01/34 | 1/28 at 100.00 | A+ | 17,067,046 |

| 6,410 | | 5.000%, 1/01/37 | 1/28 at 100.00 | A+ | 7,335,348 |

| 6,000 | | 5.000%, 1/01/38 | 1/28 at 100.00 | A+ | 6,846,120 |

| 2,500 | | Harbor Point Infrastructure Improvement District, Connecticut, Special Obligation | 4/20 at 100.00 | N/R (4) | 2,640,750 |

| | | Revenue Bonds, Harbor Point Project, Series 2010A, 7.875%, 4/01/39 (Pre-refunded 4/01/20) | | | |

| 3,565 | | Hartford County Metropolitan District, Connecticut, Clean Water Project Revenue Bonds, | 4/22 at 100.00 | AA– | 3,673,519 |

| | | Series 2013A, 4.000%, 4/01/39 | | | |

| 4,949 | | Mashantucket Western Pequot Tribe, Connecticut, Special Revenue Bonds, Subordinate | No Opt. Call | N/R | 169,496 |

| | | Series 2013A, 6.050%, 7/01/31 (cash 4.000%, PIK 2.050%) | | | |

| 43,114 | | Total Connecticut | | | 43,588,977 |

| | | Delaware – 0.3% (0.2% of Total Investments) | | | |

| 800 | | Delaware Health Facilities Authority, Revenue Bonds, Beebe Medical Center Project, | 12/28 at 100.00 | BBB | 896,104 |

| | | Series 2018, 5.000%, 6/01/48 | | | |

| 7,255 | | Delaware Transportation Authority, Revenue Bonds, US 301 Project, Series 2015, | 6/25 at 100.00 | A1 | 8,102,964 |

| | | 5.000%, 6/01/55 | | | |

| 8,055 | | Total Delaware | | | 8,999,068 |

| | | District of Columbia – 1.6% (1.0% of Total Investments) | | | |

| 935 | | District of Columbia Housing Finance Agency, GNMA Collateralized Single Family Mortgage | 6/19 at 100.00 | AA+ | 937,655 |

| | | Revenue Bonds, Series 1988E-4, 6.375%, 6/01/26 (AMT) | | | |

| 4,365 | | District of Columbia Tobacco Settlement Corporation, Tobacco Settlement Asset-Backed | No Opt. Call | A– | 4,801,456 |

| | | Bonds, Series 2001, 6.500%, 5/15/33 | | | |

| 21,000 | | District of Columbia Tobacco Settlement Corporation, Tobacco Settlement Asset-Backed | 6/19 at 18.94 | N/R | 3,241,350 |

| | | Bonds, Series 2006A, 0.000%, 6/15/46 | | | |

| 23,745 | | District of Columbia Water and Sewer Authority, Public Utility Revenue Bonds, Series | No Opt. Call | AA | 25,973,231 |

| | | 1998, 5.500%, 10/01/23 – AGM Insured (UB) | | | |

| | | District of Columbia, General Obligation Bonds, Series 1998B: | | | |

| 5,000 | | 6.000%, 6/01/19 – NPFG Insured | No Opt. Call | AA+ | 5,017,600 |

| 9,505 | | 6.000%, 6/01/20 – NPFG Insured | No Opt. Call | AA+ | 9,952,115 |

| 64,550 | | Total District of Columbia | | | 49,923,407 |

| | | Florida – 9.6% (6.1% of Total Investments) | | | |

| 1,480 | | Atlantic Beach, Florida, Healthcare Facilities Revenue Refunding Bonds, Fleet Landing | 11/23 at 100.00 | BBB | 1,580,418 |

| | | Project, Series 2013A, 5.000%, 11/15/37 | | | |

| | | Bay County, Florida, Educational Facilities Revenue Refunding Bonds, Bay Haven Charter | | | |

| | | Academy, Inc. Project, Series 2013A: | | | |

| 450 | | 5.000%, 9/01/45 | 9/23 at 100.00 | BBB | 470,498 |

| 875 | | 5.000%, 9/01/48 | 9/23 at 100.00 | BBB | 914,550 |

| 7,500 | | Broward County, Florida, Airport System Revenue Bonds, Series 2015A, 5.000%, | 10/25 at 100.00 | A+ | 8,363,250 |

| | | 10/01/45 (AMT) | | | |